0000035315fmr:C000234189Memberfmr:AAMunicipalSecuritiesMember2024-08-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-02105

Fidelity Salem Street Trust

(Exact name of registrant as specified in charter)

245 Summer St., Boston, Massachusetts 02210

(Address of principal executive offices) (Zip code)

Nicole Macarchuk, Secretary

245 Summer St.

Boston, Massachusetts 02210

(Name and address of agent for service)

Registrant's telephone number, including area code:

617-563-7000

| |

Date of fiscal year end: | August 31 |

|

|

Date of reporting period: | August 31, 2024 |

This report on Form N-CSR relates solely to the Registrant’s Fidelity Flex Conservative Income Bond Fund, Fidelity Intermediate Bond Fund, Fidelity Investment Grade Bond Fund, Fidelity SAI Low Duration Income Fund, Fidelity SAI Short-Term Bond Fund, Fidelity SAI Sustainable Core Plus Bond Fund, Fidelity SAI Total Bond Fund, Fidelity Short-Term Bond Fund, and Fidelity Tactical Bond Fund (the “Funds”).

Item 1.

Reports to Stockholders

| |

| | ANNUAL SHAREHOLDER REPORT | AS OF AUGUST 31, 2024 | This report describes changes to the Fund that occurred during the reporting period. |

| | Fidelity Flex® Conservative Income Bond Fund Fidelity Flex® Conservative Income Bond Fund : FJTDX |

| | | |

This annual shareholder report contains information about Fidelity Flex® Conservative Income Bond Fund for the period September 1, 2023 to August 31, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-800-544-3455 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last year?(based on hypothetical $10,000 investment)

FUND COST (PREVIOUS YEAR)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Fidelity Flex® Conservative Income Bond Fund | $ 0 A | 0.00%B | |

A Amount represents less than $.50

B Amount represents less than 0.005%

What affected the Fund's performance this period?

•U.S. taxable investment-grade bonds posted a strong advance for the 12 months ending August 31, 2024, helped by a late-period gain, as the bond market reflected anticipated interest-rate reductions by the U.S. Federal Reserve, which are expected to start in September. The full 12-month period was marked by high volatility.

•Against this backdrop, the fund's strategy of holding short-term debt in high-quality corporations contributed to performance versus the all-U.S.-Treasury benchmark. Within corporates, debt holdings among financial institutions - especially banks - and industrial firms, particularly in the consumer cyclical and consumer non-cyclical segments, added notable value.

•Non-benchmark exposure to asset-backed securities, including car loan debt and credit card receivables, also meaningfully contributed.

•In contrast, a higher-than-usual allocation to interest-earning cash - which we maintained as tight credit spreads and less-attractive valuations led us to reinvest fewer maturing securities back into risk assets - was a modest drag on relative performance.

•At period end, corporates made up about 54% of fund assets, down notably from roughly 71% a year ago. At the same time, we increased exposure to U.S. Treasurys from 12% to roughly 17% of assets, while establishing a new, out-of-benchmark position in asset-backed securities, which stood at approximately 14% as of August 31. The fund's cash position ticked down from about 16% to 15% this period.

How did the Fund perform over the life of Fund?

CUMULATIVE PERFORMANCE

May 31, 2018 through August 31, 2024.

Initial investment of $10,000.

Fidelity Flex® Conservative Income Bond Fund | $10,000 | $10,066 | $10,348 | $10,565 | $10,614 | $10,637 | $11,153 |

Bloomberg U.S. 3-6 Month Treasury Bill Index | $10,000 | $10,050 | $10,302 | $10,457 | $10,466 | $10,495 | $10,945 |

Bloomberg U.S. Aggregate Bond Index | $10,000 | $10,054 | $11,077 | $11,794 | $11,784 | $10,427 | $10,303 |

| | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 |

AVERAGE ANNUAL TOTAL RETURNS: | | 1 Year | 5 Year | Life of Fund A |

| Fidelity Flex® Conservative Income Bond Fund | 6.11% | 2.72% | 2.73% |

| Bloomberg U.S. 3-6 Month Treasury Bill Index | 5.55% | 2.32% | 2.34% |

| Bloomberg U.S. Aggregate Bond Index | 7.30% | -0.04% | 1.62% |

A From May 31, 2018

Visit www.401k.com for more recent performance information. |

The Fund's past performance is not a good predictor of the Fund's future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. |

Key Fund Statistics (as of August 31, 2024)

KEY FACTS | | |

| Fund Size | $447,221,578 | |

| Number of Holdings | 313 | |

| Total Advisory Fee | $0 | |

| Portfolio Turnover | 72% | |

What did the Fund invest in?

(as of August 31, 2024)

| U.S. Government and U.S. Government Agency Obligations | 16.5 |

| AAA | 14.1 |

| AA | 2.5 |

| A | 24.8 |

| BBB | 19.4 |

| Short-Term Investments and Net Other Assets (Liabilities) | 22.7 |

QUALITY DIVERSIFICATION (% of Fund's net assets) |

|

| |

| We have used ratings from Moody's Investors Service, Inc. Where Moody's® ratings are not available, we have used S&P® ratings. All ratings are as of the date indicated and do not reflect subsequent changes. |

| Corporate Bonds | 46.6 |

| U.S. Treasury Obligations | 16.5 |

| Asset-Backed Securities | 14.1 |

| Other Investments | 0.1 |

| Short-Term Investments and Net Other Assets (Liabilities) | 22.7 |

ASSET ALLOCATION (% of Fund's net assets) |

|

|

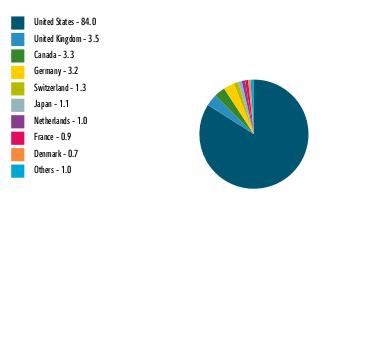

| United States | 84.0 |

| United Kingdom | 3.5 |

| Canada | 3.3 |

| Germany | 3.2 |

| Switzerland | 1.3 |

| Japan | 1.1 |

| Netherlands | 1.0 |

| France | 0.9 |

| Denmark | 0.7 |

| Others | 1.0 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

| |

|

TOP HOLDINGS (% of Fund's net assets) | | |

| US Treasury Bill | 11.6 | |

| US Treasury Notes | 4.9 | |

| Royal Bank of Canada | 1.5 | |

| Bank of America Corp | 1.3 | |

| Volkswagen Group of America Finance LLC | 1.3 | |

| Goldman Sachs Group Inc/The | 1.3 | |

| General Motors Financial Co Inc | 1.1 | |

| Morgan Stanley | 1.0 | |

| JPMorgan Chase & Co | 1.0 | |

| Barclays PLC | 1.0 | |

| | 26.0 | |

How has the Fund changed?

This is a summary of certain changes to the Fund since September 1, 2023. For more complete information, you may review the Fund's next prospectus, which we expect to be available by October 30, 2024 at fundresearch.fidelity.com/prospectus/sec or upon request at 1-800-544-3455 or by sending an e-mail to fidfunddocuments@fidelity.com.

The fund added a contractual proxy and shareholder meeting expense cap during the reporting period. | The fund's principal investment strategies were modified during the reporting period, as described in the prospectus.

|

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9913655.100 3087-TSRA-1024 |

| |

| | ANNUAL SHAREHOLDER REPORT | AS OF AUGUST 31, 2024 | This report describes changes to the Fund that occurred during the reporting period. |

| | Fidelity® Tactical Bond Fund Fidelity Advisor® Tactical Bond Fund Class M : FTYMX |

| | | |

This annual shareholder report contains information about Fidelity® Tactical Bond Fund for the period September 1, 2023 to August 31, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-877-208-0098 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last year?(based on hypothetical $10,000 investment)

FUND COST (PREVIOUS YEAR)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Class M | $ 98 | 0.95% | |

What affected the Fund's performance this period?

•U.S. taxable investment-grade bonds posted a strong advance for the 12 months ending August 31, 2024, helped by a late-period gain, as the bond market reflected anticipated interest-rate reductions by the U.S. Federal Reserve, which are expected to start in September. The full 12-month period was marked by high volatility.

•Against this backdrop, relative to the benchmark Bloomberg U.S. Aggregate Bond Index, the fund benefited from favorable duration positioning, as the fund was more interest-rate sensitive than the index in a period of often-falling rates.

•Yield curve positioning, however, detracted a bit as the curve steepened.

•The fund also benefited from being overweight credit risk via high-yield corporate debt and leveraged loans, which added value as credit spreads approached all-time tight levels.

•Other notable contributors included the fund's allocation to securitized products, including outperforming stakes in commercial mortgage-backed securities and asset-backed securities

•Notable changes in positioning include reduced exposure to corporate bonds and increased exposure to U.S. Treasury debt.

How did the Fund perform over the life of Fund?

CUMULATIVE PERFORMANCE

February 10, 2022 through August 31, 2024.

Initial investment of $10,000 and the current sales charge was paid.

Class M | $9,600 | $8,887 | $8,910 |

Bloomberg U.S. Aggregate Bond Index | $10,000 | $9,301 | $9,190 |

| | 2022 | 2023 | 2024 |

AVERAGE ANNUAL TOTAL RETURNS: | | 1 Year | Life of Fund A |

| Class M (incl. 4.00% sales charge) | 3.29% | -1.64% |

| Class M (without 4.00% sales charge) | 7.60% | -0.06% |

| Bloomberg U.S. Aggregate Bond Index | 7.30% | -0.55% |

A From February 10, 2022

Visit institutional.fidelity.com for more recent performance information. |

The Fund's past performance is not a good predictor of the Fund's future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. |

Key Fund Statistics (as of August 31, 2024)

KEY FACTS | | |

| Fund Size | $56,713,648 | |

| Number of Holdings | 95 | |

| Total Advisory Fee | $295,549 | |

| Portfolio Turnover | 32% | |

What did the Fund invest in?

(as of August 31, 2024)

| U.S. Government and U.S. Government Agency Obligations | 57.1 |

| AAA | 0.6 |

| AA | 0.5 |

| A | 3.3 |

| BBB | 11.6 |

| BB | 9.5 |

| B | 8.6 |

| CCC,CC,C | 1.6 |

| D | 0.1 |

| Not Rated | 3.1 |

| Equities | 0.7 |

| Short-Term Investments and Net Other Assets (Liabilities) | 3.3 |

QUALITY DIVERSIFICATION (% of Fund's net assets) |

|

| |

| We have used ratings from Moody's Investors Service, Inc. Where Moody's® ratings are not available, we have used S&P® ratings. All ratings are as of the date indicated and do not reflect subsequent changes. |

| U.S. Treasury Obligations | 57.1 |

| Corporate Bonds | 16.1 |

| Bank Loan Obligations | 9.0 |

| Foreign Government and Government Agency Obligations | 4.8 |

| Asset-Backed Securities | 4.5 |

| Preferred Securities | 2.3 |

| CMOs and Other Mortgage Related Securities | 1.5 |

| Municipal Securities | 0.7 |

| Common Stocks | 0.4 |

| Alternative Funds | 0.3 |

| Short-Term Investments and Net Other Assets (Liabilities) | 3.3 |

ASSET ALLOCATION (% of Fund's net assets) |

|

|

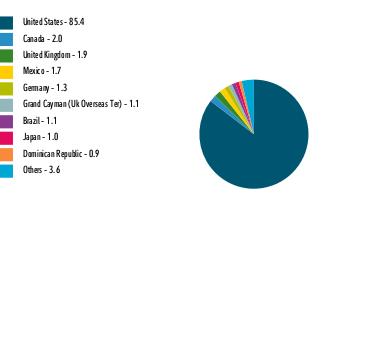

| United States | 85.4 |

| Canada | 2.0 |

| United Kingdom | 1.9 |

| Mexico | 1.7 |

| Germany | 1.3 |

| Grand Cayman (Uk Overseas Ter) | 1.1 |

| Brazil | 1.1 |

| Japan | 1.0 |

| Dominican Republic | 0.9 |

| Others | 3.6 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

| |

|

TOP HOLDINGS (% of Fund's net assets) | | |

| US Treasury Notes | 44.7 | |

| US Treasury Bonds | 12.4 | |

| Domino's Pizza Master Issuer LLC | 1.5 | |

| Bank of Nova Scotia/The | 1.2 | |

| Japan Government | 1.0 | |

| Petroleos Mexicanos | 0.9 | |

| Dominican Republic | 0.9 | |

| Kinder Morgan Inc | 0.9 | |

| DPL Inc | 0.8 | |

| Planet Fitness Master Issuer LLC | 0.8 | |

| | 65.1 | |

How has the Fund changed?

This is a summary of certain changes to the Fund since September 1, 2023. For more complete information, you may review the Fund's next prospectus, which we expect to be available by October 30, 2024 at fundresearch.fidelity.com/prospectus/sec or upon request at 1-877-208-0098 or by sending an e-mail to fidfunddocuments@fidelity.com.

The fund's transfer agent and pricing & bookkeeping fees were changed to a fixed rate effective December 1, 2023, through February 29, 2024, in anticipation of the transition to a new management fee structure. Effective March 1, 2024, the fund's management contract was amended to incorporate administrative services previously covered under separate services agreements (transfer agent and pricing & bookkeeping). The amended contract incorporates a management fee rate that may vary by class. The Adviser or an affiliate pays certain expenses of managing and operating the fund out of each class's management fee. | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9913680.100 6505-TSRA-1024 |

| |

| | ANNUAL SHAREHOLDER REPORT | AS OF AUGUST 31, 2024 | This report describes changes to the Fund that occurred during the reporting period. |

| | Fidelity® Investment Grade Bond Fund Fidelity Advisor® Investment Grade Bond Fund Class M : FGBTX |

| | | |

This annual shareholder report contains information about Fidelity® Investment Grade Bond Fund for the period September 1, 2023 to August 31, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-877-208-0098 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last year?(based on hypothetical $10,000 investment)

FUND COST (PREVIOUS YEAR)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Class M | $ 78 | 0.75% | |

What affected the Fund's performance this period?

•U.S. taxable investment-grade bonds posted a strong advance for the 12 months ending August 31, 2024, helped by a late-period gain, as the bond market reflected anticipated interest-rate reductions by the U.S. Federal Reserve, which are expected to start in September. The full 12-month period was marked by high volatility.

•Against this backdrop, relative to the benchmark Bloomberg U.S. Aggregate Bond Index, the fund benefited from favorable duration positioning, as the fund was more interest-rate sensitive than the index in a period of often-falling rates.

•The fund also benefited from being overweight credit risk, which added value as credit spreads approached historically tight levels.

•Other notable contributors included the fund's allocations to securitized products, including outperforming stakes in commercial mortgage-backed securities, asset-backed securities and collateralized loan obligations.

•An overweight in investment-grade corporate bonds, especially those of bank issuers, also added value, although our positioning among industrial and utility bonds were modestly offsetting detractors.

•Notable changes in positioning include reduced exposure to investment-grade corporate bonds, increased exposure to U.S. Treasury debt, and purchases of mortgage bonds during periods of wider credit spreads.

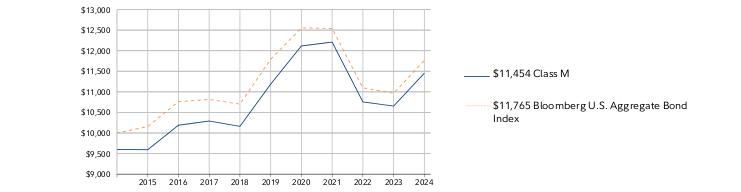

How did the Fund perform over the past 10 years?

CUMULATIVE PERFORMANCE

August 31, 2014 through August 31, 2024.

Initial investment of $10,000 and the current sales charge was paid.

Class M | $9,600 | $9,593 | $10,189 | $10,291 | $10,161 | $11,187 | $12,115 | $12,210 | $10,756 | $10,654 | $11,454 |

Bloomberg U.S. Aggregate Bond Index | $10,000 | $10,156 | $10,761 | $10,814 | $10,701 | $11,789 | $12,553 | $12,542 | $11,098 | $10,965 | $11,765 |

| | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 |

AVERAGE ANNUAL TOTAL RETURNS: | | 1 Year | 5 Year | 10 Year |

| Class M (incl. 4.00% sales charge) | 3.21% | -0.34% | 1.37% |

| Class M (without 4.00% sales charge) | 7.51% | 0.47% | 1.78% |

| Bloomberg U.S. Aggregate Bond Index | 7.30% | -0.04% | 1.64% |

Visit institutional.fidelity.com for more recent performance information. |

The Fund's past performance is not a good predictor of the Fund's future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. |

Key Fund Statistics (as of August 31, 2024)

KEY FACTS | | |

| Fund Size | $10,877,326,398 | |

| Number of Holdings | 3,997 | |

| Total Advisory Fee | $26,423,417 | |

| Portfolio Turnover | 232% | |

What did the Fund invest in?

(as of August 31, 2024)

| U.S. Government and U.S. Government Agency Obligations | 61.9 |

| AAA | 7.6 |

| AA | 0.6 |

| A | 6.0 |

| BBB | 16.7 |

| BB | 3.3 |

| B | 0.9 |

| CCC,CC,C | 0.0 |

| Not Rated | 3.7 |

QUALITY DIVERSIFICATION (% of Fund's net assets) |

|

| Short-Term Investments and Net Other Assets (Liabilities) - (0.7)% |

| |

| We have used ratings from Moody's Investors Service, Inc. Where Moody's® ratings are not available, we have used S&P® ratings. All ratings are as of the date indicated and do not reflect subsequent changes. |

| U.S. Treasury Obligations | 51.8 |

| Corporate Bonds | 24.5 |

| U.S. Government Agency - Mortgage Securities | 10.1 |

| Asset-Backed Securities | 7.1 |

| CMOs and Other Mortgage Related Securities | 6.8 |

| Preferred Securities | 0.2 |

| Foreign Government and Government Agency Obligations | 0.1 |

| Other Investments | 0.1 |

| Municipal Securities | 0.0 |

| Bank Loan Obligations | 0.0 |

ASSET ALLOCATION (% of Fund's net assets) |

|

| Short-Term Investments and Net Other Assets (Liabilities) - (0.7)% |

|

| United States | 90.5 |

| Grand Cayman (UK Overseas Ter) | 4.2 |

| Germany | 1.1 |

| Mexico | 0.7 |

| United Kingdom | 0.7 |

| Ireland | 0.5 |

| Switzerland | 0.5 |

| Bailiwick Of Jersey | 0.4 |

| Italy | 0.3 |

| Others | 1.1 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

| |

|

TOP HOLDINGS (% of Fund's net assets) | | |

| US Treasury Notes | 43.0 | |

| US Treasury Bonds | 8.8 | |

| Uniform Mortgage Backed Securities | 3.4 | |

| Fannie Mae Mortgage pass-thru certificates | 3.2 | |

| Freddie Mac Gold Pool | 1.7 | |

| Ginnie Mae II Pool | 1.6 | |

| Citigroup Inc | 1.5 | |

| Bank of America Corp | 1.2 | |

| Charter Communications Operating LLC / Charter Communications Operating Capital | 1.0 | |

| Bayer US Finance II LLC | 0.9 | |

| | 66.3 | |

How has the Fund changed?

This is a summary of certain changes to the Fund since September 1, 2023. For more complete information, you may review the Fund's next prospectus, which we expect to be available by October 30, 2024 at fundresearch.fidelity.com/prospectus/sec or upon request at 1-877-208-0098 or by sending an e-mail to fidfunddocuments@fidelity.com.

The fund's contractual management fee was reduced during the reporting period. | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9913587.100 1125-TSRA-1024 |

| |

| | ANNUAL SHAREHOLDER REPORT | AS OF AUGUST 31, 2024 | This report describes changes to the Fund that occurred during the reporting period. |

| | Fidelity® Short-Term Bond Fund Fidelity Advisor® Short-Term Bond Fund Class M : FBNTX |

| | | |

This annual shareholder report contains information about Fidelity® Short-Term Bond Fund for the period September 1, 2023 to August 31, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-877-208-0098 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last year?(based on hypothetical $10,000 investment)

FUND COST (PREVIOUS YEAR)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Class M | $ 53 | 0.51% | |

What affected the Fund's performance this period?

•U.S. taxable investment-grade bonds posted a strong advance for the 12 months ending August 31, 2024, helped by a late-period gain, as the bond market reflected anticipated interest-rate reductions by the U.S. Federal Reserve, which are expected to start in September. The full 12-month period was marked by high volatility.

•Against this backdrop, the fund's strategy of favoring short-term corporate bonds, while underweighting similar-duration U.S. Treasurys, contributed to its performance versus the benchmark. Within corporates, debt holdings among financial institutions - especially banks - and industrial firms, particularly in the consumer cyclical and consumer non-cyclical segments, added notable value.

•Non-benchmark exposure to asset-backed securities, including car loan debt and collateralized loan obligations, also meaningfully contributed. An out-of-benchmark allocation to commercial mortgage-backed securities helped as well.

•In contrast, the fund's yield-curve positioning detracted from relative performance. Specifically, underweighting one- and two- year bonds in favor of three- and five-year maturities hurt.

•At period end, corporates made up about 46% of fund assets, down from roughly 49% a year ago but still notably overweight versus the benchmark average of 25%. Exposure to U.S. Treasurys stood at 26% as of August 31, compared with an average of 67% for the benchmark.

How did the Fund perform over the life of Fund?

CUMULATIVE PERFORMANCE

July 12, 2016 through August 31, 2024.

Initial investment of $10,000 and the current sales charge was paid.

Class M | $9,850 | $9,859 | $9,939 | $9,950 | $10,360 | $10,745 | $10,765 | $10,293 | $10,508 |

Bloomberg U.S. 1-3 Year Government/Credit Bond Index | $10,000 | $10,001 | $10,091 | $10,107 | $10,573 | $10,961 | $11,004 | $10,566 | $10,731 |

Bloomberg U.S. Aggregate Bond Index | $10,000 | $10,020 | $10,069 | $9,963 | $10,977 | $11,687 | $11,678 | $10,333 | $10,209 |

| | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 |

AVERAGE ANNUAL TOTAL RETURNS: | | 1 Year | 5 Year | Life of Fund A |

| Class M (incl. 1.50% sales charge) | 4.91% | 1.25% | 1.39% |

| Class M (without 1.50% sales charge) | 6.51% | 1.56% | 1.58% |

| Bloomberg U.S. 1-3 Year Government/Credit Bond Index | 6.25% | 1.52% | 1.62% |

| Bloomberg U.S. Aggregate Bond Index | 7.30% | -0.04% | 1.13% |

A From July 12, 2016

Visit institutional.fidelity.com for more recent performance information. |

The Fund's past performance is not a good predictor of the Fund's future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. |

Key Fund Statistics (as of August 31, 2024)

KEY FACTS | | |

| Fund Size | $2,346,008,597 | |

| Number of Holdings | 491 | |

| Total Advisory Fee | $4,742,667 | |

| Portfolio Turnover | 68% | |

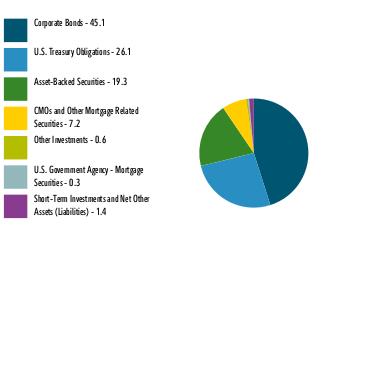

What did the Fund invest in?

(as of August 31, 2024)

| U.S. Government and U.S. Government Agency Obligations | 26.4 |

| AAA | 22.3 |

| AA | 2.9 |

| A | 21.6 |

| BBB | 20.4 |

| BB | 1.3 |

| B | 0.3 |

| Not Rated | 3.4 |

| Short-Term Investments and Net Other Assets (Liabilities) | 1.4 |

QUALITY DIVERSIFICATION (% of Fund's net assets) |

|

| |

| We have used ratings from Moody's Investors Service, Inc. Where Moody's® ratings are not available, we have used S&P® ratings. All ratings are as of the date indicated and do not reflect subsequent changes. |

| Corporate Bonds | 45.1 |

| U.S. Treasury Obligations | 26.1 |

| Asset-Backed Securities | 19.3 |

| CMOs and Other Mortgage Related Securities | 7.2 |

| Other Investments | 0.6 |

| U.S. Government Agency - Mortgage Securities | 0.3 |

| Short-Term Investments and Net Other Assets (Liabilities) | 1.4 |

ASSET ALLOCATION (% of Fund's net assets) |

|

|

| United States | 77.7 |

| Grand Cayman (Uk Overseas Ter) | 4.4 |

| Canada | 3.6 |

| United Kingdom | 3.3 |

| Germany | 3.1 |

| France | 2.1 |

| Ireland | 1.2 |

| Japan | 1.0 |

| Italy | 0.7 |

| Others | 2.9 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

| |

|

TOP HOLDINGS (% of Fund's net assets) | | |

| US Treasury Notes | 26.1 | |

| JPMorgan Chase & Co | 1.4 | |

| Wells Fargo & Co | 1.2 | |

| Barclays PLC | 1.0 | |

| Athene Global Funding | 0.9 | |

| AerCap Ireland Capital DAC / AerCap Global Aviation Trust | 0.9 | |

| General Motors Financial Co Inc | 0.9 | |

| American Express Co | 0.8 | |

| Citigroup Inc | 0.8 | |

| Ford Motor Credit Co LLC | 0.8 | |

| | 34.8 | |

How has the Fund changed?

This is a summary of certain changes to the Fund since September 1, 2023. For more complete information, you may review the Fund's next prospectus, which we expect to be available by October 30, 2024 at fundresearch.fidelity.com/prospectus/sec or upon request at 1-877-208-0098 or by sending an e-mail to fidfunddocuments@fidelity.com.

The fees associated with this class changed during the reporting year. The variations in class fees are primarily the result of the following changes: - •Management fee

- •Operating expenses

| |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9913621.100 2844-TSRA-1024 |

| |

| | ANNUAL SHAREHOLDER REPORT | AS OF AUGUST 31, 2024 | This report describes changes to the Fund that occurred during the reporting period. |

| | Fidelity® SAI Sustainable Core Plus Bond Fund Fidelity® SAI Sustainable Core Plus Bond Fund : FIABX |

| | | |

This annual shareholder report contains information about Fidelity® SAI Sustainable Core Plus Bond Fund for the period September 1, 2023 to August 31, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-800-544-3455 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last year?(based on hypothetical $10,000 investment)

FUND COST (PREVIOUS YEAR)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Fidelity® SAI Sustainable Core Plus Bond Fund | $ 37 | 0.36% | |

What affected the Fund's performance this period?

•U.S. taxable investment-grade bonds posted a strong advance for the 12 months ending August 31, 2024, helped by a late-period gain, as the bond market reflected anticipated interest-rate reductions by the U.S. Federal Reserve, which are expected to start in September. The full 12-month period was marked by high volatility.

•Against this backdrop, an out-of-benchmark allocation to high-yield bonds notably contributed to the fund's outperformance of the Bloomberg U.S. Aggregate Bond Index for the fiscal year.

•Choices among investment-grade asset-backed securities also made a meaningful contribution to the relative result, led by fund holdings in collateralized loan obligations.

•Non-benchmark picks among global bonds also were beneficial.

•In contrast, holdings in the corporate sector detracted versus the Aggregate index the past 12 months, primarily due to an underweight in industrial bonds within the sector.

Application of FMR's environmental, social, and governance (ESG) ratings process and/or its sustainable investing exclusion criteria may affect the fund's exposure to certain issuers, sectors, regions, and countries and may affect the fund's performance.

How did the Fund perform over the life of Fund?

CUMULATIVE PERFORMANCE

April 13, 2022 through August 31, 2024.

Initial investment of $10,000.

Fidelity® SAI Sustainable Core Plus Bond Fund | $10,000 | $9,587 | $9,551 |

Bloomberg MSCI U.S. Aggregate ESG Choice Bond Index | $10,000 | $9,703 | $9,590 |

Bloomberg U.S. Aggregate Bond Index | $10,000 | $9,696 | $9,581 |

| | 2022 | 2023 | 2024 |

AVERAGE ANNUAL TOTAL RETURNS: | | 1 Year | Life of Fund A |

| Fidelity® SAI Sustainable Core Plus Bond Fund | 7.31% | 1.04% |

| Bloomberg MSCI U.S. Aggregate ESG Choice Bond Index | 7.26% | 1.19% |

| Bloomberg U.S. Aggregate Bond Index | 7.30% | 1.16% |

A From April 13, 2022

Visit www.fidelity.com for more recent performance information. |

The Fund's past performance is not a good predictor of the Fund's future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. |

Key Fund Statistics (as of August 31, 2024)

KEY FACTS | | |

| Fund Size | $83,384,427 | |

| Number of Holdings | 690 | |

| Total Advisory Fee | $160,853 | |

| Portfolio Turnover | 364% | |

What did the Fund invest in?

(as of August 31, 2024)

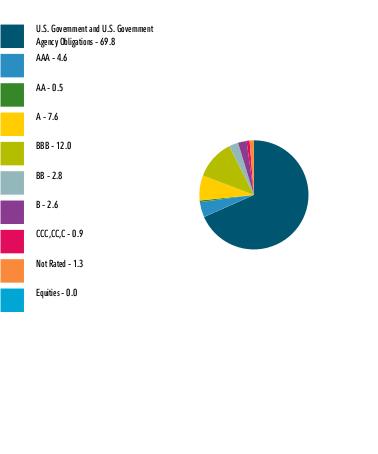

| U.S. Government and U.S. Government Agency Obligations | 69.8 |

| AAA | 4.6 |

| AA | 0.5 |

| A | 7.6 |

| BBB | 12.0 |

| BB | 2.8 |

| B | 2.6 |

| CCC,CC,C | 0.9 |

| Not Rated | 1.3 |

| Equities | 0.0 |

QUALITY DIVERSIFICATION (% of Fund's net assets) |

|

| Short-Term Investments and Net Other Assets (Liabilities) - (2.1)% |

| |

| We have used ratings from Moody's Investors Service, Inc. Where Moody's® ratings are not available, we have used S&P® ratings. All ratings are as of the date indicated and do not reflect subsequent changes. |

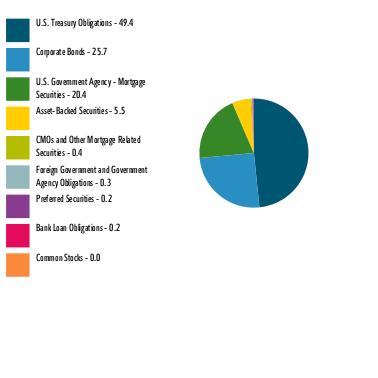

| U.S. Treasury Obligations | 49.4 |

| Corporate Bonds | 25.7 |

| U.S. Government Agency - Mortgage Securities | 20.4 |

| Asset-Backed Securities | 5.5 |

| CMOs and Other Mortgage Related Securities | 0.4 |

| Foreign Government and Government Agency Obligations | 0.3 |

| Preferred Securities | 0.2 |

| Bank Loan Obligations | 0.2 |

| Common Stocks | 0.0 |

ASSET ALLOCATION (% of Fund's net assets) |

|

| Short-Term Investments and Net Other Assets (Liabilities) - (2.1)% |

|

| United States | 88.3 |

| Grand Cayman (Uk Overseas Ter) | 3.4 |

| United Kingdom | 1.5 |

| Bailiwick Of Jersey | 1.3 |

| Canada | 0.9 |

| Netherlands | 0.7 |

| Multi-national | 0.6 |

| France | 0.6 |

| Germany | 0.5 |

| Others | 2.2 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

| |

|

TOP HOLDINGS (% of Fund's net assets) | | |

| US Treasury Notes | 34.9 | |

| US Treasury Bonds | 10.4 | |

| Uniform Mortgage Backed Securities | 9.3 | |

| Ginnie Mae II Pool | 5.4 | |

| US Treasury Bill | 4.1 | |

| Fannie Mae Mortgage pass-thru certificates | 3.9 | |

| Freddie Mac Gold Pool | 1.6 | |

| Morgan Stanley | 1.2 | |

| Bank of America Corp | 0.9 | |

| AES Corp/The | 0.7 | |

| | 72.4 | |

How has the Fund changed?

This is a summary of certain changes to the Fund since September 1, 2023. For more complete information, you may review the Fund's next prospectus, which we expect to be available by October 30, 2024 at fundresearch.fidelity.com/prospectus/sec or upon request at 1-800-544-3455 or by sending an e-mail to fidfunddocuments@fidelity.com.

The fund's contractual management fee was reduced during the reporting period. | The fund modified its principal investment risks during the reporting period.

|

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9913691.100 6540-TSRA-1024 |

| |

| | ANNUAL SHAREHOLDER REPORT | AS OF AUGUST 31, 2024 | This report describes changes to the Fund that occurred during the reporting period. |

| | Fidelity® Tactical Bond Fund Fidelity Advisor® Tactical Bond Fund Class I : FBAHX |

| | | |

This annual shareholder report contains information about Fidelity® Tactical Bond Fund for the period September 1, 2023 to August 31, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-877-208-0098 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last year?(based on hypothetical $10,000 investment)

FUND COST (PREVIOUS YEAR)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Class I | $ 72 | 0.70% | |

What affected the Fund's performance this period?

•U.S. taxable investment-grade bonds posted a strong advance for the 12 months ending August 31, 2024, helped by a late-period gain, as the bond market reflected anticipated interest-rate reductions by the U.S. Federal Reserve, which are expected to start in September. The full 12-month period was marked by high volatility.

•Against this backdrop, relative to the benchmark Bloomberg U.S. Aggregate Bond Index, the fund benefited from favorable duration positioning, as the fund was more interest-rate sensitive than the index in a period of often-falling rates.

•Yield curve positioning, however, detracted a bit as the curve steepened.

•The fund also benefited from being overweight credit risk via high-yield corporate debt and leveraged loans, which added value as credit spreads approached all-time tight levels.

•Other notable contributors included the fund's allocation to securitized products, including outperforming stakes in commercial mortgage-backed securities and asset-backed securities

•Notable changes in positioning include reduced exposure to corporate bonds and increased exposure to U.S. Treasury debt.

How did the Fund perform over the life of Fund?

CUMULATIVE PERFORMANCE

February 10, 2022 through August 31, 2024.

Initial investment of $10,000.

Class I | $10,000 | $9,270 | $9,317 |

Bloomberg U.S. Aggregate Bond Index | $10,000 | $9,301 | $9,190 |

| | 2022 | 2023 | 2024 |

AVERAGE ANNUAL TOTAL RETURNS: | | 1 Year | Life of Fund A |

| Class I | 7.86% | 0.19% |

| Bloomberg U.S. Aggregate Bond Index | 7.30% | -0.55% |

A From February 10, 2022

Visit institutional.fidelity.com for more recent performance information. |

The Fund's past performance is not a good predictor of the Fund's future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. |

Key Fund Statistics (as of August 31, 2024)

KEY FACTS | | |

| Fund Size | $56,713,648 | |

| Number of Holdings | 95 | |

| Total Advisory Fee | $295,549 | |

| Portfolio Turnover | 32% | |

What did the Fund invest in?

(as of August 31, 2024)

| U.S. Government and U.S. Government Agency Obligations | 57.1 |

| AAA | 0.6 |

| AA | 0.5 |

| A | 3.3 |

| BBB | 11.6 |

| BB | 9.5 |

| B | 8.6 |

| CCC,CC,C | 1.6 |

| D | 0.1 |

| Not Rated | 3.1 |

| Equities | 0.7 |

| Short-Term Investments and Net Other Assets (Liabilities) | 3.3 |

QUALITY DIVERSIFICATION (% of Fund's net assets) |

|

| |

| We have used ratings from Moody's Investors Service, Inc. Where Moody's® ratings are not available, we have used S&P® ratings. All ratings are as of the date indicated and do not reflect subsequent changes. |

| U.S. Treasury Obligations | 57.1 |

| Corporate Bonds | 16.1 |

| Bank Loan Obligations | 9.0 |

| Foreign Government and Government Agency Obligations | 4.8 |

| Asset-Backed Securities | 4.5 |

| Preferred Securities | 2.3 |

| CMOs and Other Mortgage Related Securities | 1.5 |

| Municipal Securities | 0.7 |

| Common Stocks | 0.4 |

| Alternative Funds | 0.3 |

| Short-Term Investments and Net Other Assets (Liabilities) | 3.3 |

ASSET ALLOCATION (% of Fund's net assets) |

|

|

| United States | 85.4 |

| Canada | 2.0 |

| United Kingdom | 1.9 |

| Mexico | 1.7 |

| Germany | 1.3 |

| Grand Cayman (Uk Overseas Ter) | 1.1 |

| Brazil | 1.1 |

| Japan | 1.0 |

| Dominican Republic | 0.9 |

| Others | 3.6 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

| |

|

TOP HOLDINGS (% of Fund's net assets) | | |

| US Treasury Notes | 44.7 | |

| US Treasury Bonds | 12.4 | |

| Domino's Pizza Master Issuer LLC | 1.5 | |

| Bank of Nova Scotia/The | 1.2 | |

| Japan Government | 1.0 | |

| Petroleos Mexicanos | 0.9 | |

| Dominican Republic | 0.9 | |

| Kinder Morgan Inc | 0.9 | |

| DPL Inc | 0.8 | |

| Planet Fitness Master Issuer LLC | 0.8 | |

| | 65.1 | |

How has the Fund changed?

This is a summary of certain changes to the Fund since September 1, 2023. For more complete information, you may review the Fund's next prospectus, which we expect to be available by October 30, 2024 at fundresearch.fidelity.com/prospectus/sec or upon request at 1-877-208-0098 or by sending an e-mail to fidfunddocuments@fidelity.com.

The fund's transfer agent and pricing & bookkeeping fees were changed to a fixed rate effective December 1, 2023, through February 29, 2024, in anticipation of the transition to a new management fee structure. Effective March 1, 2024, the fund's management contract was amended to incorporate administrative services previously covered under separate services agreements (transfer agent and pricing & bookkeeping). The amended contract incorporates a management fee rate that may vary by class. The Adviser or an affiliate pays certain expenses of managing and operating the fund out of each class's management fee. | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9913681.100 6506-TSRA-1024 |

| |

| | ANNUAL SHAREHOLDER REPORT | AS OF AUGUST 31, 2024 | This report describes changes to the Fund that occurred during the reporting period. |

| | Fidelity® Short-Term Bond Fund Fidelity Advisor® Short-Term Bond Fund Class C : FANCX |

| | | |

This annual shareholder report contains information about Fidelity® Short-Term Bond Fund for the period September 1, 2023 to August 31, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-877-208-0098 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last year?(based on hypothetical $10,000 investment)

FUND COST (PREVIOUS YEAR)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Class C | $ 140 | 1.36% | |

What affected the Fund's performance this period?

•U.S. taxable investment-grade bonds posted a strong advance for the 12 months ending August 31, 2024, helped by a late-period gain, as the bond market reflected anticipated interest-rate reductions by the U.S. Federal Reserve, which are expected to start in September. The full 12-month period was marked by high volatility.

•Against this backdrop, the fund's strategy of favoring short-term corporate bonds, while underweighting similar-duration U.S. Treasurys, contributed to its performance versus the benchmark. Within corporates, debt holdings among financial institutions - especially banks - and industrial firms, particularly in the consumer cyclical and consumer non-cyclical segments, added notable value.

•Non-benchmark exposure to asset-backed securities, including car loan debt and collateralized loan obligations, also meaningfully contributed. An out-of-benchmark allocation to commercial mortgage-backed securities helped as well.

•In contrast, the fund's yield-curve positioning detracted from relative performance. Specifically, underweighting one- and two- year bonds in favor of three- and five-year maturities hurt.

•At period end, corporates made up about 46% of fund assets, down from roughly 49% a year ago but still notably overweight versus the benchmark average of 25%. Exposure to U.S. Treasurys stood at 26% as of August 31, compared with an average of 67% for the benchmark.

How did the Fund perform over the life of Fund?

CUMULATIVE PERFORMANCE

July 12, 2016 through August 31, 2024.

Initial investment of $10,000.

Class C | $10,000 | $10,001 | $10,003 | $9,917 | $10,250 | $10,530 | $10,469 | $9,928 | $10,050 |

Bloomberg U.S. 1-3 Year Government/Credit Bond Index | $10,000 | $10,001 | $10,091 | $10,107 | $10,573 | $10,961 | $11,004 | $10,566 | $10,731 |

Bloomberg U.S. Aggregate Bond Index | $10,000 | $10,020 | $10,069 | $9,963 | $10,977 | $11,687 | $11,678 | $10,333 | $10,209 |

| | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 |

AVERAGE ANNUAL TOTAL RETURNS: | | 1 Year | 5 Year | Life of Fund A |

| Class C (incl. contingent deferred sales charge) | 4.50% | 0.68% | 0.73% |

| Class C | 5.50% | 0.68% | 0.73% |

| Bloomberg U.S. 1-3 Year Government/Credit Bond Index | 6.25% | 1.52% | 1.62% |

| Bloomberg U.S. Aggregate Bond Index | 7.30% | -0.04% | 1.13% |

A From July 12, 2016

Visit institutional.fidelity.com for more recent performance information. |

The Fund's past performance is not a good predictor of the Fund's future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. |

Key Fund Statistics (as of August 31, 2024)

KEY FACTS | | |

| Fund Size | $2,346,008,597 | |

| Number of Holdings | 491 | |

| Total Advisory Fee | $4,742,667 | |

| Portfolio Turnover | 68% | |

What did the Fund invest in?

(as of August 31, 2024)

| U.S. Government and U.S. Government Agency Obligations | 26.4 |

| AAA | 22.3 |

| AA | 2.9 |

| A | 21.6 |

| BBB | 20.4 |

| BB | 1.3 |

| B | 0.3 |

| Not Rated | 3.4 |

| Short-Term Investments and Net Other Assets (Liabilities) | 1.4 |

QUALITY DIVERSIFICATION (% of Fund's net assets) |

|

| |

| We have used ratings from Moody's Investors Service, Inc. Where Moody's® ratings are not available, we have used S&P® ratings. All ratings are as of the date indicated and do not reflect subsequent changes. |

| Corporate Bonds | 45.1 |

| U.S. Treasury Obligations | 26.1 |

| Asset-Backed Securities | 19.3 |

| CMOs and Other Mortgage Related Securities | 7.2 |

| Other Investments | 0.6 |

| U.S. Government Agency - Mortgage Securities | 0.3 |

| Short-Term Investments and Net Other Assets (Liabilities) | 1.4 |

ASSET ALLOCATION (% of Fund's net assets) |

|

|

| United States | 77.7 |

| Grand Cayman (Uk Overseas Ter) | 4.4 |

| Canada | 3.6 |

| United Kingdom | 3.3 |

| Germany | 3.1 |

| France | 2.1 |

| Ireland | 1.2 |

| Japan | 1.0 |

| Italy | 0.7 |

| Others | 2.9 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

| |

|

TOP HOLDINGS (% of Fund's net assets) | | |

| US Treasury Notes | 26.1 | |

| JPMorgan Chase & Co | 1.4 | |

| Wells Fargo & Co | 1.2 | |

| Barclays PLC | 1.0 | |

| Athene Global Funding | 0.9 | |

| AerCap Ireland Capital DAC / AerCap Global Aviation Trust | 0.9 | |

| General Motors Financial Co Inc | 0.9 | |

| American Express Co | 0.8 | |

| Citigroup Inc | 0.8 | |

| Ford Motor Credit Co LLC | 0.8 | |

| | 34.8 | |

How has the Fund changed?

This is a summary of certain changes to the Fund since September 1, 2023. For more complete information, you may review the Fund's next prospectus, which we expect to be available by October 30, 2024 at fundresearch.fidelity.com/prospectus/sec or upon request at 1-877-208-0098 or by sending an e-mail to fidfunddocuments@fidelity.com.

The fees associated with this class changed during the reporting year. The variations in class fees are primarily the result of the following changes: - •Management fee

- •Operating expenses

| |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9913620.100 2843-TSRA-1024 |

| |

| | ANNUAL SHAREHOLDER REPORT | AS OF AUGUST 31, 2024 | This report describes changes to the Fund that occurred during the reporting period. |

| | Fidelity® Short-Term Bond Fund Fidelity Advisor® Short-Term Bond Fund Class A : FBNAX |

| | | |

This annual shareholder report contains information about Fidelity® Short-Term Bond Fund for the period September 1, 2023 to August 31, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-877-208-0098 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last year?(based on hypothetical $10,000 investment)

FUND COST (PREVIOUS YEAR)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Class A | $ 52 | 0.50% | |

What affected the Fund's performance this period?

•U.S. taxable investment-grade bonds posted a strong advance for the 12 months ending August 31, 2024, helped by a late-period gain, as the bond market reflected anticipated interest-rate reductions by the U.S. Federal Reserve, which are expected to start in September. The full 12-month period was marked by high volatility.

•Against this backdrop, the fund's strategy of favoring short-term corporate bonds, while underweighting similar-duration U.S. Treasurys, contributed to its performance versus the benchmark. Within corporates, debt holdings among financial institutions - especially banks - and industrial firms, particularly in the consumer cyclical and consumer non-cyclical segments, added notable value.

•Non-benchmark exposure to asset-backed securities, including car loan debt and collateralized loan obligations, also meaningfully contributed. An out-of-benchmark allocation to commercial mortgage-backed securities helped as well.

•In contrast, the fund's yield-curve positioning detracted from relative performance. Specifically, underweighting one- and two- year bonds in favor of three- and five-year maturities hurt.

•At period end, corporates made up about 46% of fund assets, down from roughly 49% a year ago but still notably overweight versus the benchmark average of 25%. Exposure to U.S. Treasurys stood at 26% as of August 31, compared with an average of 67% for the benchmark.

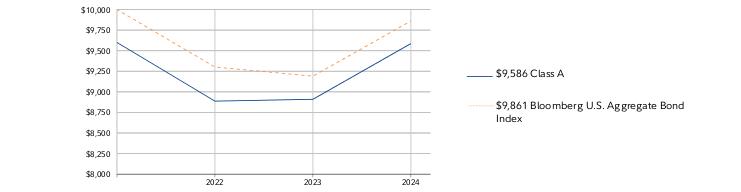

How did the Fund perform over the life of Fund?

CUMULATIVE PERFORMANCE

July 12, 2016 through August 31, 2024.

Initial investment of $10,000 and the current sales charge was paid.

Class A | $9,850 | $9,859 | $9,941 | $9,952 | $10,364 | $10,750 | $10,771 | $10,299 | $10,516 |

Bloomberg U.S. 1-3 Year Government/Credit Bond Index | $10,000 | $10,001 | $10,091 | $10,107 | $10,573 | $10,961 | $11,004 | $10,566 | $10,731 |

Bloomberg U.S. Aggregate Bond Index | $10,000 | $10,020 | $10,069 | $9,963 | $10,977 | $11,687 | $11,678 | $10,333 | $10,209 |

| | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 |

AVERAGE ANNUAL TOTAL RETURNS: | | 1 Year | 5 Year | Life of Fund A |

| Class A (incl. 1.50% sales charge) | 4.92% | 1.26% | 1.40% |

| Class A (without 1.50% sales charge) | 6.52% | 1.57% | 1.59% |

| Bloomberg U.S. 1-3 Year Government/Credit Bond Index | 6.25% | 1.52% | 1.62% |

| Bloomberg U.S. Aggregate Bond Index | 7.30% | -0.04% | 1.13% |

A From July 12, 2016

Visit institutional.fidelity.com for more recent performance information. |

The Fund's past performance is not a good predictor of the Fund's future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. |

Key Fund Statistics (as of August 31, 2024)

KEY FACTS | | |

| Fund Size | $2,346,008,597 | |

| Number of Holdings | 491 | |

| Total Advisory Fee | $4,742,667 | |

| Portfolio Turnover | 68% | |

What did the Fund invest in?

(as of August 31, 2024)

| U.S. Government and U.S. Government Agency Obligations | 26.4 |

| AAA | 22.3 |

| AA | 2.9 |

| A | 21.6 |

| BBB | 20.4 |

| BB | 1.3 |

| B | 0.3 |

| Not Rated | 3.4 |

| Short-Term Investments and Net Other Assets (Liabilities) | 1.4 |

QUALITY DIVERSIFICATION (% of Fund's net assets) |

|

| |

| We have used ratings from Moody's Investors Service, Inc. Where Moody's® ratings are not available, we have used S&P® ratings. All ratings are as of the date indicated and do not reflect subsequent changes. |

| Corporate Bonds | 45.1 |

| U.S. Treasury Obligations | 26.1 |

| Asset-Backed Securities | 19.3 |

| CMOs and Other Mortgage Related Securities | 7.2 |

| Other Investments | 0.6 |

| U.S. Government Agency - Mortgage Securities | 0.3 |

| Short-Term Investments and Net Other Assets (Liabilities) | 1.4 |

ASSET ALLOCATION (% of Fund's net assets) |

|

|

| United States | 77.7 |

| Grand Cayman (Uk Overseas Ter) | 4.4 |

| Canada | 3.6 |

| United Kingdom | 3.3 |

| Germany | 3.1 |

| France | 2.1 |

| Ireland | 1.2 |

| Japan | 1.0 |

| Italy | 0.7 |

| Others | 2.9 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

| |

|

TOP HOLDINGS (% of Fund's net assets) | | |

| US Treasury Notes | 26.1 | |

| JPMorgan Chase & Co | 1.4 | |

| Wells Fargo & Co | 1.2 | |

| Barclays PLC | 1.0 | |

| Athene Global Funding | 0.9 | |

| AerCap Ireland Capital DAC / AerCap Global Aviation Trust | 0.9 | |

| General Motors Financial Co Inc | 0.9 | |

| American Express Co | 0.8 | |

| Citigroup Inc | 0.8 | |

| Ford Motor Credit Co LLC | 0.8 | |

| | 34.8 | |

How has the Fund changed?

This is a summary of certain changes to the Fund since September 1, 2023. For more complete information, you may review the Fund's next prospectus, which we expect to be available by October 30, 2024 at fundresearch.fidelity.com/prospectus/sec or upon request at 1-877-208-0098 or by sending an e-mail to fidfunddocuments@fidelity.com.

The fees associated with this class changed during the reporting year. The variations in class fees are primarily the result of the following changes: - •Management fee

- •Operating expenses

| |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9913619.100 2842-TSRA-1024 |

| |

| | ANNUAL SHAREHOLDER REPORT | AS OF AUGUST 31, 2024 | This report describes changes to the Fund that occurred during the reporting period. |

| | Fidelity® Short-Term Bond Fund Fidelity Advisor® Short-Term Bond Fund Class I : FBNIX |

| | | |

This annual shareholder report contains information about Fidelity® Short-Term Bond Fund for the period September 1, 2023 to August 31, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-877-208-0098 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last year?(based on hypothetical $10,000 investment)

FUND COST (PREVIOUS YEAR)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Class I | $ 31 | 0.30% | |

What affected the Fund's performance this period?

•U.S. taxable investment-grade bonds posted a strong advance for the 12 months ending August 31, 2024, helped by a late-period gain, as the bond market reflected anticipated interest-rate reductions by the U.S. Federal Reserve, which are expected to start in September. The full 12-month period was marked by high volatility.

•Against this backdrop, the fund's strategy of favoring short-term corporate bonds, while underweighting similar-duration U.S. Treasurys, contributed to its performance versus the benchmark. Within corporates, debt holdings among financial institutions - especially banks - and industrial firms, particularly in the consumer cyclical and consumer non-cyclical segments, added notable value.

•Non-benchmark exposure to asset-backed securities, including car loan debt and collateralized loan obligations, also meaningfully contributed. An out-of-benchmark allocation to commercial mortgage-backed securities helped as well.

•In contrast, the fund's yield-curve positioning detracted from relative performance. Specifically, underweighting one- and two- year bonds in favor of three- and five-year maturities hurt.

•At period end, corporates made up about 46% of fund assets, down from roughly 49% a year ago but still notably overweight versus the benchmark average of 25%. Exposure to U.S. Treasurys stood at 26% as of August 31, compared with an average of 67% for the benchmark.

How did the Fund perform over the life of Fund?

CUMULATIVE PERFORMANCE

July 12, 2016 through August 31, 2024.

Initial investment of $10,000.

Class I | $10,000 | $10,011 | $10,109 | $10,136 | $10,570 | $10,980 | $11,017 | $10,550 | $10,791 |

Bloomberg U.S. 1-3 Year Government/Credit Bond Index | $10,000 | $10,001 | $10,091 | $10,107 | $10,573 | $10,961 | $11,004 | $10,566 | $10,731 |

Bloomberg U.S. Aggregate Bond Index | $10,000 | $10,020 | $10,069 | $9,963 | $10,977 | $11,687 | $11,678 | $10,333 | $10,209 |

| | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 |

AVERAGE ANNUAL TOTAL RETURNS: | | 1 Year | 5 Year | Life of Fund A |

| Class I | 6.73% | 1.73% | 1.75% |

| Bloomberg U.S. 1-3 Year Government/Credit Bond Index | 6.25% | 1.52% | 1.62% |

| Bloomberg U.S. Aggregate Bond Index | 7.30% | -0.04% | 1.13% |

A From July 12, 2016

Visit institutional.fidelity.com for more recent performance information. |

The Fund's past performance is not a good predictor of the Fund's future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. |

Key Fund Statistics (as of August 31, 2024)

KEY FACTS | | |

| Fund Size | $2,346,008,597 | |

| Number of Holdings | 491 | |

| Total Advisory Fee | $4,742,667 | |

| Portfolio Turnover | 68% | |

What did the Fund invest in?

(as of August 31, 2024)

| U.S. Government and U.S. Government Agency Obligations | 26.4 |

| AAA | 22.3 |

| AA | 2.9 |

| A | 21.6 |

| BBB | 20.4 |

| BB | 1.3 |

| B | 0.3 |

| Not Rated | 3.4 |

| Short-Term Investments and Net Other Assets (Liabilities) | 1.4 |

QUALITY DIVERSIFICATION (% of Fund's net assets) |

|

| |

| We have used ratings from Moody's Investors Service, Inc. Where Moody's® ratings are not available, we have used S&P® ratings. All ratings are as of the date indicated and do not reflect subsequent changes. |

| Corporate Bonds | 45.1 |

| U.S. Treasury Obligations | 26.1 |

| Asset-Backed Securities | 19.3 |

| CMOs and Other Mortgage Related Securities | 7.2 |

| Other Investments | 0.6 |

| U.S. Government Agency - Mortgage Securities | 0.3 |

| Short-Term Investments and Net Other Assets (Liabilities) | 1.4 |

ASSET ALLOCATION (% of Fund's net assets) |

|

|

| United States | 77.7 |

| Grand Cayman (Uk Overseas Ter) | 4.4 |

| Canada | 3.6 |

| United Kingdom | 3.3 |

| Germany | 3.1 |

| France | 2.1 |

| Ireland | 1.2 |

| Japan | 1.0 |

| Italy | 0.7 |

| Others | 2.9 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

| |

|

TOP HOLDINGS (% of Fund's net assets) | | |

| US Treasury Notes | 26.1 | |

| JPMorgan Chase & Co | 1.4 | |

| Wells Fargo & Co | 1.2 | |

| Barclays PLC | 1.0 | |

| Athene Global Funding | 0.9 | |

| AerCap Ireland Capital DAC / AerCap Global Aviation Trust | 0.9 | |

| General Motors Financial Co Inc | 0.9 | |

| American Express Co | 0.8 | |

| Citigroup Inc | 0.8 | |

| Ford Motor Credit Co LLC | 0.8 | |

| | 34.8 | |

How has the Fund changed?

This is a summary of certain changes to the Fund since September 1, 2023. For more complete information, you may review the Fund's next prospectus, which we expect to be available by October 30, 2024 at fundresearch.fidelity.com/prospectus/sec or upon request at 1-877-208-0098 or by sending an e-mail to fidfunddocuments@fidelity.com.

The fees associated with this class changed during the reporting year. The variations in class fees are primarily the result of the following changes: - •Management fee

- •Operating expenses

- •Expense reductions

| |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9913622.100 2845-TSRA-1024 |

| |

| | ANNUAL SHAREHOLDER REPORT | AS OF AUGUST 31, 2024 | This report describes changes to the Fund that occurred during the reporting period. |

| | Fidelity® Investment Grade Bond Fund Fidelity® Investment Grade Bond Fund : FBNDX |

| | | |

This annual shareholder report contains information about Fidelity® Investment Grade Bond Fund for the period September 1, 2023 to August 31, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-800-544-8544 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last year?(based on hypothetical $10,000 investment)

FUND COST (PREVIOUS YEAR)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Fidelity® Investment Grade Bond Fund | $ 47 | 0.45% | |

What affected the Fund's performance this period?

•U.S. taxable investment-grade bonds posted a strong advance for the 12 months ending August 31, 2024, helped by a late-period gain, as the bond market reflected anticipated interest-rate reductions by the U.S. Federal Reserve, which are expected to start in September. The full 12-month period was marked by high volatility.

•Against this backdrop, relative to the benchmark Bloomberg U.S. Aggregate Bond Index, the fund benefited from favorable duration positioning, as the fund was more interest-rate sensitive than the index in a period of often-falling rates.

•The fund also benefited from being overweight credit risk, which added value as credit spreads approached historically tight levels.

•Other notable contributors included the fund's allocations to securitized products, including outperforming stakes in commercial mortgage-backed securities, asset-backed securities and collateralized loan obligations.

•An overweight in investment-grade corporate bonds, especially those of bank issuers, also added value, although our positioning among industrial and utility bonds were modestly offsetting detractors.

•Notable changes in positioning include reduced exposure to investment-grade corporate bonds, increased exposure to U.S. Treasury debt, and purchases of mortgage bonds during periods of wider credit spreads.

How did the Fund perform over the past 10 years?

CUMULATIVE PERFORMANCE

August 31, 2014 through August 31, 2024.

Initial investment of $10,000.

Fidelity® Investment Grade Bond Fund | $10,000 | $10,028 | $10,688 | $10,834 | $10,733 | $11,854 | $12,877 | $13,015 | $11,515 | $11,425 | $12,320 |

Bloomberg U.S. Aggregate Bond Index | $10,000 | $10,156 | $10,761 | $10,814 | $10,701 | $11,789 | $12,553 | $12,542 | $11,098 | $10,965 | $11,765 |

| | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 |

AVERAGE ANNUAL TOTAL RETURNS: | | 1 Year | 5 Year | 10 Year |

| Fidelity® Investment Grade Bond Fund | 7.83% | 0.77% | 2.11% |

| Bloomberg U.S. Aggregate Bond Index | 7.30% | -0.04% | 1.64% |

Visit www.fidelity.com for more recent performance information. |

The Fund's past performance is not a good predictor of the Fund's future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. |

Key Fund Statistics (as of August 31, 2024)

KEY FACTS | | |

| Fund Size | $10,877,326,398 | |

| Number of Holdings | 3,997 | |

| Total Advisory Fee | $26,423,417 | |

| Portfolio Turnover | 232% | |

What did the Fund invest in?

(as of August 31, 2024)

| U.S. Government and U.S. Government Agency Obligations | 61.9 |

| AAA | 7.6 |

| AA | 0.6 |

| A | 6.0 |

| BBB | 16.7 |

| BB | 3.3 |

| B | 0.9 |

| CCC,CC,C | 0.0 |

| Not Rated | 3.7 |

QUALITY DIVERSIFICATION (% of Fund's net assets) |

|

| Short-Term Investments and Net Other Assets (Liabilities) - (0.7)% |

| |

| We have used ratings from Moody's Investors Service, Inc. Where Moody's® ratings are not available, we have used S&P® ratings. All ratings are as of the date indicated and do not reflect subsequent changes. |

| U.S. Treasury Obligations | 51.8 |

| Corporate Bonds | 24.5 |

| U.S. Government Agency - Mortgage Securities | 10.1 |

| Asset-Backed Securities | 7.1 |

| CMOs and Other Mortgage Related Securities | 6.8 |

| Preferred Securities | 0.2 |

| Foreign Government and Government Agency Obligations | 0.1 |

| Other Investments | 0.1 |

| Municipal Securities | 0.0 |

| Bank Loan Obligations | 0.0 |

ASSET ALLOCATION (% of Fund's net assets) |

|

| Short-Term Investments and Net Other Assets (Liabilities) - (0.7)% |

|

| United States | 90.5 |

| Grand Cayman (UK Overseas Ter) | 4.2 |

| Germany | 1.1 |

| Mexico | 0.7 |

| United Kingdom | 0.7 |

| Ireland | 0.5 |

| Switzerland | 0.5 |

| Bailiwick Of Jersey | 0.4 |

| Italy | 0.3 |

| Others | 1.1 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

| |

|

TOP HOLDINGS (% of Fund's net assets) | | |

| US Treasury Notes | 43.0 | |

| US Treasury Bonds | 8.8 | |

| Uniform Mortgage Backed Securities | 3.4 | |

| Fannie Mae Mortgage pass-thru certificates | 3.2 | |

| Freddie Mac Gold Pool | 1.7 | |

| Ginnie Mae II Pool | 1.6 | |

| Citigroup Inc | 1.5 | |

| Bank of America Corp | 1.2 | |

| Charter Communications Operating LLC / Charter Communications Operating Capital | 1.0 | |

| Bayer US Finance II LLC | 0.9 | |

| | 66.3 | |

How has the Fund changed?

This is a summary of certain changes to the Fund since September 1, 2023. For more complete information, you may review the Fund's next prospectus, which we expect to be available by October 30, 2024 at fundresearch.fidelity.com/prospectus/sec or upon request at 1-800-544-8544 or by sending an e-mail to fidfunddocuments@fidelity.com.

The fund's contractual management fee was reduced during the reporting period. | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9913589.100 26-TSRA-1024 |

| |

| | ANNUAL SHAREHOLDER REPORT | AS OF AUGUST 31, 2024 | This report describes changes to the Fund that occurred during the reporting period. |

| | Fidelity® Tactical Bond Fund Fidelity Advisor® Tactical Bond Fund Class C : FTKCX |

| | | |

This annual shareholder report contains information about Fidelity® Tactical Bond Fund for the period September 1, 2023 to August 31, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-877-208-0098 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last year?(based on hypothetical $10,000 investment)

FUND COST (PREVIOUS YEAR)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Class C | $ 176 | 1.70% | |

What affected the Fund's performance this period?

•U.S. taxable investment-grade bonds posted a strong advance for the 12 months ending August 31, 2024, helped by a late-period gain, as the bond market reflected anticipated interest-rate reductions by the U.S. Federal Reserve, which are expected to start in September. The full 12-month period was marked by high volatility.

•Against this backdrop, relative to the benchmark Bloomberg U.S. Aggregate Bond Index, the fund benefited from favorable duration positioning, as the fund was more interest-rate sensitive than the index in a period of often-falling rates.

•Yield curve positioning, however, detracted a bit as the curve steepened.

•The fund also benefited from being overweight credit risk via high-yield corporate debt and leveraged loans, which added value as credit spreads approached all-time tight levels.

•Other notable contributors included the fund's allocation to securitized products, including outperforming stakes in commercial mortgage-backed securities and asset-backed securities

•Notable changes in positioning include reduced exposure to corporate bonds and increased exposure to U.S. Treasury debt.

How did the Fund perform over the life of Fund?

CUMULATIVE PERFORMANCE

February 10, 2022 through August 31, 2024.

Initial investment of $10,000.

Class C | $10,000 | $9,210 | $9,174 |

Bloomberg U.S. Aggregate Bond Index | $10,000 | $9,301 | $9,190 |

| | 2022 | 2023 | 2024 |

AVERAGE ANNUAL TOTAL RETURNS: | | 1 Year | Life of Fund A |

| Class C (incl. contingent deferred sales charge) | 5.79% | -0.80% |

| Class C | 6.79% | -0.80% |

| Bloomberg U.S. Aggregate Bond Index | 7.30% | -0.55% |

A From February 10, 2022

Visit institutional.fidelity.com for more recent performance information. |

The Fund's past performance is not a good predictor of the Fund's future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. |

Key Fund Statistics (as of August 31, 2024)

KEY FACTS | | |

| Fund Size | $56,713,648 | |

| Number of Holdings | 95 | |

| Total Advisory Fee | $295,549 | |

| Portfolio Turnover | 32% | |

What did the Fund invest in?

(as of August 31, 2024)

| U.S. Government and U.S. Government Agency Obligations | 57.1 |

| AAA | 0.6 |

| AA | 0.5 |

| A | 3.3 |

| BBB | 11.6 |

| BB | 9.5 |

| B | 8.6 |

| CCC,CC,C | 1.6 |

| D | 0.1 |

| Not Rated | 3.1 |

| Equities | 0.7 |

| Short-Term Investments and Net Other Assets (Liabilities) | 3.3 |

QUALITY DIVERSIFICATION (% of Fund's net assets) |

|

| |

| We have used ratings from Moody's Investors Service, Inc. Where Moody's® ratings are not available, we have used S&P® ratings. All ratings are as of the date indicated and do not reflect subsequent changes. |

| U.S. Treasury Obligations | 57.1 |

| Corporate Bonds | 16.1 |

| Bank Loan Obligations | 9.0 |

| Foreign Government and Government Agency Obligations | 4.8 |

| Asset-Backed Securities | 4.5 |

| Preferred Securities | 2.3 |

| CMOs and Other Mortgage Related Securities | 1.5 |

| Municipal Securities | 0.7 |

| Common Stocks | 0.4 |

| Alternative Funds | 0.3 |

| Short-Term Investments and Net Other Assets (Liabilities) | 3.3 |

ASSET ALLOCATION (% of Fund's net assets) |

|

|

| United States | 85.4 |

| Canada | 2.0 |

| United Kingdom | 1.9 |

| Mexico | 1.7 |

| Germany | 1.3 |

| Grand Cayman (Uk Overseas Ter) | 1.1 |

| Brazil | 1.1 |

| Japan | 1.0 |

| Dominican Republic | 0.9 |

| Others | 3.6 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

| |

|

TOP HOLDINGS (% of Fund's net assets) | | |

| US Treasury Notes | 44.7 | |

| US Treasury Bonds | 12.4 | |

| Domino's Pizza Master Issuer LLC | 1.5 | |

| Bank of Nova Scotia/The | 1.2 | |

| Japan Government | 1.0 | |

| Petroleos Mexicanos | 0.9 | |

| Dominican Republic | 0.9 | |

| Kinder Morgan Inc | 0.9 | |

| DPL Inc | 0.8 | |

| Planet Fitness Master Issuer LLC | 0.8 | |

| | 65.1 | |

How has the Fund changed?

This is a summary of certain changes to the Fund since September 1, 2023. For more complete information, you may review the Fund's next prospectus, which we expect to be available by October 30, 2024 at fundresearch.fidelity.com/prospectus/sec or upon request at 1-877-208-0098 or by sending an e-mail to fidfunddocuments@fidelity.com.

The fund's transfer agent and pricing & bookkeeping fees were changed to a fixed rate effective December 1, 2023, through February 29, 2024, in anticipation of the transition to a new management fee structure. Effective March 1, 2024, the fund's management contract was amended to incorporate administrative services previously covered under separate services agreements (transfer agent and pricing & bookkeeping). The amended contract incorporates a management fee rate that may vary by class. The Adviser or an affiliate pays certain expenses of managing and operating the fund out of each class's management fee. | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9913679.100 6504-TSRA-1024 |

| |

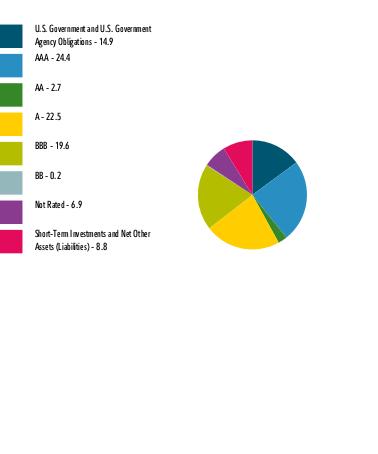

| | ANNUAL SHAREHOLDER REPORT | AS OF AUGUST 31, 2024 | This report describes changes to the Fund that occurred during the reporting period. |

| | Fidelity® SAI Total Bond Fund Fidelity® SAI Total Bond Fund : FSMTX |

| | | |

This annual shareholder report contains information about Fidelity® SAI Total Bond Fund for the period September 1, 2023 to August 31, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-800-544-3455 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last year?(based on hypothetical $10,000 investment)

FUND COST (PREVIOUS YEAR)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Fidelity® SAI Total Bond Fund | $ 30 | 0.29% | |

What affected the Fund's performance this period?

•U.S. taxable investment-grade bonds posted a strong advance for the 12 months ending August 31, 2024, helped by a late-period gain, as the bond market reflected anticipated interest-rate reductions by the U.S. Federal Reserve, which are expected to start in September. The full 12-month period was marked by high volatility.

•Against this backdrop, allocations to "plus sectors" - including high-yield bonds, leveraged loans and emerging markets debt - notably contributed to the fund's outperformance of the Bloomberg U.S. Aggregate Index for the fiscal year.

•Among investment-grade securities, security selection and sector allocation also meaningfully contributed.

•In terms of sector allocation, investment choices and overweight positions in the asset-backed securities, mortgage-backed securities and commercial mortgage-backed securities segments each helped relative performance the past 12 months.

•As for security selection, fund holdings in the corporate segment made a notable contribution, led by picks among financials, particularly REITs and banks. In contrast, the fund's underweight in industrial bonds within the corporate sector detracted versus the Aggregate index the past 12 months.

How did the Fund perform over the life of Fund?

CUMULATIVE PERFORMANCE

October 25, 2018 through August 31, 2024.

Initial investment of $10,000.

Fidelity® SAI Total Bond Fund | $10,000 | $11,067 | $11,859 | $12,193 | $10,847 | $10,891 | $11,836 |

Bloomberg U.S. Universal Bond Index | $10,000 | $11,125 | $11,839 | $11,944 | $10,528 | $10,486 | $11,317 |

Bloomberg U.S. Aggregate Bond Index | $10,000 | $11,154 | $11,876 | $11,866 | $10,499 | $10,374 | $11,131 |

| | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 |

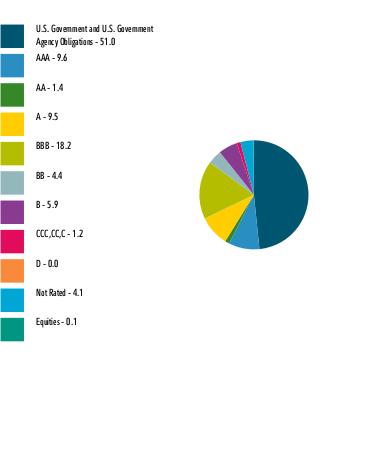

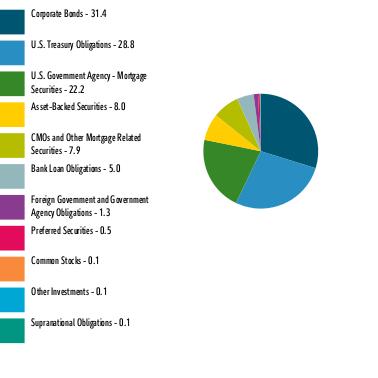

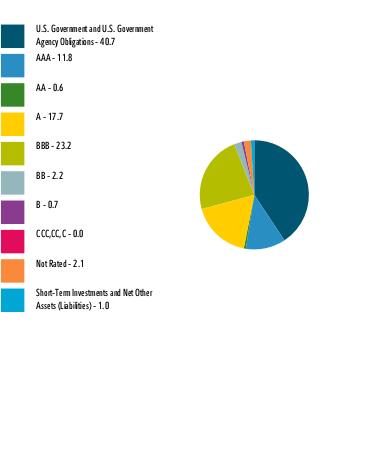

AVERAGE ANNUAL TOTAL RETURNS: | | 1 Year | 5 Year | Life of Fund A |