SCHEDULE 14A

(RULE 14A-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

PROXY STATEMENT PURSUANT TO SECTION 14(A) OF THE

SECURITIES EXCHANGE ACT OF 1934 (Amendment No. )

Filed by the Registrantx Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to 240.14a-11(c) or 240.14a-12 |

TECO Energy, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) filing Proxy Statement if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i) (4) and 0-11. |

| | 1) | Title of each class of securities to which transaction applies: |

| | 2) | Aggregate number of securities to which transaction applies: |

| | 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | 4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | 1) | Amount Previously Paid: |

| | 2) | Form, Schedule or Registration Statement No.: |

NOTICEof Annual Meeting of Shareholders

TECO Energy, Inc., P.O. Box 111, Tampa., FL 33601 (813) 228-1111

| | |

| | March 25, 2004 |

Notice of Annual Meeting of Shareholders

to be held on April 28, 2004

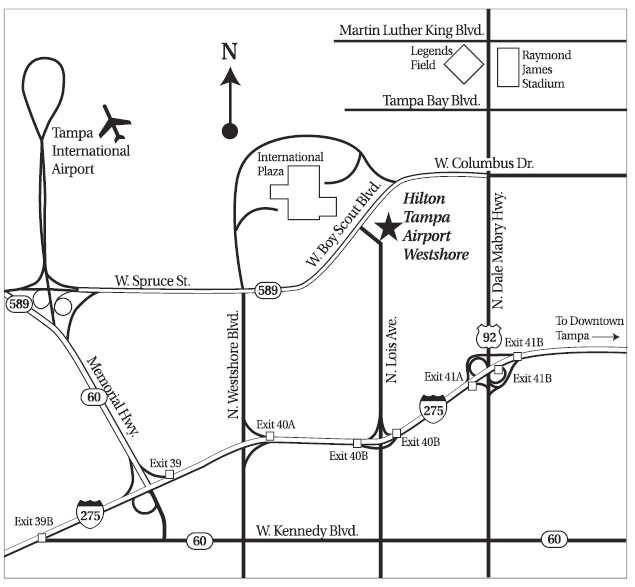

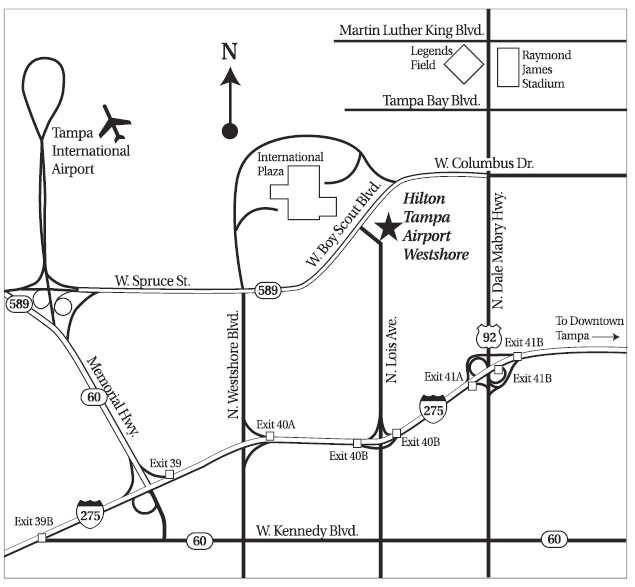

The Annual Meeting of the Shareholders of TECO Energy, Inc. will be held at the Hilton Tampa Airport Westshore Hotel, 2225 North Lois Avenue, Tampa, Florida, on Wednesday, April 28, 2004 at 11:30 a.m., for the following purposes:

| | 1. | To elect three directors. |

| | 2. | To approve the 2004 Equity Incentive Plan. |

| | 3. | To ratify the selection of the Corporation’s independent auditor. |

| | 4. | To consider and act on such other matters, including the shareholder proposals on pages 16-18 of the accompanying proxy statement, as may properly come before the meeting. |

Shareholders of record at the close of business on February 18, 2004 will be entitled to vote at the meeting and at any adjournments thereof.

Even if you plan to attend the meeting, you are requested to either mark, sign and date the enclosed proxy card and return it promptly in the accompanying envelope or vote by telephone or internet by following the instructions on the proxy card. If you attend the meeting and wish to vote in person, your proxy will not be used.

|

| By order of the Board of Directors, |

|

| |

D. E. Schwartz,Secretary |

| | | | |

| TECO Energy: Notice of Annual Meeting | | | | |

PROXYStatement

TECO Energy, Inc.

P.O. Box 111, Tampa., FL 33601

Proxy Statement

The enclosed proxy is solicited on behalf of the Board of Directors of TECO Energy, Inc. (the “Corporation”) to be voted at the Annual Meeting of Shareholders of the Corporation to be held at the time and place and for the purposes set forth in the foregoing notice. This proxy statement and the enclosed proxy are being mailed to shareholders beginning on or about March 25, 2004.

Voting Securities

As of February 18, 2004, the record date for the determination of shareholders entitled to vote at the meeting, the Corporation had outstanding 188,170,776 shares of Common Stock, $1 par value (“Common Stock”), the only class of stock of the Corporation outstanding and entitled to vote at the meeting. The holders of Common Stock are entitled to one vote for each share registered in their names on the record date with respect to all matters to be acted upon at the meeting.

The presence at the meeting, in person or by proxy, of a majority of the shares outstanding on the record date will constitute a quorum. Abstentions and broker non-votes will be considered as shares present for purposes of determining the presence of a quorum.

A shareholder submitting a proxy may revoke it at any time before it is exercised at the meeting by filing with the Secretary of the Corporation a written notice of revocation, submitting a proxy bearing a later date or attending the meeting and voting in person.

Shares represented by valid proxies received will be voted in the manner specified on the proxies. If no instructions are indicated on the proxy, the proxy will be voted for the election of the nominees for director named below, the approval of the 2004 Equity Incentive Plan and the ratification of the Corporation’s independent auditor and against the two shareholder proposals set forth below.

The affirmative vote of a majority of the Common Stock represented at the meeting in person or by proxy will be required to elect directors, to approve the 2004 Equity Incentive Plan and to approve the shareholder proposals. Abstentions will be considered as represented at the meeting and, therefore, will be the equivalent of a negative vote; broker non-votes will not be considered as represented at the meeting.

Attending in Person

Only shareholders or their proxy holders and the Corporation’s guests may attend the meeting, and a form of personal photo identification will be required. Directions to the meeting are provided on the last page of this proxy statement. Admission will be on a first-come, first-served basis. For safety and security reasons, cameras will not be allowed in the meeting, and bags, briefcases and other items will be subject to security check.

For registered shareholders, an admission ticket is attached to your proxy card. Please bring the admission ticket with you to the meeting.

If your shares are held in the name of your broker, bank, or other nominee, you must bring to the meeting an account statement or letter from the nominee indicating that you beneficially owned the shares on February 18,2004, the record date for voting.

Any persons who do not present proper photo identification and an admission ticket or verification of ownership may not be admitted to the meeting.

Election of Directors

The Corporation’s Bylaws provide for the Board of Directors to be divided into three classes, with each class to be as nearly equal in number as possible and to hold office until its successor is elected and qualified. As the term of one class of directors expires, their successors are elected for a term of three years at each annual meeting of shareholders. Messrs. Rankin, Rockford and Touch ton have been nominated for reelection to terms expiring in 2007. Each of these nominees has consented to serve if elected. If any nominee is unable to serve, the shares represented by valid proxies will be voted for the election of such other person as the Board may designate.

| | | | |

| | | 1 | | TECO Energy: Proxy Statement |

PROXYStatement

The following table contains certain information as to the nominees and each person whose term of office as a director will continue after the meeting. Information on the share ownership of each of these individuals is included under “Share Ownership” on pages 4 and 5.

| | | | | | | | |

Name

| | Age

| | Principal Occupation During Last Five Years

and Other Directorships Held(1)

| | Director Since(1)

| | Present Term

Expires

|

| | | | |

| DuBose Ausley | | 66 | | Attorney and former Chairman, Ausley & McMullen (attorneys), Tallahassee, Florida; also a director of Sprint Corporation and Capital City Bank Group, Inc. | | 1992 | | 2005 |

| | | | |

| Sara L. Baldwin | | 72 | | Private Investor, Tampa, Florida | | 1980 | | 2006 |

| | | | |

| Robert D. Fagan | | 59 | | Chairman of the Board, President and Chief Executive Officer, TECO Energy, Inc.; formerly President, PP&L Global, Inc. (diversified energy company), Fairfax, Virginia | | 1999 | | 2006 |

| | | | |

| James L. Ferman, Jr. | | 60 | | President, Ferman Motor Car Company, Inc. (automobile dealerships), Tampa, Florida; also a director of Florida Investment Advisers, Inc. and Chairman of The Bank of Tampa and its holding company, The Tampa Banking Company | | 1985 | | 2005 |

| | | | |

| Luis Guinot, Jr. | | 68 | | Attorney and former Equity Partner, Shapiro, Sher, Guinot & Sandler, P.A. (attorneys), Washington, D.C.; formerly, United States Ambassador to the Republic of Costa Rica | | 1999 | | 2006 |

| | | | |

| Ira D. Hall | | 59 | | President and Chief Executive Officer, Utendahl Capital Management, L.P. (money management), New York, New York; formerly Treasurer, Texaco Inc. (integrated oil company), White Plains, New York; also a director of Imagistics International, Inc., Pepsi Bottling Group, Inc. and Reynolds and Reynolds Company | | 2001 | | 2005(2) |

| | | | |

| Sherrill W. Hudson | | 61 | | Retired; formerly Managing Partner for South Florida, Deloitte & Touche LLP (public accounting), Miami, Florida; also a director of MasTec, Inc., Publix Super Markets, Inc., SportsLine.com, Inc. and The Standard Register Company | | 2003 | | 2006 |

| | | | |

| *Tom L. Rankin | | 63 | | Independent Investment Manager; formerly Chairman of the Board and Chief Executive Officer, Lykes Energy, Inc. (the former holding company for Peoples Gas System) and Lykes Bros. Inc.; also a director of Media General, Inc. | | 1997 | | 2004 |

| | | | |

| *William D. Rockford | | 58 | | President, Primary Energy Holdings LLC (power generation), Oak Brook, Illinois; formerly Managing Director, Chase Securities Inc. (financial services), New York, New York | | 2000 | | 2004 |

| | | | |

| William P. Sovey | | 70 | | Chairman of the Board and former Chief Executive Officer, Newell Rubbermaid Inc. (consumer products), Freeport, Illinois; also a director of Actuant Corporation | | 1996 | | 2006 |

| | | | |

| *J. Thomas Touchton | | 65 | | Managing Partner, The Witt-Touchton Company (private investment partnership), Tampa, Florida | | 1987 | | 2004 |

| | | | |

| James O. Welch, Jr. | | 72 | | Retired; formerly Vice Chairman, RJR Nabisco, Inc. and Chairman, Nabisco Brands, Inc. | | 1976 | | 2005 |

| * | Nominee for election as director |

| (1) | All of the directors of the Corporation also serve as directors of Tampa Electric Company, and the period of service shown includes service on Tampa Electric Company’s Board prior to the formation of the Corporation on January 15, 1981. On April 15, 1981, the Corporation became the corporate parent of Tampa Electric Company as a result of a reorganization. |

| (2) | Mr. Hall is resigning from the Board of Directors effective May 31,2004. |

| | | | |

| TECO Energy: Proxy Statement | | 2 | | |

Information about the Board and its Committees

The Board of Directors held 14 meetings in 2003. All directors attended at least 75 percent of the meetings of the Board and Committees on which they served. The Corporation’s policy is for directors to attend the Corporation’s Annual Meeting of Shareholders; in 2003,12 of the 13 directors attended that meeting. The non-management directors met in executive session at least quarterly, and the presiding director for those sessions rotates alphabetically on a quarterly basis. The Board determined that all of the directors except Messrs. Ausley and Fagan meet the independence standards of the New York Stock Exchange and those set forth in the Corporation’s Corporate Governance Guidelines. The Board also determined that simultaneous service by Messrs. Hall and Hudson on the audit committees of more than three public companies would not impair their ability to serve effectively on the Corporation’s Audit Committee.

The Corporation has standing Audit, Compensation, Finance, and Governance and Nominating Committees of the Board of Directors. The Audit, Compensation and Governance and Nominating Committees are comprised exclusively of independent directors. The Corporate Governance Guidelines, the Charters of each Committee and the Code of Ethics applicable to all directors, officers and employees, the Standards of Integrity, are available on the Investor Relations page of the Corporation’s website, www.tecoenergy.com. Any shareholder wishing to contact either the non-management directors or the Audit Committee may do so utilizing the special postal or e-mail addresses located on the Investor Relations page of the Corporation’s website, www.tecoenergy.com.

The Audit Committee met nine times in 2003; its members are Messrs. Hall, Hudson (Chairman), Rankin and Touchton. Mr. Hudson is an audit committee financial expert, as that term has been defined by the Securities and Exchange Commission. Additional information about the Audit Committee is included in the Audit Committee Report on page 19.

The Compensation Committee, which met three times in 2003, is composed of Mrs. Baldwin and Messrs. Guinot, Sovey (Chairman) and Welch, as well as John A. Urquhart, who is retiring from the Board effective the date of the annual meeting. For additional information about the Compensation Committee, see the Compensation Committee Report on Executive Compensation on pages 6 and 7.

The Finance Committee, which assists the Board in formulating the financial policies of the Corporation and evaluating significant investments and other financial commitments by the Corporation, met 12 times in 2003; its members are Messrs. Ausley, Fagan, Hall (Chairman), Hudson, Rankin and Rockford.

The Governance and Nominating Committee assists the Board with respect to corporate governance matters, including the composition and functioning of the Board. It met five times in 2003, and its members are Messrs. Ferman (Chairman), Sovey, Touchton and Urquhart. The Committee has the responsibilities set forth in its Charter with respect to identifying individuals qualified to become members of the Board; recommending to the Board when new members should be added to the Board; recommending to the Board individuals to fill vacancies and nominees for the next annual meeting of shareholders; periodically developing and recommending to the Board updates to the Corporate Governance Guidelines; and overseeing the annual evaluation of the Board and Committees. The minimum criteria the Governance and Nominating Committee feels candidates should meet and the qualities each should possess are set forth in the Corporate Governance Guidelines. The Governance and Nominating Committee considers suggestions from many sources, including shareholders, regarding possible candidates for director. The Governance and Nominating Committee reviews the qualifications and backgrounds of all the candidates, as well as the overall composition of the Board, and recommends to the Board the slate of candidates to be nominated for election at the annual meeting of shareholders. Shareholder recommendations for nominees for membership on the Board will be given due consideration by the Committee for recommendation to the Board based on the nominee’s qualifications in the same manner as all other candidates. Shareholder nominee recommendations should be submitted in writing to the Chairman of the Governance and Nominating Committee in care of the Corporate Secretary.

Compensation of Directors

Directors who are not employees or former employees of the Corporation or any of its subsidiaries are paid an annual retainer of $27,000 and attendance fees of $750 for each meeting of the Board of the Corporation, $750 for each meeting of the Board of Tampa Electric Company and $1,000 for each meeting of a standing Committee of the Board on which they serve. (The meeting fee for an ad hoc committee formed by the Board is $500.) Each director who serves as a Committee Chairman receives an additional annual retainer of $5,000. Directors may elect to receive all or a portion of their compensation in the form of Common Stock. Directors may also elect to defer any of their cash compensation with a return calculated at either one percent above the prime rate or a rate equal to the total return on the Corporation’s Common Stock.

All non-employee directors participate in the Corporation’s 1997 Director Equity Plan, which allows for a variety of equity-based awards. Currently, each new non-employee director receives an option for 10,000 shares of Common Stock and each continuing non-employee director receives an annual grant consisting of 500 shares and an option for 2,500 shares of Common Stock. The exercise price for these options is the fair market value of the shares on the date of grant. They are exercisable immediately and expire ten years after grant or earlier as provided in the plan following termination of service on the Board.

| | | | |

| | | 3 | | TECO Energy: Proxy Statement |

PROXYStatement

Certain Relationships and Related Party Transactions

The Corporation paid legal fees of $1,178,615 for 2003 to Ausley & McMullen, of which Mr. Ausley is an employee. The Corporation also paid legal fees of $1,000 for 2003 to Shapiro, Sher, Guinot & Sandler, P.A., of which Mr. Guinot was a partner.

Share Ownership

The following table sets forth information with respect to all persons who are known to the Corporation to be the beneficial owner of more than five percent of the outstanding Common Stock as of December 31, 2003.

| | | | |

Name and Address

| | Shares

| | Percent of Class

|

Franklin Resources, Inc (“Franklin”) Charles B. Johnson Rupert H. Johnson One Franklin Parkway, San Mateo, CA 94403 | | 11,369,345(1) | | 6.0 |

| (1) | Based on a Schedule 13G filed with the Securities and Exchange Commission on February 17, 2004, which reported that Franklin (and Charles B. Johnson and Rupert H. Johnson, as its principal shareholders) had sole voting power and investment power over these shares. This amount includes 387,345 common shares that would be issued upon the conversion of 466,400 Convertible Preferred Units. This amount also includes 11,337,345 shares (6.0% of the class) over which Franklin’s subsidiary, Franklin Advisers, Inc., reports having sole voting and investment power. Franklin and the Messrs. Johnson disclaim beneficial ownership of any of these shares. The Franklin-affiliated entities that hold these shares have agreed to vote all of their shares in excess of five percent of the Corporation’s outstanding Common Stock in the same manner (proportionately) as all other shares of Common Stock entitled to vote on the matter, unless otherwise approved in writing in advance by the Corporation. |

The following table sets forth the shares of Common Stock beneficially owned as of January 31, 2004 by the Corporation’s directors and nominees, its executive officers named in the summary compensation table below and its directors and executive officers as a group. Except as otherwise noted, such persons have sole investment and voting power over the shares. The number of shares of the Corporation’s Common Stock beneficially owned by any director or executive officer does not exceed 1% of such shares outstanding at January 31, 2004; the percentage beneficially owned by all directors and executive officers as a group as of such date is 1.9%.

| | | | | | | | |

Name

| | Shares(1)

| | | Name

| | Shares(1)

| |

DuBose Ausley | | 58,425 | | | John A. Urquhart | | 35,841 | (8) |

Sara L. Baldwin | | 48,101 | (2) | | James O. Welch, Jr. | | 144,586 | (9) |

Robert D. Fagan | | 599,737 | (3) | | John B. Ramil | | 251,207 | (3)(10) |

James L. Ferman, Jr. | | 69,399 | (4)(5) | | William N.Cantrell | | 266,069 | (3)(11) |

Luis Guinot, Jr. | | 22,325 | | | Richard E. Ludwig | | 254,804 | (3)(5) |

Ira D. Hall | | 16,000 | | | Gordon L. Gillette | | 125,401 | (3) |

Sherrill W.Hudson | | 15,500 | (6) | | Sheila M. McDevitt | | 106,989 | (3)(5) |

Tom L. Rankin | | 1,056,667 | (5)(7) | | D. Jeffrey Rankin | | 161,520 | (3)(12) |

William D.Rockford | | 24,613 | | | All directors and executive officers as a group (23 persons) | | 3,699,523 | (3)(5)(13) |

William E Sovey | | 40,082 | | | |

J. Thomas Touchton | | 67,950 | (5) | | |

| (1) | The amounts listed include the following shares that are subject to options granted under the Corporation’s stock option plans that are exercisable within 60 days of January 31, 2004: Messrs. Ausley, Ferman, Urquhart and Welch, 21,500 shares each; Mrs. Baldwin and Messrs. Guinot and Touchton, 19,500 shares each; Mr. Fagan, 299,931 shares; Mr. Hall, 15,000 shares; Mr. Hudson, 12,500 shares; Mr. Rankin, 23,500 shares; Mr. Rockford, 14,500 shares; Mr. Sovey, 25,500 shares; Mr. Ramil, 155,210 shares; Mr. Cantrell, 135,107 shares; Mr. Ludwig, 201,837 shares; Mr. Gillette, 71,943 shares; Ms. McDevitt, 57,037 shares; Mr. D. J. Rankin, 76,210 shares and all directors and executive officers as a group, 1,430,405 shares. |

| (2) | Includes 381 shares held by a trust of which Mrs. Baldwin is a trustee. |

| (3) | The amounts listed include the following shares that are held by benefit plans of the Corporation for an officer’s account: Mr. Fagan, 1,516 shares; Mr. Ramil, 5,839 shares; Mr. Cantrell, 11,112 shares; Mr. Ludwig, 5,636 shares; Mr. Gillette, 7,774 shares; Ms. McDevitt, 5,272 shares; Mr. D. J. Rankin, 11,107 shares and all directors and executive officers as a group, 70,067 shares. |

| | | | |

| TECO Energy: Proxy Statement | | 4 | | |

| (4) | Includes 32,420 shares owned jointly by Mr. Ferman and his wife. Also includes 2,154 shares owned by Mr. Ferman’s wife, as to which shares he disclaims any beneficial interest. |

| (5) | The amounts listed include the following shares that the following holders of equity security units are entitled to receive upon the early settlement of the purchase contracts issued as part of such units: Mr. Ferman, 8,305 shares; Mr. Rankin, 623 shares; Mr. Touchton, 5,814 shares; Mr. Ludwig, 6,623 shares; Ms. McDevitt, 361 shares and all directors and executive officers as a group, 21,726 shares. |

| (6) | Includes 2,500 shares owned jointly by Mr. Hudson and his wife. |

| (7) | Includes 1,343 shares owned by Mr. Rankin’s wife, as to which shares he disclaims any beneficial interest. |

| (8) | Includes 1,000 shares owned by Mr. Urquhart’s wife, as to which shares he disclaims any beneficial interest. |

| (9) | Includes 41,990 shares owned by Mr. Welch’s wife, as to which shares he disclaims any beneficial interest. Also includes 36,860 shares held by trusts of which Mr. Welch is a trustee. |

| (10) | Includes 2,013 shares owned jointly by Mr. Ramil and other family members. |

| (11) | Includes 26,240 shares owned by Mr. Cantrell’s wife, as to which shares he disclaims any beneficial interest. |

| (12) | Includes 24,299 shares owned jointly by Mr. D. J. Rankin and his wife. |

| (13) | Includes a total of 61,232 shares owned jointly. Also includes a total of 72,727 shares owned by spouses, as to which shares beneficial interest is disclaimed. |

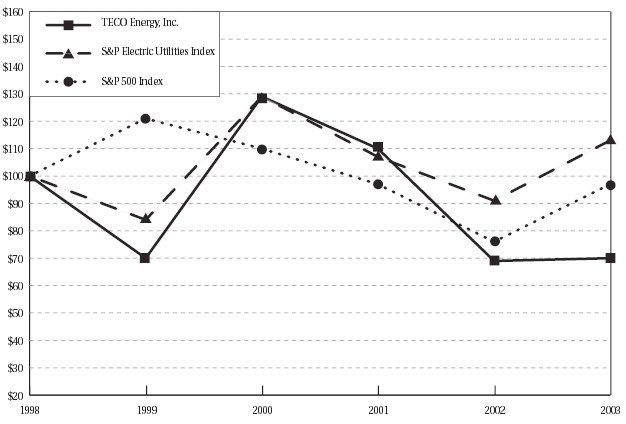

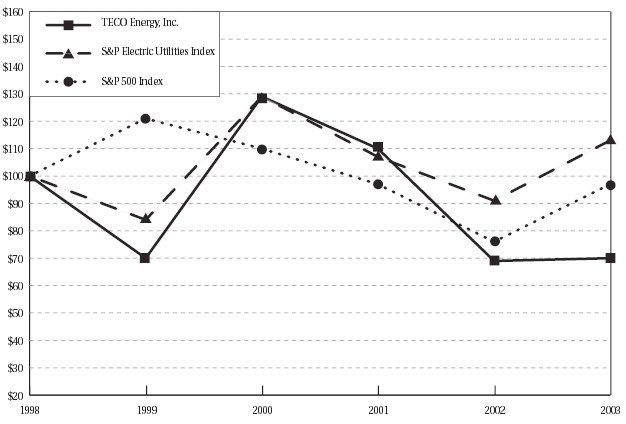

Shareholder Return Performance Graph

The following graph shows the cumulative total shareholder return on the Corporation’s Common Stock on a yearly basis over the five-year period ended December 31, 2003, and compares this return with that of the S&P 500 Composite Index and the S&P Electric Utilities Index. The graph assumes that the value of the investment in the Corporation’s Common Stock and each index was $100 on December 31,1998 and that all dividends were reinvested.

| | | | | | | | | | | | | | | | | | |

December 31,

| | 1998

| | 1999

| | 2000

| | 2001

| | 2002

| | 2003

|

TECO Energy, Inc. | | $ | 100 | | $ | 70 | | $ | 129 | | $ | 110 | | $ | 69 | | $ | 70 |

S&P Electric Utilities Index | | $ | 100 | | $ | 84 | | $ | 129 | | $ | 107 | | $ | 91 | | $ | 113 |

S&P 500 Index | | $ | 100 | | $ | 121 | | $ | 110 | | $ | 97 | | $ | 76 | | $ | 97 |

| | | | |

| | | 5 | | TECO Energy: Proxy Statement |

PROXYStatement

Executive Compensation

Compensation Committee Report On Executive Compensation

The Compensation Committee of the Board of Directors, composed entirely of independent directors, recommends to the Board the compensation of executive officers and administers the Corporation’s long-term incentive plan. The objective of the Corporation’s compensation program is to enhance shareholder value by attracting and retaining the talent needed to manage and build the Corporation’s businesses. The Committee seeks, therefore, to provide compensation opportunities that are competitive and link the interests of shareholders and executives.

Upon the Committee’s recommendation, the Board has adopted stock ownership guidelines of five times base salary for the CEO and three times base salary for the other executive officers. These guidelines allow the executives five years to acquire this amount of stock and do not recognize stock options as shares owned.

The components of the Corporation’s executive compensation program, base salary, annual incentive awards and long-term incentive awards, are described below.

Base Salary.Base salary is designed to provide each executive with a fixed amount of annual compensation that is competitive with the marketplace. The Corporation’s salary structure for its executive officers utilizes various salary grade ranges and associated midpoints. Each executive officer is assigned to a salary grade by the Board, on the recommendation of the Committee, based on the officer’s experience level and scope of responsibility and a market assessment conducted by the Committee’s outside compensation consultant, Towers Perrin, of the median compensation paid to executives with similar positions by organizations having comparable revenues in the energy services industry and in general industry. (Because the Corporation has non-utility subsidiaries, it does not benchmark compensation only against companies in the S&P Electric Utility Index.) Each year, the Committee adjusts the salary ranges based on surveys by outside consultants of expected changes in compensation levels at general industrial and energy services companies and recommends adjustments to the base salaries for the executive officers. In recommending base salary adjustments for the executive officers, the Committee typically takes into account the midpoint of the officer’s assigned salary grade and the Committee’s subjective evaluation of the officer’s individual performance. For 2003, however, the Committee recommended and the Board approved a freeze of all officer salaries at the 2002 levels. For 2003, Mr. Fagan’s base salary was 97% of the midpoint of his salary grade.

Annual Incentive Awards.The Corporation has an annual incentive program intended to encourage actions that contribute to improved operating and financial results which provides for incentive awards based on the achievement of corporate and individual performance goals. Target award percentages range up to 70% for the CEO, 40-60% for the other named executive officers and lower percentages for other officers, and are multiplied by the greater of the midpoint of the officer’s salary range or the officer’s salary. In setting these percentages, the Committee used data from the market assessment referred to above. Under the Corporation’s program, additional payments of up to 50% of the target awards may be made if the goals are exceeded; lesser amounts may be paid if the goals are not achieved, but only if the Corporation’s net income exceeds a threshold designated for that year. The Committee may decide to adjust awards if the plan formula would unduly penalize or reward management and, in individual cases, to vary the calculated award based on the officer’s total performance.

The 2003 objectives for all the executive officers under the incentive program included overall operating and financial performance targets measured by the Corporation’s net income and cash utilization on an absolute basis and by the Corporation’s earnings per share growth and return on equity relative to other companies in the utility industry. 60% of Mr. Fagan’s potential 2003 award was based on these factors. Additional quantitative targets were used for some of the other executive officers including, in the case of certain officers, targets relating specifically to the performance of the companies for which they have chief operating responsibility.

In addition to having these quantitative targets, each executive officer had qualitative objectives that focused on aspects of the Corporation’s business that directly related to the executive officer’s individual responsibilities. 40% of Mr. Fagan’s potential 2003 award was based on qualitative objectives relating to corporate performance for 2003/2004, effective execution of corporate strategy and the demonstration of leadership through safety, diversity, affirmative action and leadership development.

Although many of the 2003 objectives were achieved, because the Corporation’s net income in 2003 did not exceed the threshold designated for that year, there were no annual incentive awards made to any of the Corporation’s officers.

Long-Term Incentive Awards.The long-term component of the Corporation’s incentive compensation program consists of equity-based grants which have been in the form of stock options and restricted stock. These grants are designed to create a mutuality of interest with shareholders by motivating the CEO and the other executive officers and key personnel to manage the Corporation’s business so that the shareholders’ investment will grow in value over time. The Committee’s policy has been to base individual awards on an annual study by its outside consultant comparing the value of long-term incentive grants to salary levels in the energy services industry and in general industry.

| | | | |

| TECO Energy: Proxy Statement | | 6 | | |

In granting these awards, the Committee was aware that each year in the late March-April time frame, the restricted stock granted three years earlier will vest if the applicable vesting conditions are met and, thus, each year at this time, shares may be sold by the executive officers or withheld by the Corporation in order to pay the taxes due upon vesting. Accordingly, investors who see the reported sales of these shares by executive officers should not assume that such sales represent negative views of the Corporation’s prospects by the executive officers.

The Committee does not normally consider the amount of an individual’s outstanding or previously granted options or shares in determining the size of the grant. The 67,246 shares of performance-based restricted stock, 67,246 shares of time-vested restricted stock and 99,671 options granted to Mr. Fagan in 2003 reflected the policies described above and, as in the case of the other executive officers, the results of the Committee’s review of his performance conducted in early 2003.

The performance-based restricted stock granted in 2003 has a payout that is dependent upon the total return of the Common Stock over a three-year period relative to that of the median company (in terms of total return) in the Dow Jones Electric Utility Index. (This index was selected because it allows for more readily available computations of the total return of a peer group than the S&P Electric Utility Index.) If the Common Stock’s total return is equal to that of the median company during the three-year period, the payout will be equal to 90 percent of the target amount. If the total return is in the top 10 percent of the companies in the index, the payout will be at 200 percent. If the total return is in the bottom one-third of these companies, there will be no payout. A minimum payout of 50 percent of target will be made if performance is equal to the 33 1/3 percentile. The payout for performance between the top 10 percent and the bottom one-third is prorated. The time-vested restricted stock granted in 2003 vests following three years of service. The stock options granted in 2003 vest over a three-year period and have a ten-year term.

As part of the Corporation’s internal reorganization in 2003, the Corporation entered into an agreement with two executive officers which provided for severance benefits that were recommended by the Committee. The Committee’s policy has been to provide severance arrangements that are based on the officer’s existing compensation and within the bounds of competitive practice, based on information from its outside consultant. The terms of these arrangements are described under the heading “Employment, Termination and Change in Control Arrangements” on page 11.

With respect to qualifying compensation paid to executive officers under Section 162(m) of the Internal Revenue Code, the Corporation does not expect to have a significant amount of compensation exceeding the $1 million per person annual limitation. Accordingly, the Committee has recommended that the Corporation continue to structure its executive compensation program to meet the objectives described in this report. Compensation attributable to the Corporation’s performance-based restricted stock and stock options is not subject to the Section 162(m) limit because of the performance-based exemption.

By the Compensation Committee,

William P. Sovey (Chairman)

Sara L. Baldwin

Luis Guinot, Jr.

John A. Urquhart

James O. Welch, Jr.

| | | | |

| | | 7 | | TECO Energy: Proxy Statement |

PROXYStatement

The following tables set forth certain compensation information for the Chief Executive Officer of the Corporation, each of the five other most highly compensated executive officers of the Corporation and its subsidiaries in 2003, and one former executive officer.

Summary Compensation Table

| | | | | | | | | | | | | | | | | | | |

| | | | | Annual Compensation

| | Long-Term Compensation

| | |

| | | | | | | | | Awards

| | Payouts

| | |

Name and

Principal Position

| | Year

| | Salary

| | Bonus(1)

| | Restricted

Stock

Awards(2)

| | Shares

Underlying

Options/SARs (#)

| | LTIP Payouts

| | All Other Compensation(3)

|

| | | | | | | |

Robert D. Fagan Chairman, President and CEO | | 2003

2002

2001 | | $

| 675,000

675,000

625,000 | | $

| 0

475,954

602,105 | | $

| 798,268

857,082

| | 99,671

168,110

137,857 | |

$

|

825,700

| | $

| 43,828

55,543

50,632 |

| | | | | | | |

John B. Ramil Executive VP and Chief Operating Officer | | 2003

2002

2001 | |

| 370,000

370,000

343,000 | |

| 0

203,500

271,822 | |

| 305,433

263,190

| | 34,233

51,622

43,482 | |

|

214,538

| |

| 22,689

28,484

24,946 |

| | | | | | | |

William N. Cantrell President of Tampa Electric and Peoples Gas System | | 2003

2002

2001 | |

| 315,000

315,000

300,000 | |

| 0

158,445

190,977 | |

| 199,211

209,505

| | 24,364

41,094

36,070 | | | 195,210 | |

| 19,260

21,951

20,369 |

| | | | | | | |

Richard E. Ludwig Former President of TECO Power Services(4) | | 2003

2002

2001 | |

| 302,500

330,000

315,000 | |

| 0

182,913

228,532 | |

| 180,454

263,190

| | 30,608

51,622

29,250 | |

| 335,055

135,759

| |

| 831,999

22,825

21,302 |

| | | | | | | |

Gordon L. Gillette Sr. Vice President Finance and Chief Financial Officer | | 2003

2002

2001 | |

| 290,000

290,000

266,500 | |

| 0

130,500

162,092 | |

| 145,981

143,701

| | 16,710

28,188

25,200 | |

|

147,563

| |

| 16,217

19,902

18,185 |

| | | | | | | |

Sheila M. McDevitt Sr. Vice President General Counsel | | 2003

2002

2001 | |

| 270,000

270,000

254,000 | |

| 0

108,000

128,029 | |

| 124,453

136,787

| | 15,909

26,830

22,729 | |

|

147,563

| |

| 10,528

12,036

15,873 |

| | | | | | | |

D. Jeffrey Rankin President of TECO Transport Corporation | | 2003

2002

2001 | |

| 270,000

270,000

252,000 | |

| 0

129,664

132,879 | |

| 121,716

143,701

| | 16,710

28,188

25,200 | |

|

147,563

| |

| 16,149

16,326

14,918 |

| (1) | Because the portion of each executive officer’s annual bonus that is based on the Corporation’s annual earnings per share growth and return on equity relative to that of other companies in the industry is determined using comparative data that does not become available until after the time of printing of the Corporation’s proxy statement for that year, this portion of the annual bonus, if any, is reported in the Corporation’s proxy statement for the following year. |

| (2) | Of the reported restricted stock, the only shares awarded that will vest in less than three years from the date of grant are (i) the following shares which vested on January 29, 2004: Mr. Fagan, 2,088 shares; Mr. Ramil, 3,731 shares; Mr. Cantrell, 1,776 shares; Mr. Gillette, 1,290 shares; and Ms. McDevitt, 339 shares and (ii) the following shares which will vest on April 22, 2004: Mr. Fagan 3,181 shares; Mr. Ramil, 907 shares; Mr. Cantrell, 706 shares; Mr. Gillette, 872 shares; Ms. McDevitt, 722 shares; and Mr. D. J. Rankin, 263 shares. The reported values of the restricted stock awards were determined using the closing market price of the Common Stock on the date of grant. Restricted stock holdings and the values thereof based on the closing price of the Common Stock on December 31, 2003 were as follows: Mr. Fagan, 260,286 shares ($3,750,721); Mr. Ramil, 83,350 shares ($1,201,074); Mr. Cantrell, 62,412 shares ($899,357); Mr. Gillette, 41,051 shares ($591,545); Ms. McDevitt, 37,388 shares ($538,761); and Mr. D. J. Rankin, 48,252 shares ($695,311). Holders of restricted stock receive the same dividends as holders of other shares of Common Stock. |

| (3) | The reported amounts for 2003 consist of $322 in premiums paid by the Corporation to the Executive Supplemental Life Insurance Plan, with the balance in each case, except for Mr. Ludwig, being employer contributions under the TECO Energy Group Retirement Savings Plan and Retirement Savings Excess Benefit Plan. The reported amount for Mr. Ludwig includes a severance payment of $788,627. |

| (4) | Mr. Ludwig retired from the Corporation effective December 1, 2003. |

| | | | |

TECO Energy: Proxy Statement | | 8 | | |

Option/SAR Grants in Last Fiscal Year

| | | | | | | | | | | | |

| | | Individual Grants

| | |

Name

| | Number of

Shares Underlying

Options/SARs Granted(1)

| | % of Total Options/SARs

Granted to Employees

in Fiscal Year

| | Exercise

or Base

Price Per Share

| | Expiration

Date

| | Grant Date

Present Value(2)

|

Robert D. Fagan | | 99,671 | | 3.52 | | $ | 11.085 | | 4/20/13 | | $ | 204,177 |

John B. Ramil | | 34,233 | | 1.21 | | | 11.085 | | 4/20/13 | | | 70,127 |

William N. Cantrell | | 24,364 | | 0.86 | | | 11.085 | | 4/20/13 | | | 49,910 |

Richard E. Ludwig | | 30,608 | | 1.08 | | | 11.085 | | 4/20/13 | | | 62,701 |

Gordon L. Gillette | | 16,710 | | 0.59 | | | 11.085 | | 4/20/13 | | | 34,231 |

Sheila M. McDevitt | | 15,909 | | 0.56 | | | 11.085 | | 4/20/13 | | | 32,590 |

D. Jeffrey Rankin | | 16,710 | | 0.59 | | | 11.085 | | 4/20/13 | | | 34,231 |

| (1) | The options are exercisable in three equal annual installments beginning one year from the date of grant. |

| (2) | The values shown are based on the Black-Scholes valuation model and are stated in current annualized dollars on a present value basis. The key assumptions used for purposes of this calculation include the following: (a) a 4.33% discount rate; (b) a volatility factor based upon the average trading price for the 36-month period ending March 19, 2003; (c) a dividend factor based upon the 3-year average dividend paid for the period ending March 19, 2003; (d) the 10-year option term; and (e) an exercise price equal to the fair market value on the date of grant. The values shown have not been reduced to reflect the non-transferability of the options or the vesting or forfeiture provisions. The actual value an executive may realize will depend upon the extent to which the stock price exceeds the exercise price on the date the option is exercised. Accordingly, the value, if any, realized by an executive will not necessarily be the value determined by the Black-Scholes model. |

Aggregated Option/SAR Exercises in Last Fiscal Year and Fiscal Year-End Option/SAR Value

| | | | | | | | | |

| | | | | | | Number of Shares

Underlying Unexercised

Options/SARs at Year-End

| | Value of Unexercised In-The-Money

Options/SARs at Year-End

|

Name

| | Shares Acquired

on Exercise (#)

| | Value

Realized ($)

| | Exercisable/

Unexercisable

| | Exercisable/

Unexercisable

|

Robert D. Fagan | | 0 | | 0 | | 299,931 / 257,696 | | $ | 0 /331,406 |

John B. Ramil | | 0 | | 0 | | 155,210 / 83,141 | | $ | 0 /113,825 |

William N. Cantrell | | 0 | | 0 | | 135,107 / 63,783 | | $ | 0 / 81,010 |

Richard E. Ludwig | | 0 | | 0 | | 201,837 / 0 | | $ | 441,061 / 0 |

Gordon L. Gillette | | 0 | | 0 | | 71,943 / 43,902 | | $ | 0 / 55,561 |

Sheila M. McDevitt | | 0 | | 0 | | 41,371 / 57,037 | | $ | 0 / 52,897 |

D. Jeffrey Rankin | | 0 | | 0 | | 76,210 / 43,902 | | $ | 0 / 55,561 |

| | | | |

| | | 9 | | TECO Energy: Proxy Statement |

PROXYStatement

Long-Term Incentive Plans – Awards in Last Fiscal Year

| | | | | | | | | | |

Name

| | Number of shares, units or other rights

| | Performance or other period until maturation or payout

| | Threshold (#)

| | Target (#)

| | Maximum (#)

|

Robert D. Fagan | | 67,246 | | April 1, 2003 to March 31, 2006 | | 33,623 | | 67,246 | | 134,492 |

John B. Ramil | | 22,378 | | April 1, 2003 to March 31, 2006 | | 11,189 | | 22,378 | | 44,756 |

William N. Cantrell | | 15,303 | | April 1, 2003 to March 31, 2006 | | 7,651 | | 15,303 | | 30,606 |

Richard E. Ludwig | | 16,510 | | April 1, 2003 to March 31, 2006 | | 8,255 | | 16,510 | | 33,020 |

Gordon L. Gillette | | 10,873 | | April 1, 2003 to March 31, 2006 | | 5,436 | | 10,873 | | 21,746 |

Sheila M. McDevitt | | 10,241 | | April 1, 2003 to March 31, 2006 | | 5,120 | | 10,241 | | 20,482 |

D. Jeffrey Rankin | | 10,873 | | April 1, 2003 to March 31, 2006 | | 5,436 | | 10,873 | | 21,746 |

For additional information about the 2003 awards of performance-based restricted stock, see the section of the Compensation Committee Report on Executive Compensation entitled “Long-Term Incentive Awards” on pages 6 and 7.

Pension Table

The following table shows estimated annual benefits payable under the Corporation’s pension plan arrangements for the named executive officers other than Mr. Fagan.

| | | | | | | | | | | | |

| | | Years of Service

|

Final

Average

Earnings

| | 5

| | 10

| | 15

| | 20 or More

|

| $300,000 | | $ | 45,000 | | $ | 90,000 | | $ | 135,000 | | $ | 180,000 |

| 350,000 | | | 52,500 | | | 105,000 | | | 157,500 | | | 210,000 |

| 400,000 | | | 60,000 | | | 120,000 | | | 180,000 | | | 240,000 |

| 450,000 | | | 67,500 | | | 135,000 | | | 202,500 | | | 270,000 |

| 500,000 | | | 75,000 | | | 150,000 | | | 225,000 | | | 300,000 |

| 550,000 | | | 82,500 | | | 165,000 | | | 247,500 | | | 330,000 |

| 600,000 | | | 90,000 | | | 180,000 | | | 270,000 | | | 360,000 |

| 650,000 | | | 97,500 | | | 195,000 | | | 292,500 | | | 390,000 |

| 700,000 | | | 105,000 | | | 210,000 | | | 315,000 | | | 420,000 |

| 750,000 | | | 112,500 | | | 225,000 | | | 337,500 | | | 450,000 |

| 800,000 | | | 120,000 | | | 240,000 | | | 360,000 | | | 480,000 |

The annual benefits payable to each of the named executive officers are equal to a stated percentage of such officer’s final average earnings multiplied by his number of years of service, up to a stated maximum. Final average earnings are based on the greater of (a) the officer’s final 36 months of earnings or (b) the officer’s highest three consecutive calendar years of earnings out of the five calendar years preceding retirement. The amounts shown in the table are based on 3% of such earnings and a maximum of 20 years of service. The amount payable to Mr. Fagan is based on 20% of earnings plus 4% of earnings for each year of service, up to a maximum of 60% of earnings.

The earnings covered by the pension plan arrangements are the same as those reported as salary and bonus in the summary compensation table above. Years of service for the named executive officers are as follows: Mr. Fagan (5 years), Mr. Ramil (27 years), Mr. Cantrell (28 years), Mr. Ludwig (21 years), Mr. Gillette (22 years), Ms. McDevitt (22 years) and Mr. Rankin (34 years). The pension benefit is computed as a straight-life annuity commencing at the officer’s normal retirement age and is reduced by the officer’s Social Security benefits. The normal retirement age is 63 for Mr. Fagan, Mr. Cantrell, Mr. Ludwig, Ms. McDevitt and Mr. Rankin, 63 and 2 months for Mr. Ramil and 64 for Mr. Gillette.

The present value of the officer’s pension benefit is, at the election of the officer, payable in the form of a lump sum. The pension plan arrangements also provide death benefits to the surviving spouse of an officer equal to 50% of the benefit payable to the officer. If the officer dies during employment before reaching his normal retirement age, the benefit is based on the officer’s service as if his employment had continued until such age. The death benefit is payable for the life of the spouse.

| | | | |

| TECO Energy: Proxy Statement | | 10 | | |

Employment, Termination and Change in Control Arrangements

The Corporation has severance agreements with the named executive officers under which payments will be made under certain circumstances in connection with a change in control of the Corporation. A change in control means in general an acquisition by any person of 30% or more of the Common Stock, a change in a majority of the directors, a merger or consolidation of the Corporation in which the Corporation’s shareholders do not have at least 65% of the voting power in the surviving entity or a liquidation or sale of the assets of the Corporation. Each of these officers is required, subject to the terms of the severance agreements, to remain in the employ of the Corporation for one year following a potential change in control (as defined) unless a change in control earlier occurs. The severance agreements provide that in the event employment is terminated by the Corporation without cause (as defined) or by one of these officers for good reason (as defined) in contemplation of or following a change in control, or if the officer terminates his employment for any reason during the thirteenth month following a change in control, the Corporation will make a lump sum severance payment to the officer of three times annual salary and bonus. In such event, the severance agreements also provide for: (a) a cash payment equal to the additional retirement benefit which would have been earned under the Corporation’s retirement plans if employment had continued for five years following the date of termination, in the case of Mr. Fagan, and three years following the date of termination, in the case of the other executive officers, (b) participation in the life, disability, accident and health insurance plans of the Corporation for a three-year period except to the extent such benefits are provided by a subsequent employer and (c) a payment to compensate for the additional taxes, if any, payable on the benefits received under the severance agreements and any other benefits contingent on a change in control as a result of the application of the excise tax associated with Section 280G of the Internal Revenue Code. In addition, the pension plan arrangements for the Corporation’s executive officers and the terms of the Corporation’s stock options and restricted stock provide for vesting upon a change in control.

The Corporation has an agreement with Mr. Fagan which provides that, if his employment is terminated by the Corporation without cause or by Mr. Fagan for good reason prior to January 28, 2006, he will receive (a) severance benefits equal to two times annual salary and bonus, (b) life, disability, accident and health insurance for a period of two years and (c) a lump sum payment equal to the equivalent of two additional years of service under the Corporation’s pension plan arrangements. Additionally, the agreement prohibits Mr. Fagan from engaging in specific competitive activities for a period ending two years after his termination of employment. Any payments under this agreement would be offset against any amount payable under Mr. Fagan’s change-in-control severance agreement.

In connection with the Corporation’s internal reorganization in 2003, the Corporation entered in a separation agreement with Mr. Ludwig. This agreement provided for severance payments of one and one-half times annual salary and target bonus, a payment equal to the present value of an additional two years of age and service under the Corporation’s pension plan arrangements, payments for unused vacation time, cash in lieu of outplacement and retraining expenses and health and dental insurance for an additional year and a half. See Footnote (3) to the Summary Compensation Table for additional information.

Approval of the 2004 Equity Incentive Plan

General

On January 27, 2004, the Board of Directors adopted, subject to shareholder approval, the 2004 Equity Incentive Plan (the “Plan”) as an amendment and restatement of the Corporation’s 1996 Equity Incentive Plan (the “1996 Plan”). If the Plan is approved by shareholders, the Plan will supersede the 1996 Plan and no additional grants will be made thereunder. The rights of the holders of outstanding options under the 1996 Plan will not be affected. The purpose of the Plan is to attract and retain key employees and consultants of the Corporation, to provide an incentive for them to achieve long-range performance goals and to enable them to participate in the long-term growth of the Corporation. The Plan will continue to be administered by a committee (the “Committee”) of not less than three independent, non-employee members of the Board of Directors, currently the Compensation Committee. The Committee may grant awards to any employee or consultant of the Corporation or its affiliates who is capable of contributing significantly to the successful performance of the Corporation. As of February 18, 2004, approximately 325 key employees were eligible to participate in the Plan.

Proposed Amendments to the 1996 Plan

Approval of the Plan would amend the 1996 Plan to (a) increase the number of shares of Common Stock subject to grants by 10,000,000 shares (subject to the cap described in the paragraph below), (b) place various limitations on the types of awards available to be granted, (c) specify a ten-year term for the Plan and any grants made thereunder, (d) allow the Committee to make awards to consultants to the Corporation and (e) reapprove the business criteria upon which objective performance goals may be established by the Committee to continue to permit the Corporation to take Federal tax deductions for performance-based awards made to certain senior officers under Section 162(m) of the tax code.

| | | | |

| | | 11 | | TECO Energy: Proxy Statement |

PROXYStatement

The Plan prohibits (i) the repricing of options without prior shareholder approval and (ii) the use of reload stock options. It requires a vesting period of at least three years for stock grants, except for awards granted in lieu of cash or to new hires, and except in the cases of death, disability, retirement, change-in-control, termination by the Corporation without cause or similar circumstances as may be specified by the Committee at the time of grant, and awards which satisfy a performance-based vesting schedule. Subject to these same exceptions, the Plan also requires that option and SAR grants vest no more rapidly than at the rate of one-third on each anniversary of the date of grant and that these grants expire no later than ten years after the date of grant. The Plan also restricts executive officers of the Corporation from delivering a promissory note as consideration for the exercise of an award, consistent with the requirements of The Sarbanes-Oxley Act of 2002. The Plan will expire ten years from its effective date. Except as described above, the Plan does not materially differ from the 1996 Plan.

The Board of Directors believes that the proposed increase in authorized shares under the Plan is necessary to ensure that a sufficient number of shares will remain available to attract, motivate, and retain the Corporation’s workforce in the future. The Board also believes that the ability to make awards to consultants will give the Corporation the flexibility to respond to a changing business environment. The Board further believes that the new limitations incorporated in the Plan such as setting a ten-year expiration date for the Plan and any options, imposing a minimum vesting schedule in most cases, prohibiting the use of reload stock options, and requiring the Corporation to seek shareholder approval of any option repricing will promote greater accountability to shareholders in the management and operation of the Plan.

Shares Subject to Awards

As of February 18, 2004, 1,451,871 shares were available for awards under the 1996 Plan. The proposed Plan would add 10,000,000 shares, bringing the total number of shares available for awards under the Plan to 11,451,871, or about 6.1% of the Corporation’s outstanding shares, as of February 18, 2004. No more than 30 percent of these shares will be available for stock grants. The number and kind of shares are subject to adjustment to reflect stock dividends, recapitalizations or other changes affecting the Common Stock. If any outstanding award under the 1996 Plan or any future award under the Plan expires or is terminated unexercised or is settled in a manner that results in fewer shares outstanding than were initially awarded, the shares which would have been issuable will again be available for award under the Plan. The closing price of the Common Stock on the New York Stock Exchange on February 18, 2004 was $15.35 per share.

Description of Awards

The Plan will provide for the following three basic types of awards:

Stock Grants.The Committee may make stock grants for no cash consideration, for such minimum consideration as may be required by applicable law or for such other consideration as the Committee may determine. Stock grants may include without limitation shares subject to forfeiture (“restricted stock”), grants conditioned upon attainment of performance criteria (“performance shares”), restricted stock where vesting accelerates upon attainment of performance criteria (“performance-accelerated restricted stock”) and outright stock grants (“bonus stock”). With respect to any stock grant, the Committee has full discretion to determine the number of shares subject to the grant and the terms and conditions of the grant, subject to the minimum vesting period and maximum grant restrictions in the Plan.

Stock Options.The Committee may grant options to purchase Common Stock. Stock options may include without limitation incentive stock options eligible for special tax treatment (“ISOs”), options not entitled to such tax treatment (“nonstatutory stock options”), options where the exercise price is adjusted to reflect market changes (“indexed stock options”), options that become exercisable based on attainment of performance criteria (“performance-vested stock options”) and options where exercisability is accelerated upon attainment of performance criteria (“performance-accelerated stock options”). The Committee will determine the option price, term and exercise period of each option granted, provided that the option price may not be less than the fair market value of the Common Stock on the date of grant, and shall be subject to the vesting and exercise period restrictions in the Plan. An option may be exercised by the payment of the option price in whole or in part in cash or, to the extent permitted by the Committee, by delivery of a promissory note (in the case of non-executive officers) or shares of Common Stock owned by the participant valued at fair market value on the date of delivery, for consideration received by the Corporation under a broker-assisted cashless exercise program, or such other lawful consideration as the Committee may determine.

| | | | |

| TECO Energy: Proxy Statement | | 12 | | |

Stock Equivalents.The Committee may make awards where the amount to be paid to the participant is based on the value of the Common Stock. Stock equivalents may include without limitation payments based on the full value of the Common Stock (“phantom stock”), payments based on the value of the Common Stock upon attainment of performance criteria (“performance units”), rights to receive payments based on dividends paid on the Common Stock (“dividend equivalents”) and stock appreciation rights (“SARs”) where the participant receives payment equal in value to the difference between the exercise price of the award and the fair market value of the Common Stock on the date of exercise. SARs may be granted in tandem with options (at or after award of the option) or alone and unrelated to an option. SARs granted in tandem with an option terminate to the extent that the related option is exercised, and the related option terminates to the extent that the tandem SAR is exercised. The exercise price of an SAR may not be less than the fair market value of the Common Stock on the date of grant or, in the case of a tandem SAR, the exercise price of the related option. The Committee also has discretion to grant any other type of stock equivalent award and to determine the terms and conditions of payment of the award (subject to the vesting period and grant restrictions in the Plan) and whether payment values will be settled in whole or in part in cash or other property, including Common Stock.

Internal Revenue Code Section 162(m)

United States tax laws generally do not allow publicly-held companies to obtain tax deductions for compensation of more than $1 million paid in any year to any of the five most highly paid executive officers (each, a “covered employee”) unless the compensation is “performance-based” as defined in the Section 162(m) of the tax code. Stock options and SARs granted under an equity compensation plan are performance-based compensation if (i) shareholders approve a maximum aggregate per person limit on the number of shares that may be granted each year, (ii) any stock options or SARs are granted by a committee consisting solely of outside directors, and (iii) the stock options or SARs have an exercise price that is not less than the fair market value of common stock on the date of grant.

The Committee has designed the Plan with the intention of satisfying Section 162(m) with respect to stock options and SARs granted to covered employees.

In the case of restricted stock, performance shares, performance-accelerated restricted stock, performance units, and other equity awards, Section 162 (m) requires that the general business criteria of any performance goals that are established by a plan’s committee be approved and periodically reapproved by shareholders (generally every five years) in order for such awards to be considered performance-based and deductible by the employer. Generally, the performance goals must be established before the beginning of the relevant performance period. Furthermore, satisfaction of any performance goals during the relevant performance period must be certified by the committee.

The shareholders of the Corporation previously approved the following list of business criteria upon which the Committee was permitted to establish performance goals for performance-based awards (other than stock options or SARs) to be made under the 1996 Plan to covered employees: total shareholder return, stock price, earnings per share, net earnings, consolidated pre-tax earnings, revenues, operating income, earnings before interest and taxes, cash flow, return on equity, capital or assets, value created, operating margin, market penetration, geographic expansion, costs, and goals relating to acquisitions or divestitures, or any combination of the foregoing, including without limitation goals based on any of such measures relative to appropriate peer groups or market indices.

In connection with the approval of the Plan, the Corporation is seeking reapproval of the Committee’s right to develop performance goals based upon the above business criteria for future awards to covered employees. Under the Plan, performance goals may be particular to a participant or may be based, in whole or in part, on the performance of the division, department, line of business, subsidiary, or other business unit in which the participant works, or on the performance of the Corporation generally. The Committee has the authority to reduce (but not to increase) the amount payable at any given level of performance to take into account factors that the Committee may deem relevant.

Shareholder approval of these business criteria will enable the Corporation to realize a full Federal income tax deduction for performance-based awards under the Plan, if any, where the deduction would otherwise be restricted by Section 162(m) of the tax code.

| | | | |

| | | 13 | | TECO Energy: Proxy Statement |

PROXYStatement

Additional Plan Information

Awards under the Plan may contain such terms and conditions not inconsistent with the Plan as the Committee in its discretion approves. The Committee has discretion to administer the Plan in the manner which it determines, from time to time, is in the best interest of the Corporation. For example, the Committee will establish the terms of stock options, stock grants and stock equivalents and determine when, in the case of options and SARs, they may be exercised, subject to the vesting and exercise period restrictions set forth in the Plan described above. Awards may be granted subject to conditions relating to continued employment and restrictions on transfer. The Committee may provide, at the time an award is made or at any time thereafter, for the acceleration of a participant’s rights or cash settlement upon a change in control of the Corporation. The terms and conditions of awards need not be the same for each participant. The foregoing examples illustrate, but do not limit, the manner in which the Committee may exercise its authority in administering the Plan.

The maximum aggregate number of shares subject to stock options, SARs and other awards that maybe granted under the Plan to a participant in any calendar year will not exceed 1,000,000 shares, subject to adjustment to reflect dividends, recapitalizations or other changes affecting the Common Stock. With respect to any performance-based award settled in cash, no more than $5,000,000 may be paid to any one individual with respect to each year of a performance period. These limits are intended to qualify awards granted under the Plan as performance-based compensation that is not subject to the $1 million limit on deductibility for federal income tax purposes of compensation paid to covered employees.

Amendment

The Board has authority to amend, suspend or terminate the Plan subject to any shareholder approval that the Board determines is necessary or advisable. Subject to the prohibition on option repricing without shareholder approval, the Committee has authority to amend outstanding awards, including changing the date of exercise and converting an incentive stock option to a nonstatutory option, if the Committee determines that such actions would not adversely affect the participant or are otherwise permitted by the terms of the Plan.

Federal Income Tax Consequences Relating to Stock Options

Incentive Stock Options.An optionee does not realize taxable income upon the grant or exercise of an ISO under the Plan. If no disposition of shares issued to an optionee pursuant to the exercise of an ISO is made by the optionee within two years from the date of grant or within one year from the date of exercise, then (a) upon sale of such shares, any amount realized in excess of the option price (the amount paid for the shares) is taxed to the optionee as long-term capital gain and any loss sustained will be a long-term capital loss and (b) no deduction is allowed to the Corporation for Federal income tax purposes. The exercise of ISOs gives rise to an adjustment in computing alternative minimum taxable income that may result in alternative minimum tax liability for the optionee. If shares of Common Stock acquired upon the exercise of an ISO are disposed of prior to the expiration of the two-year and one-year holding periods described above (a “disqualifying disposition”) then (a) the optionee realizes ordinary income in the year of disposition in an amount equal to the excess (if any) of the fair market value of the shares at exercise (or, if less, the amount realized on a sale of such shares) over the option price thereof and (b) the Corporation is entitled to deduct such amount for federal income tax purposes. Any further gain realized is taxed as a short-term or long-term capital gain and does not result in any deduction to the Corporation. A disqualifying disposition in the year of exercise will generally avoid the alternative minimum tax consequences of the exercise of an ISO.

Nonstatutory Stock Options.No income is realized by the optionee at the time a nonstatutory option is granted. Upon exercise, (a) ordinary income is realized by the optionee in an amount equal to the difference between the option price and the fair market value of the shares on the date of exercise and (b) the Company receives a tax deduction for the same amount. Upon disposition of the shares, appreciation or depreciation after the date of exercise is treated as a short-term or long-term capital gain or loss and will not result in any deduction by the Corporation.

| | | | |

| TECO Energy: Proxy Statement | | 14 | | |

Equity Compensation Plan Information

The following table summarizes the share and exercise price information for the Corporation’s equity compensation plans as of December 31,2003. The table does not include information on any shares issuable under the 2004 Equity Incentive Plan that maybe approved by the Corporation’s shareholders at the meeting.

| | | | | | |

| (thousands, except per share price) | | (a) | | (b) | | (c) |

Plan Category

| | Number of securities to be issued upon exercise of outstanding options, warrants and rights(1)

| | Weighted-average exercise price of outstanding options, warrants and rights

| | Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a))( 2)

|

Equity compensation plans/arrangements approved bythe stockholders | | | | | | |

1996 Equity Incentive Plan | | 9,372 | | $21.35 | | 1,000 |

1997 Director Equity Plan | | 236 | | $23.08 | | 230 |

| | |

| |

| |

|

| | | 9,608 | | $21.39 | | 1,230 |

| | |

| |

| |

|

Equity compensation plans/arrangements not approved bythe stockholders | | | | | | |

None | | — | | — | | — |

| | |

| |

| |

|

Total | | 9,608 | | $21.39 | | 1,230 |

| | |

| |

| |

|

| (1) | The reported amount for the 1996 Equity Incentive Plan includes shares which have been awarded (but not issued) subject to a performance-based vesting schedule. Because of the nature of these awards, these shares have not been taken into account in calculating the weighted-average exercise price under column (b) of this table. |

| (2) | The reported amount for the 1996 Equity Incentive Plan includes shares which may be issued as restricted stock, performance shares, performance-accelerated restricted stock, bonus stock, phantom stock, performance units, dividend equivalents and other forms of award available for grant under the plan. |

Plan Document

The foregoing summary of the Plan is qualified by reference to the full text of the Plan attached as Appendix A to this proxy statement.

The Board of Directors recommends a vote FOR this proposal.

Ratification of Appointment of Auditor

The Audit Committee has appointed the firm of PricewaterhouseCoopers LLC as the Corporation’s independent auditors for 2004. Although action by the shareholders is not required, the Audit Committee believes that it is appropriate to seek shareholder ratification of this appointment in light of the critical role played by the independent auditors.

Representatives of PricewaterhouseCoopers are expected to be present at the Annual Meeting of Shareholders and to be available to respond to appropriate questions. They will also have the opportunity to make a statement if they desire.

The Board of Directors recommends a vote FOR the ratification of the action taken by the Audit Committee appointing PricewaterhouseCoopers LLC as the Corporation’s independent auditors to conduct the annual audit of the financial statements for the fiscal year ending December 31, 2004.

| | | | |

| | | 15 | | TECO Energy: Proxy Statement |

PROXYStatement

Shareholder Proposals

| | 1. | The United Brotherhood of Carpenters Pension Fund, 101 Constitution Avenue, N. W., Washington, D.C. 20001, the beneficial owner of 3,000 shares of Common Stock, has submitted the following proposal: |

Resolved, that the shareholders of TECO Energy, Inc. (“Company”) hereby request that the Board of Directors’ Compensation Committee, in developing future senior executive equity compensation plans, utilize performance and time-based restricted share programs in lieu of stock options. Restricted shares issued by the Company should include the following features:

(1) Operational Performance Measures - The restricted share program should utilize justifiable operational performance criteria combined with challenging performance benchmarks for each criteria utilized. The performance criteria and associated performance benchmarks selected by the Compensation Committee should be clearly disclosed to shareholders.

(2) Time-Based Vesting - A time-based vesting requirement of at least three years should also be a feature of the restricted shares program. That is, in addition to the operational performance criteria, no restricted shares should vest in less than three years from the date of grant.

(3) Dividend Limitation - No dividend or proxy voting rights should be granted or exercised prior to the vesting of the restricted shares.

(4) Share Retention - In order to link shareholder and management interests, a retention feature should also be included; that is, all shares granted pursuant to the restricted share program should be retained by the senior executives for the duration of their tenure with the Company.

The Board and Compensation Committee should implement this restricted share program in a manner that does not violate any existing employment agreement or equity compensation plan.

Supporting Statement: As long-term shareholders of the Company, we support executive compensation policies and practices that provide challenging performance objectives and serve to motivate executives to achieve long-term corporate value creation goals. The Company’s executive compensation program should include a long-term equity compensation component with clearly defined operational performance criteria and challenging performance benchmarks.

We believe that performance and time-based restricted shares are a preferred mechanism for providing senior executives long-term equity compensation. We believe that stock option plans, as generally constituted, all too often provide extraordinary pay for ordinary performance. In our opinion, performance and time-based restricted shares provide a better means to tie the levels of equity compensation to meaningful financial performance beyond stock price performance and to condition equity compensation on performance above that of peer companies.

Our proposal recognizes that the Compensation Committee is in the best position to determine the appropriate performance measures and benchmarks. It is requested that detailed disclosure of the criteria be made so that shareholders may assess whether, in their opinion, the equity compensation system provides challenging targets for senior executives to meet. In addition, the restricted share program prohibits the receipt of dividends and the exercise of voting rights until shares vest.

We believe that a performance and time-based restricted share program with the features described above offers senior executives the opportunity to acquire significant levels of equity commensurate with their long-term contributions. We believe such a system best advances the long-term interests of our Company, its shareholders, employees and other important constituents. We urge shareholders to support this reform.

The Board of Directors OPPOSES the adoption of the above resolution for the following reasons:

The Compensation Committee of the Board of Directors, which is comprised exclusively of independent directors, works closely with outside consultants to design a long-term incentive program for the Corporation’s executives that will provide the greatest long-term benefit to shareholders. This program currently uses three types of long-term incentives, stock options, time-vested restricted stock, and performance-based restricted stock. Each of these components serves a different purpose.

| | | | |

| TECO Energy: Proxy Statement | | 16 | | |

Stock options with an exercise price equal to fair market value align an executive’s interest with shareholders by allowing the executive to be rewarded only when shareholders are rewarded. Time-vested restricted stock enables the Corporation to retain highly qualified executives by placing restrictions that provide for the stock to be forfeited if the executive voluntarily leaves the Corporation prior to the end of the vesting period. Performance-based restricted stock has the same retention element, but ties the level of payout to performance of the Corporation’s common stock relative to that of its peers during the three-year performance period. (For example, if the Corporation’s performance is in the bottom one-third, the payout on the performance-based restricted stock is zero.)

The Board of Directors does not believe that eliminating stock options would be in the best interests of shareholders. Although several of the companies that recently experienced corporate governance failures had made excessive stock option grants and, as a result, stock options have been the subject of recent criticism, most compensation experts agree that stock options, in an appropriate amount, represent an important component in an effective long-term incentive program. In fact, many companies are now moving to the same three-pronged approach that the Corporation moved to two years ago (by retaining stock options as part of their long-term incentive programs and adding time-vested and performance-based restricted stock as additional components), in order to provide the appropriate mix of retention and incentives to align the interests of executives and shareholders.

The proposal advocates the use of operational measures for performance-based restricted stock grants. The Corporation’s performance-based restricted stock grants already utilize an effective performance measure, stock performance on a relative basis. While the proposal also suggests a time-based vesting requirement of at least three years, the Corporation’s time-vested restricted stock grants have contained this requirement (and the proposed 2004 Equity Incentive Plan will require that future restricted stock grants contain this requirement), except for small amounts of restricted stock granted in lieu of cash. The proposal requests that no dividend or voting right be granted prior to vesting, but the Board believes it is advantageous to provide restricted stock grants that place all of the elements of ownership in the hands of the grantees, so they will be more closely aligned with shareholders. Likewise, the Board believes that the Corporation’s stock ownership guidelines provide a better way of linking shareholder and management interests than mandating that all shares be held until retirement.

In summary, the Board of Directors strongly supports the Corporation’s current three-prong approach to long-term incentives for its executives and thus is not in favor of the proposal to restrict the Corporation from continuing use of this approach.

The Board of Directors recommends a vote AGAINST this proposal.

| | 2. | The Central Laborers’ Pension Fund, P. O. Box 1267, Jacksonville, IL 62651, the beneficial owner of 1,000 shares of Common Stock, has submitted the following proposal: |