Fifth Third Bancorp 2Q19 Earnings Presentation July 23, 2019 Refer to earnings release dated July 23, 2019 for further information. Exhibit 99.2

Cautionary statement This presentation contains statements that we believe are “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Rule 175 promulgated thereunder, and Section 21E of the Securities Exchange Act of 1934, as amended, and Rule 3b-6 promulgated thereunder. These statements relate to our financial condition, results of operations, plans, objectives, future performance or business. They usually can be identified by the use of forward-looking language such as “will likely result,” “may,” “are expected to,” “is anticipated,” “potential,” “estimate,” “forecast,” “projected,” “intends to,” or may include other similar words or phrases such as “believes,” “plans,” “trend,” “objective,” “continue,” “remain,” or similar expressions, or future or conditional verbs such as “will,” “would,” “should,” “could,” “might,” “can,” or similar verbs. You should not place undue reliance on these statements, as they are subject to risks and uncertainties, including but not limited to the risk factors set forth in our most recent Annual Report on Form 10-K as updated by our Quarterly Reports on Form 10-Q. When considering these forward-looking statements, you should keep in mind these risks and uncertainties, as well as any cautionary statements we may make. Moreover, you should treat these statements as speaking only as of the date they are made and based only on information then actually known to us. We undertake no obligation to release revisions to these forward-looking statements or reflect events or circumstances after the date of this document. There are a number of important factors that could cause future results to differ materially from historical performance and these forward-looking statements. Factors that might cause such a difference include, but are not limited to: (1) deteriorating credit quality; (2) loan concentration by location or industry of borrowers or collateral; (3) problems encountered by other financial institutions; (4) inadequate sources of funding or liquidity; (5) unfavorable actions of rating agencies; (6) inability to maintain or grow deposits; (7) limitations on the ability to receive dividends from subsidiaries; (8) cyber-security risks; (9) Fifth Third’s ability to secure confidential information and deliver products and services through the use of computer systems and telecommunications networks; (10) failures by third-party service providers; (11) inability to manage strategic initiatives and/or organizational changes; (12) inability to implement technology system enhancements; (13) failure of internal controls and other risk management systems; (14) losses related to fraud, theft or violence; (15) inability to attract and retain skilled personnel; (16) adverse impacts of government regulation; (17) governmental or regulatory changes or other actions; (18) failures to meet applicable capital requirements; (19) regulatory objections to Fifth Third’s capital plan; (20) regulation of Fifth Third’s derivatives activities; (21) deposit insurance premiums; (22) assessments for the orderly liquidation fund; (23) replacement of LIBOR; (24) weakness in the national or local economies; (25) global political and economic uncertainty or negative actions; (26) changes in interest rates; (27) changes and trends in capital markets; (28) fluctuation of Fifth Third’s stock price; (29) volatility in mortgage banking revenue; (30) litigation, investigations, and enforcement proceedings by governmental authorities; (31) breaches of contractual covenants, representations and warranties; (32) competition and changes in the financial services industry; (33) changing retail distribution strategies, customer preferences and behavior; (34) risks relating to the merger with MB Financial, Inc. and Fifth Third’s ability to realize anticipated benefits of the merger; (35) difficulties in identifying, acquiring or integrating suitable strategic partnerships, investments or acquisitions; (36) potential dilution from future acquisitions; (37) loss of income and/or difficulties encountered in the sale and separation of businesses, investments or other assets; (38) results of investments or acquired entities; (39) changes in accounting standards or interpretation or declines in the value of Fifth Third’s goodwill or other intangible assets; (40) inaccuracies or other failures from the use of models; (41) effects of critical accounting policies and judgments or the use of inaccurate estimates; (42) weather-related events or other natural disasters; and (43) the impact of reputational risk created by these or other developments on such matters as business generation and retention, funding and liquidity. You should refer to our periodic and current reports filed with the Securities and Exchange Commission, or “SEC,” for further information on other factors, which could cause actual results to be significantly different from those expressed or implied by these forward-looking statements. Annualized, pro forma, projected and estimated numbers are used for illustrative purpose only, are not forecasts and may not reflect actual results. In this presentation, we may sometimes provide non-GAAP financial information. Please note that although non-GAAP financial measures provide useful insight to analysts, investors and regulators, they should not be considered in isolation or relied upon as a substitute for analysis using GAAP measures. We provide a discussion of non-GAAP measures and reconciliations to the most directly comparable GAAP measures in later slides in this presentation, as well as on pages 26 through 28 of our 2Q19 earnings release. Management does not provide a reconciliation for forward-looking non-GAAP financial measures where it is unable to provide a meaningful or accurate calculation or estimation of reconciling items and the information is not available without unreasonable effort. This is due to the inherent difficulty of forecasting the occurrence and the financial impact of various items that have not yet occurred, are out of the Bancorp's control or cannot be reasonably predicted. For the same reasons, the Bancorp's management is unable to address the probable significance of the unavailable information. Forward-looking non-GAAP financial measures provided without the most directly comparable GAAP financial measures may vary materially from the corresponding GAAP financial measures.

Strategic priorities 1 2 Maintain credit, expense and capital discipline Invest to drive organic growth and profitability 3 Expand market share in key geographies Focused on generating continued positive operating leverage 4 Leverage technology capabilities to accelerate digital transformation

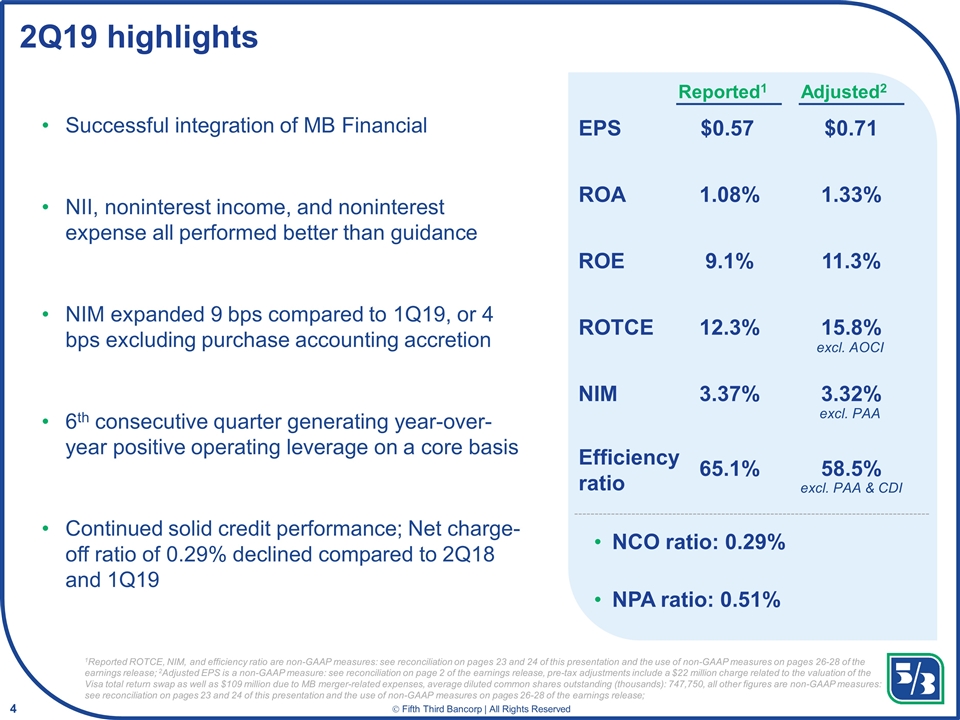

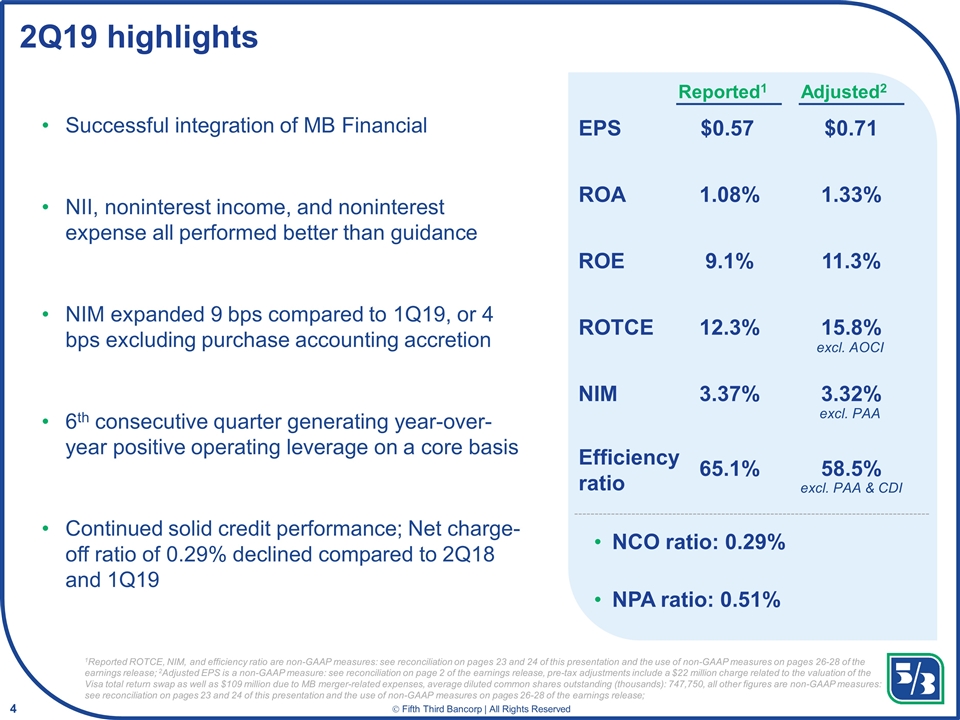

Successful integration of MB Financial NII, noninterest income, and noninterest expense all performed better than guidance NIM expanded 9 bps compared to 1Q19, or 4 bps excluding purchase accounting accretion 6th consecutive quarter generating year-over-year positive operating leverage on a core basis Continued solid credit performance; Net charge-off ratio of 0.29% declined compared to 2Q18 and 1Q19 2Q19 highlights Reported1 1Reported ROTCE, NIM, and efficiency ratio are non-GAAP measures: see reconciliation on pages 23 and 24 of this presentation and the use of non-GAAP measures on pages 26-28 of the earnings release; 2Adjusted EPS is a non-GAAP measure: see reconciliation on page 2 of the earnings release, pre-tax adjustments include a $22 million charge related to the valuation of the Visa total return swap as well as $109 million due to MB merger-related expenses, average diluted common shares outstanding (thousands): 747,750, all other figures are non-GAAP measures: see reconciliation on pages 23 and 24 of this presentation and the use of non-GAAP measures on pages 26-28 of the earnings release; Adjusted2 EPS ROA Efficiency ratio ROTCE $0.57 $0.71 1.33% NCO ratio: 0.29% NPA ratio: 0.51% 15.8% NIM 3.32% 3.37% 1.08% 12.3% 58.5% 65.1% ROE 11.3% 9.1% excl. AOCI excl. PAA excl. PAA & CDI

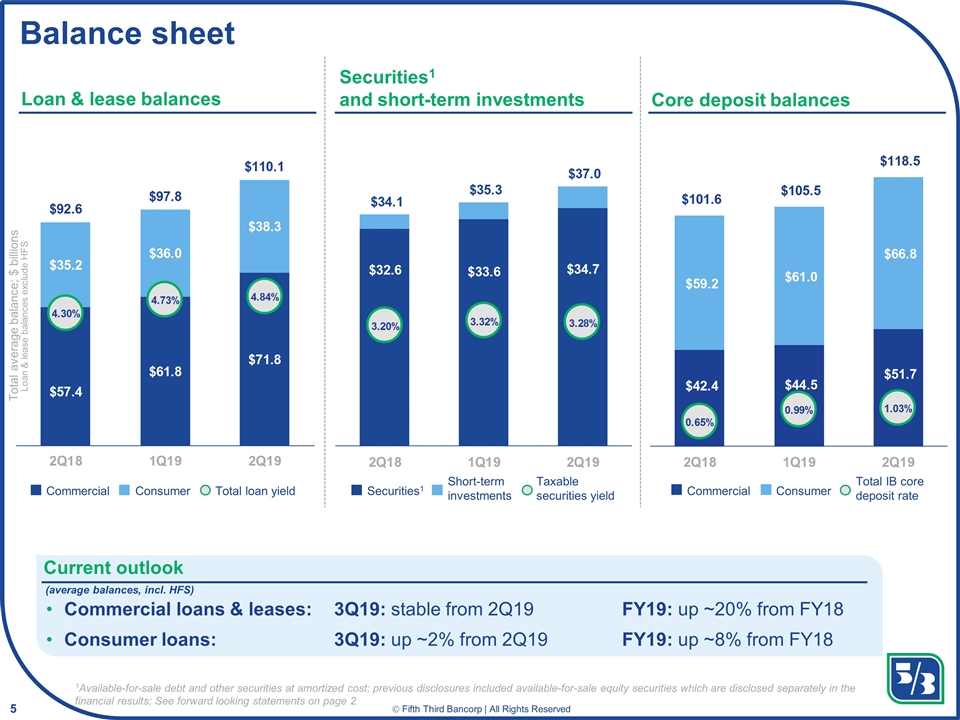

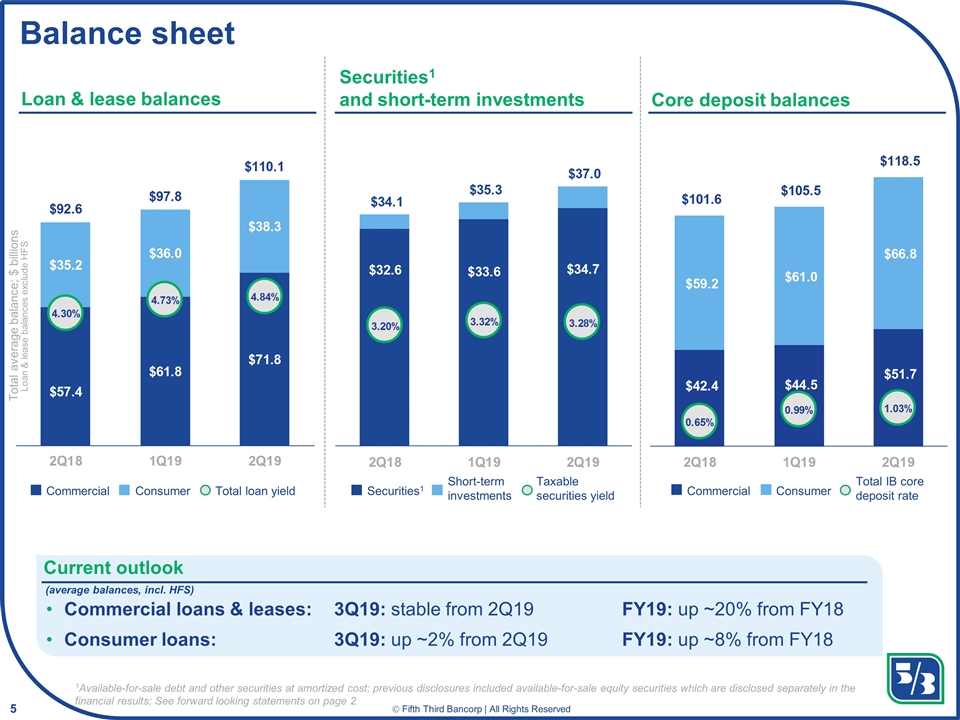

Commercial Balance sheet Securities1 and short-term investments Loan & lease balances Core deposit balances Securities1 Short-term investments Commercial Consumer Total IB core deposit rate 1Available-for-sale debt and other securities at amortized cost; previous disclosures included available-for-sale equity securities which are disclosed separately in the financial results; See forward looking statements on page 2 Consumer Total loan yield Taxable securities yield Total average balance; $ billions Commercial loans & leases:3Q19: stable from 2Q19FY19: up ~20% from FY18 Consumer loans:3Q19: up ~2% from 2Q19FY19: up ~8% from FY18 Current outlook (average balances, incl. HFS) Loan & lease balances exclude HFS

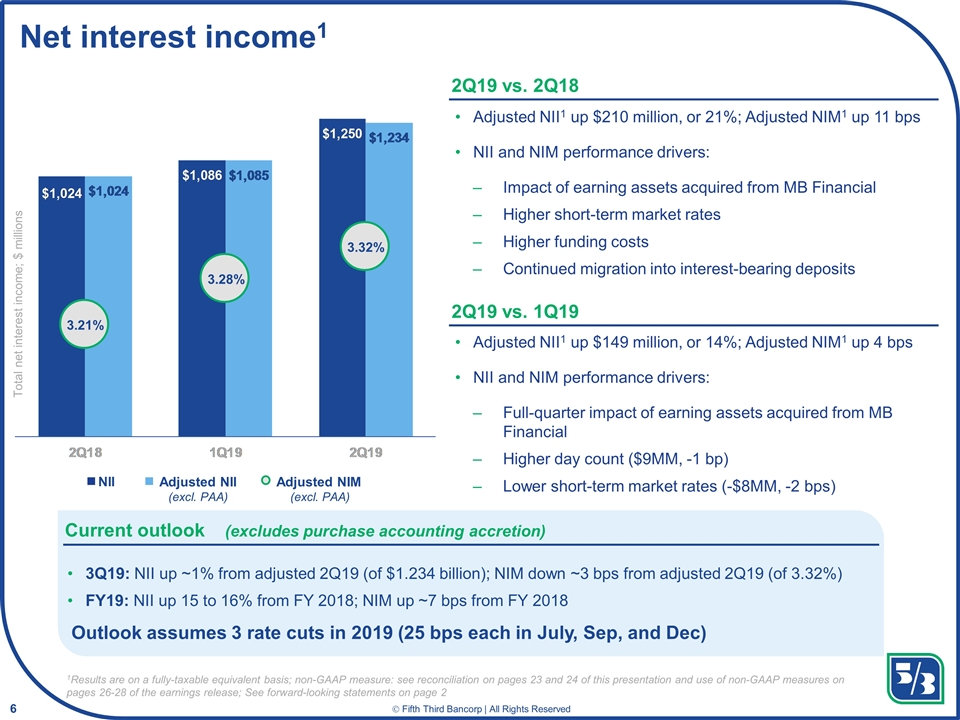

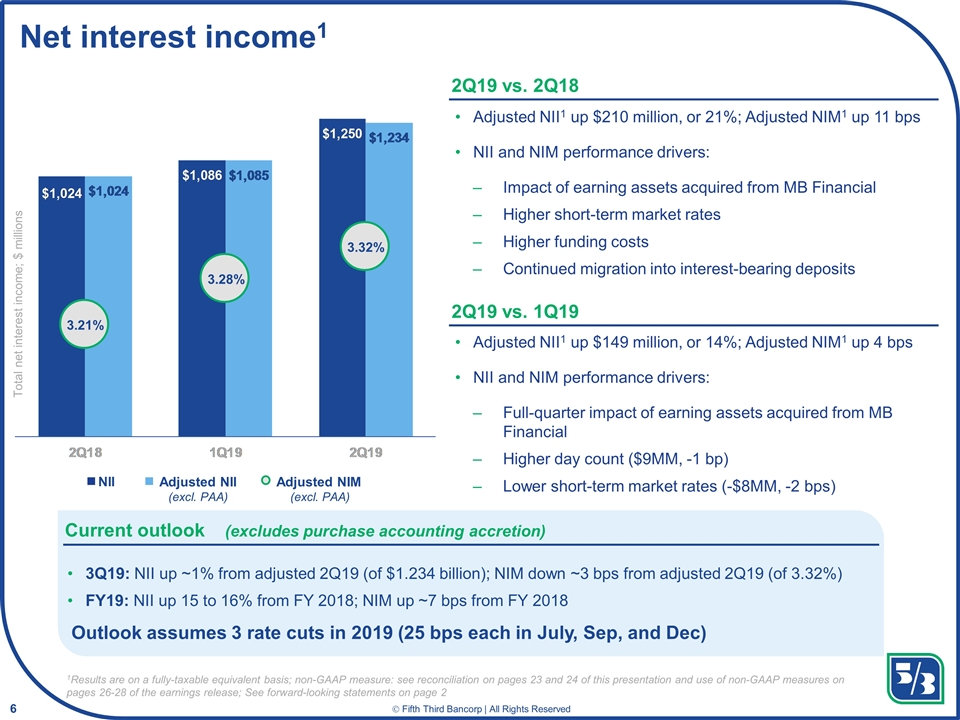

Net interest income1 2Q19 vs. 2Q18 Current outlook (excludes purchase accounting accretion) 2Q19 vs. 1Q19 Adjusted NII1 up $210 million, or 21%; Adjusted NIM1 up 11 bps NII and NIM performance drivers: Impact of earning assets acquired from MB Financial Higher short-term market rates Higher funding costs Continued migration into interest-bearing deposits Adjusted NII1 up $149 million, or 14%; Adjusted NIM1 up 4 bps NII and NIM performance drivers: Full-quarter impact of earning assets acquired from MB Financial Higher day count ($9MM, -1 bp) Lower short-term market rates (-$8MM, -2 bps) 1Results are on a fully-taxable equivalent basis; non-GAAP measure: see reconciliation on pages 23 and 24 of this presentation and use of non-GAAP measures on pages 26-28 of the earnings release; See forward-looking statements on page 2 3Q19: NII up ~1% from adjusted 2Q19 (of $1.234 billion); NIM down ~3 bps from adjusted 2Q19 (of 3.32%) FY19: NII up 15 to 16% from FY 2018; NIM up ~7 bps from FY 2018 Total net interest income; $ millions Adjusted NII (excl. PAA) NII 3.21% 3.28% 3.32% Adjusted NIM (excl. PAA) Outlook assumes 3 rate cuts in 2019 (25 bps each in July, Sep, and Dec)

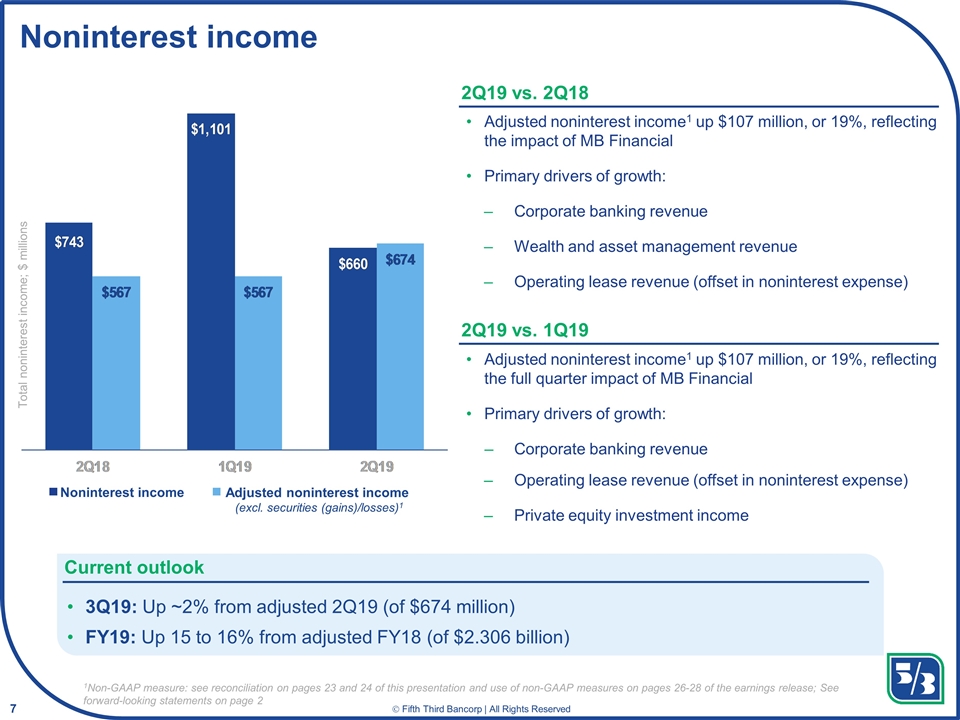

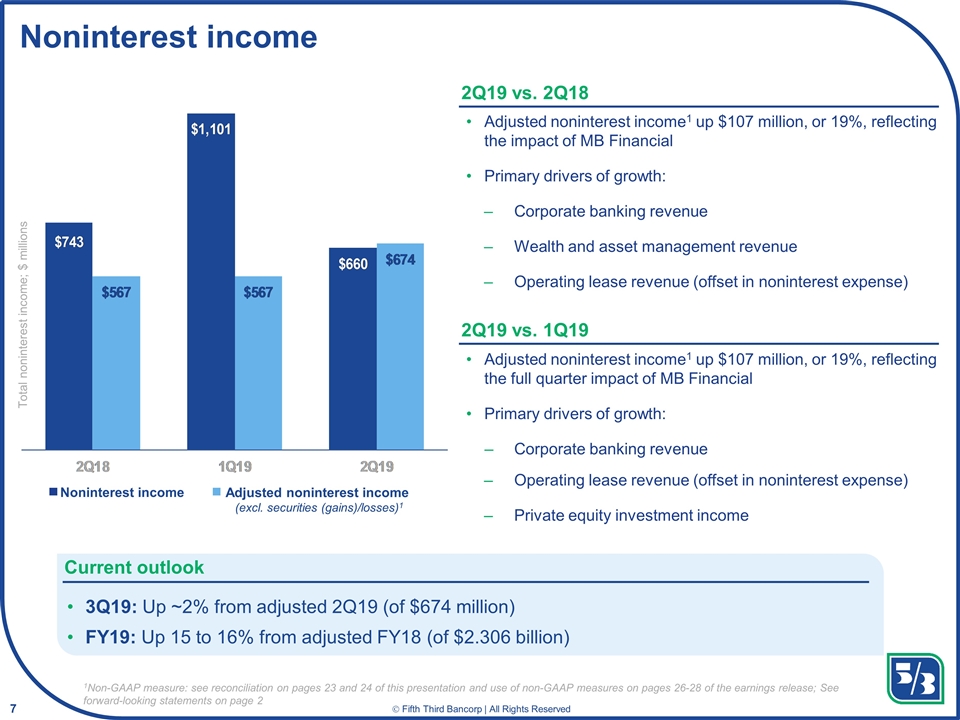

Adjusted noninterest income (excl. securities (gains)/losses)1 Noninterest income 2Q19 vs. 2Q18 Current outlook 2Q19 vs. 1Q19 Adjusted noninterest income1 up $107 million, or 19%, reflecting the impact of MB Financial Primary drivers of growth: Corporate banking revenue Wealth and asset management revenue Operating lease revenue (offset in noninterest expense) Adjusted noninterest income1 up $107 million, or 19%, reflecting the full quarter impact of MB Financial Primary drivers of growth: Corporate banking revenue Operating lease revenue (offset in noninterest expense) Private equity investment income 1Non-GAAP measure: see reconciliation on pages 23 and 24 of this presentation and use of non-GAAP measures on pages 26-28 of the earnings release; See forward-looking statements on page 2 Total noninterest income; $ millions 3Q19: Up ~2% from adjusted 2Q19 (of $674 million) FY19: Up 15 to 16% from adjusted FY18 (of $2.306 billion) Noninterest income

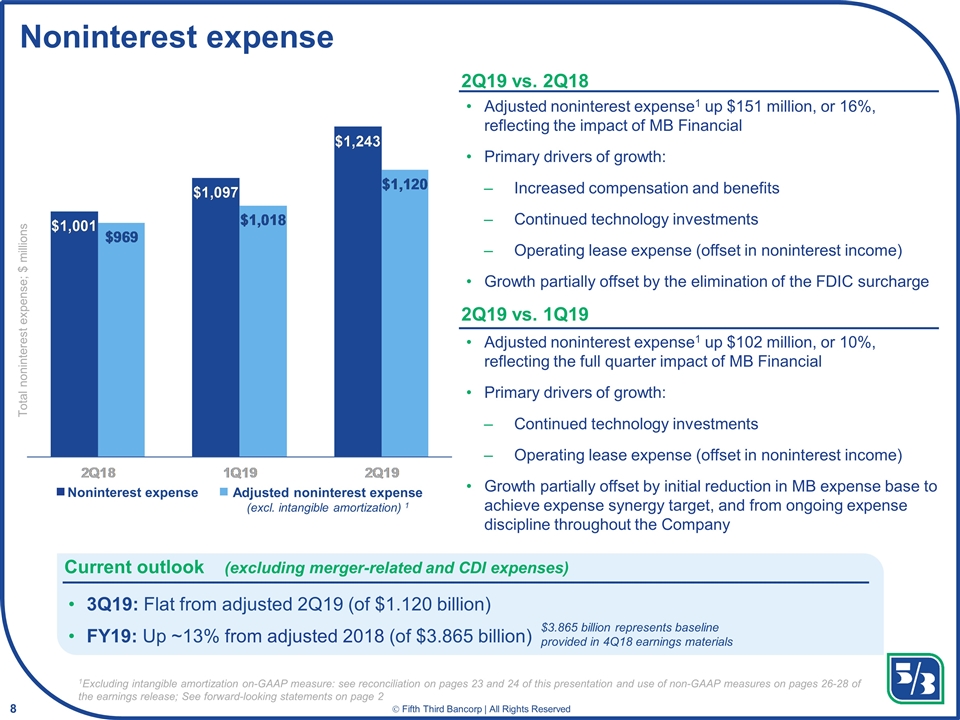

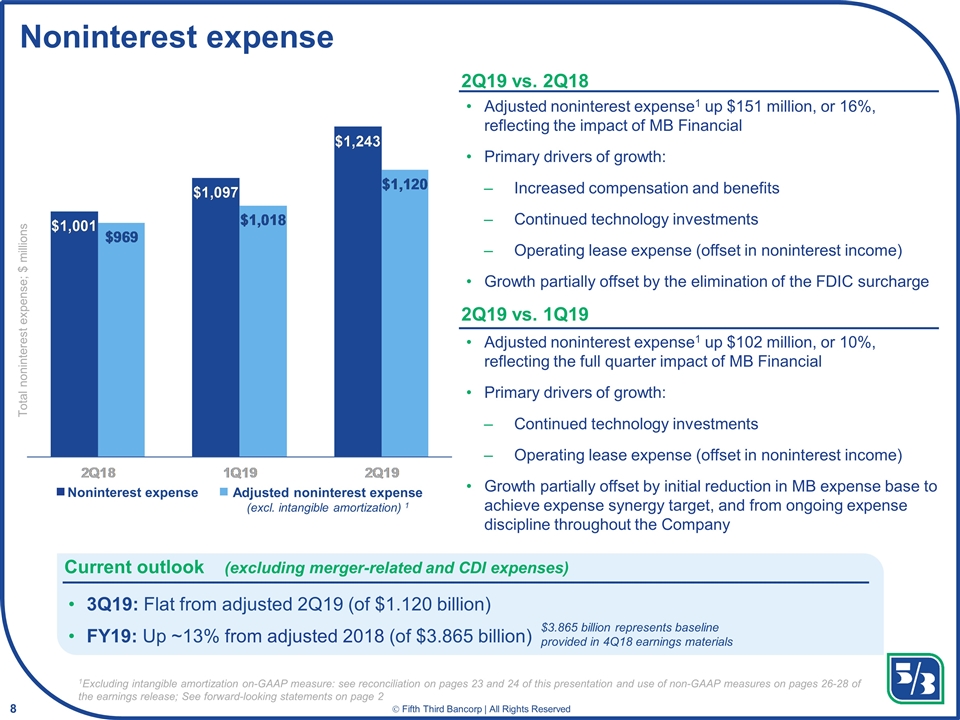

Adjusted noninterest expense (excl. intangible amortization) 1 Noninterest expense 2Q19 vs. 2Q18 2Q19 vs. 1Q19 Adjusted noninterest expense1 up $102 million, or 10%, reflecting the full quarter impact of MB Financial Primary drivers of growth: Continued technology investments Operating lease expense (offset in noninterest income) Growth partially offset by initial reduction in MB expense base to achieve expense synergy target, and from ongoing expense discipline throughout the Company 3Q19: Flat from adjusted 2Q19 (of $1.120 billion) FY19: Up ~13% from adjusted 2018 (of $3.865 billion) Total noninterest expense; $ millions Current outlook (excluding merger-related and CDI expenses) Adjusted noninterest expense1 up $151 million, or 16%, reflecting the impact of MB Financial Primary drivers of growth: Increased compensation and benefits Continued technology investments Operating lease expense (offset in noninterest income) Growth partially offset by the elimination of the FDIC surcharge $3.865 billion represents baseline provided in 4Q18 earnings materials Noninterest expense 1Excluding intangible amortization on-GAAP measure: see reconciliation on pages 23 and 24 of this presentation and use of non-GAAP measures on pages 26-28 of the earnings release; See forward-looking statements on page 2

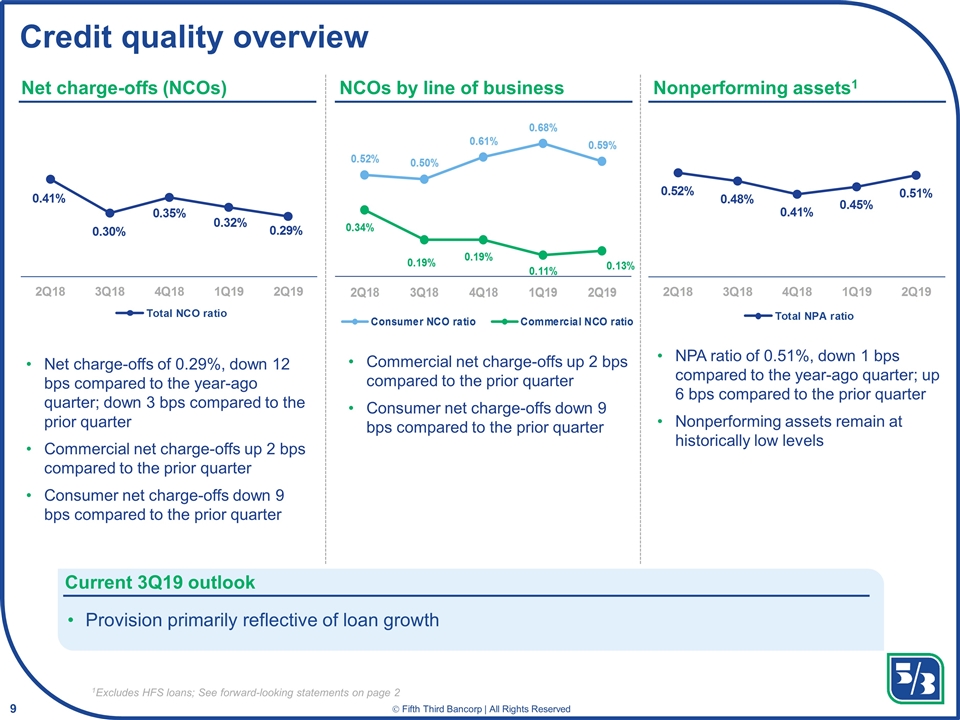

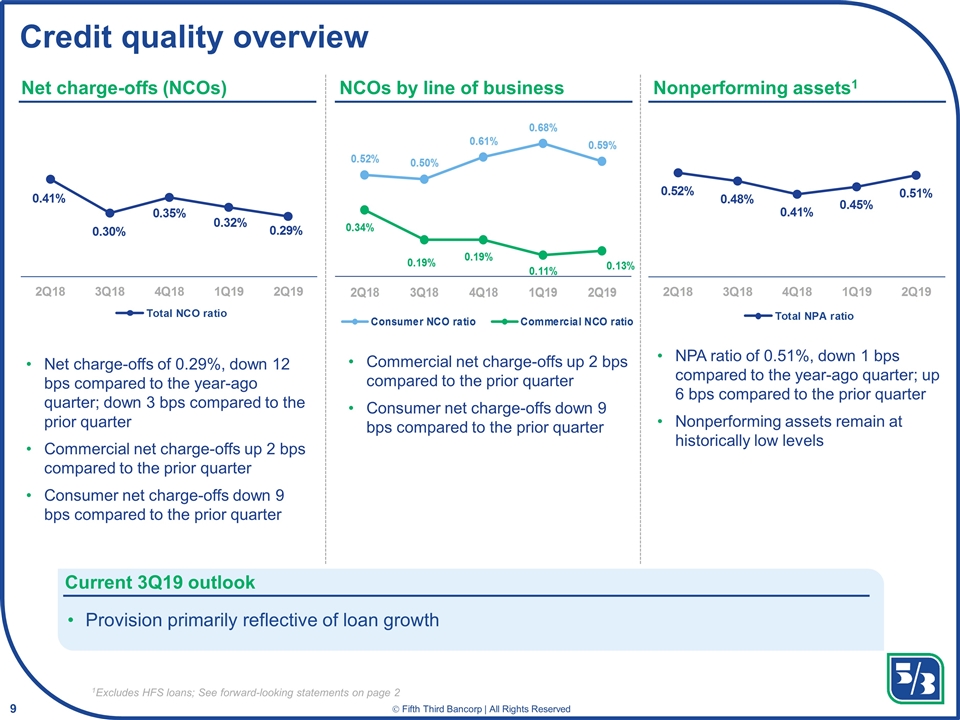

Credit quality overview 1Excludes HFS loans; See forward-looking statements on page 2 Net charge-offs of 0.29%, down 12 bps compared to the year-ago quarter; down 3 bps compared to the prior quarter Commercial net charge-offs up 2 bps compared to the prior quarter Consumer net charge-offs down 9 bps compared to the prior quarter Commercial net charge-offs up 2 bps compared to the prior quarter Consumer net charge-offs down 9 bps compared to the prior quarter NPA ratio of 0.51%, down 1 bps compared to the year-ago quarter; up 6 bps compared to the prior quarter Nonperforming assets remain at historically low levels NCOs by line of business Net charge-offs (NCOs) Nonperforming assets1 Provision primarily reflective of loan growth Current 3Q19 outlook

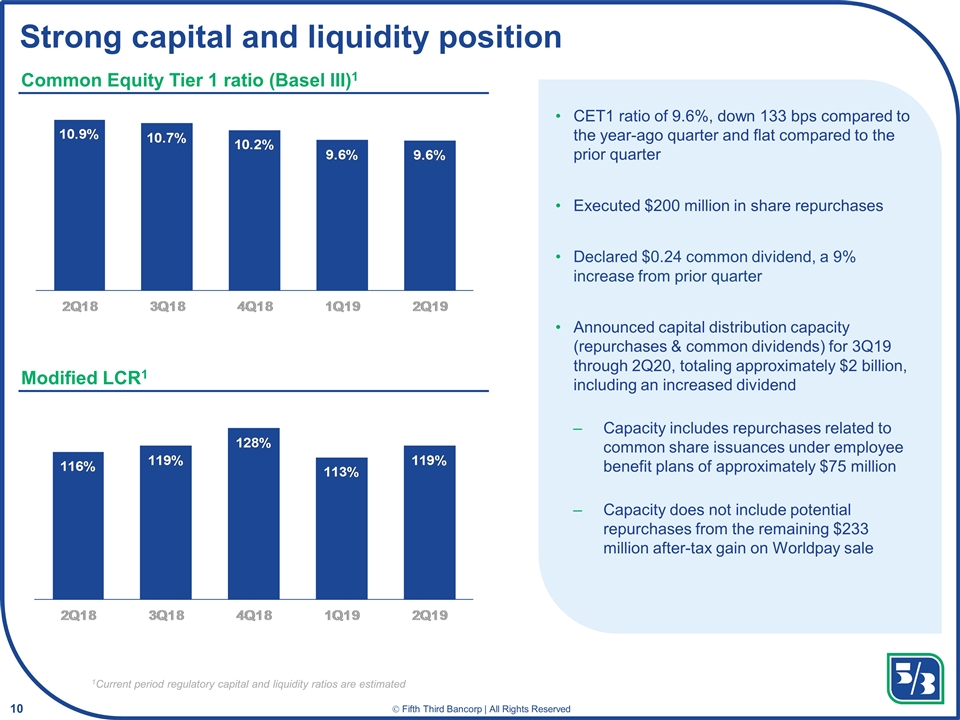

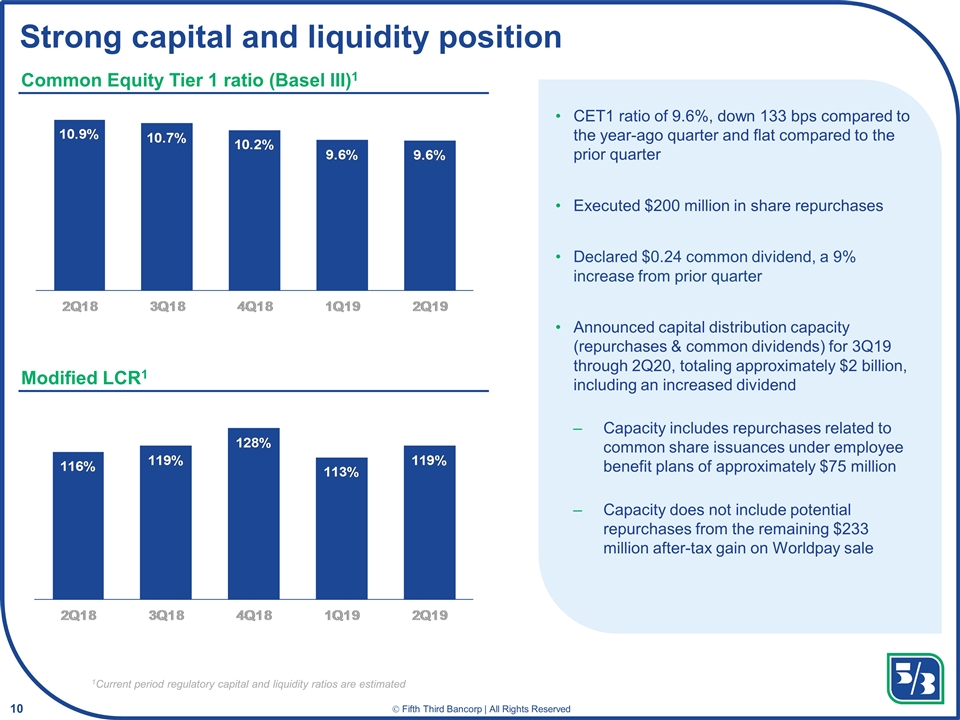

Strong capital and liquidity position 1Current period regulatory capital and liquidity ratios are estimated Common Equity Tier 1 ratio (Basel III)1 Modified LCR1 CET1 ratio of 9.6%, down 133 bps compared to the year-ago quarter and flat compared to the prior quarter Executed $200 million in share repurchases Declared $0.24 common dividend, a 9% increase from prior quarter Announced capital distribution capacity (repurchases & common dividends) for 3Q19 through 2Q20, totaling approximately $2 billion, including an increased dividend Capacity includes repurchases related to common share issuances under employee benefit plans of approximately $75 million Capacity does not include potential repurchases from the remaining $233 million after-tax gain on Worldpay sale

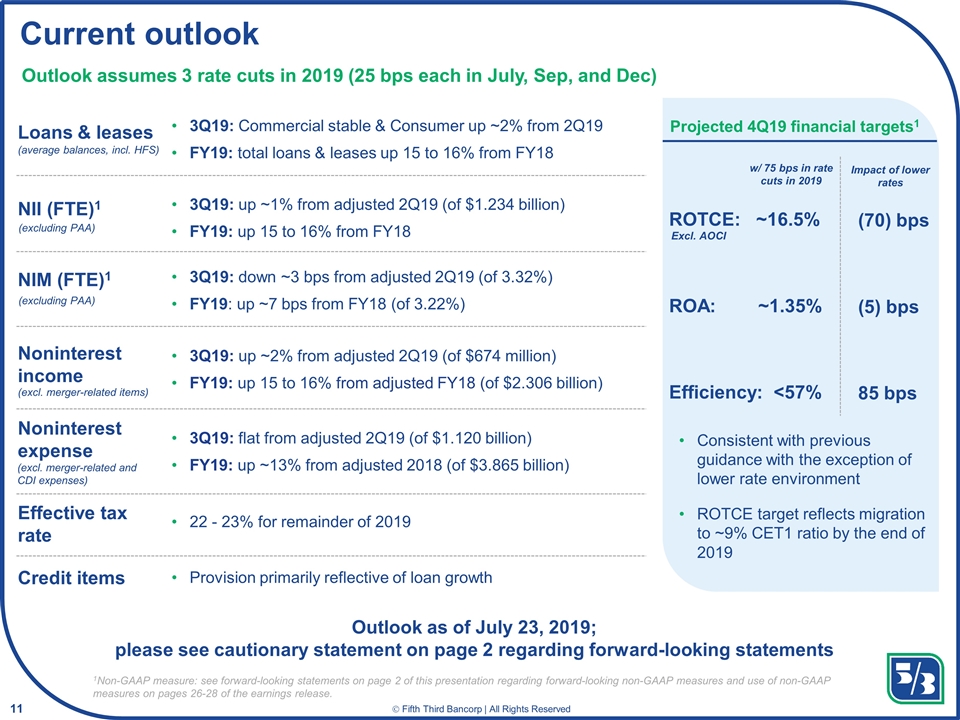

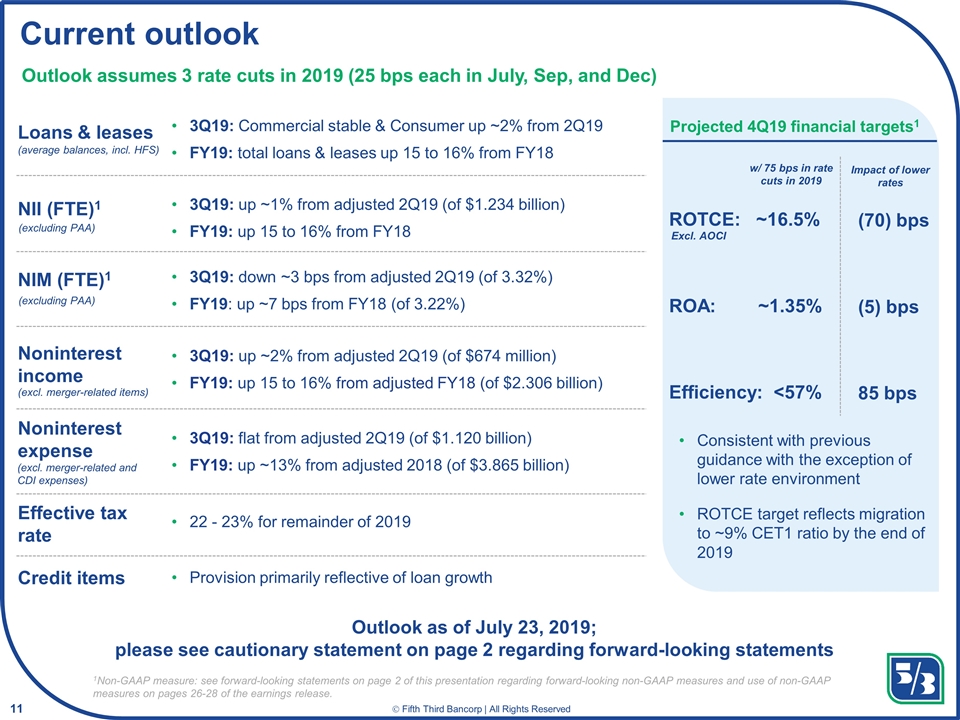

Current outlook Loans & leases Noninterest expense Effective tax rate Noninterest income NII (FTE)1 NIM (FTE)1 Credit items 1Non-GAAP measure: see forward-looking statements on page 2 of this presentation regarding forward-looking non-GAAP measures and use of non-GAAP measures on pages 26-28 of the earnings release. (average balances, incl. HFS) 3Q19: up ~1% from adjusted 2Q19 (of $1.234 billion) FY19: up 15 to 16% from FY18 3Q19: down ~3 bps from adjusted 2Q19 (of 3.32%) FY19: up ~7 bps from FY18 (of 3.22%) 22 - 23% for remainder of 2019 Provision primarily reflective of loan growth Outlook as of July 23, 2019; please see cautionary statement on page 2 regarding forward-looking statements 3Q19: Commercial stable & Consumer up ~2% from 2Q19 FY19: total loans & leases up 15 to 16% from FY18 3Q19: flat from adjusted 2Q19 (of $1.120 billion) FY19: up ~13% from adjusted 2018 (of $3.865 billion) 3Q19: up ~2% from adjusted 2Q19 (of $674 million) FY19: up 15 to 16% from adjusted FY18 (of $2.306 billion) ROTCE: ~16.5% ROA: ~1.35% Efficiency: <57% Projected 4Q19 financial targets1 (excl. merger-related and CDI expenses) (excl. merger-related items) (excluding PAA) (excluding PAA) Excl. AOCI (70) bps (5) bps 85 bps Consistent with previous guidance with the exception of lower rate environment ROTCE target reflects migration to ~9% CET1 ratio by the end of 2019 w/ 75 bps in rate cuts in 2019 Outlook assumes 3 rate cuts in 2019 (25 bps each in July, Sep, and Dec) Impact of lower rates

Strategic priorities Focused on top quartile through-the-cycle performance to create long-term shareholder value 1 3 2 4 Leverage technology capabilities to accelerate digital transformation Maintain credit, expense and capital discipline Expand market share in key geographies Invest to drive organic growth and profitability

Appendix

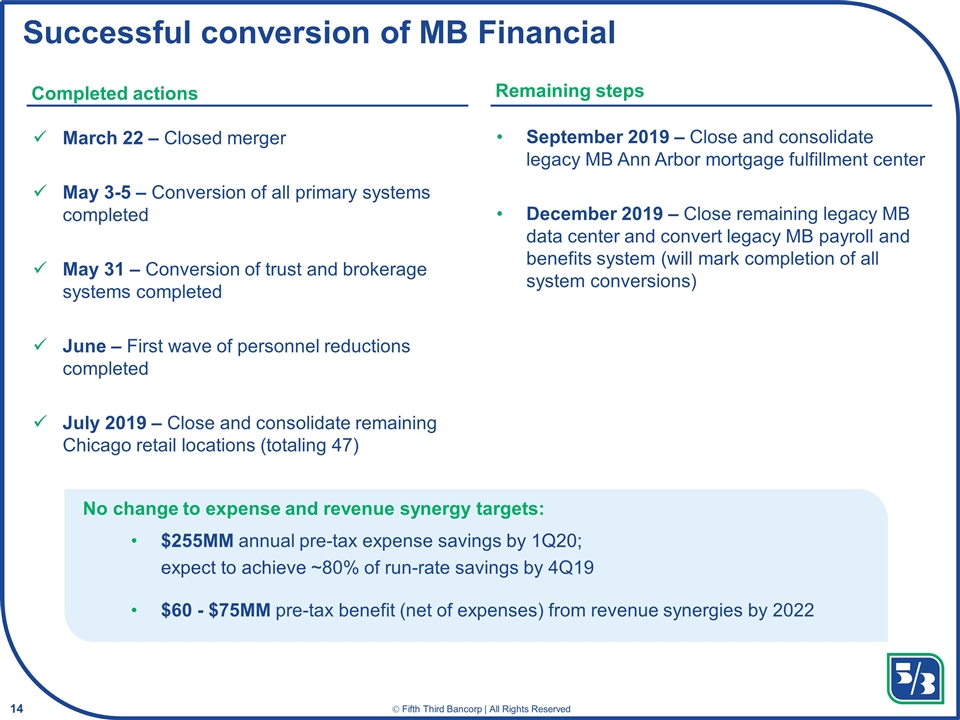

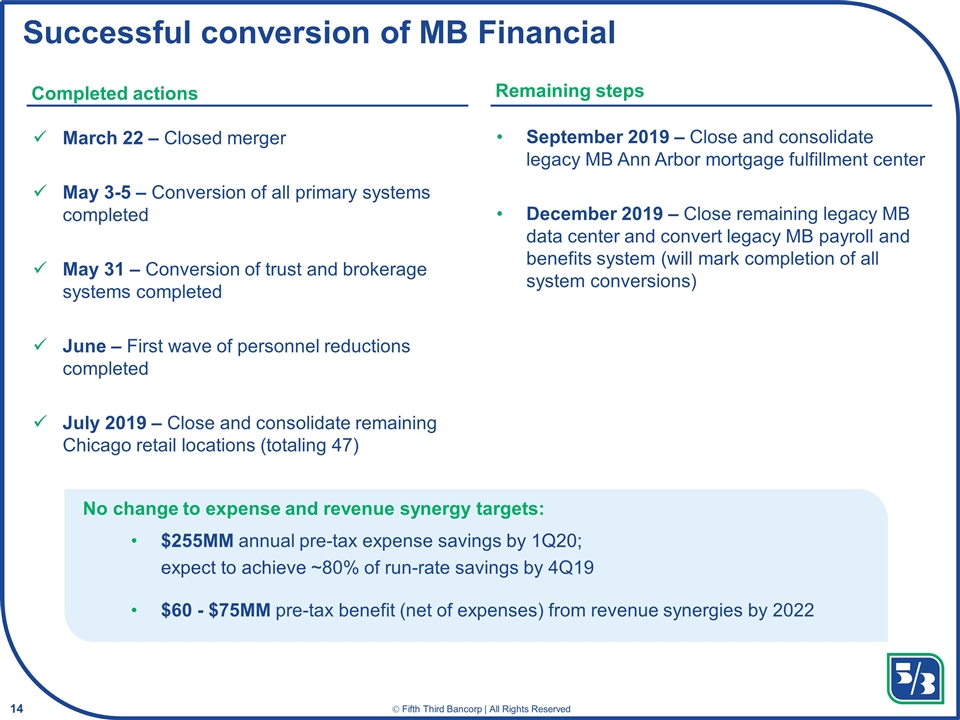

March 22 – Closed merger May 3-5 – Conversion of all primary systems completed May 31 – Conversion of trust and brokerage systems completed June – First wave of personnel reductions completed July 2019 – Close and consolidate remaining Chicago retail locations (totaling 47) No change to expense and revenue synergy targets: $255MM annual pre-tax expense savings by 1Q20; expect to achieve ~80% of run-rate savings by 4Q19 $60 - $75MM pre-tax benefit (net of expenses) from revenue synergies by 2022 Completed actions September 2019 – Close and consolidate legacy MB Ann Arbor mortgage fulfillment center December 2019 – Close remaining legacy MB data center and convert legacy MB payroll and benefits system (will mark completion of all system conversions) Remaining steps Successful conversion of MB Financial

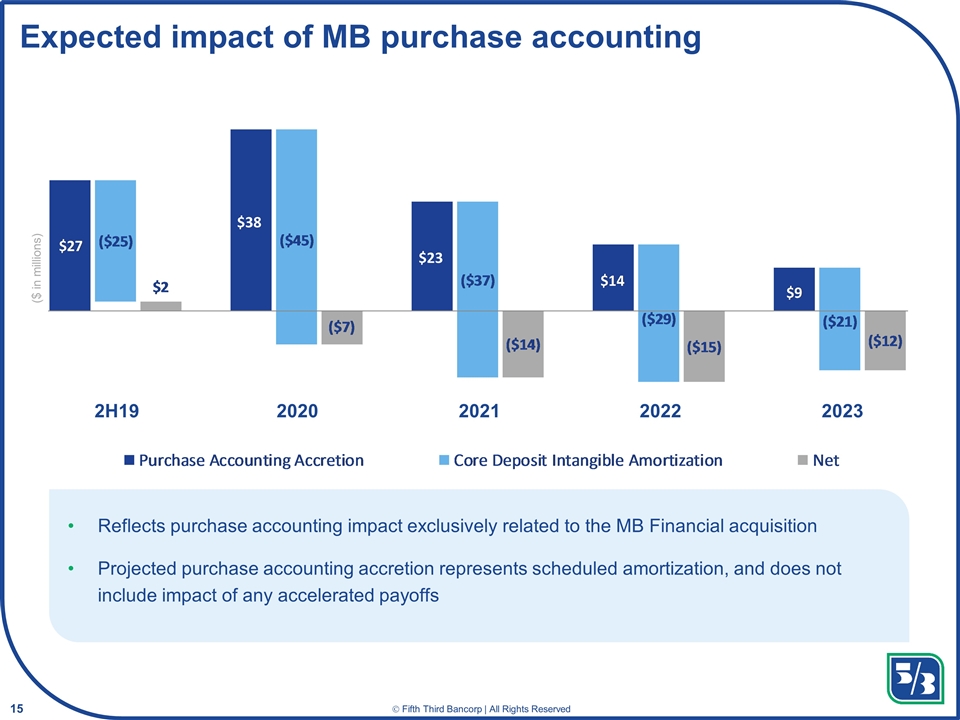

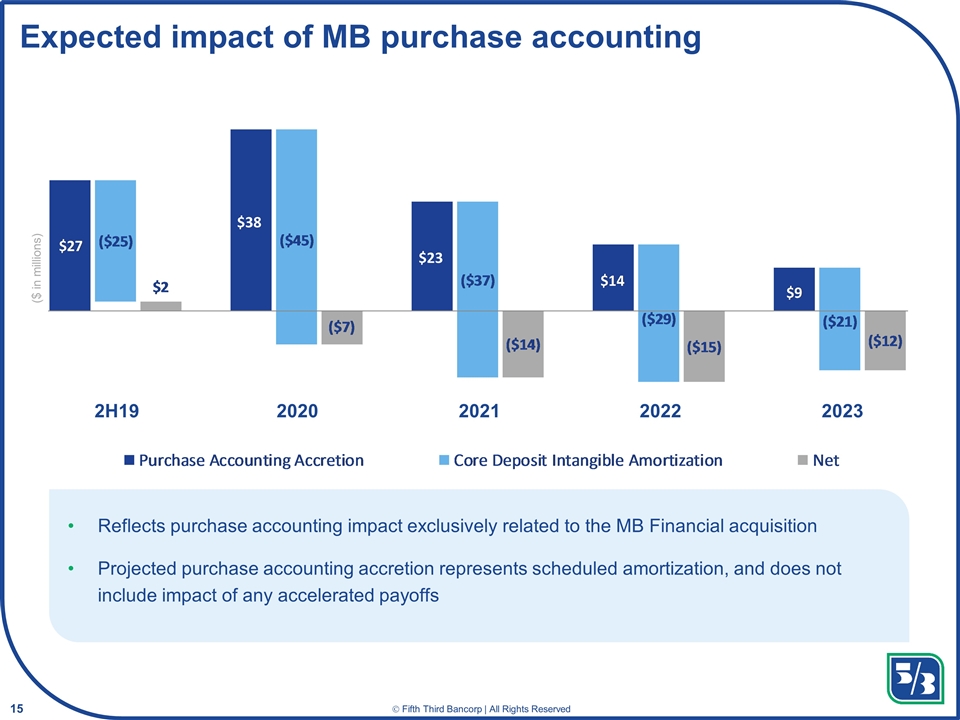

Expected impact of MB purchase accounting 2H19 2020 2021 ($ in millions) 2022 2023 Reflects purchase accounting impact exclusively related to the MB Financial acquisition Projected purchase accounting accretion represents scheduled amortization, and does not include impact of any accelerated payoffs $38 $23

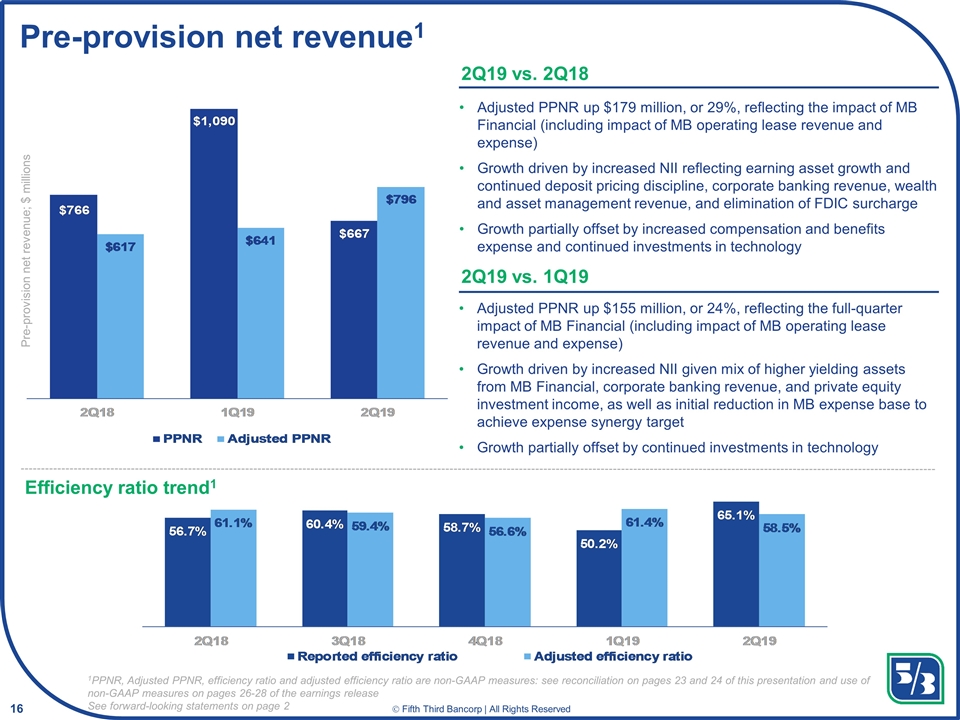

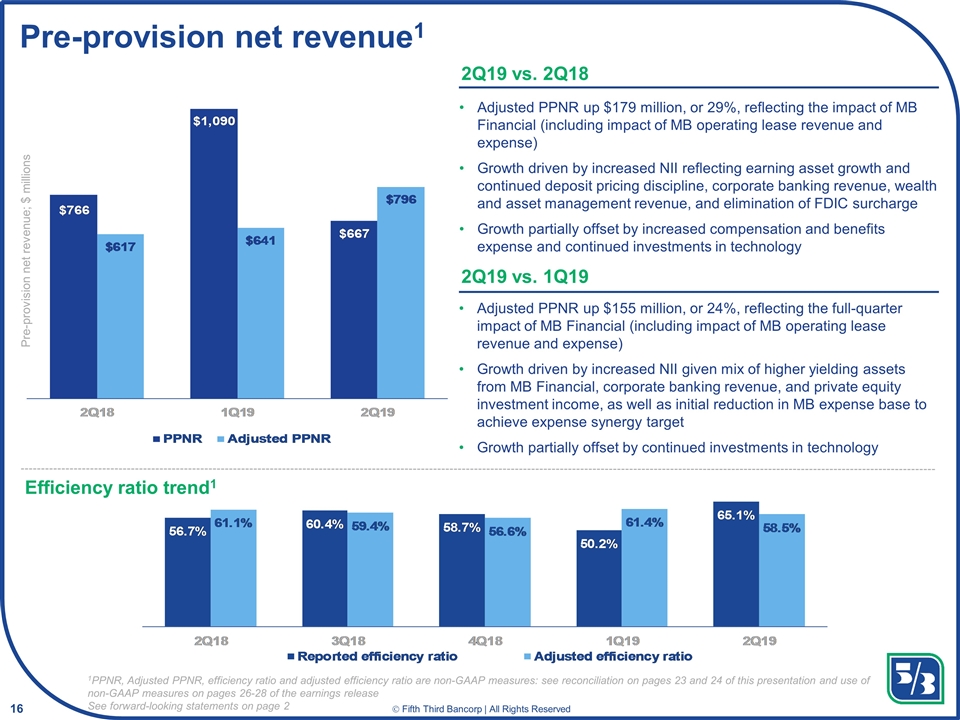

Adjusted PPNR up $179 million, or 29%, reflecting the impact of MB Financial (including impact of MB operating lease revenue and expense) Growth driven by increased NII reflecting earning asset growth and continued deposit pricing discipline, corporate banking revenue, wealth and asset management revenue, and elimination of FDIC surcharge Growth partially offset by increased compensation and benefits expense and continued investments in technology Efficiency ratio trend1 Pre-provision net revenue1 2Q19 vs. 2Q18 2Q19 vs. 1Q19 Adjusted PPNR up $155 million, or 24%, reflecting the full-quarter impact of MB Financial (including impact of MB operating lease revenue and expense) Growth driven by increased NII given mix of higher yielding assets from MB Financial, corporate banking revenue, and private equity investment income, as well as initial reduction in MB expense base to achieve expense synergy target Growth partially offset by continued investments in technology 1PPNR, Adjusted PPNR, efficiency ratio and adjusted efficiency ratio are non-GAAP measures: see reconciliation on pages 23 and 24 of this presentation and use of non-GAAP measures on pages 26-28 of the earnings release See forward-looking statements on page 2 Pre-provision net revenue; $ millions

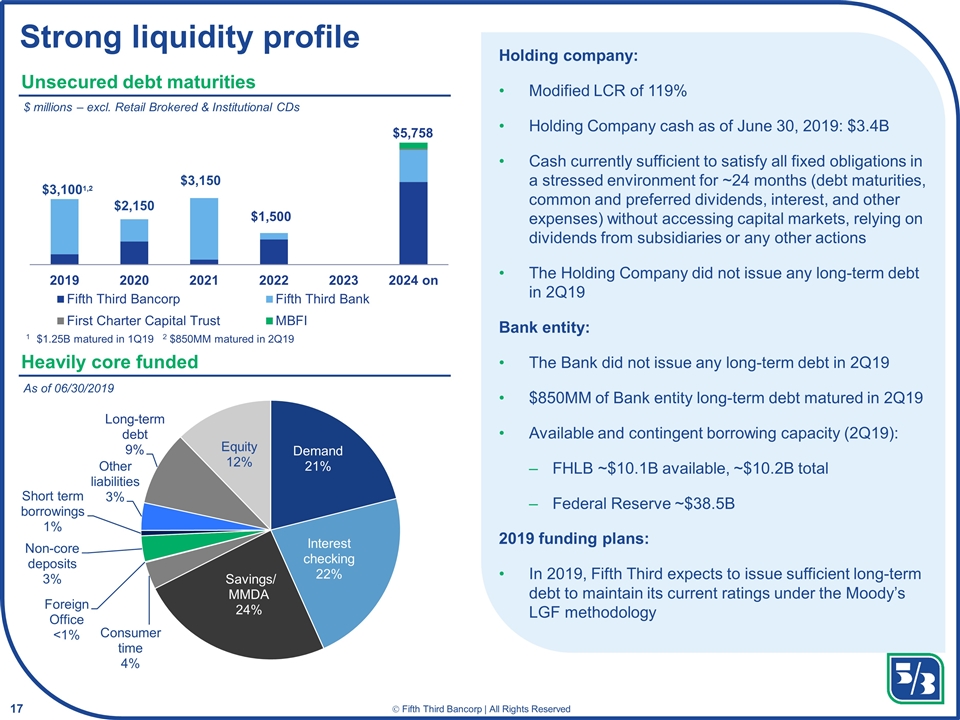

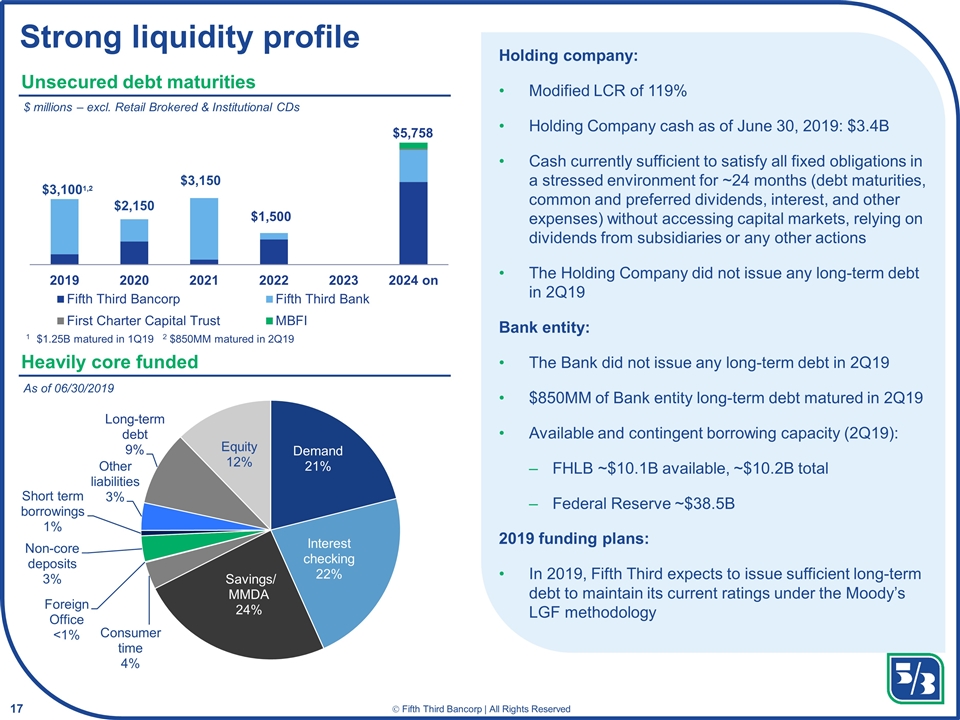

Strong liquidity profile $ millions – excl. Retail Brokered & Institutional CDs Unsecured debt maturities Heavily core funded Holding company: Modified LCR of 119% Holding Company cash as of June 30, 2019: $3.4B Cash currently sufficient to satisfy all fixed obligations in a stressed environment for ~24 months (debt maturities, common and preferred dividends, interest, and other expenses) without accessing capital markets, relying on dividends from subsidiaries or any other actions The Holding Company did not issue any long-term debt in 2Q19 Bank entity: The Bank did not issue any long-term debt in 2Q19 $850MM of Bank entity long-term debt matured in 2Q19 Available and contingent borrowing capacity (2Q19): FHLB ~$10.1B available, ~$10.2B total Federal Reserve ~$38.5B 2019 funding plans: In 2019, Fifth Third expects to issue sufficient long-term debt to maintain its current ratings under the Moody’s LGF methodology As of 06/30/2019 $3,1001,2 $2,150 1 $1.25B matured in 1Q19 2 $850MM matured in 2Q19

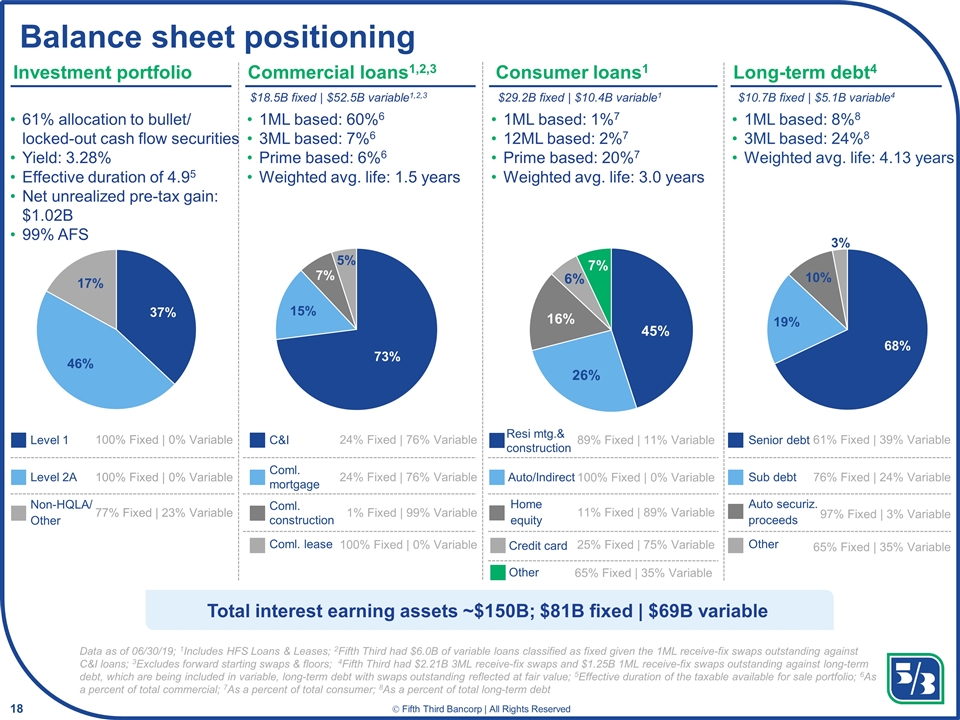

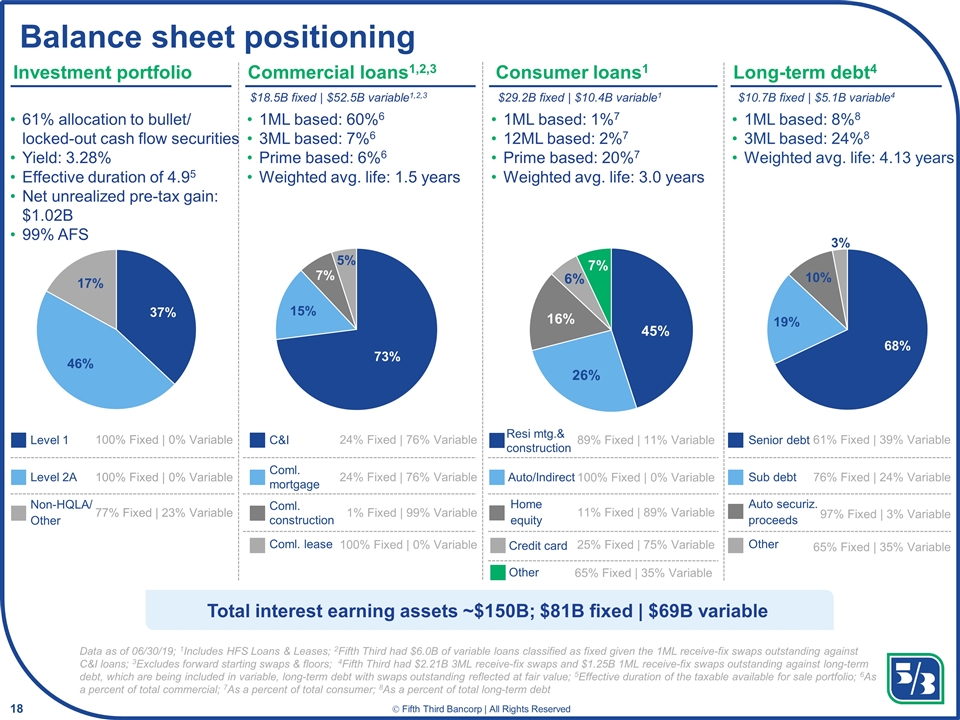

Balance sheet positioning Investment portfolio $18.5B fixed | $52.5B variable1,2,3 Commercial loans1,2,3 Consumer loans1 Long-term debt4 $29.2B fixed | $10.4B variable1 $10.7B fixed | $5.1B variable4 61% allocation to bullet/ locked-out cash flow securities Yield: 3.28% Effective duration of 4.95 Net unrealized pre-tax gain: $1.02B 99% AFS 1ML based: 60%6 3ML based: 7%6 Prime based: 6%6 Weighted avg. life: 1.5 years 1ML based: 1%7 12ML based: 2%7 Prime based: 20%7 Weighted avg. life: 3.0 years Data as of 06/30/19; 1Includes HFS Loans & Leases; 2Fifth Third had $6.0B of variable loans classified as fixed given the 1ML receive-fix swaps outstanding against C&I loans; 3Excludes forward starting swaps & floors; 4Fifth Third had $2.21B 3ML receive-fix swaps and $1.25B 1ML receive-fix swaps outstanding against long-term debt, which are being included in variable, long-term debt with swaps outstanding reflected at fair value; 5Effective duration of the taxable available for sale portfolio; 6As a percent of total commercial; 7As a percent of total consumer; 8As a percent of total long-term debt 1ML based: 8%8 3ML based: 24%8 Weighted avg. life: 4.13 years Level 1 100% Fixed | 0% Variable Level 2A 100% Fixed | 0% Variable Non-HQLA/ Other 77% Fixed | 23% Variable C&I 24% Fixed | 76% Variable Coml. mortgage 24% Fixed | 76% Variable Coml. lease 100% Fixed | 0% Variable Resi mtg.& construction 89% Fixed | 11% Variable Auto/Indirect 100% Fixed | 0% Variable Home equity 11% Fixed | 89% Variable Senior debt 61% Fixed | 39% Variable Sub debt 76% Fixed | 24% Variable Auto securiz. proceeds 97% Fixed | 3% Variable Coml. construction 1% Fixed | 99% Variable Credit card 25% Fixed | 75% Variable Other 65% Fixed | 35% Variable Other 65% Fixed | 35% Variable Total interest earning assets ~$150B; $81B fixed | $69B variable

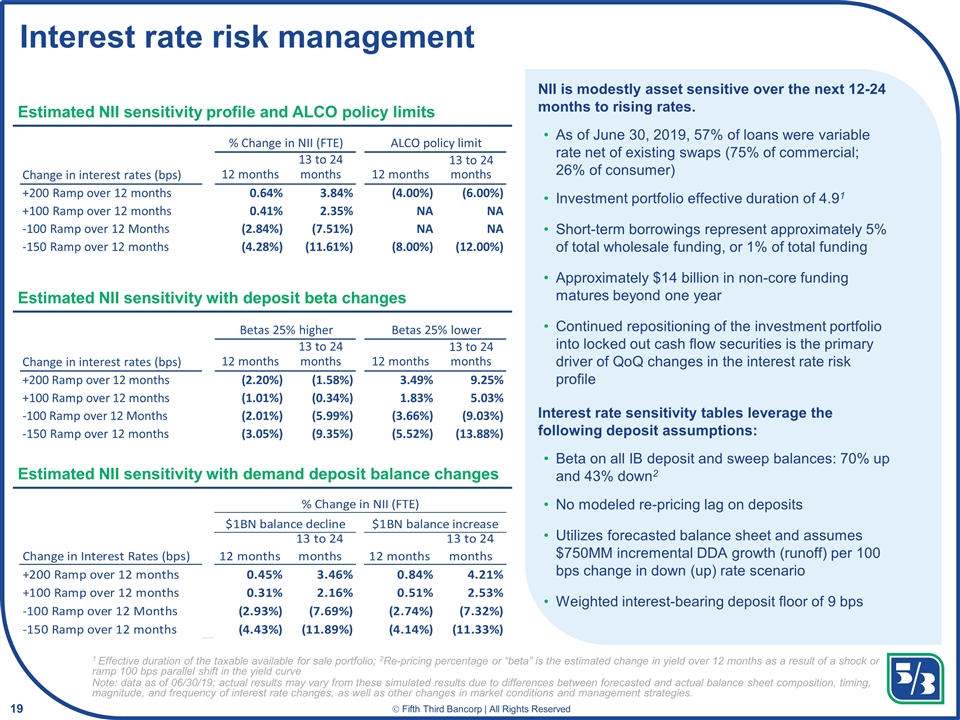

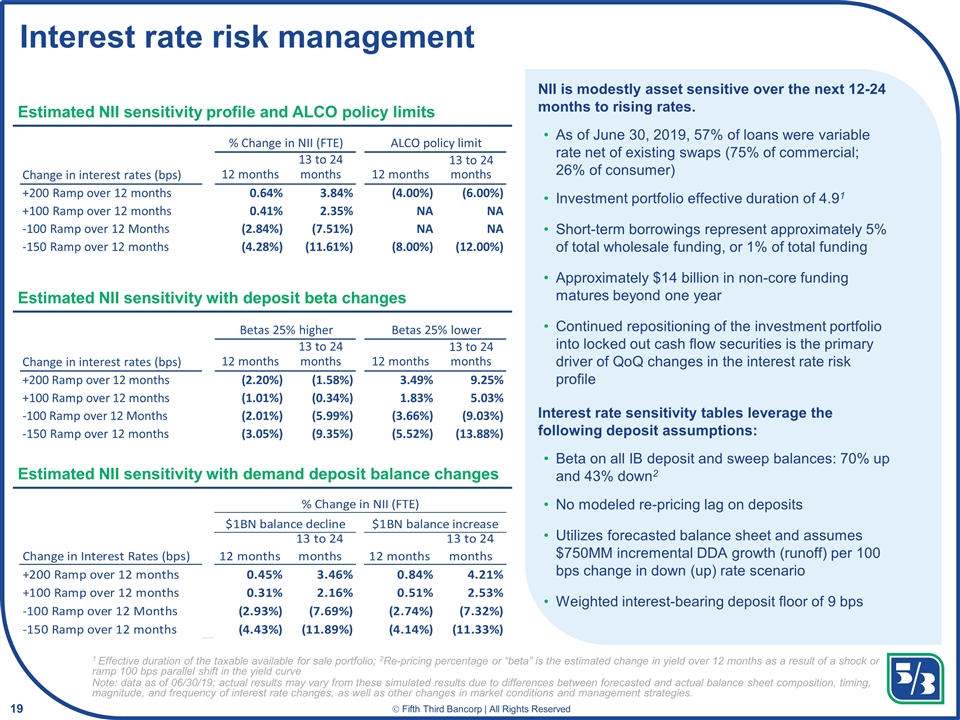

Interest rate risk management Estimated NII sensitivity profile and ALCO policy limits Estimated NII sensitivity with deposit beta changes Estimated NII sensitivity with demand deposit balance changes 1 Effective duration of the taxable available for sale portfolio; 2Re-pricing percentage or “beta” is the estimated change in yield over 12 months as a result of a shock or ramp 100 bps parallel shift in the yield curve Note: data as of 06/30/19; actual results may vary from these simulated results due to differences between forecasted and actual balance sheet composition, timing, magnitude, and frequency of interest rate changes, as well as other changes in market conditions and management strategies. NII is modestly asset sensitive over the next 12-24 months to rising rates. As of June 30, 2019, 57% of loans were variable rate net of existing swaps (75% of commercial; 26% of consumer) Investment portfolio effective duration of 4.91 Short-term borrowings represent approximately 5% of total wholesale funding, or 1% of total funding Approximately $14 billion in non-core funding matures beyond one year Continued repositioning of the investment portfolio into locked out cash flow securities is the primary driver of QoQ changes in the interest rate risk profile Interest rate sensitivity tables leverage the following deposit assumptions: Beta on all IB deposit and sweep balances: 70% up and 43% down2 No modeled re-pricing lag on deposits Utilizes forecasted balance sheet and assumes $750MM incremental DDA growth (runoff) per 100 bps change in down (up) rate scenario Weighted interest-bearing deposit floor of 9 bps Betas 25% higher Betas 25% lower Change in interest rates (bps) 12 months 13 to 24 months 12 months 13 to 24 months + 200 Ramp over 12 months (2.20%) (1.58%) 3.49% 9.25% + 100 Ramp over 12 months (1.01%) (0.34%) 1.83% 5.03% - 100 Ramp over 12 Months (2.01%) (5.99%) (3.66%) (9.03%) -150 Ramp over 12 months (3.05%) (9.35%) (5.52%) (13.88%) ALCO policy limit Change in interest rates (bps) 12 months 13 to 24 months 12 months 13 to 24 months +200 Ramp over 12 months 0.64% 3.84% (4.00%) (6.00%) +100 Ramp over 12 months 0.41% 2.35% NA NA -100 Ramp over 12 Months (2.84%) (7.51%) NA NA -150 Ramp over 12 months (4.28%) (11.61%) (8.00%) (12.00%) % Change in NII (FTE)

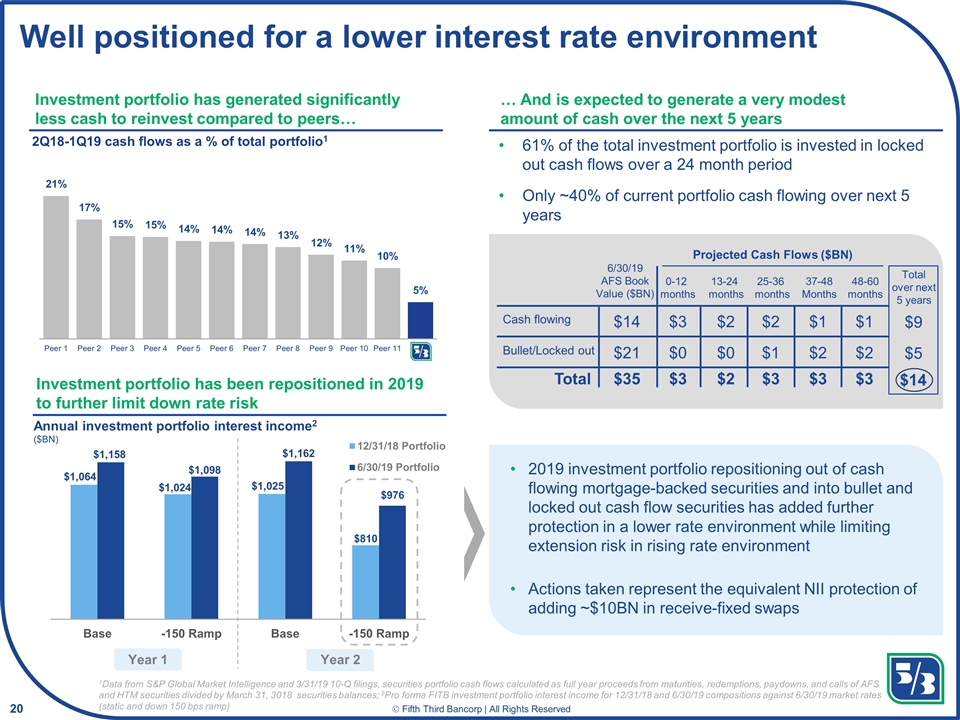

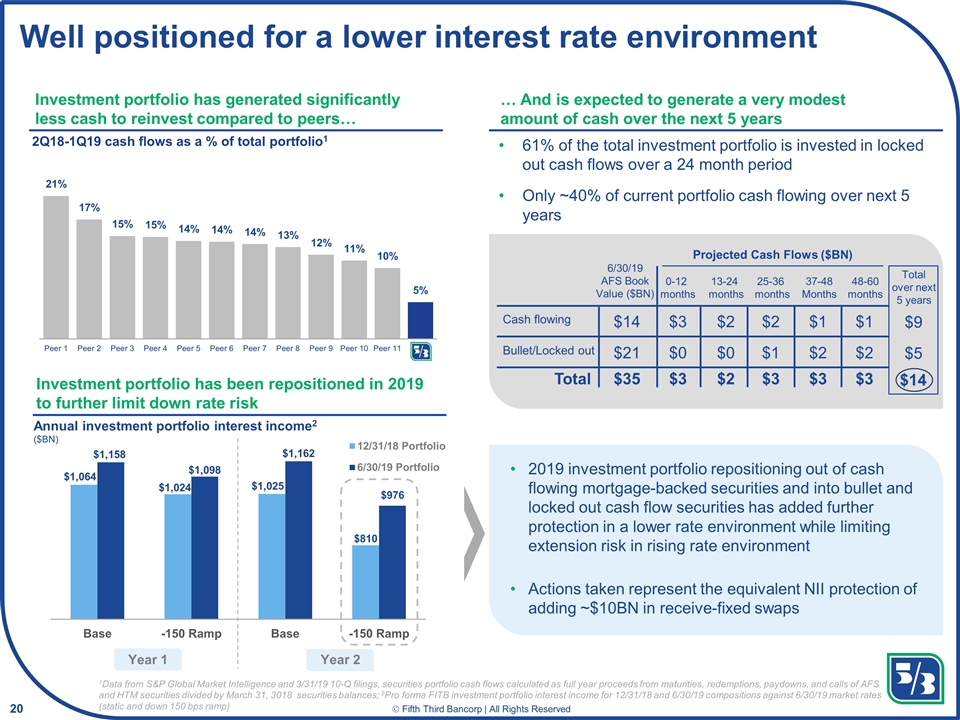

1Data from S&P Global Market Intelligence and 3/31/19 10-Q filings, securities portfolio cash flows calculated as full year proceeds from maturities, redemptions, paydowns, and calls of AFS and HTM securities divided by March 31, 3018 securities balances; 2Pro forma FITB investment portfolio interest income for 12/31/18 and 6/30/19 compositions against 6/30/19 market rates (static and down 150 bps ramp) Investment portfolio has generated significantly less cash to reinvest compared to peers… 2Q18-1Q19 cash flows as a % of total portfolio1 Investment portfolio has been repositioned in 2019 to further limit down rate risk … And is expected to generate a very modest amount of cash over the next 5 years 61% of the total investment portfolio is invested in locked out cash flows over a 24 month period Only ~40% of current portfolio cash flowing over next 5 years Year 1 Year 2 Annual investment portfolio interest income2 ($BN) 2019 investment portfolio repositioning out of cash flowing mortgage-backed securities and into bullet and locked out cash flow securities has added further protection in a lower rate environment while limiting extension risk in rising rate environment Actions taken represent the equivalent NII protection of adding ~$10BN in receive-fixed swaps Well positioned for a lower interest rate environment Cash flowing Bullet/Locked out $14 $21 $0 $3 $0 $1 $2 $2 $2 $2 $1 $1 6/30/19 AFS Book Value ($BN) 0-12 months 13-24 months 25-36 months 37-48 Months 48-60 months Projected Cash Flows ($BN) Total $35 $3 $2 $3 $3 $3 $5 $9 Total over next 5 years $14

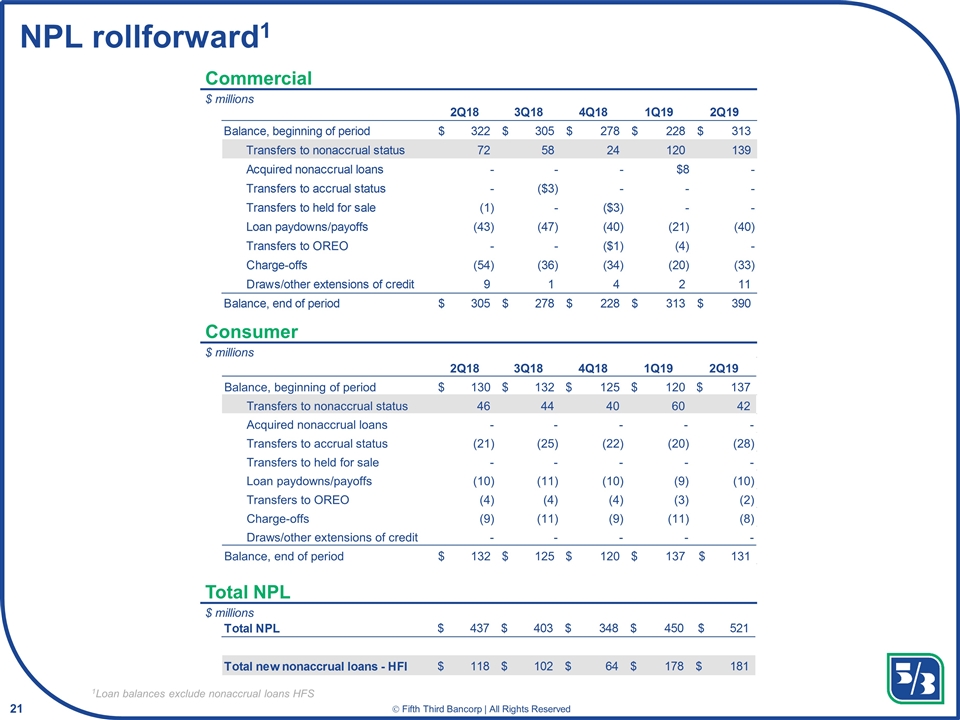

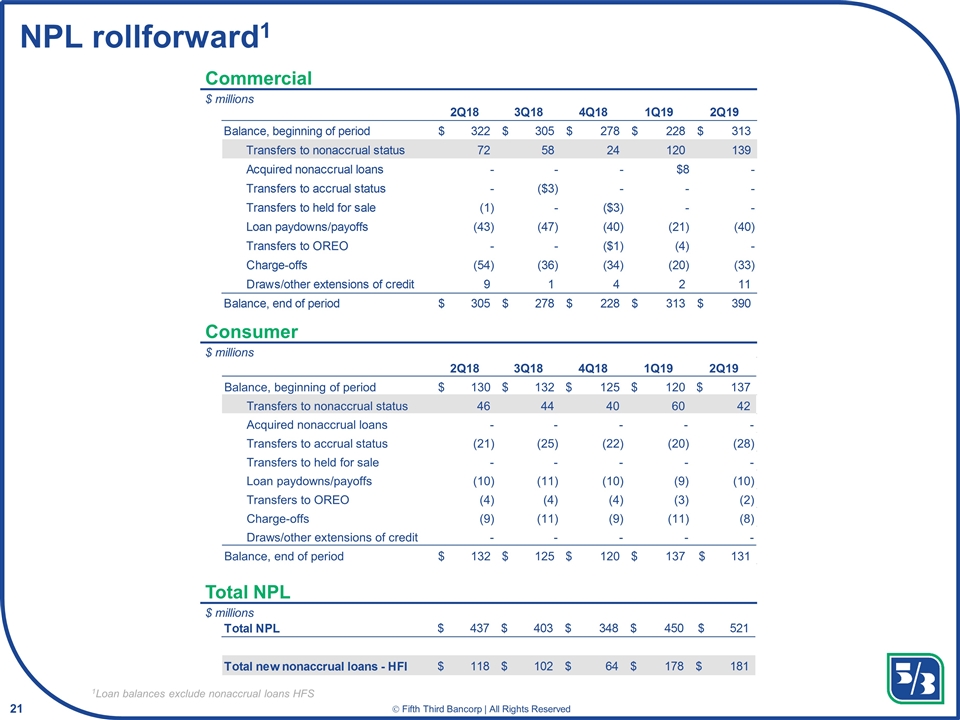

NPL rollforward1 1Loan balances exclude nonaccrual loans HFS Commercial $ millions Consumer $ millions Total NPL $ millions 2Q18 3Q18 4Q18 1Q19 2Q19 130 $ 132 $ 125 $ 120 $ 137 $ Transfers to nonaccrual status 46 44 40 60 42 Acquired nonaccrual loans - - - - - Transfers to accrual status (21) (25) (22) (20) (28) Transfers to held for sale - - - - - Loan paydowns/payoffs (10) (11) (10) (9) (10) Transfers to OREO (4) (4) (4) (3) (2) Charge-offs (9) (11) (9) (11) (8) Draws/other extensions of credit - - - - - 132 $ 125 $ 120 $ 137 $ 131 $ Balance, beginning of period Balance, end of period

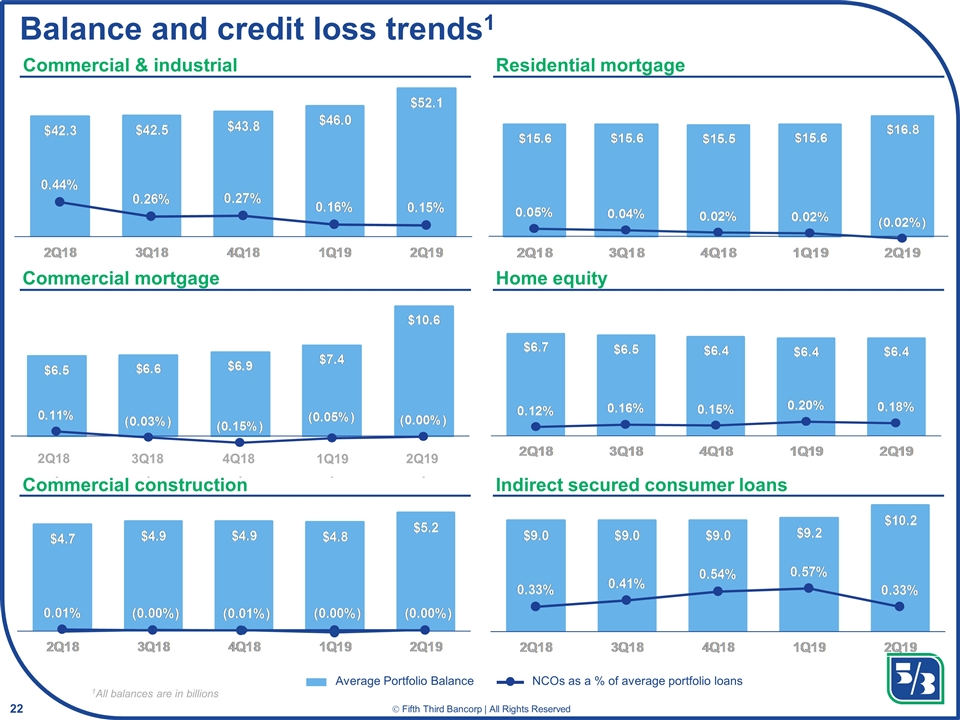

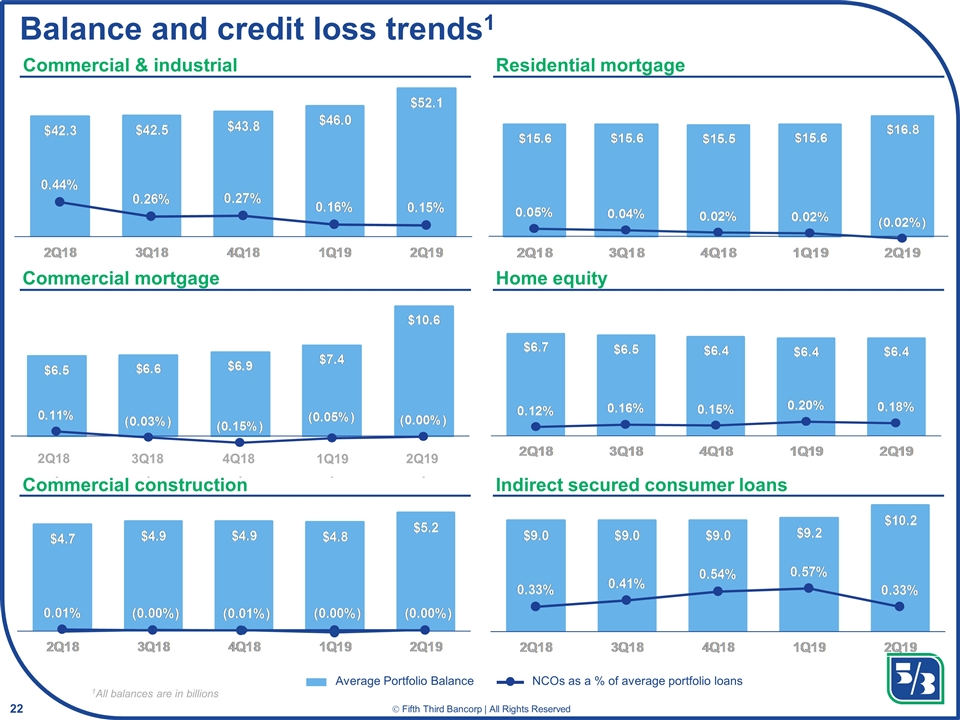

Balance and credit loss trends1 Commercial & industrial Residential mortgage Commercial mortgage Commercial construction Home equity Indirect secured consumer loans Average Portfolio Balance NCOs as a % of average portfolio loans 1All balances are in billions 2Q18 2Q19 3Q18 4Q18 1Q19

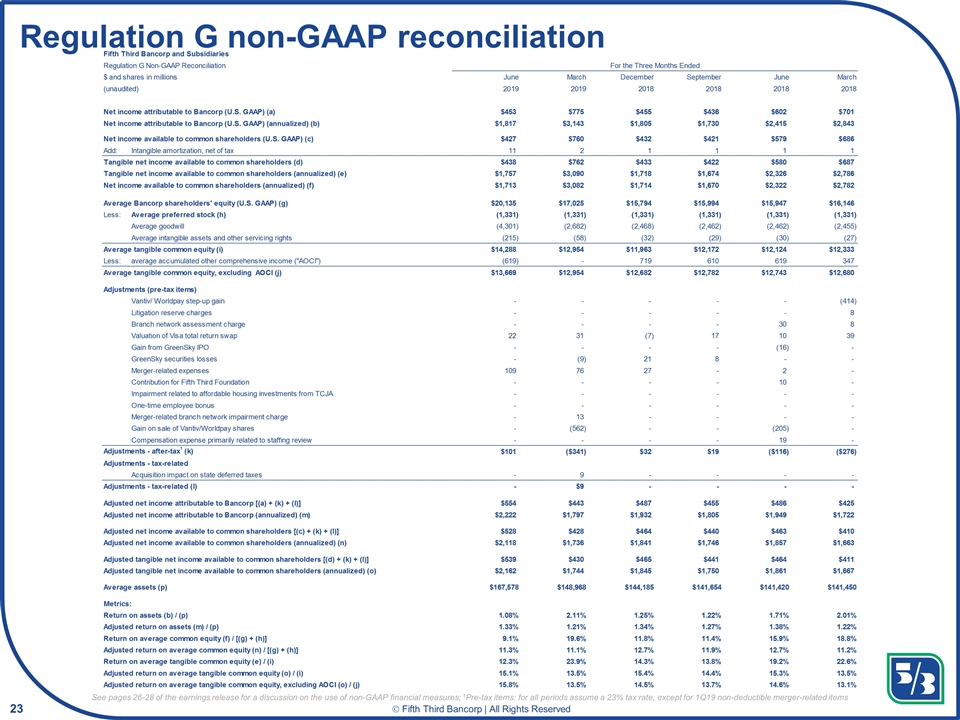

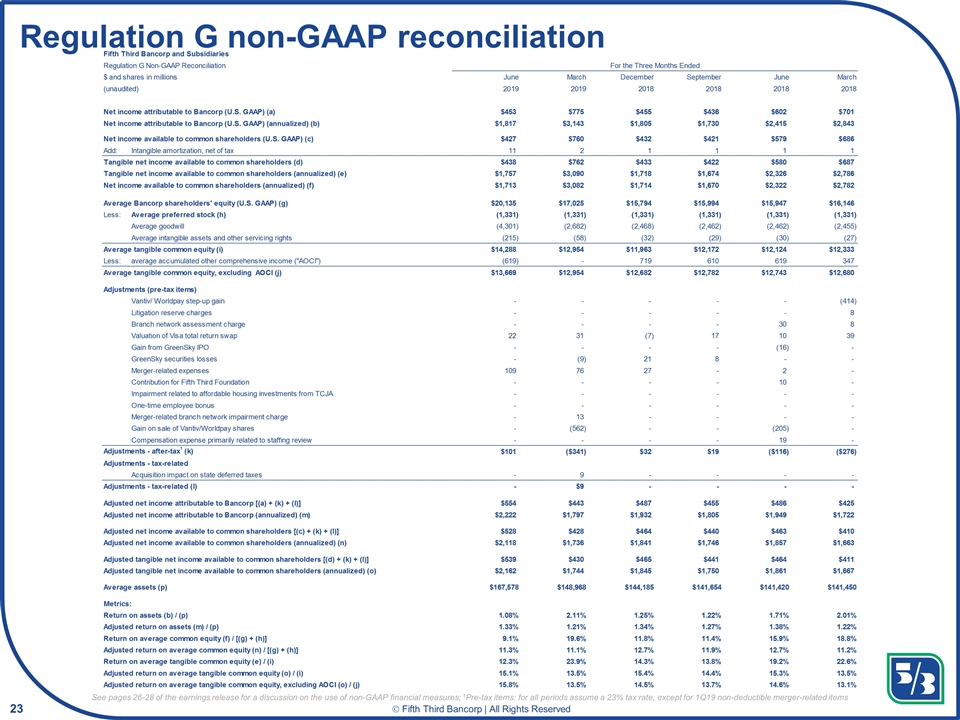

Regulation G non-GAAP reconciliation See pages 26-28 of the earnings release for a discussion on the use of non-GAAP financial measures; 1Pre-tax items: for all periods assume a 23% tax rate, except for 1Q19 non-deductible merger-related items

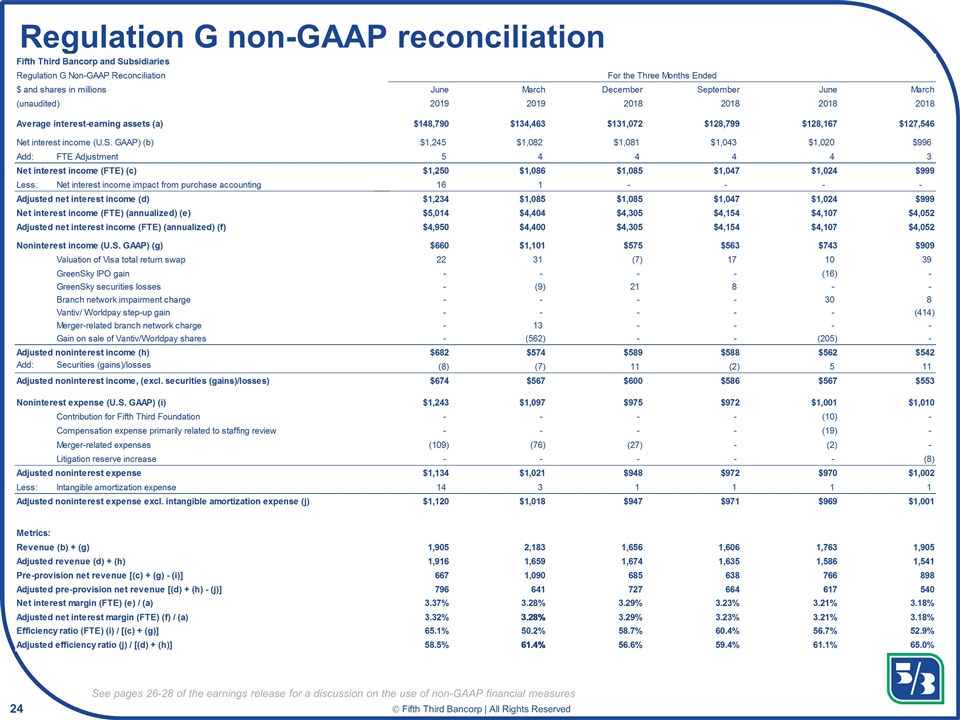

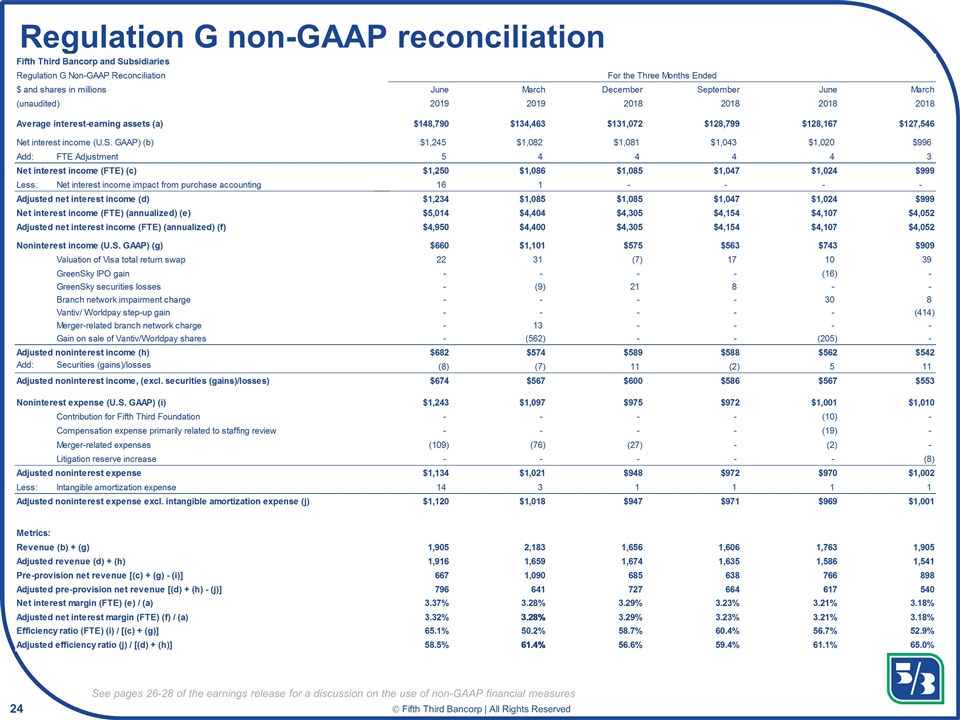

Regulation G non-GAAP reconciliation See pages 26-28 of the earnings release for a discussion on the use of non-GAAP financial measures