UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-03143

Templeton Global Smaller Companies Fund

(Exact name of registrant as specified in charter)

500 East Broward Blvd., Suite 2100, Fort Lauderdale, FL 33394-3091

(Address of principal executive offices) (Zip code)

Craig S. Tyle, One Franklin Parkway, San Mateo, CA 94403-1906

(Name and address of agent for service)

Registrant's telephone number, including area code: (954) 527-7500_

Date of fiscal year end: _8/31__

Date of reporting period: 8/31/10__

Item 1. Reports to Stockholders.

SPECIALIZED EXPERTISE

TRUE DIVERSIFICATION

RELIABILITY YOU CAN TRUST

MUTUAL FUNDS |

Franklin Templeton Investments

Gain From Our Perspective®

Franklin Templeton’s distinct multi-manager structure combines the specialized expertise of three world-class investment management groups—Franklin, Templeton and Mutual Series.

Each of our portfolio management groups operates autonomously, relying on its own research and staying true to the unique investment disciplines that underlie its success.

Franklin. Founded in 1947, Franklin is a recognized leader in fixed income investing and also brings expertise in growth- and value-style U.S. equity investing.

Templeton. Founded in 1940, Templeton pioneered international investing and, in 1954, launched what has become the industry’s oldest global fund. Today, with offices in over 25 countries, Templeton offers investors a truly global perspective.

Mutual Series. Founded in 1949, Mutual Series is dedicated to a unique style of value investing, searching aggressively for opportunity among what it believes are undervalued stocks, as well as arbitrage situations and distressed securities.

Because our management groups work independently and adhere to different investment approaches, Franklin, Templeton and Mutual Series funds typically have distinct portfolios. That’s why our funds can be used to build truly diversified allocation plans covering every major asset class.

At Franklin Templeton Investments, we seek to consistently provide investors with exceptional risk-adjusted returns over the long term, as well as the reliable, accurate and personal service that has helped us become one of the most trusted names in financial services.

RETIREMENT PLANS | 529 COLLEGE SAVINGS PLANS | SEPARATE ACCOUNTS

| Not part of the annual report |

What is a carry trade?

A carry trade is a strategy in which an investor sells a certain currency with a relatively low interest rate and uses the funds to purchase a different currency yielding a higher interest rate. A trader using this strategy attempts to capture the difference between the rates.

note that index performance information is provided for reference and that we do not attempt to track the index, but rather undertake investments on the basis of fundamental research. You can find the Fund’s long-term performance data in the Performance Summary beginning on page 8.

Economic and Market Overview

The 12-month period under review captured the end of the 2009 market surge when global equities recovered from their financial crisis depths, as well as a period of renewed economic anxiety and range-bound trading that defined the market’s behavior throughout most of 2010. By the onset of the review period, an aggressive policy response by governments around the world had stabilized the global financial system and provided stimulus for growth. Emerging markets in particular continued to expand, attracting capital inflows as investors pinned their recovery hopes on new sources of demand in the developing world. Global financial institutions proceeded with necessary deleveraging, and a robust economic recovery supported investors’ renewed risk taking, driving up the prices of virtually all asset classes in practically every region around the globe. This positive momentum carried into 2010 as corporat e earnings and economic indicators continued to recover. However, the rally soon sputtered as concerns became more pronounced about the state of sovereign finances in Europe and the ability of policymak-ers to engineer a sustainable global recovery. Despite corporate strength and vigilant policy support in the developed world, including a 750 billion euro pledge to forestall European sovereign debt defaults, sentiment trended significantly lower and many investors capitulated to the growing consensus that the year-long equity rally had run its course.

As the reporting period drew to a close, the market’s major concerns included fiscal imbalances in Europe (where several weaker countries had their credit ratings slashed) and fears of a renewed economic downturn. Currency movements reflected these concerns — the euro continued its protracted depreciation and the Japanese yen strengthened as risk-averse investors sought safer currencies or unwound carry trades. And although economic data remained generally mixed, news reports tended to focus on negative data in developed and emerging markets toward the end of the 12-month review period. Corporate profitability remained a bright spot in the global financial landscape. The majority of companies reported better-than-expected earnings, though outlooks became notably cautious as the period progressed. An

4 | Annual Report

increase in merger and acquisition activity over the summer also supported equity markets, and many companies that had cut costs and repaired balance sheets during the downturn emerged as strategic buyers in an environment of historically depressed valuations. Yet, individual investors remained largely unconvinced, and at period-end global investment capital continued to flow from equities into fixed income securities offering investors unusually low yields.

Investment Strategy

At Templeton, when choosing investments for the Fund, we take a bottom-up, value-oriented, long-term approach, focusing on the market price of a company’s securities relative to our evaluation of the company’s long-term earnings, asset value and cash flow growth potential. We also consider the company’s price/earnings ratio, profit margins and liquidation value.

Manager’s Discussion

Several holdings performed well during the fiscal year. One of the most significant contributions to return came from bed manufacturer Tempur-Pedic International, as investors reacted to the improving economic outlook and rewarded the company’s steady improvements in sales. Tempur-Pedic is the fourth-largest mattress manufacturer and the largest specialty mattress maker in North America. The Fund profitably liquidated its Tempur-Pedic holdings by period-end.

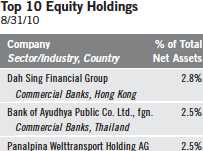

Hong Kong retailer and distributor Giordano International announced operating results that were well above consensus expectations due to sharply improved profit margins and an unexpected special dividend, which prompted a strong share-price advance.

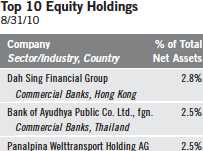

Swiss logistics operation Panalpina Welttransport Holding performed well during the period as investors recognized its high gearing to reviving global trade flows. Freight forwarding is Panalpina’s core operation, accounting for about 87% of its revenue. It is the world’s third-largest air freight forwarder and the fourth-largest ocean freight forwarder. Looking at the longer term, business fundamentals were solid at period-end as the company carries a strong balance sheet with net cash. According to our analysis, its business model is asset light, high return, and highly cash generative, and the company has sufficient scale to maintain its competitive position.

Annual Report | 5

Despite its positive absolute and relative performance, the Fund had some disappointments during the period. One example was U.K.-based Game Group, Europe’s largest retailer of computer software, video games, consoles and related products. We believe it is a fundamentally strong company with a solid balance sheet. However, the company reported weak operating results during the year, with unit hardware sales increases unable to offset the effect of price cuts. Although sales of the most popular new games were strong, competition from supermarkets hurt Game Group’s margins, and sales of less heavily supported games were weaker than expected.

Another detractor was Niscayah Group, formerly known as Securitas Systems, a Swedish designer and installer of corporate security systems. Weak economic conditions led to a drop in sales growth during the period, but a large-scale restructuring program has left the company well positioned going forward, in our view. Over the longer term, we also believe Niscayah holds strong potential for margin expansion as the business expands its installed security base and number of associated service contracts.

VASCO Data Security International is a U.S. information technology (IT) company with a flexible software platform, coupled with hardware and software devices that allow banks and enterprises to provide higher levels of security to their employees and customers when accessing e-commerce, e-banking and internal networks remotely. This is undoubtedly a growth market, driven by identity theft and fraud. During the period, however, weak quarterly results prompted a stock market sell-off in VASCO shares. Although IT budgets among its key European banking customers remained relatively tight during the year under review, VASCO management suggested the shortfall was a matter of timing and maintained its full-year guidance. At period-end, the company held cash on the balance sheet, was continuing to win customer orders, and in our view had a strong order book covering an increasingly diversified customer base, which w e believe bodes well for its longer term performance.

6 | Annual Report

Thank you for your continued participation in Templeton Global Smaller Companies Fund. We look forward to serving your future investment needs.

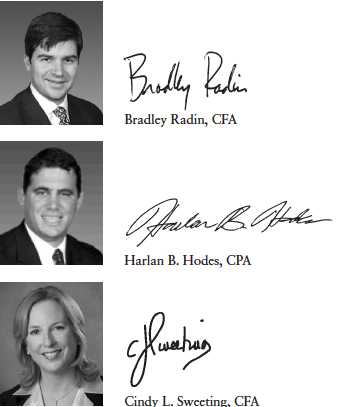

Portfolio Management Team

Templeton Global Smaller Companies Fund

The foregoing information reflects our analysis, opinions and portfolio holdings as of August 31, 2010, the end of the reporting period. The way we implement our main investment strategies and the resulting portfolio holdings may change depending on factors such as market and economic conditions. These opinions may not be relied upon as investment advice or an offer for a particular security. The information is not a complete analysis of every aspect of any market, country, industry, security or the Fund. Statements of fact are from sources considered reliable, but the investment manager makes no representation or warranty as to their completeness or accuracy. Although historical performance is no guarantee of future results, these insights may help you understand our investment management philosophy.

Annual Report | 7

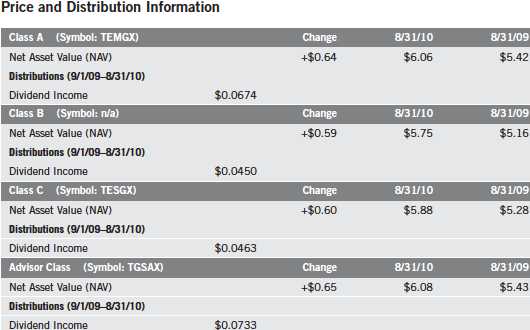

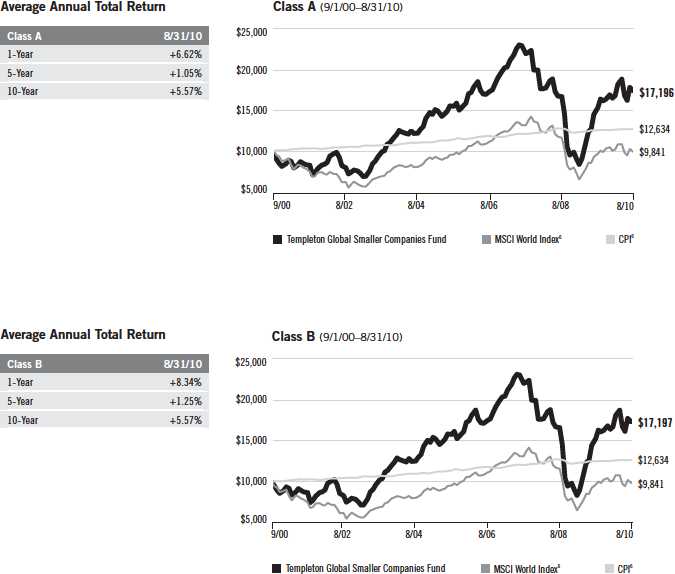

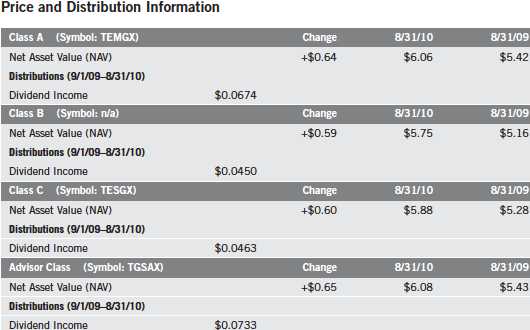

Performance Summary as of 8/31/10

Your dividend income will vary depending on dividends or interest paid by securities in the Fund’s portfolio, adjusted for operating expenses of each class. Capital gain distributions are net profits realized from the sale of portfolio securities. The performance table and graphs do not reflect any taxes that a shareholder would pay on Fund dividends, capital gain distributions, if any, or any realized gains on the sale of Fund shares. Total return reflects reinvestment of the Fund’s dividends and capital gain distributions, if any, and any unrealized gains or losses.

8 | Annual Report

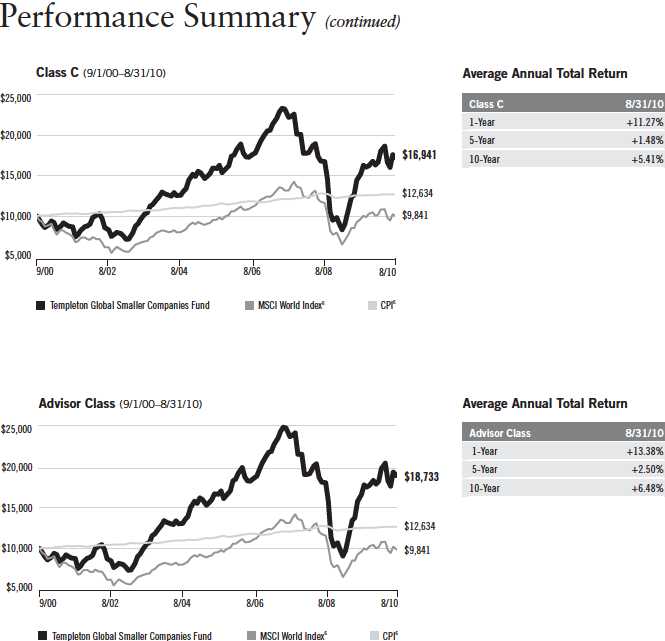

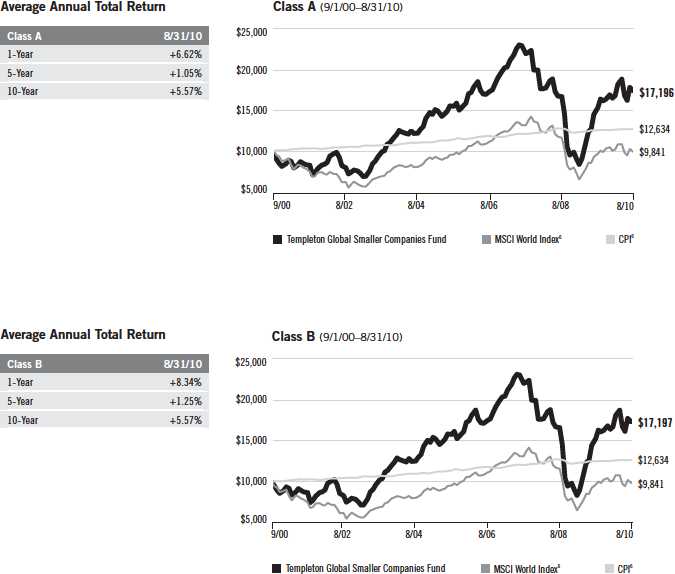

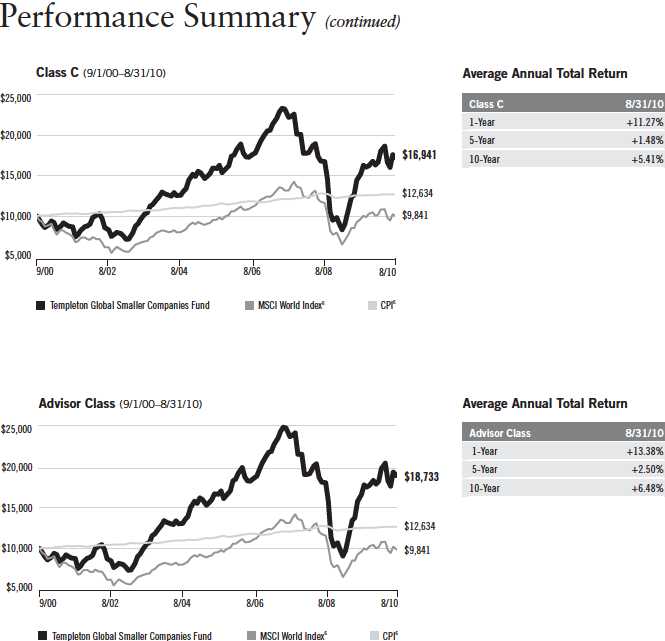

Performance Summary (continued)

Performance

Cumulative total return excludes sales charges. Average annual total returns and value of $10,000 investment include maximum sales charges. Class A: 5.75% maximum initial sales charge; Class B: contingent deferred sales charge (CDSC) declining from 4% to 1% over six years, and eliminated thereafter; Class C: 1% CDSC in first year only; Advisor Class: no sales charges.

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, go to franklintempleton.com or call (800) 342-5236.

Annual Report | 9

Performance Summary (continued)

Total Return Index Comparison for a Hypothetical $10,000 Investment

Total return represents the change in value of an investment over the periods shown. It includes any current, applicable, maximum sales charge, Fund expenses, account fees and reinvested distributions. The unmanaged index includes reinvestment of any income or distributions. It differs from the Fund in composition and does not pay management fees or expenses. One cannot invest directly in an index.

10 | Annual Report

Annual Report | 11

Performance Summary (continued)

Endnotes

Special risks are associated with foreign investing, including currency fluctuations, economic instability and political developments. Investments in emerging markets involve heightened risks related to the same factors, in addition to those associated with these markets’ smaller size and lesser liquidity. In addition, smaller company stocks have historically exhibited greater price volatility than large-company stocks, particularly over the short term. The Fund’s prospectus also includes a description of the main investment risks.

| |

Class B: Class C: | These shares have higher annual fees and expenses than Class A shares. Prior to 1/1/04, these shares were offered with an initial sales charge; thus actual total returns would have differed. These shares have higher annual fees and expenses than Class A shares. |

Advisor Class: | Shares are available to certain eligible investors as described in the prospectus. |

1. Cumulative total return represents the change in value of an investment over the periods indicated.

2. Average annual total return represents the average annual change in value of an investment over the periods indicated.

3. These figures represent the value of a hypothetical $10,000 investment in the Fund over the periods indicated.

4. In accordance with SEC rules, we provide standardized average annual total return information through the latest calendar quarter.

5. Figures are as stated in the Fund’s prospectus current as of the date of this report. In periods of market volatility, assets may decline significantly, causing total annual Fund operating expenses to become higher than the figures shown.

6. Source: © 2010 Morningstar. The MSCI World Index is a free float-adjusted, market capitalization-weighted index designed to measure equity market performance in global developed markets. The Consumer Price Index (CPI), calculated by the U.S. Bureau of Labor Statistics, is a commonly used measure of the inflation rate.

12 | Annual Report

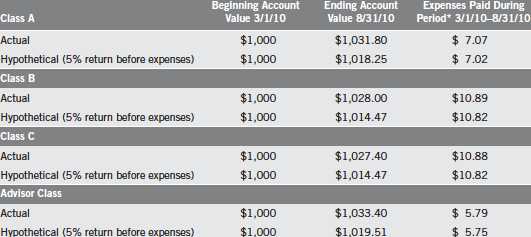

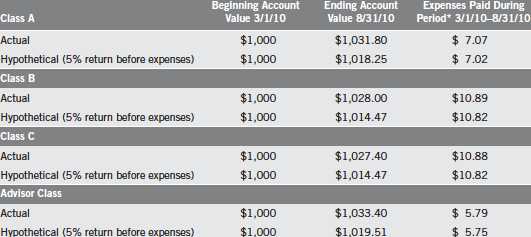

Your Fund’s Expenses

As a Fund shareholder, you can incur two types of costs:

Transaction costs, including sales charges (loads) on Fund purchases; and

Ongoing Fund costs, including management fees, distribution and service (12b-1) fees, and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses.

The following table shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The first line (Actual) for each share class listed in the table provides actual account values and expenses. The “Ending Account Value” is derived from the Fund’s actual return, which includes the effect of Fund expenses.

You can estimate the expenses you paid during the period by following these steps. Of course, your account value and expenses will differ from those in this illustration:

| 1. | Divide your account value by $1,000. |

| | If an account had an $8,600 value, then $8,600 ÷ $1,000 = 8.6. |

| 2. | Multiply the result by the number under the heading “Expenses Paid During Period.” |

| | If Expenses Paid During Period were $7.50, then 8.6 x $7.50 = $64.50. |

In this illustration, the estimated expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Information in the second line (Hypothetical) for each class in the table can help you compare ongoing costs of investing in the Fund with those of other mutual funds. This information may not be used to estimate the actual ending account balance or expenses you paid during the period. The hypothetical “Ending Account Value” is based on the actual expense ratio for each class and an assumed 5% annual rate of return before expenses, which does not represent the Fund’s actual return. The figure under the heading “Expenses Paid During Period” shows the hypothetical expenses your account would have incurred under this scenario. You can compare this figure with the 5% hypothetical examples that appear in shareholder reports of other funds.

Annual Report | 13

Your Fund’s Expenses (continued)

Please note that expenses shown in the table are meant to highlight ongoing costs and do not reflect any transaction costs, such as sales charges. Therefore, the second line for each class is useful in comparing ongoing costs only, and will not help you compare total costs of owning different funds. In addition, if transaction costs were included, your total costs would have been higher. Please refer to the Fund prospectus for additional information on operating expenses.

*Expenses are calculated using the most recent six-month expense ratio, annualized for each class (A: 1.38%; B: 2.13%; C: 2.13%; and Advisor: 1.13%), multiplied by the average account value over the period, multiplied by 184/365 to reflect the one-half year period.

14 | Annual Report

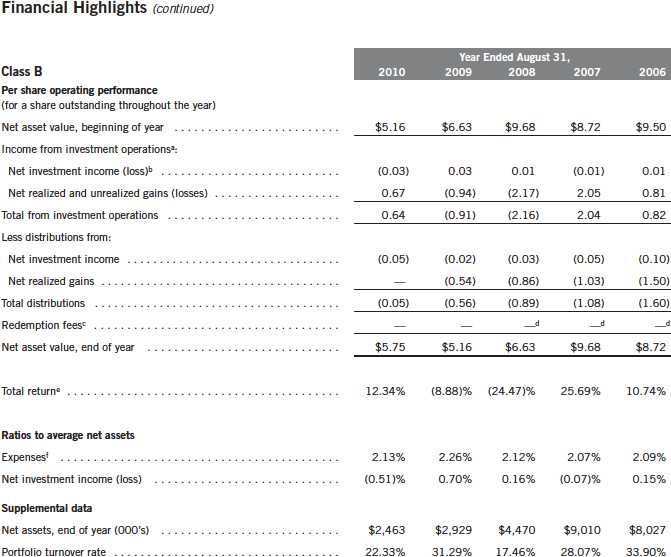

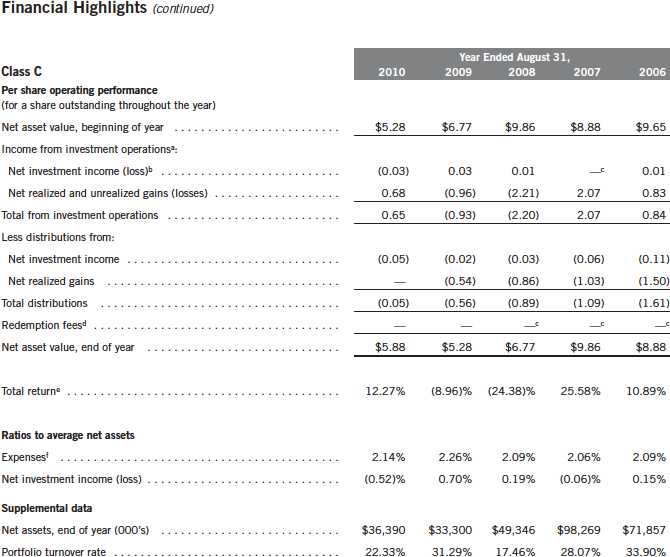

Templeton Global Smaller Companies Fund

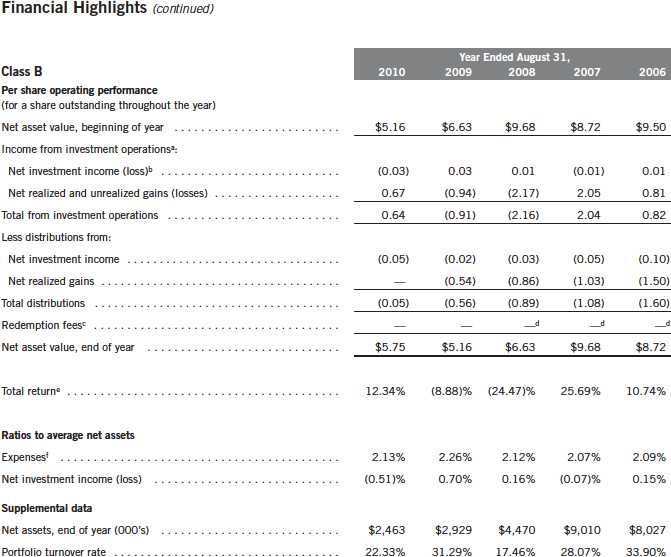

Financial Highlights

aThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and repurchases of the Fund shares in relation to income earned and/or fluctuating market value of the investments of the Fund.

bBased on average daily shares outstanding.

cEffective September 1, 2008, the redemption fee was eliminated.

dAmount rounds to less than $0.01 per share.

eTotal return does not reflect sales commissions or contingent deferred sales charges, if applicable.

fBenefit of expense reduction rounds to less than 0.01%.

Annual Report | The accompanying notes are an integral part of these financial statements. | 15

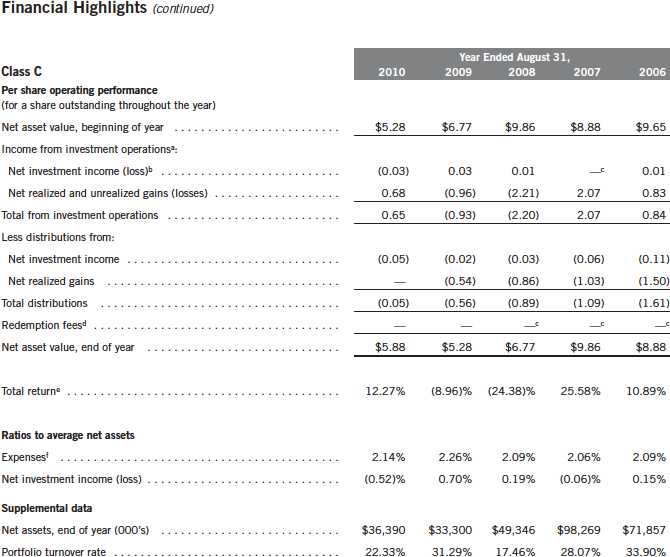

Templeton Global Smaller Companies Fund

aThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and repurchases of the Fund shares in relation to income earned and/or fluctuating market value of the investments of the Fund.

bBased on average daily shares outstanding.

cEffective September 1, 2008, the redemption fee was eliminated.

dAmount rounds to less than $0.01 per share.

eTotal return does not reflect sales commissions or contingent deferred sales charges, if applicable.

fBenefit of expense reduction rounds to less than 0.01%.

16 | The accompanying notes are an integral part of these financial statements. | Annual Report

Templeton Global Smaller Companies Fund

aThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and repurchases of the Fund shares in relation to income earned and/or fluctuating market value of the investments of the Fund.

bBased on average daily shares outstanding.

cAmount rounds to less than $0.01 per share.

dEffective September 1, 2008, the redemption fee was eliminated.

eTotal return does not reflect sales commissions or contingent deferred sales charges, if applicable.

fBenefit of expense reduction rounds to less than 0.01%.

Annual Report | The accompanying notes are an integral part of these financial statements. | 17

Templeton Global Smaller Companies Fund

aThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and repurchases of the Fund shares in relation to income earned and/or fluctuating market value of the investments of the Fund.

bBased on average daily shares outstanding.

cEffective September 1, 2008, the redemption fee was eliminated.

dAmount rounds to less than $0.01 per share.

eBenefit of expense reduction rounds to less than 0.01%.

18 | The accompanying notes are an integral part of these financial statements. | Annual Report

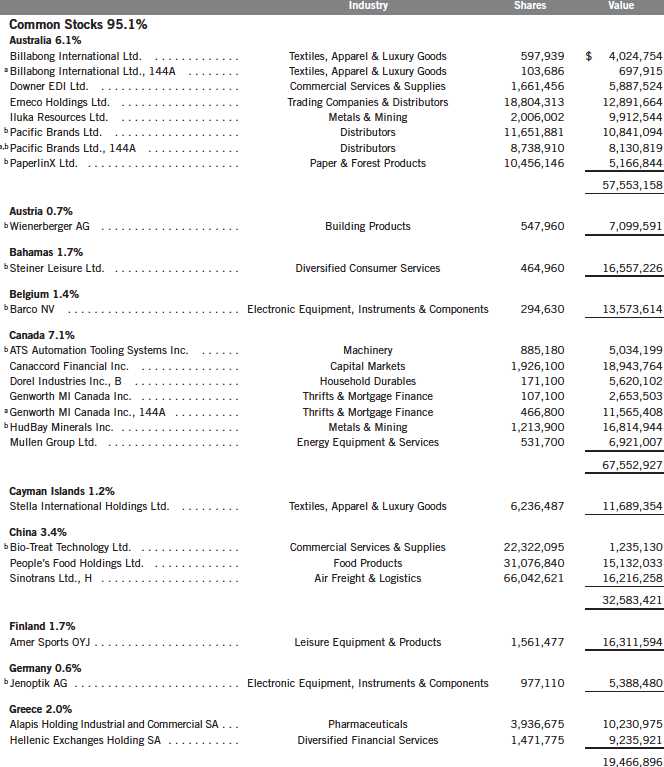

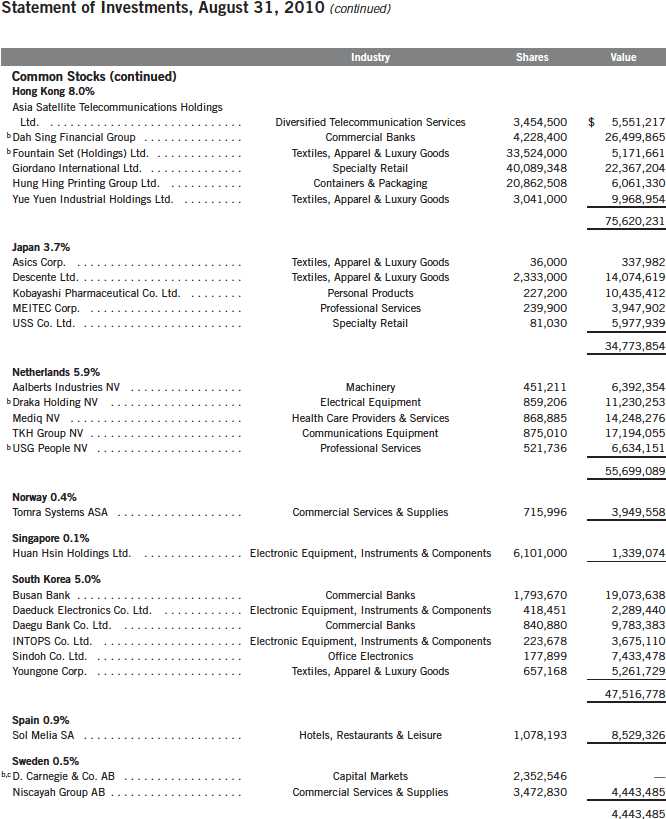

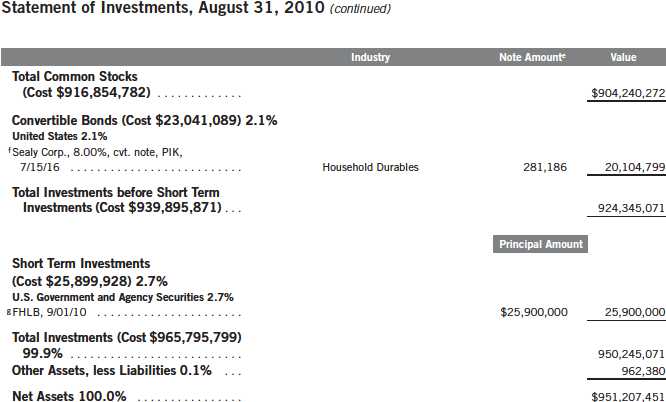

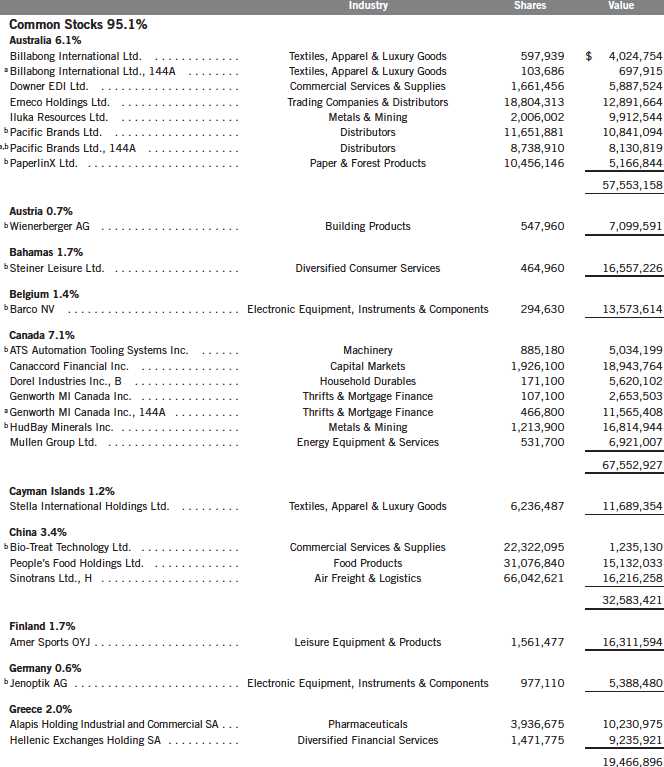

Templeton Global Smaller Companies Fund

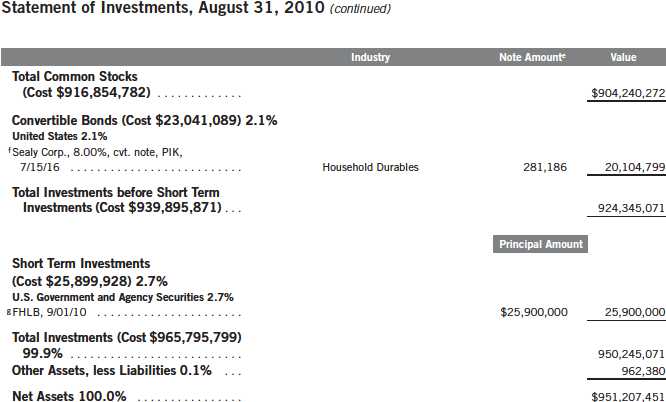

Statement of Investments, August 31, 2010

Annual Report | 19

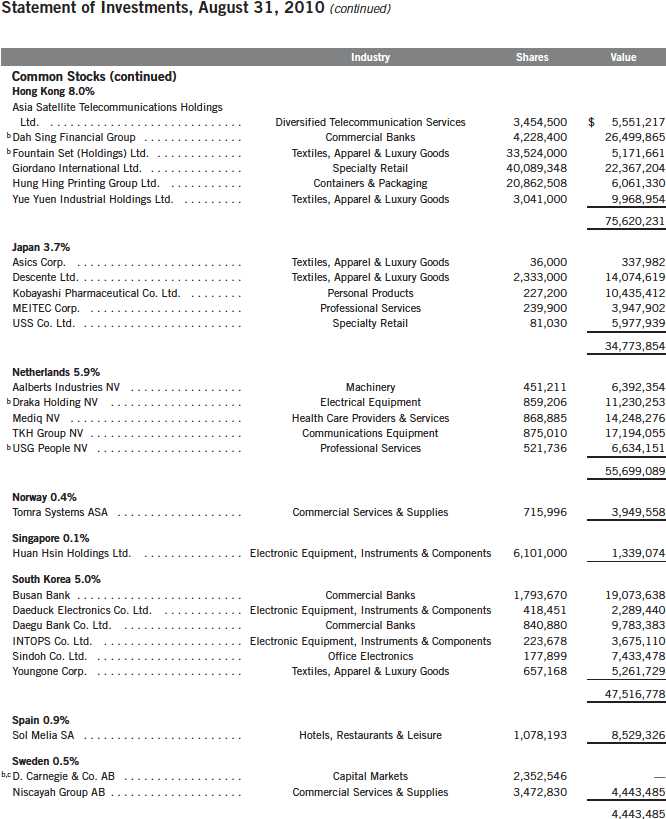

Templeton Global Smaller Companies Fund

20 | Annual Report

Templeton Global Smaller Companies Fund

Templeton Global Smaller Companies Fund

See Abbreviations on page 36.

aSecurity was purchased pursuant to Rule 144A under the Securities Act of 1933 and may be sold in transactions exempt from registration only to qualified institutional buyers or in a public offering registered under the Securities Act of 1933. These securities have been deemed liquid under guidelines approved by the Fund’s Board of Trustees. At August 31, 2010, the aggregate value of these securities was $20,394,142, representing 2.14% of net assets.

bNon-income producing.

cSecurity has been deemed illiquid because it may not be able to be sold within seven days.

dSee Note 8 regarding holdings of 5% voting securities.

ePrincipal amount is equal to $27 per note, total principal amount is $7,592,022. The PIK interest increases the principal amount of the notes on PIK payment dates.

fIncome may be received in additional securities and/or cash.

gThe security is traded on a discount basis with no stated coupon rate.

22 | The accompanying notes are an integral part of these financial statements. | Annual Report

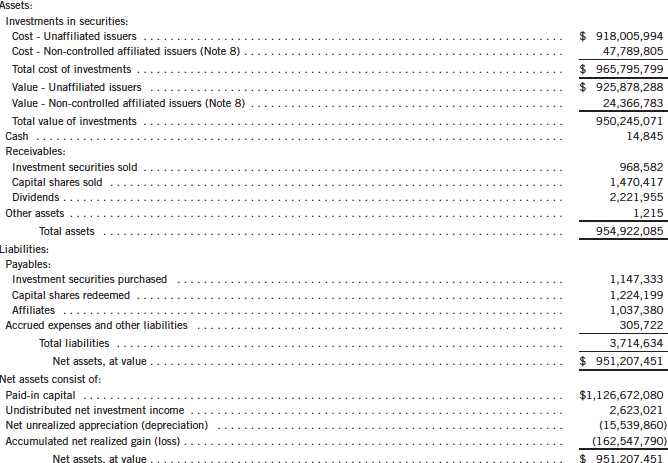

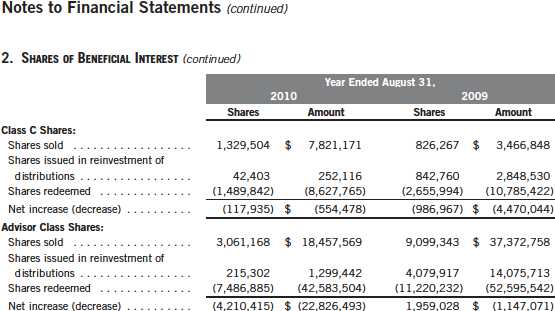

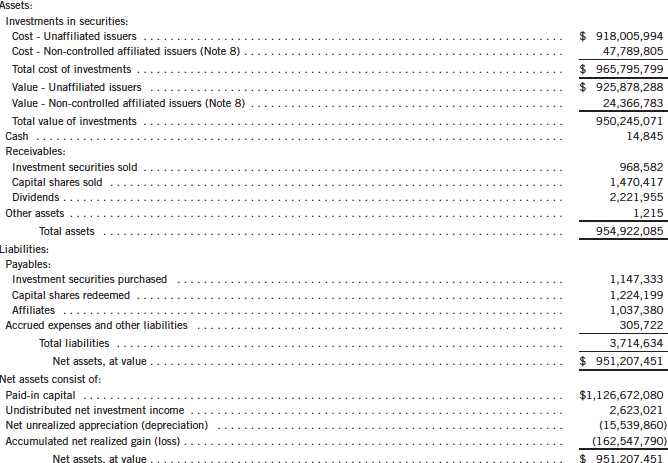

Templeton Global Smaller Companies Fund

Financial Statements

Statement of Assets and Liabilities

August 31, 2010 |

Annual Report | The accompanying notes are an integral part of these financial statements. | 23

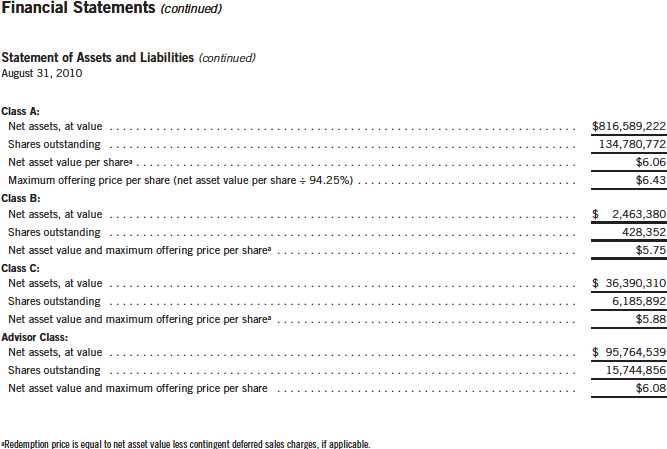

Templeton Global Smaller Companies Fund

24 | The accompanying notes are an integral part of these financial statements. | Annual Report

Templeton Global Smaller Companies Fund

Financial Statements (continued)

Statement of Operations

for the year ended August 31, 2010 |

Annual Report | The accompanying notes are an integral part of these financial statements. | 25

Templeton Global Smaller Companies Fund

26 | The accompanying notes are an integral part of these financial statements. | Annual Report

Templeton Global Smaller Companies Fund

Notes to Financial Statements

1. ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES

Templeton Global Smaller Companies Fund (Fund) is registered under the Investment Company Act of 1940, as amended, (1940 Act) as an open-end investment company. The Fund offers four classes of shares: Class A, Class B, Class C, and Advisor Class. Each class of shares differs by its initial sales load, contingent deferred sales charges, distribution fees, voting rights on matters affecting a single class and its exchange privilege.

The following summarizes the Fund’s significant accounting policies.

a. Financial Instrument Valuation

The Fund values its investments in securities and other assets and liabilities carried at fair value daily. Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants on the measurement date. Under procedures approved by the Fund’s Board of Trustees, the Fund may utilize independent pricing services, quotations from securities and financial instrument dealers, and other market sources to determine fair value.

Equity securities listed on an exchange or on the NASDAQ National Market System are valued at the last quoted sale price or the official closing price of the day, respectively. Foreign equity securities are valued as of the close of trading on the foreign stock exchange on which the security is primarily traded, or the NYSE, whichever is earlier. The value is then converted into its U.S. dollar equivalent at the foreign exchange rate in effect at the close of the NYSE on the day that the value of the security is determined. Over-the-counter securities are valued within the range of the most recent quoted bid and ask prices. Securities that trade in multiple markets or on multiple exchanges are valued according to the broadest and most representative market. Certain equity securities are valued based upon fundamental characteristics or relationships to similar securities.

Debt securities generally trade in the over-the-counter market rather than on a securities exchange. The Fund’s pricing services use multiple valuation techniques to determine fair value. In instances where sufficient market activity exists, the pricing services may utilize a market-based approach through which quotes from market makers are used to determine fair value. In instances where sufficient market activity may not exist or is limited, the pricing services also utilize proprietary valuation models which may consider market characteristics such as benchmark yield curves, option-adjusted spreads, credit spreads, estimated default rates, coupon rates, anticipated timing of principal repayments, underlying collateral, and other unique security features in order to estimate the relevant cash flows, which are then discounted to calculate the fair value. Securities denominated in a foreign currency are converted into their U.S. dollar equivalent at the foreign exchange rate in effect at the close of the NYSE on the date that the values of the foreign debt securities are determined.

The Fund has procedures to determine the fair value of securities and other financial instruments for which market prices are not readily available or which may not be reliably priced.

Annual Report | 27

Templeton Global Smaller Companies Fund

Notes to Financial Statements (continued)

| 1. | ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES (continued) |

| a. | Financial Instrument Valuation (continued) |

Under these procedures, the Fund primarily employs a market-based approach which may use related or comparable assets or liabilities, recent transactions, market multiples, book values, and other relevant information for the investment to determine the fair value of the investment. The Fund may also use an income-based valuation approach in which the anticipated future cash flows of the investment are discounted to calculate fair value. Discounts may also be applied due to the nature or duration of any restrictions on the disposition of the investments. Due to the inherent uncertainty of valuations of such investments, the fair values may differ significantly from the values that would have been used had an active market existed.

Trading in securities on foreign exchanges and over-the-counter markets may be completed before the daily close of business on the NYSE. Occasionally, events occur between the time at which trading in a foreign security is completed and the close of the NYSE that might call into question the reliability of the value of a portfolio security held by the Fund. As a result, differences may arise between the value of the Fund’s portfolio securities as determined at the foreign market close and the latest indications of value at the close of the NYSE. In order to minimize the potential for these differences, the investment manager monitors price movements following the close of trading in foreign stock markets through a series of country specific market proxies (such as baskets of American Depository Receipts, futures contracts and exchange traded funds). These price movements are measured against established trigger thresholds for each specific market proxy to assist in determining if an event has occurred that may call into question the reliability of the values of the foreign securities held by the Fund. If such an event occurs, the securities may be valued using fair value procedures, which may include the use of independent pricing services.

b. Foreign Currency Translation

Portfolio securities and other assets and liabilities denominated in foreign currencies are translated into U.S. dollars based on the exchange rate of such currencies against U.S. dollars on the date of valuation. The Fund may enter into foreign currency exchange contracts to facilitate transactions denominated in a foreign currency. Purchases and sales of securities, income and expense items denominated in foreign currencies are translated into U.S. dollars at the exchange rate in effect on the transaction date. Occasionally, events may impact the availability or reliability of foreign exchange rates used to convert the U.S. dollar equivalent value. If such an event occurs, the foreign exchange rate will be valued at fair value using procedures established and approved by the Fund’s Board of Trustees.

The Fund does not separately report the effect of changes in foreign exchange rates from changes in market prices on securities held. Such changes are included in net realized and unrealized gain or loss from investments on the Statement of Operations.

Realized foreign exchange gains or losses arise from sales of foreign currencies, currency gains or losses realized between the trade and settlement dates on securities transactions and the

28 | Annual Report

Templeton Global Smaller Companies Fund

Notes to Financial Statements (continued)

| 1. | ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES (continued) |

| b. | Foreign Currency Translation (continued) |

difference between the recorded amounts of dividends, interest, and foreign withholding taxes and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized foreign exchange gains and losses arise from changes in foreign exchange rates on foreign denominated assets and liabilities other than investments in securities held at the end of the reporting period.

c. Income Taxes

It is the Fund’s policy to qualify as a regulated investment company under the Internal Revenue Code and to distribute to shareholders substantially all of its taxable income and net realized gains. As a result, no provision for U.S. federal income taxes is required. The Fund files U.S. income tax returns as well as tax returns in certain other jurisdictions. The Fund recognizes in its financial statements the effects including penalties and interest, if any, of a tax position taken on a tax return (or expected to be taken) when it’s more likely than not (a greater than 50% probability), based on the technical merits, that the tax position will be sustained upon examination by the tax authorities. As of August 31, 2010, and for all open tax years, the Fund has determined that no provision for income tax is required in the Fund’s financial statements. Open tax years are those that remain subjec t to examination and are based on each tax jurisdiction statute of limitation. The Fund is not aware of any tax position for which it is reasonably possible that the total amounts of unrecognized tax effects will significantly change in the next twelve months.

Foreign securities held by the Fund may be subject to foreign taxation on income received. Foreign taxes, if any, are recorded based on the tax regulations and rates that exist in the foreign markets in which the Fund invests.

The Fund may be subject to a tax imposed on net realized gains on securities of certain foreign countries.

d. Security Transactions, Investment Income, Expenses and Distributions

Security transactions are accounted for on trade date. Realized gains and losses on security transactions are determined on a specific identification basis. Interest income and estimated expenses are accrued daily. Amortization of premium and accretion of discount on debt securities are included in interest income. Dividend income is recorded on the ex-dividend date except that certain dividends from foreign securities are recognized as soon as the Fund is notified of the ex-dividend date. Distributions to shareholders are recorded on the ex-dividend date and are determined according to income tax regulations (tax basis). Distributable earnings determined on a tax basis may differ from earnings recorded in accordance with accounting principles generally accepted in the United States of America. These differences may be permanent or temporary. Permanent differences are reclassified among capital accounts to r eflect their tax character. These reclassifications have no impact on net assets or the results of operations. Temporary differences are not reclassified, as they may reverse in subsequent periods.

Annual Report | 29

Templeton Global Smaller Companies Fund

Notes to Financial Statements (continued)

| 1. | ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES (continued) |

| d. | Security Transactions, Investment Income, Expenses and Distributions (continued) |

Realized and unrealized gains and losses and net investment income, not including class specific expenses, are allocated daily to each class of shares based upon the relative proportion of net assets of each class. Differences in per share distributions, by class, are generally due to differences in class specific expenses.

e. Accounting Estimates

The preparation of financial statements in accordance with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the amounts of income and expenses during the reporting period. Actual results could differ from those estimates.

f. Guarantees and Indemnifications

Under the Fund’s organizational documents, its officers and trustees are indemnified by the Fund against certain liabilities arising out of the performance of their duties to the Fund. Additionally, in the normal course of business, the Fund enters into contracts with service providers that contain general indemnification clauses. The Fund’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Fund that have not yet occurred. Currently, the Fund expects the risk of loss to be remote.

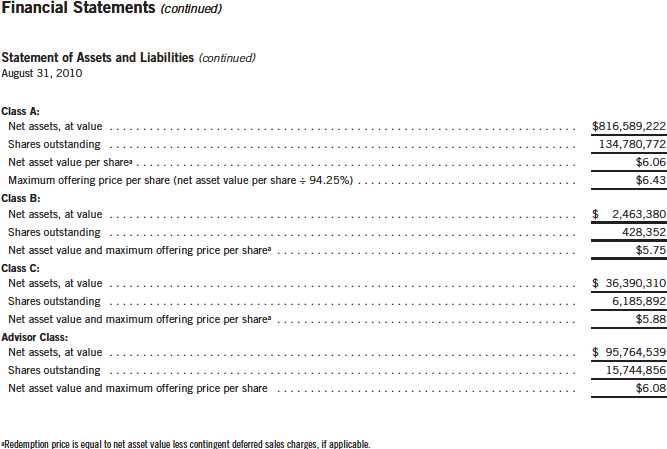

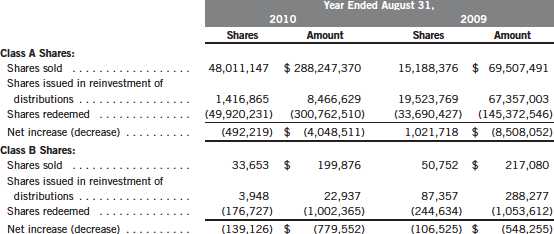

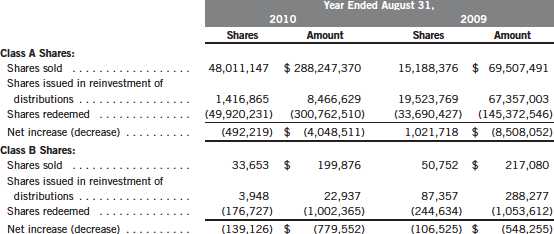

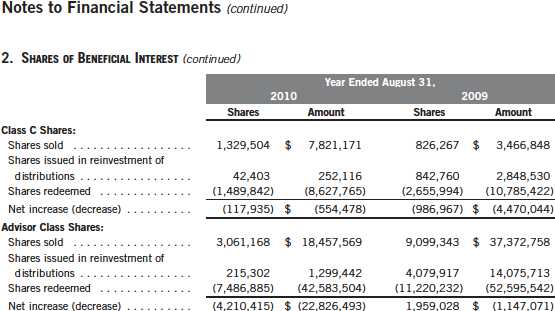

2. SHARES OF BENEFICIAL INTEREST

At August 31, 2010, there were an unlimited number of shares authorized (without par value).

Transactions in the Fund’s shares were as follows:

30 | Annual Report

Templeton Global Smaller Companies Fund

3. TRANSACTIONS WITH AFFILIATES

Franklin Resources, Inc. is the holding company for various subsidiaries that together are referred to as Franklin Templeton Investments. Certain officers and trustees of the Fund are also officers and/or directors of the following subsidiaries:

| |

Subsidiary Franklin Templeton Investment Corp. (FTIC) Templeton Investment Counsel, LLC (TIC) Franklin Templeton Services, LLC (FT Services) Franklin Templeton Distributors, Inc. (Distributors) Franklin Templeton Investor Services, LLC (Investor Services) | Affiliation Investment manager Investment manager – sub advisor Administrative manager Principal underwriter Transfer agent |

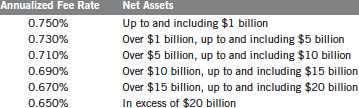

a. Management Fees

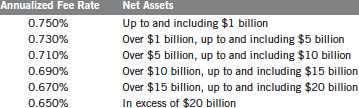

The Fund pays an investment management fee to FTIC based on the average daily net assets of the Fund as follows:

Under a subadvisory agreement, TIC, an affiliate of FTIC, provides subadvisory services to the Fund. The fee is paid by FTIC based on the average daily net assets and is not an additional expense of the Fund.

Annual Report | 31

Templeton Global Smaller Companies Fund

Notes to Financial Statements (continued)

| 3. | TRANSACTIONS WITH AFFILIATES (continued) |

| b. | Administrative Fees |

The Fund pays an administrative fee to FT Services based on the Fund’s average daily net assets as follows:

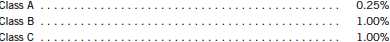

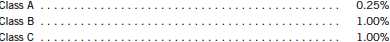

c. Distribution Fees

The Fund’s Board of Trustees has adopted distribution plans for each share class, with the exception of Advisor Class shares, pursuant to Rule 12b-1 under the 1940 Act. Under the Fund’s Class A reimbursement distribution plan, the Fund reimburses Distributors for costs incurred in connection with the servicing, sale and distribution of the Fund’s shares up to the maximum annual plan rate. Under the Class A reimbursement distribution plan, costs exceeding the maximum for the current plan year cannot be reimbursed in subsequent periods.

In addition, under the Fund’s Class B and C compensation distribution plans, the Fund pays Distributors for costs incurred in connection with the servicing, sale and distribution of the Fund’s shares up to the maximum annual plan rate for each class.

The maximum annual plan rates, based on the average daily net assets, for each class, are as follows:

d. Sales Charges/Underwriting Agreements

Distributors has advised the Fund of the following commission transactions related to the sales and redemptions of the Fund’s shares for the year:

e. Transfer Agent Fees

For the year ended August 31, 2010, the Fund paid transfer agent fees of $1,937,611, of which $1,070,881 was retained by Investor Services.

32 | Annual Report

Templeton Global Smaller Companies Fund

Notes to Financial Statements (continued)

4. EXPENSE OFFSET ARRANGEMENT

The Fund has entered into an arrangement with its custodian whereby credits realized as a result of uninvested cash balances are used to reduce a portion of the Fund’s custodian expenses. During the year ended August 31, 2010, the custodian fees were reduced as noted in the Statement of Operations.

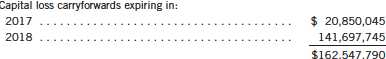

5. INCOME TAXES

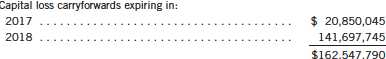

For tax purposes, capital losses may be carried over to offset future capital gains, if any.

At August 31, 2010, the capital loss carryforwards were as follows:

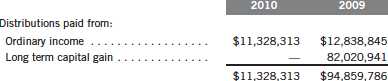

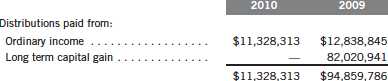

The tax character of distributions paid during the years ended August 31, 2010 and 2009, was as follows:

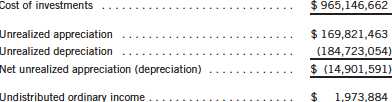

At August 31, 2010, the cost of investments, net unrealized appreciation (depreciation), and undistributed ordinary income for income tax purposes were as follows:

Net investment income differs for financial statement and tax purposes primarily due to differing treatments of foreign currency transactions, passive foreign investment company shares, payments-in-kind, non-deductible expenses, and regulatory settlements.

Net realized gains (losses) differ for financial statement and tax purposes primarily due to differing treatments of foreign currency transactions and corporate actions.

Annual Report | 33

Templeton Global Smaller Companies Fund

Notes to Financial Statements (continued)

6. INVESTMENT TRANSACTIONS

Purchases and sales of investments (excluding short term securities) for the year ended August 31, 2010, aggregated $206,345,733 and $258,077,568, respectively.

7. CONCENTRATION OF RISK

Investing in foreign securities may include certain risks and considerations not typically associated with investing in U.S. securities, such as fluctuating currency values and changing local and regional economic, political and social conditions, which may result in greater market volatility. In addition, certain foreign securities may not be as liquid as U.S. securities.

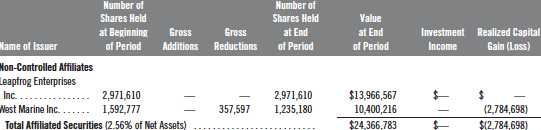

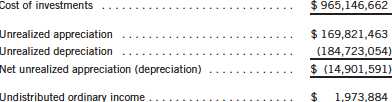

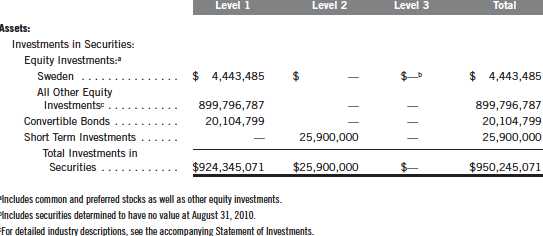

8. HOLDINGS OF 5% VOTING SECURITIES OF PORTFOLIO COMPANIES

The 1940 Act defines “affiliated companies” to include investments in portfolio companies in which a fund owns 5% or more of the outstanding voting securities. Investments in “affiliated companies” for the Fund for the year ended August 31, 2010, were as shown below.

9. CREDIT FACILITY

The Fund, together with other U.S. registered and foreign investment funds (collectively “Borrowers”), managed by Franklin Templeton Investments, are borrowers in a joint syndicated senior unsecured credit facility totaling $750 million (Global Credit Facility) which matures on January 21, 2011. This Global Credit Facility provides a source of funds to the Borrowers for temporary and emergency purposes, including the ability to meet future unanticipated or unusually large redemption requests.

Under the terms of the Global Credit Facility, the Fund shall, in addition to interest charged on any borrowings made by the Fund and other costs incurred by the Fund, pay its share of fees and expenses incurred in connection with the implementation and maintenance of the Global Credit Facility, based upon its relative share of the aggregate net assets of all of the Borrowers, including an annual commitment fee of 0.10% based upon the unused portion of the Global Credit Facility, which is reflected in other expenses on the Statement of Operations. During the year ended August 31, 2010, the Fund did not use the Global Credit Facility.

34 | Annual Report

Templeton Global Smaller Companies Fund

Notes to Financial Statements (continued)

10. REGULATORY AND LITIGATION MATTERS

During the year ended August 31, 2010, the Fund received $519,847 resulting from a settlement between the SEC and Franklin Advisers, Inc. (an affiliate of the investment manager) relating to market-timing activities, as previously reported in the Fund’s financial statements during the years ended August 31, 2004 through August 31, 2007. This payment is included in capital shares transactions on the Statements of Changes in Net Assets.

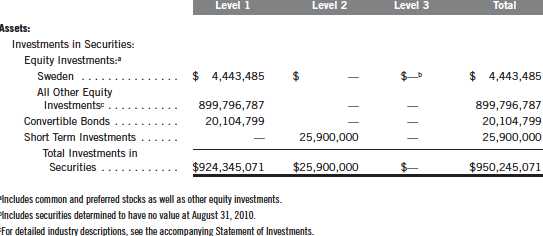

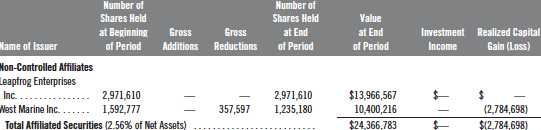

11. FAIR VALUE MEASUREMENTS

The Fund follows a fair value hierarchy that distinguishes between market data obtained from independent sources (observable inputs) and the Fund’s own market assumptions (unobservable inputs). These inputs are used in determining the value of the Fund’s investments and are summarized in the following fair value hierarchy:

Level 1 – quoted prices in active markets for identical securities

Level 2 – other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speed, credit risk, etc.)

Level 3 – significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments)

The inputs or methodology used for valuing securities are not an indication of the risk associated with investing in those securities.

For movements between levels within the fair value hierarchy, the Fund has adopted a policy of recognizing the transfers as of the date of the underlying event which caused the movement.

The following is a summary of the inputs used as of August 31, 2010, in valuing the Fund’s assets carried at fair value:

Annual Report | 35

Templeton Global Smaller Companies Fund

Notes to Financial Statements (continued)

12. SUBSEQUENT EVENTS

The Fund has evaluated subsequent events through the issuance of the financial statements and determined that no events have occurred that require disclosure.

ABBREVIATIONS

Selected Portfolio

FHLB - Federal Home Loan Bank

PIK - Payment-In-Kind |

36 | Annual Report

Templeton Global Smaller Companies Fund

Report of Independent Registered Public Accounting Firm

To the Board of Trustees and Shareholders of Templeton Global Smaller Companies Fund

In our opinion, the accompanying statement of assets and liabilities, including the statement of investments, and the related statements of operations and of changes in net assets and the financial highlights present fairly, in all material respects, the financial position of Templeton Global Smaller Companies Fund (the “Fund”) at August 31, 2010, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended and the financial highlights for each of the five years in the period then ended, in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereafter referred to as “financial statements”) are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements based on o ur audits. We conducted our audits of these financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits, which included confirmation of securities at August 31, 2010 by correspondence with the custodian and brokers, provide a reasonable basis for our opinion.

| | PricewaterhouseCoopers LLP

San Francisco, California

October 21, 2010 |

Annual Report | 37

Templeton Global Smaller Companies Fund

Tax Designation (unaudited)

Under Section 854(b)(2) of the Code, the Fund designates 3.28% of the ordinary income dividends as income qualifying for the dividends received deduction for the fiscal year ended August 31, 2010.

Under Section 854(b)(2) of the Code, the Fund designates the maximum amount allowable but no less than $8,645,496 as qualified dividends for purposes of the maximum rate under Section 1(h)(11) of the Code for the fiscal year ended August 31, 2010. Distributions, including qualified dividend income, paid during calendar year 2010 will be reported to shareholders on Form 1099-DIV in January 2011. Shareholders are advised to check with their tax advisors for information on the treatment of these amounts on their individual income tax returns.

Under Section 871(k)(1)(C) of the Code, the Fund designates the maximum amount allowable but no less than $14,832 as interest related dividends for purposes of the tax imposed under Section 871(a)(1)(A) of the Code for the fiscal year ended August 31, 2010.

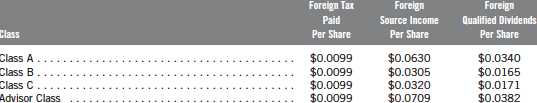

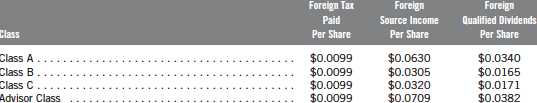

At August 31, 2009, more than 50% of the Fund’s total assets were invested in securities of foreign issuers. In most instances, foreign taxes were withheld from income paid to the Fund on these investments. As shown in the table below, the Fund designates to shareholders the foreign source income and foreign taxes paid, pursuant to Section 853 of the Code. This designation will allow shareholders of record on December 17, 2009, to treat their proportionate share of foreign taxes paid by the Fund as having been paid directly by them. The shareholder shall consider these amounts as foreign taxes paid in the tax year in which they receive the Fund distribution.

The following table provides a detailed analysis of foreign tax paid, foreign source income, and foreign qualified dividends as designated by the Fund, to Class A, Class B, Class C, and Advisor Class shareholders of record.

38 | Annual Report

Templeton Global Smaller Companies Fund

Tax Designation (unaudited) (continued)

Foreign Tax Paid Per Share (Column 1) is the amount per share available to you, as a tax credit (assuming you held your shares in the Fund for a minimum of 16 days during the 31-day period beginning 15 days before the ex-dividend date of the Fund’s distribution to which the foreign taxes relate), or, as a tax deduction.

Foreign Source Income Per Share (Column 2) is the amount per share of income dividends paid to you that is attributable to foreign securities held by the Fund, plus any foreign taxes withheld on these dividends. The amounts reported include foreign source qualified dividends that have not been adjusted for the rate differential applicable to such dividend income.1

Foreign Qualified Dividends Per Share (Column 3) is the amount per share of foreign source qualified dividends the Fund paid to you, plus any foreign taxes withheld on these dividends. These amounts represent the portion of the Foreign Source Income reported to you in column 2 that were derived from qualified foreign securities held by the Fund.1

In January 2010, shareholders received Form 1099-DIV which included their share of taxes paid and foreign source income distributed during the calendar year 2009. The Foreign Source Income reported on Form 1099-DIV has not been adjusted for the rate differential on foreign source qualified dividend income. Shareholders are advised to check with their tax advisors for information on the treatment of these amounts on their 2009 individual income tax returns.

1Qualified dividends are taxed at reduced long term capital gain tax rates. In determining the amount of foreign tax credit that may be applied against the U.S. tax liability of individuals receiving foreign source qualified dividends, adjustments may be required to the foreign tax credit limitation calculation to reflect the rate differential applicable to such dividend income. The rules however permit certain individuals to elect not to apply the rate differential adjustments for capital gains and/or dividends for any taxable year. Please consult your tax advisor and the instructions to Form 1116 for more information.

Annual Report | 39

Templeton Global Smaller Companies Fund

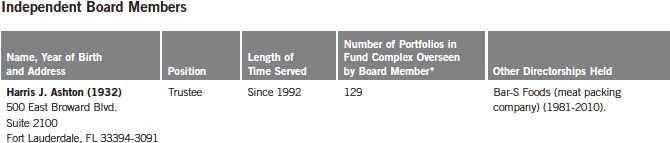

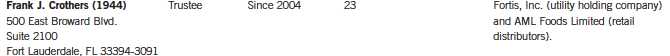

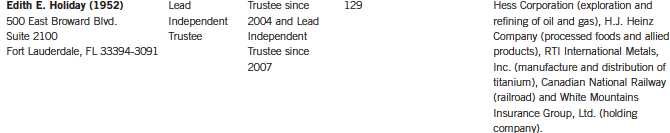

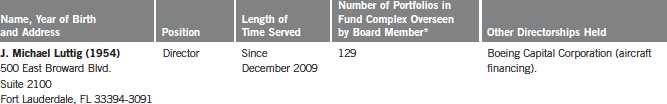

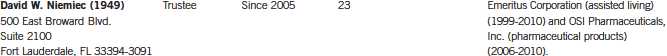

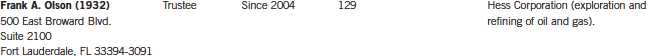

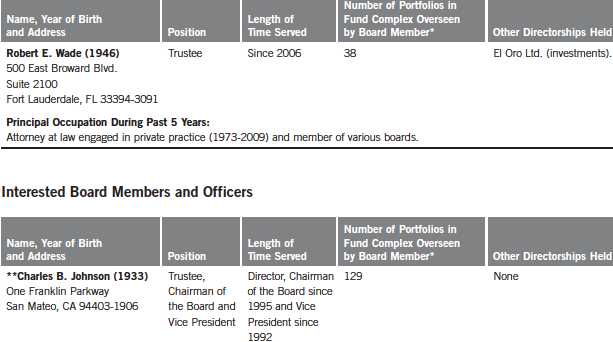

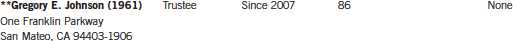

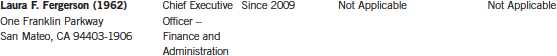

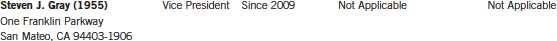

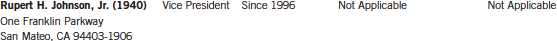

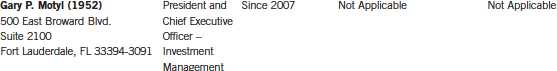

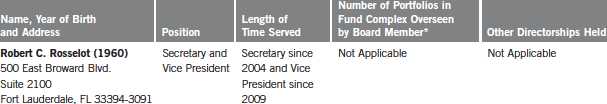

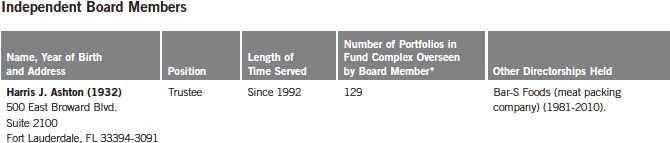

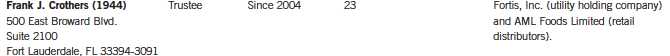

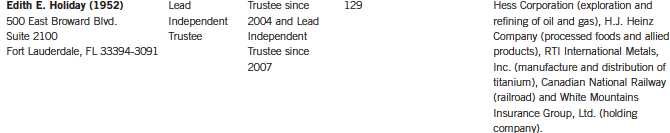

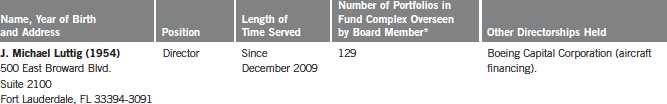

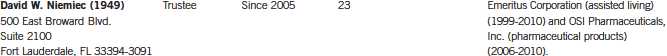

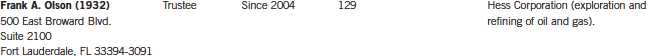

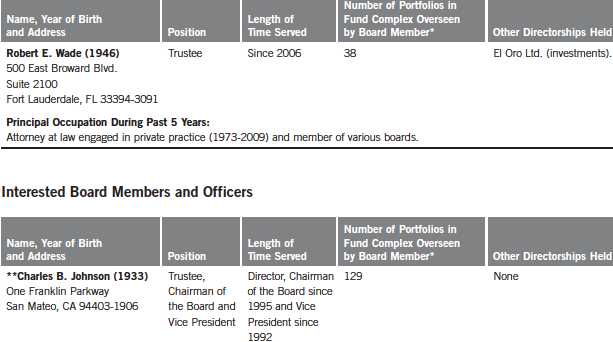

Board Members and Officers

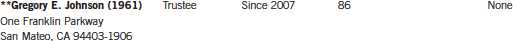

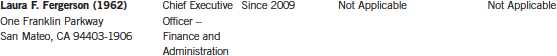

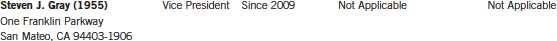

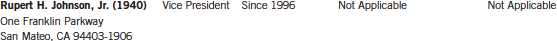

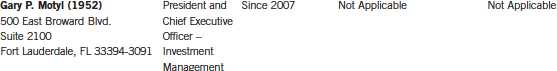

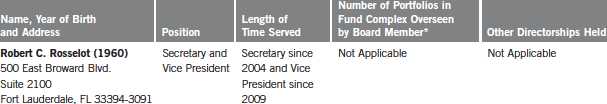

The name, year of birth and address of the officers and board members, as well as their affiliations, positions held with the Fund, principal occupations during the past five years and number of U.S. registered portfolios overseen in the Franklin Templeton Investments fund complex are shown below. Generally, each board member serves until that person’s successor is elected and qualified.

Principal Occupation During Past 5 Years:

Director of various companies; and formerly, Director, RBC Holdings, Inc. (bank holding company) (until 2002); and President, Chief Executive Officer and Chairman of the Board, General Host Corporation (nursery and craft centers) (until 1998).

Principal Occupation During Past 5 Years:

Independent strategic and financial consultant; and formerly, Executive Vice President and Chief Financial Officer, NHP Incorporated (manager of multifamily housing) (1995-1997); and Vice President and Treasurer, US Airways, Inc. (until 1995).

Principal Occupation During Past 5 Years:

Director and Vice Chairman, Caribbean Utilities Company, Ltd.; director of various other private business and nonprofit organizations; and formerly, Chairman, Atlantic Equipment and Power Ltd. (1977-2003).

Principal Occupation During Past 5 Years:

Director or Trustee of various companies and trusts; and formerly, Assistant to the President of the United States and Secretary of the Cabinet (1990-1993); General Counsel to the United States Treasury Department (1989-1990); and Counselor to the Secretary and Assistant Secretary for Public Affairs and Public Liaison-United States Treasury Department (1988-1989).

40 | Annual Report

Principal Occupation During Past 5 Years:

Executive Vice President, General Counsel and member of Executive Council, The Boeing Company; and formerly, Federal Appeals Court Judge, U.S. Court of Appeals for the Fourth Circuit (1991-2006).

Principal Occupation During Past 5 Years:

Advisor, Saratoga Partners (private equity fund); and formerly, Managing Director, Saratoga Partners (1998-2001) and SBC Warburg Dillon Read (investment banking) (1997-1998); Vice Chairman, Dillon, Read & Co. Inc. (investment banking) (1991-1997); and Chief Financial Officer, Dillon, Read & Co. Inc. (1982-1997).

Principal Occupation During Past 5 Years:

Chairman Emeritus, The Hertz Corporation (car rental) (since 2000) (Chairman of the Board (1980-2000) and Chief Executive Officer (1977-1999)); and formerly, Chairman of the Board, President and Chief Executive Officer, UAL Corporation (airlines).

Principal Occupation During Past 5 Years:

Senior Vice President – Government Affairs, General Counsel and Secretary, PepsiCo, Inc. (consumer products); and formerly, Director, Delta Airlines (aviation) (2003-2005) and Providian Financial Corp. (credit card provider) (1997-2001); Senior Fellow of The Brookings Institution (2003-2004); Visiting Professor, University of Georgia School of Law (2004); and Deputy Attorney General, U.S. Department of Justice (2001-2003).

Principal Occupation During Past 5 Years:

Physician, Chief of Staff, owner and operator of the Lyford Cay Hospital (1987-present); director of various nonprofit organizations; and formerly, Cardiology Fellow, University of Maryland (1985-1987) and Internal Medicine Resident, Greater Baltimore Medical Center (1982-1985).

Annual Report | 41

Principal Occupation During Past 5 Years:

Chairman of the Board, Member – Office of the Chairman and Director, Franklin Resources, Inc.; and officer and/or director or trustee, as the case may be, of some of the other subsidiaries of Franklin Resources, Inc. and of 41 of the investment companies in Franklin Templeton Investments.

Principal Occupation During Past 5 Years:

Director, President and Chief Executive Officer, Franklin Resources, Inc.; and officer and/or director or trustee, as the case may be, of some of the other subsidiaries of Franklin Resources, Inc. and of 33 of the investment companies in Franklin Templeton Investments.

Principal Occupation During Past 5 Years:

Director, Global Compliance, Franklin Resources, Inc.; officer of some of the other subsidiaries of Franklin Resources, Inc. and of 45 of the investment companies in Franklin Templeton Investments; and formerly, Director of Compliance, Franklin Resources, Inc. (1994-2001).

Principal Occupation During Past 5 Years:

Senior Vice President, Franklin Templeton Services, LLC; officer of 45 of the investment companies in Franklin Templeton Investments; and formerly, Director and member of Audit and Valuation Committees, Runkel Funds, Inc. (2003-2004); Assistant Treasurer of most of the investment companies in Franklin Templeton Investments (1997-2003); and Vice President, Franklin Templeton Services, LLC (1997-2003).

42 | Annual Report

Principal Occupation During Past 5 Years:

Associate General Counsel, Franklin Templeton Investments; officer of 45 of the investment companies in Franklin Templeton Investments; and formerly, Litigation Associate, Steefel, Levitt & Weiss, LLP (2000-2004).

Principal Occupation During Past 5 Years:

Senior Associate General Counsel, Franklin Templeton Investments: and officer and/or director, as the case maybe, of some of the other subsidiaries of Franklin Resources, Inc. and of 45 of the investment companies in Franklin Templeton Investments.

Principal Occupation During Past 5 Years:

Senior Associate General Counsel, Franklin Templeton Investments; Vice President, Franklin Templeton Distributors, Inc.; and officer of 45 of the investment companies in Franklin Templeton Investments.

Principal Occupation During Past 5 Years:

Vice Chairman, Member – Office of the Chairman and Director, Franklin Resources, Inc.; Director, Franklin Advisers, Inc.; Senior Vice President, Franklin Advisory Services, LLC; and officer and/or director or trustee, as the case may be, of some of the other subsidiaries of Franklin Resources, Inc. and of 25 of the investment companies in Franklin Templeton Investments.

Principal Occupation During Past 5 Years:

President, Templeton Investment Counsel, LLC; Executive Vice President, Franklin Templeton Institutional, LLC; and officer and/or director of some of the other subsidiaries of Franklin Resources, Inc. and of six of the investment companies in Franklin Templeton Investments.

Principal Occupation During Past 5 Years:

Director, Global Fund Accounting Operations, Franklin Templeton Investments; and officer of 14 of the investment companies in Franklin Templeton Investments.

Annual Report | 43

Principal Occupation During Past 5 Years:

Senior Associate General Counsel, Franklin Templeton Investments; Assistant Secretary, Franklin Resources, Inc.; Vice President and Secretary, Templeton Investment Counsel, LLC; Vice President, Secretary and Trust Officer, Fiduciary Trust International of the South; and officer of 45 of the investment companies in Franklin Templeton Investments.

Principal Occupation During Past 5 Years:

Senior Associate General Counsel, Franklin Templeton Investments; and officer of 45 of the investment companies in Franklin Templeton Investments.

Principal Occupation During Past 5 Years:

General Counsel and Executive Vice President, Franklin Resources, Inc.; officer of some of the other subsidiaries of Franklin Resources, Inc. and of 45 of the investment companies in Franklin Templeton Investments; and formerly, Partner, Shearman & Sterling, LLP (2004-2005); and General Counsel, Investment Company Institute (ICI) (1997-2004).

*We base the number of portfolios on each separate series of the U.S. registered investment companies within the Franklin Templeton Investments fund complex. These portfolios have a common investment manager or affiliated investment managers.

**Charles B. Johnson is considered to be interested person of the Trust under the federal securities laws due to his position as officer and director and major shareholder of Franklin Resources, Inc. (Resources), which is the parent company of the Trust’s investment manager and distributor. Gregory E. Johnson is considered to be interested person of the Trust under the federal securities laws due to his position as officer and director Resources.

Note 1: Charles B. Johnson and Rupert H. Johnson, Jr. are brothers and the father and uncle, respectively, of Gregory E. Johnson.

Note 2: Officer information is current as of the date of this report. It is possible that after this date, information about officers may change.

The Sarbanes-Oxley Act of 2002 and Rules adopted by the U.S. Securities and Exchange Commission require the Fund to disclose whether the Fund’s Audit Committee includes at least one member who is an audit committee financial expert within the meaning of such Act and Rules. The Fund’s Board has determined that there is at least one such financial expert on the Audit Committee and has designated each of Ann Torre Bates and David W. Niemiec as an audit committee financial expert. The Board believes that Ms. Bates and Mr. Niemiec qualify as such an expert in view of their extensive business background and experience. Ms. Bates has served as a member of the Fund Audit Committee since 2008. She currently serves as a director of SLM Corporation and Ares Capital Corporation and was formerly a director of Allied Capital Corporation from 2003 to 2010, Executive Vice President and Chief Financi al Officer of NHP Incorporated and Vice President and Treasurer of US Airways, Inc. Mr. Niemiec has served as a member of the Fund Audit Committee since 2005, currently serves as an Advisor to Saratoga Partners and was formerly its Managing Director from 1998 to 2001. Mr. Niemiec is formerly a director of Emeritus Corporation from 1999 to 2010 and OSI Pharmaceuticals, Inc. from 2006 to 2010, Managing Director of SBC Warburg Dillon Read from 1997 to 1998, and was Vice Chairman from 1991 to 1997 and Chief Financial Officer from 1982 to 1997 of Dillon, Read & Co. Inc. As a result of such background and experience, the Board believes that Ms. Bates and Mr. Niemiec have each acquired an understanding of generally accepted accounting principles and financial statements, the general application of such principles in connection with the accounting estimates, accruals and reserves, and analyzing and evaluating financial statements that present a breadth and level of complexity of accounting issues generally compa rable to those of the Fund, as well as an understanding of internal controls and procedures for financial reporting and an understanding of audit committee functions. Ms. Bates and Mr. Niemiec are independent Board members as that term is defined under the applicable U.S. Securities and Exchange Commission Rules and Releases.

The Statement of Additional Information (SAI) includes additional information about the board members and is available, without charge, upon request. Shareholders may call (800) DIAL BEN/(800) 342-5236 to request the SAI.

44 | Annual Report

Templeton Global Smaller Companies Fund

Shareholder Information

Board Review of Investment Management Agreement

At a meeting held May 18, 2010, the Board of Trustees (Board), including a majority of non-interested or independent Trustees, approved renewal of the investment management agreement for the Fund. In reaching this decision, the Board took into account information furnished throughout the year at regular Board meetings, as well as information prepared specifically in connection with the annual renewal review process. Information furnished and discussed throughout the year included investment performance reports and related financial information for the Fund, as well as periodic reports on shareholder services, legal, compliance, pricing, brokerage commissions and execution and other services provided by the Investment Manager (Manager) and its affiliates. Information furnished specifically in connection with the renewal process included a report for the Fund prepared by Lipper, Inc. (Lipper), an independent o rganization, as well as additional material, including a Fund profitability analysis report prepared by management. The Lipper report compared the Fund’s investment performance and expenses with those of other mutual funds deemed comparable to the Fund as selected by Lipper. The Fund profitability analysis report discussed the profitability to Franklin Templeton Investments from its overall U.S. fund operations, as well as on an individual fund-by-fund basis. Included with such profitability analysis report was information on a fund-by-fund basis listing portfolio managers and other accounts they manage, as well as information on management fees charged by the Manager and its affiliates to U.S. mutual funds and other accounts, including management’s explanation of differences where relevant and a three-year expense analysis with an explanation for any increase in expense ratios. Additional material accompanying such report was a memorandum prepared by management describing project initiatives and c apital investments relating to the services provided to the Fund by the Franklin Templeton Investments organization, as well as a memorandum relating to economies of scale and a comparative analysis concerning transfer agent fees charged the Fund.

In considering such materials, the independent Trustees received assistance and advice from and met separately with independent counsel. In approving continuance of the investment management agreement for the Fund, the Board, including a majority of independent Trustees, determined that the existing management fee structure was fair and reasonable and that continuance of the investment management agreement was in the best interests of the Fund and its shareholders. While attention was given to all information furnished, the following discusses some primary factors relevant to the Board’s decision.

NATURE, EXTENT AND QUALITY OF SERVICES. The Board was satisfied with the nature and quality of the overall services provided by the Manager and its affiliates to the Fund and its shareholders. In addition to investment performance and expenses discussed later, the Board’s opinion was based, in part, upon periodic reports furnished it showing that the investment policies and restrictions for the Fund were consistently complied with as well as other reports periodically furnished the Board covering matters such as the compliance of portfolio managers and other management personnel with the code of ethics adopted throughout the Franklin Templeton fund complex, the adherence to fair value pricing procedures established by the Board, and the accuracy

Annual Report | 45

Templeton Global Smaller Companies Fund

Shareholder Information (continued)

Board Review of Investment Management Agreement (continued)

of net asset value calculations. The Board also noted the extent of benefits provided Fund shareholders from being part of the Franklin Templeton family of funds, including the right to exchange investments between the same class of funds without a sales charge, the ability to reinvest Fund dividends into other funds and the right to combine holdings in other funds to obtain a reduced sales charge. Favorable consideration was given to management’s continuous efforts and expenditures in establishing back-up systems and recovery procedures to function in the event of a natural disaster, it being noted that such systems and procedures had functioned smoothly during the Florida hurricanes and blackouts experienced in recent years. Among other factors taken into account by the Board were the Manager’s best execution trading policies, including a favorable report by an independent portfolio trading analy tical firm. Consideration was also given to the experience of the Fund’s portfolio management team, the number of accounts managed and general method of compensation. In this latter respect, the Board noted that a primary factor in management’s determination of a portfolio manager’s bonus compensation was the relative investment performance of the funds he or she managed and that a portion of such bonus was required to be invested in a predesignated list of funds within such person’s fund management area so as to be aligned with the interests of Fund shareholders. The Board also took into account the transfer agent and shareholder services provided Fund shareholders by an affiliate of the Manager, noting continuing expenditures by management to increase and improve the scope of such services, periodic favorable reports on such service conducted by third parties, and the continuous enhancements to and high industry ranking given the Franklin Templeton website. Particular attention was give n to management’s conservative approach and diligent risk management procedures, including continuous monitoring of counterparty credit risk and attention given to derivatives and other complex instruments. The Board also took into account, among other things, management’s efforts in establishing a global credit facility for the benefit of the Fund and other accounts managed by Franklin Templeton Investments to provide a source of cash for temporary and emergency purposes or to meet unusual redemption requests as well as the strong financial position of the Manager’s parent company and its commitment to the mutual fund business as evidenced by its subsidization of money market funds. The Board also noted management’s efforts to minimize any negative impact on the nature and quality of services provided the Fund arising from Franklin Templeton Investments’ implementation of a hiring freeze and employee reductions in response to market conditions during the latter part of 2008 and earl y 2009.

INVESTMENT PERFORMANCE. The Board placed significant emphasis on the investment performance of the Fund in view of its importance to shareholders. While consideration was given to performance reports and discussions with portfolio managers at Board meetings during the year, particular attention in assessing such performance was given to the Lipper report furnished for the agreement renewal. The Lipper report prepared for the Fund showed the investment performance of its Class A shares for the one-year period ended February 28, 2010, as well as the previous 10 years ended on such date in comparison to a performance universe consisting of the Fund and all retail and institutional global small/mid-cap funds as selected by Lipper. On a comparative basis,

46 | Annual Report

Templeton Global Smaller Companies Fund

Shareholder Information (continued)

Board Review of Investment Management Agreement (continued)

the Lipper report showed the Fund’s total return to be in the highest quintile of such performance universe for the one-year period, and on an annualized basis to be in the middle quintile of such performance universe for the previous three- and five-year periods and the highest quintile of such performance universe for the previous 10-year period. The Board found such comparative performance to be satisfactory.

COMPARATIVE EXPENSES. Consideration was given to a comparative analysis of the management fee and total expense ratio of the Fund compared with those of a group of other funds selected by Lipper as its appropriate Lipper expense group. Lipper expense data is based upon information taken from each fund’s most recent annual report, which reflects historical asset levels that may be quite different from those currently existing, particularly in a period of market volatility. While recognizing such inherent limitation and the fact that expense ratios generally increase as assets decline and decrease as assets grow, the Board believed the independent analysis conducted by Lipper to be an appropriate measure of comparative expenses. In reviewing comparative costs, Lipper provides information on the Fund’s contractual i nvestment management fee in comparison with the contractual investment management fee that would have been charged by other funds within its Lipper expense group assuming they were similar in size to the Fund, as well as the actual total expenses of the Fund in comparison with those of its Lipper expense group. The Lipper contractual investment management fee analysis includes administrative charges as being part of a management fee, and total expenses, for comparative consistency, are shown by Lipper for Fund Class A shares. The results of such expense comparisons showed that the contractual investment management fee rate for the Fund was in the middle quintile of its Lipper expense group while its actual total expense ratio was in the least expensive quintile of such group. The Board was satisfied with the management fee and total expense ratio of the Fund in comparison to its Lipper expense group.

MANAGEMENT PROFITABILITY. The Board also considered the level of profits realized by the Manager and its affiliates in connection with the operation of the Fund. In this respect, the Board reviewed the Fund profitability analysis that addresses the overall profitability of Franklin Templeton’s U.S. fund business, as well as its profits in providing management and other services to the Fund during the 12-month period ended September 30, 2009, being the most recent fiscal year-end for Franklin Resources, Inc., the Manager’s parent. In reviewing the analysis, attention was given to the methodology followed in allocating costs to the Fund, it being recognized that allocation methodologies are inherently subjective and various allocation methodologies may each be reasonable while producing different results. In this r espect, the Board noted that, while being continuously refined and reflecting changes in the Manager’s own cost accounting, the allocation methodology was consistent with that followed in profitability report presentations for the Fund made in prior years and that the Fund’s independent registered public accounting firm had been engaged by the Manager to review the reasonableness of the allocation methodologies solely for use by the Fund’s Board in reference to the profitability analysis. In reviewing and discussing such analysis, management discussed with the Board its belief that costs incurred in establishing the infrastructure necessary for the type of mutual fund operations conducted by the Manager

Templeton Global Smaller Companies Fund

Shareholder Information (continued)

Board Review of Investment Management Agreement (continued)

and its affiliates may not be fully reflected in the expenses allocated to the Fund in determining its profitability, as well as the fact that the level of profits, to a certain extent, reflected operational cost savings and efficiencies initiated by management. The Board also took into account management’s expenditures in improving shareholder services provided the Fund, as well as the need to meet additional regulatory and compliance requirements resulting from the Sarbanes-Oxley Act and recent SEC and other regulatory requirements. In addition, the Board considered a third-party study comparing the profitability of the Manager’s parent on an overall basis to other publicly held managers broken down to show profitability from management operations exclusive of distribution expenses, as well as profitability including distribution expenses. The Board also considered the extent to which the Manager and its affiliates might derive ancillary benefits from fund operations, including its interest in a joint venture entity that financed up-front commissions paid to brokers/dealers who sold fund Class B shares prior to February 2005 when the offering of such shares was discontinued, as well as potential benefits resulting from allocation of fund brokerage and the use of commission dollars to pay for research. Based upon its consideration of all these factors, the Board determined that the level of profits realized by the Manager and its affiliates from providing services to the Fund was not excessive in view of the nature, quality and extent of services provided.

ECONOMIES OF SCALE. The Board also considered whether economies of scale are realized by the Manager as the Fund grows larger and the extent to which this is reflected in the level of management fees charged. While recognizing that any precise determination is inherently subjective, the Board noted that based upon the Fund profitability analysis, it appears that as some funds get larger, at some point economies of scale do result in the Manager realizing a larger profit margin on management services provided such a fund. The Board also noted that economies of scale are shared with a fund and its shareholders through management fee breakpoints so that as a fund grows in size, its effective management fee rate declines. The Fund’s investment management agreement provides a fee at the rate of 0.75% on the first $1 billio n of Fund net assets; 0.73% on the next $4 billion of Fund net assets; with further breakpoints continuing thereafter up to the $20 billion level of Fund net assets. The Fund is also charged a separate fee for administrative services that starts at 0.15% on the first $200 million of Fund net assets, and declines through breakpoints to a fixed rate of 0.075% after net assets reach the $1.2 billion level. In discussing such fee structure, management stated its view that it starts with a relatively low rate reflecting anticipated economies of scale as the Fund’s assets increase and pointed out the Fund’s favorable effective management fee rate and actual total expense rate as previously discussed under “Comparative Expenses.” At the end of 2009, the Fund’s net assets were approximately $1 billion, and to the extent economies of scale may be realized by the Manager and its affiliates, the Board believes the schedules of fees under the investment management agreement provide a sharing of benefits with the Fund and its shareholders.

48 | Annual Report

Templeton Global Smaller Companies Fund

Shareholder Information (continued)

Proxy Voting Policies and Procedures

The Fund’s investment manager has established Proxy Voting Policies and Procedures (Policies) that the Fund uses to determine how to vote proxies relating to portfolio securities. Shareholders may view the Fund’s complete Policies online at franklintempleton.com. Alternatively, shareholders may request copies of the Policies free of charge by calling the Proxy Group collect at (954) 527-7678 or by sending a written request to: Franklin Templeton Companies, LLC, 500 East Broward Boulevard, Suite 1500, Fort Lauderdale, FL 33394, Attention: Proxy Group. Copies of the Fund’s proxy voting records are also made available online at franklintempleton.com and posted on the U.S. Securities and Exchange Commission’s website at sec.gov and reflect the most recent 12-month period ended June 30.

Quarterly Statement of Investments

The Fund files a complete statement of investments with the U.S. Securities and Exchange Commission for the first and third quarters for each fiscal year on Form N-Q. Shareholders may view the filed Form N-Q by visiting the Commission’s website at sec.gov. The filed form may also be viewed and copied at the Commission’s Public Reference Room in Washington, DC. Information regarding the operations of the Public Reference Room may be obtained by calling (800) SEC-0330.

Householding of Reports and Prospectuses

You will receive the Fund’s financial reports every six months as well as an annual updated summary prospectus (prospectus available upon request). To reduce Fund expenses, we try to identify related shareholders in a household and send only one copy of the financial reports and summary prospectus. This process, called “householding,” will continue indefinitely unless you instruct us otherwise. If you prefer not to have these documents householded, please call us at (800) 632-2301. At any time you may view current prospectuses/summary prospectuses and financial reports on our website. If you choose, you may receive these documents through electronic delivery.

Annual Report | 49

This page intentionally left blank.

This page intentionally left blank.

This page intentionally left blank.

| | Sign up for electronic delivery

on franklintempleton. com |

Annual Report and Shareholder Letter

TEMPLETON GLOBAL SMALLER

COMPANIES FUND

| | Investment Manager

Franklin Templeton Investments Corp.

Subadvisor

Templeton Investment Counsel, LLC

Principal Underwriter

Franklin Templeton Distributors, Inc.

(800) DIAL BEN®

franklintempleton. com

Shareholder Services

(800) 632-2301 |