IKON

Second Quarter, Fiscal 2005

Preliminary Earnings Release

April 28, 2005

Matthew J. Espe, Chairman & CEO

Robert F. Woods, Sr. Vice President & CFO

Dan Murphy, VP of Investor Relations

Investment

Considerations

The following presentation includes information about IKON’s financial and business

goals and strategies which constitutes forward-looking statements within the meaning of

the federal securities laws. These forward-looking statements include, but are not limited

to, statements relating to: our press release issued on April 21, 2005 and our Form 8-K

filed with the SEC on April 28, 2005; expected third and fourth quarters and full year Fiscal

2005 results; growth in targeted revenue streams; estimated remaining charges relating to

our restructuring actions announced on March 1, 2005; a proposed sale of certain

operations in France; the run-off of our retained U.S. lease portfolio; our ability to repay

debt; and our ability to execute strategic initiatives, long-term growth objectives and

operational efficiency. Such forward-looking statements reflect the current views of IKON

with respect to future events and are subject to certain risks, uncertainties and

assumptions that could affect IKON’s current plans, anticipated actions, and future results

as described in IKON’s filings with the Securities and Exchange Commission.

In this presentation, we will comment on certain non-GAAP financial measures. A

reconciliation of these non-GAAP financial measures to GAAP can be found within the

Investor Relations section of www.IKON.com.

2

Important Notice

On April 21, 2005, IKON announced that it is conducting a review of

its billing controls and reserve practices for trade accounts

receivable. This review is not yet complete. In addition, IKON filed

a Form 8-K today to report that, based on preliminary data

currently available, the Audit Committee of its Board of Directors

concluded on April 26, 2005 that the Company will be required to

restate its previously issued results for one or more periods. A

summary of these announcements is included on slide 5 of this

presentation.

Certain numbers presented on the following charts are based on

preliminary data and may change as a result of the completion of

this review. The specific changes will not be known until the

review is completed.

3

IKON 2Q Earnings Call

Matthew J. Espe, Chairman and CEO

Billing and Trade A/R Review

2nd Quarter Overview

Strategic Update

Revenue Trends

Fiscal 2005 Expectations

4

Review of Billing Controls and

A/R Reserve Practices

Announced on April 21, 2005

Conducted an analysis of aged trade accounts receivable

Also performing Sarbanes-Oxley work

Identified deficiencies in processes and timeliness by which we issue and

adjust certain invoices

Causes appear to be:

Centralization of billing centers

Migration to a new billing platform

Based on preliminary data, the estimated overstatement of A/R is $45 million,

but may change.

Limited to components of U.S. trade A/R totaling $372 million as of March 31,

2005

Likely represents a cumulative effect over multiple periods

Identity of and impact on prior periods to be determined consistent with

Audit Committee’s conclusion on April 26, 2005

Charge or reduction in revenue is non-cash

Work plan completed; work underway

Goal is May 10, 2005 10-Q filing date, but we anticipate delaying that filing

We are moving with all required speed, but emphasis is on getting the work

done right.

5

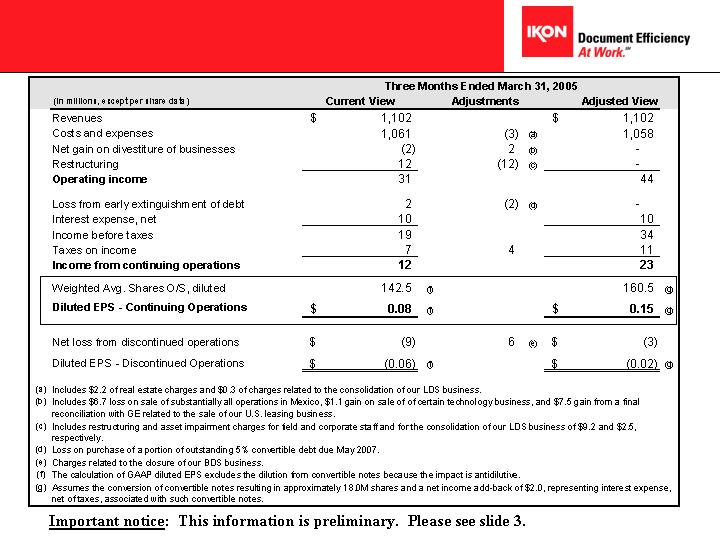

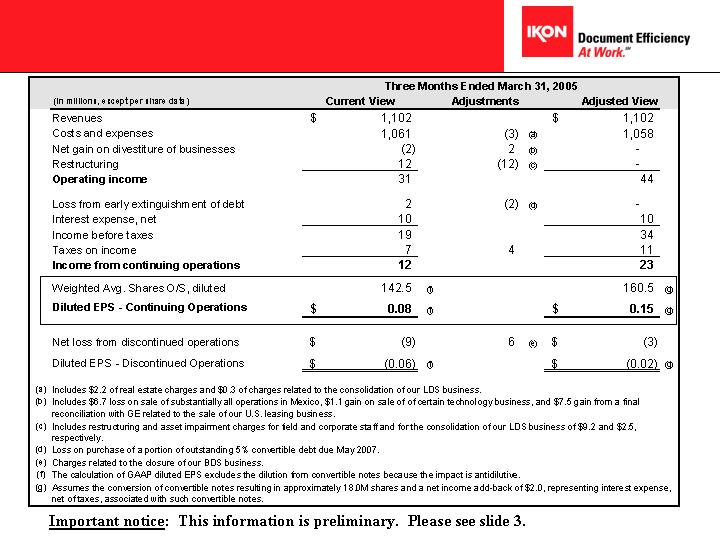

2Q 2005 Recap

Diluted Earnings Per

Share

EPS from continuing

operations of $.08

EPS includes charges for

actions announced

3/1/2005, and other

actions

EPS from continuing

operations, excluding the

above charges, is

estimated at $.15

Loss from discontinued

operations of $.06

Revenue down 6%;

Targeted revenue up 1%

Net Sales up 2% y/y

Services down 2% y/y

Finance down 72% y/y

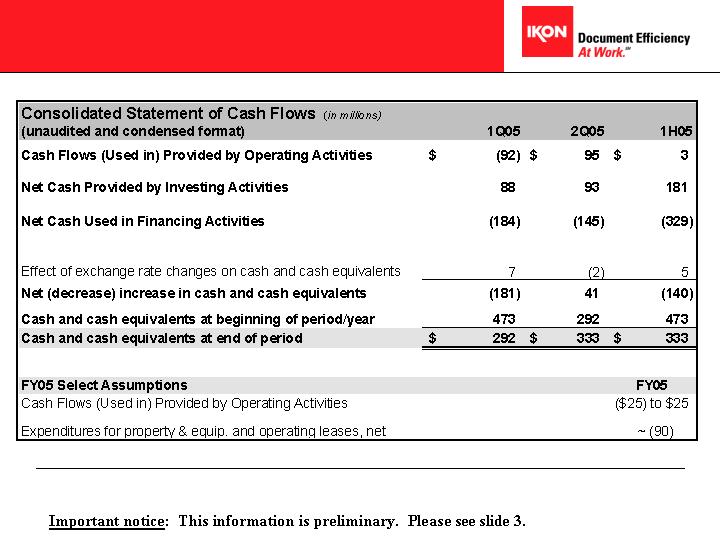

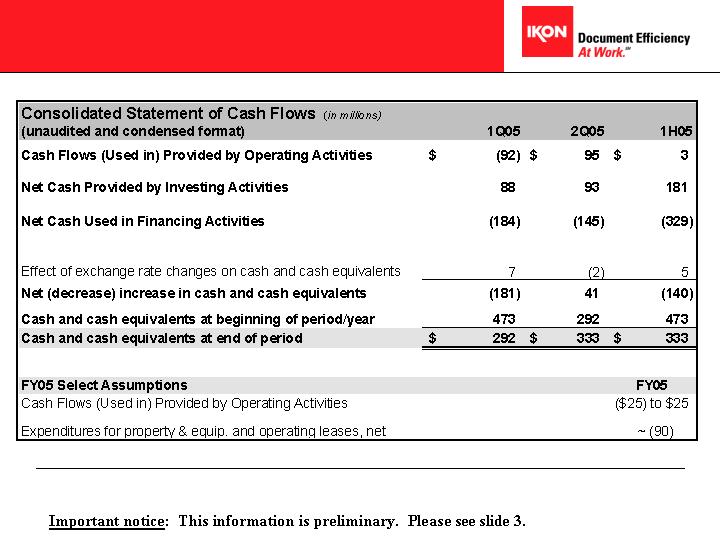

Strong cash flow from

operations - $95 million

$333 million of

unrestricted cash at end

of 2Q05

Purchased $45 million of

convertible debt

Purchased $12 million of

shares

Paid $6 million in

dividends

Note: See slide 8 for details on targeted revenue

Note: Numbers above reflect no impact

from the review announced on 4/21/2005

Note: Numbers above reflect no impact

from the review announced on 4/21/2005

Earnings Per Share

Total Revenue

Cash Performance

Note: Numbers above will not be impacted

by the review announced on 4/21/2005

6

Operational Platform

New SVP Operations

Improving OI

Reduced headcount

Exited unprofitable

businesses

Closed unprofitable

locations

Identified and

Addressing Billing

and Trade Accounts

Receivable Issue

Enterprise Services

On-site revenue up 6%

33 net new contracts

$12 million in incremental

annualized revenue

Off-site structured to

improve results – down

year to year

Professional Services

revenue up 7% - margins

improving

Europe

Revenue up 5%

Good momentum

Integrated Selling Model

Model 100% launched

across North America

276 new integrated

account execs

New VP of middle

markets

National Accounts

13 new contract wins

Anheuser-Busch

Color Growth

Revenue up 8%

Launch of IKON CPP500

2005 Strategic Priorities

Operational

Leverage

Core

Growth

Related

Expansion

7

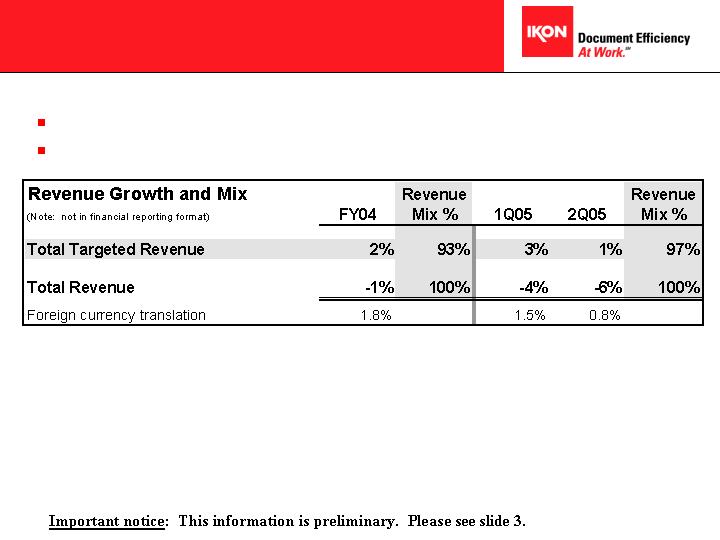

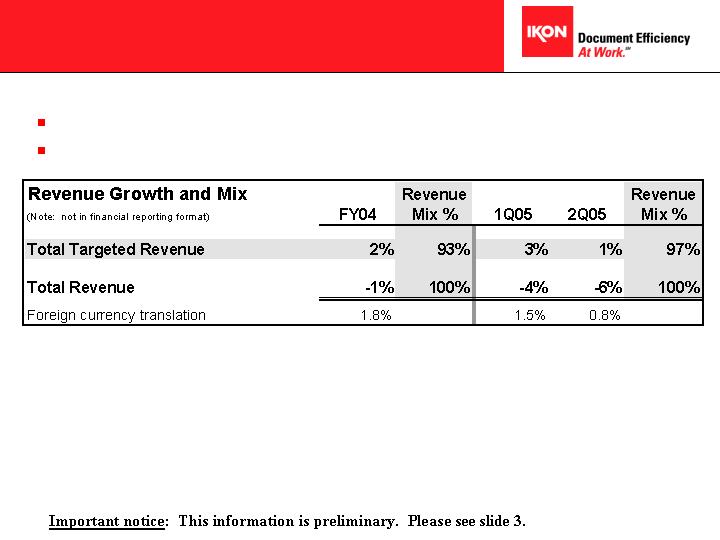

Revenue Trends

Revenues of $1.1 billion, down 6% yr-yr

Targeted revenues up 1% – represent 97% of mix

* Excludes North American leasing and de-emphasized Technology Hardware

*

8

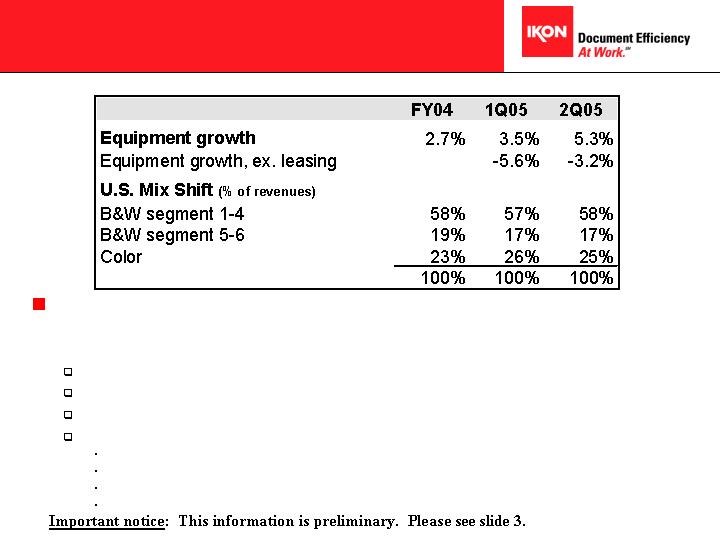

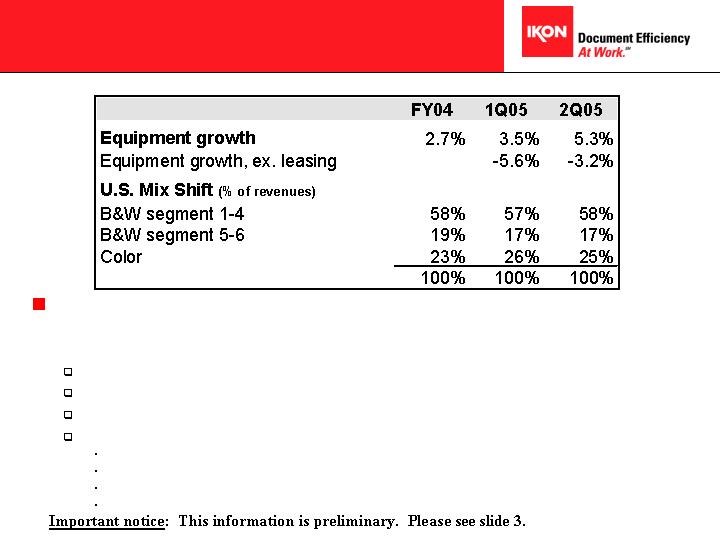

Equipment Revenue Trends

5.3% y/y growth from 2Q FY04, -3.2%

excluding leasing

10% sequential equipment growth

8% y/y growth in color worldwide

Strong y/y performance in Europe offset by weakness in N. America

U.S. equipment y/y trends:

5% decline in office black & white

10% decline in production black & white

Placements up 2%

Total ASPs down 5% (including mix impact)

9

Services

Revenue down 2% y/y

Total Copy Volume Up

Color Volume Up

Production B&W Up

Office B&W Down

Billing and Trade Accounts

Receivable issue primarily impacts

Services

Update on Services Revenue pending

completion of our review

Total Revenue

10

Financial Review

Financial Results

Restructuring Actions

Balance Sheet and Cash Performance

Robert F. Woods, Sr. Vice President & CFO

11

2nd Qtr. FY05 P&L

(condensed)

12

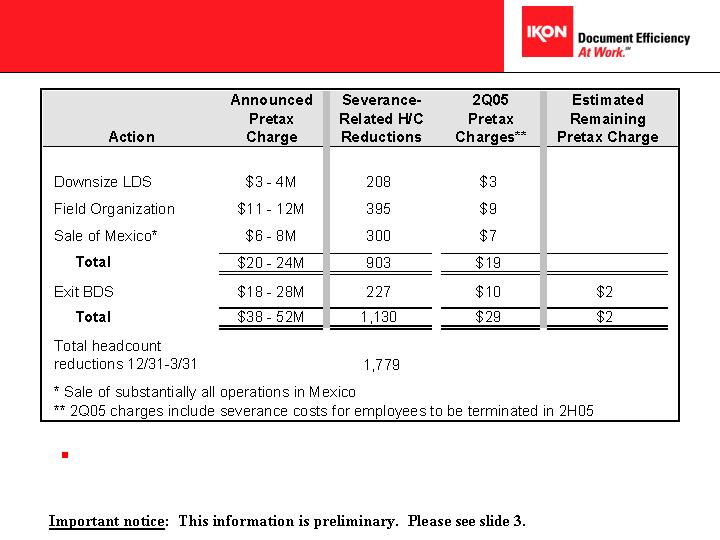

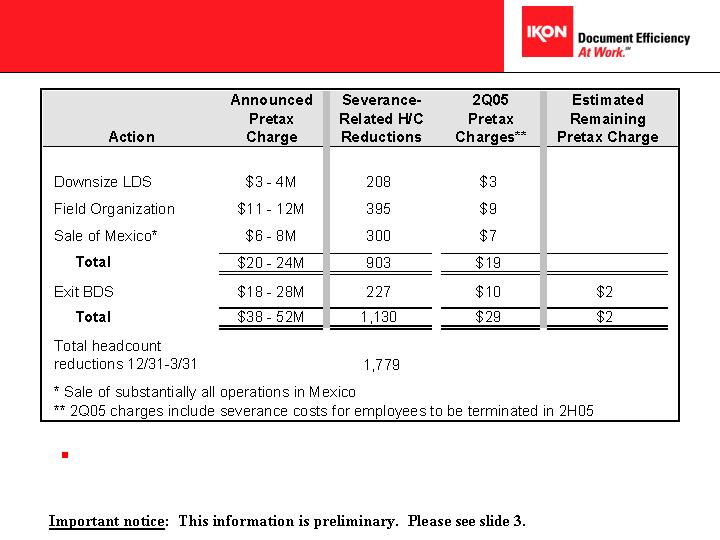

2Q05 Actions

2Q05 Headcount reduction of 1,779 vs. 1,500 estimated from actions

13

Gross Profit

Yr-Yr

Total GP % impacted by leasing transition

Net Sales margins decline due to lower supplies margins

Services margins down 0.4 points

14

Selling & Administrative

Yr-Yr

Year-to-year improvement of $27.2 million primarily driven by impact of:

Leasing: ($18.5 million)

Headcount reductions, net of ISM investment: ($6.5 million)

Foreign currency: $2.3 million

Real estate charges: $2.2 million

Total expense to revenue ratio improves 50 basis points

% of

% of

% of

2Q FY04

revenue

1Q FY05

revenue

2Q FY05

revenue

Total S&A

378.3

$

32.3%

352.8

$

32.5%

351.1

$

31.8%

15

Cash Flow

16

Balance Sheet

* Pending our review, to be split between taxes and equity

IKON Consolidated Balance Sheet

Unaudited, Condensed Format, Non-GAAP

(in millions)

Assets

4Q FY04

1Q FY05

2Q FY05

Cash and cash equivalents

473

$

292

$

333

$

Restricted cash

27

27

24

Accounts receivable, less allowances

773

787

710

Less: impact of announced estimated accounts receivable reduction

TBD

TBD

(45)

Adjusted accounts receivable

773

787

665

Finance receivables, less allowances

1,211

1,117

996

Inventories

233

290

217

Prepaids, Other Current Assets, Deferred Taxes

121

112

105

PP&E, net, including equipment on operating leases

243

248

244

Goodwill, net and Other Assets and Unsold Residual

1,457

1,495

1,455

Assets held for sale

-

-

30

Total Assets

4,538

$

4,368

$

4,069

$

Liabilities and Shareholders' Equity

Corporate debt & Notes Payable

805

$

748

$

699

$

Debt supporting finance contracts and unsold residual value

863

787

680

Trade accounts payable, Accrued Expenses, Def'd Revenues

754

698

617

Deferred taxes

187

151

129

Other long-term liabilities

203

219

228

Liabilities held for sale

-

-

26

Total Liabilities

2,812

2,603

2,379

Total Shareholders' Equity

1,726

1,765

1,735

Less: impact of announced estimated accounts receivable reduction*

TBD

TBD

(45)

Adjusted Shareholders' Equity

1,726

1,765

1,690

Total Liabilities and Shareholders' Equity

4,538

$

4,368

$

4,069

$

Ratios:

Total debt

1,668

$

1,535

$

1,378

$

Debt to capital

49%

47%

45%

17

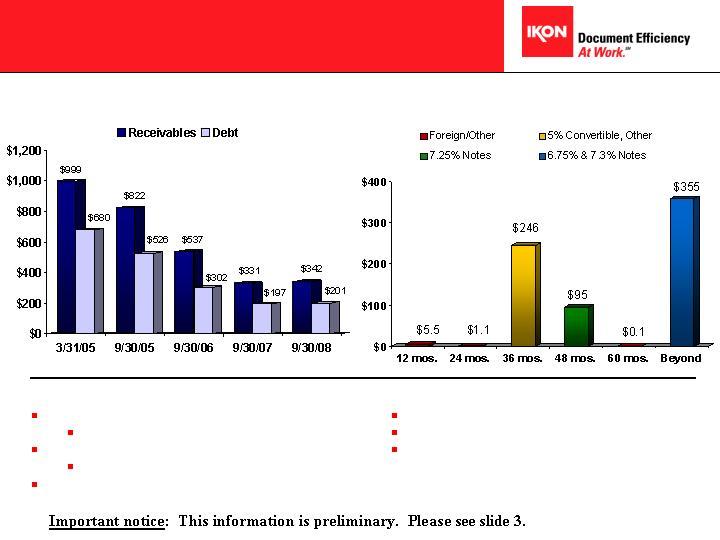

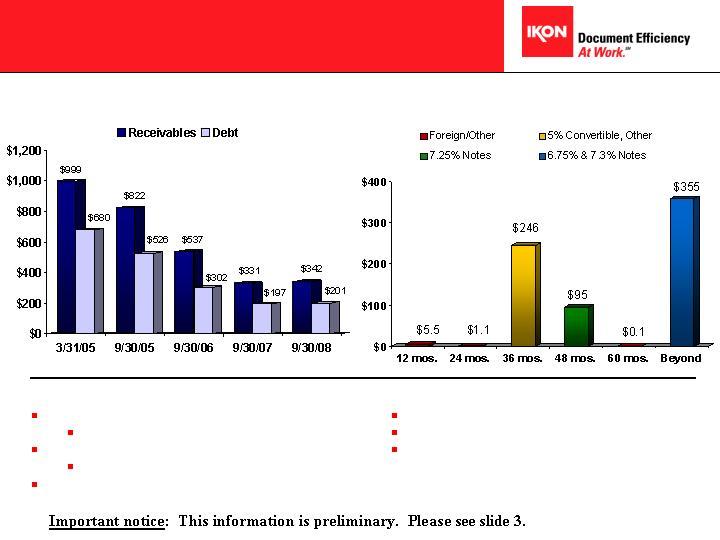

Debt Structure

Corporate Debt Maturities

(as of 3/31/05) (in millions)

Actual Projected -------------------------------------

Lease-Supported Receivables vs. Debt

(as of 3/31/05) (in millions)

As of 3/31/05:

$999 million total receivables

$702 million in U.S. portfolio receivables

$680 million total debt

$495 million in U.S. portfolio debt

$181 million in projected tax payments on retained portfolio

51% of corporate debt matures 2025/2027

Purchased $45 million in convertible notes in 2Q05

Remaining $245 million convertible converts at $15.03

or matures May 2007; callable in May 2005

18

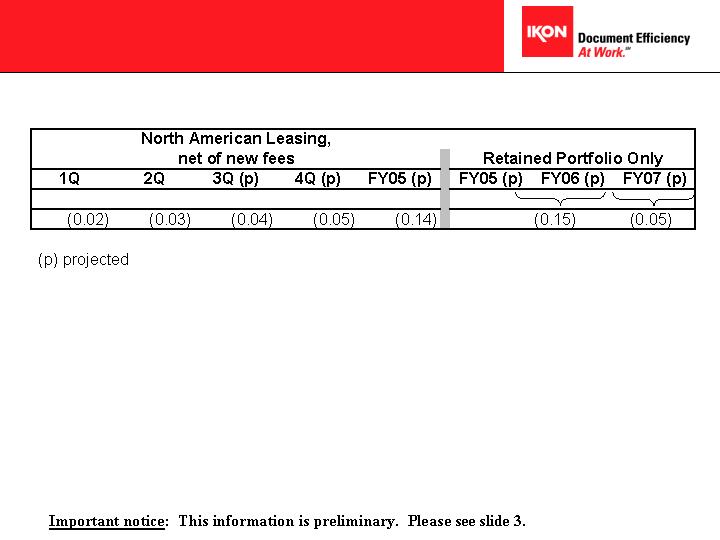

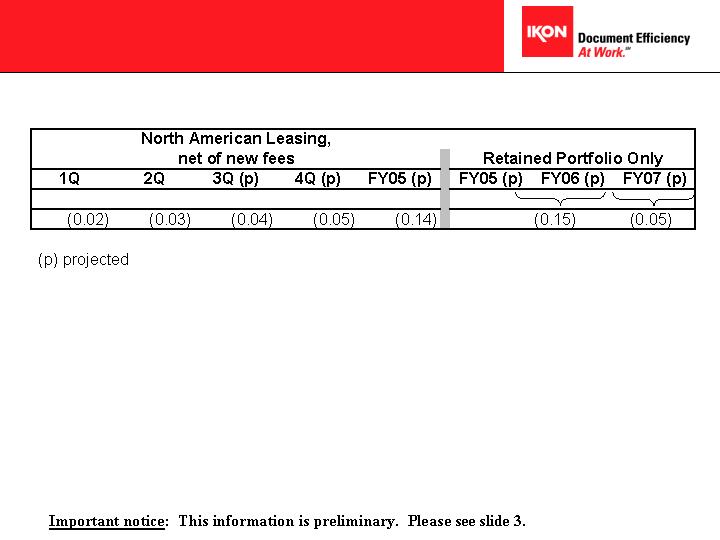

Leasing Headwind

19

2Q05 Summary

ITEM

Targeted Revenue Growth

Sequential Equipment Growth

Strong Cash From Operations

100 bp Reduction in E/R

Exit BDS

Downsize LDS

Realigned Field Structure

Reduced Corporate Staff

Sale of Mexico

Real Estate Closures

Other Actions:

GE Balance Sheet Settlement (US)

Sale of TS Businesses

Debt Purchase

Billing and Accounts Receivable

RESULT

Achieved 1%

Achieved 10%

Generated $95 million

On Target

Done; 2 Locations To Go

Done; 1 Location To Go

Done

Done

Done

On-Going

Done

Done

Done

Identified and Addressing Issue

20

* Excluding any non-recurring charges and the impact of the pending billing and trade A/R review.

** See slide 8 for an explanation of targeted revenues.

FISCAL 2005 CONTINUING OPERATIONS*

Earnings (per diluted share)

Revenue Assumptions:

Total Revenue

Targeted Revenue**

THIRD QUARTER CONTINUING OPERATIONS*

Earnings (per diluted share) ��

Fiscal 2005 Expectations

EXPECTATIONS

$.63 to $.68

Expected to be at low end of range

(3%) to (4%)

0% to 1%

$.16 to $.18

21