UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-02105

Fidelity Salem Street Trust

(Exact name of registrant as specified in charter)

245 Summer St., Boston, Massachusetts 02210

(Address of principal executive offices) (Zip code)

Cynthia Lo Bessette, Secretary

245 Summer St.

Boston, Massachusetts 02210

(Name and address of agent for service)

Registrant's telephone number, including area code:

617-563-7000

| |

Date of fiscal year end: | January 31 |

|

|

Date of reporting period: | January 31, 2023 |

Item 1.

Reports to Stockholders

Fidelity® Tax-Free Bond Fund

Annual Report

January 31, 2023

Contents

To view a fund's proxy voting guidelines and proxy voting record for the 12-month period ended June 30, visit http://www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission's (SEC) web site at http://www.sec.gov.

You may also call 1-800-544-8544 to request a free copy of the proxy voting guidelines.

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third-party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR LLC or an affiliated company. © 2023 FMR LLC. All rights reserved.

This report and the financial statements contained herein are submitted for the general information of the shareholders of the Fund. This report is not authorized for distribution to prospective investors in the Fund unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-PORT. Forms N-PORT are available on the SEC's web site at http://www.sec.gov. A fund's Forms N-PORT may be reviewed and copied at the SEC's Public Reference Room in Washington, DC. Information regarding the operation of the SEC's Public Reference Room may be obtained by calling 1-800-SEC-0330.

For a complete list of a fund's portfolio holdings, view the most recent holdings listing, semiannual report, or annual report on Fidelity's web site at http://www.fidelity.com, http://www.institutional.fidelity.com, or http://www.401k.com, as applicable.

NOT FDIC INSURED •MAY LOSE VALUE •NO BANK GUARANTEE

Neither the Fund nor Fidelity Distributors Corporation is a bank.

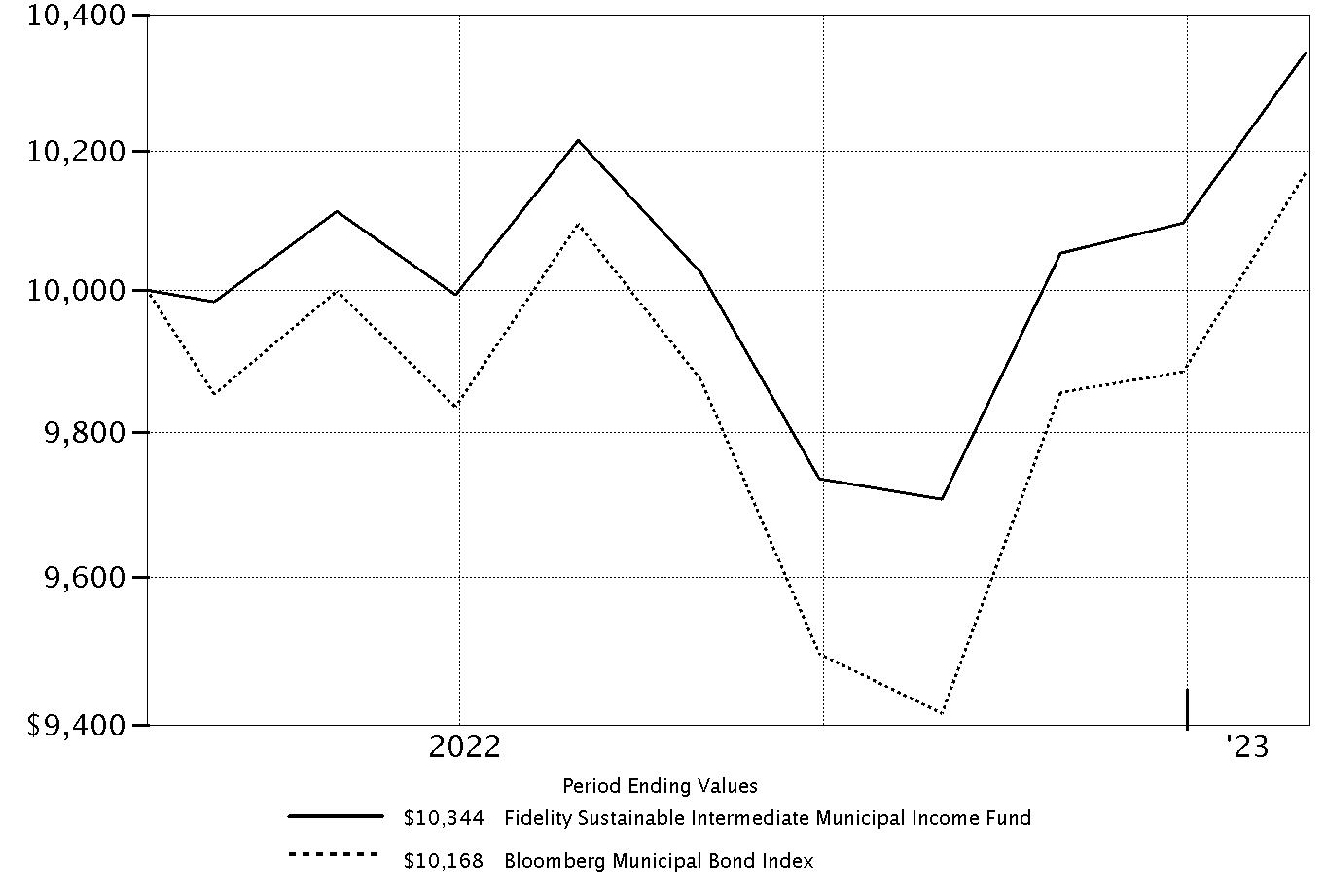

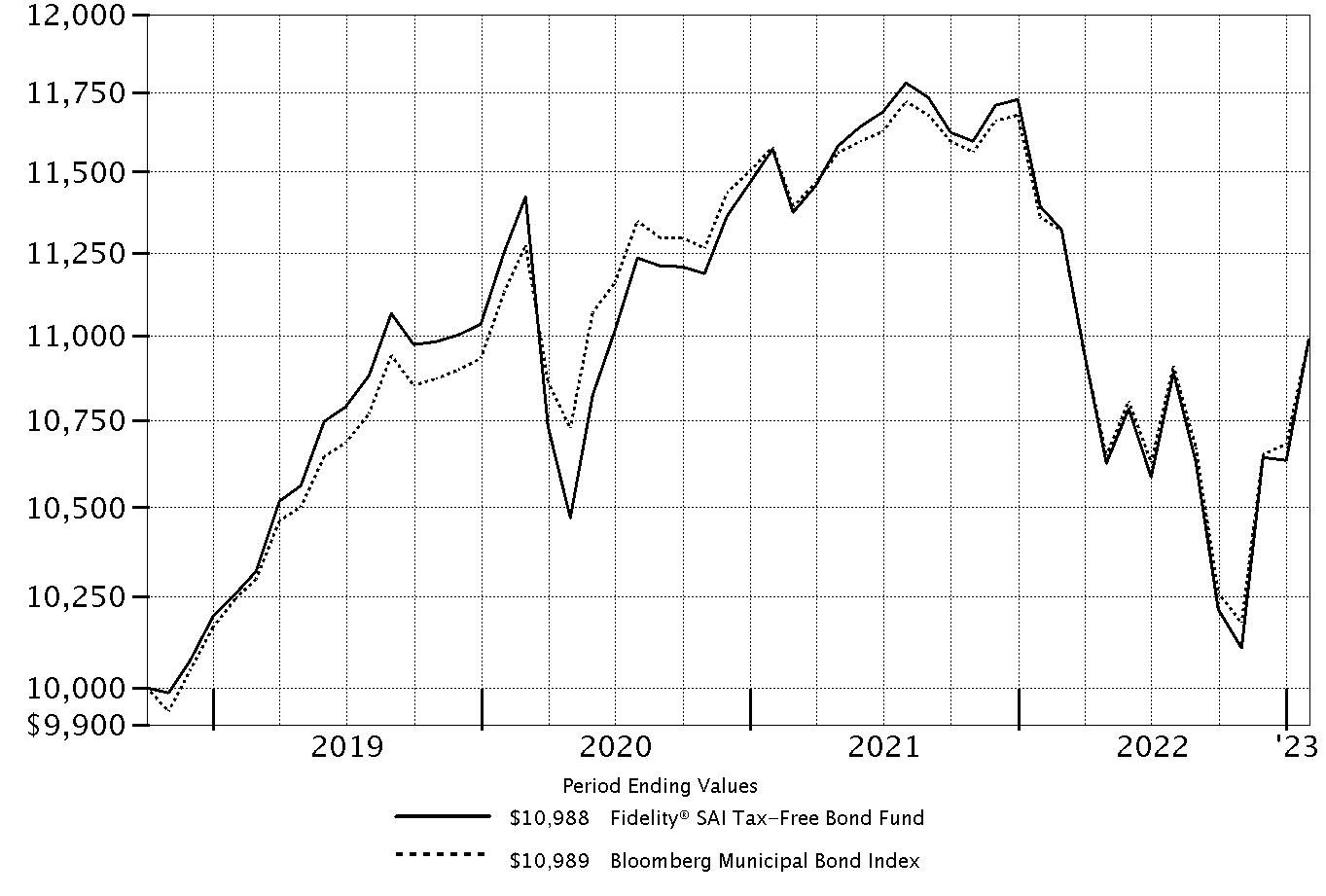

Average annual total return reflects the change in the value of an investment, assuming reinvestment of distributions from dividend income and capital gains (the profits earned upon the sale of securities that have grown in value, if any) and assuming a constant rate of performance each year. The hypothetical investment and the average annual total returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. During periods of reimbursement by Fidelity, a fund's total return will be greater than it would be had the reimbursement not occurred. How a fund did yesterday is no guarantee of how it will do tomorrow.

| Average Annual Total Returns |

| | | | |

Periods ended January 31, 2023 | Past 1 year | Past 5 years | Past 10 years |

| Fidelity® Tax-Free Bond Fund | -4.38% | 2.16% | 2.63% |

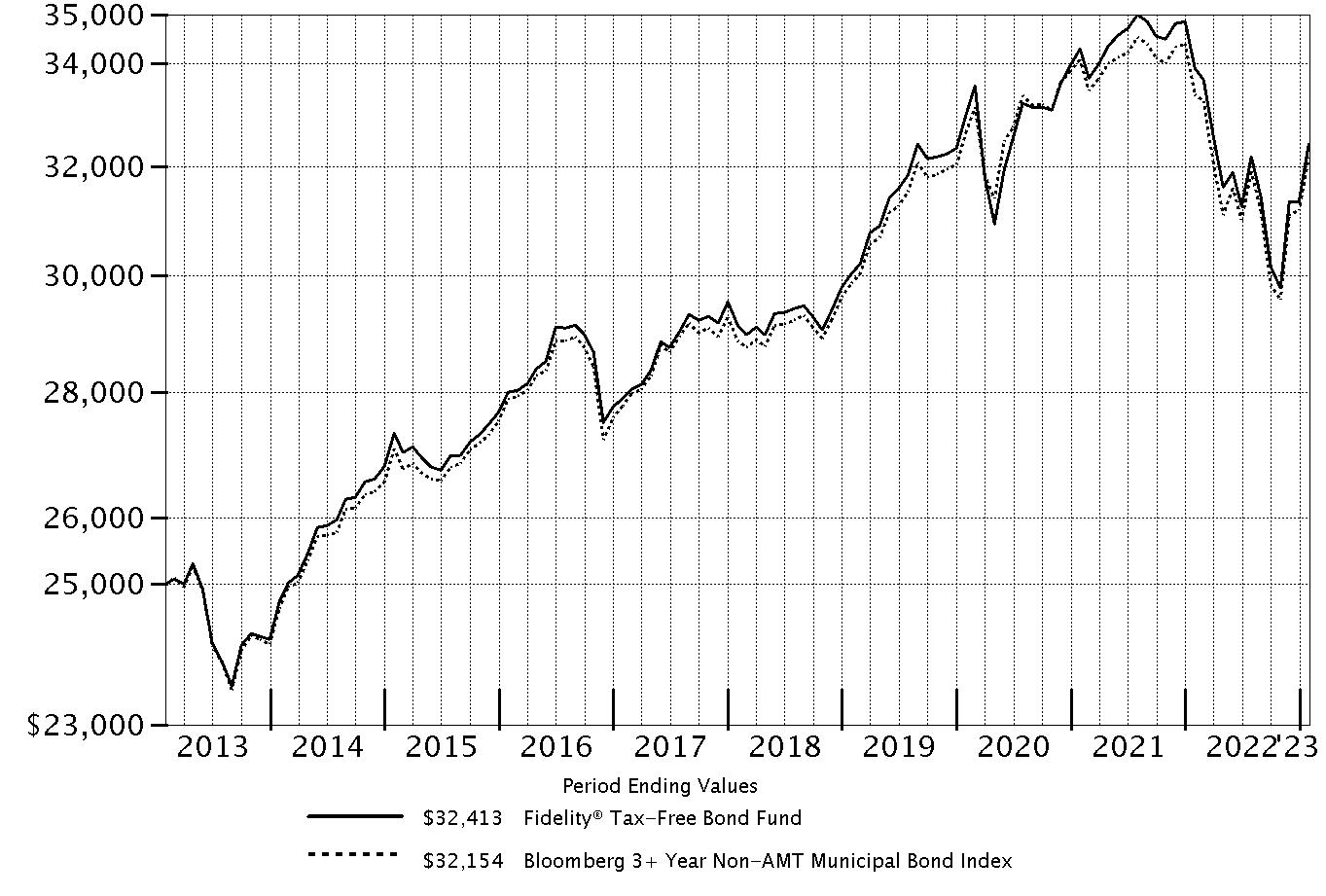

| $25,000 Over 10 Years |

| |

Let's say hypothetically that $25,000 was invested in Fidelity® Tax-Free Bond Fund on January 31, 2013. The chart shows how the value of your investment would have changed, and also shows how the Bloomberg 3+ Year Non-AMT Municipal Bond Index performed over the same period. |

Market Recap:

Tax-exempt municipal bonds declined for the 12 months ending January 31, 2023, with a late-period rally partially offsetting a steep fall earlier on. The Bloomberg Municipal Bond Index returned -3.25% for the period. By early 2022, the Federal Reserve had begun its pivot from monetary easing to monetary tightening, tapering the large-scale asset purchases it restarted in 2020 amid the COVID-19 pandemic. In March, the Fed, faced with persistent inflationary pressure, began implementing an aggressive series of rate hikes, eventually raising its benchmark interest rate seven times, by a total of 4.25 percentage points, through mid-December. This helped push municipal bond yields to their highest level in more than a decade. Muni bond prices, which move inversely to yields, fell sharply. Credit spreads significantly widened, as investors demanded more yield for lower-quality munis as recession risk increased. In November, December and January, the tax-exempt market reversed course and rallied strongly (+7.99%) - including a gain of 2.87% in January - amid market expectations for the Fed to pause monetary policy tightening in 2023. Muni yields declined and prices rebounded. Favorable supply and demand was helpful; issuance remained subdued, while net inflows into munis turned positive. Muni tax-backed credit fundamentals were solid throughout the period and, for the most part, the risk of credit-rating downgrades appeared low. Shorter-duration (lower sensitivity to changes in interest rates) and higher-credit-quality munis led the way for the year.

Comments from Co-Portfolio Managers Michael Maka, Cormac Cullen and Elizah McLaughlin:

For the fiscal year ending January 31, 2023, the fund returned -4.38%, lagging the -3.66% result of the supplemental index, the Bloomberg Municipal Bond 3+ Year Index, as well as the -3.25% result of the benchmark, the broad-based Bloomberg Municipal Bond Index. The past 12 months, we continued to focus on longer-term objectives and sought to generate attractive tax-exempt income and a competitive risk-adjusted return. Versus the supplemental index, the fund's underweight exposure to high-quality AAA-rated securities - which outpaced lower-quality securities as credit spreads widened - detracted from relative performance. An overweight to hospitals, a segment that lagged the index, also hurt. A larger-than-index stake in bonds backed by the state of Illinois further crimped the relative result. Pricing-related factors significantly detracted as well. Fund holdings are priced by a third-party pricing service and validated daily by Fidelity Management & Research's fair-value processes. Securities within the index, however, are priced by the index provider. In contrast, duration (interest rate) positioning contributed to performance versus the supplemental index. The fund had less sensitivity to interest rates, as measured by its shorter duration, during periods when interest rates rose and therefore was hurt less. A higher-than-average yield on the fund's underlying holdings provided another boost to the relative result.

The views expressed above reflect those of the portfolio manager(s) only through the end of the period as stated on the cover of this report and do not necessarily represent the views of Fidelity or any other person in the Fidelity organization. Any such views are subject to change at any time based upon market or other conditions and Fidelity disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Fidelity fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Fidelity fund.

| Top Five States (% of Fund's net assets) |

| | |

| Illinois | 14.9 |

| New York | 6.5 |

| Texas | 6.5 |

| Pennsylvania | 6.3 |

| Florida | 6.1 |

| | |

| Revenue Sources (% of Fund's net assets) |

| Health Care | 25.6% | |

| General Obligations | 20.4% | |

| Transportation | 17.1% | |

| Education | 9.2% | |

| Special Tax | 7.5% | |

| State G.O. | 5.3% | |

| Others* (Individually Less Than 5%) | 14.9% | |

| | 100.0% | |

| |

| *Includes net other assets | | |

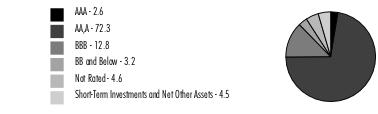

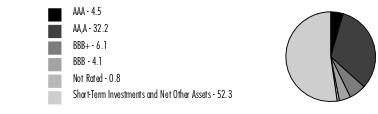

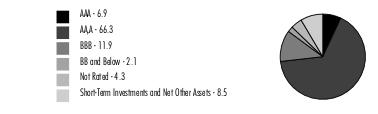

Quality Diversification (% of Fund's net assets) |

|

| |

| We have used ratings from Moody's Investors Service, Inc. Where Moody's® ratings are not available, we have used S&P® ratings. All ratings are as of the date indicated and do not reflect subsequent changes. |

Showing Percentage of Net Assets

| Municipal Bonds - 95.5% |

| | | Principal Amount (a) | Value ($) |

| Alabama - 2.1% | | | |

| Auburn Univ. Gen. Fee Rev. Series 2018 A, 5% 6/1/43 | | 1,700,000 | 1,838,965 |

| Homewood Edl. Bldg. Auth. Rev. Series 2019 A: | | | |

| 4% 12/1/33 | | 270,000 | 280,715 |

| 4% 12/1/35 | | 880,000 | 896,581 |

| 4% 12/1/37 | | 1,180,000 | 1,185,842 |

| 4% 12/1/38 | | 225,000 | 225,305 |

| 4% 12/1/39 | | 1,605,000 | 1,595,562 |

| 4% 12/1/41 | | 3,845,000 | 3,751,550 |

| 4% 12/1/44 | | 2,265,000 | 2,172,320 |

| 4% 12/1/49 | | 530,000 | 494,941 |

| Lower Alabama Gas District Bonds (No. 2 Proj.) Series 2020, 4%, tender 12/1/25 (b) | | 23,020,000 | 23,124,198 |

| Montgomery Med. Clinic Facilities Series 2015: | | | |

| 5% 3/1/26 | | 55,000 | 55,906 |

| 5% 3/1/27 | | 110,000 | 111,393 |

| 5% 3/1/28 | | 120,000 | 121,383 |

| 5% 3/1/29 | | 100,000 | 100,986 |

| 5% 3/1/30 | | 120,000 | 120,949 |

| 5% 3/1/36 | | 2,315,000 | 2,230,720 |

| Southeast Energy Auth. Rev. Bonds: | | | |

| (Proj. No. 2) Series 2021 B1: | | | |

4% 6/1/29 | | 1,260,000 | 1,295,720 |

4% 6/1/30 | | 955,000 | 978,708 |

4% 6/1/31 | | 825,000 | 838,358 |

| Bonds (Proj. No. 2) Series 2021 B1, 4%, tender 12/1/31 (b) | | 20,155,000 | 20,089,805 |

TOTAL ALABAMA | | | 61,509,907 |

| Alaska - 0.1% | | | |

| Alaska Int'l. Arpts. Revs. Series 2016 B: | | | |

| 5% 10/1/31 | | 1,590,000 | 1,699,056 |

| 5% 10/1/33 | | 2,075,000 | 2,204,233 |

TOTAL ALASKA | | | 3,903,289 |

| Arizona - 2.3% | | | |

| Arizona Board of Regents Ctfs. of Prtn. (Univ. of Arizona Univ. Revs.) Series 2018 B: | | | |

| 5% 6/1/27 | | 470,000 | 520,770 |

| 5% 6/1/30 | | 1,390,000 | 1,562,305 |

| Arizona Health Facilities Auth. Rev. (Banner Health Sys. Proj.) Series 2007 B, 3 month U.S. LIBOR + 0.810% 3.995%, tender 1/1/37 (b)(c) | | 945,000 | 885,143 |

| Arizona Indl. Dev. Auth. Hosp. Rev. Series 2021 A: | | | |

| 4% 2/1/38 | | 1,415,000 | 1,432,476 |

| 4% 2/1/39 | | 1,415,000 | 1,424,778 |

| Arizona Indl. Dev. Auth. Lease Rev. Series 2020 A: | | | |

| 4% 9/1/37 | | 385,000 | 393,329 |

| 4% 9/1/38 | | 420,000 | 425,854 |

| 4% 9/1/39 | | 380,000 | 384,252 |

| 4% 9/1/40 | | 410,000 | 413,279 |

| 4% 9/1/46 | | 945,000 | 943,779 |

| 5% 9/1/31 | | 185,000 | 209,427 |

| 5% 9/1/32 | | 285,000 | 320,524 |

| 5% 9/1/33 | | 390,000 | 435,797 |

| 5% 9/1/34 | | 330,000 | 366,329 |

| Arizona Indl. Dev. Auth. Rev. (Provident Group-Eastern Michigan Univ. Parking Proj.) Series 2018: | | | |

| 5% 5/1/37 | | 1,030,000 | 798,980 |

| 5% 5/1/43 | | 945,000 | 678,538 |

| Arizona State Univ. Revs. Series 2021 C: | | | |

| 5% 7/1/32 | | 1,150,000 | 1,375,350 |

| 5% 7/1/34 | | 1,180,000 | 1,397,560 |

| 5% 7/1/35 | | 945,000 | 1,107,411 |

| Glendale Indl. Dev. Auth. (Terraces of Phoenix Proj.) Series 2018 A: | | | |

| 5% 7/1/38 | | 145,000 | 130,003 |

| 5% 7/1/48 | | 190,000 | 159,309 |

| Maricopa County Indl. Dev. Auth. (Creighton Univ. Proj.) Series 2020, 5% 7/1/47 | | 1,890,000 | 2,022,441 |

| Maricopa County Indl. Dev. Auth. Sr. Living Facilities Series 2016: | | | |

| 5.75% 1/1/36 (d) | | 1,735,000 | 1,375,484 |

| 6% 1/1/48 (d) | | 3,290,000 | 2,378,133 |

| Maricopa County Rev.: | | | |

| Series 2017 D, 3% 1/1/48 | | 4,000,000 | 3,150,545 |

| Series 2019 E, 3% 1/1/49 | | 2,375,000 | 1,852,614 |

| Maricopa County Unified School District #48 Scottsdale Series 2017 B: | | | |

| 5% 7/1/31 | | 755,000 | 841,443 |

| 5% 7/1/32 | | 3,070,000 | 3,417,398 |

| Phoenix Civic Impt. Board Arpt. Rev.: | | | |

| Series 2017 B: | | | |

5% 7/1/30 | | 2,475,000 | 2,752,671 |

5% 7/1/34 | | 1,890,000 | 2,087,015 |

5% 7/1/35 | | 1,890,000 | 2,070,326 |

| Series 2019 A, 5% 7/1/44 | | 5,300,000 | 5,743,454 |

| Phoenix Civic Impt. Corp. Series 2019 A: | | | |

| 5% 7/1/30 | | 1,040,000 | 1,182,525 |

| 5% 7/1/32 | | 335,000 | 378,145 |

| 5% 7/1/36 | | 560,000 | 613,565 |

| 5% 7/1/37 | | 490,000 | 533,660 |

| 5% 7/1/38 | | 785,000 | 851,801 |

| 5% 7/1/45 | | 6,800,000 | 7,240,969 |

| Phoenix Civic Impt. Corp. District Rev. (Plaza Expansion Proj.) Series 2005 B, 5.5% 7/1/38 (Nat'l. Pub. Fin. Guarantee Corp. Insured) | | 4,720,000 | 5,962,372 |

| Phoenix IDA Student Hsg. Rev. (Downtown Phoenix Student Hsg. II LLC Arizona State Univ. Proj.) Series 2019 A: | | | |

| 5% 7/1/49 | | 1,060,000 | 1,065,149 |

| 5% 7/1/54 | | 3,335,000 | 3,343,924 |

| Salt Verde Finl. Corp. Sr. Gas Rev. Series 2007, 5.25% 12/1/23 | | 2,360,000 | 2,389,027 |

TOTAL ARIZONA | | | 66,617,854 |

| California - 2.9% | | | |

| California Gen. Oblig. Series 2004: | | | |

| 5.25% 12/1/33 | | 35,000 | 35,078 |

| 5.5% 4/1/30 | | 5,000 | 5,013 |

| California Hsg. Fin. Agcy. Series 2021 1, 3.5% 11/20/35 | | 1,690,335 | 1,637,767 |

| California Muni. Fin. Auth. Student Hsg. (CHF-Davis I, LLC - West Village Student Hsg. Proj.) Series 2018: | | | |

| 5% 5/15/35 | | 2,020,000 | 2,119,045 |

| 5% 5/15/38 | | 2,830,000 | 2,936,216 |

| 5% 5/15/43 | | 3,775,000 | 3,859,959 |

| California Pub. Fin. Auth. Univ. Hsg. Rev.: | | | |

| (Claremont Colleges Proj.) Series 2017 A, 5% 7/1/27 (d) | | 340,000 | 331,875 |

| (NCCD - Claremont Properties LLC - Claremont Colleges Proj.) Series 2017 A, 5% 7/1/47 (d) | | 280,000 | 277,324 |

| California Pub. Works Board Lease Rev. (Various Cap. Projs.) Series 2022 C, 5% 8/1/32 | | 2,190,000 | 2,673,172 |

| California Statewide Cmntys. Dev. Auth. Series 2016: | | | |

| 5% 5/15/25 | | 945,000 | 980,050 |

| 5% 5/15/26 | | 945,000 | 993,692 |

| 5% 5/15/27 | | 945,000 | 993,091 |

| 5% 5/15/28 | | 945,000 | 990,389 |

| 5% 5/15/32 | | 1,180,000 | 1,224,369 |

| 5% 5/15/33 | | 1,415,000 | 1,465,141 |

| 5% 5/15/40 | | 945,000 | 963,843 |

| California Statewide Cmntys. Dev. Auth. Rev. Series 2015, 5% 2/1/45 | | 2,150,000 | 1,799,544 |

| Mount Diablo Unified School District Series 2022 B: | | | |

| 4% 8/1/29 | | 1,800,000 | 1,998,829 |

| 4% 8/1/32 | | 1,100,000 | 1,237,046 |

| 4% 8/1/33 | | 1,425,000 | 1,584,311 |

| Poway Unified School District: | | | |

| (District #2007-1 School Facilities Proj.) Series 2008 A, 0% 8/1/32 | | 1,225,000 | 926,207 |

| Series B: | | | |

0% 8/1/33 | | 4,105,000 | 2,982,881 |

0% 8/1/37 | | 7,555,000 | 4,430,913 |

0% 8/1/38 | | 3,990,000 | 2,227,710 |

0% 8/1/39 | | 6,815,000 | 3,610,493 |

0% 8/1/41 | | 4,625,000 | 2,208,007 |

| Poway Unified School District Pub. Fing. Series 2015 A: | | | |

| 5% 9/1/27 | | 990,000 | 1,042,384 |

| 5% 9/1/30 | | 1,295,000 | 1,350,891 |

| Sacramento City Fing. Auth. Rev. Series A, 0% 12/1/26 (Nat'l. Pub. Fin. Guarantee Corp. Insured) | | 1,510,000 | 1,356,930 |

| San Diego Cmnty. College District Series 2011, 0% 8/1/35 | | 2,830,000 | 1,872,610 |

| San Diego Unified School District: | | | |

| Series 2008 C: | | | |

0% 7/1/34 | | 1,225,000 | 857,875 |

0% 7/1/37 | | 4,820,000 | 2,867,624 |

| Series 2008 E, 0% 7/1/47 (e) | | 2,455,000 | 1,882,338 |

| San Francisco City & County Arpts. Commission Int'l. Arpt. Rev.: | | | |

| Series 2019 B, 5% 5/1/49 | | 2,765,000 | 2,975,970 |

| Series 2022 B, 5% 5/1/52 | | 14,945,000 | 16,489,457 |

| San Marcos Unified School District Series 2010 B, 0% 8/1/47 | | 3,495,000 | 1,287,788 |

| Santa Rosa Wastewtr. Rev. Series 2002 B, 0% 9/1/25 (AMBAC Insured) | | 1,605,000 | 1,511,798 |

| Tobacco Securitization Auth. Southern California Tobacco Settlement Series 2019 A1: | | | |

| 5% 6/1/27 | | 945,000 | 1,018,747 |

| 5% 6/1/28 | | 1,425,000 | 1,558,409 |

| 5% 6/1/29 | | 945,000 | 1,045,443 |

| Univ. of California Revs. Series 2017 AV, 5% 5/15/36 | | 1,520,000 | 1,674,164 |

TOTAL CALIFORNIA | | | 83,284,393 |

| Colorado - 0.8% | | | |

| Arkansas River Pwr. Auth. Rev. Series 2018 A: | | | |

| 5% 10/1/38 | | 1,370,000 | 1,404,769 |

| 5% 10/1/43 | | 5,485,000 | 5,540,245 |

| Colorado Health Facilities Auth. Rev. Bonds: | | | |

| (Parkview Episcopal Med. Ctr., Co. Proj.) Series 2017: | | | |

5% 9/1/23 | | 255,000 | 258,008 |

5% 9/1/24 | | 210,000 | 215,968 |

5% 9/1/25 | | 245,000 | 256,182 |

5% 9/1/28 | | 2,075,000 | 2,236,891 |

| (Parkview Med. Ctr., Inc. Proj.) Series 2016, 5% 9/1/46 | | 3,495,000 | 3,569,641 |

| Series 2019 A, 4% 11/1/39 | | 2,815,000 | 2,820,123 |

| Series 2019 A2: | | | |

3.25% 8/1/49 | | 2,700,000 | 2,048,344 |

4% 8/1/49 | | 4,390,000 | 4,127,843 |

| Series 2020 A, 4% 9/1/50 | | 1,020,000 | 883,557 |

| Colorado Hsg. & Fin. Auth. Series 2019 H, 4.25% 11/1/49 | | 825,000 | 842,088 |

TOTAL COLORADO | | | 24,203,659 |

| Connecticut - 2.5% | | | |

| Connecticut Gen. Oblig.: | | | |

| Series 2018 F, 5% 9/15/27 | | 945,000 | 1,060,291 |

| Series 2020 A: | | | |

4% 1/15/34 | | 6,615,000 | 7,170,916 |

5% 1/15/40 | | 2,610,000 | 2,862,065 |

| Series 2021 A: | | | |

3% 1/15/35 | | 1,000,000 | 977,749 |

3% 1/15/39 | | 960,000 | 866,031 |

3% 1/15/40 | | 1,230,000 | 1,087,129 |

| Series 2021 B, 3% 6/1/40 | | 1,000,000 | 882,583 |

| Series 2022 B, 3% 1/15/40 | | 2,625,000 | 2,320,092 |

| Connecticut Health & Edl. Facilities Auth. Rev.: | | | |

| (Sacred Heart Univ., CT. Proj.) Series 2017 I-1: | | | |

5% 7/1/34 | | 990,000 | 1,069,519 |

5% 7/1/35 | | 1,135,000 | 1,216,399 |

5% 7/1/36 | | 380,000 | 404,219 |

5% 7/1/37 | | 1,470,000 | 1,556,975 |

5% 7/1/42 | | 3,570,000 | 3,728,566 |

| Bonds Series 2020 B, 5%, tender 1/1/27 (b) | | 4,445,000 | 4,792,022 |

| Series 2016 K, 4% 7/1/46 | | 4,215,000 | 3,855,573 |

| Series 2019 A: | | | |

5% 7/1/34 (d) | | 1,325,000 | 1,297,774 |

5% 7/1/49 (d) | | 1,925,000 | 1,689,065 |

| Series 2020 A, 4% 7/1/39 | | 2,830,000 | 2,831,929 |

| Series 2020 C, 4% 7/1/45 | | 3,985,000 | 3,881,873 |

| Series 2020 K: | | | |

5% 7/1/37 | | 945,000 | 1,034,925 |

5% 7/1/38 | | 1,415,000 | 1,543,206 |

5% 7/1/39 | | 1,465,000 | 1,590,608 |

5% 7/1/44 (d) | | 1,295,000 | 1,269,879 |

| Series 2021 S, 4% 6/1/51 | | 1,120,000 | 1,057,623 |

| Series 2022 M: | | | |

4% 7/1/37 | | 3,305,000 | 3,241,148 |

4% 7/1/52 | | 1,680,000 | 1,614,947 |

| Series G, 5% 7/1/50 (d) | | 1,100,000 | 1,060,508 |

| Series K1: | | | |

5% 7/1/31 | | 1,415,000 | 1,466,282 |

5% 7/1/35 | | 1,210,000 | 1,236,267 |

| Series N: | | | |

4% 7/1/39 | | 1,165,000 | 1,040,591 |

4% 7/1/49 | | 1,395,000 | 1,126,298 |

5% 7/1/32 | | 520,000 | 544,874 |

5% 7/1/33 | | 470,000 | 490,388 |

5% 7/1/34 | | 235,000 | 243,581 |

| Connecticut Hsg. Fin. Auth. Series 2019 B1, 4% 5/15/49 | | 1,040,000 | 1,059,476 |

| Connecticut State Revolving Fund Gen. Rev. Series 2017 A, 5% 5/1/35 | | 2,195,000 | 2,414,421 |

| Hbr. Point Infrastructure Impt. District Series 2017: | | | |

| 5% 4/1/30 (d) | | 2,295,000 | 2,334,504 |

| 5% 4/1/39 (d) | | 2,950,000 | 2,950,128 |

| New Haven Gen. Oblig. Series 2016 A, 5% 8/15/25 (Assured Guaranty Muni. Corp. Insured) | | 540,000 | 572,298 |

TOTAL CONNECTICUT | | | 71,442,722 |

| District Of Columbia - 0.9% | | | |

| District of Columbia Gen. Oblig. Series 2017 A, 5% 6/1/33 | | 2,170,000 | 2,415,293 |

| District of Columbia Hosp. Rev. Series 2015: | | | |

| 5% 7/15/29 | | 3,775,000 | 4,014,404 |

| 5% 7/15/30 | | 6,130,000 | 6,502,150 |

| Metropolitan Washington Arpts. Auth. Dulles Toll Road Rev. (Dulles Metrorail and Cap. Impt. Projs.): | | | |

| Series 2019 A: | | | |

5% 10/1/33 | | 1,180,000 | 1,314,077 |

5% 10/1/34 | | 1,890,000 | 2,099,541 |

5% 10/1/36 | | 1,890,000 | 2,061,473 |

| Series 2019 B, 3% 10/1/50 (Assured Guaranty Muni. Corp. Insured) | | 4,210,000 | 3,248,675 |

| Washington D.C. Metropolitan Transit Auth. Rev. Series 2017 B, 5% 7/1/33 | | 4,290,000 | 4,686,613 |

TOTAL DISTRICT OF COLUMBIA | | | 26,342,226 |

| Florida - 6.1% | | | |

| Brevard County Health Facilities Auth. Rev. Series 2023 A, 5% 4/1/32 (f)(g) | | 2,220,000 | 2,502,275 |

| Broward County School Board Ctfs. of Prtn.: | | | |

| (Broward County School District Proj.) Series 2016 A, 5% 7/1/28 | | 1,505,000 | 1,638,957 |

| Series 2016, 5% 7/1/32 | | 965,000 | 1,038,375 |

| Cap. Projs. Fin. Auth. Student Hsg. Rev. (Cap. Projs. Ln. Prog. - Florida Univs.) Series 2020 A, 5% 10/1/29 | | 1,650,000 | 1,707,511 |

| Central Florida Expressway Auth. Sr. Lien Rev. Series 2021: | | | |

| 4% 7/1/34 (Assured Guaranty Muni. Corp. Insured) | | 4,015,000 | 4,338,687 |

| 4% 7/1/35 (Assured Guaranty Muni. Corp. Insured) | | 3,890,000 | 4,167,961 |

| 4% 7/1/37 (Assured Guaranty Muni. Corp. Insured) | | 4,320,000 | 4,505,169 |

| 4% 7/1/38 (Assured Guaranty Muni. Corp. Insured) | | 2,700,000 | 2,803,890 |

| 4% 7/1/39 (Assured Guaranty Muni. Corp. Insured) | | 2,175,000 | 2,240,791 |

| Duval County School Board Ctfs. of Prtn. Series 2015 B, 5% 7/1/29 | | 6,025,000 | 6,370,573 |

| Escambia County Health Facilities Auth. Health Facilities Rev. Series 2020 A, 4% 8/15/45 | | 2,255,000 | 2,142,708 |

| Florida Higher Edl. Facilities Fing. Auth.: | | | |

| (St. Leo Univ. Proj.) Series 2019, 5% 3/1/49 | | 4,530,000 | 4,084,906 |

| Series 2019, 5% 10/1/27 | | 615,000 | 654,720 |

| Florida Hsg. Fin. Corp. Rev. Series 2019 1, 4% 7/1/50 | | 3,140,000 | 3,179,434 |

| Florida Mid-Bay Bridge Auth. Rev.: | | | |

| Series 2015 A, 5% 10/1/35 | | 2,455,000 | 2,532,250 |

| Series 2015 C, 5% 10/1/35 | | 1,890,000 | 1,941,741 |

| Florida Muni. Pwr. Agcy. Rev.: | | | |

| (Pwr. Supply Proj.) Series 2017 A, 5% 10/1/28 | | 380,000 | 430,358 |

| (Requirements Pwr. Supply Proj.) Series 2016 A: | | | |

5% 10/1/30 | | 930,000 | 1,008,495 |

5% 10/1/31 | | 1,015,000 | 1,097,343 |

| Series 2015 B, 5% 10/1/29 | | 1,180,000 | 1,255,737 |

| Gainesville Utils. Sys. Rev. Series 2017 A, 5% 10/1/35 | | 4,720,000 | 5,191,305 |

| Halifax Hosp. Med. Ctr. Rev. Series 2015: | | | |

| 5% 6/1/24 | | 790,000 | 811,034 |

| 5% 6/1/28 (Pre-Refunded to 6/1/25 @ 100) | | 620,000 | 657,975 |

| Hillsborough County School Board Ctfs. of Prtn. Series 2015 A, 5% 7/1/26 | | 7,555,000 | 7,973,778 |

| Jacksonville Health Care Facilities (Baptist Med. Ctr. Proj.) Series 2017: | | | |

| 5% 8/15/26 | | 1,890,000 | 2,053,442 |

| 5% 8/15/34 | | 2,595,000 | 2,836,853 |

| Miami Beach Health Facilities Auth. Hosp. Rev. Series 2014 A, 5% 11/15/39 | | 1,445,000 | 1,467,884 |

| Miami-Dade County Aviation Rev. Series 2020 A: | | | |

| 4% 10/1/35 | | 1,510,000 | 1,566,919 |

| 4% 10/1/41 | | 1,135,000 | 1,132,360 |

| 5% 10/1/31 | | 2,020,000 | 2,342,905 |

| Miami-Dade County Expressway Auth.: | | | |

| Series 2010 A, 5% 7/1/40 | | 3,115,000 | 3,118,804 |

| Series 2014 A: | | | |

5% 7/1/25 | | 1,350,000 | 1,386,600 |

5% 7/1/27 | | 945,000 | 971,017 |

5% 7/1/28 | | 2,100,000 | 2,157,521 |

5% 7/1/29 | | 955,000 | 981,025 |

5% 7/1/44 | | 15,860,000 | 16,109,259 |

| Series 2014 B, 5% 7/1/30 | | 2,360,000 | 2,423,982 |

| Miami-Dade County Gen. Oblig. Series 2020, 2.25% 7/1/38 | | 1,000,000 | 792,420 |

| Miami-Dade County School Board Ctfs. of Prtn.: | | | |

| Series 2015 A, 5% 5/1/29 | | 11,680,000 | 12,294,076 |

| Series 2016 A, 5% 5/1/32 | | 9,440,000 | 10,044,355 |

| Series 2016 B, 5% 8/1/26 | | 4,255,000 | 4,616,038 |

| Palm Beach County School Board Ctfs. of Prtn.: | | | |

| Series 2015 D, 5% 8/1/28 | | 1,870,000 | 1,981,836 |

| Series 2018 A, 5% 8/1/24 | | 720,000 | 746,528 |

| Pinellas County Idr (Drs. Kiran & Pallavi Patel 2017 Foundation for Global Understanding, Inc. Proj.) Series 2019: | | | |

| 5% 7/1/29 | | 200,000 | 204,158 |

| 5% 7/1/39 | | 400,000 | 398,471 |

| Saint Lucie County School Board Ctfs. of Prtn. Series 2013 A, 5% 7/1/26 | | 2,375,000 | 2,397,473 |

| South Florida Wtr. Mgmt. District Ctfs. of Prtn. Series 2015: | | | |

| 5% 10/1/27 | | 470,000 | 509,706 |

| 5% 10/1/28 | | 3,775,000 | 4,093,912 |

| 5% 10/1/30 | | 1,890,000 | 2,045,449 |

| 5% 10/1/32 | | 3,125,000 | 3,363,184 |

| South Miami Health Facilities Auth. Hosp. Rev. (Baptist Med. Ctr., FL. Proj.) Series 2017: | | | |

| 5% 8/15/29 | | 1,395,000 | 1,532,334 |

| 5% 8/15/32 | | 3,700,000 | 4,030,064 |

| 5% 8/15/35 | | 665,000 | 712,436 |

| 5% 8/15/37 | | 4,720,000 | 4,990,698 |

| 5% 8/15/42 | | 3,210,000 | 3,321,152 |

| 5% 8/15/47 | | 4,910,000 | 5,051,023 |

| Tallahassee Health Facilities Rev.: | | | |

| (Tallahassee Memorial Healthcare, Inc. Proj.) Series 2016 A: | | | |

5% 12/1/29 | | 1,345,000 | 1,405,648 |

5% 12/1/36 | | 1,040,000 | 1,066,445 |

| Series 2015 A, 5% 12/1/40 | | 945,000 | 960,161 |

| Volusia County Edl. Facilities Auth. Rev. (Embry-Riddle Aeronautical Univ., Inc. Proj.) Series 2020 A: | | | |

| 5% 10/15/44 | | 720,000 | 765,395 |

| 5% 10/15/49 | | 1,340,000 | 1,416,958 |

| Volusia County School Board Ctfs. of Prtn. (Florida Master Lease Prog.) Series 2016 A: | | | |

| 5% 8/1/30 (Build America Mutual Assurance Insured) | | 1,095,000 | 1,173,505 |

| 5% 8/1/31 (Build America Mutual Assurance Insured) | | 2,090,000 | 2,236,717 |

TOTAL FLORIDA | | | 174,974,686 |

| Georgia - 3.9% | | | |

| Brookhaven Dev. Auth. Rev. Series 2019 A, 5% 7/1/36 | | 1,435,000 | 1,604,760 |

| Burke County Indl. Dev. Auth. Poll. Cont. Rev.: | | | |

| (Georgia Transmission Corp. Proj.) Series 2012, 2.75% 1/1/52 (b) | | 2,900,000 | 2,031,350 |

| Bonds (Georgia Pwr. Co. Plant Vogtle Proj.) Series 2013 1st, 2.925%, tender 3/12/24 (b) | | 9,065,000 | 8,990,963 |

| Coweta County Dev. Auth. Rev. (Piedmont Healthcare, Inc. Proj.) Series 2019 A, 5% 7/1/44 | | 6,080,000 | 6,399,590 |

| DeKalb Private Hosp. Auth. Rev. Series 2019 B, 5% 7/1/35 | | 1,285,000 | 1,451,309 |

| Fulton County Dev. Auth. Rev.: | | | |

| Series 2019 C, 5% 7/1/38 | | 1,160,000 | 1,279,018 |

| Series 2019, 4% 6/15/49 | | 1,115,000 | 1,104,225 |

| Gainesville & Hall County Hosp. Auth. Rev. Series 2020 A, 3% 2/15/47 | | 9,015,000 | 7,107,647 |

| Georgia Muni. Elec. Auth. Pwr. Rev. Series 2019 A: | | | |

| 4% 1/1/49 | | 5,760,000 | 5,479,961 |

| 5% 1/1/30 | | 390,000 | 436,278 |

| 5% 1/1/32 | | 885,000 | 986,136 |

| 5% 1/1/34 | | 1,815,000 | 2,007,263 |

| 5% 1/1/35 | | 875,000 | 958,804 |

| 5% 1/1/36 | | 1,075,000 | 1,161,671 |

| 5% 1/1/37 | | 1,055,000 | 1,131,522 |

| 5% 1/1/38 | | 1,085,000 | 1,156,520 |

| 5% 1/1/44 | | 2,825,000 | 2,937,626 |

| Hosp. Auth. of Savannah Auth. Rev. Series 2019 A: | | | |

| 4% 7/1/35 | | 4,620,000 | 4,726,922 |

| 4% 7/1/39 | | 2,360,000 | 2,370,797 |

| 4% 7/1/43 | | 2,470,000 | 2,428,106 |

| Main Street Natural Gas, Inc. Bonds: | | | |

| Series 2019 B, 4%, tender 12/2/24 (b) | | 5,705,000 | 5,742,513 |

| Series 2021 A, 4%, tender 9/1/27 (b) | | 21,715,000 | 22,132,371 |

| Series 2021 C, 4%, tender 12/1/28 (b) | | 20,380,000 | 20,419,937 |

| Private Colleges & Univs. Auth. Rev.: | | | |

| (The Savannah College of Art & Design Projs.) Series 2021: | | | |

4% 4/1/38 | | 500,000 | 505,667 |

4% 4/1/40 | | 1,320,000 | 1,325,718 |

5% 4/1/36 | | 1,060,000 | 1,175,311 |

| Series 2020 B: | | | |

5% 9/1/31 | | 1,060,000 | 1,263,189 |

5% 9/1/33 | | 2,360,000 | 2,790,096 |

TOTAL GEORGIA | | | 111,105,270 |

| Hawaii - 0.1% | | | |

| Hawaii Gen. Oblig. Series 2020 C: | | | |

| 4% 7/1/37 | | 1,040,000 | 1,079,917 |

| 4% 7/1/38 | | 1,180,000 | 1,218,326 |

TOTAL HAWAII | | | 2,298,243 |

| Idaho - 0.2% | | | |

| Idaho Health Facilities Auth. Rev. Series 2015 ID: | | | |

| 5% 12/1/24 | | 470,000 | 491,309 |

| 5.5% 12/1/27 | | 3,070,000 | 3,293,432 |

| Idaho Hsg. & Fin. Assoc. Single Family Mtg.: | | | |

| (Idaho St Garvee Proj.) Series 2017 A: | | | |

5% 7/15/24 | | 665,000 | 689,615 |

5% 7/15/25 | | 665,000 | 706,764 |

5% 7/15/26 | | 470,000 | 511,817 |

| Series 2019 A, 4% 1/1/50 | | 375,000 | 380,319 |

TOTAL IDAHO | | | 6,073,256 |

| Illinois - 14.9% | | | |

| Chicago Board of Ed.: | | | |

| Series 2012 A, 5% 12/1/42 | | 2,660,000 | 2,654,508 |

| Series 2015 C, 5.25% 12/1/39 | | 755,000 | 758,600 |

| Series 2016 B, 6.5% 12/1/46 | | 400,000 | 425,784 |

| Series 2017 A, 7% 12/1/46 (d) | | 1,400,000 | 1,534,967 |

| Series 2017 C: | | | |

5% 12/1/24 | | 1,735,000 | 1,773,861 |

5% 12/1/25 | | 2,670,000 | 2,754,355 |

5% 12/1/26 | | 500,000 | 519,910 |

| Series 2017 D: | | | |

5% 12/1/24 | | 1,705,000 | 1,743,189 |

5% 12/1/31 | | 1,845,000 | 1,914,094 |

| Series 2017 H, 5% 12/1/36 | | 440,000 | 448,786 |

| Series 2018 A: | | | |

5% 12/1/24 | | 1,590,000 | 1,625,613 |

5% 12/1/29 | | 4,195,000 | 4,392,220 |

5% 12/1/31 | | 850,000 | 888,865 |

| Series 2018 C, 5% 12/1/46 | | 8,210,000 | 8,178,163 |

| Series 2019 A: | | | |

5% 12/1/25 | | 2,360,000 | 2,434,561 |

5% 12/1/26 | | 1,985,000 | 2,064,042 |

5% 12/1/29 | | 2,920,000 | 3,101,831 |

5% 12/1/30 | | 3,820,000 | 4,022,092 |

5% 12/1/32 | | 1,700,000 | 1,784,142 |

| Chicago Gen. Oblig.: | | | |

| Series 2020 A: | | | |

5% 1/1/26 | | 1,565,000 | 1,620,193 |

5% 1/1/27 | | 7,225,000 | 7,555,409 |

5% 1/1/29 | | 3,645,000 | 3,879,396 |

5% 1/1/30 | | 7,320,000 | 7,856,884 |

| Series 2021 A, 5% 1/1/32 | | 4,405,000 | 4,741,931 |

| Chicago Midway Arpt. Rev. Series 2016 B: | | | |

| 4% 1/1/35 | | 770,000 | 779,098 |

| 5% 1/1/36 | | 4,250,000 | 4,427,501 |

| 5% 1/1/37 | | 5,005,000 | 5,200,456 |

| Chicago O'Hare Int'l. Arpt. Rev.: | | | |

| Series 2016 B, 5% 1/1/34 | | 2,675,000 | 2,843,949 |

| Series 2016 C: | | | |

5% 1/1/32 | | 4,485,000 | 4,780,687 |

5% 1/1/33 | | 1,230,000 | 1,309,714 |

5% 1/1/34 | | 1,425,000 | 1,515,001 |

| Series 2017 B: | | | |

5% 1/1/34 | | 1,430,000 | 1,549,715 |

5% 1/1/35 | | 2,400,000 | 2,588,977 |

5% 1/1/36 | | 1,560,000 | 1,669,647 |

5% 1/1/37 | | 6,045,000 | 6,436,251 |

5% 1/1/38 | | 2,125,000 | 2,252,846 |

| Series 2018 B: | | | |

4% 1/1/44 | | 2,510,000 | 2,488,753 |

5% 1/1/48 | | 1,055,000 | 1,112,997 |

5% 1/1/53 | | 1,060,000 | 1,113,628 |

| Series 2020 A, 4% 1/1/37 | | 6,305,000 | 6,467,443 |

| Chicago Transit Auth. Series 2017, 5% 12/1/46 | | 1,795,000 | 1,851,095 |

| Chicago Transit Auth. Cap. Grant Receipts Rev. Series 2017: | | | |

| 5% 6/1/23 | | 830,000 | 835,950 |

| 5% 6/1/25 | | 705,000 | 737,213 |

| 5% 6/1/26 | | 1,505,000 | 1,606,255 |

| Chicago Wtr. Rev. Series 2017, 5.25% 11/1/33 (Assured Guaranty Muni. Corp. Insured) | | 420,000 | 424,332 |

| Cook County Ccsd 034 Glenview Series 2021 A, 2% 12/1/37 | | 2,010,000 | 1,544,215 |

| Cook County Gen. Oblig. Series 2016 A, 5% 11/15/29 | | 5,770,000 | 6,251,244 |

| Grundy & Will Counties Cmnty. School Gen. Oblig. Series 2018, 5% 2/1/29 | | 635,000 | 700,385 |

| Illinois Fin. Auth.: | | | |

| Series 2020 A: | | | |

3% 5/15/50 | | 7,190,000 | 5,229,401 |

3% 5/15/50 (Build America Mutual Assurance Insured) | | 3,390,000 | 2,567,943 |

3.25% 8/15/49 | | 1,340,000 | 1,085,222 |

| Series 2020, 5% 7/1/36 | | 4,150,000 | 4,777,789 |

| Illinois Fin. Auth. Academic Facilities (Provident Group UIUC Properties LLC Univ. of Illinois at Urbana-Champaign Proj.) Series 2019 A: | | | |

| 5% 10/1/31 | | 190,000 | 214,278 |

| 5% 10/1/32 | | 275,000 | 307,942 |

| 5% 10/1/33 | | 470,000 | 521,434 |

| 5% 10/1/35 | | 285,000 | 310,452 |

| 5% 10/1/36 | | 285,000 | 307,506 |

| 5% 10/1/37 | | 330,000 | 354,200 |

| 5% 10/1/38 | | 355,000 | 379,716 |

| 5% 10/1/39 | | 610,000 | 649,817 |

| Illinois Fin. Auth. Rev.: | | | |

| (Bradley Univ. Proj.) Series 2017 C, 5% 8/1/31 | | 2,230,000 | 2,352,426 |

| (Depaul Univ. Proj.) Series 2016 A: | | | |

4% 10/1/31 | | 1,395,000 | 1,431,866 |

5% 10/1/33 | | 1,415,000 | 1,511,181 |

| (Northwestern Memorial Hosp.,IL. Proj.) Series 2017 A: | | | |

5% 7/15/25 | | 750,000 | 794,707 |

5% 7/15/27 | | 1,225,000 | 1,356,603 |

5% 7/15/30 | | 1,405,000 | 1,573,815 |

| (OSF Healthcare Sys.) Series 2018 A: | | | |

4.125% 5/15/47 | | 10,465,000 | 10,058,897 |

5% 5/15/43 | | 9,440,000 | 9,733,975 |

| (Presence Health Proj.) Series 2016 C: | | | |

5% 2/15/29 | | 3,260,000 | 3,570,951 |

5% 2/15/36 | | 2,255,000 | 2,380,616 |

| (Rosalind Franklin Univ. Research Bldg. Proj.) Series 2017 C, 5% 8/1/49 | | 465,000 | 468,287 |

| (Rush Univ. Med. Ctr. Proj.) Series 2015 A, 5% 11/15/34 | | 1,135,000 | 1,173,508 |

| Series 2015 A, 5% 11/15/31 | | 3,305,000 | 3,465,714 |

| Series 2015 C: | | | |

5% 8/15/35 | | 3,155,000 | 3,248,451 |

5% 8/15/44 | | 15,205,000 | 15,269,215 |

| Series 2016 A: | | | |

5% 7/1/33 (Pre-Refunded to 7/1/26 @ 100) | | 1,745,000 | 1,902,120 |

5% 7/1/34 (Pre-Refunded to 7/1/26 @ 100) | | 945,000 | 1,030,088 |

5% 7/1/36 (Pre-Refunded to 7/1/26 @ 100) | | 1,445,000 | 1,575,108 |

5.25% 8/15/29 (Pre-Refunded to 8/15/26 @ 100) | | 960,000 | 1,055,871 |

| Series 2016 B: | | | |

5% 8/15/30 | | 2,830,000 | 3,071,449 |

5% 8/15/33 | | 4,330,000 | 4,647,037 |

5% 8/15/34 | | 2,280,000 | 2,439,768 |

| Series 2016 C: | | | |

3.75% 2/15/34 | | 685,000 | 700,178 |

4% 2/15/36 | | 2,915,000 | 2,975,180 |

4% 2/15/41 | | 8,645,000 | 8,655,271 |

4% 2/15/41 (Pre-Refunded to 2/15/27 @ 100) | | 395,000 | 419,413 |

5% 2/15/31 | | 1,965,000 | 2,145,768 |

| Series 2016: | | | |

4% 2/15/41 (Pre-Refunded to 2/15/27 @ 100) | | 20,000 | 21,236 |

5% 12/1/29 | | 970,000 | 1,027,658 |

5% 12/1/46 | | 2,510,000 | 2,539,874 |

| Series 2017 A, 5% 8/1/47 | | 405,000 | 408,307 |

| Series 2017: | | | |

5% 7/1/33 | | 3,175,000 | 3,469,098 |

5% 7/1/34 | | 2,610,000 | 2,837,463 |

5% 7/1/35 | | 530,000 | 575,544 |

| Series 2019: | | | |

4% 9/1/37 | | 380,000 | 332,713 |

4% 9/1/39 | | 945,000 | 813,537 |

5% 9/1/30 | | 180,000 | 185,671 |

5% 9/1/38 | | 850,000 | 835,848 |

| Illinois Gen. Oblig.: | | | |

| Series 2006, 5.5% 1/1/31 | | 1,835,000 | 2,082,394 |

| Series 2013 A, 5% 4/1/35 | | 850,000 | 851,482 |

| Series 2013, 5.5% 7/1/38 | | 1,890,000 | 1,901,737 |

| Series 2014: | | | |

5% 2/1/25 | | 2,120,000 | 2,164,271 |

5% 2/1/27 | | 1,155,000 | 1,175,973 |

5% 4/1/28 | | 550,000 | 560,766 |

5% 5/1/28 | | 3,140,000 | 3,205,409 |

5% 5/1/32 | | 1,320,000 | 1,341,940 |

5% 5/1/33 | | 1,510,000 | 1,533,872 |

5.25% 2/1/29 | | 2,830,000 | 2,882,003 |

5.25% 2/1/30 | | 2,550,000 | 2,594,393 |

5.25% 2/1/31 | | 1,230,000 | 1,250,449 |

| Series 2016: | | | |

5% 2/1/26 | | 945,000 | 998,049 |

5% 6/1/26 | | 575,000 | 609,985 |

5% 2/1/27 | | 3,535,000 | 3,780,719 |

5% 2/1/28 | | 3,300,000 | 3,514,853 |

5% 2/1/29 | | 3,100,000 | 3,288,598 |

| Series 2017 A, 5% 12/1/26 | | 3,165,000 | 3,378,382 |

| Series 2018 A: | | | |

5% 10/1/26 | | 1,415,000 | 1,507,399 |

5% 10/1/28 | | 3,305,000 | 3,588,718 |

| Series 2020 B, 4% 10/1/32 | | 5,055,000 | 5,173,234 |

| Series 2021 A: | | | |

5% 3/1/32 | | 100,000 | 109,666 |

5% 3/1/35 | | 710,000 | 765,973 |

5% 3/1/36 | | 565,000 | 604,869 |

5% 3/1/37 | | 710,000 | 754,137 |

5% 3/1/46 | | 2,830,000 | 2,909,418 |

| Series 2021 B, 4% 12/1/34 | | 3,355,000 | 3,382,723 |

| Series 2022 A: | | | |

5% 3/1/32 | | 1,755,000 | 1,942,421 |

5% 3/1/36 | | 7,365,000 | 7,938,310 |

5.25% 3/1/37 | | 1,605,000 | 1,748,466 |

| Series 2022 B: | | | |

5% 3/1/29 | | 3,495,000 | 3,805,363 |

5% 3/1/32 | | 1,550,000 | 1,715,503 |

| Illinois Hsg. Dev. Auth. Series 2021, 3% 4/1/51 | | 6,620,000 | 6,516,713 |

| Illinois Hsg. Dev. Auth. Multi-family Hsg. Rev. Series 2019, 2.9% 7/1/35 | | 4,527,862 | 4,203,383 |

| Illinois Muni. Elec. Agcy. Pwr. Supply Series 2015 A, 5% 2/1/31 | | 1,785,000 | 1,878,898 |

| Illinois Toll Hwy. Auth. Toll Hwy. Rev.: | | | |

| Series 2016 A, 5% 12/1/31 | | 890,000 | 951,824 |

| Series 2019 A, 5% 1/1/44 | | 1,060,000 | 1,145,532 |

| Kane, McHenry, Cook & DeKalb Counties Unit School District #300: | | | |

| Series 2015 5% 1/1/28 | | 2,625,000 | 2,707,856 |

| Series 2017, 5% 1/1/29 | | 970,000 | 1,067,786 |

| Kendall, Kane & Will Counties Cmnty. Unit School District #308 Series 2016, 5% 2/1/33 | | 10,270,000 | 10,966,431 |

| Lake County Cmnty. Consolidated School District #73 Gen. Oblig. Series 2021, 2.25% 1/1/40 | | 1,245,000 | 958,917 |

| McHenry County Cmnty. School District #200 Series 2006 B: | | | |

| 0% 1/15/24 | | 2,165,000 | 2,101,653 |

| 0% 1/15/25 | | 4,190,000 | 3,942,679 |

| 0% 1/15/26 | | 3,150,000 | 2,883,402 |

| Metropolitan Pier & Exposition: | | | |

| (McCormick Place Expansion Proj.): | | | |

Series 2010 B1: | | | |

0% 6/15/43 (Assured Guaranty Muni. Corp. Insured) | | 30,875,000 | 12,315,195 |

0% 6/15/45 (Assured Guaranty Muni. Corp. Insured) | | 11,465,000 | 4,110,250 |

0% 6/15/47 (Assured Guaranty Muni. Corp. Insured) | | 10,015,000 | 3,231,473 |

Series 2012 B, 0% 12/15/51 | | 5,570,000 | 1,246,535 |

| Series 2002 A, 0% 6/15/35 (Nat'l. Pub. Fin. Guarantee Corp. Insured) | | 1,310,000 | 782,918 |

| Series 2002, 0% 12/15/36 (Nat'l. Pub. Fin. Guarantee Corp. Insured) | | 12,285,000 | 6,725,114 |

| Series 2017 B: | | | |

5% 12/15/28 | | 1,890,000 | 1,985,426 |

5% 12/15/32 | | 850,000 | 890,173 |

| Series 2020 A, 5% 6/15/50 | | 21,945,000 | 22,274,129 |

| Series 2022 A, 4% 12/15/42 | | 5,405,000 | 5,055,506 |

| Univ. of Illinois Rev.: | | | |

| Series 2013: | | | |

6% 10/1/42 | | 1,825,000 | 1,861,191 |

6.25% 10/1/38 | | 1,795,000 | 1,834,812 |

| Series 2018 A, 5% 4/1/29 | | 3,720,000 | 4,150,043 |

| Will County Cmnty. Unit School District #365-U Series 2007 B, 0% 11/1/26 (Assured Guaranty Muni. Corp. Insured) | | 3,000,000 | 2,686,337 |

TOTAL ILLINOIS | | | 429,456,511 |

| Indiana - 1.4% | | | |

| Beech Grove School Bldg. Corp. Series 1996, 5.625% 7/5/24 (Escrowed to Maturity) | | 475,000 | 486,427 |

| Indiana Fin. Auth. Hosp. Rev. (Parkview Health Sys. Proj.) Series 2017 A: | | | |

| 5% 11/1/28 | | 425,000 | 482,808 |

| 5% 11/1/29 | | 1,320,000 | 1,526,823 |

| 5% 11/1/30 | | 295,000 | 347,260 |

| Indiana Fin. Auth. Rev.: | | | |

| (Butler Univ. Proj.) Series 2019, 4% 2/1/44 | | 2,450,000 | 2,405,484 |

| Series 2015 A, 5.25% 2/1/32 | | 2,775,000 | 2,933,467 |

| Series 2015, 5% 3/1/36 | | 4,250,000 | 4,392,194 |

| Series 2016: | | | |

5% 9/1/27 | | 1,745,000 | 1,892,405 |

5% 9/1/31 | | 1,735,000 | 1,860,681 |

| Indiana Hsg. & Cmnty. Dev. Auth.: | | | |

| (Glasswater Creek of Whitestown Proj.) Series 2020, 5.375% 10/1/40 (d) | | 1,660,000 | 1,385,828 |

| Series 2021 B, 3% 7/1/50 | | 1,085,000 | 1,068,885 |

| Indiana Muni. Pwr. Agcy. Pwr. Supply Sys. Rev. Series 2017 A: | | | |

| 5% 1/1/32 | | 3,775,000 | 4,239,635 |

| 5% 1/1/34 | | 1,890,000 | 2,113,708 |

| Indianapolis Local Pub. Impt. (Courthouse and Jail Proj.) Series 2019 A, 5% 2/1/49 | | 3,090,000 | 3,303,730 |

| Indianapolis Wtr. Sys. Rev. Series 2018 A, 5% 10/1/32 | | 2,830,000 | 3,188,251 |

| Saint Joseph County Econ. Dev. Auth. Rev. (St. Mary's College Proj.): | | | |

| Series 2019: | | | |

4% 4/1/39 | | 945,000 | 940,709 |

4% 4/1/46 | | 2,115,000 | 2,047,055 |

5% 4/1/40 | | 2,115,000 | 2,251,945 |

| Series 2020: | | | |

4% 4/1/37 | | 1,565,000 | 1,571,880 |

5% 4/1/29 | | 970,000 | 1,084,595 |

TOTAL INDIANA | | | 39,523,770 |

| Iowa - 0.3% | | | |

| Iowa Fin. Auth. Rev.: | | | |

| Series 2018 B, 5% 2/15/48 | | 2,360,000 | 2,463,805 |

| Series A: | | | |

5% 5/15/43 | | 775,000 | 684,696 |

5% 5/15/48 | | 1,355,000 | 1,157,814 |

| Tobacco Settlement Auth. Tobacco Settlement Rev.: | | | |

| Series 2021 A2, 4% 6/1/49 | | 2,645,000 | 2,411,572 |

| Series 2021 B1, 4% 6/1/49 | | 3,215,000 | 3,214,858 |

TOTAL IOWA | | | 9,932,745 |

| Kentucky - 3.3% | | | |

| Ashland Med. Ctr. Rev.: | | | |

| (Ashland Hosp. Corp. d/b/a King's Daughters Med. Ctr. Proj.) Series 2016 A, 5% 2/1/40 | | 1,135,000 | 1,157,860 |

| Series 2019: | | | |

3% 2/1/40 (Assured Guaranty Muni. Corp. Insured) | | 1,665,000 | 1,396,774 |

5% 2/1/28 | | 45,000 | 48,795 |

5% 2/1/32 | | 60,000 | 65,365 |

| Boyle County Edl. Facilities Rev. Series 2017, 5% 6/1/37 | | 1,585,000 | 1,671,591 |

| Kenton County Arpt. Board Arpt. Rev.: | | | |

| Series 2016: | | | |

5% 1/1/24 | | 755,000 | 772,189 |

5% 1/1/27 | | 1,415,000 | 1,523,881 |

5% 1/1/33 | | 1,225,000 | 1,309,721 |

| Series 2019, 5% 1/1/44 | | 2,120,000 | 2,279,077 |

| Kentucky Econ. Dev. Fin. Auth.: | | | |

| Series 2019 A1: | | | |

5% 8/1/33 | | 945,000 | 1,037,959 |

5% 8/1/44 | | 945,000 | 983,768 |

| Series 2019 A2, 5% 8/1/49 | | 2,360,000 | 2,430,765 |

| Kentucky Econ. Dev. Fin. Auth. Hosp. Rev.: | | | |

| Series 2015 A: | | | |

5% 6/1/25 | | 45,000 | 47,025 |

5% 6/1/26 | | 50,000 | 52,237 |

5% 6/1/27 | | 50,000 | 52,140 |

5% 6/1/28 | | 55,000 | 57,236 |

5% 6/1/29 | | 60,000 | 62,355 |

5% 6/1/30 | | 60,000 | 62,335 |

| Series 2017 B: | | | |

5% 8/15/32 | | 2,530,000 | 2,725,553 |

5% 8/15/33 | | 1,250,000 | 1,343,874 |

5% 8/15/35 | | 1,415,000 | 1,505,502 |

| Kentucky State Property & Buildings Commission Rev.: | | | |

| (Proj. No. 119) Series 2018: | | | |

5% 5/1/29 | | 1,760,000 | 1,970,954 |

5% 5/1/30 | | 1,180,000 | 1,320,452 |

5% 5/1/31 | | 505,000 | 567,782 |

5% 5/1/32 | | 265,000 | 296,194 |

5% 5/1/33 | | 595,000 | 664,582 |

5% 5/1/34 | | 680,000 | 754,663 |

5% 5/1/35 | | 400,000 | 438,894 |

5% 5/1/36 | | 340,000 | 369,571 |

| Series A: | | | |

4% 11/1/38 | | 600,000 | 608,427 |

5% 11/1/29 | | 3,625,000 | 4,095,920 |

5% 11/1/30 | | 2,030,000 | 2,292,767 |

| Kentucky, Inc. Pub. Energy Bonds Series A, 4%, tender 6/1/26 (b) | | 29,720,000 | 29,775,559 |

| Louisville & Jefferson County: | | | |

| Bonds: | | | |

Series 2020 C, 5%, tender 10/1/26 (b) | | 1,360,000 | 1,448,286 |

Series 2020 D, 5%, tender 10/1/29 (b) | | 1,635,000 | 1,820,372 |

| Series 2013 A, 5.5% 10/1/33 | | 1,205,000 | 1,225,629 |

| Series 2016 A: | | | |

5% 10/1/31 | | 6,045,000 | 6,446,490 |

5% 10/1/32 | | 7,310,000 | 7,778,776 |

5% 10/1/33 | | 4,155,000 | 4,409,253 |

| Series 2020 A: | | | |

3% 10/1/43 | | 5,505,000 | 4,531,526 |

4% 10/1/40 | | 1,090,000 | 1,059,398 |

5% 10/1/37 | | 2,715,000 | 2,876,311 |

TOTAL KENTUCKY | | | 95,337,808 |

| Louisiana - 0.2% | | | |

| Louisiana Pub. Facilities Auth. Hosp. Rev. (Franciscan Missionaries of Our Lady Health Sys. Proj.) Series 2017 A, 5% 7/1/47 | | 1,605,000 | 1,642,807 |

| Louisiana Pub. Facilities Auth. Rev. (Tulane Univ. of Louisiana Proj.) Series 2016 A: | | | |

| 5% 12/15/25 | | 420,000 | 451,454 |

| 5% 12/15/27 | | 1,890,000 | 2,071,674 |

| 5% 12/15/29 | | 1,135,000 | 1,234,321 |

TOTAL LOUISIANA | | | 5,400,256 |

| Maine - 1.0% | | | |

| Maine Health & Higher Edl. Facilities Auth. Rev.: | | | |

| Series 2016 A: | | | |

4% 7/1/41 | | 1,120,000 | 1,055,598 |

4% 7/1/46 | | 1,665,000 | 1,516,364 |

5% 7/1/41 | | 455,000 | 456,430 |

5% 7/1/46 | | 310,000 | 293,683 |

| Series 2018 A: | | | |

5% 7/1/30 | | 1,120,000 | 1,227,547 |

5% 7/1/31 | | 1,040,000 | 1,136,518 |

5% 7/1/34 | | 1,890,000 | 2,035,331 |

5% 7/1/35 | | 2,590,000 | 2,769,163 |

5% 7/1/36 | | 3,070,000 | 3,260,855 |

5% 7/1/37 | | 2,830,000 | 2,994,744 |

5% 7/1/38 | | 2,150,000 | 2,271,189 |

5% 7/1/43 | | 4,250,000 | 4,426,859 |

| Maine Tpk. Auth. Tpk. Rev. Series 2018: | | | |

| 5% 7/1/33 | | 660,000 | 744,822 |

| 5% 7/1/34 | | 945,000 | 1,061,826 |

| 5% 7/1/35 | | 1,040,000 | 1,160,131 |

| 5% 7/1/36 | | 1,890,000 | 2,089,399 |

TOTAL MAINE | | | 28,500,459 |

| Maryland - 1.0% | | | |

| Baltimore Gen. Oblig. Series 2022 A, 5% 10/15/37 | | 735,000 | 865,513 |

| City of Westminster Series 2016, 5% 11/1/31 | | 1,865,000 | 1,984,591 |

| Maryland Cmnty. Dev. Admin Dept. Hsg. & Cmnty. Dev.: | | | |

| Series 2019 B, 4% 9/1/49 | | 1,590,000 | 1,608,103 |

| Series 2019 C, 3.5% 3/1/50 | | 1,755,000 | 1,754,778 |

| Maryland Dept. of Trans. Series 2022 B, 5% 12/1/23 | | 995,000 | 1,016,732 |

| Maryland Health & Higher Edl. Series 2021 A, 3% 7/1/51 | | 4,320,000 | 3,251,369 |

| Maryland Health & Higher Edl. Facilities Auth. Rev.: | | | |

| Series 2015, 5% 7/1/40 | | 1,890,000 | 1,921,830 |

| Series 2016 A: | | | |

4% 7/1/42 | | 735,000 | 682,214 |

5% 7/1/35 | | 1,940,000 | 2,018,714 |

5% 7/1/38 | | 1,060,000 | 1,088,491 |

| Maryland Stadium Auth. Built to Learn Rev.: | | | |

| Series 2021, 4% 6/1/46 | | 850,000 | 842,528 |

| Series 2022 A: | | | |

4% 6/1/37 | | 2,240,000 | 2,327,648 |

4% 6/1/38 | | 2,455,000 | 2,542,717 |

| Washington Metropolitan Area Transit Auth. Series 2020 A, 5% 7/15/38 | | 7,100,000 | 7,973,181 |

TOTAL MARYLAND | | | 29,878,409 |

| Massachusetts - 2.1% | | | |

| Massachusetts Dev. Fin. Agcy. Rev.: | | | |

| (Lesley Univ. Proj.) Series 2016, 5% 7/1/39 | | 960,000 | 974,142 |

| (Univ. of Massachusetts Health Cr., Inc. Proj.) Series 2017 L, 4% 7/1/44 | | 9,440,000 | 8,969,458 |

| (Wentworth Institute of Technology Proj.) Series 2017: | | | |

5% 10/1/30 | | 1,100,000 | 1,166,239 |

5% 10/1/33 | | 1,280,000 | 1,346,105 |

| Series 2015 D, 5% 7/1/44 | | 2,430,000 | 2,467,946 |

| Series 2016 A, 5% 1/1/47 | | 6,610,000 | 6,713,878 |

| Series 2019, 5% 9/1/59 | | 11,260,000 | 11,786,483 |

| Series 2020 A, 4% 7/1/45 | | 9,790,000 | 9,026,636 |

| Series J2, 5% 7/1/53 | | 2,360,000 | 2,402,506 |

| Series M: | | | |

4% 10/1/50 | | 9,975,000 | 8,888,246 |

5% 10/1/45 | | 7,515,000 | 7,805,815 |

TOTAL MASSACHUSETTS | | | 61,547,454 |

| Michigan - 2.0% | | | |

| Detroit Downtown Dev. Auth. Tax Series A, 5% 7/1/37 (Assured Guaranty Muni. Corp. Insured) | | 975,000 | 993,152 |

| Detroit Gen. Oblig. Series 2021 A, 5% 4/1/46 | | 1,840,000 | 1,822,844 |

| Grand Traverse County Hosp. Fin. Auth. Series 2021, 3% 7/1/51 | | 1,860,000 | 1,407,985 |

| Great Lakes Wtr. Auth. Sew Disp. Sys. Series 2018 A: | | | |

| 5% 7/1/43 | | 1,415,000 | 1,512,081 |

| 5% 7/1/48 | | 6,135,000 | 6,449,703 |

| Jackson County Series 2019: | | | |

| 4% 5/1/32 (Build America Mutual Assurance Insured) | | 2,050,000 | 2,224,848 |

| 4% 5/1/33 (Build America Mutual Assurance Insured) | | 2,110,000 | 2,276,353 |

| Kalamazoo Hosp. Fin. Auth. Hosp. Facilities Rev. Series 2016: | | | |

| 5% 5/15/28 | | 1,365,000 | 1,453,531 |

| 5% 5/15/28 (Pre-Refunded to 5/15/26 @ 100) | | 10,000 | 10,834 |

| Michigan Fin. Auth. Rev.: | | | |

| (Charter County of Wayne Criminal Justice Ctr. Proj.) Series 2018, 5% 11/1/43 | | 1,740,000 | 1,859,440 |

| Series 2016, 5% 11/15/32 | | 4,545,000 | 4,871,634 |

| Series 2019 A: | | | |

3% 12/1/49 | | 2,645,000 | 2,057,521 |

5% 11/15/48 | | 1,555,000 | 1,610,900 |

| Series 2020 A, 4% 6/1/49 | | 2,070,000 | 1,869,706 |

| Michigan Hosp. Fin. Auth. Rev. Series 2008 C: | | | |

| 5% 12/1/32 | | 290,000 | 322,101 |

| 5% 12/1/32 (Pre-Refunded to 12/1/27 @ 100) | | 40,000 | 45,057 |

| Portage Pub. Schools Series 2016: | | | |

| 5% 11/1/33 | | 945,000 | 1,011,864 |

| 5% 11/1/36 | | 1,180,000 | 1,256,676 |

| 5% 11/1/37 | | 945,000 | 1,005,802 |

| Warren Consolidated School District Series 2016: | | | |

| 5% 5/1/28 | | 3,870,000 | 4,182,666 |

| 5% 5/1/29 | | 3,995,000 | 4,311,267 |

| Wayne County Arpt. Auth. Rev.: | | | |

| Series 2015 D: | | | |

5% 12/1/30 | | 1,225,000 | 1,309,427 |

5% 12/1/31 | | 2,170,000 | 2,318,392 |

| Series 2015 G: | | | |

5% 12/1/31 | | 1,415,000 | 1,511,763 |

5% 12/1/32 | | 1,415,000 | 1,510,276 |

5% 12/1/33 | | 1,890,000 | 2,014,296 |

| Series 2015, 5% 12/1/29 | | 1,510,000 | 1,614,364 |

| Series 2017 A: | | | |

5% 12/1/28 | | 565,000 | 630,558 |

5% 12/1/29 | | 520,000 | 577,635 |

5% 12/1/30 | | 660,000 | 732,617 |

5% 12/1/33 | | 330,000 | 366,124 |

5% 12/1/37 | | 470,000 | 510,065 |

5% 12/1/37 | | 255,000 | 272,484 |

| Series 2017 C, 5% 12/1/28 | | 1,040,000 | 1,163,189 |

TOTAL MICHIGAN | | | 57,087,155 |

| Minnesota - 1.6% | | | |

| Duluth Econ. Dev. Auth. Health Care Facilities Rev. Series 2018 A: | | | |

| 5% 2/15/48 | | 6,685,000 | 6,901,502 |

| 5% 2/15/58 | | 11,185,000 | 11,480,265 |

| Maple Grove Health Care Sys. Rev.: | | | |

| Series 2015, 5% 9/1/27 | | 1,215,000 | 1,271,261 |

| Series 2017: | | | |

5% 5/1/23 | | 470,000 | 472,508 |

5% 5/1/24 | | 1,135,000 | 1,164,803 |

| Minneapolis & Saint Paul Hsg. & Redev. Auth. Health Care Sys. Rev. (Allina Health Sys. Proj.) Series 2017 A, 5% 11/15/25 | | 1,290,000 | 1,377,382 |

| Minnesota Higher Ed. Facilities Auth. Rev. Series 2018 A: | | | |

| 5% 10/1/29 | | 945,000 | 1,036,397 |

| 5% 10/1/32 | | 675,000 | 734,812 |

| 5% 10/1/33 | | 825,000 | 894,443 |

| 5% 10/1/45 | | 975,000 | 1,011,970 |

| Minnesota Hsg. Fin. Agcy.: | | | |

| Series B, 4% 8/1/41 | | 1,270,000 | 1,287,471 |

| Series D: | | | |

4% 8/1/38 | | 2,265,000 | 2,329,114 |

4% 8/1/40 | | 2,455,000 | 2,500,124 |

4% 8/1/41 | | 1,610,000 | 1,632,148 |

4% 8/1/43 | | 1,820,000 | 1,828,966 |

| Saint Cloud Health Care Rev. Series 2019: | | | |

| 4% 5/1/49 | | 3,265,000 | 3,165,002 |

| 5% 5/1/48 | | 4,085,000 | 4,254,033 |

| Shakopee Sr. Hsg. Rev. Bonds Series 2018, 5.85%, tender 11/1/25 (b)(d) | | 3,150,000 | 3,123,750 |

TOTAL MINNESOTA | | | 46,465,951 |

| Mississippi - 0.1% | | | |

| Mississippi Home Corp. Series 2021 B: | | | |

| 3% 6/1/51 | | 2,890,000 | 2,846,210 |

| 5% 6/1/28 | | 705,000 | 789,256 |

TOTAL MISSISSIPPI | | | 3,635,466 |

| Missouri - 1.0% | | | |

| Cape Girardeau County Indl. Dev. Auth. Series 2017 A: | | | |

| 5% 3/1/27 | | 30,000 | 31,880 |

| 5% 3/1/29 | | 1,390,000 | 1,469,620 |

| Kansas City San. Swr. Sys. Rev. Series 2018 B: | | | |

| 5% 1/1/26 | | 225,000 | 242,999 |

| 5% 1/1/28 | | 470,000 | 532,997 |

| 5% 1/1/33 | | 450,000 | 506,753 |

| Kansas City Wtr. Rev. Series 2020 A, 4% 12/1/39 | | 1,190,000 | 1,227,257 |

| Missouri Health & Edl. Facilities Rev.: | | | |

| Series 2015 B: | | | |

3.125% 2/1/27 | | 380,000 | 384,042 |

3.25% 2/1/28 | | 380,000 | 384,799 |

5% 2/1/34 | | 2,940,000 | 3,057,100 |

5% 2/1/36 | | 1,135,000 | 1,173,077 |

| Series 2019 A: | | | |

4% 10/1/48 | | 2,030,000 | 2,011,324 |

5% 10/1/46 | | 3,990,000 | 4,335,581 |

| Missouri Hsg. Dev. Commission Single Family Mtg. Rev. Series 2019, 4% 5/1/50 | | 480,000 | 486,507 |

| Saint Louis Arpt. Rev.: | | | |

| Series 2019 A: | | | |

5% 7/1/44 | | 1,320,000 | 1,414,785 |

5% 7/1/49 | | 1,085,000 | 1,152,543 |

| Series A, 5.25% 7/1/26 (Assured Guaranty Muni. Corp. Insured) | | 2,830,000 | 3,100,120 |

| Saint Louis County Indl. Dev. Auth. Sr. Living Facilities Rev. Series 2018 A, 5.125% 9/1/48 | | 2,510,000 | 2,313,639 |

| The Indl. Dev. Auth. of Hannibal (Hannibal Reg'l. Healthcare Sys. Proj.) Series 2017: | | | |

| 5% 10/1/42 | | 3,235,000 | 3,338,676 |

| 5% 10/1/47 | | 2,005,000 | 2,058,856 |

TOTAL MISSOURI | | | 29,222,555 |

| Montana - 0.1% | | | |

| Montana Board Hsg. Single Family Series 2019 B, 4% 6/1/50 | | 265,000 | 269,802 |

| Montana Facility Fin. Auth. Series 2021 A, 3% 6/1/50 | | 2,665,000 | 1,972,664 |

TOTAL MONTANA | | | 2,242,466 |

| Nebraska - 1.1% | | | |

| Central Plains Energy Proj. Gas Supply Bonds Series 2019, 4%, tender 8/1/25 (b) | | 13,495,000 | 13,666,859 |

| Douglas County Neb Edl. Facilities Rev. (Creighton Univ. Projs.): | | | |

| Series 2017, 4% 7/1/33 | | 730,000 | 756,884 |

| Series 2021 A, 3% 7/1/51 | | 1,190,000 | 873,729 |

| Lincoln Elec. Sys. Rev. Series 2018: | | | |

| 5% 9/1/31 | | 1,890,000 | 2,091,015 |

| 5% 9/1/32 | | 3,525,000 | 3,895,189 |

| 5% 9/1/33 | | 2,115,000 | 2,331,825 |

| Nebraska Invt. Fin. Auth. Single Family Hsg. Rev. Series 2020 A, 3.5% 9/1/50 | | 1,190,000 | 1,191,356 |

| Nebraska Pub. Pwr. District Rev.: | | | |

| Series 2016 A: | | | |

5% 1/1/32 | | 1,575,000 | 1,674,806 |

5% 1/1/34 | | 945,000 | 1,001,341 |

| Series 2016 B, 5% 1/1/32 | | 4,720,000 | 5,019,100 |

TOTAL NEBRASKA | | | 32,502,104 |

| Nevada - 0.6% | | | |

| Carson City Hosp. Rev. (Carson Tahoe Hosp. Proj.) Series 2017: | | | |

| 5% 9/1/37 | | 2,555,000 | 2,645,731 |

| 5% 9/1/42 | | 6,295,000 | 6,490,964 |

| Clark County School District Series 2020 B, 3% 6/15/39 | | 2,630,000 | 2,270,140 |

| Las Vegas Valley Wtr. District Wtr. Impt. Gen. Oblig. Series 2016 B, 5% 6/1/36 | | 2,550,000 | 2,728,267 |

| Nevada Hsg. Division Single Family Mtg. Rev. Series 2019 B, 4% 10/1/49 | | 775,000 | 784,444 |

| Tahoe-Douglas Visitors Auth. Series 2020, 5% 7/1/51 | | 2,830,000 | 2,853,717 |

TOTAL NEVADA | | | 17,773,263 |

| New Hampshire - 1.3% | | | |

| Nat'l. Fin. Auth. Hosp. Rev. (St. Luke's Univ. Health Network Proj.) Series 2021 B, 3% 8/15/51 (Assured Guaranty Muni. Corp. Insured) | | 2,300,000 | 1,748,627 |

| Nat'l. Finnance Auth. Series 2020 1, 4.125% 1/20/34 | | 4,700,434 | 4,748,745 |

| New Hampshire Health & Ed. Facilities Auth.: | | | |

| (Dartmouth-Hitchcock Oblgtd Grp Proj.): | | | |

Series 2018 A: | | | |

5% 8/1/31 | | 1,225,000 | 1,348,379 |

5% 8/1/32 | | 235,000 | 258,312 |

5% 8/1/34 | | 2,830,000 | 3,086,430 |

5% 8/1/36 | | 1,890,000 | 2,019,984 |

5% 8/1/37 | | 2,265,000 | 2,401,952 |

Series 2018, 5% 8/1/35 | | 2,595,000 | 2,802,063 |

| (Partners Healthcare Sys., Inc. Proj.) Series 2017, 5% 7/1/41 | | 1,985,000 | 2,080,136 |

| Series 2017: | | | |

5% 7/1/36 | | 1,135,000 | 1,169,772 |

5% 7/1/44 | | 1,790,000 | 1,771,303 |

| New Hampshire Health & Ed. Facilities Auth. Rev.: | | | |

| Series 2012: | | | |

4% 7/1/23 | | 945,000 | 945,700 |

4% 7/1/32 | | 850,000 | 850,284 |

| Series 2016: | | | |

4% 10/1/38 | | 1,100,000 | 1,084,031 |

5% 10/1/28 | | 2,830,000 | 3,018,080 |

5% 10/1/32 | | 4,870,000 | 5,156,325 |

5% 10/1/38 | | 3,555,000 | 3,646,034 |

TOTAL NEW HAMPSHIRE | | | 38,136,157 |

| New Jersey - 5.6% | | | |

| New Jersey Econ. Dev. Auth.: | | | |

| (White Horse HMT Urban Renewal LLC Proj.) Series 2020, 5% 1/1/40 (d) | | 855,000 | 654,688 |

| Series A, 5% 11/1/36 | | 4,895,000 | 5,307,888 |

| Series QQQ: | | | |

4% 6/15/34 | | 755,000 | 789,459 |

4% 6/15/36 | | 1,040,000 | 1,060,588 |

4% 6/15/39 | | 945,000 | 946,982 |

4% 6/15/41 | | 945,000 | 934,354 |

4% 6/15/46 | | 1,415,000 | 1,359,138 |

4% 6/15/50 | | 1,890,000 | 1,796,837 |

5% 6/15/31 | | 1,040,000 | 1,199,605 |

5% 6/15/33 | | 190,000 | 216,056 |

| New Jersey Econ. Dev. Auth. Rev.: | | | |

| (Black Horse EHT Urban Renewal LLC Proj.) Series 2019 A, 5% 10/1/39 (d) | | 750,000 | 576,771 |

| (Provident Montclair Proj.) Series 2017: | | | |

5% 6/1/27 (Assured Guaranty Muni. Corp. Insured) | | 40,000 | 43,666 |

5% 6/1/28 (Assured Guaranty Muni. Corp. Insured) | | 55,000 | 59,819 |

5% 6/1/29 (Assured Guaranty Muni. Corp. Insured) | | 40,000 | 43,400 |

| Series 2014 PP, 5% 6/15/26 | | 5,665,000 | 5,840,731 |

| Series 2016 AAA, 5% 6/15/41 | | 2,370,000 | 2,449,135 |

| Series LLL, 4% 6/15/49 | | 2,655,000 | 2,528,685 |

| Series MMM, 4% 6/15/36 | | 755,000 | 768,275 |

| New Jersey Edl. Facility Series 2016 A, 5% 7/1/29 | | 2,480,000 | 2,625,037 |

| New Jersey Gen. Oblig. Series 2020 A, 5% 6/1/29 | | 3,000,000 | 3,482,961 |

| New Jersey Health Care Facilities Fing. Auth. Rev.: | | | |

| Series 2016 A: | | | |

5% 7/1/25 (Escrowed to Maturity) | | 995,000 | 1,055,915 |

5% 7/1/25 (Escrowed to Maturity) | | 465,000 | 492,905 |

5% 7/1/26 (Escrowed to Maturity) | | 145,000 | 157,558 |

5% 7/1/27 (Pre-Refunded to 7/1/26 @ 100) | | 220,000 | 239,053 |

5% 7/1/28 (Pre-Refunded to 7/1/26 @ 100) | | 35,000 | 38,091 |

5% 7/1/28 (Pre-Refunded to 7/1/26 @ 100) | | 645,000 | 700,860 |

5% 7/1/30 | | 945,000 | 1,024,691 |

| Series 2016: | | | |

4% 7/1/48 | | 1,700,000 | 1,423,573 |

5% 7/1/41 | | 2,070,000 | 2,060,665 |

| New Jersey Higher Ed. Student Assistance Auth. Student Ln. Rev. Series 2019 A: | | | |

| 5% 12/1/24 | | 550,000 | 572,924 |

| 5% 12/1/25 | | 1,005,000 | 1,072,287 |

| New Jersey Tpk. Auth. Tpk. Rev. Series 2022 B: | | | |

| 4.25% 1/1/43 | | 6,000,000 | 6,172,020 |

| 5% 1/1/46 | | 8,000,000 | 8,808,590 |

| New Jersey Trans. Trust Fund Auth.: | | | |

| (Trans. Prog.) Series 2019 AA, 5.25% 6/15/43 | | 15,160,000 | 16,065,816 |

| Series 2006 C: | | | |

0% 12/15/31 (FGIC Insured) | | 5,300,000 | 3,918,904 |

0% 12/15/36 (AMBAC Insured) | | 10,000,000 | 5,663,285 |

| Series 2010 A, 0% 12/15/27 | | 6,980,000 | 6,004,960 |

| Series 2014 BB2, 5% 6/15/34 | | 5,370,000 | 6,085,009 |

| Series 2016 A: | | | |

5% 6/15/27 | | 890,000 | 959,652 |

5% 6/15/29 | | 3,350,000 | 3,603,514 |

| Series 2018 A: | | | |

5% 12/15/32 | | 3,025,000 | 3,361,901 |

5% 12/15/34 | | 945,000 | 1,033,072 |

| Series 2019 BB, 4% 6/15/50 | | 1,770,000 | 1,682,752 |

| Series 2021 A: | | | |

4% 6/15/38 | | 510,000 | 513,698 |

5% 6/15/32 | | 3,360,000 | 3,880,693 |

5% 6/15/33 | | 945,000 | 1,081,843 |

| Series 2022 A: | | | |

4% 6/15/41 | | 4,625,000 | 4,572,899 |

4% 6/15/42 | | 3,105,000 | 3,041,612 |

| Series 2022 AA: | | | |

5% 6/15/29 | | 7,555,000 | 8,557,306 |

5% 6/15/35 | | 590,000 | 668,972 |

5% 6/15/36 | | 6,915,000 | 7,709,647 |

5% 6/15/37 | | 3,195,000 | 3,522,041 |

| Series A: | | | |

4% 12/15/39 | | 945,000 | 946,758 |

4.25% 12/15/38 | | 2,345,000 | 2,386,811 |

| Series AA: | | | |

4% 6/15/38 | | 2,660,000 | 2,676,635 |

4% 6/15/45 | | 6,365,000 | 6,137,579 |

4% 6/15/50 | | 895,000 | 850,883 |

5% 6/15/37 | | 2,830,000 | 3,079,702 |

5% 6/15/50 | | 3,160,000 | 3,321,677 |

| South Jersey Trans. Auth. Trans. Sys. Rev. Series 2022 A: | | | |

| 4.5% 11/1/42 | | 1,500,000 | 1,519,516 |

| 4.625% 11/1/47 | | 2,500,000 | 2,542,862 |

TOTAL NEW JERSEY | | | 161,893,206 |

| New Mexico - 0.1% | | | |

| New Mexico Mtg. Fin. Auth. Series 2019 D, 3.75% 1/1/50 | | 1,035,000 | 1,042,791 |

| Santa Fe Retirement Fac. Series 2019 A: | | | |

| 5% 5/15/34 | | 215,000 | 206,206 |

| 5% 5/15/39 | | 160,000 | 145,985 |

| 5% 5/15/44 | | 170,000 | 148,043 |

| 5% 5/15/49 | | 335,000 | 283,537 |

TOTAL NEW MEXICO | | | 1,826,562 |

| New York - 6.5% | | | |

| Dorm. Auth. New York Univ. Rev.: | | | |

| (Memorial Sloan-Kettring Cancer Ctr.) Series 2017 1, 5% 7/1/42 | | 1,470,000 | 1,556,689 |

| Series 2016 A: | | | |

5% 7/1/23 | | 30,000 | 30,304 |

5% 7/1/25 | | 65,000 | 68,385 |

5% 7/1/32 | | 2,360,000 | 2,520,202 |

| Hempstead Local Dev. Corp. Rev. (Hofstra Univ. Proj.) Series 2021 A, 3% 7/1/51 | | 2,285,000 | 1,770,367 |

| Hudson Yards Infrastructure Corp. New York Rev. Series 2017 A, 5% 2/15/33 | | 3,395,000 | 3,736,924 |

| Long Island Pwr. Auth. Elec. Sys. Rev. Series 2017: | | | |

| 5% 9/1/33 | | 470,000 | 521,621 |

| 5% 9/1/35 | | 1,890,000 | 2,071,693 |

| 5% 9/1/36 | | 1,070,000 | 1,168,310 |

| MTA Hudson Rail Yards Trust Oblig. Series 2016 A, 5% 11/15/56 | | 16,100,000 | 15,944,888 |

| New York City Edl. Construction Fund Series 2021 B, 5% 4/1/46 | | 4,505,000 | 4,885,006 |

| New York City Gen. Oblig.: | | | |

| Series 2021 A1, 5% 8/1/31 | | 6,010,000 | 7,169,639 |

| Series 2022 B1, 5% 8/1/32 | | 1,000,000 | 1,233,420 |

| New York City Transitional Fin. Auth. Rev.: | | | |

| Series 2016 A, 5% 5/1/40 | | 1,840,000 | 1,955,448 |

| Series 2017 B, 5% 8/1/40 | | 1,890,000 | 2,017,633 |

| Series 2019 B1, 5% 8/1/34 | | 1,890,000 | 2,127,949 |

| New York Convention Ctr. Dev. Corp. Rev. Series 2015: | | | |

| 5% 11/15/28 | | 6,805,000 | 7,214,920 |

| 5% 11/15/29 | | 4,720,000 | 4,990,358 |

| New York Dorm. Auth. Rev. Series 2022 A: | | | |

| 5% 7/1/33 | | 660,000 | 773,435 |

| 5% 7/1/34 | | 1,370,000 | 1,588,246 |

| 5% 7/15/37 | | 570,000 | 602,888 |

| 5% 7/1/38 | | 1,785,000 | 1,968,535 |

| 5% 7/1/42 | | 1,180,000 | 1,265,627 |

| 5% 7/15/42 | | 1,605,000 | 1,659,431 |

| 5% 7/15/50 | | 4,150,000 | 4,222,432 |

| New York Dorm. Auth. Sales Tax Rev.: | | | |

| Series 2016 A, 5% 3/15/32 | | 1,835,000 | 2,005,331 |

| Series 2018 C, 5% 3/15/38 | | 7,820,000 | 8,519,508 |

| New York Metropolitan Trans. Auth. Rev.: | | | |

| Series 2016 C1, 5% 11/15/56 | | 1,890,000 | 1,902,158 |

| Series 2017 C-2: | | | |

0% 11/15/29 | | 2,150,000 | 1,694,947 |

0% 11/15/33 | | 5,285,000 | 3,498,239 |

| Series 2017 D, 5% 11/15/30 | | 4,720,000 | 5,006,036 |

| Series 2020 D: | | | |

4% 11/15/46 | | 31,520,000 | 28,540,925 |

4% 11/15/47 | | 2,205,000 | 1,983,198 |

| New York State Dorm. Auth.: | | | |

| Series 2019 D, 3% 2/15/49 | | 5,070,000 | 4,065,763 |

| Series 2021 E, 3% 3/15/50 | | 5,030,000 | 3,966,602 |

| New York State Urban Dev. Corp. Series 2020 E: | | | |

| 4% 3/15/44 | | 22,920,000 | 22,756,745 |

| 4% 3/15/45 | | 18,600,000 | 18,387,173 |

| New York Urban Dev. Corp. Rev.: | | | |

| (New York State Gen. Oblig. Proj.) Series 2017 A, 5% 3/15/34 | | 3,495,000 | 3,828,975 |

| Gen. Oblig. (New York State Gen. Oblig. Proj.) Series 2017 A, 5% 3/15/32 | | 2,955,000 | 3,260,594 |

| Oneida County Local Dev. Corp. Rev. (Mohawk Valley Health Sys. Proj.) Series 2019 A: | | | |

| 4% 12/1/32 (Assured Guaranty Muni. Corp. Insured) | | 945,000 | 982,240 |

| 5% 12/1/25 (Assured Guaranty Muni. Corp. Insured) | | 595,000 | 606,822 |

| 5% 12/1/30 (Assured Guaranty Muni. Corp. Insured) | | 1,415,000 | 1,612,637 |

| Suffolk County Econ. Dev. Corp. Rev. Series 2021: | | | |

| 5.125% 11/1/41 (d) | | 600,000 | 482,397 |

| 5.375% 11/1/54 (d) | | 1,020,000 | 787,678 |

TOTAL NEW YORK | | | 186,952,318 |

| North Carolina - 1.5% | | | |

| Charlotte Ctfs. of Prtn. (Convention Facility Projs.) Series 2019 A, 5% 6/1/46 | | 2,245,000 | 2,450,832 |

| Charlotte Int'l. Arpt. Rev.: | | | |

| Series 2017 A: | | | |

5% 7/1/35 | | 1,890,000 | 2,062,919 |

5% 7/1/42 | | 2,715,000 | 2,872,834 |

| Series 2017 C: | | | |

4% 7/1/36 | | 1,415,000 | 1,447,692 |

4% 7/1/37 | | 1,415,000 | 1,437,323 |

| New Hanover County Hosp. Rev. Series 2017, 5% 10/1/27 (Escrowed to Maturity) | | 210,000 | 235,166 |

| North Carolina Med. Care Commission Health Care Facilities Rev.: | | | |

| Series 2019 A: | | | |

5% 12/1/29 | | 1,310,000 | 1,457,573 |

5% 12/1/30 | | 1,360,000 | 1,512,674 |

5% 12/1/32 | | 1,035,000 | 1,144,980 |

5% 12/1/33 | | 755,000 | 830,750 |

| Series 2020 A, 3% 7/1/45 | | 1,730,000 | 1,386,495 |

| Series 2021 A: | | | |

4% 3/1/36 | | 850,000 | 724,326 |

4% 3/1/51 | | 1,790,000 | 1,304,787 |

| North Carolina Muni. Pwr. Agcy. #1 Catawba Elec. Rev. Series 2015 C, 5% 1/1/29 | | 7,555,000 | 8,106,918 |

| North Carolina Tpk. Auth. Triangle Expressway Sys. Series 2019: | | | |

| 4% 1/1/55 | | 3,045,000 | 2,852,314 |

| 5% 1/1/43 | | 4,250,000 | 4,471,966 |

| 5% 1/1/44 | | 5,295,000 | 5,559,602 |

| 5% 1/1/49 | | 1,890,000 | 1,967,964 |

TOTAL NORTH CAROLINA | | | 41,827,115 |

| North Dakota - 0.1% | | | |

| Univ. of North Dakota Series 2021 A, 3% 6/1/61 (Assured Guaranty Muni. Corp. Insured) | | 3,620,000 | 2,588,667 |

| Ohio - 2.7% | | | |

| Akron Bath Copley Hosp. District Rev. Series 2016, 5.25% 11/15/46 | | 3,965,000 | 4,056,329 |

| American Muni. Pwr., Inc. (Solar Electricity Prepayment Proj.) Series 2019 A: | | | |

| 5% 2/15/38 | | 1,415,000 | 1,525,867 |

| 5% 2/15/39 | | 945,000 | 1,015,758 |

| 5% 2/15/44 | | 2,975,000 | 3,152,694 |

| American Muni. Pwr., Inc. Rev. (Greenup Hydroelectric Proj.): | | | |

| Series 2016 A, 5% 2/15/41 | | 3,775,000 | 3,915,602 |

| Series 2016, 5% 2/15/46 | | 1,210,000 | 1,247,346 |

| Buckeye Tobacco Settlement Fing. Auth.: | | | |

| Series 2020 A2: | | | |

3% 6/1/48 | | 2,570,000 | 1,955,278 |

4% 6/1/48 | | 850,000 | 781,282 |

5% 6/1/27 | | 2,125,000 | 2,270,517 |

5% 6/1/29 | | 3,870,000 | 4,235,250 |

5% 6/1/34 | | 1,140,000 | 1,242,009 |

| Series 2020 B2, 5% 6/1/55 | | 7,105,000 | 6,774,741 |

| Cleveland Arpt. Sys. Rev. Series 2016 A: | | | |

| 5% 1/1/26 (Assured Guaranty Muni. Corp. Insured) | | 470,000 | 492,966 |

| 5% 1/1/27 (Assured Guaranty Muni. Corp. Insured) | | 2,055,000 | 2,156,452 |

| 5% 1/1/31 (Assured Guaranty Muni. Corp. Insured) | | 945,000 | 989,525 |

| Cleveland Income Tax Rev. Series 2018 A: | | | |

| 5% 10/1/35 | | 1,890,000 | 2,089,911 |

| 5% 10/1/37 | | 1,180,000 | 1,292,346 |

| 5% 10/1/38 | | 1,415,000 | 1,545,402 |

| Columbus City School District Series 2016 A, 5% 12/1/32 | | 945,000 | 1,019,504 |

| Fairfield County Hosp. Facilities Rev. (Fairfield Med. Ctr. Proj.) Series 2013: | | | |

| 5% 6/15/25 | | 65,000 | 65,235 |

| 5% 6/15/26 | | 70,000 | 70,260 |

| 5% 6/15/27 | | 75,000 | 75,269 |

| 5% 6/15/28 | | 80,000 | 80,273 |

| 5.25% 6/15/43 | | 4,720,000 | 4,665,307 |

| Lake County Hosp. Facilities Rev. Series 2015, 5% 8/15/27 (Pre-Refunded to 8/15/25 @ 100) | | 60,000 | 63,718 |

| Lancaster Port Auth. Gas Rev. Bonds Series 2019, 5%, tender 2/1/25 (b) | | 10,450,000 | 10,757,324 |

| Muskingum County Hosp. Facilities (Genesis Healthcare Sys. Obligated Group Proj.) Series 2013, 5% 2/15/27 | | 160,000 | 160,104 |

| Ohio Higher Edl. Facility Commission Rev. Series 2019, 4% 10/1/44 | | 1,675,000 | 1,611,360 |

| Ohio Hosp. Facilities Rev. Series 2017 A, 5% 1/1/31 | | 130,000 | 146,196 |

| Ohio Hosp. Rev. Series 2020 A, 4% 1/15/50 | | 780,000 | 720,796 |

| Ohio Hsg. Fin. Agcy. Residential Mtg. Rev. (Mtg. Backed Securities Prog.) Series 2019 B, 4.5% 3/1/50 | | 375,000 | 383,766 |

| Ohio Tpk. Commission Tpk. Rev. (Infrastructure Proj.) Series 2005 A, 0% 2/15/42 | | 5,475,000 | 2,461,380 |

| Scioto County Hosp. Facilities Rev.: | | | |

| Series 2016, 5% 2/15/29 | | 1,195,000 | 1,254,612 |

| Series 2019, 5% 2/15/29 | | 2,530,000 | 2,674,935 |

| Univ. of Akron Gen. Receipts Series 2019 A: | | | |

| 4% 1/1/28 | | 3,495,000 | 3,706,023 |

| 5% 1/1/30 | | 1,700,000 | 1,937,257 |

| Washington County Hosp. Rev. Series 2022: | | | |

| 6% 12/1/28 | | 1,075,000 | 1,116,683 |

| 6% 12/1/29 | | 1,140,000 | 1,190,699 |

| 6% 12/1/30 | | 1,205,000 | 1,262,861 |

| 6% 12/1/31 | | 1,280,000 | 1,344,083 |

TOTAL OHIO | | | 77,506,920 |

| Oklahoma - 0.1% | | | |

| Oklahoma City Pub. Property Auth. Hotel Tax Rev. Series 2015: | | | |

| 5% 10/1/24 | | 1,045,000 | 1,088,779 |

| 5% 10/1/32 | | 1,040,000 | 1,106,474 |

| Oklahoma Dev. Fin. Auth. Rev. (Oklahoma City Univ. Proj.) Series 2019, 5% 8/1/44 | | 1,590,000 | 1,600,491 |

TOTAL OKLAHOMA | | | 3,795,744 |

| Oregon - 0.7% | | | |

| Oregon State Hsg. & Cmnty. Svcs. Dept. Series 2019 A, 4% 7/1/50 | | 4,385,000 | 4,436,888 |

| Polk Marion & Benton School District # 13J Series B, 0% 12/15/38 | | 1,995,000 | 1,089,853 |

| Salem Hosp. Facility Auth. Rev. (Salem Health Projs.) Series 2019 A, 3% 5/15/49 | | 3,960,000 | 3,034,479 |

| Washington, Multnomah & Yamhill County School District #1J Series 2017: | | | |

| 5% 6/15/33 | | 1,020,000 | 1,131,596 |

| 5% 6/15/35 | | 2,960,000 | 3,256,692 |

| 5% 6/15/36 | | 2,830,000 | 3,092,829 |

| 5% 6/15/38 | | 2,830,000 | 3,074,583 |

TOTAL OREGON | | | 19,116,920 |

| Pennsylvania - 6.3% | | | |

| Allegheny County Arpt. Auth. Rev. Series 2021 B: | | | |

| 5% 1/1/51 | | 5,350,000 | 5,712,188 |

| 5% 1/1/56 | | 11,795,000 | 12,522,780 |

| Allegheny County Hosp. Dev. Auth. Rev. Series 2019 A, 4% 7/15/36 | | 2,360,000 | 2,392,894 |

| Allegheny County Indl. Dev. Auth. Rev. Series 2021: | | | |

| 3.5% 12/1/31 | | 1,265,000 | 1,070,769 |

| 4% 12/1/41 | | 2,135,000 | 1,621,127 |

| 4.25% 12/1/50 | | 2,375,000 | 1,712,759 |

| Bucks County Indl. Dev. Auth. Hosp. Rev. Series 2021: | | | |

| 5% 7/1/37 | | 1,390,000 | 1,389,984 |

| 5% 7/1/39 | | 2,765,000 | 2,701,887 |

| Cap. Region Wtr. Wtr. Rev. Series 2018: | | | |

| 5% 7/15/26 | | 945,000 | 1,025,804 |

| 5% 7/15/38 | | 945,000 | 1,040,085 |

| Coatesville Area School District Series 2017, 5% 8/1/23 (Assured Guaranty Muni. Corp. Insured) | | 425,000 | 430,168 |

| Dauphin County Gen. Auth. (Pinnacle Health Sys. Proj.) Series 2016 A, 5% 6/1/29 | | 1,255,000 | 1,332,868 |

| Delaware County Auth. Rev. Series 2017, 5% 7/1/26 | | 1,115,000 | 1,150,040 |

| Doylestown Hosp. Auth. Hosp. Rev. Series 2016 A, 5% 7/1/46 | | 785,000 | 657,469 |

| Lancaster County Hosp. Auth. Health Ctr. Rev. Series 2021, 5% 11/1/51 | | 3,110,000 | 3,237,361 |

| Lehigh County Gen. Purp. Hosp. Rev. Series 2019 A: | | | |

| 4% 7/1/37 | | 1,890,000 | 1,893,181 |

| 4% 7/1/38 | | 2,060,000 | 2,060,362 |

| 4% 7/1/39 | | 2,360,000 | 2,352,010 |

| 5% 7/1/44 | | 2,360,000 | 2,474,542 |

| Monroeville Fin. Auth. UPMC Rev. Series 2012, 5% 2/15/26 | | 1,605,000 | 1,722,991 |

| Montgomery County Higher Ed. & Health Auth. Rev.: | | | |

| Series 2014 A, 5% 10/1/23 | | 2,225,000 | 2,238,855 |

| Series 2016 A: | | | |

5% 10/1/28 | | 40,000 | 41,078 |

5% 10/1/29 | | 40,000 | 41,056 |

5% 10/1/30 | | 4,105,000 | 4,210,682 |

5% 10/1/32 | | 130,000 | 133,125 |

5% 10/1/36 | | 4,395,000 | 4,419,047 |

5% 10/1/40 | | 2,405,000 | 2,334,318 |

| Series 2019, 4% 9/1/44 | | 4,875,000 | 4,757,518 |

| Northampton County Gen. Purp. Auth. Hosp. Rev. (St. Luke's Univ. Health Network Proj.) Series 2018 A, 4% 8/15/48 | | 6,835,000 | 6,470,299 |

| Pennsylvania Ctfs. Prtn. Series 2018 A: | | | |

| 5% 7/1/35 | | 710,000 | 784,691 |

| 5% 7/1/36 | | 945,000 | 1,037,535 |

| 5% 7/1/37 | | 755,000 | 826,038 |

| 5% 7/1/38 | | 710,000 | 773,127 |

| 5% 7/1/43 | | 1,890,000 | 2,011,433 |

| Pennsylvania Higher Edl. Facilities Auth. Rev.: | | | |

| (Drexel Univ. Proj.) Series 2016, 5% 5/1/35 | | 1,495,000 | 1,572,420 |

| Series 2016: | | | |

5% 5/1/29 | | 945,000 | 1,007,713 |

5% 5/1/31 | | 945,000 | 1,003,644 |

| Pennsylvania Pub. School Bldg. Auth. School Rev. (The School District of The City of Harrisburg Proj.) Series 2016 A: | | | |

| 5% 12/1/29 | | 4,595,000 | 4,913,443 |

| 5% 12/1/29 (Pre-Refunded to 12/1/26 @ 100) | | 720,000 | 792,607 |

| Pennsylvania State Univ. Series 2020 A, 4% 9/1/50 | | 2,050,000 | 2,060,234 |

| Pennsylvania Tpk. Commission Tpk. Rev. Series 2021 A, 4% 12/1/50 | | 16,995,000 | 16,097,000 |

| Philadelphia Arpt. Rev. Series 2017 A: | | | |

| 5% 7/1/28 | | 470,000 | 520,144 |

| 5% 7/1/29 | | 470,000 | 518,022 |

| 5% 7/1/30 | | 520,000 | 572,597 |

| 5% 7/1/31 | | 565,000 | 620,621 |

| 5% 7/1/32 | | 520,000 | 570,520 |

| 5% 7/1/33 | | 565,000 | 617,480 |

| 5% 7/1/42 | | 2,255,000 | 2,367,288 |

| Philadelphia Auth. for Indl. Dev. Series 2017, 5% 11/1/47 | | 10,470,000 | 10,683,438 |

| Philadelphia Gas Works Rev.: | | | |

| Series 16 A, 4% 8/1/45 (Assured Guaranty Muni. Corp. Insured) | | 2,185,000 | 2,192,392 |

| Series 2015: | | | |

5% 8/1/26 | | 945,000 | 998,223 |

5% 8/1/27 | | 945,000 | 998,223 |

5% 8/1/28 | | 1,890,000 | 1,995,978 |

| Philadelphia Gen. Oblig. Series 2019 B: | | | |

| 5% 2/1/33 | | 1,510,000 | 1,691,248 |

| 5% 2/1/36 | | 1,400,000 | 1,536,141 |

| 5% 2/1/37 | | 1,810,000 | 1,970,612 |

| Philadelphia School District: | | | |

| Series 2016 F, 5% 9/1/29 | | 3,280,000 | 3,536,703 |

| Series 2018 A: | | | |

5% 9/1/34 | | 1,370,000 | 1,513,245 |

5% 9/1/35 | | 945,000 | 1,035,765 |

| Series 2018 B, 5% 9/1/43 | | 1,315,000 | 1,404,991 |

| Series 2019 A: | | | |

4% 9/1/35 | | 2,175,000 | 2,261,162 |

4% 9/1/36 | | 1,890,000 | 1,945,887 |

5% 9/1/31 | | 1,100,000 | 1,246,858 |

5% 9/1/33 | | 1,945,000 | 2,206,728 |

5% 9/1/33 | | 6,485,000 | 7,316,066 |

| Pittsburgh & Allegheny County Parking Sys. Series 2017: | | | |

| 5% 12/15/35 | | 1,060,000 | 1,152,750 |

| 5% 12/15/37 | | 470,000 | 508,763 |

| Pittsburgh Wtr. & Swr. Auth. Wtr. & Swr. Sys. Rev. Series 2019 B, 5% 9/1/32 (Assured Guaranty Muni. Corp. Insured) | | 1,890,000 | 2,301,249 |

| Pocono Mountains Indl. Park Auth. (St. Luke's Hosp. - Monroe Proj.) Series 2015 A, 5% 8/15/40 | | 1,695,000 | 1,724,919 |

| Southcentral Pennsylvania Gen. Auth. Rev. Series 2019 A: | | | |

| 4% 6/1/44 | | 1,405,000 | 1,398,895 |

| 4% 6/1/49 | | 3,345,000 | 3,185,962 |

| 5% 6/1/44 | | 2,450,000 | 2,581,456 |

| 5% 6/1/49 | | 3,915,000 | 4,099,884 |

| State Pub. School Bldg. Auth. Lease Rev. (The School District of Philadelphia Proj.) Series 2015 A, 5% 6/1/26 | | 695,000 | 728,999 |

| Union County Hosp. Auth. Rev. Series 2018 B: | | | |

| 5% 8/1/33 | | 945,000 | 1,011,367 |

| 5% 8/1/38 | | 3,025,000 | 3,191,510 |

| 5% 8/1/48 | | 2,690,000 | 2,754,067 |

TOTAL PENNSYLVANIA | | | 180,987,285 |

| Puerto Rico - 1.0% | | | |

| Puerto Rico Commonwealth Aqueduct & Swr. Auth.: | | | |

| Series 2021 B: | | | |

4% 7/1/42 (d) | | 2,165,000 | 1,932,638 |

5% 7/1/33 (d) | | 1,030,000 | 1,056,845 |

5% 7/1/37 (d) | | 4,335,000 | 4,400,194 |

| Series 2022 A, 4% 7/1/42 (d) | | 2,165,000 | 1,932,638 |

| Puerto Rico Commonwealth Pub. Impt. Gen. Oblig. Series 2021 A1: | | | |

| 0% 7/1/33 | | 10,912,493 | 6,319,863 |

| 4% 7/1/33 | | 8,345,792 | 7,803,317 |

| 4% 7/1/35 | | 3,005,000 | 2,729,450 |

| 5.625% 7/1/27 | | 1,085,763 | 1,137,219 |

| 5.625% 7/1/29 | | 1,260,915 | 1,340,575 |

TOTAL PUERTO RICO | | | 28,652,739 |

| Rhode Island - 0.5% | | | |

| Rhode Island Health & Edl. Bldg. Corp. Higher Ed. Facilities Rev.: | | | |

| Series 2016 B: | | | |

5% 9/1/31 | | 4,605,000 | 4,630,791 |

5% 9/1/36 | | 185,000 | 179,391 |

| Series 2016, 5% 5/15/39 | | 3,100,000 | 3,147,771 |

| Rhode Island Hsg. & Mtg. Fin. Corp.: | | | |

| Series 2019 70, 4% 10/1/49 | | 785,000 | 793,578 |

| Series 2021 74, 3% 4/1/49 | | 5,090,000 | 5,019,305 |

TOTAL RHODE ISLAND | | | 13,770,836 |

| South Carolina - 2.0% | | | |

| Charleston County Arpt. District Series 2019: | | | |

| 5% 7/1/43 | | 1,510,000 | 1,639,659 |

| 5% 7/1/48 | | 11,330,000 | 12,198,677 |

| South Carolina Hsg. Fin. & Dev. Auth. Mtg. Rev.: | | | |

| Series 2019 A, 4% 1/1/50 | | 1,270,000 | 1,291,852 |