Exhibit 99.2

Exhibit 99.2

• • •

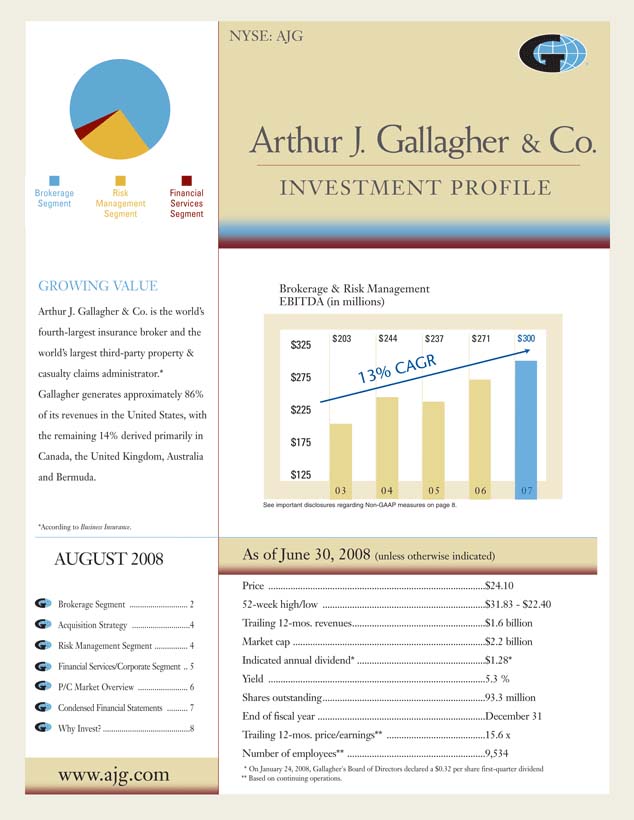

Brokerage Segment

Risk Management

Financial Services Segment

GROWING VALUE

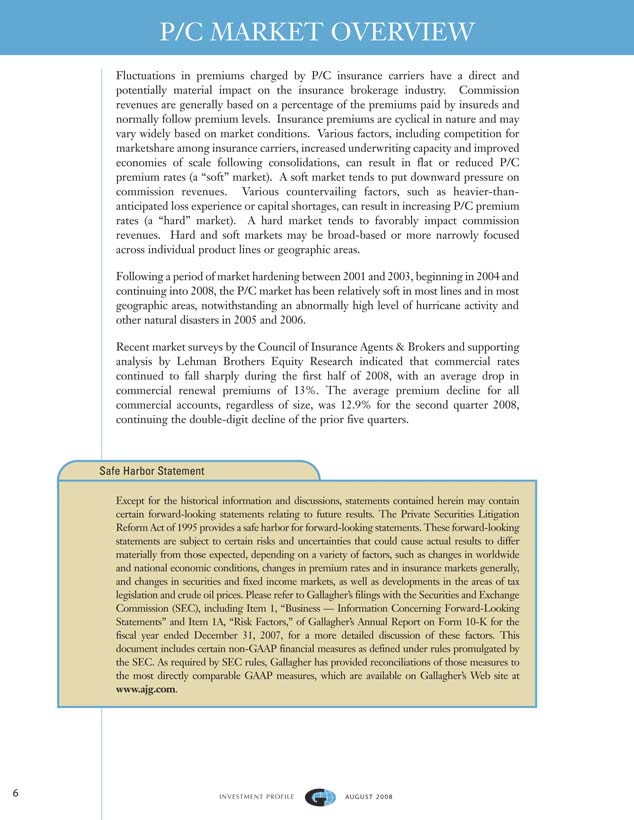

Arthur J. Gallagher & Co. is the world’s fourth-largest insurance broker and the world’s largest third-party property & casualty claims administrator.* Gallagher generates approximately 86% of its revenues in the United States, with the remaining 14% derived primarily in Canada, the United Kingdom, Australia and Bermuda.

*According to Business Insurance.

AUGUST 2008

Brokerage Segment 2

Acquisition Strategy 4

Risk Management Segment 4

Financial Services/Corporate Segment 5

P/C Market Overview 6

Condensed Financial Statements 7

Why Invest? 8

www.ajg.com

NYSE: AJG

Arthur J. Gallagher & Co.

INVESTMENT PROFILE

Brokerage & Risk Management EBITDA (in millions)

$325

$275

$225

$175

$125

13% CAGR

$203 $244 $237 $271 $300

03 04 05 06 07

See important disclosures regarding Non-GAAP measures on page 8.

As of June 30, 2008 (unless otherwise indicated)

Price $24.10

52-week high/low $31.83—$22.40

Trailing 12-mos. revenues $1.6 billion

Market cap $2.2 billion

Indicated annual dividend* $1.28*

Yield 5.3 %

Shares outstanding 93.3 million

End of fiscal year December 31

Trailing 12-mos. price/earnings** 15.6 x

Number of employees** 9,534

* | | On January 24, 2008, Gallagher’s Board of Directors declared a $0.32 per share first-quarter dividend |

** Based on continuing operations.

BROKERAGE SEGMENT – 71% OF 6/30/08 REVENUES

Gallagher operates its Brokerage operations through a network of more than 200 retail and wholesale sales and service offices located throughout the United States and in 14 countries abroad. In addition, Gallagher does business through a Strategic Alliance Network of independent insurance brokers and consultants in more than 100 countries around the world.

RETAIL INSURANCE BROKERAGE OPERATIONS

77% OF 6/30/08 BROKERAGE SEGMENT REVENUES

Gallagher negotiates and places nearly all lines of property & casualty (P/C) insurance, employer-provided health and welfare insurance and retirement solutions, principally for middle-market commercial, industrial, public entity, religious and not-for-profit entities. Revenues are generated through commissions paid by insurance companies, which are usually based upon a percentage of the premium paid by insureds, and through brokerage and advisory fees paid directly by its clients.

Lines of Coverage

• Aviation • Errors & Omissions • Products Liability

• Commercial Auto • Fire • Professional Liability

• Dental • General Liability • Property

• Directors & Officers Liability • Life • Retirement Solutions

• Disability • Marine • Wind

• Earthquake • Medical • Workers Compensation

Gallagher’s retail brokerage operations are organized in approximately 150 geographical profit centers located throughout North America and operate primarily within certain key Niche/Practice Groups, which account for approximately 65% of its retail brokerage revenues. These specialized teams target areas of business and/or industries in which Gallagher has developed a depth of expertise and a large client base.

Niche/Practice Groups

• Agribusiness • Healthcare • Real Estate

• Aviation & Aerospace • Higher Education • Religious Institutions

• Captives • Hospitality • Restaurant

• Construction • Marine • Shopping Centers

• Energy • Not-for-Profit • Technology & Telecom

• Fine Arts • Personal • Transportation

• Global Risks • Professional Groups

• Habitational • Public Entity

2 | | INVESTMENT PROFILE AUGUST 2008 |

Gallagher’s specialized focus on these Niche/Practice Groups allows for highly-focused marketing efforts and facilitates the development of value-added products and services specific to those industries or business segments. Gallagher believes that the detailed understanding and broad client contacts developed within these Niche/Practice Groups provide Gallagher with a competitive advantage.

Gallagher anticipates that its greatest revenue growth over the next several years for its retail brokerage operations will continue to come from: (1) its Niche/Practice Groups and middle-market accounts, (2) cross-selling other brokerage products to existing customers, (3) developing and managing alternative market mechanisms, such as captives, rent-a-captives, deductible plans and self-insurance, (4) mergers and acquisitions.

WHOLESALE INSURANCE BROKERAGE OPERATIONS

23% OF 6/30/08 BROKERAGE SEGMENT REVENUES

Gallagher’s wholesale brokerage operations assist Gallagher’s retail brokers and other unaffiliated retail brokers and agents in the placement of specialized, unique and hard-to-place insurance programs. Revenues are generated by sharing the commission paid to the retail broker by the insurer.

Gallagher’s wholesale brokerage operations are organized in approximately 60 geographical profit centers located in the U.S. and through its approved Lloyd’s of London brokerage in London. In certain cases Gallagher acts as a brokerage wholesaler and in other cases Gallagher acts as a managing general agent or managing general underwriter, distributing specialized insurance coverages for insurance carriers.

More than 75% of Gallagher’s wholesale brokerage revenues come from retail brokers and agents that are not affiliated with Gallagher. Based on revenues, Gallagher’s U.S. wholesale brokerage operation currently ranks as the fifth-largest wholesaler.

Gallagher anticipates growing its wholesale brokerage operations by increasing its number of broker-clients, by developing new managing general agency and underwriter programs, and through mergers and acquisitions.

Strategic Alliance Network

Gallagher has a strong worldwide Strategic Alliance Network of independent broker partners. These relationships are based on strength, service capabilities and shared business philosophies. The network extends Gallagher’s client-service capabilities to more than 100 countries around the world. In 2006, Gallagher introduced a process to brand this network as the Gallagher Optimus Network. Ultimately, this move will give Gallagher’s preferred strategic partners a greater tie to the organization, which should further enhance client services to global accounts.

INVESTMENT PROFILE AUGUST 2008 3

Brokerage Segment Acquisition Strategy

Gallagher is highly growth-oriented. Its Brokerage Segment growth strategy has two primary components — organic growth through strong new business production and the strategic acquisition of complementary businesses. Gallagher completed over 200 acquisitions from 1985 through June 30, 2008, almost exclusively within the Brokerage Segment. Most were regional or local retail or wholesale brokers possessing a strong middle-market focus or significant expertise in a desirable market niche. Gallagher typically acquires companies that fall within the $2 million to $10 million in annual revenues range.

Gallagher is highly selective. An acquisition must offer significant benefits, such as expanding the company’s talent pool, enhancing its geographic presence and service capabilities, and/or broadening and further diversifying its business mix. In selecting acquisition candidates, Gallagher focuses on:

• a corporate culture that matches its own

• a profitable, growing business that could further enhance its ability to compete by gaining access to Gallagher’s greater resources

• clearly defined financial criteria.

Management anticipates that Gallagher’s historical acquisition pace will continue. Contributing to the company’s success as an acquirer is its attractiveness as a merger partner. Growth-oriented independent brokers and consultants are attracted by Gallagher’s aggressive, sales-oriented culture, team-based approach and depth of resources.

RISK MANAGEMENT SEGMENT – 29% OF 6/30/08 REVENUES

Expertise

• Real-time Claims Reporting • Managed Care Services

• Recoveries (subrogation, salvage, etc.) • Loss Control Services

• Appraisal Services • Safety Programs

• Litigation Management • Settlement Management

• Information Management • Education & Training

Based on revenues, Gallagher’s Risk Management operation currently ranks as the world’s largest third-party P/C claims administrator. Gallagher provides contract claim settlement and administration services for enterprises that choose to self-insure and for insurance companies that choose to outsource their claims-handling services.

4 | | INVESTMENT PROFILE AUGUST 2008 |

Approximately 70% of Risk Management Segment revenues are from workers compensation-related claims, 26% are from general and commercial auto liability-related claims and 4% are from property-related claims. In addition, Gallagher generates revenues from integrated disability management programs, information services, risk control consulting (loss control) services and appraisal services, either individually or in combination with managing claims. Revenues are substantially in the form of fees, generally negotiated in advance on a per-claim or per-service basis, depending upon the type and estimated volume of the services to be performed.

Gallagher manages its third-party claims-management operations through a network of approximately 120 offices located throughout the U.S., the U.K., Australia, New Zealand and Canada. Clients are primarily Fortune 1000 companies, larger middle-market companies, not-for-profit organizations and public entities. More than 80% of Gallagher’s risk management revenues come from clients that do not use Gallagher as their retail or wholesale insurance broker.

The Risk Management Segment expects its most significant growth prospects through the next several years will come from Fortune 1000 companies, larger middle-market companies, captives, program business and the outsourcing of insurance company claims departments.

FINANCIAL SERVICES/CORPORATE SEGMENT

This segment manages Gallagher’s interests in tax-advantaged and clean-energy investments as well as its equity ownership position in an alternative investment fund manager that has ownership interests in private investment management firms. Gallagher has been winding down its financial services activities since 2003. Management expects to continue to divest most of the remaining investments in this segment throughout 2008 and 2009.

In addition, Gallagher’s interest expense and corporate-related administrative expenses are reported in this segment.

INVESTMENT PROFILE AUGUST 2008 5

P/C MARKET OVERVIEW

Fluctuations in premiums charged by P/C insurance carriers have a direct and potentially material impact on the insurance brokerage industry. Commission revenues are generally based on a percentage of the premiums paid by insureds and normally follow premium levels. Insurance premiums are cyclical in nature and may vary widely based on market conditions. Various factors, including competition for marketshare among insurance carriers, increased underwriting capacity and improved economies of scale following consolidations, can result in flat or reduced P/C premium rates (a “soft” market). A soft market tends to put downward pressure on commission revenues. Various countervailing factors, such as heavier-than-anticipated loss experience or capital shortages, can result in increasing P/C premium rates (a “hard” market). A hard market tends to favorably impact commission revenues. Hard and soft markets may be broad-based or more narrowly focused across individual product lines or geographic areas.

Following a period of market hardening between 2001 and 2003, beginning in 2004 and continuing into 2008, the P/C market has been relatively soft in most lines and in most geographic areas, notwithstanding an abnormally high level of hurricane activity and other natural disasters in 2005 and 2006.

Recent market surveys by the Council of Insurance Agents & Brokers and supporting analysis by Lehman Brothers Equity Research indicated that commercial rates continued to fall sharply during the first half of 2008, with an average drop in commercial renewal premiums of 13%. The average premium decline for all commercial accounts, regardless of size, was 12.9% for the second quarter 2008, continuing the double-digit decline of the prior five quarters.

Safe Harbor Statement

Except for the historical information and discussions, statements contained herein may contain certain forward-looking statements relating to future results. The Private Securities Litigation Reform Act of 1995 provides a safe harbor for forward-looking statements. These forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from those expected, depending on a variety of factors, such as changes in worldwide and national economic conditions, changes in premium rates and in insurance markets generally, and changes in securities and fixed income markets, as well as developments in the areas of tax legislation and crude oil prices. Please refer to Gallagher’s filings with the Securities and Exchange Commission (SEC), including Item 1, “Business — Information Concerning Forward-Looking Statements” and Item 1A, “Risk Factors,” of Gallagher’s Annual Report on Form 10-K for the fiscal year ended December 31, 2007, for a more detailed discussion of these factors. This document includes certain non-GAAP financial measures as defined under rules promulgated by the SEC. As required by SEC rules, Gallagher has provided reconciliations of those measures to the most directly comparable GAAP measures, which are available on Gallagher’s Web site at www.ajg.com.

6 | | INVESTMENT PROFILE AUGUST 2008 |

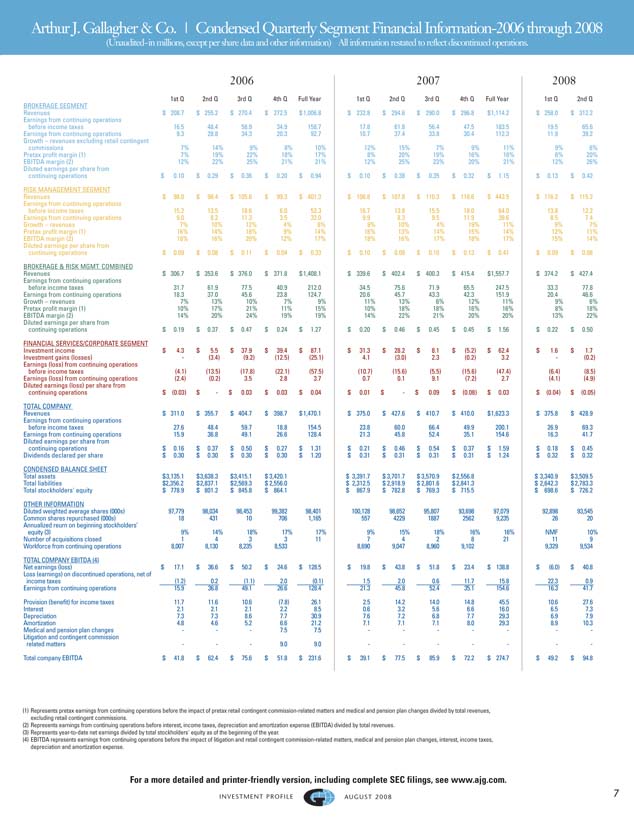

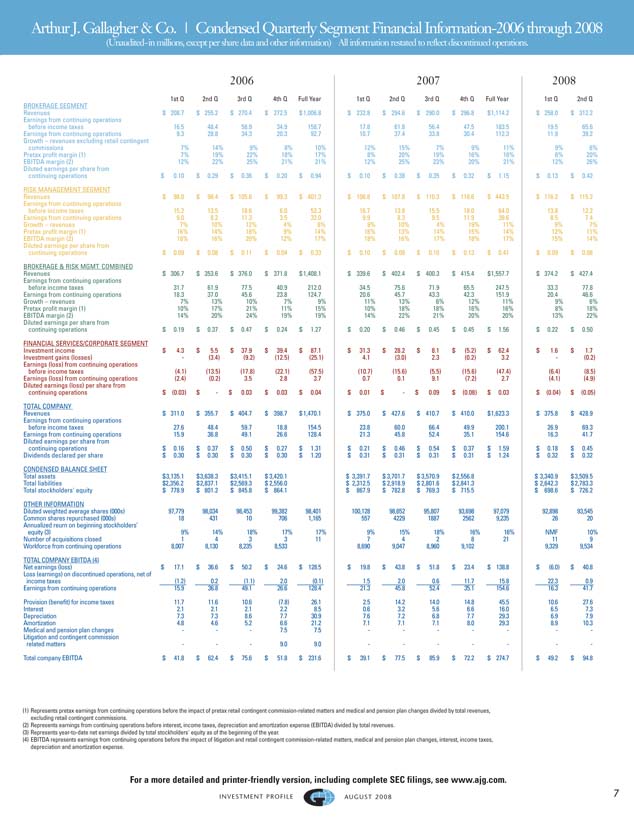

Arthur J. Gallagher & Co. | Condensed Quarterly Segment Financial Information-2006 through 2008

(Unaudited-in millions, except per share data and other information) All information restated to reflect discontinued operations.

2006 2007 2008

1st Q 2nd Q 3rd Q 4th Q Full Year 1st Q 2nd Q 3rd Q 4th Q Full Year 1st Q 2nd Q

BROKERAGE SEGMENT

Revenues $ 208.7 $ 255.2 $ 270.4 $ 272.5 $ 1,006.8 $ 232.8 $ 294.6 $ 290.0 $ 296.8 $1,114.2 $ 258.0 $ 312.2

Earnings from continuing operations before income taxes 16.5 48.4 58.9 34.9 158.7 17.8 61.8 56.4 47.5 183.5 19.5 65.6

Earnings from continuing operations 9.3 28.8 34.3 20.3 92.7 10.7 37.4 33.8 30.4 112.3 11.9 39.2

Growth – revenues excluding retail contingent commissions 7% 14% 9% 8% 10% 12% 15% 7% 9% 11% 9% 6%

Pretax profit margin (1) 7% 19% 22% 18% 17% 8% 20% 19% 16% 16% 6% 20%

EBITDA margin (2) 12% 22% 25% 21% 21% 12% 25% 23% 20% 21% 12% 26%

Diluted earnings per share from continuing operations $ 0.10 $ 0.29 $ 0.36 $ 0.20 $ 0.94 $ 0.10 $ 0.38 $ 0.35 $ 0.32 $ 1.15 $ 0.13 $ 0.42

RISK MANAGEMENT SEGMENT

Revenues $ 98.0 $ 98.4 $ 105.6 $ 99.3 $ 401.3 $ 106.8 $ 107.8 $ 110.3 $ 118.6 $ 443.5 $ 116.2 $ 115.2

Earnings from continuing operations before income taxes 15.2 13.5 18.6 6.0 53.3 16.7 13.8 15.5 18.0 64.0 13.8 12.2

Earnings from continuing operations 9.0 8.2 11.3 3.5 32.0 9.9 8.3 9.5 11.9 39.6 8.5 7.4

Growth – revenues 7% 10% 12% 4% 8% 9% 10% 4% 19% 11% 9% 7%

Pretax profit margin (1) 16% 14% 18% 9% 14% 16% 13% 14% 15% 14% 12% 11%

EBITDA margin (2) 18% 16% 20% 12% 17% 18% 16% 17% 18% 17% 15% 14%

Diluted earnings per share from continuing operations $ 0.09 $ 0.08 $ 0.11 $ 0.04 $ 0.33 $ 0.10 $ 0.08 $ 0.10 $ 0.13 $ 0.41 $ 0.09 $ 0.08

BROKERAGE & RISK MGMT. COMBINED

Revenues $ 306.7 $ 353.6 $ 376.0 $ 371.8 $ 1,408.1 $ 339.6 $ 402.4 $ 400.3 $ 415.4 $1,557.7 $ 374.2 $ 427.4

Earnings from continuing operations before income taxes 31.7 61.9 77.5 40.9 212.0 34.5 75.6 71.9 65.5 247.5 33.3 77.8

Earnings from continuing operations 18.3 37.0 45.6 23.8 124.7 20.6 45.7 43.3 42.3 151.9 20.4 46.6

Growth – revenues 7% 13% 10% 7% 9% 11% 13% 6% 12% 11% 9% 6%

Pretax profit margin (1) 10% 17% 21% 11% 15% 10% 18% 18% 16% 16% 8% 18%

EBITDA margin (2) 14% 20% 24% 19% 19% 14% 22% 21% 20% 20% 13% 22%

Diluted earnings per share from continuing operations $ 0.19 $ 0.37 $ 0.47 $ 0.24 $ 1.27 $ 0.20 $ 0.46 $ 0.45 $ 0.45 $ 1.56 $ 0.22 $ 0.50

FINANCIAL SERVICES/CORPORATE SEGMENT

Investment income $ 4.3 $ 5.5 $ 37.9 $ 39.4 $ 87.1 $ 31.3 $ 28.2 $ 8.1 $ (5.2) $ 62.4 $ 1.6 $ 1.7

Investment gains (losses) -(3.4)(9.2)(12.5)(25.1) 4.1(3.0) 2.3(0.2) 3.2 -(0.2)

Earnings (loss) from continuing operations before income taxes ( 4. 1) ( 13. 5) ( 17. 8) ( 22. 1) ( 57. 5) ( 10. 7) ( 15. 6) ( 5. 5) ( 15. 6) ( 47. 4) ( 6. 4) ( 8. 5)

Earnings (loss) from continuing operations( 2. 4) ( 0. 2) 3.5 2.8 3.7 0.7 0.1 9.1(7.2) 2.7(4.1)(4.9)

Diluted earnings (loss) per share from continuing operations $ (0.03) $—$ 0.03 $ 0.03 $ 0.04 $ 0.01 $—$ 0.09 $ (0.08) $ 0.03 $ (0.04) $ (0.05)

TOTAL COMPANY

Revenues $ 311.0 $ 355.7 $ 404.7 $ 398.7 $ 1,470.1 $ 375.0 $ 427.6 $ 410.7 $ 410.0 $1,623.3 $ 375.8 $ 428.9

Earnings from continuing operations before income taxes 27.6 48.4 59.7 18.8 154.5 23.8 60.0 66.4 49.9 200.1 26.9 69.3

Earnings from continuing operations 15.9 36.8 49.1 26.6 128.4 21.3 45.8 52.4 35.1 154.6 16.3 41.7

Diluted earnings per share from continuing operations $ 0.16 $ 0.37 $ 0.50 $ 0.27 $ 1.31 $ 0.21 $ 0.46 $ 0.54 $ 0.37 $ 1.59 $ 0.18 $ 0.45

Dividends declared per share $ 0.30 $ 0.30 $ 0.30 $ 0.30 $ 1.20 $ 0.31 $ 0.31 $ 0.31 $ 0.31 $ 1.24 $ 0.32 $ 0.32

CONDENSED BALANCE SHEET

Total assets $3,135.1 $3,638.3 $3,415.1 $ 3,420.1 $ 3,391.7 $ 3,701.7 $ 3,570.9 $ 2,556.8 $ 3,340.9 $ 3,509.5

Total liabilities $2,356.2 $2,837.1 $2,569.3 $ 2,556.0 $ 2,312.5 $ 2,918.9 $ 2,801.6 $ 2,841.3 $ 2,642.3 $ 2,783.3

Total stockholders’ equity $ 778.9 $ 801.2 $ 845.8 $ 864.1 $ 867.9 $ 782.8 $ 769.3 $ 715.5 $ 698.6 $ 726.2

OTHER INFORMATION

Diluted weighted average shares (000s) 97,779 98,034 98,453 99,382 98,401 100,128 98,652 95,807 93,698 97,079 92,898 93,545

Common shares repurchased (000s) 18 431 10 706 1,165 557 4229 1887 2562 9,235 26 20

Annualized reurn on beginning stockholders’ equity (3) 9% 14% 18% 17% 17% 9% 15% 18% 16% 16% NMF 10%

Number of acquisitions closed 1 4 3 3 11 7 4 2 8 21 11 9

Workforce from continuing operations 8,007 8,130 8,235 8,533 8,690 9,047 8,960 9,102 9,329 9,534

TOTAL COMPANY EBITDA (4)

Net earnings (loss) $ 17.1 $ 36.6 $ 50.2 $ 24.6 $ 128.5 $ 19.8 $ 43.8 $ 51.8 $ 23.4 $ 138.8 $ (6.0) $ 40.8

Loss (earnings) on discontinued operations, net of income taxes(1.2) 0.2(1.1) 2.0(0.1) 1.5 2.0 0.6 11.7 15.8 22.3 0.9

Earnings from continuing operations 15.9 36.8 49.1 26.6 128.4 21.3 45.8 52.4 35.1 154.6 16.3 41.7

Provision (benefit) for income taxes 11.7 11.6 10.6(7.8) 26.1 2.5 14.2 14.0 14.8 45.5 10.6 27.6

Interest 2.1 2.1 2.1 2.2 8.5 0.6 3.2 5.6 6.6 16.0 6.5 7.3

Depreciation 7.3 7.3 8.6 7.7 30.9 7.6 7.2 6.8 7.7 29.3 6.9 7.9

Amortization 4.8 4.6 5.2 6.6 21.2 7.1 7.1 7.1 8.0 29.3 8.9 10.3

Medical and pension plan changes - 7.5 7.5 -

Litigation and contingent commission related matters - 9.0 9.0 -

Total company EBITDA $ 41.8 $ 62.4 $ 75.6 $ 51.8 $ 231.6 $ 39.1 $ 77.5 $ 85.9 $ 72.2 $ 274.7 $ 49.2 $ 94.8

(1) Represents pretax earnings from continuing operations before the impact of pretax retail contingent commission-related matters and medical and pension plan changes divided by total revenues, excluding retail contingent commissions.

(2) Represents earnings from continuing operations before interest, income taxes, depreciation and amortization expense (EBITDA) divided by total revenues.

(3) | | Represents year-to-date net earnings divided by total stockholders’ equity as of the beginning of the year. |

(4) EBITDA represents earnings from continuing operations before the impact of litigation and retail contingent commission-related matters, medical and pension plan changes, interest, income taxes, depreciation and amortization expense.

For a more detailed and printer-friendly version, including complete SEC filings, see www.ajg.com.

INVESTMENT PROFILE AUGUST 2008 7

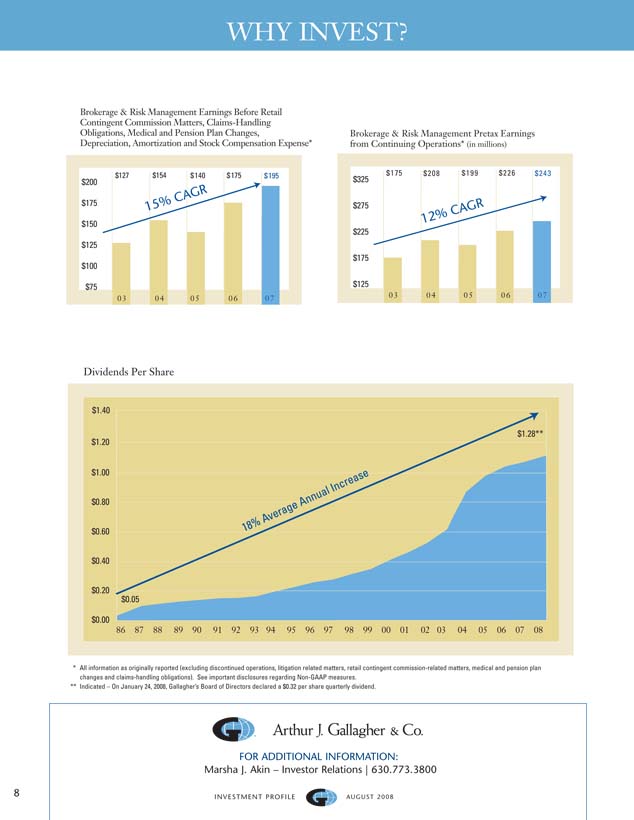

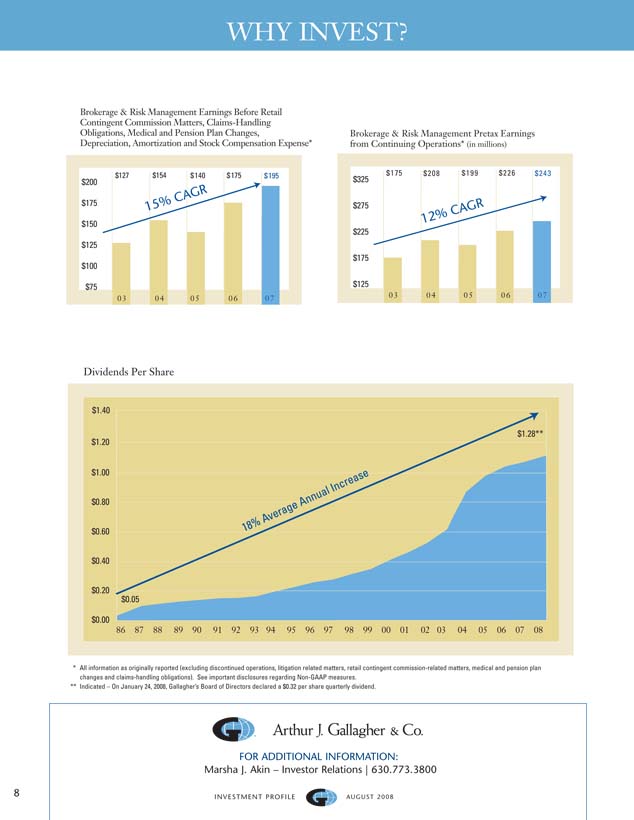

WHY INVEST?

Brokerage & Risk Management Earnings Before Retail Contingent Commission Matters, Claims-Handling Obligations, Medical and Pension Plan Changes, Depreciation, Amortization and Stock Compensation Expense*

$200

$175

$150

$125

$100

$75

$127 $154 $140 $175 $195

15%CAGR

03 04 05 06 07

Brokerage & Risk Management Pretax Earnings from Continuing Operations* (in millions)

$325

$275

$225

$175

$125

$175 $208 $199 $226 $243

12% CAGR

03 04 05 06 07

Dividends Per Share

$1.40

$1.20

$1.00

$0.80

$0.60

$0.40

$0.20

$0.00

$0.05

18% Average Annual Increase

$1.28**

86 87 88 89 90 91 92 93 94 95 96 97 98 99 00 01 02 03 04 05 06 07 08

* All information as originally reported (excluding discontinued operations, litigation related matters, retail contingent commission-related matters, medical and pension plan changes and claims-handling obligations). See important disclosures regarding Non-GAAP measures.

** Indicated – On January 24, 2008, Gallagher’s Board of Directors declared a $0.32 per share quarterly dividend.

Arthur J. Gallagher & Co.

FOR ADDITIONAL INFORMATION:

Marsha J. Akin – Investor Relations | 630.773.3800

8 | | INVESTMENT PROFILE AUGUST 2008 |