UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x Filed by a Party other than the Registrant o

Check the appropriate box:

o | Preliminary Proxy Statement |

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| o | Definitive Additional Materials |

o | Soliciting Material Pursuant to §240.14a-12 |

FLIR SYSTEMS, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| o | Fee paid previously with preliminary materials. |

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

27700 SW Parkway Avenue

Wilsonville, Oregon 97070

(503) 498 -3547

___________________________________________

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON APRIL 27, 2012

________________________________________________________________________

To the Shareholders of FLIR Systems, Inc.:

NOTICE IS HEREBY GIVEN that the Annual Meeting of Shareholders (the “Annual Meeting”) of FLIR Systems, Inc. (the “Company”) will be held on Friday, April 27, 2012, at 10:00 a.m., at FLIR Systems, Inc., 27700 SW Parkway Avenue, Wilsonville, Oregon 97070 for the following purposes:

| 1. | Election of Directors. To elect the two director nominees identified in the attached Proxy Statement, each for a three-year term expiring in 2015 and to hold office until his successor is elected and qualified; |

| 2. | Approval of the Executive Bonus Plan. To approve the adoption of the 2012 Executive Bonus Plan for the Company's executive officers; |

| 3. | Ratification of Appointment of the Independent Registered Public Accounting Firm. To ratify the appointment by the Audit Committee of the Company’s Board of Directors of KPMG LLP as the independent registered public accounting firm of the Company for the fiscal year ending December 31, 2012; |

| 4. | Shareholder Proposal regarding Declassification of the Board. To consider a shareholder proposal that the Company's Board of Directors take steps to begin the process of declassifying the Company's Board of Directors, provided the shareholder proposal is presented properly at the Annual Meeting; |

| 5. | Shareholder Proposal regarding Adoption of a Majority Vote Standard. To consider a shareholder proposal that the Company's Board of Directors take steps to adopt a majority vote standard to be used in uncontested director elections, provided the shareholder proposal is presented properly at the Annual Meeting; and |

| 6. | Other Business. To transact such other business as may properly come before the Annual Meeting or any adjournments or postponements thereof. |

The Board of Directors of the Company has fixed the close of business on February 29, 2012 as the record date for the determination of shareholders entitled to notice of and to vote at the Annual Meeting. Only shareholders of record at the close of business on that date will be entitled to notice of and to vote at the Annual Meeting or any adjournments or postponements thereof.

By Order of the Board,

Earl R. Lewis

Chairman of the Board of Directors, President

and Chief Executive Officer

Wilsonville, Oregon

March 16, 2012

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF SHAREHOLDERS TO BE HELD ON APRIL 27, 2012

The Notice of Annual Meeting, Proxy Statement and Annual Report on Form 10-K are available at www.flir.com/investor.

| IT IS IMPORTANT THAT PROXIES BE COMPLETED AND SUBMITTED PROMPTLY. THEREFORE, WHETHER OR NOT YOU PLAN TO BE PRESENT IN PERSON AT THE ANNUAL MEETING, PLEASE SUBMIT YOUR VOTE BY PROXY VIA THE INTERNET, BY TELEPHONE OR BY MAIL IN THE ENCLOSED POSTAGE-PAID ENVELOPE IN ACCORDANCE WITH THE ACCOMPANYING INSTRUCTIONS. |

FLIR SYSTEMS, INC.

27700 SW Parkway Avenue

Wilsonville, Oregon 97070

(503) 498-3547

_____________________________________

PROXY STATEMENT

for the

ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON APRIL 27, 2012

_____________________________________

INTRODUCTION

General

This Proxy Statement is being furnished to the shareholders of FLIR Systems, Inc., an Oregon corporation (“FLIR,” the ���Company, “we,” “us,” or “our”), as part of the solicitation of proxies by the Company’s Board of Directors (the “Board of Directors” or the “Board”) from holders of the outstanding shares of FLIR common stock, par value $0.01 per share (the “Common Stock”), for use at the Company’s Annual Meeting of Shareholders to be held on April 27, 2012, and at any adjournments or postponements thereof (the “Annual Meeting”). At the Annual Meeting, shareholders will be asked to elect two members to the Board of Directors, approve the adoption of the 2012 Executive Bonus Plan, ratify the appointment by the Audit Committee of the Company’s Board of Directors of KPMG LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2012, consider a shareholder proposal that we take steps to begin the process of declassifying the Company's Board of Directors, provided the proposal is properly presented at the Annual Meeting, consider a shareholder proposal that we take steps to adopt a majority vote standard to be used in uncontested director elections, provided the proposal is properly presented at the Annual Meeting, and transact such other business as may properly come before the Annual Meeting. This Proxy Statement, together with the enclosed proxy card, is first being made available to shareholders of FLIR on or about March 16, 2012.

Solicitation, Voting and Revocability of Proxies

The Board of Directors has fixed the close of business on February 29, 2012 as the record date for the determination of the shareholders entitled to notice of and to vote at the Annual Meeting. Accordingly, only holders of record of shares of Common Stock at the close of business on such date will be entitled to vote at the Annual Meeting, with each such share entitling its owner to one vote on all matters properly presented at the Annual Meeting. On the record date, there were 154,062,236 shares of Common Stock then outstanding. The presence, in person or by proxy, of a majority of the total number of outstanding shares of Common Stock entitled to vote at the Annual Meeting is necessary to constitute a quorum at the Annual Meeting.

If you are a shareholder of record, you can vote (i) by attending the Annual Meeting, (ii) by signing, dating and mailing in your proxy card, or (iii) by following the instructions on your proxy card for voting by telephone or on the Internet. If you hold your shares through a broker, bank or other nominee, that institution will instruct you as to how your shares may be voted by proxy. If you hold your shares through a broker, bank or other nominee and would like to vote in person at the Annual Meeting, you must first obtain a proxy issued in your name from the institution that holds your shares.

If the form of proxy is properly executed and returned in time to be voted at the Annual Meeting, the shares represented thereby will be voted in accordance with the instructions marked thereon. Executed but unmarked proxies will be voted FOR the election of the two nominees to the Board of Directors, FOR the approval of the 2012 Executive Bonus Plan, FOR the ratification of the appointment of KPMG LLP as the Company’s independent registered public accounting firm, AGAINST the shareholder proposal that we take steps to begin the process of declassifying the Company's Board of Directors and AGAINST the shareholder proposal that we take steps to adopt a majority vote standard to be used in uncontested director elections. The Board of Directors does not know of any matters other than those described in the Notice of Annual Meeting that are to come before the Annual Meeting. If any other matters are properly brought before the Annual Meeting, the persons named in the proxy will vote the shares represented by such proxy upon such matters as determined by a majority of the Board of Directors.

The presence of a shareholder at the Annual Meeting will not automatically revoke such shareholder’s proxy. A shareholder may, however, revoke a proxy at any time prior to its exercise by filing a written notice of revocation with, or by delivering a duly executed proxy bearing a later date to, the Corporate Secretary, FLIR Systems, Inc., 27700 SW Parkway Avenue, Wilsonville, Oregon 97070, or by attending the Annual Meeting and voting in person. However, a shareholder who attends the Annual Meeting need not revoke a previously executed proxy and vote in person unless such shareholder wishes to do so. All valid, unrevoked proxies will be voted at the Annual Meeting.

1

ELECTION OF DIRECTORS

The Company’s Board of Directors has seven members. At the Annual Meeting, two directors will be elected, each for a three-year term expiring in 2015 and to hold office until his successor is elected and qualified. Unless otherwise specified on the proxy, it is the intention of the persons named in the proxy to vote the shares represented by each properly executed proxy “FOR” the election as directors of the persons named below as nominees. The Board of Directors believes that the nominees will stand for election and will serve if elected as directors. However, if either of the persons nominated by the Board of Directors fails to stand for election or is unable to accept election, the number of directors constituting the Board of Directors may be reduced prior to the Annual Meeting or the proxies may be voted for the election of such other person as the Board of Directors may recommend.

Under the Company’s Articles of Incorporation and Bylaws, the directors are divided into three classes. The term of office of only one class of directors expires in each year, and the successors of the members of each class are elected for terms of three years and until their successors are elected and qualified. There is no cumulative voting for election of directors.

Information as to Nominees and Continuing Directors

The following table sets forth the names of the Board of Directors’ nominees for election as a director and those directors who will continue to serve after the Annual Meeting. Also set forth in this section is certain other information with respect to each such person’s age, principal occupation or employment during at least the past five years, the periods during which he has served as a director of FLIR, the expiration of his term as a director, and the positions currently held with FLIR.

| Nominees: | Age | Director Since . | Expiration of Current Term . | Expiration of Term for which Nominated | Position Held with FLIR | ||||||

| Earl R. Lewis | 68 | 1999 | 2012 | 2015 | Chairman of the Board of Directors, President and Chief Executive Officer | ||||||

| Steven E. Wynne | 59 | 1999 | 2012 | 2015 | Director | ||||||

| Continuing Directors: | |||||||||||

| John D. Carter | 66 | 2003 | 2013 | — | Director | ||||||

| William W. Crouch | 70 | 2005 | 2014 | — | Director | ||||||

| Angus L. Macdonald | 57 | 2001 | 2014 | — | Director | ||||||

| Michael T. Smith | 68 | 2002 | 2013 | — | Director | ||||||

| John W. Wood, Jr. | 68 | 2009 | 2013 | — | Director | ||||||

EARL R. LEWIS. Mr. Lewis has served as Chairman, President and Chief Executive Officer of the Company since November 1, 2000. His current term on the Board expires at the Company’s 2012 Annual Meeting of Shareholders, at which time his election to the Board for a three year term expiring in 2015 and to hold office until his successor is elected and qualified will be voted upon. Mr. Lewis was initially elected to the Board in June 1999 in connection with the acquisition of Spectra Physics AB by Thermo Instrument Systems, Inc. Prior to joining FLIR, Mr. Lewis served in various capacities at Thermo Instrument Systems, Inc., with his last role as President and Chief Executive Officer. Mr. Lewis is a member of the Board of Directors of Harvard BioScience and NxStage Medical, Inc. Mr. Lewis is a Trustee of Clarkson University and New Hampton School. Mr. Lewis holds a B.S. from Clarkson College of Technology and has attended post-graduate programs at the University of Buffalo, Northeastern University and Harvard University. Mr. Lewis has a Professional Director Certification earned through an extended series of director education programs sponsored by the Corporate Directors group. Qualifications: Mr. Lewis’ leadership of the Company for the past decade affords him a deep understanding of the Company’s technology and operations, as well as the markets in which the Company operates. Mr. Lewis’ prior service in executive management positions and his past and present service on other company boards of directors, including public company boards, enable him to provide insight and guidance in an array of areas including global operations and strategic planning, enterprise risk management, and corporate governance. Mr. Lewis has played, and continues to play, an active role in the Company’s financial management and corporate development, including merger and acquisition activity.

STEVEN E. WYNNE. Mr. Wynne has served as a director of the Company since November 1999. His current term on the Board expires at the Company’s 2012 Annual Meeting of Shareholders, at which time his election to the Board for a three year term expiring in 2015 and to hold office until his successor is elected and qualified will be voted upon. Since January 1, 2011, Mr. Wynne has served as Executive Vice-President of JELD-WEN, Inc. Mr. Wynne was Senior Vice President of The ODS Companies, a diversified insurance company from February 1, 2010 to January 2011. From March 1, 2004 through March 31,

2

2007, Mr. Wynne was President and Chief Executive Officer of SBI International, Ltd., parent company of sports apparel and footwear company Fila. From August 2001 through March 2002, and from April 2003 through February 2004, Mr. Wynne was a partner in the Portland, Oregon law firm of Ater Wynne LLP. Mr. Wynne served as acting Senior Vice President and General Counsel to the Company from April 2002 through March 2003. Mr. Wynne was formerly Chairman and Chief Executive Officer of eteamz.com, an on-line community serving amateur athletics, from June 2000 until its sale to Active.com in January 2001. From February 1995 to March 2000, Mr. Wynne served as President and Chief Executive Officer of adidas America, Inc. Prior to that time, he was a partner in the law firm of Ater Wynne LLP. Mr. Wynne received an undergraduate degree and a J.D. from Willamette University. Mr. Wynne also serves on the Board of Directors of Planar Systems, Inc. Qualifications: Mr. Wynne has been associated with the Company in a variety of capacities since 1983, including prior service as its outside counsel. By virtue of this extensive relationship, Mr. Wynne has developed a high degree of familiarity with the Company’s operations, risks and opportunities. In addition, Mr. Wynne’s legal training and senior executive leadership experience with other companies qualifies Mr. Wynne to provide insight and guidance as a member of the Company’s Audit Committee, as well as in the areas of corporate governance, strategic planning and enterprise risk management.

GENERAL WILLIAM W. CROUCH (UNITED STATES ARMY—RETIRED). General Crouch has served as a director of the Company since May 2005. General Crouch retired from the United States Army in 1999 following a 36-year career during which he served in numerous roles including Commanding General—Eighth Army and Chief of Staff, United Nations Command and United States Forces Korea; Commander in Chief, United States Army, Europe; Commanding General, NATO Implementation (later Stabilization) Force, Bosnia/Herzegovina; and the United States Army’s 27th Vice Chief of Staff. Until 2010, he served as one of five generals who oversaw the Army’s Battle Command Training Program. In October 2000, General Crouch was named co-chair of the USS COLE Commission, which was formed to examine the terrorist attack on the USS COLE. He is a Distinguished Senior Fellow with the Center for Civil Military Operations at the United States Naval Post Graduate School, and serves on the Board of the Keck Institute for International and Strategic Studies at Claremont McKenna College. He received a B.A. in Civil Government from Claremont McKenna College, and a M.A. in History from Texas Christian University. Qualifications: General Crouch’s career as an Army officer and continuing interest in the U.S. military afford the Company significant insight into the Company’s important military customers in terms of strategic and tactical doctrines and how the Company’s products should be developed and adapted to facilitate the implementation of these doctrines. General Crouch also possesses an understanding of the political and military realities in certain global regions in which the Company’s products are employed. In addition, General Crouch’s experience in senior leadership roles in large Army commands enables him to offer guidance on the leadership of complex organizations.

ANGUS L. MACDONALD. Mr. Macdonald has served as a director of the Company since April 2001. In 2000, Mr. Macdonald founded and is currently President of Venture Technology Merchants, LLC, an advisory and merchant banking firm to growth companies regarding capital formation, corporate development and strategy. From 1996 to 2000, Mr. Macdonald was Senior Vice President and headed Special Situations in the health care equities research group at Lehman Brothers, Inc. Prior to joining Lehman Brothers, Mr. Macdonald was a senior securities analyst at Fahnestock, Inc. (now Oppenheimer). He holds a B.A. from the University of Pennsylvania and an MBA from Cranfield University, UK. Qualifications: Through his education and prior experiences, including his current role as founder and President of Venture Technology Merchants, LLC, Mr. Macdonald has developed extensive expertise in corporate development strategies for technology enterprises such as the Company as well as in financial structuring and strategy. Mr. Macdonald’s years of experience in the financial services sector provide the Company with insight into the value creation impacts of various financial and operational strategies. These skills enable him to serve as a member of the Company’s Audit Committee and to provide insight to the Company in the development of its financial management and capital deployment strategies.

JOHN D. CARTER. Mr. Carter has served as a director of the Company since August 2003. Mr. Carter served as President and Chief Executive Officer of Schnitzer Steel Industries Inc., a metals recycling company, from May 2005 to November 2008. Since December 1, 2008, Mr. Carter has served as Chairman of the Board of Directors of Schnitzer Steel Industries, Inc. From 2002 to May 2005, Mr. Carter was a principal in the consulting firm of Imeson & Carter, a firm specializing in transportation and international businesses transactions. From 1982 to 2002, Mr. Carter served in a variety of senior management capacities at Bechtel Group, Inc., including Executive Vice President and Director, as well as President of Bechtel Enterprises, Inc., a wholly owned subsidiary and other operating groups. Mr. Carter is a member of the Board of Directors of Northwest Natural Gas Company. He is Chairman of privately-owned Kuni Enterprises, Inc. and on the Board of the Oregon chapter of the Nature Conservancy. He also is the manager of Birch Creek Associates LLC and Dusky Goose LLC, engaged in agricultural and commercial land ownership, vineyard ownership and wine business. He received his B.A. from in History from Stanford University and his J.D. from Harvard Law School. Qualifications: In addition to his legal experience gained while practicing law, Mr. Carter brings many years of senior executive management experience, most recently as president and chief executive officer of a multi-billion dollar public company. This combination of legal and management experiences enables Mr. Carter to provide guidance to the Company in the areas of legal risk oversight and enterprise risk management, corporate governance, financial management and corporate strategic planning.

3

MICHAEL T. SMITH. Mr. Smith has served as a director of the Company since July 2002. From 1997 until his retirement in May 2001, Mr. Smith was Chairman of the Board and Chief Executive Officer of Hughes Electronics Corporation. From 1985 until 1997 he served in a variety of capacities for Hughes, including Vice Chairman of Hughes Electronics, Chairman of Hughes Missile Systems and Chairman of Hughes Aircraft Company. Prior to joining Hughes in 1985, Mr. Smith spent nearly 20 years with General Motors in a variety of financial management positions. Mr. Smith is also a director of Ingram Micro, Inc., Teledyne Technologies Incorporated and WABCO Holdings Inc. Mr. Smith holds a B.A. from Providence College and an MBA from Babson College. He also served as an officer in the United States Army. Qualifications: Throughout his career, Mr. Smith has had extensive financial and general management experience, including service as CEO of a large public company. These skills and experiences qualify him to serve as the Company’s Audit Committee financial expert. By virtue of his years of service on other public company boards of directors, Mr. Smith also provides the Company with expertise in corporate governance, enterprise risk management and strategic planning. In addition, Mr. Smith’s years in a variety of executive leadership roles with other companies qualifies him to provide guidance to the Company in the areas of global operations and corporate strategic development.

JOHN W. WOOD, JR. Mr. Wood has served as a director of the Company since May 2009. Mr. Wood served as Chief Executive Officer of Analogic Corporation, a leading designer and manufacturer of medical imaging and security systems, from 2003 to 2006, and is currently a consultant. Prior to joining Analogic, Mr. Wood held senior executive positions over a 22-year career at Thermo Electron Corporation. He served as President of Peek Ltd., a division of Thermo Electron Corporation, and as a Senior Vice President of the parent company. He previously served as President and Chief Executive Officer of Thermedics, a subsidiary of Thermo Electron Corporation. Mr. Wood is a director of ESCO Corporation and American Superconductor. Mr. Wood earned a Bachelor’s degree in Electrical Engineering from Louisiana Tech University and a Master’s degree in Electrical Engineering from Massachusetts Institute of Technology. Qualifications: Through his academic training and his extensive executive experience with companies in relevant industries, Mr. Wood possesses the knowledge and expertise to understand and offer guidance regarding the Company’s technologies and markets. In addition, as the former chief executive officer of a public company, Mr. Wood is qualified to provide leadership in the areas of corporate governance, operations and enterprise risk management.

Recommendation of the Board of Directors

The Board of Directors unanimously recommends that shareholders vote FOR the election of its nominees for director. If a quorum is present, the Company’s Bylaws provide that directors are elected by a plurality of the votes cast by the shares entitled to vote. Abstentions and broker non-votes are counted for purposes of determining whether a quorum exists at the Annual Meeting, but are not counted and have no effect on the determination of whether a plurality of the votes cast by the shares entitled to vote exists with respect to a given nominee. See “Corporate Governance and Related Matters – Majority Vote Policy” for additional information regarding procedures relating to the election of the Company’s directors.

CORPORATE GOVERNANCE AND RELATED MATTERS

Communications with Directors

Shareholders and other parties interested in communicating directly with the Chairman or with the non-employee directors as a group may do so by writing to the Chairman of the Board, c/o Corporate Secretary, FLIR Systems, Inc., 27700 SW Parkway Avenue, Wilsonville, Oregon 97070. Concerns relating to accounting, internal controls or auditing matters are promptly brought to the attention of the Audit Committee and handled in accordance with procedures established by the Audit Committee with respect to such matters.

Meetings

During 2011, the Company’s Board of Directors held eight meetings. Each incumbent director attended more than 75% of the aggregate of the total number of meetings held by the Board of Directors and the total number of meetings held by all committees of the Board on which he served. Under the Company’s Corporate Governance Principles, each director is expected to commit the time necessary to prepare for and attend all Board meetings and meetings of committees of the Board on which they serve, as well as the Company’s Annual Meeting of Shareholders. All members of the Company’s Board of Directors attended the 2011 Annual Meeting of Shareholders.

Board of Directors Committees

The Board of Directors has standing Audit, Compensation, Corporate Governance and Strategy & Technology Committees. Each committee operates pursuant to a written charter, which is reviewed annually. The charter of each committee may be viewed online at www.flir.com/investor. The performance of each committee is reviewed annually. Each committee may obtain advice and assistance from internal or external legal, accounting and other advisors. The members of the Audit, Compensation and Corporate Governance Committees have all been determined to be “independent” as defined by applicable NASDAQ Global Select Market (“NASDAQ”) rules. The members of each committee are identified in the following table. Mr. Lewis, the Company’s President and Chief Executive Officer, is not “independent” as defined by applicable NASDAQ rules.

4

| Name | Audit | Corporate Governance | Compensation | Strategy & Technology | |||

| John D. Carter | Chair | ||||||

| William W. Crouch | X | X | X | ||||

| Earl R. Lewis | Chair | ||||||

| Angus L. Macdonald | X | Chair | |||||

| Michael T. Smith | Chair | X | |||||

| John W. Wood, Jr. | X | X | |||||

| Steven E. Wynne | X | X | |||||

The Audit Committee is responsible for overseeing the integrity of the Company’s financial statements and financial reporting process; the Company’s compliance with legal and regulatory requirements; the independent registered public accounting firm’s qualifications, appointment and independence; the performance of the internal audit function; the review of all third-party transactions involving, directly or indirectly, the Company and any of its directors or officers; and the adequacy of the Company’s accounting and internal control systems. During fiscal year 2011, the Audit Committee held nine meetings.

The Compensation Committee is responsible for all matters relating to the compensation of the Company’s executives, including salaries, bonuses, fringe benefits, incentive compensation, equity-based compensation, retirement benefits, severance pay and benefits, and compensation and benefits in the event of a change of control of the Company. The Compensation Committee also administers the Company’s equity compensation plans. During fiscal year 2011, the Compensation Committee held five meetings. See also the “Compensation Discussion and Analysis” section of this Proxy Statement for a description of the Company’s processes and procedures for determining executive compensation.

The Corporate Governance Committee is responsible for recommending to the Board operating policies that conform to appropriate levels of corporate governance practice; overseeing the Board’s annual self-evaluation; identifying qualified candidates to serve on the Board; determining the qualification of Board members; evaluating the size and composition of the Board and its committees; reviewing the Company’s Corporate Governance Principles; reviewing the compensation policies for non-employee directors, and recommending nominees to stand for election at each annual meeting of shareholders. The Corporate Governance Committee seeks candidates to serve on the Board who are persons of integrity, with significant accomplishments and recognized business experience. As required by its Charter, the Corporate Governance Committee considers diversity of backgrounds and viewpoints when considering nominees for director but has not established a formal policy regarding diversity in identifying director nominees. During fiscal year 2011, the Corporate Governance Committee held three meetings.

The Strategy and Technology Committee is responsible for serving as a liaison between the Board and the Company's operating unit personnel in the areas of technology innovations and strategy development (including, without limitation, products and applications, markets and customers, and potential acquisitions); providing guidance and expertise in these areas to the operating units; and monitoring industry developments in the technologies and strategic initiatives that are of importance to the Company and its shareholders. Following its formation in July 2011, the Strategy and Technology Committee held one meeting.

Shareholder Nominations

The Corporate Governance Committee will review recommendations by shareholders of individuals for consideration as candidates for election to the Board of Directors. Any such recommendations should be submitted in writing to the Corporate Secretary, FLIR Systems, Inc., 27700 SW Parkway Avenue, Wilsonville, Oregon 97070. Historically, the Company has not had a formal policy concerning shareholder recommendations to the Corporate Governance Committee (or its predecessors) because it believes that the informal consideration process in place to date has been adequate given that the Company has never received any director recommendations from shareholders. The absence of such a policy does not mean, however, that a recommendation would not have been considered had one been received.

The Company’s Bylaws set forth procedures that must be followed by shareholders seeking to make nominations for directors. The Company’s Bylaws may be accessed at http://www.sec.gov/Archives/edgar/data/354908/000119312509170208/dex32.htm. Each notice given by a shareholder with respect to nominations for the election of directors must comply with the requirements of Section 14 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and the Company’s Bylaws.

5

Majority Vote Policy

The Board has recently approved an amendment to the Company’s Corporate Governance Principles that provides that any nominee for director in an uncontested election who receives a greater number of votes “withheld” from his or her election than votes “for” such election must tender his or her resignation for consideration by the Corporate Governance Committee. The Corporate Governance Committee is then required to make a recommendation to the Board as to whether to accept or reject the resignation of such director, or whether other action should be taken. The Board must then make a decision regarding the resignation and publicly disclose its decision, and the rationale underlying it, within 90 days of the election. This 90-day period is subject to extension for an additional 90-day period. The director who has tendered his or her resignation may not participate in any of the deliberations of the Corporate Governance Committee or the Board regarding whether to accept the resignation.

Corporate Governance

FLIR maintains a Corporate Governance page on its website that provides specific information about its corporate governance initiatives, including FLIR’s Corporate Governance Principles, Codes of Ethical Business Conduct, Code of Ethics for Senior Financial Officers and charters for the committees of the Board of Directors. The Corporate Governance page can be found on our website at www.flir.com/investor.

FLIR’s policies and practices reflect corporate governance initiatives that are compliant with the listing requirements of NASDAQ and the corporate governance requirements of the Sarbanes-Oxley Act of 2002 (“SOX”), including:

| • | The Board of Directors has adopted clear corporate governance policies; |

| • | A majority of the Board members are independent of FLIR and its management based on the relevant independence requirements contained in the Company’s Corporate Governance Principles as well as any additional or supplemental independence standards established by NASDAQ; |

| • | All members of the Board's Audit, Compensation and Corporate Governance Committees are independent based on the relevant independence requirements contained in the Company’s Corporate Governance Principles as well as any additional or supplemental independence standards established by NASDAQ and SOX; |

| • | The independent members of the Board of Directors meet regularly without the presence of management; |

| • | FLIR has a Code of Ethical Business Conduct for FLIR Operations Inside the U.S. and a Code of Ethical Business Conduct for FLIR Operations Outside the U.S.; |

| • | The charters of the Board committees clearly establish their respective roles and responsibilities; |

| • | FLIR has an ethics officer and an internet-based hotline monitored by EthicsPoint® that is available to all employees, and FLIR’s Audit Committee has procedures in place for the anonymous submission of employee complaints on accounting, internal controls or auditing matters; and |

| • | FLIR has adopted a Code of Ethics for Senior Financial Officers that applies to its Chief Executive Officer, Chief Financial Officer, Chief Accounting Officer/Corporate Controller, Corporate Treasurer, Business Unit Controllers and Site Controllers. |

You may obtain copies of the documents posted on FLIR’s Corporate Governance page on its website by writing to the Corporate Secretary, FLIR Systems, Inc., 27700 SW Parkway Avenue, Wilsonville, Oregon 97070.

Board Leadership Structure and Role in Risk Oversight

The Board has determined that having its Chief Executive Officer serve as Chairman of the Board is appropriate for the Company at this time. Mr. Lewis’ extensive knowledge of the Company’s business and industry combined with his experience as Chairman and Chief Executive Officer promotes strategy development and execution and facilitates information flow between management and the Board. No single leadership model is right for all companies at all times, however, so the Board periodically reviews its leadership structure. The Board does not currently have a lead independent director.

The Board is actively involved in oversight of risks inherent in the operation of the Company’s business including, without limitation, those risks described in the Company’s reports filed from time to time with the Securities and Exchange Commission (the "SEC"). It is management’s responsibility to manage risk and bring to the Board’s attention the material risks to the Company. The Board of Directors has oversight responsibility of the processes established to report and monitor systems for material risks applicable to the Company. The Board manages this responsibility at the Board level with assistance from its four committees, as appropriate. The Board has delegated to the Audit Committee certain tasks related to the Company’s risk management process. The Audit Committee (i) serves as an independent and objective body to monitor the Company’s financial reporting process and internal control systems, and (ii) assists the Board in oversight of the Company’s compliance with legal and regulatory requirements. The Board has delegated to the Compensation Committee basic responsibility for oversight of management’s compensation risk

6

assessment, including the annual determination of whether or not the Company’s compensation policies and practices are reasonably likely to have a material adverse effect on the Company. The Corporate Governance Committee oversees the Company’s risks in the areas of corporate governance and ethics and compliance, and is primarily responsible for Board and committee performance and director nomination/succession. The Strategy and Technology Committee serves as a liaison between the Board and management in the areas of technology innovation and strategy development. These committees report the results of their review processes to the full Board during regularly scheduled Board meetings or more frequently, if warranted. In addition to review and discussion of reports prepared by the committees of the Board, the Board periodically discusses risk oversight in specific areas as they arise, including as part of its corporate strategy review.

Compensation Risk

We recently conducted an assessment of our compensation policies and practices, including our executive compensation programs, to evaluate the potential risks associated with these policies and practices. We reviewed and discussed the findings of the assessment with the Compensation Committee and concluded that our compensation programs are designed with an appropriate balance of risk and reward and do not encourage excessive or unnecessary risk-taking behavior. As a result, we do not believe that risks relating to our compensation policies and practices for our employees are reasonably likely to have a material adverse effect on the Company.

In conducting this review, we considered the following attributes of our programs:

| • | Mix of base salary, annual incentive opportunities, and long-term equity compensation; |

| • | Balance between annual and longer-term performance opportunities; |

| • | Alignment of annual and long-term incentives to ensure that the awards encourage consistent behaviors and achievable performance results; |

| • | Use of ten-year stock options and equity awards that vest over time; |

| • | Generally providing senior executives with long-term equity-based compensation on an annual basis. We believe that accumulating equity over a period of time encourages executives to take actions that promote the long-term sustainability of our business; |

| • | Stock ownership guidelines that are reasonable and designed to align the interests of our executive officers with those of our shareholders. This discourages executive officers from focusing on short-term results without regard for longer-term consequences; and |

| • | Compensation decisions include subjective considerations, which limit the influence of strictly formulaic factors on excessive risk taking. |

Our Compensation Committee considered compensation risk implications during its deliberations on the design of our 2012 executive compensation programs with the goal of appropriately balancing short-term incentives and long-term performance.

7

MANAGEMENT

Executive Officers

The executive officers of the Company are as follows:

| Name | Age | Position | ||

| Earl R. Lewis | 68 | Chairman of the Board of Directors, President and Chief Executive Officer | ||

| William W. Davis | 55 | Senior Vice President, General Counsel and Secretary | ||

| William A. Sundermeier | 48 | President, Government Systems | ||

| Andrew C. Teich | 51 | President, Commercial Systems | ||

| Anthony L. Trunzo | 49 | Senior Vice President, Finance and Chief Financial Officer | ||

Information concerning the principal occupation of Mr. Lewis is set forth under “Election of Directors - Information as to Nominees and Continuing Directors.” Information concerning the principal occupation or employment during at least the past five years of the executive officers of the Company who are not also directors of the Company is set forth below.

WILLIAM W. DAVIS. Mr. Davis joined FLIR in July 2007 as Senior Vice President, General Counsel and Secretary. Prior to joining FLIR, from 1999 to 2007, Mr. Davis was employed as in-house legal counsel with Brunswick Corporation, a global manufacturer and marketer of recreation products (2005-2007), and two subsidiaries of General Dynamics Corporation (1999 -2005). From 1990 to 1992 and 1993 to 1999, Mr. Davis engaged in the private practice of law, most recently as a partner in the firm of Katten, Muchin & Zavis LLP. From 1992 to 1993, Mr. Davis served as a law clerk to the Honorable Edward Carnes of the United States Court of Appeals for the Eleventh Circuit. Mr. Davis received his B.S. with distinction from the United States Naval Academy and his J.D. from the University of Chicago Law School. Following graduation from the Naval Academy, Mr. Davis served as an officer in the United States Marine Corps and Marine Corps Reserve.

WILLIAM A. SUNDERMEIER. Mr. Sundermeier has been serving as the President of FLIR’s Government Systems Division since April 2006. Mr. Sundermeier joined FLIR in 1994 as Product Marketing Manager for Thermography Products and was appointed Director of Product Marketing for commercial and government products in 1995. In 1999, Mr. Sundermeier was appointed Senior Vice President for Product Strategy, focused on the integration of newly acquired companies. In September 2000, Mr. Sundermeier was appointed Senior Vice President and General Manager, Portland Operations. In April 2004, he was appointed Co-President of the Imaging Division. Prior to joining FLIR, Mr. Sundermeier was a founder of Quality Check Software, Ltd. in 1993. Mr. Sundermeier received his B.S. in Computer Science from Oregon State University and is an alumnus of the Harvard Business School Advanced Management Program.

ANDREW C. TEICH. Mr. Teich has been President of the Company’s Commercial Systems Division since January 2010. From April 2006 to January 2010, he served as President of the Company’s Commercial Vision Systems Division. From 2000 to 2006, he served as the Senior Vice President of Sales and Marketing and then as Co-President of the Imaging Division at FLIR. Mr. Teich joined FLIR as Senior Vice President, Marketing, as a result of FLIR’s acquisition of Inframetrics in March 1999. While at Inframetrics, Mr. Teich served as Vice President of Sales and Marketing from 1996 to 1999. From 1984 to 1996, Mr. Teich served in various capacities within the sales organization at Inframetrics. He holds a B.S. degree in Marketing from Arizona State University and is an alumnus of the Harvard Business School Advanced Management Program.

ANTHONY L. TRUNZO. Mr. Trunzo has been FLIR's Senior Vice President, Finance and Chief Financial Officer since June 2010. From August 2003, when he joined FLIR, until June 2010 he served as FLIR's Senior Vice President, Corporate Strategy and Development. From 1996 until joining FLIR, Mr. Trunzo was Managing Director in the Investment Banking Group at Banc of America Securities, LLC. From 1986 to 1996, he held various positions at PNC Financial Services Group, Inc. Mr. Trunzo holds a B.A. in Economics from the Catholic University of America, an MBA with a concentration in Finance from the University of Pittsburgh, and is an alumnus of the Harvard Business School Advanced Management Program.

8

COMPENSATION DISCUSSION AND ANALYSIS

The following discussion and analysis contains statements regarding future Company performance targets and goals. These targets and goals are disclosed in the context of FLIR’s compensation programs and should not be understood to be statements of management’s expectations or estimates of results or other guidance. FLIR specifically cautions investors not to apply these statements to other contexts.

Philosophy and Objectives of Compensation Programs

General Philosophy

We believe the total compensation of our Named Executive Officers (the “NEOs”) should support the following objectives:

| • | To attract and retain NEOs with the skills, experience and motivation to enable the Company to achieve its stated objectives. This means that the Company provides an opportunity for NEOs to earn above average compensation for delivering consistently superior results; |

| • | To provide a mix of current, short-term and long-term compensation to achieve a balance between current income and long-term incentive opportunity and promote focus on both annual and multi-year business objectives. This means that NEOs have a higher percentage of their total pay opportunity tied to performance-based (versus fixed) and long-term (versus short-term) pay; |

| • | To align total compensation with the performance commitments we make to our shareholders, including, long-term growth in revenue and diluted earnings per share (“EPS”). This means that benefits to our NEOs from both our short-term and long-term incentive programs are heavily influenced by our achieving EPS and revenue growth; |

| • | To allow NEOs who demonstrate consistent performance over a multi-year period to earn above-average compensation when FLIR achieves above-average long-term performance. This means that our compensation program for NEOs has a high degree of variability—significant upside for performance that exceeds goals, with commensurate risk when performance falls short of goals; |

| • | Is affordable and appropriate in light of the Company’s size, strategy and anticipated performance. This means that while the Compensation Committee considers competitive practice in its decision-making, it places significant emphasis on the Company’s specific strategy, financial situation and performance in the ultimate determination of compensation decisions; and |

| • | Is straightforward and transparent in its design, so that shareholders and other interested parties can clearly understand all elements of our compensation plans, individually and in the aggregate. This means generally limiting the number of compensation elements, types of compensation, perquisites and post employment benefits while still remaining competitive in our compensation practices. |

For purposes of this Compensation Discussion and Analysis, our NEOs consist of our Chief Executive Officer (the “CEO”), our Chief Financial Officer (the “CFO”), and our three next most highly compensated executives as of December 31, 2011. The NEOs are the same five individuals listed in the “Management” section above.

Annual Process for Determining NEO Compensation

We evaluate our compensation plans and programs annually. In the case of establishing our 2011 compensation, the process began in October 2010. At that time, Pearl Meyer & Partners (“Pearl Meyer”), who had been retained by the Compensation Committee as its independent compensation consultant, provided an executive compensation overview presentation to the Compensation Committee. The presentation contained a competitive pay analysis based on a methodology that included a review of peer group data, and evaluated the three major components of our executive compensation program - base salary, annual incentive, and long term incentive, as well as the impact of FLIR’s financial performance on executive compensation. This data was then integrated with other considerations such as relative compensation among the NEOs, overall Company performance in both absolute terms and relative to the peer group, and the results achieved by each individual NEO during the previous year. With the assistance of our human resources team, our CEO then makes recommendations regarding base salary and target levels of annual incentive and long-term incentive compensation for each NEO (other than the CEO) to the Compensation Committee for its review and approval. The Compensation Committee independently reviews the peer group data relating to CEO compensation, the overall Company performance and the performance of our CEO to determine his base salary and target levels of annual incentive and long-term incentive compensation. Concurrently, our human resources team and our CFO and CEO develop and recommend performance targets for the Annual Incentive Plan (“AIP”) to the Compensation Committee for its review and approval. The criteria for establishing these metrics include our anticipated financial performance for the year as measured by our internal budget, our long-term performance outlook as communicated to our shareholders, the Company’s recent and anticipated financial results, and consistency with historical practice.

9

The largest single element of total direct compensation (“TDC”) for our NEOs is long-term incentive compensation. TDC is defined as the sum of base salary, annual incentive compensation and long-term incentive compensation. Approximately 64% of our CEO’s target TDC is tied to the Company’s long-term performance. Compensation under our Long-Term Incentive Program (“LTIP”) for our NEOs, excluding our CEO, accounts for approximately 54% of their target TDC. The higher proportion of long-term incentive compensation for our CEO reflects market practices as well as our objective to align his compensation with long-term corporate performance. LTIP compensation vehicles have varied historically. From 2006 to 2010 we used various combinations of performance and time-based options and time-based restricted stock units. In 2011, the NEO LTIP consisted of time-based options, time-based RSUs and performance-based RSUs (as discussed on page 18).

We currently use the same metrics and similar plan design elements for the AIP compensation offered to our NEOs as those we use for the rest of our employees. While the amount of compensation that is at risk for performance varies among employee groups, all of our annual incentive pools are determined based on achievement of a target level of EPS and revenue. We believe EPS and revenue, and their annual growth rates, are important performance metrics for our shareholders. EPS and revenue growth are equally weighted. We believe that the use of these two key metrics in the AIP is aligned with market practice (as discussed on page 15).

We believe this approach to short-term and long-term compensation offers appropriate incentives to our NEOs who are most able to impact long-term success, while aligning the objectives of all of our employees with those of our shareholders. The Compensation Committee periodically reviews this approach to ensure it remains consistent with the best interests of our shareholders.

Linking Pay to Performance

Our approach to executive compensation is to pay for performance – that is, an NEO’s total compensation should rise or fall based on Company and individual performance. By making equity a substantial component of NEO compensation, we tie our NEOs’ long-term interests to that of stockholders. Our financial results for 2011 resulted in a significant decline in compensation for our NEOs by reduced AIP payments and forfeiture of equity grants.

For 2011, this pay for performance link is illustrated below.

| • | Our under achievement in relation to the EPS and revenue targets set in our AIP resulted in AIP payments at 53% of target. 2011 AIP payments for our NEOs as a group declined 64% compared to 2010, resulting in a $1.2 million decline in total AIP payments. |

| • | Our under achievement in relation to the EPS targets set in our 2009 and 2011 performance-based equity grants has resulted in the forfeiture of our NEOs’ performance-based options and RSUs with an aggregate grant date fair value of $1.4 million. |

This strong link between pay and performance is highlighted in our "Annual Incentive Plan" and "Long-Term Incentive Program" descriptions in the "Compensation Design and Elements of Compensation" section below.

Defining the Market—Benchmarking

Management, in collaboration with the Compensation Committee and (in some years) a compensation consultant, reviews the group of comparison companies that we benchmark our NEO compensation against (the “Peer Group”). In October 2010, the Compensation Committee, based on input from Pearl Meyer, approved several changes to our Peer Group. Two companies (DRS Technologies, Inc. and Varian, Inc.) were acquired, and thus removed from the Peer Group. Four companies (Ametek, Inc., Illumina, Inc., Itron, Inc., and Mettler Toledo International, Inc.) were added to maintain an appropriate group size and better reflect the change and growth in our business. Since there are no public companies directly comparable to FLIR, the Peer Group consisted of companies of similar size (based on revenues, assets and market capitalization) and in similar, but not identical, industries that had financial performance reasonably similar to ours. Over the past five years we have maintained between sixteen to eighteen Peer Group companies. Twelve of the 2011 Peer Group companies have been in the group for at least five years.

The 2011 Peer Group was as follows: (1) Ametek, Inc., (2) Barnes Group, Inc., (3) Dionex Corporation, (4) ESCO Technologies, Inc., (5) Esterline Technologies Corporation, (6) Garmin Corporation, (7) Illumina, Inc., (8) Itron, Inc., (9) Mettler Toledo International, Inc., (10) Mine Safety Appliances Company, (11) MKS Instruments, Inc., (12) National Instruments Corporation, (13) Perkin Elmer, Inc., (14) Rofin-Sinar Technologies, Inc., (15) Roper Industries, Inc., (16) Teledyne Technologies Incorporated, (17) Trimble Navigation Limited, and (18) Waters Corporation. Based on the data available at the time of the benchmarking, the Company was near the median of the Peer Group based on revenues (47th percentile) and assets (48th percentile), but above the Peer Group median with respect to market capitalization (72nd percentile).

10

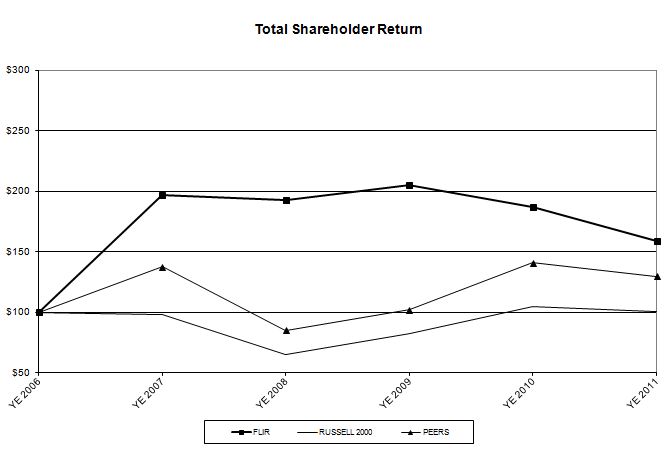

Over the five year period ending December 31, 2011, FLIR has outperformed both the Russell 2000 Index and the Peer Group in total shareholder return, as reflected in the following graph.

Since we place significant emphasis on long-term growth in our stock price, we believe the information provided in the graph above to be important in understanding our compensation philosophy and its role in the achievement of our long-term objectives. During the five year period shown above, FLIR’s total shareholder return was in the top quartile of the companies in the Peer Group.

The Compensation Committee periodically reviews all elements of compensation and makes modifications as needed to remain competitive, fair, reasonable and consistent with the objectives described above and with established Company practices and policies. We have not established a specific percentile objective versus the market, nor have we established specific target TDC levels for our CEO or other NEOs. However, the Compensation Committee concluded, based on the Company’s performance compared with the Peer Group, information provided by Pearl Meyer, and its own analysis, that current compensation levels are appropriate for each of the NEOs evaluated. We expect to make changes to our NEO compensation plans and practices when they are suggested by evolving best practices, changes in Company financial performance, and changes in accounting and tax rules. We would generally engage outside consultants to assist us in the event any major changes to our plans are contemplated.

Compensation Design and Elements of Compensation

We have designed our compensation plans to reward achievement of superior financial results, as measured by growth in EPS and revenue both annually and over multi-year periods. If we continue to meet the objectives we have set for the Company, which reflect superior results compared to the market and our Peer Group, our NEOs will earn above-average compensation. Failure to achieve targeted results will significantly reduce total compensation, since a significant portion of our NEOs’ pay is in the form of short-term incentives that are based on achieving a target growth in EPS and revenue and long-term incentives in the form of performance-based RSUs that are based on achieving a target growth in EPS and time-based stock options. We believe this “pay for performance” philosophy attracts, retains and motivates our NEOs to be aligned with the Company’s objectives, and helps attract and retain the talent needed to meet its goals.

The details of compensation for our NEOs are provided in the Compensation of Executive Officers section of this Proxy Statement starting on page 17.

11

Base Salary

Key considerations in establishing base salary levels include the overall level of responsibility a given NEO has, the importance of their role, and the experience, expertise and specific performance of the individual. We consider current base salary levels for each of our NEOs to be consistent with these criteria and, absent any changes in responsibilities, that the individuals would expect increases in base salary to be in line with the market for such positions in the future. Our CEO’s base salary is contractually established in his employment agreements at $850,000 for 2011 and $875,000 for 2012. All other NEOs’ base salaries are determined annually by the Compensation Committee in consultation with our CEO. In 2011, these recommendations were derived principally from information and analysis provided by Pearl Meyer. For our NEOs, base salaries for 2011 accounted for 23% of their TDC. This means our NEOs have 77% of their total pay opportunity tied to performance-based and/or long-term incentive compensation.

Annual Incentive Plan

We have an Annual Incentive Plan that covers virtually all U.S. employees that are not eligible for sales incentives and all employees outside of the United States that are not eligible for sales incentives, profit sharing or other individual incentives. For our NEOs, this program awards annual cash incentive compensation based upon achievement of increases in EPS and revenue from the prior year.

The 2011 AIP funding was based on achievement of reported EPS and revenue targets, which were the same for our NEOs and all other employees. For the Company, growth in EPS and revenue are critical performance measures. We believe that aligning our NEOs’ non-equity incentive award with these measures, if done annually and consistently, is a simple and easy to understand approach that is well aligned with our shareholders’ interests. The Annual Incentive Plan was designed so that if the Company achieves the EPS and revenue targets, the AIP pool would equal 100% of the target incentive awards for all NEOs, including our CEO. The EPS and revenue metrics are equally weighted at 50% each, with each metric measured separately. For the half measured against the EPS metric, with each $0.01 variance above or below the target EPS, the AIP pool for NEOs was increased or decreased by 5%. The EPS target for 2011 was $1.69, representing a 10% increase over our actual EPS of $1.54 in 2010. For the half measured against the revenue metric, with each $1,000,000 variance above or below the target revenue, the AIP pool for NEOs was increased or decreased by 0.5%. The revenue target for 2011 was $1,593,000,000, representing a 15% increase over our actual revenue of $1,385,000,000 in 2010. The target award for our CEO was 100% of his base salary. Target awards for our other NEOs ranged from 60% to 70% of base salary. These target award levels were compared with the annual incentive levels of individuals in the Peer Group and, based on our performance and our compensation objectives, the Compensation Committee determined that they were appropriate. While we compared our specific AIP targets against the Peer Group on a position by position basis, we also evaluated the overall mix of base salaries, short-term and long-term incentive compensation using the Peer Group data as a guide.

| 2011 Annual Incentive Plan Matrix | |||||||||

| Below Threshold | Threshold | Target | Maximum | Actual | |||||

| EPS | Below $1.55 | 92% of target $1.55 | 100% of target $1.69 | 124% of target $2.09 | 92% of target $1.55 | ||||

| Revenue | Below $1,450M | 91% of target $1,450M | 100% of target $1,593M | 125% of target $1,993M | 97% of target $1,544M | ||||

| Annual Incentive | No payout | 27.5% of target | 100% of target | 300% of target | 53% of target | ||||

For 2011, FLIR’s reported EPS and revenue were $1.38 and $1,544,062,000, respectively. The Compensation Committee determined that a pre-tax legal settlement expense of $39 million should be excluded from the AIP calculation resulting in an adjusted EPS of $1.55. The adjusted EPS and reported revenue, resulted in an AIP payout at 53% of target.

The NEOs’ incentive payments and the non-executive employee pools have fluctuated from year to year in relation to our performance relative to our targets. For our NEOs as a group, non-equity incentive compensation for 2011 accounted for 10% of TDC. The chart below details the past 5 years of AIP targets, actual results and payouts as a percentage of the target awards. The AIP results illustrate our pay-for-performance philosophy. Note that from 2007 to 2009, we utilized a single AIP target of EPS and, commencing in 2010, we have used revenue and EPS targets under the AIP.

12

| Annual Incentive Plan Historical Targets and Results | |||||||||||

| Year | Target EPS | Actual EPS | Target Revenue (in millions) | Actual Revenue (in millions) | Payout as Percent of Target | ||||||

| 2007 | $0.76 | $0.89 | n/a | n/a | 200 | % | |||||

| 2008 | 1.06 | 1.28 | n/a | n/a | 254 | % | |||||

| 2009 | 1.54 | 1.50 | n/a | n/a | 72 | % | |||||

| 2010 | 1.60 | 1.54 | $1,262 | $1,385 | 125 | % | |||||

| 2011 | 1.69 | 1.55 | 1,593 | 1,544 | 53 | % | |||||

In 2007, we received shareholder approval for, and adopted, an Executive Bonus Plan. The Executive Bonus Plan is designed so that AIP payments paid under it may, subject to our compliance with Section 162(m) of the United States Internal Revenue Code (the “Code”), be deductible for federal income tax purposes. The Executive Bonus Plan provides for a maximum annual award to any NEO of $5,000,000. In 2011, the maximum AIP payout for our CEO was the lesser of 1% of net earnings and $5,000,000 and for our other NEOs was the lesser of 0.5% of net earnings and $5,000,000.

Long-Term Incentive Program

We believe sustained long-term growth in our share price, achieved through growing revenue and EPS, is the primary responsibility of our NEOs. Long-term incentives in the form of stock options, restricted stock units (“RSU”) or other equity instruments are an appropriate way to link the interests of management and shareholders, and to incent management to achieve this objective. Therefore, we have consistently used such instruments as an integral part of our compensation programs, and the largest single component of each NEO’s target compensation. We believe this has helped contribute to our shareholder returns, which are superior to market indices and our Peer Group. For example, our annualized shareholder return from the end of 2006 through the end of 2011 was 9.7%, compared with an average annual return of 0.2% for the Russell 2000 Index and 5.4% for the Peer Group during that time period. Over the past several years, it has been our practice to issue stock-based compensation annually following our annual meeting. Pursuant to the Compensation Committee Charter and the Equity Granting Policy adopted by the Compensation Committee in March 2007, we expect to continue to make annual grants in the future.

For our 2011 LTIP, we allocated the total value of the annual equity awards as follows: 25% time-based RSUs, 25% performance-based RSUs and 50% time-based stock options. The time-based stock options and RSUs granted in 2011 vest at the rate of one third per year, while the performance-based RSUs vest based on EPS performance over a three-year performance period according to the following performance matrix:

| Vesting and Performance Criteria for 2011 Performance-Based RSUs | ||||||||

| First Performance Period Jan 2011 - Dec 2011 | Second Performance Period Jan 2012 - Dec 2012 | Third Performance Period Jan 2013 - Dec 2013 | ||||||

| EPS | Percent of Target Shares that will Vest | EPS | Percent of Target Shares that will Vest | EPS | Percent of Target Shares that will Vest | |||

| Threshold Performance | $1.62 | 50% | $1.86 | 50% | $2.24 | 50% | ||

| Target Performance | 1.69 | 100% | 1.95 | 100% | 2.34 | 100% | ||

| Maximum Performance | 1.85 | 200% | 2.12 | 200% | 2.53 | 200% | ||

Our earnings per share in 2011 were insufficient to meet the threshold established for the vesting of the third tranche of performance-based options granted in 2009 and the first tranche of the performance-based RSUs granted in 2011. The following table reflects the number of equity instruments forfeited and their respective dollar values at the time of grant. The fact that the NEOs are not receiving full vesting when our performance does not meet the established thresholds illustrates our pay-for-performance philosophy. Based on 2011 performance, our NEOs forfeited an aggregate of 77,769 performance-based options and 15,701 performance-based RSUs, representing an aggregate grant date fair value of $1,397,922.

13

| Forfeiture of Performance-Based Equity Awards | ||||||||||

| 2009 Performance-Based Options Forfeited Based on 2011 Performance (1) | Value at Grant | 2011 Performance-Based RSUs Forfeited Based on 2011 Performance (2) | Value at Grant | Total Equity Value Forfeited | ||||||

| Earl R. Lewis | 32,067 | $353,058 | 7,476 | $257,922 | $ 610,980 | |||||

| Anthony L. Trunzo | 10,700 | 117,807 | 2,243 | 77,384 | 195,191 | |||||

| William A. Sundermeier | 12,834 | 141,302 | 2,243 | 77,384 | 218,686 | |||||

| Andrew C. Teich | 12,834 | 141,302 | 2,243 | 77,384 | 218,686 | |||||

| William W. Davis | 9,334 | 102,767 | 1,496 | 51,612 | 154,379 | |||||

| TOTAL | 77,769 | $856,236 | 15,701 | $541,686 | $1,397,922 | |||||

_______________

| (1) | Performance-based options were granted May 5, 2009 with an exercise price equal to $25.64. By not achieving our 2011 performance threshold of EPS of $1.61, these performance-based options were forfeited. |

| (2) | Performance-based RSUs were granted May 3, 2011. By not achieving our 2011 performance threshold of EPS of $1.62, these performance-based RSUs were forfeited. |

Perquisites and Other Benefits

In general, we minimize the value and number of perquisites provided to our NEOs. We believe this makes our overall compensation program simpler, easier to understand, and more transparent to stakeholders. The primary perquisite for our NEOs is an automobile allowance. In addition, our NEOs have supplemental life insurance benefits beyond those provided to other U.S.-based employees. Our standard life insurance benefit is equal to two times an employee’s annual salary to a maximum of $500,000. The NEOs supplemental life insurance benefit provides three times the NEO’s salary, up to a maximum benefit of $1,200,000. The values of all perquisites for our NEOs are included in the All Other Compensation Table on page 18.

Our NEOs are also eligible to participate in our other benefit plans on the same terms as other employees. These plans include health plans, disability plans, retirement plans and an employee stock purchase plan.

Supplemental Executive Retirement Plan

In January 2001, we implemented a Supplemental Executive Retirement Plan (the “SERP”) for certain executives then employed by FLIR in the United States. This plan was implemented as an important retention tool at a time of uncertainty in the Company. Since the SERP’s inception, no additional participants have been added, and we do not intend to add participants in the future. Messrs. Lewis, Sundermeier and Teich are the only participants in the SERP.

Non-Qualified Deferred Compensation Plans

In early 2008, we implemented a non-qualified deferred compensation (“NQDC”) plan and a stock deferral plan. Participation by our employees, including our NEOs, is optional. The NQDC plan provides an additional pre-tax savings vehicle for our more highly compensated U.S.-based employees whose retirement savings opportunity is limited under our 401(k) plan. The stock deferral plan allows eligible employees to defer the receipt of vested RSUs. The NQDC and stock deferral plans are available to all our U.S.-based employees earning over a specified annual salary. The NQDC plan does not allow for Company contributions to be made to the plan on behalf of any employee, including the NEOs. See page 23 for additional details.

Employment Agreements

Our CEO has an employment agreement approved by the Compensation Committee that establishes base salary levels and provides for annual incentive and long-term incentive awards under our approved plans (i.e., AIP and LTIP) for each year covered by his contract. This contract, and the Company’s obligations under it, is further described on page 19.

14

Post Termination Elements of Compensation

Severance

With the exception of our CEO, we do not have any formal severance arrangements with any of our NEOs.

In the past we have provided severance on a case by case basis in situations where a termination was not for cause, and such payment was deemed to be appropriate and in the best interests of the Company. We are likely to continue doing so in the future.

Change of Control Agreements

We consider a sound and vital management team to be essential in protecting and enhancing the best interests of the Company and our shareholders. To this end, we recognize that the possibility of a change of control could arise and that such possibility may result in the departure or distraction of management to the detriment of the Company and our shareholders. In order to encourage the continued attention and dedication of our NEOs to their assigned duties without distraction in circumstances arising from the possibility of a change of control of the Company, we entered into change of control agreements, effective April 30, 2009, with our NEOs, with the exception of our CEO.

The terms and value of these severance and change of control termination benefits are further described starting on page 24.

Compensation Committee Governance

Compensation Committee Members and Compensation Committee Charter

Our NEO compensation policies are established, reviewed and approved by the Compensation Committee of the Board of Directors. The Compensation Committee is composed of three non-employee directors—Angus L. Macdonald (Chair), William W. Crouch and Michael T. Smith—all of whom have been determined by the Board to be “independent” as defined by the Board’s Corporate Governance Principles and applicable SEC and NASDAQ rules. The members of the Compensation Committee, in aggregate, have significant experience in executive positions including management, talent development, finance, and accounting, and have been involved in executive compensation matters in their respective careers. See page 2 in this Proxy Statement for a more detailed biography for each of our directors. In accordance with its Charter, the Board’s Corporate Governance Committee annually reviews the operation, structure, and membership of all committees, including the Compensation Committee.

The Compensation Committee has primary responsibility for all matters relating to the compensation of our NEOs, as well as certain compensation elements for other employees. “Compensation” for this purpose means all forms of remuneration including, without limitation, salaries, bonuses, annual and long-term incentive compensation, equity-based compensation, retirement benefits, severance pay and benefits, fringe benefits and perquisites, and compensation and benefits in the event of a change of control of the Company. The Compensation Committee, in its discretion, may retain the services of outside consultants to assist it in compensation matters. The Compensation Committee is governed by a charter adopted by the Board, which can be found at www.flir.com/investor. The Corporate Governance Committee of the Board annually considers and makes recommendations, as appropriate, to the Board regarding the content of all Board committee charters, including the Compensation Committee’s charter. The Compensation Committee charter was first adopted by the Board in October 2002, and was most recently updated in February 2010.

Compensation Consultant

The Compensation Committee has from time to time engaged professional compensation consultants to advise the Compensation Committee on our executive compensation programs and policies. As indicated earlier, the Compensation Committee engaged Pearl Meyer to conduct a competitive analysis of our executive compensation levels in late 2010, and utilized that analysis as part of its determination of executive compensation levels for 2011. Pearl Meyer had been previously engaged in 2008 and 2006 to perform similar services and has been engaged on an ad-hoc basis as the Compensation Committee determines a need. The Compensation Committee and the Corporate Governance Committee intend to continue using compensation consultants in the future, but not necessarily Pearl Meyer, and not necessarily on an annual basis. Decisions as to whether the use of a consultant is appropriate for any annual period will be determined by the respective committees based on considerations including length of time since the last engagement of a consultant and changes in factors affecting executive compensation at the Company or in the market at large.

Role of Executives in Establishing Compensation

Our CFO and Vice President of Global Human Resources have participated in the development of certain NEO compensation programs, particularly the AIP and the LTIP described above. Once formulated, these programs are reviewed by our CEO and other individuals whose counsel may be sought from time to time and submitted to the Compensation Committee for its review

15

and approval. The Committee considers these recommendations in its decision process, but they are not necessarily determinative. As noted previously, with the assistance of our human resources team, our CEO makes recommendations regarding base salary and target levels of the AIP and LTIP compensation for each NEO (other than himself) to the Compensation Committee. Our human resources team, CFO and CEO also recommend to the Compensation Committee the performance targets under the AIP and LTIP, if applicable. From time to time, certain individuals including our CEO, CFO and Vice President of Global Human Resources are invited to attend meetings of the Compensation Committee. A person, who may be a member of the Company’s management, will be designated by the Compensation Committee Chairman to act as Secretary to the Compensation Committee. During 2011, the Company’s Senior Vice President, General Counsel and Secretary served in this capacity. While these individuals may be asked to provide input and perspective, only Compensation Committee members vote on NEO compensation matters. Our Vice President of Global Human Resources is responsible for the implementation, execution and operation of our compensation programs, as directed by the CEO and the Compensation Committee.

Stock Ownership/Retention Requirements

We impose stock ownership requirements on our NEOs. The Corporate Governance Principles require our NEOs to hold shares of Common Stock, time-based RSUs, performance-based RSUs (valued at the target performance level) or in-the-money stock options valued in an amount equal to no less than one year’s base salary. The Corporate Governance Principles are reviewed annually by the Corporate Governance Committee of the Board. As of the date of this Proxy Statement, all NEOs are in compliance with these requirements.

“Say on Pay” Vote

The Compensation Committee seeks to align the objectives on the Company’s executive compensation program with the interests of our shareholders. In that respect, as part of its on-going review of the NEOs’ compensation programs, the Compensation Committee considered the approval by approximately 97% of the votes cast for the Company’s “say on pay” vote at the Company’s prior annual meeting of shareholders and determined that the NEO compensation philosophy and compensation elements continued to be appropriate and did not make any changes to the NEO compensation program in response to such shareholder vote.

Impact of Tax and Accounting on Compensation Decisions

As a general matter, the Compensation Committee takes into account the various tax and accounting implications of the compensation vehicles employed by the Company.