UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT

OF

REGISTERED MANAGEMENT COMPANY

| Investment Company Act file number: | 811-1530 |

| Name of Registrant: | Vanguard Explorer Fund |

| Address of Registrant: | P.O. Box 2600

Valley Forge, PA 19482 |

| Name and address of agent for service: | Heidi Stam, Esquire

P.O. Box 876

Valley Forge, PA 19482 |

Registrant’s telephone number, including area code: (610) 669-1000

| Date of fiscal year end: | October 31 |

| Date of reporting period: | November 1, 2005 - April 30, 2006 |

| Item 1: | Reports to Shareholders |

|

Vanguard® ExplorerTM Fund > Semiannual Report April 30, 2006 |

> | Vanguard Explorer Fund returned nearly 19% during the first half of the fund’s 2006 fiscal year. |

> | Small-capitalization stock returns were roughly twice those of their large-cap counterparts for the period. |

> | The fund modestly trailed its benchmarks because of under allocations to top-performing sectors and some weak stock selections. |

Contents | |

| |

Your Fund’s Total Returns | 1 |

Chairman’s Letter | 2 |

Advisors’ Report | 6 |

Fund Profile | 12 |

Performance Summary | 13 |

Financial Statements | 14 |

About Your Fund’s Expenses | 39 |

Trustees Renew Advisory Arrangements | 41 |

Glossary | 43 |

Please note: The opinions expressed in this report are just that—informed opinions. They should not be considered promises or advice. Also, please keep in mind that the information and opinions cover the period through the date on the cover of this report. Of course, the risks of investing in your fund are spelled out in the prospectus.

Your Fund’s Total Returns

Six Months Ended April 30, 2006 | |

| Total |

| Return |

Vanguard Explorer Fund | |

Investor Shares | 18.6% |

Admiral™ Shares1 | 18.7 |

Russell 2500 Growth Index | 19.1 |

Average Small-Cap Growth Fund2 | 19.4 |

Dow Jones Wilshire 5000 Index | 11.1 |

Your Fund’s Performance at a Glance | | |

October 31, 2005–April 30, 2006 | | | | |

| | | | |

| | | Distributions Per Share |

| Starting | Ending | Income | Capital |

| Share Price | Share Price | Dividends | Gains |

Vanguard Explorer Fund | | | | |

Investor Shares | $76.67 | $83.81 | $0.230 | $6.206 |

Admiral Shares | 71.47 | 78.06 | 0.346 | 5.776 |

1 | A lower-cost class of shares available to many longtime shareholders and to those with significant investments in the fund. |

2 | Derived from data provided by Lipper Inc. |

1

Chairman’s Letter

Dear Shareholder,

During the six months ended April 30, 2006, U.S. equity markets advanced strongly, even as investors grappled with rising energy prices and higher interest rates. Against this backdrop, the Explorer Fund’s Investor Shares returned 18.6%. (The Admiral Shares returned 18.7%.) This excellent return was nevertheless slightly short of the results for the fund’s index benchmark and its average peer group.

Stocks continued their healthy climb despite high energy prices

Following a lackluster finish in 2005, U.S. stock prices climbed steadily during the first four months of 2006, ending near a five-year high. Despite continuing worries over rising energy costs and the possibility of inflation, investors’ confidence in the economy remained firm. The job market remained tight and retail sales were strong during the fiscal half-year.

Small-capitalization stocks in the United States continued to outperform their large-cap counterparts, as has been the general trend since the bear market ended in 2002. During the half-year, small-caps bested large-caps by a margin of 9 percentage points. International stocks continued to produce outstanding gains, most notably in Japan and emerging markets.

2

The Fed continued its measured pace of raising short-term rates

For the six-month period, bonds provided slim returns as rising interest rates put a lid on bond performance. On March 28, the Federal Reserve Board raised its target for the federal funds rate to 4.75%, continuing its gradual tightening of monetary policy to defuse the threat of inflation. This was the Fed’s 15th consecutive rate increase since June 2004. (Shortly after the close of the fiscal period, the Fed extended its streak of rate increases to 16, raising its target to 5.00%.) Interest rate movements followed a normal pattern during the period, rising across the maturity spectrum. Short-term and municipal securities outperformed long-term bonds.

Your fund generated good returns in a great market

Explorer’s 18.6% return for the half-year was a reflection of the outstanding gains seen among small-capitalization stocks. Returns in nine of the ten sectors in which the fund invested were strongly positive. In absolute terms, the fund’s return was outstanding; in relative terms it was very good.

The fund’s small shortfall relative to its benchmark resulted from comparatively small positions in a few top-performing sectors and a handful of missed opportunities and subpar stock selections in other sectors. For example, the fund was somewhat underweighted in the strong-performing energy and industrials

Market Barometer | | | |

| | Total Returns |

| Periods Ended April 30, 2006 |

| Six Months | One Year | Five Years1 |

Stocks | | | |

Russell 1000 Index (Large-caps) | 9.9% | 16.7% | 3.4% |

Russell 2000 Index (Small-caps) | 18.9 | 33.5 | 10.9 |

Dow Jones Wilshire 5000 Index (Entire market) | 11.1 | 18.9 | 4.5 |

MSCI All Country World Index ex USA (International) | 25.0 | 38.1 | 11.4 |

| | | |

Bonds | | | |

Lehman Aggregate Bond Index (Broad taxable market) | 0.6% | 0.7% | 5.2% |

Lehman Municipal Bond Index | 1.6 | 2.2 | 5.4 |

Citigroup 3-Month Treasury Bill Index | 2.0 | 3.6 | 2.1 |

| | | |

CPI | | | |

Consumer Price Index | 1.2% | 3.5% | 2.6% |

3

sectors versus their corresponding weightings in the Russell 2500 Growth Index, which detracted from relative return. Although the fund’s six independent investment advisors largely succeeded in identifying good stocks, their strong security selection couldn’t offset the penalty paid for not committing greater portions of their portfolios to surging stocks in those sectors.

Explorer also missed out on some outstanding performers, particularly in the health care sector. The fund did not hold some of the more speculative, better-performing names among biotech firms, equipment makers, and drugmakers. And in the telecommunication services area, the fund did not hold a number of wireless communication companies that posted excellent six-month returns.

Despite its somewhat disappointing relative return during this short period, the fund’s long-term results are very strong. Over time, Explorer has delivered solid performance by drawing upon the complementary talents of its six advisory firms, each of which manages its portion of fund assets according to its own investment philosophy and strategy. In addition to excellent returns, our multiadvisor approach has produced an exceptional level of diversification not typically seen among small-cap funds. Indeed, as of April 30, the fund held more than 1,000 stocks, far more than the average small-cap fund.

The fund’s extremely low expenses are an important element of its competitive long-term record. As shown in the table below, the fund’s expenses are far below those of the average small-cap growth fund.

For more details on the fund’s positioning and performance during the period, please see the Advisors’ Report, which begins on page 6.

Keep your ‘investing road map’ handy as you invest

Road maps can be a practical and invaluable tool for drivers venturing toward a distant destination. In the same way, your personal investing road map can help keep you on course as you navigate your way toward your financial goals.

Annualized Expense Ratios1 | | | |

Your fund compared with its peer group | | |

| | | Average |

| Investor | Admiral | Small-Cap |

| Shares | Shares | Growth Fund |

Explorer Fund | 0.48% | 0.30% | 1.68% |

1 | Fund expense ratios reflect the six months ended April 30, 2006. Peer-group expense ratio is derived from data provided by Lipper Inc. and captures information through year-end 2005. |

4

In meeting with thousands of Vanguard investors over the years, I have often heard about how difficult it can be to keep an objective outlook on investing, especially in the midst of the incessant market analysis to which we are all subject through television, the Internet, and other news media. However, I always respond to these observations by suggesting that the best way to move toward your destination is to keep your eyes straight ahead, and not get sidetracked by the distractions and detours that are bound to pop up.

To reach your investment goals—whether they include, for example, a secure retirement, a new home, or a college education for your children—your investing road map should be based on your risk tolerance and time horizon.

It should reflect a carefully thought-out strategy and consist of a portfolio of stock, bond, and money market funds that is designed to meet your long-term goals. While the road to these goals may not always be as smooth as you would like, you’ll always be prepared if you remember your map.

Thank you for your continued confidence in Vanguard.

Sincerely,

John J. Brennan

Chairman and Chief Executive Officer

May 12, 2006

5

Advisors’ Report

During the six months ended April 30, 2006, the Investor Shares of Vanguard Explorer Fund returned 18.6% and the lower-cost Admiral Shares 18.7%. This performance reflects the combined efforts of your fund’s six independent advisors. The use of multiple advisors provides exposure to distinct, yet complementary, investment approaches, enhancing the fund’s diversification.

The advisors, the percentage of fund assets each manages, and brief descriptions of their investment strategies are presented in the table on page 11. The advisors have also prepared a discussion of the investment environment that existed during the fiscal half-year and of how their portfolio positioning reflects this assessment.

Grantham, Mayo,

Van Otterloo & Co. LLC

Portfolio Manager:

Sam Wilderman, CFA, Partner and Director

of U.S. Equity Management

On the positive side, our portfolio’s holdings in health care and materials & processing had favorable impacts on overall relative performance for the period. In addition, the portfolio made notable stock selections among consumer discretionary, other energy, and financial services issues. The portfolio’s earnings-and price-momentum models for stock selection helped to raise overall relative returns for the period. (We use index sectors as categorized by Russell, which are different from the Global Industry Classification System used by Vanguard funds and reflected in the Fund Profile.)

On the negative side, both sector weights and stock selection detracted from overall portfolio performance. At the sector level, our portfolio’s underweighting in producer durables and technology and its overweighting in consumer discretionary and other energy were the chief detractors from relative returns. Meanwhile, stock selections among health care and producer durables were weak for the period. The portfolio’s valuation component for stock selection detracted from performance.

Over the fiscal half-year, we enlarged the portfolio’s weighting in integrated oils so that it is now on par with the benchmark weighting. At the same time, the portfolio added to its tech sector weighting and reduced its exposure to utilities. As of April 30, the portfolio continued its focus on traditional growth-oriented sectors, including consumer discretionary, technology, and health care.

Vanguard Quantitative

Equity Group

Portfolio Manager:

James D. Troyer, CFA, Principal

Our quantitative investment process evaluates a security’s attractiveness in terms of three attributes: valuation, sentiment, and balance-sheet characteristics.

6

In our experience, each of our underlying models performs well over long time frames, but their effectiveness varies over shorter periods. For example, over the past six months, our sentiment and balance-sheet models performed relatively well, but our valuation model was out of sync with the small-cap growth market.

Our process evaluates securities relative to their peer group (e.g., comparing a semiconductor stock to the universe of semiconductor stocks). We purchase the most attractively ranked stocks and sell those that we believe are overvalued, based on our model’s output. At the same time, our process neutralizes risk characteristics versus a small-cap growth benchmark. During the period, the benchmark we used to manage the risk exposures of the portfolio changed from the MSCI U.S. Small-Cap Growth Index to the Russell 2500 Growth Index.

We do not maintain a “view” on the market or individual sectors that is applied in the current management of our portfolio. Our process is focused solely on stockpicking—that is, overweighting those stocks in an industry group that we believe will outperform their peers, while avoiding securities in the same industry group that we believe will underperform. Although it may seem incongruous, our portfolio positioning is both static and dynamic. It’s static in that our portfolio always reflects the market cap and industry-group weightings of its benchmark. Yet, it’s dynamic because we are regularly buying and selling securities within these market-cap and industry-group buckets to try to outperform the benchmark’s return.

Granahan Investment

Management, Inc.

Portfolio Manager:

Jack Granahan, Managing Partner

Stocks in the technology, financial services, and transportation industries made major positive contributions to our portfolio’s performance during the six months ended April 30. The fund’s health care sector holdings were strong relative to the benchmark sector. (We use index sectors as categorized by Russell, which are different from the Global Industry Classification System used by Vanguard funds and reflected in the Fund Profile.)

Our tech holdings benefited from two related developments. The first was an improvement in spending on product development by worldwide carriers and cable companies following five years of reduced expenditures on optical components and hardware. The second development was a dramatic increase in usage of Internet and cell-phone bandwidth for music and video, which generated demand for components enabling wireless capability.

Financial services stocks, including Jefferies Group, United Rentals, and Dun & Bradstreet provided strong results.

7

Transportation, while not a big sector for us, nonetheless provided strong contributions from holdings such as Swift Transportation, C.H. Robinson, and Tidewater.

Our large health care holdings showed good performance relative to the benchmark sector and included several significant individual contributors. Two of our holdings—Abgenix (acquired by Amgen) and Serologicals—were bought at premiums. Good product-development news boosted returns for Vertex, Nektar, Medarex, and Adolor. We incurred some penalties in the device and equipment area, where Bausch & Lomb’s well-publicized problems with lens-care solutions provided a significant negative, and, to a lesser degree, Cyberonics, Affymetrix, and Cooper Companies were also detractors.

Producer durables and materials & processing, two relatively small sectors in the portfolio, were disappointments. Other sectors, including the consumer-oriented and energy groups, were a slight negative to performance.

Overall, our portfolio holdings continued to show strong earnings comparisons, ranging from triple-digit gains in energy and technology to more modest gains in consumer and materials companies. Profit-margin improvements are still the main driver of profit gains, though we also saw some acceleration in our companies’ revenue gains during this period. Valuations, as measured on reported earnings, remained high by historical standards.

Wellington Management

Company, LLP

Portfolio Manager:

Kenneth L. Abrams, Senior Vice President

and Partner

Over the last six months, our portion of the fund benefited from favorable security selection in the health care, energy, and financials sectors. Within health care, our holdings in biotechnology companies Abgenix and Human Genome Sciences aided returns. Abgenix was acquired by Amgen, and Human Genome Sciences benefited from positive clinical data for its hepatitis treatment. Within energy, shares of energy services provider TETRA Technologies climbed on record profits as energy exploration and production companies seek to increase production. And in financials, shares of Investment Technology Group, an alternative trading network, rose on strong earnings growth amid record electronic-trading volumes.

Conversely, detractors over the fiscal period included PortalPlayer, a maker of semiconductors and software for digital music players; the company’s share price declined on concern that its products may no longer be used in the manufacture of Apple’s iPod. Another detractor was specialty drug maker Salix Pharmaceuticals, whose shares decreased on lower-than-expected earnings. And shares of biotech holding ICOS fell as a result of increasing concerns that the market for its key drug, Cialis, may be diminishing.

8

Our sector positioning remains predominantly a consequence of our bottom-up stock-selection process. In light of continued strong small-cap performance and the prospects for an economic slowdown in the second half of 2006, we have begun to adopt a more defensive posture. Compared with the benchmark, we ended the period overweighted in financials and underweighted in the industrials and information technology sectors.

Chartwell Investment Partners

Portfolio Managers:

Edward N. Antoian, CFA, Managing Partner

John A. Heffern, Managing Partner

Mark J. Cunneen, Managing Partner

Stock selection was the primary driver of our performance during the period, and the most positive contributors were the consumer-oriented, energy, and business services categories. Consumer-oriented stocks were robust as individuals continued to spend despite rising energy costs. Our portfolio’s selections in apparel retail and lodging were noteworthy contributors.

In energy, we benefited from an overweighted position relative to the benchmark and from outstanding stock selection. We expect continued growth in this sector, but we trimmed several of our investments following their vigorous performance during the period.

Within business services, continued solid fundamentals and earnings reports drove a number of our holdings.

During the half-year, stocks geared toward capital spending and technology were slight drags on our portfolio on a relative basis. Although some of our holdings fell shy of the impressive Russell 2500 Growth Index sector returns, in general, our holdings were up nicely.

We continue to identify pockets of growth for small and mid-size companies with products and capabilities to exploit changing demand patterns. This underscores our optimism about potential long-term investment returns from small- and mid-cap growth companies. Quantitatively, valuations in these asset classes are supportive. While small- and mid-cap growth stocks have outperformed value recently, they have lagged considerably in the last several years, and we believe that the opportunity for reversion to a more normalized return environment strongly favors our investment style.

Kalmar Investment Advisers

Portfolio Managers:

Ford B. Draper, Jr., President and Chief

Investment Officer

Dana F. Walker, CFA

Gregory A. Hartley, CFA

As the newest subadvisor to the Explorer Fund, we remind shareholders that Kalmar’s “growth with value” approach concentrates on the discovery and longer-term ownership of legitimate growth businesses whose stocks are currently undervalued. These are “real companies” that have the capability to add meaningfully to their intrinsic business value over time and that can also benefit from upward stock revaluation.

9

In the six months covered by this semiannual report, our portfolio’s holdings—with the exception of temporary “problem issues,” of which we will always have a few in our roughly 80-stock selection—have indeed grown their revenues and earnings well. As part of our long-term investment strategy, we continue to focus primarily on higher-quality businesses with more sustainable growth models and not on the clearly more cyclical, commodity-oriented materials, industrials, and durable goods companies that have led market returns when commodity prices soared.

In our opinion, the market has made an increasingly aggressive bet on the endurance of a hot commodity cycle and has also been driven by a higher level of risk-taking by investors, as stocks with high betas (high volatility relative to that of the market) and low returns on equity have set the pace. This makes Kalmar increasingly nervous about the risks in these sectors and strategies. Even though our growth-with-value investment approach may appear out of sync when the market embraces such a risk-taking psychology, we feel that the approach has proven itself ably over time.

Despite our concern for risk in these areas of the market, we continue to expect that 2006 will produce better returns than 2005, for a number of reasons. Those include strong corporate balance sheets, profitability, and earnings growth; reasonable overall valuations; ongoing restrained inflation; a likely end to Fed interest rate hikes; still-adequate monetary liquidity; shareholder-friendly corporate cash deployment; and rising merger-and-acquisition activity.

10

Vanguard Explorer Fund Investment Advisors |

| | | |

| Fund Assets Managed | |

Investment Advisor | % | $ Million | Investment Strategy |

Grantham, Mayo, | 27 | 3,381 | Employs a highly disciplined approach to buying and |

Van Otterloo & Co. LLC | | | selling stocks ranked among the 3,000 largest in the |

| | | U.S. market, minus the very largest 500. Stocks are |

| | | compared with one another and evaluated monthly |

| | | using three disciplines, each of which represents an |

| | | individual subportfolio. |

Vanguard Quantitative | 24 | 3,124 | Conducts quantitative management using models that |

Equity Group | | | assess valuation, marketplace sentiment, and balance- |

| | | sheet characteristics of companies as compared with |

| | | their peers. |

Granahan Investment | 20 | 2,558 | Bases its investment process on the beliefs that |

Management, Inc. | | | earnings drive stock prices and that small, dynamic |

| | | companies with exceptional growth prospects have |

| | | the greatest long-term potential. A bottom-up, |

| | | fundamental approach places companies in one of |

| | | three life-cycle categories: core growth, pioneer, and |

| | | special situation. In each, the process looks for |

| | | companies with strong earnings growth and |

| | | leadership in their markets. |

Wellington Management | 11 | 1,456 | Conducts research and analysis of individual |

Company, LLP | | | companies to select stocks believed to have |

| | | exceptional growth potential relative to their market |

| | | valuations Each stock is considered individually |

| | | before purchase, and company developments are |

| | | continually monitored for comparison with |

| | | expectations for growth. |

Chartwell Investment Partners | 7 | 897 | Uses a bottom-up, fundamental, research-driven |

| | | stock-selection strategy focusing on companies with |

| | | sustainable growth, strong management teams, |

| | | competitive positions, and outstanding product and |

| | | service offerings. These companies should continually |

| | | demonstrate growth in earnings per share. |

Kalmar Investment Advisers | 6 | 816 | Employs a “growth with value” strategy using |

| | | creative, bottom-up research to uncover vigorously |

| | | growing, high-quality businesses. The process also |

| | | seeks out stocks that are inefficiently valued or that |

| | | offer value through longer-term company ownership. |

| | | The strategy has a dual objective of superior returns |

| | | with lower risk. |

Cash Investments1 | 5 | 651 | — |

1 | These short-term reserves are invested by Vanguard in equity index products to simulate investment in stocks. Each advisor also may maintain a modest cash position. |

11

Fund Profile

As of April 30, 2006

Portfolio Characteristics | | |

| | Comparative | Broad |

| Fund | Index1 | Index2 |

Number of Stocks | 1,073 | 1,671 | 4,978 |

Median Market Cap | $2.3B | $2.5B | $27.3B |

Price/Earnings Ratio | 25.6x | 28.8x | 20.2x |

Price/Book Ratio | 3.4x | 3.9x | 3.0x |

Yield | | 0.5% | 1.7% |

Investor Shares | 0.3% | | |

Admiral Shares | 0.4% | | |

Return on Equity | 12.0% | 13.2% | 17.3% |

Earnings Growth Rate | 18.4% | 18.8% | 9.9% |

Foreign Holdings | 1.8% | 0.0% | 1.9% |

Turnover Rate | 97%3 | — | — |

Expense Ratio | | — | — |

Investor Shares | 0.48%3 | | |

Admiral Shares | 0.30%3 | | |

Short-Term Reserves | 2% | — | — |

Sector Diversification (% of portfolio) |

| | Comparative | Broad |

| Fund | Index1 | Index2 |

Consumer Discretionary | 18% | 17% | 13% |

Consumer Staples | 2 | 2 | 8 |

Energy | 8 | 9 | 9 |

Financials | 9 | 10 | 22 |

Health Care | 17 | 17 | 12 |

Industrials | 14 | 16 | 11 |

Information Technology | 25 | 23 | 16 |

Materials | 3 | 4 | 3 |

Telecommunication Services | 1 | 2 | 3 |

Utilities | 1 | 0 | 3 |

Short-Term Reserves | 2% | — | — |

Volatility Measures | | | |

| | Comparative | | Broad |

| Fund | Index1 | Fund | Index2 |

R-Squared | 0.99 | 1.00 | 0.86 | 1.00 |

Beta | 0.98 | 1.00 | 1.56 | 1.00 |

Ten Largest Holdings4 (% of total net assets) |

| | |

Red Hat, Inc. | systems software | 0.8% |

Helix Energy Solutions Group, Inc. | oil and gas equipment and services | 0.6 |

MSC Industrial | trading companies | |

Direct Co., Inc. Class A | and distributors | 0.6 |

Alliance Data Systems Corp. | data processing and outsourced services | 0.6 |

Tidewater Inc. | oil and gas equipment and services | 0.5 |

Akamai Technologies, Inc. | internet software and services | 0.5 |

Swift Transportation Co., Inc. | trucking | 0.5 |

O’Reilly Automotive, Inc. | automotive retail | 0.5 |

Foundry Networks, Inc. | Communications equipment | 0.5 |

Grant Prideco, Inc. | oil and gas equipment and services | 0.5 |

Top Ten | | 5.6% |

Investment Focus

1 | Russell 2500 Growth Index. |

2 | Dow Jones Wilshire 5000 Index. |

4 | “Ten Largest Holdings” excludes any temporary cash investments and equity index products. See page 43 for a glossary of investment terms. |

12

Performance Summary

All of the returns in this report represent past performance, which is not a guarantee of future results that may be achieved by the fund. (Current performance may be lower or higher than the performance data cited. For performance data current to the most recent month-end, visit our website at www.vanguard.com.) Note, too, that both investment returns and principal value can fluctuate widely, so an investor’s shares, when sold, could be worth more or less than their original cost. The returns shown do not reflect taxes that a shareholder would pay on fund distributions or on the sale of fund shares.

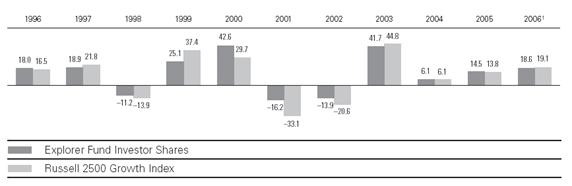

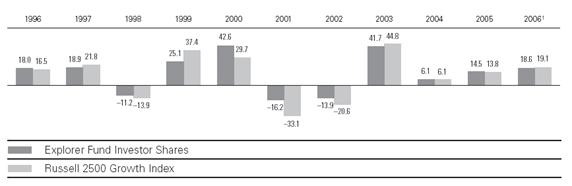

Fiscal-Year Total Returns (%): October 31, 1995–April 30, 2006

Average Annual Total Returns: Periods Ended March 31, 2006

This table presents average annual total returns through the latest calendar quarter—rather than through the end of the fiscal period. Securities and Exchange Commission rules require that we provide this information.

| Inception Date | One Year | Five Years | Ten Years |

Investor Shares | 12/11/1967 | 25.77% | 11.06% | 11.22% |

Admiral Shares | 11/12/2001 | 25.99 | 12.902 | — |

1 | Six months ended April 30, 2006. |

Note: See Financial Highlights tables on pages 33 and 34 for dividend and capital gains information.

13

Financial Statements (unaudited)

Statement of Net Assets

As of April 30, 2006

The fund provides a complete list of its holdings four times in each fiscal year, at the quarter-ends. For the second and fourth fiscal quarters, the lists appear in the fund’s semiannual and annual reports to shareholders. For the first and third fiscal quarters, the fund files the lists with the Securities and Exchange Commission on Form N-Q. Shareholders can look up the fund’s Forms N-Q on the SEC’s website at www.sec.gov. Forms N-Q may also be reviewed and copied at the SEC’s Public Reference Room (see the back cover of this report for further information).

| | | Market |

| | | Value• |

| | Shares | ($000) |

| Common Stocks (94.3%)1 | | |

| Consumer Discretionary (17.5%) | | |

* | O’Reilly Automotive, Inc. | 1,876,150 | 63,564 |

| Advance Auto Parts, Inc. | 1,073,850 | 43,190 |

* | Carter’s, Inc. | 533,050 | 35,906 |

| ^Garmin Ltd. | 407,125 | 35,159 |

* | Hibbett Sporting Goods, Inc. | 1,135,640 | 34,421 |

* | Lamar Advertising Co. Class A | 620,860 | 34,141 |

*^ | Netflix.com, Inc. | 1,133,600 | 33,600 |

| Ryland Group, Inc. | 515,400 | 32,527 |

| Brinker International, Inc. | 808,300 | 31,653 |

| Phillips-Van Heusen Corp. | 773,800 | 31,107 |

| Men’s Wearhouse, Inc. | 841,548 | 29,824 |

* | Rare Hospitality International Inc. | 938,965 | 29,221 |

* | Genesco, Inc. | 703,300 | 29,067 |

* | Career Education Corp. | 731,100 | 26,956 |

| Ethan Allen Interiors, Inc. | 594,600 | 26,692 |

| Claire’s Stores, Inc. | 744,700 | 26,228 |

* | Dollar Tree Stores, Inc. | 954,964 | 24,896 |

| SCP Pool Corp. | 525,800 | 24,565 |

* | Valassis Communications, Inc. | 823,000 | 24,089 |

* | Tractor Supply Co. | 369,355 | 23,931 |

| Polo Ralph Lauren Corp. | 375,915 | 22,826 |

* | The Gymboree Corp. | 756,993 | 22,770 |

* | The Dress Barn, Inc. | 899,800 | 22,756 |

| Ross Stores, Inc. | 719,516 | 22,046 |

* | Coldwater Creek Inc. | 779,285 | 21,789 |

* | ITT Educational Services, Inc. | 338,700 | 21,524 |

| Harte-Hanks, Inc. | 773,800 | 21,125 |

* | Guess ?, Inc. | 519,700 | 20,596 |

| BorgWarner, Inc. | 335,500 | 20,375 |

* | The Pantry, Inc. | 301,102 | 19,930 |

* | Papa John’s International, Inc. | 581,533 | 19,435 |

* | Helen of Troy Ltd. | 914,300 | 18,889 |

* | TiVo Inc. | 2,273,800 | 18,873 |

| ADVO, Inc. | 660,700 | 18,724 |

* | Quiksilver, Inc. | 1,359,400 | 18,583 |

* | DreamWorks Animation SKG, Inc. | 674,100 | 18,268 |

| Laureate Education Inc. | 350,195 | 17,541 |

* | Bright Horizons Family Solutions, Inc. | 439,421 | 17,454 |

* | Life Time Fitness, Inc. | 379,275 | 17,371 |

| Aaron Rents, Inc. Class B | 641,675 | 17,235 |

*^ | Nutri/System Inc. | 247,600 | 16,802 |

* | TRW Automotive Holdings Corp. | 738,800 | 16,387 |

* | The Goodyear Tire & Rubber Co. | 1,161,803 | 16,265 |

* | NVR, Inc. | 21,500 | 16,232 |

* | Texas Roadhouse, Inc. | 1,068,650 | 16,137 |

* | DSW Inc. Class A | 513,837 | 16,083 |

* | GameStop Corp. Class A | 321,925 | 15,195 |

| Catalina Marketing Corp. | 639,300 | 15,139 |

| Abercrombie & Fitch Co. | 245,900 | 14,934 |

| Williams-Sonoma, Inc. | 353,000 | 14,780 |

14

| | | Market |

| | | Value• |

| | Shares | ($000) |

| Tenma Corp. | 773,000 | 14,741 |

| Borders Group, Inc. | 615,600 | 14,528 |

| Tiffany & Co. | 416,205 | 14,521 |

| Harman International Industries, Inc. | 157,325 | 13,843 |

| Service Corp. International | 1,684,250 | 13,558 |

| K-Swiss, Inc. | 465,895 | 13,362 |

| Beazer Homes USA, Inc. | 231,400 | 13,336 |

* | The Cheesecake Factory Inc. | 419,948 | 13,254 |

| DeVry, Inc. | 511,975 | 13,240 |

| United Auto Group, Inc. | 310,400 | 13,130 |

| Thor Industries, Inc. | 258,000 | 13,024 |

* | LodgeNet Entertainment Corp. | 674,600 | 12,871 |

* | Panera Bread Co. | 172,500 | 12,796 |

| Ruby Tuesday, Inc. | 428,200 | 12,748 |

* | priceline.com, Inc. | 513,500 | 12,550 |

* | AnnTaylor Stores Corp. | 331,800 | 12,386 |

* | Imax Corp. | 1,237,000 | 12,333 |

| Circuit City Stores, Inc. | 422,300 | 12,141 |

*^ | Charter Communications, Inc. | 10,245,700 | 12,090 |

| CBRL Group, Inc. | 284,189 | 11,569 |

* | Pacific Sunwear of California, Inc. | 491,042 | 11,441 |

| Applebee’s International, Inc. | 491,161 | 11,400 |

| MDC Holdings, Inc. | 195,749 | 11,310 |

* | Meritage Corp. | 172,300 | 11,299 |

| Regis Corp. | 321,000 | 11,257 |

* | Playboy Enterprises, Inc. Class B | 849,738 | 11,208 |

* | MarineMax, Inc. | 341,245 | 11,179 |

* | Sonic Corp. | 325,950 | 11,053 |

* | Jack in the Box Inc. | 256,500 | 10,722 |

* | Ruth’s Chris Steak House | 459,100 | 10,720 |

* | Too Inc. | 274,100 | 10,531 |

* | CEC Entertainment Inc. | 291,850 | 10,244 |

| KB Home | 164,000 | 10,097 |

* | Hovnanian Enterprises Inc. Class A | 252,300 | 10,034 |

* | Sotheby’s Holdings Class A | 329,822 | 9,891 |

| OSI Restaurant Partners, Inc. | 228,600 | 9,761 |

| Barnes & Noble, Inc. | 215,554 | 9,717 |

* | Penn National Gaming, Inc. | 232,625 | 9,472 |

| Liz Claiborne, Inc. | 235,500 | 9,196 |

* | Insight Enterprises, Inc. | 464,325 | 9,180 |

| Jackson Hewitt Tax Service Inc. | 307,100 | 9,176 |

* | Morningstar, Inc. | 213,921 | 9,100 |

| Foot Locker, Inc. | 386,800 | 8,966 |

* | Champion Enterprises, Inc. | 587,100 | 8,959 |

* | Gaylord Entertainment Co. | 200,030 | 8,851 |

^ | Brookfield Homes Corp. | 189,420 | 8,827 |

| Standard Pacific Corp. | 276,400 | 8,765 |

| Astro All Asia Networks PLC | 6,930,200 | 8,753 |

* | Guitar Center, Inc. | 162,730 | 8,748 |

| Darden Restaurants Inc. | 220,400 | 8,728 |

| Tupperware Corp. | 408,300 | 8,615 |

* | VistaPrint Ltd. | 268,720 | 8,594 |

* | Build-A-Bear-Workshop, Inc. | 261,100 | 8,434 |

* | Jos. A. Bank Clothiers, Inc. | 199,831 | 8,393 |

^ | Regal Entertainment Group Class A | 393,700 | 8,276 |

| bebe stores, inc. | 460,537 | 8,142 |

* | Leapfrog Enterprises, Inc. | 770,000 | 8,085 |

| Hilton Hotels Corp. | 297,100 | 8,004 |

| John Wiley & Sons Class A | 217,900 | 7,984 |

* | Harris Interactive Inc. | 1,612,500 | 7,788 |

* | Toll Brothers, Inc. | 241,600 | 7,767 |

* | The Children’s Place Retail Stores, Inc. | 125,500 | 7,753 |

* | The Warnaco Group, Inc. | 346,200 | 7,713 |

* | Timberland Co. | 220,000 | 7,491 |

* | Hollywood Media Corp. | 1,561,823 | 7,341 |

* | WMS Industries, Inc. | 233,668 | 7,302 |

* | Payless ShoeSource, Inc. | 313,800 | 7,208 |

| Finish Line, Inc. | 435,089 | 7,170 |

* | Zumiez Inc. | 220,000 | 7,150 |

* | Rent-A-Center, Inc. | 255,300 | 7,051 |

* | CarMax, Inc. | 197,500 | 6,974 |

| Orient-Express Hotel Ltd. | 169,490 | 6,949 |

* | Education Management Corp. | 163,440 | 6,940 |

*^ | William Lyon Homes, Inc. | 69,200 | 6,923 |

15

| | | Market |

| | | Value• |

| | Shares | ($000) |

| Brunswick Corp. | 172,900 | 6,781 |

| Stein Mart, Inc. | 426,487 | 6,738 |

| Building Materials Holding Corp. | 199,100 | 6,654 |

| Sinclair Broadcast Group, Inc. | 844,673 | 6,631 |

| Station Casinos, Inc. | 85,500 | 6,590 |

^ | Oakley, Inc. | 361,800 | 6,570 |

*^ | Select Comfort Corp. | 163,784 | 6,545 |

* | Urban Outfitters, Inc. | 279,220 | 6,478 |

* | Chico’s FAS, Inc. | 169,500 | 6,282 |

*^ | Columbia Sportswear Co. | 122,500 | 6,234 |

| Michaels Stores, Inc. | 164,325 | 6,216 |

* | Zale Corp. | 250,300 | 6,170 |

| Harrah’s Entertainment, Inc. | 75,120 | 6,133 |

* | Tenneco Automotive, Inc. | 245,800 | 5,911 |

* | The Sports Authority, Inc. | 158,800 | 5,901 |

| Domino’s Pizza, Inc. | 222,051 | 5,847 |

* | Emmis Communications, Inc. | 468,971 | 5,768 |

| Getty Images, Inc. | 89,025 | 5,698 |

* | Steiner Leisure Ltd. | 131,909 | 5,688 |

| Gentex Corp. | 385,850 | 5,657 |

* | IAC/InterActiveCorp | 195,705 | 5,650 |

* | JAKKS Pacific, Inc. | 242,400 | 5,495 |

| American Eagle Outfitters, Inc. | 164,400 | 5,327 |

| Steven Madden, Ltd. | 97,200 | 5,175 |

| RadioShack Corp. | 296,900 | 5,047 |

| Talbots Inc. | 212,200 | 5,033 |

| International Speedway Corp. | 101,300 | 4,983 |

| Fortune Brands, Inc. | 61,115 | 4,908 |

* | Pinnacle Entertainment, Inc. | 177,700 | 4,851 |

* | ProQuest Co. | 305,800 | 4,801 |

* | Charlotte Russe Holding Inc. | 220,558 | 4,764 |

| PETsMART, Inc. | 165,900 | 4,589 |

^ | Red Robin Gourmet Burgers | 98,475 | 4,427 |

| The Stanley Works | 82,100 | 4,290 |

* | Volcom, Inc. | 120,000 | 4,280 |

* | Fleetwood Enterprises, Inc. | 453,700 | 4,265 |

* | P.F. Chang’s China Bistro, Inc. | 98,300 | 4,189 |

| Polaris Industries, Inc. | 83,400 | 3,995 |

* | RCN Corp. | 143,225 | 3,830 |

* | Steak n Shake Co. | 200,100 | 3,824 |

^ | Winnebago Industries, Inc. | 128,400 | 3,781 |

* | Fossil, Inc. | 227,250 | 3,695 |

*^ | Tempur-Pedic International Inc. | 214,300 | 3,384 |

* | Marvel Entertainment, Inc. | 172,400 | 3,364 |

| Choice Hotel International, Inc. | 62,600 | 3,351 |

* | XM Satellite Radio Holdings, Inc. | 163,890 | 3,314 |

| Family Dollar Stores, Inc. | 132,200 | 3,305 |

| Oxford Industries, Inc. | 74,100 | 3,238 |

* | Monarch Casino & Resort, Inc. | 100,987 | 3,179 |

* | Aeropostale, Inc. | 99,100 | 3,043 |

| Meredith Corp. | 60,800 | 3,016 |

* | Charming Shoppes, Inc. | 218,000 | 2,997 |

| Whirlpool Corp. | 33,170 | 2,977 |

| Speedway Motorsports, Inc. | 76,400 | 2,909 |

* | Alderwoods Group, Inc. | 151,983 | 2,897 |

* | Citi Trends Inc. | 59,477 | 2,888 |

^ | Pre-Paid Legal Services, Inc. | 79,300 | 2,680 |

| Blyth, Inc. | 129,400 | 2,659 |

* | Blount International, Inc. | 169,300 | 2,622 |

^ | Charles & Colvard Ltd. | 181,125 | 2,139 |

| Journal Register Co. | 183,200 | 2,048 |

| Kenneth Cole Productions, Inc. | 73,500 | 1,875 |

| Cato Corp. Class A | 74,500 | 1,686 |

* | McCormick & Schmick’s Seafood Restaurants, Inc. | 66,400 | 1,660 |

* | Saks Inc. | 74,300 | 1,496 |

| IHOP Corp. | 31,100 | 1,490 |

| Interactive Data Corp. | 66,141 | 1,473 |

| AFC Enterprises, Inc. | 101,397 | 1,407 |

* | PetMed Express, Inc. | 84,900 | 1,367 |

* | R.H. Donnelley Corp. | 23,500 | 1,319 |

| Christopher & Banks Corp. | 48,000 | 1,268 |

| World Wrestling Entertainment, Inc. | 72,000 | 1,248 |

16

| | | Market |

| | | Value• |

| | Shares | ($000) |

| Group 1 Automotive, Inc. | 22,500 | 1,228 |

*^ | Escala Group, Inc. | 40,318 | 1,109 |

* | MTR Gaming Group Inc. | 107,000 | 1,054 |

| Ambassadors Group, Inc. | 39,000 | 1,041 |

* | Conn’s, Inc. | 27,000 | 923 |

| Journal Communications, Inc. | 78,400 | 920 |

* | Radio One, Inc. Class D | 116,918 | 841 |

* | Skechers U.S.A., Inc. | 24,800 | 678 |

| Matthews International Corp. | 19,000 | 661 |

* | The Wet Seal, Inc. Class A | 100,400 | 577 |

* | Lincoln Educational Services | 27,927 | 475 |

* | Interface, Inc. | 35,911 | 462 |

| CKE Restaurants Inc. | 27,600 | 437 |

* | Isle of Capri Casinos, Inc. | 10,400 | 324 |

| Autoliv, Inc. | 5,700 | 315 |

| M/I Homes, Inc. | 6,800 | 294 |

* | GameStop Corp. Class B | 5,953 | 253 |

| Dover Downs Gaming & Entertainment, Inc. | 6,700 | 173 |

* | Visteon Corp. | 23,000 | 135 |

| Monro Muffler Brake, Inc. | 2,700 | 98 |

| Value Line, Inc. | 2,100 | 87 |

* | Dolby Laboratories Inc. | 3,500 | 82 |

| Stage Stores, Inc. | 2,135 | 67 |

| Deb Shops, Inc. | 1,757 | 51 |

* | Cache, Inc. | 1 | — |

| | | 2,251,729 |

| Consumer Staples (1.8%) | | |

* | Revlon, Inc. Class A | 9,229,842 | 29,997 |

*^ | Hansen Natural Corp. | 174,900 | 22,643 |

* | Performance Food Group Co. | 721,100 | 22,138 |

* | Central Garden and Pet Co. | 433,587 | 21,358 |

* | Playtex Products, Inc. | 1,666,900 | 18,686 |

| Longs Drug Stores, Inc. | 359,232 | 17,031 |

| Nu Skin Enterprises, Inc. | 812,900 | 13,429 |

* | Energizer Holdings, Inc. | 215,300 | 11,013 |

| The Great Atlantic & Pacific Tea Co., Inc. | 389,300 | 10,550 |

| Brown-Forman Corp. Class B | 118,500 | 8,828 |

^ | Sanderson Farms, Inc. | 271,200 | 7,190 |

*^ | USANA Health Sciences, Inc. | 159,500 | 5,836 |

* | NBTY, Inc. | 249,848 | 5,659 |

*^ | Parlux Fragrances, Inc. | 181,537 | 4,952 |

| American Italian Pasta Co. | 566,300 | 4,706 |

| Alberto-Culver Co. Class B | 80,100 | 3,602 |

| Lancaster Colony Corp. | 79,981 | 3,283 |

| Seaboard Corp. | 2,115 | 3,261 |

* | Chattem, Inc. | 66,634 | 2,401 |

| Church & Dwight, Inc. | 60,500 | 2,219 |

^ | Mannatech, Inc. | 118,700 | 2,181 |

* | Wild Oats Markets Inc. | 123,500 | 2,122 |

| Inter Parfums, Inc. | 74,061 | 1,403 |

* | BJ’s Wholesale Club, Inc. | 45,400 | 1,390 |

| Pilgrim’s Pride Corp. | 51,400 | 1,343 |

| Flowers Foods, Inc. | 43,000 | 1,208 |

| Premium Standard Farms Inc. | 39,100 | 651 |

* | Pathmark Stores, Inc. | 62,900 | 651 |

| Coca-Cola Bottling Co. | 11,800 | 569 |

| WD-40 Co. | 15,532 | 488 |

| Alico, Inc. | 8,400 | 422 |

| National Beverage Corp. | 18,700 | 287 |

* | Gold Kist Inc. | 17,000 | 228 |

| J & J Snack Foods Corp. | 2,319 | 79 |

| | | 231,804 |

| Energy (7.9%) | | |

* | Helix Energy Solutions Group, Inc. | 2,115,200 | 82,112 |

| Tidewater Inc. | 1,194,850 | 69,588 |

* | Grant Prideco, Inc. | 1,179,760 | 60,404 |

| St. Mary Land & Exploration Co. | 1,303,998 | 54,977 |

| Patterson-UTI Energy, Inc. | 1,615,921 | 52,291 |

| Frontier Oil Corp. | 780,300 | 47,232 |

| Helmerich & Payne, Inc. | 586,434 | 42,657 |

* | Cooper Cameron Corp. | 746,430 | 37,501 |

| Tesoro Petroleum Corp. | 430,500 | 30,101 |

| CONSOL Energy, Inc. | 326,200 | 27,779 |

* | Unit Corp. | 407,000 | 23,504 |

* | Hornbeck Offshore Services, Inc. | 623,110 | 22,376 |

* | Western Oil Sands Inc. | 711,400 | 21,465 |

17

| | | Market |

| | | Value• |

| | Shares | ($000) |

| Rowan Cos., Inc. | 442,100 | 19,598 |

* | TETRA Technologies, Inc. | 394,400 | 19,404 |

| Holly Corp. | 239,100 | 18,451 |

| TODCO Class A | 398,959 | 18,300 |

* | Oil States International, Inc. | 448,003 | 18,086 |

* | Comstock Resources, Inc. | 562,200 | 17,473 |

* | Grey Wolf, Inc. | 2,215,195 | 17,279 |

| Ultra Petroleum Corp. | 263,500 | 16,853 |

* | Pride International, Inc. | 419,300 | 14,629 |

* | OPTI Canada Inc. | 362,700 | 13,860 |

| CARBO Ceramics Inc. | 232,550 | 13,472 |

| Arch Coal, Inc. | 140,500 | 13,346 |

| World Fuel Services Corp. | 321,800 | 12,885 |

* | Superior Energy Services, Inc. | 398,470 | 12,811 |

* | Southwestern Energy Co. | 351,300 | 12,654 |

| Alon USA Energy, Inc. | 467,300 | 12,538 |

* | Maverick Tube Corp. | 230,100 | 12,522 |

| Western Gas Resources, Inc. | 226,200 | 11,762 |

* | Giant Industries, Inc. | 162,700 | 11,695 |

| XTO Energy, Inc. | 268,258 | 11,361 |

* | NS Group Inc. | 204,672 | 10,238 |

* | KCS Energy, Inc. | 331,000 | 9,715 |

| Range Resources Corp. | 302,626 | 8,029 |

| ENSCO International, Inc. | 147,405 | 7,885 |

* | Complete Production Services, Inc. | 285,255 | 7,539 |

| Atwood Oceanics, Inc. | 140,200 | 7,480 |

* | Parker Drilling Co. | 882,100 | 7,410 |

* | FMC Technologies Inc. | 134,200 | 7,325 |

* | Forest Oil Corp. | 189,425 | 6,927 |

* | Hercules Offshore, Inc. | 164,900 | 6,743 |

* | Hydrill Co. | 83,800 | 6,717 |

* | Veritas DGC Inc. | 133,629 | 6,404 |

* | National Oilwell Varco Inc. | 90,280 | 6,227 |

* | Oceaneering International, Inc. | 99,400 | 6,066 |

* | Pioneer Drilling Co. | 369,100 | 5,983 |

| Niko Resources Ltd. | 77,475 | 4,529 |

| Duvernay Oil Corp. | 111,875 | 4,273 |

| Pogo Producing Co. | 81,300 | 4,040 |

| Cabot Oil & Gas Corp. | 77,100 | 3,798 |

* | SEACOR Holdings Inc. | 35,900 | 3,175 |

*^ | GMX Resources Inc. | 69,500 | 2,927 |

* | Gulfmark Offshore, Inc. | 106,465 | 2,917 |

* | Energy Partners, Ltd. | 112,758 | 2,908 |

* | Denbury Resources, Inc. | 72,500 | 2,363 |

| Lufkin Industries, Inc. | 31,800 | 2,037 |

| RPC Inc. | 71,600 | 1,983 |

* | Edge Petroleum Corp. | 50,400 | 1,165 |

| Massey Energy Co. | 23,600 | 912 |

| W&T Offshore, Inc. | 20,000 | 854 |

* | Plains Exploration & Production Co. | 20,300 | 748 |

* | Newpark Resources, Inc. | 102,900 | 685 |

* | NATCO Group Inc. | 17,300 | 512 |

| Hugoton Royalty Trust | 15,988 | 442 |

| | | 1,021,922 |

| Financials (8.2%) | | |

* | CB Richard Ellis Group, Inc. | 558,990 | 49,130 |

* | Affiliated Managers Group, Inc. | 456,790 | 46,273 |

* | Nasdaq Stock Market Inc. | 1,148,090 | 42,962 |

* | Investment Technology Group, Inc. | 801,000 | 42,445 |

| CapitalSource Inc. REIT | 1,589,796 | 37,359 |

| Jefferies Group, Inc. | 545,800 | 36,268 |

| Cullen/Frost Bankers, Inc. | 607,800 | 35,179 |

| W.R. Berkley Corp. | 774,715 | 28,990 |

| Cash America International Inc. | 881,100 | 28,971 |

| Nuveen Investments, Inc. Class A | 484,800 | 23,329 |

| IndyMac Bancorp, Inc. | 433,700 | 20,956 |

| TCF Financial Corp. | 756,200 | 20,312 |

| Strategic Hotels and Resorts, Inc. REIT | 845,395 | 19,174 |

* | AmeriCredit Corp. | 622,900 | 18,861 |

| ^Corus Bankshares Inc. | 268,100 | 17,947 |

| Kilroy Realty Corp. REIT | 232,800 | 16,603 |

* | First Cash Financial Services, Inc. | 772,683 | 16,358 |

18

| | | Market |

| | | Value• |

| | Shares | ($000) |

| HCC Insurance Holdings, Inc. | 486,700 | 16,300 |

| Webster Financial Corp. | 344,708 | 16,184 |

| Aspen Insurance Holdings Ltd. | 645,150 | 15,709 |

| Apollo Investment Corp. | 798,475 | 14,931 |

| Hanover Insurance Group Inc. | 280,100 | 14,817 |

| Redwood Trust, Inc. REIT | 348,300 | 14,792 |

* | Conseco, Inc. | 583,400 | 14,731 |

| International Bancshares Corp. | 505,400 | 14,459 |

| U-Store-It Trust REIT | 761,100 | 13,913 |

* | Signature Bank | 375,300 | 13,274 |

| Platinum Underwriters Holdings, Ltd. | 466,200 | 12,853 |

| Reinsurance Group of America, Inc. | 254,500 | 12,241 |

| First American Corp. | 271,600 | 11,570 |

| Equity Inns, Inc. REIT | 703,100 | 11,390 |

| First Community Bancorp | 188,000 | 10,904 |

| Federated Investors, Inc. | 297,599 | 10,446 |

* | E*TRADE Financial Corp. | 418,350 | 10,409 |

| Willis Group Holdings Ltd. | 291,975 | 10,263 |

| BankUnited Financial Corp. | 330,124 | 10,132 |

* | Arch Capital Group Ltd. | 154,725 | 9,400 |

| Bank of Hawaii Corp. | 167,900 | 9,119 |

| The Phoenix Cos., Inc. | 600,100 | 9,116 |

| People’s Bank | 272,595 | 8,927 |

| Jones Lang Lasalle Inc. | 104,000 | 8,815 |

| Student Loan Corp. | 41,800 | 8,705 |

| Brown & Brown, Inc. | 272,400 | 8,507 |

| Federal Realty Investment Trust REIT | 121,200 | 8,269 |

* | Argonaut Group, Inc. | 210,708 | 7,354 |

| Arthur J. Gallagher & Co. | 266,500 | 7,313 |

| UCBH Holdings, Inc. | 412,725 | 7,301 |

| Host Marriott Corp. REIT | 345,135 | 7,255 |

| BlackRock, Inc. | 47,600 | 7,213 |

| Commerce Bancorp, Inc. | 176,100 | 7,104 |

| Tanger Factory Outlet Centers, Inc. REIT | 206,700 | 6,776 |

| Zenith National Insurance Corp. | 146,477 | 6,463 |

| Hanmi Financial Corp. | 316,162 | 6,159 |

| Equity Lifestyle Properties, Inc. REIT | 138,330 | 6,085 |

* | CompuCredit Corp. | 152,300 | 6,084 |

| StanCorp Financial Group, Inc. | 121,000 | 5,970 |

| Sterling Financial Corp. | 180,632 | 5,807 |

| Wintrust Financial Corp. | 112,187 | 5,806 |

| Investors Financial Services Corp. | 118,495 | 5,671 |

| Wilmington Trust Corp. | 127,100 | 5,631 |

| Unitrin, Inc. | 113,700 | 5,554 |

| Mid-America Apartment Communities, Inc. REIT | 104,300 | 5,528 |

* | Universal American Financial Corp. | 360,300 | 5,311 |

| Boston Private Financial Holdings, Inc. | 151,796 | 5,047 |

| Greenhill & Co., Inc. | 67,700 | 4,801 |

| International Securities Exchange, Inc. | 107,225 | 4,713 |

| American Equity Investment Life Holding Co. | 339,075 | 4,598 |

| AmerUs Group Co. | 69,900 | 4,100 |

* | GFI Group Inc. | 69,127 | 3,932 |

| Independent Bank Corp. (MI) | 142,270 | 3,884 |

| Flagstar Bancorp, Inc. | 234,800 | 3,757 |

| First BanCorp Puerto Rico | 343,000 | 3,636 |

| Doral Financial Corp. | 456,100 | 3,608 |

| Nara Bancorp, Inc. | 189,728 | 3,567 |

| The Macerich Co. REIT | 46,000 | 3,368 |

* | Portfolio Recovery Associates, Inc. | 62,700 | 3,226 |

| United Dominion Realty Trust REIT | 117,400 | 3,192 |

| LandAmerica Financial Group, Inc. | 45,100 | 3,129 |

| Global Signal, Inc. REIT | 61,300 | 3,047 |

| Fremont General Corp. | 135,300 | 3,009 |

| Westamerica Bancorporation | 57,500 | 2,941 |

19

| | | Market |

| | | Value• |

| | Shares | ($000) |

* | Asset Acceptance Capital Corp. | 123,711 | 2,584 |

^ | The First Marblehead Corp. | 53,442 | 2,571 |

| Bristol West Holdings, Inc. | 127,738 | 2,358 |

| Eaton Vance Corp. | 76,200 | 2,169 |

| Financial Federal Corp. | 74,100 | 2,104 |

| Glimcher Realty Trust REIT | 73,400 | 1,894 |

| Mills Corp. REIT | 58,800 | 1,876 |

| Scottish Re Group Ltd. | 75,000 | 1,742 |

| Advanta Corp. Class B | 44,293 | 1,690 |

| LaSalle Hotel Properties REIT | 37,300 | 1,631 |

* | Primus Guaranty, Ltd. | 137,900 | 1,600 |

| CBL & Associates Properties, Inc. REIT | 39,200 | 1,568 |

| United Community Banks, Inc. | 52,216 | 1,547 |

| ASTA Funding, Inc. | 39,603 | 1,439 |

* | Trammell Crow Co. | 35,400 | 1,378 |

| Ventas, Inc. REIT | 41,800 | 1,366 |

| Old Second Bancorp, Inc. | 43,900 | 1,352 |

| Republic Bancorp, Inc. | 116,400 | 1,335 |

*^ | Tejon Ranch Co. | 29,500 | 1,331 |

| American Financial Group, Inc. | 29,400 | 1,302 |

* | Texas Capital Bancshares, Inc. | 53,736 | 1,239 |

| Placer Sierra Bancshares | 43,300 | 1,150 |

| Forest City Enterprise Class A | 24,300 | 1,097 |

| City Holding Co. | 29,636 | 1,072 |

| Advance America Cash Advance Centers Inc. | 70,300 | 1,040 |

| Erie Indemnity Co. Class A | 20,100 | 1,024 |

| Center Financial Corp. | 44,000 | 982 |

| City National Corp. | 10,400 | 759 |

| GMH Communities Trust REIT | 55,600 | 684 |

| Highland Hospitality Corp. REIT | 52,400 | 676 |

| Radian Group, Inc. | 9,600 | 602 |

| Frontier Financial Corp. | 13,969 | 466 |

| Midland Co. | 12,879 | 459 |

| Glacier Bancorp, Inc. | 14,717 | 447 |

| Safety Insurance Group, Inc. | 9,000 | 417 |

| Preferred Bank, Los Angeles | 7,756 | 392 |

| First State Bancorporation | 14,666 | 378 |

| Saul Centers, Inc. REIT | 8,900 | 364 |

| TriCo Bancshares | 13,302 | 363 |

| Delphi Financial Group, Inc. | 6,200 | 325 |

| U.S.B. Holding Co., Inc. | 13,900 | 309 |

| Consolidated-Tomoka Land Co. | 4,800 | 294 |

* | Capital Crossing Bank | 7,500 | 220 |

| Camden National Corp. | 5,500 | 210 |

* | World Acceptance Corp. | 7,151 | 206 |

| National Financial Partners Corp. | 3,200 | 166 |

| Suffolk Bancorp | 5,100 | 156 |

* | United PanAm Financial Corp. | 4,700 | 141 |

| Digital Realty Trust, Inc. REIT | 3,500 | 99 |

| Harleysville National Corp. | 4,765 | 95 |

| Raymond James Financial, Inc. | 2,700 | 82 |

| Univest Corp. of Pennsylvania | 3,000 | 80 |

| SEI Investments Co. | 1,700 | 73 |

| Mercantile Bank Corp. | 1,188 | 49 |

| United Security Bancshares, Inc. | 1,900 | 49 |

| Washington Trust Bancorp, Inc. | 800 | 21 |

| | | 1,060,256 |

| Health Care (16.4%) | | |

| Pharmaceutical Product Development, Inc. | 1,593,306 | 57,152 |

* | Health Net Inc. | 1,276,500 | 51,954 |

* | Henry Schein, Inc. | 1,105,845 | 51,554 |

* | Cephalon, Inc. | 722,425 | 47,434 |

* | Lincare Holdings, Inc. | 1,155,500 | 45,677 |

| Omnicare, Inc. | 726,200 | 41,183 |

^ | Bausch & Lomb, Inc. | 746,300 | 36,531 |

* | Covance, Inc. | 611,115 | 35,659 |

* | Endo Pharmaceuticals Holdings, Inc. | 1,063,790 | 33,456 |

* | Community Health Systems, Inc. | 894,235 | 32,407 |

* | PDL BioPharma Inc. | 1,043,602 | 30,035 |

20

| | | Market |

| | | Value• |

| | Shares | ($000) |

* | Intuitive Surgical, Inc. | 235,564 | 29,917 |

* | Genesis Healthcare Corp. | 627,564 | 29,665 |

| Manor Care, Inc. | 661,907 | 29,025 |

* | ResMed Inc. | 662,150 | 28,572 |

* | Serologicals Corp. | 889,800 | 27,691 |

* | Pediatrix Medical Group, Inc. | 544,250 | 27,550 |

* | Barr Pharmaceuticals Inc. | 431,250 | 26,112 |

* | Techne Corp. | 458,774 | 25,994 |

* | Human Genome Sciences, Inc. | 2,263,700 | 25,829 |

* | Respironics, Inc. | 697,450 | 25,541 |

* | Vertex Pharmaceuticals, Inc. | 691,778 | 25,160 |

| Universal Health Services Class B | 485,122 | 24,639 |

* | IDEXX Laboratories Corp. | 294,702 | 24,522 |

* | Amylin Pharmaceuticals, Inc. | 560,800 | 24,423 |

* | United Surgical Partners International, Inc. | 735,358 | 24,274 |

* | Nektar Therapeutics | 1,095,700 | 23,569 |

* | Hologic, Inc. | 486,846 | 23,208 |

* | Alkermes, Inc. | 1,056,608 | 22,685 |

*^ | Cerner Corp. | 541,286 | 21,462 |

* | ICOS Corp. | 965,395 | 21,171 |

* | Millennium Pharmaceuticals, Inc. | 2,321,100 | 21,076 |

* | Celgene Corp. | 487,945 | 20,572 |

| DENTSPLY International Inc. | 326,250 | 19,467 |

* | Invitrogen Corp. | 288,300 | 19,031 |

* | Medarex, Inc. | 1,553,200 | 18,654 |

* | Kindred Healthcare, Inc. | 759,700 | 18,430 |

* | AMN Healthcare Services, Inc. | 948,172 | 18,224 |

* | LifePoint Hospitals, Inc. | 558,500 | 17,704 |

| Cooper Cos., Inc. | 315,450 | 17,293 |

* | Millipore Corp. | 227,600 | 16,792 |

| Kissei Pharmaceutical Co. | 847,000 | 16,392 |

* | Matria Healthcare, Inc. | 516,400 | 15,848 |

* | Per-Se Technologies, Inc. | 564,875 | 15,788 |

| Hogy Medical Co., Ltd. | 289,300 | 15,270 |

* | Kyphon Inc. | 367,342 | 15,263 |

* | Advanced Medical Optics, Inc. | 325,100 | 15,150 |

* | Cyberonics, Inc. | 649,700 | 15,067 |

| Dade Behring Holdings Inc. | 378,800 | 14,773 |

| Chemed Corp. | 265,850 | 14,486 |

* | Bruker BioSciences Corp. | 2,391,860 | 13,992 |

* | Edwards Lifesciences Corp. | 313,301 | 13,923 |

* | Watson Pharmaceuticals, Inc. | 485,800 | 13,816 |

* | King Pharmaceuticals, Inc. | 767,800 | 13,352 |

* | American Retirement Corp. | 519,700 | 13,200 |

* | DaVita, Inc. | 234,425 | 13,189 |

* | Neurocrine Biosciences, Inc. | 228,056 | 13,081 |

* | Healthways, Inc. | 265,000 | 13,001 |

* | Cubist Pharmaceuticals, Inc. | 566,270 | 12,837 |

* | Salix Pharmaceuticals, Ltd. | 908,514 | 12,447 |

* | Qiagen NV | 823,300 | 12,267 |

* | IntraLase Corp. | 570,000 | 12,244 |

* | Emdeon Corp. | 1,043,639 | 11,908 |

* | Zymogenetics, Inc. | 579,137 | 11,855 |

* | Gen-Probe Inc. | 217,575 | 11,634 |

* | QLT Inc. | 1,384,900 | 11,384 |

* | Kinetic Concepts, Inc. | 257,600 | 11,247 |

* | Haemonetics Corp. | 201,780 | 10,996 |

* | WellCare Health Plans Inc. | 250,500 | 10,491 |

* | Affymetrix, Inc. | 363,400 | 10,411 |

* | Illumina, Inc. | 327,265 | 10,351 |

* | Thoratec Corp. | 568,772 | 10,244 |

* | Ventana Medical Systems, Inc. | 208,700 | 10,164 |

* | Cambridge Antibody Technology Group | 755,600 | 10,057 |

* | CV Therapeutics, Inc. | 502,400 | 9,973 |

*^ | Abraxis Bioscience, Inc. | 316,800 | 9,897 |

* | Sunrise Senior Living, Inc. | 261,400 | 9,724 |

* | Sierra Health Services, Inc. | 247,000 | 9,685 |

* | Connetics Corp. | 637,150 | 9,653 |

| Medicis Pharmaceutical Corp. | 290,900 | 9,565 |

* | Nuvelo, Inc. | 571,400 | 9,354 |

| Valeant Pharmaceuticals International | 514,300 | 9,206 |

* | Sybron Dental Specialties, Inc. | 195,600 | 9,201 |

21

| | | Market |

| | | Value• |

| | Shares | ($000) |

| Varian Medical Systems, Inc. | 174,950 | 9,164 |

* | InterMune Inc. | 562,500 | 8,994 |

* | Triad Hospitals, Inc. | 215,800 | 8,891 |

| Intermagnetics General Corp. | 409,000 | 8,883 |

* | Rigel Pharmaceuticals, Inc. | 816,400 | 8,760 |

* | United Therapeutics Corp. | 143,103 | 8,522 |

| Mentor Corp. | 195,100 | 8,454 |

| Hillenbrand Industries, Inc. | 163,600 | 8,402 |

* | NPS Pharmaceuticals Inc. | 973,800 | 8,345 |

* | ViroPharma Inc. | 733,500 | 8,245 |

* | Cell Genesys, Inc. | 1,210,500 | 8,231 |

* | Axcan Pharma Inc. | 611,700 | 8,209 |

* | Candela Corp. | 332,350 | 7,727 |

* | Kos Pharmaceuticals, Inc. | 159,100 | 7,700 |

* | Psychiatric Solutions, Inc. | 229,000 | 7,571 |

* | The TriZetto Group, Inc. | 479,675 | 7,540 |

* | Exelixis, Inc. | 679,700 | 7,314 |

* | Regeneron Pharmaceuticals, Inc. | 500,100 | 7,261 |

* | Apria Healthcare Group Inc. | 328,100 | 7,185 |

* | Syneron Medical Ltd. | 275,000 | 7,114 |

* | Myriad Genetics, Inc. | 262,400 | 6,725 |

| Mylan Laboratories, Inc. | 306,190 | 6,687 |

* | Seattle Genetics, Inc. | 1,358,504 | 6,670 |

* | Adolor Corp. | 281,700 | 6,626 |

* | Xenoport Inc. | 294,313 | 6,607 |

* | ICU Medical, Inc. | 159,586 | 6,573 |

* | Arena Pharmaceuticals, Inc. | 455,850 | 6,455 |

* | Momenta Pharmaceuticals, Inc. | 375,274 | 6,346 |

| LCA-Vision Inc. | 112,100 | 6,296 |

* | Odyssey Healthcare, Inc. | 356,650 | 6,202 |

* | Durect Corp. | 1,270,000 | 6,172 |

* | Myogen, Inc. | 185,900 | 6,146 |

* | Impax Laboratories, Inc. | 662,300 | 6,143 |

* | Magellan Health Services, Inc. | 150,400 | 6,114 |

* | Isis Pharmaceuticals, Inc. | 675,849 | 5,799 |

* | Molina Healthcare Inc. | 176,700 | 5,778 |

* | Radiation Therapy Services, Inc. | 225,744 | 5,768 |

* | Noven Pharmaceuticals, Inc. | 302,300 | 5,713 |

*^ | Pain Therapeutics, Inc. | 613,200 | 5,678 |

* | Symmetry Medical Inc. | 282,200 | 5,616 |

* | Cytokinetics, Inc. | 729,049 | 5,286 |

* | ImmunoGen, Inc. | 1,286,000 | 5,247 |

* | Nighthawk Radiology Holdings, Inc. | 208,875 | 5,061 |

* | Onyx Pharmaceuticals, Inc. | 212,500 | 4,962 |

*^ | Tanox, Inc. | 297,379 | 4,785 |

* | Digene Corp. | 112,469 | 4,646 |

*^ | Telik, Inc. | 251,055 | 4,617 |

| STERIS Corp. | 199,200 | 4,586 |

* | Cutera, Inc. | 173,800 | 4,574 |

* | Sirna Therapeutics, Inc. | 594,000 | 4,491 |

| PolyMedica Corp. | 104,502 | 4,317 |

*^ | Geron Corp. | 558,693 | 4,190 |

* | Greatbatch, Inc. | 168,400 | 4,126 |

* | LifeCell Corp. | 147,000 | 3,975 |

* | AmSurg Corp. | 143,563 | 3,667 |

| Computer Programs and Systems, Inc. | 77,300 | 3,650 |

* | Ventiv Health, Inc. | 119,682 | 3,595 |

| Alpharma, Inc. Class A | 131,300 | 3,447 |

| Owens & Minor, Inc. Holding Co. | 107,800 | 3,436 |

* | AMERIGROUP Corp. | 130,000 | 3,358 |

* | VCA Antech, Inc. | 107,800 | 3,352 |

*^ | Idenix Pharmaceuticals Inc. | 333,187 | 3,345 |

* | ArthroCare Corp. | 71,255 | 3,230 |

* | Diversa Corp. | 301,171 | 3,171 |

* | OraSure Technologies, Inc. | 293,600 | 3,150 |

* | Symbion, Inc. | 130,487 | 3,003 |

| ^Martek Biosciences Corp. | 93,400 | 2,774 |

* | Humana Inc. | 60,600 | 2,738 |

* | Charles River Laboratories, Inc. | 55,700 | 2,632 |

* | Hi-Tech Pharmacal Co., Inc. | 96,000 | 2,343 |

* | PSS World Medical, Inc. | 124,978 | 2,255 |

* | First Horizon Pharmaceutical Corp. | 99,625 | 2,219 |

* | Abaxis, Inc. | 78,300 | 2,045 |

*^ | SurModics, Inc. | 56,477 | 2,008 |

22

| | | Market |

| | | Value• |

| | Shares | ($000) |

| Vital Signs, Inc. | 39,509 | 1,964 |

* | Applera Corp.–Celera Genomics Group | 157,980 | 1,894 |

* | Alnylam Pharmaceuticals Inc. | 105,500 | 1,625 |

* | Viasys Healthcare Inc. | 55,000 | 1,599 |

* | Allscripts Healthcare Solutions, Inc. | 83,366 | 1,420 |

* | Kendle International Inc. | 36,600 | 1,374 |

* | American Medical Systems Holdings, Inc. | 60,100 | 1,335 |

* | Merit Medical Systems, Inc. | 113,434 | 1,326 |

| Beckman Coulter, Inc. | 24,600 | 1,263 |

* | Quidel Corp. | 109,700 | 1,256 |

* | Cytyc Corp. | 45,703 | 1,181 |

| Meridian Bioscience Inc. | 41,700 | 1,083 |

* | Somanetics Corp. | 63,400 | 1,040 |

* | Merge Technologies, Inc. | 73,213 | 925 |

* | Immunomedics Inc. | 303,100 | 921 |

* | New River Pharmaceuticals Inc. | 20,400 | 694 |

| CNS, Inc. | 30,600 | 658 |

* | Zoll Medical Corp. | 23,742 | 629 |

*^ | WebMD Health Corp. Class A | 12,900 | 561 |

* | Pharmion Corp. | 24,926 | 483 |

| PerkinElmer, Inc. | 19,800 | 425 |

| Young Innovations, Inc. | 10,361 | 369 |

| West Pharmaceutical Services, Inc. | 9,700 | 346 |

* | PRA International | 12,294 | 286 |

* | IRIS International, Inc. | 20,500 | 243 |

* | BioMarin Pharmaceutical Inc. | 4,900 | 60 |

| | | 2,109,547 |

| Industrials (13.6%) | | |

| MSC Industrial Direct Co., Inc. Class A | 1,518,019 | 78,724 |

* | Swift Transportation Co., Inc. | 2,174,247 | 65,119 |

* | The Dun & Bradstreet Corp. | 617,300 | 47,544 |

| Robert Half International, Inc. | 1,122,837 | 47,462 |

| Joy Global Inc. | 719,700 | 47,277 |

* | AMR Corp. | 1,487,700 | 36,657 |

| Fastenal Co. | 752,400 | 35,220 |

| Harsco Corp. | 420,560 | 35,054 |

* | The Advisory Board Co. | 616,440 | 34,595 |

| Oshkosh Truck Corp. | 554,400 | 33,929 |

* | Monster Worldwide Inc. | 557,415 | 31,996 |

| Donaldson Co., Inc. | 957,200 | 31,817 |

* | Labor Ready, Inc. | 1,063,028 | 28,096 |

| Con-way, Inc. | 500,748 | 27,902 |

*^ | USG Corp. | 256,200 | 27,406 |

| Albany International Corp. | 697,700 | 27,280 |

| JLG Industries, Inc. | 945,300 | 27,111 |

* | ChoicePoint Inc. | 607,181 | 26,734 |

* | Wesco International, Inc. | 350,900 | 26,317 |

* | Alliant Techsystems, Inc. | 322,500 | 25,797 |

| UTI Worldwide, Inc. | 813,045 | 25,359 |

| Cummins Inc. | 241,600 | 25,247 |

* | Jacobs Engineering Group Inc. | 300,900 | 24,884 |

* | Aviall, Inc. | 652,000 | 24,580 |

| Watsco, Inc. | 385,700 | 24,473 |

| The Corporate Executive Board Co. | 223,552 | 23,949 |

* | McDermott International, Inc. | 390,489 | 23,742 |

| Heartland Express, Inc. | 964,140 | 23,438 |

| Knight Transportation, Inc. | 1,129,600 | 22,061 |

* | United Rentals, Inc. | 582,200 | 20,767 |

* | Continental Airlines, Inc. Class B | 788,700 | 20,538 |

* | AirTran Holdings, Inc. | 1,375,750 | 19,233 |

| Manpower Inc. | 279,700 | 18,222 |

* | BE Aerospace, Inc. | 697,043 | 18,144 |

| Herman Miller, Inc. | 588,000 | 18,105 |

| Lennox International Inc. | 538,600 | 17,575 |

* | URS Corp. | 403,200 | 17,366 |

| Chicago Bridge & Iron Co. N.V. | 693,225 | 16,617 |

| Carlisle Co., Inc. | 186,225 | 15,736 |

* | Terex Corp. | 175,400 | 15,181 |

| DRS Technologies, Inc. | 269,500 | 14,965 |

| The Timken Co. | 420,499 | 14,675 |

23

| | | Market |

| | | Value• |

| | Shares | ($000) |

* | Flowserve Corp. | 254,400 | 14,633 |

* | Corrections Corp. of America | 323,065 | 14,499 |

| Administaff, Inc. | 244,400 | 14,114 |

* | JetBlue Airways Corp. | 1,374,300 | 14,100 |

* | Energy Conversion Devices, Inc. | 273,952 | 13,700 |

| Werner Enterprises, Inc. | 675,500 | 12,956 |

* | West Corp. | 270,059 | 12,509 |

* | FuelCell Energy, Inc. | 949,200 | 12,463 |

| Mueller Industries Inc. | 309,200 | 11,712 |

* | Navistar International Corp. | 439,157 | 11,585 |

| The Toro Co. | 228,900 | 11,319 |

| Arkansas Best Corp. | 263,300 | 11,301 |

| HNI Corp. | 213,500 | 11,290 |

| Equifax, Inc. | 280,900 | 10,826 |

* | US Airways Group Inc. | 247,400 | 10,703 |

* | Resources Connection, Inc. | 391,975 | 10,544 |

| Simpson Manufacturing Co. | 243,900 | 9,754 |

| ^United Industrial Corp. | 147,789 | 9,710 |

| Precision Castparts Corp. | 140,705 | 8,862 |

| Skywest, Inc. | 375,011 | 8,839 |

* | Trex Co., Inc. | 290,000 | 8,665 |

| Ametek, Inc. | 174,775 | 8,611 |

| Pacer International, Inc. | 247,185 | 8,476 |

* | Stericycle, Inc. | 128,600 | 8,467 |

* | Allied Waste Industries, Inc. | 594,600 | 8,420 |

| Landstar System, Inc. | 196,200 | 8,337 |

| Pentair, Inc. | 217,000 | 8,307 |

| Roper Industries Inc. | 173,400 | 8,230 |

| Aramark Corp. Class B | 292,300 | 8,217 |

* | Encore Wire Corp. | 194,857 | 8,170 |

* | Hexcel Corp. | 362,097 | 7,999 |

* | American Commercial Lines Inc. | 147,465 | 7,953 |

* | H&E Equipment Services, Inc. | 227,800 | 7,952 |

* | Amerco, Inc. | 74,494 | 7,780 |

* | Global Cash Access, Inc. | 394,680 | 7,692 |

* | AAR Corp. | 282,800 | 7,545 |

| Steelcase Inc. | 400,100 | 7,490 |

* | Consolidated Graphics, Inc. | 140,825 | 7,364 |

* | General Cable Corp. | 230,100 | 7,264 |

* | Spherion Corp. | 680,000 | 7,194 |

* | Teletech Holdings Inc. | 514,672 | 6,608 |

* | FTI Consulting, Inc. | 218,600 | 6,283 |

| Actuant Corp. | 97,725 | 6,250 |

| Lincoln Electric Holdings, Inc. | 113,100 | 6,199 |

| Walter Industries, Inc. | 93,139 | 6,178 |

| J.B. Hunt Transport Services, Inc. | 258,832 | 6,168 |

^ | Dynamic Materials Corp. | 160,100 | 6,114 |

* | Thomas & Betts Corp. | 100,400 | 5,718 |

| Freightcar America Inc. | 82,200 | 5,499 |

* | Copart, Inc. | 203,400 | 5,461 |

| John H. Harland Co. | 129,500 | 5,368 |

* | EGL, Inc. | 114,400 | 5,345 |

* | The Middleby Corp. | 59,400 | 5,246 |

* | Mobile Mini, Inc. | 148,976 | 4,913 |

* | United Stationers, Inc. | 90,300 | 4,845 |

* | Williams Scotsman International Inc. | 168,425 | 4,138 |

* | Genlyte Group, Inc. | 59,386 | 4,092 |

| The Manitowoc Co., Inc. | 77,710 | 3,854 |

| Trinity Industries, Inc. | 55,300 | 3,512 |

| C.H. Robinson Worldwide Inc. | 78,600 | 3,486 |

* | CRA International Inc. | 70,300 | 3,428 |

* | Quanta Services, Inc. | 205,200 | 3,328 |

| GATX Corp. | 69,700 | 3,262 |

| Mine Safety Appliances Co. | 75,600 | 3,160 |

*^ | Distributed Energy Systems Corp. | 450,500 | 2,843 |

| American Woodmark Corp. | 79,600 | 2,767 |

* | Insituform Technologies Inc. Class A | 104,600 | 2,665 |

| Applied Industrial Technology, Inc. | 62,350 | 2,591 |

| Apogee Enterprises, Inc. | 151,300 | 2,456 |

* | American Reprographics Co. | 68,300 | 2,423 |

| Bluelinx Holdings Inc. | 146,300 | 2,216 |

24

| | | Market |

| | | Value• |

| | Shares | ($000) |

| Washington Group International, Inc. | 39,400 | 2,191 |

* | Ceradyne, Inc. | 40,539 | 2,149 |

* | K&F Industries Holdings | 121,100 | 2,148 |

* | ExpressJet Holdings, Inc. | 353,000 | 1,977 |

* | American Superconductor Corp. | 157,400 | 1,725 |

| Forward Air Corp. | 41,300 | 1,659 |

* | Innovative Solutions and Support, Inc. | 104,000 | 1,645 |

* | Teledyne Technologies, Inc. | 41,700 | 1,518 |

* | Accuride Corp. | 131,800 | 1,351 |

* | Cenveo Inc. | 78,400 | 1,328 |

* | Herley Industries Inc. | 58,600 | 1,241 |

* | Builders FirstSource, Inc. | 56,506 | 1,218 |

* | Clean Harbors Inc. | 39,693 | 1,142 |

* | RailAmerica, Inc. | 97,700 | 1,116 |

| Graco, Inc. | 23,350 | 1,092 |

| Navigant Consulting, Inc. | 51,400 | 1,084 |

* | Old Dominion Freight Line, Inc. | 33,355 | 1,074 |

| Franklin Electric, Inc. | 17,700 | 1,032 |

| Bowne & Co., Inc. | 59,400 | 933 |

*^ | Lamson & Sessions Co. | 35,800 | 900 |

* | Columbus McKinnon Corp. | 26,800 | 717 |

| McGrath RentCorp | 26,103 | 702 |

* | ABX Air, Inc. | 103,034 | 668 |

* | Kirby Corp. | 8,400 | 619 |

| Brady Corp. Class A | 16,300 | 586 |

* | On Assignment, Inc. | 41,300 | 537 |

* | Heidrick & Struggles International, Inc. | 14,225 | 514 |

| HEICO Corp. | 15,600 | 512 |

| Regal-Beloit Corp. | 9,900 | 462 |

| Ryder System, Inc. | 8,000 | 417 |

* | U.S. Xpress Enterprises, Inc. | 17,400 | 342 |

| The Greenbrier Cos., Inc. | 8,000 | 321 |

* | American Science & Engineering, Inc. | 3,441 | 295 |

* | Armor Holdings, Inc. | 3,700 | 226 |

* | Kforce Inc. | 15,800 | 222 |

| UAP Holding Corp. | 6,900 | 143 |

| Cubic Corp. | 4,700 | 108 |

| | | 1,754,776 |

| Information Technology (23.1%) | | |

| Communications Equipment (3.4%) | | |

* | Foundry Networks, Inc. | 4,335,628 | 61,609 |

| Harris Corp. | 810,100 | 37,726 |

* | Polycom, Inc. | 1,409,275 | 31,004 |

| ADTRAN Inc. | 1,134,650 | 28,525 |

* | CommScope, Inc. | 765,100 | 25,287 |

* | Ciena Corp. | 6,065,000 | 24,806 |

* | Stratex Networks, Inc. | 3,857,500 | 24,341 |

* | Powerwave Technologies, Inc. | 1,964,804 | 21,908 |

| Plantronics, Inc. | 534,800 | 20,055 |

* | Avocent Corp. | 670,038 | 18,051 |

* | ViaSat, Inc. | 576,600 | 17,373 |

* | Tellabs, Inc. | 1,086,700 | 17,224 |

* | NICE-Systems Ltd. ADR | 265,246 | 14,535 |

* | Sycamore Networks, Inc. | 3,053,354 | 14,351 |

* | Avaya Inc. | 971,700 | 11,660 |

* | Bookham, Inc. | 1,874,500 | 11,416 |

* | Tekelec | 636,404 | 9,088 |

*^ | Finisar Corp. | 1,571,500 | 7,386 |

* | Andrew Corp. | 579,402 | 6,130 |

* | F5 Networks, Inc. | 97,800 | 5,727 |

* | Comverse Technology, Inc. | 245,345 | 5,557 |

| Ixia | 442,875 | 5,004 |

* | Blue Coat Systems, Inc. | 200,900 | 4,372 |

* | Arris Group Inc. | 325,304 | 3,855 |

* | NETGEAR, Inc. | 132,412 | 2,973 |

* | Symmetricom Inc. | 114,600 | 928 |

* | JDS Uniphase Corp. | 224,700 | 784 |

* | Anaren, Inc. | 23,400 | 481 |

| Inter-Tel, Inc. | 19,339 | 444 |

* | ADC Telecommunications, Inc. | 14,800 | 331 |

| SpectraLink Corp. | 20,355 | 243 |

| Optical Cable Corp. | 8,891 | — |

25

| | | Market |

| | | Value• |

| | Shares | ($000) |

| Computers & Peripherals (1.5%) | | |

* | Western Digital Corp. | 2,221,800 | 46,747 |

* | Brocade Communications Systems, Inc. | 4,330,300 | 26,675 |

* | Electronics for Imaging, Inc. | 949,500 | 26,073 |

* | Hutchinson Technology, Inc. | 764,600 | 18,175 |

* | Komag, Inc. | 403,128 | 16,948 |

* | Emulex Corp. | 911,277 | 16,540 |

| NCR Corp. | 343,450 | 13,532 |

* | QLogic Corp. | 517,000 | 10,759 |

* | Intermec, Inc. | 311,825 | 8,260 |

| Diebold, Inc. | 162,200 | 6,902 |

* | Synaptics Inc. | 93,862 | 2,461 |

* | Palm, Inc. | 102,000 | 2,305 |

* | Neoware Systems, Inc. | 104,700 | 2,269 |

* | Presstek, Inc. | 100,400 | 1,201 |

* | Rimage Corp. | 27,300 | 604 |

| Electronic Equipment & Instruments (2.5%) | | |

* | Ingram Micro, Inc. Class A | 2,260,800 | 41,576 |

* | Mettler-Toledo International Inc. | 397,699 | 25,771 |

* | Plexus Corp. | 583,054 | 25,398 |

* | Trimble Navigation Ltd. | 522,100 | 24,737 |

| Tektronix, Inc. | 671,900 | 23,732 |

| Amphenol Corp. | 410,400 | 23,721 |

* | Avnet, Inc. | 756,800 | 19,790 |

* | Benchmark Electronics, Inc. | 700,200 | 19,115 |

* | Brightpoint, Inc. | 473,962 | 15,868 |

* | Littelfuse, Inc. | 486,800 | 15,719 |

* | Itron, Inc. | 191,561 | 12,844 |

*^ | Multi-Fineline Electronix, Inc. | 188,669 | 10,996 |

* | Vishay Intertechnology, Inc. | 572,100 | 8,936 |

* | Solectron Corp. | 2,092,895 | 8,372 |

* | TTM Technologies, Inc. | 478,560 | 7,781 |

| AVX Corp. | 415,400 | 7,394 |

* | Coherent, Inc. | 161,756 | 5,987 |

* | Global Imaging Systems, Inc. | 104,200 | 3,892 |

* | ScanSource, Inc. | 60,700 | 3,800 |

* | Aeroflex, Inc. | 225,188 | 2,840 |

| Anixter International Inc. | 48,000 | 2,440 |

* | Paxar Corp. | 86,400 | 1,887 |

* | Photon Dynamics, Inc. | 83,300 | 1,587 |

| CDW Corp. | 24,100 | 1,434 |

* | Metrologic Instruments, Inc. | 83,600 | 1,420 |

* | Tech Data Corp. | 36,800 | 1,351 |

| MTS Systems Corp. | 13,200 | 591 |

* | LoJack Corp. | 24,200 | 535 |

* | PAR Technology Corp. | 12,100 | 203 |

* | Fargo Electronics | 1,417 | 26 |

| Internet Software & Services (2.3%) | | |

* | Akamai Technologies, Inc. | 2,007,280 | 67,625 |

* | ValueClick, Inc. | 1,914,675 | 32,262 |

* | WebEx Communications, Inc. | 677,000 | 23,932 |

* | CNET Networks, Inc. | 1,944,261 | 20,959 |

* | Digital Insight Corp. | 501,899 | 17,310 |

* | Marchex, Inc. | 792,100 | 17,236 |

* | aQuantive, Inc. | 599,468 | 15,023 |

* | Vignette Corp. | 890,500 | 14,114 |

* | Ariba, Inc. | 1,375,725 | 12,712 |

* | Openwave Systems Inc. | 587,058 | 10,925 |

| VeriSign, Inc. | 458,785 | 10,791 |

* | Digitas Inc. | 700,200 | 9,880 |

* | RealNetworks, Inc. | 980,300 | 9,823 |

* | Websense, Inc. | 342,600 | 8,517 |

* | InfoSpace, Inc. | 281,600 | 7,189 |

* | EarthLink, Inc. | 716,300 | 6,511 |

* | The Knot, Inc. | 285,000 | 5,250 |

* | j2 Global Communications, Inc. | 94,535 | 4,641 |

| United Online, Inc. | 338,722 | 4,366 |

*^ | Bankrate, Inc. | 33,000 | 1,593 |

* | 24/7 Real Media, Inc. | 111,700 | 1,130 |

| IT Services (3.7%) | | |

* | Alliance Data Systems Corp. | 1,291,790 | 71,047 |

* | MPS Group, Inc. | 2,514,845 | 40,137 |

* | DST Systems, Inc. | 624,200 | 38,401 |

26

| | | Market |

| | | Value• |

| | Shares | ($000) |

* | Euronet Worldwide, Inc. | 946,300 | 33,821 |

* | Ceridian Corp. | 1,300,050 | 31,500 |

| Global Payments Inc. | 518,000 | 24,569 |

* | SRA International, Inc. | 741,275 | 23,736 |

* | Sapient Corp. | 2,886,600 | 22,602 |

* | CheckFree Corp. | 385,751 | 20,780 |

| Affiliated Computer Services, Inc. Class A | 309,100 | 17,235 |

* | Iron Mountain, Inc. | 406,400 | 15,890 |

* | ManTech International Corp. | 465,335 | 15,370 |

* | BISYS Group, Inc. | 828,569 | 13,207 |

| Fidelity National Information Services, Inc. | 326,600 | 12,411 |

| Acxiom Corp. | 466,550 | 12,093 |

* | CSG Systems International, Inc. | 477,770 | 12,078 |

* | Anteon International Corp. | 218,800 | 11,957 |

| MoneyGram International, Inc. | 295,100 | 10,004 |

| Talx Corp. | 364,202 | 9,473 |

| Hewitt Associates, Inc. | 291,775 | 8,459 |

* | Cognizant Technology Solutions Corp. | 112,947 | 7,185 |

*^ | Heartland Payment Systems, Inc. | 264,566 | 6,942 |

| MAXIMUS, Inc. | 169,225 | 5,896 |

* | Kanbay International Inc. | 358,667 | 5,559 |

* | Sykes Enterprises, Inc. | 151,785 | 2,457 |

* | Keane, Inc. | 152,300 | 2,154 |

* | TNS Inc. | 93,000 | 1,928 |

| infoUSA Inc. | 169,128 | 1,889 |

* | iPayment Holdings, Inc. | 39,597 | 1,713 |

* | Wright Express Corp. | 28,969 | 892 |

* | Tyler Technologies, Inc. | 48,600 | 536 |

* | eFunds Corp. | 15,700 | 404 |

* | SI International Inc. | 7,400 | 252 |

| Office Electronics (0.0%) | | |

* | Zebra Technologies Corp. Class A | 14,600 | 579 |

| Semiconductors & Semiconductor Equipment (4.6%) | | |

* | MEMC Electronic | | |

| Materials, Inc. | 1,296,815 | 52,651 |

* | Microsemi Corp. | 1,499,347 | 40,962 |

* | Zoran Corp. | 1,373,140 | 37,679 |