| ITEM 1. | REPORTS TO STOCKHOLDERS. |

Table of Contents

The Alger Funds

Dear Shareholders,

“Compound interest is the eighth wonder of the world. He who understands it, earns it; he who doesn’t, pays it.” – Albert Einstein

This principle resonates deeply with us at Alger, where we embrace the power of compound growth in corporate fundamentals, such as sales, earnings, and cash flow, as a cornerstone of long-term wealth creation. Our investment approach focuses on identifying companies with strong potential for sustained earnings growth over the long-term, avoiding those that we believe are “short duration” companies, or businesses with high current earnings and low potential for future long-term growth. In most instances, short duration companies, in our view, return most of their profits to shareholders because of a lack of compelling reinvestment opportunities. By investing in companies that we believe will gain market share and compound their earnings growth, we aim to position our portfolios to be resilient across varying economic conditions, thereby maximizing long-term value for our shareholders.

Reflecting on the fiscal year ended October 31, 2023, the narrative of the market was one of resilience and recovery. Following a turbulent 2022, where higher interest rates in response to elevated inflation reduced equity valuations, investor sentiment turned positive in 2023, driven by easing inflation, stabilizing corporate earnings, and the increasing likelihood of a soft-landing (i.e., an economic slowdown without a recession). Further, a surge of enthusiasm around Artificial Intelligence (AI) contributed to outsized returns for certain of the largest companies within the Information Technology and Communication Services sectors. Not all sectors shared in this rally, as the Energy and Health Care sectors underperformed the S&P 500 Index. While there were bumps along the way, from a regional banking crisis in March 2023 to a steady rise in interest rates, the S&P 500 Index finished up 10.14% during the fiscal twelve-month period ended October 31, 2023.

In the final two months of 2022, optimism grew as core Consumer Price Index (“CPI”) readings for November and December came in below expectations, suggesting the peak of the Federal Reserve’s (the “Fed”) tightening cycle. However, persistent wage inflation and an inverted yield curve raised concerns about potential policy errors and an impending economic downturn. In December, Fed Chairman Jerome Powell affirmed a “higher-for-longer” stance for interest rates and forecasted a terminal rate above 5.0%, casting doubts on the stock market’s recovery.

As we moved into 2023, however, the first quarter saw a reversal in the bearish sentiment that had marked much of the previous year. In February, the Fed slowed down its rate hikes to 25 basis points, a reduction from December’s 50 basis point hike. In March, concerns around bank funding and liquidity emerged following the collapse of two regional banks, leading to significant deposit outflows at the regional level. The Fed, U.S. Treasury, and Federal Deposit Insurance Corporation (FDIC) took steps to alleviate these market concerns, including announcing an emergency liquidity program, guaranteeing uninsured deposits, and allowing some bank mergers and acquisitions.

Transitioning into the second quarter, U.S. economic data released in June reinforced the soft-landing-narrative with signs of (1) disinflation, as evidenced by the May CPI report coming in softer than expected with headline CPI posting the lowest annual increase in more than two years, (2) resilient labor markets, as May payrolls beat estimates for a 14th straight month, and (3) a stronger housing market, with builder confidence at the highest in nearly a year, housing starts at the highest in over a year, and multi-unit starts at the highest in nearly four decades.

Despite the strong first half rally in 2023, U.S. equities fell during the third quarter. While investors initially embraced a continuation of prevailing narratives around AI and expectations of a soft-landing lifting equity markets in July, mounting concerns surrounding aggressive Fed policy and a sharp rise in interest rates led to declining equity prices in August and September. Moreover, the resumption of student loan payments, diminished savings from the pandemic, and higher energy prices reignited worries that a decline in U.S. consumer spending could lead to the possibility of an upcoming recession. Rising interest rates were seen as one of the largest headwinds to risk assets during the third quarter, where the yield of the U.S. 10-year note increased by 76 basis points to 4.57% and the yield on the two-year note increased nearly 20 basis points to 5.04%. While the rate of inflation decelerated meaningfully over the past year, the monthly CPI readings for July and August rose 0.2% and 0.6%, respectively. That said, the rise in interest rates was driven more by the term premium (i.e., the additional yield that investors demand for lending money for longer periods of time) and less so on rising inflation expectations during the third quarter.

On the monetary policy front, after a 25 basis point rate hike in July that met expectations, the Fed held rates steady at its September meeting, bringing the Federal Funds rate to 5.25-5.50%. In October, U.S. equities fell in large part due to rising interest rates, with the yield of the U.S. 10-year note increasing by approximately 30 basis points to 4.88%. Higher bond yields were driven by several factors, such as an increase in U.S. Treasury issuance and a reinforced stance on a higher-for-longer Fed policy, bolstered by a robust September retail sales report and better-than-expected U.S. GDP data for the third quarter. Further, the average 30-year fixed mortgage rate reached new multi decade highs of 8.06%, as of October 31, 2023, helping drive mortgage demand from homebuyers to the lowest level since 1995.

Among non-U.S. equities, developed markets saw strong performance during the fiscal twelve-month period ended October 31, 2023. Notable strength was driven by Europe avoiding an energy crisis due to a mild winter, and Japan’s economy being bolstered by well-received corporate reforms to improve governance. As such, the MSCI ACWI ex-USA Index rose 12.66% during the fiscal twelve-month period ended October 31, 2023, with the Financials and Consumer Discretionary sectors showing strong results, while the Real Estate and Utilities sectors saw weaker performance. Within Emerging Markets, encouraging market sentiment stemmed from Chinese officials abandoning their ‘Zero-Covid’ policy in late 2022, indicating an earlier-than-expected re-opening of the economy. While renewed concerns about China’s property sector and weaker-than-expected economic recovery data curtailed investor enthusiasm in the first half of 2023, better-than-feared third quarter GDP data emerged in October. As such, the MSCI Emerging Markets Index was up 11.26% during the fiscal twelve-month period ended October 31, 2023. Strong performance within the Consumer Discretionary and Information Technology sectors was partially offset by relative weakness in the Materials and Utilities sectors.

Going Forward

We continue to believe that an unprecedented level of innovation is creating compelling investment opportunities – corporations are digitizing their operations, cloud computing growth continues to support future innovation, and artificial intelligence, which is at an inflection point in our view, potentially enabling significant increases in productivity. In the Health Care sector, we believe that advances in surgical technologies and innovations within biotechnology offer attractive opportunities ahead. As such, we intend to continue to focus on conducting in-depth fundamental research as we seek leaders of innovation rather than taking short-term bets on market sentiment. We believe this strategy embodies Albert Einstein’s wisdom, harnessing the powerful force of compound interest to help our shareholders achieve their long-term investment goals.

Portfolio Matters

Alger Capital Appreciation Fund

The Alger Capital Appreciation Fund returned 16.95% for the fiscal twelve-month period ended October 31, 2023, compared to the 18.95% return of the Russell 1000 Growth Index. During the reporting period, the largest sector weightings were Information Technology and Consumer Discretionary. The largest sector overweight was Health Care and the largest sector underweight was Consumer Staples.

Contributors to Performance

The Consumer Discretionary and Industrials sectors provided the largest contributions to relative performance. Regarding individual positions, Microsoft Corp.; NVIDIA Corp.; Amazon.com, Inc.; TransDigm Group Incorporated; and Meta Platforms Inc. were among the top contributors to absolute performance.

Microsoft is a beneficiary of corporate America’s transformative digitization. Microsoft’s CEO expects technology spending as a percent of GDP to jump from about 5% now to 10% in 10 years and that Microsoft will continue to capture market share within the technology sector. The company operates through three segments: Productivity and Business Processes (Office, LinkedIn, and Dynamics), Intelligent Cloud (Server Products and Cloud Services, Azure, and Enterprise Services), and More Personal Computing (Windows, Devices, Gaming, and Search). While the company reported operating results that met consensus estimates, their investment in OpenAI’s ChatGPT captured the attention of investors, contributing to positive performance. Throughout the period, Microsoft surprised investors with continual rollouts of new AI capabilities across the company’s portfolio (e.g., Bing, GitHub, Teams, Office 365). Moreover, the company witnessed significant growth in its Intelligent Cloud segment, as Azure continues to expand its market share. Despite the encouraging results throughout the period, demand challenges stemming from companies looking to optimize their cloud spending led to a deceleration in cloud growth during the fiscal fourth quarter, compared to the previous quarter. Acknowledging that cloud optimization may curb the company’s growth in the short term, we remain confident about the company’s prospects going forward, particularly in the realm of AI adoption. Further, CEO Satya Nadella has recently indicated that substantial revenue contributions from AI could begin to materialize around the first half of 2024.

Detractors from Performance

The Health Care and Financials sectors were the largest detractors from relative performance. Regarding individual positions, Tesla, Inc.; Albemarle Corp.; UnitedHealth Group Inc.; Signature Bank; and Humana Inc. were among the top detractors from absolute performance.

UnitedHealth Group is an integrated healthcare benefits company uniquely positioned to address rising healthcare costs for its customers, due to its vertical integration, size, and scale. The Optum health benefits services unit, which accounts for approximately 45% of the company’s operating earnings, in our view, has the potential to grow even further as customers look for ways to manage rising healthcare costs. During the period, shares detracted from performance due to several factors, including (1) many 2022 healthcare winners with shorter duration profiles and persistent earnings profiles, such as UnitedHealth Group, underperformed in the first quarter of 2023, (2) uncertainty surrounding Medicare Advantage reimbursement levels from the Federal government in 2023, which will be determined later in 2023, and (3) increased regulatory scrutiny in the form of potential Medicare Advantage audits across the industry. While these concerns have impacted UnitedHealth in the near-term, we believe company fundamentals remain intact given its large-scale business model, competitive advantages, and medium- to long-term growth prospects.

Alger 35 Fund

The Alger 35 Fund generated a 1.38% return for the fiscal twelve-month period ended October 31, 2023, compared to the 10.14% return of the S&P 500 Index. During the reporting period, the largest sector weightings were Information Technology and Consumer Discretionary. The largest sector overweight was Consumer Discretionary and the largest sector underweight was Financials.

Contributors to Performance

The Materials and Financials sectors provided the largest contributions to relative performance. Regarding individual positions, Microsoft Corp.; Advanced Micro Devices, Inc.; Netflix, Inc.; NVIDIA Corp.; and Alphabet Inc. were among the top contributors to absolute performance.

NVIDIA is a leading supplier of graphics processing units for a variety of end markets, such as gaming, PCs, data centers, virtual reality and high-performance computing. The company is leading in most secular growth categories in computing, especially artificial intelligence and super-computing parallel processing techniques for solving complex computational problems. Simply put, NVIDIA’s computational power is a critical enabler of AI and therefore, in our view, critical to AI adoption. As such, we believe NVIDIA is a long-term high unit volume growth opportunity. During the period, shares contributed to performance as NVIDIA reported solid operating results well above analyst expectations, driven by strong demand from data centers. Growing AI data center workloads are driving demand for the increased interconnections and fully accelerated software stacks, thereby enabling leading application performance and fast result times.

Detractors from Performance

The Information Technology and Consumer Discretionary sectors were the largest detractors from relative performance. Regarding individual positions, 908 Devices Inc.; JD.com, Inc.; Schlumberger N.V.; Rivian Automotive, Inc.; and Lindblad Expeditions Holdings, Inc. were among the top detractors from absolute performance.

Schlumberger engages in the provision of technology and services for reservoir characterization, drilling, production and processing to the oil and gas industry. During the fiscal year, the company reported mixed operating results, where better-than-expected revenues were offset by lower-than-expected gross profit margins. Strong company revenues were driven by solid execution within Well Construction and Production Systems, while Schlumberger’s Digital & Integration segment saw some weakness as a result of a pipeline shutdown causing temporary production delays in Ecuador, along with falling commodity prices that impacted Canadian projects. Moreover, despite management raising forward guidance on operating profits and free-cash-flow generation, these projections fell short of analyst estimates.

Alger Growth & Income Fund

The Alger Growth & Income Fund returned 11.39% for the fiscal twelve-month period ended October 31, 2023, compared to the 10.14% return of the S&P 500 Index. During the reporting period, the largest sector weightings were Information Technology and Health Care. The largest sector overweight was Energy and the largest sector underweight was Consumer Discretionary.

Contributors to Performance

The Information Technology and Health Care sectors provided the largest contributions to relative performance. Regarding individual positions, Microsoft Corp.; Broadcom Inc.; KLA Corp.; Meta Platforms Inc.; and Apple Inc. were among the top contributors to absolute performance. Shares of Microsoft Corp. contributed to performance in response to developments identified in the Alger Capital Appreciation Fund discussion.

Detractors from Performance

The Consumer Discretionary and Industrials sectors were the largest detractors from relative performance. Regarding individual positions, Bank of America Corp; Chevron Corp.; Pfizer Inc.; Crown Castle Inc.; and Johnson & Johnson were among the top detractors from absolute performance.

Bank of America Corp is one of the world’s leading financial firms that offers a wide array of banking and non-banking financial services and products both domestically and internationally. These services are delivered through three primary business segments: Global Consumer & Small Business Banking, Global Corporate & Investment Banking, and Global Wealth & Investment Management. While the company reported better-than-expected operating results, driven by strong net interest income, shares declined after two regional banks failed which sparked contagion concerns in late March. Further, the company reported during its fiscal third quarter earnings report that its unrealized held-to-maturity securities losses were greater than expected.

Alger Mid Cap Growth Fund

The Alger Mid Cap Growth Fund returned 0.18% for the fiscal twelve-month period ended October 31, 2023, compared to the 3.35% return of the Russell Midcap Growth Index. During the reporting period, the largest sector weightings were Information Technology and Industrials. The largest sector overweight was Real Estate and the largest sector underweight was Consumer Discretionary.

Contributors to Performance

The Energy and Communication Services sectors provided the largest contributions to relative performance. Regarding individual positions, Prometheus Biosciences, Inc.; Cadence Design Systems, Inc.; TransDigm Group Inc.; Constellation Software Inc.; and Chipotle Mexican Grill, Inc. were among the top contributors to absolute performance.

TransDigm specializes in the production of engineered aerospace components, systems and subsystems. Its core Power and Control segment includes operations that primarily develop, produce and market systems and components that provide power to or control power of aircrafts utilizing electronic, fluid, power and mechanical motion control technologies. Shares contributed to performance during the period, as the company has reported solid operating results, driven by strength in all three of their major market channels – commercial original equipment manufacturing, commercial aftermarket, and defense. Moreover, strong order bookings have been aided by China’s easing COVID-19 mobility restrictions, which has increased air travel. Given the robust order bookings and favorable trends in the commercial aerospace market recovery, management raised their fiscal full year earnings guidance.

Detractors from Performance

The Consumer Discretionary and Industrials sectors were the largest detractors from relative performance. Regarding individual positions, CrowdStrike Holdings, Inc.; Repligen Corp.; Paycom Software, Inc.; DexCom, Inc.; and TransUnion were among the top detractors from absolute performance.

Repligen Corp. is a life science organization committed to supplying tools, consumables, and data analytics to the bioprocessing industry. It functions via four divisions: Filtration, Chromatography, Proteins & Affinity Resins, and Process Analytics. Repligen’s offerings play a key role in the creation and production of biological therapeutics, such as monoclonal antibodies, recombinant proteins, viral vectors, and cell and gene therapies. While the company reported operating results that were roughly in-line with consensus estimates, management lowered their full year 2023 forward guidance for revenues and earnings. The downward revision was attributed to destocking pressures throughout the bioprocessing industry, as inventory levels built up during COVID-19 remain higher than expected, leading to irregular order patterns in the near-term. Further, during its fiscal first quarter, the company experienced a 40% drop in orders from China, approximately 10% of company sales, which raised concerns about China’s recovery from COVID-19 lockdowns.

Alger Mid Cap Focus Fund

The Alger Mid Cap Focus Fund generated a -6.67% return for the fiscal twelve-month period ended October 31, 2023, compared to the 3.35% return of the Russell Midcap Growth Index. During the reporting period, the largest sector weightings were Information Technology and Health Care. The largest sector overweight was Information Technology and the largest sector underweight was Financials.

Contributors to Performance

The Energy and Materials sectors provided the largest contributions to relative performance. Regarding individual positions, Vertiv Holdings Co.; Bentley Systems, Inc.; Splunk Inc.; Prometheus Biosciences, Inc; and AppFolio Inc were among the top contributors to absolute performance.

Vertiv offers critical cooling and power management infrastructure technologies to meet the specific requirements of a diverse group of customers which primarily include datacenter customers. We believe the company is well positioned to potentially benefit from the secular demand in datacenters, as Vertiv holds leading positions in power and thermal management across the datacenter complex. During the period, the company reported strong operating results, where revenues and earnings handedly beat analyst estimates. Better-than-expected revenues were driven by higher pricing and volume growth. As the leading global supplier of power and thermal solutions to datacenters, we believe Vertiv is well positioned to benefit from the AI investment in datacenters, given the intense demand from hyperscalers for faster computing.

Detractors from Performance

The Health Care and Information Technology sectors were the largest detractors from relative performance. Regarding individual positions, Natera, Inc.; Everbridge, Inc.; RAPT Therapeutics, Inc.; Madrigal Pharmaceuticals, Inc.; and Constellation Energy Corp. were among the top detractors from absolute performance.

Constellation Energy Corporation is a leading generation and retail company that manages the largest fleet of nuclear and other carbon-free electricity sources in the United States. The company aims to achieve 100% carbon-free owned assets by 2040, with an interim goal of 95% by 2030. Around 90% of the generated output comes from nuclear power or renewable energy sources, with their assets primarily located in the Mid-Atlantic and Northeast regions (IL, PA, NJ, MD, & NY). As the second-largest retail business in the U.S., Constellation Energy holds over 20% market share in the commercial and industrial sector. During the period, shares detracted from performance as natural gas prices, which typically set the electricity price powered by nuclear, plummeted due to the warm winter experienced in North America. While the company hedged 90% of its topline natural gas exposure, the decline in gas prices served as an overhang because of its detrimental impact on 2024. It is important to note that the Production Tax Credits (PTC) will take effect in 2024, providing a minimum price from 2024-2032. However, weak natural gas prices remove the potential benefits associated on the name, resulting in negative sentiment. Natural gas prices may be weather dependent going forward.

Alger Weatherbie Specialized Growth Fund

The Alger Weatherbie Specialized Growth Fund generated a -12.53% return for the fiscal twelve-month period ended October 31, 2023, compared to the -4.80% return of the Russell 2500 Growth Index. During the reporting period, the largest sector weightings were Health Care and Industrials. The largest sector overweight was Health Care and the largest sector underweight was Materials.

Contributors to Performance

The Real Estate and Energy sectors provided the largest contributions to relative performance. Regarding individual positions, SPS Commerce, Inc.; Vertex, Inc.; Glaukos Corp; Hamilton Lane Inc.; and FirstService Corp were among the top contributors to absolute performance.

SPS Commerce is a global provider of cloud-based supply chain management solutions for fulfillment, analytics, drop shipping and other use cases. The SPS Commerce platform improves the way retailers, suppliers, grocers, distributors, and logistics companies manage orders, monitor sell-through performance, and discover new products by leveraging cloud technology. During the period, shares contributed to performance as the company reported strong operating results, where revenues came in above consensus estimates. Additionally, recurring revenue increased 20% year-over-year, driven by double digit growth in both fulfillment and analytics. Despite a difficult macroeconomic environment with high inflation and recession concerns, management expressed confidence in its subscription-based business model, which is largely reliant on the number of client connections with only a small portion tied to volumes. Moreover, we believe the company is a key beneficiary of supply chain digitalization over the long-term, given the growing influence of e-commerce.

Detractors from Performance

The Consumer Discretionary and Health Care sectors were the largest detractors from relative performance. Regarding individual positions, Chegg, Inc.; Agiliti, Inc.; Montrose Environmental Group Inc; Definitive Healthcare Corp.; and Nevro Corp. were among the top detractors from absolute performance.

Chegg is a leading online direct-to-consumer education business, which provides online textbook rentals and other internet-delivered services, such as homework help, tutoring and assistance with obtaining scholarships and finding internships. Despite reporting strong operating results, the company provided disappointing forward guidance citing greater competitive pressure from ChatGPT/AI platforms. While management appears to be doing its best to address this issue, including a collaboration with OpenAI announced in April, the company remains unable to offer visibility as to how the impact of ChatGPT/AI will play out as four-year college students weigh subscription costs for all learning resources versus free access to generative AI platforms.

Alger Small Cap Growth Fund

The Alger Small Cap Growth Fund returned -10.53% for the fiscal twelve-month period ended October 31, 2023, compared to the -7.63% return of the Russell 2000 Growth Index. During the reporting period, the largest sector weightings were Health Care and Information Technology. The largest sector overweight was Health Care and the largest sector underweight was Industrials.

Contributors to Performance

The Information Technology and Real Estate sectors provided the largest contributions to relative performance. Regarding individual positions, Manhattan Associates, Inc.; NeoGenomics, Inc.; Structure Therapeutics, Inc.; SPS Commerce, Inc.; and HubSpot, Inc. were among the top contributors to absolute performance.

Hubspot is a cloud-based marketing and sales platform for small- and medium-sized businesses (“SMBs”), focusing on inbound marketing strategies to attract, engage, and convert website visitors into customers. Its platform provides a comprehensive suite of applications including search engine optimization (SEO), blogging, marketing automation, customer relationship management (CRM), and analytics, utilizing a centralized database for personalized interactions. In our view, this approach fosters warmer prospect engagement compared to traditional methods like cold calling and email blasts. Over the years, the company has evolved from a small business CRM vendor to a comprehensive provider of marketing, sales and content management solutions for global SMBs. With an approximate 3% combined market share, a large customer base, robust partner network and extensive HubSpot suite, we believe the company is well positioned to capture additional market share in the large SMB front office applications industry, as well as to expand in the upmarket segment (i.e., companies with 200 to 2,000 employees). Shares contributed to performance during the period, as the company reported strong operating results, noting better-than-expected revenues coupled with the highest number of new customer adds in two years. With the avid appetite to embrace generative AI technologies, we believe Hubspot has the potential to further its momentum with noteworthy architectural advantages tied to a unified data platform, broad distribution reach and a central role in front-office workflows.

Detractors from Performance

The Health Care and Industrials sectors were the largest detractors from relative performance. Regarding individual positions, Insulet Corp.; Tandem Diabetes Care, Inc.; Bio-Techne Corp.; Xometry, Inc.; and QuidelOrtho Corp. were among the top detractors from absolute performance.

Insulet Corp. is a medical device company focused on commercializing its Omnipod portfolio of insulin delivery devices. The company’s Omnipod device is a tubeless insulin pump that is in the shape of a pod and is directly attached to a patient’s body. The key differentiator between Insulet’s insulin delivery devices and those of competitors is the tubeless feature – this enables a more discrete administration of insulin. Insulet’s Omnipod portfolio includes three key product lines: Classic Omnipod, Omnipod DASH, and Omnipod 5. The Omnipod technology is also used as a subcutaneous drug delivery system to deliver certain therapeutics. During the period, shares detracted from performance as investors became concerned about the long-term impact of GLP-1 drugs, a newer class of drugs that are highly effective in treating diabetes and obesity.

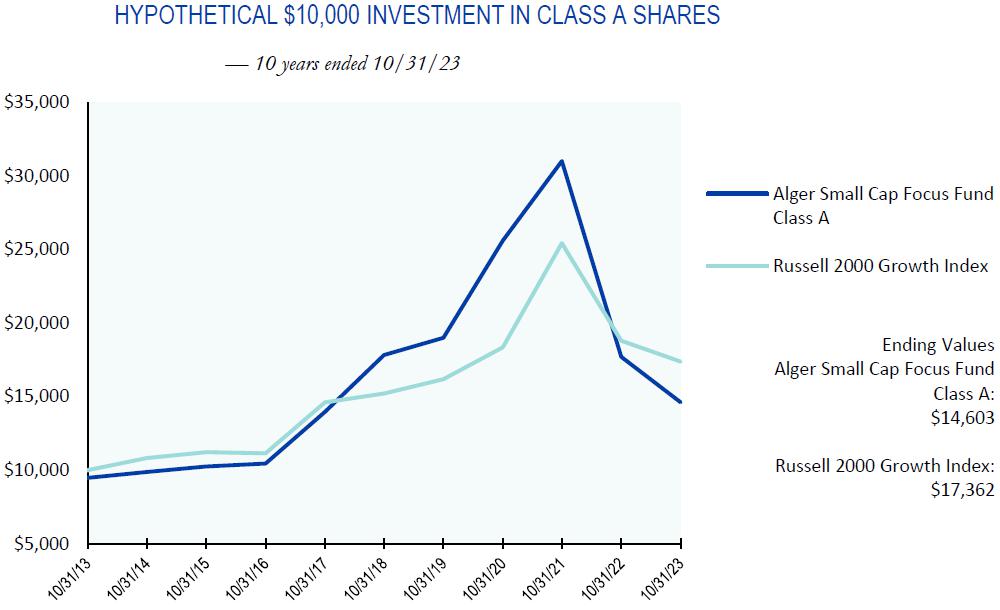

Alger Small Cap Focus Fund

The Alger Small Cap Focus Fund returned -17.50% for the fiscal twelve-month period ended October 31, 2023, compared to the -7.63% return of the Russell 2000 Growth Index. During the reporting period, the largest sector weightings were Health Care and Information Technology. The largest sector overweight was Health Care and the largest sector underweight was Industrials.

Contributors to Performance

The Consumer Discretionary and Materials sectors provided the largest contributions to relative performance. Regarding individual positions, Prometheus Biosciences, Inc.; Heska Corp.; Guidewire Software, Inc.; AppFolio Inc; and Agilysys, Inc. were among the top contributors to absolute performance.

Heska Corp. sells diagnostic tools and specialty products to the animal health market. Specifically, Heska sells blood testing and supplies, digital imaging products, software and single-use products primarily for cats and dogs. The company also offers private label vaccines and pharmaceutical produces primarily for cattle and other small mammals. Shares contributed to performance after the company announced on April 3, 2023 that private company Mars, Incorporated had agreed to take Heska private.

Detractors from Performance

The Health Care and Industrials sectors were the largest detractors from relative performance. Regarding individual positions, Xometry, Inc.; CryoPort, Inc.; Silk Road Medical, Inc.; Shockwave Medical, Inc.; and BioLife Solutions, Inc. were among the top detractors from absolute performance.

Xometry is a leading two-sided marketplace for on-demand manufacturing services. The company provides real-time access to global manufacturing demand and capacity, with sourcing and pricing available across a network of buyers and sellers. This marketplace enables buyers (e.g., engineers and product designers) to efficiently source manufacturing processes and sellers of manufacturing services to grow their businesses. Xometry’s AI-enabled technology platform is powered by proprietary machine learning algorithms, resulting in a sophisticated marketplace for manufacturing. During the period, shares detracted from performance as the company reported weaker-than-expected operating results, where company revenues came in well below consensus estimates. Management noted that suppliers accepted orders more quickly than usual on the Xometry platform due to a challenging macroeconomic environment. As a result, this prompted the company’s proprietary algorithm to lower market pricing, which in turn led to slower revenue growth and gross margin compression.

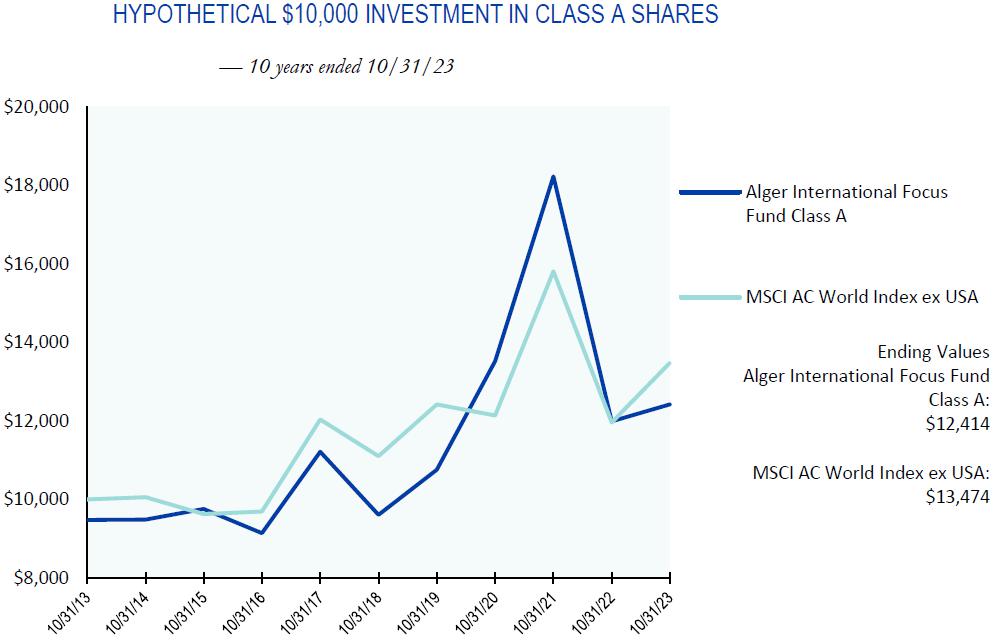

Alger International Focus Fund

The Alger International Focus Fund recorded a 3.61% return for the fiscal twelve-month period ended October 31, 2023, compared to the 12.66% return of the MSCI ACWI ex USA Index. During the reporting period, the largest sector weightings were Consumer Discretionary and Financials. The largest sector overweight was Consumer Discretionary and the largest sector underweight was Materials.

Contributors to Performance

The Consumer Discretionary and Health Care sectors provided the largest contributions to relative performance. Regarding individual positions, Ferrari NV; Nu Holdings Ltd.; ASML Holding NV; Kalyan Jewellers India Ltd.; and Elm Co. were among the top contributors to absolute performance.

Nu Holdings Ltd. (NU) is a rapidly growing Brazilian neobank (i.e., a financial technology bank) founded in 2013 initially focusing on customer-friendly credit cards. The company has grown to over 48 million customers and offers a wide variety of financial products like personal loans, checking accounts, and brokerage accounts. We believe NU offers a strong value proposition compared to neobank peers and incumbent players and has ample runway to grow across Latin America due to its exceptionally low customer acquisition costs. During the period, shares contributed to performance after the company reported strong operating results, where revenues and earnings beat analyst estimates. Better-than-expected revenues were driven by higher rates and improved returns on credit cards following fast expansion of their interest earning portfolio. Moreover, client growth remained strong despite high penetration in Brazil, while non-performing-loan trends appear to be stabilizing, giving management comfort to accelerate loan origination.

Detractors from Performance

The Industrials and Financials sectors were the largest detractors from relative performance. Regarding individual positions, Alfen NV; Teleperformance SA; VERBIO Vereinigte BioEnergie AG; Arezzo Industria e Comercio S.A.; and Angel One Limited were among the top detractors from absolute performance.

Alfen is a supplier of smart energy solutions which are geared towards energy transition. The company designs, develops, and produces smart grids, energy storage systems and EV charging equipment. During the period, shares detracted from performance as the company released its first half 2023 fiscal results that fell short of expectations. Despite accelerating strength and a growing backlog in its Smart Grid and Energy Storage Solutions (ESS) businesses, its EV Charging business continued to experience volume headwinds from inventory destocking at their channel partners. In addition, the mix shift effects of hyper growth in ESS were margin-dilutive at the group level. While both factors were widely known, the negative sentiment continued to weigh on the stock.

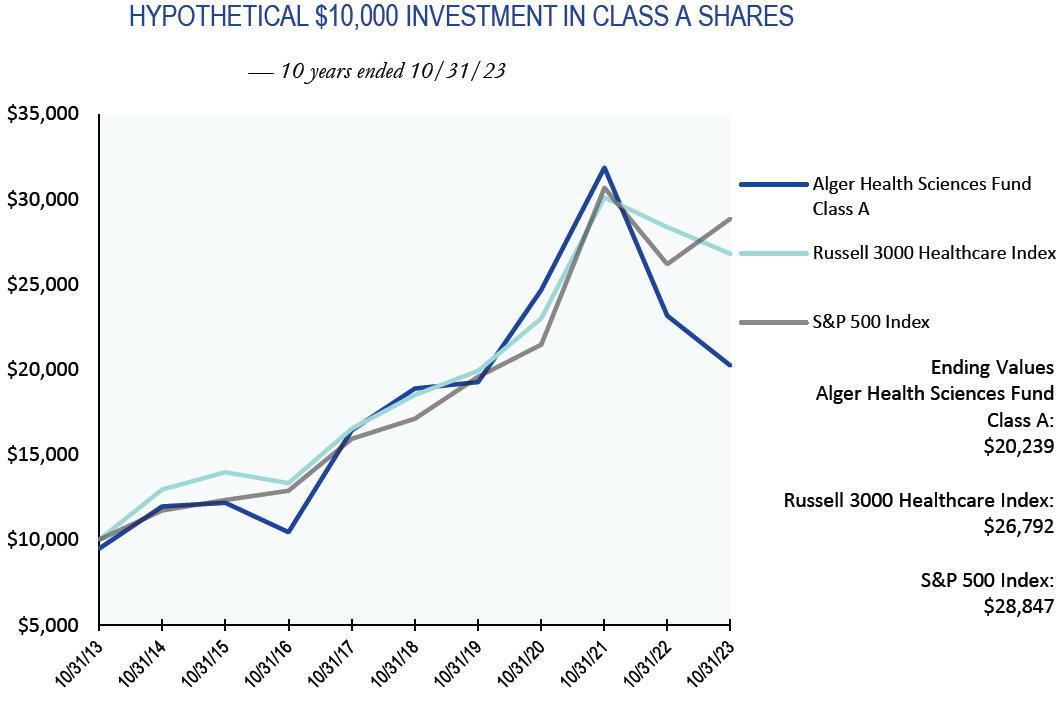

Alger Health Sciences Fund

The Alger Health Sciences Fund returned -12.61% for the fiscal twelve-month period ended October 31, 2023, compared to the 10.14% return of the S&P 500 Index and the -5.47% return of the Russell 3000 Health Care Index.

Contributors to Performance

Regarding individual positions, Prometheus Biosciences, Inc.; Reata Pharmaceuticals, Inc.; Eli Lilly and Co.; ADMA Biologics, Inc.; and Tenet Healthcare Corp. were among the top contributors to absolute performance.

Prometheus Biosciences is a biotechnology company focused on developing precision-based medicines to treat autoimmune conditions, primarily those afflicting the intestines such as inflammatory bowel disease (IBD) indications like ulcerative colitis and Crohn’s disease by leveraging a proprietary bioinformatics database. Shares outperformed after the company announced in April 2023 that it would be acquired by Merck & Co.

Detractors from Performance

Regarding individual positions, Shockwave Medical, Inc.; Elanco Animal Health, Inc.; AstraZeneca; Acadia Healthcare Co., Inc.; and Charles River Laboratories International, Inc. were among the top detractors from absolute performance.

Acadia Healthcare Co. is a leading U.S. mental health services provider and operator of various treatment centers and facilities. Demand for behavioral health services continued to grow to all-time highs outstripping already insufficient supply, where only 28% of the U.S. population has adequate access to mental health care professionals, according to the Health Resources & Services Administration. As such, patients, employers, payers and society-at-large are increasingly recognizing the importance of mental behavioral health, which has resulted in (1) unmet demand in the market and (2) greater funding and improved rate increases to be directed at mental health providers. We believe the unmet demand trends and supportive payments backdrop allow Acadia to grow via facility expansions, new facility openings and tuck-in acquisitions. During the period, the company reported in-line operating results where management raised full year 2023 sales guidance but maintained 2023 earnings guidance. Subsequently, shares sold off following management’s comments around higher than anticipated labor costs, which explained why analysts’ 2023 earnings guidance remained unchanged.

I thank you for putting your trust in Alger.

Sincerely,

Daniel C. Chung, CFA

Chief Executive Officer, Chief Investment Officer

Fred Alger Management, LLC

Investors cannot invest directly in an index. Index performance does not reflect the deduction for fees, expenses, or taxes.

This report and the financial statements contained herein are submitted for the general information of shareholders of the funds. This report is not authorized for distribution to prospective investors in a fund unless preceded or accompanied by an effective prospectus for the fund. Performance of funds discussed above, other than the Alger 35 Fund, represents the twelve-month period return of Class A shares prior to the deduction of any sales charges and includes the reinvestment of any dividends or distributions. Performance for the Alger 35 Fund represents Class Z shares.

The performance data quoted in this material represents past performance, which is not an indication or a guarantee of future results.

Standard performance results can be found on the following pages. The investment return and principal value of an investment in a Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted. For performance data current to the most recent month-end, visit us at www.alger.com, or call us at (800) 992-3863.

The views and opinions of the funds’ management in this report are as of the date of the Shareholders’ Letter and are subject to change at any time subsequent to this date. There is no guarantee that any of the assumptions that formed the basis for the opinions stated herein are accurate or that they will materialize. Moreover, the information forming the basis for such assumptions is from sources believed to be reliable; however, there is no guarantee that such information is accurate. Any securities mentioned, whether owned in a fund or otherwise, are considered in the context of the construction of an overall portfolio of securities and therefore reference to them should not be construed as a recommendation or offer to purchase or sell any such security. Inclusion of such securities in a fund and transactions in such securities, if any, may be for a variety of reasons, including, without limitation, in response to cash flows, inclusion in a benchmark, and risk control. The reference to a specific security should also be understood in such context and not viewed as a statement that the security is a significant holding in a fund. Please refer to the Schedule of Investments for each fund which is included in this report for a complete list of fund holdings as of October 31, 2023. Securities mentioned in the Shareholders’ Letter, if not found in the Schedules of Investments, may have been held by the funds during the fiscal twelve-month period ended October 31, 2023.

Risk Disclosures

Alger Capital Appreciation Fund

Investing in the stock market involves risks, including the potential loss of principal. Growth stocks may be more volatile than other stocks as their prices tend to be higher in relation to their companies’ earnings and may be more sensitive to market, political, and economic developments. Local, regional or global events such as environmental or natural disasters, war, terrorism, pandemics, outbreaks of infectious diseases and similar public health threats, recessions, or other events could have a significant impact on investments. A significant portion of assets may be invested in securities of companies in related sectors, and may be similarly affected by economic, political, or market events and conditions and may be more vulnerable to unfavorable sector developments. Foreign securities involve special risks including currency fluctuations, inefficient trading, political and economic instability, and increased volatility. Active trading may increase transaction costs, brokerage commissions, and taxes, which can lower the return on investment. At times, cash may be a larger position in the portfolio and may underperform relative to equity securities.

Alger 35 Fund

Investing in the stock market involves risks, including the potential loss of principal. Growth stocks may be more volatile than other stocks as their prices tend to be higher in relation to their companies’ earnings and may be more sensitive to market, political, and economic developments. Local, regional or global events such as environmental or natural disasters, war, terrorism, pandemics, outbreaks of infectious diseases and similar public health threats, recessions, or other events could have a significant impact on investments. A significant portion of assets may be invested in securities of companies in related sectors, and may be similarly affected by economic, political, or market events and conditions and may be more vulnerable to unfavorable sector developments. Investing in companies of small and medium capitalizations involves the risk that such issuers may have limited product lines or financial resources, lack management depth, or have limited liquidity. Foreign securities involve special risks including currency fluctuations, inefficient trading, political and economic instability, and increased volatility. The fund is classified as a “non-diversified fund” under federal securities laws because it can invest in fewer individual companies than a diversified fund. Assets may be focused in a small number of holdings, making them susceptible to risks associated with a single economic, political or regulatory event than a more diversified portfolio. Active trading may increase transaction costs, brokerage commissions, and taxes, which can lower the return on investment. At times, cash may be a larger position in the portfolio and may underperform relative to equity securities.

Alger Growth & Income Fund

Investing in the stock market involves risks, including the potential loss of principal. Growth stocks may be more volatile than other stocks as their prices tend to be higher in relation to their companies’ earnings and may be more sensitive to market, political, and economic developments. Local, regional or global events such as environmental or natural disasters, war, terrorism, pandemics, outbreaks of infectious diseases and similar public health threats, recessions, or other events could have a significant impact on investments. A significant portion of assets may be invested in securities of companies in related sectors, and may be similarly affected by economic, political, or market events and conditions and may be more vulnerable to unfavorable sector developments. Income-producing securities may cut or fail to declare dividends due to market downturns or for other reasons. At times, cash may be a larger position in the portfolio and may underperform relative to equity securities.

Alger Mid Cap Growth Fund

Investing in the stock market involves risks, including the potential loss of principal. Growth stocks may be more volatile than other stocks as their prices tend to be higher in relation to their companies’ earnings and may be more sensitive to market, political, and economic developments. Local, regional or global events such as environmental or natural disasters, war, terrorism, pandemics, outbreaks of infectious diseases and similar public health threats, recessions, or other events could have a significant impact on investments. A significant portion of assets may be invested in securities of companies in related sectors, and may be similarly affected by economic, political, or market events and conditions and may be more vulnerable to unfavorable sector developments. Investing in companies of medium capitalizations involves the risk that such issuers may have limited product lines or financial resources, lack management depth, or have limited liquidity. Foreign securities involve special risks including currency fluctuations, inefficient trading, political and economic instability, and increased volatility. Active trading may increase transaction costs, brokerage commissions, and taxes, which can lower the return on investment. At times, cash may be a larger position in the portfolio and may underperform relative to equity securities.

Alger Mid Cap Focus Fund

Investing in the stock market involves risks, including the potential loss of principal. Growth stocks may be more volatile than other stocks as their prices tend to be higher in relation to their companies’ earnings and may be more sensitive to market, political, and economic developments. Local, regional or global events such as environmental or natural disasters, war, terrorism, pandemics, outbreaks of infectious diseases and similar public health threats, recessions, or other events could have a significant impact on investments. Investing in companies of medium capitalizations involves the risk that such issuers may have limited product lines or financial resources, lack management depth, or have limited liquidity. Assets may be focused in a small number of holdings, making them susceptible to risks associated with a single economic, political or regulatory event than a more diversified portfolio. A significant portion of assets may be invested in securities of companies in related sectors or industries, and may be similarly affected by economic, political, or market events and conditions and may be more vulnerable to unfavorable sector or industry developments. Foreign securities involve special risks including currency fluctuations, inefficient trading, political and economic instability, and increased volatility. Active trading may increase transaction costs, brokerage commissions, and taxes, which can lower the return on investment. At times, cash may be a larger position in the portfolio and may underperform relative to equity securities.

Alger Weatherbie Specialized Growth Fund

Investing in the stock market involves risks, including the potential loss of principal. Growth stocks may be more volatile than other stocks as their prices tend to be higher in relation to their companies’ earnings and may be more sensitive to market, political, and economic developments. Local, regional or global events such as environmental or natural disasters, war, terrorism, pandemics, outbreaks of infectious diseases and similar public health threats, recessions, or other events could have a significant impact on investments. A significant portion of assets may be invested in securities of companies in related sectors, and may be similarly affected by economic, political, or market events and conditions and may be more vulnerable to unfavorable sector developments. Investing in companies of small and medium capitalizations involves the risk that such issuers may have limited product lines or financial resources, lack management depth, or have limited liquidity. Assets may be focused in a small number of holdings, making them susceptible to risks associated with a single economic, political or regulatory event than a more diversified portfolio. Foreign securities and emerging markets involve special risks including currency fluctuations, inefficient trading, political and economic instability, and increased volatility. At times, cash may be a larger position in the portfolio and may underperform relative to equity securities.

Alger Small Cap Growth Fund

Investing in the stock market involves risks, including the potential loss of principal. Growth stocks may be more volatile than other stocks as their prices tend to be higher in relation to their companies’ earnings and may be more sensitive to market, political, and economic developments. Local, regional or global events such as environmental or natural disasters, war, terrorism, pandemics, outbreaks of infectious diseases and similar public health threats, recessions, or other events could have a significant impact on investments. A significant portion of assets may be invested in securities of companies in related sectors, and may be similarly affected by economic, political, or market events and conditions and may be more vulnerable to unfavorable sector or industry developments. Investing in companies of small capitalizations involves the risk that such issuers may have limited product lines or financial resources, lack management depth, or have limited liquidity. At times, cash may be a larger position in the portfolio and may underperform relative to equity securities.

Alger Small Cap Focus Fund

Investing in the stock market involves risks, including the potential loss of principal. Growth stocks may be more volatile than other stocks as their prices tend to be higher in relation to their companies’ earnings and may be more sensitive to market, political, and economic developments. Local, regional or global events such as environmental or natural disasters, war, terrorism, pandemics, outbreaks of infectious diseases and similar public health threats, recessions, or other events could have a significant impact on investments. A significant portion of assets may be invested in securities of companies in related sectors or industries, and may be similarly affected by economic, political, or market events and conditions and may be more vulnerable to unfavorable sector or industry developments. Investing in companies of small capitalizations involves the risk that such issuers may have limited product lines or financial resources, lack management depth, or have limited liquidity. Assets may be focused in a small number of holdings, making them susceptible to risks associated with a single economic, political or regulatory event than a more diversified portfolio. At times, cash may be a larger position in the portfolio and may underperform relative to equity securities.

Alger International Focus Fund

Investing in the stock market involves risks, including the potential loss of principal. Growth stocks may be more volatile than other stocks as their prices tend to be higher in relation to their companies’ earnings and may be more sensitive to market, political, and economic developments. Local, regional or global events such as environmental or natural disasters, war, terrorism, pandemics, outbreaks of infectious diseases and similar public health threats, recessions, or other events could have a significant impact on investments. A significant portion of assets may be invested in securities of companies in related sectors, and may be similarly affected by economic, political, or market events and conditions and may be more vulnerable to unfavorable sector developments. Assets may be focused in a small number of holdings, making them susceptible to risks associated with a single economic, political or regulatory event than a more diversified portfolio. Foreign securities and emerging markets involve special risks including currency fluctuations, inefficient trading, political and economic instability, and increased volatility. Investing in companies of small capitalizations involves the risk that such issuers may have limited product lines or financial resources, lack management depth, or have limited liquidity. At times, cash may be a larger position in the portfolio and may underperform relative to equity securities.

Alger Health Sciences Fund

Investing in the stock market involves risks, including the potential loss of principal. Growth stocks may be more volatile than other stocks as their prices tend to be higher in relation to their companies’ earnings and may be more sensitive to market, political, and economic developments. Local, regional or global events such as environmental or natural disasters, war, terrorism, pandemics, outbreaks of infectious diseases and similar public health threats, recessions, or other events could have a significant impact on investments. A significant portion of assets will be invested in healthcare companies, which may be significantly affected by competition, innovation, regulation, and product obsolescence, and may be more volatile than the securities of other companies. A significant portion of assets may be invested in securities of companies in related industries, and may be similarly affected by economic, political, or market events and conditions and may be more vulnerable to unfavorable sector developments. Assets may be focused in a small number of holdings, making them susceptible to risks associated with a single economic, political or regulatory event than a more diversified portfolio. Investing in companies of small capitalizations involves the risk that such issuers may have limited product lines or financial resources, lack management depth, or have limited liquidity. Private placements are offerings of a company’s securities not registered with the SEC and not offered to the public, for which limited information may be available. Such investments are generally considered to be illiquid. Foreign securities involve special risks including currency fluctuations, inefficient trading, political and economic instability, and increased volatility. Active trading may increase transaction costs, brokerage commissions, and taxes, which can lower the return on investment. At times, cash may be a larger position in the portfolio and may underperform relative to equity securities.

For a more detailed discussion of the risks associated with a fund, please see the prospectus.

Before investing, carefully consider a fund’s investment objective, risks, charges, and expenses. For a prospectus and summary prospectus containing this and other information or for The Alger Funds’ most recent month-end performance data, visit www.alger.com, call (800) 992-3863 or consult your financial advisor. Read the prospectus and summary prospectus carefully before investing.

Distributor: Fred Alger & Company, LLC

NOT FDIC INSURED. NOT BANK GUARANTEED. MAY LOSE VALUE.

Definitions:

| ● | Earnings per share (EPS) is calculated as a company’s profit divided by the outstanding shares of its common stock. |

| ● | The Consumer Price Index (CPI) measures the monthly change in prices paid by U.S. consumers. The Bureau of Labor Statistics (BLS) calculates the CPI as a weighted average of prices for a basket of goods and services representative of aggregate U.S. consumer spending. |

| ● | The MSCI ACWI ex USA Index captures large- and mid-cap representation across developed markets countries (excluding the US) and emerging markets countries. The index covers approximately 85% of the global equity opportunity set outside the U.S. |

| ● | The MSCI Emerging Markets Index captures large- and mid-cap representation across Emerging Markets countries. The index covers approximately 85% of the free float-adjusted market capitalization in each country. |

| ● | The Russell 1000 Growth Index measures the performance of the large-cap growth segment of the U.S. equity universe. It includes those Russell 1000 companies with higher growth earning potential as defined by Russell’s leading style methodology. The Russell 1000 Growth Index is constructed to provide a comprehensive and unbiased barometer for the large-cap growth segment. |

| ● | The Russell 1000 Index measures the performance of the large-cap segment of the U.S. equity universe. It is a subset of the Russell 3000 Index and includes approximately 1,000 of the largest securities based on a combination of their market cap and current index membership. |

| ● | The Russell 2000 Growth Index measures the performance of the small-cap growth segment of the U.S. equity universe. It includes those Russell 2000 companies with higher growth earning potential as defined by Russell’s leading style methodology. The Russell 2000 Growth Index is constructed to provide a comprehensive and unbiased barometer for the small-cap growth segment. |

| ● | The Russell 2000 Index measures the performance of the small-cap segment of the U.S. equity universe. The Russell 2000 Index is constructed to provide a comprehensive and unbiased barometer of the small-cap segment. |

| ● | The Russell 2500 Growth Index measures the performance of the small to mid-cap growth segment of the U.S. equity universe. It includes those Russell 2500 companies with higher growth earning potential as defined by Russell’s leading style methodology. The Russell 2500 Growth Index is constructed to provide a comprehensive and unbiased barometer of the small to mid-cap growth market. |

| ● | The Russell 2500 Index measures the performance of the small to midcap segment of the U.S. equity universe, commonly referred to as “smid” cap. The Russell 2500 Index is constructed to provide a comprehensive and unbiased barometer for the small to mid-cap segment. |

| ● | The Russell 3000 Healthcare Index is an unmanaged index that measures the performance of those companies in the Russell 3000 Index involved in the medical services or healthcare field. Also included are companies involved in research, development and production of pharmaceuticals and biotechnology |

| ● | The Russell 3000 Index measures the performance of the largest 3,000 U.S. companies of the investable U.S. equity market. The Russell 3000 Index is constructed to provide a comprehensive, unbiased and stable barometer of the broad market. |

| ● | The Russell Microcap Index measures the performance of the microcap segment of the U.S. equity market. The Russell Microcap Index is constructed to provide a comprehensive and unbiased barometer for the microcap segment trading on national exchanges. |

| ● | The Russell Midcap Growth Index measures the performance of the mid-cap growth segment of the U.S. equity universe. It includes those Russell Midcap Index companies with higher growth earning potential as defined by Russell’s leading style methodology. The Russell Midcap Growth Index is constructed to provide a comprehensive and unbiased barometer of the mid-cap growth market. |

| ● | The Russell Midcap Index measures the performance of the mid-cap segment of the U.S. equity universe. The Russell Midcap Index is constructed to provide a comprehensive and unbiased barometer for the mid-cap segment. |

| ● | The S&P 500 Index is an unmanaged index considered representative of large-cap growth stocks. |

ALGER CAPITAL APPRECIATION FUND

Fund Highlights Through October 31, 2023 (Unaudited)

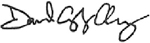

The chart above illustrates the change in value of a hypothetical $10,000 investment made in the Alger Capital Appreciation Fund Class A shares, with a maximum sales charge of 5.25%, and the Russell 1000 Growth Index (an unmanaged index of common stocks) for the ten years ended October 31, 2023. Figures for the Alger Capital Appreciation Fund Class A shares and the Russell 1000 Growth Index include reinvestment of dividends. Figures for the Alger Capital Appreciation Fund Class A shares also include reinvestment of capital gains. Performance for Alger Capital Appreciation Fund Class C and Class Z shares will vary from the results shown above due to differences in expenses and sales charges those classes bear. Investors cannot invest directly in any index. Index performance does not reflect deduction for fees, expenses, or taxes.

ALGER CAPITAL APPRECIATION FUND

Fund Highlights Through October 31, 2023 (Unaudited) (Continued)

PERFORMANCE COMPARISON AS OF 10/31/23

AVERAGE ANNUAL TOTAL RETURNS

| 1 YEAR | 5 YEARS | 10 YEARS | ||||

| Class A | 10.82% | 8.72% | 10.52% | |||

| Class C | 15.03% | 9.08% | 10.29% | |||

| Class Z | 17.44% | 10.28% | 11.50% | |||

| Russell 1000 Growth Index | 18.95% | 14.22% | 13.82% | |||

The performance data quoted represents past performance, which is not an indication or a guarantee of future results. The Fund’s average annual total returns include changes in share price and reinvestment of dividends and capital gains. Class A returns reflect the maximum initial sales charge and Class C returns reflect the applicable contingent deferred sales charge. The chart and table above do not reflect the deduction of taxes that a shareholder would have paid on Fund distributions or on the redemption of Fund shares. Investment return and principal will fluctuate and the Fund’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance quoted. For updated performance, visit us at www.alger.com or call us at (800) 992-3863.

ALGER 35 FUND

Fund Highlights Through October 31, 2023 (Unaudited)

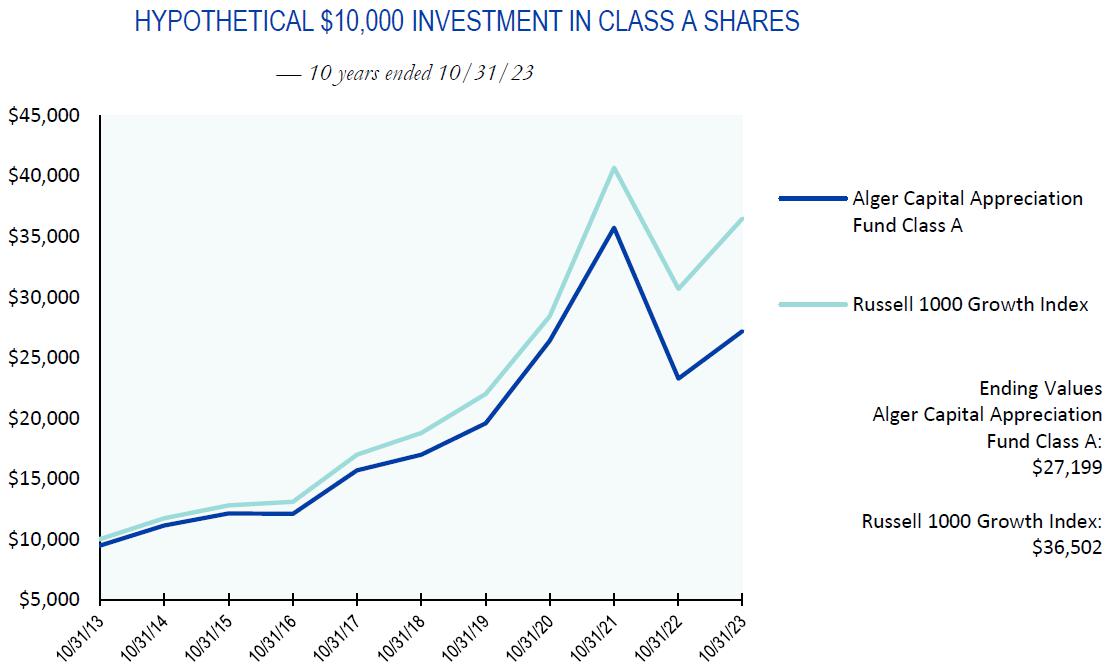

The chart above illustrates the change in value of a hypothetical $10,000 investment made in the Alger 35 Fund Class Z shares and the S&P 500 Index (an unmanaged index of common stocks) from March 29, 2018, the inception date of the Alger 35 Fund Class Z shares, through October 31, 2023. Effective May 7, 2021, Class P shares of the Alger 35 Fund were reclassified as Class Z shares. The reclassified Class Z shares have the same annual returns as the Class P shares because the shares are invested in the same portfolio of securities and the reclassified Class Z shares have the same expenses as the Fund’s Class P shares. Historical performance prior to May 7, 2021 is that of the Fund’s Class P shares. Figures for the Alger 35 Fund Class Z shares and the S&P 500 Index include reinvestment of dividends. Figures for the Alger 35 Fund Class Z shares also include reinvestment of capital gains. Investors cannot invest directly in any index. Index performance does not reflect deduction for fees, expenses, or taxes.

ALGER 35 FUND

Fund Highlights Through October 31, 2023 (Unaudited) (Continued)

PERFORMANCE COMPARISON AS OF 10/31/23

AVERAGE ANNUAL TOTAL RETURNS

| 1 YEAR | 5 YEARS | Since Inception | ||||

| Class Z (Inception 3/29/18) | 1.38% | 8.66% | 8.43% | |||

| S&P 500 Index | 10.14% | 11.01% | 10.52% | |||

The performance data quoted represents past performance, which is not an indication or a guarantee of future results. The Fund’s average annual total returns include changes in share price and reinvestment of dividends and capital gains. Effective May 7, 2021, Class P shares of the Alger 35 Fund were reclassified as Class Z shares. The reclassified Class Z shares have the same annual returns as the Class P shares because the shares are invested in the same portfolio of securities and the reclassified Class Z shares have the same expenses as the Fund’s Class P shares. Historical performance prior to May 7, 2021 is that of the Fund’s Class P shares. The chart and table above do not reflect the deduction of taxes that a shareholder would have paid on Fund distributions or on the redemption of Fund shares. Investment return and principal will fluctuate and the Fund’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance quoted. For updated performance, visit us at www.alger. com or call us at (800) 992-3863.

ALGER GROWTH & INCOME FUND

Fund Highlights Through October 31, 2023 (Unaudited)

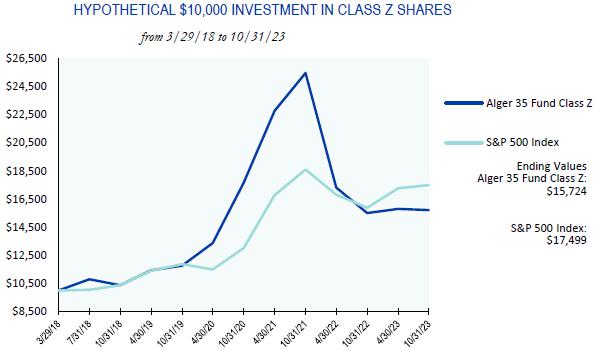

The chart above illustrates the change in value of a hypothetical $10,000 investment made in the Alger Growth & Income Fund Class A shares, with a maximum sales charge of 5.25%, and the S&P 500 Index (an unmanaged index of common stocks) for the ten years ended October 31, 2023. Figures for the Alger Growth & Income Fund Class A shares and the S&P 500 Index include reinvestment of dividends. Figures for the Alger Growth & Income Fund Class A shares also include reinvestment of capital gains. Performance for the Alger Growth & Income Fund Class C and Class Z shares will vary from the results shown above due to differences in expenses and sales charges those classes bear. Investors cannot invest directly in any index. Index performance does not reflect deduction for fees, expenses, or taxes.

ALGER GROWTH & INCOME FUND

Fund Highlights Through October 31, 2023 (Unaudited) (Continued)

PERFORMANCE COMPARISON AS OF 10/31/23

AVERAGE ANNUAL TOTAL RETURNS

| 1 YEAR | 5 YEARS | 10 YEARS | ||||

| Class A | 5.54% | 10.20% | 10.10% | |||

| Class C | 9.56% | 10.56% | 9.87% | |||

| Class Z | 11.75% | 11.77% | 11.04% | |||

| S&P 500 Index | 10.14% | 11.01% | 11.18% | |||

The performance data quoted represents past performance, which is not an indication or a guarantee of future results. The Fund’s average annual total returns include changes in share price and reinvestment of dividends and capital gains. Class A returns reflect the maximum initial sales charge and Class C returns reflect the applicable contingent deferred sales charge. The chart and table above do not reflect the deduction of taxes that a shareholder would have paid on Fund distributions or on the redemption of Fund shares. Investment return and principal will fluctuate and the Fund’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance quoted. For updated performance, visit us at www.alger.com or call us at (800) 992-3863.

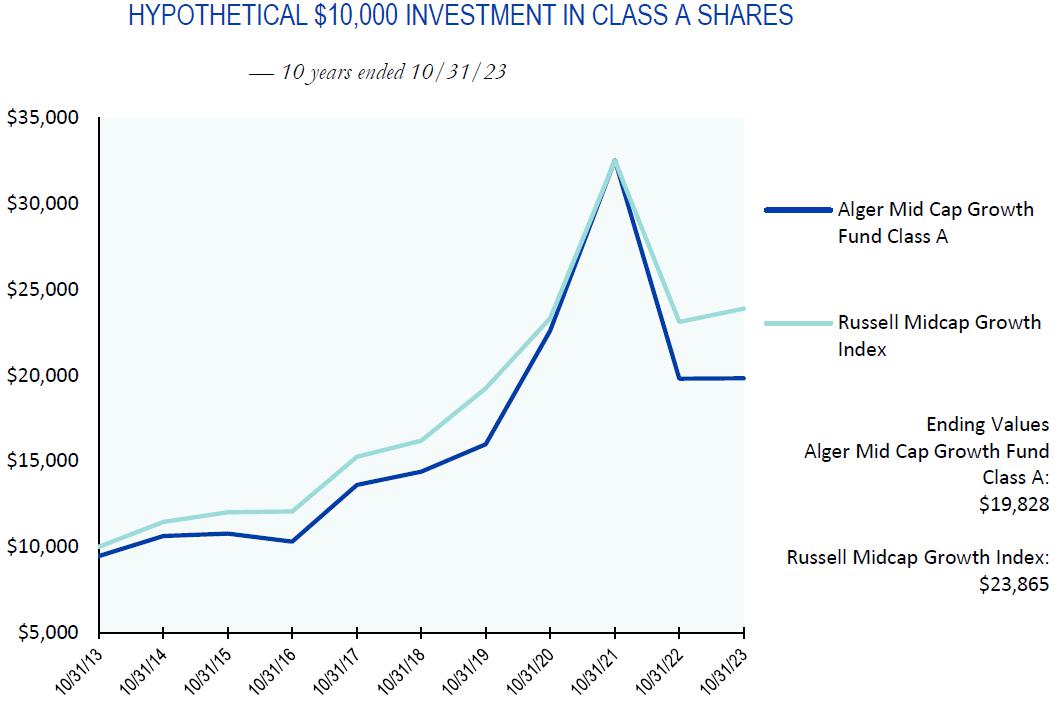

ALGER MID CAP GROWTH FUND*

Fund Highlights Through October 31, 2023 (Unaudited)

The chart above illustrates the change in value of a hypothetical $10,000 investment made in the Alger Mid Cap Growth Fund Class A shares, with a maximum sales charge of 5.25%, and the Russell Midcap Growth Index (an unmanaged index of common stocks) for the ten years ended October 31, 2023. Figures for the Alger Mid Cap Growth Fund Class A shares and Russell Midcap Growth Index include reinvestment of dividends. Figures for the Alger Mid Cap Growth Fund Class A shares also include reinvestment of capital gains. Performance for the Alger Mid Cap Growth Fund Class B, Class C and Class Z shares will vary from the results shown above due to differences in expenses and sales charges those classes bear. Investors cannot invest directly in any index. Index performance does not reflect deduction for fees, expenses, or taxes.

ALGER MID CAP GROWTH FUND*

Fund Highlights Through October 31, 2023 (Unaudited) (Continued)

PERFORMANCE COMPARISON AS OF 10/31/23

AVERAGE ANNUAL TOTAL RETURNS

| 1 YEAR | 5 YEARS | 10 YEARS | ||||

| Class A | (5.08)% | 5.48% | 7.08% | |||

| Class B | (4.85)% | 6.39% | 7.27% | |||

| Class C | (1.62)% | 5.77% | 6.80% | |||

| Russell Midcap Growth Index | 3.35% | 8.09% | 9.09% | |||

| 1 YEAR | 5 YEARS | Since Inception | ||||

| Class Z (Inception 5/28/15) | 0.54% | 6.95% | 6.65% | |||

| Russell Midcap Growth Index | 3.35% | 8.09% | 7.91% | |||

The performance data quoted represents past performance, which is not an indication or a guarantee of future results. The Fund’s average annual total returns include changes in share price and reinvestment of dividends and capital gains. Class A returns reflect the maximum initial sales charge and Class B and C returns reflect the applicable contingent deferred sales charge. The chart and table above do not reflect the deduction of taxes that a shareholder would have paid on Fund distributions or on the redemption of Fund shares. Investment return and principal will fluctuate and the Fund’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance quoted. For updated performance, visit us at www.alger.com or call us at (800) 992-3863.

| * | Pursuant to the U.S. Securities and Exchange Commission’s rules on Fair Fund and Disgorgement Plans, the Alger Mid Cap Growth Fund received a Fair Fund distribution of $9,346,397 on September 10, 2021, which contributed approximately 0.60% and 0.30% to its five and ten year annual returns, respectively. |

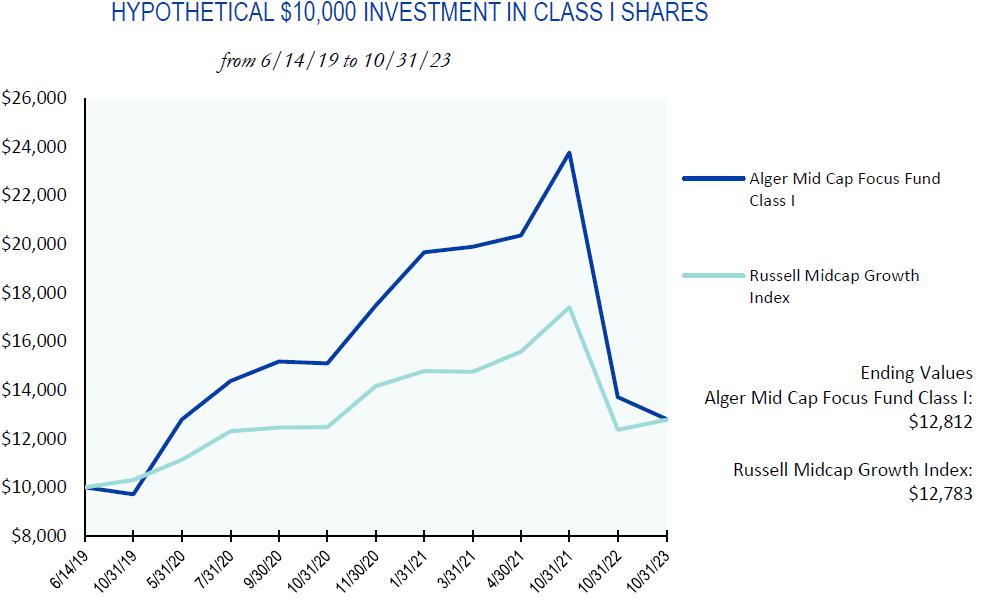

ALGER MID CAP FOCUS FUND

Fund Highlights Through October 31, 2023 (Unaudited)

The chart above illustrates the change in value of a hypothetical $10,000 investment made in the Alger Mid Cap Focus Fund Class I shares and the Russell Midcap Growth Index (an unmanaged index of common stocks) from June 14, 2019, the inception date of the Alger Mid Cap Focus Fund Class I shares, through October 31, 2023. Figures for the Alger Mid Cap Focus Fund Class I shares and the Russell Midcap Growth Index include reinvestment of dividends. Figures for the Alger Mid Cap Focus Fund Class I shares also include reinvestment of capital gains. Performance for the Alger Mid Cap Focus Fund Class A, C, Y and Z shares will vary from the results shown above due to differences in the expenses and sales charges that those classes bear. Investors cannot invest directly in any index. Index performance does not reflect deduction for fees, expenses, or taxes.

ALGER MID CAP FOCUS FUND

Fund Highlights Through October 31, 2023 (Unaudited) (Continued)

PERFORMANCE COMPARISON AS OF 10/31/23

AVERAGE ANNUAL TOTAL RETURNS

| 1 YEAR | 5 YEARS | Since Inception | ||||

| Class I (Inception 6/14/19) | (6.59)% | n/a | 5.83% | |||

| Class Z (Inception 6/14/19) | (6.28)% | n/a | 6.13% | |||

| Russell Midcap Growth Index | 3.35% | n/a | 5.77% |

| 1 YEAR | 5 YEARS | Since Inception | ||||

| Class Y (Inception 2/26/21) | (6.28)% | n/a | (16.41)% | |||

| Russell Midcap Growth Index | 3.35% | n/a | (5.91)% |

| 1 YEAR | 5 YEARS | Since Inception | ||||

| Class A (Inception 7/29/21) | (11.55)% | n/a | (21.53)% | |||

| Class C (Inception 7/29/21) | (8.25)% | n/a | (20.25)% | |||

| Russell Midcap Growth Index | 3.35% | n/a | (11.00)% |

The performance data quoted represents past performance, which is not an indication or a guarantee of future results. The Fund’s average annual total returns include changes in share price and reinvestment of dividends and capital gains. Class A returns reflect the maximum initial sales charge and Class C returns reflect the applicable contingent deferred sales charge. The chart and table above do not reflect the deduction of taxes that a shareholder would have paid on Fund distributions or on the redemption of Fund shares. Investment return and principal will fluctuate and the Fund’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance quoted. For updated performance, visit us at www.alger.com or call us at (800) 992-3863.

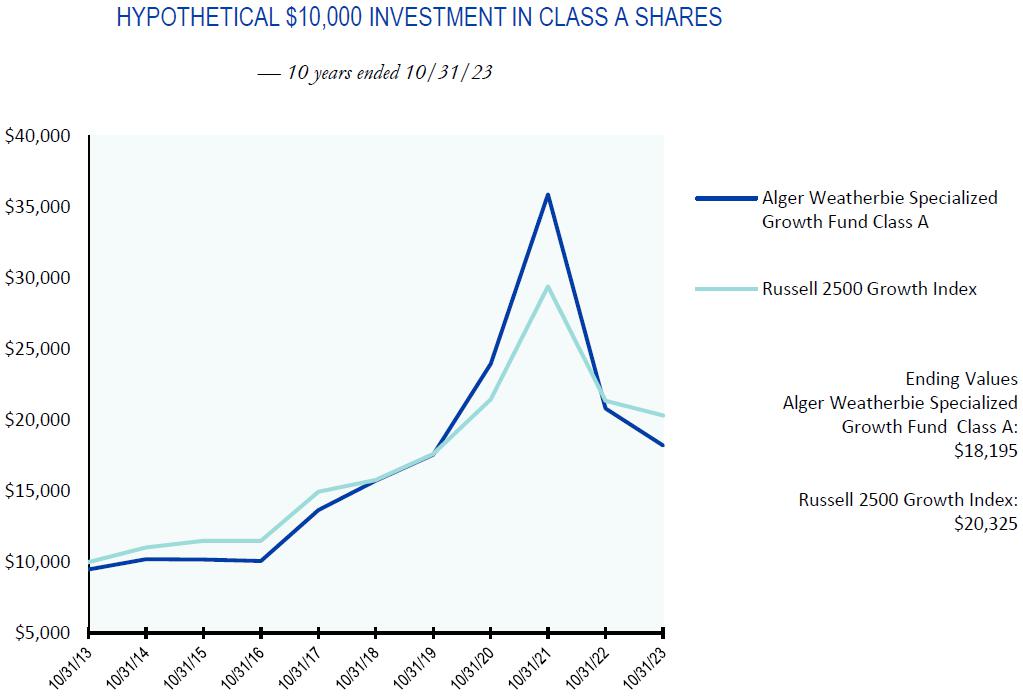

ALGER WEATHERBIE SPECIALIZED GROWTH FUND

Fund Highlights Through October 31, 2023 (Unaudited)

The chart above illustrates the change in value of a hypothetical $10,000 investment made in the Alger Weatherbie Specialized Growth Fund Class A shares, with a maximum sales charge of 5.25%, and the Russell 2500 Growth Index (an unmanaged index of common stocks) for the ten years ended October 31, 2023. From August 30, 2017 to September 30, 2019, the Fund was named Alger SMid Cap Focus Fund. Prior to August 30, 2017, the Fund followed different investment strategies under the name Alger SMid Cap Growth Fund and prior to March 1, 2017 was managed by different portfolio managers. Accordingly, performance prior to those dates does not reflect the Fund’s current investment strategies and investment personnel. Figures for the Alger Weatherbie Specialized Growth Fund Class A shares and the Russell 2500 Growth Index include reinvestment of dividends. Figures for the Alger Weatherbie Specialized Growth Fund Class A shares also include reinvestment of capital gains. Performance for the Alger Weatherbie Specialized Growth Fund Class C, Class I, Class Y and Class Z shares will vary from the results shown above due to differences in expenses and sales charges those classes bear. Investors cannot invest directly in any index. Index performance does not reflect deduction for fees, expenses, or taxes.

ALGER WEATHERBIE SPECIALIZED GROWTH FUND

Fund Highlights Through October 31, 2023 (Unaudited) (Continued)

PERFORMANCE COMPARISON AS OF 10/31/23

AVERAGE ANNUAL TOTAL RETURNS

| 1 YEAR | 5 YEARS | 10 YEARS | ||||

| Class A | (17.12)% | 1.87% | 6.17% | |||

| Class C | (14.22)% | 2.17% | 5.92% | |||

| Class I | (12.59)% | 2.98% | 6.74% | |||

| Class Z | (12.25)% | 3.31% | 7.10% | |||

| Russell 2500 Growth Index | (4.80)% | 5.22% | 7.35% | |||

| 1 YEAR | 5 YEARS | Since Inception | ||||

| Class Y (Inception 8/30/17) | (12.21)% | 3.38% | 6.32% | |||

| Russell 2500 Growth Index | (4.80)% | 5.22% | 6.48% | |||

The performance data quoted represents past performance, which is not an indication or a guarantee of future results. The Fund’s average annual total returns include changes in share price and reinvestment of dividends and capital gains. Class A returns reflect the maximum initial sales charge and Class C returns reflect the applicable contingent deferred sales charge. The chart and table above do not reflect the deduction of taxes that a shareholder would have paid on Fund distributions or on the redemption of Fund shares. From August 30, 2017 to September 30, 2019, the Fund was named “Alger SMid Cap Focus Fund.” Prior to August 30, 2017, the Fund followed different investment strategies under the name “Alger SMid Cap Growth Fund” and prior to March 1, 2017 was managed by different portfolio managers. Accordingly, performance prior to those dates does not reflect the Fund’s current investment strategies and investment personnel. Investment return and principal will fluctuate and the Fund’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance quoted. For updated performance, visit us at www.alger. com or call us at (800) 992-3863.

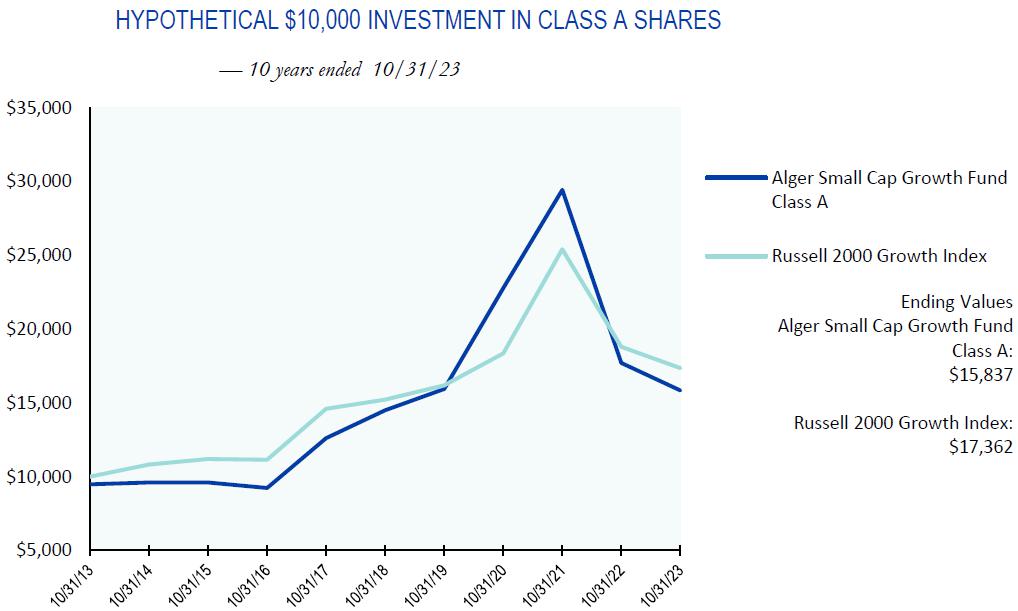

ALGER SMALL CAP GROWTH FUND*

Fund Highlights Through October 31, 2023 (Unaudited)

The chart above illustrates the change in value of a hypothetical $10,000 investment made in the Alger Small Cap Growth Fund Class A shares, with a maximum sales charge of 5.25%, and the Russell 2000 Growth Index (an unmanaged index of common stocks) for the ten years ended October 31, 2023. Figures for the Alger Small Cap Growth Fund Class A shares and the Russell 2000 Growth Index include reinvestment of dividends. Figures for the Alger Small Cap Growth Fund Class A shares also include reinvestment of capital gains. Performance for the Alger Small Cap Growth Fund Class B, Class C, Class Y and Class Z shares will vary from the results shown above due to differences in expenses and sales charges those classes bear. Investors cannot invest directly in any index. Index performance does not reflect deduction for fees, expenses, or taxes.

ALGER SMALL CAP GROWTH FUND*

Fund Highlights Through October 31, 2023 (Unaudited) (Continued)

PERFORMANCE COMPARISON AS OF 10/31/23

AVERAGE ANNUAL TOTAL RETURNS

| 1 YEAR | 5 YEARS | 10 YEARS | ||||

| Class A | (15.24)% | 0.68% | 4.71% | |||

| Class B | (15.08)% | 1.38% | 4.81% | |||

| Class C | (12.14)% | 0.97% | 4.45% | |||

| Class Z | (10.23)% | 2.13% | 5.64% | |||

| Russell 2000 Growth Index | (7.63)% | 2.68% | 5.67% | |||

| 1 YEAR | 5 YEARS | Since Inception | ||||

| Class Y (Inception 12/31/21) | (10.20)% | n/a | (24.11)% | |||

| Russell 2000 Growth Index | (7.63)% | n/a | (16.75)% | |||

The performance data quoted represents past performance, which is not an indication or a guarantee of future results. The Fund’s average annual total returns include changes in share price and reinvestment of dividends and capital gains. Class A returns reflect the maximum initial sales charge and Class B and C returns reflect the applicable contingent deferred sales charge. The chart and table above do not reflect the deduction of taxes that a shareholder would have paid on Fund distributions or on the redemption of Fund shares. Investment return and principal will fluctuate and the Fund’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance quoted. For updated performance, visit us at www.alger.com or call us at (800) 992-3863.

| * | Pursuant to the U.S. Securities and Exchange Commission’s Rules on Fair Fund and Disgorgement Plans, the Alger Small Cap Growth Fund received a Fair Fund distribution of $3,738,004 on September 10, 2021, which contributed approximately 0.11% and 0.06% to its five and ten year annual returns, respectively. |

ALGER SMALL CAP FOCUS FUND

Fund Highlights Through October 31, 2023 (Unaudited)

The chart above illustrates the change in value of a hypothetical $10,000 investment made in the Alger Small Cap Focus Fund Class A shares, with an initial 5.25% maximum sales charge, and the Russell 2000 Growth (an unmanaged index of common stocks) for the ten years ended October 31, 2023. Prior to August 7, 2015, the Fund followed different investment strategies under the name “Alger Growth Opportunities Fund” and prior to February 12, 2015 was managed by a different portfolio manager. Accordingly, performance prior to those dates does not reflect the Fund’s current investment strategies and investment personnel. Figures for the Alger Small Cap Focus Fund Class A shares and the Russell 2000 Growth Index include reinvestment of dividends. Figures for the Alger Small Cap Focus Fund Class A shares also include reinvestment of capital gains. Performance for the Alger Small Cap Focus Fund Class C, Class I, Class Y and Class Z shares will vary from the results shown above due to differences in expenses and sales charges those classes bear. Investors cannot invest directly in any index. Index performance does not reflect deduction for fees, expenses, or taxes.

ALGER SMALL CAP FOCUS FUND

Fund Highlights Through October 31, 2023 (Unaudited) (Continued)

PERFORMANCE COMPARISON AS OF 10/31/23