UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-2460

Fidelity Union Street Trust

(Exact name of registrant as specified in charter)

82 Devonshire St., Boston, Massachusetts 02109

(Address of principal executive offices) (Zip code)

Eric D. Roiter, Secretary

82 Devonshire St.

Boston, Massachusetts 02109

(Name and address of agent for service)

Registrant's telephone number, including area code: 617-563-7000

Date of fiscal year end: | August 31 |

| |

Date of reporting period: | February 28, 2006 |

Item 1. Reports to Stockholders

| | Fidelity®

Arizona Municipal

Income Fund

and

Fidelity

Arizona Municipal

Money Market Fund

|

| | Semiannual Report

February 28, 2006

|

| Contents | | | | |

| |

| Chairman’s Message | | 3 | | Ned Johnson’s message to shareholders. |

| Shareholder Expense | | 4 | | An example of shareholder expenses. |

| Example | | | | |

| Fidelity Arizona Municipal Income Fund |

| Investment Changes | | 6 | | A summary of major shifts in the fund’s |

| | | | | investments over the past six months. |

| Investments | | 7 | | A complete list of the fund’s investments |

| | | | | with their market values. |

| Financial Statements | | 12 | | Statements of assets and liabilities, |

| | | | | operations, and changes in net assets, |

| | | | | as well as financial highlights. |

| Fidelity Arizona Municipal Money Market Fund |

| Investment Changes | | 16 | | A summary of major shifts in the fund’s |

| | | | | investments over the past six months and |

| | | | | one year. |

| Investments | | 17 | | A complete list of the fund’s investments. |

| Financial Statements | | 23 | | Statements of assets and liabilities, |

| | | | | operations, and changes in net assets, |

| | | | | as well as financial highlights. |

| Notes | | 27 | | Notes to the financial statements. |

| Board Approval of | | 31 | | |

| Investment Advisory | | | | |

| Contracts and | | | | |

| Management Fees | | | | |

To view a fund’s proxy voting guidelines and proxy voting record for the 12 month period

ended June 30, visit www.fidelity.com/proxyvotingresults or visit the Securities and Exchange

Commission’s (SEC) web site at www.sec.gov. You may also call 1-800-544-8544 to request a free

copy of the proxy voting guidelines.

Standard & Poor’s, S&P and S&P 500 are registered service marks of The McGraw Hill Companies, Inc.

and have been licensed for use by Fidelity Distributors Corporation.

Other third party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks

of FMR Corp. or an affiliated company.

|

| | This report and the financial statements contained herein are submitted for the general in-

formation of the shareholders of the funds. This report is not authorized for distribution to

prospective investors in the funds unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third

quarters of each fiscal year on Form N Q. Forms N Q are available on the SEC’s web site at

http://www.sec.gov. A fund’s Forms N Q may be reviewed and copied at the SEC’s Public Refer

ence Room in Washington, DC. Information regarding the operation of the SEC’s Public Reference

Room may be obtained by calling 1-800-SEC-0330. For a complete list of a fund’s portfolio

holdings, view the most recent quarterly holdings report, semiannual report, or annual report

on Fidelity’s web site at http://www.fidelity.com/holdings.

NOT FDIC INSURED · MAY LOSE VALUE · NO BANK GUARANTEE

Neither the funds nor Fidelity Distributors Corporation is a bank.

|

Semiannual Report 2

Chairman’s Message

(photograph of Edward C. Johnson 3d)

Dear Shareholder:

Although many securities markets made gains in early 2006, there is only one certainty when it comes to investing: There is no sure thing. There are, however, a number of time tested, fundamental investment principles that can put the historical odds in your favor.

One of the basic tenets is to invest for the long term. Over time, riding out the markets’ inevitable ups and downs has proven much more effective than selling into panic or chasing the hottest trend. Even missing only a few of the markets’ best days can significantly diminish investor returns. Patience also affords the benefits of compounding of earning interest on additional income or reinvested dividends and capital gains. There are tax advantages and cost benefits to consider as well. The more you sell, the more taxes you pay, and the more you trade, the higher the costs. While staying the course doesn’t eliminate risk, it can considerably lessen the effect of short term declines.

You can further manage your investing risk through diversification. And today, more than ever, geographic diversifica tion should be taken into account. Studies indicate that asset allocation is the single most important determinant of a portfolio’s long term success. The right mix of stocks, bonds and cash aligned to your particular risk tolerance and investment objective is very important. Age appropriate rebalancing is also an essential aspect of asset allocation. For younger investors, an emphasis on equities which historically have been the best performing asset class over time is encouraged. As investors near their specific goal, such as retirement or sending a child to college, consideration may be given to replacing volatile assets (e.g. common stocks) with more stable fixed investments (bonds or savings plans).

A third investment principle investing regularly can help lower the average cost of your purchases. Investing a certain amount of money each month or quarter helps ensure you won’t pay for all your shares at market highs. This strategy known as dollar cost averaging also reduces unconstructive “emotion” from investing, helping shareholders avoid selling weak performers just prior to an upswing, or chasing a hot performer just before a correction.

We invite you to contact us via the Internet, through our Investor Centers or over the phone. It is our privilege to provide you the information you need to make the investments that are right for you.

Sincerely,

/s/ Edward C. Johnson 3d

Edward C. Johnson 3d

3 Semiannual Report

Shareholder Expense Example

As a shareholder of a Fund, you incur two types of costs: (1) transaction costs, including redemption fees, and (2) ongoing costs, including management fees and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (September 1, 2005 to February 28, 2006).

The first line of the table below for each fund provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000.00 (for example, an $8,600 account value divided by $1,000.00 = 8.6), then multiply the result by the number in the first line for a fund under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period. A small balance maintenance fee of $12.00 that is charged once a year may apply for certain accounts with a value of less than $2,000. This fee is not included in the table below. If it was, the estimate of expenses you paid during the period would be higher, and your ending account value lower, by this amount.

Hypothetical Example for Comparison Purposes

The second line of the table below for each fund provides information about hypothetical account values and hypothetical expenses based on a fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. A small balance maintenance fee of $12.00 that is charged once a year may apply for certain accounts with a value of less than $2,000. This fee is not included in the table below. If it was, the estimate of expenses you paid during the period would be higher, and your ending account value lower, by this amount. Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | | | Expenses Paid |

| | | Beginning | | Ending | | During Period* |

| | | Account Value | | Account Value | | September 1, 2005 |

| | | September 1, 2005 | | February 28, 2006 | | to February 28, 2006 |

| Fidelity Arizona Municipal | | | | | | | | | | | | |

| Income Fund | | | | | | | | | | | | |

| Actual | | $ | | 1,000.00 | | $ | | 1,006.00 | | $ | | 2.74 |

| HypotheticalA | | $ | | 1,000.00 | | $ | | 1,022.07 | | $ | | 2.76 |

| Fidelity Arizona Municipal | | | | | | | | | | | | |

| Money Market Fund | | | | | | | | | | | | |

| Actual | | $ | | 1,000.00 | | $ | | 1,012.20 | | $ | | 2.49 |

| HypotheticalA | | $ | | 1,000.00 | | $ | | 1,022.32 | | $ | | 2.51 |

A 5% return per year before expenses | | | | | | | | |

* Expenses are equal to each Fund’s annualized expense ratio (shown in the table below); multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one half year period).

| | | Annualized |

| | | Expense Ratio |

| Fidelity Arizona Municipal Income Fund | | 55% |

| Fidelity Arizona Municipal Money Market Fund | | 50% |

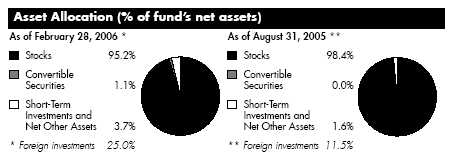

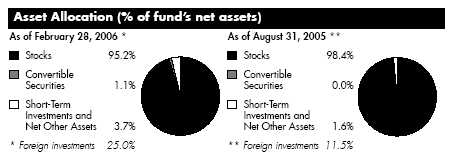

| Fidelity Arizona Municipal Income Fund | | | | |

| Investment Changes | | | | |

| |

| Top Five Sectors as of February 28, 2006 | | | | |

| | | % of fund’s | | % of fund’s net assets |

| | | net assets | | 6 months ago |

| Water & Sewer | | 20.9 | | 17.8 |

| Special Tax | | 19.2 | | 20.0 |

| General Obligations | | 18.9 | | 21.3 |

| Escrowed/Pre Refunded | | 11.9 | | 15.5 |

| Electric Utilities | | 8.8 | | 10.5 |

Average Years to Maturity as of February 28, 2006 | | | | |

| | | | | 6 months ago |

| Years | | 13.5 | | 13.4 |

Average years to maturity is based on the average time remaining to the stated maturity date of each bond, weighted by the market value of each bond.

| Duration as of February 28, 2006 | | | | |

| | | | | | | 6 months ago |

| Years | | | | 6.7 | | 6.8 |

Duration shows how much a bond fund’s price fluctuates with changes in comparable interest rates. If rates rise 1%, for example, a fund with a five year duration is likely to lose about 5% of its value. Other factors also can influence a bond fund’s performance and share price. Accordingly, a bond fund’s actual performance may differ from this example.

We have used ratings from Moody’s® Investors Services, Inc. Where Moody’s ratings are not available, we have used S&P® ratings.

Semiannual Report 6

| Fidelity Arizona Municipal Income Fund | | | | |

| |

| Investments February 28, 2006 (Unaudited) |

| Showing Percentage of Net Assets | | | | |

| |

| Municipal Bonds 96.9% | | | | |

| | | Principal | | Value (Note 1) |

| | | Amount | | |

| Arizona – 88.3% | | | | |

| Arizona Health Facilities Auth. Rev. (Catholic Health Care West | | | | |

| Proj.): | | | | |

| Series A, 6.125% 7/1/09 | | $ 245,000 | | $ 255,381 |

| 6.125% 7/1/09 (c) | | 210,000 | | 218,898 |

| Arizona School Facilities Board Ctfs. of Prtn.: | | | | |

| Series A2, 5% 9/1/18 (FGIC Insured) | | 1,000,000 | | 1,074,260 |

| Series B, 5.25% 9/1/19 (Pre-Refunded to 9/1/14 @ | | | | |

| 100) (c) | | 1,000,000 | | 1,107,490 |

| Series C, 5% 9/1/11 (FSA Insured) | | 1,060,000 | | 1,131,751 |

| Arizona School Facilities Board State School Impt. Rev.: | | | | |

| 5.25% 7/1/18 (Pre-Refunded to 7/1/12 @ 100) (c) | | 1,000,000 | | 1,089,030 |

| 5.25% 7/1/20 (Pre-Refunded to 7/1/12 @ 100) (c) | | 1,000,000 | | 1,089,030 |

| Arizona State Univ. Revs.: | | | | |

| 5% 7/1/26 (AMBAC Insured) | | 1,000,000 | | 1,061,160 |

| 5.75% 7/1/27 (Pre-Refunded to 7/1/12 @ 100) (c) | | 1,500,000 | | 1,675,560 |

| Arizona Student Ln. Acquisition Auth. Student Ln. Rev. | | | | |

| Subseries B1, 6.15% 5/1/29 (b) | | 500,000 | | 531,130 |

| Arizona Trans. Board Hwy. Rev.: | | | | |

| Series B, 5.25% 7/1/19 | | 2,500,000 | | 2,709,375 |

| 5.25% 7/1/13 | | 1,500,000 | | 1,614,420 |

| Arizona Wtr. Infrastructure Fin. Auth. Rev. (Wtr. Quality Proj.) | | | | |

| Series A, 5.375% 10/1/11 | | 2,000,000 | | 2,180,000 |

| Central Arizona Wtr. Conservation District Contract Rev. | | | | |

| (Central Arizona Proj.) Series A, 5.5% 11/1/09 | | 1,000,000 | | 1,064,580 |

| Chandler Gen. Oblig.: | | | | |

| 5.7% 7/1/15 | | 75,000 | | 82,183 |

| 6.5% 7/1/10 (MBIA Insured) | | 200,000 | | 223,890 |

| 6.5% 7/1/11 (MBIA Insured) | | 225,000 | | 256,597 |

| Chandler Indl. Dev. Auth. Indl. Dev. Rev. (Intel Corp. Proj.) | | | | |

| 4.375%, tender 12/1/10 (a)(b) | | 1,000,000 | | 1,019,910 |

| Cottonwood Wtr. Sys. Rev.: | | | | |

| 5% 7/1/30 (XL Cap. Assurance, Inc. Insured) | | 825,000 | | 865,681 |

| 5% 7/1/35 (XL Cap. Assurance, Inc. Insured) | | 1,300,000 | | 1,358,604 |

| Downtown Phoenix Hotel Corp. Rev. Series A, 5.25% 7/1/23 | | | | |

| (FGIC Insured) | | 1,750,000 | | 1,903,965 |

| Gilbert Wtr. Resources Muni. Property Corp. Wastewtr. Sys. & | | | | |

| Util. Rev. 4.9% 4/1/19 | | 1,025,000 | | 1,033,323 |

| Glendale Indl. Dev. Auth. Hosp. Rev. (John C. Lincoln Health | | | | |

| Network Proj.): | | | | |

| Series 2005 B, 5.25% 12/1/19 | | 1,040,000 | | 1,090,034 |

| 5% 12/1/35 | | 1,000,000 | | 1,007,600 |

| |

| |

| See accompanying notes which are an integral part of the financial statements. | | |

| |

| 7 | | Semiannual Report |

| Fidelity Arizona Municipal Income Fund | | | | | | |

| Investments (Unaudited) continued | | | | | | |

| |

| Municipal Bonds continued | | | | | | |

| | | | | Principal | | Value (Note 1) |

| | | | | Amount | | |

| Arizona – continued | | | | | | |

| Maricopa County Hosp. Rev. (Sun Health Corp. Proj.): | | | | | | |

| 5% 4/1/14 | | | | $ 1,000,000 | | $ 1,043,150 |

| 6.125% 4/1/18 | | | | 85,000 | | 88,863 |

| 6.125% 4/1/18 (Pre-Refunded to 4/1/07 @ 102) (c) | | | | 215,000 | | 225,124 |

| Maricopa County Indl. Dev. Auth. Health Facilities Rev. | | | | | | |

| (Catholic Health Care West Proj.): | | | | | | |

| 5% 7/1/16 | | | | 680,000 | | 698,686 |

| 5% 7/1/16 (Pre-Refunded to 7/1/07 @ 100) (c) | | | | 50,000 | | 51,686 |

| Maricopa County Indl. Dev. Auth. Hosp. Facilities Rev. (Mayo | | | | | | |

| Clinic Hosp. Proj.) 5.25% 11/15/37 | | | | 1,000,000 | | 1,043,360 |

| Maricopa County School District #28 Kyrene Elementary | | | | | | |

| Series C, 0% 1/1/10 (FGIC Insured) | | | | 1,425,000 | | 1,234,706 |

| Maricopa County Unified School District #48 Scottsdale: | | | | | | |

| Series A, 5% 7/1/18 (FGIC Insured) | | | | 1,000,000 | | 1,081,210 |

| 7.4% 7/1/10 | | | | 1,000,000 | | 1,150,090 |

| Maricopa County Unified School District #80 Chandler (2002 | | | | | | |

| Proj.) Series A, 5% 7/1/17 (FSA Insured) | | | | 500,000 | | 534,410 |

| Mesa Indl. Dev. Auth. Rev. (Discovery Health Sys. Proj.) | | | | | | |

| Series A, 5.625% 1/1/29 (Pre-Refunded to 1/1/10 @ | | | | | | |

| 101) (c) | | | | 795,000 | | 859,570 |

| Mesa Street & Hwy. Rev. 6.5% 7/1/11 (FSA Insured) | | | | 1,500,000 | | 1,710,645 |

| Mesa Util. Sys. Rev. 5.75% 7/1/14 (FGIC Insured) | | | | 1,000,000 | | 1,137,270 |

| Northern Arizona Univ. Sys. Rev.: | | | | | | |

| 5.5% 6/1/23 (FGIC Insured) | | | | 530,000 | | 589,265 |

| 5.5% 6/1/26 (FGIC Insured) | | | | 1,305,000 | | 1,448,981 |

| Phoenix Arpt. Rev. Series D, 6.4% 7/1/12 (MBIA Insured) (b) . | | | | 810,000 | | 818,586 |

| Phoenix Civic Impt. Board Arpt. Rev. Series B, 5.25% 7/1/27 | | | | | | |

| (FGIC Insured) (b) | | | | 1,000,000 | | 1,048,690 |

| Phoenix Civic Impt. Corp. Arpt. Excise Tax Rev. 5.25% | | | | | | |

| 7/1/09 (b) | | | | 400,000 | | 416,540 |

| Phoenix Civic Impt. Corp. Excise Tax Rev.: | | | | | | |

| (Civic Plaza Expansion Proj.) Series A, 5% 7/1/30 (FGIC | | | | | | |

| Insured) | | | | 1,000,000 | | 1,057,200 |

| (Muni. Courthouse Proj.) Series A: | | | | | | |

| 5.375% 7/1/29 | | | | 560,000 | | 596,036 |

| 5.5% 7/1/11 | | | | 200,000 | | 214,430 |

| 5.75% 7/1/15 | | | | 675,000 | | 728,737 |

| Phoenix Civic Impt. Corp. Muni. Facilities Excise Tax Rev.: | | | | | | |

| 5.75% 7/1/12 (FGIC Insured) | | | | 1,250,000 | | 1,367,475 |

| 5.75% 7/1/14 (FGIC Insured) | | | | 1,000,000 | | 1,093,960 |

See accompanying notes which are an integral part of the financial statements.

| Municipal Bonds continued | | | | | | |

| | | | | Principal | | Value (Note 1) |

| | | | | Amount | | |

| Arizona – continued | | | | | | |

| Phoenix Civic Impt. Corp. Wastewtr. Sys. Rev. 5% 7/1/29 | | | | | | |

| (MBIA Insured) | | | | $ 770,000 | | $ 809,555 |

| Phoenix Civic Impt. Corp. Wtr. Sys. Rev.: | | | | | | |

| Series 2001, 5.5% 7/1/24 (FGIC Insured) | | | | 1,000,000 | | 1,174,840 |

| 4.75% 7/1/27 (MBIA Insured) | | | | 1,020,000 | | 1,049,376 |

| 5% 7/1/20 (MBIA Insured) | | | | 5,000,000 | | 5,373,696 |

| 5% 7/1/29 (MBIA Insured) | | | | 1,000,000 | | 1,057,200 |

| 5.5% 7/1/17 (FGIC Insured) | | | | 1,500,000 | | 1,650,120 |

| 5.5% 7/1/20 (FGIC Insured) | | | | 1,500,000 | | 1,643,910 |

| Phoenix Gen. Oblig.: | | | | | | |

| Series A, 6.25% 7/1/17 | | | | 1,000,000 | | 1,212,440 |

| Series B, 5.375% 7/1/20 | | | | 1,000,000 | | 1,097,220 |

| Phoenix Indl. Dev. Auth. Single Family Mtg. Rev. 0% 12/1/14 | | | | | | |

| (Escrowed to Maturity) (c) | | | | 1,250,000 | | 875,813 |

| Phoenix Street & Hwy. User Rev. 6.25% 7/1/11 (MBIA | | | | | | |

| Insured) | | | | 35,000 | | 35,056 |

| Pima County Indl. Dev. Auth. Rev. (HealthPartners Proj.) | | | | | | |

| Series A, 5.625% 4/1/14 (MBIA Insured) | | | | 200,000 | | 207,912 |

| Pima County Unified School District #1 Tucson: | | | | | | |

| 7.5% 7/1/08 (FGIC Insured) | | | | 1,000,000 | | 1,088,370 |

| 7.5% 7/1/10 (FGIC Insured) | | | | 250,000 | | 289,275 |

| Pinal County Indl. Dev. Auth. Corr Facilities Contract Rev. | | | | | | |

| (Florence West Prison Expansion, LLC Proj.) Series A, 5.25% | | | | | | |

| 10/1/12 (American Cap. Access Corp. Insured) | | | | 1,000,000 | | 1,063,900 |

| Salt River Proj. Agric. Impt. & Pwr. District Elec. Sys. Rev.: | | | | | | |

| Series 2005 A: | | | | | | |

| 4.75% 1/1/35 | | | | 1,000,000 | | 1,026,020 |

| 5% 1/1/35 | | | | 1,500,000 | | 1,580,895 |

| Series A: | | | | | | |

| 5.25% 1/1/18 | | | | 1,000,000 | | 1,082,590 |

| 5.25% 1/1/19 | | | | 1,615,000 | | 1,744,862 |

| Series B: | | | | | | |

| 5% 1/1/20 | | | | 1,500,000 | | 1,590,615 |

| 5% 1/1/21 | | | | 255,000 | | 270,560 |

| Scottsdale Indl. Dev. Auth. Hosp. Rev. (Scottsdale Health Care | | | | | | |

| Proj.) 5.8% 12/1/31 | | | | 250,000 | | 268,603 |

| Scottsdale Wtr. & Swr. Rev. (1989 Proj.) Series E, 7% 7/1/07 . | | | | 150,000 | | 156,903 |

| Sedona Excise Tax Rev. 5% 7/1/19 (MBIA Insured) | | | | 1,000,000 | | 1,077,970 |

| Tempe Gen. Oblig.: | | | | | | |

| 5% 7/1/19 | | | | 1,680,000 | | 1,794,509 |

See accompanying notes which are an integral part of the financial statements.

9 Semiannual Report

| Fidelity Arizona Municipal Income Fund | | | | | | |

| Investments (Unaudited) continued | | | | | | |

| |

| Municipal Bonds continued | | | | | | |

| | | | | Principal | | Value (Note 1) |

| | | | | Amount | | |

| Arizona – continued | | | | | | |

| Tempe Gen. Oblig.: – continued | | | | | | |

| 5.5% 7/1/17 | | | | $ 1,035,000 | | $ 1,161,115 |

| Tempe Union High School District #213 7% 7/1/08 (FGIC | | | | | | |

| Insured) | | | | 310,000 | | 333,960 |

| Tucson Gen. Oblig.: | | | | | | |

| Series 1995 A, 7.375% 7/1/11 | | | | 1,000,000 | | 1,176,160 |

| Series A, 6% 7/1/13 | | | | 800,000 | | 912,152 |

| 5% 7/1/18 (FGIC Insured) | | | | 3,295,000 | | 3,562,587 |

| Tucson Street & Hwy. User Rev.: | | | | | | |

| Series 1994 B, 7.5% 7/1/11 (MBIA Insured) | | | | 1,015,000 | | 1,203,658 |

| Series 1994 C, 7% 7/1/11 (FGIC Insured) | | | | 500,000 | | 580,925 |

| Series A, 7% 7/1/11 (MBIA Insured) | | | | 300,000 | | 348,555 |

| Tucson Wtr. Rev.: | | | | | | |

| Series A, 5% 7/1/11 (FGIC Insured) | | | | 1,410,000 | | 1,499,225 |

| 5.5% 7/1/14 | | | | 425,000 | | 464,869 |

| Univ. Med. Ctr. Corp. Hosp. Rev. 5.25% 7/1/15 | | | | 1,000,000 | | 1,060,820 |

| Univ. of Arizona Ctfs. of Prtn. Series C, 5% 6/1/14 (AMBAC | | | | | | |

| Insured) | | | | 600,000 | | 643,494 |

| Univ. of Arizona Univ. Revs.: | | | | | | |

| Series 2005 A, 5% 6/1/18 (AMBAC Insured) | | | | 1,000,000 | | 1,080,600 |

| 5.25% 6/1/13 (FSA Insured) | | | | 245,000 | | 253,896 |

| Yavapai County Indl. Dev. Auth. Solid Waste Disp. Rev. (Waste | | | | | | |

| Mgmt., Inc. Proj.) 4%, tender 6/1/10 (a)(b) | | | | 1,000,000 | | 995,320 |

| Yuma County Hosp. District #1 6.35% 11/15/07 (Escrowed to | | | | | | |

| Maturity) (c) | | | | 265,000 | | 268,723 |

| | | | | | | 90,650,791 |

| |

| Guam 0.1% | | | | | | |

| Guam Wtrwks. Auth. Wtr. and Wastewtr. Sys. Rev. 5.875% | | | | | | |

| 7/1/35 | | | | 125,000 | | 132,083 |

| Puerto Rico 8.5% | | | | | | |

| Puerto Rico Commonwealth Hwy. & Trans. Auth. Hwy. Rev.: | | | | | | |

| Series 1996 Y, 5% 7/1/36 (FSA Insured) | | | | 1,100,000 | | 1,166,429 |

| Series Y: | | | | | | |

| 5.5% 7/1/36 (FSA Insured) | | | | 500,000 | | 562,015 |

| 5.5% 7/1/36 (MBIA Insured) | | | | 100,000 | | 112,403 |

| Puerto Rico Commonwealth Hwy. & Trans. Auth. Trans. Rev.: | | | | | | |

| Series 1998, 5.75% 7/1/22 (CIFG North America Insured) | | | | 700,000 | | 778,036 |

| 5.75% 7/1/19 (FGIC Insured) | | | | 700,000 | | 782,278 |

See accompanying notes which are an integral part of the financial statements.

| Municipal Bonds continued | | | | | | |

| | | | | Principal | | Value (Note 1) |

| | | | | Amount | | |

| Puerto Rico continued | | | | | | |

| Puerto Rico Commonwealth Infrastructure Fing. Auth. | | | | | | |

| Series 2000 A: | | | | | | |

| 5.5% 10/1/32 (Escrowed to Maturity) (c) | | | | $ 2,525,000 | | $ 2,735,131 |

| 5.5% 10/1/40 (Escrowed to Maturity) (c) | | | | 1,685,000 | | 1,817,812 |

| Puerto Rico Elec. Pwr. Auth. Pwr. Rev.: | | | | | | |

| Series HH, 5.25% 7/1/29 (FSA Insured) | | | | 200,000 | | 214,820 |

| Series QQ, 5.25% 7/1/14 (XL Cap. Assurance, Inc. Insured) | | | | 500,000 | | 552,820 |

| | | | | | | 8,721,744 |

| |

| |

| TOTAL INVESTMENT PORTFOLIO 96.9% | | | | | | |

| (Cost $97,285,626) | | | | | | 99,504,618 |

| |

| |

| NET OTHER ASSETS – 3.1% | | | | | | 3,160,387 |

| NET ASSETS 100% | | | | | | $ 102,665,005 |

Legend

(a) The coupon rate shown on floating or

adjustable rate securities represents the

rate at period end.

(b) Private activity obligations whose

interest is subject to the federal

alternative minimum tax for individuals.

(c) Security collateralized by an amount

sufficient to pay interest and principal.

|

Other Information

The distribution of municipal securities by revenue source, as a percentage of total net assets, is as follows:

| Water & Sewer | | 20.9% |

| Special Tax | | 19.2% |

| General Obligations | | 18.9% |

| Escrowed/Pre Refunded | | 11.9% |

| Electric Utilities | | 8.8% |

| Health Care | | 6.6% |

| Education | | 5.4% |

| Others* (individually less than 5%) | | 8.3% |

| | | 100.0% |

| *Includes net other assets | | |

See accompanying notes which are an integral part of the financial statements.

11 Semiannual Report

| Fidelity Arizona Municipal Income Fund | | | | |

| Financial Statements | | | | | | |

| |

| Statement of Assets and Liabilities | | | | | | |

| | | | | February 28, 2006 (Unaudited) |

| |

| Assets | | | | | | |

| Investment in securities, at value See accompanying | | | | | | |

| schedule: | | | | | | |

| Unaffiliated issuers (cost $97,285,626) | | | | | | $ 99,504,618 |

| Cash | | | | | | 2,481,424 |

| Receivable for fund shares sold | | | | | | 10,059 |

| Interest receivable | | | | | | 1,003,178 |

| Other receivables | | | | | | 8,953 |

| Total assets | | | | | | 103,008,232 |

| |

| Liabilities | | | | | | |

| Payable for fund shares redeemed | | | | $ 182,434 | | |

| Distributions payable | | | | 114,643 | | |

| Accrued management fee | | | | 46,114 | | |

| Other affiliated payables | | | | 36 | | |

| Total liabilities | | | | | | 343,227 |

| |

| Net Assets | | | | | | $ 102,665,005 |

| Net Assets consist of: | | | | | | |

| Paid in capital | | | | | | $ 100,217,907 |

| Undistributed net investment income | | | | | | 11,946 |

| Accumulated undistributed net realized gain (loss) on | | | | | | |

| investments | | | | | | 216,160 |

| Net unrealized appreciation (depreciation) on | | | | | | |

| investments | | | | | | 2,218,992 |

| Net Assets, for 9,004,243 shares outstanding | | | | | | $ 102,665,005 |

| Net Asset Value, offering price and redemption price per | | | | | | |

| share ($102,665,005 ÷ 9,004,243 shares) | | | | | | $ 11.40 |

See accompanying notes which are an integral part of the financial statements.

| Statement of Operations | | | | | | |

| | | Six months ended February 28, 2006 (Unaudited) |

| |

| Investment Income | | | | | | |

| Interest | | | | | | $ 2,048,850 |

| |

| Expenses | | | | | | |

| Management fee | | | | $ 273,742 | | |

| Independent trustees’ compensation | | | | 212 | | |

| Miscellaneous | | | | 88 | | |

| Total expenses before reductions | | | | 274,042 | | |

| Expense reductions | | | | (21,917) | | 252,125 |

| |

| Net investment income | | | | | | 1,796,725 |

| Realized and Unrealized Gain (Loss) | | | | | | |

| Net realized gain (loss) on: | | | | | | |

| Investment securities: | | | | | | |

| Unaffiliated issuers | | | | 409,018 | | |

| Futures contracts | | | | 540 | | |

| Total net realized gain (loss) | | | | | | 409,558 |

| Change in net unrealized appreciation (depreciation) on | | | | | | |

| investment securities | | | | | | (1,618,964) |

| Net gain (loss) | | | | | | (1,209,406) |

| Net increase (decrease) in net assets resulting from | | | | | | |

| operations | | | | | | $ 587,319 |

See accompanying notes which are an integral part of the financial statements.

13 Semiannual Report

| Fidelity Arizona Municipal Income Fund | | | | | | | | |

| Financial Statements continued | | | | | | | | |

| |

| Statement of Changes in Net Assets | | | | | | | | |

| | | Six months ended | | | | Year ended |

| | | February 28, 2006 | | | | August 31, |

| | | (Unaudited) | | | | 2005 |

| Increase (Decrease) in Net Assets | | | | | | | | |

| Operations | | | | | | | | |

| Net investment income | | | | $ 1,796,725 | | | | $ 3,227,117 |

| Net realized gain (loss) | | | | 409,558 | | | | 279,981 |

| Change in net unrealized appreciation (depreciation) . | | | | (1,618,964) | | | | 444,357 |

| Net increase (decrease) in net assets resulting from | | | | | | | | |

| operations | | | | 587,319 | | | | 3,951,455 |

| Distributions to shareholders from net investment income . | | | | (1,794,049) | | | | (3,235,508) |

| Distributions to shareholders from net realized gain | | | | (444,779) | | | | (377,090) |

| Total distributions | | | | (2,238,828) | | | | (3,612,598) |

| Share transactions | | | | | | | | |

| Proceeds from sales of shares | | | | 16,776,046 | | | | 34,309,224 |

| Reinvestment of distributions | | | | 1,314,024 | | | | 2,144,524 |

| Cost of shares redeemed | | | | (14,469,815) | | | | (14,386,971) |

| Net increase (decrease) in net assets resulting from | | | | | | | | |

| share transactions | | | | 3,620,255 | | | | 22,066,777 |

| Redemption fees | | | | 778 | | | | 977 |

| Total increase (decrease) in net assets | | | | 1,969,524 | | | | 22,406,611 |

| |

| Net Assets | | | | | | | | |

| Beginning of period | | | | 100,695,481 | | | | 78,288,870 |

| End of period (including undistributed net investment | | | | | | | | |

| income of $11,946 and undistributed net investment | | | | | | | | |

| income of $16,823, respectively) | | | | $ 102,665,005 | | | | $ 100,695,481 |

| |

| Other Information | | | | | | | | |

| Shares | | | | | | | | |

| Sold | | | | 1,472,866 | | | | 2,973,441 |

| Issued in reinvestment of distributions | | | | 115,492 | | | | 185,788 |

| Redeemed | | | | (1,271,049) | | | | (1,246,428) |

| Net increase (decrease) | | | | 317,309 | | | | 1,912,801 |

See accompanying notes which are an integral part of the financial statements.

| Financial Highlights | | | | | | | | | | |

| | | Six months ended | | | | | | | | | | |

| | | February 28, 2006 | | Years ended August 31, |

| | | (Unaudited) | | 2005 | | 2004 | | 2003 | | 2002 | | 2001 |

| Selected PerShare Data | | | | | | | | | | |

| Net asset value, | | | | | | | | | | | | |

| beginning of period | | $ 11.59 | | $ 11.56 | | $ 11.32 | | $ 11.50 | | $ 11.26 | | $ 10.72 |

| Income from | | | | | | | | | | | | |

| Investment | | | | | | | | | | | | |

| Operations | | | | | | | | | | | | |

| Net investment | | | | | | | | | | | | |

| incomeD | | 205 | | .417 | | .427 | | .435 | | .444F | | .472 |

| Net realized and | | | | | | | | | | | | |

| unrealized gain | | | | | | | | | | | | |

| (loss) | | (.139) | | .087 | | .306 | | (.090) | | .254F | | .542 |

| Total from invest- | | | | | | | | | | | | |

| ment operations | | .066 | | .504 | | .733 | | .345 | | .698 | | 1.014 |

| Distributions from net | | | | | | | | | | | | |

| investment income | | (.205) | | (.419) | | (.427) | | (.435) | | (.443) | | (.475) |

| Distributions from net | | | | | | | | | | | | |

| realized gain | | (.051) | | (.055) | | (.066) | | (.090) | | (.015) | | (.001) |

| Total distributions . | | (.256) | | (.474) | | (.493) | | (.525) | | (.458) | | (.476) |

| Redemption fees | | | | | | | | | | | | |

| added to paid in | | | | | | | | | | | | |

| capitalD | | —G | | —G | | —G | | —G | | —G | | .002 |

| Net asset value, end | | | | | | | | | | | | |

| of period | | $ 11.40 | | $ 11.59 | | $ 11.56 | | $ 11.32 | | $ 11.50 | | $ 11.26 |

| Total ReturnB,C | | 60% | | 4.46% | | 6.58% | | 3.01% | | 6.38% | | 9.70% |

| Ratios to Average Net AssetsE | | | | | | | | | | | | |

| Expenses before | | | | | | | | | | | | |

| reductions | | 55%A | | .55% | | .55% | | .55% | | .55% | | .55% |

| Expenses net of fee | | | | | | | | | | | | |

| waivers, if any | | 55%A | | .55% | | .55% | | .55% | | .55% | | .55% |

| Expenses net of all | | | | | | | | | | | | |

| reductions | | 51%A | | .50% | | .53% | | .52% | | .48% | | .41% |

| Net investment | | | | | | | | | | | | |

| income | | 3.64%A | | 3.62% | | 3.72% | | 3.77% | | 3.96%F | | 4.32% |

| Supplemental Data | | | | | | | | | | | | |

| Net assets, end | | | | | | | | | | | | |

| of period | | | | | | | | | | | | |

| (000 omitted) | | $102,665 | | $100,695 | | $78,289 | | $68,689 | | $66,105 | | $50,716 |

| Portfolio turnover | | | | | | | | | | | | |

| rate | | 24%A | | 13% | | 14% | | 19% | | 30% | | 24% |

A Annualized

B Total returns for periods of less than one year are not annualized.

C Total returns would have been lower had certain expenses not been reduced during the periods shown.

D Calculated based on average shares outstanding during the period.

E Expense ratios reflect operating expenses of the fund. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or

expense offset arrangements and do not represent the amount paid by the fund during periods when reimbursements or reductions occur. Ex

penses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from expense offset arrange

ments. Expenses net of all reductions represent the net expenses paid by the fund.

F Effective September 1, 2001, the fund adopted the provisions of the AICPA Audit and Accounting Guide for Investment Companies and began

amortizing premium and discount on all debt securities. Per share data and ratios for periods prior to adoption have not been restated to reflect

this change.

G Amount represents less than $.001 per share.

|

See accompanying notes which are an integral part of the financial statements.

15 Semiannual Report

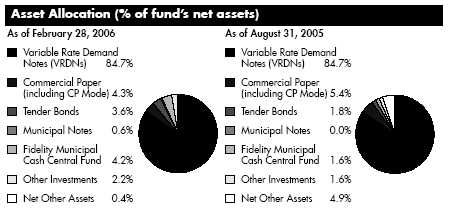

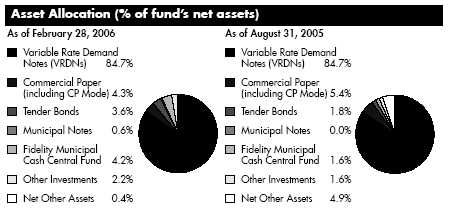

| Fidelity Arizona Municipal Money Market Fund | | | | |

| Investment Changes | | | | | | |

| |

| Maturity Diversification | | | | | | |

| Days | | % of fund’s | | % of fund’s | | % of fund’s |

| | | investments | | investments | | investments |

| | | 2/28/06 | | 8/31/05 | | 2/28/05 |

| 0 – 30 | | 92.0 | | 97.6 | | 88.5 |

| 31 – 90 | | 1.6 | | 1.7 | | 3.6 |

| 91 – 180 | | 2.8 | | 0.7 | | 2.8 |

| 181 – 397 | | 3.6 | | 0.0 | | 5.1 |

| Weighted Average Maturity | | | | | | |

| | | 2/28/06 | | 8/31/05 | | 2/28/05 |

| Fidelity Arizona Municipal Money | | | | | | |

| Market Fund | | 18 Days | | 9 Days | | 20 Days |

| All Tax Free Money Market Funds Average* | | 24 Days | | 28 Days | | 28 Days |

*Source: iMoneyNet, Inc.

Semiannual Report 16

| Fidelity Arizona Municipal Money Market Fund | | | | |

| |

| Investments February 28, 2006 (Unaudited) |

| Showing Percentage of Net Assets | | | | | | |

| |

| Municipal Securities 99.6% | | | | | | |

| | | | | Principal | | Value (Note 1) |

| | | | | Amount | | |

| Arizona – 92.0% | | | | | | |

| Arizona Health Facilities Auth. Rev. (Southwest Behavioral | | | | | | |

| Health Services, Inc. Proj.) 3.27%, LOC JPMorgan Chase | | | | | | |

| Bank, VRDN (b) | | | | $ 1,930,000 | | $ 1,930,000 |

| Arizona Muni. Fing. Prog. Defeased Ctfs. of Prtn. Bonds | | | | | | |

| Series 15: | | | | | | |

| 8.75% 8/1/06 (Escrowed to Maturity) (e) | | | | 2,115,000 | | 2,164,902 |

| 8.75% 8/1/06 (Escrowed to Maturity) (e) | | | | 1,410,000 | | 1,443,268 |

| Arizona School Facilities Board Ctfs. of Prtn. Participating | | | | | | |

| VRDN: | | | | | | |

| Series IXIS 05 5, 3.22% (Liquidity Facility CDC Fin.-CDC | | | | | | |

| IXIS) (b)(f) | | | | 1,800,000 | | 1,800,000 |

| Series PT 2800, 3.22% (Liquidity Facility Merrill Lynch & Co., | | | | | | |

| Inc.) (b)(f) | | | | 3,000,000 | | 3,000,000 |

| Series Putters 735, 3.22% (Liquidity Facility Dresdner Bank | | | | | | |

| AG) (b)(f) | | | | 3,660,000 | | 3,660,000 |

| Series Putters 940, 3.22% (Liquidity Facility JPMorgan Chase | | | | | | |

| Bank) (b)(f) | | | | 6,880,000 | | 6,880,000 |

| Series RF 04 2, 3.26% (Liquidity Facility Bank of New York, | | | | | | |

| New York) (b)(f) | | | | 1,375,000 | | 1,375,000 |

| Series ROC II R 4069, 3.22% (Liquidity Facility Citigroup | | | | | | |

| Global Markets Hldgs., Inc.) (b)(f) | | | | 1,695,000 | | 1,695,000 |

| Arizona School Facilities Board State School Impt. Rev. | | | | | | |

| Participating VRDN: | | | | | | |

| Series MS 00 497, 3.21% (Liquidity Facility Morgan | | | | | | |

| Stanley) (b)(f) | | | | 1,032,500 | | 1,032,500 |

| Series Putters 483, 3.22% (Liquidity Facility PNC Bank NA, | | | | | | |

| Pittsburgh) (b)(f) | | | | 2,455,000 | | 2,455,000 |

| Series Putters 484, 3.22% (Liquidity Facility JPMorgan Chase | | | | | | |

| Bank) (b)(f) | | | | 1,475,000 | | 1,475,000 |

| Arizona State Univ. Ctfs. of Prtn. Participating VRDN Series | | | | | | |

| Putters 694, 3.22% (Liquidity Facility JPMorgan Chase & | | | | | | |

| Co.) (b)(f) | | | | 2,620,000 | | 2,620,000 |

| Arizona State Univ. Revs. Participating VRDN: | | | | | | |

| Series PT 2264, 3.22% (Liquidity Facility Merrill Lynch & Co., | | | | | | |

| Inc.) (b)(f) | | | | 4,145,000 | | 4,145,000 |

| Series ROC II R174, 3.22% (Liquidity Facility Citibank | | | | | | |

| NA) (b)(f) | | | | 3,700,000 | | 3,700,000 |

| Arizona Tourism & Sports Auth. Tax Rev. Participating VRDN: | | | | | | |

| Series PT 2312, 3.22% (Liquidity Facility Merrill Lynch & Co., | | | | | | |

| Inc.) (b)(f) | | | | 1,600,000 | | 1,600,000 |

| Series Putters 690, 3.22% (Liquidity Facility JPMorgan Chase | | | | | | |

| & Co.) (b)(f) | | | | 1,695,000 | | 1,695,000 |

| |

| |

| See accompanying notes which are an integral part of the financial statements. | | |

| |

| 17 | | | | Semiannual Report |

| Fidelity Arizona Municipal Money Market Fund | | | | |

| Investments (Unaudited) continued | | | | | | |

| |

| Municipal Securities continued | | | | | | |

| | | | | Principal | | Value (Note 1) |

| | | | | Amount | | |

| |

| Arizona – continued | | | | | | |

| Arizona Trans. Board Hwy. Rev. Participating VRDN | | | | | | |

| Series ROC II R1038, 3.22% (Liquidity Facility Citigroup | | | | | | |

| Global Markets Hldgs., Inc.) (b)(f) | | | | $ 2,025,000 | | $ 2,025,000 |

| Arizona Wtr. Infrastructure Fin. Auth. Rev. Participating VRDN | | | | | | |

| Series PT 2237, 3.22% (Liquidity Facility Merrill Lynch & Co., | | | | | | |

| Inc.) (b)(f) | | | | 1,500,000 | | 1,500,000 |

| Casa Grande Indl. Dev. Auth. Indl. Dev. Rev. (Price | | | | | | |

| Companies, Inc. Proj.) Series A, 3.24%, LOC Bank of | | | | | | |

| America NA, VRDN (b)(d) | | | | 1,865,000 | | 1,865,000 |

| Chandler Indl. Dev. Auth. Indl. Dev. Rev. (Red Rock Stamping | | | | | | |

| Co. Proj.) Series 2000, 3.35%, LOC Key Bank NA, | | | | | | |

| VRDN (b)(d) | | | | 2,190,000 | | 2,190,000 |

| Cochise County Poll. Cont. Rev. Solid Waste Disp. Rev. Bonds | | | | | | |

| (Arizona Elec. Pwr. Coop. Proj.) 2.88%, tender 9/1/06 | | | | | | |

| (Nat’l. Rural Utils. Coop. Fin. Corp. Guaranteed) (b)(d) | | | | 8,900,000 | | 8,900,000 |

| Coconino County Poll. Cont. Corp. Rev. (Arizona Pub. Svc. Co. | | | | | | |

| Navajo Proj.) Series 1994 A, 3.13%, LOC KBC Bank NV, | | | | | | |

| VRDN (b)(d) | | | | 5,400,000 | | 5,400,000 |

| Downtown Phoenix Hotel Corp. Rev. Participating VRDN | | | | | | |

| Series LB 06 P3U, 3.23% (Liquidity Facility Lehman Brothers | | | | | | |

| Hldgs., Inc.) (b)(f) | | | | 2,250,000 | | 2,250,000 |

| Flagstaff Indl. Dev. Auth. Solid Waste Disp. Rev. (Norton Envir., | | | | | | |

| Inc. Proj.) Series 1997, 3.35%, LOC Key Bank NA, | | | | | | |

| VRDN (b)(d) | | | | 2,100,000 | | 2,100,000 |

| Maricopa County Indl. Dev. Auth. Indl. Dev. Rev.: | | | | | | |

| Bonds (American Wtr. Corp. Proj.) Series 1988, 3.24% | | | | | | |

| tender 4/13/06, CP mode (d) | | | | 1,600,000 | | 1,600,000 |

| (Clayton Homes, Inc. Proj.) Series 1998, 3.28%, LOC U.S. | | | | | | |

| Bank NA, Minnesota, VRDN (b)(d) | | | | 1,000,000 | | 1,000,000 |

| Maricopa County Indl. Dev. Auth. Multi-family Hsg. Rev.: | | | | | | |

| (Glenn Oaks Apts. Proj.) Series 2001, 3.3%, LOC Fannie | | | | | | |

| Mae, VRDN (b)(d) | | | | 3,299,675 | | 3,299,675 |

| (Ranchwood Apt. Proj.) Series 2001 A, 3.25%, LOC Fannie | | | | | | |

| Mae, VRDN (b)(d) | | | | 5,000,000 | | 5,000,000 |

| (San Angelin Apts. Proj.) 3.28%, LOC Fannie Mae, | | | | | | |

| VRDN (b)(d) | | | | 3,100,000 | | 3,100,000 |

| (San Lucas Apts. Proj.) 3.28%, LOC Fannie Mae, | | | | | | |

| VRDN (b)(d) | | | | 1,700,000 | | 1,700,000 |

| (San Martin Apts. Proj.): | | | | | | |

| Series A1, 3.22%, LOC Fannie Mae, VRDN (b)(d) | | | | 3,200,000 | | 3,200,000 |

| Series A2, 3.22%, LOC Fannie Mae, VRDN (b)(d) | | | | 720,000 | | 720,000 |

| (San Miguel Apts. Proj.) 3.28%, LOC Fannie Mae, | | | | | | |

| VRDN (b)(d) | | | | 1,300,000 | | 1,300,000 |

| (San Remo Apts. Proj.) 3.22%, LOC Fannie Mae, | | | | | | |

| VRDN (b)(d) | | | | 3,400,000 | | 3,400,000 |

See accompanying notes which are an integral part of the financial statements.

| Municipal Securities continued | | | | |

| | | Principal | | Value (Note 1) |

| | | Amount | | |

| |

| Arizona – continued | | | | |

| Maricopa County Indl. Dev. Auth. Multi-family Hsg. Rev.: - | | | | |

| continued | | | | |

| (Village Square Apts. Proj.) 3.28%, LOC Fannie Mae, | | | | |

| VRDN (b)(d) | | $ 1,600,000 | | $ 1,600,000 |

| Maricopa County Indl. Dev. Auth. Single Family Mtg. Rev. | | | | |

| Participating VRDN Series MS 1165, 3.25% (Liquidity | | | | |

| Facility Morgan Stanley) (b)(d)(f) | | 1,800,000 | | 1,800,000 |

| Maricopa County Indl. Dev. Auth. Solid Waste Disp. Rev. | | | | |

| Participating VRDN Series MT 48, 3.29% (Liquidity Facility | | | | |

| Lloyds TSB Bank PLC) (b)(d)(f) | | 1,770,000 | | 1,770,000 |

| Maricopa County Unified School District #48 Scottsdale Bonds | | | | |

| 4% 7/1/06 (FSA Insured) | | 1,735,000 | | 1,741,139 |

| Phoenix Civic Impt. Board Arpt. Rev. Participating VRDN | | | | |

| Series Merlots 02 A28, 3.28% (Liquidity Facility Wachovia | | | | |

| Bank NA) (b)(d)(f) | | 1,275,000 | | 1,275,000 |

| Phoenix Civic Impt. Corp. District Rev. Participating VRDN | | | | |

| Series PZ 85, 3.26% (Liquidity Facility Merrill Lynch & Co., | | | | |

| Inc.) (b)(f) | | 2,905,000 | | 2,905,000 |

| Phoenix Civic Impt. Corp. Excise Tax Rev.: | | | | |

| Participating VRDN: | | | | |

| Series EGL 03 28 Class A, 3.22% (Liquidity Facility | | | | |

| Citibank NA, New York) (b)(f) | | 1,300,000 | | 1,300,000 |

| Series MACN 05 L, 3.22% (Liquidity Facility Bank of | | | | |

| America NA) (b)(f) | | 2,100,000 | | 2,100,000 |

| Series 1995, 3.24%, LOC Landesbank Hessen-Thuringen, | | | | |

| VRDN (b)(d) | | 19,300,000 | | 19,300,000 |

| Phoenix Civic Impt. Corp. Transit Excise Tax Rev. Participating | | | | |

| VRDN: | | | | |

| Series EGL 7050040 Class A, 3.22% (Liquidity Facility | | | | |

| Citibank NA) (b)(f) | | 1,800,000 | | 1,800,000 |

| Series EGL 720050020, 3.22% (Liquidity Facility Citibank | | | | |

| NA) (b)(f) | | 1,800,000 | | 1,800,000 |

| Phoenix Civic Impt. Corp. Wastewtr. Sys. Rev. Participating | | | | |

| VRDN: | | | | |

| Series MS 991, 3.21% (Liquidity Facility Morgan | | | | |

| Stanley) (b)(f) | | 3,328,000 | | 3,328,000 |

| Series ROC II R6039, 3.22% (Liquidity Facility Citibank | | | | |

| NA) (b)(f) | | 3,065,000 | | 3,065,000 |

| Phoenix Civic Impt. Corp. Wtr. Sys. Rev. Participating VRDN | | | | |

| Series EGL 7050056, 3.22% (Liquidity Facility Citibank | | | | |

| NA) (b)(f) | | 2,000,000 | | 2,000,000 |

| Phoenix Indl. Dev. Auth. Multi-family Hsg. Rev.: | | | | |

| (Bell Square Apt. Proj.) Series 1995, 3.24%, LOC Bank of | | | | |

| America NA, VRDN (b) | | 2,000,000 | | 2,000,000 |

See accompanying notes which are an integral part of the financial statements.

19 Semiannual Report

| Fidelity Arizona Municipal Money Market Fund | | | | |

| Investments (Unaudited) continued | | | | |

| |

| Municipal Securities continued | | | | |

| | | | | Principal | | Value (Note 1) |

| | | | | Amount | | |

| Arizona – continued | | | | | | |

| Phoenix Indl. Dev. Auth. Multi-family Hsg. Rev.: – continued | | | | | | |

| (Paradise Lakes Apt. Proj.) Series 1995, 3.24%, LOC Bank | | | | | | |

| of America NA, VRDN (b) | | | | $ 6,000,000 | | $ 6,000,000 |

| (Westward Ho Apts. Proj.) Series 2003 A, 3.28%, LOC Fleet | | | | | | |

| Nat’l. Bank, VRDN (b)(d) | | | | 1,700,000 | | 1,700,000 |

| Phoenix Indl. Dev. Auth. Rev.: | | | | | | |

| (Independent Newspaper, Inc. Proj.) Series 2000, 3.35%, | | | | | | |

| LOC Wachovia Bank NA, VRDN (b)(d) | | | | 900,000 | | 900,000 |

| (Laura Dozer Ctr. Proj.) 3.43%, LOC JPMorgan Chase Bank, | | | | | | |

| VRDN (b) | | | | 1,000,000 | | 1,000,000 |

| (Phoenix Expansion Proj.) 3.48%, LOC JPMorgan Chase | | | | | | |

| Bank, VRDN (b)(d) | | | | 2,340,000 | | 2,340,000 |

| (Plastican Proj.) Series 1997, 3.24%, LOC Fleet Bank NA, | | | | | | |

| VRDN (b)(d) | | | | 2,740,000 | | 2,740,000 |

| (Swift Aviation Svcs., Inc. Proj.) 3.1%, LOC U.S. Bank NA, | | | | | | |

| Minnesota, VRDN (b)(d) | | | | 5,320,000 | | 5,320,000 |

| Phoenix Indl. Dev. Auth. Single Family Mtg. Rev. Participating | | | | | | |

| VRDN: | | | | | | |

| Series Merlots 01 A23, 3.28% (Liquidity Facility Wachovia | | | | | | |

| Bank NA) (b)(d)(f) | | | | 155,000 | | 155,000 |

| Series MT 156, 3.27% (Liquidity Facility Landesbank | | | | | | |

| Hessen-Thuringen) (b)(d)(f) | | | | 2,200,000 | | 2,200,000 |

| Pima County Indl. Dev. Auth. Indl. Rev. Participating VRDN | | | | | | |

| Series LB 00 L21, 3.23% (Liquidity Facility Lehman Brothers | | | | | | |

| Hldgs., Inc.) (b)(f) | | | | 4,340,000 | | 4,340,000 |

| Pima County Indl. Dev. Auth. Multi-family Hsg. Rev. (River | | | | | | |

| Point Proj.) Series 2001, 3.25%, LOC Fannie Mae, | | | | | | |

| VRDN (b)(d) | | | | 6,000,000 | | 6,000,000 |

| Pima County Indl. Dev. Auth. Rev. (El Dorado Hosp. Proj.) | | | | | | |

| 3.22%, LOC Branch Banking & Trust Co., VRDN (b) | | | | 1,600,000 | | 1,600,000 |

| Pima County Indl. Dev. Auth. Single Family Mortgage Rev. | | | | | | |

| Participating VRDN Series RF 05 17 Class A, 3.38% | | | | | | |

| (Liquidity Facility Bank of New York, New York) (b)(d)(f) | | | | 4,950,000 | | 4,950,000 |

| Salt River Proj. Agric. Impt. & Pwr. District Elec. Sys. Rev.: | | | | | | |

| Participating VRDN: | | | | | | |

| Series EGL 06 0014, 3.22% (Liquidity Facility Citibank | | | | | | |

| NA) (b)(f) | | | | 2,400,000 | | 2,400,000 |

| Series MS 04 1227, 3.21% (Liquidity Facility Morgan | | | | | | |

| Stanley) (b)(f) | | | | 2,100,000 | | 2,100,000 |

| Series PT 1512, 3.22% (Liquidity Facility Merrill Lynch & | | | | | | |

| Co., Inc.) (b)(f) | | | | 1,200,000 | | 1,200,000 |

| Series ROC II R1002, 3.22% (Liquidity Facility Citigroup | | | | | | |

| Global Markets Hldgs., Inc.) (b)(f) | | | | 1,280,000 | | 1,280,000 |

| |

| See accompanying notes which are an integral part of the financial statements. | | |

| |

| Semiannual Report | | 20 | | | | |

| Municipal Securities continued | | | | |

| | | Principal | | Value (Note 1) |

| | | Amount | | |

| Arizona – continued | | | | |

| Salt River Proj. Agric. Impt. & Pwr. District Elec. Sys. Rev.: - | | | | |

| continued | | | | |

| Participating VRDN: | | | | |

| Series ROC II R1003, 3.22% (Liquidity Facility Citigroup | | | | |

| Global Markets Hldgs., Inc.) (b)(f) | | $ 1,280,000 | | $ 1,280,000 |

| Series ROC II R455, 3.22% (Liquidity Facility Citibank | | | | |

| NA) (b)(f) | | 4,970,000 | | 4,970,000 |

| Series SG 03 160, 3.22% (Liquidity Facility Societe | | | | |

| Generale) (b)(f) | | 1,390,000 | | 1,390,000 |

| Series 1997 A: | | | | |

| 3.12% 3/7/06, CP | | 2,200,000 | | 2,200,000 |

| 3.15% 3/13/06, CP | | 2,100,000 | | 2,100,000 |

| 3.18% 4/7/06, CP | | 2,200,000 | | 2,200,000 |

| Series 1997 B, 3.17% 3/9/06, CP | | 2,200,000 | | 2,200,000 |

| Scottsdale Indl. Dev. Auth. Rev. (Notre Dame Preparatory | | | | |

| School and Foundation for Sr. Living Proj.) Series 2001 B, | | | | |

| 3.43%, LOC JPMorgan Chase Bank, VRDN (b) | | 1,400,000 | | 1,400,000 |

| Sun Devil Energy Ctr. LLC Rev. (Arizona State Univ. Proj.) | | | | |

| 3.22% (FGIC Insured), VRDN (b) | | 3,800,000 | | 3,800,000 |

| Tempe Indl. Dev. Auth. Rev. (ASUF Brickyard Proj.) Series 2004 | | | | |

| A, 3.19%, LOC Bank of America NA, VRDN (b) | | 6,590,000 | | 6,590,000 |

| Univ. of Arizona Ctfs. of Prtn. (Univ. of Arizona Projs.) | | | | |

| Series 2004 B, 3.19% (AMBAC Insured), VRDN (b) | | 8,865,000 | | 8,865,000 |

| Yavapai County Indl. Dev. Auth. Indl. Dev. Rev. (Oxycal Lab. | | | | |

| Proj.) Series 1999 A, 3.48%, LOC Wells Fargo Bank NA, | | | | |

| San Francisco, VRDN (b)(d) | | 1,000,000 | | 1,000,000 |

| | | | | 225,224,484 |

| |

| Puerto Rico 3.4% | | | | |

| Puerto Rico Commonwealth Gen. Oblig.: | | | | |

| Participating VRDN Series Putters 441, 3.17% (Liquidity | | | | |

| Facility JPMorgan Chase Bank) (b)(f) | | 1,595,000 | | 1,595,000 |

| TRAN 4.5% 7/28/06, LOC Bank of Nova Scotia, New York | | | | |

| Agcy., LOC BNP Paribas SA | | 1,500,000 | | 1,507,658 |

| Puerto Rico Commonwealth Hwy. & Trans. Auth. Trans. Rev. | | | | |

| Participating VRDN: | | | | |

| Series EGL 7053018, 3.21% (Liquidity Facility Citibank | | | | |

| NA) (b)(f) | | 2,200,000 | | 2,200,000 |

| Series MACN 05 N, 3.18% (Liquidity Facility Bank of | | | | |

| America NA) (b)(f) | | 600,000 | | 600,000 |

See accompanying notes which are an integral part of the financial statements.

21 Semiannual Report

| Fidelity Arizona Municipal Money Market Fund | | | | |

| Investments (Unaudited) continued | | | | |

| |

| Municipal Securities continued | | | | |

| | | Principal | | Value (Note 1) |

| | | Amount | | |

| Puerto Rico continued | | | | |

| Puerto Rico Commonwealth Hwy. & Trans. Auth. Trans. Rev. | | | | |

| Participating VRDN: – continued | | | | |

| Series ROC 2 98 1, 3.21% (Liquidity Facility Citibank NA) (b)(f) . | | $ 1,000,000 | | $ 1,000,000 |

| Puerto Rico Elec. Pwr. Auth. Pwr. Rev. Participating VRDN | | | | |

| Series ROC II R179, 3.21% (Liquidity Facility Citibank NA) (b)(f) | | 1,495,000 | | 1,495,000 |

| | | | | 8,397,658 |

| |

| | | Shares | | |

| Other – 4.2% | | | | |

| Fidelity Municipal Cash Central Fund, 3.16% (a)(c) | | 10,222,333 | | 10,222,333 |

| TOTAL INVESTMENT PORTFOLIO 99.6% | | | | |

| (Cost $243,844,475) | | | | 243,844,475 |

| |

| NET OTHER ASSETS – 0.4% | | | | 960,170 |

| NET ASSETS 100% | | | | $ 244,804,645 |

| Security Type Abbreviations |

| CP | | — | | COMMERCIAL PAPER |

| TRAN | | — | | TAX AND REVENUE |

| | | | | ANTICIPATION NOTE |

| VRDN | | — | | VARIABLE RATE DEMAND |

| | | | | NOTE |

Legend

(a) Affiliated fund that is available only to

investment companies and other

accounts managed by Fidelity

Investments. The rate quoted is the

annualized seven-day yield of the fund

at period end. A complete unaudited

listing of the fund’s holdings as of its

most recent quarter end is available

upon request.

|

(b) The coupon rate shown on floating or

adjustable rate securities represents the

rate at period end.

(c) Information in this report regarding

holdings by state and security types

does not reflect the holdings of the

Fidelity Municipal Cash Central Fund.

(d) Private activity obligations whose

interest is subject to the federal

alternative minimum tax for individuals.

(e) Security collateralized by an amount

sufficient to pay interest and principal.

(f) Provides evidence of ownership in one

or more underlying municipal bonds.

|

Affiliated Central Funds

Information regarding fiscal year to date income earned by the fund from the affiliated Central funds is as follows:

| Fund | | | | Income earned |

| Fidelity Municipal Cash Central Fund | | | | $ 30,013 |

See accompanying notes which are an integral part of the financial statements.

Semiannual Report 22

| Fidelity Arizona Municipal Money Market Fund | | |

| Financial Statements | | | | | | |

| |

| Statement of Assets and Liabilities | | | | | | |

| | | | | February 28, 2006 (Unaudited) |

| |

| Assets | | | | | | |

| Investment in securities, at value See accompanying | | | | | | |

| schedule: | | | | | | |

| Unaffiliated issuers (cost $233,622,142) | | | | $ 233,622,142 | | |

| Affiliated Central Funds (cost $10,222,333) | | | | 10,222,333 | | |

| Total Investments (cost $243,844,475) | | | | | | $ 243,844,475 |

| Cash | | | | | | 2,527,077 |

| Receivable for fund shares sold | | | | | | 5,288,225 |

| Interest receivable | | | | | | 1,105,847 |

| Other receivables | | | | | | 54,054 |

| Total assets | | | | | | 252,819,678 |

| |

| Liabilities | | | | | | |

| Payable for investments purchased | | | | $ 5,000,000 | | |

| Payable for fund shares redeemed | | | | 2,910,163 | | |

| Distributions payable | | | | 3,845 | | |

| Accrued management fee | | | | 100,967 | | |

| Other affiliated payables | | | | 58 | | |

| Total liabilities | | | | | | 8,015,033 |

| |

| Net Assets | | | | | | $ 244,804,645 |

| Net Assets consist of: | | | | | | |

| Paid in capital | | | | | | $ 244,786,965 |

| Undistributed net investment income | | | | | | 17,518 |

| Accumulated undistributed net realized gain (loss) on | | | | | | |

| investments | | | | | | 162 |

| Net Assets, for 244,680,736 shares outstanding | | | | | | $ 244,804,645 |

| Net Asset Value, offering price and redemption price per | | | | | | |

| share ($244,804,645 ÷ 244,680,736 shares) | | | | | | $ 1.00 |

See accompanying notes which are an integral part of the financial statements.

23 Semiannual Report

| Fidelity Arizona Municipal Money Market Fund | | |

| Financial Statements continued | | | | | | |

| |

| Statement of Operations | | | | | | |

| | | | | Six months ended February 28, 2006 (Unaudited) |

| |

| Investment Income | | | | | | |

| Interest | | | | | | $ 3,127,418 |

| Income from affiliated Central Funds | | | | | | 30,013 |

| Total income | | | | | | 3,157,431 |

| |

| Expenses | | | | | | |

| Management fee | | | | $ 560,512 | | |

| Independent trustees’ compensation | | | | 466 | | |

| Total expenses before reductions | | | | 560,978 | | |

| Expense reductions | | | | (130,950) | | 430,028 |

| |

| Net investment income | | | | | | 2,727,403 |

| Realized and Unrealized Gain (Loss) | | | | | | |

| Net realized gain (loss) on: | | | | | | |

| Investment securities: | | | | | | |

| Unaffiliated issuers | | | | | | 11 |

| Net increase in net assets resulting from operations | | | | | | $ 2,727,414 |

See accompanying notes which are an integral part of the financial statements.

Semiannual Report 24

| Statement of Changes in Net Assets | | | | | | | | | | |

| | | | | Six months ended | | | | Year ended |

| | | | | February 28, 2006 | | | | August 31, |

| | | | | (Unaudited) | | | | 2005 |

| Increase (Decrease) in Net Assets | | | | | | | | | | |

| Operations | | | | | | | | | | |

| Net investment income | | | | | | $ 2,727,403 | | | | $ 2,933,810 |

| Net realized gain (loss) | | | | | | 11 | | | | 6,668 |

| Net increase in net assets resulting from operations | | . | | | | 2,727,414 | | | | 2,940,478 |

| Distributions to shareholders from net investment income | | . | | | | (2,729,139) | | | | (2,931,883) |

| Share transactions at net asset value of $1.00 per share | | | | | | | | | | |

| Proceeds from sales of shares | | | | | | 356,405,546 | | | | 502,664,387 |

| Reinvestment of distributions | | | | | | 2,693,173 | | | | 2,899,293 |

| Cost of shares redeemed | | | | | | (332,111,806) | | | | (444,707,485) |

| Net increase (decrease) in net assets and shares re- | | | | | | | | | | |

| sulting from share transactions | | | | | | 26,986,913 | | | | 60,856,195 |

| Total increase (decrease) in net assets | | | | | | 26,985,188 | | | | 60,864,790 |

| |

| Net Assets | | | | | | | | | | |

| Beginning of period | | | | | | 217,819,457 | | | | 156,954,667 |

| End of period (including undistributed net investment | | | | | | | | | | |

| income of $17,518 and undistributed net investment | | | | | | | | |

| income of $19,254, respectively) | | | | | | $ 244,804,645 | | | | $ 217,819,457 |

See accompanying notes which are an integral part of the financial statements.

25 Semiannual Report

| Financial Highlights | | | | | | | | | | |

| | | Six months ended | | | | | | | | | | |

| | | February 28, 2006 | | Years ended August 31, |

| | | (Unaudited) | | 2005 | | 2004 | | 2003 | | 2002 | | 2001 |

| Selected Per Share Data | | | | | | | | | | | | |

| Net asset value, | | | | | | | | | | | | |

| beginning of | | | | | | | | | | | | |

| period | | $ 1.00 | | $ 1.00 | | $ 1.00 | | $ 1.00 | | $ 1.00 | | $ 1.00 |

| Income from | | | | | | | | | | | | |

| Investment | | | | | | | | | | | | |

| Operations | | | | | | | | | | | | |

| Net investment | | | | | | | | | | | | |

| income | | 012 | | .016 | | .006 | | .008 | | .013 | | .032 |

| Net realized and | | | | | | | | | | | | |

| unrealized | | | | | | | | | | | | |

| gain (loss)F | | — | | — | | — | | — | | — | | — |

| Total from invest | | | | | | | | | | | | |

| ment operations | | .012 | | .016 | | .006 | | .008 | | .013 | | .032 |

| Distributions from | | | | | | | | | | | | |

| net investment | | | | | | | | | | | | |

| income | | (.012) | | (.016) | | (.006) | | (.008) | | (.013) | | (.032) |

| Distributions from | | | | | | | | | | | | |

| net realized gain | | — | | — | | — | | —F | | — | | — |

| Total distributions | | (.012) | | (.016) | | (.006) | | (.008) | | (.013) | | (.032) |

| Net asset value, | | | | | | | | | | | | |

| end of period | | $ 1.00 | | $ 1.00 | | $ 1.00 | | $ 1.00 | | $ 1.00 | | $ 1.00 |

| Total ReturnB,C,D | | 1.22% | | 1.60% | | .60% | | .86% | | 1.30% | | 3.23% |

| Ratios to Average Net AssetsE | | | | | | | | | | | | |

| Expenses before | | | | | | | | | | | | |

| reductions | | 50%A | | .50% | | .50% | | .50% | | .50% | | .50% |

| Expenses net of | | | | | | | | | | | | |

| fee waivers, if | | | | | | | | | | | | |

| any | | 50%A | | .50% | | .50% | | .50% | | .50% | | .50% |

| Expenses net of | | | | | | | | | | | | |

| all reductions | | .39%A | | .43% | | .49% | | .48% | | .45% | | .47% |

| Net investment | | | | | | | | | | | | |

| income | | 2.45%A | | 1.63% | | .60% | | .82% | | 1.27% | | 3.19% |

| Supplemental Data | | | | | | | | | | | | |

| Net assets, end | | | | | | | | | | | | |

| of period | | | | | | | | | | | | |

| (000 omitted) | | $244,805 | | $217,819 | | $156,955 | | $134,118 | | $132,208 | | $101,853 |

A Annualized

B Total returns for periods of less than one year are not annualized.

C Total returns would have been lower had certain expenses not been reduced during the periods shown.

D Total returns do not include the effect of the former account closeout fee.

E Expense ratios reflect operating expenses of the fund. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or

expense offset arrangements and do not represent the amount paid by the fund during periods when reimbursements or reductions occur. Ex

penses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from expense offset arrange

ments. Expenses net of all reductions represent the net expenses paid by the fund.

F Amount represents less than $.001 per share.

|

See accompanying notes which are an integral part of the financial statements.

Notes to Financial Statements

For the period ended February 28, 2006 (Unaudited)

1. Significant Accounting Policies.

Fidelity Arizona Municipal Income Fund (the income fund) is a fund of Fidelity Union Street Trust. Fidelity Arizona Municipal Money Market Fund (the money market fund) is a fund of Fidelity Union Street Trust II. Each trust is registered under the Investment Company Act of 1940, as amended (the 1940 Act), as an open end management invest ment company. Fidelity Union Street Trust and Fidelity Union Street Trust II (the trusts) are organized as a Massachusetts business trust and a Delaware statutory trust, respec tively. The income fund is a non diversified fund. Each fund is authorized to issue an unlimited number of shares. Each fund may be affected by economic and political developments in the state of Arizona. Certain funds may invest in affiliated money market central funds (Money Market Central Funds) which are open end investment companies available to investment companies and other accounts managed by Fidelity Management & Research Company (FMR) and its affiliates. The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America, which require management to make certain estimates and assumptions at the date of the financial statements. The following summarizes the significant accounting policies of the income fund and the money market fund:

Security Valuation. Investments are valued and net asset value per share is calculated (NAV calculation) as of the close of business of the New York Stock Exchange, normally 4:00 p.m. Eastern time. Wherever possible, each fund uses independent pricing services approved by the Board of Trustees to value their investments. For the income fund, debt securities, including restricted securities, for which quotes are readily available, are valued by independent pricing services or by dealers who make markets in such securi ties. Pricing services consider yield or price of bonds of comparable quality, coupon, maturity and type as well as dealer supplied prices. When current market prices or quotations are not readily available or do not accurately reflect fair value, valuations may be determined in accordance with procedures adopted by the Board of Trustees. The frequency of when fair value pricing is used is unpredictable. The value of securities used for NAV calculation under fair value pricing may differ from published prices for the same securities. Investments in open end mutual funds are valued at their closing net asset value each business day. Short term securities with remaining maturities of sixty days or less for which quotations are not readily available are valued at amortized cost, which approximates value.

As permitted by compliance with certain conditions under Rule 2a 7 of the 1940 Act, securi ties owned by the money market fund are valued at amortized cost which approximates value.

Investment Transactions and Income. Security transactions are accounted for as of trade date. Gains and losses on securities sold are determined on the basis of identified cost. Interest income is accrued as earned. Interest income includes coupon interest and amortization of premium and accretion of discount on debt securities.

27 Semiannual Report

| Notes to Financial Statements (Unaudited) continued |

1. Significant Accounting Policies continued |

Expenses. Most expenses of each trust can be directly attributed to a fund. Expenses which cannot be directly attributed are apportioned among each fund in the trust.

Income Tax Information and Distributions to Shareholders. Each year, each fund intends to qualify as a regulated investment company by distributing all of its taxable income and realized gains under Subchapter M of the Internal Revenue Code. As a result, no provision for income taxes is required in the accompanying financial statements.

Dividends are declared daily and paid monthly from net investment income. Distribu tions from realized gains, if any, are recorded on the ex dividend date. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from generally accepted accounting principles. In addition, certain funds claimed a portion of the payment made to redeeming shareholders as a distribu tion for income tax purposes.

Capital accounts within the financial statements are adjusted for permanent book tax differences. These adjustments have no impact on net assets or the results of operations. Temporary book tax differences will reverse in a subsequent period.

Book tax differences are primarily due to futures transactions, market discount, deferred trustees compensation and losses deferred due to wash sales.

The funds purchase municipal securities whose interest, in the opinion of the issuer, is free from federal income tax. There is no assurance that the Internal Revenue Service (IRS) will agree with this opinion. In the event the IRS determines that the issuer does not comply with relevant tax requirements, interest payments from a security could become federally taxable, possibly retroactively to the date the security was issued.

The federal tax cost of investments and unrealized appreciation (depreciation) as of period end were as follows for each fund:

| | | Cost for Federal | | | | | | | | Net | | Unrealized |

| | | Income Tax | | | | Unrealized | | | | Unrealized | | Appreciation/ |

| | | Purposes | | | | Appreciation | | | | Depreciation | | (Depreciation) |

| Fidelity Arizona Municipal | | | | | | | | | | | | |

| Income Fund | | $ 97,266,311 | | | | $ 2,457,777 | | | | $ (219,470) | | $ 2,238,307 |

| Fidelity Arizona Municipal | | | | | | | | | | | | |

| Money Market Fund | | 243,844,475 | | | | — | | | | — | | — |

Short Term Trading (Redemption) Fees. Shares held in the income fund less than 30 days are subject to a redemption fee equal to .50% of the proceeds of the redeemed shares. All redemption fees, including any estimated redemption fees paid by FMR, are retained by the fund and accounted for as an addition to paid in capital.

Futures Contracts. The income fund may use futures contracts to manage its exposure to the bond market and to fluctuations in interest rates. Buying futures tends to increase a fund’s exposure to the underlying instrument, while selling futures tends to decrease a fund’s exposure to the underlying instrument or hedge other fund investments. Upon entering into a futures contract, a fund is required to deposit with a clearing broker, no later than the following business day, an amount (“initial margin”) equal to a certain percentage of the face value of the contract. The initial margin may be in the form of cash or securities and is transferred to a segregated account on settlement date. Subsequent payments (“variation margin”) are made or received by a fund depending on the daily fluctuations in the value of the futures contract and are accounted for as unrealized gains or losses. Realized gains (losses) are recorded upon the expiration or closing of the futures contract. Securities deposited to meet margin requirements are identified in the income funds’ Schedule of Investments. Losses may arise from changes in the value of the underlying instruments or if the counterparties do not perform under the contract’s terms. Futures contracts are valued at the settlement price established each day by the board of trade or exchange on which they are traded.

3. Purchases and Sales of Investments.

Purchases and sales of securities, other than short term securities and U.S. government securities, for the income fund aggregated $13,185,478 and $11,642,065, respectively.

4. Fees and Other Transactions with Affiliates.

Management Fee. FMR and its affiliates provide the funds with investment manage ment related services for which the funds pay a monthly management fee. FMR pays all other expenses, except the compensation of the independent Trustees and certain exceptions such as interest expense. The management fee paid to FMR by the funds is reduced by an amount equal to the fees and expenses paid by the funds to the indepen dent Trustees. Each fund’s management fee is equal to the following annual rate of average net assets:

| Fidelity Arizona Municipal Income Fund | | 55% | | |

| Fidelity Arizona Municipal Money Market Fund | | 50% | | |

Affiliated Central Funds. Certain funds may invest in Money Market Central Funds which seek preservation of capital and current income and are managed by Fidelity Investments Money Management, Inc. (FIMM) an affiliate of FMR.

The Money Market Central Funds do not pay a management fee.

29 Semiannual Report

| Notes to Financial Statements (Unaudited) continued |

5. Committed Line of Credit. | | |

The income fund participates with other funds managed by FMR in a $4.2 billion credit facility (the “line of credit”) to be utilized for temporary or emergency purposes to fund shareholder redemptions or for other short term liquidity purposes. The participating funds have agreed to pay commitment fees on their pro rata portion of the line of credit, which is included in Miscellaneous Expense on the Statement of Operations. During the period, there were no borrowings on this line of credit.

Through arrangements with each applicable fund’s custodian and transfer agent, credits realized as a result of uninvested cash balances were used to reduce each applicable fund’s management fee. During the period, these credits reduced management fee by the following amounts:

| Fidelity Arizona Municipal Income Fund | | | | $ 21,917 | | |

| Fidelity Arizona Municipal Money Market Fund | | | | 130,950 | | |

| |

| 7. Other. | | | | | | |

The funds’ organizational documents provide former and current trustees and officers with a limited indemnification against liabilities arising in connection with the performance of their duties to the funds. In the normal course of business, the funds may also enter into contracts that provide general indemnifications. The funds’ maximum exposure under these arrangements is unknown as this would be dependent on future claims that may be made against the funds. The risk of material loss from such claims is considered remote.

Board Approval of Investment Advisory Contracts and Management Fees

Fidelity Arizona Municipal Income Fund / Fidelity Arizona Municipal Money Market Fund

On January 19, 2006, the Board of Trustees, including the Independent Trustees (together, the Board), voted to approve a general research services agreement (the Agreement) between FMR, FMR Co., Inc. (FMRC), Fidelity Investments Money Manage ment, Inc. (FIMM), and Fidelity Research & Analysis Company (FRAC) (together, the Investment Advisers) for each fund, effective January 20, 2006, pursuant to which FRAC may provide general research and investment advisory support services to FMRC and FIMM. The Board considered that it has approved previously various sub advisory agreements for each fund with affiliates of FMR that allow FMR to obtain research, non discretionary advice, or discretionary portfolio management at no additional expense to each fund. The Board, assisted by the advice of fund counsel and independent Trustees’ counsel, considered a broad range of information and determined that it would be beneficial for each fund to access the research and investment advisory support services supplied by FRAC at no additional expense to each fund.

The Board reached this determination in part because the new arrangement will involve no changes in (i) the contractual terms of and fees payable under each fund’s manage ment contract or sub advisory agreements; (ii) the investment process or strategies employed in the management of each fund’s assets; (iii) the nature or level of services provided under each fund’s management contract or sub advisory agreements; (iv) the day to day management of each fund or the persons primarily responsible for such management; or (v) the ultimate control or beneficial ownership of FMR, FMRC, or FIMM. The Board also considered that the establishment of each Agreement would not necessitate prior shareholder approval of the Agreement or result in an assignment and termination of each fund’s management contract or sub advisory agreements under the Investment Company Act of 1940.

Because the Board was approving an arrangement with FRAC under which each fund will not bear any additional management fees or expenses and under which each fund’s portfolio manager would not change, it did not consider each fund’s investment performance, competitiveness of management fee and total expenses, costs of services and profitability, or economies of scale to be significant factors in its decision.

In connection with its future renewal of each fund’s management contract and sub advisory agreements, the Board will consider: (i) the nature, extent, and quality of services provided to each fund, including shareholder and administrative services and investment performance; (ii) the competitiveness of each fund’s management fee and total expenses; (iii) the costs of the services and profitability, including the revenues earned and the expenses incurred by Fidelity in conducting the business of developing, marketing, distributing, managing, administering, and servicing each fund and its shareholders; and (iv) whether there have been economies of scale in respect of the

31 Semiannual Report

Board Approval of Investment Advisory Contracts and Management Fees continued

management of the Fidelity funds, whether the Fidelity funds (including each fund) have appropriately benefited from any such economies of scale, and whether there is potential for realization of any further economies.

Based on its evaluation of all of the conclusions noted above, and after considering all material factors, the Board ultimately concluded that each fund’s Agreement is fair and reasonable, and that each fund’s Agreement should be approved.

Managing Your Investments

Fidelity offers several ways to conveniently manage your personal investments via your telephone or PC. You can access your account information, conduct trades and research your investments 24 hours a day.

By Phone

Fidelity Automated Service Telephone provides a single toll free number to access account balances, positions, quotes and trading. It’s easy to navigate the service, and on your first call, the system will help you create a personal identification number (PIN) for security.

By PC

Fidelity’s web site on the Internet provides a wide range of information, including daily financial news, fund performance, interactive planning tools and news about Fidelity products and services.

* When you call the quotes line, please remember that a fund’s yield and return will vary and, except for money market funds, share price will also vary. This means that you may have a gain or loss when you sell your shares. There is no assurance that money market funds will be able to maintain a stable $1 share price; an investment in a money market fund is not insured or guar anteed by the U.S. government. Total returns are historical and include changes in share price, reinvestment of dividends and capital gains, and the effects of any sales charges.

33 Semiannual Report

| | Investment Adviser

Fidelity Management & Research Company

Boston, MA

Sub Advisers

Fidelity Investments

Money Management, Inc.