Washington, D.C. 20549

Mr. Hal Liebes

Form N-CSR is to be used by management investment companies to file reports with the Commission, not later than 10 days after the transmission to Stockholders of any report to be transmitted to Stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to the Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Table of Contents

The Alger Funds

| Shareholders’ Letter (Unaudited) | April 30, 2023 |

Dear Shareholders,

The Pendulum of Market Sentiment

“In the short run, the market is a voting machine but in the long run, it is a weighing machine.” – Benjamin Graham.

Stock prices may have fluctuated over the six month period ended April 30, 2023, mostly based on interest rate movements, but we agree with Graham that over the longer term, company earnings and cash flows ultimately determine stock prices. We believe the rise in interest rates and the corresponding decline in equity valuations are subsiding, leaving Graham’s proverbial scale to determine where stocks are headed. In the final two months of 2022, optimism surrounding the potential peak of the Federal Reserve Bank’s (Fed) tightening cycle was reinforced by lower-than-expected core Consumer Price Index (CPI) readings for both November and December. Persistent inflation, particularly in wages, remained a focal point for the Fed, and the inverted yield curve amplified fears of a policy misstep or a looming economic downturn. Fed Chairman Jerome Powell indicated in December 2022, that the institution would maintain its “higher-for-longer” approach for interest rates and projected a long-run terminal rate exceeding 5.0%, which sparked concerns about the sustainability of a stock market rebound.

The first quarter of 2023 saw a reversal in the bearish investor sentiment that had marked much of the previous year. In February, the Fed reduced the pace of rate hikes to 25 basis points (bps), after a 50 bps hike in December. Powell, acknowledging the disinflation trend, did not resist the easing of financial conditions, and U.S. Treasury yields fell during the first quarter. In March, concerns around bank funding and liquidity emerged following the collapse of two regional banks, leading to significant deposit outflows at the regional level. However, the Fed, U.S. Treasury, and Federal Deposit Insurance Corporation (FDIC) took steps to contain market concerns. These steps included announcing an emergency liquidity program, guaranteeing uninsured deposits at the impacted regional banks, and allowing some bank mergers and acquisitions to take place. At the end of March, the Fed raised rates by another 25 bps, bringing the Federal Funds rate to 5.0%. In April, U.S. Gross Domestic Product (GDP) grew 1.1%, missing the 2.0% forecast and falling from the prior quarter’s 2.6%, despite robust consumer spending.

Among non-U.S. equities, developed markets saw strong performance during the fiscal six-month period ended April 30, 2023. Notable strength was driven by Europe avoiding an energy crisis due to a mild winter, and global supply chain bottlenecks seeing continued relief. As such, the MSCI EAFE Index was up 24.6%, driven by strong performance in the Financials and Industrials sectors, while the Real Estate and Energy sectors experienced relative weakness. From a broader perspective, the MSCI ACWI Index rose 13.0% during the fiscal six-month period, where the Communication Services and Information Technology sectors showed strong results, while the Healthcare and Energy sectors saw weaker performance. Within Emerging Markets, notable strength was driven by China reopening its borders, and the MSCI Emerging Markets Index was up 16.5% during the fiscal six-month period. Strong performance within the Communication Services and Information Technology sectors was slightly offset by relative weakness in the Real Estate and Energy sectors.

- 1 -

During the fiscal six-month period, growth outperformed value, with the Russell 3000 Growth Index returning 10.8%, outperforming the Russell 3000 Value Index, which posted a return of 3.4% for the period. There was also a notable bifurcation between small- and large- cap stocks, where the -3.5% return of the Russell 2000 Index considerably underperformed the 7.2% return of the Russell 1000 Index during the fiscal six-month period.

Slow Dance into Recession

The Conference Board’s Index of Leading Economic Indicators (LEI) – a composite of economic information that includes housing, consumer confidence and durable goods orders – has historically proven to be a strong predictor of recessions, particularly when the index moves into negative territory. The LEI fell into negative territory in August 2022, and as of March 2023, it shows a year-over-year decline of 7.8%.

Further, over the past thirteen tightening cycles, the United States has only achieved a soft landing (i.e., an economic slowdown without a recession) on three occasions (1984, 1994- 1995 and 2020). In each of these instances, interest rates were increased by only 300 bps. As of April 30, 2023, the Fed has increased rates by approximately 500 bps since it began its hiking cycle in March 2022. If history is any guide, we find it unlikely that the Fed can successfully orchestrate a soft landing, given the Fed has now hiked well above the approximate “soft landing” rate increase of 300 bps.

Further challenging the ability for a soft landing is the lagged impact of the Fed’s aggressive tightening cycle. It is important to note the strong historical relationship between small bank lending standards and U.S. corporate business spending, known as capital expenditures. As bank lending standards tighten, fewer loans are made and companies’ cost of capital rises. As a result, companies reduce their capital projects, either due to a lack of funds or because the higher cost makes these projects less financially attractive. In our view, bank lending standards will likely continue to tighten and slow business capital expenditures, pressuring earnings for more economically sensitive companies that rely on capital expansion projects.

As of the writing of this letter, the Fed has continued to tighten financial conditions via its interest rate increases and the roll-off of debt from its balance sheet. Further, the broader money supply growth is decelerating and is now in outright contraction for the first time since 1938, which is likely to slow economic activity. For these reasons, we believe the United States may have already entered a recession.

Going Forward

We continue to believe that unprecedented levels of innovation are creating compelling investment opportunities - corporations are digitizing their operations, cloud computing growth continues to support future innovation, and artificial intelligence, which is at an inflection point in our view, potentially enabling significant increases in productivity. In the Healthcare sector, we believe that advances in surgical technologies and innovations within biotechnology offer attractive opportunities ahead. As such, we intend to continue to focus on conducting in-depth fundamental research as we seek leaders of innovation rather than taking short-term bets on market sentiment. We believe doing so is the best strategy for helping our valued shareholders reach their investment goals.

- 2 -

Portfolio Matters

Alger Capital Appreciation Fund

The Alger Capital Appreciation Fund returned 9.42% for the fiscal six-month period ended April 30, 2023, compared to the 11.51% return of the Russell 1000 Growth Index. During the reporting period, the largest sector weightings were Information Technology and Healthcare. The largest sector overweight was Healthcare and the largest sector underweight was Information Technology.

Contributors to Performance

The Consumer Discretionary and Industrials sectors provided the largest contributions to relative performance. Regarding individual positions, Microsoft Corporation; NVIDIA Corporation; TransDigm Group Incorporated; MercadoLibre, Inc.; and Apple Inc. were among the top contributors to absolute performance.

Microsoft is a beneficiary of corporate America’s transformative digitization. Microsoft’s CEO expects technology spending as a percent of GDP to jump from about 5% now to 10% in 10 years and that Microsoft will continue to capture market share within the technology sector. The company operates through three segments: Productivity and Business Processes (Office, LinkedIn, and Dynamics), Intelligent Cloud (Server Products and Cloud Services, Azure, and Enterprise Services), and More Personal Computing (Windows, Devices, Gaming, and Search). While the company reported operating results that met consensus estimates, their investment in OpenAI’s ChatGPT captured the attention of investors, contributing to positive performance. Throughout the period, Microsoft surprised investors with continual rollouts of new AI capabilities across the company’s portfolio (e.g., Bing, GitHub, Teams, Office 365). Furthermore, the company announced Microsoft 365 Copilot, which leverages GPT-4, a large language model, combined with the Microsoft Graph of data to provide AI virtual assistance. We believe Microsoft’s investment in OpenAI provides a first-mover advantage in the AI transformer model space.

Detractors from Performance

The Healthcare and Communication Services sectors were the largest detractors from relative performance. Regarding individual positions, Tesla, Inc.; UnitedHealth Group Incorporated; Signature Bank; Albemarle Corporation; and Humana Inc. were among the top detractors from absolute performance.

UnitedHealth Group is an integrated healthcare benefits company uniquely positioned to address rising healthcare costs for its customers, due to its vertical integration, size, and scale. The Optum health benefits services unit, which accounts for approximately 45% of the company’s operating earnings, in our view, has the potential to grow even further as customers look for ways to manage rising healthcare costs. During the period, shares detracted from performance due to several factors: (1) many 2022 healthcare winners with shorter duration profiles and persistent earnings profiles, such as UnitedHealth Group, underperformed in the first quarter of 2023, (2) uncertainty surrounding Medicare Advantage reimbursement levels from the Federal government in 2023, which will be determined later in the year, and (3) increased regulatory scrutiny in the form of potential Medicare Advantage audits across the industry. While these concerns have impacted UnitedHealth in the near-term, we believe company fundamentals remain intact given its large-scale business model, competitive advantages, and medium- to long-term growth prospects.

- 3 -

Alger 35 Fund

The Alger 35 Fund generated a 1.91% return for the fiscal six-month period ended April 30, 2023, compared to the 8.63% return of the S&P 500 Index. During the reporting period, the largest sector weightings were Information Technology and Consumer Discretionary. The largest sector overweight was Consumer Discretionary and the largest sector underweight was Financials.

Contributors to Performance

The Consumer Discretionary and Real Estate sectors provided the largest contributions to relative performance. Regarding individual positions, MercadoLibre, Inc.; Advanced Micro Devices, Inc.; TransMedics Group, Inc.; Cabaletta Bio, Inc.; and Netflix, Inc. were among the top contributors to absolute performance.

MercadoLibre is the largest e-commerce company in Latin America, with its largest markets being Brazil, Argentina, and Mexico. The company offers a comprehensive suite of services, including an online marketplace for buyers and sellers, payment solutions through Mercado Pago, merchant and buyer financing through Mercado Credito, shipping services through Mercado Envios, and asset management through Mercado Fondo, among other services. We believe the e-commerce market within Central and South America remains underpenetrated, creating a favorable backdrop for MercadoLibre, as they have been growing and investing heavily to expand its first mover advantage. Moreover, we believe that the company’s growing fintech payments business, Mercado Pago, is well-positioned to potentially emerge as a leader in Central and South America, as well as an emerging online advertising presence that offers attractive margin expansion potential, in our view. During the period, shares contributed to performance after the company reported resilient fiscal fourth quarter earnings that exceeded analyst estimates. Notable drivers that contributed to the earnings beat included strong gross-merchandise-value and an increase in the average take-rate within both e-commerce and Mercado Pago.

Detractors from Performance

The Information Technology and Communication Services sectors were the largest detractors from relative performance. Regarding individual positions, 908 Devices Inc.; JD.com, Inc.; RAPT Therapeutics, Inc.; Rivian Automotive, Inc.; and Alphabet Inc. were among the top detractors from absolute performance.

Alphabet is a global technology company specializing in cloud operating systems and digital advertising. Company revenues are primarily driven by online advertising on its Google search platform, along with selling hardware devices and apps on Google Play. Shares detracted from results during the period as the company reported mixed results. The company’s net revenues were slightly below analysts’ estimates as advertisers reduced their spending during the period. However, growth in Alphabet’s cloud computing segment—Google Cloud—saw an acceleration during the period.

Alger Growth & Income Fund

The Alger Growth & Income Fund returned 9.20% for the fiscal six-month period ended April 30, 2023, compared to the 8.63% return of the S&P 500 Index. During the reporting period, the largest sector weightings were Information Technology and Healthcare. The largest sector overweight was Energy and the largest sector underweight was Consumer Discretionary.

- 4 -

Contributors to Performance

The Financials and Materials sectors provided the largest contributions to relative performance. Regarding individual positions, Microsoft Corporation; Broadcom Inc.; Apple Inc.; Meta Platforms Inc.; and KLA Corporation were among the top contributors to absolute performance. Shares of Microsoft Corporation contributed to performance in response to developments identified in the Alger Capital Appreciation Fund discussion.

Detractors from Performance

The Healthcare and Industrials sectors were the largest detractors from relative performance. Regarding individual positions, UnitedHealth Group Incorporated; Bank of America Corp; CVS Health Corporation; Cheniere Energy Partners, L.P.; and Pfizer Inc. were among the top detractors from absolute performance. Shares of UnitedHealth Group Incorporated detracted from performance in response to developments identified in the Alger Capital Appreciation Fund discussion.

Alger Mid Cap Growth Fund

The Alger Mid Cap Growth Fund returned 5.45% for the fiscal six-month period ended April 30, 2023, compared to the 6.60% return of the Russell Midcap Growth Index. During the reporting period, the largest sector weightings were Information Technology and Industrials. The largest sector overweight was Information Technology and the largest sector underweight was Consumer Discretionary.

Contributors to Performance

The Information Technology and Energy sectors provided the largest contributions to relative performance. Regarding individual positions, Prometheus Biosciences, Inc.; Constellation Software Inc.; Chipotle Mexican Grill, Inc.; Cadence Design Systems, Inc.; and TransDigm Group Incorporated were among the top contributors to absolute performance.

TransDigm Group specializes in the production of engineered aerospace components, systems and subsystems. Its core Power and Control segment includes operations that primarily develop, produce and market systems and components that provide power to or control power of aircrafts utilizing electronic, fluid, power and mechanical motion control technologies. During the period, the company reported solid fiscal first quarter results, where both revenues and earnings beat analyst estimates. Better-than-expected results were driven by strength in all three of their major market channels – commercial original equipment manufacturing (OEM), commercial aftermarket and defense – as well as strong order bookings. Moreover, management raised their fiscal full year guidance, noting favorable trends in the commercial aerospace market recovery.

Detractors from Performance

The Consumer Discretionary and Consumer Staples sectors were the largest detractors from relative performance. Regarding individual positions, CrowdStrike Holdings, Inc.; First Republic Bank; Aritzia, Inc.; BILL Holdings, Inc.; and Enphase Energy, Inc. were among the top detractors from absolute performance.

BILL Holdings is the leading provider of business-to-business (B2B) commerce solutions for small- and medium-sized businesses (SMBs), including streamlining financial operations such as accounts payables (AP) and accounts receivables (AR). Their target market is primarily U.S. SMBs with revenues up to $100 million. The company earns revenue from: (1) subscription fees charged for access to its cloud-based services; (2) usage-based transaction fees, including payments-related fees; and (3) interest earned on funds held on behalf of customers. The company is positioned as a back-office financial operations and an AP automation software-as-a-service (SaaS) platform for the SMB segment of B2B payments. According to our analysis, roughly 42% of B2B payments are still made via physical check, and 93% of businesses with less than $1 billion of annual revenue reported receiving physical checks as payment. During the period, shares detracted from performance, as the company reported weaker than expected results. Specifically, growth in total payment volume and transaction growth weakened due to the challenging macroeconomic backdrop, along with fewer net-customer additions. Despite these events, we believe company fundamentals remain intact and are well positioned to continue to penetrate the underserved SMB market with its differentiated product offerings over the long-term.

- 5 -

Alger Mid Cap Focus Fund

The Alger Mid Cap Focus Fund generated a -1.89% return for the fiscal six-month period ended April 30, 2023, compared to the 6.60% return of the Russell Midcap Growth Index. During the reporting period, the largest sector weightings were Information Technology and Healthcare. The largest sector overweight was Healthcare and the largest sector underweight was Financials.

Contributors to Performance

The Energy and Communication Services sectors provided the largest contributions to relative performance. Regarding individual positions, Prometheus Biosciences, Inc.; Insulet Corporation; Coupa Software, Inc.; Bentley Systems, Incorporated; and Viridian Therapeutics, Inc. were among the top contributors to absolute performance.

Coupa Software is a cloud-based spend management platform that digitizes many areas of core transactional spending functions, including travel and expense management, invoicing and procurement. On December 12, 2022, Coupa announced that it entered into a definitive agreement to be acquired by Thoma Bravo for $8 billion, or $81 per share, in an all-cash transaction. Shares contributed to performance in response to the Thoma Bravo announcement, as the acquisition price was at a sizable premium.

Detractors from Performance

The Information Technology and Healthcare sectors were the largest detractors from relative performance. Regarding individual positions, RAPT Therapeutics, Inc.; BILL Holdings, Inc.; Constellation Energy Corporation; CrowdStrike Holdings, Inc.; and CyberArk Software Ltd. were among the top detractors from absolute performance. Shares of BILL Holdings detracted from performance in response to developments identified in the Alger Mid Cap Growth Fund discussion.

Alger Weatherbie Specialized Growth Fund

The Alger Weatherbie Specialized Growth Fund generated a -3.20% return for the fiscal six-month period ended April 30, 2023, compared to the 1.88% return of the Russell 2500 Growth Index. During the reporting period, the largest sector weightings were Industrials and Healthcare. The largest sector overweight was Real Estate and the largest sector underweight was Materials.

Contributors to Performance

The Energy and Real Estate sectors provided the largest contributions to relative performance. Regarding individual positions, FirstService Corp; SiteOne Landscape Supply, Inc.; SPS Commerce, Inc.; Planet Fitness, Inc.; and Hamilton Lane Incorporated were among the top contributors to absolute performance.

- 6 -

SPS Commerce is a global provider of cloud-based supply chain management solutions for fulfillment, analytics, drop shipping and other use cases. The SPS Commerce platform improves the way retailers, suppliers, grocers, distributors, and logistics companies manage orders, monitor sell-through performance, and discover new products by leveraging cloud technology. During the period, shares contributed to performance as the company reported strong operating results, where revenues came in above consensus estimates. Additionally, recurring revenue increased 20% year-over-year, driven by double digit growth in both fulfillment and analytics. Despite a difficult macroeconomic environment with high inflation and recession concerns, management expressed confidence in its subscription-based business model, which is largely reliant on the number of client connections with only a small portion tied to volumes. Moreover, we believe the company is a key beneficiary of supply chain digitalization over the long-term, given the growing influence of e-commerce.

Detractors from Performance

The Healthcare and Industrials sectors were the largest detractors from relative performance. Regarding individual positions, Montrose Environmental Group Inc.; Xometry, Inc.; StepStone Group, Inc.; Globant SA; and Progyny, Inc. were among the top detractors from absolute performance.

Xometry is a leading two-sided marketplace for on-demand manufacturing services. The company provides real-time access to global manufacturing demand and capacity, with sourcing and pricing available across a network of buyers and sellers. This marketplace enables buyers (e.g., engineers and product designers) to efficiently source manufacturing processes and sellers of manufacturing services to grow their businesses. Xometry’s AI- enabled technology platform is powered by proprietary machine learning algorithms, resulting in a sophisticated marketplace for manufacturing. During the period, the company reported weaker-than-expected revenues and revised their forward guidance below consensus. Management noted that suppliers accepted orders more quickly than usual on the Xometry platform due to a challenging macroeconomic environment, causing the proprietary algorithm to reduce market pricing, resulting in weaker revenue growth and gross margin compression. The company adjusted their proprietary algorithm in January and the company stated that it expects gross margins to improve throughout the year.

Alger Small Cap Growth Fund

The Alger Small Cap Growth Fund returned -2.15% for the fiscal six-month period ended April 30, 2023, compared to the -0.29% return of the Russell 2000 Growth Index. During the reporting period, the largest sector weightings were Healthcare and Information Technology. The largest sector overweight was Healthcare and the largest sector underweight was Industrials.

Contributors to Performance

The Information Technology and Real Estate sectors provided the largest contributions to relative performance. Regarding individual positions, NeoGenomics, Inc.; Manhattan Associates, Inc.; HubSpot, Inc.; Neogen Corp; and Wingstop, Inc. were among the top contributors to absolute performance.

- 7 -

Hubspot is a cloud-based marketing and sales platform for SMBs, focusing on inbound marketing strategies to attract, engage, and convert website visitors into customers. Its platform provides a comprehensive suite of applications including search engine optimization (SEO), blogging, marketing automation, customer relationship management (CRM), and analytics, utilizing a centralized database for personalized interactions. In our view, this approach fosters warmer prospect engagement compared to traditional methods like cold calling and email blasts. Over the years, the company has evolved from a small business CRM vendor to a comprehensive provider of marketing, sales and content management solutions for global SMBs. With an approximate 3% combined market share, a large customer base, robust partner network and extensive HubSpot suite, we believe the company is well positioned to capture additional market share in the large SMB front office applications industry, as well as to expand in the upmarket segment (i.e., companies with 200 to 2,000 employees). Shares contributed to performance during the period, as the company reported better-than-expected operating results, noting strong quarterly execution against a difficult macroeconomic environment.

Detractors from Performance

The Healthcare and Industrials sectors were the largest detractors from relative performance. Regarding individual positions, Magnolia Oil & Gas Corp.; Xometry, Inc.; BILL Holdings, Inc.; HealthEquity Inc; and CareDx, Inc. were among the top detractors from absolute performance. Shares of BILL Holdings, Inc. detracted from performance in response to developments identified in the Alger Mid Cap Growth Fund discussion.

Alger Small Cap Focus Fund

The Alger Small Cap Focus Fund returned -3.55% for the fiscal six-month period ended April 30, 2023, compared to the -0.29% return of the Russell 2000 Growth Index. During the reporting period, the largest sector weightings were Healthcare and Information Technology. The largest sector overweight was Healthcare and the largest sector underweight was Consumer Discretionary.

Contributors to Performance

The Healthcare and Energy sectors provided the largest contributions to relative performance. Regarding individual positions, Prometheus Biosciences, Inc.; Heska Corporation; Guidewire Software, Inc.; Inspire Medical Systems, Inc.; and Wingstop, Inc. were among the top contributors to absolute performance.

Guidewire Software offers on-premises and cloud-based solutions for property and casualty insurance companies, automating processes such as premium billings, claims management, and policy fulfillment. Under the InsuranceSuite brand, the company provides three core systems: BillingsCenter, ClaimsCenter, and PolicyCenter. During the period, shares contributed to performance after the company reported strong operating results, where revenues and operating profits exceeded analyst estimates. Moreover, strong performance was attributable to ongoing cloud traction as the company continued to see large cloud momentum across tier-1 and tier-2 carriers. Management also raised gross margin guidance by 200 bps for the full year, approximately 500 bps ahead of what management projected in October 2022.

Detractors from Performance

The Industrials and Information Technology sectors were the largest detractors from relative performance. Regarding individual positions, Xometry, Inc.; HealthEquity Inc.; RBC Bearings Incorporated; 908 Devices Inc.; and Paycom Software, Inc. were among the top detractors from absolute performance. Shares of Xometry, Inc. detracted from performance in response to developments identified in the Alger Mid Cap Growth Fund discussion.

- 8 -

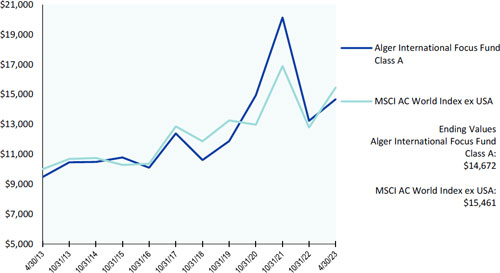

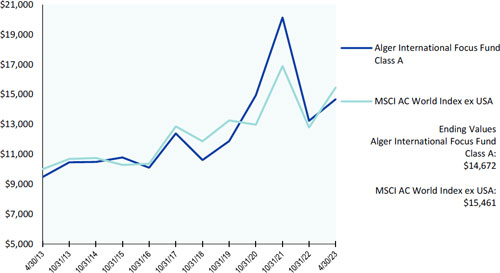

Alger International Focus Fund

The Alger International Focus Fund recorded a 10.83% return for the fiscal six-month period ended April 30, 2023, compared to the 20.96% return of the MSCI ACWI ex USA Index. During the reporting period, the largest sector weightings were Consumer Discretionary and Financials. The largest sector overweight was Consumer Discretionary and the largest sector underweight was Communication Services.

Contributors to Performance

The Healthcare and Consumer Discretionary sectors provided the largest contributions to relative performance. Regarding individual positions, Moncler SpA; Ferrari NV; LVMH Moet Hennessy Louis Vuitton SE; ASML Holding NV; and HENSOLDT AG were among the top contributors to absolute performance.

ASML is the market leader in providing photolithography systems for the semiconductor industry. ASML’s cutting-edge technology is essential to the semiconductor manufacturing process of increasingly smaller and more powerful microchips, which are widely used in consumer electronics, telecommunications, automotive, and various other industries. Despite macroeconomic weakness, the company reported strong results during the period, where earnings came in better-than-expected. Further, management noted a robust order backlog, reflecting strong demand for Extreme Ultraviolet Lithography and raised fiscal 2023 revenue guidance well above analyst estimates.

Detractors from Performance

The Financials and Energy sectors were the largest detractors from relative performance. Regarding individual positions, VERBIO Vereinigte BioEnergie AG; Angel One Limited; Teleperformance SA; Arezzo Industria e Comercio S.A.; and Alfen NV were among the top detractors from absolute performance.

VERBIO is a leading producer of the complete range of biofuels (biodiesel, bioethanol and biomethane) and byproducts at industrial scale. The company benefits from environmental protection tailwinds and an increasing effort to curb greenhouse gas emissions globally. Moreover, with biomethane serving as a direct substitute for natural gas, there is heightened investor focus on VERBIO’s ability to scale and serve as a solution to a potential energy crisis in Europe. During the period, shares detracted from performance as natural gas prices plummeted due to warmer-than-expected temperatures in Europe and the region’s ability to maintain high levels of gas storage throughout the winter. As a result, demand for biomethane slowed during the period, which negatively impacted company results.

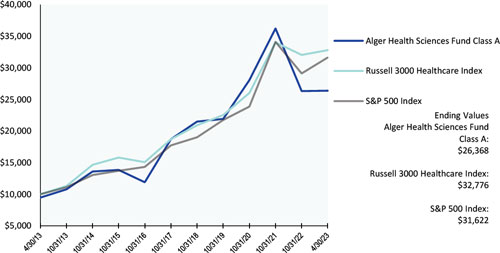

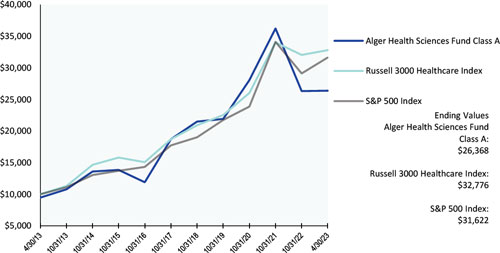

Alger Health Sciences Fund

The Alger Health Sciences Fund returned 0.14% for the fiscal six-month period ended April 30, 2023, compared to the 8.63% return of the S&P 500 Index and the 2.29% return of the Russell 3000 Healthcare Index.

- 9 -

Contributors to Performance

Regarding individual positions, Prometheus Biosciences, Inc.; Reata Pharmaceuticals, Inc.; TransMedics Group, Inc.; Tenet Healthcare Corporation; and GE Healthcare Technologies Inc. were among the top contributors to absolute performance.

Prometheus Biosciences is a biotechnology company focused on developing precision-based medicines to treat autoimmune conditions, primarily those afflicting the intestines such as inflammatory bowel disease (IBD) indications, like ulcerative colitis and Crohn’s disease, by leveraging a proprietary bioinformatics database. Shares contributed to performance during the period as the company reported positive Phase 2 clinical trial results from its IBD study, as the drug PRA023 demonstrated significant patient improvement that was well above expectations. On April 15, 2023, the company entered into an agreement to be acquired by Merck & Co. Inc. for $9.6 billion in cash, which was approximately a 75% premium from the prior trading day’s value. The deal is expected to close in the third quarter of 2023.

Detractors from Performance

Regarding individual positions, Charles River Laboratories International, Inc.; Medpace Holdings, Inc.; UnitedHealth Group Incorporated; Tandem Diabetes Care, Inc.; and Shockwave Medical, Inc. were among the top detractors from absolute performance. Shares of UnitedHealth Group Incorporated, Inc. detracted from performance in response to developments identified in the Alger Capital Appreciation Fund discussion.

I thank you for putting your trust in Alger.

Sincerely,

Daniel C. Chung, CFA

Chief Executive Officer, Chief Investment Officer

Fred Alger Management, LLC

Investors cannot invest directly in an index. Index performance does not reflect the deduction for fees, expenses, or taxes.

This report and the financial statements contained herein are submitted for the general information of shareholders of the funds. This report is not authorized for distribution to prospective investors in a fund unless preceded or accompanied by an effective prospectus for the fund. Performance of funds discussed above, other than the Alger 35 Fund and the Alger Mid Cap Focus Fund, represents the six-month period return of Class A shares prior to the deduction of any sales charges and includes the reinvestment of any dividends or distributions. Performance for the Alger 35 Fund represents Class Z shares. Performance for the Alger Mid Cap Focus Fund represents Class I shares.

The performance data quoted in this material represents past performance, which is not an indication or a guarantee of future results.

Standard performance results can be found on the following pages. The investment return and principal value of an investment in a Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted. For performance data current to the most recent month-end, visit us at www.alger.com, or call us at (800) 992-3863.

- 10 -

The views and opinions of the funds’ management in this report are as of the date of the Shareholders’ Letter and are subject to change at any time subsequent to this date. There is no guarantee that any of the assumptions that formed the basis for the opinions stated herein are accurate or that they will materialize. Moreover, the information forming the basis for such assumptions is from sources believed to be reliable; however, there is no guarantee that such information is accurate. Any securities mentioned, whether owned in a fund or otherwise, are considered in the context of the construction of an overall portfolio of securities and therefore reference to them should not be construed as a recommendation or offer to purchase or sell any such security. Inclusion of such securities in a fund and transactions in such securities, if any, may be for a variety of reasons, including, without limitation, in response to cash flows, inclusion in a benchmark, and risk control. The reference to a specific security should also be understood in such context and not viewed as a statement that the security is a significant holding in a fund. Please refer to the Schedule of Investments for each fund which is included in this report for a complete list of fund holdings as of April 30, 2023. Securities mentioned in the Shareholders’ Letter, if not found in the Schedules of Investments, may have been held by the funds during the fiscal six-month period ended April 30, 2023.

Risk Disclosures

Alger Capital Appreciation Fund

Investing in the stock market involves risks, including the potential loss of principal. Growth stocks may be more volatile than other stocks as their prices tend to be higher in relation to their companies’ earnings and may be more sensitive to market, political, and economic developments. Local, regional or global events such as environmental or natural disasters, war, terrorism, pandemics, outbreaks of infectious diseases and similar public health threats, recessions, or other events could have a significant impact on investments. A significant portion of assets may be invested in securities of companies in related sectors, and may be similarly affected by economic, political, or market events and conditions and may be more vulnerable to unfavorable sector developments. Foreign securities involve special risks including currency fluctuations, inefficient trading, political and economic instability, and increased volatility. Active trading may increase transaction costs, brokerage commissions, and taxes, which can lower the return on investment. At times, cash may be a larger position in the portfolio and may underperform relative to equity securities.

Alger 35 Fund

Investing in the stock market involves risks, including the potential loss of principal. Growth stocks may be more volatile than other stocks as their prices tend to be higher in relation to their companies’ earnings and may be more sensitive to market, political, and economic developments. Local, regional or global events such as environmental or natural disasters, war, terrorism, pandemics, outbreaks of infectious diseases and similar public health threats, recessions, or other events could have a significant impact on investments. A significant portion of assets may be invested in securities of companies in related sectors, and may be similarly affected by economic, political, or market events and conditions and may be more vulnerable to unfavorable sector developments. Investing in companies of small and medium capitalizations involves the risk that such issuers may have limited product lines or financial resources, lack management depth, or have limited liquidity. Foreign securities involve special risks including currency fluctuations, inefficient trading, political and economic instability, and increased volatility. The Fund is classified as a “non-diversified fund” under federal securities laws because it can invest in fewer individual companies than a diversified fund. Assets may be focused in a small number of holdings, making them susceptible to risks associated with a single economic, political or regulatory event than a more diversified portfolio. Active trading may increase transaction costs, brokerage commissions, and taxes, which can lower the return on investment. At times, cash may be a larger position in the portfolio and may underperform relative to equity securities.

- 11 -

Alger Growth & Income Fund

Investing in the stock market involves risks, including the potential loss of principal. Growth stocks may be more volatile than other stocks as their prices tend to be higher in relation to their companies’ earnings and may be more sensitive to market, political, and economic developments. Local, regional or global events such as environmental or natural disasters, war, terrorism, pandemics, outbreaks of infectious diseases and similar public health threats, recessions, or other events could have a significant impact on investments. A significant portion of assets may be invested in securities of companies in related sectors, and may be similarly affected by economic, political, or market events and conditions and may be more vulnerable to unfavorable sector developments. Income-producing securities may cut or fail to declare dividends due to market downturns or for other reasons. At times, cash may be a larger position in the portfolio and may underperform relative to equity securities.

Alger Mid Cap Growth Fund

Investing in the stock market involves risks, including the potential loss of principal. Growth stocks may be more volatile than other stocks as their prices tend to be higher in relation to their companies’ earnings and may be more sensitive to market, political, and economic developments. Local, regional or global events such as environmental or natural disasters, war, terrorism, pandemics, outbreaks of infectious diseases and similar public health threats, recessions, or other events could have a significant impact on investments. A significant portion of assets may be invested in securities of companies in related sectors, and may be similarly affected by economic, political, or market events and conditions and may be more vulnerable to unfavorable sector developments. Investing in companies of medium capitalizations involves the risk that such issuers may have limited product lines or financial resources, lack management depth, or have limited liquidity. Foreign securities involve special risks including currency fluctuations, inefficient trading, political and economic instability, and increased volatility. Active trading may increase transaction costs, brokerage commissions, and taxes, which can lower the return on investment. At times, cash may be a larger position in the portfolio and may underperform relative to equity securities.

Alger Mid Cap Focus Fund

Investing in the stock market involves risks, including the potential loss of principal. Growth stocks may be more volatile than other stocks as their prices tend to be higher in relation to their companies’ earnings and may be more sensitive to market, political, and economic developments. Local, regional or global events such as environmental or natural disasters, war, terrorism, pandemics, outbreaks of infectious diseases and similar public health threats, recessions, or other events could have a significant impact on investments. Investing in companies of medium capitalizations involves the risk that such issuers may have limited product lines or financial resources, lack management depth, or have limited liquidity. Assets may be focused in a small number of holdings, making them susceptible to risks associated with a single economic, political or regulatory event than a more diversified portfolio. A significant portion of assets may be invested in securities of companies in related sectors or industries, and may be similarly affected by economic, political, or market events and conditions and may be more vulnerable to unfavorable sector or industry developments. Foreign securities involve special risks including currency fluctuations, inefficient trading, political and economic instability, and increased volatility. Active trading may increase transaction costs, brokerage commissions, and taxes, which can lower the return on investment. At times, cash may be a larger position in the portfolio and may underperform relative to equity securities.

- 12 -

Alger Weatherbie Specialized Growth Fund

Investing in the stock market involves risks, including the potential loss of principal. Growth stocks may be more volatile than other stocks as their prices tend to be higher in relation to their companies’ earnings and may be more sensitive to market, political, and economic developments. Local, regional or global events such as environmental or natural disasters, war, terrorism, pandemics, outbreaks of infectious diseases and similar public health threats, recessions, or other events could have a significant impact on investments. A significant portion of assets may be invested in securities of companies in related sectors, and may be similarly affected by economic, political, or market events and conditions and may be more vulnerable to unfavorable sector developments. Investing in companies of small and medium capitalizations involves the risk that such issuers may have limited product lines or financial resources, lack management depth, or have limited liquidity. Assets may be focused in a small number of holdings, making them susceptible to risks associated with a single economic, political or regulatory event than a more diversified portfolio. Foreign securities and Emerging Markets involve special risks including currency fluctuations, inefficient trading, political and economic instability, and increased volatility. At times, cash may be a larger position in the portfolio and may underperform relative to equity securities.

Alger Small Cap Growth Fund

Investing in the stock market involves risks, including the potential loss of principal. Growth stocks may be more volatile than other stocks as their prices tend to be higher in relation to their companies’ earnings and may be more sensitive to market, political, and economic developments. Local, regional or global events such as environmental or natural disasters, war, terrorism, pandemics, outbreaks of infectious diseases and similar public health threats, recessions, or other events could have a significant impact on investments. A significant portion of assets may be invested in securities of companies in related sectors, and may be similarly affected by economic, political, or market events and conditions and may be more vulnerable to unfavorable sector or industry developments. Investing in companies of small capitalizations involves the risk that such issuers may have limited product lines or financial resources, lack management depth, or have limited liquidity. At times, cash may be a larger position in the portfolio and may underperform relative to equity securities.

Alger Small Cap Focus Fund

Investing in the stock market involves risks, including the potential loss of principal. Growth stocks may be more volatile than other stocks as their prices tend to be higher in relation to their companies’ earnings and may be more sensitive to market, political, and economic developments. Local, regional or global events such as environmental or natural disasters, war, terrorism, pandemics, outbreaks of infectious diseases and similar public health threats, recessions, or other events could have a significant impact on investments. A significant portion of assets may be invested in securities of companies in related sectors or industries, and may be similarly affected by economic, political, or market events and conditions and may be more vulnerable to unfavorable sector or industry developments. Investing in companies of small capitalizations involves the risk that such issuers may have limited product lines or financial resources, lack management depth, or have limited liquidity. Assets may be focused in a small number of holdings, making them susceptible to risks associated with a single economic, political or regulatory event than a more diversified portfolio. At times, cash may be a larger position in the portfolio and may underperform relative to equity securities.

- 13 -

Alger International Focus Fund

Investing in the stock market involves risks, including the potential loss of principal. Growth stocks may be more volatile than other stocks as their prices tend to be higher in relation to their companies’ earnings and may be more sensitive to market, political, and economic developments. Local, regional or global events such as environmental or natural disasters, war, terrorism, pandemics, outbreaks of infectious diseases and similar public health threats, recessions, or other events could have a significant impact on investments. A significant portion of assets may be invested in securities of companies in related sectors, and may be similarly affected by economic, political, or market events and conditions and may be more vulnerable to unfavorable sector developments. Assets may be focused in a small number of holdings, making them susceptible to risks associated with a single economic, political or regulatory event than a more diversified portfolio. Foreign securities and Emerging Markets involve special risks including currency fluctuations, inefficient trading, political and economic instability, and increased volatility. Investing in companies of small capitalizations involves the risk that such issuers may have limited product lines or financial resources, lack management depth, or have limited liquidity. At times, cash may be a larger position in the portfolio and may underperform relative to equity securities.

Alger Health Sciences Fund

Investing in the stock market involves risks, including the potential loss of principal. Growth stocks may be more volatile than other stocks as their prices tend to be higher in relation to their companies’ earnings and may be more sensitive to market, political, and economic developments. Local, regional or global events such as environmental or natural disasters, war, terrorism, pandemics, outbreaks of infectious diseases and similar public health threats, recessions, or other events could have a significant impact on investments. A significant portion of assets will be invested in healthcare companies, which may be significantly affected by competition, innovation, regulation, and product obsolescence, and may be more volatile than the securities of other companies. A significant portion of assets may be invested in securities of companies in related industries, and may be similarly affected by economic, political, or market events and conditions and may be more vulnerable to unfavorable sector developments. Assets may be focused in a small number of holdings, making them susceptible to risks associated with a single economic, political or regulatory event than a more diversified portfolio. Investing in companies of small capitalizations involves the risk that such issuers may have limited product lines or financial resources, lack management depth, or have limited liquidity. Private placements are offerings of a company’s securities not registered with the SEC and not offered to the public, for which limited information may be available. Such investments are generally considered to be illiquid. Foreign securities involve special risks including currency fluctuations, inefficient trading, political and economic instability, and increased volatility. Active trading may increase transaction costs, brokerage commissions, and taxes, which can lower the return on investment. At times, cash may be a larger position in the portfolio and may underperform relative to equity securities.

- 14 -

For a more detailed discussion of the risks associated with a fund, please see the prospectus.

Before investing, carefully consider a fund’s investment objective, risks, charges, and expenses. For a prospectus and summary prospectus containing this and other information or for The Alger Funds’ most recent month-end performance data, visit www.alger.com, call (800) 992-3863 or consult your financial advisor. Read the prospectus and summary prospectus carefully before investing.

Distributor: Fred Alger & Company, LLC

NOT FDIC INSURED. NOT BANK GUARANTEED. MAY LOSE VALUE.

Definitions:

| ● | Earnings per share (EPS) is calculated as a company’s profit divided by the outstanding shares of its common stock. |

| ● | The Consumer Price Index (CPI) measures the monthly change in prices paid by U.S. consumers. The Bureau of Labor Statistics (BLS) calculates the CPI as a weighted average of prices for a basket of goods and services representative of aggregate U.S. consumer spending. |

| ● | The MSCI ACWI captures large- and mid-cap representation across developed markets and emerging markets countries. The index covers approximately 85% of the global equity opportunity set. |

| ● | The MSCI ACWI ex USA Index captures large- and mid-cap representation across developed markets countries (excluding the US) and emerging markets countries. The index covers approximately 85% of the global equity opportunity set outside the US. |

| ● | The MSCI EAFE Index captures large- and mid-cap representation across Emerging Markets countries. The index covers approximately 85% of the free float-adjusted market capitalization in each country. The MSCI Emerging Markets Index is a free float-adjusted market capitalization index that is designed to measure equity market performance in the global emerging markets. |

| ● | The MSCI Emerging Markets Index captures large- and mid-cap representation across Emerging Markets countries. The index covers approximately 85% of the free float-adjusted market capitalization in each country. |

| ● | The Russell 1000 Growth Index measures the performance of the large-cap growth segment of the U.S. equity universe. It includes those Russell 1000 companies with higher growth earning potential as defined by Russell’s leading style methodology. The Russell 1000 Growth Index is constructed to provide a comprehensive and unbiased barometer for the large-cap growth segment. |

- 15 -

| ● | The Russell 1000 Index measures the performance of the large-cap segment of the US equity universe. It is a subset of the Russell 3000 Index and includes approximately 1,000 of the largest securities based on a combination of their market cap and current index membership. |

| ● | The Russell 2000 Growth Index measures the performance of the small- cap growth segment of the U.S. equity universe. It includes those Russell 2000 companies with higher growth earning potential as defined by Russell’s leading style methodology. The Russell 2000 Growth Index is constructed to provide a comprehensive and unbiased barometer for the small-cap growth segment. |

| ● | The Russell 2000 Index measures the performance of the small-cap segment of the US equity universe. The Russell 2000 Index is constructed to provide a comprehensive and unbiased barometer of the small-cap segment. |

| ● | The Russell 2500 Growth Index measures the performance of the small to mid-cap growth segment of the U.S. equity universe. It includes those Russell 2500 companies with higher growth earning potential as defined by Russell’s leading style methodology. The Russell 2500 Growth Index is constructed to provide a comprehensive and unbiased barometer of the small to mid-cap growth market. |

| ● | The Russell 2500 Index measures the performance of the small to midcap segment of the US equity universe, commonly referred to as “smid” cap. The Russell 2500 Index is constructed to provide a comprehensive and unbiased barometer for the small to mid-cap segment. |

| ● | The Russell 3000 Growth Index combines the large-cap Russell 1000 Growth, the small-cap Russell 2000 Growth and the Russell Microcap Growth Index. It includes companies that are considered more growth oriented relative to the overall market as defined by Russell’s leading style methodology. The Russell 3000 Growth Index is constructed to provide a comprehensive, unbiased, and stable barometer of the growth opportunities within the broad market. |

| ● | The Russell 3000 Healthcare Index is an unmanaged index that measures the performance of those companies in the Russell 3000 Index involved in the medical services or healthcare field. Also included are companies involved in research, development and production of pharmaceuticals and biotechnology |

| ● | The Russell 3000 Index measures the performance of the largest 3,000 US companies of the investable US equity market. The Russell 3000 Index is constructed to provide a comprehensive, unbiased and stable barometer of the broad market. |

- 16 -

| ● | The Russell 3000 Value Index measures the performance of the broad value segment of the US equity value universe. It includes those Russell 3000 companies with lower price-to-book ratios and lower forecasted growth values. The Russell 3000 Value Index is constructed to provide a comprehensive, unbiased and stable barometer of the broad value market. |

| ● | The Russell Microcap Growth Index measures the performance of the microcap growth segment of the US equity market. It includes Russell Microcap companies with relatively higher price-to-book ratios, higher I/B/E/S forecast medium term (2 year) growth and higher sales per share historical growth (5 years). |

| ● | The Russell Microcap Index measures the performance of the microcap segment of the US equity market. The Russell Microcap Index is constructed to provide a comprehensive and unbiased barometer for the microcap segment trading on national exchanges. |

| ● | The Russell Midcap Growth Index measures the performance of the mid- cap growth segment of the U.S. equity universe. It includes those Russell Midcap Index companies with higher growth earning potential as defined by Russell’s leading style methodology. The Russell Midcap Growth Index is constructed to provide a comprehensive and unbiased barometer of the mid-cap growth market. |

| ● | The Russell Midcap Index measures the performance of the mid-cap segment of the US equity universe. The Russell Midcap Index is constructed to provide a comprehensive and unbiased barometer for the mid-cap segment. |

| ● | The S&P 500 Index is an unmanaged index considered representative of large-cap growth stocks. |

- 17 -

ALGER CAPITAL APPRECIATION FUND

Fund Highlights Through April 30, 2023 (Unaudited)

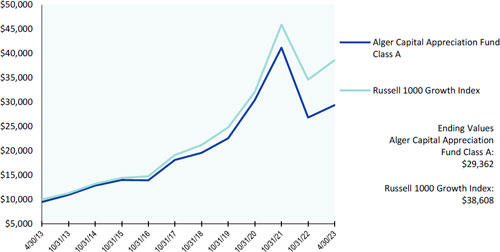

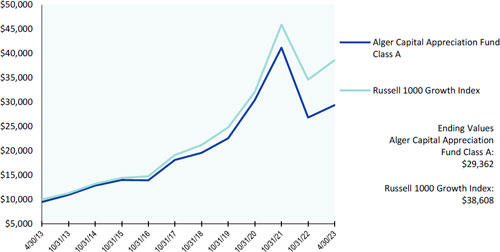

HYPOTHETICAL $10,000 INVESTMENT IN CLASS A SHARES

— 10 years ended 4/30/23

The chart above illustrates the change in value of a hypothetical $10,000 investment made in the Alger Capital Appreciation Fund Class A shares, with a maximum sales charge of 5.25%, and the Russell 1000 Growth Index (an unmanaged index of common stocks) for the ten years ended April 30, 2023. Figures for the Alger Capital Appreciation Fund Class A shares and the Russell 1000 Growth Index include reinvestment of dividends. Figures for the Alger Capital Appreciation Fund Class A shares also include reinvestment of capital gains. Performance for Alger Capital Appreciation Fund Class C and Class Z shares will vary from the results shown above due to differences in expenses and sales charges those classes bear. Investors cannot invest directly in any index. Index performance does not reflect deduction for fees, expenses, or taxes.

- 18 -

ALGER CAPITAL APPRECIATION FUND

Fund Highlights Through April 30, 2023 (Unaudited) (Continued)

| PERFORMANCE COMPARISON AS OF 4/30/23 |

| AVERAGE ANNUAL TOTAL RETURNS |

| | 1 YEAR | 5 YEARS | 10 YEARS |

| Class A | (7.95)% | 7.71% | 11.37% |

| Class C | (4.51)% | 8.06% | 11.14% |

| Class Z | (2.50)% | 9.25% | 12.35% |

| Russell 1000 Growth Index | 2.34% | 13.80% | 14.46% |

| | | | |

The performance data quoted represents past performance, which is not an indication or a guarantee of future results. The Fund’s average annual total returns include changes in share price and reinvestment of dividends and capital gains. Class A returns reflect the maximum initial sales charge and Class C returns reflect the applicable contingent deferred sales charge. The chart and table above do not reflect the deduction of taxes that a shareholder would have paid on Fund distributions or on the redemption of Fund shares. Investment return and principal will fluctuate and the Fund’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance quoted. For updated performance, visit us at www.alger.com or call us at (800) 992-3863.

- 19 -

ALGER 35 FUND

Fund Highlights Through April 30, 2023 (Unaudited)

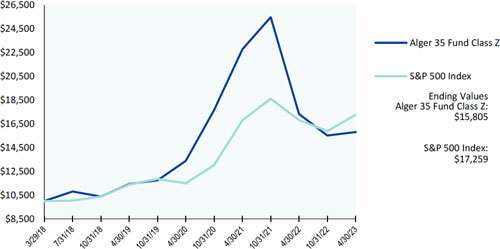

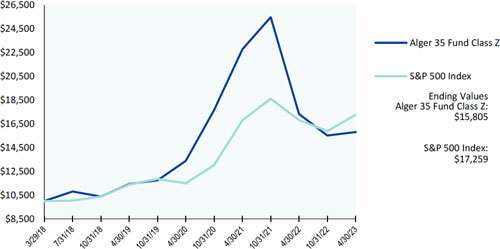

HYPOTHETICAL $10,000 INVESTMENT IN CLASS Z SHARES

from 3/29/18 to 4/30/23

The chart above illustrates the change in value of a hypothetical $10,000 investment made in the Alger 35 Fund Class Z shares and the S&P 500 Index (an unmanaged index of common stocks) from March 29, 2018, the inception date of the Alger 35 Fund Class Z shares, through April 30, 2023. Effective May 7, 2021, Class P shares of the Alger 35 Fund were reclassified as Class Z shares. The reclassified Class Z shares have the same annual returns as the Class P shares because the shares are invested in the same portfolio of securities and the reclassified Class Z shares have the same expenses as the Fund’s Class P shares. Historical performance prior to May 7, 2021 is that of the Fund’s Class P shares. Figures for the Alger 35 Fund Class Z shares and the S&P 500 Index include reinvestment of dividends. Figures for the Alger 35 Fund Class Z shares also include reinvestment of capital gains. Investors cannot invest directly in any index. Index performance does not reflect deduction for fees, expenses, or taxes.

- 20 -

ALGER 35 FUND

Fund Highlights Through April 30, 2023 (Unaudited) (Continued)

| PERFORMANCE COMPARISON AS OF 4/30/23 |

| AVERAGE ANNUAL TOTAL RETURNS |

| | 1 YEAR | 5 YEARS | Since

Inception |

| Class Z (Inception 3/29/18) | (8.70)% | 9.35% | 9.41% |

| S&P 500 Index | 2.66% | 11.45% | 11.32% |

| | | | |

The performance data quoted represents past performance, which is not an indication or a guarantee of future results. The Fund’s average annual total returns include changes in share price and reinvestment of dividends and capital gains. Effective May 7, 2021, Class P shares of the Alger 35 Fund were reclassified as Class Z shares. The reclassified Class Z shares have the same annual returns as the Class P shares because the shares are invested in the same portfolio of securities and the reclassified Class Z shares have the same expenses as the Fund’s Class P shares. Historical performance prior to May 7, 2021 is that of the Fund’s Class P shares. The chart and table above do not reflect the deduction of taxes that a shareholder would have paid on Fund distributions or on the redemption of Fund shares. Investment return and principal will fluctuate and the Fund’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance quoted. For updated performance, visit us at www.alger. com or call us at (800) 992-3863.

- 21 -

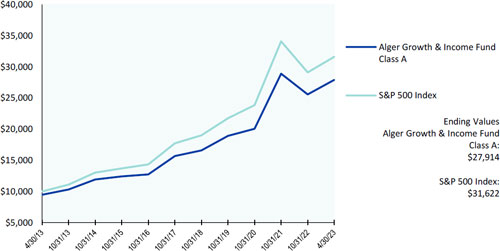

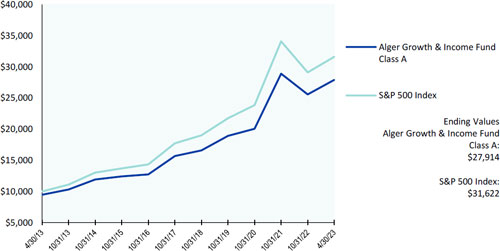

ALGER GROWTH & INCOME FUND

Fund Highlights Through April 30, 2023 (Unaudited)

HYPOTHETICAL $10,000 INVESTMENT IN CLASS A SHARES

— 10 years ended 4/30/23

The chart above illustrates the change in value of a hypothetical $10,000 investment made in the Alger Growth & Income Fund Class A shares, with a maximum sales charge of 5.25%, and the S&P 500 Index (an unmanaged index of common stocks) for the ten years ended April 30, 2023. Figures for the Alger Growth & Income Fund Class A shares and the S&P 500 Index include reinvestment of dividends. Figures for the Alger Growth & Income Fund Class A shares also include reinvestment of capital gains. Performance for the Alger Growth & Income Fund Class C and Class Z shares will vary from the results shown above due to differences in expenses and sales charges those classes bear. Investors cannot invest directly in any index. Index performance does not reflect deduction for fees, expenses, or taxes.

- 22 -

ALGER GROWTH & INCOME FUND

Fund Highlights Through April 30, 2023 (Unaudited) (Continued)

| PERFORMANCE COMPARISON AS OF 4/30/23 |

| AVERAGE ANNUAL TOTAL RETURNS |

| | 1 YEAR | 5 YEARS | 10 YEARS |

| Class A | (2.11)% | 10.72% | 10.81% |

| Class C | 1.54% | 11.08% | 10.57% |

| Class Z | 3.62% | 12.31% | 11.75% |

| S&P 500 Index | 2.66% | 11.45% | 12.20% |

| | | | |

The performance data quoted represents past performance, which is not an indication or a guarantee of future results. The Fund’s average annual total returns include changes in share price and reinvestment of dividends and capital gains. Class A returns reflect the maximum initial sales charge and Class C returns reflect the applicable contingent deferred sales charge. The chart and table above do not reflect the deduction of taxes that a shareholder would have paid on Fund distributions or on the redemption of Fund shares. Investment return and principal will fluctuate and the Fund’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance quoted. For updated performance, visit us at www.alger.com or call us at (800) 992-3863.

- 23 -

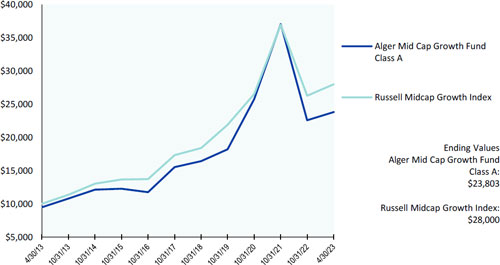

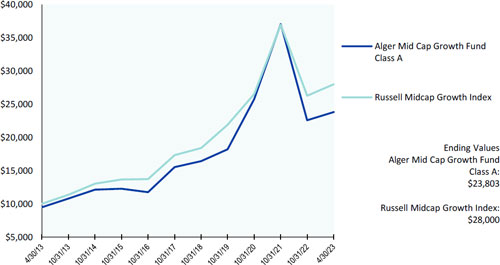

ALGER MID CAP GROWTH FUND*

Fund Highlights Through April 30, 2023 (Unaudited)

HYPOTHETICAL $10,000 INVESTMENT IN CLASS A SHARES

— 10 years ended 4/30/23

The chart above illustrates the change in value of a hypothetical $10,000 investment made in the Alger Mid Cap Growth Fund Class A shares, with a maximum sales charge of 5.25%, and the Russell Midcap Growth Index (an unmanaged index of common stocks) for the ten years ended April 30, 2023. Figures for the Alger Mid Cap Growth Fund Class A shares and Russell Midcap Growth Index include reinvestment of dividends. Figures for the Alger Mid Cap Growth Fund Class A shares also include reinvestment of capital gains. Performance for the Alger Mid Cap Growth Fund Class B, Class C and Class Z shares will vary from the results shown above due to differences in expenses and sales charges those classes bear. Investors cannot invest directly in any index. Index performance does not reflect deduction for fees, expenses, or taxes.

- 24 -

ALGER MID CAP GROWTH FUND*

Fund Highlights Through April 30, 2023 (Unaudited) (Continued)

| PERFORMANCE COMPARISON AS OF 4/30/23 |

| AVERAGE ANNUAL TOTAL RETURNS |

| | 1 YEAR | 5 YEARS | 10 YEARS |

| Class A | (7.61)% | 7.00% | 9.06% |

| Class B | (7.33)% | 7.86% | 9.21% |

| Class C | (4.17)% | 7.30% | 8.77% |

| Russell Midcap Growth Index | 1.60% | 8.96% | 10.84% |

| | | | |

| | 1 YEAR | 5 YEARS | Since

Inception |

| Class Z (Inception 5/28/15) | (2.08)% | 8.49% | 7.76% |

| Russell Midcap Growth Index | 1.60% | 8.96% | 8.85% |

| | | | |

The performance data quoted represents past performance, which is not an indication or a guarantee of future results. The Fund’s average annual total returns include changes in share price and reinvestment of dividends and capital gains. Class A returns reflect the maximum initial sales charge and Class B and C returns reflect the applicable contingent deferred sales charge. The chart and table above do not reflect the deduction of taxes that a shareholder would have paid on Fund distributions or on the redemption of Fund shares. Investment return and principal will fluctuate and the Fund’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance quoted. For updated performance, visit us at www.alger.com or call us at (800) 992-3863.

| * | Pursuant to the U.S. Securities and Exchange Commission’s rules on Fair Fund and Disgorgement Plans, the Alger Mid Cap Growth Fund received a Fair Fund distribution of $9,346,397 on September 10, 2021, which contributed approximately 0.61% and 0.31% to its five and ten year annual returns, respectively. |

- 25 -

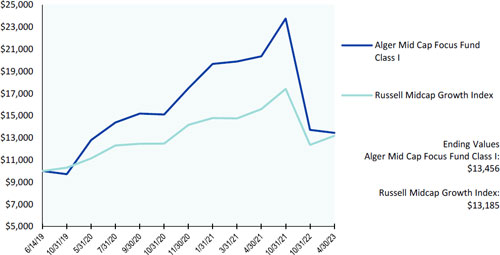

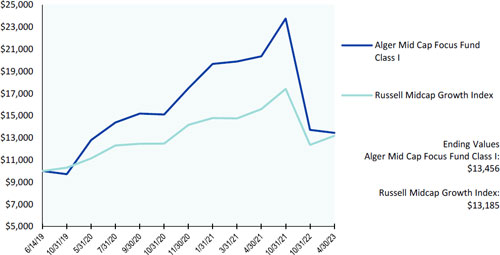

ALGER MID CAP FOCUS FUND

Fund Highlights Through April 30, 2023 (Unaudited)

HYPOTHETICAL $10,000 INVESTMENT IN CLASS I SHARES

— 10 years ended 4/30/23

The chart above illustrates the change in value of a hypothetical $10,000 investment made in the Alger Mid Cap Focus Fund Class I shares and the Russell Midcap Growth Index (an unmanaged index of common stocks) from June 14, 2019, the inception date of the Alger Mid Cap Focus Fund Class I shares, through April 30, 2023. Figures for the Alger Mid Cap Focus Fund Class I shares and the Russell Midcap Growth Index include reinvestment of dividends. Figures for the Alger Mid Cap Focus Fund Class I shares also include reinvestment of capital gains. Performance for the Alger Mid Cap Focus Fund Class A, C, Y and Z shares will vary from the results shown above due to differences in the expenses and sales charges that those classes bear. Investors cannot invest directly in any index. Index performance does not reflect deduction for fees, expenses, or taxes.

- 26 -

ALGER MID CAP FOCUS FUND

Fund Highlights Through April 30, 2023 (Unaudited) (Continued)

| PERFORMANCE COMPARISON AS OF 4/30/23 |

| AVERAGE ANNUAL TOTAL RETURNS |

| | 1 YEAR | 5 YEARS | Since

Inception |

| Class I (Inception 6/14/19) | (14.99)% | n/a | 7.96% |

| Class Z (Inception 6/14/19) | (14.72)% | n/a | 8.27% |

| Russell Midcap Growth Index | 1.60% | n/a | 7.40% |

| | | | |

| | 1 YEAR | 5 YEARS | Since

Inception |

| Class Y (Inception 2/26/21) | (14.66)% | n/a | (18.05)% |

| Russell Midcap Growth Index | 1.60% | n/a | (5.90)% |

| | 1 YEAR | 5 YEARS | Since

Inception |

| Class A (Inception 7/29/21) | (19.54)% | n/a | (24.73)% |

| Class C (Inception 7/29/21) | (16.56)% | n/a | (22.96)% |

| Russell Midcap Growth Index | 1.60% | n/a | (12.40)% |

The performance data quoted represents past performance, which is not an indication or a guarantee of future results. The Fund’s average annual total returns include changes in share price and reinvestment of dividends and capital gains. Class A returns reflect the maximum initial sales charge and Class C returns reflect the applicable contingent deferred sales charge. The chart and table above do not reflect the deduction of taxes that a shareholder would have paid on Fund distributions or on the redemption of Fund shares. Investment return and principal will fluctuate and the Fund’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance quoted. For updated performance, visit us at www.alger.com or call us at (800) 992-3863.

- 27 -

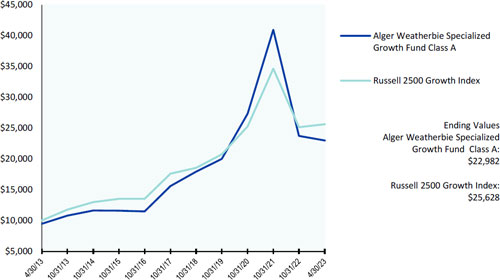

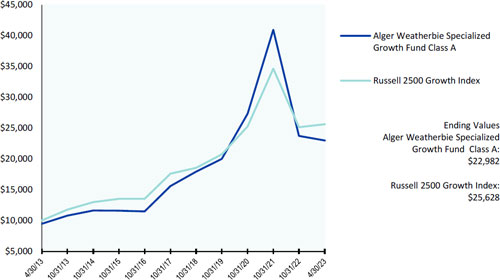

ALGER WEATHERBIE SPECIALIZED GROWTH FUND

Fund Highlights Through April 30, 2023 (Unaudited)

HYPOTHETICAL $10,000 INVESTMENT IN CLASS A SHARES

— 10 years ended 4/30/23

The chart above illustrates the change in value of a hypothetical $10,000 investment made in the Alger Weatherbie Specialized Growth Fund Class A shares, with a maximum sales charge of 5.25%, and the Russell 2500 Growth Index (an unmanaged index of common stocks) for the ten years ended April 30, 2023. From August 30, 2017 to September 30, 2019, the Fund was named Alger SMid Cap Focus Fund. Prior to August 30, 2017, the Fund followed different investment strategies under the name Alger SMid Cap Growth Fund and prior to March 1, 2017 was managed by different portfolio managers. Accordingly, performance prior to those dates does not reflect the Fund’s current investment strategies and investment personnel. Figures for the Alger Weatherbie Specialized Growth Fund Class A shares and the Russell 2500 Growth Index include reinvestment of dividends. Figures for the Alger Weatherbie Specialized Growth Fund Class A shares also include reinvestment of capital gains. Performance for the Alger Weatherbie Specialized Growth Fund Class C, Class I, Class Y and Class Z shares will vary from the results shown above due to differences in expenses and sales charges those classes bear. Investors cannot invest directly in any index. Index performance does not reflect deduction for fees, expenses, or taxes.

- 28 -

ALGER WEATHERBIE SPECIALIZED GROWTH FUND

Fund Highlights Through April 30, 2023 (Unaudited) (Continued)

| PERFORMANCE COMPARISON AS OF 4/30/23 |

| AVERAGE ANNUAL TOTAL RETURNS |

| | 1 YEAR | 5 YEARS | 10 YEARS |

| Class A | (15.47)% | 5.20% | 8.68% |

| Class C | (12.29)% | 5.54% | 8.42% |

| Class I | (10.69)% | 6.38% | 9.27% |

| Class Z | (10.45)% | 6.71% | 9.62% |

| Russell 2500 Growth Index | (0.07)% | 6.69% | 9.87% |

| | | | |

| | 1 YEAR | 5 YEARS | Since

Inception |

| Class Y (Inception 8/30/17) | (10.30)% | 6.78% | 8.81% |

| Russell 2500 Growth Index | (0.07)% | 6.69% | 8.36% |

| | | | |

The performance data quoted represents past performance, which is not an indication or a guarantee of future results. The Fund’s average annual total returns include changes in share price and reinvestment of dividends and capital gains. Class A returns reflect the maximum initial sales charge and Class C returns reflect the applicable contingent deferred sales charge. The chart and table above do not reflect the deduction of taxes that a shareholder would have paid on Fund distributions or on the redemption of Fund shares. From August 30, 2017 to September 30, 2019, the Fund was named “Alger SMid Cap Focus Fund.” Prior to August 30, 2017, the Fund followed different investment strategies under the name “Alger SMid Cap Growth Fund” and prior to March 1, 2017 was managed by different portfolio managers. Accordingly, performance prior to those dates does not reflect the Fund’s current investment strategies and investment personnel. Investment return and principal will fluctuate and the Fund’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance quoted. For updated performance, visit us at www.alger. com or call us at (800) 992-3863.

- 29 -

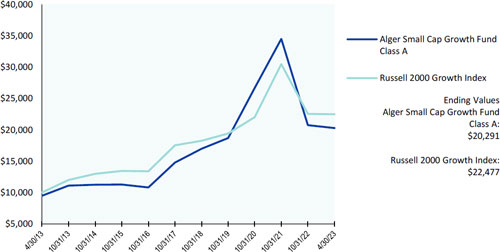

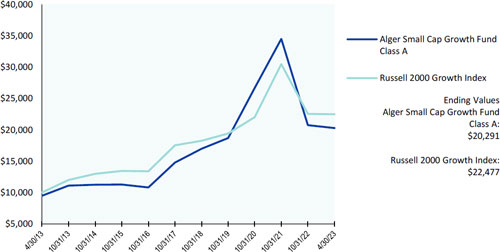

ALGER SMALL CAP GROWTH FUND*

Fund Highlights Through April 30, 2023 (Unaudited)

HYPOTHETICAL $10,000 INVESTMENT IN CLASS A SHARES

— 10 years ended 4/30/23

The chart above illustrates the change in value of a hypothetical $10,000 investment made in the Alger Small Cap Growth Fund Class A shares, with a maximum sales charge of 5.25%, and the Russell 2000 Growth Index (an unmanaged index of common stocks) for the ten years ended April 30, 2023. Figures for the Alger Small Cap Growth Fund Class A shares and the Russell 2000 Growth Index include reinvestment of dividends. Figures for the Alger Small Cap Growth Fund Class A shares also include reinvestment of capital gains. Performance for the Alger Small Cap Growth Fund Class B, Class C, Class Y and Class Z shares will vary from the results shown above due to differences in expenses and sales charges those classes bear. Investors cannot invest directly in any index. Index performance does not reflect deduction for fees, expenses, or taxes.

- 30 -

ALGER SMALL CAP GROWTH FUND*

Fund Highlights Through April 30, 2023 (Unaudited) (Continued)

| PERFORMANCE COMPARISON AS OF 4/30/23 |

| AVERAGE ANNUAL TOTAL RETURNS |

| | 1 YEAR | 5 YEARS | 10 YEARS |

| Class A | (14.88)% | 3.96% | 7.33% |

| Class B | (14.84)% | 4.56% | 7.40% |

| Class C | (11.85)% | 4.22% | 7.04% |

| Class Z | (9.90)% | 5.45% | 8.28% |

| Russell 2000 Growth Index | 0.72% | 4.00% | 8.44% |

| | | | |

| | 1 YEAR | 5 YEARS | Since

Inception |

| Class Y (Inception 12/31/21) | (9.79)% | n/a | (27.04)% |

| Russell 2000 Growth Index | 0.72% | n/a | (17.76)% |

| | | | |

The performance data quoted represents past performance, which is not an indication or a guarantee of future results. The Fund’s average annual total returns include changes in share price and reinvestment of dividends and capital gains. Class A returns reflect the maximum initial sales charge and Class B and C returns reflect the applicable contingent deferred sales charge. The chart and table above do not reflect the deduction of taxes that a shareholder would have paid on Fund distributions or on the redemption of Fund shares. Investment return and principal will fluctuate and the Fund’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance quoted. For updated performance, visit us at www.alger.com or call us at (800) 992-3863.

| * | Pursuant to the U.S. Securities and Exchange Commission’s Rules on Fair Fund and Disgorgement Plans, the Alger Small Cap Growth Fund received a Fair Fund distribution of $3,738,004 on September 10, 2021, which contributed approximately 0.12% and 0.06% to its five and ten year annual returns, respectively. |

- 31 -

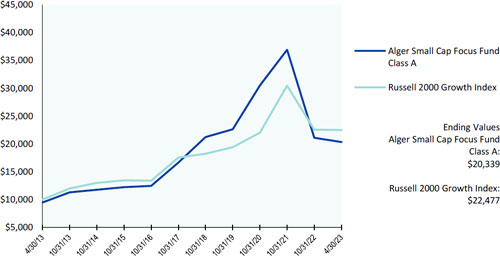

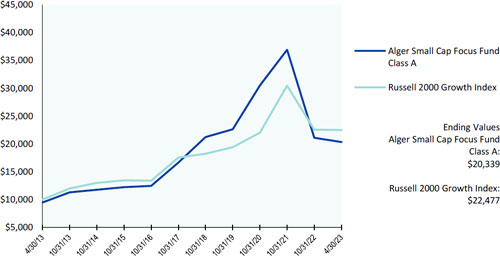

ALGER SMALL CAP FOCUS FUND

Fund Highlights Through April 30, 2023 (Unaudited)

HYPOTHETICAL $10,000 INVESTMENT IN CLASS A SHARES

— 10 years ended 4/30/23

The chart above illustrates the change in value of a hypothetical $10,000 investment made in the Alger Small Cap Focus Fund Class A shares, with an initial 5.25% maximum sales charge, and the Russell 2000 Growth (an unmanaged index of common stocks) for the ten years ended April 30, 2023. Prior to August 7, 2015, the Fund followed different investment strategies under the name “Alger Growth Opportunities Fund” and prior to February 12, 2015 was managed by a different portfolio manager. Accordingly, performance prior to those dates does not reflect the Fund’s current investment strategies and investment personnel. Figures for the Alger Small Cap Focus Fund Class A shares and the Russell 2000 Growth Index include reinvestment of dividends. Figures for the Alger Small Cap Focus Fund Class A shares also include reinvestment of capital gains. Performance for the Alger Small Cap Focus Fund Class C, Class I, Class Y and Class Z shares will vary from the results shown above due to differences in expenses and sales charges those classes bear. Investors cannot invest directly in any index. Index performance does not reflect deduction for fees, expenses, or taxes.

- 32 -

ALGER SMALL CAP FOCUS FUND

Fund Highlights Through April 30, 2023 (Unaudited) (Continued)

| PERFORMANCE COMPARISON AS OF 4/30/23 |

| AVERAGE ANNUAL TOTAL RETURNS |

| | 1 YEAR | 5 YEARS | 10 YEARS |

| Class A | (11.60)% | 0.66% | 7.36% |

| Class C | (8.12)% | 1.07% | 7.20% |

| Class I | (6.44)% | 1.85% | 8.05% |

| Class Z | (6.18)% | 2.17% | 8.37% |

| Russell 2000 Growth Index | 0.72% | 4.00% | 8.44% |

| | | | |

| | 1 YEAR | 5 YEARS | Since

Inception |

| Class Y (Inception 2/28/17) | (6.18)% | 2.17% | 6.72% |

| Russell 2000 Growth Index | 0.72% | 4.00% | 6.35% |

| | | | |