UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-02628

Fidelity Municipal Trust

(Exact name of registrant as specified in charter)

245 Summer St., Boston, MA 02210

(Address of principal executive offices) (Zip code)

Margaret Carey, Secretary

245 Summer St.

Boston, Massachusetts 02210

(Name and address of agent for service)

Registrant's telephone number, including area code:

617-563-7000

| |

Date of fiscal year end: | December 31 |

|

|

Date of reporting period: | June 30, 2024 |

Item 1.

Reports to Stockholders

| |

| | SEMI-ANNUAL SHAREHOLDER REPORT | AS OF JUNE 30, 2024 | |

| | Fidelity® Municipal Income Fund Fidelity Advisor® Municipal Income Fund Class I : FROGX |

| | | |

This semi-annual shareholder report contains information about Fidelity® Municipal Income Fund for the period January 1, 2024 to June 30, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-877-208-0098 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last six months?(based on hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Class I | $ 26 | 0.52% | |

Key Fund Statistics (as of June 30, 2024)

KEY FACTS | | |

| Fund Size | $4,615,397,246 | |

| Number of Holdings | 1,417 | |

| Portfolio Turnover | 11% | |

What did the Fund invest in?

(as of June 30, 2024)

REVENUE SOURCES (% of Fund's net assets) |

| Transportation | 23.8 | |

| General Obligations | 22.0 | |

| Health Care | 20.5 | |

| Education | 9.8 | |

| Special Tax | 9.3 | |

| State G.O. | 6.1 | |

| Others(Individually Less Than 5%) | 8.5 | |

| 100.0 | |

| |

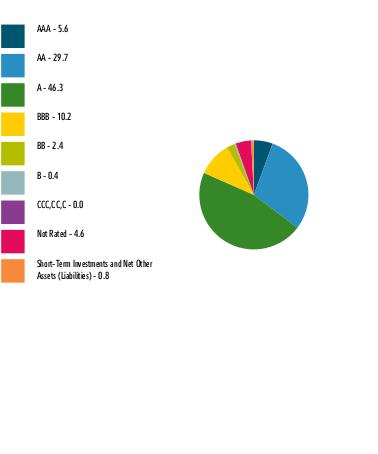

| AAA | 5.6 |

| AA | 29.7 |

| A | 46.3 |

| BBB | 10.2 |

| BB | 2.4 |

| B | 0.4 |

| CCC,CC,C | 0.0 |

| Not Rated | 4.6 |

| Short-Term Investments and Net Other Assets (Liabilities) | 0.8 |

QUALITY DIVERSIFICATION (% of Fund's net assets) |

|

| |

| We have used ratings from Moody's Investors Service, Inc. Where Moody's® ratings are not available, we have used S&P® ratings. All ratings are as of the date indicated and do not reflect subsequent changes. |

TOP STATES (% of Fund's net assets) |

| Illinois | 14.9 |

| New York | 9.0 |

| Pennsylvania | 7.7 |

| New Jersey | 6.5 |

| Florida | 6.3 |

| | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9915940.100 3071-TSRS-0824 |

| |

| | SEMI-ANNUAL SHAREHOLDER REPORT | AS OF JUNE 30, 2024 | |

| | Fidelity® Michigan Municipal Income Fund Fidelity® Michigan Municipal Income Fund : FMHTX |

| | | |

This semi-annual shareholder report contains information about Fidelity® Michigan Municipal Income Fund for the period January 1, 2024 to June 30, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-800-544-8544 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last six months?(based on hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Fidelity® Michigan Municipal Income Fund | $ 24 | 0.48% | |

Key Fund Statistics (as of June 30, 2024)

KEY FACTS | | |

| Fund Size | $466,692,866 | |

| Number of Holdings | 285 | |

| Portfolio Turnover | 17% | |

What did the Fund invest in?

(as of June 30, 2024)

REVENUE SOURCES (% of Fund's net assets) |

| Health Care | 22.7 | |

| General Obligations | 22.6 | |

| Transportation | 13.2 | |

| Education | 11.5 | |

| Housing | 9.5 | |

| Electric Utilities | 6.6 | |

| Others(Individually Less Than 5%) | 13.9 | |

| 100.0 | |

| |

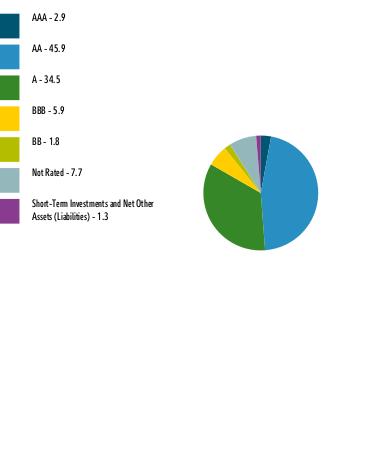

| AAA | 2.9 |

| AA | 45.9 |

| A | 34.5 |

| BBB | 5.9 |

| BB | 1.8 |

| Not Rated | 7.7 |

| Short-Term Investments and Net Other Assets (Liabilities) | 1.3 |

QUALITY DIVERSIFICATION (% of Fund's net assets) |

|

| |

| We have used ratings from Moody's Investors Service, Inc. Where Moody's® ratings are not available, we have used S&P® ratings. All ratings are as of the date indicated and do not reflect subsequent changes. |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9915977.100 81-TSRS-0824 |

| |

| | SEMI-ANNUAL SHAREHOLDER REPORT | AS OF JUNE 30, 2024 | |

| | Fidelity® Limited Term Municipal Income Fund Fidelity Advisor® Limited Term Municipal Income Fund Class A : FASHX |

| | | |

This semi-annual shareholder report contains information about Fidelity® Limited Term Municipal Income Fund for the period January 1, 2024 to June 30, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-877-208-0098 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last six months?(based on hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Class A | $ 27 | 0.55% | |

Key Fund Statistics (as of June 30, 2024)

KEY FACTS | | |

| Fund Size | $2,594,296,689 | |

| Number of Holdings | 988 | |

| Portfolio Turnover | 19% | |

What did the Fund invest in?

(as of June 30, 2024)

REVENUE SOURCES (% of Fund's net assets) |

| General Obligations | 24.0 | |

| Transportation | 21.7 | |

| Health Care | 16.7 | |

| Housing | 7.5 | |

| State G.O. | 7.3 | |

| Electric Utilities | 7.0 | |

| Others(Individually Less Than 5%) | 15.8 | |

| 100.0 | |

| |

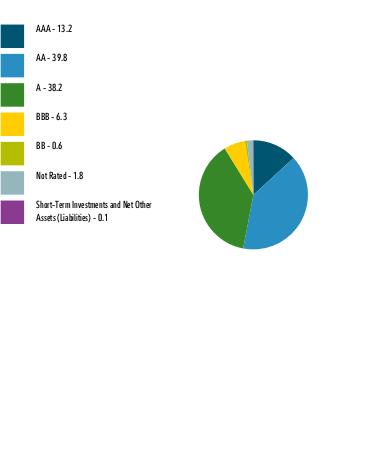

| AAA | 13.2 |

| AA | 39.8 |

| A | 38.2 |

| BBB | 6.3 |

| BB | 0.6 |

| Not Rated | 1.8 |

| Short-Term Investments and Net Other Assets (Liabilities) | 0.1 |

QUALITY DIVERSIFICATION (% of Fund's net assets) |

|

| |

| We have used ratings from Moody's Investors Service, Inc. Where Moody's® ratings are not available, we have used S&P® ratings. All ratings are as of the date indicated and do not reflect subsequent changes. |

TOP STATES (% of Fund's net assets) |

| Texas | 15.5 |

| New York | 11.5 |

| Illinois | 8.8 |

| New Jersey | 4.6 |

| Florida | 4.3 |

| | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9916011.100 1272-TSRS-0824 |

| |

| | SEMI-ANNUAL SHAREHOLDER REPORT | AS OF JUNE 30, 2024 | |

| | Fidelity® Conservative Income Municipal Bond Fund Fidelity Advisor® Conservative Income Municipal Bond Fund Class Z : FMNHX |

| | | |

This semi-annual shareholder report contains information about Fidelity® Conservative Income Municipal Bond Fund for the period January 1, 2024 to June 30, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-877-208-0098 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last six months?(based on hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Class Z | $ 10 | 0.20% | |

Key Fund Statistics (as of June 30, 2024)

KEY FACTS | | |

| Fund Size | $1,498,953,331 | |

| Number of Holdings | 540 | |

| Portfolio Turnover | 73% | |

What did the Fund invest in?

(as of June 30, 2024)

REVENUE SOURCES (% of Fund's net assets) |

| Synthetics | 19.2 | |

| General Obligations | 17.4 | |

| Resource Recovery | 12.8 | |

| Industrial Development | 11.6 | |

| Transportation | 10.1 | |

| Health Care | 7.8 | |

| Electric Utilities | 7.8 | |

| Housing | 6.0 | |

| Others(Individually Less Than 5%) | 7.3 | |

| 100.0 | |

| |

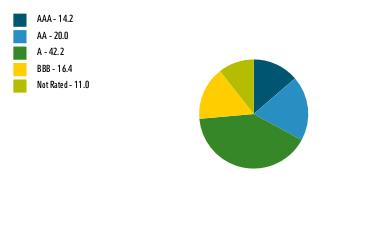

| AAA | 14.2 |

| AA | 20.0 |

| A | 42.2 |

| BBB | 16.4 |

| Not Rated | 11.0 |

QUALITY DIVERSIFICATION (% of Fund's net assets) |

|

| Short-Term Investments and Net Other Assets (Liabilities) - (3.8)%* |

| |

| We have used ratings from Moody's Investors Service, Inc. Where Moody's® ratings are not available, we have used S&P® ratings. All ratings are as of the date indicated and do not reflect subsequent changes. |

TOP STATES (% of Fund's net assets) |

| Non-state Specific | 12.9 |

| Texas | 11.3 |

| Florida | 8.0 |

| Pennsylvania | 7.0 |

| North Dakota | 6.2 |

| | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9916158.100 7367-TSRS-0824 |

| |

| | SEMI-ANNUAL SHAREHOLDER REPORT | AS OF JUNE 30, 2024 | |

| | Fidelity® Limited Term Municipal Income Fund Fidelity® Limited Term Municipal Income Fund : FSTFX |

| | | |

This semi-annual shareholder report contains information about Fidelity® Limited Term Municipal Income Fund for the period January 1, 2024 to June 30, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-800-544-8544 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last six months?(based on hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Fidelity® Limited Term Municipal Income Fund | $ 15 | 0.30% | |

Key Fund Statistics (as of June 30, 2024)

KEY FACTS | | |

| Fund Size | $2,594,296,689 | |

| Number of Holdings | 988 | |

| Portfolio Turnover | 19% | |

What did the Fund invest in?

(as of June 30, 2024)

REVENUE SOURCES (% of Fund's net assets) |

| General Obligations | 24.0 | |

| Transportation | 21.7 | |

| Health Care | 16.7 | |

| Housing | 7.5 | |

| State G.O. | 7.3 | |

| Electric Utilities | 7.0 | |

| Others(Individually Less Than 5%) | 15.8 | |

| 100.0 | |

| |

| AAA | 13.2 |

| AA | 39.8 |

| A | 38.2 |

| BBB | 6.3 |

| BB | 0.6 |

| Not Rated | 1.8 |

| Short-Term Investments and Net Other Assets (Liabilities) | 0.1 |

QUALITY DIVERSIFICATION (% of Fund's net assets) |

|

| |

| We have used ratings from Moody's Investors Service, Inc. Where Moody's® ratings are not available, we have used S&P® ratings. All ratings are as of the date indicated and do not reflect subsequent changes. |

TOP STATES (% of Fund's net assets) |

| Texas | 15.5 |

| New York | 11.5 |

| Illinois | 8.8 |

| New Jersey | 4.6 |

| Florida | 4.3 |

| | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9916016.100 404-TSRS-0824 |

| |

| | SEMI-ANNUAL SHAREHOLDER REPORT | AS OF JUNE 30, 2024 | |

| | Fidelity® Conservative Income Municipal Bond Fund Fidelity® Conservative Income Municipal Bond Fund : FMNDX |

| | | |

This semi-annual shareholder report contains information about Fidelity® Conservative Income Municipal Bond Fund for the period January 1, 2024 to June 30, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-800-544-8544 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last six months?(based on hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Fidelity® Conservative Income Municipal Bond Fund | $ 13 | 0.25% | |

Key Fund Statistics (as of June 30, 2024)

KEY FACTS | | |

| Fund Size | $1,498,953,331 | |

| Number of Holdings | 540 | |

| Portfolio Turnover | 73% | |

What did the Fund invest in?

(as of June 30, 2024)

REVENUE SOURCES (% of Fund's net assets) |

| Synthetics | 19.2 | |

| General Obligations | 17.4 | |

| Resource Recovery | 12.8 | |

| Industrial Development | 11.6 | |

| Transportation | 10.1 | |

| Health Care | 7.8 | |

| Electric Utilities | 7.8 | |

| Housing | 6.0 | |

| Others(Individually Less Than 5%) | 7.3 | |

| 100.0 | |

| |

| AAA | 14.2 |

| AA | 20.0 |

| A | 42.2 |

| BBB | 16.4 |

| Not Rated | 11.0 |

QUALITY DIVERSIFICATION (% of Fund's net assets) |

|

| Short-Term Investments and Net Other Assets (Liabilities) - (3.8)%* |

| |

| We have used ratings from Moody's Investors Service, Inc. Where Moody's® ratings are not available, we have used S&P® ratings. All ratings are as of the date indicated and do not reflect subsequent changes. |

TOP STATES (% of Fund's net assets) |

| Non-state Specific | 12.9 |

| Texas | 11.3 |

| Florida | 8.0 |

| Pennsylvania | 7.0 |

| North Dakota | 6.2 |

| | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9916155.100 2579-TSRS-0824 |

| |

| | SEMI-ANNUAL SHAREHOLDER REPORT | AS OF JUNE 30, 2024 | |

| | Fidelity Flex® Conservative Income Municipal Bond Fund Fidelity Flex® Conservative Income Municipal Bond Fund : FUEMX |

| | | |

This semi-annual shareholder report contains information about Fidelity Flex® Conservative Income Municipal Bond Fund for the period January 1, 2024 to June 30, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-800-544-3455 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last six months?(based on hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Fidelity Flex® Conservative Income Municipal Bond Fund | $ 0 A | 0.00%B | |

A Amount represents less than $.50

B Amount represents less than 0.005%

Key Fund Statistics (as of June 30, 2024)

KEY FACTS | | |

| Fund Size | $179,825,903 | |

| Number of Holdings | 366 | |

| Portfolio Turnover | 63% | |

What did the Fund invest in?

(as of June 30, 2024)

REVENUE SOURCES (% of Fund's net assets) |

| Synthetics | 21.1 | |

| General Obligations | 19.3 | |

| Resource Recovery | 11.8 | |

| Industrial Development | 10.8 | |

| Health Care | 9.3 | |

| Electric Utilities | 9.2 | |

| Transportation | 7.6 | |

| Others(Individually Less Than 5%) | 10.9 | |

| 100.0 | |

| |

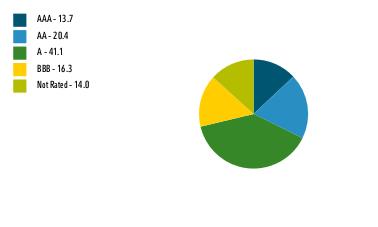

| AAA | 13.7 |

| AA | 20.4 |

| A | 41.1 |

| BBB | 16.3 |

| Not Rated | 14.0 |

QUALITY DIVERSIFICATION (% of Fund's net assets) |

|

| Short-Term Investments and Net Other Assets (Liabilities) - (5.5)%* |

| |

| We have used ratings from Moody's Investors Service, Inc. Where Moody's® ratings are not available, we have used S&P® ratings. All ratings are as of the date indicated and do not reflect subsequent changes. |

TOP STATES (% of Fund's net assets) |

| Texas | 12.7 |

| North Dakota | 10.5 |

| Non-state Specific | 10.5 |

| Pennsylvania | 7.9 |

| Florida | 6.4 |

| | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9916170.100 3042-TSRS-0824 |

| |

| | SEMI-ANNUAL SHAREHOLDER REPORT | AS OF JUNE 30, 2024 | |

| | Fidelity® Conservative Income Municipal Bond Fund Fidelity Advisor® Conservative Income Municipal Bond Fund Class A : FMNFX |

| | | |

This semi-annual shareholder report contains information about Fidelity® Conservative Income Municipal Bond Fund for the period January 1, 2024 to June 30, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-877-208-0098 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last six months?(based on hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Class A | $ 21 | 0.43% | |

Key Fund Statistics (as of June 30, 2024)

KEY FACTS | | |

| Fund Size | $1,498,953,331 | |

| Number of Holdings | 540 | |

| Portfolio Turnover | 73% | |

What did the Fund invest in?

(as of June 30, 2024)

REVENUE SOURCES (% of Fund's net assets) |

| Synthetics | 19.2 | |

| General Obligations | 17.4 | |

| Resource Recovery | 12.8 | |

| Industrial Development | 11.6 | |

| Transportation | 10.1 | |

| Health Care | 7.8 | |

| Electric Utilities | 7.8 | |

| Housing | 6.0 | |

| Others(Individually Less Than 5%) | 7.3 | |

| 100.0 | |

| |

| AAA | 14.2 |

| AA | 20.0 |

| A | 42.2 |

| BBB | 16.4 |

| Not Rated | 11.0 |

QUALITY DIVERSIFICATION (% of Fund's net assets) |

|

| Short-Term Investments and Net Other Assets (Liabilities) - (3.8)%* |

| |

| We have used ratings from Moody's Investors Service, Inc. Where Moody's® ratings are not available, we have used S&P® ratings. All ratings are as of the date indicated and do not reflect subsequent changes. |

TOP STATES (% of Fund's net assets) |

| Non-state Specific | 12.9 |

| Texas | 11.3 |

| Florida | 8.0 |

| Pennsylvania | 7.0 |

| North Dakota | 6.2 |

| | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9916156.100 7365-TSRS-0824 |

| |

| | SEMI-ANNUAL SHAREHOLDER REPORT | AS OF JUNE 30, 2024 | |

| | Fidelity® Minnesota Municipal Income Fund Fidelity® Minnesota Municipal Income Fund : FIMIX |

| | | |

This semi-annual shareholder report contains information about Fidelity® Minnesota Municipal Income Fund for the period January 1, 2024 to June 30, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-800-544-8544 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last six months?(based on hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Fidelity® Minnesota Municipal Income Fund | $ 24 | 0.49% | |

Key Fund Statistics (as of June 30, 2024)

KEY FACTS | | |

| Fund Size | $539,177,396 | |

| Number of Holdings | 355 | |

| Portfolio Turnover | 32% | |

What did the Fund invest in?

(as of June 30, 2024)

REVENUE SOURCES (% of Fund's net assets) |

| General Obligations | 36.6 | |

| Health Care | 28.2 | |

| Education | 10.8 | |

| Housing | 10.8 | |

| Electric Utilities | 5.4 | |

| Others(Individually Less Than 5%) | 8.2 | |

| 100.0 | |

| |

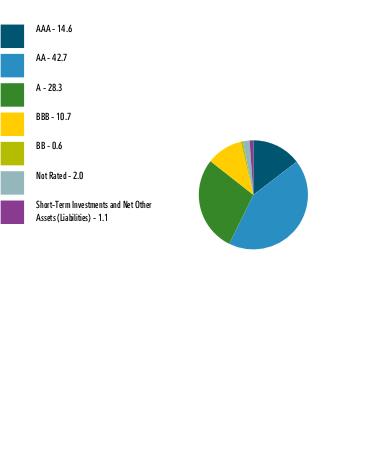

| AAA | 14.6 |

| AA | 42.7 |

| A | 28.3 |

| BBB | 10.7 |

| BB | 0.6 |

| Not Rated | 2.0 |

| Short-Term Investments and Net Other Assets (Liabilities) | 1.1 |

QUALITY DIVERSIFICATION (% of Fund's net assets) |

|

| |

| We have used ratings from Moody's Investors Service, Inc. Where Moody's® ratings are not available, we have used S&P® ratings. All ratings are as of the date indicated and do not reflect subsequent changes. |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9915978.100 82-TSRS-0824 |

| |

| | SEMI-ANNUAL SHAREHOLDER REPORT | AS OF JUNE 30, 2024 | |

| | Fidelity® Municipal Income Fund Fidelity® Municipal Income Fund : FHIGX |

| | | |

This semi-annual shareholder report contains information about Fidelity® Municipal Income Fund for the period January 1, 2024 to June 30, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-800-544-8544 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last six months?(based on hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Fidelity® Municipal Income Fund | $ 22 | 0.44% | |

Key Fund Statistics (as of June 30, 2024)

KEY FACTS | | |

| Fund Size | $4,615,397,246 | |

| Number of Holdings | 1,417 | |

| Portfolio Turnover | 11% | |

What did the Fund invest in?

(as of June 30, 2024)

REVENUE SOURCES (% of Fund's net assets) |

| Transportation | 23.8 | |

| General Obligations | 22.0 | |

| Health Care | 20.5 | |

| Education | 9.8 | |

| Special Tax | 9.3 | |

| State G.O. | 6.1 | |

| Others(Individually Less Than 5%) | 8.5 | |

| 100.0 | |

| |

| AAA | 5.6 |

| AA | 29.7 |

| A | 46.3 |

| BBB | 10.2 |

| BB | 2.4 |

| B | 0.4 |

| CCC,CC,C | 0.0 |

| Not Rated | 4.6 |

| Short-Term Investments and Net Other Assets (Liabilities) | 0.8 |

QUALITY DIVERSIFICATION (% of Fund's net assets) |

|

| |

| We have used ratings from Moody's Investors Service, Inc. Where Moody's® ratings are not available, we have used S&P® ratings. All ratings are as of the date indicated and do not reflect subsequent changes. |

TOP STATES (% of Fund's net assets) |

| Illinois | 14.9 |

| New York | 9.0 |

| Pennsylvania | 7.7 |

| New Jersey | 6.5 |

| Florida | 6.3 |

| | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9915942.100 37-TSRS-0824 |

| |

| | SEMI-ANNUAL SHAREHOLDER REPORT | AS OF JUNE 30, 2024 | |

| | Fidelity Flex® Municipal Income Fund Fidelity Flex® Municipal Income Fund : FUENX |

| | | |

This semi-annual shareholder report contains information about Fidelity Flex® Municipal Income Fund for the period January 1, 2024 to June 30, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-800-544-3455 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last six months?(based on hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Fidelity Flex® Municipal Income Fund | $ 0 A | 0.00%B | |

A Amount represents less than $.50

B Amount represents less than 0.005%

Key Fund Statistics (as of June 30, 2024)

KEY FACTS | | |

| Fund Size | $779,750,071 | |

| Number of Holdings | 1,152 | |

| Portfolio Turnover | 7% | |

What did the Fund invest in?

(as of June 30, 2024)

REVENUE SOURCES (% of Fund's net assets) |

| General Obligations | 20.6 | |

| Transportation | 20.6 | |

| Health Care | 11.1 | |

| Education | 10.9 | |

| Special Tax | 10.0 | |

| Housing | 8.0 | |

| Others(Individually Less Than 5%) | 18.8 | |

| 100.0 | |

| |

| AAA | 7.6 |

| AA | 34.7 |

| A | 37.7 |

| BBB | 9.7 |

| BB | 0.8 |

| B | 0.2 |

| CCC,CC,C | 0.2 |

| Not Rated | 3.6 |

| Short-Term Investments and Net Other Assets (Liabilities) | 5.5 |

QUALITY DIVERSIFICATION (% of Fund's net assets) |

|

| |

| We have used ratings from Moody's Investors Service, Inc. Where Moody's® ratings are not available, we have used S&P® ratings. All ratings are as of the date indicated and do not reflect subsequent changes. |

TOP STATES (% of Fund's net assets) |

| Illinois | 10.7 |

| New York | 9.9 |

| Pennsylvania | 7.5 |

| California | 6.1 |

| New Jersey | 5.9 |

| | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9916171.100 3043-TSRS-0824 |

| |

| | SEMI-ANNUAL SHAREHOLDER REPORT | AS OF JUNE 30, 2024 | |

| | Fidelity® Limited Term Municipal Income Fund Fidelity Advisor® Limited Term Municipal Income Fund Class I : FISHX |

| | | |

This semi-annual shareholder report contains information about Fidelity® Limited Term Municipal Income Fund for the period January 1, 2024 to June 30, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-877-208-0098 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last six months?(based on hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Class I | $ 15 | 0.30% | |

Key Fund Statistics (as of June 30, 2024)

KEY FACTS | | |

| Fund Size | $2,594,296,689 | |

| Number of Holdings | 988 | |

| Portfolio Turnover | 19% | |

What did the Fund invest in?

(as of June 30, 2024)

REVENUE SOURCES (% of Fund's net assets) |

| General Obligations | 24.0 | |

| Transportation | 21.7 | |

| Health Care | 16.7 | |

| Housing | 7.5 | |

| State G.O. | 7.3 | |

| Electric Utilities | 7.0 | |

| Others(Individually Less Than 5%) | 15.8 | |

| 100.0 | |

| |

| AAA | 13.2 |

| AA | 39.8 |

| A | 38.2 |

| BBB | 6.3 |

| BB | 0.6 |

| Not Rated | 1.8 |

| Short-Term Investments and Net Other Assets (Liabilities) | 0.1 |

QUALITY DIVERSIFICATION (% of Fund's net assets) |

|

| |

| We have used ratings from Moody's Investors Service, Inc. Where Moody's® ratings are not available, we have used S&P® ratings. All ratings are as of the date indicated and do not reflect subsequent changes. |

TOP STATES (% of Fund's net assets) |

| Texas | 15.5 |

| New York | 11.5 |

| Illinois | 8.8 |

| New Jersey | 4.6 |

| Florida | 4.3 |

| | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9916014.100 1276-TSRS-0824 |

| |

| | SEMI-ANNUAL SHAREHOLDER REPORT | AS OF JUNE 30, 2024 | |

| | Fidelity® Municipal Income Fund Fidelity Advisor® Municipal Income Fund Class Z : FIWEX |

| | | |

This semi-annual shareholder report contains information about Fidelity® Municipal Income Fund for the period January 1, 2024 to June 30, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-877-208-0098 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last six months?(based on hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Class Z | $ 20 | 0.41% | |

Key Fund Statistics (as of June 30, 2024)

KEY FACTS | | |

| Fund Size | $4,615,397,246 | |

| Number of Holdings | 1,417 | |

| Portfolio Turnover | 11% | |

What did the Fund invest in?

(as of June 30, 2024)

REVENUE SOURCES (% of Fund's net assets) |

| Transportation | 23.8 | |

| General Obligations | 22.0 | |

| Health Care | 20.5 | |

| Education | 9.8 | |

| Special Tax | 9.3 | |

| State G.O. | 6.1 | |

| Others(Individually Less Than 5%) | 8.5 | |

| 100.0 | |

| |

| AAA | 5.6 |

| AA | 29.7 |

| A | 46.3 |

| BBB | 10.2 |

| BB | 2.4 |

| B | 0.4 |

| CCC,CC,C | 0.0 |

| Not Rated | 4.6 |

| Short-Term Investments and Net Other Assets (Liabilities) | 0.8 |

QUALITY DIVERSIFICATION (% of Fund's net assets) |

|

| |

| We have used ratings from Moody's Investors Service, Inc. Where Moody's® ratings are not available, we have used S&P® ratings. All ratings are as of the date indicated and do not reflect subsequent changes. |

TOP STATES (% of Fund's net assets) |

| Illinois | 14.9 |

| New York | 9.0 |

| Pennsylvania | 7.7 |

| New Jersey | 6.5 |

| Florida | 6.3 |

| | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9915941.100 3287-TSRS-0824 |

| |

| | SEMI-ANNUAL SHAREHOLDER REPORT | AS OF JUNE 30, 2024 | |

| | Fidelity® Ohio Municipal Income Fund Fidelity® Ohio Municipal Income Fund : FOHFX |

| | | |

This semi-annual shareholder report contains information about Fidelity® Ohio Municipal Income Fund for the period January 1, 2024 to June 30, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-800-544-8544 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last six months?(based on hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Fidelity® Ohio Municipal Income Fund | $ 24 | 0.47% | |

Key Fund Statistics (as of June 30, 2024)

KEY FACTS | | |

| Fund Size | $489,392,781 | |

| Number of Holdings | 275 | |

| Portfolio Turnover | 8% | |

What did the Fund invest in?

(as of June 30, 2024)

REVENUE SOURCES (% of Fund's net assets) |

| Health Care | 36.6 | |

| Education | 20.2 | |

| Special Tax | 8.4 | |

| General Obligations | 7.0 | |

| Housing | 5.0 | |

| Others(Individually Less Than 5%) | 22.8 | |

| 100.0 | |

| |

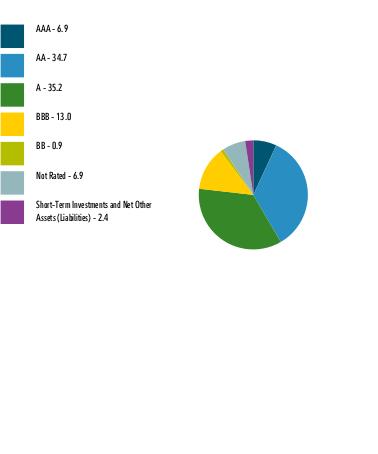

| AAA | 6.9 |

| AA | 34.7 |

| A | 35.2 |

| BBB | 13.0 |

| BB | 0.9 |

| Not Rated | 6.9 |

| Short-Term Investments and Net Other Assets (Liabilities) | 2.4 |

QUALITY DIVERSIFICATION (% of Fund's net assets) |

|

| |

| We have used ratings from Moody's Investors Service, Inc. Where Moody's® ratings are not available, we have used S&P® ratings. All ratings are as of the date indicated and do not reflect subsequent changes. |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9915979.100 88-TSRS-0824 |

| |

| | SEMI-ANNUAL SHAREHOLDER REPORT | AS OF JUNE 30, 2024 | |

| | Fidelity® Municipal Income Fund Fidelity Advisor® Municipal Income Fund Class A : FHUGX |

| | | |

This semi-annual shareholder report contains information about Fidelity® Municipal Income Fund for the period January 1, 2024 to June 30, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-877-208-0098 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last six months?(based on hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Class A | $ 38 | 0.77% | |

Key Fund Statistics (as of June 30, 2024)

KEY FACTS | | |

| Fund Size | $4,615,397,246 | |

| Number of Holdings | 1,417 | |

| Portfolio Turnover | 11% | |

What did the Fund invest in?

(as of June 30, 2024)

REVENUE SOURCES (% of Fund's net assets) |

| Transportation | 23.8 | |

| General Obligations | 22.0 | |

| Health Care | 20.5 | |

| Education | 9.8 | |

| Special Tax | 9.3 | |

| State G.O. | 6.1 | |

| Others(Individually Less Than 5%) | 8.5 | |

| 100.0 | |

| |

| AAA | 5.6 |

| AA | 29.7 |

| A | 46.3 |

| BBB | 10.2 |

| BB | 2.4 |

| B | 0.4 |

| CCC,CC,C | 0.0 |

| Not Rated | 4.6 |

| Short-Term Investments and Net Other Assets (Liabilities) | 0.8 |

QUALITY DIVERSIFICATION (% of Fund's net assets) |

|

| |

| We have used ratings from Moody's Investors Service, Inc. Where Moody's® ratings are not available, we have used S&P® ratings. All ratings are as of the date indicated and do not reflect subsequent changes. |

TOP STATES (% of Fund's net assets) |

| Illinois | 14.9 |

| New York | 9.0 |

| Pennsylvania | 7.7 |

| New Jersey | 6.5 |

| Florida | 6.3 |

| | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9915937.100 3068-TSRS-0824 |

| |

| | SEMI-ANNUAL SHAREHOLDER REPORT | AS OF JUNE 30, 2024 | |

| | Fidelity® Limited Term Municipal Income Fund Fidelity Advisor® Limited Term Municipal Income Fund Class Z : FIWAX |

| | | |

This semi-annual shareholder report contains information about Fidelity® Limited Term Municipal Income Fund for the period January 1, 2024 to June 30, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-877-208-0098 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last six months?(based on hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Class Z | $ 13 | 0.25% | |

Key Fund Statistics (as of June 30, 2024)

KEY FACTS | | |

| Fund Size | $2,594,296,689 | |

| Number of Holdings | 988 | |

| Portfolio Turnover | 19% | |

What did the Fund invest in?

(as of June 30, 2024)

REVENUE SOURCES (% of Fund's net assets) |

| General Obligations | 24.0 | |

| Transportation | 21.7 | |

| Health Care | 16.7 | |

| Housing | 7.5 | |

| State G.O. | 7.3 | |

| Electric Utilities | 7.0 | |

| Others(Individually Less Than 5%) | 15.8 | |

| 100.0 | |

| |

| AAA | 13.2 |

| AA | 39.8 |

| A | 38.2 |

| BBB | 6.3 |

| BB | 0.6 |

| Not Rated | 1.8 |

| Short-Term Investments and Net Other Assets (Liabilities) | 0.1 |

QUALITY DIVERSIFICATION (% of Fund's net assets) |

|

| |

| We have used ratings from Moody's Investors Service, Inc. Where Moody's® ratings are not available, we have used S&P® ratings. All ratings are as of the date indicated and do not reflect subsequent changes. |

TOP STATES (% of Fund's net assets) |

| Texas | 15.5 |

| New York | 11.5 |

| Illinois | 8.8 |

| New Jersey | 4.6 |

| Florida | 4.3 |

| | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9916015.100 3284-TSRS-0824 |

| |

| | SEMI-ANNUAL SHAREHOLDER REPORT | AS OF JUNE 30, 2024 | |

| | Fidelity® Pennsylvania Municipal Income Fund Fidelity® Pennsylvania Municipal Income Fund : FPXTX |

| | | |

This semi-annual shareholder report contains information about Fidelity® Pennsylvania Municipal Income Fund for the period January 1, 2024 to June 30, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-800-544-8544 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last six months?(based on hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Fidelity® Pennsylvania Municipal Income Fund | $ 24 | 0.48% | |

Key Fund Statistics (as of June 30, 2024)

KEY FACTS | | |

| Fund Size | $399,407,787 | |

| Number of Holdings | 221 | |

| Portfolio Turnover | 4% | |

What did the Fund invest in?

(as of June 30, 2024)

REVENUE SOURCES (% of Fund's net assets) |

| Health Care | 26.9 | |

| Transportation | 19.3 | |

| Education | 18.9 | |

| General Obligations | 13.4 | |

| Housing | 7.2 | |

| Others(Individually Less Than 5%) | 14.3 | |

| 100.0 | |

| |

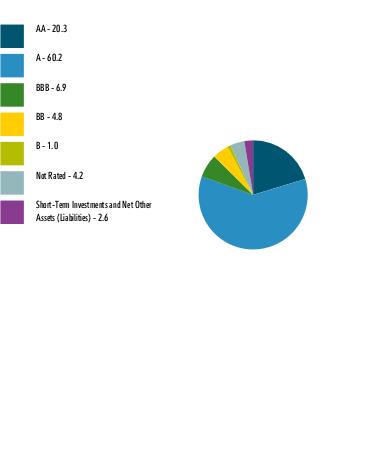

| AA | 20.3 |

| A | 60.2 |

| BBB | 6.9 |

| BB | 4.8 |

| B | 1.0 |

| Not Rated | 4.2 |

| Short-Term Investments and Net Other Assets (Liabilities) | 2.6 |

QUALITY DIVERSIFICATION (% of Fund's net assets) |

|

| |

| We have used ratings from Moody's Investors Service, Inc. Where Moody's® ratings are not available, we have used S&P® ratings. All ratings are as of the date indicated and do not reflect subsequent changes. |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9916010.100 402-TSRS-0824 |

| |

| | SEMI-ANNUAL SHAREHOLDER REPORT | AS OF JUNE 30, 2024 | |

| | Fidelity® Limited Term Municipal Income Fund Fidelity Advisor® Limited Term Municipal Income Fund Class C : FCSHX |

| | | |

This semi-annual shareholder report contains information about Fidelity® Limited Term Municipal Income Fund for the period January 1, 2024 to June 30, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-877-208-0098 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last six months?(based on hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Class C | $ 64 | 1.29% | |

Key Fund Statistics (as of June 30, 2024)

KEY FACTS | | |

| Fund Size | $2,594,296,689 | |

| Number of Holdings | 988 | |

| Portfolio Turnover | 19% | |

What did the Fund invest in?

(as of June 30, 2024)

REVENUE SOURCES (% of Fund's net assets) |

| General Obligations | 24.0 | |

| Transportation | 21.7 | |

| Health Care | 16.7 | |

| Housing | 7.5 | |

| State G.O. | 7.3 | |

| Electric Utilities | 7.0 | |

| Others(Individually Less Than 5%) | 15.8 | |

| 100.0 | |

| |

| AAA | 13.2 |

| AA | 39.8 |

| A | 38.2 |

| BBB | 6.3 |

| BB | 0.6 |

| Not Rated | 1.8 |

| Short-Term Investments and Net Other Assets (Liabilities) | 0.1 |

QUALITY DIVERSIFICATION (% of Fund's net assets) |

|

| |

| We have used ratings from Moody's Investors Service, Inc. Where Moody's® ratings are not available, we have used S&P® ratings. All ratings are as of the date indicated and do not reflect subsequent changes. |

TOP STATES (% of Fund's net assets) |

| Texas | 15.5 |

| New York | 11.5 |

| Illinois | 8.8 |

| New Jersey | 4.6 |

| Florida | 4.3 |

| | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9916012.100 1274-TSRS-0824 |

| |

| | SEMI-ANNUAL SHAREHOLDER REPORT | AS OF JUNE 30, 2024 | |

| | Fidelity® Municipal Income Fund Fidelity Advisor® Municipal Income Fund Class M : FLUVX |

| | | |

This semi-annual shareholder report contains information about Fidelity® Municipal Income Fund for the period January 1, 2024 to June 30, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-877-208-0098 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last six months?(based on hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Class M | $ 37 | 0.75% | |

Key Fund Statistics (as of June 30, 2024)

KEY FACTS | | |

| Fund Size | $4,615,397,246 | |

| Number of Holdings | 1,417 | |

| Portfolio Turnover | 11% | |

What did the Fund invest in?

(as of June 30, 2024)

REVENUE SOURCES (% of Fund's net assets) |

| Transportation | 23.8 | |

| General Obligations | 22.0 | |

| Health Care | 20.5 | |

| Education | 9.8 | |

| Special Tax | 9.3 | |

| State G.O. | 6.1 | |

| Others(Individually Less Than 5%) | 8.5 | |

| 100.0 | |

| |

| AAA | 5.6 |

| AA | 29.7 |

| A | 46.3 |

| BBB | 10.2 |

| BB | 2.4 |

| B | 0.4 |

| CCC,CC,C | 0.0 |

| Not Rated | 4.6 |

| Short-Term Investments and Net Other Assets (Liabilities) | 0.8 |

QUALITY DIVERSIFICATION (% of Fund's net assets) |

|

| |

| We have used ratings from Moody's Investors Service, Inc. Where Moody's® ratings are not available, we have used S&P® ratings. All ratings are as of the date indicated and do not reflect subsequent changes. |

TOP STATES (% of Fund's net assets) |

| Illinois | 14.9 |

| New York | 9.0 |

| Pennsylvania | 7.7 |

| New Jersey | 6.5 |

| Florida | 6.3 |

| | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9915939.100 3070-TSRS-0824 |

| |

| | SEMI-ANNUAL SHAREHOLDER REPORT | AS OF JUNE 30, 2024 | |

| | Fidelity® Limited Term Municipal Income Fund Fidelity Advisor® Limited Term Municipal Income Fund Class M : FTSHX |

| | | |

This semi-annual shareholder report contains information about Fidelity® Limited Term Municipal Income Fund for the period January 1, 2024 to June 30, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-877-208-0098 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last six months?(based on hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Class M | $ 27 | 0.55% | |

Key Fund Statistics (as of June 30, 2024)

KEY FACTS | | |

| Fund Size | $2,594,296,689 | |

| Number of Holdings | 988 | |

| Portfolio Turnover | 19% | |

What did the Fund invest in?

(as of June 30, 2024)

REVENUE SOURCES (% of Fund's net assets) |

| General Obligations | 24.0 | |

| Transportation | 21.7 | |

| Health Care | 16.7 | |

| Housing | 7.5 | |

| State G.O. | 7.3 | |

| Electric Utilities | 7.0 | |

| Others(Individually Less Than 5%) | 15.8 | |

| 100.0 | |

| |

| AAA | 13.2 |

| AA | 39.8 |

| A | 38.2 |

| BBB | 6.3 |

| BB | 0.6 |

| Not Rated | 1.8 |

| Short-Term Investments and Net Other Assets (Liabilities) | 0.1 |

QUALITY DIVERSIFICATION (% of Fund's net assets) |

|

| |

| We have used ratings from Moody's Investors Service, Inc. Where Moody's® ratings are not available, we have used S&P® ratings. All ratings are as of the date indicated and do not reflect subsequent changes. |

TOP STATES (% of Fund's net assets) |

| Texas | 15.5 |

| New York | 11.5 |

| Illinois | 8.8 |

| New Jersey | 4.6 |

| Florida | 4.3 |

| | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9916013.100 1275-TSRS-0824 |

| |

| | SEMI-ANNUAL SHAREHOLDER REPORT | AS OF JUNE 30, 2024 | |

| | Fidelity® Conservative Income Municipal Bond Fund Fidelity Advisor® Conservative Income Municipal Bond Fund Class I : FMNGX |

| | | |

This semi-annual shareholder report contains information about Fidelity® Conservative Income Municipal Bond Fund for the period January 1, 2024 to June 30, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-877-208-0098 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last six months?(based on hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Class I | $ 13 | 0.25% | |

Key Fund Statistics (as of June 30, 2024)

KEY FACTS | | |

| Fund Size | $1,498,953,331 | |

| Number of Holdings | 540 | |

| Portfolio Turnover | 73% | |

What did the Fund invest in?

(as of June 30, 2024)

REVENUE SOURCES (% of Fund's net assets) |

| Synthetics | 19.2 | |

| General Obligations | 17.4 | |

| Resource Recovery | 12.8 | |

| Industrial Development | 11.6 | |

| Transportation | 10.1 | |

| Health Care | 7.8 | |

| Electric Utilities | 7.8 | |

| Housing | 6.0 | |

| Others(Individually Less Than 5%) | 7.3 | |

| 100.0 | |

| |

| AAA | 14.2 |

| AA | 20.0 |

| A | 42.2 |

| BBB | 16.4 |

| Not Rated | 11.0 |

QUALITY DIVERSIFICATION (% of Fund's net assets) |

|

| Short-Term Investments and Net Other Assets (Liabilities) - (3.8)%* |

| |

| We have used ratings from Moody's Investors Service, Inc. Where Moody's® ratings are not available, we have used S&P® ratings. All ratings are as of the date indicated and do not reflect subsequent changes. |

TOP STATES (% of Fund's net assets) |

| Non-state Specific | 12.9 |

| Texas | 11.3 |

| Florida | 8.0 |

| Pennsylvania | 7.0 |

| North Dakota | 6.2 |

| | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9916157.100 7366-TSRS-0824 |

| |

| | SEMI-ANNUAL SHAREHOLDER REPORT | AS OF JUNE 30, 2024 | |

| | Fidelity® Municipal Income Fund Fidelity Advisor® Municipal Income Fund Class C : FKISX |

| | | |

This semi-annual shareholder report contains information about Fidelity® Municipal Income Fund for the period January 1, 2024 to June 30, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-877-208-0098 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last six months?(based on hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Class C | $ 75 | 1.51% | |

Key Fund Statistics (as of June 30, 2024)

KEY FACTS | | |

| Fund Size | $4,615,397,246 | |

| Number of Holdings | 1,417 | |

| Portfolio Turnover | 11% | |

What did the Fund invest in?

(as of June 30, 2024)

REVENUE SOURCES (% of Fund's net assets) |

| Transportation | 23.8 | |

| General Obligations | 22.0 | |

| Health Care | 20.5 | |

| Education | 9.8 | |

| Special Tax | 9.3 | |

| State G.O. | 6.1 | |

| Others(Individually Less Than 5%) | 8.5 | |

| 100.0 | |

| |

| AAA | 5.6 |

| AA | 29.7 |

| A | 46.3 |

| BBB | 10.2 |

| BB | 2.4 |

| B | 0.4 |

| CCC,CC,C | 0.0 |

| Not Rated | 4.6 |

| Short-Term Investments and Net Other Assets (Liabilities) | 0.8 |

QUALITY DIVERSIFICATION (% of Fund's net assets) |

|

| |

| We have used ratings from Moody's Investors Service, Inc. Where Moody's® ratings are not available, we have used S&P® ratings. All ratings are as of the date indicated and do not reflect subsequent changes. |

TOP STATES (% of Fund's net assets) |

| Illinois | 14.9 |

| New York | 9.0 |

| Pennsylvania | 7.7 |

| New Jersey | 6.5 |

| Florida | 6.3 |

| | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9915938.100 3069-TSRS-0824 |

Item 2.

Code of Ethics

Not applicable.

Item 3.

Audit Committee Financial Expert

Not applicable.

Item 4.

Principal Accountant Fees and Services

Not applicable.

Item 5.

Audit Committee of Listed Registrants

Not applicable.

Item 6.

Investments

(a)

Not applicable.

(b)

Not applicable

Item 7.

Financial Statements and Financial Highlights for Open-End Management Investment Companies

Fidelity® Limited Term Municipal Income Fund

Semi-Annual Report

June 30, 2024

Includes Fidelity and Fidelity Advisor share classes

Contents

To view a fund's proxy voting guidelines and proxy voting record for the 12-month period ended June 30, visit http://www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission's (SEC) web site at http://www.sec.gov.

You may also call 1-800-544-8544 if you're an individual investing directly with Fidelity, call 1-800-835-5092 if you're a plan sponsor or participant with Fidelity as your recordkeeper or call 1-877-208-0098 on institutional accounts or if you're an advisor or invest through one to request a free copy of the proxy voting guidelines.

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third-party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR LLC or an affiliated company. © 2024 FMR LLC. All rights reserved.

This report and the financial statements contained herein are submitted for the general information of the shareholders of the Fund. This report is not authorized for distribution to prospective investors in the Fund unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-PORT. Forms N-PORT are available on the SEC's web site at http://www.sec.gov. A fund's Forms N-PORT may be reviewed and copied at the SEC's Public Reference Room in Washington, DC. Information regarding the operation of the SEC's Public Reference Room may be obtained by calling 1-800-SEC-0330.

For a complete list of a fund's portfolio holdings, view the most recent holdings listing, semiannual report, or annual report on Fidelity's web site at http://www.fidelity.com, http://www.institutional.fidelity.com, or http://www.401k.com, as applicable.

NOT FDIC INSURED •MAY LOSE VALUE •NO BANK GUARANTEE

Neither the Fund nor Fidelity Distributors Corporation is a bank.

Item 7: Financial Statements and Financial Highlights for Open-End Management Investment Companies (Semi-Annual Report)

Fidelity® Limited Term Municipal Income Fund

Schedule of Investments June 30, 2024 (Unaudited)

Showing Percentage of Net Assets

| Municipal Bonds - 99.9% |

| | | Principal Amount (a) (000s) | Value ($) (000s) |

| Alabama - 2.6% | | | |

| Birmingham Arpt. Auth. Series 2020: | | | |

| 5% 7/1/26 (Build America Mutual Assurance Insured) | | 555 | 573 |

| 5% 7/1/27 (Build America Mutual Assurance Insured) | | 500 | 525 |

| Black Belt Energy Gas District: | | | |

| Bonds: | | | |

(Proj. No. 5) Series A, 4%, tender 10/1/26 (b) | | 4,000 | 4,003 |

Series 2022 E, 5%, tender 6/1/28 (b) | | 4,945 | 5,150 |

Series 2023 D1, 5.5%, tender 2/1/29 (b) | | 4,460 | 4,733 |

| Series 2022 C1: | | | |

5.25% 12/1/26 | | 1,845 | 1,896 |

5.25% 6/1/27 | | 1,290 | 1,334 |

5.25% 12/1/27 | | 1,170 | 1,218 |

5.25% 6/1/28 | | 1,540 | 1,604 |

5.25% 12/1/28 | | 1,275 | 1,333 |

5.25% 6/1/29 | | 1,000 | 1,052 |

| Huntsville Health Care Auth. Bonds Series 2023 A, 5%, tender 6/1/30 (b) | | 8,950 | 9,553 |

| Jefferson County Swr. Rev. Series 2024, 5% 10/1/29 | | 1,195 | 1,283 |

| Mobile County Board of School Commissioners Series 2016 A, 5% 3/1/25 | | 1,225 | 1,236 |

| Mobile Indl. Dev. Board Poll. Cont. Rev. Bonds Series 2009 E, 1%, tender 6/26/25 (b) | | 5,030 | 4,881 |

| Southeast Energy Auth. Coop. Dis Bonds (Proj. No. 6) Series 2023 B, 5%, tender 6/1/30 (b) | | 10,000 | 10,557 |

| Southeast Energy Auth. Rev.: | | | |

| (Proj. No. 2) Series 2021 B1: | | | |

4% 6/1/25 | | 725 | 723 |

4% 6/1/26 | | 1,500 | 1,490 |

4% 6/1/27 | | 2,440 | 2,421 |

4% 6/1/28 | | 3,780 | 3,743 |

| Bonds Series 2022 B1, 5%, tender 8/1/28 (b) | | 6,035 | 6,270 |

| Univ. of Alabama Gen. Rev. Series 2019 C, 5% 7/1/31 | | 2,285 | 2,480 |

TOTAL ALABAMA | | | 68,058 |

| Alaska - 0.1% | | | |

| Alaska Hsg. Fin. Corp. Mtg. Rev. Series 2022 A, 3% 6/1/51 | | 985 | 946 |

| Alaska Int'l. Arpts. Revs. Series 2021 C, 5% 10/1/26 (c) | | 1,510 | 1,554 |

| Alaska Muni. Bond Bank Series 2015 B, 5% 3/1/28 (c) | | 1,390 | 1,401 |

TOTAL ALASKA | | | 3,901 |

| Arizona - 2.1% | | | |

| Arizona Board of Regents Arizona State Univ. Rev.: | | | |

| Series 2016 A, 5% 7/1/26 | | 275 | 280 |

| Series 2021: | | | |

5% 8/1/26 | | 1,100 | 1,141 |

5% 8/1/27 | | 1,500 | 1,583 |

| Arizona Health Facilities Auth. Rev. (Scottsdale Lincoln Hospitals Proj.) Series 2014 A, 5% 12/1/24 | | 1,465 | 1,472 |

| Arizona Indl. Dev. Auth. Hosp. Rev. Series 2021 A: | | | |

| 5% 2/1/25 | | 1,100 | 1,109 |

| 5% 2/1/26 | | 1,200 | 1,230 |

| 5% 2/1/27 | | 1,200 | 1,250 |

| Chandler Indl. Dev. Auth. Indl. Dev. Rev. Bonds (Intel Corp. Proj.) Series 2022 2, 5%, tender 9/1/27 (b)(c) | | 8,765 | 8,998 |

| Glendale Union School District 205 Series A: | | | |

| 5% 7/1/26 (Assured Guaranty Muni. Corp. Insured) | | 200 | 206 |

| 5% 7/1/27 (Assured Guaranty Muni. Corp. Insured) | | 250 | 261 |

| Maricopa County Indl. Dev. Auth. Series 2024 D: | | | |

| 5% 12/1/28 (d) | | 2,100 | 2,221 |

| 5% 12/1/29 (d) | | 4,000 | 4,286 |

| 5% 12/1/30 (d) | | 3,250 | 3,516 |

| Maricopa County Indl. Dev. Auth. Sr. Living Facilities (Christian Care Surprise, Inc. Proj.) Series 2016, 5% 1/1/26 (e) | | 515 | 497 |

| Maricopa County Rev. Bonds: | | | |

| Series 2019 D, 5%, tender 5/15/26 (b) | | 6,765 | 6,930 |

| Series 2023 A2, 5%, tender 5/15/28 (b) | | 4,480 | 4,720 |

| Maricopa County Spl. Health Care District Gen. Oblig. Series 2021 D, 5% 7/1/26 | | 3,000 | 3,100 |

| Maricopa County Unified School District #48 Scottsdale Series D: | | | |

| 4% 7/1/25 | | 800 | 806 |

| 4% 7/1/26 | | 900 | 914 |

| 4% 7/1/27 | | 225 | 231 |

| Phoenix Civic Impt. Board Arpt. Rev. Series 2019 B, 5% 7/1/25 (c) | | 1,500 | 1,521 |

| Phoenix Civic Impt. Corp. Series 2019 B, 5% 7/1/28 | | 1,910 | 2,013 |

| Pima County Unified School District #1 Tucson Series 2024 A: | | | |

| 5% 7/1/28 (Assured Guaranty Muni. Corp. Insured) | | 900 | 962 |

| 5% 7/1/29 (Assured Guaranty Muni. Corp. Insured) | | 600 | 651 |

| Tucson Ctfs. of Prtn. Series 2016, 5% 7/1/27 (Assured Guaranty Muni. Corp. Insured) | | 1,245 | 1,285 |

| Western Maricopa Ed. Ctr. District Series 2019 B, 5% 7/1/26 | | 2,000 | 2,068 |

TOTAL ARIZONA | | | 53,251 |

| California - 4.2% | | | |

| Bay Area Toll Auth. San Francisco Bay Toll Bridge Rev. Bonds: | | | |

| Series 2021 A, 2%, tender 4/1/28 (b) | | 7,365 | 6,833 |

| Series A, 2.95%, tender 4/1/26 (b) | | 4,770 | 4,676 |

| Series B, 2.85%, tender 4/1/25 (b) | | 3,900 | 3,860 |

| California Gen. Oblig.: | | | |

| Series 2017, 5% 8/1/26 | | 1,200 | 1,244 |

| Series 2020: | | | |

4% 11/1/26 | | 700 | 713 |

5% 11/1/28 | | 6,690 | 7,216 |

| Series 2023, 5% 10/1/28 | | 4,000 | 4,308 |

| California Infrastructure and Econ. Dev. Bank Rev.: | | | |

| Bonds (Los Angeles County Museum of Art Proj.) Series 2021 A, 1.2%, tender 6/1/28 (b) | | 780 | 687 |

| Series 2024 A, 3.25% 8/1/29 | | 1,005 | 986 |

| California Pub. Works Board Lease Rev.: | | | |

| (Various Cap. Projs.) Series 2023 B, 5% 12/1/28 | | 5,950 | 6,427 |

| Series 2023 A, 5% 12/1/29 | | 2,000 | 2,197 |

| Castaic Lake Wtr. Agcy. Ctfs. of Prtn. Series 1999, 0% 8/1/28 (AMBAC Insured) | | 1,435 | 1,255 |

| Fresno Arpt. Rev. Series 2023 A: | | | |

| 5% 7/1/26 (Build America Mutual Assurance Insured) (c) | | 1,000 | 1,024 |

| 5% 7/1/27 (Build America Mutual Assurance Insured) (c) | | 1,340 | 1,390 |

| 5% 7/1/28 (Build America Mutual Assurance Insured) (c) | | 2,885 | 3,027 |

| 5% 7/1/29 (Build America Mutual Assurance Insured) (c) | | 3,025 | 3,192 |

| Los Angeles Dept. Arpt. Rev.: | | | |

| Series 2016 A: | | | |

5% 5/15/25 (c) | | 880 | 890 |

5% 5/15/25 (Escrowed to Maturity) (c) | | 120 | 121 |

| Series 2017 B, 5% 5/15/25 (c) | | 2,265 | 2,292 |

| Series 2018 B: | | | |

5% 5/15/25 (c) | | 1,305 | 1,320 |

5% 5/15/26 (c) | | 1,545 | 1,585 |

| Series 2018 C, 5% 5/15/27 (c) | | 1,615 | 1,672 |

| Series 2020 C, 5% 5/15/26 (c) | | 2,645 | 2,714 |

| Los Angeles Unified School District Series 2024 A, 5% 7/1/28 | | 5,000 | 5,373 |

| Los Angeles Unified School District Ctfs. of Prtn. Series 2023 A, 5% 10/1/28 | | 3,450 | 3,715 |

| Port of Oakland Rev.: | | | |

| Series 2017, 5% 5/1/26 (c) | | 1,825 | 1,869 |

| Series 2021: | | | |

5% 5/1/26 (c) | | 5 | 5 |

5% 5/1/27 (c) | | 3,395 | 3,519 |

5% 5/1/27 (c) | | 5 | 5 |

5% 5/1/28 (c) | | 985 | 1,032 |

5% 5/1/28 (c) | | 15 | 16 |

| San Diego County Reg'l. Arpt. Auth. Arpt. Rev. Series 2020 C, 5% 7/1/26 (c) | | 1,000 | 1,022 |

| San Francisco City & County Arpts. Commission Int'l. Arpt. Rev.: | | | |

| Series 2019 A, 5% 1/1/27 (c) | | 2,405 | 2,472 |

| Series 2022 A: | | | |

5% 5/1/26 (c) | | 4,535 | 4,652 |

5% 5/1/27 (c) | | 4,590 | 4,737 |

5% 5/1/28 (c) | | 6,130 | 6,401 |

5% 5/1/29 (c) | | 4,100 | 4,336 |

| Series 2023 A, 5% 5/1/25 (c) | | 1,770 | 1,791 |

| Southern California Pub. Pwr. Auth. Rev. Bonds Series 2020 C, 0.65%, tender 7/1/25 (b) | | 8,000 | 7,700 |

TOTAL CALIFORNIA | | | 108,274 |

| Colorado - 1.8% | | | |

| Colorado Health Facilities Auth. Rev. Bonds Bonds: | | | |

| Series 2019 B: | | | |

5%, tender 8/1/25 (b) | | 2,950 | 2,978 |

5%, tender 8/1/26 (b) | | 2,035 | 2,075 |

5%, tender 11/19/26 (b) | | 615 | 638 |

5%, tender 11/19/26 (b) | | 6,065 | 6,255 |

| Series 2023 A1, 5%, tender 11/15/28 (b) | | 12,265 | 13,020 |

| Series 2024 A1, 5%, tender 11/15/29 (b) | | 2,070 | 2,231 |

| Series 2024 A2, 5%, tender 11/15/31 (b) | | 1,270 | 1,395 |

| Colorado Hsg. & Fin. Auth.: | | | |

| Series 2019 F, 4.25% 11/1/49 | | 895 | 894 |

| Series 2019 H, 4.25% 11/1/49 | | 430 | 430 |

| Colorado Reg'l. Trans. District Ctfs. of Prtn. Series 2020, 5% 6/1/26 | | 1,000 | 1,033 |

| Denver City & County Arpt. Rev.: | | | |

| Series 2018 A, 5% 12/1/29 (c) | | 1,205 | 1,265 |

| Series 2020 B1, 5% 11/15/24 (c) | | 1,500 | 1,507 |

| E-470 Pub. Hwy. Auth. Rev. Series 2020 A, 5% 9/1/26 | | 1,750 | 1,809 |

| Univ. of Colorado Enterprise Sys. Rev. Bonds: | | | |

| Series 2019 C, 2%, tender 10/15/24 (b) | | 9,030 | 8,983 |

| Series 2021 C3A, 2%, tender 10/15/25 (b) | | 1,625 | 1,584 |

| Series 2021 C3B, 2%, tender 10/15/26 (b) | | 1,345 | 1,283 |

TOTAL COLORADO | | | 47,380 |

| Connecticut - 2.3% | | | |

| Connecticut Gen. Oblig.: | | | |

| Series 2019 A, 5% 4/15/30 | | 965 | 1,042 |

| Series 2020 C, 2% 6/1/25 | | 1,000 | 982 |

| Series 2022 E, 5% 11/15/26 | | 6,000 | 6,256 |

| Series C, 4% 6/1/26 | | 1,100 | 1,117 |

| Connecticut Health & Edl. Facilities Auth. Rev.: | | | |

| Bonds: | | | |

Series 2014 B, 1.8%, tender 7/1/24 (b) | | 3,150 | 3,150 |

Series 2017 B2, 3.2%, tender 7/1/26 (b) | | 3,370 | 3,353 |

Series 2017 C2, 2.8%, tender 2/3/26 (b) | | 19,250 | 18,979 |

Series 2024 B, 5%, tender 7/1/29 (b)(d) | | 9,195 | 9,876 |

| Series 2016 A, 2%, tender 7/1/26 (b) | | 1,725 | 1,667 |

| Series 2019 A: | | | |

4% 7/1/24 (e) | | 1,090 | 1,090 |

5% 7/1/25 (e) | | 705 | 698 |

5% 7/1/28 (e) | | 1,315 | 1,273 |

5% 7/1/29 (e) | | 940 | 906 |

| Series 2022 M: | | | |

5% 7/1/24 | | 175 | 175 |

5% 7/1/27 | | 250 | 258 |

5% 7/1/28 | | 300 | 312 |

| Connecticut Spl. Tax Oblig. Trans. Infrastructure Rev. Series A, 5% 9/1/26 | | 1,025 | 1,065 |

| Hartford County Metropolitan District Gen. Oblig. Series 2021 A: | | | |

| 5% 9/1/27 | | 800 | 846 |

| 5% 9/1/28 | | 775 | 834 |

| New Haven Gen. Oblig. Series 2016 A, 5% 8/15/25 (Assured Guaranty Muni. Corp. Insured) | | 980 | 994 |

| Stratford Gen. Oblig. Series 2019, 5% 1/1/26 | | 3,735 | 3,817 |

| Univ. of Connecticut Gen. Oblig. Series 2019 A, 5% 11/1/26 | | 1,000 | 1,038 |

TOTAL CONNECTICUT | | | 59,728 |

| Delaware - 0.1% | | | |

| Delaware Econ. Dev. Auth. Rev. Bonds (Delmarva Pwr. & Lt. Co. Proj.) Series A, 1.05%, tender 7/1/25 (b) | | 1,475 | 1,432 |

| District Of Columbia - 2.5% | | | |

| District of Columbia Income Tax Rev. Series 2022 C, 5% 12/1/27 | | 5,900 | 6,263 |

| District of Columbia Wtr. & Swr. Auth. Pub. Util. Rev. Bonds Series 2019 C, 1.75%, tender 10/1/24 (b) | | 7,540 | 7,485 |

| Metropolitan Washington DC Arpts. Auth. Sys. Rev.: | | | |

| Series 2014 A, 5% 10/1/26 (c) | | 1,140 | 1,144 |

| Series 2017 A, 5% 10/1/26 (c) | | 12,905 | 13,278 |

| Series 2019 A, 5% 10/1/25 (c) | | 1,410 | 1,433 |

| Series 2020 A: | | | |

5% 10/1/24 (c) | | 4,470 | 4,481 |

5% 10/1/25 (c) | | 4,470 | 4,543 |

| Series 2021 A: | | | |

5% 10/1/25 (c) | | 3,000 | 3,049 |

5% 10/1/28 (c) | | 20,500 | 21,476 |

| Washington D.C. Metropolitan Transit Auth. Rev. Series 2018, 5% 7/1/31 | | 1,790 | 1,861 |

TOTAL DISTRICT OF COLUMBIA | | | 65,013 |

| Florida - 4.3% | | | |

| Brevard County Health Facilities Auth. Rev. Series 2023 A: | | | |

| 5% 4/1/26 | | 1,920 | 1,964 |

| 5% 4/1/28 | | 2,115 | 2,219 |

| Broward County Arpt. Sys. Rev.: | | | |

| Series 2012 P-1, 5% 10/1/25 (c) | | 6,645 | 6,650 |

| Series 2015 C, 5% 10/1/24 (c) | | 1,015 | 1,017 |

| Series 2019 A: | | | |

5% 10/1/24 (c) | | 1,300 | 1,303 |

5% 10/1/25 (c) | | 1,500 | 1,521 |

| Series 2019 B: | | | |

5% 10/1/24 (c) | | 750 | 752 |

5% 10/1/25 (c) | | 755 | 766 |

| Cap. Projs. Fin. Auth. Student Hsg. Rev. (Cap. Projs. Ln. Prog. - Florida Univs.) Series 2020 A: | | | |

| 5% 10/1/24 | | 540 | 540 |

| 5% 10/1/26 | | 1,940 | 1,964 |

| Central Florida Expressway Auth. Sr. Lien Rev. Series 2021: | | | |

| 5% 7/1/26 (Assured Guaranty Muni. Corp. Insured) | | 1,485 | 1,535 |

| 5% 7/1/27 (Assured Guaranty Muni. Corp. Insured) | | 8,200 | 8,626 |

| Florida Dev. Fin. Corp. Healthcare Facility Rev. Bonds (Tampa Gen. Hosp. Proj.) Series 2024 B, 5%, tender 10/1/31 (b) | | 3,940 | 4,236 |

| Florida Hsg. Fin. Corp. Multi-family Mtg. Rev. Bonds: | | | |

| Series 2023 C, 5%, tender 12/1/25 (b) | | 1,270 | 1,286 |

| Series 2024 E, 3.8%, tender 6/1/27 (b) | | 2,675 | 2,681 |

| Florida Hsg. Fin. Corp. Rev. Series 2021 1, 3% 1/1/52 | | 4,780 | 4,641 |

| Florida Mid-Bay Bridge Auth. Rev. Series 2015 A: | | | |

| 5% 10/1/24 | | 1,955 | 1,959 |

| 5% 10/1/25 | | 1,710 | 1,732 |

| 5% 10/1/26 | | 1,955 | 1,977 |

| Florida Muni. Pwr. Agcy. Rev. Series 2016 A, 4% 10/1/26 | | 530 | 536 |

| Greater Orlando Aviation Auth. Arpt. Facilities Rev.: | | | |

| Series 2015 A, 5% 10/1/29 (Pre-Refunded to 10/1/25 @ 100) (c) | | 1,070 | 1,084 |

| Series 2016 A, 5% 10/1/25 (Escrowed to Maturity) (c) | | 620 | 630 |

| Series 2016, 5% 10/1/26 (c) | | 1,300 | 1,336 |

| Series 2017 A: | | | |

5% 10/1/25 (c) | | 320 | 325 |

5% 10/1/25 (Escrowed to Maturity) (c) | | 1,675 | 1,701 |

5% 10/1/26 (c) | | 545 | 559 |

5% 10/1/26 (Escrowed to Maturity) (c) | | 2,025 | 2,083 |

5% 10/1/27 (Escrowed to Maturity) (c) | | 580 | 605 |

| Series 2019 A: | | | |

5% 10/1/25 (c) | | 6,700 | 6,829 |

5% 10/1/27 (c) | | 1,940 | 2,012 |

| Highlands County Health Facilities Auth. Rev. Bonds Series 2024 C, 5%, tender 11/15/31 (b) | | 2,675 | 2,935 |

| Hillsborough County School Board Ctfs. of Prtn. (School Board of Hillsbrough County, Florida Master Lease Prog.) Series 2017 B, 5% 7/1/28 | | 2,375 | 2,474 |

| Jacksonville Spl. Rev. Series 2022 A: | | | |

| 5% 10/1/24 | | 785 | 788 |

| 5% 10/1/25 | | 610 | 623 |

| 5% 10/1/26 | | 435 | 452 |

| 5% 10/1/27 | | 345 | 365 |

| 5% 10/1/28 | | 685 | 735 |

| 5% 10/1/29 | | 595 | 649 |

| 5% 10/1/30 | | 560 | 620 |

| 5% 10/1/32 | | 510 | 580 |

| Lee County Arpt. Rev. Series 2021 A: | | | |

| 5% 10/1/24 (c) | | 1,795 | 1,799 |

| 5% 10/1/25 (c) | | 3,325 | 3,372 |

| Lee Memorial Health Sys. Hosp. Rev. Bonds Series 2019 A2, 5%, tender 4/1/26 (b) | | 4,810 | 4,880 |

| Miami-Dade County Aviation Rev.: | | | |

| Series 2012 A, 5% 10/1/24 (c) | | 1,800 | 1,801 |

| Series 2014 A, 5% 10/1/31 (c) | | 1,750 | 1,752 |

| Series 2016 A, 5% 10/1/27 | | 1,275 | 1,311 |

| Miami-Dade County School Board Ctfs. of Prtn. Series 2015 A, 5% 5/1/27 (Assured Guaranty Muni. Corp. Insured) | | 1,880 | 1,902 |

| Orange County Hsg. Fin. Auth. Multi-family Rev. Bonds Series 2021 B, 0.55%, tender 7/1/24 (b) | | 9,950 | 9,950 |

| Palm Beach County Health Facilities Auth. Hosp. Rev.: | | | |

| (Jupiter Med. Ctr. Proj.) Series 2022, 5% 11/1/28 | | 150 | 155 |

| Series 2014, 5% 12/1/24 (Escrowed to Maturity) | | 380 | 382 |

| Palm Beach County Health Facilities Auth. Rev.: | | | |

| Series 2015 C, 5% 5/15/30 | | 2,490 | 2,493 |

| Series 2021 C, 4% 5/15/29 | | 1,440 | 1,386 |

| Pinellas County Hsg. Fin. Auth. Bonds Series 2021 B, 0.65%, tender 7/1/24 (b) | | 2,170 | 2,170 |

| Seminole County School Board Ctfs. of Prtn. Series 2016 C: | | | |

| 5% 7/1/25 | | 980 | 997 |

| 5% 7/1/26 | | 1,115 | 1,152 |

TOTAL FLORIDA | | | 110,792 |

| Georgia - 4.3% | | | |

| Atlanta Arpt. Rev.: | | | |

| Series 2020 A, 5% 7/1/26 (c) | | 3,000 | 3,079 |

| Series 2020 B: | | | |

5% 7/1/27 (c) | | 4,000 | 4,143 |

5% 7/1/29 (c) | | 1,920 | 2,027 |

| Series 2021 C, 5% 7/1/30 (c) | | 1,315 | 1,403 |

| Series 2023 G: | | | |

5% 7/1/28 (c) | | 2,015 | 2,108 |

5% 7/1/29 (c) | | 5,635 | 5,949 |

| Burke County Indl. Dev. Auth. Poll. Cont. Rev.: | | | |

| (Georgia Pwr. Co. Plant Vogtle Proj.) Series 1994, 3.7%, tender 6/13/28 (b) | | 2,265 | 2,283 |

| Bonds: | | | |

(Georgia Pwr. Co. Plant Vogtle Proj.): | | | |

Series 1995 4, 3.8%, tender 5/21/26 (b) | | 3,500 | 3,509 |

Series 2012, 1.7%, tender 8/22/24 (b) | | 3,400 | 3,383 |

(Oglethorpe Pwr. Corp. Vogtle Proj.) Series 2017 E, 3.25%, tender 2/3/25 (b) | | 900 | 892 |

| Columbus Med. Ctr. Hosp. Auth. Bonds (Piedmont Healthcare, Inc. Proj.) Series 2019 A, 5%, tender 7/1/26 (b) | | 4,840 | 4,922 |

| Georgia Gen. Oblig. Series 2016 A, 5% 2/1/27 | | 4,980 | 5,112 |

| Georgia Muni. Elec. Auth. Pwr. Rev. Series 2020 A: | | | |

| 4% 11/1/24 | | 1,420 | 1,421 |

| 5% 1/1/25 | | 1,000 | 1,007 |

| 5% 1/1/26 | | 1,125 | 1,150 |

| 5% 1/1/26 | | 1,000 | 1,022 |

| 5% 1/1/27 | | 760 | 786 |

| Main Street Natural Gas, Inc.: | | | |

| Bonds: | | | |

Series 2021 A, 4%, tender 9/1/27 (b) | | 15,000 | 15,061 |

Series 2021 C, 4%, tender 12/1/28 (b) | | 16,990 | 17,044 |

Series 2023 D, 5%, tender 12/1/30 (b) | | 11,820 | 12,521 |

| Series 2022 A: | | | |

4% 12/1/24 | | 1,100 | 1,097 |

4% 12/1/25 | | 170 | 169 |

4% 12/1/26 | | 1,955 | 1,940 |

| Series 2023 D, 5% 12/1/29 | | 2,750 | 2,879 |

| Series 2024 C: | | | |

5% 12/1/28 | | 1,250 | 1,302 |

5% 12/1/29 | | 2,700 | 2,827 |

5% 12/1/30 | | 3,500 | 3,684 |

| Monroe County Dev. Auth. Poll. Cont. Rev. (Georgia Pwr. Co. Plant Scherer Proj.) Series 1995, 2.25% 7/1/25 | | 6,505 | 6,356 |

| Private Colleges & Univs. Auth. Rev. (The Savannah College of Art & Design Projs.) Series 2021, 5% 4/1/26 | | 1,200 | 1,229 |

TOTAL GEORGIA | | | 110,305 |

| Hawaii - 0.6% | | | |

| Hawaii Arpts. Sys. Rev. Series 2018 A, 5% 7/1/31 (c) | | 1,000 | 1,039 |

| Hawaii Gen. Oblig. Series 2015 EZ, 5% 10/1/26 | | 10,000 | 10,191 |

| Honolulu City & County Gen. Oblig.: | | | |

| Series 2016 C, 5% 10/1/28 | | 1,000 | 1,077 |

| Series 2020 F, 5% 7/1/26 | | 800 | 828 |