UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-02105

Fidelity Salem Street Trust

(Exact name of registrant as specified in charter)

245 Summer St., Boston, MA 02210

(Address of principal executive offices) (Zip code)

Margaret Carey, Secretary

245 Summer St.

Boston, Massachusetts 02210

(Name and address of agent for service)

Registrant's telephone number, including area code:

617-563-7000

Date of fiscal year end: | September 30 |

Date of reporting period: | March 31, 2024 |

Item 1.

Reports to Stockholders

Contents

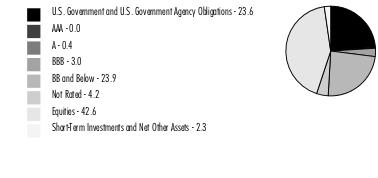

Quality Diversification (% of Fund's net assets) |

|

Percentages shown as 0.0% may reflect amounts less than 0.05%. |

| We have used ratings from Moody's Investors Service, Inc. Where Moody's® ratings are not available, we have used S&P® ratings. All ratings are as of the date indicated and do not reflect subsequent changes. |

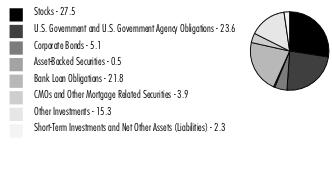

Asset Allocation (% of Fund's net assets) |

|

U.S. Treasury Inflation-Indexed Securities - 23.6% |

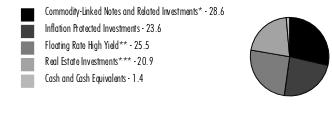

Holdings Distribution (% of Fund's net assets) |

|

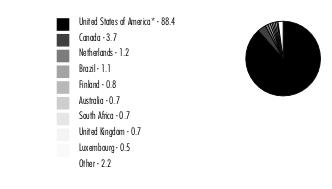

Geographic Diversification (% of Fund's net assets) |

|

* Includes Short-Term investments and Net Other Assets (Liabilities). Percentages are adjusted for the effect of derivatives, if applicable. |

| Nonconvertible Bonds - 3.6% | |||

Principal Amount (a) | Value ($) | ||

| CONSUMER DISCRETIONARY - 0.2% | |||

| Hotels, Restaurants & Leisure - 0.2% | |||

| Hilton Domestic Operating Co., Inc. 4% 5/1/31 (b) | 350,000 | 312,818 | |

| Hilton Grand Vacations Borrower Escrow LLC 4.875% 7/1/31 (b) | 395,000 | 353,657 | |

| Times Square Hotel Trust 8.528% 8/1/26 (b) | 160,973 | 160,377 | |

| 826,852 | |||

| Household Durables - 0.0% | |||

| LGI Homes, Inc. 4% 7/15/29 (b) | 170,000 | 148,514 | |

| TRI Pointe Homes, Inc. 5.25% 6/1/27 | 100,000 | 97,672 | |

| 246,186 | |||

TOTAL CONSUMER DISCRETIONARY | 1,073,038 | ||

| ENERGY - 0.0% | |||

| Oil, Gas & Consumable Fuels - 0.0% | |||

| EG Global Finance PLC 12% 11/30/28 (b) | 250,000 | 265,734 | |

| FINANCIALS - 0.1% | |||

| Financial Services - 0.1% | |||

| Brixmor Operating Partnership LP 4.05% 7/1/30 | 350,000 | 324,631 | |

| HEALTH CARE - 0.0% | |||

| Health Care Providers & Services - 0.0% | |||

| Sabra Health Care LP 3.2% 12/1/31 | 250,000 | 207,671 | |

| REAL ESTATE - 3.3% | |||

| Equity Real Estate Investment Trusts (REITs) - 3.1% | |||

| American Homes 4 Rent LP: | |||

| 2.375% 7/15/31 | 750,000 | 609,172 | |

| 3.625% 4/15/32 | 1,000,000 | 879,372 | |

| American Tower Corp.: | |||

| 2.7% 4/15/31 | 750,000 | 634,918 | |

| 4.05% 3/15/32 | 750,000 | 686,376 | |

| 5.55% 7/15/33 | 250,000 | 251,935 | |

| CBL & Associates LP 5.95% (c)(d) | 132,000 | 0 | |

| Crown Castle, Inc.: | |||

| 2.25% 1/15/31 | 1,250,000 | 1,028,445 | |

| 2.5% 7/15/31 | 500,000 | 413,748 | |

| 3.8% 2/15/28 | 100,000 | 94,672 | |

| EPR Properties: | |||

| 3.6% 11/15/31 | 250,000 | 208,940 | |

| 4.95% 4/15/28 | 250,000 | 237,901 | |

| Equinix, Inc.: | |||

| 2.15% 7/15/30 | 500,000 | 414,366 | |

| 3.9% 4/15/32 | 250,000 | 226,210 | |

| GLP Capital LP/GLP Financing II, Inc.: | |||

| 3.25% 1/15/32 | 250,000 | 210,457 | |

| 4% 1/15/31 | 500,000 | 446,158 | |

| 5.3% 1/15/29 | 1,000,000 | 983,284 | |

| Invitation Homes Operating Partnership LP: | |||

| 2% 8/15/31 | 750,000 | 595,943 | |

| 4.15% 4/15/32 | 1,000,000 | 915,171 | |

| MPT Operating Partnership LP/MPT Finance Corp. 4.625% 8/1/29 | 915,000 | 702,234 | |

| Omega Healthcare Investors, Inc.: | |||

| 3.375% 2/1/31 | 500,000 | 426,781 | |

| 4.5% 4/1/27 | 83,000 | 80,321 | |

| Public Storage 5.1% 8/1/33 | 500,000 | 502,170 | |

| Realty Income Corp. 4% 7/15/29 | 250,000 | 237,455 | |

| Safehold Operating Partnership LP 6.1% 4/1/34 | 250,000 | 248,392 | |

| SBA Communications Corp. 3.125% 2/1/29 | 500,000 | 441,253 | |

| Sun Communities Operating LP: | |||

| 2.7% 7/15/31 | 1,000,000 | 823,497 | |

| 4.2% 4/15/32 | 4,000 | 3,587 | |

| 5.7% 1/15/33 | 250,000 | 247,934 | |

| Uniti Group LP/Uniti Fiber Holdings, Inc./CSL Capital LLC 6% 1/15/30 (b) | 105,000 | 78,289 | |

| Uniti Group LP/Uniti Group Finance, Inc./CSL Capital LLC: | |||

| 6.5% 2/15/29 (b) | 235,000 | 182,131 | |

| 10.5% 2/15/28 (b) | 235,000 | 243,631 | |

| Ventas Realty LP 4.75% 11/15/30 | 250,000 | 241,071 | |

| VICI Properties LP 5.125% 5/15/32 | 1,250,000 | 1,195,622 | |

| VICI Properties LP / VICI Note Co. 4.625% 12/1/29 (b) | 500,000 | 472,862 | |

| Welltower OP LLC 3.85% 6/15/32 | 500,000 | 452,294 | |

| Weyerhaeuser Co. 4% 4/15/30 | 250,000 | 236,174 | |

| 15,652,766 | |||

| Real Estate Management & Development - 0.2% | |||

| Cushman & Wakefield U.S. Borrower LLC 6.75% 5/15/28 (b) | 285,000 | 281,433 | |

| Extra Space Storage LP 2.35% 3/15/32 | 500,000 | 400,059 | |

| Howard Hughes Corp. 4.125% 2/1/29 (b) | 40,000 | 35,950 | |

| 717,442 | |||

TOTAL REAL ESTATE | 16,370,208 | ||

| TOTAL NONCONVERTIBLE BONDS (Cost $19,140,884) | 18,241,282 | ||

| U.S. Treasury Inflation-Protected Obligations - 23.6% | |||

Principal Amount (a) | Value ($) | ||

| U.S. Treasury Inflation-Indexed Bonds: | |||

| 0.125% 2/15/51 | 2,006,746 | 1,200,652 | |

| 0.125% 2/15/52 | 2,659,008 | 1,566,791 | |

| 0.625% 2/15/43 | 3,081,334 | 2,367,329 | |

| 0.75% 2/15/42 | 77,800 | 62,126 | |

| 0.75% 2/15/45 | 1,820,525 | 1,398,034 | |

| 0.875% 2/15/47 | 668,216 | 515,540 | |

| 1% 2/15/46 | 212,167 | 169,959 | |

| 1% 2/15/48 | 1,111,863 | 876,109 | |

| 1% 2/15/49 | 2,426,787 | 1,902,427 | |

| 1.375% 2/15/44 | 3,162,783 | 2,775,363 | |

| 1.75% 1/15/28 | 650,704 | 645,053 | |

| 2% 1/15/26 | 828,234 | 824,025 | |

| 2.125% 2/15/40 | 1,132,982 | 1,147,225 | |

| 2.125% 2/15/41 | 1,457,642 | 1,477,156 | |

| 2.125% 2/15/54 | 693,402 | 701,242 | |

| 2.375% 1/15/27 | 919,145 | 926,072 | |

| 2.5% 1/15/29 | 1,794,189 | 1,842,670 | |

| 3.375% 4/15/32 | 34,751 | 38,492 | |

| 3.625% 4/15/28 | 1,697,114 | 1,803,824 | |

| U.S. Treasury Inflation-Indexed Notes: | |||

| 0.125% 4/15/25 | 2,114,609 | 2,060,992 | |

| 0.125% 10/15/25 | 3,071,446 | 2,979,380 | |

| 0.125% 4/15/26 | 3,124,738 | 2,991,034 | |

| 0.125% 7/15/26 | 3,470,149 | 3,324,264 | |

| 0.125% 10/15/26 | 2,172,690 | 2,071,680 | |

| 0.125% 4/15/27 | 5,723,862 | 5,390,484 | |

| 0.125% 1/15/30 | 3,863,539 | 3,496,309 | |

| 0.125% 7/15/30 | 3,286,377 | 2,959,832 | |

| 0.125% 1/15/31 | 3,732,057 | 3,319,533 | |

| 0.125% 7/15/31 | 4,770,885 | 4,219,977 | |

| 0.125% 1/15/32 | 4,728,550 | 4,130,315 | |

| 0.25% 7/15/29 | 4,416,589 | 4,071,041 | |

| 0.375% 7/15/25 | 5,661,294 | 5,534,550 | |

| 0.375% 1/15/27 | 5,493,984 | 5,237,960 | |

| 0.375% 7/15/27 | 2,394,278 | 2,277,170 | |

| 0.5% 1/15/28 | 7,073,173 | 6,690,038 | |

| 0.625% 1/15/26 | 4,260,003 | 4,135,236 | |

| 0.625% 7/15/32 | 4,999,665 | 4,532,927 | |

| 0.75% 7/15/28 | 5,216,933 | 4,981,944 | |

| 0.875% 1/15/29 | 2,690,832 | 2,564,298 | |

| 1.125% 1/15/33 | 5,000,934 | 4,689,448 | |

| 1.25% 4/15/28 | 2,179,848 | 2,116,632 | |

| 1.375% 7/15/33 | 3,838,590 | 3,683,550 | |

| 1.5% 2/15/53 | 1,307,313 | 1,141,805 | |

| 1.75% 1/15/34 | 3,421,389 | 3,377,416 | |

| 2.375% 10/15/28 | 3,927,027 | 4,016,436 | |

| TOTAL U.S. TREASURY INFLATION-PROTECTED OBLIGATIONS (Cost $128,194,760) | 118,234,340 | ||

| Asset-Backed Securities - 0.5% | |||

Principal Amount (a) | Value ($) | ||

| American Homes 4 Rent Series 2015-SFR2 Class XS, 0% 10/17/52 (b)(d)(e)(f) | 133,884 | 1 | |

| DigitalBridge Issuer, LLC / DigitalBridge Co.-Issuer, LLC Series 2021-1A Class A2, 3.933% 9/25/51 (b) | 85,000 | 79,543 | |

| Home Partners of America Trust: | |||

| Series 2021-1 Class F, 3.325% 9/17/41 (b) | 85,108 | 67,186 | |

| Series 2021-2 Class G, 4.505% 12/17/26 (b) | 181,712 | 160,285 | |

| New Residential Mortgage Loan Trust Series 2022-SFR2 Class E1, 4% 9/4/39 (b) | 100,000 | 89,329 | |

| Progress Residential: | |||

| Series 2022-SFR3 Class F, 6.6% 4/17/39 (b) | 250,000 | 240,007 | |

| Series 2022-SFR4 Class E1, 6.121% 5/17/41 (b) | 221,000 | 215,653 | |

| Series 2022-SFR5: | |||

Class E1, 6.618% 6/17/39 (b) | 201,000 | 198,598 | |

Class E2, 6.863% 6/17/39 (b) | 336,000 | 332,914 | |

| Progress Residential Trust: | |||

| Series 2021-SFR6 Class F, 3.422% 7/17/38 (b) | 100,000 | 90,753 | |

| Series 2022-SFR2 Class E2, 4.8% 4/17/27 (b) | 100,000 | 93,216 | |

| Starwood Mortgage Residential Trust Series 2022-SFR3 Class F, CME Term SOFR 1 Month Index + 4.500% 9.8253% 5/17/24 (b)(e)(g) | 500,000 | 486,397 | |

| Tricon Residential Series 2022-SFR1: | |||

| Class E1, 5.344% 4/17/39 (b) | 238,000 | 229,462 | |

| Class E2, 5.739% 4/17/39 (b) | 295,000 | 284,858 | |

| TOTAL ASSET-BACKED SECURITIES (Cost $2,667,441) | 2,568,202 | ||

| Commercial Mortgage Securities - 3.9% | |||

Principal Amount (a) | Value ($) | ||

| BAMLL Commercial Mortgage Securities Trust floater Series 2021-JACX Class E, CME Term SOFR 1 Month Index + 3.860% 9.1905% 9/15/38 (b)(e)(g) | 106,000 | 79,943 | |

| BANK: | |||

| sequential payer: | |||

Series 2021-BN35 Class A5, 2.285% 6/15/64 | 134,000 | 111,442 | |

Series 2022-BNK42: | |||

| Class D, 2.5% 6/15/55 (b) | 180,000 | 116,188 | |

| Class E, 2.5% 6/15/55 (b) | 141,000 | 82,033 | |

Series 2022-BNK44, Class A5, 5.745% 11/15/55 (e) | 100,000 | 105,348 | |

| Series 2020-BN30 Class MCDG, 2.9182% 12/15/53 (d)(e) | 264,000 | 107,058 | |

| Series 2021-BN38 Class C, 3.2175% 12/15/64 (e) | 554,000 | 423,131 | |

| Series 2022-BNK41, Class C, 3.7902% 4/15/65 (d)(e) | 567,000 | 449,087 | |

| Series 2022-BNK42 Class C, 4.7224% 6/15/55 (e) | 500,000 | 426,321 | |

| BBCMS Mortgage Trust: | |||

| sequential payer Series 2022-C17 Class D, 2.5% 9/15/55 (b) | 163,000 | 99,395 | |

| Series 2020-C7 Class C, 3.6019% 4/15/53 (e) | 500,000 | 344,427 | |

| Series 2022-C15, Class A5, 3.662% 4/15/55 | 178,000 | 160,725 | |

| Series 2022-C16 Class C, 4.6% 6/15/55 (e) | 750,000 | 630,697 | |

| Benchmark Mortgage Trust: | |||

| sequential payer Series 2022-B36 Class A5, 4.4699% 7/15/55 | 100,000 | 95,918 | |

| Series 2020-B18 Class AGNG, 4.3885% 7/15/53 (b)(e) | 63,000 | 55,721 | |

| Series 2020-IG2 Class D, 3.2931% 9/15/48 (b)(e) | 417,000 | 147,438 | |

| Series 2022-B36 Class D, 2.5% 7/15/55 (b) | 250,000 | 143,949 | |

| Series 2023-C5 Class B, 6.476% 6/15/56 (e) | 250,000 | 261,814 | |

| BMO Mortgage Trust Series 2022-C1: | |||

| Class 360D, 3.9387% 2/17/55 (b)(d)(e) | 84,000 | 53,988 | |

| Class 360E, 3.9387% 2/17/55 (b)(e) | 105,000 | 64,632 | |

| BX Commercial Mortgage Trust: | |||

| floater: | |||

Series 2019-XL Class J, CME Term SOFR 1 Month Index + 2.760% 8.0898% 10/15/36 (b)(e)(g) | 80,094 | 78,953 | |

Series 2021-CIP Class F, CME Term SOFR 1 Month Index + 3.330% 8.6585% 12/15/38 (b)(e)(g) | 210,000 | 206,082 | |

Series 2021-PAC Class G, CME Term SOFR 1 Month Index + 3.060% 8.3856% 10/15/36 (b)(e)(g) | 198,000 | 189,518 | |

Series 2021-SOAR: | |||

| Class F, CME Term SOFR 1 Month Index + 2.460% 7.7905% 6/15/38 (b)(e)(g) | 422,834 | 417,813 | |

| Class J, CME Term SOFR 1 Month Index + 3.860% 9.1905% 6/15/38 (b)(e)(g) | 529,646 | 518,053 | |

Series 2021-VINO: | |||

| Class F, CME Term SOFR 1 Month Index + 2.910% 8.2418% 5/15/38 (b)(e)(g) | 251,691 | 248,230 | |

| Class G, CME Term SOFR 1 Month Index + 4.060% 9.3918% 5/15/38 (b)(e)(g) | 151,922 | 150,467 | |

Series 2021-VOLT: | |||

| Class F, CME Term SOFR 1 Month Index + 2.510% 7.8398% 9/15/36 (b)(e)(g) | 100,000 | 99,000 | |

| Class G, CME Term SOFR 1 Month Index + 2.960% 8.2898% 9/15/36 (b)(e)(g) | 105,000 | 103,754 | |

Series 2022-LBA6: | |||

| Class F, CME Term SOFR 1 Month Index + 3.350% 8.6753% 1/15/39 (b)(e)(g) | 100,000 | 98,785 | |

| Class G, CME Term SOFR 1 Month Index + 4.200% 9.5253% 1/15/39 (b)(e)(g) | 100,000 | 98,443 | |

| Series 2019-OC11 Class E, 3.944% 12/9/41 (b)(e) | 284,000 | 245,224 | |

| Series 2020-VIVA Class E, 3.5488% 3/11/44 (b)(e) | 789,000 | 649,670 | |

| BX Trust floater: | |||

| Series 2021-MFM1: | |||

Class F, CME Term SOFR 1 Month Index + 3.110% 8.4395% 1/15/34 (b)(e)(g) | 257,464 | 253,525 | |

Class G, CME Term SOFR 1 Month Index + 4.010% 9.3395% 1/15/34 (b)(e)(g) | 130,265 | 126,524 | |

| Series 2022-VAMF Class F, CME Term SOFR 1 Month Index + 3.290% 8.6243% 1/15/39 (b)(e)(g) | 157,000 | 146,720 | |

| Citigroup Commercial Mortgage Trust Series 2023-SMRT Class C, 5.8524% 10/12/40 (b)(e) | 250,000 | 246,922 | |

| COMM Mortgage Trust: | |||

| sequential payer Series 2013-LC6 Class E, 3.5% 1/10/46 (b) | 150,000 | 135,669 | |

| Series 2012-CR1 Class G, 2.462% 5/15/45 (b)(d) | 25,444 | 382 | |

| Series 2017-CD4 Class D, 3.3% 5/10/50 (b) | 56,000 | 43,681 | |

| Series 2019-CD4 Class C, 4.3497% 5/10/50 (e) | 232,000 | 204,745 | |

| Credit Suisse Commercial Mortgage Trust floater Series 2021-SOP2 Class F, CME Term SOFR 1 Month Index + 4.330% 9.6567% 6/15/34 (b)(d)(g) | 80,000 | 24,211 | |

| CSAIL Commercial Mortgage Trust: | |||

| Series 2017-C8 Class D, 4.4148% 6/15/50 (b)(e) | 156,000 | 116,483 | |

| Series 2019-C16 Class C, 4.2371% 6/15/52 (e) | 750,000 | 633,763 | |

| ELP Commercial Mortgage Trust floater Series 2021-ELP: | |||

| Class F, CME Term SOFR 1 Month Index + 2.780% 8.1075% 11/15/38 (b)(e)(g) | 478,443 | 473,659 | |

| Class J, CME Term SOFR 1 Month Index + 3.720% 9.0554% 11/15/38 (b)(e)(g) | 209,756 | 199,340 | |

| GS Mortgage Securities Trust Series 2011-GC5: | |||

| Class E, 5.1524% 8/10/44 (b)(d)(e) | 63,000 | 7,089 | |

| Class F, 4.5% 8/10/44 (b)(d) | 42,000 | 126 | |

| Hilton U.S.A. Trust Series 2016-HHV: | |||

| Class E, 4.1935% 11/5/38 (b)(e) | 900,000 | 839,852 | |

| Class F, 4.1935% 11/5/38 (b)(e) | 163,000 | 150,026 | |

| Independence Plaza Trust Series 2018-INDP Class E, 4.996% 7/10/35 (b) | 100,000 | 92,766 | |

| J.P. Morgan Chase Commercial Mortgage Securities Trust floater Series 2022-NXSS Class D, CME Term SOFR 1 Month Index + 4.120% 9.4543% 9/15/39 (b)(e)(g) | 330,000 | 332,784 | |

| JPMBB Commercial Mortgage Securities Trust Series 2014-C23 Class UH5, 4.7094% 9/15/47 (b) | 54,000 | 51,193 | |

| JPMorgan Chase Commercial Mortgage Securities Trust: | |||

| floater Series 2021-MHC Class F, CME Term SOFR 1 Month Index + 3.060% 8.3905% 4/15/38 (b)(e)(g) | 210,000 | 207,741 | |

| sequential payer Series 2021-1MEM Class E, 2.6535% 10/9/42 (b)(e) | 100,000 | 57,473 | |

| Series 2011-C3 Class E, 5.5259% 2/15/46 (b)(d)(e) | 200,000 | 81,979 | |

| Series 2012-CBX Class G 4% 6/15/45 (b)(d) | 151,000 | 102,177 | |

| KNDR Trust floater Series 2021-KIND Class F, CME Term SOFR 1 Month Index + 4.060% 9.3945% 8/15/38 (b)(e)(g) | 99,185 | 93,272 | |

| Merit floater Series 2021-STOR: | |||

| Class G, CME Term SOFR 1 Month Index + 2.860% 8.1905% 7/15/38 (b)(e)(g) | 105,000 | 103,556 | |

| Class J, CME Term SOFR 1 Month Index + 4.060% 9.3905% 7/15/38 (b)(e)(g) | 100,000 | 98,247 | |

| MHC Commercial Mortgage Trust floater Series 2021-MHC: | |||

| Class F, CME Term SOFR 1 Month Index + 2.710% 8.0404% 4/15/38 (b)(e)(g) | 83,888 | 83,049 | |

| Class G, CME Term SOFR 1 Month Index + 3.310% 8.6404% 4/15/38 (b)(e)(g) | 167,775 | 165,881 | |

| MHP Commercial Mortgage Trust floater Series 2022-MHIL Class F, CME Term SOFR 1 Month Index + 3.250% 8.5845% 1/15/27 (b)(e)(g) | 91,161 | 90,310 | |

| Morgan Stanley Capital I Trust: | |||

| sequential payer Series 2021-L5 Class C, 3.156% 5/15/54 | 513,000 | 400,548 | |

| Series 2011-C2: | |||

Class D, 5.2118% 6/15/44 (b)(e) | 179,409 | 166,727 | |

Class F, 5.2118% 6/15/44 (b)(d)(e) | 343,000 | 143,388 | |

Class XB, 0.4615% 6/15/44 (b)(e)(f) | 5,269,286 | 18,456 | |

| Series 2011-C3 Class G, 4.9439% 7/15/49 (b)(e) | 112,000 | 96,376 | |

| Series 2017-H1 Class C, 4.281% 6/15/50 | 231,000 | 204,147 | |

| Series 2020-L4, Class C, 3.536% 2/15/53 | 542,000 | 407,708 | |

| MSWF Commercial Mortgage Trust sequential payer Series 2023-1 Class B, 6.6828% 5/15/56 (e) | 250,000 | 260,732 | |

| Open Trust 2023-Air sequential payer Series 2023-AIR Class D, CME Term SOFR 1 Month Index + 6.680% 12.0091% 10/15/28 (b)(e)(g) | 239,216 | 240,692 | |

| OPG Trust floater Series 2021-PORT: | |||

| Class G, CME Term SOFR 1 Month Index + 2.510% 7.8385% 10/15/36 (b)(e)(g) | 205,406 | 200,271 | |

| Class J, CME Term SOFR 1 Month Index + 3.460% 8.7865% 10/15/36 (b)(e)(g) | 61,227 | 58,665 | |

| PKHL Commercial Mortgage Trust floater Series 2021-MF: | |||

| Class E, CME Term SOFR 1 Month Index + 2.710% 8.0405% 7/15/38 (b)(e)(g) | 100,000 | 77,636 | |

| Class G, CME Term SOFR 1 Month Index + 4.460% 9.7905% 7/15/38 (b)(d)(e)(g) | 100,000 | 64,249 | |

| Prima Capital CRE Securitization Ltd. Series 2020-8A Class C, 3% 12/26/70 (b) | 350,000 | 270,515 | |

| Prima Capital Ltd. floater Series 2021-9A Class C, CME Term SOFR 1 Month Index + 2.460% 7.7908% 12/15/37 (b)(e)(g) | 143,092 | 136,890 | |

| Providence Place Group Ltd. Partnership Series 2000-C1 Class A2, 7.75% 7/20/28 (b) | 150,506 | 153,213 | |

| SG Commercial Mortgage Securities Trust Series 2020-COVE: | |||

| Class F, 3.7276% 3/15/37 (b)(e) | 150,000 | 132,399 | |

| Class G, 3.7276% 3/15/37 (b)(e) | 100,000 | 87,502 | |

| SREIT Trust floater: | |||

| Series 2021-IND Class G, CME Term SOFR 1 Month Index + 3.380% 8.7053% 10/15/38 (b)(e)(g) | 198,000 | 184,896 | |

| Series 2021-MFP Class G, CME Term SOFR 1 Month Index + 3.080% 8.4136% 11/15/38 (b)(e)(g) | 120,565 | 119,332 | |

| Series 2021-MFP2: | |||

Class F, CME Term SOFR 1 Month Index + 2.730% 8.0577% 11/15/36 (b)(e)(g) | 100,000 | 98,188 | |

Class J, CME Term SOFR 1 Month Index + 4.020% 9.355% 11/15/36 (b)(e)(g) | 128,000 | 124,276 | |

| Series 2021-PALM Class G, CME Term SOFR 1 Month Index + 3.730% 9.0556% 10/15/34 (b)(e)(g) | 164,000 | 161,324 | |

| STWD Trust floater sequential payer Series 2021-LIH: | |||

| Class F, CME Term SOFR 1 Month Index + 3.660% 8.991% 11/15/36 (b)(e)(g) | 100,000 | 95,662 | |

| Class G, CME Term SOFR 1 Month Index + 4.310% 9.64% 11/15/36 (b)(e)(g) | 42,000 | 40,009 | |

| TPGI Trust floater Series 2021-DGWD Class E, CME Term SOFR 1 Month Index + 2.460% 7.7945% 6/15/26 (b)(e)(g) | 402,400 | 401,395 | |

| Wells Fargo Commercial Mortgage Trust: | |||

| Series 2018-C44 Class D, 3% 5/15/51 (b) | 535,000 | 383,363 | |

| Series 2019-C52: | |||

Class B, 3.375% 8/15/52 | 785,000 | 670,669 | |

Class C, 3.561% 8/15/52 | 100,000 | 79,676 | |

| Series 2020-C58 Class C, 3.162% 7/15/53 | 1,000,000 | 762,260 | |

| WF-RBS Commercial Mortgage Trust Series 2013-C11 Class E, 4.0604% 3/15/45 (b)(e) | 220,000 | 133,531 | |

| WFCM Series 2022-C62: | |||

| Class C, 4.3512% 4/15/55 (e) | 500,000 | 399,867 | |

| Class D, 2.5% 4/15/55 (b) | 294,000 | 174,308 | |

| WP Glimcher Mall Trust Series 2015-WPG Class PR1, 3.516% 6/5/35 (b)(d)(e) | 140,000 | 107,247 | |

| TOTAL COMMERCIAL MORTGAGE SECURITIES (Cost $20,950,600) | 19,282,509 | ||

| Common Stocks - 15.3% | |||

| Shares | Value ($) | ||

| COMMUNICATION SERVICES - 0.1% | |||

| Diversified Telecommunication Services - 0.1% | |||

| Cellnex Telecom SA (b) | 7,396 | 261,728 | |

| Helios Towers PLC (h) | 101,610 | 121,678 | |

| 383,406 | |||

| CONSUMER STAPLES - 1.2% | |||

| Food Products - 1.2% | |||

| Archer Daniels Midland Co. | 65,130 | 4,090,815 | |

| JBS SA | 340,660 | 1,460,384 | |

| Tyson Foods, Inc. Class A | 11,920 | 700,062 | |

| 6,251,261 | |||

| ENERGY - 5.9% | |||

| Energy Equipment & Services - 0.4% | |||

| Archrock, Inc. | 3,800 | 74,746 | |

| DOF Group ASA | 179,100 | 1,218,639 | |

| Kodiak Gas Services, Inc. | 22,280 | 609,135 | |

| Tidewater, Inc. (h) | 4,500 | 414,000 | |

| 2,316,520 | |||

| Oil, Gas & Consumable Fuels - 5.5% | |||

| Alliance Resource Partners LP | 15,690 | 314,585 | |

| Antero Resources Corp. (h) | 101,011 | 2,929,319 | |

| Canadian Natural Resources Ltd. | 31,050 | 2,368,694 | |

| Cenovus Energy, Inc. (Canada) | 175,520 | 3,509,104 | |

| Cheniere Energy, Inc. | 1,807 | 291,433 | |

| Coal India Ltd. | 42,700 | 222,396 | |

| Diamondback Energy, Inc. | 2,270 | 449,846 | |

| Energy Transfer LP | 126,886 | 1,995,917 | |

| Exxon Mobil Corp. | 44,630 | 5,187,791 | |

| Mach Natural Resources LP | 37,460 | 722,978 | |

| MEG Energy Corp. (h) | 66,960 | 1,537,435 | |

| Petroleo Brasileiro SA - Petrobras (ON) | 67,100 | 512,156 | |

| Plains All American Pipeline LP | 1,508 | 26,480 | |

| Plains GP Holdings LP Class A | 80,000 | 1,460,000 | |

| Shell PLC (London) | 131,782 | 4,371,422 | |

| Targa Resources Corp. | 11,589 | 1,297,852 | |

| The Williams Companies, Inc. | 6,803 | 265,113 | |

| 27,462,521 | |||

TOTAL ENERGY | 29,779,041 | ||

| INDUSTRIALS - 0.4% | |||

| Commercial Services & Supplies - 0.2% | |||

| GFL Environmental, Inc. | 8,167 | 281,762 | |

| Republic Services, Inc. | 1,134 | 217,093 | |

| Waste Connections, Inc. (United States) | 1,177 | 202,456 | |

| 701,311 | |||

| Construction & Engineering - 0.0% | |||

| Ferrovial SE | 3,488 | 138,079 | |

| Electrical Equipment - 0.0% | |||

| GrafTech International Ltd. | 46,660 | 64,391 | |

| Ground Transportation - 0.1% | |||

| Canadian National Railway Co. | 159 | 20,938 | |

| Canadian Pacific Kansas City Ltd. | 1,059 | 93,372 | |

| CSX Corp. | 3,895 | 144,388 | |

| Norfolk Southern Corp. | 592 | 150,883 | |

| Union Pacific Corp. | 607 | 149,280 | |

| 558,861 | |||

| Transportation Infrastructure - 0.1% | |||

| Aena SME SA (b) | 3,028 | 596,241 | |

| Athens International Airport SA | 3,600 | 33,025 | |

| 629,266 | |||

TOTAL INDUSTRIALS | 2,091,908 | ||

| MATERIALS - 7.1% | |||

| Chemicals - 1.2% | |||

| CF Industries Holdings, Inc. | 6,250 | 520,063 | |

| Corteva, Inc. | 39,600 | 2,283,732 | |

| FMC Corp. | 12,610 | 803,257 | |

| Nutrien Ltd. | 40,530 | 2,201,995 | |

| 5,809,047 | |||

| Construction Materials - 0.1% | |||

| Ultratech Cement Ltd. | 3,300 | 386,003 | |

| Containers & Packaging - 0.2% | |||

| Billerud AB | 23,020 | 207,037 | |

| Smurfit Kappa Group PLC | 17,420 | 794,699 | |

| 1,001,736 | |||

| Metals & Mining - 4.1% | |||

| Alamos Gold, Inc. | 44,220 | 651,955 | |

| Alcoa Corp. | 4,520 | 152,731 | |

| Anglo American Platinum Ltd. | 6,543 | 266,277 | |

| Anglo American PLC (United Kingdom) | 39,950 | 984,247 | |

| BHP Group Ltd. (London) | 66,985 | 1,922,944 | |

| Champion Iron Ltd. | 357,310 | 1,693,562 | |

| ERO Copper Corp. (h) | 35,760 | 689,591 | |

| First Quantum Minerals Ltd. | 145,345 | 1,562,365 | |

| Franco-Nevada Corp. | 9,380 | 1,117,705 | |

| Impala Platinum Holdings Ltd. | 125,160 | 518,612 | |

| Northam Platinum Holdings Ltd. | 250,570 | 1,498,501 | |

| Reliance, Inc. | 6,990 | 2,335,918 | |

| Sigma Lithium Corp. (h) | 30,035 | 389,254 | |

| Sumitomo Metal Mining Co. Ltd. | 7,610 | 230,646 | |

| Tata Steel Ltd. | 435,200 | 813,778 | |

| Teck Resources Ltd. Class B (sub. vtg.) | 73,300 | 3,355,186 | |

| Wheaton Precious Metals Corp. | 50,910 | 2,397,976 | |

| 20,581,248 | |||

| Paper & Forest Products - 1.5% | |||

| Interfor Corp. (h) | 43,440 | 678,620 | |

| Mondi PLC | 12 | 211 | |

| Stora Enso Oyj (R Shares) | 84,340 | 1,172,844 | |

| Suzano SA | 68,960 | 879,729 | |

| Svenska Cellulosa AB SCA (B Shares) (i) | 68,310 | 1,051,243 | |

| UPM-Kymmene Corp. | 81,470 | 2,714,291 | |

| West Fraser Timber Co. Ltd. | 13,270 | 1,145,854 | |

| 7,642,792 | |||

TOTAL MATERIALS | 35,420,826 | ||

| REAL ESTATE - 0.2% | |||

| Equity Real Estate Investment Trusts (REITs) - 0.2% | |||

| American Tower Corp. | 978 | 193,243 | |

| Crown Castle, Inc. | 651 | 68,895 | |

| Equinix, Inc. | 196 | 161,765 | |

| Prologis, Inc. | 1,094 | 142,461 | |

| Segro PLC | 14,853 | 169,393 | |

| Tritax Big Box REIT PLC | 37,147 | 73,686 | |

| 809,443 | |||

| Real Estate Management & Development - 0.0% | |||

| Corporacion Inmobiliaria Vesta S.A.B. de CV ADR | 478 | 18,757 | |

TOTAL REAL ESTATE | 828,200 | ||

| UTILITIES - 0.4% | |||

| Electric Utilities - 0.3% | |||

| Constellation Energy Corp. | 1,118 | 206,662 | |

| Iberdrola SA | 5,292 | 65,753 | |

| Kansai Electric Power Co., Inc. | 5,577 | 80,866 | |

| NextEra Energy, Inc. | 6,899 | 440,915 | |

| Southern Co. | 5,693 | 408,416 | |

| SSE PLC | 6,151 | 128,206 | |

| 1,330,818 | |||

| Independent Power and Renewable Electricity Producers - 0.0% | |||

| RWE AG | 3,191 | 108,345 | |

| Vistra Corp. | 568 | 39,561 | |

| 147,906 | |||

| Multi-Utilities - 0.1% | |||

| National Grid PLC | 20,569 | 277,081 | |

| Sempra | 3,217 | 231,077 | |

| 508,158 | |||

TOTAL UTILITIES | 1,986,882 | ||

| TOTAL COMMON STOCKS (Cost $67,641,185) | 76,741,524 | ||

| Preferred Stocks - 2.6% | |||

| Shares | Value ($) | ||

| Convertible Preferred Stocks - 0.1% | |||

| FINANCIALS - 0.1% | |||

| Mortgage Real Estate Investment Trusts - 0.1% | |||

| Great Ajax Corp. 7.25% | 11,467 | 284,955 | |

| REAL ESTATE - 0.0% | |||

| Equity Real Estate Investment Trusts (REITs) - 0.0% | |||

| Braemar Hotels & Resorts, Inc. 5.50% | 2,700 | 36,315 | |

| RLJ Lodging Trust Series A, 1.95% | 400 | 9,832 | |

| 46,147 | |||

| TOTAL CONVERTIBLE PREFERRED STOCKS | 331,102 | ||

| Nonconvertible Preferred Stocks - 2.5% | |||

| FINANCIALS - 1.1% | |||

| Mortgage Real Estate Investment Trusts - 1.1% | |||

| AGNC Investment Corp.: | |||

| 6.125%(e) | 7,000 | 160,930 | |

| Series C, CME Term SOFR 3 Month Index + 5.110% 7.00%(e)(g) | 14,200 | 356,846 | |

| Series E, 6.50%(e) | 17,400 | 419,340 | |

| Series G, 7.75%(e) | 16,000 | 382,080 | |

| Annaly Capital Management, Inc.: | |||

| 6.75%(e) | 8,600 | 213,968 | |

| Series F, CME Term SOFR 3 Month Index + 4.990% 6.95%(e)(g) | 8,800 | 221,056 | |

| Series G, CME Term SOFR 3 Month Index + 4.430% 6.50%(e)(g) | 23,000 | 567,640 | |

| Arbor Realty Trust, Inc.: | |||

| Series D, 6.375% | 1,500 | 29,355 | |

| Series F, 6.25%(e) | 13,000 | 264,550 | |

| Armour Residential REIT, Inc. Series C 7.00% | 1,000 | 20,850 | |

| Chimera Investment Corp.: | |||

| 8.00%(e) | 5,000 | 122,500 | |

| Series B, 8.00%(e) | 16,587 | 410,694 | |

| Series C, 7.75%(e) | 8,700 | 179,220 | |

| Dynex Capital, Inc. Series C 6.90% (e) | 23,400 | 567,450 | |

| Ellington Financial LLC 6.75% (e) | 2,000 | 47,040 | |

| PennyMac Mortgage Investment Trust: | |||

| 6.75% | 1,300 | 24,726 | |

| 8.125% | 5,700 | 135,509 | |

| Series B, 8.00%(e) | 9,300 | 216,411 | |

| Rithm Capital Corp.: | |||

| 7.125%(e) | 6,200 | 151,280 | |

| Series A, 7.50%(e) | 14,700 | 364,193 | |

| Series C, 6.375%(e) | 10,300 | 233,295 | |

| Series D, 7.00%(e) | 2,700 | 61,560 | |

| Two Harbors Investment Corp.: | |||

| Series A, 8.125%(e) | 6,938 | 159,435 | |

| Series B, 7.625%(e) | 6,320 | 144,096 | |

| 5,454,024 | |||

| REAL ESTATE - 1.4% | |||

| Equity Real Estate Investment Trusts (REITs) - 1.2% | |||

| Agree Realty Corp. 4.375% | 1,500 | 26,655 | |

| American Homes 4 Rent Series G, 5.875% | 5,200 | 119,756 | |

| Armada Hoffler Properties, Inc. 6.75% | 6,000 | 133,920 | |

| Ashford Hospitality Trust, Inc.: | |||

| Series H, 7.50% | 400 | 5,532 | |

| Series I, 7.50% | 1,200 | 15,660 | |

| Cedar Realty Trust, Inc.: | |||

| 7.25% | 1,673 | 27,186 | |

| Series C, 6.50% | 4,900 | 63,357 | |

| CTO Realty Growth, Inc. 6.375% | 1,000 | 20,250 | |

| DiamondRock Hospitality Co. 8.25% | 11,337 | 285,579 | |

| Digital Realty Trust, Inc.: | |||

| 5.25% | 5,800 | 127,890 | |

| Series L, 5.20% | 12,700 | 281,432 | |

| Gladstone Commercial Corp.: | |||

| 6.625% | 3,600 | 84,600 | |

| Series G, 6.00% | 18,200 | 364,000 | |

| Global Medical REIT, Inc. Series A, 7.50% | 2,100 | 52,710 | |

| Global Net Lease, Inc.: | |||

| 7.50% | 16,700 | 355,710 | |

| Series A, 7.25% | 9,300 | 190,464 | |

| Series B 6.875% | 2,200 | 42,416 | |

| Series E, 7.375% | 10,000 | 214,200 | |

| Healthcare Trust, Inc.: | |||

| 7.125% | 2,000 | 31,800 | |

| Series A 7.375% | 4,200 | 65,436 | |

| Hudson Pacific Properties, Inc. Series C, 4.75% | 18,100 | 255,934 | |

| Kimco Realty Corp.: | |||

| 5.125% | 11,600 | 265,408 | |

| Series M, 5.25% | 16,500 | 378,345 | |

| National Storage Affiliates Trust Series A, 6.00% | 200 | 4,624 | |

| Pebblebrook Hotel Trust: | |||

| 6.30% | 10,273 | 208,953 | |

| 6.375% | 8,700 | 178,698 | |

| 6.375% | 17,200 | 353,288 | |

| Series H, 5.70% | 10,600 | 197,690 | |

| Pennsylvania (REIT): | |||

| Series B, 7.375%(h) | 4,082 | 1,719 | |

| Series D, 6.875%(h) | 2,500 | 1,097 | |

| Public Storage: | |||

| 4.00% | 1,200 | 22,212 | |

| 4.00% | 2,300 | 42,504 | |

| Series F, 5.15% | 3,200 | 77,120 | |

| Series G, 5.05% | 6,000 | 146,280 | |

| Series I, 4.875% | 6,000 | 137,880 | |

| Series J, 4.70% | 1,200 | 25,836 | |

| Series K, 4.75% | 13,800 | 298,770 | |

| Series M, 4.125% | 1,000 | 19,270 | |

| Realty Income Corp. 6.00% | 6,700 | 165,624 | |

| Regency Centers Corp.: | |||

| 5.875% | 2,000 | 46,740 | |

| Series A, 6.25% | 4,500 | 108,720 | |

| Rexford Industrial Realty, Inc.: | |||

| Series B, 5.875% | 1,200 | 26,640 | |

| Series C, 5.625% | 4,400 | 95,040 | |

| Saul Centers, Inc. Series D, 6.125% | 1,300 | 29,140 | |

| SITE Centers Corp. 6.375% | 5,500 | 123,860 | |

| Sotherly Hotels, Inc. Series C, 7.875% | 1,700 | 32,079 | |

| Summit Hotel Properties, Inc.: | |||

| Series E, 6.25% | 6,800 | 139,808 | |

| Series F, 5.875% | 4,000 | 78,560 | |

| Sunstone Hotel Investors, Inc.: | |||

| Series H, 6.125% | 3,500 | 74,165 | |

| Series I, 5.70% | 9,600 | 190,464 | |

| UMH Properties, Inc. Series D, 6.375% | 3,900 | 88,764 | |

| Vornado Realty Trust Series L, 5.40% | 1,000 | 14,980 | |

| 6,338,765 | |||

| Real Estate Management & Development - 0.2% | |||

| Digitalbridge Group, Inc.: | |||

| Series H, 7.125% | 12,830 | 300,222 | |

| Series I, 7.15% | 13,800 | 321,264 | |

| Series J, 7.15% | 12,600 | 296,730 | |

| 918,216 | |||

TOTAL REAL ESTATE | 7,256,981 | ||

| TOTAL NONCONVERTIBLE PREFERRED STOCKS | 12,711,005 | ||

| TOTAL PREFERRED STOCKS (Cost $13,706,622) | 13,042,107 | ||

| Bank Loan Obligations - 0.0% | |||

Principal Amount (a) | Value ($) | ||

| FINANCIALS - 0.0% | |||

| Financial Services - 0.0% | |||

Walker & Dunlop, Inc. Tranche B 1LN, term loan CME Term SOFR 1 Month Index + 2.250% 7.6802% 12/16/28 (e)(g)(j) (Cost $4,879) | 4,888 | 4,863 | |

| Equity Funds - 23.7% | |||

| Shares | Value ($) | ||

| Fidelity Commodity Strategy Central Fund (k) | 805,570 | 72,928,275 | |

| Fidelity Real Estate Equity Central Fund (k) | 355,704 | 45,587,039 | |

| TOTAL EQUITY FUNDS (Cost $134,148,839) | 118,515,314 | ||

| Fixed-Income Funds - 25.5% | |||

| Shares | Value ($) | ||

Fidelity Floating Rate Central Fund (k) (Cost $127,887,183) | 1,296,659 | 127,915,422 | |

| Preferred Securities - 0.0% | |||

Principal Amount (a) | Value ($) | ||

| FINANCIALS - 0.0% | |||

| Financial Services - 0.0% | |||

Crest Clarendon Street 2002-1 Ltd. Series 2002-1A Class PS, 12/28/35 (b)(d) (Cost $594,368) | 500,000 | 0 | |

| Money Market Funds - 1.4% | |||

| Shares | Value ($) | ||

| Fidelity Cash Central Fund 5.39% (l) | 6,112,608 | 6,113,831 | |

| Fidelity Securities Lending Cash Central Fund 5.39% (l)(m) | 968,903 | 969,000 | |

| TOTAL MONEY MARKET FUNDS (Cost $7,082,831) | 7,082,831 | ||

| TOTAL INVESTMENT IN SECURITIES - 100.1% (Cost $522,019,592) | 501,628,394 |

NET OTHER ASSETS (LIABILITIES) - (0.1)% | (302,773) |

| NET ASSETS - 100.0% | 501,325,621 |

| (a) | Amount is stated in United States dollars unless otherwise noted. |

| (b) | Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. At the end of the period, the value of these securities amounted to $18,103,993 or 3.6% of net assets. |

| (c) | Non-income producing - Security is in default. |

| (d) | Level 3 security |

| (e) | Coupon rates for floating and adjustable rate securities reflect the rates in effect at period end. |

| (f) | Interest Only (IO) security represents the right to receive only monthly interest payments on an underlying pool of mortgages or assets. Principal shown is the outstanding par amount of the pool as of the end of the period. |

| (g) | Coupon is indexed to a floating interest rate which may be multiplied by a specified factor and/or subject to caps or floors. |

| (h) | Non-income producing |

| (i) | Security or a portion of the security is on loan at period end. |

| (j) | Remaining maturities of bank loan obligations may be less than the stated maturities shown as a result of contractual or optional prepayments by the borrower. Such prepayments cannot be predicted with certainty. |

| (k) | Affiliated fund that is generally available only to investment companies and other accounts managed by Fidelity Investments. A complete unaudited schedule of portfolio holdings for each Fidelity Central Fund is filed with the SEC for the first and third quarters of each fiscal year on Form N-PORT and is available upon request or at the SEC's website at www.sec.gov. An unaudited holdings listing for the Fund, which presents direct holdings as well as the pro-rata share of securities and other investments held indirectly through its investment in underlying non-money market Fidelity Central Funds, other than the Commodity Strategy Central Fund, is available at fidelity.com and/or institutional.fidelity.com, as applicable. In addition, each Fidelity Central Fund's financial statements are available on the SEC's website or upon request. |

| (l) | Affiliated fund that is generally available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. In addition, each Fidelity Central Fund's financial statements are available on the SEC's website or upon request. |

| (m) | Investment made with cash collateral received from securities on loan. |

| Affiliate | Value, beginning of period ($) | Purchases ($) | Sales Proceeds ($) | Dividend Income ($) | Realized Gain (loss) ($) | Change in Unrealized appreciation (depreciation) ($) | Value, end of period ($) | % ownership, end of period |

| Fidelity Cash Central Fund 5.39% | 5,257,233 | 70,765,671 | 69,909,073 | 167,460 | - | - | 6,113,831 | 0.0% |

| Fidelity Commodity Strategy Central Fund | 80,369,516 | 3,489,875 | 7,753,996 | 1,489,874 | (1,841,897) | (1,335,223) | 72,928,275 | 35.8% |

| Fidelity Floating Rate Central Fund | 139,118,660 | 8,448,160 | 20,449,286 | 6,449,995 | (334,978) | 1,132,866 | 127,915,422 | 8.7% |

| Fidelity Real Estate Equity Central Fund | 48,764,668 | 4,281,190 | 14,210,137 | 737,405 | (645,140) | 7,396,458 | 45,587,039 | 4.6% |

| Fidelity Securities Lending Cash Central Fund 5.39% | - | 1,520,469 | 551,469 | 884 | - | - | 969,000 | 0.0% |

| Total | 273,510,077 | 88,505,365 | 112,873,961 | 8,845,618 | (2,822,015) | 7,194,101 | 253,513,567 | |

| Valuation Inputs at Reporting Date: | ||||

| Description | Total ($) | Level 1 ($) | Level 2 ($) | Level 3 ($) |

Investments in Securities: | ||||

| Equities: | ||||

Communication Services | 383,406 | 121,678 | 261,728 | - |

Consumer Staples | 6,251,261 | 6,251,261 | - | - |

Energy | 29,779,041 | 29,779,041 | - | - |

Financials | 5,738,979 | 5,454,024 | 284,955 | - |

Industrials | 2,091,908 | 2,091,908 | - | - |

Materials | 35,420,826 | 34,902,214 | 518,612 | - |

Real Estate | 8,131,328 | 8,079,649 | 51,679 | - |

Utilities | 1,986,882 | 1,858,676 | 128,206 | - |

| Corporate Bonds | 18,241,282 | - | 18,241,282 | - |

| U.S. Government and Government Agency Obligations | 118,234,340 | - | 118,234,340 | - |

| Asset-Backed Securities | 2,568,202 | - | 2,568,201 | 1 |

| Commercial Mortgage Securities | 19,282,509 | - | 18,141,528 | 1,140,981 |

| Bank Loan Obligations | 4,863 | - | 4,863 | - |

| Equity Funds | 118,515,314 | 118,515,314 | - | - |

| Fixed-Income Funds | 127,915,422 | 127,915,422 | - | - |

| Preferred Securities | - | - | - | - |

| Money Market Funds | 7,082,831 | 7,082,831 | - | - |

| Total Investments in Securities: | 501,628,394 | 342,052,018 | 158,435,394 | 1,140,982 |

| Statement of Assets and Liabilities | ||||

March 31, 2024 (Unaudited) | ||||

| Assets | ||||

| Investment in securities, at value (including securities loaned of $921,946) - See accompanying schedule: | ||||

Unaffiliated issuers (cost $252,900,739) | $ | 248,114,827 | ||

Fidelity Central Funds (cost $269,118,853) | 253,513,567 | |||

| Total Investment in Securities (cost $522,019,592) | $ | 501,628,394 | ||

| Cash | 73,494 | |||

| Foreign currency held at value (cost $24,960) | 24,917 | |||

| Receivable for investments sold | 4,717,794 | |||

| Receivable for fund shares sold | 313,059 | |||

| Dividends receivable | 298,693 | |||

| Interest receivable | 542,931 | |||

| Distributions receivable from Fidelity Central Funds | 30,178 | |||

| Prepaid expenses | 285 | |||

| Receivable from investment adviser for expense reductions | 24,407 | |||

| Other receivables | 713 | |||

Total assets | 507,654,865 | |||

| Liabilities | ||||

| Payable for investments purchased | $ | 4,359,699 | ||

| Payable for fund shares redeemed | 617,734 | |||

| Accrued management fee | 280,254 | |||

| Distribution and service plan fees payable | 19,429 | |||

| Other payables and accrued expenses | 83,128 | |||

| Collateral on securities loaned | 969,000 | |||

| Total liabilities | 6,329,244 | |||

| Net Assets | $ | 501,325,621 | ||

| Net Assets consist of: | ||||

| Paid in capital | $ | 816,228,293 | ||

| Total accumulated earnings (loss) | (314,902,672) | |||

| Net Assets | $ | 501,325,621 | ||

| Net Asset Value and Maximum Offering Price | ||||

| Class A : | ||||

Net Asset Value and redemption price per share ($48,733,687 ÷ 5,770,582 shares)(a) | $ | 8.45 | ||

| Maximum offering price per share (100/96.00 of $8.45) | $ | 8.80 | ||

| Class M : | ||||

Net Asset Value and redemption price per share ($7,907,660 ÷ 935,235 shares)(a) | $ | 8.46 | ||

| Maximum offering price per share (100/96.00 of $8.46) | $ | 8.81 | ||

| Class C : | ||||

Net Asset Value and offering price per share ($8,897,134 ÷ 1,072,905 shares)(a) | $ | 8.29 | ||

| Strategic Real Return : | ||||

Net Asset Value, offering price and redemption price per share ($256,796,192 ÷ 30,233,605 shares) | $ | 8.49 | ||

| Class K6 : | ||||

Net Asset Value, offering price and redemption price per share ($98,180,377 ÷ 11,506,328 shares) | $ | 8.53 | ||

| Class I : | ||||

Net Asset Value, offering price and redemption price per share ($53,299,842 ÷ 6,292,463 shares) | $ | 8.47 | ||

| Class Z : | ||||

Net Asset Value, offering price and redemption price per share ($27,510,729 ÷ 3,245,143 shares) | $ | 8.48 | ||

(a)Redemption price per share is equal to net asset value less any applicable contingent deferred sales charge. | ||||

| Statement of Operations | ||||

Six months ended March 31, 2024 (Unaudited) | ||||

| Investment Income | ||||

| Dividends | $ | 1,409,886 | ||

| Interest | 3,040,335 | |||

| Income from Fidelity Central Funds (including $884 from security lending) | 8,845,618 | |||

| Total income | 13,295,839 | |||

| Expenses | ||||

| Management fee | $ | 1,451,851 | ||

| Transfer agent fees | 265,697 | |||

| Distribution and service plan fees | 123,290 | |||

| Accounting fees | 97,570 | |||

| Custodian fees and expenses | 34,836 | |||

| Independent trustees' fees and expenses | 820 | |||

| Registration fees | 37,310 | |||

| Audit | 59,428 | |||

| Legal | 497 | |||

| Miscellaneous | 1,268 | |||

| Total expenses before reductions | 2,072,567 | |||

| Expense reductions | (277,832) | |||

| Total expenses after reductions | 1,794,735 | |||

| Net Investment income (loss) | 11,501,104 | |||

| Realized and Unrealized Gain (Loss) | ||||

| Net realized gain (loss) on: | ||||

| Investment Securities: | ||||

| Unaffiliated issuers | (2,481,026) | |||

| Fidelity Central Funds | (2,822,015) | |||

| Foreign currency transactions | (8,710) | |||

| Total net realized gain (loss) | (5,311,751) | |||

| Change in net unrealized appreciation (depreciation) on: | ||||

| Investment Securities: | ||||

| Unaffiliated issuers (net of increase in deferred foreign taxes of $6,869) | 12,758,415 | |||

| Fidelity Central Funds | 7,194,101 | |||

| Assets and liabilities in foreign currencies | 1,938 | |||

| Total change in net unrealized appreciation (depreciation) | 19,954,454 | |||

| Net gain (loss) | 14,642,703 | |||

| Net increase (decrease) in net assets resulting from operations | $ | 26,143,807 | ||

| Statement of Changes in Net Assets | ||||

Six months ended March 31, 2024 (Unaudited) | Year ended September 30, 2023 | |||

| Increase (Decrease) in Net Assets | ||||

| Operations | ||||

| Net investment income (loss) | $ | 11,501,104 | $ | 32,743,073 |

| Net realized gain (loss) | (5,311,751) | (57,410,545) | ||

| Change in net unrealized appreciation (depreciation) | 19,954,454 | 68,181,545 | ||

| Net increase (decrease) in net assets resulting from operations | 26,143,807 | 43,514,073 | ||

| Distributions to shareholders | (17,392,951) | (63,438,683) | ||

| Share transactions - net increase (decrease) | (51,630,502) | (297,827,803) | ||

| Total increase (decrease) in net assets | (42,879,646) | (317,752,413) | ||

| Net Assets | ||||

| Beginning of period | 544,205,267 | 861,957,680 | ||

| End of period | $ | 501,325,621 | $ | 544,205,267 |

Fidelity Advisor® Strategic Real Return Fund Class A |

Six months ended (Unaudited) March 31, 2024 | Years ended September 30, 2023 | 2022 | 2021 | 2020 | 2019 | |||||||

Selected Per-Share Data | ||||||||||||

| Net asset value, beginning of period | $ | 8.29 | $ | 8.53 | $ | 9.42 | $ | 8.07 | $ | 8.39 | $ | 8.88 |

| Income from Investment Operations | ||||||||||||

Net investment income (loss) A,B | .174 | .358 | .719 | .568 | .257 | .216 | ||||||

| Net realized and unrealized gain (loss) | .251 | .050 | (1.078) C | .950 | (.365) | .012 | ||||||

| Total from investment operations | .425 | .408 | (.359) | 1.518 | (.108) | .228 | ||||||

| Distributions from net investment income | (.265) | (.648) | (.531) | (.168) | (.212) | (.293) | ||||||

| Distributions from net realized gain | - | - | - | - | - | (.425) | ||||||

| Total distributions | (.265) | (.648) | (.531) | (.168) | (.212) | (.718) | ||||||

| Net asset value, end of period | $ | 8.45 | $ | 8.29 | $ | 8.53 | $ | 9.42 | $ | 8.07 | $ | 8.39 |

Total Return D,E,F | 5.29 % | 4.93% | (4.09)% C | 19.05% | (1.28)% | 2.86% | ||||||

Ratios to Average Net Assets B,G,H | ||||||||||||

| Expenses before reductions | 1.04% I | 1.05% | 1.06% | 1.11% | 1.12% | 1.10% | ||||||

| Expenses net of fee waivers, if any | .94 % I | .95% | .96% | 1.00% | 1.00% | 1.09% | ||||||

| Expenses net of all reductions | .94% I | .95% | .96% | 1.00% | 1.00% | 1.09% | ||||||

| Net investment income (loss) | 4.24% I | 4.26% | 7.81% | 6.40% | 3.22% | 2.60% | ||||||

| Supplemental Data | ||||||||||||

| Net assets, end of period (000 omitted) | $ | 48,734 | $ | 54,548 | $ | 76,811 | $ | 37,357 | $ | 25,212 | $ | 29,652 |

Portfolio turnover rate J | 27 % I | 29% | 32% | 13% | 47% | 19% |

Fidelity Advisor® Strategic Real Return Fund Class M |

Six months ended (Unaudited) March 31, 2024 | Years ended September 30, 2023 | 2022 | 2021 | 2020 | 2019 | |||||||

Selected Per-Share Data | ||||||||||||

| Net asset value, beginning of period | $ | 8.30 | $ | 8.54 | $ | 9.43 | $ | 8.07 | $ | 8.39 | $ | 8.89 |

| Income from Investment Operations | ||||||||||||

Net investment income (loss) A,B | .174 | .359 | .721 | .567 | .257 | .215 | ||||||

| Net realized and unrealized gain (loss) | .251 | .050 | (1.080) C | .960 | (.365) | .002 | ||||||

| Total from investment operations | .425 | .409 | (.359) | 1.527 | (.108) | .217 | ||||||

| Distributions from net investment income | (.265) | (.649) | (.531) | (.167) | (.212) | (.292) | ||||||

| Distributions from net realized gain | - | - | - | - | - | (.425) | ||||||

| Total distributions | (.265) | (.649) | (.531) | (.167) | (.212) | (.717) | ||||||

| Net asset value, end of period | $ | 8.46 | $ | 8.30 | $ | 8.54 | $ | 9.43 | $ | 8.07 | $ | 8.39 |

Total Return D,E,F | 5.28 % | 4.94% | (4.09)% C | 19.17% | (1.28)% | 2.73% | ||||||

Ratios to Average Net Assets B,G,H | ||||||||||||

| Expenses before reductions | 1.05% I | 1.06% | 1.06% | 1.12% | 1.14% | 1.12% | ||||||

| Expenses net of fee waivers, if any | .94 % I | .95% | .96% | 1.00% | 1.00% | 1.10% | ||||||

| Expenses net of all reductions | .94% I | .95% | .96% | 1.00% | 1.00% | 1.10% | ||||||

| Net investment income (loss) | 4.24% I | 4.26% | 7.81% | 6.40% | 3.22% | 2.59% | ||||||

| Supplemental Data | ||||||||||||

| Net assets, end of period (000 omitted) | $ | 7,908 | $ | 8,796 | $ | 11,557 | $ | 7,293 | $ | 6,141 | $ | 7,903 |

Portfolio turnover rate J | 27 % I | 29% | 32% | 13% | 47% | 19% |

Fidelity Advisor® Strategic Real Return Fund Class C |

Six months ended (Unaudited) March 31, 2024 | Years ended September 30, 2023 | 2022 | 2021 | 2020 | 2019 | |||||||

Selected Per-Share Data | ||||||||||||

| Net asset value, beginning of period | $ | 8.15 | $ | 8.39 | $ | 9.28 | $ | 7.95 | $ | 8.26 | $ | 8.77 |

| Income from Investment Operations | ||||||||||||

Net investment income (loss) A,B | .141 | .290 | .639 | .491 | .195 | .151 | ||||||

| Net realized and unrealized gain (loss) | .232 | .055 | (1.057) C | .946 | (.358) | .004 | ||||||

| Total from investment operations | .373 | .345 | (.418) | 1.437 | (.163) | .155 | ||||||

| Distributions from net investment income | (.233) | (.585) | (.472) | (.107) | (.147) | (.240) | ||||||

| Distributions from net realized gain | - | - | - | - | - | (.425) | ||||||

| Total distributions | (.233) | (.585) | (.472) | (.107) | (.147) | (.665) | ||||||

| Net asset value, end of period | $ | 8.29 | $ | 8.15 | $ | 8.39 | $ | 9.28 | $ | 7.95 | $ | 8.26 |

Total Return D,E,F | 4.71 % | 4.22% | (4.78)% C | 18.24% | (2.00)% | 1.99% | ||||||

Ratios to Average Net Assets B,G,H | ||||||||||||

| Expenses before reductions | 1.78% I | 1.80% | 1.79% | 1.88% | 1.89% | 1.86% | ||||||

| Expenses net of fee waivers, if any | 1.69 % I | 1.70% | 1.71% | 1.75% | 1.75% | 1.85% | ||||||

| Expenses net of all reductions | 1.69% I | 1.70% | 1.71% | 1.75% | 1.75% | 1.85% | ||||||

| Net investment income (loss) | 3.49% I | 3.51% | 7.07% | 5.65% | 2.47% | 1.83% | ||||||

| Supplemental Data | ||||||||||||

| Net assets, end of period (000 omitted) | $ | 8,897 | $ | 10,720 | $ | 13,730 | $ | 4,549 | $ | 5,694 | $ | 8,555 |

Portfolio turnover rate J | 27 % I | 29% | 32% | 13% | 47% | 19% |

Fidelity® Strategic Real Return Fund |

Six months ended (Unaudited) March 31, 2024 | Years ended September 30, 2023 | 2022 | 2021 | 2020 | 2019 | |||||||

Selected Per-Share Data | ||||||||||||

| Net asset value, beginning of period | $ | 8.34 | $ | 8.58 | $ | 9.47 | $ | 8.10 | $ | 8.43 | $ | 8.92 |

| Income from Investment Operations | ||||||||||||

Net investment income (loss) A,B | .185 | .382 | .749 | .593 | .278 | .239 | ||||||

| Net realized and unrealized gain (loss) | .241 | .050 | (1.087) C | .965 | (.376) | .009 | ||||||

| Total from investment operations | .426 | .432 | (.338) | 1.558 | (.098) | .248 | ||||||

| Distributions from net investment income | (.276) | (.672) | (.552) | (.188) | (.232) | (.313) | ||||||

| Distributions from net realized gain | - | - | - | - | - | (.425) | ||||||

| Total distributions | (.276) | (.672) | (.552) | (.188) | (.232) | (.738) | ||||||

| Net asset value, end of period | $ | 8.49 | $ | 8.34 | $ | 8.58 | $ | 9.47 | $ | 8.10 | $ | 8.43 |

Total Return D,E | 5.27 % | 5.21% | (3.85)% C | 19.51% | (1.14)% | 3.10% | ||||||

Ratios to Average Net Assets B,F,G | ||||||||||||

| Expenses before reductions | .80% H | .79% | .78% | .85% | .87% | .83% | ||||||

| Expenses net of fee waivers, if any | .70 % H | .70% | .71% | .75% | .75% | .83% | ||||||

| Expenses net of all reductions | .70% H | .70% | .71% | .75% | .75% | .83% | ||||||

| Net investment income (loss) | 4.49% H | 4.51% | 8.06% | 6.64% | 3.47% | 2.86% | ||||||

| Supplemental Data | ||||||||||||

| Net assets, end of period (000 omitted) | $ | 256,796 | $ | 260,909 | $ | 387,040 | $ | 236,076 | $ | 158,896 | $ | 197,152 |

Portfolio turnover rate I | 27 % H | 29% | 32% | 13% | 47% | 19% |

Fidelity® Strategic Real Return Fund Class K6 |

Six months ended (Unaudited) March 31, 2024 | Years ended September 30, 2023 | 2022 | 2021 | 2020 A | ||||||

Selected Per-Share Data | ||||||||||

| Net asset value, beginning of period | $ | 8.37 | $ | 8.60 | $ | 9.48 | $ | 8.11 | $ | 8.34 |

| Income from Investment Operations | ||||||||||

Net investment income (loss) B,C | .194 | .398 | .760 | .616 | .281 | |||||

| Net realized and unrealized gain (loss) | .247 | .054 | (1.082) D | .948 | (.352) | |||||

| Total from investment operations | .441 | .452 | (.322) | 1.564 | (.071) | |||||

| Distributions from net investment income | (.281) | (.682) | (.558) | (.194) | (.159) | |||||

| Total distributions | (.281) | (.682) | (.558) | (.194) | (.159) | |||||

| Net asset value, end of period | $ | 8.53 | $ | 8.37 | $ | 8.60 | $ | 9.48 | $ | 8.11 |

Total Return E,F | 5.44 % | 5.44% | (3.68)% D | 19.57% | (.81)% | |||||

Ratios to Average Net Assets C,G,H | ||||||||||

| Expenses before reductions | .65% I | .65% | .66% | .69% | .71% I | |||||

| Expenses net of fee waivers, if any | .50 % I | .51% | .52% | .56% | .56% I | |||||

| Expenses net of all reductions | .50% I | .51% | .52% | .56% | .56% I | |||||

| Net investment income (loss) | 4.68% I | 4.70% | 8.25% | 6.83% | 3.66% I | |||||

| Supplemental Data | ||||||||||

| Net assets, end of period (000 omitted) | $ | 98,180 | $ | 101,688 | $ | 99,831 | $ | 20,606 | $ | 6,331 |

Portfolio turnover rate J | 27 % I | 29% | 32% | 13% | 47% I |

Fidelity Advisor® Strategic Real Return Fund Class I |

Six months ended (Unaudited) March 31, 2024 | Years ended September 30, 2023 | 2022 | 2021 | 2020 | 2019 | |||||||

Selected Per-Share Data | ||||||||||||

| Net asset value, beginning of period | $ | 8.32 | $ | 8.55 | $ | 9.44 | $ | 8.08 | $ | 8.40 | $ | 8.90 |

| Income from Investment Operations | ||||||||||||

Net investment income (loss) A,B | .185 | .381 | .741 | .594 | .280 | .240 | ||||||

| Net realized and unrealized gain (loss) | .240 | .060 | (1.079) C | .955 | (.369) | - D | ||||||

| Total from investment operations | .425 | .441 | (.338) | 1.549 | (.089) | .240 | ||||||

| Distributions from net investment income | (.275) | (.671) | (.552) | (.189) | (.231) | (.315) | ||||||

| Distributions from net realized gain | - | - | - | - | - | (.425) | ||||||

| Total distributions | (.275) | (.671) | (.552) | (.189) | (.231) | (.740) | ||||||

| Net asset value, end of period | $ | 8.47 | $ | 8.32 | $ | 8.55 | $ | 9.44 | $ | 8.08 | $ | 8.40 |

Total Return E,F | 5.27 % | 5.33% | (3.86)% C | 19.45% | (1.04)% | 3.01% | ||||||

Ratios to Average Net Assets A,G,H | ||||||||||||

| Expenses before reductions | .78% I | .79% | .79% | .83% | .83% | .81% | ||||||

| Expenses net of fee waivers, if any | .69 % I | .70% | .71% | .75% | .75% | .81% | ||||||

| Expenses net of all reductions | .69% I | .70% | .71% | .75% | .75% | .81% | ||||||

| Net investment income (loss) | 4.49% I | 4.51% | 8.07% | 6.64% | 3.47% | 2.88% | ||||||

| Supplemental Data | ||||||||||||

| Net assets, end of period (000 omitted) | $ | 53,300 | $ | 66,743 | $ | 185,361 | $ | 49,988 | $ | 26,872 | $ | 116,302 |

Portfolio turnover rate J | 27 % I | 29% | 32% | 13% | 47% | 19% |

Fidelity Advisor® Strategic Real Return Fund Class Z |

Six months ended (Unaudited) March 31, 2024 | Years ended September 30, 2023 | 2022 | 2021 | 2020 | 2019 A | |||||||

Selected Per-Share Data | ||||||||||||

| Net asset value, beginning of period | $ | 8.32 | $ | 8.56 | $ | 9.45 | $ | 8.08 | $ | 8.40 | $ | 8.93 |

| Income from Investment Operations | ||||||||||||

Net investment income (loss) B,C | .189 | .389 | .755 | .610 | .282 | .244 | ||||||

| Net realized and unrealized gain (loss) | .249 | .051 | (1.087) D | .952 | (.365) | (.026) | ||||||

| Total from investment operations | .438 | .440 | (.332) | 1.562 | (.083) | .218 | ||||||

| Distributions from net investment income | (.278) | (.680) | (.558) | (.192) | (.237) | (.323) | ||||||

| Distributions from net realized gain | - | - | - | - | - | (.425) | ||||||

| Total distributions | (.278) | (.680) | (.558) | (.192) | (.237) | (.748) | ||||||

| Net asset value, end of period | $ | 8.48 | $ | 8.32 | $ | 8.56 | $ | 9.45 | $ | 8.08 | $ | 8.40 |

Total Return E,F | 5.43 % | 5.32% | (3.79)% D | 19.61% | (.96)% | 2.76% | ||||||

Ratios to Average Net Assets C,G,H | ||||||||||||

| Expenses before reductions | .68% I | .69% | .70% | .73% | .74% | .71% I | ||||||

| Expenses net of fee waivers, if any | .59 % I | .61% | .62% | .66% | .66% | .71% I | ||||||

| Expenses net of all reductions | .59% I | .61% | .62% | .66% | .66% | .71% I | ||||||

| Net investment income (loss) | 4.59% I | 4.60% | 8.15% | 6.73% | 3.56% | 2.97% I | ||||||

| Supplemental Data | ||||||||||||

| Net assets, end of period (000 omitted) | $ | 27,511 | $ | 40,802 | $ | 87,627 | $ | 56,997 | $ | 9,511 | $ | 9,369 |

Portfolio turnover rate J | 27 % I | 29% | 32% | 13% | 47% | 19% I |

| Fidelity Central Fund | Investment Manager | Investment Objective | Investment Practices | Expense RatioA |

| Fidelity Commodity Strategy Central Fund | Geode Capital Management, LLC (Geode) | Seeks to provide investment returns that correspond to the performance of the commodities market. | Investment in commodity-related investments through a wholly-owned subsidiary organized under the laws of the Cayman Islands Futures | .01% |

| Fidelity Floating Rate Central Fund | Fidelity Management & Research Company LLC (FMR) | Seeks a high level of income by normally investing in floating rate loans and other floating rate securities. | Loans & Direct Debt Instruments Restricted Securities | .01% |

| Fidelity Real Estate Equity Central Fund | Fidelity Management & Research Company LLC (FMR) | Seeks above-average income and long-term capital growth by investing primarily in equity securities of issuers in the real estate industry. | Loans & Direct Debt Instruments | Less than .005% |

| Fidelity Money Market Central Funds | Fidelity Management & Research Company LLC (FMR) | Each fund seeks to obtain a high level of current income consistent with the preservation of capital and liquidity. | Short-term Investments | Less than .005% |

| Gross unrealized appreciation | $16,988,204 |

| Gross unrealized depreciation | (39,234,802) |

| Net unrealized appreciation (depreciation) | $(22,246,598) |

| Tax cost | $523,874,992 |

| Short-term | $(29,929,699) |

| Long-term | (260,815,392) |

| Total capital loss carryforward | $(290,745,091) |

| Purchases ($) | Sales ($) | |

| Fidelity Strategic Real Return Fund | 54,048,486 | 98,150,700 |

| Maximum Management Fee Rate % | |

| Class A | .72 |

| Class M | .73 |

| Class C | .71 |

| Strategic Real Return | .72 |

| Class K6 | .57 |

| Class I | .71 |

| Class Z | .61 |

| Total Management Fee Rate % | |

| Class A | .71 |

| Class M | .72 |

| Class C | .70 |

| Strategic Real Return | .69 |

| Class K6 | .56 |

| Class I | .70 |

| Class Z | .60 |

| Distribution Fee | Service Fee | Total Fees ($) | Retained by FDC ($) | |

| Class A | - % | .25% | 63,979 | 1,688 |

| Class M | - % | .25% | 10,238 | - |

| Class C | .75% | .25% | 49,073 | 7,902 |

| 123,290 | 9,590 |

| Retained by FDC ($) | |

| Class A | 1,681 |

| Class M | 90 |

Class C A | 10 |

1,781 |

| % of Class-Level Average Net Assets | |

| Class A | .1592 |

| Class M | .1668 |

| Class C | .1457 |

| Strategic Real Return | .1564 |

| Class I | .1469 |

| Amount ($) | % of Class-Level Average Net Assets | |

| Class A | 34,147 | .16 |

| Class M | 5,793 | .17 |

| Class C | 6,054 | .15 |

| Strategic Real Return | 175,006 | .16 |

| Class K6 | 4,120 | .01 |

| Class I | 33,631 | .14 |

| Class Z | 6,946 | .05 |

265,697 |

| % of Average Net Assets | |

| Fidelity Strategic Real Return Fund | .0447 |

| % of Average Net Assets | |

| Fidelity Strategic Real Return Fund | .05 |

| Amount ($) | |

| Fidelity Strategic Real Return Fund | 765 |

| Purchases ($) | Sales ($) | Realized Gain (Loss)($) | |

| Fidelity Strategic Real Return Fund | 1,884,857 | 704,895 | (9,656) |

| Amount ($) | |

| Fidelity Strategic Real Return Fund | 696 |

| Total Security Lending Fees Paid to NFS ($) | Security Lending Income From Securities Loaned to NFS ($) | Value of Securities Loaned to NFS at Period End ($) | |

| Fidelity Strategic Real Return Fund | 150 | - | - |

| Expense Limitations | Reimbursement ($) | |

| Class A | .95% | 24,390 |

| Class M | .95% | 4,303 |

| Class C | 1.70% | 3,994 |

| Strategic Real Return | .70% | 125,038 |

| Class K6 | .51% | 67,821 |

| Class I | .70% | 22,323 |

| Class Z | .61% | 12,308 |

260,177 |

Six months ended March 31, 2024 | Year ended September 30, 2023 | |

| Fidelity Strategic Real Return Fund | ||

| Distributions to shareholders | ||

| Class A | $1,692,837 | $5,546,458 |

| Class M | 271,481 | 857,201 |

| Class C | 294,904 | 940,471 |

| Strategic Real Return | 8,628,556 | 28,527,671 |

| Class K6 | 3,291,610 | 8,017,562 |

| Class I | 1,997,063 | 13,013,562 |

| Class Z | 1,216,500 | 6,535,758 |

Total | $17,392,951 | $63,438,683 |

| Shares | Shares | Dollars | Dollars | |

Six months ended March 31, 2024 | Year ended September 30, 2023 | Six months ended March 31, 2024 | Year ended September 30, 2023 | |

| Fidelity Strategic Real Return Fund | ||||

| Class A | ||||

| Shares sold | 207,444 | 1,252,516 | $1,699,999 | $10,533,993 |

| Reinvestment of distributions | 205,105 | 657,984 | 1,663,394 | 5,466,958 |

| Shares redeemed | (1,220,023) | (4,338,289) | (10,004,268) | (36,445,834) |

| Net increase (decrease) | (807,474) | (2,427,789) | $(6,640,875) | $(20,444,883) |

| Class M | ||||

| Shares sold | 17,718 | 185,722 | $146,714 | $1,570,072 |

| Reinvestment of distributions | 33,053 | 101,789 | 268,428 | 846,754 |

| Shares redeemed | (174,992) | (581,471) | (1,439,000) | (4,893,760) |

| Net increase (decrease) | (124,221) | (293,960) | $(1,023,858) | $(2,476,934) |

| Class C | ||||

| Shares sold | 41,009 | 443,441 | $329,964 | $3,679,169 |

| Reinvestment of distributions | 36,932 | 114,692 | 294,706 | 937,586 |

| Shares redeemed | (321,087) | (879,026) | (2,598,704) | (7,278,112) |

| Net increase (decrease) | (243,146) | (320,893) | $(1,974,034) | $(2,661,357) |

| Strategic Real Return | ||||

| Shares sold | 4,738,841 | 5,370,568 | $39,179,414 | $45,507,707 |

| Reinvestment of distributions | 943,687 | 3,058,582 | 7,695,162 | 25,543,645 |

| Shares redeemed | (6,735,126) | (22,270,314) | (55,651,074) | (188,002,277) |

| Net increase (decrease) | (1,052,598) | (13,841,164) | $(8,776,498) | $(116,950,925) |

| Class K6 | ||||

| Shares sold | 1,448,435 | 3,319,211 | $12,041,949 | $28,129,663 |

| Reinvestment of distributions | 402,099 | 956,923 | 3,291,610 | 8,017,562 |

| Shares redeemed | (2,488,178) | (3,735,565) | (20,747,734) | (31,582,608) |

| Net increase (decrease) | (637,644) | 540,569 | $(5,414,175) | $4,564,617 |

| Class I | ||||

| Shares sold | 1,207,403 | 5,829,914 | $10,031,456 | $49,442,614 |

| Reinvestment of distributions | 244,083 | 1,531,493 | 1,982,476 | 12,758,214 |

| Shares redeemed | (3,184,714) | (21,008,384) | (26,183,964) | (177,141,314) |

| Net increase (decrease) | (1,733,228) | (13,646,977) | $(14,170,032) | $(114,940,486) |

| Class Z | ||||

| Shares sold | 306,128 | 1,838,169 | $2,516,830 | $15,494,846 |

| Reinvestment of distributions | 125,198 | 631,756 | 1,017,606 | 5,264,158 |

| Shares redeemed | (2,089,157) | (7,803,449) | (17,165,466) | (65,676,839) |

| Net increase (decrease) | (1,657,831) | (5,333,524) | $(13,631,030) | $(44,917,835) |

| The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (October 1, 2023 to March 31, 2024). |

Annualized Expense Ratio- A | Beginning Account Value October 1, 2023 | Ending Account Value March 31, 2024 | Expenses Paid During Period- C October 1, 2023 to March 31, 2024 | |||||||

| Fidelity® Strategic Real Return Fund | ||||||||||

| Class A | .94% | |||||||||

| Actual | $ 1,000 | $ 1,052.90 | $ 4.82 | |||||||

Hypothetical-B | $ 1,000 | $ 1,020.30 | $ 4.75 | |||||||

| Class M | .94% | |||||||||

| Actual | $ 1,000 | $ 1,052.80 | $ 4.82 | |||||||

Hypothetical-B | $ 1,000 | $ 1,020.30 | $ 4.75 | |||||||

| Class C | 1.69% | |||||||||

| Actual | $ 1,000 | $ 1,047.10 | $ 8.65 | |||||||

Hypothetical-B | $ 1,000 | $ 1,016.55 | $ 8.52 | |||||||

| Fidelity® Strategic Real Return Fund | .70% | |||||||||

| Actual | $ 1,000 | $ 1,052.70 | $ 3.59 | |||||||

Hypothetical-B | $ 1,000 | $ 1,021.50 | $ 3.54 | |||||||

| Class K6 | .50% | |||||||||

| Actual | $ 1,000 | $ 1,054.40 | $ 2.57 | |||||||

Hypothetical-B | $ 1,000 | $ 1,022.50 | $ 2.53 | |||||||

| Class I | .69% | |||||||||

| Actual | $ 1,000 | $ 1,052.70 | $ 3.54 | |||||||

Hypothetical-B | $ 1,000 | $ 1,021.55 | $ 3.49 | |||||||

| Class Z | .59% | |||||||||

| Actual | $ 1,000 | $ 1,054.30 | $ 3.03 | |||||||

Hypothetical-B | $ 1,000 | $ 1,022.05 | $ 2.98 | |||||||

- Highly liquid investments - cash or convertible to cash within three business days or less

- Moderately liquid investments - convertible to cash in three to seven calendar days

- Less liquid investments - can be sold or disposed of, but not settled, within seven calendar days

- Illiquid investments - cannot be sold or disposed of within seven calendar days

| A special meeting of shareholders was held on October 18, 2023. The results of votes taken among shareholders on the proposal before them are reported below. Each vote reported represents one dollar of net asset value held on the record date for the meeting. | ||

| Proposal 1 | ||

| To elect a Board of Trustees. | ||

# of Votes | % of Votes | |

| Abigail P. Johnson | ||

| Affirmative | 378,729,502,260.01 | 97.58 |

| Withheld | 9,407,876,478.96 | 2.42 |

| TOTAL | 388,137,378,738.97 | 100.00 |

| Jennifer Toolin McAuliffe | ||

| Affirmative | 378,454,868,010.95 | 97.51 |

| Withheld | 9,682,510,728.02 | 2.49 |

| TOTAL | 388,137,378,738.97 | 100.00 |

| Christine J. Thompson | ||

| Affirmative | 378,837,121,274.52 | 97.60 |

| Withheld | 9,300,257,464.45 | 2.40 |

| TOTAL | 388,137,378,738.97 | 100.00 |

| Elizabeth S. Acton | ||

| Affirmative | 378,262,110,794.85 | 97.46 |

| Withheld | 9,875,267,944.12 | 2.54 |

| TOTAL | 388,137,378,738.97 | 100.00 |

| Laura M. Bishop | ||

| Affirmative | 380,482,113,171.06 | 98.03 |

| Withheld | 7,655,265,567.91 | 1.97 |

| TOTAL | 388,137,378,738.97 | 100.00 |

| Ann E. Dunwoody | ||

| Affirmative | 380,016,034,008.12 | 97.91 |

| Withheld | 8,121,344,730.85 | 2.09 |

| TOTAL | 388,137,378,738.97 | 100.00 |

| John Engler | ||

| Affirmative | 379,432,488,394.20 | 97.76 |

| Withheld | 8,704,890,344.77 | 2.24 |

| TOTAL | 388,137,378,738.97 | 100.00 |

| Robert F. Gartland | ||

| Affirmative | 378,741,819,600.60 | 97.58 |

| Withheld | 9,395,559,138.37 | 2.42 |

| TOTAL | 388,137,378,738.97 | 100.00 |

| Robert W. Helm | ||

| Affirmative | 380,389,324,755.07 | 98.00 |

| Withheld | 7,748,053,983.90 | 2.00 |

| TOTAL | 388,137,378,738.97 | 100.00 |

| Arthur E. Johnson | ||

| Affirmative | 378,427,694,151.67 | 97.50 |

| Withheld | 9,709,684,587.30 | 2.50 |

| TOTAL | 388,137,378,738.97 | 100.00 |

| Michael E. Kenneally | ||

| Affirmative | 377,842,228,145.18 | 97.35 |

| Withheld | 10,295,150,593.79 | 2.65 |

| TOTAL | 388,137,378,738.97 | 100.00 |

| Mark A. Murray | ||

| Affirmative | 380,158,432,703.37 | 97.94 |

| Withheld | 7,978,946,035.60 | 2.06 |

| TOTAL | 388,137,378,738.97 | 100.00 |

| Carol J. Zierhoffer | ||

| Affirmative | 380,522,113,360.24 | 98.04 |

| Withheld | 7,615,265,378.73 | 1.96 |

| TOTAL | 388,137,378,738.97 | 100.00 |

| Proposal 1 reflects trust-wide proposal and voting results. | ||

|

Item 2.

Code of Ethics

Not applicable.

Item 3.

Audit Committee Financial Expert

Not applicable.

Item 4.

Principal Accountant Fees and Services

Not applicable.

Item 5.

Audit Committee of Listed Registrants

Not applicable.

Item 6.

Investments

(a)

Not applicable.

(b)

Not applicable

Item 7.

Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies

Not applicable.

Item 8.

Portfolio Managers of Closed-End Management Investment Companies

Not applicable.

Item 9.

Purchase of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers

Not applicable.

Item 10.

Submission of Matters to a Vote of Security Holders

There were no material changes to the procedures by which shareholders may recommend nominees to the Fidelity Salem Street Trust’s Board of Trustees.

Item 11.

Controls and Procedures

(a)(i) The President and Treasurer and the Chief Financial Officer have concluded that the Fidelity Salem Street Trust’s (the “Trust”) disclosure controls and procedures (as defined in Rule 30a-3(c) under the Investment Company Act) provide reasonable

assurances that material information relating to the Trust is made known to them by the appropriate persons, based on their evaluation of these controls and procedures as of a date within 90 days of the filing date of this report.

(a)(ii) There was no change in the Trust’s internal control over financial reporting (as defined in Rule 30a-3(d) under the Investment Company Act) that occurred during the period covered by this report that has materially affected, or is reasonably likely to materially affect, the Trust’s internal control over financial reporting.

Item 12.

Disclosure of Securities Lending Activities for Closed-End Management

Investment Companies

Not applicable.

Item 18.

Recovery of Erroneously Awarded Compensation

(a)

Not applicable.

(b)

Not applicable.

Item 19.

Exhibits

(a) | (1) | Not applicable. |

(a) | (2) | |

(a) | (3) | Not applicable. |

(b) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Fidelity Salem Street Trust

By: | /s/Laura M. Del Prato |

Laura M. Del Prato | |

President and Treasurer (Principal Executive Officer) | |

Date: | May 22, 2024 |

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

By: | /s/Laura M. Del Prato |

Laura M. Del Prato | |

President and Treasurer (Principal Executive Officer) | |

Date: | May 22, 2024 |

By: | /s/John J. Burke III |

John J. Burke III | |

Chief Financial Officer (Principal Financial Officer) | |

Date: | May 22, 2024 |