Filed by FirstMerit Corporation Pursuant to Rule 425

Under the Securities Act of 1933

And Deemed Filed Pursuant to Rule 14a-12

Under the Securities Exchange Act of 1934

Subject Company: FirstMerit Corporation

Commission File No.: 001- 11267

Date: April 4, 2016

The following communication was made available to employees of FirstMerit Corporation on April 4, 2016.

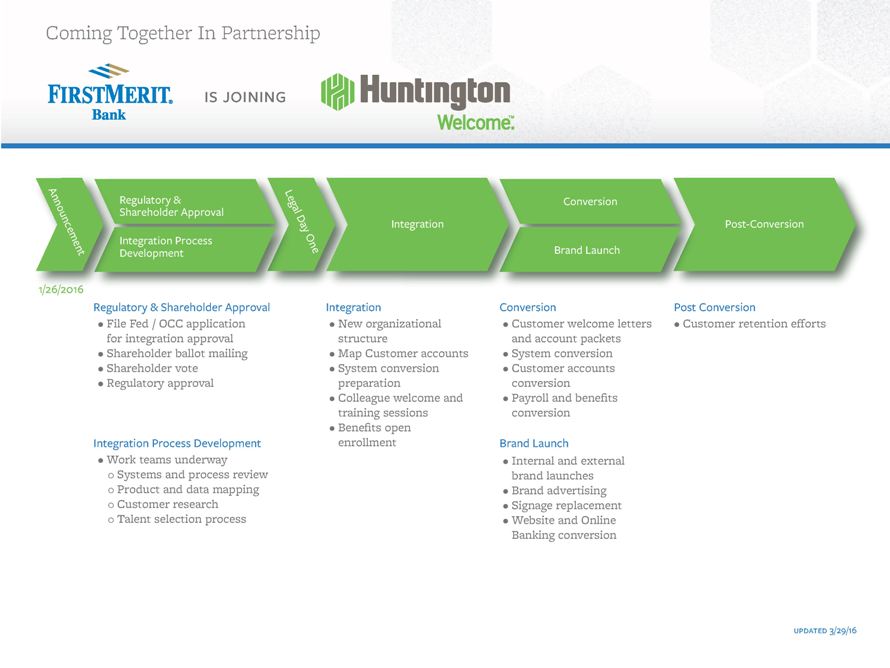

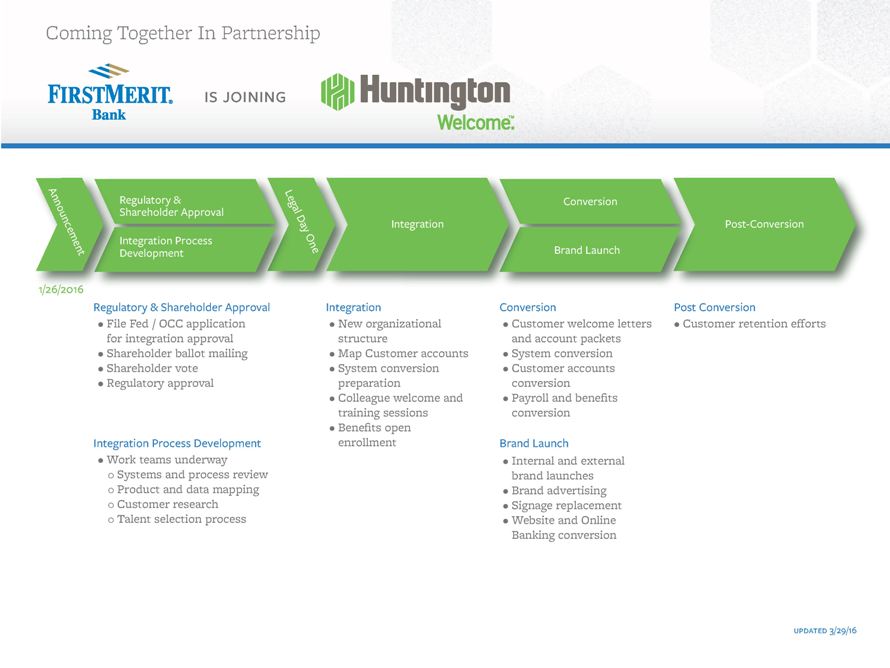

Integration Timeline We understand that since the announcement of FirstMerit’s merger with Huntington, many employees have been wondering what happens next. Work continues at both FirstMerit and Huntington as both companies navigate through the process of coming together. The timeline on the next page shows the ordered progression of the steps, with key activities, that will take us through the approval process, integration, conversion, brand launch and beyond. While we do not yet have specific dates for future milestones, steady progress is being made toward transaction close expected in the 3rd Quarter. Right now, we have begun the ‘Regulatory & Shareholder Approval’ and ‘Integration Process Development’ phases, which are happening concurrently. The Federal Reserve and OCC applications have been filed, and we are targeting shareholder meetings for both companies in the 2nd Quarter. The integration work teams are well underway in mapping both companies’ products, data and systems. Huntington is working on its new organizational structure and the process for identifying and filling talent needs. Soon we’ll be ready to communicate about the launch of a new employee microsite and the initial steps in the talent selection process. As we move forward, we’ll continue to share progress updates through FirstNet stories, emails and a monthly update from Paul Greig. It is important to remember that as we work toward the legal close of this transaction (which transitions us to the Integration phase), we must operate as two independent companies. As integration teams at both companies, backed by both executive leadership teams, together continue to identify and assess our collective strengths, all of us must remain focused on the tasks at hand, providing exceptional service to our customers and each other. Your questions are important and we continue to update the Integration Portal on FirstNet with answers provided by appropriate subject matter experts. Popular topics with many answered questions now available on the portal include PTO and medical benefits (included in the Benefits section), severance process and policy, product offerings and more. Answers are not yet available to all questions. As we can answer questions, we will post them as soon as possible. Please continue to send your questions to integration.questions@firstmerit.com and check the Integration Portal often for the latest updates. FOR INTERNAL USE ONLY

Coming Together In Partnership is joining 1/26/2016 File Fed / OCC application for integration approval Shareholder ballot mailing Shareholder vote Regulatory approval New organizational structure Map Customer accounts System conversion preparation Colleague welcome and training sessions Benefits open enrollment Internal and external brand launches Brand advertising Signage replacement Website and Online Banking conversion Customer welcome letters and account packets System conversion Customer accounts conversion Payroll and benefits conversion Customer retention efforts Work teams underway U Systems and process review U Product and data mapping U Customer research U Talent selection process Regulatory & Shareholder Approval Integration Process Development Conversion Integration Post-Conversion Brand Launch Announcement Legal Day One Regulatory & Shareholder Approval Integration Conversion Brand Launch Post Conversion updated 3/29/16 Integration Process Development

Important Additional Information In connection with the proposed transaction, Huntington has filed with the SEC a registration statement on Form S-4 that includes a joint proxy statement of Huntington and FirstMerit and a prospectus of Huntington, as well as other relevant documents concerning the proposed transaction. The proposed transaction involving Huntington and FirstMerit will be submitted to FirstMerit’s stockholders and Huntington’s stockholders for their consideration. This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. Before making any voting or investment decision, investors and stockholders of Huntington and FirstMerit are urged to carefully read the entire Registration Statement and Joint Proxy Statement/Prospectus, as well as any amendments or supplements to these documents, because they will contain important information about the proposed transaction. A copy of the definitive joint proxy statement/prospectus, as well as other filings containing information about Huntington and FirstMerit, can be obtained, without charge, at the SEC’s website (http://www.sec.gov). Copies of the joint proxy statement/prospectus and the filings with the SEC that are incorporated by reference in the joint proxy statement/prospectus can also be obtained, without charge, by directing a request to Huntington Investor Relations, Huntington Bancshares Incorporated, Huntington Center, HC0935, 41 South High Street, Columbus, Ohio 43287, (800) 576?5007 or to FirstMerit Corporation, Attention: Thomas P. O’Malley, III Cascade Plaza, Akron, Ohio 44308, (330) 384?7109. Participants in the Solicitation Huntington, FirstMerit, and certain of their respective directors, executive officers and employees may be deemed to be participants in the solicitation of proxies in respect of the proposed transaction. Information regarding Huntington’s directors and executive officers is available in its definitive proxy statement, which was filed with the SEC on March 10, 2016, and certain of its Current Reports on Form 8?K. Information regarding FirstMerit’s directors and executive officers is available in its definitive proxy statement, which was filed with SEC on March 6, 2015, and certain of its Current Reports on Form 8?K. Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, is available in the joint proxy statement/prospectus and other relevant materials filed with the SEC. Free copies of this document may be obtained as described in the preceding paragraph. FOR INTERNAL USE ONLY 3