Filed by FirstMerit Corporation Pursuant to Rule 425

Under the Securities Act of 1933

And Deemed Filed Pursuant to Rule 14a-12

Under the Securities Exchange Act of 1934

Subject Company: FirstMerit Corporation

Commission File No.: 001- 11267

Date: March 31, 2016

The following updates to FirstMerit Corporation’s Employee Integration Portal internal website were made available to employees of FirstMerit Corporation on March 31, 2016.

First Merit Bank

Coming Together In Partnership

First Merit Bank is joining Huntington Welcome

Huntington

Customer

Employee

Submit a

Microsite

Communications

Communications

Question

Welcome to the integration page, a resource for answers to questions, updated communications and more as we work together with Huntington to create a stronger, market-leading regional bank.

As we move toward the closing of the transaction in 2016, systems integration in 2017 and beyond, you may have questions. Use the “Submit a Question” link to ask your questions and suggest topics for future communications. We will provide a response as soon as possible and answers will be posted on this page.

We will have more answers as we continue through the transaction process, updating this page with new information as we get it. Be sure to check out the FAQs below and the Latest Communication page for new information. Stay tuned.

Frequently Asked Questions (Updated: 3/31/16 9:30 am est)

Employment - General

Employment - General Questions

What is Huntington’s policy on flex time or working from home?

Huntington’s practice is to support alternative work schedules when business needs can accommodate the request and with the manager’s review and approval. Some examples of alternative work schedules are listed below.

Flextime

Flextime schedules permit you to adjust your daily scheduled starting and ending times within limits set by management. The flexible periods are at either end of established core business hours, during which all employees are required to be at work.

Staggered Hours

With this schedule, employees in an area have fixed arrival and departure times that may vary among the work group. Once you have established a schedule with your manager, you will be expected to maintain it on a consistent basis. For example, your department may allow you to choose a schedule of 7:00a.m. - 4:00 p.m., 7:30 a.m. - 4:30 p.m. or 8:00 a.m. - 5:00 p.m.

Mobile Workforce

Huntington’s Mobile Workforce Guidelines may offer you the opportunity to work at home or an alternative location on a regular schedule. You may be connected to the office via computer, fax and/or telephone. In addition to your manager’s review and approval, a mobile workforce arrangement requires specific considerations and evaluation.

Compressed Work Weeks

This option compresses the standard work week into less than five days. The most common schedules are four ten-hour days, again with manager approval.

Part-Time

This schedule provides you with the opportunity to work less than 40 hours each week. This program may allow you to make time/income trade-offs on a pre-arranged basis, rather than having to make ad hoc arrangements with your manager.

Alternative work schedules are not necessarily limited to the examples above. Huntington encourages the development of scheduling alternatives that meet business objectives and colleagues’ personal situations.

Published: 3/31/16 (HR Policy-16)

If my status is full-time as a FirstMerit employee, if I am offered employment at Huntington will my status remain full-time?

Huntington’s goal is to offer as many comparable job offers as possible for situations where continued employment at Huntington is offered. However, there may also be situations where non-comparable job offers are offered.

At Huntington, full-time is defined as 40 hours/week. Huntington also has a part-time classification (referred to as P1) defined as 30-39 hours/week. Both full-time and P1 classifications at Huntington are offered medical benefits at the same rates. Please refer to FirstMerit’s Severance Pay Policy for further details on comparable vs. non-comparable job offers.

Published: 3/29/16 (Employment-13)

Would it be a possibility for FirstMerit employees to preview the Huntington Bank Employee handbook?

Huntington will share handbook statements with FirstMerit employees after regulatory approval. Because we are still in the early stages of the integration process, sharing the complete Huntington employee handbook is not appropriate at this time.

Published: 3/17/16 (HR Policy-8)

As an operation center employee we are able to dress casual: jeans, casual slacks, sweatshirts, t-shirts, sweaters, etc. Will we be able to wear the same kind of attire if the operation center stays open here in Akron and we retain our jobs here or will we have to have Huntington attire? I understand the dress code listed, however does that apply to the entire bank? Do the Contact Center and non-customer contact areas follow the same dress code?

The Huntington practice is the same for all of its employees and departments. We do allow the Management team to determine the acceptable dress code for their business segment, including guidelines for: business professional, business casual, seasonal dress code (if applicable), and potential “dress-down” days for special events.

The Huntington Management team provides general guidelines for professional image and acceptable attire in the workplace based on the following Huntington principles:

to present a professional image befitting employees in the financial services industry

• to inspire a high level of customer confidence, reliance and trust in Huntington and its’ employees

• to allow employees to dress comfortably without compromising Huntington’s professional image

If your job does not routinely involve direct customer contact, then you may wear business professional or business casual attire depending on the standard chosen by your business segment, region or the most senior manager at a facility.

As appropriate, each business segment or region generally has the flexibility to determine which of the two guidelines applies to its workplace. Consideration may be given to seasonal temperatures, geographic customs and community standards for acceptable business attire. Each business segment or region may also make exceptions to the standard dress code for special events, casual day incentive awards or other situations when business professional or business casual attire may not be appropriate.

Where multiple work groups share a common location and normal building traffic patterns result in significant mixing of employees and external customers or business contacts, management of these work groups are encouraged to work together to formulate the acceptable dress code for all employees in that location.

Published: 3/17/16 (HR Policy-9)

Do hourly employees at Huntington have to punch in and out of an online timesheet?

Yes. Huntington uses a web-based timekeeping system called eTime. All hourly paid employees access the system using a link which allows them to easily log in, click a button to record their time, and then log out. Training on eTime will be provided for all hourly employees at a later date.

Published: 3/17/16 (Payroll-10)

How is payroll done? Example: every other week or twice a month?

All Huntington employees are paid bi-weekly every other Friday on a one-week lag. For example, an employee paid on Friday, October 14, 2016 would be paid for days worked during the period of September 25, 2016 through October 8, 2016.

Exempt (salaried) employees are paid on alternate Fridays from non-exempt (hourly)

employees.

Details regarding the transition of pay cycles will be communicated at a later date.

Published: 3/17/16 (Payroll-1)

How will Christmas be observed? FirstMerit indicated that the bank would be closed and observing 12/26/2016. How will Huntington observe this day?

Huntington observes several holidays throughout the year which does include Christmas Day. The 2016 holiday schedule outlines the nine holidays that will be officially observed at Huntington.

Please note that a limited number of locations/departments (i.e., Phone Bank, In-Store Branches) may remain open on these holidays to provide service to customers. If an employee’s location/department remains open, the employee should consult with his/her manager regarding how holiday time and pay will be administered. Huntington will observe the following nine holidays in 2016:

New Year’s Day: Friday, January 1

Birthday of Dr. Martin Luther King, Jr.: Monday, January 18

Washington’s Birthday/Presidents’ Day: Monday, February 15

Memorial Day: Monday, May 30

Independence Day: Monday, July 4

Labor Day: Monday, September 5

Veterans Day: Friday, November 11

Thanksgiving Day: Thursday, November 24

Christmas Day: Sunday, December 25 (Observed Monday, December 26)

More details for Traditional Retail Branches:

Huntington’s traditional retail branches will close by 2 p.m. on Saturday, December 24, 2016. Traditional branches will close at their regular closing times on Saturday, December 31, 2016.

More details for In-Store Branches:

Meijer and Giant Eagle In-Store branches will be closed on the following days in 2016: New Year’s Day (Friday, January 1); Easter (Sunday, March 27); Memorial Day (Monday, May 30); 4th of July (Monday, July 4); Labor Day (Monday, September 5);Thanksgiving Day

(Thursday, November 24)l; and Christmas Day (Sunday, December 25) and day after Christmas (Monday, December 26). In-store employees need to consult with their managers regarding how holiday time will be administered.

In-Store branches will close at 2 p.m. on Saturday, December 24, 2016 and at 5 p.m. on Saturday, December 31, 2016. In-Store branches will adjust scheduled work hours during these weeks to ensure no loss of hours worked.

How Holiday Time Works:

Full-time employees (both exempt and nonexempt) will be paid Holiday Time, according to the Holiday Time Schedule, regardless of whether or not they are regularly scheduled to work on the observed holiday. Part-time (both exempt and non-exempt) employees are eligible for paid Holiday Time, according to the Holiday Time Schedule, only for those observed holidays on which they are regularly scheduled to work.

Published: 3/17/16 (Misc-19)

I noticed that Huntington does not observe Columbus Day as a Holiday. Will we be closed this year because it was in FirstMerit’s published schedule or will we be open?

As of the transaction close, the Huntington holiday schedule will be followed. Huntington does not recognize Columbus Day as a holiday. If the transaction closing occurs prior to Columbus Day, then the Bank will be open.

Published: 3/17/16 (Misc-18)

What are considered part time hours for Huntington and full time hours?

Full-time (F) = 40 hours/week. Huntington also has three (3) part-time categories: P1 = 30-39 hours/week; P2 = 20-29 hours/week; and P3 = less than 20 hours a week. Both full-time and P1 job classifications are offered the same medical benefits at the same cost. P2 job classification is also offered medical benefits but at a higher cost. More detailed information regarding available benefits options and costs will be provided at a later date. A general summary of benefit eligibility and coverages are provided under the “Benefits” FAQ dropdown category (See Question: Does Huntington offer benefits for part-time employees?)

Published: 3/17/16 (Misc-15)

If a current FirstMerit employee’s job has them working past the transaction close and through the conversion process, of which company will they be considered to be an employee? FirstMerit or Huntington?

Upon the transaction close, all FirstMerit employees will become Huntington employees.

Published: 3/17/16 (Employment-9)

If an employee’s position is not eliminated prior to the closing date, is that employee still considered a FirstMerit employee? Or, would that employee be considered a Huntington employee or a contractor for Huntington? How does this affect benefits?

Any FirstMerit employee whose position is not eliminated prior to the transaction closing will become a Huntington employee. Benefits will be provided to all eligible employees consistent with information provided in answers to other benefits-related questions on the FirstMerit integration portal.

Published: 3/17/16 (Employment-6)

I would like to know if we have to interview with Huntington staff to retain our positions with Huntington.

Huntington and FirstMerit are currently in the process of developing the overall selection process. Although final decisions have not yet been made, some placement decisions may require interviews as part of the selection process while other placement decisions will not require interviews. As more decisions are finalized regarding the overall selection process and timing of selection decisions, we will share additional information with you.

Published: 3/17/16 (Employment-5)

If we previously worked for Huntington, will we keep our current employee numbers or will we get our Huntington numbers back?

All FirstMerit employees will be assigned a Huntington Employee Number and Novell ID. If a previous Huntington employee’s Novell ID began with HB, then they should retain that same employee number and Novell ID if rehired at Huntington. If an employee was employed long ago and their information is not in the HR systems, then he or she would be assigned a new Huntington Employee Number and new Novell ID.

Published: 3/16/16

Will the FirstMerit/Huntington merger affect the Merit increases if any for 2016 for employees?

Performance-based merit increases similar to last year will go forward for this year and will be effective May 1, 2016.

Published: 3/4/16 (Merit-2)

How will non-compete agreements be treated with the merger? If someone chooses to leave directly due to the merger, will their non-compete be released? If someone chooses to stay and ends up dissatisfied with Huntington, will they still be bound to the contract made with FirstMerit?

This question appears to be about non-solicit agreements and not non-compete agreements. Employees who have non-solicit agreements in effect are bound to those agreements, regardless of the merger action taking place, and the agreements do not allow employees to be released from their non-solicit obligation as a result of dissatisfaction with the employer, whether the employer be FirstMerit currently or Huntington as the successor.

Published: 3/4/16 (Misc-2)

How many employees will join Huntington from FirstMerit?

Huntington is currently in the process of evaluating the organizational structure that will be put in place once the partnership is complete.

While some duplicative work will be identified as the two companies work toward closing, we believe the combination of these two great companies will present employees with new opportunities. There will be new roles to contribute to a stronger, market-leading regional bank, enabling employees to further careers by expanding current responsibilities, skill development and increased leadership opportunities.

FirstMerit branch employees with satisfactory performance will be offered job opportunities within Huntington. All FirstMerit employees will have priority access to job opportunities at Huntington throughout all of FirstMerit and Huntington’s combined footprint. We will maintain operational hubs in Flint and Akron.

Published: 1/26/16

What are the next steps for FirstMerit employees?

We know that you may be concerned about what impact this transaction has on your job. We will keep you updated throughout the process to help you make informed decisions during this transition.

Again, FirstMerit branch employees with satisfactory performance will be offered job opportunities within Huntington. All FirstMerit employees will have priority access to job opportunities at Huntington throughout all of FirstMerit and Huntington’s combined footprint.

Published: 1/26/16

When will we have access to Huntington’s current job openings? Can we begin applying for positions now?

Because it is important that both companies continue to provide a seamless experience for customers throughout this partnership, FirstMerit employees must continue to operate as FirstMerit through closing and the systems conversion. We will continue to keep you updated as to when Huntington job opportunities will be available for FirstMerit employees to consider as we get closer to closing.

In addition, maintaining your current employment through closing will allow your seniority with FirstMerit to carry over to Huntington.

Between now and closing, Huntington will ask you for additional information about your background and experience so we can consider you for available Huntington positions. More information from Huntington’s Human Resources team will be coming at a later date with further details.

Published: 1/26/16

Will we be subject to Huntington’s pre-employment nicotine testing?

No. New employees who join Huntington as part of a merger or acquisition are not required to complete pre-employment nicotine testing. However, similar to FirstMerit’s health plan, non-tobacco users pay lower premiums under Huntington’s health plan. FirstMerit employees who enroll in Huntington’s health care plan will need to disclose their tobacco status in order to receive lower health care premiums.

Published: 1/26/16

I read on Huntington’s website that they are a smoke free environment: no nicotine, no patches, no gum & no vapors. So what does this mean for current FirstMerit employees who smoke?

New employees who join Huntington as part of a merger or acquisition are not required to complete pre-employment nicotine testing. However, similar to FirstMerit’s health plan, non-tobacco users pay lower premiums under Huntington’s health plan. FirstMerit employees who enroll in Huntington’s health care plan will need to disclose their non-tobacco status in order to receive lower health care premiums. In addition, Huntington’s practice is to provide a safe, healthy, comfortable and productive work environment that is tobacco-free.

Employees are not permitted to use tobacco (including, but not limited to, cigarettes, cigars, pipes, smokeless tobacco, chewing tobacco, snuff or snus, electronic cigarettes, or vapor cigarettes) in the following areas or during the following circumstances:

On Huntington-owned property, including parking lots and parking garages, with the exception of within your own personal vehicle

In any Huntington building

In Company-owned vehicles that are used for business purposes

At any Company-sponsored event at which an employee is representing Huntington

Huntington’s wellness program offers many free tools and resources, including tobacco cessation programs, for those individuals who use tobacco and are ready to quit.

Published: 2/16/16 (HR Policy-1)

If I once worked for Huntington, how will my prior service be taken into account?

If you worked for Huntington Bancshares Incorporated or one of its subsidiary or affiliate companies any time during the five-year period immediately preceding your new date of employment, then you will be given credit for those years when calculating your available Paid Time Off (PTO). Please note that the period between when you left Huntington and were rehired is not considered when calculating your available PTO. Previous employment with a company that has since merged with or been acquired by Huntington will not be considered as employment with Huntington for purposes of this calculation. Service with FirstMerit will be credited as described below.

Published: 1/26/16

After the closing, will we keep our seniority from FirstMerit?

Your documented service date from FirstMerit will carry over to Huntington for all purposes in any Huntington compensation or benefit plan in which you are eligible to participate following the closing (including, without limitation Paid Time Off (PTO) and leave eligibility), subject to certain exceptions as set forth in the merger agreement. Your documented service date from FirstMerit will also carry over to reflect years of service with Huntington.

For example, if your documented service date with FirstMerit reflects a hire date of September 30, 2000, then your Huntington service date would also reflect September 30, 2000. As a result, you would have 16 years of service with Huntington, assuming a closing date of September 30, 2016.

Published: 1/26/16

Does Huntington have paperless paystubs?

Yes. Huntington has paperless paystubs that may be viewed online and/or printed. W-2s are also able to be viewed online and/or printed.

Published: 2/16/16 (Misc-1)

We would like to know the status of our jobs with Huntington. Are they going to keep us? As a manager, I need to know how many jobs will be retained and where those jobs will be located (Akron or Columbus).

Specific employment decisions have not been made at this time. At the appropriate time, employment decisions will be communicated to all FirstMerit employees to let them know whether they will continue employment with Huntington.

Published: 2/26/16 (Employment-1)

If I am currently an officer with FirstMerit, will I maintain this title with Huntington assuming that I come over as a Huntington employee?

FirstMerit officer titles and Huntington officer titles are generally the same. While we have not completed an individual business by business review of officer titles, our promotions criteria and process is very similar. It is not Huntington’s intention to re-evaluate current officer titles as part of the integration process. As organizational structures and staffing decisions are finalized for each group, your responsibilities, including officer titles, may change commensurate with your ongoing role.

Published: 2/26/16 (Misc-3)

Will current officer titles and position levels (Position level I, II, III) be considered when offering employment at Huntington?

All jobs at FirstMerit will be appropriately mapped into existing job codes/descriptions at Huntington. Current FirstMerit functional titles may not be identical when mapped to Huntington. For example, an Analyst III at FirstMerit may be mapped to a Senior Analyst job title at Huntington.

Published: 2/26/16 (Misc-6)

What is the Huntington Bank holiday schedule?

Huntington’s practice is to provide paid Holiday Time to eligible employees of up to a maximum of nine (9) holidays per calendar year. Holiday Time is available for use by eligible employees on the date the Company designates for the holiday observance. Huntington provides paid Holiday Time in observance of the following nine (9) holidays on which the offices are generally closed unless otherwise communicated.

New Year’s Day

Martin Luther King Day

Presidents’ Day

Memorial Day

Independence Day

Labor Day

Veterans Day

Thanksgiving Day

Christmas Day

Upon closing, Huntington’s holiday schedule will be observed. Note: Huntington does not observe Columbus Day.

Published: 2/26/16 (Misc-8)

Important Additional Information

In connection with the proposed transaction, Huntington has filed with the SEC a registration statement on Form S-4 that includes a joint proxy statement of Huntington and FirstMerit and a prospectus of Huntington, as well as other relevant documents concerning the proposed transaction. The proposed transaction involving Huntington and FirstMerit will be submitted to FirstMerit’s stockholders and Huntington’s stockholders for their consideration. This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. BEFORE MAKING ANY VOTING OR INVESTMENT DECISION, INVESTORS AND

STOCKHOLDERS OF HUNTINGTON AND FIRSTMERIT ARE URGED TO CAREFULLY READ THE ENTIRE REGISTRATION STATEMENT AND JOINT PROXY STATEMENT/PROSPECTUS, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. A copy of the definitive joint proxy statement/prospectus, as well as other filings containing information about Huntington and FirstMerit, can be obtained, without charge, at the SEC’s website (http://www.sec.gov). Copies of the joint proxy statement/prospectus and the filings with the SEC that are incorporated by reference in the joint proxy statement/prospectus can also be obtained, without charge, by directing a request to Huntington Investor Relations, Huntington Bancshares Incorporated, Huntington Center, HC0935, 41 South High Street, Columbus, Ohio 43287, (800) 576-5007 or to FirstMerit Corporation, Attention: Thomas P. O’Malley, III Cascade Plaza, Akron, Ohio 44308, (330) 384-7109.

Participants in the Solicitation

Huntington, FirstMerit, and certain of their respective directors, executive officers and employees may be deemed to be participants in the solicitation of proxies in respect of the proposed transaction. Information regarding Huntington’s directors and executive officers is available in its definitive proxy statement, which was filed with the SEC on March 10, 2016, and certain of its Current Reports on Form 8-K. Information regarding FirstMerit’s directors and executive officers is available in its definitive proxy statement, which was filed with SEC on March 6, 2015, and certain of its Current Reports on Form 8-K. Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, is available in the joint proxy statement/prospectus and other relevant materials filed with the SEC. Free copies of this document may be obtained as described in the preceding paragraph.

FIRSTMERIT bank

Coming Together In Partnership

FIRSTMERIT Bank IS JOINING Huntington Welcome.

Huntington Microsite

Customer Communications

Employee Communications

Submit a Question

Welcome to the integration page, a resource for answers to questions, updated communications and more as we work together with Huntington to create a stronger, market-leading regional bank.

As we move toward the closing of the transaction in 2016, systems integration in 2017 and beyond, you may have questions. Use the “Submit a Question” link to ask your questions and suggest topics for future communications. We will provide a response as soon as possible and answers will be posted on this page.

We will have more answers as we continue through the transaction process, updating this page with new information as we get it. Be sure to check out the FAQs below and the Latest Communication page for new information. Stay tuned.

Frequently Asked Questions (Updated: 3/31/16 9:30 am est)

Benefits

Benefit Questions

Does Huntington offer Dependent Care Accounts?

Yes, Huntington offers a Dependent Care spending Account (DCSA) to full time, P1 and P2 employees. The minimum pre-tax contribution is $1,200 per year and the maximum is $5,000. Employees can use DCSA funds to pay for daycare for a dependent child under age 13 or other dependent (such as an elderly parent) who is physically or mentally incapable of self-support. Employees may submit claims until April 30 for claims that are incurred in the previous calendar year. Contributions are pre-tax and qualified withdrawals are tax-free.

Published: 3/31/16 (Medical-14)

What are Huntington’s Bereavement Time Benefits?

Huntington offers the following Bereavement Time benefits:

Immediate Family Members

Huntington employees are eligible for paid bereavement time of up to five (5) days for an immediate family member. This time can be used for grieving, making any final funeral arrangements and/or attending the funeral or memorial service. Not all bereavement circumstances are alike, so you should discuss your time off request for bereavement with your manager.

You will receive paid bereavement time for your scheduled hours provided you are scheduled to work on the day(s) bereavement time is taken. Time off taken under this practice will not be used in the calculation of overtime.

Immediate Family Members include:

Spouse/Partner – up to five (5) days

Child/Step-Child/Foster Child – up to five (5) days

Child lost during pregnancy or birth – up to five (5) days

Mother/Father /Step Mother/Step Father– up to five (5) days

Mother-in-law/Father-in-law – up to five (5) days

Brother/Sister/Step Brother/Step Sister – up to five (5) days

**Special Note – an immediate family member also includes anyone else who is a member of your household.

Family Members

Huntington employees are eligible for paid bereavement time for up to three (3) days for family members. This time can be used for grieving, making any final funeral arrangements and/or attending the funeral or memorial service. Not all bereavement circumstances are alike, so you should discuss your time off request for bereavement with your manager.

You will receive paid bereavement time for your scheduled hours provided you are scheduled to work on the day(s) bereavement time is taken. Time off taken under this practice will not be used in the calculation of overtime.

Family Members include:

Brother-in-law/sister-in-law – up to three (3) days

Son-in-law/daughter-in-law – up to three (3) days

Aunt/Uncle/Step Aunt/ Step Uncle – up to three (3) days

Grandparent/Great Grandparent/Step Grandparent, Grandparent-in-law – up to three (3) days

Grandchild/Step-Grandchild of either you or your spouse/partner – up to three (3) days

Other Family or Close Friend

Huntington employees are eligible for paid bereavement time of up to (1) day per year for any close friends or family members not specifically outlined above. This time can be used for grieving, making any final arrangements and/or attending the funeral or memorial service. Not all bereavement circumstances are alike, so you should discuss your time off request for bereavement with your manager.

Published: 3/29/16 (HR Policy-13)

How will Paid Time Off (PTO) be handled? When will FirstMerit employees transition to Huntington’s PTO program?

All FirstMerit PTO policies [Full-time (salaried and commissioned) Employees, High-Time & Part-Time Employees

(Including Officers)] will remain in effect through December 31, 2016. Assuming close of the transaction in 2016, FirstMerit employees will transition to Huntington’s PTO program as of January 1, 2017. The number of PTO hours/days that former FirstMerit employees who continue employment with Huntington will be eligible for in 2017 will be dependent upon the job grade and job classification (full-time, part-time) of the employees’ positions with Huntington.

Any FirstMerit employee who voluntarily resigns prior to the transaction close will receive PTO payout according to the FirstMerit “PTO Paid at Time of Separation” Policy for the state in which he or she works.

Any FirstMerit employee whose position has been identified for position elimination between transaction close and December 31, 2016 will receive PTO payout according to the FirstMerit “PTO Paid at Time of Separation” Policy for the state in which he or she works.

Huntington’s PTO program does not include a PTO carry-over option, so FirstMerit employees are encouraged to use available PTO time by December 31, 2016. However, to accommodate FirstMerit employees who are not able to utilize all of their PTO by December 31, 2016, Huntington will provide payment equivalent to the value of the amount of carry-over PTO previously allowed as outlined in FirstMerit’s PTO Policies. Eligible part-time and high-time employees would be eligible to have a maximum of 16 hours of unused PTO paid, and eligible full-time employees would be eligible to have a maximum of 24 hours of unused PTO paid. Huntington anticipates that these payments for eligible employees occur by the end of January 2017.

If your position has been slated for job elimination effective January 1, 2017 or after, any PTO payout, if applicable, will be paid according to Huntington’s PTO employee handbook statement.

Published: 3/17/16 (PTO-16)

Does Huntington allow you to take hours of PTO or just full days off?

If you are a non-exempt (hourly) employee, you may use PTO in as small as one (1) hour increments. If you are an exempt (salaried) employee, you may use PTO in as small as half (1/2) day increments.

Published: 3/17/16 (PTO-15)

While trying to plan any vacation/PTO time for the remainder of this year, is there any black out time period where time off will not be allowed?

As long as your manager has approved PTO, you may utilize the PTO. As we get closer to the anticipated transaction close and related conversion activities, there may be specific periods of time that will require a majority of resources to complete required tasks. Such demands will likely be different for each segment of the business so it is important for you to consult with your manager when planning your PTO.

Published: 3/17/16 (PTO-9)

Does Huntington allow employees to purchase PTO time?

Yes - Huntington’s practice is to provide eligible employees with the opportunity to take up to one week (up to 5 consecutive days) of Elective Time Off Unpaid (ETO) in a rolling 12-month period with manager approval. This practice reflects Huntington’s commitment to the work/life balance of their employees by providing more flexibility in their schedules and is in addition to available PTO time.

You may elect to take up to one week (5 days) of ETO once during a 12-month period with your manager’s approval. To minimize the financial impact to you, a salary adjustment for the total ETO taken may be made by equal earnings reductions over 26 pay periods following the time off. While you also have the option to elect to have the earnings reductions end sooner you would not be eligible to use ETO again until 12-months after the most recent ETO usage.

You are eligible to request up to one week (5 days) of ETO if the following criteria are met:

You are actively at work (i.e., not on any type of leave of absence)

You are a full-time(F) or part-time employee (P1, P2, P3)

You have completed 90 days employment (which includes years of service at FirstMerit)

You are not on a Performance Improvement Plan at the time of your ETO request

Published: 3/17/16 (PTO-8)

Does Huntington offer a Commuter Benefit (tax-free parking via salary reduction)?

Yes - Huntington currently offers a Commuter Benefit program that permits eligible employees to pay for eligible commuter expenses – including qualified parking, transit passes and van pools on a pre-tax basis.

Published: 3/17/16 (Misc-16)

Does Huntington provide assistance with parking costs for those employees who work in downtown Columbus?

No - Huntington does not provide assistance with parking costs at any of their locations. However, Huntington currently does offer a Commuter Benefit program that permits eligible employees to pay for eligible commuter expenses (including qualified parking, transit passes and van pools) on a pre-tax basis.

Published: 3/17/16 (Misc-14)

I am located in Nashville, TN and am curious how “out of footprint” folks access benefits. I’m sure that this is something Huntington deals with now.

Huntington strives to offer the same benefit programs to its eligible employees regardless of where they are in the geographic footprint. From a medical and prescription drug standpoint, employees throughout Huntington’s footprint currently have access to Anthem Blue Cross Blue Shield for medical and Caremark for prescription drugs. For more information on the health care plan vendors, see the answer to the Medical-3 question previously posted on the FirstMerit integration portal.

Published: 3/17/16 (Misc-13)

Does Huntington have an FSA account as a benefit and do they allow the $500 rollover at year end? Would any excess FMER FSA funds rollover at year end if so?

Huntington currently offers health care flexible spending accounts (HCSAs) as a benefit. Huntington’s current HCSA program is open to employees in full-time, P-1 and P-2 employment classifications. The minimum annual contribution is $120 and the maximum annual contribution is $2,500. Huntington’s HCSA program does not permit funds in an employee’s HCSA account to roll over from year to year. For example, employees have until April 30, 2016 to submit for reimbursement of expenses incurred on or before December 31, 2015. Reimbursement of expenses incurred in 2016 can only be made from employees’ 2016 HCSA accounts.

The $500 rollover at year-end is part of the FirstMerit program and any changes to how this portion of the FirstMerit program operates in connection with the upcoming merger and transition to Huntington benefit programs will be communicated by FirstMerit.

Published: 3/17/16 (Medical-7)

Does Huntington Bank offer employees PPO Health Insurance options?

Huntington does not offer traditional PPO Health Insurance options. However, Huntington has health plan options to choose from, with an emphasis on Wellness, that provide many benefits to employees. Please refer to the answer to the following question (also found under the FAQ HR-Benefits category) on the FirstMerit Integration Portal for a detailed answer on our current health insurance options: Does Huntington only offer High Deductible Health Plans, and if so how does that compare to the PPO plan that I have now?

Published: 3/17/16 (Medical-10)

Does Huntington only offer High Deductible Health Plans, and if so how does that compare to the PPO plan that I have now?

Huntington only offers the following account-based medical plans from which to choose

PPO Consumer Directed High – higher premiums and lower out-of-pockets

PPO Consumer Directed Low – lower premiums and higher out-of-pockets

An account-based plan combines a high-deductible medical plan with a tax-advantaged health savings account. In terms of deductibles and out of pocket maximums, Huntington’s PPO Consumer Directed High is similar to FirstMerit’s PPO.

FirstMerit employees will be provided with detailed information about how Huntington’s medical program works in the coming months.

Until then, here is a very high level summary of how an account based plan works:

In an account based plan, preventive medical care and preventive prescription drugs are paid 100% by the plan. After that, employees pay for most types of care (other than preventive medical care and preventive prescription drugs) until they meet their annual deductible. After the annual deductible is met employees pay either 20% or 30% coinsurance (depending upon plan design elected) until their annual out-of-pocket maximum is met. Once the out-of-pocket maximum is met the plan pays 100% of the medical and prescription drug expenses.

An important part of the account based plan design is the health savings account (HSA). A health savings account is a tax favored account used to pay eligible health care expenses, on a pre-tax basis. Both Huntington and employees contribute to the health savings account. Employees contribute on a pre-tax basis (similar to a 401(k) plan). Employees can use the funds in their health savings account to help pay for medical and prescription drug expenses incurred prior to the annual deductible being met. At Huntington, employees that engage in wellness activities receive employer contributions to their health savings accounts. In 2016, employees that fully engage in wellness can receive up to a maximum of $750 (employee only coverage) or $1,500 (all other coverage levels).

Published: 3/17/16 (Medical-5)

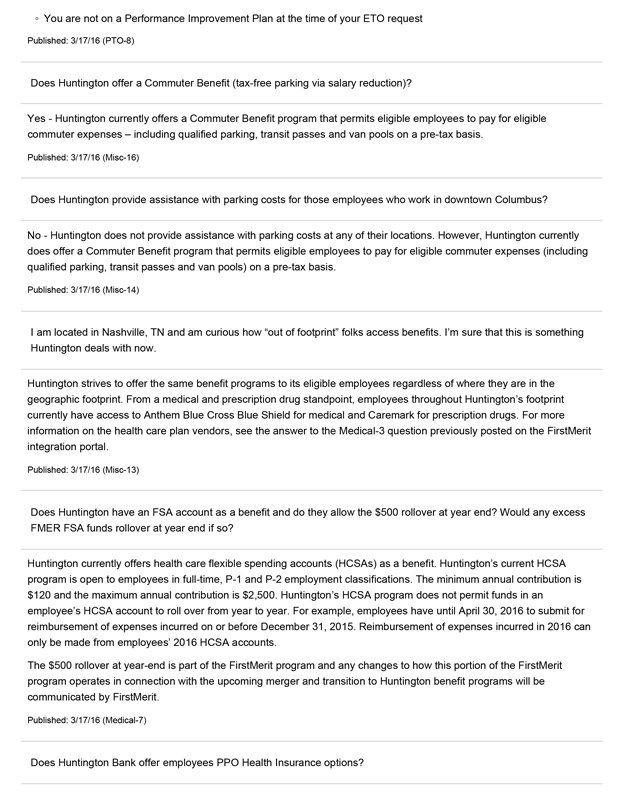

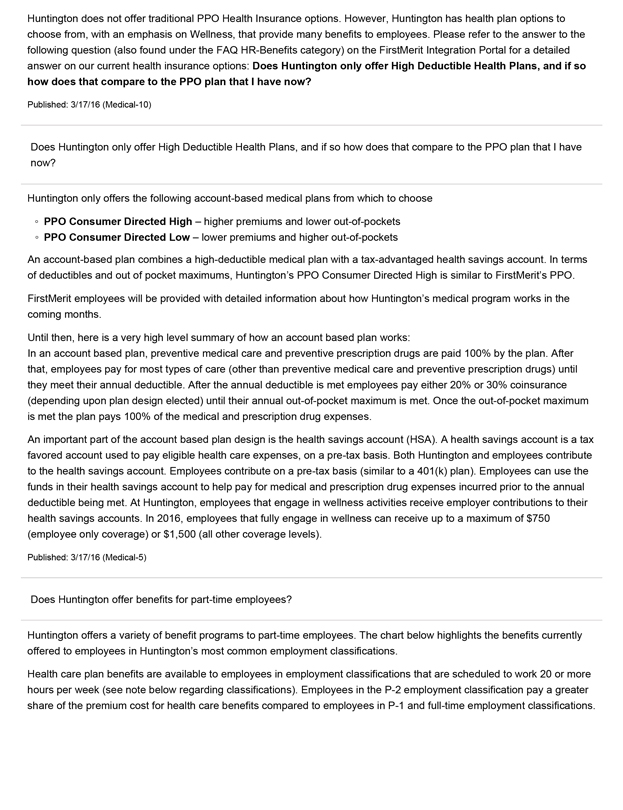

Does Huntington offer benefits for part-time employees?

Huntington offers a variety of benefit programs to part-time employees. The chart below highlights the benefits currently offered to employees in Huntington’s most common employment classifications.

Health care plan benefits are available to employees in employment classifications that are scheduled to work 20 or more hours per week (see note below regarding classifications). Employees in the P-2 employment classification pay a greater share of the premium cost for health care benefits compared to employees in P-1 and full-time employment classifications.

Employee Classification

Full-Time

P1

P2

P3

Medical, Dental and Vision

Yes

Yes

Yes

No

Spending Accounts

Yes

Yes

Yes

No

Basic, Optional, Dependent and Business Travel Life Insurance

Yes

Yes

Yes

Yes

AD&D Insurance

Yes

Yes

Yes

No

Short and Long Term Disability Benefits

Yes

Yes

Yes

No

401 (k) Plan

Yes

Yes

Yes

Yes

Employee Assistance Plan

Yes

Yes

Yes

Yes

Paid Time Off and Paid Holidays

Yes

Yes

Yes

Yes

Notes:

• Full-time - scheduled to work 40 hours per week

• P-1 - scheduled to work between 30 and 39 hours per week

• P-2- scheduled to work between 20 and 29 hours per week

• P-3 - scheduled to work fewer than 20 hours per week

Published: 3/17/16 (Medical-4)

If a position is not available at Huntington are there any medical benefits included post-employment like the payroll severance benefit?

The current plan is to maintain FirstMerit health and welfare benefits through December 2016 and transition to

Huntington’s health and welfare benefits beginning in 2017. FirstMerit employees who terminate employment either prior to or after the financial close may elect to continue their group health care plan coverage (provided they are enrolled at the time their employment terminates) for a maximum of 18 months (29 months if a disability occurs) under COBRA.

COBRA (the Consolidated Omnibus Budget Reconciliation Act) is a federal law that allows eligible employees and enrolled dependents to stay on the employer-sponsored health care plan under certain circumstances, including termination of employment. Employees who elect COBRA must pay the entire premium. FirstMerit 2016 monthly COBRA rates are available on FirstNet: View 2016 COBRA rates. Huntington’s 2017 COBRA rates are not yet available.

Published: 3/17/16 (Medical-1)

My husband and I are considering having another child next year. Would it be possible to see your maternity leave policy?

Huntington will provide FirstMerit employees with benefits program information at a future point in time. Generally, under Huntington’s current benefit programs, Huntington offers eligible employees unpaid medical and/or family leave, Paid Time Off, disability benefits and/or paid bonding time in connection with the birth of a baby, adoption of a child or placement of a foster child. In general, prior service with FirstMerit will be counted as service under these programs for employees employed by FirstMerit on the date of the transaction close.

A high level summary of Huntington’s current program is provided below. Details surrounding these programs (including any eligibility requirements in order to be covered under the programs) will be provided at a later date.

• Family Medical Leave Act (FMLA) - Under FMLA, eligible employees can take up to 12 weeks of unpaid leave in a rolling 12-month period for the birth and care of a newborn child or the placement of a child for adoption or foster care.

FMLA is unpaid, but a combination of Family Time Off, Short Term Disability and Paid Time Off may provide pay during the unpaid FMLA time.

• Family Time Off - Full-time, P1 or P2 employees employed at Huntington for at least 12 months are eligible for a maximum of 5 paid Family Time Off (FTO) days within a 12-month calendar period. FTO gives parents up to five paid days off to allow for bonding time after the birth of a baby, adoption of a child or placement of a foster child. FTO is in addition to PTO and doesn’t count against available PTO. FTO must be used within the first 90 days of birth or placement.

• Short Term Disability - Employees in full-time or P-1 employment classifications are eligible to receive 60%, 80% or 100% of their pay (based on length of service) for the time they are considered disabled in connection with birth or pregnancy under the terms of the Short Term Disability plan. The Short Term Disability plan reimbursement percentage reduces to 60% for disabilities that last longer than eight weeks up to a maximum of 173 calendar days.

Following the expiration of Short Term Disability benefits, long term disability (LTD) benefits are available to employees in full-time and P-1 employment classifications who satisfy the LTD plan’s requirements for benefits.

• Paid Time Off (PTO) — Typically after Family Time Off and Short Term Disability end, employees can use PTO to receive pay for what would otherwise be unpaid leave time. Otherwise, the remainder of FMLA leave is unpaid.

Published: 3/17/16 (HR Policy-7)

I was just wondering if I have already booked a vacation for the end of this year (November) if I will still be able to go if it is during the time of conversion.

As long as the PTO is approved by your manager, the PTO may be utilized.

Published: 2/26/16 (PTO-5)

What health insurance company does Huntington Bank use? What percentage do employees pay for their health insurance?

At Huntington, employees can choose from a variety of medical vendors, depending upon where they live. The table below illustrates the vendors currently available throughout Huntington’s current geographic footprint. Prescription drug coverage for all vendors is provided through Caremark.

• Northeast Ohio: Anthem, Aultcare, Medical Mutual of Ohio

• Eastern Ohio: Anthem, Medical Mutual of Ohio

• Central/Southern/Northern Ohio: Anthem, Medical Mutual of Ohio

• Northwest Ohio: Anthem, Medical Mutual of Ohio, Paramount

• Southern Michigan: Anthem, Paramount

• Pennsylvania/West Virginia: Anthem, UPMC

• All Locations: Anthem

The percentage a Huntington employee pays for health care coverage depends upon the employee’s base salary level, coverage level elected, whether or not the employee and/or his or her adult dependent is a tobacco user, and whether or not the employee is paying an Adult Dependent Surcharge.

Huntington also offers a Wellness Program that encourages employees to take care of their own health by rewarding them for the healthy actions they take. By participating in wellness activities that fit their lifestyle, employees earn Wellness Dollars that are contributed to their Health Savings Accounts (HSAs). These funds can then be used to offset out-of-pocket costs for things like medical expenses and prescription drugs. Employees that maximize this opportunity can earn enough Wellness Dollars to reduce the deductible in Huntington’s most popular medical plan option in half.

Although many factors can impact a company’s medical expenses, our employees’ participation in our Wellness Program has helped keep premium increases low for the past several years. For example, employees saw no increase in their premium rates from 2015 to 2016.

Published: 2/26/16 (HR Medical-3)

Under FirstMerits health plan, if a spouse is offered benefits through their employer and pay less than 50% of the premiums for that coverage, we are not able to cover them under our insurance policy. Will this situation change with the transition to Huntington or will this stipulation remain in place?

Huntington permits its employees to enroll eligible dependents in its health care plan even if other coverage is available through that dependent’s employer. However, Huntington does have an Adult Dependent Surcharge. Employees who enroll a spouse under Huntington’s health care plan must certify at the point of enrollment whether or not their spouse has other coverage available through his or her employer. Employees that choose to enroll their spouse when other coverage is available will pay an additional surcharge. This surcharge is in addition to the normal applicable rate for the coverage being elected.

Published: 2/26/16 (HR Medical-6)

On FirstNet, it states that Huntington offers education reimbursement for a 2 year or 4 year degree program. Does that include a 2 year Master’s Degree program?

The requirement for a degree program is met if the courses taken are leading to a degree program as follows:

Undergraduate programs that are Associate (two-year) or Bachelor (four-year) degree programs with business or job-related degrees as determined by Huntington;

OR

Graduate programs for MBAs or job-related Master’s degrees.

You may be required to submit documentation from your college/university regarding your degree program. Some examples of degree programs that would meet this requirement are programs in business, accounting, finance, public relations, marketing, communications, human resources or computer information systems.

Published: 2/26/16 (HR Policy-6)

How do Huntington’s benefits compare to FirstMerit’s?

Huntington offers comprehensive benefits through its Huntington Total Health program, including medical/prescription drug, dental, vision, life insurance and disability coverage; a 401(k) plan with a profit sharing opportunity; paid time off; and others.

With Huntington Total Health, the goal is to “live life well” - physically, financially, personally and professionally. That’s why Huntington also offers a comprehensive wellness program that allows colleagues who participate the opportunity to earn wellness dollars that are contributed into health savings accounts (HSA). These funds can be used to help pay for out-of-pocket expenses under Huntington’s health care plan. Through the wellness program, colleagues have access to a state-of-the-art wellness website that offers many resources and the opportunity to participate in wellness-related activities.

In addition, a Benefits Overview will be provided soon, along with access to a website with more information about the benefits offered at Huntington.

Huntington has not finalized any decisions regarding the treatment of FirstMerit’s benefit programs and other Human Resources policies and practices post-closing. Huntington will evaluate FirstMerit’s benefit programs and other Human Resources policies and practices and determine how to best align these items within this new partnership.

Published: 1/26/16

How will Huntington treat personal time, vacation time and holiday time with FirstMerit following the closing?

Huntington provides a flexible Paid Time Off (PTO) program for both full-time and part-time employees on an annual basis to provide employees with time away from work to balance work and personal life. PTO may be used for a variety of reasons, including, but not limited to, vacation, celebration of non-Huntington observed holidays, illness, appointments and other personal situations.

Huntington will fully review the treatment of FirstMerit’s personal time, vacation time and holiday time policies and programs for integration post-closing.

Published: 1/26/16

How much vacation time do you earn at Huntington/how is it calculated?

To help employees balance work and personal life, Huntington provides Paid Time Off (PTO) for full-time and part-time employees. The PTO program is designed to be flexible so employees can use their time off work to best fit their needs or circumstances. PTO may be used to take time away from work for things like vacation, personal or family illnesses, personal time for appointments, emergencies, celebration of non-Huntington observed holidays, school or social events.

The amount of PTO employees are eligible to receive is based upon their employment classification, salary grade and length of service with Huntington. Service with FirstMerit will count when determining the amount of PTO at Huntington for those FirstMerit employees who join Huntington at the financial close. PTO for full-time employees with less than five years of service ranges between 16 days and 26 days, depending upon salary grade. PTO for full time employees with between five and 14 years of service ranges between 22 days and 27 days, depending upon salary grade. Full time employees with 15 or more years of service receive 27 days of PTO regardless of salary grade.

Published: 2/12/16 (PTO-4)

At Huntington, what happens to any Paid Time Off (PTO) that I don’t use during the year? Am I able to bank the time or is it forfeited?

Huntington’s Paid Time Off (PTO) program does not allow unused PTO to be carried over into another calendar year. However, if a Huntington business need prevents you from being able to use your PTO, your manager can approve payout of any unused PTO by submitting a special form to Payroll at the end of the year. Payout of unused PTO due to a Huntington business need is typically paid out in January of the following calendar year.

Huntington is aware that FirstMerit currently has a carry-over option for PTO. After Huntington has determined how FirstMerit’s PTO will be transitioned to Huntington, additional information will be provided.

Published: 1/26/16

What will happen to my benefits?

The current plan is to maintain FirstMerit’s health and welfare benefits through December 31, 2016 as long as you are actively employed. There is nothing you need to do now. You may continue to use your medical, dental, vision, flexible spending account and any other benefits in which you are currently enrolled in accordance with respective plans.

Published: 2/8/16

How does this impact a leave of absence?

Through the end of 2016, any leave of absence requests will continue to be processed through Prudential, FirstMerit’s leave administrator. More information on Huntington’s leave program will be forwarded as it becomes available, including information for anyone on leave during the transition.

Published: 2/8/16

Who do I call with questions on my benefits?

• Any questions on your benefits should be directed to the FirstMerit Benefit Center at 877-231-5977.

• If you have individual questions on claims being paid, contact your carrier directly.

• Questions on the 401k should be directed to Schwab at 800-724-7526. You can also check your balance by going to Schwab’s website at https://workplace.schwab.com.

• To check the balance in your flexible spending account, contact NEO Administration at 800-775-3539, or go to their website at www.flexneo.com.

• If you are going on leave or have questions on your leave, contact Prudential at 877-367-7781.

As a reminder, our Employee Assistance Program is available to help any employees or family members with personal or work-related issues. You can contact them directly at 800-227-6007.

Published: 2/8/16

Does Huntington offer educational reimbursement as a part of the benefits package?

Yes. Huntington offers tuition reimbursement to eligible employees (minimum of 90 days of service which would include your service date at FirstMerit; and working in a job classification of 20 or more hours/week) to reimburse all or a portion of the tuition for business and/or job-related accredited college or university courses toward a 2-year or 4 year degree program. In addition, American Institute of Banking courses are eligible for reimbursement. The maximum amount of tuition reimbursement an eligible employee may receive each calendar year is $5,250. Please note that tuition reimbursement may be considered taxable income to recipients.

Published: 2/16/16 (HR Policy-3)

In regards to our employee discounts, does Huntington have a partnership with Verizon like FirstMerit does? Does Huntington offer the Corporate Perks like FirstMerit does?

Huntington employees have access to substantial corporate discounts on Huntington products and services including free checking, along with reduced rates on credit cards, loans, and other banking products and services that make banking at Huntington a smart choice. In addition, Huntington has partnered with many of its business customers to provide employee discounts on products and services. These include discounts on a variety of mobile devices. As we get closer to the transaction close we will communicate Huntington’s broad array of discounts in more detail.

Published: 2/16/16 (Misc-4)

Important Additional Information

In connection with the proposed transaction, Huntington has filed with the SEC a registration statement on Form S-4 that includes a joint proxy statement of Huntington and FirstMerit and a prospectus of Huntington, as well as other relevant documents concerning the proposed transaction. The proposed transaction involving Huntington and FirstMerit will be submitted to FirstMerit’s stockholders and Huntington’s stockholders for their consideration. This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. BEFORE MAKING ANY VOTING OR INVESTMENT DECISION, INVESTORS AND STOCKHOLDERS OF HUNTINGTON AND FIRSTMERIT ARE URGED TO CAREFULLY READ THE ENTIRE REGISTRATION STATEMENT AND JOINT PROXY STATEMENT/PROSPECTUS, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED

TRANSACTION. A copy of the definitive joint proxy statement/prospectus, as well as other filings containing information about Huntington and FirstMerit, can be obtained, without charge, at the SEC’s website (http://www.sec.gov). Copies of the joint proxy statement/prospectus and the filings with the SEC that are incorporated by reference in the joint proxy statement/prospectus can also be obtained, without charge, by directing a request to Huntington Investor Relations, Huntington Bancshares Incorporated, Huntington Center, HC0935, 41 South High Street, Columbus, Ohio 43287, (800) 576-5007 or to FirstMerit Corporation, Attention: Thomas P. O’Malley, III Cascade Plaza, Akron, Ohio 44308, (330) 384-7109.

Participants in the Solicitation

Huntington, FirstMerit, and certain of their respective directors, executive officers and employees may be deemed to be participants in the solicitation of proxies in respect of the proposed transaction. Information regarding Huntington’s directors and executive officers is available in its definitive proxy statement, which was filed with the SEC on March 10, 2016, and certain of its Current Reports on Form 8-K. Information regarding FirstMerit’s directors and executive officers is available in its definitive proxy statement, which was filed with SEC on March 6, 2015, and certain of its Current Reports on Form 8-K. Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, is available in the joint proxy statement/prospectus and other relevant materials filed with the SEC. Free copies of this document may be obtained as described in the preceding paragraph.