SCHEDULE 14A

(RULE 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

¨ Preliminary Proxy Statement | | ¨ Confidential,For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

x Definitive Proxy Statement | | |

¨ Definitive Additional Materials | | |

¨ Soliciting Material Under Rule 14a-12 | | |

TECO Energy, Inc.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

x No fee required.

¨ Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

| | 1. | | Title of each class of securities to which transaction applies: |

| | 2. | | Aggregate number of securities to which transaction applies: |

| | 3. | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | 4. | | Proposed maximum aggregate value of transaction: |

¨ Fee paid previously with preliminary materials:

| | ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| | 1. | | Amount previously paid: |

| | 2. | | Form, Schedule or Registration Statement No.: |

[TECO Energy Logo]

March 7, 2003

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON APRIL 22, 2003

The Annual Meeting of the Shareholders of TECO Energy, Inc. will be held at the principal office of the Corporation, TECO Plaza, 702 North Franklin Street, Tampa, Florida, on Tuesday, April 22, 2003 at 11:30 a.m., for the following purposes:

| | 1. | | To elect five directors. |

| | 2. | | To consider and act on such other matters, including the shareholder proposals on pages 13-17 of the accompanying proxy statement, as may properly come before the meeting. |

Shareholders of record at the close of business on February 13, 2003 will be entitled to vote at the meeting and at any adjournments thereof.

Even if you plan to attend the meeting, you are requested to either mark, sign and date the enclosed proxy card and return it promptly in the accompanying envelope or vote by telephone or internet by following the instructions on the proxy card. If you attend the meeting and wish to vote in person, your proxy will not be used.

By order of the Board of Directors,

D. E. Schwartz,Secretary

TECO ENERGY, INC.

P.O. Box 111 Tampa, Florida 33601 (813) 228-4111

TECO ENERGY, INC.

P.O. Box 111, Tampa, Florida 33601

PROXY STATEMENT

The enclosed proxy is solicited on behalf of the Board of Directors of TECO Energy, Inc. (the “Corporation”) to be voted at the Annual Meeting of Shareholders of the Corporation to be held at the time and place and for the purposes set forth in the foregoing notice. This proxy statement and the enclosed proxy are being mailed to shareholders beginning on or about March 7, 2003.

VOTING OF SECURITIES

As of February 13, 2003, the record date for the determination of shareholders entitled to vote at the meeting, the Corporation had outstanding 175,875,568 shares of Common Stock, $1 par value (“Common Stock”), the only class of stock of the Corporation outstanding and entitled to vote at the meeting. The holders of Common Stock are entitled to one vote for each share registered in their names on the record date with respect to all matters to be acted upon at the meeting.

The presence at the meeting, in person or by proxy, of a majority of the shares outstanding on the record date will constitute a quorum. Abstentions and broker non-votes will be considered as shares present for purposes of determining the presence of a quorum.

A shareholder submitting a proxy may revoke it at any time before it is exercised at the meeting by filing with the Secretary of the Corporation a written notice of revocation, submitting a proxy bearing a later date or attending the meeting and voting in person.

Shares represented by valid proxies received will be voted in the manner specified on the proxies. If no instructions are indicated on the proxy, the proxy will be voted for the election of the nominees for director named below and against the three shareholder proposals set forth below.

The affirmative vote of a majority of the Common Stock represented at the meeting in person or by proxy will be required to elect directors and to approve the shareholder proposals. Abstentions will be considered as represented at the meeting and, therefore, will be the equivalent of a negative vote; broker non-votes will not be considered as represented at the meeting.

ELECTION OF DIRECTORS

The Corporation’s Bylaws provide for the Board of Directors to be divided into three classes, with each class to be as nearly equal in number as possible and to hold office until its successor is elected and qualified. As the term of one class of directors expires, their successors are elected for a term of three years at each annual meeting of shareholders. Mrs. Baldwin and Messrs. Fagan, Guinot, Hudson and Sovey have been nominated for terms expiring in 2006. Each of these nominees has consented to serve if elected. If any nominee is unable to serve, the shares represented by valid proxies will be voted for the election of such other person as the Board may designate.

The following table contains certain information as to the nominees and each person whose term of office as a director will continue after the meeting. Information on the share ownership of each of these individuals is included under “Share Ownership” on pages 5 and 6.

Name

| | Age

| | Principal Occupation During Last Five Years and Other Directorships Held (1)

| | Director Since (1)

| | Present Term Expires

|

DuBose Ausley | | 65 | | Member and former Chairman, Ausley & McMullen (attorneys), Tallahassee, Florida; also a director of Sprint Corporation and Chairman of Capital City Bank Group, Inc. | | 1992 | | 2005 |

|

*Sara L. Baldwin | | 71 | | Private Investor; formerly Vice President, Baldwin and Sons, Inc. (insurance agency), Tampa, Florida | | 1980 | | 2003 |

|

*Robert D. Fagan | | 58 | | Chairman of the Board, President and Chief Executive Officer, TECO Energy, Inc.; formerly President, PP&L Global, Inc. (diversified energy company), Fairfax, Virginia | | 1999 | | 2003 |

|

James L. Ferman, Jr. | | 59 | | President, Ferman Motor Car Company, Inc. (automobile dealerships), Tampa, Florida; also a director of Florida Investment Advisers, Inc. and Chairman of The Bank of Tampa and its holding company, The Tampa Banking Company | | 1985 | | 2005 |

|

*Luis Guinot, Jr. | | 67 | | Partner, Shapiro, Sher, Guinot & Sandler, P.A. (attorneys), Washington, D.C.; formerly United States Ambassador to the Republic of Costa Rica | | 1999 | | 2003 |

|

Ira D. Hall | | 58 | | President and Chief Executive Officer, Utendahl Capital Management, L.P. (money management), New York, New York; formerly Treasurer, Texaco Inc. (integrated oil company), White Plains, New York; prior thereto, General Manager, Alliance Management, Texaco Inc.; and prior thereto, Director of Business Development, IBM Global Services, IBM Corp. (information technology products and services company), Armonk, New York; also a director of Imagistics International, Inc. and Reynolds and Reynolds Company | | 2001 | | 2005 |

2

Name

| | Age

| | Principal Occupation During Last Five Years and Other Directorships Held (1)

| | Director Since (1)

| | Present Term Expires

|

*Sherrill W. Hudson | | 60 | | Retired; formerly Managing Partner for South Florida, Deloitte & Touche LLP (public accounting), Miami, Florida; also a director of Publix Super Markets, Inc. and The Standard Register Company | | 2003 | | 2003 |

|

Tom L. Rankin | | 62 | | Independent Investment Manager; formerly Chairman of the Board and Chief Executive Officer, Lykes Energy, Inc. (the former holding company for Peoples Gas System) and Lykes Bros. Inc.; also a director of Media General, Inc. | | 1997 | | 2004 |

|

William D. Rockford | | 57 | | President, Private Power, LLC (power generation), Oak Brook, Illinois; formerly Managing Director, Chase Securities Inc. (financial services), New York, New York | | 2000 | | 2004 |

|

*William P. Sovey | | 69 | | Chairman of the Board and former Chief Executive Officer, Newell Rubbermaid Inc. (consumer products), Freeport, Illinois; also a director of Actuant Corporation | | 1996 | | 2003 |

|

J. Thomas Touchton | | 64 | | Managing Partner, The Witt-Touchton Company (private investment partnership), Tampa, Florida | | 1987 | | 2004 |

|

John A. Urquhart | | 74 | | President, John A. Urquhart Associates (management consultants), Fairfield, Connecticut; formerly Senior Advisor to the Chairman, Enron Corp. (energy and communications), Houston, Texas; prior thereto, Senior Vice President/Executive Vice President, G.E. Industrial & Power Systems, General Electric Company; also a director of Catalytica Energy Systems, Inc. | | 1991 | | 2004 |

|

James O. Welch, Jr. | | 71 | | Retired; formerly Vice Chairman, RJR Nabisco, Inc. and Chairman, Nabisco Brands, Inc. | | 1976 | | 2005 |

| * | | Nominee for election as director |

| (1) | | All of the directors of the Corporation also serve as directors of Tampa Electric Company, and the period of service shown includes service on Tampa Electric Company’s Board prior to the formation of the Corporation on January 15, 1981. On April 15, 1981, the Corporation became the corporate parent of Tampa Electric Company as a result of a reorganization. |

3

The Board of Directors held 10 meetings in 2002. All directors attended at least 75 percent of the meetings of the Board and Committees on which they served. The Corporation has standing Audit, Compensation, Finance, and Governance and Nominating Committees of the Board of Directors.

The Audit Committee met five times in 2002; its members are Messrs. Ferman, Hall, Hudson, Rankin and Touchton (Chairman). Additional information about the Audit Committee is included in the Audit Committee Report on page 17.

The Compensation Committee, which met four times in 2002, is composed of Mrs. Baldwin and Messrs. Sovey (Chairman), Urquhart and Welch. For additional information about the Compensation Committee, see the Compensation Committee Report on Executive Compensation on page 7.

The Finance Committee, which assists the Board in formulating the financial policies of the Corporation and evaluating significant investments and other financial commitments by the Corporation, met twice in 2002; its members are Messrs. Ausley, Fagan, Guinot, Rankin, Rockford and Urquhart (Chairman).

The Governance and Nominating Committee assists the Board with respect to corporate governance matters, including the composition and functioning of the Board. It met three times in 2002, and its members are Messrs. Ferman (Chairman), Sovey, Touchton and Urquhart, each of whom is an independent director. Shareholder recommendations for nominees for membership on the Board will be given due consideration by the Committee for recommendation to the Board based on the nominee’s qualifications. Shareholder nominee recommendations should be submitted in writing to the Chairman of the Governance and Nominating Committee in care of the Corporate Secretary.

Compensation of Directors

Directors who are not employees or former employees of the Corporation or any of its subsidiaries are paid an annual retainer of $27,000 and attendance fees of $750 for each meeting of the Board of the Corporation, $750 for each meeting of the Board of Tampa Electric Company and $1,000 for each meeting of a Committee of the Board on which they serve. Each director who serves as a Committee Chairman receives an additional annual retainer of $5,000. Directors may elect to receive all or a portion of their compensation in the form of Common Stock. Directors may also elect to defer any of their cash compensation with a return calculated at either one percent above the prime rate or a rate equal to the total return on the Corporation’s Common Stock.

All non-employee directors participate in the Corporation’s 1997 Director Equity Plan, which allows for a variety of equity-based awards. Currently, each new non-employee director receives an option for 10,000 shares of Common Stock and each reelected non-employee director receives an annual grant consisting of 500 shares and an option for 2,500 shares of Common Stock. The exercise price for these options is the fair market value on the date of grant. They are exercisable immediately and expire ten years after grant or earlier as provided in the plan following termination of service on the Board.

CERTAIN RELATIONSHIPS AND RELATED PARTY TRANSACTIONS

The Corporation paid legal fees of $1,143,144 for 2002 to Ausley & McMullen, of which Mr. Ausley is a member. The Corporation also paid legal fees of $30,570 for 2002 to Shapiro, Sher, Guinot & Sandler, P.A., of which Mr. Guinot is a partner.

Mr. Hudson was a partner of Deloitte & Touche LLP (“Deloitte”) until he retired in August 2002. In 2002, Deloitte performed auditing work for two jointly owned entities in which subsidiaries of TECO Power Services Corporation own an interest, Commonwealth Chesapeake Company, a power generation project in Virginia, and EEGSA, the electricity distribution company in Guatemala. Deloitte also assisted the Corporation with the implementation of risk management software in 2002. All of the foregoing work was performed by offices of Deloitte outside the region for which Mr. Hudson had oversight responsibility, and Mr. Hudson did not join the Corporation’s Board until after he had retired from Deloitte.

4

SHARE OWNERSHIP

There is no person known to the Corporation to be the beneficial owner of more than five percent of the outstanding Common Stock as of December 31, 2002.

The following table sets forth the shares of Common Stock beneficially owned as of January 31, 2003 by the Corporation’s directors and nominees, its executive officers named in the summary compensation table below and its directors and executive officers as a group. Except as otherwise noted, such persons have sole investment and voting power over the shares. The number of shares of the Corporation’s Common Stock beneficially owned by any director or executive officer does not exceed 1% of such shares outstanding at January 31, 2003; the percentage beneficially owned by all directors and executive officers as a group as of such date is 1.7%.

Name

| | Shares (1)

| | | Name

| | Shares (1)

| |

DuBose Ausley | | 57,295 | | | J. Thomas Touchton | | 64,950 | (5) |

Sara L. Baldwin | | 47,070 | (2) | | John A. Urquhart | | 33,995 | (7) |

Robert D. Fagan | | 355,013 | (3) | | James O. Welch, Jr. | | 143,586 | (8) |

James L. Ferman, Jr. | | 68,342 | (4)(5) | | John B. Ramil | | 174,153 | (3)(9) |

Luis Guinot, Jr. | | 19,325 | | | Richard E. Ludwig | | 176,407 | (3)(5) |

Ira D. Hall | | 13,000 | | | William N. Cantrell | | 216,430 | (3)(10) |

Sherrill W. Hudson | | 10,000 | | | Gordon L. Gillette | | 90,563 | (3) |

Tom L. Rankin | | 1,053,667 | (5)(6) | | All directors and executive officers as a group (22 persons) | | 3,072,486 | (3)(5)(11) |

William D. Rockford | | 18,744 | | | | | | |

William P. Sovey | | 37,082 | | | | | | |

| (1) | | The amounts listed include the following shares that are subject to options granted under the Corporation’s stock option plans that are exercisable within 60 days of January 31, 2003: Messrs. Ausley, Ferman, Rankin, Urquhart and Welch, 21,000 shares each; Mrs. Baldwin, 19,000 shares; Mr. Fagan, 154,841 shares; Messrs. Guinot and Touchton, 17,000 shares each; Mr. Hall, 12,500 shares; Mr. Hudson, 10,000 shares; Mr. Rockford, 12,000 shares; Mr. Sovey, 23,000 shares; Mr. Ramil, 109,716 shares; Mr. Ludwig, 100,088 shares; Mr. Cantrell, 104,504 shares; Mr. Gillette, 46,465 shares and all directors and executive officers as a group, 1,009,299. |

| (2) | | Includes 350 shares held by a trust of which Mrs. Baldwin is a trustee. |

| (3) | | The amounts listed include the following shares that are held by benefit plans of the Corporation for an officer’s account: Mr. Fagan, 823 shares; Mr. Ramil, 4,958 shares; Mr. Ludwig, 4,696 shares; Mr. Cantrell, 10,106 shares; Mr. Gillette, 6,782 shares and all directors and executive officers as a group, 53,790 shares. |

| (4) | | Includes 31,920 shares owned jointly by Mr. Ferman and his wife. Also includes 2,097 shares owned by Mr. Ferman’s wife, as to which shares he disclaims any beneficial interest. |

| (5) | | The amounts listed include the following shares that the following holders of equity security units are entitled to receive upon the early settlement of the purchase contracts issued as part of such units: Mr. Ferman, 8,305 shares; Mr. Rankin, 623 shares; Mr. Touchton, 5,814 shares; Mr. Ludwig 6,623 shares and all directors and executive officers as a group, 21,365 shares. |

| (6) | | Includes 1,343 shares owned by Mr. Rankin’s wife, as to which shares he disclaims any beneficial interest. |

| (7) | | Includes 1,000 shares owned by Mr. Urquhart’s wife, as to which shares he disclaims any beneficial interest. |

| (8) | | Includes 41,990 shares owned by Mr. Welch’s wife, as to which shares he disclaims any beneficial interest. Also includes 36,860 shares held by a trust of which Mr. Welch is a trustee. |

5

| (9) | | Includes 1,889 shares owned jointly by Mr. Ramil and other family members. |

| (10) | | Includes 26,240 shares owned by Mr. Cantrell’s wife, as to which shares he disclaims any beneficial interest. |

| (11) | | Includes a total of 58,108 shares owned jointly. Also includes a total of 48,210 shares owned by spouses, as to which shares beneficial interest is disclaimed. |

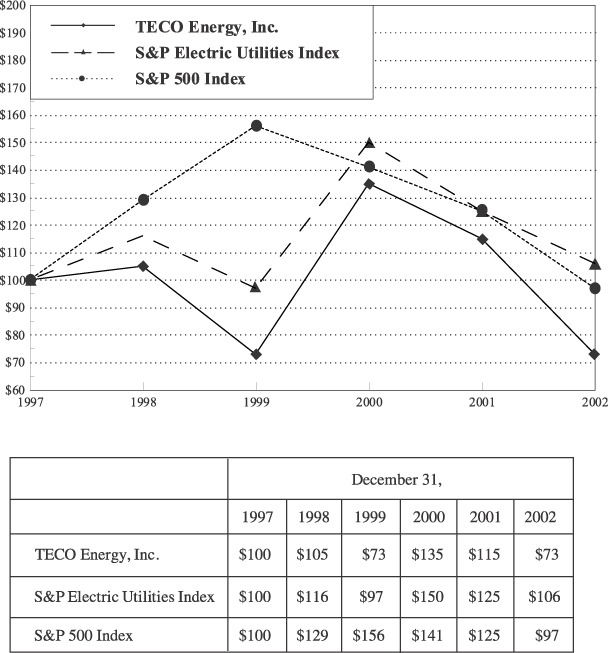

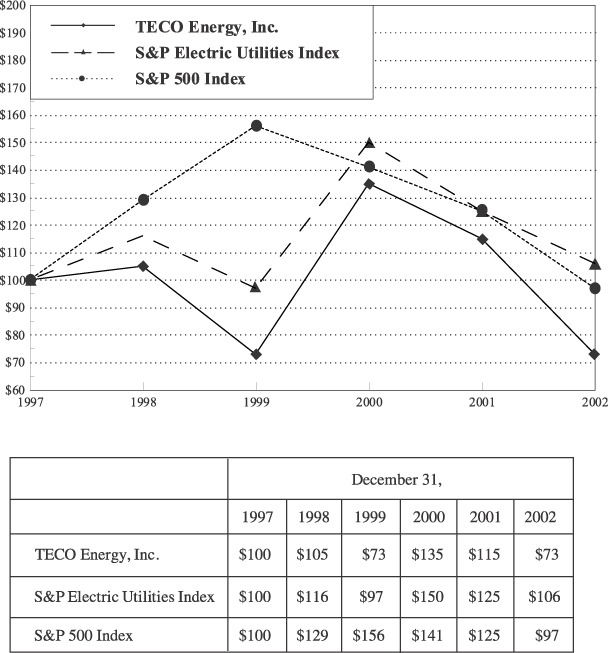

SHAREHOLDER RETURN PERFORMANCE GRAPH

The following graph shows the cumulative total shareholder return on the Corporation’s Common Stock on a yearly basis over the five-year period ended December 31, 2002, and compares this return with that of the S&P 500 Composite Index and the S&P Electric Utilities Index. The graph assumes that the value of the investment in the Corporation’s Common Stock and each index was $100 on December 31, 1997 and that all dividends were reinvested.

6

EXECUTIVE COMPENSATION

Compensation Committee Report On Executive Compensation

The Compensation Committee of the Board of Directors, composed entirely of independent directors, recommends to the Board the compensation of executive officers and administers the Corporation’s long-term incentive plan. The objective of the Corporation’s compensation program is to enhance shareholder value by attracting and retaining the talent needed to manage and build the Corporation’s businesses. The Committee seeks, therefore, to provide compensation opportunities that are competitive and link the interests of shareholders and executives.

Upon the Committee’s recommendation, the Board has adopted stock ownership guidelines of five times base salary for the CEO and three times base salary for the other executive officers. These guidelines allow the executives five years to acquire this amount of stock and do not recognize stock options as shares owned. As of the end of 2002, the CEO and the other executive officers were in compliance with their ownership guidelines.

The components of the Corporation’s executive compensation program, base salary, annual incentive awards and long-term incentive awards, are described below.

Base Salary. Base salary is designed to provide each executive with a fixed amount of annual compensation that is competitive with the marketplace. The Corporation’s salary structure for its executive officers utilizes various salary grade ranges and associated midpoints. Each executive officer is assigned to a salary grade by the Board, on the recommendation of the Committee, based on the officer’s experience level and scope of responsibility and a market assessment conducted by the Corporation’s outside consultant, Towers Perrin, of the median compensation paid to executives with similar positions by organizations having comparable revenues in the energy services industry and in general industry. Each year, the Committee adjusts the salary ranges based on surveys by outside consultants of expected changes in compensation levels at general industrial and energy services companies and recommends adjustments to the base salaries for the executive officers. In 2002, adjustments were made to the base salaries for each executive officer. In making these adjustments, the Committee took into account the midpoint of the officer’s assigned salary grade and the Committee’s subjective evaluation of the officer’s individual performance. For 2002, Mr. Fagan’s base salary was 99% of the midpoint of his salary grade.

Annual Incentive Awards. The Corporation has an annual incentive program intended to encourage actions that contribute to improved operating and financial results which provides for incentive awards based on the achievement of corporate and individual performance goals. Target award percentages range up to 70% for the CEO, 45-60% for the other named executive officers and lower percentages for other officers, and are multiplied by the greater of the midpoint of the officer’s salary range or the officer’s salary. In setting these percentages, the Committee used data from the market assessment referred to above. Under the Corporation’s program, additional payments of up to 50% of the target awards may be made if the goals are exceeded; lesser amounts may be paid if the goals are not achieved, but only if the Corporation’s net income exceeds a threshold designated for that year. The Committee may decide to adjust awards if the plan formula would unduly penalize or reward management and, in individual cases, to vary the calculated award based on the officer’s total performance.

The 2002 objectives for all the executive officers under the incentive program included overall operating and financial performance targets measured by the Corporation’s net income and cash utilization on an absolute basis and by the Corporation’s earnings per share growth and return on equity relative to other companies in the industry. 60% of Mr. Fagan’s 2002 award was based on these factors.Additional quantitative targets were used for some of the other executive officers including, in the case of certain officers, targets relating specifically to the performance of the companies for which they have chief operating responsibility.

In addition to measuring performance against the 2002 quantitative targets, the Committee evaluated each executive’s performance against qualitative objectives. These objectives focused on aspects of the Corporation’s business that directly related to the executive officer’s individual responsibilities. 40% of Mr. Fagan’s 2002 award was based on qualitative objectives relating to positioning the Corporation for 2003, effective execution of corporate strategy and the demonstration of leadership through safety, diversity, affirmative action, succession planning and development

7

of employees. The Committee’s review consisted of a subjective evaluation of the officer’s achievement of these objectives. Based on this evaluation and the Corporation’s 2002 net income and cash utilization, Mr. Fagan received an incentive award of 70% of the midpoint of his salary grade. In addition, Mr. Fagan received a grant of 2,088 shares of restricted stock in early 2003 in lieu of cash for that portion of his 2002 annual incentive award that exceeded target. Other executive officers received similar grants of restricted stock in lieu of cash.

Long-Term Incentive Awards. The long-term component of the Corporation’s incentive compensation program consists of equity-based grants which have been in the form of stock options and restricted stock. These grants are designed to create a mutuality of interest with shareholders by motivating the CEO and the other executive officers and key personnel to manage the Corporation’s business so that the shareholders’ investment will grow in value over time. The Committee’s policy has been to base individual awards on an annual study by Towers Perrin comparing the value of long-term incentive grants to salary levels in the energy services industry and in general industry.

In granting these awards, the Committee was aware that each year in the late March-April time frame, the restricted stock granted three years earlier will vest if the applicable vesting conditions are met and, thus, each year at this time, about 50,000 shares may be sold by the executive officers or withheld by the Corporation in order to pay the taxes due upon vesting. Accordingly, investors who see the reported sales of these shares by executive officers should not assume that such sales represent negative views of the Corporation’s prospects by the executive officers.

The Committee does not normally consider the amount of an individual’s outstanding or previously granted options or shares in determining the size of the grant. The 30,621 shares of performance-based restricted stock, 30,621 shares of time-vested restricted stock and 168,110 options granted to Mr. Fagan in 2002 reflected the policies described above and, as in the case of the other executive officers, the results of the Committee’s review of his performance conducted when it considered his base salary for 2002.

For 2002, the value of the long-term incentive grants to the executive officers was weighted with approximately one-third of the value in performance-based restricted stock, one-third in time-vested restricted stock and one-third in stock options. The performance-based restricted stock has a payout that is dependent upon the total return of the Common Stock over a three-year period relative to that of the median company (in terms of total return) in the Dow Jones Electric Utility Index. If the Common Stock’s total return is equal to that of the median company during the three-year period, the payout will be equal to 90 percent of the target amount. If the total return is in the top 10 percentile of the companies in the index, the payout will be at 200 percent. If the total return is in the bottom 1/3 of these companies, there will be no payout. A minimum payout of 50 percent of target will be made if performance is equal to the 33 and 1/3 percentile. The payout for performance between the top 10 percent and the bottom 1/3 is prorated. The time-vested restricted stock vests following three years of service.

With respect to qualifying compensation paid to executive officers under Section 162(m) of the Internal Revenue Code, the Corporation does not expect to have any significant amount of compensation exceeding the $1-million annual limitation. Accordingly, the Committee has recommended that the Corporation continue to structure its executive compensation program to meet the objectives described in this report. Compensation attributable to the Corporation’s performance-based restricted stock and stock options is not subject to the Section 162(m) limit because of the performance-based exemption.

By the Compensation Committee,

William P. Sovey (Chairman)

Sara L. Baldwin

John A. Urquhart

James O. Welch, Jr.

8

The following tables set forth certain compensation information for the Chief Executive Officer of the Corporation and each of the four other most highly compensated executive officers of the Corporation and its subsidiaries in 2002.

Summary Compensation Table

| | | | | Annual Compensation

| | Long-Term Compensation

| | |

| | | | | | | | | Awards

| | Payouts

| | |

Name and Principal Position

| | Year

| | Salary

| | Bonus (1)

| | Restricted Stock Awards (2)

| | Shares Underlying Options/SARs (#)

| | LTIP Payouts

| | All Other Compen- sation (3)

|

Robert D. Fagan Chairman, President and CEO | | 2002 2001 2000 | | $ | 675,000 625,000 540,000 | | $ | 475,954 602,105 522,494 | | $ | 857,082 | | 168,110 137,857 129,304 | | $ | 825,700 | | $ | 55,543 50,632 22,728 |

|

John B. Ramil Executive VP / President of Tampa Electric | | 2002 2001 2000 | | | 370,000 343,000 299,000 | | | 203,500 271,822 225,847 | | | 263,190 | | 51,622 43,482 41,377 | | | 214,538 | | | 28,484 24,946 12,212 |

|

Richard E. Ludwig President of TECO Power Services | | 2002 2001 2000 | | | 330,000 315,000 260,000 | | | 173,317 228,532 183,330 | | | 263,190 | | 51,622 29,250 36,057 | | | 135,759 | | | 22,825 21,302 11,448 |

|

William N. Cantrell President of Peoples Gas System and TECO Solutions | | 2002 2001 2000 | | | 315,000 300,000 275,000 | | | 158,445 190,977 176,117 | | | 209,505 | | 41,094 36,070 28,447 | | | 195,210 | | | 21,951 20,369 11,427 |

|

Gordon L. Gillette Sr. Vice President- Finance and Chief Financial Officer | | 2002 2001 2000 | | | 290,000 266,500 232,500 | | | 130,500 162,092 175,351 | | | 143,701 | | 28,188 25,200 28,447 | | | 147,563 | | | 19,902 18,185 9,997 |

| (1) | | Since the portion of each executive officer’s annual bonus that is based on the Corporation’s 2002 earnings per share growth and return on equity relative to that of other companies in the industry is determined using comparative data that was not available at the time of printing of this proxy statement, this portion of the annual bonus for 2002 will be reported in the 2004 proxy statement as part of the 2002 bonus amount. |

| (2) | | The reported values of the restricted stock awards were determined using the closing market price of the Common Stock on the date of grant. Restricted stock holdings and the values thereof based on the |

9

closing price of the Common Stock on December 31, 2002 were as follows: Mr. Fagan, 161,551 shares ($2,499,194); Mr. Ramil, 51,859 shares ($802,259); Mr. Ludwig, 54,689 shares ($846,039); Mr. Cantrell, 43,125 shares ($667,144); and Mr. Gillette, 31,393 shares ($485,650). Holders of restricted stock receive the same dividends as holders of other shares of Common Stock.

| (3) | | The reported amounts for 2002 consist of $372 in premiums paid by the Corporation to the Executive Supplemental Life Insurance Plan, with the balance in each case being employer contributions under the TECO Energy Group Retirement Savings Plan and Retirement Savings Excess Benefit Plan. |

Option/SAR Grants in Last Fiscal Year

| | | Individual Grants

| | |

| | | Number of Shares Underlying Options/SARs Granted(1)

| | % of Total Options/SARs Granted to Employees in Fiscal Year

| | Exercise or Base Price Per Share

| | Expiration Date

| | Grant Date Present Value(2)

|

Robert D. Fagan | | 168,110 | | 9.50 | | $27.965 | | 4/16/12 | | $856,558 |

|

John B. Ramil | | 51,622 | | 2.92 | | 27.965 | | 4/16/12 | | 263,026 |

|

Richard E. Ludwig | | 51,622 | | 2.92 | | 27.965 | | 4/16/12 | | 263,026 |

|

William N. Cantrell | | 41,094 | | 2.32 | | 27.965 | | 4/16/12 | | 209,383 |

|

Gordon L. Gillette | | 28,188 | | 1.59 | | 27.965 | | 4/16/12 | | 143,624 |

| (1) | | The options are exercisable in three equal annual installments beginning one year from the date of grant. |

| (2) | | The values shown are based on the Black-Scholes valuation model and are stated in current annualized dollars on a present value basis. The key assumptions used for purposes of this calculation include the following: (a) a 5.69% discount rate; (b) a volatility factor based upon the average trading price for the 36-month period ending March 19, 2002; (c) a dividend factor based upon the 3-year average dividend paid for the period ending March 19, 2002; (d) the 10-year option term; and (e) an exercise price equal to the fair market value on the date of grant.The values shown have not been reduced to reflect the non-transferability of the options or the vesting or forfeiture provisions. The actual value an executive may realize will depend upon the extent to which the stock price exceeds the exercise price on the date the option is exercised. Accordingly, the value, if any, realized by an executive will not necessarily be the value determined by the Black-Scholes model. |

10

Aggregated Option/SAR Exercises in Last Fiscal Year and Fiscal Year-End Option/SAR Value

| | | | | | | Number of Shares Underlying Unexercised Options/SARs at Year-End

| | Value of Unexercised In-The-Money Options/SARs at Year-End

|

Name

| | Shares Acquired on Exercise (#)

| | Value Realized($)

| | Exercisable/ Unexercisable

| | Exercisable/ Unexercisable

|

Robert D. Fagan | | 117,315 | | 804,611 | | 154,841 / 303,115 | | $0 / 0 |

|

John B. Ramil | | 8,200 | | 60,775 | | 109,716 / 94,402 | | $0 / 0 |

|

Richard E. Ludwig | | 10,000 | | 89,862 | | 100,088 / 83,141 | | $0 / 0 |

|

William N. Cantrell | | 5,000 | | 39,631 | | 104,504 / 74,622 | | $0 / 0 |

|

Gordon L. Gillette | | 23,318 | | 150,487 | | 46,465 / 54,470 | | $0 / 0 |

Long-Term Incentive Plans—Awards in Last Fiscal Year

Name

| | Number of shares, units or other rights

| | Performance or other period until maturation or payout

| | Threshold (#)

| | Target (#)

| | Maximum (#)

|

Robert D. Fagan | | 30,621 | | April 1, 2002 to March 31, 2005 | | 15,311 | | 30,621 | | 61,242 |

|

John B. Ramil | | 9,403 | | April 1, 2002 to March 31, 2005 | | 4,702 | | 9,403 | | 18,806 |

|

Richard E. Ludwig | | 9,403 | | April 1, 2002 to March 31, 2005 | | 4,702 | | 9,403 | | 18,806 |

|

William N. Cantrell | | 7,485 | | April 1, 2002 to March 31, 2005 | | 3,743 | | 7,485 | | 14,970 |

|

Gordon L. Gillette | | 5,134 | | April 1, 2002 to March 31, 2005 | | 2,567 | | 5,134 | | 10,268 |

For additional information about the 2002 awards of performance-based restricted stock, see the section of the Compensation Committee Report on Executive Compensation entitled “Long-Term Incentive Awards” on page 8.

11

Pension Table

The following table shows estimated annual benefits payable under the Corporation’s pension plan arrangements for the named executive officers other than Mr. Fagan.

| | | Years of Service

|

Final Average Earnings

| | 5

| | 10

| | 15

| | 20 or More

|

$300,000 | | $ | 45,000 | | $ | 90,000 | | $ | 135,000 | | $ | 180,000 |

350,000 | | | 52,500 | | | 105,000 | | | 157,500 | | | 210,000 |

400,000 | | | 60,000 | | | 120,000 | | | 180,000 | | | 240,000 |

450,000 | | | 67,500 | | | 135,000 | | | 202,500 | | | 270,000 |

500,000 | | | 75,000 | | | 150,000 | | | 225,000 | | | 300,000 |

550,000 | | | 82,500 | | | 165,000 | | | 247,500 | | | 330,000 |

600,000 | | | 90,000 | | | 180,000 | | | 270,000 | | | 360,000 |

650,000 | | | 97,500 | | | 195,000 | | | 292,500 | | | 390,000 |

700,000 | | | 105,000 | | | 210,000 | | | 315,000 | | | 420,000 |

750,000 | | | 112,500 | | | 225,000 | | | 337,500 | | | 450,000 |

800,000 | | | 120,000 | | | 240,000 | | | 360,000 | | | 480,000 |

The annual benefits payable to each of the named executive officers are equal to a stated percentage of such officer’s final average earnings multiplied by his number of years of service, up to a stated maximum. Final average earnings are based on the greater of (a) the officer’s final 36 months of earnings or (b) the officer’s highest three consecutive calendar years of earnings out of the five calendar years preceding retirement. The amounts shown in the table are based on 3% of such earnings and a maximum of 20 years of service. The amount payable to Mr. Fagan is based on 20% of earnings plus 4% of earnings for each year of service, up to a maximum of 60% of earnings.

The earnings covered by the pension plan arrangements are the same as those reported as salary and bonus in the summary compensation table above. Years of service for the named executive officers are as follows: Mr. Fagan (4 years), Mr. Ramil (26 years), Mr. Ludwig (20 years), Mr. Cantrell (27 years) and Mr. Gillette (21 years). The pension benefit is computed as a straight-life annuity commencing at the officer’s normal retirement age and is reduced by the officer’s Social Security benefits. The normal retirement age is 63 for Messrs. Fagan, Ludwig and Cantrell, 63 and 2 months for Mr. Ramil and 64 for Mr. Gillette.

The present value of the officer’s pension benefit is, at the election of the officer, payable in the form of a lump sum. The pension plan arrangements also provide death benefits to the surviving spouse of an officer equal to 50% of the benefit payable to the officer. If the officer dies during employment before reaching his normal retirement age, the benefit is based on the officer’s service as if his employment had continued until such age. The death benefit is payable for the life of the spouse.

Employment and Change in Control Arrangements

The Corporation has severance agreements with the named executive officers under which payments will be made under certain circumstances in connection with a change in control of the Corporation. A change in control means in general an acquisition by any person of 30% or more of the Common Stock, a change in a majority of the directors, a merger or consolidation of the Corporation in which the Corporation’s shareholders do not have at least 65% of the voting power in the surviving entity or a liquidation or sale of the assets of the Corporation. Each of these officers is required, subject to the terms of the severance agreements, to remain in the employ of the Corporation for one year following a potential change in control (as defined) unless a change in control earlier occurs. The severance agreements provide that in the event employment is terminated by the Corporation without cause (as defined) or by one of these

12

officers for good reason (as defined) in contemplation of or following a change in control, or if the officer terminates his employment for any reason during the thirteenth month following a change in control, the Corporation will make a lump sum severance payment to the officer of three times annual salary and bonus. In such event, the severance agreements also provide for: (a) a cash payment equal to the additional retirement benefit which would have been earned under the Corporation’s retirement plans if employment had continued for five years following the date of termination, in the case of Mr. Fagan, and three years following the date of termination, in the case of the other executive officers, (b) participation in the life, disability, accident and health insurance plans of the Corporation for a three-year period except to the extent such benefits are provided by a subsequent employer and (c) a payment to compensate for the additional taxes, if any, payable on the benefits received under the severance agreements and any other benefits contingent on a change in control as a result of the application of the excise tax associated with Section 280G of the Internal Revenue Code. In addition, the terms of the Corporation’s stock options and restricted stock provide for vesting upon a change in control.

SHAREHOLDER PROPOSALS

| 1. | | John J. Phillips, 8020 34th Avenue North, St. Petersburg, Florida 33710, the holder of 800 shares of Common Stock, has submitted the following proposal: |

RESOLVED: That the stockholders of Teco Energy., assembled in annual meeting in person and by proxy hereby request that starting as soon as possible, that the Board of Directors adopt a resolution that there shall be a minimum of, but not limited to, two candidates for each directorship on our Board of Directors to be filled by voting of stockholders at annual meetings.

REASONS: The term “Election of Directors” is inappropriate. Each year the nominating committee proposes only the number of candidates as there are directorships to be filled. Thus it is impossible for shareholders to bring about director turnover or replace a director that they may feel should be replaced. An example is, if there are three positions to be filled and only three nominees, a nominee that received any votes at all would be elected to office. Our only choices are to vote for, or withhold our vote for a candidate. A proxy marked “WITHHOLD” in respect to one or more director nominees would not be counted as a vote, although it would be counted for purpose of determining whether there was a quorum. Thus, no practical means exists for stockholders to bring about director turnover until this or a similar proposal is adopted.

The reason for the existence of Boards of Directors in Public Corporations is to represent the shareholders. The most important function of directors is management selection, evaluation, compensation, and replacement. Therefore, it is extremely important that the shareholders, who are the owners of the company, should have the opportunity to vote for those persons whose qualifications and views represent the shareholders’ interests. In a democracy, those who govern are elected by those whom they represent and are accountable to those who elect them. Nominees for the positions of directors who run unopposed, may or may not represent shareholders’ interests. Thus, the shareholders have lost control of their company. Approval of this proposal will provide us with truly democratically elected officials, and provide the shareholders with the option of replacing any director whom they feel needs to be replaced.

There is a wealth of talented, experienced persons who would make great choices as nominees for a director’s position. This is particularly true if the pool from which directors are selected could be expanded to include younger candidates, including women and minorities, whose backgrounds qualify them to oversee a company’s business and to represent the shareholders’ interests. If a thorough search is made by the nominating committee, there should be no shortage of qualified candidates. I repeat, we should be able to replace any or all directors whom we feel are not representing the shareholders. This cannot be done if we have no choice.

Only when we have a selection of candidates for our directors will we have an opportunity to affect the direction of our company and our investment. Vote for this proposal.

13

The Board of Directors OPPOSES the adoption of the above resolution for the following reasons:

The Corporation’s bylaws already provide for the nomination by shareholders of candidates for election to the Board of Directors. This proposal calls upon the Corporation to adopt a procedure that would involve contested elections for each position on the Board of Directors, with the incumbent Board not being in a position to provide any meaningful guidance to shareholders in choosing between the contestants. As far as the Board is aware, no other publicly held company has adopted a procedure of this kind. For good reason.

In the Board’s judgment, the adoption of this approach would seriously impede the Board’s ability to exercise its fiduciary responsibilities to all of the Corporation’s shareholders, by restricting its ability to identify and support candidates for election to the Board. The Board currently has a Governance and Nominating Committee, comprised exclusively of independent directors, charged with the responsibility for recommending director candidates to the Board. This committee also reviews and makes recommendations to the Board with respect to any candidates proposed by shareholders. The Board believes this procedure best serves the interests of the Corporation’s shareholders.

Moreover, as a practical matter, it is difficult to understand how any Board of Directors would be able to identify qualified candidates of the highest caliber who would be willing to take on the burden of an election contest, without the recommendation and backing of the incumbent Board. The proposal does not suggest how these contests would be conducted, financed or regulated, but any such contests would likely entail substantial additional costs that would have to be borne by the Corporation, and thus indirectly by the shareholders.

In addition, requiring that positions on the Board of Directors be contested would create risks of promoting instability, potentially depriving the Corporation of the benefits of accumulated experience and knowledge of the Corporation and its businesses and could adversely affect the Board’s ability to maintain and develop diversity in its composition. In the Board’s judgment, these risks make this proposal inadvisable and contrary to the interests of the Corporation’s shareholders.

The Board of Directors recommends a vote AGAINST this proposal.

| 2. | | United Association S&P 500 Index Fund, 370 Seventeenth Street, Suite 3100, Denver, Colorado 80202, the holder of 11,439 shares of Common Stock, has submitted the following proposal: |

Resolved, that the shareholders of Teco Energy, Inc. (the “Company”) request that the Board of Directors adopt an executive compensation policy that all future stock option grants to senior executives shall be performance-based. For the purposes of this resolution, a stock option is performance-based if the option exercise price is indexed or linked to an industry peer group stock performance index so that the options have value only to the extent that the Company’s stock price performance exceeds the peer group performance level.

Statement of Support: As long-term shareholders of the Company, we support executive compensation policies and practices that provide challenging performance objectives and serve to motivate executives to achieve long-term corporate value maximization goals. While salaries and bonuses compensate management for short-term results, the grant of stock and stock options has become the primary vehicle for focusing management on achieving long-term results. Unfortunately, stock option grants can and do often provide levels of compensation well beyond those merited. It has become abundantly clear that stock option grants without specific performance-based targets often reward executives for stock price increases due solely to a general stock market rise, rather than to extraordinary company performance.

Indexed stock options are options whose exercise price moves with an appropriate peer group index composed of a company’s primary competitors. The resolution requests that the Company’s Board ensure that future senior executive stock option plans link the options exercise price to an industry performance index associated with a peer group of companies selected by the Board, such as those companies used in the Company’s proxy statement to compare 5 year stock price performance.

14

Implementing an indexed stock option plan would mean that our Company’s participating executives would receive payouts only if the Company’s stock price performance was better then that of the peer group average. By tying the exercise price to a market index, indexed options reward participating executives for outperforming the competition. Indexed options would have value when our Company’s stock price rises in excess of its peer group average or declines less than its peer group average stock price decline. By downwardly adjusting the exercise price of the option during a downturn in the industry, indexed options remove pressure to reprice stock options. In short, superior performance would be rewarded.

At present, stock options granted by the Company are not indexed to peer group performance standards. As long-term owners, we feel strongly that our Company would benefit from the implementation of a stock option program that rewarded superior long-term corporate performance. In response to strong negative public and shareholder reactions to the excessive financial rewards provided executives by non-performance based option plans, a growing number of shareholder organizations, executive compensation experts, and companies are supporting the implementation of performance-based stock option plans such as that advocated in this resolution. We urge your support for this important governance reform.

The Board of Directors OPPOSES the adoption of the above resolution for the following reasons:

The Compensation Committee of the Board of Directors, which is comprised exclusively of independent directors, works closely with outside consultants to design a long-term incentive program for the Corporation’s executives that will provide the greatest long-term benefit to shareholders. This program currently uses three types of long-term incentives, stock options, time-vested restricted stock, and performance-based restricted stock. Each of these components serves a different purpose.

Stock options with an exercise price equal to fair market value align an executive’s interest with shareholders by allowing the executive to be rewarded only when shareholders are rewarded. Time-vested restricted stock enables the Corporation to retain highly qualified executives by placing restrictions that provide for the stock to be forfeited if the executive voluntarily leaves the Corporation prior to the end of the vesting period. Performance-based restricted stock has the same retention element, but ties the level of payout to performance of the Corporation’s common stock relative to that of its peers during the three-year performance period. (For example, if the Corporation’s performance is in the bottom one-third, the payout on the performance-based restricted stock is zero.)

The Board of Directors does not believe that indexed stock options are in the best interests of shareholders. First, if the Corporation’s stock falls, but falls less than its peers, executives would profit at a time that shareholders are losing value. In essence, this would allow the executives’ options to be repriced with a lower strike price, while the Corporation’s shareholders would receive no such economic benefit. The Board believes executives should not enjoy stock option gains during a period in which shareholders are faced with losses. Second, because indexed stock options have a lower market value (under the various option pricing models), the Corporation would need to issue more of those stock options in order to remain competitive with its peers who issue stock options that are not indexed. This would lead to additional dilution for shareholders, and (as described above) this dilution could occur even if the Corporation’s stock depreciates in value.

The Board of Directors strongly supports the Corporation’s current three-prong approach to long-term incentives for its executives. It believes that it supplies the appropriate mix of retention and incentives to align the interests of executives and shareholders. Accordingly, the Board does not support the proposal to restrict the Corporation from issuing stock options in the form currently issued.

The Board of Directors recommends a vote AGAINST this proposal.

15

| 3. | | Massachusetts Carpenters Pension & Annuity Funds, 350 Fordham Road, Wilmington, Massachusetts 01887, the holder of 43,960 shares of Common Stock, has submitted the following proposal: |

Resolved, that the shareholders of TECO Energy Inc. (“Company”) hereby request that the Company’s Board of Directors establish a policy of expensing in the Company’s annual income statement the costs of all future stock options issued by the Company.

Statement of Support: Current accounting rules give companies the choice of reporting stock option expenses annually in the company income statement or as a footnote in the annual report (See: Financial Accounting Standards Board Statement 123). Most companies, including ours, report the cost of stock options as a footnote in the annual report, rather than include the option costs in determining operating income. We believe that expensing stock options would more accurately reflect a company’s operational earnings.

Stock options are an important component of our Company’s executive compensation program. Options have replaced salary and bonuses as the most significant element of executive pay packages at numerous companies. The lack of option expensing can promote excessive use of options in a company’s compensation plans, obscure and understate the cost of executive compensation and promote the pursuit of corporate strategies designed to promote short-term stock price rather than long-term corporate value.

A recent report issued by Standard & Poor’s indicated that the expensing of stock option grant costs would have lowered operational earnings at companies by as much as 10%. “The failure to expense stock option grants has introduced a significant distortion in reported earnings,” stated Federal Reserve Board Chairman Alan Greenspan. “Reporting stock options as expenses is a sensible and positive step toward a clearer and more precise accounting of a company’s worth.”Globe and Mail,“Expensing Options Is a Bandwagon Worth Joining,” Aug. 16, 2002.

Warren Buffett wrote in aNew York TimesOp-Ed piece on July 24, 2002:

There is a crisis of confidence today about corporate earnings reports and the credibility of chief executives. And it’s justified.

For many years, I’ve had little confidence in the earnings numbers reported by most corporations. I’m not talking about Enron and World Com -examples of outright crookedness. Rather, I am referring to the legal, but improper, accounting methods used by chief executives to inflate reported earnings . . .

Options are a huge cost for many corporations and a huge benefit to executives. No wonder, then, that they have fought ferociously to avoid making a charge against their earnings. Without blushing, almost all C.E.O.’s have told their shareholders that options are cost-free . . .

When a company gives something of value to its employees in return for their services, it is clearly a compensation expense. And if expenses don’t belong in the earnings statement, where in the world do they belong?

Many companies have responded to investors’ concerns about their failure to expense stock options. In recent months, more than 100 companies, including such prominent ones as Coca Cola, Washington Post, and General Electric, have decided to expense stock options in order to provide their shareholders more accurate financial statements. Our Company has yet to act. We urge your support.

16

The Board of Directors OPPOSES the adoption of the above resolution for the following reasons:

The Audit Committee of the Board of Directors, which is comprised exclusively of independent directors, has examined the issue of expensing stock options. It believes the Corporation should continue to apply the current accounting treatment for stock options until new accounting standards are adopted which will result in stock options being reported in a uniform manner by all public companies. The Board agrees with the position of the Audit Committee and, thus, does not support the proposal which would provide for expensing stock options before such uniform standards are in place.

The Board of Directors recommends a vote AGAINST this proposal.

AUDIT COMMITTEE REPORT

The Audit Committee is composed of five directors, each of whom is independent as defined by applicable New York Stock Exchange listing standards. The Committee assists the Board of Directors in overseeing (a) the integrity of the financial statements of the Corporation, (b) the annual independent audit process, (c) the Corporation’s systems of internal accounting and financial controls, (d) the independence and performance of the Corporation’s outside auditor and (e) the Corporation’s compliance with legal and regulatory requirements. The Committee operates under a written charter adopted by the Board, a copy of which was included as Appendix A to the Corporation’s 2001 proxy statement.

In the course of its oversight of the Corporation’s financial reporting process, the Committee has:

| | 1. | | Reviewed and discussed with management the Corporation’s audited financial statements for the fiscal year ended December 31, 2002; |

| | 2. | | Discussed with PricewaterhouseCoopers LLP, the Corporation’s outside auditor, the matters required to be discussed by Statement on Auditing Standards No. 61,Communication with Audit Committees; and |

| | 3. | | Received the written disclosures and the letter from PricewaterhouseCoopers LLP required by Independence Standards Board Standard No. 1,Independence Discussions with Audit Committees, discussed with PricewaterhouseCoopers LLP its independence and considered whether the provision of nonaudit services by PricewaterhouseCoopers LLP is compatible with maintaining its independence. |

Based on the foregoing review and discussions, the Committee has recommended to the Board of Directors that the audited financial statements be included in the Corporation’s Annual Report on Form 10-K for the year ended December 31, 2002 for filing with the Securities and Exchange Commission.

By the Audit Committee,

J. Thomas Touchton (Chairman)

James L. Ferman, Jr.

Ira D. Hall

Sherrill W. Hudson

Tom L. Rankin

17

INFORMATION CONCERNING AUDITORS

The Audit Committee reappointed PricewaterhouseCoopers LLP to serve as independent accountants and to audit the Corporation’s financial statements for 2003.

The fees for services provided by PricewaterhouseCoopers LLP to the Corporation in 2002 were as follows:

Audit Fees | | $ | 885,750 |

Audit-Related Fees | | $ | 321,040 |

Tax Fees | | $ | 44,641 |

All Other Fees | | $ | 5,450 |

| | |

|

|

| | | $ | 1,256,881 |

| | |

|

|

“Audit-Related Fees” includes fees for the audit of benefit plans and reviews related to debt and equity issuance and Securities and Exchange Commission filings.

“Tax Fees” includes fees for tax return review, income tax provision review, tax planning and tax audit advice.

“All Other Fees” includes fees for accounting advice related to specific transactions, regulatory accounting advice and other miscellaneous services.

Representatives of PricewaterhouseCoopers LLP are expected to be present at the Annual Meeting of Shareholders and to be available to respond to appropriate questions. They will also have the opportunity to make a statement if they so desire.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

The Corporation’s executive officers and directors are required under Section 16(a) of the Securities Exchange Act of 1934 to file reports of ownership and changes in ownership with the Securities and Exchange Commission and the New York Stock Exchange. Copies of those reports must also be furnished to the Corporation.

Based solely on a review of the copies of reports furnished to the Corporation with respect to 2002 and written representations that no other reports were required, the Corporation believes that the executive officers and directors of the Corporation have complied in a timely manner with all applicable Section 16(a) filing requirements except that Mrs. Baldwin filed one late report covering a gift of shares, Mr. Ludwig filed one late report covering the diversification of TRASOP shares and Mr. Welch filed one report covering purchases by family members one day late.

SHAREHOLDER PROPOSALS

Proposals of shareholders intended to be presented pursuant to Rule 14a-8 under the Securities Exchange Act of 1934 (the “Exchange Act”) for inclusion in the Corporation’s proxy materials relating to the Annual Meeting of Shareholders in 2004 must be received on or before November 3, 2003. In order for a shareholder proposal made outside of Rule 14a-8 under the Exchange Act to be considered “timely” within the meaning of Rule 14a-4(c) of the Exchange Act, such proposal must be received by the Corporation not later than January 16, 2004. Any such proposals should be sent to: Secretary, TECO Energy, Inc., P.O. Box 111, Tampa, Florida 33601.

ADVANCE NOTICE PROVISIONS FOR SHAREHOLDER PROPOSALS AND NOMINATIONS

The Bylaws of the Corporation provide that in order for a shareholder to bring business before or propose director nominations at an annual meeting, the shareholder must give written notice to the Secretary of the Corporation not less than 90 days nor more than 120 days in advance of the anniversary date of the immediately preceding annual meeting of shareholders. The notice must contain specified information about the proposed business or each nominee

18

and the shareholder making the proposal or nomination. If the annual meeting is scheduled for a date that is not within 30 days before or after such anniversary date, the notice given by the shareholder must be received no later than the tenth day following the day on which the notice of such annual meeting date was mailed or public disclosure of the date of such annual meeting was made, whichever first occurs.

SOLICITATION OF PROXIES

In addition to the solicitation of proxies by mail, proxies may be solicited by telephone, facsimile or in person by regular employees of the Corporation. The Corporation has also retained Morrow & Co., Inc. to assist in the solicitation of proxies for a fee of $7,500 plus out-of-pocket expenses. All expenses of this solicitation, including the cost of preparing and mailing this proxy statement, and the reimbursement of brokerage houses and other nominees for their reasonable expenses in forwarding proxy material to beneficial owners of stock, will be paid by the Corporation.

OTHER MATTERS

The Board of Directors does not know of any business to be presented at the meeting other than the matters described in this proxy statement. If other business is properly presented for consideration at the meeting, the enclosed proxy authorizes the persons named therein to vote the shares in their discretion.

Dated: March 7, 2003

19

[TECO ENERGY LOGO]

2003 Annual Shareholders’ Meeting

Wednesday, April 22, 2003, 11:30 A.M.

TECO Plaza

702 North Franklin Street

Tampa, Florida 33602

Attached below is your proxy card for the 2003 Annual Meeting of Shareholders of TECO Energy, Inc.

You may vote by Telephone, by Internet, or by Mail.

To vote by Telephone or Internet, see instructions on reverse side.

To vote by Mail, please return your proxy in the enclosed Business Reply Envelope.

P.O. Box 8694, Edison, NJ 08818-8694.

DETACH HERE IF YOU ARE RETURNING YOUR PROXY CARD BY MAIL

ZTEC22

PROXY

TECO ENERGY, INC.

Proxy for Annual Meeting of Shareholders, April 22, 2003

THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS OF

TECO ENERGY, INC.

The undersigned hereby constitutes and appoints DuBose Ausley, Robert D. Fagan and Luis Guinot, Jr. and any one or more of them, attorneys and proxies of the undersigned, with full power of substitution to each attorney and substitute, for and in the name of the undersigned to appear and vote all shares of Common Stock of TECO Energy, Inc. that the undersigned is entitled to vote at the Annual Meeting of Shareholders of the Corporation to be held on April 22, 2003 at 11:30 A.M., and at any and all adjournments thereof, with all powers the undersigned would have if personally present, hereby revoking all proxies previously given.

SEE REVERSE SIDE

| | (THIS PROXY IS CONTINUED AND IS TO BE SIGNED ON REVERSE SIDE) | |

SEE REVERSE SIDE

|

[TECO ENERGY LOGO]

C/O EQUISERVE TRUST COMPANY N.A.

P.O. BOX 8694

EDISON, NJ 08818-8694

Voter Control Number

Your vote is important. Please vote immediately.

Vote-by-Internet [PICTURE] | | OR | | Vote-by-Telephone [PICTURE] |

|

1. Logon to the Internet and go to http://www.eproxyvote.com/te | | | | 1. Call toll-free

1-877-PRX-VOTE (1-877-779-8683) |

|

2. Enter your Voter Control Number listed above and follow the easy steps outlined on the secured website. | | | | 2. Enter your Voter Control Number listed above and follow the easy recorded instructions. |

If you vote over the Internet or by telephone,

please do not mail your proxy card.

DETACH HERE IF YOU ARE RETURNING YOUR PROXY CARD BY MAIL

ZTEC21

Please mark

x votes as in

this example.

| The | | Board Recommends a Vote FOR all Nominees. |

Instructions—To vote against any individual nominee(s),

mark Box (C) and write the name(s) of such nominee(s)

above the line provided below.

Nominees: (01) S.L. Baldwin, (02) R.D. Fagan,

(03) L. Guinot Jr., (04) S.W. Hudson and

(05) W.P. Sovey

| | | | | ¨ | | (A) FOR ALL NOMINEES | | ¨ | | (B) AGAINST ALL NOMINEES |

|

¨ |

(C) FOR ALL NOMINEES EXCEPT |

| B. | �� | SHAREHOLDER PROPOSALS |

| The | | Board Recommends a Vote AGAINST Shareholder Proposals 1 through 3. |

| | | | | FOR | | | | AGAINST | | | | ABSTAIN |

1. Double Board Nominees | | | | ¨ | | | | ¨ | | | | ¨ |

| | | | | | | | | | | | | |

2. Performance-Based Stock Options | | | | ¨ | | | | ¨ | | | | ¨ |

|

| | | | | FOR | | | | AGAINST | | | | ABSTAIN |

3. Expensing of Stock Options | | | | ¨ | | | | ¨ | | | | ¨ |

In their discretion, the proxies are also authorized to vote upon such other matters as may properly come before the meeting.

This proxy will be voted as specified, or if no specification is made, FOR Proposal A and AGAINST Proposals B 1, 2 and 3.

PLEASE SIGN AND MAIL THIS PROXY TODAY.

MARK HERE FOR ADDRESS CHANGE AND NOTE AT LEFT. | | ¨ |

INSTRUCTIONS—Signatures should correspond exactly with the name or names of Shareholders as they appear on this proxy. Persons signing as Attorney, Executor, Administrator, Trustee or Guardian should give their full titles. Execution on behalf of corporations should be by a duly authorized officer and on behalf of partnerships by a general partner or in the firm name by another duly authorized person.

Signature: | |

| | Date: | |

|

|

Signature: | |

| | Date: | |

|