Arthur J. Gallagher & Co.

July 2004

Safe Harbor Statement Under the

Private Securities Litigation Reform Act of 1995

The presentation relating to this material may contain forward-looking statements. Forward-looking statements made by or on behalf of Gallagher are subject to risks and uncertainties, including but not limited to the following: Gallagher’s commission revenues are highly dependent on premiums charged by insurers, which are subject to fluctuation; lower interest rates reduce Gallagher’s income earned on invested funds; the alternative insurance market continues to grow which could unfavorably impact commission and favorably impact fee revenue, though perhaps not to the same extent; Gallagher’s revenues vary significantly from period to period as a result of the timing of policy inception dates and the net effect of new and lost business production; the general level of economic activity can have a substantial impact on Gallagher’s renewal business; Gallagher’s operating results, returns on investments and financial position may be adversely impacted by exposure to various market risks such as interest rate, equity pricing, foreign exchange rates and the competitive environment, and Gallagher’s effective income tax rate may be subject to increase as a result of changes in income tax laws or unfavorable interpretations of existing in income tax laws. Gallagher’s ability to grow has been enhanced through acquisitions, which may or may not be available on acceptable terms in the future and which, if consummated, may or may not be advantageous to Gallagher. Accordingly, actual results may differ materially from those set forth in the forward-looking statements.

2

Non-GAAP Financial Measures

Regulation G Disclosure

This presentation includes certain non-GAAP financial measures as defined under rules promulgated by the U.S. Securities and Exchange Commission (the “SEC”). As required by SEC rules, we have provided reconciliations of those measures to the most directly comparable GAAP measures, which are available on our investor relations web-site at www.ajg.com

3

Arthur J. Gallagher & Co.

World’s fourth-largest insurance brokerage and risk management services firm

Public since 1984

Market capitalization of $2.8 billion

Shares outstanding of 91.9 million

Dividend yield of 3.3%

52-week range – $24.64—$34.25

Traded NYSE as “AJG”

As of 6/30/04, unless otherwise indicated

4

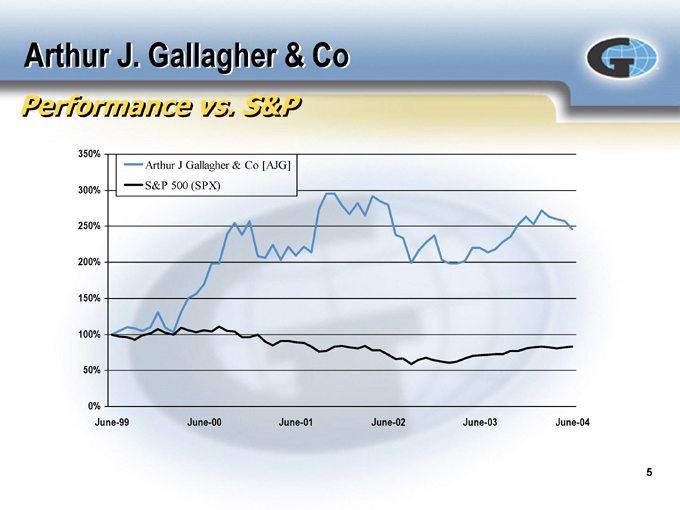

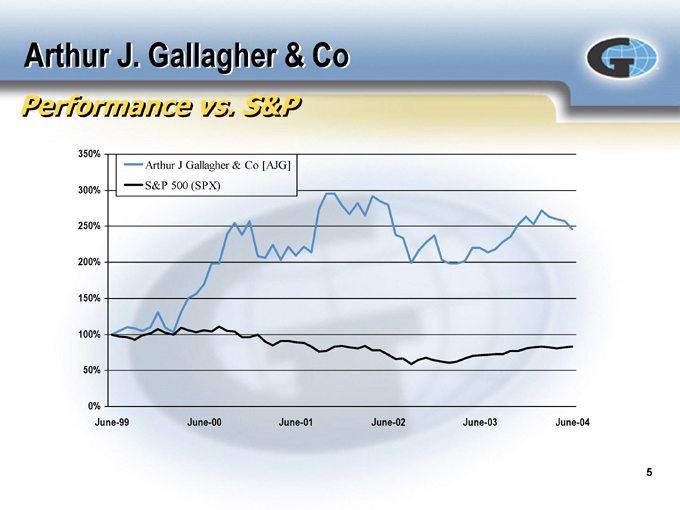

Arthur J. Gallagher & Co

Performance vs. S&P

350% 300% 250% 200% 150% 100% 50% 0%

Arthur J Gallagher & Co [AJG]

S&P 500 (SPX)

June-99 June-00 June-01 June-02 June-03 June-04

5

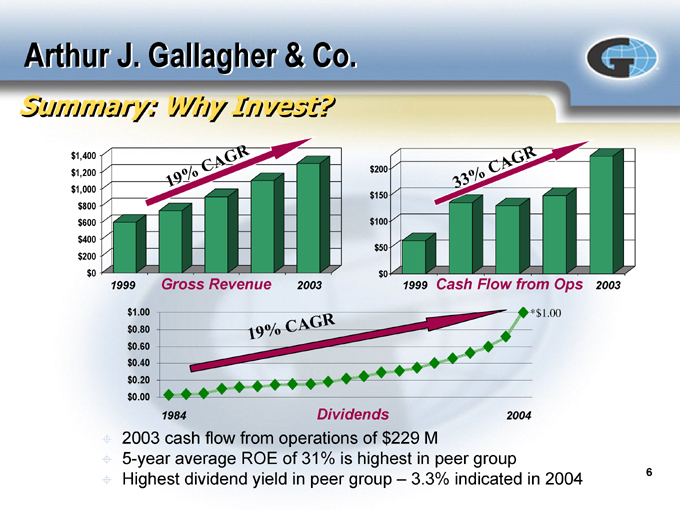

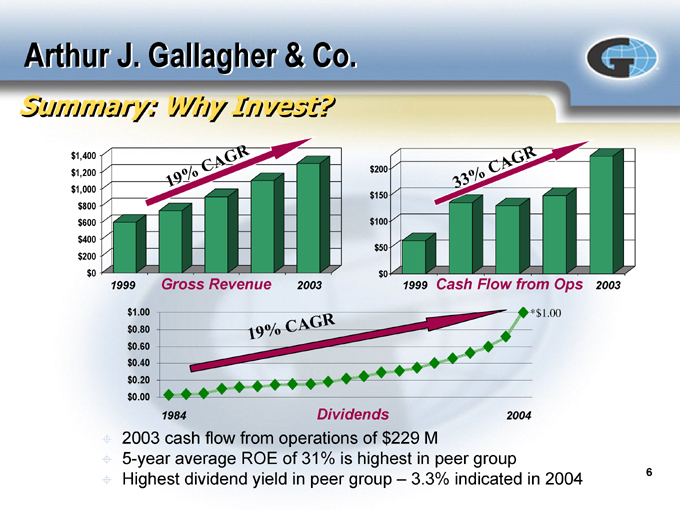

Arthur J. Gallagher & Co.

Summary: Why Invest?

$1,400 $1,200 $1,000 $800 $600 $400 $200 $0

1999 Gross Revenue 2003

19 % CAGR

$200 $150 $100 $50 $0

1999 Cash Flow from Ops 2003

33 % CAGR

$1.00 $0.80 $0.60 $0.40 $0.20 $0.00

1984 Dividends 2004

*$ 1.00

19 % CAG R

2003 cash flow from operations of $229 M

5-year average ROE of 31% is highest in peer group

Highest dividend yield in peer group – 3.3% indicated in 2004

6

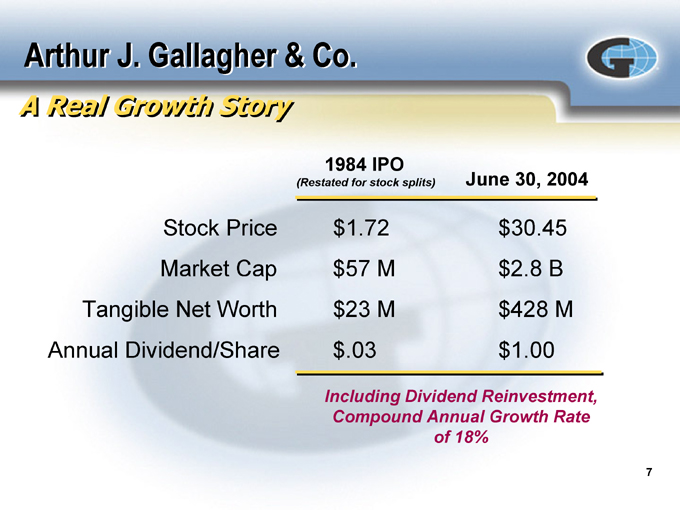

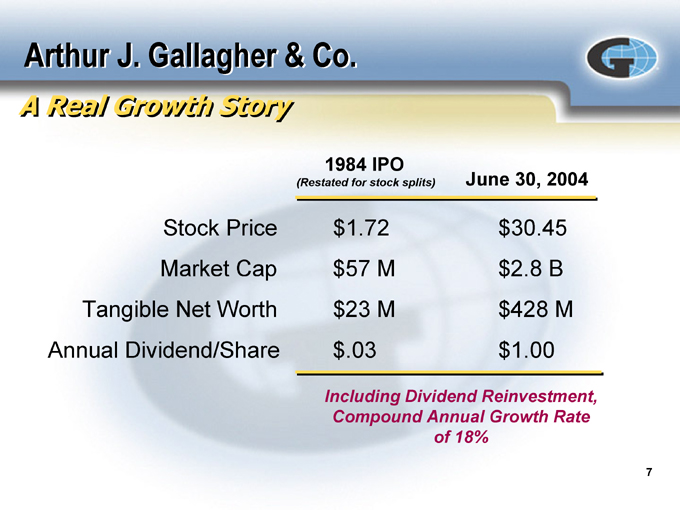

Arthur J. Gallagher & Co.

A Real Growth Story

1984 IPO (Restated for stock splits) June 30, 2004

Stock Price $ 1.72 $ 30.45

Market Cap $57 M $2.8 B

Tangible Net Worth $23 M $428 M

Annual Dividend/Share $ .03 $ 1.00

Including Dividend Reinvestment, Compound Annual Growth Rate of 18%

7

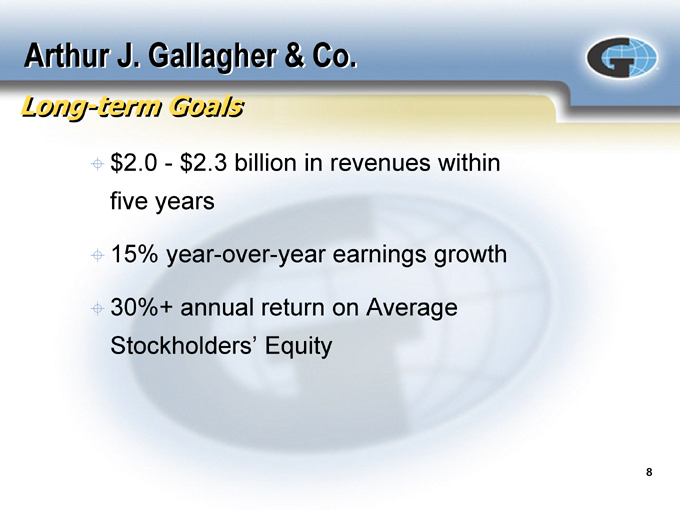

Arthur J. Gallagher & Co.

Long-term Goals

$2.0—$2.3 billion in revenues within five years

15% year-over-year earnings growth

30%+ annual return on Average

Stockholders’ Equity

8

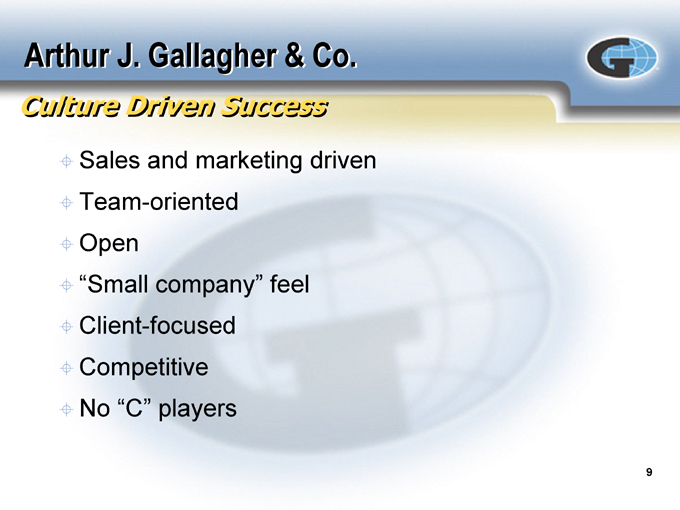

Arthur J. Gallagher & Co.

Culture Driven Success

Sales and marketing driven

Team-oriented

Open

“Small company” feel

Client-focused Competitive

No “C” players

9

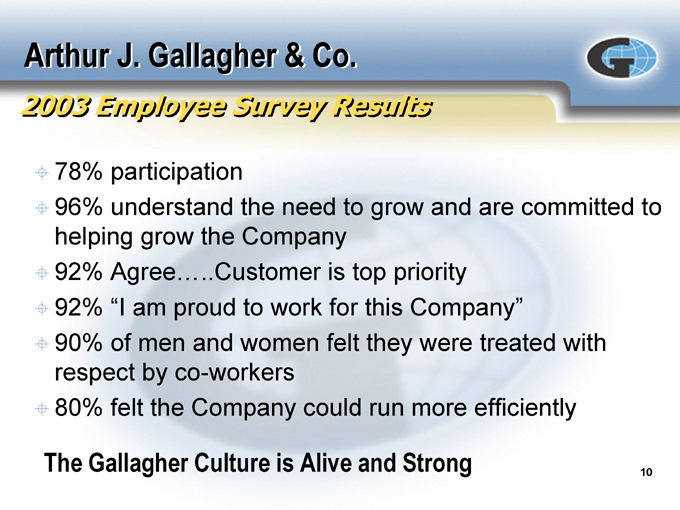

Arthur J. Gallagher & Co.

2003 Employee Survey Results

78% participation

96% understand the need to grow and are committed to helping grow the Company

92% AgreeCustomer is top priority

92% “I am proud to work for this Company”

90% of men and women felt they were treated with respect by co-workers

80% felt the Company could run more efficiently

The Gallagher Culture is Alive and Strong

10

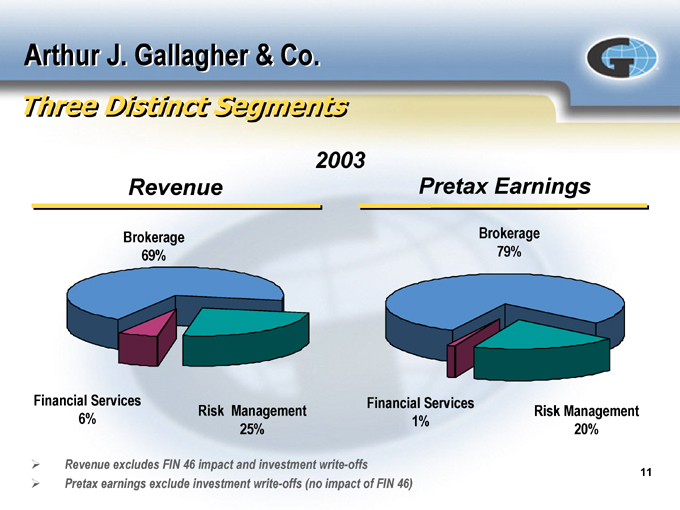

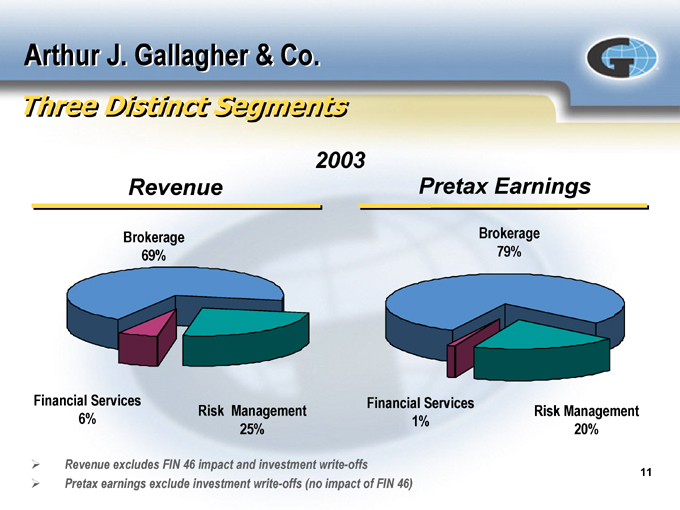

Arthur J. Gallagher & Co.

Three Distinct Segments

2003

Revenue

Pretax Earnings

Brokerage 69% Brokerage 79%

Financial Services 6%

Risk Management 25%

Financial Services 1%

Risk Management 20%

Revenue excludes FIN 46 impact and investment write-offs

Pretax earnings exclude investment write-offs (no impact of FIN 46)

11

Brokerage Segment

Gallagher’s largest business segment

Acts as intermediary – no underwriting risk

Niche driven

Alternative market leaders

(1) Business Insurance/JP Morgan

12

Brokerage Segment

A Strategic Consolidator

Geographic diversity; enhance or expand capabilities

Over 125 acquisitions since 1986 in this segment

Almost $460 million of 2003 revenue from acquired entities

The rules: financial health, similar culture

Gallagher is merger partner of choice

13

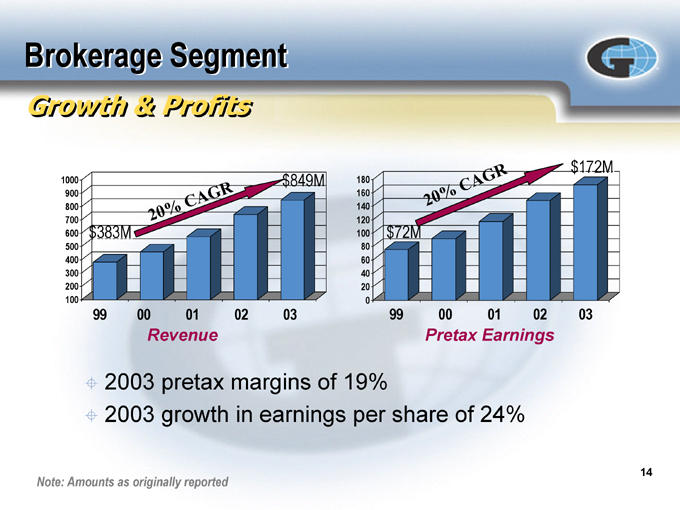

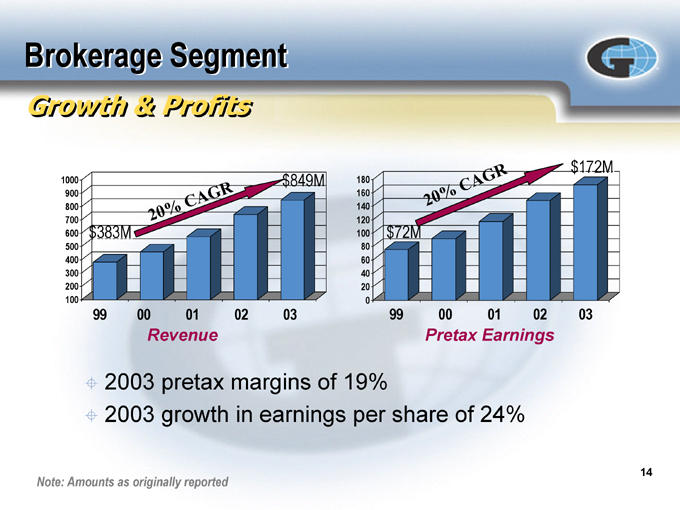

Brokerage Segment

Growth & Profits

1000 900 800 700 600 500 400 300 200 100

99 00 01 02 03

99 00 01 02 03

Revenue

Pretax Earnings

$383M $849M $72M $172M

180 160 140 120 100 80 60 40 20 0

20 % CAGR

20 % CAGR

2003 pretax margins of 19%

2003 growth in earnings per share of 24%

Note: Amounts as originally reported

14

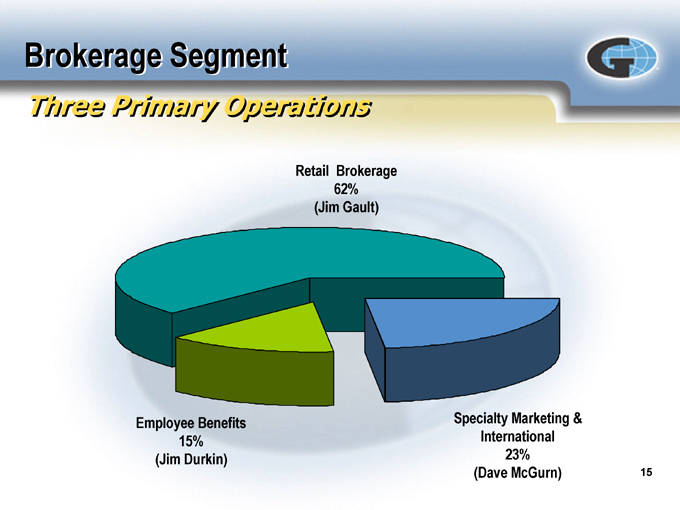

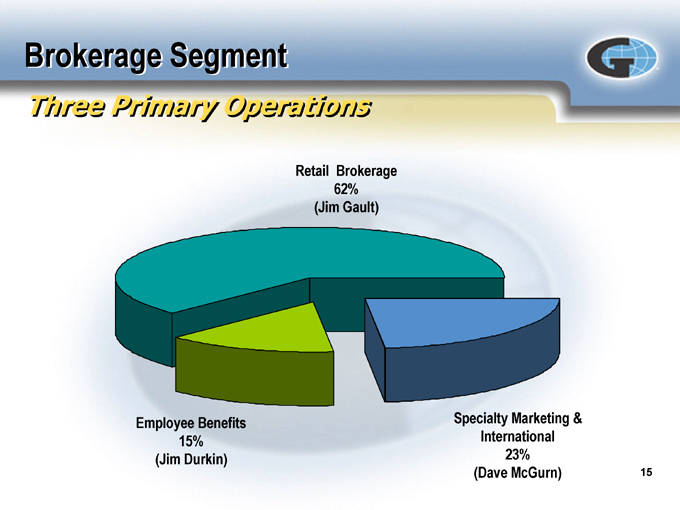

Brokerage Segment

Three Primary Operations

Retail Brokerage 62% (Jim Gault)

Employee Benefits 15% (Jim Durkin)

Specialty Marketing & International 23% (Dave McGurn)

15

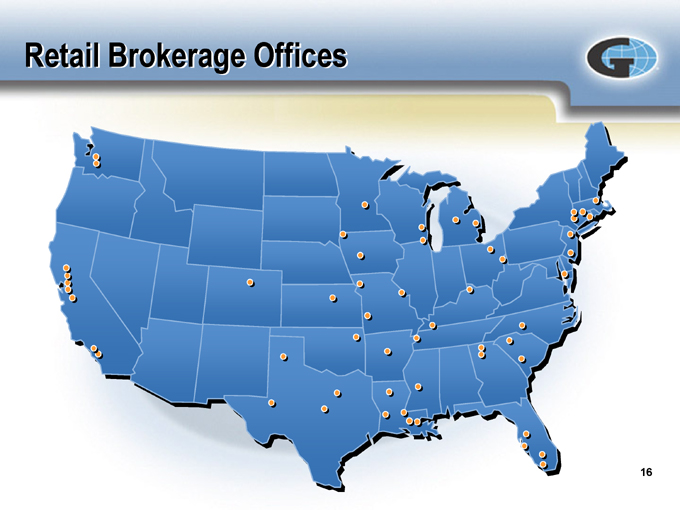

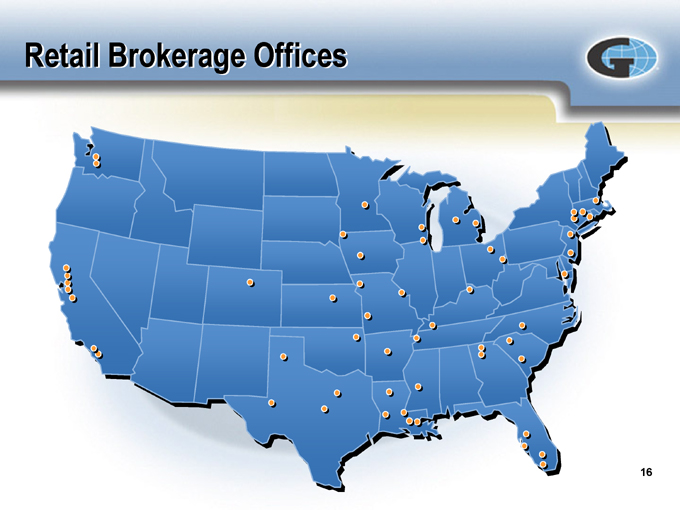

Retail Brokerage Offices

16

Retail Brokerage

Niches

Agribusiness

Public Entity

Aviation

Real Estate

General Commercial

Construction

Habitational

Energy

Hospitality

Global Risk Management

Shopping Centers

Healthcare

Religious/Nonprofit

Higher Education

Restaurant

Management Liability

Scholastic K-12

Marine

Transportation

Mergers & Acquisitions

Worldwide Risk Services

Personal Insurance

17

Retail Brokerage

High Growth & Profit Potential

Niches – number and size

Acquisitions and hiring

Alternative market

Captives

Rent-a-captives

Deductible plans

Self-insurance

18

Specialty Marketing & International

Offices, Joint Ventures & Alliances

Specialty Marketing & International

Capabilities

Reinsurance Brokerage

International P&C Brokerage

Programs/Program Administration

CoverageFirst.com

Wholesale Brokerage

Captives/Rent-a-Captives

20

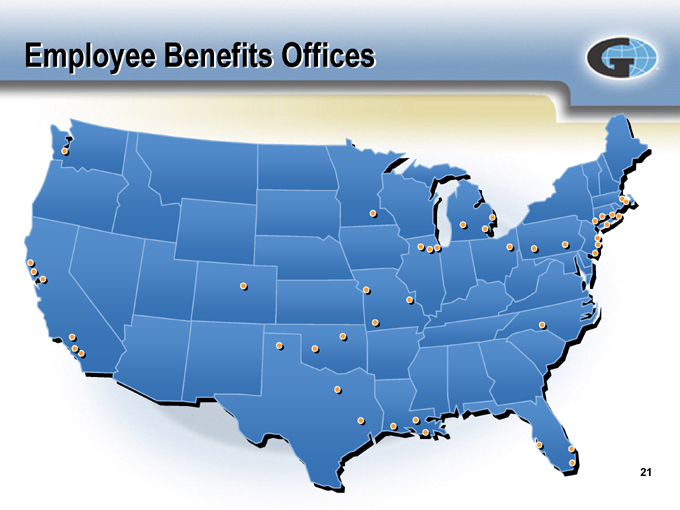

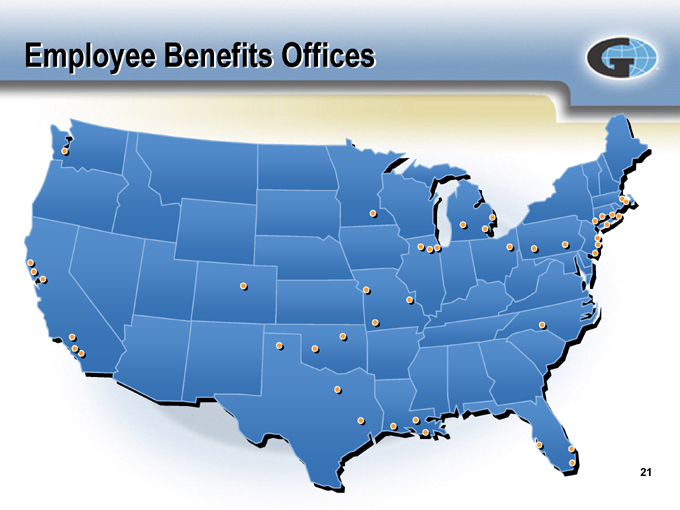

Employee Benefits Offices

21

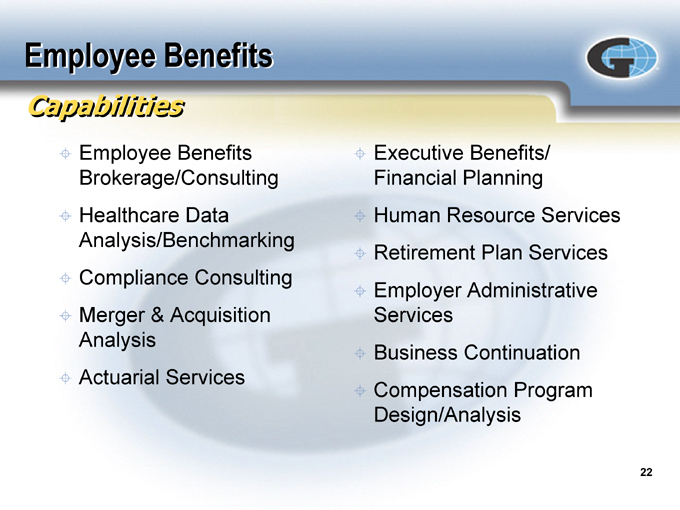

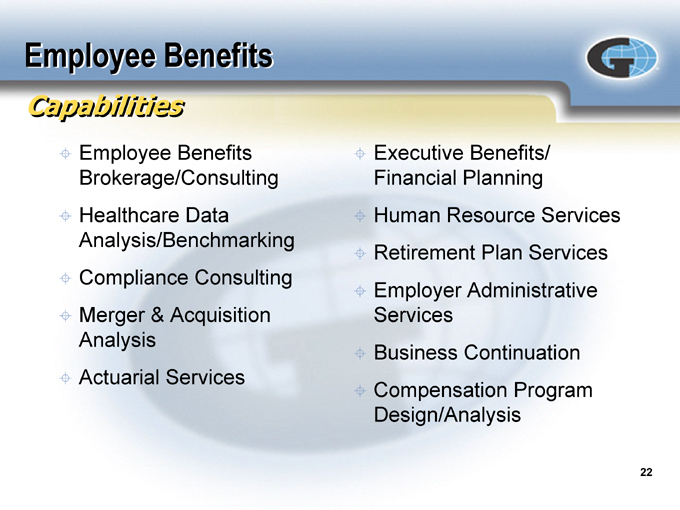

Employee Benefits

Capabilities

Employee Benefits Brokerage/Consulting

Executive Benefits/ Financial Planning

Healthcare Data Analysis/Benchmarking

Human Resource Services

Retirement Plan Services

Compliance Consulting

Employer Administrative Services

Merger & Acquisition Analysis

Business Continuation

Actuarial Services

Compensation Program Design/Analysis

22

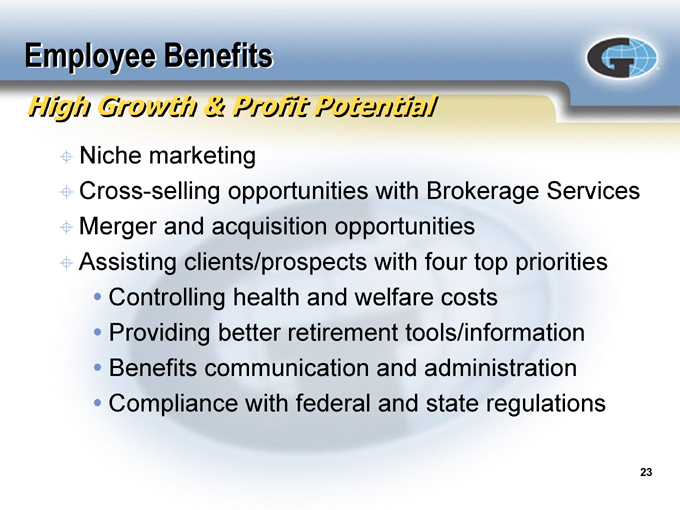

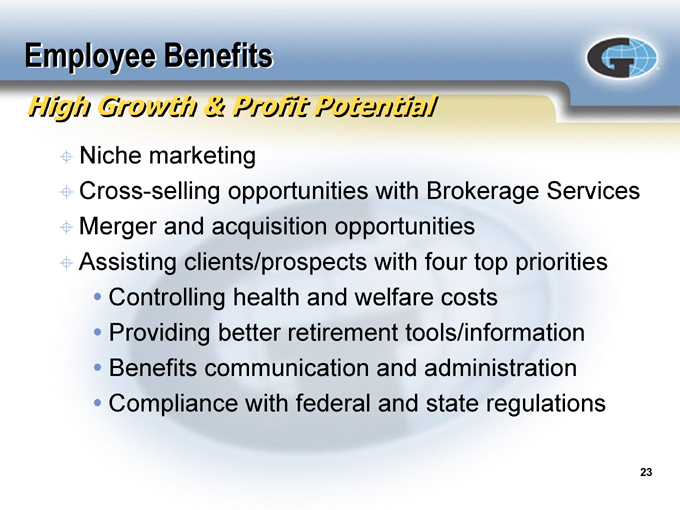

Employee Benefits

High Growth & Profit Potential

Niche marketing

Cross-selling opportunities with Brokerage Services

Merger and acquisition opportunities

Assisting clients/prospects with four top priorities

Controlling health and welfare costs

Providing better retirement tools/information

Benefits communication and administration

Compliance with federal and state regulations

23

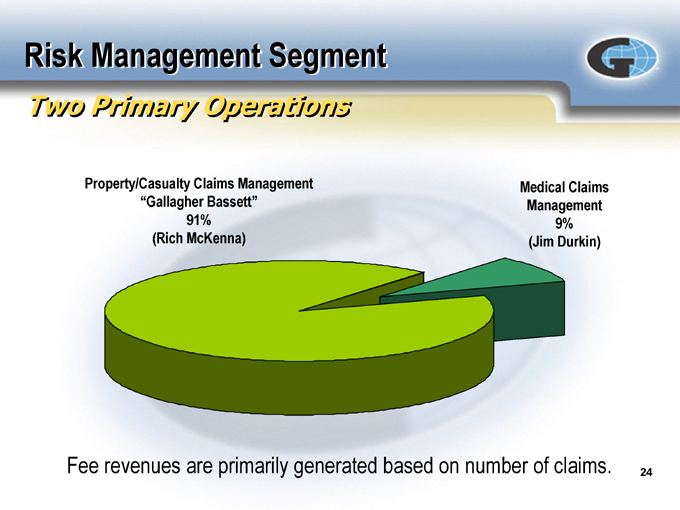

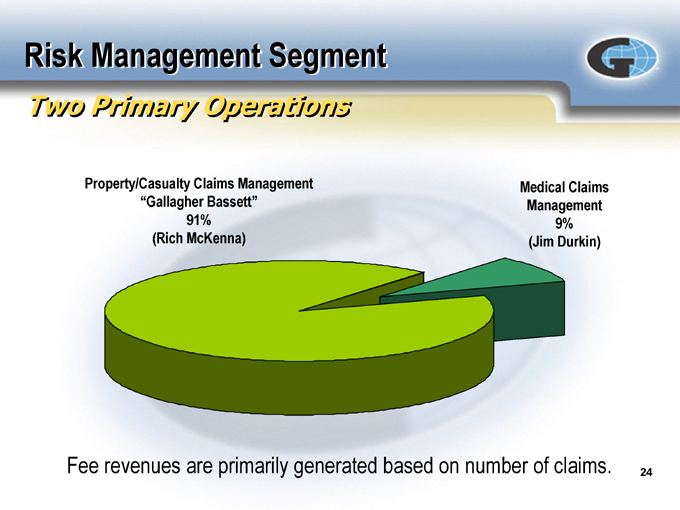

Risk Management Segment

Two Primary Operations

Property/Casualty Claims Management “Gallagher Bassett” 91% (Rich McKenna)

Medical Claims Management 9% (Jim Durkin)

Fee revenues are primarily generated based on number of claims.

24

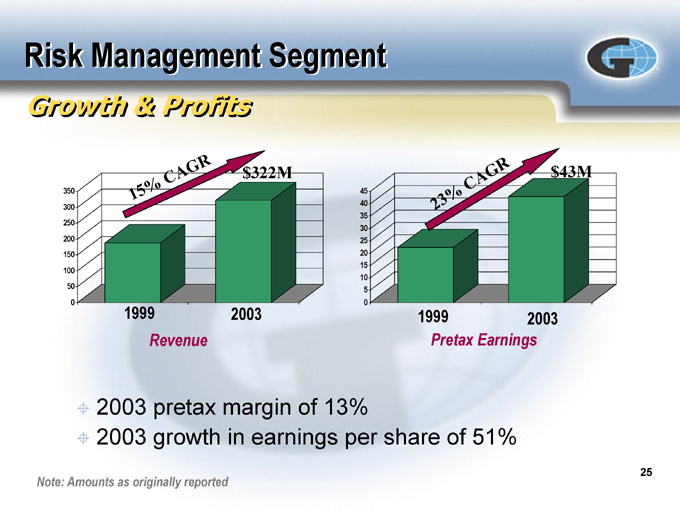

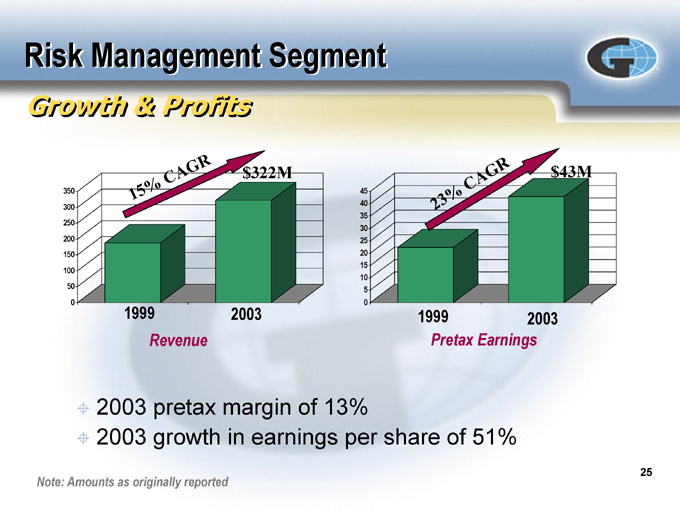

Risk Management Segment

Growth & Profits

350 300 250 200 150 100 50 0

1999 2003

1999 2003

Revenue

Pretax Earnings

45 40 35 30 25 20 15 10 5 0

$43M

$322M

23% CAGR

15% CAGR

2003 pretax margin of 13%

2003 growth in earnings per share of 51%

Note: Amounts as originally reported

25

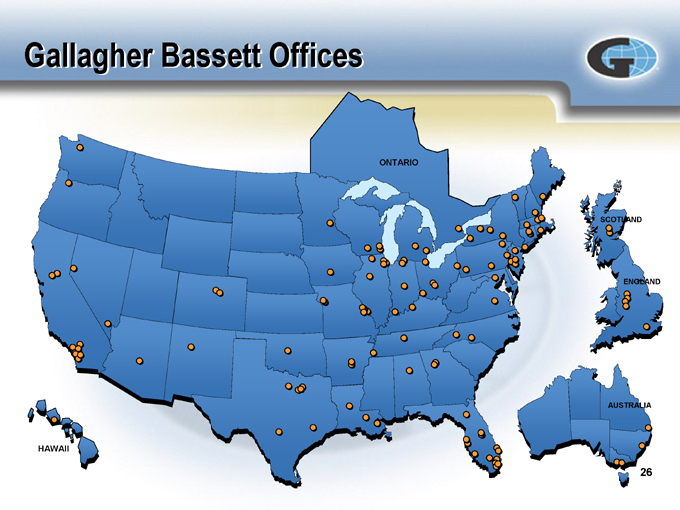

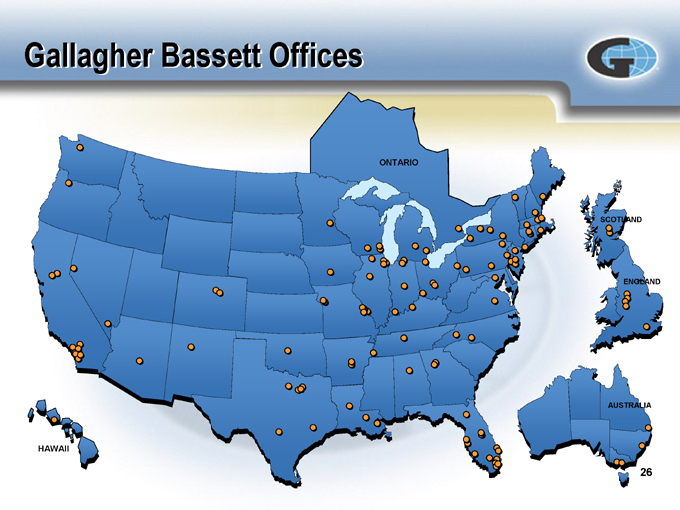

Gallagher Bassett Offices

26

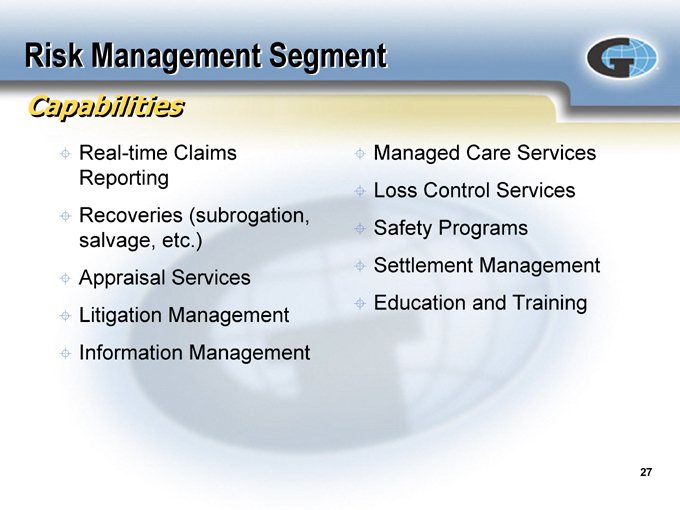

Risk Management Segment

Capabilities

Real-time Claims Reporting

Managed Care Services

Loss Control Services

Recoveries (subrogation, salvage, etc.)

Safety Programs

Settlement Management

Appraisal Services

Education and Training

Litigation Management

Information Management

27

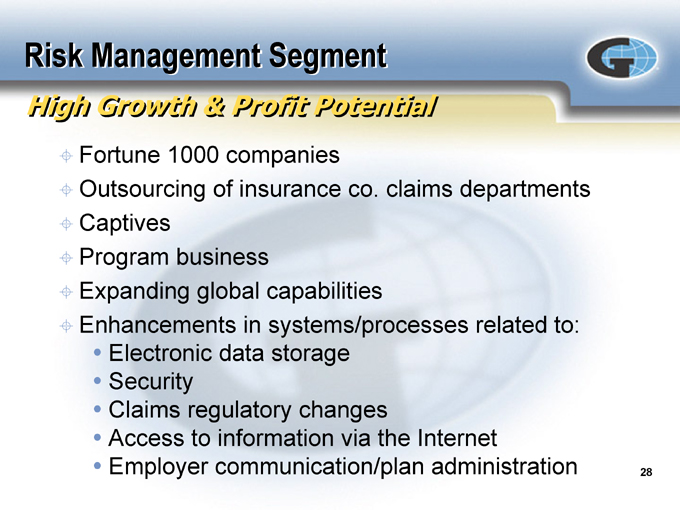

Risk Management Segment

High Growth & Profit Potential

Fortune 1000 companies

Outsourcing of insurance co. claims departments

Captives

Program business

Expanding global capabilities

Enhancements in systems/processes related to:

Electronic data storage

Security

Claims regulatory changes

Access to information via the Internet

Employer communication/plan administration

28

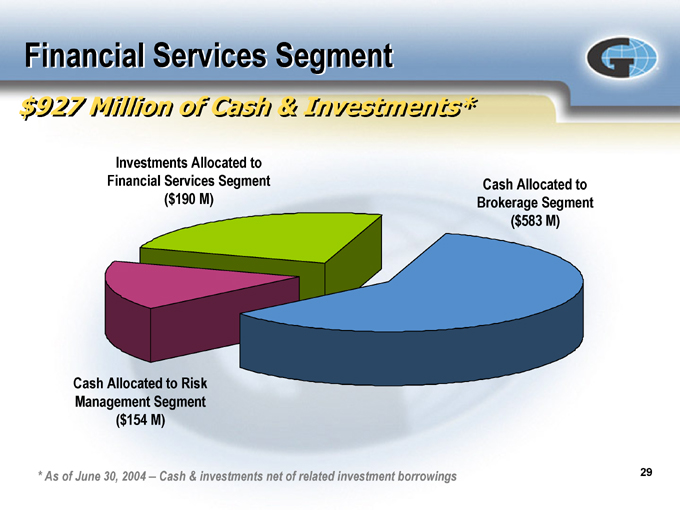

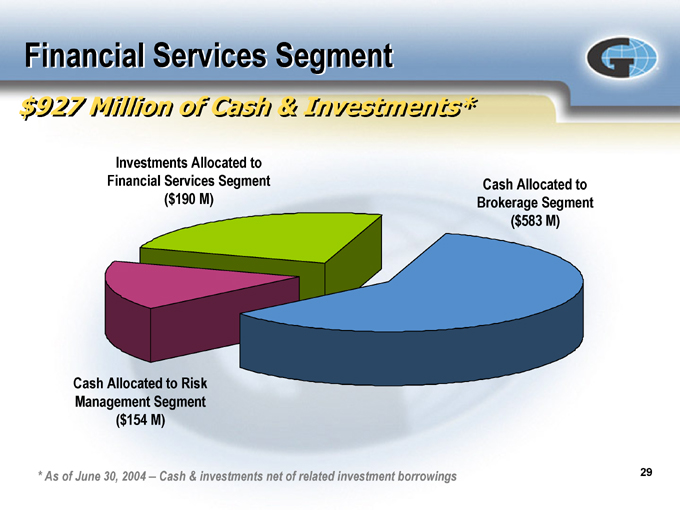

Financial Services Segment

$927 Million of Cash & Investments*

Investments Allocated to Financial Services Segment

($190 M)

Cash Allocated to Brokerage Segment

($583 M)

Cash Allocated to Risk Management Segment

($154 M)

* As of June 30, 2004 – Cash & investments net of related investment borrowings

29

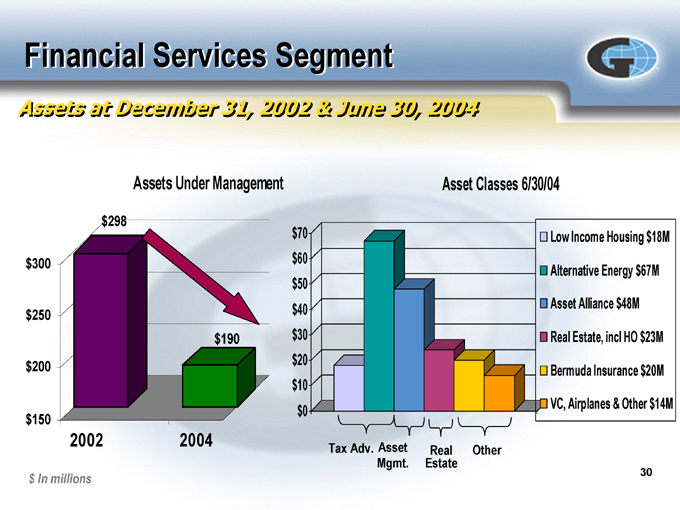

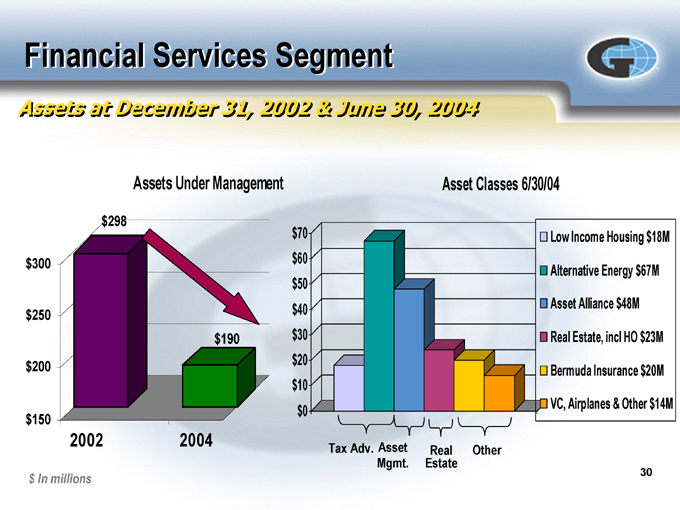

Financial Services Segment

Assets at December 31, 2002 & June 30, 2004

Assets Under Management Asset Classes 6/30/04

$300 $250 $200 $150

$298 $190

$70 $60 $50 $40 $30 $20 $10 $0

Tax Adv.

Asset Mgmt.

Real Estate

Other

Low Income Housing $18M

Alternative Energy $67M

Asset Alliance $48M

Real Estate, incl HO $23M

Bermuda Insurance $20M VC, Airplanes & Other $14M

30

Financial Services Segment

Refocused Investing

Tax advantaged – maximize through 2007

Asset management – monetize

Real estate – optimize cash flows

Venture capital – substantially exited in 2003

31

Arthur J. Gallagher & Co.

Why Invest?

32

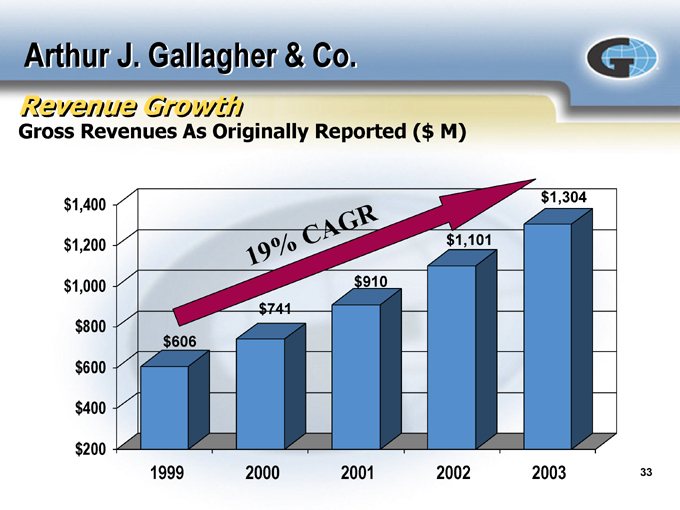

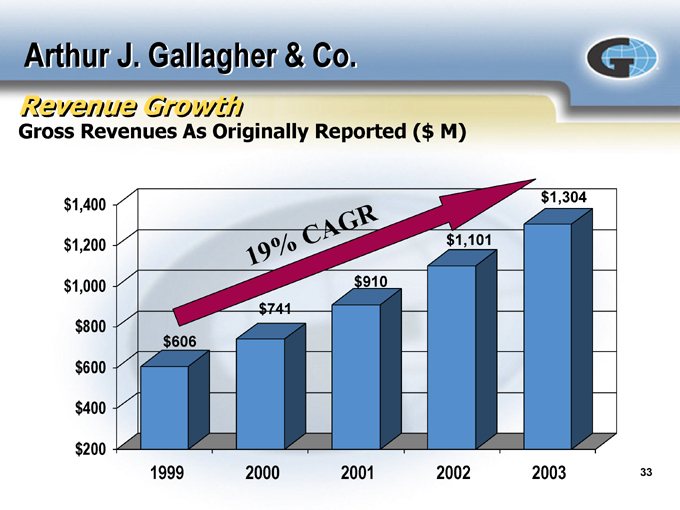

Arthur J. Gallagher & Co.

Revenue Growth

Gross Revenues As Originally Reported ($ M)

$1,400 $1,200 $1,000 $800 $600 $400 $200

1999 2000 2001 2002 2003

$606 $741 $910 $1,101 $1,304

19% CAGR

33

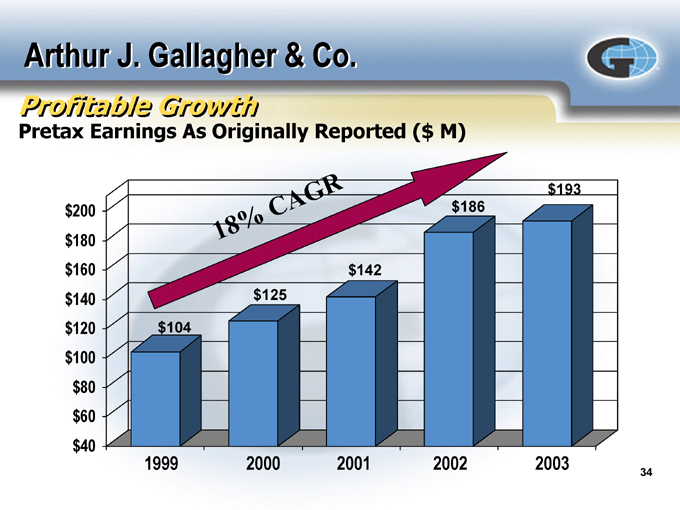

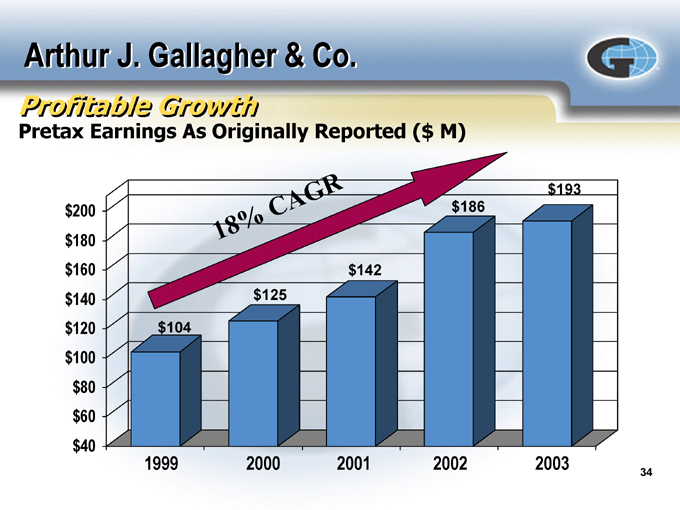

Arthur J. Gallagher & Co.

Profitable Growth

Pretax Earnings As Originally Reported ($ M)

$200 $180 $160 $140 $120 $100 $80 $60 $40

1999 2000 2001 2002 2003

$104 $125 $142 $186 $193

18% CAGR

34

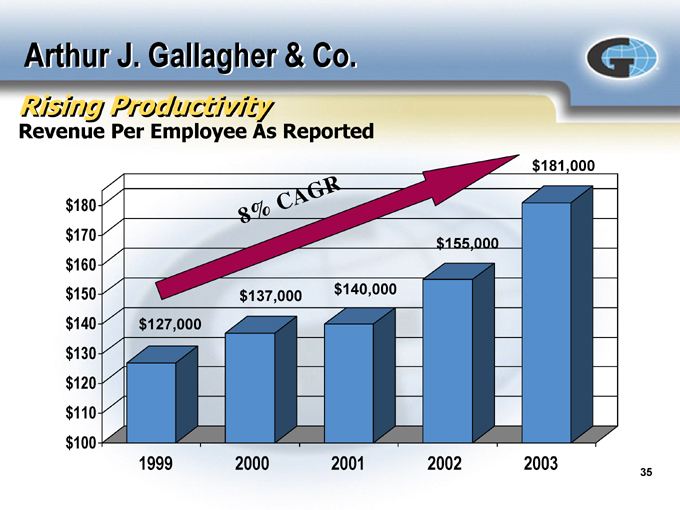

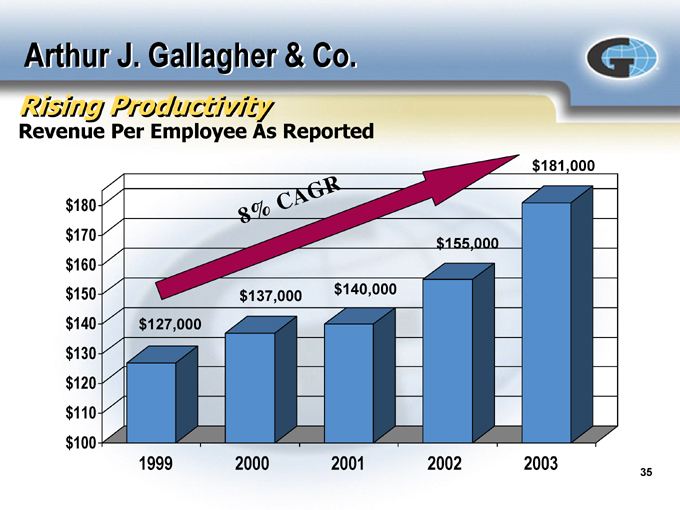

Arthur J. Gallagher & Co.

Rising Productivity

Revenue Per Employee As Reported

$180 $170 $160 $150 $140 $130 $120 $110 $100

1999 2000 2001 2002 2003

$127,000 $137,000 $140,000 $155,000 $181,000

8% CAGR

35

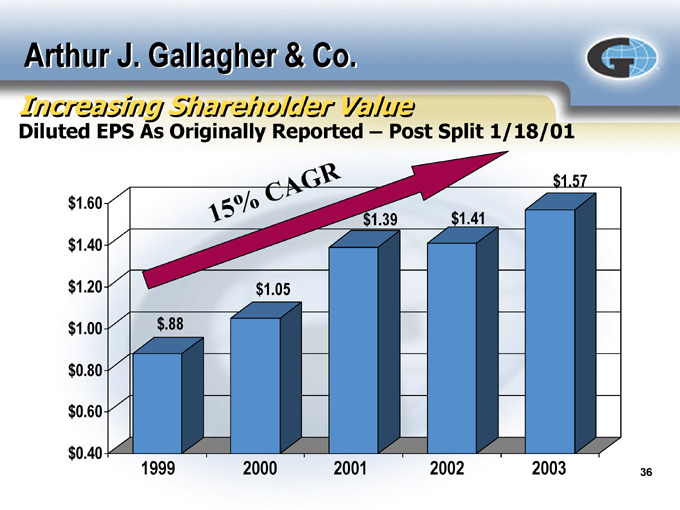

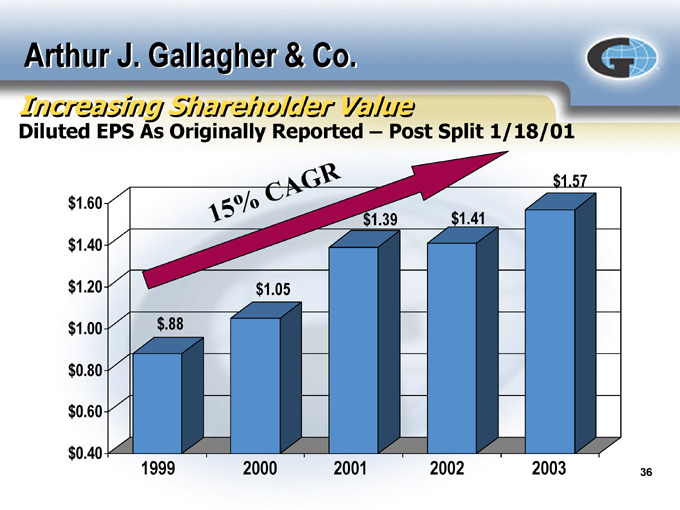

Arthur J. Gallagher & Co.

Increasing Shareholder Value

Diluted EPS As Originally Reported – Post Split 1/18/01

$1.60 $1.40 $1.20 $1.00 $0.80 $0.60 $0.40

1999 2000 2001 2002 2003

$.88 $1.05 $1.39 $1.41 $1.57

15% CAGR

36

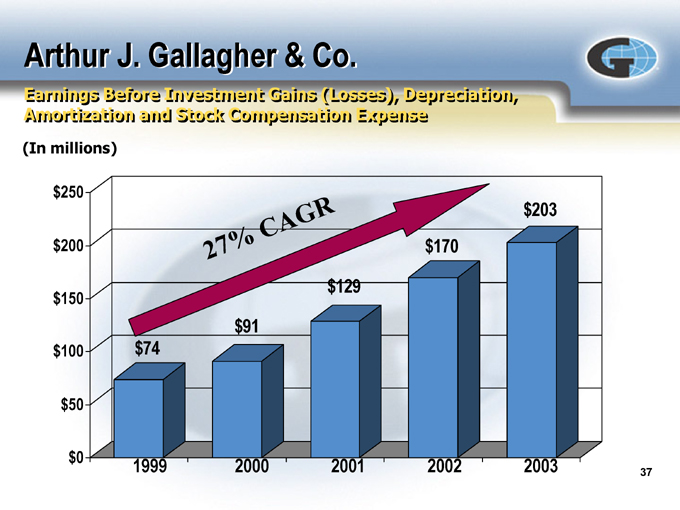

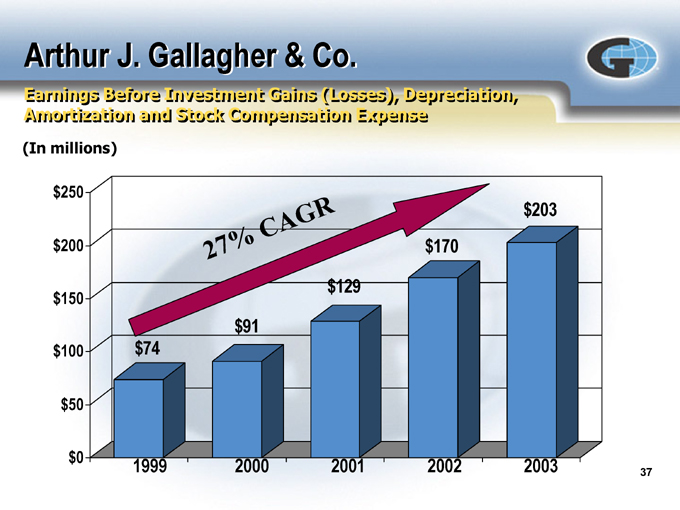

Arthur J. Gallagher & Co.

Earnings Before Investment Gains (Losses), Depreciation,

Amortization and Stock Compensation Expense

(In millions)

$250 $200 $150 $100 $50 $0

1999 2000 2001 2002 2003

$74 $91 $129 $170 $203

27% CAGR

37

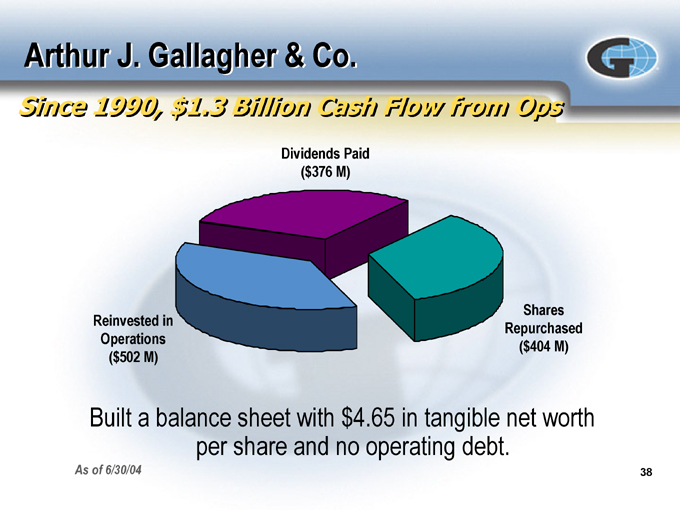

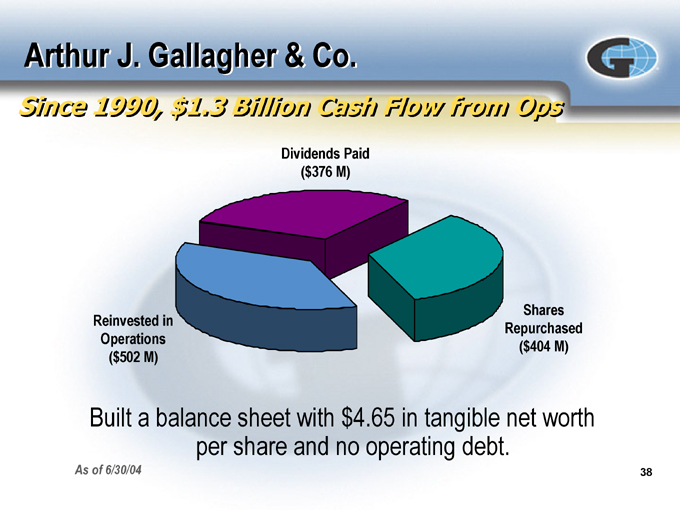

Arthur J. Gallagher & Co.

Since 1990, $1.3 Billion Cash Flow from Ops

Dividends Paid

($376 M)

Reinvested in Operations

($502 M)

Shares Repurchased

($404 M)

Built a balance sheet with $4.65 in tangible net worth per share and no operating debt.

As of 6/30/04

38

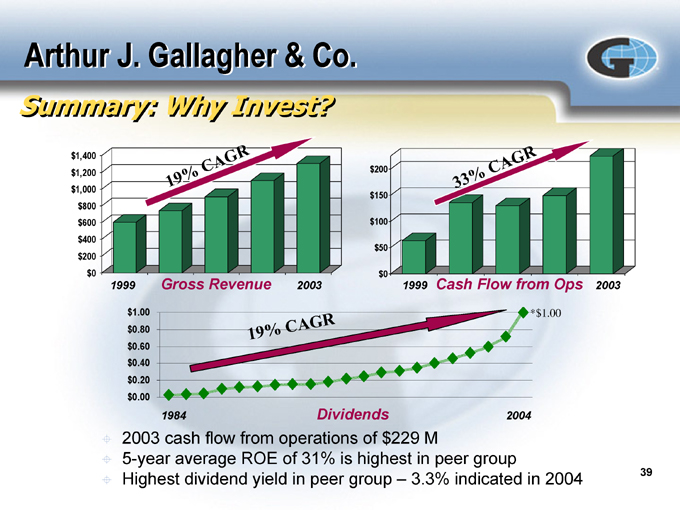

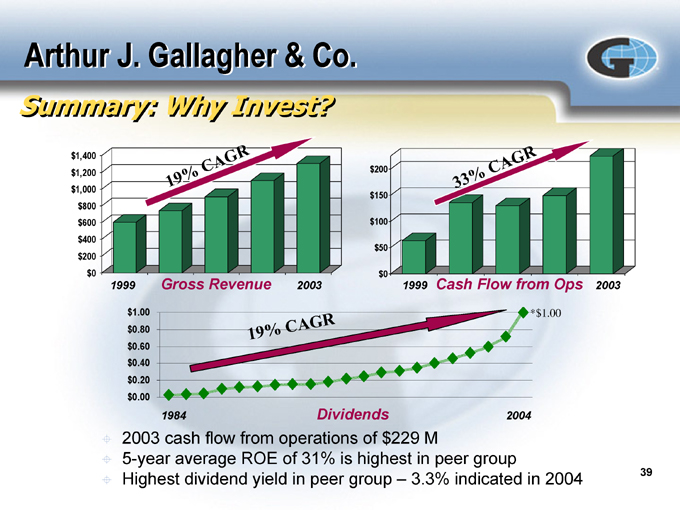

Arthur J. Gallagher & Co.

Summary: Why Invest?

$1,400 $1,200 $1,000 $800 $600 $400 $200 $0

1999 Gross Revenue 2003

$200 $150 $100 $50 $0

1999 Cash Flow from Ops 2003

$1.00 $0.80 $0.60 $0.40 $0.20 $0.00

1984 Dividends 2004

19% CAGR

33% CAGR

19% CAGR

2003 cash flow from operations of $229 M

5-year average ROE of 31% is highest in peer group

Highest dividend yield in peer group – 3.3% indicated in 2004

39

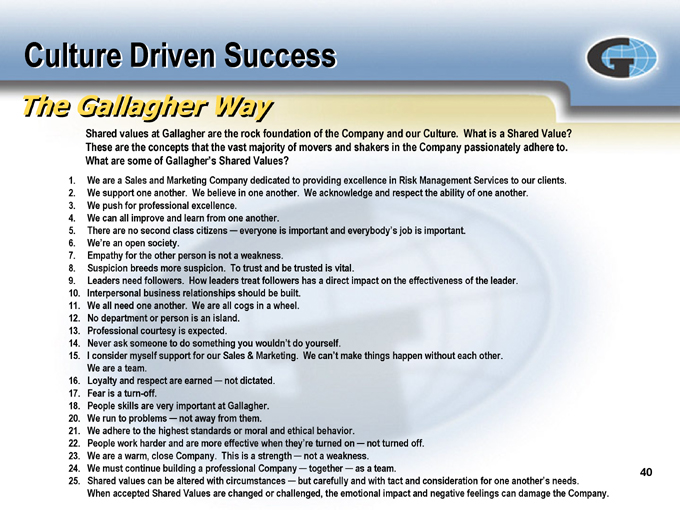

Culture Driven Success

The Gallagher Way

Shared values at Gallagher are the rock foundation of the Company and our Culture. What is a Shared Value?

These are the concepts that the vast majority of movers and shakers in the Company passionately adhere to. What are some of Gallagher’s Shared Values?

1. We are a Sales and Marketing Company dedicated to providing excellence in Risk Management Services to our clients.

2. We support one another. We believe in one another. We acknowledge and respect the ability of one another.

3. We push for professional excellence.

4. We can all improve and learn from one another.

5. There are no second class citizens - everyone is important and everybody’s job is important.

6. We’re an open society.

7. Empathy for the other person is not a weakness.

8. Suspicion breeds more suspicion. To trust and be trusted is vital.

9. Leaders need followers. How leaders treat followers has a direct impact on the effectiveness of the leader.

10. Interpersonal business relationships should be built.

11. We all need one another. We are all cogs in a wheel.

12. No department or person is an island.

13. Professional courtesy is expected.

14. Never ask someone to do something you wouldn’t do yourself.

15. I consider myself support for our Sales & Marketing. We can’t make things happen without each other. We are a team.

16. Loyalty and respect are earned - not dictated.

17. Fear is a turn-off.

18. People skills are very important at Gallagher.

20. We run to problems - not away from them.

21. We adhere to the highest standards or moral and ethical behavior.

22. People work harder and are more effective when they’re turned on - not turned off.

23. We are a warm, close Company. This is a strength - not a weakness.

24. We must continue building a professional Company - together - as a team.

25. Shared values can be altered with circumstances -but carefully and with tact and consideration for one another’s needs. When accepted Shared Values are changed or challenged, the emotional impact and negative feelings can damage the Company.

40