This proxy statement is furnished in connection with the solicitation on behalf of the Board of Directors of The Empire District Electric Company, a Kansas corporation, of proxies to be voted at our Annual Meeting of Stockholders to be held on Thursday, April 28, 2005, and at any and all adjournments of the meeting.

A form of proxy is enclosed for execution by stockholders. The proxy reflects the number of shares registered in a stockholder’s name. Any stockholder giving a proxy has the right to revoke it at any time before the proxy is exercised by written notice to the Secretary-Treasurer of Empire, by duly executing a proxy bearing a later date or by voting in person at the meeting.

A copy of our Annual Report for the year ended December 31, 2004, has been mailed or made available electronically to each stockholder of record on the record date for the meeting. You are urged to read the entire Annual Report.

The entire cost of the solicitation of proxies will be borne by us. Solicitation, commencing on or about March 18, 2005, will be made by use of the mails, telephone and fax and by our regular employees without additional compensation. We have retained Morrow & Co., Inc. to assist in soliciting proxies from stockholders at an estimated cost of $7,500 plus expenses. We will request brokers or other persons holding stock in their names, or in the names of their nominees, to forward proxy material to the beneficial owners of stock or request authority for the execution of the proxies and will reimburse those brokers or other persons for their expense in so doing.

March 1, 2005, has been fixed as the record date for the determination of stockholders entitled to vote at the meeting and at any adjournment or adjournments thereof. The stock transfer books will not be closed. As of the record date, there were 25,675,143 shares of common stock outstanding. Holders of common stock will be entitled to one vote per share on all matters presented to the meeting.

1. MATTERS TO BE CONSIDERED AT THE ANNUAL MEETING

A. ELECTION OF DIRECTORS

(Item 1 on Proxy Card)

The Board of Directors is divided into three classes with the Directors in each class serving for a term of three years. The term of office of one class of Directors expires each year in rotation so that one class is elected at each Annual Meeting for a full three-year term. Directors are permitted to stand for election until they reach the retirement age of 70. Of the Board members standing for election, Mr. William L. Gipson is an officer of the Company.

On January 31, 2005, Mr. Robert L. Lamb retired from the Board following 50 years of dedicated and outstanding service to the Company including 15 years as President and 26 years as a Director. At the opening of business on April 28, 2005, Mr. Melvin F. Chubb, Jr. will retire from the Board following 14 years of committed service to the Company.

During 2004, the Board of Directors held three regular two-day meetings, one regular one-day meeting and two special meetings. At these meetings, the Board considered a wide variety of matters involving, among other things, our strategic planning, proposed new generation, our financial condition and results of operations, our capital and operating budgets, regulatory proceedings, personnel matters, succession planning, risk management, industry issues, accounting practices and disclosure, and corporate governance practices. All of the members of the Board of Directors attended more than 75% of the aggregate of the Board meetings and meetings held by all committees of the Board on which the Director served during the periods that the Director served.

Unless otherwise specified, the persons named in the accompanying proxy intend to vote the shares represented by proxies for the election of Mr. William L. Gipson and Mr. Bill D. Helton, both of whom are current members of the Board of Directors, and Mr. Kenneth R. Allen as Class III Directors. Directors will be elected by a plurality of the votes of the stockholders present in person or represented by proxy at the meeting. Any shares not voted (whether by abstention, broker non-vote or votes withheld) are not counted as votes cast for those individuals and will be excluded from the vote.

While it is not expected that any of the nominees will be unable to qualify for or accept office, if for any reason one or more shall be unable to do so, proxies will be voted for nominees selected by the Board of Directors.

Information about Nominees

The name, age, principal occupation for the last five years, period of service as a Director of Empire and certain other directorships of each Director are set forth below.

NOMINEES FOR DIRECTOR

CLASS III DIRECTORS

Term Expiring at the 2008 Annual Meeting

Kenneth R. Allen, 47, Vice President, Treasurer and Director of Investor Relations of Texas Industries, Inc. (cement, gravel and building products firm) since 1996. Nominated for election at the 2005 Annual Meeting of Stockholders.

William L. Gipson, 48, President and Chief Executive Officer of Empire since May 1, 2002. Executive Vice President from 2001 to 2002. Chief Operating Officer from 2001 to 2002. Vice President — Commercial Operations from 1997 to 2001. Director of Empire since 2002.

Bill D. Helton, 66, Chairman and Chief Executive Officer of New Century Energies (electric utility) until 2000 (retired). Director of Empire since 2004.

2

MEMBERS OF THE BOARD OF DIRECTORS CONTINUING IN OFFICE

CLASS I DIRECTORS

Term Expiring at the 2006 Annual Meeting

D. Randy Laney, 50, Partner of Investlinc Group (private investment and consumer consulting) since 2003. Founder and Partner of Bentonville Associates Ventures (consumer service consulting) from 1995 to 2003. Founder, Chairman and President of Mercari Technologies (merchandizing optimization) from 1999 to 2003. Vice President of Finance and Treasurer of Wal-Mart Stores from 1991 to 1994. Director of Empire since 2003.

Myron W. McKinney, 60, President and Chief Executive Officer of Empire from 1997 to 2002 (retired). Non-executive Chairman of the Board since 2002. Executive Vice President — Commercial Operations of Empire from 1995 to 1997. Executive Vice President of Empire from 1994 to 1995. Vice President — Customer Service of Empire from 1982 to 1994. Director of Empire since 1991.

B. Thomas Mueller, 57, Founder and President of SALOV North America Corporation (Filippo Berio olive oil importer) since 1987 and an international tax partner with KPMG Peat Marwick from 1979 to 1987. Director of Empire since 2003.

Mary M. Posner, 65, President and Principal of Posner McCleary Inc. (international advertising, marketing and financial relations firm). Founder and President of the Memorial Day Weekend Salute to Veterans Corporation. Director of Empire since 1991. Director of United Missouri Bank of Jefferson City, Jefferson City, Missouri. Director of United Missouri Bank of Columbia, Columbia, Missouri.

CLASS II DIRECTORS

Term Expiring at the 2007 Annual Meeting

Ross C. Hartley, 57, Co-Founder and Director of NIC Inc. (electronic commerce) since 1991. Director of Empire since 1988.

Julio S. Leon, 66, President of Missouri Southern State University since 1982. Director of Empire since 2001.

Allan T. Thoms, 66, Consultant with Wilk & Associates/LECG (regulatory advocacy) since 2004. Vice President — Public Policy and External Affairs for Verizon Communication Company from 2001 to 2004. Chairman of the Iowa Utilities Board (the public utility regulator in Iowa) from 1995 to 2001. Director of Empire since 2004. Director of Carlisle Communications Company, Dubuque, Iowa.

Director Compensation

Each Director who is not an officer or full-time employee is paid a monthly retainer for his or her services as a Director at a rate of $22,500 per annum. In addition, a fee of $1,000 ($1,500 for the Audit Committee) is paid to each non-employee Director for each day the Directors meet and for each meeting of a Committee of the Board that the Director attends in person or by telephone. The Chairman of each Committee receives an annual retainer of $5,000 ($7,500 for the Chairman of the Audit Committee) and the Chairman of the Board receives an annual retainer of $50,000.

Our 1996 Stock Incentive Plan permits, and our 2006 Stock Incentive Plan if approved will permit, our Directors to receive shares of Common Stock in lieu of all or a portion of any cash payment for services rendered as a Director. In addition, a Director may defer all or part of any compensation payable for his or her services under the terms of our Deferred Compensation Plan for Directors. Amounts so deferred are credited to an account for the benefit of the Director and accrue an interest equivalent at a rate equal to the prime rate. A Director is entitled to receive all amounts deferred in a number of annual installments following retirement, as elected by him or her.

3

In addition to the cash retainer and fees for non-employee Directors, we maintain a Stock Unit Plan for non-employee Directors, which we refer to as the Stock Unit Plan, to provide Directors the opportunity to accumulate benefits in the form of common stock units. In addition, the Stock Unit Plan provided Directors the opportunity to convert cash retirement benefits earned under our prior cash retirement plan for Directors into common stock units. As of December 31, 2004, all eligible Directors who had benefits under the prior cash retirement plan have converted their cash retirement benefits to common stock units. Each common stock unit earns dividends in the form of common stock units and can be redeemed for one share of common stock upon retirement or death of the Director or, if the amended and restated Stock Unit Plan is approved, on a date elected in advance by the Director with respect to future awards. The number of units granted annually is calculated by dividing the annual contribution rate, which is either the annual retainer fee or such other amount as is established by the Compensation Committee of the Board of Directors, by the fair-market value of our common stock on January 1 of the year the units are granted. Common stock unit dividends are computed based on the fair market value of our common stock on the dividend’s record date. During 2004, 18,663 units were converted to common stock by retired Directors, 13,798 units were granted for services provided in 2004 (based on an annual contribution rate of $25,000), and 3,511 units were granted pursuant to the provisions of the plan providing for the reinvestment of dividends on stock units in additional stock units. An amended and restated Stock Unit Plan (Proposal D) has been proposed, subject to approval by stockholders, to change the focus of the Stock Unit Plan from a retirement plan to an equity compensation plan.

In accordance with Empire’s Corporate Governance Guidelines, Empire encourages Directors to attend education programs relating to the responsibilities of directors of public companies. The expenses for the Directors to attend these courses are paid by Empire. Empire reimburses Directors for expenses incurred in connection with their position as a Director including the reimbursement of expenses for transportation. Empire maintains $250,000 of business travel accident insurance for non-employee Directors while traveling on Empire business.

Director Independence

The Board of Directors has adopted the following categorical standards to assist it in making determinations of independence in accordance with the New York Stock Exchange (the “NYSE”) Listed Company Manual:

| 1. | | A Director shall not fail to meet any of the independence tests set forth in Section 303A.02(b) of the NYSE Listed Company Manual or any successor provisions thereto. |

| 2. | | The Board of Directors shall affirmatively determine that, after taking into account all relevant facts and circumstances, the Director has no material relationships with Empire (either directly or as a partner, stockholder or officer of an organization that has a relationship with Empire). For purposes of this determination, the following relationships are not material (unless otherwise prohibited by clause 1 above): |

| (a) | | If a Director (or any family member of a Director) is a current or former customer, or a current or former employee or Director of a customer (or an affiliate of a customer), of Empire. |

| (b) | | If a Director is a former employee of an organization which provides investment banking services to Empire or which publishes research opinions with respect to any securities of Empire. |

| (c) | | If a family member of a Director is an employee of, or otherwise affiliated with, a charitable organization to which Empire contributes less than $25,000 in any fiscal year. |

| (d) | | If a Director (or any family member of a Director) receives benefits payments under Empire’s Retirement Plan or Empire’s Supplemental Executive Retirement Plan. |

| (e) | | If a Director is an executive officer of an organization which is affiliated with an organization where an executive officer of Empire serves on the board. |

4

The Board of Directors of Empire has determined that each of the following meet the independence standards adopted above: Kenneth R. Allen, Ross C. Hartley, Bill D. Helton, D. Randy Laney, Julio S. Leon, B. Thomas Mueller, Mary M. Posner and Allan T. Thoms. The Board of Directors of Empire has determined that each of the following Directors does not meet the independence standards adopted above: William L. Gipson and Myron W. McKinney. Mr. McKinney will meet these independence standards as of May 1, 2005.

Executive Sessions

After each Board meeting, the terms of our corporate governance guidelines provide that Directors will meet in three separate executive sessions as follows: (1) all of the Directors and the CEO will meet in executive session, with such meeting chaired by the Chairman of the Board, (2) all of the non-management Directors will meet in executive session, with such meeting chaired by the Chairman of the Board and (3) all of the non-management independent Directors will meet in executive session, with such meeting chaired by a non-management independent Director (on a rotating basis in alphabetic order of the non-management independent Directors’ last names).

Committees of the Board of Directors

Audit Committee

We have an Audit Committee of the Board of Directors. The Board has adopted and approved a written charter for the Audit Committee. The charter is available on our website atwww.empiredistrict.com. The Audit Committee meets the definition of an audit committee as set forth in Section 3(a)(58)(A) of the Securities Exchange Act of 1934 (the “Exchange Act”).

In accordance with its written charter, the Audit Committee assists the Board in its oversight of (1) the integrity of our financial statements, (2) our compliance with legal and regulatory requirements, (3) the independent auditors’ qualification and independence and (4) the performance of our internal audit function and independent auditors. In addition, the Audit Committee is directly responsible for the appointment, compensation, retention, termination and oversight of the work of our independent auditors. The Audit Committee held nine meetings during 2004. The members of the Audit Committee are Ms. Posner and Messrs. Chubb, Hartley, Laney and Mueller, each of whom is independent (as independence is defined in the NYSE Listing Standards and the rules of the Securities and Exchange Commission (the “SEC”) applicable to audit committee members and is financially literate (as determined by the Board in its business judgment in accordance with NYSE Listing Standards)). Mr. Chubb will retire from the Board and the Audit Committee at the opening of business on April 28, 2005. The Board has determined that Messrs. Laney and Mueller are “audit committee financial experts” (as defined in Item 401(h) of Regulation S-K). The report of the Audit Committee can be found below under the heading “Other Matters — Audit Committee Report.”

Compensation Committee and Compensation Committee Interlocks and Insider Participation

We have a Compensation Committee of the Board of Directors. The Compensation Committee assists the Board in establishing and overseeing director and executive officer compensation policies and practices of Empire on behalf of the Board. The Compensation Committee determines the compensation of each of our executive officers. The charter for the Compensation Committee is available on our website atwww.empiredistrict.com. The Compensation Committee held three meetings during 2004. The members of our Compensation Committee are Ms. Posner and Messrs. Helton, Leon and Laney. Prior to his retirement from the Board on January 31, 2005, Mr. Lamb was also a member of the Compensation Committee. The Board has determined that each member of the Compensation Committee is “independent” as defined by the NYSE Listing Standards. The report of the Compensation Committee can be found below under the heading “Executive Compensation — Compensation Committee Report on Executive Compensation.”

5

With the retirement of Mr. Lamb, none of the members of our Compensation Committee has ever been an officer or employee of Empire or any of its subsidiaries. None of our current executive officers has ever served as a Director or member of the Compensation Committee (or other Board committee performing equivalent functions) of another for-profit corporation.

Nominating/Corporate Governance Committee

We have a Nominating/Corporate Governance Committee of the Board of Directors. The Nominating/Corporate Governance Committee is primarily responsible for (1) identifying individuals qualified to become Board members, consistent with criteria approved by the Board, and recommending that the Board select (or re-nominate) the Director nominees for the next annual meeting of stockholders, (2) developing and recommending to the Board a set of corporate governance guidelines applicable to the Company, (3) overseeing the evaluation of the Board and its committees, (4) annually reviewing and recommending Board committee membership, and (5) working with the Board to evaluate and/or nominate potential successors to the CEO. The charter for the Nominating/Corporate Governance Committee is available on our website atwww.empiredistrict.com. The Committee held seven meetings in 2004. The members of the Committee are Messrs. Chubb, Leon, Mueller and Thoms. Mr. Chubb will retire from the Board and the Nominating/Corporate Governance Committee at the opening of business on April 28, 2005. The Board has determined that each member of the Nominating/Corporate Governance Committee is “independent” as defined by the NYSE Listing Standards. The report of the Nominating/Corporate Governance Committee can be found below under the heading “Nominating/Corporate Governance Committee Report.”

Director Nomination Process

The Nominating/Corporate Governance Committee selects as candidates those nominees who it believes would best represent the interests of the stockholders. This assessment includes such issues as experience, integrity, competence, diversity, skills and dedication in the context of the needs of the Board. In addition, the Committee takes into account the nature of and time involved in the Director’s other employment and service on other boards. The Committee reviews with the Board, as required, the requisite skills and characteristics of individual Board members, as well as the composition of the Board as a whole, in the context of the needs of Empire. When seeking new candidates, the Committee has sometimes paid a fee to a third party to assist in the process of identifying and evaluating candidates.

The Nominating/Corporate Governance Committee will consider nominees recommended by stockholders for election to the Board of Directors. In order to be considered, proposals for nominees for director by stockholders must be submitted in writing to Secretary, The Empire District Electric Company, 602 Joplin Street, Joplin, Missouri 64801.

In order to nominate a director at the Annual Meeting, Empire’s By-Laws require that a stockholder follow the procedures set forth in Article VI, Section 5 of Empire’s Restated Articles of Incorporation. In order to recommend a nominee for a director position, a stockholder must be a stockholder of record at the time it gives notice of recommendation and must be entitled to vote for the election of directors at the meeting at which such nominee will be considered. Stockholder recommendations must be made pursuant to written notice delivered (i) in the case of a nomination for election at an annual meeting, not less than 35 days nor more than 60 days prior to the annual meeting; and (ii) in the event that less than 45 days notice or prior public disclosure of the date of the meeting is given or made to stockholders, notice by the stockholder to be timely must be received not later than the close of business on the tenth day following the day on which notice of the date of the meeting was mailed or the public disclosure was made.

6

The stockholder notice must set forth the following:

| · | | As to each person the stockholder proposes to nominate for election or re-election as a director, all information relating to such person that is required to be disclosed in solicitation of proxies for the election of directors, or is otherwise required by applicable law (including the person’s written consent to being named as a nominee and to serving as a director if elected), and |

| · | | As to the nominating stockholder on whose behalf the nomination is made, (a) the name and address, as they appear on Empire’s books, (b) a representation that the stockholder is a holder of record of the common stock entitled to vote at the meeting on the date of the notice and intends to appear in person or by proxy at the meeting to nominate the person or persons specified in the notice, and (c) a description of all arrangements or understandings between the stockholder and each nominee and any other person or persons (naming such person or persons) pursuant to which the nomination or nominations are to be made by the stockholder. |

In addition to complying with the foregoing procedures, any stockholder nominating a director must also comply with all applicable requirements of the Exchange Act and the rules and regulations thereunder. We did not receive any complying recommendations for director nominees for the current Annual Meeting of Stockholders by any of our stockholders.

Nominating/Corporate Governance Committee Report

The Nominating/Corporate Governance Committee, with the assistance of a third-party search firm, recommended that the Board nominate Bill D. Helton for election as a Class III Director. Mr. Helton was appointed as a Class III Director effective August 1, 2004. The Nominating/Corporate Governance Committee, with the assistance of a third-party search firm, recommended that the Board nominate Kenneth R. Allen for election as a Class III Director. Mr. Helton and Mr. Allen have been nominated as Class III Directors, subject to stockholder approval, for three-year terms ending at the Annual Meeting of Stockholders in 2008.

The Nominating/Corporate Governance Committee, upon its own recommendation, recommended that the Board nominate William L. Gipson for re-election as a Class III Director, subject to stockholder approval, for a three-year term ending at the Annual Meeting of Stockholders in 2008.

Melvin F. Chubb, Jr., Chairman

Julio S. Leon

B. Thomas Mueller

Allan T. Thoms

Attendance at Annual Meetings

Empire’s Corporate Governance Guidelines provide that directors are expected to attend the annual meeting of stockholders. All members of Empire’s Board of Directors attended the Annual Meeting of Stockholders in 2004.

7

Stock Ownership of Directors and Officers

The following table shows information with respect to the number of shares of our common stock beneficially owned as of March 1, 2005 by each of our executive officers named in the Summary Compensation Table, each Director and our Directors and executive officers as a group. The shares reported as beneficially owned include (a) shares owned by certain relatives with whom the Directors or officers are presumed, for proxy statement reporting purposes, to share voting or investment power and (b) shares accrued for the benefit of certain officers under certain of our employee benefit plans.

Name

| | | | Position

| | Shares of Common

Stock Beneficially

Owned (1)

|

|---|

| Myron W. McKinney | | | | Chairman of the Board | | | 31,914 | |

| Kenneth R. Allen (2) | | | | Director nominee | | | 3,600 | |

| Melvin F. Chubb, Jr. (3) | | | | Director | | | 14,134 | |

| Ross C. Hartley | | | | Director | | | 20,428 | |

| Bill D. Helton | | | | Director | | | 1,000 | |

| D. Randy Laney | | | | Director | | | 500 | |

| Julio S. Leon | | | | Director | | | 1,862 | |

| B. Thomas Mueller | | | | Director | | | 539 | |

| Mary M. Posner | | | | Director | | | 12,303 | |

| Allan T. Thoms | | | | Director | | | 220 | |

| William L. Gipson | | | | President and Chief Executive Officer | | | 25,750 | |

| Bradley P. Beecher | | | | Vice President — Energy Supply | | | 4,482 | |

| David W. Gibson | | | | Vice President — Regulatory and General Services | | | 7,660 | |

| Gregory A. Knapp | | | | Vice President — Finance and Chief Financial Officer | | | 4,807 | |

| Michael E. Palmer | | | | Vice President — Commercial Operations | | | 2,469 | |

| Directors and named executive officers, as a group | | 131,668 | |

| (1) | | No Director or executive officer owns more than 0.5% of the outstanding shares of our common stock and all Directors and executive officers as a group own less than 1% of the outstanding shares of our common stock. |

| (2) | | Mr. Allen is standing for election as a Class III Director to replace Mr. Chubb on the Board. |

| (3) | | Mr. Chubb will retire as a Director effective April 28, 2005. |

Other Stock Ownership

No person known to us owns beneficially more than 5% of our common stock.

8

EXECUTIVE COMPENSATION

Set forth below is information concerning the various forms of compensation of each person who was (i) at any time during 2004 our Chief Executive Officer or (ii) at December 31, 2004, one of our four most highly compensated executive officers, other than the Chief Executive Officer.

Summary Compensation Table

| |

| | Annual Compensation

| | Long-Term

Compensation

Awards — Securities

Underlying

Options (1)

| | All Other

Compensation (2)

|

|---|

Name and Principal Position

| | Year

| | Salary

| | Bonus

| | Other Annual

Compensation

| | |

|---|

William L. Gipson, 48

President and Chief

Executive Officer | | | 2004

2003

2002 | | | $ | 300,000

275,000

221,925 | | | $ | 49,088

114,450

87,234 | | | | —

—

— | | | | 31,600

28,900

20,800 | | | | $5,788

5,335

8,887 | |

| Bradley P. Beecher, 39

Vice President — Energy

Supply | | | 2004

2003

2002 | | | | 153,000

134,000

121,500 | | | | 21,882

27,598

24,532 | | | | —

—

— | | | | 4,900

4,300

3,700 | | | | 5,367

6,447

3,825 | |

| David W. Gibson, 59

Vice President — Regulatory &

General Services | | | 2004

2003

2002 | | | | 132,000

128,000

118,000 | | | | 10,207

28,224

18,957 | | | | —

—

— | | | | 4,200

4,100

3,600 | | | | 6,063

9,730

4,710 | |

| Gregory A. Knapp, 53

Vice President —

Finance and

Chief Financial Officer | | | 2004

2003

2002 | | | | 141,000

118,000

101,000 | | | | 24,874

23,381

20,120 | | | | —

—

— | | | | 4,500

3,800

3,000 | | | | 7,597

4,153

2,247 | |

| Michael E. Palmer, 48

Vice President —

Commercial Operations | | | 2004

2003

2002 | | | | 149,000

132,000

121,500 | | | | 12,214

17,364

19,046 | | | | —

—

— | | | | 4,800

4,200

3,700 | | | | 6,831

6,786

3,870 | |

| (1) | | Set forth below is information concerning individual grants of stock options made under our 1996 Stock Incentive Plan to each of the named executive officers. |

| (2) | | Included for 2004: (a) our matching contributions under our 401(k) Retirement Plan in the amounts of $2,732, $4,738, $3,954, $4,358 and $4,617 for Messrs. Gipson, Beecher, Gibson, Knapp and Palmer, respectively, (b) our payments of premiums for term life insurance on behalf of Messrs. Gipson, Beecher, Gibson, Knapp and Palmer in the amounts of $887, $386, $1,585, $277 and $626, respectively and (c) our payments on behalf of Messrs. Gipson, Beecher, Gibson, Knapp and Palmer for executive physicals in the amounts of $2,169, $243, $524, $2,962 and $1,588, respectively. |

9

Option Grants in 2004

| | Individual Grants (1)

| | Exercise or

Base Price

($/Share)

| | Expiration

Date

| | Potential Realizable Value at

Assumed Annual Rates of

Stock Price Appreciation for

Option Term

|

|---|

| | Number of

Securities

Underlying

Options

Granted (#)

| | Percent of

Total Options

Granted to

Employees in 2004

| | | |

|---|

Name

| 5% ($)

| | 10% ($)

|

|---|

| William L. Gipson | | | 31,600 | | | | 58.3 | % | | $ | 21.79 | | | | 01/28/2014 | | | $ | 433,034 | | | $ | 1,097,394 | |

| Bradley P. Beecher | | | 4,900 | | | | 9.0 | % | | $ | 21.79 | | | | 01/28/2014 | | | $ | 67,148 | | | $ | 170,165 | |

| David W. Gibson | | | 4,200 | | | | 7.8 | % | | $ | 21.79 | | | | 01/28/2014 | | | $ | 57,555 | | | $ | 145,856 | |

| Gregory A. Knapp | | | 4,500 | | | | 8.3 | % | | $ | 21.79 | | | | 01/28/2014 | | | $ | 61,666 | | | $ | 156,274 | |

| Michael E. Palmer | | | 4,800 | | | | 8.9 | % | | $ | 21.79 | | | | 01/28/2014 | | | $ | 65,777 | | | $ | 166,693 | |

| (1) | | These options have a ten-year term and first become exercisable on the third anniversary of the grant date provided the named executive officer remains in employment until that date, but subject to accelerated vesting in the event of a change in control of Empire or termination of employment under certain specified circumstances. The stock options granted to the Chief Executive Officer in 2004 were designed to have a value equal to 50% of his annual rate of base salary (as determined at the beginning of the year). For each of the other executive officers, the stock option grants in 2004 were designed to have a value equal to 15% of the executive’s base salary. The stock options were valued on the basis of an expanded Black-Scholes model provided by a management consulting firm. All options granted in 2004 were granted with dividend equivalent rights. |

Set forth below is information concerning each exercise of stock options during 2004 by each of the named executive officers and the value of unexercised options at December 31, 2004.

Aggregated Option Exercises in 2004 and Values at December 31, 2004

| | Shares

Acquired on

Exercise (#)

| | Value

Realized

($)

| | Number of Securities Underlying

Unexercised Options at

December 31, 2004 (#)

| | Value of Unexercised

In-the-Money Options at

December 31, 2004 ($) (1)

|

|---|

Name

| | | | Exercisable/Unexercisable

| | Exercisable/Unexercisable

|

|---|

| William L. Gipson | | | 0 | | | | 0 | | | | 0 / 81,300 | | | | 0 / $386,439 | |

| Bradley P. Beecher | | | 0 | | | | 0 | | | | 0 / 12,900 | | | | 0 / $ 61,299 | |

| David W. Gibson | | | 0 | | | | 0 | | | | 0 / 11,900 | | | | 0 / $ 57,825 | |

| Gregory A. Knapp | | | 0 | | | | 0 | | | | 0 / 11,300 | | | | 0 / $ 53,037 | |

| Michael E. Palmer | | | 0 | | | | 0 | | | | 0 / 12,700 | | | | 0 / $ 60,383 | |

| (1) | | Includes the value of the accumulated dividend equivalent rights as of December 31, 2004. |

Set forth below is information concerning long-term performance-based awards granted in 2004 under our 1996 Stock Incentive Plan to each of the named executive officers.

Long-Term Incentive Plans — Awards in 2004

| | Number of

Shares, Units

or Other

Rights (1)

| | Performance or Other

Period Until

Maturation or Payout

| | Estimated Future Payouts Under Non-Stock

Price-Based Plans

|

|---|

Name

| | | | Threshold

(# of Shares)

| | Target

(# of Shares)

| | Maximum

(# of Shares)

|

|---|

| William L. Gipson | | | 7,600 | | | | 3 | years | | | 3,800 | | | | 7,600 | | | | 15,200 | |

| Bradley P. Beecher | | | 1,200 | | | | 3 | years | | | 600 | | | | 1,200 | | | | 2,400 | |

| David W. Gibson | | | 1,000 | | | | 3 | years | | | 500 | | | | 1,000 | | | | 2,000 | |

| Gregory A. Knapp | | | 1,100 | | | | 3 | years | | | 550 | | | | 1,100 | | | | 2,200 | |

| Michael E. Palmer | | | 1,200 | | | | 3 | years | | | 600 | | | | 1,200 | | | | 2,400 | |

| (1) | | The performance-based restricted stock award granted to Mr. Gipson in 2004 was designed to have a value equal to 50% of his annual rate of base salary at the target level of performance (as determined at the |

10

| | beginning of the year). For each of the other named executive officers, the performance-based restricted stock awards in 2004 were designed to have a value equal to 15% of the executive’s base salary at the target level of performance. The value of the performance-based restricted stock awards was determined on the basis of a model provided by a management consulting firm. |

Retirement Plans

We maintain a Retirement Plan covering substantially all of our employees. The Retirement Plan is a noncontributory, trusteed pension plan designed to meet the requirements of Section 401(a) of the Internal Revenue Code. Each covered employee is eligible for retirement at normal retirement date (age 65), with early retirement permitted under certain conditions. We also maintain a Supplemental Executive Retirement Plan which covers our officers who are participants in the Retirement Plan. This Plan is intended to provide benefits which, except for the application of the limits of Section 415 and Section 401(a)(17) of the Internal Revenue Code, would have been payable under the Retirement Plan. This Plan is not qualified under the Internal Revenue Code and benefits payable under the plan are paid out of our general funds.

The following table shows estimated maximum annual benefits payable following retirement (assuming payments on a normal life annuity basis and not including any survivor benefit) to an employee in specified remuneration and Years of Credited Service classifications. These amounts are based on assumed average annual earnings in the years preceding retirement and retirement at a normal retirement age of 65 and are approximated without consideration of any reduction which would result from various options which may be elected prior to actual retirement. Only that portion of the Pension Plan Table which is reasonably likely to be applicable to our named executive officers has been reproduced in this proxy statement.

Pension Plan Table

Average Annual

Earnings (1)

| | Years of Credited Service (2)

|

|---|

| | 15 Years

| | 20 Years

| | 25 Years

| | 30 Years

| | 35 Years

| | 40 Years

|

|---|

| $ 125,000 | | $ | 27,938 | | | $ | 37,250 | | | $ | 46,563 | | | $ | 55,875 | | | $ | 65,188 | | | $ | 75,344 | |

| 150,000 | | | 34,032 | | | | 45,375 | | | | 56,719 | | | | 68,063 | | | | 79,407 | | | | 91,595 | |

| 175,000 | | | 40,126 | | | | 53,500 | | | | 66,876 | | | | 80,250 | | | | 93,626 | | | | 107,845 | |

| 200,000 | | | 46,219 | | | | 61,625 | | | | 77,032 | | | | 92,438 | | | | 107,844 | | | | 124,094 | |

| 225,000 | | | 52,313 | | | | 69,750 | | | | 87,188 | | | | 104,625 | | | | 122,063 | | | | 140,344 | |

| 250,000 | | | 58,407 | | | | 77,875 | | | | 97,344 | | | | 116,813 | | | | 136,282 | | | | 156,595 | |

| 275,000 | | | 64,501 | | | | 86,000 | | | | 107,501 | | | | 129,000 | | | | 150,501 | | | | 172,845 | |

| 300,000 | | | 70,594 | | | | 94,125 | | | | 117,657 | | | | 141,188 | | | | 164,719 | | | | 189,094 | |

| 325,000 | | | 76,688 | | | | 102,250 | | | | 127,813 | | | | 153,375 | | | | 178,938 | | | | 205,344 | |

| 350,000 | | | 82,782 | | | | 110,375 | | | | 137,969 | | | | 165,563 | | | | 193,157 | | | | 221,595 | |

| 375,000 | | | 88,876 | | | | 118,500 | | | | 148,126 | | | | 177,750 | | | | 207,376 | | | | 237,845 | |

| 400,000 | | | 94,969 | | | | 126,625 | | | | 158,282 | | | | 189,938 | | | | 221,594 | | | | 254,094 | |

| (1) | | “Average Annual Earnings” is the average annual compensation over the five consecutive years within the ten-year period prior to termination of employment which produces the highest average. The compensation used to calculate this average for a salaried employee is the aggregate of the employee’s annual compensation, which generally corresponds with the employee’s salary and incentive compensation. The earnings of Messrs. Gipson, Beecher, Gibson, Knapp and Palmer covered by the Plans correspond substantially to such amounts shown for them in the Summary Compensation Table. |

| (2) | | As of December 31, 2004, Messrs. Gipson, Beecher, Gibson, Knapp and Palmer had accrued 23, 15, 25, 25 and 18 Years of Credited Service, respectively, under the Retirement Plan and the Supplemental Executive Retirement Plan. |

11

Severance Pay Plan

We have a Change of Control Severance Pay Plan, referred to as the Severance Plan, which provides certain key employees with severance benefits following a change in control of Empire. A change in control generally includes: (i) specified events relating to the continued existence of Empire in its current form, (ii) an acquisition by any person of 25% or more of the securities entitled to vote in the election of Directors or (iii) the current Directors, or their approved successors, no longer constitute a majority of the Board of Directors. All of our executive officers and some of our senior managers were selected by the Compensation Committee of the Board of Directors to enter into one-year agreements pursuant to the Severance Plan, which are automatically extended for one-year terms unless we have given prior notice of termination.

A participant in the Severance Plan is entitled to receive specified benefits in the event of certain involuntary terminations of employment (including terminations by the employee following specified changes in duties, benefits, etc., that are treated as involuntary terminations) occurring within three years after a change in control, or a voluntary termination of employment occurring during a period of twelve to eighteen months after a change in control.

Under the Plan, an executive officer participant would be entitled to receive benefits of three times such participant’s annual compensation. A participant who is not an executive officer would receive approximately two weeks of severance compensation for each full year of employment with us, with a minimum of seventeen weeks. Payments to participants resulting from involuntary terminations are to be paid in a lump sum within 30 days following termination, while payments resulting from voluntary termination are paid in monthly installments and cease if the participant becomes otherwise employed. In addition, all restricted stock held by a participant vests upon voluntary or involuntary termination after a change of control. Also, participants who qualify for payments under the Severance Plan will continue to receive benefits for a specified period of time under health, insurance and our other employee benefit plans in existence at the time of the change in control. If any payments are subject to the excise tax on “excess parachute payments” under Section 4999 of the Internal Revenue Code, executive officer participants are also entitled to an additional amount essentially designed to put them in the same after-tax position as if this excise tax had not been imposed.

Compensation Committee Report on Executive Compensation

Our executive compensation policies are designed to enable us to attract and retain high caliber individuals for key positions while at the same time linking their compensation to the interests of our stockholders, our financial performance and their own performance. This is accomplished by dividing executive compensation into four components: a base salary and three types of incentive compensation. These three types of incentive compensation consist of a cash annual incentive award tied to performance measured against predetermined short-term tactical goals, stock options coupled with dividend equivalent rights, and restricted stock with an earn-out feature tied to our performance. In no event will any incentive compensation be awarded unless we pay dividends per share of common stock at least equal to the dividends per share paid in the preceding year.

The total compensation package for executive officers has been set at levels designed to be competitive with other companies in our peer group. For 2004 and 2005, the total compensation package for each executive officer was targeted (or is targeted, in the case of 2005) so as to place the executive officer within the 37th to 50th percentile range when compared to a peer group of companies assuming performance at target levels by the executive officer and the Company (with the 100th percentile representing the highest level of total compensation). The companies in the peer group are for the most part either electric or electric and gas utilities.

The base salary of each executive officer is set at the beginning of the calendar year (and adjusted, if necessary, upon a change in office or responsibilities) by the Committee. For 2004, the mid-point base salary for each executive officer position was set at the 25th percentile for the applicable position for our peer group as established in a study prepared by a management consulting firm (with the 100th percentile representing the highest level of base salary). Adjustments were made to this mid-point base salary level to reflect the executive’s experience and performance. For 2005, base salaries for all executive officers were held at the same levels as in 2004.

12

Our annual incentive plan is the short-term component of our incentive compensation package. Under this plan, executive officers can earn additional compensation based on their performance measured against annual tactical goals. The specific tactical goals for each executive for each calendar year and the weight to be attached to each goal are established at the beginning of the calendar year and are geared to the particular executive’s responsibilities. Examples of the performance measures utilized under the annual incentive plan for the award with respect to 2004 (paid in early 2005) and for the award to be made with respect to 2005 (payable in 2006) include expense control, regulatory performance, project completion, financial performance, and customer service. Threshold, target and maximum performance levels are set for each performance measure. For executives to receive any incentive compensation based on any particular performance measure, at least the threshold level of performance must have been achieved. Greater incentive compensation is payable under the annual incentive plan if the target or maximum performance is achieved. If the target level objective is reached in each of the executive officer’s performance areas, the executive officer would receive the target annual incentive award established for that executive. In the case of the award for 2004 (paid in early 2005) and the award for 2005 (payable in early 2006), the target annual incentive award was set at 35% of base salary for the Chief Executive Officer and was set at 15% of base salary for all other officers. The award under the annual incentive plan is paid in cash.

The other two types of incentive compensation — stock options and performance-based restricted stock — are intended to motivate executive officers over the long-term to respond to our business opportunities and challenges in furtherance of the interests of our stockholders and to align the interests of the executive officers with those of our stockholders. The stock options are intended to represent approximately one-half of the total value of each executive’s long-term incentive opportunity with the performance-based restricted stock representing the remaining one-half.

The stock options granted in 2004 and 2005 to executive officers enable the executives to purchase shares of our common stock at an option price equal to the average value of our common stock on the grant date. These options have a ten-year term and first become exercisable on the third anniversary of the grant date provided the executive remains employed until that date, but subject to accelerated vesting in the event of a change in control of Empire or termination of employment under certain specified circumstances. Dividend equivalents were also awarded in 2004 and 2005 in conjunction with each stock option grant. Under these dividend equivalent awards, the dividends that would have been payable if the executive owned the shares covered by the related options are accumulated for the three-year period until the option becomes exercisable and are then converted into restricted shares of our common stock issued under our stock incentive plan equivalent in value to the accumulated dividends. Such restricted shares vest on the eighth anniversary of the grant of the dividend equivalent or earlier upon exercise of the related stock option in full or a change in control of Empire. The restricted shares are subject to forfeiture if the related option terminates without having been exercised in full prior to the vesting of the restricted shares.

The stock options granted to the Chief Executive Officer in 2004 and 2005 were designed to have a value equal to 50% of his annual rate of base salary (as determined at the beginning of the year). For each of the other executive officers, the stock option grants in 2004 and 2005 were designed to have a value equal to 15% of the executive’s base salary. The stock options were valued on the basis of an expanded Black-Scholes model provided by a management consulting firm.

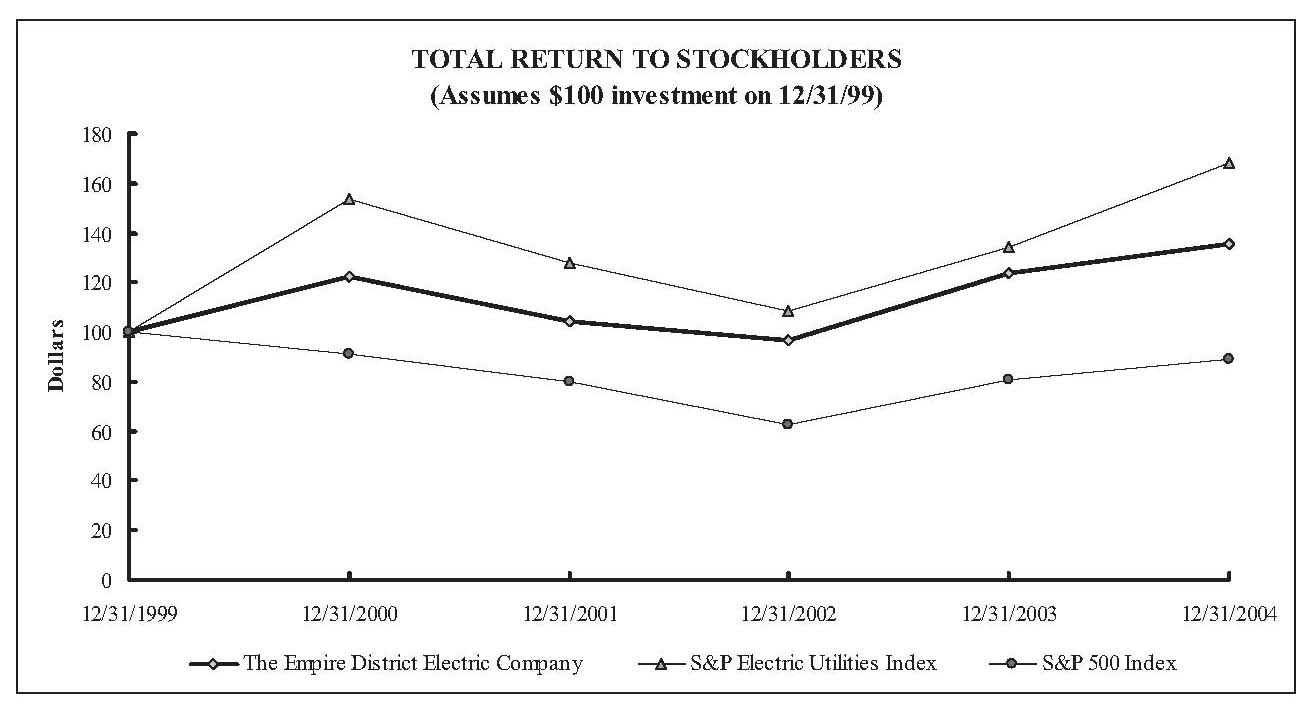

The performance-based restricted stock awards granted to executive officers in 2004 and 2005 provide the executive with the opportunity to receive a number of shares of our common stock at the end of a three-year performance period if performance goals set forth in the award are satisfied. The performance goals are tied to the percentile ranking of our total stockholder return (share price appreciation or decline plus dividends paid) for the three-year performance period as measured against a pre-selected peer group of companies for the same period. The threshold level of performance under the 2004 and 2005 grants was set at the 20th percentile level of the peer group, target at the 50th percentile level, and maximum at the 80th percentile level. The executive would earn at the end of the performance period (December 31, 2006 in the case of awards made in 2004 or December 31, 2007 in the case of awards made in 2005) 100% of the target number of shares if the target level of performance is reached, 50% if the threshold is reached, and 200% if the percentile ranking is at or above the maximum, with

13

the number of shares interpolated between these levels. However, no shares would be payable if the threshold is not reached. The performance-based restricted stock awards are subject to forfeiture if the executive’s employment terminates, except under certain specified circumstances the executive might be entitled to a pro-rata portion of the shares that the executive would otherwise have earned. Earned shares are distributed after the end of the performance period (i.e., in early 2007 in the case of the award made in 2004 and early 2008 in the case of the award made in 2005).

The performance-based restricted stock awards granted to the Chief Executive Officer in 2004 and 2005 were designed to have a value equal to 50% of his annual rate of base salary at the target level of performance (as determined at the beginning of the year). For each of the other executives, the performance-based restricted stock awards in 2004 and 2005 were designed to have a value equal to 15% of the executive’s base salary at the target level of performance. The value of the performance-based restricted stock awards was determined on the basis of a model provided by a management consulting firm.

Regardless of the extent to which performance goals are met in any calendar year, no incentive compensation is provided to any executive for any year in which we do not pay dividends per share of common stock at least equal to the dividends per share paid in the preceding year. Thus, if the dividend had been reduced in 2004 compared to 2003, no annual incentive compensation awards would have been payable in 2005 with respect to 2004 performance and no grants of stock options or performance-based restricted stock would be made in 2005. This restriction did not come into play because the dividends paid in 2004 on each share of our common stock were equal to those paid in 2003.

The compensation of our Chief Executive Officer was determined in accordance with the policies discussed in this report. For 2004, the base salary paid to Mr. Gipson was $300,000. As a result of the level of attainment of performance goals, Mr. Gipson received an award of $49,088 for 2004 (paid in 2005) under our annual incentive plan. During 2004, Mr. Gipson was granted options to purchase 31,600 shares of our common stock. The option price per share under these options is $21.79, which was the average value of our common stock on the date of grant. In addition, during 2004, Mr. Gipson was awarded 7,600 shares (at target) of performance-based restricted stock. The terms of the stock options and performance-based restricted stock were consistent with the description of these types of awards provided above in this report.

On February 2, 2005, the Compensation Committee, based upon the analysis and recommendation of its consulting firm, concluded the percentile ranking of our total stockholder return (share price appreciation or decline plus dividends paid) measured against a peer group for the performance-based restricted stock awards made in during 2002 was 37.1%. Under the terms of the plan, our Chief Executive Officer was awarded 4,396 shares of our common stock.

Based on our current level of executive compensation, the Committee does not believe it is necessary to adopt a policy with respect to Section 162(m) of the Internal Revenue Code at this time.

D. Randy Laney, Chairman

Bill D. Helton

Julio S. Leon

Mary M. Posner

B. PROPOSAL TO AMEND THE COMPANY’S EMPLOYEE STOCK PURCHASE PLAN

(Item 2 on Proxy Card)

We have offered participation in the Employee Stock Purchase Plan (the “ESPP”) to employees and officers of Empire since 1970. Since that time forty-three purchase periods have been approved which continue in effect through May 31, 2013. In the thirty-four completed purchase periods, almost 1.1 million shares have been purchased by employees.

On February 3, 2005, the Board of Directors amended the ESPP, subject to stockholder approval, to reserve an additional 500,000 shares for offering and purchase under the ESPP and to allow shares to be issued through book entry form rather than through a physical certificate.

14

This summary is qualified in its entirety by the full text of the ESPP, which is attached to this Proxy Statement as Appendix A.

Purpose of the Plan

The Board of Directors believes that the ESPP provides employees with a favorable opportunity to acquire a proprietary interest in Empire through the purchase of common stock and provides employees with an added incentive to continue in employment with Empire and to promote its welfare. Purchases under the ESPP are made without any fee, commission or charge payable by participants, other than the purchase price. The purchase price reflects a 10% discount from prevailing market prices for participants.

Summary of the ESPP

Description of the ESPP

The first purchase period began on June 1, 1970 and ended on May 31, 1971, with each June 1st thereafter beginning a new one-year purchase period (the “Purchase Period”). The price per share at which shares of common stock are purchased under the ESPP in any Purchase Period is 90% of the lower of the closing price on the first and last trading days of the Purchase Period. An employee may enter into the ESPP only as of the beginning of a Purchase Period. If an individual becomes an employee after the beginning of a Purchase Period, he or she may not enter into the ESPP until the beginning of the next Purchase Period.

At the beginning of a Purchase Period, participants elect the number of shares of common stock which they wish to purchase in the period, but the election does not become binding until the day prior to the end of the Purchase Period. Throughout the Purchase Period, amounts are deducted from the participant’s payroll and credited to the participant’s account to provide funds for the purchase of shares at the end of the Purchase Period. At the end of the Purchase Period, the amount credited to the participant’s account through these payroll deductions and interest (5% per annum on the amounts deducted) is used to purchase the shares as elected by the participant. Any amounts left over in the accounts of participants at the end of a Purchase Period are refunded to the participants. Payroll deductions may not be less than 2% nor more than 20% of a participant’s base pay. Participants may not make direct cash payments to their accounts nor purchase more shares than elected at the beginning of the Purchase Period.

The ESPP qualifies as an employee stock purchase plan within the meaning of Section 423(b) of the Internal Revenue Code.

Administration

We make no cash contributions to the ESPP, but bear the expense of administering the ESPP. The ESPP is currently administered by the Secretary-Treasurer of Empire who has the authority to make rulings and interpretations.

The purchase price of each share is received by us and is used for general corporate purposes.

Eligibility and Participation

All regular full-time employees of Empire and its subsidiaries, and employees whose customary employment is for more than five months in any calendar year or 20 hours per week, are eligible to participate in the ESPP.

Participation in the ESPP is voluntary and participants may withdraw at any time or terminate their authorization to purchase shares of common stock except on the date on which common stock is being purchased under the ESPP. Participants who have withdrawn from the ESPP may rejoin it at the beginning of any future Purchase Period.

No employee may purchase stock through the ESPP having a fair market value of more than $25,000 per Purchase Period (determined at the beginning of the Purchase Period). A participant may not transfer, pledge or assign his or her rights under the ESPP.

15

Adjustments

The purchase price of subscribed shares, the number of shares elected to be purchased and the maximum number of shares which may be issued under the ESPP, will be proportionately increased or decreased in the event of a stock split, a stock dividend, or a combination or consolidation of the common stock into a lesser number of shares.

Shares Available for Awards

As of December 31, 2004, the maximum number of shares of stock which may be purchased under the ESPP is 1,162,175 shares of which 1,061,222 shares have already been purchased by Empire employees. The additional 500,000 shares approved by the Board of Directors, subject to stockholder approval, will increase the maximum number of shares of stock which may be purchased under the ESPP to 1,662,175 shares.

Termination, Suspension and Modification

The Board of Directors may, at any time, terminate, suspend or amend the ESPP. The authority of the Board of Directors has been limited so that it may not amend the ESPP to increase the maximum number of shares to be issued without the approval of stockholders.

Future Plan Benefits

The shares of stock, if any, that an individual may elect to purchase under the ESPP is at the discretion of the employee subject to the limitations imposed by the ESPP and therefore cannot be determined in advance.

Federal Income Tax Consequences

The following discussion summarizes the material federal income tax consequences of participation in the ESPP. This discussion is general in nature and does not address issues related to the tax circumstances of any particular employee. The discussion is based on federal income tax laws in effect on the date hereof and is, therefore, subject to possible future changes in law. This discussion does not address state, local or foreign tax consequences.

An employee will not recognize any income upon the commencement of a Purchase Period nor upon the purchase of shares at the end of a Purchase Period. However, an employee will be taxed on any interest credited to his or her account in the year in which it is so credited. The treatment of any gain realized upon sale or other disposition of our common stock purchased under the ESPP will depend on the holding period. If the employee does not dispose of the stock received until more than one year after the purchase and more than two years after the beginning of the Purchase Period, or if the employee dies without having disposed of the shares, the employee will recognize ordinary income in the year of disposition or death equal to the lesser of (1) the amount by which the fair market value of the shares on the date of disposition or death exceeded the purchase price paid for the shares, or (2) the amount by which the fair market value of the shares on the first day of the Purchase Period in which the shares were acquired exceeded the purchase price paid for the shares. Any additional gain on disposition will be taxed as long-term capital gain. If the employee disposes of his or her shares within one year after the purchase or within two years after the beginning of the Purchase Period, such disposition will be a disqualifying disposition. In the case of the disqualifying disposition, the portion of the gain realized on disposition equal to the excess of the fair market value of the shares at the time the shares were purchased over the purchase price will be ordinary income taxable as compensation in the year of disposition. The balance, if any, of the gain will be capital gain.

We are entitled to a deduction with respect to a share purchased under the ESPP only if a disqualifying disposition occurs. In that event, the deduction would be available in the taxable year of the Company in which the disqualifying disposition occurs and would generally be equal to the ordinary income, if any, recognized by the employee upon disposition of the shares.

THE BOARD HAS APPROVED AN AMENDMENT TO THE EMPLOYEE STOCK PURCHASE PLAN AND BELIEVES THAT IT IS FAIR TO, AND IN THE BEST INTERESTS OF, THE COMPANY AND ITS STOCKHOLDERS. THE BOARD RECOMMENDS THAT STOCKHOLDERS VOTE “FOR” PROPOSAL B.

16

C. PROPOSAL TO APPROVE THE ADOPTION OF THE COMPANY’S

2006 STOCK INCENTIVE PLAN

(Item 3 on Proxy Card)

We currently maintain a 1996 Stock Incentive Plan (the “1996 Plan”), which was approved by our stockholders in 1995 and which was designed to enable qualified executive, managerial, supervisory and professional personnel and directors of Empire to acquire or increase their ownership of Common Stock on reasonable terms. The opportunity so provided was intended to foster in participants a strong incentive to put forth maximum effort for the continued success and growth of Empire, to aid in retaining individuals who put forth such efforts and to assist in attracting the best available individuals in the future. The 1996 Plan expires on December 31, 2005. The Board of Directors believes that the 1996 Plan has helped the Company achieve these goals and accordingly has adopted the 2006 Stock Incentive Plan (the “2006 Plan”), which is substantially the same as the 1996 Plan, and is submitting the 2006 Plan for stockholder approval.

The Board has reserved 650,000 shares of Common Stock for issuance upon the grant or exercise of awards pursuant to the 2006 Plan. The terms and conditions of any option or stock grant would be determined by the Compensation Committee of the Board of Directors.

A summary of the 2006 Plan is set forth below. This summary is qualified in its entirety by the full text of the 2006 Plan, which is attached to this Proxy Statement as Appendix B.

Summary of the Plan

Administration

The 2006 Plan will be administered by the Compensation Committee of the Board of Directors. All of the members of the Compensation Committee are “Non-Employee Directors” as defined in Rule 16b-3 adopted pursuant to the Exchange Act and “outside directors” within the meaning of Section 162(m) of the Internal Revenue Code. The Secretary of Empire is to administer the portion of the 2006 Plan under which non-employee directors may elect to receive common stock in lieu of cash remuneration for services as a Director.

The Compensation Committee will have the authority to designate participants; determine the type or types of awards to be granted to each participant and the number, terms and conditions thereof; establish, adopt or revise any rules and regulations as it may deem advisable to administer the 2006 Plan; and make all other decisions and determinations that may be required under the 2006 Plan.

Eligibility

The Compensation Committee may select as a participant in the 2006 Plan any qualified executive, managerial, supervisory or professional employee, including officers of Empire or any subsidiary. A Director who is not an employee is not eligible to receive awards under the 2006 Plan. Non-employee directors may, however, elect to receive common stock under the 2006 Plan in lieu of cash remuneration for services as a Director. Awards may be made to eligible employees whether or not they have received prior awards under the 2006 Plan or under any other plan, and whether or not they are participants in our other benefit plans.

Permissible Awards

The 2006 Plan authorizes the granting of awards in any of the following forms:

Stock Options. A stock option (an “Option”) is the right to purchase, in the future, shares of common stock at a set price. Under the 2006 Plan, the purchase price of shares subject to any Option must be at least 100% of the fair market value of the shares on the date of grant. Fair market value is defined as the mean between the high and low prices of the common stock on the day the grant is made. Options granted may be either non-qualified stock options or incentive stock options under the Internal Revenue Code.

The maximum term of any Option is ten years from the date the Option was granted. The Compensation Committee can fix a shorter period, and can impose such other terms and conditions on the grant of Options

17

as it chooses, consistent with applicable laws and regulations. No Option shall become exercisable prior to the third anniversary of the date granted.

Restricted Stock Awards. A Restricted Stock Award is the grant of a right to receive common stock, either immediately or on a future date upon certain conditions, which may be upon the attainment of specified performance goals. Restricted Stock Awards restrict transfer of the shares received and affect the timing of the realization of tax consequences on the transaction. The restriction on the transfer of the shares granted shall lapse no earlier than the third anniversary, or later than the tenth anniversary, of the date on which the Restricted Stock Award was granted. The conditions established by the Compensation Committee on which the shares included in a Restricted Stock Award will be subject to forfeiture may, but need not, include conditions tied to performance measures selected by the Compensation Committee.

The Compensation Committee may also allow the grantee to receive a credit equal to the dividends payable on the restricted shares awarded to the grantee, but not yet delivered to him, and may provide for the payment of such amounts currently or at the time the related shares are distributed.

The Compensation Committee may grant Restricted Stock Awards to satisfy dividend equivalent rights previously granted in connection with stock options.

As under the 1996 Plan, we expect to grant performance-based Restricted Stock Awards under this portion of the 2006 Plan.

Share Delivery in Lieu of Cash Incentive Awards. The 2006 Plan also provides that an employee otherwise eligible for a grant or an award under the 2006 Plan may, if the employee is eligible to receive a cash payment under any other management bonus or incentive plan of the Company (a “Cash Payment”) applicable to the employee, make application to the Compensation Committee requesting the delivery of common stock in lieu of all or a portion of the Cash Payment.

The number of shares so delivered will be equivalent in dollar value to that of the Cash Payment which would otherwise have been made, determined on the basis of the fair market value of the shares on the date of the share delivery.

Share Delivery in Lieu of Directors Fees. The 2006 Plan also provides that a non-employee Director may elect to receive common stock under the 2006 Plan in lieu of all or any portion of future cash payments for services rendered as a Director.

Shares Available for Awards

The maximum number of shares of common stock which may be used in connection with awards under the 2006 Plan, or share deliveries as described above, is 650,000. The 2006 Plan limits the issuance of common stock for Restricted Stock Awards to 325,000 shares.

Adjustments

If any change in the number of outstanding shares of our common stock after adoption of the 2006 Plan occurs through stock splits, a stock dividend, recapitalization or a combination or consolidation of the common stock into a lesser number of shares, the share authorization limits under the 2006 Plan will automatically be adjusted proportionately. The shares then subject to each award, and per share option prices, will automatically be adjusted proportionately as well. If we are involved in another corporate transaction or event that affects the common stock, such as an extraordinary cash dividend, reorganization, merger, consolidation, split-up, spin-off or exchange of shares, the Compensation Committee may adjust the 2006 Plan’s share authorization limits and outstanding awards to preserve the benefits or potential benefits of the awards.

Any shares subject to Options which lapse unexercised, and any shares forming part of a Restricted Stock Award which do not vest in the grantee, shall once again be available for grant of awards and share deliveries. Shares delivered in lieu of cash payments are also considered to have been used by the 2006 Plan and are not available for further awards or such delivery.

18

Exercise of Options and Purchase Price

Upon the exercise of an Option, the optionee must deliver to us the full purchase price of the shares represented by the Option being exercised. Such purchase price can be paid either in cash or common stock having a then fair market value equivalent to the purchase price, or any combination thereof. The Compensation Committee may also permit the exercise through broker-assisted arrangements.

Termination, Suspension and Modification

The Board of Directors may, at any time, terminate, suspend or amend the 2006 Plan. Any amendment or modification of the 2006 Plan for which stockholder approval is required by applicable rule or regulation of any governmental regulatory body, or under the rules of any stock exchange in which the shares are listed, shall be subject to the approval of our stockholders. No termination, suspension or modification of the 2006 Plan may adversely affect any award previously granted under the 2006 Plan without the written consent of the participant. No awards may be granted under the 2006 Plan after December 31, 2015.

Prohibition on Repricing

Outstanding Options cannot be repriced, directly or indirectly, without the prior consent of our stockholders.

Withholding Taxes

We shall be entitled to withhold the amount of any withholding tax payable with respect to any awards and share deliveries, and to sell the number of shares necessary to produce the amount required to be withheld, unless the recipient supplies to us cash in the amount requested by us for this purpose. The Compensation Committee may adopt rules allowing the recipient of any award payable in shares, or any person electing to receive shares, to satisfy any applicable tax withholding requirements in whole, or in part, by delivering to us shares or by instructing us to withhold shares otherwise deliverable to the person as part of the award, in either case with a fair market value not in excess of the amount of the applicable withholding requirements.

Future Plan Benefits

The persons to whom awards will be granted during the term of the 2006 Plan and the positions they hold, or the type of award or number of shares to be covered by any such awards if the 2006 Plan is approved by our stockholders, have not yet been determined and it is not anticipated that any such determination will be made prior to such approval. Therefore, it is not possible to state in advance the number or type of awards to be made or the identities of future grantees under the Plan. However, the 2006 Plan is similar in operation to the 1996 Plan, under which Messrs. Gipson, Beecher, Gibson, Knapp and Palmer received in 2004 the awards set forth in the Summary Compensation Table and other compensation tables included in this Proxy Statement.

Federal Income Tax Consequences

The following discussion summarizes the material federal income tax consequences of participation in the 2006 Plan. This discussion is general in nature and does not address issues related to the tax circumstances of any particular employee or director. The discussion is based on federal income tax laws in effect on the date hereof and is, thereof, subject to possible future changes in law. This discussion does not address state, local and foreign tax consequences.

ISOs. An optionee will not recognize any income upon either grant or exercise of an incentive stock option (an “ISO”), although the exercise may subject the optionee to alternative minimum tax liability in the year of exercise because the excess of the fair market value of the shares at the time of exercise over the purchase price of the shares is included in income for purposes of the alternative minimum tax. The treatment of any gain realized upon sale or other disposition of our common stock received upon exercise of an ISO will depend on the holding period. If the optionee does not dispose of the stock received until more than one year after exercise of the ISO and more than two years after grant, any gain realized upon disposition will be characterized as long-term capital

19

gain. If the optionee disposes of his or her shares within either one year after exercise of the ISO or two years after grant, such disposition will be a disqualifying disposition. In the case of a disqualifying disposition, the portion of the gain realized on disposition equal to the excess of the fair market value of the shares at the time the ISO was exercised over the purchase price will be ordinary income taxable as compensation in the year of disposition. The balance, if any, of the gain will be capital gain.

If the optionee sells the shares in a disqualifying disposition at a price that is below the fair market value of the shares at the time the ISO was exercised, the optionee’s ordinary income will be limited to the excess of the amount realized upon the disposition over the adjusted basis in the shares.

We are entitled to a deduction with respect to an ISO only if a disqualifying disposition occurs. In that event, the deduction would be available in the taxable year of Empire in which the disqualifying disposition occurs and would generally be equal to the ordinary income, if any, recognized by the optionee upon disposition of the shares.

Nonqualifying Stock Options. An optionee will not recognize any income upon either grant or vesting of a nonqualifying stock option (“NQSO”). Upon exercise of any part of an NQSO, the optionee will recognize ordinary income in an amount equal to the difference between the then fair market value of the shares acquired and the purchase price.

In general, upon a subsequent disposition of the shares, the optionee’s basis for determining taxable gain or loss would be the amount paid for such shares plus the amount that was includable in the optionee’s income at the time of exercise. Any gain recognized on such disposition would generally be taxed as long-term or short-term capital gain depending on the length of time the optionee is deemed to have held these shares. We will generally be entitled to a deduction for federal income tax purposes upon exercise of an NQSO in an amount equal to the ordinary income recognized by the optionee.

Restricted Stock. The recipient of a Restricted Stock Award will not be subject to tax upon its grant, unless the shares are issued and the recipient makes an election under Section 83(b) of the Internal Revenue Code. Assuming no election under Section 83(b) is made, the holder will be subject to tax at ordinary income tax rates at the time of the lapse or earlier termination of the restrictions in an amount equal to the fair market value of the shares covered by the Restricted Stock Award at the time that the restrictions lapse or terminate. The tax basis of the shares will be the amount so included in income, and their holding period for capital gains purposes will commence on the date the restrictions lapse or terminate. If a holder makes an election under Section 83(b) of the Internal Revenue Code, the holder will be subject to tax at ordinary income rates based on the fair market value of the shares covered by the Restricted Stock Award at the date of grant. The tax basis of the shares will be the amount so included in income, and their holding period for capital gains purposes will commence on the date of grant. We will generally be entitled to a deduction with respect to the amount of ordinary income recognized by the employee.

Share Delivery in Lieu of Cash Incentive Awards or Directors’ Fees. If an employee or Director receives shares of our common stock in lieu of a cash payment, the employee or Director will be subject to tax at ordinary income rates in an amount equal to the fair market value of the shares that the employee or director receives. The tax basis of the shares so received will be their fair market value on the date of their receipt, and the holding period for capital gains purposes will commence upon their receipt. We will generally be entitled to a deduction with respect to the amount of ordinary income recognized by the employee or director.

THE BOARD HAS APPROVED THE 2006 STOCK INCENTIVE PLAN AND BELIEVES THAT IT IS FAIR TO, AND IN THE BEST INTERESTS OF, THE COMPANY AND ITS STOCKHOLDERS. THE BOARD RECOMMENDS THAT STOCKHOLDERS VOTE “FOR” PROPOSAL C.

20

D. PROPOSAL TO APPROVE THE COMPANY’S AMENDED AND

RESTATED STOCK UNIT PLAN FOR DIRECTORS

(Item 4 on Proxy Card)

Our Board of Directors adopted the Stock Unit Plan for Directors (the “Stock Unit Plan”) in 1998 in order to enhance our ability to attract and retain competent and experienced persons to serve as Directors and to recognize the service of Directors of Empire by providing non-employee Directors with a stock-based retirement compensation program. The Board of Directors is now recommending an amendment to and restatement of the Stock Unit Plan that will change the Stock Unit Plan from a stock-based retirement plan providing for payout only after termination of service to a stock-based compensation program for Directors that will allow payouts of future awards prior to termination of service. The Stock Unit Plan currently has 200,000 shares reserved for issuance under the Plan and the Board of Directors is also recommending an additional 200,000 shares be reserved for issuance under the Stock Unit Plan. Since our stockholders have not previously been required to approve the Stock Unit Plan, the amended and restated Stock Unit Plan is now being submitted to stockholders, in its entirety, for approval.

A summary of the amended and restated Stock Unit Plan, which is subject to stockholder approval, is set forth below. This summary is qualified in its entirety by the full text of the Stock Unit Plan, which is attached to this Proxy Statement as Appendix C.

Summary of the Plan

Background of Plan

The Stock Unit Plan for Directors was implemented in 1998 to replace a cash retirement plan in effect for Directors since 1990. The Directors on the Board in 1998 who had not previously been employees of Empire were eligible to convert accrued benefits under the existing cash retirement plan into stock units or remain under the cash retirement plan. As of December 31, 2004, all eligible Directors had converted their cash benefits to stock units.

Eligibility

Any Director who is not an officer of Empire at the time of grant is eligible to participate in the Stock Unit Plan.

Description of Stock Units