0000350852us-gaap:MeasurementInputDiscountForLackOfMarketabilityMemberus-gaap:FairValueInputsLevel3Memberus-gaap:MarketApproachValuationTechniqueMembersrt:MinimumMember2020-12-31

| 1

|

| | |

| 1

|

| | |

| 1

|

| | |

| 4

|

| | |

| 15

|

| |

|

| 15

|

| | |

| 16

|

| | |

| 16

|

| | |

| 17

|

| | |

| 18

|

| | |

| 18

|

| | |

| 19

|

| | |

| 20

|

| | |

| 38

|

| | |

| 39

|

| | |

| 43

|

| | |

| 99

|

| | |

| 102

|

| | |

| 102

|

| | |

| 104

|

| | |

| 104

|

| | |

| 104

|

| | |

| 104 |

| | |

| 104

|

| | |

| 105

|

| | |

| 105 |

| | |

| 106

|

| | |

| 106

|

| | |

| 108

|

| | |

| 109

|

REGARDING FORWARD LOOKING STATEMENTS

Certain of the statements contained herein that are not historical facts are forward-looking statements within the meaning of the Private Securities Litigation Reform Act. Community Trust Bancorp, Inc.’s (“CTBI”) actual results may differ materially from those included in the forward-looking statements. Forward-looking statements are typically identified by words or phrases such as “believe,” “expect,” “anticipate,” “intend,” “estimate,” “may increase,” “may fluctuate,” and similar expressions or future or conditional verbs such as “will,” “should,” “would,” and “could.” These forward-looking statements involve risks and uncertainties including, but not limited to, economic conditions, portfolio growth, the credit performance of the portfolios, including bankruptcies, and seasonal factors; changes in general economic conditions including the performance of financial markets, prevailing inflation and interest rates, realized gains from sales of investments, gains from asset sales, and losses on commercial lending activities; the effects of the COVID-19 pandemic on our business operations and credit quality and on general economic and financial market conditions, as well as our ability to respond to the related challenges; our participation in the Paycheck Protection Program administered by the U.S. Small Business Administration (“SBA”); results of various investment activities; the effects of competitors’ pricing policies, changes in laws and regulations, competition, and demographic changes on target market populations’ savings and financial planning needs; industry changes in information technology systems on which we are highly dependent; failure of acquisitions to produce revenue enhancements or cost savings at levels or within the time frames originally anticipated or unforeseen integration difficulties; and the resolution of legal proceedings and related matters. In addition, the banking industry in general is subject to various monetary, operational, and fiscal policies and regulations, which include, but are not limited to, those determined by the Federal Reserve Board, the Federal Deposit Insurance Corporation, the Consumer Financial Protection Bureau, and state regulators, whose policies, regulations, and enforcement actions could affect CTBI’s results. These statements are representative only on the date hereof, and CTBI undertakes no obligation to update any forward-looking statements made.

Community Trust Bancorp, Inc. (“CTBI”) is a bank holding company registered with the Board of Governors of the Federal Reserve System pursuant to Section 5(a) of the Bank Holding Company Act of 1956, as amended. CTBI was incorporated August 12, 1980, under the laws of the Commonwealth of Kentucky for the purpose of becoming a bank holding company. Currently, CTBI owns all the capital stock of one commercial bank and one trust company, serving small and mid-sized communities in eastern, northeastern, central, and south central Kentucky, southern West Virginia, and northeastern Tennessee. The commercial bank is Community Trust Bank, Inc., Pikeville, Kentucky (“CTB”) and the trust company is Community Trust and Investment Company, Lexington, Kentucky.

At December 31, 2021, CTBI had total consolidated assets of $5.4 billion and total consolidated deposits, including repurchase agreements, of $4.6 billion. Total shareholders’ equity at December 31, 2021 was $698.2 million. Trust assets under management at December 31, 2021 were $3.6 billion, including CTB’s investment portfolio totaling $1.5 billion.

Through our subsidiaries, CTBI engages in a wide range of commercial and personal banking and trust and wealth management activities, which include accepting time and demand deposits; making secured and unsecured loans to corporations, individuals, and others; providing cash management services to corporate and individual customers; issuing letters of credit; renting safe deposit boxes; and providing funds transfer services. The lending activities of CTB include making commercial, construction, mortgage, and personal loans. Lines of credit, revolving lines of credit, term loans, and other specialized loans, including asset-based financing, are also available. Our corporate subsidiaries act as trustees of personal trusts, as executors of estates, as trustees for employee benefit trusts, as paying agents for bond and stock issues, as investment agent, as depositories for securities, and as providers of full service brokerage and insurance services.

CTBI has supported numerous community organizations through financing projects for affordable housing, economic development, and revitalization of distressed and underserved areas. CTB’s community development lending totaled over $32 million for the year 2021. Also during 2021, CTBI made contributions totaling over $344 thousand to aid low and moderate income families and communities, encourage economic development, and provide relief to those impacted by natural disasters throughout our footprint and beyond. Our employees served over 1,100 hours throughout the year with organizations that provide affordable housing and other services to low and moderate income families, encourage economic development for small businesses and farms, and respond to natural disasters.

COMPETITION

CTBI’s subsidiaries face substantial competition for deposit, credit, trust, wealth management, and brokerage relationships in the communities we serve. Competing providers include state banks, national banks, thrifts, trust companies, insurance companies, mortgage banking operations, credit unions, finance companies, brokerage companies, and other financial and non-financial companies which may offer products functionally equivalent to those offered by our subsidiaries. As financial services become increasingly dependent on technology, permitting transactions to be conducted by telephone, mobile banking, and the internet, non-bank institutions are able to attract funds and provide lending and other financial services without offices located in our market areas. Many of our nonbank competitors have fewer regulatory constraints, broader geographic service areas, greater capital, and, in some cases, lower cost structures. In addition, competition for quality customers has intensified as a result of changes in regulation, consolidation among financial service providers, and advances in technology and product delivery systems. Many of these providers offer services within and outside the market areas served by our subsidiaries. We strive to offer competitively priced products along with quality customer service to build customer relationships in the communities we serve.

The United States and global markets, as well as general economic conditions, have been volatile. Larger financial institutions could strengthen their competitive position as a result of ongoing consolidation within the financial services industry.

Banking legislation in Kentucky places no limits on the number of banks or bank holding companies that a bank holding company may acquire. Interstate acquisitions are allowed where reciprocity exists between the laws of Kentucky and the home state of the bank or bank holding company to be acquired. Bank holding companies continue to be limited to control of less than 15% of deposits held by federally insured depository institutions in Kentucky (exclusive of inter-bank and foreign deposits). Competition for deposits may be increasing as a consequence of Federal Deposit Insurance Corporation (“FDIC”) assessments shifting from deposits to an asset based formula, as larger banks may move away from non-deposit funding sources.

No material portion of our business is seasonal. We are not dependent upon any one customer or a few customers, and the loss of any one or a few customers would not have a material adverse effect on us. See note 18 to the consolidated financial statements contained herein for additional information regarding concentrations of credit.

We do not engage in any operations in foreign countries.

HUMAN CAPITAL

We recognize the long-term value of a highly skilled, dedicated workforce, with an average tenure of over 10 years, and are committed to providing our employees with opportunities for personal and professional growth, whether it is by providing reimbursement of educational expenses, encouraging attendance at seminars and in-house training programs, or sponsoring memberships in local civic organizations.

Our employees recognize the long-term benefit of working with our organization as evidenced by the 18% of our employees who have more than 20 years of service. Our employees participate in numerous coaching, training, and educational programs, including required periodic training on topics such as ethics, privacy regulations, anti-money laundering, and UDAAP (Unfair, Deceptive, or Abusive Acts or Practices). Additionally, CTBI makes online training available to employees. Employees also have the opportunity to utilize programs that provide skill development online with over 8,000 varied courses, including topics in banking, finance, computers, customer service, sales, management, and personal skills such as time management, project management, and communication skills.

In addition to classes provided by our training department, employees also have the opportunity to work on their skill development through attending secondary education courses. These are funded through our Educational Assistance Program.

As of December 31, 2021, CTBI and our subsidiaries had 974 full-time equivalent employees. Females comprise 74% of our workforce, and 58% of our managerial positions (supervisor or above) are held by females. This includes 65% of our branch managers, 35% of our market presidents, and 29% of our senior vice presidents. At the time of this filing, our Board of Directors is 20% female.

CTBI offers our employees competitive compensation, as well as a highly competitive benefits package. A retirement plan, an employee stock ownership plan, group life insurance, major medical insurance, a cafeteria plan, education reimbursement, and management and employee incentive compensation plans are available to all eligible personnel.

Employees are also offered the opportunity to complete periodic employee satisfaction surveys anonymously.

We actively support our employees with a wellness program. Since beginning the program in 2004, participating employees have experienced improvements in preventing cardiovascular disease, cancer, and diabetes. Many of our employees have experienced decreases in elevated medical risk factors, including alcohol consumption, tobacco usage, physical inactivity, high stress, high cholesterol, and high blood pressure.

During the recent COVID-19 pandemic, CTBI has taken many steps to protect the safety of our employees by adjusting branch operations and decreasing lobby usage as needed, encouraging drive-thru and ATM use along with internet banking, having employees work remotely or work split-shifts when necessary, implementing social distancing guidelines, and consolidating operations. Management has also put a policy in place to continue to pay employees when they are required to be quarantined due to a positive COVID-19 test or exposure to COVID-19.

SUPERVISION AND REGULATION

General

As a registered bank holding company, we are restricted to those activities permissible under the Bank Holding Company Act of 1956, as amended, and are subject to actions of the Board of Governors of the Federal Reserve System thereunder. We are required to file an annual report with the Federal Reserve Board and are subject to an annual examination by the Board.

Community Trust Bank, Inc. is a state-chartered bank subject to state and federal banking laws and regulations and periodic examination by the Kentucky Department of Financial Institutions and the restrictions, including dividend restrictions, thereunder. CTB is also a member of the Federal Reserve System and is subject to certain restrictions imposed by and to examination and supervision under the Federal Reserve Act. Community Trust and Investment Company is also regulated by the Kentucky Department of Financial Institutions and the Federal Reserve.

Deposits of CTB are insured up to applicable limits by the FDIC, which subjects banks to regulation and examination under the provisions of the Federal Deposit Insurance Act.

The operations of CTBI and our subsidiaries are also affected by other banking legislation and policies and practices of various regulatory authorities. Such legislation and policies include statutory maximum rates on some loans, reserve requirements, domestic monetary and fiscal policy, and limitations on the kinds of services that may be offered.

CTBI’s annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and all amendments to those reports are available free of charge on our website at www.ctbi.com as soon as reasonably practicable after such materials are electronically filed with or furnished to the Securities and Exchange Commission. CTBI’s Code of Business Conduct and Ethics and other corporate governance documents are also available on our website. Copies of our annual report will be made available free of charge upon written request to:

Community Trust Bancorp, Inc.

Mark A. Gooch

President and CEO

P.O. Box 2947

Pikeville, KY 41502-2947

The Securities and Exchange Commission (“SEC”) maintains an internet site (http://www.sec.gov) that contains reports, proxy and information statements, and other information regarding CTBI and other issuers that file electronically with the SEC.

Capital Requirements

Insured depository institutions are required to meet certain capital level requirements. On October 29, 2019, federal banking regulators adopted a final rule to simplify the regulatory capital requirements for eligible community banks and holding companies that opt-in to the community bank leverage ratio framework (the “CBLR framework”), as required by Section 201 of the Economic Growth, Relief and Consumer Protection Act of 2018. Under the final rule, which became effective as of January 1, 2020, community banks and holding companies (which includes CTB and CTBI) that satisfy certain qualifying criteria, including having less than $10 billion in average total consolidated assets and a leverage ratio (referred to as the “community bank leverage ratio”) of greater than 9%, were eligible to opt-in to the CBLR framework. The community bank leverage ratio is the ratio of a banking organization’s Tier 1 capital to its average total consolidated assets, both as reported on the banking organization’s applicable regulatory filings.

In April 2020, as directed by Section 4012 of the CARES Act, the regulatory agencies introduced temporary changes to the CBLR. These changes, which subsequently were adopted as a final rule, temporarily reduced the CBLR requirement to 8% through the end of calendar year 2020. Beginning in calendar year 2021, the CBLR requirement increased to 8.5% for the calendar year before returning to 9% in calendar year 2022. Management has elected to use the CBLR framework for CTBI and CTB. Under either framework, CTBI and CTB would be considered well-capitalized under the applicable guidelines. CTBI’s CBLR ratio as of December 31, 2021 was 13.00%. CTB’s CBLR ratio as of December 31, 2021 was 12.42%.

An investment in our common stock is subject to risks inherent to our business. The material risks and uncertainties that management believes affect us are described below. Before making an investment decision, you should carefully consider the risks and uncertainties described below, together with all of the other information included or incorporated by reference herein. The risks and uncertainties described below are not the only ones facing us. Additional risks and uncertainties that management is not aware of or focused on or that management currently deems immaterial may also impair our business operations. This report is qualified in its entirety by these risk factors. See also, “Cautionary Statement Regarding Forward-Looking Statements.” If any of the following risks actually occur, our financial condition and results of operations could be materially and adversely affected. If this were to happen, the value of our common stock could decline significantly, and you could lose all or part of your investment.

Economic Environment Risks

Economic Risk

CTBI may continue to be adversely affected by economic and market conditions.

Our financial performance generally, and in particular the ability of borrowers to pay interest on and repay principal of outstanding loans and the value of collateral securing those loans, as well as demand for loans and other products and services we offer, is highly dependent upon the business environment in the markets where we operate, in the states of Kentucky, West Virginia, and Tennessee and in the United States as a whole. A favorable business environment is generally characterized by, among other factors, economic growth, efficient capital markets, low inflation, low unemployment, high business and investor confidence, and strong business earnings. Unfavorable or uncertain economic and market conditions can be caused by declines in economic growth, business activity, or investor or business confidence; limitations on the availability or increases in the cost of credit and capital; increases in inflation or interest rates; high unemployment; natural disasters; or a combination of these or other factors. Currently, the pandemic known as COVID-19 is causing worldwide concern and economic disruption. Economic pressure on consumers and uncertainty regarding economic improvement may result in continued changes in consumer and business spending, borrowing, and savings habits. Such conditions could adversely affect the credit quality of our loans and our business, financial condition, and results of operations.

Economy of Our Markets

Our business may continue to be adversely affected by ongoing weaknesses in the local economies on which we depend.

Our loan portfolio is concentrated primarily in eastern, northeastern, central, and south central Kentucky, southern West Virginia, and northeastern Tennessee. Our profits depend on providing products and services to clients in these local regions. Unemployment rates in our rural markets remain high compared to the national average. Increases in unemployment, decreases in real estate values, or increases in interest rates could weaken the local economies in which we operate. These economic indicators typically affect certain industries, such as real estate and financial services, more significantly. High levels of unemployment and depressed real estate asset values in certain of the markets we serve would likely prolong the economic recovery period in our market area. Also, our growth within certain of our markets may be adversely affected by inconsistent access to high speed internet, and the lack of population and business growth in such markets in recent years. Weakness in our market area could depress our earnings and consequently our financial condition because:

| • | Clients may not want, need, or qualify for our products and services; |

| • | Borrowers may not be able to repay their loans; |

| • | The value of the collateral securing our loans to borrowers may decline; and |

| • | The quality of our loan portfolio may decline. |

Climate Change Risk

Our business may be adversely impacted by climate change and related initiatives.

Climate change and other emissions-related laws, regulations, and agreements have been proposed and, in some cases adopted, on the international, federal, state, and local levels. These final and proposed initiatives take the form of restrictions, caps, taxes, or other controls on emissions. Our markets include areas where the coal industry was historically a significant part of the local economy. The importance of the coal industry to such areas has, however, continued to decline substantially and the economies of our markets have become more diversified. Nevertheless, to the extent that existing or new climate change laws, regulations, or agreements further impact production, purchase, or use of coal, the economies of certain areas within our markets, the demand for financing, the value of collateral securing our coal-related loans, and our financial condition and results of operations may be adversely affected.

We, like all businesses, as well as our market areas, borrowers, and customers, may be adversely impacted to the extent that weather-related events cause damage or disruption to properties or businesses.

Operational Risks

Interest Rate Risk

Changes in interest rates could adversely affect our earnings and financial condition.

Our earnings and financial condition are dependent to a large degree upon net interest income, which is the difference between interest earned from loans and investments and interest paid on deposits and borrowings. The narrowing of interest-rate spreads, meaning the difference between the interest rates earned on loans and investments and the interest rates paid on deposits and borrowings, could adversely affect our earnings and financial condition. Interest rates are highly sensitive to many factors, including:

| • | The rate of economic growth; |

| • | Instability in domestic and foreign financial markets. |

Changes in market interest rates will also affect the level of voluntary prepayments on our loans and the receipt of payments on our mortgage-backed securities resulting in the receipt of proceeds that may be reinvested at a lower rate than the loan or mortgage-backed security being prepaid.

We originate residential loans for sale and for our portfolio. The origination of loans for sale is designed to meet client financing needs and earn fee income. The origination of loans for sale is highly dependent upon the local real estate market and the level and trend of interest rates. Increasing interest rates may reduce the origination of loans for sale and consequently the fee income we earn. While our commercial banking, construction, and income property loan portfolios remain a significant portion of our activities, high interest rates may reduce our mortgage-banking activities and thereby our income. In contrast, decreasing interest rates have the effect of causing clients to refinance mortgage loans faster than anticipated. This causes the value of assets related to the servicing rights on loans sold to be lower than originally anticipated. If this happens, we may need to write down our servicing assets faster, which would accelerate our expense and lower our earnings.

We consider interest rate risk one of our most significant market risks. Interest rate risk is the exposure to adverse changes in net interest income due to changes in interest rates. Consistency of our net interest revenue is largely dependent upon the effective management of interest rate risk. We employ a variety of measurement techniques to identify and manage our interest rate risk, including the use of an earnings simulation model to analyze net interest income sensitivity to changing interest rates. The model is based on actual cash flows and repricing characteristics for on and off-balance sheet instruments and incorporates market-based assumptions regarding the effect of changing interest rates on the prepayment rates of certain financial assets and liabilities. Assumptions based on the historical behavior of deposit rates and balances in relation to changes in interest rates are also incorporated into the model. These assumptions are inherently uncertain, and as a result, the model cannot precisely measure net interest income or precisely predict the impact of fluctuations in interest rates on net interest income. Actual results will differ from simulated results due to timing, magnitude, and frequency of interest rate changes as well as changes in market conditions and management strategies.

Credit Risk

Our earnings and reputation may be adversely affected if we fail to effectively manage our credit risk.

Originating and underwriting loans are integral to the success of our business. This business requires us to take “credit risk,” which is the risk of losing principal and interest income because borrowers fail to repay loans. Collateral values and the ability of borrowers to repay their loans may be affected at any time by factors such as:

| • | The length and severity of downturns in the local economies in which we operate or the national economy; |

| • | The length and severity of downturns in one or more of the business sectors in which our customers operate, particularly the automobile, hotel/motel, and residential development industries; or |

| • | A rapid increase in interest rates. |

Our loan portfolio includes loans with a higher risk of loss.

We originate commercial real estate residential loans, commercial real estate nonresidential loans, hotel/motel loans, other commercial loans, consumer loans, and residential mortgage loans, primarily within our market area. Commercial real estate residential, commercial real estate nonresidential, hotel/motel, and other commercial loans tend to involve larger loan balances to a single borrower or groups of related borrowers and are most susceptible to a risk of loss during a downturn in the business cycle. These loans also have historically had a greater credit risk than other loans for the following reasons:

| • | Commercial Real Estate Residential. Repayment is dependent on income being generated in amounts sufficient to cover operating expenses and debt service. As of December 31, 2021, commercial real estate residential loans comprised approximately 10% of our total loan portfolio. |

| • | Commercial Real Estate Nonresidential. Repayment is dependent on income being generated in amounts sufficient to cover operating expenses and debt service. As of December 31, 2021, commercial real estate nonresidential loans comprised approximately 22% of our total loan portfolio. |

| • | Hotel/Motel. The hotel and motel industry is highly susceptible to changes in the domestic and global economic environments, which has caused the industry to experience substantial volatility due to the recent global pandemic. As of December 31, 2021, hotel/motel loans comprised approximately 8% of our total loan portfolio. |

| • | Other Commercial Loans. Repayment is generally dependent upon the successful operation of the borrower’s business. In addition, the collateral securing the loans may depreciate over time, be difficult to appraise, be illiquid, or fluctuate in value based on the success of the business. As of December 31, 2021, other commercial loans comprised approximately 12% of our total loan portfolio. SBA Paycheck Protection Program loans, as discussed below in the COVID-19 Risks section, comprise approximately 12% of our other commercial loan portfolio and 1% of our total loan portfolio. |

Consumer loans may carry a higher degree of repayment risk than residential mortgage loans, particularly when the consumer loan is unsecured. Repayment of a consumer loan typically depends on the borrower’s financial stability, and it is more likely to be affected adversely by job loss, illness, or personal bankruptcy. In addition, federal and state bankruptcy, insolvency, and other laws may limit the amount we can recover when a consumer client defaults. As of December 31, 2021, consumer loans comprised approximately 23% of our total loan portfolio. As of December 31, 2021, approximately 80% of our consumer loans and 18% of our total loan portfolio were consumer indirect loans. Consumer indirect loans are fixed rate loans secured by new and used automobiles, trucks, vans, and recreational vehicles originated at selling dealerships which are purchased by us following our review and approval of such loans. These loans generally have a greater risk of loss in the event of default than, for example, one-to-four family residential mortgage loans due to the rapid depreciation of vehicles securing the loans. We face the risk that the collateral for a defaulted loan may not provide an adequate source of repayment of the outstanding loan balance. We also assume the risk that the dealership administering the lending process complies with applicable consumer protection law and regulations.

A significant part of our lending business is focused on small to medium-sized business which may be impacted more severely during periods of economic weakness.

A significant portion of our commercial loan portfolio is tied to small to medium-sized businesses in our markets. During periods of economic weakness, small to medium-sized businesses may be impacted more severely than larger businesses. As a result, the ability of smaller businesses to repay their loans may deteriorate, particularly if economic challenges persist over a period of time, and such deterioration would adversely impact our results of operations and financial condition.

A large percentage of our loan portfolio is secured by real estate, in particular commercial real estate. Weakness in the real estate market or other segments of our loan portfolio would lead to additional losses, which could have a material adverse effect on our business, financial condition, and results of operations.

As of December 31, 2021, approximately 65% of our loan portfolio was secured by real estate, with approximately 40% of the portfolio consisting of commercial real estate. High levels of commercial and consumer delinquencies or declines in real estate market values could require increased net charge-offs and increases in the allowance for credit losses, which could have a material adverse effect on our business, financial condition, and results of operations and prospects.

Competition

Strong competition within our market area may reduce our ability to attract and retain deposits and originate loans.

We face competition both in originating loans and in attracting deposits. Competition in the financial services industry is intense. We compete for clients by offering excellent service and competitive rates on our loans and deposit products. The type of institutions we compete with include commercial banks, savings institutions, mortgage banking firms, credit unions, finance companies, mutual funds, insurance companies, and brokerage and investment banking firms. Competition arises from institutions located within and outside our market areas. As financial services become increasingly dependent on technology, permitting transactions to be conducted by telephone, mobile banking, and the internet, non-bank institutions are able to attract funds and provide lending and other financial services without offices located in our market areas. As a result of their size and ability to achieve economies of scale, certain of our competitors offer a broader range of products and services than we offer. With the increased consolidation in the financial industry, larger financial institutions may strengthen their competitive positions. In addition, to stay competitive in our markets we may need to adjust the interest rates on our products to match the rates offered by our competitors, which could adversely affect our net interest margin. As a result, our profitability depends upon our continued ability to successfully compete in our market areas while achieving our investment objectives.

Technology and other changes are allowing consumers to complete financial transactions through alternative methods to those which historically involved banks. For example, consumers can now hold funds that would have been held as bank deposits in mutual funds, brokerage accounts, general purpose reloadable prepaid cards, or cyber currency. In addition, consumers can complete transactions, such as paying bills or transferring funds, directly without utilizing the services of a bank. The process of eliminating banks as intermediaries (known as disintermediation) could result in the loss of fee income, as well as the loss of deposits and the income that might be generated from those deposits. The related revenue reduction could adversely affect our financial condition, cash flows, and results of operations.

Operational Risk

An extended disruption of vital infrastructure or a security breach could negatively impact our business, results of operations, and financial condition.

Our operations depend upon, among other things, our infrastructure, including equipment and facilities. Extended disruption of vital infrastructure by fire, power loss, natural disaster, telecommunications failure, computer hacking or viruses, terrorist activity or the domestic and foreign response to such activity, or other events outside of our control could have a material adverse impact on the financial services industry as a whole and on our business, results of operations, cash flows, and financial condition in particular. Our business recovery plan may not work as intended or may not prevent significant interruption of our operations. The occurrence of any failures, interruptions, or security breaches of our information systems could damage our reputation, result in the loss of customer business, subject us to additional regulatory scrutiny, or expose us to civil litigation and possible financial liability, any of which could have an adverse effect on our financial condition and results of operation.

Our information technology systems and networks may experience interruptions, delays, or cessations of service or produce errors due to regular maintenance efforts, such as systems integration or migration work that takes place from time to time. We may not be successful in implementing new systems and transitioning data, which could cause business disruptions and be more expensive, time-consuming, disruptive, and resource intensive. Such disruptions could damage our reputation and otherwise adversely impact our business and results of operations.

Third party vendors provide key components of our business infrastructure, such as processing, internet connections, and network access. While CTBI has selected these third party vendors carefully through our vendor management process, we do not control their actions and generally are not able to obtain satisfactory indemnification provisions in our third party vendor written contracts. Any problems caused by third parties or arising from their services, such as disruption in service, negligence in the performance of services or a breach of customer data security with regard to the third parties’ systems, could adversely affect our ability to deliver services, negatively impact our business reputation, cause a loss of customers, or result in increased expenses, regulatory fines and sanctions, or litigation.

Claims and litigation may arise pertaining to fiduciary responsibility.

Customers may, from time to time, make a claim and take legal action pertaining to our performance of fiduciary responsibilities. Whether customer claims and legal action related to our performance of fiduciary responsibilities are founded or unfounded, if such claims and legal actions are not resolved in a manner favorable to us, they may result in significant financial liability, adversely affect the market perception of us and our products and services, and impact customer demand for those products and services. Any such financial liability or reputational damage could have an adverse effect on our business, financial condition, and results of operations.

Significant legal actions could subject us to uninsured liabilities.

From time to time, we may be subject to claims related to our operations. These claims and legal actions, including supervisory actions by our regulators, could involve significant amounts. We maintain insurance coverage in amounts and with deductibles we believe are appropriate for our operations. However, our insurance coverage may not cover all claims against us and related costs, and further insurance coverage may not continue to be available at a reasonable cost. As a result, CTBI could be exposed to uninsured liabilities, which could adversely affect CTBI’s business, financial condition, or results of operations.

Technology Risk

CTBI continually encounters technological change.

The financial services industry is continually undergoing rapid technological change with frequent introductions of new technology-driven products and services. The effective use of technology increases efficiency and enables financial institutions to better serve customers and to reduce costs. Our future success depends, in part, upon our ability to address the needs of our customers by using technology to provide products and services that will satisfy customer demands, as well as to create additional efficiencies in our operations. Many of our competitors have substantially greater resources to invest in technological improvements. We may not be able to effectively implement new technology-driven products and services or be successful in marketing these products and services to our customers. Failure to successfully keep pace with technological change affecting the financial services industry could have a material adverse impact on our business and, in turn, our financial condition and results of operations.

Cyber Risk

A breach in the security of our systems could disrupt our business, result in the disclosure of confidential information, damage our reputation, and create significant financial and legal exposure for us.

Our businesses are dependent on our ability and the ability of our third party service providers to process, record, and monitor a large number of transactions. If the financial, accounting, data processing, or other operating systems and facilities fail to operate properly, become disabled, experience security breaches, or have other significant shortcomings, our results of operations could be materially adversely affected.

Although we and our third party service providers devote significant resources to maintain and upgrade our systems and processes that are designed to protect the security of computer systems, software, networks, and other technology assets and the confidentiality, integrity, and availability of information belonging to us and our customers, there is no assurance that our security systems and those of our third party service providers will provide absolute security. Financial services institutions and companies engaged in data processing have reported breaches in the security of their websites or other systems, some of which have involved sophisticated and targeted attacks intended to obtain unauthorized access to confidential information, destroy data, disable or degrade service, or sabotage systems, often through the introduction of computer viruses or malware, cyber-attacks, and other means. Despite our efforts and those of our third party service providers to ensure the integrity of these systems, it is possible that we or our third party service providers may not be able to anticipate or to implement effective preventive measures against all security breaches of these types, especially because techniques used change frequently or are not recognized until launched, and because security attacks can originate from a wide variety of sources.

A successful breach of the security of our systems or those of our third party service providers could cause serious negative consequences to us, including significant disruption of our operations, misappropriation of our confidential information or the confidential information of our customers, or damage to our computers or operating systems, and could result in violations of applicable privacy and other laws, financial loss to us or to our customers, loss in confidence in our security measures, customer dissatisfaction, litigation exposure, and harm to our reputation, all of which could have a material adverse effect on us. While we maintain insurance coverage that should, subject to policy terms and conditions, cover certain aspects of our cyber risks, this insurance coverage may be insufficient to cover all losses we could experience resulting from a cyber-security breach. Moreover, the cost of insurance sufficient to cover substantially all, or a reasonable portion, of losses related to cyber security breaches is expected to increase and such increases are likely to be material.

Banking customers and employees have been, and will likely continue to be, targeted by parties using fraudulent e-mails and other communications in attempts to misappropriate passwords, account information, or other personal information, or to introduce viruses or other malware to bank information systems or customers’ computers. Though we endeavor to lessen the success of such threats through the use of authentication technology and employee education, such cyber-attacks remain a serious issue. Publicity concerning security and cyber-related problems could inhibit the use or growth of electronic or web-based applications as a means of conducting banking and other commercial transactions.

We could incur increased costs or reductions in revenue or suffer reputational damage in the event of misuse of information.

Our operations rely on the secure processing, transmission, and storage of confidential information in our computer systems and networks regarding our customers and their accounts. To provide these products and services, we use information systems and infrastructure that we and third party service providers operate. As a financial institution, we also are subject to and examined for compliance with an array of data protection laws, regulations, and guidance, as well as to our own internal privacy and information security policies and programs.

Information security risks for financial institutions like us have generally increased in recent years in part because of the proliferation of new technologies, the use of the Internet and telecommunications technologies to conduct financial transactions, and the increased sophistication and activities of organized crime, hackers, and other external parties. Our technologies and systems may become the target of cyber-attacks or other attacks that could result in the misuse or destruction of our or our customers’ confidential, proprietary, or other information or that could result in disruptions to the business operations of us or our customers or other third parties. Also, our customers, in order to access some of our products and services, may use personal computers, smart mobile phones, tablet PCs, and other devices that are beyond our controls and security systems. Further, a breach or attack affecting one of our third-party service providers or partners could impact us through no fault of our own. In addition, because the methods and techniques employed by perpetrators of fraud and others to attack systems and applications change frequently and often are not fully recognized or understood until after they have been launched, we and our third-party service providers and partners may be unable to anticipate certain attack methods in order to implement effective preventative measures.

While we have policies and procedures designed to prevent or limit the effect of the possible security breach of our information systems, if unauthorized persons were somehow to get access to confidential or proprietary information in our possession or to our proprietary information, it could result in litigation and regulatory investigations, significant legal and financial exposure, damage to our reputation, or a loss of confidence in the security of our systems that could materially adversely affect our results of operation.

Counterparty Risk

The soundness of other financial institutions could adversely affect CTBI.

Our ability to engage in routine funding transactions could be adversely affected by the actions and commercial soundness of other financial institutions. Financial services companies are interrelated as a result of trading, clearing, counterparty, or other relationships. We have exposure to many different industries and counterparties, and we routinely execute transactions with counterparties in the financial services industry, including brokers and dealers, commercial banks, investment banks, mutual and hedge funds, and other institutional counterparties. As a result, defaults by, or even rumors or questions about, one or more financial services companies, or the financial services industry generally, have led to market-wide liquidity problems and could lead to losses or defaults by us or by other institutions. Many of these transactions expose us to credit risk in the event of default of our counterparty or client. In addition, our credit risk may be exacerbated when the collateral held by us cannot be realized or is liquidated at prices not sufficient to recover the full amount of the loan due us. There is no assurance that any such losses would not materially and adversely affect our businesses, financial condition, or results of operations.

Acquisition Risks

Acquisition Risk

We may have difficulty in the future continuing to grow through acquisitions.

We may experience difficulty in making acquisitions on acceptable terms due to the decreasing number of suitable acquisition targets, competition for attractive acquisitions, regulatory impediments, and certain limitations on interstate acquisitions.

Any future acquisitions or mergers by CTBI or our banking subsidiary are subject to approval by the appropriate federal and state banking regulators. The banking regulators evaluate a number of criteria in making their approval decisions, such as:

| • | Safety and soundness guidelines; |

| • | Compliance with all laws including the USA PATRIOT Act, the International Money Laundering Abatement and Anti-Terrorist Financing Act, the Sarbanes-Oxley Act and the related rules and regulations promulgated under such Act or the Exchange Act, the Equal Credit Opportunity Act, the Fair Housing Act, the Community Reinvestment Act, the Home Mortgage Disclosure Act, and all other applicable fair lending and consumer protection laws and other laws relating to discriminatory business practices; and |

| • | Anti-competitive concerns with the proposed transaction. |

If the banking regulators or a commenter on our regulatory application raise concerns about any of these criteria at the time a regulatory application is filed, the banking regulators may deny, delay, or condition their approval of a proposed transaction. We have grown, and, subject to regulatory approval, intend to continue to grow, through acquisitions of banks and other financial institutions. After these acquisitions, we may experience adverse changes in results of operations of acquired entities, unforeseen liabilities, asset quality problems of acquired entities, loss of key personnel, loss of clients because of change of identity, difficulties in integrating data processing and operational procedures, and deterioration in local economic conditions. These various acquisition risks can be heightened in larger transactions.

Integration Risk

We may not be able to achieve the expected integration and cost savings from our bank acquisition activities.

We have a long history of acquiring financial institutions and, subject to regulatory approval, we expect this acquisition activity to resume in the future. Difficulties may arise in the integration of the business and operations of the financial institutions that agree to merge with and into CTBI and, as a result, we may not be able to achieve the cost savings and synergies that we expect will result from the merger activities. Achieving cost savings is dependent on consolidating certain operational and functional areas, eliminating duplicative positions and terminating certain agreements for outside services. Additional operational savings are dependent upon the integration of the banking businesses of the acquired financial institution with that of CTBI, including the conversion of the acquired entity’s core operating systems, data systems, and products to those of CTBI and the standardization of business practices. Complications or difficulties in the conversion of the core operating systems, data systems, and products of these other banks to those of CTBI may result in the loss of clients, damage to our reputation within the financial services industry, operational problems, one-time costs currently not anticipated by us, and/or reduced cost savings resulting from the merger activities.

Market and Liquidity Risks

Market Risk

Community Trust Bancorp, Inc.’s stock price is volatile.

Our stock price has been volatile in the past, and several factors could cause the price to fluctuate substantially in the future. These factors include:

| • | Actual or anticipated variations in earnings; |

| • | Changes in analysts’ recommendations or projections; |

| • | CTBI’s announcements of developments related to our businesses; |

| • | Operating and stock performance of other companies deemed to be peers; |

| • | New technology used or services offered by traditional and non-traditional competitors; |

| • | News reports of trends, concerns, and other issues related to the financial services industry; and |

| • | Additional governmental policies and enforcement of current laws. |

Our stock price may fluctuate significantly in the future, and these fluctuations may be unrelated to CTBI’s performance. Although investor confidence in financial institutions has strengthened, the financial crisis adversely impacted investor confidence in the financial institutions sector. General market price declines or market volatility in the future could adversely affect the price of our common stock, and the current market price may not be indicative of future market prices.

Liquidity Risk

CTBI is subject to liquidity risk.

CTBI requires liquidity to meet our deposit and debt obligations as they come due and to fund loan demands. CTBI’s access to funding sources in amounts adequate to finance our activities or on terms that are acceptable to us could be impaired by factors that affect us specifically or the financial services industry or economy in general. Factors that could reduce our access to liquidity sources include a downturn in the market, difficult credit markets, or adverse regulatory actions against CTBI. CTBI’s access to deposits may also be affected by the liquidity needs of our depositors. In particular, a substantial majority of CTBI’s liabilities are demand, savings, interest checking, and money market deposits, which are payable on demand or upon several days’ notice, while by comparison, a substantial portion of our assets are loans, which cannot be called or sold in the same time frame. To the extent that consumer confidence in other investment vehicles, such as the stock market, increases, customers may move funds from bank deposits and products into such other investment vehicles. Although CTBI historically has been able to replace maturing deposits and advances as necessary, we might not be able to replace such funds in the future, especially if a large number of our depositors sought to withdraw their accounts, regardless of the reason. A failure to maintain adequate liquidity could have a material adverse effect on our financial condition and results of operations.

Legal, Legislation, and Regulation Risks

Risks Related to Regulatory Policies and Oversight

The banking industry is heavily regulated, and our business may be adversely affected by legislation or changes in regulatory policies and oversight.

The earnings of banks and bank holding companies such as ours are affected by the policies of regulatory authorities, including the Federal Reserve Board, which regulates the money supply. Among the methods employed by the Federal Reserve Board are open market operations in U.S. Government securities, changes in the discount rate on member bank borrowings, and changes in reserve requirements against member bank deposits. These methods are used in varying combinations to influence overall growth and distribution of bank loans, investments, and deposits, and their use may also affect interest rates charged on loans or paid on deposits. The monetary policies of the Federal Reserve Board have had a significant effect on the operating results of commercial and savings banks in the past and are expected to continue to do so in the future.

In recent years, federal banking regulators have increased regulatory scrutiny, and additional limitations on financial institutions have been proposed or adopted by regulators and by Congress. Moreover, banking regulatory agencies have increasingly over the last few years used authority under Section 5 of the Federal Trade Commission Act to take supervisory or enforcement action with respect to alleged unfair or deceptive acts or practices by banks to address practices that may not necessarily fall within the scope of a specific banking or consumer finance law. The banking industry is highly regulated and changes in federal and state banking regulations as well as policies and administration guidelines may affect our practices, growth prospects, and earnings. In particular, there is no assurance that governmental actions designed to stabilize the economy and banking system will not adversely affect our financial position or results of operations.

From time to time, CTBI and/or our subsidiaries may be involved in information requests, reviews, investigations, and proceedings (both formal and informal) by various governmental agencies and law enforcement authorities regarding our respective businesses. Any of these matters may result in material adverse consequences to CTBI and our subsidiaries, including adverse judgements, findings, limitations on merger and acquisition activity, settlements, fines, penalties, orders, injunctions, and other actions. Such adverse consequences may be material to the financial position of CTBI or our results of operations.

In particular, consumer products and services are subject to increasing regulatory oversight and scrutiny with respect to compliance with consumer laws and regulations. We may face a greater number or wider scope of investigations, enforcement actions, and litigation in the future related to consumer practices. In addition, any required changes to our business operations resulting from these developments could result in a significant loss of revenue, require remuneration to customers, trigger fines or penalties, limit the products or services we offer, require us to increase certain prices and therefore reduce demand for our products, impose additional compliance costs on us, cause harm to our reputation, or otherwise adversely affect our consumer business.

The financial services industry has experienced leadership changes at federal banking agencies, which may impact regulations and government policy applicable to us. New appointments to the Board of Governors of the Federal Reserve could affect monetary policy and interest rates.

We are required to maintain certain minimum amounts and types of capital and may be subject to more stringent capital requirements in the future. A failure to meet applicable capital requirements could have a material adverse effect on our financial condition and results of operations.

We are subject to regulatory requirements specifying minimum amounts and types of capital that we must maintain. From time to time, banking regulators change these regulatory capital adequacy guidelines. See Item 1 above for additional information regarding current capital requirements. A failure to meet minimum capital requirements could result in certain mandatory and possible additional discretionary actions by regulators that, if undertaken, could have a material adverse effect on our financial condition and results of operations.

Environmental Liability Risk

We are subject to environmental liability risk associated with lending activity.

A significant portion of our loan portfolio is secured by real property. During the ordinary course of business, we may foreclose on and take title to properties securing loans. In doing so, there is a risk that hazardous or toxic substances could be found on these properties. If hazardous or toxic substances are found, we may be liable for remediation costs, as well as for personal injury and property damage. Environmental laws may require us to incur substantial expenses and may materially reduce the affected property’s value or limit our ability to use or sell the affected property. In addition, future laws or more stringent interpretations or enforcement policies with respect to existing laws may increase our exposure to environmental liability. Although we have policies and procedures to perform an environmental review before initiating any foreclosure action on real property, these reviews may not be sufficient to detect all potential environmental hazards. The remediation costs and any other financial liabilities associated with an environmental hazard could have a material adverse effect on our financial condition and results of operations.

COVID-19-Related Risks

COVID-19 Risk

Since March 13, 2020, the United States has been operating under a state of emergency in response to the spread of COVID-19. COVID-19 and related governmental responses have affected economic and financial market conditions as well as the operations, results, and prospects of companies across many industries.

The COVID-19 pandemic has negatively impacted the global economy, disrupted global supply chains, lowered equity market valuations, created significant volatility and disruption in financial markets, and increased unemployment levels, all of which may become heightened concerns upon subsequent waves of infection or future developments. As a result, the demand for our products and services has been, and is expected to continue to be, significantly impacted. Furthermore, the pandemic could influence the recognition of credit losses in our loan portfolio and increase our allowance for credit losses as both businesses and consumers are negatively impacted by the economic downturn. In addition, governmental actions are meaningfully influencing the interest-rate environment, which could adversely affect our results of operations and financial condition. Our business operations have been disrupted, and may also be disrupted in the future, if significant portions of our workforce are unable to work effectively, including because of illness, quarantines, government actions, or other restrictions in connection with the pandemic, travel restrictions, technology limitations, and/or disruptions. Furthermore, our business operations have been, and may again in the future be, disrupted due to vendors and third party service providers being unable to work or provide services effectively, including because of illness, quarantines, government actions, or other restrictions in connection with the pandemic.

In response to the pandemic, we provided financial hardship relief to borrowers that were negatively impacted by the pandemic and its related economic impacts. These programs included payment deferrals and forbearances for both commercial and retail borrowers. We also temporarily suspended all residential foreclosure activity. If not effective in mitigating the effect of the COVID-19 pandemic on our customers, these actions may adversely affect our business and results of operations more substantially over a longer period of time.

The extent to which the COVID-19 pandemic impacts our business, results of operations, and financial condition, as well as our regulatory capital and liquidity ratios, will depend on future developments, which are highly uncertain, including the scope and duration of the pandemic and actions taken by governmental authorities and other third parties in response to the pandemic. Even after the COVID-19 pandemic subsides, the U.S. economy will likely require some time to recover from its effects, the length of which is unknown and during which time the U.S. may experience a recession. As a result, our business may be materially and adversely affected during this recovery. Moreover, the effects of the COVID-19 pandemic may heighten many of the other risks described in this Section 1A. entitled “Risk Factors” and any subsequent Quarterly Report on Form 10-Q or Current Report on Form 8-K, including, but not limited to, risks of credit deterioration, interest rate changes, rating agency actions, governmental actions, market volatility, theft, fraud, security breaches, and technology interruptions.

| Item 1B. | Unresolved Staff Comments |

None.

Our main office, which is owned by Community Trust Bank, Inc., is located at 346 North Mayo Trail, Pikeville, Kentucky 41501. Following is a schedule of properties owned and leased by CTBI and our subsidiaries as of December 31, 2021:

| Location | | Owned | | | Leased | | | Total | |

| Banking locations: | | | | | | | | | |

| Community Trust Bank, Inc. | | | | | | | | | |

| * | | Pikeville Market (lease land at 3 owned locations) | | | 9 | | | | 1 | | | | 10 | |

| | | 10 locations in Pike County, Kentucky | | | | | | | | | | | | |

| | | Floyd/Knott/Johnson Market (lease land at 1 owned location) | | | 3 | | | | 1 | | | | 4 | |

| | | 2 locations in Floyd County, Kentucky, 1 location in Knott County, Kentucky, and 1 location in Johnson County, Kentucky | | | | | | | | | | | | |

| | | Tug Valley Market (lease land at 1 owned location) | | | 2 | | | | 0 | | | | 2 | |

| | | 1 location in Pike County, Kentucky, 1 location in Mingo County, West Virginia | | | | | | | | | | | | |

| | | Whitesburg Market (lease land at 1 owned location) | | | 4 | | | | 1 | | | | 5 | |

| | | 5 locations in Letcher County, Kentucky | | | | | | | | | | | | |

| | | Hazard Market (lease land at 2 owned locations) | | | 3 | | | | 0 | | | | 3 | |

| | | 3 locations in Perry County, Kentucky | | | | | | | | | | | | |

| * | | Lexington Market (lease land at 3 owned locations) | | | 4 | | | | 2 | | | | 6 | |

| | | 6 locations in Fayette County, Kentucky | | | | | | | | | | | | |

| | | Winchester Market | | | 2 | | | | 0 | | | | 2 | |

| | | 2 locations in Clark County, Kentucky | | | | | | | | | | | | |

| | | Richmond Market (lease land at 1 owned location) | | | 3 | | | | 0 | | | | 3 | |

| | | 3 locations in Madison County, Kentucky | | | | | | | | | | | | |

| | | Mt. Sterling Market | | | 2 | | | | 0 | | | | 2 | |

| | | 2 locations in Montgomery County, Kentucky | | | | | | | | | | | | |

| | | Versailles Market (lease land at 2 owned locations) | | | 1 | | | | 4 | | | | 5 | |

| | | 1 location in Woodford County, Kentucky, 2 locations in Franklin County, Kentucky, and 2 locations in Scott County, Kentucky | | | | | | | | | | | | |

| * | | Danville Market (lease land at 1 owned location) | | | 3 | | | | 0 | | | | 3 | |

| | | 2 locations in Boyle County, Kentucky and 1 location in Mercer County, Kentucky | | | | | | | | | | | | |

| * | | Ashland Market (lease land at 1 owned location) | | | 5 | | | | 0 | | | | 5 | |

| | | 4 locations in Boyd County, Kentucky and 1 location in Greenup County, Kentucky | | | | | | | | | | | | |

| | | Flemingsburg Market | | | 3 | | | | 0 | | | | 3 | |

| | | 3 locations in Fleming County, Kentucky | | | | | | | | | | | | |

| | | Advantage Valley Market | | | 3 | | | | 1 | | | | 4 | |

| | | 2 locations in Lincoln County, West Virginia, 1 location in Wayne County, West Virginia, and 1 location in Cabell County, West Virginia | | | | | | | | | | | | |

| | | Summersville Market | | | 1 | | | | 0 | | | | 1 | |

| | | 1 location in Nicholas County, West Virginia | | | | | | | | | | | | |

| | | Middlesboro Market (lease land at 1 owned location) | | | 3 | | | | 0 | | | | 3 | |

| | | 3 locations in Bell County, Kentucky | | | | | | | | | | | | |

| | | Williamsburg Market | | | 5 | | | | 0 | | | | 5 | |

| | | 2 locations in Whitley County, Kentucky and 3 locations in Laurel County, Kentucky | | | | | | | | | | | | |

| | | Campbellsville Market (lease land at 2 owned locations) | | | 8 | | | | 0 | | | | 8 | |

| | | 2 locations in Taylor County, Kentucky, 2 locations in Pulaski County, Kentucky, 1 location in Adair County, Kentucky, 1 location in Green County, Kentucky, 1 location in Russell County, Kentucky, and 1 location in Marion County, Kentucky | | | | | | | | | | | | |

| | | Mt. Vernon Market | | | 2 | | | | 0 | | | | 2 | |

| | | 2 locations in Rockcastle County, Kentucky | | | | | | | | | | | | |

| * | | LaFollette Market | | | 3 | | | | 0 | | | | 3 | |

| | | 2 locations in Campbell County, Tennessee and 1 location in Anderson County, Tennessee | | | | | | | | | | | | |

| Total banking locations | | | 69 | | | | 10 | | | | 79 | |

| Operational locations: | | | | | | | | | | | | |

| Community Trust Bank, Inc. | | | | | | | | | | | | |

| | | Pikeville (Pike County, Kentucky) (lease land at 1 owned location) | | | 1 | | | | 0 | | | | 1 | |

| Total operational locations | | | 1 | | | | 0 | | | | 1 | |

| | | | | | | | | | | | | | | |

| Total locations | | | 70 | | | | 10 | | | | 80 | |

*Community Trust and Investment Company has leased offices in the main office locations in these markets.

Versailles Main location is in progress and expected to open in April 2022, and a new Georgetown location is expected to open in the fourth quarter 2022. See notes 7 and 15 to the consolidated financial statements contained herein for the year ended December 31, 2021, for additional information relating to lease commitments and amounts invested in premises and equipment.

CTBI and subsidiaries, and from time to time, our officers, are named defendants in legal actions arising from ordinary business activities. Management, after consultation with legal counsel, believes any pending actions are without merit or that the ultimate liability, if any, will not materially affect our consolidated financial position or results of operations.

| Item 4. | Mine Safety Disclosures |

Not applicable.

Information about our Executive Officers

Set forth below are the executive officers of CTBI, their positions with CTBI, and the year in which they first became an executive officer.

Name and Age (1) | Positions and Offices Currently Held | Date First Became Executive Officer | Principal Occupation |

Mark A. Gooch; 63 | Vice Chairman, President, and Chief Executive Officer | 1997 | (2) | Vice Chairman, President, and CEO of Community Trust Bancorp, Inc. |

| | | | | |

Larry W. Jones; 75 | Executive Vice President | 2002 | | Executive Vice President/ Central Kentucky Region President of Community Trust Bank, Inc. |

| | | | | |

James B. Draughn; 62 | Executive Vice President | 2001 | | Executive Vice President/Operations of Community Trust Bank, Inc. |

| | | | | |

Kevin J. Stumbo; 61 | Executive Vice President, Chief Financial Officer, and Treasurer | 2002 | | Executive Vice President/ Chief Financial Officer of Community Trust Bank, Inc. |

| | | | | |

Ricky D. Sparkman; 59 | Executive Vice President | 2002 | | Executive Vice President/ South Central Region President of Community Trust Bank, Inc. |

| | | | | |

Richard W. Newsom; 67 | Executive Vice President | 2002 | (3) | Executive Vice President/ President of Community Trust Bank, Inc. |

| | | | | |

James J. Gartner; 80 | Executive Vice President | 2002 | | Executive Vice President/ Chief Credit Officer of Community Trust Bank, Inc. |

| | | | | |

Steven E. Jameson; 65 | Executive Vice President | 2004 | (4) | Executive Vice President/ Chief Internal Audit & Risk Officer |

| | | | | |

D. Andrew Jones; 59 | Executive Vice President | 2010 | | Executive Vice President/ Northeastern Region President of Community Trust Bank, Inc. |

| | | | | |

Andy D. Waters; 56 | Executive Vice President | 2011 | | President and CEO of Community Trust and Investment Company |

| | | | | |

C. Wayne Hancock; 47 | Executive Vice President and Secretary | 2014 | (5) | Executive Vice President/ Senior Staff Attorney |

| | | | | |

David Tackett; 56 | Executive Vice President | 2022 | (6) | Executive Vice President/ Eastern Region President of Community Trust Bank, Inc. |

| (1) | The ages listed for CTBI’s executive officers are as of February 28, 2022. |

| (2) | Mr. Gooch became President of Community Trust Bancorp, Inc. on July 27, 2021 and assumed the additional positions of Vice Chairman and Chief Executive Officer of CTBI effective February 7, 2022, upon the retirement of Jean R. Hale. Mr. Gooch retained his previous position as Chief Executive Officer of Community Trust Bank, Inc. and assumed the additional roles of Chairman of Community Trust Bank, Inc. and Chairman of Community Trust and Investment Company also effective with Ms. Hale’s retirement on February 7, 2022. |

| (3) | Mr. Newsom became President of Community Trust Bank, Inc. on February 7, 2022. He previously served as President of the Eastern Region of Community Trust Bank, Inc. |

| (4) | Mr. Jameson is a non-voting member of the Executive Committee. |

| (5) | Mr. Hancock became Secretary of Community Trust Bancorp, Inc. on February 7, 2022. |

| (6) | Mr. Tackett became Executive Vice President of Community Trust Bancorp, Inc. and President of the Eastern Region of Community Trust Bank, Inc. on February 7, 2022. He previously held the position of President of the Floyd, Knott, and Johnson Market of Community Trust Bank, Inc. |

| Item 5. | Market for the Registrant’s Common Equity, Related Shareholder Matters, and Issuer Purchases of Equity Securities |

Our common stock is listed on The NASDAQ Global Select Market under the symbol CTBI. As of January 31, 2022, there were approximately 7,900 holders of record of our outstanding common shares.

Dividends

The annual dividend paid to our stockholders was increased from $1.53 per share to $1.57 per share during 2021. We have adopted a conservative policy of cash dividends by generally maintaining an average annual cash dividend ratio of approximately 45%, with periodic stock dividends. The current year cash dividend ratio was 31.8%; however, the 10 year average dividend payout ratio has been 44.31%. Dividends are typically paid on a quarterly basis. Future dividends are subject to the discretion of CTBI’s Board of Directors, cash needs, general business conditions, dividends from our subsidiaries, and applicable governmental regulations and policies. For information concerning restrictions on dividends from the subsidiary bank to CTBI, see note 20 to the consolidated financial statements contained herein for the year ended December 31, 2021.

Stock Repurchases

CTBI did not acquire any shares of stock through the stock repurchase program during the year 2021. CTBI repurchased 32,664 shares of its common stock during 2020, leaving 1,034,706 shares remaining under CTBI's current repurchase authorization. For further information, see the Stock Repurchase Program section of Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

Securities Authorized for Issuance Under Equity Compensation Plans

For information concerning securities authorized for issuance under CTBI’s equity compensation plans, see Part III, Item 12. Security Ownership of Certain Beneficial Owners and Management and Related Shareholder Matters.

Common Stock Performance

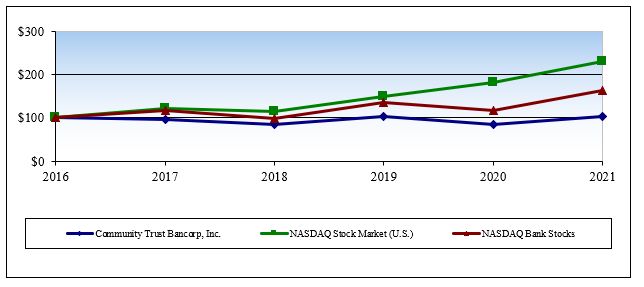

The following graph shows the cumulative total return experienced by CTBI’s shareholders during the last five years compared to the NASDAQ Stock Market (U.S.) and the NASDAQ Bank Stock Index. The graph assumes the investment of $100 on December 31, 2016 in CTBI’s common stock and in each index and the reinvestment of all dividends paid during the five-year period.

Comparison of 5 Year Cumulative Total Return

among Community Trust Bancorp, Inc., NASDAQ Stock Market (U.S.),

and NASDAQ Bank Stocks

Fiscal Year Ending December 31 ($) | | | | | |

| | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 |

Community Trust Bancorp, Inc. | 100.00 | 97.58 | 84.92 | 103.17 | 85.34 | 104.06 |

NASDAQ Stock Market (U.S.) | 100.00 | 121.38 | 114.78 | 150.55 | 182.57 | 229.84 |

NASDAQ Bank Stocks | 100.00 | 118.39 | 98.98 | 135.78 | 118.40 | 162.58 |

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations |

Overview

The following Management’s Discussion and Analysis of Financial Condition and Results of Operations (“MD&A”) is intended to help the reader understand Community Trust Bancorp, Inc., our operations, and our present business environment. The MD&A is provided as a supplement to—and should be read in conjunction with—our consolidated financial statements and the accompanying notes thereto contained in Item 8 of this annual report. The MD&A includes the following sections:

| ❖ | Financial Goals and Performance |

| ❖ | Results of Operations and Financial Condition |

| ❖ | Liquidity and Market Risk |

| ❖ | Impact of Inflation, Changing Prices, and Economic Conditions |

| ❖ | Stock Repurchase Program |

| ❖ | Critical Accounting Policies and Estimates |

Our Business

Community Trust Bancorp, Inc. (“CTBI”) is a bank holding company headquartered in Pikeville, Kentucky. Currently, we own one commercial bank, Community Trust Bank, Inc. (“CTB”) and one trust company, Community Trust and Investment Company. Through our subsidiaries, we have seventy-nine banking locations in eastern, northeastern, central, and south central Kentucky, southern West Virginia, and northeastern Tennessee, four trust offices across Kentucky, and one trust office in northeastern Tennessee. At December 31, 2021, we had total consolidated assets of $5.4 billion and total consolidated deposits, including repurchase agreements, of $4.6 billion. Total shareholders’ equity at December 31, 2021 was $698.2 million. Trust assets under management at December 31, 2021 were $3.6 billion, including CTB’s investment portfolio totaling $1.5 billion.

Through our subsidiaries, CTBI engages in a wide range of commercial and personal banking and trust and wealth management activities, which include accepting time and demand deposits; making secured and unsecured loans to corporations, individuals, and others; providing cash management services to corporate and individual customers; issuing letters of credit; renting safe deposit boxes; and providing funds transfer services. The lending activities of CTB include making commercial, construction, mortgage, and personal loans. Lease-financing, lines of credit, revolving lines of credit, term loans, and other specialized loans, including asset-based financing, are also available. Our corporate subsidiaries act as trustees of personal trusts, as executors of estates, as trustees for employee benefit trusts, as paying agents for bond and stock issues, as investment agent, as depositories for securities, and as providers of full service brokerage, and insurance services. For further information, see Item 1 of this annual report.

Financial Goals and Performance

The following table shows the primary measurements used by management to assess annual performance. The goals in the table below should not be viewed as a forecast of our performance for 2022. Rather, the goals represent a range of target performance for 2022. There is no assurance that any or all of these goals will be achieved. See “Cautionary Statement Regarding Forward Looking Statements.”

| | 2021 Goals | 2021 Performance | 2022 Goals |

| Basic earnings per share | $3.76 - $3.92 | $4.94 | $4.15 - $4.31 |

| Net income | $67.1 - $69.8 million | $87.9 million | $74.1 - $77.1 million |

| ROAA | 1.30% - 1.35% | 1.63% | 1.35% - 1.40% |

| ROAE | 9.88% - 10.28% | 12.88% | 10.18% - 10.59% |

| Revenues | $209.6 - $218.1 million | $223.5 million | $216.0 - $224.8 million |

| Noninterest revenue as % of total revenue | 24.00% - 26.00% | 27.05% | 24.00% - 26.00% |

| Assets | $5.04 - $5.35 billion | $5.42 billion | $5.42 - $5.75 billion |

| Loans | $3.48 - $3.63 billion | $3.41 billion | $3.41 - $3.55 billion |

| Deposits, including repurchase agreements | $4.30 - $4.47 billion | $4.62 billion | $4.63 - $4.82 billion |

| Shareholders’ equity | $682.6 - $710.5 million | $698.2 million | $ 733.5 - $763.4 million |

Results of Operations and Financial Condition