UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-3221

Fidelity Charles Street Trust

(Exact name of registrant as specified in charter)

82 Devonshire St., Boston, Massachusetts 02109

(Address of principal executive offices) (Zip code)

Scott C. Goebel, Secretary

82 Devonshire St.

Boston, Massachusetts 02109

(Name and address of agent for service)

Registrant's telephone number, including area code: 617-563-7000

Date of fiscal year end: | September 30 |

|

|

Date of reporting period: | March 31, 2011 |

Item 1. Reports to Stockholders

Fidelity Asset Manager® Funds -

20%, 30%, 40%, 50%, 60%, 70%, 85%

Semiannual Report

March 31, 2011

(2_fidelity_logos) (Registered_Trademark)

Contents

Chairman's Message | The Chairman's message to shareholders. | |

Shareholder Expense Example | An example of shareholder expenses. | |

Fidelity Asset Manager® 20% | Investment Changes | |

Fidelity Asset Manager 30% | Investment Changes | |

Fidelity Asset Manager 40% | Investment Changes | |

Fidelity Asset Manager 50% | Investment Changes | |

Fidelity Asset Manager 60% | Investment Changes | |

Fidelity Asset Manager 70% | Investment Changes | |

Fidelity Asset Manager 85% | Investment Changes | |

Notes | Notes to the financial statements. |

To view a fund's proxy voting guidelines and proxy voting record for the 12-month period ended June 30, visit http://www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission's (SEC) web site at http://www.sec.gov. You may also call 1-800-544-8544 to request a free copy of the proxy voting guidelines.

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR LLC or an affiliated company.

This report and the financial statements contained herein are submitted for the general information of the shareholders of the funds. This report is not authorized for distribution to prospective investors in the funds unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. Forms N-Q are available on the SEC's web site at http://www.sec.gov. A fund's Forms N-Q may be reviewed and copied at the SEC's Public Reference Room in Washington, DC. Information regarding the operation of the SEC's Public Reference Room may be obtained by calling 1-800-SEC-0330. For a complete list of a fund's portfolio holdings, view the most recent holdings listing, semiannual report, or annual report on Fidelity's web site at http://www.fidelity.com, http://www.advisor.fidelity.com, or http://www.401k.com, as applicable.

NOT FDIC INSURED • MAY LOSE VALUE • NO BANK GUARANTEE

Neither the funds nor Fidelity Distributors Corporation is a bank.

Semiannual Report

Chairman's Message

(photo_of_Abigail_P_Johnson)

Dear Shareholder:

Amid indications the U.S. economy had turned a corner, U.S. equities continued their generally upward trend in early 2011, overcoming bouts of short-term volatility following unrest in North Africa and the disaster in Japan. Still, questions remained about the longer-term outlook, most notably persistently high unemployment. Financial markets are always unpredictable, of course, but there also are several time-tested investment principles that can help put the odds in your favor.

One of the basic tenets is to invest for the long term. Over time, riding out the markets' inevitable ups and downs has proven much more effective than selling into panic or chasing the hottest trend. Even missing only a few of the markets' best days can significantly diminish investor returns. Patience also affords the benefits of compounding - of earning interest on additional income or reinvested dividends and capital gains. There can be tax advantages and cost benefits to consider as well. While staying the course doesn't eliminate risk, it can considerably lessen the effect of short-term declines.

You can further manage your investing risk through diversification. And today, more than ever, geographic diversification should be taken into account. Studies indicate that asset allocation is the single most important determinant of a portfolio's long-term success. The right mix of stocks, bonds and cash - aligned to your particular risk tolerance and investment objective - is very important. Age-appropriate rebalancing is also an essential aspect of asset allocation. For younger investors, an emphasis on equities - which historically have been the best-performing asset class over time - is encouraged. As investors near their specific goal, such as retirement or sending a child to college, consideration may be given to replacing volatile assets (e.g. common stocks) with more-stable fixed investments (bonds or savings plans).

A third principle - investing regularly - can help lower the average cost of your purchases. Investing a certain amount of money each month or quarter helps ensure you won't pay for all your shares at market highs. This strategy - known as dollar cost averaging - also reduces "emotion" from investing, helping shareholders avoid selling weak performers just prior to an upswing, or chasing a hot performer just before a correction.

We invite you to contact us via the Internet, through our Investor Centers or by phone. It is our privilege to provide you the information you need to make the investments that are right for you.

Sincerely,

(The chairman's signature appears here.)

Abigail P. Johnson

Semiannual Report

Shareholder Expense Example

The Funds invest in Fidelity Central Funds, which are open-end investment companies with similar investment objectives to those of the Funds, available only to other mutual funds and accounts managed by Fidelity Management & Research Company (FMR) and its affiliates. In addition to the direct expenses incurred by the Funds presented in the table, as a shareholder of the underlying Fidelity Central Funds, the Funds also indirectly bear their proportionate share of the expenses of the underlying Fidelity Central Funds. These expenses are not included in the Funds' annualized expense ratio used to calculate either the actual or hypothetical expense estimates presented in the table but are summarized in a footnote to the table.

As a shareholder of a Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments or redemption proceeds, and (2) ongoing costs, including management fees, distribution and/or service (12b-1) fees and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (October 1, 2010 to March 31, 2011).

Actual Expenses

The first line of the accompanying table for each class of each fund provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000.00 (for example, an $8,600 account value divided by $1,000.00 = 8.6), then multiply the result by the number in the first line for a class of the fund under the heading entitled "Expenses Paid During Period" to estimate the expenses you paid on your account during this period. A small balance maintenance fee of $12.00 that is charged once a year may apply for certain accounts with a value of less than $2,000. This fee is not included in the table below. If it was, the estimate of expenses you paid during the period would be higher, and your ending account value lower, by this amount. In addition, each Fund, as a shareholder in the underlying Fidelity Central Funds, will indirectly bear its pro-rata share of the fees and expenses incurred by the underlying Fidelity Central Funds. These fees and expenses are not included in the Fund's annualized expense ratio used to calculate the expense estimate in the table below.

Hypothetical Example for Comparison Purposes

The second line of the accompanying table for each class of each fund provides information about hypothetical account values and hypothetical expenses based on a Class' actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Class' actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. A small balance maintenance fee of $12.00 that is charged once a year may apply for certain accounts with a value of less than $2,000. This fee is not included in the table below. If it was, the estimate of expenses you paid during the period would be higher, and your ending account value lower, by this amount. In addition, each Fund, as a shareholder in the underlying Fidelity Central Funds, will indirectly bear its pro-rata share of the fees and expenses incurred by the underlying Fidelity Central Funds. These fees and expenses are not included in the Fund's annualized expense ratio used to calculate the expense estimate in the table below.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| Annualized Expense Ratio | Beginning | Ending | Expenses Paid |

Fidelity Asset Manager® 20% |

|

|

|

|

Class A | .85% |

|

|

|

Actual |

| $ 1,000.00 | $ 1,041.10 | $ 4.33 |

HypotheticalA |

| $ 1,000.00 | $ 1,020.69 | $ 4.28 |

Class T | 1.10% |

|

|

|

Actual |

| $ 1,000.00 | $ 1,039.80 | $ 5.59 |

HypotheticalA |

| $ 1,000.00 | $ 1,019.45 | $ 5.54 |

Class B | 1.65% |

|

|

|

Actual |

| $ 1,000.00 | $ 1,037.70 | $ 8.38 |

HypotheticalA |

| $ 1,000.00 | $ 1,016.70 | $ 8.30 |

Class C | 1.61% |

|

|

|

Actual |

| $ 1,000.00 | $ 1,037.30 | $ 8.18 |

HypotheticalA |

| $ 1,000.00 | $ 1,016.90 | $ 8.10 |

| Annualized Expense Ratio | Beginning | Ending | Expenses Paid |

Asset Manager 20% | .55% |

|

|

|

Actual |

| $ 1,000.00 | $ 1,042.50 | $ 2.80 |

HypotheticalA |

| $ 1,000.00 | $ 1,022.19 | $ 2.77 |

Institutional Class | .61% |

|

|

|

Actual |

| $ 1,000.00 | $ 1,043.20 | $ 3.11 |

HypotheticalA |

| $ 1,000.00 | $ 1,021.89 | $ 3.07 |

Fidelity Asset Manager 30% |

|

|

|

|

Class A | .90% |

|

|

|

Actual |

| $ 1,000.00 | $ 1,057.20 | $ 4.62 |

HypotheticalA |

| $ 1,000.00 | $ 1,020.44 | $ 4.53 |

Class T | 1.12% |

|

|

|

Actual |

| $ 1,000.00 | $ 1,056.30 | $ 5.74 |

HypotheticalA |

| $ 1,000.00 | $ 1,019.35 | $ 5.64 |

Class B | 1.65% |

|

|

|

Actual |

| $ 1,000.00 | $ 1,053.40 | $ 8.45 |

HypotheticalA |

| $ 1,000.00 | $ 1,016.70 | $ 8.30 |

Class C | 1.65% |

|

|

|

Actual |

| $ 1,000.00 | $ 1,053.60 | $ 8.45 |

HypotheticalA |

| $ 1,000.00 | $ 1,016.70 | $ 8.30 |

Asset Manager 30% | .60% |

|

|

|

Actual |

| $ 1,000.00 | $ 1,059.80 | $ 3.08 |

HypotheticalA |

| $ 1,000.00 | $ 1,021.94 | $ 3.02 |

Institutional Class | .61% |

|

|

|

Actual |

| $ 1,000.00 | $ 1,058.60 | $ 3.13 |

HypotheticalA |

| $ 1,000.00 | $ 1,021.89 | $ 3.07 |

Fidelity Asset Manager 40% |

|

|

|

|

Class A | .90% |

|

|

|

Actual |

| $ 1,000.00 | $ 1,074.50 | $ 4.65 |

HypotheticalA |

| $ 1,000.00 | $ 1,020.44 | $ 4.53 |

Class T | 1.15% |

|

|

|

Actual |

| $ 1,000.00 | $ 1,073.50 | $ 5.94 |

HypotheticalA |

| $ 1,000.00 | $ 1,019.20 | $ 5.79 |

Class B | 1.65% |

|

|

|

Actual |

| $ 1,000.00 | $ 1,070.40 | $ 8.52 |

HypotheticalA |

| $ 1,000.00 | $ 1,016.70 | $ 8.30 |

Class C | 1.65% |

|

|

|

Actual |

| $ 1,000.00 | $ 1,070.90 | $ 8.52 |

HypotheticalA |

| $ 1,000.00 | $ 1,016.70 | $ 8.30 |

Asset Manager 40% | .62% |

|

|

|

Actual |

| $ 1,000.00 | $ 1,075.90 | $ 3.21 |

HypotheticalA |

| $ 1,000.00 | $ 1,021.84 | $ 3.13 |

Institutional Class | .65% |

|

|

|

Actual |

| $ 1,000.00 | $ 1,075.90 | $ 3.36 |

HypotheticalA |

| $ 1,000.00 | $ 1,021.69 | $ 3.28 |

| Annualized Expense Ratio | Beginning | Ending | Expenses Paid |

Fidelity Asset Manager 50% |

|

|

|

|

Class A | 1.01% |

|

|

|

Actual |

| $ 1,000.00 | $ 1,092.20 | $ 5.27 |

HypotheticalA |

| $ 1,000.00 | $ 1,019.90 | $ 5.09 |

Class T | 1.23% |

|

|

|

Actual |

| $ 1,000.00 | $ 1,091.30 | $ 6.41 |

HypotheticalA |

| $ 1,000.00 | $ 1,018.80 | $ 6.19 |

Class B | 1.76% |

|

|

|

Actual |

| $ 1,000.00 | $ 1,088.40 | $ 9.16 |

HypotheticalA |

| $ 1,000.00 | $ 1,016.16 | $ 8.85 |

Class C | 1.73% |

|

|

|

Actual |

| $ 1,000.00 | $ 1,088.30 | $ 9.01 |

HypotheticalA |

| $ 1,000.00 | $ 1,016.31 | $ 8.70 |

Asset Manager 50% | .70% |

|

|

|

Actual |

| $ 1,000.00 | $ 1,094.30 | $ 3.65 |

HypotheticalA |

| $ 1,000.00 | $ 1,021.44 | $ 3.53 |

Institutional Class | .73% |

|

|

|

Actual |

| $ 1,000.00 | $ 1,093.70 | $ 3.81 |

HypotheticalA |

| $ 1,000.00 | $ 1,021.29 | $ 3.68 |

Fidelity Asset Manager 60% |

|

|

|

|

Class A | 1.10% |

|

|

|

Actual |

| $ 1,000.00 | $ 1,106.90 | $ 5.78 |

HypotheticalA |

| $ 1,000.00 | $ 1,019.45 | $ 5.54 |

Class T | 1.35% |

|

|

|

Actual |

| $ 1,000.00 | $ 1,106.50 | $ 7.09 |

HypotheticalA |

| $ 1,000.00 | $ 1,018.20 | $ 6.79 |

Class B | 1.85% |

|

|

|

Actual |

| $ 1,000.00 | $ 1,103.80 | $ 9.70 |

HypotheticalA |

| $ 1,000.00 | $ 1,015.71 | $ 9.30 |

Class C | 1.85% |

|

|

|

Actual |

| $ 1,000.00 | $ 1,104.40 | $ 9.71 |

HypotheticalA |

| $ 1,000.00 | $ 1,015.71 | $ 9.30 |

Asset Manager 60% | .81% |

|

|

|

Actual |

| $ 1,000.00 | $ 1,109.30 | $ 4.26 |

HypotheticalA |

| $ 1,000.00 | $ 1,020.89 | $ 4.08 |

Institutional Class | .85% |

|

|

|

Actual |

| $ 1,000.00 | $ 1,108.60 | $ 4.47 |

HypotheticalA |

| $ 1,000.00 | $ 1,020.69 | $ 4.28 |

Fidelity Asset Manager 70% |

|

|

|

|

Class A | 1.09% |

|

|

|

Actual |

| $ 1,000.00 | $ 1,126.80 | $ 5.78 |

HypotheticalA |

| $ 1,000.00 | $ 1,019.50 | $ 5.49 |

Class T | 1.35% |

|

|

|

Actual |

| $ 1,000.00 | $ 1,125.20 | $ 7.15 |

HypotheticalA |

| $ 1,000.00 | $ 1,018.20 | $ 6.79 |

Class B | 1.90% |

|

|

|

Actual |

| $ 1,000.00 | $ 1,122.50 | $ 10.05 |

HypotheticalA |

| $ 1,000.00 | $ 1,015.46 | $ 9.55 |

| Annualized Expense Ratio | Beginning | Ending | Expenses Paid |

Class C | 1.83% |

|

|

|

Actual |

| $ 1,000.00 | $ 1,122.80 | $ 9.69 |

HypotheticalA |

| $ 1,000.00 | $ 1,015.81 | $ 9.20 |

Asset Manager 70% | .78% |

|

|

|

Actual |

| $ 1,000.00 | $ 1,128.30 | $ 4.14 |

HypotheticalA |

| $ 1,000.00 | $ 1,021.04 | $ 3.93 |

Institutional Class | .82% |

|

|

|

Actual |

| $ 1,000.00 | $ 1,128.00 | $ 4.35 |

HypotheticalA |

| $ 1,000.00 | $ 1,020.84 | $ 4.13 |

Fidelity Asset Manager 85% |

|

|

|

|

Class A | 1.09% |

|

|

|

Actual |

| $ 1,000.00 | $ 1,151.00 | $ 5.85 |

HypotheticalA |

| $ 1,000.00 | $ 1,019.50 | $ 5.49 |

Class T | 1.34% |

|

|

|

Actual |

| $ 1,000.00 | $ 1,148.90 | $ 7.18 |

HypotheticalA |

| $ 1,000.00 | $ 1,018.25 | $ 6.74 |

Class B | 1.91% |

|

|

|

Actual |

| $ 1,000.00 | $ 1,146.00 | $ 10.22 |

HypotheticalA |

| $ 1,000.00 | $ 1,015.41 | $ 9.60 |

Class C | 1.83% |

|

|

|

Actual |

| $ 1,000.00 | $ 1,146.70 | $ 9.79 |

HypotheticalA |

| $ 1,000.00 | $ 1,015.81 | $ 9.20 |

Asset Manager 85% | .82% |

|

|

|

Actual |

| $ 1,000.00 | $ 1,152.60 | $ 4.40 |

HypotheticalA |

| $ 1,000.00 | $ 1,020.84 | $ 4.13 |

Institutional Class | .81% |

|

|

|

Actual |

| $ 1,000.00 | $ 1,152.30 | $ 4.35 |

HypotheticalA |

| $ 1,000.00 | $ 1,020.89 | $ 4.08 |

A 5% return per year before expenses

* Expenses are equal to each Class' annualized expense ratio, multiplied by the average account value over the period, multiplied by 182/ 365 (to reflect the one-half year period). The fees and expenses of the underlying Fidelity Central Funds in which the Fund invests are not included in the Fund's annualized expense ratio.

In addition to the expenses noted above, the Fund also indirectly bears its proportional share of the expenses of the underlying Fidelity Central Funds. Annualized expenses of the underlying Fidelity Central Funds as of their most recent fiscal half year ranged from less than .01% to .15%

Semiannual Report

Fidelity Asset Manager 20%

Investment Changes (Unaudited)

The information in the following tables is based on the combined investments of the Fund and its pro-rata share of the investments of Fidelity's Central Funds, other than the Commodity Strategy and Money Market Central Funds. |

Top Five Bond Issuers as of March 31, 2011 | ||

(with maturities greater than one year) | % of fund's | % of fund's net assets |

U.S. Treasury Obligations | 15.9 | 17.2 |

Fannie Mae | 15.4 | 11.6 |

Freddie Mac | 3.1 | 1.4 |

Ginnie Mae | 0.8 | 1.5 |

JPMorgan Chase Commercial Mortgage Securities Trust | 0.4 | 0.4 |

| 35.6 | |

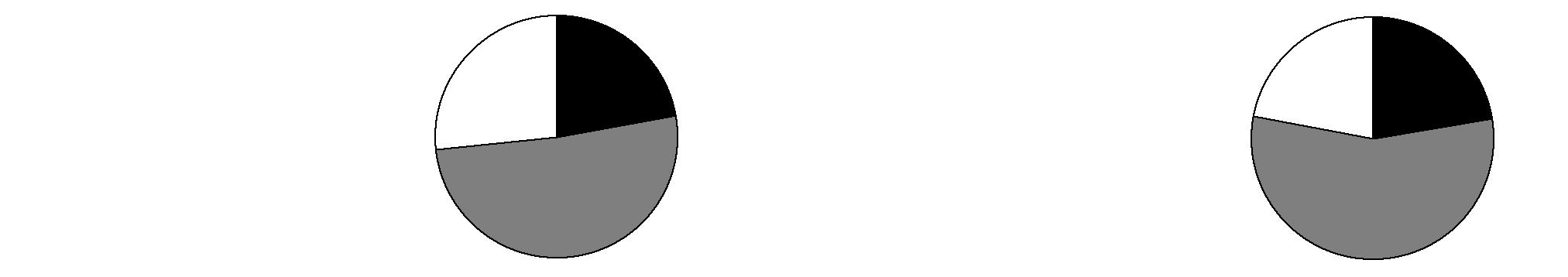

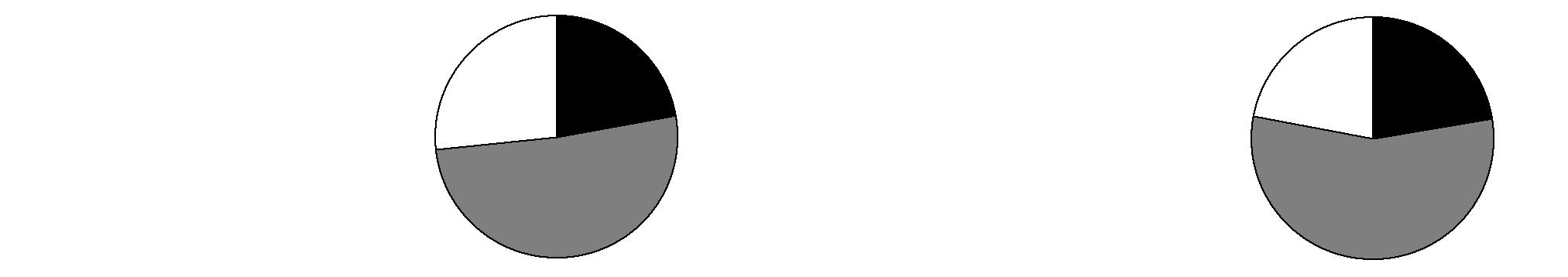

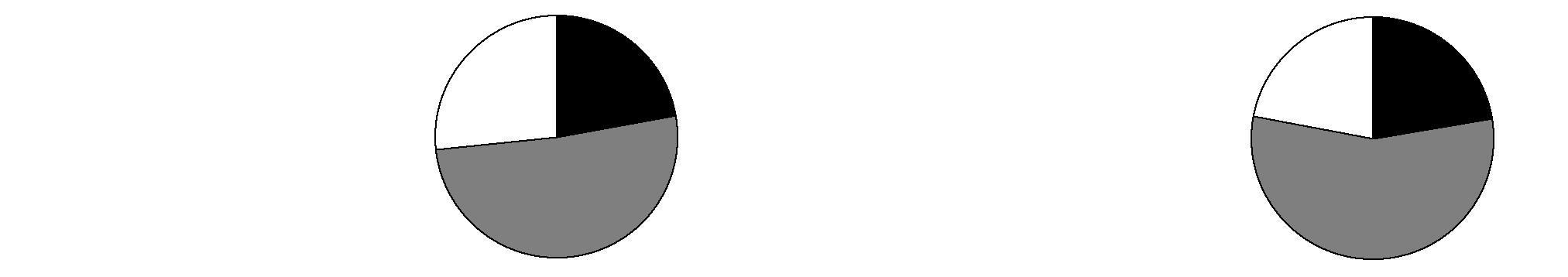

Quality Diversification (% of fund's net assets) | |||||||

As of March 31, 2011 | As of September 30, 2010 | ||||||

| U.S. Government and |

|  | U.S. Government and |

| ||

| AAA,AA,A 6.5% |

|  | AAA,AA,A 8.4% |

| ||

| BBB 6.1% |

|  | BBB 7.2% |

| ||

| BB and Below 7.9% |

|  | BB and Below 7.6% |

| ||

| Not Rated 0.8% |

|  | Not Rated 1.3% |

| ||

| Equities* 20.8% |

|  | Equities** 21.9% |

| ||

| Short-Term Investments |

|  | Short-Term Investments |

| ||

* Includes investment in Fidelity Commodity Strategy Central Fund of 1.8% |

| ** Includes investment in Fidelity Commodity Strategy Central Fund of 1.1% |

| ||||

We have used ratings from Moody's Investors Service, Inc. Where Moody's® ratings are not available, we have used S&P® ratings. All ratings are as of the report date and do not reflect subsequent changes. Percentages are adjusted for the effect of futures contracts, if applicable. |

Top Five Stocks as of March 31, 2011 | ||

| % of fund's | % of fund's net assets |

Apple, Inc. | 0.3 | 0.4 |

Exxon Mobil Corp. | 0.3 | 0.3 |

Comerica, Inc. | 0.3 | 0.1 |

Visa, Inc. Class A | 0.2 | 0.2 |

General Electric Co. | 0.2 | 0.2 |

| 1.3 | |

Asset Allocation (% of fund's net assets) | |||||||

As of March 31, 2011 | As of September 30, 2010 | ||||||

| Stock Class |

|  | Stock Class |

| ||

| Bond Class 51.2% |

|  | Bond Class 54.0% |

| ||

| Short-Term |

|  | Short-Term |

| ||

* Includes investment in Fidelity Commodity Strategy Central Fund of 1.8% |

| ** Includes investment in Fidelity Commodity Strategy Central Fund of 1.1% |

| ||||

Asset allocations in the pie charts reflect the categorization of assets as defined in the Fund's prospectus in effect as of the time periods indicated above. Percentages are adjusted for the effect of futures contracts and swap contracts, if applicable. |

Semiannual Report

Fidelity Asset Manager 20%

Investment Summary (Unaudited)

The information in the following table is based on the direct investments of the Fund.

Fund Holdings as of March 31, 2011 | |

| % of fund's |

Equity Central Funds | |

Fidelity International Equity Central Fund | 4.8 |

Fidelity Financials Central Fund | 2.7 |

Fidelity Information Technology Central Fund | 2.5 |

Fidelity Energy Central Fund | 1.9 |

Fidelity Industrials Central Fund | 1.8 |

Fidelity Commodity Strategy Central Fund | 1.8 |

Fidelity Health Care Central Fund | 1.7 |

Fidelity Consumer Discretionary Central Fund | 1.6 |

Fidelity Consumer Staples Central Fund | 1.3 |

Fidelity Emerging Markets Equity Central Fund | 0.7 |

Fidelity Materials Central Fund | 0.6 |

Fidelity Utilities Central Fund | 0.5 |

Fidelity Telecom Services Central Fund | 0.5 |

Total Equity Central Funds | 22.4 |

Fixed-Income Central Funds | |

High Yield Fixed-Income Funds | 7.1 |

Investment Grade Fixed-Income Funds | 46.5 |

Total Fixed-Income Central Funds | 53.6 |

Money Market Central Funds | 24.0 |

Net Other Assets (Liabilities) | 0.0 * |

Total | 100.0 |

* Amount represents less than 0.1% |

At period end, foreign investments including the Fund's pro-rata share of the underlying Central Funds, other than the Commodity Strategy Central Fund, was 10.3% of net assets.

An unaudited holdings listing for the Fund, which presents direct holdings as well as the pro-rata share of any securities and other investments held indirectly through its investment in underlying Fidelity Central Funds, other than the Commodity Strategy and Money Market Central Funds, is available at fidelity.com and/or advisor.fidelity.com, as applicable.

Semiannual Report

Fidelity Asset Manager 20%

Investments March 31, 2011 (Unaudited)

Showing Percentage of Net Assets

Equity Central Funds - 22.4% | |||

Shares | Value | ||

Fidelity Commodity Strategy Central Fund (b) | 4,757,156 | $ 62,794,456 | |

Fidelity Consumer Discretionary Central Fund (b) | 434,716 | 57,152,125 | |

Fidelity Consumer Staples Central Fund (b) | 348,893 | 46,901,720 | |

Fidelity Emerging Markets Equity Central Fund (b) | 109,494 | 24,881,441 | |

Fidelity Energy Central Fund (b) | 466,696 | 67,866,911 | |

Fidelity Financials Central Fund (b) | 1,585,668 | 96,551,313 | |

Fidelity Health Care Central Fund (b) | 423,456 | 58,542,769 | |

Fidelity Industrials Central Fund (b) | 403,756 | 62,311,716 | |

Fidelity Information Technology Central Fund (b) | 486,503 | 90,119,851 | |

Fidelity International Equity Central Fund (b) | 2,340,903 | 171,400,950 | |

Fidelity Materials Central Fund (b) | 120,996 | 21,779,213 | |

Fidelity Telecom Services Central Fund (b) | 123,167 | 15,815,863 | |

Fidelity Utilities Central Fund (b) | 170,918 | 17,748,130 | |

TOTAL EQUITY CENTRAL FUNDS (Cost $681,151,070) | 793,866,458 | ||

Fixed-Income Central Funds - 53.6% | |||

|

|

|

|

High Yield Fixed-Income Funds - 7.1% | |||

Fidelity Emerging Markets Debt Central Fund (b) | 1,761,256 | 17,630,166 | |

Fidelity Floating Rate Central Fund (b) | 1,129,883 | 115,361,034 | |

Fidelity High Income Central Fund 1 (b) | 1,213,655 | 120,358,185 | |

TOTAL HIGH YIELD FIXED-INCOME FUNDS | 253,349,385 | ||

|

|

|

|

Investment Grade Fixed-Income Funds - 46.5% | |||

Fidelity Tactical Income Central Fund (b) | 16,349,055 | 1,645,368,854 | |

TOTAL FIXED-INCOME CENTRAL FUNDS (Cost $1,834,782,570) | 1,898,718,239 | ||

Money Market Central Funds - 24.0% | |||

Shares | Value | ||

Fidelity Cash Central Fund, 0.16% (a) | 221,901,518 | $ 221,901,518 | |

Fidelity Money Market Central Fund, .39% (a) | 627,037,421 | 627,037,421 | |

TOTAL MONEY MARKET CENTRAL FUNDS (Cost $848,938,939) | 848,938,939 | ||

TOTAL INVESTMENT PORTFOLIO - 100.0% (Cost $3,364,872,579) | 3,541,523,636 | |

NET OTHER ASSETS (LIABILITIES) - 0.0% | 117,770 | |

NET ASSETS - 100% | $ 3,541,641,406 | |

Legend |

(a) Affiliated fund that is available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. In addition, each Fidelity Central Fund's financial statements are available on the SEC's website or upon request. |

(b) Affiliated fund that is available only to investment companies and other accounts managed by Fidelity Investments. A complete unaudited schedule of portfolio holdings for each Fidelity Central Fund is filed with the SEC for the first and third quarters of each fiscal year on Form N-Q and is available upon request or at the SEC's web site at www.sec.gov. An unaudited holdings listing for the Fund, which presents direct holdings as well as the pro rata share of securities and other investments held indirectly through its investment in underlying Fidelity Central Funds, other than the Commodity Strategy and Money Market Central Funds, is available at fidelity.com and/or advisor.fidelity.com, as applicable. In addition, each Fidelity Central Fund's financial statements are available on the SEC's web site or upon request. |

Affiliated Central Funds |

Information regarding fiscal year to date income earned by the Fund from investments in Fidelity Central Funds is as follows: |

Fund | Income earned |

Fidelity Cash Central Fund | $ 179,038 |

Fidelity Consumer Discretionary Central Fund | 283,236 |

Fidelity Consumer Staples Central Fund | 614,398 |

Fidelity Emerging Markets Debt Central Fund | 14,762 |

Fidelity Emerging Markets Equity Central Fund | 89,903 |

Fidelity Energy Central Fund | 416,047 |

Fidelity Financials Central Fund | 353,111 |

Fidelity Floating Rate Central Fund | 2,360,002 |

Fidelity Health Care Central Fund | 220,762 |

Fidelity High Income Central Fund 1 | 4,750,028 |

Fidelity Industrials Central Fund | 395,244 |

Fidelity Information Technology Central Fund | 110,770 |

Fidelity International Equity Central Fund | 1,441,270 |

Fidelity Materials Central Fund | 116,895 |

Fidelity Money Market Central Fund | 1,241,906 |

Fidelity Tactical Income Central Fund | 23,740,460 |

Fidelity Telecom Services Central Fund | 152,145 |

Fidelity Utilities Central Fund | 264,746 |

Total | $ 36,744,723 |

Additional information regarding the Fund's fiscal year to date purchases and sales, including the ownership percentage, of the non Money Market Central Funds is as follows: |

Fund | Value, beginning of period | Purchases | Sales Proceeds | Value, end of period | % ownership, end of period |

Fidelity Commodity Strategy Central Fund | $ 35,084,213 | $ 23,863,792 | $ 4,833,182 | $ 62,794,456 | 7.0% |

Fidelity Consumer Discretionary Central Fund | 45,560,668 | 7,948,066 | 3,763,775 | 57,152,125 | 8.2% |

Fidelity Consumer Staples Central Fund | 43,988,692 | 4,701,787 | 4,960,748 | 46,901,720 | 7.6% |

Fidelity Emerging Markets Debt Central Fund | - | 17,619,087 | 5,836 | 17,630,166 | 17.9% |

Fidelity Emerging Markets Equity Central Fund | 35,966,470 | 5,030,339 | 19,627,194 | 24,881,441 | 7.6% |

Fidelity Energy Central Fund | 44,327,258 | 7,693,834 | 5,465,758 | 67,866,911 | 7.8% |

Fidelity Financials Central Fund | 82,498,800 | 14,570,848 | 8,041,861 | 96,551,313 | 8.1% |

Fidelity Floating Rate Central Fund | 97,415,747 | 12,572,926 | 306,100 | 115,361,034 | 3.9% |

Fidelity Health Care Central Fund | 51,145,285 | 5,343,075 | 9,301,623 | 58,542,769 | 7.9% |

Fidelity High Income Central Fund 1 | 121,836,478 | 12,603,451 | 18,213,400 | 120,358,185 | 21.8% |

Fidelity Industrials Central Fund | 49,634,644 | 5,664,856 | 5,221,741 | 62,311,716 | 8.1% |

Fidelity Information Technology Central Fund | 76,871,824 | 5,956,640 | 8,340,227 | 90,119,851 | 8.0% |

Fidelity International Equity Central Fund | 150,090,745 | 11,888,857 | 6,402,921 | 171,400,950 | 9.1% |

Fidelity Materials Central Fund | 16,958,529 | 2,573,745 | 2,478,688 | 21,779,213 | 8.3% |

Fidelity Tactical Income Central Fund | 1,487,037,888 | 224,487,887 | 53,676,757 | 1,645,368,854 | 34.5% |

Fidelity Telecom Services Central Fund | 13,038,484 | 1,965,768 | 562,411 | 15,815,863 | 7.9% |

Fidelity Utilities Central Fund | 16,478,538 | 1,543,395 | 1,403,623 | 17,748,130 | 7.9% |

Total | $ 2,367,934,263 | $ 366,028,353 | $ 152,605,845 | $ 2,692,584,697 |

Other Information |

All investments are categorized as Level 1 under the Fair Value Hierarchy. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, please refer to the Security Valuation section in the accompanying Notes to Financial Statements. |

The information in the following table is based on the combined investments of the Fund and its pro-rata share of the investments of Fidelity's Central Funds, other than the Commodity Strategy and Money Market Central Funds. |

Distribution of investments by country of issue, as a percentage of total net assets, is as follows: (Unaudited) |

United States of America | 89.7% |

United Kingdom | 2.1% |

Others (Individually Less Than 1%) | 8.2% |

| 100.0% |

Income Tax Information |

At September 30, 2010, the Fund had a capital loss carryforward of approximately $73,793,498 all of which will expire in fiscal 2017. Capital loss carryforwards are only available to offset future capital gains of the Fund to the extent provided by regulations and may be limited. |

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Fidelity Asset Manager 20%

Financial Statements

Statement of Assets and Liabilities

| March 31, 2011 (Unaudited) | |

|

|

|

Assets | ||

Investments in Fidelity Central Funds (cost $3,364,872,579) | $3,541,523,636 | |

Receivable for investments sold | 907,521 | |

Receivable for fund shares sold | 5,130,653 | |

Distributions receivable from Fidelity Central Funds | 238,428 | |

Prepaid expenses | 3,736 | |

Other receivables | 42,661 | |

Total assets | 3,547,846,635 | |

|

|

|

Liabilities | ||

Payable for investments purchased | $ 2,803,798 | |

Payable for fund shares redeemed | 1,773,982 | |

Accrued management fee | 1,212,361 | |

Distribution and service plan fees payable | 33,367 | |

Other affiliated payables | 366,775 | |

Other payables and accrued expenses | 14,946 | |

Total liabilities | 6,205,229 | |

|

|

|

Net Assets | $ 3,541,641,406 | |

Net Assets consist of: |

| |

Paid in capital | $ 3,405,490,346 | |

Undistributed net investment income | 5,866,703 | |

Accumulated undistributed net realized gain (loss) on investments | (46,366,700) | |

Net unrealized appreciation (depreciation) on investments | 176,651,057 | |

Net Assets | $ 3,541,641,406 | |

|

|

|

Calculation of Maximum Offering Price Class A: | $ 12.96 | |

|

|

|

Maximum offering price per share (100/94.25 of $12.96) | $ 13.75 | |

Class T: | $ 12.94 | |

|

|

|

Maximum offering price per share (100/96.50 of $12.94) | $ 13.41 | |

Class B: | $ 12.93 | |

|

|

|

Class C: | $ 12.91 | |

|

|

|

Asset Manager 20%: | $ 12.98 | |

|

|

|

Institutional Class: | $ 12.98 | |

A Redemption price per share is equal to net asset value less any applicable contingent deferred sales charge.

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Statement of Operations

Six months ended March 31, 2011 (Unaudited) | ||

|

|

|

Investment Income |

|

|

Interest |

| $ 634 |

Income from Fidelity Central Funds |

| 36,744,723 |

Total income |

| 36,745,357 |

|

|

|

Expenses | ||

Management fee | $ 6,964,019 | |

Transfer agent fees | 1,626,170 | |

Distribution and service plan fees | 190,870 | |

Accounting fees and expenses | 533,030 | |

Custodian fees and expenses | 3,222 | |

Independent trustees' compensation | 6,029 | |

Registration fees | 112,789 | |

Audit | 9,390 | |

Legal | 8,513 | |

Miscellaneous | 17,365 | |

Total expenses before reductions | 9,471,397 | |

Expense reductions | (97,453) | 9,373,944 |

Net investment income (loss) | 27,371,413 | |

Realized and Unrealized Gain (Loss) Net realized gain (loss) on: | ||

Investment securities: |

|

|

Fidelity Central Funds | 27,731,384 |

|

Futures contracts | 1,972,126 | |

Capital gain distributions from Fidelity Central Funds | 18,780 |

|

Total net realized gain (loss) |

| 29,722,290 |

Change in net unrealized appreciation (depreciation) on: Investment securities | 83,583,527 | |

Futures contracts | (899,849) | |

Total change in net unrealized appreciation (depreciation) |

| 82,683,678 |

Net gain (loss) | 112,405,968 | |

Net increase (decrease) in net assets resulting from operations | $ 139,777,381 | |

Statement of Changes in Net Assets

| Six months ended March 31, 2011 (Unaudited) | Year ended |

Increase (Decrease) in Net Assets |

|

|

Operations |

|

|

Net investment income (loss) | $ 27,371,413 | $ 56,796,031 |

Net realized gain (loss) | 29,722,290 | 31,482,211 |

Change in net unrealized appreciation (depreciation) | 82,683,678 | 137,355,237 |

Net increase (decrease) in net assets resulting from operations | 139,777,381 | 225,633,479 |

Distributions to shareholders from net investment income | (27,587,712) | (53,944,822) |

Distributions to shareholders from net realized gain | (3,918,088) | (1,063,144) |

Total distributions | (31,505,800) | (55,007,966) |

Share transactions - net increase (decrease) | 297,471,944 | 610,462,151 |

Total increase (decrease) in net assets | 405,743,525 | 781,087,664 |

|

|

|

Net Assets | ||

Beginning of period | 3,135,897,881 | 2,354,810,217 |

End of period (including undistributed net investment income of $5,866,703 and undistributed net investment income of $6,083,002, respectively) | $ 3,541,641,406 | $ 3,135,897,881 |

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Financial Highlights - Class A

| Six months ended March 31, 2011 | Years ended September 30, | |||

Selected Per-Share Data | (Unaudited) | 2010 | 2009 | 2008 | 2007 G |

Net asset value, beginning of period | $ 12.55 | $ 11.80 | $ 11.35 | $ 12.90 | $ 13.13 |

Income from Investment Operations |

|

|

|

|

|

Net investment income (loss) E | .09 | .22 | .33 | .39 | .48 |

Net realized and unrealized gain (loss) | .42 | .74 | .48 | (1.27) | .40 |

Total from investment operations | .51 | .96 | .81 | (.88) | .88 |

Distributions from net investment income | (.09) | (.21) | (.36) | (.42) | (.52) |

Distributions from net realized gain | (.02) | (.01) | - | (.25) | (.59) |

Total distributions | (.10) J | (.21) I | (.36) | (.67) | (1.11) |

Net asset value, end of period | $ 12.96 | $ 12.55 | $ 11.80 | $ 11.35 | $ 12.90 |

Total Return B, C, D | 4.11% | 8.26% | 7.51% | (7.18)% | 7.03% |

Ratios to Average Net Assets H |

|

|

|

|

|

Expenses before reductions | .85% A | .84% | .87% | .86% | .87% A |

Expenses net of fee waivers, if any | .85% A | .84% | .87% | .86% | .87% A |

Expenses net of all reductions | .85% A | .83% | .87% | .86% | .87% A |

Net investment income (loss) | 1.34% A | 1.80% | 3.01% | 3.18% | 3.84% A |

Supplemental Data |

|

|

|

|

|

Net assets, end of period (000 omitted) | $ 49,033 | $ 31,268 | $ 24,488 | $ 8,030 | $ 3,422 |

Portfolio turnover rate F | 12% A | 18% | 16% | 5% | 6% |

A Annualized

B Total returns for periods of less than one year are not annualized.

C Total returns would have been lower had certain expenses not been reduced during the periods shown.

D Total returns do not include the effect of the sales charges.

E Calculated based on average shares outstanding during the period.

F Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

G For the period October 2, 2006 (commencement of sale of shares) to September 30, 2007.

H Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expense ratios before reductions for start-up periods may not be representative of longer-term operating periods. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class. Fees and expenses of the underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds. Based on their most recent shareholder report date, the expenses ranged from less than .01% to .015%.

I Total distributions of $.21 per share is comprised of distributions from net investment income of $.209 and distributions from net realized gain of $.005 per share.

J Total distributions of $.10 per share is comprised of distributions from net investment income of $.089 and distributions from net realized gain of $.015 per share.

Financial Highlights - Class T

| Six months ended March 31, 2011 | Years ended September 30, | |||

Selected Per-Share Data | (Unaudited) | 2010 | 2009 | 2008 | 2007 G |

Net asset value, beginning of period | $ 12.53 | $ 11.78 | $ 11.33 | $ 12.88 | $ 13.13 |

Income from Investment Operations |

|

|

|

|

|

Net investment income (loss) E | .07 | .19 | .30 | .36 | .45 |

Net realized and unrealized gain (loss) | .43 | .74 | .48 | (1.28) | .40 |

Total from investment operations | .50 | .93 | .78 | (.92) | .85 |

Distributions from net investment income | (.07) | (.18) | (.33) | (.38) | (.51) |

Distributions from net realized gain | (.02) | (.01) | - | (.25) | (.59) |

Total distributions | (.09) | (.18) I | (.33) | (.63) | (1.10) |

Net asset value, end of period | $ 12.94 | $ 12.53 | $ 11.78 | $ 11.33 | $ 12.88 |

Total Return B, C, D | 3.98% | 8.00% | 7.26% | (7.43)% | 6.75% |

Ratios to Average Net Assets H |

|

|

|

|

|

Expenses before reductions | 1.10% A | 1.09% | 1.11% | 1.12% | 1.11% A |

Expenses net of fee waivers, if any | 1.10% A | 1.09% | 1.11% | 1.12% | 1.11% A |

Expenses net of all reductions | 1.10% A | 1.09% | 1.11% | 1.12% | 1.11% A |

Net investment income (loss) | 1.09% A | 1.55% | 2.76% | 2.93% | 3.60% A |

Supplemental Data |

|

|

|

|

|

Net assets, end of period (000 omitted) | $ 15,967 | $ 15,771 | $ 10,032 | $ 4,915 | $ 3,954 |

Portfolio turnover rate F | 12% A | 18% | 16% | 5% | 6% |

A Annualized

B Total returns for periods of less than one year are not annualized.

C Total returns would have been lower had certain expenses not been reduced during the periods shown.

D Total returns do not include the effect of the sales charges.

E Calculated based on average shares outstanding during the period.

F Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

G For the period October 2, 2006 (commencement of sale of shares) to September 30, 2007.

H Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expense ratios before reductions for start-up periods may not be representative of longer-term operating periods. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class. Fees and expenses of the underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds. Based on their most recent shareholder report date, expenses ranged from less than .01% to .15%.

I Total distributions of $.18 per share is comprised of distributions from net investment income of $.179 and distributions from net realized gain of $.005 per share.

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Financial Highlights - Class B

| Six months ended March 31, 2011 | Years ended September 30, | |||

Selected Per-Share Data | (Unaudited) | 2010 | 2009 | 2008 | 2007 G |

Net asset value, beginning of period | $ 12.51 | $ 11.77 | $ 11.32 | $ 12.87 | $ 13.13 |

Income from Investment Operations |

|

|

|

|

|

Net investment income (loss) E | .03 | .12 | .24 | .29 | .39 |

Net realized and unrealized gain (loss) | .44 | .74 | .49 | (1.27) | .38 |

Total from investment operations | .47 | .86 | .73 | (.98) | .77 |

Distributions from net investment income | (.04) | (.11) | (.28) | (.32) | (.44) |

Distributions from net realized gain | (.02) | (.01) | - | (.25) | (.59) |

Total distributions | (.05) I | (.12) | (.28) | (.57) | (1.03) |

Net asset value, end of period | $ 12.93 | $ 12.51 | $ 11.77 | $ 11.32 | $ 12.87 |

Total Return B, C, D | 3.77% | 7.34% | 6.70% | (7.89)% | 6.13% |

Ratios to Average Net Assets H |

|

|

|

|

|

Expenses before reductions | 1.65% A | 1.67% | 1.69% | 1.67% | 1.65% A |

Expenses net of fee waivers, if any | 1.65% A | 1.65% | 1.65% | 1.66% | 1.65% A |

Expenses net of all reductions | 1.64% A | 1.64% | 1.65% | 1.66% | 1.65% A |

Net investment income (loss) | .55% A | .99% | 2.23% | 2.38% | 3.06% A |

Supplemental Data |

|

|

|

|

|

Net assets, end of period (000 omitted) | $ 3,289 | $ 3,717 | $ 2,712 | $ 1,975 | $ 991 |

Portfolio turnover rate F | 12% A | 18% | 16% | 5% | 6% |

A Annualized

B Total returns for periods of less than one year are not annualized.

C Total returns would have been lower had certain expenses not been reduced during the periods shown.

D Total returns do not include the effect of the contingent deferred sales charge.

E Calculated based on average shares outstanding during the period.

F Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

G For the period October 2, 2006 (commencement of sale of shares) to September 30, 2007.

H Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expense ratios before reductions for start-up periods may not be representative of longer-term operating periods. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class. Fees and expenses of the underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds. Based on their most recent shareholder report date, expenses ranged from less than .01% to .15%.

I Total distributions of $.05 per share is comprised of distributions from net investment income of $.036 and distributions from net realized gain of $.015 per share.

Financial Highlights - Class C

| Six months ended March 31, 2011 | Years ended September 30, | |||

Selected Per-Share Data | (Unaudited) | 2010 | 2009 | 2008 | 2007 G |

Net asset value, beginning of period | $ 12.50 | $ 11.76 | $ 11.31 | $ 12.86 | $ 13.13 |

Income from Investment Operations |

|

|

|

|

|

Net investment income (loss) E | .04 | .12 | .24 | .29 | .39 |

Net realized and unrealized gain (loss) | .43 | .74 | .49 | (1.26) | .38 |

Total from investment operations | .47 | .86 | .73 | (.97) | .77 |

Distributions from net investment income | (.04) | (.12) | (.28) | (.33) | (.45) |

Distributions from net realized gain | (.02) | (.01) | - | (.25) | (.59) |

Total distributions | (.06) | (.12) I | (.28) | (.58) | (1.04) |

Net asset value, end of period | $ 12.91 | $ 12.50 | $ 11.76 | $ 11.31 | $ 12.86 |

Total Return B, C, D | 3.73% | 7.40% | 6.75% | (7.87)% | 6.15% |

Ratios to Average Net Assets H |

|

|

|

|

|

Expenses before reductions | 1.61% A | 1.61% | 1.63% | 1.65% | 1.64% A |

Expenses net of fee waivers, if any | 1.61% A | 1.61% | 1.63% | 1.65% | 1.64% A |

Expenses net of all reductions | 1.60% A | 1.60% | 1.63% | 1.64% | 1.64% A |

Net investment income (loss) | .59% A | 1.03% | 2.24% | 2.40% | 3.07% A |

Supplemental Data |

|

|

|

|

|

Net assets, end of period (000 omitted) | $ 17,224 | $ 15,728 | $ 9,189 | $ 3,668 | $ 1,697 |

Portfolio turnover rate F | 12% A | 18% | 16% | 5% | 6% |

A Annualized

B Total returns for periods of less than one year are not annualized.

C Total returns would have been lower had certain expenses not been reduced during the periods shown.

D Total returns do not include the effect of the contingent deferred sales charge.

E Calculated based on average shares outstanding during the period.

F Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

G For the period October 2, 2006 (commencement of sale of shares) to September 30, 2007.

H Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expense ratios before reductions for start-up periods may not be representative of longer-term operating periods. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class. Fees and expenses of the underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds. Based on their most recent shareholder report date, expenses ranged from less than .01% to .15%.

I Total distributions of $.12 per share is comprised of distributions from net investment income of $.119 and distributions from net realized gain of $.005 per share.

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Financial Highlights - Asset Manager 20%

| Six months ended March 31, 2011 | Years ended September 30, | ||||

Selected Per-Share Data | (Unaudited) | 2010 | 2009 | 2008 | 2007 | 2006 |

Net asset value, beginning of period | $ 12.57 | $ 11.82 | $ 11.36 | $ 12.91 | $ 13.14 | $ 13.00 |

Income from Investment Operations |

|

|

|

|

|

|

Net investment income (loss) D | .11 | .25 | .35 | .43 | .53 | .46 |

Net realized and unrealized gain (loss) | .42 | .75 | .50 | (1.28) | .38 | .39 |

Total from investment operations | .53 | 1.00 | .85 | (.85) | .91 | .85 |

Distributions from net investment income | (.11) | (.24) | (.39) | (.45) | (.55) | (.43) |

Distributions from net realized gain | (.02) | (.01) | - | (.25) | (.59) | (.28) |

Total distributions | (.12) H | (.25) | (.39) | (.70) | (1.14) | (.71) |

Net asset value, end of period | $ 12.98 | $ 12.57 | $ 11.82 | $ 11.36 | $ 12.91 | $ 13.14 |

Total Return B, C | 4.25% | 8.54% | 7.90% | (6.90)% | 7.26% | 6.77% |

Ratios to Average Net Assets F |

|

|

|

|

|

|

Expenses before reductions | .55% A | .56% | .58% | .56% | .57% | .58% |

Expenses net of fee waivers, if any | .55% A | .56% | .58% | .56% | .57% | .58% |

Expenses net of all reductions | .55% A | .56% | .58% | .56% | .57% | .57% |

Net investment income (loss) | 1.64% A | 2.08% | 3.30% | 3.48% | 4.15% | 3.58% |

Supplemental Data |

|

|

|

|

|

|

Net assets, end of period (000 omitted) | $ 3,450,208 | $ 3,064,676 | $ 2,305,692 | $ 2,265,384 | $ 2,509,481 | $ 2,130,750 |

Portfolio turnover rate E | 12% A | 18% | 16% | 5% | 6% | 81% G |

A Annualized

B Total returns for periods of less than one year are not annualized.

C Total returns would have been lower had certain expenses not been reduced during the periods shown.

D Calculated based on average shares outstanding during the period.

E Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

F Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class. Fees and expenses of the underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds. Based on their most recent shareholder report date, expenses ranged from less than .01% to .15%.

G Portfolio turnover rate excludes securities received or delivered in-kind.

H Total distributions of $.12 per share is comprised of distributions from net investment income of $.107 and distributions from net realized gain of $.015 per share.

Financial Highlights - Institutional Class

| Six months ended March 31, 2011 | Years ended September 30, | |||

Selected Per-Share Data | (Unaudited) | 2010 | 2009 | 2008 | 2007 F |

Net asset value, beginning of period | $ 12.56 | $ 11.82 | $ 11.35 | $ 12.90 | $ 13.13 |

Income from Investment Operations |

|

|

|

|

|

Net investment income (loss) D | .10 | .25 | .36 | .42 | .53 |

Net realized and unrealized gain (loss) | .44 | .74 | .50 | (1.27) | .38 |

Total from investment operations | .54 | .99 | .86 | (.85) | .91 |

Distributions from net investment income | (.11) | (.24) | (.39) | (.45) | (.55) |

Distributions from net realized gain | (.02) | (.01) | - | (.25) | (.59) |

Total distributions | (.12) H | (.25) | (.39) | (.70) | (1.14) |

Net asset value, end of period | $ 12.98 | $ 12.56 | $ 11.82 | $ 11.35 | $ 12.90 |

Total Return B, C | 4.32% | 8.46% | 8.00% | (6.91)% | 7.24% |

Ratios to Average Net Assets G |

|

|

|

|

|

Expenses before reductions | .61% A | .56% | .56% | .57% | .59% A |

Expenses net of fee waivers, if any | .61% A | .56% | .56% | .57% | .59% A |

Expenses net of all reductions | .60% A | .55% | .56% | .56% | .59% A |

Net investment income (loss) | 1.59% A | 2.09% | 3.32% | 3.48% | 4.13% A |

Supplemental Data |

|

|

|

|

|

Net assets, end of period (000 omitted) | $ 5,921 | $ 4,739 | $ 2,697 | $ 1,722 | $ 248 |

Portfolio turnover rate E | 12% A | 18% | 16% | 5% | 6% |

A Annualized

B Total returns for periods of less than one year are not annualized.

C Total returns would have been lower had certain expenses not been reduced during the periods shown.

D Calculated based on average shares outstanding during the period.

E Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

F For the period October 2, 2006 (commencement of sale of shares) to September 30, 2007.

G Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expense ratios before reductions for start-up periods may not be representative of longer-term operating periods. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class. Fees and expenses of the underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds. Based on their most recent shareholder report date, expenses ranged from less than .01% to .15%.

H Total distributions of $.12 per share is comprised of distributions from net investment income of $.105 and distributions from net realized gain of $.015 per share.

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Fidelity Asset Manager 30%

Investment Changes (Unaudited)

The information in the following tables is based on the combined investments of the Fund and its pro-rata share of the investments of Fidelity's Central Funds, other than the Commodity Strategy and Money Market Central Funds. |

Top Five Bond Issuers as of March 31, 2011 | ||

(with maturities greater than one year) | % of fund's | % of fund's net assets |

U.S. Treasury Obligations | 16.1 | 17.4 |

Fannie Mae | 15.6 | 11.8 |

Freddie Mac | 3.1 | 1.4 |

Ginnie Mae | 0.8 | 1.5 |

JPMorgan Chase Commercial Mortgage Securities Trust | 0.4 | 0.4 |

| 36.0 | |

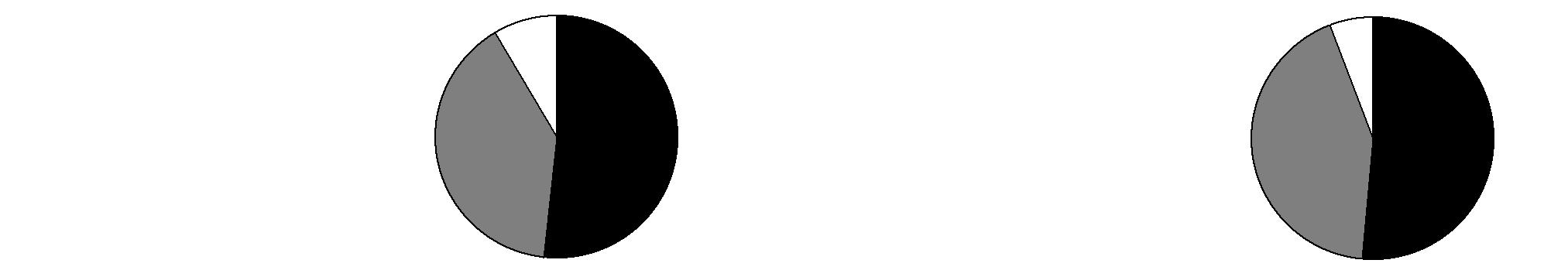

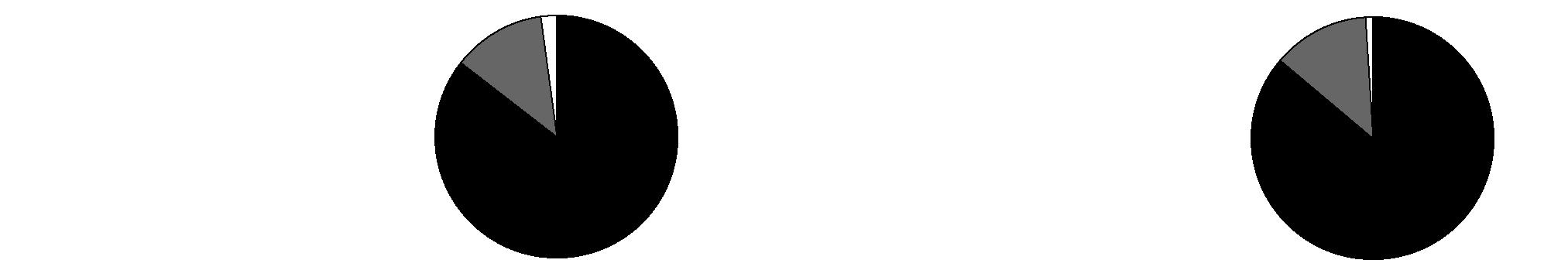

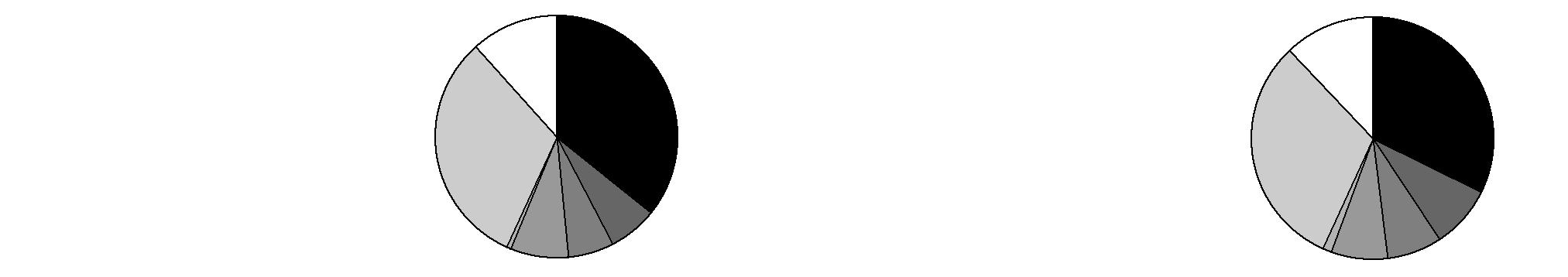

Quality Diversification (% of fund's net assets) | |||||||

As of March 31, 2011 | As of September 30, 2010 | ||||||

| U.S. Government |

|  | U.S. Government |

| ||

| AAA,AA,A 6.6% |

|  | AAA,AA,A 8.4% |

| ||

| BBB 6.1% |

|  | BBB 7.2% |

| ||

| BB and Below 7.7% |

|  | BB and Below 7.6% |

| ||

| Not Rated 0.7% |

|  | Not Rated 1.3% |

| ||

| Equities* 31.5% |

|  | Equities** 31.1% |

| ||

| Short-Term Investments |

|  | Short-Term Investments |

| ||

* Includes investment in Fidelity Commodity Strategy Central Fund of 1.8% |

| ** Includes investment in Fidelity Commodity Strategy Central Fund of 0.9% |

| ||||

We have used ratings from Moody's Investors Service, Inc. Where Moody's® ratings are not available, we have used S&P® ratings. All ratings are as of the report date and do not reflect subsequent changes. Percentages are adjusted for the effect of futures contracts, if applicable. |

Top Five Stocks as of March 31, 2011 | ||

| % of fund's | % of fund's net assets |

Apple, Inc. | 0.5 | 0.5 |

Comerica, Inc. | 0.4 | 0.2 |

Exxon Mobil Corp. | 0.4 | 0.4 |

Visa, Inc. Class A | 0.4 | 0.3 |

General Electric Co. | 0.3 | 0.3 |

| 2.0 | |

Asset Allocation (% of fund's net assets) | |||||||

As of March 31, 2011 | As of September 30, 2010 | ||||||

| Stock Class |

|  | Stocks |

| ||

| Bond Class 51.4% |

|  | Bonds 54.4% |

| ||

| Short-Term Class 16.9% |

|  | Short-Term Class 14.5% |

| ||

* Includes investment in Fidelity Commodity Strategy Central Fund of 1.8% |

| ** Includes investment in Fidelity Commodity Strategy Central Fund of 0.9% |

| ||||

Asset allocations in the pie charts reflect the categorization of assets as defined in the Fund's prospectus in effect as of the time periods indicated above. Percentages are adjusted for the effect of futures contracts and swap contracts, if applicable. |

Semiannual Report

Fidelity Asset Manager 30%

Investment Summary (Unaudited)

The information in the following table is based on the direct investments of the Fund.

Fund Holdings as of March 31, 2011 | |

| % of fund's |

Equity Central Funds | |

Fidelity International Equity Central Fund | 7.3 |

Fidelity Financials Central Fund | 4.0 |

Fidelity Information Technology Central Fund | 3.7 |

Fidelity Energy Central Fund | 2.7 |

Fidelity Industrials Central Fund | 2.5 |

Fidelity Consumer Discretionary Central Fund | 2.4 |

Fidelity Health Care Central Fund | 2.4 |

Fidelity Consumer Staples Central Fund | 1.9 |

Fidelity Commodity Strategy Central Fund | 1.8 |

Fidelity Emerging Markets Equity Central Fund | 1.2 |

Fidelity Materials Central Fund | 0.9 |

Fidelity Utilities Central Fund | 0.7 |

Fidelity Telecom Services Central Fund | 0.6 |

Total Equity Central Funds | 32.1 |

Fixed-Income Central Funds | |

High Yield Fixed-Income Funds | 6.8 |

Investment Grade Fixed-Income Funds | 47.0 |

Total Fixed-Income Central Funds | 53.8 |

Money Market Central Funds | 14.0 |

Net Other Assets (Liabilities) | 0.1 |

Total | 100.0 |

At period end, foreign investments including the Fund's pro-rata share of the underlying Central Funds, other than the Commodity Strategy Central Fund, was 13.9% of net assets.

An unaudited holdings listing for the Fund, which presents direct holdings as well as the pro-rata share of any securities and other investments held indirectly through its investment in underlying Fidelity Central Funds, other than the Commodity Strategy and Money Market Central Funds, is available at fidelity.com and/or advisor.fidelity.com, as applicable.

Semiannual Report

Fidelity Asset Manager 30%

Investments March 31, 2011 (Unaudited)

Showing Percentage of Net Assets

Equity Central Funds - 32.1% | |||

Shares | Value | ||

Fidelity Commodity Strategy Central Fund (b) | 271,043 | $ 3,577,766 | |

Fidelity Consumer Discretionary Central Fund (b) | 36,136 | 4,750,815 | |

Fidelity Consumer Staples Central Fund (b) | 28,196 | 3,790,335 | |

Fidelity Emerging Markets Equity Central Fund (b) | 10,681 | 2,427,207 | |

Fidelity Energy Central Fund (b) | 37,255 | 5,417,692 | |

Fidelity Financials Central Fund (b) | 130,811 | 7,965,088 | |

Fidelity Health Care Central Fund (b) | 33,837 | 4,677,955 | |

Fidelity Industrials Central Fund (b) | 32,374 | 4,996,307 | |

Fidelity Information Technology Central Fund (b) | 39,569 | 7,329,720 | |

Fidelity International Equity Central Fund (b) | 198,260 | 14,516,609 | |

Fidelity Materials Central Fund (b) | 9,618 | 1,731,260 | |

Fidelity Telecom Services Central Fund (b) | 9,707 | 1,246,502 | |

Fidelity Utilities Central Fund (b) | 13,881 | 1,441,367 | |

TOTAL EQUITY CENTRAL FUNDS (Cost $55,655,648) | 63,868,623 | ||

Fixed-Income Central Funds - 53.8% | |||

|

|

|

|

High Yield Fixed-Income Funds -6.8% | |||

Fidelity Emerging Markets Debt Central Fund (b) | 95,084 | 951,790 | |

Fidelity Floating Rate Central Fund (b) | 61,140 | 6,242,351 | |

Fidelity High Income Central Fund 1 (b) | 64,955 | 6,441,586 | |

TOTAL HIGH YIELD FIXED-INCOME FUNDS | 13,635,727 | ||

|

|

|

|

Investment Grade Fixed-Income Funds - 47.0% | |||

Fidelity Tactical Income Central Fund (b) | 929,124 | 93,507,056 | |

TOTAL FIXED-INCOME CENTRAL FUNDS (Cost $103,141,308) | 107,142,783 | ||

Money Market Central Funds - 14.0% | |||

Shares | Value | ||

Fidelity Cash Central Fund, 0.16% (a) | 18,094,476 | $ 18,094,476 | |

Fidelity Money Market Central Fund, .39% (a) | 9,923,538 | 9,923,538 | |

TOTAL MONEY MARKET CENTRAL FUNDS (Cost $28,018,014) | 28,018,014 | ||

TOTAL INVESTMENT PORTFOLIO - 99.9% (Cost $186,814,970) | 199,029,420 | |

NET OTHER ASSETS (LIABILITIES) - 0.1% | 136,190 | |

NET ASSETS - 100% | $ 199,165,610 | |

Legend |

(a) Affiliated fund that is available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. In addition, each Fidelity Central Fund's financial statements are available on the SEC's website or upon request. |

(b) Affiliated fund that is available only to investment companies and other accounts managed by Fidelity Investments. A complete unaudited schedule of portfolio holdings for each Fidelity Central Fund is filed with the SEC for the first and third quarters of each fiscal year on Form N-Q and is available upon request or at the SEC's web site at www.sec.gov. An unaudited holdings listing for the Fund, which presents direct holdings as well as the pro rata share of securities and other investments held indirectly through its investment in underlying Fidelity Central Funds, other than the Commodity Strategy and Money Market Central Funds, is available at fidelity.com and/or advisor.fidelity.com, as applicable. In addition, each Fidelity Central Fund's financial statements are available on the SEC's web site or upon request. |

Affiliated Central Funds |

Information regarding fiscal year to date income earned by the Fund from investments in Fidelity Central Funds is as follows: |

Fund | Income earned |

Fidelity Cash Central Fund | $ 12,406 |

Fidelity Consumer Discretionary Central Fund | 20,171 |

Fidelity Consumer Staples Central Fund | 45,580 |

Fidelity Emerging Markets Debt Central Fund | 798 |

Fidelity Emerging Markets Equity Central Fund | 5,505 |

Fidelity Energy Central Fund | 29,852 |

Fidelity Financials Central Fund | 23,568 |

Fidelity Floating Rate Central Fund | 112,468 |

Fidelity Health Care Central Fund | 15,220 |

Fidelity High Income Central Fund 1 | 218,567 |

Fidelity Industrials Central Fund | 28,253 |

Fidelity Information Technology Central Fund | 7,500 |

Fidelity International Equity Central Fund | 109,022 |

Fidelity Materials Central Fund | 8,151 |

Fidelity Money Market Central Fund | 19,655 |

Fidelity Tactical Income Central Fund | 1,133,905 |

Fidelity Telecom Services Central Fund | 9,647 |

Fidelity Utilities Central Fund | 19,192 |

Total | $ 1,819,460 |

Additional information regarding the Fund's fiscal year to date purchases and sales, including the ownership percentage, of the non Money Market Central Funds is as follows: |

Fund | Value, beginning of period | Purchases | Sales Proceeds | Value, end of period | % ownership, end of period |

Fidelity Commodity Strategy Central Fund | $ 1,240,023 | $ 1,951,432 | $ 11,886 | $ 3,577,766 | 0.4% |

Fidelity Consumer Discretionary Central Fund | 2,836,215 | 1,584,590 | 151,733 | 4,750,815 | 0.7% |

Fidelity Consumer Staples Central Fund | 2,843,919 | 1,062,367 | 335,875 | 3,790,335 | 0.6% |

Fidelity Emerging Markets Debt Central Fund | - | 950,840 | - | 951,790 | 1.0% |

Fidelity Emerging Markets Equity Central Fund | 1,939,042 | 1,057,570 | 810,499 | 2,427,207 | 0.7% |

Fidelity Energy Central Fund | 2,899,956 | 1,416,545 | 384,702 | 5,417,692 | 0.6% |

Fidelity Financials Central Fund | 5,225,903 | 2,755,134 | 464,386 | 7,965,088 | 0.7% |

Fidelity Floating Rate Central Fund | 4,064,391 | 2,013,252 | 91,907 | 6,242,351 | 0.2% |

Fidelity Health Care Central Fund | 3,238,395 | 1,237,151 | 591,834 | 4,677,955 | 0.6% |

Fidelity High Income Central Fund 1 | 4,863,799 | 2,403,368 | 1,006,204 | 6,441,586 | 1.2% |

Fidelity Industrials Central Fund | 2,985,576 | 1,406,193 | 217,728 | 4,996,307 | 0.6% |

Fidelity Information Technology Central Fund | 4,518,643 | 2,126,779 | 336,425 | 7,329,720 | 0.7% |

Fidelity International Equity Central Fund | 9,992,395 | 4,326,441 | 892,709 | 14,516,609 | 0.8% |

Fidelity Materials Central Fund | 1,042,730 | 447,122 | 66,283 | 1,731,260 | 0.7% |

Fidelity Tactical Income Central Fund | 62,297,007 | 32,403,737 | 696,741 | 93,507,056 | 2.0% |

Fidelity Telecom Services Central Fund | 753,772 | 438,026 | 40,937 | 1,246,502 | 0.6% |

Fidelity Utilities Central Fund | 1,047,040 | 407,005 | 91,433 | 1,441,367 | 0.6% |

Total | $ 111,788,806 | $ 57,987,552 | $ 6,191,282 | $ 171,011,406 |

Other Information |

All investments are categorized as Level 1 under the Fair Value Hierarchy. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, please refer to the Security Valuation section in the accompanying Notes to Financial Statements. |

The information in the following table is based on the combined investments of the Fund and its pro-rata share of the investments of Fidelity's Central Funds, other than the Commodity Strategy and Money Market Central Funds. |

Distribution of investments by country of issue, as a percentage of total net assets, is as follows: (Unaudited) |

United States of America | 86.1% |

United Kingdom | 2.6% |

Japan | 1.2% |

Others (Individually Less Than 1%) | 10.1% |

| 100.0% |

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Fidelity Asset Manager 30%

Financial Statements

Statement of Assets and Liabilities

| March 31, 2011 (Unaudited) | |

|

|

|

Assets | ||

Investments in Fidelity Central Funds (cost $186,814,970) |

| $ 199,029,420 |

Receivable for investments sold | 64,902 | |

Receivable for fund shares sold | 656,944 | |

Distributions receivable from Fidelity Central Funds | 5,917 | |

Prepaid expenses | 150 | |

Other receivables | 2,752 | |

Total assets | 199,760,085 | |

|

|

|

Liabilities | ||

Payable for investments purchased | $ 282,461 | |

Payable for fund shares redeemed | 199,682 | |

Accrued management fee | 67,111 | |

Distribution and service plan fees payable | 9,915 | |

Other affiliated payables | 21,076 | |

Other payables and accrued expenses | 14,230 | |

Total liabilities | 594,475 | |

|

|

|

Net Assets | $ 199,165,610 | |

Net Assets consist of: |

| |

Paid in capital | $ 188,265,384 | |

Undistributed net investment income | 332,656 | |

Accumulated undistributed net realized gain (loss) on investments | (1,646,880) | |

Net unrealized appreciation (depreciation) on investments | 12,214,450 | |

Net Assets | $ 199,165,610 | |

|

|

|

Calculation of Maximum Offering Price Class A: | $ 9.83 | |

|

|

|

Maximum offering price per share (100/94.25 of $9.83) | $ 10.43 | |

Class T: | $ 9.82 | |

|

|

|

Maximum offering price per share (100/96.50 of $9.82) | $ 10.18 | |

Class B: | $ 9.82 | |

|

|

|

Class C: | $ 9.80 | |

|

|

|

Asset Manager 30%: | $ 9.84 | |

|

|

|

Institutional Class: | $ 9.83 | |

A Redemption price per share is equal to net asset value less any applicable contingent deferred sales charge.

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Statement of Operations

Six months ended March 31, 2011 (Unaudited) | ||

|

|

|

Investment Income |

|

|

Interest |

| $ 9 |

Income from Fidelity Central Funds |

| 1,819,460 |

Total income |

| 1,819,469 |

|

|

|

Expenses | ||

Management fee | $ 332,095 | |

Transfer agent fees | 78,055 | |

Distribution and service plan fees | 56,954 | |

Accounting fees and expenses | 33,195 | |

Custodian fees and expenses | 2,501 | |

Independent trustees' compensation | 268 | |

Registration fees | 36,304 | |

Audit | 5,424 | |

Legal | 324 | |

Miscellaneous | 724 | |

Total expenses before reductions | 545,844 | |

Expense reductions | (7,561) | 538,283 |

Net investment income (loss) | 1,281,186 | |

Realized and Unrealized Gain (Loss) Net realized gain (loss) on: | ||

Investment securities: |

|

|

Fidelity Central Funds | 1,342,231 |

|

Futures contracts | 6,628 | |

Capital gain distributions from Fidelity Central Funds | 297 |

|

Total net realized gain (loss) |

| 1,349,156 |

Change in net unrealized appreciation (depreciation) on: Investment securities | 6,084,101 | |

Futures contracts | 500 | |

Total change in net unrealized appreciation (depreciation) |

| 6,084,601 |

Net gain (loss) | 7,433,757 | |

Net increase (decrease) in net assets resulting from operations | $ 8,714,943 | |

Statement of Changes in Net Assets

| Six months ended March 31, 2011 (Unaudited) | Year ended |

Increase (Decrease) in Net Assets |

|

|

Operations |

|

|

Net investment income (loss) | $ 1,281,186 | $ 2,024,010 |

Net realized gain (loss) | 1,349,156 | 2,731,395 |

Change in net unrealized appreciation (depreciation) | 6,084,601 | 4,522,277 |

Net increase (decrease) in net assets resulting from operations | 8,714,943 | 9,277,682 |

Distributions to shareholders from net investment income | (1,149,591) | (1,979,157) |

Distributions to shareholders from net realized gain | (4,696,545) | (414,377) |

Total distributions | (5,846,136) | (2,393,534) |

Share transactions - net increase (decrease) | 66,460,069 | 51,214,605 |

Total increase (decrease) in net assets | 69,328,876 | 58,098,753 |

|

|

|

Net Assets | ||

Beginning of period | 129,836,734 | 71,737,981 |

End of period (including undistributed net investment income of $332,656 and undistributed net investment income of $201,061, respectively) | $ 199,165,610 | $ 129,836,734 |

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Financial Highlights - Class A

| Six months ended March 31, 2011 | Years ended September 30, | ||

Selected Per-Share Data | (Unaudited) | 2010 | 2009 | 2008 G |

Net asset value, beginning of period | $ 9.66 | $ 9.04 | $ 8.66 | $ 10.00 |

Income from Investment Operations |

|

|

|

|

Net investment income (loss) E | .07 | .17 | .22 | .24 |

Net realized and unrealized gain (loss) | .47 | .67 | .40 | (1.39) |

Total from investment operations | .54 | .84 | .62 | (1.15) |

Distributions from net investment income | (.06) | (.17) | (.24) | (.19) |

Distributions from net realized gain | (.31) | (.05) | - | - |

Total distributions | (.37) | (.22) | (.24) | (.19) |

Net asset value, end of period | $ 9.83 | $ 9.66 | $ 9.04 | $ 8.66 |

Total Return B, C, D | 5.72% | 9.39% | 7.50% | (11.63)% |

Ratios to Average Net Assets H |

|

|

|

|

Expenses before reductions | .91% A | .98% | 1.21% | 1.66% A |

Expenses net of fee waivers, if any | .90% A | .90% | .90% | .98% A |

Expenses net of all reductions | .89% A | .89% | .89% | .98% A |

Net investment income (loss) | 1.38% A | 1.83% | 2.75% | 2.63% A |

Supplemental Data |

|

|

|

|

Net assets, end of period (000 omitted) | $ 8,498 | $ 7,495 | $ 4,305 | $ 1,159 |

Portfolio turnover rate F | 9% A | 20% | 12% | 24% A |

A Annualized

B Total returns for periods of less than one year are not annualized.

C Total returns would have been lower had certain expenses not been reduced during the periods shown.

D Total returns do not include the effect of the sales charges.

E Calculated based on average shares outstanding during the period.

F Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

G For the period October 9, 2007 (commencement of operations) to September 30, 2008.

H Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expense ratios before reductions for start-up periods may not be representative of longer-term operating periods. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class. Fees and expenses of the underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds. Based on their most recent shareholder report date, the expenses ranged from less than .01% to .15%.

Financial Highlights - Class T

| Six months ended March 31, 2011 | Years ended September 30, | ||

Selected Per-Share Data | (Unaudited) | 2010 | 2009 | 2008 G |

Net asset value, beginning of period | $ 9.65 | $ 9.03 | $ 8.65 | $ 10.00 |

Income from Investment Operations |

|

|

|

|

Net investment income (loss) E | .06 | .15 | .20 | .22 |

Net realized and unrealized gain (loss) | .47 | .67 | .40 | (1.40) |

Total from investment operations | .53 | .82 | .60 | (1.18) |

Distributions from net investment income | (.05) | (.15) | (.22) | (.17) |

Distributions from net realized gain | (.31) | (.05) | - | - |

Total distributions | (.36) | (.20) | (.22) | (.17) |