| Stradley Ronon Stevens & Young, LLP 2000 K Street, N.W., Suite 700 Washington, D.C. 20006 Telephone 202-822-9611 Fax 202-822-0140 www.stradley.com |

Christopher J. Zimmerman, Esq.

(202) 419-8402

czimmerman@stradley.com

April 13, 2020

VIA EDGAR

U.S. Securities and Exchange Commission

Division of Investment Management

100 F Street, N.E.

Washington, D.C. 20549-9303

| Attention: | Ms. Rebecca Marquigny, Esquire |

| | | |

| | Re: | Nationwide Variable Insurance Trust |

| | | File Nos. 002-73024 and 811-03213

|

Dear Ms. Marquigny:

On behalf of Nationwide Variable Insurance Trust (the “Registrant”) and its series the NVIT AllianzGI International Growth Fund (formerly, NVIT Multi-Manager International Growth Fund), NVIT Columbia Overseas Value Fund (formerly, Templeton NVIT International Value Fund), NVIT Mellon Dynamic U.S. Equity Income Fund (formerly, American Century NVIT Multi Cap Value Fund), and NVIT Newton Sustainable U.S. Equity Fund (formerly, Neuberger Berman NVIT Socially Responsible Fund) (each, a Fund, and together, the “Funds”), below you will find the Registrant’s responses to the comments conveyed by you on April 1, 2020, with regard to Post-Effective Amendment No. 228 (the “Amendment”) to the Registrant’s registration statement on Form N-1A. The Amendment was filed with the U.S. Securities and Exchange Commission (the “SEC”) on February 20, 2020, pursuant to the Investment Company Act of 1940, as amended (the “1940 Act”), and Rule 485(a)(1) under the Securities Act of 1933, as amended (the “Securities Act”).

Below we have provided your comments and the Registrant’s response to each comment. These responses will be incorporated into a post-effective amendment filing to be made pursuant to Rule 485(b) of the Securities Act (“485(b) filing”). Capitalized terms not otherwise defined in this letter have the meanings assigned to the terms in the Registration Statement. Page numbers referenced in this letter refer to page numbers used in the 485(b) filing.

U.S. Securities and Exchange Commission

Page 2

PROSPECTUS |

| | | |

| General |

| | | |

| | 1) Comment: Please confirm that the series and classes for each Fund have been updated on the EDGAR system to reflect each respective Fund’s new name. |

| | | |

| | Response: Registrant confirms that the series and classes have been updated on the EDGAR system to reflect each Fund’s new name. |

| | | |

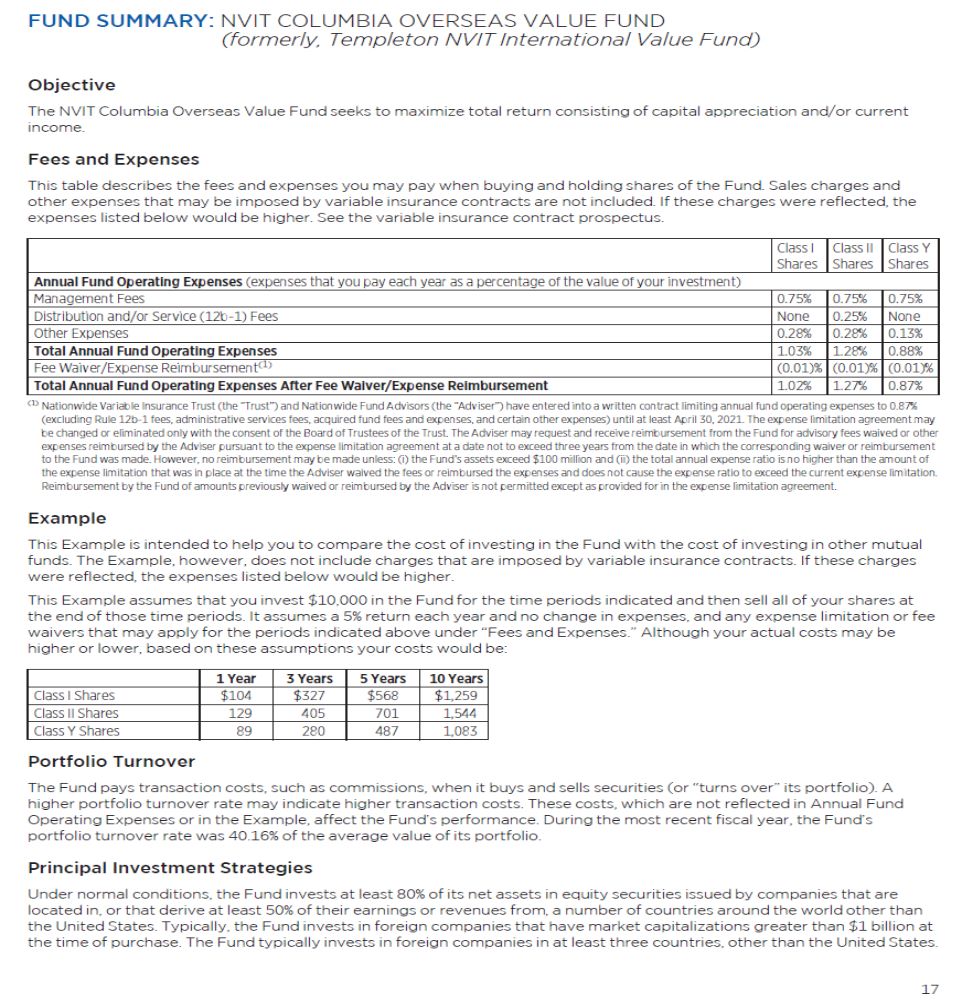

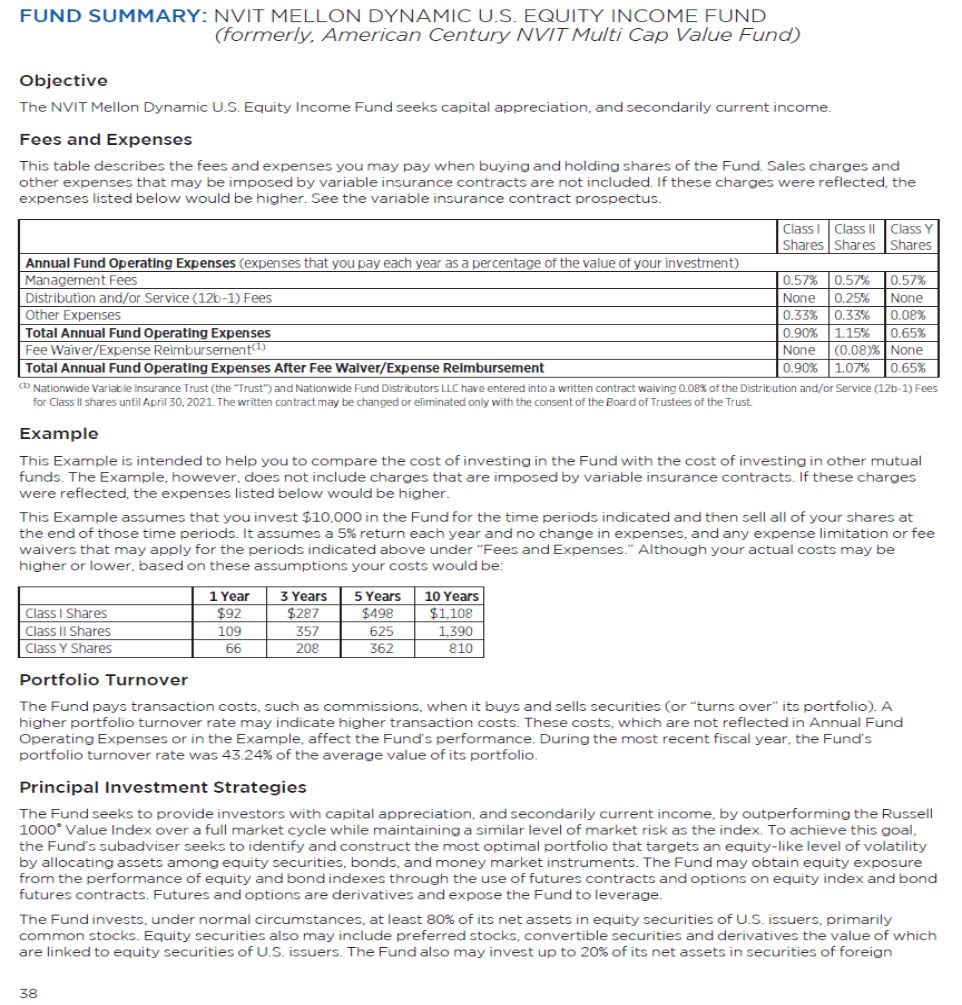

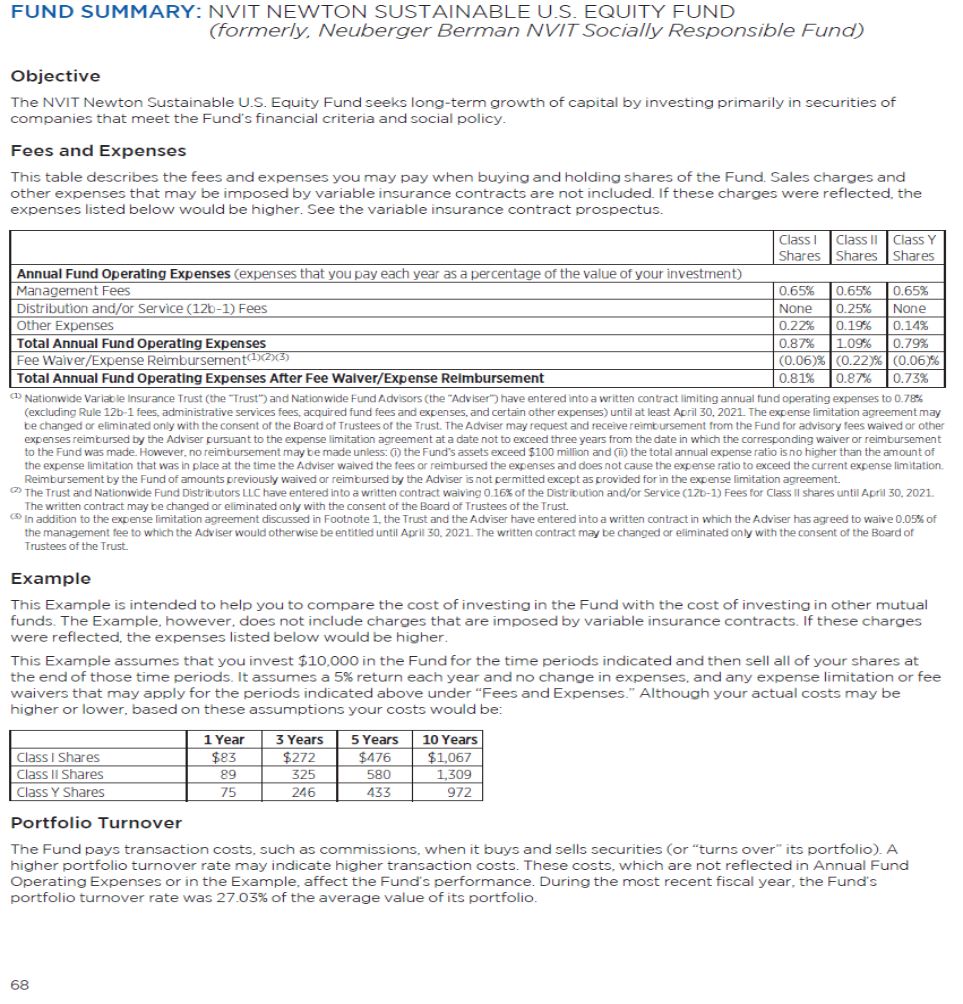

| | 2) Comment: As the information provided in the “Fees and Expenses” and “Example” tables is considered material, please provide pages of the Prospectus showing complete, updated tables to the Staff at least five days before the filing’s effective date. |

| | | |

| | Response: The pages of the prospectus showing complete, updated tables are attached to this correspondence as Exhibit A. |

| | | |

| | 3) Comment: With regard to each Fund’s 80% policy in the respective Fund’s “Principal Investment Strategies” summary, please insert the words “plus any borrowings for investment purposes” or confirm the Fund will not borrow in this manner. Additionally, for Funds subject to an 80% policy, pursuant to Rule 35d-1, please represent to the Staff that the corresponding policies are fundamental or that shareholders will receive at least 60 days’ notice in advance of the change. Finally, in each Fund’s Item 9 strategy, add a description of how this policy can be changed (e.g., shareholder vote or notice). |

| | | |

| | Response: Registrant respectfully declines to revise the disclosure as requested and confirms that the Funds do not intend to engage in any borrowings for investment purposes. Registrant represents to the Staff that shareholders will receive at least 60 days’ notice in advance of the change in 80% policy, as it is not a fundamental policy. In addition, Registrant respectfully declines to add a description of how this policy can be changed in each Fund’s Item 9 strategy discussion as such description is not required by Form N-1A, Item 9. Registrant also notes that such description is also already included in the Statement of Additional Information in “Investment Restrictions.” |

| | | |

| NVIT AllianzGI International Growth Fund: Fund Summary |

| | | |

| | 4) Comment: With regard to the language in the “Principal Investment Strategies” summary that states, “The Fund normally invests primarily in non-U.S. securities, including emerging market securities. . .”, in an appropriate place within the Registration Statement, please disclose how the Fund determines which countries qualify as emerging markets. Alternatively, provide a clear reference indicating where this information is already disclosed. |

U.S. Securities and Exchange Commission

Page 3

| | Response: Registrant notes that further information on emerging market countries other than the information included in the Item 4 summary disclosure is located on page 96 of the prospectus under “Key Terms” and in the Statement of Additional Information on page 22. Registrant respectfully declines to add cross-references in the Item 4 summary disclosure with respect to such information. |

| | | |

| | 5) Comment: As indicated in the Names Rule Adopting Release, Rel. No. IC-24828, the Staff notes that use of the term “international” connotes diversification among investments in a number of different countries throughout the world. The Staff further notes that the “Principal Investment Strategies” summary states that “The Fund . . . is not limited in the percentage of its asset that it may invest in any one country, region or geographic area.” It is the Staff’s position that this language would permit the Fund to invest all of its assets in a single country. Accordingly, please clarify the existing disclosure to specify that the Fund will not invest all of its assets in a single country. |

| | | |

| | Response: Registrant respectfully declines to revise the Fund’s disclosure as requested. Registrant does not believe that disclosing that the Fund does not limit the percentage of its assets that it may invest in any one country is the same as otherwise permitting the Fund to invest in only one country. Registrant understands that the position of the SEC and the Staff is that “international” connotes diversification among a number of different countries throughout the world and the Fund is managed consistent with such position, although Registrant also notes that the SEC and the Staff also made clear that the term “international” is not covered by Rule 35d-1. See Names Rule Adopting Release, Rel. No. IC-24828, f. 42. |

| | | |

| | 6) Comment: With regard to the reference to “exposure to secular market growth drivers” in the “Principal Investment Strategies” summary, the meaning of the term “secular” is confusing in this context. Please either delete the word “secular” or define it the first time it appears instead of, or in addition to, the Item 9 definition. |

| | | |

| | Response: Registrant respectfully declines to revise its disclosure as the word “secular” is already defined in Item 9, under “Key Terms,” on page 96 of the prospectus. |

| | | |

| | 7) Comment: With regard to the reference to ADRs in the “Principal Investment Strategies” summary, please add disclosure clarifying whether the Fund’s ADR strategy specifically anticipates investing in sponsored ADRs, unsponsored ADRs, or both. |

| | | |

| | Response: Registrant submits that the requested disclosure regarding depositary receipts is already a part of the discussion of “Foreign securities risk” disclosure under “Risks of Investing in the Fund” on page 117 of the prospectus. |

| | | |

| | 8) Comment: Significant market events have occurred since this Post-Effective Amendment was filed, namely as a result of the COVID-19 pandemic. Given that this is an international fund that invests specifically in markets that may be destabilized as a consequence of the new coronavirus, please consider whether the portfolio’s disclosure |

U.S. Securities and Exchange Commission

Page 4

| | and particularly risk disclosures, are based on how these events are affecting both debt and equity markets. If the Registrant believes that no additional disclosure is warranted, please supplementally explain. Likewise, apply a similar analysis throughout the filing and either amend each Fund’s disclosure accordingly or specifically explain the basis for concluding that a particular fund’s disclosure requires no revision. |

| | | |

| | Response: Registrant has updated “Market risk” in Item 9 of the prospectus as follows to address the pandemic crisis: |

| | | |

| | | Market risk is the risk that one or more markets in which a Fund invests will go down in value, including the possibility that the markets will go down sharply and unpredictably. In particular, market risk, including political, regulatory, market, economic and social developments, and developments that impact specific economic sectors, industries or segments of the market, can affect the value of a Fund’s investments. In addition, turbulence in financial markets and reduced liquidity in the markets may negatively affect many issuers, which could adversely affect a Fund. These risks may be magnified if certain social, political, economic and other conditions and events (such as natural disasters, epidemics and pandemics, terrorism, conflicts and social unrest) adversely interrupt the global economy; in these and other circumstances, such events or developments might affect companies world-wide and therefore can affect the value of a Fund’s investments. |

| | | |

| | Additionally, Registrant has added the following disclosure to the SAI under “Additional Information on Portfolio Investments, Strategies and Investment Policies”: |

| | | |

| | | Natural Disaster/Epidemic Risk: Natural or environmental disasters, such as earthquakes, fires, floods, hurricanes, tsunamis and other severe weather-related phenomena generally, and widespread disease, including pandemics and epidemics, have been and can be highly disruptive to economies and markets, adversely impacting individual companies, sectors, industries, markets, currencies, interest and inflation rates, credit ratings, investor sentiment, and other factors affecting the value of the Fund’s investments. Given the increasing interdependence among global economies and markets, conditions in one country, market, or region are increasingly likely to adversely affect markets, issuers, and/or foreign exchange rates in other countries, including the U.S. These disruptions could prevent the Fund from executing advantageous investment decisions in a timely manner and negatively impact the Fund’s ability to achieve its investment objectives. Any such event(s) could have a significant adverse impact on the value and risk profile of the Fund. |

| | | |

| NVIT Columbia Overseas Value Fund: Fund Summary |

| | | |

| | 9) Comment: Please amend the Fund’s objective to read “capital appreciation and current income” rather than “capital appreciation and/or current income.” By |

U.S. Securities and Exchange Commission

Page 5

| | definition, a total return investment objective seeks both capital appreciation and current income. As a result, a fund seeking one or the other is not a total return fund. |

| | | |

| | Response: Registrant respectfully declines to revise the Fund’s investment objective. Registrant believes that the Fund’s investment objective is accurate as written, as the Fund’s investment objective seeks to maximize total return through a flexible combination of capital appreciation and/or current income. |

| | | |

| | 10) Comment: With regard to the Fund’s “Fees and Expenses” table, please include the expense reimbursement information required by Form N-1A, Item 3, Instruction 3(e) when Registrant submits revised fee tables via EDGAR correspondence, pursuant to Comment 2. |

| | | |

| | Response: Registrant confirms that it is has provided the Fund’s updated and revised Fees and Expenses table in response to Comment 2. Registrant confirms that the Fees and Expenses table complies with Form N-1A Item 3. |

| | | |

| | 11) Comment: With regard to the reference to depositary receipts in the “Principal Investment Strategies” summary section, please indicate the types of depositary receipts that are principal to the Fund’s strategies (e.g., ADRs, GDRs, EDRs) and if such instruments may be unsponsored, so state. Additionally, add corresponding risk disclosure to Items 4 and 9. |

| | | |

| | Response: Registrant submits that the requested disclosure regarding depositary receipts is already a part of the discussion of “Foreign securities risk” disclosure under “Risks of Investing in the Fund” on page 117 of the prospectus. |

| | | |

| | 12) Comment: With regard to the statement, “The Fund may have significant investments in one or more countries or in particular sectors” in the “Principal Investment Strategies” summary section, if the Fund is significantly invested in this manner at present, please disclose the applicable sectors or countries. |

| | | |

| | Response: Registrant respectfully declines to revise its disclosure as it believes the current disclosure is satisfactory. Registrant notes that specific sector concentration may vary significantly from period to period as the investment process does not predict holdings by sector. Additionally, Registrant believes that specific sector disclosure may not accurately reflect the principal investment strategy of the Fund, as the sectors may change from time to time. |

| | | |

| | 13) Comment: With regard to the reference to derivatives in the “Principal Investment Strategies” summary section, please state how derivatives are valued for purposes of the Fund’s 80% test (e.g. notional or market value). Additionally, the Staff notes that the disclosure just says the Fund “may invest in derivatives such as…” Please be advised that Item 4 and 9 strategy discussions must specifically indicate each type of derivative instrument the Fund intends to use as principal means of achieving its investment |

U.S. Securities and Exchange Commission

Page 6

| | objective. Please apply this comment comprehensively across all Funds to the extent applicable. |

| | | |

| | Response: Registrant believes that the use of notional value may be an appropriate measure of the economic exposure of a fund in certain circumstances. Notwithstanding the foregoing, Registrant historically has not used, and currently does not intend to use, the type of derivatives instruments where such treatment would be appropriate. Accordingly, Registrant confirms that derivatives that provide economic exposure to assets that are consistent with its name will be valued at market value for purposes of measuring compliance with the noted 80% policy. |

| | | |

| | Additionally, Registrant believes that the Fund’s Item 4 strategies already indicates the types of derivative instruments that the Fund intends to use as principal means of achieving its investment objective. |

| | | |

| | 14) Comment: The narrative below the Highest/Lowest Quarters in the “Performance” section states, “The Fund had not commenced offering Class II or Class Y shares as of the date of this Prospectus.” If these shares are not offered, remove the corresponding reference throughout the filing. |

| | | |

| | Response: Registrant confirms that the Fund has not commenced offering Class II or Class Y shares of the prospectus. Registrant respectfully declines to remove the corresponding reference throughout the filing as Registrant has previously and properly registered such shares of the Fund through its registration statement. Registrant is also not aware of any law or regulation that would require the Fund to remove such reference. Should Registrant make future changes to the share class structure that would be considered a material amendment to the registration statement, Registrant otherwise confirms that it intends to file an amendment to the registration statement under Rule 485(a) under the Securities Act of 1933. |

| | | |

| NVIT Mellon Dynamic U.S. Equity Income Fund: Fund Summary |

| | | |

| | 15) Comment: With regard to the reference to the Russell 1000® Value Index in the “Principal Investment Strategies” summary section, it is unclear whether the Fund is targeting the capitalization range of the Index. If so, please state this expressly and provide the capitalization range of the Index as of a date reasonably appropriate based on the effective date of the Prospectus. If not, please clarify the disclosure. |

| | | |

| | Response: Registrant submits that while the Fund seeks to provide investors with capital appreciation, and secondarily current income, by outperforming the Russell 1000® Value Index over a full market cycle while maintaining a similar level of market risk as the Index, the Fund does not seek to specifically target the capitalization range of the Index as a principal investment strategy. Registrant has revised its Item 9 “Key Terms” disclosure to include the capitalization range of the Index. |

U.S. Securities and Exchange Commission

Page 7

| | 16) Comment: The initial paragraph of the “Principal Investment Strategies” summary section is jargon heavy and unnecessarily difficult to understand. As such, please define the terms “full market cycle” and “equity-like level of volatility” which appear in first and second sentences respectively. |

| | | |

| | Response: Registrant respectfully maintains that the term "full market cycle" describes the general cyclical nature of securities markets, which alternate between "appear[ing] favorable" and "appear[ing] to be unfavorable" (fifth paragraph under "Principal Investing Strategies") and may go up or down in value (see "market and selection risks"). Additionally "equity-like level of volatility" is defined under "equity securities risk" (i.e., "markets are volatile . . . [t]he price of an equity security fluctuates . . ."). Registrant believes that these concepts are discussed in reasonable and satisfactory detail. As a result, Registrant respectfully declines to amend its current disclosure. |

| | | |

| | 17) Comment: The penultimate sentence of the first paragraph of the “Principal Investment Strategies” summary section describes the Fund’s allocation strategy in terms of abstract market concepts and complex investment instruments with little to no explanation. Please consider stating the relationship between the allocation strategy and the equity and bond indices’ performance in one sentence and identify the types of futures and options the subadviser uses for this purpose in a separate sentence. |

| | | |

| | Response: Registrant respectfully declines to revise its disclosure as it believes that these concepts are further discussed and explained in the paragraphs following the sentence in question of the “Principal Investment Strategies” summary section. |

| | | |

| | 18) Comment: With regard to the reference to initial public offerings (IPOs) in the “Principal Investment Strategies” summary section, if investing in IPOs is a principal strategy, please state this more definitively, otherwise delete the reference. |

| | | |

| | Response: Registrant notes that the Fund may invest in IPOs, but is not obligated to do so. As such, Registrant respectfully declines to revise its disclosure as it believes the current disclosure is satisfactory. |

| | | |

| | 19) Comment: With regard to the reference to “sector weightings and risk characteristics generally similar to those of the Russell 1000® Value Index” in the “Principal Investment Strategies” summary section, please delete the word “generally” and clarify what “sector weightings and risk characteristics similar to those of the Russell 1000® Value Index” means. |

| | | |

| | Response: Registrant notes that the word “generally” was intentionally included in the Fund’s disclosure to give the Fund flexibility to invest in sectors outside of the Russell 1000® Value Index. Additionally, Registrant notes that the Fund’s Item 9 strategy section discloses the Index’s sector weightings. |

U.S. Securities and Exchange Commission

Page 8

| | 20) Comment: With regard to the reference to the Fund’s sector focus relative to the Russell 1000® Value Index in the “Principal Investment Strategies” summary section, if the Fund may emphasize sectors counter to the Index, please state this explicitly and in the Item 9 strategy explain more fully the factors the subadviser will use to inform this decision. |

| | | |

| | Response: Registrant respectfully refers the Staff to the response to comment 12 above. |

| | | |

| | 21) Comment: With regard to the statement “The Fund’s subadviser employs a value style of investing focusing on dividend-paying stocks and other investments and investment techniques that provide income” in the “Principal Investment Strategies” summary section, if principal, please clarify the reference to “other investments and investment techniques that provide income”, otherwise delete. |

| | | |

| | Response: Registrant notes that while such “other investments and investment techniques” are not, by themselves, principal strategies of the Fund, the ability to use them in conjunction with “a value style of investing focusing on dividend-paying stocks” is, and therefore Registrant respectfully declines the request to delete the applicable reference. Registrant does not specify the other types of investments and investment techniques that provide income, which provides the subadviser with the flexibility to choose the types of investments under varying market conditions. Registrant notes that Form N-1A, Item 9(b)(2) requires that the Fund explain in general terms how the Fund’s adviser decides which securities to buy and/or sell, which Registrant does not believe includes discussing the specific criteria the subadviser applies in this regard. |

| | | |

| | 22) Comment: With regard to the reference to covered call options in the “Principal Investment Strategies” summary section, in the corresponding Item 9 strategy, explain the criteria the subadviser applies to select a covered call option “to enhance returns and/or to limit volatility.” |

| | | |

| | Response: Registrant respectfully declines to revise its disclosure as it believes the current disclosure is satisfactory. Registrant notes that Form N-1A, Item 9(b)(2) requires that the Fund explain in general terms how the Fund’s adviser decides which securities to buy and/or sell, which Registrant does not believe includes discussing the specific criteria the subadviser applies in this regard. |

| | | |

| | 23) Comment: With regard to the reference that “the subadviser may adjust the Fund’s overall equity exposure within a range of 80%-150% of the Fund’s net assets” in the “Principal Investment Strategies” summary section, please add disclosure distinguishing between equity exposure in this context and the 80% requirement under Rule 35d-1. Please explain how compliance with each 80% policy is determined and highlight any differences in 80% calculations and the particular investments that count under each policy (e.g. explain that the purposes of the Fund’s 80% investment in equities, 80% means 80% of the Fund’s net assets plus borrowing for investment purposes). Additionally, please explain that for purposes of calculating compliance with this |

U.S. Securities and Exchange Commission

Page 9

| | requirement, the Fund will include convertible debt instruments in the 80% bucket only where they are immediately convertible into equities (i.e. in the money). Furthermore, please clarify that for purposes of complying with the bottom end of the Fund’s equity exposure range, equity exposure is a broader term than “equity” and may include, for example, convertible debt instruments that are not in the money. |

| | | |

| | Response: Registrant directs the SEC staff to the disclosure in the prospectus as set forth in the principal investment strategies, which states that, “The Fund invests, under normal circumstances, at least 80% of its net assets in equity securities of U.S. issuers, primarily common stocks. Equity securities also may include preferred stocks, convertible securities and derivatives the value of which are linked to equity securities of U.S. issuers.” |

| | | |

| | Registrant further directs the SEC staff to the disclosure in the prospectus as set forth later in the principal investment strategies, which states, “By combining equity securities, futures on stock and bond indexes, call options and money market instruments in varying amounts, the subadviser may adjust the Fund’s overall equity exposure within a range of 80%–150% of the Fund’s net assets.” |

| | | |

| | Registrant notes that the two tests, as referenced above, are for different purposes, and which Registrant believes is already sufficiently described in the principal investment strategy of the prospectus. The first test is intended to comply with Rule 35d-1 and, in particular, with respect to both requirements for a fund with a name suggesting investments in certain investments and for a fund with a name suggesting investments in certain countries (i.e., U.S.). Registrant notes that, as set forth above, at least 80% of the Fund’s net assets will be in equity securities of U.S. issuers. Equity securities are defined as primarily common stocks, but may include preferred stocks, convertible securities and derivative the value of which are linked to equity securities of U.S. issuers. |

| | | |

| | The second test is an overall equity exposure test, which can be achieved by combining equity securities, futures on stocks and bond indexes, call options and money market instruments, in varying amounts. “Equity exposure,” for this purpose, and as suggested by use of the word “exposure,” is broader than the use of the term of “equity securities” as required under the Rule 35d-1 test. |

| | | |

| | In summary, the first test is on “equity securities” and the second test is on “equity exposure.” Each test may include the same investments for purposes of compliance with such test. Nevertheless, the first test is calculated based on “value” of the Fund’s net assets, as required under Rule 35d-1, and the second test is calculated based on “exposure” of the Fund’s net assets. As set forth in the principal investment strategies, the Fund may seek to achieve overall equity exposure as high as 150% through the use of leverage, while the Fund’s 80% test is limited to the Fund’s net assets. As discussed in response 13, derivatives that provide economic exposure to assets that are consistent with its name will be valued at market value for purposes of measuring compliance with the noted 80% policy. |

U.S. Securities and Exchange Commission

Page 10

| | Registrant does not believe that further inclusion of disclosure distinguishing between the value or exposure differences in calculating, repetitively, the first test on “equity securities” and the second test on “equity exposure” is necessary or helpful to shareholders, in consideration of existing disclosure, which includes terms such as “overall,” “exposure,” and “leverage,” and in consideration of General Instruction C (c) of Form N-1A (e.g., The prospectus should avoid: including lengthy legal and technical discussions). |

| | | |

| | Separately, Registrant confirms that the “convertible securities” included in the 80% basket will be immediately convertible and “in-the-money.” |

| | | |

| | 24) Comment: With regard to the reference to “excess of amounts invested or borrowed” in “Leverage risk” in the “Principal Risks” summary section, please either delete the reference to amounts borrowed or insert “and borrowing for investment purposes” after “net assets” in the Fund’s 80% statement. |

| | | |

| | Response: Registrant has removed the term “or borrowed” from “Leverage Risk.” |

| | | |

| | 25) Comment: With regard to “Strategy risk” in the “Principal Risks” summary section, please recharacterize the second sentence in terms of investor risk rather than describing the investors for whom the strategy would not pose an inappropriate level of risk. |

| | | |

| | Response: Registrant respectfully declines to revise its disclosure as it believes the current disclosure is satisfactory. |

| | | |

| | 26) Comment: With regard to “Convertible securities risk” in the “Principal Risks” summary section, if the Fund invests or expects to invest in contingent convertibles (CoCos), supplementally confirm that CoCos are not integral to the Fund’s principal strategy or, alternatively, add appropriate disclosure in both strategy and risk descriptions here and in Item 9. |

| | | |

| | Response: Registrant supplementally confirms that the Fund will not invest in CoCos as a principal strategy and therefore believes no revisions are required. |

| | | |

| | 27) Comment: With regard to the reference to “longer-term maturities” in “Fixed-income securities risk” in the “Principal Risks” summary section, as this is an equity fund, please review and tailor the fixed income risk summary as appropriate. Please also consider revising the sentence “To the extent the Fund invests a substantial portion of its assets in debt securities”, as it seems inconsistent for an equity fund. |

| | | |

| | Response: Registrant notes that “Fixed-income securities risk” has been modified for its equity funds and does not believe additional revisions are required. Registrant also confirms that “substantial” is less than 20% in consideration of the Fund’s 80% requirement to invest in equity securities. |

U.S. Securities and Exchange Commission

Page 11

| | 28) Comment: With regard to the reference to “significant positions in cash or money market instruments” in “Cash position risk” in the “Principal Risks” summary section, in an appropriate location in the Registration Statement, please disclose what constitutes “significant position”. |

| | | |

| | Response: Registrant believes that disclosing a specific percentage would not be helpful to shareholders. Registrant believes that the use of the term “significant position” is satisfactory and reflects an appropriate amount of specificity as it is intended to preserve the level of discretion necessary to manage the Fund. |

| | | |

| | 29) Comment: Please supplementally explain how the Fund will comply with the Rule 35d-1 80% requirement in rising markets, if the Fund will increase its cash holdings relative to the holdings that satisfy the 80% requirement. |

| | | |

| | Response: Registrant will ensure at least 80% of its net assets will be invested pursuant to its 80% policy. The Fund does not intend to increase its cash positions in rising markets, rather the risk reflects holding cash in a rising market. |

| | | |

| | 30) Comment: The narrative below the Highest/Lowest Quarters in the “Performance” section states “The Fund has not commenced offering Class Y shares as of the date of this Prospectus.” If these shares are not offered, remove the corresponding reference throughout the filing. |

| | | |

| | Response: Registrant respectfully refers the Staff to the response to comment 14 above. |

| | | |

| NVIT Newton Sustainable U.S. Equity Fund: Fund Summary |

| | | |

| | 31) Comment: With regard to the last sentence in footnote 2 to the “Fees and Expenses” table, for clarity please insert “after reimbursement is taken into account” between the word “unless” and the colon before subparagraph (i). |

| | | |

| | Response: Registrant respectfully declines to make the requested revisions as it submits the language is sufficiently clear as written. |

| | | |

| | 32) Comment: With regard to the Fund’s 80% policy, given that “sustainable” is in its name, an 80% policy with respect to investing in ESG issuers is also required. Please revise or supplement the current 80% statement to disclose that the Fund also must invest at least 80% of its net assets, plus borrowings for investment purposes, in issuers that meet the subadviser’s particular criteria for identifying corporate, environmental, social, and governance policies that are considered sustainable. |

| | | |

| | Response: Registrant respectfully submits that an 80% test is not required under Rule 35d-1, because the word “Sustainable,” as used in the Fund’s name, refers to an investment strategy rather than a type of investment. Registrant notes that Rule 35d-1 |

U.S. Securities and Exchange Commission

Page 12

| | does not apply to a fund name that connotes a type of investment strategy. See Investment Company Names, Investment Company Act Rel. No. 24828 (Jan. 17, 2001); see also Frequently Asked Questions about Rule 35d-1 (Investment Company Names) (hereinafter FAQ), at Question 9, available at www.sec.gov/divisions/investment/guidance/rule35d-1faq.htm. |

| | | |

| | Registrant therefore respectfully declines to add “sustainable” to its 80% policy, because such adjective is a strategy of the Fund, rather than a “type of investment.” |

| | | |

| | 33) Comment: With regard to the Fund’s ESG criteria, as described in the “Principal Investment Strategies” summary section, the first prong of the criteria states that the subadviser considers a company to be engaged in sustainable business practices “if the company engages in such practices in an economic sense (i.e., strategy, operations, finances durable)”. As drafted, the description of sustainability in an economic sense is inconsistent with the common understanding of ESG sustainability and could be misleading. As such, explain this factor more fully. Disclose, for example, any criteria for the type of business in which a company may be engaged or any restrictions prohibiting investment in companies within certain industries (e.g., coal, gun manufacturers, etc.). |

| | | |

| | Response: Registrant respectfully submits that sustainability is commonly understood to refer to an investment strategy that considers such factors as the environmental, social and governance practices of issuers. One form of ESG sustainability is an exclusionary strategy (i.e., one where investments are evaluated based on a negative screen that excludes certain companies). Another common form of ESG sustainability is an integration strategy (i.e., one where investments are evaluated based on fundamental research and analysis that typically involves the assessment of a variety of factors, and may include the company’s business environment, management quality, balance sheet, income statement, anticipated earnings, revenues and dividends, and environmental, social and/or governance (ESG) factors). Registrant believes that the description of sustainability in an economic sense is therefore not inconsistent with the common understanding of ESG sustainability. As such, Registrant respectfully declines to revise its disclosure as it believes the current disclosure is satisfactory, and which, in fact, accurately describes the strategy of the subadviser. |

| | | |

| | 34) Comment: With regard to the Fund’s ESG criteria, as described in the “Principal Investment Strategies” summary section, the second prong of the criteria states that the subadviser considers a company to be engaged in sustainable business practices if the company “takes appropriate measures to manage any material consequences or impact of their policies and operations in relation to ESG matters (e.g., the company’s environmental footprint, labor standards, board structure, etc.).” In the Item 4 summary, provide a clearer explanation of the level of discretion the subadviser exercises in this analysis and what boundaries apply to the universe of investment. For example: (i) Does the subadviser rely on an ESG rating system? (ii)Is it proprietary or developed by a third party? (iii) Does the subadviser use particular industry standards for identifying |

U.S. Securities and Exchange Commission

Page 13

| | “material consequences” or defining “ESG matters”? (iv) Does the subadviser require companies to have specific types of policies or operations to fall within the universe of potential investment? (v) Can the Fund invest in companies that are considered (rated) “neutral” in terms of ESG impact? |

| | | |

| | Response: Registrant believes that the current disclosure in the “Principal Investment Strategies” summary section is satisfactory and reflects an appropriate amount of specificity as it is intended to preserve the level of discretion necessary to manage the Fund. Additionally, Registrant refers the Staff to the second to last paragraph in the “Principal Investment Strategies” summary section, which already refers to the use of the subadviser’s proprietary ESG quality review to consider a potential investment’s valuation. Accordingly, Registrant respectfully declines to make the requested changes. |

| | | |

| | 35) Comment: With regard to the Fund’s ESG criteria, as described in the “Principal Investment Strategies” summary section, the criteria also notes that the subadviser may invest in companies where it believes it can promote sustainable business practices through, among other things, active proxy voting. As is described more fully in Item 9, please clarify here that the Fund will not invest in companies that the subadviser deems to have material ESG issues it believes cannot be resolved through shareholder engagement. |

| | | |

| | Response: Registrant respectfully submits that the subadviser does not utilize an exclusionary strategy (i.e., one where investments are evaluated based on a negative screen that excludes certain companies). Registrant believes that the current disclosure in the “Principal Investment Strategies” summary section is satisfactory and reflects an appropriate amount of specificity as it is intended to preserve the level of discretion necessary to manage the Fund. Accordingly, Registrant respectfully declines to make the requested changes. |

| | | |

| | 36) Comment: With regard to the reference in the “Principal Investment Strategies” summary section that the Fund may also invest up to 20% of its net assets in stocks of foreign companies, including up to 10% of its net assets in the securities of issuers in emerging market companies, please clarify how the foreign and emerging market strategies are aligned with the Fund’s objective. |

| | | |

| | Response: Registrant submits that there are no geographic constraints to the Fund’s sustainability strategy and therefore Registrant does not believe that special clarification is necessary other than noting that the Fund may also invest up to 20% of its net assets in stocks of foreign companies, including up to 10% of its net assets in the securities of issuers in emerging market countries. As a result, Registrant respectfully declines to revise its disclosure. |

| | | |

| | 37) Comment: In the fourth paragraph of the “Principal Investment Strategies” summary section, please remove the first sentence, which states “The subadviser’s investment philosophy is the belief that no company market or economy can be |

U.S. Securities and Exchange Commission

Page 14

| | considered in isolation: each must be understood in a global context” as this sentence does not relate to the Fund’s principal ESG or U.S. equity strategies. Instead, this language may be included in Item 9. Additionally, please consider rewriting the second sentence to describe the “global context” in language that is less academic and more practical so it is easier to understand. |

| | | |

| | Response: Registrant believes that the sentence indicated by the Staff introduces the concepts discussed later in that paragraph. Nevertheless, Registrant agrees to remove the sentence in the Principal Investment Strategies summary section as the removal of the sentence does not detract from the reader’s understanding of the subadviser’s process. Registrant further believes that the inclusion of the sentence in the Item 9 disclosure provides additional context around the meaning of “global context” and therefore respectfully submits that no further revisions are necessary. |

| | | |

| How the Funds Invest: NVIT AllianzGI International Growth Fund |

| | | |

| | 38) Comment: With regard to the last paragraph of the “Principal Investment Strategies” section that states “Although the Fund does not invest in derivatives as a principal strategy…”, as the Fund does not invest in derivatives as a principal strategy, the Staff is puzzled that the Fund’s use of derivatives is disclosed in the last paragraph under the heading “Principal Investment Strategies”. The information is useful disclosure and appropriate in Item 9, however, it should not be presented under this heading or in between descriptions of strategies that are principal. Please insert an appropriate heading and put this language under it. |

| | | |

| | Response: Registrant submits that the disclosure itself states that it is a non-principal strategy and therefore respectfully declines to revise its disclosure as a header. |

| | | |

| How the Funds Invest: NVIT Newton Sustainable U.S. Equity Fund |

| | | |

| | 39) Comment: With regard to the statement in the “Principal Investment Strategies” section that states “The subadviser assigns an ESG quality review rating to a company based on a proprietary quality review…”, what role does the ESG quality review rating play in the subadviser’s buy and sell decisions? Please explain more clearly how the subadviser uses the ratings in the selection process. |

| | | |

| | Response: Registrant believes that the current disclosure in the “Principal Investment Strategies” summary section is appropriate and reflects an appropriate amount of specificity as it is intended to preserve the level of discretion necessary to manage the Fund. Registrant believes that the current disclosure is sufficiently clear as to how the proprietary system works. |

| | | |

| | 40) Comment: With regard to the statement “unresolvable ESG issue, profit-taking…” in the last paragraph of the “Principal Investment Strategies” section, please clarify how the subadviser determines that a material ESG issue is unresolvable and cannot be |

U.S. Securities and Exchange Commission

Page 15

| | corrected through ongoing company engagement and active proxy voting. Also, in the same sentence, explain the “profit-taking” reference more clearly. |

| | | |

| | Response: Registrant respectfully submits that the disclosure already identifies examples of when the subadviser may determine a material ESG issue is unresolvable and cannot be corrected through ongoing operating company engagement and active proxy voting. |

| | | |

| | Nonetheless, Registrant agrees to the following underlined change: |

| | | |

| | The Fund will not invest in companies that the subadviser, based on its proprietary ESG quality review, deems to have material ESG issues (which could involve a company’s environmental footprint, labor standards or board structure) that the subadviser believes are unresolvable (i.e., that cannot be corrected through ongoing company engagement and active proxy voting). |

| | | |

| Risks of Investing in the Funds |

| | | |

| | 41) Comment: With regard to “Fixed-income securities risk”, as this is a principal risk only for the NVIT Mellon Dynamic U.S. Equity Income Fund; a number of the sub-risk descriptions address concerns specific to investments in junk bonds. As the NIVT Mellon Dynamic U.S. Equity Income Fund does not mention investing in junk bonds as a principal investment strategy, please reconcile the discrepancy. If appropriate, add junk bond disclosure to the principal strategies and risks, otherwise delete the references. |

| | | |

| | Response: Registrant notes that the reference to “junk bonds” is used only in the context of describing the difference in credit ratings. The Fund does not invest in junk bonds as a principal strategy. |

| | |

| Statement of Additional Information |

| | | |

| | 42) Comment: In the “Portfolio Turnover” section, it appears that the NVIT Newton Sustainable U.S. Equity Fund was omitted from the table indicating any significant variations in the Funds’ portfolio turnover rate for the fiscal years ended December 31, 2019 and 2018. Please revise or explain. |

| | | |

| | Response: Registrant submits that this table has been updated as part of the 485(b) filing and is now accurate as presented. |

| | | |

| | 43) Comment: In the “Securities Lending Agent” section, it appears that the NVIT Newton Sustainable U.S. Equity Fund was omitted from the table indicating income earned by Funds that engaged in securities lending. Please revise or explain. In addition, please review the Registration Statement in its entirety for similar omissions and, if necessary, revise. |

| | | |

| | Response: Registrant submits that this table has been updated as part of the 485(b) filing and is now accurate as presented. Registrant additionally submits that it has reviewed its |

U.S. Securities and Exchange Commission

Page 16

| | | |

| | Registration Statement in its entirety and believes the 485(b) filing is accurate as presented. |

U.S. Securities and Exchange Commission

Page 17

In connection with the Registrant’s responses to the SEC staff’s comments on the Registration Statement, as requested by the Staff, the Registrant acknowledges that the Registrant is responsible for the adequacy of the disclosure in the Registrant’s filings, notwithstanding any review, comments, action, or absence of action by the Staff.

Please do not hesitate to contact me at (202) 419-8402 or Jessica D. Burt at (202) 419-8409, if you have any questions or wish to discuss any of the responses presented above.

| | | | | | | Respectfully submitted, |

| | | | | | | |

| | | | | | | |

| | | | | | | /s/ Christopher J. Zimmerman

|

| | | | | | | Christopher J. Zimmerman, Esquire |

| | |

| | |

| cc: | Allan J. Oster, Esquire |

| | Prufesh R. Modhera, Esquire |

| | Jessica D. Burt, Esquire |

| | Michael E. Schapiro, Esquire |

U.S. Securities and Exchange CommissionPage 18

Exhibit A

U.S. Securities and Exchange Commission

Page 19

U.S. Securities and Exchange Commission

Page 20

U.S. Securities and Exchange Commission

Page 21