UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-215

Fidelity Hastings Street Trust

(Exact name of registrant as specified in charter)

82 Devonshire St., Boston, Massachusetts 02109

(Address of principal executive offices) (Zip code)

Eric D. Roiter, Secretary

82 Devonshire St.

Boston, Massachusetts 02109

(Name and address of agent for service)

Registrant's telephone number, including area code: 617-563-7000

Date of fiscal year end: | June 30 |

| |

Date of reporting period: | June 30, 2004 |

Item 1. Reports to Stockholders

Fidelity®

Fund

Annual Report

June 30, 2004

(2_fidelity_logos) (Registered_Trademark)

Contents

Chairman's Message | 3 | Ned Johnson's message to shareholders. |

Performance | 4 | How the fund has done over time. |

Management's Discussion | 5 | The manager's review of fund performance, strategy and outlook. |

Investment Changes | 6 | A summary of major shifts in the fund's investments over the past six months. |

Investments | 7 | A complete list of the fund's investments with their market values. |

Financial Statements | 15 | Statements of assets and liabilities, operations, and changes in net assets,

as well as financial highlights. |

Notes | 19 | Notes to the financial statements. |

Report of Independent Registered Public Accounting Firm | 24 | |

Trustees and Officers | 25 | |

Distributions | 36 | |

Proxy Voting Results | 37 | |

For a free copy of the fund's proxy voting guidelines visit www.fidelity.com/goto/proxyguidelines, call 1-800-544-8544, or visit the Securities and Exchange Commission (SEC)'s web site at www.sec.gov.

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR Corp. or an affiliated company.

(Recycle graphic) This report is printed on recycled paper using soy-based inks.

This report and the financial statements contained herein are submitted for the general information of the shareholders of the fund. This report is not authorized for distribution to prospective investors in the fund unless preceded or accompanied by an effective prospectus.

Mutual fund shares are not deposits or obligations of, or guaranteed by, any depository institution. Shares are not insured by the FDIC, Federal Reserve Board or any other agency, and are subject to investment risks, including possible loss of principal amount invested.

Neither the fund nor Fidelity Distributors Corporation is a bank.

For more information on any Fidelity fund, including charges and expenses, call 1-800-544-6666 for a free prospectus. Read it carefully before you invest or send money.

Annual Report

Chairman's Message

(photo_of_Edward_C_Johnson_3d)

Dear Shareholder:

Many of you have read or heard news stories recently that were critical of mutual funds and made allegations that the mutual fund industry has been less than forthright. I find these reports unsettling and not necessarily an accurate picture of the overall industry, and I would like you to know where we at Fidelity stand.

With specific regard to allegations that certain mutual fund companies were violating the Securities and Exchange Commission's forward pricing rules or were involved in so-called "market timing" activities, I want to say two things:

First, Fidelity does not have agreements that permit customers who buy fund shares after 4 p.m. to obtain the 4 p.m. price. This is not to say that someone could not deceive the company through fraudulent acts. But I underscore that we have no so-called "agreements" which would permit this illegal practice.

Second, Fidelity has been on record for years opposing predatory short-term trading which adversely affects other shareholders in a mutual fund. In fact, in the 1980s, we began charging a fee - which is returned to the fund and, therefore, to investors - to discourage this activity. What's more, several years ago we took the industry lead in developing a Fair Value Pricing Policy to prevent market timing on foreign securities in our funds. It is reasonable to assume that another structure can be developed that would alter the system to make it much more difficult for predatory traders to operate. This, however, will only be achieved through close cooperation among regulators, legislators and the industry.

Certainly no industry is perfect, and there have been instances of unethical and illegal activity from time to time within the mutual fund industry. When this occurs, confessed or convicted offenders should be dealt with appropriately. Clearly, every system can be improved. We applaud well thought out improvements by regulators, legislators and industry representatives that achieve the common goal of building and protecting the value of investors' holdings. But we remain concerned about the risk of over-regulation and the quick application of simplistic solutions to intricate problems.

For more than 57 years, Fidelity Investments has worked very hard to improve its products and service to justify your trust. When our family founded this company in 1946, we had only a few hundred customers. Many of them were family and friends. Today, we serve more than 18 million customers including individual investors and participants in retirement plans across America.

Let me close by saying that we do not take your trust in us for granted, and we realize that we must always work to improve all aspects of our service to you. In turn, we urge you to continue your active participation with your financial matters, so that your interests can be well served.

Best regards,

/s/Edward C. Johnson 3d

Edward C. Johnson 3d

Annual Report

Performance: The Bottom Line

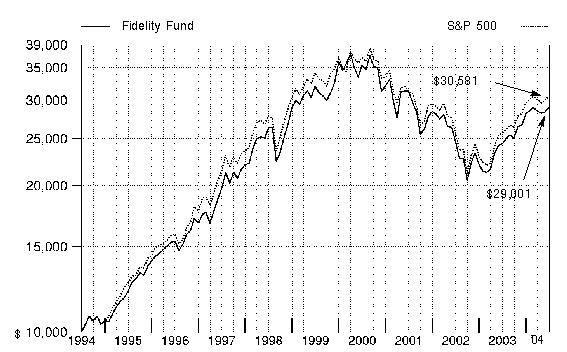

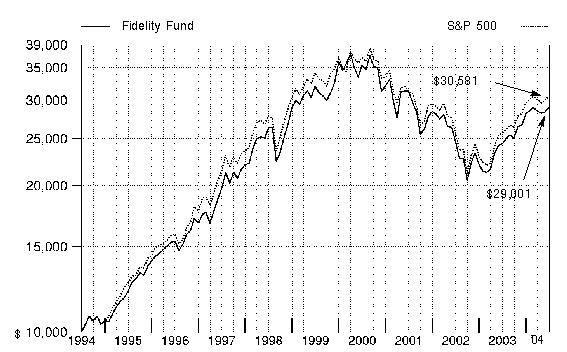

Average annual total return reflects the change in the value of an investment, assuming reinvestment of the fund's dividend income and capital gains (the profits earned upon the sale of securities that have grown in value) and assuming a constant rate of performance each year. The $10,000 table and the fund's returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. During periods of reimbursement by Fidelity, a fund's total return will be greater than it would be had the reimbursement not occurred. How a fund did yesterday is no guarantee of how it will do tomorrow.

Average Annual Total Returns

Periods ended June 30, 2004 | Past 1

year | Past 5

years | Past 10 years |

Fidelity ® Fund | 18.81% | -1.98% | 11.24% |

$10,000 Over 10 years

Let's say hypothetically that $10,000 was invested in Fidelity® Fund on June 30, 1994. The chart shows how the value of your investment would have grown, and also shows how the Standard & Poor's 500SM Index did over the same period.

Annual Report

Management's Discussion of Fund Performance

Comments from John Avery, Portfolio Manager of Fidelity® Fund

The major U.S. equity benchmarks posted double-digit returns for the 12 months ending June 30, 2004. But it could have been even better had most of the gains not been accrued in the first half of the period. Stocks slipped in the second half on concerns about the effects of potential interest rate hikes and rising inflation on corporate profits, an unsettled geopolitical environment and threats of terrorism. The Dow Jones Industrial AverageSM, for example, gained 18.60% for the year overall, but rose just 0.86% in the second half. Technology also had a big influence on market performance. Red hot in the first half, tech fell hard in the second as investors avoided stocks with future earnings potential, and focused instead on companies with steady current earnings amid the volatile investment backdrop. The Goldman Sachs® Technology Index soared 27.49% for the year, but crawled ahead just 0.74% year to date through June. Elsewhere, the Standard & Poor's 500SM Index gained 19.11% and the NASDAQ Composite® Index returned 26.78% for the overall year.

For the 12 months ending June 30, 2004, the fund returned 18.81%, slightly trailing the Standard & Poor's 500 Index but edging the 18.79% return of the LipperSM Growth & Income Funds Average. Overweighting the relatively weak media industry did some damage to the fund's relative performance, as did stock picking in telecommunication services. Two media stocks, Viacom and Clear Channel Communications, were prominent detractors. Both were affected by the lack of advertising dollars flowing into radio broadcasting, and I reduced the fund's holdings in both cases. Conversely, the largest positive influence was favorable stock picking in capital goods along with an overweighting in that group. Tyco International provided the biggest boost to performance versus the index and also helped in absolute terms. A number of its businesses benefited from the improving economy, and the restructuring taking place under CEO Ed Breen continued to make significant progress. In the aerospace industry, Boeing was a strong relative contributor, as I overweighted the stock and it outperformed the index by a considerable margin on the strength of a major contract win with the U.S. Navy.

The views expressed in this statement reflect those of the portfolio manager only through the end of the period of the report as stated on the cover and do not necessarily represent the views of Fidelity or any other person in the Fidelity organization. Any such views are subject to change at any time based upon market or other conditions and Fidelity disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Fidelity fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Fidelity fund.

Annual Report

Investment Changes

Top Ten Stocks as of June 30, 2004 |

| % of fund's

net assets | % of fund's net assets

6 months ago |

Microsoft Corp. | 4.1 | 4.0 |

General Electric Co. | 3.3 | 3.1 |

Pfizer, Inc. | 3.3 | 3.6 |

Citigroup, Inc. | 3.1 | 3.5 |

American International Group, Inc. | 2.8 | 2.8 |

Exxon Mobil Corp. | 2.0 | 2.1 |

Gillette Co. | 2.0 | 1.4 |

3M Co. | 1.9 | 2.0 |

American Express Co. | 1.9 | 1.6 |

Tyco International Ltd. | 1.8 | 1.1 |

| 26.2 | |

Top Five Market Sectors as of June 30, 2004 |

| % of fund's

net assets | % of fund's net assets

6 months ago |

Financials | 17.2 | 19.2 |

Information Technology | 15.4 | 13.7 |

Health Care | 14.7 | 13.3 |

Industrials | 14.6 | 17.9 |

Consumer Staples | 12.5 | 8.0 |

Asset Allocation (% of fund's net assets) |

As of June 30, 2004 * | As of December 31, 2003 ** |

| Stocks 98.1% | |  | Stocks 99.9% | |

| Short-Term

Investments and

Net Other Assets 1.9% | |  | Short-Term

Investments and

Net Other Assets 0.1% | |

* Foreign investments | 3.7% | | ** Foreign

investments | 5.6% | |

Annual Report

Investments June 30, 2004

Showing Percentage of Net Assets

Common Stocks - 98.1% |

| Shares | | Value (Note 1) (000s) |

CONSUMER DISCRETIONARY - 9.2% |

Automobiles - 0.5% |

Harley-Davidson, Inc. | 795,200 | | $ 49,255 |

Household Durables - 0.3% |

Fortune Brands, Inc. | 446,000 | | 33,642 |

Internet & Catalog Retail - 0.3% |

Amazon.com, Inc. (a) | 457,800 | | 24,904 |

eBay, Inc. (a) | 118,500 | | 10,896 |

| | 35,800 |

Media - 5.8% |

Clear Channel Communications, Inc. | 506,293 | | 18,708 |

Comcast Corp.: | | | |

Class A (a) | 513,423 | | 14,391 |

Class A (special) (a) | 1,684,500 | | 46,509 |

Dow Jones & Co., Inc. | 550,600 | | 24,832 |

Fox Entertainment Group, Inc. Class A (a) | 1,097,000 | | 29,290 |

McGraw-Hill Companies, Inc. | 713,300 | | 54,617 |

News Corp. Ltd. ADR | 2,236,300 | | 79,210 |

Time Warner, Inc. (a) | 6,005,660 | | 105,580 |

Viacom, Inc. Class B (non-vtg.) | 3,812,713 | | 136,190 |

Walt Disney Co. | 3,790,600 | | 96,622 |

| | 605,949 |

Specialty Retail - 2.3% |

Gap, Inc. | 1,914,000 | | 46,415 |

Home Depot, Inc. | 2,802,000 | | 98,630 |

Staples, Inc. | 3,191,400 | | 93,540 |

| | 238,585 |

TOTAL CONSUMER DISCRETIONARY | | 963,231 |

CONSUMER STAPLES - 12.5% |

Beverages - 2.9% |

Anheuser-Busch Companies, Inc. | 609,100 | | 32,891 |

PepsiCo, Inc. | 2,404,990 | | 129,581 |

The Coca-Cola Co. | 2,931,900 | | 148,002 |

| | 310,474 |

Food & Staples Retailing - 2.7% |

Albertsons, Inc. | 2,087,400 | | 55,400 |

CVS Corp. | 1,120,100 | | 47,067 |

Common Stocks - continued |

| Shares | | Value (Note 1) (000s) |

CONSUMER STAPLES - continued |

Food & Staples Retailing - continued |

Sysco Corp. | 730,529 | | $ 26,204 |

Wal-Mart Stores, Inc. | 2,893,520 | | 152,662 |

| | 281,333 |

Food Products - 1.9% |

Dean Foods Co. (a) | 1,192,200 | | 44,481 |

Hershey Foods Corp. | 956,600 | | 44,262 |

Kellogg Co. | 2,075,900 | | 86,876 |

Smithfield Foods, Inc. (a) | 1,024,700 | | 30,126 |

| | 205,745 |

Household Products - 2.5% |

Clorox Co. | 494,900 | | 26,616 |

Colgate-Palmolive Co. | 1,595,600 | | 93,263 |

Procter & Gamble Co. | 2,552,600 | | 138,964 |

| | 258,843 |

Personal Products - 2.0% |

Gillette Co. | 4,857,720 | | 205,967 |

Tobacco - 0.5% |

Altria Group, Inc. | 1,065,200 | | 53,313 |

TOTAL CONSUMER STAPLES | | 1,315,675 |

ENERGY - 6.7% |

Energy Equipment & Services - 2.5% |

Baker Hughes, Inc. | 1,923,200 | | 72,408 |

BJ Services Co. (a) | 1,265,500 | | 58,011 |

Nabors Industries Ltd. (a) | 982,600 | | 44,433 |

Schlumberger Ltd. (NY Shares) | 1,406,800 | | 89,346 |

| | 264,198 |

Oil & Gas - 4.2% |

ChevronTexaco Corp. | 569,600 | | 53,605 |

ConocoPhillips | 1,048,046 | | 79,955 |

Exxon Mobil Corp. | 4,665,100 | | 207,177 |

Occidental Petroleum Corp. | 636,000 | | 30,789 |

Valero Energy Corp. | 942,800 | | 69,541 |

| | 441,067 |

TOTAL ENERGY | | 705,265 |

Common Stocks - continued |

| Shares | | Value (Note 1) (000s) |

FINANCIALS - 17.2% |

Capital Markets - 3.8% |

Bear Stearns Companies, Inc. | 618,400 | | $ 52,137 |

Goldman Sachs Group, Inc. | 773,700 | | 72,852 |

Lehman Brothers Holdings, Inc. | 259,900 | | 19,557 |

Merrill Lynch & Co., Inc. | 2,255,900 | | 121,773 |

Morgan Stanley | 2,482,600 | | 131,007 |

| | 397,326 |

Commercial Banks - 3.8% |

Bank of America Corp. | 2,238,100 | | 189,388 |

Bank of Hawaii Corp. | 700,500 | | 31,677 |

Wells Fargo & Co. | 3,179,400 | | 181,957 |

| | 403,022 |

Consumer Finance - 2.2% |

American Express Co. | 3,754,692 | | 192,916 |

SLM Corp. | 796,450 | | 32,216 |

| | 225,132 |

Diversified Financial Services - 3.1% |

Citigroup, Inc. | 7,099,232 | | 330,114 |

Insurance - 4.1% |

AFLAC, Inc. | 2,051,000 | | 83,701 |

Allstate Corp. | 1,146,200 | | 53,356 |

American International Group, Inc. | 4,146,300 | | 295,548 |

| | 432,605 |

Real Estate - 0.2% |

Vornado Realty Trust | 398,300 | | 22,747 |

TOTAL FINANCIALS | | 1,810,946 |

HEALTH CARE - 14.7% |

Health Care Equipment & Supplies - 5.2% |

Becton, Dickinson & Co. | 1,410,000 | | 73,038 |

Biomet, Inc. | 1,498,500 | | 66,593 |

Boston Scientific Corp. (a) | 1,608,300 | | 68,835 |

C.R. Bard, Inc. | 1,025,400 | | 58,089 |

Medtronic, Inc. | 1,764,100 | | 85,947 |

Respironics, Inc. (a) | 736,100 | | 43,246 |

St. Jude Medical, Inc. (a) | 1,321,850 | | 99,998 |

Zimmer Holdings, Inc. (a) | 501,432 | | 44,226 |

| | 539,972 |

Common Stocks - continued |

| Shares | | Value (Note 1) (000s) |

HEALTH CARE - continued |

Health Care Providers & Services - 0.3% |

Cardinal Health, Inc. | 473,100 | | $ 33,141 |

Pharmaceuticals - 9.2% |

Allergan, Inc. | 301,800 | | 27,017 |

AstraZeneca PLC sponsored ADR | 1,148,100 | | 52,399 |

Eli Lilly & Co. | 495,500 | | 34,640 |

GlaxoSmithKline PLC sponsored ADR | 491,200 | | 20,365 |

Johnson & Johnson | 2,874,500 | | 160,110 |

Merck & Co., Inc. | 1,929,000 | | 91,628 |

Novartis AG sponsored ADR | 1,301,200 | | 57,903 |

Pfizer, Inc. | 10,149,320 | | 347,919 |

Roche Holding AG (participation certificate) | 353,577 | | 35,092 |

Schering-Plough Corp. | 2,969,000 | | 54,867 |

Wyeth | 2,303,940 | | 83,310 |

| | 965,250 |

TOTAL HEALTH CARE | | 1,538,363 |

INDUSTRIALS - 14.6% |

Aerospace & Defense - 3.6% |

Honeywell International, Inc. | 3,150,700 | | 115,410 |

Lockheed Martin Corp. | 2,023,330 | | 105,375 |

The Boeing Co. | 3,120,000 | | 159,401 |

| | 380,186 |

Air Freight & Logistics - 0.8% |

CNF, Inc. | 690,000 | | 28,676 |

United Parcel Service, Inc. Class B | 683,800 | | 51,401 |

| | 80,077 |

Building Products - 0.2% |

American Standard Companies, Inc. (a) | 482,100 | | 19,433 |

Commercial Services & Supplies - 0.3% |

R.R. Donnelley & Sons Co. | 994,300 | | 32,832 |

Industrial Conglomerates - 7.0% |

3M Co. | 2,145,400 | | 193,107 |

General Electric Co. | 10,809,426 | | 350,225 |

Tyco International Ltd. | 5,718,800 | | 189,521 |

| | 732,853 |

Machinery - 2.4% |

Crane Co. | 447,400 | | 14,044 |

Common Stocks - continued |

| Shares | | Value (Note 1) (000s) |

INDUSTRIALS - continued |

Machinery - continued |

Deere & Co. | 636,400 | | $ 44,637 |

Dover Corp. | 1,195,200 | | 50,318 |

Illinois Tool Works, Inc. | 277,300 | | 26,590 |

Ingersoll-Rand Co. Ltd. Class A | 683,020 | | 46,657 |

ITT Industries, Inc. | 629,600 | | 52,257 |

Pall Corp. | 853,100 | | 22,343 |

| | 256,846 |

Trading Companies & Distributors - 0.3% |

Fastenal Co. | 522,900 | | 29,716 |

TOTAL INDUSTRIALS | | 1,531,943 |

INFORMATION TECHNOLOGY - 15.4% |

Communications Equipment - 3.7% |

Cisco Systems, Inc. (a) | 6,982,800 | | 165,492 |

Motorola, Inc. | 5,301,600 | | 96,754 |

QUALCOMM, Inc. | 1,341,900 | | 97,932 |

Telefonaktiebolaget LM Ericsson ADR (a) | 954,400 | | 28,556 |

| | 388,734 |

Computers & Peripherals - 3.2% |

Dell, Inc. (a) | 3,173,500 | | 113,675 |

Diebold, Inc. | 625,100 | | 33,049 |

Hewlett-Packard Co. | 1,035,400 | | 21,847 |

International Business Machines Corp. | 1,584,100 | | 139,638 |

Lexmark International, Inc. Class A (a) | 341,400 | | 32,955 |

| | 341,164 |

Electronic Equipment & Instruments - 0.3% |

Amphenol Corp. Class A (a) | 1,024,700 | | 34,143 |

Internet Software & Services - 1.1% |

Yahoo!, Inc. (a) | 3,101,400 | | 112,674 |

Semiconductors & Semiconductor Equipment - 2.7% |

Applied Materials, Inc. (a) | 1,916,800 | | 37,608 |

ASML Holding NV (NY Shares) (a) | 1,076,200 | | 18,414 |

Intel Corp. | 6,554,630 | | 180,908 |

National Semiconductor Corp. (a) | 1,545,600 | | 33,988 |

Texas Instruments, Inc. | 462,300 | | 11,178 |

| | 282,096 |

Common Stocks - continued |

| Shares | | Value (Note 1) (000s) |

INFORMATION TECHNOLOGY - continued |

Software - 4.4% |

Microsoft Corp. | 14,812,800 | | $ 423,059 |

Oracle Corp. (a) | 2,834,400 | | 33,814 |

| | 456,873 |

TOTAL INFORMATION TECHNOLOGY | | 1,615,684 |

MATERIALS - 3.9% |

Chemicals - 3.1% |

Dow Chemical Co. | 2,672,130 | | 108,756 |

E.I. du Pont de Nemours & Co. | 659,624 | | 29,300 |

Ecolab, Inc. | 1,676,100 | | 53,132 |

Praxair, Inc. | 3,318,576 | | 132,444 |

| | 323,632 |

Containers & Packaging - 0.6% |

Ball Corp. | 592,757 | | 42,708 |

Packaging Corp. of America | 925,600 | | 22,122 |

| | 64,830 |

Metals & Mining - 0.2% |

CONSOL Energy, Inc. | 504,300 | | 18,155 |

TOTAL MATERIALS | | 406,617 |

TELECOMMUNICATION SERVICES - 3.6% |

Diversified Telecommunication Services - 3.6% |

BellSouth Corp. | 3,889,600 | | 101,985 |

SBC Communications, Inc. | 5,454,900 | | 132,281 |

Verizon Communications, Inc. | 3,933,900 | | 142,368 |

| | 376,634 |

UTILITIES - 0.3% |

Electric Utilities - 0.3% |

PG&E Corp. (a) | 1,289,800 | | 36,037 |

TOTAL COMMON STOCKS (Cost $9,139,830) | 10,300,395 |

Preferred Stocks - 0.0% |

| Shares | | Value (Note 1) (000s) |

Convertible Preferred Stocks - 0.0% |

INFORMATION TECHNOLOGY - 0.0% |

Communications Equipment - 0.0% |

Procket Networks, Inc. Series C (a)(c) | 1,612,868 | | $ 0 |

Nonconvertible Preferred Stocks - 0.0% |

HEALTH CARE - 0.0% |

Biotechnology - 0.0% |

Geneprot, Inc. Series A (c)

(Cost $19,834) | 710,000 | | 2,485 |

Money Market Funds - 1.4% |

| | | |

Fidelity Cash Central Fund, 1.16% (b)

(Cost $143,254) | 143,253,991 | | 143,254 |

TOTAL INVESTMENT PORTFOLIO - 99.5% (Cost $9,302,918) | | 10,446,134 |

NET OTHER ASSETS - 0.5% | | 53,339 |

NET ASSETS - 100% | $ 10,499,473 |

Legend |

(a) Non-income producing |

(b) Affiliated fund that is available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete listing of the fund's holdings as of its most recent fiscal year end is available upon request. |

(c) Restricted securities - Investment in securities not registered under the Securities Act of 1933 (excluding 144A issues). At the end of the period, the value of restricted securities (excluding 144A issues) amounted to $2,485,000 or 0.0% of net assets. |

Additional information on each holding is as follows: |

Security | Acquisition Date | Acquisition Cost (000s) |

Geneprot, Inc. Series A | 7/7/00 | $ 3,905 |

Procket Networks, Inc. Series C | 11/15/00 - 2/9/01 | $ 15,929 |

Other Information |

Purchases and sales of securities, other than short-term securities, aggregated $5,236,920,000 and $5,686,859,000, respectively. |

The fund placed a portion of its portfolio transactions with brokerage firms which are affiliates of the investment adviser. The commissions paid to these affiliated firms were $118,000 for the period. |

Income Tax Information |

At June 30, 2004, the fund had a capital loss carryforward of approximately $2,039,738,000 of which $943,331,000 and $1,096,407,000 will expire on June 30, 2010 and 2011, respectively. |

Annual Report

See accompanying notes which are an integral part of the financial statements.

Financial Statements

Statement of Assets and Liabilities

Amounts in thousands (except per-share amount) | June 30, 2004 |

| | |

Assets | | |

Investment in securities, at value (cost $9,302,918) - See accompanying schedule | | $ 10,446,134 |

Receivable for investments sold | | 118,165 |

Receivable for fund shares sold | | 6,402 |

Dividends receivable | | 7,967 |

Interest receivable | | 230 |

Prepaid expenses | | 23 |

Other affiliated receivables | | 36 |

Other receivables | | 513 |

Total assets | | 10,579,470 |

| | |

Liabilities | | |

Payable for investments purchased | $ 65,691 | |

Payable for fund shares redeemed | 8,395 | |

Accrued management fee | 3,178 | |

Other affiliated payables | 2,185 | |

Other payables and accrued expenses | 548 | |

Total liabilities | | 79,997 |

| | |

Net Assets | | $ 10,499,473 |

Net Assets consist of: | | |

Paid in capital | | $ 11,435,663 |

Undistributed net investment income | | 8,568 |

Accumulated undistributed net realized gain (loss) on investments and foreign currency transactions | | (2,087,974) |

Net unrealized appreciation (depreciation) on investments | | 1,143,216 |

Net Assets, for 364,447 shares outstanding | | $ 10,499,473 |

Net Asset Value, offering price and redemption price per share ($10,499,473 ÷ 364,447 shares) | | $ 28.81 |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Financial Statements - continued

Statement of Operations

Amounts in thousands | Year ended June 30, 2004 |

| | |

Investment Income | | |

Dividends | | $ 146,529 |

Interest | | 2,233 |

Security lending | | 303 |

Total income | | 149,065 |

| | |

Expenses | | |

Management fee | $ 37,004 | |

Transfer agent fees | 22,205 | |

Accounting and security lending fees | 1,062 | |

Non-interested trustees' compensation | 52 | |

Appreciation in deferred trustee compensation account | 40 | |

Custodian fees and expenses | 132 | |

Registration fees | 39 | |

Audit | 98 | |

Legal | 36 | |

Miscellaneous | 597 | |

Total expenses before reductions | 61,265 | |

Expense reductions | (1,725) | 59,540 |

Net investment income (loss) | | 89,525 |

Realized and Unrealized Gain (Loss) Net realized gain (loss) on: | | |

Investment securities | 978,121 | |

Foreign currency transactions | 138 | |

Total net realized gain (loss) | | 978,259 |

Change in net unrealized appreciation (depreciation) on investment securities | | 647,143 |

Net gain (loss) | | 1,625,402 |

Net increase (decrease) in net assets resulting from operations | | $ 1,714,927 |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Statement of Changes in Net Assets

Amounts in thousands | Year ended

June 30,

2004 | Year ended

June 30,

2003 |

Increase (Decrease) in Net Assets | | |

Operations | | |

Net investment income (loss) | $ 89,525 | $ 83,315 |

Net realized gain (loss) | 978,259 | (756,783) |

Change in net unrealized appreciation (depreciation) | 647,143 | 403,721 |

Net increase (decrease) in net assets resulting

from operations | 1,714,927 | (269,747) |

Distributions to shareholders from net investment income | (89,068) | (82,413) |

Share transactions

Net proceeds from sales of shares | 1,419,655 | 1,436,330 |

Reinvestment of distributions | 84,378 | 77,554 |

Cost of shares redeemed | (1,965,079) | (2,312,652) |

Net increase (decrease) in net assets resulting from share transactions | (461,046) | (798,768) |

Total increase (decrease) in net assets | 1,164,813 | (1,150,928) |

| | |

Net Assets | | |

Beginning of period | 9,334,660 | 10,485,588 |

End of period (including undistributed net investment income of $8,568 and undistributed net investment income of $7,973, respectively) | $ 10,499,473 | $ 9,334,660 |

Other Information Shares | | |

Sold | 52,303 | 65,924 |

Issued in reinvestment of distributions | 3,064 | 3,455 |

Redeemed | (72,621) | (106,676) |

Net increase (decrease) | (17,254) | (37,297) |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Financial Highlights

Years ended June 30, | 2004 | 2003 | 2002 | 2001 | 2000 |

Selected Per-Share Data | | | | | |

Net asset value, beginning of period | $ 24.46 | $ 25.03 | $ 31.84 | $ 41.81 | $ 40.39 |

Income from Investment Operations | | | | | |

Net investment income (loss) B | .24 | .21 | .23 | .19 | .23 |

Net realized and unrealized gain (loss) | 4.35 | (.57) | (6.83) | (4.72) | 3.61 |

Total from investment operations | 4.59 | (.36) | (6.60) | (4.53) | 3.84 |

Distributions from net investment income | (.24) | (.21) | (.21) | (.21) | (.21) |

Distributions in excess of net investment income | - | - | - | (.03) | - |

Distributions from net realized gain | - | - | - | (2.87) | (2.21) |

Distributions in excess of net realized gain | - | - | - | (2.33) | - |

Total distributions | (.24) | (.21) | (.21) | (5.44) | (2.42) |

Net asset value, end of period | $ 28.81 | $ 24.46 | $ 25.03 | $ 31.84 | $ 41.81 |

Total Return A | 18.81% | (1.36)% | (20.78)% | (11.76)% | 10.47% |

Ratios to Average Net Assets C | | | | | |

Expenses before expense reductions | .61% | .63% | .59% | .56% | .56% |

Expenses net of voluntary waivers, if any | .61% | .63% | .59% | .56% | .56% |

Expenses net of all reductions | .59% | .61% | .53% | .51% | .53% |

Net investment income (loss) | .89% | .93% | .82% | .55% | .57% |

Supplemental Data | | | | | |

Net assets, end of period (in millions) | $ 10,499 | $ 9,335 | $ 10,486 | $ 14,294 | $ 17,379 |

Portfolio turnover rate | 53% | 32% | 155% | 217% | 113% |

A Total returns would have been lower had certain expenses not been reduced during the periods shown.

B Calculated based on average shares outstanding during the period.

C Expense ratios reflect operating expenses of the fund. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or other expense offset arrangements and do not represent the amount paid by the fund during periods when reimbursements or reductions occur. Expenses net of any voluntary waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the fund.

See accompanying notes which are an integral part of the financial statements.

Annual Report

Notes to Financial Statements

For the period ended June 30, 2004

(Amounts in thousands except ratios)

1. Significant Accounting Policies.

Fidelity Fund (the fund) is a fund of Fidelity Hastings Street Trust (the trust) and is authorized to issue an unlimited number of shares. The trust is registered under the Investment Company Act of 1940, as amended (the 1940 Act), as an open-end management investment company organized as a Massachusetts business trust. The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America, which require management to make certain estimates and assumptions at the date of the financial statements. The following summarizes the significant accounting policies of the fund:

Security Valuation. Net asset value per share (NAV calculation) is calculated as of the close of business of the New York Stock Exchange, normally 4:00 p.m. Eastern time. Equity securities, including restricted securities, for which market quotations are available are valued at the last sale price or official closing price (closing bid price or last evaluated quote if no sale has occurred) on the primary market or exchange on which they trade. If prices are not readily available or do not accurately reflect fair value for a security, or if a security's value has been materially affected by events occurring after the close of the exchange or market on which the security is principally traded, that security may be valued by another method that the Board of Trustees believes accurately reflects fair value. A security's valuation may differ depending on the method used for determining value. Price movements in futures contracts and ADRs, market and trading trends, the bid/ask quotes of brokers and off-exchange institutional trading may be reviewed in the course of making a good faith determination of a security's fair value. Short-term securities with remaining maturities of sixty days or less for which quotations are not readily available are valued on the basis of amortized cost. Investments in open-end investment companies are valued at their net asset value each business day.

Foreign Currency. The fund uses foreign currency contracts to facilitate transactions in foreign-denominated securities. Losses from these transactions may arise from changes in the value of the foreign currency or if the counterparties do not perform under the contracts' terms.

Foreign-denominated assets, including investment securities, and liabilities are translated into U.S. dollars at the exchange rate at period end. Purchases and sales of investment securities, income and dividends received and expenses denominated in foreign currencies are translated into U.S. dollars at the exchange rate in effect on the transaction date.

The effects of exchange rate fluctuations on investments are included with the net realized and unrealized gain (loss) on investment securities. Other foreign currency transactions resulting in realized and unrealized gain (loss) are disclosed separately.

Annual Report

Notes to Financial Statements - continued

(Amounts in thousands except ratios)

1. Significant Accounting Policies - continued

Investment Transactions and Income. Security transactions are accounted for as of trade date. Gains and losses on securities sold are determined on the basis of identified cost. Dividend income is recorded on the ex-dividend date, except for certain dividends from foreign securities where the ex-dividend date may have passed, which are recorded as soon as the fund is informed of the ex-dividend date. Non-cash dividends included in dividend income, if any, are recorded at the fair market value of the securities received. Distributions received on securities that represent a return of capital or capital gain are recorded as a reduction of cost of investments and/or as a realized gain. The fund estimates the components of distributions received that may be considered nontaxable distributions or capital gain distributions for income tax purposes. Interest income is accrued as earned. Interest income includes coupon interest and amortization of premium and accretion of discount on debt securities. Investment income is recorded net of foreign taxes withheld where recovery of such taxes is uncertain.

Expenses. Most expenses of the trust can be directly attributed to a fund. Expenses which cannot be directly attributed are apportioned among the funds in the trust.

Deferred Trustee Compensation. Under a Deferred Compensation Plan (the Plan), non-interested Trustees must defer receipt of a portion of, and may elect to defer receipt of an additional portion of, their annual compensation. Deferred amounts are treated as though equivalent dollar amounts had been invested in shares of the fund or are invested in a cross-section of other Fidelity funds, and are marked-to-market. Deferred amounts remain in the fund until distributed in accordance with the Plan.

Income Tax Information and Distributions to Shareholders. Each year, the fund intends to qualify as a regulated investment company by distributing all of its taxable income and realized gains under Subchapter M of the Internal Revenue Code. As a result, no provision for income taxes is required in the accompanying financial statements. Foreign taxes are provided for based on the fund's understanding of the tax rules and rates that exist in the foreign markets in which it invests.

Distributions are recorded on the ex-dividend date. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from generally accepted accounting principles.

Capital accounts within the financial statements are adjusted for permanent book-tax differences. These adjustments have no impact on net assets or the results of operations. Temporary book-tax differences will reverse in a subsequent period.

Book-tax differences are primarily due to foreign currency transactions, nontaxable dividends, capital loss carryforwards and losses deferred due to wash sales and excise tax regulations.

Annual Report

1. Significant Accounting Policies - continued

Income Tax Information and Distributions to Shareholders - continued

The tax-basis components of distributable earnings and the federal tax cost as of period end were as follows:

Unrealized appreciation | $ 1,467,438 | | |

Unrealized depreciation | (372,458) | |

Net unrealized appreciation (depreciation) | 1,094,980 | |

Undistributed ordinary income | 8,760 | |

Capital loss carryforward | (2,039,738) | |

| | |

Cost for federal income tax purposes | $ 9,351,154 | |

The tax character of distributions paid was as follows:

| June 30,

2004 | June 30,

2003 |

| | |

Ordinary Income | $ 89,068 | $ 82,413 |

2. Operating Policies.

Repurchase Agreements. Fidelity Management & Research Company (FMR) has received an Exemptive Order from the Securities and Exchange Commission (the SEC) which permits the fund and other affiliated entities of FMR to transfer uninvested cash balances into joint trading accounts. These accounts are then invested in repurchase agreements that are collateralized by U.S. Treasury or Government obligations. The fund may also invest directly with institutions, in repurchase agreements that are collateralized by commercial paper obligations and corporate obligations. Collateral is held in segregated accounts with custodian banks and may be obtained in the event of a default of the counterparty. Collateral is marked-to-market daily and maintained at a value at least equal to the principal amount of the repurchase agreement (including accrued interest).

Restricted Securities. The fund may invest in securities that are subject to legal or contractual restrictions on resale. These securities generally may be resold in transactions exempt from registration or to the public if the securities are registered. Disposal of these securities may involve time-consuming negotiations and expense, and prompt sale at an acceptable price may be difficult. Information regarding restricted securities is included at the end of the fund's Schedule of Investments.

Annual Report

Notes to Financial Statements - continued

(Amounts in thousands except ratios)

3. Purchases and Sales of Investments.

Information regarding purchases and sales of securities is included under the caption "Other Information" at the end of the fund's Schedule of Investments.

4. Fees and Other Transactions with Affiliates.

Management Fee. FMR and its affiliates provide the fund with investment management related services for which the fund pays a monthly management fee. The management fee is the sum of an individual fund fee rate that is based on an annual rate of .09% of the fund's average net assets and a group fee rate that averaged .28% during the period. The group fee rate is based upon the average net assets of all the mutual funds advised by FMR. The group fee rate decreases as assets under management increase and increases as assets under management decrease. For the period, the total annual management fee rate was .37% of the fund's average net assets.

Transfer Agent Fees. Fidelity Service Company, Inc. (FSC), an affiliate of FMR, is the fund's transfer, dividend disbursing and shareholder servicing agent. FSC receives account fees and asset-based fees that vary according to account size and type of account. FSC pays for typesetting, printing and mailing of shareholder reports, except proxy statements. For the period, the transfer agent fees were equivalent to an annual rate of .22% of average net assets.

Accounting and Security Lending Fees. FSC maintains the fund's accounting records. The accounting fee is based on the level of average net assets for the month. Under a separate contract, FSC administers the security lending program. The security lending fee is based on the number and duration of lending transactions.

Central Funds. The fund may invest in affiliated Central Funds managed by Fidelity Investments Money Management, Inc. (FIMM), an affiliate of FMR. The Central Funds are open-end investment companies available only to investment companies and other accounts managed by FMR and its affiliates. The Central Funds seek preservation of capital and current income and do not pay a management fee. Income distributions earned by the fund are recorded as income in the accompanying financial statements and totaled $2,228 for the period.

Brokerage Commissions. The fund placed a portion of its portfolio transactions with brokerage firms which are affiliates of the investment adviser. The commissions paid to these affiliated firms are shown under the caption "Other Information" at the end of the fund's Schedule of Investments.

Annual Report

5. Committed Line of Credit.

The fund participates with other funds managed by FMR in a $4.2 billion credit facility (the "line of credit") to be utilized for temporary or emergency purposes to fund shareholder redemptions or for other short-term liquidity purposes. The participating fund has agreed to pay commitment fees on its pro rata portion of the line of credit. During the period, there were no borrowings on this line of credit.

6. Security Lending.

The fund lends portfolio securities from time to time in order to earn additional income. The fund receives collateral (in the form of U.S. Treasury obligations, letters of credit and/or cash) against the loaned securities and maintains collateral in an amount not less than 100% of the market value of the loaned securities during the period of the loan. The market value of the loaned securities is determined at the close of business of the fund and any additional required collateral is delivered to the fund on the next business day. If the borrower defaults on its obligation to return the securities loaned because of insolvency or other reasons, a fund could experience delays and costs in recovering the securities loaned or in gaining access to the collateral. Cash collateral is invested in cash equivalents. At period end there were no security loans outstanding.

7. Expense Reductions.

Many of the brokers with whom FMR places trades on behalf of the fund provided services to the fund in addition to trade execution. These services included payments of certain expenses on behalf of the fund totaling $1,676 for the period. In addition, through arrangements with the fund's custodian and transfer agent, credits realized as a result of uninvested cash balances were used to reduce the fund's expenses. During the period, these credits reduced the fund's custody and transfer agent expenses by $1 and $48, respectively.

Annual Report

Report of Independent Registered Public Accounting Firm

To the Trustees of Fidelity Hastings Street Trust and the Shareholders of Fidelity Fund:

In our opinion, the accompanying statement of assets and liabilities, including the schedule of investments, and the related statements of operations and of changes in net assets and the financial highlights present fairly, in all material respects, the financial position of Fidelity Fund (a fund of Fidelity Hastings Street Trust) at June 30, 2004 and the results of its operations, the changes in its net assets and the financial highlights for the periods indicated, in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereafter referred to as "financial statements") are the responsibility of the Fidelity Fund's management; our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits of these financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States), which require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits, which included confirmation of securities at June 30, 2004 by correspondence with the custodian and brokers, provide a reasonable basis for our opinion.

/s/PricewaterhouseCoopers LLP

PricewaterhouseCoopers LLP

Boston, Massachusetts

August 6, 2004

Annual Report

Trustees and Officers

The Trustees, Members of the Advisory Board, and executive officers of the trust and fund, as applicable, are listed below. The Board of Trustees governs the fund and is responsible for protecting the interests of shareholders. The Trustees are experienced executives who meet periodically throughout the year to oversee the fund's activities, review contractual arrangements with companies that provide services to the fund, and review the fund's performance. Except for William O. McCoy, each of the Trustees oversees 292 funds advised by FMR or an affiliate. Mr. McCoy oversees 294 funds advised by FMR or an affiliate.

The Trustees hold office without limit in time except that (a) any Trustee may resign; (b) any Trustee may be removed by written instrument, signed by at least two-thirds of the number of Trustees prior to such removal; (c) any Trustee who requests to be retired or who has become incapacitated by illness or injury may be retired by written instrument signed by a majority of the other Trustees; and (d) any Trustee may be removed at any special meeting of shareholders by a two-thirds vote of the outstanding voting securities of the trust. In any event, each non-interested Trustee shall retire not later than the last day of the calendar year in which his or her 72nd birthday occurs. The executive officers and Advisory Board Members hold office without limit in time, except that any officer and Advisory Board Member may resign or may be removed by a vote of a majority of the Trustees at any regular meeting or any special meeting of the Trustees. Except as indicated, each individual has held the office shown or other offices in the same company for the past five years.

The fund's Statement of Additional Information (SAI) includes more information about the Trustees. To request a free copy, call Fidelity at 1-800-544-8544.

Interested Trustees*:

Correspondence intended for each Trustee who is an "interested person" (as defined in the 1940 Act) may be sent to Fidelity Investments, 82 Devonshire Street, Boston, Massachusetts 02109.

Name, Age; Principal Occupation |

Edward C. Johnson 3d (74)** |

| Year of Election or Appointment: 1984 Mr. Johnson is Chairman of the Board of Trustees. Mr. Johnson serves

as Chief Executive Officer, Chairman, and a Director of FMR Corp.; a Director and Chairman of the Board and of the Executive Committee

of FMR; Chairman and a Director of Fidelity Management & Research (Far East) Inc.; Chairman (1998) and a Director of Fidelity Investments Money Management, Inc.; and Chairman (2001) and a Director (2000) of FMR Co., Inc. |

Abigail P. Johnson (42)** |

| Year of Election or Appointment: 2001 Senior Vice President of Fidelity Fund (2001). Ms. Johnson also serves as Senior Vice President of other Fidelity funds (2001). She is President and a Director of FMR (2001), Fidelity Investments Money Management, Inc. (2001), FMR Co., Inc. (2001), and a Director of FMR Corp. Previously, Ms. Johnson managed a number of Fidelity funds. |

Laura B. Cronin (50) |

| Year of Election or Appointment: 2003 Ms. Cronin is an Executive Vice President (2002) and Chief Financial Officer (2002) of FMR Corp. and is a member of the Fidelity Management Committee (2003). Previously, Ms. Cronin served as Vice President of Finance of FMR (1997-1999), and Chief Financial Officer of FMR (1999-2001), Fidelity Personal Investments (2001), and Fidelity Brokerage Company (2001-2002). |

Robert L. Reynolds (52) |

| Year of Election or Appointment: 2003 Mr. Reynolds is a Director (2003) and Chief Operating Officer (2002) of FMR Corp. and is the head of the Fidelity Management Committee (2003). He also serves on the Board at Fidelity Investments Canada, Ltd. (2000). Previously, Mr. Reynolds served as President of Fidelity Investments Institutional Retirement Group (1996-2000). |

* Trustees have been determined to be "Interested Trustees" by virtue of, among other things, their affiliation with the trust or various entities under common control with FMR.

** Edward C. Johnson 3d, Trustee, is Abigail P. Johnson's father.

Annual Report

Non-Interested Trustees:

Correspondence intended for each non-interested Trustee (that is, the Trustees other than the Interested Trustees) may be sent to Fidelity Investments, P.O. Box 55235, Boston, Massachusetts 02205-5235.

Name, Age; Principal Occupation |

J. Michael Cook (61) |

| Year of Election or Appointment: 2001 Prior to Mr. Cook's retirement in May 1999, he served as Chairman and Chief Executive Officer of Deloitte & Touche LLP (accounting/consulting), Chairman of the Deloitte & Touche Foundation, and a member of the Board of Deloitte Touche Tohmatsu. He currently serves as a Director of Comcast (telecommunications, 2002), International Flavors & Fragrances, Inc. (2000), The Dow Chemical Company (2000), and Northrop Grumman Corporation (global defense technology, 2003). He is a Member of the Diversity Advisory Council of Marakon (2003) and the Advisory Council of the Public Company Accounting Oversight Board (PCAOB), Chairman Emeritus of the Board of Catalyst (a leading organization for the advancement of women in business), and is Chairman of the Accountability Advisory Council to the Comptroller General of the United States. He also serves as a Member of the Advisory Board of the Graduate School of Business of the University of Florida, his alma mater. |

Ralph F. Cox (72) |

| Year of Election or Appointment: 1991 Mr. Cox is President of RABAR Enterprises (management consulting for the petroleum industry). Prior to February 1994, he was President of Greenhill Petroleum Corporation (petroleum exploration and production). Until March 1990, Mr. Cox was President and Chief Operating Officer of Union Pacific Resources Company (exploration and production). He is a Director of CH2M Hill Companies (engineering), and Abraxas Petroleum (petroleum exploration and production, 1999). In addition, he is a member of advisory boards of Texas A&M University and the University of Texas at Austin. |

Robert M. Gates (60) |

| Year of Election or Appointment: 1997 Dr. Gates is President of Texas A&M University (2002). He was Director of the Central Intelligence Agency (CIA) from 1991 to 1993. From 1989 to 1991, Dr. Gates served as Assistant to the President of the United States and Deputy National Security Advisor. Dr. Gates is a Director of NACCO Industries, Inc. (mining and manufacturing), Parker Drilling Co., Inc. (drilling and rental tools for the energy industry, 2001), and Brinker International (restaurant management, 2003). He also serves as a member of the Advisory Board of VoteHere.net (secure Internet voting, 2001). Previously, Dr. Gates served as a Director of LucasVarity PLC (automotive components and diesel engines), a Director of TRW Inc. (automotive, space, defense, and information technology), and Dean of the George Bush School of Government and Public Service at Texas A&M University (1999-2001). Dr. Gates also is a Trustee of the Forum for International Policy. |

George H. Heilmeier (68) |

| Year of Election or Appointment: 2004 Dr. Heilmeier is Chairman Emeritus of Telcordia Technologies (communication software and systems), where prior to his retirement, he served as company Chairman and Chief Executive Officer. He currently serves on the Boards of Directors of The Mitre Corporation (systems engineering and information technology support for the government), INET Technologies Inc. (telecommunications network surveillance, 2001) and Teletech Holdings (customer management services, 1998). He is Chairman of the General Motors Technology Advisory Committee and a Life Fellow of the IEEE (2000). Dr. Heilmeier is a member of the Defense Science Board and the National Security Agency Advisory Board. He is also a member of the National Academy of Engineering, the American Academy of Arts and Sciences and The Board of Overseers of the School of Engineering and Applied Science of the University of Pennsylvania. Previously, Dr. Heilmeier served as a Director of TRW Inc. (automotive, space, defense, and information technology, 1992-2002) and Compaq (1994-2002). |

Donald J. Kirk (71) |

| Year of Election or Appointment: 1987 Mr. Kirk is a Governor of the American Stock Exchange (2001), a Trustee and former Chairman of the Board of Trustees of the Greenwich Hospital Association, a Director of the Yale-New Haven Health Services Corp. (1998), and a Director Emeritus and former Chairman of the Board of Directors of National Arts Strategies Inc. Mr. Kirk was an Executive-in-Residence (1995-2000) and a Professor (1987-1995) at Columbia University Graduate School of Business. Prior to 1987, he was Chairman of the Financial Accounting Standards Board. Previously, Mr. Kirk served as a Governor of the National Association of Securities Dealers, Inc. (1996-2002), a member and Vice Chairman of the Public Oversight Board of the American Institute of Certified Public Accountants' SEC Practice Section (1995-2002), a Director of General Re Corporation (reinsurance, 1987-1998) and as a Director of Valuation Research Corp. (appraisals and valuations). |

Marie L. Knowles (57) |

| Year of Election or Appointment: 2001 Prior to Ms. Knowles' retirement in June 2000, she served as Executive Vice President and Chief Financial Officer of Atlantic Richfield Company (ARCO) (diversified energy, 1996-2000). From 1993 to 1996, she was a Senior Vice President of ARCO and President of ARCO Transportation Company. She served as a Director of ARCO from 1996 to 1998. She currently serves as a Director of Phelps Dodge Corporation (copper mining and manufacturing) and McKesson Corporation (healthcare service, 2002). Ms. Knowles is a Trustee of the Brookings Institution and the Catalina Island Conservancy and also serves as a member of the Advisory Board for the School of Engineering of the University of Southern California. |

Ned C. Lautenbach (60) |

| Year of Election or Appointment: 2000 Mr. Lautenbach has been a partner of Clayton, Dubilier & Rice, Inc. (private equity investment firm) since September 1998. Previously, Mr. Lautenbach was with the International Business Machines Corporation (IBM) from 1968 until his retirement in 1998. He was most recently Senior Vice President and Group Executive of Worldwide Sales and Services. From 1993 to 1995, he was Chairman of IBM World Trade Corporation, and from 1994 to 1998 was a member of IBM's Corporate Executive Committee. Mr. Lautenbach serves as Co-Chairman and a Director of Covansys, Inc. (global provider of business and technology solutions, 2000). In addition, he is a Director of Italtel Holding S.p.A. (telecommunications (Milan, Italy), 2004) and Eaton Corporation (diversified industrial) as well as the Philharmonic Center for the Arts in Naples, Florida (1999). He also is a member of the Council on Foreign Relations. |

Marvin L. Mann (71) |

| Year of Election or Appointment: 1993 Mr. Mann is Chairman of the non-interested Trustees (2001). He is Chairman Emeritus of Lexmark International, Inc. (computer peripherals) where he served as CEO until April 1998 and retired as Chairman May 1999, and remains a member of the Board. Prior to 1991, he held the positions of Vice President of International Business Machines Corporation (IBM) and President and General Manager of various IBM divisions and subsidiaries. He is also a member of the Executive Committee and Chairman of the Policy Committee of the Independent Director's Council of the Investment Company Institute. In addition, Mr. Mann is a member of the President's Cabinet at the University of Alabama and the Board of Visitors of the Culverhouse College of Commerce and Business Administration at the University of Alabama. |

William O. McCoy (70) |

| Year of Election or Appointment: 1997 Prior to his retirement in December 1994, Mr. McCoy was Vice Chairman of the Board of BellSouth Corporation (telecommunications) and President of BellSouth Enterprises. He is currently a Director of Liberty Corporation (holding company), Duke Realty Corporation (real estate), and Progress Energy, Inc. (electric utility). He is also a partner of Franklin Street Partners (private investment management firm) and a member of the Research Triangle Foundation Board. In addition, Mr. McCoy served as the Interim Chancellor (1999-2000) and a member of the Board of Visitors (1994-1998) for the University of North Carolina at Chapel Hill and currently serves on the Board of Directors of the University of North Carolina Health Care System and the Board of Visitors of the Kenan-Flagler Business School (University of North Carolina at Chapel Hill). He also served as Vice President of Finance for the University of North Carolina (16-school system, 1995-1998). |

William S. Stavropoulos (65) |

| Year of Election or Appointment: 2001 Mr. Stavropoulos is Chairman of the Board (2000), CEO (2002), a position he previously held from 1995-2000, Chairman of the Executive Committee (2000), and a Member of the Board of Directors of The Dow Chemical Company. Since joining The Dow Chemical Company in 1967, Mr. Stavropoulos served in numerous senior management positions, including President (1993-2000; 2002-2003). Currently, he is a Director of NCR Corporation (data warehousing and technology solutions), BellSouth Corporation (telecommunications), Chemical Financial Corporation, and Maersk Inc. (industrial conglomerate, 2002). He also serves as a member of the Board of Trustees of the American Enterprise Institute for Public Policy Research. In addition, Mr. Stavropoulos is a member of The Business Council, J.P. Morgan International Council and the University of Notre Dame Advisory Council for the College of Science. |

Advisory Board Members and Executive Officers:

Correspondence intended for Mr. Dirks and Ms. Small may be sent to Fidelity Investments, P.O. Box 55235, Boston, Massachusetts 02205-5235. Correspondence intended for each executive officer and Mr. Lynch may be sent to Fidelity Investments, 82 Devonshire Street, Boston, Massachusetts 02109.

Name, Age; Principal Occupation |

Dennis J. Dirks (56) |

| Year of Election or Appointment: 2004 Member of the Advisory Board of Fidelity Hastings Street Trust. Prior to his retirement in May 2003, Mr. Dirks was Chief Operating Officer and a member of the Board of The Depository Trust & Clearing Corporation (DTCC) (1999-2003). He also served as President, Chief Operating Officer, and Board member of The Depository Trust Company (DTC) (1999-2003) and President and Board member of the National Securities Clearing Corporation (NSCC) (1999-2003). In addition, Mr. Dirks served as Chief Executive Officer and Board member of the Government Securities Clearing Corporation (2001-2003) and Chief Executive Officer and Board member of the Mortgage-Backed Securities Clearing Corporation (2001-2003). |

Peter S. Lynch (61) |

| Year of Election or Appointment: 2003 Member of the Advisory Board of Fidelity Hastings Street Trust. Vice Chairman and a Director of FMR, and Vice Chairman (2001) and a Director (2000) of FMR Co., Inc. Previously, Mr. Lynch served as a Trustee of the Fidelity funds (1990-2003). Prior to May 31, 1990, he was a Director of FMR and Executive Vice President of FMR (a position he held until March 31, 1991), Vice President of Fidelity® Magellan® Fund and FMR Growth Group Leader, and Managing Director of FMR Corp. Mr. Lynch was also Vice President of Fidelity Investments Corporate Services. In addition, he serves as a Trustee of Boston College, Massachusetts Eye & Ear Infirmary, Historic Deerfield, John F. Kennedy Library, and the Museum of Fine Arts of Boston. |

Cornelia M. Small (59) |

| Year of Election or Appointment: 2004 Member of the Advisory Board of Fidelity Hastings Street Trust. Ms. Small is a member (2000) and Chairperson (2002) of the Investment Committee, and a member (2002) of the Board of Trustees of Smith College. Previously, she served as Chief Investment Officer (1999-2000), Director of Global Equity Investments (1996-1999), and a member of the Board of Directors of Scudder, Stevens & Clark (1990-1997) and Scudder Kemper Investments (1997-1998). In addition, Ms. Small served as Co-Chair (2000-2003) of the Annual Fund for the Fletcher School of Law and Diplomacy. |

Bart A. Grenier (45) |

| Year of Election or Appointment: 2001 Vice President of Fidelity Fund. Mr. Grenier also serves as Vice President of certain Equity Funds (2001), a position he previously held from 1999 to 2000, and Vice President of certain High Income Funds (2002). He is Senior Vice President of FMR (1999) and FMR Co., Inc. (2001), and President and Director of Strategic Advisers, Inc. (2002). He also heads Fidelity's Asset Allocation Group (2000), Fidelity's Growth and Income Group (2001), Fidelity's Value Group (2001), and Fidelity's High Income Division (2001). Previously, Mr. Grenier served as President of Fidelity Ventures (2000), Vice President of certain High Income Funds (1997-2000), High Income Division Head (1997-2000), Group Leader of the Income-Growth and Asset Allocation-Income Groups (1996-2000), and Assistant Equity Division Head (1997-2000). |

John D. Avery (39) |

| Year of Election or Appointment: 2002 Vice President of Fidelity Fund. Mr. Avery also serves as Vice President of other funds advised by FMR. Prior to assuming his current responsibilities, Mr. Avery worked as a research analyst and portfolio manager. |

Eric D. Roiter (55) |

| Year of Election or Appointment: 1998 Secretary of Fidelity Fund. He also serves as Secretary of other Fidelity funds (1998); Vice President, General Counsel, and Clerk of FMR Co., Inc. (2001) and FMR (1998); Vice President and Clerk of FDC (1998); Assistant Clerk of Fidelity Management & Research (U.K.) Inc. (2001) and Fidelity Management & Research (Far East) Inc. (2001); and Assistant Secretary of Fidelity Investments Money Management, Inc. (2001). Prior to joining Fidelity, Mr. Roiter was with the law firm of Debevoise & Plimpton, as an associate (1981-1984) and as a partner (1985-1997), and served as an Assistant General Counsel of the U.S. Securities and Exchange Commission (1979-1981). Mr. Roiter is an Adjunct Member, Faculty of Law, at Boston College Law School (2003). |

Stuart Fross (44) |

| Year of Election or Appointment: 2003 Assistant Secretary of Fidelity Fund. Mr. Fross also serves as Assistant Secretary of other Fidelity funds (2003) and is an employee of FMR. |

Christine Reynolds (45) |

| Year of Election or Appointment: 2004 President, Treasurer, and Anti-Money Laundering (AML) officer of Fidelity Fund. Ms. Reynolds also serves as President, Treasurer, and AML officer of other Fidelity funds (2004) and is a Vice President (2003) and an employee (2002) of FMR. Before joining Fidelity Investments, Ms. Reynolds worked at PricewaterhouseCoopers LLP (PwC) (1980-2002), where she was most recently an audit partner with PwC's investment management practice. |

Timothy F. Hayes (53) |

| Year of Election or Appointment: 2002 Chief Financial Officer of Fidelity Fund. Mr. Hayes also serves as Chief Financial Officer of other Fidelity funds (2002). Recently he was appointed President of Fidelity Service Company (2003) where he also serves as a Director. Mr. Hayes also serves as President of Fidelity Investments Operations Group (FIOG, 2002), which includes Fidelity Pricing and Cash Management Services Group (FPCMS), where he was appointed President in 1998. Previously, Mr. Hayes served as Chief Financial Officer of Fidelity Investments Corporate Systems and Service Group (1998) and Fidelity Systems Company (1997-1998). |

John R. Hebble (46) |

| Year of Election or Appointment: 2003 Deputy Treasurer of Fidelity Fund. Mr. Hebble also serves as Deputy Treasurer of other Fidelity funds (2003), and is an employee of FMR. Before joining Fidelity Investments, Mr. Hebble worked at Deutsche Asset Management where he served as Director of Fund Accounting (2002-2003) and Assistant Treasurer of the Scudder Funds (1998-2003). |

Kimberley H. Monasterio (40) |

| Year of Election or Appointment: 2004 Deputy Treasurer of Fidelity Fund. Ms. Monasterio also serves as Deputy Treasurer of other Fidelity funds (2004) and is an employee of FMR (2004). Before joining Fidelity Investments, Ms. Monasterio served as Treasurer (2000-2004) and Chief Financial Officer (2002-2004) of the Franklin Templeton Funds and Senior Vice President of Franklin Templeton Services, LLC (2000-2004). |

John H. Costello (57) |

| Year of Election or Appointment: 1986 Assistant Treasurer of Fidelity Fund. Mr. Costello also serves as Assistant Treasurer of other Fidelity funds and is an employee of FMR. |

Francis V. Knox, Jr. (57) |

| Year of Election or Appointment: 2002 Assistant Treasurer of Fidelity Fund. Mr. Knox also serves as Assistant Treasurer of other Fidelity funds (2002), and is a Vice President and an employee of FMR. Previously, Mr. Knox served as Vice President of Investment & Advisor Compliance (1990-2001), and Compliance Officer of Fidelity Management & Research (U.K.) Inc. (1992-2002), Fidelity Management & Research (Far East) Inc. (1991-2002), and FMR Corp. (1995-2002). |

Peter L. Lydecker (50) |

| Year of Election or Appointment: 2004 Assistant Treasurer of Fidelity Fund. Mr. Lydecker also serves as Assistant Treasurer of other Fidelity funds (2004) and is an employee of FMR. |

Mark Osterheld (49) |

| Year of Election or Appointment: 2002 Assistant Treasurer of Fidelity Fund. Mr. Osterheld also serves as Assistant Treasurer of other Fidelity funds (2002) and is an employee of FMR. |

Kenneth B. Robins (34) |

| Year of Election or Appointment: 2004 Assistant Treasurer of Fidelity Fund. Mr. Robins also serves as Assistant Treasurer of other Fidelity funds (2004) and is an employee of FMR (2004). Before joining Fidelity Investments, Mr. Robins worked at KPMG LLP, where he was a partner in KPMG's department of professional practice (2002-2004) and a Senior Manager (1999-2000). In addition, Mr. Robins served as Assistant Chief Accountant, United States Securities and Exchange Commission (2000-2002). |

Thomas J. Simpson (46) |

| Year of Election or Appointment: 2000 Assistant Treasurer of Fidelity Fund. Mr. Simpson is Assistant Treasurer of other Fidelity funds (2000) and an employee of FMR (1996). Prior to joining FMR, Mr. Simpson was Vice President and Fund Controller of Liberty Investment Services (1987-1995). |

Annual Report

Distributions

A total of .13% of the dividends distributed during the fiscal year was derived from interest on U.S. Government securities which is generally exempt from state income tax.

The fund designates 100% of the dividends distributed during the fiscal year as qualifying for the dividends-received deduction for corporate shareholders.

The fund designates 100% of the dividends distributed in September, December, March and June during the fiscal year as amounts which may be taken into account as a dividend for purposes of the maximum rate under section 1(h)(11) of the Internal Revenue Code.

The fund will notify shareholders in January 2005 of amounts for use in preparing 2004 income tax returns.

Annual Report

Proxy Voting Results

A special meeting of the fund's shareholders was held on March 24, 2004. The results of votes taken among shareholders on proposals before them are reported below. Each vote reported represents one dollar of net asset value held on the record date for the meeting.

PROPOSAL 1 |

To amend the Declaration of Trust to allow the Board of Trustees, if permitted by applicable law, to authorize fund mergers without shareholder approval.* |

| # of

Votes | % of

Votes |

Affirmative | 5,641,899,809.90 | 76.930 |

Against | 1,195,910,893.93 | 16.307 |

Abstain | 258,684,030.15 | 3.527 |

Broker Non-Votes | 237,317,184.17 | 3.236 |

TOTAL | 7,333,811,918.15 | 100.000 |

PROPOSAL 2 |

To approve the inclusion of language inadvertently omitted from the Amended and Restated Declaration of Trust presented to shareholders in June 2001.* |

| # of

Votes | % of

Votes |

Affirmative | 6,758,135,344.08 | 92.150 |

Against | 290,380,904.34 | 3.960 |

Abstain | 285,295,669.73 | 3.890 |

TOTAL | 7,333,811,918.15 | 100.000 |

PROPOSAL 3 |

To elect a Board of Trustees.* |

| # of

Votes | % of

Votes |

J. Michael Cook |

Affirmative | 6,986,573,775.53 | 95.265 |

Withheld | 347,238,142.62 | 4.735 |

TOTAL | 7,333,811,918.15 | 100.000 |

| # of

Votes | % of

Votes |

Ralph F. Cox |

Affirmative | 6,972,215,836.08 | 95.069 |

Withheld | 361,596,082.07 | 4.931 |

TOTAL | 7,333,811,918.15 | 100.000 |

Laura B. Cronin |

Affirmative | 6,984,375,675.44 | 95.235 |

Withheld | 349,436,242.71 | 4.765 |

TOTAL | 7,333,811,918.15 | 100.000 |

Robert M. Gates |

Affirmative | 6,981,063,293.96 | 95.190 |

Withheld | 352,748,624.19 | 4.810 |

TOTAL | 7,333,811,918.15 | 100.000 |

George H. Heilmeier |

Affirmative | 6,981,086,173.64 | 95.190 |

Withheld | 352,725,744.51 | 4.810 |

TOTAL | 7,333,811,918.15 | 100.000 |

Abigail P. Johnson |

Affirmative | 6,970,753,191.54 | 95.050 |

Withheld | 363,058,726.61 | 4.950 |

TOTAL | 7,333,811,918.15 | 100.000 |

Edward C. Johnson 3d |

Affirmative | 6,970,410,843.13 | 95.045 |

Withheld | 363,401,075.02 | 4.955 |

TOTAL | 7,333,811,918.15 | 100.000 |

Donald J. Kirk |

Affirmative | 6,977,181,783.66 | 95.137 |

Withheld | 356,630,134.49 | 4.863 |

TOTAL | 7,333,811,918.15 | 100.000 |

| # of

Votes | % of

Votes |

Marie L. Knowles |

Affirmative | 6,987,619,394.87 | 95.280 |

Withheld | 346,192,523.28 | 4.720 |

TOTAL | 7,333,811,918.15 | 100.000 |

Ned C. Lautenbach |

Affirmative | 6,991,038,771.41 | 95.326 |

Withheld | 342,773,146.74 | 4.674 |

TOTAL | 7,333,811,918.15 | 100.000 |

Marvin L. Mann |

Affirmative | 6,976,048,339.97 | 95.122 |

Withheld | 357,763,578.18 | 4.878 |

TOTAL | 7,333,811,918.15 | 100.000 |

William O. McCoy |

Affirmative | 6,976,743,035.70 | 95.131 |

Withheld | 357,068,882.45 | 4.869 |

TOTAL | 7,333,811,918.15 | 100.000 |

Robert L. Reynolds |

Affirmative | 6,989,941,130.39 | 95.311 |

Withheld | 343,870,787.76 | 4.689 |

TOTAL | 7,333,811,918.15 | 100.000 |

William S. Stavropoulos |

Affirmative | 6,987,371,028.43 | 95.276 |

Withheld | 346,440,889.72 | 4.724 |

TOTAL | 7,333,811,918.15 | 100.000 |

* Denotes trust-wide proposals and voting results. |

Annual Report

Managing Your Investments

Fidelity offers several ways to conveniently manage your personal investments via your telephone or PC. You can access your account information, conduct trades and research your investments 24 hours a day.

By Phone

Fidelity Automated Service Telephone provides a single toll-free number to access account balances, positions, quotes and trading. It's easy to navigate the service, and on your first call, the system will help you create a personal identification number (PIN) for security.

(phone_graphic)Fidelity Automated

Service Telephone (FAST®)

1-800-544-5555

Press

1 For mutual fund and brokerage trading.

2 For quotes.*

3 For account balances and holdings.

4 To review orders and mutual

fund activity.

5 To change your PIN.

*0 To speak to a Fidelity representative.

By PC

Fidelity's web site on the Internet provides a wide range of information, including daily financial news, fund performance, interactive planning tools and news about Fidelity products and services.

(computer_graphic)Fidelity's Web Site

www.fidelity.com

* When you call the quotes line, please remember that a fund's yield and return will vary and, except for money market funds, share price will also vary. This means that you may have a gain or loss when you sell your shares. There is no assurance that money market funds will be able to maintain a stable $1 share price; an investment in a money market fund is not insured or guaranteed by the U.S. government. Total returns are historical and include changes in share price, reinvestment of dividends and capital gains, and the effects of any sales charges.

Annual Report

Investment Adviser

Fidelity Management &

Research Company

Boston, MA

Investment Sub-Advisers

FMR Co., Inc.

Fidelity Management & Research

(U.K.) Inc.

Fidelity Management & Research

(Far East) Inc.

Fidelity Investments Japan Limited

Fidelity International Investment

Advisors

Fidelity International Investment

Advisors (U.K.) Limited

General Distributor

Fidelity Distributors Corporation

Boston, MA

Transfer and Shareholder

Servicing Agent

Fidelity Service Company, Inc.

Boston, MA

Custodian

JPMorgan Chase Bank

New York, NY

Fidelity's Growth and Income Funds

Balanced Fund

Convertible Securities Fund

Equity-Income Fund

Equity-Income II Fund

Fidelity® Fund

Global Balanced Fund

Growth & Income Portfolio

Growth & Income II Portfolio

Puritan® Fund

Real Estate Income Fund

Real Estate Investment Portfolio

Utilities Fund

The Fidelity Telephone Connection

Mutual Fund 24-Hour Service

Exchanges/Redemptions

and Account Assistance 1-800-544-6666

Product Information 1-800-544-6666

Retirement Accounts 1-800-544-4774

(8 a.m. - 9 p.m.)

TDD Service 1-800-544-0118

for the deaf and hearing impaired

(9 a.m. - 9 p.m. Eastern time)

Fidelity Automated Service

Telephone (FAST®) (automated graphic) 1-800-544-5555

(automated graphic) Automated line for quickest service

(Fidelity Investment logo)(registered trademark)

Corporate Headquarters

82 Devonshire St., Boston, MA 02109

www.fidelity.com

FID-UANN-0804

1.787731.101

Fidelity®

Growth & Income II

Portfolio

Annual Report

June 30, 2004

(2_fidelity_logos) (Registered_Trademark)

Contents

Chairman's Message | 3 | Ned Johnson's message to shareholders. |

Performance | 4 | How the fund has done over time. |

Management's Discussion | 5 | The manager's review of fund performance, strategy and outlook. |

Investment Changes | 6 | A summary of major shifts in the fund's investments over the past six months. |

Investments | 7 | A complete list of the fund's investments with their market values. |

Financial Statements | 12 | Statements of assets and liabilities, operations, and changes in net assets,

as well as financial highlights. |

Notes | 16 | Notes to the financial statements. |

Report of Independent Registered Public Accounting Firm | 21 | |

Trustees and Officers | 22 | |

Distributions | 33 | |

Proxy Voting Results | 34 | |

For a free copy of the fund's proxy voting guidelines visit www.fidelity.com/goto/proxyguidelines, call 1-800-544-8544, or visit the Securities and Exchange Commission (SEC)'s web site at www.sec.gov.

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR Corp. or an affiliated company.

(Recycle graphic) This report is printed on recycled paper using soy-based inks.

This report and the financial statements contained herein are submitted for the general information of the shareholders of the fund. This report is not authorized for distribution to prospective investors in the fund unless preceded or accompanied by an effective prospectus.

Mutual fund shares are not deposits or obligations of, or guaranteed by, any depository institution. Shares are not insured by the FDIC, Federal Reserve Board or any other agency, and are subject to investment risks, including possible loss of principal amount invested.

Neither the fund nor Fidelity Distributors Corporation is a bank.

For more information on any Fidelity fund, including charges and expenses, call 1-800-544-6666 for a free prospectus. Read it carefully before you invest or send money.

Chairman's Message

(photo_of_Edward_C_Johnson_3d)

Dear Shareholder:

Many of you have read or heard news stories recently that were critical of mutual funds and made allegations that the mutual fund industry has been less than forthright. I find these reports unsettling and not necessarily an accurate picture of the overall industry, and I would like you to know where we at Fidelity stand.

With specific regard to allegations that certain mutual fund companies were violating the Securities and Exchange Commission's forward pricing rules or were involved in so-called "market timing" activities, I want to say two things: