UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT

COMPANIES

Investment Company Act file number: 811-03290

Name of Fund: BlackRock Variable Series Funds, Inc.

BlackRock Basic Value V.I. Fund

BlackRock Capital Appreciation V.I. Fund

BlackRock Equity Dividend V.I. Fund

BlackRock Global Allocation V.I. Fund

BlackRock Global Opportunities V.I. Fund

BlackRock Government Money Market V.I. Fund

BlackRock High Yield V.I. Fund

BlackRock International V.I. Fund

BlackRock iShares Alternative Strategies V.I. Fund

BlackRock iShares Dynamic Allocation V.I Fund

BlackRock iShares Dynamic Fixed Income V.I. Fund

BlackRock iShares Equity Appreciation V.I. Fund

BlackRock Large Cap Core V.I. Fund

BlackRock Large Cap Growth V.I. Fund

BlackRock Large Cap Value V.I. Fund

BlackRock Managed Volatility V.I. Fund

BlackRock S&P 500 Index V.I. Fund

BlackRock Total Return V.I. Fund

BlackRock U.S. Government Bond V.I. Fund

BlackRock Value Opportunities V.I. Fund

Fund Address: 100 Bellevue Parkway, Wilmington, DE 19809

Name and address of agent for service: John M. Perlowski, Chief Executive Officer, BlackRock Variable Series Funds, Inc., 55 East 52nd Street, New York, NY 10055

Registrant’s telephone number, including area code: (800) 441-7762

Date of fiscal year end: 12/31/2016

Date of reporting period: 06/30/2016

Item 1 – Report to Stockholders

JUNE 30, 2016

| | | | |

SEMI-ANNUAL REPORT (UNAUDITED) | | | | BLACKROCK® |

BlackRock Variable Series Funds, Inc.

| | |

| Not FDIC Insured ¡ May Lose Value ¡ No Bank Guarantee | | |

Dear Shareholder,

Uneven economic outlooks and divergence of monetary policies across regions have been the overarching themes driving financial markets over the past couple of years. In the latter half of 2015, as U.S. growth outpaced other developed markets, investors were focused largely on the timing of the Federal Reserve’s (the “Fed”) decision to end its near-zero interest rate policy. The Fed ultimately hiked rates in December, whereas the European Central Bank and the Bank of Japan took additional steps to stimulate growth, even introducing negative interest rates. The U.S. dollar had strengthened considerably ahead of these developments, causing profit challenges for U.S. companies that generate revenues overseas, and pressuring emerging market currencies and commodities prices.

Also during this time period, oil prices collapsed due to excess global supply. China, one of the world’s largest consumers of oil, was another notable source of stress for financial markets as the country showed signs of slowing economic growth and took measures to devalue its currency. Declining confidence in the country’s policymakers stoked investors’ worries about the potential impact of China’s weakness on the global economy. Global market volatility increased and risk assets (such as equities and high yield bonds) suffered in this environment.

The elevated market volatility spilled over into 2016, but as the first quarter wore on, fears of a global recession began to fade, allowing markets to calm and risk assets to rebound. Central bank stimulus in Europe and Japan, combined with a more tempered outlook for rate hikes in the United States, helped bolster financial markets. A softening in U.S. dollar strength brought relief to U.S. exporters and emerging market economies. Oil prices rebounded as the world’s largest producers agreed to reduce supply.

Volatility spiked again in late June when the United Kingdom shocked investors with its vote to leave the European Union. Uncertainty around how the British exit might affect the global economy and political landscape long term drove investors to high quality assets, pushing already-low global yields to even lower levels.

At BlackRock, we believe investors need to think globally, extend their scope across a broad array of asset classes and be prepared to adjust accordingly as market conditions change over time. We encourage you to talk with your financial advisor and visit blackrock.com for further insight about investing in today’s markets.

Sincerely,

Rob Kapito

President, BlackRock Advisors, LLC

Rob Kapito

President, BlackRock Advisors, LLC

| | | | | | | | |

| Total Returns as of June 30, 2016 | |

| | | 6-month | | | 12-month | |

U.S. large cap equities (S&P 500® Index) | | | 3.84 | % | | | 3.99 | % |

U.S. small cap equities (Russell 2000® Index) | | | 2.22 | | | | (6.73 | ) |

International equities (MSCI Europe, Australasia,

Far East Index) | | | (4.42 | ) | | | (10.16 | ) |

Emerging market equities (MSCI Emerging Markets Index) | | | 6.41 | | | | (12.05 | ) |

3-month Treasury bill (BofA Merrill Lynch

3-Month U.S. Treasury

Bill Index) | | | 0.15 | | | | 0.19 | |

U.S. Treasury securities (BofA Merrill Lynch

10- Year U.S. Treasury

Index) | | | 7.95 | | | | 9.49 | |

U.S. investment grade

bonds (Barclays U.S.

Aggregate Bond Index) | | | 5.31 | | | | 6.00 | |

Tax-exempt municipal

bonds (S&P Municipal

Bond Index) | | | 4.35 | | | | 7.80 | |

U.S. high yield bonds (Barclays U.S. Corporate

High Yield 2% Issuer

Capped Index) | | | 9.06 | | | | 1.65 | |

|

| Past performance is no guarantee of future results. Index performance is shown for illustrative purposes only. You cannot invest directly in an index. | |

| | | | | | |

| | | THIS PAGE NOT PART OF YOUR FUND REPORT | | | | |

JUNE 30, 2016

| | | | |

SEMI-ANNUAL REPORT (UNAUDITED) | | | | BLACKROCK® |

BlackRock Variable Series Funds, Inc.

▶ BlackRock Basic Value V.I. Fund

| | |

| Not FDIC Insured ¡ May Lose Value ¡ No Bank Guarantee | | |

| | | | |

| Fund Summary as of June 30, 2016 | | | BlackRock Basic Value V.I. Fund | |

BlackRock Basic Value V.I. Fund’s (the “Fund”) investment objective is to seek capital appreciation and, secondarily, income.

|

| Portfolio Management Commentary |

How did the Fund perform?

| • | | For the six-month period ended June 30, 2016, the Fund underperformed its benchmark, the Russell 1000® Value Index. |

What factors influenced performance?

| • | | Stock selection in the financials sector was the leading detractor from performance relative to the benchmark over the six-month period. In particular, overweight positions in Capital One Financial Corporation and Discover Financial Services, Inc. lagged amid concerns regarding consumer credit quality, while overweight positions in Citigroup, Inc. and JP Morgan Chase & Co. detracted as falling interest rates renewed concerns about pressure on bank net interest margins. The Fund’s underweight to real estate investment trusts also weighed on relative returns as falling interest rates continued to increase investor demand for yield. |

| • | | The Fund’s underweight allocation to consumer staples detracted from relative performance over the period, as investors gravitated to the sector’s perceived safety and stability without regard for valuation. Selection within the sector also hindered performance, in particular an overweight position in Kroger Co. as the grocery-store operator lagged due in part to concerns that food inflation may dampen same-store sales. |

| • | | On the positive side, stock selection in both health care and utilities contributed to relative performance during the period. In health care, an |

| | overweight position in St. Jude Medical, Inc. added value as shares of the medical device company rallied following the announcement of a planned acquisition by Abbott Laboratories. In addition, a position in biopharmaceutical company Baxalta Inc. benefited from the closing of its merger with Shire PLC. Stock selection in utilities was highlighted by overweight positions in Exelon Corp., AES Corp., and Dynegy, Inc., all of which benefited from the rebound in power prices during the quarter. Finally, relative performance was aided by an overweight in telecommunication services (“telecom”), most notably the Fund’s position in Verizon Communications, Inc. |

Describe recent portfolio activity.

| • | | During the period, portfolio management modestly increased the Fund’s investments in the energy and utilities sectors, while reducing exposure to financials and telecom. |

Describe portfolio positioning at period end.

| • | | Relative to the Russell 1000® Value Index, the Fund ended the period with the largest sector overweights in the health care, information technology, and energy sectors, while the most significant underweights were consumer staples, industrials and materials. |

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

| | |

| Sector Allocation | | Percent of Net Assets |

Financials | | 27% |

Health Care | | 16 |

Energy | | 15 |

Information Technology | | 13 |

Utilities | | 8 |

Consumer Discretionary | | 6 |

Industrials | | 5 |

Telecommunication Services | | 5 |

Materials | | 2 |

Consumer Staples | | 2 |

Short-Term Securities | | 8 |

Liabilities in Excess of Other Assets | | (7) |

For Fund compliance purposes, the Fund’s sector classifications refer to one or more of the sector sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by the investment adviser. These definitions may not apply for purposes of this report, which may combine sector sub-classifications for reporting ease.

| | | | | | |

| 2 | | BLACKROCK VARIABLE SERIES FUNDS, INC. | | JUNE 30, 2016 | | |

| | | | |

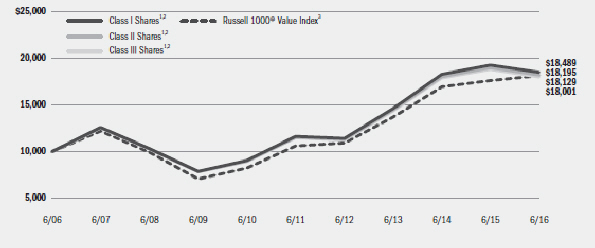

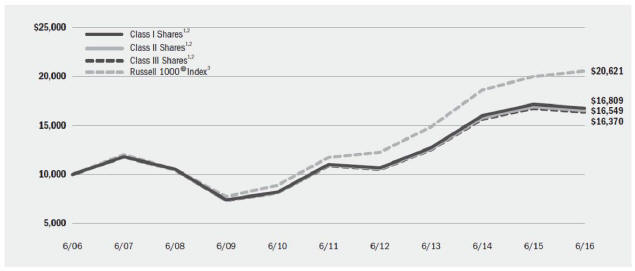

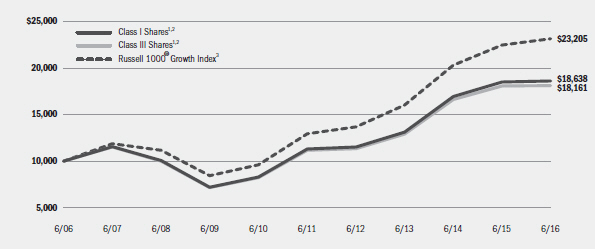

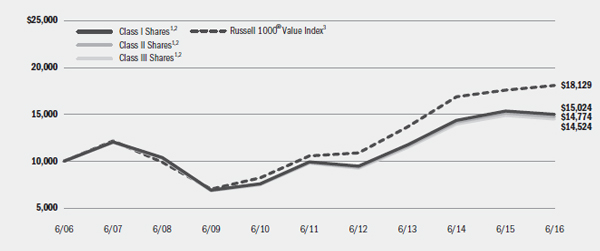

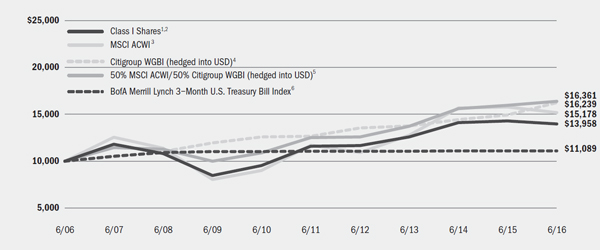

| | | | BlackRock Basic Value V.I. Fund | |

|

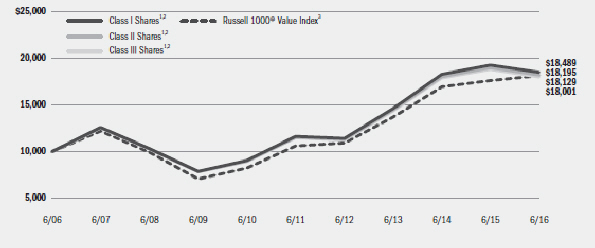

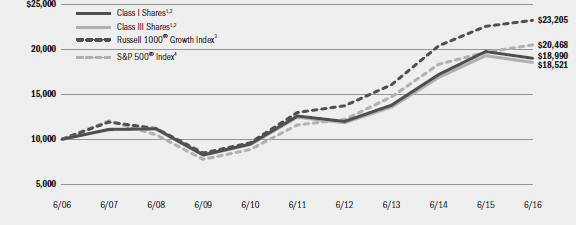

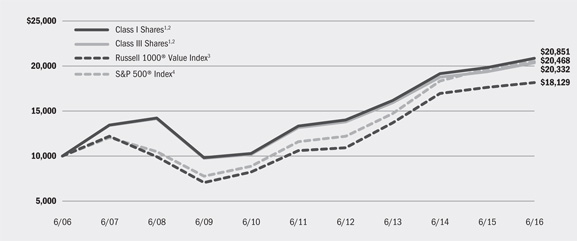

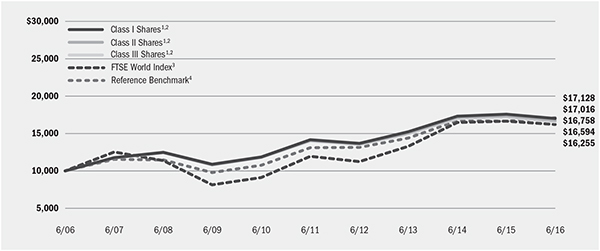

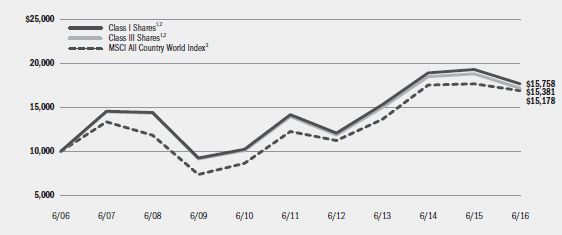

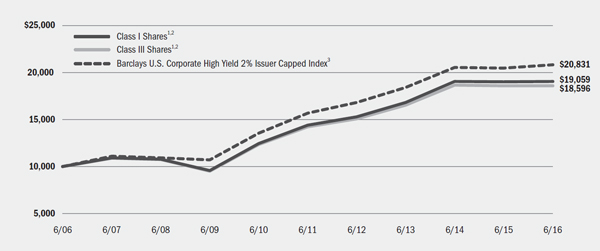

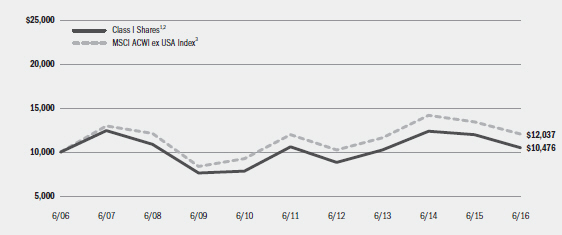

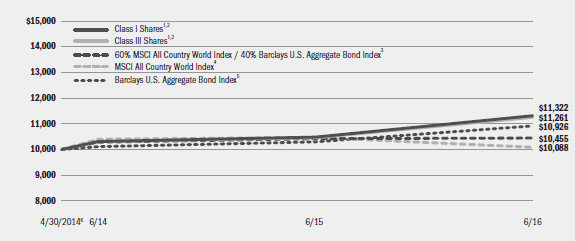

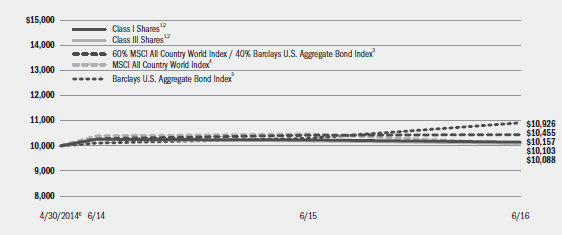

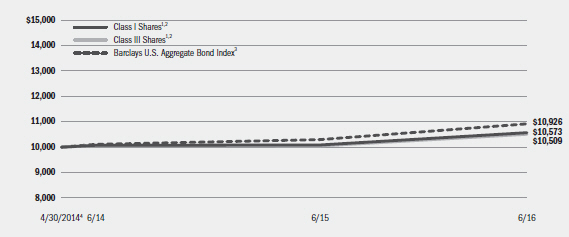

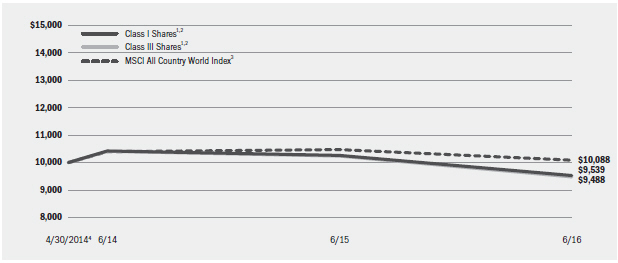

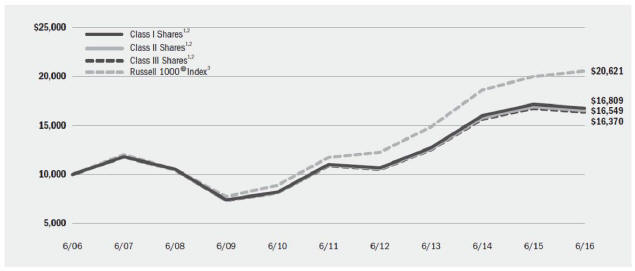

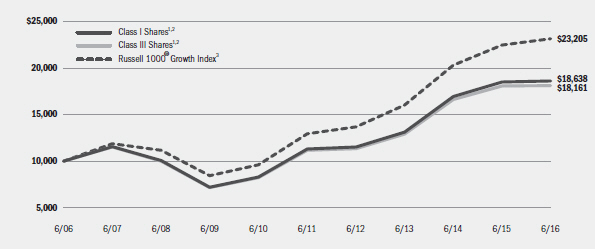

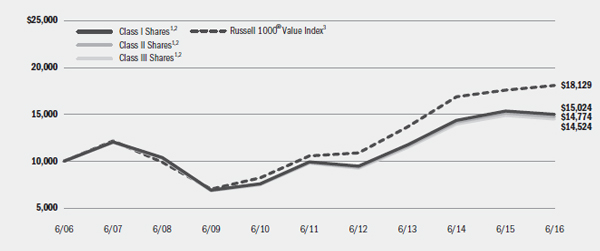

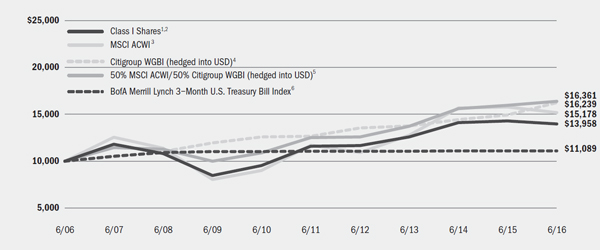

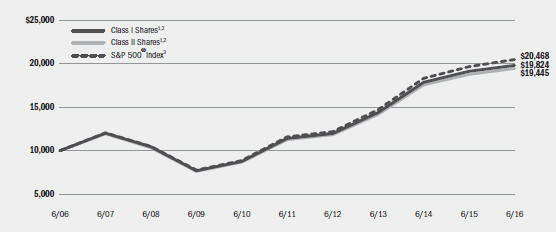

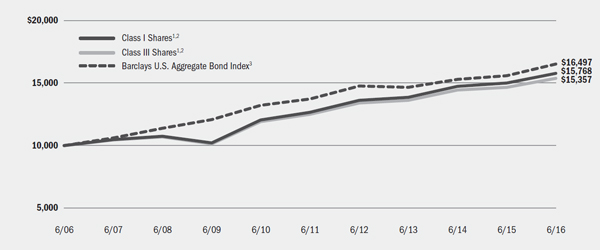

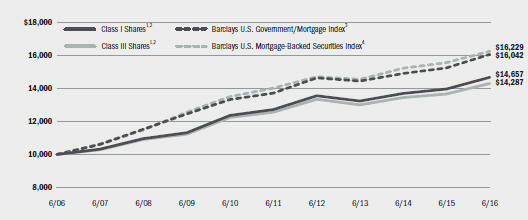

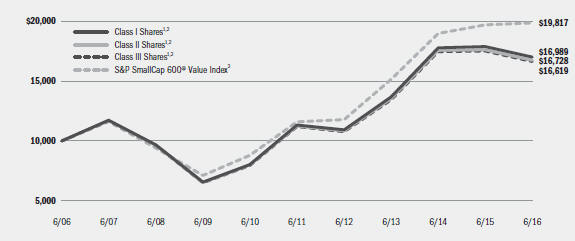

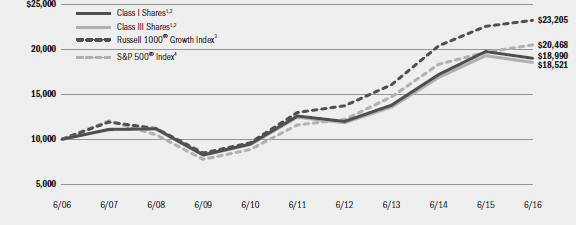

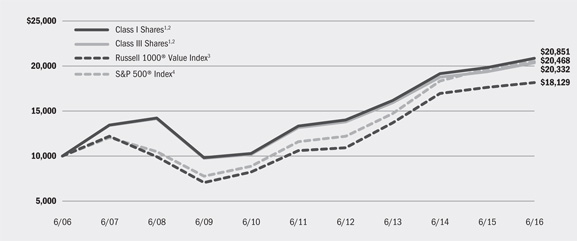

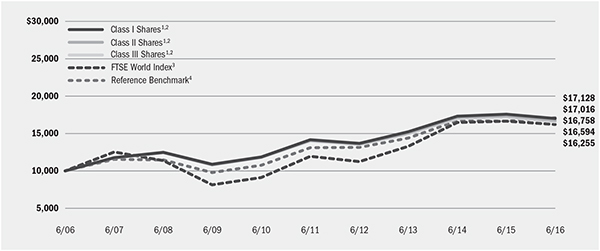

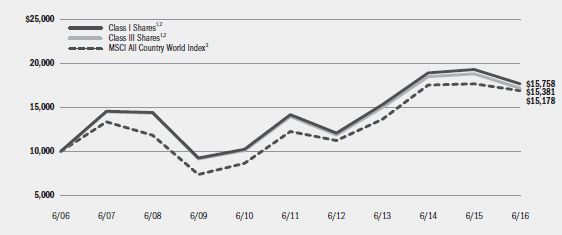

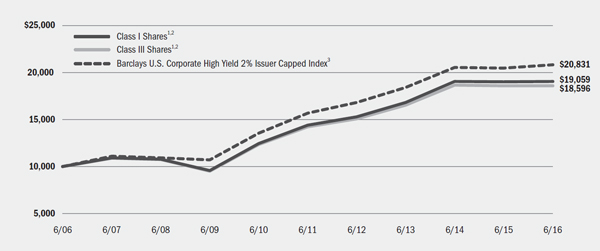

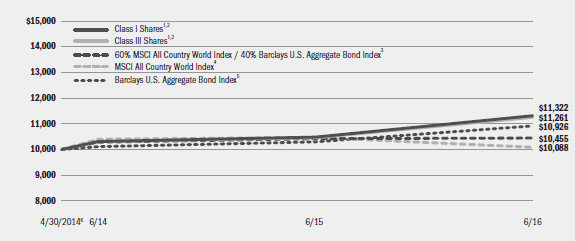

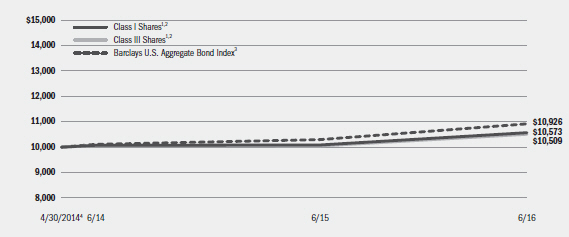

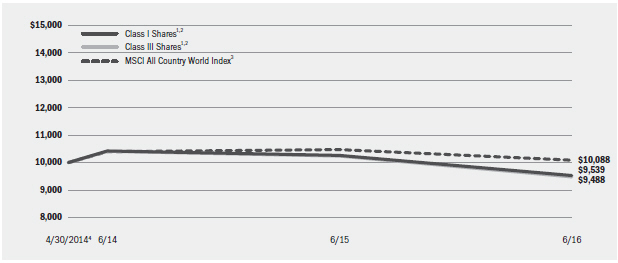

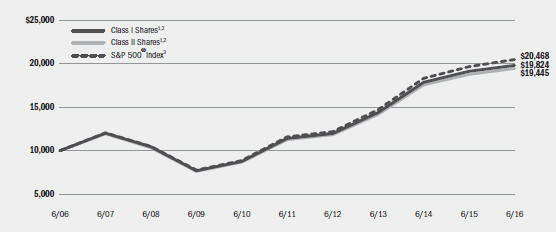

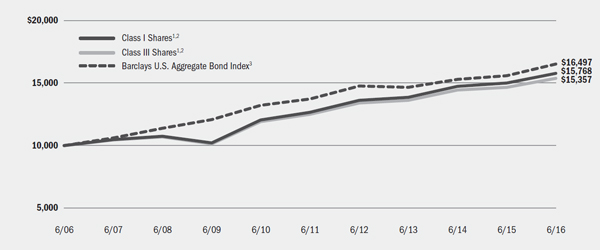

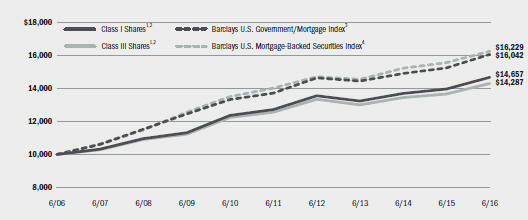

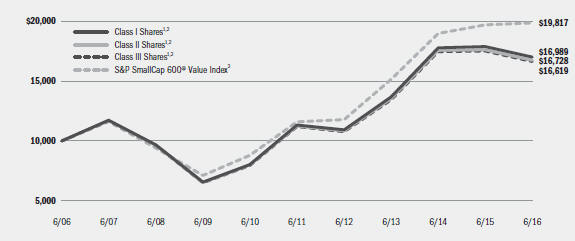

| Total Return Based on a $10,000 Investment |

| | 1 | Assuming transaction costs, if any, and other operating expenses, including investment advisory fees. Does not include insurance-related fees and expenses. |

| | 2 | The Fund invests primarily in equity securities that Fund management believes are undervalued, which means that their prices are less than Fund management believes they are worth. |

| | 3 | An unmanaged index that is a subset of the Russell 1000® Index that consists of those Russell 1000® securities with lower price-to-book ratios and lower expected growth values. |

| | | | | | | | | | | | |

| Performance Summary for the Period Ended June 30, 2016 |

| | | | |

| | | | | | | | | Average Annual Total Returns |

| | | | | 6-Month Total Returns5 | | | | 1 Year5 | | 5 Years5 | | 10 Years5 |

Class I4 | | | | 5.24% | | | | (4.12)% | | 9.77% | | 6.34% |

Class II4 | | | | 5.10 | | | | (4.26) | | 9.59 | | 6.17 |

Class III4 | | | | 4.97 | | | | (4.41) | | 9.45 | | 6.05 |

Russell 1000® Value Index | | | | 6.30 | | | | 2.86 | | 11.35 | | 6.13 |

| | 4 | | Average annual and cumulative total returns are based on changes in net asset value for the periods shown, and assume reinvestment of all distributions at net asset value on the ex-dividend date. Insurance-related fees and expenses are not reflected in these returns. |

| | 5 | | For a portion of the period, the Fund’s investment advisor waived a portion of its fee. Without such waiver, the Fund’s performance would have been lower. |

| | | | Past performance is not indicative of future results. Performance results do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

| | | | | | | | | | | | | | |

| Expense Example |

| | | |

| | | Actual | | Hypothetical7 | | |

| | | Beginning

Account Value January 1, 2016 | | Ending

Account Value

June 30, 2016 | | Expenses Paid

During the Period6 | | Beginning

Account Value

January 1, 2016 | | Ending

Account Value

June 30, 2016 | | Expenses Paid

During the Period6 | | Annualized

Expense

Ratio |

Class I | | $1,000.00 | | $1,052.40 | | $3.73 | | $1,000.00 | | $1,021.23 | | $3.67 | | 0.73% |

Class II | | $1,000.00 | | $1,051.00 | | $4.59 | | $1,000.00 | | $1,020.39 | | $4.52 | | 0.90% |

Class III | | $1,000.00 | | $1,049.70 | | $5.15 | | $1,000.00 | | $1,019.84 | | $5.07 | | 1.01% |

| | 6 | | For each class of the Fund, expenses are equal to the annualized expense ratio for the class, multiplied by the average account value over the period, multiplied by 182/366 (to reflect the one-half year period shown). |

| | 7 | | Hypothetical 5% annual return before expenses is calculated by prorating the number of days in the most recent fiscal half year divided by 366. |

| | | | See “Disclosure of Expenses” on the following page for further information on how expenses were calculated. |

| | | | | | |

| | | BLACKROCK VARIABLE SERIES FUNDS, INC. | | JUNE 30, 2016 | | 3 |

| | | | |

| | | | BlackRock Basic Value V.I. Fund | |

Disclosure of Expenses

Shareholders of the Fund may incur the following charges: (a) transactional expenses, such as sales charges; and (b) operating expenses, including investment advisory fees, service and distribution fees, including 12b-1 fees, acquired fund fees and expenses, and other fund expenses. The expense example on the previous page (which is based on a hypothetical investment of $1,000 invested on January 1, 2016 and held through June 30, 2016) is intended to assist shareholders both in calculating expenses based on an investment in the Fund and in comparing these expenses with similar costs of investing in other mutual funds.

The expense example provides information about actual account values and actual expenses. In order to estimate the expenses a shareholder paid during the period covered by this report, shareholders can divide their account value by $1,000 and then multiply the result by the number corresponding to their share class under the heading entitled “Expenses Paid During the Period.”

The expense example also provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses. In order to assist shareholders in comparing the ongoing expenses of investing in the Fund and other funds, compare the 5% hypothetical example with the 5% hypothetical examples that appear in shareholder reports of other funds.

The expenses shown in the expense example are intended to highlight shareholders’ ongoing costs only and do not reflect any transactional expenses, such as sales charges, if any. Therefore, the hypothetical example is useful in comparing ongoing expenses only, and will not help shareholders determine the relative total expenses of owning different funds. If these transactional expenses were included, shareholder expenses would have been higher.

| | | | | | |

| 4 | | BLACKROCK VARIABLE SERIES FUNDS, INC. | | JUNE 30, 2016 | | |

| | | | |

| Schedule of Investments June 30, 2016 (Unaudited) | | | BlackRock Basic Value V.I. Fund | |

| | | (Percentages shown are based on Net Assets) | |

| | | | | | | | |

| Common Stocks | | Shares | | | Value | |

Aerospace & Defense — 2.0% | | | | | | | | |

B/E Aerospace, Inc. | | | 20,180 | | | $ | 931,811 | |

Boeing Co. | | | 25,870 | | | | 3,359,737 | |

Honeywell International, Inc. | | | 11,560 | | | | 1,344,659 | |

Huntington Ingalls Industries, Inc. | | | 11,310 | | | | 1,900,419 | |

Northrop Grumman Corp. | | | 1,810 | | | | 402,327 | |

Raytheon Co. | | | 4,230 | | | | 575,069 | |

| | | | | | | | |

| | | | | | | | 8,514,022 | |

Airlines — 0.5% | | | | | | | | |

American Airlines Group, Inc. | | | 75,150 | | | | 2,127,497 | |

Auto Components — 1.3% | |

Lear Corp. | | | 51,290 | | | | 5,219,270 | |

Magna International, Inc. | | | 11,720 | | | | 411,020 | |

| | | | | | | | |

| | | | | | | | 5,630,290 | |

Automobiles — 0.2% | | | | | | | | |

Thor Industries, Inc. | | | 13,999 | | | | 906,295 | |

Banks — 12.4% | | | | | | | | |

Bank of America Corp. | | | 355,030 | | | | 4,711,248 | |

Citigroup, Inc. | | | 466,500 | | | | 19,774,935 | |

JPMorgan Chase & Co. | | | 336,946 | | | | 20,937,824 | |

KeyCorp | | | 221,490 | | | | 2,447,465 | |

Regions Financial Corp. | | | 327,260 | | | | 2,784,982 | |

Wells Fargo & Co. | | | 75,510 | | | | 3,573,888 | |

| | | | | | | | |

| | | | | | | | 54,230,342 | |

Biotechnology — 1.3% | | | | | | | | |

Gilead Sciences, Inc. | | | 69,600 | | | | 5,806,032 | |

Capital Markets — 0.9% | | | | | | | | |

Ameriprise Financial, Inc. | | | 10,320 | | | | 927,252 | |

KKR & Co. LP | | | 3,414 | | | | 42,129 | |

Morgan Stanley | | | 114,600 | | | | 2,977,308 | |

| | | | | | | | |

| | | | | | | | 3,946,689 | |

Chemicals — 0.5% | | | | | | | | |

Akzo Nobel NV — ADR | | | 63,985 | | | | 1,346,244 | |

Ashland, Inc. | | | 5,600 | | | | 642,712 | |

| | | | | | | | |

| | | | | | | | 1,988,956 | |

Communications Equipment — 6.0% | | | | | | | | |

Cisco Systems, Inc. | | | 774,970 | | | | 22,233,889 | |

Nokia OYJ — ADR (a) | | | 376,880 | | | | 2,144,447 | |

Telefonaktiebolaget LM Ericsson — ADR (a) | | | 256,091 | | | | 1,966,779 | |

| | | | | | | | |

| | | | | | | | 26,345,115 | |

Construction & Engineering — 0.4% | | | | | | | | |

AECOM (b) | | | 56,130 | | | | 1,783,250 | |

Consumer Finance — 6.9% | | | | | | | | |

Capital One Financial Corp. | | | 171,700 | | | | 10,904,667 | |

| | | | | | | | |

| Common Stocks | | Shares | | | Value | |

Consumer Finance (continued) | |

Discover Financial Services | | | 295,200 | | | $ | 15,819,768 | |

SLM Corp. (b) | | | 544,957 | | | | 3,367,834 | |

| | | | | | | | |

| | | | | | | | 30,092,269 | |

Containers & Packaging — 0.7% | | | | | | | | |

Avery Dennison Corp. | | | 10,840 | | | | 810,290 | |

Bemis Co., Inc. | | | 27,730 | | | | 1,427,818 | |

Crown Holdings, Inc. (b) | | | 16,870 | | | | 854,803 | |

| | | | | | | | |

| | | | | | | | 3,092,911 | |

Diversified Financial Services — 1.2% | |

Nasdaq, Inc. | | | 77,800 | | | | 5,031,326 | |

Diversified Telecommunication Services — 2.8% | |

Verizon Communications, Inc. | | | 215,830 | | | | 12,051,947 | |

Electric Utilities — 3.2% | | | | | | | | |

Exelon Corp. | | | 387,200 | | | | 14,078,592 | |

Energy Equipment & Services — 1.0% | |

Superior Energy Services, Inc. (b) | | | 244,122 | | | | 4,494,286 | |

Food & Staples Retailing — 1.2% | | | | | | | | |

CVS Health Corp. | | | 8,560 | | | | 819,534 | |

Kroger Co. | | | 119,652 | | | | 4,401,997 | |

| | | | | | | | |

| | | | | | | | 5,221,531 | |

Food Products — 0.3% | | | | | | | | |

Mondelez International, Inc., Class A | | | 28,860 | | | | 1,313,419 | |

Health Care Equipment & Supplies — 6.2% | |

Baxter International, Inc. | | | 242,200 | | | | 10,952,284 | |

Medtronic PLC | | | 63,218 | | | | 5,485,426 | |

St. Jude Medical, Inc. | | | 29,900 | | | | 2,332,200 | |

Zimmer Biomet Holdings, Inc. | | | 67,300 | | | | 8,101,574 | |

| | | | | | | | |

| | | | | | | | 26,871,484 | |

Hotels, Restaurants & Leisure — 0.0% | |

Wyndham Worldwide Corp. (a) | | | 620 | | | | 44,163 | |

Household Durables — 1.2% | | | | | | | | |

Newell Brands, Inc. | | | 101,880 | | | | 4,948,312 | |

Tupperware Brands Corp. (a) | | | 8,620 | | | | 485,134 | |

| | | | | | | | |

| | | | | | | | 5,433,446 | |

Independent Power and Renewable Electricity Producers — 4.5% | |

AES Corp. | | | 1,038,530 | | | | 12,960,854 | |

Dynegy, Inc. (b) | | | 377,290 | | | | 6,504,480 | |

| | | | | | | | |

| | | | | | | | 19,465,334 | |

Insurance — 3.9% | | | | | | | | |

Genworth Financial, Inc., Class A (b) | | | 381,450 | | | | 984,141 | |

Hartford Financial Services Group, Inc. | | | 117,701 | | | | 5,223,570 | |

Lincoln National Corp. | | | 81,727 | | | | 3,168,556 | |

| | |

| Portfolio Abbreviation |

| ADR | | American Depositary Receipts |

See Notes to Financial Statements.

| | | | | | |

| | | BLACKROCK VARIABLE SERIES FUNDS, INC. | | JUNE 30, 2016 | | 5 |

| | | | |

| Schedule of Investments (continued) | | | BlackRock Basic Value V.I. Fund | |

| | | | |

| | | | | | | | |

| Common Stocks | | Shares | | | Value | |

Insurance (continued) | | | | | | | | |

MetLife, Inc. | | | 11,131 | | | $ | 443,348 | |

Prudential Financial, Inc. | | | 58,570 | | | | 4,178,384 | |

XL Group PLC | | | 89,370 | | | | 2,976,915 | |

| | | | | | | | |

| | | | | | | | 16,974,914 | |

Internet & Catalog Retail — 0.0% | | | | | | | | |

Priceline Group, Inc. (b) | | | 100 | | | | 124,841 | |

IT Services — 0.2% | | | | | | | | |

Fidelity National Information Services, Inc. | | | 6,220 | | | | 458,290 | |

First Data Corp., Class A (b) | | | 48,920 | | | | 541,544 | |

| | | | | | | | |

| | | | | | | | 999,834 | |

Media — 2.9% | | | | | | | | |

Comcast Corp., Class A | | | 73,390 | | | | 4,784,294 | |

Interpublic Group of Cos., Inc. | | | 91,180 | | | | 2,106,258 | |

Omnicom Group, Inc. (a) | | | 17,890 | | | | 1,457,856 | |

Scripps Networks Interactive, Inc., Class A (a) | | | 66,980 | | | | 4,170,845 | |

| | | | | | | | |

| | | | | | | | 12,519,253 | |

Metals & Mining — 0.6% | | | | | | | | |

Allegheny Technologies, Inc. (a) | | | 20,100 | | | | 256,275 | |

Reliance Steel & Aluminum Co. | | | 31,800 | | | | 2,445,420 | |

| | | | | | | | |

| | | | | | | | 2,701,695 | |

Multiline Retail — 0.1% | | | | | | | | |

Dollar General Corp. (a) | | | 2,330 | | | | 219,020 | |

Oil, Gas & Consumable Fuels — 14.3% | | | | | | | | |

Apache Corp. (a) | | | 301,410 | | | | 16,779,495 | |

Devon Energy Corp. | | | 332,900 | | | | 12,067,625 | |

Gulfport Energy Corp. (b) | | | 253,940 | | | | 7,938,164 | |

Hess Corp. | | | 11,070 | | | | 665,307 | |

Marathon Oil Corp. | | | 800,362 | | | | 12,013,434 | |

Marathon Petroleum Corp. | | | 105,850 | | | | 4,018,066 | |

Parsley Energy, Inc., Class A (b) | | | 82,520 | | | | 2,232,991 | |

Suncor Energy, Inc. | | | 16,590 | | | | 460,041 | |

Valero Energy Corp. (a) | | | 125,710 | | | | 6,411,210 | |

| | | | | | | | |

| | | | | | | | 62,586,333 | |

Personal Products — 0.1% | | | | | | | | |

Unilever NV — NY Shares | | | 9,320 | | | | 437,481 | |

Pharmaceuticals — 8.9% | | | | | | | | |

Merck & Co., Inc. | | | 281,370 | | | | 16,209,726 | |

Pfizer, Inc. | | | 519,570 | | | | 18,294,060 | |

Shire PLC — ADR | | | 13,316 | | | | 2,451,209 | |

Teva Pharmaceutical Industries Ltd. — ADR | | | 41,290 | | | | 2,073,997 | |

| | | | | | | | |

| | | | | | | | 39,028,992 | |

Professional Services — 2.6% | | | | | | | | |

Dun & Bradstreet Corp. | | | 5,641 | | | | 687,299 | |

Nielsen Holdings PLC | | | 204,140 | | | | 10,609,156 | |

| | | | | | | | |

| | | | | | | | 11,296,455 | |

Real Estate Investment Trusts (REITs) — 1.1% | | | | | | | | |

Brixmor Property Group, Inc. | | | 49,290 | | | | 1,304,213 | |

Starwood Property Trust, Inc. (a) | | | 178,690 | | | | 3,702,457 | |

| | | | | | | | |

| | | | | | | | 5,006,670 | |

Semiconductors & Semiconductor Equipment — 5.1% | | | | | | | | |

Lam Research Corp. | | | 550 | | | | 46,233 | |

QUALCOMM, Inc. | | | 389,190 | | | | 20,848,908 | |

Teradyne, Inc. | | | 76,470 | | | | 1,505,694 | |

| | | | | | | | |

| | | | | | | | 22,400,835 | |

Software — 0.1% | | | | | | | | |

Oracle Corp. | | | 5,470 | | | | 223,887 | |

| | | | | | | | |

| Common Stocks | | Shares | | | Value | |

Specialty Retail — 0.6% | | | | | | | | |

GNC Holdings, Inc., Class A | | | 113,490 | | | $ | 2,756,672 | |

Technology Hardware, Storage & Peripherals — 1.0% | |

Apple Inc. | | | 46,730 | | | | 4,467,388 | |

Thrifts & Mortgage Finance — 0.5% | | | | | | | | |

New York Community Bancorp, Inc. (a) | | | 148,300 | | | | 2,223,017 | |

Trading Companies & Distributors — 0.1% | | | | | | | | |

AerCap Holdings NV (b) | | | 3,870 | | | | 129,993 | |

Air Lease Corp. (a) | | | 6,440 | | | | 172,463 | |

| | | | | | | | |

| | | | | | | | 302,456 | |

Wireless Telecommunication Services — 1.9% | | | | | | | | |

Telephone & Data Systems, Inc. | | | 242,554 | | | | 7,194,152 | |

United States Cellular Corp. (b) | | | 29,883 | | | | 1,173,505 | |

| | | | | | | | |

| | | | | | | | 8,367,657 | |

Total Common Stocks — 98.7% | | | | | | | 431,106,596 | |

| | | | | | | | |

| Preferred Stocks | | | | | | |

Food Products — 0.5% | | | | | | | | |

Tyson Foods, Inc., 4.75% (c) | | | 27,359 | | | | 2,021,283 | |

Machinery — 0.1% | | | | | | | | |

Stanley Black & Decker, Inc., 6.25% (a)(c) | | | 3,270 | | | | 379,647 | |

Total Preferred Stocks — 0.6% | | | | 2,400,930 | |

Total Long-Term Investments (Cost — $404,075,120) — 99.3% | | | | 433,507,526 | |

| | | | | | | | |

| Short-Term Securities | | | | | | |

BlackRock Liquidity Funds, TempFund, Institutional Class, 0.40% (d)(e) | | | 6,308,310 | | | | 6,308,310 | |

| | | Beneficial

Interest

(000) | | | | |

BlackRock Liquidity Series, LLC, Money Market Series, 0.59% (d)(e)(f) | | $ | 28,215 | | | | 28,215,428 | |

Total Short-Term Securities (Cost — $34,523,738) — 7.9% | | | | 34,523,738 | |

Total Investments (Cost — $438,598,858) — 107.2% | | | | 468,031,264 | |

Liabilities in Excess of Other Assets — (7.2)% | | | | (31,320,797 | ) |

| | | | | | | | |

Net Assets — 100.0% | | | | | | $ | 436,710,467 | |

| | | | | | | | |

See Notes to Financial Statements.

| | | | | | |

| 6 | | BLACKROCK VARIABLE SERIES FUNDS, INC. | | JUNE 30, 2016 | | |

| | | | |

| Schedule of Investments (concluded) | | | BlackRock Basic Value V.I. Fund | |

|

| Notes to Schedule of Investments |

| (a) | Security, or a portion of security, is on loan. |

| (b) | Non-income producing security. |

| (d) | During the six months ended June 30, 2016, investments in issuers considered to be affiliates of the Fund for purposes of Section 2(a)(3) of the Investment Company Act of 1940, as amended, were as follows: |

| | | | | | | | | | | | | | | | | | | | |

| Affiliate | | Shares/Beneficial

Interest Held at

December 31, 2015 | | | Net Activity | | | Shares/Beneficial

Interest Held at

June 30, 2016 | | | Value at

June 30, 2016 | | | Income | |

BlackRock Liquidity Funds, TempFund, Institutional Class | | | 2,943,348 | | | | 3,364,962 | | | | 6,308,310 | | | $ | 6,308,310 | | | $ | 2,560 | |

BlackRock Liquidity Series, LLC Money Market Series | | | 27,873,304 | | | $ | 342,124 | | | | 28,215,428 | | | | 28,215,428 | | | | 46,865 | 1 |

Total | | | | | | | | | | | | | | $ | 34,523,738 | | | $ | 49,425 | |

| | | | | | | | | | | | | | | | |

| | 1 | | Represents securities lending income earned from the reinvestment of cash collateral from loaned securities, net of fees and collateral investment expenses, and other payments to and from borrowers of securities. |

| (e) | Current yield as of period end. |

| (f) | Security was purchased with the cash collateral from loaned securities. The Fund may withdraw up to 25% of its investment daily, although the manager of the BlackRock Liquidity Series, LLC, Money Market Series, in its sole discretion, may permit an investor to withdraw more than 25% on any one day. |

| • | | For Fund compliance purposes, the Fund’s industry classifications refer to one or more of the industry sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by the investment adviser. These definitions may not apply for purposes of this report, which may combine such industry sub-classifications for reporting ease. |

|

| Fair Value Hierarchy as of Period End |

Various inputs are used in determining the fair value of investments. For information about the Fund’s policy regarding valuation of investments, refer to the Notes to Financial Statements.

The following table summarizes the Fund’s investments categorized in the disclosure hierarchy:

| | | | | | | | | | | | | | | | |

| | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

Assets: | | | | | | | | | | | | | | | | |

Investments: | | | | | | | | | | | | | | | | |

Long-Term Investments1 | | $ | 433,507,526 | | | | — | | | | — | | | $ | 433,507,526 | |

Short-Term Securities | | | 6,308,310 | | | $ | 28,215,428 | | | | — | | | | 34,523,738 | |

| | | | |

Total | | $ | 439,815,836 | | | $ | 28,215,428 | | | | — | | | $ | 468,031,264 | |

| | | | |

| | 1 | | See above Schedule of Investments for values in each industry. |

The Fund may hold assets and/or liabilities in which the fair value approximates the carrying amount for financial statement purposes. As of period end, collateral on securities loaned at value of $28,215,428 is categorized as Level 2 within the disclosure hierarchy.

During the six months ended June 30, 2016, there were no transfers between levels.

See Notes to Financial Statements.

| | | | | | |

| | | BLACKROCK VARIABLE SERIES FUNDS, INC. | | JUNE 30, 2016 | | 7 |

| | | | |

| Statement of Assets and Liabilities | | | | |

| | | | |

| June 30, 2016 (Unaudited) | | BlackRock

Basic Value V.I. Fund | |

| | | | |

| Assets | | | | |

Investments at value — unaffiliated (including securities loaned at value of $27,711,546) (cost — $404,075,120) | | $ | 433,507,526 | |

Investments at value — affiliated (cost — $34,523,738) | | | 34,523,738 | |

Receivables: | | | | |

Investments sold | | | 7,467,597 | |

Securities lending income — affiliated | | | 7,430 | |

Capital shares sold | | | 24,373 | |

Dividends — affiliated | | | 868 | |

Dividends — unaffiliated | | | 477,552 | |

From the Manager | | | 83,351 | |

Prepaid expenses | | | 1,011 | |

| | | | |

Total assets | | | 476,093,446 | |

| | | | |

| | | | |

| Liabilities | | | | |

Collateral on securities loaned at value | | | 28,215,428 | |

Payables: | | | | |

Investments purchased | | | 2,501,658 | |

Capital shares redeemed | | | 8,099,677 | |

Distribution fees | | | 10,209 | |

Investment advisory fees | | | 219,193 | |

Officer’s and Directors’ fees | | | 4,011 | |

Other accrued expenses | | | 330,373 | |

Other affiliates | | | 2,430 | |

| | | | |

Total liabilities | | | 39,382,979 | |

| | | | |

Net Assets | | $ | 436,710,467 | |

| | | | |

| | | | |

| Net Assets Consist of | | | | |

Paid-in capital | | $ | 399,936,153 | |

Undistributed net investment income | | | 3,732,479 | |

Accumulated net realized gain | | | 3,609,429 | |

Net unrealized appreciation (depreciation) | | | 29,432,406 | |

| | | | |

Net Assets | | $ | 436,710,467 | |

| | | | |

| | | | |

| Net Asset Value | | | | |

Class I — Based on net assets of $385,144,215 and 27,402,747 shares outstanding, 300 million shares authorized, $0.10 par value | | $ | 14.05 | |

| | | | |

Class II — Based on net assets of $5,281,585 and 377,036 shares outstanding, 100 million shares authorized, $0.10 par value | | $ | 14.01 | |

| | | | |

Class III — Based on net assets of $46,284,667 and 3,318,730 shares outstanding, 100 million shares authorized, $0.10 par value | | $ | 13.95 | |

| | | | |

See Notes to Financial Statements.

| | | | | | |

| 8 | | BLACKROCK VARIABLE SERIES FUNDS, INC. | | JUNE 30, 2016 | | |

| | | | |

| Six Months Ended June 30, 2016 (Unaudited) | | BlackRock

Basic Value V.I. Fund | |

| | | | |

| Investment Income | | | | |

Dividends — unaffiliated | | $ | 5,370,564 | |

Securities lending — affiliated — net | | | 46,865 | |

Dividends — affiliated | | | 2,560 | |

Foreign taxes withheld | | | (68,384 | ) |

| | | | |

Total income | | | 5,351,605 | |

| | | | |

| | | | |

| Expenses | | | | |

Investment advisory | | | 1,280,954 | |

Transfer agent — class specific | | | 400,678 | |

Distribution — class specific | | | 58,570 | |

Accounting services | | | 48,462 | |

Professional | | | 36,359 | |

Custodian | | | 27,543 | |

Printing | | | 13,891 | |

Officer and Directors | | | 12,533 | |

Transfer agent | | | 2,463 | |

Miscellaneous | | | 7,606 | |

| | | | |

Total expenses | | | 1,889,059 | |

Less: | | | | |

Fees waived by the Manager | | | (466 | ) |

Transfer agent fees reimbursed — class specific | | | (265,132 | ) |

| | | | |

Total expenses after fees waived and/or reimbursed | | | 1,623,461 | |

| | | | |

Net investment income | | | 3,728,144 | |

| | | | |

| | | | |

| Realized and Unrealized Gain | | | | |

Net realized gain from investments | | | 2,047,576 | |

Net change in unrealized appreciation (depreciation) on investments | | | 15,726,168 | |

| | | | |

Total realized and unrealized gain | | | 17,773,744 | |

| | | | |

Net Increase in Net Assets Resulting from Operations | | $ | 21,501,888 | |

| | | | |

See Notes to Financial Statements.

| | | | | | |

| | | BLACKROCK VARIABLE SERIES FUNDS, INC. | | JUNE 30, 2016 | | 9 |

| | | | |

| Statements of Changes in Net Assets | | | BlackRock Basic Value V.I. Fund | |

| | | | | | | | |

| Increase (Decrease) in Net Assets: | | Six Months Ended

June 30, 2016

(Unaudited) | | | Year Ended December 31, 2015 | |

| | | | | | | | |

| Operations | | | | | | | | |

Net investment income | | $ | 3,728,144 | | | $ | 7,171,154 | |

Net realized gain | | | 2,047,576 | | | | 54,034,585 | |

Net change in unrealized appreciation (depreciation) | | | 15,726,168 | | | | (88,682,929 | ) |

| | | | |

Net increase (decrease) in net assets resulting from operations | | | 21,501,888 | | | | (27,477,190 | ) |

| | | | |

| | | | | | | | |

| Distributions to Shareholders1 | | | | | | | | |

From net investment income: | | | | | | | | |

Class I | | | — | | | | (6,536,936 | ) |

Class II | | | — | | | | (80,368 | ) |

Class III | | | — | | | | (614,442 | ) |

From net realized gain: | | | | | | | | |

Class I | | | — | | | | (47,597,385 | ) |

Class II | | | — | | | | (660,255 | ) |

Class III | | | — | | | | (5,510,489 | ) |

| | | | |

Decrease in net assets resulting from distributions to shareholders | | | — | | | | (60,999,875 | ) |

| | | | |

| | | | | | | | |

| Capital Share Transactions | | | | | | | | |

Net increase (decrease) in net assets derived from capital share transactions | | | (28,824,875 | ) | | | 3,007,568 | |

| | | | |

| | | | | | | | |

| Net Assets | | | | | | | | |

Total decrease in net assets | | | (7,322,987 | ) | | | (85,469,497 | ) |

Beginning of period | | | 444,033,454 | | | | 529,502,951 | |

| | | | |

End of period | | $ | 436,710,467 | | | $ | 444,033,454 | |

| | | | |

Undistributed net investment income, end of period | | $ | 3,732,479 | | | $ | 4,335 | |

| | | | |

| 1 | Distributions for annual periods determined in accordance with federal income tax regulations. |

See Notes to Financial Statements.

| | | | | | |

| 10 | | BLACKROCK VARIABLE SERIES FUNDS, INC. | | JUNE 30, 2016 | | |

| | | | |

| Financial Highlights | | | BlackRock Basic Value V.I. Fund | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Class I | |

| | | Six Months

Ended

June 30, 2016

(Unaudited) | | | Year Ended December 31, | |

| | | | 2015 | | | 2014 | | | 2013 | | | 2012 | | | 2011 | |

| Per Share Operating Performance | | | | | | | | | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | $ | 13.36 | | | $ | 16.42 | | | $ | 17.44 | | | $ | 12.80 | | | $ | 11.43 | | | $ | 11.94 | |

| | | | |

Net investment income1 | | | 0.12 | | | | 0.24 | | | | 0.25 | | | | 0.22 | | | | 0.22 | | | | 0.19 | |

Net realized and unrealized gain (loss) | | | 0.57 | | | | (1.20 | ) | | | 1.51 | | | | 4.65 | | | | 1.38 | | | | (0.48 | ) |

| | | | |

Net increase (decrease) from investment operations | | | 0.69 | | | | (0.96 | ) | | | 1.76 | | | | 4.87 | | | | 1.60 | | | | (0.29 | ) |

| | | | |

Distributions:2 | | | | | | | | | | | | | | | | | | | | | | | | |

From net investment income | | | — | | | | (0.25 | ) | | | (0.27 | ) | | | (0.23 | ) | | | (0.23 | ) | | | (0.22 | ) |

From net realized gain | | | — | | | | (1.85 | ) | | | (2.51 | ) | | | — | | | | — | | | | — | |

| | | | |

Total distributions | | | — | | | | (2.10 | ) | | | (2.78 | ) | | | (0.23 | ) | | | (0.23 | ) | | | (0.22 | ) |

| | | | |

Net asset value, end of period | | $ | 14.05 | | | $ | 13.36 | | | $ | 16.42 | | | $ | 17.44 | | | $ | 12.80 | | | $ | 11.43 | |

| | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| Total Return3 | | | | | | | | | | | | | | | | | | | | | | | | |

Based on net asset value | | | 5.24 | %4 | | | (5.95 | )% | | | 9.93 | % | | | 38.07 | % | | | 14.05 | % | | | (2.45 | )% |

| | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| Ratios to Average Net Assets | | | | | | | | | | | | | | | | | | | | | | | | |

Total expenses | | | 0.85 | %5 | | | 0.86 | % | | | 0.85 | % | | | 0.84 | % | | | 0.79 | % | | | 0.67 | % |

| | | | |

Total expenses after fees waived and/or reimbursed | | | 0.73 | %5 | | | 0.73 | % | | | 0.72 | % | | | 0.72 | % | | | 0.71 | % | | | 0.67 | % |

| | | | |

Net investment income | | | 1.78 | %5 | | | 1.47 | % | | | 1.40 | % | | | 1.41 | % | | | 1.79 | % | | | 1.58 | % |

| | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| Supplemental Data | | | | | | | | | | | | | | | | | | | | | | | | |

Net assets, end of period (000) | | $ | 385,144 | | | $ | 393,370 | | | $ | 468,876 | | | $ | 448,299 | | | $ | 363,954 | | | $ | 366,990 | |

| | | | |

Portfolio turnover rate | | | 21 | % | | | 50 | % | | | 39 | % | | | 47 | % | | | 42 | % | | | 58 | % |

| | | | |

| |

| | | Class II | |

| | | Six Months

Ended

June 30, 2016

(Unaudited) | | | Year Ended December 31, | |

| | | | 2015 | | | 2014 | | | 2013 | | | 2012 | | | 2011 | |

| Per Share Operating Performance | | | | | | | | | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | $ | 13.33 | | | $ | 16.38 | | | $ | 17.40 | | | $ | 12.77 | | | $ | 11.40 | | | $ | 11.91 | |

| | | | |

Net investment income1 | | | 0.11 | | | | 0.21 | | | | 0.22 | | | | 0.19 | | | | 0.20 | | | | 0.17 | |

Net realized and unrealized gain (loss) | | | 0.57 | | | | (1.18 | ) | | | 1.51 | | | | 4.64 | | | | 1.38 | | | | (0.48 | ) |

| | | | |

Net increase (decrease) from investment operations | | | 0.68 | | | | (0.97 | ) | | | 1.73 | | | | 4.83 | | | | 1.58 | | | | (0.31 | ) |

| | | | |

Distributions:2 | | | | | | | | | | | | | | | | | | | | | | | | |

From net investment income | | | — | | | | (0.23 | ) | | | (0.24 | ) | | | (0.20 | ) | | | (0.21 | ) | | | (0.20 | ) |

From net realized gain | | | — | | | | (1.85 | ) | | | (2.51 | ) | | | — | | | | — | | | | — | |

| | | | |

Total distributions | | | — | | | | (2.08 | ) | | | (2.75 | ) | | | (0.20 | ) | | | (0.21 | ) | | | (0.20 | ) |

| | | | |

Net asset value, end of period | | $ | 14.01 | | | $ | 13.33 | | | $ | 16.38 | | | $ | 17.40 | | | $ | 12.77 | | | $ | 11.40 | |

| | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| Total Return3 | | | | | | | | | | | | | | | | | | | | | | | | |

Based on net asset value | | | 5.10 | %4 | | | (6.07 | )% | | | 9.75 | % | | | 37.85 | % | | | 13.89 | % | | | (2.64 | )% |

| | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| Ratios to Average Net Assets | | | | |

Total expenses | | | 1.03 | %5 | | | 1.02 | % | | | 1.02 | % | | | 1.01 | % | | | 0.95 | % | | | 0.82 | % |

| | | | |

Total expenses after fees waived and/or reimbursed | | | 0.90 | %5 | | | 0.90 | % | | | 0.89 | % | | | 0.89 | % | | | 0.87 | % | | | 0.82 | % |

| | | | |

Net investment income | | | 1.61 | %5 | | | 1.30 | % | | | 1.23 | % | | | 1.24 | % | | | 1.63 | % | | | 1.41 | % |

| | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| Supplemental Data | | | | | | | | | | | | | | | | | | | | | | | | |

Net assets, end of period (000) | | $ | 5,282 | | | $ | 5,466 | | | $ | 6,233 | | | $ | 6,715 | | | $ | 6,058 | | | $ | 6,462 | |

| | | | |

Portfolio turnover rate | | | 21 | % | | | 50 | % | | | 39 | % | | | 47 | % | | | 42 | % | | | 58 | % |

| | | | |

| | 1 | | Based on average shares outstanding. |

| | 2 | | Distributions for annual periods determined in accordance with federal income tax regulations. |

| | 3 | | Where applicable, excludes insurance-related fees and expenses and assumes the reinvestment of distributions. |

| | 4 | | Aggregate total return. |

See Notes to Financial Statements.

| | | | | | |

| | | BLACKROCK VARIABLE SERIES FUNDS, INC. | | JUNE 30, 2016 | | 11 |

| | | | |

| Financial Highlights (concluded) | | | BlackRock Basic Value V.I. Fund | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Class III | |

| | | Six Months

Ended

June 30, 2016

(Unaudited) | | | Year Ended December 31, | |

| | | | 2015 | | | 2014 | | | 2013 | | | 2012 | | | 2011 | |

| Per Share Operating Performance | | | | | | | | | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | $ | 13.28 | | | $ | 16.32 | | | $ | 17.35 | | | $ | 12.74 | | | $ | 11.37 | | | $ | 11.89 | |

| | | | |

Net investment income1 | | | 0.10 | | | | 0.19 | | | | 0.20 | | | | 0.17 | | | | 0.19 | | | | 0.16 | |

Net realized and unrealized gain (loss) | | | 0.57 | | | | (1.17 | ) | | | 1.50 | | | | 4.62 | | | | 1.38 | | | | (0.49 | ) |

| | | | |

Net increase (decrease) from investment operations | | | 0.67 | | | | (0.98 | ) | | | 1.70 | | | | 4.79 | | | | 1.57 | | | | (0.33 | ) |

| | | | |

Distributions:2 | | | | | | | | | | | | | | | | | | | | | | | | |

From net investment income | | | — | | | | (0.21 | ) | | | (0.22 | ) | | | (0.18 | ) | | | (0.20 | ) | | | (0.19 | ) |

From net realized gain | | | — | | | | (1.85 | ) | | | (2.51 | ) | | | — | | | | — | | | | — | |

| | | | |

Total distributions | | | — | | | | (2.06 | ) | | | (2.73 | ) | | | (0.18 | ) | | | (0.20 | ) | | | (0.19 | ) |

| | | | |

Net asset value, end of period | | $ | 13.95 | | | $ | 13.28 | | | $ | 16.32 | | | $ | 17.35 | | | $ | 12.74 | | | $ | 11.37 | |

| | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| Total Return3 | | | | | | | | | | | | | | | | | | | | | | | | |

Based on net asset value | | | 4.97 | %4 | | | (6.15 | )% | | | 9.63 | % | | | 37.65 | % | | | 13.81 | % | | | (2.78 | )% |

| | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| Ratios to Average Net Assets | | | | | | | | | | | | | | | | | | | | | | | | |

Total expenses | | | 1.13 | %5 | | | 1.13 | % | | | 1.11 | % | | | 1.12 | % | | | 1.05 | % | | | 0.92 | % |

| | | | |

Total expenses after fees waived and/or reimbursed | | | 1.01 | %5 | | | 1.01 | % | | | 1.00 | % | | | 1.00 | % | | | 0.98 | % | | | 0.92 | % |

| | | | |

Net investment income | | | 1.50 | %5 | | | 1.19 | % | | | 1.11 | % | | | 1.14 | % | | | 1.52 | % | | | 1.37 | % |

| | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| Supplemental Data | | | | | | | | | | | | | | | | | | | | | | | | |

Net assets, end of period (000) | | $ | 46,285 | | | $ | 45,197 | | | $ | 54,394 | | | $ | 47,184 | | | $ | 38,758 | | | $ | 35,132 | |

| | | | |

Portfolio turnover rate | | | 21 | % | | | 50 | % | | | 39 | % | | | 47 | % | | | 42 | % | | | 58 | % |

| | | | |

| | 1 | | Based on average shares outstanding. |

| | 2 | | Distributions for annual periods determined in accordance with federal income tax regulations. |

| | 3 | | Where applicable, excludes insurance-related fees and expenses and assumes the reinvestment of distributions. |

| | 4 | | Aggregate total return. |

See Notes to Financial Statements.

| | | | | | |

| 12 | | BLACKROCK VARIABLE SERIES FUNDS, INC. | | JUNE 30, 2016 | | |

| | | | |

| Notes to Financial Statements (Unaudited) | | | BlackRock Basic Value V.I. Fund | |

1. Organization:

BlackRock Variable Series Funds, Inc. (the “Company”) is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as an open-end management investment company. The Company is organized as a Maryland corporation that is comprised of 20 separate funds. The funds offer shares to insurance companies for their separate accounts to fund benefits under certain variable annuity and variable life insurance contracts. The financial statements presented are for BlackRock Basic Value V.I. Fund (the “Fund”). The Fund is classified as diversified. Class I, Class II and Class III Shares have equal voting, dividend, liquidation and other rights, except that only shares of the respective classes are entitled to vote on matters concerning only that class. In addition, Class II and Class III Shares bear certain expenses related to the distribution of such shares.

The Fund, together with certain other registered investment companies advised by BlackRock Advisors, LLC (the “Manager”) or its affiliates, is included in a complex of open-end funds referred to as the Equity-Bond Complex.

2. Significant Accounting Policies:

The financial statements are prepared in conformity with accounting principles generally accepted in the United States of America (“U.S. GAAP”), which may require management to make estimates and assumptions that affect the reported amounts of assets and liabilities in the financial statements, disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates. The Fund is considered an investment company under U.S. GAAP and follows the accounting and reporting guidance applicable to investment companies. Below is a summary of significant accounting policies:

Investment Transactions and Investment Income: For financial reporting purposes, investment transactions are recorded on the dates the transactions are entered into (the trade dates). Realized gains and losses on investment transactions are determined on the identified cost basis. Dividend income is recorded on the ex-dividend date. Dividends from foreign securities where the ex-dividend date may have passed are subsequently recorded when the Fund is informed of the ex-dividend date. Under the applicable foreign tax laws, a withholding tax at various rates may be imposed on capital gains, dividends and interest. Upon notification from issuers, some of the dividend income received from a real estate investment trust may be redesignated as a reduction of cost of the related investment and/or realized gain. Income, expenses and realized and unrealized gains and losses are allocated daily to each class based on its relative net assets.

Distributions: Distributions paid by the Fund are recorded on the ex-dividend date. The character and timing of distributions are determined in accordance with federal income tax regulations, which may differ from U.S. GAAP.

Indemnifications: In the normal course of business, the Fund enters into contracts that contain a variety of representations that provide general indemnification. The Fund’s maximum exposure under these arrangements is unknown because it involves future potential claims against the Fund, which cannot be predicted with any certainty.

Other: Expenses directly related to the Fund or its classes are charged to the Fund or the applicable class. Other operating expenses shared by several funds, including other funds managed by the Manager, are prorated among those funds on the basis of relative net assets or other appropriate methods. Expenses directly related to the Fund and other shared expenses prorated to the Fund are allocated daily to each class based on its relative net assets or other appropriate methods.

The Fund has an arrangement with its custodian whereby fees may be reduced by credits earned on uninvested cash balances, which, if applicable, are shown as fees paid indirectly in the Statement of Operations. The custodian imposes fees on overdrawn cash balances, which can be offset by accumulated credits earned or may result in additional custody charges.

3. Investment Valuation and Fair Value Measurements:

Investment Valuation Policies: The Fund’s investments are valued at fair value (also referred to as “market value” within the financial statements) as of the close of trading on the New York Stock Exchange (“NYSE”) (generally 4:00 p.m., Eastern time) U.S. GAAP defines fair value as the price the Fund would receive to sell an asset or pay to transfer a liability in an orderly transaction between market participants at the measurement date. The Fund determines the fair values of its financial instruments using various independent dealers or pricing services under policies approved by the Board of Directors of the Company (the “Board”). The BlackRock Global Valuation Methodologies Committee (the “Global Valuation Committee”) is the committee formed by management to develop global pricing policies and procedures and to oversee the pricing function for all financial instruments.

| | | | | | |

| | | BLACKROCK VARIABLE SERIES FUNDS, INC. | | JUNE 30, 2016 | | 13 |

| | | | |

| Notes to Financial Statements (continued) | | | BlackRock Basic Value V.I. Fund | |

Fair Value Inputs and Methodologies: The following methods (or “techniques”) and inputs are used to establish the fair value of the Fund’s assets and liabilities:

| • | | Equity investments traded on a recognized securities exchange are valued at the official closing price each day, if available. For equity investments traded on more than one exchange, the official close price on the exchange where the stock is primarily traded is used. Equity investments traded on a recognized exchange for which there were no sales on that day may be valued at the last available bid (long positions) or ask (short positions) price. |

| • | | Investments in open-end U.S. mutual funds are valued at net asset value each business day. |

| • | | The Fund values its investment in BlackRock Liquidity Series, LLC, Money Market Series (the “Money Market Series”) at fair value, which is ordinarily based upon its pro rata ownership in the underlying fund’s net assets. The Money Market Series seeks current income consistent with maintaining liquidity and preserving capital. Although the Money Market Series is not registered under the 1940 Act, its investments may follow the parameters of investments by a money market fund that is subject to Rule 2a-7 under the 1940 Act. The Fund may withdraw up to 25% of its investment daily, although the manager of the Money Market Series, in its sole discretion, may permit an investor to withdraw more than 25% on any one day. |

If events (e.g., a company announcement, market volatility or a natural disaster) occur that are expected to materially affect the value of such instruments, or in the event that the application of these methods of valuation results in a price for an investment that is deemed not to be representative of the market value of such investment, or if a price is not available, the investment will be valued by the Global Valuation Committee or its delegate, in accordance with a policy approved by the Board as reflecting fair value (“Fair Valued Investments”). When determining the price for Fair Valued Investments, the Global Valuation Committee, or its delegate, seeks to determine the price that the Fund might reasonably expect to receive or pay from the current sale or purchase of that asset or liability in an arm’s-length transaction. Fair value determinations shall be based upon all available factors that the Global Valuation Committee, or its delegate, deems relevant consistent with the principles of fair value measurement. The pricing of all Fair Valued Investments is subsequently reported to the Board or a committee thereof on a quarterly basis.

Fair Value Hierarchy: Various inputs are used in determining the fair value of investments. These inputs to valuation techniques are categorized into a fair value hierarchy consisting of three broad levels for financial statement purposes as follows:

| • | | Level 1 — unadjusted price quotations in active markets/exchanges for identical assets or liabilities that the Fund has the ability to access |

| • | | Level 2 — other observable inputs (including, but not limited to, quoted prices for similar assets or liabilities in markets that are active, quoted prices for identical or similar assets or liabilities in markets that are not active, inputs other than quoted prices that are observable for the assets or liabilities (such as interest rates, yield curves, volatilities, prepayment speeds, loss severities, credit risks and default rates) or other market–corroborated inputs) |

| • | | Level 3 — unobservable inputs based on the best information available in the circumstances, to the extent observable inputs are not available (including the Fund’s own assumptions used in determining the fair value of investments) |

The hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1 measurements) and the lowest priority to unobservable inputs (Level 3 measurements). Accordingly, the degree of judgment exercised in determining fair value is greatest for instruments categorized in Level 3. The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the fair value hierarchy classification is determined based on the lowest level input that is significant to the fair value measurement in its entirety. The significant unobservable inputs used by the Global Valuation Committee in determining the price for Fair Valued Investments are typically categorized as Level 3. The fair value hierarchy for the Fund’s investments has been included in the Schedule of Investments.

Changes in valuation techniques may result in transfers into or out of an assigned level within the hierarchy. In accordance with the Fund’s policy, transfers between different levels of the fair value hierarchy are deemed to have occurred as of the beginning of the reporting period. The categorization of a value determined for investments is based on the pricing transparency of the investments and is not necessarily an indication of the risks associated with investing in those securities.

4. Securities and Other Investments:

Preferred Stock: Preferred stock has a preference over common stock in liquidation (and generally in receiving dividends as well) but is subordinated to the liabilities of the issuer in all respects. As a general rule, the market value of preferred stock with a fixed dividend rate and no conversion element varies inversely with interest rates and perceived credit risk, while the market price of convertible preferred stock generally also reflects some element of conversion value. Because preferred stock is junior to debt securities and other obligations of the issuer, deterioration in the credit quality of the issuer will cause greater changes in the value of a preferred stock than in a more senior debt security with similar stated yield characteristics. Unlike interest payments on debt securities, preferred stock dividends are payable only if declared by the issuer’s board of directors. Preferred stock also may be subject to optional or mandatory redemption provisions.

| | | | | | |

| 14 | | BLACKROCK VARIABLE SERIES FUNDS, INC. | | JUNE 30, 2016 | | |

| | |

| Notes to Financial Statements (continued) | | BlackRock Basic Value V.I. Fund |

Securities Lending: The Fund may lend its securities to approved borrowers, such as brokers, dealers and other financial institutions. The borrower pledges and maintains with the Fund collateral consisting of cash, an irrevocable letter of credit issued by a bank, or securities issued or guaranteed by the U.S. Government. The initial collateral received by the Fund is required to have a value of at least 102% of the current value of the loaned securities for securities traded on U.S. exchanges and a value of at least 105% for all other securities. The collateral is maintained thereafter at a value equal to at least 100% of the current market value of the securities on loan. The market value of the loaned securities is determined at the close of each business day of the Fund and any additional required collateral is delivered to the Fund, or excess collateral returned by the Fund, on the next business day. During the term of the loan, the Fund is entitled to all distributions made on or in respect of the loaned securities. Loans of securities are terminable at any time and the borrower, after notice, is required to return borrowed securities within the standard time period for settlement of securities transactions.

The market value of any securities on loan, all of which were classified as common stocks in the Fund’s Schedule of Investments, and the value of any related collateral are shown separately in the Statement of Assets and Liabilities as a component of investments at value-unaffiliated, and collateral on securities loaned at value, respectively. As of period end, any securities on loan were collateralized by cash. The cash collateral invested by the securities lending agent, BlackRock Investment Management, LLC (“BIM”), if any, is disclosed in the Schedule of Investments.

Securities lending transactions are entered into by the Fund under Master Securities Lending Agreements (each, an “MSLA”), which provide the right, in the event of default (including bankruptcy or insolvency), for the non-defaulting party to liquidate the collateral and calculate a net exposure to the defaulting party or request additional collateral. In the event that a borrower defaults, the Fund, as lender, would offset the market value of the collateral received against the market value of the securities loaned. When the value of the collateral is greater than that of the market value of the securities loaned, the lender is left with a net amount payable to the defaulting party. However, bankruptcy or insolvency laws of a particular jurisdiction may impose restrictions on or prohibitions against such a right of offset in the event of an MSLA counterparty’s bankruptcy or insolvency. Under the MSLA, absent an event of default the borrower can resell or re-pledge the loaned securities, and the Fund can reinvest cash collateral received in connection with loaned securities. Upon an event of default, the parties’ obligations to return the securities or collateral to the other party are extinguished, and the parties can resell or re-pledge the loaned securities or the collateral received in connection with the loaned securities in order to satisfy the defaulting party’s net payment obligation for all transactions under the MSLA. The defaulting party remains liable for any deficiency.

As of period end, the following table is a summary of the Fund’s securities lending agreements by counterparty which are subject to offset under an MSLA:

| | | | | | | | | | | | | | | | | | |

| Counterparty | | | | | Securities

Loaned at Value | | | Cash Collateral Received1 | | | Net Amount | | | |

Citigroup Global Markets, Inc. | | | | | | $ | 820,384 | | | $ | (820,384 | ) | | — | | | | |

JP Morgan Securities LLC | | | | | | | 3,978,172 | | | | (3,978,172 | ) | | — | | | | |

Morgan Stanley | | | | | | | 5,370,450 | | | | (5,370,450 | ) | | — | | | | |

State Street Bank & Trust Co. | | | | | | | 17,191,184 | | | | (17,191,184 | ) | | — | | | | |

UBS Securities LLC | | | | | | | 351,356 | | | | (351,356 | ) | | — | | | | |

| | | | |

Total | | | | | | $ | 27,711,546 | | | $ | (27,711,546 | ) | | — | | | | |

| | | | |

| | 1 | | Collateral with a value of $28,215,428 has been received in connection with securities lending agreements. Collateral received in excess of the value of securities loaned from the individual counterparty is not shown for financial reporting purposes in the above table. |

The risks of securities lending include the risk that the borrower may not provide additional collateral when required or may not return the securities when due. To mitigate these risks, the Fund benefits from a borrower default indemnity provided by BIM. BIM’s indemnity allows for full replacement of the securities loaned if the collateral received does not cover the value on the securities loaned in the event of borrower default. The Fund could suffer a loss if the value of an investment purchased with cash collateral falls below the market value of loaned securities or if the value of an investment purchased with cash collateral falls below the value of the original cash collateral received.

5. Investment Advisory Agreement and Other Transactions with Affiliates:

The PNC Financial Services Group, Inc. is the largest stockholder and an affiliate of BlackRock, Inc. (“BlackRock”) for 1940 Act purposes.

Investment Advisory

The Company, on behalf of the Fund, entered into an Investment Advisory Agreement with the Manager, the Fund’s investment adviser, an indirect, wholly owned subsidiary of BlackRock, to provide investment advisory and administration services. The Manager is responsible for the management of the Fund’s portfolio and provides the personnel, facilities, equipment and certain other services necessary to the operations of the Fund. For such services, the Fund pays the Manager a monthly fee, which is determined by calculating a percentage of the Fund’s average daily net assets, based on the following annual rates:

| | | | | | |

| | | BLACKROCK VARIABLE SERIES FUNDS, INC. | | JUNE 30, 2016 | | 15 |

| | |

| Notes to Financial Statements (continued) | | BlackRock Basic Value V.I. Fund |

| | |

| Average Daily Net Assets | | Investment

Advisory Fees |

First $1 Billion | | 0.60% |

$1 Billion — $3 Billion | | 0.56% |

$3 Billion — $5 Billion | | 0.54% |

$5 Billion — $10 Billion | | 0.52% |

Greater than $10 Billion | | 0.51% |

Distribution Fees

The Company, on behalf of the Fund, entered into a Distribution Agreement and a Distribution Plan with BlackRock Investments, LLC (“BRIL”), an affiliate of the Manager. Pursuant to the Distribution Plan and in accordance with Rule 12b-1 under the 1940 Act, the Fund pays BRIL ongoing distribution fees. The fees are accrued daily and paid monthly at annual rates of 0.15% and 0.25% based upon the average daily net assets attributable to Class II and Class III, respectively.

For the six months ended June 30, 2016, the following table shows the class specific distribution fees borne directly by each share class of the Fund:

| | | | |

| Class II | | Class III | | Total |

$3,845 | | $54,725 | | $58,570 |

Transfer Agent

The Manager, on behalf of the Fund, entered into agreements with insurance companies and other financial intermediaries (“Service Organizations”), some of which may be affiliates. Pursuant to these agreements, the Service Organizations provide the Fund with administrative, networking, recordkeeping, sub-transfer agency and shareholder services to sub-accounts they service. For these services, the Service Organizations receive an annual fee per shareholder account, which will vary depending on share class and/or net assets of Fund shareholders serviced by the Service Organizations which is shown as transfer agent — class specific. For the six months ended June 30, 2016, the Fund paid the following amounts to affiliates in return for these services, which is included in transfer agent — class specific in the Statement of Operations.

| | | | | | |

| Class I | | Class II | | Class III | | Total |

$350,080 | | $5,438 | | $45,160 | | $400,678 |

In addition, the Fund pays the transfer agent, which is not an affiliate, a fee for issuance, transfer and redemption of shares and the opening and maintenance of shareholder accounts, which is included in transfer agent in the Statement of Operations.

Expense Limitations, Waivers and Reimbursements

The Manager, with respect to the Fund, contractually agreed to waive and/or reimburse fees or expenses in order to limit expenses, excluding interest expense, dividend expense, tax expense, acquired fund fees and expenses, and certain other fund expenses, which constitute extraordinary expenses not incurred in the ordinary course of the Fund’s business. The expense limitations as a percentage of average daily net assets are as follows:

| | | | |

Class I | | | 1.25 | % |

Class II | | | 1.40 | % |

Class III | | | 1.50 | % |

The Manager has agreed not to reduce or discontinue this contractual expense limitation prior to May 1, 2017, unless approved by the Board, including a majority of the Independent Directors who are not “interested persons” of the Fund, as defined in the 1940 Act (“Independent Directors”) or by a majority of the outstanding voting securities of the Fund.

The Manager, with respect to the Fund, voluntarily agreed to waive its investment advisory fees by the amount of investment advisory fees the Fund pays to the Manager indirectly through its investment in affiliated money market funds. This amount is shown as fees waived by the Manager in the Statement of Operations. However, the Manager does not waive its investment advisory fees by the amount of investment advisory fees paid in connection with the Fund’s investment in other affiliated investment companies, if any. For the six months ended June 30, 2016, the amount waived was $466.

| | | | | | |

| 16 | | BLACKROCK VARIABLE SERIES FUNDS, INC. | | JUNE 30, 2016 | | |

| | | | |

| Notes to Financial Statements (continued) | | | BlackRock Basic Value V.I. Fund | |

The Manager has contractually agreed to reimburse transfer agent fees in order to limit such expenses to a percentage of average daily net assets as follows:

| | | | |

Class I | | | 0.06 | % |

Class II | | | 0.08 | % |

Class III | | | 0.09 | % |

The Manager has agreed not to reduce or discontinue this contractual reimbursement prior to May 1, 2017 unless approved by the Board, including a majority of the Independent Directors or by a majority of the outstanding voting securities of the Fund.

These amounts waived and/or reimbursed are included in fees waived by the Manager, and shown as transfer agent fees reimbursed — class specific in the Statement of Operations. Class specific expense waivers and/or reimbursements are as follows:

| | | | | | | | | | | | | | | | |

| | | Class I | | | Class II | | | Class III | | | Total | |

Transfer Agent Fees Reimbursed | | $ | 236,346 | | | | $3,382 | | | $ | 25,404 | | | $ | 265,132 | |

For the six months ended June 30, 2016, the Fund reimbursed the Manager $2,411 for certain accounting services, which is included in accounting services in the Statement of Operations.

Securities Lending

The U.S. Securities and Exchange Commission has issued an exemptive order which permits BIM, an affiliate of the Manager, to serve as securities lending agent for the Fund, subject to applicable conditions. As securities lending agent, BIM bears all operational costs directly related to securities lending. The Fund is responsible for expenses in connection with the investment of cash collateral received for securities on loan (the “collateral investment expenses”). The cash collateral is invested in a private investment company managed by the Manager or its affiliates. However, BIM has agreed to cap the collateral investment expenses of the private investment company to an annual rate of 0.04%. The investment adviser to the private investment company will not charge any advisory fees with respect to shares purchased by the Fund.

Securities lending income is equal to the total of income earned from the reinvestment of cash collateral, net of fees and other payments to and from borrowers of securities, and less the collateral investment expenses. The Fund retains a portion of securities lending income and remits a remaining portion to BIM as compensation for its services as securities lending agent.

Pursuant to a securities lending agreement, the Fund retains 71.5% of securities lending income, and this amount retained can never be less than 65% of the total of securities lending income plus the collateral investment expenses.

In addition, commencing the business day following the date that the aggregate securities lending income earned across the Equity-Bond Complex in a calendar year exceeds a specified threshold, the Fund, pursuant to the securities lending agreement, will retain for the remainder of that calendar year securities lending income as follows: 75% of securities lending income, and this amount retained can never be less than 65% of the total of securities lending income plus the collateral investment expenses.

The share of securities lending income earned by the Fund is shown as securities lending — affiliated — net in the Statement of Operations. For the six months ended June 30, 2016, the Fund paid BIM $16,872 for securities lending agent services.

Officers and Directors

Certain officers and/or directors of the Company are officers and/or directors of BlackRock or its affiliates. The Fund reimburses the Manager for a portion of the compensation paid to the Company’s Chief Compliance Officer, which is included in Officer and Directors in the Statement of Operations.

6. Purchases and Sales:

For the six months ended June 30, 2016, purchases and sales of investments, excluding short-term securities, were $91,496,993 and $115,587,307, respectively.

7. Income Tax Information:

It is the Fund’s policy to comply with the requirements of the Internal Revenue Code of 1986, as amended, applicable to regulated investment companies, and to distribute substantially all of its taxable income to its shareholders. Therefore, no federal income tax provision is required.

| | | | | | |

| | | BLACKROCK VARIABLE SERIES FUNDS, INC. | | JUNE 30, 2016 | | 17 |

| | | | |

| Notes to Financial Statements (continued) | | | BlackRock Basic Value V.I. Fund | |

The Fund files U.S. federal and various state and local tax returns. No income tax returns are currently under examination. The statute of limitations on the Fund’s U.S. federal tax returns generally remains open for each of the four years ended December 31, 2015. The statutes of limitations on the Fund’s state and local tax returns may remain open for an additional year depending upon the jurisdiction.

Management has analyzed tax laws and regulations and their application to the Fund as of June 30, 2016, inclusive of the open tax return years, and does not believe there are any uncertain tax positions that require recognition of a tax liability in the Fund’s financial statements.

As of June 30, 2016, gross unrealized appreciation and depreciation based on cost for federal income tax purposes were as follows:

| | | | |

Tax cost | | $ | 440,127,270 | |

| | | | |

Gross unrealized appreciation | | $ | 52,838,052 | |

Gross unrealized depreciation | | | (24,934,058 | ) |

| | | | |

Net unrealized appreciation | | $ | 27,903,994 | |

| | | | |

8. Bank Borrowings:

The Company, on behalf of the Fund, along with certain other funds managed by the Manager and its affiliates (“Participating Funds”), is a party to a 364-day, $2.1 billion credit agreement with a group of lenders. Under this agreement, the Fund may borrow to fund shareholder redemptions. Excluding commitments designated for certain individual funds, the Participating Funds, including the Fund, can borrow up to an aggregate commitment amount of $1.6 billion at any time outstanding, subject to asset coverage and other limitations as specified in the agreement. The credit agreement has the following terms: a fee of 0.12% per annum on unused commitment amounts and interest at a rate equal to the higher of (a) one-month LIBOR (but, in any event, not less than 0.00%) on the date the loan is made plus 0.80% per annum or (b) the Fed Funds rate (but, in any event, not less than 0.00%) in effect from time to time plus 0.80% per annum on amounts borrowed. The agreement expires in April 2017 unless extended or renewed. Prior to April 21, 2016, the credit agreement had a fee per annum of 0.06% on unused commitment amounts and interest at a rate equal to the higher of (a) one-month LIBOR (but, in any event, not less than 0.00%) on the date the loan is made plus 0.80% per annum or (b) the Fed Funds rate (but, in any event, not less than 0.00%) in effect from time to time plus 0.80% per annum on amounts borrowed. Participating Funds paid administration, legal and arrangement fees, which, if applicable, are included in miscellaneous expenses in the Statement of Operations. These fees were allocated among such funds based upon portions of the aggregate commitment available to them and relative net assets of Participating Funds. During the six months ended June 30, 2016, the Fund did not borrow under the credit agreement.

9. Principal Risks:

In the normal course of business, the Fund invests in securities and enters into transactions where risks exist due to fluctuations in the market (market risk) or failure of the issuer to meet all its obligations, including the ability to pay principal and interest when due (issuer credit risk). The value of securities held by the Fund may decline in response to certain events, including those directly involving the issuers of securities owned by the Fund. Changes arising from the general economy, the overall market and local, regional or global political and/or social instability, as well as currency, interest rate and price fluctuations, may also affect the securities’ value.

Counterparty Credit Risk: Similar to issuer credit risk, the Fund may be exposed to counterparty credit risk, or the risk that an entity may fail to or be unable to perform on its commitments related to unsettled or open transactions. The Fund manages counterparty credit risk by entering into transactions only with counterparties that the Manager believes have the financial resources to honor their obligations and by monitoring the financial stability of those counterparties. Financial assets, which potentially expose the Fund to market, issuer and counterparty credit risks, consist principally of financial instruments and receivables due from counterparties. The extent of the Fund’s exposure to market, issuer and counterparty credit risks with respect to these financial assets is approximately their value recorded in the Statement of Assets and Liabilities, less any collateral held by the Fund.

Concentration Risk: As of period end, the Fund invested a significant portion of its assets in securities in the financials sector. Changes in economic conditions affecting such sector would have a greater impact on the Fund and could affect the value, income and/or liquidity of positions in such securities.

| | | | | | |

| 18 | | BLACKROCK VARIABLE SERIES FUNDS, INC. | | JUNE 30, 2016 | | |

| | | | |

| Notes to Financial Statements (concluded) | | | BlackRock Basic Value V.I. Fund | |

10. Capital Share Transactions:

Transactions in capital shares for each class were as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Six Months Ended

June 30, 2016 | | | | | Year Ended

December 31, 2015 | |

| | | | | | Shares | | | Amount | | | | | | | | | | | Shares | | | Amount | | | | |

| Class l | | | | | | | | | | | | | | | | | | | | | | | | | | |

Shares sold | | | | | | | 278,628 | | | $ | 3,685,657 | | | | | | | | | | | | | | 691,099 | | | $ | 11,155,149 | | | | | |

Shares issued in reinvestment of distributions | | | | | | | — | | | | — | | | | | | | | | | | | | | 3,981,747 | | | | 54,134,322 | | | | | |

Shares redeemed | | | | | | | (2,312,040 | ) | | | (31,022,562 | ) | | | | | | | | | | | | | (3,796,900 | ) | | | (62,537,434 | ) | | | | |

| | | | | | | | | | |

Net increase (decrease) | | | | | | | (2,033,412 | ) | | $ | (27,336,905 | ) | | | | | | | | | | | | | 875,946 | | | $ | 2,752,037 | | | | | |

| | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |