0000035315fmr:C000243071Memberfmr:AAOtherInvestmentsMember2024-08-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-02105

Fidelity Salem Street Trust

(Exact name of registrant as specified in charter)

245 Summer St., Boston, Massachusetts 02210

(Address of principal executive offices) (Zip code)

Nicole Macarchuk, Secretary

245 Summer St.

Boston, Massachusetts 02210

(Name and address of agent for service)

Registrant's telephone number, including area code:

617-563-7000

| |

Date of fiscal year end: | August 31 |

|

|

Date of reporting period: | August 31, 2024 |

This report on Form N-CSR relates solely to the Registrant’s Fidelity Conservative Income Bond Fund, Fidelity SAI Investment Grade Securitized Fund, Fidelity SAI Sustainable Low Duration Income Fund, Fidelity Series Corporate Bond Fund, Fidelity Series Sustainable Investment Grade Bond Fund, Fidelity Short-Term Bond Index Fund,

Fidelity Sustainability Bond Index Fund, Fidelity Sustainable Core Plus Bond Fund, and

Fidelity Sustainable Low Duration Bond Fund (the “Funds”).

Item 1.

Reports to Stockholders

| |

| | ANNUAL SHAREHOLDER REPORT | AS OF AUGUST 31, 2024 | This report describes changes to the Fund that occurred during the reporting period. |

| | Fidelity® Sustainable Core Plus Bond Fund Fidelity Advisor® Sustainable Core Plus Bond Fund Class I : FIALX |

| | | |

This annual shareholder report contains information about Fidelity® Sustainable Core Plus Bond Fund for the period September 1, 2023 to August 31, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-877-208-0098 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last year?(based on hypothetical $10,000 investment)

FUND COST (PREVIOUS YEAR)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Class I | $ 44 | 0.42% | |

What affected the Fund's performance this period?

•U.S. taxable investment-grade bonds posted a strong advance for the 12 months ending August 31, 2024, helped by a late-period gain, as the bond market reflected anticipated interest-rate reductions by the U.S. Federal Reserve, which are expected to start in September. The full 12-month period was marked by high volatility.

•Against this backdrop, an out-of-benchmark allocation to high-yield bonds notably contributed to the fund's outperformance of the Bloomberg U.S. Aggregate Bond Index for the fiscal year.

•Choices among investment-grade asset-backed securities aso made a meaningful contribution to the relative result, led by fund holdings in collateralized loan obligations. Non-benchmark picks among global bonds were beneficial, too.

•Holdings in the corporate sector added value as well, particularly picks among financials and utilities, as well as overweights within those segments.

•In contrast, the fund's underweight in industrial bonds within the corporate sector detracted versus the Aggregate index the past 12 months.

Application of FMR's environmental, social, and governance (ESG) ratings process and/or its sustainable investing exclusion criteria may affect the fund's exposure to certain issuers, sectors, regions, and countries and may affect the fund's performance.

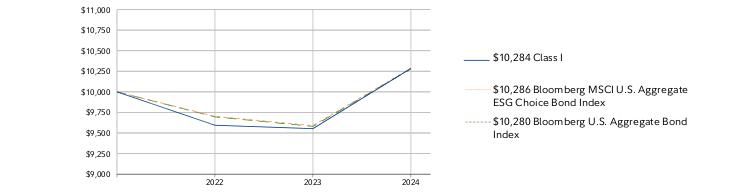

How did the Fund perform over the life of Fund?

CUMULATIVE PERFORMANCE

April 13, 2022 through August 31, 2024.

Initial investment of $10,000.

Class I | $10,000 | $9,594 | $9,553 |

Bloomberg MSCI U.S. Aggregate ESG Choice Bond Index | $10,000 | $9,703 | $9,590 |

Bloomberg U.S. Aggregate Bond Index | $10,000 | $9,696 | $9,581 |

| | 2022 | 2023 | 2024 |

AVERAGE ANNUAL TOTAL RETURNS: | | 1 Year | Life of Fund A |

| Class I | 7.66% | 1.18% |

| Bloomberg MSCI U.S. Aggregate ESG Choice Bond Index | 7.26% | 1.19% |

| Bloomberg U.S. Aggregate Bond Index | 7.30% | 1.16% |

A From April 13, 2022

Visit institutional.fidelity.com for more recent performance information. |

The Fund's past performance is not a good predictor of the Fund's future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. |

Key Fund Statistics (as of August 31, 2024)

KEY FACTS | | |

| Fund Size | $39,262,600 | |

| Number of Holdings | 597 | |

| Total Advisory Fee | $121,381 | |

| Portfolio Turnover | 334% | |

What did the Fund invest in?

(as of August 31, 2024)

| U.S. Government and U.S. Government Agency Obligations | 57.2 |

| AAA | 6.4 |

| AA | 1.0 |

| A | 11.6 |

| BBB | 16.3 |

| BB | 2.7 |

| B | 2.8 |

| CCC,CC,C | 1.5 |

| Not Rated | 2.1 |

| Equities | 0.0 |

QUALITY DIVERSIFICATION (% of Fund's net assets) |

|

| Short-Term Investments and Net Other Assets (Liabilities) - (1.6)% |

| |

| We have used ratings from Moody's Investors Service, Inc. Where Moody's® ratings are not available, we have used S&P® ratings. All ratings are as of the date indicated and do not reflect subsequent changes. |

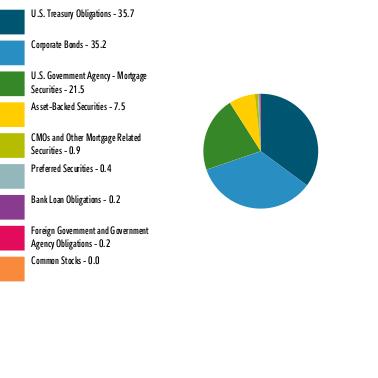

| U.S. Treasury Obligations | 35.7 |

| Corporate Bonds | 35.2 |

| U.S. Government Agency - Mortgage Securities | 21.5 |

| Asset-Backed Securities | 7.5 |

| CMOs and Other Mortgage Related Securities | 0.9 |

| Preferred Securities | 0.4 |

| Bank Loan Obligations | 0.2 |

| Foreign Government and Government Agency Obligations | 0.2 |

| Common Stocks | 0.0 |

ASSET ALLOCATION (% of Fund's net assets) |

|

| Short-Term Investments and Net Other Assets (Liabilities) - (1.6)% |

|

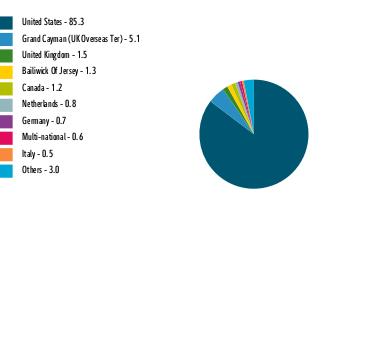

| United States | 85.3 |

| Grand Cayman (UK Overseas Ter) | 5.1 |

| United Kingdom | 1.5 |

| Bailiwick Of Jersey | 1.3 |

| Canada | 1.2 |

| Netherlands | 0.8 |

| Germany | 0.7 |

| Multi-national | 0.6 |

| Italy | 0.5 |

| Others | 3.0 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

| |

|

TOP HOLDINGS (% of Fund's net assets) | | |

| US Treasury Notes | 25.0 | |

| US Treasury Bonds | 10.6 | |

| Uniform Mortgage Backed Securities | 10.1 | |

| Ginnie Mae II Pool | 5.4 | |

| Fannie Mae Mortgage pass-thru certificates | 3.2 | |

| Freddie Mac Gold Pool | 2.4 | |

| Symphony Clo Xxvi Ltd / Symphony Clo Xxvi LLC | 1.5 | |

| Bank of America Corp | 1.4 | |

| Morgan Stanley | 1.0 | |

| Citigroup Inc | 0.9 | |

| | 61.5 | |

How has the Fund changed?

This is a summary of certain changes to the Fund since September 1, 2023. For more complete information, you may review the Fund's next prospectus, which we expect to be available by October 30, 2024 at fundresearch.fidelity.com/prospectus/sec or upon request at 1-877-208-0098 or by sending an e-mail to fidfunddocuments@fidelity.com.

The fees associated with this class changed during the reporting year. The variations in class fees are primarily the result of the following changes: | The fund modified its principal investment risks during the reporting period.

|

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9913696.100 6545-TSRA-1024 |

| |

| | ANNUAL SHAREHOLDER REPORT | AS OF AUGUST 31, 2024 | This report describes changes to the Fund that occurred during the reporting period. |

| | Fidelity® Sustainable Core Plus Bond Fund Fidelity Advisor® Sustainable Core Plus Bond Fund Class C : FIAJX |

| | | |

This annual shareholder report contains information about Fidelity® Sustainable Core Plus Bond Fund for the period September 1, 2023 to August 31, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-877-208-0098 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last year?(based on hypothetical $10,000 investment)

FUND COST (PREVIOUS YEAR)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Class C | $ 146 | 1.41% | |

What affected the Fund's performance this period?

•U.S. taxable investment-grade bonds posted a strong advance for the 12 months ending August 31, 2024, helped by a late-period gain, as the bond market reflected anticipated interest-rate reductions by the U.S. Federal Reserve, which are expected to start in September. The full 12-month period was marked by high volatility.

•Against this backdrop, an out-of-benchmark allocation to high-yield bonds notably contributed to the fund's outperformance of the Bloomberg U.S. Aggregate Bond Index for the fiscal year.

•Choices among investment-grade asset-backed securities aso made a meaningful contribution to the relative result, led by fund holdings in collateralized loan obligations. Non-benchmark picks among global bonds were beneficial, too.

•Holdings in the corporate sector added value as well, particularly picks among financials and utilities, as well as overweights within those segments.

•In contrast, the fund's underweight in industrial bonds within the corporate sector detracted versus the Aggregate index the past 12 months.

Application of FMR's environmental, social, and governance (ESG) ratings process and/or its sustainable investing exclusion criteria may affect the fund's exposure to certain issuers, sectors, regions, and countries and may affect the fund's performance.

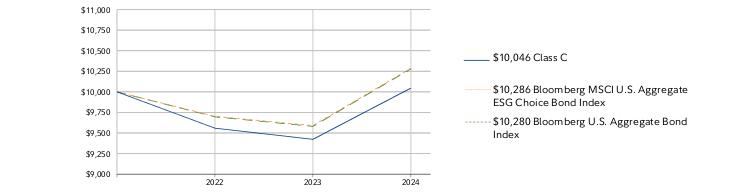

How did the Fund perform over the life of Fund?

CUMULATIVE PERFORMANCE

April 13, 2022 through August 31, 2024.

Initial investment of $10,000.

Class C | $10,000 | $9,559 | $9,423 |

Bloomberg MSCI U.S. Aggregate ESG Choice Bond Index | $10,000 | $9,703 | $9,590 |

Bloomberg U.S. Aggregate Bond Index | $10,000 | $9,696 | $9,581 |

| | 2022 | 2023 | 2024 |

AVERAGE ANNUAL TOTAL RETURNS: | | 1 Year | Life of Fund A |

| Class C (incl. contingent deferred sales charge) | 5.60% | 0.19% |

| Class C | 6.60% | 0.19% |

| Bloomberg MSCI U.S. Aggregate ESG Choice Bond Index | 7.26% | 1.19% |

| Bloomberg U.S. Aggregate Bond Index | 7.30% | 1.16% |

A From April 13, 2022

Visit institutional.fidelity.com for more recent performance information. |

The Fund's past performance is not a good predictor of the Fund's future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. |

Key Fund Statistics (as of August 31, 2024)

KEY FACTS | | |

| Fund Size | $39,262,600 | |

| Number of Holdings | 597 | |

| Total Advisory Fee | $121,381 | |

| Portfolio Turnover | 334% | |

What did the Fund invest in?

(as of August 31, 2024)

| U.S. Government and U.S. Government Agency Obligations | 57.2 |

| AAA | 6.4 |

| AA | 1.0 |

| A | 11.6 |

| BBB | 16.3 |

| BB | 2.7 |

| B | 2.8 |

| CCC,CC,C | 1.5 |

| Not Rated | 2.1 |

| Equities | 0.0 |

QUALITY DIVERSIFICATION (% of Fund's net assets) |

|

| Short-Term Investments and Net Other Assets (Liabilities) - (1.6)% |

| |

| We have used ratings from Moody's Investors Service, Inc. Where Moody's® ratings are not available, we have used S&P® ratings. All ratings are as of the date indicated and do not reflect subsequent changes. |

| U.S. Treasury Obligations | 35.7 |

| Corporate Bonds | 35.2 |

| U.S. Government Agency - Mortgage Securities | 21.5 |

| Asset-Backed Securities | 7.5 |

| CMOs and Other Mortgage Related Securities | 0.9 |

| Preferred Securities | 0.4 |

| Bank Loan Obligations | 0.2 |

| Foreign Government and Government Agency Obligations | 0.2 |

| Common Stocks | 0.0 |

ASSET ALLOCATION (% of Fund's net assets) |

|

| Short-Term Investments and Net Other Assets (Liabilities) - (1.6)% |

|

| United States | 85.3 |

| Grand Cayman (UK Overseas Ter) | 5.1 |

| United Kingdom | 1.5 |

| Bailiwick Of Jersey | 1.3 |

| Canada | 1.2 |

| Netherlands | 0.8 |

| Germany | 0.7 |

| Multi-national | 0.6 |

| Italy | 0.5 |

| Others | 3.0 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

| |

|

TOP HOLDINGS (% of Fund's net assets) | | |

| US Treasury Notes | 25.0 | |

| US Treasury Bonds | 10.6 | |

| Uniform Mortgage Backed Securities | 10.1 | |

| Ginnie Mae II Pool | 5.4 | |

| Fannie Mae Mortgage pass-thru certificates | 3.2 | |

| Freddie Mac Gold Pool | 2.4 | |

| Symphony Clo Xxvi Ltd / Symphony Clo Xxvi LLC | 1.5 | |

| Bank of America Corp | 1.4 | |

| Morgan Stanley | 1.0 | |

| Citigroup Inc | 0.9 | |

| | 61.5 | |

How has the Fund changed?

This is a summary of certain changes to the Fund since September 1, 2023. For more complete information, you may review the Fund's next prospectus, which we expect to be available by October 30, 2024 at fundresearch.fidelity.com/prospectus/sec or upon request at 1-877-208-0098 or by sending an e-mail to fidfunddocuments@fidelity.com.

The fund modified its principal investment risks during the reporting period. | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9913694.100 6543-TSRA-1024 |

| |

| | ANNUAL SHAREHOLDER REPORT | AS OF AUGUST 31, 2024 | This report describes changes to the Fund that occurred during the reporting period. |

| | Fidelity® Sustainable Low Duration Bond Fund Fidelity Advisor® Sustainable Low Duration Bond Fund Class I : FAPDX |

| | | |

This annual shareholder report contains information about Fidelity® Sustainable Low Duration Bond Fund for the period September 1, 2023 to August 31, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-877-208-0098 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last year?(based on hypothetical $10,000 investment)

FUND COST (PREVIOUS YEAR)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Class I | $ 26 | 0.25% | |

What affected the Fund's performance this period?

•U.S. taxable investment-grade bonds posted a strong advance for the 12 months ending August 31, 2024, helped by a late-period gain, as the bond market reflected anticipated interest-rate reductions by the U.S. Federal Reserve, which are expected to start in September. The full 12-month period was marked by high volatility.

•Against this backdrop, the fund's strategy of holding short-term debt in high-quality corporations contributed to performance versus the all-U.S.-Treasury benchmark. Within corporates, debt holdings among financial institutions - especially banks - and industrial firms, particularly in the consumer cyclical and consumer non-cyclical segments, added notable value.

•Non-benchmark exposure to asset-backed securities, primarily car loan debt, also meaningfully contributed.

•There were no notable relative detractors among the fund's principal investment strategies.

•At period end, corporates made up about 60% of fund assets, down from roughly 67% a year ago. At the same time, we decreased exposure to U.S. Treasurys from about 27% to roughly 26% of assets, while increasing out-of-benchmark exposure to asset-backed securities from about 6% to roughly 11% of assets as of August 31.

Application of FMR's environmental, social, and governance (ESG) ratings process and/or its sustainable investing exclusion criteria may affect the fund's exposure to certain issuers, sectors, regions, and countries and may affect the fund's performance.

How did the Fund perform over the life of Fund?

CUMULATIVE PERFORMANCE

April 13, 2022 through August 31, 2024.

Initial investment of $10,000.

Class I | $10,000 | $10,001 | $10,404 |

Bloomberg US Treasury Bill: 6-9 Months Index | $10,000 | $9,990 | $10,301 |

Bloomberg U.S. Aggregate Bond Index | $10,000 | $9,696 | $9,581 |

| | 2022 | 2023 | 2024 |

AVERAGE ANNUAL TOTAL RETURNS: | | 1 Year | Life of Fund A |

| Class I | 5.79% | 4.10% |

| Bloomberg US Treasury Bill: 6-9 Months Index | 5.37% | 3.49% |

| Bloomberg U.S. Aggregate Bond Index | 7.30% | 1.16% |

A From April 13, 2022

Visit institutional.fidelity.com for more recent performance information. |

The Fund's past performance is not a good predictor of the Fund's future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. |

Key Fund Statistics (as of August 31, 2024)

KEY FACTS | | |

| Fund Size | $29,475,941 | |

| Number of Holdings | 267 | |

| Total Advisory Fee | $53,128 | |

| Portfolio Turnover | 67% | |

What did the Fund invest in?

(as of August 31, 2024)

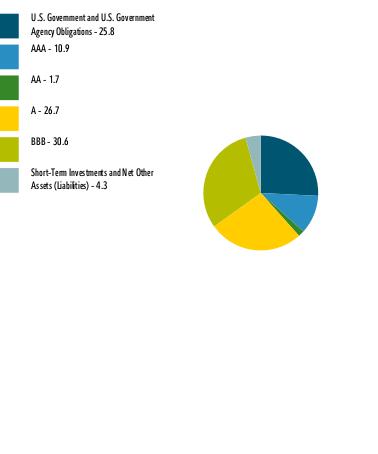

| U.S. Government and U.S. Government Agency Obligations | 25.8 |

| AAA | 10.9 |

| AA | 1.7 |

| A | 26.7 |

| BBB | 30.6 |

| Short-Term Investments and Net Other Assets (Liabilities) | 4.3 |

QUALITY DIVERSIFICATION (% of Fund's net assets) |

|

| |

| We have used ratings from Moody's Investors Service, Inc. Where Moody's® ratings are not available, we have used S&P® ratings. All ratings are as of the date indicated and do not reflect subsequent changes. |

| Corporate Bonds | 58.1 |

| U.S. Treasury Obligations | 25.8 |

| Asset-Backed Securities | 10.6 |

| Other Investments | 0.9 |

| CMOs and Other Mortgage Related Securities | 0.3 |

| Short-Term Investments and Net Other Assets (Liabilities) | 4.3 |

ASSET ALLOCATION (% of Fund's net assets) |

|

|

| United States | 91.4 |

| Canada | 6.5 |

| Netherlands | 0.8 |

| China | 0.8 |

| Germany | 0.5 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

| |

|

TOP HOLDINGS (% of Fund's net assets) | | |

| US Treasury Bill | 25.8 | |

| General Motors Financial Co Inc | 2.0 | |

| Morgan Stanley | 1.9 | |

| Bank of America Corp | 1.9 | |

| Goldman Sachs Group Inc/The | 1.7 | |

| Equitable Financial Life Global Funding | 1.7 | |

| Capital One Financial Corp | 1.6 | |

| Wells Fargo & Co | 1.6 | |

| Hyundai Capital America | 1.6 | |

| JPMorgan Chase & Co | 1.3 | |

| | 41.1 | |

How has the Fund changed?

This is a summary of certain changes to the Fund since September 1, 2023. For more complete information, you may review the Fund's next prospectus, which we expect to be available by October 30, 2024 at fundresearch.fidelity.com/prospectus/sec or upon request at 1-877-208-0098 or by sending an e-mail to fidfunddocuments@fidelity.com.

The fees associated with this class changed during the reporting year. The variations in class fees are primarily the result of the following changes: - •Management fee

- •Operating expenses

| The fund modified its principal investment risks during the reporting period.

|

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9913689.100 6530-TSRA-1024 |

| |

| | ANNUAL SHAREHOLDER REPORT | AS OF AUGUST 31, 2024 | This report describes changes to the Fund that occurred during the reporting period. |

| | Fidelity® Sustainable Core Plus Bond Fund Fidelity Advisor® Sustainable Core Plus Bond Fund Class A : FIAIX |

| | | |

This annual shareholder report contains information about Fidelity® Sustainable Core Plus Bond Fund for the period September 1, 2023 to August 31, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-877-208-0098 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last year?(based on hypothetical $10,000 investment)

FUND COST (PREVIOUS YEAR)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Class A | $ 71 | 0.68% | |

What affected the Fund's performance this period?

•U.S. taxable investment-grade bonds posted a strong advance for the 12 months ending August 31, 2024, helped by a late-period gain, as the bond market reflected anticipated interest-rate reductions by the U.S. Federal Reserve, which are expected to start in September. The full 12-month period was marked by high volatility.

•Against this backdrop, an out-of-benchmark allocation to high-yield bonds notably contributed to the fund's outperformance of the Bloomberg U.S. Aggregate Bond Index for the fiscal year.

•Choices among investment-grade asset-backed securities aso made a meaningful contribution to the relative result, led by fund holdings in collateralized loan obligations. Non-benchmark picks among global bonds were beneficial, too.

•Holdings in the corporate sector added value as well, particularly picks among financials and utilities, as well as overweights within those segments.

•In contrast, the fund's underweight in industrial bonds within the corporate sector detracted versus the Aggregate index the past 12 months.

Application of FMR's environmental, social, and governance (ESG) ratings process and/or its sustainable investing exclusion criteria may affect the fund's exposure to certain issuers, sectors, regions, and countries and may affect the fund's performance.

How did the Fund perform over the life of Fund?

CUMULATIVE PERFORMANCE

April 13, 2022 through August 31, 2024.

Initial investment of $10,000 and the current sales charge was paid.

Class A | $9,600 | $9,202 | $9,137 |

Bloomberg MSCI U.S. Aggregate ESG Choice Bond Index | $10,000 | $9,703 | $9,590 |

Bloomberg U.S. Aggregate Bond Index | $10,000 | $9,696 | $9,581 |

| | 2022 | 2023 | 2024 |

AVERAGE ANNUAL TOTAL RETURNS: | | 1 Year | Life of Fund A |

| Class A (incl. 4.00% sales charge) | 3.09% | -0.79% |

| Class A (without 4.00% sales charge) | 7.38% | 0.92% |

| Bloomberg MSCI U.S. Aggregate ESG Choice Bond Index | 7.26% | 1.19% |

| Bloomberg U.S. Aggregate Bond Index | 7.30% | 1.16% |

A From April 13, 2022

Visit institutional.fidelity.com for more recent performance information. |

The Fund's past performance is not a good predictor of the Fund's future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. |

Key Fund Statistics (as of August 31, 2024)

KEY FACTS | | |

| Fund Size | $39,262,600 | |

| Number of Holdings | 597 | |

| Total Advisory Fee | $121,381 | |

| Portfolio Turnover | 334% | |

What did the Fund invest in?

(as of August 31, 2024)

| U.S. Government and U.S. Government Agency Obligations | 57.2 |

| AAA | 6.4 |

| AA | 1.0 |

| A | 11.6 |

| BBB | 16.3 |

| BB | 2.7 |

| B | 2.8 |

| CCC,CC,C | 1.5 |

| Not Rated | 2.1 |

| Equities | 0.0 |

QUALITY DIVERSIFICATION (% of Fund's net assets) |

|

| Short-Term Investments and Net Other Assets (Liabilities) - (1.6)% |

| |

| We have used ratings from Moody's Investors Service, Inc. Where Moody's® ratings are not available, we have used S&P® ratings. All ratings are as of the date indicated and do not reflect subsequent changes. |

| U.S. Treasury Obligations | 35.7 |

| Corporate Bonds | 35.2 |

| U.S. Government Agency - Mortgage Securities | 21.5 |

| Asset-Backed Securities | 7.5 |

| CMOs and Other Mortgage Related Securities | 0.9 |

| Preferred Securities | 0.4 |

| Bank Loan Obligations | 0.2 |

| Foreign Government and Government Agency Obligations | 0.2 |

| Common Stocks | 0.0 |

ASSET ALLOCATION (% of Fund's net assets) |

|

| Short-Term Investments and Net Other Assets (Liabilities) - (1.6)% |

|

| United States | 85.3 |

| Grand Cayman (UK Overseas Ter) | 5.1 |

| United Kingdom | 1.5 |

| Bailiwick Of Jersey | 1.3 |

| Canada | 1.2 |

| Netherlands | 0.8 |

| Germany | 0.7 |

| Multi-national | 0.6 |

| Italy | 0.5 |

| Others | 3.0 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

| |

|

TOP HOLDINGS (% of Fund's net assets) | | |

| US Treasury Notes | 25.0 | |

| US Treasury Bonds | 10.6 | |

| Uniform Mortgage Backed Securities | 10.1 | |

| Ginnie Mae II Pool | 5.4 | |

| Fannie Mae Mortgage pass-thru certificates | 3.2 | |

| Freddie Mac Gold Pool | 2.4 | |

| Symphony Clo Xxvi Ltd / Symphony Clo Xxvi LLC | 1.5 | |

| Bank of America Corp | 1.4 | |

| Morgan Stanley | 1.0 | |

| Citigroup Inc | 0.9 | |

| | 61.5 | |

How has the Fund changed?

This is a summary of certain changes to the Fund since September 1, 2023. For more complete information, you may review the Fund's next prospectus, which we expect to be available by October 30, 2024 at fundresearch.fidelity.com/prospectus/sec or upon request at 1-877-208-0098 or by sending an e-mail to fidfunddocuments@fidelity.com.

The fund modified its principal investment risks during the reporting period. | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9913693.100 6542-TSRA-1024 |

| |

| | ANNUAL SHAREHOLDER REPORT | AS OF AUGUST 31, 2024 | This report describes changes to the Fund that occurred during the reporting period. |

| | Fidelity® Sustainable Low Duration Bond Fund Fidelity Advisor® Sustainable Low Duration Bond Fund Class A : FAMZX |

| | | |

This annual shareholder report contains information about Fidelity® Sustainable Low Duration Bond Fund for the period September 1, 2023 to August 31, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-877-208-0098 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last year?(based on hypothetical $10,000 investment)

FUND COST (PREVIOUS YEAR)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Class A | $ 46 | 0.45% | |

What affected the Fund's performance this period?

•U.S. taxable investment-grade bonds posted a strong advance for the 12 months ending August 31, 2024, helped by a late-period gain, as the bond market reflected anticipated interest-rate reductions by the U.S. Federal Reserve, which are expected to start in September. The full 12-month period was marked by high volatility.

•Against this backdrop, the fund's strategy of holding short-term debt in high-quality corporations contributed to performance versus the all-U.S.-Treasury benchmark. Within corporates, debt holdings among financial institutions - especially banks - and industrial firms, particularly in the consumer cyclical and consumer non-cyclical segments, added notable value.

•Non-benchmark exposure to asset-backed securities, primarily car loan debt, also meaningfully contributed.

•There were no notable relative detractors among the fund's principal investment strategies.

•At period end, corporates made up about 60% of fund assets, down from roughly 67% a year ago. At the same time, we decreased exposure to U.S. Treasurys from about 27% to roughly 26% of assets, while increasing out-of-benchmark exposure to asset-backed securities from about 6% to roughly 11% of assets as of August 31.

Application of FMR's environmental, social, and governance (ESG) ratings process and/or its sustainable investing exclusion criteria may affect the fund's exposure to certain issuers, sectors, regions, and countries and may affect the fund's performance.

How did the Fund perform over the life of Fund?

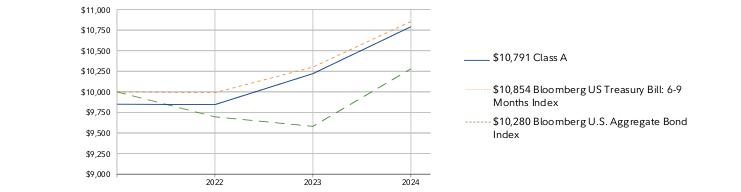

CUMULATIVE PERFORMANCE

April 13, 2022 through August 31, 2024.

Initial investment of $10,000 and the current sales charge was paid.

Class A | $9,850 | $9,845 | $10,221 |

Bloomberg US Treasury Bill: 6-9 Months Index | $10,000 | $9,990 | $10,301 |

Bloomberg U.S. Aggregate Bond Index | $10,000 | $9,696 | $9,581 |

| | 2022 | 2023 | 2024 |

AVERAGE ANNUAL TOTAL RETURNS: | | 1 Year | Life of Fund A |

| Class A (incl. 1.50% sales charge) | 3.99% | 3.24% |

| Class A (without 1.50% sales charge) | 5.58% | 3.90% |

| Bloomberg US Treasury Bill: 6-9 Months Index | 5.37% | 3.49% |

| Bloomberg U.S. Aggregate Bond Index | 7.30% | 1.16% |

A From April 13, 2022

Visit institutional.fidelity.com for more recent performance information. |

The Fund's past performance is not a good predictor of the Fund's future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. |

Key Fund Statistics (as of August 31, 2024)

KEY FACTS | | |

| Fund Size | $29,475,941 | |

| Number of Holdings | 267 | |

| Total Advisory Fee | $53,128 | |

| Portfolio Turnover | 67% | |

What did the Fund invest in?

(as of August 31, 2024)

| U.S. Government and U.S. Government Agency Obligations | 25.8 |

| AAA | 10.9 |

| AA | 1.7 |

| A | 26.7 |

| BBB | 30.6 |

| Short-Term Investments and Net Other Assets (Liabilities) | 4.3 |

QUALITY DIVERSIFICATION (% of Fund's net assets) |

|

| |

| We have used ratings from Moody's Investors Service, Inc. Where Moody's® ratings are not available, we have used S&P® ratings. All ratings are as of the date indicated and do not reflect subsequent changes. |

| Corporate Bonds | 58.1 |

| U.S. Treasury Obligations | 25.8 |

| Asset-Backed Securities | 10.6 |

| Other Investments | 0.9 |

| CMOs and Other Mortgage Related Securities | 0.3 |

| Short-Term Investments and Net Other Assets (Liabilities) | 4.3 |

ASSET ALLOCATION (% of Fund's net assets) |

|

|

| United States | 91.4 |

| Canada | 6.5 |

| Netherlands | 0.8 |

| China | 0.8 |

| Germany | 0.5 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

| |

|

TOP HOLDINGS (% of Fund's net assets) | | |

| US Treasury Bill | 25.8 | |

| General Motors Financial Co Inc | 2.0 | |

| Morgan Stanley | 1.9 | |

| Bank of America Corp | 1.9 | |

| Goldman Sachs Group Inc/The | 1.7 | |

| Equitable Financial Life Global Funding | 1.7 | |

| Capital One Financial Corp | 1.6 | |

| Wells Fargo & Co | 1.6 | |

| Hyundai Capital America | 1.6 | |

| JPMorgan Chase & Co | 1.3 | |

| | 41.1 | |

How has the Fund changed?

This is a summary of certain changes to the Fund since September 1, 2023. For more complete information, you may review the Fund's next prospectus, which we expect to be available by October 30, 2024 at fundresearch.fidelity.com/prospectus/sec or upon request at 1-877-208-0098 or by sending an e-mail to fidfunddocuments@fidelity.com.

The fees associated with this class changed during the reporting year. The variations in class fees are primarily the result of the following changes: - •Management fee

- •Operating expenses

| The fund modified its principal investment risks during the reporting period.

|

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9913686.100 6527-TSRA-1024 |

| |

| | ANNUAL SHAREHOLDER REPORT | AS OF AUGUST 31, 2024 | |

| | Fidelity® Series Sustainable Investment Grade Bond Fund Fidelity® Series Sustainable Investment Grade Bond Fund : FIGDX |

| | | |

This annual shareholder report contains information about Fidelity® Series Sustainable Investment Grade Bond Fund for the period September 1, 2023 to August 31, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-800-544-8544.

What were your Fund costs for the last year?(based on hypothetical $10,000 investment)

FUND COST (PREVIOUS YEAR)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Fidelity® Series Sustainable Investment Grade Bond Fund | $ 0 A | 0.00%B | |

A Amount represents less than $.50

B Amount represents less than 0.005%

What affected the Fund's performance this period?

•U.S. taxable investment-grade bonds posted a strong advance for the 12 months ending August 31, 2024, helped by a late-period gain, as the bond market reflected anticipated interest-rate reductions by the U.S. Federal Reserve, which are expected to start in September. The full 12-month period was marked by high levels of volatility.

•Against this backdrop, security selection was the key contributor to the fund's outperformance of the Bloomberg U.S. Aggregate Bond Index for the fiscal year.

•Specifically, choices among asset-backed securities made a notable contribution to the relative result, led by fund holdings in collateralized loan obligations.

•Holdings in the corporate sector added value as well, particularly picks among financials and utilities, as well as overweights within those segments.

•In contrast, the fund's underweight in industrial bonds within the corporate sector detracted versus the Aggregate index the past 12 months.

Application of FMR's environmental, social, and governance (ESG) ratings process and/or its sustainable investing exclusion criteria may affect the fund's exposure to certain issuers, sectors, regions, and countries and may affect the fund's performance.

How did the Fund perform over the life of Fund?

CUMULATIVE PERFORMANCE

May 11, 2023 through August 31, 2024.

Initial investment of $10,000.

Fidelity® Series Sustainable Investment Grade Bond Fund | $10,000 | $9,778 |

Bloomberg MSCI U.S. Aggregate ESG Choice Bond Index | $10,000 | $9,772 |

Bloomberg U.S. Aggregate Bond Index | $10,000 | $9,768 |

| | 2023 | 2024 |

AVERAGE ANNUAL TOTAL RETURNS: | | 1 Year | Life of Fund A |

| Fidelity® Series Sustainable Investment Grade Bond Fund | 7.42% | 3.82% |

| Bloomberg MSCI U.S. Aggregate ESG Choice Bond Index | 7.26% | 3.66% |

| Bloomberg U.S. Aggregate Bond Index | 7.30% | 3.65% |

A From May 11, 2023

Visit www.fidelity.com for more recent performance information. |

The Fund's past performance is not a good predictor of the Fund's future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. |

Key Fund Statistics (as of August 31, 2024)

KEY FACTS | | |

| Fund Size | $8,246,880 | |

| Number of Holdings | 126 | |

| Total Advisory Fee | $0 | |

| Portfolio Turnover | 405% | |

What did the Fund invest in?

(as of August 31, 2024)

| U.S. Government and U.S. Government Agency Obligations | 66.7 |

| AAA | 3.1 |

| AA | 0.8 |

| A | 10.4 |

| BBB | 13.0 |

| BB | 0.2 |

| Not Rated | 3.0 |

| Short-Term Investments and Net Other Assets (Liabilities) | 2.8 |

QUALITY DIVERSIFICATION (% of Fund's net assets) |

|

| |

| We have used ratings from Moody's Investors Service, Inc. Where Moody's® ratings are not available, we have used S&P® ratings. All ratings are as of the date indicated and do not reflect subsequent changes. |

| U.S. Treasury Obligations | 44.9 |

| Corporate Bonds | 24.4 |

| U.S. Government Agency - Mortgage Securities | 21.8 |

| Asset-Backed Securities | 6.1 |

| Short-Term Investments and Net Other Assets (Liabilities) | 2.8 |

ASSET ALLOCATION (% of Fund's net assets) |

|

|

| United States | 92.5 |

| Grand Cayman (UK Overseas Ter) | 6.1 |

| Canada | 0.7 |

| China | 0.4 |

| United Kingdom | 0.3 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

| |

|

TOP HOLDINGS (% of Fund's net assets) | | |

| US Treasury Notes | 32.5 | |

| US Treasury Bonds | 11.3 | |

| Uniform Mortgage Backed Securities | 9.3 | |

| Fannie Mae Mortgage pass-thru certificates | 5.1 | |

| Ginnie Mae II Pool | 4.9 | |

| RR 28 LTD / RR 28 LLC | 3.1 | |

| Allegro Clo Xii Ltd | 3.0 | |

| Bank of America Corp | 1.6 | |

| Morgan Stanley | 1.4 | |

| Freddie Mac Gold Pool | 1.2 | |

| | 73.4 | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9913700.100 7314-TSRA-1024 |

| |

| | ANNUAL SHAREHOLDER REPORT | AS OF AUGUST 31, 2024 | |

| | Fidelity® Short-Term Bond Index Fund Fidelity® Short-Term Bond Index Fund : FNSOX |

| | | |

This annual shareholder report contains information about Fidelity® Short-Term Bond Index Fund for the period September 1, 2023 to August 31, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-800-544-8544 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last year?(based on hypothetical $10,000 investment)

FUND COST (PREVIOUS YEAR)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Fidelity® Short-Term Bond Index Fund | $ 3 | 0.03% | |

What affected the Fund's performance this period?

•U.S. taxable investment-grade bonds posted a strong advance for the 12 months ending August 31, 2024, helped by late-period gains as the bond market priced in anticipated interest-rate reductions by the U.S. Federal Reserve, which are expected to start in September. The full 12-month period was marked by high levels of volatility.

•Given the large number of securities in the index (roughly 3,600) and the significant costs associated with full replication of the index, we construct the portfolio using optimization. This approach minimizes the differences between risk exposures of the fund relative to the index.

•Exposures include duration, key rate durations, credit quality, sector and issuer allocation, and other factors.

How did the Fund perform over the life of Fund?

CUMULATIVE PERFORMANCE

October 18, 2017 through August 31, 2024.

Initial investment of $10,000.

Fidelity® Short-Term Bond Index Fund | $10,000 | $9,969 | $10,565 | $11,052 | $11,073 | $10,427 | $10,551 | $11,255 |

Bloomberg U.S. 1-5 Year Government/Credit Bond Index | $10,000 | $9,990 | $10,586 | $11,086 | $11,122 | $10,472 | $10,596 | $11,303 |

Bloomberg U.S. Aggregate Bond Index | $10,000 | $9,938 | $10,949 | $11,658 | $11,648 | $10,307 | $10,184 | $10,927 |

| | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 |

AVERAGE ANNUAL TOTAL RETURNS: | | 1 Year | 5 Year | Life of Fund A |

| Fidelity® Short-Term Bond Index Fund | 6.68% | 1.27% | 1.74% |

| Bloomberg U.S. 1-5 Year Government/Credit Bond Index | 6.67% | 1.32% | 1.80% |

| Bloomberg U.S. Aggregate Bond Index | 7.30% | -0.04% | 1.30% |

A From October 18, 2017

Visit www.fidelity.com for more recent performance information. |

The Fund's past performance is not a good predictor of the Fund's future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. |

Key Fund Statistics (as of August 31, 2024)

KEY FACTS | | |

| Fund Size | $2,772,790,791 | |

| Number of Holdings | 1,262 | |

| Total Advisory Fee | $732,285 | |

| Portfolio Turnover | 80% | |

What did the Fund invest in?

(as of August 31, 2024)

| U.S. Government and U.S. Government Agency Obligations | 67.5 |

| AAA | 3.3 |

| AA | 2.9 |

| A | 13.4 |

| BBB | 12.2 |

| BB | 0.5 |

| Short-Term Investments and Net Other Assets (Liabilities) | 0.2 |

QUALITY DIVERSIFICATION (% of Fund's net assets) |

|

| |

| We have used ratings from Moody's Investors Service, Inc. Where Moody's® ratings are not available, we have used S&P® ratings. All ratings are as of the date indicated and do not reflect subsequent changes. |

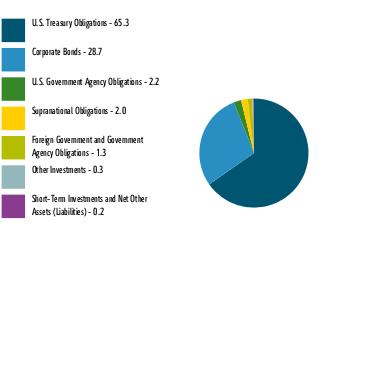

| U.S. Treasury Obligations | 65.3 |

| Corporate Bonds | 28.7 |

| U.S. Government Agency Obligations | 2.2 |

| Supranational Obligations | 2.0 |

| Foreign Government and Government Agency Obligations | 1.3 |

| Other Investments | 0.3 |

| Short-Term Investments and Net Other Assets (Liabilities) | 0.2 |

ASSET ALLOCATION (% of Fund's net assets) |

|

|

| United States | 90.5 |

| Multi-national | 2.1 |

| Canada | 1.7 |

| United Kingdom | 1.6 |

| Japan | 1.2 |

| Germany | 0.6 |

| Australia | 0.4 |

| Spain | 0.3 |

| Ireland | 0.2 |

| Others | 1.4 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

| |

|

TOP HOLDINGS (% of Fund's net assets) | | |

| US Treasury Notes | 65.3 | |

| Bank of America Corp | 1.0 | |

| Fannie Mae | 0.9 | |

| JPMorgan Chase & Co | 0.8 | |

| Morgan Stanley | 0.8 | |

| Federal Home Loan Bank | 0.7 | |

| HSBC Holdings PLC | 0.7 | |

| Goldman Sachs Group Inc/The | 0.6 | |

| Asian Development Bank | 0.6 | |

| International Bank for Reconstruction & Development | 0.5 | |

| | 71.9 | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9913653.100 3041-TSRA-1024 |

| |

| | ANNUAL SHAREHOLDER REPORT | AS OF AUGUST 31, 2024 | This report describes changes to the Fund that occurred during the reporting period. |

| | Fidelity® Sustainable Low Duration Bond Fund Fidelity Advisor® Sustainable Low Duration Bond Fund Class Z : FAPEX |

| | | |

This annual shareholder report contains information about Fidelity® Sustainable Low Duration Bond Fund for the period September 1, 2023 to August 31, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-877-208-0098 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last year?(based on hypothetical $10,000 investment)

FUND COST (PREVIOUS YEAR)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Class Z | $ 21 | 0.20% | |

What affected the Fund's performance this period?

•U.S. taxable investment-grade bonds posted a strong advance for the 12 months ending August 31, 2024, helped by a late-period gain, as the bond market reflected anticipated interest-rate reductions by the U.S. Federal Reserve, which are expected to start in September. The full 12-month period was marked by high volatility.

•Against this backdrop, the fund's strategy of holding short-term debt in high-quality corporations contributed to performance versus the all-U.S.-Treasury benchmark. Within corporates, debt holdings among financial institutions - especially banks - and industrial firms, particularly in the consumer cyclical and consumer non-cyclical segments, added notable value.

•Non-benchmark exposure to asset-backed securities, primarily car loan debt, also meaningfully contributed.

•There were no notable relative detractors among the fund's principal investment strategies.

•At period end, corporates made up about 60% of fund assets, down from roughly 67% a year ago. At the same time, we decreased exposure to U.S. Treasurys from about 27% to roughly 26% of assets, while increasing out-of-benchmark exposure to asset-backed securities from about 6% to roughly 11% of assets as of August 31.

Application of FMR's environmental, social, and governance (ESG) ratings process and/or its sustainable investing exclusion criteria may affect the fund's exposure to certain issuers, sectors, regions, and countries and may affect the fund's performance.

How did the Fund perform over the life of Fund?

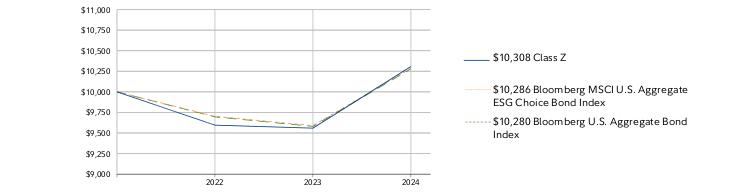

CUMULATIVE PERFORMANCE

April 13, 2022 through August 31, 2024.

Initial investment of $10,000.

Class Z | $10,000 | $10,003 | $10,411 |

Bloomberg US Treasury Bill: 6-9 Months Index | $10,000 | $9,990 | $10,301 |

Bloomberg U.S. Aggregate Bond Index | $10,000 | $9,696 | $9,581 |

| | 2022 | 2023 | 2024 |

AVERAGE ANNUAL TOTAL RETURNS: | | 1 Year | Life of Fund A |

| Class Z | 5.84% | 4.15% |

| Bloomberg US Treasury Bill: 6-9 Months Index | 5.37% | 3.49% |

| Bloomberg U.S. Aggregate Bond Index | 7.30% | 1.16% |

A From April 13, 2022

Visit institutional.fidelity.com for more recent performance information. |

The Fund's past performance is not a good predictor of the Fund's future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. |

Key Fund Statistics (as of August 31, 2024)

KEY FACTS | | |

| Fund Size | $29,475,941 | |

| Number of Holdings | 267 | |

| Total Advisory Fee | $53,128 | |

| Portfolio Turnover | 67% | |

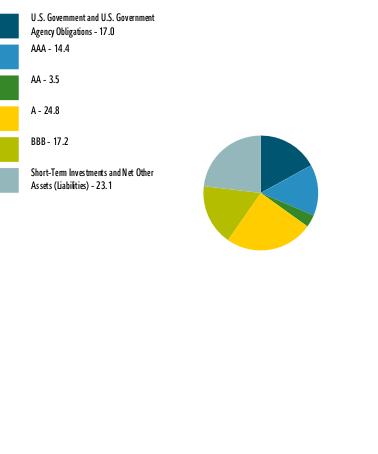

What did the Fund invest in?

(as of August 31, 2024)

| U.S. Government and U.S. Government Agency Obligations | 25.8 |

| AAA | 10.9 |

| AA | 1.7 |

| A | 26.7 |

| BBB | 30.6 |

| Short-Term Investments and Net Other Assets (Liabilities) | 4.3 |

QUALITY DIVERSIFICATION (% of Fund's net assets) |

|

| |

| We have used ratings from Moody's Investors Service, Inc. Where Moody's® ratings are not available, we have used S&P® ratings. All ratings are as of the date indicated and do not reflect subsequent changes. |

| Corporate Bonds | 58.1 |

| U.S. Treasury Obligations | 25.8 |

| Asset-Backed Securities | 10.6 |

| Other Investments | 0.9 |

| CMOs and Other Mortgage Related Securities | 0.3 |

| Short-Term Investments and Net Other Assets (Liabilities) | 4.3 |

ASSET ALLOCATION (% of Fund's net assets) |

|

|

| United States | 91.4 |

| Canada | 6.5 |

| Netherlands | 0.8 |

| China | 0.8 |

| Germany | 0.5 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

| |

|

TOP HOLDINGS (% of Fund's net assets) | | |

| US Treasury Bill | 25.8 | |

| General Motors Financial Co Inc | 2.0 | |

| Morgan Stanley | 1.9 | |

| Bank of America Corp | 1.9 | |

| Goldman Sachs Group Inc/The | 1.7 | |

| Equitable Financial Life Global Funding | 1.7 | |

| Capital One Financial Corp | 1.6 | |

| Wells Fargo & Co | 1.6 | |

| Hyundai Capital America | 1.6 | |

| JPMorgan Chase & Co | 1.3 | |

| | 41.1 | |

How has the Fund changed?

This is a summary of certain changes to the Fund since September 1, 2023. For more complete information, you may review the Fund's next prospectus, which we expect to be available by October 30, 2024 at fundresearch.fidelity.com/prospectus/sec or upon request at 1-877-208-0098 or by sending an e-mail to fidfunddocuments@fidelity.com.

The fees associated with this class changed during the reporting year. The variations in class fees are primarily the result of the following changes: - •Management fee

- •Operating expenses

| The fund modified its principal investment risks during the reporting period.

|

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9913690.100 6531-TSRA-1024 |

| |

| | ANNUAL SHAREHOLDER REPORT | AS OF AUGUST 31, 2024 | This report describes changes to the Fund that occurred during the reporting period. |

| | Fidelity® Sustainable Low Duration Bond Fund Fidelity® Sustainable Low Duration Bond Fund : FAPGX |

| | | |

This annual shareholder report contains information about Fidelity® Sustainable Low Duration Bond Fund for the period September 1, 2023 to August 31, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-800-544-8544 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last year?(based on hypothetical $10,000 investment)

FUND COST (PREVIOUS YEAR)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Fidelity® Sustainable Low Duration Bond Fund | $ 26 | 0.25% | |

What affected the Fund's performance this period?

•U.S. taxable investment-grade bonds posted a strong advance for the 12 months ending August 31, 2024, helped by a late-period gain, as the bond market reflected anticipated interest-rate reductions by the U.S. Federal Reserve, which are expected to start in September. The full 12-month period was marked by high volatility.

•Against this backdrop, the fund's strategy of holding short-term debt in high-quality corporations contributed to performance versus the all-U.S.-Treasury benchmark. Within corporates, debt holdings among financial institutions - especially banks - and industrial firms, particularly in the consumer cyclical and consumer non-cyclical segments, added notable value.

•Non-benchmark exposure to asset-backed securities, primarily car loan debt, also meaningfully contributed.

•There were no notable relative detractors among the fund's principal investment strategies.

•At period end, corporates made up about 60% of fund assets, down from roughly 67% a year ago. At the same time, we decreased exposure to U.S. Treasurys from about 27% to roughly 26% of assets, while increasing out-of-benchmark exposure to asset-backed securities from about 6% to roughly 11% of assets as of August 31.

Application of FMR's environmental, social, and governance (ESG) ratings process and/or its sustainable investing exclusion criteria may affect the fund's exposure to certain issuers, sectors, regions, and countries and may affect the fund's performance.

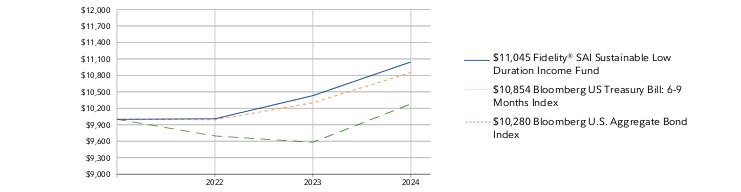

How did the Fund perform over the life of Fund?

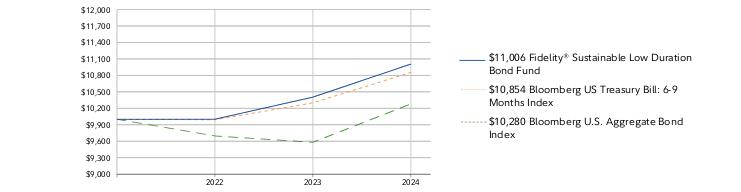

CUMULATIVE PERFORMANCE

April 13, 2022 through August 31, 2024.

Initial investment of $10,000.

Fidelity® Sustainable Low Duration Bond Fund | $10,000 | $10,001 | $10,404 |

Bloomberg US Treasury Bill: 6-9 Months Index | $10,000 | $9,990 | $10,301 |

Bloomberg U.S. Aggregate Bond Index | $10,000 | $9,696 | $9,581 |

| | 2022 | 2023 | 2024 |

AVERAGE ANNUAL TOTAL RETURNS: | | 1 Year | Life of Fund A |

| Fidelity® Sustainable Low Duration Bond Fund | 5.79% | 4.10% |

| Bloomberg US Treasury Bill: 6-9 Months Index | 5.37% | 3.49% |

| Bloomberg U.S. Aggregate Bond Index | 7.30% | 1.16% |

A From April 13, 2022

Visit www.fidelity.com for more recent performance information. |

The Fund's past performance is not a good predictor of the Fund's future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. |

Key Fund Statistics (as of August 31, 2024)

KEY FACTS | | |

| Fund Size | $29,475,941 | |

| Number of Holdings | 267 | |

| Total Advisory Fee | $53,128 | |

| Portfolio Turnover | 67% | |

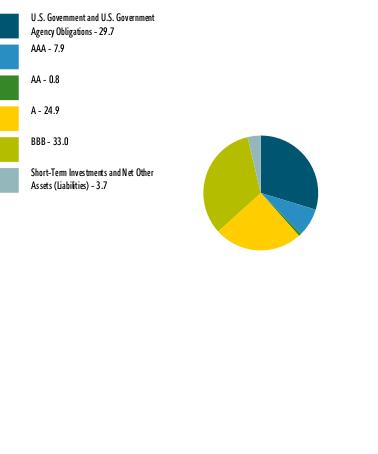

What did the Fund invest in?

(as of August 31, 2024)

| U.S. Government and U.S. Government Agency Obligations | 25.8 |

| AAA | 10.9 |

| AA | 1.7 |

| A | 26.7 |

| BBB | 30.6 |

| Short-Term Investments and Net Other Assets (Liabilities) | 4.3 |

QUALITY DIVERSIFICATION (% of Fund's net assets) |

|

| |

| We have used ratings from Moody's Investors Service, Inc. Where Moody's® ratings are not available, we have used S&P® ratings. All ratings are as of the date indicated and do not reflect subsequent changes. |

| Corporate Bonds | 58.1 |

| U.S. Treasury Obligations | 25.8 |

| Asset-Backed Securities | 10.6 |

| Other Investments | 0.9 |

| CMOs and Other Mortgage Related Securities | 0.3 |

| Short-Term Investments and Net Other Assets (Liabilities) | 4.3 |

ASSET ALLOCATION (% of Fund's net assets) |

|

|

| United States | 91.4 |

| Canada | 6.5 |

| Netherlands | 0.8 |

| China | 0.8 |

| Germany | 0.5 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

| |

|

TOP HOLDINGS (% of Fund's net assets) | | |

| US Treasury Bill | 25.8 | |

| General Motors Financial Co Inc | 2.0 | |

| Morgan Stanley | 1.9 | |

| Bank of America Corp | 1.9 | |

| Goldman Sachs Group Inc/The | 1.7 | |

| Equitable Financial Life Global Funding | 1.7 | |

| Capital One Financial Corp | 1.6 | |

| Wells Fargo & Co | 1.6 | |

| Hyundai Capital America | 1.6 | |

| JPMorgan Chase & Co | 1.3 | |

| | 41.1 | |

How has the Fund changed?

This is a summary of certain changes to the Fund since September 1, 2023. For more complete information, you may review the Fund's next prospectus, which we expect to be available by October 30, 2024 at fundresearch.fidelity.com/prospectus/sec or upon request at 1-800-544-8544 or by sending an e-mail to fidfunddocuments@fidelity.com.

The fees associated with this class changed during the reporting year. The variations in class fees are primarily the result of the following changes: - •Management fee

- •Operating expenses

| The fund modified its principal investment risks during the reporting period.

|

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9913685.100 6526-TSRA-1024 |

| |

| | ANNUAL SHAREHOLDER REPORT | AS OF AUGUST 31, 2024 | This report describes changes to the Fund that occurred during the reporting period. |

| | Fidelity® Sustainable Low Duration Bond Fund Fidelity Advisor® Sustainable Low Duration Bond Fund Class M : FAPBX |

| | | |

This annual shareholder report contains information about Fidelity® Sustainable Low Duration Bond Fund for the period September 1, 2023 to August 31, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-877-208-0098 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last year?(based on hypothetical $10,000 investment)

FUND COST (PREVIOUS YEAR)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Class M | $ 45 | 0.43% | |

What affected the Fund's performance this period?

•U.S. taxable investment-grade bonds posted a strong advance for the 12 months ending August 31, 2024, helped by a late-period gain, as the bond market reflected anticipated interest-rate reductions by the U.S. Federal Reserve, which are expected to start in September. The full 12-month period was marked by high volatility.

•Against this backdrop, the fund's strategy of holding short-term debt in high-quality corporations contributed to performance versus the all-U.S.-Treasury benchmark. Within corporates, debt holdings among financial institutions - especially banks - and industrial firms, particularly in the consumer cyclical and consumer non-cyclical segments, added notable value.

•Non-benchmark exposure to asset-backed securities, primarily car loan debt, also meaningfully contributed.

•There were no notable relative detractors among the fund's principal investment strategies.

•At period end, corporates made up about 60% of fund assets, down from roughly 67% a year ago. At the same time, we decreased exposure to U.S. Treasurys from about 27% to roughly 26% of assets, while increasing out-of-benchmark exposure to asset-backed securities from about 6% to roughly 11% of assets as of August 31.

Application of FMR's environmental, social, and governance (ESG) ratings process and/or its sustainable investing exclusion criteria may affect the fund's exposure to certain issuers, sectors, regions, and countries and may affect the fund's performance.

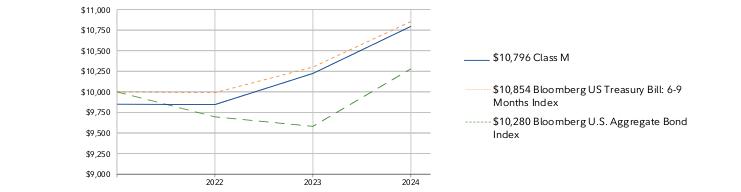

How did the Fund perform over the life of Fund?

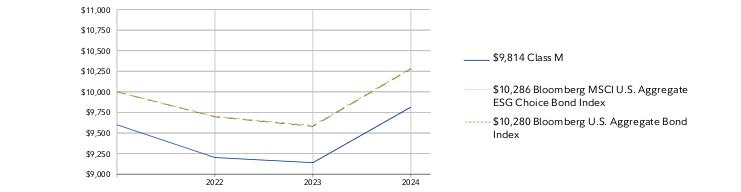

CUMULATIVE PERFORMANCE

April 13, 2022 through August 31, 2024.

Initial investment of $10,000 and the current sales charge was paid.

Class M | $9,850 | $9,845 | $10,224 |

Bloomberg US Treasury Bill: 6-9 Months Index | $10,000 | $9,990 | $10,301 |

Bloomberg U.S. Aggregate Bond Index | $10,000 | $9,696 | $9,581 |

| | 2022 | 2023 | 2024 |

AVERAGE ANNUAL TOTAL RETURNS: | | 1 Year | Life of Fund A |

| Class M (incl. 1.50% sales charge) | 4.01% | 3.26% |

| Class M (without 1.50% sales charge) | 5.60% | 3.92% |

| Bloomberg US Treasury Bill: 6-9 Months Index | 5.37% | 3.49% |

| Bloomberg U.S. Aggregate Bond Index | 7.30% | 1.16% |

A From April 13, 2022

Visit institutional.fidelity.com for more recent performance information. |

The Fund's past performance is not a good predictor of the Fund's future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. |

Key Fund Statistics (as of August 31, 2024)

KEY FACTS | | |

| Fund Size | $29,475,941 | |

| Number of Holdings | 267 | |

| Total Advisory Fee | $53,128 | |

| Portfolio Turnover | 67% | |

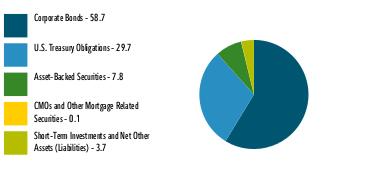

What did the Fund invest in?

(as of August 31, 2024)

| U.S. Government and U.S. Government Agency Obligations | 25.8 |

| AAA | 10.9 |

| AA | 1.7 |

| A | 26.7 |

| BBB | 30.6 |

| Short-Term Investments and Net Other Assets (Liabilities) | 4.3 |

QUALITY DIVERSIFICATION (% of Fund's net assets) |

|

| |

| We have used ratings from Moody's Investors Service, Inc. Where Moody's® ratings are not available, we have used S&P® ratings. All ratings are as of the date indicated and do not reflect subsequent changes. |

| Corporate Bonds | 58.1 |

| U.S. Treasury Obligations | 25.8 |

| Asset-Backed Securities | 10.6 |

| Other Investments | 0.9 |

| CMOs and Other Mortgage Related Securities | 0.3 |

| Short-Term Investments and Net Other Assets (Liabilities) | 4.3 |

ASSET ALLOCATION (% of Fund's net assets) |

|

|

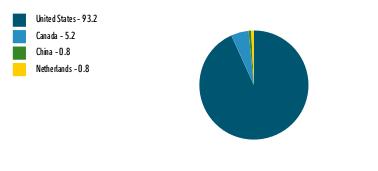

| United States | 91.4 |

| Canada | 6.5 |

| Netherlands | 0.8 |

| China | 0.8 |

| Germany | 0.5 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

| |

|

TOP HOLDINGS (% of Fund's net assets) | | |

| US Treasury Bill | 25.8 | |

| General Motors Financial Co Inc | 2.0 | |

| Morgan Stanley | 1.9 | |

| Bank of America Corp | 1.9 | |

| Goldman Sachs Group Inc/The | 1.7 | |

| Equitable Financial Life Global Funding | 1.7 | |

| Capital One Financial Corp | 1.6 | |

| Wells Fargo & Co | 1.6 | |

| Hyundai Capital America | 1.6 | |

| JPMorgan Chase & Co | 1.3 | |

| | 41.1 | |

How has the Fund changed?

This is a summary of certain changes to the Fund since September 1, 2023. For more complete information, you may review the Fund's next prospectus, which we expect to be available by October 30, 2024 at fundresearch.fidelity.com/prospectus/sec or upon request at 1-877-208-0098 or by sending an e-mail to fidfunddocuments@fidelity.com.

The fees associated with this class changed during the reporting year. The variations in class fees are primarily the result of the following changes: - •Management fee

- •Operating expenses

| The fund modified its principal investment risks during the reporting period.

|

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9913688.100 6529-TSRA-1024 |

| |

| | ANNUAL SHAREHOLDER REPORT | AS OF AUGUST 31, 2024 | This report describes changes to the Fund that occurred during the reporting period. |

| | Fidelity® Sustainable Low Duration Bond Fund Fidelity Advisor® Sustainable Low Duration Bond Fund Class C : FANDX |

| | | |

This annual shareholder report contains information about Fidelity® Sustainable Low Duration Bond Fund for the period September 1, 2023 to August 31, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-877-208-0098 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last year?(based on hypothetical $10,000 investment)

FUND COST (PREVIOUS YEAR)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Class C | $ 131 | 1.28% | |

What affected the Fund's performance this period?

•U.S. taxable investment-grade bonds posted a strong advance for the 12 months ending August 31, 2024, helped by a late-period gain, as the bond market reflected anticipated interest-rate reductions by the U.S. Federal Reserve, which are expected to start in September. The full 12-month period was marked by high volatility.

•Against this backdrop, the fund's strategy of holding short-term debt in high-quality corporations contributed to performance versus the all-U.S.-Treasury benchmark. Within corporates, debt holdings among financial institutions - especially banks - and industrial firms, particularly in the consumer cyclical and consumer non-cyclical segments, added notable value.

•Non-benchmark exposure to asset-backed securities, primarily car loan debt, also meaningfully contributed.

•There were no notable relative detractors among the fund's principal investment strategies.

•At period end, corporates made up about 60% of fund assets, down from roughly 67% a year ago. At the same time, we decreased exposure to U.S. Treasurys from about 27% to roughly 26% of assets, while increasing out-of-benchmark exposure to asset-backed securities from about 6% to roughly 11% of assets as of August 31.

Application of FMR's environmental, social, and governance (ESG) ratings process and/or its sustainable investing exclusion criteria may affect the fund's exposure to certain issuers, sectors, regions, and countries and may affect the fund's performance.

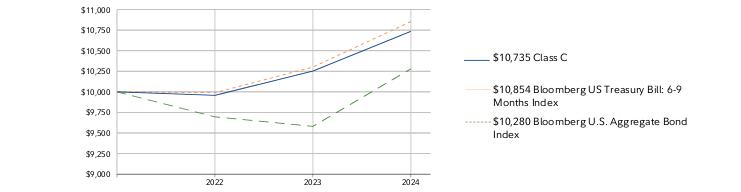

How did the Fund perform over the life of Fund?

CUMULATIVE PERFORMANCE

April 13, 2022 through August 31, 2024.

Initial investment of $10,000.

Class C | $10,000 | $9,957 | $10,253 |

Bloomberg US Treasury Bill: 6-9 Months Index | $10,000 | $9,990 | $10,301 |

Bloomberg U.S. Aggregate Bond Index | $10,000 | $9,696 | $9,581 |

| | 2022 | 2023 | 2024 |

AVERAGE ANNUAL TOTAL RETURNS: | | 1 Year | Life of Fund A |

| Class C (incl. contingent deferred sales charge) | 3.71% | 3.02% |

| Class C | 4.71% | 3.02% |

| Bloomberg US Treasury Bill: 6-9 Months Index | 5.37% | 3.49% |

| Bloomberg U.S. Aggregate Bond Index | 7.30% | 1.16% |

A From April 13, 2022

Visit institutional.fidelity.com for more recent performance information. |

The Fund's past performance is not a good predictor of the Fund's future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. |

Key Fund Statistics (as of August 31, 2024)

KEY FACTS | | |

| Fund Size | $29,475,941 | |

| Number of Holdings | 267 | |

| Total Advisory Fee | $53,128 | |

| Portfolio Turnover | 67% | |

What did the Fund invest in?

(as of August 31, 2024)

| U.S. Government and U.S. Government Agency Obligations | 25.8 |

| AAA | 10.9 |

| AA | 1.7 |

| A | 26.7 |

| BBB | 30.6 |

| Short-Term Investments and Net Other Assets (Liabilities) | 4.3 |

QUALITY DIVERSIFICATION (% of Fund's net assets) |

|

| |

| We have used ratings from Moody's Investors Service, Inc. Where Moody's® ratings are not available, we have used S&P® ratings. All ratings are as of the date indicated and do not reflect subsequent changes. |

| Corporate Bonds | 58.1 |

| U.S. Treasury Obligations | 25.8 |

| Asset-Backed Securities | 10.6 |

| Other Investments | 0.9 |

| CMOs and Other Mortgage Related Securities | 0.3 |

| Short-Term Investments and Net Other Assets (Liabilities) | 4.3 |

ASSET ALLOCATION (% of Fund's net assets) |

|

|

| United States | 91.4 |

| Canada | 6.5 |

| Netherlands | 0.8 |

| China | 0.8 |

| Germany | 0.5 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

| |

|

TOP HOLDINGS (% of Fund's net assets) | | |

| US Treasury Bill | 25.8 | |

| General Motors Financial Co Inc | 2.0 | |

| Morgan Stanley | 1.9 | |

| Bank of America Corp | 1.9 | |

| Goldman Sachs Group Inc/The | 1.7 | |

| Equitable Financial Life Global Funding | 1.7 | |

| Capital One Financial Corp | 1.6 | |

| Wells Fargo & Co | 1.6 | |

| Hyundai Capital America | 1.6 | |

| JPMorgan Chase & Co | 1.3 | |

| | 41.1 | |

How has the Fund changed?

This is a summary of certain changes to the Fund since September 1, 2023. For more complete information, you may review the Fund's next prospectus, which we expect to be available by October 30, 2024 at fundresearch.fidelity.com/prospectus/sec or upon request at 1-877-208-0098 or by sending an e-mail to fidfunddocuments@fidelity.com.

The fees associated with this class changed during the reporting year. The variations in class fees are primarily the result of the following changes: - •Management fee

- •Operating expenses

| The fund modified its principal investment risks during the reporting period.

|

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9913687.100 6528-TSRA-1024 |

| |

| | ANNUAL SHAREHOLDER REPORT | AS OF AUGUST 31, 2024 | |

| | Fidelity® Sustainability Bond Index Fund Fidelity® Sustainability Bond Index Fund : FNDSX |

| | | |

This annual shareholder report contains information about Fidelity® Sustainability Bond Index Fund for the period September 1, 2023 to August 31, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-800-544-8544 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last year?(based on hypothetical $10,000 investment)

FUND COST (PREVIOUS YEAR)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Fidelity® Sustainability Bond Index Fund | $ 11 | 0.10% | |

What affected the Fund's performance this period?

•U.S. taxable investment-grade bonds posted a strong advance for the 12 months ending August 31, 2024, helped by late-period gains as the bond market priced in anticipated interest-rate reductions by the U.S. Federal Reserve, which are expected to start in September. The full 12-month period was marked by high levels of volatility.

•Given the large number of securities in the index (roughly 11,000) and the significant costs associated with full replication of the index, we construct the portfolio using optimization. This approach minimizes the differences between risk exposures of the fund relative to the index.

•Exposures include duration, key rate durations, credit quality, sector and issuer allocation, and other factors.

Application of FMR's environmental, social, and governance (ESG) ratings process and/or its sustainable investing exclusion criteria may affect the fund's exposure to certain issuers, sectors, regions, and countries and may affect the fund's performance.

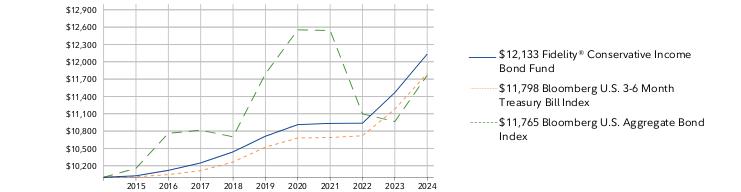

How did the Fund perform over the life of Fund?

CUMULATIVE PERFORMANCE

June 19, 2018 through August 31, 2024.

Initial investment of $10,000.

Fidelity® Sustainability Bond Index Fund | $10,000 | $10,076 | $11,088 | $11,813 | $11,746 | $10,407 | $10,280 |

Bloomberg MSCI U.S. Aggregate ESG Choice Bond Index | $10,000 | $10,090 | $11,103 | $11,834 | $11,805 | $10,466 | $10,344 |

Bloomberg U.S. Aggregate Bond Index | $10,000 | $10,091 | $11,117 | $11,837 | $11,827 | $10,465 | $10,340 |

| | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 |

AVERAGE ANNUAL TOTAL RETURNS: | | 1 Year | 5 Year | Life of Fund A |

| Fidelity® Sustainability Bond Index Fund | 7.06% | -0.15% | 1.56% |

| Bloomberg MSCI U.S. Aggregate ESG Choice Bond Index | 7.26% | -0.01% | 1.69% |

| Bloomberg U.S. Aggregate Bond Index | 7.30% | -0.04% | 1.69% |

A From June 19, 2018

Visit www.fidelity.com for more recent performance information. |

The Fund's past performance is not a good predictor of the Fund's future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. |

Key Fund Statistics (as of August 31, 2024)

KEY FACTS | | |

| Fund Size | $458,215,582 | |

| Number of Holdings | 2,505 | |

| Total Advisory Fee | $379,383 | |

| Portfolio Turnover | 55% | |

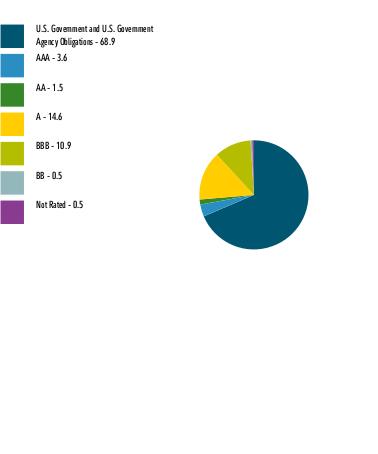

What did the Fund invest in?

(as of August 31, 2024)

| U.S. Government and U.S. Government Agency Obligations | 68.9 |

| AAA | 3.6 |

| AA | 1.5 |

| A | 14.6 |

| BBB | 10.9 |

| BB | 0.5 |

| Not Rated | 0.5 |

QUALITY DIVERSIFICATION (% of Fund's net assets) |

|

| Short-Term Investments and Net Other Assets (Liabilities) - (0.5)% |

| |

| We have used ratings from Moody's Investors Service, Inc. Where Moody's® ratings are not available, we have used S&P® ratings. All ratings are as of the date indicated and do not reflect subsequent changes. |

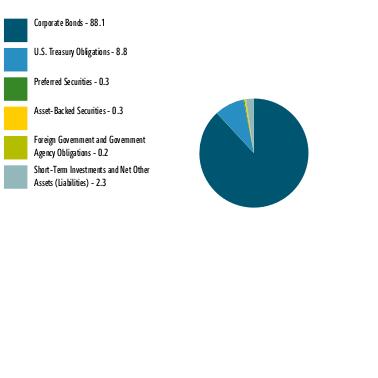

| U.S. Treasury Obligations | 42.7 |

| Corporate Bonds | 23.7 |

| U.S. Government Agency - Mortgage Securities | 25.3 |

| Foreign Government and Government Agency Obligations | 5.1 |

| Supranational Obligations | 1.4 |

| CMOs and Other Mortgage Related Securities | 1.2 |

| U.S. Government Agency Obligations | 0.9 |

| Asset-Backed Securities | 0.2 |

| Other Investments | 0.0 |

ASSET ALLOCATION (% of Fund's net assets) |

|

| Short-Term Investments and Net Other Assets (Liabilities) - (0.5)% |

|

| United States | 92.0 |

| Multi-national | 1.5 |

| United Kingdom | 1.4 |

| Canada | 1.1 |

| Japan | 0.9 |

| Mexico | 0.3 |

| Spain | 0.3 |

| Germany | 0.3 |

| Panama | 0.3 |

| Others | 1.9 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

| |

|

TOP HOLDINGS (% of Fund's net assets) | | |

| US Treasury Notes | 33.1 | |

| Fannie Mae Mortgage pass-thru certificates | 9.8 | |

| US Treasury Bonds | 9.6 | |

| Freddie Mac Gold Pool | 8.1 | |

| Ginnie Mae II Pool | 4.6 | |

| Uniform Mortgage Backed Securities | 1.6 | |

| Ginnie Mae I Pool | 1.2 | |

| JPMorgan Chase & Co | 0.9 | |

| Bank of America Corp | 0.8 | |

| Freddie Mac Multiclass Mortgage participation certificates | 0.7 | |

| | 70.4 | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9913654.100 3086-TSRA-1024 |

| |

| | ANNUAL SHAREHOLDER REPORT | AS OF AUGUST 31, 2024 | |

| | Fidelity® Series Corporate Bond Fund Fidelity® Series Corporate Bond Fund : FHMFX |

| | | |

This annual shareholder report contains information about Fidelity® Series Corporate Bond Fund for the period September 1, 2023 to August 31, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-800-544-8544.

What were your Fund costs for the last year?(based on hypothetical $10,000 investment)

FUND COST (PREVIOUS YEAR)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Fidelity® Series Corporate Bond Fund | $ 0 A | 0.00%B | |

A Amount represents less than $.50

B Amount represents less than 0.005%

What affected the Fund's performance this period?

•U.S. taxable investment-grade bonds posted a strong advance for the 12 months ending August 31, 2024, helped by a late-period gain, as the bond market reflected anticipated interest-rate reductions by the U.S. Federal Reserve, which are expected to start in September. The full 12-month period was marked by high volatility.