QuickLinks -- Click here to rapidly navigate through this documentAs filed with the Securities and Exchange Commission on April 28, 2004

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F

(Mark One)

- o

- Registration statement pursuant to Section 12(b) or 12(g) of the Securities Exchange Act of 1934

or

- ý

- Annual report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

For the fiscal year ended December 31, 2003

or

- o

- Transition report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Commission file number: 1-8382

AKTIEBOLAGET SVENSK EXPORTKREDIT

(SWEDISH EXPORT CREDIT CORPORATION)

(Exact name of Registrant as Specified in Its Charter)

Kingdom of Sweden

(Jurisdiction of incorporation or organization)

Västra Trädgårdsgatan 11 B, Stockholm, Sweden

(Address of principal executive offices)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

None

(Title of Class)

Securities registered or to be registered pursuant to Section 12 (g) of the Act:

None

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

Medium-Term Notes, Series B

(Title of Class)

Indicate the number of outstanding shares of each of the issuer's classes of capital or common stock as of the close of the period covered by the annual report:

| Class A shares | | 640,000 |

| Class B shares | | 350,000 |

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days:

Yesý No

Indicate by check mark which financial statement item the registrant has elected to follow:

Item 17o Item 18ý

TABLE OF CONTENTS

| PART I | | 1 |

| |

ITEM 1. |

|

IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISORS |

|

1 |

| | ITEM 2. | | OFFER STATISTICS AND EXPECTED TIMETABLE | | 1 |

| | ITEM 3. | | KEY INFORMATION | | 1 |

| | ITEM 4. | | INFORMATION ON THE COMPANY | | 4 |

| | ITEM 5. | | OPERATING AND FINANCIAL REVIEW AND PROSPECTS | | 15 |

| | ITEM 6. | | DIRECTORS, SENIOR MANAGEMENT AND EMPLOYEES | | 28 |

| | ITEM 7. | | MAJOR SHAREHOLDERS AND RELATED PARTY TRANSACTIONS | | 31 |

| | ITEM 8. | | FINANCIAL INFORMATION | | 32 |

| | ITEM 9. | | THE OFFER AND LISTING | | 32 |

| | ITEM 10. | | ADDITIONAL INFORMATION | | 32 |

| | ITEM 11. | | QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK | | 35 |

| | ITEM 12. | | DESCRIPTION OF SECURITIES OTHER THAN EQUITY SECURITIES | | 45 |

PART II |

|

45 |

| |

ITEM 13. |

|

DEFAULTS, DIVIDEND ARREARAGES AND DELINQUENCIES |

|

45 |

| | ITEM 14. | | MATERIAL MODIFICATIONS TO THE RIGHTS OF SECURITY HOLDERS AND USE OF PROCEEDS | | 45 |

| | ITEM 15. | | CONTROLS AND PROCEDURES | | 45 |

| | ITEM 16A. | | AUDIT COMMITTEE FINANCIAL EXPERT | | 45 |

| | ITEM 16B. | | CODE OF ETHICS | | 46 |

| | ITEM 16C. | | PRINCIPAL ACCOUNTANT FEES AND SERVICES | | 46 |

PART III |

|

47 |

| |

ITEM 17. |

|

FINANCIAL STATEMENTS |

|

47 |

| | ITEM 18. | | FINANCIAL STATEMENTS | | 47 |

| | ITEM 19. | | EXHIBITS | | 49 |

i

In this Report, unless otherwise specified, all amounts are expressed in Swedish kronor ("Skr"). See Item 3, "Key Information", for a description of historical exchange rates and other matters relating to the Swedish kronor. On April 26, 2004, the exchange rate for U.S. dollars into Swedish kronor based on the noon buying rate in New York City for cable transfers in foreign currencies as certified for customs purposes by the Federal Reserve Bank of New York was 7.6960 Skr per U.S. dollar. No representation is made that Swedish kronor amounts have been, could have been or could be converted into U.S. dollars at that rate.

INTRODUCTORY NOTES

In this Report, unless otherwise indicated, all descriptions and financial information relate to Aktiebolaget Svensk Exportkredit (Swedish Export Credit Corporation) ("SEK" or the "Company") as a whole, and include both the "Market Rate System" (the "M-system") and the "State Support System" (the "S-system"), each of which is described in detail herein. In certain instances, information relating to the S-system on a stand-alone basis is provided separately. References herein to "SEK excluding the S-system" mean the same as references to the "Market Rate System".

SEK is a "public company" according to the Swedish Companies Act. A Swedish company, even if its shares are not listed on an exchange and are not publicly traded, may choose to declare itself a "public company". Only public debt companies are allowed to raise funds from the public through the issuance of debt instruments. In certain cases, a public company is required to add the denotation "publ" to its name.

FORWARD-LOOKING STATEMENTS

This Report contains forward-looking statements. In addition, the Company may make forward-looking statements in its periodic reports to the U.S. Securities and Exchange Commission (the "SEC") on Form 6-K, in its annual and interim reports, offering circulars and prospectuses, press releases and other written information. The Board of Directors, officers and employees may also make oral forward-looking statements to third parties, including financial analysts. Forward-looking statements are statements that are not historical facts. Examples of forward-looking statements include:

- •

- financial projections and estimates and their underlying assumptions;

- •

- statements regarding plans, objectives and expectations relating to future operations and services;

- •

- statements regarding the impact of regulatory initiatives on the Company's operations;

- •

- statements regarding general industry and macroeconomic growth rates and the Company's performance relative to them; and

- •

- statements regarding future performance.

Forward-looking statements generally are identified by the words "expect", "anticipate", "believe", "intend", "estimate", "should", and similar expressions.

Forward-looking statements are based on current plans, estimates and projections, and therefore you should not place too much reliance on them. Forward-looking statements speak only as of the date they are made, and the Company undertakes no obligation to update any forward-looking statement in light of new information or future events, although the Company intends to continue to meet its ongoing disclosure obligations under the U.S. securities laws (such as the obligations to file annual reports on Form 20-F and reports on Form 6-K) and under other applicable laws. Forward-looking statements involve inherent risks and uncertainties, most of which are difficult to predict and generally beyond the Company's control. You are cautioned that a number of important factors could cause

ii

actual results or outcomes to differ materially from those expressed in, or implied by, the forward-looking statements. These factors include, among others, the following:

- •

- changes in general economic business conditions, especially in Sweden;

- •

- changes and volatility in currency exchange and interest rates; and

- •

- changes in government policy and regulations and in political and social conditions.

iii

PART I

Item 1. Identity of Directors, Senior Management and Advisors

Not required as this 20-F is filed as an Annual Report.

Item 2. Offer Statistics and Expected Timetable

Not required as this 20-F is filed as an Annual Report.

Item 3. Key Information

The following selected financial data at and for the years ended December 31, 2003, 2002, 2001, 2000, and 1999 have been derived from SEK's consolidated financial statements prepared in accordance with generally accepted accounting principles in Sweden (Swedish GAAP). SEK prepares its accounts in accordance with Swedish GAAP, which differs in significant respects from generally accepted accounting principles in the United States (U.S. GAAP). Information relating to the nature and effect of such differences is presented in Note 33 to the Consolidated Financial Statements.

On January 1, 2001, SFAS No. 133, Accounting for Derivative Instruments and Hedging Activities, and SFAS No. 138, Accounting for Certain Derivative Instruments and Certain Hedging Activities, became applicable to SEK. SEK did not achieve hedge accounting under U.S. GAAP for any of its instruments at the inception of SFAS 133. Although SEK structured a substantial portion of its transactions to qualify for hedge accounting treatment under these rules beginning in July 2002, certain transactions for which SEK is economically hedged continue not to qualify for hedge accounting treatment under U.S. GAAP. For these reasons, from January 1, 2001 and going forward there have been and are expected to continue to be significant differences between SEK's net profit and shareholders' funds calculated under Swedish GAAP as compared to these items calculated under U.S. GAAP. These differences arise primarily from the requirements of U.S. GAAP that (1) changes in the fair value of derivatives that are not part of a qualifying fair value hedge relationship are required to be recognized currently in the income statement while the contract which the derivative is economically hedging is carried at amortized cost and (2) changes in currency exchange rates affecting the fair value of foreign-currency instruments in the available-for-sale portfolio that are not eligible for hedge accounting are reported only as increases or decreases in shareholders' funds, while the largely offsetting changes in the Swedish kronor position of the related funding must be recognized currently in the income statement. Based on its experience and knowledge of the functioning of SEK's economic hedging, management believes Swedish GAAP better reflects the effects of the economic hedge relationships on net income and shareholders' funds.

The following information should be read in conjunction with the more detailed discussion contained in Item 5 "Operating and Financial Review and Prospects".

1

Selected Financial Data

| | Year Ended December 31,

| |

|---|

| | 2003

| | 2002

| | 2001

| | 2000

| | 1999

| |

|---|

| | (In Skr million, unless otherwise stated)

| |

|---|

| INCOME STATEMENT DATA | | | | | | | | | | | |

Net interest revenues/(expenses): |

|

|

|

|

|

|

|

|

|

|

|

| | SEK excluding the S-system | | 757.5 | | 798.2 | | 830.7 | | 895.5 | | 904.0 | |

| | S-system(A) | | (67.5 | ) | (193.9 | ) | (230.6 | ) | (334.1 | ) | (297.8 | ) |

Operating profit |

|

595.3 |

|

664.4 |

|

729.0 |

|

829.9 |

|

826.8 |

|

Net profit (Swedish GAAP) |

|

427.5 |

|

479.7 |

|

540.7 |

|

601.8 |

|

600.4 |

|

| | |

| |

| |

| |

| |

| |

After-tax return on equity (%) |

|

13.6 |

% |

14.0 |

% |

16.2 |

% |

15.9 |

% |

14.0 |

% |

| Earnings per share (Swedish GAAP) (Skr) | | 432 | | 485 | | 546 | | 712 | | 858 | |

| Dividend per share (Skr)(C) | | 1,252 | | 364 | | 405 | | 2,041 | | 953 | |

Net profit (loss) (U.S. GAAP)(D)(E) |

|

643.2 |

|

2,613.4 |

|

(312.3 |

) |

608.7 |

|

600.2 |

|

| | |

| |

| |

| |

| |

| |

Comprehensive income (loss) (U.S. GAAP)(F) |

|

70.9 |

|

429.5 |

|

1,587.9 |

|

488.1 |

|

(353.1 |

) |

Ratios of earnings to fixed charges (Swedish GAAP)(G) |

|

1.16 |

|

1.16 |

|

1.12 |

|

1.13 |

|

1.16 |

|

Ratios of earnings to fixed charges (U.S. GAAP)(G) |

|

1.22 |

|

1.96 |

|

0.91 |

|

1.13 |

|

1.16 |

|

Earnings (loss) per share (U.S. GAAP) (Skr) |

|

650 |

|

2,640 |

|

(315 |

) |

720 |

|

857 |

|

| |

At December 31,

|

|---|

| | 2003

| | 2002

| | 2001

| | 2000

| | 1999

|

|---|

| | (Skr million)

|

|---|

| BALANCE SHEET DATA | | | | | | | | | | |

| Total credits outstanding(H) | | 60,870.5 | | 65,470.1 | | 70,361.1 | | 60,855.6 | | 60,314.4 |

| | of which SEK excluding the S-system(H) | | 53,140.5 | | 53,988.9 | | 54,906.7 | | 46,774.6 | | 46,016.4 |

| | of which S-system(H) | | 7,730.0 | | 11,481.2 | | 15,454.4 | | 14,081.0 | | 14,298.0 |

| Total assets | | 151,800.5 | | 132,538.5 | | 149,540.8 | | 169,804.1 | | 149,476.6 |

| Total debt | | 135,565.9 | | 114,838.2 | | 128,039.0 | | 145,652.9 | | 129,534.2 |

| | of which subordinated debt | | 3,001.0 | | 2,224.6 | | 4,738.0 | | 4,256.9 | | 3,410.0 |

| Deferred taxes related to untaxed reserves(B) | | 376.5 | | 380.8 | | 385.0 | | 390.4 | | 434.5 |

| Shareholders' funds (Swedish GAAP) | | 2,952.2 | | 3,764.7 | | 3,645.4 | | 3,505.7 | | 4,629.0 |

| Total liabilities and shareholders' funds | | 151,800.5 | | 132,538.5 | | 149,540.8 | | 169,804.1 | | 149,476.6 |

| Shareholders' funds (U.S. GAAP)(C)(D)(E) | | 3,879.6 | | 5,048.7 | | 4,979.7 | | 3,792.7 | | 5,029.7 |

- (A)

- The difference between interest revenues, net commission revenues and any net foreign exchange gains related to lending and liquid assets under the S-system, on the one hand, and interest expenses related to borrowing, all financing costs and any net foreign exchange losses incurred by SEK under the S-system, on the other hand, is reimbursed by the Swedish State and, therefore, has no impact on operating profit or net profit.

- (B)

- In accordance with Swedish GAAP, no untaxed reserves are reported in the Consolidated Balance Sheet nor are changes in untaxed reserves reported in the Consolidated Income Statement. Instead, in the Consolidated Balance Sheet, the untaxed reserves are broken down by (i) an after-tax portion, included in non-distributable capital, and (ii) a portion representing deferred

2

taxes, reported as one component of allocations. (See Note 25 to the Consolidated Financial Statements.)

- (C)

- In connection with the sale of the Class B shares to the Swedish State on June 30, 2003, SEK paid a total dividend in 2003 of Skr 1,240 million solely to ABB Structured Finance Investment AB, the former holder of the Class B shares that represented approximately 35.5% of the Company's share capital. There was no dividend paid in 2003 to the Swedish State, which now owns all of the shares of SEK.

- (D)

- On January 1, 2001, SEK adopted SFAS No. 133, Accounting for Derivative Instruments and Hedging Activities, and SFAS No. 138, Accounting for Certain Derivative Instruments and Certain Hedging Activities. These adoptions resulted in significant adjustments in computing net profit and shareholders' funds according to U.S. GAAP. This was a result of having to mark at fair value in the balance sheet, certain derivatives which did not qualify for hedge accounting. During 2002, the variability in net income related to the instruments that qualified for hedge accounting was to some extent reduced when the Company was able to apply hedge accounting to certain assets and liabilities. (See Note 33 to the Consolidated Financial Statements.)

- (E)

- SEK holds securities in a number of different currencies which are classified as available for sale for U.S. GAAP purposes. No foreign exchange exposures arise from these holdings, because, although the value of the assets in Swedish kronor terms changes according to the relevant exchange rates, there is an identical offsetting change in the Swedish kronor value of the related funding. Under Swedish GAAP both the assets and the liabilities are translated at closing exchange rates and the differences between historical book value and current value are reflected in foreign exchange effects in earnings, where they offset each other. This reflects the economic substance of holding assets in a certain currency, financed by liabilities in that currency. However, under U.S. GAAP, after the adoption of SFAS No. 133, the valuation effects of changes in currency exchange rates on the value of the investments classified as available for sale and not otherwise hedged by a derivative in a fair value hedging relationship are taken directly to equity whereas the offsetting changes in Swedish kronor terms of the borrowing are reflected in earnings. This leads to an accounting result which does not reflect either the underlying risk position or the economics of the transactions. The result of the foregoing is that for the year 2003 SEK's U.S. GAAP net profit reflects the addition of Skr 720.4 million of foreign exchange difference on available-for-sale securities, which amount is not reflected in Swedish GAAP net profit before tax effects (2002: addition of 2,695.9 million, 2001: subtraction of 2,458.9 million). There is no difference in total shareholders' funds between Swedish GAAP and U.S. GAAP as a result of this treatment (even though there are differences in individual components of shareholders' funds). (See Note 33 to the Consolidated Financial Statements.)

- (F)

- Comprehensive income (loss) (U.S. GAAP) comprises net profit (loss) (U.S. GAAP) and other comprehensive income (U.S. GAAP). (See Note 33 to the Consolidated Financial Statements.)

- (G)

- For the purpose of calculating ratios of earnings to fixed charges, earnings consist of net profit for the year, plus taxes and fixed charges. Fixed charges consist of interest expenses, including borrowing costs, in the M-system.

- (H)

- Amounts of credits as reported under the "old format". The old format includes all credits—i.e., credits documented as interest-bearing securities (which are not included in the amounts reported as credits under the "new format"), as well as credits granted against traditional documentation. The amounts reported under the old format, in SEK's opinion, reflect the real credit/lending volumes of SEK. The comments regarding lending volumes included in this report therefore refer to amounts based on the old format unless otherwise stated. (See Note 17 to the Consolidated Financial Statements.)

3

Foreign Exchange Rates

The Company publishes its financial statements in Swedish kronor ("Skr"). The following table sets forth for the years indicated certain information concerning the exchange rate for Swedish kronor as against the U.S. dollar ("USD") based on the noon buying rate in New York City for cable transfers in foreign currencies as certified for customs purposes by the Federal Reserve Bank of New York.

Calendar Year

| | High

| | Low

| | Average(A)

| | Period End

|

|---|

| 2004 (through April 26) | | 7.7510 | | 7.0850 | | 7.5228 | | 7.6960 |

| 2003 | | 8.7920 | | 7.1950 | | 8.0351 | | 7.1950 |

| 2002 | | 10.7290 | | 8.6950 | | 9.6571 | | 8.6950 |

| 2001 | | 11.0270 | | 9.3250 | | 10.4328 | | 10.4571 |

| 2000 | | 10.3600 | | 8.3530 | | 9.2251 | | 9.4440 |

| 1999 | | 8.6500 | | 7.7060 | | 8.3001 | | 8.5050 |

- (A)

- The average of the exchange rates on the last day of each month during the period.

The following table sets forth for the months indicated certain information concerning the exchange rate for Swedish kronor as against the U.S. dollar based on the noon buying rate in New York City for cable transfers in foreign currencies as certified for customs purposes by the Federal Reserve Bank of New York.

One-Month Period Ended

| | High

| | Low

|

|---|

| April 2004 (through April 26) | | 7.7510 | | 7.4650 |

| March 31, 2004 | | 7.6620 | | 7.3660 |

| February 28, 2004 | | 7.4330 | | 7.1295 |

| January 31, 2004 | | 7.4120 | | 7.0850 |

| December 31, 2003 | | 7.5420 | | 7.1950 |

| November 30, 2003 | | 7.9150 | | 7.5200 |

| October 31, 2003 | | 7.8140 | | 7.5970 |

| September 30, 2003 | | 8.4345 | | 7.7040 |

The noon buying rate on April 26, 2004 was USD 1 = Skr 7.6960.

No representation is made that Swedish kronor amounts have been, could have been or could be converted into U.S. dollars at the foregoing rates on any of the dates indicated.

Item 4. Information on the Company

- a.

- General

SEK is a public stock corporation wholly-owned by the Swedish State through the Ministry of Foreign Affairs ("Sweden" or the "State").

SEK was founded in 1962 in order to strengthen the competitiveness of the Swedish export industry by meeting the need for long-term credits. SEK's objective is to engage in financing activities in accordance with the Swedish Financing Business Act and in connection therewith primarily to promote the development of Swedish commerce and industry as well as otherwise engage in Swedish and international financing activities on commercial grounds.

SEK aims to be a strong financial partner for both customers and investors. With the Nordic region as its base and home market, SEK provides long-term financial solutions tailored for the private and public sectors. Business activities include export credits, lending, project financing, leasing, capital market products and financial advisory services. SEK extends credits, or loans, under two principal lending systems. Credits on commercial terms at prevailing fixed or floating market rates of interest are

4

provided under the "Market Rate System" (the "M-system"), and credits on State-supported terms at fixed rates of interest that may be lower than prevailing fixed market rates are provided under the "State Support System" (the "S-system"). The S-system is administered on behalf of the State by SEK against compensation.

From its roots and base in export credits, SEK's product range has expanded to promote the development of Swedish commerce and industry and the Swedish export industry. Over the years, SEK has been active in the creation of new financial solutions. SEK's clear niche specialization in long-term financial products, combined with its financial capacity and flexible organization, are key factors in the management of its operations. SEK's borrowing activities in the international capital markets have given SEK expertise in financial instruments, an expertise that has earned international awards from financial publications on several occasions. This experience, together with maintaining credit quality and credit ratings (as of April 2004: AA+ stable outlook from Standard & Poors and Aa1 from Moody's Investors Service), has allowed SEK to offer its customers tailored products and what SEK believes are highly competitive terms.

SEK has intensified the broadening of both its range of services and customer base in recent years in response to changes in demand and the opportunities created by the development of new forms of cooperation and financial instruments. Among other things SEK has increased its financing of infrastructure projects with Swedish regional and local authorities, with the aim of supporting the development and competitiveness of Swedish commerce and industry. SEK has also to a greater extent become involved as a financial advisor for international projects. The expansion of SEK's services and customer base reflects SEK's efforts to become a broader-range finance house with specialists in a number of areas, while continuing to emphasize its traditional role as a long-term lender.

The increasing integration of business in the Nordic countries is consistent with SEK's goal of having a position in the Nordic countries within its niche: long-term financial solutions. The establishment in 2002 of SEK's representative office in Helsinki, with its focus on major Finnish companies and local authorities, furthers this development. The operations in Helsinki are important for strengthening SEK's position in the Nordic market.

SEK has been involved in Sweden's fast-growing trade with the countries in the Baltic region since the early 1990s. The overall goal is to contribute to a continued positive economic development in the region, while strengthening the presence of Swedish and Nordic business. Within the framework of these activities there are also links to the business opportunities that can be created by the enlargement in 2004 of the European Union to include new members from the Baltic region and Eastern Europe.

SEK's relationship with national, Nordic and other international investors and partners strengthen its ability to develop financial solutions which meet its customers' requirements. This network enables SEK to participate in co-financing solutions and advisory assignments, as well as in benchmarking and cooperation in areas such as risk management and business systems.

The address of the Company's principal executive office is AB Svensk Exportkredit (Swedish Export Credit Corporation), Västra Trädgårdsgatan 11B, Stockholm, Sweden, and the Company's telephone number is 011-46-8-613-8300. The Company's authorized representative in the United States is the Consulate General of Sweden, One Dag Hammarskjöld Plaza, 885 Second Avenue, New York, NY 10017, and the telephone number is (212) 583-2550.

5

The following table summarizes SEK's credits outstanding and debt outstanding at December 31, 2003, 2002, and 2001:

| | At December 31,

|

|---|

| | 2003

| | 2002

| | 2001

|

|---|

| | (Skr million)

|

|---|

| Total credits outstanding (old format)(A) | | 60,871 | | 65,470 | | 70,361 |

| | Of which S-system | | 7,730 | | 11,481 | | 15,454 |

Total debt outstanding |

|

135,566 |

|

114,838 |

|

128,039 |

| | Of which S-system | | 554 | | 3,179 | | 5,171 |

- (A)

- Amounts of credits as reported under the "old format". The old format includes all credits—i.e., credits documented as interest-bearing securities (which are not included in the amounts reported as credits under the "new format"), as well as credits granted against traditional documentation. These amounts, in SEK's opinion, reflect the real credit/lending volumes of SEK. The comments regarding lending volumes included in this report therefore refer to amounts based on the old format unless otherwise stated. (See also Note 17 to the Consolidated Financial Statements.)

- b.

- Lending Operations—General

The following table sets forth certain data regarding the Company's lending operations during the five-year period ended December 31, 2003:

| | At December 31,

| |

|---|

| | 2003

| | 2002

| | 2001

| | 2000

| | 1999

| |

|---|

| | (Skr million)

| |

|---|

| Offers of long-term credits accepted(A) | | 18,960 | | 13,365 | | 20,245 | | 20,665 | | 15,495 | |

| | Of which S-system(B) | | 1,939 | | 172 | | 743 | | 10,103 | | 3,881 | |

| Total credit disbursements | | 9,954 | | 7,896 | | 17,576 | | 7,760 | | 6,380 | |

| | Of which S-system | | 1,032 | | 1,377 | | 3,324 | | 1,573 | | 955 | |

| Total credit repayments, including effects of currency translations | | 17,334 | | 14,599 | | 17,563 | | 3,567 | | 6,134 | |

| | Of which S-system | | 4,784 | | 5,357 | | 1,951 | | 1,774 | | 2,454 | |

| Total net increase / (decrease) in credits outstanding | | 1,739 | | (6,478 | ) | (2,156 | ) | 4,042 | | (370 | ) |

| | Of which S-system | | (3,238 | ) | (3,981 | ) | 1,354 | | (201 | ) | (1,499 | ) |

Credits outstanding at December 31: |

|

|

|

|

|

|

|

|

|

|

|

| Credits outstanding (old format)(A) | | 60,870 | | 65,470 | | 70,361 | | 60,856 | | 60,314 | |

| Credits outstanding (new format)(A) | | 40,772 | | 39,033 | | 45,511 | | 47,667 | | 43,625 | |

| | Of which S-system | | 8,264 | | 11,502 | | 15,482 | | 14,128 | | 14,329 | |

| Total credit commitments outstanding at December 31 | | 14,358 | | 11,849 | | 16,444 | | 19,145 | | 7,838 | |

| | Of which S-system | | 10,025 | | 10,124 | | 12,088 | | 13,456 | | 4,445 | |

- (A)

- Amounts of credits reported under the "old format" include all credits—i.e., credits granted against documentation in the form of interest-bearing securities (which are not included in the credits reported as credits under the "new format"), as well as credits granted against traditional credit agreement documentation. Amounts reported under the old format, in SEK's opinion, reflect the real credit/lending volumes of SEK. The comments regarding lending volumes included in this report, therefore, refer to amounts based on the old format unless otherwise stated. (See also Note 17 to the Consolidated Financial Statements.)

- (B)

- SEK offers S-system financing at CIRR (Commercial Interest Reference Rate) rates. The CIRR-rates for new credits are subject to periodic review and adjustment by the OECD. As

6

described below under "—S-system", the OECD Consensus stipulates that credit offers will be valid for acceptance during a period of not more than four months. The attractiveness of an S-system credit offer is, therefore, dependent on the general movement of interest rates during the relevant four month period which is, in turn, a significant factor contributing to the year-to-year differences in offers of long-term credits accepted in the S-system.

Most of the credits granted by SEK are related to Swedish exports. Measured by revenues, the largest markets for the export of goods from Sweden are Western Europe and North America. However, exports to other, including less developed, markets are also important. Accordingly, the need for export financing may be related to transactions involving buyers in many different countries, with varying levels of creditworthiness. Pursuant to its counterparty risk exposure policy, SEK is selective in accepting any type of risk exposure. This policy seeks to ensure that SEK is not dependent on the creditworthiness of individual buyers of Swedish goods and services, nor on the countries in which they are domiciled, but on the creditworthiness of individual counterparties to whom SEK accepts counterparty risk exposure.

The following tables show the geographic distribution of SEK's credits outstanding (including credits granted against documentation in the form of interest-bearing securities) by domicile of borrower at the dates indicated. The tables further show, by domicile and category, the related risk counterparties to whom SEK's counterparty risk exposures are allocated when taking into account prevailing guarantees and collateral.

| |

| | At December 31, 2003

Domicile and category of the related counterparties, to whose risk SEK is exposed

|

|---|

| |

| | Sweden

| | Other Nordic Area

| | Other Western Europe & U.S.

|

|---|

Domicile of borrowers

| | Total

amount

| | Sum

| | Govern-

ment &

Munici-

palities

| | Bank

| | Corpo-

ration

| | Sum

| | Govern-

ment

| | Bank

| | Corpo-

ration

| | Sum

| | Govern-

ment

| | Bank

| | Corpo-

ration

|

|---|

| |

| | (Skr billions)

|

|---|

| Africa | | 1.4 | | 1.4 | | 1.3 | | | | 0.1 | | | | | | | | | | | | | | | | |

| Asia | | 8.1 | | 6.1 | | 5.8 | | 0.2 | | 0.1 | | 0.8 | | 0.7 | | 0.1 | | | | 1.2 | | 0.3 | | 0.9 | | |

| Latin America | | 5.6 | | 4.5 | | 4.1 | | 0.3 | | 0.1 | | 0.1 | | | | 0.1 | | | | 1.0 | | 0.3 | | 0.5 | | 0.2 |

| North America | | 1.1 | | 0.5 | | 0.3 | | | | 0.2 | | | | | | | | | | 0.6 | | | | 0.2 | | 0.4 |

| Sweden | | 31.5 | | 26.1 | | 10.0 | | 8.5 | | 7.6 | | | | | | | | | | 5.4 | | | | 5.4 | | |

| Other Nordic Area | | 9.1 | | | | | | | | | | 6.8 | | 1.6 | | 1.7 | | 3.5 | | 2.3 | | | | 2.3 | | |

| Other Western Europe | | 3.3 | | 0.1 | | 0.1 | | | | | | | | | | | | | | 3.2 | | | | 3.2 | | |

| Baltic Area | | 0.1 | | | | | | | | | | | | | | | | | | 0.1 | | | | | | 0.1 |

| Other Eastern Europe | | 0.7 | | 0.2 | | 0.2 | | | | | | | | | | | | | | 0.5 | | | | 0.5 | | |

| | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

|

| Total | | 60.9 | | 38.9 | | 21.8 | | 9.0 | | 8.1 | | 7.7 | | 2.3 | | 1.9 | | 3.5 | | 14.3 | | 0.6 | | 13.0 | | 0.7 |

| | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

|

7

| |

| | At December 31, 2002

Domicile and category of the related counterparties, to whose risk SEK is exposed

|

|---|

| |

| | Sweden

| | Other Nordic Area

| | Other Western Europe & U.S.

|

|---|

Domicile of borrowers

| | Total

amount

| | Sum

| | Govern-

ment &

Munici-

palities

| | Bank

| | Corpo-

ration

| | Sum

| | Govern-

ment

| | Bank

| | Corpo-

ration

| | Sum

| | Govern-

ment

| | Bank

| | Corpo-

ration

|

|---|

| |

| | (Skr billions)

|

|---|

| Africa | | 1.4 | | 1.3 | | 1.3 | | | | | | | | | | | | | | 0.1 | | 0.1 | | 0.0 | | |

| Asia | | 12.0 | | 9.2 | | 8.7 | | 0.4 | | 0.1 | | 1.1 | | 1.0 | | 0.1 | | | | 1.7 | | 0.4 | | 1.3 | | |

| Pacific | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Latin America | | 7.2 | | 6.2 | | 5.7 | | 0.4 | | 0.1 | | 0.1 | | | | 0.1 | | | | 0.9 | | 0.4 | | 0.5 | | |

| North America | | 6.3 | | 0.2 | | 0.2 | | | | | | | | | | | | | | 6.1 | | | | 5.2 | | 0.9 |

| Sweden | | 25.3 | | 25.1 | | 7.3 | | 9.1 | | 8.7 | | 0.2 | | | | | | 0.2 | | | | | | | | |

| Other Nordic Area | | 6.7 | | | | | | | | | | 6.7 | | 1.2 | | 1.2 | | 4.3 | | | | | | | | |

| Other Western Europe | | 6.1 | | 0.2 | | 0.1 | | 0.1 | | 0.0 | | | | | | | | | | 5.9 | | | | 4.7 | | 1.2 |

| Baltic Area | | 0.1 | | 0.1 | | 0.1 | | | | 0.0 | | | | | | | | | | | | | | | | |

| Other Eastern Europe | | 0.4 | | 0.4 | | 0.3 | | | | 0.1 | | | | | | | | | | | | | | | | |

| | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

|

| Total | | 65.5 | | 42.7 | | 23.7 | | 10.0 | | 9.0 | | 8.1 | | 2.2 | | 1.4 | | 4.5 | | 14.7 | | 0.9 | | 11.7 | | 2.1 |

| | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

|

| |

| | At December 31, 2001

Domicile and category of the related counterparties, to whose risk SEK is exposed

|

|---|

| |

| | Sweden

| | Other Nordic Area

| | Other Western Europe & U.S.

|

|---|

Domicile of borrowers

| | Total

amount

| | Sum

| | Govern-

ment &

Munici-

palities

| | Bank

| | Corpo-

ration

| | Sum

| | Govern-

ment

| | Bank

| | Corpo-

ration

| | Sum

| | Govern-

ment

| | Bank

| | Corpo-

ration

|

|---|

| |

| | (Skr billions)

|

|---|

| Africa | | 1.9 | | 1.8 | | 1.7 | | 0.1 | | 0.0 | | 0.0 | | | | 0.0 | | 0.0 | | 0.1 | | 0.1 | | 0.0 | | |

| Asia | | 16.0 | | 12.4 | | 11.7 | | 0.6 | | 0.1 | | 1.6 | | 1.5 | | 0.1 | | 0.0 | | 2.0 | | 0.1 | | 1.9 | | |

| Latin America | | 10.0 | | 8.6 | | 8.0 | | 0.6 | | 0.0 | | 0.1 | | | | 0.1 | | 0.0 | | 1.3 | | 0.5 | | 0.8 | | 0.0 |

| North America | | 4.7 | | 0.2 | | 0.1 | | 0.0 | | 0.1 | | | | | | | | | | 4.5 | | | | 3.7 | | 0.8 |

| Sweden | | 25.9 | | 25.6 | | 5.2 | | 11.7 | | 8.7 | | 0.3 | | | | | | 0.3 | | | | | | | | |

| Other Nordic Area | | 7.2 | | | | | | | | | | 7.2 | | 2.0 | | 1.2 | | 4.0 | | | | | | | | |

| Other Western Europe | | 3.8 | | 0.2 | | 0.2 | | 0.0 | | | | 0.0 | | 0.0 | | | | 0.0 | | 3.6 | | | | 3.2 | | 0.4 |

| Baltic Area | | 0.2 | | 0.2 | | 0.2 | | 0.0 | | 0.0 | | 0.0 | | | | | | 0.0 | | | | | | | | |

| Other Eastern Europe | | 0.7 | | 0.7 | | 0.3 | | 0.0 | | 0.4 | | | | | | | | | | | | | | | | |

| | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

|

| Total | | 70.4 | | 49.7 | | 27.4 | | 13.0 | | 9.3 | | 9.2 | | 3.5 | | 1.4 | | 4.3 | | 11.5 | | 0.7 | | 9.6 | | 1.2 |

| | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

|

As most credits are supported by elements from more than one category, resulting in more than one party being responsible for the same payments to SEK, the above tables reflect the counterparty (either borrower or guarantor) that SEK believes to be the stronger credit.

8

M-system

SEK reports credits in the M-System in the following categories:

- 1.

- Medium and long-term export financing of capital goods and services.

- 2.

- Lines of credit for the refinancing of finance companies', banks' and exporting companies' portfolios of revolving export receivables ("continuous-flow financing").

- 3.

- Credits for investments in infrastructure, as well as research and development, to promote Swedish industry and commerce.

- 4.

- Refinancing of export leasing agreements and short-term export finance.

- 5.

- Credits for direct market investments abroad that will promote exports of Swedish goods and services.

- 6.

- Balance of payment credits, made on behalf of the State against State guarantees, to countries in Central and Eastern Europe in fulfillment of the Swedish commitment within the Group of 24 countries ("G-24 loans").

SEK's lending also includes financing in cooperation with intergovernmental organizations and foreign export credit agencies. (These credits are included under the relevant underlying type of credit).

The Company also extends export financing by establishing credit lines or protocols, principally with countries in Eastern Europe and Asia. (These credits are included under the relevant underlying type of credit).

Under the regulations of the Swedish Financial Supervisory Authority, as described in Note 1 to the Consolidated Financial Statements, credits granted against documentation in the form of interest-bearing securities, as opposed to traditional credit agreements, are reported on the balance sheet as one component of securities classified as fixed financial assets. However, deposits with banks and repurchase agreements are reported as credits.

Credits outstanding in the M-system at December 31, 2003, 2002 and 2001 were distributed among SEK's various categories of credits as follows:

Credits outstanding, type of credits

| | 2003

| | 2002

| | 2001

|

|---|

| | (Skr million)

|

|---|

| Financing of capital goods exports | | 10,919 | | 12,699 | | 17,074 |

| Other export related credits | | 17,212 | | 20,994 | | 25,854 |

| Infrastructure | | 25,009 | | 20,296 | | 11,979 |

| | |

| |

| |

|

| Total | | 53,140 | | 53,989 | | 54,906 |

| | |

| |

| |

|

Offers granted by the Company for credits under the M-system that borrowers accepted during the years ended December 31, 2003, 2002 and 2001 were distributed among SEK's various categories of credits as follows:

Offers accepted, type of credit

| | 2003

| | 2002

| | 2001

|

|---|

| | (Skr million)

|

|---|

| Financing of capital goods exports | | 4,148 | | 701 | | 5,634 |

| Other export related credits | | 7,863 | | 8,447 | | 12,448 |

| Infrastructure | | 5,010 | | 4,045 | | 1,421 |

| | |

| |

| |

|

| Total | | 17,021 | | 13,193 | | 19,503 |

| | |

| |

| |

|

9

The reduction over the last three years in credits attributable to the financing of export transactions directly and indirectly through continuous flow financing reflects several factors. One of the more important is the general business downturn that reduced capital expenditures, especially in the private sector.

A more long-term relevant trend has been the reduction in importance of the financing of traditional capital goods in Sweden's export industry. SEK's services have therefore changed over time to meet customers' needs. This means that a credit granted could be either in the form of capital goods export financing or another category of export related credits. In addition, export financing has become more competitive, especially in the recent low interest-rate environment, as financial markets have been deregulated and more exporting companies finance their own sales to gain additional revenue and enhance their competitive position. As SEK is a relatively small player in the market, the changes in volumes from year to year are more the effect of specific business opportunities than the effect of fluctuation in the overall volume of the markets for export credits.

The growth in infrastructure credits reflects the decision in 1996 to broaden SEK's mandate to include infrastructure financing that directly or indirectly enhances the Swedish export industry. In that connection municipalities and other public authorities in Sweden and elsewhere in the Nordic region have become an increasingly important sector of business that SEK targets.

Export financing credits in the M-system are made at prevailing market rates of interest. The Company normally makes credit offers at a quoted interest rate that is subject to change prior to acceptance of the credit offer (an "indicative credit offer"). However, credit offers can also be made at a binding interest rate (a "firm credit offer"), but such credit offers have until now rarely been made in the M-system and are then only valid for short periods. When a borrower accepts an indicative credit offer, the interest rate is set and a binding credit commitment by the Company arises. Before the Company makes any credit commitment, it ensures that the currency in which the credit is to be funded is expected to be available for the entire credit period at an interest rate that, as of the day the commitment is made, results in a margin that the Company deems sufficient. Except for the portion of the Company's credits in Swedish kronor that are financed by the Company's shareholders' funds and untaxed reserves, the Company borrows, on an aggregate basis, at maturities corresponding to or exceeding those of prospective credits. The Company may accordingly decide not to hedge for movements in interest rate risk particular credit commitments until some time after they are made. Interest rate risks associated with such uncovered commitments are monitored closely and may not exceed interest rate risks limits established by the Board of Directors. The Company's policies with regard to counterparty exposures are described in Item 11.a "Quantitative and Qualitative Disclosures about Market Risk—Risk Management—Credit or Counterparty Risks".

The Company's initial credit offer and subsequent credit commitment set forth the maximum principal amount of the credit, the currency in which the credit will be denominated, the repayment schedule and the disbursement schedule.

10

The following table shows the currency breakdown of credit offers accepted in the M-system for credits with maturities exceeding one year for each year in the three-year period ended December 31, 2003.

| | Percentage of credit offers accepted

| |

|---|

Currency in which credit is denominated

| |

|---|

| | 2003

| | 2002

| | 2001

| |

|---|

| Swedish kronor | | 36 | % | 47 | % | 23 | % |

| Euro | | 40 | % | 47 | % | 34 | % |

| U.S. dollars | | 17 | % | 5 | % | 40 | % |

| Other | | 7 | % | 1 | % | 3 | % |

| Total | | 100 | % | 100 | % | 100 | % |

S-system

The S-system was established by the State on July 1, 1978, as a State-sponsored export financing program designed to maintain the competitive position of Swedish exporters of capital goods and services in world markets. After a trial period, in April 1984 the Swedish Parliament extended the S-system indefinitely. The S-system today comprises the normal export financing program and a tied aid credit program. Pursuant to arrangements established in 1978 and amended from time to time thereafter, the Company administers the S-system on behalf of the State against compensation based mainly on outstanding credit volumes.

Pursuant to agreements between SEK and the State, as long as any credits or borrowings remain outstanding under the S-system, the difference between interest revenues and net commission revenues related to lending and liquid assets under the S-system, on the one hand, and interest expenses related to borrowing, all financing costs and any net foreign exchange losses incurred by SEK under the S-system, on the other hand, are reimbursed by the State. SEK treats the S-system as a separate operation for accounting purposes, with its own income statement. Although the deficits (surpluses) of programs under the S-system are reimbursed by (paid to) the State, any credit losses that would be incurred under such programs are not reimbursed by the State. Accordingly, SEK has to obtain appropriate credit support for these credits as well, all of which are reported on SEK's balance sheet.

The S-system is designed to comply with the Arrangement on Guidelines for Officially Supported Export Credits of the Organization for Economic Cooperation and Development (the "OECD Consensus"), of which Sweden is a member. The OECD Consensus establishes minimum interest rates, required down payments and maximum credit periods for government-supported export credit programs. Terms vary according to the per capita income of the importing country.

SEK offers S-system financing at CIRR (Commercial Interest Reference Rate) rates. The CIRR-rates for new credits are subject to periodic review and adjustment by the OECD. The OECD Consensus stipulates that credit offers will be valid for acceptance during a period of not more than four months.

Effective September 1, 2002, certain new conditions were introduced for CIRR-based credits. Firstly, the commitment fee of 0.25 percent was removed. Secondly, a compensation of 0.25 percent per annum, based on outstanding credit amount was introduced to the benefit of the bank or financial institution leading the credit, to cover the costs of arranging and managing the facility. In addition, the conditions have been amended to permit the applicant to submit the application to the Swedish Export Credits Guarantee Board (the "EKN"), as an alternative to SEK. Regardless, SEK will be responsible for the administration and funding of all transactions.

The OECD Consensus also strengthens the rules for tied or partially tied concessionary credits. In principle, during 2003 such credits were not permitted to be extended to countries whose per capita

11

GNP for the year 2002 was greater than USD 2,935. Tied or partially tied concessionary credits to other countries were not permitted to be extended to finance public or private projects that normally would be commercially viable if financed on market or OECD Consensus terms.

SEK participates with government agencies in a State-sponsored export financing program (the "Concessionary Credit Program") for exports to certain developing countries, presently incorporating a foreign aid element of at least 35 percent. The foreign aid element is granted in the form of lower rates of interest and/or deferred repayment schedules, and the State reimburses SEK in the S-system for the costs incurred as a result of SEK's participation in such program. In general, credits under the program are made with State guarantees administered by the EKN. All such credits granted by SEK must also undergo SEK's customary approval process.

The following table sets forth the volumes of offers accepted, undisbursed credits at year end, new credits disbursed and credits outstanding at year end under the various programs in the S-system for each year in the three-year period ended December 31, 2003.

| | Concessionary Credit Program

| | CIRR-credits

| | Total

|

|---|

| | 2003

| | 2002

| | 2001

| | 2003

| | 2002

| | 2001

| | 2003

| | 2002

| | 2001

|

|---|

| | (Skr million)

|

|---|

| Offers accepted | | 47 | | 172 | | 279 | | 1,892 | | 0 | | 464 | | 1,939 | | 172 | | 743 |

| Undisbursed credits at year end | | 67 | | 253 | | 316 | | 9,957 | | 9,871 | | 11,772 | | 10,025 | | 10,124 | | 12,088 |

| New credits disbursed | | 148 | | 204 | | 208 | | 884 | | 1,173 | | 3,116 | | 1,032 | | 1,377 | | 3,324 |

| Credits outstanding at year-end | | 2,106 | | 3,990 | | 5,699 | | 5,624 | | 7,491 | | 9,755 | | 7,730 | | 11,481 | | 15,454 |

Credit Support for Outstanding Credits

The Company's policies with regard to counterparty exposures are described in Item 11.a "Quantitative and Qualitative Disclosures about Market Risk—Risk Management—Credit or Counterparty Risks".

The following table shows the credit support by category for the Company's outstanding credits for the five-year period ended December 31, 2003. As most credits are supported by elements from more than one category, resulting in more than one party being responsible for the same payments to SEK, this table reflects the counterparty (either borrower or guarantor) that SEK believes to be the stronger credit.

| | Percentage of Total Credits

Outstanding at December 31,

| |

|---|

| | 2003

| | 2002

| | 2001

| | 2000

| | 1999

| |

|---|

| Credits with State guarantees via | | | | | | | | | | | |

| National Debt Office(A) | | 3 | % | 3 | % | 3 | % | 5 | % | 5 | % |

| Credits with State guarantees via EKN(B) | | 20 | % | 26 | % | 33 | % | 29 | % | 31 | % |

| Credits with State guarantees (total) | | 23 | % | 29 | % | 36 | % | 34 | % | 36 | % |

| Credits to or guaranteed by Swedish credit institutions(C) | | 15 | % | 15 | % | 18 | % | 30 | % | 33 | % |

| Credits to or guaranteed by foreign bank groups or governments(D) | | 28 | % | 25 | % | 22 | % | 13 | % | 14 | % |

| Credits to or guaranteed by other Swedish counterparties, primarily corporations(E) | | 10 | % | 14 | % | 10 | % | 13 | % | 10 | % |

| Credits to or guaranteed by Municipalities | | 14 | % | 7 | % | 3 | % | 2 | % | 2 | % |

| Credits to or guaranteed by other foreign counterparties, primarily corporations | | 10 | % | 10 | % | 11 | % | 8 | % | 5 | % |

| | |

| |

| |

| |

| |

| |

| Total | | 100 | % | 100 | % | 100 | % | 100 | % | 100 | % |

| | |

| |

| |

| |

| |

| |

12

See "—Lending Operations—General" for information on the geographical distribution of borrowers.

- (A)

- State guarantees issued by the National Debt Office are unconditional obligations backed by the full faith and credit of Sweden.

- (B)

- EKN guarantees are in substance credit insurance against losses caused by the default of a foreign borrower or buyer in meeting its contractual obligations in connection with the purchase of Swedish goods or services. In the case of a foreign private borrower or buyer, coverage is for "commercial" and, in most cases, "political" risks. Coverage for "commercial" risk refers to losses caused by events such as the borrower's or buyer's insolvency or failure to make required payments within a certain time period (usually six months). Coverage for "political" risk refers to losses caused by events such as a moratorium, revolution or war in the importing country or the imposition of import or currency control measures in such country.

Generally, an EKN guarantee covers 85-90 percent of losses incurred due to covered risks. Disputed claims must be resolved by a court judgment or arbitral award, unless otherwise agreed by EKN. In the case of a governmental borrower or buyer, the coverage provided by EKN guarantees is effectively as broad. In the table above, only the percentages guaranteed have been included.

EKN is a State agency whose obligations are backed by the full faith and credit of Sweden.

- (C)

- At December 31, 2003, credits in this category amounting to approximately 7 percent of total credits were obligations of the four largest commercial bank groups in Sweden.

- (D)

- Principally obligations of other Nordic, Western European or North American bank groups, together with obligations of Western European governments.

- (E)

- At December 31, 2003, approximately 63 percent of credits in this category represented credits to or guarantees issued by ten large Swedish corporations.

The decline in credits guaranteed by the Swedish Government and credit institutions and the increase in credits guaranteed by foreign governments and institutions is a result of SEK's diversification strategy. Under this strategy, SEK's intention is to reduce the relative proportion of its risk exposure towards Swedish counterparties.

- c.

- Organization

SEK organizes its activities into two main business areas: Corporate & Structured Finance, and Capital Markets.

Corporate & Structured Finance. The Corporate & Structured Finance group is responsible for all activities in general lending, export credits, project finance, leasing and other structured finance projects, as well as origination and advisory services. Corporate has overall responsibility for SEK's relationships with its customers. As a complement to SEK's lending activity, advisory services offers independent consulting services to both the private and public sectors based on SEK's experience in various areas, especially export credits and project finance, risk management and capital markets.

Capital Markets. The Capital Markets group comprises three sub-functions and one wholly-owned limited company. The three sub-functions are Treasury, Syndication, and Credit Investments. The limited company is AB SEK Securities. Treasury is responsible for managing SEK's borrowing program and the investment of its liquidity portfolio. See Item 5, "Operating and Financial Review and Prospects—Liquidity, Capital Resources and Funding—Liquidity". Syndication handles risk syndication and risk cover solutions. Credit Investments handles corporate bond investment and trading. AB SEK Securities is a wholly-owned subsidiary with a license from the Swedish Financial Supervisory Authority

13

to conduct a securities business. AB SEK Securities intermediates capital markets products principally in the primary market via private placements.

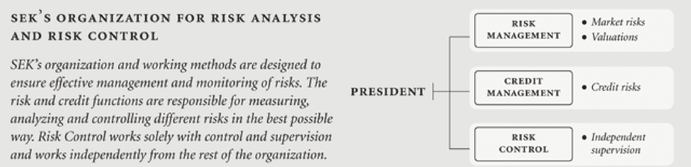

In addition, SEK maintains a risk control unit that operates independently of the business areas. See Item 11, "Quantitative and Qualitative Disclosures About Market Risk—Risk Management—Risk Control".

- d.

- Swedish Government Supervision

The Company operates as a credit market institution within the meaning of the Swedish Financing Business Act (1992:1610) (the "Act"). As such, it is subject to supervision and regulation by the Swedish Financial Supervisory Authority (the "Supervisory Authority"), an arm of the Ministry of Finance, which licenses and monitors the activities of credit market companies to ensure their compliance with the Act and regulations thereunder and their corporate charters.

Among other things, the Swedish Financial Supervisory Authority requires SEK to submit reports on a three-month, six-month and twelve-month basis and may conduct periodic inspections. The Supervisory Authority also may (and currently does) appoint an external auditor to participate with SEK's independent auditors in examining the Company's financial statements and the management of the Company.

As a credit market institution, SEK is also subject to regulation of its capital adequacy and limits on credit to a single customer pursuant to the Capital Adequacy and Large Exposures (Credit Institutions and Securities Companies) Act, as amended.

The capital adequacy requirements under Swedish law comply with international guidelines, including the recommendations issued by the Basel Committee on Banking Regulation and Supervisory Practices at the Bank for International Settlements. The principal measure of capital adequacy is a capital to risk asset ratio, which compares the capital base to the total of assets and off-balance sheet items. The capital base is divided into two components, one of them being "core" or "Tier 1" capital, which includes equity capital and, with certain limitations, non-cumulative preferred shares and similar instruments. Non-cumulative preferred shares and similar instruments may not be included in Tier 1 capital to the extent they exceed 15% of the Tier 1 capital other than non-cumulative preferred shares and similar instruments. The other component in the capital base is "supplementary" or "Tier 2" capital, which includes non-cumulative preferred shares and similar instruments not included in core capital, plus subordinated obligations with an original term of at least five years (with a deduction of 20% for each of the last five years prior to maturity). Assets are assigned a weighting based on relative credit risk (0%, 20%, 50% or 100%) depending on the debtor or the type of collateral, if any, securing the assets. The minimum capital ratio requirement is 8%, and not more than 50% of an institution's regulatory capital may comprise supplementary capital. SEK's policy is to maintain a strong capital base, well in excess of the regulatory minimum. At December 31, 2003, SEK's total regulatory capital ratio was 16.6% and its Tier 1 ratio was 9.5%. See also Item 5, "Operating and Financial Review and Prospects—Liquidity, Capital Resources and Funding—Capital Adequacy."

Under the regulatory rules for large exposures, a "large exposure" is defined as an (risk-weighted) exposure to a single counterparty (or counterparty group) that exceeds 10 percent of the institution's regulatory total capital base. These rules state that no individual large exposure may exceed 25 percent of the regulatory total capital base of the institution, and that the aggregate amount of large exposures may not exceed 800 percent of the institution's regulatory total capital base. The aggregate amount of SEK's large exposures on December 31, 2003, was less than 150 percent of SEK's regulatory total capital base, and consisted of risk-weighted exposures to ten different counterparties (or counterparty groups). These counterparties (or counterparty groups) were all rated by at least one of the major rating agencies, Moody's and Standard & Poor's, with ratings of not lower than investment grade.

14

The Company's subsidiary, AB SEK Securities, has been licensed to conduct a securities business and as such is regulated by the Swedish Financial Supervisory Authority under the Securities Operations Act.

- e.

- Competition

SEK is the only institution authorized by the State to make export financing credits under the S-system. In that connection, and with support from the Swedish State, SEK competes with the export credit agencies of other OECD member countries in providing government-supported export credits. Lending in the M-system faces competition from other Swedish and foreign financial institutions, as well as from direct or indirect financing programs of exporters themselves. Deregulation and globalization of the word's financial markets have resulted in an increasingly competitive environment for financial institutions, including SEK, for both lending opportunities and funding sources.

- f.

- Property, Plants and Equipment

The Company owns, through its wholly-owned subsidiary AB SEKTIONEN, an office building in the City of Stockholm. The major part of the building is used by the Company as its headquarters.

Item 5. Operating and Financial Review and Prospects

- a.

- Overview

Substantially all of SEK's revenues and net income derive from the net interest revenues earned on its credits and interest-bearing securities. Funding for these assets comes from shareholders' funds and debt securities issued in the international capital markets. Accordingly, key elements in SEK's profits from year to year are the spread, or difference, between the rate of interest earned on its debt-financed assets and the cost of that debt, the rate of interest earned on the investment of its shareholders' funds and the outstanding volumes of credits and interest-bearing securities in the balance sheet, as well as the relative proportions of its assets funded by debt and shareholders' funds.

In recent years SEK's net profit under Swedish GAAP has been declining. This reflects several factors, including (1) reductions in shareholders' funds in 2000 and 2003 in connection with changes in SEK's ownership, resulting in a higher proportion of SEK's assets being funded through debt financing, and (2) the lower interest rate environment in recent years that has resulted in maturing investments of the Company's shareholders' funds being reinvested at lower interest rates.

The Company expects to rebuild shareholders' funds through retained earnings and a restrictive dividend policy. In recent years SEK has also expanded into business areas that may produce non-interest revenue, although commission income has not thus far made a material contribution to SEK's revenues and profits.

- b.

- Critical Accounting Policies and Estimates

Critical Accounting Policies and Estimates under Swedish GAAP

The Company has identified as critical accounting policies those accounting policies regarding the application of hedge accounting according to Swedish GAAP. For accounting policies regarding hedge accounting according to Swedish GAAP see below and Note 1(j), and Note1(q) to the Consolidated Financial Statements.

The Company's lending and investing transactions are hedged on-balance sheet or off-balance sheet by transactions with matching principal or notional amounts, interest rates, currencies, and other relevant factors, such that the Company's exposure to changes in net fair values of such transactions due to movements in interest and/or exchange rates is hedged. Under Swedish GAAP, SEK applies hedge accounting for all transactions that are economically hedged.

For transactions without matched and offsetting balance sheet positions, SEK enters into derivative transactions, in order to achieve an effective economic hedge. These instruments include interest-rate related, currency related and other agreements that SEK uses for the purpose of hedging or eliminating mainly interest rate and currency exchange rate exposures.

SEK accounts for derivatives in accordance with hedge accounting rules under Swedish GAAP. If hedge accounting is applicable, changes in the amortized cost of the derivative is recorded in earnings which

15

corresponds to a similar but opposite change in the amortized cost of the underlying assets or liabilities also recorded in earnings. For the major part of transactions on- or off balance sheet, both derivatives and underlying instruments are recorded at amortized cost or both derivatives and underlying instruments are marked-to-market, meaning that the economic purpose of holding the derivative is always reflected in the accounting treatment under Swedish GAAP.

In reporting the amounts of its assets, liabilities, derivatives, and its revenues and expenses, the Company must make assumptions and estimates in assessing the fair value of certain assets, liabilities, and derivatives especially where unquoted or illiquid securities or other debt instruments are involved. If the conditions underlying these assumptions and estimates were to change, the amounts reported could be different. However, under Swedish GAAP, when applying hedge accounting, the net of revenues and expenses would be substantially unchanged.

Changes in amounts reported are reflected in the net carrying value of the securities where they are carried at fair value. Where the securities are carried at amortized cost, changes in their estimated fair values, arising from changes in management's assessment of the underlying assumptions, may result in the recording of a permanent diminution in their value. In such case, it would also be necessary for SEK's management to exercise judgment as to whether or not changes in the underlying valuation assumptions are only temporary. SEK monitors on an ongoing basis the validity of such assumptions.

SEK is economically hedged regarding foreign currency exchange revaluation effects related to revaluation of balance sheet components. A major part of its assets, liabilities, and related derivatives is denominated in foreign currency. Under Swedish GAAP both the assets and the liabilities are translated at closing exchange rates and the differences between historical book value and current value are reflected as foreign exchange effects in revenues and expenses, where they offset each other. This reflects the economic substance of holding currency assets financed by liabilities denominated in, or hedged, into the same currency.

Critical Accounting Policies in Reconciliation to U.S. GAAP

The Company has also identified as critical accounting policies those accounting policies regarding the application of hedge accounting according to U.S GAAP. For accounting policies regarding hedge accounting and measurements of fair values according to U.S. GAAP see Note 1(j), 1(q), and Note 33.

On January 1, 2001, SFAS No. 133, Accounting for Derivative Instruments and Hedging Activities, and SFAS No. 138, Accounting for Certain Derivative Instruments and Certain Hedging Activities, became applicable to SEK. SEK did not achieve hedge accounting under U.S. GAAP for any of its instruments at the inception of SFAS 133. Although SEK structured a substantial portion of its transactions to qualify for hedge accounting treatment under these rules beginning in July 2002, certain transactions for which SEK is economically hedged continue not to qualify for hedge accounting treatment under U.S. GAAP. For these reasons, from January 1, 2001 and going forward there have been and are expected to continue to be significant differences between SEK's net profit and shareholders' funds calculated under Swedish GAAP as compared to these items calculated under U.S. GAAP. These differences arise primarily from the requirements of U.S. GAAP that (1) changes in the fair value of derivatives that are not part of a qualifying fair value hedge relationship are required to be recognized currently in the income statement while the contract which the derivative is economically hedging is carried at amortized cost and (2) changes in currency exchange rates affecting the fair value of foreign-currency instruments in the available-for-sale portfolio that are not eligible for hedge accounting are reported only as increases or decreases in shareholders' funds, while the largely offsetting changes in the Swedish kronor position of the related funding must be recognized currently in the income statement. Based on its experience and knowledge of the functioning of SEK's economic hedging, management believes Swedish GAAP better reflects the effects of the economic hedge relationships on net income and shareholders' funds.

For a more detailed description of critical accounting policies and estimates under U.S. GAAP, see Note 33 to the Consolidated Financial Statements.

- c.

- Assets and Business Volume

16

Total Assets

SEK's total assets at December 31, 2003, increased to Skr 151.8 billion (2002: 132.5). The main components of the net change in total assets were an increase by Skr 20.6 billion in the portfolio of interest-bearing securities, and a decrease by Skr 4.6 billion in the credit portfolio. Currency exchange effects negatively affected the book values of the aforementioned portfolios by approximately Skr 6.2 billion and Skr 4.0 billion, respectively, primarily as a result of the depreciation of the U.S. dollar. Credits outstanding represented Skr 60.9 billion (2002: 65.5) of total assets, while interest-bearing securities represented Skr 79.6 billion (2002: 59.0).

In addition to the revenue-generating assets, the balance sheet at year-end 2003 also included Skr 3.4 billion (2002: 3.4) representing accrued and prepaid items, Skr 0.2 billion (2002: 0.2) representing non-financial assets, and Skr 7.7 billion (2002: 4.5) representing other assets. The main component of the latter item is the aggregate net value of derivative instruments with positive values (see Note 1 (q) to the Consolidated Financial Statements). The approximate month-end average volume of total assets during the year was Skr 139.3 billion (2002: 140.0).

SEK experienced a lower cost of funding after the change in ownership in June 2003, although there was no change in responsibility for SEK's obligations. This resulted in increased borrowing activities during the latter part of the year and, in turn, the significant growth in interest-bearing securities by year-end. The increase in borrowed funds from such activities has and will be used to fund credits committed though not yet disbursed as well as offers accepted. The volume of credits committed though not yet disbursed increased during the year.

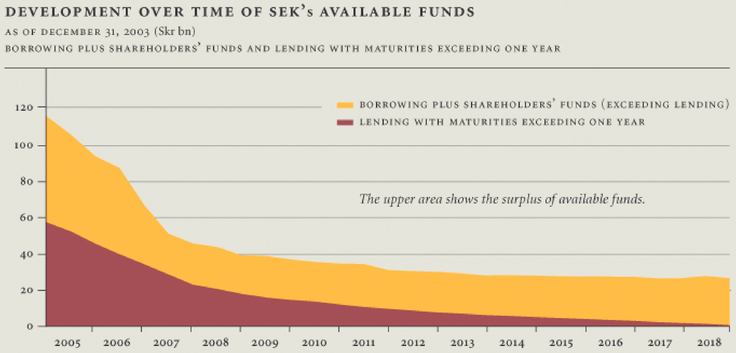

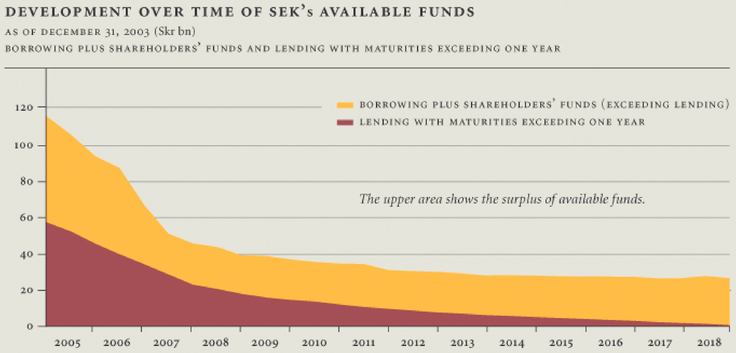

SEK continues to have a high level of liquid assets and a low funding risk. At December 31, 2003, the aggregate volume of funds borrowed and shareholders' funds exceeded the aggregate volume of credits outstanding and credits committed though not yet disbursed at all maturities. See also the graph "Development over Time of SEK's Available Funds" under Item 11, "Quantitative and Qualitative Disclosures About Market Risks—Risk Management—Funding and Liquidity Risks". SEK's current policy is to invest its surplus liquidity in instruments with maturities not exceeding three years and ratings of at least AA3 from Moody's and AA- from Standard & Poor's.

Business Volume

In 2003 SEK reached a total volume of new customer-related financial transactions amounting to Skr 23.2 billion (2002: 17.9). New direct long-term credits granted totaled Skr 19.0 billion (2002: 13.4) and SEK's share of syndicated customer transactions totaled Skr 4.2 billion (2002: 4.5). The increase in new business during the year was achieved in spite of the weak international economic development.

Of the direct lending to customers, export credits represented Skr 6.1 billion (2002: 0.9) of new credits, infrastructure credits Skr 5.0 billion (2002: 4.0) and other direct lending Skr 7.9 billion (2002: 8.5).

Skr 1.9 billion (2002: 0.2) of these credits was granted under the S-system.

Syndicated customer transactions were partly provided by AB SEK Securities ("SEK Securities"), a wholly-owned subsidiary established in 2002. SEK Securities offers SEKs' customers financing via the capital market, primarily in private placement transactions.

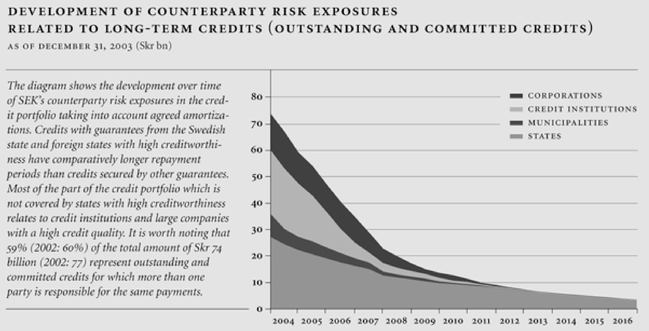

The aggregate amount of credits outstanding and credits committed though not yet disbursed at year-end was Skr 74.4 billion (2002: 77.3), of which Skr 60.9 billion (2002: 65.5) represented credits outstanding. Of the aggregate amount of credits outstanding and credits committed at December 31, 2003, Skr 17.8 billion (2002: 21.6) was related to the S-system, of which Skr 7.7 billion (2002: 11.5) represented credits outstanding. The decrease in credits outstanding mainly reflects currency exchange effects due to the weakening of the U.S. dollar during the year.

At the same time, the aggregate amount of outstanding offers for new credits at year-end decreased to Skr 30.7 billion (2002: 59.7). The decrease was due to the fact that a few large offers expired during 2003.

17

Volume Development, Lending

| | Total

| | Of which S-system

|

|---|

| |

| |

| | Total

| | Of which

|

|---|

| | 2003

| | 2002

| | 2003

| | 2002

| | CIRR-credits

2003

| | Concessionary credits

2003

|

|---|

| | (Skr million)

|

|---|

| Offers of direct long-term credits accepted(A) | | 18,960 | | 13,365 | | 1,939 | | 172 | | 1,892 | | 47 |

| Syndicated customer transactions | | 4,227 | | 4,558 | | — | | — | | — | | — |

| Total customer-related financial transactions | | 23,238 | | 17,923 | | 1,939 | | 172 | | 1,892 | | 47 |

| Undisbursed credits at year-end(A) | | 13,494 | | 11,849 | | 10,025 | | 10,124 | | 9,957 | | 67 |

| Credits outstanding at year-end (old format)(A) | | 60,870 | | 65,470 | | 7,730 | | 11,481 | | 5,624 | | 2,106 |

| Credits outstanding at year-end (new format)(A) | | 40,772 | | 39,033 | | 8,264 | | 11,502 | | 6,158 | | 2,106 |

- (A)

- Amounts of credits reported under the "old format" include all credits—i.e., credits granted against documentation in the form of interest-bearing securities (which are not included in the credits reported as credits under the "new format"), as well as credits granted against traditional credit agreement documentation. Amounts reported under the old format, in SEK's opinion, reflect the real credit/lending volumes of SEK. The comments regarding lending volumes included in this report, therefore, refers to amounts based on the old format unless otherwise stated. See also Note 17 to the Consolidated Financial Statements.

- d.

- Counterparty Risk Exposures

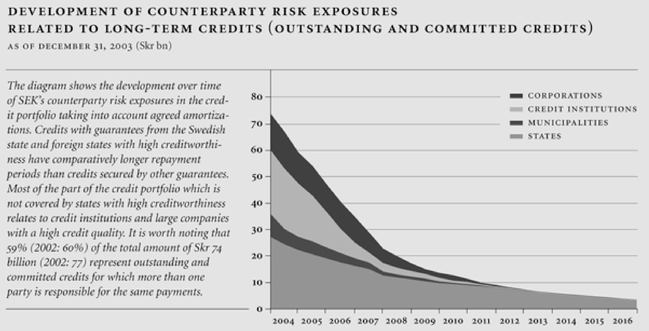

SEK aims to maintain its asset quality at a high level. The table "Counterparty Risk Exposures" in Item 11.a, "Quantitative and Qualitative Disclosures About Market Risk—Risk Management—Credit or Counterparty Risks" shows the distribution of risk exposures to the various categories of counterparties of SEK's on-balance sheet assets and off-balance sheet items. Of the total risk exposure 18 percent (2002: 27) was against highly rated OECD states; 6 percent (2002: 4) was against local and regional authorities; 65 percent (2002: 56) was against banks, mortgage institutions and other financial institutions and 11 percent (2002: 13) was against corporations and others.

SEK is a party to financial instruments with off-balance sheet exposures in its ordinary course of business. The amounts of such exposures are shown in the table "Capital Base and Required Capital" under "—Liquidity, Capital Resources and Funding—Capital Adequacy". These instruments include interest-rate related, currency related and other agreements that SEK uses for the purpose of hedging or eliminating mainly interest rate and currency exchange rate exposures. The accounting policies applied to such instruments are described in Note 1 (q) to the Consolidated Financial Statements. Certain values related to derivatives and other financial instruments, traditionally denoted "off-balance sheet instruments", are accounted for as on-balance sheet items included in the items "Other assets" and "Other liabilities".

SEK has maintained, and intends to maintain, a conservative policy as regards counterparty exposures arising from its credit portfolio and from other assets as well as from derivative instruments and other financial instruments traditionally accounted for as off-balance sheet instruments.

- e.

- Results of Operations

SEK excluding the S-system

Operating profit in 2003 was Skr 595.3 million (2002: 664.4, 2001:729.0). The decrease in profit was due mainly to the impact of the change in ownership in, which resulted in a reduction in shareholders' funds and the issuance of new hybrid capital (see "—Liquidity, Capital Resources and Funding—Funding"), as well as to increases in administrative expenses and depreciation of non-financial assets. Costs related to the change in ownership negatively affected net interest revenues by approximately Skr 48 million.

18

Net interest earnings totaled Skr 757.5 million (2002: 798.2, 2001: 830.7). Net interest earnings include net margins from debt-financed assets, on the one hand, and revenues from the investment portfolio (i.e., the long-term fixed-rate assets representing the investment of SEK's equity), on the other hand. For the financial year 2003, the contribution to net interest earnings from debt-financed assets was Skr 447.2 million (2002: 465.9, 2001: 489.1). The underlying average volume of such debt-financed assets was Skr 114.5 billion (2002: 111.7, 2001: 126.9), with an average margin of 0.39 percent p.a. (2002: 0.42, 2001: 0.39). The decline in average margin in 2003 was due mainly to the interest cost of the hybrid capital raised in connection with the change in ownership. The amount of hybrid capital outstanding at year-end was USD 150 million higher than at December 31, 2002. This additional amount, raised in 2003, had carried a negative margin during 2003, before being economically hedged during the latter part of 2003 and beginning of 2004. The increase in average margin in 2002 reflected an increase in margins on new credits that year as well as a reduction in the proportion of debt-financed assets comprising the liquidity portfolio, where the average margin is less than that of the credit portfolio. The average margin remained at 0.42 percent p.a. for the first six months of 2003 prior to the change in ownership.