UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM N-CSRS

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-03143

Templeton Global Smaller Companies Fund

(Exact name of registrant as specified in charter)

300 S.E. 2nd Street, Fort Lauderdale, FL 33301-1923

(Address of principal executive offices) (Zip code)

Craig S. Tyle, One Franklin Parkway, San Mateo, CA 94403-1906

(Name and address of agent for service)

Registrant's telephone number, including area code: (954) 527-7500_

Date of fiscal year end: _8/31__

Date of reporting period: 2/28/14_

Item 1. Reports to Stockholders.

| | | | | |

| | Contents | | | |

| Shareholder Letter | 1 | Semiannual Report | | Financial Highlights and Statement of | |

| | | | | Investments | 13 |

| | | Templeton Global | | | |

| | | Smaller Companies Fund | 3 | Financial Statements | 22 |

| | | Performance Summary | 8 | Notes to Financial Statements | 26 |

| | | Your Fund’s Expenses | 11 | Shareholder Information | 37 |

Semiannual Report

Templeton Global Smaller Companies Fund

Your Fund’s Goal and Main Investments: Templeton Global Smaller Companies Fund seeks to achieve long-term capital growth. Under normal market conditions, the Fund invests at least 80% of its net assets in equity securities of smaller companies located anywhere in the world.

This semiannual report for Templeton Global Smaller Companies Fund covers the period ended February 28, 2014.

|

| Performance data represent past |

| performance, which does not |

| guarantee future results. |

| Investment return and principal |

| value will fluctuate, and you may |

| have a gain or loss when you sell |

| your shares. Current performance |

| may differ from figures shown. |

| Please visit franklintempleton.com |

| or call (800) 342-5236 for most |

| recent month-end performance. |

Performance Overview

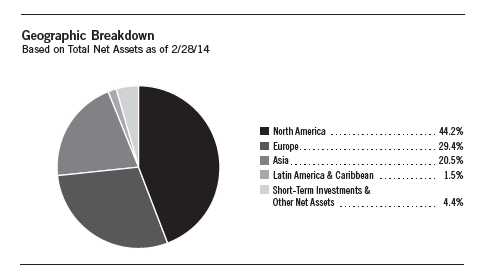

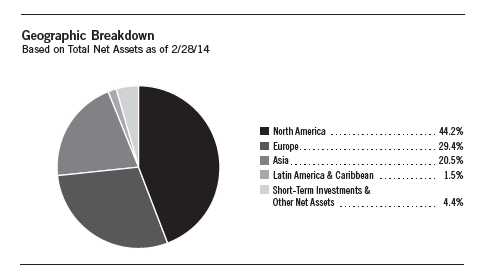

For the six months under review, Templeton Global Smaller Companies Fund –Class A delivered a +16.04% cumulative total return. In comparison, the MSCI All Country (AC) World Small Cap Index, which measures performance of small capitalization companies in global developed and emerging markets, posted a +17.90% total return.1, 2 Please note index performance information is provided for reference and we do not attempt to track the index but rather undertake investments on the basis of fundamental research. You can find the Fund’s long-term performance data in the Performance Summary beginning on page 8.

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s Statement of Investments (SOI). The SOI begins on page 17.

Semiannual Report | 3

| | |

| Top 10 Countries | | |

| Based on Equity Securities | | |

| 2/28/14 | | |

| | % of Total | |

| | Net Assets | |

| U.S. | 37.5 | % |

| Japan | 8.2 | % |

| U.K. | 6.1 | % |

| Canada | 5.5 | % |

| South Korea | 4.6 | % |

| Switzerland | 4.1 | % |

| Netherlands | 3.4 | % |

| Germany | 3.0 | % |

| Finland | 2.9 | % |

| Hong Kong | 2.9 | % |

Economic and Market Overview

The six months under review were characterized by continued economic recovery in most developed countries, and many central banks reaffirmed their accommodative monetary stances. In contrast, growth in emerging market economies generally tended to slow, and central banks in many emerging markets raised interest rates as they sought to control inflation and currency depreciation.

In the U.S., economic data were generally positive. Manufacturing activity expanded during the review period and unemployment declined. In October 2013, the federal government temporarily shut down after Congress reached a budget impasse. However, Congress passed a spending bill in January to fund the federal government through September 2014. Congress then approved suspension of the debt ceiling until March 2015. Encouraged by positive economic and employment reports, the Federal Reserve Board (Fed) in January 2014 began reducing its bond purchases by $10 billion a month and committed to keeping interest rates low. The new Fed Chair, Janet Yellen, confirmed that the Fed would continue to reduce its asset purchases, although it would reconsider its plan if the economic outlook changed significantly.

Outside the U.S., the U.K. enjoyed strong growth, driven by easing credit conditions and stronger consumer confidence. Elsewhere, economic activity in the eurozone and Japan showed signs of improvement. Although technically out of its recession, the eurozone experienced weak employment trends and deflationary risks. However, German Chancellor Angela Merkel’s reelection and the European Central Bank’s rate cut to a record low helped partly restore investor confidence. In Japan, improving business sentiment, personal consumption and higher exports resulting from a weaker yen supported the economy, and the unemployment rate reached its lowest level in six years. The Bank of Japan announced it would provide additional monetary stimulus, if required. Political turmoil in Ukraine surfaced in November 2013 when its government avoided firming up trade links with the European Union, raising fears of a sovereign default and investor concerns over the country’s relationship with Russia.

4 | Semiannual Report

Growth in many emerging market economies moderated based on lower domestic demand, falling exports and weakening commodity prices. However, select emerging market economies such as those of China, Malaysia, South Korea, Poland and Hungary improved in 2013’s second half. Monetary policies tightened in several emerging market countries, including Brazil, India, Turkey and South Africa, as their central banks raised interest rates to curb inflation and support their currencies.

Stocks in Europe helped developed market equities advance for most of the period despite a January 2014 decline. Led by Asian equities, emerging market equities also gained, although weak economic data, especially in China, weighed on markets in January. Several emerging market currencies depreciated against the U.S. dollar during the period. Gold prices declined for the period despite a rally in early 2014, and international oil prices rose amid supply concerns related to political unrest and adverse U.S. weather.

Investment Strategy

At Templeton, when choosing investments for this Fund, we take a bottom-up, value-oriented, long-term approach, focusing on the market price of a company’s securities relative to our evaluation of the company’s long-term earnings, asset value and cash flow growth potential. We also consider the company’s price/earnings ratio, profit margins and liquidation value.

Manager’s Discussion

Several holdings performed well during the six-month period under review. Switzerland-based Logitech International sells computer peripherals and appliances for the digital home. Its product line includes mice, keyboards, cameras, gaming accessories, audio devices and remotes. During the period, the company surprised investors with a lower-than-expected decline in sales. The company’s renewed research and development efforts began to bear fruit, helping combat the trend of weak PC and peripheral sales, and shares benefited as a result.

Arkansas Best is one of North America’s largest motor carriers for shipping relatively small freight loads. Shares rose as the company’s financial performance improved during the period, with net income up significantly from 2012

| | | |

| Top 10 Equity Holdings | | | |

| 2/28/14 | | | |

| |

| Company | % of Total | |

| Sector/Industry, Country | Net Assets | |

| AllianceBernstein Holding LP | | 2.1 | % |

| Capital Markets, U.S. | | | |

| Arkansas Best Corp. | | 1.9 | % |

| Road & Rail, U.S. | | | |

| Amer Sports OYJ | | 1.9 | % |

| Leisure Equipment & Products, Finland | |

| Columbia Sportswear Co. | | 1.8 | % |

| Textiles, Apparel & Luxury Goods, U.S. | | |

| Spartan Stores Inc. | | 1.8 | % |

| Food & Staples Retailing, U.S. | | | |

| Hibbett Sports Inc. | | 1.7 | % |

| Specialty Retail, U.S. | | | |

| Hillenbrand Inc. | | 1.7 | % |

| Diversified Consumer Services, U.S. | | |

| Heidrick & Struggles International Inc. | 1.6 | % |

| Professional Services, U.S. | | | |

| Hyster-Yale Materials Handling Inc. | | 1.6 | % |

| Machinery, U.S. | | | |

| Simpson Manufacturing Co. Inc. | | 1.6 | % |

| Building Products, U.S. | | | |

Semiannual Report | 5

levels. Arkansas Best has a net cash balance sheet and a strong management team, and company and industry fundamentals have slowly improved. We believe an improved U.S. economy and the company’s strong operating leverage could produce solid stock performance over the long term.

AllianceBernstein Holding is one of the largest U.S.-based asset managers. The company’s share price recovered from earlier lows because of marked improvement in the company’s equity asset performance and a stock market turnaround.

In contrast, the Fund had some poor performers. Based in California, LeapFrog is the leading technology based educational toy and product maker targeting young children. LeapFrog had a strong brand name synonymous with electronic learning and a strong balance sheet during the period. These features helped the company experience a turnaround in performance. We believe the company could expand following a period of declining business activity, as LeapFrog’s debt was limited and its operating margins were at unsustainably depressed levels that could improve. LeapFrog’s management took the proper steps in returning the company to profitability, in our view.

Headquarted in London, African Minerals is a minerals exploration and development firm. Shares fell in line with iron-ore price expectations during the period as commodity-price weakness impacted metals stocks. However, the company has a strong Sierra Leone-based iron ore production growth profile that could, in our view, help offset any potential further weakness in the underlying commodity price.

Daphne International is China’s second-largest women’s shoe retailer. Shares were impacted during the period by uncertainty about global economic conditions. We believe Daphne could be well positioned to benefit from rising footwear consumption in China. As one of the first domestic footwear retailers, the company has well-established brand positioning and one of the largest store networks in China. Its store coverage is strong and difficult to copy, and we believe recent restructuring could narrow the company’s gap with top peers in terms of operating efficiency and consistency. Over the mid-to-long term, this could, in our opinion, become a multi-year turnaround story, which may support Daphne’s long-term earnings and possible share price recovery.

6 | Semiannual Report

Thank you for your continued participation in Templeton Global Smaller Companies Fund. We look forward to serving your future investment needs.

Portfolio Management Team

Templeton Global Smaller Companies Fund

The foregoing information reflects our analysis, opinions and portfolio holdings as of February 28, 2014, the end

of the reporting period. The way we implement our main investment strategies and the resulting portfolio holdings

may change depending on factors such as market and economic conditions. These opinions may not be relied upon

as investment advice or an offer for a particular security. The information is not a complete analysis of every

aspect of any market, country, industry, security or the Fund. Statements of fact are from sources considered

reliable, but the investment manager makes no representation or warranty as to their completeness or accuracy.

Although historical performance is no guarantee of future results, these insights may help you understand our

investment management philosophy.

The index is unmanaged and includes reinvested dividends. One cannot invest directly in an index, and an index is not

representative of the Fund’s portfolio.

1. Source: © 2014 Morningstar. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar

and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or

timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of

this information.

2. Source: MSCI. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever

with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for

other indices or any securities or financial products. This report is not approved, reviewed or produced by MSCI.

Semiannual Report | 7

Performance Summary as of 2/28/14

Your dividend income will vary depending on dividends or interest paid by securities in the Fund’s portfolio, adjusted for operating expenses of each class. Capital gain distributions are net profits realized from the sale of portfolio securities. The performance table does not reflect any taxes that a shareholder would pay on Fund dividends, capital gain distributions, if any, or any realized gains on the sale of Fund shares. Total return reflects reinvestment of the Fund’s dividends and capital gain distributions, if any, and any unrealized gains or losses.

| | | | | | | | |

| Price and Distribution Information | | | | | | |

| |

| Class A (Symbol: TEMGX) | | | | Change | | 2/28/14 | | 8/31/13 |

| Net Asset Value (NAV) | | | +$ | 1.23 | $ | 9.04 | $ | 7.81 |

| Distributions (9/1/13–2/28/14) | | | | | | | | |

| Dividend Income | $ | 0.0220 | | | | | | |

| Class C (Symbol: TESGX) | | | | Change | | 2/28/14 | | 8/31/13 |

| Net Asset Value (NAV) | | | +$ | 1.18 | $ | 8.71 | $ | 7.53 |

| Class R6 (Symbol: n/a) | | | | Change | | 2/28/14 | | 8/31/13 |

| Net Asset Value (NAV) | | | +$ | 1.23 | $ | 9.07 | $ | 7.84 |

| Distributions (9/1/13–2/28/14) | | | | | | | | |

| Dividend Income | $ | 0.0551 | | | | | | |

| Advisor Class (Symbol: TGSAX) | | | | Change | | 2/28/14 | | 8/31/13 |

| Net Asset Value (NAV) | | | +$ | 1.22 | $ | 9.06 | $ | 7.84 |

| Distributions (9/1/13–2/28/14) | | | | | | | | |

| Dividend Income | $ | 0.0407 | | | | | | |

8 | Semiannual Report

Performance Summary (continued)

Performance1

Cumulative total return excludes sales charges. Aggregate and average annual total returns and value of $10,000 investment include maximum sales charges. Class A: 5.75% maximum initial sales charge; Class C: 1% contingent deferred sales charge in first year only; Class R6/Advisor Class: no sales charges.

| | | | | | | | | | | | |

| Class A | | 6-Month | | | 1-Year | | | 5-Year | | | 10-Year | |

| Cumulative Total Return2 | + | 16.04 | % | + | 23.98 | % | + | 216.20 | % | + | 112.25 | % |

| Average Annual Total Return3 | + | 9.32 | % | + | 16.79 | % | + | 24.42 | % | + | 7.18 | % |

| Value of $10,000 Investment4 | $ | 10,932 | | $ | 11,679 | | $ | 29,819 | | $ | 20,013 | |

| Avg. Ann. Total Return (3/31/14)5 | | | | + | 15.54 | % | + | 22.62 | % | + | 7.37 | % |

| Total Annual Operating Expenses6 | | | | | 1.39 | % | | | | | | |

| Class C | | 6-Month | | | 1-Year | | | 5-Year | | | 10-Year | |

| Cumulative Total Return2 | + | 15.67 | % | + | 23.20 | % | + | 204.25 | % | + | 97.06 | % |

| Average Annual Total Return3 | + | 14.67 | % | + | 22.20 | % | + | 24.92 | % | + | 7.02 | % |

| Value of $10,000 Investment4 | $ | 11,467 | | $ | 12,220 | | $ | 30,425 | | $ | 19,706 | |

| Avg. Ann. Total Return (3/31/14)5 | | | | + | 20.59 | % | + | 23.18 | % | + | 7.20 | % |

| Total Annual Operating Expenses6 | | | | | 2.14 | % | | | | | | |

| Class R6 | | | | | | | | 6-Month | | | Inception (5/1/13) | |

| Cumulative Total Return2 | | | | | | | + | 16.41 | % | + | 22.83 | % |

| Aggregate Total Return3 | | | | | | | + | 16.41 | % | + | 22.83 | % |

| Value of $10,000 Investment4 | | | | | | | $ | 11,641 | | $ | 12,283 | |

| Aggregate Total Return (3/31/14)5, 7 | | | | | | | | | | + | 23.24 | % |

| Total Annual Operating Expenses6 | | | | | 3.26 | % | | | | | | |

| Advisor Class | | 6-Month | | | 1-Year | | | 5-Year | | | 10-Year | |

| Cumulative Total Return2 | + | 16.09 | % | + | 24.34 | % | + | 219.26 | % | + | 117.36 | % |

| Average Annual Total Return3 | + | 16.09 | % | + | 24.34 | % | + | 26.13 | % | + | 8.07 | % |

| Value of $10,000 Investment4 | $ | 11,609 | | $ | 12,434 | | $ | 31,926 | | $ | 21,736 | |

| Avg. Ann. Total Return (3/31/14)5 | | | | + | 22.74 | % | + | 24.44 | % | + | 8.27 | % |

| Total Annual Operating Expenses6 | | | | | 1.14 | % | | | | | | |

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, go to franklintempleton.com or call (800) 342-5236.

Semiannual Report | 9

Performance Summary (continued)

All investments involve risks, including possible loss of principal. Special risks are associated with foreign investing, including currency fluctuations, economic instability and political developments. Investments in emerging markets involve heightened risks related to the same factors, in addition to those associated with these markets’ smaller size and lesser liquidity. In addition, smaller company stocks have historically exhibited greater price volatility than large-company stocks, particularly over the short term. The Fund is actively managed but there is no guarantee that the manager’s investment decisions will produce the desired results. The Fund’s prospectus also includes a description of the main investment risks.

Class C: These shares have higher annual fees and expenses than Class A shares.

Class R6: Shares are available to certain eligible investors as described in the prospectus.

Advisor Class: Shares are available to certain eligible investors as described in the prospectus.

1. The Fund has a fee waiver associated with its investments in a Franklin Templeton money fund, contractually guaranteed through at least its

current fiscal year end. Fund investment results reflect the fee waiver, to the extent applicable; without this reduction, the results would have been

lower.

2. Cumulative total return represents the change in value of an investment over the periods indicated.

3. Average annual total return represents the average annual change in value of an investment over the periods indicated. Six-month return has not

been annualized.

4. These figures represent the value of a hypothetical $10,000 investment in the Fund over the periods indicated.

5. In accordance with SEC rules, we provide standardized average annual total return information through the latest calendar quarter.

6. Figures are as stated in the Fund’s current prospectus. In periods of market volatility, assets may decline significantly, causing total annual Fund

operating expenses to become higher than the figures shown.

7. Aggregate total return represents the change in value of an investment for the periods indicated. Since Class R6 shares have existed for less than

one year, average annual total return is not available.

10 | Semiannual Report

Your Fund’s Expenses

As a Fund shareholder, you can incur two types of costs:

- Transaction costs, including sales charges (loads) on Fund purchases; and

- Ongoing Fund costs, including management fees, distribution and service (12b-1) fees, and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses.

The following table shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The first line (Actual) for each share class listed in the table provides actual account values and expenses. The “Ending Account Value” is derived from the Fund’s actual return, which includes the effect of Fund expenses.

You can estimate the expenses you paid during the period by following these steps. Of course, your account value and expenses will differ from those in this illustration:

| 1. | Divide your account value by $1,000. |

| | If an account had an $8,600 value, then $8,600 ÷ $1,000 = 8.6. |

| 2. | Multiply the result by the number under the heading “Expenses Paid During Period.” |

| | If Expenses Paid During Period were $7.50, then 8.6 x $7.50 = $64.50. |

In this illustration, the estimated expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Information in the second line (Hypothetical) for each class in the table can help you compare ongoing costs of investing in the Fund with those of other mutual funds. This information may not be used to estimate the actual ending account balance or expenses you paid during the period. The hypothetical “Ending Account Value” is based on the actual expense ratio for each class and an assumed 5% annual rate of return before expenses, which does not represent the Fund’s actual return. The figure under the heading “Expenses Paid During Period” shows the hypothetical expenses your account would have incurred under this scenario. You can compare this figure with the 5% hypothetical examples that appear in shareholder reports of other funds.

Semiannual Report | 11

Your Fund’s Expenses (continued)

Please note that expenses shown in the table are meant to highlight ongoing costs and do not reflect any transaction costs, such as sales charges. Therefore, the second line for each class is useful in comparing ongoing costs only, and will not help you compare total costs of owning different funds. In addition, if transaction costs were included, your total costs would have been higher. Please refer to the Fund prospectus for additional information on operating expenses.

| | | | | | |

| | | Beginning Account | | Ending Account | | Expenses Paid During |

| Class A | | Value 9/1/13 | | Value 2/28/14 | | Period* 9/1/13–2/28/14 |

| Actual | $ | 1,000 | $ | 1,160.40 | $ | 7.23 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,018.10 | $ | 6.76 |

| Class C | | | | | | |

| Actual | $ | 1,000 | $ | 1,156.70 | $ | 11.23 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,014.38 | $ | 10.49 |

| Class R6 | | | | | | |

| Actual | $ | 1,000 | $ | 1,164.10 | $ | 4.94 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,020.23 | $ | 4.61 |

| Advisor Class | | | | | | |

| Actual | $ | 1,000 | $ | 1,160.90 | $ | 5.89 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,019.34 | $ | 5.51 |

*Expenses are calculated using the most recent six-month expense ratio, annualized for each class (A: 1.35%; C: 2.10%; R6: 0.92%; and Advisor: 1.10%), multiplied by the average account value over the period, multiplied by 181/365 to reflect the one-half year period.

12 | Semiannual Report

Templeton Global Smaller Companies Fund

Financial Highlights

| | | | | | | | | | | | | | | | | | |

| | | Six Months Ended | | | | | | | | | | | | | |

| | | February 28, 2014 | | | Year Ended August 31, | | | | |

| Class A | | (unaudited) | | | 2013 | | | 2012 | | | 2011 | | | 2010 | | | 2009 | |

| Per share operating performance | | | | | | | | | | | | | | | | | | |

| (for a share outstanding throughout the period) | | | | | | | | | | | | | | | | | | |

| Net asset value, beginning of period | $ | 7.81 | | $ | 6.39 | | $ | 6.61 | | $ | 6.06 | | $ | 5.42 | | $ | 6.97 | |

| Income from investment operationsa: | | | | | | | | | | | | | | | | | | |

| Net investment income (loss)b | | (0.01 | ) | | 0.05 | | | 0.07 | | | 0.06 | | | 0.01 | | | 0.06 | |

| Net realized and unrealized gains (losses) | | 1.26 | | | 1.47 | | | (0.23 | ) | | 0.51 | | | 0.70 | | | (0.98 | ) |

| Total from investment operations | | 1.25 | | | 1.52 | | | (0.16 | ) | | 0.57 | | | 0.71 | | | (0.92 | ) |

| Less distributions from: | | | | | | | | | | | | | | | | | | |

| Net investment income | | (0.02 | ) | | (0.10 | ) | | (0.06 | ) | | (0.02 | ) | | (0.07 | ) | | (0.09 | ) |

| Net realized gains | | — | | | — | | | — | | | — | | | — | | | (0.54 | ) |

| Total distributions | | (0.02 | ) | | (0.10 | ) | | (0.06 | ) | | (0.02 | ) | | (0.07 | ) | | (0.63 | ) |

| Net asset value, end of period | $ | 9.04 | | $ | 7.81 | | $ | 6.39 | | $ | 6.61 | | $ | 6.06 | | $ | 5.42 | |

| |

| Total returnc | | 16.04 | % | | 24.04 | % | | (2.31 | )% | | 9.31 | % | | 13.11 | % | | (8.08 | )% |

| |

| Ratios to average net assetsd | | | | | | | | | | | | | | | | | | |

| Expenses | | 1.35 | % | | 1.39 | %e | | 1.41 | % | | 1.35 | %e | | 1.39 | %e | | 1.49 | %e |

| Net investment income (loss) | | (0.19 | )% | | 0.72 | % | | 1.06 | % | | 0.80 | % | | 0.23 | % | | 1.47 | % |

| |

| Supplemental data | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (000’s) | $ | 1,067,475 | | $ | 892,067 | | $ | 726,065 | | $ | 833,869 | | $ | 816,589 | | $ | 732,847 | |

| Portfolio turnover rate | | 11.25 | % | | 27.67 | % | | 25.44 | % | | 23.31 | % | | 22.33 | % | | 31.29 | % |

aThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and repurchases of

the Fund shares in relation to income earned and/or fluctuating market value of the investments of the Fund.

bBased on average daily shares outstanding.

cTotal return does not reflect sales commissions or contingent deferred sales charges, if applicable, and is not annualized for periods less than one year.

dRatios are annualized for periods less than one year.

eBenefit of expense reduction rounds to less than 0.01%.

Semiannual Report | The accompanying notes are an integral part of these financial statements. | 13

Templeton Global Smaller Companies Fund

Financial Highlights (continued)

| | | | | | | | | | | | | | | | | | |

| | | Six Months Ended | | | | | | | | | | | | | | | | |

| | | February 28, 2014 | | | | | | Year Ended August 31, | | | | |

| Class C | | (unaudited) | | | 2013 | | | 2012 | | | 2011 | | | 2010 | | | 2009 | |

| Per share operating performance | | | | | | | | | | | | | | | | | | |

| (for a share outstanding throughout the period) | | | | | | | | | | | | | | | | | | |

| Net asset value, beginning of period | $ | 7.53 | | $ | 6.16 | | $ | 6.39 | | $ | 5.88 | | $ | 5.28 | | $ | 6.77 | |

| Income from investment operationsa: | | | | | | | | | | | | | | | | | | |

| Net investment income (loss)b | | (0.04 | ) | | —c | | | 0.02 | | | —c | | | (0.03 | ) | | 0.03 | |

| Net realized and unrealized gains (losses) | | 1.22 | | | 1.42 | | | (0.23 | ) | | 0.51 | | | 0.68 | | | (0.96 | ) |

| Total from investment operations | | 1.18 | | | 1.42 | | | (0.21 | ) | | 0.51 | | | 0.65 | | | (0.93 | ) |

| Less distributions from: | | | | | | | | | | | | | | | | | | |

| Net investment income | | — | | | (0.05 | ) | | (0.02 | ) | | — | | | (0.05 | ) | | (0.02 | ) |

| Net realized gains | | — | | | — | | | — | | | — | | | — | | | (0.54 | ) |

| Total distributions | | — | | | (0.05 | ) | | (0.02 | ) | | — | | | (0.05 | ) | | (0.56 | ) |

| Net asset value, end of period | $ | 8.71 | | $ | 7.53 | | $ | 6.16 | | $ | 6.39 | | $ | 5.88 | | $ | 5.28 | |

| |

| Total returnd | | 15.67 | % | | 23.19 | % | | (3.07 | )% | | 8.67 | % | | 12.27 | % | | (8.96 | )% |

| |

| Ratios to average net assetse | | | | | | | | | | | | | | | | | | |

| Expenses | | 2.10 | % | | 2.14 | %f | | 2.16 | % | | 2.10 | %f | | 2.14 | %f | | 2.26 | %f |

| Net investment income (loss) | | (0.94 | )% | | (0.03 | )% | | 0.31 | % | | 0.05 | % | | (0.52 | )% | | 0.70 | % |

| |

| Supplemental data | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (000’s) | $ | 47,386 | | $ | 39,726 | | $ | 34,090 | | $ | 42,043 | | $ | 36,390 | | $ | 33,300 | |

| Portfolio turnover rate | | 11.25 | % | | 27.67 | % | | 25.44 | % | | 23.31 | % | | 22.33 | % | | 31.29 | % |

aThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and repurchases of

the Fund shares in relation to income earned and/or fluctuating market value of the investments of the Fund.

bBased on average daily shares outstanding.

cAmount rounds to less than $0.01 per share.

dTotal return does not reflect sales commissions or contingent deferred sales charges, if applicable, and is not annualized for periods less than one year.

eRatios are annualized for periods less than one year.

fBenefit of expense reduction rounds to less than 0.01%.

14 | The accompanying notes are an integral part of these financial statements. | Semiannual Report

Templeton Global Smaller Companies Fund

Financial Highlights (continued)

| | | | | | |

| | | Six Months Ended | | | Period Ended | |

| | | February 28, 2014 | | | August 31, | |

| Class R6 | | (unaudited) | | | 2013 | a |

| Per share operating performance | | | | | | |

| (for a share outstanding throughout the period) | | | | | | |

| Net asset value, beginning of period | $ | 7.84 | | $ | 7.43 | |

| Income from investment operationsb: | | | | | | |

| Net investment incomec | | 0.02 | | | 0.03 | |

| Net realized and unrealized gains (losses) | | 1.27 | | | 0.38 | |

| Total from investment operations | | 1.29 | | | 0.41 | |

| Less distributions from net investment income | | (0.06 | ) | | — | |

| Net asset value, end of period | $ | 9.07 | | $ | 7.84 | |

| |

| Total returnd | | 16.41 | % | | 5.52 | % |

| |

| Ratios to average net assetse | | | | | | |

| Expenses before waiver and payments by affiliates | | 0.92 | % | | 3.26 | % |

| Expenses net of waiver and payments by affiliates | | 0.92 | % | | 0.95 | % |

| Net investment income (loss) | | 0.24 | % | | (1.15 | )% |

| |

| Supplemental data | | | | | | |

| Net assets, end of period (000’s) | $ | 25,772 | | $ | 5 | |

| Portfolio turnover rate | | 11.25 | % | | 27.67 | % |

aFor the period May 1, 2013 (effective date) to August 31, 2013.

bThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and repurchases of

the Fund shares in relation to income earned and/or fluctuating market value of the investments of the Fund.

cBased on average daily shares outstanding.

dTotal return is not annualized for periods less than one year.

eRatios are annualized for periods less than one year.

Semiannual Report | The accompanying notes are an integral part of these financial statements. | 15

Templeton Global Smaller Companies Fund

Financial Highlights (continued)

| | | | | | | | | | | | | | | | | | |

| | | Six Months Ended | | | | | | | | | | | | | |

| | | February 28, 2014 | | | Year Ended August 31, | | | | |

| Advisor Class | | (unaudited) | | | 2013 | | | 2012 | | | 2011 | | | 2010 | | | 2009 | |

| Per share operating performance | | | | | | | | | | | | | | | | | | |

| (for a share outstanding throughout the period) | | | | | | | | | | | | | | | | | | |

| Net asset value, beginning of period | $ | 7.84 | | $ | 6.41 | | $ | 6.63 | | $ | 6.08 | | $ | 5.43 | | $ | 7.00 | |

| Income from investment operationsa: | | | | | | | | | | | | | | | | | | |

| Net investment incomeb | | — | | | 0.07 | | | 0.08 | | | 0.08 | | | 0.03 | | | 0.07 | |

| Net realized and unrealized gains (losses) | | 1.26 | | | 1.48 | | | (0.23 | ) | | 0.51 | | | 0.69 | | | (1.00 | ) |

| Total from investment operations | | 1.26 | | | 1.55 | | | (0.15 | ) | | 0.59 | | | 0.72 | | | (0.93 | ) |

| Less distributions from: | | | | | | | | | | | | | | | | | | |

| Net investment income | | (0.04 | ) | | (0.12 | ) | | (0.07 | ) | | (0.04 | ) | | (0.07 | ) | | (0.10 | ) |

| Net realized gains | | — | | | — | | | — | | | — | | | — | | | (0.54 | ) |

| Total distributions | | (0.04 | ) | | (0.12 | ) | | (0.07 | ) | | (0.04 | ) | | (0.07 | ) | | (0.64 | ) |

| Net asset value, end of period | $ | 9.06 | | $ | 7.84 | | $ | 6.41 | | $ | 6.63 | | $ | 6.08 | | $ | 5.43 | |

| |

| Total returnc | | 16.09 | % | | 24.43 | % | | (2.07 | )% | | 9.60 | % | | 13.38 | % | | (7.94 | )% |

| |

| Ratios to average net assetsd | | | | | | | | | | | | | | | | | | |

| Expenses | | 1.10 | % | | 1.14 | %e | | 1.16 | % | | 1.10 | %e | | 1.14 | %e | | 1.26 | %e |

| Net investment income | | 0.06 | % | | 0.97 | % | | 1.31 | % | | 1.05 | % | | 0.48 | % | | 1.70 | % |

| |

| Supplemental data | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (000’s) | $ | 140,914 | | $ | 140,733 | | $ | 116,877 | | $ | 113,402 | | $ | 95,765 | | $ | 108,383 | |

| Portfolio turnover rate | | 11.25 | % | | 27.67 | % | | 25.44 | % | | 23.31 | % | | 22.33 | % | | 31.29 | % |

aThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and repurchases of

the Fund shares in relation to income earned and/or fluctuating market value of the investments of the Fund.

bBased on average daily shares outstanding.

cTotal return is not annualized for periods less than one year.

dRatios are annualized for periods less than one year.

eBenefit of expense reduction rounds to less than 0.01%.

16 | The accompanying notes are an integral part of these financial statements. | Semiannual Report

Templeton Global Smaller Companies Fund

Statement of Investments, February 28, 2014 (unaudited)

| | | | |

| | Industry | Shares/Units | | Value |

| Common Stocks and Other Equity | | | | |

| Interests 93.1% | | | | |

| Austria 0.8% | | | | |

| Wienerberger AG | Building Products | 542,738 | $ | 10,249,770 |

| |

| Bahamas 0.9% | | | | |

| a Steiner Leisure Ltd. | Diversified Consumer Services | 262,880 | | 11,624,554 |

| |

| Belgium 1.0% | | | | |

| Barco NV | Electronic Equipment, Instruments & Components | 167,740 | | 13,277,761 |

| |

| Brazil 0.6% | | | | |

| Companhia de Saneamento de Minas Gerais | Water Utilities | 505,400 | | 7,198,075 |

| |

| Canada 5.5% | | | | |

| Canaccord Genuity Group Inc. | Capital Markets | 1,696,800 | | 12,418,975 |

| Dorel Industries Inc., B | Household Durables | 238,300 | | 8,010,084 |

| Ensign Energy Services Inc. | Energy Equipment & Services | 247,500 | | 3,960,626 |

| Genworth MI Canada Inc. | Thrifts & Mortgage Finance | 503,300 | | 16,371,917 |

| HudBay Minerals Inc. | Metals & Mining | 1,944,350 | | 16,057,973 |

| Major Drilling Group International Inc. | Metals & Mining | 142,600 | | 1,141,625 |

| Mullen Group Ltd. | Energy Equipment & Services | 304,600 | | 7,549,632 |

| Trican Well Service Ltd. | Energy Equipment & Services | 451,600 | | 5,708,760 |

| | | | | 71,219,592 |

| |

| China 1.3% | | | | |

| b Daphne International Holdings Ltd. | Textiles, Apparel & Luxury Goods | 11,116,000 | | 5,643,658 |

| Digital China Holdings Ltd. | Electronic Equipment, Instruments & Components | 4,200,000 | | 4,156,487 |

| Shenguan Holdings Group Ltd. | Food Products | 4,632,300 | | 1,934,005 |

| Yingde Gases | Chemicals | 5,269,000 | | 4,678,033 |

| | | | | 16,412,183 |

| |

| Finland 2.9% | | | | |

| Amer Sports OYJ | Leisure Products | 1,089,557 | | 24,598,710 |

| Huhtamaki OYJ | Containers & Packaging | 433,970 | | 12,516,562 |

| | | | | 37,115,272 |

| |

| France 0.9% | | | | |

| Ipsos | Media | 258,820 | | 11,040,174 |

| |

| Germany 2.2% | | | | |

| Gerresheimer AG | Life Sciences Tools & Services | 186,540 | | 12,721,953 |

| Jenoptik AG | Electronic Equipment, Instruments & Components | 349,090 | | 6,154,282 |

| a Kloeckner & Co. SE | Trading Companies & Distributors | 650,140 | | 10,017,162 |

| | | | | 28,893,397 |

| |

| Greece 0.6% | | | | |

| a JUMBO SA | Specialty Retail | 384,950 | | 7,293,801 |

Semiannual Report | 17

Templeton Global Smaller Companies Fund

Statement of Investments, February 28, 2014 (unaudited) (continued)

| | | | |

| | Industry | Shares/Units | | Value |

| Common Stocks and Other Equity | | | | |

| Interests (continued) | | | | |

| Hong Kong 2.9% | | | | |

| Dah Sing Financial Group | Banks | 1,411,600 | $ | 7,075,826 |

| Luk Fook Holdings (International) Ltd. | Specialty Retail | 1,709,000 | | 5,835,846 |

| Techtronic Industries Co. Ltd. | Household Durables | 6,681,000 | | 17,734,730 |

| Value Partners Group Ltd. | Capital Markets | 9,469,000 | | 6,052,039 |

| | | | | 36,698,441 |

| |

| India 0.4% | | | | |

| Jain Irrigation Systems Ltd. | Machinery | 4,981,389 | | 4,775,680 |

| |

| Italy 2.9% | | | | |

| Amplifon SpA | Health Care Providers & Services | 737,246 | | 4,507,079 |

| Azimut Holding SpA | Capital Markets | 336,681 | | 11,239,152 |

| Marr SpA | Food & Staples Retailing | 396,973 | | 7,516,128 |

| a Sorin SpA | Health Care Equipment & Supplies | 4,314,669 | | 13,420,864 |

| | | | | 36,683,223 |

| |

| Japan 8.2% | | | | |

| Asahi Co. Ltd. | Specialty Retail | 288,000 | | 3,788,134 |

| Asics Corp. | Textiles, Apparel & Luxury Goods | 923,400 | | 18,014,464 |

| Capcom Co. Ltd. | Software | 307,800 | | 5,883,878 |

| Descente Ltd. | Textiles, Apparel & Luxury Goods | 356,000 | | 2,430,452 |

| en-japan Inc. | Professional Services | 1,600 | | 33,855 |

| Keihin Corp. | Auto Components | 409,900 | | 6,156,553 |

| Kobayashi Pharmaceutical Co. Ltd. | Personal Products | 324,110 | | 18,338,640 |

| MEITEC Corp. | Professional Services | 452,700 | | 11,851,134 |

| Nissin Kogyo Co. Ltd. | Auto Components | 248,670 | | 4,824,393 |

| Seria Co. Ltd. | Multiline Retail | 220,000 | | 9,119,843 |

| Shinko Plantech Co. Ltd. | Energy Equipment & Services | 810,200 | | 6,263,530 |

| Square Enix Holdings Co. Ltd. | Software | 488,800 | | 11,101,234 |

| Tokai Rika Co. Ltd. | Auto Components | 166,300 | | 2,955,174 |

| Unipres Corp. | Auto Components | 265,300 | | 4,808,237 |

| | | | | 105,569,521 |

| |

| Netherlands 3.4% | | | | |

| Aalberts Industries NV | Machinery | 604,221 | | 20,424,542 |

| Accell Group NV | Leisure Products | 129,828 | | 2,597,858 |

| Arcadis NV | Construction & Engineering | 282,970 | | 10,699,662 |

| USG People NV | Professional Services | 530,646 | | 10,098,299 |

| | | | | 43,820,361 |

| |

| Norway 0.1% | | | | |

| Ekornes ASA | Household Durables | 73,278 | | 1,099,060 |

| |

| Russia 0.5% | | | | |

| a,c X5 Retail Group NV, GDR, Reg S | Food & Staples Retailing | 347,670 | | 6,157,236 |

18 | Semiannual Report

Templeton Global Smaller Companies Fund

Statement of Investments, February 28, 2014 (unaudited) (continued)

| | | | |

| | Industry | Shares/Units | | Value |

| Common Stocks and Other Equity | | | | |

| Interests (continued) | | | | |

| South Korea 4.6% | | | | |

| BS Financial Group Inc. | Banks | 1,306,050 | $ | 19,480,300 |

| Daum Communication Corp. | Internet Software & Services | 79,242 | | 5,203,460 |

| DGB Financial Group Inc. | Banks | 855,240 | | 13,157,415 |

| KIWOOM Securities Co. Ltd. | Capital Markets | 53,212 | | 2,665,567 |

| Sindoh Co. Ltd. | Technology Hardware, Storage & Peripherals | 143,648 | | 8,422,060 |

| Youngone Corp. | Textiles, Apparel & Luxury Goods | 312,788 | | 10,695,136 |

| | | | | 59,623,938 |

| |

| Spain 2.3% | | | | |

| Construcciones y Auxiliar de Ferrocarriles SA | Machinery | 26,200 | | 13,954,408 |

| Melia Hotels International SA | Hotels, Restaurants & Leisure | 575,173 | | 7,302,396 |

| Tecnicas Reunidas SA | Energy Equipment & Services | 151,737 | | 8,421,950 |

| | | | | 29,678,754 |

| |

| Sweden 0.5% | | | | |

| a,dD Carnegie & Co. AB | Capital Markets | 1,176 | | — |

| Oriflame Cosmetics SA, SDR | Personal Products | 240,230 | | 6,103,732 |

| | | | | 6,103,732 |

| |

| Switzerland 4.1% | | | | |

| b Logitech International SA | Technology Hardware, Storage & Peripherals | 1,110,610 | | 17,592,063 |

| Nobel Biocare Holding AG | Health Care Equipment & Supplies | 430,620 | | 6,315,368 |

| Panalpina Welttransport Holding AG | Air Freight & Logistics | 115,460 | | 19,151,448 |

| Vontobel Holding AG | Capital Markets | 272,678 | | 10,137,074 |

| | | | | 53,195,953 |

| |

| Taiwan 2.1% | | | | |

| Giant Manufacturing Co. Ltd. | Leisure Products | 1,707,311 | | 11,634,098 |

| a Ta Chong Bank Ltd. | Banks | 21,954,166 | | 7,570,652 |

| Tripod Technology Corp. | Electronic Equipment, Instruments & Components | 3,773,000 | | 7,221,291 |

| | | | | 26,426,041 |

| |

| Thailand 0.5% | | | | |

| Hana Microelectronics PCL, fgn. | Electronic Equipment, Instruments & Components | 8,794,600 | | 6,896,135 |

| |

| Turkey 0.3% | | | | |

| Aygaz AS | Gas Utilities | 976,325 | | 3,492,243 |

| |

| United Kingdom 6.1% | | | | |

| a African Minerals Ltd. | Metals & Mining | 2,793,310 | | 6,978,514 |

| Bellway PLC | Household Durables | 236,410 | | 6,634,357 |

| Bodycote PLC | Machinery | 274,636 | | 3,474,282 |

| Bovis Homes Group PLC | Household Durables | 457,650 | | 7,139,682 |

| Greggs PLC | Food & Staples Retailing | 1,168,575 | | 9,839,070 |

| a Just Retirement Group PLC | Insurance | 1,490,137 | | 6,310,680 |

| Laird PLC | Electronic Equipment, Instruments & Components | 3,054,860 | | 16,074,381 |

| a Persimmon PLC | Household Durables | 287,427 | | 6,954,648 |

| |

| | | Semiannual Report | 19 |

Templeton Global Smaller Companies Fund

Statement of Investments, February 28, 2014 (unaudited) (continued)

| | | | |

| | Industry | Shares/Units | | Value |

| Common Stocks and Other Equity | | | | |

| Interests (continued) | | | | |

| United Kingdom (continued) | | | | |

| UBM PLC | Media | 455,240 | $ | 5,463,728 |

| a Vectura Group PLC | Pharmaceuticals | 3,479,600 | | 9,399,290 |

| | | | | 78,268,632 |

| |

| United States 37.5% | | | | |

| AllianceBernstein Holding LP | Capital Markets | 1,105,374 | | 26,772,158 |

| Arkansas Best Corp. | Road & Rail | 747,400 | | 24,858,524 |

| a Brocade Communications Systems Inc. | Communications Equipment | 1,776,880 | | 17,004,742 |

| Columbia Sportswear Co. | Textiles, Apparel & Luxury Goods | 284,220 | | 23,615,840 |

| a Deckers Outdoor Corp. | Textiles, Apparel & Luxury Goods | 93,150 | | 6,925,703 |

| The Finish Line Inc., A | Specialty Retail | 207,044 | | 5,594,329 |

| FirstMerit Corp. | Banks | 926,670 | | 19,237,669 |

| a,bGlu Mobile Inc. | Software | 2,296,440 | | 11,551,093 |

| a Green Dot Corp. | Consumer Finance | 619,220 | | 12,477,283 |

| GulfMark Offshore Inc., A | Energy Equipment & Services | 284,425 | | 13,493,122 |

| e Heidrick & Struggles International Inc. | Professional Services | 1,144,810 | | 21,053,056 |

| a Hibbett Sports Inc. | Specialty Retail | 388,970 | | 22,299,650 |

| Hillenbrand Inc. | Diversified Consumer Services | 718,100 | | 21,456,828 |

| Hyster-Yale Materials Handling Inc. | Machinery | 206,770 | | 20,871,364 |

| a Investment Technology Group Inc. | Capital Markets | 870,170 | | 15,036,538 |

| iShares MSCI EAFE Small-Cap ETF | Diversified Financial Services | 358,900 | | 18,928,386 |

| iShares Russell 2000 ETF | Diversified Financial Services | 163,400 | | 19,202,768 |

| b,eJAKKS Pacific Inc. | Leisure Products | 1,553,200 | | 11,120,912 |

| Janus Capital Group Inc. | Capital Markets | 1,640,250 | | 18,354,398 |

| a,bLeapFrog Enterprises Inc. | Leisure Products | 2,663,380 | | 19,389,406 |

| a Navistar International Corp. | Machinery | 173,590 | | 6,509,625 |

| Simpson Manufacturing Co. Inc. | Building Products | 584,770 | | 20,671,619 |

| Spartan Stores Inc. | Food & Staples Retailing | 1,012,270 | | 22,867,179 |

| a Stillwater Mining Co. | Metals & Mining | 1,267,200 | | 17,157,888 |

| a,bSwift Energy Co. | Oil, Gas & Consumable Fuels | 1,140,610 | | 11,406,100 |

| a Tutor Perini Corp. | Construction & Engineering | 783,870 | | 19,322,395 |

| a Unit Corp. | Energy Equipment & Services | 178,760 | | 10,975,864 |

| a VASCO Data Security International Inc. | Software | 911,310 | | 7,272,254 |

| a,e West Marine Inc. | Specialty Retail | 1,235,180 | | 15,415,046 |

| | | | | 480,841,739 |

| |

| Total Common Stocks and Other Equity | | | | |

| Interests (Cost $892,049,685) | | | | 1,193,655,268 |

| |

| Preferred Stocks (Cost $9,474,935) 0.8% | | | | |

| Germany 0.8% | | | | |

| Draegerwerk AG & Co. KGAA, pfd. | Health Care Equipment & Supplies | 74,200 | | 9,935,484 |

| |

| Total Investments before Short | | | | |

| Term Investments | | | | |

| (Cost $901,524,620) | | | | 1,203,590,752 |

20 | Semiannual Report

Templeton Global Smaller Companies Fund

Statement of Investments, February 28, 2014 (unaudited) (continued)

| | | | |

| | | Shares/Units | | Value |

| Short Term Investments | | | | |

| (Cost $45,414,368) 3.6% | | | | |

| f Investments from Cash Collateral | | | | |

| Received for Loaned Securities | | | | |

| Money Market Funds 3.6% | | | | |

| United States 3.6% | | | | |

| g BNY Mellon Overnight Government Fund, | | | | |

| 0.032% | | 45,414,368 | $ | 45,414,368 |

| |

| Total Investments | | | | |

| (Cost $946,938,988) 97.5% | | | | 1,249,005,120 |

| Other Assets, less Liabilities 2.5% | | | | 32,543,426 |

| |

| Net Assets 100.0% | | | $ | 1,281,548,546 |

See Abbreviations on page 36.

aNon-income producing.

bA portion or all of the security is on loan at February 28, 2014. See Note 1(c).

cSecurity was purchased pursuant to Regulation S under the Securities Act of 1933, which exempts from registration securities offered and sold outside of the United States. Such a

security cannot be sold in the United States without either an effective registration statement filed pursuant to the Securities Act of 1933, or pursuant to an exemption from regis-

tration. This security has been deemed liquid under guidelines approved by the Fund’s Board of Trustees.

dSecurity has been deemed illiquid because it may not be able to be sold within seven days.

eSee Note 8 regarding holdings of 5% voting securities.

fSee Note 1(c) regarding securities on loan.

gThe rate shown is the annualized seven-day yield at period end.

Semiannual Report | The accompanying notes are an integral part of these financial statements. | 21

Templeton Global Smaller Companies Fund

Financial Statements

Statement of Assets and Liabilities

February 28, 2014 (unaudited)

| | | |

| Assets: | | | |

| Investments in securities: | | | |

| Cost - Unaffiliated issuers | $ | 886,275,104 | |

| Cost - Non-controlled affiliated issuers (Note 8) | | 60,663,884 | |

| Total cost of investments | $ | 946,938,988 | |

| Value - Unaffiliated issuers | $ | 1,201,416,106 | |

| Value - Non-controlled affiliated issuers (Note 8) | | 47,589,014 | |

| Total value of investments (includes securities loaned in the amount $43,619,485) | | 1,249,005,120 | |

| Cash | | 81,995,395 | |

| Receivables: | | | |

| Investment securities sold | | 3,966,816 | |

| Capital shares sold | | 2,888,162 | |

| Dividends and interest | | 2,183,497 | |

| Other assets | | 879 | |

| Total assets | | 1,340,039,869 | |

| Liabilities: | | | |

| Payables: | | | |

| Investment securities purchased | | 9,833,757 | |

| Capital shares redeemed | | 1,591,584 | |

| Management fees | | 710,794 | |

| Administrative fees | | 115,559 | |

| Distribution fees | | 233,653 | |

| Transfer agent fees | | 357,109 | |

| Payable upon return of securities loaned | | 45,414,368 | |

| Accrued expenses and other liabilities | | 234,499 | |

| Total liabilities | | 58,491,323 | |

| Net assets, at value | $ | 1,281,548,546 | |

| Net assets consist of: | | | |

| Paid-in capital | $ | 1,044,815,465 | |

| Distributions in excess of net investment income | | (897,659 | ) |

| Net unrealized appreciation (depreciation) | | 302,081,567 | |

| Accumulated net realized gain (loss) | | (64,450,827 | ) |

| Net assets, at value | $ | 1,281,548,546 | |

22 | The accompanying notes are an integral part of these financial statements. | Semiannual Report

Templeton Global Smaller Companies Fund

Financial Statements (continued)

Statement of Assets and Liabilities (continued)

February 28, 2014 (unaudited)

| | | |

| Class A: | | | |

| Net assets, at value | $ | | 1,067,475,264 |

| Shares outstanding | | | 118,108,304 |

| Net asset value per sharea | | $ | 9.04 |

| Maximum offering price per share (net asset value per share ÷ 94.25%) | | $ | 9.59 |

| Class C: | | | |

| Net assets, at value | $ | | 47,386,477 |

| Shares outstanding | | | 5,442,867 |

| Net asset value and maximum offering price per sharea | | $ | 8.71 |

| Class R6: | | | |

| Net assets, at value | $ | | 25,772,438 |

| Shares outstanding | | | 2,842,992 |

| Net asset value and maximum offering price per share | | $ | 9.07 |

| Advisor Class: | | | |

| Net assets, at value | $ | | 140,914,367 |

| Shares outstanding | | | 15,546,911 |

| Net asset value and maximum offering price per share | | $ | 9.06 |

| |

| |

| aRedemption price is equal to net asset value less contingent deferred sales charges, if applicable. | | | |

Semiannual Report | The accompanying notes are an integral part of these financial statements. | 23

Templeton Global Smaller Companies Fund

Financial Statements (continued)

Statement of Operations

for the six months ended February 28, 2014 (unaudited)

| | | |

| Investment income: | | | |

| Dividends: (net of foreign taxes $511,672) | | | |

| Unaffiliated issuers | $ | 6,009,857 | |

| Non-controlled affiliated issuers (Note 8) | | 279,811 | |

| Interest | | 112 | |

| Income from securities loaned | | 666,990 | |

| Total investment income | | 6,956,770 | |

| Expenses: | | | |

| Management fees (Note 3a) | | 4,475,839 | |

| Administrative fees (Note 3b) | | 732,854 | |

| Distribution fees: (Note 3c) | | | |

| Class A | | 1,249,685 | |

| Class C | | 220,894 | |

| Transfer agent fees: (Note 3e) | | | |

| Class A | | 904,067 | |

| Class C | | 39,939 | |

| Class R6 | | 41 | |

| Advisor Class | | 134,996 | |

| Custodian fees (Note 4) | | 79,846 | |

| Reports to shareholders | | 94,416 | |

| Registration and filing fees | | 50,810 | |

| Professional fees | | 43,816 | |

| Trustees’ fees and expenses | | 39,299 | |

| Other | | 15,816 | |

| Total expenses | | 8,082,318 | |

| Net investment income (loss) | | (1,125,548 | ) |

| Realized and unrealized gains (losses): | | | |

| Net realized gain (loss) from: | | | |

| Investments | | 30,335,539 | |

| Foreign currency transactions | | (307,807 | ) |

| Net realized gain (loss) | | 30,027,732 | |

| Net change in unrealized appreciation (depreciation) on: | | | |

| Investments | | 145,281,284 | |

| Translation of other assets and liabilities denominated in foreign currencies | | 122,159 | |

| Net change in unrealized appreciation (depreciation) | | 145,403,443 | |

| Net realized and unrealized gain (loss) | | 175,431,175 | |

| Net increase (decrease) in net assets resulting from operations | $ | 174,305,627 | |

24 | The accompanying notes are an integral part of these financial statements. | Semiannual Report

Templeton Global Smaller Companies Fund

Financial Statements (continued)

| | | | | | |

| Statements of Changes in Net Assets | | | | | | |

| |

| |

| |

| | | Six Months Ended | | | | |

| | | February 28, 2014 | | | Year Ended | |

| | | (unaudited) | | | August 31, 2013 | |

| Increase (decrease) in net assets: | | | | | | |

| Operations: | | | | | | |

| Net investment income (loss) | $ | (1,125,548 | ) | $ | 6,955,524 | |

| Net realized gain (loss) from investments and foreign currency transactions | | 30,027,732 | | | 57,754,548 | |

| Net change in unrealized appreciation (depreciation) on investments and translation of | | | | | | |

| other assets and liabilities denominated in foreign currencies | | 145,403,443 | | | 139,069,817 | |

| Net increase (decrease) in net assets resulting from operations | | 174,305,627 | | | 203,779,889 | |

| Distributions to shareholders from: | | | | | | |

| Net investment income: | | | | | | |

| Class A | | (2,577,762 | ) | | (11,272,741 | ) |

| Class C | | — | | | (269,735 | ) |

| Class R6 | | (37 | ) | | — | |

| Advisor Class | | (741,716 | ) | | (2,061,929 | ) |

| Total distributions to shareholders | | (3,319,515 | ) | | (13,604,405 | ) |

| Capital share transactions: (Note 2) | | | | | | |

| Class A | | 32,789,466 | | | 8,305,557 | |

| Class B | | — | | | (458,067 | ) |

| Class C | | 1,438,735 | | | (1,570,949 | ) |

| Class R6 | | 25,553,064 | | | 5,000 | |

| Advisor Class | | (21,751,388 | ) | | (1,377,132 | ) |

| Total capital share transactions | | 38,029,877 | | | 4,904,409 | |

| Net increase (decrease) in net assets | | 209,015,989 | | | 195,079,893 | |

| Net assets: | | | | | | |

| Beginning of period | | 1,072,532,557 | | | 877,452,664 | |

| End of period | $ | 1,281,548,546 | | $ | 1,072,532,557 | |

| Undistributed net investment income (distributions in excess of net investment income) | | | | | | |

| included in net assets: | | | | | | |

| End of period | $ | (897,659 | ) | $ | 3,547,404 | |

Semiannual Report | The accompanying notes are an integral part of these financial statements. | 25

Templeton Global Smaller Companies Fund

Notes to Financial Statements (unaudited)

1. ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES

Templeton Global Smaller Companies Fund (Fund) is registered under the Investment Company Act of 1940, as amended, (1940 Act) as an open-end investment company. The Fund offers four classes of shares: Class A, Class C, Class R6, and Advisor Class. Each class of shares differs by its initial sales load, contingent deferred sales charges, voting rights on matters affecting a single class, its exchange privilege and fees primarily due to differing arrangements for distribution and transfer agent fees.

The following summarizes the Fund’s significant accounting policies.

a. Financial Instrument Valuation

The Fund’s investments in financial instruments are carried at fair value daily. Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants on the measurement date. The Fund calculates the net asset value (NAV) per share at the close of the New York Stock Exchange (NYSE), generally at 4 p.m. Eastern time (NYSE close) on each day the NYSE is open for trading. Under procedures approved by the Fund’s Board of Trustees (the Board), the Fund’s administrator, investment manager and other affiliates have formed the Valuation and Liquidity Oversight Committee (VLOC). The VLOC provides administration and oversight of the Fund’s valuation policies and procedures, which are approved annually by the Board. Among other things, these procedures allow the Fund to utilize independent pricing services, quotations from securities and financial instrument dealers, and other market sources to determine fair value.

Equity securities listed on an exchange or on the NASDAQ National Market System are valued at the last quoted sale price or the official closing price of the day, respectively. Foreign equity securities are valued as of the close of trading on the foreign stock exchange on which the security is primarily traded or as of the NYSE close, whichever is earlier. The value is then converted into its U.S. dollar equivalent at the foreign exchange rate in effect at the NYSE close on the day that the value of the security is determined. Over-the-counter (OTC) securities are valued within the range of the most recent quoted bid and ask prices. Securities that trade in multiple markets or on multiple exchanges are valued according to the broadest and most representative market. Certain equity securities are valued based upon fundamental characteristics or relationships to similar securities. Investments in non-registered money market funds are valued at the closing net asset value.

The Fund has procedures to determine the fair value of financial instruments for which market prices are not reliable or readily available. Under these procedures, the VLOC convenes on a regular basis to review such financial instruments and considers a number of factors, including significant unobservable valuation inputs, when arriving at fair value. The VLOC primarily employs a market-based approach which may use related or comparable assets or liabilities, recent transactions, market multiples, book values, and other relevant information for the investment to determine the fair value of the investment. An income-based valuation approach may also be used in which the anticipated future cash flows of the investment are discounted to calculate fair value.

26 | Semiannual Report

Templeton Global Smaller Companies Fund

Notes to Financial Statements (unaudited) (continued)

| 1. | ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES (continued) |

| a. | Financial Instrument Valuation (continued) |

Discounts may also be applied due to the nature or duration of any restrictions on the disposition of the investments. Due to the inherent uncertainty of valuations of such investments, the fair values may differ significantly from the values that would have been used had an active market existed. The VLOC employs various methods for calibrating these valuation approaches including a regular review of key inputs and assumptions, transactional back-testing or disposition analysis, and reviews of any related market activity.

Trading in securities on foreign securities stock exchanges and OTC markets may be completed before the daily NYSE close. In addition, trading in certain foreign markets may not take place on every NYSE business day. Occasionally, events occur between the time at which trading in a foreign security is completed and the close of the NYSE that might call into question the reliability of the value of a portfolio security held by the Fund. As a result, differences may arise between the value of the Fund’s portfolio securities as determined at the foreign market close and the latest indications of value at the close of the NYSE. In order to minimize the potential for these differences, the VLOC monitors price movements following the close of trading in foreign stock markets through a series of country specific market proxies (such as baskets of American Depositary Receipts, futures contracts and exchange traded funds). These price movements are measured against established trigger thresholds for each specific market proxy to assist in determining if an event has occurred that may call into question the reliability of the values of the foreign securities held by the Fund. If such an event occurs, the securities may be valued using fair value procedures, which may include the use of independent pricing services.

Also, when the last day of the reporting period is a non-business day, certain foreign markets may be open on those days that the NYSE is closed, which could result in differences between the value of the Fund’s portfolio securities on the last business day and the last calendar day of the reporting period. Any significant security valuation changes due to an open foreign market are adjusted and reflected by the Fund for financial reporting purposes.

b. Foreign Currency Translation

Portfolio securities and other assets and liabilities denominated in foreign currencies are translated into U.S. dollars based on the exchange rate of such currencies against U.S. dollars on the date of valuation. The Fund may enter into foreign currency exchange contracts to facilitate transactions denominated in a foreign currency. Purchases and sales of securities, income and expense items denominated in foreign currencies are translated into U.S. dollars at the exchange rate in effect on the transaction date. Portfolio securities and assets and liabilities denominated in foreign currencies contain risks that those currencies will decline in value relative to the U.S. dollar. Occasionally, events may impact the availability or reliability of foreign exchange rates used to convert the U.S. dollar equivalent value. If such an event occurs, the foreign exchange rate will be valued at fair value using procedures established and approved by the Board.

Semiannual Report | 27

Templeton Global Smaller Companies Fund

Notes to Financial Statements (unaudited) (continued)

| 1. | ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES (continued) |

| b. | Foreign Currency Translation (continued) |

The Fund does not separately report the effect of changes in foreign exchange rates from changes in market prices on securities held. Such changes are included in net realized and unrealized gain or loss from investments on the Statement of Operations.

Realized foreign exchange gains or losses arise from sales of foreign currencies, currency gains or losses realized between the trade and settlement dates on securities transactions and the difference between the recorded amounts of dividends, interest, and foreign withholding taxes and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized foreign exchange gains and losses arise from changes in foreign exchange rates on foreign denominated assets and liabilities other than investments in securities held at the end of the reporting period.

c. Securities Lending

The Fund participates in an agency based securities lending program. The Fund receives cash collateral against the loaned securities in an amount equal to at least 102% of the market value of the loaned securities. Collateral is maintained over the life of the loan in an amount not less than 100% of the market value of loaned securities, as determined at the close of fund business each day; any additional collateral required due to changes in security values is delivered to the Fund on the next business day. The collateral is invested in a non-registered money fund as indicated on the Statement of Investments. The Fund receives income from the investment of cash collateral, in addition to lending fees and rebates paid by the borrower. The Fund bears the market risk with respect to the collateral investment, securities loaned, and the risk that the agent may default on its obligations to the Fund. The securities lending agent has agreed to indemnify the Fund in the event of default by a third party borrower.

d. Income and Deferred Taxes

It is the Fund’s policy to qualify as a regulated investment company under the Internal Revenue Code. The Fund intends to distribute to shareholders substantially all of its taxable income and net realized gains to relieve it from federal income and excise taxes. As a result, no provision for U.S. federal income taxes is required.

The Fund may be subject to foreign taxation related to income received, capital gains on the sale of securities and certain foreign currency transactions in the foreign jurisdictions in which it invests. Foreign taxes, if any, are recorded based on the tax regulations and rates that exist in the foreign markets in which the Fund invests. When a capital gain tax is determined to apply the Fund records an estimated deferred tax liability in an amount that would be payable if the securities were disposed of on the valuation date.

28 | Semiannual Report

Templeton Global Smaller Companies Fund

Notes to Financial Statements (unaudited) (continued)

| 1. | ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES (continued) |

| d. | Income and Deferred Taxes (continued) |

The Fund recognizes the tax benefits of uncertain tax positions only when the position is “more likely than not” to be sustained upon examination by the tax authorities based on the technical merits of the tax position. As of February 28, 2014, and for all open tax years, the Fund has determined that no liability for unrecognized tax benefits is required in the Fund’s financial statements related to uncertain tax positions taken on a tax return (or expected to be taken on future tax returns). Open tax years are those that remain subject to examination and are based on each tax jurisdiction statute of limitation.

e. Security Transactions, Investment Income, Expenses and Distributions

Security transactions are accounted for on trade date. Realized gains and losses on security transactions are determined on a specific identification basis. Interest income and estimated expenses are accrued daily. Amortization of premium and accretion of discount on debt securities are included in interest income. Dividend income is recorded on the ex-dividend date except that certain dividends from foreign securities are recognized as soon as the Fund is notified of the ex-dividend date. Distributions to shareholders are recorded on the ex-dividend date and are determined according to income tax regulations (tax basis). Distributable earnings determined on a tax basis may differ from earnings recorded in accordance with accounting principles generally accepted in the United States of America. These differences may be permanent or temporary. Permanent differences are reclassified among capital accounts to reflect their tax character. These reclassifications have no impact on net assets or the results of operations. Temporary differences are not reclassified, as they may reverse in subsequent periods.

Realized and unrealized gains and losses and net investment income, not including class specific expenses, are allocated daily to each class of shares based upon the relative proportion of net assets of each class. Differences in per share distributions, by class, are generally due to differences in class specific expenses.

f. Accounting Estimates

The preparation of financial statements in accordance with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the amounts of income and expenses during the reporting period. Actual results could differ from those estimates.

Semiannual Report | 29

Templeton Global Smaller Companies Fund

Notes to Financial Statements (unaudited) (continued)

1. ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES (continued) g. Guarantees and Indemnifications

Under the Fund’s organizational documents, its officers and trustees are indemnified by the Fund against certain liabilities arising out of the performance of their duties to the Fund. Additionally, in the normal course of business, the Fund enters into contracts with service providers that contain general indemnification clauses. The Fund’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Fund that have not yet occurred. Currently, the Fund expects the risk of loss to be remote.

2. SHARES OF BENEFICIAL INTEREST

At February 28, 2014, there were an unlimited number of shares authorized (without par value).

Transactions in the Fund’s shares were as follows:

| | | | | | | | | | | | |

| | Six Months Ended | | Year Ended | |

| | February 28, 2014 | | August 31, 2013 | |

| | Shares | | | | Amount | | Shares | | | | Amount | |

| Class A Shares: | | | | | | | | | | | | |

| Shares sold | 17,072,135 | | $ | 146,939,653 | | 21,872,236 | | $ | 162,224,042 | |

| Shares issued in reinvestment of | | | | | | | | | | | | |

| distributions | 267,627 | | | | 2,357,791 | | 1,470,109 | | | | 10,070,246 | |

| Shares redeemed | (13,468,163 | ) | | (116,507,978 | ) | (22,783,857 | ) | | (163,988,731 | ) |

| Net increase (decrease) | 3,871,599 | | | $ | 32,789,466 | | 558,488 | | | $ | 8,305,557 | |

| Class B Sharesa: | | | | | | | | | | | | |

| Shares sold | | | | | | | 682 | | | $ | 4,321 | |

| Shares redeemed | | | | | | | (70,218 | ) | | | (462,388 | ) |

| Net increase (decrease) | | | | | | | (69,536 | ) | | $ | (458,067 | ) |

| Class C Shares: | | | | | | | | | | | | |

| Shares sold | 643,714 | | | $ | 5,393,805 | | 875,497 | | | $ | 6,183,553 | |

| Shares issued in reinvestment of | | | | | | | | | | | | |

| Distributions | — | | | | — | | 35,428 | | | | 235,241 | |

| Shares redeemed | (475,708 | ) | | | (3,955,070 | ) | (1,168,004 | ) | | | (7,989,743 | ) |

| Net increase (decrease) | 168,006 | | | $ | 1,438,735 | | (257,079 | ) | | $ | (1,570,949 | ) |

| Class R6 Sharesb: | | | | | | | | | | | | |

| Shares sold | 2,889,855 | | | $ | 25,978,010 | | 673 | | | $ | 5,000 | |

| Shares redeemed | (47,536 | ) | | | (424,946 | ) | — | | | | — | |

| Net increase (decrease) | 2,842,319 | | | $ | 25,553,064 | | 673 | | | $ | 5,000 | |

| Advisor Class Shares: | | | | | | | | | | | | |

| Shares sold | 1,546,013 | | | $ | 13,416,453 | | 2,584,735 | | | $ | 18,937,131 | |

| Shares issued in reinvestment of | | | | | | | | | | | | |

| distributions | 78,708 | | | | 694,990 | | 282,548 | | | | 1,938,283 | |

| Shares redeemed | (4,033,648 | ) | | | (35,862,831 | ) | (3,145,132 | ) | | | (22,252,546 | ) |

| Net increase (decrease) | (2,408,927 | ) | $ | (21,751,388 | ) | (277,849 | ) | | $ | (1,377,132 | ) |

aEffective March 22, 2013, all Class B shares were converted to Class A.

bFor the period May 1, 2013 (effective date) to August 31, 2013.

30 | Semiannual Report

Templeton Global Smaller Companies Fund

Notes to Financial Statements (unaudited) (continued)

3. TRANSACTIONS WITH AFFILIATES

Franklin Resources, Inc. is the holding company for various subsidiaries that together are referred to as Franklin Templeton Investments. Certain officers and trustees of the Fund are also officers and/or directors of the following subsidiaries:

| |

| Subsidiary | Affiliation |

| Franklin Templeton Investment Corp. (FTIC) | Investment manager |

| Templeton Investment Counsel, LLC (TIC) | Investment manager – sub-advisor |

| Franklin Templeton Services, LLC (FT Services) | Administrative manager |

| Franklin Templeton Distributors, Inc. (Distributors) | Principal underwriter |

| Franklin Templeton Investor Services, LLC (Investor Services) | Transfer agent |

a. Management Fees

The Fund pays an investment management fee to FTIC based on the average daily net assets of the Fund as follows:

| | |

| Annualized Fee Rate | | Net Assets |

| 0.750 | % | Up to and including $1 billion |

| 0.730 | % | Over $1 billion, up to and including $5 billion |

| 0.710 | % | Over $5 billion, up to and including $10 billion |

| 0.690 | % | Over $10 billion, up to and including $15 billion |

| 0.670 | % | Over $15 billion, up to and including $20 billion |

| 0.650 | % | In excess of $20 billion |

Under a subadvisory agreement, TIC, an affiliate of FTIC, provides subadvisory services to the Fund. The subadvisory fee is paid by FTIC fees based on the average daily net assets and is not an additional expense of the Fund.

b. Administrative Fees

The Fund pays an administrative fee to FT Services based on the Fund’s average daily net assets as follows:

| | |

| Annualized Fee Rate | | Net Assets |

| 0.150 | % | Up to and including $200 million |

| 0.135 | % | Over $200 million, up to and including $700 million |

| 0.100 | % | Over $700 million, up to and including $1.2 billion |

| 0.075 | % | In excess of $1.2 billion |

c. Distribution Fees

The Board has adopted distribution plans for each share class, with the exception of Class R6 and Advisor Class shares, pursuant to Rule 12b-1 under the 1940 Act. Distribution fees are not charged on shares held by affiliates. Under the Fund’s Class A reimbursement distribution plan, the Fund reimburses Distributors for costs incurred in connection with the servicing, sale and distribution of the Fund’s shares up to the maximum annual plan rate. Under the Class A reimbursement distribution plan, costs exceeding the maximum for the current plan year cannot be

Semiannual Report | 31

Templeton Global Smaller Companies Fund

Notes to Financial Statements (unaudited) (continued)

| 3. | TRANSACTIONS WITH AFFILIATES (continued) |

| c. | Distribution Fees (continued) |

reimbursed in subsequent periods. In addition, under the Fund’s Class C compensation distribution plans, the Fund pays Distributors for costs incurred in connection with the servicing, sale and distribution of the Fund’s shares up to the maximum annual plan rate for each class. The plan year, for purposes of monitoring compliance with the maximum annual plan rates, is February 1 through January 31.

The maximum annual plan rates, based on the average daily net assets, for each class, are as follows:

d. Sales Charges/Underwriting Agreements

Front-end sales charges and contingent deferred sales charges (CDSC) do not represent expenses of the Fund. These charges are deducted from the proceeds of sales of Fund shares prior to investment or from redemption proceeds prior to remittance, as applicable. Distributors has advised the Fund of the following commission transactions related to the sales and redemptions of the Fund’s shares for the period:

| | |

| Sales charges retained net of commissions paid to unaffiliated | | |

| broker/dealers | $ | 369,134 |

| CDSC retained | $ | 2,371 |

e. Transfer Agent Fees

Each class of shares, except for Class R6, pays transfer agent fees to Investor Services for its performance of shareholder servicing obligations and reimburses Investor Services for out of pocket expenses incurred, including shareholding servicing fees paid to third parties. These fees are allocated daily based upon their relative proportion of such classes’ aggregate net assets. Class R6 pays Investor Services transfer agent fees specific to that class.

For the period ended February 28, 2014, the Fund paid transfer agent fees of $1,079,043, of which $469,178 was retained by Investor Services.

f. Waiver and Expense Reimbursements

Investor Services has contractually agreed in advance to waive or limit its fees so that the Class R6 transfer agent fees do not exceed 0.01% until December 31, 2014. There were no expenses waived during the period ended February 28, 2014.

32 | Semiannual Report

Templeton Global Smaller Companies Fund

Notes to Financial Statements (unaudited) (continued)

4. EXPENSE OFFSET ARRANGEMENT

The Fund has entered into an arrangement with its custodian whereby credits realized as a result of uninvested cash balances are used to reduce a portion of the Fund’s custodian expenses. During the period ended February 28, 2014, there were no credits earned.

5. INCOME TAXES

For tax purposes, capital losses may be carried over to offset future capital gains. Capital loss carryforwards with no expiration, if any, must be fully utilized before those losses with expiration dates.

At August 31, 2013, the Fund had capital loss carryforwards of $86,469,348 expiring in 2018.

At February 28, 2014, the cost of investments and net unrealized appreciation (depreciation) for income tax purposes were as follows:

| | | |

| Cost of investments | $ | 953,148,313 | |

| |

| Unrealized appreciation | $ | 359,985,069 | |

| Unrealized depreciation | | (64,128,262 | ) |

| Net unrealized appreciation (depreciation) | $ | 295,856,807 | |

Differences between income and/or capital gains as determined on a book basis and a tax basis are primarily due to differing treatments of passive foreign investment company shares.