| Stradley Ronon Stevens & Young, LLP 2000 K Street, N.W., Suite 700 Washington, D.C. 20006 Telephone 202-822-9611 Fax 202-822-0140 www.stradley.com |

| | |

Christopher J. Zimmerman, Esq.

(202) 419-8402

czimmerman@stradley.com

March 17, 2021

VIA EDGAR

U.S. Securities and Exchange Commission

Division of Investment Management

100 F Street, N.E.

Washington, D.C. 20549-9303

| Attention: | | Ms. Rebecca Marquigny, Esquire |

| | | | |

| | | Re: | Nationwide Variable Insurance Trust |

| | | | File Nos. 811-03213 and 002-73024

|

Dear Ms. Marquigny:

On behalf of Nationwide Variable Insurance Trust (the “Registrant”) and its series the NVIT Defender S&P 500® 1-Year Buffer Fund Jan, NVIT Defender S&P 500® 1-Year Buffer Fund Feb, NVIT Defender S&P 500® 1-Year Buffer Fund Mar, NVIT Defender S&P 500® 1-Year Buffer Fund Apr, NVIT Defender S&P 500® 1-Year Buffer Fund May, NVIT Defender S&P 500® 1-Year Buffer Fund June, NVIT Defender S&P 500® 1-Year Buffer Fund July, NVIT Defender S&P 500® 1-Year Buffer Fund Aug, NVIT Defender S&P 500® 1-Year Buffer Fund Sept, NVIT Defender S&P 500® 1-Year Buffer Fund Oct, NVIT Defender S&P 500® 1-Year Buffer Fund Nov, NVIT Defender S&P 500® 1-Year Buffer Fund Dec, NVIT Defender S&P 500® 5-Year Buffer Fund Q1, NVIT Defender S&P 500® 5-Year Buffer Fund Q2, NVIT Defender S&P 500® 5-Year Buffer Fund Q3 and NVIT Defender S&P 500® 5-Year Buffer Fund Q4 (the “Funds”), below you will find the Registrant’s responses to the comments conveyed by you on January 7, 2021 with regard to Post-Effective Amendment No. 242 (the “Amendment”) to the Registrant’s registration statement on Form N-1A. The Amendment was filed with the U.S. Securities and Exchange Commission (the “SEC”) on November 13, 2020, pursuant to the Investment Company Act of 1940, as amended, and Rule 485(a)(2) under the Securities Act of 1933, as amended (the “Securities Act”).

Below we have provided your comments and the Registrant’s response to each comment. These responses will be incorporated into a post-effective amendment filing to be made pursuant to Rule 485(b) of the Securities Act (“Registration Statement”). Capitalized terms not otherwise defined in this letter have the meanings assigned to the terms in the Registration Statement.

U.S. Securities and Exchange Commission

Page 2

PROSPECTUS

|

| | | |

| General |

| | | |

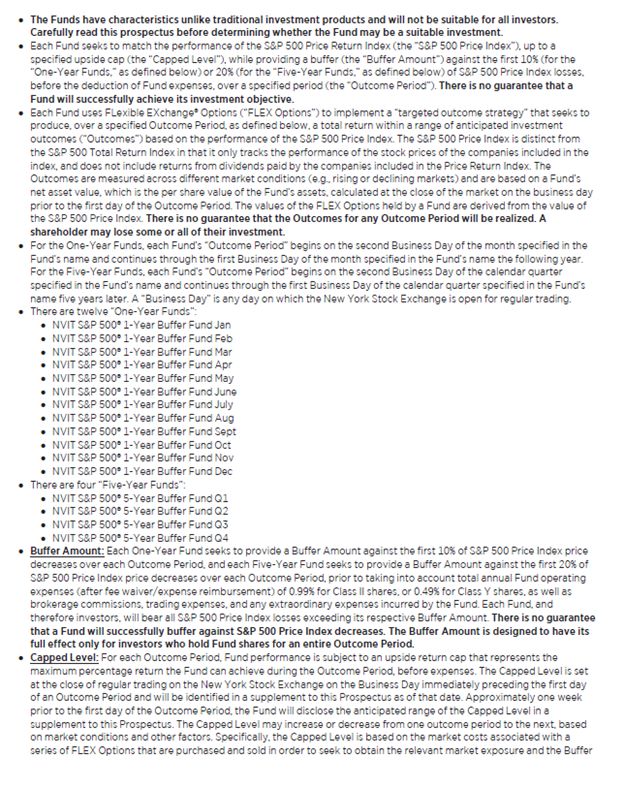

| | 1) Comment: Since defined outcome funds pose unique risks, the Staff requires defined outcome funds to include risk disclosure on the Prospectus and Summary Prospectus cover pages. We note that the cover page of the Prospectus has neither the standard risk disclosure bullet points nor the suitability/unsuitability disclosure that the Staff has required of similarly situated S&P 500 buffer funds. Please provide the cover page disclosures highlighting investment concerns raised by these funds, including suitability risks. |

| | | |

| | Specifically, please: (1) define the cap in terms of percentage both before and after fees and expenses; (2) define the buffer percentage after fees and expenses; (3) define the outcome period from the start date to the end date; (4) disclose that specified outcomes may not be achieved and investors may lose some or all of their investment; (5) clearly and prominently state that the Funds only provide the specified outcome if an investor buys on the first day of the period and holds until the end of the period; (6) disclose that if investors buy or sell on a date other than the start or end date, their returns will be different and they may incur losses that are greater than the floor or buffer;(7) explain how investors may obtain the current return profile for the Funds through the end of the outcome period; (8) state that the cap and the buffer will likely change each year (or five years) on the specified reset date; and, if applicable, (9) identify the related website where current information may be available. Supplementally provide the Staff with a screenshot example of the related website so that the Staff can determine if more comments are needed. |

| | | |

| | Response: Registrant has revised the summary and statutory prospectuses to include the requested cover page disclosure, and a draft of each is attached for reference (although information with respect to the Capped Level is currently unstated for the reasons discussed in the response to comment 4; instead, the Capped Level will be disclosed via supplement in the multi-step process described in the response to comment 7 below). Registrant further notes that the related website is currently under development and Registrant will inform the Staff once publicly available. |

| | | |

| | 2) Comment: The Staff is concerned that the term “defender” in the Funds’ name is not appropriate because the Funds are not providing safety and protection from loss to all investors or in all circumstances. While the buffer may provide a partial loss protection by the use of options, we believe that the Funds’ names should be changed to prevent the misperception that investors are defended against loss. Therefore, please remove “defender” from the Funds’ names or qualify the term in the Funds’ names. In addition, because these Funds have both a buffer and a cap, we believe the Funds’ names should reflect both features and reference the cap as well as the buffer. Please refer to IM Guidance Update No. 2013-12 and respond via EDGAR with the new name proposal. |

U.S. Securities and Exchange Commission

Page 3

| | Response: Registrant has considered the SEC staff’s comment and has determined to remove the reference to “Defender” from each Fund’s name. |

| | | |

| | The new names of the Funds are: NVIT S&P 500® 1-Year Buffer Fund Jan, NVIT S&P 500® 1-Year Buffer Fund Feb, NVIT S&P 500® 1-Year Buffer Fund Mar, NVIT S&P 500® 1-Year Buffer Fund Apr, NVIT S&P 500® 1-Year Buffer Fund May, NVIT S&P 500® 1-Year Buffer Fund June, NVIT S&P 500® 1-Year Buffer Fund July, NVIT S&P 500® 1-Year Buffer Fund Aug, NVIT S&P 500® 1-Year Buffer Fund Sept, NVIT S&P 500® 1-Year Buffer Fund Oct, NVIT S&P 500® 1-Year Buffer Fund Nov, NVIT S&P 500® 1-Year Buffer Fund Dec, NVIT S&P 500® 5-Year Buffer Fund Q1, NVIT S&P 500® 5-Year Buffer Fund Q2, NVIT S&P 500® 5-Year Buffer Fund Q3 and NVIT Defender S&P 500® 5-Year Buffer Fund Q4. |

| | | |

| | While Registrant has agreed to remove the name “Defender,” Registrant respectfully declines to include the term “Cap” in each Fund’s name. Registrant notes a Fund’s name is not intended to encapsulate the entirety of the Fund’s operations and that the disclosure throughout the prospectus, as well as the inclusion of the requested cover page language, clearly describes the Capped Level and other material information in detail. Registrant also notes that it is aware of other similar funds that do not include the term “Cap” as part of the fund’s name and Registrant does not want to be at a competitive disadvantage by using a name not used by other similar funds. |

| | | |

| | 3) Comment: Currently, the Funds’ names only include “S&P 500”; however, the Funds actually seek to match the S&P 500 Price Return Index. To prevent investor confusion and to ensure the appropriate comparison, please modify the Funds’ names to more accurately reflect the index the Funds will track. |

| | | |

| | Response: Registrant has considered the comment and respectfully declines to revise each Fund’s name to include reference to “Price Return.” |

| | | |

| | The S&P500® includes various indexes that are either based on (1) Total Return, (2) Price Return, or (3) Net Total Return. Each index has the same methodology construction, including with respect to the eligible universe, market capitalization, and public float. Nevertheless, the performance of each may differ as the Total Return includes the before tax reinvestment of dividends, interest, rights offering, and other distributions. Funds that track the S&P500® Total Return Index typically do not include “Total Return” in their names. Likewise, Registrant does not believe the Funds are required to include “Price Return” in their name. |

| | | |

| | Registrant believes that the disclosure in the prospectus clearly describes that each Fund seeks to approximate the performance of the S&P 500® Price Return Index. Registrant also notes that it is aware of other similar funds that do not include the term “Price Return” as part of the fund’s name and Registrant does not want to be at a competitive disadvantage by using a name not used by other similar funds. |

U.S. Securities and Exchange Commission

Page 4

| | 4) Comment: Please restate the Funds’ investment objective to include the upside cap percentage, the buffer percentage, and the Funds’ outcome period. For example, “The Fund seeks to provide investors with returns that match those of the S&P 500 Price Return Index up to the upside cap of X% (prior to taking into account management and other fees) and Y% (after taking into account management and other fees) while providing a buffer against the first X% of [index name] losses over the period from the second business day of January to the first business day of January the following year.” |

| | | |

| | Response: As requested, the Registrant has restated each Fund’s investment objective as follows (using the NVIT S&P 500® 1-Year Buffer Fund Jan as an example): |

| | | |

| | | The NVIT S&P 500® 1-Year Buffer Fund Jan seeks to match the performance of the S&P 500 Price Return Index (the “S&P 500 Price Index”), up to a specified upside cap (the “Capped Level”), while providing a buffer against the first 10% (the “Buffer Amount”) of S&P 500 Price Index losses, before the deduction of Fund expenses, over the period from the second business day of January to the first business day of January the following year. |

| | | |

| | Registrant respectfully declines to add the Capped Level percentage to the investment objective as the Capped Level cannot be determined and set until the business day immediately prior to the first day of an Outcome Period when the Fund purchases and sells a new set of FLEX Options for that Outcome Period. Registrant will supplement the prospectus with this information. |

| | | |

| | 5) Comment: Please add plain English disclosure explaining the applicable measuring period, valuation method, and buffer (e.g., “based upon the value of the index at the time the Fund entered into the FLEX Options on the first day of the target period”). Such disclosure should be included throughout the filing and on the Funds’ cover pages. |

| | | |

| | Response: Registrant has revised the first paragraph of each Fund as follows and included the following on the cover page (using the NVIT S&P 500® 1-Year Buffer Fund Jan as an example): |

| | | |

| | | The Fund uses FLexible EXchange® Options (“FLEX Options”) to implement a “targeted outcome strategy” that seeks to produce, over a specified Outcome Period, as defined below, a total return within a range of anticipated investment outcomes (“Outcomes”) based on the performance of the S&P 500 Price Return Index (the “S&P 500 Price Index”) , with limits on the Fund’s upside performance and constraints on the Fund’s downside loss. The S&P 500 Price Index is distinct from the S&P 500 Total Return Index in that it only tracks the performance of the stock prices of the companies included in the index, and does not include returns from dividends paid by the companies included in the Price Return Index. The Outcomes are measured across different market |

U.S. Securities and Exchange Commission

Page 5

| | | conditions (e.g., rising or declining markets) and are based on the Fund’s net asset value, which is the per share value of the Fund’s assets, calculated at the close of the market on the business day prior to the first day of the Outcome Period. The values of the FLEX Options held by the Fund are derived from the value of the S&P 500 Price Index. The Fund’s “Outcome Period” begins on the second Business Day in January and continues through the first Business Day in January the following year. A “Business Day” is any day on which the New York Stock Exchange is open for regular trading. |

| | | |

| | 6) Comment: The Prospectus indicates that the reference index for the Funds is the S&P 500 Price Return Index. We note that certain FLEX Options reference the S&P 500 Index through ETFs. In ETFs, the tracking index may not match the performance of the index exactly due to cash drag and differences between the portfolio of the ETF and the components of the index. Please confirm that the FLEX Options the Funds will purchase will replicate the index and the performance will correlate with the Funds’ reference to the S&P 500 Price Return Index or explain how a consistent trigger for the defined outcomes (i.e., cap and buffer) is possible. |

| | | |

| | Response: The Registrant confirms that it intends to only use FLEX Options that replicate the S&P 500® Price Return Index and the Funds’ performance will correlate to the S&P500® Price Return Index and not that of an ETF that tracks the Index. |

| | | |

| | 7) Comment: The Staff believes the cap, floors, and buffers are material product features that investors must know prior to making an informed investment decision. Please explain the Registrant’s process and timing for finalizing deal terms and updating disclosures to investors prior to the offer and sale of shares. |

| | | |

| | Response: Please see the response to comment 4. As noted, the Capped Level cannot be determined and set until the business day immediately prior to the first day of an Outcome Period when the Fund purchases and sells a new set of FLEX Options for that Outcome Period. The market costs associated with those purchases and sales determines the Capped Level. Once the Capped Level for the next Outcome Period is determined, the Capped Level will be disclosed on the Fund’s website and the Registrant will update the Fund’s Registration Statement to disclose the Capped Level via a Rule 497(e) filing. Each Fund expects to advise shareholders of the changed Capped Level at the conclusion of each Outcome Period in a multi-step process: |

| | | |

| | 1. | Approximately one week prior to the end of the current Outcome Period, the Fund will supplement the prospectus and post on its website to disclose the anticipated range of the Capped Level for the next Outcome Period. |

| | | |

| | 2. | Following the close of business on the business day immediately prior to the first day of the next Outcome Period, the Fund will supplement the prospectus and post |

U.S. Securities and Exchange Commission

Page 6

| | | on its website to disclose the Fund’s actual Capped Level for the next Outcome Period. |

| | | |

| Fees and Expenses (All Funds) |

| | | |

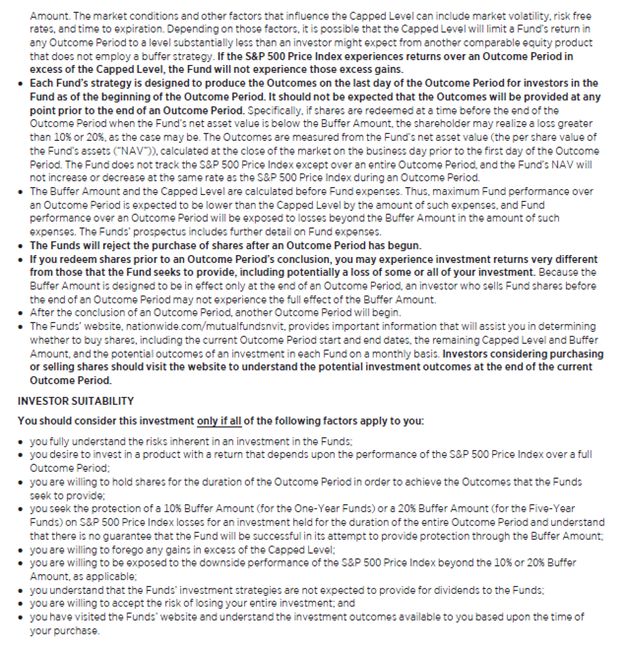

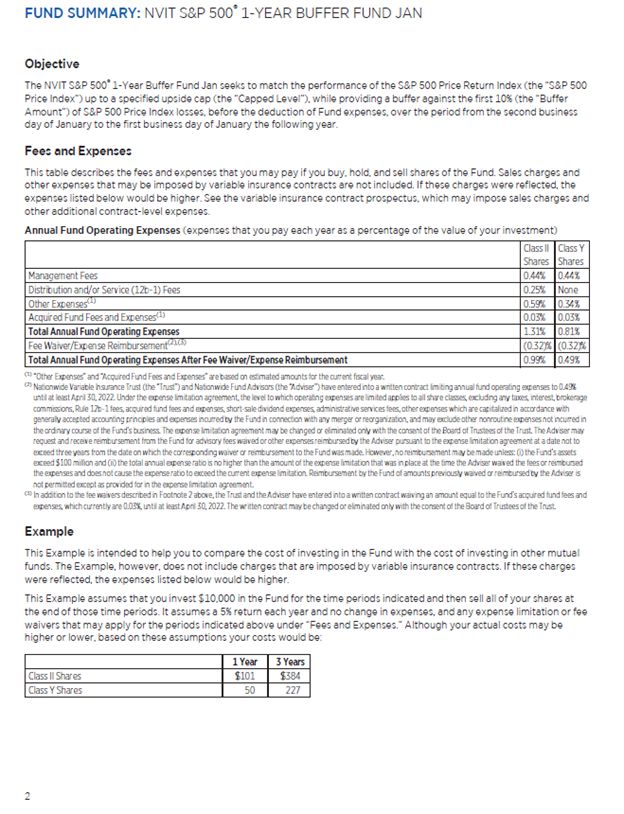

| | 8) Comment: In the preamble to the Fees and Expenses table, please clarify the reference to the variable insurance prospectus. Specifically, explain that the Funds can be purchased only as an underlying investment option under a variable insurance contract, which may impose sales charges and other additional contract-level expenses. |

| | | |

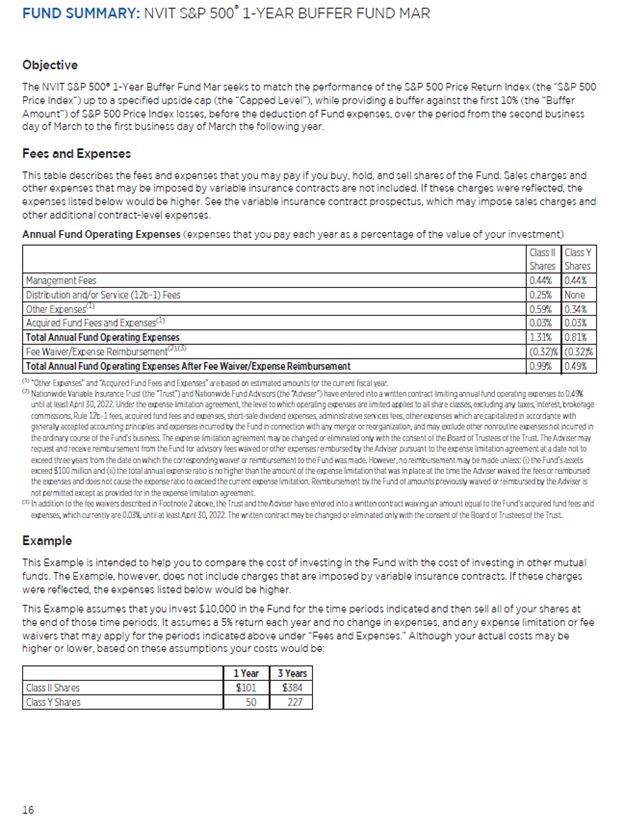

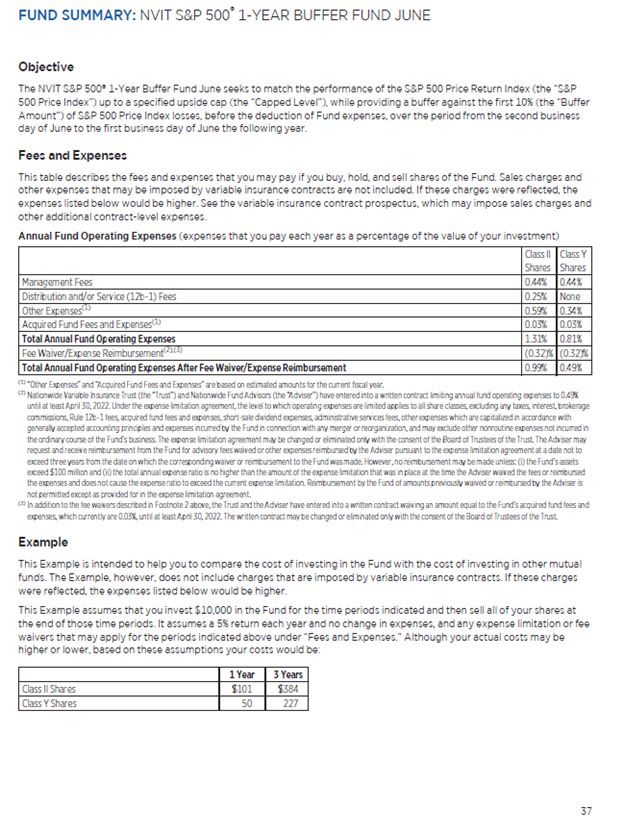

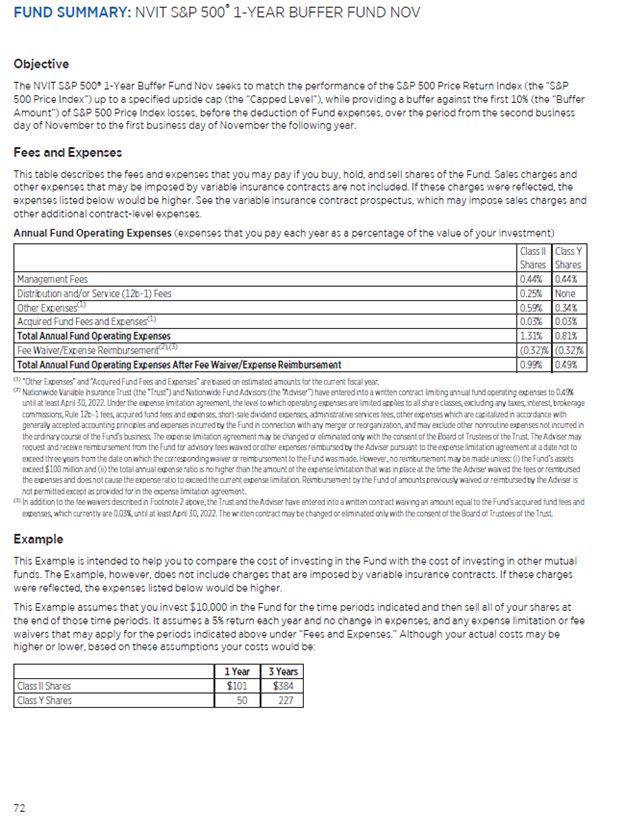

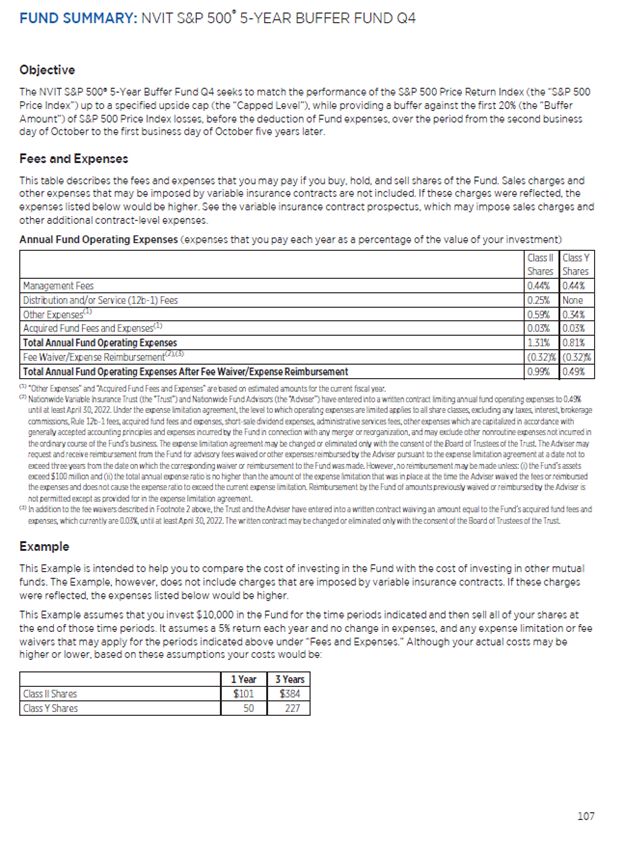

| | Response: Registrant has revised the last sentence in the first paragraph of the Fees and Expenses Table to state, “See the variable insurance contract prospectus, which may impose sales charges and other additional contract-level expenses.” |

| | | |

| | 9) Comment: It is the Staff’s understanding that both Class II and Class Y shares will be sold through variable product contracts, so please explain to the Staff the drivers behind the class differences in the Funds’ expense level with respect to “other expenses.” What does the additional 0.25% in other expenses provide the Class II shareholder? |

| | | |

| | Response: The difference in “Other Expenses” between the Funds’ Class II and Class Y shares is due to the 0.25% administrative services fee charged to Class II shares. These fees are paid by the Funds to insurance companies or their affiliates (including Nationwide Life Insurance Company) that provide administrative support services to variable insurance contract holders on behalf of the Funds. Class Y shares are sold to other mutual funds, such as funds-of-funds that invest in the Funds, and to separate accounts of insurance companies that do not seek administrative services fees. This information is disclosed in the prospectus in the “Investing with Nationwide Funds” section under “Choosing a Share Class” and “Distribution and Services Plans—Administrative Services Plan.” |

| | | |

| | 10) Comment: Since these are new Funds, please include a footnote to the fee table explaining that acquired fund fees and expenses are based on estimated amounts for the current fiscal year or explain why this footnote is not appropriate. |

| | | |

| | Response: Registrant has revised as requested. |

| | | |

| Example (All Funds) |

| | | |

| | 11) Comment: Please provide the expense example information that is currently missing as the Staff may have further comments. |

| | | |

| | Response: Registrant has included the final expense example in the Registration Statement, and it is attached for reference. |

| | | |

| Principal Investment Strategies (All Funds) |

U.S. Securities and Exchange Commission

Page 7

| | 12) Comment: The first line of the Funds’ strategy states that the Funds use a “targeted outcome strategy.” Please define the term “outcome,” as the term is used throughout the disclosure like a defined term. |

| | | |

| | Response: Registrant has revised as requested. Please see the response to comment 5. |

| | | |

| | 13) Comment: In the first line of the Funds’ strategy, please qualify the phrase “within a range of anticipated investment outcomes” so that investors understand that the range means limits on the Funds’ upside performance and constraints on downside loss. |

| | | |

| | Response: Registrant has revised as requested. Please see the response to comment 5. |

| | | |

| | 14) Comment: The first bullet point in the Funds’ strategy discusses the “Capped Level.” Please explain to the Staff whether the capped level will be made available to investors on the Funds’ website, and if so, when. Please provide the Staff with sample website disclosure. |

| | | |

| | Response: Registrant confirms that the Capped Level will be made available via a prospectus supplement on the Funds’ website and in accordance with the response to comment 7. |

| | | |

| | 15) Comment: The second bullet point in the Funds’ strategy states that if the S&P 500 Price Index experiences losses of 10% or less, “the Fund seeks to provide shareholders with a return of 0% prior to the deduction of Fund expenses. If the S&P 500 Price Index experiences losses over the Outcome Period of more than 10%, the Fund seeks to provide shareholders with a loss that is 10% less than the percentage amount of the loss on the S&P 500 Price Index.” As drafted, the reference to a return of 0% before the deduction of Fund expenses indicates a relationship between the Funds’ NAV and the reference index; however, the correlation is not expressed clearly. Is there a direct and consistent correlation between the Funds’ NAV and the movement of the reference index? If the Funds’ NAV will not necessarily decrease by the same percentage as the reference index, please explain this as well. |

| | | |

| | Response: Registrant refers the SEC Staff to the disclosure included in “FLEX Options Valuation Risk,” which provides that, “During the Outcome Period, the Fund’s net asset value therefore might not correlate on a day-to-day basis with the returns experienced by the S&P 500 Price Index. As a FLEX Option approaches its expiration date, its value typically moves increasingly with the value of the S&P 500 Price Index.” |

| | | |

| | 16) Comment: The last sentence of the second bullet point states, “As a result, you should expect that, if the S&P 500 Price Index experiences losses of more than 10% over the Outcome Period, you will bear all such losses on a one-to-one basis.” Please clarify this statement. Specifically, please clarify the phrase, “you will bear all such |

U.S. Securities and Exchange Commission

Page 8

| | losses.” If the losses incurred after the 10% are on a one-to-one basis, would this not also include fees and expenses of the Fund? |

| | | |

| | Response: Registrant has deleted the sentence and replaced it with the following: |

| | | |

| | | As a result, you should expect that, if the S&P 500 Price Index experiences losses of more than 10% over the Outcome Period, investors will bear the amount of any loss in excess of a 10% loss on the S&P 500 Price Index, in addition to Fund expenses. |

| | | |

| | 17) Comment: Please consider revising the organization of information in the Funds’ strategy. Specifically, there is information about late initial purchases throughout the strategy. Please address all aspects of an investor’s initial purchase date before discussing subsequent outcome periods and clarify that even though the Funds intend to limit investment losses for contract owners who hold shares for the entire outcome period, there is no guarantee they will do so successfully. Please also directly state that variable contract owners who purchase shares after the outcome period starts may lose their entire investment. As written, it is not clear that this total loss is the consequence intended by the phrase, “without understanding fully the consequences of doing so.” |

| | | |

| | Response: Registrant has revised the organization of the information as requested. In addition, Registrant has revised the disclosure to note that the Fund will reject the purchase of shares after the Outcome Period has begun. |

| | | |

| | 18) Comment: Consider providing examples to help investors understand the practical impact of purchasing late after the outcome period starts. |

| | | |

| | Response: Please see the response to comment 17. The Registrant notes that a Fund will reject any purchase of shares after the Outcome Period has begun, and has revised the disclosure accordingly. |

| | | |

| | 19) Comment: After discussing the consequences of a purchase after the initiation of an outcome period (late purchase), explain the concept of subsequent outcome periods and the mechanics of transitioning between outcome periods for investors who wish to stay in the Funds and investors who do not wish to remain in the Funds at the expiration of any particular outcome period. Note that the discussion currently in the first three sentences following the bullets on page 3 does not address this adequately. Please revise and supplement accordingly. |

| | | |

| | Response: Registrant has added the following sentence to the paragraph: |

| | | |

| | | The “targeted outcome strategy” is designed to realize the Outcomes only on the final day of the Outcome Period. To achieve the Outcomes sought by the Fund for an Outcome Period, an investor must hold shares of the Fund for the entire Outcome Period.This means that a shareholder should hold or |

U.S. Securities and Exchange Commission

Page 9

| | | purchase shares of the Fund prior the beginning of the Outcome Period to achieve the intended result. Further, the Fund’s operations are intended to be continuous. The Fund will not terminate and distribute its assets at the conclusion of each Outcome Period. At the close of the market on the business day prior to the first day of the new Outcome Period, the Fund will invest in a new set of FLEX Options. |

| | | |

| | 20) Comment: The strategy states, “Either in lieu of or in addition to stocks, the Fund may invest in unaffiliated exchange-traded funds or in affiliated or unaffiliated mutual funds (‘Underlying Funds’).” At present, this disclosure does not provide an adequately coherent picture of the adviser’s portfolio construction process. Please clarify the strategy informing the subadviser’s choice between stocks, unaffiliated ETFs, or affiliated or unaffiliated mutual funds. What factors does the subadviser consider when making this decision? If there are particular circumstances in which the subadviser will favor underlying funds, please disclose. |

| | | |

| | Response: Registrant intends to invest in Underlying Funds until scalable assets are achieved for the Fund. Registrant has revised the sentence to read as follows: |

| | | |

| | | Either in lieu of or in addition to stocks (and until the Fund grows to a size necessary to support efficient operations), the Fund may invest in unaffiliated exchange-traded funds or in affiliated or unaffiliated mutual funds (“Underlying Funds”). |

| | | |

| | 21) Comment: In the first full paragraph on page 4, the Fund’s strategy references FLEX Options. Please provide more information about the Fund’s options strategy, and specifically, how the Fund determines whether to use FLEX Options or a different type of exchange-traded option. Please include this new disclosure in Item 4 or 9 or both. |

| | | |

| | Response: Registrant notes that, while it is anticipated that the Fund will only invest in FLEX Options, it would prefer to retain some level of flexibility within the prospectus. Notwithstanding, Registrant has revised the first sentence of the first full paragraph as follows: “Options purchased and sold by the Fund are FLEX Options that reference the S&P 500 Price Index.” |

| | | |

| | 22) Comment: In the second full paragraph on page 4, the Fund’s strategy states, “any obligations of the Fund created by its writing of options will be covered by offsetting positions in other purchased options or in equity securities held by the Fund.” Please add a plain English statement explaining why offsetting positions and the Fund’s net long status matter to an investor. |

| | | |

| | Response: Registrant has revised the sentence to read as follows: |

| | | |

| | | Therefore, any obligations of the Fund created by its writing of options will be covered by offsetting positions in other purchased options or in |

U.S. Securities and Exchange Commission

Page 10

| | | equity securities held by the Fund, which thus limits the amount of leverage in the Fund. |

| | | |

| Principal Risks (All Funds) |

| | | |

| | 23) Comment: In the disclosure for “buffered loss risk,” please provide a graphical depiction of how the cap and buffer work relative to index returns for clarity and investor comprehension. |

| | | |

| | Response: Please see the response to comment 38. |

| | | |

| | 24) Comment: Given that “capped level change risk” is listed as a principal risk, please enhance the Item 4 and Item 9 strategy discussion to provide a more substantive discussion of the basis for this risk. In particular, the strategy should explain how “prevailing market conditions” control the adviser’s determination of the appropriate subsequent capped performance level at any given time. |

| | | |

| | Response: Registrant has revised as requested. The new risk disclosure is as follows: |

| | | |

| | | Capped Level change risk - a new Capped Level is established at the beginning of each Outcome Period and is dependent on prevailing market conditions. Accordingly, the Capped Level may rise or fall from one Outcome Period to the next and is unlikely to remain the same for consecutive Outcome Periods. Specifically, the Capped Level is based on the market costs associated with a series of FLEX Options that are purchased and sold in order to seek to obtain the relevant market exposure and the Buffer Amount. The market conditions and other factors that influence the Capped Level can include market volatility, risk free rates, and time to expiration. Depending on those factors, it is possible that the Capped Level will limit the Fund’s return in any Outcome Period to a level substantially less than an investor might expect from another comparable equity product that does not employ a buffer strategy. |

| | | |

| | 25) Comment: In the disclosure for “tracking error risk,” please explain how the Fund’s transaction costs impact tracking error. If correct, disclose that these costs generally refer to brokerage commissions and trading expenses incurred by the Fund in executing portfolio transactions and can exacerbate the difference between the Fund’s performance and the performance of the index the Fund is tracking. Please also describe how caps and buffers impact the Fund’s ability to track the performance of the index. |

| | | |

| | Response: Registrant has revised the sentence in the risk to state as follows: |

| | | |

| | | Tracking error may occur because of the differences between the securities and other instruments held in the Fund’s portfolio and those included in |

U.S. Securities and Exchange Commission

Page 11

| | | the S&P 500 Price Index, the Fund’s expenses, changes in the composition of the index, transaction costs incurred by the Fund (such as brokerage commissions in executing transactions), the Fund’s holding of uninvested cash and the timing of purchases and redemptions of Fund shares. |

| | | |

| | Registrant respectfully declines to add disclosure regarding the Buffer Amount or Capped Level to the Tracking Error Risk. Registrant notes that the risk disclosure already provides that the disclosure is without regard to the Buffer Amount or Capped Level, which are already described in detail elsewhere in the prospectus. |

| | | |

| | 26) Comment: In the disclosure for “FLEX Options risk,” please clarify that the additional risk associated with FLEX Options guaranteed for settlement by the Options Clearing Corporation is a form of counterparty risk. |

| | | |

| | Response: Registrant has revised the first sentence as follows: |

| | | |

| | | The Fund bears the risk that the OCC will be unable or unwilling to perform its obligations under the FLEX Options contracts, which is a form of counterparty risk. |

| | | |

| | 27) Comment: To the extent that this applies to the derivatives upon which the Fund will rely, in the disclosure for “Derivatives risk,” please consider highlighting or otherwise drawing attention to the statement, “some derivatives have the potential for unlimited loss.” If relevant, please do the same with the disclosure in the related sub-descriptions for types of derivatives key to the Fund. |

| | | |

| | Response: Registrant has considered the Staff’s comment and respectfully declines to highlight the sentence as requested. |

| | | |

| | 28) Comment: The “Derivatives risk” disclosure contains a sub-section for “futures” and “swaps.” We note that prior to this disclosure, there are no references to futures or swaps in the Fund’s strategy. Please revise the strategy discussion to clarify the basis for these sub-risks or delete them. |

| | | |

| | Response: Registrant refers to the strategy section that states, “Some Underlying Funds may, when consistent with their investment objectives, use certain futures, options and swap contracts (which are also derivatives), either for hedging purposes or to increase returns. The Fund also may invest in equity index futures in order to replicate the performance of the S&P 500 Price Index” |

| | | |

| | 29) Comment: Please consider whether “Smaller Company risk” is actually a principal risk of the Fund. If not, please delete the description and related strategy references. |

| | | |

| | Response: Registrant confirms that the Fund may invest as a principal strategy in the securities of all market capitalizations, including those of smaller capitalizations. |

U.S. Securities and Exchange Commission

Page 12

| | 30) Comment: The “Exchange-traded funds risk” disclosure suggests that the Fund invests in a singular unaffiliated ETF. If this is not correct, please revise this disclosure. |

| | | |

| | Response: Registrant has revised the disclosure to make clear that the Funds may invest in more than one ETF. |

| | | |

| | 31) Comment: Please remove “Fund-of-funds risk” or explain why this risk is appropriate for this product. |

| | | |

| | Response: Registrant refers the SEC Staff to the response to comment 20. |

| | | |

| | 32) Comment: In the “Price Return Index risk” disclosure, please clarify how the risks associated with this index differ from the risks associated with an S&P index that includes returns from dividends paid by the companies in the S&P 500 Price Index. Is the overall risk greater? If so, how and why? |

| | | |

| | Response: Registrant refers the SEC Staff to the response to comment 3. While the performance may differ, Registrant believes that the methodology construction between the S&P 500® Price Return Index and the S&P 500® Total Return Index are the same and the risks are not materially different. |

| | | |

| | 33) Comment: Please confirm whether the first sentence in the “Redemptions risk” disclosure applies to the Fund. The Staff was under the impression that this Fund would only be available through variable contracts affiliated with and sold through Nationwide. Please clarify how this sentence applies to the rest of the risk description. |

| | | |

| | Response: Please see the response to comment 17. The Registrant notes that a Fund will reject any purchase of shares after the Outcome Period has begun, and has revised the disclosure accordingly. |

| | | |

| | 34) Comment: Please clarify the origin of the Fund’s liquidity risk. To the extent appropriate, please explain the relationship between liquidity and specifically investing in options in the description of “Liquidity risk.” |

| | | |

| | Response: Registrant has removed “Liquidity risk.” |

| | | |

| | 35) Comment: Given that “Cash positions risk” is listed as a principal risk of the Fund, please clarify in the Fund’s strategy what significant positions in cash or money market instruments means. If this refers to coverage required based on derivatives holdings, state this directly. |

| | | |

| | Response: Registrant refers to the strategy section that states, “The Fund may hold cash or invest in cash equivalents in order to collateralize its derivatives positions.” Additionally, Registrant has revised the first sentence of the risk disclosure as follows: |

U.S. Securities and Exchange Commission

Page 13

| | | The Fund may hold significant positions in cash or money market instruments as a result of regulations associated with the FLEX Options or other derivatives in which the Fund may invest. |

| | | |

| Principal Investment Strategies (5-Year Funds) |

| | | |

| | 36) Comment: With respect to the five-year products, please explain in greater detail how the FLEX Options strategy works to provide the structured return being offered; in this respect, it is unclear whether the five-year FLEX Options are currently, and will be in the future, offered, and how the portfolio will be managed if they are not. To the extent the Registrant will rely on one-year FLEX Options, please ensure your disclosure appropriately addresses roll costs narratively and in the Fees and Expenses table. In addition, to the extent that overall returns may be impacted by the need to buy/sell FLEX Options as a result of investor redemptions and purchases, please ensure your disclosure appropriately reflects the potential impact to the Funds of such activity. |

| | | |

| | Response: Registrant confirms that five-year FLEX Options are currently being offered. Registrant notes that while it anticipates that five-year FLEX Options will continue to be offered in the future, it cannot guarantee so. As such, Registrant has added the following sentence to the Capped Level risk: “The Capped Level and ultimately the Fund’s strategy is dependent on the availability now and in the future of FLEX Options.” |

| | | |

| | See the responses to comments 24 and 25 with respect to narrative disclosure on roll costs and the effect of those costs on the Fund’s strategy. Such roll costs are brokerage and trading costs, and are not required to be specifically disclosed in the Fees and Expenses Table required by Form N-1A other than as “Other Expenses.” Registrant confirms that the Fees and Expenses Table will appropriately include such roll costs. |

| | | |

| How the Funds Invest (All Funds) |

| | | |

| | 37) Comment: The last sentence under the section titled “Capped Levels” states, “Since each Fund also invests in equity securities (or Underlying Funds that invest in equity securities), it may use the amounts of any dividends the Fund has received from underlying issuers to achieve a higher Capped Level.” Please explain how this disclosure is consistent with a passive investment strategy. |

| | | |

| | Response: Registrant notes that the disclosure is with respect to the establishment of the Capped Level and that each Fund may use the amounts of any dividend a Fund has received from underlying issuers to achieve a higher Capped Level. The Registrant notes that the Fund’s investment strategy is discussed in the sub-section, “How the Funds Invest.” |

| | |

| | 38) Comment: In the section titled “Buffer Amount and Capped Levels Hypothetical Examples,” please include a graphical description of the return profile illustrating how |

U.S. Securities and Exchange Commission

Page 14

| | | |

| | the Funds operate during periods of positive, negative, and flat index performance. The graphics should depict the hypothetical return that a Fund seeks to provide where a shareholder purchases shares on the initial investment day and holds them for the entire outcome period. The outcomes illustrated must fairly represent what the Funds currently offer (e.g., current capped level as of the Prospectus date and returns calculated based on S&P 500 Price Return Index’s hypothetical performance). |

| | | |

| | Response: Registrant has included the requested graphical description in the Item 4 Principal Investment Strategies section for each Fund. |

U.S. Securities and Exchange Commission

Page 15

In connection with the Registrant’s responses to the SEC Staff’s comments on the Registration Statement, as requested by the Staff, the Registrant acknowledges that the Registrant is responsible for the adequacy of the disclosure in the Registrant’s filings, notwithstanding any review, comments, action, or absence of action by the Staff.

Please do not hesitate to contact me at (202) 419-8402 or Jessica D. Burt at (202) 419-8409, if you have any questions or wish to discuss any of the responses presented above.

| | | | | | | |

| | | | | | | |

| | | | | | | Respectfully submitted, |

| | | | | | | |

| | | | | | | /s/ Christopher J. Zimmerman

|

| | | | | | | Christopher J. Zimmerman, Esquire |

| | |

| | |

| cc: | Allan J. Oster, Esquire |

| | Prufesh R. Modhera, Esquire |

| | Jessica D. Burt, Esquire |

| | Jessica L. Patrick, Esquire |

U.S. Securities and Exchange Commission

Page 16

U.S. Securities and Exchange Commission

Page 17

U.S. Securities and Exchange Commission

Page 18

U.S. Securities and Exchange Commission

Page 19

U.S. Securities and Exchange Commission

Page 20

U.S. Securities and Exchange Commission

Page 21

U.S. Securities and Exchange Commission

Page 22

U.S. Securities and Exchange Commission

Page 23

U.S. Securities and Exchange Commission

Page 24

U.S. Securities and Exchange Commission

Page 25

U.S. Securities and Exchange Commission

Page 26

U.S. Securities and Exchange Commission

Page 27

U.S. Securities and Exchange Commission

Page 28

U.S. Securities and Exchange Commission

Page 29

U.S. Securities and Exchange Commission

Page 30

U.S. Securities and Exchange Commission

Page 31

U.S. Securities and Exchange Commission

Page 32

U.S. Securities and Exchange Commission

Page 33

U.S. Securities and Exchange Commission

Page 34

U.S. Securities and Exchange Commission

Page 35