SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrantx Filed by a Party other than the Registrant¨

Check the appropriate box:

x | Preliminary Proxy Statement |

¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

¨ | Definitive Proxy Statement |

¨ | Definitive Additional Materials |

¨ | Soliciting Material Pursuant to Sec. 240.14a-12 |

UNIGENE LABORATORIES, INC.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than Registrant)

Payment of Filing Fee (Check the appropriate box):

¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | 1) | Title of each class of securities to which transaction applies: |

| | 2) | Aggregate number of securities to which transaction applies: |

| | 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | 4) | Proposed maximum aggregate value of transaction: |

¨ | Fee paid previously with preliminary materials. |

¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | 1) | Amount Previously Paid: |

| | 2) | Form, Schedule or Registration Statement No.: |

Explanatory Note:

This preliminary proxy statement replaces in its entirety the definitive proxy statement filed by the Registrant on April 24, 2006, which was filed as a definitive statement in error.

Unigene Laboratories, Inc.

110 Little Falls Road

Fairfield, New Jersey 07004

(973) 882-0860

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To be held on June 15, 2006

NOTICE IS HEREBY GIVEN that the Annual Meeting of Stockholders of Unigene Laboratories, Inc., a Delaware corporation (the “Company”), will be held at The Days Inn of Parsippany, 3159 U.S. Highway 46 East, Parsippany, New Jersey 07054 on June 15, 2006, at 11:00 A.M., Eastern Daylight Time, for the following purposes:

1. To elect directors of the Company;

2. To approve an amendment to the Certificate of Incorporation of the Company to increase the number of authorized shares of Common Stock, par value $.01 per share, from 100,000,000 shares to 135,000,000 shares;

3. To approve the adoption of the Company’s 2006 Stock-Based Incentive Compensation Plan.

4. To ratify the appointment by the Audit Committee of the Company’s Board of Directors of Grant Thornton LLP as independent auditors of the Company for the Company’s 2006 fiscal year; and

5. To transact such other business as may properly come before the meeting and any adjournment thereof.

The Board of Directors has fixed the close of business on April 27, 2006 as the record date for the determination of stockholders who are entitled to notice of and to vote at the meeting.

A copy of the Company’s Annual Report for the year ended December 31, 2005 is being sent to you along with the Proxy Statement.

To assure your representation at the meeting, please sign, date and return your proxy before June 15, 2006 in the enclosed envelope, which requires no postage if mailed in the United States.

|

By Order of the Board of Directors |

|

| |

RONALD S. LEVY |

Secretary |

May 8, 2006

Unigene Laboratories, Inc.

110 Little Falls Road

Fairfield, New Jersey 07004

(973) 882-0860

PROXY STATEMENT

ANNUAL MEETING OF STOCKHOLDERS

This Proxy Statement is furnished in connection with the solicitation of proxies by the Board of Directors of Unigene Laboratories, Inc., a Delaware corporation (the “Company”), for the Annual Meeting of Stockholders of the Company to be held at The Days Inn of Parsippany, 3159 U.S. Highway 46 East, Parsippany, New Jersey 07054 on June 15, 2006, at 11:00 A.M., Eastern Daylight Time.

You are requested to complete, date and sign the accompanying form of proxy and return it to the Company in the enclosed envelope. The proxy may be revoked at any time before it is exercised by written notice to the Company bearing a later date than the date on the proxy, provided such notice is received by the Company prior to the start of the meeting. Any stockholder attending the meeting may vote in person whether or not he or she has previously submitted a proxy. Where instructions are indicated, a duly executed proxy will be voted in accordance with such instructions. Where no instructions are indicated, a duly executed proxy will be voted for each of the director nominees named herein and in favor of each of the proposals set forth in the attached Notice of Annual Meeting of Stockholders.

The Board of Directors has fixed the close of business on April 27, 2006 as the record date (the “Record Date”) for the determination of stockholders who are entitled to notice of and to vote at the meeting. As of the Record Date, the outstanding shares of the Company entitled to vote were 87,598,065 shares of common stock, par value $.01 per share (“Common Stock”), the holders of which are each entitled to one vote per share.

The holders of a majority of the outstanding shares of Common Stock, present in person or represented by proxy, will constitute a quorum for the conduct of business at the Annual Meeting. Directors will be elected by a plurality of the votes cast. The affirmative vote of the holders of a majority of the shares present and entitled to vote at the Annual Meeting is required for the approval of the increase in the authorized shares of Common Stock, the adoption of the Company’s 2006 Stock-Based Incentive Compensation Plan and for the ratification of the appointment of Grant Thornton LLP as auditors of the Company. For adoption of matters that require the affirmative vote of a majority of the shares of Common Stock present and entitled to vote, abstentions are considered as shares present and entitled to vote and, therefore, have the effect of a “no” vote, whereas broker non-votes will be treated as shares that are not present and entitled to vote and are not counted in determining whether the affirmative vote required for the approval of Proposals 2, 3 and 4 has been cast.

This Proxy Statement and the accompanying Notice of Annual Meeting of Stockholders and form of proxy are being mailed to the stockholders on or about May 10, 2006. A copy of the Company’s Annual Report for the year ended December 31, 2005 is also enclosed.

PRINCIPAL STOCKHOLDERS

The following table sets forth information as of April 3, 2006, concerning the persons who are known by the Company to own beneficially more than 5 percent of the outstanding shares of Common Stock.

| | | | | | |

Name and Address of Beneficial Owner | | Amount and Nature

Of Beneficial

Ownership | | | Percentage of

Outstanding

Shares | |

Magnetar Capital Master Fund, Ltd. 1603 Orrington Avenue Evanston, IL 60201 | | 5,000,000 | (1) | | 5.6 | % |

(1) | Consists of 4,000,000 shares of Common Stock and a warrant to purchase 1,000,000 shares of Common Stock, which is exercisable immediately. |

SECURITY OWNERSHIP OF MANAGEMENT

The following table sets forth information as of April 3, 2006, concerning the beneficial ownership of Common Stock by each director and nominee for director of the Company, each executive officer of the Company listed in the Summary Compensation Table, and all directors and executive officers of the Company as a group.

| | | | | | |

Name of Beneficial Owner | | Amount and Nature of

Beneficial

Ownership (1) | | | Percent of

Class | |

Warren P. Levy | | 2,593,800 | (2)(3)(4) | | 3.0 | % |

Ronald S. Levy | | 2,408,800 | (3)(5) | | 2.7 | % |

Jay Levy | | 430,160 | (6) | | * | |

James P. Gilligan | | 429,760 | (7) | | * | |

Nozer M. Mehta | | 226,826 | (8) | | * | |

Paul P. Shields | | 122,910 | (9) | | * | |

J. Thomas August | | 193,552 | (10) | | * | |

Allen Bloom | | 251,000 | (11) | | * | |

Robert F. Hendrickson | | 67,000 | (12) | | * | |

Marvin L. Miller | | 7,000 | (13) | | * | |

Bruce Morra | | 101,000 | | | * | |

Peter Slusser | | 500 | | | * | |

Officers and Directors

as a Group (13 persons) | | 6,439,039 | (2)(3)(14) | | 7.2 | % |

(1) | Unless otherwise noted, each person or group member has reported sole voting and sole dispositive power with respect to securities shown as beneficially owned by him. |

(2) | Includes 200,000 shares of Common Stock held in a family trust over which Warren P. Levy in his capacity as trustee has voting and dispositive power. Warren Levy disclaims beneficial ownership of those reported securities, except to the extent of his pecuniary interest therein. |

2

(3) | Warren Levy and Ronald Levy are general partners of, and have a pecuniary interest in, the W&R Levy Family Limited Partnership, which owns 513,095 shares of Unigene Laboratories, Inc. common stock. Warren Levy and Ronald Levy each disclaim beneficial ownership of those reported securities, except to the extent of their pecuniary interest therein. |

(4) | Includes 100,000 shares of Common Stock that Warren P. Levy has the right to acquire upon the exercise of stock options that are exercisable either immediately or within 60 days. |

(5) | Includes 100,000 shares of Common Stock that Ronald S. Levy has the right to acquire upon the exercise of stock options that are exercisable either immediately or within 60 days. |

(6) | Includes 420,000 shares of Common Stock that Jay Levy has the right to acquire pursuant to stock options that are exercisable either immediately or within 60 days. |

(7) | Includes 365,000 shares of Common Stock that James P. Gilligan has the right to acquire pursuant to stock options that are exercisable either immediately or within 60 days. |

(8) | Includes 126,666 shares of Common Stock that Nozer M. Mehta has the right to acquire pursuant to stock options that are exercisable either immediately or within 60 days. |

(9) | Includes 122,750 shares of Common Stock that Paul P. Shields has the right to acquire pursuant to stock options that are exercisable either immediately or within 60 days. |

(10) | Includes 181,000 shares of Common Stock that J. Thomas August has the right to acquire pursuant to stock options that are exercisable either immediately or within 60 days. |

(11) | Includes 250,000 shares of Common Stock that Allen Bloom has the right to acquire pursuant to stock options that are exercisable either immediately or within 60 days. |

(12) | Includes 17,000 shares of Common Stock that Robert F. Hendrickson has the right to acquire pursuant to stock options that are exercisable either immediately or within 60 days. |

(13) | Consists of 7,000 shares of Common Stock that Marvin L. Miller has the right to acquire pursuant to stock options that are exercisable either immediately or within 60 days. |

(14) | Includes an aggregate of 1,770,082 shares of Common Stock that such persons have the right to acquire pursuant to stock options that are exercisable either immediately or within 60 days. |

3

PROPOSAL 1

ELECTION OF DIRECTORS

All nine directors of the Company are to be elected at the Annual Meeting. The directors will be elected to serve until the Annual Meeting of Stockholders to be held in 2007, and until their respective successors shall have been elected and qualified.

All of the nominees are currently directors of the Company and all, except for Bruce Morra and Peter Slusser, were elected as directors at the Company’s Annual Meeting of Stockholders in 2005. The Board of Directors has no reason to believe that any of the nominees are or will become unavailable for election as a director. However, should any of them become unwilling or unable to serve as a director, the individuals named in the enclosed proxy will vote for the election of a substitute nominee selected by the Board of Directors or, if no such person is nominated, the Board of Directors will reduce the number of directors to be elected.

The Board of Directors believes that candidates for director should have certain minimum qualifications, including being over the age of 21, being able to read and understand basic financial statements, having relevant business experience and having high moral character. However, the Board retains the right to modify these minimum qualifications from time to time. The process for identifying and evaluating nominees is as follows. In the case of incumbent directors whose terms of office are set to expire, we review such directors’ overall service to the Company, including the number of meetings attended, level of participation and quality of performance. In the case of new candidates, the Board uses its network of contacts to create a list of potential candidates, meets to discuss such candidates, interviews candidates, considers his or her qualifications and chooses a candidate by majority vote. The Board will consider recommendations by stockholders. Such recommendations should be submitted to the Board of Directors and should contain a detailed justification for the submission, as well as a complete resume for the recommended director. At this time, the Board does not feel it is necessary to have a formal policy regarding director recommendations by stockholders; however, the Board reserves the right to institute such a policy if it determines such a policy to be in the best interests of the Company. The Board does not intend to alter the method of evaluation if the candidate is recommended by a stockholder.

DIRECTORS WILL BE ELECTED BY A PLURALITY OF THE VOTES CAST. THE BOARD OF DIRECTORS RECOMMENDS A VOTEFOR THE ELECTION OF THE NOMINEES AS DIRECTOR.

INFORMATION REGARDING DIRECTORS, NOMINEES AND EXECUTIVE OFFICERS

| | | | | | |

Name | | Age | | Year Joined Unigene | | Position |

Warren P. Levy (1) | | 54 | | 1980 | | President, CEO and Director |

Ronald S. Levy (1) | | 57 | | 1980 | | Executive Vice President, Secretary and Director |

Jay Levy (1) | | 82 | | 1980 | | Treasurer, Chairman of the Board and Director |

James P. Gilligan | | 53 | | 1981 | | Vice President of Product Development |

Nozer M. Mehta | | 58 | | 1982 | | Vice President, Biological R & D |

Paul P. Shields | | 45 | | 1989 | | Vice President, Mfg. Operations |

William J. Steinhauer | | 51 | | 1987 | | Vice President of Finance |

J. Thomas August | | 78 | | 1990 | | Director of Research and Director |

Allen Bloom | | 62 | | 1998 | | Director |

Robert F. Hendrickson | | 73 | | 2004 | | Director |

Marvin L. Miller | | 69 | | 2005 | | Director |

Bruce Morra | | 52 | | 2006 | | Director |

Peter Slusser | | 76 | | 2006 | | Director |

(1) | Warren P. Levy and Ronald S. Levy are brothers and are the sons of Jay Levy. |

4

Dr. Warren P. Levy, a founder of the Company, has served as President, Chief Executive Officer and Director of the Company since its formation in November 1980. Dr. Levy holds a Ph.D. in biochemistry and molecular biology from Northwestern University and a bachelor’s degree in chemistry from the Massachusetts Institute of Technology.

Dr. Ronald S. Levy, a founder of the Company, has served as Director of the Company since its formation in November 1980, as Executive Vice President since April 1999 and as Secretary since May 1986. From November 1980 through March 1999, he served as Vice President of the Company. Dr. Levy holds a Ph.D. in bioinorganic chemistry from Pennsylvania State University and a bachelor’s degree in chemistry from Rutgers University.

Mr. Jay Levy, a founder of the Company, has served as Chairman of the Board of Directors and Treasurer of the Company since its formation in November 1980. Mr. Levy was Chief Financial Officer of the Company from 1980 through February 2005. He holds a B.B.A. degree from City College of New York and has more than 25 years of progressively responsible experience leading to senior accounting and financial management positions with several internationally known manufacturing corporations. For 17 years he was the principal financial advisor for the late Nathan Cummings, a noted industrialist and philanthropist. From 1985 through 1991 he served in similar capacity to the estate of Nathan Cummings and to the Nathan Cummings Foundation, a large charitable foundation. Mr. Levy is a part-time employee and devotes approximately 15% of his time to the Company.

Dr. J. Thomas August is a Distinguished Service Professor of the Departments of Oncology, Pharmacology and Molecular Sciences at the Johns Hopkins University School of Medicine, where he has been employed since 1976. He is also Director, Johns Hopkins Singapore Biomedical Centre. Dr. August has served as Unigene’s Director of Research since 1990. He serves on the Board of Directors of Bioqual, Inc. and is also a consultant for various biotechnology and medical companies. Dr. August received his medical degree from Stanford University School of Medicine.

Dr. Allen Bloom, a patent attorney, has been an independent consultant since January, 2004. He retired from Dechert LLP, a law firm, after serving as a partner from July 1994 through December 2003. He currently is Of Counsel at the firm, where he was Co-Chair of the Intellectual Property Group and headed a patent practice group which focused on biotechnology, pharmaceuticals and medical devices. For the nine years prior thereto, he was Vice President, General Counsel and Secretary of The Liposome Company, Inc., a biotechnology company. His responsibilities there included patent, regulatory and licensing activities. Dr. Bloom serves on the Board of Directors of Cytogen Corporation. Dr. Bloom holds a Ph.D. in organic chemistry from Iowa State University, a J.D. degree from New York Law School and a B.S. in chemistry from Brooklyn College.

Dr. James P. Gilligan has been employed by Unigene since 1981 and has served as Vice President of Product Development since April 1999. From February 1995 to March 1999, he served as Director of Product Development. Dr. Gilligan holds a Ph.D. in pharmacology from the University of Connecticut and a Masters of International Business from Seton Hall University.

Mr. Robert F. Hendrickson was Senior Vice President, Manufacturing and Technology, for Merck & Co., Inc., an international pharmaceutical company, from 1985 to 1990. Since 1990, Mr. Hendrickson has been a management consultant with a number of biotechnology and pharmaceutical companies among his clients. He previously served as a director of Unigene from 1997 through 2001 and is currently a director of Cytogen Corporation. Mr. Hendrickson received an A.B. degree from Harvard College and a Master in Business Administration degree from the Harvard Graduate School of Business Administration.

Dr. Bruce S. Morra was elected a director of Unigene in February 2006. Dr. Morra has been an independent consultant since February 2000. He was the President of West Drug Delivery Systems, a division of West Pharmaceutical Services, Inc. from April 2003 through December 2004. He served as the

5

President, COO, CFO, and board member of Biopore Corporation and Polygenetics, Inc., two related companies developing technology for drug delivery and medical devices for biomedical and industrial applications from 1998 through 2002, then served as Executive Vice President, Chief Business Officer and board member from 2002 to 2004. From 1993 through 2000, he served as President and COO of Flamel Technologies, Inc., a company developing, manufacturing and licensing drug and agrochemical delivery technologies and products. Dr. Morra previously served as director of Unigene from 2001 to 2003. He currently serves as a director for Medisys Technologies, Inc. and InforMedix Holdings, Inc. Dr. Morra holds a Ph.D. in polymer science and engineering and an M.B.A. from the University of Massachusetts, Amherst and a B.S.E. in chemical engineering from Princeton University.

Mr. Peter Slusser was elected a director of Unigene in February 2006. Since July 1988, Mr. Slusser has been the President and Chief Executive Officer of Slusser Associates, Inc., a private investment banking company. From December 1975 to March 1988, he was Managing Director and head of Mergers and Acquisitions for Paine Webber Incorporated. Mr. Slusser currently serves as a director of Sparton Corporation, an undersea defense products and electronics contract manufacturer, and as a director of Ampex Corporation, a manufacturer of high speed digital recording equipment with a significant portfolio of digital video technology patents. Mr. Slusser received a B.A. degree from Stanford University and an M.B.A. degree from Harvard University.

Mr. Marvin L. Miller has been the Executive Chairman of Onconova Therapeutics, Inc., a biotechnology company, since 2002. From 1994 through 2002, he served as President of Nextran Inc., a biotechnology company affiliated with Baxter Healthcare Corporation. Prior to joining Nextran, Mr. Miller served as Vice President, Biotechnology Licensing for American Cyanamid Company. Previously, Mr. Miller was Vice President, Johnson & Johnson International as well as Corporate Vice President at Hoffman-LaRoche. Mr. Miller is currently a director of GTC Biotherapeutics, Inc. and Tepnel Life Sciences PLC. Mr. Miller received a B.S. degree in pharmacy from the Philadelphia College of Pharmacy & Science and an M.B.A. degree from the University of Wisconsin.

Dr. Nozer M. Mehta has served as our Vice President, Biological Research and Development since March 1, 2005. Dr. Mehta served as Director of Biological Research and Development from May 2003 through February 2005, as Director of Molecular and Cell Biology from 1999 through May 2002 and in various other capacities from 1982 through 1999. Dr. Mehta obtained a Doctorat d’Universite degree (equivalent to a Ph.D.) from the Universite Louis Pasteur in Strasbourg, France in 1976. Prior to joining Unigene, Dr. Mehta worked at the Cancer Research Institute in Bombay, India, and at the University of Nebraska at Lincoln.

Dr. Paul P. Shields has served as our Vice President, Manufacturing Operations since March 1, 2005. Dr. Shields served as Director of Plant Operations from 2001 through February 2005, as Plant Manager from 1995 through 2001, and in various other capacities from 1989 through 1995. Dr. Shields holds a Ph.D. in biochemistry from the University of Pennsylvania and a B.S. in chemical engineering from the University of Michigan.

Mr. William J. Steinhauer, CPA, has served as our Vice President of Finance since March 1, 2005. Mr. Steinhauer served as Unigene’s Director of Finance from October 2003 through February 2005 and as Controller from July 1987 through September 2003. Prior thereto, Mr. Steinhauer served as Chief Financial Officer, Treasurer and Secretary of Refac Technology Development Corporation, a company involved in patent licensing and technology transfer. Mr. Steinhauer holds a Bachelor of Science degree in accounting from Brooklyn College.

6

BOARD OF DIRECTORS AND COMMITTEES

During 2005, there were eight meetings of the Board of Directors. Except for unusual circumstances, all directors are expected to attend the Company’s Annual Meeting. All incumbent directors who were directors at that time attended the Company’s 2005 Annual Meeting. Each member of the Board of Directors attended more than 75 percent of the combined total meetings of the Board of Directors and of the committees of the Board of Directors on which such member served for the period of 2005 during which he served as a Director.

Stockholders may contact the Board of Directors by writing to Jay Levy, Chairman of the Board, Unigene Laboratories, Inc., 110 Little Falls Road, Fairfield, NJ 07004.

Several important functions of the Board of Directors may be performed by committees that are comprised of members of the Board of Directors. The Company’s By-laws authorize the formation of these committees and grant the Board of Directors the authority to prescribe the functions of each committee and the standards for membership of each committee. The Board of Directors has two standing committees: an Audit Committee and a Compensation Committee. The Board of Directors does not have a standing nominating committee and, therefore, no nominating committee charter. The Board of Directors believes that all members of the Board should participate in the consideration and nomination of new Board members.

The responsibilities of the Audit Committee are to (i) annually select a firm of independent public accountants to act as auditors of the Company; (ii) review the scope of the annual audit with the auditors in advance of the audit, (iii) review the results of the audit and the adequacy of the Company’s accounting, financial and operating controls; (iv) review the Company’s accounting and reporting principles, policies and practices; and (v) approve fees paid to the auditors for audit and non-audit services. The current members of the Audit Committee are Allen Bloom (Chairman), Robert F. Hendrickson, Marvin L. Miller, and Peter Slusser. The Audit Committee held thirteen meetings during 2005. The Board of Directors adopted a written Audit Committee charter in 2005 and that charter is attached hereto as Appendix A. All members of the Audit Committee are considered to be “independent” as that term is defined under the listing standards of the National Association of Securities Dealers and two members, Robert F. Hendrickson and Peter Slusser, are considered by the Board of Directors to be “financial experts” as described in Rule 401(h) of Regulation S-K, promulgated under the Securities Act of 1933, as amended.

The responsibilities of the Compensation Committee are to (i) review and recommend to the Board for approval, compensation (including incentive-compensation plans and equity-based compensation plans) of the Company’s CEO, executive officers and other key officers; (ii) review and approve general benefits and compensation strategies; (iii) develop and approve all stock ownership, stock option and other equity-based compensation plans of the Company; (iv) grant any shares, stock options, or other equity-based awards under all equity-based compensation plans; and (v) approve the Compensation Committee report included in the Company’s proxy statement. The current members of the Compensation Committee are Robert F. Hendrickson (Chairman), Allen Bloom, Marvin L. Miller and Bruce Morra. The Compensation Committee held three meetings during 2005. The Board of Directors adopted a written Compensation Committee charter in 2005. All members of the Compensation Committee are considered to be “independent” as that term is defined under the listing standards of the National Association of Securities Dealers.

In addition, subject to the limitations set forth in the plans, the Compensation Committee oversees the employee stock option plans and (i) selects the employees to be granted options; (ii) fixes the number of shares to be covered by the options granted; and (iii) determines the exercise price and other terms and conditions of each option.

7

Directors who are not employees received an annual retainer in 2005 of $8,000 as well as a fee of $1,500 for each Board of Directors meeting attended. Non-employee Directors receive a fee of $750 for any Board of Directors meeting conducted via conference call. Allen Bloom, J. Thomas August and Robert F. Hendrickson are the current directors who received such fees in 2005. The annual retainer increased to $12,000 in 2006. Board members earn additional compensation for service on the Audit and Compensation Committees as follows: $500 per committee conference call, $1,000 per meeting of the committee if such meeting is convened solely to transact committee business, or $500 per meeting if such meeting is convened on a date or in conjunction with other activities of the Company or its Board of Directors or other committees for purposes in addition to committee business. The Chairmen of the Audit and Compensation Committees received 115% of the aforementioned fees in 2005. Beginning in 2006, the Chairmen of the Audit and Compensation Committees will receive annual retainers of $10,000 and $6,000, respectively, in addition to the annual Board retainer. Jay Levy receives annual compensation of $75,000 in his capacities as Chairman of the Board, Treasurer, and Assistant Secretary.

At the 1999 Annual Meeting, the stockholders approved a new Directors Stock Option Plan (the “1999 Plan”) to replace the 1994 Outside Directors Stock Option Plan (the “1994 Plan”). Under the 1999 Plan, each person elected to the Board of Directors who is not an employee receives, on the date of his initial election, an option to purchase 21,000 shares of Common Stock (an “Initial Option”). On May 1st of each year, each non-employee director receives an option to purchase 10,000 shares of Common Stock if he has served as a non-employee director for at least six months prior to the May 1st grant date (an “Additional Option”). Each option granted under the 1999 Plan has a ten-year term and an exercise price equal to the market price of the Common Stock on the date of the grant. Each Initial Option vests in equal installments of 1/3 over a period of three years, commencing on the date of the grant and each Additional Option vests in its entirety on the first anniversary of the grant.

All options become exercisable upon the vesting thereof, and remain exercisable for the remaining term of the option, unless the director’s service as a non-employee director terminates prior to the expiration of the term. If the grantee’s service as a director terminates prior to the expiration of the option, the option will remain exercisable for a 90-day period following termination of service, except (i) if a non-employee director resigns due to disability, the option will remain exercisable for 180 days following termination, and (ii) if a non-employee director dies while serving as a director, or within 90 days following termination of service (180 days in the case of disability), the option will remain exercisable for 180 days following the person’s death. After such period, the option will terminate and cease to be exercisable. Under the 1999 Plan, Allen Bloom has received options to purchase 70,000 shares of Common Stock (60,000 of which are currently exercisable), J. Thomas August has received options to purchase 61,000 shares of Common Stock (51,000 shares of which are currently exercisable), Robert F. Hendrickson has received options to purchase 31,000 shares of Common Stock (7,000 of which are currently exercisable), Marvin L. Miller has received options to purchase 21,000 shares of Common Stock (7,000 of which are currently exercisable) and Bruce Morra and Peter Slusser have each received options to purchase 21,000 shares of Common Stock (none of which are currently exercisable).

Under the 1994 Plan, each person who was an outside director at the time of the adoption of the 1994 Plan was granted, and each person who subsequently is elected as an outside director is granted, a ten-year option to purchase 30,000 shares of Common Stock at an exercise price equal to the market price of the Common Stock on the date of the grant. The options vest in equal increments over the three-year period following the grant. If the recipient’s service as a director terminates, the option will expire three months after the date of such termination. Under the 1994 Plan, Allen Bloom has received a grant of options to purchase 30,000 shares (all of which are currently exercisable).

8

On December 5, 2001, the Board of Directors granted stock options to the entire Board of Directors as follows:

| | |

Jay Levy | | 300,000 |

Allen Bloom | | 150,000 |

J. Thomas August | | 120,000 |

Warren P. Levy | | 100,000 |

Ronald S. Levy | | 100,000 |

The exercise price of these options is $.47 per share, the closing stock price on December 5, 2001. These ten-year options vested 10% on December 5, 2001 and 30% on each of June 5, 2002, December 5, 2002 and June 5, 2003. For the stock options granted to Allen Bloom and J. Thomas August, upon termination of their status as director, their time to exercise after termination will be based upon tenure as follows:

| | |

Tenure as Director | | Time period after Termination to Exercise |

Up to 1 year | | 90 days |

Greater than 1 and up to 3 years | | 180 days |

Greater than 3 and up to 5 years | | 1 year |

Greater than 5 years | | 2 years |

For the stock options granted to Jay Levy, Warren P. Levy and Ronald S. Levy, in the event of termination, each option holder has three months to exercise his options.

AUDIT COMMITTEE REPORT FOR 2005

The following report of the Audit Committee of the Board shall not be deemed to be “soliciting material” or to be incorporated by reference by any general statement incorporating by reference this Proxy Statement into any filing by the Company under either the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act, except to the extent that the Company specifically incorporates this information by reference. The following report shall not otherwise be deemed filed under such Acts.

The role of the Audit Committee is to assist the Board of Directors in fulfilling its responsibilities to oversee management’s conduct of the Company’s financial reporting process. Its responsibilities are to (1) annually select a firm of independent public accountants to act as auditors of the Company; (2) review the scope of the annual audit with the auditors in advance of the audit, (3) review the results of the audit and the adequacy of the Company’s accounting, financial and operating controls; (4) review the Company’s accounting and reporting principles, policies and practices; and (5) approve fees paid to the auditors for audit and non-audit services. The Committee selects the Company’s outside auditors, and once selected the outside auditors report directly to the Committee. The Committee is responsible for approving both audit and non-audit services to be provided by the outside auditors.

Management of the Company is responsible for the preparation, presentation and integrity of the Company’s financial statements, the Company’s accounting and financial reporting principles and internal controls and procedures which are designed to assure compliance with accounting standards and applicable laws and regulations. The independent auditors are responsible for auditing the Company’s financial statements and expressing an opinion as to their conformity with U.S. generally accepted accounting principles. The Committee’s responsibility is to monitor and review the work of management and the independent auditors in these areas. It is not the Committee’s duty or responsibility to conduct auditing or accounting reviews.

9

In the performance of its oversight function, the Committee has considered and discussed the audited financial statements with management, which included a discussion of the quality, and not just the acceptability, of the accounting principles, the reasonableness of significant judgments and the clarity of disclosures in the financial statements. The Committee met with the independent auditors, with and without management, to discuss the results of their examination and their judgments regarding the Company’s accounting policies. The Committee has also discussed with the independent auditors the matters required to be discussed by Statement on Auditing Standards No. 61, “Communication with Audit Committees,” as currently in effect. Finally, the Committee has received the written disclosures and the letter from the independent auditors required by Independence Standards Board Standard No. 1, “Independence Discussions with Audit Committees,” as currently in effect, has considered whether the provision of non-audit services by the independent auditors to the Company is compatible with maintaining the auditor’s independence and has discussed with the auditors the auditors’ independence. In addition, as part of fulfilling its responsibilities, the Audit Committee spent a significant amount of time during 2005 conferring with management, Grant Thornton and outside consultants and overseeing management’s year-long compliance efforts with Section 404 of the Sarbanes-Oxley Act of 2002.

Based upon the reports and discussions described in this report, and subject to the limitations on the role and responsibilities of the Committee referred to above, the Committee recommended to the Board that the audited financial statements be included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2005 for filing with the Securities and Exchange Commission and selected Grant Thornton LLP as the independent auditors for fiscal year 2006. The Board is recommending that stockholders ratify that selection at the annual meeting.

|

SUBMITTED BY THE AUDIT COMMITTEE OF THE COMPANY’S BOARD OF DIRECTORS |

Allen Bloom, Chairman Robert F. Hendrickson Marvin L. Miller Peter Slusser |

April 3, 2006

10

REPORT OF THE COMPENSATION COMMITTEE ON 2005 EXECUTIVE COMPENSATION

The information contained in this report shall not be deemed to be “soliciting material” or “filed” or “incorporated by reference” in future filings with the Securities and Exchange Commission, or subject to the liabilities of Section 18 of the Exchange Act, except to the extent that we specifically incorporate it by reference into a document filed under the Securities Act of 1933, as amended, or the Exchange Act.

The Compensation Committee was responsible for determining the 2005 compensation of the executive officers of the Company. This Report describes the policies and other considerations used by the Compensation Committee in establishing such compensation.

The members of the Compensation Committee are familiar with various forms and types of remuneration from reports of other public corporations and from their own business experience.

The Compensation Committee determined that, because the Company was still in a research and preproduction phase at the start of 2005, compensation for 2005 for executive officers could not be related primarily to the performance of the Company’s stock or to the annual profit performance of the Company. A primary consideration for the compensation of an executive officer of the Company is his leadership effort in the development of proprietary products and processes, and in planning for future growth and profitability. Of particular importance is the signing of revenue-generating licensing and distribution agreements as well as the achievement of milestones in these agreements. Other significant factors considered by the Compensation Committee in determining executive officers’ compensation were salaries paid by other public companies in the health-care related biotechnology field to comparable officers, the duties and responsibilities of the executive officers in the past and as projected, their past performance and commitment to the Company, and incentives for future performance, although no specific weighting was allocated to any of these considerations. The executive officers were also consulted with respect to their compensation and their plans for compensation for other personnel in order to coordinate all compensation policies of the Company. These factors were used to determine compensation for the executives under their employment agreements. See “Employment Agreements.”

The compensation for the Chief Executive Officer for 2005 was based on the same policies and considerations set forth above for executive officers generally.

SUBMITTED BY THE COMPENSATION COMMITTEE

OF THE COMPANY’S BOARD OF DIRECTORS

Robert F. Hendrickson, Chairman

Allen Bloom

Marvin L. Miller

April 3, 2006

11

Section 16(a) Beneficial Ownership Reporting Compliance

Based solely on the reports received by the Company and on written representations from reporting persons, the Company believes that the directors, executive officers and greater than ten percent beneficial owners complied with all section 16(a) filing requirements during 2005, except that: (i) Mr. Gilligan failed to file Form 4 for stock option transactions on December 7 and December 8, 2005 for 160,000 shares since he was out of the country and, upon discovery of the oversight, Mr. Gilligan filed a Form 4 on December 23, 2005, and (ii) Mr. Gilligan, through inadvertence, failed to file a Form 4 for one transaction on December 21, 2005 relating to a pre-arranged sale of 20,000 shares of Company common stock and, upon discovery of the oversight, Mr. Gilligan filed a Form 4 on January 26, 2006.

Code of Ethics

The Company has adopted a code of ethics. It describes specific policies concerning the ethical conduct of the Company’s business and applies to all officers, directors and employees. The Company’s code of ethics is posted on its internet website which can be found at http://www.unigene.com. Upon written request to Unigene Laboratories, Inc., 110 Little Falls Road, Fairfield, NJ 07004, we will provide without charge a copy of our code of ethics.

Employment Agreements

The Company entered into an employment agreement, effective January 1, 2000, with Warren P. Levy for an initial term of two years. Dr. Levy serves as President and Chief Executive Officer of the Company and received an annual salary of $160,000 for the initial year of the agreement. Salary increases beyond the first year are at the discretion of the Compensation Committee. Dr. Levy’s annual salary increased in February 2006 to $250,000 from $220,000 in 2005.

The Company entered into an employment agreement, effective January 1, 2000, with Dr. Ronald S. Levy for an initial term of two years. Dr. Levy serves as Executive Vice President of the Company and received an annual salary of $155,000 for the initial year of the agreement. Salary increases beyond the first year are at the discretion of the Compensation Committee. Dr. Levy’s annual salary increased in February 2006 to $231,000 from $210,000 in 2005.

Each agreement provides that, after the initial two-year term, the agreement will be renewed on a year-to-year basis unless either party notifies the other of the desire not to renew the agreement no later than three months prior to the scheduled termination date. Each agreement also provides that, upon (a) termination of the employment of the executive by the Company without cause or (b) resignation of the executive for good reason (which is defined to mean a change of control of the Company or a material diminution of the executive’s responsibilities without his consent), the Company will make a lump-sum severance payment to the executive equal to (i) the salary that the executive would have earned for the remaining term of this agreement, if the remaining term (either the initial term or as extended) is more than one year or (ii) the executive’s then-current annual salary, if the remaining term of the agreement (either the initial term or as extended) is one year or less.

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

Executive compensation for 2005 was determined by the Compensation Committee of the Company, at the time consisting of Robert F. Hendrickson, Marvin Miller and Allen Bloom. None of Mr. Hendrickson, Mr. Miller or Mr. Bloom currently serves as an officer of the Company. There are no compensation committee interlocks between the Company and any other entity involving the Company’s or such entity’s executive officers or board members.

12

No member of the Compensation Committee had a relationship that requires disclosure under Item 402(j)(3) of Regulation S-K.

Related Party Transactions

One of our directors, J. Thomas August, serves as our Research Director, receiving $73,500 in annual compensation. One of our officers, James Gilligan, exercised a stock option in December 2005 with payment of $55,000 paid to us in January 2006. This amount is included in Accounts and Other Receivable at December 31, 2005. One of our directors, Allen Bloom, was a partner in Dechert LLP, a law firm that we engaged for legal services in 2005 and that we continue to engage in 2006. Dr. Bloom retired from such firm effective December 31, 2003 and he continues as Of Counsel to the firm.

Three of the current nine-member Board of Directors, Warren P. Levy, Ronald S. Levy and Jay Levy, are executive officers of the Company. Jay Levy is the father of Warren and Ronald Levy.

To satisfy our short-term liquidity needs, Jay Levy, our Chairman of the Board and an officer, Warren Levy and Ronald Levy, each a director and executive officer of Unigene, and another Levy family member, from time to time have made loans to us. We have not made principal and interest payments on certain loans when due. However, the Levys waived all default provisions including additional interest penalties due under these loans through December 31, 2000. Beginning January 1, 2001, interest on loans originated through March 4, 2001 increased an additional 5% per year and is calculated on both past due principal and interest. This additional interest was approximately $853,000, and total interest expense on all Levy loans was approximately $1,516,000 for the year ended December 31, 2005. As of December 31, 2005, total accrued interest on all Levy loans was approximately $6,549,000 and the outstanding loans by these individuals to us, classified as short-term debt, totaled $10,105,000. In October 2005, we repaid an aggregate of $448,000 in principal on certain of these default loans. We also repaid an aggregate of $2,000,000 in principal on certain of these default loans on March 31, 2006.

Outstanding stockholder loans consist of the following at December 31, 2005 and 2004 (in thousands):

| | | | | | |

| | | 2005 | | 2004 |

Jay Levy term loans(1) | | $ | 1,870 | | $ | 1,870 |

Jay Levy demand loans(2) | | | 8,225 | | | 8,225 |

Warren Levy demand loans(3) | | | 5 | | | 235 |

Ronald Levy demand loans(4) | | | 5 | | | 223 |

| | | | | | |

| | | 10,105 | | | 10,553 |

Accrued interest | | | 6,549 | | | 5,850 |

| | | | | | |

Total loans and interest due to stockholders | | $ | 16,654 | | $ | 16,403 |

| | | | | | |

1) | Loans from Jay Levy in the aggregate principal amount of $1,870,000 evidenced by term notes that matured January 2002, and bear interest at the fixed rate of 11% per year. These loans were originally at 6%. These loans are secured by a security interest in all of our equipment and a mortgage on our real property. The terms of the notes required us to make installment payments of principal and interest beginning in October 1999 and ending in January 2002 in an aggregate amount of $72,426 per month. No installment payments have been made to date. Accrued interest on these loans at December 31, 2005 was approximately $1,646,000. |

2) | Loans from Jay Levy in the aggregate principal amount of $2,525,000, which are evidenced by demand notes bearing a floating interest rate equal to the Merrill Lynch Margin Loan Rate plus |

13

| | 5.25% (13% at December 31, 2005 and 11% at December 31, 2004) that are classified as short-term debt. These loans were originally at the Merrill Lynch Margin Loan Rate plus .25%. These loans are secured by a security interest in our equipment and real property. Accrued interest on these loans at December 31, 2005 was approximately $3,421,000. |

2) | Loans from Jay Levy in 2001 and 2002 in the aggregate principal amount of $5,700,000 which are evidenced by demand notes bearing a floating interest rate equal to the Merrill Lynch Margin Loan Rate plus .25%, (7.5% at December 31, 2005 and 5.5% at December 31, 2004) and are classified as short-term debt and which are secured by a security interest in certain of our patents. Accrued interest on these loans at December 31, 2005 was approximately $1,479,000. On February 15, 2005, Jay Levy transferred these $5,700,000 of demand notes to the Jaynjean Levy Family Limited Partnership in exchange for partnership units. Warren Levy and Ronald Levy are general partners of that partnership. |

3) | Loan from Warren Levy in the amount of $5,000 bears interest at the Merrill Lynch Loan Rate plus .25% (7.5% at December 31, 2005 and 5.5% at December 31, 2004) and is classified as short-term debt. This loan is secured by a secondary security interest in our equipment and real property. Accrued interest on this loan at December 31, 2005 was approximately $1,500. An additional loan in the aggregate principal amount of $230,000 was repaid in full in October 2005. |

4) | Loan from Ronald Levy in the amount of $5,000 bears interest at the Merrill Lynch Margin Loan Rate plus .25% (7.5% at December 31, 2005 and 5.5% at December 31, 2004) and is classified as short-term debt. This loan is secured by a secondary security interest in our equipment and real property. Accrued interest on this loan at December 31, 2005 was approximately $1,500. An additional loan in the aggregate principal amount of $218,323 was repaid in full in October 2005. |

14

EXECUTIVE COMPENSATION

The following table sets forth, for the years 2005, 2004 and 2003, compensation paid to the Chief Executive Officer of the Company and the four other most highly compensated officers of the Company, for services rendered by such executive officers in all capacities in which they served:

SUMMARY COMPENSATION TABLE

| | | | | | | | | | | | | | | | | |

| | | Annual Compensation | | | Long Term Compensation |

Name and Principal Position | | Year | | Salary | | Bonus | | Other Annual

Compensation | | | Securities

Underlying Options | | All Other Compensation(1) |

Warren P. Levy, President, Chief Executive Officer and

Director | | 2005 | | $ | 218,270 | | $ | 22,000 | | $ | -0- | | | -0- | | $ | 8,169 |

| | 2004 | | | 194,689 | | | 2,450 | | | -0- | | | -0- | | | 14,004 |

| | 2003 | | | 179,453 | | | 1,600 | | | -0- | | | -0- | | | 13,989 |

Ronald S. Levy, Executive Vice President and Director | | 2005 | | | 209,033 | | | 21,000 | | | -0- | | | -0- | | | 9,968 |

| | 2004 | | | 190,438 | | | 2,375 | | | -0- | | | -0- | | | 17,004 |

| | 2003 | | | 175,103 | | | 1,550 | | | -0- | | | -0- | | | 16,914 |

James P. Gilligan, Vice President | | 2005 | | | 193,424 | | | 19,500 | | | 7 269 | (2) | | 120,000 | | | -0- |

| | 2004 | | | 174,741 | | | 2,250 | | | 7,385 | (2) | | -0- | | | -0- |

| | 2003 | | | 158,713 | | | 1,450 | | | 8,365 | (2) | | 90,000 | | | -0- |

Nozer M. Mehta, Vice President | | 2005 | | | 183,597 | | | 18,500 | | | 11,252 | (2) | | 65,000 | | | -0- |

| | 2004 | | | 166,916 | | | 2,125 | | | 5,862 | (3) | | -0- | | | -0- |

| | 2003 | | | 155,118 | | | 1,450 | | | 23,586 | (4) | | 75,000 | | | -0- |

Paul P. Shields, Vice President | | 2005 | | | 166,746 | | | 17,000 | | | 3,701 | (2) | | 40,000 | | | -0- |

| | 2004 | | | 142,923 | | | 1,850 | | | 11,740 | (5) | | -0- | | | -0- |

| | 2003 | | | 137,755 | | | 1,300 | | | 5,625 | (6) | | 75,000 | | | -0- |

(1) | Represents premium paid by the Company on executive split-dollar life insurance (terminated in 2005). |

(2) | Represents reimbursement for unused vacation days. |

(3) | Represents reimbursement for unused vacation days in the amount of $3,462 and retroactive pay adjustment in the amount of $2,400. |

(4) | Represents reimbursement for unused vacation days in the amount of $10,695 and retroactive pay adjustment in the amount of $12,891. |

(5) | Represents reimbursement for unused vacation days in the amount of $4,169 and retroactive pay adjustment in the amount of $7,571. |

(6) | Represents reimbursement for unused vacation days in the amount of $4,566 and retroactive pay adjustment in the amount of $1,059. |

For information regarding directors’ compensation, please see the above section entitled “Board of Directors and Committees.”

15

STOCK OPTION GRANTS DURING THE YEAR ENDED DECEMBER 31, 2005

The following table sets forth certain information relating to stock options grants to each of the executive officers named in the Summary Compensation Table during the year ended December 31, 2005:

| | | | | | | | | | | | | | |

Name | | Number of

Shares

Underlying

Options

Granted | | Percent of

Total

Options

shares

Granted to

Employees(1) | | | Exercise

Price

per Share(2) | | Expiration

Date | | Grant

Date

Value | |

Warren P. Levy | | -0- | | — | | | $ | — | | — | | $ | — | |

Ronald S. Levy | | -0- | | — | | | $ | — | | — | | $ | — | |

James P Gilligan | | 45,000 | | 8 | % | | $ | 2.30 | | 2/28/15 | | $ | 93,047 | (3) |

James P. Gilligan | | 75,000 | | 13.3 | % | | $ | 1.58 | | 4/05/15 | | $ | 106,373 | (4) |

Nozer M. Mehta | | 40,000 | | 7.1 | % | | $ | 2.30 | | 2/28/15 | | $ | 82,708 | (3) |

Nozer M. Mehta | | 25,000 | | 4.4 | % | | $ | 1.58 | | 4/05/15 | | $ | 35,458 | (4) |

Paul P. Shields | | 40,000 | | 7.1 | % | | $ | 2.30 | | 2/28/15 | | $ | 82,708 | (3) |

(1) | Options exercisable for an aggregate of 565,865 shares of Common Stock were granted to employees in 2005 under the 2000 Stock Option Plan. |

(2) | Fair market value on the date of grant |

(3) | The fair value of the stock option granted is estimated at grant date using the Black-Scholes option-pricing model with the following weighted average assumptions: dividend yield of 0%; expected volatility of 97.2%; a risk-free interest rate of 4.0%; and expected life of 5 years. |

(4) | The fair value of the stock option granted is estimated at grant date using the Black-Scholes option-pricing model with the following weighted average assumptions: dividend yield of 0%; expected volatility of 96.7%; a risk-free interest rate of 4.1%; and expected life of 5 years. |

AGGREGATED OPTION EXERCISES AND YEAR-END OPTION VALUES

The following table sets forth information as to the exercises of options during the year ended December 31, 2005, and the number and value of unexercised options held as of December 31, 2005, by each of the executive officers named in the Summary Compensation Table:

| | | | | | | | | | | | | | | |

| | | Exercises During

The Fiscal Year | | Number of

Shares Underlying

Unexercised Options | | Value of Unexercised

In-the-Money Options(1) |

| | | Number of

Shares

Acquired | | Value

Realized | | Exercisable | | Unexercisable | | Exercisable | | Unexercisable |

Warren P. Levy | | 0 | | $ | 0 | | 100,000 | | 0 | | $ | 394,000 | | $ | 0 |

Ronald S. Levy | | 0 | | $ | 0 | | 100,000 | | 0 | | $ | 394,000 | | $ | 0 |

James P. Gilligan | | 200,000 | | $ | 453,119 | | 295,000 | | 110,000 | | $ | 1,004,775 | | $ | 327,950 |

Nozer M. Mehta | | 100,000 | | $ | 204,134 | | 178,333 | | 71,667 | | $ | 676,782 | | $ | 213,093 |

Paul P. Shields | | 170,000 | | $ | 438,461 | | 132,750 | | 55,000 | | $ | 462,120 | | $ | 165,925 |

(1) | Based upon a closing price of $4.41 on December 31, 2005. |

16

EQUITY COMPENSATION PLAN INFORMATION

The table below summarizes the status of our equity compensation plans at December 31, 2005:

| | | | | | | |

Plan category | | Number of securities

to be issued upon

exercise of

outstanding options,

warrants and rights

(a) | | Weighted-average

exercise price of

outstanding options,

warrants and rights

(b) | | Number of securities remaining

available for future issuance

under equity compensation

plans (excluding securities

reflected in column (a))

(c) |

Equity compensation plans

approved by security holders | | 3,377,315 | | $ | 1.05 | | 817,610 |

Equity compensation plans

not approved by security holders | | 1,601,571 | | $ | 1.42 | | — |

| | | | | | | |

Total | | 4,978,886 | | $ | 1.17 | | 817,610 |

| | | | | | | |

17

STOCKHOLDER RETURN PERFORMANCE PRESENTATION

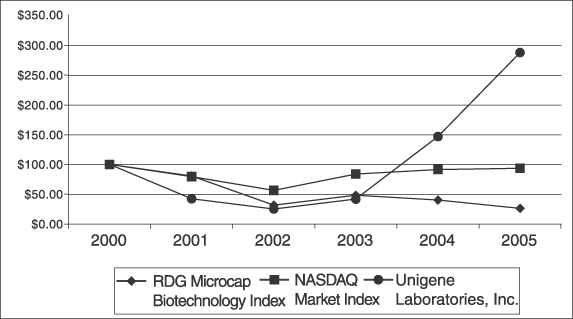

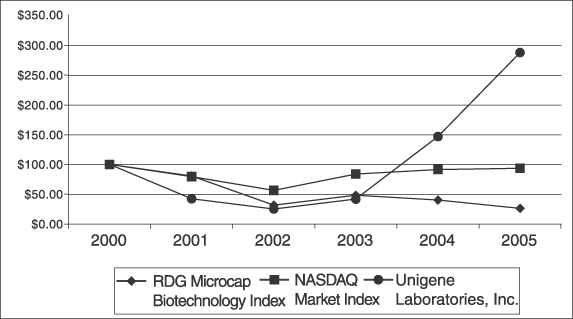

Set forth below is a line graph comparing the yearly percentage change in the cumulative total stockholder return on the Company’s Common Stock to the cumulative total return of the NASDAQ Market Index, and the RDG Microcap Biotechnology Index.

COMPARISON OF CUMULATIVE TOTAL RETURN

OF COMPANY, INDUSTRY INDEX AND BROAD MARKET

FISCAL YEAR ENDING

| | | | | | | | | | | | |

COMPANY/INDEX/MARKET | | 12/31/2000 | | 12/31/2001 | | 12/31/2002 | | 12/31/2003 | | 12/31/2004 | | 12/31/2005 |

Unigene Laboratories, Inc. | | 100.00 | | 42.45 | | 25.47 | | 41.79 | | 146.93 | | 287.99 |

NASDAQ Market Index | | 100.00 | | 79.57 | | 56.48 | | 84.08 | | 91.61 | | 93.72 |

RDG Microcap Biotechnology Index | | 100.00 | | 81.00 | | 31.96 | | 48.43 | | 40.58 | | 26.40 |

Assumes $100 Invested on January 1, 2001

Assumes Dividends Reinvested

Fiscal Years Ending December 31.

The industry index chosen was the RDG Microcap Biotechnology Index.

The Broad Market index chosen was the NASDAQ Market Index.

18

PROPOSAL 2

AMENDMENT OF CERTIFICATE OF INCORPORATION TO INCREASE AUTHORIZED COMMON STOCK FROM 100,000,000 TO 135,000,000 SHARES

The Board of Directors unanimously has adopted resolutions approving and recommending that the stockholders approve an amendment to Article FOURTH of the Company’s Certificate of Incorporation to increase the number of authorized shares of common stock, par value $.01 per share, from 100,000,000 shares to 135,000,000 shares.

As of April 3, 2006, of the 100,000,000 shares of common stock that currently are authorized, (i) 87,528,565 shares were issued and outstanding, (ii) 5,698,836 shares were reserved for issuance upon the exercise of outstanding options and warrants, (iii) 770,610 shares were reserved for issuance upon the exercise of options available for grant under the Company’s existing 2000 Stock Option Plan and the Company’s Directors Stock Option Plan, and if the stockholders approve Proposal 3 to adopt the Company’s 2006 Stock-Based Incentive Compensation Plan (the “2006 Plan”) these shares will be incorporated and reserved for issuance under the 2006 Plan; and (iv) an additional 3,000,000 shares will be available for grant under the 2006 Plan if stockholders approve Proposal 3 to adopt the 2006 Plan. The Board of Directors of the Company believes that the increase in the number of authorized shares of Common Stock is in the best interests of the Company and its stockholders.

The additional shares of Common Stock would be available for various corporate purposes, including financing transactions, the issuance of equity securities to a licensing partner or as compensation for services (either directly or through the exercise of warrants or options).

Under the Delaware General Corporation Law, the Board of Directors generally may issue authorized but unissued shares of Common Stock without further stockholder approval. The Board of Directors does not currently intend to seek stockholder approval prior to any future issuance of the additional authorized shares of Common Stock, unless stockholder action is required in a specific case by applicable law, the rules of any exchange or market on which the Company’s securities may then be listed, or the Certificate of Incorporation or By-Laws of the Company as then in effect. Frequently, opportunities arise that require prompt action, and the Company believes that the delay necessitated for stockholder approval of a specific issuance could be to the detriment of the Company and its stockholders.

The additional shares of Common Stock authorized for issuance pursuant to this proposal will have the same rights and privileges that all of the currently outstanding shares of Common Stock possess under the Company’s Certificate of Incorporation and under Delaware law. These rights and privileges include one vote per share on all matters submitted to a vote of the holders of Common Stock, including the election of directors, and right to dividends and other distributions when and if declared by the Board of Directors. The shares of Common Stock do not have preemptive or similar rights.

The issuance of any additional shares of Common Stock by the Company would dilute existing stockholders by reducing their percentage ownership of Common Stock. The existence of additional authorized but unissued shares of Common Stock could be used to make a change in control of the Company more difficult. For example, such shares could be sold to purchasers who might side with the Board of Directors in opposing a takeover bid that the Board determines not to be in the best interests of the Company and its stockholders. Such a sale could have the effect of discouraging an attempt by another person or entity, through the acquisition of a substantial number of shares of Common Stock, to acquire control of the Company, since the issuance of new shares could be used to dilute the stock ownership of the acquirer. The Company is not aware of any pending or threatened efforts to obtain control of the Company and, as of the date of this proxy statement, the Company has no specific plans, arrangements or understandings with respect to the sale or issuance of these additional shares of Common Stock.

19

To accomplish the increase of the authorized shares of Common Stock, the following resolution authorizing the amendment of the Certificate of Incorporation will be submitted to a vote of the stockholders at the meeting:

“RESOLVED, that the Certificate of Incorporation of this Corporation be amended by changing Article FOURTH thereof so that, as amended, said Article shall be and read as follows:

FOURTH: The total number of shares of stock that the Corporation shall have authority to issue is one hundred thirty-five million (135,000,000), having a par value of $.01 per share. All such shares are of one class and are common stock.”

Approval of the resolution authorizing the amendment to the Certificate of Incorporation to increase the number of authorized shares of Common Stock requires the affirmative vote of the holders of a majority of the shares of Common Stock present and entitled to vote at the Annual Meeting.

THE BOARD OF DIRECTOR RECOMMENDS A VOTEFOR THE APPROVAL OF THE AMENDMENT TO THE COMPANY’S CERTIFICATE OF INCORPORATION TO INCREASE THE NUMBER OF AUTHORIZED SHARES OF COMMON STOCK FROM 100,000,000 TO 135,000,000 SHARES.

PROPOSAL 3

ADOPTION OF THE COMPANY’S 2006 STOCK-BASED INCENTIVE COMPENSATION PLAN

The Board of Directors is submitting to stockholders for approval at the 2006 Annual Meeting a proposal to adopt the Unigene Laboratories, Inc. 2006 Stock-Based Incentive Compensation Plan (the “2006 Plan”) to replace the Company’s Directors Stock Option Plan and the Company’s 2000 Stock Option Plan.

In 1999, the Company’s Board of Directors adopted and the stockholders approved the Unigene Laboratories, Inc. Directors Stock Option Plan (the “Directors’ Plan”). Under the terms of the Directors’ Plan, the Company was authorized to grant options for the purchase of up to 350,000 shares of its common stock, par value $.01 per share (“Common Stock”), to eligible non-employee directors. As of April 21, 2006, options for the purchase of for an aggregate of 317,000 shares of Common Stock have been granted under the Directors’ Plan. After taking into account the cancellation of options for 104,000 shares, 137,000 shares remain available for option grants under the Directors’ Plan.

In 2000, the Company’s Board of Directors adopted and the stockholders approved the Unigene Laboratories, Inc. 2000 Stock Option Plan (the “2000 Plan”). Under the terms of the 2000 Plan, the Company was authorized to issue up to 4,000,000 shares of Common Stock pursuant to the exercise of stock options granted to eligible employees and consultants. As of April 21, 2006, options for an aggregate of 3,888,265 shares of Common Stock had been granted. After taking into account the cancellation of options for 219,875 shares, 331,610 shares remain available for option grants under the 2000 Plan.

At a meeting held on April 20, 2006, the Company’s Board of Directors approved and recommended that the Company’s stockholders approve the 2006 Plan. The purpose of the 2006 Plan is to promote the success and enhance the value of the Company by linking personal interests of the members of the Board of Directors, employees and consultants to those of the Company stockholders and to provide such individuals with an incentive for outstanding performance to generate superior

20

returns to the Company’s stockholders. In the current environment of evolving practice in the area of equity-based compensation, the 2006 Plan will also give the Company the flexibility to offer a variety of types of equity compensation to remain competitive in recruiting and retaining qualified key personnel.

The 2006 Plan is being presented to the stockholders for approval. Upon approval of the 2006 Plan by the stockholders, no further grants of shares will be made under the Directors’ Plan or the 2000 Plan. The following is a description of the principal provisions of the 2006 Plan. However, this summary is qualified in its entirety by reference to the 2006 Plan, which is included in its entirety as Appendix B hereto.

SUMMARY OF THE UNIGENE LABORATORIES, INC.

2006 STOCK-BASED INCENTIVE COMPENSATION PLAN

General

The general purpose of the 2006 Plan is to assist the Company and its subsidiaries in attracting and retaining valued employees, consultants and non-employee directors by offering them a greater stake in the Company’s success and a closer identity with it, and to encourage ownership of the Company’s stock by such employees, consultants and non-employee directors.

Summary of the 2006 Plan

The following general description of certain features of the 2006 Plan is qualified in its entirety by reference to the 2006 Plan which is attached hereto as Appendix B. Capitalized terms not otherwise defined in this summary have the meanings given to them in the 2006 Plan.

General.The 2006 Plan will authorize the grant of Options, Stock Appreciation Rights, Restricted Stock, Deferred Stock, Phantom Stock, and other stock-based awards (collectively, “Awards”). Options granted under the 2006 Plan may be either “incentive stock options” as defined in section 422 of the Internal Revenue Code (the “Code”), or nonqualified stock options, as determined by the Committee.

Number of Shares Authorized.The number of shares of Unigene Laboratories, Inc. (“Company”) Common Stock initially available for award under the 2006 Plan is 3,000,000 shares, increased by (i) any shares reserved but not subject to awards under the Directors’ Plan and the 2000 Plan, and (ii) shares subject to awards under the Directors’ Plan or the 2000 Plan that are forfeited, cancelled or expire thereunder. All shares of Common Stock reserved under the 2006 Plan may be issued pursuant to Incentive Stock Options.

If any Award is forfeited, or if any Option terminates, expires or lapses without being exercised, shares of Common Stock subject to such Award will again be available for future grant. In addition, any shares under the 2006 Plan that are used to satisfy award obligations under the plan of another entity that is acquired by the Company will not count against the remaining number of shares available. Finally, if there is any change in the Company’s corporate capitalization, the Committee in its sole discretion may cancel and make substitutions of Awards or may adjust the number of shares available for award under the 2006 Plan, the number and kind of shares covered by Awards then outstanding under the 2006 Plan and the exercise price of outstanding Options and Stock Appreciation Rights.

Administration. The Compensation Committee (the “Committee”) will administer the 2006 Plan. The full Board of the Company or a Secondary Committee designated by the Board, shall administer the 2006 Plan and exercise the Committee’s authority with respect to grants made to non-employee directors. Subject to the other provisions of the 2006 Plan, the Committee has the authority to:

| | • | | select the employees, consultants and non-employee directors who will receive Awards pursuant to the 2006 Plan; |

21

| | • | | determine the type or types of Awards to be granted to each participant; |

| | • | | determine the number of shares of Common Stock to which an Award will relate, the terms and conditions of any Award granted under the 2006 Plan (including, but not limited to, restrictions as to vesting, transferability or forfeiture, exercisability or settlement of an Award and waivers or accelerations thereof, and waivers of or modifications to performance goals relating to an Award, based in each case on such considerations as the Committee shall determine) and all other matters to be determined in connection with an Award; |

| | • | | determine whether, to what extent, and under what circumstances an Award may be canceled, forfeited, or surrendered; |

| | • | | determine whether, and to certify that, performance goals to which the settlement of an Award is subject are satisfied; |

| | • | | correct any defect or supply any omission or reconcile any inconsistency in the 2006 Plan, and adopt, amend and rescind such rules, regulations, guidelines, forms of agreements and instruments relating to the 2006 Plan as it may deem necessary or advisable; and |

| | • | | make all other determinations as it may deem necessary or advisable for the administration of the 2006 Plan. |

Eligibility.The 2006 Plan provides that Awards may be granted to employees, non-employee directors and consultants of the Company or its subsidiaries. Incentive stock options may be granted only to employees. The maximum number of shares that may be awarded to any participant as Qualified Performance-Based Awards (described below) in any calendar year shall not exceed 200,000.

Each Award granted under the 2006 Plan will be evidenced by a written agreement between the participant and the Company, which will describe the Award and state the terms and conditions applicable to such Award. The principal terms and conditions of each particular type of Award are described below.

Performance Goals

The Award agreements may provide for vesting or earning the Award based on achievement of performance goals. Performance goals may be established on a Company-wide basis; with respect to one or more subsidiary corporations, business units, divisions, department, or functions, and in either absolute terms or relative to the performance of one or more comparable companies or an index covering multiple companies. Performance goals, the number of shares or units to which they pertain, the time and manner of payment of the Award shall be specified in the Award agreement.

Except in the case of Awards intended to meet the requirements of Section 162(m) of the Code applicable to qualified performance-based compensation (“Qualified Performance-Based Awards”), the Committee may modify performance goals in whole or in part, during the performance period, as it deems appropriate and equitable. In the case of Qualified Performance-Based Awards, the applicable performance goals are limited to one or more of the following:

| | • | | specified levels of or increases in the Company’s, a division’s or a Subsidiary’s return on capital, equity or assets; |

| | • | | earnings measures/ratios (on a gross, net, pre-tax or post-tax basis), including diluted earnings per share, total earnings, operating earnings, earnings growth, earnings before interest and taxes (EBIT) and earnings before interest, taxes, depreciation and amortization (EBITDA); |

| | • | | net economic profit (which is operating earnings minus a charge to capital); |

22

| | • | | share price (including but not limited to growth measures and total shareholder return); |

| | • | | per period or cumulative cash flow (including but not limited to operating cash flow and free cash flow) or cash flow return on investment (which equals net cash flow divided by total capital); |

| | • | | financial return ratios; |

| | • | | balance sheet measurements such as receivable turnover; |

| | • | | improvement in or attainment of expense levels; |

| | • | | improvement in or attainment of working capital levels; |

| | • | | customer or employee satisfaction; |

| | • | | any other financial or other measurement deemed appropriate by the Committee as it relates to the results of operations or other measurable progress of the Company and Subsidiaries (or any business unit thereof); and |

| | • | | any combination of any of the foregoing criteria. |

Phantom Stock

Awards of Phantom Stock may be made under the 2006 Plan. A share of Phantom Stock is a book-entry unit with a value equal to one share of Common Stock. A grant of Phantom Stock will vest and become payable to the participant upon other future events, including the achievement during a specified performance cycle of performance goals established by the Committee or the passage of time. Each grant of Phantom Stock shall specify the conditions, including the passage of time and performance goals, if applicable, that must be satisfied in order for payment to be made. Payment of Phantom Stock may be made in cash, shares of Common Stock, or a combination thereof, equal to the fair market value of the shares of Common Stock to which the Award relates.

Options

An Option is the right to purchase shares of Common Stock for a specified period of time at a fixed price (the “exercise price”). Each Option agreement will specify the exercise price, the type of Option, the term of the Option, the date when the Option will become exercisable and any applicable performance goals. Each grant of Options shall specify the length of service and/or any applicable performance goals that must be achieved before it becomes exercisable. Incentive stock options may only be granted to employees, shall only be transferable by will or under the laws of descent and distribution, and, during the participant’s lifetime, may only be exercised by the participant. No Award of incentive stock options may permit the fair market value of any such Options becoming first exercisable in any calendar year to exceed $100,000.

Exercise Price. The Committee will determine the exercise price of an Option at the time the Option is granted. The exercise price under an incentive stock option or non-qualified stock option will not be less than 100% of the fair market value of Common Stock on the date the Option is granted. However, any participant who owns more than 10% of the combined voting power of all classes of the Company’s outstanding Common Stock (a “10% Stockholder”) will not be eligible for the grant of an incentive stock option unless the exercise price of the incentive stock option is at least 110% of the fair market value of the Common Stock on the date of grant.

23

Consideration.The means of payment for shares issued upon exercise of an Option will be specified in each Option agreement and generally may be made by the participant in cash, in a cash payment through a broker or bank from the proceeds of the sale of the shares purchased through the exercise of the Option (a “cashless exercise”), with the Committee’s consent, in whole or in part with shares of Common Stock, or a combination of the foregoing methods. The Committee may also permit Options to be exercised with such other consideration as it deems appropriate, as reflected in the applicable Award agreement.

Term of the Option. The term of an Option granted under the 2006 Plan will be no longer than ten years from the date of grant. In the case of an Option granted to a 10% Stockholder, the term of an incentive stock option will be for no more than five years from the date of grant.

Stock Appreciation Rights

A stock appreciation right (“SAR”) entitles the recipient to receive, upon exercise of the SAR, the increase in the fair market value of a specified number of shares of Common Stock from the date of the grant of the SAR to the date of exercise, payable in cash, shares of Common Stock, or any combination thereof. The Committee shall set the exercise price of an SAR which shall not be less than the Fair Market Value of the underlying Common Stock on the date of the grant. Each grant of SARs shall specify the length of service and/or any applicable performance goals that must be achieved before it becomes exercisable and may specify permissible dates or periods on or during which the SAR shall be exercisable. No SAR may be exercised more than ten years after the grant date.

Restricted Stock

An Award of Restricted Stock is a grant to the recipient of a specified number of shares of Common Stock which are subject to forfeiture upon specified events during the restriction period. Each grant of Restricted Stock shall specify the duration of the restriction period and any other conditions under which the Restricted Stock would be forfeitable to the Company, including any applicable performance goals, and will include restrictions on transfer to third parties during the restriction period.

Unless otherwise provided by the Committee an Award of Restricted Stock entitles the participant to dividend, voting and other ownership rights during the restriction period. Unless otherwise provided by the Committee, dividends on Restricted Stock will be subject to the same restrictions as the Restricted Stock.

Deferred Stock