UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-03290

Name of Fund: BlackRock Variable Series Funds, Inc.

BlackRock Advantage Large Cap Core V.I. Fund (Formerly BlackRock Large Cap Core V.I. Fund)

BlackRock Advantage Large Cap Value V.I. Fund (Formerly BlackRock Large Cap Value V.I. Fund)

BlackRock Advantage U.S. Total Market V.I. Fund (Formerly BlackRock Value Opportunities V.I. Fund)

BlackRock Basic Value V.I. Fund

BlackRock Capital Appreciation V.I. Fund

BlackRock Equity Dividend V.I. Fund

BlackRock Global Allocation V.I. Fund

BlackRock Global Opportunities V.I. Fund

BlackRock Government Money Market V.I. Fund

BlackRock High Yield V.I. Fund

BlackRock International V.I. Fund

BlackRock iShares Alternative Strategies V.I. Fund

BlackRock iShares Dynamic Allocation V.I Fund

BlackRock iShares Dynamic Fixed Income V.I. Fund

BlackRock iShares Equity Appreciation V.I. Fund

BlackRock Large Cap Focus Growth V.I. Fund (Formerly BlackRock Large Cap Growth V.I. Fund)

BlackRock Managed Volatility V.I. Fund

BlackRock S&P 500 Index V.I. Fund

BlackRock Total Return V.I. Fund

BlackRock U.S. Government Bond V.I. Fund

Fund Address: 100 Bellevue Parkway, Wilmington, DE 19809

Name and address of agent for service: John M. Perlowski, Chief Executive Officer, BlackRock Variable Series Funds, Inc., 55 East 52nd Street, New York, NY 10055

Registrant’s telephone number, including area code: (800) 441-7762

Date of fiscal year end: 12/31/2017

Date of reporting period: 06/30/2017

Item 1 – Report to Stockholders

JUNE 30, 2017

| | | | |

SEMI-ANNUAL REPORT (UNAUDITED) | | | | BLACKROCK® |

BlackRock Variable Series Funds, Inc.

| | |

| Not FDIC Insured ◾ May Lose Value ◾ No Bank Guarantee | | |

Dear Shareholder,

In the 12 months ended June 30, 2017, risk assets, such as stocks and high-yield bonds, delivered strong performance. These markets showed great resilience during a period with big surprises, including the aftermath of the U.K.’s vote to leave the European Union and the outcome of the U.S. presidential election, which brought only brief spikes in equity market volatility. However, interest rates rose, which worked against high-quality assets with more interest rate sensitivity. Aside from the shortest-term Treasury bills, most U.S. Treasuries posted negative returns, as rising energy prices, modest wage increases and steady job growth led to expectations of higher inflation and anticipation of interest rate increases by the U.S. Federal Reserve (the “Fed”).

The global reflationary theme — rising nominal growth, wages and inflation — was the dominant driver of asset returns during the period, outweighing significant political upheavals and economic uncertainty. Reflationary expectations accelerated after the U.S. election in November 2016 and continued into the beginning of 2017, stoked by expectations that the new administration’s policies would provide an extra boost to U.S. growth.

The Fed has responded to these positive developments by increasing interest rates three times in the last six months, setting expectations for additional interest rate increases and moving toward normalizing monetary policy. For its part, the European Central Bank also began to signal its intent to wind down asset purchases and begin the long move toward policy normalization, contingent upon further improvement in economic growth.

In recent months, growing skepticism about the near-term likelihood of significant U.S. tax reform and infrastructure spending has tempered enthusiasm around the reflation trade. Similarly, renewed concern about oversupply has weighed on energy prices. Nonetheless, financial markets — and to an extent the Fed — have adopted a “wait-and-see” approach to the economic data and potential fiscal stimulus. Although uncertainty has persisted, benign credit conditions, modest inflation and the outlook for economic growth have kept markets relatively tranquil.

In the fifth edition of our Global Investor Pulse Survey, we heard from 28,000 individuals across 18 countries, including more than 4,000 respondents from the United States. While retirement remains the single most important issue for American investors, only a third of respondents feel confident that they will have enough retirement income, and nearly 40% of respondents have yet to begin saving for retirement. We encourage you to talk with your financial advisor and visit blackrock.com for further insight about investing in today’s markets.

Sincerely,

Rob Kapito

President, BlackRock Advisors, LLC

Rob Kapito

President, BlackRock Advisors, LLC

| | | | | | | | |

| Total Returns as of June 30, 2017 | |

| | | 6-month | | | 12-month | |

U.S. large cap equities (S&P 500® Index) | | | 9.34 | % | | | 17.90 | % |

U.S. small cap equities (Russell 2000® Index) | | | 4.99 | | | | 24.60 | |

International equities (MSCI Europe, Australasia, Far East Index) | | | 13.81 | | | | 20.27 | |

Emerging market equities (MSCI Emerging Markets Index) | | | 18.43 | | | | 23.75 | |

3-month Treasury bill (BofA Merrill Lynch 3-Month U.S. Treasury Bill Index) | | | 0.31 | | | | 0.49 | |

U.S. Treasury securities (BofA Merrill Lynch 10-Year U.S. Treasury Index) | | | 2.08 | | | | (5.58 | ) |

U.S. investment grade bonds (Bloomberg Barclays U.S.Aggregate Bond Index) | | | 2.27 | | | | (0.31 | ) |

Tax-exempt municipal bonds (S&P Municipal Bond Index) | | | 3.26 | | | | (0.28 | ) |

U.S. high yield bonds (Bloomberg Barclays U.S. Corporate High Yield 2% IssuerCapped Index) | | | 4.92 | | | | 12.69 | |

|

| Past performance is no guarantee of future results. Index performance is shown for illustrative purposes only. You cannot invest directly in an index. | |

| | | | | | |

| | | THIS PAGE NOT PART OF YOUR FUND REPORT | | | | 1 |

JUNE 30, 2017

| | | | |

SEMI-ANNUAL REPORT (UNAUDITED) | | | | BLACKROCK® |

BlackRock Variable Series Funds, Inc.

▶ BlackRock Advantage Large Cap Core V.I. Fund

| | |

| Not FDIC Insured ◾ May Lose Value ◾ No Bank Guarantee | | |

| | | | |

| Fund Summary as of June 30, 2017 | | | BlackRock Advantage Large Cap Core V.I. Fund | |

BlackRock Advantage Large Cap Core V.I. Fund’s (the “Fund”) investment objective is to seek high total investment return.

On March 27, 2017, the Fund’s Board approved a proposal to change the name of BlackRock Large Cap Core V.I. Fund to BlackRock Advantage Large Cap Core V.I. Fund. The Board also approved certain changes to the Fund’s investment strategies. These changes were effective on June 12, 2017.

|

| Portfolio Management Commentary |

How did the Fund perform?

| • | | For the six-month period ended June 30, 2017, the Fund outperformed its benchmark, the Russell 1000® Index. |

What factors influenced performance?

| • | | In sector terms, information technology (“IT”) was the prime contributor to relative performance due to strength among semiconductor and software holdings. Consumer discretionary also aided results, in particular media, household durables and hotels, restaurants & leisure. Selection in materials and underweight exposure to telecommunication services benefited as well. The main detractors from performance were health care and financials. Pharmaceutical and biotechnology weakness weighed in health care, while banks and capital markets were a drag in financials. |

| • | | On a stock-specific basis, IT holdings Lam Research Corp. and Activision Blizzard Inc. were the top individual contributors. Lam performed very well on the back of strong execution and growing demand for its products, driven by the build-out of 3D NAND capacity, for which the company is a key supplier. The valuation remained reasonable, reflecting ongoing concerns that this may be the peak of the cycle, resulting in strong stock performance while the fundamentals continued to improve. Activision outperformed amid consistently strong earnings results, allaying investor worries earlier in the period about weak Call of Duty sales. Investor excitement continued to grow around the company’s new content like Overwatch and Destiny 2, and the secular shifts in the industry such as the movement to digital monetization and eSports. |

| • | | Cruise operator Carnival Corp. also added value. Carnival outperformed early in the period after a report from competitor Royal Caribbean confirmed strengthening demand in both the Caribbean and Mediterranean markets. Later, the company delivered strong earnings results, which |

| | | indicated ongoing favorable supply/demand dynamics in all of the developed cruise markets, leading to continued improvement in pricing power. Elsewhere, an underweight to poor-performing Exxon Mobil Corp. proved advantageous. |

| • | | Conversely, financial holdings Goldman Sachs Group Inc. and JPMorgan Chase & Co. detracted from relative results. Goldman underperformed after the company reported an uncharacteristically weak quarter reflecting poor performance in its core FICC (fixed income, currencies and commodities) trading business. JPMorgan underperformed as the yield curve flattened and optimism around the Trump administration’s pro-growth policy initiatives weakened, reflecting the current uncertain environment in Washington DC. |

| • | | Underweights to Amazon.com Inc. and Facebook Inc., two of the so-called “FANG” stocks, also weighed as both posted gains of more than 25% for the first half of the year. |

Describe recent portfolio activity.

| • | | During the six-month period, the Fund’s exposure to the industrials and real estate sectors materially increased, particularly within machinery, industrial conglomerates and equity real estate investment trusts. Exposure to utilities increased as well. The largest reductions were in IT and financials, largely with respect to communications equipment and banks. Energy exposure also declined. |

Describe portfolio positioning at period end.

| • | | Relative to the Russell 1000® Index, the Fund ended the period with its largest sector overweight in consumer discretionary, followed by materials and industrials. The most notable underweights were financials, consumer staples and energy. That said, the Fund remained diversified across stock selection insights. |

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

| | | | | | |

| 2 | | BLACKROCK VARIABLE SERIES FUNDS, INC. | | JUNE 30, 2017 | | |

| | | | |

| | | | BlackRock Advantage Large Cap Core V.I. Fund | |

|

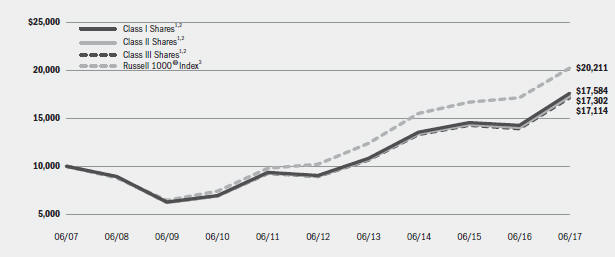

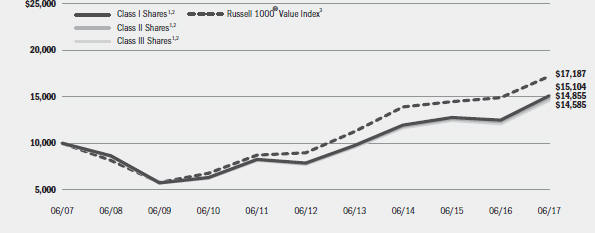

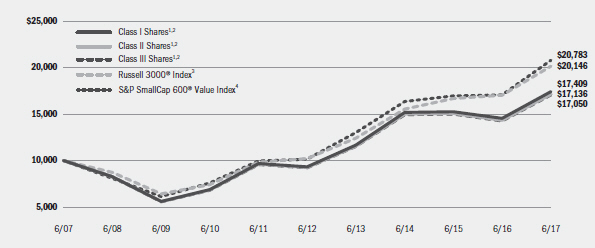

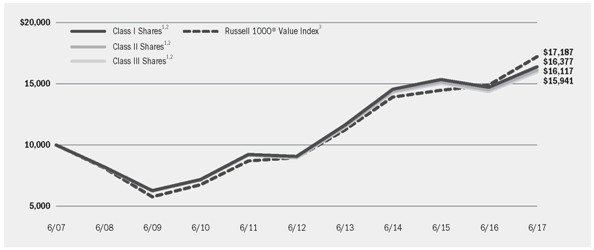

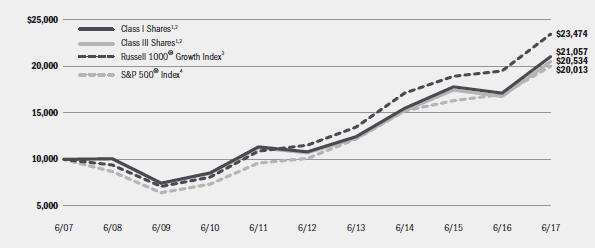

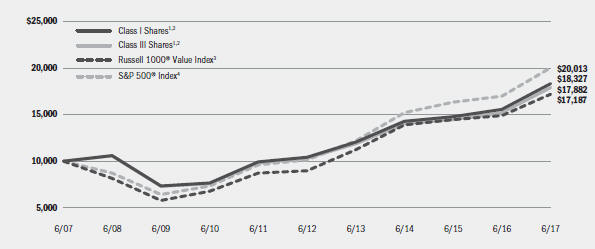

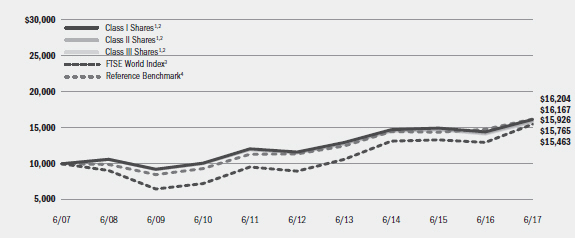

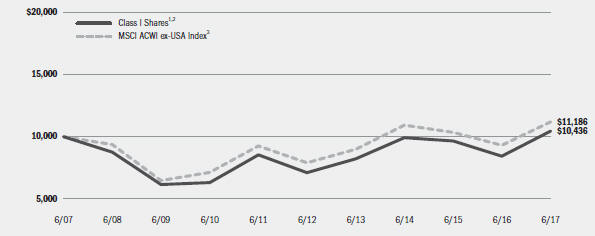

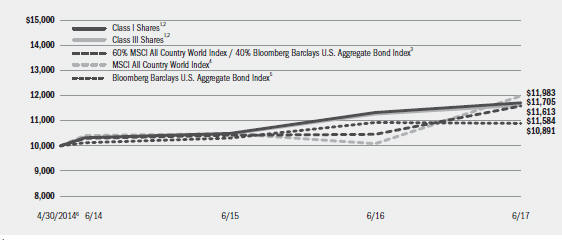

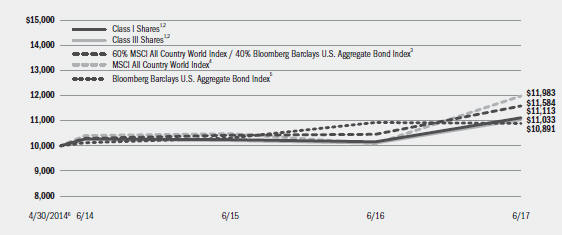

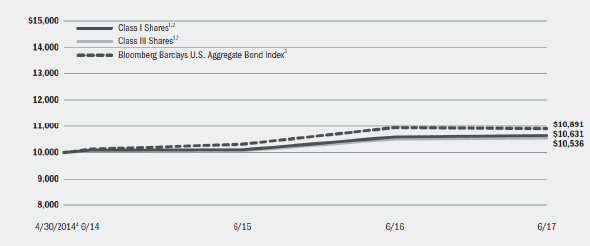

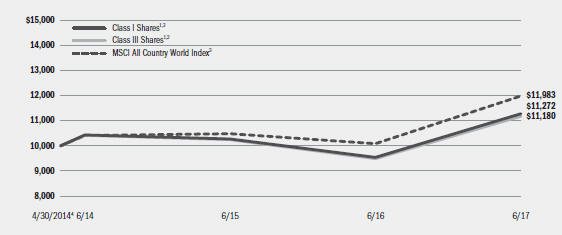

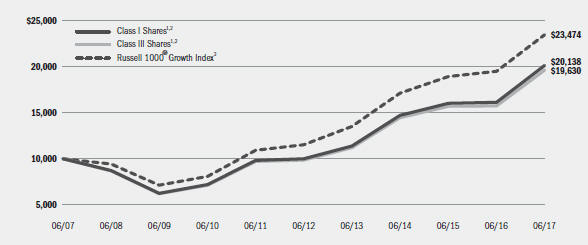

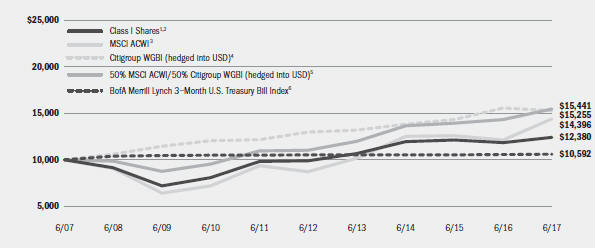

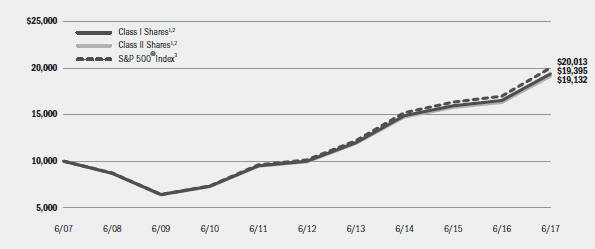

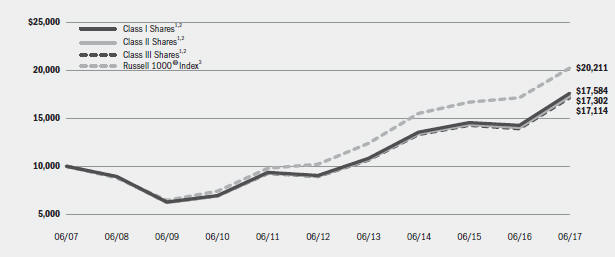

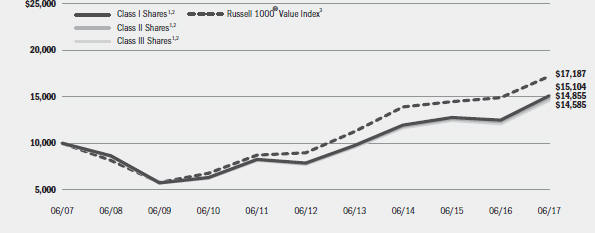

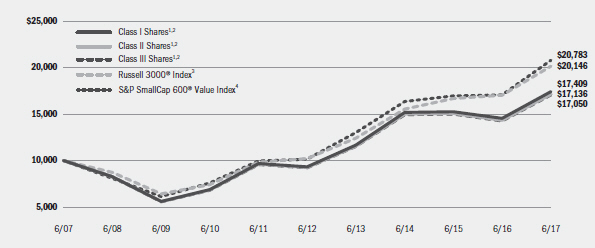

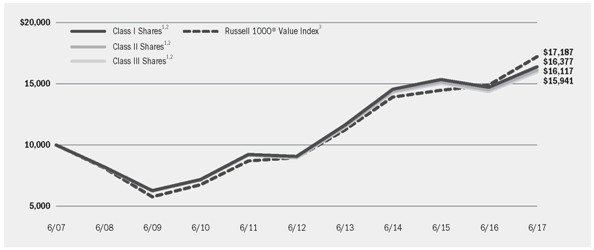

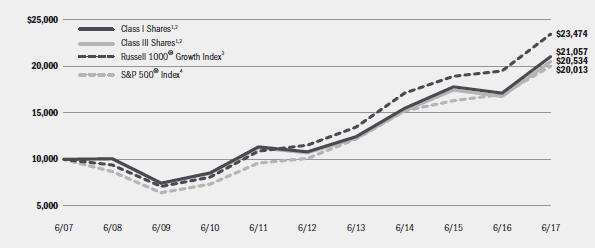

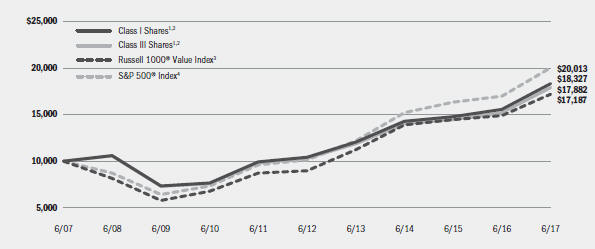

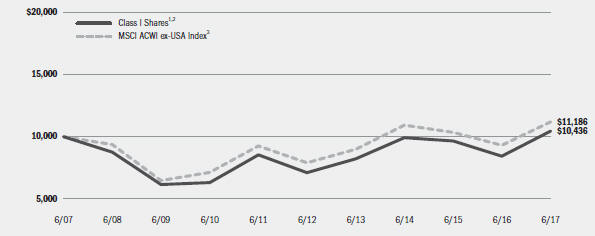

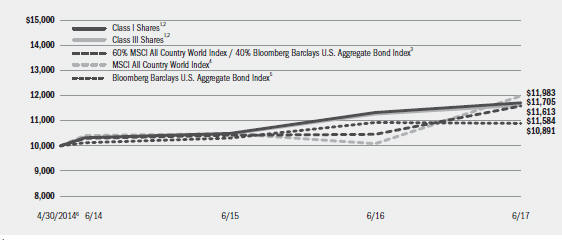

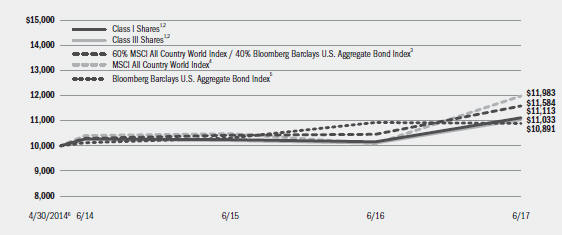

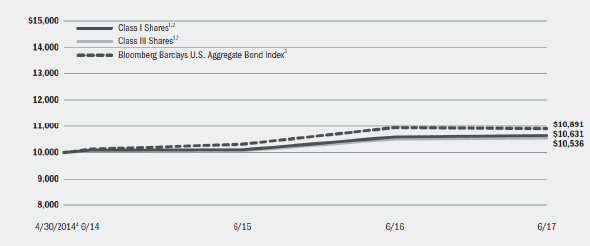

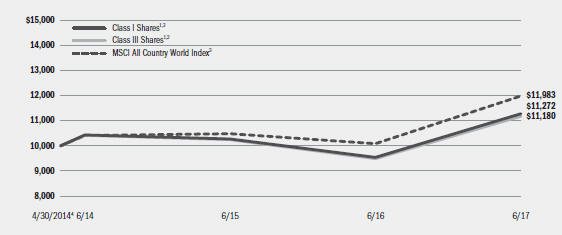

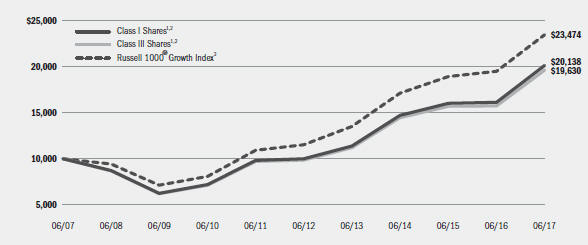

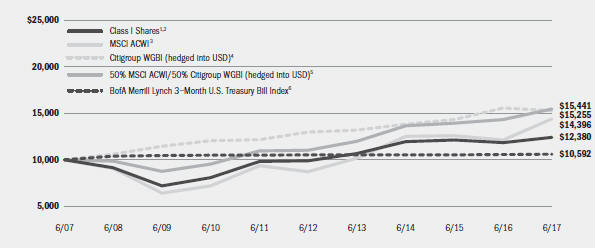

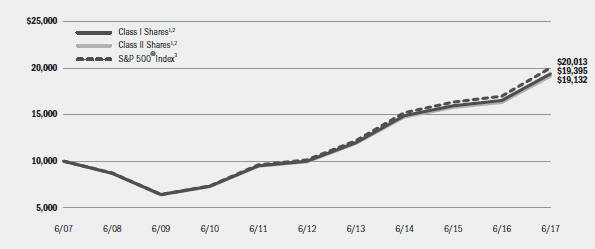

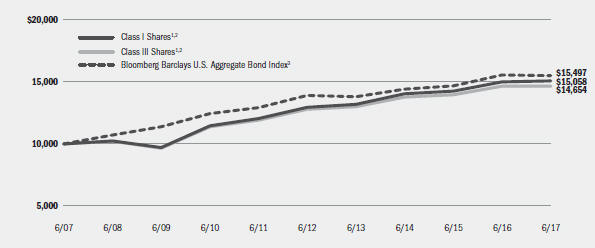

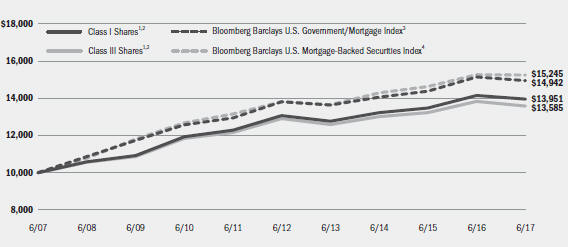

| Total Return Based on a $10,000 Investment |

| | 1 | Assuming transaction costs, if any, and other operating expenses, including investment advisory fees. Does not include insurance related fees and expenses. For a portion of the period, returns do not show the effects of distribution fees (12b-1 fees) applicable to Class II Shares. If such fees were included, returns shown would have been lower. The returns for Class III Shares prior to January 27, 2009, the recommencement of operations of Class III Shares, are based upon the performance of the Fund’s Class I Shares. The returns for Class III Shares, however, are adjusted to reflect the distribution (12b-1) fees applicable to Class III Shares. |

| | 2 | Under normal circumstances, the Fund seeks to invest at least 80% of its net assets, plus the amount of any borrowings for investment purposes, in large cap equity securities and derivatives that have similar economic characteristics to such securities. The Fund’s total returns prior to June 12, 2017 are the returns of the Fund when it followed different investment strategies under the name BlackRock Large Cap Core V.I. Fund. |

| | 3 | An index that measures the performance of the large cap segment of the U.S. equity universe. It is a subset of the Russell 3000® Index and includes approximately 1,000 of the largest securities based on a combination of their market capitalization and current index membership. The index represents approximately 92% of the total market capitalization of the Russell 3000® Index. |

|

| Performance Summary for the Period Ended June 30, 2017 |

| | | | | | | | | | | | | | | | | | | | |

| | | | | Average Annual Total Returns |

| | | 6-Month

Total Returns5 | | 1 Year5 | | 5 Years5 | | 10 Years5 |

Class I4 | | | | 9.62 | % | | | | 23.63 | % | | | | 14.24 | % | | | | 5.81 | % |

Class II4 | | | | 9.52 | | | | | 23.39 | | | | | 14.05 | | | | | 5.64 | |

Class III4 | | | | 9.42 | | | | | 23.25 | | | | | 13.92 | | | | | 5.52 | 6 |

Russell 1000® Index | | | | 9.27 | | | | | 18.03 | | | | | 14.67 | | | | | 7.29 | |

| | 4 | | Average annual and cumulative total returns are based on changes in net asset value for the periods shown, and assume reinvestment of all distributions at net asset value on the ex-dividend date. Insurance-related fees and expenses are not reflected in these returns. For a portion of the period, returns do not show the effects of distribution fees (12b-1 fees) applicable to Class II Shares. If such fees were included, returns shown would have been lower. The Fund’s total returns prior to June 12, 2017 are the returns of the Fund when it followed different investment strategies under the name BlackRock Large Cap Core V.I. Fund. |

| | 5 | | For a portion of the period, the Fund’s investment adviser waived a portion of its fee. Without such waiver, the Fund’s performance would have been lower. |

| | 6 | | The returns for Class III Shares prior to January 27, 2009, the recommencement of operations of Class III Shares, are based upon the performance of the Fund’s Class I Shares. The returns for Class III Shares, however, are adjusted to reflect the distribution (12b-1) fees applicable to Class III Shares. |

| | | | Past performance is not indicative of future results. Performance results do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

| | | | Performance results may include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles. |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Actual | | Hypothetical8 | | |

| | | Beginning

Account Value

January 1, 2017 | | Ending

Account Value

June 30, 2017 | | Expenses Paid

During the Period7 | | Beginning

Account Value

January 1, 2017 | | Ending

Account Value

June 30, 2017 | | Expenses Paid

During the Period7 | | Annualized

Expense

Ratio |

Class I | | | | $1,000.00 | | | | | $1,096.20 | | | | | $2.96 | | | | | $1,000.00 | | | | | $1,021.97 | | | | | $2.86 | | | | | 0.57 | % |

Class II | | | | $1,000.00 | | | | | $1,095.20 | | | | | $3.84 | | | | | $1,000.00 | | | | | $1,021.12 | | | | | $3.71 | | | | | 0.74 | % |

Class III | | | | $1,000.00 | | | | | $1,094.20 | | | | | $4.41 | | | | | $1,000.00 | | | | | $1,020.58 | | | | | $4.26 | | | | | 0.85 | % |

| | 7 | | For each class of the Fund, expenses are equal to the annualized expense ratio for the class, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period shown). |

| | 8 | | Hypothetical 5% annual return before expenses is calculated by prorating the number of days in the most recent fiscal half year divided by 365. |

| | | | See “Disclosure of Expenses” on the following page for further information on how expenses were calculated. |

| | | | | | |

| | | BLACKROCK VARIABLE SERIES FUNDS, INC. | | JUNE 30, 2017 | | 3 |

| | | | |

| | | | BlackRock Advantage Large Cap Core V.I. Fund | |

| | |

| Portfolio Information as of June 30, 2017 | | |

| | | | | |

| Sector Allocation | | Percent of

Net Assets |

Information Technology | | | | 22 | % |

Health Care | | | | 14 | |

Financials | | | | 14 | |

Consumer Discretionary | | | | 13 | |

Industrials | | | | 11 | |

Consumer Staples | | | | 8 | |

Energy | | | | 5 | |

Materials | | | | 4 | |

Real Estate | | | | 3 | |

Utilities | | | | 3 | |

Telecommunication Services | | | | 2 | |

Short-Term Securities | | | | 8 | |

Liabilities in Excess of Other Assets | | | | (7 | ) |

| | | | For Fund compliance purposes, the Fund’s sector classifications refer to one or more of the sector sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by the investment adviser. These definitions may not apply for purposes of this report, which may combine sector sub-classifications for reporting ease. |

Shareholders of the Fund may incur the following charges: (a) transactional expenses, such as sales charges; and (b) operating expenses, including investment advisory fees, service and distribution fees, including 12b-1 fees, acquired fund fees and expenses, and other fund expenses. The expense example on the previous page (which is based on a hypothetical investment of $1,000 invested on January 1, 2017 and held through June 30, 2017) is intended to assist shareholders both in calculating expenses based on an investment in the Fund and in comparing these expenses with similar costs of investing in other mutual funds.

The expense example provides information about actual account values and actual expenses. In order to estimate the expenses a shareholder paid during the period covered by this report, shareholders can divide their account value by $1,000 and then multiply the result by the number corresponding to their share class under the heading entitled “Expenses Paid During the Period.”

The expense example also provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses. In order to assist shareholders in comparing the ongoing expenses of investing in the Fund and other funds, compare the 5% hypothetical example with the 5% hypothetical examples that appear in shareholder reports of other funds.

The expenses shown in the expense example are intended to highlight shareholders’ ongoing costs only and do not reflect transactional expenses, such as sales charges, if any. Therefore, the hypothetical example is useful in comparing ongoing expenses only, and will not help shareholders determine the relative total expenses of owning different funds. If these transactional expenses were included, shareholder expenses would have been higher.

|

| Derivative Financial Instruments |

The Fund may invest in various derivative financial instruments. These instruments are used to obtain exposure to a security, commodity, index, market and/or other asset without owning or taking physical custody of securities, commodities and/or other referenced assets or to manage market, equity, credit, interest rate, foreign currency exchange rate, commodity and/or other risks. Derivative financial instruments may give rise to a form of economic leverage and involve risks, including the imperfect correlation between the value of a derivative financial instrument and the underlying asset, possible default of the counterparty to the transac-

tion or illiquidity of the instrument. The Fund’s successful use of a derivative financial instrument depends on the investment adviser’s ability to predict pertinent market movements accurately, which cannot be assured. The use of these instruments may result in losses greater than if they had not been used, may limit the amount of appreciation the Fund can realize on an investment and/or may result in lower distributions paid to shareholders. The Fund’s investments in these instruments, if any, are discussed in detail in the Notes to Financial Statements.

| | | | | | |

| 4 | | BLACKROCK VARIABLE SERIES FUNDS, INC. | | JUNE 30, 2017 | | |

| | | | |

| Schedule of Investments June 30, 2017 (Unaudited) | | | BlackRock Advantage Large Cap Core V.I. Fund | |

| | | (Percentages shown are based on Net Assets) | |

| | | | | | | | |

| Common Stocks | | Shares | | | Value | |

Aerospace & Defense — 1.7% | | | | | | | | |

HEICO Corp., Class A | | | 72 | | | $ | 4,468 | |

L3 Technologies, Inc. | | | 10,652 | | | | 1,779,736 | |

Raytheon Co. | | | 40,563 | | | | 6,550,113 | |

| | | | | | | | |

| | | | | | | | 8,334,317 | |

Air Freight & Logistics — 0.3% | | | | | | | | |

XPO Logistics, Inc. (a) | | | 20,139 | | | | 1,301,584 | |

Auto Components — 0.1% | | | | | | | | |

Delphi Automotive PLC | | | 8,379 | | | | 734,419 | |

Automobiles — 0.3% | | | | | | | | |

Thor Industries, Inc. | | | 15,871 | | | | 1,658,837 | |

Banks — 5.3% | | | | | | | | |

Bank of America Corp. (b) | | | 438,762 | | | | 10,644,366 | |

Citigroup, Inc. | | | 14,329 | | | | 958,324 | |

Citizens Financial Group, Inc. | | | 165,335 | | | | 5,899,153 | |

JPMorgan Chase & Co. | | | 15,923 | | | | 1,455,362 | |

Popular, Inc. | | | 10,391 | | | | 433,409 | |

SunTrust Banks, Inc. | | | 98,933 | | | | 5,611,480 | |

Synovus Financial Corp. | | | 36,264 | | | | 1,604,319 | |

U.S. Bancorp | | | 3,739 | | | | 194,129 | |

Western Alliance Bancorp (a) | | | 3,575 | | | | 175,890 | |

| | | | | | | | |

| | | | | | | | 26,976,432 | |

Beverages — 1.2% | | | | | | | | |

Coca-Cola European Partners PLC | | | 9,593 | | | | 390,147 | |

Dr. Pepper Snapple Group, Inc. | | | 62,606 | | | | 5,704,033 | |

| | | | | | | | |

| | | | | | | | 6,094,180 | |

Biotechnology — 4.8% | | | | | | | | |

Amgen, Inc. | | | 34,103 | | | | 5,873,560 | |

Biogen, Inc. (a) | | | 20,878 | | | | 5,665,454 | |

Celgene Corp. (a) | | | 41,479 | | | | 5,386,878 | |

Gilead Sciences, Inc. | | | 105,242 | | | | 7,449,029 | |

| | | | | | | | |

| | | | | | | | 24,374,921 | |

Building Products — 1.0% | | | | | | | | |

Allegion PLC | | | 2,720 | | | | 220,646 | |

JELD-WEN Holding, Inc. (a) | | | 4,747 | | | | 154,088 | |

Masco Corp. | | | 124,898 | | | | 4,772,353 | |

| | | | | | | | |

| | | | | | | | 5,147,087 | |

Capital Markets — 3.7% | | | | | | | | |

CME Group, Inc. | | | 12,268 | | | | 1,536,444 | |

Evercore Partners, Inc., Class A | | | 22,207 | | | | 1,565,594 | |

Intercontinental Exchange, Inc. | | | 87,279 | | | | 5,753,432 | |

Morningstar, Inc. | | | 3,715 | | | | 291,033 | |

S&P Global, Inc. | | | 43,041 | | | | 6,283,556 | |

SEI Investments Co. | | | 64,243 | | | | 3,454,989 | |

| | | | | | | | |

| | | | | | | | 18,885,048 | |

Chemicals — 1.6% | | | | | | | | |

AdvanSix, Inc. (a) | | | 13,055 | | | | 407,838 | |

| | | | | | | | |

| Common Stocks | | Shares | | | Value | |

Chemicals (continued) | | | | | | | | |

Cabot Corp. | | | 50,684 | | | $ | 2,708,046 | |

Eastman Chemical Co. | | | 56,457 | | | | 4,741,823 | |

LyondellBasell Industries NV, Class A | | | 2,120 | | | | 178,907 | |

| | | | | | | | |

| | | | | | | | 8,036,614 | |

Commercial Services & Supplies — 0.1% | | | | | | | | |

LSC Communications, Inc. | | | 15,573 | | | | 333,262 | |

R.R. Donnelley & Sons Co. (b) | | | 28,102 | | | | 352,399 | |

| | | | | | | | |

| | | | | | | | 685,661 | |

Communications Equipment — 0.0% | | | | | | | | |

Cisco Systems, Inc. | | | 2,307 | | | | 72,209 | |

InterDigital, Inc. | | | 938 | | | | 72,507 | |

| | | | | | | | |

| | | | | | | | 144,716 | |

Consumer Finance — 0.3% | | | | | | | | |

Discover Financial Services | | | 27,549 | | | | 1,713,272 | |

Containers & Packaging — 1.5% | | | | | | | | |

Avery Dennison Corp. | | | 26,157 | | | | 2,311,494 | |

Packaging Corp. of America | | | 25,018 | | | | 2,786,755 | |

Silgan Holdings, Inc. | | | 37,946 | | | | 1,205,924 | |

WestRock Co. | | | 17,743 | | | | 1,005,318 | |

| | | | | | | | |

| | | | | | | | 7,309,491 | |

Diversified Consumer Services — 0.1% | | | | | | | | |

H&R Block, Inc. | | | 7,588 | | | | 234,545 | |

Diversified Financial Services — 0.6% | | | | | | | | |

Berkshire Hathaway, Inc., Class B (a) | | | 17,518 | | | | 2,967,024 | |

Diversified Telecommunication Services — 0.3% | | | | | | | | |

Level 3 Communications, Inc. (a) | | | 6,366 | | | | 377,504 | |

Verizon Communications, Inc. | | | 9,898 | | | | 442,045 | |

Zayo Group Holdings, Inc. (a) | | | 15,843 | | | | 489,549 | |

| | | | | | | | |

| | | | | | | | 1,309,098 | |

Electric Utilities — 1.8% | | | | | | | | |

Portland General Electric Co. | | | 76,400 | | | | 3,490,716 | |

Westar Energy, Inc. | | | 105,805 | | | | 5,609,781 | |

| | | | | | | | |

| | | | | | | | 9,100,497 | |

Electrical Equipment — 1.2% | | | | | | | | |

Rockwell Automation, Inc. | | | 37,241 | | | | 6,031,552 | |

Electronic Equipment, Instruments & Components — 1.9% | | | | | |

CDW Corp. | | | 20,022 | | | | 1,251,976 | |

Dolby Laboratories, Inc., Class A | | | 5,993 | | | | 293,417 | |

Flex Ltd. (a) | | | 117,405 | | | | 1,914,876 | |

FLIR Systems, Inc. | | | 2,189 | | | | 75,871 | |

TE Connectivity Ltd | | | 17,524 | | | | 1,378,788 | |

Tech Data Corp. (a) | | | 20,115 | | | | 2,031,615 | |

Zebra Technologies Corp., Class A (a) | | | 25,014 | | | | 2,514,407 | |

| | | | | | | | |

| | | | | | | | 9,460,950 | |

| | | | | | | | | | |

| Portfolio Abbreviation |

| S&P | | Standard & Poor’s | | | | | | | | |

See Notes to Financial Statements.

| | | | | | |

| | | BLACKROCK VARIABLE SERIES FUNDS, INC. | | JUNE 30, 2017 | | 5 |

| | | | |

| Schedule of Investments (continued) | | | BlackRock Advantage Large Cap Core V.I. Fund | |

| | | | |

| | | | | | | | |

| Common Stocks | | Shares | | | Value | |

Equity Real Estate Investment Trusts (REITs) — 3.2% | | | | | | | | |

Brixmor Property Group, Inc. | | | 3,964 | | | $ | 70,876 | |

Duke Realty Corp. | | | 14,643 | | | | 409,272 | |

Gaming and Leisure Properties, Inc. | | | 32,458 | | | | 1,222,693 | |

Host Hotels & Resorts, Inc. | | | 4,437 | | | | 81,064 | |

Outfront Media, Inc. | | | 44,819 | | | | 1,036,215 | |

Prologis, Inc. | | | 13,421 | | | | 787,007 | |

Simon Property Group, Inc. | | | 34,910 | | | | 5,647,042 | |

Ventas, Inc. | | | 84,357 | | | | 5,861,124 | |

Weingarten Realty Investors | | | 28,761 | | | | 865,706 | |

| | | | | | | | |

| | | | | | | | 15,980,999 | |

Food & Staples Retailing — 2.1% | | | | | | | | |

Walgreens Boots Alliance, Inc. | | | 43,877 | | | | 3,436,008 | |

Wal-Mart Stores, Inc. | | | 95,337 | | | | 7,215,104 | |

| | | | | | | | |

| | | | | | | | 10,651,112 | |

Food Products — 2.0% | | | | | | | | |

Archer-Daniels-Midland Co. | | | 142,061 | | | | 5,878,484 | |

Hershey Co. | | | 8,599 | | | | 923,275 | |

Ingredion, Inc. | | | 10,168 | | | | 1,212,127 | |

McCormick & Co, Inc., Non-Voting Shares | | | 3,276 | | | | 319,443 | |

Tyson Foods, Inc., Class A | | | 30,879 | | | | 1,933,952 | |

| | | | | | | | |

| | | | | | | | 10,267,281 | |

Health Care Equipment & Supplies — 3.1% | | | | | | | | |

Baxter International, Inc. | | | 100,113 | | | | 6,060,841 | |

Hill-Rom Holdings, Inc. | | | 445 | | | | 35,426 | |

IDEXX Laboratories, Inc. (a) | | | 32,794 | | | | 5,293,607 | |

Masimo Corp. (a) | | | 28,114 | | | | 2,563,435 | |

West Pharmaceutical Services, Inc. | | | 16,061 | | | | 1,518,086 | |

| | | | | | | | |

| | | | | | | | 15,471,395 | |

Health Care Providers & Services — 2.8% | | | | | | | | |

Aetna, Inc. | | | 718 | | | | 109,014 | |

AmerisourceBergen Corp. | | | 2,691 | | | | 254,380 | |

Centene Corp. (a) | | | 12,152 | | | | 970,702 | |

Express Scripts Holding Co. (a) | | | 8,181 | | | | 522,275 | |

Humana, Inc. | | | 8,831 | | | | 2,124,915 | |

McKesson Corp. | | | 8,032 | | | | 1,321,585 | |

UnitedHealth Group, Inc. | | | 46,456 | | | | 8,613,872 | |

| | | | | | | | |

| | | | | | | | 13,916,743 | |

Health Care Technology — 0.6% | | | | | | | | |

Veeva Systems, Inc., Class A (a) | | | 48,773 | | | | 2,990,273 | |

Hotels, Restaurants & Leisure — 3.2% | | | | | | | | |

Carnival Corp. | | | 84,507 | | | | 5,541,124 | |

Choice Hotels International, Inc. | | | 5,514 | | | | 354,275 | |

Extended Stay America, Inc. | | | 105,198 | | | | 2,036,633 | |

Hilton Grand Vacations, Inc. (a) | | | 12,350 | | | | 445,341 | |

International Game Technology PLC (a) | | | 15 | | | | 275 | |

McDonald’s Corp. | | | 49,052 | | | | 7,512,804 | |

| | | | | | | | |

| | | | | | | | 15,890,452 | |

Household Durables — 0.0% | | | | | | | | |

D.R. Horton, Inc. | | | 5,008 | | | | 173,127 | |

Household Products — 0.5% | | | | | | | | |

Energizer Holdings, Inc. | | | 52,819 | | | | 2,536,368 | |

Industrial Conglomerates — 2.5% | | | | | | | | |

3M Co. | | | 38,813 | | | | 8,080,478 | |

Honeywell International, Inc. | | | 35,660 | | | | 4,753,121 | |

| | | | | | | | |

| | | | | | | | 12,833,599 | |

Insurance — 4.0% | | | | | | | | |

Aon PLC | | | 3,213 | | | | 427,168 | |

First American Financial Corp. | | | 21,721 | | | | 970,711 | |

FNF Group | | | 7,701 | | | | 345,236 | |

| | | | | | | | |

| Common Stocks | | Shares | | | Value | |

Insurance (continued) | | | | | | | | |

Hartford Financial Services Group, Inc. | | | 8,168 | | | $ | 429,392 | |

Lincoln National Corp. | | | 67,198 | | | | 4,541,241 | |

Marsh & McLennan Cos., Inc. | | | 81,568 | | | | 6,359,041 | |

Principal Financial Group, Inc. | | | 5,386 | | | | 345,081 | |

Prudential Financial, Inc. | | | 56,479 | | | | 6,107,639 | |

Unum Group | | | 14,364 | | | | 669,793 | |

| | | | | | | | |

| | | | | | | | 20,195,302 | |

Internet & Direct Marketing Retail — 1.3% | | | | | | | | |

Amazon.com, Inc. (a) | | | 7,010 | | | | 6,785,680 | |

Internet Software & Services — 4.8% | | | | | | | | |

Alphabet, Inc., Class A (a) | | | 11,462 | | | | 10,655,992 | |

Alphabet, Inc., Class C (a) | | | 6,497 | | | | 5,904,019 | |

Facebook, Inc., Class A (a) | | | 40,275 | | | | 6,080,720 | |

VeriSign, Inc. (a) | | | 13,116 | | | | 1,219,263 | |

Yelp, Inc. (a) | | | 18,828 | | | | 565,217 | |

| | | | | | | | |

| | | | | | | | 24,425,211 | |

IT Services — 3.8% | | | | | | | | |

Accenture PLC, Class A (b) | | | 45,663 | | | | 5,647,600 | |

Booz Allen Hamilton Holding Corp | | | 37,119 | | | | 1,207,852 | |

Fidelity National Information Services, Inc. | | | 71,634 | | | | 6,117,544 | |

Mastercard, Inc., Class A | | | 51,447 | | | | 6,248,238 | |

| | | | | | | | |

| | | | | | | | 19,221,234 | |

Leisure Products — 1.1% | | | | | | | | |

Hasbro, Inc. | | | 48,401 | | | | 5,397,196 | |

Life Sciences Tools & Services — 0.1% | | | | | | | | |

Mettler-Toledo International, Inc. (a) | | | 1,028 | | | | 605,019 | |

Machinery — 3.2% | | | | | | | | |

Dover Corp. | | | 7,821 | | | | 627,401 | |

Illinois Tool Works, Inc. | | | 34,997 | | | | 5,013,320 | |

Ingersoll-Rand PLC | | | 40,344 | | | | 3,687,038 | |

PACCAR, Inc. | | | 59,327 | | | | 3,917,955 | |

Stanley Black & Decker, Inc. | | | 19,772 | | | | 2,782,514 | |

| | | | | | | | |

| | | | | | | | 16,028,228 | |

Media — 2.9% | | | | | | | | |

CBS Corp., Class B, Non-Voting Shares | | | 50,427 | | | | 3,216,234 | |

Comcast Corp., Class A | | | 214,044 | | | | 8,330,592 | |

Lions Gate Entertainment Corp., Class B (a) | | | 19,730 | | | | 518,504 | |

Scripps Networks Interactive, Inc., Class A (b) | | | 11,139 | | | | 760,905 | |

Time Warner, Inc. | | �� | 16,740 | | | | 1,680,863 | |

| | | | | | | | |

| | | | | | | | 14,507,098 | |

Metals & Mining — 0.3% | | | | | | | | |

Newmont Mining Corp. | | | 14,690 | | | | 475,809 | |

Reliance Steel & Aluminum Co. | | | 13,812 | | | | 1,005,652 | |

Steel Dynamics, Inc. | | | 1,605 | | | | 57,475 | |

| | | | | | | | |

| | | | | | | | 1,538,936 | |

Multiline Retail — 1.0% | | | | | | | | |

Target Corp. | | | 97,217 | | | | 5,083,477 | |

Multi-Utilities — 1.2% | | | | | | | | |

Black Hills Corp. | | | 7,147 | | | | 482,208 | |

CMS Energy Corp. | | | 124,214 | | | | 5,744,898 | |

| | | | | | | | |

| | | | | | | | 6,227,106 | |

Oil, Gas & Consumable Fuels — 5.2% | | | | | | | | |

Anadarko Petroleum Corp. | | | 88,853 | | | | 4,028,595 | |

ConocoPhillips | | | 120,413 | | | | 5,293,355 | |

Devon Energy Corp. | | | 102,794 | | | | 3,286,324 | |

Exxon Mobil Corp. | | | 70,504 | | | | 5,691,788 | |

Phillips 66 | | | 14,523 | | | | 1,200,907 | |

See Notes to Financial Statements.

| | | | | | |

| 6 | | BLACKROCK VARIABLE SERIES FUNDS, INC. | | JUNE 30, 2017 | | |

| | | | |

| Schedule of Investments (continued) | | | BlackRock Advantage Large Cap Core V.I. Fund | |

| | | | |

| | | | | | | | |

| Common Stocks | | Shares | | | Value | |

Oil, Gas & Consumable Fuels (continued) | | | | | | | | |

Suncor Energy, Inc. | | | 64,434 | | | $ | 1,881,473 | |

Tellurian, Inc. (a)(b) | | | 18,944 | | | | 190,008 | |

Valero Energy Corp. | | | 69,047 | | | | 4,657,911 | |

| | | | | | | | |

| | | | | | | | 26,230,361 | |

Paper & Forest Products — 0.4% | | | | | | | | |

Domtar Corp. | | | 49,737 | | | | 1,910,896 | |

Personal Products — 0.8% | | | | | | | | |

Estee Lauder Cos., Inc., Class A | | | 42,968 | | | | 4,124,069 | |

Herbalife Ltd. (a)(b) | | | 1,511 | | | | 107,780 | |

| | | | | | | | |

| | | | | | | | 4,231,849 | |

Pharmaceuticals — 2.9% | | | | | | | | |

Bristol-Myers Squibb Co. | | | 79,629 | | | | 4,436,928 | |

Catalent, Inc. (a) | | | 4,720 | | | | 165,672 | |

Johnson & Johnson | | | 16,266 | | | | 2,151,829 | |

Merck & Co., Inc. | | | 106,166 | | | | 6,804,179 | |

Zoetis, Inc. | | | 17,291 | | | | 1,078,613 | |

| | | | | | | | |

| | | | | | | | 14,637,221 | |

Professional Services — 0.7% | | | | | | | | |

Equifax, Inc. | | | 6,495 | | | | 892,543 | |

ManpowerGroup, Inc. | | | 14,048 | | | | 1,568,459 | |

Robert Half International, Inc. | | | 23,386 | | | | 1,120,891 | |

| | | | | | | | |

| | | | | | | | 3,581,893 | |

Real Estate Management & Development — 0.1% | | | | | | | | |

CBRE Group, Inc., Class A (a) | | | 18,431 | | | | 670,888 | |

Retail — 0.1% | | | | | | | | |

Blue Apron Holdings, Inc., Class A (a) | | | 73,297 | | | | 684,594 | |

Road & Rail — 0.2% | | | | | | | | |

Norfolk Southern Corp. | | | 4,342 | | | | 528,421 | |

Union Pacific Corp. | | | 2,251 | | | | 245,156 | |

| | | | | | | | |

| | | | | | | | 773,577 | |

Semiconductors & Semiconductor Equipment — 3.5% | | | | | | | | |

Analog Devices, Inc. | | | 66,725 | | | | 5,191,205 | |

Intel Corp. | | | 226,301 | | | | 7,635,396 | |

KLA-Tencor Corp. | | | 4,895 | | | | 447,941 | |

Lam Research Corp. | | | 259 | | | | 36,630 | |

Maxim Integrated Products, Inc. | | | 100,361 | | | | 4,506,209 | |

| | | | | | | | |

| | | | | | | | 17,817,381 | |

Software — 4.6% | | | | | | | | |

Activision Blizzard, Inc. | | | 34,466 | | | | 1,984,208 | |

Adobe Systems, Inc. (a) | | | 49,389 | | | | 6,985,580 | |

CDK Global, Inc. | | | 12,522 | | | | 777,115 | |

Dell Technologies, Inc., Class V (a) | | | 28,967 | | | | 1,770,173 | |

Fortinet, Inc. (a) | | | 9,075 | | | | 339,768 | |

Microsoft Corp. | | | 80,023 | | | | 5,515,985 | |

VMware, Inc., Class A (a)(b) | | | 64,448 | | | | 5,634,689 | |

| | | | | | | | |

| | | | | | | | 23,007,518 | |

| | | | | | | | |

| Common Stocks | | Shares | | | Value | |

Specialty Retail — 2.5% | | | | | | | | |

Aaron’s, Inc. | | | 1,031 | | | $ | 40,106 | |

Best Buy Co., Inc. | | | 6,034 | | | | 345,929 | |

Home Depot, Inc. | | | 34,927 | | | | 5,357,802 | |

Lowe’s Cos., Inc. | | | 89,932 | | | | 6,972,428 | |

Staples, Inc. | | | 10,578 | | | | 106,520 | |

| | | | | | | | |

| | | | | | | | 12,822,785 | |

Technology Hardware, Storage & Peripherals — 3.3% | | | | | | | | |

Apple Inc. | | | 88,278 | | | | 12,713,798 | |

HP, Inc. | | | 9,133 | | | | 159,645 | |

NCR Corp. (a) | | | 72,561 | | | | 2,963,391 | |

NetApp, Inc. | | | 22,320 | | | | 893,916 | |

| | | | | | | | |

| | | | | | | | 16,730,750 | |

Textiles, Apparel & Luxury Goods — 0.5% | | | | | | | | |

Carter’s, Inc. | | | 3,831 | | | | 340,767 | |

NIKE, Inc., Class B (b) | | | 34,015 | | | | 2,006,885 | |

| | | | | | | | |

| | | | | | | | 2,347,652 | |

Tobacco — 1.2% | | | | | | | | |

Altria Group, Inc. | | | 62,035 | | | | 4,619,746 | |

Philip Morris International, Inc. | | | 1,260 | | | | 147,987 | |

Reynolds American, Inc. | | | 17,875 | | | | 1,162,590 | |

| | | | | | | | |

| | | | | | | | 5,930,323 | |

Wireless Telecommunication Services — 1.3% | | | | | | | | |

Telephone & Data Systems, Inc. | | | 44,964 | | | | 1,247,751 | |

T-Mobile U.S., Inc. (a) | | | 85,632 | | | | 5,191,012 | |

| | | | | | | | |

| | | | | | | | 6,438,763 | |

Total Long-Term Investments (Cost — $461,408,692) — 98.8% | | | | | | | 499,042,532 | |

| | | | | | | | |

| Short-Term Securities | | | | | | |

BlackRock Liquidity Funds, T-Fund, Institutional

Class, 0.84% (c)(d) | | | 22,950,740 | | | | 22,950,740 | |

SL Liquidity Series, LLC, Money Market

Series, 1.27% (c)(d)(e) | | | 16,460,221 | | | | 16,461,867 | |

Total Short-Term Securities (Cost — $39,414,252) — 7.8% | | | | | | | 39,412,607 | |

Total Investments (Cost — $500,822,944) — 106.6% | | | | | | | 538,455,139 | |

Liabilities in Excess of Other Assets — (6.6)% | | | | | | | (33,325,005 | ) |

| | | | | | | | |

Net Assets — 100.0% | | | | | | $ | 505,130,134 | |

| | | | | | | | |

|

| Notes to Schedule of Investments |

| (a) | Non-income producing security. |

| (b) | Security, or a portion of the security, is on loan. |

See Notes to Financial Statements.

| | | | | | |

| | | BLACKROCK VARIABLE SERIES FUNDS, INC. | | JUNE 30, 2017 | | 7 |

| | | | |

| Schedule of Investments (continued) | | | BlackRock Advantage Large Cap Core V.I. Fund | |

| (c) | During the six months ended June 30, 2017, investments in issuers considered to be affiliates of the Fund for purposes of Section 2(a)(3) of the Investment Company Act of 1940, as amended, were as follows: |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Affiliate | | Shares

Held at

December 31, 2016 | | | Net

Activity | | | Shares

Held at

June 30, 2017 | | | Value at

June 30, 2017 | | | Income | | | Net Realized

Loss | | | Change in

Unrealized

Appreciation

(Depreciation) | |

BlackRock Liquidity Funds, T-Fund, Institutional Class | | | 16,275,353 | | | | 6,675,387 | | | | 22,950,740 | | | | $22,950,740 | | | | $35,613 | | | | — | | | | — | |

SL Liquidity Series, LLC, Money Market Series | | | 15,692,070 | | | | 768,151 | | | | 16,460,221 | | | | 16,461,867 | | | | 26,349 | 1 | | | $(1,075 | ) | | | $(159 | ) |

Total | | | | | | | | | | | | | | | $39,412,607 | | | | $61,962 | | | | $(1,075 | ) | | | $(159 | ) |

| | | | | | | | | | | | | | | | |

| 1 | Represents securities lending income earned from the reinvestment of cash collateral from loaned securities, net of fees and collateral investment expenses, and other payments to and from borrowers of securities. |

| (d) | Current yield as of period end. |

| (e) | Security was purchased with the cash collateral from loaned securities. |

| • | | For Fund compliance purposes, the Fund’s industry classifications refer to one or more of the industry sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by the investment adviser. These definitions may not apply for purposes of this report, which may combine such industry sub-classifications for reporting ease. |

|

| Derivative Financial Instruments Outstanding as of Period End |

| | | | | | | | | | | | | | |

Futures Contracts | |

Contracts

Long | | Issue | | Expiration | | | Notional

Value | | | Unrealized

Depreciation | |

| 54 | | S&P 500 E-Mini Index | | | September 2017 | | | $ | 6,536,430 | | | | $(18,152 | ) |

|

| Derivative Financial Instruments Categorized by Risk Exposure |

As of period end, the fair values of derivative financial instruments located in the Statement of Assets and Liabilities were as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Commodity

Contracts | | | Credit

Contracts | | | Equity

Contracts | | | Foreign Currency

Exchange Contracts | | | Interest Rate

Contracts | | | Total | |

| Liabilities — Derivative Financial Instruments | | | | | | | | | | | | | | | | | | |

Futures contracts | | Net unrealized depreciation1 | | | — | | | | — | | | | $18,152 | | | | — | | | | — | | | $ | 18,152 | |

| | 1 | | Includes cumulative appreciation (depreciation) on futures contracts, if any, as reported in the Schedule of Investments. Only current day’s variation margin is reported within the Statement of Assets and Liabilities. |

For the six months ended June 30, 2017, the effect of derivative financial instruments in the Statement of Operations was as follows:

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Commodity

Contracts | | | Credit

Contracts | | | Equity

Contracts | | | Foreign Currency

Exchange Contracts | | | Interest Rate

Contracts | | | Total | |

Net Realized Gain from: | | | | | | | | | | | | | | | | | | | | | | | | |

Futures contracts | | | — | | | | — | | | | $155,396 | | | | — | | | | — | | | | $155,396 | |

| | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| Net Change in Unrealized Appreciation (Depreciation) on: | | | | | | | | | | | | | | | | | | |

Futures contracts | | | — | | | | — | | | | $ 72,130 | | | | — | | | | — | | | | $ 72,130 | |

| | | | |

|

| Average Quarterly Balances of Outstanding Derivative Financial Instruments |

| | | | |

Futures contracts: | | | | |

Average notional value of contracts - long | | $ | 3,268,215 | |

For more information about the Fund’s investment risks regarding derivative financial instruments, refer to the Notes to Financial Statements.

See Notes to Financial Statements.

| | | | | | |

| 8 | | BLACKROCK VARIABLE SERIES FUNDS, INC. | | JUNE 30, 2017 | | |

| | | | |

| Schedule of Investments (concluded) | | | BlackRock Advantage Large Cap Core V.I. Fund | |

|

| Fair Value Hierarchy as of Period End |

Various inputs are used in determining the fair value of investments and derivative financial instruments. For information about the Fund’s policy regarding valuation of investments and derivative financial instruments, refer to the Notes to Financial Statements.

The following tables summarize the Fund’s investments and derivative financial instruments categorized in the disclosure hierarchy:

| | | | | | | | | | | | | | | | |

| | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

Assets: | | | | | | | | | | | | | | | | |

Investments: | | | | | | | | | | | | | | | | |

Long-Term Investments: | | | | | | | | | | | | | | | | |

Common Stocks1 | | $ | 499,042,532 | | | | — | | | | — | | | $ | 499,042,532 | |

Short-Term Securities | | | 22,950,740 | | | | — | | | | — | | | | 22,950,740 | |

| | | | |

Subtotal | | $ | 521,993,272 | | | | — | | | | — | | | $ | 521,993,272 | |

| | | | |

Investments Valued at NAV2 | | | | | | | | | | | | | | | 16,461,867 | |

| | | | | | | | | | | | | | | | |

Total Investments | | | | | | | | | | | | | | $ | 538,455,139 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

Derivative Financial Instruments3 | | | | | | | | | | | | | | | | |

Liabilities: | | | | | | | | | | | | | | | | |

Equity contracts | | $ | (18,152 | ) | | | — | | | | — | | | $ | (18,152 | ) |

| | 1 | | See above Schedule of Investments for values in each industry |

| | 2 | | As of June 30, 2017, certain investments of the Fund were fair valued using NAV per share as no quoted market value is available and therefore have been excluded from the fair value hierarchy. |

| | 3 | | Derivative financial instruments are futures contracts, which are valued at the unrealized appreciation (depreciation) on the instrument. |

During the six months ended June 30, 2017, there were no transfers between levels.

See Notes to Financial Statements.

| | | | | | |

| | | BLACKROCK VARIABLE SERIES FUNDS, INC. | | JUNE 30, 2017 | | 9 |

| | | | |

| Statement of Assets and Liabilities | | | | |

| | | | |

| June 30, 2017 (Unaudited) | | BlackRock

Advantage Large

Cap Core V.I. Fund | |

| | | | |

| Assets | | | | |

Investments at value — unaffiliated (including securities loaned at value of $16,213,539) (cost — $461,408,692) | | $ | 499,042,532 | |

Investments at value — affiliated (cost — $39,414,252) | | | 39,412,607 | |

Cash | | | 212,077 | |

Cash pledged for futures contracts | | | 445,000 | |

Receivables: | | | | |

Investments sold | | | 1,279,903 | |

Securities lending income — affiliated | | | 4,316 | |

Capital shares sold | | | 14,025 | |

Dividends — affiliated | | | 17,890 | |

Dividends — unaffiliated | | | 324,341 | |

From the Manager | | | 116,279 | |

Variation margin on futures contracts | | | 2,430 | |

Prepaid expenses | | | 1,255 | |

| | | | |

Total assets | | | 540,872,655 | |

| | | | |

| | | | |

| Liabilities | | | | |

Cash collateral on securities loaned at value | | | 16,461,565 | |

Payables: | | | | |

Investments purchased | | | 18,475,492 | |

Capital shares redeemed | | | 177,843 | |

Distribution fees | | | 67,430 | |

Investment advisory fees | | | 190,867 | |

Officer’s and Directors’ fees | | | 1,685 | |

Other accrued expenses | | | 109,038 | |

Other affiliates | | | 4,024 | |

Transfer agent fees | | | 254,577 | |

| | | | |

Total liabilities | | | 35,742,521 | |

| | | | |

Net Assets | | $ | 505,130,134 | |

| | | | |

| | | | |

| Net Assets Consist of | | | | |

Paid-in capital | | $ | 351,725,824 | |

Undistributed net investment income | | | 2,967,266 | |

Accumulated net realized gain | | | 112,823,001 | |

Net unrealized appreciation (depreciation) | | | 37,614,043 | |

| | | | |

Net Assets | | $ | 505,130,134 | |

| | | | |

| | | | |

| Net Asset Value | | | | |

Class I — Based on net assets of $177,570,506 and 5,076,980 shares outstanding, 200 million shares authorized, $0.10 par value | | $ | 34.98 | |

| | | | |

Class II — Based on net assets of $4,539,207 and 129,796 shares outstanding, 100 million shares authorized, $0.10 par value | | $ | 34.97 | |

| | | | |

Class III — Based on net assets of $323,020,421 and 9,299,611 shares outstanding, 100 million shares authorized, $0.10 par value | | $ | 34.73 | |

| | | | |

See Notes to Financial Statements.

| | | | | | |

| 10 | | BLACKROCK VARIABLE SERIES FUNDS, INC. | | JUNE 30, 2017 | | |

| | | | |

| Six Months Ended June 30, 207 (Unaudited) | | BlackRock

Advantage Large

Cap Core V.I. Fund | |

| | | | |

| Investment Income | | | | |

Dividends — unaffiliated | | $ | 4,729,819 | |

Securities lending income — affiliated — net | | | 26,349 | |

Dividends — affiliated | | | 35,613 | |

Foreign taxes withheld | | | (41,702 | ) |

| | | | |

Total investment income | | | 4,750,079 | |

| | | | |

| | | | |

| Expenses | | | | |

Investment advisory | | | 1,164,639 | |

Transfer agent | | | 2,481 | |

Transfer agent — class specific | | | 518,744 | |

Distribution — class specific | | | 410,234 | |

Accounting services | | | 56,954 | |

Professional | | | 40,256 | |

Printing | | | 35,336 | |

Custodian | | | 15,810 | |

Officer and Directors | | | 13,004 | |

Miscellaneous | | | 7,617 | |

| | | | |

Total expenses | | | 2,265,075 | |

Less: | | | | |

Fees waived by the Manager | | | (4,062 | ) |

Transfer agent fees reimbursed — class specific | | | (342,452 | ) |

| | | | |

Total expenses after fees waived and/or reimbursed | | | 1,918,561 | |

| | | | |

Net investment income | | | 2,831,518 | |

| | | | |

| | | | |

| Realized and Unrealized Gain (Loss) | | | | |

Net realized gain (loss) from: | | | | |

Investments — unaffiliated | | | 104,274,794 | |

Investments — affiliated | | | (1,075 | ) |

Futures contracts | | | 155,396 | |

| | | | |

| | | 104,429,115 | |

| | | | |

Net change in unrealized appreciation (depreciation) on: | | | | |

Investments — unaffiliated | | | (60,732,023 | ) |

Investments — affiliated | | | (159 | ) |

Futures contracts | | | 72,130 | |

| | | | |

| | | (60,660,052 | ) |

| | | | |

Total realized and unrealized gain | | | 43,769,063 | |

| | | | |

Net Increase in Net Assets Resulting from Operations | | $ | 46,600,581 | |

| | | | |

See Notes to Financial Statements.

| | | | | | |

| | | BLACKROCK VARIABLE SERIES FUNDS, INC. | | JUNE 30, 2017 | | 11 |

| | | | |

| Statements of Changes in Net Assets | | | BlackRock Advantage Large Cap Core V.I. Fund | |

| | | | | | | | |

| Increase (Decrease) in Net Assets: | | Six Months

Ended

June 30, 2017

(Unaudited) | | | Year Ended

December 31,

2016 | |

| | | | | | | | |

| Operations | | | | | | | | |

Net investment income | | $ | 2,831,518 | | | $ | 5,228,756 | |

Net realized gain | | | 104,429,115 | | | | 40,746,201 | |

Net change in unrealized appreciation (depreciation) | | | (60,660,052 | ) | | | 3,376,349 | |

| | | | |

Net increase in net assets resulting from operations | | | 46,600,581 | | | | 49,351,306 | |

| | | | |

| | | | | | | | |

| Distributions to Shareholders1 | | | | | | | | |

From net investment income: | | | | | | | | |

Class I | | | — | | | | (2,047,574 | ) |

Class II | | | — | | | | (53,362 | ) |

Class III | | | — | | | | (2,999,067 | ) |

From net realized gain: | | | | | | | | |

Class I | | | — | | | | (12,366,480 | ) |

Class II | | | — | | | | (370,135 | ) |

Class III | | | — | | | | (23,127,170 | ) |

| | | | |

Decrease in net assets resulting from distributions to shareholders | | | — | | | | (40,963,788 | ) |

| | | | |

| | | | | | | | |

| Capital Share Transactions | | | | | | | | |

Net increase (decrease) in net assets derived from capital share transactions | | | (50,627,908 | ) | | | 4,719,038 | |

| | | | |

| | | | | | | | |

| Net Assets | | | | | | | | |

Total increase (decrease) in net assets | | | (4,027,327 | ) | | | 13,106,556 | |

Beginning of period | | | 509,157,461 | | | | 496,050,905 | |

| | | | |

End of period | | $ | 505,130,134 | | | $ | 509,157,461 | |

| | | | |

Undistributed net investment income, end of period | | $ | 2,967,266 | | | $ | 135,748 | |

| | | | |

| 1 | | Distributions for annual periods determined in accordance with U.S. federal income tax regulations. |

See Notes to Financial Statements.

| | | | | | |

| 12 | | BLACKROCK VARIABLE SERIES FUNDS, INC. | | JUNE 30, 2017 | | |

| | | | |

| Financial Highlights | | | BlackRock Advantage Large Cap Core V.I. Fund | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Class I | |

| | | Six Months

Ended

June 30, 2017 | | | Year Ended December 31, | |

| | | (Unaudited) | | | 2016 | | | 2015 | | | 2014 | | | 2013 | | | 2012 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| Per Share Operating Performance | | | | | | | | | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | $ | 31.91 | | | $ | 31.40 | | | $ | 33.26 | | | $ | 33.80 | | | $ | 25.55 | | | $ | 23.00 | |

| | | | |

Net investment income1 | | | 0.22 | | | | 0.39 | | | | 0.36 | | | | 0.34 | | | | 0.30 | | | | 0.39 | |

Net realized and unrealized gain (loss) | | | 2.85 | | | | 2.91 | | | | (0.16 | ) | | | 3.86 | | | | 8.27 | | | | 2.54 | |

| | | | |

Net increase from investment operations | | | 3.07 | | | | 3.30 | | | | 0.20 | | | | 4.20 | | | | 8.57 | | | | 2.93 | |

| | | | |

Distributions:2 | | | | | | | | | | | | | | | | | | | | | | | | |

From net investment income | | | — | | | | (0.40 | ) | | | (0.39 | ) | | | (0.36 | ) | | | (0.32 | ) | | | (0.38 | ) |

From net realized gain | | | — | | | | (2.39 | ) | | | (1.67 | ) | | | (4.38 | ) | | | — | | | | — | |

| | | | |

Total distributions | | | — | | | | (2.79 | ) | | | (2.06 | ) | | | (4.74 | ) | | | (0.32 | ) | | | (0.38 | ) |

| | | | |

Net asset value, end of period | | $ | 34.98 | | | $ | 31.91 | | | $ | 31.40 | | | $ | 33.26 | | | $ | 33.80 | | | $ | 25.55 | |

| | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| Total Return3 | | | | | | | | | | | | | | | | | | | | | | | | |

Based on net asset value | | | 9.62 | %4 | | | 10.55 | % | | | 0.52 | % | | | 12.36 | % | | | 33.56 | % | | | 12.75 | % |

| | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| Ratios to Average Net Assets | | | | | | | | | | | | | | | | | | | | | | | | |

Total expenses | | | 0.73 | %5 | | | 0.72 | % | | | 0.71 | % | | | 0.73 | % | | | 0.73 | % | | | 0.69 | % |

| | | | |

Total expenses after fees waived and/or reimbursed | | | 0.57 | %5 | | | 0.58 | % | | | 0.56 | % | | | 0.57 | % | | | 0.58 | % | | | 0.59 | % |

| | | | |

Net investment income | | | 1.30 | %5 | | | 1.26 | % | | | 1.08 | % | | | 0.97 | % | | | 1.03 | % | | | 1.56 | % |

| | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| Supplemental Data | | | | | | | | | | | | | | | | | | | | | | | | |

Net assets, end of period (000) | | $ | 177,571 | | | $ | 175,947 | | | $ | 184,151 | | | $ | 212,067 | | | $ | 219,418 | | | $ | 191,227 | |

| | | | |

Portfolio turnover rate | | | 86 | % | | | 50 | % | | | 31 | % | | | 48 | % | | | 42 | % | | | 110 | % |

| | | | |

| | 1 | | Based on average shares outstanding. |

| | 2 | | Distributions for annual periods determined in accordance with U.S. federal income tax regulations. |

| | 3 | | Where applicable, excludes insurance-related fees and expenses and assumes the reinvestment of distributions. |

| | 4 | | Aggregate total return. |

See Notes to Financial Statements.

| | | | | | |

| | | BLACKROCK VARIABLE SERIES FUNDS, INC. | | JUNE 30, 2017 | | 13 |

| | | | |

| Financial Highlights (continued) | | | BlackRock Advantage Large Cap Core V.I. Fund | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Class II | |

| | | Six Months

Ended

June 30, 2017 | | | Year Ended December 31, | |

| | | (Unaudited) | | | 2016 | | | 2015 | | | 2014 | | | 2013 | | | 2012 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| Per Share Operating Performance | | | | | | | | | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | $ | 31.93 | | | $ | 31.42 | | | $ | 33.27 | | | $ | 33.79 | | | $ | 25.56 | | | $ | 23.01 | |

| | | | |

Net investment income1 | | | 0.19 | | | | 0.34 | | | | 0.30 | | | | 0.28 | | | | 0.25 | | | | 0.35 | |

Net realized and unrealized gain (loss) | | | 2.85 | | | | 2.90 | | | | (0.16 | ) | | | 3.87 | | | | 8.25 | | | | 2.54 | |

| | | | |

Net increase from investment operations | | | 3.04 | | | | 3.24 | | | | 0.14 | | | | 4.15 | | | | 8.50 | | | | 2.89 | |

| | | | |

Distributions:2 | | | | | | | | | | | | | | | | | | | | | | | | |

From net investment income | | | — | | | | (0.34 | ) | | | (0.32 | ) | | | (0.29 | ) | | | (0.27 | ) | | | (0.34 | ) |

From net realized gain | | | — | | | | (2.39 | ) | | | (1.67 | ) | | | (4.38 | ) | | | — | | | | — | |

| | | | |

Total distributions | | | — | | | | (2.73 | ) | | | (1.99 | ) | | | (4.67 | ) | | | (0.27 | ) | | | (0.34 | ) |

| | | | |

Net asset value, end of period | | $ | 34.97 | | | $ | 31.93 | | | $ | 31.42 | | | $ | 33.27 | | | $ | 33.79 | | | $ | 25.56 | |

| | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| Total Return3 | | | | | | | | | | | | | | | | | | | | | | | | |

Based on net asset value | | | 9.52 | %4 | | | 10.37 | % | | | 0.34 | % | | | 12.23 | % | | | 33.28 | % | | | 12.59 | % |

| | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| Ratios to Average Net Assets | | | | | | | | | | | | | | | | | | | | | | | | |

Total expenses | | | 0.88 | %5 | | | 0.88 | % | | | 0.85 | % | | | 0.89 | % | | | 0.86 | % | | | 0.85 | % |

| | | | |

Total expenses after fees waived and/or reimbursed | | | 0.74 | %5 | | | 0.75 | % | | | 0.73 | % | | | 0.74 | % | | | 0.75 | % | | | 0.74 | % |

| | | | |

Net investment income | | | 1.11 | %5 | | | 1.09 | % | | | 0.91 | % | | | 0.81 | % | | | 0.86 | % | | | 1.42 | % |

| | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| Supplemental Data | | | | | | | | | | | | | | | | | | | | | | | | |

Net assets, end of period (000) | | $ | 4,539 | | | $ | 5,170 | | | $ | 5,333 | | | $ | 6,203 | | | $ | 6,080 | | | $ | 4,603 | |

| | | | |

Portfolio turnover rate | | | 86 | % | | | 50 | % | | | 31 | % | | | 48 | % | | | 42 | % | | | 110 | % |

| | | | |

| | 1 | | Based on average shares outstanding. |

| | 2 | | Distributions for annual periods determined in accordance with U.S. federal income tax regulations. |

| | 3 | | Where applicable, excludes insurance-related fees and expenses and assumes the reinvestment of distributions. |

| | 4 | | Aggregate total return. |

See Notes to Financial Statements.

| | | | | | |

| 14 | | BLACKROCK VARIABLE SERIES FUNDS, INC. | | JUNE 30, 2017 | | |

| | | | |

| Financial Highlights (concluded) | | | BlackRock Advantage Large Cap Core V.I. Fund | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Class III | |

| | | Six Months

Ended

June 30, 2017 | | | Year Ended December 31, | |

| | | (Unaudited) | | | 2016 | | | 2015 | | | 2014 | | | 2013 | | | 2012 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| Per Share Operating Performance | | | | | | | | | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | $ | 31.74 | | | $ | 31.25 | | | $ | 33.11 | | | $ | 33.66 | | | $ | 25.46 | | | $ | 22.92 | |

| | | | |

Net investment income1 | | | 0.17 | | | | 0.31 | | | | 0.27 | | | | 0.24 | | | | 0.22 | | | | 0.32 | |

Net realized and unrealized gain (loss) | | | 2.82 | | | | 2.88 | | | | (0.17 | ) | | | 3.84 | | | | 8.22 | | | | 2.54 | |

| | | | |

Net increase from investment operations | | | 2.99 | | | | 3.19 | | | | 0.10 | | | | 4.08 | | | | 8.44 | | | | 2.86 | |

| | | | |

Distributions:2 | | | | | | | | | | | | | | | | | | | | | | | | |

From net investment income | | | — | | | | (0.31 | ) | | | (0.29 | ) | | | (0.25 | ) | | | (0.24 | ) | | | (0.32 | ) |

From net realized gain | | | — | | | | (2.39 | ) | | | (1.67 | ) | | | (4.38 | ) | | | — | | | | — | |

| | | | |

Total distributions | | | — | | | | (2.70 | ) | | | (1.96 | ) | | | (4.63 | ) | | | (0.24 | ) | | | (0.32 | ) |

| | | | |

Net asset value, end of period | | $ | 34.73 | | | $ | 31.74 | | | $ | 31.25 | | | $ | 33.11 | | | $ | 33.66 | | | $ | 25.46 | |

| | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| Total Return3 | | | | | | | | | | | | | | | | | | | | | | | | |

Based on net asset value | | | 9.42 | %4 | | | 10.26 | % | | | 0.23 | % | | | 12.07 | % | | | 33.16 | % | | | 12.49 | % |

| | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| Ratios to Average Net Assets | | | | | | | | | | | | | | | | | | | | | | | | |

Total expenses | | | 0.98 | %5 | | | 0.97 | % | | | 0.96 | % | | | 0.98 | % | | | 0.99 | % | | | 0.94 | % |

| | | | |

Total expenses after fees waived and/or reimbursed | | | 0.85 | %5 | | | 0.86 | % | | | 0.84 | % | | | 0.85 | % | | | 0.86 | % | | | 0.87 | % |

| | | | |

Net investment income | | | 1.01 | %5 | | | 0.98 | % | | | 0.80 | % | | | 0.69 | % | | | 0.75 | % | | | 1.30 | % |

| | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| Supplemental Data | | | | | | | | | | | | | | | | | | | | | | | | |

Net assets, end of period (000) | | $ | 323,020 | | | $ | 328,040 | | | $ | 306,567 | | | $ | 322,418 | | | $ | 300,005 | | | $ | 232,024 | |

| | | | |

Portfolio turnover rate | | | 86 | % | | | 50 | % | | | 31 | % | | | 48 | % | | | 42 | % | | | 110 | % |

| | | | |

| | 1 | | Based on average shares outstanding. |

| | 2 | | Distributions for annual periods determined in accordance with U.S. federal income tax regulations. |

| | 3 | | Where applicable, excludes insurance-related fees and expenses and assumes the reinvestment of distributions. |

| | 4 | | Aggregate total return. |

See Notes to Financial Statements.

| | | | | | |

| | | BLACKROCK VARIABLE SERIES FUNDS, INC. | | JUNE 30, 2017 | | 15 |

| | | | |

| Notes to Financial Statements (Unaudited) | | | BlackRock Advantage Large Cap Core V.I. Fund | |

1. Organization:

BlackRock Variable Series Funds, Inc. (the “Company”) is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as an open-end management investment company. The Company is organized as a Maryland corporation that is comprised of 20 separate funds. The funds offer shares to insurance companies for their separate accounts to fund benefits under certain variable annuity and variable life insurance contracts. The financial statements presented are for BlackRock Advantage Large Cap Core V.I. Fund (the “Fund”) (formerly known as BlackRock Large Cap Core V.I. Fund). The Fund is classified as diversified. Class I, Class II and Class III Shares have equal voting, dividend, liquidation and other rights, except that only shares of the respective classes are entitled to vote on matters concerning only that class. In addition, Class II and Class III Shares bear certain expenses related to the distribution of such shares.

The Fund, together with certain other registered investment companies advised by BlackRock Advisors, LLC (the “Manager”) or its affiliates, is included in a complex of open-end funds referred to as the Equity-Bond Complex.

2. Significant Accounting Policies:

The financial statements are prepared in conformity with accounting principles generally accepted in the United States of America (“U.S. GAAP”), which may require management to make estimates and assumptions that affect the reported amounts of assets and liabilities in the financial statements, disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates. The Fund is considered an investment company under U.S. GAAP and follows the accounting and reporting guidance applicable to investment companies. Below is a summary of significant accounting policies:

Segregation and Collateralization: In cases where the Fund enters into certain investments (e.g., futures contracts) that would be treated as “senior securities” for 1940 Act purposes, the Fund may segregate or designate on its books and records cash or liquid assets having a market value at least equal to the amount of the Fund’s future obligations under such investments. Doing so allows the investment to be excluded from treatment as a “senior security.” Furthermore, if required by an exchange or counterparty agreement, the Fund may be required to deliver/deposit cash and/or securities to/with an exchange, or broker-dealer or custodian as collateral for certain investments or obligations.

Investment Transactions and Income Recognition: For financial reporting purposes, investment transactions are recorded on the dates the transactions are entered into (the trade dates). Realized gains and losses on investment transactions are determined on the identified cost basis. Dividend income is recorded on the ex-dividend date. Dividends from foreign securities where the ex-dividend date may have passed are subsequently recorded when the Fund is informed of the ex-dividend date. Under the applicable foreign tax laws, a withholding tax at various rates may be imposed on capital gains, dividends and interest. Income, expenses and realized and unrealized gains and losses are allocated daily to each class based on its relative net assets.

Distributions: Distributions paid by the Fund are recorded on the ex-dividend date. Distributions of capital gains are recorded on the ex-dividend date and made at least annually. The character and timing of distributions are determined in accordance with U.S. federal income tax regulations, which may differ from U.S. GAAP.

SEC Reporting Modernization: The U.S. Securities and Exchange Commission (“SEC”) adopted new rules and forms and amended other rules to enhance the reporting and disclosure of information by registered investment companies. As part of these changes, the SEC amended Regulation S-X to standardize and enhance disclosures in investment company financial statements. The compliance date for implementing the new or amended rules is August 1, 2017.

Indemnifications: In the normal course of business, the Fund enters into contracts that contain a variety of representations that provide general indemnification. The Fund’s maximum exposure under these arrangements is unknown because it involves future potential claims against the Fund, which cannot be predicted with any certainty.

Other: Expenses directly related to the Fund or its classes are charged to the Fund or the applicable class. Other operating expenses shared by several funds, including other funds managed by the Manager, are prorated among those funds on the basis of relative net assets or other appropriate methods. Expenses directly related to the Fund and other shared expenses prorated to the Fund are allocated daily to each class based on its relative net assets or other appropriate methods.

The Fund has an arrangement with its custodian whereby credits are earned on uninvested cash balances, which could be used to reduce custody fees and/or overdraft charges. The Fund may incur charges on certain uninvested cash balances and overdrafts, subject to certain conditions.

| | | | | | |

| 16 | | BLACKROCK VARIABLE SERIES FUNDS, INC. | | JUNE 30, 2017 | | |

| | | | |

| Notes to Financial Statements (continued) | | | BlackRock Advantage Large Cap Core V.I. Fund | |

3. Investment Valuation and Fair Value Measurements:

Investment Valuation Policies: The Fund’s investments are valued at fair value (also referred to as “market value” within the financial statements) as of the close of trading on the New York Stock Exchange (“NYSE”) (generally 4:00 p.m., Eastern time) (or if the reporting date falls on a day the NYSE is closed, investments are valued at fair value as of the period end). U.S. GAAP defines fair value as the price the Fund would receive to sell an asset or pay to transfer a liability in an orderly transaction between market participants at the measurement date. The Fund determines the fair values of its financial instruments using various independent dealers or pricing services under policies approved by the Board of Directors of the Company (the “Board”). The BlackRock Global Valuation Methodologies Committee (the “Global Valuation Committee”) is the committee formed by management to develop global pricing policies and procedures and to oversee the pricing function for all financial instruments.

Fair Value Inputs and Methodologies: The following methods and inputs are used to establish the fair value of the Fund’s assets and liabilities:

| • | | Equity investments traded on a recognized securities exchange are valued at the official closing price each day, if available. For equity investments traded on more than one exchange, the official closing price on the exchange where the stock is primarily traded is used. Equity investments traded on a recognized exchange for which there were no sales on that day may be valued at the last available bid (long positions) or ask (short positions) price. |

| • | | Investments in open-end U.S. mutual funds are valued at NAV each business day. |

| • | | The Fund values its investment in SL Liquidity Series, LLC, Money Market Series (the “Money Market Series”) at fair value, which is ordinarily based upon its pro rata ownership in the underlying fund’s net assets. The Money Market Series seeks current income consistent with maintaining liquidity and preserving capital. Although the Money Market Series is not registered under the 1940 Act, its investments may follow the parameters of investments by a money market fund that is subject to Rule 2a-7 under the 1940 Act. |

| • | | Futures contracts traded on exchanges are valued at their last sale price. |

If events (e.g., a company announcement, market volatility or a natural disaster) occur that are expected to materially affect the value of such instruments, or in the event that the application of these methods of valuation results in a price for an investment that is deemed not to be representative of the market value of such investment, or if a price is not available, the investment will be valued by the Global Valuation Committee, or its delegate, in accordance with a policy approved by the Board as reflecting fair value (“Fair Valued Investments”). The fair valuation approaches that may be used by the Global Valuation Committee will include Market approach, Income approach and the Cost approach. Valuation techniques such as discounted cash flow, use of market comparables and matrix pricing are types of valuation approaches and typically used in determining fair value. When determining the price for Fair Valued Investments, the Global Valuation Committee, or its delegate, seeks to determine the price that the Fund might reasonably expect to receive or pay from the current sale or purchase of that asset or liability in an arm’s-length transaction. Fair value determinations shall be based upon all available factors that the Global Valuation Committee, or its delegate, deems relevant and consistent with the principles of fair value measurement. The pricing of all Fair Valued Investments is subsequently reported to the Board or a committee thereof on a quarterly basis.

Fair Value Hierarchy: Various inputs are used in determining the fair value of investments and derivative financial instruments. These inputs to valuation techniques are categorized into a fair value hierarchy consisting of three broad levels for financial statement purposes as follows:

| • | | Level 1 — Unadjusted price quotations in active markets/exchanges for identical assets or liabilities that the Fund has the ability to access |

| • | | Level 2 — Other observable inputs (including, but not limited to, quoted prices for similar assets or liabilities in markets that are active, quoted prices for identical or similar assets or liabilities in markets that are not active, inputs other than quoted prices that are observable for the assetsor liabilities (such as interest rates, yield curves, volatilities, prepayment speeds, loss severities, credit risks and default rates) or other market–

corroborated inputs) |

| • | | Level 3 — Unobservable inputs based on the best information available in the circumstances, to the extent observable inputs are not available (including the Fund’s own assumptions used in determining the fair value of investments and derivative financial instruments) |

The hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1 measurements) and the lowest priority to unobservable inputs (Level 3 measurements). Accordingly, the degree of judgment exercised in determining fair value is greatest for instruments categorized in Level 3. The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the fair value hierarchy classification is determined based on the lowest level input that is significant to the fair value measurement in its entirety. Investments classified within Level 3 have significant unobservable inputs used by the Global Valuation Committee in determining the price for Fair Valued investments. Level 3 investments include equity or debt issued by private companies. There may not be a secondary market, and/or there are a limited number of investors. Level 3 investments may also be adjusted to reflect illiquidity and/or non-transferability, with the amount of such discount estimated by the Global Valuation Committee in the absence of market information.

| | | | | | |

| | | BLACKROCK VARIABLE SERIES FUNDS, INC. | | JUNE 30, 2017 | | 17 |

| | | | |

| Notes to Financial Statements (continued) | | | BlackRock Advantage Large Cap Core V.I. Fund | |

Changes in valuation techniques may result in transfers into or out of an assigned level within the hierarchy. In accordance with the Fund’s policy, transfers between different levels of the fair value hierarchy are deemed to have occurred as of the beginning of the reporting period. The categorization of a value determined for investments and derivative financial instruments is based on the pricing transparency of the investments and derivative financial instruments and is not necessarily an indication of the risks associated with investing in those securities.

As of June 30, 2017, certain investments of the Fund were valued using NAV as no quoted market value is available and therefore have been excluded from the fair value hierarchy.

4. Securities and Other Investments:

Securities Lending: The Fund may lend its securities to approved borrowers, such as brokers, dealers and other financial institutions. The borrower pledges and maintains with the Fund collateral consisting of cash, an irrevocable letter of credit issued by a bank, or securities issued or guaranteed by the U.S. Government. The initial collateral received by the Fund is required to have a value of at least 102% of the current value of the loaned securities for securities traded on U.S. exchanges and a value of at least 105% for all other securities. The collateral is maintained thereafter at a value equal to at least 100% of the current market value of the securities on loan. The market value of the loaned securities is determined at the close of each business day of the Fund and any additional required collateral is delivered to the Fund, or excess collateral returned by the Fund, on the next business day. During the term of the loan, the Fund is entitled to all distributions made on or in respect of the loaned securities but does not receive interest income on securities received as collateral. Loans of securities are terminable at any time and the borrower, after notice, is required to return borrowed securities within the standard time period for settlement of securities transactions.

The market value of any securities on loan, all of which were classified as common stocks in the Fund’s Schedule of Investments, and the value of any related collateral are shown separately in the Statement of Assets and Liabilities as a component of investments at value — unaffiliated, and collateral on securities loaned at value, respectively. As of period end, any securities on loan were collateralized by cash and/or U.S. Government obligations. Cash collateral invested by the securities lending agent, BlackRock Investment Management, LLC (“BIM”), if any, is disclosed in the Schedule of Investments.