UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrantx Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

FLIR SYSTEMS, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| (1) | Title of each class of securities to which the transaction applies: |

| (2) | Aggregate number of securities to which the transaction applies: |

| (3) | Per unit price or other underlying value of the transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of the transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

27700 SW Parkway Avenue

Wilsonville, Oregon 97070

(503) 498 -3547

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON APRIL 23, 2010

To the Shareholders of FLIR Systems, Inc.:

NOTICE IS HEREBY GIVEN that the Annual Meeting of Shareholders (the “Annual Meeting”) of FLIR Systems, Inc. (the “Company”) will be held on Friday, April 23, 2010, at 10:00 a.m., at FLIR Systems, Inc., 27700 SW Parkway Avenue, Wilsonville, Oregon 97070 for the following purposes:

| 1. | Election of Directors. To elect three Directors, each for a three-year term expiring in 2013; |

| 2. | Ratification of Appointment of the Independent Registered Public Accounting Firm. To ratify the appointment by the Audit Committee of the Company’s Board of Directors of KPMG LLP as the independent registered public accounting firm of the Company for the fiscal year ending December 31, 2010; and |

| 3. | Other Business. To transact such other business as may properly come before the Annual Meeting or any adjournments or postponements thereof. |

The Board of Directors of the Company has fixed the close of business on February 19, 2010 as the record date for the determination of shareholders entitled to notice of and to vote at the Annual Meeting. Only shareholders of record at the close of business on that date will be entitled to notice of and to vote at the Annual Meeting or any adjournments or postponements thereof.

By Order of the Board,

Earl R. Lewis

Chairman of the Board of Directors, President

and Chief Executive Officer

Wilsonville, Oregon

February 26, 2010

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF SHAREHOLDERS TO BE HELD ON APRIL 23, 2010

The Notice of Annual Meeting, Proxy Statement and Annual Report on Form 10-K are available at www.flir.com/investor.

IT IS IMPORTANT THAT PROXIES BE COMPLETED AND SUBMITTED PROMPTLY. THEREFORE, WHETHER OR NOT YOU PLAN TO BE PRESENT IN PERSON AT THE ANNUAL MEETING, PLEASE SUBMIT YOUR VOTE BY PROXY VIA THE INTERNET, BY TELEPHONE OR BY MAIL IN THE ENCLOSED POSTAGE-PAID ENVELOPE IN ACCORDANCE WITH THE ACCOMPANYING INSTRUCTIONS.

FLIR SYSTEMS, INC.

27700 SW Parkway Avenue

Wilsonville, Oregon 97070

(503) 498-3547

PROXY STATEMENT

for the

ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON APRIL 23, 2010

INTRODUCTION

General

This Proxy Statement is being furnished to the shareholders of FLIR Systems, Inc., an Oregon corporation (“FLIR” or the “Company”), as part of the solicitation of proxies by the Company’s Board of Directors (the “Board of Directors” or the “Board”) from holders of the outstanding shares of FLIR common stock, par value $0.01 per share (the “Common Stock”), for use at the Company’s Annual Meeting of Shareholders to be held on April 23, 2010, and at any adjournments or postponements thereof (the “Annual Meeting”). At the Annual Meeting, shareholders will be asked to elect three members of the Board of Directors, ratify the appointment by the Audit Committee of the Company’s Board of Directors of KPMG LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2010, and transact such other business as may properly come before the Annual Meeting or any adjournments or postponements thereof. This Proxy Statement, together with the enclosed proxy card, is first being made available to shareholders of FLIR on or about February 26, 2010.

Solicitation, Voting and Revocability of Proxies

The Board of Directors has fixed the close of business on February 19, 2010 as the record date for the determination of the shareholders entitled to notice of and to vote at the Annual Meeting. Accordingly, only holders of record of shares of Common Stock at the close of business on such date will be entitled to vote at the Annual Meeting, with each such share entitling its owner to one vote on all matters properly presented at the Annual Meeting. On the record date, there were approximately 75,054 beneficial holders of the approximately 152,890,203 shares of Common Stock then outstanding. The presence, in person or by proxy, of a majority of the total number of outstanding shares of Common Stock entitled to vote at the Annual Meeting is necessary to constitute a quorum at the Annual Meeting.

If you are a shareholder of record, you can vote (i) by attending the Annual Meeting, (ii) by signing, dating and mailing in your proxy card or (iii) by following the instructions on your proxy card for voting by telephone or on the Internet. If you hold your shares through a broker, bank or other nominee, that institution will instruct you as to how your shares may be voted by proxy. If you hold your shares through a broker, bank or other nominee and would like to vote in person at the Annual Meeting, you must first obtain a proxy issued in your name from the institution that holds your shares.

If the form of proxy is properly executed and returned in time to be voted at the Annual Meeting, the shares represented thereby will be voted in accordance with the instructions marked thereon.Executed but unmarked proxies will be voted FOR the election of the three nominees for election to the Board of Director and FOR the ratification of the appointment of KPMG LLP as the Company’s independent registered public accounting firm.The Board of Directors does not know of any matters other than those described in the Notice of Annual

1

Meeting that are to come before the Annual Meeting. If any other matters are properly brought before the Annual Meeting, the persons named in the proxy will vote the shares represented by such proxy upon such matters as determined by a majority of the Board of Directors.

The presence of a shareholder at the Annual Meeting will not automatically revoke such shareholder’s proxy. A shareholder may, however, revoke a proxy at any time prior to its exercise by filing a written notice of revocation with, or by delivering a duly executed proxy bearing a later date to, the Corporate Secretary, FLIR Systems, Inc., 27700 SW Parkway Avenue, Wilsonville, Oregon 97070, or by attending the Annual Meeting and voting in person. However, a shareholder who attends the Annual Meeting need not revoke a previously executed proxy and vote in person unless such shareholder wishes to do so. All valid, unrevoked proxies will be voted at the Annual Meeting.

2

ELECTION OF DIRECTORS

The Company’s Board of Directors has eight members. At the Annual Meeting, three Directors will be elected, each for a three-year term expiring in 2013. Unless otherwise specified on the proxy, it is the intention of the persons named in the proxy to vote the shares represented by each properly executed proxy “FOR” the election as Directors of the persons named below as nominees. The Board of Directors believes that the nominees will stand for election and will serve if elected as Directors. However, if any of the persons nominated by the Board of Directors fails to stand for election or is unable to accept election, the number of Directors constituting the Board of Directors may be reduced prior to the Annual Meeting or the proxies may be voted for the election of such other person as the Board of Directors may recommend.

Under the Company’s Articles of Incorporation and Bylaws, the Directors are divided into three classes. The term of office of only one class of Directors expires in each year, and the successors of the members of each class are elected for terms of three years and until their successors are elected and qualified. There is no cumulative voting for election of Directors.

Information as to Nominees and Continuing Directors

The following table sets forth the names of the Board of Directors’ nominees for election as a Director and those Directors who will continue to serve after the Annual Meeting. Also set forth in this section is certain other information with respect to each such person’s age, principal occupation or employment during at least the past five years, the periods during which he has served as a Director of FLIR, the expiration of his term as a Director and the positions currently held with FLIR.

Nominees: | Age | Director Since | Expiration of Current Term | Expiration of Term for which Nominated | Position Held with FLIR | |||||

John D. Carter | 64 | 2003 | 2010 | 2013 | Director | |||||

Michael T. Smith | 66 | 2002 | 2010 | 2013 | Director | |||||

John W. Wood, Jr. | 66 | 2009 | 2010 | 2013 | Director | |||||

Continuing Directors: | ||||||||||

William W. Crouch | 68 | 2005 | 2011 | — | Director | |||||

John C. Hart | 76 | 1987 | 2011 | — | Director | |||||

Earl R. Lewis | 66 | 1999 | 2012 | — | President, Chief Executive Officer and Chairman of the Board of Directors | |||||

Angus L. Macdonald | 55 | 2001 | 2011 | — | Director | |||||

Steven E. Wynne | 57 | 1999 | 2012 | — | Director | |||||

JOHN D. CARTER. Mr. Carter has served as a Director of the Company since August 2003. His current term on the Board expires at the Company’s 2010 Annual Meeting of Shareholders, at which time his election to the Board for a three year term expiring in 2013 will be voted upon. Mr. Carter was President and Chief Executive Officer of Schnitzer Steel Industries, Inc., a metals recycling company, from May 2005 through November 2008. Since December 1, 2008, Mr. Carter has served as Chairman of the Board of Directors of Schnitzer Steel Industries, Inc. From 2002 to 2005, Mr. Carter was a principal in the consulting firm of Imeson & Carter, a firm specializing in transportation and international business transactions. From 1982 to 2002, Mr. Carter served in a variety of senior management capacities at Bechtel Group, Inc. including Executive Vice President and Director, as well as President of Bechtel Enterprises, Inc., a wholly owned subsidiary, and other operating groups. Mr. Carter is a member of the Board of Directors of Northwest Natural Gas Company. He also is the manager of Birch Creek Associates LLC and Dusky Goose LLC, engaged in agricultural and commercial land ownership, vineyard ownership and wine business. He received his B.A. in History from Stanford University and his J.D. from Harvard Law School.

3

MICHAEL T. SMITH. Mr. Smith has served as a Director of the Company since July 2002. His current term on the Board expires at the Company’s 2010 Annual Meeting of Shareholders, at which time his election to the Board for a three year term expiring in 2013 will be voted upon. From 1997 until his retirement in May 2001, Mr. Smith was Chairman of the Board and Chief Executive Officer of Hughes Electronics Corporation. From 1985 until 1997 he served in a variety of capacities for Hughes, including Vice Chairman of Hughes Electronics, Chairman of Hughes Missile Systems and Chairman of Hughes Aircraft Company. Prior to joining Hughes in 1985, Mr. Smith spent nearly 20 years with General Motors in a variety of financial management positions. Mr. Smith is also a Director of Ingram Micro, Inc., Teledyne Technologies Incorporated and WABCO Holdings Inc. Mr. Smith holds a B.A. from Providence College and an MBA from Babson College. He also served as an officer in the United States Army.

JOHN J. WOOD, JR. Mr. Wood was elected to the Company’s Board of Directors in May 2009, based upon the recommendations of three current members of the Board. His current term on the Board expires at the Company’s 2010 Annual Meeting of Shareholders, at which time his election to the Board for a three year term expiring in 2013 will be voted upon. Mr. Wood served as Chief Executive Officer of Analogic Corporation, a leading designer and manufacturer of medical imaging and security systems, from 2003 to 2006, and is currently a consultant. Prior to joining Analogic, Mr. Wood held senior executive positions over a 22-year career at Thermo Electron Corporation. He served as President of Peek Ltd., a division of Thermo Electron Corporation, and as a Senior Vice President of the parent company. He previously served as President and Chief Executive Officer of Thermedics, a subsidiary of Thermo Electron Corporation. Mr. Wood is a director of ESCO Corporation and American Superconductor. Mr. Wood earned a Bachelor’s degree in Electrical Engineering from Louisiana Tech University and a Master’s degree in Electrical Engineering from Massachusetts Institute of Technology.

GENERAL WILLIAM W. CROUCH (UNITED STATES ARMY—RETIRED). General Crouch has served as a Director of the Company since May 2005. General Crouch retired from the United States Army in 1999 following a 36-year career during which he served in numerous roles including Commanding General—Eighth Army and Chief of Staff, United Nations Command and United States Forces Korea; Commander in Chief, United States Army, Europe; Commanding General, NATO Implementation (later Stabilization) Force, Bosnia/Herzegovina; and the United States Army’s 27th Vice Chief of Staff. In retirement, he has served as one of five generals who oversee the Army’s Battle Command Training Program. In October 2000, General Crouch was named co-chair of the USS COLE Commission, which was formed to examine the terrorist attack on the USS COLE. He is a Senior Mentor with the Leadership Development and Education Program for Sustained Peace at the United States Naval Post Graduate School and serves on the Board of the Keck Institute for International and Strategic Studies at Claremont McKenna College. He received a B.A. in Civil Government from Claremont McKenna College, and a M.A. in History from Texas Christian University while serving as an Assistant Professor of Military Science.

JOHN C. HART. Mr. Hart has served as a Director of the Company since February 1987. He served as Chairman of the Board of Directors of the Company from 1987 to April 1993. From 1982 until his retirement in 1993, Mr. Hart served as Vice President of Finance, Treasurer, Chief Financial Officer and a member of the Board of Directors of Louisiana-Pacific Corporation. Mr. Hart also served as interim President and Chief Executive Officer of the Company from May through November 2000. Mr. Hart holds a B.A. from the University of Oregon.

EARL R. LEWIS. Mr. Lewis has served as Chairman, President and Chief Executive Officer of the Company since November 1, 2000. Mr. Lewis was initially elected to the Board in June 1999 in connection with the acquisition of Spectra Physics AB by Thermo Instrument Systems, Inc. Prior to joining FLIR, Mr. Lewis served in various capacities at Thermo Instrument Systems, Inc., with his last role as President and Chief Executive Officer. Mr. Lewis is a member of the Board of Directors of Harvard BioScience, NxStage Medical, Inc. and American DG Energy, Inc. Mr. Lewis is a Trustee of Clarkson University and New Hampton School. Mr. Lewis holds a B.S. from Clarkson College of Technology and has attended post-graduate programs at the University of

4

Buffalo, Northeastern University and Harvard University. Mr. Lewis has a Professional Director Certification, earned through an extended series of director education programs sponsored by the Corporate Directors Group, an accredited organization of RiskMetrics ISS.

ANGUS L. MACDONALD. Mr. Macdonald has served as a Director of the Company since April 2001. In 2000, Mr. Macdonald founded and is currently President of Venture Technology Merchants, LLC, an advisory and merchant banking firm to growth companies regarding capital formation, corporate development and strategy. From 1996 to 2000, Mr. Macdonald was Senior Vice President and headed Special Situations in the health care equities research group at Lehman Brothers, Inc. Prior to joining Lehman Brothers, Mr. Macdonald was a senior securities analyst at Fahnestock, Inc. (now Oppenheimer). He holds a B.A. from the University of Pennsylvania and an MBA from Cranfield University, UK.

STEVEN E. WYNNE. Mr. Wynne has served as a Director of the Company since November 1999. Since February 1, 2010, Mr. Wynne has served as Senior Vice President of The ODS Companies, a diversified insurance company. From March 1, 2004 through March 31, 2007, Mr. Wynne was President and Chief Executive Officer of SBI International, Ltd., parent company of sports apparel and footwear company Fila. From August 2001 through March 2002, and from April 2003 through February 2004, Mr. Wynne was a partner in the Portland, Oregon law firm of Ater Wynne LLP. Mr. Wynne served as acting Senior Vice President and General Counsel to the Company from April 2002 through March 2003. Mr. Wynne was formerly Chairman and Chief Executive Officer of eteamz.com, an on-line community serving amateur athletics, from June 2000 until its sale to Active.com in January 2001. From February 1995 to March 2000, Mr. Wynne served as President and Chief Executive Officer of adidas America, Inc. Prior to that time, he was a partner in the law firm of Ater Wynne LLP. Mr. Wynne received an undergraduate degree and a J.D. from Willamette University. Mr. Wynne also serves on the Board of Directors of Planar Systems, Inc.

Recommendation of the Board of Directors

The Board of Directors unanimously recommends that shareholders vote FOR the election of its nominees for Director. If a quorum is present, the Company’s Bylaws provide that Directors are elected by a plurality of the votes cast by the shares entitled to vote. Abstentions and broker non-votes are counted for purposes of determining whether a quorum exists at the Annual Meeting, but are not counted and have no effect on the determination of whether a plurality of the votes cast by the shares entitled to vote exists with respect to a given nominee.

CORPORATE GOVERNANCE AND RELATED MATTERS

Communications with Directors

Shareholders and other parties interested in communicating directly with the Chairman or with the non-employee Directors as a group may do so by writing to the Chairman of the Board, c/o Corporate Secretary, FLIR Systems, Inc., 27700 SW Parkway Avenue, Wilsonville, Oregon 97070. Concerns relating to accounting, internal controls or auditing matters are promptly brought to the attention of the Audit Committee and handled in accordance with procedures established by the Audit Committee with respect to such matters.

Meetings

During 2009 the Company’s Board of Directors held four meetings. Each incumbent Director attended more than 75% of the aggregate of the total number of meetings held by the Board of Directors and the total number of meetings held by all committees of the Board on which he served. Under the Company’s Corporate Governance Principles, each Director is expected to commit the time necessary to prepare for and attend all Board meetings and meetings of committees of the Board on which they serve, as well as the Company’s Annual Meeting of Shareholders. All members of the Company’s Board of Directors attended the 2009 Annual Meeting of Shareholders.

5

Board of Directors Committees

The Board of Directors has standing Audit, Compensation and Corporate Governance Committees. Each committee operates pursuant to a written charter, which is reviewed annually. The charter of each committee may be viewed online at www.flir.com/investor. The performance of each committee is reviewed annually. Each committee may obtain advice and assistance from internal or external legal, accounting and other advisors. The members of the committees, each of whom has been determined to be “independent” as defined by applicable NASDAQ Global Select Market (“NASDAQ”) rules, are identified in the following table. Mr. Lewis, the Company’s President and Chief Executive Officer, is not “independent” as defined by applicable NASDAQ rules.

Name | Audit | Corporate Governance | Compensation | |||

John D. Carter | Chair | |||||

William W. Crouch | X | X | ||||

John C. Hart | X | |||||

Angus L. Macdonald | X | Chair | ||||

Michael T. Smith | Chair | X | ||||

John W. Wood, Jr. | X | |||||

Steven E. Wynne | X |

The Audit Committee is responsible for overseeing the integrity of the Company’s financial statements and financial reporting process; the Company’s compliance with legal and regulatory requirements; the independent registered public accounting firm’s qualification, appointment and independence; the performance of the internal audit function; the review of all third-party transactions involving, directly or indirectly, the Company and any of its Directors or officers; and the adequacy of the Company’s accounting and internal control systems. During fiscal year 2009, the Audit Committee held nine meetings.

The Compensation Committee is responsible for all matters relating to the compensation of the Company’s executives, including salaries, bonuses, fringe benefits, incentive compensation, equity-based compensation, retirement benefits, compensation, severance pay and benefits, and compensation and benefits in the event of a change of control of the Company. The Compensation Committee also administers the Company’s equity compensation plans. During fiscal year 2009, the Compensation Committee held six meetings. See also the “Compensation Discussion and Analysis” section of this Proxy Statement for a description of the Company’s processes and procedures for determining executive compensation.

The Corporate Governance Committee is responsible for recommending to the Board operating policies that conform to appropriate levels of corporate governance practice; overseeing the Board’s annual self-evaluation; identifying qualified candidates to serve on the Board; determining the qualification of Board members; evaluating the size and composition of the Board and its committees; reviewing the Company’s Corporate Governance Principles; reviewing the compensation policies for non-employee Directors and recommending nominees to stand for election at each annual meeting of shareholders. The Corporate Governance Committee seeks candidates to serve on the Board who are persons of integrity, with significant accomplishments and recognized business experience. During fiscal year 2009, the Corporate Governance Committee held three meetings.

Shareholder Nominations

The Corporate Governance Committee will review recommendations by shareholders of individuals for consideration as candidates for election to the Board of Directors. Any such recommendations should be submitted in writing to the Corporate Secretary, FLIR Systems, Inc., 27700 SW Parkway Avenue, Wilsonville, Oregon 97070. Historically, the Company has not had a formal policy concerning shareholder recommendations to the Corporate Governance Committee (or its predecessors) because it believes that the informal consideration

6

process in place to date has been adequate given that the Company has never received any Director recommendations from shareholders. The absence of such a policy does not mean, however, that a recommendation would not have been considered had one been received.

The Company’s Bylaws set forth procedures that must be followed by shareholders seeking to make nominations for Directors. In order for a shareholder of the Company to make any nominations, he, she or it must give written notice to the Corporate Secretary not less than 90 days nor more than 120 days prior to the anniversary date of the immediately preceding annual meeting of shareholders; provided, however, that in the event that the annual meeting is called for a date that is not within 30 days before or after such anniversary date, notice by the shareholder must be received not later than the close of business on the 10th day following the day on which notice of the date of the annual meeting was mailed or public disclosure of an annual meeting date was made. Each notice given by a shareholder with respect to nominations for the election of Directors must set forth the shareholder and shareholder nominee information called for in the Company’s Bylaws.

7

Corporate Governance

FLIR maintains a Corporate Governance page on its website that provides specific information about its corporate governance initiatives, including FLIR’s Corporate Governance Principles, Code of Ethical Business Conduct, Code of Ethics for Senior Financial Officers and charters for the committees of the Board of Directors. The Corporate Governance page can be found on our website at www.flir.com/investor.

FLIR’s policies and practices reflect corporate governance initiatives that are compliant with the listing requirements of NASDAQ and the corporate governance requirements of the Sarbanes-Oxley Act of 2002 (“SOX”), including:

| • | The Board of Directors has adopted clear corporate governance policies; |

| • | A majority of the Board members are independent of FLIR and its management based on the relevant independence requirements contained in the Company’s Corporate Governance Principles as well as any additional or supplemental independence standards established by NASDAQ; |

| • | All members of the Board committees—the Audit, Compensation and Corporate Governance Committees—are independent based on the relevant independence requirements contained in the Company’s Corporate Governance Principles as well as any additional or supplemental independence standards established by NASDAQ and SOX; |

| • | The independent members of the Board of Directors meet regularly without the presence of management; |

| • | FLIR has a Code of Ethical Business Conduct for FLIR Operations Inside the U.S. and a Code of Ethical Business Conduct for FLIR Operations Outside the U.S.; |

| • | The charters of the Board committees clearly establish their respective roles and responsibilities; |

| • | FLIR has an ethics officer and an internet-based hotline monitored by EthicsPoint® that is available to all employees, and FLIR’s Audit Committee has procedures in place for the anonymous submission of employee complaints on accounting, internal controls or auditing matters; and |

| • | FLIR has adopted a Code of Ethics for Senior Financial Officers that applies to its Chief Executive Officer, Chief Financial Officer, Corporate Controller, Corporate Treasurer, Business Unit Controllers and Site Controllers. |

You may obtain copies of the documents posted on FLIR’s Corporate Governance page on its website by writing to the Corporate Secretary, FLIR Systems, Inc., 27700 SW Parkway Avenue, Wilsonville, Oregon 97070.

8

MANAGEMENT

Executive Officers

The executive officers of the Company are as follows:

Name | Age | Position | ||

Earl R. Lewis | 66 | Chairman of the Board of Directors, President and Chief Executive Officer | ||

Arne Almerfors | 64 | Executive Vice President | ||

Stephen M. Bailey | 61 | Senior Vice President, Finance and Chief Financial Officer | ||

William W. Davis | 53 | Senior Vice President, General Counsel and Secretary | ||

William A. Sundermeier | 46 | President, Government Systems | ||

Andrew C. Teich | 49 | President, Commercial Systems | ||

Anthony L. Trunzo | 46 | Senior Vice President, Corporate Strategy and Development |

Information concerning the principal occupation of Mr. Lewis is set forth under “Election of Directors.” Information concerning the principal occupation during at least the last five years of the executive officers of the Company who are not also Directors of the Company is set forth below.

ARNE ALMERFORS. Mr. Almerfors joined FLIR in December 1997 in connection with FLIR’s acquisition of AGEMA Infrared Systems AB, and currently serves as Executive Vice President of the Company. From 1997 through 2009, Mr. Almerfors served as President of the Thermography Division. From 1995 to 1997, Mr. Almerfors was President and Chief Executive Officer of AGEMA Infrared Systems AB. He also served as President and Chief Executive Officer of CE Johansson AB, a manufacturer of coordinate measuring devices, from 1989 to 1995. Mr. Almerfors received his B.S., MBA, Masters in Political Science and certification for post-graduate courses in corporate finance and accounting from the University of Stockholm.

STEPHEN M. BAILEY. Mr. Bailey joined FLIR in April 2000 as Senior Vice President, Finance and Chief Financial Officer. Prior to joining FLIR, Mr. Bailey served as Vice President and Chief Financial Officer of Bauce Communications, Inc., President of Pro Golf of Portland, Inc., and Chief Financial Officer and Chief Operating Officer of Desk2Web Technologies, Inc. From 1975 to 1988, Mr. Bailey served in various senior executive positions with AMFAC, Inc., including President of AMFAC Supply Company, Senior Vice President and Controller of AMFAC, Inc. and Senior Vice President and Controller of AMFAC Foods, Inc. A CPA, Mr. Bailey also worked at Touche Ross & Company (which subsequently became Deloitte & Touche) from 1970 to 1975. Mr. Bailey received his B.S. from Oregon State University.

WILLIAM W. DAVIS. Mr. Davis joined FLIR in July 2007 as Senior Vice President, General Counsel & Secretary. Prior to joining FLIR, from 2005 to 2007, Mr. Davis served as Deputy General Counsel of Brunswick Corporation, a global manufacturer and marketer of recreation products. From 1999 to 2005, he was employed in various capacities with General Dynamics Corporation, a provider of aerospace and combat, marine and information systems products and services, including Vice President and General Counsel of its Land Systems and Armament and Technical Products subsidiaries. From 1990 to 1992 and 1993 to 1999, Mr. Davis practiced law, most recently as a partner in the firm of Katten, Muchin & Zavis. From 1992 to 1993, Mr. Davis served as a law clerk to the Honorable Edward Carnes of the United States Court of Appeals for the Eleventh Circuit. Mr. Davis received his B.S. with distinction from the United States Naval Academy and his J.D. from the University of Chicago Law School. Following graduation from the Naval Academy, Mr. Davis served as an officer in the United States Marine Corps and Marine Corps Reserve.

WILLIAM A. SUNDERMEIER. Mr. Sundermeier has been serving as the President of FLIR’s Government Systems Division since April of 2006. Mr. Sundermeier joined FLIR in 1994 as Product Marketing Manager for Thermography Products and was appointed Director of Product Marketing for commercial and government products in 1995. In 1999, Mr. Sundermeier was appointed Senior Vice President for Product Strategy, focused

9

on the integration of newly acquired companies. In September 2000, Mr. Sundermeier was appointed Senior Vice President and General Manager, Portland Operations. In April 2004, he was appointed Co-President of the Imaging Division. Prior to joining FLIR, Mr. Sundermeier was a founder of Quality Check Software, Ltd. in 1993. Mr. Sundermeier received his B.S. in Computer Science from Oregon State University.

ANDREW C. TEICH. Mr. Teich has been serving as President of FLIR’s Commercial Vision Systems Division since April 2006 and, effective January 1, 2010, is now the President of the Company’s Commercial Systems Division. Mr. Teich joined FLIR as Senior Vice President, Marketing, as a result of FLIR’s acquisition of Inframetrics in March of 1999. From 2000 to 2006, he served as the Senior Vice President of Sales and Marketing and then as Co-President of the Imaging Division at FLIR. While at Inframetrics, Mr. Teich served as Vice President of Sales and Marketing from 1996 to 1999. From 1984 to 1996, Mr. Teich served in various capacities within the sales organization at Inframetrics. He holds a B.S. degree in Marketing from Arizona State University and has attended executive education courses at Stanford University.

ANTHONY L. TRUNZO. Mr. Trunzo joined FLIR in August 2003 as Senior Vice President, Corporate Strategy and Development. From 1996 until joining FLIR, Mr. Trunzo was Managing Director in the Investment Banking Group at Banc of America Securities, LLC. From 1986 to 1996, he held various positions at PNC Financial Services Group, Inc. Mr. Trunzo holds a B.A. in Economics from the Catholic University of America and an MBA with a concentration in Finance from the University of Pittsburgh.

10

COMPENSATION DISCUSSION AND ANALYSIS

The following discussion and analysis contains statements regarding future Company performance targets and goals. These targets and goals are disclosed in the context of FLIR’s compensation programs and should not be understood to be statements of management’s expectations or estimates of results or other guidance. FLIR specifically cautions investors not to apply these statements to other contexts.

Philosophy and Objectives of Compensation Programs

General Philosophy

We believe the total compensation of our executive officers (the “Executives”) should support the following objectives:

| • | To attract and retain Executives with the skills, experience and motivation to enable the Company to achieve its stated objectives. This means that the Company provides an opportunity for Executives to earn above average compensation for delivering consistently superior results; |

| • | To provide a mix of current, short-term and long-term compensation to achieve a balance between current income and long-term incentive opportunity and promote focus on both annual and multi-year business objectives. This means that Executives have a higher percentage of their total pay opportunity tied to performance-based (versus fixed) and long-term (versus short-term) pay; |

| • | To align total compensation with the performance commitments we make to our shareholders; including, long-term growth in revenue and diluted earnings per share (“EPS”). This means that both our short-term and long-term incentive programs are based primarily on achieving EPS growth; |

| • | To allow Executives who demonstrate consistent performance over a multi-year period to earn above-average compensation when FLIR achieves above-average long-term performance. This means that our compensation program for Executives has a high degree of variability – significant upside for performance that exceeds goals, with commensurate risk when performance falls short of goals; |

| • | Is affordable and appropriate in light of the Company’s size, strategy and anticipated performance. This means that while the Compensation Committee considers competitive practice in its decision-making, it places significant emphasis on the Company’s specific strategy, financial situation and performance in the ultimate determination of compensation decisions; and |

| • | Is straightforward and transparent in its design, so that shareholders and other interested parties can clearly understand all elements of our compensation plans, individually and in the aggregate. This means generally limiting the number of compensation elements, types of compensation, perquisites and post employment benefits while still remaining competitive in our compensation practices. |

For purposes of this Compensation Discussion and Analysis, Executives are defined as the Company’s Chief Executive Officer (the “CEO”) and his direct staff of six listed in the “Management” section above. These same individuals are also our Section 16 Officers as defined by the 1934 Act. Named Executive Officers (the “NEOs”), consist of our CEO, Chief Financial Officer (the “CFO”) and the three next most highly compensated Executives as of December 31, 2009.

Annual Process for Determining Executive Compensation

We evaluate our compensation plans and programs annually. This process begins early in each fiscal year with our human resources team gathering and presenting relevant data on executive compensation of our peer group (as discussed below) to our CEO. This data is then integrated with other considerations such as relative compensation among the Executives, overall Company performance in both absolute terms and relative to the peer group, and the results achieved by each individual Executive during the previous year. With the assistance

11

of our human resources team, our CEO then makes a recommendation regarding base salary and target levels of annual incentive and long-term incentive compensation (as defined below) for each Executive (other than the CEO) to the Compensation Committee for its review and approval. The Compensation Committee independently reviews the peer group data relating to CEO compensation, the overall Company performance and the performance of our CEO to determine his base salary and target levels of annual incentive and long-term incentive compensation. Concurrently, our human resources team and our CEO develop and recommend performance targets for the Annual Incentive Plan (“AIP”) and Long-Term Incentive Program (“LTIP”) to the Compensation Committee for its review and approval. The criteria for establishing these metrics include our long-term performance outlook as communicated to our shareholders, the Company’s recent and anticipated financial results, and consistency with historical practice. We have applied a consistent approach to our compensation plans for the past four years, with key elements such as the use of performance-based vesting for a portion of LTIP compensation and increasing annual EPS as the basis for AIP compensation remaining substantially unchanged. If necessary, however, we will modify elements of our compensation plans to address changing market dynamics, evolving compensation best practices, the impact of accounting rule changes and shifts in business objectives.

The largest single element of total direct compensation (“TDC”) for our Executives is long-term incentive compensation because we believe, based on shareholder feedback and our own historical performance, that long-term growth in EPS is the single most important metric for our shareholders. TDC is defined as the sum of base salary, annual incentive compensation and long-term incentive compensation. Approximately 59% of our CEO’s target TDC is tied to long-term performance. LTIP compensation for our Executives, excluding our CEO, accounts for approximately 56% of their target TDC. The higher proportion of long-term incentive compensation for our CEO reflects market practices as well as our objective to align his compensation with long-term corporate performance.

We currently use the same metrics and similar plan design elements for the AIP and LTIP compensation offered to our Executives as those we use for the rest of our employees. While the amount of compensation that is at risk for performance varies among employee groups, all of our annual incentive pools are determined based on achievement of a target level of EPS. We believe EPS, and annual growth in EPS, are important performance metrics for our shareholders, and have historically designed our incentive compensation plans around these metrics. We believe this approach offers appropriate incentives to our Executives who are most able to impact long-term success, while aligning the objectives of all of our employees with those of our Executives and our shareholders. The Compensation Committee periodically reviews this approach to ensure it remains consistent with the best interests of our shareholders.

Defining the Market—Benchmarking

In February 2009, management, in collaboration with the Compensation Committee and our compensation consultant, identified a group of sixteen companies (the “Peer Group”) and compared each element of our Executives’ compensation to the Peer Group. Since there are no public companies directly comparable to FLIR, the Peer Group consisted of companies of similar size (based on revenues, assets and market capitalization) and in similar, but not identical, industries that had financial performance superior to most public companies as measured by the Russell 2000 index.

The Peer Group was as follows: (1) Barnes Group, Inc., (2) Dionex Corporation, (3) DRS Technologies, Inc., (4) ESCO Technologies, Inc., (5) Esterline Technologies Corporation, (6) Garmin Corporation, (7) Mine Safety Appliances Company, (8) MKS Instruments, Inc., (9) National Instruments Corporation, (10) Perkin Elmer, Inc., (11) Rofin-Sinar Technologies, Inc., (12) Roper Industries, Inc., (13) Teledyne Technologies Incorporated, (14) Trimble Navigation Limited, (15) Varian, Inc. and (16) Waters Corporation. This Peer Group is slightly different than the one we used in 2008. Two companies were removed due to no longer being comparable in revenue and market capitalization: (1) Thermo Fisher Scientific, Inc. and (2) MTS Systems Corporation. Based on the data available at the time of the benchmarking, the Company was smaller than the

12

median of the Peer Group based on revenues (26th percentile) and assets (44th percentile), but above the Peer Group median with respect to market capitalization (89th percentile).

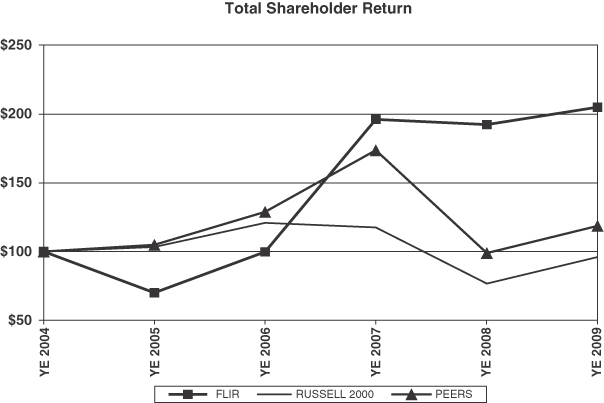

Over the five year period ending December 31, 2009, FLIR has outperformed both the Russell 2000 market index and the Peer Group in total shareholder return, as reflected in the following graph.

Since we place significant emphasis on long-term growth in our stock price, we believe the information provided in the graph above to be important in understanding our compensation philosophy and its role in the achievement of our long-term objectives. During the five year period shown above, FLIR’s total shareholder return was the highest among the companies in the Peer Group and, on average in 2009, TDC for our Executives was between the 50th and 75th percentile of the Peer Group. We have not established a specific percentile objective versus the market, nor have we established specific target TDC levels for our CEO or other Executives. However, the Compensation Committee concluded, based on the Company’s performance compared with the Peer Group, an analysis conducted by our compensation consultant, and its own analysis, that current compensation levels are appropriate for each of the Executives evaluated.

The Compensation Committee periodically reviews all elements of compensation and makes modifications as needed to remain competitive, fair, reasonable and consistent with the objectives described above and with established Company practices and policies. In general, we expect to utilize the services of outside compensation consultants, but not necessarily on an annual basis, because we have not found the additional cost of annual third party reviews to be justified. In years where we do not use a consultant, we will utilize information on executive compensation available from third party sources, such as Equilar, to assist us in evaluating our compensation levels. We used the consulting firm of Pearl Meyer and Partners in our evaluation of 2009 Executive compensation. Pearl Meyer and Partners conducted a comprehensive analysis comparing each element of compensation and TDC of each of our Executives with comparable positions in the Peer Group companies. Where comparable positions were not present in the Peer Group, Pearl Meyer and Partners reviewed published salary surveys. We expect to make changes to our Executive compensation plans and practices when they are

13

required by evolving best practices, changes in Company financial performance, and changes in accounting and tax rules. We would generally engage outside consultants to assist us in the event any major changes to our plans are contemplated.

Compensation Design and Elements of Compensation

We have designed our compensation plans to reward achievement of superior financial results, as measured by growth in EPS both annually and over multi-year periods. If we continue to meet the objectives we have set for the Company, which reflect superior results compared to our peers, our Executives will earn above-average compensation. Failure to achieve targeted results will significantly reduce total compensation, since a significant portion of our Executives’ pay is in the form of short-term and long-term incentives that are based on achieving a target growth in EPS. We believe this “pay for performance” philosophy attracts, retains and motivates our Executives to be aligned with the Company’s objectives, and helps attract and retain the talent needed to meet its goals.

Our CEO and CFO have employment agreements approved by the Compensation Committee that establish base salary levels and provide for annual incentive and long-term incentive awards under our approved plans (i.e., AIP and LTIP) for each year covered by their respective contracts. These contracts, and the Company’s obligations under them, are further described on page 24. The details of compensation for our Executives who are the NEOs are provided in the Compensation of Executive Officers section of this Proxy Statement starting on page 21.

Base Salary

Key considerations in establishing base salary levels include the overall level of responsibility a given Executive has, the importance of the role, and the experience, expertise and specific performance of the individual. We consider current base salary levels for each of our Executives to be consistent with these objectives and, absent any changes in responsibilities, that the individuals would expect increases in base salary to be in line with the market for such positions in the future. Our CEO and CFO’s base salaries are contractually established in their employment agreements at $950,000 for 2009 and 2010 for our CEO and $400,000 for 2009 and 2010 for our CFO. All other Executive base salaries are determined annually by the Compensation Committee in consultation with our CEO. Our CEO’s recommendations are supported by information and analysis provided by our human resources department and Pearl Meyer and Partners. In 2009, FLIR employees, including the Executives, did not receive salary increases. Our CEO and CFO agreed to not accept their contractual salary increases listed above and instead remained at their 2008 levels of $825,000 and $370,000, respectively. For our NEOs, base salaries for 2009 accounted for 26% of their TDC. This means our NEOs have 74% of their total pay opportunity tied to performance-based and/or long-term incentive pay.

Annual Incentive Plan

We have an Annual Incentive Plan that covers virtually all non-commission earning U.S. employees and all non-commission earning non-management employees outside of the United States. For our Executives, this program awards annual cash incentive compensation based upon achievement of an increase in EPS from the prior year.

The 2009 AIP funding was based on achievement of a reported EPS target, which was the same for all our Executives and all other employees. This approach has been in place for our CEO since 2004 and in each year the target EPS has been significantly higher than in the prior year. For example, in 2004, the EPS target was $0.39; while in 2009 it was $1.54, representing a compound annual growth rate of 32%. Since long-term growth in EPS is one of our critical performance measures, we believe that aligning our Executives’ non-equity incentive award with this measure, if done annually and consistently, represents a simple, easy to understand metric that is well aligned with our shareholders’ interests. The Annual Incentive Plan was designed so that if the Company

14

achieves the EPS target, the AIP pool would equal 100% of the target incentive awards for all Executives, including our CEO. For 2009, with each $0.01 variance above or below the target EPS, the AIP pool for Executives was increased or decreased by 7%. The EPS target for 2009 was $1.54, representing a 20% increase over our actual EPS of $1.28 in 2008. The target award for our CEO was 100% of his base salary. Target awards for our other Executives were between 50% and 60% of base salary. These target award levels were compared with the annual incentive levels of individuals in the Peer Group and, based on our performance and our compensation objectives, the Compensation Committee determined that they were appropriate. While we benchmarked our specific AIP targets against the Peer Group on a position by position basis, we also evaluated the overall mix of base salaries, short-term and long-term incentive compensation using the Peer Group data as a guide.

2009 Annual Incentive Plan Matrix

| Threshold | Target | Outstanding | Actual | |||||

EPS | 91% of target $1.40 | $1.54 | 109% of target $1.68 | 97% of target $1.50 | ||||

Annual Incentive | 0% of target | 100% of target | 200% of target | 72% of target | ||||

For 2009, FLIR’s reported EPS was $1.45. The Compensation Committee adjusted the EPS for AIP calculation purposes to $1.50 due to one-time non-operating events, as allowed under the Executive Bonus Plan. The AIP award for each Executive was based on this adjusted EPS.

The Executive incentive payments and the non-executive employee pools have fluctuated from year to year in relation to our performance relative to our targets. For our Executives, non-equity incentive compensation for 2009 accounted for 13% of TDC.

In 2007, we received shareholder approval for, and adopted, an Executive Bonus Plan. The Executive Bonus Plan is designed so that bonuses paid under it may, subject to our compliance with Section 162(m) of the United States Internal Revenue Code (the “Code”), be deductible for federal income tax purposes. Due to the one-time adjustment noted above, the 2009 bonus payments were not compliant with Section 162(m) and certain Executive bonuses may not be deductible for federal income tax purposes. The Executive Bonus Plan provides for a maximum annual award to any NEO of $5,000,000.

Long-Term Equity Incentive Program

We believe sustained long-term growth in our share price, achieved through growing revenue and EPS, is the primary responsibility of our Executives. Long-term incentives in the form of stock options, restricted stock units (“RSU”) or other equity instruments are an appropriate way to link the interests of management and shareholders, and to incent management to achieve this objective. Therefore, we have consistently used such instruments as an integral part of our compensation programs, and the largest single component of each Executive’s target compensation. We believe this has helped contribute to our shareholder returns, which are superior to market indices and our Peer Group. For example, our annualized shareholder return from the end of 2004 through the end of 2009 was 15%, compared with an average annual return of negative 1% for the Russell 2000 Index and 3% for the Peer Group during that time period. Over the past several years, it has been our practice to issue stock-based compensation annually following our annual meeting. Pursuant to the Compensation Committee Charter and the Equity Granting Policy (as discussed on page 19) adopted by the Compensation Committee in March 2007, we expect to continue to make annual grants in the future.

Starting in 2005, we introduced additional performance elements to our stock option grants, particularly for our Executives. In 2006, we further modified our grants to make stock option vesting contingent on the

15

achievement of certain increases in annual EPS, in addition to the passage of time. We used this same general approach in 2007 and 2008. In 2009, we granted both time-based and performance-based stock options.

The Executive annual LTIP awards in 2009 were established on a dollar value basis for each Executive, including our CEO. The 2009 award values were then apportioned as follows: two thirds time-based (split 75% time-based stock options and 25% time-based RSUs) and one third performance-based stock options. For example, if an Executive was to receive an LTIP award with a total value of $100,000, $50,000 of the award would be delivered in the form of time-based stock options, $16,667 of the award would be delivered in the form of RSUs and $33,333 of the award would be delivered in the form of a performance-based stock option grant. For this purpose, RSUs are valued at the closing market price of a share of Common Stock on the date of grant and stock options are valued using the Black-Scholes option pricing model as of the date of grant.

The RSUs awarded in 2009 vest equally over a three year period. The time-based RSUs address our retention needs by providing a certain level of compensation that requires future service on the part of the Executive. The time-based options granted in 2009 vest at the rate of one third per year. The performance-based stock options granted in 2009 vest at the rate of one third per year, subject to the achievement of minimum EPS levels for each year in the three-year performance period. The vesting of the performance-based stock options for the second and third years of any grant is independent of the vesting of stock options in prior years. Stock options that do not vest due to the Company not achieving the minimum EPS levels in any year are permanently forfeited. At the time the 2009 LTIP awards were made, it was anticipated that Messrs. Almerfors and Bailey may retire within the three year vesting period. Thus, each received a smaller award than would normally have been the case, and the vesting periods of the awards were shortened to one year from grant date for Mr. Almerfors and two years from grant date for Mr. Bailey. In order to achieve 100%, 75%, or 50% vesting of stock options granted in 2009, the Company must achieve the following EPS levels in each year:

Performance Year | 100% Vesting | 75% Vesting | 50% Vesting | 0% Vesting | ||||||||

2009 | $ | 1.47 | $ | 1.43 | $ | 1.38 | <$ | 1.38 | ||||

2010 | $ | 1.69 | $ | 1.61 | $ | 1.49 | <$ | 1.49 | ||||

2011 | $ | 1.95 | $ | 1.80 | $ | 1.61 | <$ | 1.61 | ||||

For 2009, FLIR’s reported EPS was $1.45. The Compensation Committee adjusted the EPS for purposes of calculating the portion of the 2009 LTIP that was performance-vested to $1.50 due to one-time non-operating events, as allowed under the 2009 performance-vested option agreements.

We use this vesting methodology because it holds our Executives to a uniquely high standard of performance that must be achieved over a multi-year period in order for them to realize the potential value of their awards.

We expect future annual LTIP awards to include similar components, although we may make changes to certain aspects of the program as circumstances change. For example, the aggregate annual level of grants and the mix of RSUs and options may vary, based on factors such as anticipated share dilution, accounting costs, changing market compensation dynamics and the Company’s financial objectives. In 2009, we reduced the portion of the annual equity grants that were allocated to performance-based stock options and included time-based options in the program. Based on our research and that of Pearl Meyer and Partners, the prevalence of performance-based options is generally very low, and none of our Peer Group utilize performance-based options.

The 2009 annual LTIP award amounts were compared with the long-term incentive levels of individuals in the Peer Group and the Compensation Committee determined that they were appropriate and consistent with the Company’s objectives. While we benchmarked the specific LTIP awards against the Peer Group on a position by position basis, we did not set our Executive LTIP awards solely on this basis. We determined that the awards were generally consistent with the market and our objectives relating to pay mix and performance-based compensation.

16

In addition to the usual annual LTIP awards described above, Messrs. Sundermeier and Teich each received special recognition awards in 2009 due to the exceptional performance of their respective divisions. These special awards were granted in the form of RSUs and fully vested 13 months from the grant date.

Perquisites and Other Benefits

In general, we minimize the value and number of perquisites provided to our Executives. We believe this makes our overall compensation simpler, easier to understand and more transparent to stakeholders. The primary perquisite for our Executives is an automobile allowance for our U.S.-based Executives and a leased automobile for Mr. Almerfors in Sweden. In addition, our U.S.-based NEOs have supplemental life insurance benefits provided through the Supplemental Executive Retirement Plan (the “SERP”) and Mr. Almerfors has an executive health care plan that supplements the standard benefits provided to our employees in Sweden. The values of all perquisites for our NEOs are included in the All Other Compensation Table on page 22.

Our Executives are also eligible to participate in our other benefit plans on the same terms as other employees. These plans include health plans, disability and life insurance plans, retirement plans and an employee stock purchase plan.

Supplemental Executive Retirement Plan

In January 2001, we implemented a SERP for certain executives then employed by FLIR in the United States. This plan was most recently amended in October 2009. The amendment was designed to simplify and clarify the method of payment of benefits under the SERP, improve administrative oversight and clarify certain aspects of the SERP’s operation. The amendment was not designed to increase or decrease the benefits payable to any of the plan participants. This plan was implemented as an important retention tool at a time of uncertainty in the Company. Since the SERP’s inception, no additional participants have been added, and we do not intend to add participants in the future. Our U.S.-based NEOs are the only participants in the SERP. See page 27 for additional information.

Non-Qualified Deferred Compensation Plan

In early 2008, we implemented a NQDC plan. Participation by our employees, including our Executives, is optional. This plan provides an additional pre-tax savings vehicle for our more highly compensated U.S.-based employees whose retirement savings opportunity was limited to $16,500 in 2009 under our 401(k) plan. The NQDC plan is available to all our U.S.-based employees earning over a specified annual salary. The NQDC plan does not allow for Company contributions to be made to the plan on behalf of any employee, including the Executives. See page 28 for additional details.

Post Termination Elements of Compensation

Severance

With the exception of our CEO and CFO, we do not have any formal severance arrangements with any of our Executives.

In the past we have provided severance on a case by case basis in situations where a termination was not for cause, and such payment was deemed to be appropriate and in the best interests of the Company. We are likely to continue doing so in the future.

Change of Control Agreements

We consider a sound and vital management team to be essential in protecting and enhancing the best interests of the Company and our shareholders. To this end, we recognize that the possibility of a change of

17

control could arise and that such possibility may result in the departure or distraction of management to the detriment of the Company and our shareholders. In order to encourage the continued attention and dedication of our Executives to their assigned duties without distraction in circumstances arising from the possibility of a change of control of the Company, we entered into change of control agreements, effective January 1, 2009, with our Executives, with the exception of our CEO and CFO. These change of control agreements replaced the agreements that terminated according to their terms on December 31, 2008 and provide the same level of benefits as the terminated agreements. In the case of our CFO, change of control benefits are included as part of his employment agreement, as described on page 24.

The terms and value of these severance and change of control termination benefits are further described starting on page 28.

Compensation Committee Governance

Compensation Committee Members and Compensation Committee Charter

Our Executive compensation policies are established, reviewed and approved by the Compensation Committee of the Board of Directors. The Compensation Committee is composed of three non-employee Directors—Angus L. Macdonald (Chair), William W. Crouch and Michael T. Smith—all of whom have been determined by the Board to be “independent” as defined by the Board’s Corporate Governance Principles and applicable SEC and NASDAQ rules. The members of the Compensation Committee, in aggregate, have significant experience in executive positions including management, talent development, finance and accounting and have been involved in executive compensation matters in their respective careers. See page 3 in this Proxy Statement for a more detailed biography for each of our Directors. In accordance with its Charter, the Board’s Corporate Governance Committee annually reviews the operation, structure and membership of all committees, including the Compensation Committee.

The Compensation Committee has primary responsibility for all matters relating to the compensation of our Executives, as well as certain compensation elements for other employees. “Compensation” for this purpose means all forms of remuneration including, without limitation, salaries, bonuses, annual and long-term incentive compensation, equity-based compensation, retirement benefits, severance pay and benefits, fringe benefits and perquisites, and compensation and benefits in the event of a change of control of the Company. The Compensation Committee, in its discretion, may retain the services of outside consultants to assist the Compensation Committee in compensation matters. The Compensation Committee is governed by a charter adopted by the Board, which can be found at www.flir.com/investor. The Corporate Governance Committee of the Board annually considers and makes recommendations, as appropriate, to the Board regarding the content of all Board committee charters, including the Compensation Committee’s charter. The Compensation Committee charter was first adopted by the Board on October 24, 2002, and was most recently updated in February 2010.

Compensation Consultant

The Compensation Committee has from time to time engaged professional compensation consultants to advise the Compensation Committee on our Executive compensation programs and policies. Most recently, the Compensation Committee engaged Pearl Meyer and Partners to conduct a competitive analysis of our Executive compensation levels. This study, as described on page 13, was used as part of the determination of Executive compensation levels for 2009. The Compensation Committee and the Corporate Governance Committee intend to continue using compensation consultants in the future, but not necessarily on an annual basis. Decisions as to whether the use of a consultant is appropriate for any annual period will be determined by the respective committees based on considerations including length of time since the last engagement of a consultant and changes in factors affecting executive compensation at the Company or in the market at large.

18

Role of Executives in Establishing Compensation

Our Senior Vice President for Corporate Strategy and Development and Vice President of Human Resources have participated in the development of certain Executive compensation programs, particularly the AIP and the LTIP described above. Once formulated, these programs are reviewed by our CEO and other individuals whose counsel may be sought from time to time and submitted to the Compensation Committee for its review and approval. As noted previously, with the assistance of our human resources team, our CEO makes recommendations regarding base salary and target levels of the AIP and LTIP compensation for each Executive (other than the CEO) to the Compensation Committee. Our human resources team and CEO also recommend to the Compensation Committee the performance targets under the AIP and LTIP. From time to time, certain individuals including our CEO, Senior Vice President for Corporate Strategy and Development and Vice President of Human Resources are invited to attend meetings of the Compensation Committee. A person, who may be a member of the Company’s management, will be designated by the Compensation Committee Chairman to act as Secretary to the Compensation Committee. During 2009, the Company’s Senior Vice President, General Counsel and Secretary served in this capacity. While these individuals may be asked to provide input and perspective, only Compensation Committee members vote on Executive compensation matters. Our Vice President of Human Resources is responsible for the implementation, execution and operation of our compensation programs, as directed by the CEO and the Compensation Committee.

Equity Granting Policy

Recognizing the importance of adhering to appropriate practices and procedures when granting equity awards, we implemented an equity granting policy in early 2007 to formalize our practices and processes. The policy was last updated in July 2009. The policy establishes the following practices, which may be modified from time to time by the Compensation Committee:

| • | All grants to Executives must be approved at a meeting of the Compensation Committee, and may not occur through action by unanimous written consent; |

| • | The grant date of all equity awards approved at a meeting of the Compensation Committee shall be the second trading day after the date of the next public announcement of the Company’s quarterly earnings following the date of approval; |

| • | All equity awards approved by the CEO to be granted out of the CEO Reserve, will be granted quarterly. The grant date will be the second trading day after the date of the next public announcement of the Company’s quarterly earnings following the date of approval; and |

| • | The exercise price for all stock option awards shall not be less than the closing market price of the Common Stock on the grant date. |

Stock Ownership/Retention Requirements

We impose stock ownership requirements on our Executives. The Corporate Governance Principles require our Executives to hold shares of Common Stock, RSUs or in-the-money stock options valued in an amount equal to no less than one year’s base salary. The Corporate Governance Principles are reviewed annually by the Corporate Governance Committee of the Board. As of the date of this Proxy Statement, all Executives are in compliance with these requirements.

Impact of Tax and Accounting on Compensation Decisions

As a general matter, the Compensation Committee always takes into account the various tax and accounting implications of the compensation vehicles employed by the Company.

When determining the amounts of long-term incentive compensation for Executives and employees, the Compensation Committee examines the accounting cost associated with the grants. Grants of stock options,

19

RSUs and other share-based payments result in an accounting expense for the Company. The accounting expense is equal to the fair value of the instruments being issued. For the RSUs, the expense is equal to the fair value of a share of Common Stock on the date of grant times the number of units granted. For stock options, the expense is equal to the fair value of the option on the date of grant using a Black-Scholes option pricing model times the number of options granted. The expenses are amortized over the vesting period.

Section 162(m) of the Code generally prohibits any publicly held corporation from taking a federal income tax deduction for compensation paid in excess of $1,000,000 in any taxable year to “covered employees” under Section 162(m). Exceptions are made for qualified performance-based compensation, among other things. It is the Compensation Committee’s policy to maximize the effectiveness of our Executive compensation plans in this regard. However, the Compensation Committee believes that compensation and benefits decisions should be primarily driven by the needs of the business, rather than by tax policy. Therefore, the Compensation Committee may make decisions that result in compensation expense that is not fully deductible under Section 162(m). For example, in 2009 the Compensation Committee adjusted the AIP payouts which will cause some of the AIP payouts to not be fully tax deductible in 2010, as described on page 15.

COMPENSATION COMMITTEE REPORT

We have reviewed and discussed the Compensation Discussion and Analysis with FLIR’s management and, based on our review and discussions, we recommended to the Board that the Compensation Discussion and Analysis be included in this Proxy Statement and the Company’s Annual Report on Form 10-K for the year ended December 31, 2009.

| THE COMPENSATION COMMITTEE |

| Angus L. Macdonald, Chair |

| William W. Crouch |

| Michael T. Smith |

20

COMPENSATION OF EXECUTIVE OFFICERS

2009 Summary Compensation Table

The following table summarizes compensation for our CEO, CFO and our three other NEOs for the years ended December 31, 2009, 2008 and 2007.

Name and Principal Position | Year | Salary ($) | Stock Awards ($)(1) | Option Awards ($)(2) | Non-Equity Incentive Plan Compensation ($)(3) | Change in Pension Value ($)(4) | All Other Compensation ($)(5) | Total ($) | |||||||||||||||

Earl R. Lewis | 2009 | $ | 825,000 | $ | 868,530 | $ | 1,858,017 | $ | 594,000 | $ | 1,627,954 | $ | 43,840 | $ | 5,817,341 | ||||||||

Chief Executive Officer | 2008 2007 |

| 823,206 750,000 |

| 657,932 258,029 |

| 1,453,590 744,124 |

| 2,095,500 1,500,000 |

| 3,847,576 619,704 |

| 39,538 45,569 |

| 8,917,342 3,917,426 | ||||||||

Stephen M. Bailey | 2009 | 370,000 | 243,654 | 537,591 | 159,840 | 616,965 | 34,825 | 1,962,875 | |||||||||||||||

Chief Financial Officer(6) | 2008 2007 |

| 369,308 339,519 |

| 203,726 95,166 |

| 480,888 264,784 |

| 563,880 408,000 |

| 1,279,743 165,409 |

| 32,771 34,271 |

| 2,930,316 1,307,149 | ||||||||

Arne Almerfors | 2009 | 493,812 | 225,562 | 502,505 | 162,720 | n/a | 65,219 | 1,449,818 | |||||||||||||||

Former President, Thermography Division(7) | 2008 2007 |

| 589,109 569,943 |

| 200,356 92,399 |

| 460,799 255,717 |

| 574,040 420,000 |

| n/a n/a |

| 76,368 73,046 |

| 1,900,672 1,411,105 | ||||||||

William A. Sundermeier | 2009 | 332,000 | 360,755 | 564,654 | 143,424 | 402,596 | 28,229 | 1,831,658 | |||||||||||||||

President, Government Systems Division | 2008 2007 |

| 327,769 306,923 |

| 323,111 84,893 |

| 439,551 240,426 |

| 508,000 372,000 |

| 552,704 47,463 |

| 26,231 29,065 |

| 2,177,366 1,080,770 | ||||||||

Andrew C. Teich | 2009 | 332,000 | 290,454 | 564,654 | 143,424 | 467,566 | 28,551 | 1,826,649 | |||||||||||||||

President, Commercial Vision Systems Division | 2008 2007 |

| 327,769 307,923 |

| 186,059 84,893 |

| 439,551 240,426 |

| 508,000 372,000 |

| 660,982 56,761 |

| 27,213 32,447 |

| 2,149,574 1,094,450 | ||||||||

| (1) | Represents the compensation expense recognized for financial reporting purposes related to the shares issuable under time-based RSU awards granted in 2009, 2008, 2007 and 2006. The fair value used to calculate the compensation expense is the closing market price of our Common Stock on the date of grant. For additional information regarding the calculation of the expense associated with RSU awards, see Note 1 to Notes to Consolidated Financial Statements in our Annual Report on Form 10-K for the year ended December 31, 2009. |

| (2) | Represents the compensation expense recognized for financial reporting purposes related to the performance-based stock options granted in 2009, 2008, 2007 and 2006 at an exercise price of $25.64, $34.31, $20.75 and $12.57 per share, respectively, and time-based stock options granted in 2009 at an exercise price of $25.64 per share. Fair value used to calculate the compensation expense of the stock option awards is determined using the Black-Scholes option pricing model. For additional information regarding the calculation of the expense associated with the stock option awards, see Note 1 to Notes to Consolidated Financial Statements in our Annual Report on Form 10-K for the year ended December 31, 2009. |

| (3) | Represents amounts earned under our AIP with respect to the specified year. The AIP and the metrics used to determine annual payment are described in the Compensation Discussion and Analysis under “Annual Incentive Plan.” |

| (4) | Represents the aggregate change in actuarial present value of each NEO’s accumulated benefit under the SERP during the years indicated. The significant increases in pension values in 2008 are primarily due to the impact of AIP awards. The Change in Pension Value in the table above is calculated on the basis of Minimum Retirement Benefit (as described in the Pension Benefits table on page 27) for all participants, even though Messrs. Sundermeier and Teich have not achieved eligibility for such benefits. |

| (5) | Represents actual cash expenses incurred by the Company and includes car allowances, Company matching contributions under our 401(k) plan, healthcare premiums, group life insurance premiums, supplemental executive life insurance premiums, and other personal benefits. Details are described in the All Other Compensation Table on page 22. |

| (6) | Mr. Bailey has announced his intent to retire from the Company effective May 31, 2010. |

| (7) | Mr. Almerfors has announced his intent to retire from the Company effective May 31, 2010. |

21

2009 All Other Compensation Table

The following table provides the components of the amounts shown for 2009 in the “All Other Compensation” column of the Summary Compensation Table above.

Name and Principal Position | Car Allowance ($) | Company Contributions under a Retirement Plan ($) | Healthcare Premiums ($) | Group Life Insurance Premiums ($) | Supplemental Executive Life Insurance Premiums ($) | Other Personal Benefits ($) | Total ($) | ||||||||||||||||

Earl R. Lewis | $ | 18,000 | $ | 8,250 | (1) | $ | — | $ | 7,723 | $ | 9,457 | $ | 410 | (2) | $ | 43,840 | |||||||

Stephen M. Bailey | 18,000 | 8,250 | (1) | — | 3,598 | 4,977 | — | 34,825 | |||||||||||||||

Arne Almerfors | 14,074 | 49,362 | (3) | 1,783 | n/a | n/a | — | 65,219 | |||||||||||||||

William A. Sundermeier | 18,000 | 8,250 | (1) | — | 810 | 1,169 | — | 28,229 | |||||||||||||||

Andrew C. Teich | 18,000 | 8,250 | (1) | — | 810 | 1,491 | — | 28,551 | |||||||||||||||

| (1) | Represents the Company matching contributions under the Company’s 401(k) plan for the U.S.-based officers. |

| (2) | Airline club membership dues. |

| (3) | Represents the Company contributions under the Swedish retirement plan. |

2009 Grants of Plan-Based Awards

The following Grants of Plan-Based Awards table provides additional information about stock and stock option awards and equity and non-equity incentive plan awards granted to our NEOs during the year ended December 31, 2009.

Name | Grant Date | Approval Date | Estimated Possible Payouts under Non-Equity Incentive Plan Awards(1) | Estimated Future Payouts under Equity Incentive Plan Awards | All Other Stock Awards; Number of Shares of Stock or Units (#) | All Other Option Awards; Number of Securities Underlying Options (#) | Exercise or Base Price of Option Awards ($/Sh) | Grant Date Fair Value of Stock and Option Awards ($) | |||||||||||||||

| Target ($) | Threshold (#) | Target (#) | |||||||||||||||||||||

Earl R. Lewis | 2/03/2009(2 | ) | $ | 825,000 | |||||||||||||||||||

| 5/05/2009(3 | ) | 4/30/2009(4 | ) | 48,100 | 96,200 | $ | 25.64 | $ | 966,170 | ||||||||||||||

| 5/05/2009(5 | ) | 4/30/2009(4 | ) | 141,700 | 25.64 | 1,455,340 | |||||||||||||||||

| 5/05/2009(6 | ) | 4/30/2009(4 | ) | 18,550 | 475,622 | ||||||||||||||||||

Stephen M. Bailey | 2/03/2009(2 | ) | 222,000 | ||||||||||||||||||||

| 5/05/2009(7 | ) | 4/30/2009(4 | ) | 10,000 | 20,000 | 25.64 | 191,200 | ||||||||||||||||

| 5/05/2009(8 | ) | 4/30/2009(4 | ) | 29,500 | 25.64 | 287,035 | |||||||||||||||||

| 5/05/2009(9 | ) | 4/30/2009(4 | ) | 3,850 | 98,714 | ||||||||||||||||||

Arne Almerfors | 2/03/2009(2 | ) | 226,000 | ||||||||||||||||||||

| 5/05/2009(10 | ) | 4/30/2009(4 | ) | 4,800 | 9,600 | 25.64 | 86,976 | ||||||||||||||||

| 5/05/2009(11 | ) | 4/30/2009(4 | ) | 14,200 | 25.64 | 131,776 | |||||||||||||||||

| 5/05/2009(12 | ) | 4/30/2009(4 | ) | 1,850 | 47,434 | ||||||||||||||||||

William A. Sundermeier | 2/03/2009(2 | ) | 200,000 | ||||||||||||||||||||

| 2/09/2009(13 | ) | 2/03/2009(14 | ) | 5,000 | 118,000 | ||||||||||||||||||