UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-3275

Smith Barney Investment Funds Inc.

(Exact name of registrant as specified in charter)

125 Broad Street, New York, NY 10004

(Address of principal executive offices) (Zip code)

Robert I. Frenkel, Esq.

Legg Mason & Co., LLC

300 First Stamford Place, 4th Floor

Stamford, CT 06902

(Name and address of agent for service)

Registrant’s telephone number, including area code: (800) 451-2010

Date of fiscal year end: December 31

Date of reporting period: December 31, 2005

ITEM 1. REPORT TO STOCKHOLDERS.

The Annual Report to Stockholders is filed herewith.

EXPERIENCE

ANNUAL REPORT

DECEMBER 31, 2005

Smith Barney

Investment Grade Bond Fund

INVESTMENT PRODUCTS: NOT FDIC INSURED • NO BANK GUARANTEE • MAY LOSE VALUE

Smith Barney Investment Grade Bond Fund

Annual Report • December 31, 2005

What’s

Inside

Fund Objective

The Fund seeks as high a level of current income as is consistent with prudent investment management and preservation of capital.

Under a licensing agreement between Citigroup and Legg Mason, the names of funds, the names of any classes of shares of funds, and the names of investment advisers of funds, as well as all logos, trademarks and service marks related to Citigroup or any of its affiliates (“Citi Marks”) are licensed for use by Legg Mason. Citi Marks include, but are not limited to, “Smith Barney,” “Salomon Brothers,” “Citi” and “Citigroup Asset Management”. Legg Mason and its affiliates, as well as the Fund’s investment manager, are not affiliated with Citigroup.

All Citi Marks are owned by Citigroup, and are licensed for use until no later than one year after the date of the licensing agreement.

Letter from the Chairman

R. JAY GERKEN, CFA

Chairman, President and Chief Executive Officer

Dear Shareholder,

Despite numerous obstacles, including rising short-term interest rates, surging oil prices, a destructive hurricane season, and geopolitical issues, the U.S. economy continued to expand at a healthy pace during the reporting period. After a 3.8% advance in the first quarter of 2005, gross domestic product (“GDP”)i growth was 3.3% during the second quarter and 4.1% in the third quarter. While fourth quarter figures have not yet been released, another slight gain is anticipated.

Given the strength of the economy and inflationary pressures, the Federal Reserve Board (“Fed”)ii continued to raise interest rates throughout the period. After raising rates five times from June 2004 through December 2004, the Fed increased its target for the federal funds rateiii in 0.25% increments eight additional times over the reporting period. This represents the longest sustained Fed tightening cycle since the 1970s. All told, the Fed’s thirteen rate hikes have brought the target for the federal funds rate from 1.00% to 4.25%. After the end of the Fund’s reporting period, at its January meeting, the Fed once again raised its target for the federal funds rate by 0.25% to 4.50%.

As the year began, it was widely expected that both short- and long-term interest rates would rise. This panned out with short-term interest rates, as two-year U.S. Treasury notes’ yields rose from 3.08% to 4.41% over the 12-month period ended December 31, 2005. However, while there were periods of volatility, over the same period long-term interest rates experienced only a modest increase, as yields on 10-year U.S. Treasury notes rose from 4.24% to 4.37%. In late December, the yield curve inverted as the yields on two-year U.S. Treasury notes exceeded those of 10-year U.S. Treasury notes. This anomaly has historically foreshadowed an economic slowdown or recession.

Smith Barney Investment Grade Bond Fund I

Looking at the one-year period as a whole, the overall bond market, as measured by the Lehman Brothers Aggregate Bond Indexiv, returned 2.43%.

After two years of strong returns in 2003 and 2004, the high-yield bond market took a step backwards in 2005. While corporate balance sheets generally continued to strengthen and corporate profits were strong overall, these positive developments took a back seat to the highly publicized downgrades of General Motors Corporation and Ford Motor Company. However, later in the year the high-yield bond market rallied as the uncertainty surrounding the downgrades lifted and investors searched for incremental yield. During the one-year period ended December 31, 2005, the Citigroup High Yield Market Indexv returned 2.08%.

Emerging markets debt had another strong year in 2005, as the JPMorgan Emerging Markets Bond Index Global (“EMBI Global”)vi returned 10.73%. Many issuers in emerging market countries have improved their balance sheets in recent years. In addition, strong domestic demand and high energy and commodity prices, including prices of oil, metals, and agriculture, supported many emerging market countries. This more than offset the potential negatives associated with rising U.S. interest rates.

Please read on for a more detailed look at prevailing economic and market conditions during the Fund’s fiscal year and to learn how those conditions have affected Fund performance.

Special Shareholder Notices

On December 1, 2005, Citigroup Inc. (“Citigroup”) completed the sale of substantially all of its asset management business, Citigroup Asset Management (“CAM”), to Legg Mason, Inc. (“Legg Mason”). As a result, the fund’s investment manager (the “Manager”), previously an indirect wholly-owned subsidiary of Citigroup, has become a wholly-owned subsidiary of Legg Mason. Completion of the sale caused the Fund’s existing investment management contract to terminate. The Fund’s shareholders previously approved a new investment management contract between the Fund and the Manager, which became effective on December 1, 2005.

II Smith Barney Investment Grade Bond Fund

On or about April 7, 2006, the Smith Barney Investment Grade Bond Fund will be renamed Legg Mason Partners Investment Grade Bond Fund.

Information About Your Fund

As you may be aware, several issues in the mutual fund industry have recently come under the scrutiny of federal and state regulators. The Manager and some of its affiliates have received requests for information from various government regulators regarding market timing, late trading, fees, and other mutual fund issues in connection with various investigations. The regulators appear to be examining, among other things, the Fund’s response to market timing and shareholder exchange activity, including compliance with prospectus disclosure related to these subjects. The Fund has been informed that the Manager and its affiliates are responding to those information requests, but are not in a position to predict the outcome of these requests and investigations.

Important information concerning the Fund and its Manager with regard to recent regulatory developments is contained in the Notes to Financial Statements included in this report.

Smith Barney Investment Grade Bond Fund III

As always, thank you for your confidence in our stewardship of your assets. We look forward to helping you continue to meet your financial goals.

Sincerely,

R. Jay Gerken, CFA

Chairman, President and Chief Executive Officer

February 2, 2006

All index performance reflects no deduction for fees, expenses or taxes. Please note that an investor cannot invest directly in an index.

| i | | Gross domestic product is a market value of goods and services produced by labor and property in a given country. |

| ii | | The Federal Reserve Board is responsible for the formulation of a policy designed to promote economic growth, full employment, stable prices, and a sustainable pattern of international trade and payments. |

| iii | | The federal funds rate is the interest rate that banks with excess reserves at a Federal Reserve district bank charge other banks that need overnight loans. |

| iv | | The Lehman Brothers Aggregate Bond Index is a broad-based bond index comprised of government, corporate, mortgage and asset-backed issues, rated investment grade or higher and having at least one year to maturity. |

| v | | The Citigroup High Yield Market Index is a broad-based unmanaged index of high yield securities. |

| vi | | JPMorgan Emerging Markets Bond Index Global (EMBI Global) tracks total returns for U.S. dollar denominated debt instruments issued by emerging market sovereign and quasi-sovereign entities: Brady bonds, loans, Eurobonds, and local market instruments. Countries covered are Algeria, Argentina, Brazil, Bulgaria, Chile, China, Colombia, Cote d’Ivoire, Croatia, Ecuador, Greece, Hungary, Lebanon, Malaysia, Mexico, Morocco, Nigeria, Panama, Peru, the Philippines, Poland, Russia, South Africa, South Korea, Thailand, Turkey and Venezuela. |

IV Smith Barney Investment Grade Bond Fund

Manager Overview

Special Shareholder Notice

Effective February 10, 2006, the Manager appointed the following team to assume the day-to-day portfolio management responsibilities for the Fund: S. Kenneth Leech, Stephen A. Walsh, James V. Nelson, Jeffery D. Van Schaick and Carl L. Eichstaedt.

Each of the new portfolio managers is a portfolio manager of Western Asset Management Company (“Western Asset”), which, like the manager, is a subsidiary of Legg Mason. Messrs. Leech, Walsh, Nelson, Van Schaick and Eichstaedt have been employed by Western Asset for more than five years.

The team consists of portfolio managers, sector specialists and other investment professionals. The portfolio managers lead the team, and their focus is on portfolio structure, including sector allocation, duration weighting and term structure decisions.

Q. What were the overall market conditions during the Fund’s reporting period?

A. During the 12 months ended December 31, 2005, the markets were primarily driven by Federal Reserve Board (“Fed”)i activity, employment and inflation data and rising energy costs, exacerbated by the devastating impact of Hurricane Katrina on the U.S. Gulf Coast. The Fed’s eight “measured” 25-basis-point hikes during the period brought the federal funds rateii from 2.25% to 4.25% by period end. After the end of the Fund’s reporting period, at its January meeting, the Fed once again raised its target for the federal funds rate 0.25% to 4.50%. These measured, consecutive rate hikes exerted upward pressure on short-term bond yields, driving 2-year yields up about 134 basis points during the 12 months. However, in what Fed Chairman Alan Greenspan termed a “conundrum,” yields on the long bond stayed low during the period, declining 29 basis points over the 12 months. This sharp rise in shorter yields and decline in longer yields resulted in the extensive yield curve flattening seen throughout the period and, near year end, a brief yield curve inversion as 2-year U.S. Treasury yields broke above 10-year U.S. Treasury yields on stronger-than-expected housing starts.

As the market appeared to fully expect each 25-basis-point hike in the federal funds rate during the period — thanks to the Fed’s well-telegraphed intentions to raise rates at a measured pace — investors spent much of the period dissecting language from the Fed for clues on its assessment of the U.S. economy and the pace of rate hikes. The Fed reiterated throughout much of the year that it would increase rates “at a pace that is likely to be measured,” noting that core inflation remained low through the year and long-term inflation expectations were “contained”. However, higher energy costs, exacerbated by the supply disruption following Hurricanes Katrina and Rita, augmented already building inflationary pressure. Although the Fed maintained its “measured” language until the very end of the quarter due to continued strong economic growth and manageable inflation, in an important departure from previous accompanying statements, the Federal Open Market Committee (FOMC) removed its characterization of monetary policy as “accommodative” in its December statement, as well as the signal phrase “at a pace that is likely to be measured”, a key indicator of future rate hikes. The overall tone of the

Smith Barney Investment Grade Bond Fund 2005 Annual Report 1

December statement also indicated that monetary policy decisions will become more data-dependent as the Fed shifts from its focus on reaching neutral to limiting pricing pressures. The nomination of Ben Bernanke in October as Fed Chairman Alan Greenspan’s replacement also affected the financial markets, leaving open the question of future policy direction, as Mr. Bernanke’s specific focus and leadership skills are, in part, unknown.

Economic growth remained remarkably resilient during the annual period, particularly in light of the volatility seen in employment indicators and mixed industrial production, retail sales and consumer sentiment during Spring 2005 and in the aftermath of Fall 2005’s Hurricanes Katrina and Rita. Although the pace of improvement remained uneven month to month, the U.S. labor market trended broadly positive during the annual period, continuing the upswing in employment that began in early 2004. Unemployment fell through the majority of the period, declining from 5.4% in December 2004 to 4.9% in December 2005. While September 2005 saw a 0.2% month-over-month uptick in unemployment to 5.1% as the dislocation in the Gulf region flowed through the economy, the unemployment rate shifted back down in the fourth quarter. An exceedingly strong housing market also supported economic growth during the year, continuing its upward charge through the period despite some softening by year end.

Industrial production and retail sales remained broadly positive through most of the period, even considering the volatility in the auto sector as General Motors Corporation and Ford Motor Company were successively downgraded by three major statistical credit rating agencies to below investment grade in Spring 2005. While auto sales dragged headline retail numbers by period end, as reductions in auto production hit the market and the highly successful automotive dealer incentive packages offered through the summer came to an end, overall retail sales (ex-autos) remained reasonably stable. Industrial production declined in September on the impact of the hurricanes but rebounded sharply in October, resuming the strong upswing seen through the majority of the annual period. Consumer confidence, which plummeted through the Fall, ended the year up slightly at 103.6 versus December 2004’s 102.3 reading, as gasoline prices fell in the fourth quarter.

Despite the resilience of the U.S. economy during the period, slowing global growth, broadly rising inflation and higher oil prices undoubtedly restrained economic activity during the 12 months. U.S. gross domestic product (“GDP”)iii growth declined year-over-year to 3.8% growth in first quarter 2005 (from first quarter 2004’s 4.5% pace) and 3.3% growth in second quarter 2005 (from second quarter 2004’s 3.5% pace). While economic growth rebounded into the third quarter, gaining 4.1% on an annualized basis, the recovery was at least partially fueled by the massive fiscal stimulus injected into the Gulf region in the wake of the hurricanes. Therefore, although growth remained strong throughout the period, fears of potential slowing, combined with increasing inflation, drove markets. Oil prices, which breached $70 per barrel in late August before drifting back down to the mid-$60s, also cast a pall on growth and consumer spending expectations.

While inflationary pressures from sustained high commodity prices began to creep into the economy, particularly near the end of the year, continued strong growth and limited

2 Smith Barney Investment Grade Bond Fund 2005 Annual Report

wage pressures kept long-term inflation expectations relatively “contained” through 2005. Core inflation rates, in particular, remained at moderate levels, with core Consumer Price Index (CPI)iv inflation consistently registering below market expectations through early Fall despite growing inflationary pressure. Inflation fears tapered off slightly during the last two months of the quarter as energy costs came off their September highs, with headline inflation even surprising on the downside in December. However, despite the apparently moderate pace of inflation through 2005, the Fed remained extremely vigilant, as some inflation pressures began to seep into producer prices and U.S. economic growth continued at its surprisingly strong pace. Consistently high energy prices also began to push up core CPI inflation by December-end, stopping its downward month-to-month drift to end the year with a 0.2% month-over-month increase in December, near the upper end of the Fed’s apparent comfort range.

Performance Review

For the 12 months ended December 31, 2005, Class A shares of the Smith Barney Investment Grade Bond Fund, excluding sales charges, returned 1.82%. These shares underperformed the Lipper Corporate Debt Funds A-Rated Funds Category Average,1 which increased 1.90%. The Fund’s unmanaged benchmarks, the Lehman Brothers Long-Term Credit Bond Indexv and the Citigroup Credit Index 10+vi, returned 3.76% and 4.00%, respectively, for the same period.

| | | | |

| Performance Snapshot as of December 31, 2005 (excluding sales charges) (unaudited) |

| | |

| | | 6 Months | | 12 Months |

Investment Grade Bond Fund — Class A Shares | | -2.42% | | 1.82% |

|

Lehman Brothers Long-Term Credit Bond Index | | -1.79% | | 3.76% |

|

Citigroup Credit Index 10+ | | -1.71% | | 4.00% |

|

Lipper Corporate Debt Funds A-Rated Funds Category Average1 | | -0.33% | | 1.90% |

|

| | | | |

| The performance shown represents past performance. Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown above. Principal value and investment returns will fluctuate and investors’ shares, when redeemed, may be worth more or less than their original cost. To obtain performance data current to the most recent month-end, please visit our website at www.citigroupam.com. |

All share class returns assume the reinvestment of all distributions, including returns of capital, if any, at net asset value and the deduction of all Fund expenses. Returns have not been adjusted to include sales charges that may apply when shares are purchased or the deduction of taxes that a shareholder would pay on Fund distributions. Excluding sales charges, Class B shares returned -2.70%, Class C shares returned -2.74% and Class Y shares returned -2.22% over the six months ended December 31, 2005. Excluding sales charges, Class B shares returned 1.27%, Class C shares returned 1.24% and Class Y shares returned 2.23% over the 12 months ended December 31, 2005. |

1 Lipper, Inc. is a major independent mutual-fund tracking organization. Returns are based on the period ended December 31, 2005, including the reinvestment of all distributions, including returns of capital, if any, calculated among the 187 funds for the six-month period and among the 183 funds for the 12-month period in the Fund’s Lipper category and excluding sales charges. |

Smith Barney Investment Grade Bond Fund 2005 Annual Report 3

Q. What were the most significant factors affecting Fund performance?

What were the leading contributors to performance?

A. Our yield curve and interest rate management contributed positively to Fund performance during the annual period. The Fund’s portfolio had a shorter average duration earlier in the period but we increased it in the second half. We also maintained a “yield curve flattener trade” during the first half of the period, by which we overweighted the very short and long ends of the curve in anticipation of continued flattening in the U.S. Treasury yield curve.

What were the leading detractors from performance?

A. The portfolio’s shorter duration posture versus the Fund’s benchmarks detracted from performance throughout the period, as the longer end (10+ year) of the yield curve held up better than many market participants expected.

Q. Were there any significant changes to the Fund during the reporting period?

A. We increased both our U.S. Treasury and spread duration during the annual period due to the remarkable yield curve flattening seen during the 12 months ended December 31, 2005. (Duration is a measure of a portfolio’s price sensitivity to interest rate movements. A shorter duration helps cushion price declines in the event of rising rates.) We also removed our “yield curve flattener trade”, in which we had underweighted the short end of the yield curve and overweighted the long end.

We reduced total short-term investments and slightly reduced our minimal exposure to mortgage-backed securities and U.S. agency securities in the portfolio.

4 Smith Barney Investment Grade Bond Fund 2005 Annual Report

Thank you for your investment in the Smith Barney Investment Grade Bond Fund. As ever, we appreciate that you have chosen us to manage your assets and we remain focused on achieving the Fund’s investment goals.

Sincerely,

| | |

. .

David A. Torchia Portfolio Manager | |

Gerald J. Culmone Portfolio Manager |

February 2, 2006

The information provided is not intended to be a forecast of future events, a guarantee of future results or investment advice. Views expressed may differ from those of the firm as a whole.

RISKS: Keep in mind, the Fund is subject to credit risks and fluctuations in share price as interest rates rise and fall. Investments in bonds are subject to interest rate and credit risks. As interest rates rise, bond prices fall, reducing the value of the Fund’s share price. The Fund is subject to certain risks of overseas investing, including currency fluctuations and changes in political and economic conditions. The Fund has greater sensitivity to changes in interest rates than a fund investing in securities with shorter maturities. The Fund may use derivatives, such as options and futures, which can be illiquid, may disproportionately increase losses, and have a potentially large impact on Fund performance. Please see the Fund’s prospectus for more information on these and other risks.

All index performance reflects no deduction for fees, expenses or taxes. Please note an investor cannot invest directly in an index.

| i | | The Federal Reserve Board is responsible for the formulation of a policy designed to promote economic growth, full employment, stable prices, and a sustainable pattern of international trade and payments. |

| ii | | The federal funds rate is the interest rate that banks with excess reserves at a Federal Reserve district bank charge other banks that need overnight loans. |

| iii | | Gross domestic product is a market value of goods and services produced by labor and property in a given country. |

| iv | | The Consumer Price Index measures the average change in U.S. consumer prices over time in a fixed market basket of goods and services determined by the U.S. Bureau of Labor Statistics. |

| v | | The Lehman Brothers Long-Term Credit Bond Index is a broad-based unmanaged index of investment-grade corporate bonds. |

| vi | | The Citigroup Credit Index 10+ is an unmanaged broad-based index of corporate bonds with maturities greater than 10 years. |

Smith Barney Investment Grade Bond Fund 2005 Annual Report 5

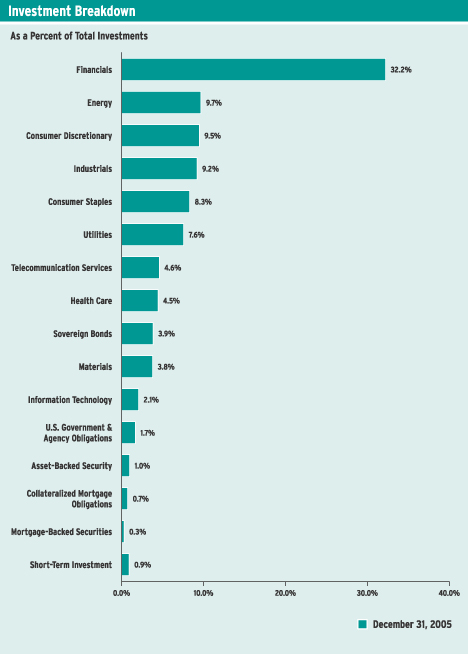

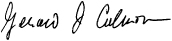

Fund at a Glance (unaudited)

6 Smith Barney Investment Grade Bond Fund 2005 Annual Report

Fund Expenses (unaudited)

Example

As a shareholder of the Fund, you may incur two types of costs: (1) transaction costs, including front-end and back-end sales charges (loads) on purchase payments; and (2) ongoing costs, including management fees; distribution and/or service (12b-1) fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

This example is based on an investment of $1,000 invested on July 1, 2005 and held for the six months ended December 31, 2005.

Actual Expenses

The table below titled “Based on Actual Total Return” provides information about actual account values and actual expenses. You may use the information provided in this table, together with the amount you invested, to estimate the expenses that you paid over the period. To estimate the expenses you paid on your account, divide your ending account value by $1,000 (for example, an $8,600 ending account value divided by $1,000 = 8.6), then multiply the result by the number under the heading entitled “Expenses Paid During the Period”.

| | | | | | | | | | | | | | | |

| Based on Actual Total Return(1) | | | | | | | | | | | | | |

| | | | | |

| | | Actual Total

Return Without

Sales Charges(2) | | | Beginning

Account

Value | | Ending

Account

Value | | Annualized

Expense

Ratio | | | Expenses

Paid During

the Period(3) |

Class A | | (2.42 | )% | | $ | 1,000.00 | | $ | 975.80 | | 1.05 | % | | $ | 5.23 |

|

Class B | | (2.70 | ) | | | 1,000.00 | | | 973.00 | | 1.59 | | | | 7.91 |

|

Class C | | (2.74 | ) | | | 1,000.00 | | | 972.60 | | 1.70 | | | | 8.45 |

|

Class Y | | (2.22 | ) | | | 1,000.00 | | | 977.80 | | 0.65 | | | | 3.24 |

|

| (1) | | For the six months ended December 31, 2005. |

| (2) | | Assumes reinvestment of all distributions, including returns of capital, if any, at net asset value and does not reflect the deduction of the applicable sales charges with respect to Class A shares or the applicable contingent deferred sales charges (“CDSC”) with respect to Class B and C shares. Total return is not annualized, as it may not be representative of the total return for the year. Past performance is no guarantee of future results. |

| (3) | | Expenses are equal to each class’ respective annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year, then divided by 365. |

Smith Barney Investment Grade Bond Fund 2005 Annual Report 7

Fund Expenses (unaudited) (continued)

Hypothetical Example for Comparison Purposes

The table below titled “Based on Hypothetical Total Return” provides information about hypothetical account values and hypothetical expenses based on the actual expense ratio and an assumed rate of return of 5.00% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use the information provided in this table to compare the ongoing costs of investing in the Fund and other funds. To do so, compare the 5.00% hypothetical example relating to the Fund with the 5.00% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table below are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as front-end or back-end sales charges (loads). Therefore, the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transaction costs were included, your costs would have been higher.

| | | | | | | | | | | | | | | |

| Based on Hypothetical Total Return(1) |

| | | | | |

| | | Hypothetical

Annualized

Total Return | | | Beginning

Account

Value | | Ending

Account

Value | | Annualized

Expense

Ratio | | | Expenses

Paid During

the Period(2) |

Class A | | 5.00 | % | | $ | 1,000.00 | | $ | 1,019.91 | | 1.05 | % | | $ | 5.35 |

|

Class B | | 5.00 | | | | 1,000.00 | | | 1,017.19 | | 1.59 | | | | 8.08 |

|

Class C | | 5.00 | | | | 1,000.00 | | | 1,016.64 | | 1.70 | | | | 8.64 |

|

Class Y | | 5.00 | | | | 1,000.00 | | | 1,021.93 | | 0.65 | | | | 3.31 |

|

| (1) | | For the six months ended December 31, 2005. |

| (2) | | Expenses are equal to each class’ respective annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year, then divided by 365. |

8 Smith Barney Investment Grade Bond Fund 2005 Annual Report

Fund Performance

| | | | | | | | | | | | |

| Average Annual Total Returns(1) (unaudited) | | | | | | | | | | |

| |

| | | Without Sales Charges(2)

| |

| | | Class A | | | Class B | | | Class C | | | Class Y | |

Twelve Months Ended 12/31/05 | | 1.82 | % | | 1.27 | % | | 1.24 | % | | 2.23 | % |

|

|

Five Years Ended 12/31/05 | | 7.06 | | | 6.52 | | | 6.55 | | | 7.46 | |

|

|

Ten Years Ended 12/31/05 | | 6.04 | | | 5.51 | | | 5.55 | | | N/A | |

|

|

Inception* through 12/31/05 | | 7.87 | | | 9.76 | | | 6.74 | | | 6.61 | |

|

|

| |

| | | With Sales Charges(3)

| |

| | | Class A | | | Class B | | | Class C | | | Class Y | |

Twelve Months Ended 12/31/05 | | (2.79 | )% | | (3.07 | )% | | 0.27 | % | | 2.23 | % |

|

|

Five Years Ended 12/31/05 | | 6.09 | | | 6.36 | | | 6.55 | | | 7.46 | |

|

|

Ten Years Ended 12/31/05 | | 5.56 | | | 5.51 | | | 5.55 | | | N/A | |

|

|

Inception* through 12/31/05 | | 7.49 | | | 9.76 | | | 6.74 | | | 6.61 | |

|

|

| | | | | | | | |

| Cumulative Total Returns(1) (unaudited) | | | | | | | | |

| |

| | | Without Sales Charges(2) |

Class A (12/31/95 through 12/31/05) | | | | 79.76% | | |

|

Class B (12/31/95 through 12/31/05) | | | | 70.92 | | |

|

Class C (12/31/95 through 12/31/05) | | | | 71.57 | | |

|

Class Y (Inception* through 12/31/05) | | | | 88.38 | | |

|

| (1) | | All figures represent past performance and are not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Performance figures may reflect voluntary fee waivers and/or expense reimbursements. In the absence of voluntary fee waivers and/or expense reimbursements, the total return would have been lower. |

| (2) | | Assumes reinvestment of all distributions, including returns of capital, if any, at net asset value and does not reflect the deduction of the applicable sales charges with respect to Class A shares or the applicable contingent deferred sales charges (“CDSC”) with respect to Class B and C shares. |

| (3) | | Assumes reinvestment of all distributions, including returns of capital, if any, at net asset value. In addition, Class A shares reflect the deduction of the maximum sales charge of 4.50%, Class B shares reflect the deduction of a 4.50% CDSC, which applies if shares are redeemed within one year from purchase payment. This CDSC declines by 0.50% the first year after purchase and thereafter by 1.00% per year until no CDSC is incurred. Class C shares also reflect the deduction of a 1.00% CDSC, which applies if shares are redeemed within the first year of purchase payment. |

| * | | Inception dates for Class A, B, C and Y shares is November 6, 1992, January 4, 1982, February 26, 1993 and February 7, 1996, respectively. |

Smith Barney Investment Grade Bond Fund 2005 Annual Report 9

Historical Performance (unaudited)

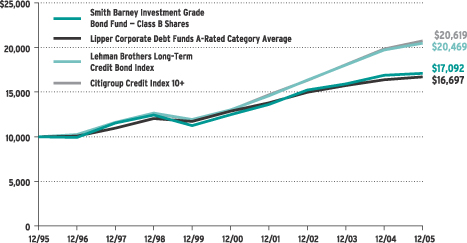

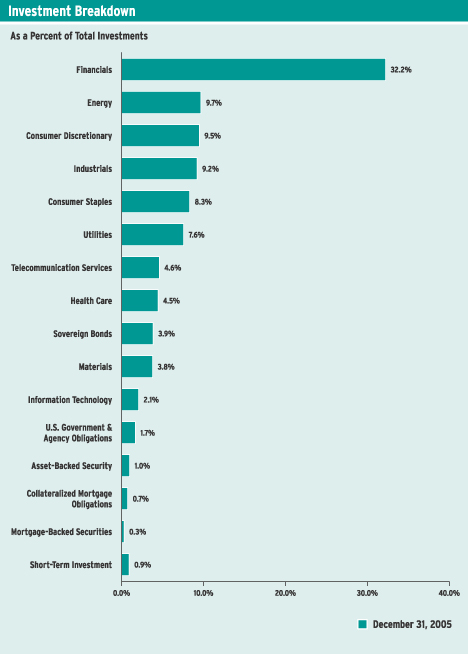

Value of $10,000 Invested in Class B Shares of the Smith Barney Investment Grade Bond Fund vs. the Lehman Brothers Long-Term Credit Bond Index, Citigroup Credit Index 10+ and Lipper Corporate Debt Funds A-Rated Category Average† (December 1995 — December 2005)

| † | | Hypothetical illustration of $10,000 invested in Class B shares on December 31, 1995, assuming reinvestment of all distributions, including returns of capital, if any, at net asset value through December 31, 2005. The Lehman Brothers Long-Term Credit Bond Index is a broad-based unmanaged index of investment-grade corporate bonds. The Citigroup Credit Index 10+ is a broad-based unmanaged index of investment-grade corporate bonds with maturities of ten years or more. The Indexes are unmanaged and are not subject to the same management and trading expenses as a mutual fund. Please note that an investor cannot invest directly in an index. The Lipper Corporate Debt Funds A-Rated Category Average is composed of the Fund’s peer group of 183 mutual funds as of December 31, 2005. The performance of the Fund’s other classes may be greater or less than the performance of Class B shares indicated on this chart, depending on whether higher or lower sales charges and fees were incurred by shareholders investing in the other classes. |

All figures represent past performance and are not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Performance figures may reflect voluntary fee waivers and/or expense reimbursements. In the absence of voluntary fee waivers and/or expense reimbursements, the total return would have been lower.

10 Smith Barney Investment Grade Bond Fund 2005 Annual Report

Schedule of Investments (December 31, 2005)

SMITH BARNEY INVESTMENT GRADE BOND FUND

| | | | | | | | | |

| | | |

Face

Amount | | Rating‡ | | Security | | Value | |

| | | | | | | | | | |

| | CORPORATE BONDS & NOTES — 90.3% | | | | |

| | Aerospace & Defense — 2.7% | | | | |

| $ | 6,500,000 | | A | | Boeing Co., Debentures, 6.875% due 10/15/43 | | $ | 7,719,322 | |

| | 1,000,000 | | A | | Honeywell Inc., Debentures, 6.625% due 6/15/28 | | | 1,150,349 | |

| | 4,000,000 | | BBB+ | | Northrop Grumman Corp., Debentures, 7.750% due 2/15/31 | | | 5,129,868 | |

| | 5,000,000 | | BBB | | Raytheon Co., Debentures, 7.200% due 8/15/27 | | | 5,926,555 | |

| | 5,250,000 | | A | | United Technologies Corp., Debentures, 7.500% due 9/15/29 | | | 6,692,548 | |

|

|

|

| | | | | | Total Aerospace & Defense | | | 26,618,642 | |

|

|

|

| | Automobiles — 1.8% | | | | |

| | 6,500,000 | | BBB | | DaimlerChrysler Corp., Debentures, 7.450% due 3/1/27 | | | 7,073,462 | |

| | 5,000,000 | | BB+ | | Ford Motor Co., Notes, 7.450% due 7/16/31 | | | 3,425,000 | |

| | 10,000,000 | | B | | General Motors Corp., Senior Debentures, 8.375% due 7/15/33 | | | 6,650,000 | |

|

|

|

| | | | | | Total Automobiles | | | 17,148,462 | |

|

|

|

| | Beverages — 1.7% | | | | |

| | 3,000,000 | | A+ | | Anheuser-Busch Cos. Inc., Senior Bonds, 6.000% due 11/1/41 | | | 3,196,515 | |

| | 7,125,000 | | A- | | Diageo Capital PLC, Notes, 4.850% due 5/15/18 | | | 6,799,224 | |

| | 6,900,000 | | A | | PepsiAmericas Inc., Bonds, 5.500% due 5/15/35 | | | 6,870,868 | |

|

|

|

| | | | | | Total Beverages | | | 16,866,607 | |

|

|

|

| | Building Products — 0.4% | | | | |

| | 4,000,000 | | BBB+ | | Masco Corp., Bonds, 6.500% due 8/15/32 | | | 4,152,420 | |

|

|

|

| | Capital Markets — 4.7% | | | | |

| | 7,125,000 | | BBB+ | | Amvescap PLC, Senior Notes, 5.900% due 1/15/07 | | | 7,151,220 | |

| | 6,250,000 | | A | | Bank of New York Co. Inc., Senior Subordinated Notes,

3.400% due 3/15/13 (a) | | | 6,047,794 | |

| | 6,025,000 | | A+ | | Goldman Sachs Group Inc., Notes, 6.125% due 2/15/33 | | | 6,344,705 | |

| | 5,000,000 | | A+ | | Lehman Brothers Holdings Inc., Senior Notes, 8.800% due 3/1/15 | | | 6,276,240 | |

| | 6,850,000 | | A | | Mellon Funding Corp., Subordinated Notes, 5.500% due 11/15/18 | | | 7,060,747 | |

| | | | | | Merrill Lynch & Co. Inc., Notes: | | | | |

| | 1,600,000 | | A+ | | 6.875% due 11/15/18 | | | 1,829,806 | |

| | 5,000,000 | | A+ | | 6.750% due 6/1/28 | | | 5,677,550 | |

| | 4,530,000 | | AA- | | State Street Corp., Notes, 7.350% due 6/15/26 | | | 5,601,680 | |

|

|

|

| | | | | | Total Capital Markets | | | 45,989,742 | |

|

|

|

| | Chemicals — 1.7% | | | | |

| | 5,750,000 | | A- | | Dow Chemical Co., Debentures, 7.375% due 11/1/29 | | | 6,948,978 | |

| | 3,437,000 | | BBB | | ICI Wilmington Inc., Global Notes, 4.375% due 12/1/08 | | | 3,351,443 | |

| | 5,000,000 | | A | | PPG Industries Inc., Debentures, 9.000% due 5/1/21 | | | 6,491,800 | |

|

|

|

| | | | | | Total Chemicals | | | 16,792,221 | |

|

|

|

| | Commercial Banks — 8.8% | | | | |

| | 10,000,000 | | A | | BAC Capital Trust VI, Capital Securities, 5.625% due 3/8/35 | | | 9,890,060 | |

| | 4,700,000 | | Baa2(b) | | Banco Mercantil del Norte SA/Cayman Islands, Subordinated Notes, 5.875% due 2/17/14 (a)(c) | | | 4,688,250 | |

| | 6,000,000 | | A | | HSBC Holdings PLC, Subordinated Notes, 7.625% due 5/17/32 | | | 7,498,986 | |

See Notes to Financial Statements.

Smith Barney Investment Grade Bond Fund 2005 Annual Report 11

Schedule of Investments (December 31, 2005) (continued)

| | | | | | | | | |

| | | |

Face

Amount | | Rating‡ | | Security | | Value | |

| | | | | | | | | | |

| | Commercial Banks — 8.8% (continued) | | | | |

| $ | 7,000,000 | | A- | | Huntington National Bank, Senior Notes, 3.125% due 5/15/08 | | $ | 6,728,113 | |

| | 7,100,000 | | A1(b) | | National City Bank of Indiana, Bonds, 4.250% due 7/1/18 | | | 6,446,281 | |

| | 7,050,000 | | A+ | | Nationwide Building Society, Bonds, 5.000% due 8/1/15 (c) | | | 6,975,390 | |

| | 7,500,000 | | A- | | PNC Bank N.A., Subordinated Notes, 4.875% due 9/21/17 | | | 7,201,800 | |

| | 5,000,000 | | BBB- | | Sovereign Bank, Subordinated Notes, 4.375% due 8/1/13 (a) | | | 4,910,270 | |

| | 5,800,000 | | A- | | Standard Chartered Bank PLC, Subordinated Notes,

8.000% due 5/30/31 (c) | | | 7,507,961 | |

| | 5,625,000 | | A+ | | SunTrust Bank, Subordinated Notes, 5.450% due 12/1/17 | | | 5,754,060 | |

| | 5,775,000 | | A | | US Bancorp, Subordinated Debentures, 7.500% due 6/1/26 | | | 7,122,556 | |

| | 5,800,000 | | A+ | | Wachovia Bank NA, Subordinated Notes, 7.800% due 8/18/10 | | | 6,516,480 | |

| | 4,850,000 | | BBB- | | Webster Bank, Subordinated Notes, 5.875% due 1/15/13 | | | 4,977,167 | |

|

|

|

| | | | | | Total Commercial Banks | | | 86,217,374 | |

|

|

|

| | Commercial Services & Supplies — 1.6% | | | | |

| | 6,850,000 | | A- | | Avery Dennison Corp., Notes, 4.875% due 1/15/13 | | | 6,765,245 | |

| | 5,146,000 | | BBB | | PHH Corp., Senior Notes, 6.000% due 3/1/08 | | | 5,224,106 | |

| | 3,375,000 | | A+ | | Pitney Bowes Inc., Global Medium-Term Notes, 4.750% due 1/15/16 | | | 3,258,704 | |

|

|

|

| | | | | | Total Commercial Services & Supplies | | | 15,248,055 | |

|

|

|

| | Communications Equipment — 0.6% | | | | |

| | 5,000,000 | | BBB+ | | Motorola Inc., Debentures, 6.500% due 9/1/25 | | | 5,468,140 | |

|

|

|

| | Computers & Peripherals — 1.5% | | | | |

| | 6,075,000 | | A | | Dell Inc., Debentures, 7.100% due 4/15/28 | | | 7,265,390 | |

| | 6,275,000 | | A+ | | International Business Machines Corp., Debentures,

7.000% due 10/30/25 | | | 7,448,431 | |

|

|

|

| | | | | | Total Computers & Peripherals | | | 14,713,821 | |

|

|

|

| | Consumer Finance — 1.2% | | | | |

| | 4,400,000 | | BBB | | MBNA America Bank NA, Subordinated Notes, 6.750% due 3/15/08 | | | 4,565,990 | |

| | 6,800,000 | | A | | SLM Corp., Medium-Term Notes, 5.625% due 8/1/33 | | | 6,855,189 | |

|

|

|

| | | | | | Total Consumer Finance | | | 11,421,179 | |

|

|

|

| | Diversified Financial Services — 10.6% | | | | |

| | 8,000,000 | | AA+ | | AIG SunAmerica Global Financing X, Bonds, 6.900% due 3/15/32 (c) | | | 9,363,856 | |

| | 6,300,000 | | A | | Ameritech Capital Funding, Debentures, 6.875% due 10/15/27 | | | 6,667,303 | |

| | 5,000,000 | | A+ | | BHP Finance USA Ltd., Debentures, 7.250% due 3/1/16 | | | 5,773,885 | |

| | 4,600,000 | | BBB | | Capital One Bank, Notes, 5.750% due 9/15/10 | | | 4,714,508 | |

| | 7,400,000 | | A | | CIT Group Co. of Canada, Notes, 5.200% due 6/1/15 (c) | | | 7,327,709 | |

| | 7,090,000 | | A | | Countrywide Home Loans Inc., Medium-Term Notes, Series M,

4.125% due 9/15/09 | | | 6,835,185 | |

| | 6,600,000 | | A+ | | Credit Suisse First Boston (USA) Inc., Notes, 4.700% due 6/1/09 | | | 6,551,893 | |

| | 5,000,000 | | A- | | EnCana Holdings Finance Corp., Notes, 5.800% due 5/1/14 | | | 5,220,410 | |

| | 5,000,000 | | BB+ | | Ford Motor Credit Co., Notes, 7.875% due 6/15/10 | | | 4,503,515 | |

| | 8,775,000 | | AAA | | General Electric Capital Corp., Global Medium-Term Notes,

6.000% due 6/15/12 | | | 9,254,089 | |

| | 5,025,000 | | BB | | General Motors Acceptance Corp., Notes, 6.875% due 9/15/11 | | | 4,587,750 | |

| | 7,000,000 | | A- | | Goldman Sachs Capital I, Capital Securities, 6.345% due 2/15/34 | | | 7,378,406 | |

See Notes to Financial Statements.

12 Smith Barney Investment Grade Bond Fund 2005 Annual Report

Schedule of Investments (December 31, 2005) (continued)

| | | | | | | | | |

| | | |

Face

Amount | | Rating‡ | | Security | | Value | |

| | | | | | | | | | |

| | Diversified Financial Services — 10.6% (continued) | | | | |

| $ | 5,000,000 | | AA | | ING USA Global Funding Trust 1, Secured Medium-Term Notes, 4.500% due 10/1/10 | | $ | 4,906,675 | |

| | 6,950,000 | | AA- | | International Lease Finance Corp., Notes, 5.875% due 5/1/13 | | | 7,202,799 | |

| | 6,600,000 | | A | | JPMorgan Chase & Co., Subordinated Notes, 6.625% due 3/15/12 | | | 7,121,274 | |

| | 5,670,000 | | AAA | | Prudential Holdings LLC, Bonds, Series B, FSA-Insured,

7.245% due 12/18/23 (c) | | | 6,797,213 | |

|

|

|

| | | | | | Total Diversified Financial Services | | | 104,206,470 | |

|

|

|

| | Diversified Telecommunication Services — 2.6% | | | | |

| | 7,000,000 | | A | | BellSouth Telecommunications Inc., Debentures, 5.850% due 11/15/45 | | | 6,667,549 | |

| | 8,684,000 | | A+ | | GTE Florida Inc., Debentures, Series E, 6.860% due 2/1/28 | | | 8,432,998 | |

| | 5,000,000 | | A | | SBC Communications Inc., Bonds, 6.450% due 6/15/34 | | | 5,220,140 | |

| | 5,000,000 | | BBB+ | | Telecom Italia Capital SA, Senior Notes, 6.000% due 9/30/34 | | | 4,832,895 | |

|

|

|

| | | | | | Total Diversified Telecommunication Services | | | 25,153,582 | |

|

|

|

| | Electric Utilities — 4.2% | | | | |

| | 6,225,000 | | A | | Alabama Power Co., Bonds, Series 1, 5.650% due 3/15/35 | | | 6,033,339 | |

| | 4,950,000 | | BBB | | Appalachian Power Co., Bonds, Series H, 5.950% due 5/15/33 | | | 4,989,026 | |

| | 7,000,000 | | BBB | | Carolina Power & Light Co., First Mortgage Bonds,

6.125% due 9/15/33 | | | 7,440,587 | |

| | 5,000,000 | | A- | | Commonwealth Edison Co., Secured Notes, 5.875% due 2/1/33 | | | 5,029,510 | |

| | 4,950,000 | | BBB+ | | Entergy Gulf States Inc., First Mortgage Bonds, 6.200% due 7/1/33 | | | 4,782,150 | |

| | 7,175,000 | | A | | Florida Power & Light Co., First Mortgage Bonds, 5.625% due 4/1/34 | | | 7,259,844 | |

| | 925,000 | | A- | | MidAmerican Energy Co., Bonds, 6.750% due 12/30/31 | | | 1,061,216 | |

| | 5,000,000 | | BBB- | | MidAmerican Energy Holdings Co., Senior Notes, 4.625% due 10/1/07 | | | 4,965,915 | |

|

|

|

| | | | | | Total Electric Utilities | | | 41,561,587 | |

|

|

|

| | Electrical Equipment — 1.2% | | | | |

| | 4,450,000 | | BBB- | | Arizona Public Service Co., Senior Notes, 6.500% due 3/1/12 | | | 4,758,025 | |

| | 7,150,000 | | A- | | Cooper Industries Inc., Senior Notes, 5.500% due 11/1/09 | | | 7,286,200 | |

|

|

|

| | | | | | Total Electrical Equipment | | | 12,044,225 | |

|

|

|

| | Energy Equipment & Services — 2.8% | | | | |

| | 6,000,000 | | A- | | Baker Hughes Inc., Senior Notes, 6.875% due 1/15/29 | | | 7,136,022 | |

| | 4,925,000 | | BBB | | Consolidated Natural Gas Co., Debentures, 6.800% due 12/15/27 | | | 5,452,709 | |

| | 6,350,000 | | A- | | TransCanada PipeLines Ltd., Medium-Term Notes, 7.700% due 6/15/29 | | | 8,206,911 | |

| | 5,480,000 | | A- | | Transocean Inc., Notes, 7.500% due 4/15/31 | | | 6,926,567 | |

|

|

|

| | | | | | Total Energy Equipment & Services | | | 27,722,209 | |

|

|

|

| | Food & Staples Retailing — 2.5% | | | | |

| | 3,750,000 | | BBB- | | Kroger Co., Senior Notes, 6.750% due 4/15/12 | | | 3,948,708 | |

| | 5,000,000 | | BBB- | | Safeway Inc., Notes, 5.800% due 8/15/12 | | | 5,032,315 | |

| | 7,400,000 | | A+ | | Sysco Corp., Senior Notes, 5.375% due 9/21/35 | | | 7,270,034 | |

| | | | | | Wal-Mart Stores Inc., Senior Notes: | | | | |

| | 950,000 | | AA | | 6.875% due 8/10/09 | | | 1,011,868 | |

| | 5,600,000 | | AA | | 7.550% due 2/15/30 | | | 7,167,905 | |

|

|

|

| | | | | | Total Food & Staples Retailing | | | 24,430,830 | |

|

|

|

See Notes to Financial Statements.

Smith Barney Investment Grade Bond Fund 2005 Annual Report 13

Schedule of Investments (December 31, 2005) (continued)

| | | | | | | | | |

| | | |

Face

Amount | | Rating‡ | | Security | | Value | |

| | | | | | | | | | |

| | Food Products — 3.3% | | | | |

| $ | 1,275,000 | | A | | Archer-Daniels-Midland Co., Senior Debentures, 6.625% due 5/1/29 | | $ | 1,441,171 | |

| | 5,700,000 | | A | | Campbell Soup Co., Debentures, 8.875% due 5/1/21 | | | 7,837,335 | |

| | 2,700,000 | | A- | | H.J. Heinz Finance Co., Notes, 6.750% due 3/15/32 | | | 2,974,976 | |

| | 6,200,000 | | BBB+ | | Kraft Foods Inc., Bonds, 6.500% due 11/1/31 | | | 6,843,256 | |

| | 5,000,000 | | BBB+ | | Sara Lee Corp., Notes, 6.250% due 9/15/11 | | | 5,156,710 | |

| | 7,500,000 | | A+ | | Unilever Capital Corp., Senior Notes, 5.900% due 11/15/32 | | | 7,971,487 | |

|

|

|

| | | | | | Total Food Products | | | 32,224,935 | |

|

|

|

| | Gas Utilities — 1.2% | | | | |

| | 4,750,000 | | BBB+ | | AGL Capital Corp., Senior Notes, 4.950% due 1/15/15 | | | 4,625,583 | |

| | 7,025,000 | | A- | | Equitable Resources Inc., Notes, 5.150% due 11/15/12 | | | 7,117,281 | |

|

|

|

| | | | | | Total Gas Utilities | | | 11,742,864 | |

|

|

|

| | Health Care Providers & Services — 2.2% | | | | |

| | 4,750,000 | | BBB | | Humana Inc., Senior Notes, 6.300% due 8/1/18 | | | 5,014,005 | |

| | 4,775,000 | | BBB+ | | Quest Diagnostics Inc., Senior Notes, 6.750% due 7/12/06 | | | 4,817,679 | |

| | 6,800,000 | | A | | UnitedHealth Group Inc., Senior Notes, 5.000% due 8/15/14 | | | 6,778,471 | |

| | 4,390,000 | | BBB+ | | WellPoint Health Networks Inc., Notes, 6.375% due 1/15/12 | | | 4,668,866 | |

|

|

|

| | | | | | Total Health Care Providers & Services | | | 21,279,021 | |

|

|

|

| | Hotels, Restaurants & Leisure — 0.7% | | | | |

| | 6,150,000 | | A | | McDonald’s Corp., Debentures, 6.375% due 1/8/28 | | | 6,895,343 | |

|

|

|

| | Household Durables — 1.1% | | | | |

| | 6,750,000 | | BBB | | Lennar Corp., Series B, Senior Notes, 5.600% due 5/31/15 | | | 6,528,992 | |

| | 5,150,000 | | BBB- | | Pulte Homes Inc., Notes, 6.000% due 2/15/35 | | | 4,585,704 | |

|

|

|

| | | | | | Total Household Durables | | | 11,114,696 | |

|

|

|

| | Household Products — 0.6% | | | | |

| | 5,000,000 | | AA- | | Procter & Gamble Co., Debentures, 6.450% due 1/15/26 | | | 5,669,835 | |

|

|

|

| | Independent Power Producers & Energy Traders — 0.6% | | | | |

| | 5,000,000 | | BBB | | Duke Energy Corp., Bonds, 6.450% due 10/15/32 | | | 5,387,815 | |

|

|

|

| | Insurance — 2.4% | | | | |

| | 4,005,000 | | BBB | | Infinity Property & Casualty Corp., Senior Notes, Series B,

5.500% due 2/18/14 | | | 3,908,824 | |

| | 9,450,000 | | AA- | | New York Life Insurance Co., Notes, 5.875% due 5/15/33 (c) | | | 9,897,779 | |

| | 5,000,000 | | A+ | | Progressive Corp., Senior Notes, 6.625% due 3/1/29 | | | 5,644,675 | |

| | 4,500,000 | | A3(b) | | Stingray Pass-Through Trust Certificates, Medium-Term Notes,

5.902% due 1/12/15 (c) | | | 4,455,370 | |

|

|

|

| | | | | | Total Insurance | | | 23,906,648 | |

|

|

|

| | Machinery — 1.2% | | | | |

| | 5,000,000 | | A- | | Deere & Co., Debentures, 8.100% due 5/15/30 | | | 6,787,225 | |

| | 5,000,000 | | AA | | Illinois Tool Works Inc., Notes, 5.750% due 3/1/09 | | | 5,149,225 | |

|

|

|

| | | | | | Total Machinery | | | 11,936,450 | |

|

|

|

See Notes to Financial Statements.

14 Smith Barney Investment Grade Bond Fund 2005 Annual Report

Schedule of Investments (December 31, 2005) (continued)

| | | | | | | | | |

| | | |

Face

Amount | | Rating‡ | | Security | | Value | |

| | | | | | | | | | |

| | Media — 3.3% | | | | |

| $ | 4,500,000 | | BBB+ | | Comcast Corp., Notes, 7.050% due 3/15/33 | | $ | 4,873,423 | |

| | 4,411,000 | | BBB- | | Cox Communications Inc., Notes, 7.750% due 11/1/10 | | | 4,782,239 | |

| | 6,600,000 | | BBB+ | | Knight-Ridder Inc., Debentures, 6.875% due 3/15/29 | | | 5,488,474 | |

| | 5,000,000 | | BBB | | News America Holdings Inc., Senior Debentures, 8.500% due 2/23/25 | | | 6,031,180 | |

| | 5,000,000 | | BBB+ | | Time Warner Cos. Inc., Debentures, 7.570% due 2/1/24 | | | 5,467,605 | |

| | 5,000,000 | | BBB+ | | Viacom Inc., Senior Notes, 8.625% due 8/1/12 | | | 5,653,075 | |

|

|

|

| | | | | | Total Media | | | 32,295,996 | |

|

|

|

| | Metals & Mining — 1.5% | | | | |

| | 6,700,000 | | A- | | Alcoa Inc., Senior Notes, 6.500% due 6/1/11 | | | 7,160,444 | |

| | 7,500,000 | | A+ | | Nucor Corp., Notes, 4.875% due 10/1/12 | | | 7,450,553 | |

|

|

|

| | | | | | Total Metals & Mining | | | 14,610,997 | |

|

|

|

| | Multi-Utilities — 1.5% | | | | |

| | 7,100,000 | | A | | Consolidated Edison Co. of New York, Senior Notes,

5.375% due 12/15/15 | | | 7,216,795 | |

| | 8,175,000 | | BBB+ | | United Utilities PLC, Bonds, 4.550% due 6/19/18 | | | 7,466,628 | |

|

|

|

| | | | | | Total Multi-Utilities | | | 14,683,423 | |

|

|

|

| | Multiline Retail — 0.5% | | | | |

| | 4,775,000 | | A- | | Nordstrom Inc., Senior Debentures, 6.950% due 3/15/28 | | | 5,279,951 | |

|

|

|

| | Oil, Gas & Consumable Fuels — 6.8% | | | | |

| | 1,350,000 | | A- | | Apache Corp., Debentures, 7.950% due 4/15/26 | | | 1,761,948 | |

| | 4,800,000 | | BBB+ | | Burlington Resources Finance Co., Senior Notes, 6.680% due 2/15/11 | | | 5,181,024 | |

| | 4,800,000 | | BBB+ | | Canadian National Resources Ltd., Senior Notes, 7.200% due 1/15/32 | | | 5,681,597 | |

| | 5,575,000 | | A | | Colonial Pipeline Co., Senior Notes, 7.630% due 4/15/32 (c) | | | 7,336,683 | |

| | 6,040,000 | | A- | | ConocoPhillips Holding Co., Senior Notes, 6.950% due 4/15/29 | | | 7,312,568 | |

| | 3,500,000 | | A- | | Global Marine Inc., Notes, 7.000% due 6/1/28 | | | 4,059,146 | |

| | 6,400,000 | | AA | | Lasmo (USA) Inc., Notes, 7.300% due 11/15/27 | | | 8,024,506 | |

| | 5,000,000 | | BBB+ | | Marathon Oil Corp., Debentures, 9.125% due 1/15/13 | | | 6,139,740 | |

| | 8,225,000 | | A | | Norsk Hydro A/S, Debentures, 6.800% due 1/15/28 | | | 9,756,084 | |

| | 5,000,000 | | BBB | | Ocean Energy Inc., Senior Notes, 7.500% due 9/15/27 | | | 5,988,545 | |

| | 5,050,000 | | BBB- | | Valero Energy Corp., Notes, 4.750% due 6/15/13 | | | 4,909,160 | |

|

|

|

| | | | | | Total Oil, Gas & Consumable Fuels | | | 66,151,001 | |

|

|

|

| | Paper & Forest Products — 0.5% | | | | |

| | 5,000,000 | | BBB | | Willamette Industries Inc., Debentures, 7.350% due 7/1/26 | | | 5,352,450 | |

|

|

|

| | Pharmaceuticals — 2.2% | | | | |

| | 3,435,000 | | AA | | Eli Lilly & Co., Notes, 7.125% due 6/1/25 | | | 4,145,413 | |

| | 5,000,000 | | AA- | | Merck & Co. Inc., Debentures, 5.950% due 12/1/28 | | | 5,143,780 | |

| | 5,850,000 | | A | | Wyeth, Notes, 6.500% due 2/1/34 | | | 6,461,688 | |

| | 5,000,000 | | AA+ | | Zeneca Wilmington Inc., Debentures, 7.000% due 11/15/23 | | | 6,087,960 | |

|

|

|

| | | | | | Total Pharmaceuticals | | | 21,838,841 | |

|

|

|

| | Real Estate — 2.0% | | | | |

| | 4,720,000 | | BBB | | Boston Properties LP, Senior Notes, 6.250% due 1/15/13 | | | 4,958,554 | |

| | 4,750,000 | | A- | | ERP Operating LP, Notes, 5.250% due 9/15/14 | | | 4,736,358 | |

See Notes to Financial Statements.

Smith Barney Investment Grade Bond Fund 2005 Annual Report 15

Schedule of Investments (December 31, 2005) (continued)

| | | | | | | | | |

| | | |

Face

Amount | | Rating‡ | | Security | | Value | |

| | | | | | | | | | |

| | Real Estate — 2.0% (continued) | | | | |

| $ | 4,825,000 | | BBB- | | iStar Financial Inc., Senior Notes, 5.150% due 3/1/12 | | $ | 4,678,851 | |

| | 4,775,000 | | BBB | | Vornado Realty LP, Senior Notes, 5.625% due 6/15/07 | | | 4,810,053 | |

|

|

|

| | | | | | Total Real Estate | | | 19,183,816 | |

|

|

|

| | Road & Rail — 2.0% | | | | |

| | 6,000,000 | | BBB+ | | Burlington Northern Santa Fe Corp., Notes, 5.900% due 7/1/12 | | | 6,274,086 | |

| | 5,324,000 | | A- | | Canadian National Railway Co., Notes, 6.900% due 7/15/28 | | | 6,356,707 | |

| | 6,826,809 | | A | | Union Pacific Corp., Pass-Through Certificates, 4.698% due 1/2/24 | | | 6,572,681 | |

|

|

|

| | | | | | Total Road & Rail | | | 19,203,474 | |

|

|

|

| | Specialty Retail — 1.2% | | | | |

| | 4,605,000 | | BBB | | Limited Brands Inc., Debentures, 6.950% due 3/1/33 | | | 4,675,134 | |

| | 6,300,000 | | A+ | | Lowe’s Cos. Inc., Debentures, 6.875% due 2/15/28 | | | 7,432,652 | |

|

|

|

| | | | | | Total Specialty Retail | | | 12,107,786 | |

|

|

|

| | Textiles, Apparel & Luxury Goods — 0.7% | | | | |

| | 7,275,000 | | A- | | V.F. Corp., Notes, 6.000% due 10/15/33 | | | 6,921,086 | |

|

|

|

| | Thrifts & Mortgage Finance — 2.1% | | | | |

| | 4,000,000 | | BBB- | | Astoria Financial Corp., Notes, 5.750% due 10/15/12 | | | 4,093,096 | |

| | 4,975,000 | | BBB | | Independence Community Bank Corp., Notes,

3.500% due 6/20/13 (a) | | | 4,792,945 | |

| | | | | | Washington Mutual Inc.: | | | | |

| | 7,125,000 | | A- | | Notes, 4.200% due 1/15/10 | | | 6,905,058 | |

| | 5,000,000 | | BBB+ | | Subordinated Notes, 4.625% due 4/1/14 | | | 4,709,695 | |

|

|

|

| | | | | | Total Thrifts & Mortgage Finance | | | 20,500,794 | |

|

|

|

| | Tobacco — 0.1% | | | | |

| | 1,250,000 | | A+ | | Cargill Inc., Medium-Term Notes, 5.000% due 11/15/13 (c) | | | 1,236,231 | |

|

|

|

| | Wireless Telecommunication Services — 2.0% | | | | |

| | 3,675,000 | | A | | New Cingular Wireless Services Inc., Senior Notes,

8.750% due 3/1/31 | | | 4,883,208 | |

| | 6,425,000 | | A- | | Sprint Capital Corp., Notes, 8.750% due 3/15/32 | | | 8,552,311 | |

| | 6,200,000 | | A | | Vodafone Group PLC, Notes, 5.000% due 9/15/15 | | | 6,050,295 | |

|

|

|

| | | | | | Total Wireless Telecommunication Services | | | 19,485,814 | |

|

|

|

| | | | | | TOTAL CORPORATE BONDS & NOTES

(Cost — $872,490,776) | | | 884,764,833 | |

|

|

|

| | ASSET-BACKED SECURITY — 1.0% | | | | |

| | Diversified Financial Services — 1.0% | | | | |

| | 9,050,000 | | AAA | | Atlantic City Electric Transition Funding LLC, Series 2002-1, Class A4,

5.550% due 10/20/23

(Cost — $9,239,085) | | | 9,421,964 | |

|

|

|

See Notes to Financial Statements.

16 Smith Barney Investment Grade Bond Fund 2005 Annual Report

Schedule of Investments (December 31, 2005) (continued)

| | | | | | | | | |

| | | |

Face

Amount | | Rating‡ | | Security | | Value | |

| | | | | | | | | | |

| | COLLATERALIZED MORTGAGE OBLIGATIONS — 0.7% | | | | |

| $ | 2,500,000 | | AAA | | LB-UBS Commercial Mortgage Trust, Series 2004-C8, Class A4,

4.510% due 12/15/29 | | $ | 2,427,839 | |

| | 1,267,028 | | AAA | | Merrill Lynch Mortgage Investors Inc., Series 2005-A2, Class A4,

4.496% due 2/25/35 (a) | | | 1,246,859 | |

| | | | | | Structured Asset Securities Corp.: | | | | |

| | 1,341,353 | | AA (d) | | Series 1998-3, Class M1, 5.379% due 3/25/28 (a) | | | 1,342,626 | |

| | 2,219,936 | | AA | | Series 1998-8, Class M1, 5.319% due 8/25/28 (a) | | | 2,221,954 | |

|

|

|

| | | | | | TOTAL COLLATERALIZED MORTGAGE OBLIGATIONS

(Cost — $7,345,409) | | | 7,239,278 | |

|

|

|

| | MORTGAGE-BACKED SECURITIES — 0.3% | | | | |

| | FNMA — 0.0% | | | | |

| | 126,006 | | | | Federal National Mortgage Association (FNMA),

6.500% due 9/1/28-1/1/29 | | | 129,814 | |

|

|

|

| | GNMA — 0.3% | | | | |

| | 2,679,754 | | | | Government National Mortgage Association (GNMA),

6.500% due 3/15/28-3/15/29 | | | 2,805,717 | |

|

|

|

| | | | | | TOTAL MORTGAGE-BACKED SECURITIES

(Cost — $2,788,655) | | | 2,935,531 | |

|

|

|

| | SOVEREIGN BONDS — 3.8% | | | | |

| | Canada — 2.6% | | | | |

| | 5,600,000 | | A | | Province of Nova Scotia, Debentures, 7.250% due 7/27/13 | | | 6,464,635 | |

| | | | | | Province of Quebec, Debentures: | | | | |

| | 5,000,000 | | A+ | | 7.500% due 7/15/23 | | | 6,378,820 | |

| | 5,000,000 | | A+ | | 7.500% due 9/15/29 | | | 6,587,955 | |

| | 5,000,000 | | AA- | | Province of Saskatchewan, Debentures, 8.000% due 2/1/13 | | | 5,969,190 | |

|

|

|

| | | | | | Total Canada | | | 25,400,600 | |

|

|

|

| | Italy — 0.5% | | | | |

| | 3,800,000 | | AA- | | Republic of Italy, Debentures, 6.875% due 9/27/23 | | | 4,545,256 | |

|

|

|

| | Mexico — 0.7% | | | | |

| | 6,800,000 | | A | | Corporacion Andina de Fomento, Notes, 6.875% due 3/15/12 | | | 7,408,688 | |

|

|

|

| | | | | | TOTAL SOVEREIGN BONDS

(Cost — $34,598,481) | | | 37,354,544 | |

|

|

|

See Notes to Financial Statements.

Smith Barney Investment Grade Bond Fund 2005 Annual Report 17

Schedule of Investments (December 31, 2005) (continued)

| | | | | | | | | |

| | | |

Face

Amount | | | | Security | | Value | |

| | | | | | | | | | |

| | U.S. GOVERNMENT & AGENCY OBLIGATIONS — 1.7% | | | | |

| | U.S. Government Agency Obligations — 1.3% | | | | |

| $ | 10,000,000 | | | | Federal National Mortgage Association (FNMA), 6.625% due 11/15/30 | | $ | 12,371,660 | |

|

|

|

| | U.S. Government Obligations — 0.4% | | | | |

| | 3,500,000 | | | | U.S. Treasury Bonds, 5.375% due 2/15/31 | | | 3,932,579 | |

|

|

|

| | | | | | TOTAL U.S. GOVERNMENT & AGENCY OBLIGATIONS

(Cost — $14,537,351) | | | 16,304,239 | |

|

|

|

| | | | | | TOTAL INVESTMENTS BEFORE SHORT-TERM INVESTMENT

(Cost — $940,999,757) | | | 958,020,389 | |

|

|

|

| | SHORT-TERM INVESTMENT — 0.9% | | | | |

| | Repurchase Agreement — 0.9% | | | | |

| | 9,016,000 | | | | Interest in $599,979,000 joint tri-party repurchase agreement dated 12/30/05 with Merrill Lynch, Pierce, Fenner, & Smith Inc., 4.250% due 1/3/06, Proceeds at maturity — $9,020,258; (Fully collateralized by various U.S. Treasury obligations, 0.000% to 4.500% due 1/5/06 to 11/15/15; Market value — $9,196,384)

(Cost — $9,016,000) | | | 9,016,000 | |

|

|

|

| | | | | | TOTAL INVESTMENTS — 98.7% (Cost — $950,015,757#) | | | 967,036,389 | |

| | | | | | Other Assets in Excess of Liabilities — 1.3% | | | 13,082,705 | |

|

|

|

| | | | | | TOTAL NET ASSETS — 100.0% | | $ | 980,119,094 | |

|

|

|

| ‡ | | All ratings are by Standard & Poor’s Ratings Service, unless otherwise footnoted. All ratings are unaudited. |

| (a) | | Variable rate security. Coupon rate disclosed is that which is in effect at December 31, 2005. |

| (b) | | Rating by Moody’s Investors Service. All ratings are unaudited. |

| (c) | | Security is exempt from registration under Rule 144A of the Securities Act of 1933. This security may be resold in transactions that are exempt from registration, normally to qualified institutional buyers. This security has been deemed liquid pursuant to guidelines approved by the Board of Directors, unless otherwise noted. |

| (d) | | Rating by Fitch Ratings Service. All ratings are unaudited. |

| # | | Aggregate cost for federal income tax purposes is $954,970,179. |

| | | See pages 19 and 20 for definitions of ratings. |

| | |

Abbreviation used in this schedule:

|

| FSA | | —Financial Security Assurance |

See Notes to Financial Statements.

18 Smith Barney Investment Grade Bond Fund 2005 Annual Report

Bond Ratings (unaudited)

The definitions of the applicable rating symbols are set forth below:

Standard & Poor’s Ratings Service (“Standard & Poor’s”) — Ratings from “AA” to “CCC” may be modified by the addition of a plus (+) or minus (-) sign to show relative standings within the major rating categories.

AAA | — Bonds rated “AAA” have the highest rating assigned by Standard & Poor’s. Capacity to pay interest and repay principal is extremely strong. |

AA | — Bonds rated “AA” have a very strong capacity to pay interest and repay principal and differ from the highest rated issues only in a small degree. |

A | — Bonds rated “A” have a strong capacity to pay interest and repay principal although they are somewhat more susceptible to the adverse effects of changes in circumstances and economic conditions than debt in higher rated categories. |

BBB | — Bonds rated “BBB” are regarded as having an adequate capacity to pay interest and repay principal. Whereas they normally exhibit adequate protection parameters, adverse economic conditions or changing circumstances are more likely to lead to a weakened capacity to pay interest and repay principal for bonds in this category than in higher rated categories. |

BB, B, CCC and CC | — Bonds rated “BB”, “B”, “CCC” and “CC” are regarded, on balance, as predominantly speculative with respect to capacity to pay interest and repay principal in accordance with the terms of the obligation. “BB” represents a lower degree of speculation than “B”, and “CC” the highest degree of speculation. While such bonds will likely have some quality and protective characteristics, these are outweighed by large uncertainties or major risk exposures to adverse conditions. |

D | — Bonds rated “D” are in default and payment of interest and/or repayment of principal is in arrears. |

Moody’s Investors Service (“Moody’s”) — Numerical modifiers 1, 2 and 3 may be applied to each generic rating from “Aa” to “Caa,” where 1 is the highest and 3 the lowest ranking within its generic category.

Aaa | — Bonds rated “Aaa” are judged to be of the best quality. They carry the smallest degree of investment risk and are generally referred to as “gilt edge.” Interest payments are protected by a large or by an exceptionally stable margin and principal is secure. While the various protective elements are likely to change, such changes as can be visualized are most unlikely to impair the fundamentally strong position of such issues. |

Aa | — Bonds rated “Aa” are judged to be of high quality by all standards. Together with the “Aaa” group they comprise what are generally known as high grade bonds. They are rated lower than the best bonds because margins of protection may not be as large as in “Aaa” securities or fluctuation of protective elements may be of greater amplitude or there may be other elements present which make the long-term risks appear somewhat larger than in “Aaa” securities. |

A | — Bonds rated “A” possess many favorable investment attributes and are to be considered as upper medium grade obligations. Factors giving security to principal and interest are considered adequate but elements may be present which suggest a susceptibility to impairment some time in the future. |

Baa | — Bonds rated “Baa” are considered as medium grade obligations, i.e., they are neither highly protected nor poorly secured. Interest payments and principal security appear adequate for the present but certain protective elements may be lacking or may be characteristically unreliable over any great length of time. Such bonds lack outstanding investment characteristics and in fact have speculative characteristics as well. |

Ba | — Bonds rated “Ba” are judged to have speculative elements; their future cannot be considered as well assured. Often the protection of interest and principal payments may be very moderate and therefore not well safeguarded during both good and bad times over the future. Uncertainty of position characterizes bonds in this class. |

B | — Bonds rated “B” generally lack characteristics of desirable investments. Assurance of interest and principal payments or of maintenance of other terms of the contract over any long period of time may be small. |

Caa | — Bonds rated “Caa” are of poor standing. These may be in default, or present elements of danger may exist with respect to principal or interest. |

Ca | — Bonds rated “Ca” represent obligations which are speculative in a high degree. Such issues are often in default or have other marked short-comings. |

C | — Bonds rated “C” are the lowest class of bonds and issues so rated can be regarded as having extremely poor prospects of ever attaining any real investment standing. |

Smith Barney Investment Grade Bond Fund 2005 Annual Report 19

Bond Ratings (unaudited) (continued)

Fitch Ratings Service (“Fitch”) — Ratings from “AA” to “CCC” may be modified by the addition of a plus (+) or minus (-) sign to show relative standings within the major rating categories

AAA | — Bonds rated “AAA” have the highest rating assigned by Fitch. Capacity to pay interest and repay principal is extremely strong. |

AA | — Bonds rated “AA” have a very strong capacity to pay interest and repay principal and differ from the highest rated issues only in a small degree. |

A | — Bonds rated “A” have a strong capacity to pay interest and repay principal although they are somewhat more susceptible to the adverse effects of changes in circumstances and economic conditions than debt in higher rated categories. |

BBB | — Bonds rated “BBB” are regarded as having an adequate capacity to pay interest and repay principal. Whereas they normally exhibit adequate protection parameters, adverse economic conditions or changing circumstances are more likely to lead to a weakened capacity to pay interest and repay principal for bonds in this category than in higher rated categories. |

BB, B, CCC and CC | — Bonds rated “BB”, “B”, “CCC” and “CC” are regarded, on balance, as predominantly speculative with respect to capacity to pay interest and repay principal in accordance with the terms of the obligation. “BB” represents a lower degree of speculation than “B”, and “CC” the highest degree of speculation. While such bonds will likely have some quality and protective characteristics, these are outweighed by large uncertainties or major risk exposures to adverse conditions. |

NR | — Indicates that the bond is not rated by Standard & Poor’s, Moody’s or Fitch. |

20 Smith Barney Investment Grade Bond Fund 2005 Annual Report

Statement of Assets and Liabilities (December 31, 2005)

| | | | |

| ASSETS: | | | | |

Investments, at value (Cost — $950,015,757) | | $ | 967,036,389 | |

Cash | | | 911 | |

Interest receivable | | | 15,236,557 | |

Receivable for Fund shares sold | | | 1,367,783 | |

Prepaid expenses | | | 39,431 | |

|

|

Total Assets | | | 983,681,071 | |

|

|

| LIABILITIES: | | | | |

Distributions payable | | | 1,584,354 | |

Payable for Fund shares repurchased | | | 911,252 | |

Management fee payable | | | 515,054 | |

Transfer agent fees payable | | | 249,756 | |

Distribution fees payable (Notes 2 and 4) | | | 125,054 | |

Directors’ fees payable | | | 6,781 | |

Accrued expenses | | | 169,726 | |

|

|

Total Liabilities | | | 3,561,977 | |

|

|

Total Net Assets | | $ | 980,119,094 | |

|

|

| NET ASSETS: | | | | |

Par value (Note 6) | | $ | 78,983 | |

Paid-in capital in excess of par value | | | 969,615,448 | |

Undistributed net investment income | | | 449,405 | |

Accumulated net realized loss on investments | | | (7,045,374 | ) |

Net unrealized appreciation on investments | | | 17,020,632 | |

|

|

Total Net Assets | | $ | 980,119,094 | |

|

|

Shares Outstanding: | | | | |

Class A | | | 37,105,222 | |

| |

Class B | | | 13,026,500 | |

| |

Class C | | | 5,804,745 | |

| |

Class Y | | | 23,046,120 | |

| |

Net Asset Value: | | | | |

Class A (and redemption price) | | | $12.42 | |

| |

Class B * | | | $12.39 | |

| |

Class C * | | | $12.35 | |

| |

Class Y (and redemption price) | | | $12.41 | |

| |

Maximum Public Offering Price Per Share: | | | | |

Class A (based on maximum sales charge of 4.50%) | | | $13.01 | |

|

|

| * | | Redemption price is NAV of Class B and C shares reduced by a 4.50% and 1.00% CDSC, respectively, if shares are redeemed within one year from purchase payment (See Note 2). |

See Notes to Financial Statements.

Smith Barney Investment Grade Bond Fund 2005 Annual Report 21

Statement of Operations (For the year ended December 31, 2005)

| | | | |

| INVESTMENT INCOME: | | | | |

Interest | | $ | 51,761,407 | |

|

|

| EXPENSES: | | | | |

Management fee (Note 2) | | | 4,416,683 | |

Distribution fees (Notes 2 and 4) | | | 2,911,535 | |

Administration fee (Note 2) | | | 1,704,807 | |

Transfer agent fees (Notes 2 and 4) | | | 1,070,998 | |

Shareholder reports (Note 4) | | | 144,061 | |

Custody fees | | | 76,393 | |

Registration fees | | | 58,231 | |

Directors’ fees | | | 45,080 | |

Legal fees | | | 32,173 | |

Audit and tax | | | 29,800 | |

Insurance | | | 17,509 | |

Miscellaneous expenses | | | 6,093 | |

|

|

Total Expenses | | | 10,513,363 | |

|

|

Net Investment Income | | | 41,248,044 | |

|

|

REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS (NOTES 1 AND 3): | | | | |

Net Realized Gain From Investments | | | 7,200,337 | |

|

|

Change in Net Unrealized Appreciation/Depreciation From Investments | | | (31,006,009 | ) |

|

|

Net Loss on Investments | | | (23,805,672 | ) |

|

|

Increase in Net Assets From Operations | | $ | 17,442,372 | |

|

|

See Notes to Financial Statements.

22 Smith Barney Investment Grade Bond Fund 2005 Annual Report

Statements of Changes in Net Assets (For the years ended December 31,)

| | | | | | | | |

| | |

| | | 2005 | | | 2004 | |

| OPERATIONS: | | | | | | | | |

Net investment income | | $ | 41,248,044 | | | $ | 42,300,953 | |

Net realized gain | | | 7,200,337 | | | | 14,582,223 | |

Change in net unrealized appreciation/depreciation | | | (31,006,009 | ) | | | 4,108,548 | |

|

|

Increase in Net Assets From Operations | | | 17,442,372 | | | | 60,991,724 | |

|

|

DISTRIBUTIONS TO SHAREHOLDERS FROM (NOTES 1 AND 5): | | | | | | | | |

Net investment income | | | (44,235,172 | ) | | | (46,334,893 | ) |

Net realized gains | | | (8,707,709 | ) | | | (17,320,560 | ) |

|

|

Decrease in Net Assets From

Distributions to Shareholders | | | (52,942,881 | ) | | | (63,655,453 | ) |

|

|

| FUND SHARE TRANSACTIONS (NOTE 6): | | | | | | | | |

Net proceeds from sale of shares | | | 230,718,665 | | | | 225,164,001 | |

Reinvestment of distributions | | | 30,998,920 | | | | 35,281,394 | |

Cost of shares repurchased | | | (245,545,488 | ) | | | (209,775,202 | ) |

|

|

Increase in Net Assets From Fund Share Transactions | | | 16,172,097 | | | | 50,670,193 | |

|

|

Increase (Decrease) in Net Assets | | | (19,328,412 | ) | | | 48,006,464 | |

| NET ASSETS: | | | | | | | | |

Beginning of year | | | 999,447,506 | | | | 951,441,042 | |

|

|

End of year* | | $ | 980,119,094 | | | $ | 999,447,506 | |

|

|

*Includes undistributed (overdistributed) net investment income of: | | | $449,405 | | | | $(3,613,854 | ) |

|

|

See Notes to Financial Statements.

Smith Barney Investment Grade Bond Fund 2005 Annual Report 23

Financial Highlights

For a share of each class of capital stock outstanding throughout each year ended December 31:

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

| Class A Shares(1) | | 2005 | | | 2004 | | | 2003 | | | 2002 | | | 2001 | |

Net Asset Value, Beginning of Year | | $ | 12.88 | | | $ | 12.92 | | | $ | 12.88 | | | $ | 12.10 | | | $ | 11.73 | |

|

|

Income (Loss) From Operations: | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | 0.54 | | | | 0.56 | | | | 0.58 | | | | 0.62 | | | | 0.74 | |

Net realized and unrealized gain (loss) | | | (0.31 | ) | | | 0.25 | | | | 0.08 | | | | 0.83 | | | | 0.37 | |

|

|

Total Income From Operations | | | 0.23 | | | | 0.81 | | | | 0.66 | | | | 1.45 | | | | 1.11 | |

|

|

Less Distributions From: | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | (0.58 | ) | | | (0.62 | ) | | | (0.60 | ) | | | (0.64 | ) | | | (0.74 | ) |

Net realized gains | | | (0.11 | ) | | | (0.23 | ) | | | (0.02 | ) | | | — | | | | — | |

Return of capital | | | — | | | | — | | | | — | | | | (0.03 | ) | | | — | |

|

|

Total Distributions | | | (0.69 | ) | | | (0.85 | ) | | | (0.62 | ) | | | (0.67 | ) | | | (0.74 | ) |

|

|

Net Asset Value, End of Year | | $ | 12.42 | | | $ | 12.88 | | | $ | 12.92 | | | $ | 12.88 | | | $ | 12.10 | |

|

|

Total Return(2) | | | 1.82 | % | | | 6.47 | % | | | 5.22 | % | | | 12.43 | % | | | 9.70 | % |

|

|

Net Assets, End of Year (millions) | | | $461 | | | | $438 | | | | $420 | | | | $384 | | | | $288 | |

|

|

Ratios to Average Net Assets: | | | | | | | | | | | | | | | | | | | | |

Gross expenses | | | 1.05 | % | | | 1.06 | % | | | 1.03 | % | | | 1.03 | % | | | 1.00 | % |

Net expenses | | | 1.05 | | | | 1.05 | (3) | | | 1.03 | | | | 1.03 | | | | 1.00 | |

Net investment income | | | 4.24 | | | | 4.37 | | | | 4.45 | | | | 5.06 | | | | 6.10 | |

|

|

Portfolio Turnover Rate | | | 40 | % | | | 43 | % | | | 53 | % | | | 52 | % | | | 39 | % |

|

|

| (1) | | Per share amounts have been calculated using the average shares method. |

| (2) | | Performance figures may reflect voluntary fee waivers and/or expense reimbursements. Past performance is no guarantee of future results. In the absence of voluntary fee waivers and/or expense reimbursements, the total return would have been lower. |

| (3) | | The investment manager voluntarily waived a portion of its fees. |

See Notes to Financial Statements.

24 Smith Barney Investment Grade Bond Fund 2005 Annual Report

Financial Highlights (continued)

For a share of each class of capital stock outstanding throughout each year ended December 31:

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

| Class B Shares(1) | | 2005 | | | 2004 | | | 2003 | | | 2002 | | | 2001 | |

Net Asset Value, Beginning of Year | | $ | 12.85 | | | $ | 12.89 | | | $ | 12.86 | | | $ | 12.08 | | | $ | 11.71 | |

|

|