UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrantx Filed by a Party other than the Registrant¨

Check the appropriate box:

| x | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ¨ | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

FLIR SYSTEMS, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| (1) | Title of each class of securities to which the transaction applies: |

| (2) | Aggregate number of securities to which the transaction applies: |

| (3) | Per unit price or other underlying value of the transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of the transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

27700A SW Parkway Avenue

Wilsonville, Oregon 97070

(503) 498 -3547

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON APRIL 25, 2008

To the Shareholders of FLIR Systems, Inc.:

NOTICE IS HEREBY GIVEN that the Annual Meeting of Shareholders (the “Annual Meeting”) of FLIR Systems, Inc. (the “Company”) will be held on Friday, April 25, 2008, at 2:00 p.m., at the Multnomah Athletic Club, 1849 SW Salmon Street, Portland, Oregon 97205 for the following purposes:

| 1. | Election of Directors. To elect three Directors, each for a three-year term expiring in 2011; |

| 2. | Approval of Amendment of Articles of Incorporation. To approve an amendment of the Company’s Articles of Incorporation to increase the number of shares of Common Stock that the Company is authorized to issue from 200,000,000 to 500,000,000; |

| 3. | Ratification of Appointment of the Independent Registered Public Accounting Firm. To ratify the appointment by the Audit Committee of the Company’s Board of Directors of KPMG LLP as the independent registered public accounting firm of the Company for the fiscal year ending December 31, 2008; and |

| 4. | Other Business. To transact such other business as may properly come before the Annual Meeting or any adjournments or postponements thereof. |

The Board of Directors of the Company has fixed the close of business on March 3, 2008 as the record date for the determination of shareholders entitled to notice of and to vote at the Annual Meeting. Only shareholders of record at the close of business on that date will be entitled to notice of and to vote at the Annual Meeting or any adjournments or postponements thereof.

By Order of the Board,

Earl R. Lewis

Chairman of the Board of Directors, President

and Chief Executive Officer

Wilsonville, Oregon

March 14, 2008

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF SHAREHOLDERS TO BE HELD ON APRIL 25, 2008

The Proxy Statement and Annual Report on Form 10-K are available at www.investor.flir.com.

IT IS IMPORTANT THAT PROXIES BE COMPLETED AND SUBMITTED PROMPTLY. THEREFORE, WHETHER OR NOT YOU PLAN TO BE PRESENT IN PERSON AT THE ANNUAL MEETING, PLEASE COMPLETE THE ENCLOSED PROXY AND SUBMIT IT IN ACCORDANCE WITH THE ACCOMPANYING INSTRUCTIONS. IF MAILED IN THE ENCLOSED ENVELOPE, NO POSTAGE IS REQUIRED IF MAILED IN THE UNITED STATES.

FLIR SYSTEMS, INC.

27700A SW Parkway Avenue

Wilsonville, Oregon 97070

(503) 498-3547

PROXY STATEMENT

for the

ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON APRIL 25, 2008

INTRODUCTION

General

This Proxy Statement is being furnished to the shareholders of FLIR Systems, Inc., an Oregon corporation (“FLIR” or the “Company”), as part of the solicitation of proxies by the Company’s Board of Directors (the “Board of Directors” or the “Board”) from holders of the outstanding shares of FLIR common stock, par value $0.01 per share (the “Common Stock”), for use at the Company’s Annual Meeting of Shareholders to be held on April 25, 2008, and at any adjournments or postponements thereof (the “Annual Meeting”). At the Annual Meeting, shareholders will be asked to elect three members of the Board of Directors, approve an amendment of the Company’s Articles of Incorporation to increase the number of authorized shares of Common Stock by 300,000,000, ratify the appointment by the Audit Committee of the Company’s Board of Directors of KPMG LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2008 and transact such other business as may properly come before the Annual Meeting or any adjournments or postponements thereof. This Proxy Statement, together with the enclosed proxy card, is first being made available to shareholders of FLIR on or about March 14, 2008.

Solicitation, Voting and Revocability of Proxies

The Board of Directors has fixed the close of business on March 3, 2008 as the record date for the determination of the shareholders entitled to notice of and to vote at the Annual Meeting. Accordingly, only holders of record of shares of Common Stock at the close of business on such date will be entitled to vote at the Annual Meeting, with each such share entitling its owner to one vote on all matters properly presented at the Annual Meeting. On the record date, there were approximately 58,000 beneficial holders of the approximately 137,251,000 shares of Common Stock then outstanding. The presence, in person or by proxy, of a majority of the total number of outstanding shares of Common Stock entitled to vote at the Annual Meeting is necessary to constitute a quorum at the Annual Meeting.

If you are a shareholder of record, you can vote (i) by attending the Annual Meeting or (ii) by signing, dating and mailing in your proxy card. If you hold your shares through a broker, bank or other nominee, that institution will instruct you as to how your shares may be voted by proxy. If you hold your shares through a broker, bank or other nominee and would like to vote in person at the meeting, you must first obtain a proxy issued in your name from the institution that holds your shares.

If the form of proxy is properly executed and returned in time to be voted at the Annual Meeting, the shares represented thereby will be voted in accordance with the instructions marked thereon.Executed but unmarked proxies will be voted FOR the election of the three nominees for election to the Board of Directors, FOR the approval of the amendment of the Company’s Articles of Incorporation to increase the number of authorized shares of Common Stock by 300,000,000 and FOR the ratification of the appointment of the Company’s

1

independent registered public accounting firm.The Board of Directors does not know of any matters other than those described in the Notice of Annual Meeting that are to come before the Annual Meeting. If any other matters are properly brought before the Annual Meeting, the persons named in the proxy will vote the shares represented by such proxy upon such matters as determined by a majority of the Board of Directors.

The presence of a shareholder at the Annual Meeting will not automatically revoke such shareholder’s proxy. A shareholder may, however, revoke a proxy at any time prior to its exercise by filing a written notice of revocation with, or by delivering a duly executed proxy bearing a later date, to the Corporate Secretary, FLIR Systems, Inc., 27700A SW Parkway Avenue, Wilsonville, Oregon 97070, or by attending the Annual Meeting and voting in person. However, a shareholder who attends the Annual Meeting need not revoke a previously executed proxy and vote in person unless such shareholder wishes to do so. All valid, unrevoked proxies will be voted at the Annual Meeting.

2

ELECTION OF DIRECTORS

The Company’s Board of Directors has seven members. At the Annual Meeting, three Directors will be elected, each for a three-year term expiring in 2011. Unless otherwise specified on the proxy, it is the intention of the persons named in the proxy to vote the shares represented by each properly executed proxy for the election as Directors of the persons named below as nominees. The Board of Directors believes that the nominees will stand for election and will serve if elected as Directors. However, if any of the persons nominated by the Board of Directors fails to stand for election or is unable to accept election, the number of Directors constituting the Board of Directors may be reduced prior to the Annual Meeting or the proxies may be voted for the election of such other person as the Board of Directors may recommend.

Under the Company’s Articles of Incorporation and Bylaws, the Directors are divided into three classes. The term of office of only one class of Directors expires in each year, and their successors are elected for terms of three years and until their successors are elected and qualified. There is no cumulative voting for election of Directors.

Information as to Nominees and Continuing Directors

The following table sets forth the names of the Board of Directors’ nominees for election as a Director and those Directors who will continue to serve after the Annual Meeting. Also set forth is certain other information with respect to each such person’s age, principal occupation or employment during the past five years, the periods during which he has served as a Director of FLIR, the expiration of his term as a Director and the positions currently held with FLIR.

Under the Company’s Corporate Governance Principles, Directors may generally not serve on the Board of Directors beyond seven consecutive three-year terms or age 75, whichever comes first. However, exceptions to these limitations may be made based on the Board of Directors’ determination that such an exception would be in the best interests of the Company. John C. Hart has served seven consecutive three-year terms on the Company’s Board of Directors. The Board of Directors, however, has determined that in light of Mr. Hart’s many past and continuing contributions to the Company, it is in the best interests of the Company to grant an exception to the Corporate Governance Principles’ age and term limitations to permit Mr. Hart to stand for reelection.

Nominees: | Age | Director Since | Expiration of Current Term | Expiration of Term for which Nominated | Position Held with FLIR | |||||

William W. Crouch | 66 | 2005 | 2008 | 2011 | Director | |||||

John C. Hart | 74 | 1987 | 2008 | 2011 | Director | |||||

Angus L. Macdonald | 53 | 2001 | 2008 | 2011 | Director | |||||

Continuing Directors: | ||||||||||

John D. Carter | 62 | 2003 | 2010 | — | Director | |||||

Earl R. Lewis | 64 | 1999 | 2009 | — | President, Chief Executive Officer and Chairman of the Board of Directors | |||||

Michael T. Smith | 64 | 2002 | 2010 | — | Director | |||||

Steven E. Wynne | 55 | 1999 | 2009 | — | Director | |||||

GENERAL WILLIAM W. CROUCH (US ARMY—RETIRED). General Crouch was elected to the Board of Directors in May 2005. His current term on the Board expires at the Company’s 2008 Annual Meeting of Shareholders, at which time his election to the Board for a three year term expiring in 2011 will be voted upon. General Crouch retired from the United States Army in 1999 following a 36-year career during which he served in numerous roles including Commanding General—Eighth Army and Chief of Staff, United Nations Command

3

and US Forces Korea; Commander in Chief, United States Army, Europe; Commanding General, NATO Implementation (later Stabilization) Force, Bosnia/Herzegovina; and the US Army’s 27th Vice Chief of Staff. In retirement, he has served as one of five generals who oversee the Army’s Battle Command Training Program. In October 2000, General Crouch was named co-chair of the USS COLE Commission, which was formed to examine the terrorist attack on the USS COLE. He is a Senior Mentor with the Leadership Development and Education Program for Sustained Peace at the US Naval Post Graduate School and serves on the Boards of the Community Anti-Drug Coalitions of America and the Keck Institute for International and Strategic Studies at Claremont McKenna College. He received a B.A. in Civil Government from Claremont McKenna College, and a M.A. in History from Texas Christian University while serving as an Assistant Professor of Military Science.

JOHN C. HART. Mr. Hart has served as a Director of the Company since February 1987. His current term on the Board expires at the Company’s 2008 Annual Meeting of Shareholders, at which time his election to the Board for a three year term expiring in 2011 will be voted upon. He served as Chairman of the Board of Directors from 1987 to April 1993. From 1982 until his retirement in 1993, Mr. Hart served as Vice President of Finance, Treasurer, Chief Financial Officer and a member of the Board of Directors of Louisiana-Pacific Corporation. Mr. Hart also served as interim President and Chief Executive Officer of the Company from May through November 2000. Mr. Hart holds a B.A. from the University of Oregon. Mr. Hart is also a trustee of the Columbia River Maritime Museum.

ANGUS L. MACDONALD. Mr. Macdonald has served as a Director of the Company since April 2001. His current term on the Board expires at the Company’s 2008 Annual Meeting of Shareholders, at which time his election to the Board for a three year term expiring in 2011 will be voted upon. In 2000, Mr. Macdonald founded and is currently President of Venture Technology Merchants, LLC, an advisory and merchant banking firm to growth companies regarding capital formation, corporate development and strategy. From 1996 to 2000, Mr. Macdonald was Senior Vice President and headed Special Situations in the health care equities research group at Lehman Brothers, Inc. Prior to joining Lehman Brothers, Mr. Macdonald was a senior securities analyst at Fahnestock, Inc. (now Oppenheimer). He holds a B.A. from the University of Pennsylvania and an MBA from Cranfield University, UK.

JOHN D. CARTER. Mr. Carter was elected to the Board of Directors in 2003. Mr. Carter was elected President and Chief Executive Officer of Schnitzer Steel Industries, Inc. in May 2005. From 2002 to 2005, Mr. Carter was a principal in the consulting firm of Imeson & Carter, a firm specializing in transportation and international business transactions. From 1982 to 2002, Mr. Carter served in a variety of senior management capacities at Bechtel Group, Inc. including Executive Vice President and Director, as well as President of Bechtel Enterprises, Inc., a wholly owned subsidiary, and other operating groups. Mr. Carter is a member of the Board of Directors of Northwest Natural Gas Company and Schnitzer Steel Industries, Inc. He is Chairman of the Board of Kuni Automotive Industries, Inc., a private company in the auto dealership business. He also is the manager of Birch Creek Associates LLC, Dusky Goose LLC, and Tsarina Wines LLC, engaged in agricultural land ownership, vineyard ownership and wine business. He received his B.S. in History from Stanford University and his J.D. from Harvard Law School.

EARL R. LEWIS. Mr. Lewis has served as Chairman, President and Chief Executive Officer of the Company since November 1, 2000. Mr. Lewis was initially elected to the Board in June 1999 in connection with the acquisition of Spectra Physics AB by Thermo Instrument Systems, Inc. He was formerly President and Chief Executive Officer of Thermo Instrument Systems, Inc. and is also a Director of Harvard BioScience, Inc. and a trustee of Dean College, Clarkson University, New Hampton School. Mr. Lewis holds a B.S. from Clarkson College of Technology and has attended post-graduate programs at the University of Buffalo, Northeastern University and Harvard University.

MICHAEL T. SMITH. Mr. Smith was elected to the Board of Directors in July 2002. From 1997 until his retirement in May 2001, Mr. Smith was Chairman of the Board and Chief Executive Officer of Hughes Electronics Corporation. From 1985 until 1997 he served in a variety of capacities for Hughes, including Vice

4

Chairman of Hughes Electronics, Chairman of Hughes Missile Systems and Chairman of Hughes Aircraft Company. Prior to joining Hughes in 1985, Mr. Smith spent nearly 20 years with General Motors in a variety of financial management positions. Mr. Smith is also a Director of Alliant Techsystems, Inc., Ingram Micro, Inc., Teledyne Technologies Incorporated and WABCO Holdings Inc. Mr. Smith holds a B.A. from Providence College and an MBA from Babson College. He also served as an officer in the US Army.

STEVEN E. WYNNE. Mr. Wynne was elected to the Board of Directors in November 1999. From March 1, 2004 through March 31, 2007, Mr. Wynne was President and Chief Executive Officer of SBI International, Ltd., parent company of sports apparel and footwear company Fila. From August 2001 through March 2002, and from April 2003 through February 2004, Mr. Wynne was a partner in the Portland, Oregon law firm of Ater Wynne LLP, the Company’s outside legal counsel. Mr. Wynne served as acting Senior Vice President and General Counsel to the Company from April 2002 through March 2003. Mr. Wynne was formerly Chairman and Chief Executive Officer of eteamz.com, an on-line community serving amateur athletics, from June 2000 until its sale to Active.com in January 2001. From February 1995 to March 2000, Mr. Wynne served as President and Chief Executive Officer of adidas America, Inc. Prior to that time, he was a partner in the law firm of Ater Wynne LLP. Mr. Wynne received an undergraduate degree and a J.D. from Willamette University. Mr. Wynne also serves on the Board of Directors of Planar Systems, Inc.

Recommendation of the Board of Directors

The Board of Directors unanimously recommends that shareholders vote FOR the election of its nominees for Director. If a quorum is present, the Company’s Bylaws provide that Directors are elected by a plurality of the votes cast by the shares entitled to vote. Abstentions and broker non-votes are counted for purposes of determining whether a quorum exists at the Annual Meeting, but are not counted and have no effect on the determination of whether a plurality of the votes cast by the shares entitled to vote exists with respect to a given nominee.

CORPORATE GOVERNANCE AND RELATED MATTERS

Communications with Directors

Shareholders and other parties interested in communicating directly with the Chairman or with the non-employee Directors as a group may do so by writing to the Chairman of the Board, c/o Corporate Secretary, FLIR Systems, Inc., 27700A SW Parkway Avenue, Wilsonville, Oregon 97070. Concerns relating to accounting, internal controls or auditing matters are immediately brought to the attention of the Audit Committee and handled in accordance with procedures established by the Audit Committee with respect to such matters.

Meetings

During 2007 the Company’s Board of Directors held five meetings. Other than Mr. Carter, each incumbent Director attended more than 75% of the aggregate of the total number of meetings held by the Board of Directors and the total number of meetings held by all committees of the Board on which he served during the period that he served. Mr. Carter attended 71% of such meetings. Under the Company’s Corporate Governance Principles, each Director is expected to commit the time necessary to prepare for and attend all Board meetings and meetings of committees of the Board on which they serve, as well as the Company’s Annual Meeting of Shareholders. All members of the Company’s Board of Directors attended the 2007 Annual Meeting of Shareholders.

Board of Directors Committees

The Board of Directors has standing Audit, Compensation and Corporate Governance Committees. Each committee operates pursuant to a written charter, which is reviewed annually. The charter of each committee may be viewed online at www.flir.com. The performance of each committee is reviewed annually. Each committee

5

may obtain advice and assistance from internal or external legal, accounting and other advisors. The members of the committees, each of whom has been determined to be “independent” as defined by applicable Securities and Exchange Commission (the “SEC”) and NASDAQ Stock Market rules, are identified in the following table. Mr. Lewis, the Company’s President and Chief Executive Officer, is not “independent” as defined by applicable SEC and NASDAQ Stock Market rules.

Name | Audit | Corporate Governance | Compensation | |||

John D. Carter | Chair | |||||

William W. Crouch | X | X | ||||

John C. Hart | X | X | ||||

Angus L. Macdonald | X | Chair | ||||

Michael T. Smith | Chair | X |

The Audit Committee is responsible for overseeing the integrity of the Company’s financial statements and financial reporting process; the Company’s compliance with legal and regulatory requirements; the independent auditor’s qualification, appointment and independence; the performance of any internal audit function; the review of all third-party transactions involving, directly or indirectly, the Company and any of its Directors or officers; and the adequacy of the Company’s accounting and internal control systems. During fiscal year 2007, the Audit Committee held nine meetings.

The Compensation Committee is responsible for all matters relating to the compensation of the Company’s executives, including salaries, bonuses, fringe benefits, incentive compensation, equity-based compensation, retirement benefits, severance pay and benefits, and compensation and benefits in the event of a change of control of the Company. The Committee also administers the Company’s equity compensation plans. During fiscal year 2007, the Compensation Committee held seven meetings. See also the “Compensation Discussion and Analysis” section of this Proxy Statement for a description of the Company’s processes and procedures for determining executive compensation.

The Corporate Governance Committee is responsible for recommending to the Board operating policies that conform to superior levels of corporate governance practice; overseeing the Board’s annual self-evaluation; identifying qualified candidates to serve on the Board; determining the qualification of Board members; evaluating the size and composition of the Board and its Committees; reviewing the Company’s Corporate Governance Principles; reviewing the compensation policies for non-employee Directors and recommending nominees to stand for election at each Annual Meeting of Shareholders. The Corporate Governance Committee seeks candidates to serve on the Board who are persons of integrity, with significant accomplishments and recognized business experience. During fiscal year 2007, the Corporate Governance Committee held two meetings.

Shareholder Nominations

The Corporate Governance Committee will consider recommendations by shareholders of individuals to consider as candidates for election to the Board of Directors. Any such recommendations should be submitted to the Corporate Secretary, FLIR Systems, Inc., 27700A SW Parkway Avenue, Wilsonville, Oregon 97070. Historically, the Company has not had a formal policy concerning shareholder recommendations to the Corporate Governance Committee (or its predecessors) because it believes that the informal consideration process in place to date has been adequate given that the Company has never received any Director recommendations from shareholders. The absence of such a policy does not mean, however, that a recommendation would not have been considered had one been received. The Corporate Governance Committee intends to periodically review whether a more formal policy should be adopted.

The Company’s Bylaws set forth procedures that must be followed by shareholders seeking to make nominations for Directors. In order for a shareholder of the Company to make any nominations, he or she must give written notice to the Corporate Secretary not less than 60 days nor more than 90 days prior to the date of any

6

such Annual Meeting; provided, however, that if less than 60 days’ notice of the Annual Meeting is given to shareholders, such written notice must be delivered not later than the close of business on the 10th day following the day on which notice of the Annual Meeting was mailed or public disclosure of the Annual Meeting date was made. Each notice given by a shareholder with respect to nominations for the election of Directors must set forth (i) the name, age, business address and residence address of each nominee proposed in such notice; (ii) the principal occupation or employment of each such nominee; (iii) the class and number of shares of stock of the Company that are beneficially owned by each such nominee; and (iv) any other information relating to such nominee that is required to be disclosed in solicitations of proxies for election of Directors, or is otherwise required, in each case pursuant to Regulation 14A under the Securities Exchange Act of 1934, as amended (including, without limitation, such person’s written consent to being named in the proxy statement as a nominee and to serving as a Director if elected). In addition, the shareholder making such nomination must set forth (i) his or her name and address, as they appear on the Company’s books, and (ii) the class and number of shares of stock of the Company which are beneficially owned by such stockholder. At the request of the Board of Directors, the shareholder making such nomination must promptly provide any other information reasonably requested by the Company.

7

Corporate Governance

FLIR maintains a Corporate Governance page on its website that includes specific information about its corporate governance initiatives, including FLIR’s Corporate Governance Principles, Code of Ethical Business Conduct and charters for the committees of the Board of Directors. The Corporate Governance page can be found at www.flir.com within the Investor Relations segment of the website.

FLIR’s policies and practices reflect corporate governance initiatives that are compliant with the listing requirements of the NASDAQ Stock Market and the corporate governance requirements of the Sarbanes-Oxley Act of 2002 (“SOX”), including:

| • | the Board of Directors has adopted clear corporate governance policies; |

| • | a majority of the Board members are independent of FLIR and its management based on the relevant independence requirements contained in the Company’s Corporate Governance Principles as well as any additional or supplemental independence standards established by the NASDAQ Stock Market and SOX; |

| • | all members of the Board committees—the Audit, Compensation and Corporate Governance Committees—are independent based on the relevant independence requirements contained in the Company’s Corporate Governance Principles as well as any additional or supplemental independence standards established by the NASDAQ Stock Market and SOX; |

| • | the independent members of the Board of Directors meet regularly without the presence of management; |

| • | FLIR has a clear Code of Ethical Business Conduct that is annually affirmed by its employees and monitored by its Senior Vice President, General Counsel and Secretary, who acts as the Company’s ethics officer; |

| • | the charters of the Board committees clearly establish their respective roles and responsibilities; |

• | FLIR has an ethics officer and an internet-based hotline monitored by EthicsPoint® that is available to all employees, and FLIR’s Audit Committee has procedures in place for the anonymous submission of employee complaints on accounting, internal controls or auditing matters; and |

| • | FLIR has adopted a Code of Ethics for Senior Financial Officers that applies to its principal executive officer and all members of its finance department, including the Chief Financial Officer, Corporate Controller, Corporate Treasurer, Business Unit Controllers and Site Controllers. You may obtain a copy of the Company’s Code of Ethics for Senior Financial Officers by writing to the Corporate Secretary, FLIR Systems, Inc., 27700A SW Parkway Avenue, Wilsonville, Oregon 97070. |

8

MANAGEMENT

Executive Officers

The executive officers of the Company are as follows:

Name | Age | Position | ||

Earl R. Lewis | 64 | Chairman of the Board of Directors, President and Chief Executive Officer | ||

Arne Almerfors | 62 | Executive Vice President and President, Thermography Division | ||

Stephen M. Bailey | 59 | Senior Vice President, Finance and Chief Financial Officer | ||

William W. Davis | 51 | Senior Vice President, General Counsel and Secretary | ||

William A. Sundermeier | 44 | President, Government Systems Division | ||

Andrew C. Teich | 47 | President, Commercial Vision Systems Division | ||

Anthony L. Trunzo | 45 | Senior Vice President, Corporate Strategy and Development |

Information concerning the principal occupation of Mr. Lewis is set forth under “Election of Directors.” Information concerning the principal occupation during the last five years of the executive officers of the Company who are not also Directors of the Company is set forth below.

ARNE ALMERFORS. Mr. Almerfors joined FLIR in December 1997 in connection with FLIR’s acquisition of AGEMA Infrared Systems AB, and currently serves as Executive Vice President and President of the Thermography Division. From 1995 to 1997, Mr. Almerfors was President and Chief Executive Officer of AGEMA Infrared Systems AB. He also served as President and Chief Executive Officer of CE Johansson AB, a manufacturer of coordinate measuring devices, from 1989 to 1995. Mr. Almerfors received his B.S., MBA, Masters in Political Science and certification for post-graduate courses in corporate finance and accounting from the University of Stockholm.

STEPHEN M. BAILEY. Mr. Bailey joined FLIR in April 2000 as Senior Vice President, Finance and Chief Financial Officer. Prior to joining FLIR, Mr. Bailey served as Vice President and Chief Financial Officer of Bauce Communications, Inc., President of Pro Golf of Portland, Inc., and Chief Financial Officer and Chief Operating Officer of Desk2Web Technologies, Inc. From 1975 to 1988, Mr. Bailey served in various senior executive positions with AMFAC, Inc., including President of AMFAC Supply Company, Senior Vice President and Controller of AMFAC, Inc. and Senior Vice President and Controller of AMFAC Foods, Inc. A CPA, Mr. Bailey also worked at Touche Ross & Company (which subsequently became Deloitte & Touche) from 1970 to 1975. Mr. Bailey received his B.S. from Oregon State University.

WILLIAM W. DAVIS. Mr. Davis joined FLIR in July 2007 as Senior Vice President, General Counsel & Secretary. Prior to joining FLIR, from 2005 to 2007, Mr. Davis served as Deputy General Counsel of Brunswick Corporation. From 1999 to 2005, he was employed in various capacities with General Dynamics Corporation including Vice President and General Counsel of its Land Systems and Armament and Technical Products subsidiaries. From 1990 to 1992 and 1993 to 1999, Mr. Davis practiced law in Chicago, most recently as a partner in the firm of Katten, Muchin & Zavis. From 1992 to 1993, Mr. Davis served as a law clerk to the Honorable Edward Carnes of the United States Court of Appeals for the Eleventh Circuit. Mr. Davis received his B.S. with distinction from the US Naval Academy and his J.D. from the University of Chicago Law School. Following graduation from the Naval Academy, Mr. Davis served as an officer in the United States Marine Corps and Marine Corps Reserve.

WILLIAM A. SUNDERMEIER. Mr. Sundermeier has been serving as the President of the Government Systems Division within FLIR since April of 2006. Mr. Sundermeier joined FLIR in 1994 as Product Marketing Manager for Thermography Products and was appointed Director of Product Marketing for commercial and government products in 1995. In 1999, Mr. Sundermeier was appointed Senior Vice President for Product Strategy, focused on the integration of newly acquired companies. In September 2000, Mr. Sundermeier was appointed Senior Vice President and General Manager, Portland Operations. In April 2004, he was appointed

9

Co-President of the Imaging Division. Prior to joining FLIR, Mr. Sundermeier was a founder of Quality Check Software, Ltd. in 1993. From 1985 to 1993, Mr. Sundermeier served as Product Line Manager at Cadre Technologies, Inc. Mr. Sundermeier also served as Software/Hardware Intern Engineer at Tektronix, Inc. from 1980 to 1985. Mr. Sundermeier received his B.S. in Computer Science from Oregon State University.

ANDREW C. TEICH. Mr. Teich has been serving as the President of the Commercial Vision Systems Division within FLIR since April 2006. Prior to this, he was Co-President of the Imaging Division since April 2004. Prior to that Mr. Teich had been serving as Senior Vice President, Sales and Marketing since 2000. Mr. Teich joined FLIR as Senior Vice President, Marketing as a result of the acquisition of Inframetrics in March of 1999. While at Inframetrics, Mr. Teich served as Vice President of Sales and Marketing from 1996 to 1999. From 1984 to 1996, Mr. Teich served in various capacities within the sales organization at Inframetrics, concluding in the role of Vice President of Sales in 1996. He holds a B.S. degree in Marketing from Arizona State University and has attended executive education courses at Stanford University.

ANTHONY L. TRUNZO. Mr. Trunzo joined FLIR in August 2003 as Senior Vice President, Corporate Strategy and Development. From 1996 until joining FLIR, Mr. Trunzo was Managing Director in the Investment Banking Group at Banc of America Securities, LLC. From 1986 to 1996, he held various positions at PNC Bank, NA. Mr. Trunzo holds a B.A. in Economics from the Catholic University of America and an MBA with a concentration in Finance from the University of Pittsburgh.

10

COMPENSATION DISCUSSION AND ANALYSIS

The following discussion and analysis contains statements regarding future Company performance targets and goals. These targets and goals are disclosed in the context of FLIR’s compensation programs and should not be understood to be statements of management’s expectations or estimates of results or other guidance. FLIR specifically cautions investors not to apply these statements to other contexts.

Philosophy and Objectives of Compensation Programs

General Philosophy

We believe the total compensation of our executive officers (the “Executives”) should support the following objectives:

| • | Attract and retain Executives with the skills, experience and motivation to enable the Company to achieve its stated objectives. This means that the Company provides an opportunity for Executives to earn above median compensation for delivering consistently superior results; |

| • | Provide a mix of current, short-term and long-term compensation to achieve a balance between current income and long-term incentive opportunity and promote focus on both annual and multi-year business objectives. This means that Executives have a higher percentage of their total pay opportunity tied to performance (versus fixed pay) and long-term (versus short-term) pay; |

| • | Align total compensation with the performance commitments we make to our shareholders; in particular, long-term growth in diluted earnings per share (“EPS”). This means that both our short-term and long-term incentive programs are heavily based on EPS performance; |

| • | Allow Executives who demonstrate consistent performance over a multi-year period to earn above-average compensation when FLIR achieves above-average long-term performance. This means that our compensation program for Executives has a high degree of variability—significant upside for performance that exceeds goals, with commensurate risk when performance falls short of goals; and |

| • | Is affordable and appropriate in light of the Company’s size, strategy and anticipated performance. This means that while the Compensation Committee considers competitive practice in their decision-making, they place significant emphasis on the Company’s specific strategy, financial situation and performance in the ultimate determination of compensation decisions. |

For purposes of this Compensation Discussion and Analysis, Executives include our Chief Executive Officer (the “CEO”) and his direct staff. These same individuals are also our Section 16 Officers as defined by the Securities Exchange Act of 1934, as amended (the “1934 Act”).

Annual Process for Determining Executive Compensation

We evaluate our compensation plans and programs annually. For Executives other than our CEO, this process begins early in each fiscal year with our human resources team gathering and presenting relevant data on executive compensation of our Peer Group (as discussed below) to our CEO. This data is then integrated with other considerations such as relative compensation among the Executives, overall Company performance relative to the Peer Group, and the results achieved by each individual Executive during the previous year. With the assistance of the human resources team, our CEO then recommends adjustments to base salary and target levels of Annual Incentive and Long-Term Incentive compensation for each Executive to the Compensation Committee for their approval. Also at this time each year, our human resources team and our CEO recommend performance targets for the Annual and Long-Term Incentive plans to the Compensation Committee for their approval. The criteria for establishing these metrics includes our long-term performance commitments to our shareholders (including average long-term growth in EPS of 20%); the Company’s recent and anticipated financial results, and consistency with historical practice. If necessary, we will modify elements of our compensation plans to address

11

changing market dynamics, evolving compensation best practices, the impact of accounting rule changes and shifts in business objectives. For example, we have slightly modified the long-term incentive program for our Executives in each of the past three years, first issuing premium priced options in 2005 and then adopting a mix of performance-based options and restricted stock units in 2006 and 2007. The key element of the program for the past two years—using performance, rather than time to vest options—has not changed. While we value a consistent overall approach, we will continue to assess whether our programs are meeting our objectives, and make changes as needed.

Our Executives have the greatest proportion of their total direct compensation (“TDC”) based on Company performance over a multi-year period because we believe, based on shareholder feedback and available data that correlates long-term growth in EPS with total shareholder return, that this is the single most important metric for our shareholders. TDC is defined as the combination of base salary, annual incentive compensation, and long-term incentive compensation. Over 60% of our CEO’s TDC is tied to long-term performance. Long-term incentive compensation for our Executives, excluding our CEO, accounts for almost 50% of their TDC.

We currently use the same metrics and similar plan design elements for the annual and long-term incentive plans offered to our Executives as those we use for the rest of our employees. While the amount of compensation that is at risk for performance varies among employee groups, all of our annual incentive pools are determined based on achievement of a target level of EPS. We believe EPS, and annual growth in EPS, are important performance metrics for our shareholders, and have therefore designed our incentive compensation plans around these metrics. We believe this approach offers appropriate incentives to our Executives who are most able to impact long-term success, while aligning the objectives of all of our employees with those of the Executives and the shareholders.

Defining the Market—Benchmarking

Periodically the Compensation Committee has engaged leading industry compensation consultants to review all aspects of our compensation plans for our Executives. The most recent consultant review was conducted in October 2006 by Pearl Meyer & Partners (“Pearl Meyer”), which provided a report to the Compensation Committee on the total compensation of our Executives and assisted in the development of certain elements of our compensation design. At that time, Pearl Meyer identified a group of eighteen companies (the “Peer Group”), in collaboration with the Compensation Committee, and compared each element of our Executive’s compensation to the Peer Group. Since there are no public companies directly comparable to FLIR, the Peer Group consisted of companies of similar size and in similar, but not identical, industries that had financial performance superior to most public companies as measured by the Russell 2000 index.

The Peer Group used by Pearl Meyer was as follows: (1) Armor Holdings, Inc., (2) Barnes Group, Inc., (3) Dionex Corporation, (4) DRS Technologies, Inc., (5) EDO Corporation, (6) ESCO Technologies, Inc., (7) Esterline Technologies Corporation, (8) Mine Safety Appliances Company, (9) MKS Instruments, Inc., (10) MTS Systems Corporation, (11) National Instruments Corporation, (12) Rofin-Sinar Technologies, Inc., (13) Roper Industries, Inc., (14) Tektronix, Inc., (15) Teledyne Technologies Incorporated, (16) Thermo Fisher Scientific, Inc., (17) Trimble Navigation Limited, and (18) Waters Corporation. For 2007, we used a slightly modified Peer Group, removing three companies that had been acquired, and adding three companies that we believe improved the comparability of the Peer Group to FLIR. The companies that were removed were: (1) Armor Holdings, Inc., (2) EDO Corporation, and (3) Tektronix, Inc. The three companies added were: (1) Perkin Elmer, Inc., (2) Varian, Inc., and (3) Garmin Corporation. Based on the data available at the end of 2007, the Company was slightly smaller than the median of the Peer Group based on revenues (20th percentile) and assets (26th percentile) but above the Peer Group median with respect to market capitalization (81st percentile).

12

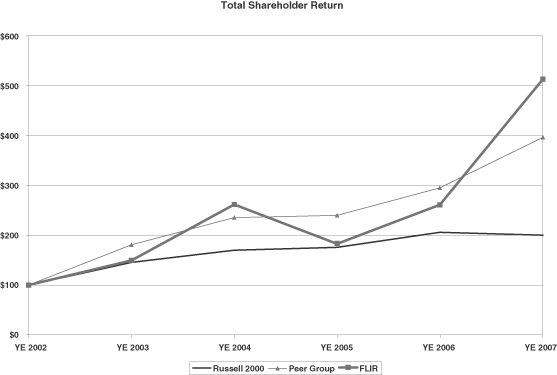

Over the five year period ending December 31, 2007, FLIR has outperformed both the Russell 2000 market index and the Peer Group in total shareholder return, as reflected in the following graph.

Since we place the largest emphasis on delivering long-term growth in EPS, and resulting long-term growth in our stock price, we believe the information provided in the graph above to be important in understanding our compensation philosophy and its role in the achievement of our long-term objectives. During the five year period shown above, FLIR’s total shareholder return was at the 78th percentile of the Peer Group and that, on average in 2007, TDC for our Executives was between the 50th and 75th percentile of the Peer Group. We have not established a specific percentile objective versus the market, nor have we established specific target TDC levels for our CEO or other Executives. However, the Compensation Committee concluded, based on the Company’s performance compared with the Peer Group, Pearl Meyer’s report and its own analysis, that current compensation levels are appropriate for each of the Executives evaluated.

We have chosen to regularly evaluate all aspects of our Executive compensation programs rather than establish rigid policies. This approach allows the Compensation Committee to periodically review all elements of compensation and make modifications as needed to remain fair, reasonable and consistent with the objectives described above. In general, we expect to utilize the services of outside compensation consultants approximately every other year, because we have not found the additional cost of annual third party reviews to be justified. In years where we do not use a consultant, we will utilize information on executive compensation available from third party sources, such as Equilar, to assist us in evaluating our compensation levels. We expect to make changes to our Executive compensation plans and practices when they are required by evolving best practices, changes in Company financial performance and changes in accounting and tax rules. We would generally engage outside consultants to assist us in the event any major changes to our plans are contemplated.

13

Compensation Design and Elements of Compensation

We have designed our compensation plans to reward achievement of superior financial results, as measured by growth in EPS both annually and over multi-year periods. If we continue to meet the objectives we have set for the Company, which reflect superior results compared to our peers, our Executives will earn above-average compensation. Failure to achieve targeted results will significantly reduce actual total compensation, since a significant portion of our Executives’ pay is in the form of short-term and long-term incentives. We believe this “pay for performance” philosophy attracts, retains and motivates our Executives to be aligned with the Company’s culture, and to provide the talent needed to meet these goals.

Our CEO and CFO each have employment agreements approved by the Compensation Committee that establish base salary and annual incentive targets for 2008 and 2009. These agreements, and the Company’s obligations, are further described on page 23. No other Executives have employment agreements. The details of compensation for our Executives who are the named executive officers (the “NEOs”) are provided in the Compensation of Executive Officers section of this Proxy Statement starting on page 21.

Base Salary

Key considerations in establishing base salary levels include the overall level of responsibility a given Executive has, the importance of the role, the experience, expertise and specific performance of the individual. We consider current base salary levels for each of our Executives to be consistent with these objectives and, absent any changes in responsibilities, that the individuals would expect increases in base salary to be in line with the market for such positions in the future. Our CEO’s base salary is established in his employment agreements at $750,000 for 2007, $825,000 for 2008 and $950,000 for 2009. Our CFO’s employment agreements establish a base salary of $340,000 for 2007, $370,000 for 2008 and $400,000 for 2009. All other Executive base salaries are determined annually by the Compensation Committee in consultation with our CEO. Our CEO’s recommendations are supported by information and analysis provided by our human resources department and by third party data. In 2007, salary increases for all FLIR full-time employees averaged 4.3%, and increases for the NEOs (other than the CEO) ranged from 5.4% to 7.9%, and averaged 6.2%. The single largest adjustment was for our CFO, reflecting the increasing level of responsibility required by the CFO position. The base salary increases for our three division Presidents was approximately equal, reflecting the view that base salaries for such positions are generally at the level desired by the Compensation Committee relative to the market. For our NEOs, base salaries for 2007 accounted for an average of 25% of their TDC. This means our NEOs have 75% of their total pay opportunity tied to performance and long-term incentive pay.

Annual Incentive Plan (“AIP”)

We award annual cash incentive compensation under our AIP based upon a mix of quantitative and qualitative factors. For 2007, there were 1,259 participants in the AIP, including our CEO and the other Executives, with target incentive opportunities ranging from 3% to 100% of base salary.

In 2007, we modified the AIP to make it simpler and improve the alignment between our CEO, Executives and all other employees. The 2007 plan funding was based on achievement of a reported EPS target, which was the same for all our Executives and all other employees. This approach has been in place for our CEO since 2004 and in each year the target EPS has been significantly higher than in the prior year. For example, in 2004, the EPS target was a split-adjusted $0.39, while in 2007 it was $0.76, representing a compound annual growth rate of 25%. Since long-term growth in EPS is one of our critical performance measures, we believe aligning our Executives’ non-equity incentive award with this measure, if done annually and consistently, represents a simple, easy to understand metric that is well aligned with our shareholders’ interests. The plan was designed so that if the Company achieved the EPS target, the AIP pool would equal 100% of the target incentive awards for all Executives, including our CEO. For each $0.01 variance above or below the target EPS, the AIP pool for Executives was increased or decreased by 4%. The EPS target for 2007 was $0.76, representing a 15% increase over our actual EPS of $0.66 in 2006. The target award for our CEO was 100% of his base salary. Target awards for our other Executives were between 43% and 60% of base salary. These target award levels were compared

14

with the AIP levels of individuals in the Peer Group and we determined that they were appropriate. While we benchmarked the specific AIP targets against the Peer Group on a position by position basis, we did not set our Executive AIP targets purely on this basis. We evaluated the overall mix of base salaries, short-term and long-term incentive compensation using the Peer Group data as a guide.

2007 Annual Incentive Plan Matrix

| Threshold | Target | Outstanding | Actual | |||||

EPS | 84% of target $0.64 | $0.76 | 116% of target $0.89 | 116% of target $0.89 | ||||

Annual Incentive | 0% of target | 100% of target | 200% of target | 200% of target | ||||

Each of our Executives received the same percentage of their actual target AIP payment for 2007. The Compensation Committee can reduce the actual AIP award paid to any Executive in any given year from the amount determined by the AIP Matrix, but cannot increase the amount paid to any Executive under the AIP. For 2007 the Compensation Committee did not reduce any individual’s AIP award, because each Executive and all areas of the Company contributed to the Company’s strong financial results.

The Executive incentive payments and the non-executive employee pools have fluctuated from year to year in relation to our performance relative to our targets. For our Executives, non-equity incentive compensation for 2007 accounted for 18% of TDC.

In 2007, we received shareholder approval for, and adopted, our 2007 Executive Bonus Plan. The 2007 Executive Bonus Plan is designed so that bonuses paid under the 2007 Executive Bonus Plan may, subject to our compliance with Section 162(m) of the Internal Revenue Code, be deductible for federal income tax purposes. The 2007 Executive Bonus Plan provides for a maximum annual award to any NEO of $5,000,000.

Long-term Equity Incentive Program (“LTIP”)

We believe sustained long-term growth in our share price, achieved through growing revenue and EPS, is the primary responsibility of our Executives. Long-term incentives in the form of stock options, restricted stock units or other equity instruments are the most effective way to link the interests of management and shareholders, and to incent management to achieve this objective. Therefore, we have consistently used such instruments as an integral part of our compensation programs, and the largest single component of each Executive’s target compensation. We believe this has helped contribute to our shareholder returns, which are superior to market indices and our Peer Group. For example, our annualized shareholder return from the end of 2002 through the end of 2007 was 39%, compared with 15% for the Russell 2000 Index and 31% for the Peer Group during that time period. Over the past several years, it has been our practice to issue stock-based compensation annually following the release of our annual financial results for the preceding year. Pursuant to the Compensation Committee Charter and the Equity Granting Policy (as discussed on page 19) adopted by the Compensation Committee in March 2007, we expect to continue to make annual grants in the future. The grant date for the annual award will be the second trading day after the date of the public announcement of earnings following the date the grant is approved by the Compensation Committee. This is generally near the annual shareholder meeting in the spring of each year. In addition, the policy permits the granting of special equity awards to Executives with approval by the Compensation Committee.

Starting in 2005, we introduced additional performance elements to our stock option grants, particularly for our Executives. In that year, options granted to our Executives were priced at a 15% premium to the market price on the date of grant. In 2006, we further modified the plan to create still greater alignment with shareholder interests, by making option vesting contingent on the achievement of certain increases in annual EPS, in addition to the passage of time. At that time, we also eliminated the premium pricing. In 2007, we again utilized a mix of performance-based options and time-based restricted stock units for our Executives’ LTIP awards.

15

The Executive LTIP awards in 2007 were established on a dollar value basis for each individual Executive, including our CEO, using the Black-Scholes formula for valuation. The 2007 award values were then apportioned as follows: 25% time-based restricted stock units and 75% performance-based stock options. For example, if an Executive was to receive an LTIP award with a total value of $100,000, $25,000 of the award would be delivered in the form of restricted stock units and $75,000 of the award would be delivered in the form of a performance-based stock option grant. This is the same allocation as we used in 2006.

The 2007 restricted stock units vest equally over a three year period. The time-based restricted stock units address our retention needs by providing a certain level of compensation that requires future service on the part of the Executive. This retention element was established at 25% of the total LTIP award value because the Compensation Committee determined that the portion of the LTIP tied to performance should exceed the portion tied to retention. The performance-based options vest at the rate of one third per year, subject to the achievement of minimum EPS levels for each individual year. The vesting of the performance-based options for the second and third years of the grant is independent of the vesting of options in prior years. Options that do not vest due to the Company not achieving the minimum EPS levels in any year are forfeited and the Executives do not have the opportunity to receive such options if performance targets are met in subsequent years. In order to achieve 100%, 75%, or 50% vesting of each year’s options, the Company must achieve the following EPS levels in each year:

Vesting Year | 100% Vesting | 75% Vesting | 50% Vesting | 0% Vesting | ||||||||

2007 | $ | 0.76 | $ | 0.74 | $ | 0.71 | <$ | 0.71 | ||||

2008 | $ | 0.88 | $ | 0.85 | $ | 0.82 | <$ | 0.82 | ||||

2009 | $ | 1.01 | $ | 0.98 | $ | 0.95 | <$ | 0.95 | ||||

We use this vesting methodology because it holds our Executives to a high standard of performance that must be achieved over a multi-year period in order for them to realize the potential value of their awards. Our compensation consultant has indicated that ours is among the most heavily performance-weighted, long-term incentive designs within our Peer Group.

We expect future LTIP awards to be made in a similar manner, although we may make changes to certain aspects of the program as circumstances change. The aggregate annual level of grants may vary, based on factors such as anticipated share dilution, accounting costs and the Company’s financial objectives.

The award amounts were compared with the LTIP levels of individuals in the Peer Group and we determined that they were appropriate. While we benchmarked the specific LTIP awards against the Peer Group on a position by position basis, we did not set our Executive LTIP awards purely on this basis. We evaluated the overall mix of base salaries, short-term and long-term incentive compensation using the Peer Group data as a guide.

Perquisites and Other Benefits

For 2007, the primary perquisites for our NEOs include an automobile allowance of $15,600 per year for our US based Executives and $15,800 per year for a leased automobile for Mr. Almerfors in Sweden. Additionally, the US based NEOs are not required to contribute to their monthly health insurance premiums. The cost of this perquisite ranges from $2,717 to $4,242 for each NEO depending on the chosen medical plan. Beginning December 1, 2007, this perquisite was discontinued. In addition, Mr. Almerfors has an executive health care plan that supplements the standard benefits provided to our employees in Sweden. This perquisite cost was $1,928 in 2007. The values of all perquisites for our NEOs are included in the Summary Compensation Table on page 21.

Our Executives also participate in our other benefit plans on the same terms as other employees. These plans include health plans, disability and life insurance plans, retirement plans, and an employee stock purchase plan.

Supplemental Executive Retirement Plan

In January 2001, we introduced a Supplemental Employee Retirement Plan (the “SERP”) for our then Executives in the United States. This plan was implemented as an important retention tool at a time of uncertainty in

16

the Company. Since the SERP’s inception, we have not added any additional participants, and do not expect to add participants in the future. Our US based NEOs are participants in the SERP. See page 25 for additional information.

Non-Qualified Deferred Compensation Plan

In early 2008, we implemented a non-qualified deferred compensation plan. Participation by our Executives is optional. This plan provides an additional pre-tax savings vehicle for our more highly compensated US based employees whose retirement savings opportunity is limited to $15,500 annually under our 401(k) plan. Based on our research, 90% of Fortune 1000 companies offer non-qualified deferred compensation plans and we determined that this plan was a necessary component to a competitive benefits program. This plan is available to all our US based employees earning over a specified annual salary. The plan does not allow for Company contributions to be made to the plan on behalf of any employee, including the Executives.

Post Termination Elements of Compensation

Severance

With the exception of our CEO and CFO, we do not have any formal severance agreements with any of our Executives, except as described below in the event of a change of control.

In the case of our CEO, his employment agreement provides for benefits in the event of involuntary termination without cause. In such a case, he is entitled to (i) continuation of his base salary in effect at the time of termination for a period of 18 months or for the duration of the remaining term of the agreement, whichever is longer; (ii) immediate vesting of all equity awards; and (iii) a bonus (in lieu of any bonus for the year of termination) in an amount not less than one year’s base salary.

In the case of our CFO, his employment agreement provides for benefits in the event of involuntary termination without cause. In such a case, he is entitled to (i) continuation of his base salary in effect at the time of termination for a period of 18 months or for the duration of the remaining term of the agreement, whichever is longer; (ii) immediate vesting of all equity awards; and (iii) a bonus (in lieu of any bonus for the year of termination) in an amount not less than 60% of one year’s base salary. Additionally, in the event of a change of control, he is entitled to (a) immediate vesting of any unvested equity awards, and (b) a payment equal to two times his average cash compensation for the two most recent full years of employment. For change of control benefits to be paid, a change of control must have occurred and Mr. Bailey must be terminated within a specific period of time prior to or following the change of control event (i.e., between 60 days prior to and 180 days after the event).

In the past we have provided severance on a case by case basis in situations where a termination was not for cause, and such payment was deemed to be appropriate and in the best interests of the Company. We are likely to continue doing so in the future.

Change of Control Agreements

We consider a sound and vital management team to be essential in protecting and enhancing the best interests of the Company and our shareholders. To this end, we recognize that the possibility of a change of control could arise and that such possibility may result in the departure or distraction of management to the detriment of the Company and our shareholders. In order to encourage the continued attention and dedication of members of our Executives to their assigned duties without distraction in circumstances arising from the possibility of a change of control of the Company, we currently have change of control agreements with Messrs. Almerfors, Sundermeier and Teich, and the other Executives, with the exception of our CEO and CFO. In the case of our CFO, change of control benefits are included as part of his employment agreement, as described above.

The terms and value of these severance and change of control termination benefits are further described starting on page 26.

17

Compensation Committee Governance

Compensation Committee Members and Compensation Committee Charter

Our Executive compensation policies are established, reviewed and approved by the Compensation Committee of the Board of Directors. The Compensation Committee is composed of three non-employee Directors—Angus L. Macdonald (Chair), William W. Crouch and Michael T. Smith—all of whom have been determined by the Board to be “independent” as defined by the Board’s Corporate Governance Principles and applicable SEC and NASDAQ Stock Market rules. The members of the Compensation Committee in aggregate have significant experience in executive positions including management, talent development, finance and accounting and have been involved in executive compensation matters in their respective careers. See page 3 in this Proxy Statement for a more detailed biography for each of our Directors. It has been our Board’s practice to rotate Compensation Committee members periodically among our independent Directors.

The Compensation Committee has primary responsibility for all matters relating to the compensation of our NEOs listed in the Summary Compensation Table on page 21, other Executives who are designated as officers by the Board for purposes of Section 16 of the 1934 Act, and any other key executives of the Company as may be specifically designated by the Board. “Compensation” for this purpose means all forms of remuneration including, without limitation, salaries, bonuses, annual and long-term incentive compensation, equity-based compensation, retirement benefits, severance pay and benefits, fringe benefits and perquisites, and compensation and benefits in the event of a change of control of the Company. The Compensation Committee is governed by a charter adopted by the Board, which can be found at www.flir.com within the Investor Relations section of that website. The Corporate Governance Committee of the Board considers and makes recommendations to the Board regarding the content of all Board committee charters, including the Compensation Committee’s charter. The Compensation Committee charter was first adopted by the Board on October 24, 2002.

Under its charter, the responsibilities and duties of the Compensation Committee include: (a) at least annually, review and approve the compensation levels for our CEO and other Executives, (b) evaluate the performance of the CEO in accordance with criteria adopted by the Compensation Committee, (c) administer each compensation and benefit plan to the extent that administrative authority is delegated to the Compensation Committee under the terms of the Plan or by action of the Board, and (d) oversee the administration of our incentive and stock-based compensation plans with respect to participation in the plans by the Executives and all other participants. The Compensation Committee, in its discretion, may retain the services of outside consultants to assist the Compensation Committee in compensation matters.

The Compensation Committee generally meets immediately preceding each quarterly Board meeting and from time to time as may be needed. The Chair of the Compensation Committee calls the meetings, sets the agenda and conducts the meetings. Decisions made by the Compensation Committee pursuant to its charter are not referred to the Board for further approval. The Compensation Committee has established a reserve of shares under the Company’s 2002 Stock Incentive Plan for issuance by our CEO for the limited purposes of employee hiring, promotion, retention and to correct errors or omissions on prior grants. This reserve applies only to the granting of equity awards to non-Executives and only if the awards are within the policy on granting equity awards established by the Compensation Committee. The Compensation Committee receives a quarterly report detailing the grants made pursuant to this program.

Compensation Consultant

The Compensation Committee has from time to time engaged professional compensation consultants to advise the Compensation Committee on our Executive compensation programs and policies. Most recently, the Compensation Committee engaged Pearl Meyer to conduct a competitive analysis of our Executive compensation levels. This study was used as part of the determination of Executive compensation levels for 2007. In late 2005, the Corporate Governance Committee, which has purview over outside Director compensation, engaged Pearl

18

Meyer to conduct a competitive analysis of our outside Director compensation program. The Compensation Committee intends to continue using compensation consultants in the future, but not necessarily on an annual basis. Decisions as to whether a consultant is appropriate for any annual period will be determined by the Compensation Committee based on factors including length of time since the last engagement and changes in factors affecting executive compensation at the Company or in the market at large.

Role of Executives in Establishing Compensation

Our Senior Vice President for Corporate Strategy and Development and Vice President of Human Resources have participated in the development of certain Executive compensation programs, particularly the non-equity incentive program and the long-term incentive program as described above. Once formulated, these programs are reviewed by our CEO and other executives whose counsel may be sought from time to time, and submitted to the Compensation Committee for its review and approval. As noted previously, with the assistance of our human resources team, our CEO recommends adjustments to base salary and target levels of the AIP and LTIP compensation for each Executive to the Compensation Committee. Our human resources team and CEO also recommend to the Compensation Committee the performance targets under the AIP and LTIP. From time to time, certain executives including our CEO, Senior Vice President for Corporate Strategy and Development and Vice President of Human Resources are invited to attend meetings of the Compensation Committee. A person, who may be a member of the Company’s management, will be designated by the Compensation Committee Chairman to act as Secretary to the Compensation Committee. While these executives may be asked to provide input and perspective, only Compensation Committee members vote on Executive compensation matters. Our Vice President of Human Resources is responsible for the implementation, execution and operation of our compensation programs, as directed by the CEO and the Compensation Committee.

Compensation Committee Activity

In 2007, the Compensation Committee met seven times. During these meetings, the Compensation Committee took the following actions: (a) approved annual non-equity incentive payments for the Executives for 2006 performance, (b) approved a new long-term incentive program for Executives and employees for 2007, (c) approved amendments to an employment agreement with our CEO, and approved a new employment agreement for our CFO, (d) approved a form of change of control agreement for our Executives (excluding our CEO and CFO), (e) reviewed and approved the Compensation Disclosure and Analysis included in our Proxy dated March 20, 2007, (f) adopted a policy establishing a formal process for granting equity awards, and (g) approved a non-qualified deferred compensation program for our Executives and certain other employees. The Compensation Committee also received reports from Pearl Meyer about our Executive compensation levels and structure and on the new rules pertaining to the disclosure of executive compensation. Our CEO, Senior Vice President of Corporate Strategy and Development and Vice President of Human Resources attended certain of those meetings as the members of our management team who administer our various compensation and benefit plans and our Senior Vice President, General Counsel and Secretary attended as Secretary to the Compensation Committee.

Equity Granting Policy

Recognizing the importance of adhering to appropriate practices and procedures when granting equity awards, we implemented an equity granting policy in early 2007 to formalize our practices and processes. The policy establishes the following practices:

| • | All grants to Executives must be approved at a meeting of the Compensation Committee, and may not occur through action by unanimous written consent. |

| • | The grant date of all equity awards approved at a meeting of the Compensation Committee shall be the second trading day after the date of the next public announcement of the Company’s quarterly earnings following the date of approval. |

19

| • | All equity awards approved by the CEO, to be granted out of the CEO reserve, will be granted quarterly. The grant date will be the second trading day after the date of the next public announcement of the Company’s quarterly earnings following the date of approval. |

| • | The exercise price for all option awards shall not be less than the Company’s closing stock price on the grant date. |

Stock Ownership/Retention Guidelines

We impose stock ownership requirements on our Executives and non-employee Directors. Beginning in 2006, our Corporate Governance Principles require that, within three years of initial election to the Board, each non-employee Director shall hold shares of the Company’s common stock, restricted stock units or in-the-money stock option value in an amount equal in value to no less than the average of one year’s cash Board compensation, including committee fees, during that three year period. Those Corporate Governance Principles also require our Executives to hold shares of the Company’s common stock, restricted stock units or in-the-money stock option value in an amount equal in value to no less than one year’s base salary. The Corporate Governance Principles are reviewed annually by the Corporate Governance Committee of the Board and the stock ownership requirements were adopted by the Board in 2006. As of the date of this Proxy Statement, all non-employee Directors and Executives are in compliance with these guidelines.

Impact of Tax and Accounting on Compensation Decisions

As a general matter, the Compensation Committee always takes into account the various tax and accounting implications of the compensation vehicles employed by the Company.

When determining the amounts of long-term incentive compensation for Executives and employees, the Compensation Committee examines the accounting cost associated with the grants. Grants of stock options, restricted stock units and other share-based payments result in an accounting expense for the Company. The accounting expense is equal to the fair value of the instruments being issued. For the restricted stock units, the expense is equal to the fair value of a share of common stock on the date of grant times the number of units granted. For stock options, the expense is equal to the fair value of the option on the date of grant using a Black-Scholes option pricing model times the number of options granted. This expense is amortized over the vesting period.

Section 162(m) of the Internal Revenue Code generally prohibits any publicly held corporation from taking a federal income tax deduction for compensation paid in excess of $1,000,000 in any taxable year to “covered employees” under Section 162(m). Exceptions are made for qualified performance-based compensation, among other things. It is the Compensation Committee’s policy to maximize the effectiveness of our Executive compensation plans in this regard. However, the Compensation Committee believes that compensation and benefits decisions should be primarily driven by the needs of the business, rather than by tax policy. Therefore, the Compensation Committee may make pay decisions that result in compensation expense that is not fully deductible under Section 162(m).

COMPENSATION COMMITTEE REPORT

We have reviewed and discussed the Compensation Discussion and Analysis with FLIR’s management and, based on our review and discussions, we recommended to the Board that the Compensation Discussion and Analysis be included in this Proxy Statement and the Company’s Annual Report on Form 10-K for the year ended December 31, 2007.

| THE COMPENSATION COMMITTEE |

| Angus L. Macdonald, Chair |

| William W. Crouch |

| Michael T. Smith |

20

COMPENSATION OF EXECUTIVE OFFICERS

The following table summarizes compensation for our CEO, CFO and our three other named executive officers for the years ended December 31, 2007 and 2006. All the numbers of shares, options and per share amounts have been adjusted to reflect the two-for-one stock split distributed as a stock dividend by the Company on December 10, 2007 (the “Stock Split”) for all periods presented.

Summary Compensation for 2007 and 2006

Name and Principal Position | Year | Salary ($) | Stock Awards ($)(1) | Option Awards ($)(2) | Non-Equity Incentive Plan Compensation ($)(3) | Change in Pension Value ($)(4) | All Other Compensation ($)(5) | Total ($) | ||||||||||||||||

Earl R. Lewis Chief Executive Officer | 2007 2006 | $

| 750,000 711,539 | $

| 258,029 101,611 | $

| 744,124 267,806 | $

| 1,500,000 840,000 | $

| 619,704 — | $

| 45,569 52,649 | (6) (6) | $

| 3,917,426 1,973,605 | ||||||||

Stephen M. Bailey Chief Financial Officer | 2007 2006 |

| 339,519 318,058 |

| 95,166 48,596 |

| 264,784 123,390 |

| 408,000 190,000 |

| 165,409 108,826 |

| 34,271 28,198 | (7) (7) |

| 1,307,149 817,068 | ||||||||

Arne Almerfors President, Thermography | 2007 2006 |

| 569,943 448,949 |

| 92,399 48,596 |

| 255,717 123,390 |

| 420,000 210,000 |

| n/a n/a |

| 73,046 67,037 | (8) (8) |

| 1,411,105 897,972 | ||||||||

William A. Sundermeier President, Government Systems | 2007 2006 |

| 306,923 296,854 |

| 84,893 41,970 |

| 240,426 110,110 |

| 372,000 150,000 |

| 47,463 6,882 |

| 29,065 24,306 | (9) (9) |

| 1,080,770 630,122 | ||||||||

Andrew C. Teich President, Commercial Vision Systems | 2007 2006 |

| 307,923 296,854 |

| 84,893 41,970 |

| 240,426 110,110 |

| 372,000 150,000 |

| 56,761 11,108 |

| 32,447 25,300 | (10) (10) |

| 1,094,450 635,342 | ||||||||

| (1) | Represents the compensation expense recognized related to the shares issuable under time-based restricted stock units granted in 2006 and 2007. The compensation expense in 2007 is based on a value of $12.57 per share for the restricted stock units granted in 2006 and $20.75 per share for the restricted stock units granted in 2007, which were the closing prices of our stock on the grant dates. The compensation expense in 2006 is based on a value of $12.57 per share. These are the same values as disclosed in Note 1 to Notes to Consolidated Financial Statements in our Annual Report on Form 10-K for the year ended December 31, 2007. |

| (2) | Represents the compensation expense recognized related to the performance-based options granted in 2006 and 2007 at an exercise price of $12.57 and $20.75 per share, respectively. The compensation expense in 2007 is based on a value of $2.77 per share for options granted in 2006 and vested in 2007; $3.59 per share for options granted in 2006 and expected to vest in 2008; and $6.22 per share for options granted in 2007 and expected to vest in 2008. The compensation expense in 2006 is based on a value of $2.77 per share for options granted in 2006 and vested in 2007. The assumptions made in determining these values are disclosed in Note 1 to Notes to Consolidated Financial Statements in our Annual Report on Form 10-K for the year ended December 31, 2007. |