| Stradley Ronon Stevens & Young, LLP 2000 K Street, N.W., Suite 700 Washington, D.C. 20006 Telephone 202-822-9611 Fax 202-822-0140 www.stradley.com |

Christopher J. Zimmerman, Esq.

(202) 419-8402

czimmerman@stradley.com

April 10, 2020

VIA EDGAR

U.S. Securities and Exchange Commission

Division of Investment Management

100 F Street, N.E.sss

Washington, D.C. 20549-9303

| Attention: | Ms. Rebecca Marquigny, Esquire |

| | | |

| | Re: | Nationwide Variable Insurance Trust |

| | | File Nos. 002-73024 and 811-03213

|

Dear Ms. Marquigny:

On behalf of Nationwide Variable Insurance Trust (the “Registrant”) and its series the NVIT Jacobs Levy Large Cap Growth Fund (formerly, NVIT Multi-Manager Large Cap Growth Fund) and NVIT Wells Fargo Discovery Fund (formerly, NVIT Multi-Manager Mid Cap Growth Fund) (each, a “Fund,” and together, the “Funds”), below you will find the Registrant’s responses to the comments conveyed by you on February 27, 2020, with regard to Post-Effective Amendment No. 227 (the “Amendment”) to the Registrant’s registration statement on Form N-1A. The Amendment was filed with the U.S. Securities and Exchange Commission (the “SEC”) on January 16, 2020, pursuant to the Investment Company Act of 1940, as amended (the “1940 Act”), and Rule 485(a)(1) under the Securities Act of 1933, as amended (the “Securities Act”).

Below we have provided your comments and the Registrant’s response to each comment. These responses will be incorporated into a post-effective amendment filing to be made pursuant to Rule 485(b) of the Securities Act. Capitalized terms not otherwise defined in this letter have the meanings assigned to the terms in the Registration Statement.

U.S. Securities and Exchange Commission

Page 2

PROSPECTUS

|

| | | |

| General |

| | | |

| | 1) Comment: Consistent with “Example” preamble, please amend the “Fees and Expenses” preamble to include the sentence, “If these charges were reflected, the expenses listed below would be higher.” |

| | | |

| | Response: Registrant has revised its disclosure as follows: |

| | | |

| | | This table describes the fees and expenses you may pay when buying and holding shares of the Fund. Sales charges and other expenses that may be imposed by variable insurance contracts are not included. If these charges were reflected, the expenses listed below would be higher. See the variable contract prospectus. |

| | | |

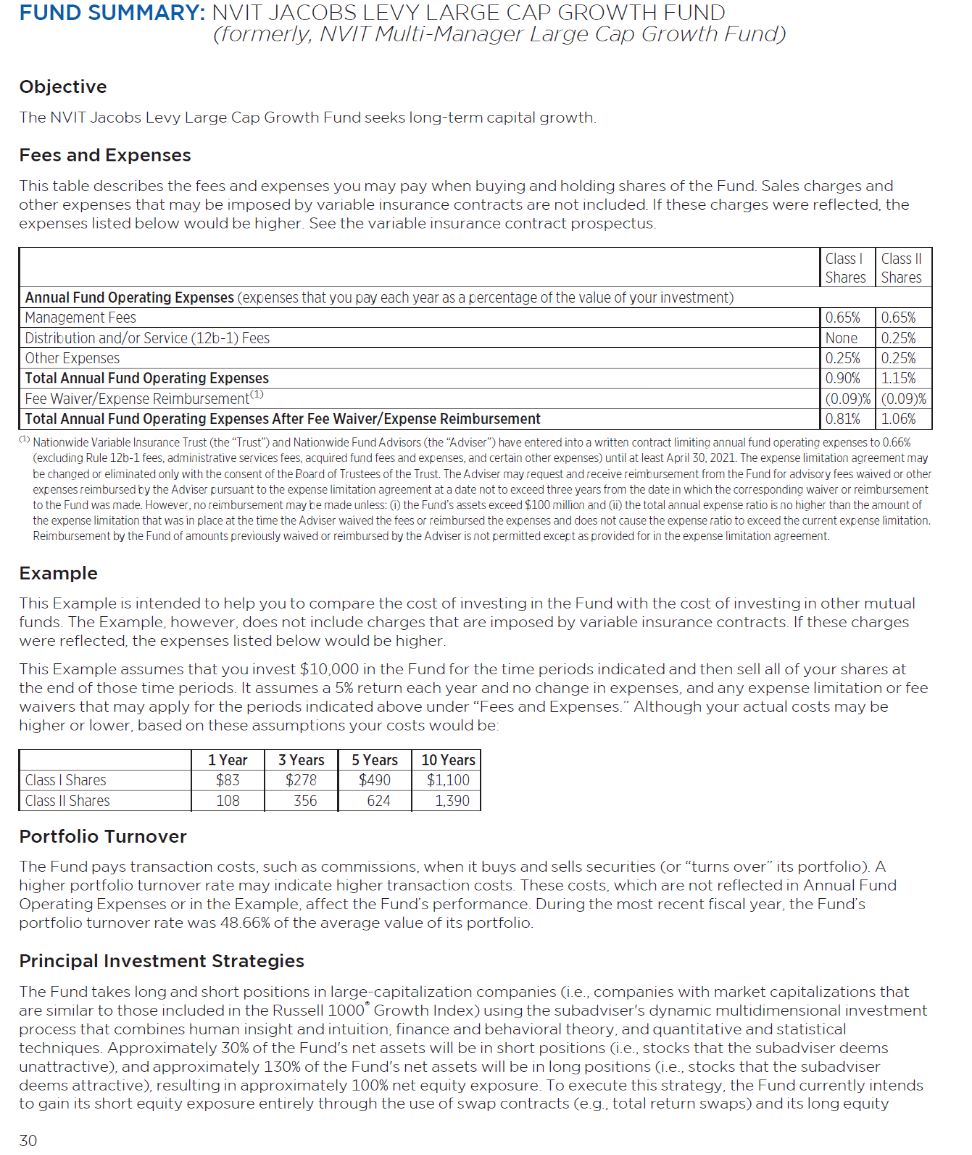

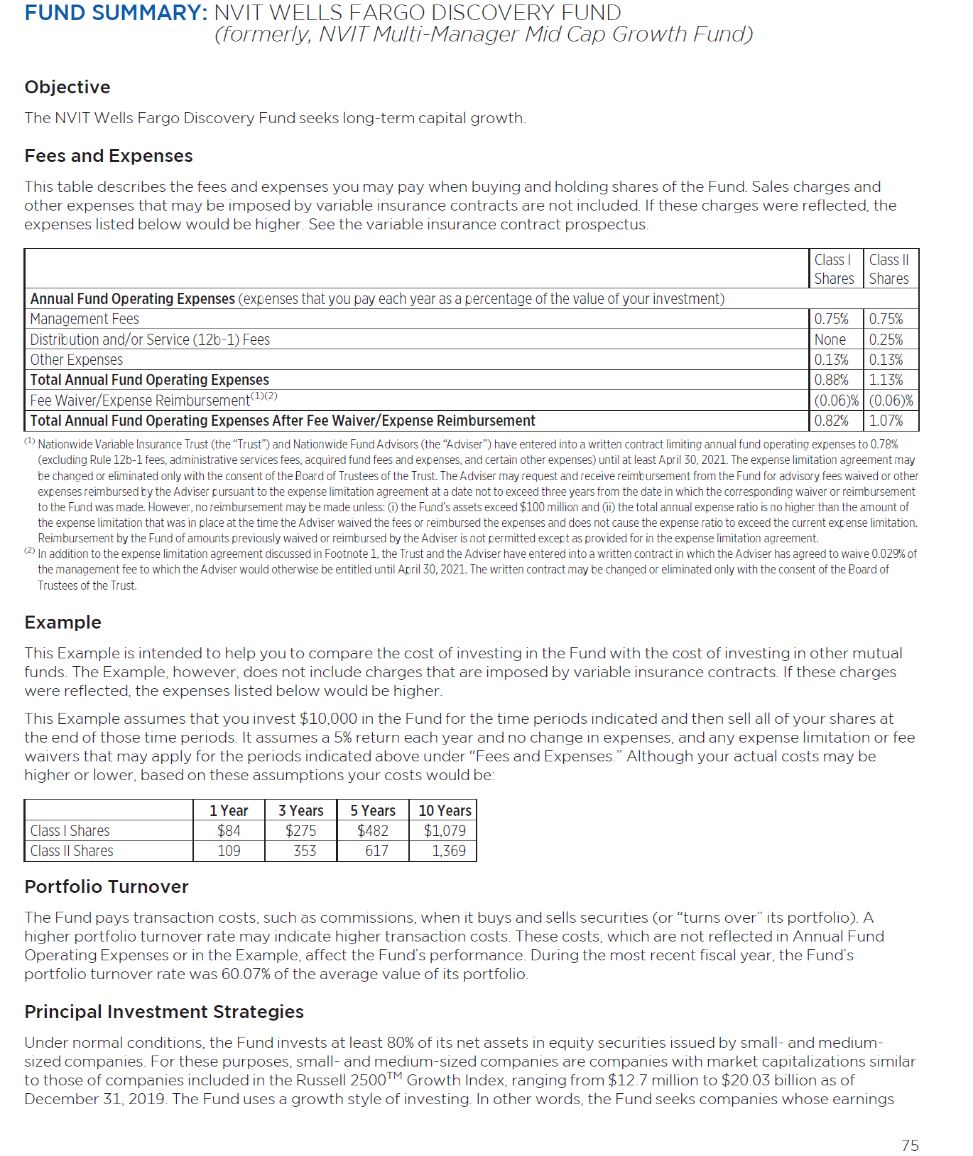

| | 2) Comment: As the information provided in the “Fees and Expenses” and “Example” tables is considered material, please provide complete, updated tables to the staff at least five days before the filing’s effective date. |

| | | |

| | Response: The complete, updated tables are attached to this correspondence as Exhibit A. |

| | | |

| | 3) Comment: The first footnote to both Funds’ fee tables states that the respective waiver agreement excludes “certain other expenses.” Please clarify the reference to “certain other expenses,” or include the full parenthetical list of exclusions from the fee waiver. |

| | | |

| | Response: Registrant respectfully declines to add the requested disclosure as it believes the full parenthetical list of exclusions from the fee waiver is not required by Form N-1A. |

| | | |

| | 4) Comment: With regard to the language in the “Example” preamble that states: “and any expense limitations or fee waivers that may apply for the periods indicated,” assuming that the limitations or fee waivers would apply through April 30, 2021, please revise the preamble to state that the fee waivers are factored into the calculation to reduce expenses solely in year one and that later years are calculated based on unwaived expenses. |

| | | |

| | Response: Registrant respectfully declines to make this revision as Registrant believes the existing language in the “Example” preamble is satisfactory as it states that, among other things, the Example table is calculated based upon “expense limitation or fee waivers that may apply for the periods indicated above under ‘Fees and Expenses.’” |

| | | |

| | 5) Comment: With regard to each Fund’s 80% policy in the respective Fund’s “Principal Investment Strategies” summary, please insert the words “plus any borrowings for investment purposes” or confirm the Fund will not borrow in this manner. |

U.S. Securities and Exchange Commission

Page 3

| | Response: Registrant confirms that the Fund will not borrow for investment purposes as a principal investment strategy. As a result, Registrant respectfully declines to revise the disclosure as requested as the Funds do not intend to engage in any borrowings for investment purposes. |

| | | |

| | 6) Comment: Pursuant to Item 4(b)(iii) of Form N-1A, if the Fund is advised or sold through an insured depository institution, please add the required disclosure or direct the staff to current disclosure required by that Item. If the Fund is not advised by or sold through an insured depository institution, please supplementally state that. |

| | | |

| | Response: Registrant has revised its disclosure as follows |

| | | |

| | | Loss of money is a risk of investing in the Fund. An investment in the Fund is not a deposit of a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. |

| | | |

| NVIT Jacobs Levy Large Cap Growth Fund: Fund Summary |

| | | |

| | 7) Comment: Since the Fund uses short sales as a principal investment strategy, please supplementally confirm that the costs and expenses associated with short sales will be included in the Fund’s fee table under “other expenses.” If not, please revise the fee table accordingly. |

| | | |

| | Response: Registrant confirms that the Fund does not use short sales as a principal investment strategy. As indicated in the Fund’s “Principal Investment Strategies” section, the Fund currently intends to gain its short equity exposure entirely through the use of swap contracts. Accordingly, Registrant respectfully submits that no revision to the fee table is necessary. |

| | | |

| | 8) Comment: With regard to the reference to the use of swaps in the “Principal Investment Strategies” summary, please clarify the types of swap contracts the Fund will use to obtain its 30% short equity exposure (e.g., interest rate swaps, contingent deferred, total return, etc.). Also, supplementally confirm that the Fund’s investments in swaps will comply with the segregation requirements set for them in SEC release 10666 and related SEC guidance. If applicable, confirm that when the Fund sells a credit default swap, the Fund calculates the segregation amount based on the notional value of the credit default swap sold. |

| | | |

| | Response: Registrant confirms that the Fund will use total return swaps to obtain its 30% short equity exposure, and Registrant has revised the disclosure to include such reference. Additionally, Registrant confirms that the Fund’s use of swaps will comply with the segregation requirements set forth in SEC Rel. 10666 and related SEC guidance as applied to swap contracts, until such guidance changes. Registrant also confirms that the Fund will not use credit default swaps as a principal investment strategy. |

U.S. Securities and Exchange Commission

Page 4

| | 9) Comment: The second paragraph of the “Principal Investment Strategies” summary states that as part of its 80% policy the Fund may invest in “derivatives the value of which are linked to equity securities issued by large-capitalization companies.” As the Fund appears to count derivatives toward the 80% policy calculation, state that the Fund will value derivatives at market value for purposes of compliance with the 80% policy. Also, if the Fund will invest principally in derivatives other than swaps, please disclose the specific types of derivative instruments the Fund will hold. |

| | | |

| | Response: Registrant believes that the use of notional value may be an appropriate measure of the economic exposure of a fund in certain circumstances. Notwithstanding the foregoing, Registrant historically has not used, and currently does not intend to use, the type of derivatives instruments where such treatment would be appropriate. Accordingly, Registrant confirms that derivatives that provide economic exposure to assets that are consistent with its name will be valued at market value for purposes of measuring compliance with the noted 80% policy. Registrant confirms that the Fund will not invest principally in derivatives other than total return swaps. |

| | | |

| | 10) Comment: The third paragraph of the “Principal Investment Strategies” summary states that the investment approach seeks “to manage risk exposures relative to the Russell 1000® Growth Index.” Please clarify what “seeking to manage risk exposures relative to the Russell 1000® Growth Index” means in practical terms. |

| | | |

| | Response: Registrant believes that the disclosure as written is satisfactory. As a result, Registrant respectfully declines the staff’s comment. |

| | | |

| | 11) Comment: With regard to the “Long/short strategy risk” summary disclosure, specifically summarize the unique risks of a strategy that is designed to combine long and short positions to achieve a particular objective. Please supplement the Item 4 and 9 risks accordingly. |

| | | |

| | Response: In response to the staff’s comment, the “Long/short strategy risk” summary disclosure has been revised as follows: |

| | | |

| | | in situations where the Fund takes a long position (i.e., owns a stock outright or gains long exposure through a swap), the Fund will lose money if the price of the stock declines. In situations where the Fund takes short positions, the Fund will lose money if the price of the stock increases. It is possible that stocks where the Fund has taken a long position will decline in value at the same time that stocks where the Fund has taken a short position increase in value, thereby increasing potential losses to the Fund. |

| | | |

| | 12) Comment: With regard to the “Leverage risk” summary disclosure, the current disclosure does not explain the compounding impact of leverage adequately. Please state that leverage exaggerates a fund’s investment exposure, which intensifies the impact of |

| | | |

U.S. Securities and Exchange Commission

Page 5

| | gains and losses on returns and can cause even small investments to have disproportionately negative consequences on total fund performance. |

| | | |

| | Response: In response to the staff’s comment, the “Leverage risk” summary disclosure has been revised as follows: |

| | | |

| | | leverage risk is a direct risk of investing in the Fund. Leverage is investment exposure that exceeds the initial amount invested. Derivatives and other transactions that give rise to leverage may cause the Fund’s performance to be more volatile than if the Fund had not been leveraged. Leveraging also may require that the Fund liquidate portfolio securities when it may not be advantageous to do so to satisfy its obligations or to meet segregation requirements. The use of leverage may expose the Fund to losses in excess of the amounts invested or borrowed. Certain derivatives provide the potential for investment gain or loss that may be several times greater than the change in the value of an underlying security, asset, interest rate, index or currency, resulting in the potential for a loss that may be substantially greater than the amount invested. Some leveraged investments have the potential for unlimited loss, regardless of the size of the initial investment. |

| | | |

| NVIT Wells Fargo Discovery Fund: Fund Summary |

| | | |

| | 13) Comment: The first paragraph of the “Principal Investment Strategies” summary states that “The Fund may also invest in equity securities of companies that are located outside the United States.” Please indicate the criteria the adviser applies to conclude that a company is “located outside the U.S.” Examples may include factors like country of incorporation or primary domicile, portion of revenue generated outside the U.S., location of a majority of company assets, currency in which the company is traded, etc. In addition, if the Fund may invest principally in emerging or developing markets, clarify this in the Item 4 and 9 strategy narrative. |

| | | |

| | Response: Registrant does not believe there is a requirement for a fund (i.e., a fund which is also not subject to Rule 35d-1 under the 1940 Act) to disclose the criteria that the adviser applies to conclude that a company is “located outside of the U.S.” As a result, Registrant respectfully declines the staff’s comment. In addition, Registrant confirms the Fund does not intend to invest principally in emerging or developing markets, and therefore no additional disclosure is required. |

| | | |

| | 14) Comment: The second paragraph of the “Principal Investment Strategies” summary states that “The Fund may invest in any sector, and at times may emphasize one or more sectors.” If the Fund’s composition currently emphasizes a particular sector or the adviser anticipates focusing on a specific sector, please name the relevant sector and describe any risks unique to it in the corresponding Item 4 and 9 risk discussions. |

U.S. Securities and Exchange Commission

Page 6

| | Response: Registrant respectfully declines as it views its current disclosure to be satisfactory. Registrant notes that specific sector concentration may vary significantly from period to period as the investment process does not predict holdings by sector. Additionally, Registrant believes that specific sector disclosure may not accurately reflect the principal investment strategy of the Fund, as the sectors may change from time to time. |

| | | |

| How the Funds Invest: NVIT Jacobs Levy Large Cap Growth Fund |

| | | |

| | 15) Comment: The strategy expressly states that the Fund uses swaps to achieve its short equity exposure and obtains its long equity exposure “by investing directly in stocks.” However, the “Key Terms” section defines “long position” as “direct ownership or simulating such ownership through the use of swaps.” To avoid confusing investors, please reconcile/revise. |

| | | |

| | Response: Registrant respectfully declines to revise its disclosure as Registrant believes the disclosure is satisfactory as written. |

| | | |

| Risks of Investing in the Funds |

| | | |

| | 16) Comment: With regard to the “Leverage risk” disclosure, specifically refer to swaps and any other types of derivatives that are principal investments likely to generate significant leverage risks for the NVIT Jacobs Levy Large Cap Growth Fund. |

| | | |

| | Response: Registrant respectfully declines to revise its disclosure as Registrant believes the disclosure is satisfactory as written. |

| | | |

| Selective Disclosure of Portfolio Holdings |

| | | |

| | 17) Comment: Please supplementally explain why the NVIT Jacobs Levy Large Cap Growth Fund’s holdings are not made publicly available on the NVIT website at the end of each month as all of the other NVIT Funds holdings are. |

| | | |

| | Response: Registrant notes that there is no legal or regulatory obligation to post a fund’s portfolio holdings to its website beyond what is stated in the fund’s prospectus. Registrant confirms that it will report its portfolio holdings to the SEC up to 60 days after the end of each fiscal quarter of the Trust, as required by regulation. |

| | | |

| Statement of Additional Information |

| |

| | 18) Comment: In the “Swap Agreements” disclosure, the language “or single/multiple security” was added. With regard to this addition, if the NVIT Jacobs Levy Large Cap Growth Fund’s new principal strategy relies heavily on multiple security swap agreements, please review the corresponding Item 9 strategy and revise as appropriate. |

U.S. Securities and Exchange Commission

Page 7

| | Response: Registrant believes no revisions are necessary as the disclosure is satisfactory as written.

|

| | | |

| | 19) Comment: Please remove the parenthetical that states “(but not limited to)” in the first sentence of the “Equity Swaps” disclosure or supplementally explain why it is appropriate. |

| | | |

| | Response: Registrant respectfully declines to remove the referenced phrase as Registrant believes the disclosure accurately reflects that the Funds are not limited to only entering equity swap contracts to invest in a market without owning or taking physical custody of securities in circumstances where direct investment in the securities is restricted for legal reasons or is otherwise impracticable. |

U.S. Securities and Exchange Commission

Page 8

In connection with the Registrant’s responses to the SEC staff’s comments on the Registration Statement, as requested by the staff, the Registrant acknowledges that the Registrant is responsible for the adequacy of the disclosure in the Registrant’s filings, notwithstanding any review, comments, action, or absence of action by the staff.

Please do not hesitate to contact me at (202) 419-8402 or Jessica D. Burt at (202) 419-8409, if you have any questions or wish to discuss any of the responses presented above.

| | | | | | | Respectfully submitted, |

| | | | | | | |

| | | | | | | |

| | | | | | | /s/ Christopher J. Zimmerman

|

| | | | | | | Christopher J. Zimmerman, Esquire |

| | | | | | | |

| | | | | | | |

| cc: | Allan J. Oster, Esquire |

| | Prufesh R. Modhera, Esquire |

| | Jessica D. Burt, Esquire |

| | Michael E. Schapiro, Esquire |

U.S. Securities and Exchange Commission

Page 9

Exhibit A

U.S. Securities and Exchange Commission

Page 10