Table of Contents

As filed with the Securities and Exchange Commission on March 19, 2012

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F

(Mark One)

o | Registration statement pursuant to Section 12(b) or 12(g) of the Securities Exchange Act of 1934 |

| |

or |

| |

x | Annual report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

For the fiscal year ended December 31, 2011 |

| |

or |

| |

o | Transition report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

| |

or |

| |

o | Shell company report pursuant to section 13 or 15(d) of the securities Exchange Act of 1934 |

Date of event requiring this shell company report . . . . . . . . . . . . . . . . . . .

For the transition period from to

Commission file number: 001-8382

AKTIEBOLAGET SVENSK EXPORTKREDIT |

(Exact name of Registrant as Specified in Its Charter) |

|

(SWEDISH EXPORT CREDIT CORPORATION) |

(Translation of Registrant’s Name into English) |

|

Kingdom of Sweden |

(Jurisdiction of incorporation or organization) |

|

Klarabergsviadukten 61-63, Stockholm, Sweden |

(Address of principal executive offices) |

Securities registered or to be registered pursuant to Section 12(b) of the Act:

Title of each Class | | Name of each exchange on which registered |

| | |

ELEMENTSSM Linked to the SPECTRUM Large Cap U.S. Sector Momentum Index developed by BNP Paribas due August 8, 2022 | | NYSE ARCA, Inc. |

| | |

ELEMENTSSM Linked to the Rogers International Commodity Index® — Agriculture Total ReturnSM due October 24, 2022 | | NYSE ARCA, Inc. |

| | |

ELEMENTSSM Linked to the Rogers International Commodity Index® — Energy Total ReturnSM due October 24, 2022 | | NYSE ARCA, Inc. |

| | |

ELEMENTSSM Linked to the Rogers International Commodity Index® — Metals Total ReturnSM due October 24, 2022 | | NYSE ARCA, Inc. |

| | |

ELEMENTSSM Linked to the Rogers International Commodity Index® — Total ReturnSM due October 24, 2022 | | NYSE ARCA, Inc. |

| | |

ELEMENTSSM Linked to the MLCX Biofuels Index (Exchange Series) — Total Return due February 13, 2023 | | NYSE ARCA, Inc. |

| | |

ELEMENTSSM Linked to the MLCX Grains Index — Total Return due February 14, 2023 | | NYSE ARCA, Inc. |

Securities registered or to be registered pursuant to Section 12(g) of the Act:

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

· Debt Securities |

· Index Warrants |

(Title of Class) |

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report:

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

x Yes o No

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

o Yes x No

Note — Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 from their obligations under those Sections.

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days:

x Yes o No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer o | | Accelerated filer o | | Non-accelerated filer x |

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

U.S. GAAP o | | International Financial Reporting Standards as issued

by the International Accounting Standards Board x | | Other o |

If “Other” has been checked in response to the previous question indicate by check mark which financial statement item the registrant has elected to follow.

o Item 17 o Item 18

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

o Yes x No

(APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PAST FIVE YEARS)

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court.

o Yes o No

Table of Contents

INTRODUCTORY NOTES

In this annual report on Form 20-F (the “annual report”), unless otherwise specified, all amounts are expressed in Swedish kronor (“Skr”). See Item 3, “Key Information”, for a description of historical exchange rates and other matters relating to the Swedish kronor.

In this annual report, unless otherwise indicated, all descriptions and financial information relate to the consolidated group consisting of Aktiebolaget Svensk Exportkredit (Publ) (Swedish Export Credit Corporation) (the “ Parent Company”), including the “State Support System” (the “S-system”), which is described in detail herein, and the Parent Company’s wholly-owned subsidiaries-AB SEK Securities, SEK Financial Advisors AB, SEK Financial Services AB, SEK Customer Finance AB, SEK Exportlånet AB and Venantius AB (including its wholly-owned subsidiary VF Finans AB) (the “Subsidiaries” and together with the Parent Company, “SEK”, the “Consolidated Group” or the “Group”). In certain instances, information relating to the S-system on a stand-alone basis is provided separately. The consolidated financial statements of SEK included in Item 18 (the “Consolidated Financial Statements”) comprise the financial statements of the Parent Company and the Subsidiaries. In certain cases, comparable figures for earlier financial periods are reported in parentheses after the relevant figure for the current period. For example, “(2010: Skr 10 million)” means that the relevant figure for 2010, or at December 31, 2010, as the context requires, was Skr 10 million.

As used herein, the words “we”, “our”, “us” and “ours” refer to the Parent Company or to the Group, as the context requires.

The Parent Company is a “public company” within the meaning of the Swedish Companies Act. A Swedish company, even if its shares are not listed on an exchange and are not publicly traded, may choose to declare itself a “public company”. Only public companies are allowed to raise funds from the public through the issuance of debt instruments. In certain cases (including that applicable to the Parent Company), a public company is required to add the notation “Publ” to its name.

FORWARD-LOOKING STATEMENTS

This annual report contains forward-looking statements. We have based these forward-looking statements on our current expectations and projections about future events. These statements include but are not limited to:

· statements regarding financial projections and estimates and their underlying assumptions;

· statements regarding plans, objectives and expectations relating to future operations and services;

· statements regarding the impact of regulatory initiatives on the SEK’s operations;

· statements regarding general industry and macroeconomic growth rates and the SEK’s performance relative to them; and

· statements regarding future performance.

Forward-looking statements generally are identified by the words “expect”, “anticipate”, “believe”, “intend”, “estimate”, “should”, and similar expressions.

Forward-looking statements are based on current plans, estimates and projections, and therefore readers should not place undue reliance on them. Forward-looking statements speak only as of the date they are made, and SEK undertakes no obligation to update any forward-looking statement in light of new information or future events, although the SEK intends to continue to meet its ongoing disclosure obligations under the U.S. securities laws (such as the obligations to file annual reports on Form 20-F and reports on Form 6-K) and under other applicable laws. Forward-looking statements involve inherent risks and uncertainties, most of which are difficult to predict and generally beyond SEK’s control. Readers are cautioned that a number of important factors could cause actual results or outcomes to differ materially from those expressed in, or implied by, forward-looking statements. These factors include, among others, the following:

· Disruptions in the financial markets or economic recessions;

· Credit risk;

· Potential material weakness in our internal controls over financial reporting;

· Potential reductions in our access to international capital markets;

· Volatile or illiquid market conditions;

· The fact that our hedging strategies may not prevent losses;

· Fluctuations in foreign currency exchange rates;

· Increasing competition;

· Operational risk;

· Natural disasters, political unrest or other events beyond our control

· Potential changes in law or regulation; and

ii

PART I

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISORS

Not required as this 20-F is filed as an Annual Report.

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not required as this 20-F is filed as an Annual Report.

1

ITEM 3. KEY INFORMATION

A Selected Financial Data

The following selected consolidated financial data should be read in conjunction with our Consolidated Financial Statements and related notes. The consolidated statement of comprehensive income data for the years ended December 31, 2011, 2010, 2009, 2008 and 2007 and the consolidated statement of financial position data as of December 31, 2011, 2010, 2009, 2008 and 2007 have been derived from SEK’s Consolidated Financial Statements prepared in accordance with International Financial Reporting Standards as issued by the International Accounting Standard Board (IASB), and as adopted by the European Union (herein “IFRS”).

While complying with IFRS, SEK also complies with additional requirements of the Swedish Annual Accounts Act for Credit Institutions and Securities Companies (1995:1559) (ÅRKL), the recommendation RFR 1.Supplementary Accounting Principles for Groups, issued by the Swedish Financial Reporting Board (RFR) and the accounting regulations of the Swedish Financial Supervisory Authority (FFFS 2008:25).

The following information should be read in conjunction with the more detailed discussion contained in Item 5 “Operating and Financial Review and Prospects”.

| | Year Ended December 31, | |

(In Skr mn, unless otherwise stated) | | 2011 | | 2010 | | 2009 | | 2008 | | 2007 | |

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME DATA | | | | | | | | | | | |

| | | | | | | | | | | |

Net interest revenues | | 1,870.8 | | 1,898.5 | | 1,994.3 | | 1,543.3 | | 833.1 | |

Operating income | | 2,500.4 | | 4,395.9 | | 3,097.2 | | 1,099.5 | | 810.3 | |

Operating profit (A) | | 1,889.1 | | 3,939.7 | | 2,368.6 | | 185.2 | | 497.0 | |

Net profit (after taxes) | | 1,399.5 | | 2,891.7 | | 1,727.3 | | 143.9 | | 345.9 | |

Proposed dividend per share (Skr) | | 105.26 | | 75.44 | (C) | 129.83 | | — | | — | |

Total comprehensive income | | 1,699.3 | | 1,521.7 | | 3,060.9 | | 343.6 | | 238.7 | |

Ratios of earnings to fixed charges (B) | | 1.23 | | 1.38 | | 1.21 | | 1.02 | | 1.05 | |

(A) Operating profit equals operating income minus personnel expenses, other expenses, depreciation and amortization of non-financial assets and net credit losses. See the Consolidated Statement of Comprehensive Income on page F-2.

(B) For the purpose of calculating ratios of earnings to fixed charges, earnings consist of net profit for the year, plus taxes and fixed charges. Fixed charges consist of interest expenses, including borrowing costs, of SEK. See also Exhibit 7.1 Statement of Ratios of Earnings to Fixed Charges.

(C) For the year 2010, an additional special dividend of Skr 1,890.0 million was also paid, due to the gain realized from the sale of Swedbank shares. This special dividend is not accounted for in the table.

2

Table of Contents

| | December 31, | |

(In Skr mn, unless otherwise stated) | | 2011 | | 2010 | | 2009 | | 2008 | | 2007 | |

CONSOLIDATED STATEMENT OF FINANCIAL POSITION DATA | | | | | | | | | | | |

| | | | | | | | | | | |

Total loans outstanding (D) | | 195,599.9 | | 179,656.4 | | 185,832.4 | | 158,678.0 | | 109,286.8 | |

Total assets | | 319,701.9 | | 339,687.6 | | 371,588.0 | | 370,014.2 | | 297,236.8 | |

Total debt | | 276,419.8 | | 303,261.9 | | 327,938.0 | | 312,791.0 | | 272,289.4 | |

of which subordinated | | 3,174.4 | | 2,590.3 | | 3,142.8 | | 3,323.5 | | 2,837.0 | |

Equity | | 13,968.1 | | 12,569.8 | | 13,455.2 | | 10,394.3 | | 4,610.4 | |

of which share capital | | 3,990.0 | | 3,990.0 | | 3,990.0 | | 3,990.0 | | 990.0 | |

Number of shares | | 3,990,000 | | 3,990,000 | | 3,990,000 | | 3,990,000 | | 990,000 | |

Total liabilities and equity | | 319,701.9 | | 339,687.6 | | 371,588.0 | | 370,014.2 | | 297,236.8 | |

(D) Loans outstanding consist of loans due from commercial and financial institutions including loans in the form of interest bearing securities. Certain deposits with banks and states are not a part of total loans, although they are included in the items Loans to Credit Institutions and Loans to the Public in the statement of financial position. For a reconciliation of loans outstanding, see Note 11 to the Consolidated Financial Statements.

B Foreign Exchange Rates

The Group’s presentation currency is the Swedish kronor (“Skr”). The following tables set forth, for the periods and dates indicated, information concerning the noon buying rates for cable transfers in Swedish kronor, expressed in Skr per $1.00, as certified for customs purposes by the Federal Reserve Bank of New York.

The average of the exchange rates on the last day of each month during the period.

Calendar Year | | High | | Low | | Average (A) | | Period End | |

2011 | | 6.9759 | | 6.0050 | | 6.4941 | | 6.9234 | |

2010 | | 8.0593 | | 6.5145 | | 7.2053 | | 6.7571 | |

2009 | | 9.2863 | | 6.7908 | | 7.6028 | | 7.1532 | |

2008 | | 8.4858 | | 5.8346 | | 6.6424 | | 7.8770 | |

2007 | | 7.1060 | | 6.2356 | | 6.7232 | | 6.4568 | |

(A) The average of the exchange rates on the last day of each month during the period.

Calendar Month 2011 | | High | | Low | | | | | |

October | | 6.9278 | | 6.3644 | | | | | |

November | | 6.9678 | | 6.5540 | | | | | |

December | | 6.9759 | | 6.7169 | | | | | |

Calendar Month 2012 | | High | | Low | | | | | |

January | | 6.9992 | | 6.7464 | | | | | |

February | | 6.7934 | | 6.5585 | | | | | |

March 1st until March 16th | | 6.8522 | | 6.6206 | | | | | |

The noon buying rate on March 16, 2012 was $1.00 = Skr 6.7489

3

Table of Contents

No representation is made that Swedish krona amounts have been, could have been or could be converted into U.S. dollars at the foregoing rates on any of the dates indicated.

C Risk factors

Disruptions in the financial markets or economic recessions may have an adverse effect on SEK’s ability to repay its debt.

SEK’s financial performance, as represented in its statement of financial position and of comprehensive income, may be adversely affected by a number of factors, many of which are outside the Group’s control. Recent disruptions in the international financial markets and the recent worldwide recession had direct and indirect effects on SEK’s business volumes, profitability, and asset quality and its ability to finance its operations. Future such disruptions or global recessions may reduce the Group’s ability to repay its debt. In addition, certain major economies around the world are currently in recession or have experienced low growth or economic stagnation in recent periods. This, or any return to recessive conditions in any significant market that has recently emerged from recession, may ultimately impact the industrial development of commercial or industrial entities in countries around the world, which could also affect the business volumes, profitability or asset qualities of the Group. There can be no certainty that measures taken by various governments and monetary authorities will succeed in re-establishing, on a sustainable basis, the conditions necessary for economic growth. Therefore, uncertainty remains as to the future global economic outlook, and many countries’ economies could experience long periods of slow growth or recurring recessions.

Additionally, even in the absence of slow economic growth or recessions, other economic circumstances — including, but not limited to, increases in energy prices, fluctuations in the prices of commodities or other raw materials, contractions in infrastructure spending, fluctuations in market interest or exchange rates, and concerns over the financial health of sovereign governments and their instrumentalities — may have negative consequences for the companies and industries that the Group provides financing to (as well as the financial condition of SEK’s financial counterparties) and could, in addition to the other factors cited above, have material adverse effects on the Group’s business prospects, financial condition or ability to fulfill debt obligations.

SEK is exposed to credit risk even in normal economic circumstances. Disruptions in the financial markets or economic recession may further affect the credit quality of borrowers and other risk counterparties negatively, which may cause credit losses or affect the value of assets.

Risks arising from the credit quality of borrowers and counterparties and the recoverability of loans and amounts due from counterparties in derivative transactions are inherent in SEK’s businesses. Consequently, SEK may incur credit losses or delinquency in debt repayments even in normal economic circumstances. Financial market disruptions or economic recessions may further affect SEK’s customers and counterparties, negatively affecting their ability to fulfill their obligations. Market and economic disruptions may affect business and consumer spending, bankruptcy rates and asset prices, among other things, creating a greater likelihood that more of SEK’s customers or counterparties could require less credit or become delinquent in their loans or other obligations to SEK. SEK has, in the recent past, been forced to write down the value of some of its assets as a result of disruptions in the financial markets, and SEK may be forced to do so again in future periods. Such disruptions may affect the recoverability and value of SEK’s assets and require an increase in SEK’s provisions for delinquent and defaulted debt and other provisions, which could in turn have a material adverse effect on SEK’s business and/or ability to repay debts.

Risks related to financial reporting and other deficiencies in internal control over financial reporting and disclosure processes could result in errors, affect operating results and cause investors to lose confidence in our reported results.

Management identified a significant deficiency in the Group’s internal control over financial reporting in its evaluation of the effectiveness of the Group’s internal control over financial reporting as of December 31, 2009

4

Table of Contents

due to a deficiency in marking-to-market certain financial instruments as of December 31, 2009. SEK has made efforts to address this deficiency and as of December 31, 2010 and December 31, 2011 the deficiency had been remediated. SEK’s financial reporting, however, remains subject to the risk that it may identify material weaknesses or significant deficiencies in its internal controls over financial reporting in future periods.

Reduced access to international capital markets for the financing of SEK’s operations, or less favorable financing terms, may have negative impacts on SEK’s profitability and its ability to fulfill its obligations.

In order to finance its operations, SEK is dependent on the international capital markets, where it competes with other issuers to obtain financing. Although SEK has been able to successfully finance its operations to date, factors outside SEK’s control may have material adverse effects on the Group’s continued ability to obtain such financing or could cause the cost of such financing to increase. Continuing market turmoil and ongoing recessions in certain major countries have made it very difficult for many issuers to obtain financing, especially with longer maturities. Continued market disruptions may make such funding more expensive and difficult to obtain, consequently reducing the Group’s profitability and/or its ability to fulfill its obligations. In addition, in the wake of the financial disruptions from 2008 and onwards, there have been recent proposals of new stricter regulations under the Basel-regime with regard to capital adequacy and liquidity coverage. These stricter regulations will mean that financial institutions in general will need to have a larger capital base in relation to their risk-weighted assets as well as have better matched funding in relation to their obligations. Furthermore, tighter rules on which assets that can be defined as liquidity reserves as well as higher requirements on clearing of derivatives are important parts of the pending regulations. If these proposed regulations come into force, the rules will increase the costs of funding for all financial institutions, including SEK, even if SEK’s management judges that SEK does not have a relative disadvantage of the new rules compared to many other financial institutions.

A key factor affecting the cost and availability of financing is SEK’s credit rating. Although the Group currently has favorable credit ratings from various credit rating agencies, those credit ratings depend on many factors, some of which are outside of SEK’s control. Credit rating agencies are also increasing their scrutiny of all issuers, particularly financial institutions. Factors that are significant in determining SEK’s credit ratings or that otherwise could affect its ability to raise financing include its ownership structure, asset quality, liquidity profile, short- and long-term financial prospects, risk exposures, capital ratios, and prudential measures, as well as government support and SEK’s public policy role. In particular, the public policy role of SEK and corresponding level of government support might receive greater scrutiny from the rating agencies in the near future, as similar institutions within the Nordic region have recently experienced dramatic changes in their government’s definition of their public policy role. Notwithstanding regular confirmation from SEK’s owner (the Swedish State) of its continued support for SEK’s current public policy role, it cannot be entirely discounted that this view could change in the future. Deterioration in any of these factors or any combination of these factors may lead rating agencies to downgrade SEK’s credit ratings. If the Group were to experience a downgrade in its credit ratings, it would likely become necessary to offer increased interest margins in the capital markets in order to obtain financing, which would likely substantially lower the Group’s profit margins and earnings, harm its overall liquidity and negatively affect its business and its ability to fulfill its obligations.

SEK may experience negative changes in the value of its assets or liabilities and may incur other losses related to volatile and illiquid market conditions.

Market volatility, illiquid market conditions and disruptions in the credit markets have during certain periods made it difficult to value certain of SEK’s assets and liabilities. Subsequent valuations, in light of factors then prevailing, may result in significant changes in the values of such assets or liabilities in future periods. In addition, at the time of any sale of any such assets, the prices SEK ultimately realizes will depend on the demand and liquidity in the market at that time and may be materially lower than such assets’ current fair values. Any of these factors could require SEK to negatively change the carrying amount of such assets or liabilities, which may have an adverse effect on the Group’s financial condition in future periods.

5

Table of Contents

SEK’s hedging strategies may not prevent losses.

SEK uses hedging instruments in an attempt to manage interest rate, currency, credit, basis and other market-related risks. If any of the variety of instruments and strategies the Group uses to hedge its exposure to these various types of risk is not effective, the Group may incur losses, impairing its ability to timely repay or refinance its debts. In addition, there can be no assurance that the Group will continue to be able to hedge risks related to current or future assets or liabilities in accordance with its current policies in an efficient manner or at all. Disruptions such as market crises and economic recessions may impose strain on the availability and effectiveness of hedging instruments or strategies and could have an adverse effect on SEK’s financial condition and its ability to fulfill its obligations.

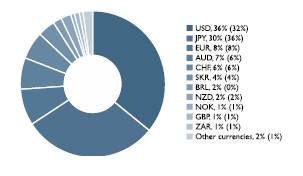

Fluctuations in foreign currency exchange rates could harm SEK’s business.

As an international lending institution, the Group is subject to exchange-rate risk. The adequacy of the Group’s financial resources may be impacted by changes in currency exchange rates that affect the value in Swedish currency of the Group’s foreign-currency obligations. The values of a majority of the items presented in the statement of financial position are subject to fluctuations as a result of changes in the U.S. dollar/Swedish krona and the euro/Swedish krona exchange rates, as well as exchange rates against other currencies. Even though the Group carefully monitors and hedges its foreign currency exposures, changes in currency exchange rates adverse to the Group could harm SEK’s business, its profitability and its ability to repay its debts. Also, any strengthening of the Swedish krona against other currencies may reduce demand for the products sold overseas by SEK’s Swedish clients and thus reduce demand for its loans from end-purchasers of such products, or cause such clients to experience increased difficulty in repaying their loans to SEK. Such eventualities could therefore have an adverse effect on SEK’s financial condition and its ability to fulfill its obligations. As part of its ordinary business activities, SEK has a material amount of euro-denominated assets reported in its statement of financial position as well as euro-denominated debt. Because of uncertainty surrounding the capacity of countries’ ability within the EMU to handle the financial problems many of these countries are experiencing, the euro may fluctuate against the Swedish krona or any other currency in which SEK has assets or liabilities. SEK might be harmed by such fluctuations in exchange rates, even if not directly exposed to it.

Increasing competition may adversely affect SEK’s income and business.

Competition in the Group’s business is based on service, product innovation, product features, price, commission structures, financial strength and name recognition. The Group competes with a large number of other credit institutions, including domestic and foreign bank, as well as from direct or indirect financing programs of exporters themselves. Some of these institutions offer a broader array of products or have more competitive pricing or greater financial resources with which to compete than SEK. Increasing competition may have significant negative effects on the Group’s financial performance if the Group is unable to match the products and services of its competitors or has to impose negative changes to its prices or rates in order to compete for customer business, investments or financing. Such changes could have material adverse effects on SEK’s business and its ability to repay debts.

We are exposed to significant operational risk.

Broadly, operational risk can arise from fraud, errors by employees, failure to document transactions properly or to obtain proper internal authorizations, equipment failures, natural disasters or the failure of external systems such as, for example, those of SEK’s suppliers or counterparties. SEK’s businesses are dependent on our ability to process complex transactions efficiently and accurately. Failure to address operational risk may lead to additional costs, losses or damages to SEK’s reputation which may negatively affect customers’ and investors’ confidence, and thus SEK’s business, financial performance and/or ability to repay debts.

There is also a risk that SEK’s reputation will be damaged if SEK fails to comply with current legislation and best practices or in any other way fails to meet its commitments, including those that are not explicit. Although operational risks can be reduced by properly documented processes, adequate systems, a culture of sensitivity to risk, compliance with regulations, effective corporate governance and other factors supporting internal control, such procedures may not be effective in controlling each of the operational risks SEK faces. A significant failure in managing our operational risk could materially and adversely affect SEK’s business, financial condition, results of operation and/or ability to repay debts.

6

Table of Contents

Changes in law or regulation may adversely affect SEK’s business.

SEK’s business is subject to regulation and regulatory oversight. Any significant regulatory development could affect the manner in which SEK conducts its business and SEK’s results of operations.

SEK is subject to financial services laws, regulations, administrative actions and policies in each location in which SEK operates. Financial regulators around the world have responded to the recent crisis by proposing significant changes to the regulatory regime applicable to financial service companies such as ours. Changes to the current system of supervision and regulation, or any failure to comply with applicable rules (and particularly those in Sweden) could materially and adversely affect SEK’s business, financial condition or results of operation and/or ability to repay debts. As previously discussed, there have been recent proposals of new, stricter regulations under the Basel-regime with regard to capital adequacy and liquidity coverage. These stricter regulations will mean that financial institutions in general will need to have a larger capital base in relation to their risk-weighted assets as well as have better matched funding in relation to their obligations. Furthermore, tighter rules on which assets that can be defined as liquidity reserves as well as higher requirements on clearing of derivatives are important part of the pending regulations. If these new regulations come into force, the rules detrimentally affect SEK’s business by limiting the volume and type of liquid assets SEK could invest in, putting restraints on the lending to SEK’s customers with regard to long-term financing. New regulations may also put restraints on the way SEK can conduct its business with regard to derivatives, if those derivatives are not cleared through a central clearing house. Other pending regulations that could harm SEK include IFRS 9 that will come into force in 2015. IFRS 9 will replace IAS 39 with regard to accounting rules for financial instruments. IFRS 9 may lead to higher costs for SEK under the adoption period in order to be able to apply IFRS 9 which might have negative impact for the cost of funding for SEK.

Developments in emerging market countries may adversely affect the Group’s business.

The Group operates in a number of emerging markets and its exposure to such markets has increased in recent years, as the number and importance of investment and trade links between Sweden and such countries has increased. Economic and political developments in emerging markets, including economic crises or political instability may have material adverse effects on the Group’s business prospects, results of operations and/or ability to repay debts.

Natural disasters, political unrest and other factors beyond SEK’s control may disrupt financial markets and economic conditions in markets that SEK relies on.

In order to finance its operations, SEK is dependent on the international capital markets, where it competes with other issuers to obtain financing. Although this has not been the case to date, natural disasters, such as the 2011 earthquake and tsunami in Japan, may have material adverse effects on the Group’s continued ability to obtain such financing or could cause the cost of such financing to increase.

ITEM 4. INFORMATION ON THE GROUP AND THE PARENT COMPANY

A History and Development

Aktiebolaget Svensk Exportkredit (Swedish Export Credit Corporation) is a “public company” under the Swedish Companies Act. It is wholly owned by the Swedish state through the Ministry of Finance (“Sweden” or the “State”).

The Parent Company was founded in 1962 in order to strengthen the competitiveness of the Swedish export industry by meeting a need for long-term credits for both exporters and their foreign customers. SEK’s objective is to engage in financing activities in accordance with the Swedish Banking and Financing Business Act and, in connection therewith, to promote the development of Swedish commerce and industry as well as otherwise

7

Table of Contents

engaging in Swedish and international financing activities on commercial terms. The duration of the Parent Company is indefinite.

The address of the Parent Company’s principal executive office is AB Svensk Exportkredit (Swedish Export Credit Corporation), Klarabergsviadukten 61-63, Stockholm, Sweden; and the Parent Company’s telephone number is +46-8-613-83-00. The Parent Company’s authorized representative in the United States is the Swedish Trade Council; the Trade Council’s contact information is as follows:

Swedish Trade Council |

The News Building |

220 E. 42nd Street |

Suite 409A |

New York, NY 10017 |

Tel. No.: (212) 507-9001 |

B Business Overview

SEK provides financial solutions for the Swedish export industry with the aim of promoting the development and international competitiveness of Swedish industry and trade. Its business activities are concentrated on lending to Swedish exporters and their customers through corporate lending, export lending, structured financing, project financing, trade financing and leasing. In addition, SEK offers financial advisory services. SEK offers its solutions to corporations and financial institutions as well as domestic and international investors. SEK extends loans, on commercial terms at prevailing fixed or floating market rates of interest in “SEK exclusive of the S-system”, as well as loans on State-supported terms at fixed rates of interest that may be lower than prevailing fixed market rates in the “State Support System” (the “S-system”). The S-system is administered on behalf of the State by SEK in return for compensation.

SEK’s mission has developed over the years since SEK began its operations in 1962. From its roots and base in export credits, SEK’s product range has expanded to more broadly promote the development of Swedish commerce and industry and particularly the Swedish export industry. However, SEK is a niche operator in the financial market. SEK works mainly with lending and as a result of this SEK acts as a complement to the banks which are active in Sweden. SEK’s unique position means that SEK cooperates with banks and other financial institutions. Over the years, SEK has been active in the creation of new financial solutions. SEK’s niche specialization in long-term export-related financing, combined with its financial capacity and flexible organization, are key factors in the management of its operations. SEK’s borrowing activities in the international capital markets have given SEK expertise in financial instruments.

SEK has sought to broaden both its range of services and its customer base in previous years in response to changes in demand and the new market opportunities. However, since the financial crisis of late 2008, SEK has concentrated its efforts on its core customers, companies in the Swedish export industry. Nonetheless, SEK also is involved as a financial advisor for international projects even if these services are not a material part of SEK’s total business activities. Since 2010, SEK has carried out extensive work to define and clarify its role and position in order to meet future challenges.

SEK believes that its relationships with domestic, Nordic and other international investors and partners strengthen its ability to develop financial solutions which meet its customers’ requirements. This network of relationships enables SEK to participate in co-financing arrangements and advisory assignments, as well as in benchmarking and cooperation in areas such as risk management and business systems.

Despite the liquidity shortage that occurred in 2008 and 2009 (and especially during the latter half of 2008), much of the Swedish export industry continued to do well, and SEK experienced significant demand for financing throughout 2009. During 2010 and 2011 Swedish export companies were more able to fund themselves directly through the capital markets and that fact, together with strong performance in the export industry, resulted in a decline in demand for financing. Meanwhile emerging economies, especially Asian markets, are continuing their strong development, with increasing purchasing power and increasingly modern and developed infrastructure. The Swedish export industry is largely focused on infrastructure, telecoms, energy

8

Table of Contents

supply, transport and environmental technology — all areas that are enjoying strong demand in emerging economies.

SEK has certain limited exposures towards countries in Europe which have been under significant economic pressure in recent periods, including Ireland, Italy, Portugal and Spain. SEK has not, however, deemed it necessary to make any write-downs related to these exposures. During 2011, these exposures have decreased and there were no exposures to counterparties in Greece. See Note 27 to the consolidated financial statements for information on exposures towards different European countries. The Japanese capital market has traditionally been an important market for SEK´s funding. SEK has been active in this market for a long time. However, part of SEK’s policy is to be independent of any specific market and SEK is therefore striving to be active in many different geographical markets for its funding.

In December 2008, SEK received an infusion of Skr 3.0 billion in new capital from its owner, the Swedish State and also received from the Swedish State the totality of the shares of Venantius AB, valued at approximately Skr 2.4 billion, as a part of the State’s program to strengthen SEK’s capacity to finance the Swedish export industry. In December 2009, Venantius’ remaining loan portfolio (with a carrying amount of less than Skr 100 million at that time) was acquired by an external counterparty. Therefore, there were no outstanding loans in SEK’s consolidated balance sheet related to Venantius on December 31, 2010 or on December 31, 2011.

In order to further enhance the possibility for SEK to promote the Swedish export industry, on February 5, 2009 the government decided to provide SEK with access to a loan facility during 2009 amounting to Skr 100 billion via the Swedish National Debt Office, an action that was approved by the parliament. Further, the parliament authorized the government to sell government guarantees to SEK, on market terms, to cover up to Skr 450 billion of new borrowing during 2009. In 2010, the parliament also has authorized the government to sell government guarantees to SEK on market terms, for new borrowing during 2010 of up to Skr 250 billion (i.e., an upper limit Skr 200 billion lower than that of the guarantees made available during 2009). In January 2011 and 2012, both the loan facility and the ability to purchase state guarantees were extended on the same terms for 2011 and 2012, respectively. SEK has not to date experienced a need to use the loan facility or purchase any of the Swedish government guarantees.

On October 28, 2010, SEK sold its entire stake in Swedbank AB. The holding was placed with a number of Swedish and international institutional investors. SEK had previously announced that it should not be regarded as a long-term owner but rather had the intention to sell the stake in a responsible way. The shares, which had been acquired at a cost of Skr 997.6 million, were sold for a total of Skr 3,562.7 million resulting in a profit of Skr 2,565.0 million before taxes. At the board meeting held on October 29, 2010, SEK’s Board of Directors resolved to call an extraordinary general meeting with the purpose to propose an extra dividend amounting to Skr 1,890.0 million, equal to the realized profit from the sale after tax. The extraordinary general meeting was held on December 1, 2010 and a decision on a special dividend amounting to Skr 1,890.0 million was made. The dividend was paid to SEK’s owner, the Swedish State, on December 15, 2010. For further information regarding SEK’s stake in Swedbank AB and SEK’s related dispute with Sparbanksstiftelsernas Förvaltnings AB (“SFAB”), see Note 23 to the Consolidated Financial Statements and Item 8 Legal Proceedings.

On April 13, 2011, SEK sold all of the shares in its wholly-owned subsidiary AB SEKTIONEN to a company in the LMK Industri AB Group. The sale generated a positive result of Skr 105.1 million for SEK, which was reported as other operating income. See Note 7 to the Consolidated Financial Statements. AB SEKTIONEN’s principal asset was its building, which served as SEK’s headquarters up to December 17, 2010, when SEK moved its headquarters to the new, rented, premises it currently occupies. AB SEKTIONEN’s only operating business before the sale was to rent its building to SEK.

The Board of Directors resolved on March 16, 2012, to propose to the Annual General Meeting to be held on April 26, 2012, that a dividend in the aggregate amount Skr 420.0 million (or Skr 105.26 per share) should be paid to the shareholder in relation to financial year 2011.

SEK has not made any material capital expenditures, nor engaged in any material divestitures (including interests in other companies) during the three financial years preceding the date of this report.

9

Table of Contents

Competition

SEK is the only institution authorized by the Swedish State to grant export financing loans under the S-system. With support from the State, SEK helps Swedish export companies compete with other export companies within OECD member countries which have similar support from their respective domestic export credit agencies, which also provide government-supported export credits. Lending from SEK exclusive of the S-system, including infrastructure credits, faces competition from other Swedish and foreign financial institutions, as well as from direct or indirect financing programs of exporters themselves. Deregulation and globalization of the world’s financial markets have resulted in an increasingly competitive environment for financial institutions, including SEK, for both lending opportunities and funding sources.

The following table summarizes SEK’s loans outstanding, including the S-system and debt outstanding at December 31, 2011 and 2010:

| | At December 31, | |

Skr mn | | 2011 | | 2010 | |

Total loans outstanding(A) | | 195,600 | | 179,656 | |

Total debt outstanding (B) | | 276,420 | | 303,262 | |

(A) Loans outstanding consist of loans due from commercial and financial institutions including loans in the form of interest bearing securities. Certain deposits with banks and states are not a part of total loans, although they are included in the items Loans to Credit Institutions and Loans to the Public in the statement of financial position. For a reconciliation of loans outstanding, see Note 11 to the Consolidated Financial Statements.

(B) Includes subordinated debt of Skr 3,174.4 million and Skr 2,590.3 million as of December 31, 2011 and 2010 respectively.

Lending Operations - General

The following table sets forth certain data regarding the Group’s lending operations, including the S-system, during the two-year period ending December 31, 2011:

| | Year ending December 31, | |

Skr mn | | 2011 | | 2010 | |

Offers of long-term loans accepted | | 51,249 | | 48,749 | |

Total loan disbursements | | –57,673 | | -39,008 | |

Total loan repayments | | 41,113 | | 37,518 | |

Total net increase/ (decrease) in loans outstanding | | 15,944 | | -6,176 | |

Loans outstanding | | 195,600 | | 179,656 | |

Loan commitments outstanding but undisbursed (A) | | 25,072 | | 38,205 | |

(A) If a loan has been accepted by the borrower it can be disbursed immediately. However, disbursement may be delayed due to a number of factors. In some cases, an accepted loan may never be disbursed, including as a result of changes in the commercial and financial institutions’ need for the funds. Currency exchange effects also affect the amount of loan commitments that will result in loans outstanding. Therefore, the volume of loans accepted does not equal the volume of disbursements of loans as presented in the Statement of Cash Flows in the Consolidated Financial Statements for a single financial year. Loans accepted but not yet disbursed are presented under the heading “Commitments” as “Committed undisbursed loans” and amounted on December 31, 2011 and 2010 to Skr 25,071.8 million and Skr 38,205.2 million, respectively. See the Statement of Financial Position in the Consolidated Financial Statements.

10

Table of Contents

Total loans outstanding by type of loan:

Skr mn | | 2011 | | 2010 | | 2009 | | 2008 | | 2007 | |

Total lending for export of durable products | | 102,566 | | 80,050 | | 68,120 | | 64,937 | | 38,646 | |

Other lending related to export | | 71,729 | | 76,809 | | 90,802 | | 65,988 | | 50,627 | |

Lending related to infrastructure | | 21,305 | | 22,797 | | 26,910 | | 27,753 | | 20,014 | |

Total | | 195,600 | | 179,656 | | 185,832 | | 158,678 | | 109,287 | |

Most of the loans granted by SEK are granted to purchasers of Swedish exports. Measured by revenues, the largest market for the export of goods from Sweden is Western Europe. However, exports to other markets, including less developed markets, are also important. Accordingly, the need for export financing may be related to transactions involving buyers in many different countries, with varying levels of creditworthiness. Pursuant to its counterparty risk exposure policy, SEK is selective in accepting any type of risk exposure. This policy seeks to ensure that SEK is neither dependent on the creditworthiness of individual buyers of Swedish goods and services, nor on the countries in which they are domiciled, but rather on the creditworthiness of individual counterparties from which SEK accepts counterparty risk exposure. For additional information on SEK’s approach to risk, see Note 30 to the Consolidated Financial Statements.

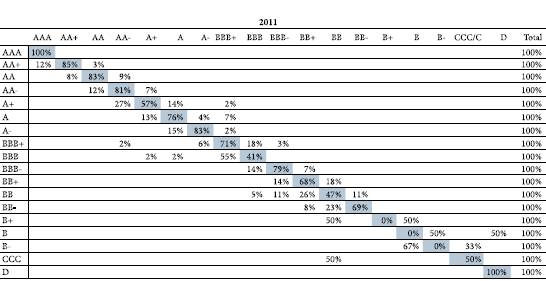

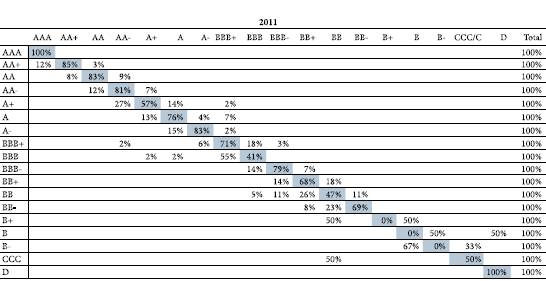

SEK relies to a large extent on guarantees in its lending. The guarantors are principally made up of government agencies, such as the Swedish EKN, the Export Import Bank of the United States (“USEXIM”), the UK’s Exports Credits Guarantee Department of the United Kingdom (“ECGD”), the Compagnie Financière pour la Commerce Extérieure (“Coface”) of France and Hermes Versicherungs AG of Germany, as well as financial institutions and, to a lesser extent, commercial entities. All counterparties are analyzed and receive an internal rating in accordance with SEK’s internal ratings methodology. The rating scale comprises 18 ratings from ‘AAA’ to ‘D’. The amount of risk SEK is willing to accept on any one counterparty is defined by a limit. Credit risk is allocated to a guarantor according to SEK’s policy and therefore, when disclosing credit risk net exposures, the majority of SEK’s guaranteed credit exposure is shown as exposure to sovereign counterparties.

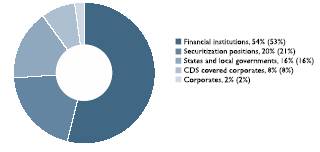

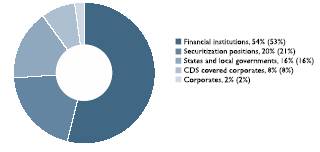

The following tables shows SEK’s gross and net credit exposures, respectively, to counterparties by geography and type of counterparty (taking into account applicable guarantees but not collateral) at December 31, 2011 and 2010.

Gross exposure by region and exposure class, as of December 31, 2011

Skr billion | | Africa | | Asia | | North

America | | Oceania | | South

America | | Sweden | | Other

Nordic

countries | | Other

European

countries | | Total | |

Central governments | | 0.0 | | 7.6 | | — | | — | | 0.2 | | 3.3 | | 2.5 | | 1.8 | | 15.4 | |

Government export credit agencies | | 0.7 | | — | | — | | — | | — | | — | | 0.0 | | — | | 0.7 | |

Regional governments | | — | | — | | — | | — | | — | | 9.7 | | 1.3 | | — | | 11.0 | |

Multilateral development banks | | — | | — | | — | | — | | — | | — | | — | | 0.0 | | 0.0 | |

Financial institutions | | 0.6 | | 1.2 | | 6.7 | | 4.4 | | — | | 22.0 | | 10.6 | | 30.3 | | 75.8 | |

Corporates | | 2.0 | | 34.8 | | 18.6 | | 0.8 | | 3.9 | | 71.1 | | 17.1 | | 46.3 | | 194.6 | |

Securitization positions | | — | | — | | 3.4 | | 3.6 | | — | | — | | — | | 9.1 | | 16.1 | |

Total | | 3.3 | | 43.6 | | 28.7 | | 8.8 | | 4.1 | | 106.1 | | 31.5 | | 87.5 | | 313.6 | |

Gross exposure by region and exposure class, as of December 31, 2010

Skr billion | | Africa | | Asia | | North

America | | Oceania | | South

America | | Sweden | | Other

Nordic

countries | | Other

European

countries | | Total | |

Central governments | | 0.0 | | 7.8 | | — | | — | | 0.3 | | 2.1 | | 3.6 | | 6.6 | | 20.4 | |

Government export credit agencies | | — | | — | | — | | — | | — | | — | | 0.0 | | — | | 0.0 | |

Regional governments | | — | | — | | — | | — | | — | | 12.9 | | 1.6 | | — | | 14.5 | |

Multilateral development banks | | — | | — | | — | | — | | — | | — | | — | | 0.0 | | 0.0 | |

Financial institutions | | 0.6 | | 0.9 | | 11.7 | | 5.5 | | — | | 31.8 | | 12.2 | | 36.1 | | 98.8 | |

Corporates | | 2.2 | | 26.7 | | 20.5 | | 0.9 | | 3.9 | | 68.2 | | 17.6 | | 46.7 | | 186.7 | |

Securitization positions | | — | | 0.0 | | 4.3 | | 4.6 | | — | | — | | — | | 16.5 | | 25.4 | |

Total | | 2.8 | | 35.4 | | 36.5 | | 11.0 | | 4.2 | | 115.0 | | 35.0 | | 105.9 | | 345.8 | |

11

Table of Contents

Net exposure by region and exposure class, as of December 31, 2011

Skr billion | | Africa | | Asia | | North

America | | Oceania | | South

America | | Sweden | | Other

Nordic

countries | | Other

European

countries | | Total | |

Central governments | | — | | 0.7 | | — | | — | | — | | 3.9 | | 2.5 | | 5.9 | | 13.0 | |

Government export credit agencies | | — | | — | | 6.4 | | — | | — | | 99.2 | | 2.4 | | 15.1 | | 123.1 | |

Regional governments | | — | | — | | — | | — | | — | | 17.5 | | 1.6 | | — | | 19.1 | |

Multilateral development banks | | — | | — | | — | | — | | — | | — | | — | | 0.4 | | 0.4 | |

Financial institutions | | — | | 0.8 | | 9.7 | | 4.4 | | — | | 19.1 | | 13.3 | | 39.2 | | 86.5 | |

Corporates | | — | | 1.6 | | 0.5 | | — | | 0.2 | | 39.1 | | 9.0 | | 5.0 | | 55.4 | |

Securitization positions | | — | | — | | 3.4 | | 3.6 | | — | | — | | — | | 9.1 | | 16.1 | |

Total | | — | | 3.1 | | 20.0 | | 8.0 | | 0.2 | | 178.8 | | 28.8 | | 74.7 | | 313.6 | |

Net exposure by region and exposure class, as of December 31, 2010

Skr billion | | Africa | | Asia | | North

America | | Oceania | | South

America | | Sweden | | Other

Nordic

countries | | Other

European

countries | | Total | |

Central governments | | — | | — | | — | | — | | — | | 2.9 | | 3.6 | | 10.0 | | 16.5 | |

Government export credit agencies | | — | | — | | 8.4 | | — | | — | | 96.2 | | 1.5 | | 17.7 | | 123.8 | |

Regional governments | | — | | — | | — | | — | | — | | 21.8 | | 1.9 | | — | | 23.7 | |

Multilateral development banks | | — | | — | | — | | — | | — | | — | | — | | 0.4 | | 0.4 | |

Financial institutions | | — | | 0.7 | | 17.5 | | 5.5 | | — | | 29.0 | | 13.0 | | 48.4 | | 114.1 | |

Corporates | | — | | 0.6 | | 1.4 | | — | | 0.1 | | 28.9 | | 7.3 | | 5.0 | | 43.3 | |

Securitization positions | | — | | 0.0 | | 4.4 | | 4.6 | | — | | — | | — | | 15.0 | | 24.0 | |

Total | | — | | 1.3 | | 31.7 | | 10.1 | | 0.1 | | 178.8 | | 27.3 | | 96.5 | | 345.8 | |

SEK has no exposure to subprime, Alt-A, negative amortizing or other high-risk lending, including loans which have been modified or would otherwise qualify as a troubled debt, other than the very limited amount of such assets disclosed in Note 9 to the Consolidated Financial Statements. As disclosed in Note 9 to the Consolidated Financial Statements, the two subprime-related CDOs that SEK is exposed to have been impaired due to an expected future inability of the relevant counterparties to fulfill the related contractual agreements.

Provisions for incurred impairment losses are made if and when SEK determines that it is probable that the obligor under a loan, or another asset held, and any existing guarantee or collateral, will fail to cover SEK’s full claim. Such determinations are made for each individual loan or asset. Objective evidence consists of significant financial difficulties affecting the issuer or debtor, outstanding or delayed payments or other observable factors, which suggest a measurable decrease in expected future cash flows. If there is objective evidence that an impairment loss on loans or receivables has been incurred, the amount of the loss is measured as the difference between the assets’ carrying amount and the present value of estimated future cash flows discounted at the financial asset’s original effective interest rate. The amount of the loss is recognized in profit and loss.

After such individual determinations have been made and if there is no objective evidence for impairment of an individually assessed financial asset, regardless of whether the asset is individually material or not, SEK includes the asset in a group of financial assets with similar credit risk characteristics and determines collectively any need for impairment of such assets. The need for impairment is related to loan losses which have been incurred as of the balance sheet date but have not yet been identified as individual loan losses. The reserve related to such impairments not linked to a specific counterparty is based on internal assessments of the credit quality of SEK’s assets, as manifested in, among other things, the credit ratings of counterparties, as determined either externally by a credit rating agency or internally in accordance with SEK’s own model for credit rating. If there is objective evidence for a general downward trend with regard to such rating this could constitute evidence for a need for an additional provision.

12

Table of Contents

Net credit losses:

| | For the Year Ended December 31, | |

Skr mn | | 2011 | | 2010 | | 2009 | | 2008 | | 2007 | |

Net credit losses | | -125.1 | | -119.7 | | -436.0 | | -561.8 | | — | |

Reversal of previous write-downs | | 10.0 | | 126.9 | | 153.0 | | 4.8 | | — | |

Net impairments and reversals | | -115.1 | | 7.2 | | -283.0 | | -557.0 | | — | |

Recovered credit losses | | 4.2 | | 1.0 | | 36.7 | | 4.7 | | — | |

Net credit losses | | -110.9 | | 8.2 | | -246.3 | | -552.3 | | — | |

of which related to loans(1) | | 12.9 | | 92.8 | | 56.7 | | -387.9 | | — | |

related to liquidity portfolio(1) | | -123.8 | | -84.6 | | -303.0 | | -164.4 | | — | |

(1) For the definition of loans and liquidity, see Note 11 to the Consolidated Financial Statements. SEK had no credit losses, recoveries or reversals of previous write-downs in 2007.

Changes in reserves of financial assets:

| | For the Year Ended December 31, | |

Skr mn | | 2011 | | 2010 | | 2009 | | 2008 | | 2007 | |

Balance brought forward | | -561.1 | | -939.9 | | -1,028.5 | | — | | — | |

Carrying value at acquisition | | — | | — | | — | | -472.1 | | — | |

Impaired financial assets sold | | — | | 371.6 | | 371.6 | | 0.6 | | — | |

Net impairments and reversals | | -115.1 | | 7.2 | | -283.0 | | -557.0 | | — | |

Balance carried forward | | -676.2 | | -561.1 | | -939.9 | | -1,028.5 | | — | |

of which related to loans(1) | | -33.5 | | -41.6 | | -472.4 | | -864.1 | | — | |

of related to liquidity portfolio(1) | | -642.7 | | -519.5 | | -467.5 | | -164.4 | | — | |

(1) For the definition of loans and liquidity, see Note 11 to the Consolidated Financial Statements. SEK had no reserves in 2007.

SEK exclusive of the S-system

Outside of the S-system, (or in “SEK exclusive of the S-system,” as we refer to the business of SEK other than the S-system), SEK reports loans in the following categories:

Loan Types and Underwriting Policies

Medium and long-term loans for the financing of exports of capital goods;

Other export-related loans, consisting primarily of:

(a) lines of credit provided to finance companies, banks and exporters to fund their portfolios of export receivables;

(b) loans for the funding of export lease agreements and short-term export finance loans;

(c) loans for direct investments outside of Sweden that will promote exports of Swedish goods and services; and

(d) loans for research and development activities designed to promote Swedish industry and commerce; and

13

Table of Contents

(e) loans for investments in infrastructure to promote Swedish industry and commerce

SEK’s credit underwriting policies and requirements are similar regardless of loan type. The majority of our loans are guaranteed by export credit agencies or banks, or by credit default swaps issued by banks or other financial institutions.

SEK’s initial loan offer and subsequent commitment set forth the maximum principal amount of the loan, the currency in which the loan will be denominated, and the repayment and disbursement schedule.

Loans outstanding (exclusive of those under the S-system) as of the dates indicated were distributed among SEK’s various categories of loans as follows:

Loans outstanding (exclusive of the S-system) by type of loans:

| | As of December 31, | |

Skr mn | | 2011 | | 2010 | | 2009 | | 2008 | | 2007 | |

Lending for export of durable products | | 68,339 | | 56,061 | | 53,806 | | 54,842 | | 29,859 | |

Other lending related to export | | 71,729 | | 76,809 | | 90,802 | | 65,988 | | 50,627 | |

Lending related to infrastructure | | 21,305 | | 22,797 | | 26,910 | | 27,753 | | 20,014 | |

Total | | 161,373 | | 155,667 | | 171,518 | | 148,583 | | 100,500 | |

Interest Rates

Outside of the S-system, SEK extends loans at prevailing market rates of interest, whether fixed or floating. SEK normally makes loan offers at a specified interest rate that is subject to change prior to acceptance of the offer (an “indicative loan offer”). When a borrower accepts an indicative loan offer, the interest rate is set normally at the then-prevailing market rate (which might have changed since the loan commitment was made), and a binding loan commitment arises.

SEK extends loans in different currencies, depending on the needs of its borrowers. Before SEK makes any loan commitment, it ensures that the currency in which the loan is to be funded is expected to be available for the entire term of the loan at an interest rate (taking into account the cost of funding) that, as of the day the commitment is made, results in a margin that management deems sufficient.

Outside the S-system, export financing is extended at prevailing market rates of interest. The Group normally makes loan offers at a quoted interest rate that is subject to change prior to acceptance of the loan offer (an “indicative loan offer”). However, loan offers can also be made at a binding interest rate (a “firm loan offer”), but such loan offers have until now rarely been made and are then only valid for short periods. When a borrower accepts an indicative loan offer, the interest rate is set and a binding loan commitment by the Group arises.

Guarantees and Credit Default Swaps

If a guarantee or credit default swap is entered into for risk-mitigating purposes the instrument protects a pre-defined amount of SEK’s exposure with respect to the principal amount of the underlying loan (and in some cases interest) as long as the issuer of the guarantee or credit default swap is financially sound. The amount so protected is ordinarily 75%-100% of the principal amount. Most of the counterparties against whom SEK accepts net exposures are rated by one or more of the internationally recognized rating agencies. For export loans, where the ultimate borrower may have relatively low creditworthiness, guarantees from export credit agencies (“ECAs”) and banks are normally used.

14

Table of Contents

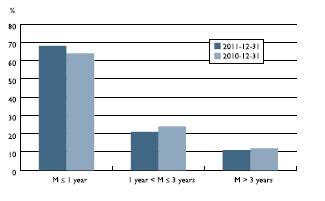

Loan Maturities

SEK was founded in 1962 in order to strengthen the competitiveness of the Swedish export industry by meeting a perceived need for long-term loans for both exporters and their foreign customers. SEK’s historical role and competitive advantage (and one that continues today) has therefore been in the provision of long-term financing in order to promote the Swedish export industry. Since many of the projects the export industry engages in are long-term projects, both with regard to disbursement periods and repayment periods, SEK’s loans often have longer terms than those of normal commercial loan products offered by commercial banks. However, SEK also meets its customers’ needs by providing short-term financing when required. SEK’s loan maturities therefore range from very short-term loans (with terms of three to six months) through loans for as long as 20 or 30 years.

Offers granted by the Group for loans that borrowers accepted (exclusive of those under the S-system) were distributed among SEK’s various categories of loans as follows on December 31, 2011 and December 31, 2010.

Offers accepted, type of loan

Skr mn | | 2011 | | 2010 | |

End customer financing | | 22,735.4 | | 15,602.0 | |

Direct customer financing | | 20,548.6 | | 24,387.5 | |

Total | | 43,284.0 | | 39,989.5 | |

Of the total volume of offers accepted during 2011, Skr 7.3 billion (2010: Skr 8.6 billion) had not been disbursed in the end of respective reporting period. If a loan has been accepted by the borrower it can be disbursed immediately. However, disbursement may be delayed due to a number of factors. In some cases, an accepted loan may never be disbursed, including as a result of changes in the customer’s need for the funds. Currency exchange effects also affect the amount of loan commitments that will result in loans outstanding.

A long-term trend in the development of SEK’s business has been the reduction in importance of the traditional financing of durable goods for Sweden’s export industry, even though an increase in SEK’s offers accepted was seen in 2008 and 2009 due to SEK being one of the few providers of financing to the export industry in Sweden during the recent market turmoil. SEK’s services have therefore changed over time to meet customers’ needs. This means that a loan “granted” could be either in the form of durable goods export financing or another type of loan such as direct lending to an export company through corporate loans or through SEK’s acquisitions of securities issued under the export company’s capital markets programs.

SEK’s mandate also includes infrastructure financing that directly or indirectly enhances the Swedish export industry.

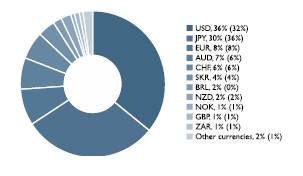

Currency

Before the Group makes any loan commitment, it ensures that the currency in which the loan is to be funded is expected to be available for the entire loan period at an interest rate (taking into account the costs of foreign exchange derivatives) that, as of the day the commitment is made, results in a margin that the Group deems sufficient. The Group borrows, on an aggregate basis, at maturities corresponding to or exceeding those of prospective loans. The Group may accordingly decide not to hedge particular loan commitments for movements in interest rate risk until sometime after they are made. Interest rate risks associated with such unhedged commitments are monitored closely and may not exceed interest rate risk limits established by the Parent Company’s board of directors. SEK’s policies with regard to counterparty exposures are described in Note 30 to the Consolidated Financial Statements.

15

Table of Contents

The following table shows the currency breakdown of loan offers accepted for loans with maturities exceeding one year for each year in the two-year period ending December 31, 2011.

| | Percentage of loan offers accepted | |

Currency in which loan is denominated | | 2011 | | 2010 | |

Swedish kronor | | 24 | % | 24 | % |

Euros | | 21 | % | 36 | % |

U.S. dollars | | 42 | % | 34 | % |

Other | | 13 | % | 6 | % |

Total | | 100 | % | 100 | % |

S-system

The S-system was established by the Swedish State on July 1, 1978, as a State-sponsored export-financing program designed to maintain the competitive position of Swedish exporters of capital goods and services in world markets. With respect to the financing of services, this could relate, for example, to services provided by the exporter to a customer in connection with the export of goods.

After a trial period, in April 1984 the Swedish Parliament extended the S-system indefinitely. The S-system today comprises the normal export-financing program at CIRR (Commercial Interest Reference Rate) rates and a concessionary loan program (with a foreign aid element), as more fully described below. Pursuant to arrangements established in 1978 and amended from time to time thereafter, the Group administers the S-system on behalf of the State in return for compensation based mainly on outstanding loan volumes.

Pursuant to agreements between SEK and the State, as long as any loans or borrowings remain outstanding under the S-system, the difference between interest revenues and net commission revenues related to lending and liquid assets under the S-system, on the one hand, and interest expenses related to borrowing, all other financing costs and any net foreign exchange losses incurred by SEK under the S-system, on the other hand, are reimbursed by (or paid to) the State. SEK treats the S-system as a separate operation for accounting purposes. Although the deficits (or surpluses) of programs under the S-system are reimbursed by (or paid to) the State, any loan losses that may be incurred under such programs are not reimbursed by the State. Accordingly, SEK has to obtain appropriate credit support for these loans as well. All of the loans for lending under the S-system are reported on SEK’s statement of financial position. SEK has consequently presented the operations of the S-system in the statement of comprehensive income as the amount of net commission received, accounted for as interest income rather than present the gross amounts collected and paid in accordance with the agreement with the Swedish State. In general, loans under the program are made with State guarantees administered by the Exportkreditnämnden (EKN) (Sweden’s Export Credits Guarantee Board). All such loans granted by SEK must also undergo SEK’s customary approval process.

The following table sets forth the volumes of offers accepted, undisbursed loans at year end, new loans disbursed and loans outstanding at year end under the various programs in the S-system for each year in the two-year period ended December 31, 2011. 2009 was a significant year due to the financial crisis with very high volumes of Export Finance both at market rates and under the CIRR loans program.

The volumes have stabilized at substantially lower levels in 2010 and 2011. The trend for the last three years has been that approximately half of the volumes are closed in the CIRR loans program with the other half closed at market rates. The CIRR interest rates have been attractive in this market characterized by low interest rates however; many customers still choose market rates. In general, Export Finance volumes are higher now than prior to the Lehman crisis and are expected to increase again due to financial turmoil in today’s market.

| | Concessionary Loan Program | | CIRR-loans | | Total | |

Skr mn | | 2011 | | 2010 | | 2011 | | 2010 | | 2011 | | 2010 | |

Offers accepted | | 0 | | 43 | | 7,965 | | 8,717 | | 7,965 | | 8,760 | |

Not disbursed loans at year-end | | 207 | | 311 | | 8,829 | | 16,259 | | 9,036 | | 16,570 | |

New loans disbursed | | 104 | | 209 | | 14,001 | | 13,939 | | 14,105 | | 14,148 | |

Loans outstanding at year-end | | 841 | | 779 | | 33,386 | | 23,210 | | 34,227 | | 23,989 | |

16

Table of Contents

Loans outstanding in the S-system by type of loan

Skr mn | | 2011 | | 2010 | | 2009 | | 2008 | | 2007 | |

Lending for export of durable products | | 34,227 | | 23,989 | | 14,314 | | 10,095 | | 8,787 | |

Other lending related to export | | n.a | | n.a | | n.a | | n.a | | n.a | |

Lending related to infrastructure | | n.a | | n.a | | n.a | | n.a | | n.a | |

Total | | 34,227 | | 23,989 | | 14,314 | | 10,095 | | 8,787 | |

Loan Types and Underwriting Policies

Within the S-system, SEK extends loans only for the medium- and long-term financing of capital goods exports.

S-system lending includes financing in cooperation with intergovernmental organizations and foreign export credit agencies (“ECAs”).

Our credit underwriting policies and requirements for S-system loans are similar regardless of loan type. The majority of these loans are also guaranteed by export credit agencies.

SEK’s initial loan offer and subsequent commitment set forth the maximum principal amount of a loan, the currency in which the loan will be denominated, the repayment schedule and the disbursement schedule.

Interest Rates

Because Sweden is a member of the Organization for Economic Cooperation and Development (the “OECD”), the S-system is designed to comply with the Arrangement on Guidelines for Officially Supported Export Credits of the OECD (the “OECD Consensus”). The OECD Consensus establishes minimum interest rates, required down payments and maximum loan periods for government-supported export loan programs. Terms vary according to the per-capita income of the importing country.

SEK offers S-system financing at commercial interest reference rates (“CIRR”) established by the OECD in accordance with the OECD Consensus. The CIRR rates for new loans are subject to periodic review and adjustment by the OECD. The OECD Consensus stipulates that loan offers may remain valid for a period of not more than four months, during which period a commercial contract must be signed, if at all, with offers that aren’t accepted within that period lapsing automatically. Thereafter the CIRR rate can be locked in for a maximum period of six months in order for the loan agreement to be finalized. No commitment fee is charged for CIRR loans to Swedish counterparties. Arranging banks receive compensation of 0.25 percent per annum, based on the outstanding loan amount, to cover their costs for arranging and managing loans. The arranging bank for an S-system loan can either be SEK itself or a commercial bank in Sweden.

The OECD Consensus also provides eligibility standards for concessionary loans. In principle, such loans are not permitted to be extended to purchasers in countries whose per-capita GNP for at least two consecutive years has exceeded the World Bank threshold applicable to the granting of 17-year World Bank loans. Concessionary credits to purchasers in other countries are not permitted to be extended to finance public or private projects that normally would be commercially viable if financed on market or OECD Consensus terms.

SEK participates with government agencies in an export-financing program (the “Concessionary Credit Program”) financed by the Swedish state to promote exports to certain developing countries, presently incorporating a foreign aid element of at least 35 percent. The foreign aid element is reflected in the form of lower rates of interest and/or deferred repayment schedules, and the Swedish government reimburses SEK through the S-system for the costs incurred as a result of SEK’s participation in such program.

17

Table of Contents

Guarantees

In general, loans under the S-system are guaranteed by Sweden’s Export Credits Guarantee Board (“EKN”). If a guarantee is entered into for risk-mitigating purposes it protects a pre-defined amount of SEK’s exposure with respect to principal (and in some cases interest) as long as the issuer of the guarantee is financially sound. All credits granted by SEK within the S-system must also undergo SEK’s customary credit approval process.

Loan Maturities

Under the S-system, loan maturities generally range from one year up to 20-30 years.

Credit Support for Outstanding Loans

The Group’s policies with regard to counterparty exposures are described in detail in Note 30 to the Consolidated Financial Statements.

The following table illustrates the counterparties for the Group’s outstanding loans and guarantees as of December 31, 2011 and December 31, 2010. Although most loans fall into more than one category for any given loan, this table reflects only the counterparty (either borrower or guarantor) that SEK believes to be the stronger in terms of creditworthiness.

Percentage of Total Loans Outstanding

| | 2011 | | 2010 | |

Loan credit exposure to Swedish State guarantees via EKN(A) | | 44 | % | 44 | % |

Loan credit exposure to Swedish credit institutions(B) | | 5 | % | 6 | % |

Loan credit exposure to foreign bank groups or governments(C) | | 21 | % | 22 | % |

Loan credit exposure to Swedish counterparties, primarily corporations(D) | | 14 | % | 13 | % |

Loan credit exposure to municipalities | | 6 | % | 6 | % |

Loan credit exposure to other foreign counterparties, primarily corporations | | 10 | % | 9 | % |

Total | | 100 | % | 100 | % |

See “— Lending Operations — General” for information on the geographical distribution of borrowers.

(A) EKN guarantees are in substance insurance against losses caused by the default of a foreign borrower or buyer in meeting its contractual obligations in connection with the purchase of Swedish goods or services. In the case of a foreign private borrower or buyer, coverage is for “commercial” and, in most cases, “political” risks. Coverage for “commercial” risk refers to losses caused by events such as the borrower’s or buyer’s insolvency or failure to make required payments within a certain time period (usually six months). Coverage for “political” risk refers to losses caused by events such as a moratorium, revolution or war in the importing country or the imposition of import or currency control measures in such country. Disputed claims must be resolved by a court judgment or arbitral award, unless otherwise agreed by EKN. In the table above only the particular amount of any given total loan that is guaranteed is listed as such. The amount of any such loan that is not covered by the relevant guarantee is excluded. EKN is a State agency whose obligations are backed by the full faith and credit of Sweden.

(B) At December 31, 2011, loans in this category amounting to approximately 2.7 percent (2010: 3.7 percent) of total loans were obligations of the four largest commercial bank groups in Sweden including guarantees in the form of bank guarantees or credit derivatives.

(C) At December 31, 2011 principally obligations of other Nordic, Western European or North American bank groups, together with obligations of Western European governments including guarantees in the form of bank guarantees or credit derivatives.

(D) At December 31, 2011, approximately 9.9 percent (2010: 8.8 percent) of the total loan credit exposure represented loans to the ten largest Swedish corporations.

18

Table of Contents

See also Note 27 to the Consolidated Financial Statements.

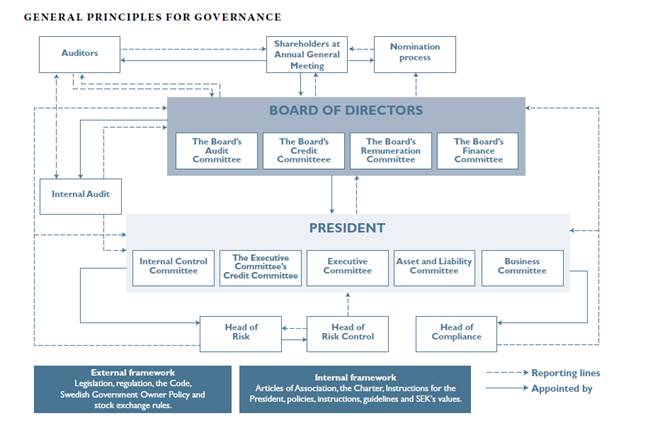

C Organizational Structure

SEK has the following two segments, as defined in IFRS 8 Segment reporting: “direct customer financing”, and “end-customer financing”. SEK organizes its activities in these segments into two main business areas which are correlated to the above business segments in accordance with financial reporting requirements: Corporate and Customer Finance, and Structured Finance. In addition, SEK has a Customer Relations Management (“CRM”) function which is responsible for all customer relations contacts with different customers and cooperates intensively with the business areas, and Funding and Treasury groups, which operate outside of the two main business areas.

Corporate and Customer Finance, and Structured Finance.

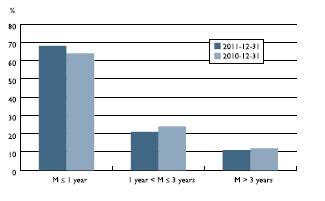

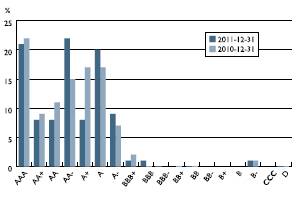

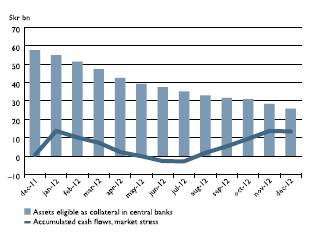

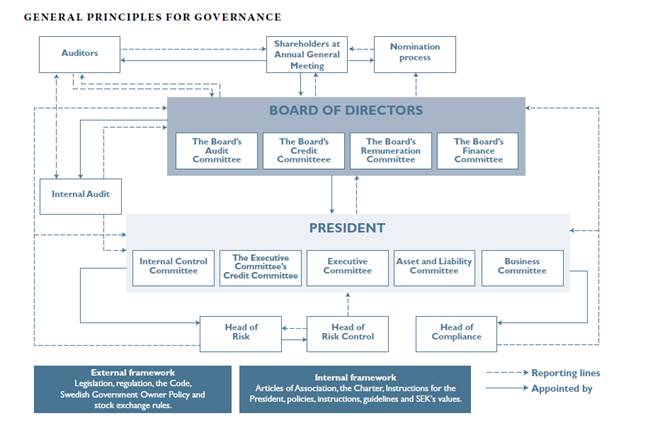

The business areas are responsible for all business activities in corporate lending, export credits, project finance, trade finance, leasing, customer finance and other structured finance projects including financing in local currencies, as well as origination within their business areas. Corporate lending is classified as direct customer financing, and Customer finance and Structured Finance are end-customer financing.