UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-3327

MFS SERIES TRUST XIII

(Exact name of registrant as specified in charter)

500 Boylston Street, Boston, Massachusetts 02116

(Address of principal executive offices) (Zip code)

Susan S. Newton

Massachusetts Financial Services Company

500 Boylston Street

Boston, Massachusetts 02116

(Name and address of agents for service)

Registrant’s telephone number, including area code: (617) 954-5000

Date of fiscal year end: February 28

Date of reporting period: August 31, 2012

| ITEM 1. | REPORTS TO STOCKHOLDERS. |

SEMIANNUAL REPORT

August 31, 2012

MFS® DIVERSIFIED INCOME FUND

DIF-SEM

MFS® DIVERSIFIED INCOME FUND

CONTENTS

Note to Shareholders: At a meeting held June 19, 2012, the Board of Trustees of the MFS Diversified Income Fund (the fund) approved investing some of all of the fund’s assets currently invested in high income debt instruments in the MFS High Yield Pooled Portfolio, a mutual fund advised by MFS that normally invests at least 80% of its assets in high income debt instruments (the “High Yield Pooled Portfolio”). The High Yield Pooled Portfolio will not charge a management fee, distribution and/or service fees, or sales charges. The investment in the MFS High Yield Pooled Portfolio is anticipated to occur in early 2013.

The report is prepared for the general information of shareholders. It is authorized for distribution to prospective investors only when preceded or accompanied by a current prospectus.

NOT FDIC INSURED Ÿ MAY LOSE VALUE Ÿ NO BANK GUARANTEE

LETTER FROM THE CHAIRMAN AND CEO

Dear Shareholders:

World financial markets continue to face a number of major economic and political challenges. While the European debt crisis has deepened and spread, there appears to be scope for improvement given the European Central Bank’s willingness to backstop troubled sovereigns. Economic activity in China, until recently the world’s growth engine, appears to be bottoming. Even the relatively strong and stable US

economy has been affected by uncertainty over the presidential election and the threat of a “fiscal cliff” at year- end. At the same time, global consumer and producer confidence has fallen sharply. And a search for safe havens by nervous investors has driven down yields on highly rated government bonds, including those issued by Germany and the United States, to multi-decade lows.

But there is also good news: Global economic data have modestly improved, performing slightly better than expected. However, the improvement is too short-lived to be called a trend. Equity markets have been largely range bound since the

Fed extended its quantitative easing program, leaving little expectation that the bank will add further money to the system. It is hard to know how much of the recent gain in financial markets has been the result of actual economic improvements versus expectations that renewed central bank action will soon lead to an economic rebound.

Through all this uncertainty, managing risk remains a top priority for investors and their advisors. At MFS®, our emphasis on global research is designed to keep our investment process functioning smoothly at all times. Close collaboration among colleagues around the world is vital in periods of uncertainty and heightened volatility. We share ideas and evaluate opportunities across continents and across all investment disciplines and types of investments. We employ this uniquely collaborative approach to build better insights — and better results — for our clients.

Like our investors, we are mindful of the many economic challenges we face at the local, national and international levels. In times like these, it is more important than ever to maintain a long-term view, adhere to time-tested investing principles such as asset allocation and diversification and work closely with investment advisors to research and identify the most suitable opportunities.

Respectfully,

Robert J. Manning

Chairman and Chief Executive Officer

MFS Investment Management®

October 17, 2012

The opinions expressed in this letter are subject to change, may not be relied upon for investment advice and no forecasts can be guaranteed.

1

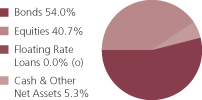

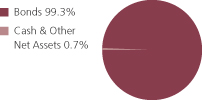

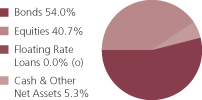

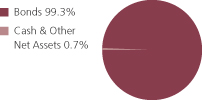

PORTFOLIO COMPOSITION

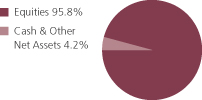

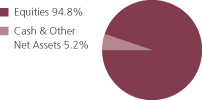

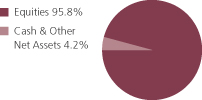

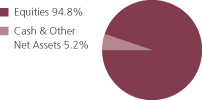

Portfolio structure (i)

| | | | |

| Top ten holdings (i) | | | | |

| U.S. Treasury Notes, 1.875%, 2014 | | | 3.0% | |

| Simon Property Group, Inc., REIT | | | 2.4% | |

| Public Storage, Inc., REIT | | | 1.5% | |

| U.S. Treasury Notes, 2.125%, 2015 | | | 1.3% | |

| Exxon Mobil Corp. | | | 1.3% | |

| Vornado Realty Trust, REIT | | | 1.1% | |

| U.S. Treasury Notes, 0.875%, 2016 | | | 1.1% | |

| U.S. Treasury Notes, 1.375%, 2013 | | | 1.0% | |

| Boston Properties, Inc., REIT | | | 0.9% | |

| AvalonBay Communities, Inc., REIT | | | 0.9% | |

| |

| Fixed income sectors (i) | | | | |

| High Yield Corporates | | | 18.8% | |

| Emerging Markets Bonds | | | 16.0% | |

| U.S. Treasury Securities | | | 8.7% | |

| Mortgage-Backed Securities | | | 7.5% | |

| High Grade Corporates | | | 1.6% | |

| U.S. Government Agencies | | | 0.8% | |

| Non-U.S. Government Bonds | | | 0.3% | |

| Municipal Bonds | | | 0.2% | |

| Commercial Mortgage-Backed Securities | | | 0.1% | |

| Collateralized Debt Obligations (o) | | | 0.0% | |

| Floating Rate Loans (o) | | | 0.0% | |

| | | | |

| Equity sectors (i) | | | | |

| Financial Services | | | 25.4% | |

| Energy | | | 2.9% | |

| Health Care | | | 2.7% | |

| Utilities & Communications | | | 2.4% | |

| Industrial Goods & Services | | | 1.7% | |

| Technology | | | 1.3% | |

| Consumer Staples | | | 1.2% | |

| Retailing | | | 1.1% | |

| Leisure | | | 0.9% | |

| Basic Materials | | | 0.7% | |

| Autos & Housing | | | 0.3% | |

| Transportation | | | 0.1% | |

| |

| Composition including fixed income credit quality (a)(i) | | | | |

| AAA | | | 0.1% | |

| AA | | | 0.4% | |

| A | | | 1.7% | |

| BBB | | | 10.9% | |

| BB | | | 9.3% | |

| B | | | 11.4% | |

| CCC | | | 3.0% | |

| CC | | | 0.1% | |

| D (o) | | | 0.0% | |

| U.S. Government | | | 8.7% | |

| Federal Agencies | | | 8.3% | |

| Not Rated | | | 0.1% | |

| Non-Fixed Income | | | 40.7% | |

| Cash & Other | | | 5.3% | |

2

Portfolio Composition – continued

| (a) | For all securities other than those specifically described below, ratings are assigned to underlying securities utilizing ratings from Moody’s, Fitch, and Standard & Poor’s rating agencies and applying the following hierarchy: If all three agencies provide a rating, the middle rating (after dropping the highest and lowest ratings) is assigned; if two of the three agencies rate a security, the lower of the two is assigned. Ratings are shown in the S&P and Fitch scale (e.g., AAA). Securities rated BBB or higher are considered investment grade. All ratings are subject to change. U.S. Government includes securities issued by the U.S. Department of the Treasury. Federal Agencies includes rated and unrated U.S. Agency fixed-income securities, U.S. Agency mortgage-backed securities, and collateralized mortgage obligations of U.S. Agency mortgage-backed securities. Not Rated includes fixed income securities, including fixed income futures contracts, which have not been rated by any rating agency. Non-Fixed Income includes equity securities (including convertible bonds and equity derivatives) and commodities. Cash & Other includes cash, other assets less liabilities, offsets to derivative positions, and short-term securities. The fund may not hold all of these instruments. The fund is not rated by these agencies. |

| (i) | For purposes of this presentation, the components include the market value of securities, and reflect the impact of the equivalent exposure of derivative positions, if any. These amounts may be negative from time to time. The bond component will include any accrued interest amounts. Equivalent exposure is a calculated amount that translates the derivative position into a reasonable approximation of the amount of the underlying asset that the portfolio would have to hold at a given point in time to have the same price sensitivity that results from the portfolio’s ownership of the derivative contract. When dealing with derivatives, equivalent exposure is a more representative measure of the potential impact of a position on portfolio performance than market value. Where the fund holds convertible bonds, these are treated as part of the equity portion of the portfolio. |

Percentages are based on net assets as of 8/31/12.

The portfolio is actively managed and current holdings may be different.

3

EXPENSE TABLE

Fund expenses borne by the shareholders during the period,

March 1, 2012 through August 31, 2012

As a shareholder of the fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on certain purchase or redemption payments, and (2) ongoing costs, including management fees; distribution and service (12b-1) fees; and other fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period March 1, 2012 through August 31, 2012.

Actual Expenses

The first line for each share class in the following table provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line for each share class in the following table provides information about hypothetical account values and hypothetical expenses based on the fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads). Therefore, the second line for each share class in the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

4

Expense Table – continued

| | | | | | | | | | | | | | | | | | |

Share

Class | | | | Annualized

Expense

Ratio | | | Beginning

Account Value

3/01/12 | | | Ending

Account Value

8/31/12 | | | Expenses

Paid During

Period (p)

3/01/12-8/31/12 | |

| A | | Actual | | | 1.06% | | | | $1,000.00 | | | | $1,050.76 | | | | $5.48 | |

| | Hypothetical (h) | | | 1.06% | | | | $1,000.00 | | | | $1,019.86 | | | | $5.40 | |

| C | | Actual | | | 1.81% | | | | $1,000.00 | | | | $1,047.82 | | | | $9.34 | |

| | Hypothetical (h) | | | 1.81% | | | | $1,000.00 | | | | $1,016.08 | | | | $9.20 | |

| I | | Actual | | | 0.81% | | | | $1,000.00 | | | | $1,052.05 | | | | $4.19 | |

| | Hypothetical (h) | | | 0.81% | | | | $1,000.00 | | | | $1,021.12 | | | | $4.13 | |

| R1 | | Actual | | | 1.81% | | | | $1,000.00 | | | | $1,046.90 | | | | $9.34 | |

| | Hypothetical (h) | | | 1.81% | | | | $1,000.00 | | | | $1,016.08 | | | | $9.20 | |

| R2 | | Actual | | | 1.31% | | | | $1,000.00 | | | | $1,050.41 | | | | $6.77 | |

| | Hypothetical (h) | | | 1.31% | | | | $1,000.00 | | | | $1,018.60 | | | | $6.67 | |

| R3 | | Actual | | | 1.06% | | | | $1,000.00 | | | | $1,050.75 | | | | $5.48 | |

| | Hypothetical (h) | | | 1.06% | | | | $1,000.00 | | | | $1,019.86 | | | | $5.40 | |

| R4 | | Actual | | | 0.81% | | | | $1,000.00 | | | | $1,052.97 | | | | $4.19 | |

| | Hypothetical (h) | | | 0.81% | | | | $1,000.00 | | | | $1,021.12 | | | | $4.13 | |

| R5 | | Actual | | | 0.78% | | | | $1,000.00 | | | | $1,029.29 | | | | $1.32 | (i) |

| | Hypothetical (h) | | | 0.78% | | | | $1,000.00 | | | | $1,021.27 | | | | $3.97 | |

| (h) | 5% class return per year before expenses. |

| (i) | For the period from the class inception, July 2, 2012, through the stated period end. |

| (p) | Expenses paid are equal to each class’ annualized expense ratio, as shown above, multiplied by the average account value over the period, multiplied by the number of days in the period, divided by the number of days in the year. Expenses paid do not include any applicable sales charges (loads). If these transaction costs had been included, your costs would have been higher. |

5

PORTFOLIO OF INVESTMENTS

8/31/12 (unaudited)

The Portfolio of Investments is a complete list of all securities owned by your fund. It is categorized by broad-based asset classes.

| | | | | | | | |

| Bonds - 53.3% | | | | | | | | |

| Issuer | | Shares/Par | | | Value ($) | |

| | | | | | | | |

| Aerospace - 0.7% | |

| Bombardier, Inc., 7.5%, 2018 (n) | | $ | 1,355,000 | | | $ | 1,507,438 | |

| Bombardier, Inc., 7.75%, 2020 (n) | | | 180,000 | | | | 202,500 | |

| CPI International, Inc., 8%, 2018 | | | 915,000 | | | | 860,100 | |

| Embraer Empresa Brasileria de Aeronaves, 5.15%, 2022 | | | 2,211,000 | | | | 2,316,023 | |

| Heckler & Koch GmbH, 9.5%, 2018 (z) | | EUR | 260,000 | | | | 259,987 | |

| Huntington Ingalls Industries, Inc., 7.125%, 2021 | | $ | 1,185,000 | | | | 1,282,763 | |

| Kratos Defense & Security Solutions, Inc., 10%, 2017 | | | 1,315,000 | | | | 1,400,475 | |

| | | | | | | | |

| | | | | | | $ | 7,829,286 | |

| Agency - Other - 0.3% | | | | | | | | |

| Financing Corp., 9.4%, 2018 | | $ | 965,000 | | | $ | 1,378,337 | |

| Financing Corp., 10.35%, 2018 | | | 715,000 | | | | 1,079,016 | |

| Financing Corp., STRIPS, 0%, 2017 | | | 860,000 | | | | 804,871 | |

| | | | | | | | |

| | | | | | | $ | 3,262,224 | |

| Agricultural Products - 0.0% | | | | | | | | |

| Corporacion Azucarera del Peru S.A., 6.375%, 2022 (n) | | $ | 137,000 | | | $ | 141,795 | |

| | |

| Apparel Manufacturers - 0.2% | | | | | | | | |

| Hanesbrands, Inc., 8%, 2016 | | | 30,000 | | | | 33,450 | |

| Hanesbrands, Inc., 6.375%, 2020 | | | 735,000 | | | | 797,475 | |

| Jones Group, Inc., 6.875%, 2019 | | | 345,000 | | | | 341,550 | |

| Levi Strauss & Co., 6.875%, 2022 | | | 105,000 | | | | 108,938 | |

| Phillips-Van Heusen Corp., 7.375%, 2020 | | | 860,000 | | | | 963,200 | |

| | | | | | | | |

| | | | | | | $ | 2,244,613 | |

| Asset-Backed & Securitized - 0.1% | | | | | | | | |

| Citigroup Commercial Mortgage Trust, FRN, 5.888%, 2049 | | $ | 198,555 | | | $ | 49,678 | |

Citigroup/Deutsche Bank Commercial Mortgage Trust,

5.322%, 2049 | | | 100,000 | | | | 112,737 | |

Commercial Mortgage Pass-Through Certificates, “A4”,

5.306%, 2046 | | | 199,556 | | | | 228,599 | |

| G-Force LLC, CDO, “A2”, 4.83%, 2036 (z) | | | 152,644 | | | | 149,591 | |

| JPMorgan Chase Commercial Mortgage Securities Corp., “A3”, FRN, 6.175%, 2051 | | | 105,201 | | | | 111,856 | |

| JPMorgan Chase Commercial Mortgage Securities Corp., “A4”, FRN, 6.003%, 2049 | | | 124,877 | | | | 142,067 | |

| | | | | | | | |

| | | | | | | $ | 794,528 | |

6

Portfolio of Investments (unaudited) – continued

| | | | | | | | |

| Issuer | | Shares/Par | | | Value ($) | |

| | | | | | | | |

| Bonds - continued | | | | | | | | |

| Automotive - 0.9% | | | | | | | | |

| Accuride Corp., 9.5%, 2018 | | $ | 1,140,000 | | | $ | 1,154,250 | |

| Allison Transmission, Inc., 7.125%, 2019 (n) | | | 900,000 | | | | 951,750 | |

| Automotores Gildemeister S.A., 8.25%, 2021 (n) | | | 1,225,000 | | | | 1,323,000 | |

| Chrysler Group LLC/CG Co-Issuer, Inc., 8.25%, 2021 | | | 205,000 | | | | 216,275 | |

| Ford Motor Co., 7.45%, 2031 | | | 215,000 | | | | 265,525 | |

| Ford Motor Credit Co. LLC, 12%, 2015 | | | 1,890,000 | | | | 2,353,050 | |

| Ford Motor Credit Co. LLC, 8.125%, 2020 | | | 280,000 | | | | 346,684 | |

| General Motors Financial Co., Inc., 4.75%, 2017 (z) | | | 365,000 | | | | 367,476 | |

| General Motors Financial Co., Inc., 6.75%, 2018 | | | 610,000 | | | | 676,333 | |

| Goodyear Tire & Rubber Co., 8.25%, 2020 | | | 165,000 | | | | 180,675 | |

| Goodyear Tire & Rubber Co., 7%, 2022 | | | 250,000 | | | | 260,000 | |

| Hyundai Capital America, 4%, 2017 (n) | | | 213,000 | | | | 227,867 | |

| Jaguar Land Rover PLC, 8.125%, 2021 (n) | | | 1,415,000 | | | | 1,503,438 | |

| Lear Corp., 8.125%, 2020 | | | 733,000 | | | | 824,625 | |

| | | | | | | | |

| | | | | | | $ | 10,650,948 | |

| Basic Industry - 0.0% | | | | | | | | |

| Trimas Corp., 9.75%, 2017 | | $ | 348,000 | | | $ | 388,020 | |

| | |

| Broadcasting - 1.2% | | | | | | | | |

| Allbritton Communications Co., 8%, 2018 | | $ | 320,000 | | | $ | 344,800 | |

| AMC Networks, Inc., 7.75%, 2021 | | | 274,000 | | | | 310,305 | |

| Clear Channel Communications, Inc., 9%, 2021 | | | 436,000 | | | | 373,870 | |

| Clear Channel Worldwide Holdings, Inc., 7.625%, 2020 | | | 965,000 | | | | 936,050 | |

| Clear Channel Worldwide Holdings, Inc., “A”, 7.625%, 2020 | | | 30,000 | | | | 28,650 | |

| Hughes Network Systems LLC, 7.625%, 2021 | | | 460,000 | | | | 508,300 | |

| Inmarsat Finance PLC, 7.375%, 2017 (n) | | | 460,000 | | | | 500,250 | |

| Intelsat Bermuda Ltd., 11.25%, 2017 | | | 975,000 | | | | 1,023,750 | |

| Intelsat Bermuda Ltd., 11.5%, 2017 (p) | | | 1,050,000 | | | | 1,102,500 | |

| Intelsat Jackson Holdings Ltd., 11.25%, 2016 | | | 684,000 | | | | 719,910 | |

| LBI Media, Inc., 8.5%, 2017 (z) | | | 125,000 | | | | 28,750 | |

| Liberty Media Corp., 8.5%, 2029 | | | 445,000 | | | | 471,700 | |

| Liberty Media Corp., 8.25%, 2030 | | | 390,000 | | | | 411,938 | |

| Local TV Finance LLC, 9.25%, 2015 (p)(z) | | | 413,826 | | | | 422,103 | |

| Newport Television LLC, 13%, 2017 (n)(p) | | | 787,432 | | | | 852,395 | |

| Nexstar Broadcasting Group, Inc., 8.875%, 2017 | | | 185,000 | | | | 198,875 | |

| Sinclair Broadcast Group, Inc., 9.25%, 2017 (n) | | | 395,000 | | | | 439,438 | |

| Sinclair Broadcast Group, Inc., 8.375%, 2018 | | | 30,000 | | | | 32,813 | |

| SIRIUS XM Radio, Inc., 13%, 2013 (n) | | | 150,000 | | | | 166,688 | |

| SIRIUS XM Radio, Inc., 8.75%, 2015 (n) | | | 405,000 | | | | 461,700 | |

| SIRIUS XM Radio, Inc., 7.625%, 2018 (n) | | | 1,250,000 | | | | 1,381,250 | |

| SIRIUS XM Radio, Inc., 5.25%, 2022 (z) | | | 110,000 | | | | 110,000 | |

| Townsquare Radio LLC, 9%, 2019 (z) | | | 265,000 | | | | 280,238 | |

7

Portfolio of Investments (unaudited) – continued

| | | | | | | | |

| Issuer | | Shares/Par | | | Value ($) | |

| | | | | | | | |

| Bonds - continued | | | | | | | | |

| Broadcasting - continued | | | | | | | | |

| Univision Communications, Inc., 6.875%, 2019 (n) | | $ | 1,055,000 | | | $ | 1,089,288 | |

| Univision Communications, Inc., 7.875%, 2020 (n) | | | 190,000 | | | | 203,775 | |

| Univision Communications, Inc., 8.5%, 2021 (n) | | | 840,000 | | | | 850,500 | |

| | | | | | | | |

| | | | | | | $ | 13,249,836 | |

| Brokerage & Asset Managers - 0.2% | | | | | | | | |

| E*TRADE Financial Corp., 7.875%, 2015 | | $ | 135,000 | | | $ | 137,363 | |

| E*TRADE Financial Corp., 12.5%, 2017 | | | 1,700,000 | | | | 1,940,125 | |

| | | | | | | | |

| | | | | | | $ | 2,077,488 | |

| Building - 0.9% | | | | | | | | |

| Building Materials Holding Corp., 6.875%, 2018 (n) | | $ | 420,000 | | | $ | 450,450 | |

| Building Materials Holding Corp., 7%, 2020 (n) | | | 460,000 | | | | 497,950 | |

| Building Materials Holding Corp., 6.75%, 2021 (n) | | | 645,000 | | | | 704,663 | |

| CEMEX Finance LLC, 9.5%, 2016 (n) | | | 435,000 | | | | 443,700 | |

| CEMEX S.A.B. de C.V., 9%, 2018 (n) | | | 1,064,000 | | | | 1,056,020 | |

| CEMEX S.A.B. de C.V., FRN, 5.461%, 2015 (n) | | | 1,155,000 | | | | 1,088,588 | |

| HD Supply, Inc., 8.125%, 2019 (n) | | | 315,000 | | | | 341,775 | |

| Masonite International Corp., 8.25%, 2021 (n) | | | 700,000 | | | | 733,250 | |

| Nortek, Inc., 8.5%, 2021 | | | 1,045,000 | | | | 1,110,313 | |

| Odebrecht Finance Ltd., 5.125%, 2022 (n) | | | 223,000 | | | | 230,805 | |

| Odebrecht Finance Ltd., 6%, 2023 (n) | | | 1,958,000 | | | | 2,144,010 | |

| Odebrecht Finance Ltd., 7.125%, 2042 (n) | | | 230,000 | | | | 251,850 | |

Roofing Supply Group LLC/Roofing Supply Finance, Inc.,

10%, 2020 (n) | | | 315,000 | | | | 337,050 | |

| USG Corp., 7.875%, 2020 (n) | | | 310,000 | | | | 329,763 | |

| | | | | | | | |

| | | | | | | $ | 9,720,187 | |

| Business Services - 0.4% | | | | | | | | |

| Ceridian Corp., 12.25%, 2015 (p) | | $ | 360,000 | | | $ | 356,400 | |

| Ceridian Corp., 8.875%, 2019 (z) | | | 160,000 | | | | 171,600 | |

| Fidelity National Information Services, Inc., 7.625%, 2017 | | | 265,000 | | | | 291,500 | |

| Fidelity National Information Services, Inc., 5%, 2022 | | | 245,000 | | | | 254,800 | |

| iGate Corp., 9%, 2016 | | | 845,000 | | | | 914,713 | |

| Iron Mountain, Inc., 8.375%, 2021 | | | 1,050,000 | | | | 1,160,250 | |

| Legend Acquisition Sub, Inc., 10.75%, 2020 (z) | | | 500,000 | | | | 493,750 | |

| SunGard Data Systems, Inc., 10.25%, 2015 | | | 85,000 | | | | 87,019 | |

| SunGard Data Systems, Inc., 7.375%, 2018 | | | 190,000 | | | | 201,875 | |

| Tencent Holdings Ltd., 3.375%, 2018 (z) | | | 547,000 | | | | 548,336 | |

| | | | | | | | |

| | | | | | | $ | 4,480,243 | |

| Cable TV - 1.0% | | | | | | | | |

| Bresnan Broadband Holdings LLC, 8%, 2018 (n) | | $ | 55,000 | | | $ | 58,300 | |

| CCH II LLC, 13.5%, 2016 | | | 775,000 | | | | 848,625 | |

| CCO Holdings LLC, 7.875%, 2018 | | | 1,355,000 | | | | 1,470,175 | |

8

Portfolio of Investments (unaudited) – continued

| | | | | | | | |

| Issuer | | Shares/Par | | | Value ($) | |

| | | | | | | | |

| Bonds - continued | | | | | | | | |

| Cable TV - continued | | | | | | | | |

| CCO Holdings LLC, 8.125%, 2020 | | $ | 915,000 | | | $ | 1,029,375 | |

| CCO Holdings LLC, 7.375%, 2020 | | | 280,000 | | | | 310,800 | |

| Cequel Communications Holdings, 8.625%, 2017 (n) | | | 400,000 | | | | 429,500 | |

| CSC Holdings LLC, 8.5%, 2014 | | | 625,000 | | | | 686,719 | |

| DISH DBS Corp., 6.75%, 2021 | | | 525,000 | | | | 559,125 | |

| EchoStar Corp., 7.125%, 2016 | | | 930,000 | | | | 1,023,000 | |

| Myriad International Holdings B.V., 6.375%, 2017 (n) | | | 793,000 | | | | 897,081 | |

| Telenet Finance Luxembourg, 6.375%, 2020 (n) | | EUR | 100,000 | | | | 130,811 | |

| UPC Holding B.V., 9.875%, 2018 (n) | | $ | 830,000 | | | | 931,675 | |

| UPCB Finance III Ltd., 6.625%, 2020 (n) | | | 470,000 | | | | 497,025 | |

| Videotron Ltee, 5%, 2022 | | | 310,000 | | | | 328,600 | |

| Virgin Media Finance PLC, 9.5%, 2016 | | | 166,000 | | | | 185,505 | |

| Virgin Media Finance PLC, 8.375%, 2019 | | | 100,000 | | | | 113,000 | |

| Virgin Media Finance PLC, 5.25%, 2022 | | | 600,000 | | | | 628,500 | |

| Ziggo Bond Co. B.V., 8%, 2018 (n) | | EUR | 440,000 | | | | 607,392 | |

| | | | | | | | |

| | | | | | | $ | 10,735,208 | |

| Chemicals - 0.6% | | | | | | | | |

| Celanese U.S. Holdings LLC, 6.625%, 2018 | | $ | 820,000 | | | $ | 904,050 | |

Hexion U.S. Finance Corp./Hexion Nova Scotia Finance,

8.875%, 2018 | | | 710,000 | | | | 715,325 | |

Hexion U.S. Finance Corp./Hexion Nova Scotia Finance,

9%, 2020 | | | 55,000 | | | | 47,025 | |

| Huntsman International LLC, 8.625%, 2021 | | | 910,000 | | | | 1,041,950 | |

| INEOS Finance PLC, 8.375%, 2019 (n) | | | 555,000 | | | | 584,138 | |

| INEOS Group Holdings PLC, 8.5%, 2016 (n) | | | 515,000 | | | | 485,388 | |

| LyondellBasell Industries N.V., 5%, 2019 | | | 290,000 | | | | 307,400 | |

| LyondellBasell Industries N.V., 6%, 2021 | | | 575,000 | | | | 655,500 | |

| Momentive Performance Materials, Inc., 12.5%, 2014 | | | 684,000 | | | | 705,375 | |

| Momentive Performance Materials, Inc., 11.5%, 2016 | | | 514,000 | | | | 313,540 | |

| Polypore International, Inc., 7.5%, 2017 | | | 530,000 | | | | 569,750 | |

| Sociedad Quimica y Minera de Chile S.A., 5.5%, 2020 (n) | | | 859,000 | | | | 975,405 | |

| | | | | | | | |

| | | | | | | $ | 7,304,846 | |

| Computer Software - 0.3% | | | | | | | | |

| Lawson Software, Inc., 11.5%, 2018 (n) | | $ | 820,000 | | | $ | 934,800 | |

| Lawson Software, Inc., 9.375%, 2019 (n) | | | 220,000 | | | | 238,150 | |

| Nuance Communications, Inc., 5.375%, 2020 (z) | | | 270,000 | | | | 276,075 | |

| Syniverse Holdings, Inc., 9.125%, 2019 | | | 1,030,000 | | | | 1,112,400 | |

| TransUnion Holding Co., Inc., 9.625%, 2018 (n)(p) | | | 250,000 | | | | 271,250 | |

| TransUnion LLC/TransUnion Financing Corp., 11.375%, 2018 | | | 515,000 | | | | 607,700 | |

| | | | | | | | |

| | | | | | | $ | 3,440,375 | |

9

Portfolio of Investments (unaudited) – continued

| | | | | | | | |

| Issuer | | Shares/Par | | | Value ($) | |

| | | | | | | | |

| Bonds - continued | | | | | | | | |

| Computer Software - Systems - 0.3% | | | | | | | | |

| Audatex North America, Inc., 6.75%, 2018 (n) | | $ | 350,000 | | | $ | 375,375 | |

| CDW LLC/CDW Finance Corp., 12.535%, 2017 | | | 530,000 | | | | 568,425 | |

| CDW LLC/CDW Finance Corp., 8.5%, 2019 | | | 1,270,000 | | | | 1,390,650 | |

| DuPont Fabros Technology, Inc., REIT, 8.5%, 2017 | | | 685,000 | | | | 756,925 | |

| | | | | | | | |

| | | | | | | $ | 3,091,375 | |

| Conglomerates - 0.2% | | | | | | | | |

| Amsted Industries, Inc., 8.125%, 2018 (n) | | $ | 1,090,000 | | | $ | 1,177,200 | |

| Dynacast International LLC, 9.25%, 2019 | | | 375,000 | | | | 393,750 | |

| Griffon Corp., 7.125%, 2018 | | | 1,055,000 | | | | 1,106,431 | |

| | | | | | | | |

| | | | | | | $ | 2,677,381 | |

| Construction - 0.0% | | | | | | | | |

| Empresas ICA, S.A.B. de C.V., 8.375%, 2017 (n) | | $ | 188,000 | | | $ | 192,230 | |

| | |

| Consumer Products - 0.2% | | | | | | | | |

| Easton-Bell Sports, Inc., 9.75%, 2016 | | $ | 245,000 | | | $ | 267,356 | |

| Elizabeth Arden, Inc., 7.375%, 2021 | | | 690,000 | | | | 765,900 | |

| FGI Operating Co./FGI Finance, Inc., 7.875%, 2020 (z) | | | 50,000 | | | | 52,750 | |

| Jarden Corp., 7.5%, 2020 | | | 870,000 | | | | 961,350 | |

| Libbey Glass, Inc., 6.875%, 2020 (n) | | | 215,000 | | | | 229,244 | |

| Prestige Brands, Inc., 8.125%, 2020 | | | 50,000 | | | | 55,375 | |

| | | | | | | | |

| | | | | | | $ | 2,331,975 | |

| Consumer Services - 0.1% | | | | | | | | |

| Service Corp. International, 6.75%, 2015 | | $ | 60,000 | | | $ | 65,550 | |

| Service Corp. International, 7%, 2017 | | | 1,125,000 | | | | 1,282,500 | |

| Service Corp. International, 7%, 2019 | | | 325,000 | | | | 355,875 | |

| | | | | | | | |

| | | | | | | $ | 1,703,925 | |

| Containers - 0.4% | | | | | | | | |

| Ardagh Packaging Finance PLC, 7.375%, 2017 (z) | | $ | 530,000 | | | $ | 567,763 | |

| Ardagh Packaging Finance PLC, 9.125%, 2020 (n) | | | 950,000 | | | | 988,000 | |

| Ball Corp., 5%, 2022 | | | 307,000 | | | | 322,350 | |

| Consolidated Container Co. LLC/Consolidated Container Finance, Inc., 10.125%, 2020 (z) | | | 265,000 | | | | 276,925 | |

| Greif, Inc., 6.75%, 2017 | | | 220,000 | | | | 239,250 | |

| Greif, Inc., 7.75%, 2019 | | | 220,000 | | | | 251,900 | |

| Reynolds Group, 7.75%, 2016 | | | 190,000 | | | | 198,550 | |

| Reynolds Group, 7.125%, 2019 | | | 845,000 | | | | 910,488 | |

| Reynolds Group, 9.875%, 2019 | | | 695,000 | | | | 734,963 | |

| Reynolds Group, 8.25%, 2021 | | | 320,000 | | | | 314,400 | |

| | | | | | | | |

| | | | | | | $ | 4,804,589 | |

10

Portfolio of Investments (unaudited) – continued

| | | | | | | | |

| Issuer | | Shares/Par | | | Value ($) | |

| | | | | | | | |

| Bonds - continued | | | | | | | | |

| Defense Electronics - 0.1% | | | | | | | | |

| Ducommun, Inc., 9.75%, 2018 | | $ | 705,000 | | | $ | 737,606 | |

| ManTech International Corp., 7.25%, 2018 | | | 380,000 | | | | 399,000 | |

| MOOG, Inc., 7.25%, 2018 | | | 500,000 | | | | 531,250 | |

| | | | | | | | |

| | | | | | | $ | 1,667,856 | |

| Electrical Equipment - 0.0% | | | | | | | | |

| Avaya, Inc., 9.75%, 2015 | | $ | 330,000 | | | $ | 286,275 | |

| Avaya, Inc., 7%, 2019 (n) | | | 170,000 | | | | 155,550 | |

| | | | | | | | |

| | | | | | | $ | 441,825 | |

| Electronics - 0.2% | | | | | | | | |

| Freescale Semiconductor, Inc., 9.25%, 2018 (n) | | $ | 1,485,000 | | | $ | 1,607,513 | |

| Nokia Corp., 5.375%, 2019 | | | 220,000 | | | | 186,135 | |

| Sensata Technologies B.V., 6.5%, 2019 (n) | | | 750,000 | | | | 791,250 | |

| | | | | | | | |

| | | | | | | $ | 2,584,898 | |

| Emerging Market Quasi-Sovereign - 6.1% | | | | | | | | |

| Abu Dhabi National Energy Co. PJSC (TAQA), 5.875%, 2021 (n) | | $ | 955,000 | | | $ | 1,098,250 | |

| Banco del Estado de Chile, 3.875%, 2022 (n) | | | 190,000 | | | | 204,654 | |

| Banco do Brasil S.A., 3.875%, 2017 | | | 1,472,000 | | | | 1,527,200 | |

| Banco do Brasil S.A., 5.875%, 2023 (n) | | | 528,000 | | | | 558,360 | |

| Banco do Estado Rio Grande do Sul S.A., 7.375%, 2022 (n) | | | 1,685,000 | | | | 1,836,650 | |

| Banco do Nordeste do Brasil (BNB), 3.625%, 2015 (n) | | | 1,236,000 | | | | 1,251,450 | |

| Banco do Nordeste do Brasil (BNB), 4.375%, 2019 (n) | | | 1,032,000 | | | | 1,038,450 | |

Banco Nacional de Desenvolvimento Economico e Social,

6.5%, 2019 | | | 509,000 | | | | 620,980 | |

| Biz Finance PLC, 8.375%, 2015 | | | 1,153,000 | | | | 1,080,938 | |

| BNDES Participacoes S.A., 6.5%, 2019 (n) | | | 248,000 | | | | 302,560 | |

| Centrais Eletricas Brasileiras S.A., 5.75%, 2021 (n) | | | 1,531,000 | | | | 1,718,548 | |

| CEZ A.S., 4.25%, 2022 (n) | | | 1,335,000 | | | | 1,418,678 | |

| CNOOC Finance (2012) Ltd., 3.875%, 2022 (n) | | | 2,245,000 | | | | 2,410,086 | |

| CNOOC Finance (2012) Ltd., 5%, 2042 (n) | | | 202,000 | | | | 234,673 | |

| CNPC (HK) Overseas Capital Ltd., 4.5%, 2021 (n) | | | 540,000 | | | | 600,731 | |

| CNPC (HK) Overseas Capital Ltd., 5.95%, 2041 (n) | | | 205,000 | | | | 266,611 | |

| Comision Federal de Electricidad, 5.75%, 2042 (n) | | | 1,575,000 | | | | 1,767,938 | |

| Corporacion Financiera de Desarrollo S.A., 4.75%, 2022 (n) | | | 2,106,000 | | | | 2,316,600 | |

| Corporacion Nacional del Cobre de Chile, 3.75%, 2020 (n) | | | 349,000 | | | | 372,715 | |

| Corporacion Nacional del Cobre de Chile, 4.25%, 2042 (n) | | | 1,234,000 | | | | 1,245,022 | |

| Development Bank of Kazakhstan, 5.5%, 2015 (n) | | | 2,149,000 | | | | 2,320,920 | |

| Dolphin Energy Ltd., 5.5%, 2021 (n) | | | 2,062,000 | | | | 2,343,463 | |

| Ecopetrol S.A., 7.625%, 2019 | | | 1,852,000 | | | | 2,389,080 | |

| Empresa Nacional del Petroleo, 4.75%, 2021 (n) | | | 1,290,000 | | | | 1,392,907 | |

| Gaz Capital S.A., 8.125%, 2014 (n) | | | 784,000 | | | | 864,591 | |

| Gaz Capital S.A., 9.25%, 2019 | | | 1,434,000 | | | | 1,862,408 | |

11

Portfolio of Investments (unaudited) – continued

| | | | | | | | |

| Issuer | | Shares/Par | | | Value ($) | |

| | | | | | | | |

| Bonds - continued | | | | | | | | |

| Emerging Market Quasi-Sovereign - continued | | | | | | | | |

| Gaz Capital S.A., 5.999%, 2021 (n) | | $ | 2,212,000 | | | $ | 2,507,988 | |

| Gaz Capital S.A., 4.95%, 2022 (n) | | | 627,000 | | | | 657,598 | |

| Georgian Oil & Gas Corp., 6.875%, 2017 (n) | | | 272,000 | | | | 274,720 | |

| JSC Georgian Railway, 7.75%, 2022 (n) | | | 1,203,000 | | | | 1,323,464 | |

| Kazakhstan Temir Zholy Co., 6.95%, 2042 (n) | | | 2,711,000 | | | | 3,192,203 | |

| Majapahit Holding B.V., 7.75%, 2020 | | | 1,351,000 | | | | 1,658,353 | |

| Naftogaz Ukraine, 9.5%, 2014 | | | 753,000 | | | | 748,294 | |

| OJSC Russian Agricultural Bank, FRN, 5.298%, 2017 (n) | | | 494,000 | | | | 518,700 | |

| OJSC Russian Agricultural Bank, FRN, 6%, 2021 (n) | | | 991,000 | | | | 1,005,865 | |

| Pemex Project Funding Master Trust, 6.625%, 2035 | | | 1,446,000 | | | | 1,796,655 | |

| Pertamina PT, 4.875%, 2022 (n) | | | 2,381,000 | | | | 2,541,718 | |

| Pertamina PT, 6%, 2042 (n) | | | 486,000 | | | | 524,880 | |

| Petrobras International Finance Co., 7.875%, 2019 | | | 566,000 | | | | 701,796 | |

| Petrobras International Finance Co., 5.375%, 2021 | | | 2,500,000 | | | | 2,782,075 | |

| Petroleos Mexicanos, 5.5%, 2021 | | | 2,395,000 | | | | 2,778,200 | |

| Petroleos Mexicanos, 5.5%, 2044 (n) | | | 467,000 | | | | 509,030 | |

| Petroleum Co. of Trinidad & Tobago Ltd., 6%, 2022 | | | 932,500 | | | | 979,125 | |

| PT Perusahaan Listrik Negara, 5.5%, 2021 (n) | | | 642,000 | | | | 699,780 | |

| Ras Laffan Liquefied Natural Gas Co. Ltd., 5.832%, 2016 (n) | | | 358,394 | | | | 390,650 | |

| Sberbank of Russia, 6.125%, 2022 (n) | | | 3,590,000 | | | | 3,926,742 | |

| Sinopec Group Overseas Development (2012) Ltd., 3.9%, 2022 (n) | | | 1,445,000 | | | | 1,552,163 | |

| Transnet SOC Ltd., 4.5%, 2016 (n) | | | 202,000 | | | | 216,316 | |

| Turkiye Halk Bankasi A.S., 4.875%, 2017 (n) | | | 484,000 | | | | 496,100 | |

| Turkiye Ihracat Kredi Bankasi A.S., 5.375%, 2016 (n) | | | 200,000 | | | | 212,500 | |

| Turkiye Ihracat Kredi Bankasi A.S., 5.875%, 2019 (n) | | | 2,725,000 | | | | 2,980,605 | |

| Vnesheconombank, 6.025%, 2022 (n) | | | 294,000 | | | | 323,782 | |

| | | | | | | | |

| | | | | | | $ | 68,343,765 | |

| Emerging Market Sovereign - 5.4% | | | | | | | | |

| Dominican Republic, 7.5%, 2021 (n) | | $ | 1,270,000 | | | $ | 1,444,625 | |

| Dominican Republic, 8.625%, 2027 | | | 833,000 | | | | 953,785 | |

| Government of Ukraine, 9.25%, 2017 (n) | | | 375,000 | | | | 379,688 | |

| Republic of Argentina, 7%, 2015 | | | 2,952,000 | | | | 2,463,280 | |

| Republic of Argentina, 8.75%, 2017 | | | 2,327,000 | | | | 2,152,475 | |

| Republic of Argentina, 8.28%, 2033 | | | 1,955,595 | | | | 1,300,471 | |

| Republic of Colombia, 6.125%, 2041 | | | 562,000 | | | | 765,725 | |

| Republic of Guatemala, 5.75%, 2022 (n) | | | 1,764,000 | | | | 1,977,444 | |

| Republic of Indonesia, 6.875%, 2018 | | | 1,100,000 | | | | 1,328,250 | |

| Republic of Indonesia, 4.875%, 2021 (n) | | | 2,623,000 | | | | 2,927,924 | |

| Republic of Latvia, 5.25%, 2017 (n) | | | 1,133,000 | | | | 1,222,280 | |

| Republic of Lithuania, 6.625%, 2022 (n) | | | 1,794,000 | | | | 2,130,375 | |

| Republic of Panama, 8.875%, 2027 | | | 427,000 | | | | 696,437 | |

| Republic of Peru, 7.35%, 2025 | | | 787,000 | | | | 1,149,020 | |

| Republic of Philippines, 5.5%, 2026 | | | 1,293,000 | | | | 1,590,390 | |

12

Portfolio of Investments (unaudited) – continued

| | | | | | | | |

| Issuer | | Shares/Par | | | Value ($) | |

| | | | | | | | |

| Bonds - continued | | | | | | | | |

| Emerging Market Sovereign - continued | | | | | | | | |

| Republic of Philippines, 7.75%, 2031 | | $ | 389,000 | | | $ | 584,473 | |

| Republic of Philippines, 6.375%, 2034 | | | 1,396,000 | | | | 1,893,325 | |

| Republic of Romania, 6.75%, 2022 (n) | | | 1,362,000 | | | | 1,477,770 | |

| Republic of Slovakia, 4.375%, 2022 (n) | | | 4,190,000 | | | | 4,343,186 | |

| Republic of South Africa, 5.5%, 2020 | | | 1,035,000 | | | | 1,226,475 | |

| Republic of South Africa, 4.665%, 2024 | | | 1,655,000 | | | | 1,859,806 | |

| Republic of South Africa, 6.25%, 2041 | | | 655,000 | | | | 880,975 | |

| Republic of Sri Lanka, 5.875%, 2022 (n) | | | 214,000 | | | | 219,885 | |

| Republic of Turkey, 5.625%, 2021 | | | 1,594,000 | | | | 1,849,040 | |

| Republic of Turkey, 6.25%, 2022 | | | 2,021,000 | | | | 2,445,410 | |

| Republic of Turkey, 6%, 2041 | | | 350,000 | | | | 412,125 | |

| Republic of Uruguay, 8%, 2022 | | | 980,500 | | | | 1,414,371 | |

| Republic of Uruguay, 7.625%, 2036 | | | 974,000 | | | | 1,502,395 | |

| Republic of Venezuela, 7.75%, 2019 | | | 449,000 | | | | 379,405 | |

| Republic of Venezuela, 12.75%, 2022 | | | 2,753,000 | | | | 2,876,885 | |

| Republic of Venezuela, 9.25%, 2027 | | | 1,659,000 | | | | 1,447,478 | |

| Republic of Venezuela, 7%, 2038 | | | 2,450,000 | | | | 1,708,875 | |

| Republic of Vietnam, 6.875%, 2016 | | | 994,000 | | | | 1,058,610 | |

| Russian Federation, 4.5%, 2022 (n) | | | 1,800,000 | | | | 1,995,750 | |

| Russian Federation, 7.5%, 2030 | | | 1,312,955 | | | | 1,637,911 | |

| Russian Federation, 5.625%, 2042 (n) | | | 1,200,000 | | | | 1,417,500 | |

| United Mexican States, 5.125%, 2020 | | | 1,672,000 | | | | 1,998,040 | |

| United Mexican States, 3.625%, 2022 | | | 3,416,000 | | | | 3,713,192 | |

| | | | | | | | |

| | | | | | | $ | 60,825,051 | |

| Energy - Independent - 1.8% | | | | | | | | |

| ATP Oil & Gas Corp., 11.875%, 2015 (a) | | $ | 185,000 | | | $ | 48,100 | |

| BreitBurn Energy Partners LP, 8.625%, 2020 | | | 230,000 | | | | 247,250 | |

| BreitBurn Energy Partners LP, 7.875%, 2022 (n) | | | 280,000 | | | | 285,600 | |

| Carrizo Oil & Gas, Inc., 8.625%, 2018 | | | 305,000 | | | | 325,588 | |

| Chaparral Energy, Inc., 7.625%, 2022 (n) | | | 440,000 | | | | 465,300 | |

| Chesapeake Energy Corp., 6.875%, 2020 | | | 575,000 | | | | 596,563 | |

| Concho Resources, Inc., 8.625%, 2017 | | | 670,000 | | | | 738,675 | |

| Concho Resources, Inc., 6.5%, 2022 | | | 430,000 | | | | 464,400 | |

| Continental Resources, Inc., 8.25%, 2019 | | | 1,005,000 | | | | 1,135,650 | |

| Denbury Resources, Inc., 8.25%, 2020 | | | 1,330,000 | | | | 1,509,550 | |

| Energy XXI Gulf Coast, Inc., 9.25%, 2017 | | | 1,235,000 | | | | 1,377,025 | |

Everest Acquisition LLC/Everest Acquisition Finance, Inc.,

9.375%, 2020 (n) | | | 1,495,000 | | | | 1,625,813 | |

| EXCO Resources, Inc., 7.5%, 2018 | | | 725,000 | | | | 659,750 | |

| Harvest Operations Corp., 6.875%, 2017 | | | 920,000 | | | | 984,400 | |

| Hilcorp Energy I/Hilcorp Finance Co., 8%, 2020 (n) | | | 175,000 | | | | 193,813 | |

| Laredo Petroleum, Inc., 9.5%, 2019 | | | 325,000 | | | | 368,875 | |

13

Portfolio of Investments (unaudited) – continued

| | | | | | | | |

| Issuer | | Shares/Par | | | Value ($) | |

| | | | | | | | |

| Bonds - continued | | | | | | | | |

| Energy - Independent - continued | | | | | | | | |

| LINN Energy LLC, 6.5%, 2019 (n) | | $ | 145,000 | | | $ | 144,275 | |

| LINN Energy LLC, 8.625%, 2020 | | | 465,000 | | | | 502,200 | |

| LINN Energy LLC, 7.75%, 2021 | | | 385,000 | | | | 401,363 | |

| Newfield Exploration Co., 6.875%, 2020 | | | 935,000 | | | | 1,021,488 | |

| OGX Austria GmbH, 8.375%, 2022 (n) | | | 227,000 | | | | 192,950 | |

| OGX Petroleo e Gas Participacoes S.A., 8.5%, 2018 (n) | | | 913,000 | | | | 810,288 | |

| Plains Exploration & Production Co., 8.625%, 2019 | | | 1,100,000 | | | | 1,245,750 | |

| QEP Resources, Inc., 6.875%, 2021 | | | 1,090,000 | | | | 1,231,700 | |

| Range Resources Corp., 8%, 2019 | | | 420,000 | | | | 464,100 | |

| Range Resources Corp., 5%, 2022 | | | 225,000 | | | | 234,281 | |

| Samson Investment Co., 9.75%, 2020 (z) | | | 225,000 | | | | 231,750 | |

| SandRidge Energy, Inc., 8%, 2018 (n) | | | 1,320,000 | | | | 1,376,100 | |

| SM Energy Co., 6.5%, 2021 | | | 830,000 | | | | 867,350 | |

| Whiting Petroleum Corp., 6.5%, 2018 | | | 440,000 | | | | 473,550 | |

| | | | | | | | |

| | | | | | | $ | 20,223,497 | |

| Energy - Integrated - 0.3% | | | | | | | | |

| Pacific Rubiales Energy Corp., 7.25%, 2021 (n) | | $ | 2,849,000 | | | $ | 3,304,840 | |

| | |

| Engineering - Construction - 0.1% | | | | | | | | |

| B-Corp. Merger Sub, Inc., 8.25%, 2019 (n) | | $ | 730,000 | | | $ | 726,350 | |

| | |

| Entertainment - 0.2% | | | | | | | | |

| AMC Entertainment, Inc., 8.75%, 2019 | | $ | 405,000 | | | $ | 443,475 | |

| AMC Entertainment, Inc., 9.75%, 2020 | | | 870,000 | | | | 961,350 | |

| Cedar Fair LP, 9.125%, 2018 | | | 370,000 | | | | 419,950 | |

| Cinemark USA, Inc., 8.625%, 2019 | | | 555,000 | | | | 621,600 | |

| | | | | | | | |

| | | | | | | $ | 2,446,375 | |

| Financial Institutions - 1.3% | | | | | | | | |

| Ally Financial, Inc., 5.5%, 2017 | | $ | 1,980,000 | | | $ | 2,059,414 | |

| CIT Group, Inc., 5.25%, 2014 (n) | | | 1,340,000 | | | | 1,391,925 | |

| CIT Group, Inc., 7%, 2017 (n) | | | 502,923 | | | | 503,426 | |

| CIT Group, Inc., 5.25%, 2018 | | | 665,000 | | | | 693,263 | |

| CIT Group, Inc., 6.625%, 2018 (n) | | | 1,124,000 | | | | 1,220,945 | |

| CIT Group, Inc., 5.5%, 2019 (n) | | | 625,000 | | | | 651,563 | |

| Credit Acceptance Corp., 9.125%, 2017 | | | 595,000 | | | | 654,500 | |

| GMAC, Inc., 8%, 2031 | | | 90,000 | | | | 106,425 | |

| Icahn Enterprises LP, 8%, 2018 (z) | | | 108,000 | | | | 115,020 | |

| Icahn Enterprises LP, 8%, 2018 | | | 783,000 | | | | 833,895 | |

| International Lease Finance Corp., 4.875%, 2015 | | | 255,000 | | | | 261,694 | |

| International Lease Finance Corp., 8.625%, 2015 | | | 270,000 | | | | 302,738 | |

| International Lease Finance Corp., 7.125%, 2018 (n) | | | 637,000 | | | | 732,550 | |

| Nationstar Mortgage LLC/Capital Corp., 10.875%, 2015 | | | 910,000 | | | | 994,175 | |

14

Portfolio of Investments (unaudited) – continued

| | | | | | | | |

| Issuer | | Shares/Par | | | Value ($) | |

| | | | | | | | |

| Bonds - continued | | | | | | | | |

| Financial Institutions - continued | | | | | | | | |

| Nationstar Mortgage LLC/Capital Corp., 9.625%, 2019 (n) | | $ | 400,000 | | | $ | 440,000 | |

| PHH Corp., 9.25%, 2016 | | | 900,000 | | | | 992,250 | |

| PHH Corp., 7.375%, 2019 | | | 110,000 | | | | 113,575 | |

| SLM Corp., 8.45%, 2018 | | | 395,000 | | | | 456,225 | |

| SLM Corp., 8%, 2020 | | | 1,750,000 | | | | 1,981,875 | |

| SLM Corp., 7.25%, 2022 | | | 120,000 | | | | 129,600 | |

| | | | | | | | |

| | | | | | | $ | 14,635,058 | |

| Food & Beverages - 0.8% | | | | | | | | |

| ARAMARK Corp., 8.5%, 2015 | | $ | 160,000 | | | $ | 164,002 | |

| B&G Foods, Inc., 7.625%, 2018 | | | 1,005,000 | | | | 1,089,797 | |

| BRF - Brasil Foods S.A., 5.875%, 2022 (n) | | | 1,175,000 | | | | 1,236,688 | |

| Corporacion Jose R Lindey S.A., 6.75%, 2021 (n) | | | 630,000 | | | | 702,450 | |

| Grupo Bimbo S.A.B. de C.V., 4.5%, 2022 (n) | | | 1,185,000 | | | | 1,279,856 | |

| JBS USA LLC/JBS USA Finance, 8.25%, 2020 (n) | | | 320,000 | | | | 305,600 | |

| Pinnacle Foods Finance LLC, 9.25%, 2015 | | | 231,000 | | | | 237,064 | |

| Pinnacle Foods Finance LLC, 8.25%, 2017 | | | 585,000 | | | | 620,100 | |

| Sigma Alimentos S.A., 5.625%, 2018 (n) | | | 2,360,000 | | | | 2,601,900 | |

| TreeHouse Foods, Inc., 7.75%, 2018 | | | 485,000 | | | | 528,650 | |

| | | | | | | | |

| | | | | | | $ | 8,766,107 | |

| Forest & Paper Products - 0.3% | | | | | | | | |

| Boise, Inc., 8%, 2020 | | $ | 735,000 | | | $ | 812,175 | |

| Georgia-Pacific Corp., 8%, 2024 | | | 88,000 | | | | 120,242 | |

| Graphic Packaging Holding Co., 7.875%, 2018 | | | 630,000 | | | | 702,450 | |

| Inversiones CMPC S.A., 4.75%, 2018 (n) | | | 525,000 | | | | 561,999 | |

| Sappi Papier Holding GmbH, 7.75%, 2017 (n) | | | 225,000 | | | | 235,125 | |

| Smurfit Kappa Group PLC, 7.75%, 2019 (n) | | EUR | 225,000 | | | | 309,890 | |

| Tembec Industries, Inc., 11.25%, 2018 | | $ | 250,000 | | | | 260,000 | |

| Tembec Industries, Inc., 11.25%, 2018 (n) | | | 90,000 | | | | 93,600 | |

| | | | | | | | |

| | | | | | | $ | 3,095,481 | |

| Gaming & Lodging - 0.9% | | | | | | | | |

| Caesars Operating Escrow LLC, 8.5%, 2020 (n) | | $ | 235,000 | | | $ | 231,769 | |

| Choice Hotels International, Inc., 5.75%, 2022 | | | 105,000 | | | | 112,613 | |

| Fontainebleau Las Vegas Holdings LLC, 10.25%, 2015 (a)(d)(n) | | | 505,000 | | | | 316 | |

| GWR Operating Partnership LLP, 10.875%, 2017 | | | 145,000 | | | | 163,488 | |

| Harrah’s Operating Co., Inc., 11.25%, 2017 | | | 1,775,000 | | | | 1,912,563 | |

| Host Hotels & Resorts, Inc., 5.25%, 2022 (n) | | | 345,000 | | | | 368,719 | |

| Isle of Capri Casinos, Inc., 8.875%, 2020 (z) | | | 585,000 | | | | 601,088 | |

| MGM Mirage, 10.375%, 2014 | | | 35,000 | | | | 39,725 | |

| MGM Mirage, 6.625%, 2015 | | | 585,000 | | | | 609,863 | |

| MGM Mirage, 7.5%, 2016 | | | 90,000 | | | | 93,938 | |

| MGM Resorts International, 11.375%, 2018 | | | 650,000 | | | | 749,125 | |

15

Portfolio of Investments (unaudited) – continued

| | | | | | | | |

| Issuer | | Shares/Par | | | Value ($) | |

| | | | | | | | |

| Bonds - continued | | | | | | | | |

| Gaming & Lodging - continued | | | | | | | | |

| MGM Resorts International, 9%, 2020 | | $ | 840,000 | | | $ | 937,650 | |

| Penn National Gaming, Inc., 8.75%, 2019 | | | 1,053,000 | | | | 1,175,411 | |

| Pinnacle Entertainment, Inc., 8.75%, 2020 | | | 295,000 | | | | 323,763 | |

Rivers Pittsburgh Borrower LP/Rivers Pittsburgh Finance Corp.,

9.5%, 2019 (n) | | | 105,000 | | | | 111,300 | |

| Seven Seas Cruises S. DE R.L., 9.125%, 2019 | | | 930,000 | | | | 967,200 | |

| Starwood Hotels & Resorts Worldwide, Inc., 6.75%, 2018 | | | 315,000 | | | | 372,100 | |

| Wyndham Worldwide Corp., 7.375%, 2020 | | | 320,000 | | | | 384,182 | |

| Wynn Las Vegas LLC, 7.75%, 2020 | | | 565,000 | | | | 631,388 | |

| | | | | | | | |

| | | | | | | $ | 9,786,201 | |

| Industrial - 0.2% | | | | | | | | |

| Altra Holdings, Inc., 8.125%, 2016 | | $ | 205,000 | | | $ | 219,863 | |

| Dematic S.A., 8.75%, 2016 (z) | | | 855,000 | | | | 910,575 | |

| Hyva Global B.V., 8.625%, 2016 (n) | | | 400,000 | | | | 344,000 | |

| Mueller Water Products, Inc., 8.75%, 2020 | | | 237,000 | | | | 264,255 | |

| Rexel S.A., 6.125%, 2019 (n) | | | 420,000 | | | | 430,500 | |

| SPL Logistics Escrow, LLC, 8.875%, 2020 (z) | | | 325,000 | | | | 334,750 | |

| | | | | | | | |

| | | | | | | $ | 2,503,943 | |

| Insurance - 0.4% | | | | | | | | |

| American International Group, Inc., 8.25%, 2018 | | $ | 485,000 | | | $ | 611,883 | |

| American International Group, Inc., 8.175% to 2038, FRN to 2068 | | | 2,550,000 | | | | 3,044,063 | |

| MetLife, Inc., 9.25% to 2038, FRN to 2068 (n) | | | 300,000 | | | | 382,500 | |

| | | | | | | | |

| | | | | | | $ | 4,038,446 | |

| Insurance - Health - 0.0% | | | | | | | | |

| AMERIGROUP Corp., 7.5%, 2019 | | $ | 425,000 | | | $ | 495,125 | |

| | |

| Insurance - Property & Casualty - 0.2% | | | | | | | | |

| Liberty Mutual Group, Inc., 10.75% to 2038, FRN to 2088 (n) | | $ | 700,000 | | | $ | 978,250 | |

| XL Group PLC, 6.5% to 2017, FRN to 2049 | | | 1,105,000 | | | | 1,006,931 | |

| | | | | | | | |

| | | | | | | $ | 1,985,181 | |

| International Market Quasi-Sovereign - 0.0% | | | | | | | | |

| Israel Electric Corp. Ltd., 6.7%, 2017 (n) | | $ | 402,000 | | | $ | 430,643 | |

| | |

| International Market Sovereign - 0.2% | | | | | | | | |

| Republic of Iceland, 4.875%, 2016 (n) | | | 1,933,000 | | | | 2,015,153 | |

| Republic of Iceland, 5.875%, 2022 (n) | | | 483,000 | | | | 511,980 | |

| | | | | | | | |

| | | | | | | $ | 2,527,133 | |

16

Portfolio of Investments (unaudited) – continued

| | | | | | | | |

| Issuer | | Shares/Par | | | Value ($) | |

| | | | | | | | |

| Bonds - continued | | | | | | | | |

| Local Authorities - 0.1% | | | | | | | | |

Nashville & Davidson County, TN, Metropolitan Government Convention Center Authority (Build America Bonds),

6.731%, 2043 | | $ | 115,000 | | | $ | 138,940 | |

| Port Authority NY & NJ (168th Series), 4.926%, 2051 | | | 395,000 | | | | 462,403 | |

| San Francisco, CA, City & County Public Utilities Commission, Water Rev. (Build America Bonds), 6%, 2040 | | | 15,000 | | | | 18,625 | |

| State of California (Build America Bonds), 7.625%, 2040 | | | 65,000 | | | | 87,428 | |

| University of California Rev. (Build America Bonds), 5.77%, 2043 | | | 60,000 | | | | 75,721 | |

| | | | | | | | |

| | | | | | | $ | 783,117 | |

| Machinery & Tools - 0.4% | | | | | | | | |

| Ashtead Capital, Inc., 6.5%, 2022 (z) | | $ | 210,000 | | | $ | 218,400 | |

| Case Corp., 7.25%, 2016 | | | 335,000 | | | | 376,875 | |

| Case New Holland, Inc., 7.875%, 2017 | | | 1,200,000 | | | | 1,410,000 | |

| CNH Capital LLC, 6.25%, 2016 (n) | | | 140,000 | | | | 151,900 | |

| H&E Equipment Services LLC, 7%, 2022 (z) | | | 275,000 | | | | 285,313 | |

| NESCO LLC/NESCO Holdings Corp., 11.75%, 2017 (z) | | | 455,000 | | | | 477,750 | |

| RSC Equipment Rental, Inc., 8.25%, 2021 | | | 830,000 | | | | 908,850 | |

| UR Financing Escrow Corp., 5.75%, 2018 (n) | | | 265,000 | | | | 280,238 | |

| UR Financing Escrow Corp., 7.625%, 2022 (n) | | | 767,000 | | | | 828,360 | |

| | | | | | | | |

| | | | | | | $ | 4,937,686 | |

| Major Banks - 0.2% | | | | | | | | |

| Bank of America Corp., 5.65%, 2018 | | $ | 530,000 | | | $ | 592,103 | |

| DBS Bank Ltd., 3.625% to 2017, FRN to 2022 (n) | | | 654,000 | | | | 671,620 | |

| Royal Bank of Scotland Group PLC, 7.648% to 2031, FRN to 2049 | | | 1,080,000 | | | | 1,015,200 | |

Royal Bank of Scotland Group PLC, 6.99% to 2017, FRN to

2049 (a)(d)(n) | | | 100,000 | | | | 84,000 | |

| | | | | | | | |

| | | | | | | $ | 2,362,923 | |

| Medical & Health Technology & Services - 1.2% | | | | | | | | |

| Biomet, Inc., 10%, 2017 | | $ | 185,000 | | | $ | 195,753 | |

| Biomet, Inc., 11.625%, 2017 | | | 695,000 | | | | 742,781 | |

| Biomet, Inc., 6.5%, 2020 (z) | | | 160,000 | | | | 166,000 | |

| Davita, Inc., 6.375%, 2018 | | | 1,500,000 | | | | 1,601,250 | |

| Davita, Inc., 6.625%, 2020 | | | 455,000 | | | | 485,713 | |

| Fresenius Medical Care AG & Co. KGaA, 9%, 2015 (n) | | | 175,000 | | | | 201,469 | |

| Fresenius Medical Care Capital Trust III, 5.625%, 2019 (n) | | | 615,000 | | | | 657,281 | |

| HCA, Inc., 8.5%, 2019 | | | 2,125,000 | | | | 2,395,938 | |

| HCA, Inc., 7.5%, 2022 | | | 990,000 | | | | 1,101,375 | |

| HCA, Inc., 5.875%, 2022 | | | 250,000 | | | | 265,938 | |

| HealthSouth Corp., 8.125%, 2020 | | | 1,115,000 | | | | 1,225,106 | |

| Hologic, Inc., 6.25%, 2020 (z) | | | 105,000 | | | | 111,169 | |

| IASIS Healthcare LLC/IASIS Capital Corp., 8.375%, 2019 | | | 660,000 | | | | 629,475 | |

17

Portfolio of Investments (unaudited) – continued

| | | | | | | | |

| Issuer | | Shares/Par | | | Value ($) | |

| | | | | | | | |

| Bonds - continued | | | | | | | | |

| Medical & Health Technology & Services - continued | | | | | | | | |

| Physio-Control International, Inc., 9.875%, 2019 (z) | | $ | 330,000 | | | $ | 356,400 | |

| Select Medical Corp., 7.625%, 2015 | | | 89,000 | | | | 90,168 | |

| Teleflex, Inc., 6.875%, 2019 | | | 365,000 | | | | 390,550 | |

| Tenet Healthcare Corp., 9.25%, 2015 | | | 480,000 | | | | 536,400 | |

| Truven Health Analytics, Inc., 10.625%, 2020 (z) | | | 275,000 | | | | 293,563 | |

| Universal Health Services, Inc., 7%, 2018 | | | 1,030,000 | | | | 1,112,400 | |

| Universal Hospital Services, Inc., 7.625%, 2020 (z) | | | 560,000 | | | | 589,400 | |

| Universal Hospital Services, Inc., FRN, 4.111%, 2015 | | | 65,000 | | | | 64,106 | |

| Vanguard Health Systems, Inc., 8%, 2018 | | | 290,000 | | | | 304,500 | |

| | | | | | | | |

| | | | | | | $ | 13,516,735 | |

| Metals & Mining - 1.0% | | | | | | | | |

| AngloGold Ashanti Holdings Finance PLC, 5.375%, 2020 | | $ | 520,000 | | | $ | 550,319 | |

| AngloGold Ashanti Holdings PLC, 5.125%, 2022 | | | 830,000 | | | | 848,264 | |

| Arch Coal, Inc., 7.25%, 2020 | | | 550,000 | | | | 497,750 | |

| Cloud Peak Energy, Inc., 8.25%, 2017 | | | 950,000 | | | | 1,030,750 | |

| Cloud Peak Energy, Inc., 8.5%, 2019 | | | 905,000 | | | | 1,004,550 | |

| Consol Energy, Inc., 8%, 2017 | | | 415,000 | | | | 447,163 | |

| Consol Energy, Inc., 8.25%, 2020 | | | 70,000 | | | | 75,425 | |

| Fortescue Metals Group Ltd., 8.25%, 2019 (n) | | | 280,000 | | | | 278,600 | |

| Peabody Energy Corp., 6%, 2018 (n) | | | 230,000 | | | | 235,175 | |

| Peabody Energy Corp., 6.25%, 2021 (n) | | | 230,000 | | | | 234,025 | |

| Southern Copper Corp., 6.75%, 2040 | | | 1,656,000 | | | | 1,925,300 | |

| Vale Overseas Ltd., 5.625%, 2019 | | | 1,134,000 | | | | 1,261,128 | |

| Vale Overseas Ltd., 4.375%, 2022 | | | 2,046,000 | | | | 2,096,902 | |

| Vale Overseas Ltd., 6.875%, 2039 | | | 273,000 | | | | 323,555 | |

| | | | | | | | |

| | | | | | | $ | 10,808,906 | |

| Mortgage-Backed - 7.5% | | | | | | | | |

| Fannie Mae, 4.325%, 2013 | | $ | 138,659 | | | $ | 139,849 | |

| Fannie Mae, 4.374%, 2013 | | | 89,681 | | | | 91,010 | |

| Fannie Mae, 4.518%, 2013 | | | 85,144 | | | | 85,420 | |

| Fannie Mae, 5.155%, 2013 | | | 42,170 | | | | 43,348 | |

| Fannie Mae, 5.37%, 2013 | | | 63,328 | | | | 63,301 | |

| Fannie Mae, 4.561%, 2014 | | | 66,083 | | | | 69,135 | |

| Fannie Mae, 4.607%, 2014 | | | 112,324 | | | | 116,860 | |

| Fannie Mae, 4.791%, 2014 | | | 152,927 | | | | 158,042 | |

| Fannie Mae, 4.88%, 2014 | | | 95,537 | | | | 101,650 | |

| Fannie Mae, 4.935%, 2014 | | | 154,706 | | | | 160,354 | |

| Fannie Mae, 5.1%, 2014 - 2019 | | | 330,422 | | | | 361,147 | |

| Fannie Mae, 4.56%, 2015 | | | 70,431 | | | | 75,315 | |

| Fannie Mae, 4.564%, 2015 | | | 257,085 | | | | 270,795 | |

| Fannie Mae, 4.6%, 2015 - 2019 | | | 155,587 | | | | 178,476 | |

| Fannie Mae, 4.7%, 2015 | | | 139,059 | | | | 150,571 | |

| Fannie Mae, 4.78%, 2015 | | | 78,875 | | | | 85,596 | |

18

Portfolio of Investments (unaudited) – continued

| | | | | | | | |

| Issuer | | Shares/Par | | | Value ($) | |

| | | | | | | | |

| Bonds - continued | | | | | | | | |

| Mortgage-Backed - continued | | | | | | | | |

| Fannie Mae, 4.79%, 2015 | | $ | 119,750 | | | $ | 130,156 | |

| Fannie Mae, 4.81%, 2015 | | | 177,820 | | | | 193,055 | |

| Fannie Mae, 4.815%, 2015 | | | 106,603 | | | | 115,241 | |

| Fannie Mae, 4.85%, 2015 | | | 171,617 | | | | 184,345 | |

| Fannie Mae, 4.856%, 2015 | | | 62,170 | | | | 67,380 | |

| Fannie Mae, 4.86%, 2015 | | | 151,154 | | | | 161,905 | |

| Fannie Mae, 4.907%, 2015 | | | 195,116 | | | | 212,962 | |

| Fannie Mae, 5.034%, 2015 | | | 123,962 | | | | 137,063 | |

| Fannie Mae, 5.275%, 2015 | | | 126,325 | | | | 137,691 | |

| Fannie Mae, 5.465%, 2015 | | | 471,549 | | | | 522,434 | |

| Fannie Mae, 5.5%, 2015 - 2040 | | | 9,400,399 | | | | 10,335,925 | |

| Fannie Mae, 5.09%, 2016 | | | 63,401 | | | | 69,905 | |

| Fannie Mae, 5.152%, 2016 | | | 298,088 | | | | 334,956 | |

| Fannie Mae, 5.272%, 2016 | | | 311,852 | | | | 350,542 | |

| Fannie Mae, 5.35%, 2016 | | | 98,741 | | | | 110,924 | |

| Fannie Mae, 5.395%, 2016 | | | 104,769 | | | | 117,689 | |

| Fannie Mae, 5.423%, 2016 | | | 119,326 | | | | 135,057 | |

| Fannie Mae, 5.45%, 2016 | | | 110,000 | | | | 125,532 | |

| Fannie Mae, 5.724%, 2016 | | | 227,169 | | | | 259,509 | |

| Fannie Mae, 5.845%, 2016 | | | 37,636 | | | | 40,813 | |

| Fannie Mae, 5.93%, 2016 | | | 110,862 | | | | 124,881 | |

| Fannie Mae, 1.9%, 2017 | | | 199,370 | | | | 204,875 | |

| Fannie Mae, 2.71%, 2017 | | | 57,181 | | | | 61,096 | |

| Fannie Mae, 3.308%, 2017 | | | 441,114 | | | | 482,053 | |

| Fannie Mae, 5.05%, 2017 - 2019 | | | 120,645 | | | | 136,029 | |

| Fannie Mae, 5.478%, 2017 | | | 197,767 | | | | 228,012 | |

| Fannie Mae, 5.506%, 2017 | | | 66,306 | | | | 75,086 | |

| Fannie Mae, 6%, 2017 - 2038 | | | 2,129,109 | | | | 2,364,015 | |

| Fannie Mae, 6.5%, 2017 - 2037 | | | 596,144 | | | | 679,812 | |

| Fannie Mae, 2.578%, 2018 | | | 900,000 | | | | 956,156 | |

| Fannie Mae, 3.8%, 2018 | | | 90,146 | | | | 100,281 | |

| Fannie Mae, 3.849%, 2018 | | | 296,348 | | | | 332,270 | |

| Fannie Mae, 3.91%, 2018 | | | 117,745 | | | | 131,378 | |

| Fannie Mae, 3.99%, 2018 | | | 150,000 | | | | 168,894 | |

| Fannie Mae, 4%, 2018 | | | 117,903 | | | | 132,385 | |

| Fannie Mae, 4.19%, 2018 | | | 108,154 | | | | 122,251 | |

| Fannie Mae, 5.16%, 2018 | | | 214,652 | | | | 239,205 | |

| Fannie Mae, 5.34%, 2018 | | | 374,858 | | | | 434,904 | |

| Fannie Mae, 4.45%, 2019 | | | 90,779 | | | | 104,614 | |

| Fannie Mae, 4.5%, 2019 - 2041 | | | 2,100,319 | | | | 2,293,729 | |

| Fannie Mae, 4.67%, 2019 | | | 28,000 | | | | 32,558 | |

| Fannie Mae, 4.83%, 2019 | | | 72,193 | | | | 83,903 | |

| Fannie Mae, 4.876%, 2019 | | | 113,361 | | | | 132,116 | |

19

Portfolio of Investments (unaudited) – continued

| | | | | | | | |

| Issuer | | Shares/Par | | | Value ($) | |

| | | | | | | | |

| Bonds - continued | | | | | | | | |

| Mortgage-Backed - continued | | | | | | | | |

| Fannie Mae, 5%, 2019 - 2041 | | $ | 5,164,875 | | | $ | 5,672,940 | |

| Fannie Mae, 5.08%, 2019 | | | 23,947 | | | | 27,596 | |

| Fannie Mae, 5.51%, 2019 | | | 115,439 | | | | 134,025 | |

| Fannie Mae, 3.87%, 2020 | | | 70,936 | | | | 80,124 | |

| Fannie Mae, 4.14%, 2020 | | | 42,869 | | | | 49,011 | |

| Fannie Mae, 5.19%, 2020 | | | 109,841 | | | | 127,189 | |

| Fannie Mae, 4.5%, 2025 | | | 113,513 | | | | 122,607 | |

| Fannie Mae, 3%, 2027 | | | 794,322 | | | | 839,408 | |

| Fannie Mae, 3.5%, 2042 | | | 744,792 | | | | 794,676 | |

| Fannie Mae, TBA, 3%, 2027 - 2042 | | | 4,350,000 | | | | 4,543,071 | |

| Fannie Mae, TBA, 3.5%, 2042 | | | 4,250,000 | | | | 4,500,195 | |

| Fannie Mae, TBA, 4%, 2042 | | | 1,874,000 | | | | 2,003,130 | |

| Freddie Mac, 1.655%, 2016 | | | 602,929 | | | | 622,451 | |

| Freddie Mac, 3.882%, 2017 | | | 555,000 | | | | 624,677 | |

| Freddie Mac, 6%, 2017 - 2038 | | | 1,107,725 | | | | 1,233,404 | |

| Freddie Mac, 2.303%, 2018 | | | 915,000 | | | | 962,472 | |

| Freddie Mac, 2.323%, 2018 | | | 1,138,000 | | | | 1,196,641 | |

| Freddie Mac, 2.412%, 2018 (n) | | | 1,000,000 | | | | 1,058,736 | |

| Freddie Mac, 2.699%, 2018 | | | 1,200,000 | | | | 1,288,622 | |

| Freddie Mac, 3.154%, 2018 | | | 478,000 | | | | 522,304 | |

| Freddie Mac, 5%, 2018 - 2040 | | | 887,891 | | | | 965,371 | |

| Freddie Mac, 2.13%, 2019 | | | 1,100,000 | | | | 1,144,917 | |

| Freddie Mac, 4.186%, 2019 | | | 146,000 | | | | 167,053 | |

| Freddie Mac, 5.085%, 2019 | | | 162,000 | | | | 191,504 | |

| Freddie Mac, 2.757%, 2020 | | | 282,875 | | | | 301,951 | |

| Freddie Mac, 3.32%, 2020 | | | 257,498 | | | | 280,774 | |

| Freddie Mac, 4.224%, 2020 | | | 99,963 | | | | 115,703 | |

| Freddie Mac, 4.251%, 2020 | | | 230,000 | | | | 265,488 | |

| Freddie Mac, 4.5%, 2024 - 2041 | | | 1,370,108 | | | | 1,476,284 | |

| Freddie Mac, 5.5%, 2024 - 2038 | | | 1,259,601 | | | | 1,390,046 | |

| Freddie Mac, 4%, 2025 | | | 290,899 | | | | 310,019 | |

| Freddie Mac, 6.5%, 2037 - 2038 | | | 184,541 | | | | 208,077 | |

| Freddie Mac, 3.5%, 2041 - 2042 | | | 1,106,565 | | | | 1,180,527 | |

| Freddie Mac, TBA, 2.5%, 2027 | | | 2,550,000 | | | | 2,640,047 | |

| Freddie Mac, TBA, 3%, 2027 - 2042 | | | 5,510,000 | | | | 5,753,960 | |

| Freddie Mac, TBA, 3.5%, 2042 | | | 3,190,000 | | | | 3,374,920 | |

| Ginnie Mae, 4.5%, 2033 - 2041 | | | 2,446,400 | | | | 2,713,485 | |

| Ginnie Mae, 5.5%, 2033 - 2042 | | | 1,055,591 | | | | 1,184,233 | |

| Ginnie Mae, 4%, 2039 - 2040 | | | 426,254 | | | | 468,658 | |

| Ginnie Mae, 3.5%, 2041 - 2042 | | | 792,936 | | | | 860,798 | |

| Ginnie Mae, 5.612%, 2058 | | | 272,611 | | | | 289,708 | |

| Ginnie Mae, 6.357%, 2058 | | | 194,468 | | | | 208,445 | |

| Ginnie Mae, TBA, 3%, 2042 | | | 2,300,000 | | | | 2,405,656 | |

20

Portfolio of Investments (unaudited) – continued

| | | | | | | | |

| Issuer | | Shares/Par | | | Value ($) | |

| | | | | | | | |

| Bonds - continued | | | | | | | | |

| Mortgage-Backed - continued | | | | | | | | |

| Ginnie Mae, TBA, 3.5%, 2042 | | $ | 4,500,000 | | | $ | 4,864,219 | |

| | | | | | | | |

| | | | | | | $ | 84,679,578 | |

| Municipals - 0.2% | | | | | | | | |

Florida Department of Transportation, (Right of Way), “A”,

5%, 2021 | | $ | 240,000 | | | $ | 301,253 | |

| Garland, TX, Independent School District, N, 5%, 2022 | | | 475,000 | | | | 589,760 | |

| Metropolitan Government of Nashville & Davidson County, TN, General Obligation, 5%, 2022 | | | 460,000 | | | | 589,076 | |

| Omaha, NE, General Obligation, (Omaha Convention Center/Arena Project), 5.25%, 2022 | | | 315,000 | | | | 408,851 | |

| Seattle, WA, General Obligation, 5%, 2021 | | | 265,000 | | | | 336,081 | |

| | | | | | | | |

| | | | | | | $ | 2,225,021 | |

| Natural Gas - Distribution - 0.1% | | | | | | | | |

| AmeriGas Finance LLC, 6.75%, 2020 | | $ | 685,000 | | | $ | 729,525 | |

| Ferrellgas LP/Ferrellgas Finance Corp., 6.5%, 2021 | | | 570,000 | | | | 558,600 | |

| | | | | | | | |

| | | | | | | $ | 1,288,125 | |

| Natural Gas - Pipeline - 0.6% | | | | | | | | |

| Atlas Pipeline Partners LP, 8.75%, 2018 | | $ | 740,000 | | | $ | 793,650 | |

| Crosstex Energy, Inc., 8.875%, 2018 | | | 1,000,000 | | | | 1,067,500 | |

| El Paso Corp., 7%, 2017 | | | 545,000 | | | | 623,378 | |

| El Paso Corp., 7.75%, 2032 | | | 1,370,000 | | | | 1,612,986 | |

| Energy Transfer Equity LP, 7.5%, 2020 | | | 1,090,000 | | | | 1,253,500 | |

| Enterprise Products Partners LP, 8.375% to 2016, FRN to 2066 | | | 537,000 | | | | 601,440 | |

| Enterprise Products Partners LP, 7.034% to 2018, FRN to 2068 | | | 71,000 | | | | 79,520 | |

| MarkWest Energy Partners LP, 5.5%, 2023 | | | 465,000 | | | | 475,463 | |

| Rockies Express Pipeline LLC, 5.625%, 2020 (n) | | | 267,000 | | | | 254,985 | |

| | | | | | | | |

| | | | | | | $ | 6,762,422 | |

| Network & Telecom - 0.3% | | | | | | | | |

| Centurylink, Inc., 7.65%, 2042 | | $ | 310,000 | | | $ | 323,179 | |

| Cincinnati Bell, Inc., 8.25%, 2017 | | | 260,000 | | | | 278,200 | |

| Citizens Communications Co., 9%, 2031 | | | 260,000 | | | | 273,000 | |

| Eileme 2 AB, 11.625%, 2020 (n) | | | 400,000 | | | | 438,000 | |

| Frontier Communications Corp., 8.125%, 2018 | | | 795,000 | | | | 884,438 | |

| Qwest Communications International, Inc., 7.125%, 2018 (n) | | | 780,000 | | | | 829,530 | |

| Windstream Corp., 8.125%, 2018 | | | 150,000 | | | | 159,750 | |

| Windstream Corp., 7.75%, 2020 | | | 680,000 | | | | 714,000 | |

| | | | | | | | |

| | | | | | | $ | 3,900,097 | |

21

Portfolio of Investments (unaudited) – continued

| | | | | | | | |

| Issuer | | Shares/Par | | | Value ($) | |

| | | | | | | | |

| Bonds - continued | | | | | | | | |

| Oil Services - 0.3% | | | | | | | | |

| Afren PLC, 11.5%, 2016 (n) | | $ | 200,000 | | | $ | 224,000 | |

| Afren PLC, 10.25%, 2019 (n) | | | 216,000 | | | | 237,600 | |

| Chesapeake Energy Corp., 6.625%, 2019 (n) | | | 175,000 | | | | 168,000 | |

| Dresser-Rand Group, Inc., 6.5%, 2021 | | | 215,000 | | | | 225,750 | |

| Edgen Murray Corp., 12.25%, 2015 | | | 885,000 | | | | 940,313 | |

| Pioneer Energy Services Corp., 9.875%, 2018 | | | 595,000 | | | | 644,088 | |

| Unit Corp., 6.625%, 2021 (z) | | | 400,000 | | | | 406,000 | |

| Unit Corp., 6.625%, 2021 | | | 320,000 | | | | 324,800 | |

| | | | | | | | |

| | | | | | | $ | 3,170,551 | |

| Other Banks & Diversified Financials - 1.2% | | | | | | | | |

| Ajecorp B.V., 6.5%, 2022 (n) | | $ | 200,000 | | | $ | 209,000 | |

| Banco de Credito del Peru, 6.125% to 2022, FRN to 2027 (n) | | | 432,000 | | | | 464,400 | |

| Banco PanAmericano S.A., 8.5%, 2020 (n) | | | 617,000 | | | | 697,210 | |

| Bancolombia S.A., 5.95%, 2021 | | | 1,374,000 | | | | 1,514,835 | |

| BBVA Banco Continental S.A., 5%, 2022 (z) | | | 398,000 | | | | 408,945 | |

| BBVA Bancomer S.A. Texas, 6.5%, 2021 (n) | | | 1,770,000 | | | | 1,871,775 | |

| BBVA Bancomer S.A. Texas, 6.75%, 2022 (n) | | | 416,000 | | | | 447,200 | |

| BBVA Continental, 5.75%, 2017 (n) | | | 500,000 | | | | 540,000 | |

| Capital One Financial Corp., 10.25%, 2039 | | | 1,890,000 | | | | 1,946,700 | |

| Groupe BPCE S.A., 12.5% to 2019, FRN to 2049 (n) | | | 130,000 | | | | 139,914 | |

| Itau Unibanco Holding S.A., 5.5%, 2022 (n) | | | 2,424,000 | | | | 2,468,844 | |

| LBG Capital No. 1 PLC, 7.875%, 2020 (n) | | | 680,000 | | | | 657,856 | |

| Santander UK PLC, 8.963% to 2030, FRN to 2049 | | | 1,324,000 | | | | 1,357,100 | |

| UBS AG, 7.625%, 2022 | | | 310,000 | | | | 312,403 | |

| | | | | | | | |

| | | | | | | $ | 13,036,182 | |

| Pharmaceuticals - 0.2% | | | | | | | | |

| Capsugel FinanceCo. SCA, 9.875%, 2019 (n) | | EUR | 325,000 | | | $ | 456,817 | |

| Endo Health Solutions, Inc., 7%, 2019 | | $ | 420,000 | | | | 453,600 | |

| Valeant Pharmaceuticals International, Inc., 6.5%, 2016 (n) | | | 655,000 | | | | 691,025 | |

| Valeant Pharmaceuticals International, Inc., 7%, 2020 (n) | | | 410,000 | | | | 424,350 | |

| | | | | | | | |

| | | | | | | $ | 2,025,792 | |

| Pollution Control - 0.0% | | | | | | | | |

| Heckmann Corp., 9.875%, 2018 | | $ | 380,000 | | | $ | 359,100 | |

| | |

| Printing & Publishing - 0.1% | | | | | | | | |

| American Media, Inc., 13.5%, 2018 (z) | | $ | 26,083 | | | $ | 24,714 | |

| Nielsen Finance LLC, 11.5%, 2016 | | | 204,000 | | | | 228,480 | |

| Nielsen Finance LLC, 7.75%, 2018 | | | 385,000 | | | | 433,125 | |

| | | | | | | | |

| | | | | | | $ | 686,319 | |

22

Portfolio of Investments (unaudited) – continued

| | | | | | | | |

| Issuer | | Shares/Par | | | Value ($) | |

| | | | | | | | |

| Bonds - continued | | | | | | | | |

| Railroad & Shipping - 0.0% | |

| Kansas City Southern de Mexico S.A. de C.V., 6.125%, 2021 | | $ | 145,000 | | | $ | 162,400 | |

| | |

| Real Estate - 0.2% | | | | | | | | |

| CB Richard Ellis Group, Inc., 11.625%, 2017 | | $ | 235,000 | | | $ | 264,375 | |

| CNL Lifestyle Properties, Inc., REIT, 7.25%, 2019 | | | 140,000 | | | | 130,375 | |

| Entertainment Properties Trust, REIT, 7.75%, 2020 | | | 715,000 | | | | 796,578 | |

| Kennedy Wilson, Inc., 8.75%, 2019 | | | 210,000 | | | | 223,125 | |

| MPT Operating Partnership LP, REIT, 6.875%, 2021 | | | 940,000 | | | | 1,022,250 | |

| | | | | | | | |

| | | | | | | $ | 2,436,703 | |

| Retailers - 0.6% | | | | | | | | |

| Academy Ltd., 9.25%, 2019 (n) | | $ | 330,000 | | | $ | 361,350 | |

| Burlington Coat Factory Warehouse Corp., 10%, 2019 | | | 575,000 | | | | 619,563 | |

| J. Crew Group, Inc., 8.125%, 2019 | | | 385,000 | | | | 402,806 | |

| Limited Brands, Inc., 6.9%, 2017 | | | 1,110,000 | | | | 1,262,625 | |

| Limited Brands, Inc., 6.95%, 2033 | | | 60,000 | | | | 59,700 | |

| Neiman Marcus Group, Inc., 10.375%, 2015 | | | 630,000 | | | | 646,544 | |

| Pantry, Inc., 8.375%, 2020 (z) | | | 275,000 | | | | 284,281 | |

| QVC, Inc., 7.375%, 2020 (n) | | | 680,000 | | | | 757,704 | |

| Rite Aid Corp., 9.25%, 2020 | | | 445,000 | | | | 457,238 | |

| Sally Beauty Holdings, Inc., 6.875%, 2019 | | | 225,000 | | | | 251,438 | |

| Toys “R” Us Property Co. II LLC, 8.5%, 2017 | | | 625,000 | | | | 676,563 | |

| Toys “R” Us, Inc., 10.75%, 2017 | | | 580,000 | | | | 639,450 | |

| Yankee Acquisition Corp., 8.5%, 2015 | | | 3,000 | | | | 3,049 | |

| YCC Holdings LLC/Yankee Finance, Inc., 10.25%, 2016 (p) | | | 470,000 | | | | 489,388 | |

| | | | | | | | |

| | | | | | | $ | 6,911,699 | |

| Specialty Chemicals - 0.0% | | | | | | | | |

| Koppers, Inc., 7.875%, 2019 | | $ | 180,000 | | | $ | 196,650 | |

| | |

| Specialty Stores - 0.1% | | | | | | | | |

| Gymboree Corp., 9.125%, 2018 | | $ | 105,000 | | | $ | 99,750 | |

| Michaels Stores, Inc., 11.375%, 2016 | | | 125,000 | | | | 131,408 | |

| Michaels Stores, Inc., 7.75%, 2018 | | | 675,000 | | | | 718,875 | |

| | | | | | | | |

| | | | | | | $ | 950,033 | |

| Steel - 0.1% | | | | | | | | |

| Evraz Group S.A., 7.4%, 2017 (n) | | $ | 1,341,000 | | | $ | 1,356,086 | |

| | |

| Supermarkets - 0.0% | | | | | | | | |

| SUPERVALU, Inc., 7.5%, 2014 | | $ | 525,000 | | | $ | 504,000 | |

23

Portfolio of Investments (unaudited) – continued

| | | | | | | | |

| Issuer | | Shares/Par | | | Value ($) | |

| | | | | | | | |

| Bonds - continued | | | | | | | | |

| Telecommunications - Wireless - 1.3% | | | | | | | | |

| America Movil S.A.B. de C.V., 5%, 2020 | | $ | 877,000 | | | $ | 1,019,277 | |

| America Movil S.A.B. de C.V., 3.125%, 2022 | | | 2,248,000 | | | | 2,304,276 | |

| Clearwire Corp., 12%, 2015 (n) | | | 365,000 | | | | 361,350 | |

| Cricket Communications, Inc., 7.75%, 2016 | | | 500,000 | | | | 527,500 | |

| Cricket Communications, Inc., 7.75%, 2020 | | | 665,000 | | | | 645,050 | |

| Crown Castle International Corp., 9%, 2015 | | | 170,000 | | | | 183,813 | |

| Crown Castle International Corp., 7.125%, 2019 | | | 1,235,000 | | | | 1,343,063 | |

| Digicel Group Ltd., 8.25%, 2017 (n) | | | 856,000 | | | | 907,360 | |

| Digicel Group Ltd., 10.5%, 2018 (n) | | | 895,000 | | | | 966,600 | |

Globo Comunicacoes e Participacoes S.A., 6.25% to 2015,

9.375% to 2049 (n) | | | 1,499,000 | | | | 1,596,435 | |

| MetroPCS Wireless, Inc., 7.875%, 2018 | | | 215,000 | | | | 231,125 | |

| Sprint Capital Corp., 6.875%, 2028 | | | 325,000 | | | | 294,125 | |

| Sprint Nextel Corp., 6%, 2016 | | | 780,000 | | | | 795,600 | |

| Sprint Nextel Corp., 8.375%, 2017 | | | 870,000 | | | | 957,000 | |

| Sprint Nextel Corp., 9%, 2018 (n) | | | 235,000 | | | | 277,300 | |

| Wind Acquisition Finance S.A., 11.75%, 2017 (n) | | | 1,250,000 | | | | 1,143,750 | |

| Wind Acquisition Finance S.A., 7.25%, 2018 (n) | | | 700,000 | | | | 644,000 | |

| | | | | | | | |

| | | | | | | $ | 14,197,624 | |

| Telephone Services - 0.2% | | | | | | | | |

| Cogent Communications Group, Inc., 8.375%, 2018 (n) | | $ | 105,000 | | | $ | 114,188 | |

| Level 3 Financing, Inc., 9.375%, 2019 | | | 420,000 | | | | 459,900 | |

| Level 3 Financing, Inc., 8.625%, 2020 | | | 550,000 | | | | 588,500 | |

| Oi S.A., 5.75%, 2022 (n) | | | 676,000 | | | | 702,229 | |

| | | | | | | | |

| | | | | | | $ | 1,864,817 | |

| Transportation - 0.1% | | | | | | | | |

| Navios South American Logistics, Inc., 9.25%, 2019 | | $ | 623,000 | | | $ | 576,275 | |

| | |

| Transportation - Services - 0.6% | | | | | | | | |

| ACL I Corp., 10.625%, 2016 (p) | | $ | 405,302 | | | $ | 385,387 | |

| Aguila American Resources Ltd., 7.875%, 2018 (n) | | | 845,000 | | | | 890,419 | |

| Avis Budget Car Rental LLC, 8.25%, 2019 | | | 280,000 | | | | 302,400 | |

| Avis Budget Car Rental LLC, 8.25%, 2019 (n) | | | 125,000 | | | | 135,000 | |

| Avis Budget Car Rental LLC, 9.75%, 2020 | | | 185,000 | | | | 208,356 | |

| CEVA Group PLC, 8.375%, 2017 (n) | | | 1,445,000 | | | | 1,405,263 | |

| Commercial Barge Line Co., 12.5%, 2017 | | | 820,000 | | | | 918,400 | |

| Navios Maritime Acquisition Corp., 8.625%, 2017 | | | 555,000 | | | | 520,313 | |

| Navios Maritime Holdings, Inc., 8.875%, 2017 (z) | | | 25,000 | | | | 25,219 | |

| Navios Maritime Holdings, Inc., 8.875%, 2017 | | | 610,000 | | | | 621,438 | |

| Swift Services Holdings, Inc., 10%, 2018 | | | 1,040,000 | | | | 1,141,400 | |

| | | | | | | | |

| | | | | | | $ | 6,553,595 | |

24

Portfolio of Investments (unaudited) – continued

| | | | | | | | |

| Issuer | | Shares/Par | | | Value ($) | |

| | | | | | | | |

| Bonds - continued | | | | | | | | |

| U.S. Government Agencies and Equivalents - 0.5% | | | | | | | | |

| Aid-Egypt, 4.45%, 2015 | | $ | 170,000 | | | $ | 190,426 | |

| FDIC Structured Sale Guarantee Note, 0%, 2012 (n) | | | 25,000 | | | | 24,995 | |

| Freddie Mac, 2.375%, 2022 | | | 4,680,000 | | | | 4,918,193 | |

| Small Business Administration, 6.34%, 2021 | | | 138,069 | | | | 154,234 | |

| Small Business Administration, 6.07%, 2022 | | | 146,978 | | | | 163,587 | |

| Small Business Administration, 5.16%, 2028 | | | 211,376 | | | | 241,506 | |

| | | | | | | | |

| | | | | | | $ | 5,692,941 | |

| U.S. Treasury Obligations - 8.6% | | | | | | | | |

| U.S. Treasury Bonds, 9.25%, 2016 | | $ | 47,000 | | | $ | 61,306 | |

| U.S. Treasury Bonds, 6.375%, 2027 | | | 106,000 | | | | 164,929 | |

| U.S. Treasury Bonds, 5.25%, 2029 | | | 546,000 | | | | 778,391 | |

| U.S. Treasury Bonds, 4.5%, 2036 | | | 70,000 | | | | 95,517 | |

| U.S. Treasury Bonds, 4.375%, 2038 | | | 638,000 | | | | 860,802 | |

| U.S. Treasury Bonds, 4.5%, 2039 | | | 5,872,000 | | | | 8,107,946 | |

| U.S. Treasury Notes, 1.375%, 2012 | | | 750,000 | | | | 751,025 | |

| U.S. Treasury Notes, 1.375%, 2013 | | | 11,536,000 | | | | 11,609,900 | |

| U.S. Treasury Notes, 3.125%, 2013 | | | 305,000 | | | | 314,543 | |

| U.S. Treasury Notes, 4%, 2014 | | | 18,000 | | | | 18,984 | |

| U.S. Treasury Notes, 1.875%, 2014 | | | 32,644,000 | | | | 33,447,336 | |

| U.S. Treasury Notes, 1.875%, 2014 | | | 417,000 | | | | 428,370 | |

| U.S. Treasury Notes, 4%, 2015 | | | 1,397,000 | | | | 1,524,149 | |

| U.S. Treasury Notes, 2.125%, 2015 | | | 14,254,000 | | | | 14,971,107 | |

| U.S. Treasury Notes, 0.875%, 2016 | | | 11,711,000 | | | | 11,902,217 | |

| U.S. Treasury Notes, 2.625%, 2018 | | | 955,000 | | | | 1,055,052 | |

| U.S. Treasury Notes, 2.75%, 2019 | | | 1,590,000 | | | | 1,775,831 | |

| U.S. Treasury Notes, 3.125%, 2019 | | | 454,000 | | | | 518,979 | |

| U.S. Treasury Notes, 3.5%, 2020 | | | 5,671,000 | | | | 6,664,752 | |

| U.S. Treasury Notes, 3.125%, 2021 | | | 672,000 | | | | 771,908 | |

| U.S. Treasury Notes, 1.75%, 2022 | | | 1,663,000 | | | | 1,696,779 | |

| | | | | | | | |

| | | | | | | $ | 97,519,823 | |

| Utilities - Electric Power - 1.1% | | | | | | | | |

| AES Corp., 8%, 2017 | | $ | 760,000 | | | $ | 887,300 | |

| Atlantic Power Corp., 9%, 2018 | | | 300,000 | | | | 313,500 | |

| Calpine Corp., 8%, 2016 (n) | | | 675,000 | | | | 729,844 | |

| Calpine Corp., 7.875%, 2020 (n) | | | 1,025,000 | | | | 1,153,125 | |

| Covanta Holding Corp., 7.25%, 2020 | | | 705,000 | | | | 786,848 | |

| Covanta Holding Corp., 6.375%, 2022 | | | 165,000 | | | | 180,406 | |

| Dolphin Subsidiary ll, Inc., 7.25%, 2021 (n) | | | 340,000 | | | | 387,600 | |

| Edison Mission Energy, 7%, 2017 | | | 375,000 | | | | 196,875 | |