UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-3221

Fidelity Charles Street Trust

(Exact name of registrant as specified in charter)

82 Devonshire St., Boston, Massachusetts 02109

(Address of principal executive offices) (Zip code)

Scott C. Goebel, Secretary

82 Devonshire St.

Boston, Massachusetts 02109

(Name and address of agent for service)

Registrant's telephone number, including area code: 617-563-7000

Date of fiscal year end: | October 31 |

|

|

Date of reporting period: | April 30, 2011 |

Item 1. Reports to Stockholders

Fidelity®

Global Balanced

Fund

Semiannual Report

April 30, 2011

(2_fidelity_logos) (Registered_Trademark)

Contents

Chairman's Message | The Chairman's message to shareholders. | |

Shareholder Expense Example | An example of shareholder expenses. | |

Investment Changes | A summary of major shifts in the fund's investments over the past six months. | |

Investments | A complete list of the fund's investments with their market values. | |

Financial Statements | Statements of assets and liabilities, operations, and changes in net assets, as well as financial highlights. | |

Notes | Notes to financial statements. |

To view a fund's proxy voting guidelines and proxy voting record for the 12-month period ended June 30, visit http://www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission's (SEC) web site at http://www.sec.gov. You may also call 1-800-544-8544 to request a free copy of the proxy voting guidelines.

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR LLC or an affiliated company.

This report and the financial statements contained herein are submitted for the general information of the shareholders of the fund. This report is not authorized for distribution to prospective investors in the fund unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. Forms N-Q are available on the SEC's web site at http://www.sec.gov. A fund's Forms N-Q may be reviewed and copied at the SEC's Public Reference Room in Washington, DC. Information regarding the operation of the SEC's Public Reference Room may be obtained by calling 1-800-SEC-0330. For a complete list of a fund's portfolio holdings, view the most recent holdings listing, semiannual report, or annual report on Fidelity's web site at http://www.fidelity.com, http://www.advisor.fidelity.com, or http://www.401k.com, as applicable.

NOT FDIC INSURED • MAY LOSE VALUE • NO BANK GUARANTEE

Neither the fund nor Fidelity Distributors Corporation is a bank.

Semiannual Report

Chairman's Message

(photo_of_Abigail_P_Johnson)

Dear Shareholder:

Amid indications the U.S. economy had turned a corner, U.S. equities continued their generally upward trend in early 2011, overcoming bouts of short-term volatility following unrest in North Africa and the disaster in Japan. Still, questions remained about the longer-term outlook, most notably persistently high unemployment. Financial markets are always unpredictable, of course, but there also are several time-tested investment principles that can help put the odds in your favor.

One of the basic tenets is to invest for the long term. Over time, riding out the markets' inevitable ups and downs has proven much more effective than selling into panic or chasing the hottest trend. Even missing only a few of the markets' best days can significantly diminish investor returns. Patience also affords the benefits of compounding - of earning interest on additional income or reinvested dividends and capital gains. There can be tax advantages and cost benefits to consider as well. While staying the course doesn't eliminate risk, it can considerably lessen the effect of short-term declines.

You can further manage your investing risk through diversification. And today, more than ever, geographic diversification should be taken into account. Studies indicate that asset allocation is the single most important determinant of a portfolio's long-term success. The right mix of stocks, bonds and cash - aligned to your particular risk tolerance and investment objective - is very important. Age-appropriate rebalancing is also an essential aspect of asset allocation. For younger investors, an emphasis on equities - which historically have been the best-performing asset class over time - is encouraged. As investors near their specific goal, such as retirement or sending a child to college, consideration may be given to replacing volatile assets (e.g. common stocks) with more-stable fixed investments (bonds or savings plans).

A third principle - investing regularly - can help lower the average cost of your purchases. Investing a certain amount of money each month or quarter helps ensure you won't pay for all your shares at market highs. This strategy - known as dollar cost averaging - also reduces "emotion" from investing, helping shareholders avoid selling weak performers just prior to an upswing, or chasing a hot performer just before a correction.

We invite you to contact us via the Internet, through our Investor Centers or by phone. It is our privilege to provide you the information you need to make the investments that are right for you.

Sincerely,

(The chairman's signature appears here.)

Abigail P. Johnson

Semiannual Report

Shareholder Expense Example

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments or redemption proceeds, redemption fees, and (2) ongoing costs, including management fees, distribution and/or service (12b-1) fees and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (November 1, 2010 to April 30, 2011).

Actual Expenses

The first line of the accompanying table for each class of the Fund provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000.00 (for example, an $8,600 account value divided by $1,000.00 = 8.6), then multiply the result by the number in the first line for a class of the Fund under the heading entitled "Expenses Paid During Period" to estimate the expenses you paid on your account during this period. A small balance maintenance fee of $12.00 that is charged once a year may apply for certain accounts with a value of less than $2,000. This fee is not included in the table below. If it was, the estimate of expenses you paid during the period would be higher, and your ending account value lower, by this amount. In addition, the Fund, as a shareholder in the underlying Fidelity Central Funds, will indirectly bear its pro-rata share of the fees and expenses incurred by the underlying Fidelity Central Funds. These fees and expenses are not included in the Fund's annualized expense ratio used to calculate the expense estimate in the table below.

Hypothetical Example for Comparison Purposes

The second line of the accompanying table for each class of the Fund provides information about hypothetical account values and hypothetical expenses based on a Class' actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Class' actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. A small balance maintenance fee of $12.00 that is charged once a year may apply for certain accounts with a value of less than $2,000. This fee is not included in the table below. If it was, the estimate of expenses you paid during the period would be higher, and your ending account value lower, by this amount. In addition, the Fund, as a shareholder in the underlying Fidelity Central Funds, will indirectly bear its pro-rata share of the fees and expenses incurred by the underlying Fidelity Central Funds. These fees and expenses are not included in the Fund's annualized expense ratio used to calculate the expense estimate in the table below.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

Semiannual Report

Shareholder Expense Example - continued

| Annualized | Beginning | Ending | Expenses Paid |

Class A | 1.39% |

|

|

|

Actual |

| $ 1,000.00 | $ 1,108.30 | $ 7.27 |

HypotheticalA |

| $ 1,000.00 | $ 1,017.90 | $ 6.95 |

Class T | 1.61% |

|

|

|

Actual |

| $ 1,000.00 | $ 1,107.00 | $ 8.41 |

HypotheticalA |

| $ 1,000.00 | $ 1,016.81 | $ 8.05 |

Class B | 2.17% |

|

|

|

Actual |

| $ 1,000.00 | $ 1,104.30 | $ 11.32 |

HypotheticalA |

| $ 1,000.00 | $ 1,014.03 | $ 10.84 |

Class C | 2.14% |

|

|

|

Actual |

| $ 1,000.00 | $ 1,104.60 | $ 11.17 |

HypotheticalA |

| $ 1,000.00 | $ 1,014.18 | $ 10.69 |

Global Balanced | 1.08% |

|

|

|

Actual |

| $ 1,000.00 | $ 1,110.60 | $ 5.65 |

HypotheticalA |

| $ 1,000.00 | $ 1,019.44 | $ 5.41 |

Institutional Class | 1.12% |

|

|

|

Actual |

| $ 1,000.00 | $ 1,109.70 | $ 5.86 |

HypotheticalA |

| $ 1,000.00 | $ 1,019.24 | $ 5.61 |

A 5% return per year before expenses

* Expenses are equal to each Class' annualized expense ratio, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). The fees and expenses of the underlying Fidelity Central Funds in which the Fund invests are not included in the Fund's annualized expense ratio.

Semiannual Report

Investment Changes (Unaudited)

The information in the following tables is based on the combined investments of the Fund and its pro-rata share of its investments in each non-money market Fidelity Central Fund. |

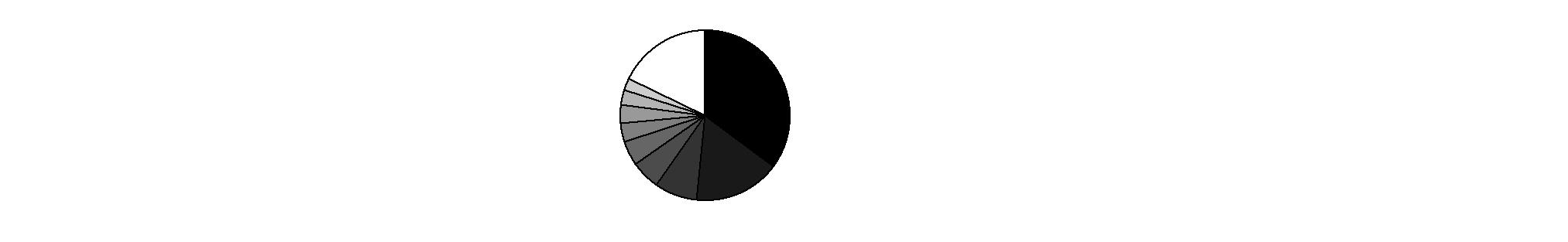

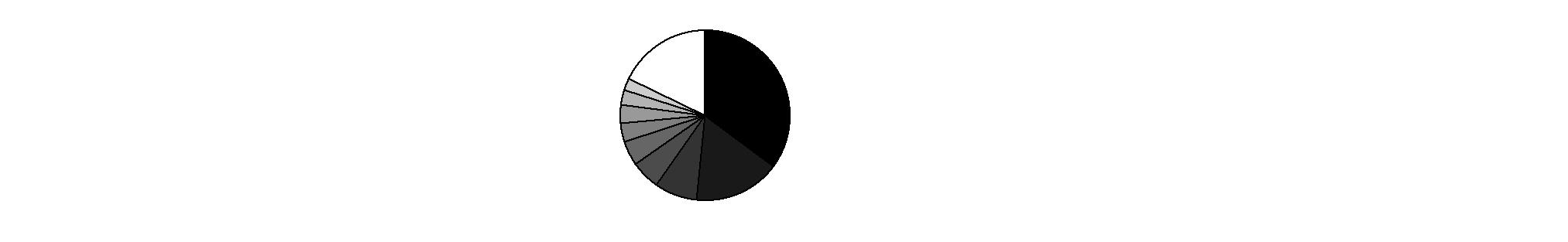

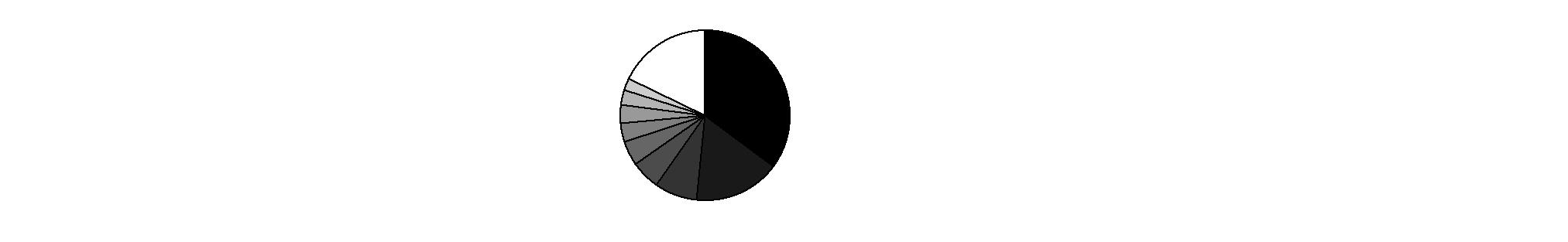

Geographic Diversification (% of fund's net assets) | |||

As of April 30, 2011 | |||

| United States of America 35.2% |

| |

| Japan 16.5% |

| |

| United Kingdom 8.0% |

| |

| Canada 5.7% |

| |

| France 4.7% |

| |

| Germany 3.5% |

| |

| Italy 3.5% |

| |

| Spain 2.8% |

| |

| Australia 2.2% |

| |

| Other 17.9% |

| |

Percentages are adjusted for the effect of futures contracts, if applicable. |

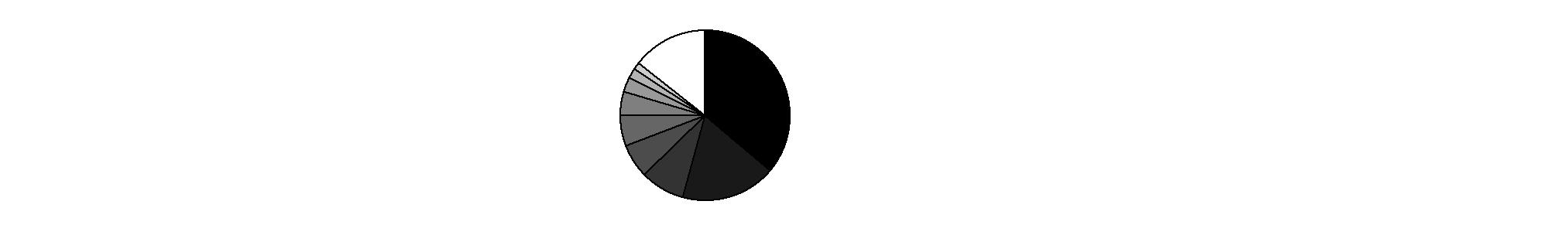

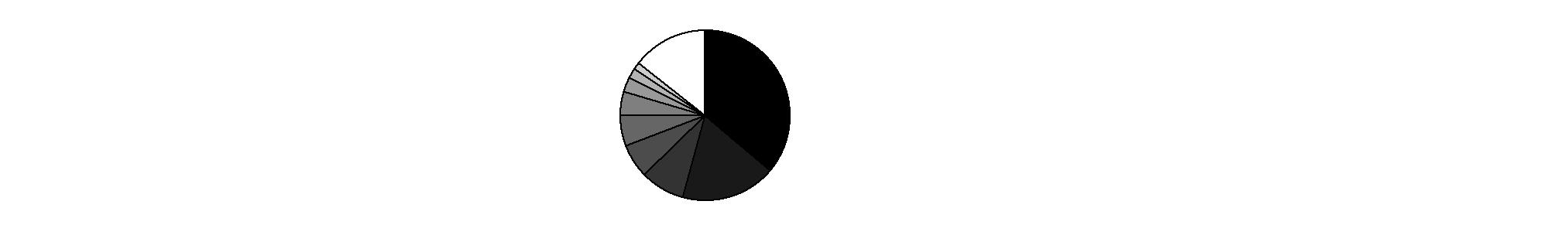

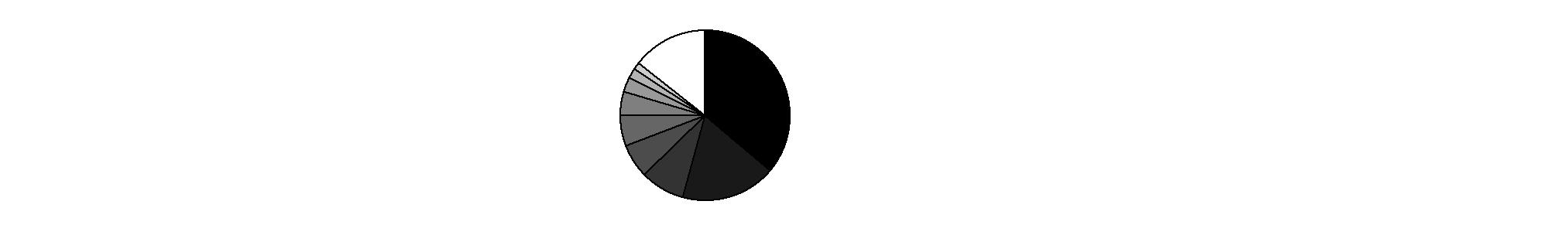

As of October 31, 2010 | |||

| United States of America 36.1% |

| |

| Japan 18.2% |

| |

| United Kingdom 8.4% |

| |

| Germany 6.5% |

| |

| France 5.9% |

| |

| Canada 4.4% |

| |

| Australia 2.8% |

| |

| Switzerland 1.9% |

| |

| Netherlands 1.4% |

| |

| Other 14.4% |

| |

Percentages are adjusted for the effect of futures contracts, if applicable. |

Asset Allocation | ||

| % of fund's | % of fund's net assets |

Stocks | 62.2 | 57.9 |

Bonds | 34.1 | 38.5 |

Convertible Securities | 0.1 | 0.1 |

Other Investments | 0.0 | 0.1 |

Short-Term Investments and Net Other Assets | 3.6 | 3.4 |

Top Five Stocks as of April 30, 2011 | ||

| % of fund's | % of fund's net assets |

Estee Lauder Companies, Inc. Class A (United States of America) | 1.2 | 1.0 |

Alcatel-Lucent SA sponsored ADR (France) | 1.1 | 0.0 |

Lincoln National Corp. (United States of America) | 1.1 | 0.0 |

Exxon Mobil Corp. (United States of America) | 1.1 | 1.1 |

Apple, Inc. (United States of America) | 0.9 | 1.1 |

| 5.4 | |

Top Five Bond Issuers as of April 30, 2011 | ||

(with maturities greater than one year) | % of fund's | % of fund's net assets |

Japan Government | 8.5 | 10.3 |

Italian Republic | 2.2 | 0.2 |

U.S. Treasury Obligations | 2.0 | 3.3 |

Spanish Kingdom | 1.3 | 0.5 |

German Federal Republic | 1.3 | 3.9 |

| 15.3 | |

Market Sectors as of April 30, 2011 | ||

| % of fund's | % of fund's net assets |

Financials | 18.4 | 15.9 |

Consumer Discretionary | 9.6 | 9.9 |

Energy | 10.0 | 6.3 |

Information Technology | 9.4 | 9.7 |

Health Care | 7.4 | 5.9 |

Industrials | 6.8 | 10.6 |

Materials | 5.9 | 5.8 |

Consumer Staples | 3.7 | 3.9 |

Telecommunication Services | 2.3 | 2.3 |

Utilities | 1.5 | 1.4 |

A holdings listing for the Fund, which presents direct holdings as well as the pro-rata share of any securities and other investments held indirectly through its investment in underlying non-money market Fidelity Central Funds, is available at fidelity.com and/or advisor.fidelity.com, as applicable. |

Semiannual Report

Investments April 30, 2011 (Unaudited)

Showing Percentage of Net Assets

Common Stocks - 58.8% | |||

Shares | Value | ||

Australia - 1.8% | |||

AMP Ltd. | 61,461 | $ 369,308 | |

ASX Ltd. | 1,634 | 57,513 | |

Australia & New Zealand Banking Group Ltd. | 10,884 | 289,168 | |

BHP Billiton Ltd. | 33,234 | 1,683,239 | |

Billabong International Ltd. | 24,135 | 178,632 | |

Coca-Cola Amatil Ltd. | 13,366 | 174,990 | |

Cochlear Ltd. | 4,450 | 392,891 | |

Commonwealth Bank of Australia | 22,764 | 1,340,641 | |

Crown Ltd. | 35,037 | 323,864 | |

CSL Ltd. | 13,695 | 515,819 | |

Fosters Group Ltd. | 51,948 | 320,121 | |

JB Hi-Fi Ltd. | 8,888 | 184,291 | |

Macquarie Group Ltd. | 12,190 | 469,960 | |

National Australia Bank Ltd. | 29,851 | 886,372 | |

Newcrest Mining Ltd. | 13,519 | 614,438 | |

QBE Insurance Group Ltd. | 18,230 | 373,998 | |

Redstone Resources Ltd. (a) | 488,373 | 187,425 | |

Rio Tinto Ltd. | 6,743 | 607,836 | |

Suncorp-Metway Ltd. | 53,653 | 489,470 | |

Telstra Corp. Ltd. | 110,010 | 351,022 | |

Wesfarmers Ltd. | 18,890 | 689,739 | |

Worleyparsons Ltd. | 10,439 | 347,397 | |

TOTAL AUSTRALIA | 10,848,134 | ||

Bailiwick of Jersey - 0.7% | |||

Charter International PLC | 31,100 | 426,505 | |

Experian PLC | 63,500 | 855,458 | |

Randgold Resources Ltd. sponsored ADR | 7,100 | 614,647 | |

Shire PLC | 30,957 | 960,703 | |

Shire PLC sponsored ADR | 17,000 | 1,584,570 | |

TOTAL BAILIWICK OF JERSEY | 4,441,883 | ||

Belgium - 0.1% | |||

Anheuser-Busch InBev SA NV (strip VVPR) (a) | 9,280 | 41 | |

Umicore SA | 13,364 | 766,552 | |

TOTAL BELGIUM | 766,593 | ||

Bermuda - 0.3% | |||

GOME Electrical Appliances Holdings Ltd. (a) | 571,000 | 205,129 | |

Huabao International Holdings Ltd. | 306,000 | 453,900 | |

Li & Fung Ltd. | 72,000 | 368,052 | |

Noble Group Ltd. | 176,000 | 320,641 | |

Common Stocks - continued | |||

Shares | Value | ||

Bermuda - continued | |||

Pacific Basin Shipping Ltd. | 256,000 | $ 158,552 | |

Ports Design Ltd. | 38,000 | 104,709 | |

TOTAL BERMUDA | 1,610,983 | ||

British Virgin Islands - 0.1% | |||

Arcos Dorados Holdings, Inc. | 20,000 | 440,600 | |

Canada - 5.1% | |||

Agnico-Eagle Mines Ltd. (Canada) | 1,500 | 104,513 | |

Agrium, Inc. | 3,200 | 290,067 | |

Alimentation Couche-Tard, Inc. Class B (sub. vtg.) | 800 | 21,013 | |

Astral Media, Inc. Class A (non-vtg.) | 1,300 | 50,579 | |

Bank of Montreal | 7,000 | 459,761 | |

Bank of Nova Scotia | 13,400 | 817,087 | |

Barrick Gold Corp. | 10,300 | 526,050 | |

Baytex Energy Corp. | 4,800 | 296,442 | |

BCE, Inc. | 11,600 | 434,770 | |

Bombardier, Inc. Class B (sub. vtg.) | 219,100 | 1,632,655 | |

Brookfield Asset Management, Inc. Class A | 6,700 | 225,623 | |

Brookfield Properties Corp. | 6,800 | 134,548 | |

CAE, Inc. | 8,000 | 107,811 | |

Calfrac Well Services Ltd. | 3,200 | 113,206 | |

Canadian Imperial Bank of Commerce | 6,100 | 528,116 | |

Canadian National Railway Co. | 7,800 | 605,054 | |

Canadian Natural Resources Ltd. | 18,200 | 856,233 | |

Cenovus Energy, Inc. | 9,500 | 365,300 | |

CGI Group, Inc. Class A (sub. vtg.) (a) | 19,200 | 420,082 | |

Copper Mountain Mining Corp. (a) | 3,000 | 22,989 | |

Crescent Point Energy Corp. | 3,500 | 158,926 | |

Detour Gold Corp. (a) | 4,600 | 155,489 | |

Eldorado Gold Corp. | 11,100 | 206,607 | |

Enbridge, Inc. | 9,700 | 630,536 | |

Finning International, Inc. | 10,000 | 293,309 | |

First Quantum Minerals Ltd. | 7,900 | 1,125,840 | |

Gildan Activewear, Inc. | 3,000 | 111,743 | |

Goldcorp, Inc. | 23,000 | 1,285,773 | |

Grande Cache Coal Corp. (a) | 84,100 | 717,352 | |

IAMGOLD Corp. | 5,500 | 114,348 | |

IESI-BFC Ltd. | 3,900 | 98,974 | |

Imperial Oil Ltd. | 5,400 | 285,382 | |

Industrial Alliance Life Insurance Co. | 2,500 | 107,441 | |

Intact Financial Corp. | 2,200 | 111,616 | |

Ivanhoe Mines Ltd. (a) | 3,910 | 102,534 | |

Common Stocks - continued | |||

Shares | Value | ||

Canada - continued | |||

Keyera Corp. | 60,423 | $ 2,506,076 | |

Kodiak Oil & Gas Corp. (a) | 117,000 | 821,340 | |

Lundin Mining Corp. (a) | 25,000 | 244,689 | |

MacDonald Dettwiler & Associates Ltd. | 1,700 | 102,438 | |

Magna International, Inc. Class A (sub. vtg.) | 3,100 | 159,309 | |

Manulife Financial Corp. | 19,000 | 341,201 | |

Metro, Inc. Class A (sub. vtg.) | 3,000 | 146,813 | |

National Bank of Canada | 2,300 | 190,447 | |

Niko Resources Ltd. | 800 | 67,604 | |

Open Text Corp. (a) | 2,000 | 122,524 | |

Osisko Mining Corp. (a) | 2,500 | 36,598 | |

Pacific Rubiales Energy Corp. | 3,500 | 106,358 | |

Penn West Petroleum Ltd. | 5,000 | 128,316 | |

Petrobank Energy & Resources Ltd. | 5,900 | 124,847 | |

Petrominerales Ltd. | 7,105 | 271,929 | |

Potash Corp. of Saskatchewan, Inc. | 13,200 | 745,735 | |

Precision Drilling Corp. (a) | 8,000 | 121,171 | |

Quebecor, Inc. Class B (sub. vtg.) | 2,200 | 78,155 | |

Rogers Communications, Inc. Class B (non-vtg.) | 4,050 | 153,293 | |

Royal Bank of Canada | 17,400 | 1,096,121 | |

Silver Wheaton Corp. | 10,000 | 406,934 | |

SNC-Lavalin Group, Inc. | 2,000 | 121,002 | |

Sun Life Financial, Inc. | 8,900 | 291,336 | |

Suncor Energy, Inc. | 31,672 | 1,459,905 | |

SunOpta, Inc. (a) | 17,000 | 120,020 | |

SXC Health Solutions Corp. (a) | 8,600 | 475,313 | |

Talisman Energy, Inc. | 41,600 | 1,004,714 | |

Teck Resources Ltd. Class B (sub. vtg.) | 5,800 | 315,288 | |

TELUS Corp. | 4,200 | 221,342 | |

The Toronto-Dominion Bank | 10,600 | 917,823 | |

Thomson Reuters Corp. | 5,000 | 202,727 | |

Tim Hortons, Inc. (Canada) | 4,000 | 194,609 | |

Trican Well Service Ltd. | 7,000 | 172,540 | |

Trinidad Drilling Ltd. | 49,200 | 563,712 | |

Uranium One, Inc. | 72,700 | 302,757 | |

Valeant Pharmaceuticals International, Inc. (Canada) | 57,160 | 3,014,781 | |

Vermilion Energy, Inc. | 2,000 | 107,388 | |

TOTAL CANADA | 30,974,924 | ||

Cayman Islands - 0.3% | |||

E-Commerce China Dangdang, Inc. ADR | 3,000 | 69,030 | |

Geely Automobile Holdings Ltd. | 515,000 | 206,231 | |

Common Stocks - continued | |||

Shares | Value | ||

Cayman Islands - continued | |||

Hengdeli Holdings Ltd. | 936,000 | $ 560,421 | |

Herbalife Ltd. | 4,000 | 359,120 | |

Minth Group Ltd. | 92,000 | 141,442 | |

Shenguan Holdings Group Ltd. | 104,000 | 138,197 | |

Tencent Holdings Ltd. | 13,900 | 395,542 | |

The United Laboratories International Holdings Ltd. | 12,000 | 20,210 | |

TOTAL CAYMAN ISLANDS | 1,890,193 | ||

China - 0.1% | |||

Baidu.com, Inc. sponsored ADR (a) | 5,200 | 772,304 | |

Denmark - 0.7% | |||

Carlsberg A/S Series B | 6,400 | 760,134 | |

FLSmidth & Co. A/S | 4,900 | 441,836 | |

Novo Nordisk A/S Series B | 22,275 | 2,819,979 | |

Pandora A/S | 8,900 | 400,906 | |

TOTAL DENMARK | 4,422,855 | ||

Finland - 0.2% | |||

Fortum Corp. | 14,300 | 492,674 | |

Nokian Tyres PLC | 15,500 | 803,551 | |

TOTAL FINLAND | 1,296,225 | ||

France - 3.6% | |||

Alcatel-Lucent SA sponsored ADR (a) | 1,029,000 | 6,729,660 | |

Alstom SA | 17,600 | 1,170,373 | |

Arkema SA | 7,100 | 739,837 | |

Atos Origin SA (a) | 10,516 | 648,052 | |

AXA SA (e) | 45,000 | 1,009,808 | |

BNP Paribas SA | 20,236 | 1,601,487 | |

Club Mediterranee SA (a) | 13,200 | 307,648 | |

Compagnie Generale de Geophysique SA (a) | 10,400 | 366,382 | |

Danone | 14,800 | 1,084,141 | |

Iliad Group SA | 5,064 | 650,994 | |

L'Oreal SA | 9,400 | 1,191,972 | |

LVMH Moet Hennessy - Louis Vuitton | 6,377 | 1,145,281 | |

Natixis SA | 96,700 | 556,027 | |

PPR SA | 7,300 | 1,305,641 | |

Publicis Groupe SA | 12,100 | 685,716 | |

Remy Cointreau SA | 5,491 | 452,535 | |

Safran SA | 16,200 | 628,681 | |

Common Stocks - continued | |||

Shares | Value | ||

France - continued | |||

Schneider Electric SA | 6,236 | $ 1,101,946 | |

VINCI SA | 6,300 | 420,853 | |

TOTAL FRANCE | 21,797,034 | ||

Germany - 1.8% | |||

adidas AG | 8,900 | 662,562 | |

Bayerische Motoren Werke AG (BMW) | 26,000 | 2,452,008 | |

Fresenius Medical Care AG & Co. KGaA | 8,500 | 668,036 | |

HeidelbergCement AG | 10,900 | 833,570 | |

Infineon Technologies AG | 34,700 | 393,912 | |

Kabel Deutschland Holding AG (a) | 12,700 | 793,740 | |

Linde AG | 3,964 | 713,972 | |

MAN SE | 6,079 | 847,207 | |

SAP AG | 16,138 | 1,039,807 | |

Siemens AG | 15,171 | 2,207,130 | |

TOTAL GERMANY | 10,611,944 | ||

Hong Kong - 0.4% | |||

BOC Hong Kong (Holdings) Ltd. | 158,000 | 496,401 | |

Cheung Kong Holdings Ltd. | 20,000 | 314,693 | |

Esprit Holdings Ltd. | 19,600 | 81,516 | |

Hong Kong Exchanges and Clearing Ltd. | 23,300 | 531,625 | |

Hutchison Whampoa Ltd. | 46,000 | 525,372 | |

SJM Holdings Ltd. | 131,000 | 282,366 | |

TOTAL HONG KONG | 2,231,973 | ||

Ireland - 0.4% | |||

Covidien PLC | 35,000 | 1,949,150 | |

James Hardie Industries NV CDI (a) | 49,111 | 317,716 | |

TOTAL IRELAND | 2,266,866 | ||

Isle of Man - 0.1% | |||

Genting Singapore PLC (a) | 200,000 | 354,561 | |

Italy - 0.8% | |||

Enel SpA | 191,395 | 1,364,741 | |

Fiat Industrial SpA (a) | 54,000 | 802,248 | |

Fiat SpA | 37,100 | 395,933 | |

Intesa Sanpaolo SpA | 303,193 | 1,006,859 | |

Prysmian SpA | 15,800 | 372,809 | |

Saipem SpA | 11,308 | 642,005 | |

TOTAL ITALY | 4,584,595 | ||

Common Stocks - continued | |||

Shares | Value | ||

Japan - 6.0% | |||

Asahi Glass Co. Ltd. | 122,000 | $ 1,548,759 | |

Asahi Kasei Corp. | 159,000 | 1,098,912 | |

Canon, Inc. | 3,700 | 174,221 | |

Cookpad, Inc. (a)(e) | 3,800 | 80,288 | |

Cosmos Pharmaceutical Corp. | 4,000 | 177,200 | |

CyberAgent, Inc. | 306 | 1,101,976 | |

Daibiru Corp. | 15,100 | 119,785 | |

Daiwa House Industry Co. Ltd. | 20,000 | 242,294 | |

DeNA Co. Ltd. | 6,700 | 251,488 | |

Denso Corp. | 1,600 | 53,540 | |

Don Quijote Co. Ltd. | 23,300 | 872,531 | |

East Japan Railway Co. | 10,800 | 600,196 | |

Elpida Memory, Inc. (a) | 45,600 | 683,185 | |

Exedy Corp. | 8,300 | 265,127 | |

Fast Retailing Co. Ltd. | 1,200 | 189,188 | |

Ferrotec Corp. | 24,800 | 567,067 | |

Fuji Machine Manufacturing Co. Ltd. | 13,900 | 325,116 | |

Fujifilm Holdings Corp. | 3,100 | 96,361 | |

Fujitsu Ltd. | 217,000 | 1,243,189 | |

GREE, Inc. | 33,500 | 689,793 | |

Hitachi Construction Machinery Co. Ltd. | 26,100 | 636,218 | |

Hitachi Transport System Ltd. | 14,000 | 194,519 | |

Honda Motor Co. Ltd. | 14,500 | 557,371 | |

Ishikawajima-Harima Heavy Industries Co. Ltd. | 100,000 | 254,410 | |

Japan Tobacco, Inc. | 145 | 563,444 | |

JX Holdings, Inc. | 109,880 | 773,755 | |

Kakaku.com, Inc. | 49 | 282,343 | |

Kenedix Realty Investment Corp. | 36 | 152,982 | |

Kuraray Co. Ltd. | 21,600 | 314,619 | |

Lawson, Inc. | 8,700 | 426,804 | |

Makita Corp. | 23,300 | 1,071,222 | |

Mandom Corp. | 4,700 | 123,550 | |

Marubeni Corp. | 35,000 | 255,666 | |

Mitsubishi Corp. | 19,400 | 526,212 | |

Mitsui & Co. Ltd. | 93,500 | 1,663,636 | |

MORI TRUST Sogo (REIT), Inc. | 44 | 446,874 | |

MS&AD Insurance Group Holdings, Inc. | 38,300 | 896,794 | |

NHK Spring Co. Ltd. | 52,000 | 494,451 | |

Nichi-iko Pharmaceutical Co. Ltd. | 12,400 | 320,479 | |

Nippon Television Network Corp. | 910 | 129,387 | |

Nitto Boseki Co. Ltd. | 96,000 | 233,150 | |

NOK Corp. | 35,000 | 598,173 | |

Common Stocks - continued | |||

Shares | Value | ||

Japan - continued | |||

NTT DoCoMo, Inc. | 503 | $ 933,139 | |

NTT Urban Development Co. | 499 | 413,993 | |

Oracle Corp. Japan | 2,700 | 116,984 | |

ORIX Corp. | 11,020 | 1,082,528 | |

Pioneer Corp. (a) | 33,400 | 141,259 | |

Raito Kogyo Co. Ltd. | 27,400 | 99,131 | |

Rakuten, Inc. | 730 | 677,758 | |

Santen Pharmaceutical Co. Ltd. | 7,800 | 301,666 | |

SBI Holdings, Inc. Japan | 2,504 | 269,910 | |

SMC Corp. | 10,200 | 1,863,060 | |

SOFTBANK CORP. | 23,200 | 978,846 | |

Sumitomo Heavy Industries Ltd. | 141,000 | 929,705 | |

Sumitomo Metal Mining Co. Ltd. | 26,000 | 464,187 | |

Sumitomo Mitsui Financial Group, Inc. | 39,200 | 1,217,475 | |

Sumitomo Mitsui Trust Holdings, Inc. | 155,000 | 533,559 | |

T&D Holdings, Inc. | 26,400 | 651,822 | |

Takasago Thermal Engineering Co. Ltd. | 12,500 | 106,751 | |

Terumo Corp. | 5,300 | 295,545 | |

Toray Industries, Inc. | 55,000 | 407,918 | |

Toshiba Corp. | 101,000 | 537,748 | |

Tosoh Corp. | 152,000 | 587,932 | |

Toyo Engineering Corp. | 72,000 | 290,849 | |

Toyota Motor Corp. | 28,900 | 1,152,712 | |

Universal Entertainment Corp. (a) | 6,400 | 234,199 | |

Yamaha Motor Co. Ltd. (a) | 18,700 | 359,410 | |

Yamato Kogyo Co. Ltd. | 5,400 | 178,197 | |

TOTAL JAPAN | 36,122,558 | ||

Luxembourg - 0.1% | |||

ArcelorMittal SA (Netherlands) | 18,900 | 698,490 | |

Netherlands - 0.8% | |||

AEGON NV (a) | 118,000 | 937,946 | |

ASML Holding NV (Netherlands) | 12,500 | 521,043 | |

ING Groep NV (Certificaten Van Aandelen) (a) | 81,900 | 1,079,006 | |

LyondellBasell Industries NV Class A | 56,200 | 2,500,900 | |

TOTAL NETHERLANDS | 5,038,895 | ||

Norway - 0.5% | |||

Aker Solutions ASA | 33,100 | 798,738 | |

DnB NOR ASA | 32,000 | 520,286 | |

Storebrand ASA (A Shares) (e) | 160,500 | 1,667,302 | |

TOTAL NORWAY | 2,986,326 | ||

Common Stocks - continued | |||

Shares | Value | ||

Papua New Guinea - 0.0% | |||

Oil Search Ltd. | 40,255 | $ 311,184 | |

Poland - 0.1% | |||

Eurocash SA | 42,000 | 514,211 | |

Russia - 0.5% | |||

Magnit OJSC GDR (Reg. S) | 21,800 | 610,400 | |

Magnitogorsk Iron & Steel Works OJSC unit | 27,700 | 347,912 | |

Mechel Steel Group OAO sponsored ADR | 16,000 | 457,120 | |

OAO Gazprom sponsored ADR | 62,200 | 1,061,132 | |

Sberbank (Savings Bank of the Russian Federation) GDR | 1,300 | 518,457 | |

Uralkali JSC GDR (Reg. S) | 7,400 | 310,578 | |

TOTAL RUSSIA | 3,305,599 | ||

Singapore - 0.2% | |||

Avago Technologies Ltd. | 12,100 | 404,866 | |

Keppel Corp. Ltd. | 54,100 | 525,951 | |

TOTAL SINGAPORE | 930,817 | ||

South Africa - 0.1% | |||

Barloworld Ltd. | 24,200 | 274,466 | |

Mr Price Group Ltd. | 49,400 | 505,375 | |

TOTAL SOUTH AFRICA | 779,841 | ||

Spain - 1.2% | |||

Banco Santander SA (e) | 185,450 | 2,368,365 | |

Gestevision Telecinco SA | 184,123 | 2,069,149 | |

Inditex SA | 12,323 | 1,105,026 | |

Telefonica SA | 67,903 | 1,824,287 | |

TOTAL SPAIN | 7,366,827 | ||

Sweden - 0.5% | |||

Elekta AB (B Shares) | 7,600 | 346,329 | |

Medivir AB (B Shares) (a) | 8,000 | 185,654 | |

Swedbank AB (A Shares) | 31,246 | 592,503 | |

Telefonaktiebolaget LM Ericsson: | |||

(B Shares) | 75,319 | 1,142,656 | |

(B Shares) sponsored ADR | 37,000 | 562,400 | |

TOTAL SWEDEN | 2,829,542 | ||

Switzerland - 0.8% | |||

Compagnie Financiere Richemont SA Series A | 18,987 | 1,226,808 | |

Schindler Holding AG (participation certificate) | 5,308 | 686,546 | |

The Swatch Group AG (Bearer) | 2,090 | 1,027,908 | |

Common Stocks - continued | |||

Shares | Value | ||

Switzerland - continued | |||

Transocean Ltd. (a) | 7,600 | $ 552,900 | |

UBS AG (a) | 73,536 | 1,471,389 | |

TOTAL SWITZERLAND | 4,965,551 | ||

United Kingdom - 4.8% | |||

ARM Holdings PLC sponsored ADR | 6,000 | 188,760 | |

Aviva PLC | 88,300 | 660,856 | |

BG Group PLC | 74,001 | 1,895,579 | |

BHP Billiton PLC | 29,454 | 1,245,354 | |

BP PLC | 170,200 | 1,308,414 | |

BP PLC sponsored ADR | 12,400 | 572,136 | |

British Land Co. PLC | 64,876 | 650,755 | |

British Sky Broadcasting Group PLC | 36,500 | 513,364 | |

Burberry Group PLC | 43,000 | 930,162 | |

Carphone Warehouse Group PLC (a) | 219,850 | 1,460,687 | |

Cookson Group PLC | 42,900 | 512,728 | |

Filtrona PLC | 61,800 | 355,114 | |

Fresnillo PLC | 17,000 | 465,991 | |

HSBC Holdings PLC sponsored ADR | 31,596 | 1,721,034 | |

International Personal Finance PLC | 71,800 | 440,760 | |

Kazakhmys PLC | 21,200 | 488,338 | |

Kesa Electricals PLC | 162,900 | 351,020 | |

Lloyds Banking Group PLC (a) | 911,800 | 905,315 | |

Micro Focus International PLC | 129,900 | 806,099 | |

Misys PLC | 108,500 | 571,988 | |

Morgan Crucible Co. PLC | 136,100 | 704,758 | |

Next PLC | 9,100 | 340,038 | |

Prudential PLC | 125,959 | 1,629,633 | |

Reckitt Benckiser Group PLC | 18,400 | 1,021,643 | |

Royal Dutch Shell PLC Class A (United Kingdom) | 85,637 | 3,322,291 | |

Sage Group PLC | 83,300 | 396,561 | |

Schroders PLC | 15,100 | 478,733 | |

SuperGroup PLC (a) | 17,900 | 474,217 | |

Taylor Wimpey PLC (a) | 425,800 | 276,750 | |

Vodafone Group PLC | 817,200 | 2,362,435 | |

Wolfson Microelectronics PLC (a) | 101,000 | 403,218 | |

Xstrata PLC | 53,800 | 1,367,334 | |

TOTAL UNITED KINGDOM | 28,822,065 | ||

United States of America - 26.7% | |||

AboveNet, Inc. | 21,800 | 1,455,150 | |

Acorda Therapeutics, Inc. (a) | 13,000 | 364,520 | |

Common Stocks - continued | |||

Shares | Value | ||

United States of America - continued | |||

Affiliated Managers Group, Inc. (a) | 12,000 | $ 1,308,960 | |

Agilent Technologies, Inc. (a) | 47,200 | 2,355,752 | |

Air Lease Corp. Class A | 10,000 | 276,000 | |

Altera Corp. | 11,000 | 535,700 | |

Amazon.com, Inc. (a) | 9,600 | 1,886,400 | |

Apple, Inc. (a) | 15,800 | 5,502,034 | |

Ardea Biosciences, Inc. (a) | 20,200 | 572,670 | |

Ariba, Inc. (a) | 67,027 | 2,330,529 | |

Armstrong World Industries, Inc. | 30,100 | 1,346,975 | |

Aruba Networks, Inc. (a) | 37,000 | 1,329,410 | |

Baker Hughes, Inc. | 41,000 | 3,173,810 | |

Baxter International, Inc. | 27,000 | 1,536,300 | |

BGC Partners, Inc. Class A | 27,000 | 260,550 | |

Biogen Idec, Inc. (a) | 2,000 | 194,700 | |

Brigham Exploration Co. (a) | 32,000 | 1,072,960 | |

Cal Dive International, Inc. (a) | 61,000 | 479,460 | |

Calix Networks, Inc. (a) | 7,000 | 153,020 | |

Carlisle Companies, Inc. | 66,000 | 3,269,640 | |

Ceva, Inc. (a) | 26,000 | 795,080 | |

Chevron Corp. | 31,000 | 3,392,640 | |

Ciena Corp. (a) | 41,000 | 1,157,840 | |

Cognizant Technology Solutions Corp. Class A (a) | 7,100 | 588,590 | |

Concho Resources, Inc. (a) | 6,000 | 641,100 | |

Convio, Inc. (a) | 7,700 | 94,248 | |

CSX Corp. | 33,000 | 2,596,770 | |

Cummins, Inc. | 1,800 | 216,324 | |

Deckers Outdoor Corp. (a) | 6,000 | 509,160 | |

DexCom, Inc. (a) | 2,000 | 33,300 | |

Double Eagle Petroleum Co. (a) | 57,000 | 580,260 | |

DSW, Inc. Class A (a) | 27,100 | 1,286,708 | |

Dynavax Technologies Corp. (a) | 33,000 | 91,740 | |

eBay, Inc. (a) | 75,000 | 2,580,000 | |

Edwards Lifesciences Corp. (a) | 47,000 | 4,058,450 | |

Elizabeth Arden, Inc. (a) | 30,000 | 901,800 | |

EMC Corp. (a) | 48,000 | 1,360,320 | |

Equity Residential (SBI) | 46,000 | 2,747,120 | |

Estee Lauder Companies, Inc. Class A | 75,000 | 7,275,000 | |

Exxon Mobil Corp. | 74,300 | 6,538,400 | |

Fossil, Inc. (a) | 33,000 | 3,160,740 | |

Fresh Market, Inc. | 500 | 20,910 | |

G-III Apparel Group Ltd. (a) | 55,700 | 2,498,702 | |

Green Mountain Coffee Roasters, Inc. (a) | 37,000 | 2,477,520 | |

Common Stocks - continued | |||

Shares | Value | ||

United States of America - continued | |||

GT Solar International, Inc. (a) | 34,000 | $ 379,780 | |

Halliburton Co. | 24,300 | 1,226,664 | |

HeartWare International, Inc. (a) | 7,400 | 552,114 | |

Holly Corp. | 22,000 | 1,273,800 | |

Illumina, Inc. (a) | 23,100 | 1,639,638 | |

ImmunoGen, Inc. (a) | 19,000 | 253,840 | |

Informatica Corp. (a) | 54,000 | 3,024,540 | |

Intuit, Inc. (a) | 69,000 | 3,833,640 | |

iRobot Corp. (a) | 57,000 | 2,018,940 | |

Kenexa Corp. (a) | 12,000 | 353,040 | |

Key Energy Services, Inc. (a) | 75,000 | 1,365,000 | |

KKR Financial Holdings LLC | 96,000 | 969,600 | |

Leucadia National Corp. | 25,700 | 993,562 | |

Limited Brands, Inc. | 15,000 | 617,400 | |

Lincoln National Corp. | 214,000 | 6,683,220 | |

Magma Design Automation, Inc. (a) | 29,000 | 184,440 | |

Mako Surgical Corp. (a) | 88,600 | 2,433,842 | |

Marathon Oil Corp. | 65,500 | 3,539,620 | |

MasterCard, Inc. Class A | 5,000 | 1,379,450 | |

McKesson Corp. | 39,000 | 3,237,390 | |

Mead Johnson Nutrition Co. Class A | 8,100 | 541,728 | |

Micromet, Inc. (a) | 25,000 | 169,000 | |

Neurocrine Biosciences, Inc. (a) | 12,700 | 97,663 | |

Noble Energy, Inc. | 3,900 | 375,453 | |

Northern Oil & Gas, Inc. (a) | 14,000 | 332,640 | |

Occidental Petroleum Corp. | 5,000 | 571,450 | |

Oil States International, Inc. (a) | 9,400 | 780,294 | |

ONEOK, Inc. | 8,000 | 559,520 | |

OpenTable, Inc. (a) | 3,000 | 333,870 | |

Pall Corp. | 8,000 | 467,520 | |

Perrigo Co. | 50,000 | 4,518,000 | |

Pioneer Natural Resources Co. | 19,000 | 1,942,370 | |

Polycom, Inc. (a) | 20,000 | 1,196,600 | |

Polypore International, Inc. (a) | 32,400 | 2,001,348 | |

PPL Corp. | 72,000 | 1,974,960 | |

Prestige Brands Holdings, Inc. (a) | 73,000 | 843,150 | |

QUALCOMM, Inc. | 47,000 | 2,671,480 | |

Rackspace Hosting, Inc. (a) | 7,000 | 323,330 | |

ResMed, Inc. CDI | 70,541 | 228,177 | |

Resolute Energy Corp. (a) | 8,400 | 148,596 | |

Retail Ventures, Inc. (a) | 40,000 | 821,200 | |

RightNow Technologies, Inc. (a) | 5,000 | 180,900 | |

Common Stocks - continued | |||

Shares | Value | ||

United States of America - continued | |||

Riverbed Technology, Inc. (a) | 7,000 | $ 245,980 | |

salesforce.com, Inc. (a) | 4,500 | 623,700 | |

SandRidge Energy, Inc. (a) | 42,000 | 519,120 | |

Sirius XM Radio, Inc. (a) | 963,000 | 1,916,370 | |

Southern Co. | 12,000 | 468,480 | |

Spectrum Brands Holdings, Inc. (a) | 15,000 | 487,500 | |

SPS Commerce, Inc. (a) | 9,300 | 152,613 | |

St. Jude Medical, Inc. | 41,000 | 2,191,040 | |

Starbucks Corp. | 59,000 | 2,135,210 | |

SuccessFactors, Inc. (a) | 17,000 | 589,390 | |

Superior Energy Services, Inc. (a) | 31,000 | 1,191,020 | |

SVB Financial Group (a) | 56,900 | 3,439,036 | |

Targa Resources Corp. | 7,100 | 248,642 | |

Targacept, Inc. (a) | 17,210 | 416,138 | |

Tesoro Logistics LP | 8,400 | 199,164 | |

Theravance, Inc. (a) | 41,000 | 1,137,750 | |

TIBCO Software, Inc. (a) | 18,000 | 539,820 | |

TJX Companies, Inc. | 65,000 | 3,485,300 | |

Ulta Salon, Cosmetics & Fragrance, Inc. (a) | 12,000 | 638,280 | |

Universal Display Corp. (a) | 11,000 | 604,340 | |

Vera Bradley, Inc. | 15,100 | 734,464 | |

Vertex Pharmaceuticals, Inc. (a) | 34,000 | 1,870,680 | |

Virgin Media, Inc. | 31,700 | 959,242 | |

W.R. Grace & Co. (a) | 27,000 | 1,224,720 | |

WebMD Health Corp. (a) | 22,220 | 1,285,871 | |

Weight Watchers International, Inc. | 14,000 | 1,088,500 | |

ZIOPHARM Oncology, Inc. (a) | 77,000 | 582,120 | |

TOTAL UNITED STATES OF AMERICA | 161,020,521 | ||

TOTAL COMMON STOCKS (Cost $286,087,894) | 355,004,094 | ||

Preferred Stocks - 0.4% | |||

|

|

|

|

Convertible Preferred Stocks - 0.1% | |||

United States of America - 0.1% | |||

PPL Corp. 8.75% (a) | 9,000 | 480,375 | |

Preferred Stocks - continued | |||

Shares | Value | ||

Nonconvertible Preferred Stocks - 0.3% | |||

Germany - 0.3% | |||

ProSiebenSat.1 Media AG | 25,200 | $ 721,703 | |

Volkswagen AG | 5,300 | 1,044,098 | |

TOTAL GERMANY | 1,765,801 | ||

TOTAL PREFERRED STOCKS (Cost $1,428,646) | 2,246,176 | ||

Corporate Bonds - 11.5% | ||||

| Principal |

| ||

Convertible Bonds - 0.0% | ||||

United States of America - 0.0% | ||||

Greenbrier Companies, Inc. 3.5% 4/1/18 (f) | $ 260,000 | 267,475 | ||

Nonconvertible Bonds - 11.5% | ||||

Australia - 0.4% | ||||

Fairfax Media Group Finance Pty Ltd. 6.25% 6/15/12 | EUR | 250,000 | 373,259 | |

Optus Finance Pty Ltd. 3.5% 9/15/20 | EUR | 200,000 | 279,164 | |

Rio Tinto Finance (USA) Ltd. 9% 5/1/19 | 250,000 | 333,224 | ||

Westpac Banking Corp.: | ||||

4.25% 9/22/16 | EUR | 250,000 | 374,807 | |

4.875% 11/19/19 | 600,000 | 628,455 | ||

WT Finance (Aust) Pty Ltd./Westfield Europe Finance PLC/WEA Finance 3.625% 6/27/12 | EUR | 400,000 | 598,535 | |

TOTAL AUSTRALIA | 2,587,444 | |||

Bailiwick of Jersey - 0.1% | ||||

BAA Funding Ltd. 4.125% 10/12/18 | EUR | 250,000 | 365,121 | |

Gatwick Funding Ltd. 6.5% 3/2/43 | GBP | 250,000 | 430,591 | |

TOTAL BAILIWICK OF JERSEY | 795,712 | |||

Belgium - 0.1% | ||||

Fortis Banque SA 4.625% (Reg. S) (g)(h) | EUR | 450,000 | 603,219 | |

Bermuda - 0.1% | ||||

Li & Fung Ltd. 5.25% 5/13/20 | 700,000 | 711,512 | ||

Brazil - 0.1% | ||||

Telemar Norte Leste SA 5.125% 12/15/17 (Reg. S) | EUR | 250,000 | 364,283 | |

British Virgin Islands - 0.1% | ||||

CNOOC Finance 2011 Ltd. 4.25% 1/26/21 | 400,000 | 389,264 | ||

Corporate Bonds - continued | ||||

| Principal | Value | ||

Nonconvertible Bonds - continued | ||||

Canada - 0.0% | ||||

Xstrata Finance Canada Ltd. 5.25% 6/13/17 | EUR | 150,000 | $ 235,266 | |

Cayman Islands - 0.4% | ||||

Banco Do Brasil SA 4.5% 1/20/16 (Reg. S) | EUR | 200,000 | 293,515 | |

Bishopgate Asset Finance Ltd. 4.808% 8/14/44 | GBP | 200,000 | 271,273 | |

Hutchison Whampoa International 09 Ltd. 7.625% 4/9/19 (Reg. S) | 400,000 | 479,716 | ||

MUFG Capital Finance 5 Ltd. 6.299% (h) | GBP | 300,000 | 478,570 | |

SMFG Preferred Capital GBP 2 Ltd. 10.231% (Reg. S) (g)(h) | GBP | 150,000 | 292,529 | |

Thames Water Utilities Cayman Finance Ltd. 6.125% 2/4/13 | EUR | 150,000 | 234,295 | |

Yorkshire Water Services Finance Ltd. 6.375% 8/19/39 | GBP | 100,000 | 193,786 | |

TOTAL CAYMAN ISLANDS | 2,243,684 | |||

Cyprus - 0.1% | ||||

Alfa MTN Issuance Ltd. 8% 3/18/15 | 300,000 | 323,052 | ||

Denmark - 0.0% | ||||

TDC AS 4.375% 2/23/18 | EUR | 200,000 | 299,081 | |

France - 1.1% | ||||

Arkema SA 4% 10/25/17 | EUR | 250,000 | 362,453 | |

AXA SA 5.25% 4/16/40 (h) | EUR | 500,000 | 679,597 | |

BNP Paribas SA 5.019% (g)(h) | EUR | 150,000 | 202,184 | |

Caisse Nationale des Caisses d' Epargne et de Prevoyance 6.117% (g)(h) | EUR | 50,000 | 66,761 | |

Compagnie de St. Gobain 1.53% 4/11/12 (h) | EUR | 175,000 | 258,902 | |

Credit Agricole SA 7.875% (g)(h) | EUR | 200,000 | 306,608 | |

Credit Commercial de France 4.875% 1/15/14 | EUR | 250,000 | 386,074 | |

Credit Logement SA: | ||||

1.773% (g)(h) | EUR | 150,000 | 185,520 | |

4.604% (g)(h) | EUR | 250,000 | 303,646 | |

EDF SA 4.625% 9/11/24 | EUR | 150,000 | 222,635 | |

Lafarge SA 8.75% 5/30/17 | GBP | 250,000 | 495,377 | |

Legrand SA 4.375% 3/21/18 | EUR | 400,000 | 592,343 | |

Safran SA 4% 11/26/14 | EUR | 550,000 | 811,656 | |

Societe Generale: | ||||

1.273% 6/7/17 (h) | EUR | 100,000 | 143,742 | |

7.756% (g)(h) | EUR | 350,000 | 522,308 | |

Corporate Bonds - continued | ||||

| Principal | Value | ||

Nonconvertible Bonds - continued | ||||

France - continued | ||||

Societe Generale SCF 4% 7/7/16 | EUR | 450,000 | $ 682,872 | |

Veolia Environnement 6.125% 11/25/33 | EUR | 250,000 | 404,157 | |

TOTAL FRANCE | 6,626,835 | |||

Germany - 0.1% | ||||

Bayerische Landesbank Girozentrale 4.5% 2/7/19 (h) | EUR | 250,000 | 319,010 | |

Landesbank Berlin AG 5.875% 11/25/19 | EUR | 250,000 | 365,387 | |

TOTAL GERMANY | 684,397 | |||

India - 0.0% | ||||

Export-Import Bank of India 0.6913% 6/7/12 (h) | JPY | 20,000,000 | 242,539 | |

Ireland - 0.3% | ||||

Allied Irish Banks PLC 1.248% 9/15/11 (h) | EUR | 350,000 | 489,907 | |

Ardagh Glass Group PLC 10.75% 3/1/15 pay-in-kind | EUR | 302,642 | 466,204 | |

Bank of Ireland 0.8534% 2/15/12 (h) | GBP | 550,000 | 849,816 | |

TOTAL IRELAND | 1,805,927 | |||

Isle of Man - 0.1% | ||||

AngloGold Ashanti Holdings PLC 5.375% 4/15/20 | 300,000 | 308,883 | ||

Italy - 0.5% | ||||

Intesa Sanpaolo SpA: | ||||

2.7125% 2/24/14 (f)(h) | 400,000 | 409,950 | ||

3.75% 11/23/16 | EUR | 350,000 | 503,006 | |

4.375% 8/16/16 | EUR | 500,000 | 748,265 | |

6.375% 11/12/17 (h) | GBP | 150,000 | 247,671 | |

Pirelli & C SpA 5.125% 2/22/16 | EUR | 500,000 | 744,746 | |

Unione di Banche Italiane SCpA 4.5% 2/22/16 | EUR | 200,000 | 296,326 | |

TOTAL ITALY | 2,949,964 | |||

Japan - 0.1% | ||||

ORIX Corp. 5% 1/12/16 | 450,000 | 464,088 | ||

Sumitomo Mitsui Banking Corp. 4% 11/9/20 (Reg. S) | EUR | 200,000 | 266,971 | |

TOTAL JAPAN | 731,059 | |||

Korea (South) - 0.6% | ||||

Export-Import Bank of Korea 5.875% 1/14/15 | 500,000 | 548,015 | ||

Kookmin Bank 5.875% 6/11/12 | 200,000 | 208,321 | ||

Korea Electric Power Corp. 5.5% 7/21/14 (Reg. S) | 190,000 | 205,705 | ||

Korea National Housing Corp. 4.875% 9/10/14 | 800,000 | 848,681 | ||

Korea Resources Corp. 4.125% 5/19/15 | 610,000 | 626,787 | ||

Corporate Bonds - continued | ||||

| Principal | Value | ||

Nonconvertible Bonds - continued | ||||

Korea (South) - continued | ||||

National Agricultural Cooperative Federation: | ||||

4.25% 1/28/16 (Reg. S) | $ 450,000 | $ 462,029 | ||

5% 9/30/14 (Reg. S) | 200,000 | 212,976 | ||

Shinhan Bank 6% 6/29/12 (Reg. S) | 300,000 | 314,799 | ||

TOTAL KOREA (SOUTH) | 3,427,313 | |||

Luxembourg - 0.8% | ||||

Alrosa Finance SA 7.75% 11/3/20 (Reg. S) | 600,000 | 646,500 | ||

ArcelorMittal SA 6.75% 3/1/41 | 200,000 | 204,684 | ||

Fiat Industrial Finance Europe SA 6.25% 3/9/18 | EUR | 300,000 | 444,938 | |

Gaz Capital SA (Luxembourg): | ||||

5.364% 10/31/14 | EUR | 150,000 | 233,305 | |

6.51% 3/7/22 (Reg. S) | 450,000 | 474,750 | ||

6.58% 10/31/13 | GBP | 100,000 | 177,949 | |

Glencore Finance (Europe) SA: | ||||

5.25% 3/22/17 | EUR | 250,000 | 377,706 | |

7.125% 4/23/15 | EUR | 150,000 | 244,945 | |

OAO Industry & Construction Bank 5.01% 9/29/15 (Issued by Or-ICB SA for OAO Industry & Construction Bank) (h) | 800,000 | 794,760 | ||

Olivetti Finance NV 7.75% 1/24/33 | EUR | 300,000 | 484,952 | |

SB Capital SA 5.4% 3/24/17 (Reg. S) | 400,000 | 407,750 | ||

Steel Capital SA 6.7% 10/25/17 (Reg. S) | 300,000 | 308,625 | ||

TMK Capital SA 7.75% 1/27/18 | 300,000 | 311,250 | ||

TOTAL LUXEMBOURG | 5,112,114 | |||

Mexico - 0.1% | ||||

America Movil SAB de CV 5% 3/30/20 | 400,000 | 417,570 | ||

Multi-National - 0.2% | ||||

European Community 3.25% 4/4/18 | EUR | 1,000,000 | 1,472,021 | |

Netherlands - 0.4% | ||||

AI Finance BV 10.875% 7/15/12 | 100,000 | 87,500 | ||

BOATS Investments (Netherlands) BV 11% 3/31/17 pay-in-kind | EUR | 400,987 | 544,315 | |

GT 2005 Bonds BV 5% 7/21/14 (h) | 250,000 | 233,370 | ||

ING Bank NV 4.75% 5/27/19 | EUR | 200,000 | 311,140 | |

Koninklijke KPN NV 5.625% 9/30/24 | EUR | 300,000 | 470,808 | |

Corporate Bonds - continued | ||||

| Principal | Value | ||

Nonconvertible Bonds - continued | ||||

Netherlands - continued | ||||

OI European Group BV 6.875% 3/31/17 (Reg. S) | EUR | 200,000 | $ 305,133 | |

Rabobank Nederland 5.875% 5/20/19 | EUR | 350,000 | 554,683 | |

TOTAL NETHERLANDS | 2,506,949 | |||

Norway - 0.4% | ||||

DnB NOR Bank ASA 4.5% 5/29/14 | EUR | 200,000 | 307,768 | |

Kommunalbanken AS 5.125% 5/30/12 | 1,900,000 | 1,991,523 | ||

TOTAL NORWAY | 2,299,291 | |||

Russia - 0.1% | ||||

Raspadskaya Securities Ltd. 7.5% 5/22/12 | 300,000 | 311,670 | ||

RSHB Capital SA 7.5% 3/25/13 | RUB | 11,000,000 | 409,474 | |

TOTAL RUSSIA | 721,144 | |||

Spain - 0.3% | ||||

Banco Bilbao Vizcaya Argentaria SA 4.25% 3/30/15 | EUR | 900,000 | 1,329,374 | |

Mapfre SA 5.921% 7/24/37 (h) | EUR | 250,000 | 310,154 | |

Santander Finance Preferred SA Unipersonal 7.3% 7/27/19 (h) | GBP | 100,000 | 173,883 | |

Telefonica Emisiones SAU 4.75% 2/7/17 | EUR | 100,000 | 150,390 | |

TOTAL SPAIN | 1,963,801 | |||

Sweden - 0.3% | ||||

Nordea Bank AB 0.5095% 6/9/16 (h) | 400,000 | 398,098 | ||

Svenska Handelsbanken AB 3.625% 2/16/16 | EUR | 450,000 | 661,033 | |

Swedbank AB 0.4935% 5/18/17 (h) | 500,000 | 487,655 | ||

TOTAL SWEDEN | 1,546,786 | |||

Switzerland - 0.1% | ||||

Credit Suisse New York Branch 5.4% 1/14/20 | 500,000 | 516,065 | ||

United Arab Emirates - 0.0% | ||||

Emirates Bank International PJSC 4.7728% 4/30/12 (h) | 229,000 | 233,008 | ||

United Kingdom - 2.1% | ||||

3i Group PLC: | ||||

1.362% 6/8/12 (h) | EUR | 400,000 | 578,729 | |

5.625% 3/17/17 | EUR | 150,000 | 225,112 | |

Anglo American Capital PLC 6.875% 5/1/18 | GBP | 300,000 | 567,007 | |

Barclays Bank PLC: | ||||

4.875% (g)(h) | EUR | 350,000 | 447,137 | |

6.75% 1/16/23 (h) | GBP | 300,000 | 523,039 | |

Corporate Bonds - continued | ||||

| Principal | Value | ||

Nonconvertible Bonds - continued | ||||

United Kingdom - continued | ||||

BAT International Finance PLC: | ||||

7.25% 3/12/24 | GBP | 100,000 | $ 195,874 | |

8.125% 11/15/13 | 200,000 | 229,606 | ||

BP Capital Markets PLC 3.875% 3/10/15 | 850,000 | 891,750 | ||

Broadgate PLC 1.6206% 10/5/25 (h) | GBP | 23,750 | 35,308 | |

Daily Mail & General Trust PLC 5.75% 12/7/18 | GBP | 300,000 | 497,051 | |

EDF Energy Networks EPN PLC 6% 11/12/36 | GBP | 160,000 | 290,171 | |

Experian Finance PLC 4.75% 11/23/18 | GBP | 300,000 | 511,539 | |

First Hydro Finance PLC 9% 7/31/21 | GBP | 320,000 | 637,580 | |

Imperial Tobacco Finance: | ||||

7.25% 9/15/14 | EUR | 150,000 | 247,674 | |

7.75% 6/24/19 | GBP | 500,000 | 988,443 | |

Legal & General Group PLC 4% 6/8/25 (h) | EUR | 150,000 | 206,094 | |

Lloyds TSB Bank PLC 4.875% 1/21/16 | 550,000 | 577,324 | ||

Marks & Spencer PLC: | ||||

6.125% 12/2/19 | GBP | 100,000 | 174,702 | |

7.125% 12/1/37 (f) | 200,000 | 199,118 | ||

Motability Operations Group PLC 3.75% 11/29/17 | EUR | 300,000 | 436,957 | |

Old Mutual PLC: | ||||

4.5% 1/18/17 (h) | EUR | 450,000 | 656,162 | |

7.125% 10/19/16 | GBP | 200,000 | 366,773 | |

Royal Bank of Scotland PLC: | ||||

0.9895% 4/11/16 (h) | 250,000 | 223,896 | ||

5.75% 5/21/14 | EUR | 500,000 | 776,120 | |

Severn Trent Utilities Finance PLC 6.25% 6/7/29 | GBP | 300,000 | 560,588 | |

Standard Chartered Bank 5.875% 9/26/17 (Reg. S) | EUR | 200,000 | 312,836 | |

Tesco PLC 5.875% 9/12/16 | EUR | 100,000 | 164,757 | |

Ubs AG London Branch 6.25% 9/3/13 | EUR | 100,000 | 158,574 | |

Virgin Media Secured Finance PLC 7% 1/15/18 | GBP | 100,000 | 179,568 | |

Wales & West Utilities Finance PLC 6.75% 12/17/36 (h) | GBP | 150,000 | 270,632 | |

Western Power Distribution PLC 5.75% 3/23/40 | GBP | 150,000 | 256,762 | |

TOTAL UNITED KINGDOM | 12,386,883 | |||

United States of America - 2.5% | ||||

Altria Group, Inc.: | ||||

8.5% 11/10/13 | 210,000 | 245,278 | ||

9.25% 8/6/19 | 400,000 | 526,841 | ||

Apache Corp. 5.1% 9/1/40 | 450,000 | 432,123 | ||

Bank of America Corp. 4.75% 5/6/19 | EUR | 250,000 | 354,549 | |

Corporate Bonds - continued | ||||

| Principal | Value | ||

Nonconvertible Bonds - continued | ||||

United States of America - continued | ||||

Citigroup, Inc.: | ||||

4.25% 2/25/30 (h) | EUR | 600,000 | $ 730,157 | |

4.587% 12/15/15 | 500,000 | 529,349 | ||

Comcast Corp. 6.4% 3/1/40 | 300,000 | 319,075 | ||

COX Communications, Inc. 8.375% 3/1/39 (f) | 200,000 | 264,527 | ||

Credit Suisse New York Branch: | ||||

4.375% 8/5/20 | 600,000 | 599,335 | ||

5% 5/15/13 | 400,000 | 428,736 | ||

DIRECTV Holdings LLC/DIRECTV Financing, Inc. 5.2% 3/15/20 | 400,000 | 420,020 | ||

Enbridge Energy Partners LP 5.2% 3/15/20 | 250,000 | 265,327 | ||

Frontier Oil Corp. 6.875% 11/15/18 | 45,000 | 47,025 | ||

General Electric Capital Corp. 5.9% 5/13/14 | 160,000 | 178,395 | ||

General Electric Co. 5.25% 12/6/17 | 400,000 | 443,134 | ||

Glencore Funding LLC 6% 4/15/14 (Reg. S) | 309,000 | 333,881 | ||

Goldman Sachs Group, Inc. 6% 5/1/14 | 150,000 | 165,753 | ||

JPMorgan Chase & Co. 4.25% 10/15/20 | 1,020,000 | 992,517 | ||

KeyBank NA: | ||||

1.203% 11/21/11 (h) | EUR | 50,000 | 73,373 | |

1.254% 2/9/12 (h) | EUR | 510,000 | 733,785 | |

Liberty Mutual Group, Inc. 5.75% 3/15/14 (f) | 250,000 | 265,216 | ||

Merck & Co., Inc. 5.85% 6/30/39 | 300,000 | 333,890 | ||

Metropolitan Life Global Funding I 4.625% 5/16/17 | EUR | 900,000 | 1,366,447 | |

Morgan Stanley 1.638% 7/20/12 (h) | EUR | 430,000 | 633,807 | |

Motorola, Inc. 6.625% 11/15/37 | 500,000 | 546,438 | ||

NBC Universal, Inc. 4.375% 4/1/21 (f) | 500,000 | 488,000 | ||

News America, Inc. 6.15% 2/15/41 (f) | 350,000 | 357,110 | ||

Plains All American Pipeline LP/PAA Finance Corp. 8.75% 5/1/19 | 100,000 | 126,571 | ||

PPL Energy Supply LLC 6.5% 5/1/18 | 160,000 | 179,645 | ||

Roche Holdings, Inc. 6% 3/1/19 (f) | 150,000 | 172,202 | ||

Southeast Supply Header LLC 4.85% 8/15/14 (f) | 300,000 | 318,455 | ||

State Street Corp. 4.375% 3/7/21 | 500,000 | 504,559 | ||

Toyota Motor Credit Corp. 5.25% 2/3/12 | EUR | 200,000 | 302,864 | |

Corporate Bonds - continued | ||||

�� | Principal | Value | ||

Nonconvertible Bonds - continued | ||||

United States of America - continued | ||||

US Bank NA 4.375% 2/28/17 (h) | EUR | 450,000 | $ 657,988 | |

Wells Fargo & Co. 3.676% 6/15/16 | 450,000 | 462,681 | ||

TOTAL UNITED STATES OF AMERICA | 14,799,053 | |||

TOTAL NONCONVERTIBLE BONDS | 69,304,119 | |||

TOTAL CORPORATE BONDS (Cost $64,501,988) | 69,571,594 | |||

Government Obligations - 18.3% | ||||

| ||||

Canada - 0.6% | ||||

Canadian Government: | ||||

3.25% 6/1/21 | CAD | 1,950,000 | 2,053,137 | |

5.25% 6/1/12 | CAD | 1,350,000 | 1,485,200 | |

TOTAL CANADA | 3,538,337 | |||

Germany - 1.3% | ||||

German Federal Republic: | ||||

3.75% 1/4/17 | EUR | 300,000 | 467,587 | |

4.75% 7/4/40 | EUR | 2,550,000 | 4,454,514 | |

5.625% 1/4/28 | EUR | 1,460,000 | 2,667,724 | |

TOTAL GERMANY | 7,589,825 | |||

Italy - 2.2% | ||||

Italian Republic 4.75% 9/1/21 | EUR | 8,800,000 | 12,996,760 | |

Japan - 10.4% | ||||

Japan Government: | ||||

0.4% 5/15/11 | JPY | 950,000,000 | 11,711,061 | |

0.9% 6/20/13 | JPY | 110,000,000 | 1,375,742 | |

1.1% 12/20/12 | JPY | 18,700,000 | 233,892 | |

1.3% 3/20/15 | JPY | 740,000,000 | 9,448,192 | |

1.3% 6/20/20 | JPY | 1,176,000,000 | 14,742,665 | |

1.7% 12/20/16 | JPY | 245,000,000 | 3,209,809 | |

1.7% 9/20/17 | JPY | 311,000,000 | 4,079,377 | |

1.9% 6/20/16 | JPY | 469,250,000 | 6,192,596 | |

Government Obligations - continued | ||||

| Principal | Value | ||

Japan - continued | ||||

Japan Government: - continued | ||||

1.9% 3/20/29 | JPY | 846,500,000 | $ 10,389,239 | |

2% 9/20/40 | JPY | 141,000,000 | 1,682,580 | |

TOTAL JAPAN | 63,065,153 | |||

Poland - 0.2% | ||||

Polish Government 4% 3/23/21 | EUR | 1,100,000 | 1,488,791 | |

Spain - 1.3% | ||||

Spanish Kingdom 5.5% 4/30/21 | EUR | 5,300,000 | 7,975,181 | |

United Kingdom - 0.2% | ||||

UK Treasury GILT: | ||||

4% 9/7/16 | GBP | 150,000 | 268,861 | |

4% 3/7/22 | GBP | 385,000 | 661,838 | |

4.25% 6/7/32 | GBP | 70,000 | 118,436 | |

TOTAL UNITED KINGDOM | 1,049,135 | |||

United States of America - 2.1% | ||||

Federal Home Loan Bank 3.625% 10/18/13 | 300,000 | 319,226 | ||

Freddie Mac 2.125% 9/21/12 | 650,000 | 664,902 | ||

U.S. Treasury Bonds: | ||||

3.5% 2/15/39 | 900,000 | 769,219 | ||

4.75% 2/15/41 | 250,000 | 264,688 | ||

5.25% 2/15/29 | 250,000 | 286,485 | ||

U.S. Treasury Notes: | ||||

0.75% 12/15/13 | 450,000 | 448,735 | ||

1.75% 7/31/15 | 3,050,000 | 3,065,250 | ||

2% 1/31/16 | 820,000 | 825,061 | ||

2.125% 2/29/16 | 1,400,000 | 1,414,875 | ||

2.375% 2/28/15 | 3,400,000 | 3,520,326 | ||

3.5% 5/15/20 | 650,000 | 667,622 | ||

3.625% 2/15/21 | 400,000 | 411,188 | ||

TOTAL UNITED STATES OF AMERICA | 12,657,577 | |||

TOTAL GOVERNMENT OBLIGATIONS (Cost $99,080,073) | 110,360,759 | |||

Asset-Backed Securities - 0.2% | ||||

| Principal | Value | ||

Clock Finance BV Series 2007-1 Class B2, 1.307% 2/25/15 (h) | EUR | 100,000 | $ 140,862 | |

Geldilux Ltd. Series 2007-TS Class A, 1.369% 9/8/14 (h) | EUR | 200,000 | 290,760 | |

Tesco Property Finance 2 PLC 6.0517% 10/13/39 | GBP | 246,079 | 441,085 | |

VCL No. 11 Ltd. Class A, 2.272% 8/21/15 (h) | EUR | 89,033 | 132,346 | |

Volkswagen Car Lease Series 9 Class B, 1.352% 10/21/13 (h) | EUR | 35,737 | 52,806 | |

TOTAL ASSET-BACKED SECURITIES (Cost $978,761) | 1,057,859 | |||

Collateralized Mortgage Obligations - 0.6% | ||||

| ||||

Private Sponsor - 0.6% | ||||

Arkle Master Issuer PLC Series 2010-2X Class 1A1, 1.7135% 5/17/60 (h) | 300,000 | 301,147 | ||

Fosse Master Issuer PLC Series 2010-4 Class A2, 2.732% 10/18/54 (h) | EUR | 650,000 | 966,392 | |

Granite Master Issuer PLC Series 2005-1 Class A5, 1.346% 12/20/54 (h) | EUR | 279,469 | 394,495 | |

Holmes Master Issuer PLC: | ||||

floater Series 2011-1X Class A4, 2.439% 10/15/54 (h) | EUR | 500,000 | 744,878 | |

Series 2010-1X Class A2, 1.7031% 10/15/54 (h) | 400,000 | 401,528 | ||

Permanent Master Issuer PLC Series 2011-1X Class 1A2, 2.1992% 7/15/42 (h) | GBP | 250,000 | 417,600 | |

Storm BV Series 2010-1 Class A2, 2.172% 3/22/52 (h) | EUR | 500,000 | 735,808 | |

TOTAL COLLATERALIZED MORTGAGE OBLIGATIONS (Cost $3,653,551) | 3,961,848 | |||

Commercial Mortgage Securities - 0.2% | ||||

| ||||

France - 0.0% | ||||

FCC Proudreed Properties Class A, 1.319% 8/18/17 (h) | EUR | 160,730 | 217,837 | |

Ireland - 0.1% | ||||

German Residential Asset Note Distributor PLC Series 1 Class A, 1.578% 7/20/16 (h) | EUR | 164,128 | 230,805 | |

Netherlands - 0.0% | ||||

Skyline BV Series 2007-1 Class D, 2.159% 7/22/43 (h) | EUR | 100,000 | 133,308 | |

Commercial Mortgage Securities - continued | ||||

| Principal | Value | ||

United Kingdom - 0.1% | ||||

Eddystone Finance PLC Series 2006-1: | ||||

Class A2, 1.0294% 4/19/21 (h) | GBP | 150,000 | $ 234,900 | |

Class B, 1.1994% 4/19/21 (h) | GBP | 100,000 | 154,489 | |

London & Regional Debt Securitisation No. 1 PLC Class A, 0.9775% 10/15/14 (h) | GBP | 100,000 | 157,853 | |

REC Plantation Place Ltd. Series 5 Class A, 1.0494% 7/25/16 (Reg. S) (h) | GBP | 96,501 | 153,951 | |

TOTAL UNITED KINGDOM | 701,193 | |||

TOTAL COMMERCIAL MORTGAGE SECURITIES (Cost $1,249,114) | 1,283,143 | |||

Fixed-Income Funds - 3.4% | |||

Shares |

| ||

Fidelity Emerging Markets Debt Central Fund (i) | 2,011,655 | 20,297,595 | |

Fidelity High Income Central Fund 1 (i) | 273 | 27,343 | |

TOTAL FIXED-INCOME FUNDS (Cost $20,144,562) | 20,324,938 | ||

Preferred Securities - 0.0% | |||

Principal |

| ||

Germany - 0.0% | |||

BayernLB Capital Trust I 6.2032% (h) | $ 400,000 | 276,705 | |

Equity Central Funds - 3.1% | |||

Shares |

| ||

Fidelity Emerging Markets Equity Central Fund (i) | 80,100 | 18,813,888 | |

Money Market Funds - 3.6% | |||

Shares | Value | ||

Fidelity Cash Central Fund, 0.13% (b) | 18,444,006 | $ 18,444,006 | |

Fidelity Securities Lending Cash Central Fund, 0.12% (b)(c) | 3,572,482 | 3,572,482 | |

TOTAL MONEY MARKET FUNDS (Cost $22,016,488) | 22,016,488 | ||

TOTAL INVESTMENT PORTFOLIO - 100.1% (Cost $511,367,231) | 604,917,492 | ||

NET OTHER ASSETS (LIABILITIES) - (0.1)% | (764,983) | ||

NET ASSETS - 100% | $ 604,152,509 | ||

Currency Abbreviations | ||

CAD | - | Canadian dollar |

EUR | - | European Monetary Unit |

GBP | - | British pound |

JPY | - | Japanese yen |

RUB | - | Russian ruble |

Legend |

(a) Non-income producing |

(b) Affiliated fund that is available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. In addition, each Fidelity Central Fund's financial statements are available on the SEC's website or upon request. |

(c) Investment made with cash collateral received from securities on loan. |

(d) Principal amount is stated in United States dollars unless otherwise noted. |

(e) Security or a portion of the security is on loan at period end. |

(f) Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. At the end of the period, the value of these securities amounted to $2,742,053 or 0.5% of net assets. |

(g) Security is perpetual in nature with no stated maturity date. |

(h) Coupon rates for floating and adjustable rate securities reflect the rates in effect at period end. |

(i) Affiliated fund that is available only to investment companies and other accounts managed by Fidelity Investments. A complete unaudited schedule of portfolio holdings for each Fidelity Central Fund is filed with the SEC for the first and third quarters of each fiscal year on Form N-Q and is available upon request or at the SEC's web site at www.sec.gov. An unaudited holdings listing for the Fund, which presents direct holdings as well as the pro rata share of securities and other investments held indirectly through its investment in underlying non-money market Fidelity Central Funds, is available at fidelity.com and/or advisor.fidelity.com, as applicable. In addition, each Fidelity Central Fund's financial statements are available on the SEC's web site or upon request. |

Affiliated Central Funds |

Information regarding fiscal year to date income earned by the Fund from investments in Fidelity Central Funds is as follows: |

Fund | Income earned |

Fidelity Emerging Markets Debt Central Fund | $ 116,484 |

Fidelity Cash Central Fund | 13,446 |

Fidelity Emerging Markets Equity Central Fund | 55,547 |

Fidelity High Income Central Fund 1 | 244,982 |

Fidelity Securities Lending Cash Central Fund | 12,159 |

Total | $ 442,618 |

Additional information regarding the Fund's fiscal year to date purchases and sales, including the ownership percentage, of the non Money Market Central Funds is as follows: |

Fund | Value, | Purchases | Sales | Value, | % ownership, |

Fidelity Emerging Markets Debt Central Fund | $ - | $ 20,117,454 | $ - | $ 20,297,595 | 20.3% |

Fidelity Emerging Markets Equity Central Fund | 16,045,500 | 2,055,144 | 910,800 | 18,813,888 | 5.5% |

Fund | Value, | Purchases | Sales | Value, | % ownership, |

Fidelity High Income Central Fund 1 | $ 10,635,391 | $ 244,982 | $ 10,900,306 | $ 27,343 | 0.0% |

Total | $ 26,680,891 | $ 22,417,580 | $ 11,811,106 | $ 39,138,826 |

Other Information |

The following is a summary of the inputs used, as of April 30, 2011, involving the Fund's assets and liabilities carried at fair value. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used in the table below, please refer to the Security Valuation section in the accompanying Notes to Financial Statements. |

Valuation Inputs at Reporting Date: | ||||

Description | Total | Level 1 | Level 2 | Level 3 |

Investments in Securities: | ||||

Equities: | ||||

United States of America | $ 161,500,896 | $ 161,020,521 | $ 480,375 | $ - |

Japan | 36,122,558 | - | 36,122,558 | - |

Canada | 30,974,924 | 30,974,924 | - | - |

United Kingdom | 28,822,065 | 20,710,058 | 8,112,007 | - |

France | 21,797,034 | 21,430,652 | 366,382 | - |

Germany | 12,377,745 | 12,377,745 | - | - |

Australia | 10,848,134 | 9,164,895 | 1,683,239 | - |

Spain | 7,366,827 | 5,542,540 | 1,824,287 | - |

Netherlands | 5,038,895 | 2,500,900 | 2,537,995 | - |

Other | 42,401,192 | 35,307,975 | 7,093,217 | - |

Corporate Bonds | 69,571,594 | - | 69,571,594 | - |

Government Obligations | 110,360,759 | - | 110,360,759 | - |

Asset-Backed Securities | 1,057,859 | - | 1,057,859 | - |

Collateralized Mortgage Obligations | 3,961,848 | - | 3,961,848 | - |

Commercial Mortgage Securities | 1,283,143 | - | 1,283,143 | - |

Fixed-Income Funds | 20,324,938 | 20,324,938 | - | - |

Preferred Securities | 276,705 | - | 276,705 | - |

Equity Central Funds | 18,813,888 | 18,813,888 | - | - |

Money Market Funds | 22,016,488 | 22,016,488 | - | - |

Total Investments in Securities: | $ 604,917,492 | $ 360,185,524 | $ 244,731,968 | $ - |

The composition of credit quality ratings as a percentage of net assets is as follows (Unaudited): |

U.S. Government and U.S. Government Agency Obligations | 2.2% |

AAA,AA,A | 21.4% |

BBB | 4.7% |

BB | 1.8% |

B | 1.1% |

CCC,CC,C | 0.2% |

Not Rated | 2.7% |

Equities | 62.3% |

Short-Term Investments and | 3.6% |

| 100.0% |

We have used ratings from Moody's Investors Service, Inc. Where Moody's® ratings are not available, we have used S&P® ratings. All ratings are as of the report date and do not reflect subsequent changes. Percentages are adjusted for the effect of futures contracts, if applicable. |

The information in the above table is based on the combined investments of the Fund and its pro-rata share of its investments in each non-money market Fidelity Central Fund. |

Income Tax Information |

At October 31, 2010, the Fund had a capital loss carryforward of approximately $53,408,638 of which $23,790,891 and $29,617,747 will expire in fiscal 2016 and 2017, respectively. Capital loss carryforwards are only available to offset future capital gains of the Fund to the extent provided by regulations and may be limited. |

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Financial Statements

Statement of Assets and Liabilities

| April 30, 2011 (Unaudited) | |

|

|

|

Assets | ||

Investment in securities, at value (including securities loaned of $3,422,181) - See accompanying schedule: Unaffiliated issuers (cost $457,300,820) | $ 543,762,178 |

|

Fidelity Central Funds (cost $54,066,411) | 61,155,314 |

|

Total Investments (cost $511,367,231) |

| $ 604,917,492 |

Cash | 58,755 | |

Foreign currency held at value (cost $169,951) | 171,282 | |

Receivable for investments sold | 12,868,057 | |

Receivable for fund shares sold | 1,455,372 | |

Dividends receivable | 781,026 | |

Interest receivable | 2,035,947 | |

Distributions receivable from Fidelity Central Funds | 8,774 | |

Prepaid expenses | 431 | |

Other receivables | 25,678 | |

Total assets | 622,322,814 | |

|

|

|

Liabilities | ||

Payable for investments purchased | $ 13,134,376 | |

Payable for fund shares redeemed | 882,607 | |

Accrued management fee | 344,167 | |

Distribution and service plan fees payable | 15,657 | |

Other affiliated payables | 124,413 | |

Other payables and accrued expenses | 96,603 | |

Collateral on securities loaned, at value | 3,572,482 | |

Total liabilities | 18,170,305 | |

|

|

|

Net Assets | $ 604,152,509 | |

Net Assets consist of: |

| |

Paid in capital | $ 522,813,459 | |

Undistributed net investment income | 2,578,016 | |

Accumulated undistributed net realized gain (loss) on investments and foreign currency transactions | (14,926,361) | |

Net unrealized appreciation (depreciation) on investments and assets and liabilities in foreign currencies | 93,687,395 | |

Net Assets | $ 604,152,509 | |

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Statement of Assets and Liabilities - continued

| April 30, 2011 (Unaudited) | |

|

|

|

Calculation of Maximum Offering Price Class A: | $ 23.95 | |

|

|

|

Maximum offering price per share (100/94.25 of $23.95) | $ 25.41 | |

Class T: | $ 23.88 | |

|

|

|

Maximum offering price per share (100/96.50 of $23.88) | $ 24.75 | |

Class B: | $ 23.78 | |

|

|

|

Class C: | $ 23.71 | |

|

|

|

Global Balanced: | $ 24.07 | |

|

|

|

Institutional Class: | $ 24.05 | |

A Redemption price per share is equal to net asset value less any applicable contingent deferred sales charge.

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Financial Statements - continued

Statement of Operations

Six months ended April 30, 2011 (Unaudited) | ||

|

|

|

Investment Income |

|

|

Dividends |

| $ 2,639,525 |

Interest |

| 3,138,753 |

Income from Fidelity Central Funds |

| 442,618 |

Income before foreign taxes withheld |

| 6,220,896 |

Less foreign taxes withheld |

| (168,016) |

Total income |

| 6,052,880 |

|

|

|

Expenses | ||

Management fee | $ 2,024,198 | |

Transfer agent fees | 605,306 | |

Distribution and service plan fees | 81,020 | |

Accounting and security lending fees | 144,754 | |

Custodian fees and expenses | 176,880 | |

Independent trustees' compensation | 1,039 | |

Registration fees | 92,795 | |

Audit | 42,290 | |

Legal | 1,477 | |

Miscellaneous | 2,458 | |

Total expenses before reductions | 3,172,217 | |

Expense reductions | (33,741) | 3,138,476 |

Net investment income (loss) | 2,914,404 | |

Realized and Unrealized Gain (Loss) Net realized gain (loss) on: | ||

Investment securities: |

|

|

Unaffiliated issuers | 41,340,096 | |

Fidelity Central Funds | 462,324 |

|

Foreign currency transactions | 61,662 | |

Total net realized gain (loss) |

| 41,864,082 |

Change in net unrealized appreciation (depreciation) on: Investment securities | 15,503,650 | |

Assets and liabilities in foreign currencies | 15,350 | |

Total change in net unrealized appreciation (depreciation) |

| 15,519,000 |

Net gain (loss) | 57,383,082 | |

Net increase (decrease) in net assets resulting from operations | $ 60,297,486 | |

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Statement of Changes in Net Assets

| Six months ended | Year ended |

Increase (Decrease) in Net Assets |

|

|

Operations |

|

|

Net investment income (loss) | $ 2,914,404 | $ 5,517,939 |

Net realized gain (loss) | 41,864,082 | 19,436,953 |

Change in net unrealized appreciation (depreciation) | 15,519,000 | 41,255,535 |

Net increase (decrease) in net assets resulting | 60,297,486 | 66,210,427 |

Distributions to shareholders from net investment income | (5,506,342) | (5,069,332) |

Distributions to shareholders from net realized gain | (2,817,435) | (1,661,467) |

Total distributions | (8,323,777) | (6,730,799) |

Share transactions - net increase (decrease) | (14,792,646) | 82,336,500 |

Redemption fees | 8,029 | 14,128 |

Total increase (decrease) in net assets | 37,189,092 | 141,830,256 |

|

|

|

Net Assets | ||

Beginning of period | 566,963,417 | 425,133,161 |

End of period (including undistributed net investment income of $2,578,016 and undistributed net investment income of $5,169,954, respectively) | $ 604,152,509 | $ 566,963,417 |

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Financial Highlights - Class A

| Six months ended April 30, 2011 | Years ended October 31, | |

| (Unaudited) | 2010 | 2009 H |

Selected Per-Share Data |

|

|

|

Net asset value, beginning of period | $ 21.88 | $ 19.59 | $ 15.08 |

Income from Investment Operations |

|

|

|

Net investment income (loss) E | .08 | .17 | .12 |

Net realized and unrealized gain (loss) | 2.26 | 2.43 | 4.39 |

Total from investment operations | 2.34 | 2.60 | 4.51 |

Distributions from net investment income | (.17) | (.23) | - |

Distributions from net realized gain | (.11) | (.08) | - |

Total distributions | (.27) K | (.31) | - |

Redemption fees added to paid in capital E, J | - | - | - |

Net asset value, end of period | $ 23.95 | $ 21.88 | $ 19.59 |

Total Return B, C, D | 10.83% | 13.40% | 29.91% |

Ratios to Average Net Assets F, I |

|

|

|

Expenses before reductions | 1.39% A | 1.43% | 1.47% A |

Expenses net of fee waivers, if any | 1.39% A | 1.43% | 1.47% A |

Expenses net of all reductions | 1.38% A | 1.41% | 1.46% A |

Net investment income (loss) | .73% A | .83% | .88% A |

Supplemental Data |

|

|

|

Net assets, end of period (000 omitted) | $ 17,355 | $ 11,096 | $ 2,912 |

Portfolio turnover rate G | 196% A | 178% | 252% |

A Annualized

B Total returns for periods of less than one year are not annualized.

C Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

D Total returns do not include the effect of the sales charges.

E Calculated based on average shares outstanding during the period.

F Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

G Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

H For the period February 19, 2009 (commencement of sale of shares) to October 31, 2009.

I Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expense ratios before reductions for start-up periods may not be representative of longer-term operating periods. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

J Amount represents less than $.01 per share.

K Total distributions of $.27 per share is comprised of distributions from net investment income of $.167 and distributions from net realized gain of $.107 per share.

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Financial Highlights - Class T

| Six months ended April 30, 2011 | Years ended October 31, | |

| (Unaudited) | 2010 | 2009 H |

Selected Per-Share Data |

|

|

|

Net asset value, beginning of period | $ 21.81 | $ 19.56 | $ 15.08 |

Income from Investment Operations |

|

|

|

Net investment income (loss) E | .06 | .13 | .11 |

Net realized and unrealized gain (loss) | 2.25 | 2.42 | 4.37 |

Total from investment operations | 2.31 | 2.55 | 4.48 |

Distributions from net investment income | (.13) | (.23) | - |

Distributions from net realized gain | (.11) | (.08) | - |

Total distributions | (.24) | (.30) K | - |

Redemption fees added to paid in capital E, J | - | - | - |

Net asset value, end of period | $ 23.88 | $ 21.81 | $ 19.56 |

Total Return B, C, D | 10.70% | 13.17% | 29.71% |

Ratios to Average Net Assets F, I |

|

|

|

Expenses before reductions | 1.61% A | 1.62% | 1.69% A |

Expenses net of fee waivers, if any | 1.61% A | 1.62% | 1.69% A |

Expenses net of all reductions | 1.60% A | 1.60% | 1.68% A |

Net investment income (loss) | .51% A | .64% | .88% A |

Supplemental Data |

|

|

|

Net assets, end of period (000 omitted) | $ 7,764 | $ 5,345 | $ 981 |

Portfolio turnover rate G | 196% A | 178% | 252% |

A Annualized

B Total returns for periods of less than one year are not annualized.

C Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

D Total returns do not include the effect of the sales charges.

E Calculated based on average shares outstanding during the period.

F Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

G Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

H For the period February 19, 2009 (commencement of sale of shares) to October 31, 2009.