UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-02105

Fidelity Salem Street Trust

(Exact name of registrant as specified in charter)

245 Summer St., Boston, MA 02210

(Address of principal executive offices) (Zip code)

Margaret Carey, Secretary

245 Summer St.

Boston, Massachusetts 02210

(Name and address of agent for service)

Registrant's telephone number, including area code:

617-563-7000

Date of fiscal year end: | January 31 |

Date of reporting period: | July 31, 2023 |

Item 1.

Reports to Stockholders

Contents

| Top Five States (% of Fund's net assets) | |

| New York | 11.8 |

| Georgia | 7.2 |

| Florida | 7.1 |

| California | 6.9 |

| Massachusetts | 6.4 |

| Revenue Sources (% of Fund's net assets) | ||

| General Obligations | 23.5 | |

| Health Care | 14.8 | |

| Education | 12.5 | |

| Special Tax | 12.5 | |

| Electric Utilities | 11.8 | |

| Others* (Individually Less Than 5%) | 24.9 | |

| 100.0 | ||

| *Includes net other assets | ||

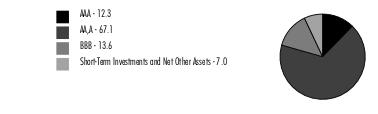

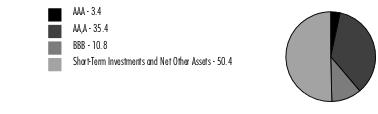

Quality Diversification (% of Fund's net assets) |

|

| We have used ratings from Moody's Investors Service, Inc. Where Moody's® ratings are not available, we have used S&P® ratings. All ratings are as of the date indicated and do not reflect subsequent changes. |

| Municipal Bonds - 93.1% | |||

Principal Amount (a) | Value ($) | ||

| Alabama - 1.7% | |||

| Black Belt Energy Gas District Bonds: | |||

| Series 2022 D1, 4%, tender 6/1/27 (b) | 10,000 | 9,962 | |

| Series 2022 F, 5.5%, tender 12/1/28 (b) | 100,000 | 105,444 | |

| Mobile Indl. Dev. Board Poll. Cont. Rev. Bonds (Alabama Pwr. Co. Barry Plant Proj.) Series 2007 C, 3.78%, tender 6/16/26 (b) | 100,000 | 99,975 | |

| Southeast Energy Auth. Rev. Bonds Bonds Series 2022 B1, 5%, tender 8/1/28 (b) | 20,000 | 20,632 | |

TOTAL ALABAMA | 236,013 | ||

| Arizona - 2.6% | |||

| Chandler Indl. Dev. Auth. Indl. Dev. Rev. (Intel Corp. Proj.) Series 2022 2, 5%, tender 9/1/27 (b)(c) | 50,000 | 51,385 | |

| Maricopa County Unified School District #48 Scottsdale Series D, 4% 7/1/24 | 80,000 | 80,525 | |

| Phoenix Civic Impt. Corp. Wastewtr. Sys. Rev. Series 2016, 5% 7/1/30 | 50,000 | 52,781 | |

| Salt Verde Finl. Corp. Sr. Gas Rev. Series 2007 1, 5% 12/1/32 | 165,000 | 174,838 | |

TOTAL ARIZONA | 359,529 | ||

| California - 6.9% | |||

| California Health Facilities Fing. Auth. Rev. Bonds Series 2019 C, 5%, tender 10/1/25 (b) | 150,000 | 153,715 | |

| California Hsg. Fin. Agcy. Series 2021 1, 3.5% 11/20/35 | 106,197 | 99,436 | |

| California Muni. Fin. Auth. Rev. Series 2018, 5% 10/1/25 | 15,000 | 15,299 | |

| California Statewide Cmntys. Dev. Auth. Rev. Series 2016, 5% 10/1/33 | 25,000 | 26,012 | |

| Los Angeles Dept. Arpt. Rev. Series 2023 A, 5.25% 5/15/39 (c) | 300,000 | 332,758 | |

| Los Angeles Dept. of Wtr. & Pwr. Wtrwks. Rev.: | |||

| Series 2017 A, 5% 7/1/32 | 15,000 | 16,150 | |

| Series 2022 B: | |||

5% 7/1/31 | 30,000 | 35,519 | |

5% 7/1/32 | 100,000 | 118,983 | |

| Riverside Elec. Rev. Series 2019 A, 5% 10/1/43 | 5,000 | 5,416 | |

| San Francisco Bay Area Rapid Transit District Sales Tax Rev. Series 2015 A, 5% 7/1/27 | 10,000 | 10,409 | |

| San Francisco Bay Area Rapid Transit Fing. Auth. Series 2019 F1, 5% 8/1/23 | 125,000 | 125,000 | |

TOTAL CALIFORNIA | 938,697 | ||

| Colorado - 3.6% | |||

| Colorado Ctfs. of Prtn. Series 2020 A, 4% 12/15/38 | 10,000 | 10,136 | |

| Colorado Health Facilities Auth. Rev. Bonds Series 2019 A2, 5% 8/1/33 | 125,000 | 134,469 | |

| Vauxmont Metropolitan District Series 2020, 5% 12/1/28 (Assured Guaranty Muni. Corp. Insured) | 325,000 | 353,938 | |

TOTAL COLORADO | 498,543 | ||

| Connecticut - 3.4% | |||

| Connecticut Gen. Oblig.: | |||

| Series 2019 A, 5% 4/15/33 | 25,000 | 27,764 | |

| Series 2021 D, 5% 7/15/28 | 75,000 | 82,456 | |

| Connecticut Health & Edl. Facilities Auth. Rev. Series 2016 A, 2%, tender 7/1/26 (b) | 35,000 | 33,155 | |

| Connecticut Hsg. Fin. Auth. Series 2021 D1: | |||

| 5% 11/15/27 | 10,000 | 10,693 | |

| 5% 11/15/28 | 25,000 | 27,142 | |

| Connecticut Spl. Tax Oblig. Trans. Infrastructure Rev.: | |||

| Series 2021 A, 4% 5/1/36 | 130,000 | 135,407 | |

| Series A: | |||

5% 9/1/26 | 100,000 | 106,031 | |

5% 5/1/29 | 20,000 | 22,404 | |

| South Central Reg'l. Wtr. Auth. Wtr. Sys. Rev. Series 32 B, 5% 8/1/32 | 25,000 | 26,484 | |

TOTAL CONNECTICUT | 471,536 | ||

| District Of Columbia - 0.2% | |||

| District of Columbia Univ. Rev. Series 2017: | |||

| 5% 4/1/29 | 20,000 | 21,191 | |

| 5% 4/1/33 | 10,000 | 10,606 | |

TOTAL DISTRICT OF COLUMBIA | 31,797 | ||

| Florida - 7.1% | |||

| Broward County School Board Ctfs. of Prtn.: | |||

| Series 2015 A, 5% 7/1/26 | 30,000 | 30,908 | |

| Series 2020 A, 5% 7/1/33 | 25,000 | 28,110 | |

| Duval County School Board Ctfs. of Prtn. Series 2022 A, 5% 7/1/34 (Assured Guaranty Muni. Corp. Insured) | 250,000 | 280,272 | |

| Escambia County Health Facilities Auth. Health Facilities Rev. Series 2020 A, 5% 8/15/34 | 200,000 | 210,427 | |

| Florida Hsg. Fin. Corp. Rev. Series 2020 1, 3.5% 7/1/51 | 70,000 | 68,478 | |

| JEA Wtr. & Swr. Sys. Rev. Series 2017 A, 5% 10/1/29 | 25,000 | 27,201 | |

| Miami-Dade County Wtr. & Swr. Rev. Series 2017 B, 5% 10/1/27 | 60,000 | 64,676 | |

| Palm Beach County Health Facilities Auth. Hosp. Rev. (Jupiter Med. Ctr. Proj.) Series 2022, 5% 11/1/35 | 100,000 | 105,493 | |

| Palm Beach County School Board Ctfs. of Prtn.: | |||

| Series 2018 A, 5% 8/1/24 | 20,000 | 20,340 | |

| Series 2021 A, 5% 8/1/38 | 125,000 | 138,484 | |

TOTAL FLORIDA | 974,389 | ||

| Georgia - 5.7% | |||

| Bartow County Dev. Auth. Poll. Cont. Rev. Bonds (Georgia Pwr. Co. Plant Bowen Proj.): | |||

| Series 2009, 3.95%, tender 3/8/28 (b) | 100,000 | 99,352 | |

| Series 2013, 2.875%, tender 8/19/25 (b) | 100,000 | 96,904 | |

| Fulton County Dev. Auth. Rev. Series 2019, 5% 6/15/44 | 10,000 | 10,718 | |

| Main Street Natural Gas, Inc. Bonds: | |||

| Series 2019 B, 4%, tender 12/2/24 (b) | 135,000 | 135,242 | |

| Series 2021 A, 4%, tender 9/1/27 (b) | 100,000 | 99,597 | |

| Series 2022 B, 5%, tender 6/1/29 (b) | 15,000 | 15,498 | |

| Metropolitan Atlanta Rapid Transit Auth. Sales Tax Rev. Series 2023 A, 5% 7/1/39 | 100,000 | 113,850 | |

| Monroe County Dev. Auth. Poll. Cont. Rev. Bonds (Georgia Pwr. Co. Plant Scherer Proj.) Series 2009, 3.875%, tender 3/6/26 (b) | 100,000 | 99,391 | |

| Private Colleges & Univs. Auth. Rev. Series 2019 A, 5% 9/1/39 | 100,000 | 108,682 | |

TOTAL GEORGIA | 779,234 | ||

| Hawaii - 0.1% | |||

| Honolulu City & County Gen. Oblig. Series 2019 A, 5% 9/1/27 | 10,000 | 10,834 | |

| Illinois - 6.1% | |||

| Illinois Fin. Auth. Series 2022 A, 5% 10/1/32 | 100,000 | 104,493 | |

| Illinois Fin. Auth. Academic Facilities: | |||

| (Provident Group - UIUC Properties LLC - Univ. of Illinois at Urbana-Champaign Proj.) Series 2019 A, 5% 10/1/29 | 250,000 | 274,002 | |

| (Provident Group UIUC Properties LLC Univ. of Illinois at Urbana-Champaign Proj.) Series 2019 A: | |||

5% 10/1/32 | 10,000 | 10,860 | |

5% 10/1/38 | 100,000 | 104,436 | |

| Illinois Fin. Auth. Rev.: | |||

| (Presence Health Proj.) Series 2016 C, 5% 2/15/36 | 30,000 | 31,448 | |

| Series 2014 A, 5% 10/1/26 | 40,000 | 40,768 | |

| Series 2016 A, 5% 7/1/31 (Pre-Refunded to 7/1/26 @ 100) | 50,000 | 52,767 | |

| Illinois Gen. Oblig.: | |||

| Series 2014, 5% 2/1/39 | 100,000 | 100,282 | |

| Series 2023 C, 5% 5/1/29 | 50,000 | 54,442 | |

| Illinois Hsg. Dev. Auth. Rev. Series D, 3.75% 4/1/50 | 20,000 | 19,691 | |

| McHenry County Conservation District Gen. Oblig. Series 2014, 5% 2/1/24 | 40,000 | 40,321 | |

TOTAL ILLINOIS | 833,510 | ||

| Indiana - 1.0% | |||

| Indiana Dev. Fin. Auth. Envir. Rev. Bonds Series 2022 A1, 4.5%, tender 6/1/32 (b)(c) | 100,000 | 100,171 | |

| Indiana Hsg. & Cmnty. Dev. Auth.: | |||

| Series 2021 B, Series 2021 B, 5% 1/1/28 | 15,000 | 16,108 | |

| Series A, 5% 7/1/28 | 25,000 | 27,331 | |

TOTAL INDIANA | 143,610 | ||

| Iowa - 0.8% | |||

| Iowa Student Ln. Liquidity Corp. Student Ln. Rev. Series 2022 B, 5% 12/1/29 (c) | 100,000 | 108,076 | |

| Kentucky - 1.8% | |||

| Kentucky Bond Dev. Corp. Edl. Facilities Series 2021: | |||

| 4% 6/1/33 | 5,000 | 5,113 | |

| 4% 6/1/35 | 15,000 | 15,081 | |

| Kentucky Econ. Dev. Fin. Auth. Solid Waste Disp. Rev. Bonds (Republic Svcs., Inc. Proj.) Series A, 4.05%, tender 9/1/23 (b)(c) | 100,000 | 99,962 | |

| Kentucky State Property & Buildings Commission Rev.: | |||

| Series A: | |||

5% 11/1/31 | 30,000 | 32,824 | |

5% 11/1/33 | 15,000 | 16,373 | |

| Series B, 5% 8/1/26 | 75,000 | 78,878 | |

TOTAL KENTUCKY | 248,231 | ||

| Louisiana - 0.7% | |||

| St. John Baptist Parish Rev. Bonds (Marathon Oil Corp.) Series 2017, 4.05%, tender 7/1/26 (b) | 100,000 | 99,346 | |

| Maine - 0.1% | |||

| Maine Health & Higher Edl. Facilities Auth. Rev. Series 2017 B, 5% 7/1/28 | 10,000 | 10,601 | |

| Maryland - 2.7% | |||

| Baltimore County Gen. Oblig. Series 2023, 5% 3/1/40 | 100,000 | 114,092 | |

| Baltimore Proj. Rev. (Wtr. Projs.) Series 2014 A, 5% 7/1/24 | 150,000 | 152,120 | |

| Maryland Dept. of Trans.: | |||

| Series 2016, 4% 9/1/27 | 15,000 | 15,688 | |

| Series 2021 A, 2% 10/1/34 | 15,000 | 12,733 | |

| Maryland Gen. Oblig. Series A, 5% 8/1/34 | 15,000 | 17,199 | |

| Montgomery County Gen. Oblig. Ctfs. of Prtn. Series 2020 A, 5% 10/1/27 | 50,000 | 54,367 | |

TOTAL MARYLAND | 366,199 | ||

| Massachusetts - 6.4% | |||

| Arlington Gen. Oblig. Series 2021: | |||

| 2% 9/15/34 | 275,000 | 233,408 | |

| 2% 9/15/35 | 100,000 | 82,521 | |

| Foxborough Gen. Oblig. Series 2016, 3% 5/15/46 | 25,000 | 20,376 | |

| Massachusetts Bay Trans. Auth. Sales Tax Rev.: | |||

| Series 2015 B, 5% 7/1/26 (Pre-Refunded to 7/1/25 @ 100) | 10,000 | 10,357 | |

| Series 2016 A, 0% 7/1/29 | 5,000 | 4,038 | |

| Series 2021 A1, 5% 7/1/35 | 45,000 | 51,713 | |

| Massachusetts Commonwealth Trans. Fund Rev. Series 2021 A, 5% 6/1/51 | 100,000 | 107,267 | |

| Massachusetts Dev. Fin. Agcy. Rev.: | |||

| (Partners Healthcare Sys., Inc. Proj.) Series 2017 S, 5% 7/1/32 | 15,000 | 16,273 | |

| Bonds Series A1, 5%, tender 1/31/30 (b) | 20,000 | 22,148 | |

| Series 2015 O1, 4% 7/1/45 | 30,000 | 28,722 | |

| Series 2018 L, 5% 10/1/33 | 35,000 | 35,971 | |

| Series 2020 A: | |||

5% 10/15/29 | 35,000 | 39,942 | |

5% 10/15/30 | 20,000 | 23,255 | |

| Series 2021 G, 4% 7/1/46 | 75,000 | 71,010 | |

| Massachusetts Gen. Oblig.: | |||

| Series 2017 A, 5% 4/1/36 | 15,000 | 15,994 | |

| Series 2017 D, 5% 7/1/27 | 25,000 | 27,112 | |

| Series A, 5% 7/1/31 | 10,000 | 10,568 | |

| Massachusetts School Bldg. Auth. Dedicated Sales Tax Rev. Series A, 5% 8/15/32 | 10,000 | 11,487 | |

| Univ. of Massachusetts Bldg. Auth. Rev. Series 2021 1, 5% 11/1/32 | 50,000 | 57,728 | |

TOTAL MASSACHUSETTS | 869,890 | ||

| Michigan - 1.7% | |||

| Grand Rapids San. Swr. Sys. Rev.: | |||

| Series 2018, 5% 1/1/35 | 5,000 | 5,407 | |

| Series 2018, 5% 1/1/29 | 25,000 | 27,371 | |

| Great Lakes Wtr. Auth. Sew Disp. Sys. Series 2018 B, 5% 7/1/29 | 45,000 | 50,423 | |

| Kalamazoo Hosp. Fin. Auth. Hosp. Facilities Rev. Series 2016, 4% 5/15/36 | 10,000 | 9,871 | |

| Lake Orion Cmnty. School District Series 2016, 5% 5/1/25 | 10,000 | 10,314 | |

| Michigan Fin. Auth. Rev.: | |||

| Bonds Series 2019 B, 5%, tender 11/16/26 (b) | 10,000 | 10,370 | |

| Series 2016: | |||

5% 11/15/28 | 15,000 | 15,634 | |

5% 11/15/30 | 35,000 | 36,554 | |

5% 11/15/34 | 15,000 | 15,619 | |

| Series 2022, 5% 12/1/32 | 25,000 | 26,393 | |

| Michigan Hosp. Fin. Auth. Rev. Series 2010 F4, 5% 11/15/47 | 10,000 | 10,447 | |

| Univ. of Michigan Rev. Series 2020 A, 5% 4/1/39 | 10,000 | 11,036 | |

TOTAL MICHIGAN | 229,439 | ||

| Minnesota - 3.1% | |||

| Anoka-Hennepin Independent School District #11 Series 2020 A, 4% 2/1/29 | 10,000 | 10,495 | |

| Hennepin County Sales Tax Rev. (Ballpark Proj.) Series 2017 A, 5% 12/15/24 | 265,000 | 271,141 | |

| Minnesota Gen. Oblig. Series 2019 A, 5% 8/1/30 | 15,000 | 16,919 | |

| Minnesota Hsg. Fin. Agcy.: | |||

| Series 2022 A, 5% 8/1/32 | 100,000 | 115,951 | |

| Series B, 4% 8/1/36 | 15,000 | 15,396 | |

TOTAL MINNESOTA | 429,902 | ||

| Nebraska - 1.4% | |||

| Central Plains Energy Proj. Gas Supply Bonds Series 2019, 4%, tender 8/1/25 (b) | 50,000 | 49,955 | |

| Douglas County Hosp. Auth. #2 Health Facilities Rev. Series 2020 A, 5% 11/15/30 | 125,000 | 139,389 | |

TOTAL NEBRASKA | 189,344 | ||

| New Hampshire - 1.6% | |||

| Nat'l. Fin. Auth. Solid Bonds (Waste Mgmt., Inc. Proj.) Series 2020 A3, 4%, tender 9/1/23 (b)(c) | 100,000 | 99,986 | |

| New Hampshire Health & Ed. Facilities Auth.: | |||

| (Concord Hosp.) Series 2017, 5% 10/1/42 | 15,000 | 15,431 | |

| (Partners Healthcare Sys., Inc. Proj.) Series 2017, 5% 7/1/25 | 5,000 | 5,165 | |

| New Hampshire Nat'l. Fin. Auth. Series 2022 2, 4% 10/20/36 | 98,987 | 94,543 | |

TOTAL NEW HAMPSHIRE | 215,125 | ||

| New Jersey - 5.0% | |||

| New Jersey Econ. Dev. Auth. Series 2024 SSS, 5% 6/15/27 (d) | 100,000 | 103,770 | |

| New Jersey Edl. Facility Series A, 5% 7/1/36 | 15,000 | 15,798 | |

| New Jersey Health Care Facilities Fing. Auth. Rev. Series 2016 A, 5% 7/1/33 | 10,000 | 10,558 | |

| New Jersey Trans. Trust Fund Auth.: | |||

| Series 2018 A, 5% 12/15/32 | 100,000 | 108,658 | |

| Series 2021 A, 5% 6/15/33 | 95,000 | 106,502 | |

| Series 2022 A, 4% 6/15/39 | 30,000 | 29,733 | |

| Series 2022 BB, 5% 6/15/31 | 135,000 | 152,477 | |

| Series 2022 CC, 5% 6/15/33 | 100,000 | 114,088 | |

| Series A, 0% 12/15/31 | 50,000 | 36,769 | |

TOTAL NEW JERSEY | 678,353 | ||

| New York - 11.8% | |||

| Dutchess County Local Dev. Corp. Rev. (Vassar College Proj.) Series 2020, 5% 7/1/45 | 25,000 | 26,711 | |

| Long Island Pwr. Auth. Elec. Sys. Rev.: | |||

| Series 2018, 5% 9/1/27 | 15,000 | 16,293 | |

| Series 2020 A, 5% 9/1/38 | 165,000 | 182,192 | |

| Series 2022 A, 5% 9/1/33 | 100,000 | 118,424 | |

| New York City Transitional Fin. Auth. Bldg. Aid Rev. Series 2017 S1, 5% 7/15/28 | 50,000 | 54,100 | |

| New York Dorm. Auth. Rev. Series 2022 A, 5% 7/1/34 | 200,000 | 217,326 | |

| New York Dorm. Auth. Sales Tax Rev. Series 2015 A, 5% 3/15/24 (Escrowed to Maturity) | 25,000 | 25,279 | |

| New York Metropolitan Trans. Auth. Rev.: | |||

| Series 2017 C1: | |||

5% 11/15/27 | 20,000 | 21,167 | |

5% 11/15/29 | 50,000 | 53,249 | |

5% 11/15/31 | 140,000 | 149,064 | |

| Series 2019 C, 5% 11/15/39 | 70,000 | 73,697 | |

| New York State Dorm. Auth.: | |||

| Series 2017 A, 5% 2/15/31 | 10,000 | 10,676 | |

| Series 2019 D, 4% 2/15/36 | 15,000 | 15,510 | |

| New York State Urban Dev. Corp. Series 2020 E, 4% 3/15/35 | 30,000 | 31,161 | |

| New York State Urban Eev Corp. Series 2019 A, 5% 3/15/37 | 80,000 | 87,515 | |

| New York Thruway Auth. Personal Income Tax Rev. Series 2021 A1, 5% 3/15/34 | 205,000 | 235,721 | |

| Saratoga County Cap. Resources Rev. (Skidmore College Proj.) Series 2020 A, 5% 7/1/45 | 85,000 | 91,084 | |

| Suffolk County Gen. Oblig. Series 2017 D, 4% 2/1/28 (Build America Mutual Assurance Insured) | 100,000 | 105,125 | |

| Triborough Bridge & Tunnel Auth. Series 2023 A, 4% 11/15/34 | 100,000 | 107,604 | |

TOTAL NEW YORK | 1,621,898 | ||

| North Carolina - 1.0% | |||

| Charlotte-Mecklenburg Hosp. Auth. Health Care Sys. Rev. Bonds Series 2021 C, 5%, tender 12/1/28 (b) | 25,000 | 27,303 | |

| Univ. of North Carolina at Chapel Hill Rev. Series 2021 B, 5% 12/1/38 | 100,000 | 112,715 | |

TOTAL NORTH CAROLINA | 140,018 | ||

| Ohio - 2.3% | |||

| Ohio Air Quality Dev. Auth. Rev. Bonds Series 2022 B, 4.25%, tender 6/1/27 (b)(c) | 150,000 | 148,632 | |

| Ohio Gen. Oblig. Series 2019 A, 5% 5/1/30 | 20,000 | 21,509 | |

| Ohio Higher Edl. Facility Commission Rev. (Univ. of Dayton Proj.) Series 2018 B, 5% 12/1/29 | 25,000 | 26,914 | |

| Ohio Hsg. Fin. Agcy. Residential Mtg. Rev. (Mtg. Backed Securities Prog.) Series 2019 B, 4.5% 3/1/50 | 90,000 | 90,230 | |

| Ohio Spl. Oblig. Series 2021 A, 5% 4/1/41 | 20,000 | 21,857 | |

| Ohio State Univ. Gen. Receipts (Multiyear Debt Issuance Prog.) Series 2020 A, 5% 12/1/29 | 10,000 | 11,328 | |

TOTAL OHIO | 320,470 | ||

| Oklahoma - 0.4% | |||

| Grand River Dam Auth. Rev. Series 2014 A, 5% 6/1/26 | 40,000 | 40,454 | |

| Oklahoma State Univ. Agricultural And Mechanical College Series 2020 A, 5% 9/1/32 | 10,000 | 11,351 | |

TOTAL OKLAHOMA | 51,805 | ||

| Oregon - 1.6% | |||

| Medford Hosp. Facilities Auth. Rev. (Asante Projs.) Series 2020 A, 5% 8/15/38 | 10,000 | 10,642 | |

| Oregon Facilities Auth. Rev. Series 2022 B, 5% 6/1/30 | 30,000 | 32,921 | |

| Salem Hosp. Facility Auth. Rev. Series 2016 A, 4% 5/15/41 | 25,000 | 24,248 | |

| Union County Hosp. Facility Auth. (Grande Ronde Hosp. Proj.) Series 2022, 5% 7/1/25 | 150,000 | 152,447 | |

TOTAL OREGON | 220,258 | ||

| Pennsylvania - 0.8% | |||

| Cumberland County Muni. Auth. Rev. (Dickinson Proj.) Series 2017, 5% 5/1/37 | 5,000 | 5,276 | |

| Dubois Hosp. Auth. Hosp. Rev. (Penn Highlands Healthcare Proj.) Series 2018: | |||

| 5% 7/15/27 | 50,000 | 52,305 | |

| 5% 7/15/28 | 35,000 | 36,934 | |

| Montgomery County Higher Ed. & Health Auth. Rev. Series 2019, 5% 9/1/31 | 10,000 | 10,826 | |

TOTAL PENNSYLVANIA | 105,341 | ||

| Rhode Island - 0.8% | |||

| Rhode Island Student Ln. Auth. Student Ln. Rev. Series 2021 A, 5% 12/1/30 (c) | 100,000 | 108,447 | |

| Tennessee - 0.6% | |||

| Knox County Health Edl. & Hsg. Facilities Board Rev. Series 2017, 5% 4/1/27 | 20,000 | 20,770 | |

| Nashville and Davidson County Metropolitan Govt. Gen. Oblig. Series 2021 C, 5% 1/1/28 | 50,000 | 54,554 | |

TOTAL TENNESSEE | 75,324 | ||

| Texas - 2.6% | |||

| Alvin Independent School District Series 2016 A, 5% 2/15/28 | 25,000 | 26,179 | |

| Cypress-Fairbanks Independent School District Series 2016, 5% 2/15/25 | 15,000 | 15,417 | |

| Georgetown Util. Sys. Rev. Series 2022, 5% 8/15/27 (Assured Guaranty Muni. Corp. Insured) | 100,000 | 107,134 | |

| Harris County Cultural Ed. Facilities Fin. Corp. Rev. Series 2014 A, 5% 12/1/26 | 90,000 | 92,155 | |

| San Antonio Wtr. Sys. Rev.: | |||

| Series 2018 A, 5% 5/15/33 | 5,000 | 5,453 | |

| Series 2020 A, 5% 5/15/27 | 10,000 | 10,742 | |

| Tarrant Reg'l. Wtr. District (City of Dallas Proj.) Series 2021 A, 4% 9/1/25 | 45,000 | 45,829 | |

| Wichita Falls Independent School District Series 2021, 4% 2/1/28 | 50,000 | 52,175 | |

TOTAL TEXAS | 355,084 | ||

| Virginia - 3.6% | |||

| Louisa Indl. Dev. Auth. Poll. Cont. Rev. Bonds (Virginia Elec. and Pwr. Co. Proj.) Series 2008 B, 0.75%, tender 9/2/25 (b) | 105,000 | 96,415 | |

| Virginia College Bldg. Auth. Edl. Facilities Rev.: | |||

| (21st Century College and Equip. Progs.) Series 2017 E, 5% 2/1/31 | 10,000 | 10,913 | |

| (Virginia Gen. Oblig.) Series 2017 E, 5% 2/1/30 | 15,000 | 16,393 | |

| Virginia Commonwealth Trans. Board Rev.: | |||

| (Virginia Gen. Oblig. Proj.) Series 2017 A, 5% 5/15/29 | 60,000 | 65,311 | |

| (Virginia Gen. Oblig.) Series 2017 A, 5% 5/15/27 | 15,000 | 16,185 | |

| Virginia Commonwealth Univ. Health Sys. Auth. Series 2017 A, 5% 7/1/28 | 270,000 | 288,789 | |

TOTAL VIRGINIA | 494,006 | ||

| Washington - 3.7% | |||

| Energy Northwest Elec. Rev. Series 2020 A, 5% 7/1/34 | 95,000 | 108,282 | |

| Washington Gen. Oblig.: | |||

| Series 2018 A, 5% 8/1/27 | 50,000 | 54,076 | |

| Series 2018 C, 5% 8/1/30 | 25,000 | 26,959 | |

| Series 2018 D, 5% 8/1/33 | 20,000 | 21,474 | |

| Series 2020 A, 5% 8/1/27 | 65,000 | 70,298 | |

| Series 2020 C, 5% 2/1/37 | 15,000 | 16,623 | |

| Series R-2017 A, 5% 8/1/30 | 10,000 | 10,552 | |

| Washington Health Care Facilities Auth. Rev.: | |||

| (Overlake Hosp. Med. Ctr., WA. Proj.) Series 2017 B, 5% 7/1/27 | 25,000 | 25,606 | |

| (Providence Health Systems Proj.) Series 2018 B, 5% 10/1/33 | 45,000 | 47,439 | |

| Series 2017 A, 4% 7/1/37 | 125,000 | 116,368 | |

| Series 2019 A2, 5% 8/1/33 | 10,000 | 10,758 | |

TOTAL WASHINGTON | 508,435 | ||

| Wisconsin - 0.2% | |||

| Wisconsin St Gen. Fund Annual Appropriation Series 2019 A: | |||

| 5% 5/1/25 (Escrowed to Maturity) | 10,000 | 10,314 | |

| 5% 5/1/26 (Escrowed to Maturity) | 20,000 | 21,058 | |

TOTAL WISCONSIN | 31,372 | ||

| TOTAL MUNICIPAL BONDS (Cost $12,777,150) | 12,754,656 | ||

| Municipal Notes - 2.2% | |||

Principal Amount (a) | Value ($) | ||

| Delaware - 0.7% | |||

| Delaware Econ. Dev. Auth. Rev. (Delmarva Pwr. & Lt. Co. Proj.) Series 1994, 4.81% 8/1/23, VRDN (b)(c) | 100,000 | 100,000 | |

| Georgia - 1.5% | |||

| Burke County Indl. Dev. Auth. Poll. Cont. Rev. (Georgia Pwr. Co. Plant Vogtle Proj.) Series 2018, 4.95% 8/1/23, VRDN (b) | 200,000 | 200,000 | |

| TOTAL MUNICIPAL NOTES (Cost $300,000) | 300,000 | ||

| Money Market Funds - 3.9% | |||

| Shares | Value ($) | ||

Fidelity Municipal Cash Central Fund 4.30% (e)(f) (Cost $543,994) | 543,891 | 544,007 | |

| TOTAL INVESTMENT IN SECURITIES - 99.2% (Cost $13,621,144) | 13,598,663 |

NET OTHER ASSETS (LIABILITIES) - 0.8% | 104,613 |

| NET ASSETS - 100.0% | 13,703,276 |

| VRDN | - | VARIABLE RATE DEMAND NOTE (A debt instrument that is payable upon demand, either daily, weekly or monthly) |

| (a) | Amount is stated in United States dollars unless otherwise noted. |

| (b) | Coupon rates for floating and adjustable rate securities reflect the rates in effect at period end. |

| (c) | Private activity obligations whose interest is subject to the federal alternative minimum tax for individuals. |

| (d) | Security or a portion of the security purchased on a delayed delivery or when-issued basis. |

| (e) | Information in this report regarding holdings by state and security types does not reflect the holdings of the Fidelity Municipal Cash Central Fund. |

| (f) | Affiliated fund that is generally available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. In addition, each Fidelity Central Fund's financial statements are available on the SEC's website or upon request. |

| Affiliate | Value, beginning of period ($) | Purchases ($) | Sales Proceeds ($) | Dividend Income ($) | Realized Gain (loss) ($) | Change in Unrealized appreciation (depreciation) ($) | Value, end of period ($) | % ownership, end of period |

| Fidelity Municipal Cash Central Fund 4.30% | 385,996 | 1,306,991 | 1,149,000 | 3,032 | - | 20 | 544,007 | 0.0% |

| Total | 385,996 | 1,306,991 | 1,149,000 | 3,032 | - | 20 | 544,007 | |

| Valuation Inputs at Reporting Date: | ||||

| Description | Total ($) | Level 1 ($) | Level 2 ($) | Level 3 ($) |

Investments in Securities: | ||||

| Municipal Securities | 13,054,656 | - | 13,054,656 | - |

| Money Market Funds | 544,007 | 544,007 | - | - |

| Total Investments in Securities: | 13,598,663 | 544,007 | 13,054,656 | - |

| Statement of Assets and Liabilities | ||||

July 31, 2023 (Unaudited) | ||||

| Assets | ||||

| Investment in securities, at value - See accompanying schedule: | ||||

Unaffiliated issuers (cost $13,077,150) | $ | 13,054,656 | ||

Fidelity Central Funds (cost $543,994) | 544,007 | |||

| Total Investment in Securities (cost $13,621,144) | $ | 13,598,663 | ||

| Cash | 100,515 | |||

| Receivable for fund shares sold | 561 | |||

| Interest receivable | 136,227 | |||

| Distributions receivable from Fidelity Central Funds | 958 | |||

| Prepaid expenses | 10 | |||

| Receivable from investment adviser for expense reductions | 5,623 | |||

| Other receivables | 40 | |||

Total assets | 13,842,597 | |||

| Liabilities | ||||

| Payable for investments purchased on a delayed delivery basis | $ | 103,754 | ||

| Payable for fund shares redeemed | 149 | |||

| Distributions payable | 3,748 | |||

| Accrued management fee | 3,946 | |||

| Distribution and service plan fees payable | 1,437 | |||

| Other affiliated payables | 1,561 | |||

| Audit fee payable | 24,603 | |||

| Other payables and accrued expenses | 123 | |||

| Total Liabilities | 139,321 | |||

| Net Assets | $ | 13,703,276 | ||

| Net Assets consist of: | ||||

| Paid in capital | $ | 13,722,870 | ||

| Total accumulated earnings (loss) | (19,594) | |||

| Net Assets | $ | 13,703,276 | ||

| Net Asset Value and Maximum Offering Price | ||||

| Class A : | ||||

Net Asset Value and redemption price per share ($1,557,183 ÷ 156,015 shares)(a) | $ | 9.98 | ||

| Maximum offering price per share (100/96.00 of $9.98) | $ | 10.40 | ||

| Class M : | ||||

Net Asset Value and redemption price per share ($1,118,388 ÷ 112,051 shares)(a) | $ | 9.98 | ||

| Maximum offering price per share (100/96.00 of $9.98) | $ | 10.40 | ||

| Class C : | ||||

Net Asset Value and offering price per share ($1,057,449 ÷ 106,983 shares)(a) | $ | 9.88 | ||

| Fidelity Sustainable Intermediate Municipal Income Fund : | ||||

Net Asset Value, offering price and redemption price per share ($7,904,438 ÷ 791,918 shares) | $ | 9.98 | ||

| Class I : | ||||

Net Asset Value, offering price and redemption price per share ($1,032,507 ÷ 103,443 shares) | $ | 9.98 | ||

| Class Z : | ||||

Net Asset Value, offering price and redemption price per share ($1,033,311 ÷ 103,522 shares) | $ | 9.98 | ||

(a)Redemption price per share is equal to net asset value less any applicable contingent deferred sales charge. | ||||

| Statement of Operations | ||||

Six months ended July 31, 2023 (Unaudited) | ||||

| Investment Income | ||||

| Interest | $ | 210,965 | ||

| Income from Fidelity Central Funds | 3,032 | |||

| Total Income | 213,997 | |||

| Expenses | ||||

| Management fee | $ | 23,175 | ||

| Transfer agent fees | 7,263 | |||

| Distribution and service plan fees | 8,608 | |||

| Accounting fees and expenses | 1,731 | |||

| Custodian fees and expenses | 3,057 | |||

| Independent trustees' fees and expenses | 22 | |||

| Registration fees | 100,287 | |||

| Audit | 25,149 | |||

| Legal | 30 | |||

| Miscellaneous | 18 | |||

| Total expenses before reductions | 169,340 | |||

| Expense reductions | (136,830) | |||

| Total expenses after reductions | 32,510 | |||

| Net Investment income (loss) | 181,487 | |||

| Realized and Unrealized Gain (Loss) | ||||

| Net realized gain (loss) on: | ||||

| Investment Securities: | ||||

| Unaffiliated issuers | 12,708 | |||

| Total net realized gain (loss) | 12,708 | |||

| Change in net unrealized appreciation (depreciation) on: | ||||

| Investment Securities: | ||||

| Unaffiliated issuers | (226,818) | |||

| Fidelity Central Funds | 20 | |||

| Total change in net unrealized appreciation (depreciation) | (226,798) | |||

| Net gain (loss) | (214,090) | |||

| Net increase (decrease) in net assets resulting from operations | $ | (32,603) | ||

| Statement of Changes in Net Assets | ||||

Six months ended July 31, 2023 (Unaudited) | For the period April 13, 2022 (commencement of operations) through January 31, 2023 | |||

| Increase (Decrease) in Net Assets | ||||

| Operations | ||||

| Net investment income (loss) | $ | 181,487 | $ | 215,330 |

| Net realized gain (loss) | 12,708 | (4,493) | ||

| Change in net unrealized appreciation (depreciation) | (226,798) | 204,317 | ||

| Net increase (decrease) in net assets resulting from operations | (32,603) | 415,154 | ||

| Distributions to shareholders | (181,830) | (220,316) | ||

| Share transactions - net increase (decrease) | 791,162 | 12,931,709 | ||

| Total increase (decrease) in net assets | 576,729 | 13,126,547 | ||

| Net Assets | ||||

| Beginning of period | 13,126,547 | - | ||

| End of period | $ | 13,703,276 | $ | 13,126,547 |

| Fidelity® Advisor Sustainable Intermediate Municipal Income Fund Class A |

Six months ended (Unaudited) July 31, 2023 | Years ended January 31, 2023 A | |||

Selected Per-Share Data | ||||

| Net asset value, beginning of period | $ | 10.14 | $ | 10.00 |

| Income from Investment Operations | ||||

Net investment income (loss) B,C | .130 | .181 | ||

| Net realized and unrealized gain (loss) | (.163) | .137 | ||

| Total from investment operations | (.033) | .318 | ||

| Distributions from net investment income | (.127) | (.178) | ||

| Total distributions | (.127) | (.178) | ||

| Net asset value, end of period | $ | 9.98 | $ | 10.14 |

Total Return D,E,F | (.32)% | 3.24% | ||

Ratios to Average Net Assets C,G,H | ||||

| Expenses before reductions | 2.72% I | 2.34% I,J | ||

| Expenses net of fee waivers, if any | .62% I | .62% I | ||

| Expenses net of all reductions | .62% I | .61% I | ||

| Net investment income (loss) | 2.61% I | 2.26% I | ||

| Supplemental Data | ||||

| Net assets, end of period (000 omitted) | $ | 1,557 | $ | 1,563 |

Portfolio turnover rate K | 26% I | 14% I |

| Fidelity® Advisor Sustainable Intermediate Municipal Income Fund Class M |

Six months ended (Unaudited) July 31, 2023 | Years ended January 31, 2023 A | |||

Selected Per-Share Data | ||||

| Net asset value, beginning of period | $ | 10.14 | $ | 10.00 |

| Income from Investment Operations | ||||

Net investment income (loss) B,C | .130 | .181 | ||

| Net realized and unrealized gain (loss) | (.163) | .137 | ||

| Total from investment operations | (.033) | .318 | ||

| Distributions from net investment income | (.127) | (.178) | ||

| Total distributions | (.127) | (.178) | ||

| Net asset value, end of period | $ | 9.98 | $ | 10.14 |

Total Return D,E,F | (.32)% | 3.24% | ||

Ratios to Average Net Assets C,G,H | ||||

| Expenses before reductions | 2.76% I | 2.36% I,J | ||

| Expenses net of fee waivers, if any | .62% I | .62% I | ||

| Expenses net of all reductions | .62% I | .61% I | ||

| Net investment income (loss) | 2.61% I | 2.26% I | ||

| Supplemental Data | ||||

| Net assets, end of period (000 omitted) | $ | 1,118 | $ | 1,122 |

Portfolio turnover rate K | 26% I | 14% I |

| Fidelity® Advisor Sustainable Intermediate Municipal Income Fund Class C |

Six months ended (Unaudited) July 31, 2023 | Years ended January 31, 2023 A | |||

Selected Per-Share Data | ||||

| Net asset value, beginning of period | $ | 10.08 | $ | 10.00 |

| Income from Investment Operations | ||||

Net investment income (loss) B,C | .092 | .120 | ||

| Net realized and unrealized gain (loss) | (.166) | .137 | ||

| Total from investment operations | (.074) | .257 | ||

| Distributions from net investment income | (.126) | (.177) | ||

| Total distributions | (.126) | (.177) | ||

| Net asset value, end of period | $ | 9.88 | $ | 10.08 |

Total Return D,E,F | (.73)% | 2.62% | ||

Ratios to Average Net Assets C,G,H | ||||

| Expenses before reductions | 3.52% I | 3.08% I,J | ||

| Expenses net of fee waivers, if any | 1.37% I | 1.37% I | ||

| Expenses net of all reductions | 1.37% I | 1.36% I | ||

| Net investment income (loss) | 1.86% I | 1.51% I | ||

| Supplemental Data | ||||

| Net assets, end of period (000 omitted) | $ | 1,057 | $ | 1,065 |

Portfolio turnover rate K | 26% I | 14% I |

| Fidelity® Sustainable Intermediate Municipal Income Fund |

Six months ended (Unaudited) July 31, 2023 | Years ended January 31, 2023 A | |||

Selected Per-Share Data | ||||

| Net asset value, beginning of period | $ | 10.14 | $ | 10.00 |

| Income from Investment Operations | ||||

Net investment income (loss) B,C | .142 | .200 | ||

| Net realized and unrealized gain (loss) | (.163) | .138 | ||

| Total from investment operations | (.021) | .338 | ||

| Distributions from net investment income | (.139) | (.198) | ||

| Total distributions | (.139) | (.198) | ||

| Net asset value, end of period | $ | 9.98 | $ | 10.14 |

Total Return D,E | (.20)% | 3.44% | ||

Ratios to Average Net Assets C,F,G | ||||

| Expenses before reductions | 2.39% H | 2.03% H,I | ||

| Expenses net of fee waivers, if any | .37% H | .37% H | ||

| Expenses net of all reductions | .37% H | .36% H | ||

| Net investment income (loss) | 2.86% H | 2.51% H | ||

| Supplemental Data | ||||

| Net assets, end of period (000 omitted) | $ | 7,904 | $ | 7,307 |

Portfolio turnover rate J | 26% H | 14% H |

| Fidelity® Advisor Sustainable Intermediate Municipal Income Fund Class I |

Six months ended (Unaudited) July 31, 2023 | Years ended January 31, 2023 A | |||

Selected Per-Share Data | ||||

| Net asset value, beginning of period | $ | 10.14 | $ | 10.00 |

| Income from Investment Operations | ||||

Net investment income (loss) B,C | .142 | .201 | ||

| Net realized and unrealized gain (loss) | (.163) | .137 | ||

| Total from investment operations | (.021) | .338 | ||

| Distributions from net investment income | (.139) | (.198) | ||

| Total distributions | (.139) | (.198) | ||

| Net asset value, end of period | $ | 9.98 | $ | 10.14 |

Total Return D,E | (.20)% | 3.44% | ||

Ratios to Average Net Assets C,F,G | ||||

| Expenses before reductions | 2.52% H | 2.12% H,I | ||

| Expenses net of fee waivers, if any | .37% H | .37% H | ||

| Expenses net of all reductions | .37% H | .36% H | ||

| Net investment income (loss) | 2.86% H | 2.51% H | ||

| Supplemental Data | ||||

| Net assets, end of period (000 omitted) | $ | 1,033 | $ | 1,035 |

Portfolio turnover rate J | 26% H | 14% H |

| Fidelity Advisor Sustainable Intermediate Municipal Income Fund Class Z |

Six months ended (Unaudited) July 31, 2023 | Years ended January 31, 2023 A | |||

Selected Per-Share Data | ||||

| Net asset value, beginning of period | $ | 10.14 | $ | 10.00 |

| Income from Investment Operations | ||||

Net investment income (loss) B,C | .145 | .205 | ||

| Net realized and unrealized gain (loss) | (.163) | .137 | ||

| Total from investment operations | (.018) | .342 | ||

| Distributions from net investment income | (.142) | (.202) | ||

| Total distributions | (.142) | (.202) | ||

| Net asset value, end of period | $ | 9.98 | $ | 10.14 |

Total Return D,E | (.17)% | 3.49% | ||

Ratios to Average Net Assets C,F,G | ||||

| Expenses before reductions | 2.38% H | 2.04% H,I | ||

| Expenses net of fee waivers, if any | .31% H | .31% H | ||

| Expenses net of all reductions | .31% H | .30% H | ||

| Net investment income (loss) | 2.92% H | 2.57% H | ||

| Supplemental Data | ||||

| Net assets, end of period (000 omitted) | $ | 1,033 | $ | 1,035 |

Portfolio turnover rate J | 26% H | 14% H |

| Fidelity Central Fund | Investment Manager | Investment Objective | Investment Practices | Expense RatioA |

| Fidelity Money Market Central Funds | Fidelity Management & Research Company LLC (FMR) | Each fund seeks to obtain a high level of current income consistent with the preservation of capital and liquidity. | Short-term Investments | Less than .005% |

| Gross unrealized appreciation | $99,240 |

| Gross unrealized depreciation | (116,925) |

| Net unrealized appreciation (depreciation) | $(17,685) |

| Tax cost | $13,616,348 |

Short-term | $(4,491) |

| Total capital loss carryforward | $(4,491) |

| Purchases ($) | Sales ($) | |

| Fidelity Sustainable Intermediate Municipal Income Fund | 2,456,891 | 1,642,119 |

| Distribution Fee | Service Fee | Total Fees | Retained by FDC | |

| Class A | -% | .25% | $1,938 | $1,340 |

| Class M | -% | .25% | 1,393 | 1,283 |

| Class C | .75% | .25% | 5,277 | 5,267 |

| $8,608 | $7,890 |

| Amount | % of Class-Level Average Net AssetsA | |

| Class A | $1,073 | .14 |

| Class M | 962 | .17 |

| Class C | 956 | .18 |

| Fidelity Sustainable Intermediate Municipal Income Fund | 3,078 | .08 |

| Class I | 937 | .18 |

| Class Z | 257 | .05 |

| $7,263 |

| % of Average Net Assets | |

| Fidelity Sustainable Intermediate Municipal Income Fund | .03 |

| Amount | |

| Fidelity Sustainable Intermediate Municipal Income Fund | $7 |

| Expense Limitations | Reimbursement | |

| Class A | .62% | $16,110 |

| Class M | .62% | 11,802 |

| Class C | 1.37% | 11,267 |

| Fidelity Sustainable Intermediate Municipal Income Fund | .37% | 75,883 |

| Class I | .37% | 10,954 |

| Class Z | .31% | 10,554 |

| $136,570 |

Six months ended July 31, 2023 | Year ended January 31, 2023A | |

| Fidelity Sustainable Intermediate Municipal Income Fund | ||

| Distributions to shareholders | ||

| Class A | $19,661 | $20,582 |

| Class M | 14,128 | 18,384 |

| Class C | 13,418 | 17,991 |

| Fidelity Sustainable Intermediate Municipal Income Fund | 105,679 | 123,006 |

| Class I | 14,323 | 19,937 |

| Class Z | 14,621 | 20,416 |

Total | $181,830 | $220,316 |

| Shares | Shares | Dollars | Dollars | |

Six months ended July 31, 2023 | Year ended January 31, 2023A | Six months ended July 31, 2023 | Year ended January 31, 2023A | |

| Fidelity Sustainable Intermediate Municipal Income Fund | ||||

| Class A | ||||

| Shares sold | 1,269 | 152,415 | $12,750 | $1,510,973 |

| Reinvestment of distributions | 1,968 | 2,073 | 19,657 | 20,582 |

| Shares redeemed | (1,382) | (328) | (13,830) | (3,253) |

| Net increase (decrease) | 1,855 | 154,160 | $18,577 | $1,528,302 |

| Class M | ||||

| Shares sold | - | 108,784 | $ - | $1,085,981 |

| Reinvestment of distributions | 1,414 | 1,853 | 14,128 | 18,384 |

| Net increase (decrease) | 1,414 | 110,637 | $14,128 | $1,104,365 |

| Class C | ||||

| Shares sold | 2 | 104,646 | $22 | $1,046,011 |

| Reinvestment of distributions | 1,354 | 1,821 | 13,418 | 17,991 |

| Shares redeemed | (4) | (836) | (44) | (8,058) |

| Net increase (decrease) | 1,352 | 105,631 | $13,396 | $1,055,944 |

| Fidelity Sustainable Intermediate Municipal Income Fund | ||||

| Shares sold | 76,599 | 731,710 | $768,022 | $7,308,238 |

| Reinvestment of distributions | 8,453 | 10,931 | 84,448 | 108,350 |

| Shares redeemed | (13,554) | (22,221) | (136,341) | (213,843) |

| Net increase (decrease) | 71,498 | 720,420 | $716,129 | $7,202,745 |

| Class I | ||||

| Shares sold | 299 | 100,000 | $3,000 | $1,000,000 |

| Reinvestment of distributions | 1,434 | 2,010 | 14,323 | 19,937 |

| Shares redeemed | (300) | - | (3,012) | - |

| Net increase (decrease) | 1,433 | 102,010 | $14,311 | $1,019,937 |

| Class Z | ||||

| Shares sold | - | 100,000 | $ - | $1,000,000 |

| Reinvestment of distributions | 1,463 | 2,059 | 14,621 | 20,416 |

| Net increase (decrease) | 1,463 | 102,059 | $14,621 | $1,020,416 |

| Fund | Affiliated % |

Fidelity Sustainable Intermediate Municipal Income Fund | 75% |

| The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (February 1, 2023 to July 31, 2023). |

Annualized Expense Ratio- A | Beginning Account Value February 1, 2023 | Ending Account Value July 31, 2023 | Expenses Paid During Period- C February 1, 2023 to July 31, 2023 | |||||||

| Fidelity® Sustainable Intermediate Municipal Income Fund | ||||||||||

| Class A | .62% | |||||||||

| Actual | $ 1,000 | $ 996.80 | $ 3.07 | |||||||

Hypothetical-B | $ 1,000 | $ 1,021.72 | $ 3.11 | |||||||

| Class M | .62% | |||||||||

| Actual | $ 1,000 | $ 996.80 | $ 3.07 | |||||||

Hypothetical-B | $ 1,000 | $ 1,021.72 | $ 3.11 | |||||||

| Class C | 1.37% | |||||||||

| Actual | $ 1,000 | $ 992.70 | $ 6.77 | |||||||

Hypothetical-B | $ 1,000 | $ 1,018.00 | $ 6.85 | |||||||

| Fidelity® Sustainable Intermediate Municipal Income Fund | .37% | |||||||||

| Actual | $ 1,000 | $ 998.00 | $ 1.83 | |||||||

Hypothetical-B | $ 1,000 | $ 1,022.96 | $ 1.86 | |||||||

| Class I | .37% | |||||||||

| Actual | $ 1,000 | $ 998.00 | $ 1.83 | |||||||

Hypothetical-B | $ 1,000 | $ 1,022.96 | $ 1.86 | |||||||

| Class Z | .31% | |||||||||

| Actual | $ 1,000 | $ 998.30 | $ 1.54 | |||||||

Hypothetical-B | $ 1,000 | $ 1,023.26 | $ 1.56 | |||||||

|

Contents

| Top Five States (% of Fund's net assets) | |

| New Jersey | 12.8 |

| Illinois | 11.9 |

| New York | 10.3 |

| California | 10.0 |

| Connecticut | 5.8 |

| Revenue Sources (% of Fund's net assets) | ||

| General Obligations | 26.3 | |

| Health Care | 15.9 | |

| Transportation | 10.4 | |

| Education | 9.5 | |

| Special Tax | 9.4 | |

| Housing | 8.4 | |

| Others* (Individually Less Than 5%) | 20.1 | |

| 100.0 | ||

| *Includes net other assets | ||

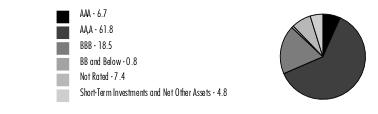

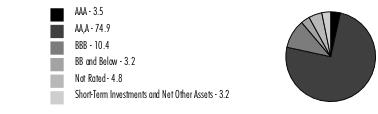

Quality Diversification (% of Fund's net assets) |

|

| We have used ratings from Moody's Investors Service, Inc. Where Moody's® ratings are not available, we have used S&P® ratings. All ratings are as of the date indicated and do not reflect subsequent changes. |

| Municipal Bonds - 95.6% | |||

Principal Amount (a) | Value ($) | ||

| Alabama - 1.9% | |||

| Black Belt Energy Gas District Bonds: | |||

| Series 2022 C1, 5.25%, tender 6/1/29 (b) | 630,000 | 661,390 | |

| Series 2022 E, 5%, tender 6/1/28 (b) | 65,000 | 67,449 | |

TOTAL ALABAMA | 728,839 | ||

| Arizona - 1.2% | |||

| Coconino County Poll. Cont. Corp. Rev. Bonds (Navada Pwr. Co. Proj.) Series 2017 B, 3.75%, tender 3/31/26 (b) | 100,000 | 100,282 | |

| Phoenix Civic Impt. Board Arpt. Rev. Series 2023, 5% 7/1/24 (c) | 100,000 | 101,053 | |

| Salt Verde Finl. Corp. Sr. Gas Rev. Series 2007, 5% 12/1/37 | 260,000 | 271,754 | |

TOTAL ARIZONA | 473,089 | ||

| California - 5.6% | |||

| California Gen. Oblig.: | |||

| Series 2020, 4% 11/1/37 | 50,000 | 51,756 | |

| Series 2022, 4.75% 12/1/42 | 250,000 | 266,645 | |

| California Hsg. Fin. Agcy.: | |||

| Series 2021 1, 3.5% 11/20/35 | 579,257 | 542,377 | |

| Series 2023 A1, 4.375% 9/20/36 | 99,891 | 99,310 | |

| California Muni. Fin. Auth. Rev. Series 2017 A: | |||

| 3.5% 6/1/34 | 50,000 | 48,717 | |

| 3.75% 6/1/37 | 40,000 | 38,086 | |

| Fresno Arpt. Rev. Series 2023 A, 5% 7/1/53 (Build America Mutual Assurance Insured) (c) | 500,000 | 523,449 | |

| Los Angeles Dept. Arpt. Rev.: | |||

| Series 2019 A, 5% 5/15/35 (c) | 10,000 | 10,734 | |

| Series 2019 C, 5% 5/15/25 (Escrowed to Maturity) | 25,000 | 25,913 | |

| Los Angeles Unified School District: | |||

| Series 2016 B, 2% 7/1/29 | 10,000 | 9,191 | |

| Series 2020 C, 3% 7/1/35 | 5,000 | 4,665 | |

| San Diego Unified School District Series 2012 R1, 0% 7/1/31 | 10,000 | 7,841 | |

| San Francisco City & County Arpts. Commission Int'l. Arpt. Rev. Series 2023 A, 5% 5/1/38 (c) | 500,000 | 541,462 | |

| San Mateo County Cmnty. College District Series 2019, 5% 9/1/38 | 5,000 | 5,545 | |

TOTAL CALIFORNIA | 2,175,691 | ||

| Colorado - 1.7% | |||

| Colorado Health Facilities Auth. Rev. Bonds: | |||

| (Parkview Med. Ctr., Inc. Proj.) Series 2016, 4% 9/1/36 | 15,000 | 14,714 | |

| (Parkview Med. Ctr., INC. Proj.) Series 2017, 5% 9/1/26 | 325,000 | 333,495 | |

| Bonds Series 2023 A1, 5%, tender 11/15/28 (b) | 90,000 | 97,956 | |

| Series 2019 A, 4% 11/1/39 | 45,000 | 44,434 | |

| Series 2019 A1, 4% 8/1/39 | 185,000 | 178,700 | |

TOTAL COLORADO | 669,299 | ||

| Connecticut - 5.8% | |||

| Connecticut Gen. Oblig.: | |||

| Series 2016 A, 5% 3/15/26 | 50,000 | 52,448 | |

| Series 2018 A, 5% 4/15/37 | 1,000,000 | 1,071,503 | |

| Series 2021 A, 3% 1/15/36 | 20,000 | 18,372 | |

| Connecticut Health & Edl. Facilities Auth. Rev.: | |||

| Series 2019 A: | |||

5% 7/1/25 | 190,000 | 192,646 | |

5% 7/1/26 | 500,000 | 511,513 | |

| Series 2020 A: | |||

4% 7/1/36 | 5,000 | 4,966 | |

5% 7/1/32 | 5,000 | 5,438 | |

| Series R, 5% 6/1/40 | 30,000 | 31,916 | |

| Connecticut Hsg. Fin. Auth. Series 2023 A, 5.25% 11/15/53 | 260,000 | 274,332 | |

| Stamford Gen. Oblig. Series 2016, 4% 8/1/26 | 5,000 | 5,091 | |

| Steelpointe Hbr. Infrastructure Impt. District (Steelpointe Hbr. Proj.) Series 2021, 4% 4/1/51 (d) | 100,000 | 81,736 | |

TOTAL CONNECTICUT | 2,249,961 | ||

| District Of Columbia - 1.9% | |||

| District of Columbia Gen. Oblig. Series 2016 A, 3% 6/1/41 | 145,000 | 121,261 | |

| District of Columbia Income Tax Rev. Series 2019 A, 5% 3/1/35 | 15,000 | 16,772 | |

| Metropolitan Washington DC Arpts. Auth. Sys. Rev.: | |||

| Series 2018 A, 5% 10/1/23 (c) | 270,000 | 270,507 | |

| Series 2021 A: | |||

4% 10/1/40 (c) | 100,000 | 97,517 | |

5% 10/1/26 (c) | 200,000 | 208,802 | |

TOTAL DISTRICT OF COLUMBIA | 714,859 | ||

| Florida - 0.2% | |||

| Florida Higher Edl. Facilities Fing. Auth. (Rollins College Proj.) Series 2020 A, 3% 12/1/48 | 100,000 | 71,818 | |

| Florida Hsg. Fin. Corp. Multi-family Mtg. Rev. Bonds Series 2023 C, 5%, tender 12/1/25 (b) | 15,000 | 15,364 | |

TOTAL FLORIDA | 87,182 | ||

| Georgia - 2.8% | |||

| Burke County Indl. Dev. Auth. Poll. Cont. Rev. Bonds (Georgia Pwr. Co. Plant Vogtle Proj.) Series 1994 4, 3.8%, tender 5/21/26 (b) | 340,000 | 337,047 | |

| Main Street Natural Gas, Inc. Bonds: | |||

| Series 2022 E, 4%, tender 12/1/29 (b) | 200,000 | 196,506 | |

| Series 2023 A, 5%, tender 6/1/30 (b) | 200,000 | 206,877 | |

| Series 2023 B, 5%, tender 3/1/30 (b) | 250,000 | 262,113 | |

| Series 2023 C, 5%, tender 9/1/30 (b) | 55,000 | 57,815 | |

| Private Colleges & Univs. Auth. Rev. (The Savannah College of Art & Design Projs.) Series 2021, 4% 4/1/38 | 5,000 | 5,081 | |

TOTAL GEORGIA | 1,065,439 | ||

| Hawaii - 0.9% | |||

| Honolulu City & County Gen. Oblig. Series 2020 F, 5% 7/1/34 | 5,000 | 5,682 | |

| Honolulu City & County Multi-family housing Rev. Bonds Series 2023, 5%, tender 6/1/26 (b) | 340,000 | 352,080 | |

TOTAL HAWAII | 357,762 | ||

| Illinois - 11.9% | |||

| Chicago Board of Ed.: | |||

| Series 2017 D, 5% 12/1/31 | 100,000 | 102,040 | |

| Series 2022 B, 4% 12/1/41 | 100,000 | 89,761 | |

| Chicago Midway Arpt. Rev. Series 2016 A, 5% 1/1/29 (c) | 20,000 | 20,494 | |

| Chicago O'Hare Int'l. Arpt. Rev.: | |||

| Series 2015 A, 5% 1/1/28 (c) | 5,000 | 5,055 | |

| Series 2016 G, 5% 1/1/42 (c) | 5,000 | 5,086 | |

| Illinois Fin. Auth. Academic Facilities (Provident Group UIUC Properties LLC Univ. of Illinois at Urbana-Champaign Proj.) Series 2019 A, 5% 10/1/38 | 350,000 | 365,526 | |

| Illinois Fin. Auth. Rev.: | |||

| Series 2015 A, 5% 11/15/25 | 60,000 | 61,886 | |

| Series 2016 A, 3% 10/1/37 | 20,000 | 17,084 | |

| Series 2016: | |||

3.125% 5/15/37 | 35,000 | 30,933 | |

4% 5/15/35 | 10,000 | 10,009 | |

5% 12/1/46 | 5,000 | 5,023 | |

| Series 2017 C, 5% 3/1/26 | 15,000 | 15,484 | |

| Series 2019, 5% 4/1/35 | 15,000 | 15,918 | |

| Illinois Gen. Oblig.: | |||

| Series 2017 D, 5% 11/1/28 | 25,000 | 26,607 | |

| Series 2021 A, 5% 3/1/30 | 120,000 | 131,878 | |

| Series 2022 A, 5% 3/1/36 | 40,000 | 43,729 | |

| Series 2023 B, 5% 5/1/37 | 500,000 | 541,239 | |

| Series 2023 D, 4% 7/1/37 | 300,000 | 297,777 | |

| Series June 2016, 3.5% 6/1/29 | 500,000 | 485,795 | |

| Illinois Hsg. Dev. Auth. Multi-family Hsg. Rev. Bonds Series 2023, 4%, tender 6/1/25 (b) | 350,000 | 350,023 | |

| Illinois Toll Hwy. Auth. Toll Hwy. Rev. Series A, 5% 1/1/45 | 20,000 | 21,269 | |

| Metropolitan Pier & Exposition: | |||

| (McCormick Place Expansion Proj.) Series A, 0% 12/15/38 (Nat'l. Pub. Fin. Guarantee Corp. Insured) | 15,000 | 7,701 | |

| Series 2002 A, 0% 12/15/33 (Nat'l. Pub. Fin. Guarantee Corp. Insured) | 20,000 | 13,398 | |

| Series 2022 A, 0% 6/15/41 | 300,000 | 132,821 | |

| Railsplitter Tobacco Settlement Auth. Rev. Series 2017: | |||

| 5% 6/1/26 | 5,000 | 5,221 | |

| 5% 6/1/27 | 300,000 | 314,238 | |

| Sales Tax Securitization Corp.: | |||

| Series 2023 A, 3% 1/1/27 | 264,000 | 256,903 | |

| Series 2023 C, 5% 1/1/35 (e) | 1,000,000 | 1,110,162 | |

| Schaumburg Village Gen. Oblig. Series 2023, 4% 12/1/30 | 100,000 | 104,692 | |

TOTAL ILLINOIS | 4,587,752 | ||

| Indiana - 0.0% | |||

| Indiana Fin. Auth. Edl. Facilities Rev. (Butler Univ. Proj.) Series 2021, 4% 2/1/30 | 10,000 | 10,389 | |

| Iowa - 0.7% | |||

| Des Moines Iowa Series 2020 A, 2% 6/1/31 | 10,000 | 8,780 | |

| Iowa Fin. Auth. Single Family Mtg. (Mtg.-Backed Securities Prog.) Series 2023 A, 5.25% 7/1/53 | 260,000 | 272,454 | |

TOTAL IOWA | 281,234 | ||

| Kentucky - 2.8% | |||

| Ashland Med. Ctr. Rev. (Ashland Hosp. Corp. D/B/A Kings Daughters Med. Ctr. Proj.) Series 2016 A, 4% 2/1/36 | 350,000 | 339,958 | |

| Kentucky Econ. Dev. Fin. Auth. Hosp. Rev. Series 2017 A, 5.25% 6/1/41 | 200,000 | 204,491 | |

| Kentucky, Inc. Pub. Energy Bonds Series A, 4%, tender 6/1/26 (b) | 95,000 | 94,784 | |

| Louisville & Jefferson County: | |||

| Bonds Series 2020 C, 5%, tender 10/1/26 (b) | 350,000 | 361,902 | |

| Series 2020 A, 3% 10/1/43 | 85,000 | 65,108 | |

| Louisville & Jefferson County Visitors & Convention Commission Rev. (Kentucky Int'l. Convention Ctr. Expansion Proj.) Series 2016, 3.125% 6/1/46 (Assured Guaranty Muni. Corp. Insured) | 20,000 | 16,084 | |

TOTAL KENTUCKY | 1,082,327 | ||

| Louisiana - 0.8% | |||

| New Orleans Aviation Board Rev. Series 2017 D2, 5% 1/1/38 (c) | 60,000 | 61,442 | |

| St. John Baptist Parish Rev. Bonds (Marathon Oil Corp.) Series 2017, 4.05%, tender 7/1/26 (b) | 260,000 | 258,300 | |

TOTAL LOUISIANA | 319,742 | ||

| Maryland - 1.5% | |||

| Maryland Health & Higher Edl. Bonds Series 2020, 5%, tender 7/1/25 (b) | 300,000 | 305,657 | |

| Univ. of Maryland Sys. Auxiliary Facility & Tuition Rev. Series 2014 A, 5% 4/1/25 | 255,000 | 258,140 | |

TOTAL MARYLAND | 563,797 | ||

| Massachusetts - 2.8% | |||

| Amesbury Gen. Oblig. Series 2020, 2% 6/1/34 | 25,000 | 20,819 | |

| Massachusetts Dev. Fin. Agcy. Rev.: | |||

| Series 2016, 5% 7/1/28 | 30,000 | 30,769 | |

| Series 2019 K, 5% 7/1/35 | 15,000 | 16,127 | |

| Series 2021 G, 4% 7/1/46 | 510,000 | 482,871 | |

| Massachusetts Edl. Fing. Auth. Rev. Series 2020 C, 5% 7/1/26 (c) | 100,000 | 102,911 | |

| Massachusetts Hsg. Fin. Agcy. Multi-Family Rev. Series 2018 A, 3.7% 12/1/38 | 370,000 | 347,819 | |

| Massachusetts Port Auth. Rev. Series 2019 A, 5% 7/1/34 (c) | 30,000 | 32,394 | |

| Worcester Gen. Oblig. Series 2021, 2% 2/15/35 (Assured Guaranty Muni. Corp. Insured) | 60,000 | 49,040 | |

TOTAL MASSACHUSETTS | 1,082,750 | ||

| Michigan - 0.4% | |||

| Detroit Gen. Oblig. Series 2021 A, 5% 4/1/38 | 100,000 | 102,714 | |

| Michigan Fin. Auth. Rev. Series 2022, 5% 12/1/32 | 25,000 | 26,393 | |

| Rochester Cmnty. School District Series 2019 II, 3% 5/1/31 | 5,000 | 4,846 | |

TOTAL MICHIGAN | 133,953 | ||

| Minnesota - 2.1% | |||

| Minneapolis Health Care Sys. Rev. Bonds Series 2023 A, 5%, tender 11/15/28 (b) | 300,000 | 322,685 | |

| Minnesota Higher Ed. Facilities Auth. Rev.: | |||

| Series 2018 A, 5% 10/1/33 | 150,000 | 159,067 | |

| Series 2023, 4.25% 10/1/38 | 300,000 | 291,959 | |

| Minnesota Hsg. Fin. Agcy. Series 2023 F, 5.75% 7/1/53 | 10,000 | 10,738 | |

| Saint Cloud Health Care Rev. Series 2016 A, 3% 5/1/32 | 15,000 | 14,052 | |

TOTAL MINNESOTA | 798,501 | ||

| Mississippi - 0.2% | |||

| Mississippi Bus. finance Corp. Exempt Facilities Rev. Bonds (Enviva, Inc. Proj.) Series 2022, 7.75%, tender 7/15/32 (b)(c) | 100,000 | 74,854 | |

| Nevada - 4.6% | |||

| Clark County Arpt. Rev. Series 2021 B, 5% 7/1/25 (c) | 1,740,000 | 1,777,723 | |

| New Hampshire - 0.2% | |||

| Nat'l. Finnance Auth. Series 2023 2A, 3.875% 1/20/38 | 100,000 | 93,152 | |

| New Jersey - 12.8% | |||

| Essex County Gen. Oblig. Series 2021 B, 2% 8/15/33 | 450,000 | 389,456 | |

| New Jersey Econ. Dev. Auth. Series 2024 SSS, 5.25% 6/15/38 (e) | 1,000,000 | 1,082,891 | |

| New Jersey Econ. Dev. Auth. Motor Vehicle Rev. Series 2017 A, 4% 7/1/34 | 10,000 | 10,045 | |

| New Jersey Econ. Dev. Auth. Wtr. Facilities Rev. Bonds (New Jersey- American Wtr. Co., INC. Proj.) Series 2020 B, 3.75%, tender 6/1/28 (b)(c) | 340,000 | 338,381 | |

| New Jersey Gen. Oblig. Series 2020, 2.375% 6/1/36 | 55,000 | 45,538 | |

| New Jersey Higher Ed. Student Assistance Auth. Student Ln. Rev.: | |||

| Series 2021 B, 5% 12/1/25 (c) | 655,000 | 670,614 | |

| Series 2023 A, 5% 12/1/30 (c) | 300,000 | 322,746 | |

| New Jersey Hsg. & Mtg. Fin. Agcy. Multi-family Rev. Series 2023 C, 5% 11/1/26 (c) | 500,000 | 509,473 | |

| New Jersey Tobacco Settlement Fing. Corp. Series 2018 B, 5% 6/1/46 | 560,000 | 559,946 | |

| New Jersey Trans. Trust Fund Auth.: | |||

| Series 2006 C: | |||

0% 12/15/24 | 150,000 | 142,745 | |

0% 12/15/31 (FGIC Insured) | 15,000 | 11,058 | |

0% 12/15/34 | 80,000 | 52,186 | |

| Series 2022 AA, 5% 6/15/25 | 250,000 | 257,321 | |

| Series AA, 5% 6/15/38 | 35,000 | 37,641 | |

| Salem County Indl. Poll. Cont. Fing. Auth. Poll. Cont. Rev. Bonds (Philadelphia Elec. Co. Proj.) Series 1993 A, 4.45%, tender 3/1/25 (b)(c) | 500,000 | 499,983 | |

TOTAL NEW JERSEY | 4,930,024 | ||

| New Mexico - 0.0% | |||

| New Mexico Mtg. Fin. Auth. Series 2018 A1, 4% 1/1/49 | 15,000 | 14,879 | |

| New York - 10.3% | |||

| Genesee County Fdg. Corp. (Rochester Reg'l. Health Proj.) Series 2022 A, 5% 12/1/30 | 250,000 | 265,340 | |

| Long Island Pwr. Auth. Elec. Sys. Rev. Series 2020 A, 5% 9/1/34 | 5,000 | 5,723 | |

| New York City Gen. Oblig.: | |||

| Bonds Series 2015 F4, 5%, tender 6/1/44 (f) | 100,000 | 102,877 | |

| Series 2023 1, 5% 8/1/28 | 1,000,000 | 1,100,938 | |

| Series 2023 D, 5% 8/1/25 | 1,000,000 | 1,037,663 | |

| New York City Hsg. Dev. Corp. Multifamily Hsg. Series 2019 J, 3.05% 11/1/49 | 15,000 | 11,332 | |

| New York Metropolitan Trans. Auth. Rev. Series 2020 D, 4% 11/15/47 | 15,000 | 14,029 | |

| New York State Hsg. Fin. Agcy. Rev. Bonds Series 2023 C2, 3.8%, tender 5/1/29 (b) | 370,000 | 370,241 | |

| New York State Urban Dev. Corp.: | |||

| Series 2020 A, 5% 3/15/37 | 5,000 | 5,568 | |

| Series 2020 C, 4% 3/15/37 | 5,000 | 5,089 | |

| New York State Urban Eev Corp. Series 2019 A, 3% 3/15/49 | 1,000,000 | 773,134 | |

| New York Trans. Dev. Corp.: | |||

| (Delta Air Lines, Inc. - LaGuardia Arpt. Termindals C&D Redev. Proj.) Series 2020, 4% 10/1/30 (c) | 20,000 | 19,892 | |

| (Term. 4 JFK Int'l. Arpt. Proj.) Series 2020 A, 5% 12/1/28 (c) | 20,000 | 21,176 | |

| (Term. 4 John F. Kennedy Int'l. Arpt. Proj.) Series 2022, 5% 12/1/34 (c) | 35,000 | 38,048 | |

| Suffolk Tobacco Asset Securitization Corp. Series 2021 B1, 4% 6/1/50 | 225,000 | 219,637 | |

TOTAL NEW YORK | 3,990,687 | ||

| North Carolina - 0.1% | |||

| Charlotte-Mecklenburg Hosp. Auth. Health Care Sys. Rev. Bonds Series 2018 C, 3.45%, tender 10/31/25 (b) | 45,000 | 44,805 | |

| North Dakota - 1.3% | |||

| Grand Forks Health Care Sys. Rev. Series 2021, 5% 12/1/28 | 500,000 | 515,514 | |

| Ohio - 1.2% | |||

| American Muni. Pwr., Inc. Rev. Series 2016 A, 3% 2/15/36 | 10,000 | 8,950 | |

| Buckeye Tobacco Settlement Fing. Auth.: | |||

| Series 2020 A2, 3% 6/1/48 | 200,000 | 153,207 | |

| Series 2020 B2, 5% 6/1/55 | 250,000 | 232,356 | |

| Cuyahoga County Econ. Dev. Rev. (The Cleveland Orchestra Proj.) Series 2019, 5% 1/1/34 | 5,000 | 5,478 | |

| Montgomery County Hosp. Rev. (Kettering Health Network Obligated Group Proj.) Series 2021, 5% 8/1/32 | 25,000 | 27,236 | |

| Ohio Higher Edl. Facility Commission Rev.: | |||

| (Kenyon College 2020 Proj.) Series 2020, 5% 7/1/35 | 30,000 | 32,976 | |

| (Xavier Univ. 2015 Proj.) Series 2015 C, 3.75% 5/1/38 | 5,000 | 4,563 | |

TOTAL OHIO | 464,766 | ||

| Oregon - 0.0% | |||

| Medford Hosp. Facilities Auth. Rev. (Asante Projs.) Series 2020 A, 5% 8/15/36 | 10,000 | 10,783 | |

| Pennsylvania - 3.5% | |||

| Centre County Pennsylvania Hosp. Auth. Rev. (Mount Nittany Med. Ctr. Proj.) Series 2018 A, 3.375% 11/15/31 | 10,000 | 9,975 | |

| Dubois Hosp. Auth. Hosp. Rev. (Penn Highlands Healthcare Proj.) Series 2018: | |||

| 5% 7/15/28 | 580,000 | 612,047 | |

| 5% 7/15/29 | 220,000 | 231,976 | |

| Geisinger Auth. Health Sys. Rev.: | |||

| Bonds Series 2020 B, 5%, tender 2/15/27 (b) | 50,000 | 52,285 | |

| Series 2017 A2, 5% 2/15/31 | 10,000 | 10,497 | |

| Pennsylvania Gen. Oblig.: | |||

| Series 2020 1, 3% 5/1/36 | 310,000 | 284,207 | |

| Series 2021, 3% 5/15/34 | 40,000 | 38,066 | |

| Pennsylvania Tpk. Commission Tpk. Rev.: | |||

| Series 2016 A1, 5% 12/1/27 | 5,000 | 5,212 | |

| Series 2021 B, 5% 12/1/33 | 25,000 | 28,583 | |

| Philadelphia Gas Works Rev. Series 15, 5% 8/1/24 | 50,000 | 50,772 | |

| Southcentral Pennsylvania Gen. Auth. Rev. Series 2019 A, 5% 6/1/39 | 10,000 | 10,554 | |

TOTAL PENNSYLVANIA | 1,334,174 | ||

| Puerto Rico - 5.5% | |||

| Puerto Rico Commonwealth Aqueduct & Swr. Auth. Series 2021 A, 5% 7/1/37 (d) | 250,000 | 251,450 | |

| Puerto Rico Commonwealth Hwys & Tra Series 2022 B, 0% 7/1/32 | 250,000 | 159,025 | |

| Puerto Rico Commonwealth Pub. Impt. Gen. Oblig. Series 2021 A1: | |||

| 0% 7/1/33 | 500,000 | 304,674 | |

| 4% 7/1/37 | 250,000 | 223,981 | |

| Puerto Rico Sales Tax Fing. Corp. Sales Tax Rev. Series 2019 A2, 4.329% 7/1/40 | 1,250,000 | 1,176,668 | |

TOTAL PUERTO RICO | 2,115,798 | ||

| Rhode Island - 3.0% | |||

| Rhode Island Health and Edl. Bldg. Corp. Higher Ed. Facility Rev. Series 2023, 5% 11/1/47 | 500,000 | 536,248 | |

| Rhode Island Student Ln. Auth. Student Ln. Rev. Series 2019 A, 5% 12/1/25 (c) | 600,000 | 616,324 | |

TOTAL RHODE ISLAND | 1,152,572 | ||

| Tennessee - 0.9% | |||

| Memphis-Shelby County Arpt. Auth. Arpt. Rev. Series 2018, 5% 7/1/38 (c) | 5,000 | 5,168 | |

| Nashville and Davidson County Metropolitan Govt. Gen. Oblig. Series 2021 C, 3% 1/1/35 | 350,000 | 334,157 | |

| Shelby County Health Edl. & Hsg. Facilities Board Rev. Series 2017 A, 3.375% 5/1/32 | 5,000 | 4,971 | |

| Tennessee Hsg. Dev. Agcy. Series 2015 A, 3.5% 7/1/45 | 10,000 | 9,857 | |

TOTAL TENNESSEE | 354,153 | ||

| Texas - 4.2% | |||

| Houston Hsg. Fin. Corp. Multi-family Hsg. Rev. Bonds Series 2023, 5%, tender 8/1/26 (b) | 25,000 | 25,740 | |

| Lower Colorado River Auth. Rev. (LCRA Transmission Svcs. Corp. Proj.) Series 2019, 5% 5/15/34 | 5,000 | 5,514 | |

| Mission Econ. Dev. Corp. Solid Waste Disp. Rev. Bonds (Republic Svcs., Inc. Proj.) Series 2020 A, 3.875%, tender 8/1/23 (b)(c) | 300,000 | 300,000 | |

| Northside Independent School District Bonds Series 2023 B, 3%, tender 8/1/29 (b) | 1,000,000 | 982,596 | |

| Southwest Higher Ed. Auth. Rev. (Southern Methodist Univ., TX. Proj.) Series 2017, 5% 10/1/39 | 5,000 | 5,267 | |

| Tarrant County Cultural Ed. Facilities Fin. Corp. Hosp. Rev. Series 2022, 5% 10/1/40 | 50,000 | 54,030 | |

| Texas Wtr. Dev. Board Rev.: | |||

| Series 2019, 5% 8/1/35 | 5,000 | 5,517 | |

| Series 2020, 3% 10/15/38 | 250,000 | 225,612 | |

| Waco Gen. Oblig. Series 2020, 2.375% 2/1/40 | 40,000 | 31,085 | |

TOTAL TEXAS | 1,635,361 | ||

| Washington - 1.2% | |||

| Port of Seattle Rev.: | |||

| Series 2018 A, 5% 5/1/37 (c) | 5,000 | 5,175 | |

| Series 2019: | |||

5% 4/1/35 (c) | 30,000 | 32,057 | |

5% 4/1/36 (c) | 5,000 | 5,307 | |

| Washington Gen. Oblig. Series 2021 A, 5% 6/1/38 | 15,000 | 16,562 | |

| Washington Health Care Facilities Auth. Rev.: | |||

| (Overlake Hosp. Med. Ctr., WA. Proj.) Series 2017 B: | |||

5% 7/1/27 | 150,000 | 153,634 | |

5% 7/1/36 | 155,000 | 154,730 | |

| (Providence Health Systems Proj.) Series 2018 B, 5% 10/1/33 | 15,000 | 15,813 | |

| (Virginia Mason Med. Ctr. Proj.) Series 2017, 5% 8/15/27 | 75,000 | 78,236 | |

| Series 2015 A, 5% 8/15/27 | 5,000 | 5,138 | |

| Series 2019 A1, 5% 8/1/36 | 10,000 | 10,567 | |

TOTAL WASHINGTON | 477,219 | ||

| West Virginia - 0.6% | |||

| Monongalia Cty W Bld Cm Rev. Series 2015, 5% 7/1/29 | 220,000 | 221,843 | |

| Wisconsin - 1.0% | |||

| Howard Suamico Scd Series 2021, 2% 3/1/38 | 15,000 | 11,267 | |

| Milwaukee Gen. Oblig. Series 2017 N4, 5% 4/1/26 | 5,000 | 5,155 | |

| Pub. Fin. Auth. Hosp. Rev. Series 2020 A, 3% 6/1/45 | 100,000 | 74,439 | |

| Roseman Univ. of Health Series 2021 A, 4.5% 6/1/56 (d) | 115,000 | 86,037 | |

| Wisconsin Gen. Oblig. Series 2014 4, 5% 5/1/25 | 25,000 | 25,571 | |

| Wisconsin Health & Edl. Facilities: | |||

| Series 2013 A, 5% 11/15/43 (Pre-Refunded to 11/15/23 @ 100) | 100,000 | 100,397 | |

| Series 2015, 3.15% 8/15/27 | 80,000 | 77,895 | |

TOTAL WISCONSIN | 380,761 | ||

| TOTAL MUNICIPAL BONDS (Cost $36,826,776) | 36,971,634 | ||

| Municipal Notes - 5.1% | |||

Principal Amount (a) | Value ($) | ||

| Alabama - 0.7% | |||

| Walker County Econ. & Indl. Dev. Auth. Solid Waste Disp. Rev. (Alabama Pwr. Co. Plant Gorgas Proj.) Series 2007, 4.65% 8/1/23, VRDN (b)(c) | 300,000 | 300,000 | |

| California - 4.4% | |||

| California Statewide Cmntys. Dev. Auth. Multi-family Hsg. Rev. Participating VRDN Series MIZ 91 22, 5% 8/1/23 (Liquidity Facility Mizuho Cap. Markets LLC) (b)(c)(g)(h) | 700,000 | 700,000 | |

| Los Angeles Cmnty. Redev. Agcy. Multi-family Hsg. Rev. Participating VRDN Series 2022 MIZ 90 90, 5% 8/1/23 (Liquidity Facility Mizuho Cap. Markets LLC) (b)(c)(g)(h) | 1,000,000 | 1,000,000 | |

TOTAL CALIFORNIA | 1,700,000 | ||

| TOTAL MUNICIPAL NOTES (Cost $2,000,000) | 2,000,000 | ||

| Money Market Funds - 3.9% | |||

| Shares | Value ($) | ||

Fidelity Municipal Cash Central Fund 4.30% (i)(j) (Cost $1,502,000) | 1,501,700 | 1,502,000 | |

| TOTAL INVESTMENT IN SECURITIES - 104.6% (Cost $40,328,776) | 40,473,634 |

NET OTHER ASSETS (LIABILITIES) - (4.6)% | (1,793,277) |

| NET ASSETS - 100.0% | 38,680,357 |

| VRDN | - | VARIABLE RATE DEMAND NOTE (A debt instrument that is payable upon demand, either daily, weekly or monthly) |

| (a) | Amount is stated in United States dollars unless otherwise noted. |

| (b) | Coupon rates for floating and adjustable rate securities reflect the rates in effect at period end. |

| (c) | Private activity obligations whose interest is subject to the federal alternative minimum tax for individuals. |

| (d) | Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. At the end of the period, the value of these securities amounted to $419,223 or 1.1% of net assets. |

| (e) | Security or a portion of the security purchased on a delayed delivery or when-issued basis. |

| (f) | Security initially issued at one coupon which converts to a higher coupon at a specified date. The rate shown is the rate at period end. |

| (g) | Provides evidence of ownership in one or more underlying municipal bonds. |

| (h) | Coupon rates are determined by re-marketing agents based on current market conditions. |

| (i) | Information in this report regarding holdings by state and security types does not reflect the holdings of the Fidelity Municipal Cash Central Fund. |

| (j) | Affiliated fund that is generally available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. In addition, each Fidelity Central Fund's financial statements are available on the SEC's website or upon request. |

| Affiliate | Value, beginning of period ($) | Purchases ($) | Sales Proceeds ($) | Dividend Income ($) | Realized Gain (loss) ($) | Change in Unrealized appreciation (depreciation) ($) | Value, end of period ($) | % ownership, end of period |

| Fidelity Municipal Cash Central Fund 4.30% | - | 28,985,000 | 27,483,000 | 53,001 | - | - | 1,502,000 | 0.1% |

| Total | - | 28,985,000 | 27,483,000 | 53,001 | - | - | 1,502,000 | |

| Valuation Inputs at Reporting Date: | ||||

| Description | Total ($) | Level 1 ($) | Level 2 ($) | Level 3 ($) |

Investments in Securities: | ||||

| Municipal Securities | 38,971,634 | - | 38,971,634 | - |

| Money Market Funds | 1,502,000 | 1,502,000 | - | - |

| Total Investments in Securities: | 40,473,634 | 1,502,000 | 38,971,634 | - |

| Statement of Assets and Liabilities | ||||

July 31, 2023 (Unaudited) | ||||

| Assets | ||||

| Investment in securities, at value - See accompanying schedule: | ||||

Unaffiliated issuers (cost $38,826,776) | $ | 38,971,634 | ||

Fidelity Central Funds (cost $1,502,000) | 1,502,000 | |||

| Total Investment in Securities (cost $40,328,776) | $ | 40,473,634 | ||

| Cash | 37,308 | |||

| Receivable for investments sold | 106 | |||

| Receivable for fund shares sold | 200 | |||

| Interest receivable | 324,118 | |||

| Distributions receivable from Fidelity Central Funds | 3,544 | |||

| Prepaid expenses | 60,039 | |||

| Receivable from investment adviser for expense reductions | 17,189 | |||

Total assets | 40,916,138 | |||

| Liabilities | ||||

| Payable for investments purchased on a delayed delivery basis | $ | 2,189,720 | ||

| Payable for fund shares redeemed | 741 | |||

| Distributions payable | 6,670 | |||

| Accrued management fee | 11,008 | |||

| Distribution and service plan fees payable | 2,606 | |||

| Other affiliated payables | 3,265 | |||

| Other payables and accrued expenses | 21,771 | |||

| Total Liabilities | 2,235,781 | |||

| Net Assets | $ | 38,680,357 | ||

| Net Assets consist of: | ||||

| Paid in capital | $ | 38,501,393 | ||

| Total accumulated earnings (loss) | 178,964 | |||

| Net Assets | $ | 38,680,357 | ||

| Net Asset Value and Maximum Offering Price | ||||

| Class A : | ||||

Net Asset Value and redemption price per share ($2,325,517 ÷ 230,610 shares)(a) | $ | 10.08 | ||

| Maximum offering price per share (100/96.00 of $10.08) | $ | 10.50 | ||

| Class M : | ||||

Net Asset Value and redemption price per share ($2,045,844 ÷ 202,876 shares)(a) | $ | 10.08 | ||

| Maximum offering price per share (100/96.00 of $10.08) | $ | 10.50 | ||

| Class C : | ||||

Net Asset Value and offering price per share ($2,038,895 ÷ 202,873 shares)(a) | $ | 10.05 | ||

| Fidelity Municipal Core Plus Bond Fund : | ||||

Net Asset Value, offering price and redemption price per share ($27,595,317 ÷ 2,736,607 shares) | $ | 10.08 | ||

| Class I : | ||||

Net Asset Value, offering price and redemption price per share ($2,051,013 ÷ 203,388 shares) | $ | 10.08 | ||

| Class Z : | ||||

Net Asset Value, offering price and redemption price per share ($2,623,771 ÷ 260,190 shares) | $ | 10.08 | ||

(a)Redemption price per share is equal to net asset value less any applicable contingent deferred sales charge. | ||||

| Statement of Operations | ||||

For the period February 16, 2023 (commencement of operations) through July 31, 2023 (Unaudited) | ||||

| Investment Income | ||||

| Interest | $ | 520,199 | ||

| Income from Fidelity Central Funds | 53,001 | |||

| Total Income | 573,200 | |||

| Expenses | ||||

| Management fee | $ | 50,227 | ||

| Transfer agent fees | 12,081 | |||

| Distribution and service plan fees | 13,840 | |||

| Accounting fees and expenses | 3,752 | |||

| Custodian fees and expenses | 667 | |||

| Independent trustees' fees and expenses | 38 | |||

| Registration fees | 63,821 | |||

| Audit | 23,490 | |||

| Legal | 54 | |||

| Miscellaneous | 128 | |||

| Total expenses before reductions | 168,098 | |||

| Expense reductions | (101,678) | |||

| Total expenses after reductions | 66,420 | |||

| Net Investment income (loss) | 506,780 | |||

| Realized and Unrealized Gain (Loss) | ||||

| Net realized gain (loss) on: | ||||

| Investment Securities: | ||||

| Unaffiliated issuers | 15,596 | |||

| Total net realized gain (loss) | 15,596 | |||

| Change in net unrealized appreciation (depreciation) on investment securities | 144,858 | |||

| Net gain (loss) | 160,454 | |||

| Net increase (decrease) in net assets resulting from operations | $ | 667,234 | ||

| Statement of Changes in Net Assets | ||

For the period February 16, 2023 (commencement of operations) through July 31, 2023 (Unaudited) | ||

| Increase (Decrease) in Net Assets | ||

| Operations | ||

| Net investment income (loss) | $ | 506,780 |

| Net realized gain (loss) | 15,596 | |

| Change in net unrealized appreciation (depreciation) | 144,858 | |

| Net increase (decrease) in net assets resulting from operations | 667,234 | |

| Distributions to shareholders | (488,270) | |

| Share transactions - net increase (decrease) | 38,501,393 | |

| Total increase (decrease) in net assets | 38,680,357 | |

| Net Assets | ||

| Beginning of period | - | |

| End of period | $ | 38,680,357 |

| Fidelity Advisor Municipal Core Plus Bond Fund Class A |

Six months ended (Unaudited) July 31, 2023 A | ||

Selected Per-Share Data | ||

| Net asset value, beginning of period | $ | 10.00 |

| Income from Investment Operations | ||

Net investment income (loss) B,C | .152 | |

| Net realized and unrealized gain (loss) | .072 D | |

| Total from investment operations | .224 | |

| Distributions from net investment income | (.144) | |

| Total distributions | (.144) | |

| Net asset value, end of period | $ | 10.08 |

Total Return E,F,G | 2.25% D | |

Ratios to Average Net Assets C,H,I | ||

| Expenses before reductions | 1.41% J | |

| Expenses net of fee waivers, if any | .62% J | |

| Expenses net of all reductions | .62% J | |

| Net investment income (loss) | 3.32% J | |

| Supplemental Data | ||

| Net assets, end of period (000 omitted) | $ | 2,326 |

Portfolio turnover rate K | 22% L |

| Fidelity Advisor Municipal Core Plus Bond Fund Class M |

Six months ended (Unaudited) July 31, 2023 A | ||

Selected Per-Share Data | ||

| Net asset value, beginning of period | $ | 10.00 |

| Income from Investment Operations | ||

Net investment income (loss) B,C | .152 | |

| Net realized and unrealized gain (loss) | .072 D | |

| Total from investment operations | .224 | |

| Distributions from net investment income | (.144) | |

| Total distributions | (.144) | |

| Net asset value, end of period | $ | 10.08 |

Total Return E,F,G | 2.25% D | |

Ratios to Average Net Assets C,H,I | ||

| Expenses before reductions | 1.42% J | |

| Expenses net of fee waivers, if any | .62% J | |

| Expenses net of all reductions | .62% J | |

| Net investment income (loss) | 3.33% J | |

| Supplemental Data | ||

| Net assets, end of period (000 omitted) | $ | 2,046 |

Portfolio turnover rate K | 22% L |

| Fidelity Advisor Municipal Core Plus Bond Fund Class C |

Six months ended (Unaudited) July 31, 2023 A | ||

Selected Per-Share Data | ||

| Net asset value, beginning of period | $ | 10.00 |

| Income from Investment Operations | ||

Net investment income (loss) B,C | .118 | |

| Net realized and unrealized gain (loss) | .076 D | |

| Total from investment operations | .194 | |

| Distributions from net investment income | (.144) | |

| Total distributions | (.144) | |

| Net asset value, end of period | $ | 10.05 |

Total Return E,F,G | 1.94% D | |

Ratios to Average Net Assets C,H,I | ||

| Expenses before reductions | 2.16% J | |

| Expenses net of fee waivers, if any | 1.37% J | |

| Expenses net of all reductions | 1.37% J | |

| Net investment income (loss) | 2.58% J | |

| Supplemental Data | ||

| Net assets, end of period (000 omitted) | $ | 2,039 |

Portfolio turnover rate K | 22% L |

| Fidelity Municipal Core Plus Bond Fund |

Six months ended (Unaudited) July 31, 2023 A | ||

Selected Per-Share Data | ||

| Net asset value, beginning of period | $ | 10.00 |

| Income from Investment Operations | ||

Net investment income (loss) B,C | .162 | |

| Net realized and unrealized gain (loss) | .073 D | |

| Total from investment operations | .235 | |

| Distributions from net investment income | (.155) | |

| Total distributions | (.155) | |

| Net asset value, end of period | $ | 10.08 |

Total Return E,F | 2.36% D | |

Ratios to Average Net Assets C,G,H | ||

| Expenses before reductions | 1.02% I | |

| Expenses net of fee waivers, if any | .37% I | |

| Expenses net of all reductions | .36% I | |

| Net investment income (loss) | 3.58% I | |

| Supplemental Data | ||

| Net assets, end of period (000 omitted) | $ | 27,595 |

Portfolio turnover rate J | 22% K |

| Fidelity Advisor Municipal Core Plus Bond Fund Class I |

Six months ended (Unaudited) July 31, 2023 A | ||

Selected Per-Share Data | ||

| Net asset value, beginning of period | $ | 10.00 |

| Income from Investment Operations | ||

Net investment income (loss) B,C | .164 | |

| Net realized and unrealized gain (loss) | .071 D | |

| Total from investment operations | .235 | |

| Distributions from net investment income | (.155) | |

| Total distributions | (.155) | |

| Net asset value, end of period | $ | 10.08 |

Total Return E,F | 2.37% D | |

Ratios to Average Net Assets C,G,H | ||

| Expenses before reductions | 1.17% I | |

| Expenses net of fee waivers, if any | .37% I | |

| Expenses net of all reductions | .37% I | |

| Net investment income (loss) | 3.58% I | |

| Supplemental Data | ||

| Net assets, end of period (000 omitted) | $ | 2,051 |

Portfolio turnover rate J | 22% K |

| Fidelity Advisor Municipal Core Plus Bond Fund Class Z |

Six months ended (Unaudited) July 31, 2023 A | ||

Selected Per-Share Data | ||

| Net asset value, beginning of period | $ | 10.00 |

| Income from Investment Operations | ||

Net investment income (loss) B,C | .166 | |

| Net realized and unrealized gain (loss) | .072 D | |

| Total from investment operations | .238 | |

| Distributions from net investment income | (.158) | |

| Total distributions | (.158) | |

| Net asset value, end of period | $ | 10.08 |

Total Return E,F | 2.39% D | |

Ratios to Average Net Assets C,G,H | ||

| Expenses before reductions | 1.03% I | |

| Expenses net of fee waivers, if any | .31% I | |

| Expenses net of all reductions | .31% I | |

| Net investment income (loss) | 3.63% I | |

| Supplemental Data | ||

| Net assets, end of period (000 omitted) | $ | 2,624 |

Portfolio turnover rate J | 22% K |