| UNITED STATES |

SECURITIES AND EXCHANGE COMMISSION |

Washington, D.C. 20549 |

FORM N-CSR |

| CERTIFIED SHAREHOLDER REPORT OF |

| REGISTERED MANAGEMENT INVESTMENT COMPANIES |

Investment Company Act file number 811-3327 |

|

| MFS SERIES TRUST XIII |

|

| (Exact name of registrant as specified in charter) |

500 Boylston Street, Boston, Massachusetts 02116 |

|

| (Address of principal executive offices) (Zip code) |

Susan S. Newton |

| Massachusetts Financial Services Company |

| 500 Boylston Street |

| Boston, Massachusetts 02116 |

|

| (Name and address of agents for service) |

| Registrant’s telephone number, including area code: (617) 954-5000 |

|

Date of fiscal year end: February 28 |

|

Date of reporting period: February 28, 2006 |

|

ITEM 1. REPORTS TO STOCKHOLDERS.

LETTER FROM THE CEO

Dear Shareholders,

It has been said that change is the only constant in life. As investors have seen, that theme is still accurate today as we recently have experienced shifting economic cycles because of natural disasters and political instability around the globe.

Markets worldwide have fluctuated in the past year as devastating hurricanes had a dramatic effect on the international economy, particularly on oil prices. We witnessed political unrest in the Middle East, highlighted by instability in Iraq, and in Africa, the usually stable Nigeria also experienced violence. As a result, energy prices have bounced up and down, with crude oil prices at one point topping a record $70 per barrel.

Such cycles are not uncommon and in fact have almost become the norm in our everyday lives. What does all of this mean to you as an investor? In times like these, it helps to know that you’re working with a seasoned investment professional who has experience to guide you through difficult times. At MFS®, we believe our investment management team has the knowledge and confidence to navigate through difficult cycles and at the same time see through adversity to find investment opportunities for our clients and shareholders.

Our investment management process, honed over 80 years, combines a unique concept of teamwork with our unwavering focus on the long term. We firmly believe that the best way to realize long-term financial goals – be it a college education, a comfortable retirement, or a secure family legacy – is to follow a three-pronged approach that focuses on longer time horizons. Allocate holdings across the major asset classes – including stocks, bonds, and cash. Diversify within each class to take advantage of different market segments and investing styles. Rebalance assets regularly to maintain a desired asset allocation. Of course, these strategies cannot guarantee a profit or protect against a loss. This long-term approach requires diligence and patience, two traits that in our experience are essential to capitalizing on the many opportunities the financial markets can offer – through both up and down economic cycles.

Respectfully,

Robert J. Manning

Chief Executive Officer and Chief Investment Officer

MFS Investment Management®

April 17, 2006

The opinions expressed in this letter are those of MFS, and no forecasts can be guaranteed.

ANNUAL REPORT 1

PORTFOLIO COMPOSITION

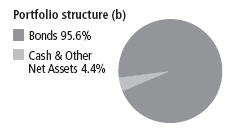

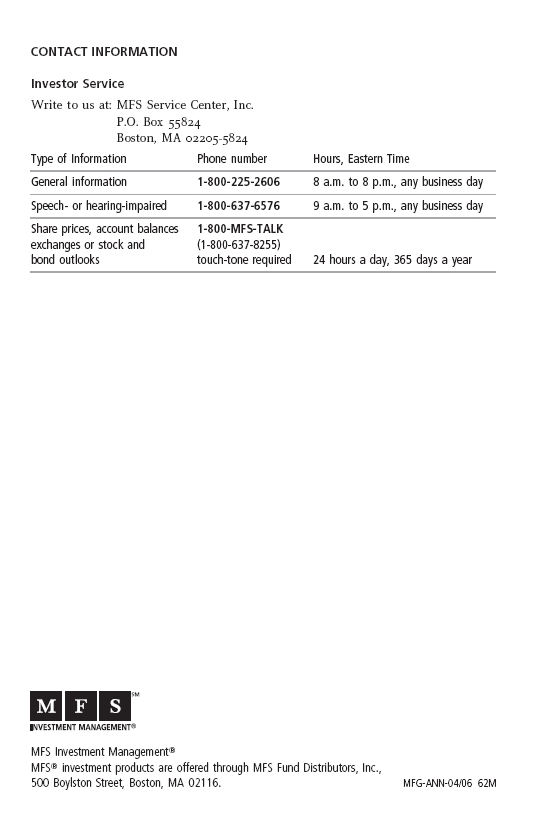

| Fixed income market sectors (b) | | |

| Mortgage-Backed Securities | | 48.6% |

|

| U.S. Government Agencies | | 36.2% |

|

| U.S. Treasury Securities | | 10.8% |

|

| Cash & Other Net Assets | | 4.4% |

|

| Credit quality of bonds (r) | | |

| AAA | | 99.2% |

|

| Not Rated | | 0.8% |

|

| Portfolio facts | | |

| Average Duration (d) | | 4.3 |

|

| Average Life (m) | | 6.9 yrs. |

|

| Average Maturity (m) | | 14.9 yrs. |

|

| Average Credit Quality of | | |

| Rated Securities (a) | | AAA |

|

| Average Short Term Credit Quality | | A-1 |

|

| (b) | | For purposes of this graphical presentation, the bond component includes both accrued interest amounts |

| | | and the equivalent exposure from any derivative holdings, if applicable. |

| (r) | | Each security is assigned a rating from Moody’s Investors Service. If not rated by Moody’s, the rating will |

| | | be that assigned by Standard & Poor’s. Likewise, if not assigned a rating by Standard & Poor’s, it will be |

| | | based on the rating assigned by Fitch, Inc. For those portfolios that hold a security which is not rated by |

| | | any of the three agencies, the security is considered Not Rated. Holdings in U.S. Treasuries and |

| | | government agency mortgage-backed securities, if any, are included in the ‘‘AAA’’-rating category. |

| | | Percentages are based on the total market value of investments as of 2/28/06. |

| (m) | | The average maturity shown is calculated using the final stated maturity on the portfolio’s holdings |

| | | without taking into account any holdings which have been pre-refunded to an earlier date or which |

| | | have a mandatory put date prior to the stated maturity. The average life shown takes into account these |

| | | earlier dates. |

| (a) | | The average credit quality of rated securities is based upon a market weighted average of portfolio |

| | | holdings that are rated by public rating agencies. |

| (d) | | Duration is a measure of how much a bond’s price is likely to fluctuate with general changes in interest |

| | | rates, e.g., if rates rise 1.00%, a bond with a 5-year duration is likely to lose about 5.00% of its value. |

| Percentages are based on net assets as of 2/28/06, unless otherwise noted. |

| The portfolio is actively managed, and current holdings may be different. |

|

2 ANNUAL REPORT |

MANAGEMENT REVIEW

Summary of Results

For the twelve months ended February 28, 2006, Class A shares of the MFS Government Securities Fund provided a total return of 2.28%, not including sales charges. In comparison, the fund’s benchmark, the Lehman Brothers U.S. Government/Mortgage Bond Index, provided a return of 3.04%.

Detractors from performance

The fund’s investments in some lower-yielding issues, relative to the benchmark, detracted from performance. Our underweighted positions in 30-year mortgage-backed securities, which outperformed comparable maturity U.S. Treasuries during the period, also hurt returns. The fund’s overweighted positions in agency securities also held back investment results, as those securities underperformed the overall index over the period.

Contributors to performance

Toward the end of the period, the portfolio’s long duration(d) stance, relative to the benchmark, contributed to performance as long-term interest rates declined.

Respectfully,

Peter Vaream

Portfolio Manager

Note to Shareholders: Effective April 1, 2006, Geoffrey Schechter replaced Peter Vaream as portfolio manager of the fund.

| (d) Duration is a measure of a portfolio’s sensitivity to changes in interest rates. |

The views expressed in this report are those of the portfolio manager only through the end of the period of the report as stated on the cover and do not necessarily reflect the views of MFS or any other person in the MFS organization. These views are subject to change at any time based on market and other conditions, and MFS disclaims any responsibility to update such views. These views may not be relied upon as investment advice or an indication of trading intent on behalf of any MFS portfolio. References to specific securities are not recommendations of such securities, and may not be representative of any MFS portfolio’s current or future investments.

The portfolio is actively managed, and current holdings may be different.

PERFORMANCE SUMMARY THROUGH 2/28/06

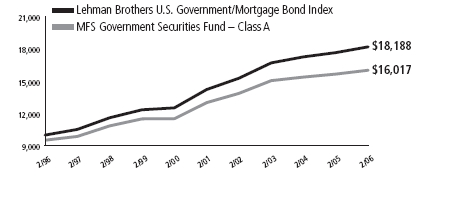

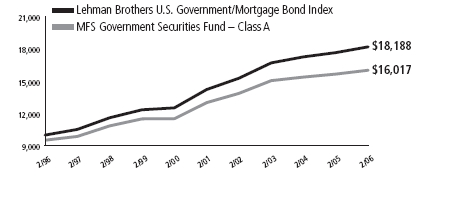

The following chart illustrates the historical performance of the fund’s Class A shares in comparison to its benchmark. Performance results include the deduction of the maximum applicable sales charge and reflect the percentage change in net asset value, including reinvestment of dividends and capital gains distributions. The performance of other share classes will be greater than or less than that of the class depicted below. Benchmark comparisons are unmanaged; do not reflect sales charges, commissions or expenses; and cannot be invested in directly. (See Notes to Performance Summary.)

Performance data shown represents past performance and is no guarantee of future results. Investment return and principal value fluctuate so your shares, when sold, may be worth more or less than the original cost; current performance may be lower or higher than quoted. For most recent month-end performance, please visit mfs.com. (For the most recent month-end performance for Class I shares call 1-888-808-6374.) The performance shown does not reflect the deduction of taxes, if any, that a shareholder would pay on fund distributions or the redemption of fund shares.

Growth of a hypothetical $10,000 investment

4 ANNUAL REPORT

Performance summary – continued

Total returns through 2/28/06

Average annual without sales charge

| Share class | | Class inception date | | 1-yr | | 5-yr | | 10-yr |

|

| A | | 7/25/84 | | 2.28% | | 4.25% | | 5.33% |

|

| B | | 8/30/93 | | 1.52% | | 3.56% | | 4.64% |

|

| C | | 4/01/96 | | 1.52% | | 3.56% | | 4.64% |

|

| I | | 1/02/97 | | 2.54% | | 4.59% | | 5.66% |

|

| R | | 12/31/02 | | 2.03% | | 4.12% | | 5.27% |

|

| R1 | | 4/01/05 | | 1.37% | | 3.53% | | 4.62% |

|

| R2 | | 4/01/05 | | 1.67% | | 3.59% | | 4.65% |

|

| R3 | | 10/31/03 | | 1.82% | | 3.71% | | 4.71% |

|

| R4 | | 4/01/05 | | 2.25% | | 4.24% | | 5.33% |

|

| R5 | | 4/01/05 | | 2.42% | | 4.27% | | 5.35% |

|

| 529A | | 7/31/02 | | 1.92% | | 4.02% | | 5.22% |

|

| 529B | | 7/31/02 | | 1.26% | | 3.38% | | 4.55% |

|

| 529C | | 7/31/02 | | 1.27% | | 3.38% | | 4.55% |

| Average annual | | | | | | |

| Comparative benchmarks | | | | | | |

|

| Average general U.S. government bond fund (l) | | 2.03% | | 4.10% | | 5.15% |

|

| Lehman Brothers U.S. Government/ | | | | | | |

| Mortgage Bond Index (s) | | 3.04% | | 5.04% | | 6.16% |

| Average annual with sales charge | | | | | | |

| Share class | | | | | | |

|

| A | | -2.58% | | 3.24% | | 4.82% |

| With Initial Sales Charge (4.75%) | | | | | | |

|

| B | | −2.41% | | 3.22% | | 4.64% |

| With CDSC (Declining over six years | | | | | | |

| from 4% to 0%) | | | | | | |

|

| C | | 0.54% | | 3.56% | | 4.64% |

| With CDSC (1% for 12 months) (c) | | | | | | |

|

| 529A | | −2.92% | | 3.01% | | 4.71% |

| With Initial Sales Charge (4.75%) | | | | | | |

|

| 529B | | −2.66% | | 3.04% | | 4.55% |

| With CDSC (Declining over six years | | | | | | |

| from 4% to 0%) | | | | | | |

|

| 529C | | 0.29% | | 3.38% | | 4.55% |

| With CDSC (1% for 12 months) (c) | | | | | | |

|

| Class I, R, R1, R2, R3, R4, and R5 shares do not have a sales charge. Please see Notes to Performance |

| Summary for more details. |

| CDSC – Contingent Deferred Sales Charge. |

| (c) | | Assuming redemption within one year from the end of the prior month of purchase. |

| (l) | | Source: Lipper Inc., an independent firm that reports mutual fund performance. |

| (s) | | Source: FactSet Research Systems, Inc. |

|

| | | ANNUAL REPORT 5 |

Performance summary – continued

Index Definition

Lehman Brothers U.S. Government/Mortgage Bond Index – measures debt issued by the U.S. Government as well as mortgage-backed pass-through securities of Ginnie Mae (GNMA), Fannie Mae (FNMA), and Freddie Mac (FHLMC).

It is not possible to invest directly in an index.

Notes to Performance Summary

Class R shares are available only to existing Class R shareholders. Class I shares are only available to certain eligible investors, and Class R1, R2, R3, R4, and R5 shares are only available to certain retirement plans. Class 529 shares are only available in conjunction with qualified tuition programs, such as the MFS 529 Savings Plan. There also is an additional annual fee, which is detailed in the program description, on qualified tuition programs. If this fee was reflected, the performance for Class 529 shares would have been lower. This annual fee is waived for Oregon residents and for those accounts with assets of $25,000 or more.

Performance for Classes I, R, R4, R5, and 529A shares includes the performance of the fund’s Class A shares for periods prior to their offering. Performance for Classes C, R1, R2, R3, 529B and 529C shares includes the performance of the fund’s Class B shares for periods prior to their offering. This blended class performance has been adjusted to take into account differences in sales loads, if any, applicable to these share classes, but has not been adjusted to take into account differences in class specific operating expenses (such as Rule 12b-1 fees). Compared to performance these share classes would have experienced had they been offered for the entire period, the use of blended performance generally results in higher performance for share classes with higher operating expenses than the share class to which it is blended, and lower performance for share classes with lower operating expenses than the share class to which it is blended.

Performance results reflect any applicable expense subsidies and waivers in effect during the periods shown. Without such subsidies and waivers the fund’s performance results would be less favorable. Please see the prospectus and financial statements for complete details.

6 ANNUAL REPORT

EXPENSE TABLE

Fund Expenses Borne by the Shareholders During the Period, September 1, 2005 through February 28, 2006.

As a shareholder of the fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on certain purchase or redemption payments and redemption fees on certain exchanges and redemptions, and (2) ongoing costs, including management fees; distribution and service (12b-1) fees; and other trust expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period September 1, 2005 through February 28, 2006.

Actual Expenses

The first line for each share class in the following table provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled ‘‘Expenses Paid During Period’’ to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line for each share class in the following table provides information about hypothetical account values and hypothetical expenses based on the fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) or redemption fees. Therefore, the second line for each share class in the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

ANNUAL REPORT 7

| Expense table – continued | | | | |

| |

| | | | | Expenses |

| | Annualized | Beginning | Ending | Paid During |

| Share | | Expense | Account Value | Account Value | Period (p) |

| Class | | Ratio | 9/01/05 | 2/28/06 | 9/01/05-2/28/06 |

|

| A | Actual | 0.81% | $1,000.00 | $996.20 | $4.01 |

|

| Hypothetical (h) | 0.81% | $1,000.00 | $1,020.78 | $4.06 |

|

| B | Actual | 1.58% | $1,000.00 | $992.40 | $7.81 |

|

| Hypothetical (h) | 1.58% | $1,000.00 | $1,016.96 | $7.90 |

|

| C | Actual | 1.58% | $1,000.00 | $992.50 | $7.81 |

|

| Hypothetical (h) | 1.58% | $1,000.00 | $1,016.96 | $7.90 |

|

| I | Actual | 0.55% | $1,000.00 | $997.40 | $2.72 |

|

| Hypothetical (h) | 0.55% | $1,000.00 | $1,022.07 | $2.76 |

|

| R | Actual | 1.07% | $1,000.00 | $996.00 | $5.30 |

|

| Hypothetical (h) | 1.07% | $1,000.00 | $1,019.49 | $5.36 |

|

| R1 | Actual | 1.67% | $1,000.00 | $991.90 | $8.25 |

|

| Hypothetical (h) | 1.67% | $1,000.00 | $1,016.51 | $8.35 |

|

| R2 | Actual | 1.33% | $1,000.00 | $993.60 | $6.57 |

|

| Hypothetical (h) | 1.33% | $1,000.00 | $1,018.20 | $6.66 |

|

| R3 | Actual | 1.22% | $1,000.00 | $995.10 | $6.04 |

|

| Hypothetical (h) | 1.22% | $1,000.00 | $1,018.74 | $6.11 |

|

| R4 | Actual | 0.96% | $1,000.00 | $996.50 | $4.75 |

|

| Hypothetical (h) | 0.96% | $1,000.00 | $1,020.03 | $4.81 |

|

| R5 | Actual | 0.66% | $1,000.00 | $997.00 | $3.27 |

|

| Hypothetical (h) | 0.66% | $1,000.00 | $1,021.52 | $3.31 |

|

| 529A | Actual | 1.17% | $1,000.00 | $995.50 | $5.79 |

|

| Hypothetical (h) | 1.17% | $1,000.00 | $1,018.99 | $5.86 |

|

| 529B | Actual | 1.82% | $1,000.00 | $992.20 | $8.99 |

|

| Hypothetical (h) | 1.82% | $1,000.00 | $1,015.77 | $9.10 |

|

| 529C | Actual | 1.83% | $1,000.00 | $992.30 | $9.04 |

|

| Hypothetical (h) | 1.83% | $1,000.00 | $1,015.72 | $9.15 |

|

| (h) | | 5% class return per year before expenses. |

| (p) | | Expenses paid is equal to each class’ annualized expense ratio, as shown above, multiplied by the average |

| | account value over the period, multiplied by the number of days in the period, divided by the number of |

| | days in the year. Expenses paid do not include any applicable sales charges (loads) or redemption fees. If |

| | these transaction costs had been included, your costs would have been higher. |

Effective October 1, 2005 the fund’s Class R1, Class R2, and Class R3 retirement plan administration and

services fee was reduced (as described in Note 3 of the Notes to the Financial Statements). Had this fee

reduction been in effect through the entire six month period, the annualized expense ratio would have been

1.65%, 1.30%, and 1.21% for Class R1, Class R2, and Class R3, respectively, and the actual expenses paid

during the period would have been approximately $8.15, $6.43, and $5.99 for Class R1, Class R2, and

Class R3, respectively. |

|

|

|

|

|

| | |

| | 8 ANNUAL REPORT |

| PORTFOLIO OF INVESTMENTS – 2/28/06 | | | | | | |

| The Portfolio of Investments is a complete list of all securities owned by your fund. | | | |

| It is categorized by broad-based asset classes. | | | | | | |

| Bonds - 97.8% | | | | | | | | |

|

| Issuer | | | | | | | Shares/Par | | | Value ($) |

|

| Agency - Other - 6.5% | | | | | | |

|

| Financing Corp., 10.7%, 2017 | | $ | 14,360,000 | | $ | 21,483,063 |

| Financing Corp., STRIPS, 0%, 2017 | | | 18,780,000 | | | 10,552,257 |

| Financing Corp., 9.4%, 2018 | | | 11,750,000 | | | 16,343,580 |

| Financing Corp., 9.8%, 2018 | | | 14,975,000 | | | 21,415,523 |

| Financing Corp., 10.35%, 2018 | | | 15,165,000 | | | 22,573,042 |

| |

|

| | | | | | | | | | $ | 92,367,465 |

|

| Mortgage Backed - 48.5% | | | | | | |

|

| Fannie Mae, 4.374%, 2013 | | $ | 2,746,118 | | $ | 2,615,473 |

| Fannie Mae, 4.45%, 2014 | | | 3,199,316 | | | 3,052,622 |

| Fannie Mae, 4.5%, 2019 | | | 62,935,011 | | | 61,234,167 |

| Fannie Mae, 4.518%, 2014 | | | 2,463,815 | | | 2,361,078 |

| Fannie Mae, 4.56%, 2015 | | | 2,413,022 | | | 2,309,838 |

| Fannie Mae, 4.6%, 2014 | | | 1,869,842 | | | 1,799,811 |

| Fannie Mae, 4.62%, 2015 | | | 3,448,673 | | | 3,315,877 |

| Fannie Mae, 4.65%, 2013 | | | 3,666,366 | | | 3,570,236 |

| Fannie Mae, 4.665%,2015 | | | 1,628,057 | | | 1,569,409 |

| Fannie Mae, 4.667%, 2014 | | | 9,429,878 | | | 9,120,162 |

| Fannie Mae, 4.69%, 2015 | | | 1,326,978 | | | 1,281,500 |

| Fannie Mae, 4.7%, 2015 | | | 1,867,583 | | | 1,804,383 |

| Fannie Mae, 4.73%, 2012 | | | 2,866,908 | | | 2,788,142 |

| Fannie Mae, 4.74%, 2015 | | | 1,810,000 | | | 1,752,112 |

| Fannie Mae, 4.77%, 2014 | | | 1,612,890 | | | 1,566,415 |

| Fannie Mae, 4.771%, 2014 | | | 7,790,960 | | | 7,590,028 |

| Fannie Mae, 4.785%, 2012 | | | 928,863 | | | 906,909 |

| Fannie Mae, 4.79%, 2012 | | | 11,265,251 | | | 11,060,061 |

| Fannie Mae, 4.8%, 2013 | | | 1,321,399 | | | 1,289,650 |

| Fannie Mae, 4.815%, 2015 | | | 1,968,000 | | | 1,914,024 |

| Fannie Mae, 4.82%, 2014 - 2015 | | | 6,715,767 | | | 6,538,848 |

| Fannie Mae, 4.845%, 2013 | | | 3,885,776 | | | 3,798,373 |

| Fannie Mae, 4.847%, 2014 | | | 10,542,778 | | | 10,306,444 |

| Fannie Mae, 4.85%, 2015 | | | 1,481,135 | | | 1,445,344 |

| Fannie Mae, 4.87%, 2015 | | | 1,414,504 | | | 1,382,206 |

| Fannie Mae, 4.88%, 2020 | | | 1,438,405 | | | 1,424,252 |

| Fannie Mae, 4.89%, 2015 | | | 1,308,931 | | | 1,280,723 |

| Fannie Mae, 4.92%, 2014 | | | 1,561,260 | | | 1,542,720 |

| Fannie Mae, 4.925%, 2015 | | | 5,211,200 | | | 5,116,354 |

| Fannie Mae, 4.996%, 2017 | | | 5,078,975 | | | 5,011,176 |

| Fannie Mae, 5%, 2013 - 2027 | | | 48,440,429 | | | 47,929,018 |

|

| | | | | | | | ANNUAL REPORT 9 |

| Portfolio of Investments – continued | | | | | | |

| Issuer | | | Shares/Par | | | Value ($) |

|

| Bonds - continued | | | | | | |

|

| Mortgage Backed - continued | | | | | | |

|

| Fannie Mae, 5.06%, 2013 | | $ | 1,552,169 | | $ | 1,534,208 |

| Fannie Mae, 5.1%, 2014 | | | 2,024,628 | | | 2,005,672 |

| Fannie Mae, 5.5%, 2017 - 2035 | | | 232,005,076 | | | 230,696,253 |

| Fannie Mae, 6%, 2016 - 2034 | | | 63,106,185 | | | 63,883,123 |

| Fannie Mae, 6.5%, 2016 - 2034 | | | 31,296,527 | | | 32,127,325 |

| Fannie Mae, 7.029%, 2007 | | | 1,268,541 | | | 1,287,718 |

| Fannie Mae, 7.5%, 2024 - 2031 | | | 848,757 | | | 889,650 |

| Freddie Mac, 3.108%, 2035 | | | 316,094 | | | 314,801 |

| Freddie Mac, 4.375%, 2015 | | | 10,023,332 | | | 9,759,186 |

| Freddie Mac, 4.5%, 2013 - 2015 | | | 9,061,525 | | | 8,961,746 |

| Freddie Mac, 5%, 2024 - 2025 | | | 14,101,011 | | | 14,016,657 |

| Freddie Mac, 5.5%, 2033 - 2035 | | | 50,576,725 | | | 50,189,734 |

| Freddie Mac, 6%, 2017 - 2035 | | | 21,263,236 | | | 21,518,511 |

| Freddie Mac, 6.5%, 2016 - 2029 | | | 3,427,586 | | | 3,516,220 |

| Ginnie Mae, 5.5%, 2033 - 2034 | | | 35,139,559 | | | 35,251,144 |

| |

|

| | | | | | $ | 684,629,303 |

|

| U.S. Government Agencies - 29.2% | | | | | | |

|

| Aid to Egypt, 4.45%, 2015 | | $ | 7,118,000 | | $ | 6,897,342 |

| Aid to Israel, 0%, 2021 | | | 9,036,000 | | | 4,161,964 |

| Aid to Israel, 0%, 2024 | | | 14,262,000 | | | 5,764,722 |

| Aid to Israel, 5.5%, 2023 | | | 16,567,000 | | | 17,721,024 |

| Empresa Energetica Cornito Ltd., 6.07%, 2010 | | | 7,239,000 | | | 7,380,088 |

| Fannie Mae, 3.125%, 2007 | | | 35,000,000 | | | 33,941,810 |

| Fannie Mae, 4.25%, 2007 | | | 30,000,000 | | | 29,682,870 |

| Fannie Mae, 4.5%, 2008 | | | 15,000,000 | | | 14,845,995 |

| Fannie Mae, 5.5%, 2011 | | | 77,391,000 | | | 79,196,377 |

| Federal Home Loan Bank, 4.625%, 2008 | | | 35,755,000 | | | 35,570,504 |

| Freddie Mac, 4.2%, 2007 | | | 16,665,000 | | | 16,462,087 |

| Freddie Mac, 4.875%, 2009 - 2013 | | | 23,401,000 | | | 23,365,707 |

| Freddie Mac, 5.05%, 2015 | | | 13,957,000 | | | 13,800,151 |

| Overseas Private Investment Corp., 0%, 2007 | | | 6,924,301 | | | 7,045,477 |

| Small Business Administration, 4.34%, 2024 | | | 4,259,192 | | | 4,039,779 |

| Small Business Administration, 4.72%, 2024 | | | 7,518,744 | | | 7,300,403 |

| Small Business Administration, 4.76%, 2025 | | | 8,532,000 | | | 8,268,513 |

| Small Business Administration, 4.77%, 2024 | | | 6,371,429 | | | 6,206,306 |

| Small Business Administration, 4.86%, 2024 - 2025 | | | 9,782,728 | | | 9,562,010 |

| Small Business Administration, 4.87%, 2024 | | | 5,741,967 | | | 5,615,427 |

| Small Business Administration, 4.88%, 2024 | | | 3,616,084 | | | 3,539,864 |

| Small Business Administration, 4.89%, 2023 | | | 7,386,070 | | | 7,250,691 |

| Small Business Administration, 4.98%, 2023 | | | 2,850,548 | | | 2,813,864 |

|

| 10 ANNUAL REPORT | | | | | | |

| Portfolio of Investments – continued | | | | | | |

| Issuer | | | | | Shares/Par | | | Value ($) |

|

| Bonds - continued | | | | | | | | |

|

| U.S. Government Agencies - continued | | | | | | |

|

| Small Business Administration, 4.99%, 2024 | | | | $ | 5,220,367 | | $ | 5,148,359 |

| Small Business Administration, 5.11%, 2025 | | | | | 5,166,024 | | | 5,124,652 |

| Small Business Administration, 5.18%, 2024 | | | | | 7,264,699 | | | 7,247,824 |

| Small Business Administration, 5.19%, 2024 | | | | | 4,610,210 | | | 4,600,503 |

| Small Business Administration, 5.52%, 2024 | | | | | 4,402,781 | | | 4,467,045 |

| Small Business Administration, 6.07%, 2022 | | | | | 3,643,251 | | | 3,771,678 |

| Small Business Administration, 6.34%, 2021 | | | | | 4,233,808 | | | 4,417,066 |

| Small Business Administration, 6.35%, 2021 | | | | | 3,564,384 | | | 3,718,475 |

| Small Business Administration, 6.44%, 2021 | | | | | 3,676,826 | | | 3,844,353 |

| Small Business Administration, 6.625%, 2021 | | | 3,690,308 | | | 3,900,376 |

| Small Business Administration, 8.625%, 2011 | | | 168,985 | | | 176,891 |

| Small Business Administration, 8.8%, 2011 | | | 190,121 | | | 199,203 |

| Small Business Administration, 9.05%, 2009 | | | | | 48,834 | | | 50,613 |

| Small Business Administration, 9.1%, 2009 | | | 37,876 | | | 39,064 |

| Small Business Administration, 9.25%, 2010 | | | | | 83,374 | | | 87,412 |

| Small Business Administration, 9.3%, 2010 | | | 159,097 | | | 167,049 |

| Small Business Administration, 9.5%, 2010 | | | 127,215 | | | 133,032 |

| Small Business Administration, 9.65%, 2010 | | | | | 190,974 | | | 200,335 |

| Small Business Administration, 9.7%, 2010 | | | 91,470 | | | 96,116 |

| Small Business Administration, 9.9%, 2008 | | | 35,201 | | | 36,302 |

| Small Business Administration, 10.05%, 2008 - 2009 | | | 17,996 | | | 18,751 |

| U.S. Department of Housing & Urban Development, 6.36%, 2016 | | | 7,000,000 | | | 7,391,762 |

| U.S. Department of Housing & Urban Development, 6.59%, 2016 | | | 6,599,000 | | | 6,785,554 |

| |

|

| | | | | | | | $ | 412,055,390 |

|

| U.S. Treasury Obligations - 13.6% | | | | | | |

|

| U.S. Treasury Bonds, 6.875%, 2025 | | | | $ | 1,307,000 | | $ | 1,667,753 |

| U.S. Treasury Bonds, 6%, 2026 | | | | | 20,408,000 | | | 23,853,442 |

| U.S. Treasury Bonds, 5.25%, 2028 | | | | | 1,139,000 | | | 1,231,455 |

| U.S. Treasury Bonds, 6.25%, 2030 | | | | | 6,166,000 | | | 7,595,501 |

| U.S. Treasury Bonds, 5.375%, 2031 | | | | | 363,000 | | | 404,079 |

| U.S. Treasury Bonds, 4.5%, 2036 | | | | | 23,636,000 | | | 23,623,071 |

| U.S. Treasury Notes, 5.5%, 2008 | | | | | 16,147,000 | | | 16,400,556 |

| U.S. Treasury Notes, 5.625%, 2008 | | | | | 8,178,000 | | | 8,339,009 |

| U.S. Treasury Notes, 6%, 2009 | | | | | 4,566,000 | | | 4,761,662 |

| U.S. Treasury Notes, 6.5%, 2010 | | | | | 87,502,000 | | | 93,295,595 |

| U.S. Treasury Notes, TIPS, 3.875%, 2009 | | | 9,956,610 | | | 10,534,173 |

| |

|

| | | | | | | | $ | 191,706,296 |

|

| Total Bonds (Identified Cost, $1,392,963,193) | | | | | $1,380,758,454 |

|

| | | | | | ANNUAL REPORT 11 |

| Portfolio of Investments – continued | | | | | | | | | |

| Call Option Purchased - 0% | | | | | | | | | |

|

| | | | | | | Number | | | |

| Issue/Expiration/Strike Price | | | | | | of Contracts | | | Value ($) |

|

| U.S. Treasury Notes 10yr Futures - May 2006 @ $109 | | | | | | | |

| (Premium Paid, $381,845) | | | | | | 277 | | $ | 112,531 |

|

| Put Option Purchased - 0% | | | | | | | | | |

|

| U.S. Treasury Notes 10yr Futures - May 2006 @ $109 | | | | | | | |

| (Premium Paid, $277,970) | | | | | | 277 | | $ | 415,500 |

|

| Repurchase Agreements - 1.6% | | | | | | | | | |

|

| Issuer | | | | | | Shares/Par | | | |

|

| Goldman Sachs, 4.55%, dated 2/28/06, due 3/01/06, total to be | | | | | |

| received $22,894,893 (secured by various U.S. Treasury and | | | | | |

| Federal Agency obligations in a jointly traded account) | | | | $ 22,892,000 | | $ | 22,892,000 |

| Morgan Stanley, 4.56%, dated 2/28/06, due 3/01/06, total to be | | | | | |

| received $234,030 (secured by various U.S. Treasury and Federal | | | | | |

| Agency obligations in a jointly traded account) | | | | | | 234,000 | | | 234,000 |

|

| Total Repurchase Agreements, at Cost | | | | | | | | $ | 23,126,000 |

|

| Total Investments (Identified Cost, $1,416,749,008) | | | | | | $ | 1,404,412,485 |

|

| Other Assets, Less Liabilities - 0.6% | | | | | | | | | 8,305,771 |

|

| Net Assets - 100.0% | | | | | | | | $ | 1,412,718,256 |

|

| Futures contracts outstanding at February 28, 2006: | | | | | |

| | | | | | | | | | Unrealized |

| | | | | | | Expiration | | | Appreciation |

| | | Contracts | | Value | | Date | | (Depreciation) |

|

| U.S. Treasury Bond (Short) | | 224 | | $25,333,000 | | June 2006 | | | $(42,565) |

| U.S. Treasury Note 5 yr (Long) | | 175 | | 18,407,813 | | June 2006 | | | 29,466 |

| U.S. Treasury Note 10 yr (Short) | | 219 | | 23,631,469 | | June 2006 | | | (53,806) |

|

| | | | | | | | | | $(66,905) |

| At February 28, 2006, the fund had sufficient cash and/or securities to cover any commitments under |

| these derivative contracts. |

The following abbreviations are used in the Portfolio of Investments and are defined: |

| STRIPS | | Separate Trading of Registered Interest and Principal of Securities |

| TIPS | | Treasury Inflation Protected Security |

See Notes to Financial Statements |

|

12 ANNUAL REPORT |

| FINANCIAL STATEMENTS | Statement of Assets and Liabilities | |

This statement represents your fund’s balance sheet, which details the assets | |

| and liabilities composing the total value of the fund. | | | |

| At 2/28/06 | | | |

| Assets | | | |

|

| Investments, at value (identified cost, $1,416,749,008) | | $1,404,412,485 | |

| Cash | | 79,617 | |

| Receivable for fund shares sold | | 1,967,266 | |

| Interest receivable | | 10,997,408 | |

| Receivable from investment adviser | | 39,692 | |

| Other assets | | 8,580 | |

|

| Total assets | | | $1,417,505,048 |

|

| Liabilities | | | |

|

| Distributions payable | | $939,666 | |

| Payable for daily variation margin on open futures contracts | | 156,283 | |

| Payable for fund shares reacquired | | 3,129,750 | |

| Payable to affiliates | | | |

| Management fee | | 10,883 | |

| Shareholder servicing costs | | 148,127 | |

| Distribution and service fees | | 11,569 | |

| Administrative services fee | | 365 | |

| Program manager fees | | 9 | |

| Retirement plan administration and services fees | | 16 | |

| Payable for independent trustees’ compensation | | 133,829 | |

| Accrued expenses and other liabilities | | 256,295 | |

|

| Total liabilities | | | $4,786,792 |

|

| Net assets | | | $1,412,718,256 |

|

| Net assets consist of: | | | |

|

| Paid-in capital | | $1,495,410,586 | |

| Unrealized appreciation (depreciation) on investments and | | | |

| translation of assets and liabilities in foreign currencies | | (12,403,428) | |

| Accumulated net realized gain (loss) on investments | | (70,748,246) | |

| Undistributed net investment income | | 459,344 | |

|

| Net assets | | | $1,412,718,256 |

|

| Shares of beneficial interest outstanding | | | 149,151,339 |

|

| | | ANNUAL REPORT 13 |

| Statement of Assets and Liabilities – continued | | | | |

| Class A shares | | | | |

|

| Net assets | | $826,000,642 | | |

| Shares outstanding | | 87,189,948 | | |

|

| Net asset value per share | | | | $9.47 |

|

| Offering price per share (100/95.25 x net asset value | | | | |

| per share) | | | | $9.94 |

|

| Class B shares | | | | |

|

| Net assets | | $175,207,254 | | |

| Shares outstanding | | 18,522,176 | | |

|

| Net asset value and offering price per share | | | | $9.46 |

|

| Class C shares | | | | |

|

| Net assets | | $35,768,002 | | |

| Shares outstanding | | 3,765,353 | | |

|

| Net asset value and offering price per share | | | | $9.50 |

|

| Class I shares | | | | |

|

| Net assets | | $359,623,175 | | |

| Shares outstanding | | 37,971,209 | | |

|

| Net asset value, offering price, and redemption price per share | | | | $9.47 |

|

| Class R shares | | | | |

|

| Net assets | | $11,750,624 | | |

| Shares outstanding | | 1,241,290 | | |

|

| Net asset value, offering price, and redemption price per share | | | | $9.47 |

|

| Class R1 shares | | | | |

|

| Net assets | | $191,680 | | |

| Shares outstanding | | 20,252 | | |

|

| Net asset value, offering price, and redemption price per share | | | | $9.46 |

|

| Class R2 shares | | | | |

|

| Net assets | | $358,471 | | |

| Shares outstanding | | 37,874 | | |

|

| Net asset value, offering price, and redemption price per share | | | | $9.46 |

|

| Class R3 shares | | | | |

|

| Net assets | | $1,391,764 | | |

| Shares outstanding | | 147,017 | | |

|

| Net asset value, offering price, and redemption price per share | | | | $9.47 |

|

| Class R4 shares | | | | |

|

| Net assets | | $1,304,948 | | |

| Shares outstanding | | 137,704 | | |

|

| Net asset value, offering price, and redemption price per share | | | | $9.48 |

|

| 14 ANNUAL REPORT | | | | |

| Statement of Assets and Liabilities – continued | | |

| Class R5 shares | | |

|

| Net assets | $51,417 | |

| Shares outstanding | 5,428 | |

|

| Net asset value, offering price, and redemption price per share | | $9.47 |

|

| Class 529A shares | | |

|

| Net assets | $400,540 | |

| Shares outstanding | 42,360 | |

|

| Net asset value per share | | $9.46 |

|

| Offering price per share (100/95.25 x net asset value | | |

| per share) | | $9.93 |

|

| Class 529B shares | | |

|

| Net assets | $434,533 | |

| Shares outstanding | 45,957 | |

|

| Net asset value and offering price per share | | $9.46 |

|

| Class 529C shares | | |

|

| Net assets | $235,206 | |

| Shares outstanding | 24,771 | |

|

| Net asset value and offering price per share | | $9.50 |

|

| On sales of $100,000 or more, the offering price of Class A and Class 529A shares is reduced. A contingent |

| deferred sales charge may be imposed on redemptions of Class A, Class B, Class C, Class 529B and Class |

| 529C shares. | | |

See Notes to Financial Statements | | |

|

| | | ANNUAL REPORT 15 |

| FINANCIAL STATEMENTS | Statement of Operations | | | | |

| This statement describes how much your fund earned in investment income and accrued in | | |

| expenses. It also describes any gains and/or losses generated by fund operations. | | |

| Year ended 2/28/06 | | | | |

| Net investment income | | | | |

|

| Interest income | | | | $70,931,046 |

|

| Expenses | | | | |

| Management fee | | $5,871,859 | | |

| Distribution and service fees | | 4,762,940 | | |

| Program manager fees | | 2,759 | | |

| Shareholder servicing costs | | 2,594,623 | | |

| Administrative services fee | | 179,477 | | |

| Retirement plan administration and services fees | | 4,469 | | |

| Independent trustees’ compensation | | 46,722 | | |

| Custodian fee | | 368,761 | | |

| Shareholder communications | | 190,186 | | |

| Auditing fees | | 52,747 | | |

| Legal fees | | 37,976 | | |

| Registration fees | | 203,899 | | |

| Miscellaneous | | 88,550 | | |

|

| Total expenses | | | | $14,404,968 |

|

| Fees paid indirectly | | (71,526) | | |

| Reduction of expenses by investment adviser | | (1,522,724) | | |

|

| Net expenses | | | | $12,810,718 |

|

| Net investment income | | | | $58,120,328 |

|

| Realized and unrealized gain (loss) on investments | | | | |

|

| Realized gain (loss) (identified cost basis) | | | | |

| Investment transactions | | $(5,599,756) | | |

| Futures contracts | | 721,520 | | |

|

| Net realized gain (loss) on investments | | | | $(4,878,236) |

|

| Change in unrealized appreciation (depreciation) | | | | |

| Investments | | $(20,739,315) | | |

| Futures contracts | | (368,468) | | |

|

| Net unrealized gain (loss) on investments | | | | $(21,107,783) |

|

| Net realized and unrealized gain (loss) on investments | | | | $(25,986,019) |

|

| Change in net assets from operations | | | | $32,134,309 |

|

| See Notes to Financial Statements | | | | |

|

16 ANNUAL REPORT | | | | |

| FINANCIAL STATEMENTS | Statements of Changes in Net Assets | | |

These statements describe the increases and/or decreases in net assets resulting | | |

| from operations, any distributions, and any shareholder transactions. | | | | |

Years ended 2/28 | | 2006 | | 2005 |

| Change in net assets | | | | |

|

| From operations | | | | |

|

| Net investment income | | $58,120,328 | | $48,264,077 |

| Net realized gain (loss) on investments | | (4,878,236) | | 9,975,483 |

| Net unrealized gain (loss) on investments | | (21,107,783) | | (35,099,066) |

|

| Change in net assets from operations | | $32,134,309 | | $23,140,494 |

|

| Distributions declared to shareholders | | | | |

|

| From net investment income | | | | |

| Class A | | $(36,730,768) | | $(30,710,051) |

| Class B | | (6,947,250) | | (7,063,974) |

| Class C | | (1,420,773) | | (1,577,976) |

| Class I | | (13,967,234) | | (9,120,541) |

| Class R | | (436,665) | | (250,685) |

| Class R1 | | (4,121) | | — |

| Class R2 | | (6,328) | | — |

| Class R3 | | (35,810) | | (5,374) |

| Class R4 | | (22,606) | | — |

| Class R5 | | (2,004) | | — |

| Class 529A | | (15,171) | | (11,688) |

| Class 529B | | (13,373) | | (12,638) |

| Class 529C | | (8,730) | | (8,125) |

|

| Total distributions declared to shareholders | | $(59,610,833) | | $(48,761,052) |

|

| Change in net assets from fund share transactions | | $(61,115,105) | | $228,335,829 |

|

| Redemption fees | | $3,132 | | $4,544 |

|

| Total change in net assets | | $(88,588,497) | | $202,719,815 |

|

| Net assets | | | | |

|

| At beginning of period | | 1,501,306,753 | | 1,298,586,938 |

| At end of period (including undistributed net | | | | |

| investment income of $459,344 and accumulated | | | | |

| distributions in excess of net investment income of | | | | |

| $3,760,665, respectively) | | $1,412,718,256 | | $1,501,306,753 |

|

| See Notes to Financial Statements | | | | |

|

| | | | | ANNUAL REPORT 17 |

| FINANCIAL STATEMENTS | Financial Highlights | | | | | | | | |

The financial highlights table is intended to help you understand the fund’s financial performance for the past |

| 5 years (or life of a particular share class, if shorter). Certain information reflects financial results for a single |

| fund share. The total returns in the table represent the rate by which an investor would have earned (or lost) |

| on an investment in the fund share class (assuming reinvestment of all distributions) held for the entire period. |

| This information has been audited by the fund’s independent registered public accounting firm, whose report, |

| together with the fund’s financial statements, are included in this report. | | | | | | |

Class A | | | | | | | | | | |

| | | Years ended 2/28 and 29 |

| | | 2006 | | 2005(j) | | 2004 | | 2003 | | 2002 |

| Net asset value, beginning of period | | $9.65 | | $9.84 | | $10.03 | | $9.73 | | $9.71 |

|

| Income (loss) from investment operations | | | | | | | | | | |

|

| Net investment income (d) | | $0.39 | | $0.36 | | $0.29 | | $0.39 | | $0.50 |

| Net realized and unrealized gain (loss) on | | | | | | | | | | |

| investments and foreign currency | | (0.17) | | (0.19) | | (0.08) | | 0.42 | | 0.12 |

|

| Total from investment operations | | $0.22 | | $0.17 | | $0.21 | | $0.81 | | $0.62 |

|

| Less distributions declared to shareholders | | | | | | | | |

|

| From net investment income | | $(0.40) | | $(0.36) | | $(0.40) | | $(0.51) | | $(0.60) |

|

| Net asset value, end of period | | $9.47 | | $9.65 | | $9.84 | | $10.03 | | $9.73 |

|

| Total return (%) (t)(r) | | 2.28 | | 1.81 | | 2.19 | | 8.54 | | 6.59 |

|

| Ratios (%) (to average net assets) | | | | | | | | | | |

| and Supplemental data: | | | | | | | | | | |

|

| Expenses before expense reductions (f) | | 0.90 | | 0.93 | | 1.00 | | 0.98 | | 1.01 |

| Expenses after expense reductions (f) | | 0.80 | | 0.83 | | 0.95 | | 0.93 | | 0.96 |

| Net investment income | | 4.03 | | 3.75 | | 2.94 | | 3.97 | | 5.16 |

| Portfolio turnover | | 73 | | 126 | | 143 | | 134 | | 116 |

| Net assets at end of period | | | | | | | | | | |

| (000 Omitted) | | $826,001 | | $932,879 | | $803,974 | | $927,886 | | $622,606 |

|

See Notes to Financial Statements | | | | | | | | | | |

|

18 ANNUAL REPORT | | | | | | | | | | |

| Financial Highlights – continued | | | | | | | | | | |

Class B | | | | | | | | | | |

| | | Years ended 2/28 and 29 |

| | | 2006 | | 2005(j) | | 2004 | | 2003 | | 2002 |

| Net asset value, beginning of period | | $9.64 | | $9.83 | | $10.02 | | $9.72 | | $9.69 |

|

| Income (loss) from investment operations | | | | | | | | | | |

|

| Net investment income (d) | | $0.31 | | $0.29 | | $0.24 | | $0.33 | | $0.44 |

| Net realized and unrealized gain (loss) on | | | | | | | | | | |

| investments and foreign currency | | (0.16) | | (0.18) | | (0.09) | | 0.41 | | 0.12 |

|

| Total from investment operations | | $0.15 | | $0.11 | | $0.15 | | $0.74 | | $0.56 |

|

| Less distributions declared to shareholders | | | | | | | | |

|

| From net investment income | | $(0.33) | | $(0.30) | | $(0.34) | | $(0.44) | | $(0.53) |

|

| Net asset value, end of period | | $9.46 | | $9.64 | | $9.83 | | $10.02 | | $9.72 |

|

| Total return (%) (t)(r) | | 1.52 | | 1.12 | | 1.53 | | 7.84 | | 5.98 |

|

| Ratios (%) (to average net assets) | | | | | | | | | | |

| and Supplemental data: | | | | | | | | | | |

|

| Expenses before expense reductions (f) | | 1.65 | | 1.62 | | 1.64 | | 1.63 | | 1.66 |

| Expenses after expense reductions (f) | | 1.55 | | 1.52 | | 1.59 | | 1.58 | | 1.61 |

| Net investment income | | 3.27 | | 3.03 | | 2.42 | | 3.32 | | 4.52 |

| Portfolio turnover | | 73 | | 126 | | 143 | | 134 | | 116 |

| Net assets at end of period | | | | | | | | | | |

| (000 Omitted) | | $175,207 | | $233,734 | | $255,512 | | $408,553 | | $263,964 |

|

| See Notes to Financial Statements | | | | | | | | | | |

|

| | | | | | | | | ANNUAL REPORT 19 |

| Financial Highlights – continued | | | | | | | | | | |

Class C | | | | | | | | | | |

| | | Years ended 2/28 and 29 |

| | | 2006 | | 2005(j) | | 2004 | | 2003 | | 2002 |

| Net asset value, beginning of period | | $9.68 | | $9.87 | | $10.06 | | $9.76 | | $9.73 |

|

| Income (loss) from investment operations | | | | | | | | | | |

|

| Net investment income (d) | | $0.32 | | $0.29 | | $0.25 | | $0.33 | | $0.44 |

| Net realized and unrealized gain (loss) on | | | | | | | | | | |

| investments and foreign currency | | (0.17) | | (0.18) | | (0.10) | | 0.41 | | 0.12 |

|

| Total from investment operations | | $0.15 | | $0.11 | | $0.15 | | $0.74 | | $0.56 |

|

| Less distributions declared to shareholders | | | | | | | | | | |

|

| From net investment income | | $(0.33) | | $(0.30) | | $(0.34) | | $(0.44) | | $(0.53) |

|

| Net asset value, end of period | | $9.50 | | $9.68 | | $9.87 | | $10.06 | | $9.76 |

|

| Total return (%) (t)(r) | | 1.52 | | 1.13 | | 1.54 | | 7.81 | | 5.97 |

|

| Ratios (%) (to average net assets) | | | | | | | | | | |

| and Supplemental data: | | | | | | | | | | |

|

| Expenses before expense reductions (f) | | 1.65 | | 1.62 | | 1.64 | | 1.63 | | 1.66 |

| Expenses after expense reductions (f) | | 1.55 | | 1.52 | | 1.59 | | 1.58�� | | 1.61 |

| Net investment income | | 3.27 | | 2.95 | | 2.47 | | 3.32 | | 4.51 |

| Portfolio turnover | | 73 | | 126 | | 143 | | 134 | | 116 |

| Net assets at end of period | | | | | | | | | | |

| (000 Omitted) | | $35,768 | | $44,692 | | $63,609 | | $110,096 | | $81,397 |

|

| See Notes to Financial Statements | | | | | | | | | | |

|

20 ANNUAL REPORT | | | | | | | | | | |

| Financial Highlights – continued | | | | | | | | | | |

Class I | | | | | | | | | | |

| | | Years ended 2/28 and 29 |

| | | 2006 | | 2005(j) | | 2004 | | 2003 | | 2002 |

| Net asset value, beginning of period | | $9.65 | | $9.84 | | $10.03 | | $9.73 | | $9.71 |

|

| Income (loss) from investment operations | | | | | | | | |

|

| Net investment income (d) | | $0.41 | | $0.39 | | $0.25 | | $0.33 | | $0.53 |

| Net realized and unrealized gain (loss) | | | | | | | | | | |

| on investments and foreign currency | | (0.17) | | (0.19) | | (0.00) | (g)(w) | 0.51 | | 0.13 |

|

| Total from investment operations | | $0.24 | | $0.20 | | $0.25 | | $0.84 | | $0.66 |

|

| Less distributions declared to shareholders | | | | | | | | |

|

| From net investment income | | $(0.42) | | $(0.39) | | $(0.44) | | $(0.54) | | $(0.64) |

|

| Net asset value, end of period | | $9.47 | | $9.65 | | $9.84 | | $10.03 | | $9.73 |

|

| Total return (%) (r) | | 2.54 | | 2.14 | | 2.55 | | 8.92 | | 6.99 |

|

| Ratios (%) (to average net assets) | | | | | | | | | | |

| and Supplemental data: | | | | | | | | | | |

|

| Expenses before expense reductions (f) | | 0.65 | | 0.60 | | 0.67 | | 0.63 | | 0.66 |

| Expenses after expense reductions (f) | | 0.55 | | 0.50 | | 0.62 | | 0.58 | | 0.61 |

| Net investment income | | 4.34 | | 4.09 | | 2.57 | | 3.64 | | 5.49 |

| Portfolio turnover | | 73 | | 126 | | 143 | | 134 | | 116 |

| Net assets at end of period | | | | | | | | | | |

| (000 Omitted) | | $359,623 | | $279,080 | | $168,124 | | $33,682 | | $1,797 |

|

| See Notes to Financial Statements | | | | | | | | | | |

|

| | | | | | | | | ANNUAL REPORT 21 |

| Financial Highlights – continued | | | | | | | | | |

Class R | | | | | | | | | |

| | | Years ended 2/28 and 29 | |

| | | 2006 | | 2005(j) | | 2004 | | 2003(i) | |

| Net asset value, beginning of period | | $9.65 | | $9.84 | | $10.03 | | $10.03 | |

| |

| Income (loss) from investment operations | | | | | | | | | |

| |

| Net investment income (d) | | $0.36 | | $0.34 | | $0.18 | | $0.16 | |

| Net realized and unrealized gain (loss) on investments | | | | | | | | | |

| and foreign currency | | (0.17) | | (0.18) | | 0.02 | (g) | (0.08) | |

| |

| Total from investment operations | | $0.19 | | $0.16 | | $0.20 | | $0.08 | |

| |

| Less distributions declared to shareholders | | | | | | | | | |

| |

| From net investment income | | $(0.37) | | $(0.35) | | $(0.39) | | $(0.08) | |

| |

| Net asset value, end of period | | $9.47 | | $9.65 | | $9.84 | | $10.03 | |

| |

| Total return (%) (r) | | 2.03 | | 1.63 | | 2.05 | | 0.78 | (n) |

| |

| Ratios (%) (to average net assets) | | | | | | | | | |

| and Supplemental data: | | | | | | | | | |

| |

| Expenses before expense reductions (f) | | 1.15 | | 1.11 | | 1.19 | | 1.13 | (a) |

| Expenses after expense reductions (f) | | 1.05 | | 1.01 | | 1.14 | | 1.08 | (a) |

| Net investment income | | 3.76 | | 3.64 | | 1.87 | | 3.04 | (a) |

| Portfolio turnover | | 73 | | 126 | | 143 | | 134 | |

| Net assets at end of period (000 Omitted) | | $11,751 | | $9,411 | | $6,188 | | $79 | |

| |

| | | Class R1 | | Class R2 | |

| | | Year ended | | Year ended | |

| | | 2/28/06(i) | | 2/28/06(i) | |

| Net asset value, beginning of period | | $9.57 | | $9.57 | |

| |

| Income (loss) from investment operations | | | | | |

| |

| Net investment income (d) | | $0.29 | | $0.31 | |

| Net realized and unrealized gain (loss) on investments and | | | | | |

| foreign currency | | (0.12) | (g) | (0.11) | (g) |

| |

| Total from investment operations | | $0.17 | | $0.20 | |

| |

| Less distributions declared to shareholders | | | | | |

| |

| From net investment income | | $(0.28) | | $(0.31) | |

| |

| Net asset value, end of period | | $9.46 | | $9.46 | |

| |

| Total return (%) (r) | | 1.82 | (n) | 2.13 | (n) |

| |

| Ratios (%) (to average net assets) | | | | | |

| and Supplemental data: | | | | | |

| |

| Expenses before expense reductions (f) | | 1.85 | (a) | 1.55 | (a) |

| Expenses after expense reductions (f) | | 1.68 | (a) | 1.34 | (a) |

| Net investment income | | 3.25 | (a) | 3.60 | (a) |

| Portfolio turnover | | 73 | | 73 | |

| Net assets at end of period (000 Omitted) | | $192 | | $358 | |

| |

| See Notes to Financial Statements | | | | | |

| |

22 ANNUAL REPORT | | | | | |

| Financial Highlights – continued | | | | | | | |

Class R3 | | | | | | | |

| | | Years ended 2/28 and 29 | |

| | | 2006 | | 2005(j) | | 2004(i) | |

| Net asset value, beginning of period | | $9.65 | | $9.84 | | $9.69 | |

| |

| Income (loss) from investment operations | | | | | | | |

| |

| Net investment income (d) | | $0.35 | | $0.38 | | $0.02 | |

| Net realized and unrealized gain (loss) on investments and | | | | | | | |

| foreign currency | | (0.18) | | (0.25) | | 0.23 | (g) |

| |

| Total from investment operations | | $0.17 | | $0.13 | | $0.25 | |

| |

| Less distributions declared to shareholders | | | | | | | |

| |

| From net investment income | | $(0.35) | | $(0.32) | | $(0.10) | |

| |

| Net asset value, end of period | | $9.47 | | $9.65 | | $9.84 | |

| |

| Total return (%) (r) | | 1.82 | | 1.38 | | 2.58 | (n) |

| |

| Ratios (%) (to average net assets) | | | | | | | |

| and Supplemental data: | | | | | | | |

| |

| Expenses before expense reductions (f) | | 1.40 | | 1.36 | | 1.42 | (a) |

| Expenses after expense reductions (f) | | 1.24 | | 1.26 | | 1.37 | (a) |

| Net investment income | | 3.64 | | 3.99 | | 0.72 | (a) |

| Portfolio turnover | | 73 | | 126 | | 143 | |

| Net assets at end of period (000 Omitted) | | $1,392 | | $422 | | $41 | |

| |

| | | Class R4 | | Class R5 | |

| | | Year ended | | Year ended | |

| | | 2/28/06(i) | | 2/28/06(i) | |

| Net asset value, beginning of period | | $9.58 | | $9.58 | |

| |

| Income (loss) from investment operations | | | | | |

| |

| Net investment income (d) | | $0.36 | | $0.37 | |

| Net realized and unrealized gain (loss) on investments and | | | | | |

| foreign currency | | (0.11) | (g) | (0.10) | (g) |

| |

| Total from investment operations | | $0.25 | | $0.27 | |

| |

| Less distributions declared to shareholders | | | | | |

| |

| From net investment income | | $(0.35) | | $(0.38) | |

| |

| Net asset value, end of period | | $9.48 | | $9.47 | |

| |

| Total return (%) (r) | | 2.64 | (n) | 2.81 | (n) |

| |

| Ratios (%) (to average net assets) | | | | | |

| and Supplemental data: | | | | | |

| |

| Expenses before expense reductions (f) | | 1.05 | (a) | 0.75 | (a) |

| Expenses after expense reductions (f) | | 0.95 | (a) | 0.65 | (a) |

| Net investment income | | 4.02 | (a) | 4.20 | (a) |

| Portfolio turnover | | 73 | | 73 | |

| Net assets at end of period (000 Omitted) | | $1,305 | | $51 | |

| |

| See Notes to Financial Statements | | | | | |

| |

| | | ANNUAL REPORT 23 | |

| Financial Highlights – continued | | | | | | | | | |

Class 529A | | | | | | | | | |

| | | Years ended 2/28 and 29 | |

| | | 2006 | | 2005(j) | | 2004 | | 2003(i) | |

| Net asset value, beginning of period | | $9.64 | | $9.83 | | $10.02 | | $9.81 | |

| |

| Income (loss) from investment operations | | | | | | | | | |

| |

| Net investment income (d) | | $0.35 | | $0.33 | | $0.26 | | $0.28 | |

| Net realized and unrealized gain (loss) on investments | | | | | | | | | |

| and foreign currency | | (0.17) | | (0.18) | | (0.07) | | 0.20 | |

| |

| Total from investment operations | | $0.18 | | $0.15 | | $0.19 | | $0.48 | |

| |

| Less distributions declared to shareholders | | | | | | | | | |

| |

| From net investment income | | $(0.36) | | $(0.34) | | $(0.38) | | $(0.27) | |

| |

| Net asset value, end of period | | $9.46 | | $9.64 | | $9.83 | | $10.02 | |

| |

| Total return (%) (t)(r) | | 1.92 | | 1.53 | | 1.94 | | 4.97 | (n) |

| |

| Ratios (%) (to average net assets) | | | | | | | | | |

| and Supplemental data: | | | | | | | | | |

| |

| Expenses before expense reductions (f) | | 1.25 | | 1.21 | | 1.25 | | 1.23 | (a) |

| Expenses after expense reductions (f) | | 1.15 | | 1.11 | | 1.20 | | 1.18 | (a) |

| Net investment income | | 3.68 | | 3.47 | | 2.69 | | 3.05 | (a) |

| Portfolio turnover | | 73 | | 126 | | 143 | | 134 | |

| Net assets at end of period (000 Omitted) | | $401 | | $388 | | $332 | | $312 | |

| |

| Class 529B | | | | | | | | | |

| | | Years ended 2/28 and 29 | | | |

| |

| |

| | | 2006 | | 2005(j) | | 2004 | | 2003(i) | |

| Net asset value, beginning of period | | $9.64 | | $9.82 | | $10.01 | | $9.80 | |

| |

| Income (loss) from investment operations | | | | | | | | | |

| |

| Net investment income (d) | | $0.29 | | $0.26 | | $0.20 | | $0.24 | |

| Net realized and unrealized gain (loss) on investments | | | | | | | | | |

| and foreign currency | | (0.17) | | (0.17) | | (0.08) | | 0.21 | |

| |

| Total from investment operations | | $0.12 | | $0.09 | | $0.12 | | $0.45 | |

| |

| Less distributions declared to shareholders | | | | | | | | | |

| |

| From net investment income | | $(0.30) | | $(0.27) | | $(0.31) | | $(0.24) | |

| |

| Net asset value, end of period | | $9.46 | | $9.64 | | $9.82 | | $10.01 | |

| |

| Total return (%) (t)(r) | | 1.26 | | 0.97 | | 1.27 | | 4.58 | (n) |

| |

| Ratios (%) (to average net assets) | | | | | | | | | |

| and Supplemental data: | | | | | | | | | |

| |

| Expenses before expense reductions (f) | | 1.90 | | 1.87 | | 1.90 | | 1.88 | (a) |

| Expenses after expense reductions (f) | | 1.80 | | 1.77 | | 1.85 | | 1.83 | (a) |

| Net investment income | | 3.03 | | 2.71 | | 2.07 | | 2.53 | (a) |

| Portfolio turnover | | 73 | | 126 | | 143 | | 134 | |

| Net assets at end of period (000 Omitted) | | $435 | | $404 | | $524 | | $522 | |

| |

| See Notes to Financial Statements | | | | | | | | | |

| |

24 ANNUAL REPORT | | | | | | | | | |

| Financial Highlights – continued | | | | | | | | | |

Class 529C | | | | | | | | | |

| | | Years ended 2/28 and 29 | |

| | | 2006 | | 2005(j) | | 2004 | | 2003(i) | |

| Net asset value, beginning of period | | $9.68 | | $9.87 | | $10.06 | | $9.84 | |

| |

| Income (loss) from investment operations | | | | | | | | | |

| |

| Net investment income (d) | | $0.29 | | $0.26 | | $0.22 | | $0.20 | |

| Net realized and unrealized gain (loss) on investments | | | | | | | | | |

| and foreign currency | | (0.17) | | (0.18) | | (0.10) | | 0.26 | |

| |

| Total from investment operations | | $0.12 | | $0.08 | | $0.12 | | $0.46 | |

| |

| Less distributions declared to shareholders | | | | | | | | | |

| |

| From net investment income | | $(0.30) | | $(0.27) | | $(0.31) | | $(0.24) | |

| |

| Net asset value, end of period | | $9.50 | | $9.68 | | $9.87 | | $10.06 | |

| |

| Total return (%) (t)(r) | | 1.27 | | 0.88 | | 1.28 | | 4.66 | (n) |

| |

| Ratios (%) (to average net assets) | | | | | | | | | |

| and Supplemental data: | | | | | | | | | |

| |

| Expenses before expense reductions (f) | | 1.90 | | 1.86 | | 1.89 | | 1.88 | (a) |

| Expenses after expense reductions (f) | | 1.80 | | 1.76 | | 1.84 | | 1.83 | (a) |

| Net investment income | | 3.01 | | 2.76 | | 2.15 | | 2.37 | (a) |

| Portfolio turnover | | 73 | | 126 | | 143 | | 134 | |

| Net assets at end of period (000 Omitted) | | $235 | | $297 | | $283 | | $383 | |

| |

| Any redemption fees charged by the fund during the 2004 and 2005 fiscal years resulted in a per share |

| impact of less than $0.01. |

(a) | | Annualized. |

| (n) | | Not annualized. |

| (d) | | Per share data are based on average shares outstanding. |

| (f) | | Ratios do not reflect reductions from fees paid indirectly. |

| (g) | | The per share amount is not in accordance with the net realized and unrealized gain/loss for the period |

| | | because of the timing of sales of fund shares and the amount of per share realized and unrealized gains |

| | | and losses at such time. |

| (i) | | For the period from the class’ inception, December 31, 2002 (Class R), July 31, 2002 (Classes 529A, 529B, |

| | | and 529C), October 31, 2003 (Class R3) and April 1, 2005 (Classes R1, R2, R4, and R5) through the |

| | | stated period end. |

| (r) | | Certain expenses have been reduced without which performance would have been lower. |

| (t) | | Total returns do not include any applicable sales charges. |

| (w) Per share amount was less than $0.01. |

|

| | | ANNUAL REPORT 25 |

| Financial Highlights – continued |

(j) | | Due to a revision, certain amounts for the year ended February 28, 2005 have been changed from what |

| | | was previously reported. The impact of the revision was an increase to the ratio of net investment income |

| | | to average net assets and a corresponding decrease to the ratio of expenses to average net assets. |

| | | Additionally, the revision resulted in rounding the net asset value for certain classes up to the next cent, |

| | | increasing total return for these classes. As a result of these revised net asset values, no shareholder |

| | | accounts were materially effected. The impact for each share class is summarized as follows: |

| | | | | | Increase in Net | | |

| | Increase in Net | | | | Asset Value | | |

| | Investment | | Decrease in | | per Share | | Increase to |

| Share Class | Income Ratio | | Expense Ratio | | (Rounded) | | Total Return |

| Class A | 0.04% | | 0.04% | | N/A | | N/A |

| Class B | 0.03% | | 0.03% | | N/A | | N/A |

| Class C | 0.03% | | 0.03% | | N/A | | N/A |

| Class I | 0.05% | | 0.05% | | $0.01 | | 0.11% |

| Class R | 0.05% | | 0.05% | | $0.01 | | 0.10% |

| Class R3 | 0.10% | | 0.10% | | $0.01 | | 0.11% |

| Class 529A | 0.04% | | 0.04% | | $0.01 | | 0.11% |

| Class 529B | 0.03% | | 0.03% | | $0.01 | | 0.10% |

| Class 529C | 0.04% | | 0.04% | | $0.01 | | 0.10% |

See Notes to Financial Statements | | | | | | |

|

26 ANNUAL REPORT | | | | | | | |

NOTES TO FINANCIAL STATEMENTS

(1) Business and Organization

MFS Government Securities Fund (the fund) is a series of MFS Series Trust XIII (formerly known as MFS Government Securities Fund) (the trust). The trust is organized as a Massachusetts business trust and is registered under the Investment Company Act of 1940, as amended, as an open-end management investment company.

(2) Significant Accounting Policies

General – The preparation of financial statements in conformity with U.S. generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

Investment Valuations – Debt instruments (other than short-term instruments), including restricted debt instruments, are generally valued at an evaluated bid price as reported by an independent pricing service. Values of debt instruments obtained from pricing services can utilize both dealer-supplied valuations and electronic data processing techniques which take into account factors such as institutional-size trading in similar groups of securities, yield, quality, coupon rate, maturity, type of issue, trading characteristics and other market data. Short-term instruments with a maturity at issuance of 365 days or less are generally valued at amortized cost, which approximates market value. Futures contracts are generally valued at settlement price as reported by an independent pricing service on the exchange on which they are primarily traded. For futures contracts in which there were no sales during the day, futures contracts are generally valued at the last quoted bid price as reported by an independent pricing service on the exchange on which they are primarily traded. Securities and other assets generally valued on the basis of information from an independent pricing service may also be valued on the basis of information from brokers and dealers. When pricing-service information or market quotations are not readily available, securities are priced at fair value as determined under the direction of the Board of Trustees.

Repurchase Agreements – The fund may enter into repurchase agreements with institutions that the fund’s investment adviser has determined are creditworthy. Each repurchase agreement is recorded at cost. The fund requires that the securities collateral in a repurchase transaction be transferred to the custodian in a manner sufficient to enable the fund to obtain those securities in the event of a default under the repurchase agreement. The fund monitors, on a daily basis, the value of the collateral to ensure that its value, including accrued interest, is greater than amounts owed to the fund under each such repurchase agreement. The fund, along with other affiliated entities of Massachusetts Financial Services Company (MFS), may utilize a joint trading account for the purpose of entering into one or more repurchase agreements.

Inflation-Adjusted Debt Securities – The fund invests in inflation-adjusted debt securities issued by the U.S. Treasury. The fund may also invest in

ANNUAL REPORT 27

Notes to Financial Statements – continued

inflation-adjusted debt securities issued by U.S. Government agencies and instrumentalities other than the U.S. Treasury and by other entities such as U.S. and foreign corporations and foreign governments. The principal value of these debt securities is adjusted by references to changes in the Consumer Price Index or another general price or wage index. These debt securities typically pay a fixed rate of interest, but this fixed rate is applied to the inflation-adjusted principal amount. The principal paid at maturity of the debt security is typically equal to the inflation-adjusted principal amount, or the security’s original par value, whichever is greater. Other types of inflation-adjusted securities may use other methods to adjust for other measures of inflation.

Derivative Risk – The fund may invest in derivatives for hedging or non-hedging purposes. While hedging can reduce or eliminate losses, it can also reduce or eliminate gains. When the fund uses derivatives as an investment to gain market exposure, or for hedging purposes, gains and losses from derivative instruments may be substantially greater than the derivative’s original cost. Derivative instruments include purchased options and futures contracts.

Futures Contracts – The fund may enter into futures contracts for the delayed delivery of securities or currency, or contracts based on financial indices at a fixed price on a future date. In entering such contracts, the fund is required to deposit with the broker either in cash or securities an amount equal to a certain percentage of the contract amount. Subsequent payments are made or received by the fund each day, depending on the daily fluctuations in the value of the contract, and are recorded for financial statement purposes as unrealized gains or losses by the fund. Upon entering into such contracts, the fund bears the risk of interest or exchange rates or securities prices moving unexpectedly, in which case, the fund may not achieve the anticipated benefits of the futures contracts and may realize a loss.

Short Term Fees – For purchases made on or after July 1, 2004 and before April 1, 2005, the fund charged a 2% redemption fee (which was retained by the fund) on proceeds from Class A, Class B, Class C, and Class I shares redeemed or exchanged within 5 business days following their acquisition (either by purchase or exchange). Effective April 1, 2005, the fund no longer charges a redemption fee. See the fund’s prospectus for details. Any redemption fees charged are accounted for as an addition to paid-in capital.

Investment Transactions and Income – Investment transactions are recorded on the trade date. Some securities may be purchased on a ‘‘when-issued’’ or ‘‘forward delivery’’ basis, which means that the securities will be delivered to the fund at a future date, usually beyond customary settlement time. Interest income is recorded on the accrual basis. All premium and discount is amortized or accreted for financial statement purposes in accordance with U.S. generally accepted accounting principles. All discount is accreted for tax reporting purposes as required by federal income tax regulations.

The fund may enter into ‘‘TBA’’ (to be announced) purchase commitments to purchase securities for a fixed unit price at a future date. Although the unit price has been established, the principal value has not been finalized.

28 ANNUAL REPORT

Notes to Financial Statements – continued

However, the principal amount of the commitments will not fluctuate more than 0.01% . The fund holds, and maintains until settlement date, cash or high-grade debt obligations in an amount sufficient to meet the purchase price, or the fund may enter into offsetting contracts for the forward sale of other securities it owns. Income on the securities will not be earned until settlement date. TBA purchase commitments may be considered securities in themselves, and involve a risk of loss if the value of the security to be purchased declines prior to settlement date, which is in addition to the risk of decline in the value of the fund’s other assets. Unsettled TBA purchase commitments are valued at the current market value of the underlying securities.

The fund may enter into ‘‘TBA’’ (to be announced) sale commitments to hedge its portfolio positions or to sell mortgage-backed securities it owns under delayed delivery arrangements. Proceeds of TBA sale commitments are not received until the contractual settlement date. During the time a TBA sale commitment is outstanding, equivalent deliverable securities, or an offsetting TBA purchase commitment deliverable on or before the sale commitment date, are held as ‘‘cover’’ for the transaction.

Fees Paid Indirectly – The fund’s custody fee is reduced according to an arrangement that measures the value of cash deposited with the custodian by the fund. This amount, for the year ended February 28, 2006, is shown as a reduction of total expenses on the Statement of Operations.

Tax Matters and Distributions – The fund intends to continue to qualify as a regulated investment company, as defined under Subchapter M of the Internal Revenue Code, and to distribute all of its taxable income, including realized capital gains. Accordingly, no provision for federal income tax is required in the financial statements. Foreign taxes, if any, have been accrued by the fund in the accompanying financial statements.

Distributions to shareholders are recorded on the ex-dividend date. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from generally accepted accounting principles. Certain capital accounts in the financial statements are periodically adjusted for permanent differences in order to reflect their tax character. These adjustments have no impact on net assets or net asset value per share. Temporary differences which arise from recognizing certain items of income, expense, gain or loss in different periods for financial statement and tax purposes will reverse at some time in the future. Distributions in excess of net investment income or net realized gains are temporary overdistributions for financial statement purposes resulting from differences in the recognition or classification of income for financial statement and tax purposes.

Book/tax differences primarily relate to expiration of capital loss carryforwards and amortization and accretion of debt securities.

ANNUAL REPORT 29

Notes to Financial Statements – continued

The tax character of distributions declared to shareholders is as follows:

| | | February 28, 2006 | | February 28, 2005 |

| Ordinary income (including | | | | |

| any short-term capital gains) | | $59,610,833 | | $48,761,052 |

The federal tax cost and the tax basis components of distributable earnings were as follows:

| As of February 28, 2006 | | |

| Cost of investments | | $1,425,783,993 |

|

| Gross appreciation | | $6,235,589 |

| Gross depreciation | | (27,607,097) |

|

| Net unrealized appreciation (depreciation) | | $(21,371,508) |

| Undistributed ordinary income | | $5,576,677 |

| Capital loss carryforwards | | (59,308,939) |

| Post-October capital loss deferral | | (2,471,227) |

| Other temporary differences | | (5,117,333) |

As of February 28, 2006, the fund had available capital loss carryforwards to offset future realized gains. Such losses expire as follows:

| February 28, 2007 | | $(5,253,445) |

| February 29, 2008 | | (15,270,459) |

| February 28, 2009 | | (3,477,230) |

| February 28, 2011 | | (11,527,172) |

| February 29, 2012 | | (5,729,829) |

| February 28, 2013 | | (11,095,767) |

| February 28, 2014 | | (6,955,037) |

|

| Total | | | | | | $(59,308,939) |

The availability of a portion of the capital loss carryforwards, which were acquired on November 19, 2004, in connection with the MFS Government Mortgage Fund merger, may be limited in a given year.

Multiple Classes of Shares of Beneficial Interest – The fund offers multiple classes of shares, which differ in their respective distribution and service fees. All shareholders bear the common expenses of the fund based on the value of settled shares outstanding of each class, without distinction between share classes. Dividends are declared separately for each class. Differences in per share dividend rates are generally due to differences in separate class expenses. Class B and Class 529B shares will convert to Class A and Class 529A shares, respectively, approximately eight years after purchase.

Other – Due to a revision to miscellaneous expenses, certain amounts on the Statement of Changes in Net Assets and Financial Highlights for the year ended February 28, 2005, have been changed from what was previously reported. The impact of the revision was to reduce expenses related to this item and thereby increase net investment income, changes in net assets from operations and net assets at end of period for the year ended February 28, 2005, by $521,341.

30 ANNUAL REPORT

Notes to Financial Statements – continued

(3) Transactions with Affiliates

Investment Adviser – The fund has an investment advisory agreement with Massachusetts Financial Services Company (MFS) to provide overall investment advisory and administrative services, and general office facilities. The management fee is computed daily and paid monthly at an annual rate of 0.40% of the fund’s average daily net assets.

As part of a settlement agreement with the New York Attorney General concerning market timing and related matters, MFS has agreed to reduce the management fee to 0.30% of the fund’s average daily net assets for the period March 1, 2004 through February 28, 2009. For the year ended February 28, 2006, this waiver amounted to $1,474,287 and is reflected as a reduction of total expenses in the Statement of Operations.

The management fee incurred for the year ended February 28, 2006 was equivalent to an annual effective rate of 0.30% of the fund’s average daily net assets.

The investment adviser has contractually agreed to pay a portion of the fund’s operating expenses, exclusive of management, distribution and service, retirement plan administration and services, program manager, and certain other fees and expenses, such that operating expenses do not exceed 0.25% annually of the fund’s average daily net assets. This contractual fee arrangement will continue until July 1, 2006. For the year ended February 28, 2006, this reduction amounted to $39,692 and is reflected as a reduction of total expenses in the Statement of Operations.

Distributor – MFS Fund Distributors, Inc. (MFD), a wholly owned subsidiary of MFS, as distributor, received $52,767 and $249 for the year ended February 28, 2006, as its portion of the initial sales charge on sales of Class A and Class 529A shares of the fund, respectively.

The Board of Trustees has adopted a distribution plan for certain class shares pursuant to Rule 12b-1 of the Investment Company Act of 1940.

The fund’s distribution plan provides that the fund will pay MFD for services provided by MFD and financial intermediaries in connection with the distribution and servicing of certain share classes. One component of the plan is a distribution fee paid to MFD and another component of the plan is a service fee paid to MFD. MFD may subsequently pay all, or a portion, of the distribution and/or service fees to financial intermediaries.

ANNUAL REPORT 31

| Notes to Financial Statements – continued | | | | | | |

Distribution Fee Plan Table: | | | | | | | | |

| | | | | | | Total | | Annual | | Distribution |

| | | Distribution | | Service | | Distribution | | Effective | | and Service |

| | | Fee Rate | | Fee Rate | | Plan(1) | | Rate(2) | | Fee |

| Class A | | 0.10% | | 0.25% | | 0.35% | | 0.25% | | $2,217,901 |

| Class B | | 0.75% | | 0.25% | | 1.00% | | 1.00% | | 2,052,972 |