Fifth Third Bank | All Rights Reserved Second Quarter 2008 Credit Trends Exhibit 99.4 |

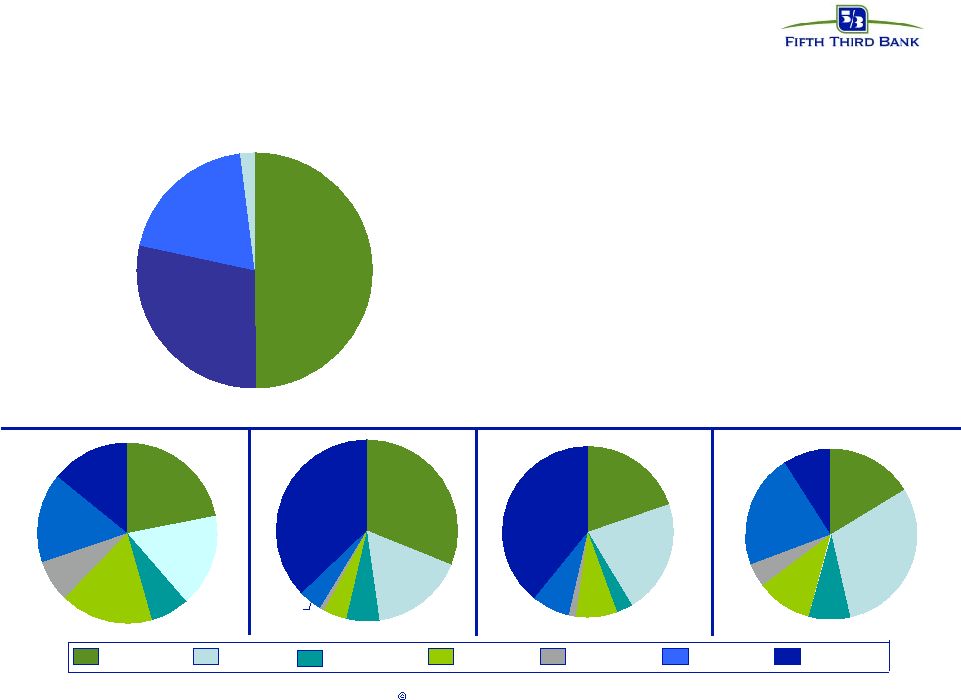

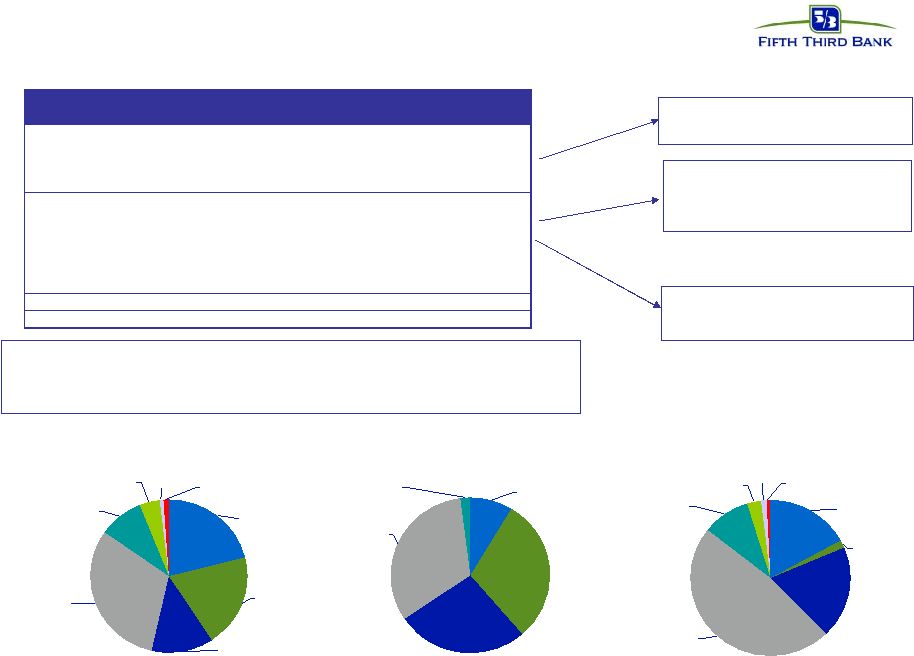

2 Fifth Third Bank | All Rights Reserved ($ in millions) C&I Commercial mortgage Commercial construction Commercial lease Total commercial Residential mortgage Home equity Auto Credit card Other consumer Total consumer Total loans & leases Loan balances $28,958 $13,394 $6,007 $3,647 $52,006 $9,866 $12,421 $8,362 $1,717 $1,152 $33,518 $85,524 % of total 34% 16% 7% 4% 61% 12% 15% 10% 2% 1% 39% Non-performing assets $414 $540 $552 $18 $1,524 $448 $183 $28 $15 $1 $674 $2,198 NPA ratio 1.43% 4.03% 9.19% 0.49% 2.93% 4.54% 1.47% 0.33% 0.88% 0.08% 2.00% 2.56% Net charge-offs $107 $21 $49 $0 $177 $63 $54 $26 $21 $3 $167 $344 Net charge-off ratio 1.52% 0.66% 3.46% -0.01% 1.41% 2.57% 1.83% 1.21% 4.93% 1.31% 2.04% 1.66% Credit by portfolio C&I 32% Home equity 16% Other consumer 1% Auto 7% Residential mortgage 18% Commercial mortgage 6% Commercial construction 14% Card 6% MI 20% KY 2% Other 25% IL 6% OH 19% IN 4% FL 24% Net charge-offs by loan type Net charge-offs by geography |

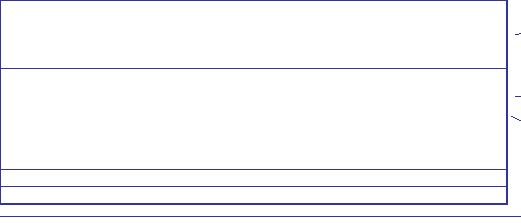

3 Fifth Third Bank | All Rights Reserved Nonperforming assets – Total NPAs of $2.2B, or 256bps – Commercial NPAs of $1.5B; recent growth driven by commercial construction and real estate, particularly in Michigan, and Florida – Consumer NPAs of $674M; recent growth driven by residential real estate, particularly in Michigan and Florida 17% 7% 17% 7% 14% 22% 16% 20% 3% 8% 1% 7% 39% 22% 31% 6% 4% 1% 4% 37% 17% C&I* (20%) CRE (49%) Residential (29%) Other Consumer (2%) ILLINOIS INDIANA FLORIDA OTHER KENTUCKY OHIO MICHIGAN Residential $630M 29% C&I* $431M 20% Other $44M 2% CRE $1.1B 49% *C&I includes commercial lease 30% 8% 4% 9% 22% 16% 11% |

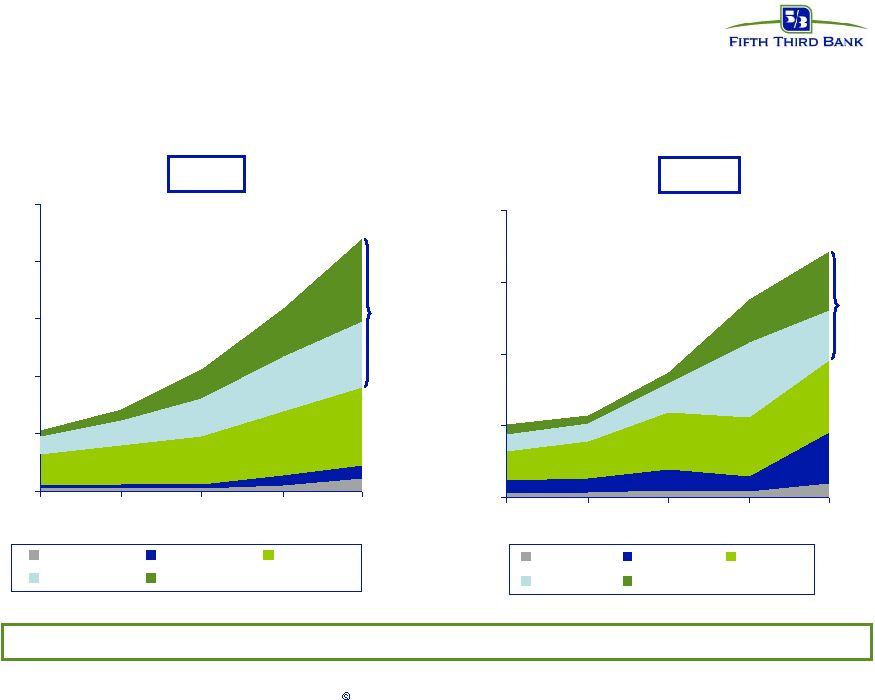

4 Fifth Third Bank | All Rights Reserved NCOs NPAs Res RE CRE NPA, charge-off growth driven by residential, commercial real estate Res RE CRE Real estate driving credit deterioration 0 500,000 1,000,000 1,500,000 2,000,000 2,500,000 Q2 2007 Q3 2007 Q4 2007 Q1 2008 Q2 2008 Auto CRE Res RE 0 100,000 200,000 300,000 400,000 Q2 2007 Q3 2007 Q4 2007 Q1 2008 Q2 2008 C&I/Lease Auto Credit Card Other CRE Res RE C&I/Lease |

5 Fifth Third Bank | All Rights Reserved NCOs NPAs Stressed markets Stressed markets Michigan and Florida: most stressed markets NPA, charge-off growth driven by Florida and Michigan - 500,000 1,000,000 1,500,000 2,000,000 2,500,000 Q2 2007 Q3 2007 Q4 2007 Q1 2008 Q2 2008 Other SE National Other MW Michigan Florida - 100,000 200,000 300,000 400,000 Q2 2007 Q3 2007 Q4 2007 Q1 2008 Q2 2008 Other SE National Other MW Michigan Florida |

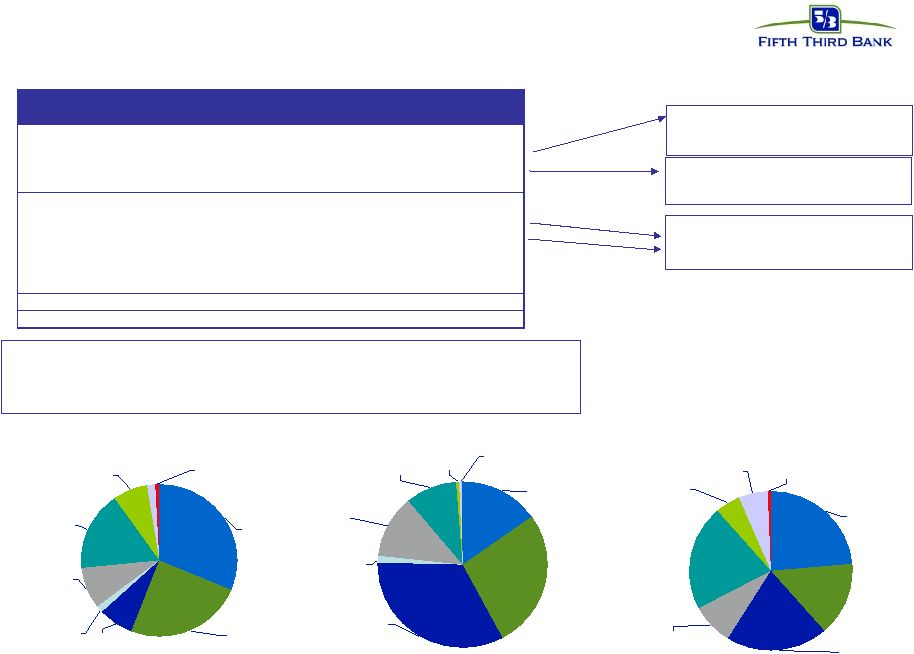

6 © Fifth Third Bank | All Rights Reserved Michigan market Total Loans Home Equity 17% Credit Card 2% Auto 7% Resi Mortgage 9% Coml Lease 1% C&I 32% Commercial Mortgage 24% Coml Const 7% Other Cons 1% NPAs Home Equity 10% Credit Card 1% Auto 1% Resi Mortgage 12% Coml Lease 1% C&I 15% Commercial Mortgage 27% Coml Const 33% Net charge-offs Auto 5% Other Cons 1% Credit Card 6% Home Equity 21% Resi Mortgage 8% C&I 24% Commercial Mortgage 15% Coml Const 20% Summary: Deterioration in home price values coupled with weak economy (unemployment rate of 7.4%) impacting credit trends due to frequency of defaults and severity Issues: homebuilders, developers tied to weak real estate market Issues: valuations, economy, unemployment Economic weakness impacts commercial real estate market ($ in millions) Loans (bn) % of FITB NPAs (mm) % of FITB NCOs (mm) % of FITB Commercial loans 5.01 17% 87 21% 16 15% Commercial mortgage 3.86 29% 152 28% 10 50% Commercial construction 1.16 19% 187 34% 14 29% Commercial lease 0.22 6% 7 42% (0) 3% Commercial 10.24 20% $434 28% 41 23% Mortgage 1.43 15% 70 16% 6 9% Home equity 2.68 22% 55 30% 15 27% Auto 1.14 14% 4 15% 4 14% Credit card 0.30 18% 3 20% 4 19% Other consumer 0.12 10% 0 6% 0 12% Consumer 5.67 17% $132 20% 29 17% Total 15.91 19% $566 26% 69 20% |

7 © Fifth Third Bank | All Rights Reserved Florida market NPAs Home Equity 2% Resi Mortgage 32% C&I 9% Commercial Mortgage 30% Coml Const 27% Net charge-offs Auto 3% Other Cons 1% Credit Card 1% Home Equity 10% Resi Mortgage 47% C&I 17% Commercial Mortgage 2% Coml Const 19% Summary: Deterioration in real estate values having effect on credit trends as evidenced by increasing NPA/NCOs in real estate related products Issues: homebuilders, developers tied to weakening real estate market Issues: increasing severity of loss due to significant declines in valuations Issues: valuations; relatively small home equity portfolio Total Loans Home Equity 9% Credit Card 1% Auto 4% Resi Mortgage 31% C&I 21% Commercial Mortgage 20% Coml Const 13% Other Cons 1% ($ in millions) Loans (bn) % of FITB NPAs (mm) % of FITB NCOs (mm) % of FITB Commercial loans 2.11 7% 61 15% 14 13% Commercial mortgage 1.95 15% 215 40% 2 8% Commercial construction 1.26 21% 193 35% 16 33% Commercial lease 0.00 0% - 0% - 0% Commercial 5.31 10% $469 31% 32 18% Mortgage 3.09 31% 233 52% 40 63% Home equity 0.91 7% 14 8% 8 15% Auto 0.42 5% 3 12% 2 9% Credit card 0.08 5% 1 4% 1 5% Other consumer 0.12 10% 0 14% 1 15% Consumer 4.61 14% $251 37% 52 31% Total 9.92 12% $720 33% 84 24% |

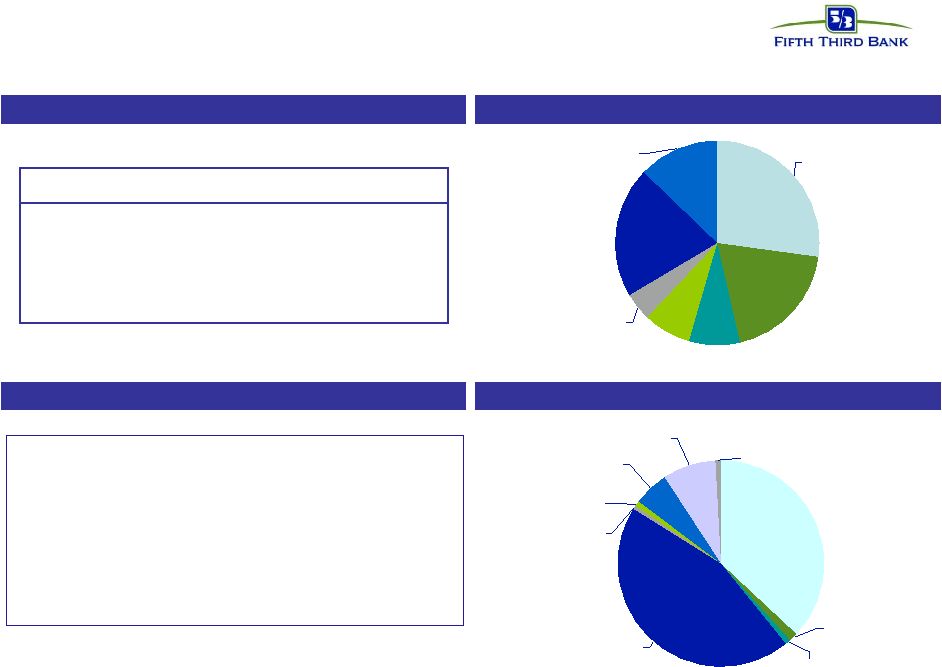

8 © Fifth Third Bank | All Rights Reserved Commercial construction FL 21% KY 5% IL 8% MI 19% IN 8% Other 13% OH 26% Accomodation 1% Auto Retailers 1% Finance & insurance 1% Construction 37% Manufacturing 1% Real estate 44% Retail Trade 1% Other 8% Wholesale Trade 6% Loans by geography Credit trends Loans by industry Comments • Declining valuations in residential and land developments • Higher concentrations in now stressed markets (Florida and Michigan) • Continued stress expected through 2008 ($ in millions) 2Q07 3Q07 4Q07 1Q08 2Q08 Balance $5,469 $5,463 $5,561 $5,592 $6,007 90+ days delinquent $33 $54 $67 $49 $53 90+ days ratio 0.60% 0.99% 1.21% 0.87% 0.88% NPAs $66 $106 $257 $418 $552 as % of loans 1.21% 1.94% 4.61% 7.48% 9.19% Net charge-offs $7 $5 $12 $72 $49 as % of loans 0.48% 0.35% 0.83% 5.20% 3.46% Commercial construction |

9 Fifth Third Bank | All Rights Reserved Homebuilder/developer Credit trends Loans by property type Comments Other MW 21% MI 22% Other SE 21% NE OH 4% FL 32% Raw & developed land 52% Other including acquired portfolio 29% Residential vertical 19% *Current definition not in use prior to 3Q07 • Making no new loans to builder/developer sector • Residential & land valuations under continued stress • 6% of commercial loans; < 4% of total gross loans • Balance by product approximately 53% Construction, 39% Mortgage, 8% C&I •12% of loans are speculative loans C&I 8% Commercial mortgage 39% Commercial construction 53% Portfolio split Loans by geography ($ in millions) 3Q07 4Q07 1Q08 2Q08 Balance $2,594 $2,868 $2,705 $3,295 90+ days delinquent $50 $57 $60 $123 90+ days ratio 1.94% 1.99% 2.21% 3.73% NPAs $78 $176 $309 $547 as % of loans 3.01% 6.14% 11.42% 16.62% Net charge-offs $4 $8 $43 $34 as % of loans 0.54% 1.11% 6.14% 4.63% Homebuilders/developers* |

10 © Fifth Third Bank | All Rights Reserved Residential mortgage 1 liens: 100% ; weighted average LTV: 77% Weighted average origination FICO: 728 Origination FICO distribution: <659 13%; 660-689 11%; 690-719 17%; 720-749 18%; 750+ 41% (note: loans <659 includes CRA loans and FHA/VA loans) Origination LTV distribution: <70 26%; 70.1-80 42%; 80.1-90 11%; 90.1-95 5%; >95% 16% Vintage distribution: 2008 8%; 2007 18%; 2006 17%; 2005 28%; 2004 14%; prior to 2004 15% % through broker: 12%; performance similar to direct OH 23% FL 31% IL 6% KY 4% MI 15% IN 6% Other 15% Loans by geography Credit trends Portfolio details Comments 31% FL concentration driving 63% total loss FL lots ($454 mm) running at 15% annualized loss rate (YTD) Mortgage company originations targeting 95% salability ($ in millions) 2Q07 3Q07 4Q07 1Q08 2Q08 Balance $8,477 $9,057 $10,540 $9,873 $9,866 90+ days delinquent $98 $116 $186 $192 $229 90+ days ratio 1.15% 1.28% 1.76% 1.95% 2.32% NPAs $112 $150 $216 $333 $448 as % of loans 1.32% 1.65% 2.04% 3.37% 4.54% Net charge-offs $9 $9 $18 $34 $63 as % of loans 0.43% 0.41% 0.72% 1.33% 2.57% Residential mortgage |

11 © Fifth Third Bank | All Rights Reserved Home equity 1 liens: 24%; 2 liens: 76% (18% of 2 liens behind FITB 1 s) Weighted average origination FICO: 755 Origination FICO distribution: <659 5%; 660-689 9%; 690-719 16%; 720- 749 19%; 750+ 51% Weighted average CLTV: 77% (1 liens 65%; 2 liens 82%)Origination CLTV distribution: <70 28%; 70.1-80 22%; 80.1-90 21%; 90.1-95 10; >95 20% Vintage distribution: 2008 7%; 2007 13%; 2006 19%; 2005 17%; 2004 13%; prior to 2004 31% % through broker channels: 20% WA FICO: 740 brokered, 758 direct; WA CLTV: 89% brokered; 74% direct Portfolio details Comments OH 25% FL 3% IL 11% KY 8% MI 20% IN 10% Other 24% OH 33% FL 8% IL 10% KY 9% MI 22% IN 10% Other 8% Brokered loans by geography Direct loans by geography Credit trends Approximately 20% of portfolio concentration in broker product driving approximately 51% total loss Portfolio experiencing increased loss severity (losses on 2 liens approximately 100%) Aggressive home equity line management strategies in place ($ in millions) 2Q07 3Q07 4Q07 1Q08 2Q08 Balance $2,810 $2,746 $2,713 $2,651 $2,433 90+ days delinquent $24 $30 $34 $33 $34 90+ days ratio 0.86% 1.08% 1.25% 1.26% 1.40% Net charge-offs $9 $14 $17 $23 $28 as % of loans 1.19% 1.94% 2.52% 3.29% 4.64% Home equity - brokered ($ in millions) 2Q07 3Q07 4Q07 1Q08 2Q08 Balance $8,970 $8,991 $9,161 $9,152 $9,988 90+ days delinquent $37 $34 $38 $43 $42 90+ days ratio 0.41% 0.38% 0.41% 0.47% 0.42% Net charge-offs $11 $14 $15 $18 $27 as % of loans 0.48% 0.59% 0.66% 0.78% 1.07% Home equity - direct Note: Brokered and direct home equity net charge-off ratios are calculated based on end of period loan balances |

12 Fifth Third Bank | All Rights Reserved Cautionary Statement This report may contain forward-looking statements about Fifth Third Bancorp and/or the company as combined acquired entities within the meaning of Sections 27A of the Securities Act of 1933, as amended, and Rule 175 promulgated thereunder, and 21E of the Securities Exchange Act of 1934, as amended, and Rule 3b-6 promulgated thereunder, that involve inherent risks and uncertainties. This report may contain certain forward-looking statements with respect to the financial condition, results of operations, plans, objectives, future performance and business of Fifth Third Bancorp and/or the combined company including statements preceded by, followed by or that include the words or phrases such as “believes,” “expects,” “anticipates,” “plans,” “trend,” “objective,” “continue,” “remain” or similar expressions or future or conditional verbs such as “will,” “would,” “should,” “could,” “might,” “can,” “may” or similar expressions. There are a number of important factors that could cause future results to differ materially from historical performance and these forward-looking statements. Factors that might cause such a difference include, but are not limited to: (1) general economic conditions and weakening in the economy, specifically the real estate market, either national or in the states in which Fifth Third, one or more acquired entities and/or the combined company do business, are less favorable than expected; (2) deteriorating credit quality; (3) political developments, wars or other hostilities may disrupt or increase volatility in securities markets or other economic conditions; (4) changes in the interest rate environment reduce interest margins; (5) prepayment speeds, loan origination and sale volumes, charge-offs and loan loss provisions; (6) Fifth Third’s ability to maintain required capital levels and adequate sources of funding and liquidity; (7) changes and trends in capital markets; (8) competitive pressures among depository institutions increase significantly; (9) effects of critical accounting policies and judgments; (10) changes in accounting policies or procedures as may be required by the Financial Accounting Standards Board or other regulatory agencies; (11) legislative or regulatory changes or actions, or significant litigation, adversely affect Fifth Third, one or more acquired entities and/or the combined company or the businesses in which Fifth Third, one or more acquired entities and/or the combined company are engaged; (12) ability to maintain favorable ratings from rating agencies; (13) fluctuation of Fifth Third’s stock price; (14) ability to attract and retain key personnel; (15) ability to receive dividends from its subsidiaries; (16) potentially dilutive effect of future acquisitions on current shareholders' ownership of Fifth Third; (17) effects of accounting or financial results of one or more acquired entities; (18) difficulties in combining the operations of acquired entities; (19) inability to generate the gains on sale and related increase in shareholders’ equity that it anticipates from the sale of certain non-core businesses, (20) loss of income from the sale of certain non-core businesses could have an adverse effect on Fifth Third’s earnings and future growth (21) ability to secure confidential information through the use of computer systems and telecommunications networks; and (22) the impact of reputational risk created by these developments on such matters as business generation and retention, funding and liquidity. Additional information concerning factors that could cause actual results to differ materially from those expressed or implied in the forward-looking statements is available in the Bancorp's Annual Report on Form 10-K for the year ended December 31, 2007, filed with the United States Securities and Exchange Commission (SEC). Copies of this filing are available at no cost on the SEC's Web site at www.sec.gov or on the Fifth Third’s Web site at www.53.com. Fifth Third undertakes no obligation to release revisions to these forward-looking statements or reflect events or circumstances after the date of this report. |