ITEM 3. - LEGAL PROCEEDINGS

On May 18, 2006, an antitrust and fraud action entitledOmnicare, Inc. v. UnitedHealth Group, Inc., et al., 2:06-cv-00103-WOB, was filed by the Company in the United States District Court for the Eastern District of Kentucky against UnitedHealth Group, Inc., PacifiCare Health Systems, Inc., and RxSolutions, Inc. d/b/a Prescription Solutions, asserting claims of violations of federal and state antitrust laws, civil conspiracy and common law fraud arising out of an alleged conspiracy by defendants to illegally and fraudulently coordinate their negotiations with the Company for Medicare Part D contracts as part of an effort to defraud the Company and fix prices. The complaint seeks, among other things, damages, injunctive relief and reformation of certain contracts. On June 5, 2006, the Company filed a first supplemental and amended complaint in which it asserted the identical claims. In an order dated November 9, 2006, a motion by defendants to transfer venue to the United States District Court for the Northern District of Illinois was granted, but a motion to dismiss the antitrust claims was denied without prejudice, with leave to refile in the transferee court. In the United States District Court for the Northern District of Illinois, the defendants renewed their motion to dismiss the Company’s antitrust claims on December 22, 2006, and on September 28, 2007 their motion was denied. On March 7, 2007, the Court entered a Minute Order setting a discovery schedule for the litigation. Under the Order, fact discovery is to be completed by January 31, 2008, and expert discovery is to be completed by May 1, 2008. These dates, among others, were extended one month by agreement to February 29, 2008 and June 2, 2008, respectively. At the present time, both parties are engaged in fact discovery and related motion practice and the parties have engaged in extensive documentary and deposition discovery. On May 22, 2007, the Court entered a Minute Order setting a trial date of October 14, 2008.

The United States Attorney’s Office, District of Massachusetts, is conducting an investigation relating to the Company’s relationships with certain manufacturers and distributors of pharmaceutical products and certain customers, as well as with respect to contracts with certain companies acquired by the Company. Any action by the U.S. Attorney’s Office, District of Massachusetts, could result in civil or criminal proceedings against the Company. The Company believes that it has complied with all applicable laws and regulations with respect to these matters.

On February 2 and February 13, 2006, respectively, two substantially similar putative class action lawsuits, entitledIndiana State Dist. Council of Laborers & HOD Carriers Pension & Welfare Fund v. Omnicare, Inc., et al., No. 2:06cv26 (“HOD Carriers”), andChi v. Omnicare, Inc., et al., No. 2:06cv31 (“Chi”), were filed against Omnicare and two of its officers in the United States District Court for the Eastern District of Kentucky purporting to assert claims for violation of §§10(b) and 20(a) of the Securities Exchange Act of 1934 and Rule 10b-5 promulgated thereunder, and seeking, among other things, compensatory damages and injunctive relief. The complaints, which purported to be brought on behalf of all open-market purchasers of Omnicare common stock from August 3, 2005 through January 27, 2006, alleged that Omnicare had artificially inflated its earnings by engaging in improper generic drug substitution and that defendants had made false and misleading statements regarding the Company’s business and prospects. On April 3, 2006, plaintiffs in theHOD Carriers case formally moved for consolidation and the appointment of lead plaintiff and lead counsel pursuant to the Private

42

Securities Litigation Reform Act of 1995. On May 22, 2006, that motion was granted, the cases were consolidated, and a lead plaintiff and lead counsel were appointed. On July 20, 2006, plaintiffs filed a consolidated amended complaint, adding a third officer as a defendant and new factual allegations primarily relating to revenue recognition, the valuation of receivables and the valuation of inventories. On October 31, 2006, plaintiffs moved for leave to file a second amended complaint, which was granted on January 26, 2007, on the condition that no further amendments would be permitted absent extraordinary circumstances. Plaintiffs thereafter filed their second amended complaint on January 29, 2007. The second amended complaint (i) expands the putative class to include all purchasers of Omnicare common stock from August 3, 2005 through July 27, 2006, (ii) names two members of the Company’s board of directors as additional defendants, (iii) adds a new plaintiff and a new claim for violation of Section 11 of the Securities Act of 1933 based on alleged false and misleading statements in the registration statement filed in connection with the Company’s December 2005 public offering, (iv) alleges that the Company failed to timely disclose its contractual dispute with UnitedHealth Group (see discussion of theUnitedHealth Group matter above), and (v) alleges that the Company failed to timely record certain special litigation reserves. Defendants filed a motion to dismiss the second amended complaint on March 12, 2007, claiming that plaintiffs had failed adequately to plead loss causation, scienter or any actionable misstatement or omission. That motion was fully briefed as of May 1, 2007. In response to certain arguments relating to the individual claims of the named plaintiffs that were raised in defendants’ pending motion to dismiss, plaintiffs filed a motion to add, or in the alternative, to intervene an additional named plaintiff, Alaska Electrical Pension Fund, on July 27, 2007. Oral argument was held on defendants’ motion to dismiss on August 2, 2007. On October 12, 2007, the court issued an opinion and order dismissing the case and denying plaintiffs’ motion to add an additional named plaintiff. On November 9, 2007, plaintiffs filed a notice of appeal with the United States Court of Appeals for the Sixth Circuit and in a subsequent filing expressed an intention to appeal all aspects of the lower court’s decision. The appellate court has issued a briefing schedule, plaintiffs obtained a 30-day extension of time to file their brief, and all briefs are now due by May 30, 2008.

On February 13, 2006, two substantially similar shareholder derivative actions, entitledIsak v. Gemunder, et al., Case No. 06-CI-390, andFragnoli v. Hutton, et al., Case No. 06-CI-389, were filed in Kentucky State Circuit Court, Kenton Circuit, against the members of Omnicare’s board of directors, individually, purporting to assert claims for breach of fiduciary duty, abuse of control, gross mismanagement, waste of corporate assets and unjust enrichment arising out of the Company’s alleged violations of federal and state health care laws based upon the same purportedly improper generic drug substitution that is the subject of the federal purported class action lawsuits. The complaints seek, among other things, damages, restitution and injunctive relief. TheIsak andFragnoli actions were later consolidated by agreement of the parties. On January 12, 2007, the defendants filed a motion to dismiss the consolidated action on the grounds that the dismissal of the substantially identical shareholder derivative action,Irwin v. Gemunder, et al.,2:06cv62, by the United States District Court for the Eastern District of Kentucky on November 20, 2006 should be given preclusive effect and thus bars re-litigation of the issues already decided inIrwin. Instead of opposing that motion, on March 16, 2007, the plaintiffs filed an amended consolidated complaint, which continues to name all of the directors as defendants and asserts the same claims, but attempts to bolster those claims by adding nearly all of the substantive allegations from the most recent complaint in the federal securities class action (see

43

discussion ofHOD Carriersabove) and an amended complaint in Irwin that added the same factual allegations that were added to the consolidated amended complaint in theHOD Carriersaction. On April 16, 2007, defendants filed a supplemental memorandum of law in further support of their pending motion to dismiss contending that the amended complaint should be dismissed on the same grounds previously articulated for dismissal, namely, the preclusive effect of the dismissal of the Irwin action. That motion has been fully briefed, oral argument was held on August 21, 2007, and the court reserved decision.

The Company believes the above-described purported class and derivative actions are without merit and will be vigorously defended.

Although the Company cannot predict the ultimate outcome of the matters described in the preceding paragraphs, there can be no assurance that the resolution of these matters will not have a material adverse impact on the Company’s consolidated results of operations, financial position or cash flows.

As part of its ongoing operations, the Company is subject to various inspections, audits, inquiries and similar actions by governmental/regulatory authorities responsible for enforcing laws and regulations to which the Company is subject, including reviews of individual Omnicare pharmacy’s reimbursement documentation and administrative practices.

44

ITEM 4. - SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS

None.

ADDITIONAL ITEM - EXECUTIVE OFFICERS OF THE COMPANY

Our executive officers of the Company at the time of this Filing are as follows:

| | | | | | |

Name | | Age | | Office(1) | | First Elected to

Present Office |

| |

| |

| |

|

| | | | | | |

Joel F. Gemunder | | 68 | | President and | | May 20, 1981 |

| | | | Chief Executive Officer(2) | | |

| | | | | | |

Patrick E. Keefe | | 62 | | Executive Vice President | | January 16, 2007 |

| | | | and Chief Operating Officer(3) | | |

| | | | | | |

W. Gary Erwin | | 55 | | Senior Vice President - | | September 28, 2006 |

| | | | Professional Services(5) | | |

| | | | | | |

Leo P. Finn III | | 49 | | Senior Vice President - Strategic | | August 15, 2005 |

| | | | Planning and Development(4) | | |

| | | | | | |

David W. Froesel, Jr. | | 56 | | Senior Vice President | | March 4, 1996 |

| | | | and Chief Financial Officer | | |

| | | | | | |

Cheryl D. Hodges | | 55 | | Senior Vice President | | February 8, 1994 |

| | | | and Secretary | | |

| | | | | | |

Mark G. Kobasuk | | 50 | | Vice President – General | | June 20, 2006 |

| | | | Counsel(6) | | |

| | | | | | |

Jeffrey M. Stamps | | 48 | | Vice President and Senior | | February 27, 2007 |

| | | | Vice President – Field | | |

| | | | Operations / Director of | | |

| | | | Field Operations(7) | | |

| |

(1) | Executive officers are elected for one-year terms at the annual organizational meeting of the Board of Directors, which follows the annual meeting of stockholders. |

| |

(2) | Mr. Gemunder was appointed Chief Executive Officer of the Company on May 21, 2001, having served as the President and a principal executive officer of the Company since 1981. |

| |

(3) | Mr. Keefe was appointed Executive Vice President and Chief Operating Officer on January 16, 2007. From August 2005 – January 2007, Mr. Keefe served as Executive Vice President – Global Markets. From February 1997 until August 2005, he served as Executive Vice President – Operations, and from 1994 to 1997 as Senior Vice President of Operations. Prior to that time, Mr. Keefe joined Omnicare in 1993 as Vice President of Operations. |

45

| |

(4) | Mr. Finn was appointed Senior Vice President – Strategic Planning and Development on August 15, 2005. From May 1997 – August 2005, Mr. Finn served as Vice President – Strategic Planning and Development. From 1995 to 1997, he served as Regional Vice President of Operations for the Company’s Illinois, Iowa, and Wisconsin pharmacy operations. Prior to that time, Mr. Finn joined Omnicare in 1990 as Vice President of Business Development. |

| |

(5) | Dr. Erwin was appointed Senior Vice President – Professional Services on September 28, 2006. From July 2000 – September 2006, Dr. Erwin served as Vice President – Health Care Systems Programs and President of Omnicare Senior Health Outcomes. Prior to that time, Dr. Erwin served Omnicare as Vice President – Health Systems Programs. Before joining Omnicare in 1997, Dr. Erwin served as Vice President for Professional Programs, and Professor of Clinical Pharmacy, Philadelphia College of Pharmacy and Science. In addition, he was on the faculty at the University of Georgia, where he specialized in geriatric pharmacotherapy and long-term care. |

| |

(6) | Mr. Kobasuk was appointed Vice President – General Counsel on June 20, 2006. Mr. Kobasuk was a partner of Taft, Stettinius and Hollister LLP from 1998 until June 2006. |

| |

(7) | Mr. Stamps was appointed corporate Vice President and Senior Vice President – Field Operations for the Company’s Pharmacy Operations Group in February 2007. From August 2005 until February 2007, he was corporate Vice President and Senior Vice President of the Central Division of the Pharmacy Operations Group. From 2001 until August 2005, he was Senior Regional Vice President – Eastern Region of the Pharmacy Operations Group. |

46

PART II

ITEM 5. - MARKET FOR THE REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Price Range of Common Stock; Holders of Record

Our Common Stock is listed on the New York Stock Exchange, and the following table sets forth the ranges of high and low closing prices during each of the calendar quarters of 2007 and 2006.

| | | | | | | | | | | | | |

| | 2007 | | 2006 | |

| |

| |

| |

| | High | | Low | | High | | Low | |

| |

| |

| |

| |

| |

First Quarter | | $ | 44.59 | | $ | 38.00 | | $ | 61.81 | | $ | 48.96 | |

Second Quarter | | $ | 41.40 | | $ | 33.17 | | $ | 57.80 | | $ | 41.95 | |

Third Quarter | | $ | 37.31 | | $ | 29.30 | | $ | 48.77 | | $ | 42.56 | |

Fourth Quarter | | $ | 35.11 | | $ | 22.18 | | $ | 45.62 | | $ | 37.13 | |

The number of holders of record of our Common Stock on January 31, 2008 was 2,440. This amount does not include stockholders with shares held under beneficial ownership in nominee name or within clearinghouse positions of brokerage firms and banks.

Stock Performance Graph

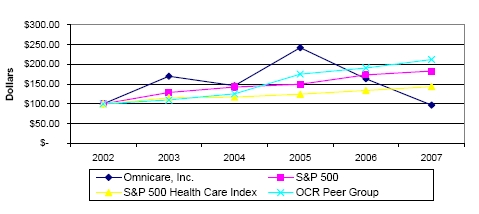

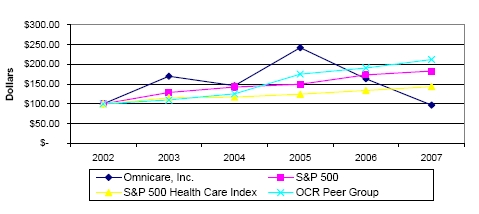

The following graph compares the cumulative total return for the last five years on a $100 investment (assuming dividend reinvestment) on December 31, 2002 in each of the Common Stock of the Company, the Standard & Poor’s 500 Stock Index, the OCR Peer Group Index and the S&P 500 Health Care Index.

47

| | | | | | | | | | | | | | | | | | | |

| | December 31, | |

| |

| |

| | 2002 | | 2003 | | 2004 | | 2005 | | 2006 | | 2007 | |

| |

| |

| |

| |

| |

| |

| |

Omnicare, Inc. | | $ | 100.00 | | $ | 169.97 | | $ | 146.05 | | $ | 241.85 | | $ | 163.62 | | $ | 96.89 | |

S&P 500 | | | 100.00 | | | 128.68 | | | 142.67 | | | 149.65 | | | 173.28 | | | 182.81 | |

S&P 500 Health Care Index | | | 100.00 | | | 115.05 | | | 116.98 | | | 124.54 | | | 133.90 | | | 143.69 | |

OCR Peer Group | | | 100.00 | | | 109.84 | | | 125.34 | | | 175.24 | | | 190.68 | | | 211.93 | |

The OCR Peer Group Index includes the following companies: AmerisourceBergen Corporation, Parexel International Corp., Pharmaceutical Product Development, Inc., PSS World Medical Inc., and Sunrise Senior Living, Inc. Beverly Enterprises, Inc. and Manor Care, Inc. have been excluded from the OCR Peer Group as they are no longer publicly traded companies. SEC Rules require that if an index is selected which is different from the index used in the immediately preceding fiscal year, the total return must be compared with both the newly selected index and the index used in the prior year. In the past, Omnicare has used a customized peer group index for this comparison. However, many of the companies included in the OCR Peer Group Index over time are no longer publicly traded companies. We believe the Standard and Poor’s 500 Health Care Index is a more appropriate index to compare us with other companies in our industry. After this year, the OCR Peer Group Index will no longer be included in the Stock Performance Graph.

Dividends

On February 14, 2008, the Board of Directors approved a quarterly cash dividend of $0.0225, for an indicated annual rate of $0.09 per common share for 2008, which is consistent with annual dividends paid per common share for the 2007 and 2006 years. It is presently intended that cash dividends on common shares will continue to be paid on a quarterly basis; however, there can be no assurances as future dividends are necessarily dependent upon our future earnings and financial condition and other factors not currently determinable.

Stock Repurchases

A summary of Omnicare’s repurchases of the Company’s common stock during the quarter ended December 31, 2007 is as follows (in thousands, except per share data):

| | | | | | | | | | |

Period | | Total Number

of Shares

Purchased(a) | | Average Price

Paid per

Share | | Total Number of

Shares Purchased as

Part of Publicly

Announced Plans or

Programs | | Maximum Number (or

Approximate Dollar Value)

of Shares that Must Yet

Be Purchased Under the

Plans or Programs | |

| |

| |

| |

| |

| |

October 1 - 31, 2007 | | 0 | | $ | — | | — | | — | |

November 1 - 30, 2007 | | 22 | | | 29.10 | | — | | — | |

December 1 - 31, 2007 | | 16 | | | 22.31 | | — | | — | |

| |

| |

|

| |

| |

| |

Total | | 38 | | $ | 26.19 | | — | | — | |

| |

| |

|

| |

| |

| |

| |

(a) | During the fourth quarter of 2007, the Company purchased 38 shares of Omnicare common stock in connection with its employee benefit plans, including purchases associated with the vesting of restricted stock awards. These purchases were not made pursuant to a publicly announced repurchase plan or program. |

Additional information regarding our equity compensation plans is included at Items 8 and 12 of this Filing.

48

ITEM 6. - SELECTED FINANCIAL DATA

The following table summarizes certain selected financial data and should be read in conjunction with our consolidated financial statements and related notes thereto and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” included at Items 8 and 7, respectively, of this Filing.

Five-Year Summary of Selected Financial Data

Omnicare, Inc. and Subsidiary Companies

(in thousands, except per share data)

| | | | | | | | | | | | | | | | |

| | For the years ended and at December 31, | |

| |

| |

| | 2007 | | 2006 | | 2005 | | 2004 | | 2003 | |

| |

| |

| |

| |

| |

| |

INCOME STATEMENT DATA:(a)(b) | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

Net sales(c) | | $ | 6,220,010 | | $ | 6,492,993 | | $ | 5,292,782 | | $ | 4,119,891 | | $ | 3,499,174 | |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

Net income | | $ | 114,056 | | $ | 183,572 | | $ | 226,491 | | $ | 236,011 | | $ | 194,368 | |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

Earnings per common share data: | | | | | | | | | | | | | | | | |

Basic | | $ | 0.96 | | $ | 1.55 | | $ | 2.19 | | $ | 2.29 | | $ | 1.97 | |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

Diluted | | $ | 0.94 | | $ | 1.50 | | $ | 2.10 | | $ | 2.17 | (d) | $ | 1.89 | (d) |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

| | | | | | | | | | | | | | | | |

Dividends per common share | | $ | 0.09 | | $ | 0.09 | | $ | 0.09 | | $ | 0.09 | | $ | 0.09 | |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

Weighted average number of common shares outstanding: | | | | | | | | | | | | | | | | |

Basic | | | 119,380 | | | 118,480 | | | 103,551 | | | 103,238 | | | 98,800 | |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

Diluted | | | 121,258 | | | 122,536 | | | 108,804 | | | 112,819 | (d) | | 107,896 | (d) |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

| | | | | | | | | | | | | | | | |

BALANCE SHEET DATA

(at end of period):(a) | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

Cash and cash equivalents | | $ | 274,448 | | $ | 138,034 | | $ | 215,421 | | $ | 84,169 | | $ | 187,413 | |

Working capital (current assets less current liabilities) | | | 1,803,990 | | | 1,872,427 | | | 1,360,391 | | | 1,082,297 | | | 920,328 | |

Goodwill | | | 4,342,169 | | | 4,225,011 | | | 4,029,482 | | | 2,003,223 | | | 1,690,558 | |

Total assets | | | 7,593,779 | | | 7,398,471 | | | 7,157,405 | | | 3,899,181 | | | 3,395,021 | |

Long-term debt (excluding current portion), net of swap(e)(f) | | | 2,820,751 | | | 2,955,120 | | | 2,719,392 | | | 1,234,067 | | | 1,082,677 | |

Stockholders’ equity(e) | | | 3,291,703 | | | 3,163,451 | | | 2,942,046 | | | 1,927,108 | | | 1,676,024 | |

| | | | | | | | | | | | | | | | |

OTHER FINANCIAL DATA:(a) | | | | | | | | | | | | | | | | |

Net cash flows from operating activities | | $ | 505,529 | | $ | 108,520 | | $ | 263,539 | | $ | 168,858 | | $ | 174,066 | |

EBITDA(g) | | | 455,346 | | | 599,991 | | | 601,951 | | | 498,732 | | | 440,603 | |

Net cash flows used by investing activities | | | (196,888 | ) | | (126,872 | ) | | (2,646,103 | ) | | (415,973 | ) | | (678,049 | ) |

Capital expenditures(h) | | | (45,270 | ) | | (31,251 | ) | | (24,239 | ) | | (17,926 | ) | | (17,115 | ) |

Net cash flows from financing activities | | | (175,139 | ) | | (60,114 | ) | | 2,514,759 | | | 144,442 | | | 549,902 | |

See the related notes to Five-Year Summary of Selected Financial Data on the following pages.

| |

(a) | Omnicare, Inc. (“Omnicare” or the “Company”) has had an active acquisition program in effect since 1989. See the “Acquisitions” note of the Notes to Consolidated Financial Statements for additional information concerning acquisitions that impact the comparability of our results. |

49

| |

(b) | The following aftertax charges are included in net income for the years ended December 31 (in thousands): |

| | | | | | | | | | | | | | | | |

| | 2007 | | 2006 | | 2005 | | 2004 | | 2003 | |

| |

| |

| |

| |

| |

| |

Call premium and write-off of unamortized debt issuance costs | | $ | — | | $ | — | | $ | 20,364 | (1) | $ | — | | $ | 7,853 | |

Restructuring and other related charges | | | 17,300 | (2) | | 18,758 | (2) | | 11,760 | (2) | | — | | | — | |

Litigation and other related professional fees | | | 26,380 | (3) | | 100,507 | (3) | | — | | | — | | | — | |

Heartland matters | | | 10,669 | (3) | | 21,232 | (3) | | — | | | — | | | — | |

Other expense | | | — | | | 3,918 | (2) | | — | | | — | | | — | |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

Total | | $ | 54,349 | | $ | 144,415 | | $ | 32,124 | | $ | — | | $ | 7,853 | |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

(1) See the “Debt” note of the Notes to Consolidated Financial Statements.

(2) See the “Restructuring and Other Related Charges” note of the Notes to Consolidated Financial Statements.

(3) See the “Commitments and Contingencies” note of the Notes to the Consolidated Financial Statements.

| |

(c) | In accordance with Emerging Issues Task Force (“EITF”) Issue No. 01-14, “Income Statement Characterization of Reimbursements Received for “Out-of-Pocket” Expenses Incurred” (“EITF No. 01-14”), Omnicare has recorded reimbursements received for “out-of-pocket” expenses on a grossed-up basis in the income statement as net sales and cost of sales. EITF No. 01-14 relates solely to the Company’s contract research services business. |

| |

(d) | In connection with the adoption of EITF Issue No. 04-8, “The Effect of Contingently Convertible Instruments on Diluted Earnings per Share” (“EITF No. 04-8”) in the fourth quarter of 2004, the Company restated previously reported diluted earnings per share and the diluted weighted average number of common shares outstanding for all periods since the second quarter of 2003, the period during which the 4.00% junior subordinated convertible debentures were outstanding. |

| |

(e) | During the fourth quarter of 2005, the Company completed its offerings of $225 million aggregate principal amount of 6.75% senior subordinated notes due 2013, $525 million aggregate principal amount of 6.875% senior subordinated notes due 2015, $977.5 million aggregate principal amount of 3.25% convertible senior debentures due 2035 (including the exercise in full by the underwriters of their option to purchase additional debentures), and 12,825,000 shares of common stock (not including the underwriters’ option to purchase additional shares), $1 par value, at $59.72 per share. During January 2006, the underwriters of the common stock offering completed by the Company in December 2005 exercised their option, in part, to purchase an additional 850,000 shares of common stock, $1 par value, at $59.72 per share. See the “Debt” and “Public Offering of Common Stock” notes of the Notes to Consolidated Financial Statements for further information on these transactions. |

| |

(f) | In 2003, the Company completed a refinancing plan in which it raised $1,033.6 million. |

| |

(g) | “EBITDA” represents earnings before interest (net of investment income), income taxes, depreciation and amortization. Omnicare uses EBITDA primarily as an indicator of the Company’s ability to service its debt, and believes that certain investors find EBITDA to be a useful financial measure for the same purpose. However, EBITDA does not represent net cash flows from operating activities, as defined by United States Generally Accepted Accounting Principles (“U.S. GAAP”), and should not be considered as a substitute for operating cash flows as a measure of liquidity. Omnicare’s calculation of EBITDA may differ from the calculation of EBITDA by others. The following is a reconciliation of EBITDA to net cash flow from operating activities for the years ended December 31 (in thousands): |

50

| | | | | | | | | | | | | | | | |

| | 2007 | | 2006 | | 2005 | | 2004 | | 2003 | |

| |

| |

| |

| |

| |

| |

EBITDA | | $ | 455,346 | | $ | 599,991 | | $ | 601,951 | | $ | 498,732 | | $ | 440,603 | |

(Subtract)/Add: | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

Interest expense, net of investment income | | | (155,445 | ) | | (159,830 | ) | | (159,823 | ) | | (67,237 | ) | | (77,134 | ) |

Income tax provision | | | (72,442 | ) | | (136,924 | ) | | (135,315 | ) | | (139,188 | ) | | (116,081 | ) |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

Changes in assets and liabilities, net of effects from acquisition of businesses | | | 23,301 | | | (358,528 | ) | | (219,333 | ) | | (226,715 | ) | | (165,442 | ) |

| | | | | | | | | | | | | | | | |

Provision for doubtful accounts | | | 213,560 | | | 82,209 | | | 58,024 | | | 45,112 | | | 44,680 | |

Deferred tax provision | | | 41,209 | | | 81,602 | | | 110,280 | | | 58,154 | | | 43,685 | |

Write-off of debt issuance costs | | | — | | | — | | | 7,755 | | | — | | | 3,755 | |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

Net cash flows from operating activities | | $ | 505,529 | | $ | 108,520 | | $ | 263,539 | | $ | 168,858 | | $ | 174,066 | |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

| |

(h) | Primarily represents the purchase of computer equipment and software; machinery and equipment; and furniture, fixtures and leasehold improvements. |

51

ITEM 7. - MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS (“MD&A”)

The following discussion should be read in conjunction with the Consolidated Financial Statements, related notes and other financial information appearing elsewhere in this report. In addition, see the “Safe Harbor Statement under the Private Securities Litigation Reform Act of 1995 Regarding Forward-Looking Information” caption below, as well as the “Risk Factors” previously discussed at Item 1A of this Filing.

|

Overview of 2007 and Consolidated Results of Operations |

|

Omnicare, Inc. (“Omnicare” or the “Company”) is a leading geriatric pharmaceutical services company. Omnicare is the nation’s largest provider of pharmaceuticals and related pharmacy and ancillary services to long-term healthcare institutions. Omnicare’s clients include primarily skilled nursing facilities (“SNFs”), assisted living facilities, retirement centers, independent living communities, hospitals, hospice, and other healthcare settings and service providers. Omnicare provides its pharmacy services to long-term care facilities and other chronic care settings comprising approximately 1,392,000 beds in 47 states in the United States (“U.S.”), the District of Columbia and Canada at December 31, 2007. As well, Omnicare provides operational software and support systems to long-term care pharmacy providers across the U.S. Omnicare’s pharmacy services also include distribution and product support services for specialty pharmaceuticals. Omnicare provides comprehensive product development and research services for the pharmaceutical, biotechnology, medical device and diagnostic industries in 30 countries worldwide.

The following summary table presents consolidated net sales and results of operations of Omnicare for each of the years ended December 31, 2007, 2006 and 2005 (in thousands, except per share amounts). In accordance with the Securities and Exchange Commission (“SEC”) release entitled “Conditions for Use of Non-GAAP Financial Measures,” the Company has disclosed in this MD&A, with the exception of EBITDA (discussed below), only those measures that are in accordance with U.S. Generally Accepted Accounting Principles (“GAAP”).

52

| | | | | | | | | | |

| | For the years ended December 31, | |

| |

| |

| | 2007 | | 2006 | | 2005 | |

| |

| |

| |

| |

Net sales | | $ | 6,220,010 | | $ | 6,492,993 | | $ | 5,292,782 | |

| |

|

| |

|

| |

|

| |

Net income | | $ | 114,056 | | $ | 183,572 | | $ | 226,491 | |

| |

|

| |

|

| |

|

| |

Earnings per share: | | | | | | | | | | |

Basic | | $ | 0.96 | | $ | 1.55 | | $ | 2.19 | |

| |

|

| |

|

| |

|

| |

Diluted | | $ | 0.94 | | $ | 1.50 | | $ | 2.10 | |

| |

|

| |

|

| |

|

| |

EBITDA(a) | | $ | 455,346 | | $ | 599,991 | | $ | 601,951 | |

| |

|

| |

|

| |

|

| |

| |

(a) | “EBITDA” represents earnings before interest (net of investment income), income taxes, depreciation and amortization. Omnicare uses EBITDA primarily as an indicator of the Company’s ability to service its debt, and believes that certain investors find EBITDA to be a useful financial measure for the same purpose. However, EBITDA does not represent net cash flows from operating activities, as defined by U.S. GAAP, and should not be considered as a substitute for operating cash flows as a measure of liquidity. The Company’s calculation of EBITDA may differ from the calculation of EBITDA by others. See Five-Year Summary of Selected Financial Data for a reconciliation of EBITDA to net cash flows from operating activities, at Part II, Item 6 of this Filing. |

The results for the year ended December 31, 2007 continued to be impacted by the unilateral reduction by UnitedHealth Group and its Affiliates (“United”) in the reimbursement rates paid by United to Omnicare by switching to its PacifiCare pharmacy network contract for services rendered by Omnicare to beneficiaries of United’s drug benefit plans under the Medicare Part D program. The differential in rates that resulted from United’s action reduced sales and operating profit for the year ended December 31, 2007 by approximately $131 million (approximately $81 million aftertax). The unilateral reduction in reimbursement rates began in April 2006; the impact on the year ended December 31, 2006 was approximately $68 million (approximately $43 million aftertax). This matter is currently the subject of litigation initiated by Omnicare and is before the federal court in the Northern District of Illinois. See further discussion at the “Legal Proceedings” section at Part I, Item 3 of this Filing.

Financial results for the year ended December 31, 2007 also reflects a change to the equity method of accounting for certain pharmacy joint venture operations in which the Company owns less than a 100% interest, which was effective in the third quarter of 2006. Accordingly, the deconsolidation of these operations excluded net sales of approximately $112 million and $48 million for the years ended December 31, 2007 and 2006, respectively, but had no impact on earnings.

53

Total net sales for the year ended December 31, 2007 decreased to $6,220.0 million from $6,493.0 million in the comparable prior year period. Diluted earnings per share for the year ended December 31, 2007 were $0.94 versus $1.50 in the same prior year period. Net income for the year ended December 31, 2006 was $114.1 million versus $183.6 million earned in the comparable 2006 period. EBITDA totaled $455.3 million for the year ended December 31, 2007 as compared with $600 million for the same period of 2006.

Net sales for the year were unfavorably impacted by a lower number of beds served, the increased availability and utilization of generic drugs, the impact of the reduction in reimbursement under the United Part D contract, the deconsolidation of the pharmacy joint-venture operations and a shift in mix towards assisted living, partially offset by the favorable impact of drug price inflation, acquisitions, and growth in hospice and specialty pharmacy services as well as CRO Services revenues. See discussion of sales and operating profit results in more detail at the “Pharmacy Services Segment” and “CRO Services Segment” captions below.

The Company’s consolidated gross profit of $1,538.6 million decreased $61.8 million for the full year 2007 from the same prior-year period amount of $1,600.4 million. Gross profit as a percentage of total net sales of 24.7% in the year ended December 31, 2007, increased from the 24.6% experienced during 2006.

Gross profit was favorably impacted in the 2007 period largely as a result of the increased availability and utilization of higher margin generic drugs, the continued integration of prior-period acquisitions, drug purchasing improvements, and year-over-year growth in specialty pharmacy services and CRO services, as well as the favorable year-over-year gross profit impact of the reduction in special items. Specifically, gross profit for the year ended December 31, 2007 included $14.8 million of incremental costs associated with the closure of the Company’s Heartland repackaging facility as compared to $27.7 million for the year ended December 31, 2006, as further described below. In addition, gross profit for the year ended December 31, 2006 included $10.3 million related to the Michigan Medicaid matter, as further discussed in the “Special Items” caption below. Offsetting these factors was the unfavorable gross profit impact of the aforementioned reduction in net sales, including the lower number of beds served, a reduction in reimbursement under the United Part D contract, as well as an increase in direct payroll costs.

Increased leverage in purchasing favorably impacts gross profit and is primarily derived through discounts, rebates and other price concessions from suppliers. Leveraging of fixed and variable overhead costs primarily relates to generating higher sales volumes from pharmacy facilities with no or limited increases in fixed costs (e.g., rent, depreciation, etc.) and negligible to moderate increases in variable costs (e.g., utilities, labor, etc.), as well as the elimination of pharmacies through the Company’s productivity and consolidation initiatives, further discussed below. The Company believes it will be able to continue to leverage fixed and variable overhead costs through both internal and acquired growth.

54

Government and other reimbursement formulas generally adjust to take into account drug price inflation or deflation. In order to enhance its gross profit margins, the Company strategically allocates its resources to those activities that will increase internal sales growth and favorably impact sales mix, or will lower costs. In addition, through the ongoing development of its pharmaceutical purchasing programs, the Company is able to obtain volume discounts and thereby manage its pharmaceutical costs.

Omnicare’s consolidated selling, general and administrative (“operating”) expenses for the year ended December 31, 2007 of $910.3 million were higher than the comparable prior-year amount of $887.4 million, by $22.9 million. Operating expenses as a percentage of net sales amounted to 14.6% in 2007, representing an increase from the 13.7% experienced in the comparable prior- year period. Operating expenses for the year ended December 31, 2007 were unfavorably impacted primarily by a $13.4 million increase in periodic pension costs, increased legal costs of $5.9 million, as well as the impact of recent acquisitions. Partially offsetting the increased operating expenses were the favorable impact of the Company’s continued integration of prior period acquisitions, and productivity enhancements, including the restructuring program relating to the NeighborCare, Inc. (“NeighborCare”) acquisition and the “Omnicare Full Potential” Plan, as further discussed in the “Restructuring and Other Related Charges” section of this MD&A.

The provision for doubtful accounts for the year ended December 31, 2007 of $213.6 million was higher than the comparable prior year amount of $82.2 million, by $131.4 million. The year ended 2007 includes an incremental charge taken in the fourth quarter relating to customer bankruptcies and other legal action against a group of customers for, among other things, the collection of past due receivables, a revised assessment of the administrative and payment issues associated with Prescription Drug Plans under Medicare Part D, particularly relating to the aging of copays and rejected claims, and the resultant adoption by the Company of a modification in its policy with respect to payment authorization for dispensed prescriptions under Medicare Part D and other payors.

Investment income for the year ended December 31, 2007 of $8.7 million was lower than the $10.5 million earned in the comparable prior year period, primarily due to lower average invested balances versus the prior year.

Interest expense for the year ended December 31, 2007 of $164.2 million is lower than the $170.3 million in the comparable prior-year period, primarily due to lower debt outstanding resulting from payments aggregating $250 million on the Company’s senior term A loan facility, maturing on July 28, 2010 (the “Term Loans”), in the latter half of 2006 and throughout 2007, partially offset by increased interest rates for variable rate loans.

The effective income tax rate was 38.8% in 2007, significantly lower than the prior-year rate of 42.7%, due primarily to certain nondeductible litigation costs recognized in the 2006 period. The effective tax rates in 2007 and 2006 are higher than the federal statutory rate largely as a result of the impact of state and local income taxes and various nondeductible expenses (including a portion of the aforementioned litigation costs).

55

Special Items

The year ended December 31, 2007 included the following charges, which primarily impacted the Pharmacy Services segment, and that management considers to be special items, as they are not related to Omnicare’s ordinary course of business:

(i) Operating income included restructuring and other related charges of approximately $27.9 million pretax ($17.3 million aftertax), $29.5 million of which related to the implementation of the “Omnicare Full Potential” Plan, a major initiative primarily designed to re-engineer the pharmacy operating model to increase efficiency and enhance customer growth, partially offset by a ($1.6) million credit adjustment to the previously disclosed consolidation and productivity initiatives related, in part, to the integration of the NeighborCare acquisition and other related activities. See further discussion at the “Restructuring and Other Related Charges” note of the Notes to Consolidated Financial Statements and the “Restructuring and Other Related Charges” section of this MD&A.

(ii) During 2006, the Company experienced certain quality control and product recall issues, as well as fire damage, at one of its repackaging facilities, Heartland Repack Services (“Heartland”), as described in further detail at the “Commitments and Contingencies” note of the Notes to Consolidated Financial Statements. In addressing and resolving these issues, the Company continues to experience increased costs and as a result, the year ended December 31, 2007 included special charges of $17.2 million pretax (approximately $14.8 million and $2.4 million was recorded in the cost of sales and operating expense sections of the Consolidated Statements of Income, respectively) ($10.7 million aftertax) for these increased costs. The Company maintains product recall, property and casualty and business interruption insurance, and the extent of insurance recovery for these expenses is currently being reviewed by its outside advisors. As of December 31, 2007, no receivables for insurance recoveries have been recorded by the Company.

(iii) Operating income included special litigation charges of $42.5 million pretax ($26.4 million aftertax) for litigation-related professional fees in connection with the administrative subpoenas from the United States Attorney’s Office, District of Massachusetts, the purported class and derivative actions, the Company’s lawsuit against United, the inquiry conducted by the Attorney General’s office in Michigan relating to certain billing issues under the Michigan Medicaid program, the investigation by the federal government and certain states relating to drug substitutions, the Company’s response to subpoenas it received relating to other legal proceedings to which the Company is not a party, and certain other larger customer disputes. With respect to these proceedings to which the Company is a party, see further discussion at the “Commitments and Contingencies” note of the Notes to Consolidated Financial Statements, and the “Legal Proceedings” section at Part I, Item 3 of this Filing.

56

Restructuring and Other Related Charges

Omnicare Full Potential Program

In the second quarter of 2006, the Company commenced the implementation of the “Omnicare Full Potential” Plan, a major initiative primarily designed to re-engineer the Company’s pharmacy operating model to increase efficiency and enhance customer growth. The Omnicare Full Potential Plan is expected to optimize resources across the entire organization by implementing best practices, including the realignment and right-sizing of functions, and a “hub-and-spoke” model whereby certain key support and production functions will be transferred to regional support centers (“hubs”) specifically designed and managed to perform these tasks, with local pharmacies (“spokes”) focusing on time-sensitive services and customer-facing processes.

This program is expected to be completed over a multi-year period and is estimated to generate pretax savings in the range of $100 million to $120 million annually upon completion of the initiative. It is anticipated that approximately one-half of these savings will be realized in cost of sales, with the remainder being realized in operating expenses. The program is estimated to result in total pretax restructuring and other related charges of approximately $93 million over this implementation period. The charges primarily include severance pay, employment agreement buy-outs, excess lease costs and professional fees, as well as other related costs. The Company recorded restructuring and other related charges for the Omnicare Full Potential Plan of approximately $29 million and $17 million pretax (approximately $18 million and $11 million aftertax) during the years ended December 31, 2007 and 2006, respectively. The remainder of the overall restructuring charge will be recognized and disclosed prospectively as various phases of the project are finalized and implemented. Incremental capital expenditures related to this program are expected to total approximately $45 million to $50 million over the implementation period. The Company estimates that the initial phase of the program has led to a reduction in force of approximately 1,200 positions as of December 31, 2007, associated primarily with pharmacy operations. While the Company is working diligently to achieve the estimated savings as discussed above, there can be no assurances as to the ultimate outcome of the program, including the related timing thereof, due to the inherent risks associated with the implementation of a project of this magnitude and the related new technologies. Specifically, the potential inability to successfully mitigate implementation risks, including but not necessarily limited to, dependence on third-party suppliers and consultants for the timely delivery of technology as well as its performance at expected capacities, compliance with federal, state and local regulatory requirements; reliance on information technology and telecommunications support, timely completion of facility lease transactions and/or leasehold improvements, and the ability to obtain adequate staffing levels, individually or in the aggregate could affect the overall success of the program from a savings and/or timing standpoint.

See further discussion at the “Restructuring and Other Related Charges” note of the Notes to Consolidated Financial Statements.

2005 Program

In the third quarter of 2005, the Company announced the implementation of consolidation plans and other productivity initiatives to streamline pharmacy services and contract research organization operations, including maximizing workforce and operating asset utilization, and

57

producing a more cost-efficient, operating infrastructure (the “2005 Program”). These consolidation and productivity initiatives were related, in part, to the integration of NeighborCare. Given the geographic overlap of the NeighborCare and Omnicare pharmacies, substantial opportunities for consolidation existed at the time of acquisition. While the majority of consolidations resulted in NeighborCare pharmacies being consolidated into Omnicare pharmacies, depending on location, capacity and operating performance, certain Omnicare pharmacies were also identified for consolidation into NeighborCare locations. Additionally, as part of the evaluation process on how best to integrate the two organizations, the Company also focused broadly on ways to lower operating infrastructure costs to maximize efficiencies and asset utilization and identified opportunities to right-size the business, streamline operations and eliminate redundant assets. The consolidation activity and other productivity initiatives of the 2005 program resulted in the closure of 29 Omnicare facilities, of which 26 were pharmacy operations. Additionally, there was a net reduction in force of approximately 900 positions relating to the 2005 Program. Of this reduction in force, approximately 96% were in the pharmacy operations and the remaining reductions were at the corporate headquarters or the Company’s contract research operations. Restructuring activities in the contract research organization segment related primarily to facility lease obligations.

The Company generated in excess of $40 million in pretax savings from pharmacy closures and other consolidation and productivity initiatives implemented in connection with these activities. The 2005 Program initiatives required cumulative restructuring and other related charges of approximately $31 million before taxes through the third quarter of 2006, which related to the costs associated with the consolidation of Omnicare pharmacies and the other consolidation and productivity initiatives described above. Specifically, the Company recorded restructuring and other related charges of approximately $12 million and $19 million pretax during the years ended December 31, 2006 and 2005, respectively (approximately $8 million and $12 million aftertax, respectively). The restructuring liabilities associated with the 2005 Program were evaluated by the Company during the 2007 year, at which time it was determined that certain liabilities were no longer expected to be utilized as part of the activities remaining under the 2005 Program. In accordance with SFAS No. 146 “Accounting for Costs Associated with Exit or Disposal Activities,” the Company recorded adjustments in 2007 to reduce the employee severance and employee agreement buy-out liabilities by approximately $1.2 million and $0.4 million pretax, respectively.

See further discussion at the “Restructuring and Other Related Charges” note of the Notes to Consolidated Financial Statements.

For a discussion regarding the Company’s outlook, please see the “Outlook” section of this MD&A.

58

Pharmacy Services Segment

| | | | | | | | | | |

| | For the years ended December 31, | |

| |

| |

| | 2007 | | 2006 | | 2005 | |

| |

| |

| |

| |

Net sales | | $ | 6,024,871 | | $ | 6,321,141 | | $ | 5,110,414 | |

| |

|

| |

|

| |

|

| |

Operating income | | $ | 439,148 | | $ | 560,991 | | $ | 583,954 | |

| |

|

| |

|

| |

|

| |

2007 vs. 2006

Omnicare’s Pharmacy Services segment recorded sales of $6,024.9 million for the year ended December 31, 2007, down from the 2006 amount of $6,321.1 million by $296.2 million, or 4.7%. At December 31, 2007, Omnicare served long-term care facilities and other chronic care settings comprising approximately 1,392,000 beds as compared with approximately 1,406,000 beds served at December 31, 2006. Pharmacy Services sales were unfavorably impacted by a lower number of beds served, the increased availability and utilization of generic drugs, the effects of the reduction in reimbursement under the United Part D contract, the aforementioned deconsolidation of the pharmacy joint-venture operations, and the impact of a bed mix shift toward assisted living, which typically has lower penetration rates than skilled nursing facilities. Partially offsetting these factors were drug price inflation, the impact of acquisitions, and year-over-year growth in hospice pharmacy and specialty pharmacy services. The company estimates that drug price inflation for its highest dollar volume products in 2007 was approximately 5% to 6%. While the Company is focused on reducing its costs to mitigate the impact of drug pricing and reimbursement issues, there can be no assurance that such issues or other pricing and reimbursement pressures will not adversely impact the Pharmacy Services segment.

Operating income of the Pharmacy Services segment was $439.1 million in 2007, a $121.9 million decrease as compared with the $561.0 million earned in 2006. As a percentage of the segment’s sales, operating income of 7.3% in 2007 was lower than the 8.9% in 2006. The decrease in operating income in 2007 is primarily attributable to a lower number of beds served, the unfavorable impact of the aforementioned reduction in the reimbursement rates under the United Part D contract, and the previously discussed increase in the provision for doubtful accounts of $131.4 million pretax. Partially offsetting these factors was the increased availability and utilization of higher margin generic drugs, drug purchasing improvements, the Company’s continued integration of prior-period acquisitions and productivity enhancements, including the restructuring program relating, in part, to the NeighborCare acquisition and the “Omnicare Full Potential” Plan, as further discussed in the “Restructuring and Other Related Charges” section of this MD&A, as well as the favorable year-over-year impact of the special items discussed below. Specifically, operating income of the Pharmacy Services segment included special pretax items of $79.8 million and $187.6 million in the years ended December 31, 2007 and December 31, 2006, respectively. Operating income in 2007 included the aforementioned special litigation charges of $42.5 million, restructuring and other related charges of approximately $20.1 million, and incremental costs associated with the closure of the Company’s Heartland repackaging facility of $17.2 million. Operating income in 2006 included

59

the aforementioned special litigation charges of $125.1 million, a $6.1 million charge associated with retention payments for certain NeighborCare employees as required under the acquisition agreement, restructuring and other related charges of approximately $22.6 million, and incremental costs associated with the closure of the Company’s Heartland repackaging facility of $33.7 million.

CRO Services Segment

| | | | | | | | | | |

| | For the years ended December 31, | |

| |

| |

| | 2007 | | 2006 | | 2005 | |

| |

| |

| |

| |

Net sales | | $ | 195,139 | | $ | 171,852 | | $ | 182,368 | |

| |

|

| |

|

| |

|

| |

Operating income | | $ | 10,378 | | $ | 5,340 | | $ | 1,561 | |

| |

|

| |

|

| |

|

| |

2007 vs. 2006

Omnicare’s CRO Services segment recorded revenues of $195.1 million for the year ended December 31, 2007, an increase of $23.2 million, or 13.5%, from the $171.9 million recorded in the same prior year period. In accordance with EITF Issue No. 01-14, the Company included $31.7 million and $25.6 million of reimbursable out-of-pockets in its CRO Services segment reported revenue and direct cost amounts for the years ended December 31, 2007 and 2006, respectively. Revenues for 2007 were higher than in the same prior year period primarily due to the commencement and ramp-up of projects that were awarded in 2006 and in the first half of 2007, exceeding project terminations and cancellations.

Operating income in the CRO Services segment was $10.4 million in 2007 compared with $5.3 million in 2006, an increase of $5.1 million. As a percentage of the segment’s revenue, operating income was 5.3% in 2007 compared with 3.1% in 2006. This increase is primarily attributable to the favorable impact of the aforementioned increase in revenues and cost reduction efforts. Backlog at December 31, 2007 of $314.3 million was $12.4 million higher than the December 31, 2006 backlog of $301.9 million.

Total net sales for the year ended December 31, 2006 rose to $6,493.0 million from $5,292.8 million in the comparable prior year period. Diluted earnings per share for the year ended December 31, 2006 were $1.50 versus $2.10 in the same prior year period. Net income for the year ended December 31, 2006 was $183.6 million versus $226.5 million earned in the comparable 2005 period. EBITDA totaled $600 million for the year ended December 31, 2006 as compared with $602.0 million for the same period of 2005.

Sales and profitability results are discussed in more detail at the “Pharmacy Services Segment” and “CRO Services Segment” captions below.

60

The new prescription drug benefit under Medicare Part D (“Part D”) became effective on January 1, 2006. As a result, Omnicare experienced a significant shift in payor mix (as a % of annual sales) during the year ended December 31, 2006. The payor mix for the 2006 full year was approximately 42% Medicare, 12% Medicaid, 43% private pay, third-party and facility, and 3% other sources. Prior to the implementation of the new Medicare Part D program, most of the Part D residents served by the Company were reimbursed under state Medicaid programs and, to a lesser extent, private pay sources. As expected with such a significant change in payor source and reimbursement system, the year ended December 31, 2006 was a transition period as the Company devoted considerable time, effort and resources to addressing certain administrative, operational and payment issues associated with the implementation of Part D. As a result, the Company incurred incremental expenses of approximately $27.3 million pretax (approximately $17.4 million aftertax) during the year ended December 31, 2006 comprising temporary labor, administrative and operating costs incurred in connection with the implementation of the new Medicare Part D drug benefit. These expenditures were necessary to support the billing and cash collection functions, as well as handle the disruption in the timing of work flow and delivery of medications created by these implementation issues. While considerable progress has been made in addressing many of the Part D implementation issues, Omnicare continues to devote resources to the ongoing resolution of these matters and expects incremental Part D transition expenses to continue until such time that the various implementation issues are resolved.

The results for the year ended December 31, 2006 were also impacted by the unilateral reduction by United in the reimbursement rates paid by United to Omnicare under its pharmacy network contract for services rendered by Omnicare to beneficiaries of United’s drug benefit plans under the Medicare Part D program. The differential in rates that resulted from United’s action reduced sales and operating profit for the year ended December 31, 2006 by approximately $68.2 million (approximately $43.3 million aftertax). This matter is currently the subject of litigation initiated by Omnicare in federal court. See further discussion at the “Legal Proceedings” section at Part I, Item 3 of this Filing.

The Company’s consolidated gross profit of $1,600.4 million increased $301.3 million for the full year 2006 from the same prior-year period amount of $1,299.1 million, due primarily to the increase in sales discussed in the “Pharmacy Services Segment” and “CRO Services Segment” captions below. Gross profit as a percentage of total net sales of 24.6% in the year ended December 31, 2006, was slightly higher than the 24.5% experienced during 2005. Positively impacting overall gross profit margin were the Company’s purchasing leverage associated with the procurement of pharmaceuticals, the increased use of generic drugs, the impact of productivity enhancements, a favorable payor mix shift (offset in large measure by the aforementioned United reimbursement rate reduction), cost savings associated with the integration of NeighborCare, and the addition of the higher-margin RxCrossroads, LLC (“RxCrossroads”) and excelleRx, Inc. (“excelleRx”) businesses. These favorable year-over-year factors were offset by competitive pricing pressures, Medicaid reimbursement reductions in late 2005 (although the impact from Medicaid reimbursement cuts now is much lower than seen historically due to the shift in payor mix largely from Medicaid to Medicare Part D), Part D transition expenses and special charges. Specifically, gross profit for the year ended December 31, 2006 was impacted by a special charge related to the quality control, product recall and fire issues at its Heartland repackaging facility, of which $27.7 million impacted gross profit, and the

61

Michigan Medicaid matter, of which $10.3 million impacted gross profit, as further discussed in “Special Charges” caption below. While progress has been made in addressing many of the Heartland matters, Omnicare continues to devote resources to the ongoing resolution of these matters and expects incremental expenses to continue until such time that the various matters are resolved. In order to replace the repackaging capacity of the Heartland facility, on February 27, 2007, Omnicare entered into an agreement for the Repackaging Services division of Cardinal Health to serve as the contract repackager for pharmaceutical volumes previously repackaged at the Heartland facility. The agreement initially extends through October 2010.

Increased leverage in purchasing favorably impacts gross profit and is primarily derived through discounts, rebates and other price concessions from suppliers. Leveraging of fixed and variable overhead costs primarily relates to generating higher sales volumes from pharmacy facilities with no or limited increases in fixed costs (e.g., rent, depreciation, etc.) and negligible to moderate increases in variable costs (e.g., utilities, labor, etc.), as well as the elimination of pharmacies through the Company’s productivity and consolidation initiatives, further discussed below. The Company believes it will be able to continue to leverage fixed and variable overhead costs through both internal and acquired growth.

Government and other reimbursement formulas generally adjust to take into account drug price inflation or deflation. In order to enhance its gross profit margins, the Company strategically allocates its resources to those activities that will increase internal sales growth and favorably impact sales mix, or will lower costs. In addition, through the ongoing development of its pharmaceutical purchasing programs, the Company is able to obtain volume discounts and thereby manage its pharmaceutical costs.

Omnicare’s operating expenses for the year ended December 31, 2006 of $887.4 million were higher than the comparable year amount of $700.6 million by $186.8 million, due primarily to the overall growth of the business, including the full year impact of the 2005 acquisitions, including NeighborCare, excelleRx and RxCrossroads. Operating expenses as a percentage of total net sales were 13.7% in 2006, representing an increase from the 13.2% experienced in the comparable prior-year period. Operating expenses for the year ended December 31, 2006 were unfavorably impacted by a $24.5 million increase in amortization and depreciation expenses, largely related to the 2005 acquisitions, $6.1 million pretax charge associated with retention payments for certain NeighborCare employees, $7.1 million pretax of additional equity-based compensation expense for stock options and stock awards related to the adoption of Statement of Accounting Standards (“SFAS”) No. 123 (revised 2004), “Share-Based Payment” (“SFAS 123R”), increased legal and professional costs and the previously discussed temporary costs associated with the implementation of the new Medicare Part D drug benefit. The provision for doubtful accounts as a percent of net sales amounted to 1.3% in 2006, modestly higher than the 1.1% in the comparable prior-year period. Partially offsetting the increased operating expenses were the favorable impact of leveraging of fixed (e.g., rents) and variable (e.g., utilities) overhead costs over a larger sales base in 2006 than that which existed in 2005 and the Company’s continued productivity enhancements, including the ongoing restructuring program commenced in connection with the NeighborCare acquisition and the commencement of the “Omnicare Full Potential” Plan, as further discussed in “Restructuring and Other Related Charges” caption below. In addition, the year ended December 31, 2005 included $4.9 million

62

pretax charge in connection with the legal settlement of certain contractual issues with two vendors, $3.0 million pretax charge for professional fees and expenses related to the first quarter 2005 trust PIERS exchange offering and the purchase of the Company’s 8.125% senior subordinated notes due 2011, and $1.1 million pretax charge for acquisition-related expenses.

Effective January 1, 2006, the Company adopted SFAS 123R, which requires the Company to record compensation costs relating to equity-based payments in its financial statements. As previously mentioned, operating income for the year ended December 31, 2006 includes additional equity-based compensation expense for stock options and stock awards of approximately $7.1 million pretax (approximately $4.5 million aftertax) related to the adoption of SFAS 123R. See additional discussion at the “Critical Accounting Policies” section of this MD&A.

Investment income for the year ended December 31, 2006 of $10.5 million was approximately $4.7 million higher than the $5.8 million earned in the comparable prior year period, primarily due to higher interest rates and average invested cash and retirement plan asset balances versus the prior year.

Interest expense for the year ended December 31, 2006 of $170.3 million was approximately $4.7 million higher than the $165.6 million in the comparable prior-year period, primarily due to increased overall borrowings resulting from the new debt issuances completed in the latter half of 2005 in connection with the previously mentioned acquisitions, and increased interest rates for variable rate loans. In addition, interest expense for the year ended December 31, 2005 included special charges of approximately $35.0 million, primarily related to the debt extinguishment and new debt issuance costs in connection with the Company’s financing plan.

The effective income tax rate was 42.7% in 2006, significantly higher than the prior-year rate of 37.4% due primarily to certain nondeductible litigation costs recognized in the 2006 period, partially offset by the favorable effect of a fourth quarter 2006 increase in tax benefits associated primarily with certain state income tax net operating losses totaling approximately $5.0 million aftertax, as well as an overall reduction of the Company’s ongoing state effective tax rate in 2006. The effective tax rates in 2006 and 2005 are higher than the federal statutory rate largely as a result of the combined impact of state and local income taxes, and various nondeductible expenses (including a portion of the aforementioned litigation costs).

Special Charges

The year ended December 31, 2006 included the following charges, which primarily impacted the Pharmacy Services segment, that management considers to be special charges, and not related to Omnicare’s ordinary course of business:

(i) Operating income included a special litigation charge of $57.5 million pretax ($45.3 million aftertax) to establish a settlement reserve relating to previously disclosed inquiries by the federal government and certain states relating to three generic pharmaceuticals provided by the Company, based on discussions between these government representatives, the Company and its legal counsel. As previously disclosed, the inquiries relate to the substitution of capsules for tablets (Ranitidine), tablets for capsules (Fluoxetine) and two 7.5 mg tablets for one 15 mg tablet

63

(Buspirone). The Company made settlement payments of approximately $51.0 million in the fourth quarter of 2006 related to these matters. This special litigation charge represented the Company’s best estimate of the settlement amounts and associated costs under SFAS No. 5, “Accounting for Contingencies” (“SFAS 5”). See further discussion at the “Commitments and Contingencies” note of the Notes to Consolidated Financial Statements, and the “Legal Proceedings” section at Part I, Item 3 of this Filing.

(ii) On October 5, 2006, the Company announced it had reached a voluntary Settlement Agreement with the State of Michigan to resolve certain billing issues under the Michigan Medicaid program. The Company also announced that it reached an agreement in principle with the State of Michigan with respect to certain hospice claims. The year ended December 31, 2006 included a special litigation charge of $54.0 million pretax, including $10.3 million and $43.7 million recorded in the net sales and litigation charges lines of the Consolidated Statements of Income, respectively ($46.7 million aftertax), based on the terms of the settlement agreements. The Company paid $43.0 million related to the Michigan settlement in the fourth quarter of 2006. See further discussion at the “Commitments and Contingencies” note of the Notes to Consolidated Financial Statements, and the “Legal Proceedings” section at Part I, Item 3 of this Filing.

(iii) Operating income included a special litigation charge of $13.6 million pretax ($8.6 million aftertax) for litigation-related professional expenses in connection with the administrative subpoenas from the United States Attorney’s Office, District of Massachusetts, the purported class and derivative actions and the Company’s lawsuit against United. See further discussion at the “Commitments and Contingencies” note of the Notes to Consolidated Financial Statements, and the “Legal Proceedings” section at Part I, Item 3 of this Filing.

(iv) Operating income included restructuring and other related charges of approximately $29.6 million pretax ($18.8 million aftertax). Approximately $17.5 million of the pretax charge ($11.1 million aftertax) relates to the implementation of the “Omnicare Full Potential” Plan, a major initiative primarily designed to re-engineer the pharmacy operating model to increase efficiency and enhance customer growth. The remaining $12.1 million of the pretax charge ($7.7 million aftertax) relates to the previously disclosed consolidation and productivity initiatives related, in part, to the integration of the NeighborCare acquisition, as well as initiatives intended to streamline pharmacy services and contract research organization operations. See further discussion at the “Restructuring and Other Related Charges” note of the Notes to Consolidated Financial Statements and the “Restructuring and Other Related Charges” section of this MD&A.

(v) During 2006, the Company experienced certain quality control and product recall issues, as well as fire damage, at one of its repackaging facilities, Heartland, as described in further detail at the “Commitments and Contingencies” note of the Notes to Consolidated Financial Statements. Addressing these issues served to increase costs and, as a result, the year ended December 31, 2006 included special charges of $33.7 million pretax (approximately $27.7 million and $6.1 million was recorded in the cost of sales and operating expense sections of the Consolidated Statements of Income, respectively) ($21.2 million aftertax) for these increased costs, particularly relating to the write-off of inventory totaling $18.9 million pretax, as well as

64

$14.8 million pretax for the incremental costs associated with the quality control, product recall and fire damage issues at Heartland. The Company maintains product recall, property and casualty, and business interruption insurance and the extent of insurance recovery for these expenses is currently being reviewed by its outside advisors. As of December 31, 2006, no receivables for insurance recoveries have been recorded by the Company.

(vi) Operating income included a special charge of approximately $6.1 million pretax ($3.9 million after tax) associated with retention payments for certain NeighborCare employees as required under the acquisition agreement.

For a discussion regarding the Company’s outlook, please see the “Outlook” section of this MD&A.

Pharmacy Services Segment

2006 vs. 2005

Omnicare’s Pharmacy Services segment recorded sales of $6,321.1 million for the year ended December 31, 2006, exceeding the 2005 amount of $5,110.4 million by $1,210.7 million, or 23.7%. At December 31, 2006, Omnicare served long-term care facilities and other chronic care settings comprising approximately 1,406,000 beds as compared with approximately 1,452,000 beds served at December 31, 2005. Contributing in large measure to the year-over-year increase in sales was the completion of several acquisitions in 2005 and 2006, in particular, the acquisition of NeighborCare completed in the third quarter of 2005. Further, the acquisitions of excelleRx and RxCrossroads in August 2005 and the completion of 17 acquisitions in 2006 also contributed to the year-over-year sales increase. In addition, Pharmacy Services sales increased due to a favorable payor mix shift (offset in large measure by the aforementioned second quarter reduction in reimbursement rates under the United Part D contract) and drug price inflation. The Company estimates that drug price inflation for its highest dollar volume products in 2006 was approximately 5%. These positive factors were partially offset by a marked increase in the use of generic drugs, a lower number of beds served along with a bed mix shift, Medicaid reimbursement reductions in late 2005 (although the impact from Medicaid reimbursement cuts now is much lower than seen historically due to the shift in payor mix largely from Medicaid to Medicare Part D) and competitive pricing pressures. Also unfavorably impacting sales for the year ended December 31, 2006, was a change to the equity method of accounting for certain pharmacy joint venture operations in which the Company owns less than a 100% interest. Accordingly, the deconsolidation of these operations excluded net sales of approximately $48 million but had no impact on earnings. While the Company is focused on reducing the impact of competitive pricing and reimbursement issues, there can be no assurance that such issues or other pricing and reimbursement pressures will not continue to impact the Pharmacy Services segment.

Operating income of the Pharmacy Services segment was $561.0 million in 2006, a $23.0 million decrease as compared with the $584.0 million earned in 2005. As a percentage of the segment’s sales, operating income was 8.9% in 2006, compared with 11.4% in 2005. Operating income in 2006 benefited from the increased sales discussed above, including the addition of NeighborCare, excelleRx and RxCrossroads, the increased use of generic drugs, the impact of productivity enhancement initiatives, as well as the overall synergies from the integration of

65

prior-period acquisitions, particularly the NeighborCare acquisition. Although operating margins are generally unfavorably impacted by the initial addition of lower-margin institutional pharmacy acquisitions, the integration efforts have historically resulted in drug purchasing improvements, the consolidation of redundant pharmacy locations and other economies of scale, which serve to leverage the Company’s operating cost structure and have historically resulted in improved operating margins in the long-term as cost synergies are realized. Pharmacy Services operating income in the year ended December 31, 2005 included an expected benefit of $8.1 million attributable to the medication management performance provisions associated with a previously announced agreement with a third party under which Omnicare provided certain services to a now completed disease management demonstration project. The aforementioned positive factors in 2006 were more than offset by the special charges discussed below, as well as the Part D transition expenses and previously mentioned intensified competitive pricing and prior period Medicaid reimbursement reductions (although the impact from Medicaid reimbursement cuts now is much lower than seen historically due to the shift in payor mix largely from Medicaid to Medicare Part D). Specifically, operating income of the Pharmacy Services segment in the year ended December 31, 2006, was impacted by special pretax charges of approximately $187.6 million, including the aforementioned special litigation charges of $125.1 million, a $6.1 million charge associated with retention payments for certain NeighborCare employees as required under the acquisition agreement and the previously mentioned restructuring and other related charges, of which approximately $22.6 million was included in the Pharmacy Services segment and the previously mentioned $33.7 million in charges related to the quality control, product recall and fire issues at Heartland. In addition, operating income of the Pharmacy Services segment in the year ended December 31, 2005, was impacted by special pretax charges of approximately $11.3 million, including a $4.9 million charge for the settlement of litigation relating to certain contractual issues with two vendors, a charge for $1.1 million for acquisition-related expenses pertaining to a proposed transaction that was not consummated and the previously mentioned restructuring and other related charges, of which approximately $5.2 million was included in the Pharmacy Services segment.

On July 28, 2005, Omnicare completed its acquisition of NeighborCare. The acquisition, accounted for as a purchase business combination, included cash consideration of approximately $1.9 billion. The cash consideration included the pay off of certain NeighborCare debt totaling approximately $328 million, of which $78 million was retired by the Company immediately following the acquisition. In addition, the Company completed a tender offer for and subsequently purchased all of the $250 million outstanding principal amount of NeighborCare’s 6.875% senior subordinated notes, due 2013 (the “NeighborCare Notes”). The total consideration, excluding accrued and unpaid interest, paid for the NeighborCare Notes was approximately $274.2 million.