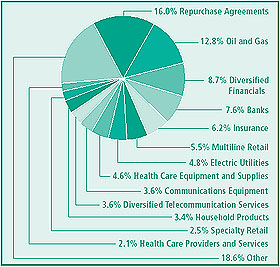

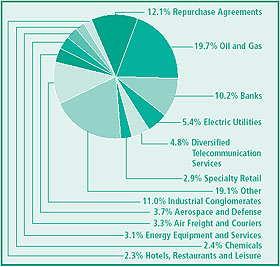

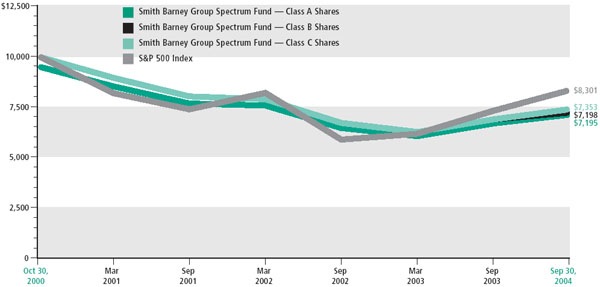

In managing the fund’s portfolio, we seek to replicate the performance of the Allocation Model by basing our investment decisions on the recommendations of the Allocation Model. Once the Allocation Model deems a sub-industry of the S&P 500 Index to be technically stronger, the fund purchases the securities of all companies in the sub-industry. Just as the Allocation Model does not select individual securities within a sub-industry, the fund does not select securities based on their individual potential to outperform the S&P 500 Index. Conversely, when the Allocation Model downgrades a sub-industry from “hold” to “avoid,” the fund will sell the securities of each issuer within the sub-industry. To the extent the recommendations of the Allocation Model or other factors do not permit the fund to be fully invested in stocks, those assets are generally allocated to money market instruments, also referred to in this Manager’s Overview as “cash”. In essence, when the Allocation Model does not identify enough sub-industries of the S&P 500 Index that are attractive to own, the fund generally invests in cash. Fund Performance For the 12 months ended September 30, 2004, the fund underperformed its benchmark index due mostly to its large cash position. While the overall market performed well over the 12 months ended September 30, 2004, there were frequent periods in the intervening weeks when our technical disciplines could not identify sub-industries that, in the Model’s evaluation, were attractive enough to own. At these times, the fund tended to maintain more significant positions in cash, which generally hurt performance against the index when the market rallied. As of September 30, 2004, the fund’s cash position was 11.13% of the fund’s total assets, although that is subject to change. Portfolio Positioning As of September 30, the fund was overweighted in the energy sector versus the benchmark. This helped relative results because energy was the strongest performing sector in the index over the last year. An underweighting in the information technology sector also enhanced relative results over the last year. Conversely, the fund’s underweight versus the benchmark in the financial sector had a negative impact on performance. Looking ahead, there are still significant uncertainties with respect to the amount of Federal Reserve Board tightening to come, the November U.S. Presidential election, and corporate earnings growth in 2005. It appears that the current lack of direction in the market, as evidenced by the recent fairly narrow trading range of the S&P 500 Index, may be a sign of investors’ wait-and-see attitude about oil prices, the economy, and potential terrorism through the end of the year. The stock market’s uncertainty over the past several months may be a signal that the economic recovery may not last. However, relatively low interest rates, coupled with steady, if not robust, economic growth and continued strong corporate profits, may provide a positive environment for equities in 2005. Thank you for your investment in the Smith Barney Group Spectrum Fund. As ever, we appreciate that you have chosen us to manage your assets and we remain focused on achieving the fund’s investment goals. Sincerely,

Kevin Kopczynski

Vice President and Investment Officer October 26, 2004 The information provided is not intended to be a forecast of future events, a guarantee of future results or investment advice. Views expressed may differ from those of the firm as a whole. RISKS: Investors in the fund could lose money if the Allocation Model’s sub-industry recommendations are incorrect; if the U.S. stock markets perform poorly relative to other types of investments; if the fund is unable to achieve a high correlation with the performance of the Allocation Model. The fund may concentrate its investments in certain sectors, which may increase the fund’s volatility. The fund may use derivatives, such as options and futures, which can be illiquid, may disproportionately increase losses, and have a potentially large impact on fund performance. All index performance reflects no deduction for fees, expenses or taxes. Please note an investor cannot invest directly in an index. |