SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to Sec. 240.14a-12 |

UNIGENE LABORATORIES, INC.

(Name of Registrant as Specified in Its Charter)

| | (Name of Person(s) Filing Proxy Statement, if other than Registrant) |

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) |

and 0-11.

| | 1) | Title of each class of securities to which transactions applies: |

| | 2) | Aggregate number of securities to which transaction applies: |

| | 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | 4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | 1) | Amount Previously Paid: |

| | 2) | Form, Schedule or Registration Statement No.: |

Unigene Laboratories, Inc.

81 Fulton Street

Boonton, New Jersey 07005

(973) 265-1100

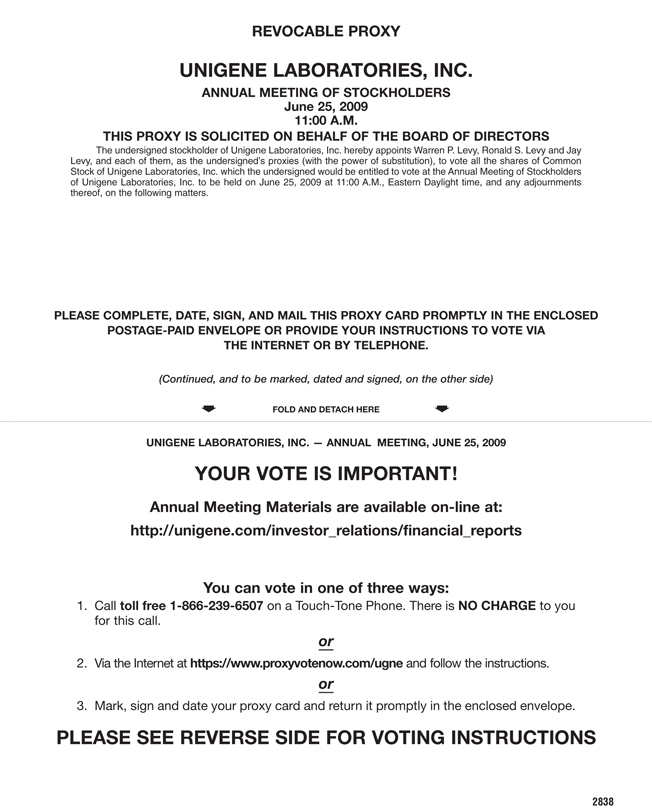

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To be held on June 25, 2009

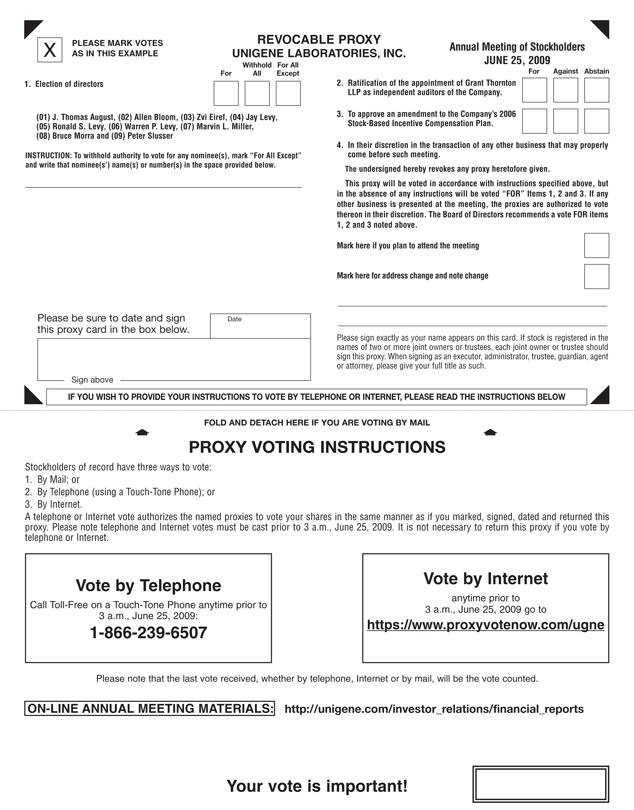

NOTICE IS HEREBY GIVEN that the Annual Meeting of Stockholders of Unigene Laboratories, Inc., a Delaware corporation (the “Company”), will be held at The Ramada Inn, 130 Route 10 West, East Hanover, NJ 07936 on June 25, 2009, at 11:00 A.M., Eastern Daylight Time, for the following purposes:

1. To elect directors of the Company;

2. To ratify the appointment by the Audit Committee of the Company’s Board of Directors of Grant Thornton LLP as independent auditors of the Company for the Company’s 2009 fiscal year;

3. To approve an amendment to the Company’s 2006 Stock-Based Incentive Compensation Plan; and

4. To transact such other business as may properly come before the meeting and any adjournment thereof.

The Board of Directors has fixed the close of business on April 30, 2009 as the record date for the determination of stockholders who are entitled to notice of and to vote at the meeting.

A copy of the Company’s Annual Report for the year ended December 31, 2008 is being sent to you along with the Proxy Statement.

YOUR VOTE IS IMPORTANT

It is important that as many shares as possible be represented at the Annual Meeting. Please read this Proxy Statement and submit your Proxy via the Internet, or if you received a paper copy of your proxy materials, by using the toll-free telephone number provided or by completing, signing, dating and returning your Proxy in the pre-addressed envelope provided. Your Proxy may be revoked by you at any time before it has been voted.

By Order of the Board of Directors

RONALD S. LEVY

Secretary

May 12, 2009

The Company’s proxy statement, proxy card and 2008 Annual Report are available at: http://unigene.com/investor_relations/financial_reports

Unigene Laboratories, Inc.

81 Fulton Street

Boonton, New Jersey 07005

(973) 265-1100

PROXY STATEMENT

ANNUAL MEETING OF STOCKHOLDERS

This Proxy Statement is furnished in connection with the solicitation of proxies by the Board of Directors of Unigene Laboratories, Inc., a Delaware corporation (the “Company”), for the Annual Meeting of Stockholders of the Company to be held at The Ramada Inn, 130 Route 10 West, East Hanover, NJ 07936 on June 25, 2009, at 11:00 A.M., Eastern Daylight Time.

Your vote is very important, regardless of the number of shares you own. You are urged to submit your vote as soon as possible. You will have the option to vote by telephone, via the Internet or by completing, dating and signing the accompanying form of proxy and returning it to the Company in the enclosed envelope. The proxy may be revoked at any time before it is exercised by written notice to the Company bearing a later date than the date on the proxy, provided such notice is received by the Company prior to the start of the meeting, by delivering a subsequently dated proxy, or by attending the Annual Meeting, withdrawing the proxy and voting in person. Any stockholder attending the meeting may vote in person whether or not he or she has previously submitted a proxy. Attendance at the Annual Meeting will not have the effect of revoking a proxy unless you give proper written notice of revocation to our Secretary before the proxy is exercised or you vote by written ballot at the Annual Meeting. Where instructions are indicated, a duly executed proxy will be voted in accordance with such instructions. Where no instructions are indicated, a duly executed proxy will be voted for each of the director nominees named herein and in favor of the proposals set forth in the attached Notice of Annual Meeting of Stockholders.

The Board of Directors has fixed the close of business on April 30, 2009 as the record date (the “Record Date”) for the determination of stockholders who are entitled to notice of and to vote at the meeting. As of April 17, 2009, the outstanding shares of the Company entitled to vote were 90,262,763 shares of common stock, par value $.01 per share (“Common Stock”), the holders of which are each entitled to one vote per share.

The holders of a majority of the outstanding shares of Common Stock, present in person or represented by proxy, will constitute a quorum for the conduct of business at the Annual Meeting. Broker non-votes, votes withheld and abstentions will be counted for purposes of determining whether a quorum has been reached. Directors will be elected by a plurality of the votes cast. The affirmative vote of the holders of a majority of the shares present and entitled to vote at the Annual Meeting is required for the ratification of the appointment of Grant Thornton LLP as auditors of the Company and for the approval of the amendment to the Company’s 2006 Stock-Based Incentive Compensation Plan. For adoption of matters that require the affirmative vote of a majority of the shares of Common Stock present and entitled to vote, abstentions are considered as shares present and entitled to vote and, therefore, have the effect of a “no” vote. Broker non-votes, however, are not counted as shares present and entitled to be voted with respect to the matters which the broker has not expressly voted. If your shares are held by a broker, the broker will ask you how you want your shares to be voted. If you give the broker instructions, your shares will be voted as you direct. If you do not give instructions, one of two things can happen, depending on the type of proposal. For the election of directors and the ratification of auditors, under the rules of various stock exchanges, the broker may vote your shares in its discretion. For the approval of the amendment to the Company’s 2006 Stock-Based Incentive Compensation Plan and other proposals, the broker may not vote your shares at all. When that happens, it is called a “broker non-vote.” Since a broker’s discretionary authority to vote in an uncontested election of directors and to ratify the Company’s auditors is not limited there cannot be any broker non-votes regarding these matters. There can be broker non-votes for the approval of the amendment to the Company’s 2006 Stock-Based Incentive Compensation Plan. Such broker non-votes will be treated as shares that are not present and entitled to vote and are not counted in determining whether the alternative vote required to approve Proposal 3 has been cast.

Copies of the following materials are available athttp://www.unigene.com: (i) this Proxy Statement, (ii) the accompanying Notice of Annual Meeting of Stockholders, (iii) the proxy card and (iv) the Company’s Annual Report for the year ended December 31, 2008. Information included in our website, other than the Notice of Annual Meeting of Stockholders, the Proxy Statement, the proxy card and the Annual Report for the year ended December 31, 2008, is not part of the proxy soliciting materials. In addition, this Proxy Statement and the accompanying Notice of Annual Meeting of Stockholders and form of proxy are being mailed to the stockholders on or about May 15, 2009. A copy of the Company’s Annual Report for the year ended December 31, 2008 is also enclosed.

2

CORPORATE GOVERNANCE

Meetings of the Board of Directors.

During 2008, there were eleven meetings of the Board of Directors. Except for unusual circumstances, all directors are expected to attend the Company’s Annual Meeting. All incumbent directors attended the Company’s 2008 Annual Meeting. Each member of the Board of Directors attended more than 75 percent of the combined total meetings of the Board of Directors and of the committees of the Board of Directors on which such member served for the period of 2008 during which he served as a Director.

Communications with the Board of Directors.

Stockholders may contact the Board of Directors by writing to Jay Levy, Chairman of the Board, Unigene Laboratories, Inc., 81 Fulton Street, Boonton, NJ 07005. The Chairman will review the correspondence and forward it to the Chairman of the appropriate committee or to any individual director or directors to whom the communication is directed, unless the communication is unduly hostile, threatening, illegal, does not reasonably relate to Unigene or its business, or is similarly inappropriate. The Chairman has the authority to discard or disregard any inappropriate communications or to take other appropriate actions with respect to any such inappropriate communications.

Director Independence.

The Board of Directors has determined that the following directors are independent under the listing standards of the Nasdaq Stock Market, LLC: Allen Bloom, Zvi Eiref, Robert Hendrickson, Marvin Miller, Bruce Morra and Peter Slusser. Mr. Eiref was elected by the Board of Directors to serve as a director effective January 5, 2009, after being recommended by a stockholder.

Committees of the Board of Directors.

Several important functions of the Board of Directors may be performed by committees that are comprised of members of the Board of Directors. Delaware General Corporation Law authorizes the formation of these committees and grants the Board of Directors the authority to prescribe the functions of each committee and the standards for membership of each committee. The Board of Directors has three standing committees: an Audit Committee, a Compensation Committee and a Nominating and Corporate Governance Committee.

The responsibilities of the Audit Committee include the following: (i) to annually select a firm of independent public accountants to act as auditors of the Company; (ii) to review the scope of the annual audit with the auditors in advance of the audit, (iii) to review the results of the audit and the adequacy of the Company’s internal controls; (iv) to oversee management’s conduct of the Company’s financial reporting process; and (v) to approve fees paid to the auditors for audit and non-audit services. The current members of the Audit Committee are Allen Bloom (Chairman), Zvi Eiref, Marvin L. Miller and Peter Slusser. The Audit Committee held five meetings during 2008. The Board of Directors adopted a written Audit Committee charter in 2005 and revised it in 2007, and that charter is available on our website,http://www.unigene.com. All members of the Audit Committee are considered to be “independent” as that term is defined under the listing standards of the Nasdaq Stock Market, LLC and as that term is used in Section 10A(m)(3) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). In addition, two members, Zvi Eiref and Peter Slusser are considered by the Board of Directors to be “audit committee financial experts” as described in Rule 407(d)(5) of Regulation S-K, promulgated under the Securities Act of 1933, as amended (the “Securities Act”).

The responsibilities of the Compensation Committee include the following: (i) to review and recommend to the Board for approval, compensation (including incentive compensation plans and equity-based compensation plans) of the Company’s Chief Executive Officer, executive officers and other key officers; (ii) to review and approve general benefits and compensation strategies; (iii) to develop and approve all stock ownership, stock option and other equity-based compensation plans of the Company; (iv) to grant any shares, stock options, or other equity-based awards under all equity-based compensation plans; and (v) to approve the Compensation Discussion and Analysis included in the Company’s proxy statement. The current members of the Compensation Committee are Zvi Eiref, Robert F. Hendrickson (Chairman), Bruce Morra and Peter Slusser. The Compensation Committee held five meetings during 2008. The Board of Directors adopted a written Compensation Committee charter in 2005 and that charter is available on our website,http://www.unigene.com. All members of the Compensation Committee are considered to be “independent” as that term is defined under the listing standards of the Nasdaq Stock Market, LLC and they all meet the definitions of “non-employee director” for purposes of Rule 16b-3 promulgated by the Securities and Exchange Commission under the Exchange Act and “outside director” for purposes of Section 162(m) of the Internal Revenue Code, as amended. In addition, subject to the limitations set forth in the 2006 Stock-Based Incentive Compensation Plan (the “2006 Plan”), the Compensation Committee oversees the 2006 Plan and (i) selects the employees to be granted stock-based awards; (ii) fixes the number of shares to be covered by the stock-based awards granted; and (iii) determines the exercise price and other terms and conditions of the stock-based awards.

The Compensation Committee meets as often as necessary to perform its duties and responsibilities. Typically the Compensation Committee’s meeting agenda is established by the Committee Chairman in consultation with the Chief Executive Officer. Typically the Company’s Chief Executive Officer attends the Committee meetings. The Committee also generally meets in executive session without management, as the Committee deems appropriate and necessary.

3

Compensation Committee members receive and review materials in advance of each meeting. These materials include information that management believes will be helpful to the Compensation Committee, as well as materials that the Compensation Committee has requested. Depending on the meeting’s agenda, such materials may include: details regarding compensation for each executive, including equity ownership, copies of performance reviews and evaluations of executives who report directly to the Chief Executive Officer, and market data such as the Radford Biotechnology Executive Compensation Survey , published by Aon Consulting, which is a resource of competitive intelligence for positions in the biotechnology and pharmaceutical industries as well as compensation information on companies considered to be Unigene’s peers.

The Compensation Committee meets in connection with the Company’s year-end reviews to discuss the Company’s compensation philosophy, to review the Company’s historical compensation practices and to review the collected market data. After considering this information, each individual executive’s contribution to the Company’s achievements and any changes in the role and responsibility of the executive during the year, the Compensation Committee reviews proposed compensation for the executive officers, including base salary, bonus and equity awards, prior to the Board taking final action. The Committee’s recommendations for the Chief Executive Officer’s and Executive Vice President’s compensation are subject to approval of the Board of Directors, with the Chief Executive Officer and the Executive Vice President abstaining from the vote.

Management plays a significant role in our compensation setting process. Most importantly, management evaluates employee performance, recommends business targets and objectives and recommends salary levels, bonus awards and stock-based awards for Company executives other than the Company’s Chief Executive Officer. The Chief Executive Officer, in particular, recommends to the Compensation Committee the salary levels, bonus awards and stock-based awards for the other named executive officers, and works with the Chairman of the Compensation Committee to establish the agenda for Compensation Committee meetings. Management also assists in preparing and distributing the meeting materials in advance of each Compensation Committee meeting.

The Compensation Committee is permitted to retain, approve fees for and terminate advisors, agents and consultants as it deems necessary to assist in the fulfillment of its responsibilities. During 2008, the Compensation Committee engaged a third-party compensation consultant to assist it in fulfilling its duties. In addition, the Compensation Committee’s charter authorizes the Committee to form and delegate authority, as it deems appropriate, to subcommittees.

In February 2007, the Board of Directors established a Nominating and Corporate Governance Committee which held three meetings in 2008. The responsibilities of the Nominating and Corporate Governance Committee are to (i) establish the criteria for, and the qualifications of, people suitable for nomination as directors and to report its recommendations to the Board; and (ii) consider corporate governance matters. The Board of Directors adopted a written Nominating and Corporate Governance Committee charter in 2007 and that charter is available on our website,http://www.unigene.com. The Nominating and Corporate Governance Committee will consider recommendations by stockholders, as more fully described in the section entitled “Submission of Stockholder Proposals and Director Nominations” in this proxy statement. The current members of the Nominating and Corporate Governance Committee are Allen Bloom, Robert Hendrickson, Marvin Miller (Chairman) and Bruce Morra. All members of the Nominating and Corporate Governance Committee are considered to be “independent” as that term is defined under the listing standards of the Nasdaq Stock Market, LLC.

Code of Ethics.

The Company has adopted a code of ethics. It describes specific policies concerning the ethical conduct of the Company’s business and applies to all officers, directors and employees. Our code of ethics is posted on our website,http://www.unigene.com.Upon written request to Unigene Laboratories, Inc., 81 Fulton Street, Boonton, NJ 07005, we will provide to stockholders without charge a copy of our code of ethics.

Director Compensation.

Directors who are not employees received an annual retainer in 2008 of $18,000, as well as a fee of $1,500 for each Board of Directors meeting attended and $750 for any Board of Directors meeting conducted via conference call. J. Thomas August, Allen Bloom, Robert F. Hendrickson, Marvin L. Miller, Bruce Morra and Peter Slusser are the current directors who received such fees in 2008. Non-employee Board members earn additional compensation for service on the Audit, Compensation and Nominating and Corporate Governance Committees as follows: $500 per committee conference call, $1,000 per meeting of the committee if such meeting is convened solely to transact committee business, or $500 per meeting if such meeting is convened on a date or in conjunction with other activities of the Company or its Board of Directors or other committees for purposes in addition to committee business. In addition, the Chairmen of the Audit, Compensation and Nominating and Corporate Governance Committees receive annual retainers of $10,000, $6,000 and $6,000, respectively, in addition to the annual Board retainer. Jay Levy receives annual compensation of $75,000 in his capacities as Treasurer and Assistant Secretary. Allen Bloom was elected Lead Director in 2008. He receives an additional annual retainer of $8,000 in this capacity.

At our June 2006 Annual Meeting, the stockholders approved the adoption of the 2006 Plan. All employees and directors, as well as certain consultants, are eligible to receive grants under the 2006 Plan. Allowable grants under the 2006 Plan include stock options, phantom stock, stock appreciation rights, restricted stock and deferred stock. Options granted under the 2006 Plan generally have a ten-year term and an exercise price equal to the market price of the Common Stock on the date of the grant. The 2006 Plan replaced our older stock option plans and, initially, had 3,426,000 shares authorized for issuance. Specific grants to directors are not mandated

4

under the 2006 Plan. Therefore, upon the recommendations of the Compensation Committee, the Board of Directors adopted the following policy that, beginning in 2007, each non-employee director will receive, (1) on the date of his initial election, an option to purchase 30,000 shares of Common Stock (an “Initial Option”) and (2) on May 1st of each year, an option to purchase 20,000 shares of Common Stock if he or she has served as a non-employee director for at least six months prior to the May 1st grant (an “Additional Option”). Generally, each Initial Option will vest in equal installments of 1/3 over a period of three years, commencing on the date of the grant, and each Additional Option will vest in its entirety on the first anniversary of the date of grant.

Director Summary Compensation Table

The table below summarizes the fees earned by directors for the fiscal year ended December 31, 2008.

| | | | | | | | | | | | | | | |

Name | | Fees Earned or

Paid in Cash

($) (1) | | Stock Awards

($) | | Option Awards

($) (2) | | Non-Equity

Incentive Plan

Compensation

($) | | Change

in Pension

Value and

Nonqualified

Deferred

Compensation

Earnings

($) | | All Other

Compensation

($) | | | Total

($) |

J. Thomas August* | | 31,500 | | — | | 20,435 | | — | | — | | 73,500 | (3) | | 125,435 |

Allen Bloom * | | 54,250 | | — | | 20,435 | | — | | — | | — | | | 74,685 |

Robert F. Hendrickson * | | 42,750 | | — | | 20,435 | | — | | — | | — | | | 63,185 |

Jay Levy | | — | | — | | — | | — | | — | | 75,000 | (4) | | 75,000 |

Ronald S. Levy (5) | | — | | — | | — | | — | | — | | — | | | — |

Warren P. Levy (5) | | — | | — | | — | | — | | — | | — | | | — |

Marvin L. Miller * | | 46,250 | | — | | 20,435 | | — | | — | | — | | | 66,685 |

Bruce Morra * | | 37,000 | | — | | 20,435 | | — | | — | | — | | | 57,435 |

Peter Slusser * | | 40,750 | | — | | 20,435 | | — | | — | | — | | | 61,185 |

| (1) | Reflects annual retainers, Board of Director and committee meeting fees and committee chairman fees for fiscal year 2008 described above under “Director Compensation.” |

| (2) | Amounts are calculated in accordance with the provisions of Statement of Financial Accounting Standards (“SFAS”) No. 123(R) “Share-based Payments.” See Note 16 of the financial statements of the Company’s Annual Report for the year ended December 31, 2008 regarding assumptions underlying valuation of equity awards. These figures represent the grant date fair value of stock options to purchase 20,000 shares of our Common Stock, which were awarded to all non-employee directors in May 2008. |

At December 31, 2008, the aggregate number of stock options outstanding for each director was as follows: J. Thomas August 231,000; Allen Bloom 260,000; Robert F. Hendrickson 81,000; Jay Levy 420,000; Ronald Levy 250,000; Warren Levy 350,000; Marvin L. Miller 71,000; Bruce Morra 61,000; and Peter Slusser 61,000.

| (3) | J. Thomas August, an outside consultant, serves as our Director of Research, receiving annual compensation of $73,500. |

| (4) | Jay Levy receives annual compensation of $75,000 in his capacities as Treasurer and Assistant Secretary. |

| (5) | See Summary Compensation Table for disclosure related to Drs. Ronald S. Levy and Warren P. Levy, each of whom served as executive officers of the Company during 2008. |

PROPOSAL 1

ELECTION OF DIRECTORS

The Board of Directors consists of such number of directors as is fixed from time to time by resolution adopted by the Board of Directors. Nine directors of the Company are to be elected at the Annual Meeting. The directors will be elected to serve until the Annual Meeting of Stockholders to be held in 2010 and until their respective successors shall have been elected and qualified.

All of the nominees are currently directors of the Company and all, except for Zvi Eiref, were elected as directors at the Company’s Annual Meeting of Stockholders in 2008. Robert F. Hendrickson, who is currently serving on the Board of Directors, wishes to retire and is not standing for re-election and the Board of Directors will be reduced by one immediately prior to the Annual Meeting. The Board of Directors has no reason to believe that any of the nominees are or will become unavailable for election as a director. However, should any of them become unwilling or unable to serve as a director, the individuals named in the enclosed proxy will vote for the election of a substitute nominee selected by the Board of Directors or, if no such person is nominated, the Board of Directors will reduce the number of directors to be elected.

5

Directors will be elected by a plurality of the votes cast. A broker’s discretionary authority to vote in an uncontested election of directors is not limited so there cannot be any broker non-votes regarding this proposal.

THE BOARD OF DIRECTORS RECOMMENDS A VOTEFOR

THE ELECTION OF THE NOMINEES AS DIRECTORS.

INFORMATION REGARDING DIRECTORS, NOMINEES AND EXECUTIVE OFFICERS

| | | | | | |

Name | | Age | | Year

Joined

Unigene | | Position |

Warren P. Levy (1) | | 57 | | 1980 | | President, CEO and Director |

Ronald S. Levy (1) | | 60 | | 1980 | | Executive Vice President, Secretary and Director |

Jay Levy (1) | | 85 | | 1980 | | Treasurer, Chairman of the Board and Director |

James P. Gilligan | | 57 | | 1981 | | Vice President of Product Development |

Nozer M. Mehta | | 61 | | 1982 | | Vice President, Biological R & D |

Paul P. Shields | | 48 | | 1989 | | Vice President, Mfg. Operations |

William Steinhauer | | 54 | | 1987 | | Vice President of Finance |

J. Thomas August | | 81 | | 1990 | | Director of Research and Director |

Allen Bloom | | 65 | | 1998 | | Director |

Zvi Eiref | | 70 | | 2009 | | Director |

Marvin L. Miller | | 72 | | 2005 | | Director |

Bruce Morra | | 55 | | 2006 | | Director |

Peter Slusser | | 79 | | 2006 | | Director |

| (1) | Warren P. Levy and Ronald S. Levy are brothers and are the sons of Jay Levy. |

Dr. Warren P. Levy, a founder of the Company, has served as President, Chief Executive Officer and Director of the Company since its formation in November 1980. Dr. Levy holds a Ph.D. in biochemistry and molecular biology from Northwestern University and a bachelor’s degree in chemistry from the Massachusetts Institute of Technology.

Dr. Ronald S. Levy, a founder of the Company, has served as Director of the Company since its formation in November 1980, as Executive Vice President since April 1999 and as Secretary since May 1986. From November 1980 through March 1999, he served as Vice President of the Company. Dr. Levy holds a Ph.D. in bioinorganic chemistry from Pennsylvania State University and a bachelor’s degree in chemistry from Rutgers University.

Mr. Jay Levy, a founder of the Company, has served as Chairman of the Board of Directors and Treasurer of the Company since its formation in November 1980. Mr. Levy was Chief Financial Officer of the Company from 1980 through February 2005. He holds a B.B.A. degree from City College of New York and has more than 25 years of progressively responsible experience leading to senior accounting and financial management positions with several internationally known manufacturing corporations. For 17 years he was the principal financial advisor for the late Nathan Cummings, a noted industrialist and philanthropist. From 1985 through 1991 he served in similar capacity to the estate of Nathan Cummings and to the Nathan Cummings Foundation, a large charitable foundation. Mr. Levy is a part-time employee and devotes approximately 15% of his time to the Company.

Dr. James P. Gilligan has been employed by Unigene since 1981 and has served as Vice President of Product Development since April 1999. From February 1995 to March 1999, he served as Director of Product Development. Dr. Gilligan holds a Ph.D. in pharmacology from the University of Connecticut and a Masters of International Business from Seton Hall University.

Dr. Nozer M. Mehta has served as our Vice President, Biological Research and Development since March 1, 2005. Dr. Mehta served as our Director of Biological Research and Development from May 2003 through February 2005, as our Director of Molecular and Cell Biology from 1999 through May 2002 and in various other capacities with the Company from 1982 through 1999. Dr. Mehta obtained a Doctorat d’Universite degree (equivalent to a Ph.D.) from the Universite Louis Pasteur in Strasbourg, France in 1976. Prior to joining Unigene, Dr. Mehta worked at the Cancer Research Institute in Bombay, India and at the University of Nebraska at Lincoln.

Dr. Paul P. Shields has served as our Vice President, Manufacturing Operations since March 1, 2005. Dr. Shields served as our Director of Plant Operations from 2001 through February 2005, as our Plant Manager from 1995 through 2001, and in various other capacities with the Company from 1989 through 1995. Dr. Shields holds a Ph.D. in biochemistry from the University of Pennsylvania and a B.S. in chemical engineering from the University of Michigan.

6

Mr. William Steinhauer, CPA, has served as our Vice President of Finance since March 1, 2005. Mr. Steinhauer served as Unigene’s Director of Finance from October 2003 through February 2005 and as our Controller from July 1987 through September 2003. Prior thereto, Mr. Steinhauer served as Chief Financial Officer, Treasurer and Secretary of Refac Technology Development Corporation, a company involved in patent licensing and technology transfer. Mr. Steinhauer holds a Bachelor of Science degree in accounting from Brooklyn College.

Dr. J. Thomas August is a Distinguished Service Professor of the Departments of Oncology, Pharmacology and Molecular Sciences at the Johns Hopkins University School of Medicine, where he has been employed since 1976. He is also Director, Johns Hopkins Singapore Biomedical Centre. Dr. August, an outside consultant, has served as Unigene’s Director of Research since 1990. He serves on the Board of Directors of Bioqual, Inc. and is also a consultant for various biotechnology and medical companies. Dr. August received his medical degree from Stanford University School of Medicine.

Dr. Allen Bloom, a patent attorney, has been an independent consultant since January 2004. He retired from Dechert LLP, a law firm, after serving as a partner from July 1994 through December 2003. At Dechert he was Co-Chair of the Intellectual Property Group and headed a patent practice group which focused on biotechnology, pharmaceuticals and medical devices. For the nine years prior thereto, he was Vice President, General Counsel and Secretary of The Liposome Company, Inc., a biotechnology company. His responsibilities there included corporate patent, regulatory and licensing activities. Dr. Bloom serves on the Board of Directors of Redpoint Bio Corporation. Dr. Bloom holds a Ph.D. in organic chemistry from Iowa State University, a J.D. degree from New York Law School and a B.S. in chemistry from Brooklyn College.

Mr. Zvi Eiref has served as a director for various public and private companies since 2006. From 1995 through 2006, and 1979 to 1988, he was Chief Financial Officer of Church & Dwight Co., Inc. a consumer packaged goods manufacturer. From 1988 to 1995 he was Chief Financial Officer of Chanel Inc. Earlier in his career, he worked for Unilever and Arthur Andersen in Europe. He currently also serves on the boards of FGX International Holdings Ltd. and Physicians Formula Holdings, Inc. Mr. Eiref graduated from Oxford University, and is an English Chartered Accountant.

Mr. Marvin L. Miller has been an independent consultant since 2006. From 2002 through February 2006, he was the Executive Chairman of Onconova Therapeutics, Inc., a biotechnology company. From 1994 through 2002, he served as President of Nextran Inc., a biotechnology company affiliated with Baxter Healthcare Corporation. Prior to joining Nextran, Mr. Miller served as Vice President, Biotechnology Licensing for American Cyanamid Company. Previously, Mr. Miller was Vice President, Johnson & Johnson International as well as Corporate Vice President at Hoffman-LaRoche. Mr. Miller is currently a director of GTC Biotherapeutics, Inc. Mr. Miller received a B.S. degree in pharmacy from the Philadelphia College of Pharmacy & Science and an M.B.A. degree from the University of Wisconsin.

Dr. Bruce S. Morra has been the President and CEO of SCOLR Pharma, Inc. since January 2009. He has been an independent consultant since February 2000. He was the President of West Drug Delivery Systems, a division of West Pharmaceutical Services, Inc., from April 2003 through December 2004. He served as the President, COO, CFO and board member of Biopore Corporation and Polygenetics, Inc., two related companies developing technology for drug delivery and medical devices for biomedical and industrial applications from 1998 through 2002, then served as Executive Vice President, Chief Business Officer and board member from 2002 to 2004. From 1993 through 2000, he served as President and COO of Flamel Technologies, Inc., a company developing, manufacturing and licensing drug and agrochemical delivery technologies and products. Dr. Morra previously served as director of Unigene from 2001 to 2003. He currently serves as a director for SCOLR Pharma, Inc. and InforMedix Holdings, Inc. Dr. Morra holds a Ph.D. in polymer science and engineering and an M.B.A. from the University of Massachusetts, Amherst and a B.S.E. in chemical engineering from Princeton University.

Mr. Peter Slusser has been the President and Chief Executive Officer of Slusser Associates, Inc., a private investment banking company since July 1988. From December 1975 to March 1988, he was Managing Director and head of Mergers and Acquisitions for Paine Webber Incorporated. Mr. Slusser currently serves as a director of Sparton Corporation. Mr. Slusser received a B.A. degree from Stanford University and an M.B.A. degree from Harvard University.

PROPOSAL 2

RATIFICATION OF THE APPOINTMENT OF INDEPENDENT AUDITORS

The Audit Committee of the Board of Directors has appointed Grant Thornton LLP, independent public accountants, to serve as the Company’s independent auditors for the fiscal year commenced January 1, 2009. Although not required by the Company’s Certificate of Incorporation or By-Laws, the Board of Directors believes that it is in the best interests of the stockholders to ratify the appointment of Grant Thornton. If stockholders vote against the ratification of Grant Thornton, the Audit Committee will consider other alternatives. Grant Thornton served as the independent auditors for the Company for the year ended December 31, 2008. A representative of the firm is expected to be present at the meeting to respond to appropriate questions and he or she will have the opportunity to make a statement, if such representative desires to do so.

7

Audit Fees. During the fiscal years ended December 31, 2008 and December 31, 2007, the fees billed by the principal accountant for the audit of the Company’s financial statements for such fiscal years and for the reviews of the Company’s interim financial statements were approximately $394,000 and $404,000, respectively.

Audit-Related Fees and Tax Fees. During the fiscal years ended December 31, 2008 and December 31, 2007, Grant Thornton did not bill the Company for any audit-related fees, nor did they provide any tax services to the Company.

All Other Fees. During the fiscal years ended December 31, 2008 and December 31, 2007, Grant Thornton did not provide any professional services other than audit services to the Company.

The Audit Committee retains the auditors and pre-approves all audit and non-audit services.

Ratification of the appointment of Grant Thornton requires the affirmative vote of the holders of a majority of the shares of Common Stock present, in person or by proxy, and entitled to vote at the Annual Meeting. A broker’s discretionary authority to vote to ratify the Company’s independent auditors is not limited so there cannot be any broker non-votes regarding this proposal and abstentions will have the effect of a “no” vote.

THE BOARD OF DIRECTORS RECOMMENDS A VOTEFOR THE RATIFICATION OF GRANT THORNTON AS INDEPENDENT AUDITORS OF THE COMPANY FOR THE COMPANY’S 2009 FISCAL YEAR.

AUDIT COMMITTEE REPORT FOR 2008

The information contained in this report shall not be deemed to be “soliciting material” or “filed” or “incorporated by reference” in future filings with the Securities and Exchange Commission, or subject to the liabilities of Section 18 of the Exchange Act, except to the extent that we specifically request that it be treated as soliciting material or incorporate it by reference into a document filed under the Securities Act or the Exchange Act.

The role of the Audit Committee is to assist the Board of Directors in fulfilling its responsibilities to oversee management’s conduct of the Company’s financial reporting process. Its responsibilities include the following: (1) to annually select a firm of independent public accountants to act as auditors of the Company; (2) to review the scope of the annual audit with the auditors in advance of the audit; (3) to review the results of the audit and the adequacy of the Company’s internal controls; (4) to oversee management’s conduct of the Company’s financial reporting process; and (5) to approve fees paid to the auditors for audit and non-audit services. Once selected by the Committee, the outside auditors report directly to the Committee. The Committee is responsible for approving both audit and non-audit services to be provided by the outside auditors.

Management of the Company is responsible for the preparation, presentation and integrity of the Company’s financial statements, the Company’s accounting and financial reporting principles and internal controls and procedures, which are designed to assure compliance with accounting standards and applicable laws and regulations. The independent auditors are responsible for auditing the Company’s financial statements and expressing an opinion as to their conformity with U.S. generally accepted accounting principles. The Committee’s responsibility is to monitor and review the work of management and the independent auditors in these areas. It is not the Committee’s duty or responsibility to conduct auditing or accounting reviews.

In the performance of its oversight function, the Committee has reviewed and discussed the audited financial statements with management, which included a discussion of the quality, and not just the acceptability, of the accounting principles, the reasonableness of significant judgments and the clarity of disclosures in the financial statements. The Committee met with the independent auditors, with and without management, to discuss the results of their examination and their judgments regarding the Company’s accounting policies. The Audit Committee and Grant Thornton LLP also discussed Grant Thornton LLP’s independence. On November 18, 2008, the Audit Committee received from Grant Thornton LLP the written disclosures and the letter regarding Grant Thornton LLP’s independence required by Public Company Accounting Oversight Board Rule 3526.

In the course of our oversight of the Company’s financial reporting process, we have: (1) reviewed and discussed with management the audited financial statements for the year ended December 31, 2008; (2) discussed with Grant Thornton, the Company’s independent registered public accounting firm, the matters required to be discussed by Statement on Auditing Standards No. 61, as amended (AICPA, Professional Standards, Vol. 1, AU section 380), as adopted by the Public Company Accounting Oversight Board in Rule 3200T; (3) received the written disclosures and the letter from the independent registered public accounting firm required by applicable requirements of the Public Company Accounting Oversight Board regarding the independent accountant’s communications with the Audit Committee concerning independence; (4) discussed with the independent registered public accounting firm its independence; and (5) considered whether the provision of nonaudit services by the independent registered public accounting firm is compatible with maintaining its independence and concluded that it is compatible at this time.

In addition, as part of fulfilling its responsibilities, the Audit Committee spent time during 2008 conferring with management and Grant Thornton regarding the Company’s compliance with Section 404 of the Sarbanes-Oxley Act of 2002.

8

Based upon the reports and discussions described in this report, and subject to the limitations on the role and responsibilities of the Committee referred to above, the Committee recommended to the Board that the audited financial statements be included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2008 for filing with the Securities and Exchange Commission and selected Grant Thornton LLP as the independent auditors for fiscal year 2009. The Board is recommending that stockholders ratify that selection at the Annual Meeting.

SUBMITTED BY THE AUDIT COMMITTEE

OF THE COMPANY’S BOARD OF DIRECTORS

Allen Bloom, Chairman

Zvi Eiref

Marvin L. Miller

Peter Slusser

April 17, 2009

PROPOSAL 3

AMENDMENT OF THE COMPANY’S

2006 STOCK-BASED INCENTIVE COMPENSATION PLAN

General

The Board of Directors is submitting to stockholders and recommending for approval at the Annual Meeting a proposal to amend the Unigene Laboratories, Inc. 2006 Stock-Based Incentive Compensation Plan (the “2006 Plan”) to increase by 2,000,000 shares the number of shares of Common Stock available for issuance thereunder. The 2006 Plan was previously filed as Appendix B to the Company’s Proxy Statement filed May 8, 2006.

At a meeting held on June 15, 2006, the Company’s stockholders approved the 2006 Plan. The purpose of the 2006 Plan is to promote the success and enhance the value of the Company by linking personal interests of the members of the Board of Directors, employees and consultants to those of the Company’s stockholders and to provide such individuals with an incentive for outstanding performance to generate superior returns to the Company’s stockholders and give the Company the flexibility to offer a variety of types of equity compensation to remain competitive in recruiting and retaining qualified key personnel.

Amendment to the 2006 Plan

As of March 31, 2009, there were approximately 1,701,000 shares of Common Stock remaining available for grant under the 2006 Plan. Subject to stockholder approval, the Board approved an amendment to the 2006 Plan that increases by 2,000,000 shares the number of shares available for issuance thereunder. The Board believes that this increase in authorized shares will meet the Company’s needs under the 2006 Plan for the foreseeable future and recommends that the stockholders vote FOR approval of the amendment. The proposed amendment is attached to this Proxy Statement as Exhibit A.

SUMMARY OF THE UNIGENE LABORATORIES, INC.

2006 STOCK-BASED INCENTIVE COMPENSATION PLAN, AS AMENDED

General

The following is a summary of the 2006 Plan, as proposed to be amended. (References herein to the “2006 Plan” shall be deemed to be references to the 2006 Plan, as amended.) Capitalized terms not otherwise defined in this summary have the meanings given to them in the 2006 Plan.

Purpose

The general purpose of the 2006 Plan is to assist the Company in attracting and retaining valued employees, consultants and non-employee directors by offering them a greater stake in the Company’s success and a closer identity with it, and to encourage ownership of the Company’s stock by such employees, consultants and non-employee directors. In addition, it gives the Company flexibility to reward employees with an alternative to cash awards.

9

2006 Plan

General. The 2006 Plan authorizes the grant of Options, Stock Appreciation Rights, Restricted Stock, Deferred Stock, Phantom Stock, and other stock-based awards (collectively, “Awards”). Options granted under the 2006 Plan may be either “incentive stock options” as defined in section 422 of the Internal Revenue Code (the “Code”), or nonqualified stock options, as determined by the Committee.

Number of Shares Authorized. The number of shares of Common Stock initially available for award under the 2006 Plan is 5,000,000 shares, increased by (i) any shares reserved but not subject to awards under the Unigene Laboratories, Inc. Directors’ Stock Option Plan (the “Directors’ Plan”) and the Unigene Laboratories, Inc. 2000 Stock Option Plan (the “2000 Plan”), and (ii) shares subject to awards under the Directors’ Plan or the 2000 Plan that are forfeited, cancelled or expire thereunder. All shares of Common Stock reserved under the 2006 Plan may be issued pursuant to Incentive Stock Options.

If any Award is forfeited, or if any Option terminates, expires or lapses without being exercised, shares of Common Stock subject to such Award will again be available for future grant. In addition, any shares under the 2006 Plan that are used to satisfy award obligations under the plan of another entity that is acquired by the Company will not count against the remaining number of shares available. Finally, if there is any change in the Company’s corporate capitalization, the Committee in its sole discretion may cancel and make substitutions of Awards or may adjust the number of shares available for award under the 2006 Plan, the number and kind of shares covered by Awards then outstanding under the 2006 Plan and the exercise price of outstanding Options and Stock Appreciation Rights.

Administration. The Compensation Committee (the “Committee”) will administer the 2006 Plan. The full Board of the Company or a Secondary Committee designated by the Board, shall administer the 2006 Plan and exercise the Committee’s authority with respect to grants made to non-employee directors. Subject to the other provisions of the 2006 Plan, the Committee has the authority to:

| | • | | select the employees, consultants and non-employee directors who will receive Awards pursuant to the 2006 Plan; |

| | • | | determine the type or types of Awards to be granted to each participant; |

| | • | | determine the number of shares of Common Stock to which an Award will relate, the terms and conditions of any Award granted under the 2006 Plan (including, but not limited to, restrictions as to vesting, transferability or forfeiture, exercisability or settlement of an Award and waivers or accelerations thereof, and waivers of or modifications to performance goals relating to an Award, based in each case on such considerations as the Committee shall determine) and all other matters to be determined in connection with an Award; |

| | • | | determine whether, to what extent, and under what circumstances an Award may be canceled, forfeited, or surrendered; |

| | • | | determine whether, and to certify that, performance goals to which the settlement of an Award is subject are satisfied; |

| | • | | correct any defect or supply any omission or reconcile any inconsistency in the 2006 Plan, and adopt, amend and rescind such rules, regulations, guidelines, forms of agreements and instruments relating to the 2006 Plan as it may deem necessary or advisable; and make all other determinations as it may deem necessary or advisable for the administration of the 2006 Plan. |

Eligibility. The 2006 Plan provides that Awards may be granted to employees, non-employee directors and consultants of the Company or its subsidiaries. Incentive stock options may be granted only to employees. The maximum number of shares that may be awarded to any participant as Qualified Performance-Based Awards (described below) in any calendar year shall not exceed 200,000.

Each Award granted under the 2006 Plan will be evidenced by a written agreement between the participant and the Company, which will describe the Award and state the terms and conditions applicable to such Award. The principal terms and conditions of each particular type of Award are described below.

Performance Goals

The Award agreements may provide for vesting or earning the Award based on achievement of performance goals. Performance goals may be established on a Company-wide basis; with respect to one or more subsidiary corporations, business units, divisions, department, or functions, and in either absolute terms or relative to the performance of one or more comparable companies or an index covering multiple companies. Performance goals, the number of shares or units to which they pertain, the time and manner of payment of the Award shall be specified in the Award agreement.

Except in the case of Awards intended to meet the requirements of Section 162(m) of the Code applicable to qualified Performance-Based compensation (“Qualified Performance-Based Awards”), the Committee may modify performance goals in whole or in part, during the performance period, as it deems appropriate and equitable. In the case of Qualified Performance-Based Awards, the applicable performance goals are limited to one or more of the following:

| | • | | specified levels of or increases in the Company’s, a division’s or a Subsidiary’s return on capital, equity or assets; |

| | • | | earnings measures/ratios (on a gross, net, pre-tax or post-tax basis), including diluted earnings per share, total earnings, operating earnings, earnings growth, earnings before interest and taxes (EBIT) and earnings before interest, taxes, depreciation and amortization (EBITDA); |

| | • | | net economic profit (which is operating earnings minus a charge to capital); |

10

| | • | | share price (including but not limited to growth measures and total shareholder return); |

| | • | | per period or cumulative cash flow (including but not limited to operating cash flow and free cash flow) or cash flow return on investment (which equals net cash flow divided by total capital); |

| | • | | financial return ratios; |

| | • | | balance sheet measurements such as receivable turnover; |

| | • | | improvement in or attainment of expense levels; |

| | • | | improvement in or attainment of working capital levels; |

| | • | | customer or employee satisfaction; |

| | • | | any other financial or other measurement deemed appropriate by the Committee as it relates to the results of operations or other measurable progress of the Company and Subsidiaries (or any business unit thereof); and |

| | • | | any combination of any of the foregoing criteria. |

Phantom Stock

Awards of Phantom Stock may be made under the 2006 Plan. A share of Phantom Stock is a book-entry unit with a value equal to one share of Common Stock. A grant of Phantom Stock will vest and become payable to the participant upon other future events, including the achievement during a specified performance cycle of performance goals established by the Committee or the passage of time. Each grant of Phantom Stock shall specify the conditions, including the passage of time and performance goals, if applicable, that must be satisfied in order for payment to be made. Payment of Phantom Stock may be made in cash, shares of Common Stock, or a combination thereof, equal to the fair market value of the shares of Common Stock to which the Award relates.

Options

An Option is the right to purchase shares of Common Stock for a specified period of time at a fixed price (the “exercise price”). Each Option agreement will specify the exercise price, the type of Option, the term of the Option, the date when the Option will become exercisable and any applicable performance goals. Each grant of Options shall specify the length of service and/or any applicable performance goals that must be achieved before it becomes exercisable. Incentive stock options may only be granted to employees, shall only be transferable by will or under the laws of descent and distribution, and, during the participant’s lifetime, may only be exercised by the participant. No Award of incentive stock options may permit the fair market value of any such Options becoming first exercisable in any calendar year to exceed $100,000.

Exercise Price. The Committee will determine the exercise price of an Option at the time the Option is granted. The exercise price under an incentive stock option or non-qualified stock option will not be less than 100% of the fair market value of Common Stock on the date the Option is granted. However, any participant who owns more than 10% of the combined voting power of all classes of the Company’s outstanding Common Stock (a “10% Stockholder”) will not be eligible for the grant of an incentive stock option unless the exercise price of the incentive stock option is at least 110% of the fair market value of the Common Stock on the date of grant.

Consideration. The means of payment for shares issued upon exercise of an Option will be specified in each Option agreement and generally may be made by the participant in cash, in a cash payment through a broker or bank from the proceeds of the sale of the shares purchased through the exercise of the Option (a “cashless exercise”), with the Committee’s consent, in whole or in part with shares of Common Stock, or a combination of the foregoing methods. The Committee may also permit Options to be exercised with such other consideration as it deems appropriate, as reflected in the applicable Award agreement.

Term of the Option. The term of an Option granted under the 2006 Plan will be no longer than ten years from the date of grant. In the case of an Option granted to a 10% Stockholder, the term of an incentive stock option will be for no more than five years from the date of grant.

11

Stock Appreciation Rights

A stock appreciation right (“SAR”) entitles the recipient to receive, upon exercise of the SAR, the increase in the fair market value of a specified number of shares of Common Stock from the date of the grant of the SAR to the date of exercise, payable in cash, shares of Common Stock, or any combination thereof. The Committee shall set the exercise price of an SAR which shall not be less than the Fair Market Value of the underlying Common Stock on the date of the grant. Each grant of SARs shall specify the length of service and/or any applicable performance goals that must be achieved before it becomes exercisable and may specify permissible dates or periods on or during which the SAR shall be exercisable. No SAR may be exercised more than ten years after the grant date.

Restricted Stock

An Award of Restricted Stock is a grant to the recipient of a specified number of shares of Common Stock which are subject to forfeiture upon specified events during the restriction period. Each grant of Restricted Stock shall specify the duration of the restriction period and any other conditions under which the Restricted Stock would be forfeitable to the Company, including any applicable performance goals, and will include restrictions on transfer to third parties during the restriction period.

Unless otherwise provided by the Committee an Award of Restricted Stock entitles the participant to dividend, voting and other ownership rights during the restriction period. Unless otherwise provided by the Committee, dividends on Restricted Stock will be subject to the same restrictions as the Restricted Stock.

Deferred Stock

An Award of Deferred Stock is an agreement by the Company to deliver to the recipient a specified number of shares of Common Stock at the end of a specified deferral period, subject to the fulfillment of any conditions specified by the Committee. Each grant of Deferred Stock shall specify the deferral period and any other conditions to which future delivery of shares to the recipient is subject, including any applicable performance goals.

An Award of Deferred Stock does not entitle the participant to any transfer, voting or any other ownership rights with respect to the Deferred Shares. Any grant of Deferred Stock may provide for the payment of dividend equivalents in cash or additional shares, which may be paid currently or deferred and reinvested, as determined by the Committee.

General Provisions

Vesting. Any Award may provide for full vesting, early exercise rights or termination of a restriction or deferral period in the event of a Change in Control or similar transaction or event.

Nontransferability of Awards. In general, during a participant’s lifetime, his or her Awards shall be exercisable only by the participant and shall not be transferable other than by will or laws of descent and distribution. However, the Committee may provide for limited lifetime transfers of Awards, other than incentive stock options, to certain family members, trusts for the benefit of family members, or partnerships in which such family members are the only partners. In addition, the Committee may provide in any Award agreement terms and conditions under which the participant must sell or offer to sell any Awards, whether or not vested, and any Common Stock acquired pursuant to an Award to the Company.

Termination of Employment, Consulting Services, or Other Services. Each Option or SAR agreement shall provide rules for the exercise of such Award following termination of employment for any reason, which may include, but not be limited to, death, disability, termination for Cause or retirement. The Committee may take actions and provide in Award agreements for such post-termination rights which it believes equitable under the circumstances or in the best interests of the Company with respect to Awards that are not fully vested in the event of termination of employment or service by reason of death, disability, normal retirement, early retirement with the consent of the Committee, other termination or a leave of absence that is approved by the Committee, or in the event of hardship or other special circumstances that are approved by the Committee.

Change in Control

In the event of a Change in Control, the Committee may take one or more of the following actions with respect to Options and SARs: (i) fully vest and make exercisable any outstanding Options or SARs, (ii) cancel all outstanding vested Options or SARs in exchange for a cash payment in an amount equal to the excess, if any, of the Fair Market Value of the Common Stock underlying the unexercised portion of the Option or SAR as of the date of the Change in Control over the exercise price of such portion, (iii) terminate all Options or SARs immediately prior to the Change in Control, or (iv) require the successor corporation, following a Change in Control if the Company does not survive such Change in Control, to assume all outstanding Options or SARs and to substitute such Options or SARs with comparable awards.

12

Similarly, the Committee may, upon a Change in Control, fully and immediately vest all Awards of Restricted Stock, Phantom Stock, Deferred Stock or other equity Awards that are outstanding or take such other actions as it deems appropriate, including immediately distributing amounts with respect to unvested Awards that would not otherwise be payable as of the date of the Change in Control.

As defined in the 2006 Plan, the term “Change in Control” means,

(a) the acquisition in one or more transactions by any “Person” (as such term is used for purposes of section 13(d) or section 14(d) of the 1934 Act) but excluding, for this purpose, the Company or its Subsidiaries, any Stockholder of the Company or any employee benefit plan of the Company or its Subsidiaries, of “Beneficial Ownership” (within the meaning of Rule 13d–3 under the 1934 Act) of thirty-five percent (35%) or more of the combined voting power of the Company’s then outstanding voting securities (the “Voting Securities”);

(b) the individuals who, as of the effective date of the Plan, constitute the Board (the “Incumbent Board”) cease for any reason to constitute at least a majority of the Board; provided, however, that if the election, or nomination for election by the Company’s Stockholders, of any new director was approved by a vote of at least a majority of the Incumbent Board, such new director shall be considered as a member of the Incumbent Board, and provided further that any reductions in the size of the Board that are instituted voluntarily by the Incumbent Board shall not constitute a Change in Control, and after any such reduction the “Incumbent Board” shall mean the Board as so reduced;

(c) a merger or consolidation involving the Company if the Stockholders of the Company, immediately before such merger or consolidation, do own, directly or indirectly, immediately following such merger or consolidation, more than seventy percent (70%) of the combined voting power of the outstanding Voting Securities of the corporation resulting from such merger or consolidation;

(d) a complete liquidation or dissolution of the Company or a sale or other disposition of all or substantially all of the assets of the Company; or

(e) acceptance by Stockholders of the Company of shares in a share exchange if the Stockholders of the Company immediately before such share exchange, do not own, directly or indirectly, immediately following such share exchange, more than seventy percent (70%) of the combined voting power of the outstanding Voting Securities of the corporation resulting from such share exchange.

Effective Date, Amendments, and Termination of the 2006 Plan. The 2006 Plan became effective on June 15, 2006, when it was approved by Company stockholders. The amendment to the 2006 Plan to increase by 2,000,000 shares the number of shares available for award under the 2006 Plan will become effective upon approval by Company stockholders. The Board of Directors has the authority to amend or terminate the 2006 Plan at any time; provided, however, that stockholder approval is required for any amendment which (i) increases the number of shares available for Awards under the 2006 Plan (other than to reflect a change in the Company’s capital structure), (ii) decreases the price at which Awards may be granted, or (iii) as otherwise required by applicable law, regulation, or rules of any stock exchange or automated quotation system on which the Common Stock may then be listed or quoted. The 2006 Plan will terminate automatically on June 15, 2016, which is ten years after it was approved by stockholders.

Certain Federal Income Tax Considerations

The following discussion is a summary of certain federal income tax considerations that may be relevant to participants in the 2006 Plan. The discussion is for general informational purposes only and does not purport to address specific federal income tax considerations that may apply to a participant based on his or her particular circumstances, nor does it address state or local income tax or other tax considerations that may be relevant to a participant.

PARTICIPANTS ARE URGED TO CONSULT THEIR OWN TAX ADVISORS WITH RESPECT TO THE PARTICULAR FEDERAL INCOME TAX CONSEQUENCES TO THEM OF PARTICIPATING IN THE 2006 PLAN, AS WELL AS WITH RESPECT TO ANY APPLICABLE STATE OR LOCAL INCOME TAX OR OTHER TAX CONSIDERATIONS.

Phantom Stock

A participant realizes no taxable income and the Company is not entitled to a deduction when Phantom Stock payable in the future and subject to conditions such as the passage of time or achievement of performance goals are awarded. When Phantom Stock vests and becomes payable as a result of the satisfaction of the terms and conditions on such Award, including, if applicable, achievement of performance goals, the participant will realize ordinary income equal to the amount of cash received or the fair market value of the shares received minus any amount paid for the shares, and, subject to Section 162(m) of the Code, the Company will be entitled to a corresponding deduction.

13

A participant’s tax basis in shares of Common Stock received upon payment will be equal to the fair market value of such shares when the participant receives them. Upon sale of the shares, the participant will realize short-term or long-term capital gain or loss, depending upon whether the shares have been held for more than one year at the time of sale. Such gain or loss will be equal to the difference between the amount realized upon the sale of the shares and the tax basis of the shares in the participant’s hands.

Deferred Stock

A participant realizes no taxable income and the Company is not entitled to a deduction when Deferred Stock is awarded. When the deferral period for the Award ends and the participant receives shares of Common Stock, the participant will realize ordinary income equal to the fair market value of the shares at that time, and, subject to Section 162(m) of the Code, the Company will be entitled to a corresponding deduction. A participant’s tax basis in shares of Common Stock received at the end of a deferral period will be equal to the fair market value of such shares when the participant receives them.

Upon sale of the shares, the participant will realize short-term or long-term capital gain or loss, depending upon whether the shares have been held for more than one year at the time of sale. Such gain or loss will be equal to the difference between the amount realized upon the sale of the shares and the tax basis of the shares in the participant’s hands.

Restricted Stock

Restricted Stock received pursuant to Awards will be considered subject to a substantial risk of forfeiture for federal income tax purposes. If a participant who receives such Restricted Stock does not make the election described below, the participant realizes no taxable income upon the receipt of Restricted Stock and the Company is not entitled to a deduction at such time. When the forfeiture restrictions with respect to the Restricted Stock lapse the participant will realize ordinary income equal to the fair market value of the shares at that time, and, subject to Section 162(m) of the Code, the Company will be entitled to a corresponding deduction. A participant’s tax basis in Restricted Stock will be equal to their fair market value when the forfeiture restrictions lapse, and the participant’s holding period for the shares will begin when the forfeiture restrictions lapse. Upon sale of the shares, the participant will realize short-term or long-term gain or loss, depending upon whether the shares have been held for more than one year at the time of sale. Such gain or loss will be equal to the difference between the amount realized upon the sale of the shares and the tax basis of the shares in the participant’s hands.

Participants receiving Restricted Stock may make an election under Section 83(b) of the Code with respect to the shares. By making a Section 83(b) election, the participant elects to realize compensation income with respect to the shares when the shares are received rather than at the time the forfeiture restrictions lapse. The amount of such compensation income will be equal to the fair market value of the shares when the participant receives them (valued without taking the restrictions into account), and the Company will be entitled to a corresponding deduction at that time. By making a Section 83(b) election, the participant will realize no additional compensation income with respect to the shares when the forfeiture restrictions lapse, and will instead recognize gain or loss with respect to the shares when they are sold. The participant’s tax basis in the shares with respect to which a Section 83(b) election is made will be equal to their fair market value when received by the participant, and the participant’s holding period for such shares begins at that time. If, however, the shares are subsequently forfeited to the Company, the participant will not be entitled to claim a loss with respect to the shares to the extent of the income realized by the participant upon the making of the Section 83(b) election. To make a Section 83(b) election, a participant must file an appropriate form of election with the Internal Revenue Service and with his or her employer, each within 30 days after shares of restricted stock are received, and the participant must also attach a copy of his or her election to his or her federal income tax return for the year in which the shares are received.

Generally, during the restriction period, dividends and distributions paid with respect to Restricted Stock will be treated as compensation income (not dividend income) received by the participant. Dividend payments received with respect to shares of restricted stock for which a Section 83(b) election has been made will be treated as dividend income, assuming the Company has adequate current or accumulated earnings and profits.

Non-qualified Options

A participant realizes no taxable income and the Company is not entitled to a deduction when a non-qualified option is granted. Upon exercise of a non-qualified option, a participant will realize ordinary income equal to the excess of the fair market value of the shares received over the exercise price of the non-qualified option, and, subject to Section 162(m) of the Code, the Company will be entitled to a corresponding deduction. A participant’s tax basis in the shares of Common Stock received upon exercise of a non-qualified option will be equal to the fair market value of such shares on the exercise date, and the participant’s holding period for such shares will begin at that time. Upon sale of the shares of Common Stock received upon exercise of a non-qualified option, the participant will realize short-term or long-term capital gain or loss, depending upon whether the shares have been held for more than one year. The amount of such gain or loss will be equal to the difference between the amount realized in connection with the sale of the shares, and the participant’s tax basis in such shares.

14

Under the 2006 Plan, non-qualified options may, with the consent of the Committee, be exercised in whole or in part with shares of Common Stock or Restricted Stock held by the participant. Payment in Common Stock will be treated as a tax-free exchange of the shares surrendered for an equivalent number of shares of Common Stock received, and the equivalent number of shares received will have a tax basis equal to the tax basis of the surrendered shares. The fair market value of shares of Common Stock received in excess of the number of shares surrendered will be treated as ordinary income and such shares have a tax basis equal to their fair market value on the date of the exercise of the non-qualified option.

Incentive Stock Options

A participant realizes no taxable income and the Company is not entitled to a deduction when an incentive stock option is granted or exercised. Provided the participant meets the applicable holding period requirements for the shares received upon exercise of an incentive stock option (two years from the date of grant and one year from the date of exercise), gain or loss realized by a participant upon sale of the shares received upon exercise will be long-term capital gain or loss, and the Company will not be entitled to a deduction. If, however, the participant disposes of the shares before meeting the applicable holding period requirements (a “disqualifying disposition”), the participant will realize ordinary income at that time equal to the excess of the fair market value of the shares on the exercise date over the exercise price of the incentive stock option. Any amount realized upon a disqualifying disposition in excess of the fair market value of the shares on the exercise date of the incentive stock option will be treated as capital gain and will be treated as long-term capital gain if the shares have been held for more than one year. If the sales price is less than the sum of the exercise price of the incentive stock option and the amount included in ordinary income due to the disqualifying disposition, this amount will be treated as a short-term or long-term capital loss, depending upon whether the shares have been held for more than one year. Notwithstanding the above, individuals who are subject to Alternative Minimum Tax may recognize ordinary income upon exercise of an incentive stock option.

Under the 2006 Plan, incentive stock options may, with the consent of the Committee, be exercised in whole or in part with shares of Common Stock held by the participant. Such an exercise will be treated as a tax-free exchange of the shares of Common Stock surrendered (assuming the surrender of the previously-owned shares does not constitute a disqualifying disposition of those shares) for an equivalent number of shares of Common Stock received, and the equivalent number of shares received will have a tax basis equal to the tax basis of the surrendered shares. Shares of Common Stock received in excess of the number of shares surrendered will have a tax basis of zero.

SARs

A participant realizes no taxable income and the Company is not entitled to a deduction when an SAR is granted. Upon exercising an SAR, a participant will realize ordinary income in an amount equal to the cash or the fair market value of the shares received minus any amount paid for the shares, and, subject to Section 162(m) of the Code, the Company will be entitled to a corresponding deduction. A participant’s tax basis in the shares of Common Stock received upon exercise of an SAR will be equal to the fair market value of such shares on the exercise date, and the participant’s holding period for such shares will begin at that time. Upon sale of the shares of Common Stock received upon exercise of an SAR, the participant will realize short-term or long-term capital gain or loss, depending upon whether the shares have been held for more than one year. The amount of such gain or loss will be equal to the difference between the amount realized in connection with the sale of the shares, and the participant’s tax basis in such shares.

Section 162(m) Limitations

Section 162(m) of the Code limits the deductibility of compensation paid to certain executive officers, unless the compensation is a Qualified Performance-Based Award. If Awards to such persons are intended to qualify as Qualified Performance-Based Awards, the 2006 Plan requires that the maximum number of shares of Common Stock underlying such Awards that may be granted to the recipient during any one calendar year is 200,000 shares.

Withholding

The Company is entitled to deduct from the payment of any Award (whether made in stock or in cash) all applicable income and employment taxes required by federal, state, local or foreign law to be withheld, or may require the participant to pay such withholding taxes to the Company as a condition of receiving payment of the Award. The Committee may allow a participant to satisfy his or her withholding obligations by directing the Company to retain the number of shares necessary to satisfy the withholding obligation, or by delivering shares held by the participant to the Company in an amount necessary to satisfy the withholding obligation.

Approval

Approval of the amendment to the 2006 Plan requires the affirmative vote of the holders of a majority of the shares of Common Stock present, in person or by proxy, and entitled to vote at the Annual Meeting. Abstentions will be counted as votes against this Proposal, while broker non-votes will not be counted for determining the number of votes cast on this Proposal.

15

| | | | | | | | |

PLAN BENEFITS (1) |

|

2006 Stock-Based Incentive Compensation Plan |

| | | | | | | | |

| | | | |

Name and Principal Position | | Dollar Value of

Stock Awards ($) | | Number of

Units of Stock | | Dollar Value of

Options ($) | | Number of

Options |

Warren P. Levy, President, Chief Executive Officer and Director | | 60,000 | | 42,105 | | 356,250 | | 250,000 |

Ronald S. Levy, Executive Vice President, Secretary and Director | | 40,000 | | 28,070 | | 213,750 | | 150,000 |

William Steinhauer, Vice President of Finance | | 20,000 | | 14,035 | | 128,250 | | 90,000 |

James P. Gilligan, Vice President of Product Development | | 20,000 | | 14,035 | | 135,375 | | 95,000 |

Paul P. Shields, Vice President, Manufacturing | | 20,000 | | 14,035 | | 114,000 | | 80,000 |

Nozer M. Mehta, Vice President, Biological R&D | | 20,000 | | 14,035 | | 121,125 | | 85,000 |

Executive Group | | 180,000 | | 126,315 | | 1,068,750 | | 750,000 |

Non-Executive Director Group | | — | | — | | 226,800 | | 120,000 |

Non-Executive Officer Employee Group | | 49,598 | | 52,646 | | 324,560 | | 359,000 |

| (1) | In accordance with SEC rules, the Plan Benefits table indicates the benefits that were received by the indicated individual or group for the fiscal year ending on December 31, 2008. |

THE BOARD OF DIRECTORS RECOMMENDS A VOTE FOR THE AMENDMENT TO

THE 2006 STOCK BASED-INCENTIVE COMPENSATION PLAN.

EQUITY COMPENSATION PLAN INFORMATION