UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-02628

Fidelity Municipal Trust

(Exact name of registrant as specified in charter)

245 Summer St., Boston, MA 02210

(Address of principal executive offices) (Zip code)

Marc Bryant, Secretary

245 Summer St.

Boston, Massachusetts 02210

(Name and address of agent for service)

Registrant's telephone number, including area code:

617-563-7000

| |

Date of fiscal year end: | December 31 |

|

|

Date of reporting period: | June 30, 2018 |

Item 1.

Reports to Stockholders

Fidelity® Conservative Income Municipal Bond Fund

Fidelity® Conservative Income Municipal Bond Fund and

Institutional Class

Semi-Annual Report June 30, 2018 |

|

Contents

To view a fund's proxy voting guidelines and proxy voting record for the 12-month period ended June 30, visit http://www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission's (SEC) web site at http://www.sec.gov.

You may also call 1-800-544-8544 to request a free copy of the proxy voting guidelines.

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third-party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR LLC or an affiliated company. © 2018 FMR LLC. All rights reserved.

This report and the financial statements contained herein are submitted for the general information of the shareholders of the Fund. This report is not authorized for distribution to prospective investors in the Fund unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. Forms N-Q are available on the SEC’s web site at http://www.sec.gov. A fund's Forms N-Q may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information regarding the operation of the SEC's Public Reference Room may be obtained by calling 1-800-SEC-0330.

For a complete list of a fund's portfolio holdings, view the most recent holdings listing, semiannual report, or annual report on Fidelity's web site at http://www.fidelity.com, http://www.institutional.fidelity.com, or http://www.401k.com, as applicable.

NOT FDIC INSURED •MAY LOSE VALUE •NO BANK GUARANTEE

Neither the Fund nor Fidelity Distributors Corporation is a bank.

Investment Summary (Unaudited)

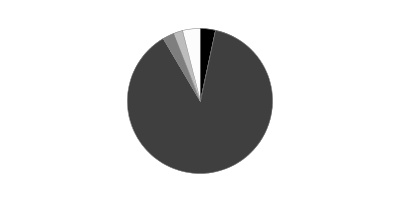

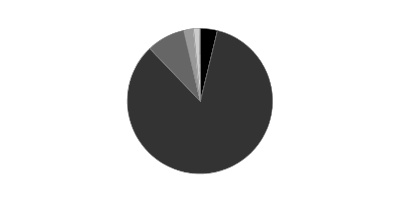

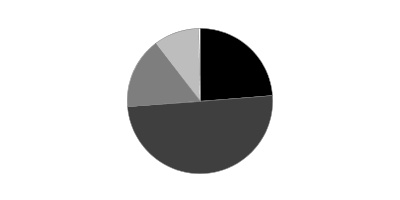

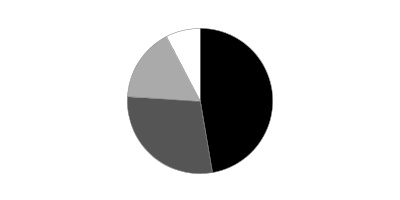

Maturity Diversification as of June 30, 2018

| | % of fund's investments |

| 1 - 7 | 38.4 |

| 8 - 30 | 1.5 |

| 31 - 60 | 3.2 |

| 61 - 90 | 1.9 |

| 91 - 180 | 4.8 |

| > 180 | 50.2 |

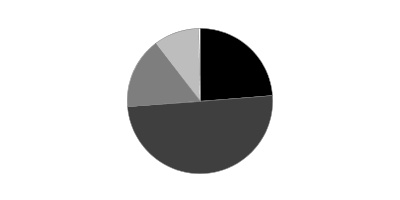

Top Five States as of June 30, 2018

| | % of fund's net assets |

| New Jersey | 17.2 |

| Texas | 8.9 |

| Louisiana | 8.6 |

| New York | 7.2 |

| Illinois | 6.6 |

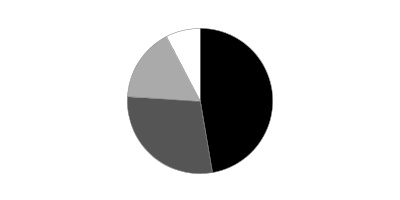

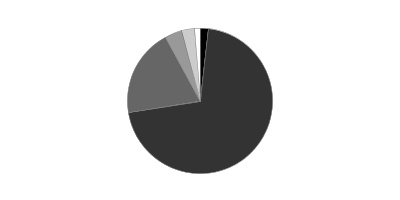

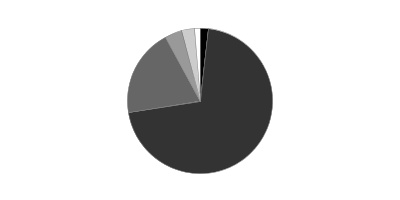

Top Five Sectors as of June 30, 2018

| | % of fund's net assets |

| General Obligations | 32.4 |

| Synthetics | 19.5 |

| Industrial Development | 13.5 |

| Electric Utilities | 12.0 |

| Transportation | 7.5 |

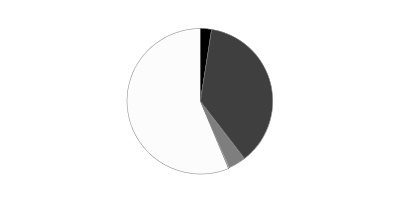

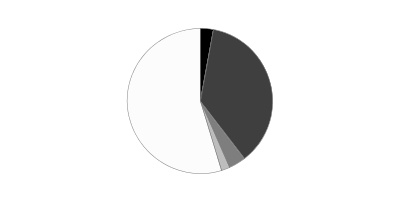

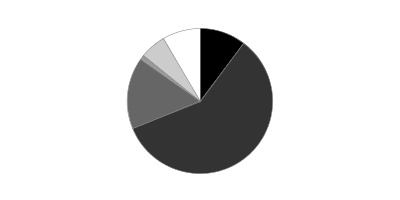

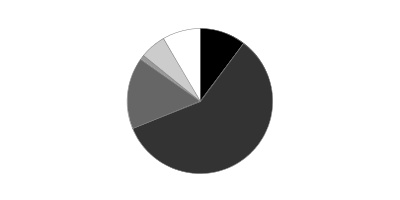

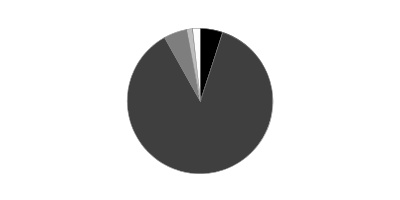

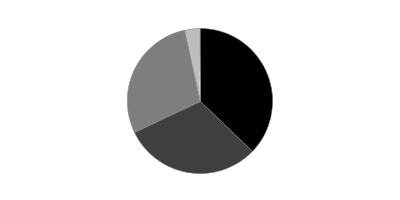

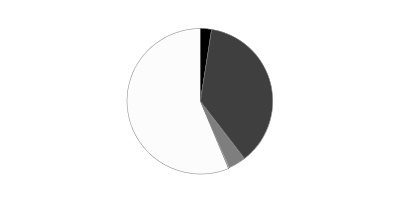

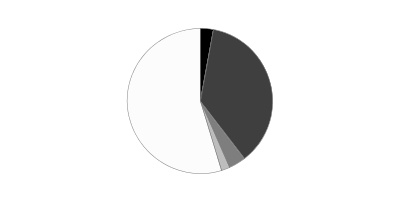

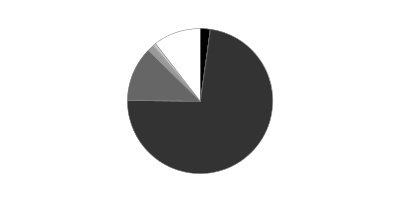

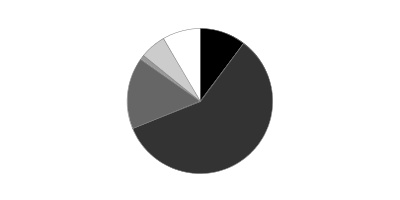

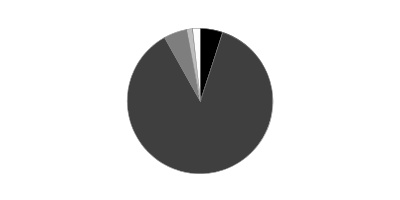

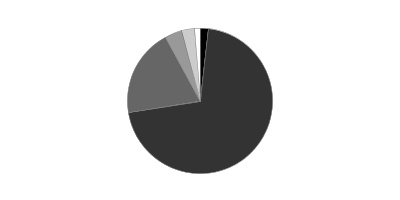

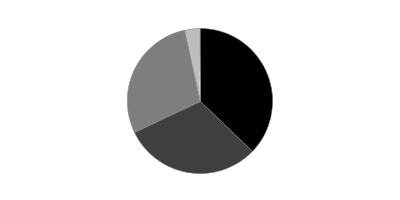

Quality Diversification (% of fund's net assets)

| As of June 30, 2018 |

| | AAA | 2.6% |

| | AA,A | 37.0% |

| | BBB | 3.8% |

| | Not Rated | 0.3% |

| | Short-Term Investments and Net Other Assets | 56.3% |

We have used ratings from Moody's Investors Service, Inc. Where Moody's® ratings are not available, we have used S&P® ratings. All ratings are as of the date indicated and do not reflect subsequent changes.

Schedule of Investments June 30, 2018 (Unaudited)

Showing Percentage of Net Assets

| Municipal Bonds - 43.8% | | | |

| | | Principal Amount | Value |

| Alabama - 0.4% | | | |

| Mobile County Board of School Commissioners: | | | |

| Series 2016 A, 3% 3/1/19 | | $410,000 | $413,239 |

| Series 2016 B, 5% 3/1/19 | | 670,000 | 684,057 |

| Mobile Indl. Dev. Board Poll. Cont. Rev. Bonds: | | | |

| (Alabama Pwr. Co. Barry Plant Proj.) Series 2008, 1.625%, tender 10/2/18 (a) | | 4,065,000 | 4,064,472 |

| Series 2009 E, 1.85%, tender 3/24/20 (a) | | 1,570,000 | 1,558,366 |

|

| TOTAL ALABAMA | | | 6,720,134 |

|

| Alaska - 0.1% | | | |

| North Slope Borough Gen. Oblig. Series 2017 A, 5% 6/30/21 (Pre-Refunded to 6/30/20 @ 100) | | 440,000 | 468,050 |

| Valdez Marine Term. Rev. (BP Pipelines (Alaska), Inc. Proj.) Series 2003 C, 5% 1/1/21 | | 665,000 | 712,468 |

|

| TOTAL ALASKA | | | 1,180,518 |

|

| Arizona - 0.6% | | | |

| Arizona Board of Regents Arizona State Univ. Rev. Series 2016 A, 5% 7/1/19 | | 370,000 | 382,624 |

| Arizona School Facilities Board Ctfs. of Prtn. Series 2015 A, 5% 9/1/19 | | 845,000 | 877,507 |

| Coconino County Poll. Cont. Corp. Rev. Bonds (Nevada Pwr. Co. Projs.): | | | |

| Series 2017 A, 1.8%, tender 5/21/20 (a)(b) | | 6,615,000 | 6,567,570 |

| Series 2017 B, 1.6%, tender 5/21/20 (a) | | 820,000 | 812,612 |

| Glendale Gen. Oblig. Series 2015, 4% 7/1/18 (FSA Insured) | | 275,000 | 275,000 |

| Maricopa County Indl. Dev. Auth. Rev. Series 2016 A, 5% 1/1/20 | | 2,360,000 | 2,470,873 |

|

| TOTAL ARIZONA | | | 11,386,186 |

|

| Arkansas - 0.2% | | | |

| Little Rock School District Series 2017, 3% 2/1/21 | | 3,255,000 | 3,330,581 |

| Colorado - 1.8% | | | |

| Colorado Reg'l. Trans. District Ctfs. of Prtn. Series 2013 A, 5% 6/1/20 | | 185,000 | 196,250 |

| Colorado Univ. Co. Hosp. Auth. Rev. Bonds Series 2017C-1, 4%, tender 3/1/20 (a) | | 8,160,000 | 8,360,491 |

| Denver City & County Arpt. Rev. Series 2017 A, 5% 11/15/19 (b) | | 1,060,000 | 1,104,096 |

| E-470 Pub. Hwy. Auth. Rev.: | | | |

| Series 1997 B, 0% 9/1/18 (Nat'l. Pub. Fin. Guarantee Corp. Insured) | | 11,010,000 | 10,980,713 |

| Series 2000 B: | | | |

| 0% 9/1/18 (Nat'l. Pub. Fin. Guarantee Corp. Insured) | | 5,165,000 | 5,151,261 |

| 0% 9/1/19 (Nat'l. Pub. Fin. Guarantee Corp. Insured) | | 3,480,000 | 3,405,980 |

| 0% 9/1/20 (Nat'l. Pub. Fin. Guarantee Corp. Insured) | | 1,300,000 | 1,243,944 |

| Series 2015 A: | | | |

| 2.35% 9/1/20 | | 300,000 | 302,142 |

| 5% 9/1/20 | | 845,000 | 898,151 |

|

| TOTAL COLORADO | | | 31,643,028 |

|

| Connecticut - 5.2% | | | |

| Connecticut Gen. Oblig.: | | | |

| Series 2005 B, 5.25% 6/1/19 | | 1,245,000 | 1,283,159 |

| Series 2011 C, SIFMA Municipal Swap Index + 1.100% 2.61% 5/15/19 (a)(c) | | 3,720,000 | 3,743,622 |

| Series 2011 D: | | | |

| 5% 11/1/18 | | 245,000 | 247,803 |

| 5% 11/1/19 | | 955,000 | 993,611 |

| Series 2012 A: | | | |

| SIFMA Municipal Swap Index + 1.100% 2.61% 4/15/19 (a)(c) | | 1,505,000 | 1,514,286 |

| SIFMA Municipal Swap Index + 1.250% 2.76% 4/15/20 (a)(c) | | 9,665,000 | 9,792,191 |

| Series 2012 C: | | | |

| 5% 6/1/19 | | 370,000 | 380,508 |

| 5% 6/1/20 | | 1,940,000 | 2,042,199 |

| Series 2012 D: | | | |

| SIFMA Municipal Swap Index + 0.770% 2.28% 9/15/18 (a)(c) | | 2,245,000 | 2,248,210 |

| SIFMA Municipal Swap Index + 0.920% 2.43% 9/15/19 (a)(c) | | 1,870,000 | 1,881,688 |

| Series 2013 A: | | | |

| SIFMA Municipal Swap Index + 0.550% 2.06% 3/1/19 (a)(c) | | 795,000 | 796,320 |

| SIFMA Municipal Swap Index + 0.650% 2.16% 3/1/20 (a)(c) | | 220,000 | 220,504 |

| 5% 10/15/19 | | 1,040,000 | 1,080,789 |

| Series 2013 D: | | | |

| SIFMA Municipal Swap Index + 0.880% 2.39% 8/15/19 (a)(c) | | 745,000 | 749,254 |

| 2.39% 8/15/18 (a) | | 2,230,000 | 2,232,275 |

| 5% 8/15/20 | | 560,000 | 592,721 |

| Series 2014 B, SIFMA Municipal Swap Index + 0.490% 2% 3/1/19 (a)(c) | | 310,000 | 310,394 |

| Series 2014 C, 5% 6/15/20 | | 1,155,000 | 1,217,070 |

| Series 2014 E, 5% 9/1/19 | | 1,245,000 | 1,289,372 |

| Series 2014 H, 5% 11/15/18 | | 235,000 | 238,008 |

| Series 2015 E, 5% 8/1/19 | | 570,000 | 588,941 |

| Series 2015 F: | | | |

| 5% 11/15/18 | | 1,785,000 | 1,807,848 |

| 5% 11/15/20 | | 530,000 | 564,280 |

| Series 2016 B: | | | |

| 5% 5/15/19 | | 2,240,000 | 2,301,712 |

| 5% 5/15/20 | | 1,495,000 | 1,572,800 |

| 5% 5/15/21 | | 5,345,000 | 5,735,292 |

| Series 2016 E: | | | |

| 4% 10/15/19 | | 2,565,000 | 2,633,255 |

| 5% 10/15/20 | | 3,460,000 | 3,676,077 |

| Series 2016 G: | | | |

| 5% 11/1/18 | | 1,600,000 | 1,618,304 |

| 5% 11/1/19 | | 1,620,000 | 1,685,497 |

| Series 2017 A, 5% 4/15/20 | | 7,610,000 | 7,992,707 |

| Series 2017 B: | | | |

| 5% 4/15/19 | | 1,880,000 | 1,927,132 |

| 5% 4/15/20 | | 300,000 | 315,087 |

| Series 2018 A, 5% 4/15/20 | | 1,315,000 | 1,381,131 |

| Series 2018 B: | | | |

| 5% 4/15/21 | | 3,285,000 | 3,519,023 |

| 5% 4/15/22 | | 1,315,000 | 1,433,915 |

| Series A, 5% 2/15/21 | | 4,425,000 | 4,509,695 |

| Series D, SIFMA Municipal Swap Index + 1.020% 2.53% 8/15/20 (a)(c) | | 615,000 | 621,728 |

| Connecticut Health & Edl. Facilities Auth. Rev.: | | | |

| Bonds: | | | |

| (Ascension Health Cr. Group Proj.) Series 1999 B, 1.65%, tender 3/1/19 (a) | | 2,025,000 | 2,022,874 |

| (Yale New Haven Hosp. Proj.) Series B, 1 month U.S. LIBOR + 0.550% 1.878%, tender 7/2/18 (a)(c) | | 3,125,000 | 3,125,375 |

| Series 2010 A2, 1.2%, tender 2/1/19 (a) | | 1,445,000 | 1,441,937 |

| Series 2008 N, 5% 7/1/22 | | 1,600,000 | 1,600,000 |

| Series 2008, 5% 7/1/34 | | 525,000 | 525,000 |

| Series 2011F, 5% 7/1/18 | | 2,015,000 | 2,015,000 |

| Series 2016 CT, 3% 12/1/19 | | 445,000 | 453,028 |

| Series A, 5% 7/1/20 | | 1,400,000 | 1,485,680 |

| Connecticut Higher Ed. Supplemental Ln. Auth. Rev. (Chelsea Ln. Prog.) Series 2013 A, 4% 11/15/18 (b) | | 600,000 | 604,170 |

| Connecticut Spl. Tax Oblig. Trans. Infrastructure Rev. Series 2014 A, 5% 9/1/20 | | 420,000 | 445,498 |

| Naugatuck Ctfs. of Prtn. (Naugatuck Incineration Facilities Proj.) Series 2014 A: | | | |

| 5% 6/15/19 (b) | | 725,000 | 746,815 |

| 5% 6/15/20 (b) | | 920,000 | 972,514 |

| New Britain Gen. Oblig. Series 2017 A: | | | |

| 5% 3/1/19 (FSA Insured) | | 370,000 | 378,580 |

| 5% 3/1/20 (FSA Insured) | | 185,000 | 195,142 |

| 5% 3/1/21 (FSA Insured) | | 255,000 | 274,173 |

| Stratford Gen. Oblig. Series 2017, 4% 7/1/19 (FSA Insured) | | 480,000 | 490,838 |

|

| TOTAL CONNECTICUT | | | 93,515,032 |

|

| District Of Columbia - 0.0% | | | |

| Metropolitan Washington DC Arpts. Auth. Sys. Rev. Series 2012 A, 5% 10/1/18 (b) | | 150,000 | 151,257 |

| Florida - 2.7% | | | |

| Broward County Arpt. Sys. Rev. Series 2012 P1, 4% 10/1/19 (b) | | 540,000 | 554,342 |

| Broward County Port Facilities Rev. Series 2011 B, 5% 9/1/18 (b) | | 230,000 | 231,274 |

| Broward County School Board Ctfs. of Prtn. Series 2011 A, 5% 7/1/19 | | 610,000 | 630,685 |

| Citizens Property Ins. Corp.: | | | |

| Series 2011 A1, 5% 6/1/19 | | 4,085,000 | 4,207,060 |

| Series 2012 A1: | | | |

| 5% 6/1/19 | | 5,305,000 | 5,463,513 |

| 5% 6/1/21 | | 7,885,000 | 8,550,573 |

| Florida Mid-Bay Bridge Auth. Rev. Series 2015 C, 5% 10/1/18 | | 205,000 | 206,738 |

| Florida Muni. Pwr. Agcy. Rev. Series 2008, 5% 10/1/18 | | 370,000 | 373,212 |

| Greater Orlando Aviation Auth. Arpt. Facilities Rev.: | | | |

| Series 2010 B, 4.25% 10/1/18 (b) | | 125,000 | 125,851 |

| Series 2016, 5% 10/1/20 (b) | | 150,000 | 159,824 |

| Halifax Hosp. Med. Ctr. Rev. Series 2016, 5% 6/1/19 | | 185,000 | 189,915 |

| Lakeland Hosp. Sys. Rev. Series 2016: | | | |

| 4% 11/15/18 | | 370,000 | 373,267 |

| 5% 11/15/19 | | 195,000 | 203,518 |

| Lee County Arpt. Rev. Series 2010A, 5.5% 10/1/18 (FSA Insured) (b) | | 780,000 | 787,387 |

| Miami-Dade County Aviation Rev.: | | | |

| Series 2010 B, 5% 10/1/18 | | 1,110,000 | 1,119,435 |

| Series 2012 A, 5% 10/1/21 (b) | | 710,000 | 773,531 |

| Series 2017 B, 5% 10/1/19 (b) | | 3,905,000 | 4,057,022 |

| Miami-Dade County Expressway Auth. Series 2014 B, 5% 7/1/18 | | 440,000 | 440,000 |

| Miami-Dade County Pub. Facilities Rev. Series 2015 A, 5% 6/1/19 | | 1,210,000 | 1,245,259 |

| Miami-Dade County School Board Ctfs. of Prtn.: | | | |

| (Miami-Dade County School District proj.) Series 2012 B-1, 5% 10/1/19 | | 415,000 | 431,837 |

| (Miami-Dade County School District) Series 2012 B-2, 4% 4/1/20 | | 400,000 | 414,476 |

| Series 2014 D: | | | |

| 5% 11/1/19 | | 5,185,000 | 5,408,577 |

| 5% 11/1/20 | | 485,000 | 519,066 |

| Series 2015 A: | | | |

| 5% 5/1/19 | | 3,310,000 | 3,401,257 |

| 5% 5/1/20 | | 1,300,000 | 1,372,267 |

| 5% 5/1/21 | | 885,000 | 956,853 |

| Series 2016 C, 5% 2/1/20 | | 1,360,000 | 1,426,069 |

| Palm Beach County School Board Ctfs. of Prtn.: | | | |

| Series 2014 B, 4% 8/1/19 | | 260,000 | 266,724 |

| Series 2015 B, 5% 8/1/19 | | 1,700,000 | 1,762,050 |

| Tampa Solid Waste Sys. Rev.: | | | |

| Series 2010, 5% 10/1/19 (FSA Insured) (b) | | 745,000 | 773,809 |

| Series 2013, 5% 10/1/20 (b) | | 490,000 | 521,424 |

| Tampa Tax Allocation (H. Lee Moffitt Cancer Ctr. Proj.) Series 2016 A: | | | |

| 5% 9/1/18 | | 295,000 | 296,673 |

| 5% 9/1/19 | | 375,000 | 389,070 |

| 5% 9/1/20 | | 435,000 | 462,644 |

|

| TOTAL FLORIDA | | | 48,095,202 |

|

| Georgia - 1.4% | | | |

| Clarke County Hosp. Auth. Series 2016: | | | |

| 5% 7/1/18 | | 670,000 | 670,000 |

| 5% 7/1/19 | | 855,000 | 883,053 |

| 5% 7/1/20 | | 560,000 | 594,614 |

| Cobb County Kennestone Hosp. Auth. Rev. (Wellstar Health Sys., Inc. Proj.) Series 2017 A: | | | |

| 5% 4/1/19 | | 95,000 | 97,529 |

| 5% 4/1/20 | | 130,000 | 137,155 |

| 5% 4/1/21 | | 300,000 | 323,409 |

| Fulton County Dev. Auth. Hosp. R (Wellstar Health Sys., Inc. Proj.) Series 2017 A: | | | |

| 3% 4/1/19 | | 110,000 | 111,306 |

| 5% 4/1/20 | | 110,000 | 116,054 |

| 5% 4/1/21 | | 245,000 | 264,117 |

| Fulton County Dev. Auth. (Piedmont Healthcare, Inc. Proj.) Series 2016, 5% 7/1/20 | | 370,000 | 392,870 |

| Georgia Muni. Elec. Auth. Pwr. Rev.: | | | |

| (Combined Cycle Proj.) Series A, 5% 11/1/18 | | 355,000 | 358,862 |

| (Gen. Resolution Proj.) Series 2008 A, 5.25% 1/1/19 | | 400,000 | 406,860 |

| (Unrefunded Balance Proj.) Series 2008, 5.75% 1/1/19 | | 140,000 | 140,346 |

| Series 2008 A: | | | |

| 5.25% 1/1/19 | | 415,000 | 422,117 |

| 5.25% 1/1/21 | | 400,000 | 430,060 |

| Series 2009 B, 5% 1/1/20 | | 9,825,000 | 10,259,756 |

| Series 2011 A: | | | |

| 5% 1/1/19 | | 2,170,000 | 2,204,568 |

| 5% 1/1/20 | | 525,000 | 548,231 |

| 5% 1/1/21 | | 585,000 | 625,429 |

| Series 2015 A: | | | |

| 5% 1/1/20 | | 290,000 | 302,833 |

| 5% 1/1/21 | | 745,000 | 796,487 |

| Series 2016 A: | | | |

| 4% 1/1/19 | | 650,000 | 657,170 |

| 4% 1/1/21 | | 820,000 | 856,859 |

| 5% 1/1/19 | | 1,115,000 | 1,132,762 |

| Series GG: | | | |

| 5% 1/1/20 | | 355,000 | 370,979 |

| 5% 1/1/21 | | 635,000 | 679,367 |

| Griffin-Spalding County Hosp. (Wellstar Health Sys., Inc. Proj.) Series 2017 A: | | | |

| 3% 4/1/19 | | 350,000 | 354,155 |

| 3% 4/1/20 | | 110,000 | 112,294 |

| 3% 4/1/21 | | 100,000 | 102,494 |

| Lagrange-Troup County Hosp. Rev. (Wellstar Health Sys., Inc. Proj.) Series 2017 A: | | | |

| 5% 4/1/20 | | 95,000 | 100,229 |

| 5% 4/1/21 | | 240,000 | 258,727 |

|

| TOTAL GEORGIA | | | 24,710,692 |

|

| Hawaii - 0.0% | | | |

| Hawaii Arpts. Sys. Rev. Series 2010 B, 5% 7/1/18 (b) | | 485,000 | 485,000 |

| Idaho - 0.1% | | | |

| Idaho Hsg. & Fin. Assoc. Single Family Mtg. (Idaho St Garvee Proj.) Series 2017 A: | | | |

| 5% 7/15/20 | | 445,000 | 472,750 |

| 5% 7/15/21 | | 660,000 | 717,585 |

|

| TOTAL IDAHO | | | 1,190,335 |

|

| Illinois - 3.5% | | | |

| Champaign County Ill Cmnty. Unit Series 2017, 5% 1/1/21 | | 745,000 | 797,612 |

| Chicago Metropolitan Wtr. Reclamation District of Greater Chicago Series 2014 D, 5% 12/1/19 | | 1,620,000 | 1,693,969 |

| Chicago O'Hare Int'l. Arpt. Rev.: | | | |

| Series 2011 B, 5% 1/1/19 | | 325,000 | 330,486 |

| Series 2015 A, 5% 1/1/19 (b) | | 355,000 | 360,779 |

| Chicago Park District Gen. Oblig. Series 2011 B, 4% 1/1/19 | | 200,000 | 201,780 |

| Chicago Transit Auth. Cap. Grant Receipts Rev.: | | | |

| Series 2015, 5% 6/1/19 | | 700,000 | 719,558 |

| Series 2017: | | | |

| 4% 6/1/19 | | 1,070,000 | 1,090,287 |

| 5% 6/1/20 | | 2,050,000 | 2,164,718 |

| 5% 6/1/21 | | 975,000 | 1,048,700 |

| Cook County Gen. Oblig.: | | | |

| Series 2014 A, 5% 11/15/18 | | 1,595,000 | 1,614,587 |

| Series 2018: | | | |

| 3% 11/15/18 | | 1,425,000 | 1,432,139 |

| 5% 11/15/19 | | 1,115,000 | 1,160,158 |

| Illinois Fin. Auth. Rev.: | | | |

| (Hosp. Sisters Svcs., Inc. Proj.) Series 2012 C, 5% 8/15/20 | | 2,005,000 | 2,136,769 |

| (Rush Univ. Med. Ctr. Proj.) Series 2015 A, 5% 11/15/19 | | 1,415,000 | 1,476,029 |

| Bonds: | | | |

| (Advocate Health Care Network Proj.) Series 2008 A2, 5%, tender 2/12/20 (a) | | 1,165,000 | 1,222,108 |

| (Ascension Health Cr. Group Proj.) Series 2012 E2, 1.75%, tender 4/1/21 (a) | | 2,100,000 | 2,085,468 |

| Series 2008 B, 5.5% 8/15/19 (Pre-Refunded to 8/15/18 @ 100) | | 185,000 | 185,890 |

| Series 2008 D, 5.5% 11/1/18 | | 660,000 | 668,534 |

| Series 2011 A, 5% 8/15/18 | | 1,860,000 | 1,867,217 |

| Series 2012 A, 5% 5/15/19 | | 485,000 | 497,557 |

| Series 2015 A, 5% 11/15/18 | | 1,000,000 | 1,012,320 |

| Series 2016 A: | | | |

| 5% 8/15/18 | | 370,000 | 371,365 |

| 5% 7/1/19 | | 445,000 | 458,568 |

| 5% 8/15/19 | | 370,000 | 380,612 |

| Series 2016 D, 5% 2/15/20 | | 1,475,000 | 1,549,842 |

| Series 2016: | | | |

| 4% 11/15/18 | | 280,000 | 282,380 |

| 5% 11/15/19 | | 260,000 | 271,032 |

| Illinois Gen. Oblig.: | | | |

| Series 2001, 5.5% 8/1/18 (Nat'l. Pub. Fin. Guarantee Corp. Insured) | | 3,700,000 | 3,709,583 |

| Series 2006 A, 5% 6/1/19 | | 485,000 | 495,757 |

| Series 2010, 5% 1/1/19 (FSA Insured) | | 2,700,000 | 2,741,256 |

| Series 2012, 5% 3/1/19 | | 300,000 | 304,995 |

| Series 2016, 5% 6/1/19 | | 350,000 | 357,763 |

| Series 2018 A, 5% 5/1/19 | | 8,500,000 | 8,672,040 |

| Illinois Muni. Elec. Agcy. Pwr. Supply: | | | |

| Series 2007 C, 5.25% 2/1/20 | | 430,000 | 452,902 |

| Series 2015 A: | | | |

| 5% 2/1/19 | | 5,145,000 | 5,246,922 |

| 5% 2/1/21 | | 980,000 | 1,053,235 |

| Illinois Reg'l. Trans. Auth.: | | | |

| Series 2010A, 5% 7/1/20 | | 1,305,000 | 1,360,985 |

| Series 2011 A, 5% 6/1/19 (FSA Insured) | | 3,055,000 | 3,143,473 |

| Series 2014 A, 5% 6/1/19 | | 585,000 | 601,942 |

| Series 2017 A: | | | |

| 5% 7/1/20 | | 520,000 | 551,190 |

| 5% 7/1/21 | | 520,000 | 564,018 |

| Illinois Toll Hwy. Auth. Toll Hwy. Rev. Series 2013 B-1, 5% 12/1/18 | | 600,000 | 608,442 |

| Railsplitter Tobacco Settlement Auth. Rev. Series 2010: | | | |

| 5% 6/1/19 | | 650,000 | 667,927 |

| 5.125% 6/1/19 | | 1,110,000 | 1,141,857 |

| 5.25% 6/1/20 | | 1,535,000 | 1,625,381 |

| Univ. of Illinois Board of Trustees Ctfs. of Prtn.: | | | |

| Series 2014 A, 5% 10/1/18 | | 460,000 | 463,533 |

| Series 2016 A, 4% 8/15/19 | | 500,000 | 510,700 |

| Univ. of Illinois Rev. Series 2001 B, 5.5% 4/1/19 | | 315,000 | 323,121 |

| Will County Illinois Series 2016, 4% 11/15/18 | | 645,000 | 651,147 |

|

| TOTAL ILLINOIS | | | 62,328,633 |

|

| Indiana - 0.6% | | | |

| Indiana Fin. Auth. (Citizens Energy Group Wtr. Proj.) Series 2014 A, 5% 10/1/19 | | 340,000 | 353,835 |

| Indiana Fin. Auth. Hosp. Rev. Series 2017 A, 5% 11/1/18 | | 670,000 | 677,685 |

| Indiana Fin. Auth. Rev. Series 2016: | | | |

| 3% 9/1/18 | | 260,000 | 260,543 |

| 3% 9/1/19 | | 185,000 | 187,366 |

| 4% 9/1/20 | | 370,000 | 385,407 |

| Indiana Fin. Auth. Wastewtr. Util. Rev.: | | | |

| (CWA Auth. Proj.) Series 2012 A, 5% 10/1/18 | | 965,000 | 973,280 |

| Series 2011 B, 5% 10/1/18 | | 650,000 | 655,577 |

| Indiana Health Facility Fing. Auth. Rev. Bonds Series 2001 A2, 4%, tender 3/1/19 (a) | | 1,210,000 | 1,227,315 |

| Indiana Muni. Pwr. Agcy. Pwr. Supply Sys. Rev. Series 2011 A, 5% 1/1/19 | | 790,000 | 803,809 |

| Indianapolis Local Pub. Impt.: | | | |

| (Indianapolis Arpt. Auth. Proj.) Series 2016 A1, 5% 1/1/19 (b) | | 645,000 | 655,855 |

| Series 2016, 5% 1/1/20 (b) | | 2,000,000 | 2,095,460 |

| Whiting Envir. Facilities Rev. (BP Products North America, Inc. Proj.) Series 2009, 5.25% 1/1/21 | | 2,510,000 | 2,704,349 |

|

| TOTAL INDIANA | | | 10,980,481 |

|

| Kansas - 0.1% | | | |

| Johnson County Unified School District # 233 Series 2016 A: | | | |

| 2% 9/1/18 | | 930,000 | 930,902 |

| 5% 9/1/20 | | 930,000 | 994,421 |

| Wyandotte County/Kansas City Unified Govt. Util. Sys. Rev. Series 2014 A, 4% 9/1/18 | | 550,000 | 552,283 |

|

| TOTAL KANSAS | | | 2,477,606 |

|

| Kentucky - 2.4% | | | |

| Ashland Med. Ctr. Rev. (Ashland Hosp. Corp. D/B/A King's Daughters Med. Ctr. Proj.) Series 2016 A, 4% 2/1/20 | | 595,000 | 607,787 |

| Carroll County Poll. Ctlr Rev. Bonds (Kentucky Utils. Co. Proj.) Series 2016 A, 1.05%, tender 9/1/19 (a) | | 12,000,000 | 11,886,120 |

| Kenton County Arpt. Board Arpt. Rev. Series 2016, 5% 1/1/20 | | 160,000 | 167,274 |

| Kentucky State Property & Buildings Commission Rev.: | | | |

| (Kentucky St Proj.): | | | |

| Series 2009, 5.25% 2/1/19 (Assured Guaranty Corp. Insured) | | 465,000 | 474,337 |

| Series D: | | | |

| 5% 5/1/20 | | 2,420,000 | 2,548,696 |

| 5% 5/1/21 | | 555,000 | 597,519 |

| (Kentucky St Proj.): | | | |

| Series 2005 5% 8/1/21 (Nat'l. Pub. Fin. Guarantee Corp. Insured) | | 835,000 | 904,455 |

| Series 2005: | | | |

| 5% 8/1/18 (Nat'l. Pub. Fin. Guarantee Corp. Insured) | | 1,235,000 | 1,238,446 |

| 5% 8/1/20 (Nat'l. Pub. Fin. Guarantee Corp. Insured) | | 1,050,000 | 1,112,895 |

| Series 2010, 5% 8/1/20 | | 600,000 | 635,814 |

| (No. 108 Proj.) Series 2015 B, 5% 8/1/18 | | 1,475,000 | 1,479,101 |

| (Proj. No. 117) Series B, 3% 5/1/20 | | 1,570,000 | 1,597,444 |

| (Proj. No. 98) Series 2010, 4% 8/1/19 | | 675,000 | 690,626 |

| (Proj. No. 99) Series 2010 A, 5% 11/1/18 | | 500,000 | 505,705 |

| (Rev. Rfdg. Bonds Proj.) Series A, 5% 8/1/18 | | 1,480,000 | 1,484,114 |

| Series 2009 A, 5% 8/1/18 | | 1,615,000 | 1,619,490 |

| Series 2015 B, 5% 8/1/19 | | 1,620,000 | 1,674,707 |

| Series 2016 B, 5% 11/1/19 | | 2,110,000 | 2,196,721 |

| Series B, 5% 8/1/21 | | 520,000 | 562,931 |

| Louisville & Jefferson County: | | | |

| (Norton Healthcare, Inc. Proj.) Series 2016 A, 5% 10/1/19 | | 1,415,000 | 1,469,718 |

| Series 2016 A, 5% 10/1/18 | | 2,250,000 | 2,268,293 |

| Louisville/Jefferson County Metropolitan Govt. Poll. Cont. Rev. Bonds (Louisville Gas & Elec. Co. Proj.) Series 2003 A, 1.5%, tender 4/1/19 (a) | | 2,245,000 | 2,239,208 |

| Trimble County Poll. Cont. Rev. Bonds (Louisville Gas and Elec. Co. Proj.) Series 2001 B, 2.55%, tender 5/3/21 (a) | | 5,580,000 | 5,582,957 |

|

| TOTAL KENTUCKY | | | 43,544,358 |

|

| Louisiana - 1.8% | | | |

| Louisiana Citizens Property Ins. Corp. Assessment Rev. Series 2015: | | | |

| 5% 6/1/19 | | 835,000 | 859,950 |

| 5% 6/1/20 | | 4,450,000 | 4,712,817 |

| 5% 6/1/21 (FSA Insured) | | 1,600,000 | 1,735,056 |

| Louisiana Gen. Oblig. Series 2016 A, 5% 9/1/20 | | 1,625,000 | 1,732,559 |

| Louisiana Local Govt. Envir. Facilities Bonds Series 2013, 1 month U.S. LIBOR + 0.700% 2.088%, tender 7/2/18 (a)(c) | | 6,155,000 | 6,156,539 |

| Louisiana Pub. Facilities Auth. Rev.: | | | |

| (Ochsner Clinic Foundation Proj.) Series 2015, 5% 5/15/21 | | 520,000 | 560,825 |

| (Tulane Univ. of Louisiana Proj.) Series 2016 A, 5% 12/15/19 | | 745,000 | 779,404 |

| Series 2009 A: | | | |

| 5% 7/1/19 | | 1,380,000 | 1,424,160 |

| 5.25% 7/1/20 | | 2,530,000 | 2,693,565 |

| Series 2015, 5% 7/1/18 | | 2,135,000 | 2,135,000 |

| New Orleans Aviation Board Rev.: | | | |

| Series 2017 D1: | | | |

| 5% 1/1/19 | | 445,000 | 452,601 |

| 5% 1/1/20 | | 745,000 | 781,125 |

| Series 2017 D2: | | | |

| 5% 1/1/19 (b) | | 560,000 | 569,285 |

| 5% 1/1/20 (b) | | 150,000 | 157,047 |

| 5% 1/1/21 (b) | | 370,000 | 395,663 |

| 5% 1/1/22 (b) | | 655,000 | 714,513 |

| Tobacco Settlement Fing. Corp. Series 2013 A: | | | |

| 5% 5/15/19 | | 4,525,000 | 4,643,329 |

| 5% 5/15/21 | | 930,000 | 1,001,666 |

|

| TOTAL LOUISIANA | | | 31,505,104 |

|

| Maine - 0.0% | | | |

| Maine Health & Higher Edl. Facilities Auth. Rev. Series 2017 B, 4% 7/1/21 | | 250,000 | 263,715 |

| Massachusetts - 1.3% | | | |

| Massachusetts Dept. of Trans. Metropolitan Hwy. Sys. Rev. Series 2010 B, 5% 1/1/20 | | 370,000 | 388,112 |

| Massachusetts Dev. Fin. Agcy. Rev.: | | | |

| (Lesley Univ. Proj.) Series 2016, 5% 7/1/20 | | 765,000 | 809,806 |

| Series 2013 F, 4% 7/1/18 | | 415,000 | 415,000 |

| Massachusetts Edl. Fing. Auth. Rev.: | | | |

| Series 2016 J, 5% 7/1/21 (b) | | 1,550,000 | 1,671,830 |

| Series 2017 A: | | | |

| 3% 7/1/19 (b) | | 185,000 | 186,941 |

| 4% 7/1/20 (b) | | 280,000 | 290,170 |

| Massachusetts Gen. Oblig.: | | | |

| Bonds Series 2014 D1, 1.05%, tender 7/1/20 (a) | | 3,720,000 | 3,664,126 |

| Series 1998 C, 0% 8/1/18 (Nat'l. Pub. Fin. Guarantee Corp. Insured) | | 135,000 | 134,843 |

| Series 2007 A, 3 month U.S. LIBOR + 0.460% 2.04% 11/1/18 (a)(c) | | 1,025,000 | 1,025,072 |

| Series 2017 B, SIFMA Municipal Swap Index + 0.600% 2.11% 2/1/20 (a)(c) | | 13,020,000 | 13,097,078 |

| Massachusetts Health & Edl. Facilities Auth. Rev.: | | | |

| (Partners Healthcare Sys., Inc. Proj.) Series 2010, 5% 7/1/21 | | 420,000 | 433,864 |

| Series 2009 D, 5% 7/1/18 | | 370,000 | 370,000 |

|

| TOTAL MASSACHUSETTS | | | 22,486,842 |

|

| Michigan - 2.6% | | | |

| Chippewa Valley Schools Series 2016, 5% 5/1/19 | | 1,445,000 | 1,486,052 |

| Clarkston Cmnty. Schools Series 2016 I, 4% 5/1/20 | | 255,000 | 264,851 |

| Ferris State Univ. Rev. Series 2016: | | | |

| 5% 10/1/19 | | 285,000 | 296,309 |

| 5% 10/1/20 | | 400,000 | 427,840 |

| Grand Haven Area Pub. Schools Series 2013, 3% 5/1/20 | | 370,000 | 378,347 |

| Grand Rapids Pub. Schools: | | | |

| Series 2016, 5% 5/1/19 (FSA Insured) | | 1,560,000 | 1,602,370 |

| 5% 5/1/19 (FSA Insured) | | 335,000 | 344,099 |

| Grand Valley Michigan State Univ. Rev. Series 2011, 5% 2/1/20 | | 975,000 | 1,022,834 |

| Huron Valley School District Series 2011, 5% 5/1/21 | | 1,475,000 | 1,592,646 |

| Ingham, Eaton and Clinton Counties Lansing School District Series 2016 I, 5% 5/1/19 | | 570,000 | 585,481 |

| Kalamazoo Hosp. Fin. Auth. Hosp. Facilities Rev. (Bronson Methodist Hsp, MI. Proj.) Series 2006, 5% 5/15/19 (FSA Insured) | | 745,000 | 764,348 |

| Kent Hosp. Fin. Auth. Hosp. Facilities Rev. (Spectrum Health Sys. Proj.) Series 2011 A, 5% 11/15/20 | | 470,000 | 503,553 |

| Lake Orion Cmnty. School District 5% 5/1/19 | | 670,000 | 688,472 |

| Lapeer Cmnty. Schools Series 2016: | | | |

| 4% 5/1/19 | | 415,000 | 422,873 |

| 4% 5/1/20 | | 905,000 | 939,960 |

| Lincoln Consolidated School District Series 2016 A, 5% 5/1/19 | | 745,000 | 764,921 |

| Michigan Fin. Auth. Rev.: | | | |

| (Mclaren Health Care Corp. Proj.) 5% 5/15/21 | | 370,000 | 401,091 |

| Bonds 1.1%, tender 8/15/19 (a) | | 975,000 | 966,839 |

| Series 2010 A, 5% 12/1/18 | | 445,000 | 451,261 |

| Series 2015 A, 5% 5/15/19 | | 355,000 | 365,217 |

| Series 2015, 5% 12/1/19 | | 2,490,000 | 2,604,042 |

| Series 2016: | | | |

| 3% 1/1/19 | | 75,000 | 75,452 |

| 3% 1/1/20 | | 110,000 | 111,693 |

| 5% 11/15/18 | | 975,000 | 986,827 |

| 5% 11/15/19 | | 495,000 | 516,003 |

| Michigan Gen. Oblig. Series 2016: | | | |

| 3% 3/15/20 | | 3,720,000 | 3,793,730 |

| 5% 3/15/20 | | 815,000 | 858,309 |

| Michigan Hosp. Fin. Auth. Rev. Bonds Series 2010 F4, 1.95%, tender 4/1/20 (a) | | 2,930,000 | 2,928,975 |

| Mount Clemens Cmnty. School District Series 2017 A: | | | |

| 5% 5/1/19 | | 530,000 | 544,835 |

| 5% 5/1/20 | | 630,000 | 666,773 |

| Portage Pub. Schools Series 2016: | | | |

| 5% 5/1/19 | | 465,000 | 478,211 |

| 5% 5/1/20 | | 500,000 | 529,185 |

| Rochester Cmnty. School District 5% 5/1/19 (Nat'l. Pub. Fin. Guarantee Corp. Insured) | | 285,000 | 293,097 |

| Royal Oak City School District Series 2018, 4% 5/1/20 | | 300,000 | 312,306 |

| Royal Oak Hosp. Fin. Auth. Hosp. Rev. Series 2014 D, 5% 9/1/18 | | 495,000 | 497,757 |

| Warren Consolidated School District Series 2016, 4% 5/1/19 | | 745,000 | 759,133 |

| Wayne County Arpt. Auth. Rev.: | | | |

| Series 2010 A, 5% 12/1/18 (b) | | 7,495,000 | 7,595,433 |

| Series 2011 A, 5% 12/1/19 (b) | | 1,225,000 | 1,278,312 |

| Series 2017 A: | | | |

| 5% 12/1/18 | | 870,000 | 882,311 |

| 5% 12/1/19 | | 930,000 | 972,203 |

| 5% 12/1/20 | | 445,000 | 478,335 |

| Series 2017 B: | | | |

| 5% 12/1/18 (b) | | 300,000 | 304,020 |

| 5% 12/1/19 (b) | | 490,000 | 511,041 |

| 5% 12/1/20 (b) | | 535,000 | 572,455 |

| Western Michigan Univ. Rev.: | | | |

| Series 2011, 5% 11/15/18 | | 520,000 | 526,755 |

| Series 2013, 5% 11/15/19 | | 370,000 | 386,879 |

| Ypsilanti School District Series A, 4% 5/1/19 | | 1,375,000 | 1,401,084 |

| Zeeland Pub. Schools Series 2015, 5% 5/1/21 | | 1,285,000 | 1,381,979 |

|

| TOTAL MICHIGAN | | | 46,516,499 |

|

| Missouri - 0.0% | | | |

| Kansas City Santn Swr. Sys. R Series 2018 B, 5% 1/1/20 (d)(e) | | 300,000 | 310,524 |

| Missouri Health & Edl. Facilities Rev. Series 2016, 5% 5/15/20 | | 590,000 | 623,595 |

|

| TOTAL MISSOURI | | | 934,119 |

|

| Montana - 0.1% | | | |

| Montana Facility Fin. Auth. Rev. Series 2016: | | | |

| 5% 2/15/19 | | 780,000 | 795,616 |

| 5% 2/15/20 | | 1,290,000 | 1,354,823 |

|

| TOTAL MONTANA | | | 2,150,439 |

|

| Nebraska - 0.1% | | | |

| Nebraska Pub. Pwr. District Rev. Series 2014, 5% 7/1/19 | | 1,250,000 | 1,291,638 |

| Nevada - 0.7% | | | |

| Clark County Arpt. Rev.: | | | |

| (Sub Lien Proj.) Series 2017 A-1, 5% 7/1/20 (b) | | 2,445,000 | 2,587,715 |

| Series 2017 C, 5% 7/1/21 (b) | | 3,020,000 | 3,260,090 |

| Clark County Poll. Cont. Rev. Bonds (Nevada Pwr. Co. Projs.) Series 2017, 1.6%, tender 5/21/20 (a) | | 3,080,000 | 3,052,249 |

| Clark County School District: | | | |

| Series 2007 A, 4.5% 6/15/19 | | 250,000 | 255,550 |

| Series 2012 A, 5% 6/15/19 | | 980,000 | 1,011,095 |

| Series 2015 D, 5% 6/15/20 | | 440,000 | 465,727 |

| Series 2016 A, 5% 6/15/21 | | 425,000 | 460,581 |

| Series 2017 B, 5% 6/15/19 | | 595,000 | 613,879 |

| Washoe County Gas Facilities Rev. Bonds (Seirra Pacific Pwr. Co. Projs.) Series 2016 A, 1.5%, tender 6/3/19 (a)(b) | | 1,040,000 | 1,035,767 |

|

| TOTAL NEVADA | | | 12,742,653 |

|

| New Hampshire - 0.2% | | | |

| New Hampshire Health & Ed. Facilities Auth. Rev.: | | | |

| (Southern NH Med. Ctr. Proj.) Series 2016: | | | |

| 3% 10/1/19 | | 460,000 | 466,297 |

| 3% 10/1/21 | | 570,000 | 580,961 |

| Series 2016: | | | |

| 3% 10/1/18 | | 835,000 | 837,655 |

| 3% 10/1/20 | | 820,000 | 834,276 |

|

| TOTAL NEW HAMPSHIRE | | | 2,719,189 |

|

| New Jersey - 4.9% | | | |

| Garden State Preservation Trust Open Space & Farmland Preservation Series 2012 A, 5% 11/1/19 | | 6,735,000 | 6,983,858 |

| Jersey City Gen. Oblig. Series 2015, 4% 2/15/20 (FSA Insured) | | 391,000 | 404,767 |

| New Jersey Econ. Dev. Auth. Rev.: | | | |

| (New Jersey Gen. Oblig. Proj.): | | | |

| Series 2008 A, 5% 5/1/19 | | 295,000 | 302,198 |

| Series 2009 AA, 5.25% 12/15/20 | | 745,000 | 766,240 |

| Series 2011 EE, 4.5% 9/1/20 | | 170,000 | 176,814 |

| Series 2017 B, 5% 11/1/19 | | 2,480,000 | 2,574,290 |

| Series 2010 DD, 5% 12/15/18 | | 1,430,000 | 1,449,491 |

| Series 2011 EE, 5% 9/1/18 | | 1,140,000 | 1,145,689 |

| Series 2013, 5% 3/1/20 | | 3,030,000 | 3,159,957 |

| Series 2014 PP, 5% 6/15/19 | | 985,000 | 1,012,472 |

| Series 2015 XX, 5% 6/15/19 | | 840,000 | 863,428 |

| Series 2017 DDD: | | | |

| 5% 6/15/19 | | 370,000 | 380,319 |

| 5% 6/15/20 | | 370,000 | 387,349 |

| Series EE, 5.25% 9/1/19 | | 1,370,000 | 1,419,854 |

| Series PP, 5% 6/15/20 | | 150,000 | 157,443 |

| New Jersey Edl. Facilities Auth. Rev. Series 2010 H, 5% 7/1/18 (Escrowed to Maturity) | | 93,000 | 93,000 |

| New Jersey Edl. Facility ( William Paterson College Proj.) Series 2017 B, 5% 7/1/20 | | 357,000 | 379,138 |

| New Jersey Gen. Oblig.: | | | |

| Series 2005 L, 5.25% 7/15/19 | | 445,000 | 461,065 |

| Series 2014, 5% 6/1/19 | | 465,000 | 478,806 |

| Series 2016 T: | | | |

| 5% 6/1/19 | | 500,000 | 514,845 |

| 5% 6/1/20 | | 510,000 | 538,932 |

| New Jersey Health Care Facilities Fing. Auth. Rev.: | | | |

| (AHS Hosp. Corp. Proj.) Series 2016, 5% 7/1/18 | | 2,430,000 | 2,430,000 |

| Series 2008: | | | |

| 5% 7/1/18 | | 2,915,000 | 2,915,000 |

| 5% 7/1/18 | | 135,000 | 135,000 |

| Series 2010, 5% 1/1/19 | | 165,000 | 167,810 |

| Series 2013 A, 5% 7/1/18 | | 135,000 | 135,000 |

| Series 2016 A, 5% 7/1/19 | | 300,000 | 309,480 |

| Series 2016: | | | |

| 5% 7/1/19 | | 755,000 | 779,538 |

| 5% 7/1/20 | | 1,500,000 | 1,592,100 |

| 4% 7/1/19 (Escrowed to Maturity) | | 180,000 | 184,100 |

| New Jersey Higher Ed. Student Assistance Auth. Student Ln. Rev.: | | | |

| Series 2011, 5% 12/1/18 (b) | | 1,085,000 | 1,099,138 |

| Series 2011-1, 5.5% 12/1/21 (b) | | 5,000,000 | 5,501,200 |

| Series 2013, 5% 12/1/19 (b) | | 500,000 | 520,830 |

| Series 2014 1A: | | | |

| 5% 12/1/20 (b) | | 6,000,000 | 6,393,780 |

| 5% 12/1/21 (b) | | 4,500,000 | 4,877,820 |

| Series 2016 1A, 5% 12/1/21 (b) | | 2,000,000 | 2,167,920 |

| Series 2017 1B: | | | |

| 5% 12/1/19 (b) | | 1,320,000 | 1,374,991 |

| 5% 12/1/20 (b) | | 2,075,000 | 2,211,182 |

| Series 2018 B: | | | |

| 5% 12/1/20 (b) | | 1,875,000 | 1,998,056 |

| 5% 12/1/21 (b) | | 1,290,000 | 1,398,308 |

| New Jersey Tobacco Settlement Fing. Corp. Series 2018 A: | | | |

| 5% 6/1/19 | | 2,210,000 | 2,272,167 |

| 5% 6/1/20 | | 1,950,000 | 2,057,231 |

| 5% 6/1/21 | | 3,090,000 | 3,328,981 |

| New Jersey Tpk. Auth. Tpk. Rev. Series 2017 C1, 1 month U.S. LIBOR + 0.340% 1.728% 1/1/21 (a)(c) | | 485,000 | 485,354 |

| New Jersey Trans. Trust Fund Auth.: | | | |

| (New Jersey St Grant Anticipati Proj.) Series 2016 A-1, 5% 6/15/21 | | 665,000 | 666,490 |

| Series 1999 A, 5.75% 6/15/20 | | 205,000 | 214,547 |

| Series 2010 D, 5% 12/15/18 | | 150,000 | 152,045 |

| Series 2013 A: | | | |

| 5% 12/15/19 | | 195,000 | 203,061 |

| 5% 6/15/20 | | 695,000 | 729,486 |

| Series 2013 AA, 5% 6/15/19 | | 355,000 | 364,901 |

| Series 2016 A, 5% 6/15/20 | | 10,485,000 | 11,005,266 |

| Series AA: | | | |

| 5% 6/15/19 | | 4,685,000 | 4,815,665 |

| 5% 6/15/20 | | 125,000 | 130,959 |

| New Jersey Transit Corp. Ctfs. of Prtn. Series 2014 A, 5% 9/15/19 | | 1,545,000 | 1,601,887 |

|

| TOTAL NEW JERSEY | | | 87,869,248 |

|

| New Mexico - 0.2% | | | |

| Farmington Poll. Cont. Rev. Bonds (Southern California Edison Co. Four Corners Proj.): | | | |

| Series 2005 A, 1.875%, tender 4/1/20 (a) | | 1,490,000 | 1,480,226 |

| Series 2005 B, 1.875%, tender 4/1/20 (a) | | 1,300,000 | 1,291,472 |

|

| TOTAL NEW MEXICO | | | 2,771,698 |

|

| New York - 0.1% | | | |

| Long Island Pwr. Auth. Elec. Sys. Rev. Series 2000 A, 0% 6/1/19 (FSA Insured) | | 400,000 | 393,700 |

| New York City Gen. Oblig. Series 2015 F, SIFMA Municipal Swap Index + 0.650% 2.16% 2/15/19 (a)(c) | | 745,000 | 746,676 |

|

| TOTAL NEW YORK | | | 1,140,376 |

|

| North Carolina - 0.1% | | | |

| Charlotte Int'l. Arpt. Rev. Series 2010 B, 5.25% 7/1/18 (b) | | 560,000 | 560,000 |

| North Carolina Muni. Pwr. Agcy. #1 Catawba Elec. Rev.: | | | |

| Series 2010 A, 5% 1/1/20 | | 330,000 | 345,903 |

| Series 2012 A, 5% 1/1/19 | | 485,000 | 493,526 |

| Series C, 5% 1/1/21 | | 355,000 | 360,886 |

|

| TOTAL NORTH CAROLINA | | | 1,760,315 |

|

| Ohio - 1.8% | | | |

| Allen County Hosp. Facilities Rev.: | | | |

| (Mercy Health Proj.) Series 2010B, 5% 9/1/18 | | 745,000 | 749,038 |

| Bonds (Mercy Health Proj.) Series 2015 B, SIFMA Municipal Swap Index + 0.750% 2.26%, tender 5/1/20 (a)(c) | | 9,670,000 | 9,672,127 |

| Cleveland Ctfs. of Prtn. Series 2010 A, 5% 11/15/19 | | 1,665,000 | 1,731,966 |

| Cleveland Pub. Pwr. Sys. Rev. Series 2016 A, 5% 11/15/19 | | 1,405,000 | 1,466,961 |

| Hamilton County HealthCare Facilities Rev. (Christ Hosp., OH. Proj.) Series 2012, 5% 6/1/20 | | 645,000 | 681,720 |

| Ohio Higher Edl. Facility Commission Rev.: | | | |

| (Kenyon College, Oh. Proj.) Series 2017, 4% 7/1/19 | | 150,000 | 153,402 |

| (Kenyon College, Oh. Proj.) Series 2017, 4% 7/1/20 | | 150,000 | 156,287 |

| Ohio Wtr. Dev. Auth. Wtr. Poll. Cont. Rev. Series 2017 B, SIFMA Municipal Swap Index + 0.220% 1.73% 12/1/20 (a)(c) | | 15,305,000 | 15,304,082 |

| Scioto County Hosp. Facilities Rev. Series 2016, 5% 2/15/20 | | 880,000 | 923,498 |

| Univ. of Akron Gen. Receipts Series 2010 A, 5% 1/1/19 (FSA Insured) | | 555,000 | 564,341 |

|

| TOTAL OHIO | | | 31,403,422 |

|

| Oklahoma - 0.1% | | | |

| Oklahoma County Fin. Auth. Edl. Facilities (Midwest City- Del City School Dis Proj.) Series 2018: | | | |

| 5% 10/1/18 | | 260,000 | 262,210 |

| 5% 10/1/19 | | 345,000 | 358,821 |

| 5% 10/1/21 | | 510,000 | 553,462 |

|

| TOTAL OKLAHOMA | | | 1,174,493 |

|

| Oregon - 0.1% | | | |

| Oregon Facilities Auth. Rev.: | | | |

| (Legacy Health Proj.) Series 2011 A, 5.25% 5/1/19 | | 260,000 | 267,680 |

| Series 2011 C, 5% 10/1/20 | | 310,000 | 331,505 |

| Port of Portland Arpt. Rev. 5% 7/1/18 (b) | | 355,000 | 355,000 |

|

| TOTAL OREGON | | | 954,185 |

|

| Pennsylvania - 3.4% | | | |

| Adams County Indl. Dev. Auth. Rev. Series 2010, 5% 8/15/20 | | 1,310,000 | 1,392,989 |

| Allegheny County Arpt. Auth. Rev. Series 2006 B, 5% 1/1/19 (b) | | 1,450,000 | 1,472,519 |

| Allegheny County Hosp. Dev. Auth. Rev. Series 2010 A, 5% 5/15/19 | | 780,000 | 802,792 |

| Doylestown Hosp. Auth. Hosp. Rev. Series 2016 B, 5% 7/1/20 | | 430,000 | 449,333 |

| Lycoming County Auth. College Rev. Series 2016: | | | |

| 4% 10/1/18 | | 370,000 | 372,202 |

| 4% 10/1/19 | | 745,000 | 765,622 |

| Monroeville Fin. Auth. UPMC Rev. Series 2014 B, 3% 2/1/19 | | 145,000 | 146,212 |

| Pennsylvania Ctfs. Prtn. Series 2018 A, 5% 7/1/21 | | 350,000 | 376,877 |

| Pennsylvania Econ. Dev. Fing. Auth. Indl. Dev. Rev. Series 2014 A, 4% 2/1/19 | | 130,000 | 131,832 |

| Pennsylvania Gen. Oblig.: | | | |

| Series 2009, 5% 7/1/19 | | 5,000,000 | 5,165,050 |

| Series 2010 A: | | | |

| 5% 5/1/19 | | 700,000 | 719,418 |

| 5% 5/1/20 | | 575,000 | 606,642 |

| Series 2014, 5% 7/1/18 | | 465,000 | 465,000 |

| Series 2016: | | | |

| 5% 1/15/19 | | 240,000 | 244,380 |

| 5% 9/15/19 | | 6,010,000 | 6,244,450 |

| 5% 9/15/20 | | 1,030,000 | 1,096,610 |

| 5% 1/15/21 | | 420,000 | 449,463 |

| 5% 1/15/22 | | 2,785,000 | 3,039,744 |

| Pennsylvania Higher Edl. Facilities Auth. Rev. Series 2010 E, 5% 5/15/19 | | 825,000 | 849,107 |

| Pennsylvania Tpk. Commission Tpk. Rev.: | | | |

| Series 2013, SIFMA Municipal Swap Index + 1.150% 2.66% 12/1/19 (a)(c) | | 1,170,000 | 1,182,145 |

| series 2015 A-2, SIFMA Municipal Swap Index + 0.650% 2.16% 12/1/18 (a)(c) | | 2,110,000 | 2,110,717 |

| Series 2018 A1: | | | |

| SIFMA Municipal Swap Index + 0.350% 1.86% 12/1/20 (a)(c) | | 5,100,000 | 5,100,000 |

| SIFMA Municipal Swap Index + 0.430% 1.94% 12/1/21 (a)(c) | | 10,010,000 | 10,010,000 |

| Philadelphia Arpt. Rev.: | | | |

| Series 2010 D, 5% 6/15/21 (b) | | 1,425,000 | 1,511,982 |

| Series 2011 A, 5% 6/15/21 (b) | | 510,000 | 549,959 |

| Series 2015 A, 5% 6/15/19 (b) | | 890,000 | 917,385 |

| Philadelphia Gas Works Rev.: | | | |

| Series 2015 13: | | | |

| 5% 8/1/19 | | 1,050,000 | 1,086,152 |

| 5% 8/1/20 | | 1,735,000 | 1,840,020 |

| 5% 8/1/21 | | 1,550,000 | 1,679,410 |

| Series 2016 14: | | | |

| 5% 10/1/19 | | 3,715,000 | 3,861,482 |

| 5% 10/1/20 | | 1,345,000 | 1,432,169 |

| Series 2017 15, 4% 8/1/20 | | 370,000 | 384,907 |

| Philadelphia School District: | | | |

| Series 2016 D, 5% 9/1/18 | | 560,000 | 563,052 |

| Series 2016 F, 5% 9/1/19 | | 745,000 | 772,170 |

| Pittsburgh & Alleg County Parkin Series 2017: | | | |

| 3% 12/15/18 | | 460,000 | 462,746 |

| 4% 12/15/19 | | 245,000 | 252,642 |

| Reading School District Series 2017, 5% 3/1/21 (FSA Insured) | | 150,000 | 160,794 |

| Saint Mary Hosp. Auth. Health Sys. Rev. (Catholic Health East Proj.) Series 2010B: | | | |

| 5% 11/15/18 | | 420,000 | 425,330 |

| 5% 11/15/19 | | 600,000 | 626,706 |

| State Pub. School Bldg. Auth. Lease Rev. (The School District of Philadelphia Proj.) Series 2016 A, 5% 6/1/19 | | 280,000 | 288,212 |

|

| TOTAL PENNSYLVANIA | | | 60,008,222 |

|

| Rhode Island - 0.1% | | | |

| Rhode Island Comm Corp. Rev. Series 2016 A, 5% 6/15/19 | | 1,680,000 | 1,734,281 |

| Rhode Island Student Ln. Auth. Student Ln. Rev. Series A, 5% 12/1/21 (b) | | 500,000 | 540,275 |

|

| TOTAL RHODE ISLAND | | | 2,274,556 |

|

| South Carolina - 0.8% | | | |

| Piedmont Muni. Pwr. Agcy. Elec. Rev.: | | | |

| Series 2009 A, 5% 1/1/20 | | 4,645,000 | 4,860,389 |

| Series 2017 A, 5% 1/1/19 | | 410,000 | 416,716 |

| Scago Edl. Facilities Corp. for Colleton School District (School District of Colleton County Proj.) Series 2015, 5% 12/1/18 | | 1,170,000 | 1,185,924 |

| South Carolina Jobs-Econ. Dev. Auth. (Anmed Health Proj.) Series 2016, 5% 2/1/20 | | 560,000 | 587,653 |

| South Carolina Pub. Svc. Auth. Rev.: | | | |

| Series 2010 B: | | | |

| 4% 1/1/20 | | 225,000 | 232,031 |

| 5% 1/1/19 (Escrowed to Maturity) | | 455,000 | 462,749 |

| Series 2011 B: | | | |

| 4% 12/1/19 | | 600,000 | 618,048 |

| 4% 12/1/20 | | 2,130,000 | 2,217,990 |

| Series 2012 D, 4% 12/1/19 | | 195,000 | 200,866 |

| Series 2015 C, 5% 12/1/19 | | 3,620,000 | 3,779,063 |

|

| TOTAL SOUTH CAROLINA | | | 14,561,429 |

|

| Tennessee - 0.3% | | | |

| Knox County Health Edl. & Hsg. Facilities Series 2016 A, 3% 1/1/19 | | 370,000 | 372,231 |

| Memphis-Shelby County Arpt. Auth. Arpt. Rev.: | | | |

| Series 2010 B, 5.5% 7/1/19 (b) | | 1,950,000 | 2,019,810 |

| Series 2011 C, 5% 7/1/19 (b) | | 210,000 | 216,489 |

| Nashville and Davidson County Metropolitan Govt. Health & Edl. Facilities Board Rev. Bonds Series 2001 B, 1.55%, tender 11/3/20 (a) | | 2,375,000 | 2,356,641 |

|

| TOTAL TENNESSEE | | | 4,965,171 |

|

| Texas - 2.3% | | | |

| Austin-Bergstrom Landhost Ente Series 2017: | | | |

| 5% 10/1/19 | | 395,000 | 409,828 |

| 5% 10/1/20 | | 675,000 | 717,984 |

| 5% 10/1/21 | | 810,000 | 879,296 |

| Brownsville Util. Sys. Rev. Series 2015, 5% 9/1/18 | | 800,000 | 804,432 |

| Corpus Christi Util. Sys. Rev. Series 2015, 4% 7/15/19 | | 500,000 | 511,830 |

| Dallas County Util. and Reclamation District Series 2016: | | | |

| 5% 2/15/19 | | 1,610,000 | 1,643,134 |

| 5% 2/15/20 | | 980,000 | 1,029,568 |

| 5% 2/15/22 | | 1,000,000 | 1,098,640 |

| Dallas Fort Worth Int'l. Arpt. Rev.: | | | |

| Series 2012 F, 5% 11/1/20 (b) | | 600,000 | 640,722 |

| Series 2013 E, 5% 11/1/18 (b) | | 7,600,000 | 7,685,424 |

| Harris County Cultural Ed. Facilities Fin. Corp. Med. Facilities Rev. (Baylor College of Medicine Proj.) Series 2016, 5% 11/15/19 | | 1,350,000 | 1,408,779 |

| Harris County Cultural Ed. Facilities Fin. Corp. Rev.: | | | |

| Bonds: | | | |

| Series 2014 B, 2.09%, tender 12/1/19 (a) | | 2,230,000 | 2,235,597 |

| Series 2015 3, 1 month U.S. LIBOR + 0.850% 2.274%, tender 6/1/20 (a)(c) | | 1,935,000 | 1,950,751 |

| Series 2013 A, 4% 12/1/18 | | 675,000 | 681,993 |

| Harris County Gen. Oblig. (Harris County Toll Road Auth.) Series 2012 A, SIFMA Municipal Swap Index + 0.780% 2.29% 8/15/18 (a)(c) | | 1,860,000 | 1,861,562 |

| Houston Arpt. Sys. Rev.: | | | |

| (Houston TX Arpt. Sys. Rev. Subord Proj.) Series 2011 A, 5% 7/1/21 (b) | | 1,325,000 | 1,432,749 |

| Series 2009A, 5% 7/1/20 | | 1,585,000 | 1,589,105 |

| Series 2011 A: | | | |

| 5% 7/1/18 (b) | | 75,000 | 75,000 |

| 5% 7/1/19 (b) | | 805,000 | 831,412 |

| Series 2012 A, 5% 7/1/18 (b) | | 210,000 | 210,000 |

| Series 2018 A, 5% 7/1/21 (b) | | 525,000 | 567,693 |

| Houston Gen. Oblig. Series 2017 A, 5% 3/1/20 | | 2,045,000 | 2,153,978 |

| Irving Hosp. Auth. Hosp. Rev. Series 2017 A: | | | |

| 5% 10/15/20 | | 370,000 | 393,021 |

| 5% 10/15/21 | | 185,000 | 200,398 |

| Los Fresnos Independent School District Series 2015, 5% 8/15/19 | | 335,000 | 347,777 |

| Love Field Arpt. Modernization Rev. Series 2015: | | | |

| 5% 11/1/18 (b) | | 585,000 | 591,458 |

| 5% 11/1/19 (b) | | 745,000 | 776,223 |

| Lower Colorado River Auth. Rev.: | | | |

| Series 2010 A: | | | |

| 5% 5/15/20 | | 2,500,000 | 2,649,475 |

| 5% 5/15/20 | | 2,740,000 | 2,903,825 |

| Series 2010: | | | |

| 5% 5/15/20 | | 240,000 | 254,350 |

| 5% 5/15/21 | | 1,255,000 | 1,329,321 |

| 5% 5/15/19 | | 445,000 | 458,079 |

| Lubbock Health Facilities Dev. Corp. Rev. (St. Joseph Health Sys. Proj.) Series 2008 B, 5% 7/1/19 | | 705,000 | 728,836 |

| Royse City Independent School District Series 2014, 0% 2/15/20 | | 415,000 | 403,085 |

| Tarrant County Cultural Ed. Facilities Fin. Corp. Rev. 5.75% 7/1/18 | | 125,000 | 125,000 |

|

| TOTAL TEXAS | | | 41,580,325 |

|

| Virginia - 1.1% | | | |

| Halifax County Indl. Dev. Auth. Bonds 2.15%, tender 9/1/20 (a) | | 2,225,000 | 2,224,043 |

| Louisa Indl. Dev. Auth. Poll. Cont. Rev. Bonds: | | | |

| Series 2008 A, 1.75%, tender 5/16/19 (a) | | 1,390,000 | 1,388,443 |

| Series 2008 B, 2.15%, tender 9/1/20 (a) | | 4,170,000 | 4,168,207 |

| Lynchburg Econ. Dev. (Centra Health Proj.) Series A: | | | |

| 5% 1/1/19 | | 255,000 | 259,190 |

| 5% 1/1/20 | | 370,000 | 387,212 |

| Wise County Indl. Dev. Auth. Waste & Sewage Rev. Bonds: | | | |

| (Virginia Elec. and Pwr. Co. Proj.) Series 2010 A, 1.875%, tender 6/1/20 (a) | | 8,240,000 | 8,194,680 |

| Series 2009 A, 2.15%, tender 9/1/20 (a) | | 2,135,000 | 2,134,082 |

| York County Econ. Dev. Auth. Poll. Cont. Rev. Bonds (Virginia Elec. and Pwr. Co. Proj.) Series 2009 A, 1.875%, tender 5/16/19 (a) | | 1,660,000 | 1,659,917 |

|

| TOTAL VIRGINIA | | | 20,415,774 |

|

| Washington - 0.6% | | | |

| Chelan County Pub. Util. District #1 Rev. Series 2011 B, 5% 7/1/18 (b) | | 330,000 | 330,000 |

| Port of Seattle Rev. Series 2015 C, 5% 4/1/21 (b) | | 1,565,000 | 1,685,802 |

| Tobacco Settlement Auth. Rev. Series 2013, 5% 6/1/20 | | 3,405,000 | 3,599,494 |

| Washington Gen. Oblig. Series 2000 S-5, 0% 1/1/19 (Nat'l. Pub. Fin. Guarantee Corp. Insured) | | 975,000 | 967,775 |

| Washington Health Care Facilities Auth. Rev.: | | | |

| ( Multicare Med. Ctr.,Tacom,WA Proj.) Series 2015 B, 4% 8/15/18 | | 745,000 | 747,190 |

| (MultiCare Health Sys. Proj.) Series 2010 A, 5.25% 8/15/19 | | 950,000 | 987,772 |

| (Providence Health Systems Proj.) Series 2011 B, 5% 10/1/19 | | 790,000 | 822,145 |

| Bonds Series 2012 B, 5%, tender 10/1/21 (a) | | 350,000 | 382,585 |

| Series 2012 A, 5% 10/1/19 | | 500,000 | 520,345 |

| Washington Pub. Pwr. Supply Sys. Nuclear Proj. #3 Rev. Series 1993 C, 0% 7/1/18 | | 500,000 | 500,000 |

|

| TOTAL WASHINGTON | | | 10,543,108 |

|

| West Virginia - 1.1% | | | |

| Harrison County Commission Solid Waste Disp. Rev. Bonds (Monongahela Pwr. Co. Proj.) Series 2018 A, 3%, tender 10/15/21 (a)(b)(d) | | 16,300,000 | 16,299,511 |

| West Virginia Econ. Dev. Auth. Poll. Cont. Rev. (Appalachian Pwr. Co. - Amos Proj.) Series 2008 D, 3.25% 5/1/19 | | 185,000 | 185,494 |

| West Virginia Econ. Dev. Auth. Solid Waste Disp. Facilities Rev. Bonds: | | | |

| (Appalachian Pwr. Co. Amos Proj.) Series 2011 A, 1.7%, tender 9/1/20 (a)(b) | | 2,320,000 | 2,288,866 |

| 1.9%, tender 4/1/19 (a) | | 395,000 | 394,443 |

|

| TOTAL WEST VIRGINIA | | | 19,168,314 |

|

| Wisconsin - 0.9% | | | |

| Milwaukee County Arpt. Rev. Series 2016 A: | | | |

| 5% 12/1/18 (b) | | 520,000 | 527,030 |

| 5% 12/1/19 (b) | | 1,810,000 | 1,889,531 |

| Wisconsin Health & Edl. Facilities: | | | |

| (Agnesian Healthcare Proj.) Series 2017: | | | |

| 3% 7/1/18 | | 165,000 | 165,000 |

| 4% 7/1/19 | | 300,000 | 306,147 |

| 5% 7/1/21 | | 300,000 | 323,490 |

| Bonds: | | | |

| (Ascension Health Cr. Group Proj.) Series 2013 B: | | | |

| 5%, tender 6/1/20 (a) | | 4,210,000 | 4,453,717 |

| 5%, tender 6/1/21 (a) | | 3,995,000 | 4,328,702 |

| Series 2013 B, 4%, tender 5/30/19 (a) | | 3,755,000 | 3,827,697 |

| Series 2013 A, 5% 11/15/18 | | 355,000 | 359,558 |

| Wisconsin Health & Edl. Facilities Auth. Rev. Series 2012 B, 5% 8/15/18 | | 560,000 | 562,302 |

|

| TOTAL WISCONSIN | | | 16,743,174 |

|

| TOTAL MUNICIPAL BONDS | | | |

| (Cost $781,598,046) | | | 779,683,051 |

|

| Municipal Notes - 55.5% | | | |

| Alabama - 0.1% | | | |

| Decatur Indl. Dev. Board Exempt Facilities Rev. (Nucor Steel Decatur LLC Proj.) Series 2003 A, 1.68% 7/6/18, VRDN (a)(b) | | 2,158,000 | $2,158,000 |

| California - 2.1% | | | |

| California Muni. Fin. Auth. Rev. Participating VRDN Series Floaters XF 26 15, 1.71% 7/6/18 (Liquidity Facility Barclays Bank PLC) (a)(b)(f) | | 1,700,000 | 1,700,000 |

| California Statewide Cmntys. Dev. Auth. Participating VRDN Series ZF 01 99, 1.54% 7/6/18 (Liquidity Facility JPMorgan Chase Bank) (a)(f) | | 1,705,000 | 1,705,000 |

| San Francisco Calif. City & Cnty. Arpts. Commn. Int'l. Arpt. Rev. Participating VRDN Series 15 ZF 01 64, 1.71% 7/6/18 (Liquidity Facility JPMorgan Chase Bank) (a)(b)(f) | | 4,960,000 | 4,960,000 |

| San Francisco City & County Arpts. Commission Int'l. Arpt. Rev. Participating VRDN: | | | |

| Series Floaters ZM 06 41, 1.71% 7/6/18 (Liquidity Facility JPMorgan Chase Bank) (a)(b)(f) | | 5,600,000 | 5,600,000 |

| Series Floaters ZM 06 44, 1.71% 7/6/18 (Liquidity Facility JPMorgan Chase Bank) (a)(b)(f) | | 7,435,000 | 7,435,000 |

| San Jose Int. Arpt. Rev. Participating VRDN Series 2017, 1.76% 7/6/18 (Liquidity Facility Citibank NA) (a)(b)(f) | | 14,880,000 | 14,880,000 |

| Shafter Indl. Dev. Auth. Indl. Dev. Rev. 2.04% 7/6/18, LOC Deutsche Bank AG, VRDN (a)(b) | | 920,000 | 920,000 |

|

| TOTAL CALIFORNIA | | | 37,200,000 |

|

| Colorado - 0.1% | | | |

| Colorado Edl. & Cultural Facilities Auth. Rev. (Mesivta of Greater Los Angeles Proj.) Series 2005, 1.86% 7/6/18, LOC Deutsche Bank AG, VRDN (a) | | 2,380,000 | 2,380,000 |

| Connecticut - 0.8% | | | |

| Derby Gen. Oblig. BAN Series 2018, 2.75% 10/25/18 | | 8,500,000 | 8,527,370 |

| Reg'l. School District # 14 Woodbuty & Bethleham BAN Series 2017, 2.25% 7/25/18 | | 5,815,000 | 5,816,861 |

|

| TOTAL CONNECTICUT | | | 14,344,231 |

|

| Delaware - 1.2% | | | |

| Delaware Econ. Dev. Auth. Rev. (Delmarva Pwr. & Lt. Co. Proj.) Series 1994, 1.75% 7/2/18, VRDN (a)(b) | | 21,900,000 | 21,900,000 |

| Florida - 2.6% | | | |

| Broward County Indl. Dev. Rev. (Florida Pwr. & Lt. Co. Proj.) Series 2015, 1.72% 7/2/18, VRDN (a)(b) | | 12,050,000 | 12,050,000 |

| Greater Orlando Aviation Auth. Arpt. Facilities Rev. Participating VRDN Series Floaters XL 00 51, 1.76% 7/6/18 (Liquidity Facility Citibank NA) (a)(b)(f) | | 33,538,000 | 33,538,000 |

|

| TOTAL FLORIDA | | | 45,588,000 |

|

| Georgia - 0.8% | | | |

| Burke County Indl. Dev. Auth. Poll. Cont. Rev. (Georgia Pwr. Co. Plant Vogtle Proj.) Series 2012, 1.73% 7/2/18, VRDN (a)(b) | | 9,050,000 | 9,050,000 |

| Heard County Dev. Auth. Poll. Cont. Rev. Series 2007, 1.7% 7/2/18, VRDN (a)(b) | | 5,000,000 | 5,000,000 |

| Monroe County Dev. Auth. Poll. Cont. Rev. (Georgia Pwr. Co. Plant Scherer Proj.) Series 2008, 1.69% 7/2/18, VRDN (a) | | 550,000 | 550,000 |

|

| TOTAL GEORGIA | | | 14,600,000 |

|

| Idaho - 0.1% | | | |

| Eagle Indl. Dev. Corp. Rev. (Camille Beckman Proj.) 1.71% 7/6/18, LOC Wells Fargo Bank NA, VRDN (a)(b) | | 790,000 | 790,000 |

| Idaho Health Facilities Auth. Rev. Participating VRDN Series 16 XG 00 66, 1.76% 7/6/18 (Liquidity Facility Deutsche Bank AG New York Branch) (a)(f) | | 1,116,000 | 1,116,000 |

|

| TOTAL IDAHO | | | 1,906,000 |

|

| Illinois - 3.1% | | | |

| Centegra Health Sys. Participating VRDN Series Floaters XF 23 39, 1.69% 7/6/18 (Liquidity Facility Barclays Bank PLC) (a)(f) | | 12,925,000 | 12,925,000 |

| Chicago Board of Ed. Participating VRDN Series Floaters XG 01 08, 1.69% 7/6/18 (Liquidity Facility Barclays Bank PLC) (a)(f) | | 6,700,000 | 6,700,000 |

| Chicago Indl. Dev. Rev. (Var Primrose Candy Co. Proj.) Series 2001, 1.64% 7/6/18, LOC Bank of America NA, VRDN (a)(b) | | 475,000 | 475,000 |

| Chicago O'Hare Int'l. Arpt. Rev. Participating VRDN Series Floaters XL 00 49, 1.76% 7/6/18 (Liquidity Facility Citibank NA) (a)(b)(f) | | 8,675,000 | 8,675,000 |

| Chicago Park District Gen. Oblig. Participating VRDN Series ROC II R 11935, 2.01% 7/6/18 (Liquidity Facility Citibank NA) (a)(f) | | 6,975,000 | 6,975,000 |

| Chicago Transit Auth. Rev. Bonds Participating VRDN Series XM 00 53, 1.76% 7/6/18 (Liquidity Facility Citibank NA) (a)(f) | | 9,080,500 | 9,080,500 |

| Cook County Gen. Oblig. Participating VRDN Series 2015 XF0124, 1.77% 7/6/18 (Liquidity Facility JPMorgan Chase Bank) (a)(f) | | 3,720,000 | 3,720,000 |

| Illinois Gen. Oblig. Participating VRDN Series 15 XF 1006, 1.76% 7/6/18 (Liquidity Facility Deutsche Bank AG) (a)(f) | | 6,621,500 | 6,621,500 |

|

| TOTAL ILLINOIS | | | 55,172,000 |

|

| Indiana - 0.8% | | | |

| Hamilton Southeastern Consolidated School Bldg. Corp. BAN Series 2018, 3% 12/15/18 | | 1,600,000 | 1,608,464 |

| Indiana Dev. Fin. Auth. Envir. Rev. (PSI Energy Proj.) Series 2003 B, 1.67% 7/6/18, VRDN (a)(b) | | 12,000,000 | 12,000,000 |

|

| TOTAL INDIANA | | | 13,608,464 |

|

| Kentucky - 0.2% | | | |

| Kentucky State Property & Buildings Commission Rev. Participating VRDN Series XG 0113, 1.71% 7/6/18 (Liquidity Facility Barclays Bank PLC) (a)(f) | | 4,165,000 | 4,165,000 |

| Louisiana - 6.8% | | | |

| New Orleans Aviation Board Rev. Participating VRDN: | | | |

| Series Floater ZF 24 97, 1.76% 7/6/18 (Liquidity Facility Citibank NA) (a)(b)(f) | | 5,580,000 | 5,580,000 |

| Series Floaters XL 00 46, 1.76% 7/6/18 (Liquidity Facility Citibank NA) (a)(b)(f) | | 19,351,500 | 19,351,500 |

| Series Floaters ZM 05 58, 1.76% 7/6/18 (Liquidity Facility Citibank NA) (a)(b)(f) | | 5,580,000 | 5,580,000 |

| Saint James Parish Gen. Oblig. (Nucor Steel Louisiana LLC Proj.): | | | |

| Series 2010 A1, 1.63% 7/6/18, VRDN (a) | | 63,885,000 | 63,884,975 |

| Series 2010 B1, 1.61% 7/6/18, VRDN (a) | | 26,410,000 | 26,410,000 |

|

| TOTAL LOUISIANA | | | 120,806,475 |

|

| Maine - 0.0% | | | |

| Auburn Rev. Oblig. Secs Series 2001, 1.75% 7/6/18, LOC TD Banknorth, NA, VRDN (a)(b) | | 380,000 | 380,000 |

| Maryland - 0.1% | | | |

| Maryland Health & Higher Edl. Facilities Auth. Rev. Series 1995, 1.74% 7/6/18 (Liquidity Facility Manufacturers & Traders Trust Co.), VRDN (a) | | 2,055,000 | 2,055,000 |

| Massachusetts - 1.2% | | | |

| Massachusetts Dev. Fin. Agcy. Rev. Participating VRDN Series Floaters XF 23 65, 1.71% 7/6/18 (Liquidity Facility Morgan Stanley Bank, West Valley City Utah) (a)(f) | | 4,959,000 | 4,959,000 |

| Massachusetts Edl. Fing. Auth. Rev. Participating VRDN Series Floaters XF 23 06, 1.76% 7/6/18 (Liquidity Facility Morgan Stanley Bank, West Valley City Utah) (a)(b)(f) | | 11,800,000 | 11,800,000 |

| Nahant BAN Series 2018 A, 3% 6/28/19 | | 1,700,000 | 1,716,065 |

| Quincy Gen. Oblig. BAN Series 2018, 3% 9/28/18 | | 1,300,000 | 1,304,576 |

| Webster Gen. Oblig. BAN Series 2017 B, 2.25% 10/12/18 | | 893,000 | 894,357 |

|

| TOTAL MASSACHUSETTS | | | 20,673,998 |

|

| Michigan - 0.2% | | | |

| Lowell Mich Ltd. Oblig. Indl. Dev. (Litehouse, Inc. Proj.) Series 2003, 1.91% 7/6/18, LOC Fifth Third Bank, Cincinnati, VRDN (a)(b) | | 575,000 | 575,000 |

| Michigan Bldg. Auth. Rev. Participating VRDN Series Floaters XM 01 23, 1.71% 7/6/18 (Liquidity Facility JPMorgan Chase Bank) (a)(f) | | 3,645,000 | 3,645,000 |

|

| TOTAL MICHIGAN | | | 4,220,000 |

|

| Mississippi - 0.3% | | | |

| Mississippi Bus. Fin. Corp. Solid Waste Disp. Rev. (Gulf Pwr. Co. Proj.) Series 2012, 1.65% 7/2/18, VRDN (a)(b) | | 4,680,000 | 4,680,000 |

| Missouri - 0.1% | | | |

| Saint Louis Arpt. Rev. RAN Series 2017 B, 5% 7/1/18 (b) | | 1,760,000 | 1,760,000 |

| Nebraska - 0.1% | | | |

| Stanton County Indl. Dev. Rev. Series 1998, 1.68% 7/6/18, VRDN (a)(b) | | 900,000 | 900,000 |

| Nevada - 0.9% | | | |

| Clark County Arpt. Rev. Participating VRDN Series ROC II R 11823, 1.71% 7/6/18 (Liquidity Facility Citibank NA) (a)(f) | | 16,250,000 | 16,250,000 |

| Sparks Econ. Dev. Rev. (RIX Industries Proj.) Series 2002, 1.71% 7/6/18, LOC Wells Fargo Bank NA, VRDN (a)(b) | | 340,000 | 340,000 |

|

| TOTAL NEVADA | | | 16,590,000 |

|

| New Jersey - 12.3% | | | |

| Bloomingdale BAN Series 2018, 3% 3/5/19 | | 6,868,381 | 6,921,954 |

| Caldwell BAN Series 2018, 3% 2/20/19 | | 4,843,417 | 4,879,500 |

| Carteret Gen. Oblig. BAN: | | | |

| Series 2017, 2.5% 10/25/18 | | 1,116,000 | 1,118,790 |

| Series 2018, 2.75% 2/1/19 | | 10,714,000 | 10,776,141 |

| East Brunswick Township Gen. Oblig. BAN Series 2018, 3% 3/14/19 | | 8,975,000 | 9,051,916 |

| Englewood Gen. Oblig. BAN Series 2018, 3% 4/2/19 | | 24,370,000 | 24,569,103 |

| Gloucester Township BAN Series 2018 B, 3% 6/20/19 | | 20,094,801 | 20,307,404 |

| Highland Park Gen. Oblig. BAN Series 2018, 3% 4/16/19 | | 5,300,000 | 5,351,198 |

| Holmdel Township Gen. Oblig. BAN Series 2017, 2.5% 10/26/18 | | 820,000 | 822,206 |

| Howell Township Gen. Oblig. BAN Series 2017 A, 3% 10/17/18 | | 2,900,000 | 2,911,542 |

| Jersey City Gen. Oblig. BAN Series 2018 A, 2.5% 1/18/19 | | 4,020,000 | 4,041,467 |

| Long Beach Township Gen. Oblig. BAN Series 2018 A, 3% 3/14/19 | | 6,300,000 | 6,357,078 |

| Long Branch Gen. Oblig. BAN Series 2018 B, 2.75% 2/8/19 | | 23,534,415 | 23,671,150 |

| Maple Shade Township BAN: | | | |

| Series 2017, 2.25% 9/7/18 | | 900,000 | 900,558 |

| Series 2018, 3% 6/27/19 | | 5,607,877 | 5,665,077 |

| Millburn Township Gen. Oblig. BAN Series 2018, 3% 6/14/19 | | 5,200,000 | 5,254,548 |

| Millstone Township Gen. Oblig. BAN Series 2017, 2.25% 9/12/18 | | 893,000 | 894,143 |

| New Jersey Bldg. Auth. State Bldg. Rev. Participating VRDN Series Floaters XF 05 53, 1.71% 7/6/18 (Liquidity Facility JPMorgan Chase Bank) (a)(f) | | 2,450,000 | 2,450,000 |

| New Jersey Health Care Facilities Fing. Auth. Rev. Participating VRDN Series 16 XG 00 47, 1.56% 7/6/18 (Liquidity Facility Deutsche Bank AG New York Branch) (a)(f) | | 6,512,627 | 6,512,627 |

| New Jersey St. Trans. Trust Fund Auth. Participating VRDN Series Floaters 16 XF1059, 1.76% 7/6/18 (Liquidity Facility Deutsche Bank AG New York Branch) (a)(f) | | 26,721,000 | 26,721,000 |

| Plainfield Gen. Oblig. BAN Series 2017, 2% 8/28/18 | | 1,023,000 | 1,023,583 |

| Roselle County of Union BAN Series 2017, 2.25% 9/14/18 | | 967,000 | 967,841 |

| Saddle Brook Township Gen. Oblig. BAN Series 2018, 3% 5/30/19 | | 8,550,000 | 8,639,091 |

| South Brunswick Township BAN Series 2017, 2.25% 10/2/18 | | 1,042,000 | 1,043,532 |

| South Orange Village Township Rev. BAN Series 2017, 3% 7/12/18 | | 7,587,250 | 7,590,285 |

| Teaneck Township Gen. Oblig. BAN Series 2018, 3% 6/28/19 | | 3,700,000 | 3,738,591 |

| Vineland Gen. Oblig. BAN Series 2017, 2.5% 11/15/18 | | 3,274,000 | 3,283,560 |

| Wall Township Gen. Oblig. BAN Series 2018, 3% 6/28/19 | | 16,856,000 | 17,033,494 |

| Wood-Ridge Gen. Oblig. BAN Series 2017, 2.25% 9/14/18 | | 7,302,320 | 7,309,987 |

|

| TOTAL NEW JERSEY | | | 219,807,366 |

|

| New York - 7.1% | | | |

| Amsterdam City School District BAN Series 2018, 3% 6/28/19 | | 19,900,000 | 20,111,537 |

| Binghamton Gen. Oblig. BAN Series 2017, 2.5% 11/16/18 | | 6,695,000 | 6,713,679 |

| Broome County Gen. Oblig. BAN Series 2018 A, 3% 5/3/19 | | 11,400,000 | 11,523,348 |

| Canastota Central School District BAN Series 2017, 2.5% 7/20/18 | | 1,115,000 | 1,115,491 |

| East Aurora Union Free School District BAN Series A, 2.25% 8/1/18 | | 820,000 | 820,369 |

| Eden BAN Series 2018, 3% 3/7/19 | | 5,830,000 | 5,877,398 |

| Geneva BAN Series 2018, 3% 5/8/19 | | 10,500,000 | 10,603,005 |

| Gloversville School District BAN Series 2017, 2.25% 10/19/18 | | 1,490,000 | 1,492,608 |

| Ithaca Gen. Oblig. BAN Series 2018 A, 2.75% 2/15/19 | | 3,987,414 | 4,013,811 |

| Lansingburgh Central School District BAN Series 2017, 2.5% 7/20/18 | | 1,265,000 | 1,265,557 |

| Nassau County Indl. Dev. Agcy. Indl. Dev. Rev. (Rubies Costume Co. Proj.) Series 1999, 1.67% 7/5/18, LOC Bank of America NA, VRDN (a) | | 190,000 | 190,000 |

| North Tonawanda City School District BAN Series 2017, 2.2% 8/24/18 | | 2,085,000 | 2,086,877 |

| Oneida County Indl. Dev. Agcy. Rev. (Champion Home Builders Co. Proj.) 1.81% 7/6/18, LOC Wells Fargo Bank NA, VRDN (a)(b) | | 5,075,000 | 5,075,000 |

| Onondaga County Indl. Dev. Agcy. Indl. Dev. Rev. (Var G A Braun, Inc. Proj.) Series 2007, 1.81% 7/6/18, LOC Manufacturers & Traders Trust Co., VRDN (a)(b) | | 4,250,000 | 4,250,000 |

| Penn Yan NY Central School District BAN Series 2018, 3% 7/19/19 (d) | | 8,400,000 | 8,491,644 |

| Poughkeepsie Town BAN Series 2018, 3% 3/8/19 | | 7,450,000 | 7,510,867 |

| Putnam County Indl. Dev. Agcy. Rev. Series 2006 A, 1.75% 7/6/18, LOC RBS Citizens NA, VRDN (a) | | 2,710,000 | 2,710,000 |

| Queensbury Union Free School District BAN Series 2017, 2.5% 7/13/18 | | 2,010,000 | 2,010,563 |

| Rome City School District BAN Series 2017, 2.25% 8/3/18 | | 2,755,000 | 2,756,102 |

| Schoharie County BAN Series 2017, 2.5% 11/8/18 | | 2,390,000 | 2,397,529 |

| South Glens Falls Central School District BAN Series 2017 A, 2.25% 7/27/18 | | 2,530,000 | 2,531,063 |

| Syracuse Gen. Oblig. RAN Series B, 2.25% 7/10/18 | | 4,910,000 | 4,910,589 |

| Troy Rensselaer County BAN Series 2018 A, 2.75% 2/8/19 | | 8,771,733 | 8,820,592 |

| Ulster County Indl. Dev. Agcy. I (Selux Corp. Proj.) Series A: | | | |

| 1.89% 7/6/18, LOC Manufacturers & Traders Trust Co., VRDN (a)(b) | | 205,000 | 205,000 |

| 1.89% 7/6/18, LOC Manufacturers & Traders Trust Co., VRDN (a)(b) | | 355,000 | 355,000 |

| Whitney Point Central School District BAN Series 2017, 2.25% 8/17/18 | | 7,969,014 | 7,972,919 |

|

| TOTAL NEW YORK | | | 125,810,548 |

|

| North Carolina - 0.2% | | | |

| Hertford County Indl. Facilities Poll. Cont. Fing. Auth. Series 2000 B, 1.66% 7/6/18, VRDN (a)(b) | | 3,300,000 | 3,300,000 |

| Ohio - 2.0% | | | |

| Avon Lake BAN Series 2017, 2.5% 7/11/18 | | 1,746,000 | 1,746,367 |

| Belmont County BAN Series 2018 A, 3% 4/18/19 | | 4,200,000 | 4,239,522 |

| Lorain County Gen. Oblig. BAN Series 2017, 2% 11/7/18 | | 1,300,000 | 1,301,365 |

| Lucas County Hosp. Rev. Participating VRDN Series Floaters 002, 1.69% 8/10/18 (Liquidity Facility Barclays Bank PLC) (a)(f)(g) | | 22,245,000 | 22,245,000 |

| Napoleon City Captial Facilities BAN Series 2018, 2.75% 2/27/19 | | 1,600,000 | 1,608,752 |

| Newark Gen. Oblig. BAN Series 2017, 2.05% 10/30/18 | | 3,685,000 | 3,689,017 |

|

| TOTAL OHIO | | | 34,830,023 |

|

| Pennsylvania - 0.6% | | | |

| Berks County Indl. Dev. Auth. Rev. (KTB Real Estate Partnership Proj.) 1.71% 7/6/18, LOC Manufacturers & Traders Trust Co., VRDN (a)(b) | | 335,000 | 335,000 |

| Deutsche Spears/Lifers Trust Participating VRDN Series Floaters XF 10 60, 1.66% 7/6/18 (Liquidity Facility Deutsche Bank AG New York Branch) (a)(f) | | 2,150,000 | 2,150,000 |

| Montgomery County Higher Ed. & Health Auth. Rev. Series 2018 D, 1.79% 7/5/21, VRDN (a) | | 5,400,000 | 5,400,000 |

| Montgomery County Indl. Dev. Auth. Rev. (Var-FXD-Big Little Assoc. Proj.) Series 1999, 1.71% 7/5/18, LOC Wells Fargo Bank NA, VRDN (a) | | 100,000 | 100,000 |

| Pennsylvania Tpk. Commission Tpk. Rev. Participating VRDN Series ROC II R 11995, 1.61% 7/6/18 (Liquidity Facility Citibank NA) (a)(f) | | 2,000,000 | 2,000,000 |

|

| TOTAL PENNSYLVANIA | | | 9,985,000 |

|

| Pennsylvania, New Jersey - 0.2% | | | |

| Delaware River Joint Toll Bridge Commission Pennsylvania-New Jersey Bridge Rev. Participating VRDN Series Floaters XF 26 11, 1.66% 7/6/18 (Liquidity Facility Citibank NA) (a)(f) | | 3,200,000 | 3,200,000 |

| South Carolina - 1.8% | | | |

| Berkeley County Indl. Dev. Rev. (Nucor Corp. Proj.): | | | |

| Series 1995, 1.68% 7/6/18, VRDN (a)(b) | | 11,700,000 | 11,700,000 |

| Series 1997, 1.68% 7/6/18, VRDN (a)(b) | | 3,800,000 | 3,800,000 |

| South Carolina Jobs-Econ. Dev. Auth. Econ. Dev. Rev. Series 2001, 1.66% 7/6/18, LOC Wells Fargo Bank NA, VRDN (a)(b) | | 500,000 | 500,000 |

| South Carolina Pub. Svc. Auth. Rev. Participating VRDN Series Floaters XM 03 84, 1.71% 7/6/18 (Liquidity Facility JPMorgan Chase Bank) (a)(f) | | 14,115,000 | 14,115,000 |

| South Carolina St. Pub. Svc. Auth. Rev. Participating VRDN Series XG 0046, 1.71% 7/6/18 (Liquidity Facility Toronto-Dominion Bank) (a)(f) | | 1,330,000 | 1,330,000 |

|

| TOTAL SOUTH CAROLINA | | | 31,445,000 |

|

| Tennessee - 0.1% | | | |

| Memphis-Shelby County Indl. Dev. Board Facilities Rev. Series 2007, 1.68% 7/6/18, VRDN (a)(b) | | 2,230,000 | 2,230,000 |

| Texas - 6.6% | | | |

| Dallas Fort Worth Int'l. Arpt. Rev. Participating VRDN Series Floaters XF 10 61, 1.73% 7/6/18 (Liquidity Facility Deutsche Bank AG New York Branch) (a)(b)(f) | | 8,370,000 | 8,370,000 |

| North Texas Tollway Auth. Rev. Participating VRDN: | | | |

| Series Floaters XF 25 05, 1.71% 7/6/18 (Liquidity Facility Citibank NA) (a)(f) | | 1,041,500 | 1,041,500 |

| Series Floaters XM 05 60, 1.76% 7/6/18 (Liquidity Facility Bank of America NA) (a)(f) | | 2,010,000 | 2,010,000 |

| Port Arthur Navigation District Envir. Facilities Rev. (Motiva Enterprises LLC Proj.): | | | |

| Series 2001 A, 1.78% 7/2/18, VRDN (a) | | 240,000 | 240,000 |

| Series 2004, 1.85% 7/6/18, VRDN (a)(b) | | 57,485,000 | 57,485,000 |

| Series 2010 B, 1.78% 7/2/18, VRDN (a) | | 2,150,000 | 2,150,000 |

| Series 2010 C, 1.78% 7/2/18, VRDN (a) | | 19,990,000 | 19,990,000 |

| Series 2010 D: | | | |

| 1.78% 7/2/18, VRDN (a) | | 19,765,000 | 19,765,000 |

| 1.78% 7/2/18, VRDN (a) | | 7,350,000 | 7,350,000 |

|

| TOTAL TEXAS | | | 118,401,500 |

|

| Utah - 2.4% | | | |

| Salt Lake City Arpt. Rev. Participating VRDN: | | | |

| Series 17 XM 0493, 1.76% 7/6/18 (Liquidity Facility Morgan Stanley Bank, West Valley City Utah) (a)(b)(f) | | 15,252,000 | 15,252,000 |

| Series Floaters XM 05 06, 1.76% 7/6/18 (Liquidity Facility Cr. Suisse AG) (a)(b)(f) | | 22,623,000 | 22,623,000 |

| Series Floaters ZM 05 51, 1.76% 7/6/18 (Liquidity Facility Citibank NA) (a)(b)(f) | | 5,580,000 | 5,580,000 |

|

| TOTAL UTAH | | | 43,455,000 |

|

| Washington - 0.3% | | | |

| Catholic Health Initiatives Participating VRDN Series XF 1017, 1.68% 7/6/18 (Liquidity Facility Deutsche Bank AG New York Branch) (a)(f) | | 470,000 | 470,000 |

| Seattle Hsg. Auth. Rev. (Douglas Apts. Proj.) 1.66% 7/6/18, LOC KeyBank NA, VRDN (a) | | 545,000 | 545,000 |

| Washington Econ. Dev. Fin. Auth. Rev. Participating VRDN Series Floaters 005, 1.86% 8/10/18 (Liquidity Facility Barclays Bank PLC) (a)(b)(f)(g) | | 5,020,000 | 5,020,000 |

|

| TOTAL WASHINGTON | | | 6,035,000 |

|

| Wisconsin - 0.3% | | | |

| River Falls Indl. Dev. Rev. 1.75% 7/6/18, LOC U.S. Bank NA, Cincinnati, VRDN (a)(b) | | 345,000 | 345,000 |

| Wisconsin Health & Edl. Facilities Participating VRDN Series 2017 ZF 2412, 1.76% 7/6/18 (Liquidity Facility Citibank NA) (a)(f) | | 5,580,000 | 5,580,000 |

|

| TOTAL WISCONSIN | | | 5,925,000 |

|

| TOTAL MUNICIPAL NOTES | | | |

| (Cost $989,595,427) | | | 989,511,605 |

| | | Shares | Value |

|

| Money Market Funds - 0.9% | | | |

| Fidelity Municipal Cash Central Fund, 1.59% (h)(i) | | | |

| (Cost $15,917,000) | | 15,915,408 | 15,917,000 |

| TOTAL INVESTMENT IN SECURITIES - 100.2% | | | |

| (Cost $1,787,110,473) | | | 1,785,111,656 |

| NET OTHER ASSETS (LIABILITIES) - (0.2)% | | | (3,136,740) |

| NET ASSETS - 100% | | | $1,781,974,916 |

Security Type Abbreviations

BAN – BOND ANTICIPATION NOTE

RAN – REVENUE ANTICIPATION NOTE

VRDN – VARIABLE RATE DEMAND NOTE (A debt instrument that is payable upon demand, either daily, weekly or monthly)

Legend

(a) Coupon rates for floating and adjustable rate securities reflect the rates in effect at period end.

(b) Private activity obligations whose interest is subject to the federal alternative minimum tax for individuals.

(c) Coupon is indexed to a floating interest rate which may be multiplied by a specified factor and/or subject to caps or floors.

(d) Security or a portion of the security purchased on a delayed delivery or when-issued basis.

(e) A portion of the security sold on a delayed delivery basis.

(f) Provides evidence of ownership in one or more underlying municipal bonds.

(g) Restricted securities - Investment in securities not registered under the Securities Act of 1933 (excluding 144A issues). At the end of the period, the value of restricted securities (excluding 144A issues) amounted to $27,265,000 or 1.5% of net assets.

(h) Information in this report regarding holdings by state and security types does not reflect the holdings of the Fidelity Municipal Cash Central Fund.

(i) Affiliated fund that is available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. In addition, each Fidelity Central Fund's financial statements are available on the SEC's website or upon request.

Additional information on each restricted holding is as follows:

| Security | Acquisition Date | Acquisition Cost |

| Lucas County Hosp. Rev. Participating VRDN Series Floaters 002, 1.69% 8/10/18 (Liquidity Facility Barclays Bank PLC) | 1/11/18 | $22,245,000 |

| Washington Econ. Dev. Fin. Auth. Rev. Participating VRDN Series Floaters 005, 1.86% 8/10/18 (Liquidity Facility Barclays Bank PLC) | 3/1/18 | $5,020,000 |

Affiliated Central Funds

Information regarding fiscal year to date income earned by the Fund from investments in Fidelity Central Funds is as follows:

| Fund | Income earned |

| Fidelity Municipal Cash Central Fund | $136,641 |

| Total | $136,641 |

Amounts in the income column in the above table include any capital gain distributions from underlying funds, which are presented in the corresponding line-item in the Statement of Operations if applicable.

Investment Valuation

The following is a summary of the inputs used, as of June 30, 2018, involving the Fund's assets and liabilities carried at fair value. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used below, please refer to the Investment Valuation section in the accompanying Notes to Financial Statements.

| | Valuation Inputs at Reporting Date: |

| Description | Total | Level 1 | Level 2 | Level 3 |

| Investments in Securities: | | | | |

| Municipal Securities | $1,769,194,656 | $-- | $1,769,194,656 | $-- |

| Money Market Funds | 15,917,000 | 15,917,000 | -- | -- |

| Total Investments in Securities: | $1,785,111,656 | $15,917,000 | $1,769,194,656 | $-- |

Other Information

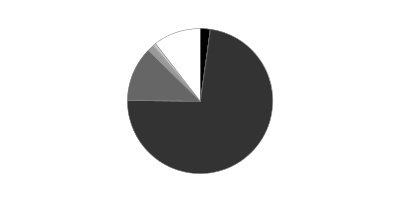

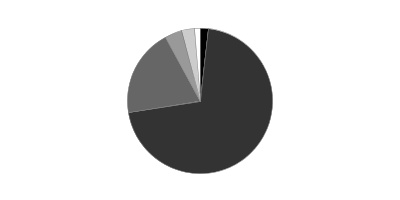

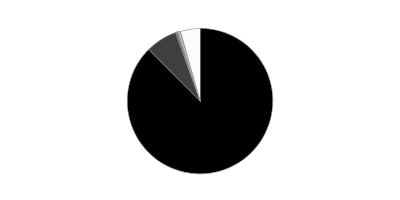

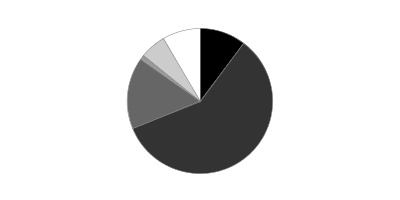

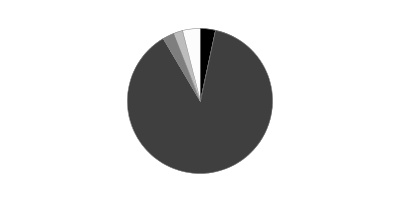

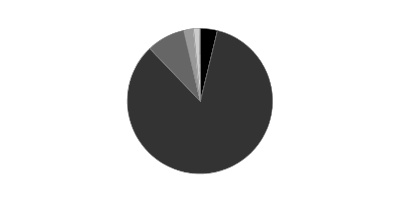

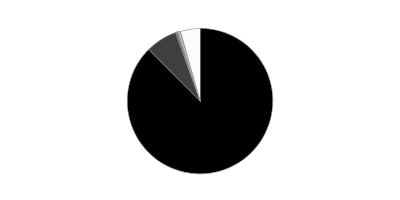

The distribution of municipal securities by revenue source, as a percentage of total Net Assets, is as follows (Unaudited):

| General Obligations | 32.4% |

| Synthetics | 19.5% |

| Industrial Development | 13.5% |

| Electric Utilities | 12.0% |

| Transportation | 7.5% |

| Health Care | 7.1% |

| Others* (Individually Less Than 5%) | 8.0% |

| | 100.0% |

* Includes net other assets

See accompanying notes which are an integral part of the financial statements.

Financial Statements

Statement of Assets and Liabilities

| | | June 30, 2018 (Unaudited) |

| Assets | | |

Investment in securities, at value — See accompanying schedule:

Unaffiliated issuers (cost $1,771,193,473) | $1,769,194,656 | |

| Fidelity Central Funds (cost $15,917,000) | 15,917,000 | |

| Total Investment in Securities (cost $1,787,110,473) | | $1,785,111,656 |

| Cash | | 2,764,082 |

| Receivable for securities sold on a delayed delivery basis | | 103,495 |

| Receivable for fund shares sold | | 9,349,854 |

| Interest receivable | | 11,896,415 |

| Distributions receivable from Fidelity Central Funds | | 58,034 |

| Receivable from investment adviser for expense reductions | | 141,387 |

| Other receivables | | 402 |

| Total assets | | 1,809,425,325 |

| Liabilities | | |

| Payable for investments purchased | | |

| Regular delivery | $16,587,199 | |

| Delayed delivery | 8,905,252 | |

| Payable for fund shares redeemed | 832,629 | |

| Distributions payable | 606,477 | |

| Accrued management fee | 436,100 | |

| Other affiliated payables | 82,752 | |

| Total liabilities | | 27,450,409 |

| Net Assets | | $1,781,974,916 |

| Net Assets consist of: | | |

| Paid in capital | | $1,784,951,733 |

| Undistributed net investment income | | 25,838 |

| Accumulated undistributed net realized gain (loss) on investments | | (1,003,838) |

| Net unrealized appreciation (depreciation) on investments | | (1,998,817) |

| Net Assets | | $1,781,974,916 |

| Conservative Income Municipal Bond: | | |

| Net Asset Value, offering price and redemption price per share ($242,158,630 ÷ 24,173,597 shares) | | $10.02 |

| Institutional Class: | | |

| Net Asset Value, offering price and redemption price per share ($1,539,816,286 ÷ 153,705,311 shares) | | $10.02 |

See accompanying notes which are an integral part of the financial statements.

Statement of Operations

| | | Six months ended June 30, 2018 (Unaudited) |

| Investment Income | | |

| Interest | | $13,060,697 |

| Income from Fidelity Central Funds | | 136,641 |

| Total income | | 13,197,338 |

| Expenses | | |

| Management fee | $2,560,648 | |

| Transfer agent fees | 487,544 | |