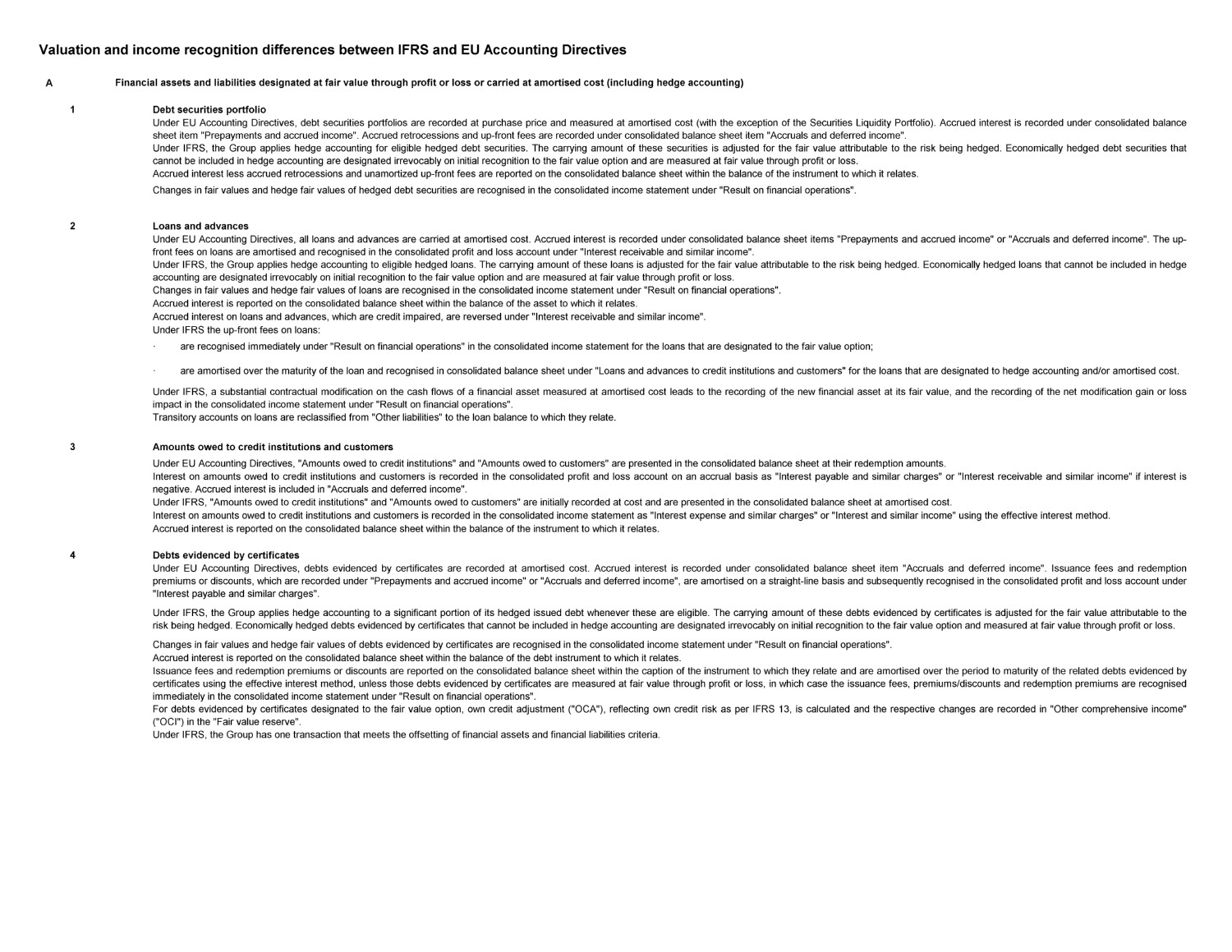

| Under EU Accounting Directives, value adjustments on loans and advances are recorded where (i) there is a risk of non-recovery of all or part of their amounts, or (ii) to capture loans in the portfolio which are impaired but have not yet been identified as such or for losses which have been incurred but not yet reported. These value adjustments are accounted for in the consolidated profit and loss account as "Value (re-)adjustments in respect of loans and advances and provisions for contingent liabilities" and are deducted from the appropriate asset items on the consolidated balance sheet. Value adjustments for debt securities are recorded, if these are other than temporary, or to capture debt securities which are impaired but have not yet been identified as such or for losses which have been incurred but not yet reported. These value adjustments are accounted for in the consolidated profit and loss account under "Value (re-)adjustments in respect of transferable securities held as financial fixed assets and participating interests" and are deducted from the appropriate asset items on the consolidated balance sheet. Under IFRS, the Group is required to recognise a loss allowance for all loans and debt securities measured at amortised cost as well as for off-balance sheet loan commitments. This allowance is based on either lifetime Expected Credit Loss ("ECL"), if there has been a significant increase in credit risk since initial recognition or the instrument is considered as being credit-impaired or otherwise on 12-months ECL. Depending on the nature of the financial instrument, the ECL allowances are deducted from the appropriate asset items on the consolidated balance sheet. For off-balance sheet items, a provision for credit loss is reported under "Provisions b) provisions for guarantees issued and commitments". Changes in the ECL allowances are recorded in the consolidated income statement either under: · "Change in impairment on loans and advances and provisions for guarantees, net of reversals" for loans and loan commitments or; · "Change in impairment on transferable securities held as financial fixed assets, shares and other variable - yield securities, net of reversals" for debt securities. D The Bank changed its accounting policy prospectively in respect of the recognition of cumulative actuarial deficits and surpluses. EU Accounting Directives accounting policy applicable for the Financial Statements as at 31 December 2020: Under EU Accounting Directives, a 10% corridor approach is adopted, whereby cumulative prior year actuarial deficits and surpluses in excess of 10% of the commitments for retirement benefits are recognised over the expected average remaining service lives of the plan’s participants (2020: average of 14.6 years) on a straight-line basis. EU Accounting Directives Accounting policy applicable for the Financial Statements as at 31 December 2021: Starting with accounting years as from 2021, the 10% corridor approach is considered, however cumulative current year actuarial gains or losses in excess of 10% of the commitments for retirement benefits are recognised over a period of 7 years on a straight-line basis in "General administrative expenses a) staff costs". Under IFRS, the Group applies IAS 19 revised for determining the income or expense related to its post-employment defined benefit plans. Cumulative actuarial surpluses and deficits are recognised in full in OCI under "Additional reserves". Adjustments to staff cost are recognised under "General administrative expenses a) staff costs" and adjustments to interest cost under "Interest expense and similar charges". E The Bank and the European Investment Fund (the "EIF") together are defined as the Group. The Bank granted a put option to the minority shareholders on their entire holding of its subsidiary, the EIF. Under EU Accounting Directives, the non-controlling interest is recorded separately in the consolidated balance sheet under "Equity attributable to minority interest" while the put option is recorded in the consolidated off-balance sheet of the Group. Under IFRS, the non-controlling interest is reclassified and a corresponding financial liability in the amount of the fair value of the option’s exercise price is recognised under "Other liabilities" and attributed to owners of the parent. Subsequently, this financial liability is measured in accordance with IFRS 9, i.e. any changes in the fair value of the financial liability subsequent to the acquisition date are recognised in the consolidated income statement under "Interest expense and similar charge". Any excess or deficit of non-controlling interest over the agreed price is reversed to "consolidated reserves". F The Group recognises under EU Accounting Directives and IFRS fee and commission income from revenues that are satisfied over time on an accrual basis over the service period. Fee and commission income earned from providing or fulfilling point-in-time services (e.g. performance-linked) is recognised when the service has been completed. For certain mandates, the Group has established a deferred income policy in order to address the misalignment between the receipt of income and the services/cost incurred by the Group during the lifetime of the respective mandate. Corresponding adjustments are recorded in the consolidated balance sheet under "Deferred income" and released against "Fee and commission income". Under EU Accounting Directives, this deferral mechanism is only applied prospectively over time, i.e. recognising deferred revenue of the financial year, while under IFRS, the Group used the modified retrospective approach, i.e. recognising the cumulative impact at transition to IFRS 15 in equity. This resulted in a different stock of deferred income and corresponding amounts of revenue to be recorded over the individual years. G Under EU Accounting Directives, the rental charges are recorded under "General administrative expenses b) other administrative expenses". In accordance with IFRS 16, the Group assesses whether a contract is a lease or not. In the case of lease, the Group recognises a right-of-use asset and a lease liability, except for those that are covered by the recognition exemptions (short-term leased assets and low value leased assets based on their original value, when new). The above-mentioned right-of-use assets are recognised under "Property, furniture and equipment" and corresponding lease liability is recognised under "Other liabilities". Subsequently, the Group carries the right-of-use asset applying a cost model, depreciating the right-of-use asset from the commencement date to the end of the lease agreements and assessing for any impairment, on an annual basis. The depreciation for the right-of-use assets is recorded under "Depreciation and amortisation: property, furniture and equipment and intangible assets a) property, furniture and equipment". The lease liability carrying amount is adjusted to reflect the lease payments made and interest from unwind of lease liability, with further re-measurements to reflect any reassessment or lease modifications. The interest from unwind of lease liability is recorded in the consolidated income statement under "Interest expense and similar charges". The revaluation result is recorded in the consolidated income statement under "Result on financial operations". H Under EU Accounting Directives, net liabilities from financial guarantees are presented in the consolidated balance sheet under "Provisions b) provision in respect of guarantee operations". Unrealised gains representing the excess of the net present value of expected future premium inflows over the amount of the excepted payment obligations remain unrecognised. Any increase or decrease in the net liability is recognised in the consolidated profit and loss account under "Value (re-)adjustments in respect of loans and advances and provisions for contingent liabilities". Under IFRS, net unrealised gains from financial guarantees are recorded in the consolidated balance sheet under "Other assets" in case the measurement of a financial guarantee contract results in a net asset position. In case the measurement of a financial guarantee contract results in a net liability position, contracts for which the amortised initial NPV is higher than the 12-months ECL or lifetime ECL, are presented under "Other liabilities". Guarantee contracts that are credit-impaired and for which a loss allowance based on lifetime ECL is recognised, are presented under "Provisions for guarantees issued and commitments". Any increase or decrease in the "Other assets" or "Other liabilities" relating to financial guarantees is recognised in the consolidated income statement under "Result on financial operations". Any increase or decrease in the "Provisions for guarantees issued and commitments" relating to financial guarantees other than the settlement of guarantee calls is recognised in the consolidated income statement under "Change in impairment on loans and advances and provisions for guarantees, net of reversals". Financial Guarantee Contracts Pension funds Non-controlling interest adjustment Fee and commission income Leases |