As of June 30, 2004

Arthur J.

Gallagher & Co.

INVESTMENT PROFILE

NYSE: AJG

Brokerage Segment

Risk Management Segment

Financial Services Segment

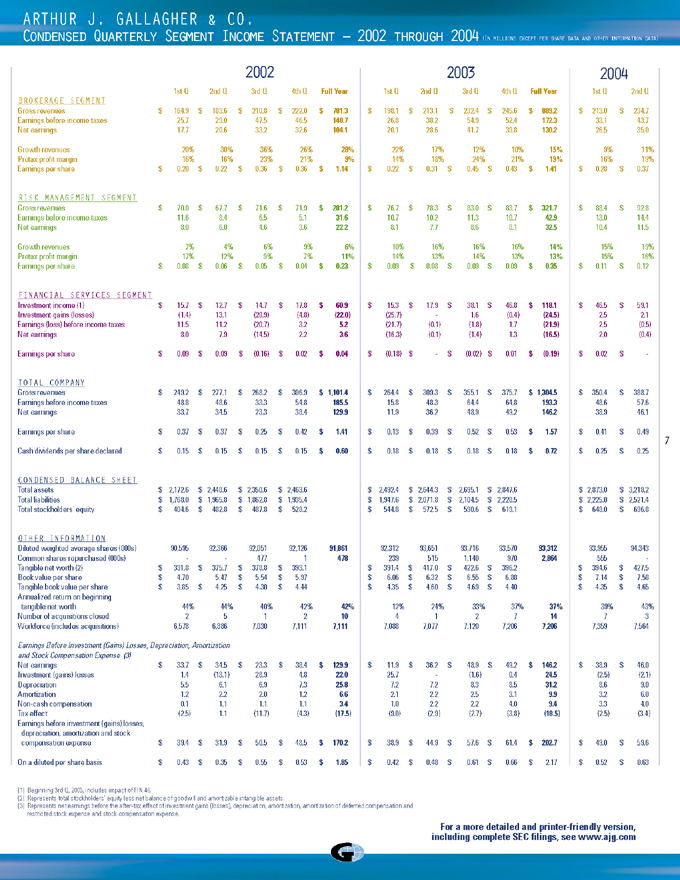

GROWING VALUE

Arthur J. Gallagher & Co. is the world’s fourth-largest insurance brokerage and risk management services firm and the third-largest broker of U.S. business. Gallagher provides a full range of property/casualty (P/C) products and services to clients of all sizes. It is also one of the world’s premier alternative risk transfer and third-party claims managers and a full-service employee benefits consultant.

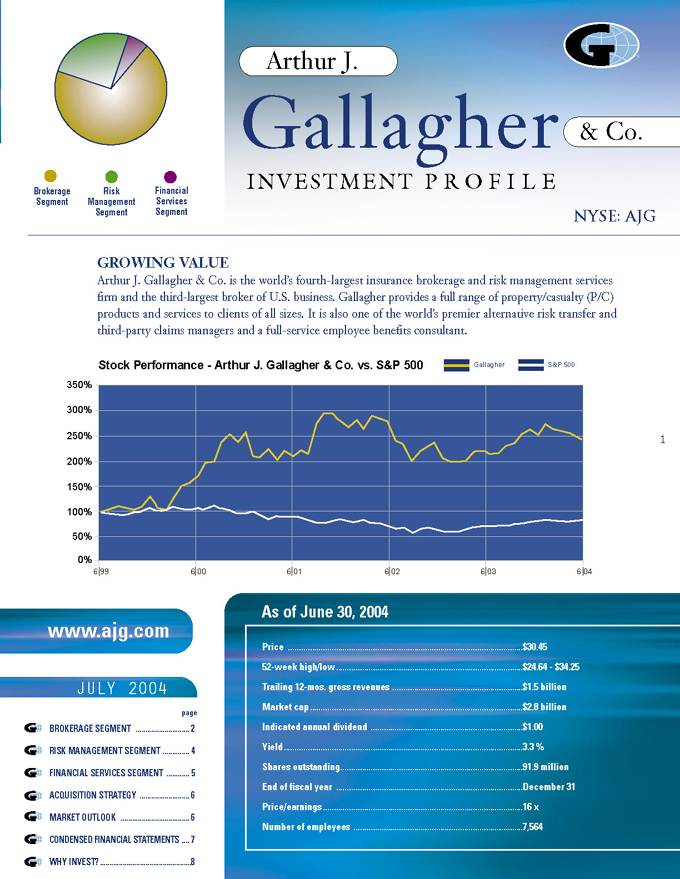

Stock Performance—Arthur J. Gallagher & Co. vs. S&P 500

Gallagher

S&P 500

350% 300% 250% 200% 150% 100% 50% 0%

6|99

6|00

6|01

6|02

6|03

6|04

www.ajg.com

JULY 2004

page

BROKERAGE SEGMENT 2

RISK MANAGEMENT SEGMENT 4

FINANCIAL SERVICES SEGMENT 5

ACQUISITION STRATEGY 6

MARKET OUTLOOK 6

CONDENSED FINANCIAL STATEMENTS 7

WHY INVEST? 8

Price $30.45

52-week high/low $24.64—$34.25

Trailing 12-mos. gross revenues $1.5 billion

Market cap $2.8 billion

Indicated annual dividend $1.00

Yield 3.3 %

Shares outstanding 91.9 million

End of fiscal year December 31

Price/earnings 16 x

Number of employees 7,564

Team Oriented

Client Focused

Innovative

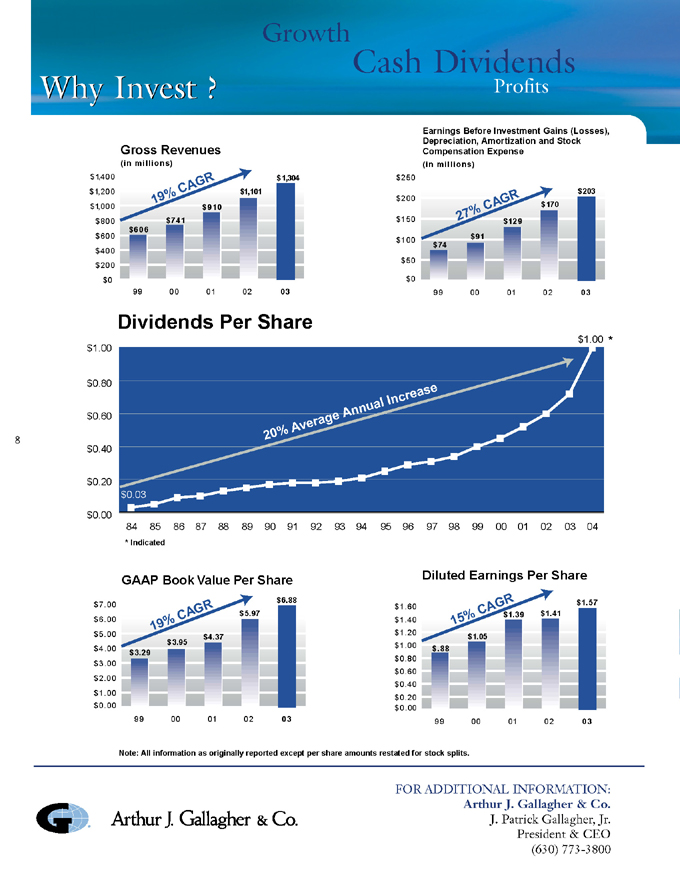

Brokerage Segment

BROKERAGE SERVICES RETAIL DIVISION

NICHES

Agribusiness

Aviation

Construction • Energy

Global Risk Management

Healthcare

Higher Education

Management Liability

Marine

Mergers & Acquisitions

Personal Insurance

Public Entity

Real Estate (4)—General Commercial—Habitational—Hospitality—Shopping Centers

Religious/Nonprofit

Restaurant

Scholastic K-12

Transportation

Worldwide Risk Services

Wrap Ups

Gallagher’s Brokerage Services Retail Division (BSD) specializes in structuring P/C insurance and risk management programs for commercial, industrial, institutional and governmental organizations. With 65 offices throughout the U.S., this operation pursues cross-selling opportunities with other Gallagher

operations and with the company’s Strategic Alliance Network of independent broker partners in more than 100 countries throughout the world.

BSD is a leading provider of insurance programs for middle-market commercial clients. While it brokers all types of P/C insurance, approximately 67% of its business falls within 22 specialized niches. These cross-divisional niche practice groups target areas of business in which Gallagher has developed a depth of expertise and a large client base. This niche focus provides advantages both in new business production and account retention. Niche practice groups allow for highly-focused marketing efforts and facilitate the development of value-added products and services specific to those industries or business segments. The detailed understanding and broad client contacts developed within the niches provide a competitive advantage.

BSD anticipates its greatest revenue growth in 2004 will come from its niche practice groups; middle-market accounts; developing and managing alternative market mechanisms like captives, rent-a-captives, deductible plans and self-insurance; and mergers and acquisitions.

SPECIALTY MARKETING AND INTERNATIONAL

CAPABILITIES

Reinsurance Brokerage

International P/C Brokerage

Programs/Program Administration

CoverageFirst.com

Wholesale Brokerage

Captive/Rent-a-Captive Management

Specialty Marketing and International is comprised of wholesale, excess/surplus and reinsurance brokerage operations in the U.S. and abroad, captive

SPECIALITY MARKETING AND INTERNATIONAL (CONTINUED)

management operations outside the Continental U.S., and P/C joint-ventures and partnerships.

From 2001 through 2003, rate increases and coverage restrictions in the P/C market increased client demand for alternative risk transfer mechanisms. Gallagher structures a broad range of alternative market mechanisms, tailored to clients’ specific needs and financial situations. Those market conditions also contributed to exceptional growth in wholesale and excess/surplus lines business, much of which is generated by producers outside the Gallagher network. A growing amount of business is coming to Gallagher via its e-commerce portal,

CoverageFirst.com, which has over 12,000 registered independent

agent, wholesale broker and managing general agent users.

Through 2004, the operation expects its greatest revenue growth opportunities will come from reinsurance, international and wholesale brokerage business, programs and program administration. In addition to its offices or joint-ventures in the U.S., U.K., Bermuda, Australia, Singapore, Malaysia and Bahrain, the operation pursues business opportunities in conjunction with Gallagher’s Strategic Alliance Network of correspondent brokers and consultants in over 100 countries around the world.

STRATEGIC

ALLIANCE

NETWORK

In addition to its own international brokerage offices, Gallagher has developed a non-owned network of leading independent brokers in more than 100 countries around the world. These relationships provide Gallagher’s clients with one of the most comprehensive worldwide sales and service networks available.

GALLAGHER BENEFIT SERVICES

3

CAPABILITIES

Employee Benefits Brokerage/Consulting

Healthcare Data Analysis/Benchmarking

Compliance Consulting

Merger & Acquisition Analysis

Actuarial Services

Executive Benefits/Financial Planning

Human Resource Services

Retirement Plan Services

Employer Administrative Services

Business Continuation

Compensation Program Design/Analysis

Gallagher Benefit Services provides employee benefit brokerage and human resource consulting to assist clients in all areas of their employee retirement and health and welfare plans. Rising healthcare costs and growing regulatory complexities have resulted in double-digit increases in employee benefit costs. Gallagher has significantly expanded its technical resources and technological capabilities over the last couple of years to better assist clients in addressing this trend.

Gallagher offers expertise and guidance in all areas of benefits planning, delivery and administration. This encompasses a broad range of benefit services, including executive benefits and financial planning, worksite marketing and voluntary products, defined contribution products, actuarial services, compensation program

design/analysis, data analysis and benchmarking, retirement services, benefits communication and out-sourcing, and training programs and tools that help employers address federal and state regulatory compliance.

The operation has also established eight niche practice groups in the following areas: healthcare, higher education, hospitality, public entity, religious, restaurant, education (K-12) and transportation. Its strongest near-term growth opportunities are expected to come from its niche practice groups, through mergers and acquisitions, from cross-selling opportunities with other Gallagher operations, and by assisting clients and prospects in addressing their most pressing benefit priorities.

Quality Driven

Comprehensive

Cost Effective

Risk Management Segment

GALLAGHER BASSETT

EXPERTISE

4

Real-Time Claims Reporting

Recoveries (subrogation, salvage, etc.)

Appraisal Services

Litigation Management

Information Management

Managed Care Services

Loss Control Services

Safety Programs

Settlement Management

Education and Training

Gallagher Bassett has built a reputation as the high-quality, cost-effective provider in the multi-billion dollar market for third-party P/C claims management services. Claims management involves managing clients’ risk exposures as well as managing and paying their claims. Based on revenues from self-insured clients, Gallagher Bassett currently ranks as the world’s largest multiline, third-party administrator, according to Business Insurance magazine. It has offices in the U.S., U.K., Australia and Canada.

Gallagher Bassett’s primary business is contracted claims management. It provides claims management services for workers compensation, liability, auto, property and integrated disability management programs. It also offers information services, risk control consulting (loss control) services and appraisal services, either individually or in combination.

The corporate world’s growing interest in self-insurance and alternative risk transfer is stimulating client demand for claims management as an unbundled function, since many self-insuring corporations and public entities require more comprehensive loss reporting and claims tracking services than are typically provided by an insurance company. With Gallagher Bassett’s sophisticated claims management data systems and extensive network, it has reached a point where scale gives it a distinct competitive advantage. The division has also maintained an unwavering commitment to quality for over a decade that has significantly reduced its rework and processing costs, leading to an exceptional annual client retention rate.

Gallagher Bassett’s Web-based, proprietary claims and loss control information management system, risxfacs.com, brings diverse elements of intelligent risk management together in a comprehensive system that streamlines client loss and claim processes. By the end of June 2004, the system had more than 8,900 users and was handling approximately 15 million site hits and over 57,000 visitor sessions per month.

The division expects its most significant growth prospects through 2004 will come from Fortune 1000 companies, captives, program business and the out-sourcing of insurance company claims departments.

GALLAGHER BENEFIT ADMINISTRATORS

CAPABILITIES

Medical Case Management

Non-Network Fee Negotiations

Customized Reporting Capabilities

EAP/Wellness Programs

Managed Healthcare Delivery

Utilization Review

Internet Enrollment/Administration

Gallagher Benefit Administrators offers a wide range of benefit administrative services as well as the ability to integrate those services. It brings clients innovative reporting capabilities, customized managed healthcare options and integrated utilization management services.

While many third-party claims administrators have fallen behind in upgrading core competencies, Gallagher Benefit Administrators has continued to address systems and processes related to electronic data interchange and security issues, claims regulatory changes, access to information via the Internet, and methods through which employers can communicate and administer their plans more efficiently.

The operation has a platform that allows for paperless claims processing and pays many claims automatically. Clients have Web access to claims data and can complete their enrollments electronically. Gallagher Benefit Administrators expects these enhancements to elevate its competitive position in an industry facing consolidation.

5

Financial Services Segment

CORE COMPETENCIES

Tax-Advantaged Investing

Real Estate

Asset Management

The Financial Services segment is responsible for managing Gallagher’s investments and tax obligations. Financial Services specializes in tax-advantaged, real estate and asset management investments.

Tax-advantaged investments are comprised primarily of low income housing developments, waste-to-energy projects and synthetic fuel plants. These investments have helped reduce Gallagher’s tax rate to 30% in 2002, 24% in 2003 and 20% in 2004.

Real estate investments include Gallagher’s 60% ownership of a 25-story office building in Itasca, Illinois that houses its home office operations and several of its profit centers. The building is 100% leased, with third parties occupying approximately 45%. Gallagher also owns 80% of an 11,000-acre community near Orlando. Known as Harmony, Florida, the site has a Johnny Miller Signature golf course and a new high school opening in August 2004. More than 100 homes have been completed and there are now more than 200

residents in Harmony. National builder D.R. Horton and several local custom builders have over 50 additional homes in various stages of development.

Asset management is primarily comprised of Gallagher’s 25% minority interest in Asset Alliance Corporation, which generally owns up to 50% of 13 alternative investment fund manager companies with approximately $4.5 billion under management.

ACQUISITION STRATEGY

Gallagher made 135 acquisitions from 1986 through June 2004, almost exclusively within the Brokerage Segment. The majority of these were regional or local P/C brokers possessing a strong middle-market focus or significant expertise in a desirable market niche. In the last few years, the company has also increased its acquisition activity in the benefits consulting area. Acquisitions typically fall within the $5 million to $15 million range. Gallagher is highly selective.

An acquisition must offer significant benefits, such as expanding its talent pool, enhancing its geographic presence and service capabilities, and/or broadening and further diversifying its business mix. In selecting acquisition candidates, Gallagher focuses on:

a corporate culture that matches its own aggressive, marketing-oriented culture

a profitable, growing business whose ability to compete would be enhanced by gaining access to Gallagher’s greater resources

clearly defined financial criteria.

Management anticipates that Gallagher’s aggressive acquisition pace will continue. Contributing to the company’s success as an acquirer is its attractiveness as a merger partner. Growth-oriented independent brokers and consultants are attracted by its aggressive, sales-oriented culture and incentive-based compensation structure.

MARKET OUTLOOK

6

The P/C market is cyclical, fluctuating between periods of broad coverage availability and widespread rate reductions (referred to as a “soft” market), and periods of significant rate increases and limited coverage availability (referred to as a “hard” market). Hard markets are typically triggered when rates have been driven so low that underwriting losses exceed total premiums collected, threatening insurer solvency on a large-scale basis.

Throughout the 1990s, an over-abundance of underwriting capacity created an extremely competitive environment for most P/C insurers, putting them under significant pressure to reduce premium rates despite growing underwriting losses. As a result, between 1992 and 2000 the overall cost of managing risk for U.S. corporations dropped 42%. A market correction began in 2000 and intensified in 2001, particularly following the September 11th terrorist attacks. Double-digit rate increases and coverage restrictions continued

throughout 2002. The magnitude of rate increases began to moderate in 2003. A market survey conducted by the Council of Insurance Agents & Brokers indicated that in the second quarter of 2004 premium rates declined by an average of 1% for small commercial accounts (less than $25,000 in commissions and fees), 3% for mid-sized accounts ($25,000-$100,000) and 6% for large accounts. A similar rate study conducted by the Risk and Insurance Management Society in the second quarter of 2004 confirmed that price declines were outpacing price gains in every major category except workers compensation. Softening market conditions are expected to continue throughout 2004.

Insurance brokers, as intermediaries between insurers and their customers, normally assume no underwriting risk. Their role is to add value to the transaction by explaining to clients the complex array of insurance and risk management products available; negotiating with insurers for optimum

rates and coverage terms and conditions; and helping to place complex risks for clients and other brokers. Large brokers such as Gallagher also help insurance companies transfer some of their own risk to reinsurance providers. As compensation, brokers receive commissions from insurers or fees directly from clients.

In addition to structuring traditional P/C programs, Gallagher assists many clients in managing risk through the alternative market, a segment that includes self-insurance, captives, rent-a-captives and risk retention groups. According to industry estimates, these mechanisms now account for nearly 50% of the total commercial P/C market in the U.S. When traditional coverage becomes more expensive and harder to obtain, interest in alternative market mechanisms escalates. While competition is beginning to increase, Gallagher continues to see a strong interest in alternative market mechanisms in 2004.

SAFE HARBOR STATEMENT

Except for the historical information and discussions contained herein, statements contained herein may constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These statements involve a number of risks, uncertainties and other factors that could cause actual results to differ materially, as discussed in the company’s filings with the U.S. Securities and Exchange Commission (the “SEC”). This document includes certain non-GAAP financial measures as defined under rules promulgated by the SEC. As required by SEC rules, we have provided reconciliations of those measures to the most directly comparable GAAP measures, which are available on our Web site at www.ajg.com.

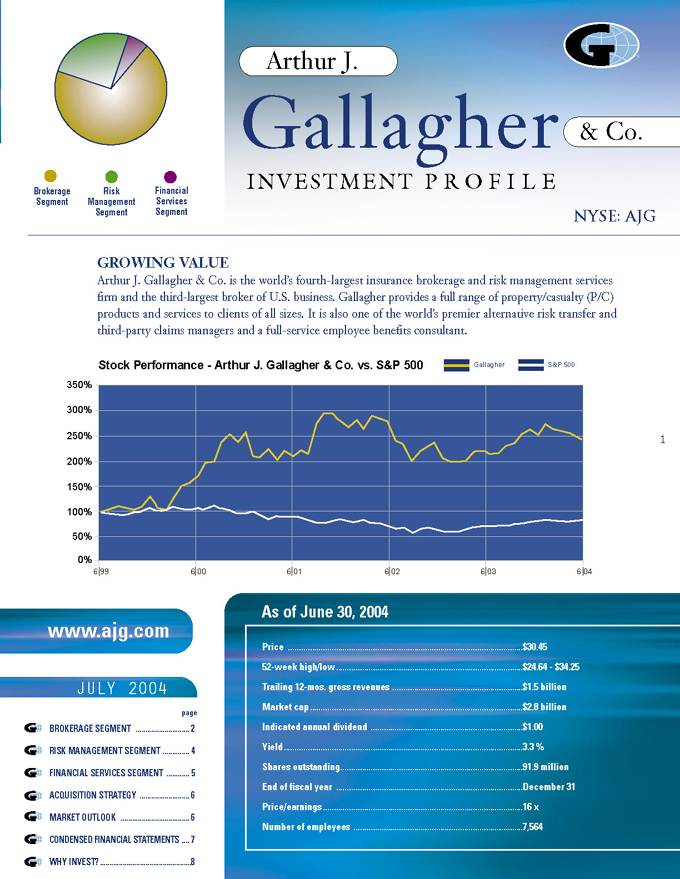

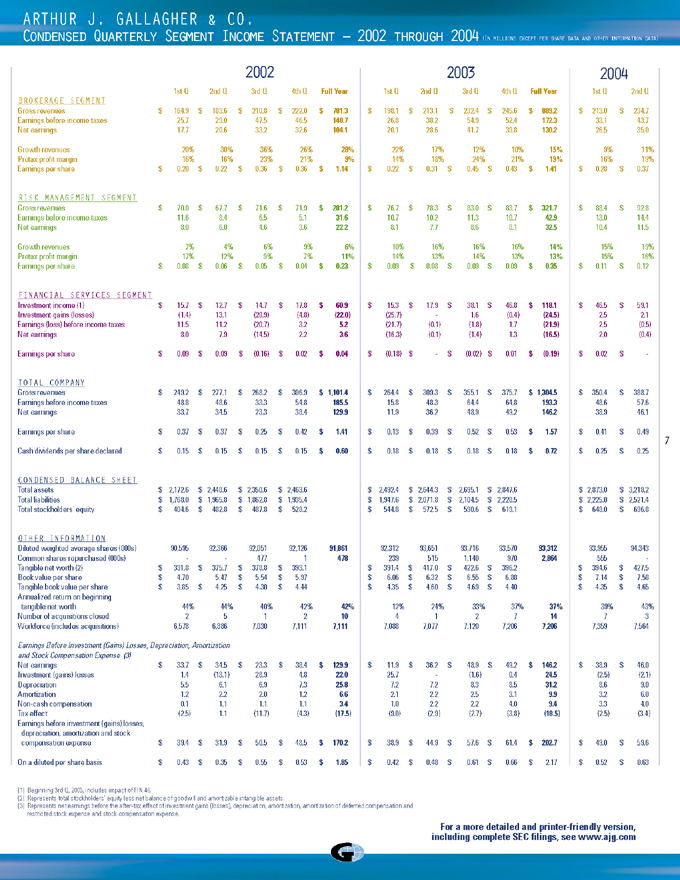

ARTHUR J. GALLAGHER & CO.

CONDENSED QUARTERLY SEGMENT INCOME STATEMENT – 2002 THROUGH 2004(IN MILLIONS EXCEPT PER SHARE DATA AND OTHER INFORMATION DATA)

2002 2003 2004

1st Q 2nd Q 3rd Q 4th Q Full Year 1st Q 2nd Q 3rd Q 4th Q Full Year 1st Q 2nd Q

BROKERAGE SEGMENT

Gross revenues $164.9 $183.6 $210.8 $222.0 $781.3 $198.1 $213.1 $232.4 $245.6 $889.2 $213.0 $234.7

Earnings before income taxes 25.7 29.0 47.5 46.5 148.7 26.8 38.2 54.9 52.4 172.3 33.1 43.7

Net earnings 17.7 20.6 33.2 32.6 104.1 20.1 28.6 41.7 39.8 130.2 26.5 35.0

Growth revenues 20% 30% 36% 26% 28% 22% 17% 12% 10% 15% 9% 11%

Pretax profit margin 16% 16% 23% 21% 9% 14% 18% 24% 21% 19% 16% 19%

Earnings per share $0.20 $0.22 $0.36 $0.36 $1.14 $0.22 $0.31 $0.45 $0.43 $1.41 $0.28 $0.37

RISK MANAGEMENT SEGMENT

Gross revenues $70.0 $67.7 $71.6 $71.9 $281.2 $76.7 $78.3 $83.0 $83.7 $321.7 $88.4 $92.8

Earnings before income taxes 11.6 8.4 6.5 5.1 31.6 10.7 10.2 11.3 10.7 42.9 13.0 14.4

Net earnings 8.0 6.0 4.6 3.6 22.2 8.1 7.7 8.6 8.1 32.5 10.4 11.5

Growth revenues 7% 4% 6% 9% 6% 10% 16% 16% 16% 14% 15% 19%

Pretax profit margin 17% 12% 9% 7% 11% 14% 13% 14% 13% 13% 15% 16%

Earnings per share $0.08 $0.06 $0.05 $0.04 $0.23 $0.09 $0.08 $0.09 $0.09 $0.35 $0.11 $0.12

FINANCIAL SERVICES SEGMENT

Investment income (1) $15.7 $12.7 $14.7 $17.8 $60.9 $15.3 $17.9 $38.1 $46.8 $118.1 $46.5 $59.1

Investment gains (losses) (1.4) 13.1 (28.9) (4.8) (22.0) (25.7) - 1.6 (0.4) (24.5) 2.5 2.1

Earnings (loss) before income taxes 11.5 11.2 (20.7) 3.2 5.2 (21.7) (0.1) (1.8) 1.7 (21.9) 2.5 (0.5)

Net earnings 8.0 7.9 (14.5) 2.2 3.6 (16.3) (0.1) (1.4) 1.3 (16.5) 2.0 (0.4)

Earnings per share $0.09 $0.09 $(0.16) $0.02 $0.04 $(0.18) $- $(0.02) $0.01 $(0.19) $0.02 $-

TOTAL COMPANY

Gross revenues $249.2 $277.1 $268.2 $306.9 $1,101.4 $264.4 $309.3 $355.1 $375.7 $1,304.5 $350.4 $388.7

Earnings before income taxes 48.8 48.6 33.3 54.8 185.5 15.8 48.3 64.4 64.8 193.3 48.6 57.6

Net earnings 33.7 34.5 23.3 38.4 129.9 11.9 36.2 48.9 49.2 146.2 38.9 46.1

Earnings per share $0.37 $0.37 $0.25 $0.42 $1.41 $0.13 $0.39 $0.52 $0.53 $1.57 $0.41 $0.49

7

Cash dividends per share declared $0.15 $0.15 $0.15 $0.15 $0.60 $0.18 $0.18 $0.18 $0.18 $0.72 $0.25 $0.25

CONDENSED BALANCE SHEET

Total assets $2,172.6 $2,448.6 $2,350.6 $2,463.6 $2,492.4 $2,644.3 $2,695.1 $2,847.6 $2,873.0 $3,218.2

Total liabilities $1,768.0 $1,965.8 $1,862.8 $1,935.4 $1,947.6 $2,071.8 $2,104.5 $2,228.5 $2,225.0 $2,521.4

Total stockholders’ equity $404.6 $482.8 $487.8 $528.2 $544.8 $572.5 $590.6 $619.1 $648.0 $696.8

OTHER INFORMATION

Diluted weighted average shares (000s) 90,595 92,366 92,051 92,126 91,861 92,312 93,651 93,716 93,570 93,312 93,955 94,343

Common shares repurchased (000s) - - 477 1 478 239 515 1,140 970 2,864 555 -

Tangible net worth (2) $331.8 $375.7 $378.8 $393.1 $391.4 $417.0 $422.6 $396.2 $394.6 $427.5

Book value per share $4.70 5.47 $5.54 $5.97 $6.06 $6.32 $6.55 $6.88 $7.14 $7.58

Tangible book value per share $3.85 $4.25 $4.30 $4.44 $4.35 $4.60 $4.69 $4.40 $4.35 $4.65

Annualized return on beginning

tangible net worth 44% 44% 40% 42% 42% 12% 24% 33% 37% 37% 39% 43%

Number of acquisitions closed 2 5 1 2 10 4 1 2 7 14 7 3

Workforce (includes acquisitions) 6,578 6,886 7,030 7,111 7,111 7,088 7,077 7,120 7,206 7,206 7,359 7,564

Earnings Before Investment (Gains) Losses, Depreciation, Amortization

and Stock Compensation Expense (3)

Net earnings $33.7 $34.5 $23.3 $38.4 $129.9 $11.9 $36.2 $48.9 $49.2 $146.2 $38.9 $46.0

Investment (gains) losses 1.4 (13.1) 28.9 4.8 22.0 25.7 - (1.6) 0.4 24.5 (2.5) (2.1)

Depreciation 5.5 6.1 6.9 7.3 25.8 7.2 7.2 8.3 8.5 31.2 8.6 9.0

Amortization 1.2 2.2 2.0 1.2 6.6 2.1 2.2 2.5 3.1 9.9 3.2 6.0

Non-cash compensation 0.1 1.1 1.1 1.1 3.4 1.0 2.2 2.2 4.0 9.4 3.3 4.0

Tax effect (2.5) 1.1 (11.7) (4.3) (17.5) (9.0) (2.9) (2.7) (3.8) (18.5) (2.5) (3.4)

Earnings before investment (gains) losses,

depreciation, amortization and stock

compensation expense $39.4 $31.9 $50.5 $48.5 $170.2 $38.9 $44.9 $57.6 $61.4 $202.7 $49.0 $59.6

On a diluted per share basis $0.43 $0.35 $0.55 $0.53 $1.85 $0.42 $0.48 $0.61 $0.66 $2.17 $0.52 $0.63

(1) Beginning 3rd Q, 2003, includes impact of FIN 46.

(2) Represents total stockholders’ equity less net balance of goodwill and amortizable intangible assets.

(3) Represents net earnings before the after-tax effect of investment gains (losses), depreciation, amortization, amortization of deferred compensation and restricted stock expense and stock compensation expense.

For a more detailed and printer-friendly version, including complete SEC filings, see www.ajg.com

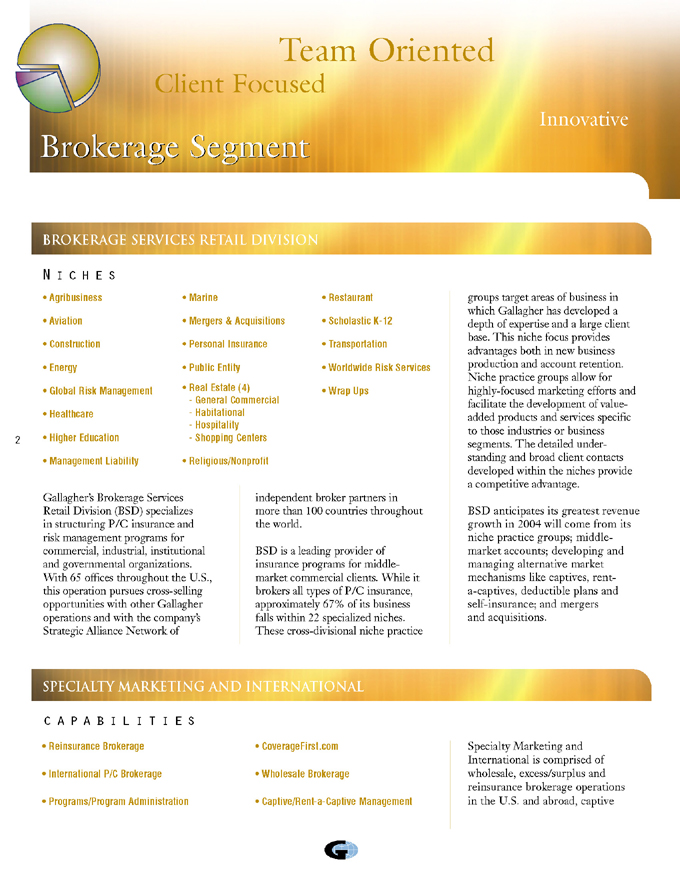

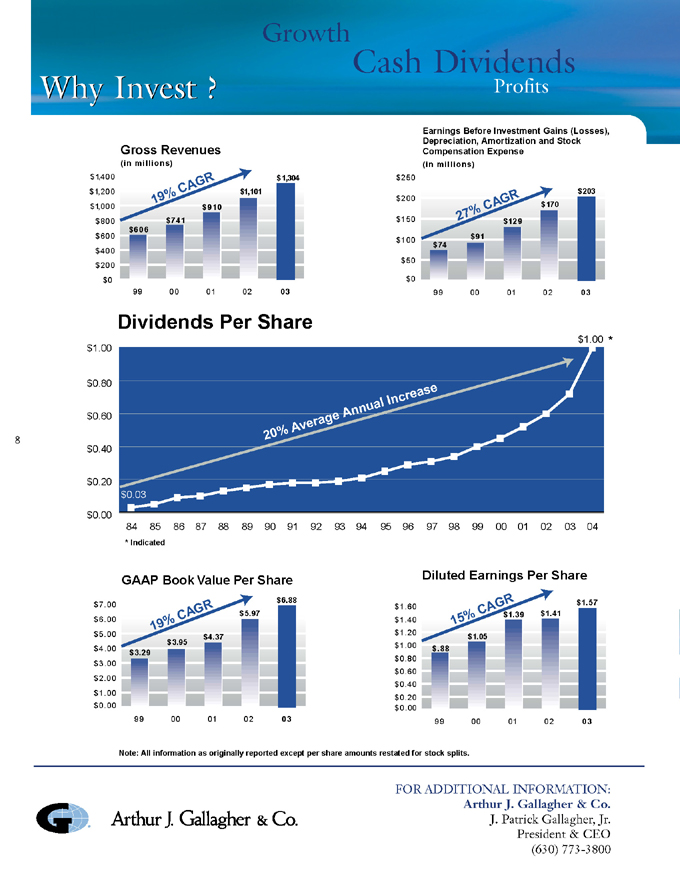

Growth

Cash Dividends

Why Invest ?

Profits

Gross Revenues

(in millions)

$1,400 $1,200 $1,000 $800 $600 $400 $200 $0

$1,304

19%

CAGR

$1,101

$910

$741 $606

99

00

01

02

03

* INDICATED

Earnings Before Investment Gains (Losses), Depreciation, Amortization and Stock Compensation Expense

(in millions)

$250 $200 $150 $100 $50 $0

$203

CAGR 27%

$170

$129

$91 $74

99

00

01

02

03

Dividends Per Share

$1.00 $0.80 $0.60 $0.40 $0.20 $0.00

$1.00 *

Increase

Annual

Average

20%

$0.03

84 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 00 01 02 03 04

GAAP Book Value Per Share

$7.00 $6.00 $5.00 $4.00 $3.00 $2.00

$1.00 $0.00

$6.88

19% CAGR $5.97

$4.37 $3.95 $3.29

99 00 01 02 03

Diluted Earnings Per Share

$1.60 $1.40 $1.20 $1.00 $0.80 $0.60 $0.40

$0.20 $0.00

15% CAGR

$1.57 $1.39 $1.41

$1.05 $.88

99 00 01 02 03

Note: All information as originally reported except per share amounts restated for stock splits.

FOR ADDITIONAL INFORMATION:

Arthur J. Gallagher & Co.

J. Patrick Gallagher, Jr.

President & CEO

(630) 773-3800