in global developed markets.1 Please note index performance information is provided for reference and we do not attempt to track the index but rather undertake investments on the basis of fundamental research. You can find the Fund’s long-term performance data in the Performance Summary beginning on page 9.

Economic and Market Overview

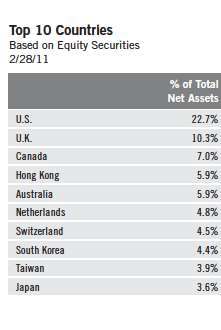

Global equities generally delivered strong gains for the six-month period as investors responded to improving economic conditions and solid corporate earnings growth, backstopped by continued policy support from the developed world’s central banks. In the U.S., the world’s largest economy, growth as measured by gross domestic product increased the most in five years, manufacturing expanded and consumer sentiment hit a three-year high after the Federal Reserve initiated a second round of quantitative easing and the Obama administration extended Bush-era tax cuts. In Europe, manufacturing accelerated at its fastest pace in more than a decade and confidence in the economic outlook improved. Results were uneven, however, with core countries such as Germany and France exhibiting strong, export-led growth, while other countries such as Greece, Portugal and Ireland suffered from fiscal spending cuts and rising unemployment. Ireland was forced to accept an 85 billion euro bailout from the European Union (EU) in November after benchmark 10-year bond yields soared and the country’s fiscal deficit ballooned. Sovereign credit concerns in the region remained high at period-end and officials agreed to double the amount of the EU’s rescue facility by the year 2013.

Emerging market growth remained robust, though regional policymakers raised interest rates and bank reserve requirements to combat inflation and discourage speculation. China, Russia, India, Brazil, South Korea, Indonesia and Thailand were among the major emerging markets that raised interest rates during the six-month period. Still, emerging market inflation remained elevated and many countries, China and India included, had negative real interest rates at period-end. Global food prices hit their highest levels on record during the period under review, helping incite a wave of protests and uprisings across North Africa and the Middle East that resulted in the ouster of Egyptian and Tunisian leaders and significant unrest in Libya. The regional instability led to a sell-off in emerging market equities at period-end, and the price of oil rose to its highest level since 2008 due to concerns of supply disruption. In currency markets, the euro advanced against the Japanese yen and

1. Source: © 2011 Morningstar. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. The index is unmanaged and includes reinvested dividends. One cannot invest directly in an index, and an index is not representative of the Fund’s portfolio.

U.S. dollar, and many Asian currencies also exhibited strength as central bankers tightened monetary policy. In fixed income markets, yields on most sovereign debt and investment-grade corporate bonds rose, reflecting elevated growth and inflation expectations. In equity markets, economic and commodity price-sensitive sectors such as materials, energy and industrials continued to exhibit leadership, while regionally, developed markets outpaced emerging markets.

Investment Strategy

At Templeton, when choosing investments for the Fund, we take a bottom-up, value-oriented, long-term approach, focusing on the market price of a company’s securities relative to our evaluation of the company’s long-term earnings, asset value and cash flow growth potential. We also consider the company’s price/earnings ratio, profit margins and liquidation value.

Manager’s Discussion

Several holdings performed well in absolute and relative terms during the six months under review. Canaccord Financial2 is Canada’s largest independent brokerage firm. During the period, its shares made gains as the company announced quarterly results well above market expectations. Looking at the longer term, we believe the company’s strong relationships with issuers and institutional clients could lead to increased business activity as markets recover. In addition, we believe Canaccord effectively reduced its workforce during 2009’s economic downturn to a level appropriate for the current business environment.

Emeco Holdings2 is a leading Australian supplier of heavy earthmoving equipment to the global mining industry. The company focuses on coal and gold and has a growing presence in iron ore. The company’s share price rose strongly during the review period as its second-half performance benefited from greater demand, an exit from underperforming U.S. and European operations, and renewed Australian mining industry sentiment after the demise of a planned mineral tax.

Swiss freight forwarder Panalpina Welttransport Holding’s2 second-quarter result beat market expectations, as its improved technology systems benefited margins, and a rise in investor optimism about world trade prospects boosted shares. Freight forwarding is Panalpina’s core operation, accounting for about 88% of its revenue. It is one of the world’s largest air freight forwarders and

| 2. This holding is not an index component. |

Semiannual Report | 5

the largest ocean freight forwarder. Looking at the longer term, business fundamentals were solid at period-end, in our view, as the company carries a strong balance sheet with net cash. According to our analysis, its business model is asset light, high return, and highly cash generative, and we believe the company has sufficient scale to maintain its competitive position.

In contrast, the Fund had some detractors from absolute and relative performance during the reporting period. Descente2 is a leading Japanese sports apparel manufacturer and wholesaler. During the period, the company revised downward its sales forecast, exacerbating pressures placed on its stock by a weak overall market and investor concerns about trade tensions with China. Looking at the longer term, however, the business is cash generative and the company has a solid balance sheet. Descente owns well-known brands and, although the domestic market is mature, we believe continued successful expansion overseas could provide necessary growth.

U.S.-based K-Swiss2 designs, develops and markets athletic footwear for sports use, fitness activities and casual wear. Although the company’s shares gained value after investors became confident that an improved product range found favor with customers, shares lost value for the reporting period overall. Looking ahead, in our view the company’s new product range could benefit margins and lead to improved share-price performance.

Alapis Holding Industrial and Commercial2 is a leading Greek pharmaceutical business. During the period, its share price fell sharply due to worries about the impact of government efforts to cut health care costs and potential debt refinancing problems. However, the company sells low-cost drugs, and we believe the government’s austerity measures could fuel demand for Alapis’ products rather than curtail it. Based on our analysis, we believe the market may eventually recognize the company’s fundamental strength and reward it with a higher valuation.

It is important to recognize the effect of currency movements on the Fund’s performance. In general, if the value of the U.S. dollar goes up compared with a foreign currency, an investment traded in that foreign currency will go down in value because it will be worth fewer U.S. dollars. This can have a negative effect on Fund performance. Conversely, when the U.S. dollar weakens in relation to a foreign currency, an investment traded in that foreign currency will increase in value, which can contribute to Fund performance. For the six months ended February 28, 2011, the U.S. dollar declined in value relative to most currencies. As a result, the Fund’s performance was positively affected by the portfolio’s investment primarily in securities with non-U.S. currency exposure. However, one cannot expect the same result in future periods.

6 | Semiannual Report

Martin Cobb assumed portfolio manager responsibilities for Templeton Global Smaller Companies Fund in February 2011. He joined Franklin Templeton in 2003 and manages several global equity portfolios. His research responsibilities are U.S. banks and financials, as well as the U.K. and the Republic of Ireland.

Prior to joining Franklin Templeton Investments, Mr. Cobb was an investment manager with SVM Asset Management in Edinburgh, where he specialized in U.K. equities. Prior to this position, he worked for First State Investments where, as senior portfolio manager, U.K. equities, he managed their flagship U.K. equities fund as well as several global portfolios for institutional and retail clients. He began his career in investment management with Baillie Gifford as an equities analyst, after which he assumed responsibility for the management of several institutional client portfolios.

8 | Semiannual Report

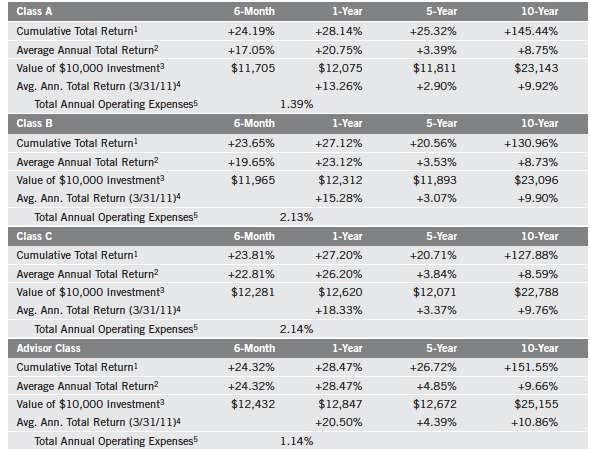

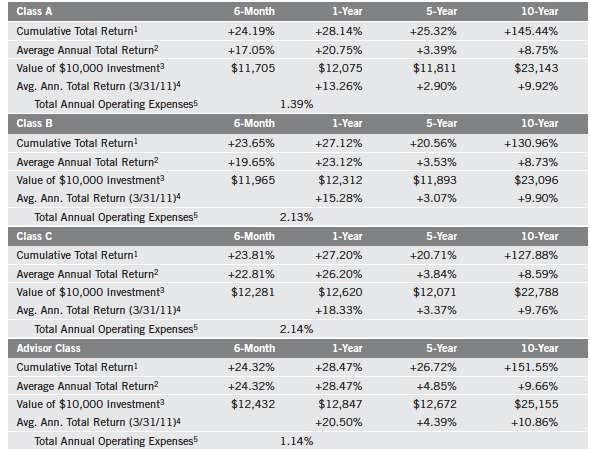

Performance Summary as of 2/28/11

Your dividend income will vary depending on dividends or interest paid by securities in the Fund’s portfolio, adjusted for operating expenses of each class. Capital gain distributions are net profits realized from the sale of portfolio securities. The performance table does not reflect any taxes that a shareholder would pay on Fund dividends, capital gain distributions, if any, or any realized gains on the sale of Fund shares. Total return reflects reinvestment of the Fund’s dividends and capital gain distributions, if any, and any unrealized gains or losses.

Semiannual Report | 9

Performance Summary (continued)

Performance

Cumulative total return excludes sales charges. Average annual total returns and value of $10,000 investment include maximum sales charges. Class A: 5.75% maximum initial sales charge; Class B: contingent deferred sales charge (CDSC) declining from 4% to 1% over six years, and eliminated thereafter; Class C: 1% CDSC in first year only; Advisor Class: no sales charges.

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, go to franklintempleton.com or call (800) 342-5236.

10 | Semiannual Report

Performance Summary (continued)

Endnotes

Special risks are associated with foreign investing, including currency fluctuations, economic instability and political developments. Investments in emerging markets involve heightened risks related to the same factors, in addition to those associated with these markets’ smaller size and lesser liquidity. In addition, smaller company stocks have historically exhibited greater price volatility than large-company stocks, particularly over the short term. The manager applies various techniques and analyses in making investment decisions for the Fund, but there can be no guarantee that these decisions will produce the desired results. The Fund’s prospectus also includes a description of the main investment risks.

| | |

Class B: Class C: | | These shares have higher annual fees and expenses than Class A shares. Prior to 1/1/04, these shares were offered with an initial sales charge; thus actual total returns would have differed. These shares have higher annual fees and expenses than Class A shares. |

Advisor Class: | | Shares are available to certain eligible investors as described in the prospectus. |

1. Cumulative total return represents the change in value of an investment over the periods indicated.

2. Average annual total return represents the average annual change in value of an investment over the periods indicated. Six-month return has not been annualized.

3. These figures represent the value of a hypothetical $10,000 investment in the Fund over the periods indicated.

4. In accordance with SEC rules, we provide standardized average annual total return information through the latest calendar quarter.

5. Figures are as stated in the Fund’s prospectus current as of the date of this report. In periods of market volatility, assets may decline significantly, causing total annual Fund operating expenses to become higher than the figures shown.

Semiannual Report | 11

Your Fund’s Expenses

As a Fund shareholder, you can incur two types of costs:

Transaction costs, including sales charges (loads) on Fund purchases; and

Ongoing Fund costs, including management fees, distribution and service (12b-1) fees, and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses.

The following table shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The first line (Actual) for each share class listed in the table provides actual account values and expenses. The “Ending Account Value” is derived from the Fund’s actual return, which includes the effect of Fund expenses.

You can estimate the expenses you paid during the period by following these steps. Of course, your account value and expenses will differ from those in this illustration:

| 1. | Divide your account value by $1,000. |

| | If an account had an $8,600 value, then $8,600 ÷ $1,000 = 8.6. |

| 2. | Multiply the result by the number under the heading “Expenses Paid During Period.” |

| | If Expenses Paid During Period were $7.50, then 8.6 x $7.50 = $64.50. |

In this illustration, the estimated expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Information in the second line (Hypothetical) for each class in the table can help you compare ongoing costs of investing in the Fund with those of other mutual funds. This information may not be used to estimate the actual ending account balance or expenses you paid during the period. The hypothetical “Ending Account Value” is based on the actual expense ratio for each class and an assumed 5% annual rate of return before expenses, which does not represent the Fund’s actual return. The figure under the heading “Expenses Paid During Period” shows the hypothetical expenses your account would have incurred under this scenario. You can compare this figure with the 5% hypothetical examples that appear in shareholder reports of other funds.

12 | Semiannual Report

Your Fund’s Expenses (continued)

Please note that expenses shown in the table are meant to highlight ongoing costs and do not reflect any transaction costs, such as sales charges. Therefore, the second line for each class is useful in comparing ongoing costs only, and will not help you compare total costs of owning different funds. In addition, if transaction costs were included, your total costs would have been higher. Please refer to the Fund prospectus for additional information on operating expenses.

*Expenses are calculated using the most recent six-month expense ratio, annualized for each class (A: 1.37%; B: 2.11%; C: 2.12%; and Advisor: 1.12%), multiplied by the average account value over the period, multiplied by 181/365 to reflect the one-half year period.

Semiannual Report | 13

Templeton Global Smaller Companies Fund

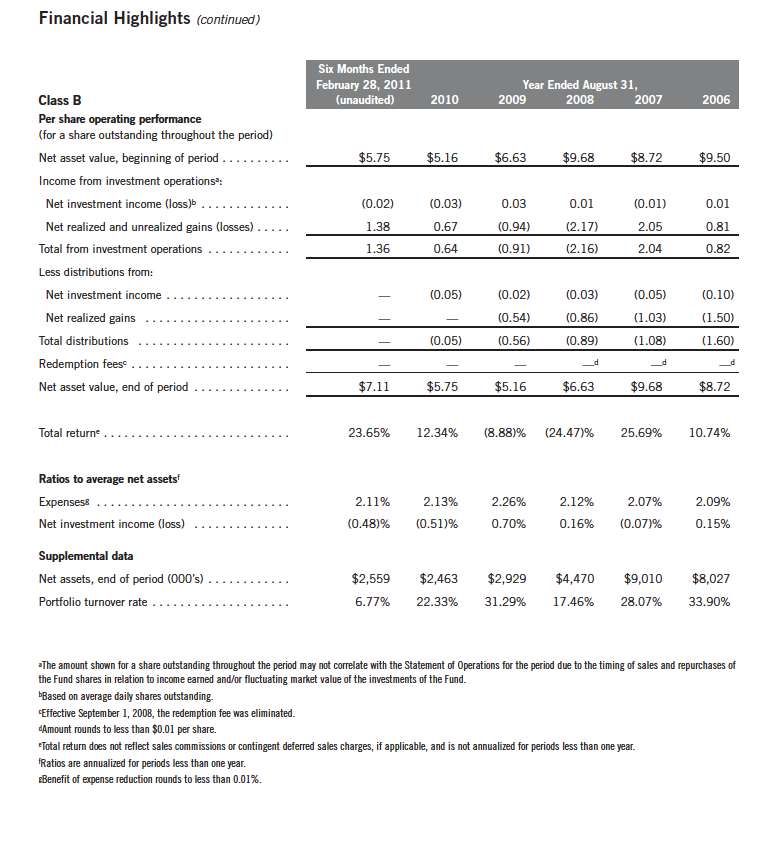

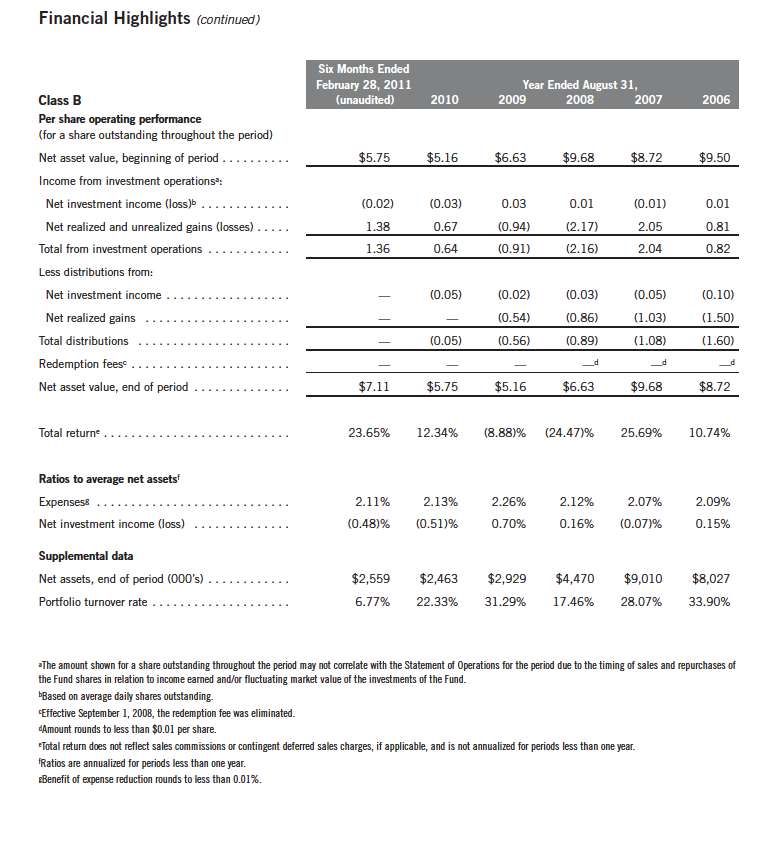

Financial Highlights

14 | The accompanying notes are an integral part of these financial statements. | Semiannual Report

Templeton Global Smaller Companies Fund

Semiannual Report | The accompanying notes are an integral part of these financial statements. | 15

Templeton Global Smaller Companies Fund

16 | The accompanying notes are an integral part of these financial statements. | Semiannual Report

Templeton Global Smaller Companies Fund

Semiannual Report | The accompanying notes are an integral part of these financial statements. | 17

Templeton Global Smaller Companies Fund

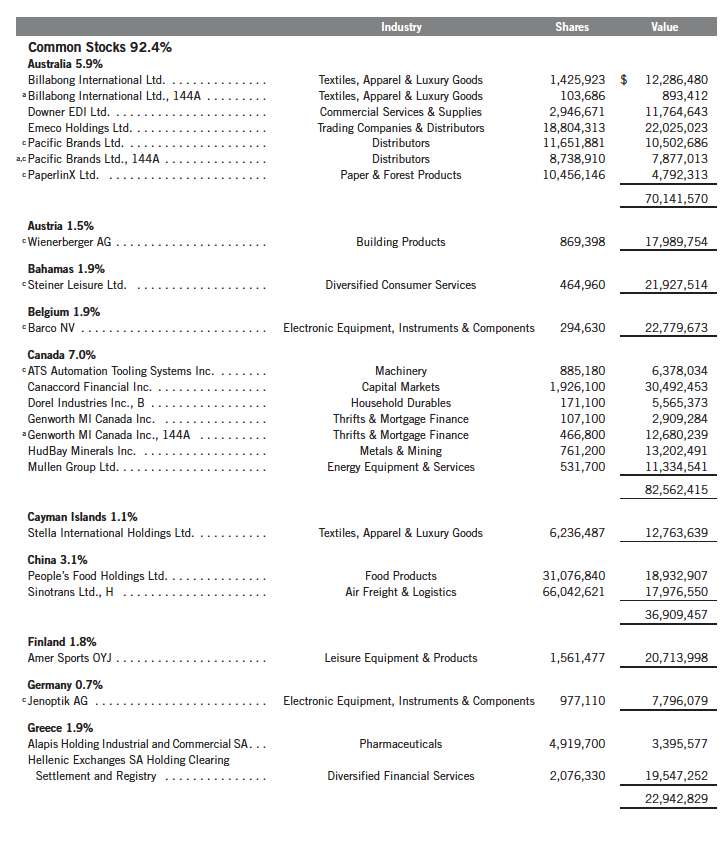

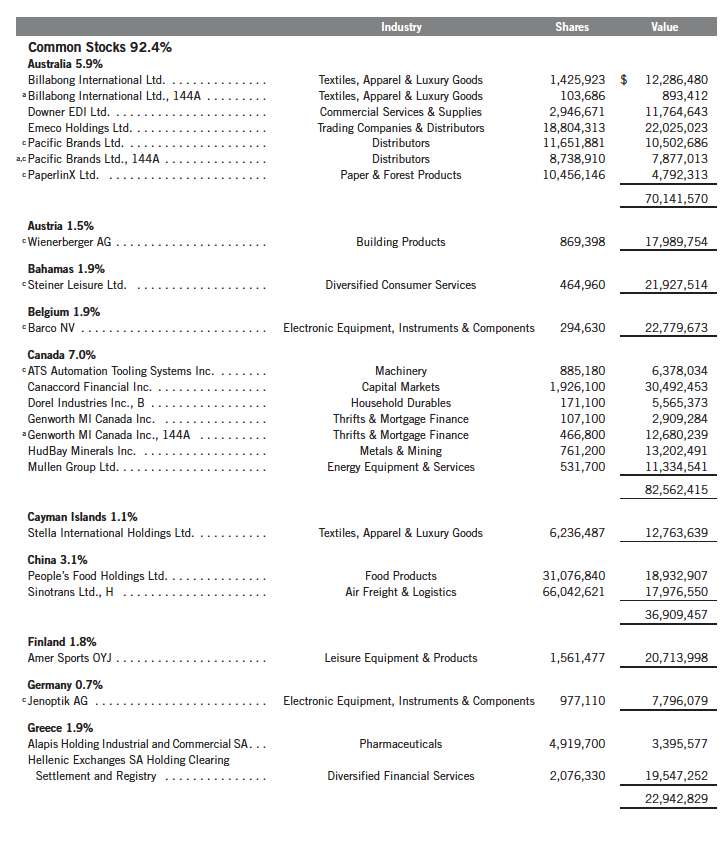

Statement of Investments, February 28, 2011 (unaudited)

18 | Semiannual Report

Templeton Global Smaller Companies Fund

Semiannual Report | 19

Templeton Global Smaller Companies Fund

20 | Semiannual Report

Templeton Global Smaller Companies Fund

Semiannual Report | The accompanying notes are an integral part of these financial statements. | 21

Templeton Global Smaller Companies Fund

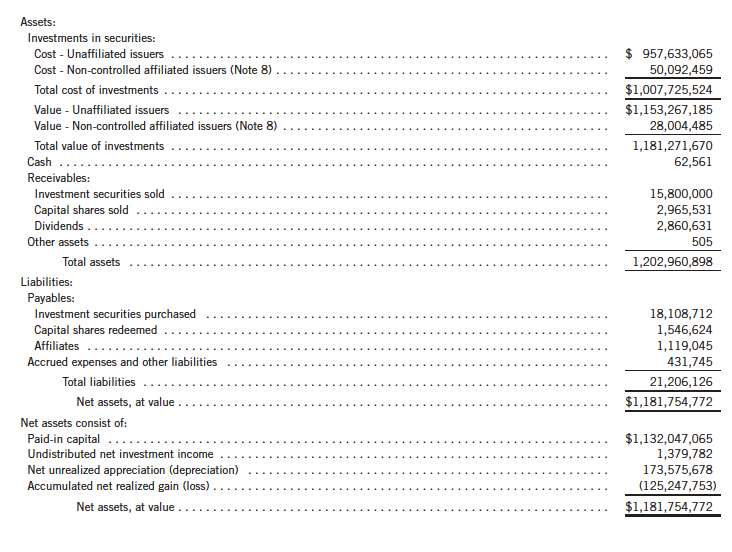

Financial Statements

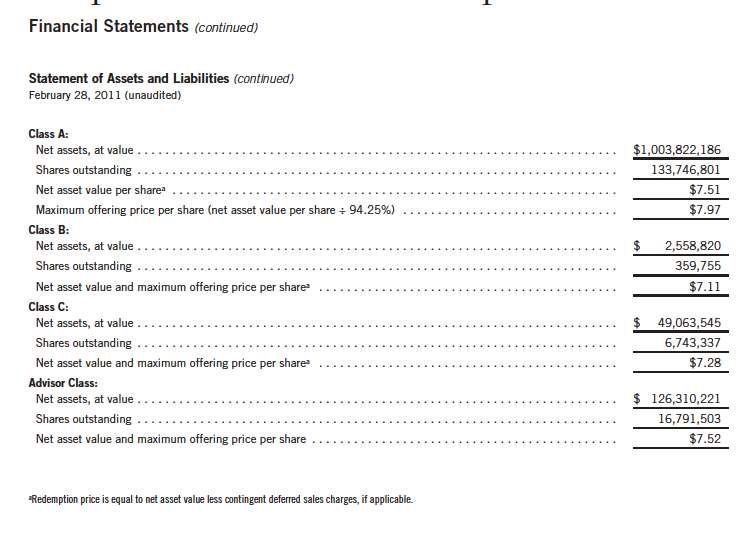

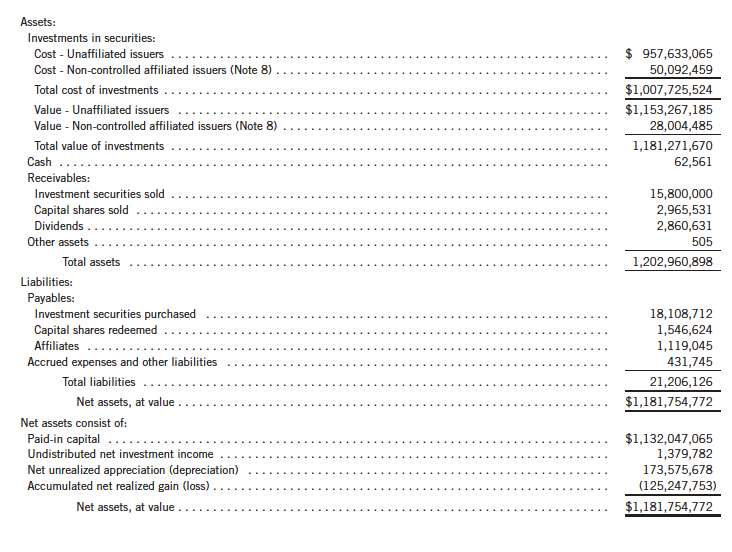

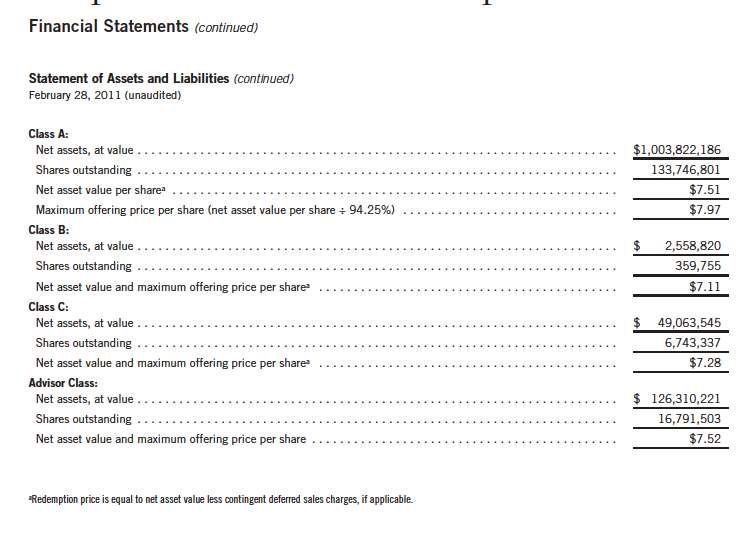

| | Statement of Assets and Liabilities

February 28, 2011 (unaudited) |

22 | The accompanying notes are an integral part of these financial statements. | Semiannual Report

Templeton Global Smaller Companies Fund

Semiannual Report | The accompanying notes are an integral part of these financial statements. | 23

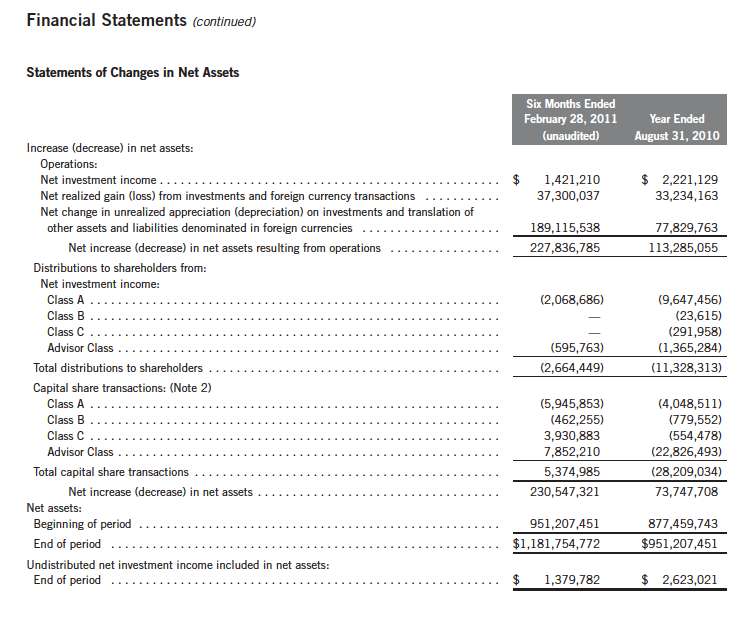

Templeton Global Smaller Companies Fund

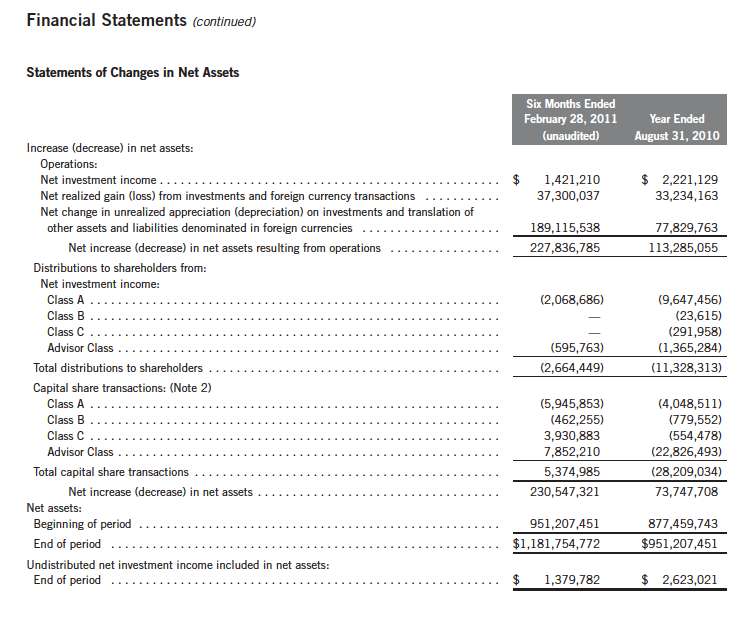

Financial Statements (continued)

| | Statement of Operations

for the six months ended February 28, 2011 (unaudited) |

24 | The accompanying notes are an integral part of these financial statements. | Semiannual Report

Templeton Global Smaller Companies Fund

Semiannual Report | The accompanying notes are an integral part of these financial statements. | 25

Templeton Global Smaller Companies Fund

Notes to Financial Statements (unaudited)

1. ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES

Templeton Global Smaller Companies Fund (Fund) is registered under the Investment Company Act of 1940, as amended, (1940 Act) as an open-end investment company. The Fund offers four classes of shares: Class A, Class B, Class C, and Advisor Class. Each class of shares differs by its initial sales load, contingent deferred sales charges, distribution fees, voting rights on matters affecting a single class and its exchange privilege.

The following summarizes the Fund’s significant accounting policies.

a. Financial Instrument Valuation

The Fund’s investments in securities and other financial instruments are carried at fair value daily. Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants on the measurement date. Under procedures approved by the Fund’s Board of Trustees, the Fund may utilize independent pricing services, quotations from securities and financial instrument dealers, and other market sources to determine fair value.

Equity securities listed on an exchange or on the NASDAQ National Market System are valued at the last quoted sale price or the official closing price of the day, respectively. Foreign equity securities are valued as of the close of trading on the foreign stock exchange on which the security is primarily traded, or the NYSE, whichever is earlier. The value is then converted into its U.S. dollar equivalent at the foreign exchange rate in effect at the close of the NYSE on the day that the value of the security is determined. Over-the-counter securities are valued within the range of the most recent quoted bid and ask prices. Securities that trade in multiple markets or on multiple exchanges are valued according to the broadest and most representative market. Certain equity securities are valued based upon fundamental characteristics or relationships to similar securities.

Debt securities generally trade in the over-the-counter market rather than on a securities exchange. The Fund’s pricing services use multiple valuation techniques to determine fair value. In instances where sufficient market activity exists, the pricing services may utilize a market-based approach through which quotes from market makers are used to determine fair value. In instances where sufficient market activity may not exist or is limited, the pricing services also utilize proprietary valuation models which may consider market characteristics such as benchmark yield curves, option-adjusted spreads, credit spreads, estimated default rates, coupon rates, anticipated timing of principal repayments, underlying collateral, and other unique security features in order to estimate the relevant cash flows, which are then discounted to calculate the fair value.

The Fund has procedures to determine the fair value of securities and other financial instruments for which market prices are not readily available or which may not be reliably priced.

26 | Semiannual Report

Templeton Global Smaller Companies Fund

Notes to Financial Statements (unaudited) (continued)

| 1. | ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES (continued) |

| a. | Financial Instrument Valuation (continued) |

Under these procedures, the Fund primarily employs a market-based approach which may use related or comparable assets or liabilities, recent transactions, market multiples, book values, and other relevant information for the investment to determine the fair value of the investment. The Fund may also use an income-based valuation approach in which the anticipated future cash flows of the investment are discounted to calculate fair value. Discounts may also be applied due to the nature or duration of any restrictions on the disposition of the investments. Due to the inherent uncertainty of valuations of such investments, the fair values may differ significantly from the values that would have been used had an active market existed.

Trading in securities on foreign securities stock exchanges and over-the-counter markets may be completed before the daily close of business on the NYSE. Occasionally, events occur between the time at which trading in a foreign security is completed and the close of the NYSE that might call into question the reliability of the value of a portfolio security held by the Fund. As a result, differences may arise between the value of the Fund’s portfolio securities as determined at the foreign market close and the latest indications of value at the close of the NYSE. In order to minimize the potential for these differences, the investment manager monitors price movements following the close of trading in foreign stock markets through a series of country specific market proxies (such as baskets of American Depository Receipts, futures contracts and exchange traded funds). These price movements are measured against established trigger thresholds for each specific market proxy to assist in determining if an event has occurred that may call into question the reliability of the values of the foreign securities held by the Fund. If such an event occurs, the securities may be valued using fair value procedures, which may include the use of independent pricing services.

b. Foreign Currency Translation

Portfolio securities and other assets and liabilities denominated in foreign currencies are translated into U.S. dollars based on the exchange rate of such currencies against U.S. dollars on the date of valuation. The Fund may enter into foreign currency exchange contracts to facilitate transactions denominated in a foreign currency. Purchases and sales of securities, income and expense items denominated in foreign currencies are translated into U.S. dollars at the exchange rate in effect on the transaction date. Portfolio securities and assets and liabilities denominated in foreign currencies contain risks that those currencies will decline in value relative to the U.S. dollar. Occasionally, events may impact the availability or reliability of foreign exchange rates used to convert the U.S. dollar equivalent value. If such an event occurs, the foreign exchange rate will be valued at fair value using procedures established and approved by the Fund’s Board of Trustees.

The Fund does not separately report the effect of changes in foreign exchange rates from changes in market prices on securities held. Such changes are included in net realized and unrealized gain or loss from investments on the Statement of Operations.

Semiannual Report | 27

Templeton Global Smaller Companies Fund

Notes to Financial Statements (unaudited) (continued)

| 1. | ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES (continued) |

| b. | Foreign Currency Translation (continued) |

Realized foreign exchange gains or losses arise from sales of foreign currencies, currency gains or losses realized between the trade and settlement dates on securities transactions and the difference between the recorded amounts of dividends, interest, and foreign withholding taxes and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized foreign exchange gains and losses arise from changes in foreign exchange rates on foreign denominated assets and liabilities other than investments in securities held at the end of the reporting period.

c. Income Taxes

It is the Fund’s policy to qualify as a regulated investment company under the Internal Revenue Code. The Fund intends to distribute to shareholders substantially all of its taxable income and net realized gains to relieve it from federal income and excise taxes. As a result, no provision for U.S. federal income taxes is required. The Fund files U.S. income tax returns as well as tax returns in certain other jurisdictions. The Fund’s application of those tax rules is subject to its understanding. The Fund records a provision for taxes in its financial statements including penalties and interest, if any, for a tax position taken on a tax return (or expected to be taken) when it fails to meet the more likely than not (a greater than 50% probability) threshold and based on the technical merits, the tax position may not be sustained upon examination by the tax authorities. As of February 28, 2011, and for all open tax years the Fund has determined that no provision for income tax is required in the Fund’s financial statements. Open tax years are those that remain subject to examination and are based on each tax jurisdiction statute of limitation. The Fund is not aware of any tax position for which it is reasonably possible that the total amounts of unrecognized tax effects will significantly change in the next twelve months.

The Fund may be subject to foreign taxation related to income received, capital gains on the sale of securities and certain foreign currency transactions in the foreign jurisdictions in which it invests. Foreign taxes, if any, are recorded based on the tax regulations and rates that exist in the foreign markets in which the Fund invests. When a capital gain tax is determined to apply the Fund records an estimated deferred tax liability for unrealized gains on these securities in an amount that would be payable if the securities were disposed of on the valuation date.

d. Security Transactions, Investment Income, Expenses and Distributions

Security transactions are accounted for on trade date. Realized gains and losses on security transactions are determined on a specific identification basis. Interest income and estimated expenses are accrued daily. Amortization of premium and accretion of discount on debt securities are included in interest income. Dividend income is recorded on the ex-dividend date except that certain dividends from foreign securities are recognized as soon as the Fund is notified of the ex-dividend date. Distributions to shareholders are recorded on the ex-dividend date and are determined according to income tax regulations (tax basis). Distributable earnings determined on a tax basis may differ from earnings recorded in accordance with accounting principles generally accepted in the United States of America. These differences may be permanent or

28 | Semiannual Report

Templeton Global Smaller Companies Fund

Notes to Financial Statements (unaudited) (continued)

| 1. | ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES (continued) |

| d. | Security Transactions, Investment Income, Expenses and Distributions (continued) |

temporary. Permanent differences are reclassified among capital accounts to reflect their tax character. These reclassifications have no impact on net assets or the results of operations. Temporary differences are not reclassified, as they may reverse in subsequent periods.

Realized and unrealized gains and losses and net investment income, not including class specific expenses, are allocated daily to each class of shares based upon the relative proportion of net assets of each class. Differences in per share distributions, by class, are generally due to differences in class specific expenses.

e. Accounting Estimates

The preparation of financial statements in accordance with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the amounts of income and expenses during the reporting period. Actual results could differ from those estimates.

f. Guarantees and Indemnifications

Under the Fund’s organizational documents, its officers and trustees are indemnified by the Fund against certain liabilities arising out of the performance of their duties to the Fund. Additionally, in the normal course of business, the Fund enters into contracts with service providers that contain general indemnification clauses. The Fund’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Fund that have not yet occurred. Currently, the Fund expects the risk of loss to be remote.

2. SHARES OF BENEFICIAL INTEREST

At February 28, 2011, there were an unlimited number of shares authorized (without par value).

Transactions in the Fund’s shares were as follows:

Semiannual Report | 29

Templeton Global Smaller Companies Fund

3. TRANSACTIONS WITH AFFILIATES

Franklin Resources, Inc. is the holding company for various subsidiaries that together are referred to as Franklin Templeton Investments. Certain officers and trustees of the Fund are also officers and/or directors of the following subsidiaries:

a. Management Fees

The Fund pays an investment management fee to FTIC based on the average daily net assets of the Fund as follows:

Templeton Global Smaller Companies Fund

Notes to Financial Statements (unaudited) (continued)

| 3. | TRANSACTIONS WITH AFFILIATES (continued) |

| a. | Management Fees (continued) |

Under a subadvisory agreement, TIC, an affiliate of FTIC, provides subadvisory services to the Fund. The subadvisory fee is paid by FTIC based on the average daily net assets, and is not an additional expense of the Fund.

b. Administrative Fees

The Fund pays an administrative fee to FT Services based on the Fund’s average daily net assets as follows:

c. Distribution Fees

The Fund’s Board of Trustees has adopted distribution plans for each share class, with the exception of Advisor Class shares, pursuant to Rule 12b-1 under the 1940 Act. Under the Fund’s Class A reimbursement distribution plan, the Fund reimburses Distributors for costs incurred in connection with the servicing, sale and distribution of the Fund’s shares up to the maximum annual plan rate. Under the Class A reimbursement distribution plan, costs exceeding the maximum for the current plan year cannot be reimbursed in subsequent periods.

In addition, under the Fund’s Class B and C compensation distribution plans, the Fund pays Distributors for costs incurred in connection with the servicing, sale and distribution of the Fund’s shares up to the maximum annual plan rate for each class.

The maximum annual plan rates, based on the average daily net assets, for each class, are as follows:

d. Sales Charges/Underwriting Agreements

Distributors has advised the Fund of the following commission transactions related to the sales and redemptions of the Fund’s shares for the period:

Semiannual Report | 31

Templeton Global Smaller Companies Fund

Notes to Financial Statements (unaudited) (continued)

| 3. | TRANSACTIONS WITH AFFILIATES (continued) |

| e. | Transfer Agent Fees |

For the period ended February 28, 2011, the Fund paid transfer agent fees of $1,024,722, of which $533,084 was retained by Investor Services.

4. EXPENSE OFFSET ARRANGEMENT

The Fund has entered into an arrangement with its custodian whereby credits realized as a result of uninvested cash balances are used to reduce a portion of the Fund’s custodian expenses. During the period ended February 28, 2011, the custodian fees were reduced as noted in the Statement of Operations.

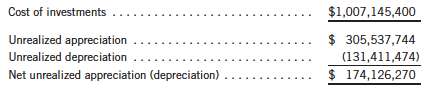

5. INCOME TAXES

For tax purposes, capital losses may be carried over to offset future capital gains, if any. At August 31, 2010, the capital loss carryforwards were as follows:

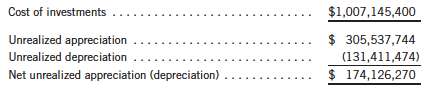

At February 28, 2011, the cost of investments and net unrealized appreciation (depreciation) for income tax purposes were as follows:

Net investment income differs for financial statement and tax purposes primarily due to differing treatments of foreign currency transactions, passive foreign investment company shares, payments-in-kind, non-deductible expenses and regulatory settlements.

Net realized gains (losses) differ for financial statement and tax purposes primarily due to differing treatments of foreign currency transactions and corporate actions.

6. INVESTMENT TRANSACTIONS

Purchases and sales of investments (excluding short term securities) for the period ended February 28, 2011, aggregated $70,651,867 and $106,277,899, respectively.

32 | Semiannual Report

Templeton Global Smaller Companies Fund

Notes to Financial Statements (unaudited) (continued)

7. CONCENTRATION OF RISK

Investing in foreign securities may include certain risks and considerations not typically associated with investing in U.S. securities, such as fluctuating currency values and changing local and regional economic, political and social conditions, which may result in greater market volatility. In addition, certain foreign securities may not be as liquid as U.S. securities.

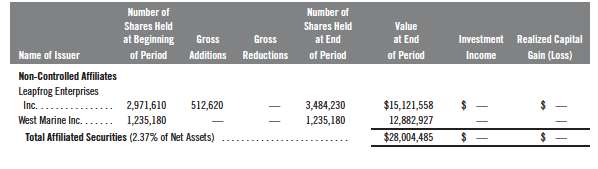

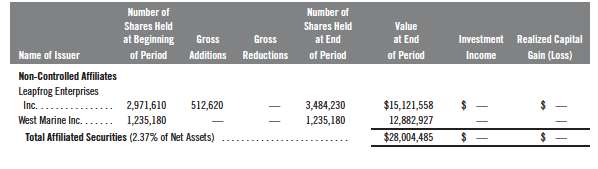

8. HOLDINGS OF 5% VOTING SECURITIES OF PORTFOLIO COMPANIES

The 1940 Act defines “affiliated companies” to include investments in portfolio companies in which a fund owns 5% or more of the outstanding voting securities. Investments in “affiliated companies” for the Fund for the period ended February 28, 2011, were as shown below.

9. CREDIT FACILITY

The Fund, together with other U.S. registered and foreign investment funds (collectively “Borrowers”), managed by Franklin Templeton Investments, are borrowers in a joint syndicated senior unsecured credit facility totaling $750 million (Global Credit Facility) which matures on January 20, 2012. This Global Credit Facility provides a source of funds to the Borrowers for temporary and emergency purposes, including the ability to meet future unanticipated or unusually large redemption requests.

Under the terms of the Global Credit Facility, the Fund shall, in addition to interest charged on any borrowings made by the Fund and other costs incurred by the Fund, pay its share of fees and expenses incurred in connection with the implementation and maintenance of the Global Credit Facility, based upon its relative share of the aggregate net assets of all of the Borrowers, including an annual commitment fee of 0.08% based upon the unused portion of the Global Credit Facility, which is reflected in other expenses on the Statement of Operations. During the period ended February 28, 2011, the Fund did not use the Global Credit Facility.

10. FAIR VALUE MEASUREMENTS

The Fund follows a fair value hierarchy that distinguishes between market data obtained from independent sources (observable inputs) and the Fund’s own market assumptions (unobservable

Semiannual Report | 33

Templeton Global Smaller Companies Fund

Notes to Financial Statements (unaudited) (continued)

10. FAIR VALUE MEASUREMENTS (continued)

inputs). These inputs are used in determining the value of the Fund’s investments and are summarized in the following fair value hierarchy:

Level 1 – quoted prices in active markets for identical securities

Level 2 – other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speed, credit risk, etc.)

Level 3 – significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments)

The inputs or methodology used for valuing securities are not an indication of the risk associated with investing in those securities.

For movements between levels within the fair value hierarchy, the Fund has adopted a policy of recognizing the transfers as of the date of the underlying event which caused the movement.

The following is a summary of the inputs used as of February 28, 2011, in valuing the Fund’s assets and liabilities carried at fair value:

At February 28, 2011 the reconciliation of assets in which significant unobservable inputs (Level 3) were used in determining fair value, is as follows:

Templeton Global Smaller Companies Fund

Notes to Financial Statements (unaudited) (continued)

11. SUBSEQUENT EVENTS

The Fund has evaluated subsequent events through the issuance of the financial statements and determined that no events have occurred that require disclosure.

ABBREVIATIONS

Selected Portfolio

FHLB - Federal Home Loan Bank

PIK - Payment-In-Kind |

Semiannual Report | 35

Templeton Global Smaller Companies Fund

Shareholder Information

Proxy Voting Policies and Procedures

The Fund’s investment manager has established Proxy Voting Policies and Procedures (Policies) that the Fund uses to determine how to vote proxies relating to portfolio securities. Shareholders may view the Fund’s complete Policies online at franklintempleton.com. Alternatively, shareholders may request copies of the Policies free of charge by calling the Proxy Group collect at (954) 527-7678 or by sending a written request to: Franklin Templeton Companies, LLC, 500 East Broward Boulevard, Suite 1500, Fort Lauderdale, FL 33394, Attention: Proxy Group. Copies of the Fund’s proxy voting records are also made available online at franklintempleton.com and posted on the U.S. Securities and Exchange Commission’s website at sec.gov and reflect the most recent 12-month period ended June 30.

Quarterly Statement of Investments

The Fund files a complete statement of investments with the U.S. Securities and Exchange Commission for the first and third quarters for each fiscal year on Form N-Q. Shareholders may view the filed Form N-Q by visiting the Commission’s website at sec.gov. The filed form may also be viewed and copied at the Commission’s Public Reference Room in Washington, DC. Information regarding the operations of the Public Reference Room may be obtained by calling (800) SEC-0330.

36 | Semiannual Report

| (a) | The Registrant has adopted a code of ethics that applies to its principal executive officers and principal financial and accounting officer. |

| (c) | N/A |

| (d) | N/A |

| (f) | Pursuant to Item 12(a)(1), the Registrant is attaching as an exhibit a copy of its code of ethics that applies to its principal executive officers and principal financial and accounting officer. |

Item 3. Audit Committee Financial Expert.

(a)(1) The Registrant has an audit committee financial expert serving on its audit committee.

(2) The audit committee financial expert is David W. Niemiec and he is "independent" as defined under the relevant Securities and Exchange Commission Rules and Releases.

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies. N/A

Item 8. Portfolio Managers of Closed-End Management Investment Companies. N/A

Item 9. Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers. N/A

Item 10. Submission of Matters to a Vote of Security Holders.

There have been no changes to the procedures by which shareholders may recommend nominees to the Registrant's Board of Trustees that would require disclosure herein.

Item 11. Controls and Procedures.

(a) Evaluation of Disclosure Controls and Procedures. The Registrant maintains disclosure controls and procedures that are designed to ensure that information required to be disclosed in the Registrant’s filings under the Securities Exchange Act of 1934 and the Investment Company Act of 1940 is recorded, processed, summarized and reported within the periods specified in the rules and forms of the Securities and Exchange Commission. Such information is

accumulated and communicated to the Registrant’s management, including its principal executive officer and principal financial officer, as appropriate, to allow timely decisions regarding required disclosure. The Registrant’s management, including the principal executive officer and the principal financial officer, recognizes that any set of controls and procedures, no matter how well designed and operated, can provide only reasonable assurance of achieving the desired control objectives.

Within 90 days prior to the filing date of this Shareholder Report on Form N-CSR, the Registrant had carried out an evaluation, under the supervision and with the participation of the Registrant’s management, including the Registrant’s principal executive officer and the Registrant’s principal financial officer, of the effectiveness of the design and operation of the Registrant’s disclosure controls and procedures. Based on such evaluation, the Registrant’s principal executive officer and principal financial officer concluded that the Registrant’s disclosure controls and procedures are effective.

| (b) Changes in Internal Controls. |

There have been no significant changes in

the Registrant’s internal controls or in other factors that could significantly affect the internal controls subsequent to the date of their evaluation in connection with the preparation of this Shareholder Report on Form N-CSR.

Item 12. Exhibits.

(a)(1) Code of Ethics |

(a)(2) Certifications pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 of Laura F. Fergerson, Chief Executive Officer - Finance and Administration, and Mark H. Otani, Chief Financial Officer and Chief Accounting Officer

(b) Certifications pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 of Laura F. Fergerson, Chief Executive Officer - Finance and Administration, and Mark H. Otani, Chief Financial Officer and Chief Accounting Officer

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

TEMPLETON GLOBAL SMALLER COMPANIES FUND

By /s/ LAURA F. FERGERSON

Laura F. Fergerson

Chief Executive Officer –

Finance and Administration

Date: April 27, 2011 |

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

By /s/ LAURA F. FERGERSON

Laura F. Fergerson

Chief Executive Officer –

Finance and Administration

Date: April 27, 2011 |

By /s/ MARK H. OTANI

Mark H. Otani

Chief Financial Officer and

Chief Accounting Officer

Date: April 27, 2011 |