UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-3320

Fidelity Colchester Street Trust

(Exact name of registrant as specified in charter)

82 Devonshire St., Boston, Massachusetts 02109

(Address of principal executive offices) (Zip code)

Scott C. Goebel, Secretary

82 Devonshire St.

Boston, Massachusetts 02109

(Name and address of agent for service)

Registrant's telephone number, including area code: 617-563-7000

Date of fiscal year end: | March 31 |

| |

Date of reporting period: | September 30, 2011 |

Item 1. Reports to Stockholders

Fidelity ®

Institutional

Money Market

Funds

Semiannual Report

September 30, 2011

Contents

Fund Goals:

Treasury Only Portfolio seeks as high a level of current income as is consistent with the security of principal and liquidity.

Treasury Portfolio, Government Portfolio, Prime Money Market Portfolio, and Money Market Portfolio seek to obtain as high a level of current income as is consistent with the preservation of principal and liquidity within the limitations prescribed for the fund.

Tax-Exempt Portfolio seeks to obtain as high a level of interest income exempt from federal income tax as is consistent with liquidity and stability of principal.

To view a fund's proxy voting guidelines and proxy voting record for the 12-month period ended June 30, visit http://www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission's (SEC) web site at http://www.sec.gov. You may also call 1-877-297-2952, or for Class F, call 1-800-835-5092, to request a free copy of the proxy voting guidelines.

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR LLC or an affiliated company.

Investments in the funds are neither insured nor guaranteed by the U.S. Government, and there can be no assurance that the funds will maintain a stable $1.00 share price.

This report and the financial statements contained herein are submitted for the general information of the shareholders of the funds. This report is not authorized for distribution to prospective investors in the funds unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. Forms N-Q are available on the SEC's web site at http://www.sec.gov. A fund's Forms N-Q may be reviewed and copied at the SEC's Public Reference Room in Washington, DC. Information regarding the operation of the SEC's Public Reference Room may be obtained by calling 1-800-SEC-0330. For a complete list of a fund's portfolio holdings, view the most recent holdings listing, semiannual report, or annual report on Fidelity's web site at http://www.fidelity.com, http://www.advisor.fidelity.com, or http://www.401k.com, as applicable.

NOT FDIC INSURED • MAY LOSE VALUE • NO BANK GUARANTEE

Neither the funds nor Fidelity Distributors Corporation is a bank.

Semiannual Report

As a shareholder of a Fund, you incur two types of costs: (1) transaction costs, and (2) ongoing costs, including management fees, distribution and/or service (12b-1) fees and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (April 1, 2011 to September 30, 2011).

Actual Expenses

The first line of the accompanying table for each class of each fund provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000.00 (for example, an $8,600 account value divided by $1,000.00 = 8.6), then multiply the result by the number in the first line for a class of the fund under the heading entitled "Expenses Paid During Period" to estimate the expenses you paid on your account during this period. A small balance maintenance fee of $12.00 that is charged once a year may apply for certain accounts with a value of less than $2,000. This fee is not included in the table below. If it was, the estimate of expenses you paid during the period would be higher, and your ending account value lower, by this amount. In addition, each Fund, as a shareholder in the underlying Fidelity Central Funds, will indirectly bear its pro-rata share of the fees and expenses incurred by the underlying Fidelity Central Funds. These fees and expenses are not included in the Fund's annualized expense ratio used to calculate the expense estimate in the table below.

Hypothetical Example for Comparison Purposes

The second line of the accompanying table for each class of each fund provides information about hypothetical account values and hypothetical expenses based on a Class' actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Class' actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. A small balance maintenance fee of $12.00 that is charged once a year may apply for certain accounts with a value of less than $2,000. This fee is not included in the table below. If it was, the estimate of expenses you paid during the period would be higher, and your ending account value lower, by this amount. In addition, each Fund, as a shareholder in the underlying Fidelity Central Funds, will indirectly bear its pro-rata share of the fees and expenses incurred by the underlying Fidelity Central Funds. These fees and expenses are not included in the Fund's annualized expense ratio used to calculate the expense estimate in the table below.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds.

| Annualized Expense Ratio | Beginning

Account Value

April 1, 2011 | Ending

Account Value

September 30, 2011 | Expenses Paid

During Period*

April 1, 2011 to

September 30, 2011 |

Treasury Only Portfolio | | | | |

Class I | .07% | | | |

Actual | | $ 1,000.00 | $ 1,000.10 | $ .35 ** |

Hypothetical A | | $ 1,000.00 | $ 1,024.65 | $ .35 ** |

Class II | .08% | | | |

Actual | | $ 1,000.00 | $ 1,000.10 | $ .40 ** |

Hypothetical A | | $ 1,000.00 | $ 1,024.60 | $ .40 ** |

Class III | .08% | | | |

Actual | | $ 1,000.00 | $ 1,000.10 | $ .40 ** |

Hypothetical A | | $ 1,000.00 | $ 1,024.60 | $ .40 ** |

Class IV | .09% | | | |

Actual | | $ 1,000.00 | $ 1,000.10 | $ .45 ** |

Hypothetical A | | $ 1,000.00 | $ 1,024.55 | $ .46 ** |

Select Class | .08% | | | |

Actual | | $ 1,000.00 | $ 1,000.10 | $ .40 ** |

Hypothetical A | | $ 1,000.00 | $ 1,024.60 | $ .40 ** |

Treasury Portfolio | | | | |

Class I | .11% | | | |

Actual | | $ 1,000.00 | $ 1,000.10 | $ .55 ** |

Hypothetical A | | $ 1,000.00 | $ 1,024.45 | $ .56 ** |

Class II | .11% | | | |

Actual | | $ 1,000.00 | $ 1,000.10 | $ .55 ** |

Hypothetical A | | $ 1,000.00 | $ 1,024.45 | $ .56 ** |

| Annualized Expense Ratio | Beginning

Account Value

April 1, 2011 | Ending

Account Value

September 30, 2011 | Expenses Paid

During Period*

April 1, 2011 to

September 30, 2011 |

Class III | .11% | | | |

Actual | | $ 1,000.00 | $ 1,000.10 | $ .55 ** |

Hypothetical A | | $ 1,000.00 | $ 1,024.45 | $ .56 ** |

Class IV | .11% | | | |

Actual | | $ 1,000.00 | $ 1,000.10 | $ .55 ** |

Hypothetical A | | $ 1,000.00 | $ 1,024.45 | $ .56 ** |

Select Class | .11% | | | |

Actual | | $ 1,000.00 | $ 1,000.10 | $ .55 ** |

Hypothetical A | | $ 1,000.00 | $ 1,024.45 | $ .56 ** |

Government Portfolio | | | | |

Class I | .16% | | | |

Actual | | $ 1,000.00 | $ 1,000.10 | $ .80 ** |

Hypothetical A | | $ 1,000.00 | $ 1,024.20 | $ .81 ** |

Class II | .16% | | | |

Actual | | $ 1,000.00 | $ 1,000.10 | $ .80 ** |

Hypothetical A | | $ 1,000.00 | $ 1,024.20 | $ .81 ** |

Class III | .16% | | | |

Actual | | $ 1,000.00 | $ 1,000.10 | $ .80 ** |

Hypothetical A | | $ 1,000.00 | $ 1,024.20 | $ .81 ** |

Select Class | .16% | | | |

Actual | | $ 1,000.00 | $ 1,000.10 | $ .80 ** |

Hypothetical A | | $ 1,000.00 | $ 1,024.20 | $ .81 ** |

Prime Money Market Portfolio | | | | |

Class I | .20% | | | |

Actual | | $ 1,000.00 | $ 1,000.50 | $ 1.00 |

Hypothetical A | | $ 1,000.00 | $ 1,024.00 | $ 1.01 |

Class II | .28% | | | |

Actual | | $ 1,000.00 | $ 1,000.10 | $ 1.40 ** |

Hypothetical A | | $ 1,000.00 | $ 1,023.60 | $ 1.42 ** |

Class III | .28% | | | |

Actual | | $ 1,000.00 | $ 1,000.10 | $ 1.40 ** |

Hypothetical A | | $ 1,000.00 | $ 1,023.60 | $ 1.42 ** |

Class IV | .28% | | | |

Actual | | $ 1,000.00 | $ 1,000.10 | $ 1.40 ** |

Hypothetical A | | $ 1,000.00 | $ 1,023.60 | $ 1.42 ** |

Select Class | .25% | | | |

Actual | | $ 1,000.00 | $ 1,000.20 | $ 1.25 |

Hypothetical A | | $ 1,000.00 | $ 1,023.75 | $ 1.26 |

Institutional Class | .14% | | | |

Actual | | $ 1,000.00 | $ 1,000.80 | $ .70 |

Hypothetical A | | $ 1,000.00 | $ 1,024.30 | $ .71 |

Money Market Portfolio | | | | |

Class I | .18% | | | |

Actual | | $ 1,000.00 | $ 1,000.70 | $ .90 |

Hypothetical A | | $ 1,000.00 | $ 1,024.10 | $ .91 |

Class II | .31% | | | |

Actual | | $ 1,000.00 | $ 1,000.10 | $ 1.55 |

Hypothetical A | | $ 1,000.00 | $ 1,023.45 | $ 1.57 |

| Annualized Expense Ratio | Beginning

Account Value

April 1, 2011 | Ending

Account Value

September 30, 2011 | Expenses Paid

During Period*

April 1, 2011 to

September 30, 2011 |

Class III | .31% | | | |

Actual | | $ 1,000.00 | $ 1,000.10 | $ 1.55 ** |

Hypothetical A | | $ 1,000.00 | $ 1,023.45 | $ 1.57 ** |

Select Class | .23% | | | |

Actual | | $ 1,000.00 | $ 1,000.50 | $ 1.15 |

Hypothetical A | | $ 1,000.00 | $ 1,023.85 | $ 1.16 |

Class F | .14% | | | |

Actual | | $ 1,000.00 | $ 1,000.90 | $ .70 |

Hypothetical A | | $ 1,000.00 | $ 1,024.30 | $ .71 |

Institutional Class | .14% | | | |

Actual | | $ 1,000.00 | $ 1,000.90 | $ .70 |

Hypothetical A | | $ 1,000.00 | $ 1,024.30 | $ .71 |

Tax-Exempt Portfolio | | | | |

Class I | .17% | | | |

Actual | | $ 1,000.00 | $ 1,000.10 | $ .85 ** |

Hypothetical A | | $ 1,000.00 | $ 1,024.15 | $ .86 ** |

Class II | .18% | | | |

Actual | | $ 1,000.00 | $ 1,000.10 | $ .90 ** |

Hypothetical A | | $ 1,000.00 | $ 1,024.10 | $ .91 ** |

Class III | .18% | | | |

Actual | | $ 1,000.00 | $ 1,000.10 | $ .90 ** |

Hypothetical A | | $ 1,000.00 | $ 1,024.10 | $ .91 ** |

Select Class | .18% | | | |

Actual | | $ 1,000.00 | $ 1,000.10 | $ .90 ** |

Hypothetical A | | $ 1,000.00 | $ 1,024.10 | $ .91 ** |

A 5% return per year before expenses

* Expenses are equal to each Class' annualized expense ratio, multiplied by the average account value over the period, multiplied by 183/ 366 (to reflect the one-half year period).

** If certain fees were not voluntarily waived by FMR or its affiliates during the period, the annualized expense ratio and the expenses paid in the actual and hypothetical examples above would have been as follows:

Treasury Only Portfolio | Annualized Expense Ratio | Expenses Paid |

Class I | .21% | �� |

Actual | | $ 1.05 |

Hypothetical A | | $ 1.06 |

Class II | .36% | |

Actual | | $ 1.80 |

Hypothetical A | | $ 1.82 |

Class III | .47% | |

Actual | | $ 2.35 |

Hypothetical A | | $ 2.38 |

Class IV | .72% | |

Actual | | $ 3.59 |

Hypothetical A | | $ 3.64 |

Select Class | .27% | |

Actual | | $ 1.35 |

Hypothetical A | | $ 1.37 |

Treasury Portfolio | Annualized Expense Ratio | Expenses Paid |

Class I | .21% | |

Actual | | $ 1.05 |

Hypothetical A | | $ 1.06 |

Class II | .36% | |

Actual | | $ 1.80 |

Hypothetical A | | $ 1.82 |

Class III | .46% | |

Actual | | $ 2.30 |

Hypothetical A | | $ 2.33 |

Class IV | .71% | |

Actual | | $ 3.54 |

Hypothetical A | | $ 3.59 |

Select Class | .26% | |

Actual | | $ 1.30 |

Hypothetical A | | $ 1.32 |

Government Portfolio | | |

Class I | .21% | |

Actual | | $ 1.05 |

Hypothetical A | | $ 1.06 |

Class II | .36% | |

Actual | | $ 1.80 |

Hypothetical A | | $ 1.82 |

Class III | .46% | |

Actual | | $ 2.30 |

Hypothetical A | | $ 2.33 |

Select Class | .26% | |

Actual | | $ 1.30 |

Hypothetical A | | $ 1.32 |

Prime Money Market Portfolio | | |

Class II | .35% | |

Actual | | $ 1.75 |

Hypothetical A | | $ 1.77 |

Class III | .45% | |

Actual | | $ 2.25 |

Hypothetical A | | $ 2.28 |

Class IV | .70% | |

Actual | | $ 3.50 |

Hypothetical A | | $ 3.54 |

Money Market Portfolio | | |

Class III | .43% | |

Actual | | $ 2.15 |

Hypothetical A | | $ 2.17 |

Tax-Exempt Portfolio | Annualized Expense Ratio | Expenses Paid |

Class I | .22% | |

Actual | | $ 1.10 |

Hypothetical A | | $ 1.11 |

Class II | .35% | |

Actual | | $ 1.75 |

Hypothetical A | | $ 1.77 |

Class III | .45% | |

Actual | | $ 2.25 |

Hypothetical A | | $ 2.28 |

Select Class | .25% | |

Actual | | $ 1.25 |

Hypothetical A | | $ 1.26 |

A 5% return per year before expenses

Semiannual Report

Treasury Only Portfolio

Investment Changes (Unaudited)

Effective Maturity Diversification |

Days | % of fund's

investments

9/30/11 | % of fund's

investments

3/31/11 | % of fund's

investments

9/30/10 |

1 - 7 | 14.6 | 8.0 | 12.1 |

8 - 30 | 33.6 | 26.3 | 37.7 |

31 - 60 | 16.5 | 22.6 | 28.1 |

61 - 90 | 15.8 | 21.1 | 10.3 |

91 - 180 | 15.5 | 18.8 | 7.7 |

> 180 | 4.0 | 3.2 | 4.1 |

Effective maturity is determined in accordance with the requirements of Rule 2a-7 under the Investment Company Act of 1940. |

Weighted Average Maturity |

| 9/30/11 | 3/31/11 | 9/30/10 |

Treasury Only Portfolio | 52 Days | 58 Days | 52 Days |

All Taxable Money Market Funds Average* | 39 Days | 45 Days | 44 Days |

This is a weighted average of all the maturities of the securities held in a fund. Weighted Average Maturity (WAM) can be used as a measure of sensitivity to interest rate changes and markets changes. Generally, the longer the maturity, the greater the sensitivity to such changes. WAM is based on the dollar-weighted average length of time until principal payments must be paid. Depending on the types of securities held in a fund, certain maturity shortening devices (e.g., demand features, interest rate resets, and call options) may be taken into account when calculating the WAM. |

Weighted Average Life |

| 9/30/11 | 3/31/11 | 9/30/10 |

Treasury Only Portfolio | 52 Days | 58 Days | 52 Days |

Weighted Average Life (WAL) is the weighted average of the life of the securities held in a fund or portfolio and can be used as a measure of sensitivity to changes in liquidity and/or credit risk. Generally, the higher the value, the greater the sensitivity. WAL is based on the dollar-weighted average length of time until principal payments must be paid, taking into account any call options exercised by the issuer and any permissible maturity shortening features other than interest rate resets. The difference between WAM and WAL is that WAM takes into account interest rate resets and WAL does not. WAL for money market funds is not the same as WAL of a mortgage- or asset-backed security. |

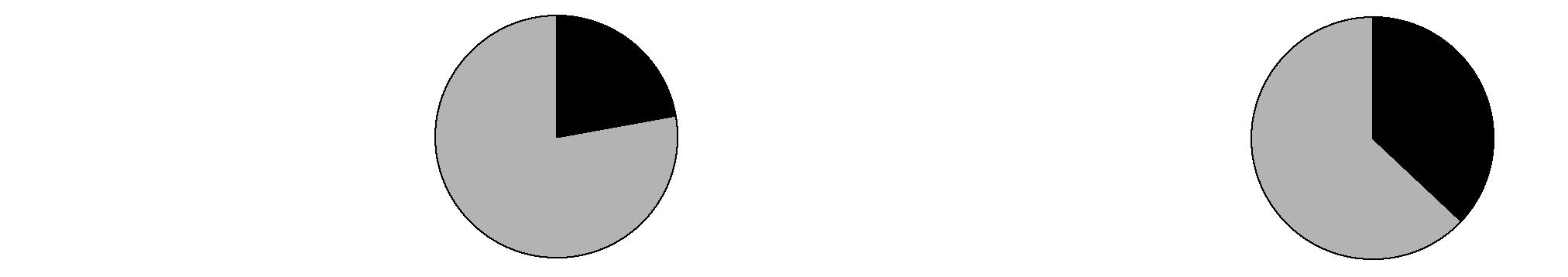

Asset Allocation (% of fund's net assets) |

As of September 30, 2011 | As of March 31, 2011 |

| U.S. Treasury

Obligations 100.4% | |  | U.S. Treasury

Obligations 99.9% | |

| Net Other Assets** (0.4)% | |  | Net Other Assets 0.1% | |

| | |  | | |

* Source: iMoneyNet, Inc.

** Net Other Assets are not included in the pie chart.

Semiannual Report

Treasury Only Portfolio

Investments September 30, 2011 (Unaudited)

Showing Percentage of Net Assets

U.S. Treasury Obligations - 100.4% |

| | Yield (a) | Principal Amount (000s) | Value (000s) |

U.S. Treasury Bills - 75.4% |

| 10/6/11 to 2/16/12 | 0.00 to 0.12% | $ 6,913,809 | $ 6,913,572 |

U.S. Treasury Notes - 25.0% |

| 10/31/11 to 6/30/12 | 0.01 to 0.32 | 2,281,000 | 2,286,350 |

TOTAL INVESTMENT PORTFOLIO - 100.4% (Cost $9,199,922) | 9,199,922 |

NET OTHER ASSETS (LIABILITIES) - (0.4)% | (36,576) |

NET ASSETS - 100% | $ 9,163,346 |

Legend |

(a) Yield represents either the annualized yield at the date of purchase, or the stated coupon rate, or, for floating and adjustable rate securities, the rate at period end. |

Other Information |

The date shown for securities represents the date when principal payments must be paid, taking into account any call options exercised by the issuer and any permissible maturity shortening features other than interest rate resets. |

All investments are categorized as Level 2 under the Fair Value Hierarchy. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, please refer to the Security Valuation section in the accompanying Notes to Financial Statements. |

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Treasury Only Portfolio

Financial Statements

Statement of Assets and Liabilities

Amounts in thousands (except per-share amounts) | September 30, 2011 (Unaudited) |

| | |

Assets | | |

Investment in securities, at value - See accompanying schedule: Unaffiliated issuers (cost $9,199,922) | | $ 9,199,922 |

Receivable for fund shares sold | | 5,906 |

Interest receivable | | 7,769 |

Other receivables | | 14 |

Total assets | | 9,213,611 |

| | |

Liabilities | | |

Payable for investments purchased | $ 44,781 | |

Payable for fund shares redeemed | 5,199 | |

Distributions payable | 17 | |

Accrued management fee | 163 | |

Other affiliated payables | 60 | |

Other payables and accrued expenses | 45 | |

Total liabilities | | 50,265 |

| | |

Net Assets | | $ 9,163,346 |

Net Assets consist of: | | |

Paid in capital | | $ 9,163,312 |

Distributions in excess of net investment income | | (1) |

Accumulated undistributed net realized gain (loss) on investments | | 35 |

Net Assets | | $ 9,163,346 |

| | |

Class I:

Net Asset Value, offering price and redemption price per share ($8,047,655 ÷ 8,046,529 shares) | | $ 1.00 |

| | |

Class II:

Net Asset Value, offering price and redemption price per share ($564,124 ÷ 564,179 shares) | | $ 1.00 |

| | |

Class III:

Net Asset Value, offering price and redemption price per share ($340,528 ÷ 340,457 shares) | | $ 1.00 |

| | |

Class IV:

Net Asset Value, offering price and redemption price per share ($17,571 ÷ 17,570 shares) | | $ 1.00 |

| | |

Select Class:

Net Asset Value, offering price and redemption price per share ($193,468 ÷ 193,479 shares) | | $ 1.00 |

Statement of Operations

Amounts in thousands | Six months ended September 30, 2011 (Unaudited) |

| | |

Investment Income | | |

Interest | | $ 3,220 |

| | |

Expenses | | |

Management fee | $ 5,427 | |

Transfer agent fees | 2,347 | |

Distribution and service plan fees | 942 | |

Accounting fees and expenses | 322 | |

Custodian fees and expenses | 42 | |

Independent trustees' compensation | 13 | |

Registration fees | 93 | |

Audit | 23 | |

Legal | 13 | |

Miscellaneous | 39 | |

Total expenses before reductions | 9,261 | |

Expense reductions | (6,428) | 2,833 |

Net investment income (loss) | | 387 |

Realized and Unrealized Gain (Loss) Net realized gain (loss) on: | | |

Investment securities: | | |

Unaffiliated issuers | | 35 |

Net increase in net assets resulting from operations | | $ 422 |

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Treasury Only Portfolio

Financial Statements - continued

Statement of Changes in Net Assets

Amounts in thousands | Six months ended September 30, 2011 (Unaudited) | Year ended

March 31,

2011 |

Increase (Decrease) in Net Assets | | |

Operations | | |

Net investment income (loss) | $ 387 | $ 856 |

Net realized gain (loss) | 35 | 101 |

Net increase in net assets resulting from operations | 422 | 957 |

Distributions to shareholders from net investment income | (388) | (854) |

Distributions to shareholders from net realized gain | - | (245) |

Total distributions | (388) | (1,099) |

Share transactions - net increase (decrease) | 1,765,360 | (2,775,464) |

Total increase (decrease) in net assets | 1,765,394 | (2,775,606) |

| | |

Net Assets | | |

Beginning of period | 7,397,952 | 10,173,558 |

End of period (including distributions in excess of net investment income of $1 and $0, respectively) | $ 9,163,346 | $ 7,397,952 |

Financial Highlights - Class I

| Six months ended

September 30, 2011 | Years ended March 31, |

| (Unaudited) | 2011 | 2010 | 2009 | 2008 | 2007 |

Selected Per-Share Data | | | | | | |

Net asset value, beginning of period | $ 1.00 | $ 1.00 | $ 1.00 | $ 1.00 | $ 1.00 | $ 1.00 |

Income from Investment Operations | | | | | | |

Net investment income (loss) | - E | - E | .001 | .010 | .040 | .048 |

Net realized and unrealized gain (loss) E | - | - | - | - | - | - |

Total from investment operations | - E | - E | .001 | .010 | .040 | .048 |

Distributions from net investment income | - E | - E | (.001) | (.010) | (.040) | (.048) |

Distributions from net realized gain | - | - E | - E | - | - | - |

Total distributions | - E | - E | (.001) | (.010) | (.040) | (.048) |

Net asset value, end of period | $ 1.00 | $ 1.00 | $ 1.00 | $ 1.00 | $ 1.00 | $ 1.00 |

Total Return B,C | .01% | .01% | .09% | 1.05% | 4.03% | 4.87% |

Ratios to Average Net Assets D | | | | | | |

Expenses before reductions | .21% A | .21% | .21% | .24% | .24% | .24% |

Expenses net of fee waivers, if any | .07% A | .18% | .20% | .23% | .20% | .20% |

Expenses net of all reductions | .07% A | .18% | .20% | .23% | .20% | .20% |

Net investment income (loss) | .01% A | .01% | .10% | .81% | 3.48% | 4.78% |

Supplemental Data | | | | | | |

Net assets, end of period (in millions) | $ 8,048 | $ 6,149 | $ 8,371 | $ 15,535 | $ 6,775 | $ 1,425 |

A Annualized

B Total returns for periods of less than one year are not annualized.

C Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

D Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed or waived or reductions from expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement and waivers but prior to reductions from expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

E Amount represents less than $.001 per share.

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Financial Highlights - Class II

| Six months ended

September 30, 2011 | Years ended March 31, |

| (Unaudited) | 2011 | 2010 | 2009 | 2008 | 2007 |

Selected Per-Share Data | | | | | | |

Net asset value, beginning of period | $ 1.00 | $ 1.00 | $ 1.00 | $ 1.00 | $ 1.00 | $ 1.00 |

Income from Investment Operations | | | | | | |

Net investment income (loss) | - E | - E | - E | .009 | .038 | .046 |

Net realized and unrealized gain (loss) E | - | - | - | - | - | - |

Total from investment operations | - E | - E | - E | .009 | .038 | .046 |

Distributions from net investment income | - E | - E | - E | (.009) | (.038) | (.046) |

Distributions from net realized gain | - | - E | - E | - | - | - |

Total distributions | - E | - E | - E | (.009) | (.038) | (.046) |

Net asset value, end of period | $ 1.00 | $ 1.00 | $ 1.00 | $ 1.00 | $ 1.00 | $ 1.00 |

Total Return B,C | .01% | .01% | .03% | .89% | 3.88% | 4.71% |

Ratios to Average Net Assets D | | | | | | |

Expenses before reductions | .36% A | .36% | .36% | .39% | .39% | .39% |

Expenses net of fee waivers, if any | .08% A | .17% | .27% | .38% | .35% | .35% |

Expenses net of all reductions | .08% A | .17% | .27% | .38% | .35% | .35% |

Net investment income (loss) | .01% A | .01% | .03% | .66% | 3.58% | 4.63% |

Supplemental Data | | | | | | |

Net assets, end of period (in millions) | $ 564 | $ 585 | $ 649 | $ 906 | $ 514 | $ 210 |

A Annualized

B Total returns for periods of less than one year are not annualized.

C Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

D Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed or waived or reductions from expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement and waivers but prior to reductions from expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

E Amount represents less than $.001 per share.

Financial Highlights - Class III

| Six months ended

September 30, 2011 | Years ended March 31, |

| (Unaudited) | 2011 | 2010 | 2009 | 2008 | 2007 |

Selected Per-Share Data | | | | | | |

Net asset value, beginning of period | $ 1.00 | $ 1.00 | $ 1.00 | $ 1.00 | $ 1.00 | $ 1.00 |

Income from Investment Operations | | | | | | |

Net investment income (loss) | - E | - E | - E | .008 | .037 | .045 |

Net realized and unrealized gain (loss) E | - | - | - | - | - | - |

Total from investment operations | - E | -E | -E | .008 | .037 | .045 |

Distributions from net investment income | - E | - E | - E | (.008) | (.037) | (.045) |

Distributions from net realized gain | - | - E | - E | - | - | - |

Total distributions | -E | - E | - E | (.008) | (.037) | (.045) |

Net asset value, end of period | $ 1.00 | $ 1.00 | $ 1.00 | $ 1.00 | $ 1.00 | $ 1.00 |

Total Return B,C | .01% | .01% | .01% | .80% | 3.77% | 4.61% |

Ratios to Average Net Assets D | | | | | | |

Expenses before reductions | .47% A | .46% | .46% | .49% | .49% | .49% |

Expenses net of fee waivers, if any | .08% A | .18% | .28% | .47% | .45% | .45% |

Expenses net of all reductions | .08% A | .18% | .28% | .47% | .45% | .45% |

Net investment income (loss) | .01% A | .01% | .02% | .57% | 3.46% | 4.53% |

Supplemental Data | | | | | | |

Net assets, end of period (in millions) | $ 341 | $ 392 | $ 615 | $ 835 | $ 514 | $ 187 |

A Annualized

B Total returns for periods of less than one year are not annualized.

C Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

D Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed or waived or reductions from expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement and waivers but prior to reductions from expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

E Amount represents less than $.001 per share.

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Financial Highlights - Class IV

| Six months ended

September 30, 2011 | Years ended March 31, |

| (Unaudited) | 2011 | 2010 | 2009 | 2008 D |

Selected Per-Share Data | | | | | |

Net asset value, beginning of period | $ 1.00 | $ 1.00 | $ 1.00 | $ 1.00 | $ 1.00 |

Income from Investment Operations | | | | | |

Net investment income (loss) | - F | - F | - F | .006 | .007 |

Net realized and unrealized gain (loss) F | - | - | - | - | - |

Total from investment operations | - F | - F | - F | .006 | .007 |

Distributions from net investment income | - F | - F | - F | (.006) | (.007) |

Distributions from net realized gain | - | - F | - F | - | - |

Total distributions | - F | - F | - F | (.006) | (.007) |

Net asset value, end of period | $ 1.00 | $ 1.00 | $ 1.00 | $ 1.00 | $ 1.00 |

Total Return B,C | .01% | .01% | .01% | .60% | .71% |

Ratios to Average Net Assets E | | | | | |

Expenses before reductions | .72% A | .71% | .72% | .74% | .77% A |

Expenses net of fee waivers, if any | .09% A | .17% | .30% | .65% | .70% A |

Expenses net of all reductions | .09% A | .17% | .30% | .65% | .70% A |

Net investment income (loss) | .01% A | .01% | .01% | .39% | 1.70% A |

Supplemental Data | | | | | |

Net assets, end of period (in millions) | $ 18 | $ 62 | $ 60 | $ 140 | $ 39 |

A Annualized

B Total returns for periods of less than one year are not annualized.

C Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

D For the period December 12, 2007 (commencement of sale of shares) to March 31, 2008.

E Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed or waived or reductions from expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur. Expense ratios before reductions for start-up periods may not be representative of longer-term operating periods. Expenses net of fee waivers reflect expenses after reimbursement and waivers but prior to reductions from expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

F Amount represents less than $.001 per share.

Financial Highlights - Select Class

| Six months ended

September 30, 2011 | Years ended March 31, |

| (Unaudited) | 2011 | 2010 | 2009 | 2008 | 2007 |

Selected Per-Share Data | | | | | | |

Net asset value, beginning of period | $ 1.00 | $ 1.00 | $ 1.00 | $ 1.00 | $ 1.00 | $ 1.00 |

Income from Investment Operations | | | | | | |

Net investment income (loss) | - E | - E | .001 | .010 | .039 | .047 |

Net realized and unrealized gain (loss) E | - | - | - | - | - | - |

Total from investment operations | - E | - E | .001 | .010 | .039 | .047 |

Distributions from net investment income | - E | - E | (.001) | (.010) | (.039) | (.047) |

Distributions from net realized gain | - | - E | - E | - | - | - |

Total distributions | - E | - E | (.001) | (.010) | (.039) | (.047) |

Net asset value, end of period | $ 1.00 | $ 1.00 | $ 1.00 | $ 1.00 | $ 1.00 | $ 1.00 |

Total Return B,C | .01% | .01% | .07% | .99% | 3.98% | 4.81% |

Ratios to Average Net Assets D | | | | | | |

Expenses before reductions | .27% A | .26% | .26% | .29% | .29% | .29% |

Expenses net of fee waivers, if any | .08% A | .18% | .23% | .28% | .25% | .25% |

Expenses net of all reductions | .08% A | .18% | .23% | .28% | .25% | .25% |

Net investment income (loss) | .01% A | .01% | .07% | .76% | 3.50% | 4.73% |

Supplemental Data | | | | | | |

Net assets, end of period (in millions) | $ 193 | $ 209 | $ 478 | $ 763 | $ 174 | $ 17 |

A Annualized

B Total returns for periods of less than one year are not annualized.

C Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

D Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed or waived or reductions from expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement and waivers but prior to reductions from expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

E Amount represents less than $.001 per share.

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Treasury Portfolio

Investment Changes (Unaudited)

Effective Maturity Diversification |

Days | % of fund's investments 9/30/11 | % of fund's investments 3/31/11 | % of fund's

investments

9/30/10 |

1 - 7 | 77.8 | 63.0 | 71.2 |

8 - 30 | 0.6 | 5.1 | 0.0 |

31 - 60 | 3.6 | 1.3 | 2.1 |

61 - 90 | 5.0 | 2.4 | 2.4 |

91 - 180 | 7.2 | 14.7 | 12.1 |

> 180 | 5.8 | 13.5 | 12.2 |

Effective maturity is determined in accordance with the requirements of Rule 2a-7 under the Investment Company Act of 1940. |

Weighted Average Maturity |

| 9/30/11 | 3/31/11 | 9/30/10 |

Treasury Portfolio | 30 Days | 51 Days | 54 Days |

All Taxable Money Market Funds Average* | 39 Days | 45 Days | 44 Days |

This is a weighted average of all the maturities of the securities held in a fund. Weighted Average Maturity (WAM) can be used as a measure of sensitivity to interest rate changes and markets changes. Generally, the longer the maturity, the greater the sensitivity to such changes. WAM is based on the dollar-weighted average length of time until principal payments must be paid. Depending on the types of securities held in a fund, certain maturity shortening devices (e.g., demand features, interest rate resets, and call options) may be taken into account when calculating the WAM. |

Weighted Average Life |

| 9/30/11 | 3/31/11 | 9/30/10 |

Treasury Portfolio | 30 Days | 51 Days | 54 Days |

Weighted Average Life (WAL) is the weighted average of the life of the securities held in a fund or portfolio and can be used as a measure of sensitivity to changes in liquidity and/or credit risk. Generally, the higher the value, the greater the sensitivity. WAL is based on the dollar-weighted average length of time until principal payments must be paid, taking into account any call options exercised by the issuer and any permissible maturity shortening features other than interest rate resets. The difference between WAM and WAL is that WAM takes into account interest rate resets and WAL does not. WAL for money market funds is not the same as WAL of a mortgage- or asset-backed security. |

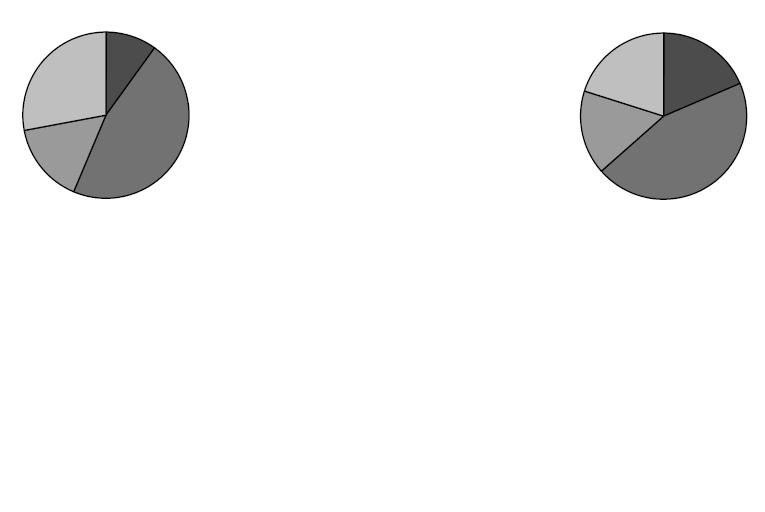

Asset Allocation (% of fund's net assets) |

As of September 30, 2011 | As of March 31, 2011 |

| U.S. Treasury

Obligations 22.2% | |  | U.S. Treasury

Obligations 37.0% | |

| Repurchase

Agreements 77.7% | |  | Repurchase

Agreements 62.9% | |

| Net Other Assets 0.1% | |  | Net Other Assets 0.1% | |

* Source: iMoneyNet, Inc.

Semiannual Report

Treasury Portfolio

Investments September 30, 2011 (Unaudited)

Showing Percentage of Net Assets

U.S. Treasury Obligations - 22.2% |

| | Yield (a) | Principal Amount (000s) | Value (000s) |

U.S. Treasury Bills - 4.3% |

| 10/20/11 to 3/8/12 | 0.06 to 0.30% | $ 758,000 | $ 757,780 |

U.S. Treasury Notes - 17.9% |

| 10/31/11 to 7/15/12 | 0.11 to 0.32 | 3,148,000 | 3,159,265 |

TOTAL U.S. TREASURY OBLIGATIONS | 3,917,045 |

Repurchase Agreements - 77.7% |

| Maturity Amount (000s) | | |

In a joint trading account at: | | | |

0.04% dated 9/30/11 due 10/3/11 (Collateralized by (U.S. Treasury Obligations)) # | $ 404,367 | | 404,366 |

0.05% dated 9/30/11 due 10/3/11 (Collateralized by (U.S. Treasury Obligations)) # | 11,365,499 | | 11,365,450 |

With: | | | |

Citigroup Global Capital Markets, Inc. at 0.04%, dated 9/29/11 due 10/6/11 (Collateralized by U.S. Treasury Obligations valued at $794,313,833, 0% - 7.63%, 2/2/12 - 11/15/40) | 778,006 | | 778,000 |

Deutsche Bank Securities, Inc. at 0.14%, dated 8/3/11 due 10/7/11 (Collateralized by U.S. Treasury Obligations valued at $394,885,288, 0% - 8.75%, 10/27/11 - 11/15/39) | 387,135 | | 387,000 |

Morgan Stanley & Co., Inc. at: | | | |

0.09%, dated 8/16/11 due 10/7/11 (Collateralized by U.S. Treasury Obligations valued at $403,732,420, 0% - 7.25%, 10/6/11 - 8/15/39) | 395,075 | | 395,000 |

0.11%, dated 8/12/11 due 10/7/11 (Collateralized by U.S. Treasury Obligations valued at $403,839,748, 0.5% - 5.5%, 1/31/12 - 8/15/41) | 395,115 | | 395,000 |

TOTAL REPURCHASE AGREEMENTS | 13,724,816 |

TOTAL INVESTMENT PORTFOLIO - 99.9% (Cost $17,641,861) | | 17,641,861 |

NET OTHER ASSETS (LIABILITIES) - 0.1% | | 9,883 |

NET ASSETS - 100% | $ 17,651,744 |

Legend |

(a) Yield represents either the annualized yield at the date of purchase, or the stated coupon rate, or, for floating and adjustable rate securities, the rate at period end. |

# Additional information on each counterparty to the repurchase agreement is as follows: |

Repurchase Agreement / Counterparty | Value

(Amounts in

thousands) |

$404,366,000 due 10/03/11 at 0.04% |

Barclays Capital, Inc. | $ 112,957 |

HSBC Securities (USA), Inc. | 212,359 |

Merrill Lynch, Pierce, Fenner & Smith, Inc. | 79,050 |

| $ 404,366 |

$11,365,450,000 due 10/03/11 at 0.05% |

Barclays Capital, Inc. | $ 2,878,123 |

Commerz Markets LLC | 382,312 |

Credit Agricole Securities (USA), Inc. | 3,058,497 |

Credit Suisse Securities (USA) LLC | 2,293,872 |

RBS Securities, Inc. | 1,911,560 |

UBS Securities LLC | 764,624 |

Wells Fargo Securities LLC | 76,462 |

| $ 11,365,450 |

Other Information |

The date shown for securities represents the date when principal payments must be paid, taking into account any call options exercised by the issuer and any permissible maturity shortening features other than interest rate resets. |

All investments are categorized as Level 2 under the Fair Value Hierarchy. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, please refer to the Security Valuation section in the accompanying Notes to Financial Statements. |

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Treasury Portfolio

Financial Statements

Statement of Assets and Liabilities

Amounts in thousands (except per-share amounts) | September 30, 2011 (Unaudited) |

| | |

Assets | | |

Investment in securities, at value (including repurchase agreements of $13,724,816) - See accompanying schedule: Unaffiliated issuers (cost $17,641,861) | | $ 17,641,861 |

Receivable for fund shares sold | | 59,912 |

Interest receivable | | 10,497 |

Other receivables | | 105 |

Total assets | | 17,712,375 |

| | |

Liabilities | | |

Payable for investments purchased | $ 59,029 | |

Payable for fund shares redeemed | 48 | |

Distributions payable | 78 | |

Accrued management fee | 1,224 | |

Distribution and service plan fees payable | 2 | |

Other affiliated payables | 101 | |

Other payables and accrued expenses | 149 | |

Total liabilities | | 60,631 |

| | |

Net Assets | | $ 17,651,744 |

Net Assets consist of: | | |

Paid in capital | | $ 17,651,760 |

Distributions in excess of net investment income | | (15) |

Accumulated undistributed net realized gain (loss) on investments | | (1) |

Net Assets | | $ 17,651,744 |

| | |

Class I:

Net Asset Value, offering price and redemption price per share ($13,114,560 ÷ 13,111,132 shares) | | $ 1.00 |

| | |

Class II:

Net Asset Value, offering price and redemption price per share ($117,907 ÷ 117,842 shares) | | $ 1.00 |

| | |

Class III:

Net Asset Value, offering price and redemption price per share ($3,606,428 ÷ 3,606,338 shares) | | $ 1.00 |

| | |

Class IV:

Net Asset Value, offering price and redemption price per share ($401,055 ÷ 400,967 shares) | | $ 1.00 |

| | |

Select Class:

Net Asset Value, offering price and redemption price per share ($411,794 ÷ 411,741 shares) | | $ 1.00 |

Statement of Operations

Amounts in thousands | Six months ended September 30, 2011 (Unaudited) |

| | |

Investment Income | | |

Interest | | $ 8,222 |

| | |

Expenses | | |

Management fee | $ 9,934 | |

Transfer agent fees | 4,275 | |

Distribution and service plan fees | 5,336 | |

Accounting fees and expenses | 495 | |

Custodian fees and expenses | 25 | |

Independent trustees' compensation | 24 | |

Registration fees | 72 | |

Audit | 28 | |

Legal | 23 | |

Miscellaneous | 57 | |

Total expenses before reductions | 20,269 | |

Expense reductions | (12,746) | 7,523 |

Net investment income (loss) | | 699 |

Realized and Unrealized Gain (Loss) Net realized gain (loss) on: | | |

Investment securities: | | |

Unaffiliated issuers | | 2 |

Net increase in net assets resulting from operations | | $ 701 |

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Statement of Changes in Net Assets

Amounts in thousands | Six months ended September 30, 2011 (Unaudited) | Year ended

March 31,

2011 |

Increase (Decrease) in Net Assets | | |

Operations | | |

Net investment income (loss) | $ 699 | $ 2,585 |

Net realized gain (loss) | 2 | 25 |

Net increase in net assets resulting from operations | 701 | 2,610 |

Distributions to shareholders from net investment income | (714) | (2,569) |

Share transactions - net increase (decrease) | 4,287,051 | (212,937) |

Total increase (decrease) in net assets | 4,287,038 | (212,896) |

| | |

Net Assets | | |

Beginning of period | 13,364,706 | 13,577,602 |

End of period (including distributions in excess of net investment income of $15 and $0, respectively) | $ 17,651,744 | $ 13,364,706 |

Financial Highlights - Class I

| Six months ended

September 30, 2011 | Years ended March 31, |

| (Unaudited) | 2011 | 2010 | 2009 | 2008 | 2007 |

Selected Per-Share Data | | | | | | |

Net asset value, beginning of period | $ 1.00 | $ 1.00 | $ 1.00 | $ 1.00 | $ 1.00 | $ 1.00 |

Income from Investment Operations | | | | | | |

Net investment income (loss) | - E | - E | .001 | .011 | .041 | .050 |

Net realized and unrealized gain (loss) E | - | - | - | - | - | - |

Total from investment operations | - E | - E | .001 | .011 | .041 | .050 |

Distributions from net investment income | - E | - E | (.001) | (.011) | (.041) | (.050) |

Distributions from net realized gain | - | - | - E | - | - | - |

Total distributions | - E | - E | (.001) | (.011) | (.041) | (.050) |

Net asset value, end of period | $ 1.00 | $ 1.00 | $ 1.00 | $ 1.00 | $ 1.00 | $ 1.00 |

Total Return B,C | .01% | .03% | .10% | 1.11% | 4.20% | 5.11% |

Ratios to Average Net Assets D | | | | | | |

Expenses before reductions | .21% A | .21% | .21% | .23% | .22% | .23% |

Expenses net of fee waivers, if any | .11% A | .20% | .21% | .22% | .20% | .20% |

Expenses net of all reductions | .11% A | .20% | .21% | .22% | .20% | .20% |

Net investment income (loss) | .01% A | .03% | .11% | 1.04% | 3.71% | 5.01% |

Supplemental Data | | | | | | |

Net assets, end of period (in millions) | $ 13,115 | $ 8,784 | $ 8,650 | $ 16,236 | $ 15,037 | $ 5,491 |

A Annualized

B Total returns for periods of less than one year are not annualized.

C Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

D Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed or waived or reductions from expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement and waivers but prior to reductions from expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

E Amount represents less than $.001 per share.

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Financial Highlights - Class II

| Six months ended

September 30, 2011 | Years ended March 31, |

September 30, | (Unaudited) | 2011 | 2010 | 2009 | 2008 | 2007 |

Selected Per-Share Data | | | | | | |

Net asset value, beginning of period | $ 1.00 | $ 1.00 | $ 1.00 | $ 1.00 | $ 1.00 | $ 1.00 |

Income from Investment Operations | | | | | | |

Net investment income (loss) | - E | - E | - E | .010 | .040 | .048 |

Net realized and unrealized gain (loss) E | - | - | - | - | - | - |

Total from investment operations | - E | - E | - E | .010 | .040 | .048 |

Distributions from net investment income | - E | - E | - E | (.010) | (.040) | (.048) |

Distributions from net realized gain | - | - | - E | - | - | - |

Total distributions | - E | - E | - E | (.010) | (.040) | (.048) |

Net asset value, end of period | $ 1.00 | $ 1.00 | $ 1.00 | $ 1.00 | $ 1.00 | $ 1.00 |

Total Return B,C | .01% | .01% | .03% | .96% | 4.04% | 4.96% |

Ratios to Average Net Assets D | | | | | | |

Expenses before reductions | .36% A | .36% | .36% | .38% | .37% | .39% |

Expenses net of fee waivers, if any | .11% A | .22% | .29% | .36% | .35% | .35% |

Expenses net of all reductions | .11% A | .22% | .29% | .36% | .35% | .35% |

Net investment income (loss) | .01% A | .01% | .03% | .90% | 3.90% | 4.86% |

Supplemental Data | | | | | | |

Net assets, end of period (in millions) | $ 118 | $ 155 | $ 164 | $ 407 | $ 305 | $ 355 |

A Annualized

B Total returns for periods of less than one year are not annualized.

C Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

D Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed or waived or reductions from expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement and waivers but prior to reductions from expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

E Amount represents less than $.001 per share.

Financial Highlights - Class III

| Six months ended

September 30, 2011 | Years ended March 31, |

| (Unaudited) | 2011 | 2010 | 2009 | 2008 | 2007 |

Selected Per-Share Data | | | | | | |

Net asset value, beginning of period | $ 1.00 | $ 1.00 | $ 1.00 | $ 1.00 | $ 1.00 | $ 1.00 |

Income from Investment Operations | | | | | | |

Net investment income (loss) | - E | - E | - E | .009 | .039 | .047 |

Net realized and unrealized gain (loss) E | - | - | - | - | - | - |

Total from investment operations | - E | - E | - E | .009 | .039 | .047 |

Distributions from net investment income | - E | - E | - E | (.009) | (.039) | (.047) |

Distributions from net realized gain | - | - | - E | - | - | - |

Total distributions | - E | - E | - E | (.009) | (.039) | (.047) |

Net asset value, end of period | $ 1.00 | $ 1.00 | $ 1.00 | $ 1.00 | $ 1.00 | $ 1.00 |

Total Return B,C | .01% | .01% | .01% | .87% | 3.94% | 4.85% |

Ratios to Average Net Assets D | | | | | | |

Expenses before reductions | .46% A | .46% | .46% | .48% | .47% | .48% |

Expenses net of fee waivers, if any | .11% A | .22% | .30% | .46% | .45% | .45% |

Expenses net of all reductions | .11% A | .22% | .30% | .46% | .45% | .45% |

Net investment income (loss) | .01% A | .01% | .02% | .80% | 3.74% | 4.76% |

Supplemental Data | | | | | | |

Net assets, end of period (in millions) | $ 3,606 | $ 3,768 | $ 3,907 | $ 5,051 | $ 5,329 | $ 3,663 |

A Annualized

B Total returns for periods of less than one year are not annualized.

C Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

D Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed or waived or reductions from expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement and waivers but prior to reductions from expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

E Amount represents less than $.001 per share.

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Financial Highlights - Class IV

| Six months ended

September 30, 2011 | Years ended March 31, |

| (Unaudited) | 2011 | 2010 | 2009 | 2008 D |

Selected Per-Share Data | | | | | |

Net asset value, beginning of period | $ 1.00 | $ 1.00 | $ 1.00 | $ 1.00 | $ 1.00 |

Income from Investment Operations | | | | | |

Net investment income (loss) | - F | - F | - F | .007 | .007 |

Net realized and unrealized gain (loss) F | - | - | - | - | - |

Total from investment operations | - F | - F | - F | .007 | .007 |

Distributions from net investment income | - F | - F | - F | (.007) | (.007) |

Distributions from net realized gain | - | - | - F | - | - |

Total distributions | - F | - F | - F | (.007) | (.007) |

Net asset value, end of period | $ 1.00 | $ 1.00 | $ 1.00 | $ 1.00 | $ 1.00 |

Total Return B,C | .01% | .01% | .01% | .71% | .68% |

Ratios to Average Net Assets E | | | | | |

Expenses before reductions | .71% A | .71% | .71% | .73% | .72% A |

Expenses net of fee waivers, if any | .11% A | .22% | .30% | .62% | .70% A |

Expenses net of all reductions | .11% A | .22% | .30% | .62% | .70% A |

Net investment income (loss) | .01% A | .01% | .03% | .64% | 2.19% A |

Supplemental Data | | | | | |

Net assets, end of period (000 omitted) | $ 401,055 | $ 304,950 | $ 492,495 | $ 453,724 | $ 117 |

A Annualized

B Total returns for periods of less than one year are not annualized.

C Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

D For the period December 12, 2007 (commencement of sale of shares) to March 31, 2008.

E Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed or waived or reductions from expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur. Expense ratios before reductions for start-up periods may not be representative of longer-term operating periods. Expenses net of fee waivers reflect expenses after reimbursement and waivers but prior to reductions from expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

F Amount represents less than $.001 per share.

Financial Highlights - Select Class

| Six months ended

September 30, 2011 | Years ended March 31, |

| (Unaudited) | 2011 | 2010 | 2009 | 2008 | 2007 |

Selected Per-Share Data | | | | | | |

Net asset value, beginning of period | $ 1.00 | $ 1.00 | $ 1.00 | $ 1.00 | $ 1.00 | $ 1.00 |

Income from Investment Operations | | | | | | |

Net investment income (loss) | - E | - E | .001 | .011 | .041 | .049 |

Net realized and unrealized gain (loss) E | - | - | - | - | - | - |

Total from investment operations | - E | - E | .001 | .011 | .041 | .049 |

Distributions from net investment income | - E | - E | (.001) | (.011) | (.041) | (.049) |

Distributions from net realized gain | - | - | - E | - | - | - |

Total distributions | - E | - E | (.001) | (.011) | (.041) | (.049) |

Net asset value, end of period | $ 1.00 | $ 1.00 | $ 1.00 | $ 1.00 | $ 1.00 | $ 1.00 |

Total Return B,C | .01% | .01% | .07% | 1.06% | 4.15% | 5.06% |

Ratios to Average Net Assets D | | | | | | |

Expenses before reductions | .26% A | .26% | .26% | .28% | .27% | .28% |

Expenses net of fee waivers, if any | .11% A | .22% | .24% | .27% | .25% | .25% |

Expenses net of all reductions | .11% A | .22% | .24% | .27% | .25% | .25% |

Net investment income (loss) | .01% A | .01% | .08% | .99% | 3.95% | 4.96% |

Supplemental Data | | | | | | |

Net assets, end of period (in millions) | $ 412 | $ 352 | $ 365 | $ 882 | $ 513 | $ 296 |

A Annualized

B Total returns for periods of less than one year are not annualized.

C Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

D Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed or waived or reductions from expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement and waivers but prior to reductions from expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

E Amount represents less than $.001 per share.

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Government Portfolio

Investment Changes (Unaudited)

Effective Maturity Diversification |

Days | % of fund's investments 9/30/11 | % of fund's investments 3/31/11 | % of fund's

investments

9/30/10 |

1 - 7 | 55.8 | 57.7 | 59.8 |

8 - 30 | 5.0 | 10.3 | 10.5 |

31 - 60 | 10.5 | 9.5 | 13.6 |

61 - 90 | 12.8 | 1.8 | 0.0 |

91 - 180 | 9.1 | 9.6 | 5.0 |

> 180 | 6.8 | 11.1 | 11.1 |

Effective maturity is determined in accordance with the requirements of Rule 2a-7 under the Investment Company Act of 1940. |

Weighted Average Maturity |

| 9/30/11 | 3/31/11 | 9/30/10 |

Government Portfolio | 49 Days | 48 Days | 48 Days |

All Taxable Money Market Funds Average* | 39 Days | 45 Days | 44 Days |

This is a weighted average of all the maturities of the securities held in a fund. Weighted Average Maturity (WAM) can be used as a measure of sensitivity to interest rate changes and markets changes. Generally, the longer the maturity, the greater the sensitivity to such changes. WAM is based on the dollar-weighted average length of time until principal payments must be paid. Depending on the types of securities held in a fund, certain maturity shortening devices (e.g., demand features, interest rate resets, and call options) may be taken into account when calculating the WAM. |

Weighted Average Life |

| 9/30/11 | 3/31/11 | 9/30/10 |

Government Portfolio | 63 Days | 88 Days | 112 Days |

Weighted Average Life (WAL) is the weighted average of the life of the securities held in a fund or portfolio and can be used as a measure of sensitivity to changes in liquidity and/or credit risk. Generally, the higher the value, the greater the sensitivity. WAL is based on the dollar-weighted average length of time until principal payments must be paid, taking into account any call options exercised by the issuer and any permissible maturity shortening features other than interest rate resets. The difference between WAM and WAL is that WAM takes into account interest rate resets and WAL does not. WAL for money market funds is not the same as WAL of a mortgage- or asset-backed security. |

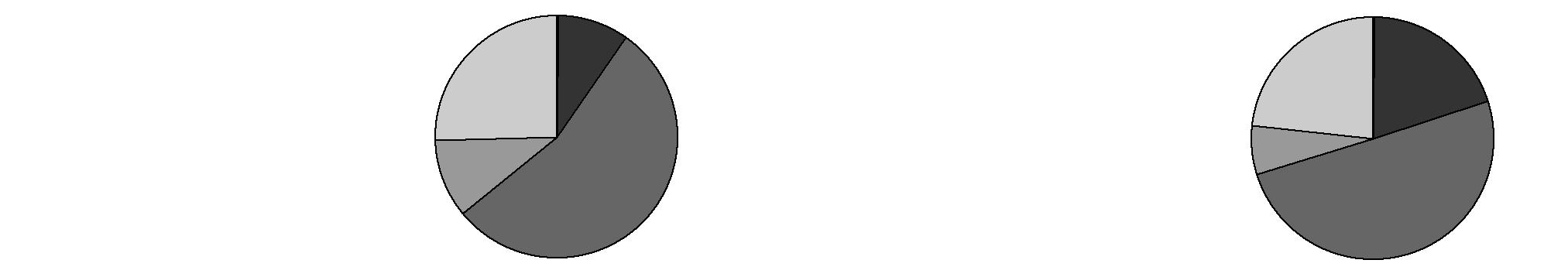

Asset Allocation (% of fund's net assets) |

As of September 30, 2011 | As of March 31, 2011 |

| Federal Agency Issues 42.0% | |  | Federal Agency Issues 43.9% | |

| U.S. Treasury Obligations 6.2% | |  | U.S. Treasury Obligations 5.4% | |

| Repurchase Agreements 52.9% | |  | Repurchase Agreements 50.6% | |

| Net Other Assets** (1.1)% | |  | Net Other Assets 0.1% | |

* Source: iMoneyNet, Inc.

** Net Other Assets are not included in the pie chart.

Semiannual Report

Government Portfolio

Investments September 30, 2011 (Unaudited)

Showing Percentage of Net Assets

Federal Agencies - 42.0% |

| | Yield (a) | Principal Amount (000s) | Value (000s) |

Fannie Mae Mortgage pass-thru certificates - 9.5% |

| 10/19/11 to 9/17/12 | 0.09 to 0.26% (b) | $ 3,441,230 | $ 3,442,694 |

Federal Farm Credit Bank - 0.2% |

| 11/29/12 | 0.19 (b) | 73,000 | 72,979 |

Federal Home Loan Bank - 24.1% |

| 10/12/11 to 11/15/12 | 0.07 to 0.41 (b) | 8,710,270 | 8,710,109 |

Freddie Mac - 8.2% |

| 10/4/11 to 11/2/12 | 0.09 to 0.35 (b) | 2,972,236 | 2,976,105 |

TOTAL FEDERAL AGENCIES | 15,201,887 |

U.S. Treasury Obligations - 6.2% |

|

U.S. Treasury Bills - 3.8% |

| 11/3/11 to 3/8/12 | 0.06 to 0.12 (c) | 1,378,000 | 1,377,705 |

U.S. Treasury Notes - 2.4% |

| 12/15/11 to 8/15/12 | 0.07 to 0.33 | 875,000 | 882,221 |

TOTAL U.S. TREASURY OBLIGATIONS | 2,259,926 |

Repurchase Agreements - 52.9% |

| Maturity Amount (000s) | | |

In a joint trading account at: | | | |

0.09% dated 9/30/11 due 10/3/11 (Collateralized by (U.S. Treasury Obligations)) # | $ 16,772,197 | | 16,772,067 |

0.09% dated 9/30/11 due 10/3/11 (Collateralized by (U.S. Treasury Obligations)) # | 740,394 | | 740,388 |

With: | | | |

Barclays Capital, Inc. at 0.15%, dated 7/27/11 due 10/7/11 (Collateralized by U.S. Treasury Obligations valued at $103,049,286, 3.13% - 4%, 5/15/21 - 2/16/26) | 101,038 | | 101,000 |

Citibank NA at: | | | |

0.08%, dated 9/28/11 due 10/5/11 (Collateralized by U.S. Treasury Obligations valued at $167,281,957, 2.75% - 3.5%, 2/15/18 - 2/15/19) | 164,003 | | 164,000 |

0.12%, dated 9/27/11 due 10/4/11 (Collateralized by U.S. Government Obligations valued at $170,343,408, 3.5% - 4.5%, 1/1/25 - 3/1/41) | 167,004 | | 167,000 |

|

| Maturity Amount (000s) | | Value (000s) |

Deutsche Bank Securities, Inc. at: | | | |

0.19%, dated 8/17/11 due 10/7/11 (Collateralized by U.S. Government Obligations valued at $107,229,195, 4% - 7%, 4/1/32 - 8/1/41) | $ 105,067 | | $ 105,000 |

0.23%, dated 8/3/11 due 10/7/11 (Collateralized by U.S. Government Obligations valued at $90,898,734, 0.56% - 7%, 7/1/23 - 6/20/60) | 89,051 | | 89,000 |

Goldman Sachs & Co. at 0.1%, dated 9/28/11 due 10/5/11 (Collateralized by U.S. Government Obligations valued at $111,181,545, 4% - 6.5%, 6/15/26 - 9/15/41) | 109,002 | | 109,000 |

ING Financial Markets LLC at: | | | |

0.17%, dated 8/9/11 due 10/7/11 (Collateralized by U.S. Government Obligations valued at $46,936,108, 0.63% - 6%, 4/15/22 - 9/1/41) | 46,020 | | 46,000 |

0.18%, dated 8/11/11 due 10/7/11 (Collateralized by U.S. Government Obligations valued at $59,175,050, 0.63% - 6.04%, 4/1/20 - 6/1/41) | 58,023 | | 58,000 |

0.19%, dated: | | | |

7/13/11 due 10/7/11 (Collateralized by U.S. Government Obligations valued at $416,024,541, 0.63% - 6.5%, 8/25/17 - 1/1/48) | 404,390 | | 404,000 |

7/15/11 due 10/7/11 (Collateralized by U.S. Government Obligations valued at $207,150,256, 0.63% - 6.39%, 6/5/18 - 9/1/41) | 203,199 | | 203,000 |

0.2%, dated 4/4/11 due 10/7/11 (Collateralized by U.S. Government Obligations valued at $54,115,781, 0.63% - 4%, 6/12/13 - 2/1/36) | 53,062 | | 53,000 |

0.23%, dated 8/4/11 due 10/7/11 (Collateralized by U.S. Government Obligations valued at $45,921,716, 0.63% - 6%, 4/15/22 - 9/1/41) | 45,052 | | 45,000 |

Repurchase Agreements - continued |

| Maturity Amount (000s) | | Value (000s) |

With: - continued | | | |

RBC Capital Markets Corp. at 0.16%, dated 8/26/11 due 10/7/11 (Collateralized by U.S. Government Obligations valued at $66,956,952, 0.61% - 7.5%, 1/1/22 - 10/25/41) | $ 65,036 | | $ 65,000 |

Wells Fargo Securities, LLC at 0.2%, dated 4/20/11 due 10/7/11 (Collateralized by U.S. Government Obligations valued at $47,998,417, 3.5% - 4%, 9/1/26 - 9/1/31) | 47,048 | | 47,000 |

TOTAL REPURCHASE AGREEMENTS | 19,168,455 |

TOTAL INVESTMENT PORTFOLIO - 101.1% (Cost $36,630,268) | | 36,630,268 |

NET OTHER ASSETS (LIABILITIES) - (1.1)% | (388,272) |

NET ASSETS - 100% | $ 36,241,996 |

Legend |

(a) Yield represents either the annualized yield at the date of purchase, or the stated coupon rate, or, for floating and adjustable rate securities, the rate at period end. |

(b) Coupon rates for floating and adjustable rate securities reflect the rates in effect at period end. |

(c) Security or a portion of the security was pledged to cover reverse repurchase agreements. At the period end, the value of securities pledged amounted to $362,976,000. The principal amount of the outstanding reverse repurchase agreement is $363,109,000. |

# Additional information on each counterparty to the repurchase agreement is as follows: |

Repurchase Agreement / Counterparty | Value

(Amounts in

thousands) |

$16,772,067,000 due 10/03/11 at 0.09% |

BNP Paribas Securities Corp. | $ 1,195,221 |

Bank of America NA | 4,387,330 |

Barclays Capital, Inc. | 1,590,408 |

Citibank NA | 1,425,883 |

Credit Agricole Securities (USA), Inc. | 438,733 |

Deutsche Bank Securities, Inc. | 1,645,249 |

HSBC Securities (USA), Inc. | 1,548,728 |

ING Financial Markets LLC | 350,987 |

J.P. Morgan Securities, Inc. | 1,096,833 |

Merrill Lynch, Pierce, Fenner & Smith, Inc. | 657,725 |

Morgan Stanley & Co., Inc. | 65,810 |

RBC Capital Markets Corp. | 767,783 |

RBS Securities, Inc. | 219,367 |

UBS Securities LLC | 219,367 |

Wells Fargo Securities LLC | 1,162,643 |

| $ 16,772,067 |

$740,388,000 due 10/03/11 at 0.09% |

Barclays Capital, Inc. | $ 408,163 |

Merrill Lynch, Pierce, Fenner & Smith, Inc. | 66,445 |

RBC Capital Markets Corp. | 75,937 |

UBS Securities LLC | 189,843 |

| $ 740,388 |

Other Information |

The date shown for securities represents the date when principal payments must be paid, taking into account any call options exercised by the issuer and any permissible maturity shortening features other than interest rate resets. |

All investments are categorized as Level 2 under the Fair Value Hierarchy. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, please refer to the Security Valuation section in the accompanying Notes to Financial Statements. |

Income Tax Information |

At March 31, 2011, the Fund had a capital loss carryforward of approximately $2,306,000 all of which will expire in fiscal 2019. Capital loss carryforwards are only available to offset future capital gains of the Fund to the extent provided by regulations and may be limited. |

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Government Portfolio

Financial Statements

Statement of Assets and Liabilities

Amounts in thousands (except per-share amounts) | September 30, 2011 (Unaudited) |

| | |

Assets | | |

Investment in securities, at value (including repurchase agreements of $19,168,455) - See accompanying schedule: Unaffiliated issuers (cost $36,630,268) | | $ 36,630,268 |

Receivable for fund shares sold | | 41,402 |

Interest receivable | | 13,760 |

Other receivables | | 336 |

Total assets | | 36,685,766 |

| | |

Liabilities | | |

Payable for investments purchased | $ 72,135 | |

Payable for fund shares redeemed | 3,737 | |

Distributions payable | 172 | |

Accrued management fee | 4,041 | |

Payable for reverse repurchase agreement | 363,106 | |

Other affiliated payables | 146 | |

Other payables and accrued expenses | 433 | |

Total liabilities | | 443,770 |

| | |

Net Assets | | $ 36,241,996 |

Net Assets consist of: | | |

Paid in capital | | $ 36,244,486 |

Distributions in excess of net investment income | | (187) |

Accumulated undistributed net realized gain (loss) on investments | | (2,303) |

Net Assets | | $ 36,241,996 |

| | |

Class I:

Net Asset Value, offering price and redemption price per share ($32,788,422 ÷ 32,780,471 shares) | | $ 1.00 |

| | |

Class II:

Net Asset Value, offering price and redemption price per share ($989,600 ÷ 989,217 shares) | | $ 1.00 |

| | |

Class III:

Net Asset Value, offering price and redemption price per share ($1,981,067 ÷ 1,980,420 shares) | | $ 1.00 |

| | |

Select Class:

Net Asset Value, offering price and redemption price per share ($482,907 ÷ 482,910 shares) | | $ 1.00 |

Statement of Operations

Amounts in thousands | Six months ended September 30, 2011 (Unaudited) |

| | |

Investment Income | | |

Interest | | $ 27,738 |

| | |

Expenses | | |

Management fee | $ 22,954 | |

Transfer agent fees | 9,877 | |

Distribution and service plan fees | 3,156 | |

Accounting fees and expenses | 791 | |

Custodian fees and expenses | 93 | |

Independent trustees' compensation | 56 | |

Registration fees | 79 | |

Audit | 32 | |

Legal | 55 | |

Miscellaneous | 166 | |

Total expenses before reductions | 37,259 | |

Expense reductions | (11,185) | 26,074 |

Net investment income (loss) | | 1,664 |

Realized and Unrealized Gain (Loss) Net realized gain (loss) on: | | |

Investment securities: | | |

Unaffiliated issuers | | 3 |

Net increase in net assets resulting from operations | | $ 1,667 |

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Statement of Changes in Net Assets

Amounts in thousands | Six months ended September 30, 2011 (Unaudited) | Year ended

March 31,

2011 |

Increase (Decrease) in Net Assets | | |

Operations | | |

Net investment income (loss) | $ 1,664 | $ 16,186 |

Net realized gain (loss) | 3 | (2,304) |

Net increase in net assets resulting from operations | 1,667 | 13,882 |

Distributions to shareholders from net investment income | (1,666) | (16,201) |

Distributions to shareholders from net realized gain | - | (976) |

Total distributions | (1,666) | (17,177) |

Share transactions - net increase (decrease) | 3,338,443 | (16,132,135) |

Total increase (decrease) in net assets | 3,338,444 | (16,135,430) |

| | |

Net Assets | | |

Beginning of period | 32,903,552 | 49,038,982 |

End of period (including distributions in excess of net investment income of $187 and distributions in excess of net investment income of $185, respectively) | $ 36,241,996 | $ 32,903,552 |

Financial Highlights - Class I

| Six months ended

September 30, 2011 | Years ended March 31, |

| (Unaudited) | 2011 | 2010 | 2009 | 2008 | 2007 |

Selected Per-Share Data | | | | | | |

Net asset value, beginning of period | $ 1.00 | $ 1.00 | $ 1.00 | $ 1.00 | $ 1.00 | $ 1.00 |

Income from Investment Operations | | | | | | |

Net investment income (loss) | - E | - E | .002 | .017 | .046 | .050 |

Net realized and unrealized gain (loss) | - E | - E | - | - | - | - |

Total from investment operations | - E | - E | .002 | .017 | .046 | .050 |

Distributions from net investment income | - E | - E | (.002) | (.017) | (.046) | (.050) |

Distributions from net realized gain | - | - E | - | - | - | - |

Total distributions | - E | - E | (.002) | (.017) | (.046) | (.050) |

Net asset value, end of period | $ 1.00 | $ 1.00 | $ 1.00 | $ 1.00 | $ 1.00 | $ 1.00 |

Total Return B,C | .01% | .05% | .17% | 1.70% | 4.74% | 5.15% |

Ratios to Average Net Assets D | | | | | | |

Expenses before reductions | .21% A | .21% | .21% | .23% | .22% | .23% |

Expenses net of fee waivers, if any | .16% A | .21% | .21% | .23% | .20% | .20% |

Expenses net of all reductions | .16% A | .21% | .21% | .23% | .20% | .20% |

Net investment income (loss) | .01% A | .05% | .18% | 1.44% | 4.39% | 5.04% |

Supplemental Data | | | | | | |

Net assets, end of period (in millions) | $ 32,788 | $ 29,687 | $ 45,414 | $ 54,931 | $ 18,583 | $ 5,711 |

A Annualized

B Total returns for periods of less than one year are not annualized.

C Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

D Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed or waived or reductions from expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement and waivers but prior to reductions from expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

E Amount represents less than $.001 per share.

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Financial Highlights - Class II

| Six months ended

September 30, 2011 | Years ended March 31, |

| (Unaudited) | 2011 | 2010 | 2009 | 2008 | 2007 |

Selected Per-Share Data | | | | | | |

Net asset value, beginning of period | $ 1.00 | $ 1.00 | $ 1.00 | $ 1.00 | $ 1.00 | $ 1.00 |

Income from Investment Operations | | | | | | |

Net investment income (loss) | - E | - E | .001 | .015 | .045 | .049 |

Net realized and unrealized gain (loss) | - E | - E | - | - | - | - |

Total from investment operations | - E | - E | .001 | .015 | .045 | .049 |

Distributions from net investment income | - E | - E | (.001) | (.015) | (.045) | (.049) |

Distributions from net realized gain | - | - E | - | - | - | - |

Total distributions | - E | - E | (.001) | (.015) | (.045) | (.049) |

Net asset value, end of period | $ 1.00 | $ 1.00 | $ 1.00 | $ 1.00 | $ 1.00 | $ 1.00 |

Total Return B,C | .01% | .01% | .08% | 1.55% | 4.59% | 5.00% |

Ratios to Average Net Assets D | | | | | | |

Expenses before reductions | .36% A | .36% | .36% | .38% | .38% | .39% |

Expenses net of fee waivers, if any | .16% A | .25% | .31% | .38% | .35% | .35% |

Expenses net of all reductions | .16% A | .25% | .31% | .38% | .35% | .35% |

Net investment income (loss) | .01% A | .01% | .07% | 1.29% | 4.32% | 4.89% |

Supplemental Data | | | | | | |

Net assets, end of period (in millions) | $ 990 | $ 807 | $ 1,413 | $ 1,936 | $ 1,342 | $ 536 |

A Annualized

B Total returns for periods of less than one year are not annualized.

C Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

D Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed or waived or reductions from expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement and waivers but prior to reductions from expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

E Amount represents less than $.001 per share.

Financial Highlights - Class III

| Six months ended

September 30, 2011 | Years ended March 31, |

| (Unaudited) | 2011 | 2010 | 2009 | 2008 | 2007 |

Selected Per-Share Data | | | | | | |

Net asset value, beginning of period | $ 1.00 | $ 1.00 | $ 1.00 | $ 1.00 | $ 1.00 | $ 1.00 |

Income from Investment Operations | | | | | | |

Net investment income (loss) | - E | - E | - E | .014 | .044 | .048 |

Net realized and unrealized gain (loss) | - E | - E | - | - | - | - |

Total from investment operations | - E | - E | - E | .014 | .044 | .048 |

Distributions from net investment income | - E | - E | - E | (.014) | (.044) | (.048) |

Distributions from net realized gain | - | - E | - | - | - | - |

Total distributions | - E | - E | - E | (.014) | (.044) | (.048) |

Net asset value, end of period | $ 1.00 | $ 1.00 | $ 1.00 | $ 1.00 | $ 1.00 | $ 1.00 |

Total Return B,C | .01% | .01% | .04% | 1.44% | 4.48% | 4.89% |

Ratios to Average Net Assets D | | | | | | |

Expenses before reductions | .46% A | .46% | .46% | .49% | .48% | .48% |

Expenses net of fee waivers, if any | .16% A | .25% | .35% | .48% | .45% | .45% |

Expenses net of all reductions | .16% A | .25% | .35% | .48% | .45% | .45% |

Net investment income (loss) | .01% A | .01% | .03% | 1.19% | 4.27% | 4.79% |

Supplemental Data | | | | | | |

Net assets, end of period (in millions) | $ 1,981 | $ 2,050 | $ 1,910 | $ 3,031 | $ 1,763 | $ 814 |

A Annualized

B Total returns for periods of less than one year are not annualized.

C Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

D Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed or waived or reductions from expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement and waivers but prior to reductions from expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

E Amount represents less than $.001 per share.

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Financial Highlights - Select Class

| Six months ended

September 30, 2011 | Years ended March 31, |

| (Unaudited) | 2011 | 2010 | 2009 | 2008 | 2007 |

Selected Per-Share Data | | | | | | |

Net asset value, beginning of period | $ 1.00 | $ 1.00 | $ 1.00 | $ 1.00 | $ 1.00 | $ 1.00 |

Income from Investment Operations | | | | | | |

Net investment income (loss) | - E | - E | .001 | .016 | .046 | .050 |

Net realized and unrealized gain (loss) | - E | - E | - | - | - | - |

Total from investment operations | - E | - E | .001 | .016 | .046 | .050 |

Distributions from net investment income | - E | - E | (.001) | (.016) | (.046) | (.050) |

Distributions from net realized gain | - | - E | - | - | - | - |

Total distributions | - E | - E | (.001) | (.016) | (.046) | (.050) |

Net asset value, end of period | $ 1.00 | $ 1.00 | $ 1.00 | $ 1.00 | $ 1.00 | $ 1.00 |

Total Return B,C | .01% | .02% | .13% | 1.65% | 4.69% | 5.10% |

Ratios to Average Net Assets D | | | | | | |

Expenses before reductions | .26% A | .26% | .26% | .28% | .27% | .28% |

Expenses net of fee waivers, if any | .16% A | .24% | .25% | .28% | .25% | .25% |

Expenses net of all reductions | .16% A | .24% | .25% | .28% | .25% | .25% |

Net investment income (loss) | .01% A | .01% | .13% | 1.39% | 4.30% | 4.99% |

Supplemental Data | | | | | | |

Net assets, end of period (in millions) | $ 483 | $ 360 | $ 302 | $ 612 | $ 266 | $ 45 |

A Annualized

B Total returns for periods of less than one year are not annualized.