- AJG Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

8-K Filing

Arthur J. Gallagher & Co. (AJG) 8-KResults of Operations and Financial Condition

Filed: 15 Feb 11, 12:00am

Arthur J. Gallagher & Co. Investment Presentation February - 2011 Exhibit 99.2 |

2 Information Regarding Forward-Looking Statements This investment presentation contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. When used in this investment presentation, the words “anticipates,” “expects,” “believes,” “should,” could,” “estimates,” “intends,” “plans” and similar expressions are intended to identify forward-looking statements. Examples of forward-looking statements in this investment presentation include, but are not limited to, statements related to the integration of the GAB Robins acquisition, Gallagher’s capabilities for future growth and expansion, Gallagher’s acquisition strategy and level of acquisition activity, expected uses of cash, drivers of organic growth in the brokerage and risk management segments, Gallagher’s international opportunities, productivity and expense reduction initiatives, and future income and tax credits generated by Gallagher’s clean-energy operations. Important factors that could cause actual results to differ materially from those in the forward-looking statements include the following: • changes in worldwide and national economic conditions, changes in premium rates and insurance markets generally, and changes in the insurance brokerage industry’s competitive landscape could impact Gallagher’s integration of the GAB Robins acquisition, capabilities for future growth and expansion, its acquisition strategy and level of acquisition activity, expected uses of cash, drivers of organic growth in the brokerage and risk management segments, its international opportunities, and productivity and expense reduction initiatives; and • uncertainties related to Gallagher’s IRC Section 45 investments, including uncertainties related to (i) receipt by Gallagher’s utility partners of long-term permits, (ii) Gallagher’s ability to find operating sites and co-investors for its non-operating operations, (iii) potential IRS challenges to Gallagher’s ability to claim tax credits under IRC Section 45, (iv) utilities’ future use of coal to generate electricity, (v) operational risks at Gallagher’s IRC Section 45 operations, (vi) business risks relating to Gallagher’s co-investors and partners, (vii) intellectual property risks and (viii) environmental risks, could impact Gallagher’s future income and tax credits generated by its clean-energy operations. Please refer to Gallagher’s filings with the SEC, including Item 1A, “Risk Factors,” of its Annual Report on Form 10-K for the fiscal year ended December 31, 2010, for a more detailed discussion of these and other factors that could impact its forward-looking statements. |

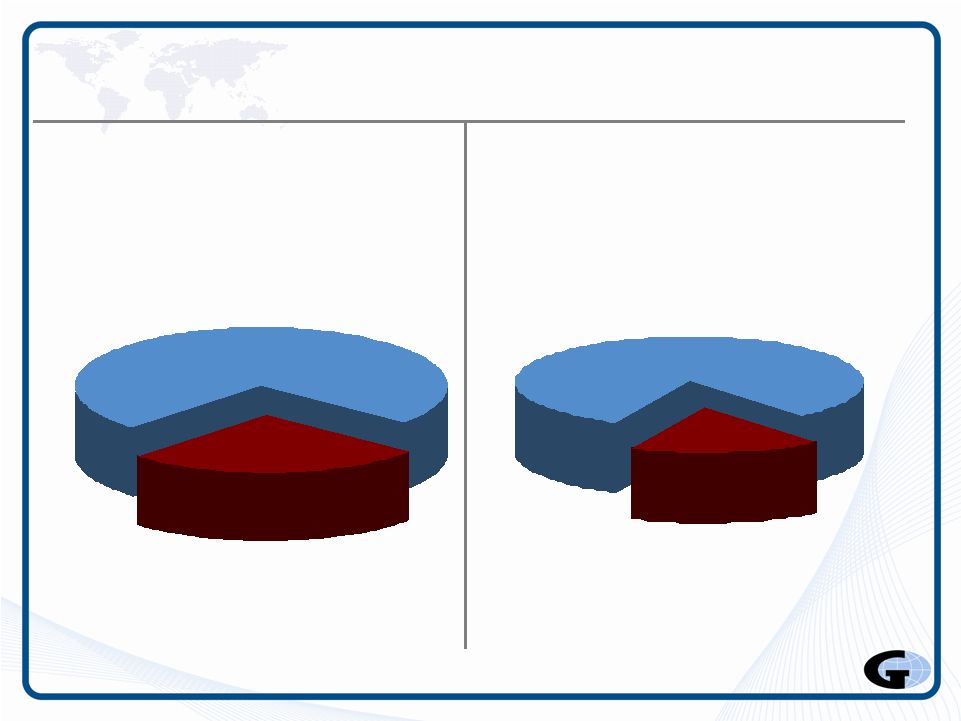

3 Two Core Businesses Revenue – $1.8 billion EBITDAC – $365 million Brokerage Segment 74% Risk Management Segment 26% Brokerage 82% Risk Management 18% Year 2010 as reported. See important disclosures regarding Non-GAAP measures in Exhibits |

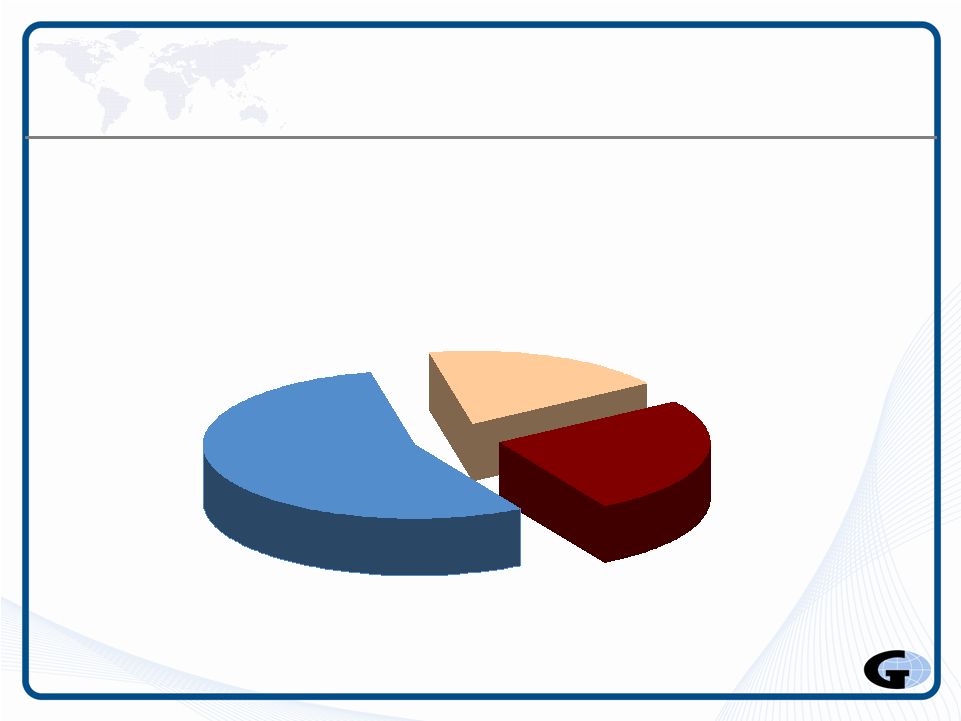

4 Brokerage Segment Revenues – $1.3 billion Retail P/C 53% Mostly U.S., Canada and U.K. Wholesale 21% Mostly U.S. and U.K. Retail-Benefits 26% U.S. and U.K. Year 2010 as reported |

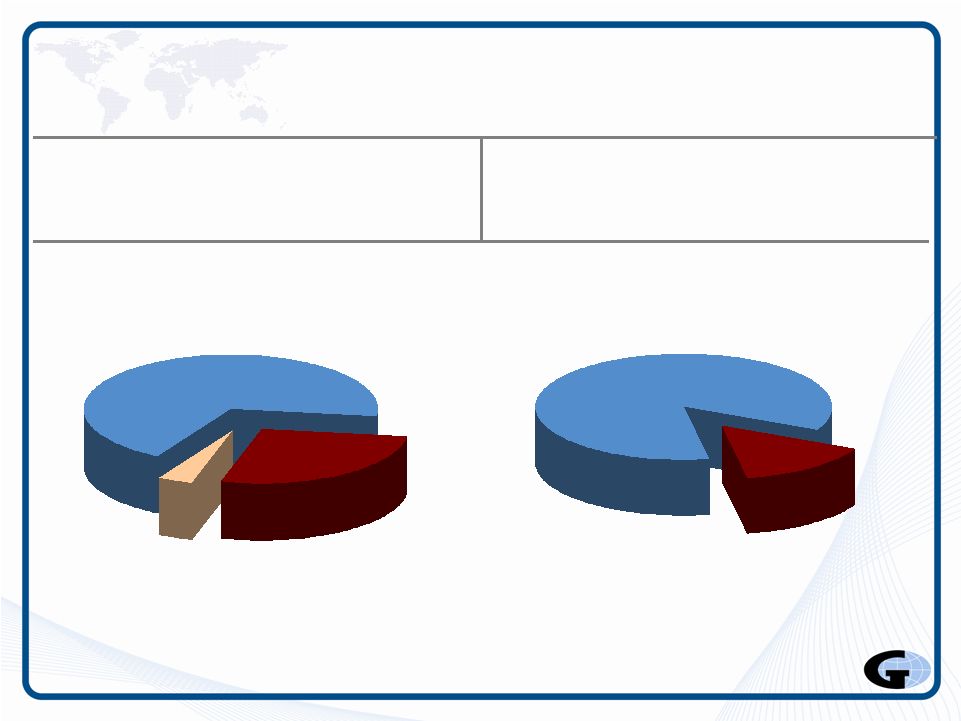

5 Risk Management Segment Revenues – $462 million Workers Compensation 69% Liability 27% Property 4% Domestic 83% International 17% EBITDAC – $65 million Year 2010 as reported. See important disclosures regarding Non-GAAP measures in Exhibits |

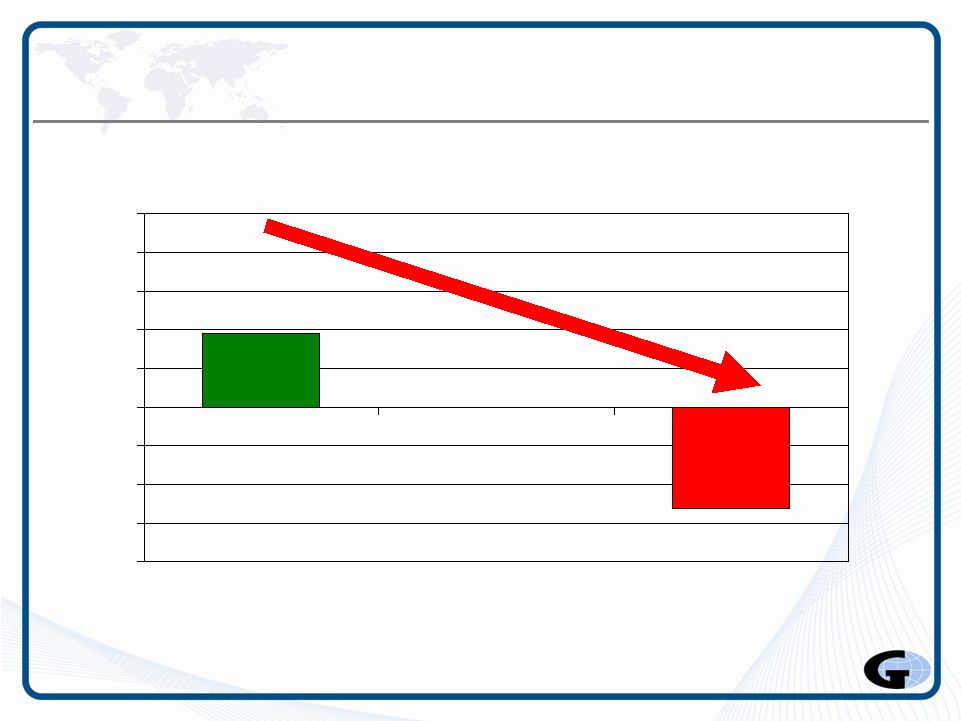

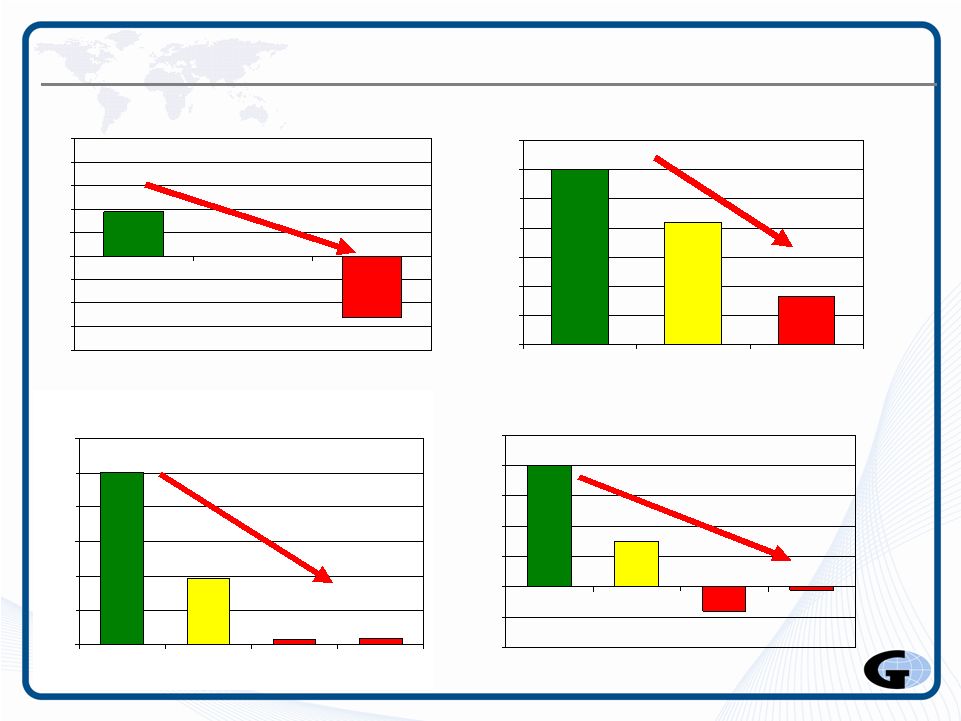

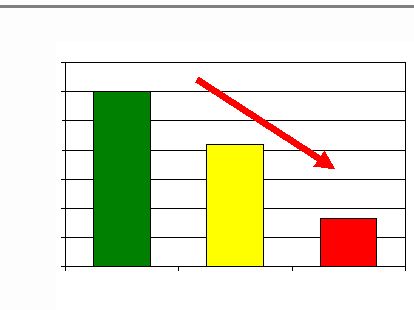

6 A Perfect Storm for Insurance Brokers? • 7 Years of soft insurance pricing • Worst economic recession since the Great Depression • Zero investment yields |

7 Economy – GDP shrinks -2.6% 0.0% 1.9% -4% -3% -2% -1% 0% 1% 2% 3% 4% 5% 2007 2008 2009 U.S. Real GDP Annual Rates of Change Source for data: Bureau of Economic Analysis |

8 U.S. Unemployment Skyrockets U.S. Unemployment Average Annual Rates. Source for data: Bureau of Labor Statistics 9.3% 5.8% 4.6% 2% 3% 4% 5% 6% 7% 8% 9% 10% 2007 2008 2009 |

9 U.S. Employment Down 9 Million Jobs Total Nonfarm Employees ( in thousands). Source for data: Bureau of Labor Statistics 129,320 134,383 137,983 126,000 128,000 130,000 132,000 134,000 136,000 138,000 140,000 YE 2007 YE 2008 YE 2009 |

10 Short-Term Interest Rates Fall 5.0% 1.9% 0.2% 0.2% 0.0% 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 2007 2008 2009 2010 Average Annual Effective Fed Funds Rates. Source for data: Bloomberg 480 bps decline |

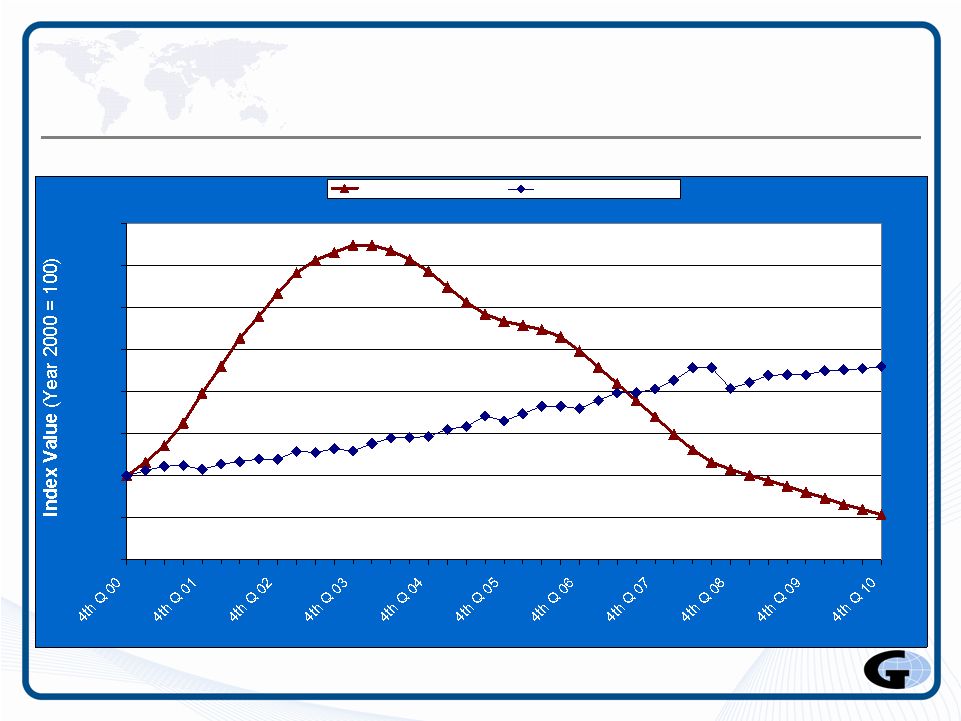

11 Commercial P&C Pricing Below Year 2000 Significantly Lagging Inflation 91 126 80 90 100 110 120 130 140 150 160 Commercial Rate Index Pro-Forma at CPI Rate Commercial Rate Index reflects the cost of P&C premiums relative to the year 2000. Constructed using Counsel of Insurance Agents and Brokers data |

12 Global P&C Market Shrinks -0.1% -0.8% 1.5% 4.0% -2% -1% 0% 1% 2% 3% 4% 5% 2006 2007 2008 2009 Global P&C change in Premiums. Source for Data: Swiss Re's “World Insurance" sigma studies (in real terms, ie adjusted for inflation) |

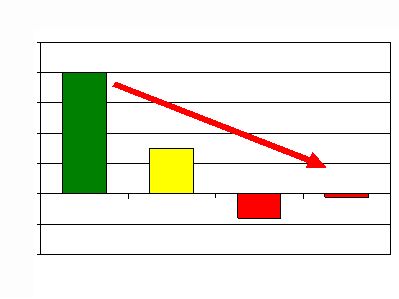

13 But, Gallagher Sailed through the Economic Storm |

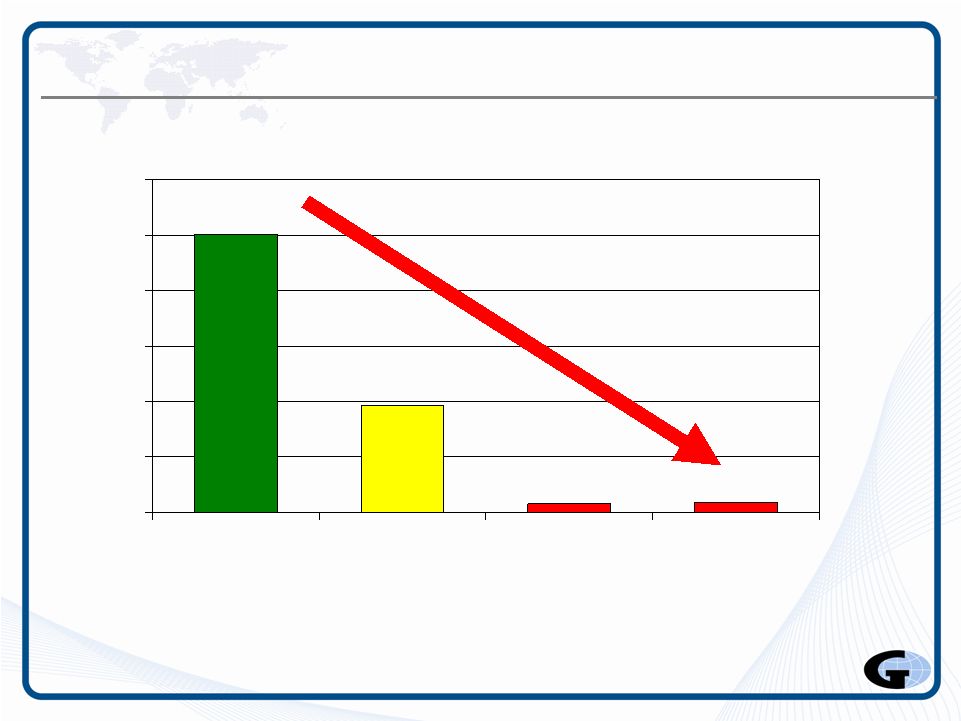

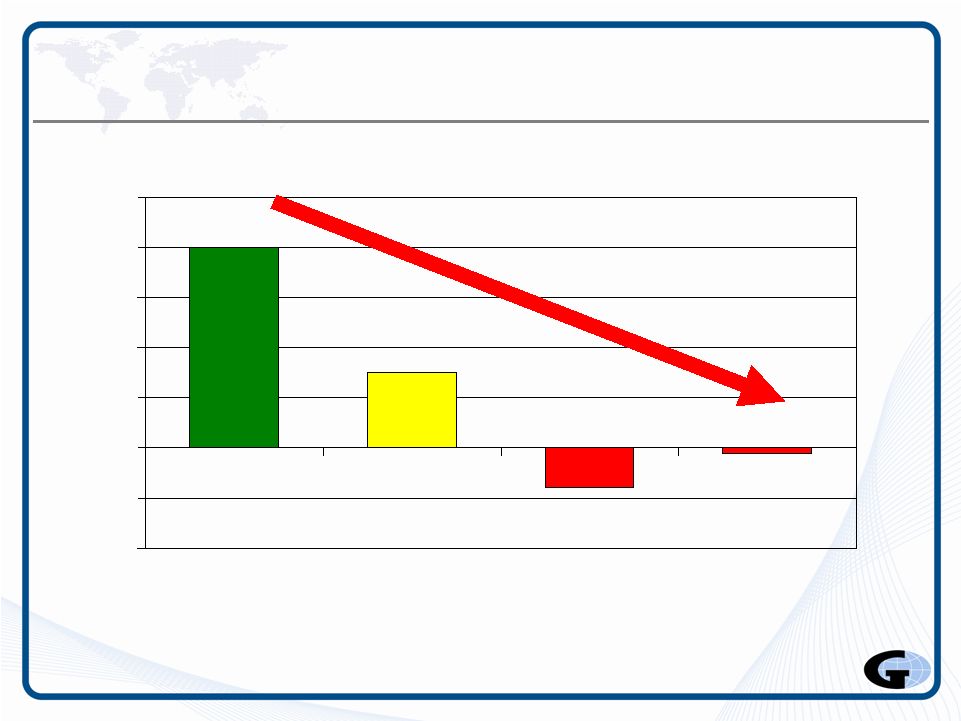

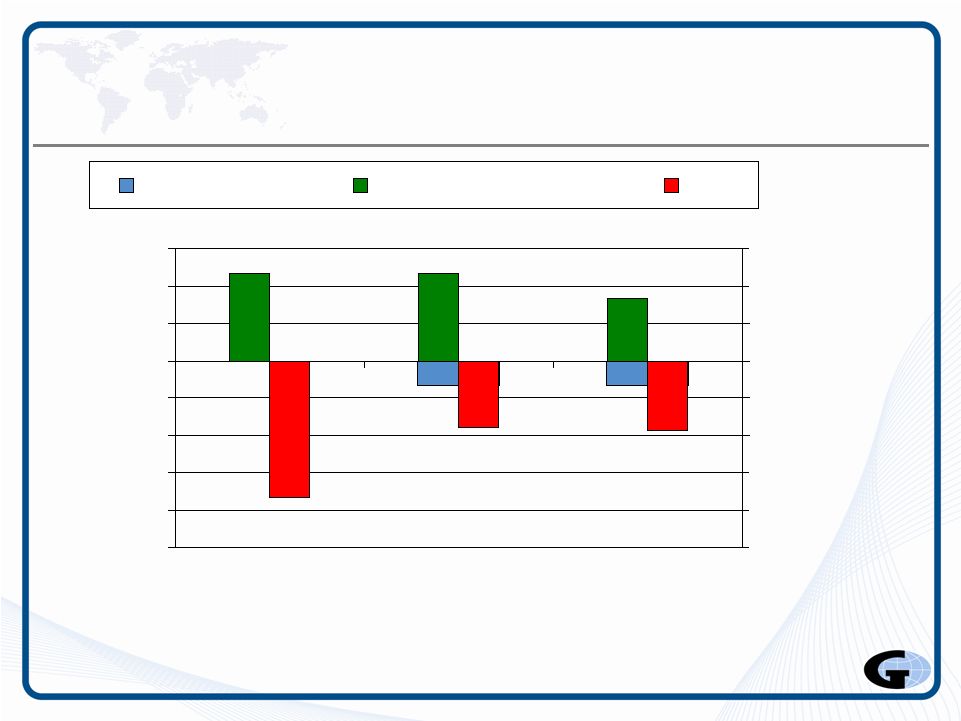

14 Gallagher’s Sales Culture Outperforms Economic Environment 0.0% -2.0% -2.0% -11.0% -5.4% -5.6% -15.0% -12.0% -9.0% -6.0% -3.0% 0.0% 3.0% 6.0% 2008 2009 2010 Gallagher Organic CIAB Avg. Commercial Rate Declines Gallagher’s Brokerage Segment Organic Growth |

15 Gallagher’s Acquisition Program Fuels Growth 0.0% -2.0% -2.0% 5.0% -11.0% -5.4% -5.6% 7.0% 7.0% -15.0% -12.0% -9.0% -6.0% -3.0% 0.0% 3.0% 6.0% 9.0% 2008 2009 2010 -15.0% -12.0% -9.0% -6.0% -3.0% 0.0% 3.0% 6.0% 9.0% Organic Revenue Growth from Acquisitions CIAB |

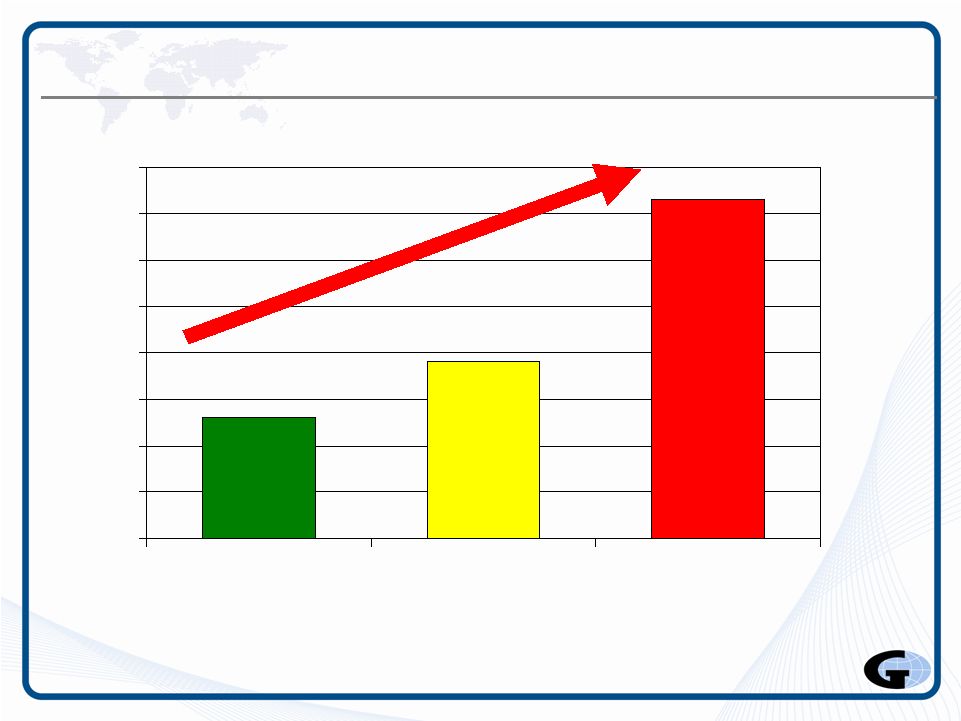

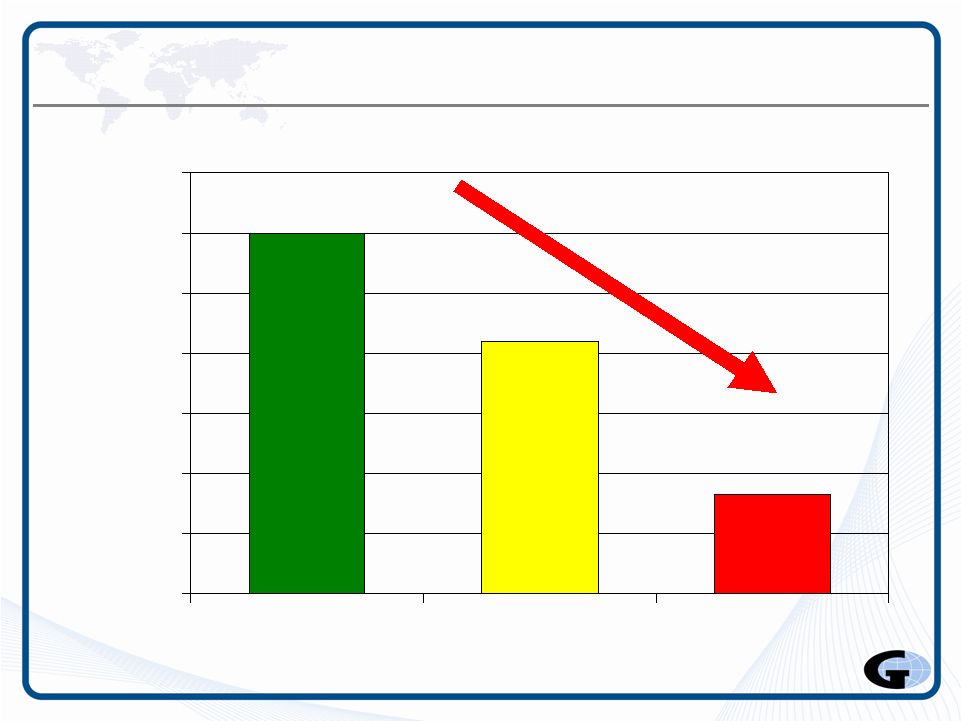

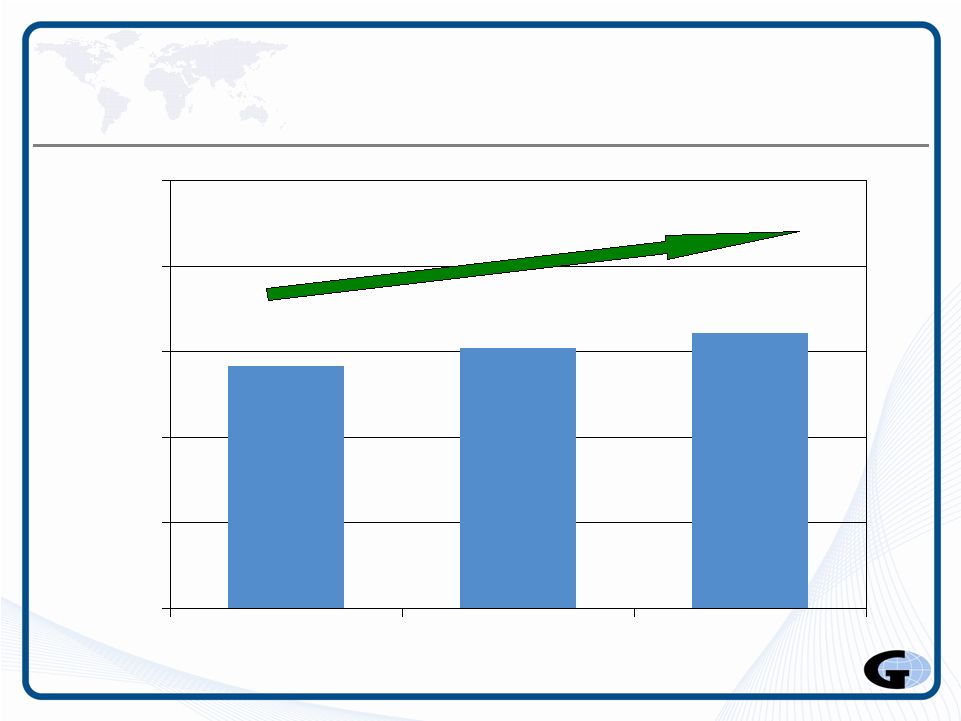

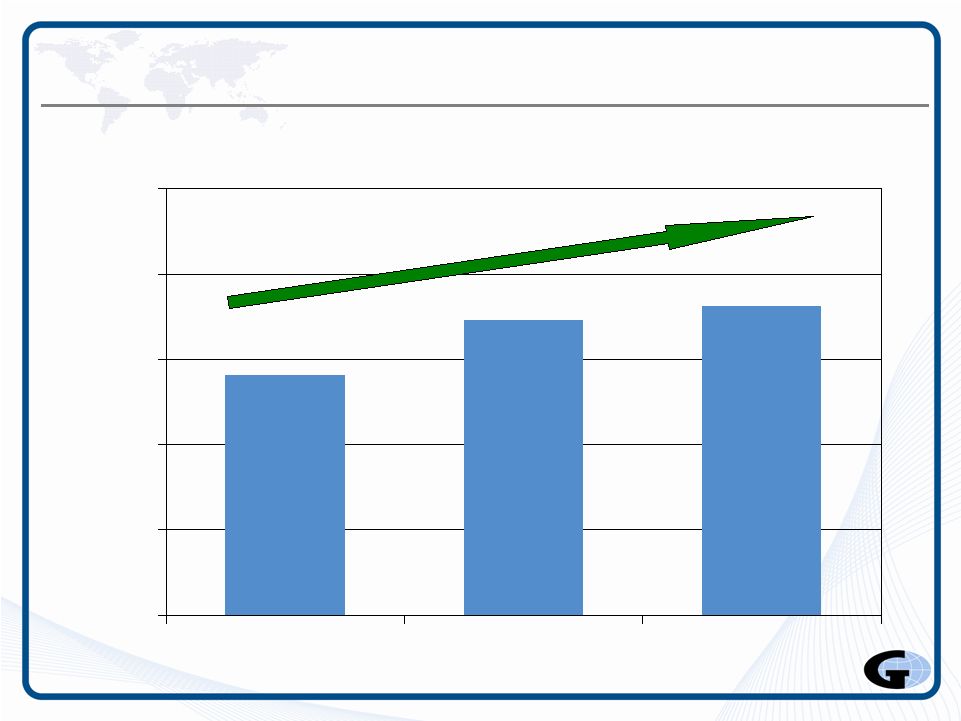

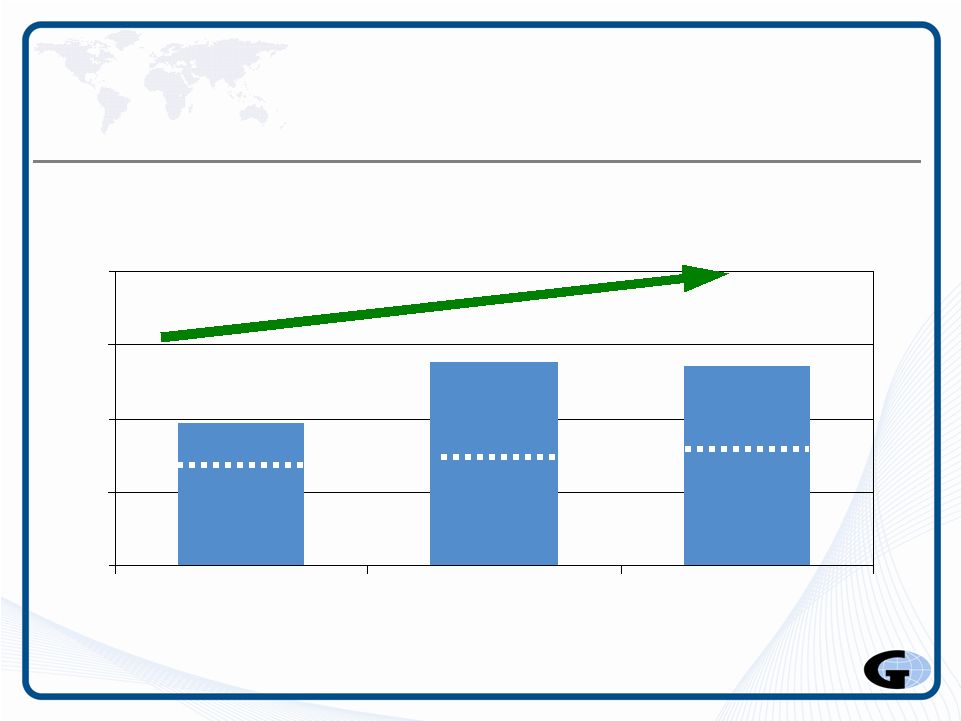

16 Gallagher Grows Adjusted Revenue 4% CAGR 2008 2009 2010 Brokerage & Risk Management Adjusted Revenues from Continuing Operations - See Non–GAAP measures in Exhibits $1,782 $1,719 $1,635 $500 $900 $1,300 $1,700 $2,100 $2,500 |

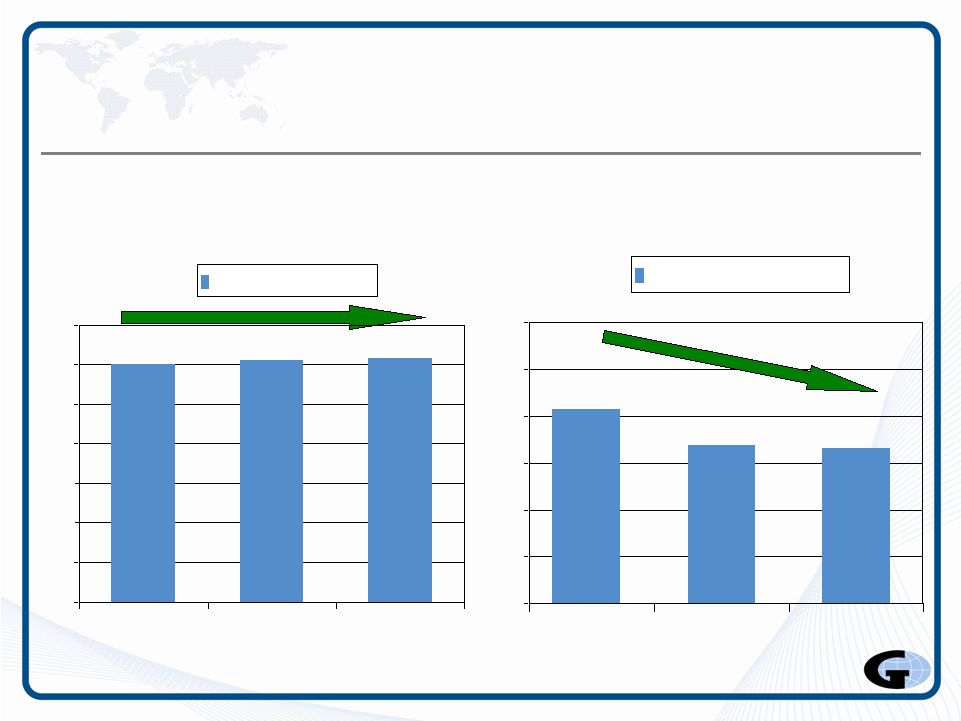

17 Gallagher’s Workforce Discipline & Expense Reduction Brokerage See important disclosures regarding Non-GAAP measures in Exhibits 16.6% 16.9% 20.8% 0% 5% 10% 15% 20% 25% 30% 2008 2009 2010 Operating Expense Ratio 61.4% 61.1% 60.1% 0% 10% 20% 30% 40% 50% 60% 70% 2008 2009 2010 Compensation Ratio |

18 Gallagher’s Workforce Discipline & Expense Reduction Risk Management See important disclosures regarding Non-GAAP measures in Exhibits 60.9% 60.9% 60.4% 0% 10% 20% 30% 40% 50% 60% 70% 2008 2009 2010 Compensation Ratio 23.5% 24.0% 27.0% 0% 5% 10% 15% 20% 25% 30% 2008 2009 2010 Operating Expense Ratio |

19 Gallagher Grows Adjusted EBITDAC $362 $347 $281 $0 $100 $200 $300 $400 $500 13% CAGR 2008 2009 2010 Brokerage & Risk Management Adjusted EBITDAC from Continuing Operations - See Non– GAAP measures in Exhibits |

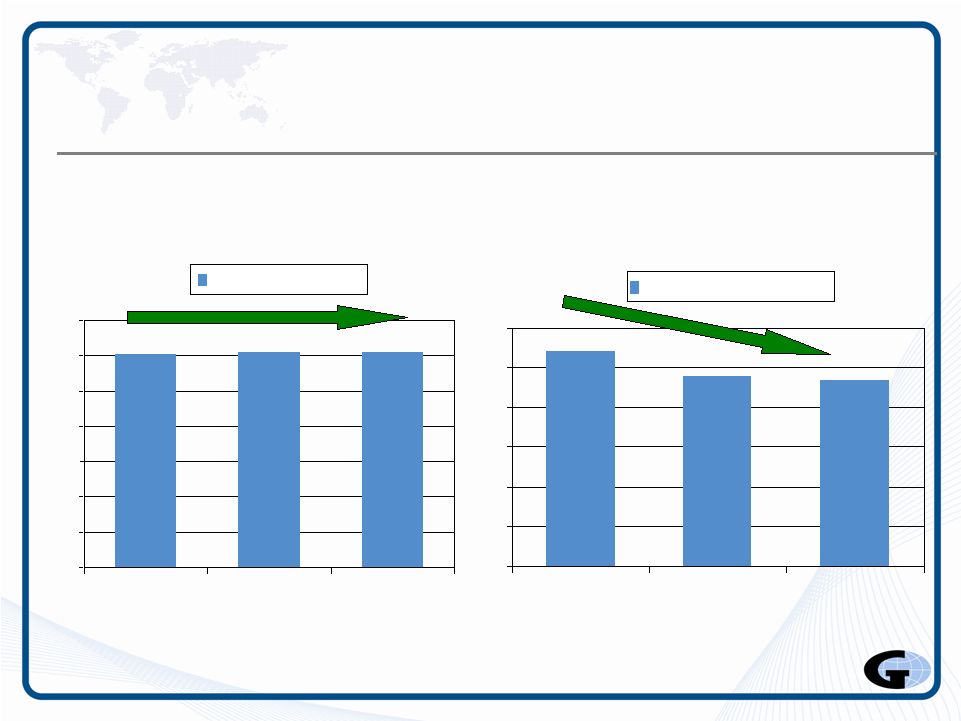

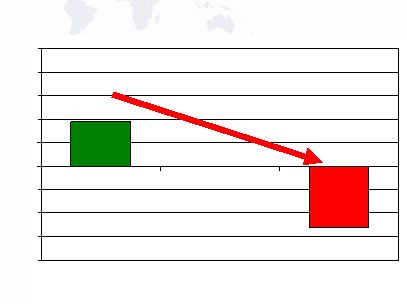

20 Gallagher Improves Adjusted EBITDAC Margins Brokerage See important disclosures regarding Non-GAAP measures in Exhibits 21.9% 19.0% 15% 16% 17% 18% 19% 20% 21% 22% 23% 2008 2010 |

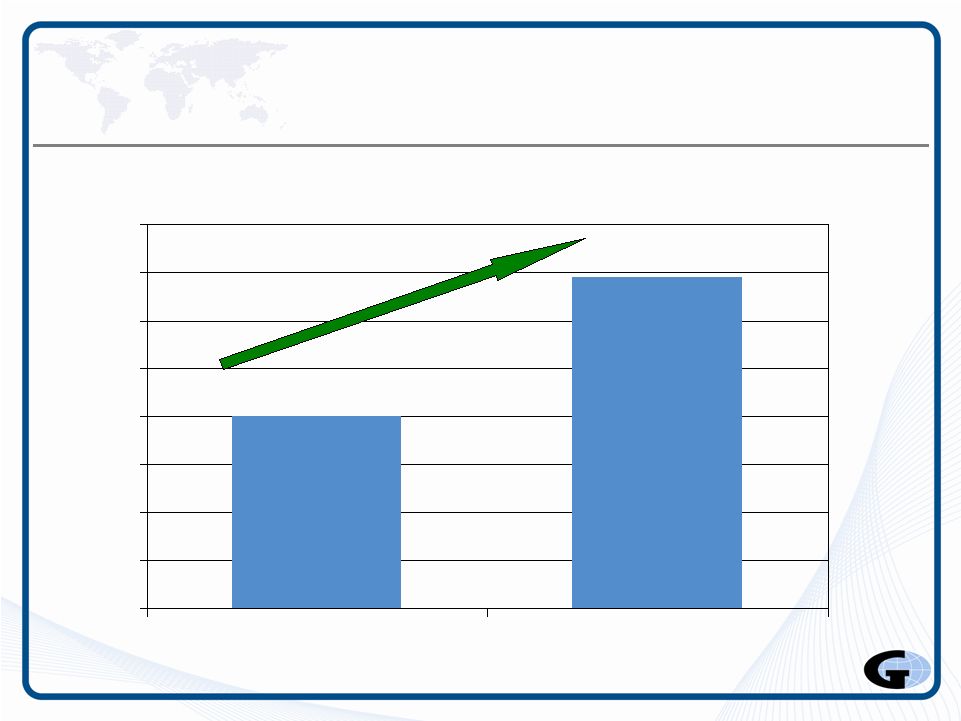

21 Gallagher Improves Adjusted EBITDAC Margins 15.6% 12.6% 10% 11% 12% 13% 14% 15% 16% 2008 2010 Risk Management See important disclosures regarding Non-GAAP measures in Exhibits |

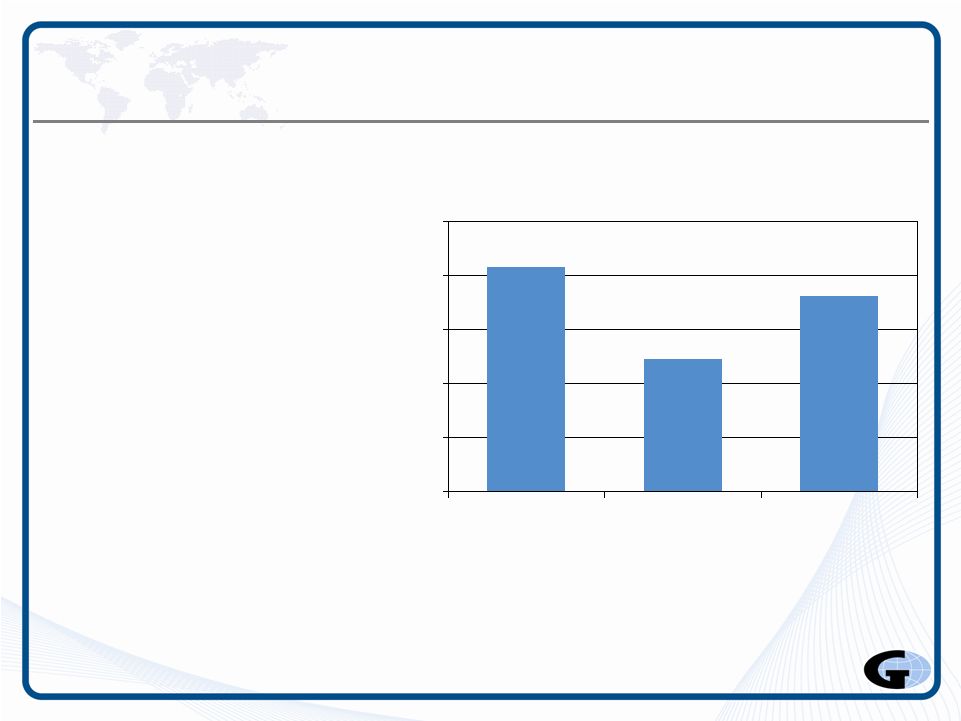

22 Gallagher Continues Acquisition Momentum $145 $98 $166 $0 $40 $80 $120 $160 $200 2008 2009 2010 (In millions) Annualized Revenues Acquired From 2008 to 2010: • Completed 71 deals • $409m in annualized revenues • Highlighted by Liberty Mutual/Wausau and GAB Robins acquisitions |

23 Risk Management M&A • GAB Robins Completed October 1, 2010 Acquired TPA and managed care subsidiaries Expect up to: • $50 million of annualized revenues • $10 million of EBITDAC by 2012 Added over 400 talented employees Excellent culture fit Integration going as planned |

24 Gallagher Continued to Invest in the Company • Positioned company for future expansion capacity • Systems investment Centralization Global Systems Centralized processes • Offshoring initiatives |

25 Gallagher Continued Relentless Focus on Quality & Customer Service |

26 Maintained Prudent Balance Sheet $s in millions. Global Insurance Brokers’ ratios are adjusted for unusual items Source for S&P 1000: Bloomberg as of 01/28/11. Gallagher @ 12/31/2010 Global Insurance Broker Avg. @ 09/30/2010 S&P 1000 Total Debt $550 Stockholders’ Equity $1,107 Debt to Total Capital (Debt/(Debt + Equity)) 33% 39% 40% Debt to EBITDAC 1.5x 2.1x 2.8x See important disclosures regarding Non-GAAP measures in Exhibits |

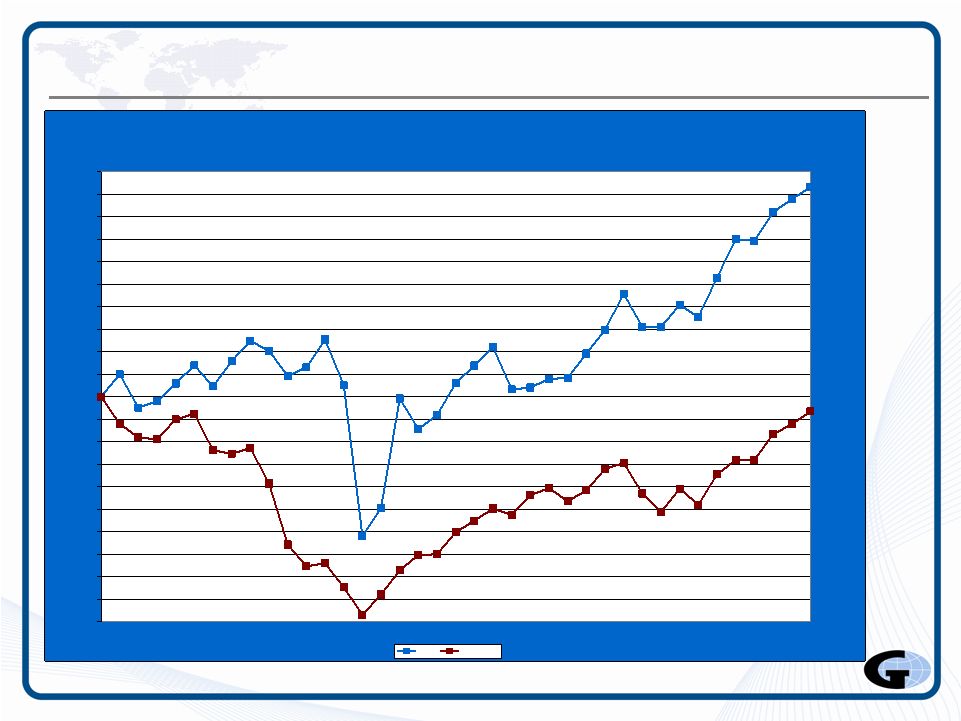

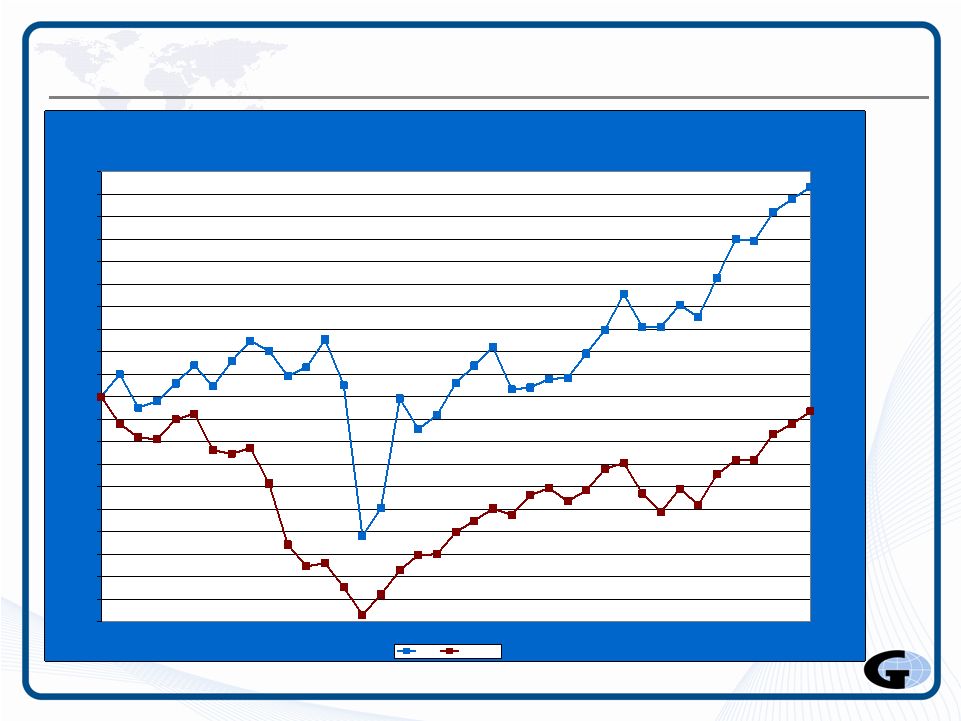

27 Gallagher’s Stockholders Benefited Source for data: Bloomberg. Total Returns assume dividend reinvestment. Total Returns January 2008 - February 2011 AJG versus S&P 500 47% -3% -50% -45% -40% -35% -30% -25% -20% -15% -10% -5% 0% 5% 10% 15% 20% 25% 30% 35% 40% 45% 50% Mar-08 Jun-08 Sep-08 Dec-08 Mar-09 Jun-09 Sep-09 Dec-09 Mar-10 Jun-10 Sep-10 Dec-10 AJG S&P 500 |

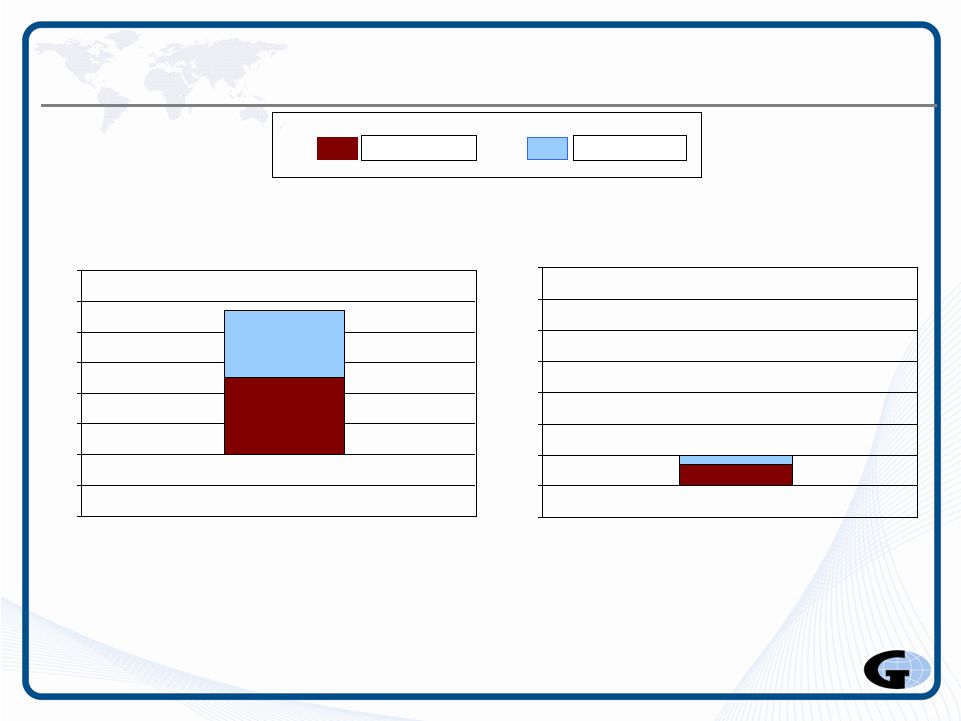

28 The Power of Dividends Source for Data: Bloomberg. Total Returns assume dividend reinvestment. Dividends Price Only + 47% -3% 25% 22% -20% -10% 0% 10% 20% 30% 40% 50% 60% AJG -10% 7% -20% -10% 0% 10% 20% 30% 40% 50% 60% S&P 500 |

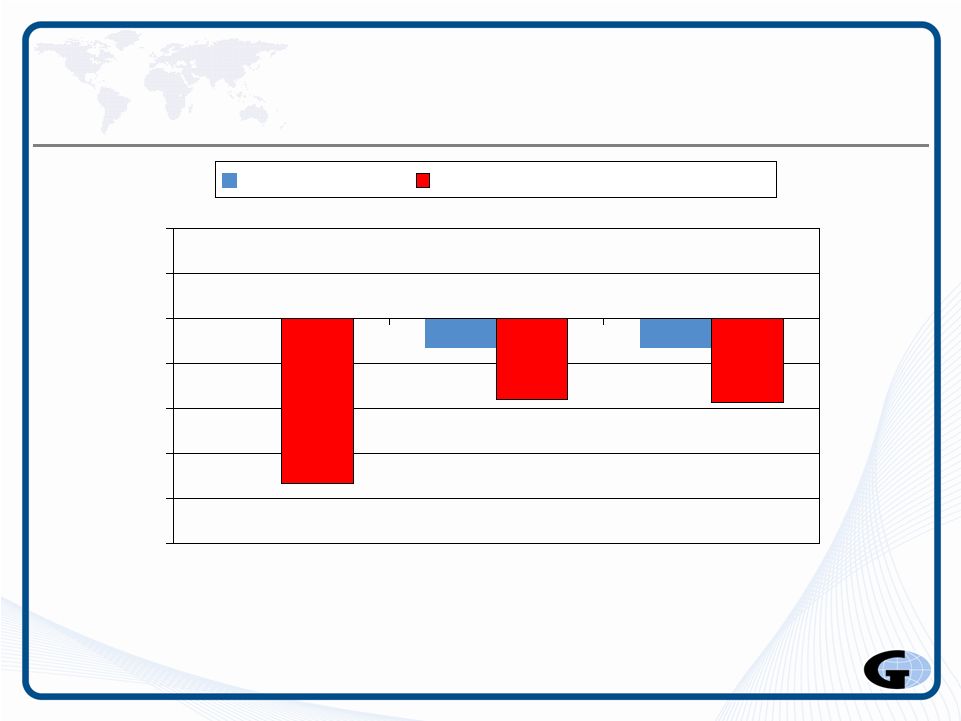

29 Cash Generation Dividend Below 50% See important disclosures regarding Non-GAAP measures in Exhibits (In millions) $0 $100 $200 $300 $400 2008 2009 2010 Dividend 29 |

30 On the Horizon….. |

31 Starting from a Strong Financial Position • Cash available for M&A $100m available cash at 12/31/10 Added $125m of new debt last week • Debt still below target of 2x EBITDAC • Significant flexibility remains $500m in credit line • Unfunded pension is $20m See important disclosures regarding Non-GAAP measures in Exhibits |

32 Three Uses of Cash • Re-invest in company – CapEx and acquisitions • Dividends • Repurchase shares – currently not anticipated |

33 Brokerage Growth - Organic Drivers • Cross-selling and new business initiatives • Recruiting new producers and teams Domestically and Internationally • Capitalize on niche expertise • Developing our own - Internship program • Focus on new niches • Improving carrier compensation • Implementing global sales management systems |

34 Brokerage Growth - Organic Drivers (cont) • Opportunities from Healthcare Turmoil Clients need help We have the tools and resources Many consulting opportunities for new/existing clients Turmoil will continue with evolution of this bill • Expanding program managers to utilize current distribution • Business migration to standard markets is slowing • Continue to expand International capabilities |

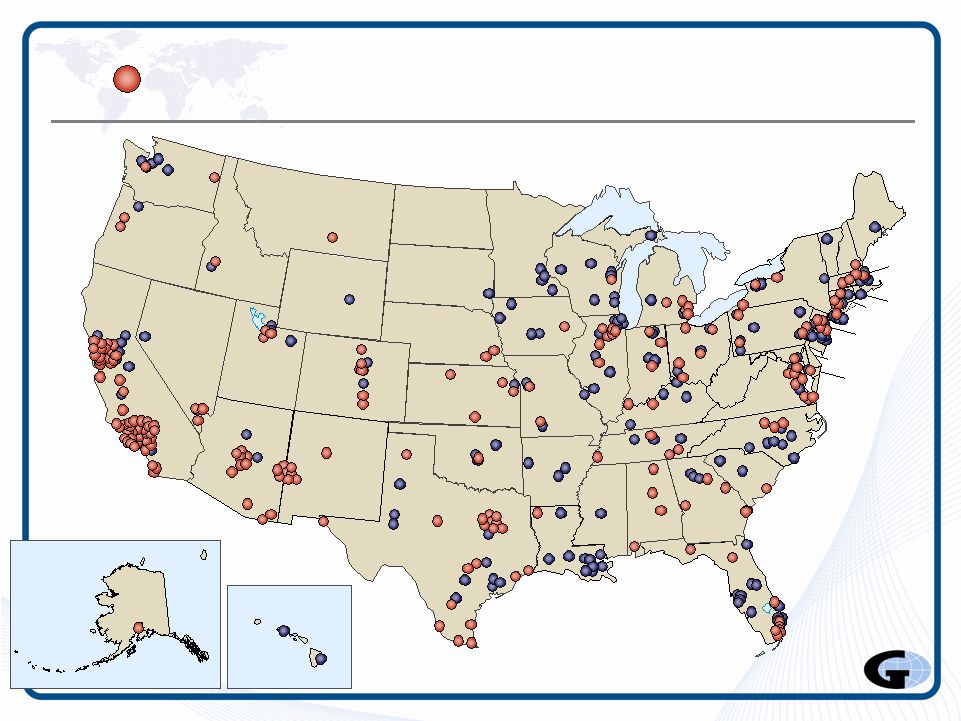

35 Acquisition Strategy - Brokerage • Unlimited opportunity 18,000 retail and wholesale brokerages and agencies* just in the U.S. (Retail P&C, Benefits and Wholesale) •Owned by baby boomers who need an exit strategy yet still want to be in the business •Need depth of capabilities to grow to the next level Small number of consolidators *Source: Hales & Company and D&B |

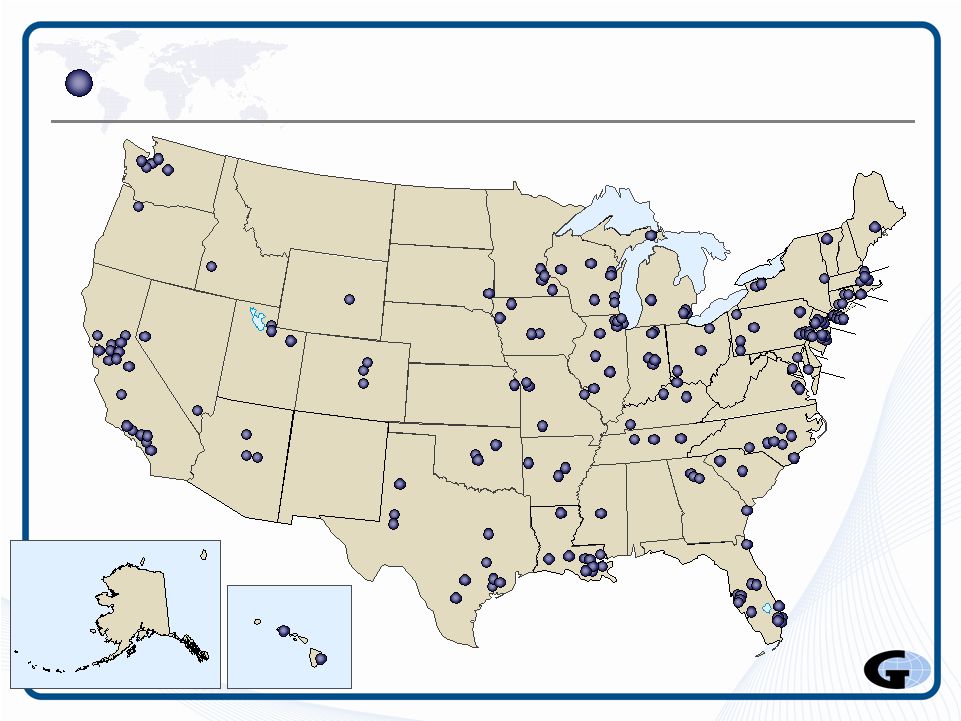

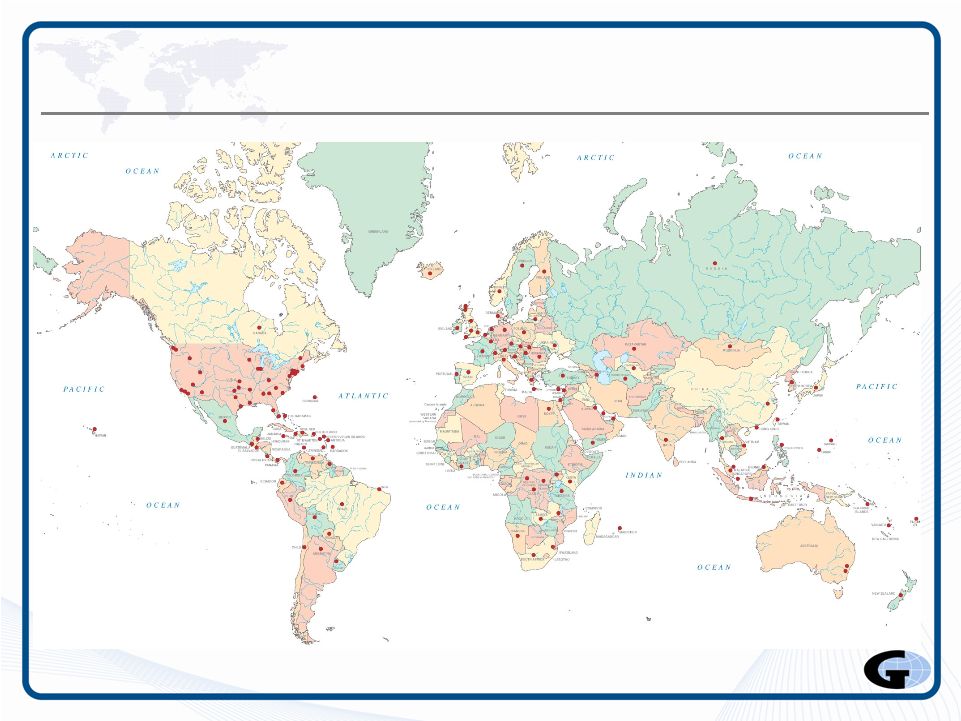

36 Current Gallagher U.S. Locations ID MT WA CA UT NV AZ NM TX OK KS NE MN WI MO AR LA TN IL WV PA NY NH ME MA CT NJ DE MD IA CO WY SD ND OR OH MI KY MS AL GA FL SC NC VT RI IN AK HI VA |

37 ID MT WA CA UT NV AZ NM TX OK KS NE MN WI MO AR LA TN IL WV PA NY NH ME MA CT NJ DE MD IA CO WY SD ND OR OH MI KY MS AL GA FL SC NC VT RI IN AK HI VA Larger cities where we aren’t located |

38 Acquisition Strategy – Brokerage (cont.) • How we do it Domestically looking for “tuck-ins” as well as stand alone platforms International expansion •Joint ventures •Network of correspondent brokers source for future partners Cultural fit is crucial |

39 Acquisition Strategy – Brokerage (cont.) • Long-term strategic value Additional expertise for niches Broaden geographic penetration Additional leverage with markets, vendors, etc. • Manage and monitor closely post acquisition to assure strategy meets return on capital targets |

40 Acquisition Strategy – International Brokerage • Solid acquisition activity in 2010 FirstCity – London Securitas – Brazil SBA – Australia – now own 100% Risk & Reward – U.K. employee benefits • Global joint ventures are important Profit sharing Additional London flow through Huge geographic opportunities |

41 Gallagher Optimus Network |

42 Brokerage Productivity & Expense Reductions • Upgrading and consolidating agency systems • Centralizing back office support • Utilizing offshore centers of excellence • Maintaining headcount controls • Reducing real estate footprint • Capitalizing on procurement/sourcing capabilities |

43 Risk Management – Growth, Productivity & Expense Management • Attract and retain clients with superior value proposition Unsurpassed claims handling capabilities and expertise Superior outcomes Industry-leading service experience Industry-specific best practice solutions Uniformly high levels of quality Stability and long-term commitment to industry leadership |

44 Risk Management – Growth, Productivity & Expense Management (cont’d) • Build on recent success in international markets Target Australia, Canada, New Zealand & U.K. Expand sales capacity and capability with a focus towards commercial sector Leverage cross-selling opportunities with AJG Int’l and domestic clients • Maintain focus on productivity and overall expense management Tightly manage headcount and compensation Opportunistically close/combine locations Reduce T&E, office expenses and outside fees where possible |

45 Corporate Segment Evolving • Clean-energy projects contributing Viewed as cash generation vehicles Earned $8 million after tax in 2010 May earn $4-6 million per quarter after tax starting in 2Q 2011 • Legacy investment era effectively behind us |

46 Summary |

47 Significant Headwinds Economy – GDP shrinks -4% -3% -2% -1% 0% 1% 2% 3% 4% 5% Short-Term Interest Rates Fall 0.0% 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% U.S. Employment Down 9 Million Jobs 126,000 128,000 130,000 132,000 134,000 136,000 138,000 140,000 Global P&C Market Shrinks -2% -1% 0% 1% 2% 3% 4% 5% 129,320 134,383 137,983 YE 2007 YE 2008 YE 2009 -0.1% -0.8% 1.5% 4.0% 2006 2007 2008 2009 -2.6% 0.0% 1.9% 2007 2008 2009 5.0% 1.9% 0.2% 0.2% 2007 2008 2009 2010 480 bps decline |

48 Gallagher Sailed Through See important disclosures regarding Non-GAAP measures in Exhibits Gallagher Continues Acquisition Momentum $145 $98 $166 $0 $40 $80 $120 $160 $200 2008 2009 2010 (In millions) Annualized Revenues Acquired Gallagher Improves Adjusted EBITDAC Margins 20.3% 17.2% 15% 16% 17% 18% 19% 20% 21% 22% 23% 2008 2010 Brokerage & Risk Management Gallagher Grows Adjusted Revenue $1,782 $1,719 $1,635 $500 $900 $1,300 $1,700 $2,100 $2,500 4% CAGR 2008 2009 2010 Gallagher Grows Adjusted EBITDAC $362 $347 $281 $0 $100 $200 $300 $400 $500 13% CAGR 2008 2009 2010 |

49 Gallagher’s Stockholders Benefited Source for data: Bloomberg. Total Returns assume dividend reinvestment. Total Returns January 2008 - February 2011 AJG versus S&P 500 47% -3% -50% -45% -40% -35% -30% -25% -20% -15% -10% -5% 0% 5% 10% 15% 20% 25% 30% 35% 40% 45% 50% Mar-08 Jun-08 Sep-08 Dec-08 Mar-09 Jun-09 Sep-09 Dec-09 Mar-10 Jun-10 Sep-10 Dec-10 AJG S&P 500 |

50 Summary • Why own Gallagher? Steady long-term growth Strong cash flows Prudent Balance Sheet History of solid dividend yield shows confidence in future growth |

51 For Additional Information • Website: www.ajg.com • Email: investor_relations@ajg.com • Marsha Akin: Marsha_Akin@ajg.com • Phone: 630-285-3501 |

52 |

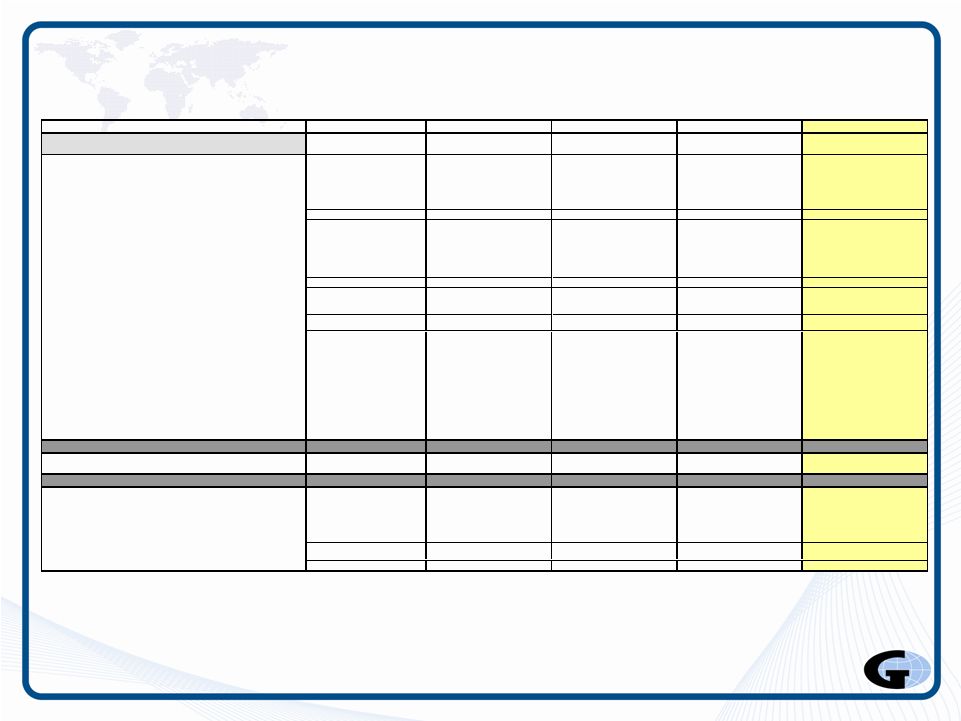

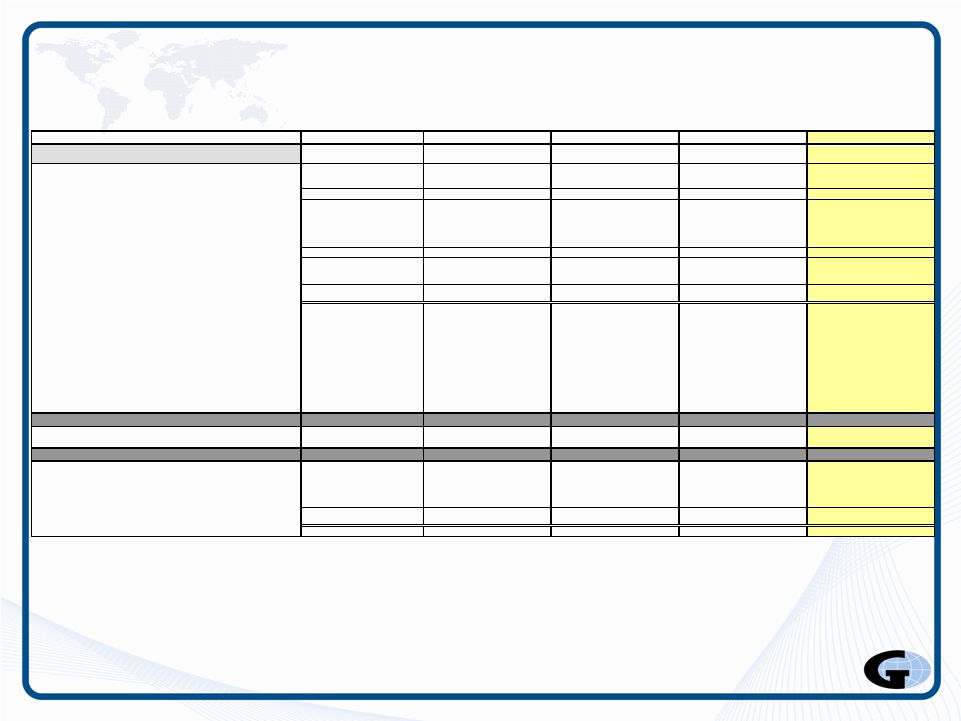

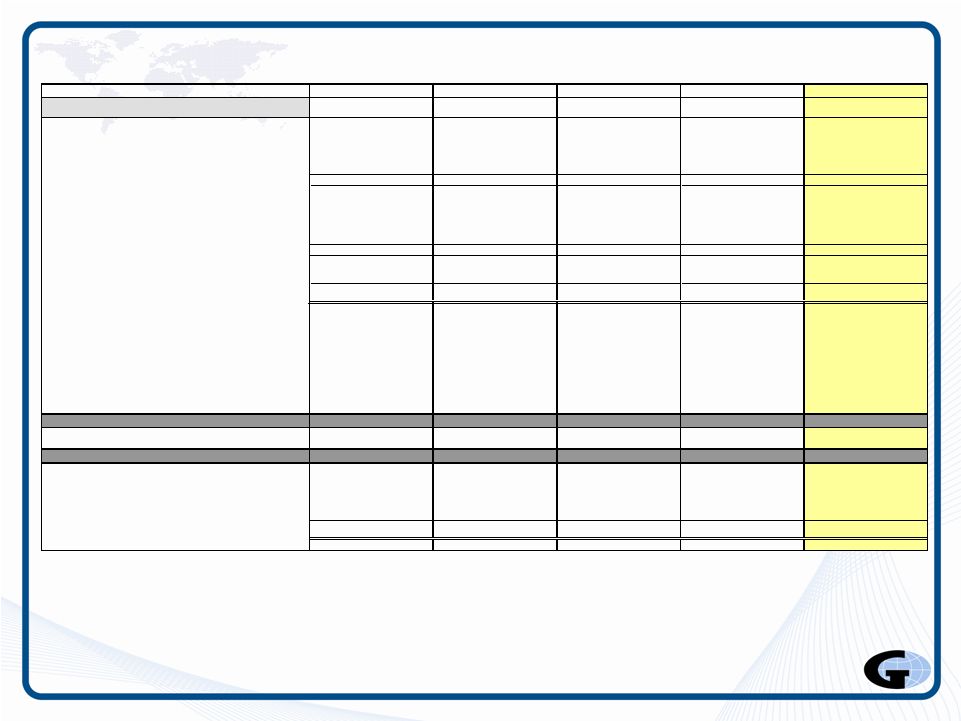

53 Brokerage Segment Statement of Earnings Reported Adjust- ments Adjusted Reported Adjust- ments Adjusted Reported Adjust- ments Adjusted Reported Adjust- ments Adjusted Reported Adjust- ments Adjusted Commissions 183.4 $ - $ 183.4 $ 232.6 $ - $ 232.6 $ 226.8 $ - $ 226.8 $ 211.4 $ - $ 211.4 $ 854.2 $ - $ 854.2 $ Fees 50.4 - 50.4 63.5 - 63.5 66.0 - 66.0 70.3 - 70.3 250.2 - 250.2 Supplemental and contingent commissions 17.9 (1.6) 16.3 8.3 3.0 11.3 12.3 2.4 14.7 7.2 2.3 9.5 45.7 6.1 51.8 Investment income 4.6 - 4.6 4.3 - 4.3 3.6 - 3.6 1.4 - 1.4 13.9 - 13.9 Gains realized on books of business sales 1.7 (1.7) - 3.5 (3.5) - 5.7 (5.7) - 12.9 (12.9) - 23.8 (23.8) - Revenues 258.0 (3.3) 254.7 312.2 (0.5) 311.7 314.4 (3.3) 311.1 303.2 (10.6) 292.6 1,187.8 (17.7) 1,170.1 Compensation 167.1 (0.1) 167.0 175.8 (0.9) 174.9 179.6 - 179.6 184.9 (2.9) 182.0 707.4 (3.9) 703.5 Operating 58.7 - 58.7 56.0 - 56.0 60.5 (1.3) 59.2 72.2 (2.3) 69.9 247.4 (3.6) 243.8 Depreciation 3.9 - 3.9 4.7 - 4.7 4.7 - 4.7 4.9 - 4.9 18.2 - 18.2 Amortization 8.8 - 8.8 10.1 - 10.1 10.1 - 10.1 14.2 (2.7) 11.5 43.2 (2.7) 40.5 Change in estimated acquisition earnout payables - - - - - - - - - - - - - - - Expenses 238.5 (0.1) 238.4 246.6 (0.9) 245.7 254.9 (1.3) 253.6 276.2 (7.9) 268.3 1,016.2 (10.2) 1,006.0 Earnings from continuing operations before income taxes 19.5 (3.2) 16.3 65.6 0.4 66.0 59.5 (2.0) 57.5 27.0 (2.7) 24.3 171.6 (7.5) 164.1 Provision for income taxes 7.6 (1.3) 6.3 26.4 0.2 26.6 23.4 (0.8) 22.6 10.0 (1.1) 8.9 67.4 (3.0) 64.4 Earnings from continuing operations 11.9 $ (1.9) $ 10.0 $ 39.2 $ 0.2 $ 39.4 $ 36.1 $ (1.2) $ 34.9 $ 17.0 $ (1.6) $ 15.4 $ 104.2 $ (4.5) $ 99.7 $ Diluted earnings from continuing operations per share 0.13 $ (0.02) $ 0.11 $ 0.42 $ 0.00 $ 0.42 $ 0.38 $ (0.01) $ 0.37 $ 0.18 $ (0.02) $ 0.16 $ 1.11 $ (0.05) $ 1.06 $ Growth (decline) - revenues 11% 9% 6% 6% 8% 7% 2% -1% 7% 5% Organic growth (decline) in commissions, fees and supplemental commissions 2% 2% 0% 0% 1% 1% -4% -4% 0% 0% Compensation expense ratio 65% 66% 56% 56% 57% 58% 61% 62% 60% 60% Operating expense ratio 23% 23% 18% 18% 19% 19% 24% 24% 21% 21% Pretax profit margin 8% 6% 21% 21% 19% 18% 9% 8% 14% 14% EBITDAC margin 12% 11% 26% 26% 24% 23% 15% 14% 20% 19% Effective tax rate 39% 39% 40% 40% 39% 39% 37% 37% 39% 39% Other Information Diluted weighted average shares outstanding (000s) 92,898 92,898 93,545 93,545 94,556 94,556 95,900 95,900 94,179 94,179 EBITDAC Earnings from continuing operations 11.9 $ (1.9) $ 10.0 $ 39.2 $ 0.2 $ 39.4 $ 36.1 $ (1.2) $ 34.9 $ 17.0 $ (1.6) $ 15.4 $ 104.2 $ (4.5) $ 99.7 $ Provision for income taxes 7.6 (1.3) 6.3 26.4 0.2 26.6 23.4 (0.8) 22.6 10.0 (1.1) 8.9 67.4 (3.0) 64.4 Depreciation 3.9 - 3.9 4.7 - 4.7 4.7 - 4.7 4.9 - 4.9 18.2 - 18.2 Amortization 8.8 - 8.8 10.1 - 10.1 10.1 - 10.1 14.2 (2.7) 11.5 43.2 (2.7) 40.5 Change in estimated acquisition earnout payables - - - - - - - - - - - - - - - EBITDAC 32.2 $ (3.2) $ 29.0 $ 80.4 $ 0.4 $ 80.8 $ 74.3 $ (2.0) $ 72.3 $ 46.1 $ (5.4) $ 40.7 $ 233.0 $ (10.2) $ 222.8 $ See information regarding Non-GAAP Financial Measures on the first page of these exhibits. Gallagher does not intend to present this adjusted information in the future. (Unaudited - in millions except share and per share data) Arthur J. Gallagher & Co. 2008 Adjusted Brokerage Segment Statement of Earnings 1st Q 08 2nd Q 08 3rd Q 08 4th Q 08 YTD 08 |

54 Risk Management Segment Statement of Earnings Reported Adjust- ments Adjusted Reported Adjust- ments Adjusted Reported Adjust- ments Adjusted Reported Adjust- ments Adjusted Reported Adjust- ments Adjusted Fees 115.1 $ - $ 115.1 $ 114.1 $ - $ 114.1 $ 117.6 $ - $ 117.6 $ 114.3 $ - $ 114.3 $ 461.1 $ - $ 461.1 $ Investment income 1.1 - 1.1 1.1 - 1.1 1.0 - 1.0 0.6 - 0.6 3.8 - 3.8 Revenues 116.2 - 116.2 115.2 - 115.2 118.6 - 118.6 114.9 - 114.9 464.9 - 464.9 Compensation 70.1 - 70.1 70.4 - 70.4 70.4 - 70.4 69.7 - 69.7 280.6 - 280.6 Operating 29.2 - 29.2 29.2 - 29.2 33.8 - 33.8 34.1 (0.6) 33.5 126.3 (0.6) 125.7 Depreciation 3.0 - 3.0 3.2 - 3.2 3.2 - 3.2 2.2 - 2.2 11.6 - 11.6 Amortization 0.1 - 0.1 0.2 - 0.2 0.1 - 0.1 0.1 - 0.1 0.5 - 0.5 Expenses 102.4 - 102.4 103.0 - 103.0 107.5 - 107.5 106.1 (0.6) 105.5 419.0 (0.6) 418.4 Earnings from continuing operations before income taxes 13.8 - 13.8 12.2 - 12.2 11.1 - 11.1 8.8 0.6 9.4 45.9 0.6 46.5 Provision for income taxes 5.3 - 5.3 4.8 - 4.8 4.1 - 4.1 3.5 0.2 3.7 17.7 0.2 17.9 Earnings from continuing operations 8.5 $ - $ 8.5 $ 7.4 $ - $ 7.4 $ 7.0 $ - $ 7.0 $ 5.3 $ 0.4 $ 5.7 $ 28.2 $ 0.4 $ 28.6 $ Diluted earnings from continuing operations per share 0.09 $ - $ 0.09 $ 0.08 $ - $ 0.08 $ 0.08 $ - $ 0.07 $ 0.06 $ 0.00 $ 0.06 $ 0.30 $ 0.00 $ 0.30 $ Growth (decline) - revenues 9% 9% 7% 7% 8% 8% -3% -3% 5% 5% Organic growth (decline) in commissions, fees and supplemental commissions 7% 7% 5% 5% 8% 8% 2% 2% 5% 5% Compensation expense ratio 60% 60% 61% 61% 59% 59% 61% 61% 60% 60% Operating expense ratio 25% 25% 25% 25% 29% 29% 30% 29% 27% 27% Pretax profit margin 12% 12% 11% 11% 9% 9% 8% 8% 10% 10% EBITDAC margin 15% 15% 14% 14% 12% 12% 10% 10% 12% 13% Effective tax rate 39% 38% 39% 39% 37% 37% 40% 39% 39% 38% Other Information Diluted weighted average shares outstanding (000s) 92,898 92,898 93,545 93,545 94,556 94,556 95,900 95,900 94,179 94,179 EBITDAC Earnings from continuing operations 8.5 $ - $ 8.5 $ 7.4 $ - $ 7.4 $ 7.0 $ - $ 7.0 $ 5.3 $ 0.4 $ 5.7 $ 28.2 $ 0.4 $ 28.6 $ Provision for income taxes 5.3 - 5.3 4.8 - 4.8 4.1 - 4.1 3.5 0.2 3.7 17.7 0.2 17.9 Depreciation 3.0 - 3.0 3.2 - 3.2 3.2 - 3.2 2.2 - 2.2 11.6 - 11.6 Amortization 0.1 - 0.1 0.2 - 0.2 0.1 - 0.1 0.1 - 0.1 0.5 - 0.5 EBITDAC 16.9 $ - $ 16.9 $ 15.6 $ - $ 15.6 $ 14.4 $ - $ 14.4 $ 11.1 $ 0.6 $ 11.7 $ 58.0 $ 0.6 $ 58.6 $ See information regarding Non-GAAP Financial Measures on the first page of these exhibits. Gallagher does not intend to present this adjusted information in the future. Arthur J. Gallagher & Co. 2008 Adjusted Risk Management Segment Statement of Earnings (Unaudited - in millions except share and per share data) 1st Q 08 2nd Q 08 3rd Q 08 4th Q 08 YTD 08 |

55 Brokerage & Risk Management Segments Combined Statement of Earnings Reported Adjust- ments Adjusted Reported Adjust- ments Adjusted Reported Adjust- ments Adjusted Reported Adjust- ments Adjusted Reported Adjust- ments Adjusted Commissions 183.4 $ - $ 183.4 $ 232.6 $ - $ 232.6 $ 226.8 $ - $ 226.8 $ 211.4 $ - $ 211.4 $ 854.2 $ - $ 854.2 $ Fees 165.5 - 165.5 177.6 - 177.6 183.6 - 183.6 184.6 - 184.6 711.3 - 711.3 Supplemental and contingent commissions 17.9 (1.6) 16.3 8.3 3.0 11.3 12.3 2.4 14.7 7.2 2.3 9.5 45.7 6.1 51.8 Investment income 5.7 - 5.7 5.4 - 5.4 4.6 - 4.6 2.0 - 2.0 17.7 - 17.7 Gains realized on books of business sales 1.7 (1.7) - 3.5 (3.5) - 5.7 (5.7) - 12.9 (12.9) - 23.8 (23.8) - Revenues 374.2 (3.3) 370.9 427.4 (0.5) 426.9 433.0 (3.3) 429.7 418.1 (10.6) 407.5 1,652.7 (17.7) 1,635.0 Compensation 237.2 (0.1) 237.1 246.2 (0.9) 245.3 250.0 - 250.0 254.6 (2.9) 251.7 988.0 (3.9) 984.1 Operating 87.9 - 87.9 85.2 - 85.2 94.3 (1.3) 93.0 106.3 (2.9) 103.4 373.7 (4.2) 369.5 Depreciation 6.9 - 6.9 7.9 - 7.9 7.9 - 7.9 7.1 - 7.1 29.8 - 29.8 Amortization 8.9 - 8.9 10.3 - 10.3 10.2 - 10.2 14.3 (2.7) 11.6 43.7 (2.7) 41.0 Change in estimated acquisition earnout payables - - - - - - - - - - - - - - - Expenses 340.9 (0.1) 340.8 349.6 (0.9) 348.7 362.4 (1.3) 361.1 382.3 (8.5) 373.8 1,435.2 (10.8) 1,424.4 Earnings from continuing operations before income taxes 33.3 (3.2) 30.1 77.8 0.4 78.2 70.6 (2.0) 68.6 35.8 (2.1) 33.7 217.5 (6.9) 210.6 Provision for income taxes 12.9 (1.3) 11.6 31.2 0.2 31.4 27.5 (0.8) 26.7 13.5 (0.9) 12.6 85.1 (2.8) 82.3 Earnings from continuing operations 20.4 $ (1.9) $ 18.5 $ 46.6 $ 0.2 $ 46.8 $ 43.1 $ (1.2) $ 41.9 $ 22.3 $ (1.2) $ 21.1 $ 132.4 $ (4.1) $ 128.3 $ Diluted earnings from continuing operations per share 0.22 $ (0.02) $ 0.20 $ 0.50 $ 0.00 $ 0.50 $ 0.46 $ (0.01) $ 0.44 $ 0.23 $ (0.01) $ 0.22 $ 1.41 $ (0.04) $ 1.36 $ Growth (decline) - revenues 10% 9% 6% 6% 8% 7% 1% -2% 6% 5% Organic growth (decline) in commissions, fees and supplemental commissions 3% 3% 2% 2% 3% 3% -2% -2% 1% 1% Compensation expense ratio 63% 64% 58% 57% 58% 58% 61% 62% 60% 60% Operating expense ratio 23% 24% 20% 20% 22% 22% 25% 25% 23% 23% Pretax profit margin 9% 8% 18% 18% 16% 16% 9% 8% 13% 13% EBITDAC margin 13% 12% 22% 23% 20% 20% 14% 13% 18% 17% Effective tax rate 39% 39% 40% 40% 39% 39% 38% 37% 39% 39% Other Information Diluted weighted average shares outstanding (000s) 92,898 92,898 93,545 93,545 94,556 94,556 95,900 95,900 94,179 94,179 EBITDAC Earnings from continuing operations 20.4 $ (1.9) $ 18.5 $ 46.6 $ 0.2 $ 46.8 $ 43.1 $ (1.2) $ 41.9 $ 22.3 $ (1.2) $ 21.1 $ 132.4 $ (4.1) $ 128.3 $ Provision for income taxes 12.9 (1.3) 11.6 31.2 0.2 31.4 27.5 (0.8) 26.7 13.5 (0.9) 12.6 85.1 (2.8) 82.3 Depreciation 6.9 - 6.9 7.9 - 7.9 7.9 - 7.9 7.1 - 7.1 29.8 - 29.8 Amortization 8.9 - 8.9 10.3 - 10.3 10.2 - 10.2 14.3 (2.7) 11.6 43.7 (2.7) 41.0 Change in estimated acquisition earnout payables - - - - - - - - - - - - - - - EBITDAC 49.1 $ (3.2) $ 45.9 $ 96.0 $ 0.4 $ 96.4 $ 88.7 $ (2.0) $ 86.7 $ 57.2 $ (4.8) $ 52.4 $ 291.0 $ (9.6) $ 281.4 $ See information regarding Non-GAAP Financial Measures on the first page of these exhibits. Gallagher does not intend to present this adjusted information in the future. Arthur J. Gallagher & Co. 2008 Adjusted Brokerage & Risk Management Segments Combined Statement of Earnings (Unaudited - in millions except share and per share data) 1st Q 08 2nd Q 08 3rd Q 08 4th Q 08 YTD 08 |

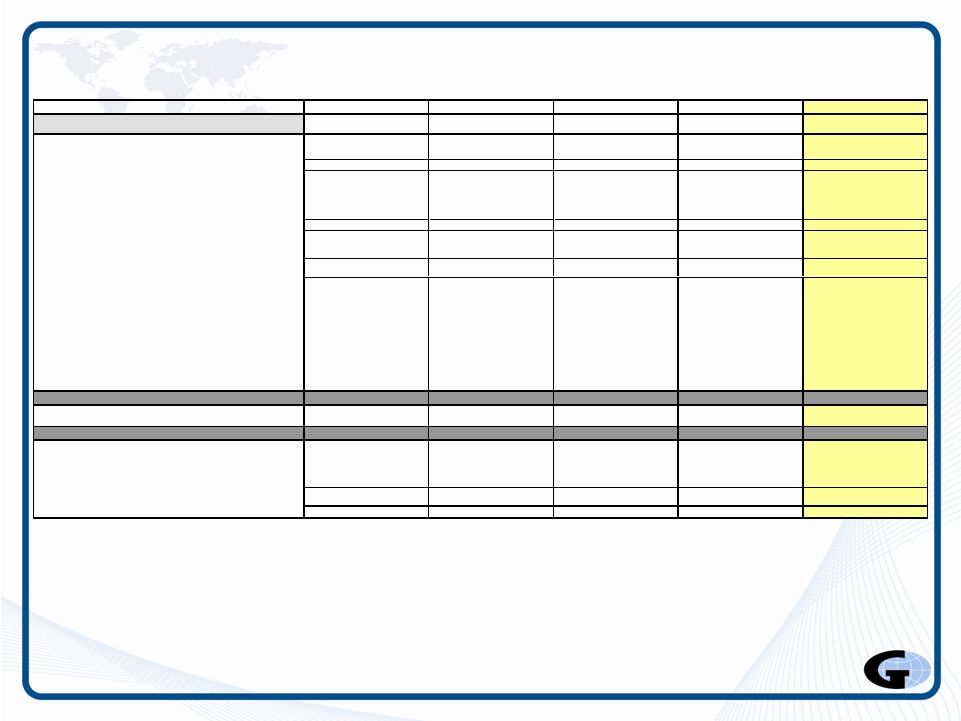

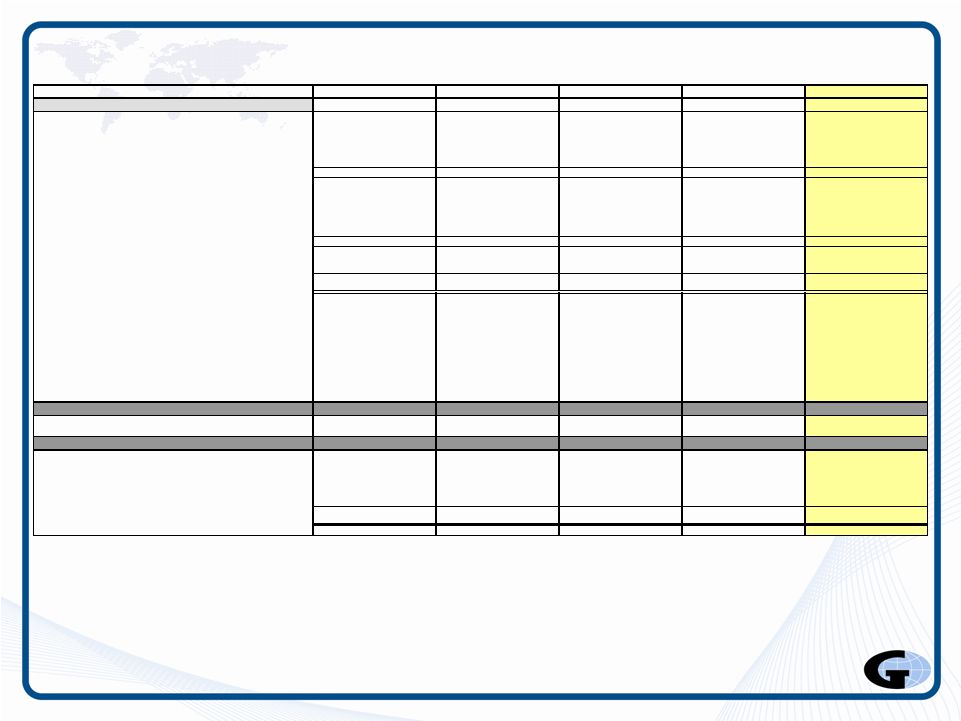

56 Brokerage Segment Statement of Earnings Reported Adjust- ments Adjusted Reported Adjust- ments Adjusted Reported Adjust- ments Adjusted Reported Adjust- ments Adjusted Reported Adjust- ments Adjusted Commissions 198.0 $ - $ 198.0 $ 249.7 $ - $ 249.7 $ 237.0 $ - $ 237.0 $ 228.2 $ - $ 228.2 $ 912.9 $ - $ 912.9 $ Fees 54.8 - 54.8 73.9 - 73.9 75.8 - 75.8 77.6 - 77.6 282.1 - 282.1 Supplemental and contingent commissions 29.5 (8.2) 21.3 11.8 4.4 16.2 10.3 5.3 15.6 13.4 (0.1) 13.3 65.0 1.4 66.4 Investment income 1.1 - 1.1 1.4 - 1.4 1.0 - 1.0 1.1 - 1.1 4.6 - 4.6 Gains realized on books of business sales 6.1 (6.1) - 3.3 (3.3) - 1.7 (1.7) - 0.5 (0.5) - 11.6 (11.6) - Revenues 289.5 (14.3) 275.2 340.1 1.1 341.2 325.8 3.6 329.4 320.8 (0.6) 320.2 1,276.2 (10.2) 1,266.0 Compensation 182.3 (0.1) 182.2 199.5 (0.6) 198.9 190.3 (0.8) 189.5 206.6 (4.0) 202.6 778.7 (5.5) 773.2 Operating 51.1 - 51.1 51.1 (0.3) 50.8 54.5 (0.8) 53.7 61.3 (2.5) 58.8 218.0 (3.6) 214.4 Depreciation 4.7 - 4.7 4.7 - 4.7 4.7 - 4.7 4.7 - 4.7 18.8 - 18.8 Amortization 12.2 - 12.2 13.9 - 13.9 13.7 - 13.7 14.5 - 14.5 54.3 - 54.3 Change in estimated acquisition earnout payables - - - 1.4 - 1.4 1.2 - 1.2 1.5 - 1.5 4.1 - 4.1 Expenses 250.3 (0.1) 250.2 270.6 (0.9) 269.7 264.4 (1.6) 262.8 288.6 (6.5) 282.1 1,073.9 (9.1) 1,064.8 Earnings from continuing operations before income taxes 39.2 (14.2) 25.0 69.5 2.0 71.5 61.4 5.2 66.6 32.2 5.9 38.1 202.3 (1.1) 201.2 Provision for income taxes 15.1 (5.7) 9.4 28.0 0.8 28.8 24.5 2.1 26.6 11.0 2.4 13.4 78.6 (0.4) 78.2 Earnings from continuing operations 24.1 $ (8.5) $ 15.6 $ 41.5 $ 1.2 $ 42.7 $ 36.9 $ 3.1 $ 40.0 $ 21.2 $ 3.5 $ 24.7 $ 123.7 $ (0.7) $ 123.0 $ Diluted earnings from continuing operations per share 0.25 $ (0.09) $ 0.16 $ 0.41 $ 0.01 $ 0.42 $ 0.36 $ 0.03 $ 0.39 $�� 0.21 $ 0.03 $ 0.24 $ 1.23 $ (0.01) $ 1.22 $ Growth (decline) - revenues 12% 8% 9% 9% 4% 6% 6% 9% 7% 8% Organic growth (decline) in commissions, fees and supplemental commissions -4% -4% -1% -1% -4% -4% 0% 0% -2% -2% Compensation expense ratio 63% 66% 59% 58% 58% 58% 64% 63% 61% 61% Operating expense ratio 18% 19% 15% 15% 17% 16% 19% 18% 17% 17% Pretax profit margin 14% 9% 20% 21% 19% 20% 10% 12% 16% 16% EBITDAC margin 19% 15% 26% 27% 25% 26% 16% 18% 22% 22% Effective tax rate 39% 38% 40% 40% 40% 40% 34% 35% 39% 39% Other Information Diluted weighted average shares outstanding (000s) 98,084 98,084 100,717 100,717 101,550 101,550 102,213 102,213 100,625 100,625 EBITDAC Earnings from continuing operations 24.1 $ (8.5) $ 15.6 $ 41.5 $ 1.2 $ 42.7 $ 36.9 $ 3.1 $ 40.0 $ 21.2 $ 3.5 $ 24.7 $ 123.7 $ (0.7) $ 123.0 $ Provision for income taxes 15.1 (5.7) 9.4 28.0 0.8 28.8 24.5 2.1 26.6 11.0 2.4 13.4 78.6 (0.4) 78.2 Depreciation 4.7 - 4.7 4.7 - 4.7 4.7 - 4.7 4.7 - 4.7 18.8 - 18.8 Amortization 12.2 - 12.2 13.9 - 13.9 13.7 - 13.7 14.5 - 14.5 54.3 - 54.3 Change in estimated acquisition earnout payables - - - 1.4 - 1.4 1.2 - 1.2 1.5 - 1.5 4.1 - 4.1 EBITDAC 56.1 $ (14.2) $ 41.9 $ 89.5 $ 2.0 $ 91.5 $ 81.0 $ 5.2 $ 86.2 $ 52.9 $ 5.9 $ 58.8 $ 279.5 $ (1.1) $ 278.4 $ See information regarding Non-GAAP Financial Measures on the first page of these exhibits. Gallagher does not intend to present this adjusted information in the future. (Unaudited - in millions except share and per share data) Arthur J. Gallagher & Co. 2009 Adjusted Brokerage Segment Statement of Earnings 1st Q 09 2nd Q 09 3rd Q 09 4th Q 09 YTD 09 |

57 Risk Management Segment Statement of Earnings Reported Adjust- ments Adjusted Reported Adjust- ments Adjusted Reported Adjust- ments Adjusted Reported Adjust- ments Adjusted Reported Adjust- ments Adjusted Fees 111.8 $ - $ 111.8 $ 113.0 $ - $ 113.0 $ 113.1 $ - $ 113.1 $ 113.8 $ - $ 113.8 $ 451.7 $ - $ 451.7 $ Investment income 0.4 - 0.4 0.3 - 0.3 0.4 - 0.4 0.4 - 0.4 1.5 - 1.5 Revenues 112.2 - 112.2 113.3 - 113.3 113.5 - 113.5 114.2 - 114.2 453.2 - 453.2 Compensation 68.1 (0.3) 67.8 69.9 - 69.9 69.9 - 69.9 74.4 (6.2) 68.2 282.3 (6.5) 275.8 Operating 26.6 (0.6) 26.0 27.0 - 27.0 26.2 - 26.2 30.1 (0.7) 29.4 109.9 (1.3) 108.6 Depreciation 3.0 - 3.0 2.8 - 2.8 3.0 - 3.0 2.9 - 2.9 11.7 - 11.7 Amortization 0.2 - 0.2 0.2 - 0.2 0.1 - 0.1 0.2 - 0.2 0.7 - 0.7 Expenses 97.9 (0.9) 97.0 99.9 - �� 99.9 99.2 - 99.2 107.6 (6.9) 100.7 404.6 (7.8) 396.8 Earnings from continuing operations before income taxes 14.3 0.9 15.2 13.4 - 13.4 14.3 - 14.3 6.6 6.9 13.5 48.6 7.8 56.4 Provision for income taxes 5.6 0.4 6.0 5.5 - 5.5 5.6 - 5.6 1.2 2.8 4.0 17.9 3.2 21.1 Earnings from continuing operations 8.7 $ 0.5 $ 9.2 $ 7.9 $ - $ 7.9 $ 8.7 $ - $ 8.7 $ 5.4 $ 4.1 $ 9.5 $ 30.7 $ 4.6 $ 35.3 $ Diluted earnings from continuing operations per share 0.09 $ 0.00 $ 0.09 $ 0.08 $ - $ 0.08 $ 0.09 $ - $ 0.09 $ 0.05 $ 0.04 $ 0.09 $ 0.30 $ 0.05 $ 0.35 $ Growth (decline) - revenues -3% -3% -2% -2% -4% -4% -1% -1% -3% -3% Organic growth (decline) in commissions, fees and supplemental commissions 1% 1% 2% 2% -3% -3% -4% -4% -1% -1% Compensation expense ratio 61% 60% 62% 62% 62% 62% 65% 60% 62% 61% Operating expense ratio 24% 23% 24% 24% 23% 23% 26% 26% 24% 24% Pretax profit margin 13% 14% 12% 12% 13% 13% 6% 12% 11% 12% EBITDAC margin 16% 16% 14% 14% 15% 15% 8% 15% 13% 15% Effective tax rate 39% 39% 41% 41% 39% 39% 18% 30% 37% 37% Other Information Diluted weighted average shares outstanding (000s) 98,084 98,084 100,717 100,717 101,550 101,550 102,213 102,213 100,625 100,625 EBITDAC Earnings from continuing operations 8.7 $ 0.5 $ 9.2 $ 7.9 $ - $ 7.9 $ 8.7 $ - $ 8.7 $ 5.4 $ 4.1 $ 9.5 $ 30.7 $ 4.6 $ 35.3 $ Provision for income taxes 5.6 0.4 6.0 5.5 - 5.5 5.6 - 5.6 1.2 2.8 4.0 17.9 3.2 21.1 Depreciation 3.0 - 3.0 2.8 - 2.8 3.0 - 3.0 2.9 - 2.9 11.7 - 11.7 Amortization 0.2 - 0.2 0.2 - 0.2 0.1 - 0.1 0.2 - 0.2 0.7 - 0.7 EBITDAC 17.5 $ 0.9 $ 18.4 $ 16.4 $ - $ 16.4 $ 17.4 $ - $ 17.4 $ 9.7 $ 6.9 $ 16.6 $ 61.0 $ 7.8 $ 68.8 $ See information regarding Non-GAAP Financial Measures on the first page of these exhibits. Gallagher does not intend to present this adjusted information in the future. Arthur J. Gallagher & Co. 2009 Adjusted Risk Management Segment Statement of Earnings (Unaudited - in millions except share and per share data) 1st Q 09 2nd Q 09 3rd Q 09 4th Q 09 YTD 09 |

58 Brokerage & Risk Management Segments Combined Statement of Earnings Reported Adjust- ments Adjusted Reported Adjust- ments Adjusted Reported Adjust- ments Adjusted Reported Adjust- ments Adjusted Reported Adjust- ments Adjusted Commissions 198.0 $ - $ 198.0 $ 249.7 $ - $ 249.7 $ 237.0 $ - $ 237.0 $ 228.2 $ - $ 228.2 $ 912.9 $ - $ 912.9 $ Fees 166.6 - 166.6 186.9 - 186.9 188.9 - 188.9 191.4 - 191.4 733.8 - 733.8 Supplemental and contingent commissions 29.5 (8.2) 21.3 11.8 4.4 16.2 10.3 5.3 15.6 13.4 (0.1) 13.3 65.0 1.4 66.4 Investment income 1.5 - 1.5 1.7 - 1.7 1.4 - 1.4 1.5 - 1.5 6.1 - 6.1 Gains realized on books of business sales 6.1 (6.1) - 3.3 (3.3) - 1.7 (1.7) - 0.5 (0.5) - 11.6 (11.6) - Revenues 401.7 (14.3) 387.4 453.4 1.1 454.5 439.3 3.6 442.9 435.0 (0.6) 434.4 1,729.4 (10.2) 1,719.2 Compensation 250.4 (0.4) 250.0 269.4 (0.6) 268.8 260.2 (0.8) 259.4 281.0 (10.2) 270.8 1,061.0 (12.0) 1,049.0 Operating 77.7 (0.6) 77.1 78.1 (0.3) 77.8 80.7 (0.8) 79.9 91.4 (3.2) 88.2 327.9 (4.9) 323.0 Depreciation 7.7 - 7.7 7.5 - 7.5 7.7 - 7.7 7.6 - 7.6 30.5 - 30.5 Amortization 12.4 - 12.4 14.1 - 14.1 13.8 - 13.8 14.7 - 14.7 55.0 - 55.0 Change in estimated acquisition earnout payables - - - 1.4 - 1.4 1.2 - 1.2 1.5 - 1.5 4.1 - 4.1 Expenses 348.2 (1.0) 347.2 370.5 (0.9) 369.6 363.6 (1.6) 362.0 396.2 (13.4) 382.8 1,478.5 (16.9) 1,461.6 Earnings from continuing operations before income taxes 53.5 (13.3) 40.2 82.9 2.0 84.9 75.7 5.2 80.9 38.8 12.8 51.6 250.9 6.7 257.6 Provision for income taxes 20.7 (5.3) 15.4 33.5 0.8 34.3 30.1 2.1 32.2 12.2 5.2 17.4 96.5 2.8 99.3 Earnings from continuing operations 32.8 $ (8.0) $ 24.8 $ 49.4 $ 1.2 $ 50.6 $ 45.6 $ 3.1 $ 48.7 $ 26.6 $ 7.6 $ 34.2 $ 154.4 $ 3.9 $ 158.3 $ Diluted earnings from continuing operations per share 0.34 $ (0.08) $ 0.25 $ 0.49 $ 0.01 $ 0.50 $ 0.45 $ 0.03 $ 0.48 $ 0.26 $ 0.07 $ 0.33 $ 1.53 $ 0.04 $ 1.57 $ Growth (decline) - revenues 7% 4% 6% 6% 1% 3% 4% 7% 5% 5% Organic growth (decline) in commissions, fees and supplemental commissions -2% -2% 0% 0% -4% -4% -1% -1% -2% -2% Compensation expense ratio 62% 65% 59% 59% 59% 59% 65% 62% 61% 61% Operating expense ratio 19% 20% 17% 17% 18% 18% 21% 20% 19% 19% Pretax profit margin 13% 10% 18% 19% 17% 18% 9% 12% 15% 15% EBITDAC margin 18% 16% 23% 24% 22% 23% 14% 17% 20% 20% Effective tax rate 39% 38% 40% 40% 40% 40% 31% 34% 38% 39% Other Information Diluted weighted average shares outstanding (000s) 98,084 98,084 100,717 100,717 101,550 101,550 102,213 102,213 100,625 100,625 EBITDAC Earnings from continuing operations 32.8 $ (8.0) $ 24.8 $ 49.4 $ 1.2 $ 50.6 $ 45.6 $ 3.1 $ 48.7 $ 26.6 $ 7.6 $ 34.2 $ 154.4 $ 3.9 $ 158.3 $ Provision for income taxes 20.7 (5.3) 15.4 33.5 0.8 34.3 30.1 2.1 32.2 12.2 5.2 17.4 96.5 2.8 99.3 Depreciation 7.7 - 7.7 7.5 - 7.5 7.7 - 7.7 7.6 - 7.6 30.5 - 30.5 Amortization 12.4 - 12.4 14.1 - 14.1 13.8 - 13.8 14.7 - 14.7 55.0 - 55.0 Change in estimated acquisition earnout payables - - - 1.4 - 1.4 1.2 - 1.2 1.5 - 1.5 4.1 - 4.1 EBITDAC 73.6 $ (13.3) $ 60.3 $ 105.9 $ 2.0 $ 107.9 $ 98.4 $ 5.2 $ 103.6 $ 62.6 $ 12.8 $ 75.4 $ 340.5 $ 6.7 $ 347.2 $ See information regarding Non-GAAP Financial Measures on the first page of these exhibits. Gallagher does not intend to present this adjusted information in the future. Arthur J. Gallagher & Co. 2009 Adjusted Brokerage & Risk Management Segments Combined Statement of Earnings (Unaudited - in millions except share and per share data) 1st Q 09 2nd Q 09 3rd Q 09 4th Q 09 YTD 09 |

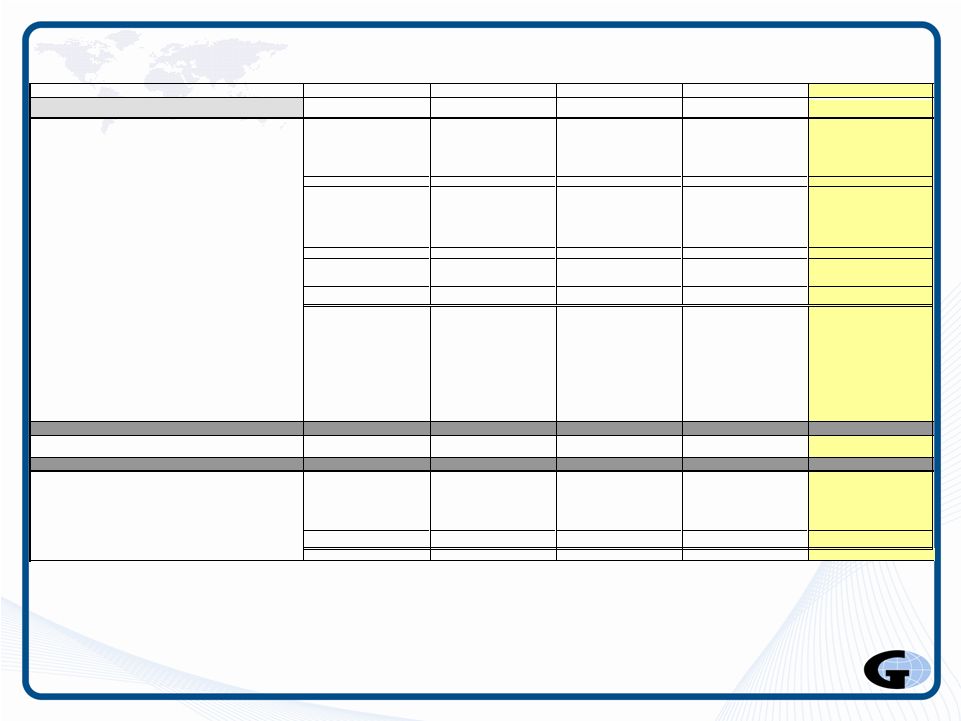

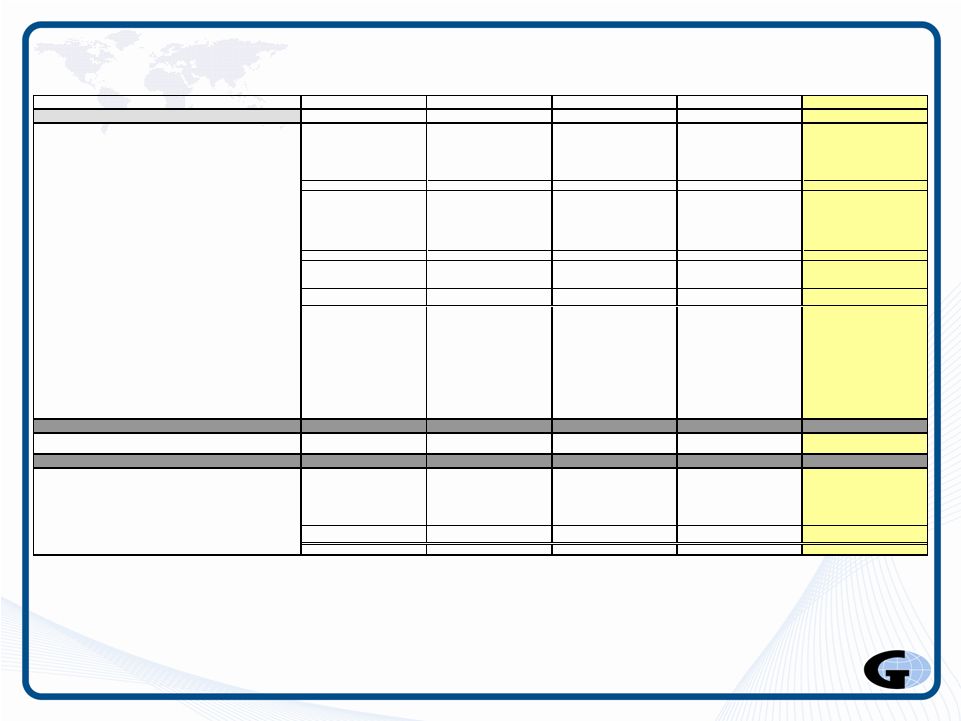

59 Brokerage Segment Statement of Earnings Reported Adjust- ments Adjusted Reported Adjust- ments Adjusted Reported Adjust- ments Adjusted Reported Adjust- ments Adjusted Reported Adjust- ments Adjusted Commissions 204.2 $ - $ 204.2 $ 257.0 $ - $ 257.0 $ 251.9 $ - $ 251.9 $ 244.2 $ - $ 244.2 $ 957.3 $ - $ 957.3 $ Fees 54.9 - 54.9 68.5 - 68.5 74.8 - 74.8 76.7 - 76.7 274.9 - 274.9 Supplemental and contingent commissions 43.4 (14.7) 28.7 19.3 - 19.3 19.7 - 19.7 15.2 - 15.2 97.6 (14.7) 82.9 Investment income 1.0 - 1.0 1.6 - 1.6 1.1 - 1.1 1.2 - 1.2 4.9 - 4.9 Gains realized on books of business sales 0.9 (0.9) - 0.6 (0.6) - 3.8 (3.8) - 0.6 (0.6) - 5.9 (5.9) - Revenues 304.4 (15.6) 288.8 347.0 (0.6) 346.4 351.3 (3.8) 347.5 337.9 (0.6) 337.3 1,340.6 (20.6) 1,320.0 Compensation 191.5 (0.4) 191.1 206.7 (3.2) 203.5 205.0 (1.2) 203.8 213.9 (1.5) 212.4 817.1 (6.3) 810.8 Operating 53.3 (0.1) 53.2 57.0 (4.0) 53.0 57.1 - 57.1 56.2 - 56.2 223.6 (4.1) 219.5 Depreciation 4.6 - 4.6 4.9 - 4.9 5.1 - 5.1 4.9 - 4.9 19.5 - 19.5 Amortization 13.7 - 13.7 16.5 (2.3) 14.2 14.4 - 14.4 15.2 - 15.2 59.8 (2.3) 57.5 Change in estimated acquisition earnout payables 1.9 (0.5) 1.4 (0.9) 2.5 1.6 (3.9) 5.6 1.7 0.3 1.2 1.5 (2.6) 8.8 6.2 Expenses 265.0 (1.0) 264.0 284.2 (7.0) 277.2 277.7 4.4 282.1 290.5 (0.3) 290.2 1,117.4 (3.9) 1,113.5 Earnings from continuing operations before income taxes 39.4 (14.6) 24.8 62.8 6.4 69.2 73.6 (8.2) 65.4 47.4 (0.3) 47.1 223.2 (16.7) 206.5 Provision for income taxes 15.9 (5.8) 10.1 25.4 2.6 28.0 29.4 (3.3) 26.1 17.0 (0.1) 16.9 87.7 (6.6) 81.1 Earnings from continuing operations 23.5 $ (8.8) $ 14.7 $ 37.4 $ 3.8 $ 41.2 $ 44.2 $ (4.9) $ 39.3 $ 30.4 $ (0.2) $ 30.2 $ 135.5 $ (10.1) $ 125.4 $ Diluted earnings from continuing operations per share 0.23 $ (0.09) $ 0.14 $ 0.36 $ 0.04 $ 0.39 $ 0.42 $ (0.05) $ 0.37 $ 0.28 $ (0.00) $ 0.28 $ 1.29 $ (0.10) $ 1.19 $ Growth (decline) - revenues 5% 5% 2% 2% 3% 5% 5% 5% 5% 4% Organic growth (decline) in commissions, fees and supplemental commissions -3% -3% -3% -3% 0% 0% 0% 0% -2% -2% Compensation expense ratio 63% 66% 60% 59% 58% 59% 63% 63% 61% 61% Operating expense ratio 18% 18% 16% 15% 16% 16% 17% 17% 17% 17% Pretax profit margin 13% 9% 18% 20% 21% 19% 14% 14% 17% 16% EBITDAC margin 20% 15% 24% 26% 25% 25% 20% 20% 22% 22% Effective tax rate 40% 41% 40% 40% 40% 40% 36% 36% 39% 39% Other Information Diluted weighted average shares outstanding (000s) 102,936 102,936 104,648 104,648 105,736 105,736 107,327 107,327 105,099 105,099 EBITDAC Earnings from continuing operations 23.5 $ (8.8) $ 14.7 $ 37.4 $ 3.8 $ 41.2 $ 44.2 $ (4.9) $ 39.3 $ 30.4 $ (0.2) $ 30.2 $ 135.5 $ (10.1) $ 125.4 $ Provision for income taxes 15.9 (5.8) 10.1 25.4 2.6 28.0 29.4 (3.3) 26.1 17.0 (0.1) 16.9 87.7 (6.6) 81.1 Depreciation 4.6 - 4.6 4.9 - 4.9 5.1 - 5.1 4.9 - 4.9 19.5 - 19.5 Amortization 13.7 - 13.7 16.5 (2.3) 14.2 14.4 - 14.4 15.2 - 15.2 59.8 (2.3) 57.5 Change in estimated acquisition earnout payables 1.9 (0.5) 1.4 (0.9) 2.5 1.6 (3.9) 5.6 1.7 0.3 1.2 1.5 (2.6) 8.8 6.2 EBITDAC 59.6 $ (15.1) $ 44.5 $ 83.3 $ 6.6 $ 89.9 $ 89.2 $ (2.6) $ 86.6 $ 67.8 $ 0.9 $ 68.7 $ 299.9 $ (10.2) $ 289.7 $ See information regarding Non-GAAP Financial Measures on the first page of these exhibits. Gallagher does not intend to present this adjusted information in the future. Arthur J. Gallagher & Co. 2010 Adjusted Brokerage Segment Statement of Earnings (Unaudited - in millions except share and per share data) YTD 10 4th Q 10 2nd Q 10 3rd Q 10 1st Q 10 |

60 Risk Management Segment Statement of Earnings Reported Adjust- ments Adjusted Reported Adjust- ments Adjusted Reported Adjust- ments Adjusted Reported Adjust- ments Adjusted Reported Adjust- ments Adjusted Fees 110.1 $ - $ 110.1 $ 110.9 $ - $ 110.9 $ 110.9 $ - $ 110.9 $ 128.2 $ - $ 128.2 $ 460.1 $ - $ 460.1 $ Investment income 0.4 - 0.4 0.5 - 0.5 0.5 - 0.5 0.6 - 0.6 2.0 - 2.0 Revenues 110.5 - 110.5 111.4 - 111.4 111.4 - 111.4 128.8 - 128.8 462.1 - 462.1 Compensation 67.7 - 67.7 66.7 (0.2) 66.5 72.5 (3.6) 68.9 81.1 (2.9) 78.2 288.0 (6.7) 281.3 Operating 24.2 - 24.2 28.2 (0.2) 28.0 24.9 0.7 25.6 31.8 (0.8) 31.0 109.1 (0.3) �� 108.8 Depreciation 3.0 - 3.0 3.0 - 3.0 3.1 - 3.1 3.3 - 3.3 12.4 - 12.4 Amortization 0.2 - 0.2 0.1 - 0.1 0.1 - 0.1 0.6 - 0.6 1.0 - 1.0 Expenses 95.1 - 95.1 98.0 (0.4) 97.6 100.6 (2.9) 97.7 116.8 (3.7) 113.1 410.5 (7.0) 403.5 Earnings from continuing operations before income taxes 15.4 - 15.4 13.4 0.4 13.8 10.8 2.9 13.7 12.0 3.7 15.7 51.6 7.0 58.6 Provision for income taxes 6.2 - 6.2 5.3 0.2 5.5 4.4 1.2 5.6 4.4 1.5 5.9 20.3 2.9 23.2 Earnings from continuing operations 9.2 $ - $ 9.2 $ 8.1 $ 0.2 $ 8.3 $ 6.4 $ 1.7 $ 8.1 $ 7.6 $ 2.2 $ 9.8 $ 31.3 $ 4.1 $ 35.4 $ Diluted earnings from continuing operations per share 0.09 $ - $ 0.09 $ 0.08 $ 0.00 $ 0.08 $ 0.06 $ 0.02 $ 0.08 $ 0.07 $ 0.02 $ 0.09 $ 0.30 $ 0.04 $ 0.34 $ Growth (decline) - revenues -2% -2% -2% -2% -2% -2% 13% 13% 2% 2% Organic growth (decline) in commissions, fees and supplemental commissions -5% -5% -3% -3% -3% -3% 0% 0% -3% -3% Compensation expense ratio 61% 61% 60% 60% 65% 62% 63% 61% 62% 61% Operating expense ratio 22% 22% 25% 25% 22% 23% 25% 24% 24% 24% Pretax profit margin 14% 14% 12% 12% 10% 12% 9% 12% 11% 13% EBITDAC margin 17% 17% 15% 15% 13% 15% 12% 15% 14% 16% Effective tax rate 40% 40% 40% 40% 41% 41% 37% 38% 39% 40% Other Information Diluted weighted average shares outstanding (000s) 102,936 102,936 104,648 104,648 105,736 105,736 107,327 107,327 105,099 105,099 EBITDAC Earnings from continuing operations 9.2 $ - $ 9.2 $ 8.1 $ 0.2 $ 8.3 $ 6.4 $ 1.7 $ 8.1 $ 7.6 $ 2.2 $ 9.8 $ 31.3 $ 4.1 $ 35.4 $ Provision for income taxes 6.2 - 6.2 5.3 0.2 5.5 4.4 1.2 5.6 4.4 1.5 5.9 20.3 2.9 23.2 Depreciation 3.0 - 3.0 3.0 - 3.0 3.1 - 3.1 3.3 - 3.3 12.4 - 12.4 Amortization 0.2 - 0.2 0.1 - 0.1 0.1 - 0.1 0.6 - 0.6 1.0 - 1.0 EBITDAC 18.6 $ - $ 18.6 $ 16.5 $ 0.4 $ 16.9 $ 14.0 $ 2.9 $ 16.9 $ 15.9 $ 3.7 $ 19.6 $ 65.0 $ 7.0 $ 72.0 $ See information regarding Non-GAAP Financial Measures on the first page of these exhibits. Gallagher does not intend to present this adjusted information in the future. Arthur J. Gallagher & Co. 2010 Adjusted Risk Management Statement of Earnings (Unaudited - in millions except share and per share data) 1st Q 10 2nd Q 10 3rd Q 10 4th Q 10 YTD 10 |

61 Brokerage & Risk Management Segments Combined Statement of Earnings Reported Adjust- ments Adjusted Reported Adjust- ments Adjusted Reported Adjust- ments Adjusted Reported Adjust- ments Adjusted Reported Adjust- ments Adjusted Commissions 204.2 $ - $ 204.2 $ 257.0 $ - $ 257.0 $ 251.9 $ - $ 251.9 $ 244.2 $ - $ 244.2 $ 957.3 $ - $ 957.3 $ Fees 165.0 - 165.0 179.4 - 179.4 185.7 - 185.7 204.9 - 204.9 735.0 - 735.0 Supplemental and contingent commissions 43.4 (14.7) 28.7 19.3 - 19.3 19.7 - 19.7 15.2 - 15.2 97.6 (14.7) 82.9 Investment income 1.4 - 1.4 2.1 - 2.1 1.6 - 1.6 1.8 - 1.8 6.9 - 6.9 Gains realized on books of business sales 0.9 (0.9) - 0.6 (0.6) - 3.8 (3.8) - 0.6 (0.6) - 5.9 (5.9) - Revenues 414.9 (15.6) 399.3 458.4 (0.6) 457.8 462.7 (3.8) 458.9 466.7 (0.6) 466.1 1,802.7 (20.6) 1,782.1 Compensation 259.2 (0.4) 258.8 273.4 (3.4) 270.0 277.5 (4.8) 272.7 295.0 (4.4) 290.6 1,105.1 (13.0) 1,092.1 Operating 77.5 (0.1) 77.4 85.2 (4.2) 81.0 82.0 0.7 82.7 88.0 (0.8) 87.2 332.7 (4.4) 328.3 Depreciation 7.6 - 7.6 7.9 - 7.9 8.2 - 8.2 8.2 - 8.2 31.9 - 31.9 Amortization 13.9 - 13.9 16.6 (2.3) 14.3 14.5 - 14.5 15.8 - 15.8 60.8 (2.3) 58.5 Change in estimated acquisition earnout payables 1.9 (0.5) 1.4 (0.9) 2.5 1.6 (3.9) 5.6 1.7 0.3 1.2 1.5 (2.6) 8.8 6.2 Expenses 360.1 (1.0) 359.1 382.2 (7.4) 374.8 378.3 1.5 379.8 407.3 (4.0) 403.3 1,527.9 (10.9) 1,517.0 Earnings from continuing operations before income taxes 54.8 (14.6) 40.2 76.2 6.8 83.0 84.4 (5.3) 79.1 59.4 3.4 62.8 274.8 (9.7) 265.1 Provision for income taxes 22.1 (5.8) 16.3 30.7 2.8 33.5 33.8 (2.1) 31.7 21.4 1.4 22.8 108.0 (3.7) 104.3 Earnings from continuing operations 32.7 $ (8.8) $ 23.9 $ 45.5 $ 4.0 $ 49.5 $ 50.6 $ (3.2) $ 47.4 $ 38.0 $ 2.0 $ 40.0 $ 166.8 $ (6.0) $ 160.8 $ Diluted earnings from continuing operations per share 0.32 $ (0.09) $ 0.23 $ 0.44 $ 0.04 $ 0.47 $ 0.48 $ (0.03) $ 0.45 $ 0.35 $ 0.02 $ 0.37 $ 1.59 $ (0.06) $ 1.53 $ Growth (decline) - revenues 3% 3% 1% 1% 2% 4% 6% 7% 4% 4% Organic growth (decline) in commissions, fees and supplemental commissions -4% -4% -3% -3% -1% -1% 0% 0% -2% -2% Compensation expense ratio 62% 65% 60% 59% 60% 59% 63% 62% 61% 61% Operating expense ratio 19% 19% 19% 18% 18% 18% 19% 19% 18% 18% Pretax profit margin 13% 10% 17% 18% 18% 17% 13% 13% 15% 15% EBITDAC margin 19% 16% 22% 23% 22% 23% 18% 19% 20% 20% Effective tax rate 40% 41% 40% 40% 40% 40% 36% 36% 39% 39% Other Information Diluted weighted average shares outstanding (000s) 102,936 102,936 104,648 104,648 105,736 105,736 107,327 107,327 105,099 105,099 EBITDAC Earnings from continuing operations 32.7 $ (8.8) $ 23.9 $ 45.5 $ 4.0 $ 49.5 $ 50.6 $ (3.2) $ 47.4 $ 38.0 $ 2.0 $ 40.0 $ 166.8 $ (6.0) $ 160.8 $ Provision for income taxes 22.1 (5.8) 16.3 30.7 2.8 33.5 33.8 (2.1) 31.7 21.4 1.4 22.8 108.0 (3.7) 104.3 Depreciation 7.6 - 7.6 7.9 - 7.9 8.2 - 8.2 8.2 - 8.2 31.9 - 31.9 Amortization 13.9 - 13.9 16.6 (2.3) 14.3 14.5 - 14.5 15.8 - 15.8 60.8 (2.3) 58.5 Change in estimated acquisition earnout payables 1.9 (0.5) 1.4 (0.9) 2.5 1.6 (3.9) 5.6 1.7 0.3 1.2 1.5 (2.6) 8.8 6.2 EBITDAC 78.2 $ (15.1) $ 63.1 $ 99.8 $ 7.0 $ 106.8 $ 103.2 $ 0.3 $ 103.5 $ 83.7 $ 4.6 $ 88.3 $ 364.9 $ (3.2) $ 361.7 $ See information regarding Non-GAAP Financial Measures on the first page of these exhibits. Gallagher does not intend to present this adjusted information in the future. Arthur J. Gallagher & Co. 2010 Adjusted Brokerage & Risk Management Segments Combined Statement of Earnings (Unaudited - in millions except share and per share data) 1st Q 10 2nd Q 10 3rd Q 10 4th Q 10 YTD 10 |

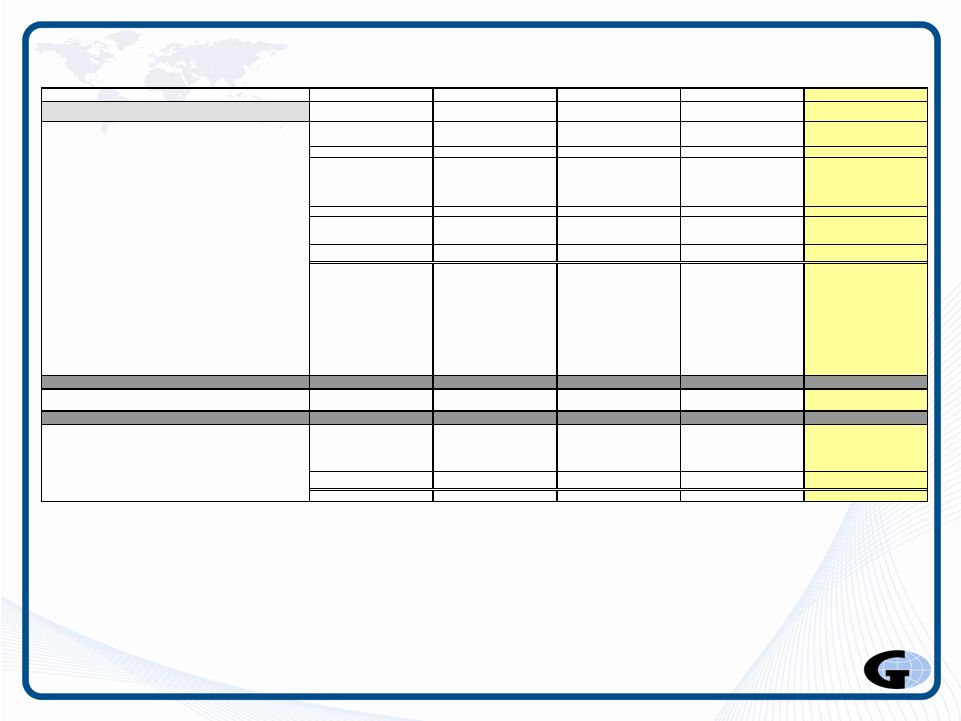

62 Brokerage Segment Statement of Earnings 2008 2009 2010 2008 2009 2010 2008 2009 2010 2008 2009 2010 2008 2009 2010 Commissions 183.4 $ 198.0 $ 204.2 $ 232.6 $ 249.7 $ 257.0 $ 226.8 $ 237.0 $ 251.9 $ 211.4 $ 228.2 $ 244.2 $ 854.2 $ 912.9 $ 957.3 $ Fees 50.4 54.8 54.9 63.5 73.9 68.5 66.0 75.8 74.8 70.3 77.6 76.7 250.2 282.1 274.9 Supplemental and contingent commissions 17.9 29.5 43.4 8.3 11.8 19.3 12.3 10.3 19.7 7.2 13.4 15.2 45.7 65.0 97.6 Investment income 4.6 1.1 1.0 4.3 1.4 1.6 3.6 1.0 1.1 1.4 1.1 1.2 13.9 4.6 4.9 Gains realized on books of business sales 1.7 6.1 0.9 3.5 3.3 0.6 5.7 1.7 3.8 12.9 0.5 0.6 23.8 11.6 5.9 Revenues 258.0 289.5 304.4 312.2 340.1 347.0 314.4 325.8 351.3 303.2 320.8 337.9 1,187.8 1,276.2 1,340.6 Compensation 167.1 182.3 191.5 175.8 199.5 206.7 179.6 190.3 205.0 184.9 206.6 213.9 707.4 778.7 817.1 Operating 58.7 51.1 53.3 56.0 51.1 57.0 60.5 54.5 57.1 72.2 61.3 56.2 247.4 218.0 223.6 Depreciation 3.9 4.7 4.6 4.7 4.7 4.9 4.7 4.7 5.1 4.9 4.7 4.9 18.2 18.8 19.5 Amortization 8.8 12.2 13.7 10.1 13.9 16.5 10.1 13.7 14.4 14.2 14.5 15.2 43.2 54.3 59.8 Change in estimated acquisition earnout payables - - 1.9 - 1.4 (0.9) - 1.2 (3.9) - 1.5 0.3 - 4.1 (2.6) Expenses 238.5 250.3 265.0 246.6 270.6 284.2 254.9 264.4 277.7 276.2 288.6 290.5 1,016.2 1,073.9 1,117.4 Earnings from continuing operations before income taxes 19.5 39.2 39.4 65.6 69.5 62.8 59.5 61.4 73.6 27.0 32.2 47.4 171.6 202.3 223.2 Provision for income taxes 7.6 15.1 15.9 26.4 28.0 25.4 23.4 24.5 29.4 10.0 11.0 17.0 67.4 78.6 87.7 Earnings from continuing operations 11.9 $ 24.1 $ 23.5 $ 39.2 $ 41.5 $ 37.4 $ 36.1 $ 36.9 $ 44.2 $ 17.0 $ 21.2 $ 30.4 $ 104.2 $ 123.7 $ 135.5 $ Diluted earnings from continuing operations per share 0.13 $ 0.25 $ 0.23 $ 0.42 $ 0.41 $ 0.36 $ 0.38 $ 0.36 $ 0.42 $ 0.18 $ 0.21 $ 0.28 $ 1.11 $ 1.23 $ 1.29 $ Growth (decline) - revenues 11% 12% 5% 6% 9% 2% 8% 4% 3% 2% 6% 5% 7% 7% 5% Organic growth (decline) in commissions, fees and supplemental commissions 2% -4% -3% 0% -1% -3% 1% -4% 0% -4% 0% 0% 0% -2% -2% Compensation expense ratio 65% 63% 63% 56% 59% 60% 57% 58% 58% 61% 64% 63% 60% 61% 61% Operating expense ratio 23% 18% 18% 18% 15% 16% 19% 17% 16% 24% 19% 17% 21% 17% 17% Pretax profit margin 8% 14% 13% 21% 20% 18% 19% 19% 21% 9% 10% 14% 14% 16% 17% EBITDAC margin 12% 19% 20% 26% 26% 24% 24% 25% 25% 15% 16% 20% 20% 22% 22% Effective tax rate 39% 39% 40% 40% 40% 40% 39% 40% 40% 37% 34% 36% 39% 39% 39% Other Information Diluted weighted average shares outstanding (000s) 92,898 98,084 102,936 93,545 100,717 104,648 94,556 101,550 105,736 95,900 102,213 107,327 94,179 100,625 105,099 EBITDAC Earnings from continuing operations 11.9 $ 24.1 $ 23.5 $ 39.2 $ 41.5 $ 37.4 $ 36.1 $ 36.9 $ 44.2 $ 17.0 $ 21.2 $ 30.4 $ 104.2 $ 123.7 $ 135.5 $ Provision for income taxes 7.6 15.1 15.9 26.4 28.0 25.4 23.4 24.5 29.4 10.0 11.0 17.0 67.4 78.6 87.7 Depreciation 3.9 4.7 4.6 4.7 4.7 4.9 4.7 4.7 5.1 4.9 4.7 4.9 18.2 18.8 19.5 Amortization 8.8 12.2 13.7 10.1 13.9 16.5 10.1 13.7 14.4 14.2 14.5 15.2 43.2 54.3 59.8 Change in estimated acquisition earnout payables - - 1.9 - 1.4 (0.9) - 1.2 (3.9) - 1.5 0.3 - 4.1 (2.6) EBITDAC 32.2 $ 56.1 $ 59.6 $ 80.4 $ 89.5 $ 83.3 $ 74.3 $ 81.0 $ 89.2 $ 46.1 $ 52.9 $ 67.8 $ 233.0 $ 279.5 $ 299.9 $ See information regarding Non-GAAP Financial Measures on the first page of these exhibits. Gallagher does not intend to present this adjusted information in the future. The information on this page is being presented to highlight the seasonality of the operating results of the Brokerage segment. Arthur J. Gallagher & Co. Reported Brokerage Segment Statement of Earnings - Quarter over Quarter for 2008 to 2010 (Unaudited - in millions except share and per share data) Q1 Reported Q2 Reported Q3 Reported Q4 Reported Full Year Reported |

63 Brokerage Segment Statement of Earnings 2008 2009 2010 2008 2009 2010 2008 2009 2010 2008 2009 2010 2008 2009 2010 Commissions 183.4 $ 198.0 $ 204.2 $ 232.6 $ 249.7 $ 257.0 $ 226.8 $ 237.0 $ 251.9 $ 211.4 $ 228.2 $ 244.2 $ 854.2 $ 912.9 $ 957.3 $ Fees 50.4 54.8 54.9 63.5 73.9 68.5 66.0 75.8 74.8 70.3 77.6 76.7 250.2 282.1 274.9 Supplemental and contingent commissions 16.3 21.3 28.7 11.3 16.2 19.3 14.7 15.6 19.7 9.5 13.3 15.2 51.8 66.4 82.9 Investment income 4.6 1.1 1.0 4.3 1.4 1.6 3.6 1.0 1.1 1.4 1.1 1.2 13.9 4.6 4.9 Gains realized on books of business sales - - - - - - - - - - - - - - - Revenues 254.7 275.2 288.8 311.7 341.2 346.4 311.1 329.4 347.5 292.6 320.2 337.3 1,170.1 1,266.0 1,320.0 Compensation 167.0 182.2 191.1 174.9 198.9 203.5 179.6 189.5 203.8 182.0 202.6 212.4 703.5 773.2 810.8 Operating 58.7 51.1 53.2 56.0 50.8 53.0 59.2 53.7 57.1 69.9 58.8 56.2 243.8 214.4 219.5 Depreciation 3.9 4.7 4.6 4.7 4.7 4.9 4.7 4.7 5.1 4.9 4.7 4.9 18.2 18.8 19.5 Amortization 8.8 12.2 13.7 10.1 13.9 14.2 10.1 13.7 14.4 11.5 14.5 15.2 40.5 54.3 57.5 Change in estimated acquisition earnout payables - - 1.4 - 1.4 1.6 - 1.2 1.7 - 1.5 1.5 - 4.1 6.2 Expenses 238.4 250.2 264.0 245.7 269.7 277.2 253.6 262.8 282.1 268.3 282.1 290.2 1,006.0 1,064.8 1,113.5 Earnings from continuing operations before income taxes 16.3 25.0 24.8 66.0 71.5 69.2 57.5 66.6 65.4 24.3 38.1 47.1 164.1 201.2 206.5 Provision for income taxes 6.3 9.4 10.1 26.6 28.8 28.0 22.6 26.6 26.1 8.9 13.4 16.9 64.4 78.2 81.1 Earnings from continuing operations 10.0 $ 15.6 $ 14.7 $ 39.4 $ 42.7 $ 41.2 $ 34.9 $ 40.0 $ 39.3 $ 15.4 $ 24.7 $ 30.2 $ 99.7 $ 123.0 $ 125.4 $ Diluted earnings from continuing operations per share 0.11 $ 0.16 $ 0.14 $ 0.42 $ 0.42 $ 0.39 $ 0.37 $ 0.39 $ 0.37 $ 0.16 $ 0.24 $ 0.28 $ 1.06 $ 1.22 $ 1.19 $ Growth (decline) - revenues 9% 8% 5% 6% 9% 2% 7% 6% 5% -1% 9% 5% 5% 8% 4% Organic growth (decline) in commissions, fees and supplemental commissions 2% -4% -3% 0% -1% -3% 1% -4% 0% -4% 0% 0% 0% -2% -2% Compensation expense ratio 66% 66% 66% 56% 58% 59% 58% 58% 59% 62% 63% 63% 60% 61% 61% Operating expense ratio 23% 19% 18% 18% 15% 15% 19% 16% 16% 24% 18% 17% 21% 17% 17% Pretax profit margin 6% 9% 9% 21% 21% 20% 18% 20% 19% 8% 12% 14% 14% 16% 16% EBITDAC margin 11% 15% 15% 26% 27% 26% 23% 26% 25% 14% 18% 20% 19% 22% 22% Effective tax rate 39% 38% 41% 40% 40% 40% 39% 40% 40% 37% 35% 36% 39% 39% 39% Other Information Diluted weighted average shares outstanding (000s) 92,898 98,084 102,936 93,545 100,717 104,648 94,556 101,550 105,736 95,900 102,213 107,327 94,179 100,625 105,099 EBITDAC Earnings from continuing operations 10.0 $ 15.6 $ 14.7 $ 39.4 $ 42.7 $ 41.2 $ 34.9 $ 40.0 $ 39.3 $ 15.4 $ 24.7 $ 30.2 $ 99.7 $ 123.0 $ 125.4 $ Provision for income taxes 6.3 9.4 10.1 26.6 28.8 28.0 22.6 26.6 26.1 8.9 13.4 16.9 64.4 78.2 81.1 Depreciation 3.9 4.7 4.6 4.7 4.7 4.9 4.7 4.7 5.1 4.9 4.7 4.9 18.2 18.8 19.5 Amortization 8.8 12.2 13.7 10.1 13.9 14.2 10.1 13.7 14.4 11.5 14.5 15.2 40.5 54.3 57.5 Change in estimated acquisition earnout payables - - 1.4 - 1.4 1.6 - 1.2 1.7 - 1.5 1.5 - 4.1 6.2 EBITDAC 29.0 $ 41.9 $ 44.5 $ 80.8 $ 91.5 $ 89.9 $ 72.3 $ 86.2 $ 86.6 $ 40.7 $ 58.8 $ 68.7 $ 222.8 $ 278.4 $ 289.7 $ See information regarding Non-GAAP Financial Measures on the first page of these exhibits. Gallagher does not intend to present this adjusted information in the future. The information on this page is being presented to highlight the seasonality of the operating results of the Brokerage segment. Arthur J. Gallagher & Co. Adjusted Brokerage Segment Statement of Earnings - Quarter over Quarter for 2008 to 2010 (Unaudited - in millions except share and per share data) Q1 Adjusted Q2 Adjusted Q3 Adjusted Q4 Adjusted Full Year Adjusted |

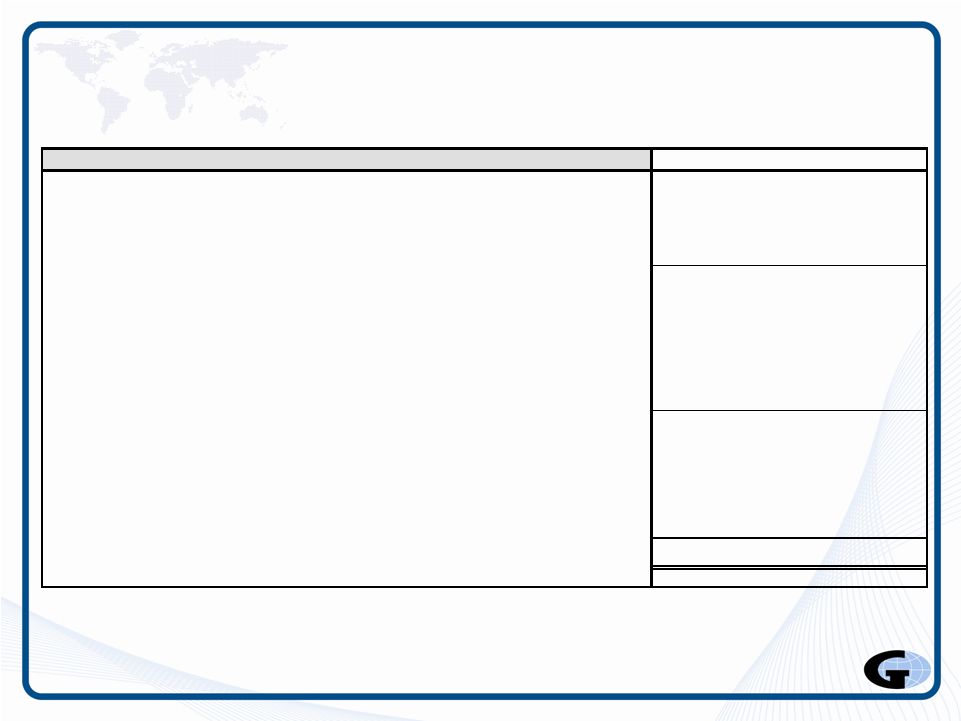

64 2008 2009 2010 Earnings from continuing operations - Brokerage & Risk Management Segments Combined 132.4 $ 154.4 $ 166.8 $ Provision for income taxes 85.1 96.5 108.0 Depreciation 29.8 30.5 31.9 Amortization 43.7 55.0 60.8 Change in estimated acquisition earnout payables - 4.1 (2.6) EBITDAC - Brokerage & Risk Management Segments Combined 291.0 340.5 364.9 Gains from books of business sales and other (23.8) (11.6) (5.9) Net supplemental commission timing 6.1 1.4 (14.7) Workforce related charges 3.9 12.0 6.8 Lease termination related charges 4.2 2.7 0.7 Litigation settlements - 2.2 6.3 GAB Robins integration costs - - 3.6 Adjusted EBITDAC - Brokerage & Risk Management Segments Combined 281.4 347.2 361.7 Stock compensation expense 18.3 16.1 15.6 Capital expenditures (32.0) (23.5) (25.4) Interest and banking costs (28.9) (29.5) (36.4) Corporate and acquisition costs (5.4) (6.2) (6.9) Income taxes paid (40.1) (27.7) (37.6) Cash generation 193.3 $ 276.4 $ 271.0 $ See information regarding Non-GAAP Financial Measures on the first page of these exhibits. Arthur J. Gallagher & Co. Cash Generation for 2008 to 2010 (Unaudited - in millions ) |