UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

| þ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | For the fiscal year ended September 30, 2010 |

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | For the transition period from to |

Commission file number 0-261

ALICO, INC.

(Exact name of registrant as specified in its charter)

| | |

| Florida | | 59-0906081 |

(State or other jurisdiction of incorporation or organization) | | (IRS Employer identification number) |

| |

| P.O. Box 338, La Belle, Florida | | 33975 |

| (Address of principal executive offices) | | (Zip code) |

Registrant’s telephone number including area code (863) 675-2966

SECURITIES REGISTERED PURSUANT TO SECTION 12(b) OF THE ACT:

| | |

Title of class: | | Name of each exchange on which registered: |

| COMMON CAPITAL STOCK, $1.00 Par value, Non-cumulative | | NASDAQ |

SECURITIES REGISTERED PURSUANT TO SECTION 12(g) OF THE ACT:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as define in Rule 405 of the Securities Act. Yes ¨ No þ

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that such registrant was required to file such reports), and (2) has been subject to such filings requirements for the past 90 days. Yes þ No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨. No ¨.

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 or Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this form 10-K. Yes ¨ No þ

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definition of “accelerated filer” “large accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act (Check one):

| | | | | | |

| Large accelerated filer | | ¨ | | Accelerated filer | | þ |

| | | |

| Non-accelerated filer | | ¨ | | Smaller Reporting Company | | ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act.) Yes ¨ No þ

The aggregate market value of the voting and nonvoting common equity held by non-affiliates based on the closing price, as quoted on the NASDAQ as of March 31, 2010 (the last business day of Alico’s most recently completed second fiscal quarter) was $89,814,502. There were 7,370,810 shares of stock outstanding at December 13, 2010.

Documents Incorporated by Reference:

Portions of the Proxy Statement of Registrant to be dated on or before January 14, 2011 are incorporated by reference in Part III of this report.

ALICO, INC.

FORM 10-K

For the year ended September 30, 2010

PART I

Alico, Inc. (the “Company”), which was formed February 29, 1960 as a spin-off of the Atlantic Coast Line Railroad Company, is a land management company operating in Central and Southwest Florida. Alico’s primary asset is 139,607 acres of land located in Collier, Glades, Hendry, Lee and Polk Counties. (See Item 2 for location and acreage by current primary use). Alico is involved in a variety of agribusiness pursuits in addition to land leasing and rentals, rock and sand mining and real estate sales activities.

Alico’s land is managed for multiple uses wherever possible. For example, cattle ranching, forestry and land leased for grazing, recreation and oil exploration utilize the same acreage in some instances.

The relative contributions of each operation to the operating revenue, profit and total assets of Alico during the past three years (all revenues are from external customers within the United States) are discussed under the caption “Reportable Segment Information” and in Note 10 to the Consolidated Financial Statements.

Alico’s retail land sales and development business is handled solely through its wholly owned subsidiary, Alico Land Development, Inc. (formerly known as Saddlebag Lake Resorts, Inc.). However, Alico has from time to time directly sold properties which, in the judgment of Management and the Board of Directors, were surplus to Alico’s primary operations. Additionally, Alico’s wholly owned subsidiary, Alico-Agri, Ltd., has also engaged in bulk land sales. Alico, through its subsidiary Alico Land Development, Inc., has recently taken actions to enhance the planning and strategic positioning of all Company owned land. These actions include seeking entitlement of Alico’s land assets in order to preserve rights should Alico choose to develop property in the future.

Subsidiary Operations

Alico has four wholly owned subsidiaries: Alico-Agri, Ltd. (“Alico-Agri”), Alico Plant World, LLC (“Plant World”), Bowen Brothers Fruit LLC (“Bowen”), and Alico Land Development, Inc. (“ALDI”), formerly known as Saddlebag Lake Resort, Inc. The Company’s Agri-Insurance Co., Ltd (“Agri”) subsidiary was liquidated in September 2010. Agri’s 99% partnership interest in Alico-Agri was transferred to ALDI as part of the liquidation.

Alico-Agri

Alico-Agri, Ltd. was formed during fiscal year 2003 to manage the Company’s real estate holdings in Lee County, Florida. The properties in Lee County, Florida surrounding Florida Gulf Coast University, and the related contracts along with cash of $1.2 million were transferred to Alico-Agri for partnership interests. Alico, Inc. holds a 1% partnership interest and acts as the managing partner, with the remaining 99% partnership interest owned by ALDI.

Plant World

In September 2004, Alico, through Alico-Agri, purchased the assets of La Belle Plant World, Inc., a wholesale grower and shipper of vegetable transplants to commercial farmers and commenced operations as Alico Plant World, LLC. Due to ongoing losses sustained by Plant World, Alico discontinued the transplant operations in June 2008 and is currently leasing Plant World’s facilities to an outside nursery operation.

1

Bowen

Bowen provides harvesting, hauling and marketing services to Alico and other outside citrus growers in the state of Florida.

ALDI

ALDI has been active in the subdivision, development and sale of real estate since its inception in 1971. ALDI has developed and sold two subdivisions near Frostproof, Florida. Through its ALDI subsidiary, Alico has recently taken actions to enhance the planning and strategic positioning of all Company owned land. These actions include seeking entitlement of Alico’s land assets in order to preserve rights should Alico choose to develop property in the future. During the fiscal years ended September 30, 2010, 2009 and 2008, the Company spent $1.3 million, $1.2 million and $2.8 million toward these efforts.

The financial results of the operations of these subsidiaries are consolidated with those of Alico. Intercompany activities and balances are eliminated in consolidation. (See Note 1 to the Consolidated Financial Statements.)

Segments

Alico engages in a variety of agricultural pursuits as well as other land management activities. For information concerning the revenues, gross profits and assets attributable to each business segment, also refer to Note 10 of the Consolidated Financial Statements.

Revenues by Segment for the fiscal years ended September 30 (dollars in thousands)

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | 2010 | | | 2009 | | | 2008 | |

| | | Total | | | % | | | Total | | | % | | | Total | | | % | |

Bowen | | | 28,896 | | | | 36 | % | | | 27,998 | | | | 31 | % | | | 45,499 | | | | 39 | % |

Citrus groves | | | 36,469 | | | | 46 | % | | | 36,030 | | | | 40 | % | | | 41,167 | | | | 36 | % |

Sugarcane | | | 4,097 | | | | 5 | % | | | 7,624 | | | | 9 | % | | | 9,671 | | | | 8 | % |

Cattle | | | 4,035 | | | | 5 | % | | | 8,201 | | | | 9 | % | | | 6,793 | | | | 6 | % |

Leasing | | | 2,357 | | | | 3 | % | | | 2,691 | | | | 3 | % | | | 2,276 | | | | 2 | % |

Real estate | | | — | | | | 0 | % | | | 1,372 | | | | 2 | % | | | 3,870 | | | | 3 | % |

All other | | | 3,938 | | | | 5 | % | | | 5,612 | | | | 6 | % | | | 7,106 | | | | 6 | % |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total | | | 79,792 | | | | 100 | % | | | 89,528 | | | | 100 | % | | | 116,382 | | | | 100 | % |

| | | | | | | | | | | | | | | | | | | | | | | | |

Agricultural Operations

Bowen Brothers

Bowen’s operations include harvesting, hauling and marketing citrus for both Alico and other growers in the state of Florida. Bowen’s operations also include the purchase and resale of citrus fruit. Bowen Brothers was purchased in February 2006 to provide Alico with additional citrus marketing expertise and the ability to harvest its own citrus crop. During fiscal years ended September 30, 2010, 2009, and 2008, Bowen’s revenue was 36%, 31% and 39% of the Company’s total operating revenue, respectively.

2

Citrus Groves

Alico’s Citrus Grove operations consist of cultivating citrus trees in order to produce citrus for delivery to the fresh and processed citrus markets in the state of Florida. Approximately 9,764 acres of citrus were grown and harvested during the 2009-10 season. During the fiscal year ended September 30, 2010, Alico sold approximately 38% of its citrus crop to Southern Gardens, a wholly owned subsidiary of U.S. Sugar Corporation (USSC). The balance of the sales concentration is attributable to citrus contracts with Florida Orange Marketers, Inc. which represented approximately 28% of Alico’s citrus sales and Cutrale, which represented approximately 27% of Alico’s 2009-10 citrus sales. While Alico believes that it can replace these arrangements with other marketing alternatives, it may not be able to do so quickly and the results may not be as favorable as the current contracts. During fiscal years ended September 30, 2010, 2009, and 2008, revenue from citrus grove operations was 46%, 40% and 36% of the Company’s total operating revenue, respectively.

Sugarcane

Alico’s sugarcane operations consist of cultivating raw sugarcane for sale to a sugar processor. The crop is harvested by a co-op, proportionately owned by sugarcane growers, including Alico. Alico had 3,463 acres, 8,307 acres, and 9,110 acres of sugarcane in production during the fiscal years ended September 30, 2010, 2009 and 2008, respectively. Since the inception of its sugarcane program in 1988, Alico has sold 100% of its product through a pooling agreement with USSC, a local Florida sugar mill. Under the terms of the pooling agreement, Alico’s sugarcane is processed and sold along with sugarcane from other growers. The proceeds, less costs and a profit margin, are distributed on a pro rata basis as the finished product is sold. Due to the location of the Company’s sugarcane fields relative to location of alternative processing plants, the loss of USSC as a customer would have a negative material impact on the Company’s sugarcane operations. During fiscal years ended September 30, 2010, 2009 and 2008, revenue from sugarcane operations was 5%, 9% and 8% of the Company’s total operating revenue, respectively.

Cattle

Alico’s cattle operation, located in Hendry and Collier Counties, Florida, is engaged primarily in the production of beef cattle, feeding cattle at western feedlots and the raising of replacement heifers. The breeding herd consists of approximately 8,995 cows, bulls and replacement heifers. Approximately 57% of the herd is from one to five years old, while the remaining 43% is at least six years old. Alico primarily sells to packing and processing plants in the United States. Alico also sells cattle through local livestock auction markets and to contract cattle buyers in the United States. These buyers provide ready markets for Alico’s cattle. In the opinion of Management, the loss of any one or a few of these processing plants and/or buyers would not have a material adverse effect on Alico’s cattle operation. During fiscal years ended September 30, 2010, 2009, and 2008, revenue from cattle sales was 5%, 9% and 6% of the Company’s total operating revenue, respectively.

Other Agricultural Operations

Alico is also engaged in the sale of native sod, and native plants and trees for landscaping purposes. The sale of these products are not significant to the overall revenue or profitability of the Company, accounting for less than 1% of the Company’s total operating revenue during the reporting periods presented.

Real Estate

ALDI has been active in the subdivision, development and sale of real estate since its inception in 1971. ALDI has developed and sold two subdivisions near Frostproof, Florida. Through its ALDI subsidiary, Alico has developed a plan to enhance the planning and strategic positioning of all Company owned land. These actions include seeking entitlement of Alico’s land assets in order to preserve rights should Alico choose to develop property in the future.

3

Non Agricultural Operations

Land Rentals for Grazing, Agricultural, Oil Exploration and Other Uses

Alico rents land to others on a tenant-at-will basis, for grazing, farming, oil exploration and recreational uses. Alico will continue to develop additional land to lease for farming as strategically advantageous and according to demand. There were no significant changes in the method of rental for these properties during the past fiscal year. During fiscal years ended September 30, 2010, 2009, and 2008, revenue from leasing activities was 3%, 3% and 2% of the Company’s total operating revenue, respectively.

Mining Operations: Rock and Sand

In May 2006, Alico acquired a 526 acre mine site for rock and fill in Glades County, Florida. Rock and sand reserves are depleted and charged to cost of goods sold proportionately as the property is mined. Additionally, ALDI is currently seeking permits for two mines, a sand mine in Hendry county and a rock mine in Collier County. Operating revenue and profits from mining operations have not been significant to the Company during the past three fiscal years but may increase as additional properties are permitted and become operational in the future.

Competition

As indicated, Alico is engaged in a variety of agricultural and nonagricultural activities, all of which are in highly competitive markets. For instance, citrus is grown in foreign countries and several states, the most notable of which are: Brazil, Florida, California, and Texas. Beef cattle are produced throughout the United States and domestic beef sales also compete with imported beef. Sugarcane products compete with products from sugar beets in the United States as well as imported sugar and sugar products from foreign countries. Forest and rock products are produced in most parts of the United States. Leasing of land is also widespread.

Alico’s share of each of the United States markets for citrus, sugarcane, cattle, mining and forest products is less than 3%.

Environmental Regulations

Alico’s operations are subject to various federal, state and local laws regulating the discharge of materials into the environment. Management believes Alico is in compliance with all such rules and such compliance has not had a material effect upon capital expenditures, earnings or Alico’s competitive position.

While compliance with environmental regulations has not had a material economic effect on Alico’s operations, executive officers are required to spend a considerable amount of time monitoring these matters. In addition, there are ongoing costs incurred in complying with permitting and reporting requirements.

Employees

At September 30, 2010, Alico and its subsidiaries had a total of 134 full-time employees classified as follows: Bowen 11; Citrus 75; Sugarcane 13; Ranch 4; Real Estate 3; Leasing 1; Facilities Maintenance Support 11; and General and Administrative 16. Management is not aware of any efforts by employees or outside organizers to create any type of labor union. Management believes that the employer/employee relationship environment is such that labor organization activities are unlikely to occur.

Seasonal Nature of Business

Revenues from Alico’s agri-business operations are seasonal in nature. The harvest and sale of citrus fruit generally occurs in all quarters, but is more concentrated during the first, second and third fiscal quarters. Sugarcane is generally harvested during the first and second fiscal quarters. The bulk of the Company’s cattle sales occur in the third and fourth fiscal quarters. Other segments of Alico’s business such as its mining and leasing operations tend to be recurring rather than seasonal in nature.

4

Capital resources and raw materials

Management believes that Alico will be able to meet its working capital requirements for the foreseeable future through internally generated funds and its existing credit line. Alico has credit commitments that provide for revolving credit that is available for Alico’s general use. Raw materials needed to propagate the various crops grown by Alico which consist primarily of fertilizer, herbicides, fuel and water are readily available from local sources.

Available Information

Alico’s internet address is: http://www.alicoinc.com. As required by SEC rules and regulations, Alico files reports with the SEC on Form 8-K, Form 10-Q, Form 10-K and the annual proxy statement. These reports are available to the public to read and copy at the SEC’s Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330.

Alico is an electronic filer with the SEC and these reports are also available through the SEC internet site (http://www.sec.gov), and through Alico’s website as soon as reasonably practicable after filing with the SEC. Copies of documents filed with the SEC are also available free of charge upon request.

5

Alico’s operations involve varying degrees of risk and each investor should consider the specific risks and speculative features inherent in and affecting the business of Alico before investing in Alico. In considering the following risk and speculative factors, an investor should realize that there is a possibility of losing his or her entire investment.

Alico’s financial condition and results of operations could be affected by the risk factors discussed below. These factors may also cause actual results to differ materially from the results contemplated by the forward looking statements in Management’s Discussion and Analysis.

The list of risks below is not intended to be all inclusive. A complete listing of risks is beyond the scope of this document. However, in contemplating the financial position and results of operations of Alico, investors should carefully consider, among other factors, the following risk factors:

General

Alico has a 51% stockholder and a limited public float which could adversely affect the price of its stock and restrict the ability of the minority shareholders to have a voice in corporate governance.

Atlantic Blue Group, Inc. (“Atlanticblue”) (formerly Atlantic Blue Trust, Inc.) is the owner of approximately 51% of Alico’s common stock. Accordingly, Alico’s common stock is thinly traded and its market price may fluctuate significantly more than stocks with a larger public float. Additionally by virtue of its ownership percentage, Atlanticblue is able to elect all the directors, appoint all of the officers and management, and consequently, is deemed to control Alico. While Atlanticblue has issued a governance letter dated December 3, 2009 reaffirming its commitment to maintaining a majority of independent directors on Alico’s Board of Directors, this commitment may be terminated at any time upon 30 days prior written notice. Alico’s Board of Directors and its Committees, establish governance procedures and guidelines designed to attract and retain quality directors. Due to the resignations of two directors, directors independent of Atlanticblue (non-affiliated directors) did not constitute a majority throughout most of the fiscal year ended September 30, 2010. In October 2010, a fifth non-affiliated director was appointed reestablishing a majority of non-affiliated independent directors. Alico does not have cumulative voting. Accordingly, stockholders of Alico other than Atlanticblue have no effective control over who the management and directors of Alico are or will be.

Alico manages its properties in an attempt to capture its highest and best use and customarily does not sell property until it determines that the property is surplus to its agricultural activities by reason of its potential for industrial, commercial or residential use. Alico has little control over when this occurs as real estate sales are primarily market driven.

Alico’s goal for its land management program is to manage and selectively improve its lands for their most profitable use. To this end, Alico continually evaluates its properties focusing on location, soil capabilities, subsurface composition, topography, transportation, availability of markets for its crops and the climatic characteristics of each of the tracts. While Alico is primarily engaged in agricultural activities, when land is determined to be better suited to industrial, commercial or residential use, Alico has classified the property as surplus to its agricultural activities and has placed the property for sale. Alico’s land management strategy is thus a long term strategy to acquire, hold and manage land for its best use, selling surplus land at opportune times and in a manner that would maximize Alico’s profits from such surplus tracts. The timing for when agricultural lands become best suited for industrial, commercial or residential use depends upon a number of factors which are beyond the control of Alico such as:

6

| | • | | national, regional and local economic conditions; |

| | • | | conditions in local real estate markets (e.g., supply of land versus demand); |

| | • | | competition from other available property; |

| | • | | current level of, or potential availability of roads and utilities; |

| | • | | availability of governmental entitlements; |

| | • | | government regulation and changes in real estate, zoning, land use, environmental or tax laws; |

| | • | | interest rates and the availability of financing, and; |

| | • | | potential liability under environmental and other laws. |

Alico is not able to predict when its properties will become best suited for non-agricultural use and has limited ability to influence this process. Additionally, changes from time to time in any or a combination of these factors could result in delays in sales opportunities. Alico’s ability to sell tracts which are determined to be surplus or its ability to realize optimum pricing from such sales is thus highly speculative.

Alico is subject to environmental liability by virtue of owning significant holdings of real estate assets.

Alico faces a potential for environmental liability by virtue of its ownership of real property. If hazardous substances (including herbicides and pesticides used by Alico or by any persons leasing Alico’s lands) are discovered on or emanating from any of Alico’s lands and the release of such substances presents a threat of harm to the public health or the environment, Alico may be held strictly liable for the cost of remediation of these hazardous substances. In addition, environmental laws that apply to a given site can vary greatly according to the site’s location, its present and former uses, and other factors such as the presence of wetlands or endangered species on the site. Alico’s management monitors environmental legislation and requirements and makes every effort to remain in compliance with such regulations. Furthermore, Alico requires lessees of its properties to comply with environmental regulations as a condition of leasing. Alico also purchases insurance when it is available for environmental liability; however, these insurance contracts may not be adequate to cover such costs or damages or may not continue to be available to Alico at prices and terms that would be satisfactory. It is possible that in some cases the cost of compliance with these environmental laws could exceed the value of a particular tract of land or be significant enough that it would have a materially adverse effect on Alico.

Alico has a large customer that accounts for 23% of revenues.

For the fiscal year ended September 30, 2010, Alico’s largest customer accounted for approximately 23% of operating revenue. Alico’s largest customer is U.S. Sugar Corporation (USSC), for whom Alico grows sugarcane. Additionally, Alico sells citrus to Southern Gardens, a wholly owned subsidiary of USSC. These marketing arrangements involve marketing pools which allow the contracting party to market Alico’s product in conjunction with the product of other entities in the pool and pay Alico a proportionate share of the resulting revenue from the sale of the entire pooled product. While Alico believes that it can replace these arrangements with other marketing alternatives, it may not be able to do so quickly and the results may not be as favorable as the current contracts.

7

Alico has drawn significant scrutiny from the Internal Revenue Service

Alico has been subject to examinations by the Internal Revenue Service (IRS) for 18 of its last 20 income tax returns. The Company utilizes a large national accounting firm to prepare its tax returns and reviews the positions taken on such returns quarterly with its accountants and legal counsel; however, the IRS has taken several positions contrary to the Company. During the fiscal years ended September 30, 2008 and August 31, 2007, the Company paid a combined total of $75.7 million in additional federal and state taxes, penalties and interest resulting from to a settlement agreement with the IRS for the tax years 2000 – 2004. While the Company will be able to utilize a portion of the taxes paid to offset taxes on future property sales, the IRS is currently examining the Company’s tax returns for the 2005 – 2007 tax years. The Company believes that it has taken the proper positions on the tax returns currently under examination; however, the IRS issued thirty day letters dated September 9, 2010 and October 28, 2010, demanding payment of $22.5 million for taxes and penalties related to positions that the IRS contends were inappropriately taken. These reports propose changes to the Company’s tax liabilities for each of these tax years and require the Company either to agree with the changes and remit the specified taxes and penalties, or to submit a rebuttal. While the IRS notices did not specify interest related to the additional taxes, the Company has estimated potential Federal interest at approximately $4.9 million. If the IRS were to prevail on all of its positions, it would also result in additional State taxes of $2.5 million and interest of $844 thousand. Alico is appealing the issues contained in these letters and believes that the positions taken by Alico and its subsidiaries were correct; however, an adverse outcome could cause a breach of the Company’s loan agreements and have a significant material adverse effect on Alico’s operations, financial condition and liquidity. For further information regarding the ongoing IRS examinations, please refer to Note 8 of the Consolidated Financial Statements.

Significant employee turnover could cause unwanted volatility

The Company has experienced significant turnover in Board and Management positions during the past several years. The Company seeks to mitigate the impacts of turnover by establishing minimum requirements for each position and through its interview processes. While the Company believes that it has retained experienced and qualified replacements, interruptions in the development and execution of the Company’s business plans, lack of familiarity with the design and execution of surrounding internal control systems, and the familiarity with the Company’s operations might cause the Company to experience problems in these areas which could result in adverse effects for Alico. Furthermore, the Company’s accounting department is small. The loss of any two key employees in close time proximity to each other could result in a possible compromise of the internal control systems or the ability to accurately report financial results in accordance with Generally Accepted Accounting Principles (GAAP). Furthermore, Alico’s rural location adds an additional challenge for recruiting and retaining qualified personnel. The Company attempts to hire qualified personnel, provide competitive compensation and benefit programs and a pleasant working environment to offset this risk.

Agricultural Risks — General

Agricultural operations generate a large portion of Alico’s revenues. Agriculture operations are subject to a wide variety of risks including product pricing due to variations in supply and demand, weather, disease, input costs and product liability.

Agricultural products are subject to supply and demand pricing which is not predictable.

Because Alico’s agricultural products are commodities, Alico is not able to predict with certainty what price it will receive for its products; however, its costs are relatively fixed and the growth cycle of such products in many instances dictates when such products must be marketed which may or may not be advantageous in obtaining the best price. Excessive supplies tend to cause severe price competition and lower prices throughout the industry affected. Conversely, shortages may cause higher prices. Shortages often result from adverse growing conditions which can reduce the available product of growers in affected growing areas while not affecting others in non-affected growing areas. Alico attempts to mitigate these risks by forward pricing mechanisms and contracts. Alico cannot accurately predict or control from year to year what its profits or losses from agricultural operations will be.

8

Alico’s agricultural assets are concentrated and the effects of adverse weather conditions such as hurricanes can be magnified.

Alico’s agricultural operations are concentrated in south Florida counties with more than 80% of its agricultural lands located in a contiguous parcel in Hendry County. All of these areas are subject to occasional periods of drought, excess rain, flooding, and freeze. Crops require water in different quantities at different times during the growth cycle. Accordingly, too much or too little water at any given point can adversely impact production. While Alico attempts to mitigate controllable weather risks through water management and crop selection, its ability to do so is limited. Alico’s operations in southern and central Florida are also subject to the risk of hurricanes. Hurricanes have the potential to destroy crops, affect cattle breeding and impact citrus production through the loss of fruit and destruction of trees either as a result of high winds or through the spread of wind blown disease. Alico was impacted by hurricanes during fiscal years 2006, 2005 and 2004 and sustained losses relating to the storms during all three of those fiscal years. Alico seeks to minimize hurricane risk by the purchase of insurance contracts, but a portion of Alico’s crops remain uninsured. Because Alico’s agricultural properties are located in relative close proximity to each other, the impact of adverse weather conditions may be magnified in Alico’s results of operations.

Alico’s agricultural earnings comprise a major portion of its revenues and are subject to wide volatility which could result in breaches of loan covenants.

Borrowing capacity represents a major source of Alico’s working capital. Alico currently has a Revolving Line of Credit (RLOC) and a Term Loan with Rabobank, N.A. Both of these loans contain covenants requiring the Company to maintain a minimum current ratio of 2.0:1, a debt ratio no greater than 60%, tangible stockholder equity of at least $80 million, and a minimum debt coverage ratio of 1.15:1. While Alico currently expects to remain within these covenants, because of the volatility of its earnings stream and the factors causing this volatility, Alico is unable in some instances, to directly control compliance with these covenants. In March 2010, Alico received a one time waiver of the debt coverage ratio requirement from its previous lender, Farm Credit of Southwest Florida, in response to a freeze which damaged crops and affected the timing of their harvest. The Company believes that, based on factors currently known, it will continue to remain in compliance with its covenants for the next several years. The Company has recently negotiated a relaxed debt coverage ratio covenant to provide that the covenant must be breached in two consecutive years in order to be considered an event of default. Nevertheless, due to earnings volatility and factors unknown to the Company at this time, it is possible that a loan covenant could be breached, a default occur, and the major portion of the Company’s borrowings become due which could have a material adverse impact on Alico’s results of operations, cash flows and financial condition.

Water Use Regulation restricts Alico’s access to water for agricultural use.

Alico’s agricultural operations are dependent upon the availability of adequate surface and underground water needed to produce its crops. The availability of water for use in irrigation is regulated by the State of Florida through water management districts which have jurisdiction over various geographic regions in which Alico’s lands are located. Currently, Alico has permits for the use of underground and surface water which are adequate for its agricultural needs. Surface water in Hendry County, where much of Alico’s agricultural land is located, comes from Lake Okeechobee via the Caloosahatchee River and the system of canals used to irrigate such land. The Army Corps of Engineers controls the level of Lake Okeechobee and ultimately determines the availability of surface water even though the use of water has been permitted by the State of Florida through the water management district. Recently the Army Corps of Engineers decided to lower the permissible level of Lake Okeechobee in response to concerns about the ability of the levees surrounding the lake to restrain rising waters which could result from hurricanes. Changes in permitting for underground or surface water use during times of drought, because of lower lake levels, may result in shortages of water for agricultural use by Alico and could have a materially adverse effect on Alico’s agricultural operations and financial results.

9

Alico’s citrus groves are subject to damage and loss from disease including but not limited to Citrus Canker and Citrus Greening diseases.

Alico’s citrus groves are subject to damage and loss from diseases such as Citrus Canker and Citrus Greening. Each of these diseases is widespread in Florida and Alico has found instances of Citrus Canker and/or Citrus Greening in several of its groves. Both diseases exist in areas where Company groves are located. There is no known cure for Citrus Canker at the present time although some pesticides inhibit the development of the disease. The disease is spread by contact with infected trees or by wind blown transmission. Alico’s policy is to destroy trees which become infected with this disease or with Citrus Greening disease. Alico maintains an inspection program to discover infestations early and utilizes best management practices to attempt to control diseases and their dissemination. Citrus Greening destroys infected trees and is spread by psyllids. Alico utilizes a pesticide program to control these hosts. At the present time, there is no known pesticide or other treatment for Citrus Greening once trees are infected. Both of these diseases pose a significant threat to the Florida Citrus industry and to Alico’s citrus groves. Wide spread dissemination of these diseases in Alico’s groves could cause a material adverse effect to Alico’s operating results and citrus grove assets.

Pesticide and herbicide use by Alico or its lessees could create liability for Alico.

Alico and some of the parties to whom Alico leases land for agricultural purposes, use herbicides, pesticides and other hazardous substances in the operation of their businesses. All pesticides and herbicides used by Alico have been approved for use by the proper governmental agencies with the hazards attributable to each substance appropriately labeled and described. Alico maintains policies requiring its employees to apply such chemicals strictly in accordance with the labeling. As a term of its leasing agreements, Alico requires that third parties also adhere to proper handling and disposal of such materials; however, Alico does not have full knowledge or control over the chemicals used by third parties who lease Alico’s lands for cultivation. It is possible that some of these herbicides and pesticides could be harmful to humans if used improperly, or that there may be unknown hazards associated with such chemicals despite any contrary government or manufacturer labels. Alico might have to pay the costs or damages associated with the improper application, accidental release or the use or misuse of such substances. Which could have a materially adverse affect to Alico.

Changes in immigration laws or enforcement of such laws could impact the ability of Alico to harvest its crops.

Alico engages third parties to provide personnel for its harvesting operations. Alico communicates to such third parties its policy of employing only workers approved to work in the United States. However, Alico does not specifically monitor such compliance and the personnel engaged by such third parties could be from pools composed of immigrant labor. The availability and number of such workers is subject to decrease if there are changes in the U.S. immigration laws or by stricter enforcement of such laws. The scarcity of available personnel to harvest Alico’s agricultural products could cause Alico’s harvesting costs to increase or could lead to the loss of product that is not timely harvested which could have a materially adverse effect upon Alico.

Changing public perceptions regarding the quality, safety or health risks of Alico’s agricultural products can affect demand and pricing of such products.

The general public’s perception regarding the quality, safety or health risks associated with particular food crops Alico grows and sells could reduce demand and prices for some of Alico’s products. To the extent that consumer preferences evolve away from products Alico produces for health or other reasons, and Alico is unable to modify its products or to develop products that satisfy new customer preferences, there could be decreased demand for Alico’s products. Even if market prices are unfavorable, produce items which are ready to be or have been harvested must be brought to market. Additionally, Alico has significant investments in its citrus groves and cannot easily shift to alternative products for this land. A decrease in the selling price received for Alico’s products due to the factors described above could have a materially adverse effect on Alico.

10

Alico faces significant competition in its agricultural operations.

Alico faces significant competition in its agricultural operations both from domestic and foreign producers and does not have any branded products. Foreign growers generally have a lower cost of production, less environmental regulation and in some instances greater resources and market flexibility than Alico. Because foreign growers have great flexibility as to when they enter the U.S. market, Alico cannot always predict the impact these competitors will have on its business and results of operations. The competition Alico faces from foreign suppliers of sugar and orange juice is mitigated by quota restriction on sugar imports imposed by the U.S. government and by a governmentally imposed tariff on U.S. orange imports. A change in the government’s sugar policy allowing more imports or a reduction in the U.S. orange juice tariff could adversely impact Alico’s results of operations.

| Item 1B. | Unresolved Staff Comments. |

None.

11

At September 30, 2010, Alico owned a total of 139,607 acres of land located in five counties in Florida. Acreage in each county and the primary classification with respect to the present use of these properties is shown in the following table:

Alico, Inc. & Subsidiaries

Current Land Utilization (1)

September 30, 2010

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Total | | | Hendry | | | Polk | | | Collier | | | Glades | | | Lee | |

Citrus: | | | | | | | | | | | | | | | | | | | | | | | | |

Producing acres | | | 9,764 | | | | 3,227 | | | | 2,985 | | | | 3,552 | | | | — | | | | — | |

Developing acres | | | 450 | | | | 425 | | | | 25 | | | | — | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total Citrus | | | 10,214 | | | | 3,652 | | | | 3,010 | | | | 3,552 | | | | — | | | | — | |

Sugarcane: | | | | | | | | | | | | | | | | | | | | | | | | |

Producing acres | | | 3,463 | | | | 3,463 | | | | — | | | | — | | | | — | | | | — | |

Developing acres | | | 7,669 | | | | 7,669 | | | | — | | | | — | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total Sugarcane | | | 11,132 | | | | 11,132 | | | | — | | | | — | | | | — | | | | — | |

Cattle (improved pastures) (2) | | | 10,040 | | | | 10,040 | | | | — | | | | — | | | | — | | | | — | |

Leasing | | | | | | | | | | | | | | | | | | | | | | | | |

Farm leases | | | 1,810 | | | | 1,810 | | | | — | | | | — | | | | — | | | | — | |

Grazing and other | | | 12,181 | | | | 1,977 | | | | 6,182 | | | | 4,022 | | | | — | | | | — | |

Recreational leases | | | 64,619 | | | | 63,363 | | | | 1,256 | | | | — | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total Leasing | | | 78,610 | | | | 67,150 | | | | 7,438 | | | | 4,022 | | | | — | | | | — | |

Commercial and residential | | | 5,238 | | | | 54 | | | | 66 | | | | — | | | | — | | | | 5,118 | |

Mining | | | 526 | | | | — | | | | — | | | | — | | | | 526 | | | | — | |

Infrastructure and other | | | 23,847 | | | | 19,633 | | | | 952 | | | | 3,262 | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total | | | 139,607 | | | | 111,661 | | | | 11,466 | | | | 10,836 | | | | 526 | | | | 5,118 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| (1) | Approximately 64,232 acres of the properties listed are encumbered by credit agreements with total credit availability of $104.4 million at September 30, 2010. For a more detailed description of the agreements and collateral please refer to Note 6 to the Consolidated Financial Statements. |

| (2) | Cattle also graze approximately 40,000 acres of property listed as recreational leases. |

12

One of Alico’s primary goals is to manage and selectively improve its properties for their most profitable use. The Company engages in detailed studies of the properties focusing on location, soil capabilities, sub-surface composition, topography, transportation, availability of markets for its crops, products and real estate parcels and the climatic characteristics of each of the tracts. Based on these studies, the use of each tract is determined. Management believes that Alico lands are suitable for agricultural, residential and commercial uses. Sales of property occur when, in the opinion of the Company’s board and management, the sale of such property will provide the maximum value to the Company’s shareholders.

Alico utilizes consultants to work with senior management and the Board of Directors to enhance the planning and strategic positioning of all Company owned land. ALDI also oversees the entitlement of Alico’s land assets in order to preserve these rights should Alico choose to develop the property in the future.

Management believes that each of the major agricultural programs is adequately supported by equipment, buildings, fences, irrigation systems, drainage systems and other amenities required for the operation of the projects.

The Company currently collects mining royalties on a 526 acre parcel of land located in Glades County, Florida. These royalties do not represent a significant portion of the Company’s revenue or operating profits. The Company is additionally seeking permits to develop two additional mines, one for an 886 acre parcel in Hendry County to be used as a sand mine and the other for a potential rock mine Collier County parcel comprising 1,640 acres. The Hendry County parcel is currently classified as leased property, while the Collier County parcel is classified as citrus. Based on initial estimates by third party engineering firms, the sand reserve of the Hendry County parcel is approximately 78 million tons and the rock reserve of the Collier County parcel is approximately 140 million tons.

In accordance with current Generally Accepted Accounting Principals in the United States, the Company’s properties are recorded based on historical costs and adjusted downward when impairments are identified. The Company believes that the current market value of its property holdings is significantly higher than the values recorded.

| Item 3. | Legal Proceedings. |

In June 2008, the Internal Revenue Service (IRS) issued a final Settlement Agreement regarding its examinations of Alico for the tax years 2000 through 2004. Pursuant to the agreement, Alico and the IRS agreed to final taxes resulting from the examinations of $41.1 million, penalties of $4.1 million and interest of $20.0 million. Alico also paid State income taxes related to the final IRS settlement of $6.2 million along with $4.3 million of related interest. The Settlement Agreement concluded that Alico must recognize unreported gains resulting from the transfer of real property to a foreign subsidiary (Agri). The real estate was originally transferred and reported at its historical cost basis. Additionally, Alico must recognize Subpart F income related to Agri’s earnings. Alico had not previously recognized income related to the transactions referenced above based on reliance on an IRS determination letter stating that Agri was a captive insurer, exempt from taxes provided certain procedural requirements were followed. Alico believed that it had followed such requirements, while the IRS ruled otherwise.

On October 29, 2008 Alico was served with a shareholder derivative action complaint filed by Baxter Troutman against JD Alexander and John R. Alexander and named Alico as a nominal defendant. Mr. Troutman is the cousin and nephew of the two defendants, respectively, and is a shareholder in Atlanticblue, a (51%) shareholder of Alico. From February 26, 2004 until January 18, 2008 Mr. Troutman was a director of Alico. The complaint alleges that JD Alexander and John R. Alexander committed breaches of fiduciary duty in connection with a 2004 proposal to merge Atlanticblue into Alico. The proposal was withdrawn by Atlanticblue in 2005. The suit also alleges, among other things, that the merger proposal was wrongly requested by defendants JD Alexander and John R. Alexander, and improperly included a proposed special dividend; and that the Alexanders’ sought to circumvent the Board’s nominating process to ensure that they constituted a substantial part of Alico’s senior management team and alleged the actions were contrary to the position of Alico’s independent directors at the time, causing a waste of Alico’s funds and the resignations of the independent directors in 2005. As a result the complaint is seeking damages to be paid to Alico by the Alexanders’ in excess of $1,000,000. The complaint concedes that Mr. Troutman has not previously made demand upon Alico to take action for the alleged wrongdoing as required by Florida law, alleging that he believed such a demand would be futile. A copy of the Complaint may be obtained from the Clerk of the Circuit Court in Polk County, Florida.

13

On June 3, 2009 a Special Committee of Alico’s Board of Directors comprised entirely of Independent Directors and which was constituted to investigate the shareholder derivative action filed by Mr. Troutman, completed its investigation with the assistance of independent legal counsel and determined that it would not be in Alico’s best interest to pursue such litigation. Alico has filed a motion to dismiss the litigation based upon the findings of the Special Committee. A hearing on this motion was held on December 7, 2010, and as of the date of filing of this report, the Court has not yet ruled on the motion to dismiss. A copy of the report was filed with the Court and it and the other pleadings in the case are available from the Clerk of Circuit Court in Polk County, Florida by reference to the matter of Baxter G. Troutman, Plaintiff vs. John R. Alexander, John D. Alexander, Defendants and Alico, Inc. Nominal Defendant, Case No. 08-CA-10178 Circuit Court, 10th Judicial Circuit, Polk County, Florida.

On October 28, 2010, the Internal Revenue Service (IRS) issued Revenue Agent Reports (RAR) pursuant to its examinations of Alico, Inc. and Agri-Insurance Co., Ltd. for the tax years 2005 through 2007, and on September 9, 2010, the IRS issued an RAR pursuant to the examination of Alico-Agri, Ltd for the tax years 2005 through 2007. These reports propose changes to the Company’s tax liabilities for each of these tax years and require the Company either to agree with the changes and remit the specified taxes and penalties, or to submit a rebuttal. The Company has obtained extensions from the IRS, allowing Alico until December 14, 2010 to submit its rebuttal which it intends to do.

These reports principally challenge the ability of Agri-Insurance to elect to be treated as a United States taxpayer and claim that Alico-Agri was a dealer in real estate during the years under examination and therefore was prohibited from recognizing income from real estate sales under the installment method. Based on the positions taken in the RARs , the IRS has calculated additional taxes and penalties due of $22.5 million. The reports do not quantify the amount of proposed interest on the taxes.

The Company maintains that Agri-Insurance was eligible to make the election to be treated as a United States taxpayer and that Alico-Agri did not meet the criteria for classification as a dealer in real estate and was therefore qualified to report real estate sales using the installment method during the years under examination. Alico plans to submit a rebuttal to the RAR and, if necessary, present its case to IRS Appeals for further consideration. Because the earnings of Agri-Insurance were included in Alico’s consolidated returns during the years under audit, and because the purchaser subsequently defaulted on the real estate transactions for which the installment method was utilized, the issues raised by the IRS are primarily timing related and will be reflected in the Company’s deferred tax accounts at September 30, 2010. With respect to the ability of Agri-Insurance to be treated as a disregarded entity and a U.S. taxpayer during the years of the examination, because the earnings from Agri-Insurance have been included in Alico’s consolidated tax return, Alico’s primary exposure on this issue is for the assessment of penalties and interest for the failure of Agri-Insurance to file separate federal tax returns for such years. With respect to the other principal issue of Alico-Agri’s characterization as a dealer in real estate and the resulting inability to use the installment method for deferred payment of the purchase price for property sales, Alico could be liable for taxes, penalties and interest. However, in the fiscal year ended September 30, 2010, Alico-Agri recovered the properties from the defaulting purchasers, and Alico-Agri should be entitled to a loss equal to (i) the amounts payable by the purchasers under the installment sales notes as of such year, in excess of (ii) the value of the property. Such loss may be available to offset income for the 2010 tax year, the prior two tax years and future years, but has limited use to offset the taxes that may become payable for the years 2005-07. Additionally, any interest that may be paid on taxes that become due should be deductible, but no deduction will be allowed for penalties for income tax purposes. For further information regarding the status of the ongoing IRS examinations, please refer to Footnote 8 of the Consolidated Financial Statements.

While an adverse determination could have a significant adverse effect on Alico’s operations, financial condition and liquidity, the Company anticipates the impact on the Company’s financial statements should be limited to any penalties and interest required to be paid by the Company.

| Item 4. | [Removed and Reserved] |

14

PART II

| Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities. |

Common Stock Prices

The common stock of Alico, Inc. is traded on the NASDAQ Stock Market, LLC (“NASDAQ”) under the symbol ALCO. The high and low prices as reported by NASDAQ, by fiscal quarter, during the fiscal years ended September 30, 2010 and 2009 are presented below:

| | | | | | | | | | | | | | | | |

| | | 2010 Price | | | 2009 Price | |

Quarter ended | | High | | | Low | | | High | | | Low | |

December 31 | | $ | 30.20 | | | $ | 24.07 | | | $ | 47.85 | | | $ | 22.34 | |

March 31 | | $ | 29.90 | | | $ | 24.01 | | | $ | 45.02 | | | $ | 20.24 | |

June 30 | | $ | 27.60 | | | $ | 22.71 | | | $ | 30.73 | | | $ | 23.25 | |

September 30 | | $ | 26.22 | | | $ | 20.17 | | | $ | 33.94 | | | $ | 26.29 | |

Approximate Number of Holders of Common Stock

As of October 31, 2010 there were approximately 382 holders of record of Alico’s Common Stock as reported by Alico’s transfer agent.

Dividend Information

Dividends declared during the last two fiscal years were as follows:

| | | | | | |

Record Date | | Payment Date | | Amount Paid

Per Share | |

October 31, 2008 | | November 14, 2008 | | $ | 0.2750 | |

January 30, 2009 | | February 15, 2009 | | $ | 0.2750 | |

April 30, 2009 | | May 15, 2009 | | $ | 0.1375 | |

July 31, 2009 | | August 15, 2009 | | $ | 0.1375 | |

October 31, 2009 | | November 13, 2009 | | $ | 0.1375 | |

October 29, 2010 | | November 15, 2010 | | $ | 0.1000 | |

Alico’s ability to pay dividends in the immediate future is dependent on a variety of factors including the earnings and the financial condition of Alico. Furthermore, Alico’s ability to pay dividends is limited by a credit agreement with its primary lender. For a discussion of these factors, see Item 7, Management’s Discussion and Analysis of Financial Condition and Results of Operations.

15

Equity Compensation Arrangements

On November 3, 1998, Alico adopted the Alico, Inc. Incentive Equity Plan (the 1998 Plan) pursuant to which the Board of Directors could grant options, stock appreciation rights and/or restricted stock to certain directors and employees. The 1998 Plan authorized grants of shares or options to purchase up to 650,000 shares of authorized but unissued common stock. This plan expired on November 3, 2008.

On February 20, 2009 Alico adopted the Alico, Inc., Incentive Equity Plan (the 2008 Plan) pursuant to which the Board of Directors of Alico may grant options, stock appreciation rights, and/or restricted stock to certain directors and employees. The 2008 Plan authorized grants of shares or options to purchase up to 350,000 shares of authorized but unissued common stock to be funded by treasury purchases. Details of the plan are more fully described in the Company’s proxy statement filed on January 23, 2009.

On October 27, 2006, the Board awarded 20,000 shares of restricted stock to the Chief Executive Officer under the 1998 Plan as additional compensation. Under the terms of the agreement, 4,000 shares vested effective August 31, 2006, 4,000 vested effective August 31, 2007 and the remaining 12,000 shares vested upon the CEO’s retirement on June 30, 2008. The fair value per share was $61.96 on the date of the award.

A grant of 25,562 restricted shares was made to four senior executives in January 2008 under the 1998 Plan with a fair value of $40.67 per share, to replace previously granted retirement benefits of which, 7,707 of the shares vested immediately. In January 2010 and 2009, a total of 3,571 and 3,571 shares vested, respectively, and the shares were issued from treasury stock. Upon the resignation of the Principal Executive Officer in fiscal year 2010, a total of 3,539 shares were forfeited. Forfeitures by other resigning participants indicate that it is unlikely that 100% of the shares granted will be vested. Accordingly, the Company has recorded a forfeiture rate for the remaining 7,174 shares granted in January 2008. Of the remaining shares, 2,392 are scheduled to vest annually in January of each year until fully vested should the requisite service period be met. The cumulative effect of the forfeitures and forfeitures expected due to the expected failure to meet the required vesting schedule was recorded as a reduction of compensation expense during the fiscal year ended September 30, 2010.

On September 30, 2008, Alico hired a President for its subsidiary ALDI. As a portion of the total compensation package, the Board awarded 7,500 shares of restricted stock under the 1998 Plan. Under the terms of the agreement, 1,500 of the shares vested on September 30, 2010 and the remaining 6,000 shares are scheduled to vest at a rate of 1,500 shares annually in September of each succeeding year until they are fully vested. The fair value per share was $47.43 on the date of the award. Based on the previous experience of the Company, a forfeiture rate was applied to the shares remaining to be vested and was recorded as a reduction of compensation expense during the fiscal year ended September 30, 2010.

No stock options or stock appreciation rights have been granted since February 2004. There were no outstanding stock options or appreciation rights outstanding at September 30, 2010.

16

| | | | | | | | | | | | |

Plan Category | | Number of

Securities to be

issued upon

exercise of

outstanding options,

warrants and rights

[a] | | | Weighted

average exercise

price of

outstanding

options, warrants

and rights

[b] | | | Number of securities

remaining available for

future issuance under

equity compensation

plans (excluding

securities reflected in

Column (a))

[c] | |

Equity compensation plans approved by security holders | | | — | | | | — | | | | 322,286 | |

Equity compensation plans not approved by security holders | | | — | | | | — | | | | — | |

Total | | | — | | | | — | | | | 322,286 | |

| | | | | | | | | | | | |

Issuer Purchases of Equity Securities

In order to fund restricted stock grants pursuant to its Incentive Equity plans for the purpose of providing restricted stock to eligible Directors and Senior Management and to align their interests with those of the Company shareholders, the table below summarizes treasury purchases during the last two fiscal years (in whole dollars):

| | | | | | | | | | | | | | | | |

Date | | Total Number of

Shares Purchased | | | Average price

paid per share | | | Total Shares

Purchased as Part of

Publicly Announced

Plans or Programs | | | Total Dollar value of

shares purchased | |

December 2008 | | | 15,733 | | | $ | 38.37 | | | | 87,471 | | | $ | 603,611 | |

January 2009 | | | 4,267 | | | $ | 41.67 | | | | 91,738 | | | $ | 177,807 | |

February 2009 | | | 2,500 | | | $ | 28.38 | | | | 94,238 | | | $ | 70,948 | |

May 2009 | | | 3,000 | | | $ | 27.21 | | | | 97,238 | | | $ | 81,643 | |

October 2009 | | | 4,000 | | | $ | 29.53 | | | | 101,238 | | | $ | 118,120 | |

December 2009 | | | 9,692 | | | $ | 27.93 | | | | 110,930 | | | $ | 270,698 | |

January 2010 | | | 2,308 | | | $ | 29.10 | | | | 113,238 | | | $ | 67,163 | |

September 2010 | | | 7,466 | | | $ | 22.98 | | | | 120,704 | | | $ | 171,546 | |

The stock repurchases began in November 2005 and will be made on a quarterly basis, or as needed until November 1, 2013 through open market transactions. The timing and actual number of shares repurchased will depend on a variety of factors including price, corporate and regulatory requirements and other market conditions. All purchases will be made subject to restrictions of Rule 10b-18 relating to volume, price and timing so as to minimize the impact of the purchases upon the market for the Company’s shares.

The Company does not anticipate that any purchases under the 2008 Plan will be made from any officer, director or control person. There are currently no arrangements with any person for the purchase of the shares. Alico may purchase an additional 321,034 shares in accordance with the authorization. Pursuant to approved plans, Alico purchased 13,692, 2,308 and 7,466 shares in the open market during the first, second and fourth quarters of fiscal year 2010, respectively, at a weighted average price of $26.74 per share, and 15,733, 6,767 and 3,000 shares in the open market during the first, second and third quarters of fiscal year 2009, respectively, at a weighted average price of $36.63 per share.

There were no purchases of common stock of Alico made during the three months ended September 30, 2010 by Alico or any “affiliated purchaser” of Alico as defined in rule 10b-18(a)(3) under the Exchange Act.

17

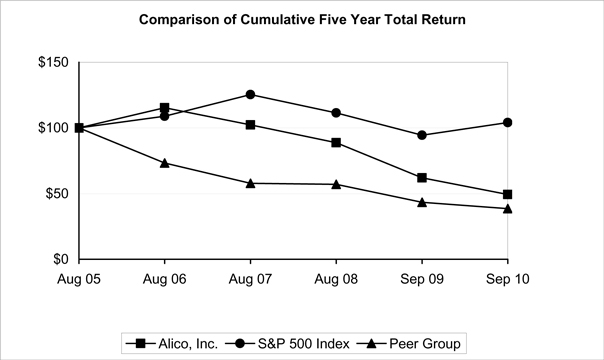

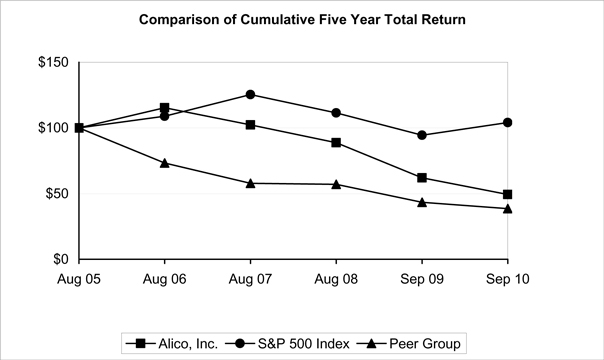

Alico Performance

The graph below represents the Company’s common stock performance, comparing the value of $100 invested on September 1, 2004 in the Company’s common stock, the S&P 500 and a Company-constructed peer group.

18

Total Return To Shareholders

(Includes reinvestment of dividends)

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | ANNUAL RETURN PERCENTAGE

Years Ending | |

Company Name / Index | | | | | Aug 06 | | | Aug 07 | | | Aug 08 | | | Sep 09 | | | Sep 10 | |

Alico, Inc. | | | | | | | 15.39 | | | | -11.28 | | | | -13.32 | | | | -30.08 | | | | -20.55 | |

S&P 500 Index | | | | | | | 8.88 | | | | 15.13 | | | | -11.14 | | | | -15.20 | | | | 10.16 | |

Peer Group | | | | | | | -26.65 | | | | -21.12 | | | | -1.34 | | | | -24.11 | | | | -10.89 | |

| | |

| | | Base | | | INDEXED RETURNS | |

| | | Period | | | Years Ending | |

Company Name / Index | | Aug 05 | | | Aug 06 | | | Aug 07 | | | Aug 08 | | | Sep 09 | | | Sep 10 | |

Alico, Inc. | | | 100 | | | | 115.39 | | | | 102.38 | | | | 88.74 | | | | 62.05 | | | | 49.30 | |

S&P 500 Index | | | 100 | | | | 108.88 | | | | 125.36 | | | | 111.40 | | | | 94.46 | | | | 104.06 | |

Peer Group | | | 100 | | | | 73.35 | | | | 57.85 | | | | 57.08 | | | | 43.32 | | | | 38.60 | |

| | | | |

Peer Group Companies | | | |

CONSOLIDATED TOMOKA LAND CO | | | | |

ST JOE CO | | | | |

TEJON RANCH CO | | | | |

TEXAS PACIFIC LAND TRUST | | | | |

THOMAS PROPERTIES GROUP | | | | |

19

| Item 6. | Selected Financial Data. |

| | | | | | | | | | | | | | | | | | | | | | | | |

Description | | September 30, | | | August 31, | |

| | 2010 | | | 2009 | | | 2008 | | | 2007(1) | | | 2007 | | | 2006 | |

Operating revenue | | $ | 79,792 | | | $ | 89,528 | | | $ | 116,382 | | | $ | 758 | | | $ | 132,005 | | | $ | 74,164 | |

Income (loss) from continuing operations | | | (623 | ) | | | (3,649 | ) | | | 5,603 | | | | (849 | ) | | | (13,395 | )(2) | | | 8,021 | |

Income (loss) from continuing operations per weighted average common share | | $ | (0.08 | ) | | $ | (0.49 | ) | | $ | 0.76 | | | $ | (0.12 | ) | | $ | (1.81 | ) | | $ | 1.09 | |

Weighted average number of shares outstanding | | | 7,374 | | | | 7,377 | | | | 7,390 | | | | 7,377 | | | | 7,391 | | | | 7,375 | |

Cash Dividend Declared Per Share | | $ | 0.10 | | | $ | 0.69 | | | $ | 1.10 | | | $ | 0.28 | | | $ | 1.10 | | | $ | 1.03 | |

Total Assets | | | 188,817 | | | | 200,235 | (3) | | | 273,932 | | | | 285,349 | | | | 281,206 | | | | 263,579 | |

Long-Term Obligations | | $ | 75,668 | | | $ | 80,715 | (3) | | $ | 140,239 | | | $ | 143,265 | | | $ | 143,790 | | | $ | 103,601 | |

| (1) | Beginning with fiscal year 2008, Alico changed its year end from August 31 to September 30. Results for September 30, 2007 are for the one month transition period created by the change. |

| (2) | During the fiscal year ended August 31, 2007, the Company revised its estimate in connection with a tax disagreement with the IRS which resulted in additional income tax expense of $25.6 million for that fiscal year. The effect of this transaction was to reduce income from continuing operations. Additionally, the Company utilized its revolving line of credit for funding to settle the dispute, causing long-term obligations to increase. For further information regarding the IRS settlement, please refer to Note 8 of the consolidated financial statements. |

| (3) | During the fiscal year ended September 30, 2009, the Company utilized cash to reduce its outstanding debt by approximately $50.0 million, causing a reduction in total assets and long-term obligations. For further information concerning the Company’s long-term obligations, please refer to Note 6 of the consolidated financial statements. |

20

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations. |

Cautionary Statement

Some of the statements in this document include statements about future expectations. Statements that are not historical facts are “forward-looking statements” for the purpose of the safe harbor provided by Section 21E of the Exchange Act and Section 27A of the Securities Act. These forward-looking statements, which may include references to one or more potential transactions, strategic alternatives under consideration or projections of performance for the upcoming fiscal year, are predictive in nature or depend upon or refer to future events or conditions. These statements are subject to known, as well as unknown, risks and uncertainties that may cause actual results to differ materially from expectations. These risks include, but are not limited to those discussed in the risk factors section of this annual report whether or not such risks are repeated in connection with any forward looking statement. There can be no assurance that any anticipated performance or future transactions will occur or be structured in the manner suggested or that any such transaction will be completed. Alico undertakes no obligation to update publicly any forward-looking statements, whether as a result of future events, new information or otherwise.

When used in this document, or in the documents incorporated by reference herein, the words anticipate, should, believe, estimate, may, intend, expect, and other words of similar meaning, are likely to address Alico’s growth strategy, financial results and/or product development programs. Actual results, performance or achievements could differ materially from those contemplated, expressed or implied by the forward-looking statements contained herein. The considerations listed herein represent certain important factors Alico believes could cause such results to differ. These considerations are not intended to represent a complete list of the general or specific risks that may affect Alico. It should be recognized that other risks, including general economic factors and expansion strategies, may be significant, presently or in the future, and the risks set forth herein may affect Alico to a greater extent than indicated.

The following discussion focuses on the results of operations and the financial condition of Alico. This section should be read in conjunction with the consolidated financial statements and notes.

Liquidity and Capital Resources

Dollar amounts listed in thousands:

| | | | | | | | | | | | |

| | | September 30, | |

| | | 2010 | | | 2009 | | | 2008 | |

Cash & liquid investments | | $ | 12,365 | | | $ | 22,204 | | | $ | 78,637 | |

Total current assets | | | 37,441 | | | | 51,335 | | | | 123,130 | |

Current liabilities | | | 7,912 | | | | 12,644 | | | | 18,200 | |

Working capital | | | 29,529 | | | | 38,691 | | | | 104,930 | |

Total assets | | | 188,817 | | | | 200,235 | | | | 273,932 | |

Notes payable | | $ | 73,460 | | | $ | 78,928 | | | $ | 137,758 | |

Current ratio | | | 4.73 | | | | 4.06 | | | | 6.77 | |

Management believes that Alico will be able to meet its working capital requirements for the foreseeable future with internally generated funds from operations and available credit. However, if the Company was required to pay a substantial portion of the amount claimed by the IRS in its audit of the Company’s 2005-2007 returns which is currently being challenged by the Company, this could materially and adversely affect the Company’s liquidity. See “Risk Factors: Alico has drawn significant scrutiny from the Internal Revenue Service.” Alico has credit commitments under a revolving line of credit that provides for revolving credit of up to $60.0 million. Of the $60.0 million credit commitment, $31.0 million was available for Alico’s general use at September 30, 2010 (see Note 6 to consolidated financial statements).

21

Cash flows from Operations

Cash flows from operations were $7.1 million, $16.4 million and $13.8 million for the fiscal years ended September 30, 2010, 2009 and 2008.

Alico refinanced its term loan and revolving line of credit in September 2010. As a result of the refinancing, Alico recognized approximately $3.4 million of additional interest expense during its fourth fiscal quarter, consisting of previously unamortized loan origination fees of $305 thousand, and prepayment penalties of $3.1 million. Loan origination fees of $1.2 million were paid as a result of the refinancing, and are being amortized over the 10 year term of the agreement. The refinancing is expected to benefit the future cash flows of the Company through reduced interest rates, an extended amortization schedule and a balloon payment. Additionally, these agreements provide a more lenient debt service coverage covenant and do not contain prepayment penalties.

During the quarter ended June 30, 2010, Alico received an income tax refund of $4.8 million resulting from a net operating loss carryback generated as a result of a prior IRS examination settlement.

The Company evaluated its real estate holdings at September 30, 2010 and determined that one parcel of real estate in Polk County, FL was impaired by $980 thousand. The impairment was recorded and charged to real estate expenses during the quarter ended September 30, 2010 as a non-cash item.

Several noncash adjustments to net (loss) income caused significant differences in cash flows from operations compared with the net loss for the fiscal year ended September 30, 2009. The Company recorded impairments related to its breeding herd, two parcels of real estate and auction rate securities totaling approximately $5.9 million during the fourth quarter of the fiscal year ended September 30, 2009. These impairments caused a decrease in net income, but were non-cash items. Additionally during the fourth quarter of the fiscal year ended September 30, 2009, the Company adjusted its deferred tax rate and created an allowance account for its charitable contribution carry forward. These noncash tax items caused net income to decrease by $836 thousand.

A settlement agreement with a vendor resulted in a $7.0 million payment to Alico in March 2009. Under the terms of the agreement, the vendor admits no wrongdoing and stipulates that Alico cannot divulge the vendor’s name or the agreement’s circumstances. Alico recognized the payment as other income during the second quarter of the fiscal year ended September 30, 2009.

In December 2008, Alico offered an option to former and retired employees to terminate future benefits under a non-qualified deferred compensation plan in exchange for cash equal to the net present value of vested future benefits. Payments of $1.4 million were paid to participants who elected the option in January 2009. Life insurance policies were liquidated to fund the distributions.

In November 2008, Alico’s subsidiary, Alico-Agri received a payment of $2.5 million in escrow in connection with the restructure of a real estate contract (“East”) with Ginn- LA Naples, Ltd, LLLP (“Ginn”). In April 2009, Ginn defaulted on the East parcel contract. Under the terms of the contract, a quarterly interest payment of $283 thousand was due on March 30, 2009, but the payment was not received. Alico-Agri foreclosed on the property in September 2010. The foreclosure is more fully described below.

Overall, operating profit and net income during fiscal year 2011 is expected to exceed that of fiscal year 2010, due to the expected lack of loan prepayment charges and improved operating results from the Company’s sugarcane division.

22

Cash flows from Investing

Cash outlays for land, equipment, buildings, and other improvements totaled $8.2 million, $6.7 million and $6.1 million during the fiscal years ended September 30, 2010, 2009 and 2008, respectively. Alico anticipates its capital needs, primarily for the care of young citrus trees, real estate entitlement work, sugarcane plantings, and raising cattle for breeding purposes, at between $4.5 million and $5.5 million for fiscal year 2011.

During September 2010 Alico restructured its funding program for its non-qualified defined benefit deferred compensation plan (the “Plan”). As a result, it surrendered life insurance policies and received cash surrender value payments of $5.7 million. The Plan does not require Alico to specify a funding source for the obligations and neither the previous nor the current life insurance policies or the proceeds therefrom are in any way legally bound to pay plan obligations.

In May 2010, Alico invested $12.15 million to obtain a 39% equity interest as a limited partner in Magnolia TC 2, LLC (“Magnolia”) a Florida Limited Liability Company whose primary business activity is acquiring tax certificates issued by various counties in the State of Florida on properties which show property tax delinquencies. In the State of Florida, such certificates are sold at general auction based on a bid interest rate. If the property owner does not redeem such certificate within two years, which requires the payment of the delinquent taxes plus the bid interest, a tax deed can be obtained by the winning bidder who can then force an auctioned sale of the property. Tax certificates represent a first lien position on the property.

In November 2008, Alico’s subsidiary, Alico-Agri, Ltd., received a principal payment on a note receivable of $1.8 million related to a real estate sale. The purchaser subsequently defaulted on the note in April 2009. In September 2010, the Company foreclosed on the property through a public auction process. The net effect of the transaction was to cancel the mortgage note, reduce accrued commissions payable, surrender the tax certificates and reclassify the net balance of $6.6 million as basis in the property. This reclassification entry, in and of itself, did not have an impact on the future cash flows or earnings of the Company.

The property consists of a 4,157 acre parcel located next to Florida Gulf Coast University in Lee County, Florida. The property has two approved Development Orders, one for a 336 unit residential community and the second for a 27-hole golf course. A portion of the property is an active aggregate mine. Under the terms of the foreclosure and the contract, Alico-Agri released 399 acres of property (outside of the areas associated with the two development orders) to Ginn-La Naples Ltd, LLLP in recognition of prior principal payments.

Recent market conditions have depressed Florida real estate markets causing the predictability of real estate sales including timing and market values to be problematic. Alico continues to market parcels of its real estate holdings which are deemed by management and the Board of Directors to be excess to the immediate needs of Alico’s core operations. The sale of any of these parcels could be material to the future operations and cash flows of Alico.

Alico’s balance sheet has carried large amounts of cash and investments over the past several years in order to comply with liquidity provisions mandated by the Bermuda Monetary Authority for Alico’s wholly owned insurance subsidiary, Agri. During the quarter ended December 31, 2008, Agri began the liquidation procedures by disposing of marketable securities which generated over $50 million in proceeds which were treated as pre-liquidation distributions to Alico and used to reduce outstanding debt. Agri was liquidated in September 2010.

23

Cash flows from Financing